March 29, 2024

2023 Annual Report

to Congress

Office of Minority and Women Inclusion

2023 Annual Report to Congress

© 2024 Federal Reserve Bank of Boston. All rights reserved.

Contents

Message from the President and the OMWI Director ........................................................ 1

Section I. Introduction and Report Overview ..................................................................... 2

Section II. Our Bank ........................................................................................................... 3

A. Bank Overview ........................................................................................................... 3

B. The Bank’s Economic Research ................................................................................ 6

C. Community Development Activities ............................................................................ 8

Section III. The Bank’s Commitment to a Diverse and Inclusive Workforce .................... 11

A. Successes, Strategies, and Initiatives ...................................................................... 11

B. Ongoing Challenges and Next Steps ....................................................................... 20

C. Workforce: Demographic Composition Results ....................................................... 21

Section IV. The Bank’s Inclusion of Minority- and Women-Owned Vendor Businesses:

Supplier Diversity Program .............................................................................................. 23

A. Successes ................................................................................................................ 23

B. Challenges and Next Steps ...................................................................................... 24

Section V. Concluding Observations ............................................................................... 25

Appendix A: EEO1 Report ............................................................................................... 27

Appendix B: OMWI Standard Metrics Report .................................................................. 29

Appendix C: 2023 Learning and Development Training Programs .................................. 32

Appendix D: Organization Chart ...................................................................................... 33

2023 Annual Report to Congress

Federal Reserve Bank of Boston | bostonfed.org | Office of Minority and Women Inclusion

1

Message from the President and the OMWI Director

In accordance with Section 342 of the Dodd-Frank Wall Street Reform and Consumer

Protection Act of 2010, the Federal Reserve Bank of Boston (“the Bank” or “Boston Fed”)

is pleased to provide Congress with the 2023 Annual Report of the Bank’s Office of

Minority and Women Inclusion (OMWI).

OMWI works in partnership with the Bank’s leadership team to help ensure individuals

and businesses have fair access to career and procurement opportunities. It does this by

collaborating across the organization to promote inclusive management practices and

equal employment opportunities.

This year, the Bank launched initiatives to align diversity, equity, and inclusion (DEI)

strategies across the organization and continued the successful integration of DEI

principles into policies and practices. Notable accomplishments include the following:

100% of Bank departments now have a DEI action plan; three new employee resource

networks (ERNs) were created to support and enhance an inclusive culture; and

performance ratings were further calibrated across the organization to promote greater

consistency, supporting more equitable availability of opportunities.

In terms of our external initiatives, the Bank pursued its mandate from Congress and our

commitment to a vibrant economy that works for all people in the region through a variety

of activities. This report includes descriptions of relevant activities, including work

supporting community economic development and financial literacy, economic research,

and our supplier diversity program.

The enclosed report provides information on the Bank’s regional footprint and insight on

our DEI successes and challenges. It highlights key initiatives aimed at continuing

progress on OMWI-related objectives, and it shares qualitative and quantitative data that

demonstrate the Bank’s progress in our mission to foster a vibrant, inclusive economy

that works for all. We are encouraged by the results and committed to continuing to

advance diversity, equity, and inclusion in our organization—and to ensuring

procurement opportunities are available to vendors throughout the region.

Susan M. Collins Danny Best

President and Chief Vice President and

Executive Officer OMWI Director

2023 Annual Report to Congress

Federal Reserve Bank of Boston | bostonfed.org | Office of Minority and Women Inclusion

2

Section I. Introduction and Report Overview

At the Federal Reserve Bank of Boston (“the Bank” or “Boston Fed”), we believe diversity

is a defining strength of our nation, the region, and the most effective organizations. We

believe that a diverse workforce and inclusive culture at the Boston Fed are essential to

fulfilling the Congressional mandates of stable prices and maximum employment, and to

achieving our overarching goal of fostering a vibrant economy that works for all people,

not just some people.

This orientation is reflected in the breadth of work undertaken across the Bank’s portfolio,

with some highlights mentioned in this report. As a case in point, President Collins

regularly spends time in every New England state, engaging with stakeholders across the

many facets of the economy to hear about their experiences and the economy’s

opportunities and challenges.

In 2023, the Bank conducted a holistic

review and update of its strategic plan.

The updated strategic plan aims to

guide the Bank’s operations and goals

through 2026. A theme throughout the

planning process was the need to

maintain the Bank’s commitment to

provide access to equal opportunity to

its workforce and the public, to

support our work to serve all

participants in the economy.

This report begins with an overview of

the Bank and our activities (Section

II). It highlights some of our economic research work and our community development

activities, including aspects of our outreach work that support greater financial literacy.

Section III outlines the Bank’s commitment to a diverse and inclusive workforce,

describing strategies, initiatives, and successes in 2023 and detailing our workforce

demographic composition. That section concludes with a summary of some ongoing

challenges and next steps. Section IV provides an update on our supplier diversity

programs. The report’s final section is a brief conclusion, followed by an appendix with a

number of supporting materials.

Boston Fed president Susan M. Collins speaks with

Vermont leaders during a 2023 visit to the state.

2023 Annual Report to Congress

Federal Reserve Bank of Boston | bostonfed.org | Office of Minority and Women Inclusion

3

Section II. Our Bank

A. Bank Overview

Who We Are

The Boston Fed is one of 12 regional Banks that, along with the Board of Governors in

Washington, make up the Federal Reserve System, established in 1914. Thus, the

Boston Fed plays a crucial role in the U.S. monetary and financial systems. The Bank

serves the First Federal Reserve District, which includes the six New England states:

Connecticut (except Fairfield County), Maine, Massachusetts, New Hampshire, Rhode

Island, and Vermont.

2023 Annual Report to Congress

Federal Reserve Bank of Boston | bostonfed.org | Office of Minority and Women Inclusion

4

Our Vision and Mission

The Bank is committed to promoting a strong, vibrant, and inclusive economy that works

for all. This aligns with the broader goals of the Federal Reserve System. The Bank

works diligently to serve the public by maintaining a safe and stable financial system,

promoting economic growth characterized by full employment and stable prices (the two

facets of our dual mandate from Congress), and ensuring the smooth functioning of

payment systems.

Boston Fed leadership believes that a truly healthy economy provides ample

opportunities to work, contribute, and prosper, regardless of an individual’s background

and identity. This requires the best ideas, energy, and participation from all. The Bank’s

staff pursues this mission through a variety of tasks and initiatives that address the

unique economic conditions and challenges faced by New Englanders.

Our Workforce

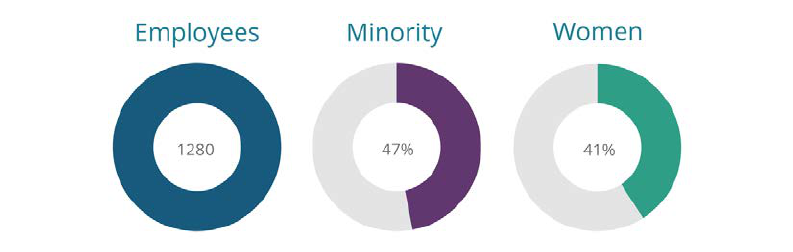

As of Dec. 31, 2023, the Bank had a workforce of 1,280 employees.

What We Do

The Boston Fed performs several core functions that are essential to achieving our vision

of promoting a vibrant, inclusive economy. These functions can be broadly categorized

as monetary policy contributions; nonpartisan economic research; community economic

development efforts; promoting financial stability; payments services and innovation; and

supervision, regulation, and credit. The following is a high-level summary of the Bank’s

functions:

Monetary Policy

The Boston Fed’s president is an active participant in the Federal Open Market

Committee (or FOMC), which sets the nation's monetary policy by influencing interest

rates and the money supply in pursuit of maximum employment and stable prices.

Economic Research

The Research department of the Boston Fed conducts rigorous, empirical, nonpartisan

research. In addition to work that contributes directly to monetary policymaking, such as

deepening understanding of inflation, employment, financial markets, and economic

growth, our experts study a range of topics related to fostering a vibrant economy. This

2023 Annual Report to Congress

Federal Reserve Bank of Boston | bostonfed.org | Office of Minority and Women Inclusion

5

includes work on issues that impact opportunities to participate in the workforce and

economy, as discussed further below.

Payments Services and Innovation

The Boston Fed provides essential services that underpin the banking and financial

system, assisting financial institutions of all sizes in serving their customers. The Bank

also conducts research supporting the continued evolution of the payments system,

including its underlying technologies and standards.

A key initiative has been the

development of the FedNow

®

Service,

created to provide real-time settlement

for instant payments and offer the

nation a faster and more efficient

payments infrastructure. The service

was launched in July 2023, and it

allows businesses and individuals to

send and receive instant payments at

any time of day through participating

financial institutions.

Other payments work includes secure

payments innovation and research,

designed to identify and address fraud challenges; work on central bank digital

currencies, focused on assessing evolving trends and developing knowledge that would

be necessary should Congress instruct the Federal Reserve to take action; and digital

and mobile payments research.

Supervision, Regulation, and Credit

The Boston Fed supervises financial institutions in the First District, at the behest of the

Board of Governors in Washington. This work serves the public by promoting financial

stability and public confidence in the banking system. The Bank works to protect

consumers by ensuring that financial institutions comply with laws and regulations, and

by encouraging those institutions to responsibly meet community needs.

Community Development

The Boston Fed team works to advance economic well-being and stability in low-and

moderate-income (or LMI) communities throughout New England. The work of promoting

economic growth and financial stability for LMI communities includes several key

initiatives: Supporting growth in smaller industrial cities and rural communities, research

and convening that advances household economic security and equity, and thought

leadership around expanding economic opportunities. Through outreach and

partnerships, the Boston Fed strives to enable progress in LMI communities. Some of this

work is described in more detail below.

The FedNow

®

Service for instant payments launched on

July 20, 2023.

2023 Annual Report to Congress

Federal Reserve Bank of Boston | bostonfed.org | Office of Minority and Women Inclusion

6

B. The Bank’s Economic Research

Boston Fed economist Christopher L. Foote moderates the panel "Race-Related Gaps in

Employment Rates" during the Bank's 67th Economic Conference, which analyzed

barriers to "full employment."

The Bank conducts rigorous academic research to enrich our understanding of the

regional, national, and international economies and to contribute to the set of analytic tools

and perspectives that inform our monetary policy contributions. This includes research on

issues that impact opportunities to participate in the workforce and the economy.

Ongoing economic research activities include the following:

• Producing working papers and briefs that disseminate empirical and theoretical

research and cover topics such as macroeconomics, monetary policy, finance, and

public policy. This work may have a regional, national or international focus.

• Illuminating regional economic conditions, data, and trends via paper series and data

products produced by our New England Public Policy Center.

• Publishing policy reports featuring descriptive, research-based analysis that provide

comprehensive understanding of issues confronting citizens and policymakers.

• Supporting our Board of Directors by providing analysis for their Primary Credit Rate

recommendations to the Board of Governors. These rates play a role in monetary

policymaking by affecting borrowing costs for financial institutions.

• Conducting regular interviews with regional businesses to yield qualitative information

for the Fed’s periodic Beige Book report on economic and business conditions.

These and other insights complement quantitative data, enriching Fed policymakers’

understanding of economic conditions.

2023 Annual Report to Congress

Federal Reserve Bank of Boston | bostonfed.org | Office of Minority and Women Inclusion

7

• Engaging in debate on current economic and monetary policy concerns via

participation in conferences, seminars, media interviews, and speaking engagements.

Specific 2023 research initiatives that relate to barriers to inclusion in the economy

included the following:

• Examining patterns in unemployment rates by race and ethnicity and potential

implications for the labor market.

• Producing several working papers and briefs that address workforce development

and economic opportunity in the New England region, household finance, and

economic well-being. Examples include child care and women’s labor force

participation, “gig” work and its implications for employment measurement, and

challenges related to working students and credit access.

• Hosting the Bank’s 67th Economic Conference, “Rethinking Full Employment,” at

which participants analyzed barriers to full employment (one aspect of the Fed’s dual

mandate from Congress) and explored past and current thinking on measuring

maximum employment. The conference explored factors and policies that likely

prevent the full labor market participation of some groups.

1

• Gathering business leaders, community development practitioners, and financial

market participants for a session of the Federal Reserve System’s “FedListens”

initiative to discuss post-pandemic economic recovery.

2

• In 2023, the Boston Fed made regional economic data more accessible to public

audiences, supporting education and awareness about the region’s economy and the

Bank’s goal of fostering a more inclusive economy for all. One example is the “New

England Economic Conditions memo,” which informs monetary policymaking and

profiles payroll employment, unemployment and labor force participation, inflation,

and housing activity in the six New England states. The memo is now regularly

posted to the public website and shared proactively with subscribers on email and via

the Bank’s social media channels.

1

Including women, minorities, and formerly incarcerated populations.

2

As part of the Federal Reserve System’s Fed Listens series, the Bank held a regional

event focused on “Transitioning to the Post-pandemic Economy.” Event participants

aimed to better understand how the pandemic reshaped the New England economy and

its workforce. The discussion focused on labor market transitions, the housing market,

and state and local government fiscal health. The event attracted regional leaders from

business, nonprofits, and state and local government. Attendees gave Federal Reserve

staff, including Governor Michelle Bowman and President Susan M. Collins, insights and

first-hand accounts about the region’s post-pandemic challenges and opportunities.

2023 Annual Report to Congress

Federal Reserve Bank of Boston | bostonfed.org | Office of Minority and Women Inclusion

8

C. Community Development Activities

The city of Bath, Maine, member of the Sagadahoc team participating in the Bank’s

Working Communities Challenge.

Given its mission and mandate, the Bank works to support community economic

development, especially in places where economic outcomes have lagged. The Bank

looks to advance equitable opportunities for underserved households and communities in

New England. This work includes the following initiatives:

Supporting economic growth in smaller industrial

cities and rural communities

The Boston Fed actively engages in research, convening, and field support for about 30

of New England’s smaller cities and rural areas.

3

The focus is on supporting local efforts

to improve prospects for low-and moderate-income residents.

A key project includes the Working Places programs, externally funded competitions that

boost local collaborative leadership efforts to improve economic outcomes for lower-

income residents. In 2023, Working Places primarily focused on rural economic mobility

in Vermont and Maine, where residents from 14 communities are at work and using the

program as a catalyst. In many cases, the focus has been on growing the workforce,

including an emphasis on opportunities for youth, single mothers, and immigrant

populations. The overall goal is to build strong economies and communities in New

England’s smaller cities and rural towns.

3

In many of New England’s once-thriving smaller cities, the decline of manufacturing

significantly decreased opportunity. New England’s rural areas have also seen decline in

core industries as its workforce ages and contracts.

2023 Annual Report to Congress

Federal Reserve Bank of Boston | bostonfed.org | Office of Minority and Women Inclusion

9

Additionally, in 2022, the Bank launched an 18-month pilot program called Leaders for

Equitable Local Economies (or LELE) to encourage and equip local leaders working to

support stronger economies for smaller cities and rural areas.

4

Reducing Wealth Disparities

The Bank has long studied disparities in economic outcomes. This is motivated by our

mandate and mission to serve all members of the public, not just some. In 2015, the

Bank published an influential study of wealth disparities by race in the Boston metro area.

In 2021, in collaboration with philanthropic partners, Bank leadership decided to lead a

new and more expansive study called Mass ECHOS. The study is designed to produce

representative household wealth estimates for several demographics in Massachusetts.

The Fed also brought together a partnership of local organizations in Connecticut to

launch The Wealth Solutions Accelerator. Its goal is to provide underrepresented

residents with accessible and effective strategies to build and retain wealth.

Financial Literacy

The Bank’s internship program for high school students, “Today’s Interns, Tomorrow’s

Professionals” (or TIP), provides paid work experience, financial literacy instruction, and

opportunities to learn essential skills. In 2023, the Bank had 12 student interns working in

several departments.

Students from Boston Public Schools participate in Job Shadow Day at the Boston Fed. Bank

staff shared information with students about the role and work of the Federal Reserve.

4

LELE focused on increasing the number and effectiveness of diverse leaders in smaller

communities and helping them lead equitable economic development work.

2023 Annual Report to Congress

Federal Reserve Bank of Boston | bostonfed.org | Office of Minority and Women Inclusion

10

Additionally, several of the communities participating in Working Places incorporated

financial literacy learning in their workforce development programs. Examples include a

local career readiness program in Springfield, Massachusetts, that formed as part of the

Bank’s Working Cities Challenge. The program includes a “whole family approach” to

workforce readiness, offering services for early childhood development, and opportunities

for parents in job training, financial literacy, debt management, and professional skills.

5

Also, LELE program provided learning resources to entrepreneurs of color, including

financial literacy training.

Boston Fed President & CEO

Susan Collins participates in a

discussion with business, civic,

and community leaders associated

with Springfield WORKS, a

community initiative formed with

the Bank's Working Cities

Challenge.

5

See a description at https://www.bostonfed.org/workingplaces/news/2021/working-

cities-career-program-helps-families-escape-poverty.aspx

2023 Annual Report to Congress

Federal Reserve Bank of Boston | bostonfed.org | Office of Minority and Women Inclusion

11

Section III. The Bank’s Commitment to a Diverse and

Inclusive Workforce

At the Boston Fed, we remain dedicated to creating an inclusive environment and

providing employment and advancement opportunities equitably. We believe that

fostering an inclusive work environment is essential to achieving our mission, which

requires a wide range of perspectives and the very best of everyone. A diverse team

broadens perspectives and ultimately expands our capacity to serve the public. We find

that the Bank’s commitment to DEI benefits all aspects of our operations.

The Boston Fed hosts a reception for new employees to meet and network with

colleagues from across the organization, including senior leaders.

In 2023, the Bank made additional progress incorporating important and beneficial

aspects of diversity, equity, and inclusion into the organization’s policies and practices.

Examples include establishing DEI foundational learning as a part of talent management

and succession-planning processes. We also enhanced analytics, and the Office of

Diversity, Equity & Inclusion (ODEI) held engagement meetings in each department,

which resulted in a robust DEI action-planning process. For the first time, 100% of

departments completed DEI action plans.

A. Successes, Strategies, and Initiatives

1. Leadership

Bank leaders are dedicated to supporting, driving, and championing efforts to provide

equal access and opportunity to all employees and job candidates. This is reflected in

their roles in the following actions and initiatives:

2023 Annual Report to Congress

Federal Reserve Bank of Boston | bostonfed.org | Office of Minority and Women Inclusion

12

• Diversity at the Bank’s top governing levels: As of 2023, the Board of Directors

continued to be diverse in gender and race/ethnicity when compared with the

financial industry benchmarks (Spencer Stuart 2023 Financials Sector Study).

• The Executive Committee’s support for DEI: The Executive Committee (or EC)

serves as the DEI Executive Council. In this role, the EC provides insight and

guidance on the Bank’s overall DEI strategy, helps to identify priorities, ensures

accountability, and delivers top-down support for sustainable DEI initiatives.

• Employee Resource Group (ERG) sponsors: Bank officers act as sponsors for our

ERGs. Their responsibilities include supporting ERG strategies, attending events,

and mentoring and developing ERG chairs.

2. Strengthening the Organization and Culture

Members of the Boston Fed's Executive Committee participate in an employee town hall

event to discuss the Bank's strategic plan and priorities. Leaders encouraged each

employee to see a role in helping achieve it.

• DEI metrics report, department Engagement Meetings, and action plans: The ODEI

team worked to enhance reportable metrics by aggregating data sources into

dashboards. Throughout the year, ODEI and Human Resources met with all

department leaders and their executive committee members to discuss successes

and opportunities and create customized DEI action plans for their specific areas.

These metrics are a constructive, illuminating tool that supports shared

understanding and informed action-planning.

• “Listen, Consider, and Respond” playbook: As part of a leadership development

program known as “Thrive,” several of the Bank’s emerging leaders created a playbook

2023 Annual Report to Congress

Federal Reserve Bank of Boston | bostonfed.org | Office of Minority and Women Inclusion

13

on how to respond to input called “Listen, Consider, and Respond.” The playbook also

outlines ways to support a listening culture and has been widely adopted.

• Performance Rating Calibration across the Bank: The Bank improved performance

rating calibration across the organization in 2023, to provide a clearer and more

consistent framework for evaluating employees and mitigating the potential for bias.

Calibrated performance ratings are crucial for consistency and fairness in evaluating

employees, aligning performance standards with organizational objectives, and

promoting transparency. The goal is to improve objectivity in employee performance

assessment and minimize rater-bias. Training on performance rating definitions and

calibration helped cement the Bank’s commitment to equity in the performance-rating

process. More than 650 Bank leaders and employees took part in performance

management sessions aimed at ensuring consistent performance ratings and

feedback processes and practices Bank-wide.

• Talent Engagement Conversations: This is a process encouraged across the Bank in

which managers engage in periodic conversations with team members to create a

foundation for effective collaboration. It also aligns individual goals with the Bank’s

objectives, builds trust, and ensures that employees feel supported and empowered.

These structured dialogues help managers demonstrate that employees are valued

and heard.

3. Expanded Employee Resource Networks for Greater

Inclusion and Engagement

Boston Fed President & CEO Susan Collins is joined by leaders of the Bank's employee

resource and affinity groups.

The Boston Fed has a strong history of employee resource group programs and

membership. In 2023, the Bank had eight employee resource groups (or ERGs) and

2023 Annual Report to Congress

Federal Reserve Bank of Boston | bostonfed.org | Office of Minority and Women Inclusion

14

three affinity groups (or AGs). The members of AGs share a professional focus or

common interest, fostering inclusivity and cultivating meaningful connections among

employees. The ERNs and the ODEI co-hosted a variety of learning and cultural events

throughout the year.

Additionally, an inaugural ERG/AG

DIWG (Diversity and Inclusion Working

Group) leadership awards ceremony

was held in January 2023 to increase

employee interest in and commitment

to ERG, AG, and DIWG goals. An ERG

Leaders Training Summit was also

held in June.

An Employee Resource Network

membership subscription tool was

created to assess Bank membership in

the groups. The data it collected

indicated 20% of the Bank population

had joined an ERG or AG as of the end of 2023. These metrics will help measure

progress in ERN employee engagement.

In 2023, three new groups were added to the Bank’s ERG/AG lineup:

• Building Tomorrow: An environmentally focused employee engagement AG created

to empower building occupants to collectively act on sustainability initiatives.

• Ability Beyond the Label (ABLE): An ERG in which employees can share and learn

about the experiences of those with disabilities, as well as discuss accessibility needs

and innovations.

• First District Parents Group: An ERG that recognizes the unique challenges of being

a working parent and offers a supportive environment and opportunities to exchange

helpful tactics.

Furthermore, the Bank seeks to instill a strong sense of community engagement by

encouraging employees to participate in volunteer initiatives. This aligns with the Bank’s

values and cultivates a collaborative and socially responsible environment. Staff

members collectively reported 479 hours in volunteer work in 2023.

Boston Fed staffers attend the ERG/AG/DIWG

leadership awards ceremony.

2023 Annual Report to Congress

Federal Reserve Bank of Boston | bostonfed.org | Office of Minority and Women Inclusion

15

4. Recruited a Diverse Workforce

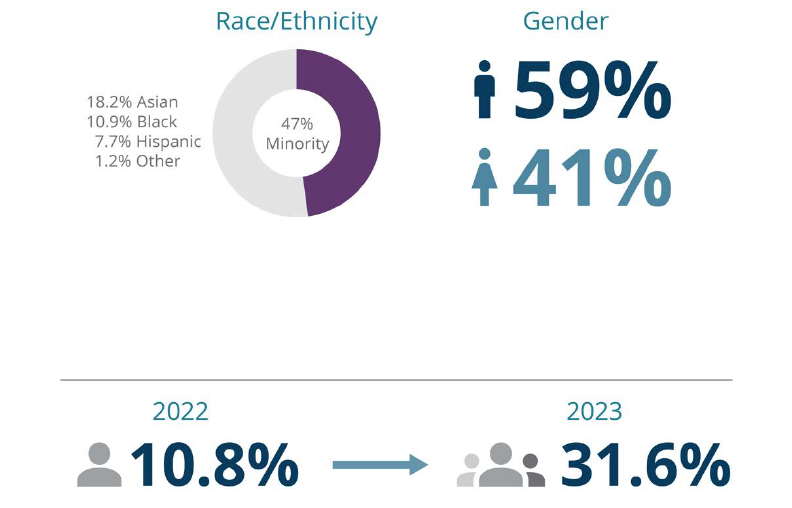

In 2023, the Bank recruited 137 new employees. Among the new hires, 41% were

women and 47% were minorities. This achievement reflects a purposeful commitment to

expanding awareness of openings. The Bank was strategically focused on recruiting new

talent with diverse perspectives and varied experiences. The Boston Fed has hired

candidates from a wide range of industries, including financial services, biotech/pharma,

information technology, and consulting.

Additionally, the Bank recruited 38 college and graduate school interns and saw a

substantial increase in minority, especially Black, representation in 2023.

Black Intern Demographics

Outreach to candidates primarily involved job boards, employment branding sites,

diversity networks, university postings, social media networks, and expanded solicitation

of employee referrals. Successful candidates came most frequently from the Federal

Reserve System internal career site (21%), employee referrals (20%), and the Federal

Reserve Bank of Boston website (19%).

Many of the outreach, selection, and engagement strategies concentrate on expanding

the applicant pool, in part through increased awareness of openings generated by a

variety of outreach and engagement initiatives. They also focus on increasing awareness

of the Boston Fed with local higher education institutions and external organizations

through job fairs and in employment advertising. This included sharing articles, regular

job postings, inviting partners to the Bank, advertising, and social media posts.

Prospective employees were also reached through state and local employment networks,

minority job-placement organizations, and local colleges.

2023 Annual Report to Congress

Federal Reserve Bank of Boston | bostonfed.org | Office of Minority and Women Inclusion

16

The Bank also partnered with organizations dedicated to providing information about

employment opportunities in a range of communities. These organizations include the following:

• MassHire, a statewide employment network, which was utilized specifically to recruit

for Cash Services operations.

• Pipeline with Purpose, which reaches into local community colleges and high schools.

• The United Negro College Fund’s Lighted Pathways program, which places students

from historically Black colleges and universities in internships with employers in the

Boston area.

• iRelaunch STEM Workforce Council. This affiliation resulted in two hires.

• Massachusetts Chamber of Commerce LGBTQ+, El Mundo Boston, and the Urban

League of Eastern Massachusetts

• Recruit Military, which allows the Bank to post vacancies on its job board.

• Curry College, Bentley University, Westfield State University, Massachusetts

Maritime Academy, and UMass Boston

• The Diverse Talent Connections networking event, during which the Bank welcomed

professionals and students from the Greater Boston area to learn about its key

functions, culture, and employment opportunities.

5. Utilized College and Graduate School Internships

The Bank is committed to investing in entry-level talent. This allows the organization to

guide and develop future leaders from within, which fosters engagement and commitment.

The Bank supports college and graduate students by offering internship opportunities.

The interns receive essential job experience, and they, in turn, provide the Bank with a

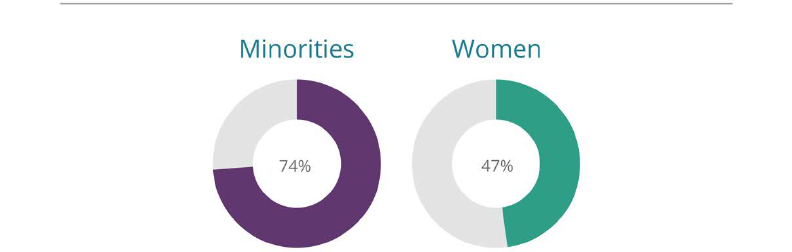

known pool of potential candidates for full-time positions. Of the Bank’s 38 paid interns,

47% were female, compared to 42% in 2022. Minorities represented 74% of interns in

2023, compared to 43% in 2022. It is especially notable that the percentage of Black

interns substantially increased, from 11% to 32%. Between 2021 and 2023, the Bank’s

total intern population was 99 students. During this period, six former interns returned to

the Bank as full-time employees.

Intern Demographics

2023 Annual Report to Congress

Federal Reserve Bank of Boston | bostonfed.org | Office of Minority and Women Inclusion

17

For additional details, see the table on intern demographics in the section below.

6. Focused on Development, Learning, and Retention,

With Opportunities for All

The Boston Fed recognizes the critical importance of nurturing talent, promoting growth,

and ensuring equal opportunities for employees. Development and retention efforts play

a pivotal role in achieving an inclusive environment. And we work to ensure equal access

to development opportunities that support career progression for all employees. Tactics

include mentorship, leadership development, and establishing pathways that facilitate

career advancement.

At the Bank, we continue to work to ensure opportunities for personal and professional

development are open to all. This has led to a welcome increase in minority

representation in our learning and development programs, which supports our goal to

build a diverse pipeline across our workforce and our leadership levels. In 2023, the Bank

offered numerous learning and development programs. These programs helped

employees accelerate growth through the development of skills, knowledge, and

leadership insights. Female and minority participation was 61% and 44%, respectively. In

total, 145 Bank employees participated in these programs. Minority representation has

increased significantly in recent years, rising from 19% in 2018 to 42% in 2023.

Audit staffers participate in engaging group training exercises.

2023 Annual Report to Congress

Federal Reserve Bank of Boston | bostonfed.org | Office of Minority and Women Inclusion

18

Examples of these programs follow:

Bank and Federal Reserve System programs

• Mentoring Circles Program: This program is an important driver of inclusion and career

development at the Bank. It is continually enhanced based on participant feedback and

the Bank’s desire to provide an ever more inclusive experience, while meeting the

career development needs of mentees. The mentoring program has proven an

effective springboard to other career development opportunities, including the Bank’s

leadership programs. Out of 50 participants, 62% were females and 42% minority.

• Essential Skills for Supervisors/Managers: The program provides participants with

the knowledge and tools to help develop their teams, maximize employee

performance, and foster a positive work environment. Out of the 33 participants, 36%

were female and 48% minority.

Boston Fed employees participate in a training session.

• Thrive: The program is designed to develop leadership capabilities and expose

participants to the challenges and realities of leading in the Federal Reserve System.

Out of the 11 participants, 82% were female and 36% minority.

• Executive Presence Coaching: This program enables participants to lead teams and

organizations effectively by enhancing their presence, communication skills, and

overall leadership perception, which improves their ability to influence and lead. Out

of the nine participants, 56% were female and 33% minority.

• Trailblazers: The program, offered to officer-level staff, is designed to develop the

leadership skills Bank officers need to lead within their function. Out of the five

participants, 80% were female and 0% minority.

2023 Annual Report to Congress

Federal Reserve Bank of Boston | bostonfed.org | Office of Minority and Women Inclusion

19

• Reach Program: The program emphasizes solving business problems and exploring

new career possibilities. It encourages innovative approaches, and it increases

collaboration by requiring participants to reach outside their comfort zones and use

their talents to develop professional capabilities. Out of the two participants, 50%

were female and 50% minority.

External Programs that Bank staff attended

• Babson Women’s Leadership Program: The program is designed to empower women

to become more impactful and effective leaders. It prepares participants to

understand and use culture, structure, and processes to enhance their leadership

journey. Out of the 13 female participants, 54% were minority.

• Bentley University Mini MBA: The program is designed to provide a strong foundation

in key business disciplines, effective leadership styles, organizational behavior,

business ethics, and financial fundamentals. Out of the seven participants, 43% were

female and 57% minority.

• Greater Boston Chamber of Commerce Women’s Leadership Program: This program

focuses on networking, skills building, negotiation, and personal leadership

development. Out of the five female participants, 40% were minorities.

• The Partnership (three programs): The Partnership offers three leadership

development programs for professionals of color: Associates, Fellowships, and Next

Generation Executives. They are designed to help participants build the skills and

knowledge needed to excel and advance to the next level. Out of five participants,

20% were female and 80% minority.

• UMass Boston Emerging Leaders Program: This program aims to provide a

transformational leadership development experience built on teamwork, trust, and

respect for diversity of thought. Out of two participants, 100% were female and 50%

minority.

• Greater Boston Chamber Future Leaders: The program provides emerging leaders

with the tools to become civically engaged, and it offers the opportunity to apply the

knowledge gained to experiential assignments. Of the two participants, one was

female, and none were minority.

• Conexiòn programs: These programs are for Hispanic-Latinae professionals in the

early or mid-stages of their careers. The curriculum builds competence in three key

leadership areas: self-leadership, relationship skills, and organizational skills. One

Hispanic female participated in the program.

DEI Training and Other Programs

• Diversity Equity and Inclusion Ted Talk Pilot: ODEI offered access to 20 TEDx talks

on a wide variety of diversity, equity, and inclusion topics. People leaders can use the

talks during trainings and department meetings.

2023 Annual Report to Congress

Federal Reserve Bank of Boston | bostonfed.org | Office of Minority and Women Inclusion

20

• Mitigating Bias in the Hiring Process: This program uses LinkedIn Learning modules

on best practices on recruiting, interviewing, and hiring processes. The training was

developed for individuals involved in hiring practices. It raises awareness on potential

biases that may arise during the hiring process.

• Learning to Go Hybrid: This Bank-wide series was completed to support employees

working a hybrid schedule. The series covered the many dimensions and norms of

the hybrid work culture. It consisted of four sessions and reached more than 600

employees, about half of the Bank’s employee population.

B. Ongoing Challenges and Next Steps

• The Bank continues to hire strong, capable talent, and we work to build diverse

candidate pools. However, attracting female candidates continued to be a challenge

in the Bank’s employee recruitment efforts in 2023. The Bank continued efforts to

identify female candidates, particularly in technical roles, by taking advantage of the

relationships we have with universities, agencies, and the organizations we recruit

from when sourcing many of our diversity candidates.

• The Bank’s ERNs are growing and membership is increasing. There is a need for

additional guidance and connectivity to leadership, including chairs and executive

sponsors. Since ERNs serve as places of employee development, we continue to

need to create space for employee participation.

• A number of impactful programs have been implemented by the ODEI. Further

incorporation of these programs into the Bank’s culture will be beneficial.

• The Bank will continue to engage partners that focus on ways to draw female job

seekers, including job boards, minority development organizations, and professional

associations.

• The organization will also improve the focus on entry-level hiring by increasing

dialogue with new sources of entry-level candidates, including higher education

institutions and skill-based development programs throughout the First District.

• Integration of DEI Experiential Learning: ODEI will continue to work closely with

Human Resources to implement trainings that highlight and address biases and their

impact on the decision-making process in hiring, performance evaluation, and

identifying high-potential job candidates.

• Recruiting ERG/AG sponsors and chairs: ERGs and AGs require significant time and

energy from volunteers, and it can be difficult to find new sponsors and chairs or

create strong leadership pipelines for each group. It will be important to redouble

recruiting efforts.

2023 Annual Report to Congress

Federal Reserve Bank of Boston | bostonfed.org | Office of Minority and Women Inclusion

21

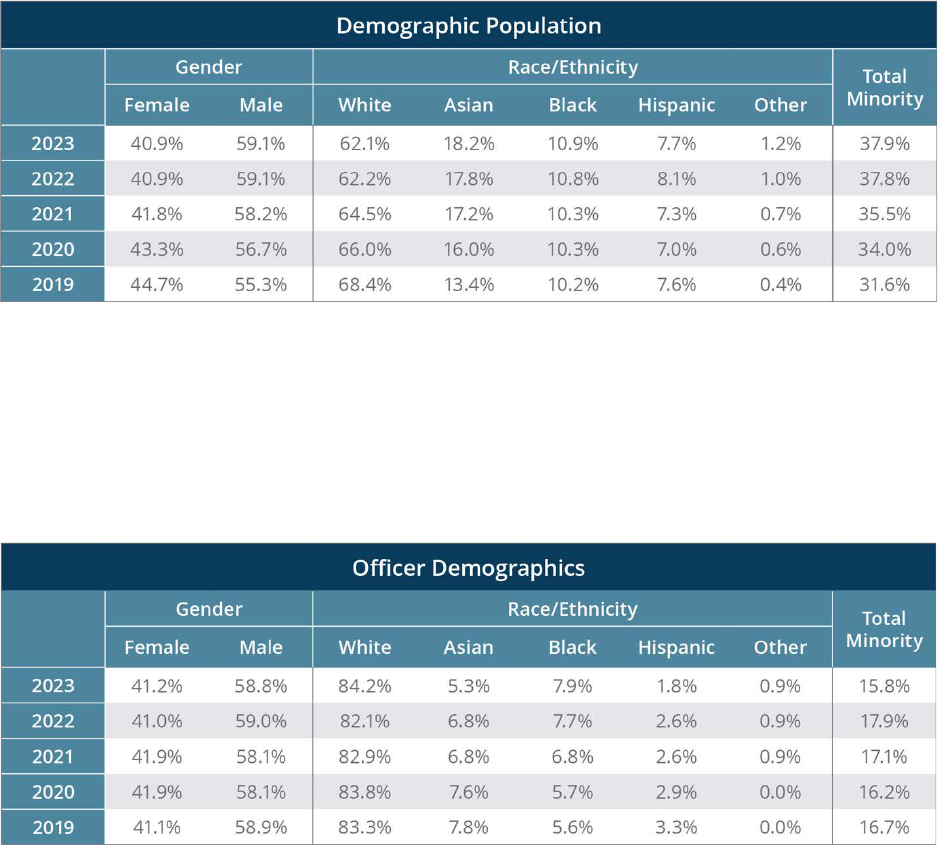

C. Workforce: Demographic Composition Results

The tables below provide additional detail on the Bank’s workforce composition, as

required in Equal Employment Opportunity reports.

1. All Employees

The Bank’s workforce increased by 1%, from 1,263 in 2022 to 1,280 in 2023. Female and

minority representation has remained consistent, with female representation at 41% and

minority representation at 38% both years.

The Other category includes two or more races, Native Americans or Alaska Native, or Hawaiian

Native or Other Pacific Islanders.

2. Leadership

Officer positions decreased from 117 in 2022 to 114 in 2023. Female officer

representation remained unchanged at 41%. Minority officer representation slightly

decreased, from 18% in 2022 to 16% in 2023.

Officers include assistant vice president, vice president, senior vice president, executive vice

president, first vice president and chief operating officer, and president and chief executive officer.

The Other category includes two or more races, Native Americans or Alaska Native, or Hawaiian

Native or Other Pacific Islanders.

2023 Annual Report to Congress

Federal Reserve Bank of Boston | bostonfed.org | Office of Minority and Women Inclusion

22

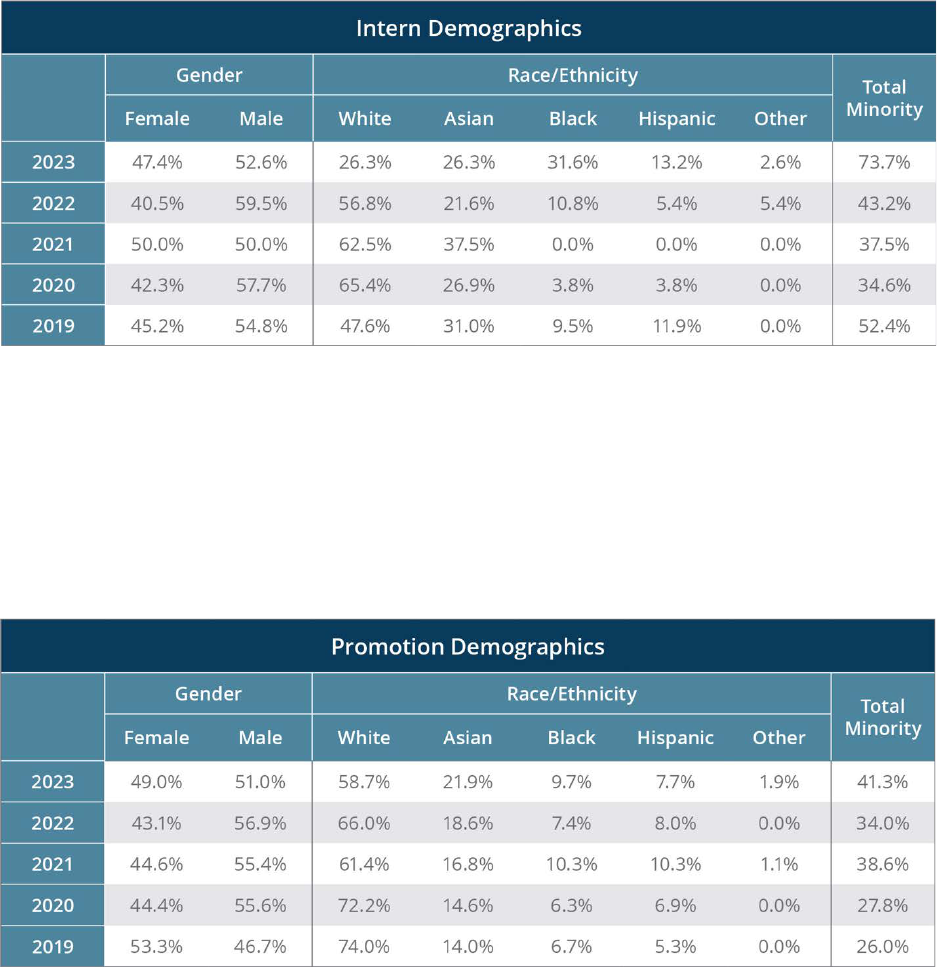

3. Interns

The Bank is committed to investing in entry-level talent. This allows the organization to

guide and develop future leaders from within, which fosters engagement and commitment.

The Other category includes two or more races, Native Americans or Alaska Native, or Hawaiian

Native or Other Pacific Islanders.

4. Promotion Results

The Bank promoted 155 employees in 2023. Females made up 49% of those promoted,

up from 43% in 2022 and above their overall representation in the Bank population

(40%). Minorities represented 41% of those promoted, up from 34% in 2022 and above

their overall representation in the Bank population (38%).

The Other category includes two or more races, Native Americans or Alaska Native, or Hawaiian

Native or Other Pacific Islanders.

2023 Annual Report to Congress

Federal Reserve Bank of Boston | bostonfed.org | Office of Minority and Women Inclusion

23

Section IV. The Bank’s Inclusion of Minority-

and Women-Owned Vendor Businesses:

Supplier Diversity Program

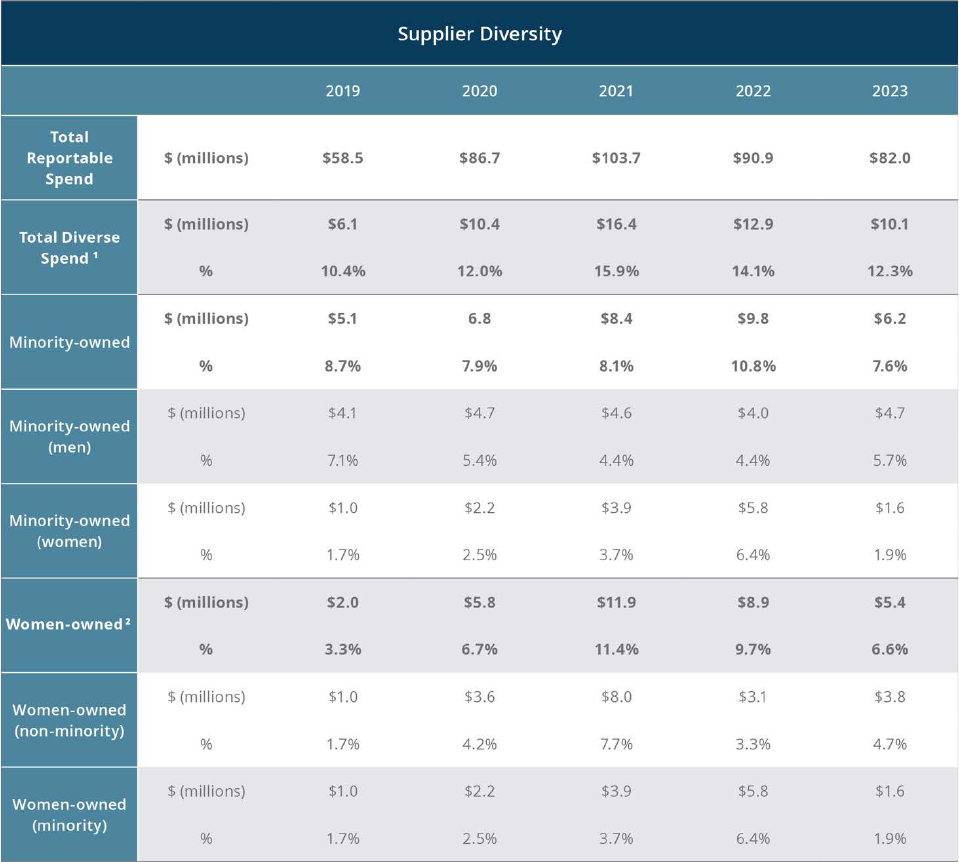

The supplier diversity program at the Bank, led by ODEI, is part of a business strategy

that aims to provide suppliers from a wide range of backgrounds equal access to the

Bank’s sourcing and purchasing

opportunities. Suppliers include

minority- and women-owned

businesses.

Reportable diverse spend was $10.1

million in 2023, or 12% of overall

spend. This was a decrease of $2.8

million, or 2% from the prior year, as

the Bank’s overall spend declined by

10%, to $82.0 million in 2023 from

$90.9 million in 2022. Despite the

decline in diverse spend, partnerships

between ODEI and various Bank

departments have resulted in several

successes. Collaboration with the Real Estate Services Group (or RESG), which focuses

mainly on large building contracts, significantly contributed to diversity spend. The

following steps have been taken to advance supplier diversity.

A. Successes

• Partnerships with departments: The supplier diversity program has developed close

partnerships with key departments, including RESG, to focus on bidding for large

building contracts. While minority- and women-owned businesses have not won the

larger contracts, they have been given increased opportunities to participate. In a few

cases, such businesses represented one of two finalists considered.

• Contract review and segmentation to create more opportunities: ODEI worked closely

with RESG to break down a large cleaning contract into multiple smaller contracts that

provided more opportunities for minority- and women-owned businesses. To date,

ODEI has provided RESG with 11 diverse suppliers to consider over seven contracts.

Of the five that have been awarded, one went to a women-owned business.

• Increased networking with new suppliers: The supplier diversity manager continues

to build a comprehensive list of vetted diverse suppliers that departments can consult

when they have procurement needs. In 2023, the supplier diversity manager

engaged 91 diverse suppliers via direct outreach.

An audience member asks a question during the

“Opportunities and Barriers in Procurement” session of

the Boston Fed’s first annual Financial Summit.

2023 Annual Report to Congress

Federal Reserve Bank of Boston | bostonfed.org | Office of Minority and Women Inclusion

24

An audience member asks a question during the "Economic Outlook" session of the

Boston Fed's first annual Financial Summit. May 18, 2023.

• Hosted the Bank’s first financial summit: The Bank partnered with the Greater New

England Minority Supplier Diversity Council to host a 2023 financial summit that

provided essential economic and financial information to diverse businesses. The

topics included the current and future state of the economy, debt acquisition,

establishing businesses, and the wealth gap.

• Increased partnership with Procurement: ODEI and Procurement continue to

collaborate and review the Bank’s procurement process from a DEI standpoint.

B. Challenges and Next Steps

The following issues are challenges ODEI faces as it continues to focus on increasing

involvement with diverse suppliers:

• Identifying diverse suppliers to participate in and be selected for competitive bids: A

diverse supplier’s “capacity” often does not speak to the quality of the work/goods

provided. The supplier diversity manager aims to provide individual departments with

diverse suppliers who have strong reputations and can satisfy their request for

proposal/request for quote (RFP/RFQ) specifications. However, the Bank has some

needs for which a diverse supplier cannot be sourced.

• Maintaining a current list of diverse suppliers who are either already certified or in the

final stages of obtaining certification: An initial listing of suppliers has been

established, but the goal is to make it a living document with suppliers who have

been vetted and can be included in future RFQs.

• Exploring why diverse suppliers do not respond to request for proposal invitations,

determining if barriers exist, and working to mitigate those barriers.

2023 Annual Report to Congress

Federal Reserve Bank of Boston | bostonfed.org | Office of Minority and Women Inclusion

25

• Ensuring timely discussions between the supplier diversity manager and departments,

to make it easier to research and acquire new vendors when they are needed.

Section V. Concluding Observations

This report has detailed the many ways that the Federal Reserve Bank of Boston sees

diversity, equity, and inclusion as essential to our mandate and mission to serve the

public by promoting a vibrant economy. We look forward to continuing to serve all

members of the public.

The Federal Reserve Bank of Boston, located in the heart of downtown Boston.

The

Boston Fed serves the New England region - Connecticut (except Fairfield County),

Maine, Massachusetts, New Hampshire, Rhode Island, and Vermont.

Appendix

2023 Annual Report to Congress

Federal Reserve Bank of Boston | bostonfed.org | Office of Minority and Women Inclusion

27

Appendix A: EEO1 Report

The information in these tables reflects the 1st District's staff representation by EEO-1 job category.

The vertical “Total” column represents total staff for the job category across all races and gender, the horizontal “Total” row represents total staff

for the race-gender combination across all categories.

2023 Annual Report to Congress

Federal Reserve Bank of Boston | bostonfed.org | Office of Minority and Women Inclusion

28

Each cell represents the race-gender’s share of the relevant job category (row). The vertical “total” column must always equal 100%. The

horizontal “Total” need not equal 100% because it represents the race-gender’s share of the entire bank across all job categories.

2023 Annual Report to Congress

Federal Reserve Bank of Boston | bostonfed.org | Office of Minority and Women Inclusion

29

Appendix B: OMWI Standard Metrics Report

2023 Annual Report to Congress

Federal Reserve Bank of Boston | bostonfed.org | Office of Minority and Women Inclusion

30

30

1

Total Diverse Spend = Minority-owned (men) + Minority-owned (women) + Women-owned

(non-minority).

2

Women-minority numbers are included in both Minority-owned and Women-owned Totals.

2023 Annual Report to Congress

Federal Reserve Bank of Boston | bostonfed.org | Office of Minority and Women Inclusion

31

31

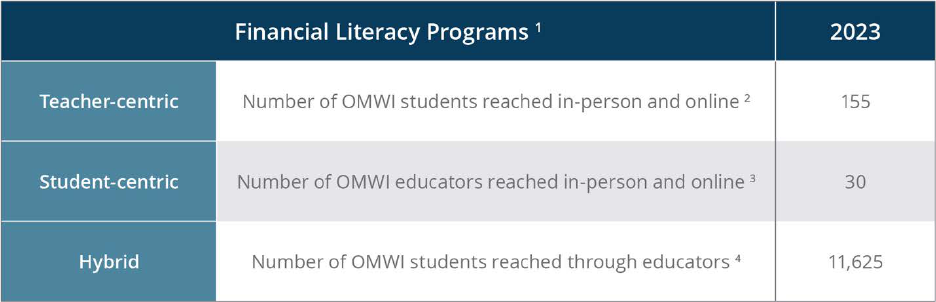

1

Measures report only those OMWI students and teachers who participate in or are reached

through programs that have a financial literacy focus.

2

Students who attended in-person programs and enrolled in online programs.

3

Educators who attended in-person programs and enrolled in online professional

development programs.

4

Students reached through educators using a common multiplier of 75.

2023 Annual Report to Congress

Federal Reserve Bank of Boston | bostonfed.org | Office of Minority and Women Inclusion

32

32

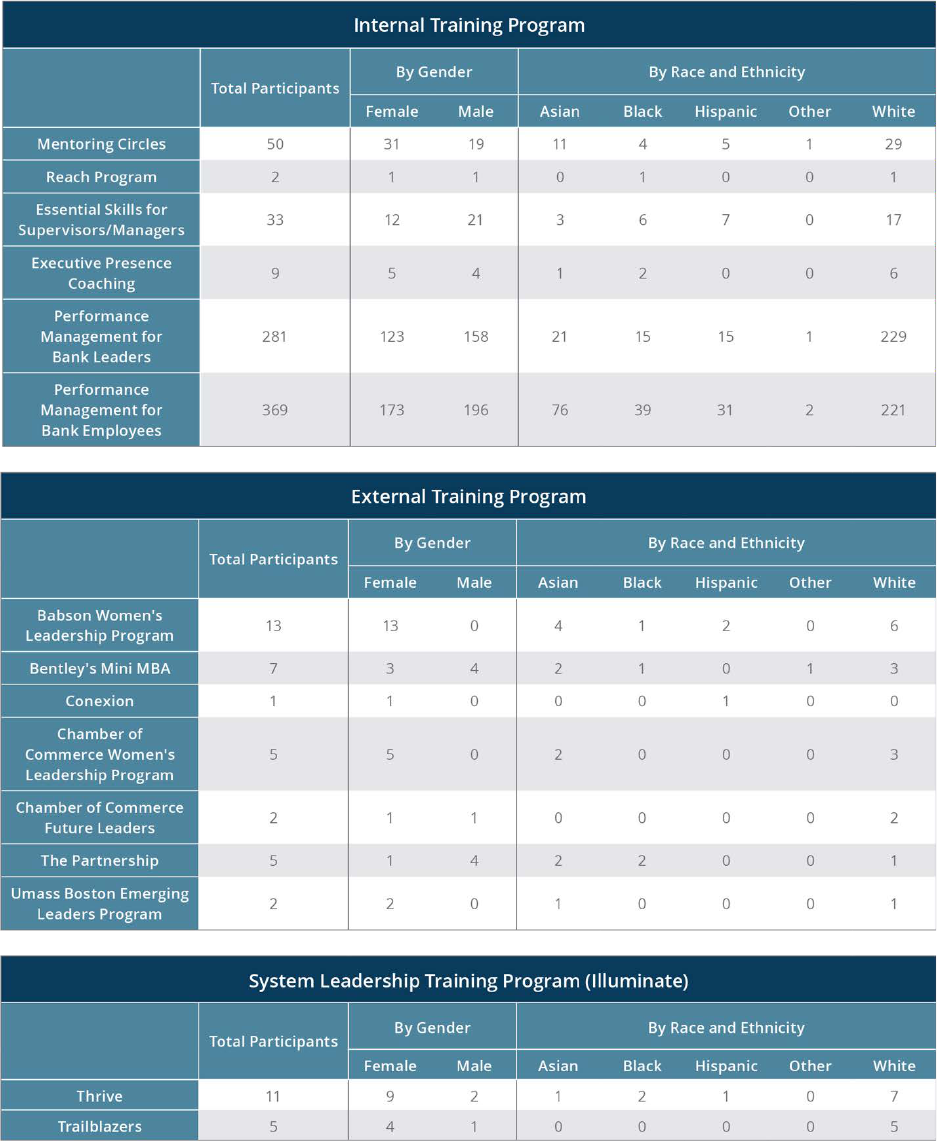

Appendix C: 2023 Learning and

Development Training Programs

2023 Annual Report to Congress

Federal Reserve Bank of Boston | bostonfed.org | Office of Minority and Women Inclusion

33

33

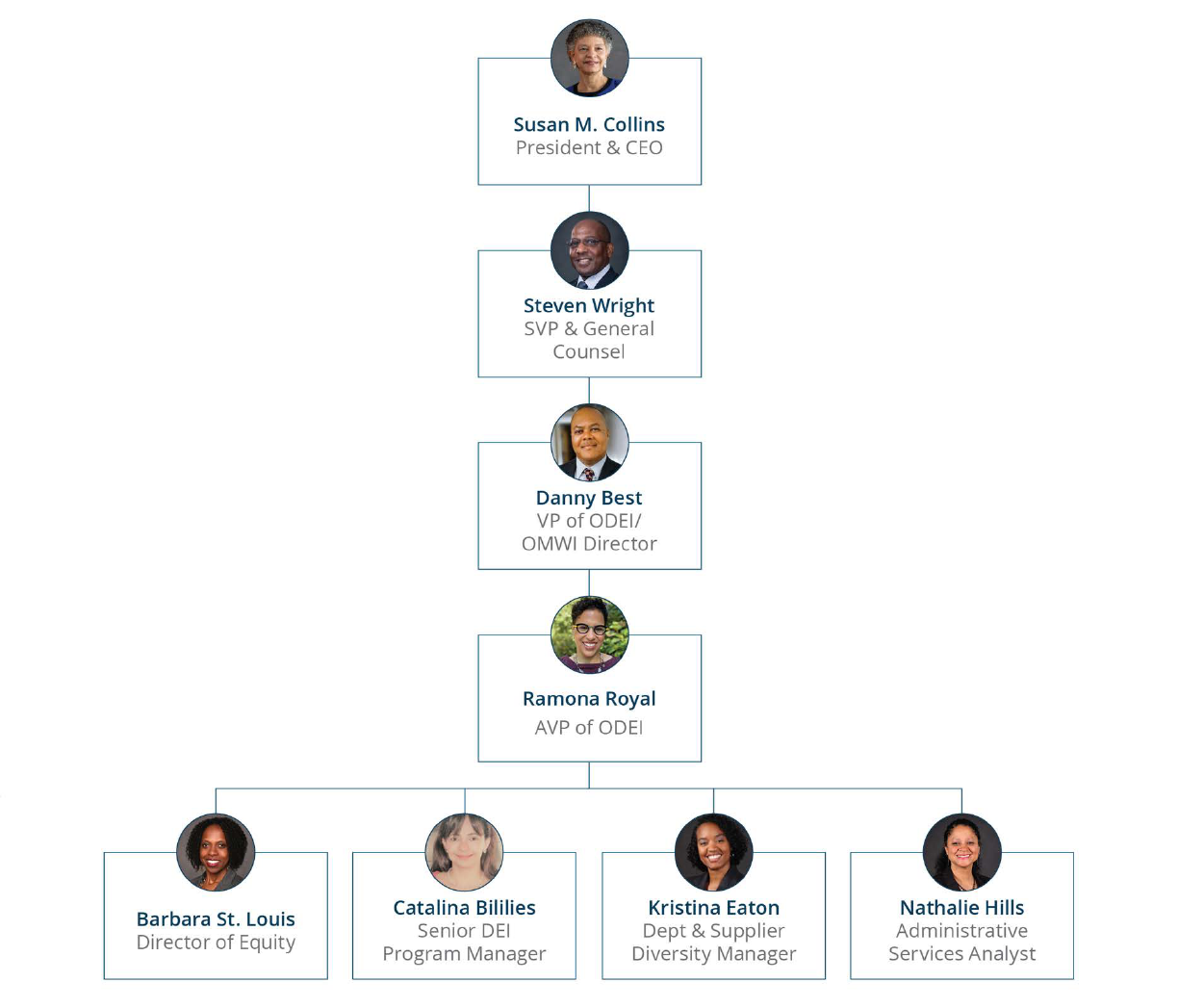

Appendix D: Organization Chart

2023 Annual Report to Congress

Federal Reserve Bank of Boston | bostonfed.org | Office of Minority and Women Inclusion

34

34