1

BOSTON PIZZA

BOSTON PIZZA

ROYALTIES INCOME FUND

ANNUAL REPORT 2022

PROFILE

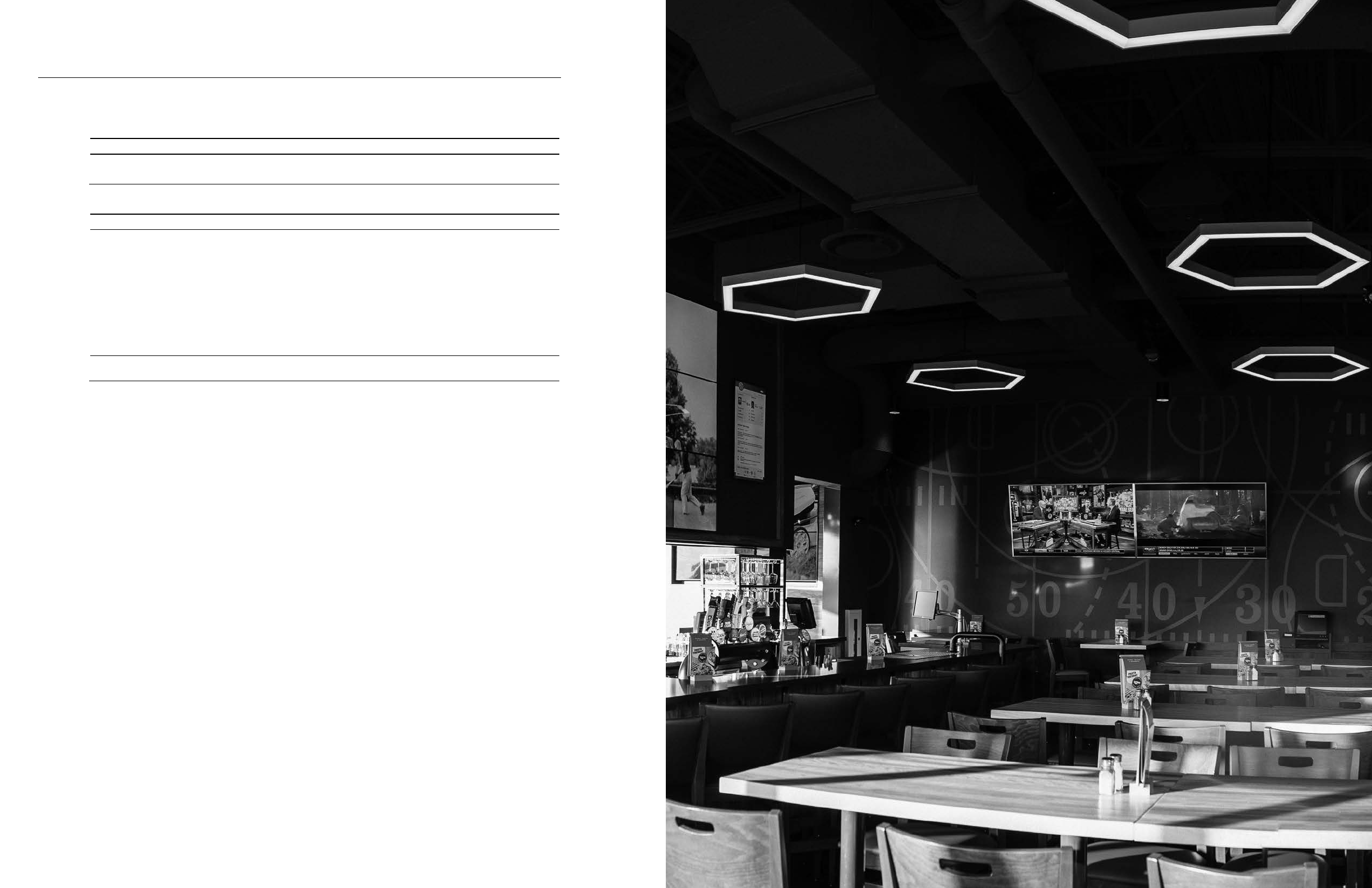

Founded in Alberta in 1964, Boston Pizza has grown to become

Canada’s #1 casual dining brand by continually improving

its menu offerings, guest experience and restaurant design.

Boston Pizza’s success has allowed the concept to grow and

prosper in new markets across Canada and served more than

50 million guests annually prior to COVID-19.

As at January 1, 2023 there were 377 Boston Pizza locations

in Canada, stretching from Victoria to St. John’s, with all but

three of the restaurants owned and operated by independent

franchisees.

In every Boston Pizza location, guests enjoy a comfortable

atmosphere, professional service and an appealing and diverse

menu. Whether it’s a business lunch, family dinner or watching

the game with friends, Boston Pizza provides its guests the

opportunity to enjoy great food in a relaxed and inviting setting.

It is this combination of key ingredients that has enabled Boston

Pizza to serve more guests in more locations than any other full-

service restaurant brand in Canada.

BOSTON PIZZA

BOSTON PIZZA

ROYALTIES INCOME FUND

ANNUAL REPORT 2022

TABLE OF CONTENTS

2022 HIGHLIGHTS 1

Message from the Chairman of Boston Pizza

Royalties Income Fund 3

Message from the President of Boston Pizza International Inc. 4

BOSTON PIZZA ROYALTIES INCOME FUND 7

Management’s Discussion & Analysis 8

Consolidated Financial Statements 51

BOSTON PIZZA INTERNATIONAL INC. 79

Management’s Discussion & Analysis 80

Consolidated Financial Statements 113

1

2022 HIGHLIGHTS

• COVID-19 continued to impact the business of Boston Pizza International Inc. (“BPI”). However on an annual basis, 2022 total Franchise

Sales* (see page 13) returned to pre-pandemic levels despite the challenges faced in the first half of the Year.

• System-Wide Gross Sales* (see page 80) of $1.1 billion, representing an increase of 32.3% compared to one year ago.

• Franchise Sales of $855.0 million for the Year representing an increase of 29.5% versus the same period one year ago.

• Same Restaurant Sales* (see page 10) of 30.4% for the Year. As COVID-19 began to adversely affect sales in Boston Pizza restaurants in

March of 2020, the Fund believes that it is also useful to calculate and report SRS comparing 2022 Franchise Sales to 2019 Franchise Sales.

If SRS were calculated comparing Franchise Sales in the Year to Franchise Sales in the same period in 2019, SRS would be 3.2%.

• Cash flows generated from operating activities of $34.4 million for the Year representing an increase of 12.7% versus the same period one

year ago.

• Distributable Cash* (see page 9) increased 25.2% for the Year, and Distributable Cash per Unit* (see page 9) increased 25.2% for the Year.

• Payout Ratio* (see page 9) of 99.4% for the Year. Cash balance at the end of the Year was $5.2 million.

• The Fund increased its monthly distribution rate twice during the Year, first with the July 2022 distribution rate from $0.085 to $0.100

per unit of the Fund (“Unit”), and then with the November 2022 distribution rate from $0.100 to $0.102 per Unit.

• The Fund declared and paid a special cash distribution to unitholders of the Fund (“Unitholders”) of $0.085 per Unit in December 2022.

* Non-GAAP Financial Measure, Non-GAAP Ratio or Supplementary Financial Measure under National Instrument 52-112. See page reference for details.

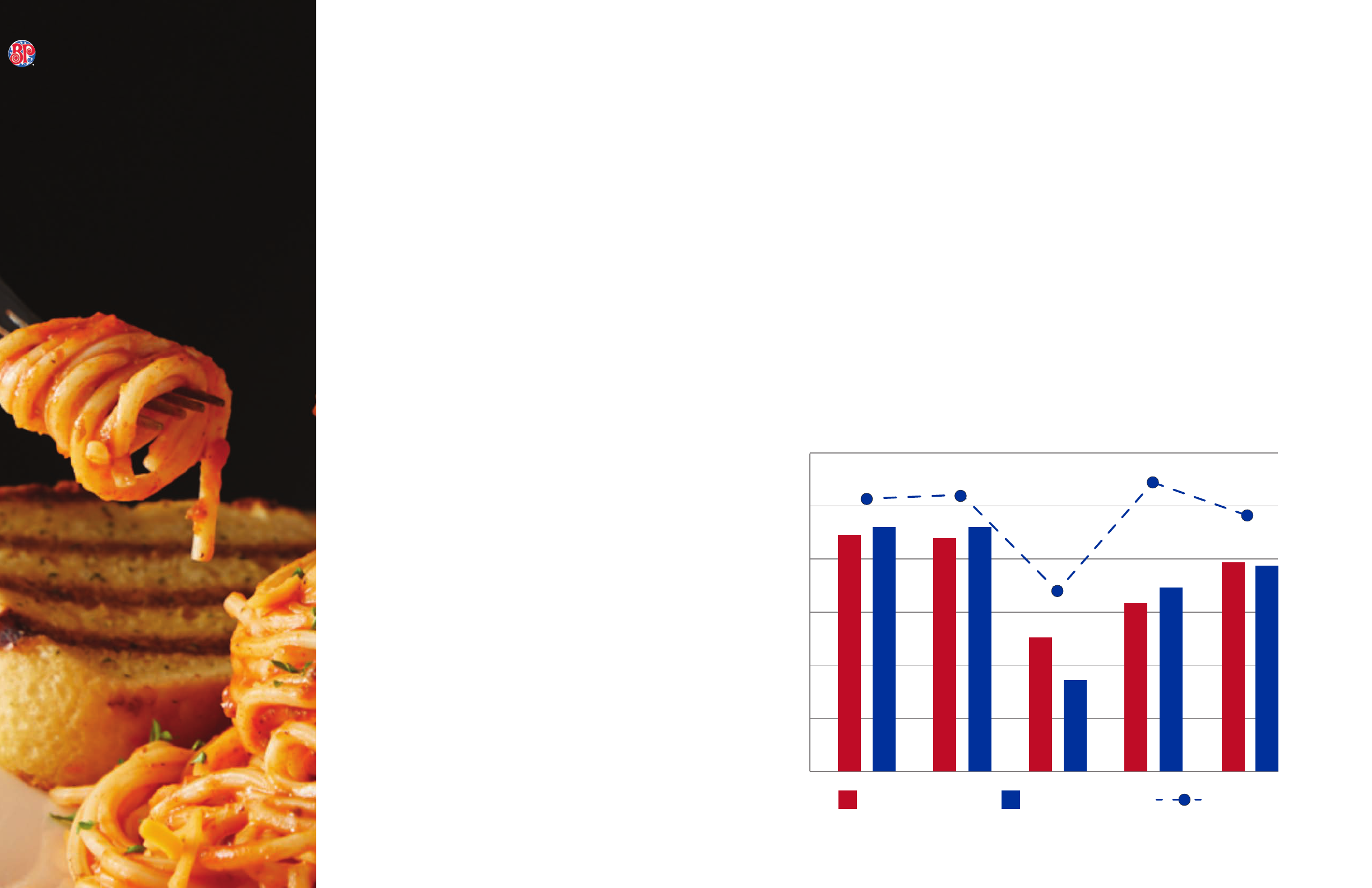

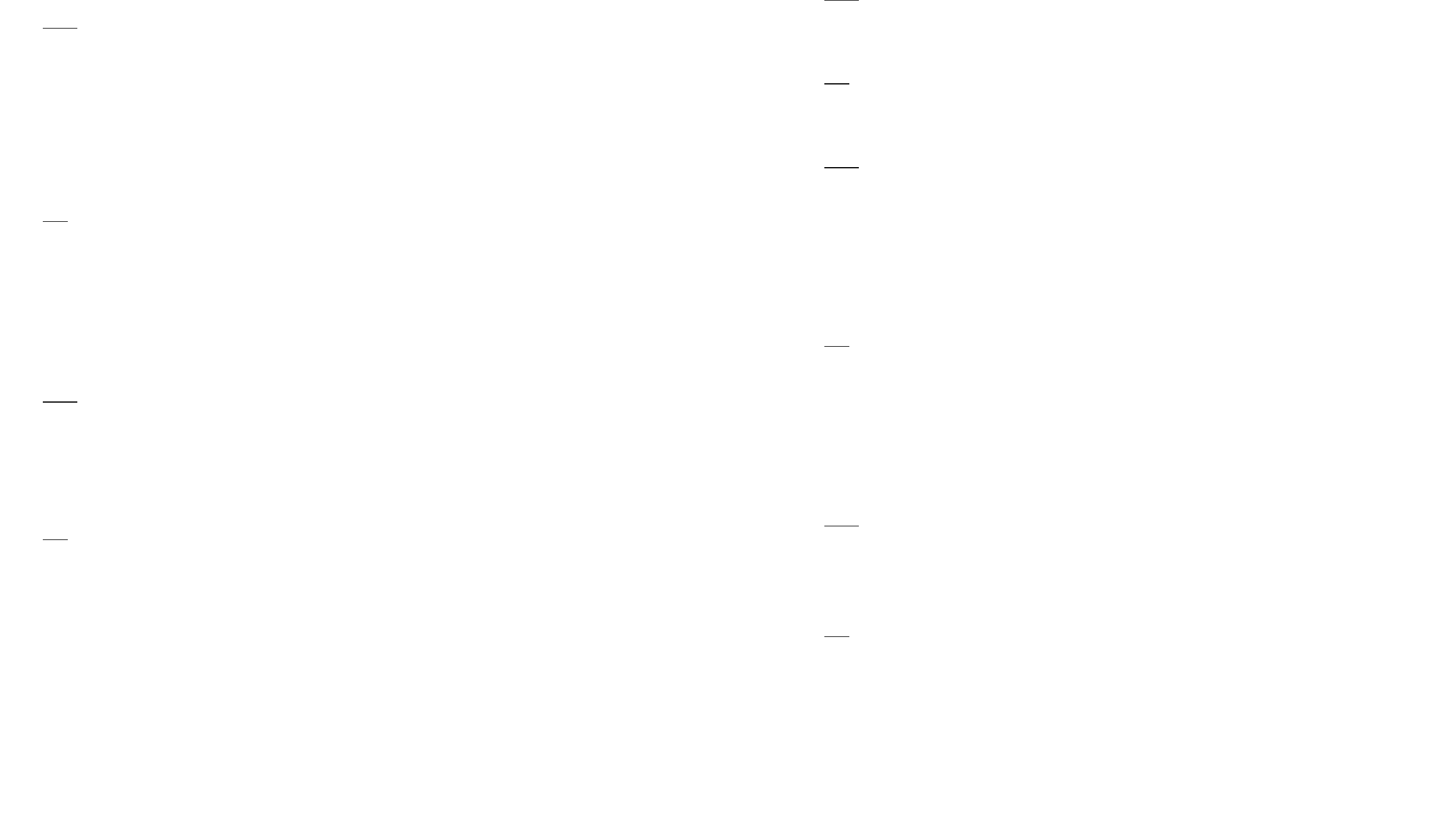

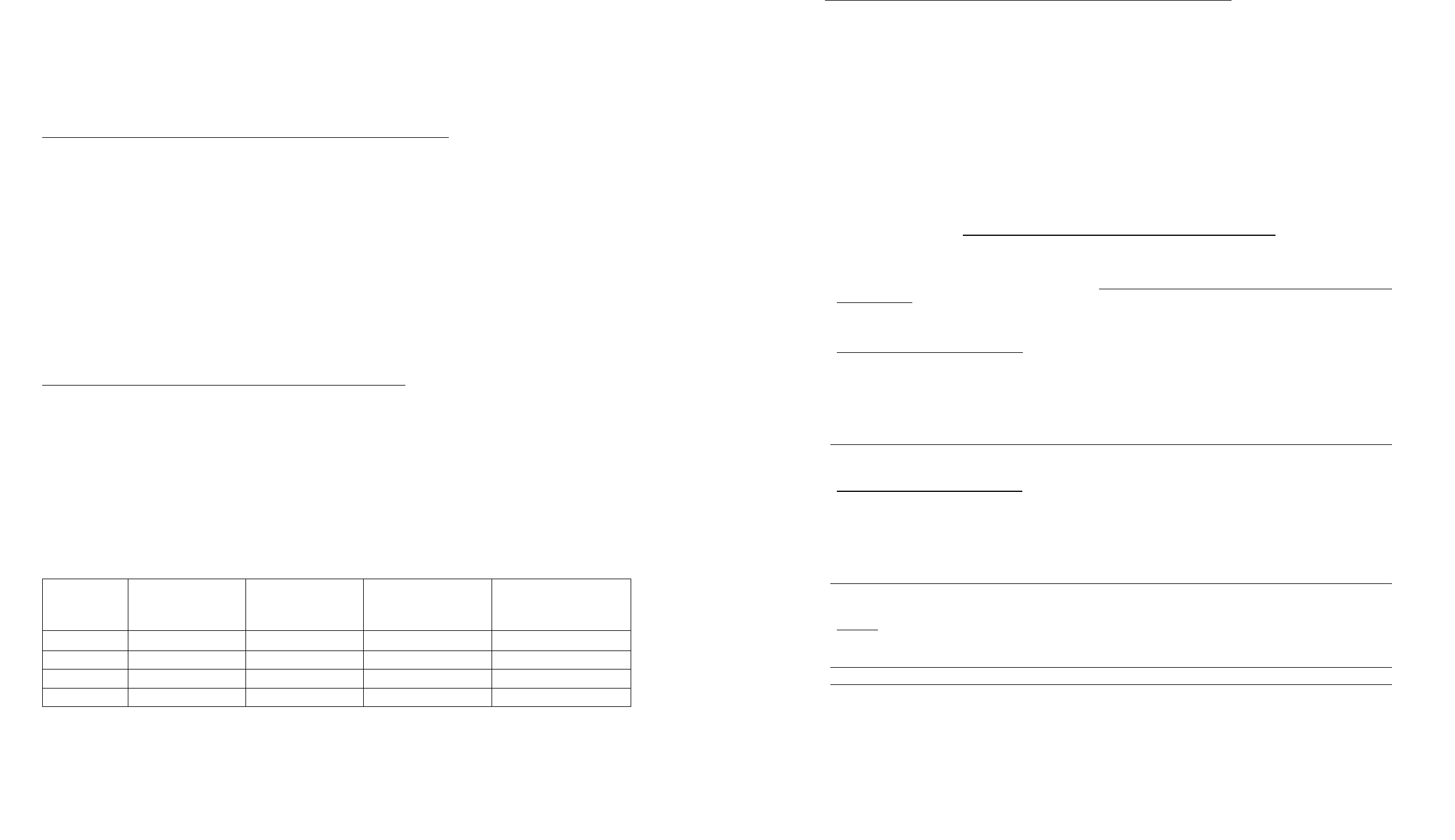

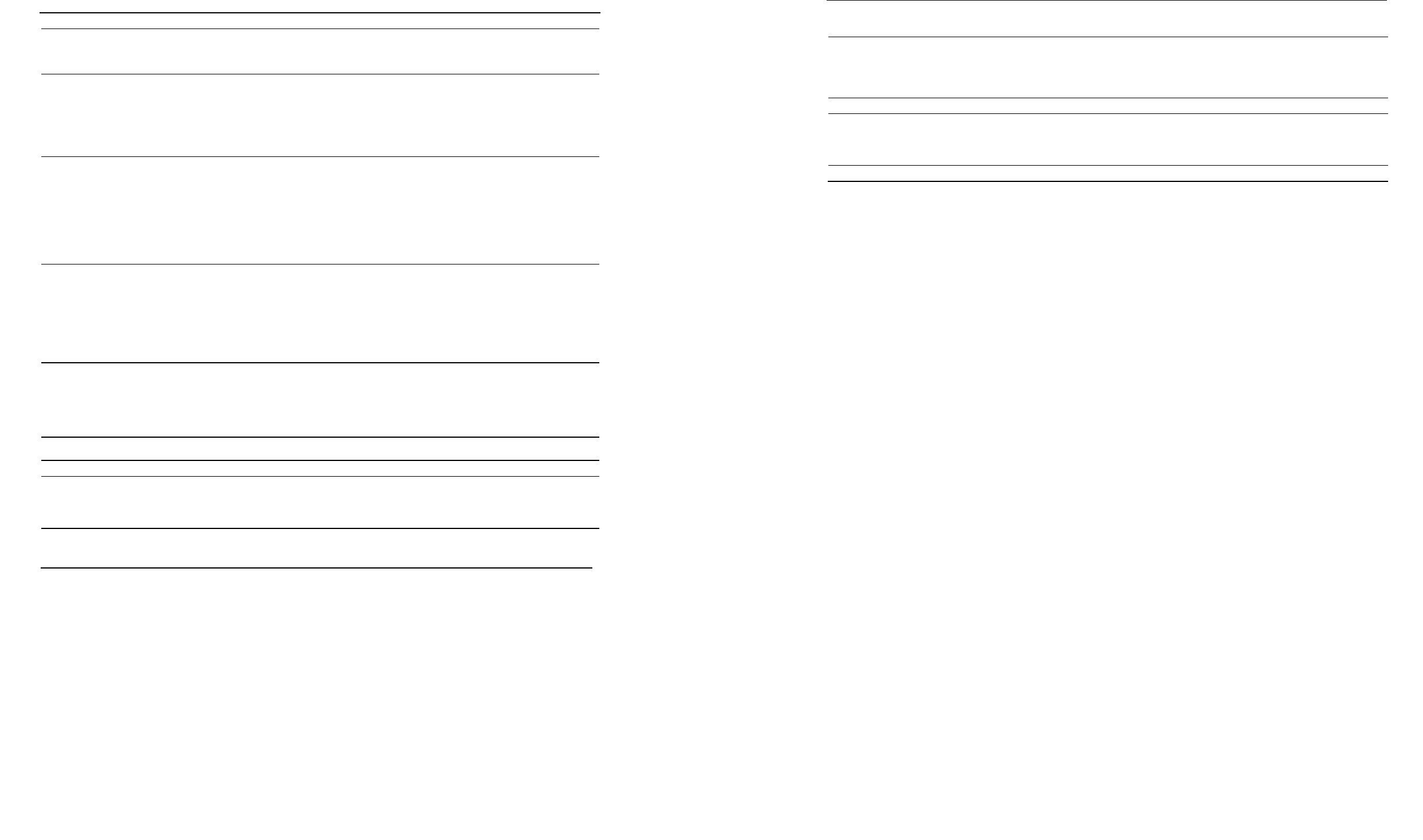

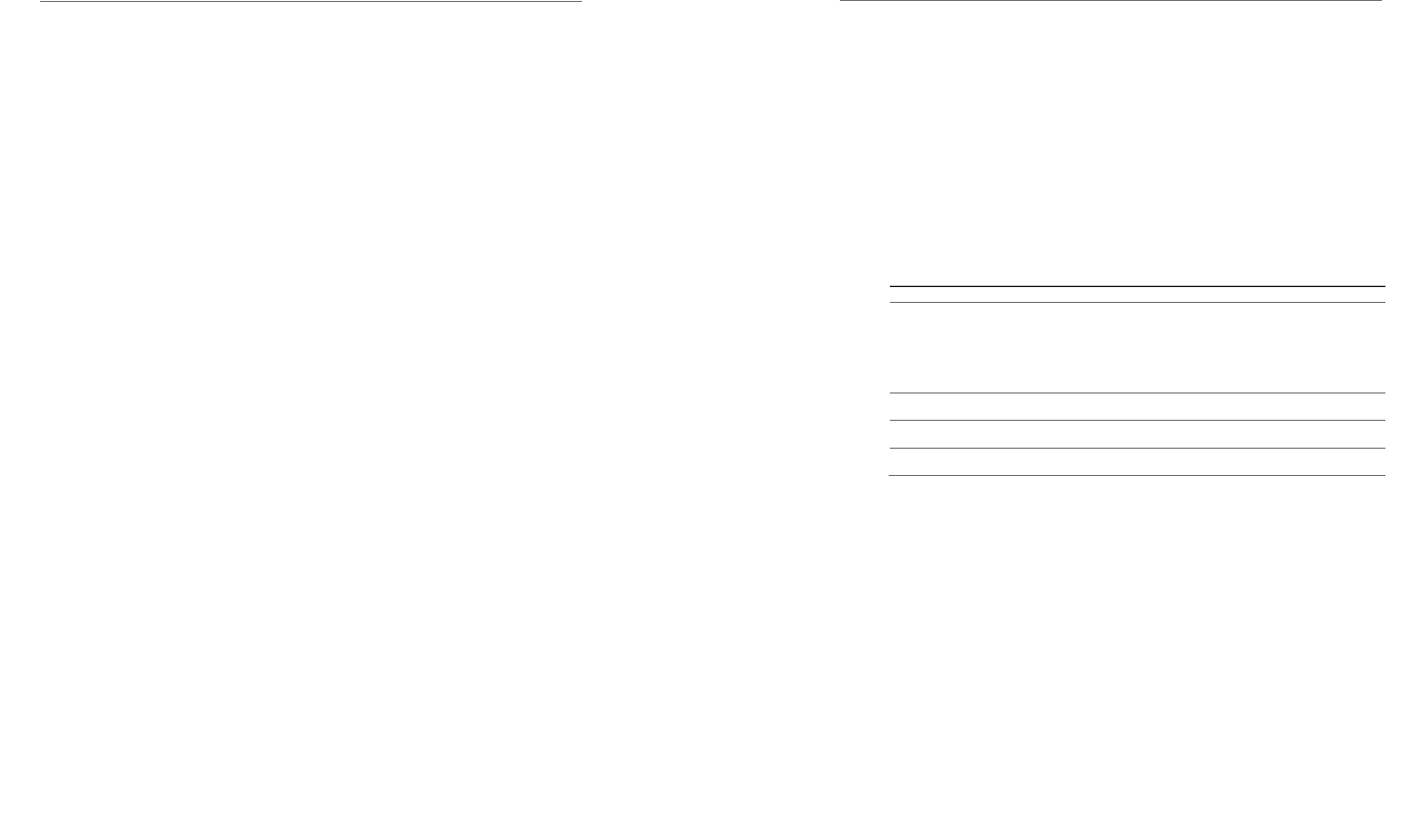

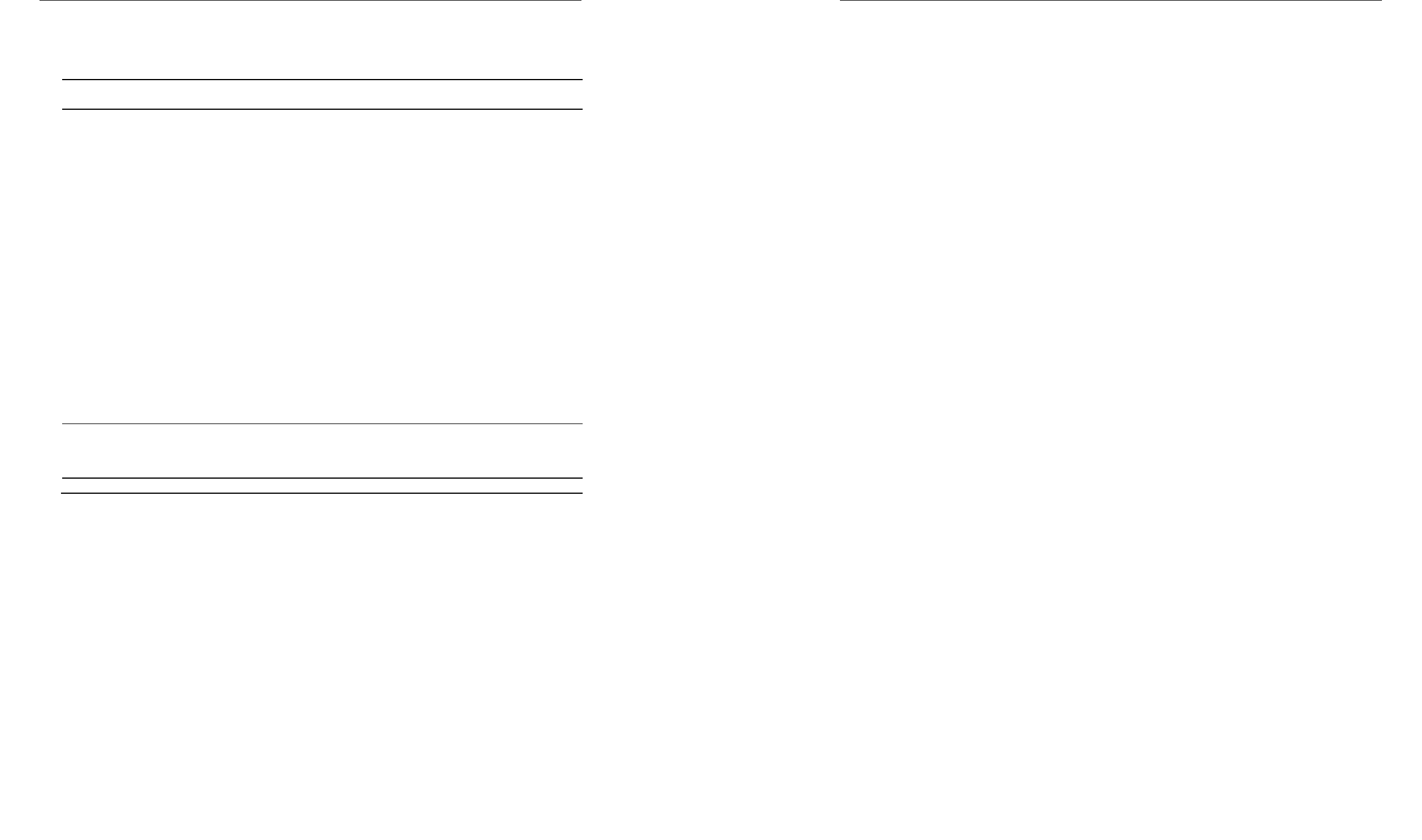

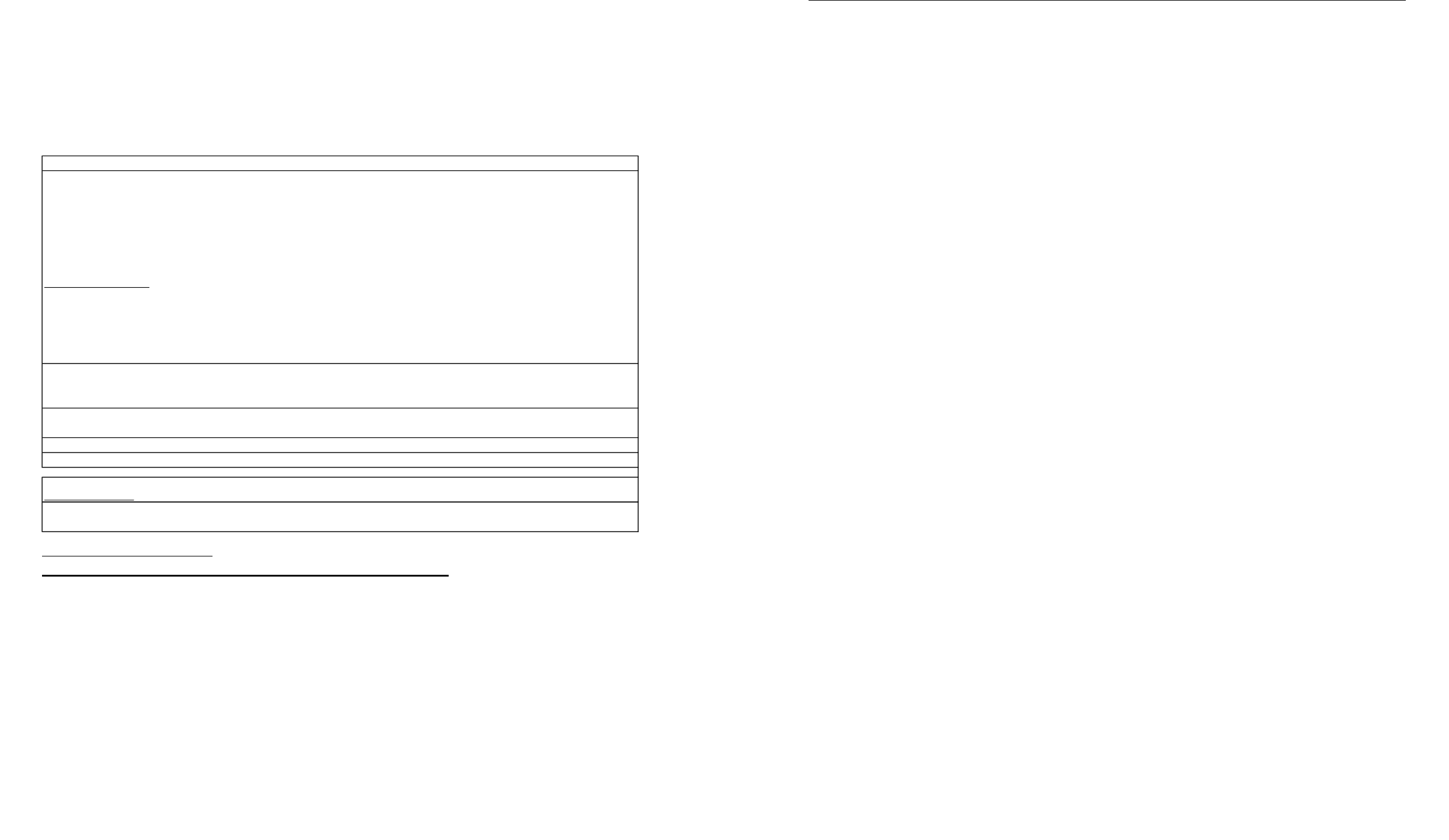

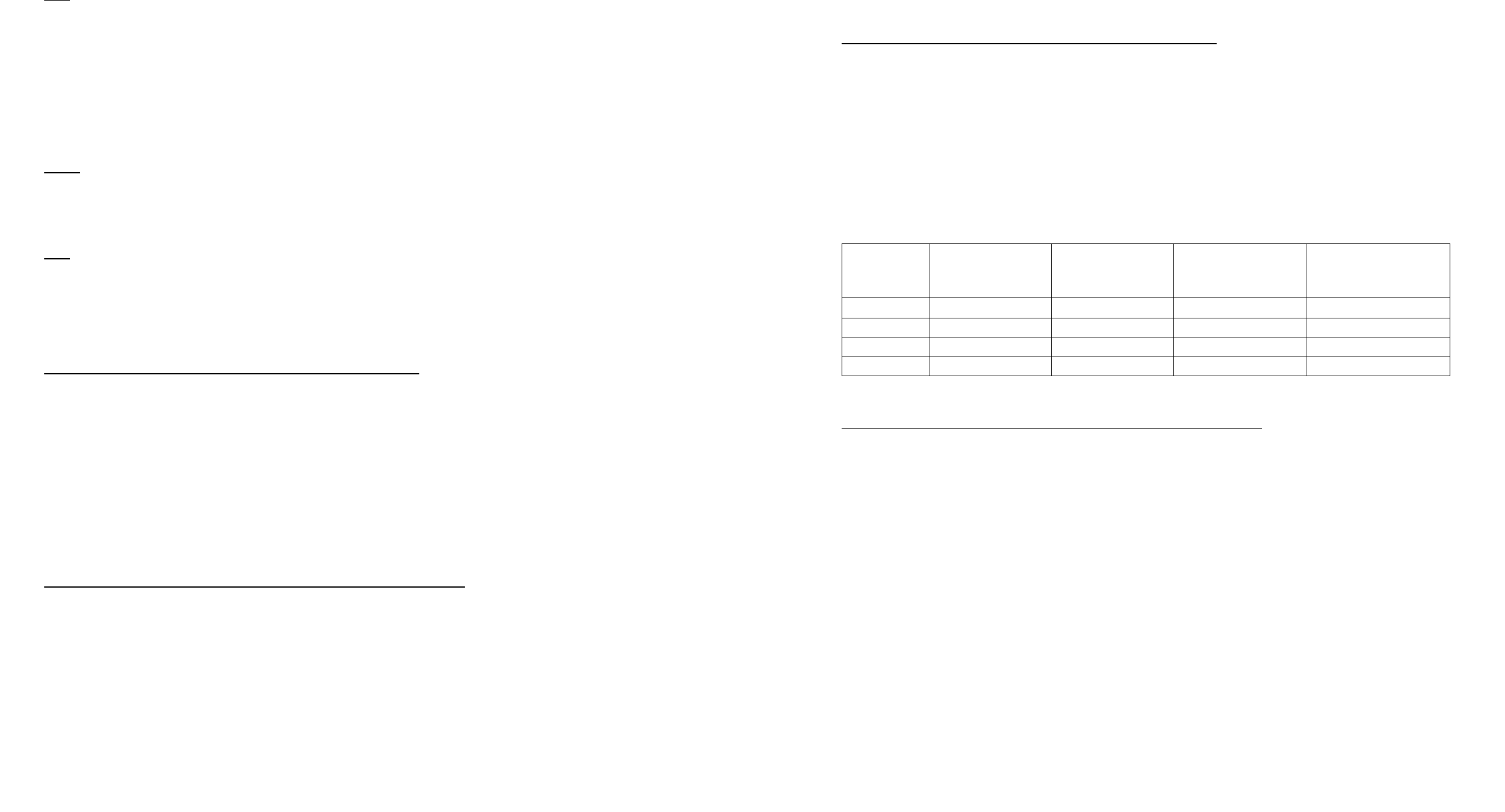

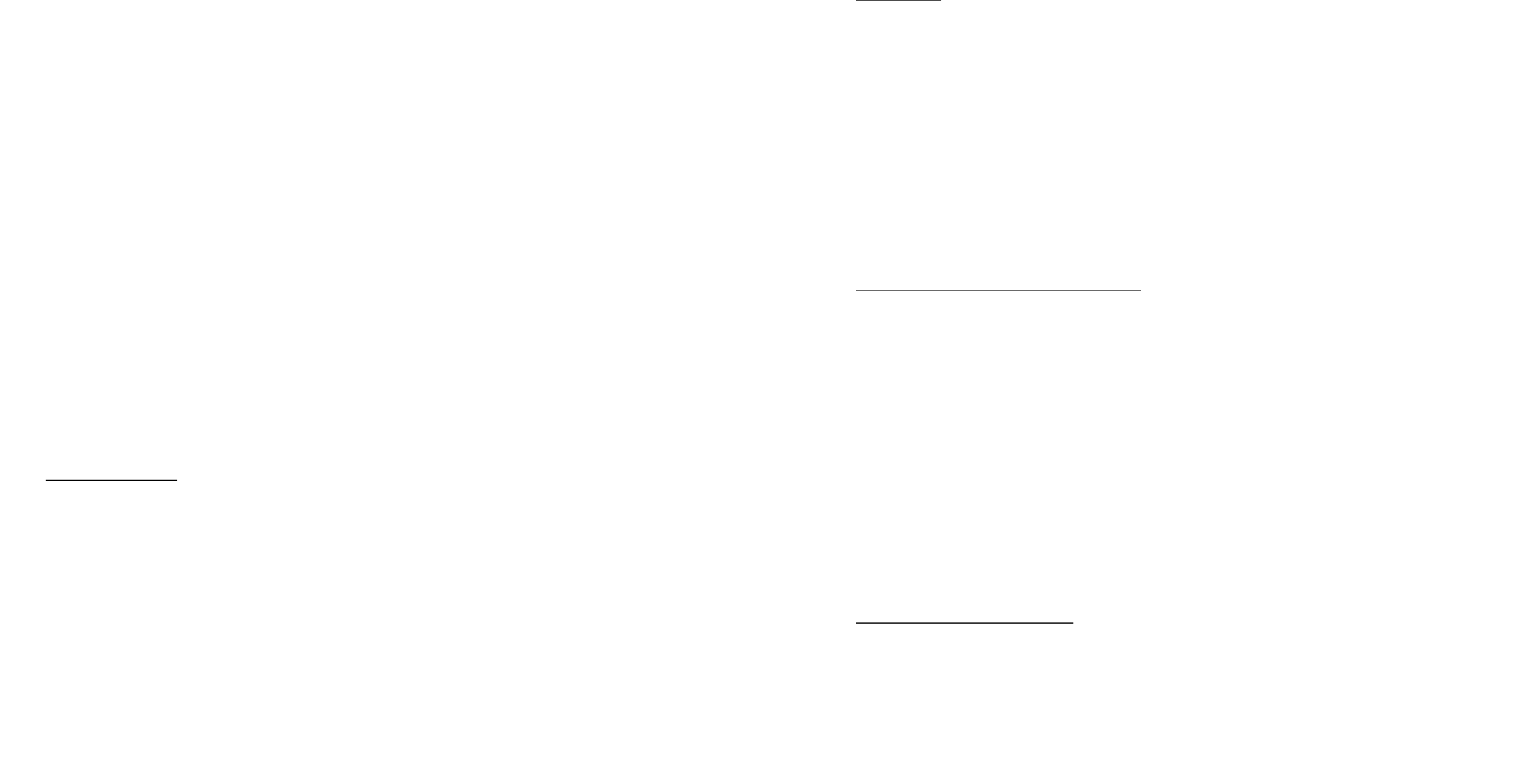

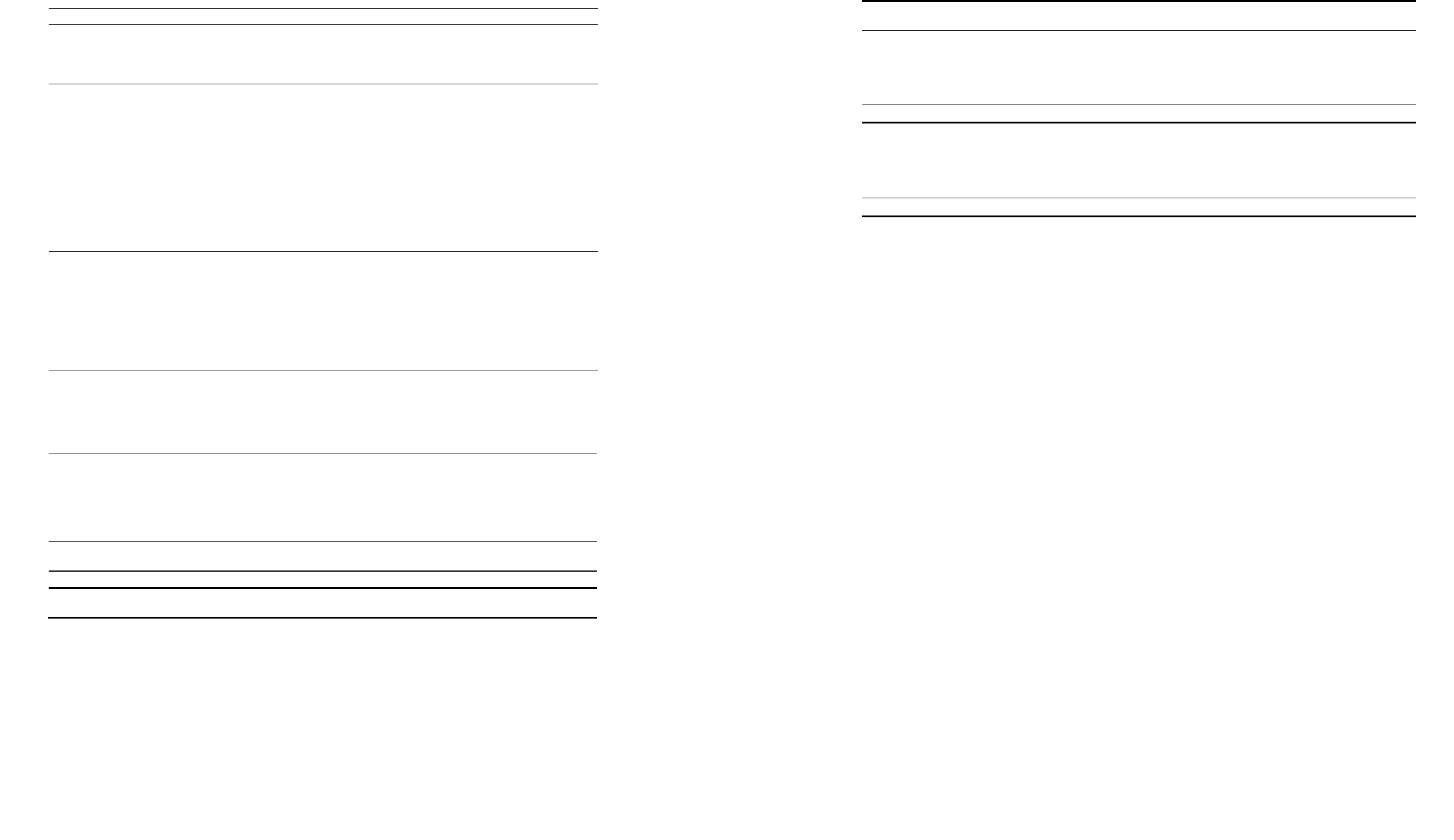

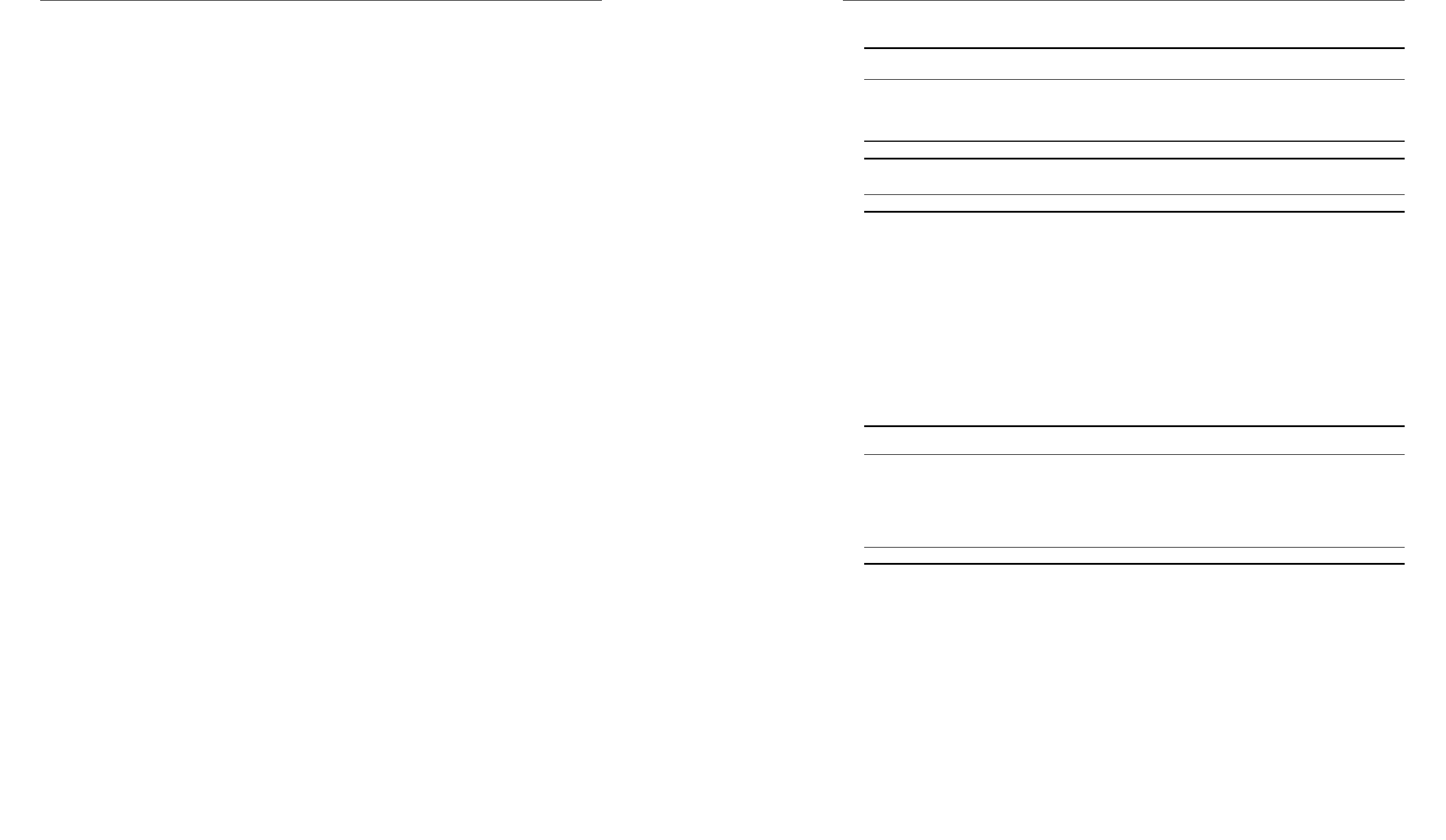

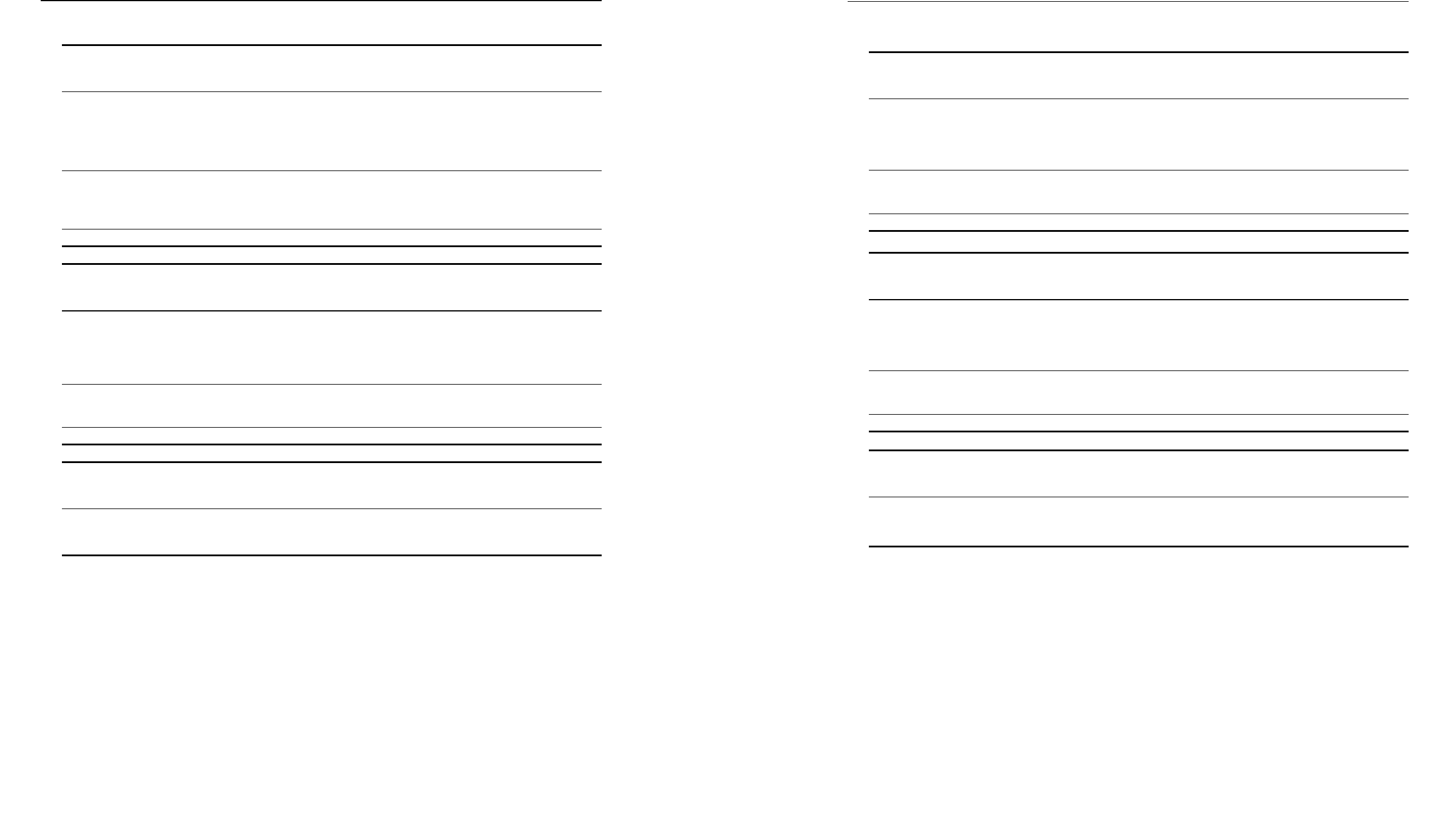

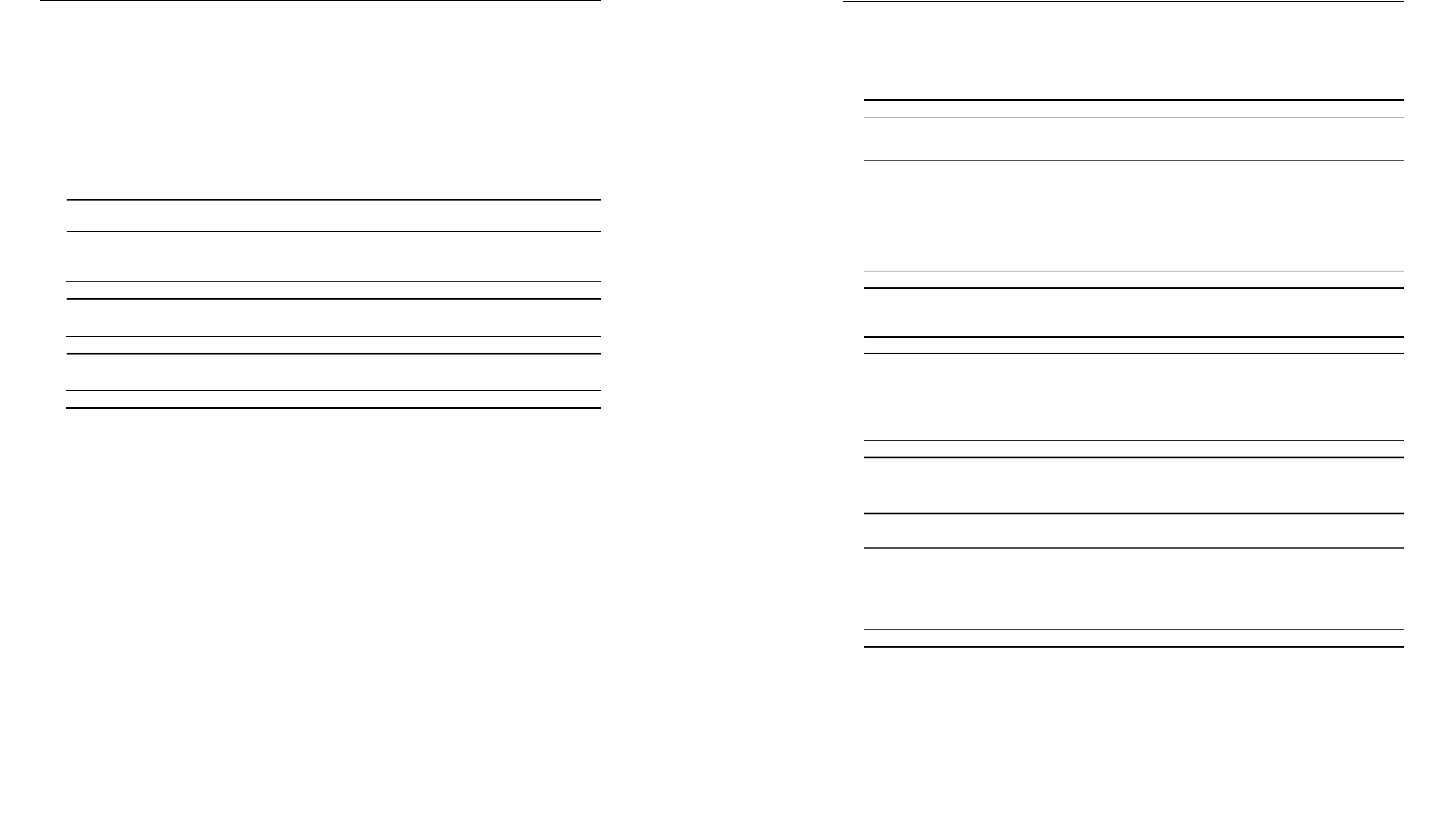

0.0

0.3

0.6

0.9

1.2

1.5

1.8

$1.189

$1.182

$1.336

$1.380

$1.317

$1.380

$0.756

$0.516

$0.950

$1.040

2018

2019

2020

2021 2022

99.4%

103.3%

104.8%

68.2%

++

109.5%

++

++

60.0%

80.0%

100.0%

120.0%

0

20.0%

40.0%

Distributable Cash per Unit Distributions Paid per Unit Payout Ratio (%)

Cash per Unit ($)

Payout Ratio (%)

A special distribution of $0.20 per unit was declared in December 2020 and paid in January 2021. The Payout Ratio is calculated by dividing the amount of distributions paid during the applicable

period by the Distributable Cash

for that period. Accordingly, the Payout Ratio for 2020 does not factor in the special distribution that was paid on January 29, 2021 even though the cash generated

to fund the special distribution was generated during 2020 as a result of monthly distributions on Units being temporarily suspended in respect of March through August of 2020. If the special

distribution was included in the calculation of Payout Ratio in the year it was declared, the Payout Ratio would be 94.6% for 2020 and 88.4% for 2021.

DISTRIBUTIONS PER UNIT AND PAYOUT RATIO

42

BOSTON PIZZA ROYALTIES INCOME FUND

Message from the Chairman of Boston Pizza Royalties Income Fund 3

BOSTON PIZZA INTERNATIONAL INC

Message from the President of Boston Pizza International Inc. 4

3

CHAIRMAN’S MESSAGE

On behalf of the trustees, I am pleased to present the 2022 annual report for Boston Pizza Royalties Income

Fund (the “Fund”).

Despite the challenges posed by COVID-19 during 2022, we are pleased to report a successful year for the

Fund. At the beginning of 2022, all regions in Canada were significantly impacted by the omicron variant of

COVID-19 and the subsequent fifth wave of the pandemic, resulting in capacity restrictions and closures of

dining rooms. By the end of the first quarter in 2022, case counts improved and government restrictions were

relaxed. Since then, government restrictions have largely been eliminated, and sales levels of Boston Pizza

restaurants have returned to more normal levels when compared to times prior to the pandemic.

The improvement in Boston Pizza’s restaurant operations during the second half of 2022 reflected positively on

the royalty and distribution payments to the Fund. This, in turn, enabled the trustees to distribute more funds to

unitholders. The following is a summary of some changes regarding distributions declared by the trustees on

units of the Fund (“Units”) during the year:

1. On August 4, 2022, the trustees increased the monthly distribution to $0.100 per Unit for July 2022 from

the previous monthly rate of $0.085 per Unit, being an increase of $0.015 per Unit or 17.6%;

2. On December 8, 2022, the trustees increased the monthly distribution to $0.102 per Unit for

November 2022 from the previous monthly rate of $0.100 per Unit, being an increase of $0.002 per Unit

or 2.0%; and

3. On December 8, 2022, the trustees declared the special distribution of $0.085 per Unit which was paid

on December 30, 2022 to unitholders of record at the close of business on December 21, 2022.

The solid financial performance of Boston Pizza International Inc. (“BPI”) and the Fund, along with the Fund’s

growing cash balance, enabled the trustees of the Fund to increase the monthly distribution rate payable to

unitholders twice during 2022 and issue a special cash distribution. The current monthly distribution rate per

unit is now equal to the level it was immediately prior to the start of COVID-19. However, the trustees of the

Fund remain cautious and will continue to closely monitor the Fund’s available cash balances and distribution

levels, based on our goal of stable and sustainable distribution flow to unitholders.

On behalf of the trustees, I would like to thank unitholders for their support during these unprecedented times

and express appreciation to BPI, Boston Pizza franchisees and their respective employees for their hard work

and commitment.

Marc Guay

Chairman, Boston Pizza Royalties Income Fund

MESSAGE FROM THE CHAIRMAN OF

BOSTON PIZZA ROYALTIES INCOME FUND

4

MESSAGE FROM THE PRESIDENT OF

BOSTON PIZZA INTERNATIONAL INC.

On behalf of Boston Pizza International Inc. (“BPI”), its board of directors, management team and

employees, I am pleased to present our 2022 Annual Report. This report covers the fiscal year-ended

December 31, 2022 (the “Year”).

HIGHLIGHTS

• Annual System-Wide Gross Sales of $1.1 billion for the Year, representing an increase of 32.3%,

versus the same period one year ago.

• Same Restaurant Sales of 30.4% for the Year and 3.2% when compared to 2019.

• COVID-19 continued to impact the business of BPI in the first half of 2022. However, on an annual

basis, 2022 total Franchise Sales returned to pre-pandemic levels despite the challenges faced in the

first half of the Year.

• Raised just over $1.5 million in 2022 for Boston Pizza Foundation, bringing the aggregate total to over

$35.0 million raised and donated since the inception of the Boston Pizza Foundation in 1990.

Readers are cautioned that they should refer to the annual audited consolidated financial statements and

Management’s Discussion and Analysis of BPI for the fiscal year-ended December 31, 2022, available on

SEDAR at www.sedar.com and on the Boston Pizza Royalties Income Fund’s website at

www.bpincomefund.com, for a full description of BPI’s financial results.

OPERATIONAL HIGHLIGHTS

During the first half of 2022, Boston Pizza restaurants across Canada continued to be impacted by

government restrictions arising from COVID-19. Since then, COVID-19 case counts have improved,

government restrictions related to COVID-19 have largely been eliminated, and sales levels of Boston Pizza

restaurants have returned to more normal levels when compared to times prior to COVID-19. Throughout

2022, Boston Pizza remained focused on the safety of guests and staff in our restaurants, and serving our

communities as permitted by government health authorities. We continued to enhance our digital ordering

systems and work with our delivery service partners to achieve year-over-year increases in the off-premise

segment of our business. We also met challenges in 2022 as Boston Pizza successfully managed through

supply chain disruptions and labour shortage challenges experienced in Canada and around the world.

Our team worked hard to maintain a stable supply chain and mitigate cost increases for our franchisees.

We also provided systems and tools to help our franchisees attract and retain staff. On the restaurant

development front, COVID-19 was a contributing factor in the six Boston Pizza restaurants that permanently

closed in 2022. As the economy continues to recover in 2023, we will continue to work diligently on new

and existing restaurant development opportunities that were delayed due to the pandemic.

With the easing of dining restrictions near the end of the first quarter, we saw an increase in guest traffic to

restaurants and were excited to welcome our guests while ensuring we continue to safely operate the dining

rooms, sports bars and patios of Boston Pizza restaurants across Canada. The first quarter of 2022 began

with a NFL Playoff Meal Deal campaign and a new winter feature menu. These promotions paired perfectly

with the lineup of sporting events during the first quarter. February saw Boston Pizza’s popular Valentine’s

Day promotion where $1 from each heart-shaped pizza and mint chocolate cake sold went to help local

charities. This campaign resulted in the Boston Pizza Foundation raising over $300,000 to help local

charities in communities across Canada. The first quarter concluded with a strong Kids Eat Free for the

month of March campaign, which saw positive increases to guest traffic and sales.

As we entered the second quarter of 2022, COVID-19 case counts continued to improve and government

restrictions were further relaxed. During the second quarter, we launched two successful promotions. The

first was our specially priced burger and beer promotion featuring a pint and burger for $17.99, and the

second was our summer patio campaign that introduced new food and drink innovations. Both promotions

MESSAGE FROM THE PRESIDENT OF

BOSTON PIZZA INTERNATIONAL INC.

5

were exceptionally well-received by our guests. We finished the quarter strongly with total second quarter

sales exceeding pre-pandemic sales.

Sales performance continued to improve in the third quarter of 2022 generating the strongest sales results

since the start of COVID-19. We were pleased to see guests continuing to return to Boston Pizza

restaurants and sales performance exceed pre-pandemic levels. During the third quarter, Boston Pizza

continued to drive improved performance and guest traffic. We also extended our summer patio campaign

into the period which highlighted new food and drink innovations. We ended the third quarter by introducing

a fall feature menu which featured two new pizzas and other food and beverage creations. Boston Pizza’s

Kids Cards promotion started towards the end of the third quarter where, for a $5 donation, a guest received

a card for five free kids’ meals. The Kids Cards promotion raised over $850,000 for the Boston Pizza

Foundation.

The strong sales momentum from the third quarter of 2022 continued into the fourth quarter. We began

the fourth quarter with our Hockey Night in Canada partnership which was supported by significant TV,

digital, and social media channels along with in-restaurant promotions at participating Boston Pizza

restaurants across Canada. In addition to this, we launched a 2022 holiday menu which featured a selection

of innovative food and beverage items along with a promotion card bonus offer. Guests also received a

free Ferrero Rocher 3-pack with the purchase of any qualifying holiday menu item. Also, we had the highest

gift card sales in 2022 compared to any previous year, helped by a successful year-end Holiday Gift Card

promotion.

We continue to be extremely pleased with the efforts of our team and Franchisees during the current

recovery phase. The easing and elimination of government-imposed restrictions in Canada related to

COVID-19 has enabled Boston Pizza to continue to drive improved performance and guest traffic.

However, with supply chain challenges, rising interest rates, increasing input costs and labour shortages

impacting most of the restaurant industry, BPI’s management remains cautious. BPI’s management

continues to adapt the business to mitigate these challenges and capitalize on the recent sales momentum

resulting from the elimination of COVID restrictions in the restaurant industry.

Boston Pizza has been a gathering place for communities across Canada for almost 60 years, providing

our guests with much-needed opportunities to share food, share life and connect. We believe that providing

genuine hospitality occasions will be even more essential to the lives of Canadians than it was pre-

pandemic. At Boston Pizza, we are excited and prepared to serve our guests from coast-to-coast this year.

I want to close by conveying my deep appreciation to our employees, Franchisees, and business partners

for their hard work and support. I am extremely proud of our accomplishments and look forward to what

we can achieve together in the future.

On behalf of Boston Pizza International Inc.,

Jordan Holm,

President, Boston Pizza International Inc.

Forward Looking Information

Certain information in this message constitutes “forward-looking information” that involves known and unknown risks, uncertainties, future expectations

and other factors which may cause the actual results, performance or achievements of Boston Pizza Royalties Income Fund (the “Fund”), Boston Pizza

Holdings Trust, Boston Pizza Royalties Limited Partnership, Boston Pizza Holdings Limited Partnership, Boston Pizza Holdings GP Inc., Boston Pizza

GP Inc., BPI, Boston Pizza Canada Limited Partnership (“BP Canada LP”), Boston Pizza Canada Holdings Inc., Boston Pizza Canada Holdings

Partnership, Boston Pizza restaurants, or industry results, to be materially different from any future results, performance or achievements expressed or

6

MESSAGE FROM THE PRESIDENT OF

BOSTON PIZZA INTERNATIONAL INC.

implied by such forward-looking information. All statements, other than statements of historical facts, included in this message that address activities,

events or developments that BPI and BP Canada LP expects or anticipates will or may occur in the future, including such thing

s as, continuing to work

diligently on new

and existing restaurant development opportunities that were delayed due to the pandemic, BPI’s management remaining cautious with

supply chain challenges, rising interest rates, increasing input costs and labour shortages impacting most of the restaurant

industry, BPI’s management

continuing to adapt the business to mitigate these challenges and capitalize on the recent sales momentum resulting from the

elimination of COVID

restrictions in the restaurant industry,

BPI believing that providing genuine hospitality occasions will be even more essential to the lives of Canadians

than it was pre

-pandemic, and other such matters are forward-looking information. When used in this message, forward-looking information may include

words such as “anticipate”, “estimat

e”, “may”, “will”, “expect”, “believe”, “plan”, “should”, “continue” and other similar terminology. The material factors

and assumptions used to develop the forward

-looking information contained in this message include the following: expectations related to future general

economic conditions, Boston Pizza restaurants maintaining operational excellence, and supply chain challenges, rising interes

t rates, and increasing

input costs and labour shortages may continue to negatively impact the restaurant industr

y. Risks, uncertainties and other factors that may cause actual

results, performance or achievements to be materially different from any future results, performance or achievement expressed

or implied by the forward-

looking information contained herein, r

elate to (among others): competition, demographic trends, consumer preferences and discretionary spending

patterns, business and economic conditions, legislation and regulation, reliance on operating revenues, accounting policies a

nd practices, the results of

operations and financial condition of BPI and BP Canada LP, as well as those factors discussed under the heading “Risks and U

ncertainties” in the most

recent Annual Information Form of the Fund.

This information reflects current expectations regarding future events and operating performance and

speaks only as of the date of this

message. Except as required by law, neither BPI, BP Canada LP nor the Fund assumes any obligation to update

previously disclosed forward

-looking information. For a complete list of the risks associated with forward-looking information and BPI’s and BP Canada

LP’s business, please refer to the “Risks and Uncertainties” and “Note Regarding Forward

-Looking Information” sections included in the most recent

Annual Information Form

of the Fund and BPI’s Management’s Discussion and Analysis for the year ended December 31, 2022 available at

www.sedar.com

and www.bpincomefund.com.

7

BOSTON PIZZA ROYALTIES INCOME FUND TITLE PAGE GOES HERE

BOSTON PIZZA ROYALTIES INCOME FUND

Management’s Discussion & Analysis 8

Management’s Statement of Responsibilities 45

Independent Auditor’s Report 46

Consolidated Financial Statements 51

MANAGEMENT’S DISCUSSION AND ANALYSIS

BOSTON PIZZA ROYALTIES INCOME FUND

For the Period and Year ended December 31, 2022

- 1 -

FINANCIAL HIGHLIGHTS

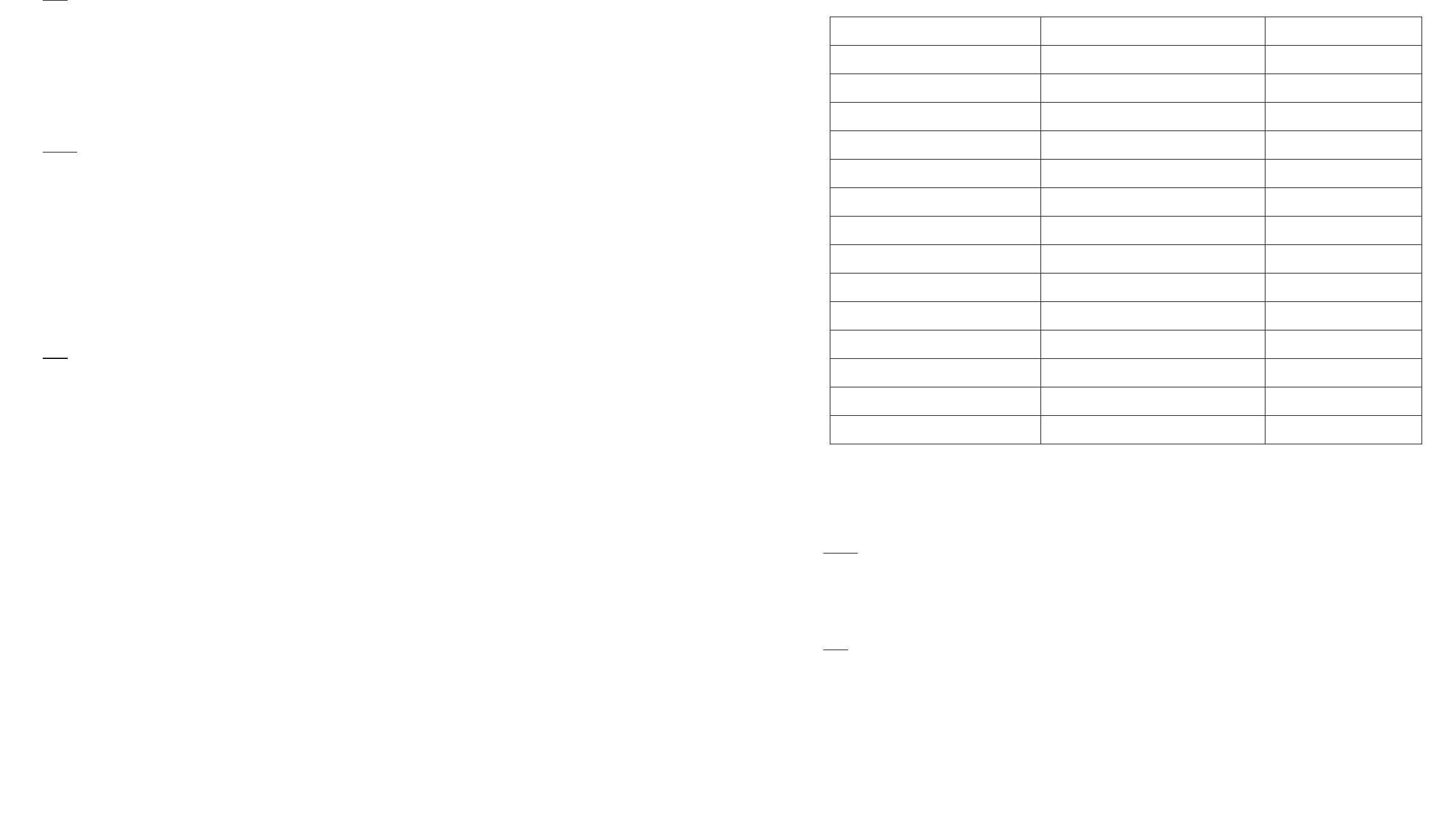

The tables below set out selected information from the audited annual consolidated financial statements of Boston

Pizza Royalties Income Fund (the “Fund”), which includes the accounts of the Fund, its wholly-owned subsidiaries

Boston Pizza Holdings Trust (the “Trust”), Boston Pizza Holdings GP Inc. (“Holdings GP”) and Boston Pizza

Holdings Limited Partnership (“Holdings LP”), its 80% owned subsidiary Boston Pizza GP Inc. (“Royalties GP”),

and Boston Pizza Royalties Limited Partnership (“Royalties LP”), together with other information and should be

read in conjunction with the audited annual consolidated financial statements of the Fund for the years ended

December 31, 2022 and December 31, 2021. The financial information in the tables included in this

Management’s Discussion and Analysis (“MD&A”) are reported in accordance with International Financial

Reporting Standards (“IFRS”) except as otherwise noted and are stated in Canadian dollars. Capitalized terms

used in the tables and notes below are defined elsewhere in this MD&A.

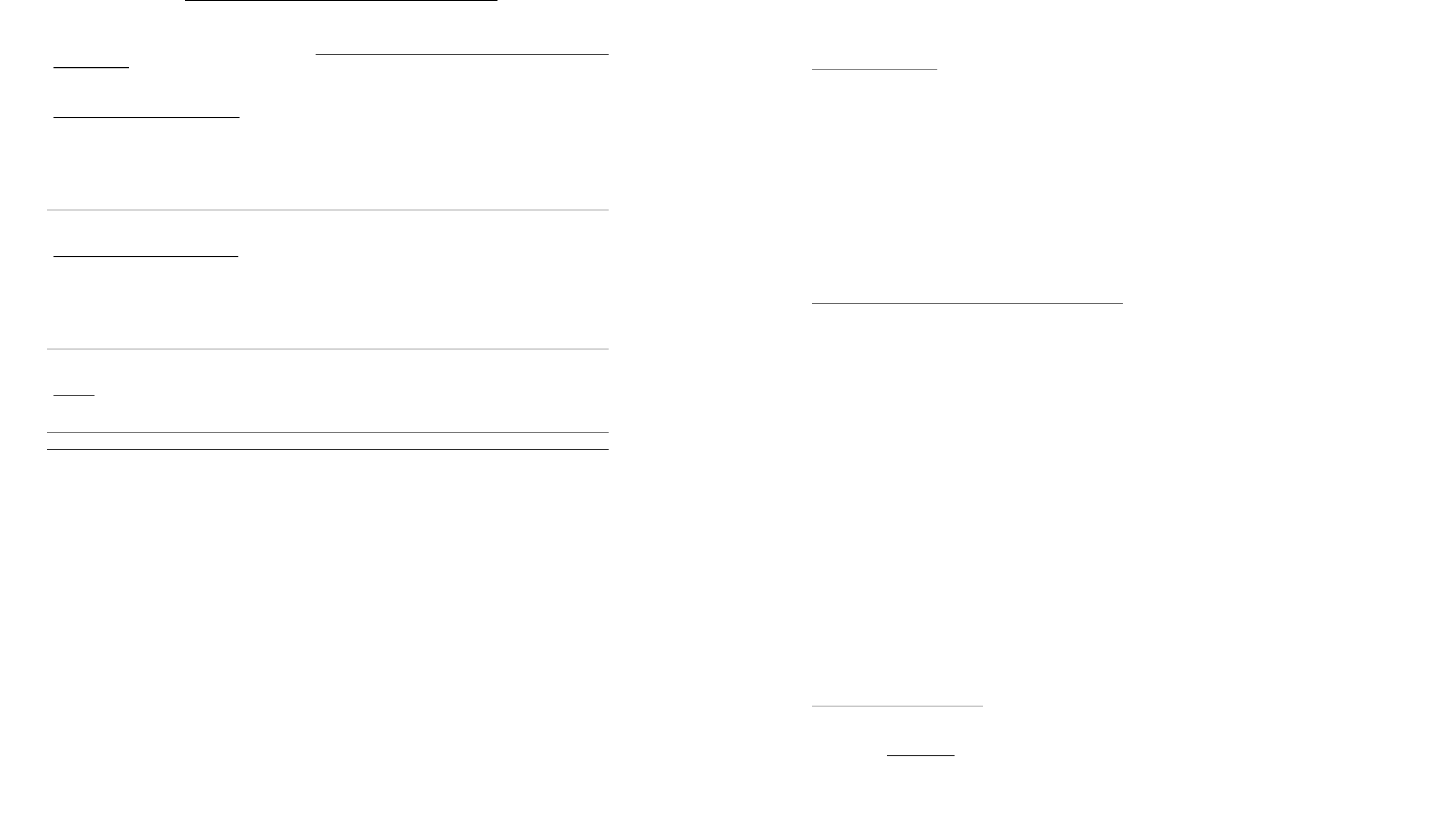

For the years ended December 31

2022

2021

2020

(in thousands of dollars – except restaurants, SRS, Payout Ratio and per Unit items)

Number of restaurants in Royalty Pool

383

387

395

Franchise Sales reported by restaurants in the Royalty Pool

854,997

660,051

613,199

Royalty income

34,200

26,402

24,528

Distribution Income

11,273

8,752

8,114

Total revenue

45,473

35,154

32,642

Administrative expenses

(1,390)

(1,299)

(1,439)

Interest expense on debt and financing fees

(3,614)

(3,879)

(3,360)

Interest expense on Class B Unit liability

(3,690)

(2,506)

(2,085)

Interest income

107

94

144

Profit before fair value gain (loss) and income taxes

36,886

27,564

25,902

Fair value (loss) gain on investment in BP Canada LP

(2,019)

25,206

(14,349)

Fair value gain (loss) on Class B Unit liability

899

(11,229)

6,382

Fair value gain (loss) on Swaps

3,891

2,303

(2,064)

Current and deferred income tax expense

(9,074)

(6,437)

(6,301)

Net and comprehensive income

30,583

37,407

9,570

Basic earnings per Unit

1.42

1.74

0.44

Diluted earnings per Unit

1.31

1.74

0.17

Distributable Cash

1

/ Distributions / Payout Ratio

2

Cash flows generated from operating activities

34,355

30,475

22,866

BPI Class B Unit entitlement

3

(3,679)

(2,770)

(2,450)

Interest paid on long-term debt

(3,576)

(3,692)

(3,157)

Principal repayments on long-term debt

(1,500)

(3,787)

(690)

Current income tax expense

(8,914)

(6,307)

(6,141)

Current income tax paid

8,904

6,520

5,871

Distributable Cash

1

25,590

20,439

16,299

Distributions paid

25,438

22,382

11,120

Payout Ratio

2

99.4%

109.5%

68.2%

Distributable Cash per Unit

4

1.189

0.950

0.756

Distributions paid per Unit

1.182

1.040

0.516

Other

Same Restaurant Sales

5

30.4%

8.5%

(27.6%)

Number of restaurants opened

0

0

2

Number of restaurants closed

6

4

11

As at December 31

2022

2021

2020

Total assets

413,701

411,313

390,804

Total liabilities

133,123

135,514

133,904

8 9

MANAGEMENT’S DISCUSSION AND ANALYSIS

BOSTON PIZZA ROYALTIES INCOME FUND

For the Period and Year ended December 31, 2022

- 2 -

Notes – Non-GAAP and Specified Financial Measures

1

“Distributable Cash” is a non-GAAP financial measure under National Instrument 52-112 Non-GAAP and Other

Financial Measures Disclosure (“NI 52-112”). Distributable Cash is not a standardized financial measure under

IFRS and may not be comparable to similar financial measures disclosed by other issuers. The Fund defines

Distributable Cash to be, in respect of any particular period, the Fund’s cash flows generated from operating

activities for that period (being the most comparable financial measure in the Fund’s primary financial statements)

minus (a) BPI’s entitlement in respect of its Class B Units in respect of the period (see note 3 below), minus

(b) interest paid on long-term debt during the period, minus (c) principal repayments on long-term debt that are

contractually required to be made during the period, minus (d) the current income tax expense in respect of the

period, plus (e) current income tax paid during the period (the sum of (d) and (e) being “SIFT Tax on Units”).

Management believes that Distributable Cash provides investors with useful information about the amount of

cash the Fund has generated and has available for distribution on the Units in respect of any period. The tables

in the “Financial Highlights” section of this MD&A provide a reconciliation from this non-GAAP financial measure

to cash flows generated from operating activities, which is the most directly comparable IFRS measure. Current

income tax expense in respect of any period is prepared using reasonable and supportable assumptions

(including that the base rate of SIFT Tax will not increase throughout the calendar year and that certain expenses

of the Fund will continue to be deductible for income tax purposes), all of which reflect the Fund’s planned courses

of action given management’s judgment about the most probable set of economic conditions. There is a risk that

the federal government of Canada could increase the base rate of SIFT Tax or that applicable taxation authorities

could assess the Fund on the basis that certain expenses of the Fund are not deductible. Investors are cautioned

that if either of these possibilities occurs, then the actual results for this component of Distributable Cash may

vary, perhaps materially, from the amounts used in the reconciliation.

2

“Payout Ratio” is a non-GAAP ratio under NI 52-112. Payout Ratio is not a standardized financial measure

under IFRS and may not be comparable to similar financial measures disclosed by other issuers. The Fund

defines Payout Ratio for any period as the aggregate distributions paid by the Fund during that period divided by

the Distributable Cash generated in that period. Management believes that Payout Ratio provides investors with

useful information regarding the extent to which the Fund distributes cash generated on Units. Since Payout

Ratio is calculated by dividing the amount of distributions paid during the applicable period by the Distributable

Cash for that period, the Payout Ratio for 2020 does not factor in the 2020 Special Distribution (defined below)

that was paid on January 29, 2021 even though the cash generated to fund the 2020 Special Distribution was

generated during 2020 as a result of monthly distributions on Units being temporarily suspended in respect of

March through August of 2020. If the 2020 Special Distribution was included in the calculation of Payout Ratio

for 2020, it would be 94.6%. Similarly, if the 2020 Special Distribution was excluded in the calculation of Payout

Ratio for 2021, it would be 88.4%.

3

“BPI Class B Unit entitlement” is a supplementary financial measure under NI 52-112 and therefore may not

be comparable to similar measures presented by other issuers. The BPI Class B Unit entitlement is the interest

expense on Class B Units in respect of a period plus management’s estimate of how much cash BPI would be

entitled to receive pursuant to the limited partnership agreement governing Royalties LP (a copy of which is

available on www.sedar.com) on its Class B Units if Royalties LP fully distributed any residual cash generated in

respect of that period after the Fund pays interest on long-term debt, principal repayments on long-term debt and

SIFT Tax on Units in respect of that period. Management believes that the BPI Class B Unit entitlement is an

important component in calculating Distributable Cash since it represents the amount of residual cash generated

that BPI would be entitled to receive and therefore would not be available for distribution to Unitholders.

Management prepares such estimate using reasonable and supportable assumptions that reflect the Fund’s

planned courses of action given management’s judgment about the most probable set of economic conditions.

4

“Distributable Cash per Unit” is a non-GAAP ratio under NI 52-112. Distributable Cash per Unit is not a

standardized financial measure under IFRS and may not be comparable to similar financial measures disclosed

by other issuers. The Fund defines Distributable Cash per Unit for any period as the Distributable Cash generated

in that period divided by the weighted average number of Units outstanding during that period. Management

believes that Distributable Cash per Unit provides investors with useful information regarding the amount of cash

per Unit that the Fund has generated and has available for distribution in respect of any period.

10

MANAGEMENT’S DISCUSSION AND ANALYSIS

BOSTON PIZZA ROYALTIES INCOME FUND

For the Period and Year ended December 31, 2022

- 3 -

5

“Same Restaurant Sales” or “SRS” is a supplementary financial measure under NI 52-112 and therefore may

not be comparable to similar measures presented by other issuers. Prior to the fourth quarter of 2021, the Fund

defined SRS as the change in gross revenues of Boston Pizza Restaurants as compared to the gross revenues

for the same period in the previous year (where restaurants were open for a minimum of 24 months).

Commencing with the fourth quarter of 2021, the Fund defines SRS as the change in Franchise Sales of Boston

Pizza Restaurants as compared to the Franchise Sales for the same period in the previous year (where

restaurants were open for a minimum of 24 months). The Fund believes that the current method of calculating

SRS provides Unitholders more meaningful information regarding the performance of Boston Pizza Restaurants

since Royalty and Distribution Income are payable to the Fund by BPI and BP Canada LP on Franchise Sales

and not gross revenues of Boston Pizza Restaurants. All historical SRS figures contained in this MD&A have

been restated to conform to the current method of calculating SRS.

11

MANAGEMENT’S DISCUSSION AND ANALYSIS

BOSTON PIZZA ROYALTIES INCOME FUND

For the Period and Year ended December 31, 2022

- 4 -

SUMMARY OF QUARTERLY RESULTS

Q4 2022

Q3 2022

Q2 2022

Q1 2022

(in thousands of dollars – except restaurants, SRS, Payout Ratio and per Unit items)

Number of restaurants in Royalty Pool

383

383

383

383

Franchise Sales reported by restaurants in the Royalty Pool

227,163

229,848

219,384

178,602

Royalty income

9,087

9,194

8,775

7,144

Distribution Income

2,988

3,027

2,895

2,363

Total revenue

12,075

12,221

11,670

9,507

Administrative expenses

(369)

(334)

(349)

(338)

Interest expense on debt and financing fees

(812)

(886)

(977)

(939)

Interest expense on Class B Unit liability

(1,557)

(835)

(733)

(565)

Interest income

61

31

10

5

Profit before fair value (loss) gain and income taxes

9,398

10,197

9,621

7,670

Fair value (loss) gain on investment in BP Canada LP

(1,146)

2,183

(14,622)

11,566

Fair value gain (loss) on Class B Unit liability

510

(972)

6,515

(5,154)

Fair value gain on Swaps

106

572

1,337

1,876

Current and deferred income tax expense

(2,462)

(2,478)

(1,075)

(3,059)

Net and comprehensive income

6,406

9,502

1,776

12,899

Basic earnings per Unit

0.30

0.44

0.08

0.60

Diluted earnings (loss) per Unit

0.26

0.41

(0.20)

0.60

Distributable Cash / Distributions / Payout Ratio

Cash flows generated from operating activities

8,919

9,667

9,118

6,651

BPI Class B Unit entitlement

(1,044)

(1,083)

(888)

(664)

Interest paid on long-term debt

(799)

(939)

(954)

(884)

Principal repayments on long-term debt

-

-

(1,000)

(500)

Current income tax expense

(2,422)

(2,438)

(2,285)

(1,769)

Current income tax paid

2,585

2,270

2,185

1,864

Distributable Cash

7,239

7,477

6,176

4,698

Distributions paid

8,329

6,133

5,488

5,488

Payout Ratio

115.1%

82.0%

88.9%

116.8%

Distributable Cash per Unit

0.336

0.347

0.287

0.218

Distributions paid per Unit

0.387

0.285

0.255

0.255

Other

Same Restaurant Sales

24.5%

8.4%

64.9%

39.1%

Number of restaurants opened

0

0

0

0

Number of restaurants closed

3

1

0

2

12

MANAGEMENT’S DISCUSSION AND ANALYSIS

BOSTON PIZZA ROYALTIES INCOME FUND

For the Period and Year ended December 31, 2022

- 5 -

SUMMARY OF QUARTERLY RESULTS (continued)

Q4 2021

Q3 2021

Q2 2021

Q1 2021

(in thousands of dollars – except restaurants, SRS, Payout Ratio and per Unit items)

Number of restaurants in Royalty Pool

387

387

387

387

Franchise Sales reported by restaurants in the Royalty Pool

183,177

213,038

134,839

128,997

Royalty income

7,327

8,522

5,393

5,160

Distribution Income

2,423

2,815

1,797

1,717

Total revenue

9,750

11,337

7,190

6,877

Administrative expenses

(327)

(317)

(309)

(346)

Interest expense on debt and financing fees

(939)

(1,000)

(999)

(941)

Interest expense on Class B Unit liability

(1,037)

(450)

(605)

(414)

Interest income

7

18

29

40

Profit before fair value gain (loss) and income taxes

7,454

9,588

5,306

5,216

Fair value gain (loss) on investment in BP Canada LP

11,294

(3,928)

6,274

11,566

Fair value (loss) gain on Class B Unit liability

(5,032)

1,751

(2,796)

(5,152)

Fair value gain on Swaps

730

262

193

1,118

Current and deferred income tax expense

(1,804)

(2,230)

(1,235)

(1,168)

Net and comprehensive income

12,642

5,443

7,742

11,580

Basic earnings per Unit

0.59

0.25

0.36

0.54

Diluted earnings per Unit

0.59

0.13

0.36

0.54

Distributable Cash / Distributions / Payout Ratio

Cash flows generated from operating activities

8,524

9,586

6,448

5,917

BPI Class B Unit entitlement

(858)

(923)

(523)

(466)

Interest paid on long-term debt

(892)

(991)

(929)

(880)

Principal repayments on long-term debt

(679)

(1,036)

(1,036)

(1,036)

Current income tax expense

(1,814)

(2,190)

(1,185)

(1,118)

Current income tax paid

1,790

2,230

1,250

1,250

Distributable Cash

6,071

6,676

4,025

3,667

Distributions paid

5,488

4,196

4,197

8,501

Payout Ratio

90.4%

62.9%

104.3%

231.8%

Distributable Cash per Unit

0.282

0.310

0.187

0.170

Distributions paid per Unit

0.255

0.195

0.195

0.395

Other

Same Restaurant Sales

25.5%

15.1%

27.0%

(24.9%)

Number of restaurants opened

0

0

0

0

Number of restaurants closed

2

0

1

1

13

MANAGEMENT’S DISCUSSION AND ANALYSIS

BOSTON PIZZA ROYALTIES INCOME FUND

For the Period and Year ended December 31, 2022

- 6 -

OVERVIEW

This MD&A covers the three-month period from October 1, 2022 to December 31, 2022 (the “Period”) and the

twelve-month period from January 1, 2022 to December 31, 2022 (the “Year”) and is dated February 8, 2023. It

provides additional analysis of the operations, financial position and financial performance of the Fund and should

be read in conjunction with the Fund’s applicable audited annual consolidated financial statements and

accompanying notes. The audited annual consolidated financial statements of the Fund are in Canadian dollars

and have been prepared in accordance with IFRS except as otherwise noted.

Purpose of the Fund / Sources of Revenue

The Fund is a limited purpose open-ended trust established in July 2002, and the units of the Fund (the “Units”)

trade on the Toronto Stock Exchange under the symbol BPF.UN. The Fund was originally created to acquire,

indirectly through Royalties LP, the Canadian trademarks owned by Boston Pizza International Inc. (“BPI”, and

where applicable also includes its wholly-owned subsidiaries) (collectively, the “BP Rights”

6

) used in connection

with the operation of Boston Pizza restaurants in Canada (“Boston Pizza Restaurants”) and the business of

BPI, its affiliated entities and franchisees (herein referred to as “Boston Pizza”). In May 2015, the Fund, indirectly

through Holdings LP, completed an investment in Boston Pizza Canada Limited Partnership (“BP Canada LP”)

to effectively increase the Fund’s interest in Franchise Sales (as defined below) of Boston Pizza Restaurants in

the Royalty Pool (as defined below) by 1.5%, from 4.0% to 5.5% less the pro rata portion payable to BPI in respect

of its retained interest in the Fund. BP Canada LP is a limited partnership controlled and operated by BPI and is

the exclusive franchisor of Boston Pizza Restaurants.

The Fund has the following principal sources of revenue:

Royalty Income

Royalties LP licenses the BP Rights to BPI in return for BPI paying Royalties LP a royalty equal to 4.0% (the

“Royalty”) of Franchise Sales of those Boston Pizza Restaurants included in the Royalty Pool, as defined in the

license and royalty agreement dated July 17, 2002, as amended on May 9, 2005 between Royalties LP and BPI

(the “License and Royalty Agreement”). As of December 31, 2022, there were 383 Boston Pizza Restaurants

in the Royalty Pool.

“Franchise Sales” means the gross revenue: (i) of the corporate Boston Pizza Restaurants owned by BPI that

are in the Royalty Pool; and (ii) reported to BP Canada LP by franchised Boston Pizza Restaurants that are in

the Royalty Pool, without audit or other form of independent assurance, and in the case of both (i) and (ii), after

deducting revenue from the sale of liquor, beer, wine and revenue from BP Canada LP approved national

promotions and discounts and excluding applicable sales and similar taxes. Nevertheless, BP Canada LP

periodically conducts audits of the Franchise Sales reported to it by its franchisees, and the Franchise Sales

reported herein include results from sales audits of earlier periods.

Distribution Income

Holdings LP holds Class 1 limited partnership units (“Class 1 LP Units”) and Class 2 limited partnership units

(“Class 2 LP Units”) of BP Canada LP, and BPI holds, indirectly through Boston Pizza Canada Holdings

Partnership (“BPCHP”), a general partnership owned and controlled by BPI, Class 2 general partnership units

(“Class 2 GP Units”) of BP Canada LP, which are exchangeable into Units. The Class 1 LP Units and Class 2

LP Units entitle Holdings LP to receive distributions from BP Canada LP equal, in aggregate, to 1.5% of Franchise

Sales, less the pro rata portion payable to BPI in respect of its retained interest in the Fund (“Distribution

Income”). Specifically, the Class 1 LP Units entitle Holdings LP to receive a priority distribution equal to the

6 BP Rights are the trademarks that as at July 17, 2002 were registered or the subject of pending applications for registration under the

Trademarks Act (Canada) and other trademarks and trade names which are confusingly similar to any of the registered or pending

trademarks. The BP Rights purchased do not include the rights outside of Canada to any trademarks or trade names used by BPI or

any affiliated entities in its business, and in particular do not include the rights outside of Canada to the trademarks registered or pending

registration under the Trademarks Act (Canada).

14

MANAGEMENT’S DISCUSSION AND ANALYSIS

BOSTON PIZZA ROYALTIES INCOME FUND

For the Period and Year ended December 31, 2022

- 7 -

amount of interest that Holdings LP pays on amounts drawn on Facility D (as defined below) plus 0.05% of that

amount, with the balance of 1.5% of Franchise Sales being distributed pro rata to Holdings LP and BPI on the

Class 2 LP Units and Class 2 GP Units, respectively.

Top-Line Fund / Increases in Franchise Sales

The Fund effectively has the right to receive from BPI and BP Canada LP an amount equal to 5.5% of Franchise

Sales (4.0% of which is payable via the Royalty and 1.5% of which is payable as Distribution Income on the

Class 1 LP Units and Class 2 LP Units), less the pro rata portion payable to BPI in respect of its retained interest

in the Fund. A key attribute of the Fund’s structure is that it is a “top-line” fund. Both Royalty and Distribution

Income of the Fund are based on Franchise Sales of Boston Pizza Restaurants in the Royalty Pool and are not

determined by the profitability of BPI, BP Canada LP or Boston Pizza Restaurants in the Royalty Pool. The

Fund’s cash payments include administrative expenses, principal repayments and interest expenses on debt,

amounts paid by Royalties LP to BPI on the Class B general partner units (“Class B Units”) of Royalties LP, and

current income tax. Therefore, the Fund is not subject to the variability of earnings or expenses associated with

an operating business. Given this structure, the success of the Fund depends primarily on the ability of BPI and

BP Canada LP to maintain and increase Franchise Sales of Boston Pizza Restaurants in the Royalty Pool.

Increases in Franchise Sales are derived from both new Boston Pizza Restaurants added to the Royalty Pool

and SRS. The two principal factors that affect SRS are changes in guest traffic and changes in average guest

cheque. These factors are dependent upon existing Boston Pizza Restaurants maintaining operational

excellence, general market conditions, weather, pricing, and marketing programs undertaken by BPI and

BP Canada LP. One of BPI’s and BP Canada LP’s competitive strengths in increasing Franchise Sales of

existing restaurants is that the standard franchise agreement for Boston Pizza Restaurants requires that each

Boston Pizza Restaurant undergoes a complete restaurant renovation every seven years and completes

equipment upgrades as required by BP Canada LP. Restaurants typically close or partially close for two to three

weeks to complete the renovation, which incorporates updated design elements that result in a refreshed and

more appealing restaurant.

Franchise Sales are also affected by the permanent closures of Boston Pizza Restaurants. A Boston Pizza

Restaurant is closed when it ceases to be viable or when the franchise agreement applicable to that Boston Pizza

Restaurant has expired or been terminated.

Addition of New Restaurants to Royalty Pool

On January 1 of each year (each, an “Adjustment Date”), an adjustment is made to add to the Royalty Pool new

Boston Pizza Restaurants that opened (“New Restaurants”) and to remove any Boston Pizza Restaurants that

permanently closed since January 1 of the previous year (“Closed Restaurants”). In return for adding new

Royalty and Distribution Income from the New Restaurants after subtracting the Royalty and Distribution Income

that is lost from the Closed Restaurants

7

(such difference, “Net Royalty and Distribution Income”), BPI receives

the right to indirectly acquire additional Units (in respect of the Royalty, “Class B Additional Entitlements” and

in respect of Distribution Income, “Class 2 Additional Entitlements”, and collectively, “Additional

Entitlements”). The calculation of Additional Entitlements is designed to be accretive to unitholders of the Fund

(“Unitholders”) as the expected increase in Franchise Sales from the New Restaurants added to the Royalty

Pool less the decrease in Franchise Sales from the Closed Restaurants is valued at a 7.5% discount. The

Additional Entitlements are calculated at 92.5% of the estimated Royalty and Distribution Income expected to be

generated by the New Restaurants less the actual Royalty and Distribution Income lost from the Closed

Restaurants, multiplied by one minus the effective tax rate estimated to be paid by the Fund, divided by the yield

of the Fund, divided by the weighted average Unit price over a specified period. BPI receives 80% of the

Additional Entitlements initially, with the balance received when the actual full year performance of the New

Restaurants and the actual effective tax rate paid by the Fund are known with certainty (such balance of Units in

respect of the increased Royalty, the “Class B Holdback”, and in respect of the increased Distribution Income,

the “Class 2 Holdback”, and collectively, the “Holdback”). BPI receives 100% of the distributions on the

7 The Royalty and Distribution Income that is lost from the Closed Restaurants is calculated based upon the actual Franchise Sales

received from the Closed Restaurants during the 12-month period immediately following their addition to the Royalty Pool.

15

MANAGEMENT’S DISCUSSION AND ANALYSIS

BOSTON PIZZA ROYALTIES INCOME FUND

For the Period and Year ended December 31, 2022

- 8 -

Additional Entitlements throughout the year. After the New Restaurants have been part of the Royalty Pool for a

full year, an audit of the Franchise Sales of these restaurants is performed, and the actual effective tax rate paid

by the Fund is determined. At such time, an adjustment is made to reconcile distributions paid to BPI and the

Additional Entitlements received by BPI.

It is possible that on an Adjustment Date, the Net Royalty and Distribution Income is negative as a result of the

estimated Royalty and Distribution Income expected to be generated by the New Restaurants being less than the

actual Royalty and Distribution Income that is lost from the Closed Restaurants (the amount by which it is less is

the “Deficiency”). In such case, BPI would not receive any Additional Entitlements, however, nor would BPI lose

any of the Additional Entitlements previously received by BPI. Rather, on future Adjustment Dates, BPI would be

required to make-up the Deficiency by first adding Net Royalty and Distribution Income in an amount equal to the

Deficiency before receiving any further Additional Entitlements (i.e., BPI only receives Additional Entitlements in

respect of the cumulative amount by which Royalty and Distribution Income from New Restaurants exceeds actual

Royalty and Distribution Income lost from Closed Restaurants).

Ongoing Effects of COVID-19

COVID-19 continued to impact the business of the Fund, BPI and BP Canada LP, and the operation of Boston

Pizza Restaurants during 2021 and the first half of 2022. Since then, COVID-19 case counts have improved,

government restrictions related to COVID-19 have largely been eliminated, and sales levels of Boston Pizza

Restaurants have returned to more normal levels when compared to times prior to COVID-19.

Economic Uncertainties

The success of BPI, BP Canada LP and Boston Pizza Restaurants, and the amount of Franchise Sales, Royalty,

Distribution Income and Distributable Cash available for distribution to Unitholders, are dependent upon many

economic factors, including impacts of inflation, increases in interest rates, unemployment rates, consumer

confidence, recession, supply chain disruption, labour availability and other globally disruptive events. However,

despite the current state of economic uncertainty, Boston Pizza Restaurants have been able to generate solid

Franchise Sales and offer affordable dining options, both on and off-premise, for guests in economically uncertain

times. As demonstrated during COVID-19, BPI, BP Canada LP and Boston Pizza Restaurants have the ability

to adapt to changes in operating environments and economic conditions. For additional information regarding

economic uncertainties, refer to the “Risks & Uncertainties – Risks Related to the Business of BPI and

BP Canada LP” section of this MD&A.

Seasonality

Boston Pizza Restaurants typically experience seasonal fluctuations in Franchise Sales, which are inherent in

the full-service restaurant industry in Canada. Seasonal factors, such as tourism and better weather generally

allow Boston Pizza Restaurants to open their patios and generally increase Franchise Sales in the second and

third quarters each year compared to the first and fourth quarters. Seasonality’s general effect on Franchise

Sales impacts the Fund’s Distributable Cash and Payout Ratio.

New Restaurant Openings, Closures and Renovations

During the Period, there were no New Restaurants and three Closed Restaurants. During the Year, there were

no New Restaurants and six Closed Restaurants. As well, eight Boston Pizza Restaurants were renovated during

the Period and 18 Boston Pizza Restaurants were renovated during the Year. Boston Pizza Restaurants typically

close or partially close for two to three weeks to complete the renovation, which incorporates updated design

elements that result in a refreshed and more appealing restaurant.

16

MANAGEMENT’S DISCUSSION AND ANALYSIS

BOSTON PIZZA ROYALTIES INCOME FUND

For the Period and Year ended December 31, 2022

- 9 -

OPERATING RESULTS

Same Restaurant Sales and Franchise Sales

Period

SRS was 24.5% for the Period compared to 25.5% reported in the fourth quarter of 2021. As COVID-19 began

to adversely affect sales in Boston Pizza Restaurants in March of 2020, the Fund believes that it is also useful to

calculate and report SRS comparing 2022 Franchise Sales to 2019 Franchise Sales. If SRS were calculated

comparing Franchise Sales in the Period to Franchise Sales in the fourth quarter of 2019, SRS would be 10.8%.

The increase in SRS for the Period compared to the fourth quarter of 2021 was principally due to increases in

restaurant guest traffic mainly as a result of the elimination of dining restrictions and increased average guest

cheque.

Franchise Sales of Boston Pizza Restaurants in the Royalty Pool were $227.2 million for the Period compared to

$183.2 million for the fourth quarter of 2021. The $44.0 million increase in Franchise Sales for the Period was

primarily due to positive SRS.

Year

SRS was 30.4% for the Year compared to 8.5% reported in 2021. If SRS were calculated comparing Franchise

Sales for the Year to Franchise Sales in 2019, SRS would be 3.2%. The increase in SRS for the Year compared

to 2021 was principally due to increases in restaurant guest traffic as a result of the easing and elimination of

dining restrictions and increased average guest cheque.

Franchise Sales of Boston Pizza Restaurants in the Royalty Pool were $855.0 million for the Year compared to

$660.1 million in 2021. The $194.9 million increase in Franchise Sales for the Year was primarily due to positive

SRS.

Royalty Income and Distribution Income

Period

Royalty income and Distribution Income earned by the Fund was $9.1 million and $3.0 million for the Period,

respectively, compared to $7.3 million and $2.4 million, respectively, for the fourth quarter of 2021. Royalty

income and Distribution Income in respect of the Period was based on the Royalty Pool of 383 Boston Pizza

Restaurants reporting Franchise Sales of $227.2 million. In the fourth quarter of 2021, Royalty income and

Distribution Income was based on the Royalty Pool of 387 Boston Pizza Restaurants reporting Franchise Sales

of $183.2 million. The $1.8 million increase in Royalty income and the $0.6 million increase in Distribution Income

for the Period were primarily due to positive SRS.

Year

Royalty income and Distribution Income earned by the Fund was $34.2 million and $11.3 million for the Year,

respectively, compared to $26.4 million and $8.8 million, respectively, in 2021. Royalty income and Distribution

Income for the Year was based on the Royalty Pool of 383 Boston Pizza Restaurants reporting Franchise Sales

of $855.0 million. In 2021, Royalty income and Distribution Income were based on the Royalty Pool of 387 Boston

Pizza Restaurants reporting Franchise Sales of $660.1 million. The $7.8 million increase in Royalty income and

the $2.5 million increase in Distribution Income for the Year were primarily due to positive SRS.

17

MANAGEMENT’S DISCUSSION AND ANALYSIS

BOSTON PIZZA ROYALTIES INCOME FUND

For the Period and Year ended December 31, 2022

- 10 -

Administrative Expenses

Period

Administrative expenses incurred by the Fund were $0.4 million for the Period, a nominal increase compared to

$0.3 million for the fourth quarter of 2021. Administrative expenses are comprised of professional fees, trustee

fees and expenses, the reimbursement charge payable to BPI and other general and administrative expenses.

Year

Administrative expenses incurred by the Fund were $1.4 million for the Year compared to $1.3 million in 2021.

Interest and Financing Expenses

Period

Interest and financing expenses incurred by the Fund totaled $2.4 million for the Period, comprised of interest on

long-term debt and financing fees of $0.8 million and interest on Class B Units of $1.6 million. Interest and

financing expenses incurred by the Fund totaled $2.0 million for the fourth quarter of 2021, comprised of interest

on long-term debt and financing fees of $1.0 million and interest on Class B Units of $1.0 million. The Class B

Units are classified as financial liabilities and therefore, amounts paid by Royalties LP to BPI in respect of the

Class B Units are classified as interest expense and not distributions. The increase in interest and financing

expenses for the Period was primarily due to the increase in interest expense on Class B Units of $0.6 million

due to higher monthly distribution rates compared to the same period in 2021 and the 2022 Special Distribution

(as defined below), partially offset by lower interest expense on long-term debt of $0.2 million due to lower interest

rates as part of the Second Supplemental Credit Agreement (as defined below).

Year

Interest and financing expenses incurred by the Fund totaled $7.3 million for the Year, comprised of interest on

long-term debt and financing fees of $3.6 million and interest on Class B Units of $3.7 million. Interest and

financing expenses incurred by the Fund totaled $6.4 million in 2021, comprised of interest on long-term debt and

financing fees of $3.9 million and interest on Class B Units of $2.5 million. The increase in interest and financing

expenses for the Year was primarily due to the increase in interest expense on Class B Units of $1.2 million due

to higher monthly distribution rates compared to the same period in 2021 and the 2022 Special Distribution,

partially offset by lower interest expense on long-term debt of $0.3 million due to lower interest rates as part of

the Second Supplemental Credit Agreement.

Profit before Fair Value Gain (Loss) and Income Taxes

Period

The Fund’s profit before fair value gain (loss) and income taxes was $9.4 million for the Period compared to

$7.5 million for the fourth quarter of 2021. The $1.9 million increase in profit before fair value gain (loss) and

income taxes for the Period was primarily due to higher Royalty and Distribution Income of $2.3 million and lower

interest expense on long-term debt of $0.2 million, partially offset by an increase in interest on Class B Units of

$0.6 million.

Year

The Fund’s profit before fair value gain (loss) and income taxes was $36.9 million for the Year compared to

$27.6 million for 2021. The $9.3 million increase in profit before fair value gain (loss) and income taxes for the

Year was primarily due to higher Royalty and Distribution Income of $10.3 million and lower interest expense on

long-term debt of $0.3 million, partially offset by an increase in interest on Class B Units of $1.2 million.

18

MANAGEMENT’S DISCUSSION AND ANALYSIS

BOSTON PIZZA ROYALTIES INCOME FUND

For the Period and Year ended December 31, 2022

- 11 -

Fair Value Gain (Loss)

The Fund classifies the investment in Class 1 LP Units and Class 2 LP Units as financial assets at fair value

through profit or loss, the Class B Unit liability as a financial liability at fair value through profit or loss, and Swaps

(as defined below) as derivative instruments. As such, fair value adjustments are recognized in the Fund’s

statements of comprehensive income in accordance with IFRS. For additional information regarding Swaps, refer

to the “Liquidity & Capital Resources – Interest Rate Swaps” section of this MD&A. For additional information

regarding financial liabilities and assets at fair value, refer to the “Critical Accounting Estimates” section of this

MD&A.

Period

During the Period, the Fund recognized a fair value loss of $0.5 million compared to a fair value gain of $7.0 million

for the same period in 2021. The change in fair value was principally due to the change in the price of Units,

which is used to estimate the value of the Class 2 LP Units and upon which the Class B Unit liability is measured.

Changes in interest rates, upon which the Swaps are measured, also impact the change in fair value.

The Fund indirectly acquired the Class 1 LP Units on May 6, 2015 for $33.3 million. The Class 1 LP Units are

entitled to distributions determined with respect to the interest cost payable on Facility D. The Fund estimates

the fair value of the Class 1 LP Units using a market-corroborated input, being the interest rate applicable on

Facility D. Consequently, the Fund estimated the fair value of Class 1 LP Units as at December 31, 2022 to be

$33.3 million (September 30, 2022 – $33.3 million), resulting in no fair value adjustment for the Period.

The Fund estimates the fair value of the Class 2 LP Units by multiplying the number of Class 2 LP Units indirectly

held by the Fund at the end of the Period by the closing price of the Units on the last business day of the Period.

Based on the Fund’s closing price of $15.08 per Unit at December 31, 2022 (September 30, 2022 – $15.29 per

Unit) and the 5,455,762 Class 2 LP Units held by the Fund (September 30, 2022 – 5,455,762), the fair value of

the Class 2 LP Units was estimated to be $82.3 million (September 30, 2022 – $83.4 million), resulting in a fair

value loss of $1.1 million for the Period. In general, the fair value of the Class 2 LP Units will increase as the

market price of Units increases and vice versa.

The Fund estimates the fair value of the Class B Unit liability by multiplying the number of Units that BPI would

be entitled to receive if it exchanged all of the Class B Units (including the Class B Holdback) held by BPI at the

end of the Period by the closing price of the Units on the last business day of the Period. Based on the Fund’s

closing price of $15.08 per Unit at December 31, 2022 (September 30, 2022 – $15.29 per Unit) and the 2,430,823

Units BPI would be entitled to receive if it exchanged all of the Class B Units (including the Class B Holdback)

held by BPI (September 30, 2022 – 2,430,823), the Class B Unit liability (on a fully-diluted basis) was valued at

$36.7 million (September 30, 2022 – $37.2 million), resulting in a fair value gain of $0.5 million. In general, the

Fund’s Class B Unit liability will increase as the market price of Units increases and vice versa. In addition, the

Fund’s Class B Unit liability increases as the number of Units BPI would be entitled to receive if it exchanged all

of its Class B Units (including the Class B Holdback) increases and vice versa.

The Fund recognized a fair value gain of $0.1 million in the Period as a result of the increase in the fair value of

the Swaps from September 30, 2022 to December 31, 2022 due to changes in interest rates during the Period.

For the same period in 2021, the Fund recognized a fair value gain of $0.7 million as a result of the increase in

the fair value of the Swaps from September 30, 2021 to December 31, 2021 due to changes in interest rates.

Year

During the Year, the Fund recognized a fair value gain of $2.8 million compared to $16.3 million for 2021. The

change in fair value was principally due to the change in the price of Units, which is used to estimate the value of

the Class 2 LP Units and upon which the Class B Unit liability is measured. Changes in interest rates, upon which

the Swaps are measured, also impact the change in fair value.

19

MANAGEMENT’S DISCUSSION AND ANALYSIS

BOSTON PIZZA ROYALTIES INCOME FUND

For the Period and Year ended December 31, 2022

- 12 -

The Fund indirectly acquired the Class 1 LP Units on May 6, 2015 for $33.3 million. As discussed above, the

Fund estimated the fair value of Class 1 LP Units as at December 31, 2022 to be $33.3 million

(December 31, 2021 – $33.3 million), resulting in no fair value adjustment for the Year.

As at December 31, 2021, the Fund indirectly held 5,455,762 Class 2 LP Units and the Fund’s closing price was

$15.45. Consequently, the Fund estimated the fair value of the Class 2 LP Units as at December 31, 2021 to be

$84.3 million. As discussed above, the Fund estimated the fair value of the Class 2 LP Units as at December 31,

2022 to be $82.3 million, resulting in a fair value loss of $2.0 million for the Year. In general, the fair value of the

Class 2 LP Units will increase as the market price of Units increases and vice versa.

As at December 31, 2021, the number of Units BPI would be entitled to receive if it exchanged all of the Class B

Units (including the Class B Holdback) held by BPI was 2,430,823 and the Fund’s closing price was $15.45 per

Unit. The Class B Unit liability (on a fully-diluted basis) as at December 31, 2021 was valued at $37.6 million. As

discussed above, the Class B Unit liability at the end of the Period was valued at $36.7 million, resulting in a fair

value gain of $0.9 million.

The Fund recorded a $3.9 million fair value gain for the Year as a result of the increase in the fair value of the

Swaps from December 31, 2021 to December 31, 2022 due to changes in interest rates for the Year. In 2021,

the Fund recorded a $2.3 million fair value gain as a result of the increase in the fair value of the Swaps from

December 31, 2020 to December 31, 2021 due to changes in interest rates.

Income Taxes

The Fund is subject to specified investment flow-through tax (“SIFT Tax”), which is the Fund’s only current income

tax expense.

Period

The Fund’s income tax expense for the Period was $2.5 million, comprised of $2.4 million in current income tax

expense and nominal non-cash deferred income tax expense. The Fund’s income tax expense for the fourth

quarter of 2021 was $1.8 million, comprised primarily of current income tax expense and nominal non-cash

deferred income tax recovery. The $0.6 million increase in current income tax expense is attributable to higher

profit before fair value gain (loss) and income taxes.

Year

The Fund’s income tax expense for the Year was $9.1 million, comprised of $8.9 million in current income tax

expense and $0.2 million in non-cash deferred income tax expense. The Fund’s income tax expense in 2021

was $6.4 million, comprised of $6.3 million in current income tax expense and $0.1 million in non-cash deferred

income tax expense. The $2.6 million increase in current income tax expense is attributable to higher profit before

fair value gain (loss) and income taxes. The $0.1 million increase in non-cash deferred income tax expense is

due to changes in the temporary differences between the accounting and tax base of: (i) the BP Rights owned by

Royalties LP generated since the inception of the Fund; and (ii) the Fund’s indirect investment in BP Canada LP.

Net and Comprehensive Income / Basic and Diluted Earnings

Period

The Fund’s net and comprehensive income was $6.4 million for the Period compared to $12.6 million for the

fourth quarter of 2021. The Fund’s basic earnings per Unit was $0.30 for the Period compared to $0.59 for the

fourth quarter of 2021. The Fund’s diluted earnings per Unit was $0.26 for the Period compared to $0.59 for the

fourth quarter of 2021. The $6.2 million decrease in the Fund’s net and comprehensive income for the Period

compared to the fourth quarter of 2021 was primarily due to a $7.5 million increase in fair value loss and an

increase in income tax expense of $0.7 million, partially offset by a $1.9 million increase in profit before fair value

gain (loss) and income taxes.

20

MANAGEMENT’S DISCUSSION AND ANALYSIS

BOSTON PIZZA ROYALTIES INCOME FUND

For the Period and Year ended December 31, 2022

- 13 -

Year

The Fund’s net and comprehensive income was $30.6 million for the Year compared to $37.4 million in 2021.

The Fund’s basic earnings per Unit was $1.42 for the Year compared to $1.74 in 2021. The Fund’s diluted

earnings per Unit was $1.31 for the Year compared to $1.74 in 2021. The $6.8 million decrease in the Fund’s

net and comprehensive income for the Year compared to 2021 was primarily due to a $13.5 million decrease in

fair value gain and an increase in income tax expense of $2.6 million, partially offset by a $9.3 million increase in

profit before fair value gain (loss) and income taxes.

Distributions

Period

During the Period, the Fund declared distributions on the Units in the aggregate amount of $10.5 million or

$0.489 per Unit. During the fourth quarter of 2021, the Fund declared distributions on the Units in the aggregate

amount of $7.3 million or $0.340 per Unit. During the Period, the Fund paid distributions on the Units in the

aggregate amount of $8.3 million or $0.387 per Unit. During the fourth quarter of 2021, the Fund paid distributions

on the Units in the aggregate amount of $5.5 million or $0.255 per Unit. The amount of distributions declared

during the Period increased by $3.2 million or $0.149 per Unit due to the monthly distribution rate increasing from

$0.085 per Unit to $0.100 per Unit commencing with the July 2022 distribution, and increasing again from

$0.100 per Unit to $0.102 per Unit commencing with the November 2022 distribution (collectively, the “2022

Distribution Increases”) and the special cash distribution to Unitholders of $0.085 per Unit, which was declared

on December 8, 2022 and was paid on December 30, 2022 to Unitholders of record at the close of business on

December 21, 2022 (the “2022 Special Distribution”). Distributions paid during the Period increased by $2.8

million or $0.132 per Unit due to the 2022 Distribution Increases and the 2022 Special Distribution.

Year

During the Year, the Fund declared distributions on the Units in the aggregate amount of $25.8 million or

$1.199 per Unit. During 2021, the Fund declared distributions on the Units in the aggregate amount of $18.5

million or $0.860 per Unit. During the Year, the Fund paid distributions on the Units in the aggregate amount of

$25.4 million or $1.182 per Unit. During 2021, the Fund paid distributions on the Units in the aggregate amount

of $22.4 million or $1.040 per Unit. The amount of distributions declared during the Year increased by $7.3 million

or $0.339 per Unit due to the monthly distribution rate increasing from $0.065 per Unit to $0.085 per Unit

commencing with the September 2021 distribution, the 2022 Distribution Increases and the 2022 Special

Distribution. The amount of distributions paid during the Year increased by $3.0 million or $0.142 per Unit due to

the monthly distribution rate increasing from $0.065 per Unit to $0.085 per Unit commencing with the September

2021 distribution, the 2022 Distribution Increases and the 2022 Special Distribution, which was partially offset by

the special distribution of $0.200 per Unit that was declared on December 16, 2020 and paid on January 29, 2021

to Unitholders of record at the close of business on December 31, 2020 (the “2020 Special Distribution”).

The Fund pays distributions on the Units in respect of any calendar month not later than the last business day of

the immediately subsequent month. Consequently, monthly distributions payable by the Fund on the Units in

respect of the Period were the October 2022 distribution (which was paid on November 30, 2022), the

November 2022 distribution (which was paid on December 30, 2022) and the December 2022 distribution (which

was paid on January 31, 2023). Similarly, the distributions payable by the Fund on the Units in respect of any

other period are paid in the immediately subsequent month of such period.

On February 8, 2023, the trustees of the Fund declared a distribution for the period of January 1, 2023 to

January 31, 2023 of $0.102 per Unit, which will be payable on February 28, 2023 to Unitholders of record on

February 21, 2023. Including the January 2023 distribution, which will be paid on February 28, 2023, the Fund

will have paid out total distributions of $397.7 million or $24.85 per Unit which includes 241 monthly distributions,

the 2022 Special Distribution and the 2020 Special Distribution.

21

MANAGEMENT’S DISCUSSION AND ANALYSIS

BOSTON PIZZA ROYALTIES INCOME FUND

For the Period and Year ended December 31, 2022

- 14 -

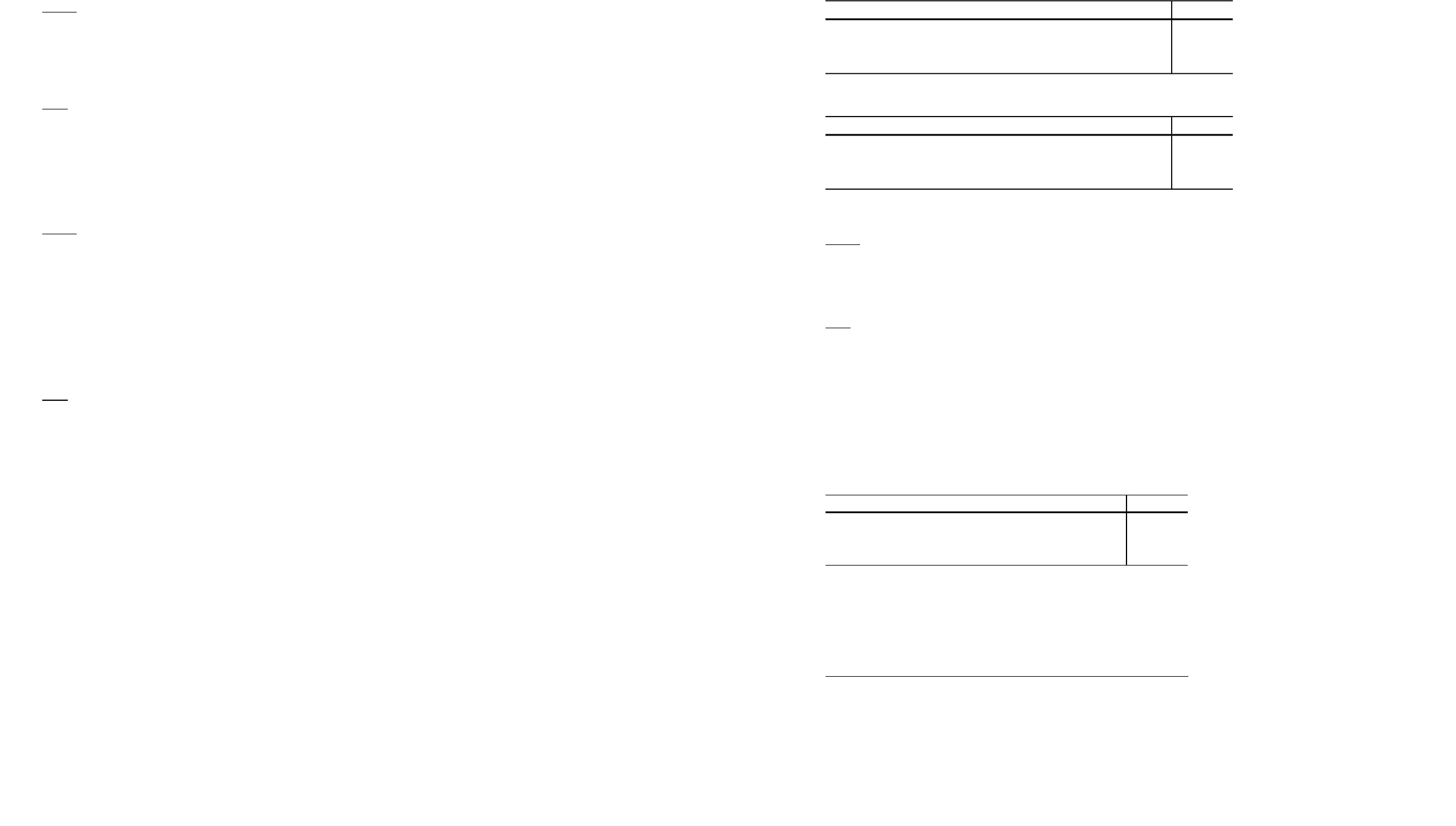

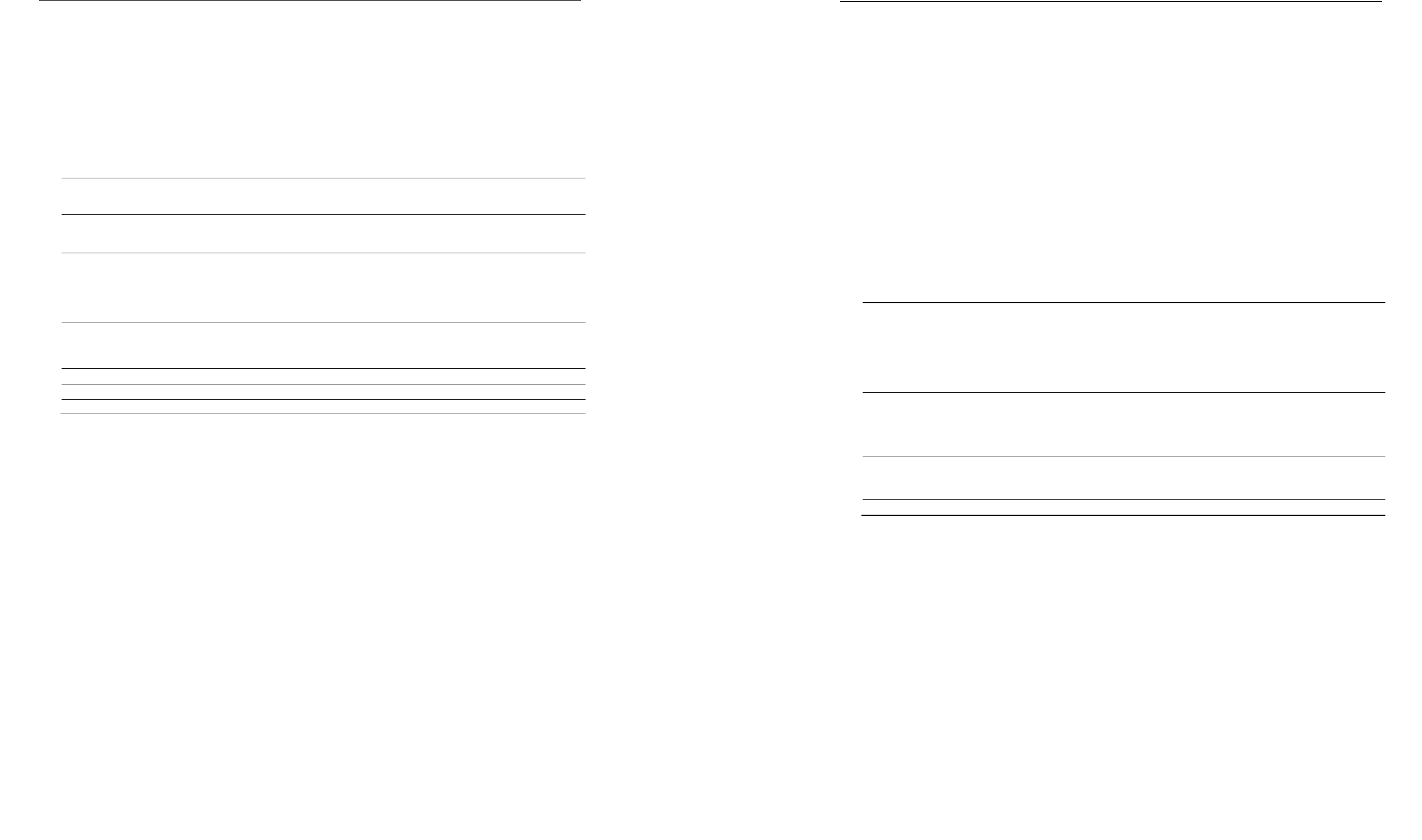

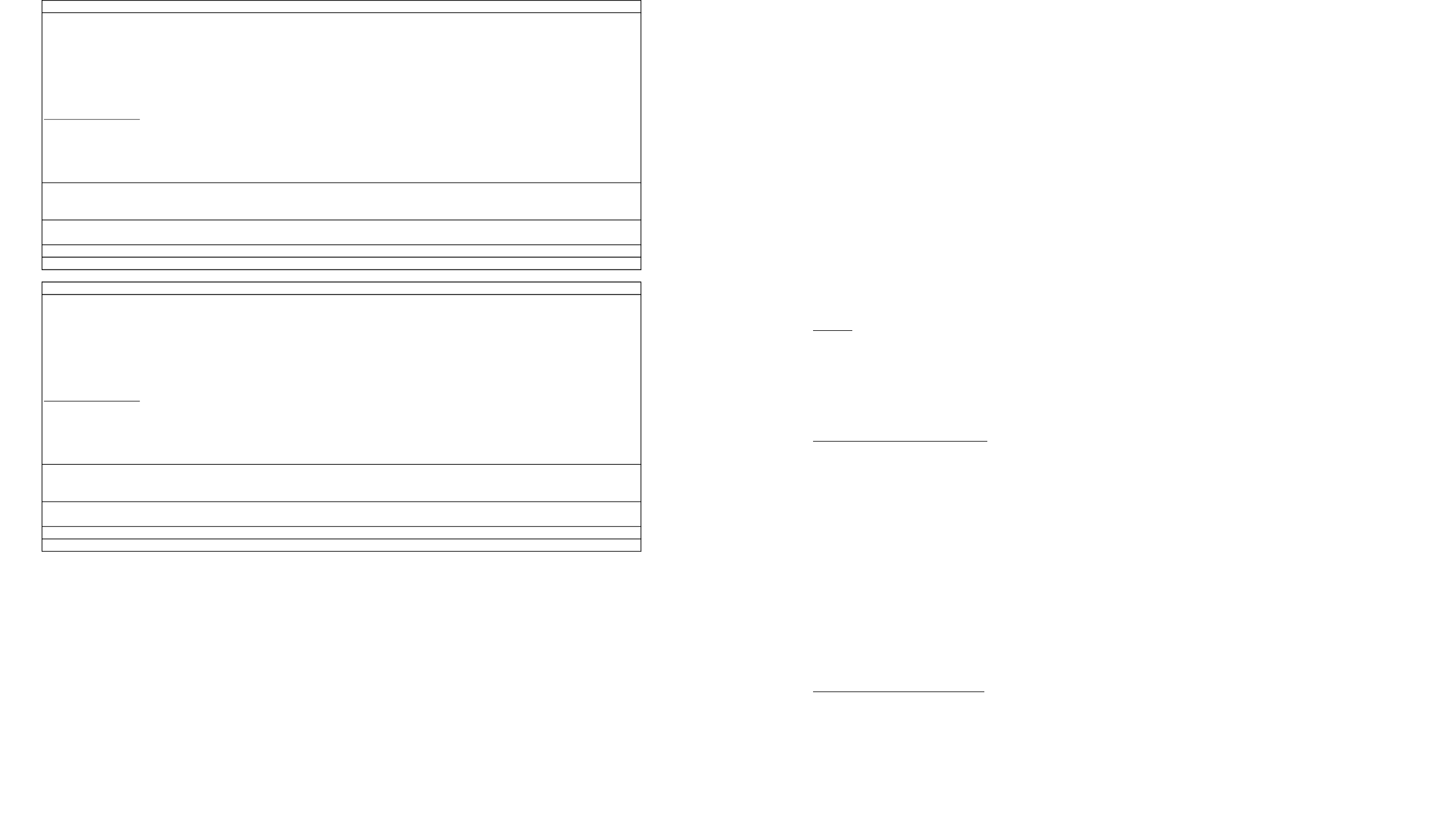

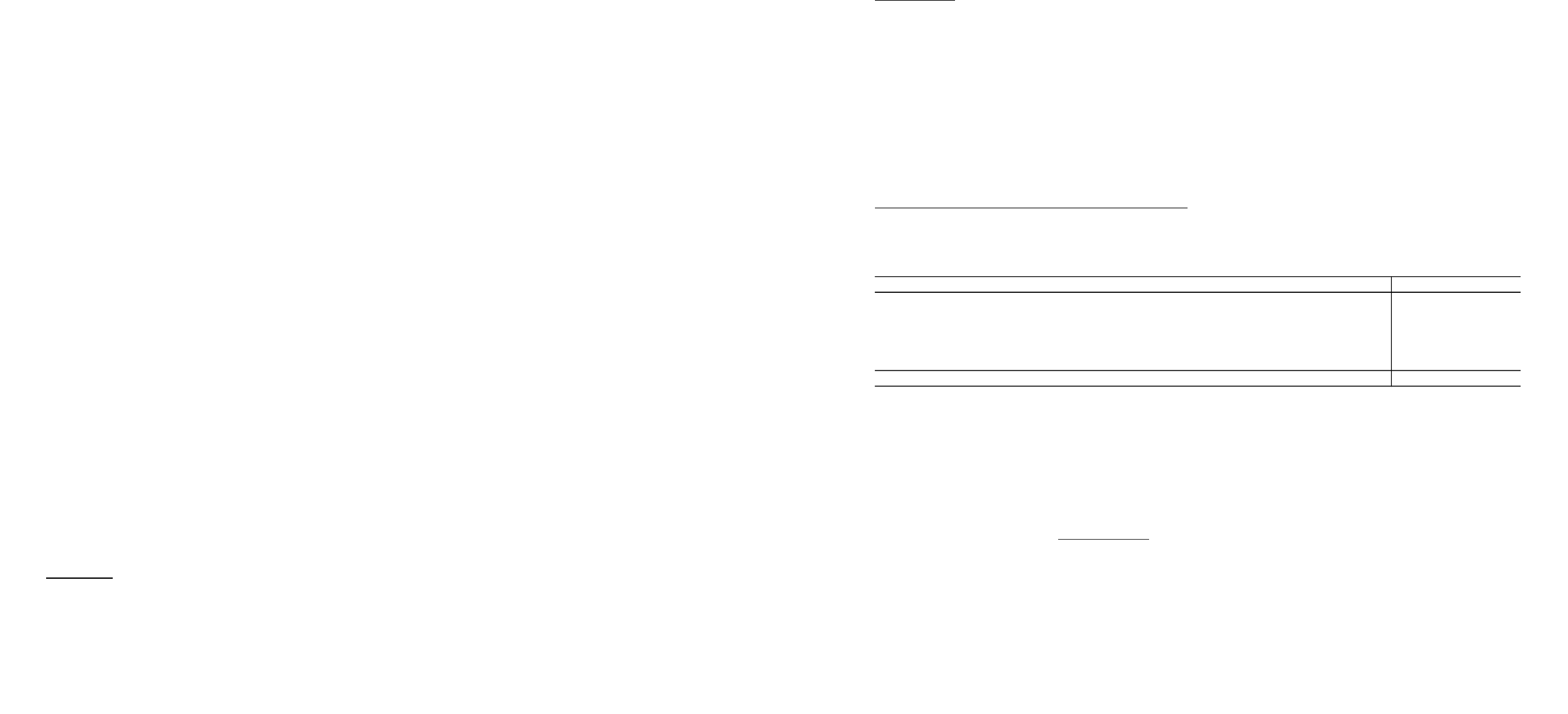

Distributions related to the Year were as follows:

PERIOD PAYMENT DATE AMOUNT/UNIT

December 1 – 31, 2021 January 31, 2022 8.5¢

January 1 – 31, 2022 February 28, 2022 8.5¢

February 1 – 28, 2022 March 31, 2022 8.5¢

March 1 – 31, 2022 April 29, 2022 8.5¢

April 1 – 30, 2022 May 31, 2022 8.5¢

May 1 – 31, 2022 June 30, 2022 8.5¢

June 1 – 30, 2022 July 29, 2022 8.5¢

July 1 – 31, 2022 August 31, 2022 10.0¢

August 1 – 30, 2022 September 30, 2022 10.0¢

September 1 – 30, 2022 October 31, 2022 10.0¢

October 1 – 31, 2022 November 30, 2022 10.0¢

November 1 – 30, 2022 December 30, 2022 10.2¢

2022 Special Distribution December 30, 2022 8.5¢

December 1 – 31, 2022* January 31, 2023* 10.2¢

* Paid subsequent to the Period and the Year.

Distributions for the Period and the Year were funded entirely by cash flows generated from operating activities.

No debt was incurred at any point during the Period or the Year to fund distributions.

Cash Flows from Operating Activities

Period

Cash generated from operating activities for the Period was $8.9 million compared to $8.5 million in the fourth

quarter of 2021. The increase of $0.4 million was due to an increase of Royalty and Distribution Income of

$2.3 million, partially offset by a decrease in changes in working capital of $1.1 million and an increase in income

taxes paid of $0.8 million.

Year

Cash generated from operating activities for the Year was $34.4 million compared to $30.5 million for 2021. The

increase of $3.9 million was due to an increase of Royalty and Distribution Income of $10.3 million, partially offset

by a decrease in changes in working capital of $4.0 million and an increase in income taxes paid of $2.4 million.

22

MANAGEMENT’S DISCUSSION AND ANALYSIS

BOSTON PIZZA ROYALTIES INCOME FUND

For the Period and Year ended December 31, 2022

- 15 -

Cash Flow used in Financing Activities

Period

During the Period, the Fund used $10.4 million in cash for financing activities compared to $7.8 million in the

fourth quarter of 2021. The increase of $2.6 million was due to higher distributions paid to Unitholders of

$2.8 million and higher interest paid on Class B Units of $0.5 million partially offset by a decrease in repayments

of long-term debt of $0.7 million.

Year

During the Year, the Fund used $34.3 million in cash for financing activities compared to $33.0 million in

2021. The increase of $1.3 million was due to higher distributions paid to Unitholders of $3.0 million, higher

interest paid on Class B Units of $0.5 million and higher deferred financing fees paid of $0.1 million, partially offset

by a decrease in repayments of long-term debt of $2.3 million.

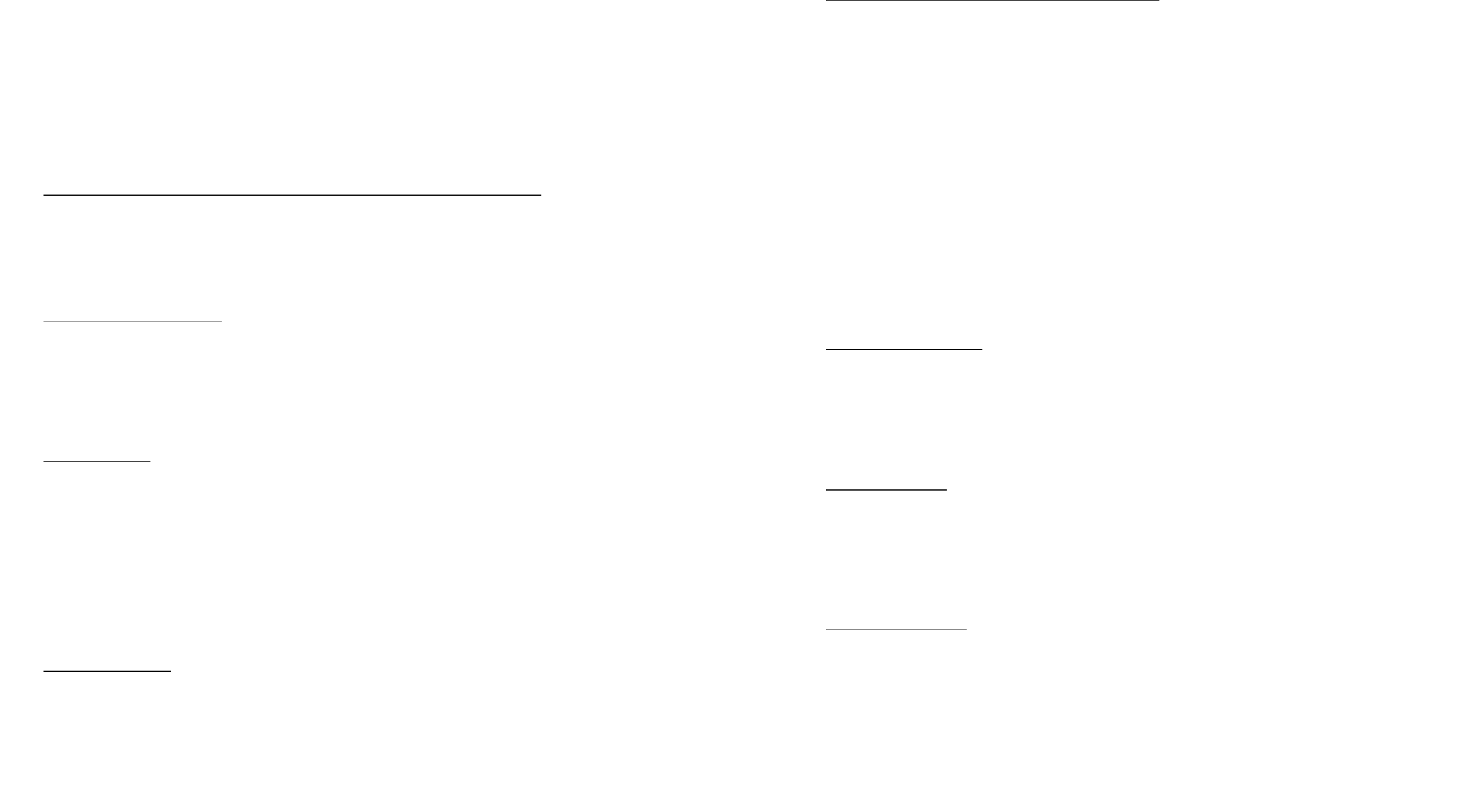

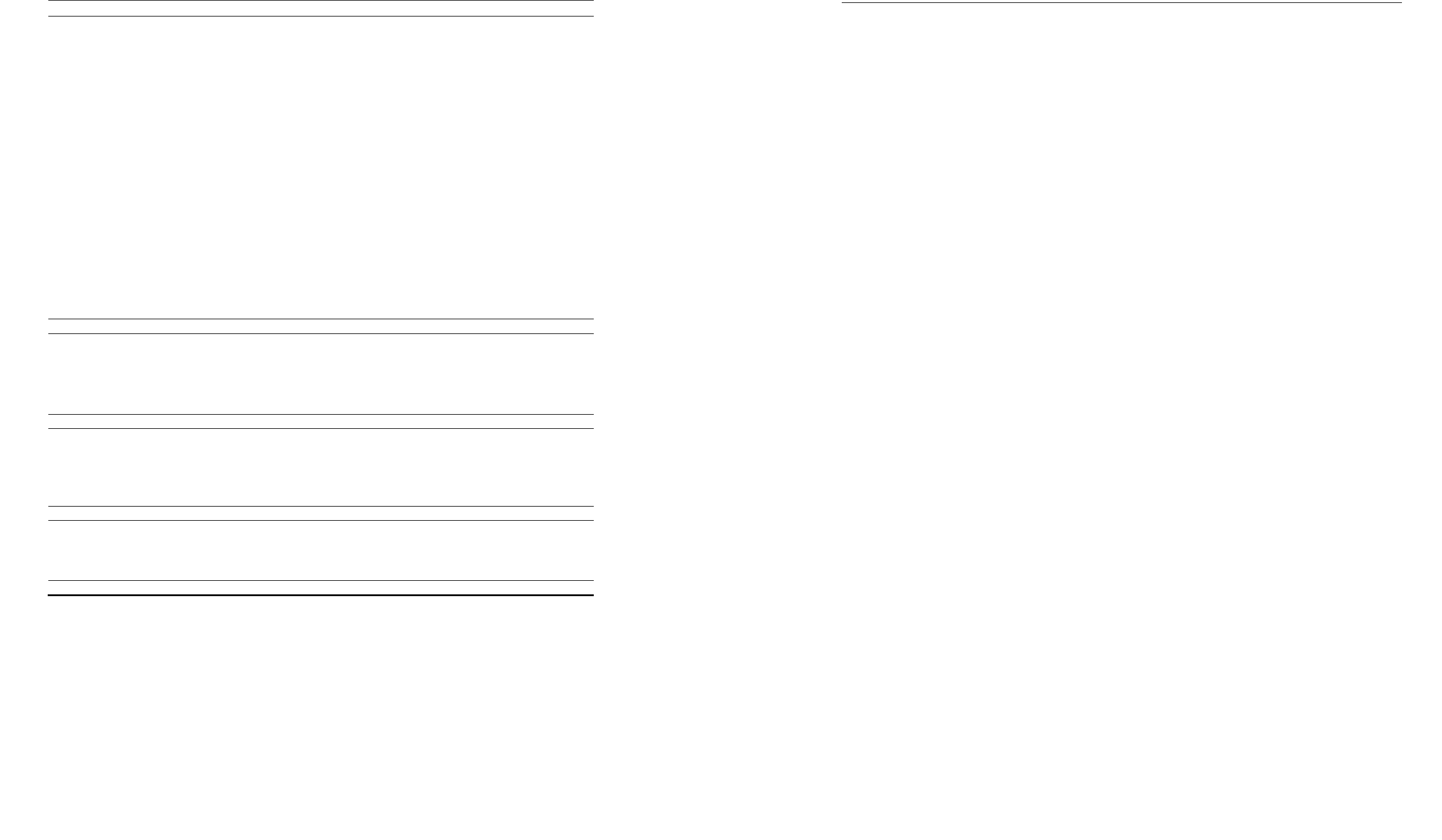

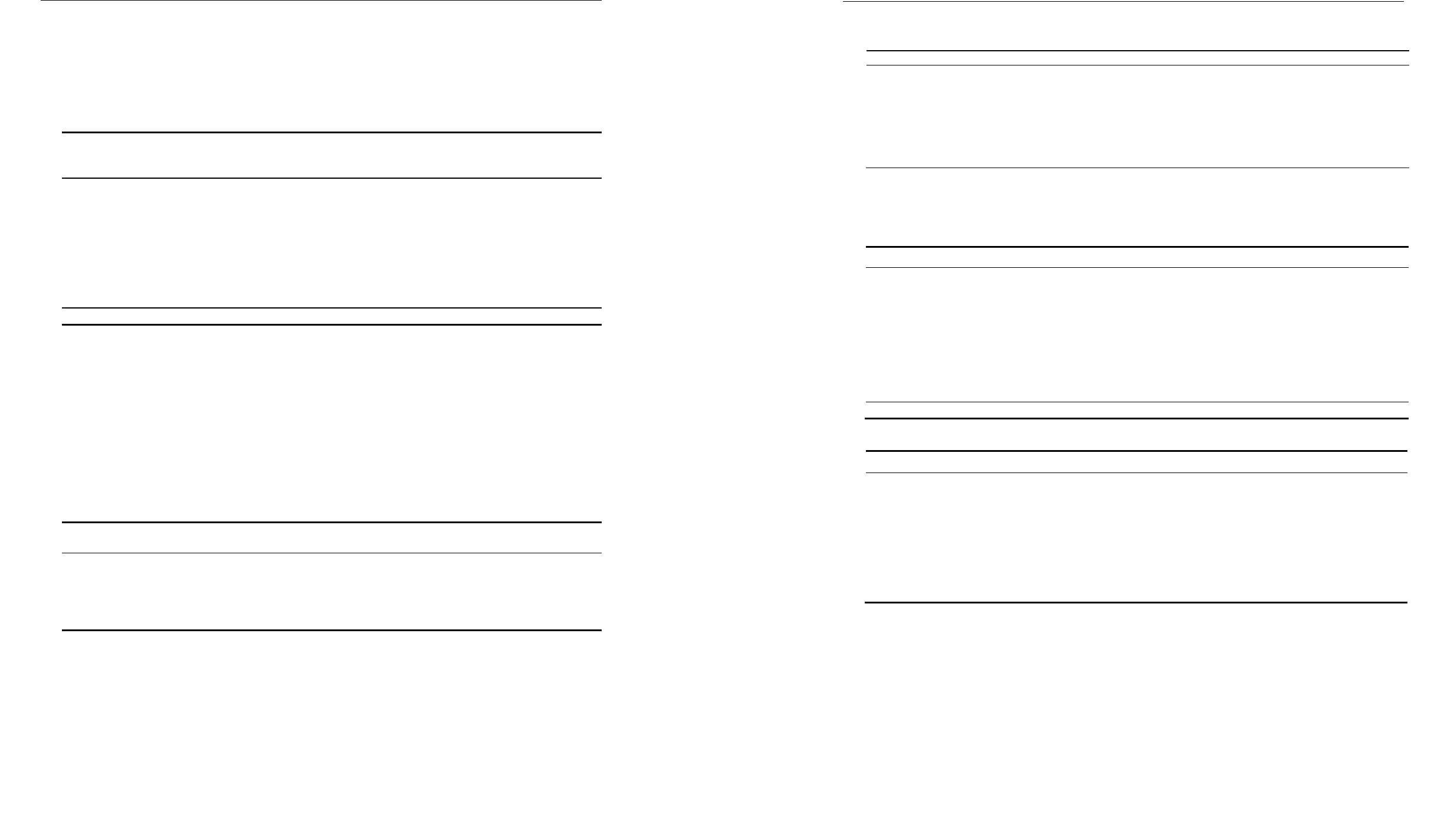

Distributable Cash / Distributable Cash per Unit

Period

The Fund generated Distributable Cash of $7.2 million for the Period compared to $6.1 million for the fourth

quarter of 2021. The increase in Distributable Cash of $1.2 million or 19.2% was primarily due to lower

repayments of long-term debt of $0.7 million, an increase of cash flows generated from operating activities of

$0.4 million and SIFT Tax on Units adjustment of $0.2 million, partially offset by increased BPI Class B Unit

entitlement of $0.2 million.

The Fund generated Distributable Cash per Unit of $0.336 for the Period compared to $0.282 per Unit for the

fourth quarter of 2021. The increase in Distributable Cash per Unit of $0.054 or 19.1% was primarily attributable

to the increase in Distributable Cash outlined above.

Year

The Fund generated Distributable Cash of $25.6 million for the Year compared to $20.4 million in 2021. The

increase in Distributable Cash of $5.2 million or 25.2% was primarily due to an increase in cash flow generated

from operating activities of $3.9 million and a decrease in repayments of long-term debt of $2.3 million, partially

offset by increased BPI Class B Unit entitlement of $0.9 million and SIFT Tax on Units adjustment of $0.2 million.

The Fund generated Distributable Cash per Unit of $1.189 for the Year compared to $0.950 per Unit in 2021.

The increase in Distributable Cash per Unit of $0.239 or 25.2% was primarily attributable to the increase in

Distributable Cash outlined above.

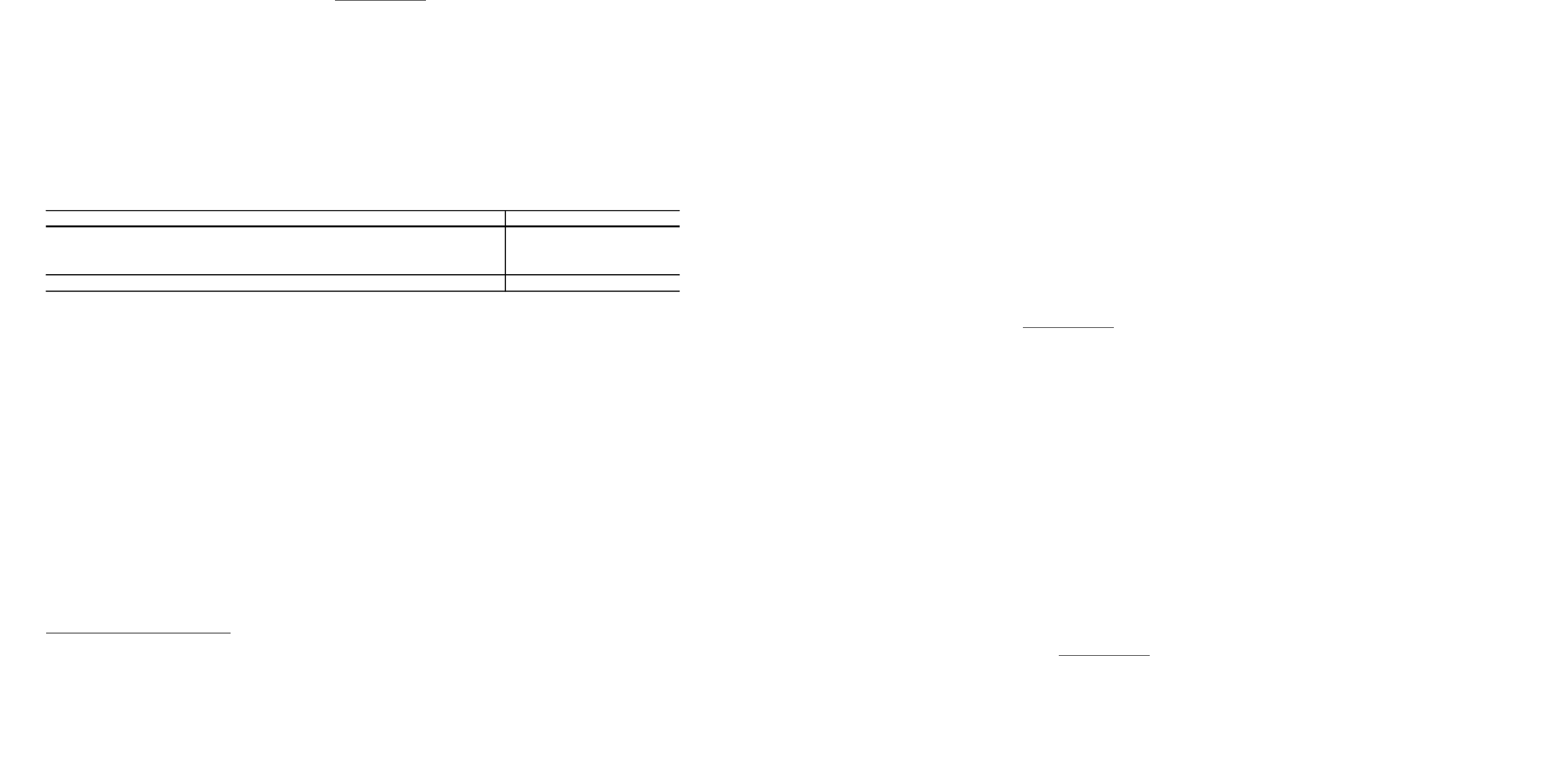

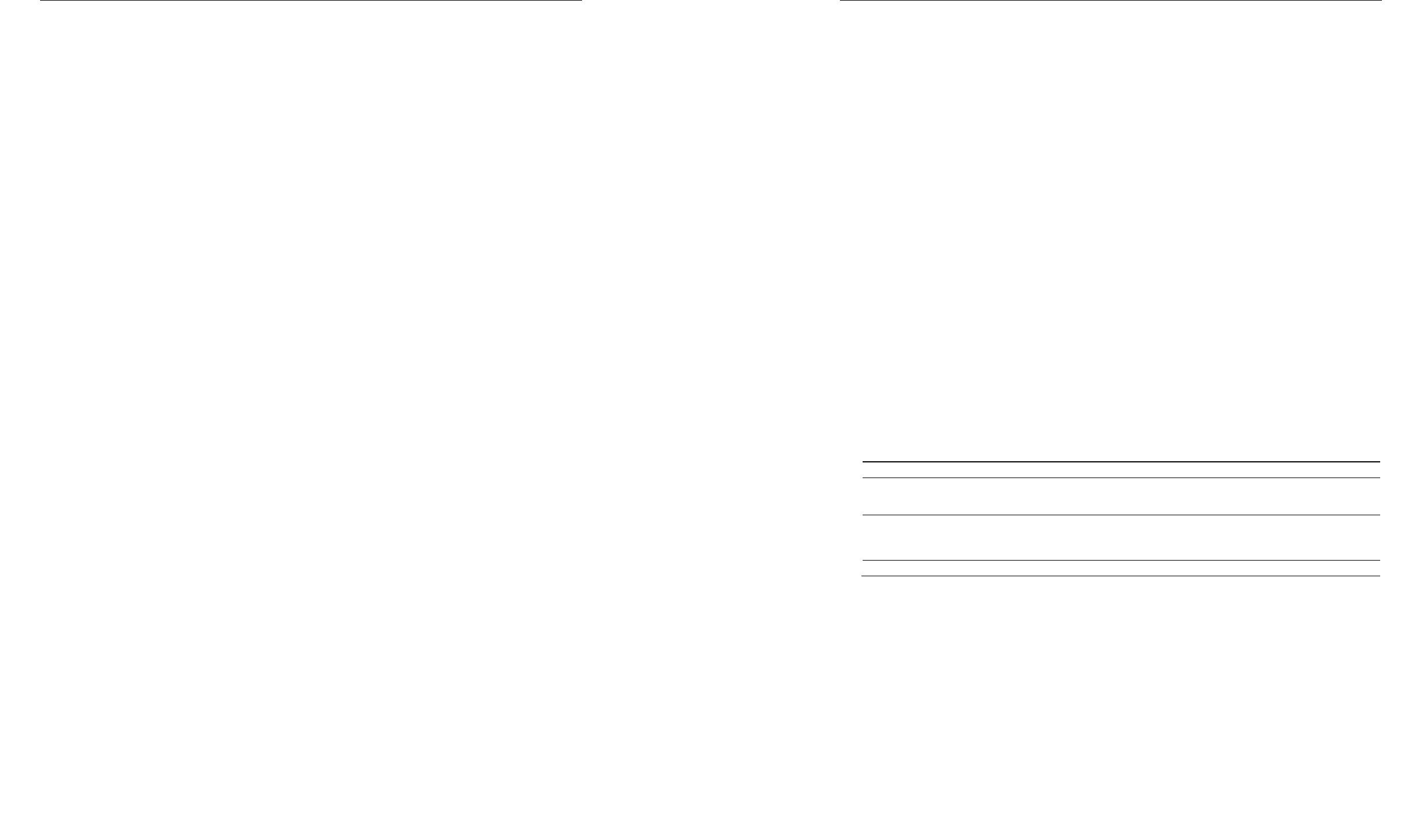

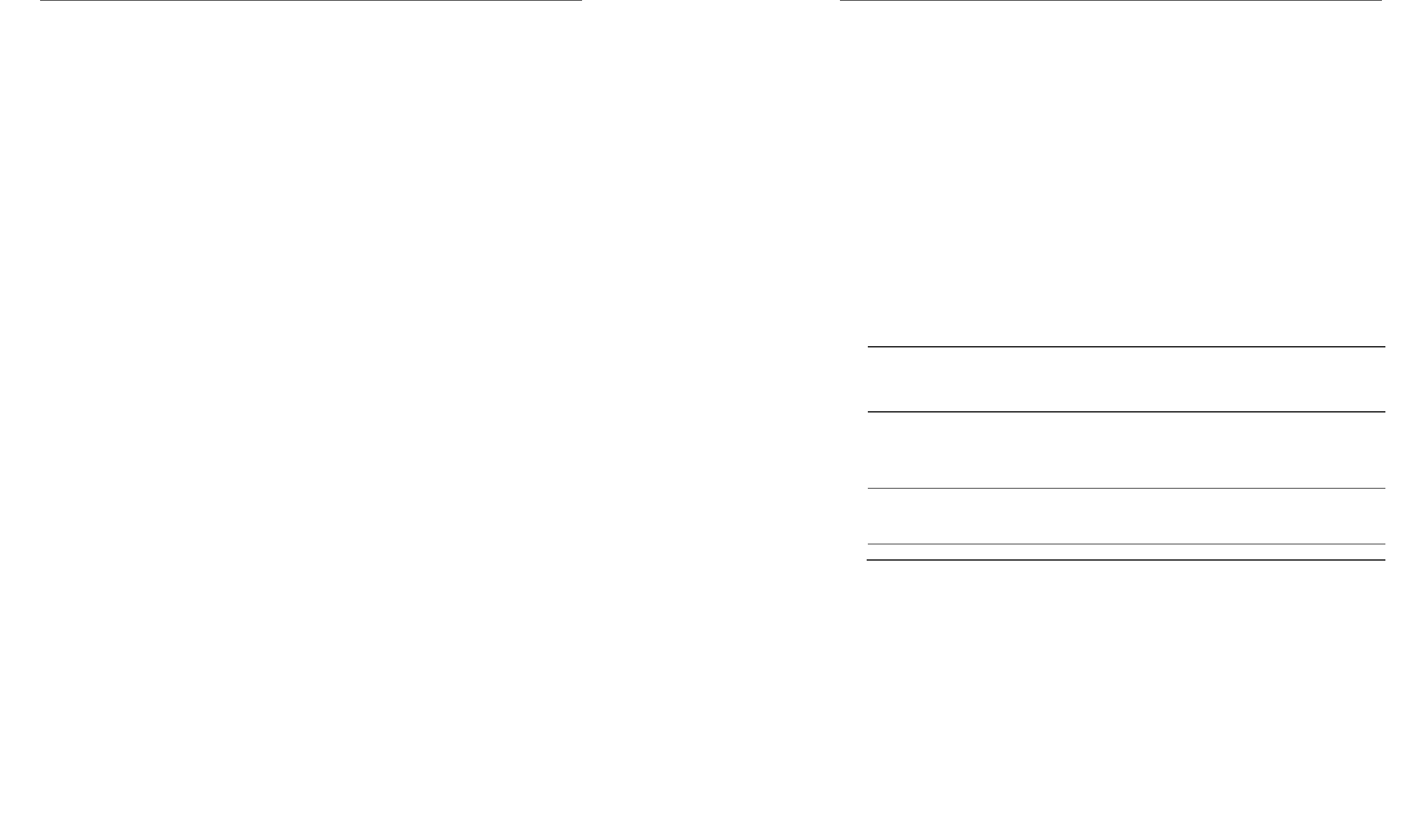

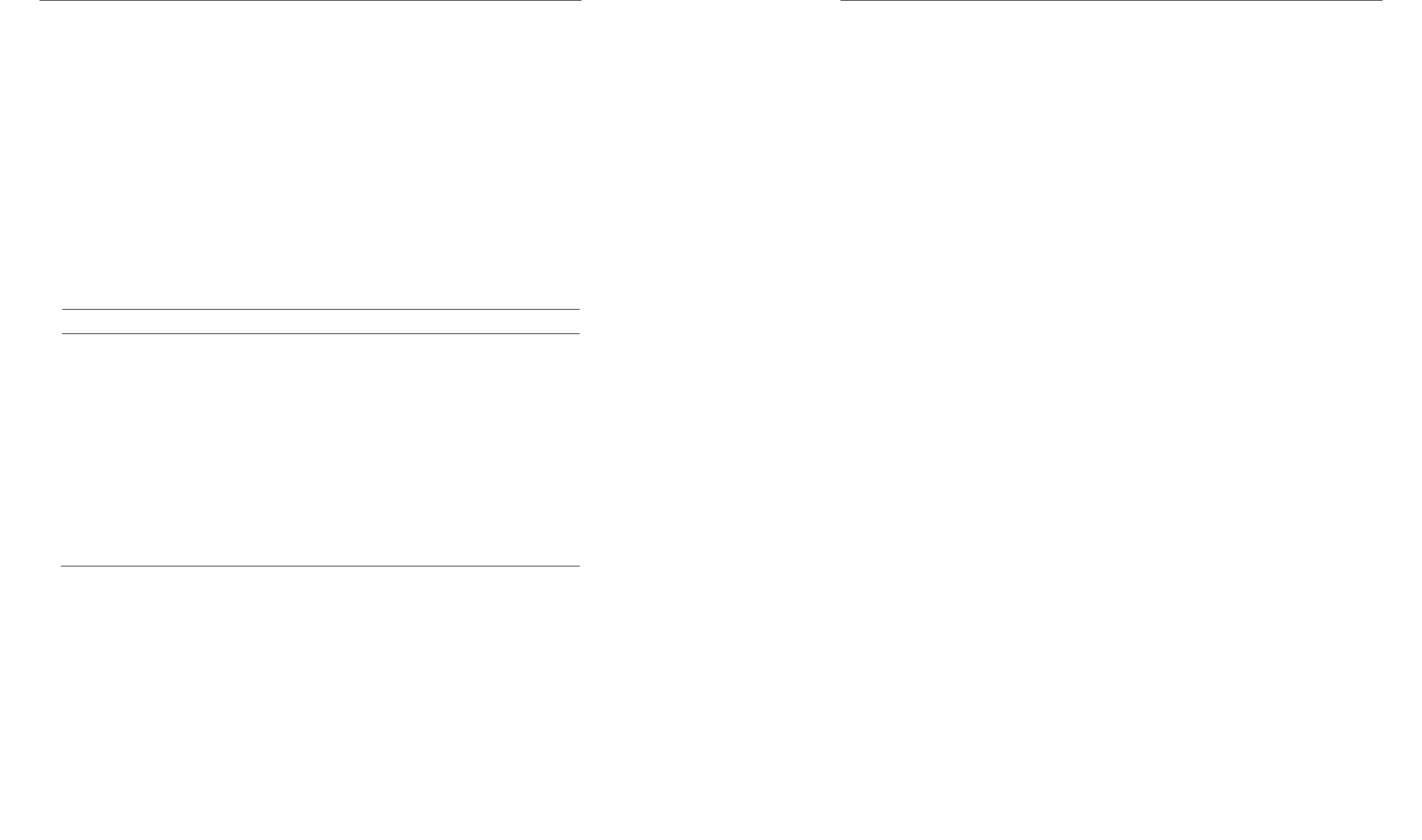

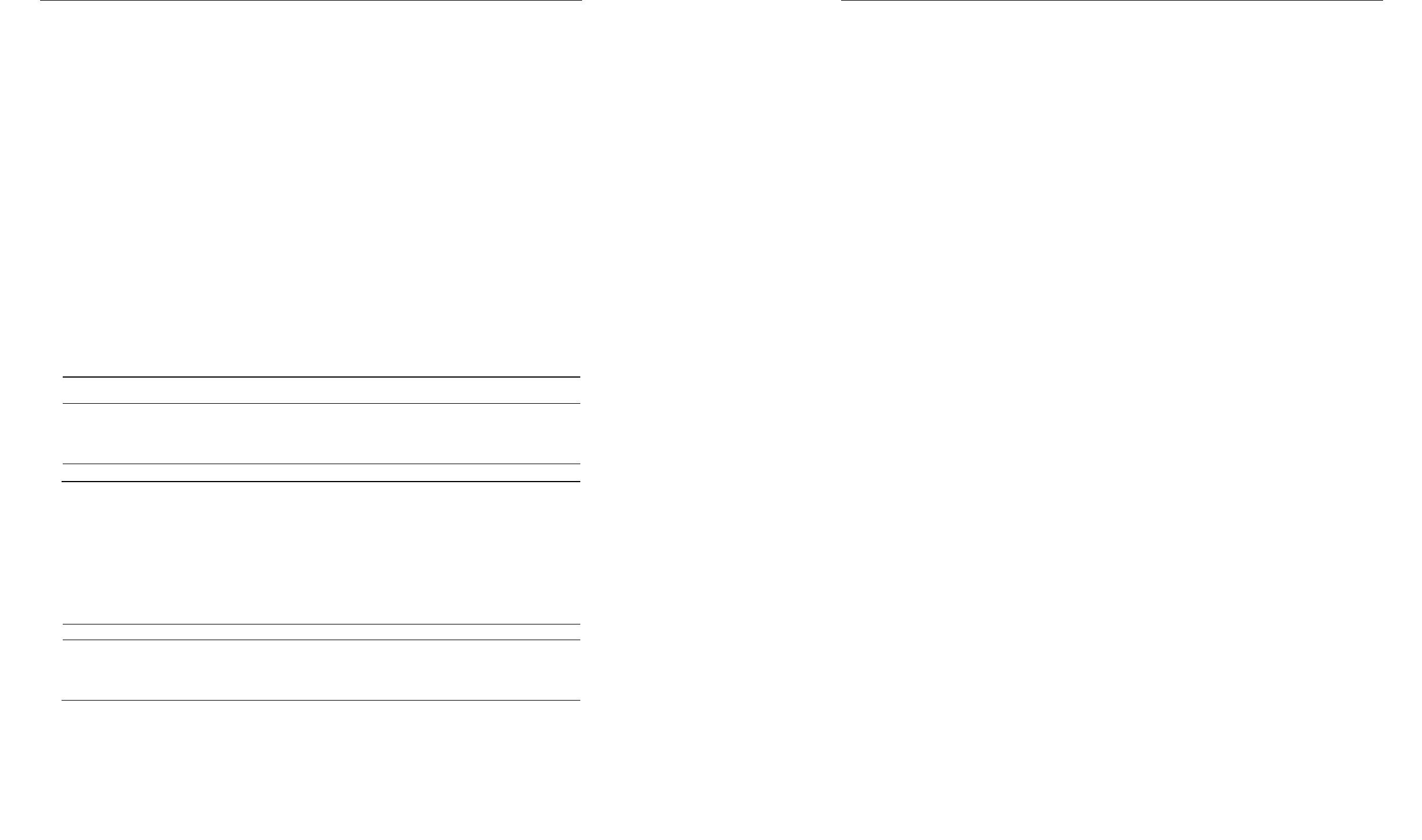

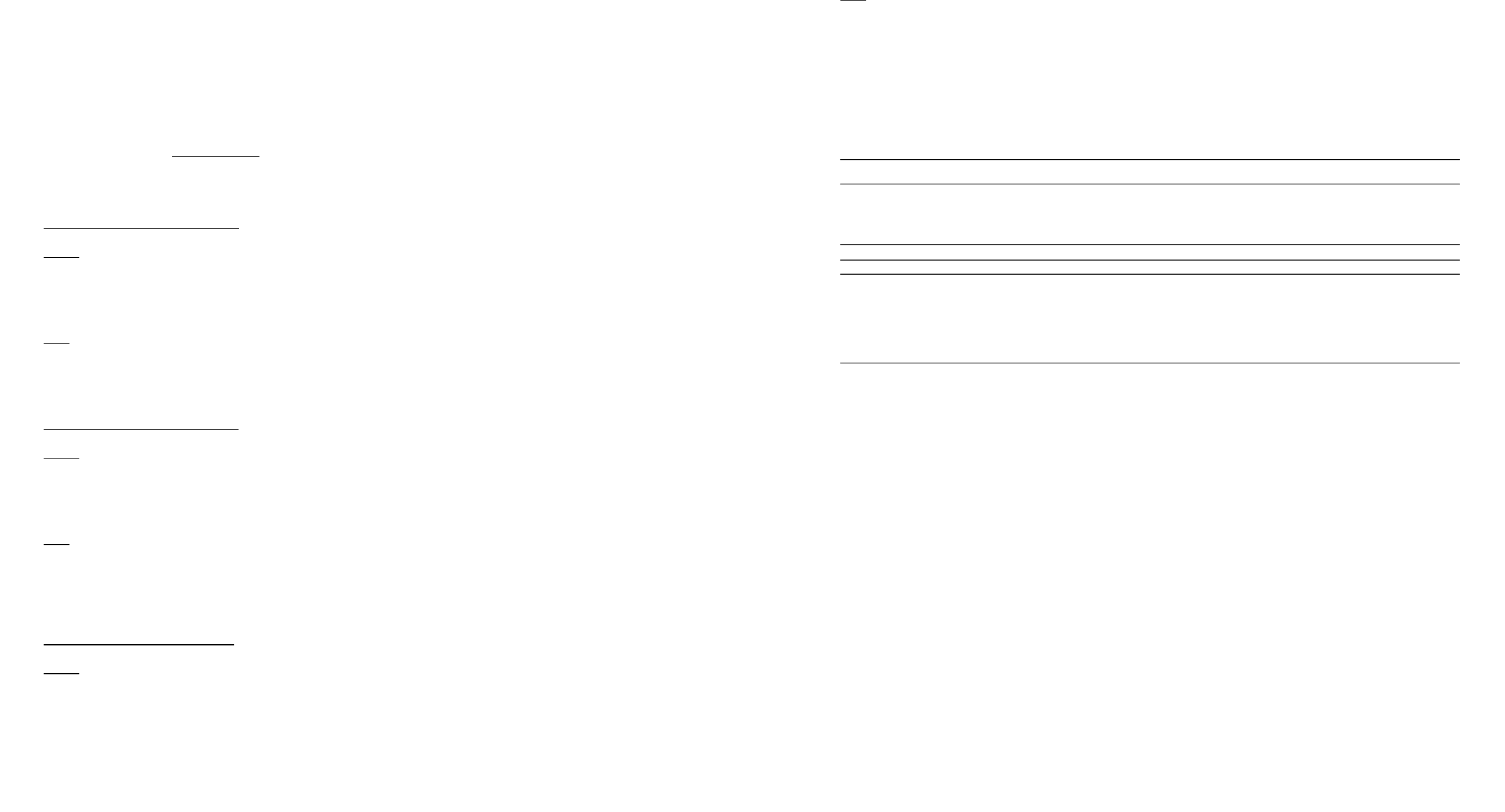

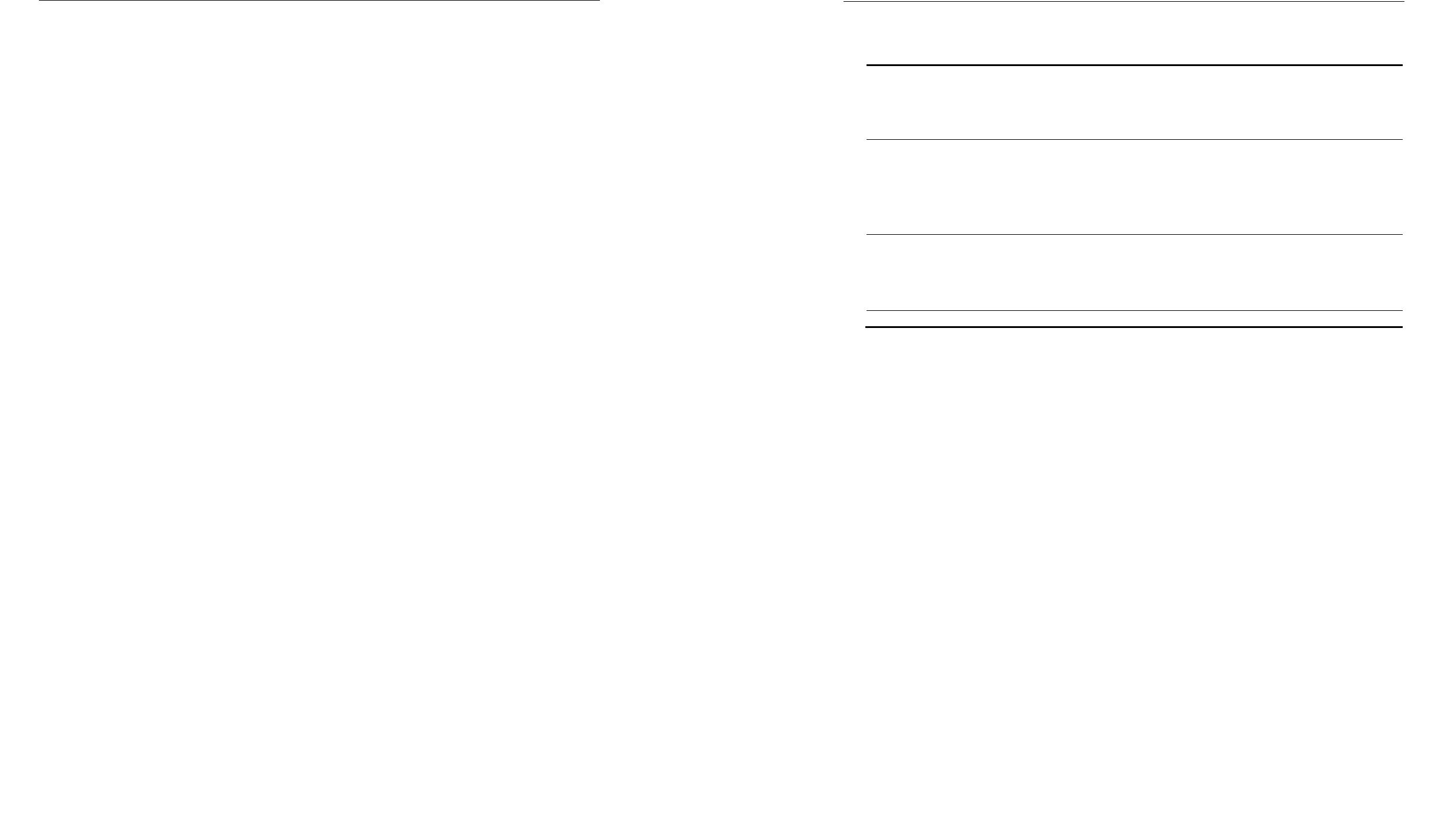

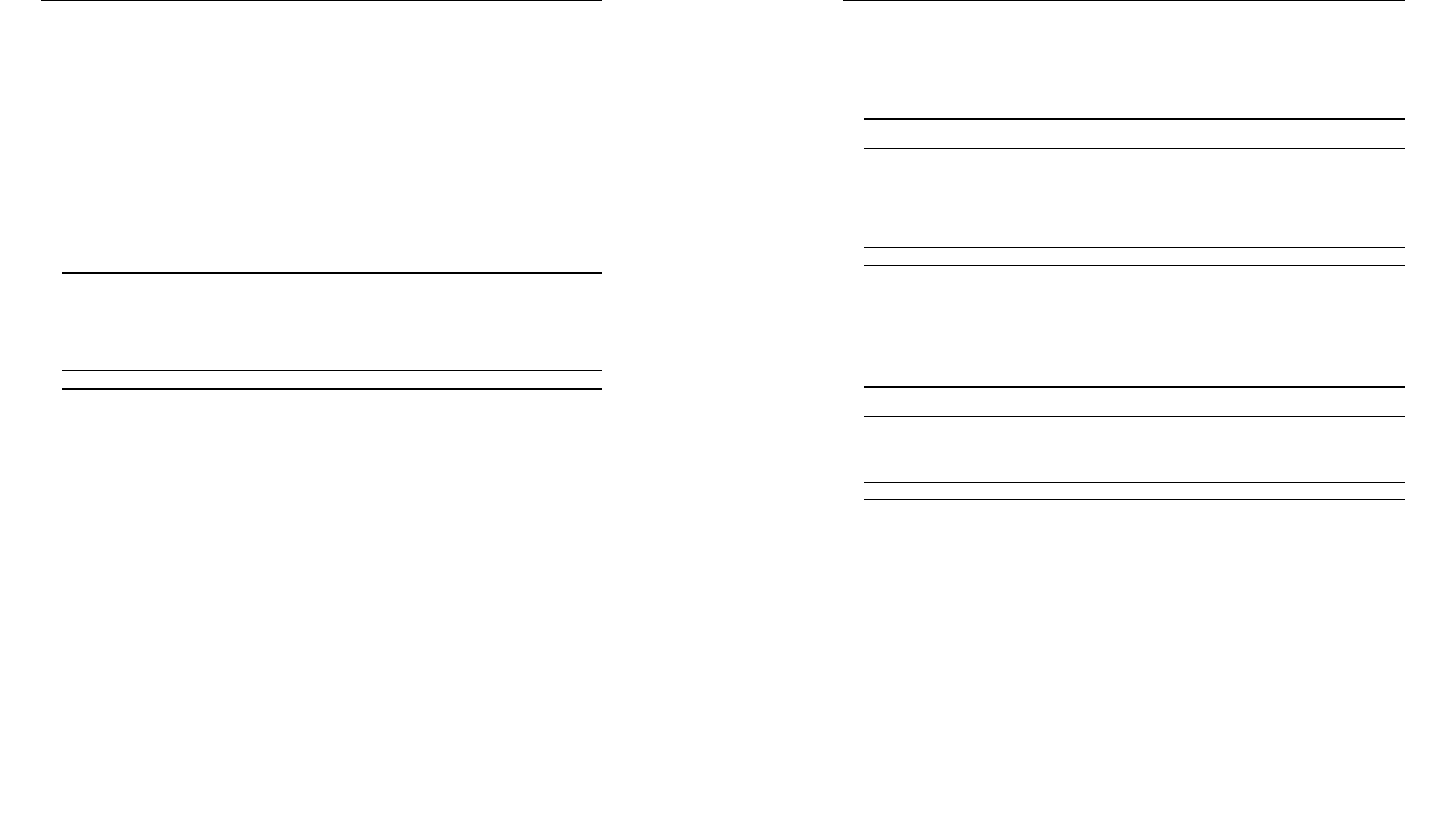

The Fund’s Distributable Cash and Distributable Cash per Unit since January 1, 2020, generated in each financial

quarter, are as follows:

23

MANAGEMENT’S DISCUSSION AND ANALYSIS

BOSTON PIZZA ROYALTIES INCOME FUND

For the Period and Year ended December 31, 2022

- 16 -

Distributable Cash

Distributable Cash per Unit

Payout Ratio

Period

The Fund’s Payout Ratio for the Period was 115.1% compared to 90.4% in the fourth quarter of 2021. The

increase in the Fund’s Payout Ratio for the Period was due to distributions paid increasing by $2.8 million or

51.8%, partially offset by Distributable Cash increasing by $1.2 million or 19.2%.

Year

The Fund’s Payout Ratio for the Year was 99.4% compared to 109.5% in 2021. The decrease in the Fund’s

Payout Ratio for the Year was due to Distributable Cash increasing by $5.2 million or 25.2%, partially offset by

distributions paid increasing by $3.0 million or 13.7%. As discussed above, Payout Ratio is calculated by dividing

the amount of distributions paid during the applicable period by the Distributable Cash for that period. Accordingly,