MANAGEMENT’S DISCUSSION AND ANALYSIS

BOSTON PIZZA INTERNATIONAL INC.

For the three-month and nine-month periods ended September 30, 2021

- 1 -

FINANCIAL HIGHLIGHTS

The tables below set out selected information from the condensed consolidated interim financial statements of

Boston Pizza International Inc. (“BPI” and where applicable also includes its wholly-owned subsidiaries), and the

accounts of Boston Pizza Canada Limited Partnership (“BP Canada LP”), together with other data, and should be

read in conjunction with the condensed consolidated interim financial statements of BPI for the three-month and

nine-month periods ended September 30, 2021 and September 30, 2020, and in conjunction with the Management

Discussion and Analysis (“MD&A”) of BPI for the year ended December 31, 2020. The financial information

reported in the tables included in this MD&A are reported in accordance with International Financial Reporting

Standards (“IFRS”) except as otherwise noted and are stated in Canadian dollars.

123

1

) “System-Wide Gross Sales” means the gross revenue: (i) of the corporate Boston Pizza Restaurants (defined below) in Canada owned by BPI; and (ii) reported to BP Canada LP by

franchised Boston Pizza Restaurants in Canada, without audit or other form of independent assurance, and in the case of both (i) and (ii), including revenue from the sale of liquor, beer,

wine and revenue from BP Canada LP approved national promotions and discounts, but excluding applicable sales and similar taxes.

2

) As at the end of the applicable period.

3

) “Franchise Sales” means the gross revenue: (i) of the corporate Boston Pizza Restaurants in Canada owned by BPI; and (ii) reported to BP Canada LP by franchised Boston Pizza

Restaurants in Canada, without audit or other form of independent assurance, and in the case of both (i) and (ii), after deducting revenue from the sale of liquor, beer, wine and revenue

from BP Canada LP approved national promotions and discounts, and excluding applicable sales and similar taxes.

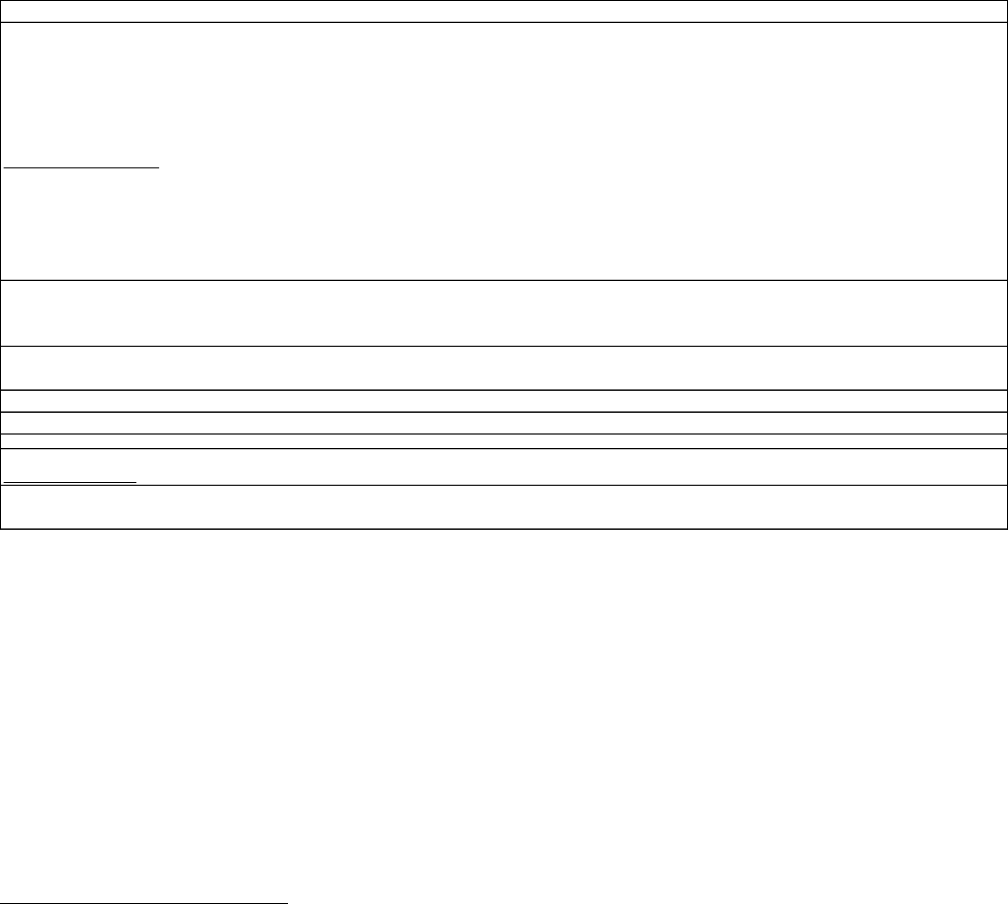

For the periods ended September 30 Q3 2021 Q3 2020 YTD 2021 YTD 2020

(in thousands of dollars - except number of restaurants and per share items)

System-Wide Gross Sales

1

266,363 237,208 586,035 591,810

Number of Boston Pizza Restaurants

2

385 388 385 388

Franchise Sales reported by Boston Pizza Restaurants

3

213,038 186,412 476,874 468,437

Income Statement Data

Total revenues 28,426 24,499 64,021 64,553

Royalty expense (8,522) (7,417) (19,075) (18,666)

Distribution expense (2,815) (2,452) (6,329) (6,168)

Operating expenses excluding Royalty and Distribution expense (10,349) (12,906) (29,396) (39,015)

Earnings before interest and fair value gain (loss) 6,740 1,724 9,221 704

Net interest expense (142) (700) (367) (1,121)

Fair value gain (loss) 2,177 7,109 (7,715) 23,971

Earnings before income taxes 8,775 8,133 1,139 23,554

Current and deferred income tax (expense) recovery (1,925) 1,127 (2,312) 4,958

Net and comprehensive income (loss) 6,850 9,260 (1,173) 28,512

Basic and diluted income (loss) per share 69.84 94.41 (11.96) 290.68

Balance Sheet Data Sept 30, 2021 Dec 31, 2020

Total assets 148,526 147,829

Total liabilities 404,915 403,045

MANAGEMENT’S DISCUSSION AND ANALYSIS

BOSTON PIZZA INTERNATIONAL INC.

For the three-month and nine-month periods ended September 30, 2021

- 2 -

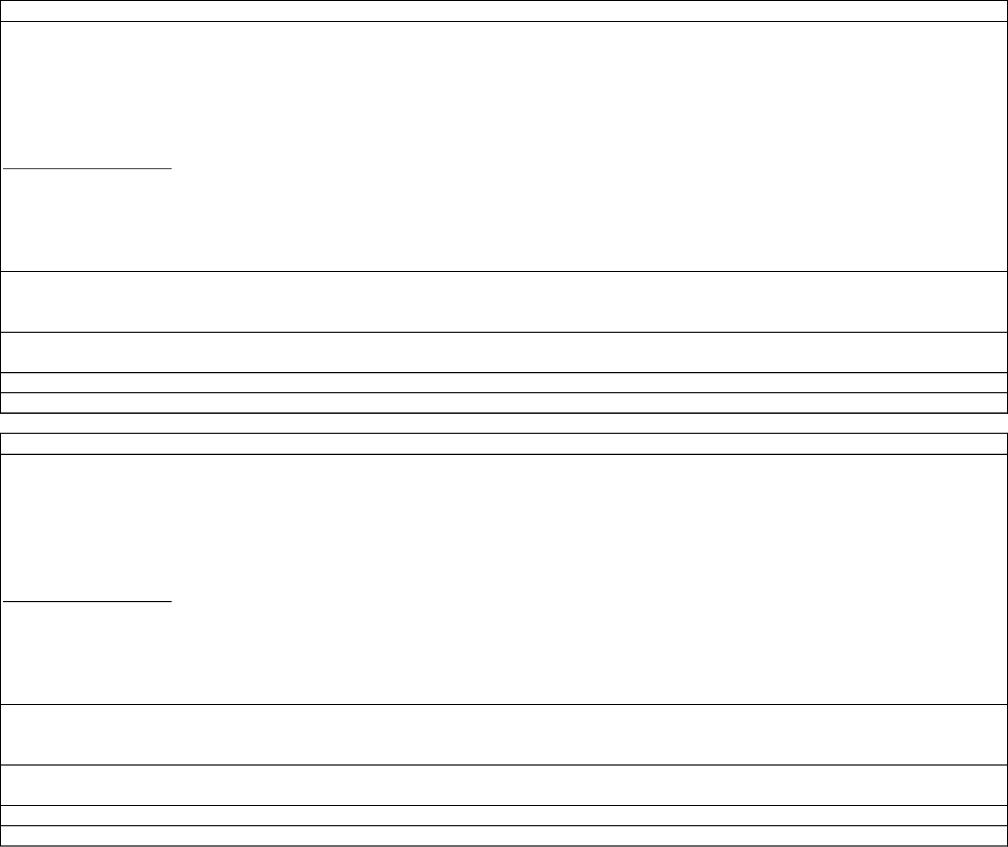

SUMMARY OF QUARTERLY RESULTS

Q3 2021 Q2 2021 Q1 2021 Q4 2020

(in thousands of dollars - except number of restaurants and per share items)

System-Wide Gross Sales

1

266,363 162,931 156,741 181,723

Number of Boston Pizza Restaurants

2

385 385 386 387

Franchise Sales reported by Boston Pizza Restaurants

3

213,038 134,839 128,997 146,657

Income Statement Data

Total revenues 28,426 18,296 17,299 21,522

Royalty expense (8,522) (5,393) (5,160) (5,862)

Distribution expense (2,815) (1,797) (1,717) (1,946)

Operating expenses excluding Royalty and Distribution expense (10,349) (9,961) (9,086) (11,873)

Earnings before interest and fair value gain (loss) 6,740 1,145 1,336 1,841

Net interest (expense) income (142) (42) (183) 735

Fair value gain (loss) 2,177 (3,478) (6,414) (16,004)

Earnings (loss) before income taxes 8,775 (2,375) (5,261) (13,428)

Current and deferred income tax expense (1,925) (49) (338) (7,272)

Net and comprehensive income (loss) 6,850 (2,424) (5,599) (20,700)

Basic and diluted income (loss) per share 69.84 (24.71) (57.08) (211.04)

Q3 2020 Q2 2020 Q1 2020 Q4 2019

(in thousands of dollars - except number of restaurants and per share items)

System-Wide Gross Sales

1

237,208 129,845 224,757 276,509

Number of Boston Pizza Restaurants

2

388 390 394 395

Franchise Sales reported by Boston Pizza Restaurants

3

186,412 107,522 174,503 213,089

Income Statement Data

Total revenues 24,499 14,703 25,351 31,397

Royalty expense (7,417) (4,286) (6,963) (8,447)

Distribution expense (2,452) (1,423) (2,293) (2,785)

Operating expenses excluding Royalty and Distribution expense (12,906) (8,188) (17,921) (17,778)

Earnings (loss) before interest and fair value gain (loss) 1,724 806 (1,826) 2,387

Net interest (expense) income (700) (513) 92 732

Fair value gain (loss) 7,109 (3,994) 20,856 11,570

Earnings (loss) before income taxes 8,133 (3,701) 19,122 14,689

Current and deferred income tax recovery (expense) 1,127 (1,225) 5,056 2,257

Net and comprehensive income (loss) 9,260 (4,926) 24,178 16,946

Basic and diluted income (loss) per share 94.41 (50.22) 246.50 172.76

MANAGEMENT’S DISCUSSION AND ANALYSIS

BOSTON PIZZA INTERNATIONAL INC.

For the three-month and nine-month periods ended September 30, 2021

- 3 -

OVERVIEW

This MD&A covers the three-month period from July 1, 2021 to September 30, 2021 (the “Period”) and the nine-

month period from January 1, 2021 to September 30, 2021 (“YTD”) and is dated November 10, 2021. It provides

additional analysis of the operations, financial position and financial performance of BPI and should be read in

conjunction with BPI’s applicable condensed consolidated interim financial statements and the accompanying

notes. The condensed consolidated interim financial statements of BPI are in Canadian dollars and have been

prepared in accordance with IFRS except as otherwise noted.

General

BPI is a privately controlled company and prior to April 6, 2015, was the exclusive franchisor of the Boston Pizza

(defined below) concept in Canada. On April 6, 2015, BP Canada LP, a British Columbia limited partnership

controlled and operated by BPI, became the exclusive franchisor of the Boston Pizza concept in Canada. On

May 6, 2015, Boston Pizza Royalties Income Fund (the “Fund”) completed an indirect investment in BP Canada LP

to effectively increase the Fund’s indirect interest in Franchise Sales of Boston Pizza Restaurants (defined below)

in the Royalty Pool (defined below) by 1.5%, from 4.0% to 5.5% less the pro rata portion payable to BPI in respect

of its retained interest in the Fund (the “2015 Transaction”).

BPI and BP Canada LP compete in the casual dining sector of the restaurant industry and Boston Pizza is the

number one casual dining brand in Canada. With approximately 380 restaurants stretching from Victoria to St.

John’s, Boston Pizza has more restaurants and serves more customers annually than any other casual dining

restaurant chain in Canada.

Royalty

BP Canada LP charges a 7.0% royalty fee on Franchise Sales for full-service Boston Pizza restaurants open in

Canada (the “Boston Pizza Restaurants”). BPI pays Boston Pizza Royalties Limited Partnership (“Royalties LP”),

an entity controlled by the Fund, a 4.0% royalty fee (the “Royalty”) on Franchise Sales from the Boston Pizza

Restaurants in the royalty pool (the “Royalty Pool”) for the use of the Boston Pizza trademarks in Canada (the “BP

Rights”

4

). As at September 30, 2021, there were 387 Boston Pizza Restaurants in the Royalty Pool.

Distributions from BP Canada LP

Boston Pizza Holdings Limited Partnership (“Holdings LP”), an entity controlled by the Fund, holds Class 1 limited

partnership units (“Class 1 LP Units”) and Class 2 limited partnership units (“Class 2 LP Units”) of BP Canada LP,

and BPI holds, indirectly through Boston Pizza Canada Holdings Partnership (“BPCHP”), Class 2 general

partnership units of BP Canada LP (“Class 2 GP Units”), which are exchangeable for units of the Fund (“Fund

Units”). The Class 1 LP Units and Class 2 LP Units provide Holdings LP with the right to receive distributions from

BP Canada LP equal, in aggregate, to 1.5% of Franchise Sales, less the pro rata portion payable to BPI in respect

of its Class 2 GP Units (the “Distributions”). Specifically, the Class 1 LP Units entitle Holdings LP to receive a

priority distribution equal to the amount of interest that Holdings LP pays on certain indebtedness of Holdings LP

plus 0.05% of that amount, with the balance of 1.5% of Franchise Sales being distributed pro rata to Holdings LP

and BPI on the Class 2 LP Units and Class 2 GP Units, respectively. After BP Canada LP pays distributions on the

Class 1 LP Units, Class 2 LP Units and Class 2 GP Units, BPI is entitled to all residual distributions from

BP Canada LP on the Class 3 general partnership units, Class 4 general partnership units, Class 5 general

partnership units and Class 6 general partnership units of BP Canada LP that BPI holds.

4

) BP Rights are the trademarks that as at July 17, 2002 were registered or the subject of pending applications for registration under the

Trademarks Act (Canada), and other trademarks and trade names which are confusing with the registered or pending trademarks. The

BP Rights purchased do not include the rights outside of Canada to any trademarks or trade names used by BPI or any affiliated entities

in its business, and in particular do not include the rights outside of Canada to the trademarks registered or pending registration under the

Trademarks Act (Canada).

MANAGEMENT’S DISCUSSION AND ANALYSIS

BOSTON PIZZA INTERNATIONAL INC.

For the three-month and nine-month periods ended September 30, 2021

- 4 -

Addition of New Restaurants to Royalty Pool

On January 1 of each year (each, an “Adjustment Date”), an adjustment is made to add to the Royalty Pool new

Boston Pizza Restaurants that opened (“New Restaurants”) and to remove any Boston Pizza Restaurants that

permanently closed since January 1 of the previous year (“Closed Restaurants”). In return for adding new Royalty

and Distributions from the New Restaurants and after subtracting the Royalty and Distributions that are lost from

the Closed Restaurants

5

(such difference, “Net Royalty and Distributions”), BPI receives the right to indirectly

acquire additional Fund Units (in respect of the Royalty, “Class B Additional Entitlements” and in respect of

Distributions, “Class 2 Additional Entitlements”, and collectively, “Additional Entitlements”). The calculation of

Additional Entitlements is designed to be accretive to unitholders of the Fund (“Unitholders”) as the expected

increase in Franchise Sales from the New Restaurants added to the Royalty Pool less the decrease in Franchise

Sales from the Closed Restaurants is valued at a 7.5% discount. The Additional Entitlements are calculated at

92.5% of the estimated Royalty and Distributions expected to be generated by the New Restaurants less the actual

Royalty and Distributions lost from the Closed Restaurants, multiplied by one minus the effective tax rate estimated

to be paid by the Fund, divided by the yield of the Fund, divided by the weighted average Fund Unit price over a

specified period. BPI receives 80% of the Additional Entitlements initially, with the balance received when the actual

full year performance of the New Restaurants and the actual effective tax rate paid by the Fund are known with

certainty (such balance of Fund Units in respect of the increased Royalty, the “Class B Holdback”, and in respect

of the increased Distributions, the “Class 2 Holdback”, and collectively, the “Holdback”). BPI receives 100% of

the distributions on the Additional Entitlements throughout the year. After the New Restaurants have been part of

the Royalty Pool for a full year, an audit of the Franchise Sales of these restaurants is performed, and the actual

effective tax rate paid by the Fund is determined. At such time, an adjustment is made to reconcile distributions

paid to BPI and the Additional Entitlements received by BPI.

It is possible that on an Adjustment Date the Net Royalty and Distributions is negative as a result of the estimated

Royalty and Distributions expected to be generated by the New Restaurants being less than the actual Royalty and

Distributions that is lost from the Closed Restaurants (the amount by which it is less is the “Deficiency”). In such

case, BPI would not receive any Additional Entitlements, however, nor would BPI lose any of the Additional

Entitlements previously received by BPI. Rather, on future Adjustment Dates, BPI would be required to make-up

the Deficiency by first adding Net Royalty and Distributions in an amount equal to the Deficiency before receiving

any further Additional Entitlements (i.e. BPI only receives Additional Entitlements in respect of the cumulative

amount by which Royalty and Distributions from New Restaurants exceeds actual Royalty and Distributions lost

from Closed Restaurants).

Business Strategy

The success of the business of BPI, BP Canada LP, their affiliated entities and franchisees (“Boston Pizza”) can

be attributed to four simple underlying principles that are the foundation for all strategic decision-making – the “Four

Pillars” strategy.

• Building the brand

• Continually improving the guest experience

• A commitment to Franchisee profitability

• On-going engagement in local communities

BPI and BP Canada LP realize that franchisees have to be profitable to succeed. To enhance profitability and to

facilitate the growth of Boston Pizza, BPI and BP Canada LP aggressively enhance and promote the Boston Pizza

brand through television, radio, digital, social media, and national and local promotions. The costs associated with

national marketing of Boston Pizza are paid for by the Boston Pizza advertising fund (the “Advertising Fund”).

Franchisees pay 3.0% of Franchise Sales into the Co-op; 76.0% of these funds are used to purchase television,

5

) The Royalty and Distributions that are lost from the Closed Restaurants is calculated based upon the actual Franchise Sales received from

the Closed Restaurants during the first 12-month period immediately following their addition to the Royalty Pool.

MANAGEMENT’S DISCUSSION AND ANALYSIS

BOSTON PIZZA INTERNATIONAL INC.

For the three-month and nine-month periods ended September 30, 2021

- 5 -

radio, digital and social media advertising, and the remaining 24.0% is used for production of materials and

administration. Both Boston Pizza franchisees and the corporate support staff continuously find new ways to

improve the guests’ experience so that guests will return to Boston Pizza again and again. Boston Pizza and its

franchisees connect with their communities by hosting events, engaging with local organizations, and supporting

philanthropic causes. Management is confident that this “Four Pillars” strategy will continue to focus BPI’s and

BP Canada LP’s efforts, develop new markets and strengthen Boston Pizza’s position as Canada’s number one

casual dining brand.

Ongoing Effects of COVID-19

COVID-19 had significant adverse effects on the business of the Fund, BPI and BP Canada LP during the Period

and YTD. Various governmental authorities across Canada had imposed assorted restrictions on the operations of

restaurants in an attempt to control the spread of COVID-19. The restrictions ranged from limiting operating hours,

reductions in permitted hours to serve alcohol, closures of indoor dining rooms and closures of patio dining

depending upon the particular regions and times within the Period and YTD. During the Period, restrictions eased

in all provinces to allow dine-in services which resulted in increased Franchise Sales. However, by the end of the

Period, various governmental authorities across Canada implemented vaccine card or vaccine passport systems

that required guests to show proof of vaccination when dining in restaurants. See the “Operating Results” section

of this MD&A for details.

COVID-19 continues to impact the business of the Fund, BPI and BP Canada LP, and the operation of Boston Pizza

Restaurants. After the end of the Period, the vaccine card or vaccine passport systems referenced above resulted

in a decrease in customer traffic to restaurants and a decrease in sales. Franchise Sales, and the resulting Royalty

and Distributions, for October 2021 were approximately 109% of the level they were in October 2020 and

approximately 88% of the level they were in October 2019. SRS for October 2021 was approximately positive 8%

when compared to the same period in 2020 and approximately negative 15% when compared to the same period

in 2019.

Seasonality

Boston Pizza Restaurants typically experience seasonal fluctuations in Franchise Sales, which are inherent in the

full-service restaurant industry in Canada. Seasonal factors, such as tourism and better weather generally allow

Boston Pizza Restaurants to open their patios and generally increase Franchise Sales in the second and third

quarters each year compared to the first and fourth quarters. It is unknown how and to what extent seasonality will

affect Franchise Sales given the effects of COVID-19 on Boston Pizza Restaurants.

New Restaurant Openings, Permanent/Temporary Closures and Renovations

During the Period, there were no New Restaurants (YTD – nil) and no Closed Restaurants (YTD – 2). The two

Closed Restaurants YTD were corporately owned restaurants operated by subsidiaries of BPI. BPI previously had

five corporately owned Boston Pizza Restaurants. BPI’s strategy is to divest itself of the remaining three corporately

owned Boston Pizza Restaurants and exclusively focus on strengthening the brand and its franchised business.

Subsequent to the end of the Period, there was one Closed Restaurant. As well, during the Period, two Boston

Pizza Restaurants were renovated (YTD – 7). Boston Pizza Restaurants typically close for two to three weeks to

complete the renovation and experience an incremental sales increase in the year following the re-opening.

OPERATING RESULTS

Same Restaurant Sales (“SRS”)

SRS

6

, a key driver of distribution growth for Unitholders, is the change in gross sales of Boston Pizza Restaurants

as compared to the gross sales for the same period in the previous year, where restaurants were open for a

6

) SRS is a non-IFRS financial measure and as such, does not have a standardized meaning prescribed by IFRS and therefore may not be

comparable to similar measures presented by other issuers. A reconciliation of SRS to an IFRS measure is not possible as there is no

directly comparable measure under IFRS. BPI believes that SRS provides investors with useful information regarding the change in gross

sales of Boston Pizza Restaurants.

MANAGEMENT’S DISCUSSION AND ANALYSIS

BOSTON PIZZA INTERNATIONAL INC.

For the three-month and nine-month periods ended September 30, 2021

- 6 -

minimum of 24 months. The two principal factors that affect SRS are changes in guest traffic and changes in

average guest cheque.

Period

SRS was positive 13.3% for the Period compared to negative 15.2% reported in the third quarter of 2020. As

COVID-19 began to adversely affect sales in Boston Pizza Restaurants in March of 2020, BPI believes that it is

also useful to calculate and report SRS comparing 2021 gross sales to 2019 gross sales. If SRS were calculated

comparing gross sales in the Period to gross sales in the third quarter of 2019, SRS would be negative 3.8%.

Franchise Sales, the basis upon which Royalty and Distributions are paid by BPI and BP Canada LP respectively,

indirectly to the Fund, excludes revenue from sales of liquor, beer, wine and approved national promotions and

discounts. On a Franchise Sales basis, SRS was positive 15.1% for the Period compared to negative 14.6% for

the third quarter of 2020. If SRS on a Franchise Sales basis were calculated comparing Franchise Sales in the

Period to Franchise Sales in the third quarter of 2019, SRS would be negative 1.5%. The increase in SRS for the

Period was principally due to increases in restaurant guest traffic due to the easing of dining restrictions during the

Period.

YTD

SRS was positive 0.3% YTD compared to negative 28.2% reported year-to-date in 2020. If SRS were calculated

comparing gross sales YTD to gross sales year-to-date in 2019, SRS would be negative 28.1%. On a Franchise

Sales basis, SRS was positive 3.1% YTD compared to negative 27.0% year-to-date in 2020. If SRS on a Franchise

Sales basis were calculated comparing Franchise Sales YTD to Franchise Sales year-to-date in 2019, SRS would

be negative 24.7%. The increase in SRS YTD was principally due to increases in restaurant guest traffic due to the

easing of dining restrictions and increased take-out and delivery sales.

Revenues

Period

BPI’s total revenue was $28.4 million for the Period compared to $24.5 million for the third quarter of 2020. BPI’s

revenue was principally derived from royalty revenue and Advertising Fund contributions received by

BP Canada LP from franchised Boston Pizza Restaurants, sales from corporately owned restaurants, initial

franchise fees, franchise renewal fees and supplier contributions. The $3.9 million increase in revenue for the

Period was primarily due to higher royalty revenues, supplier contributions, Advertising Fund revenue and revenues

from corporately owned restaurants resulting from higher SRS.

YTD

BPI’s total revenue was $64.0 million YTD compared to $64.6 million year-to-date in 2020. The $0.6 million

decrease in revenue YTD was primarily due to lower revenues from corporately owned restaurants resulting from

closure of two corporate restaurants, partially offset by higher royalty revenues, supplier contributions, and

Advertising Fund revenues resulting from positive SRS.

Royalty Expense and Distribution Expense

Period

BPI’s Royalty expense to Royalties LP (being 4.0% of Franchise Sales from Boston Pizza Restaurants in the

Royalty Pool) was $8.5 million and Distribution expense (being 1.5% of Franchise Sales from Boston Pizza

Restaurants in the Royalty Pool, less BPI’s retained interest) was $2.8 million for the Period compared to

$7.4 million and $2.5 million, respectively, for the third quarter of 2020. The $1.1 million increase in Royalty

expense and $0.3 million increase in Distribution expense for the Period was due to positive SRS on a Franchise

Sales basis.

MANAGEMENT’S DISCUSSION AND ANALYSIS

BOSTON PIZZA INTERNATIONAL INC.

For the three-month and nine-month periods ended September 30, 2021

- 7 -

YTD

BPI’s Royalty expense to Royalties LP was $19.1 million and Distribution expense was $6.3 million YTD compared

to $18.7 million and $6.2 million, respectively, year-to-date in 2020. The $0.4 million increase in Royalty expense

and $0.1 million increase in Distribution expense YTD was due to positive SRS on a Franchise Sales basis.

Operating Expenses Excluding Royalty Expense and Distribution Expense

Period

BPI’s operating expenses excluding Royalty expense and Distribution expense were $10.3 million for the Period,

which included Advertising Fund expenses of $4.1 million, compensation expense of $3.8 million, depreciation and

amortization of $1.2 million, operational costs of corporately owned restaurants of $1.2 million and other expense

associated with services provided to franchised Boston Pizza Restaurants of $0.7 million. These expenses were

partially offset by the amortization of deferred gain on the sale of BP Rights to Royalties LP of $0.7 million. In the

third quarter of 2020, BPI’s operating expenses excluding Royalty expense and Distribution expense were $12.9

million for the Period, which included compensation expense of $4.8 million, Advertising Fund expenses of

$3.7 million, other costs associated with services provided to franchised Boston Pizza Restaurants of $2.2 million,

operational costs of corporately owned restaurants of $1.7 million and depreciation and amortization of $1.3 million.

These expenses were partially offset by the amortization of deferred gain on the sale of BP Rights to Royalties LP

of $0.7 million.

The decrease in operating expenses excluding Royalty expense and Distribution expense of $2.6 million for the

Period was due to expenses such as bad debt and compensation expense being higher in the prior year due to the

impact of COVID-19, and a decrease in restaurant operating costs resulting from the closure of two corporately

owned restaurants, partially offset by an increase in Advertising Fund expenses due to increased advertising activity

and lower government wage and rent subsidies received.

BPI is receiving government financial assistance under the Canada Emergency Wage Subsidy (“CEWS”) and

Canada Emergency Rent Subsidy (“CERS”) program. During the Period, BPI recognized $0.6 million of

government financial assistance under the CEWS and CERS programs (Q3 2020 – $2.2 million).

The deferred gain on the sale of BP Rights to Royalties LP is amortized over 99 years beginning in 2002 for the

term of the License and Royalty Agreement dated July 17, 2002, as amended on May 9, 2005, between

Royalties LP and BPI. The net deferred gain at September 30, 2021 was $225.6 million compared to $228.4 million

at September 30, 2020.

YTD

BPI’s operating expenses excluding Royalty expense and Distribution expense were $29.4 million YTD, which

included compensation expense of $11.4 million, Advertising Fund expenses of $10.7 million, depreciation and

amortization of $3.7 million, other expense associated with services provided to franchised Boston Pizza

Restaurants of $3.3 million, and operational costs of corporately owned restaurants of $2.5 million. These expenses

were partially offset by the amortization of deferred gain on the sale of BP Rights to Royalties LP of $2.1 million.

During the same period in 2020, BPI’s operating expenses excluding Royalty expense and Distribution expense

were $39.0 million YTD, which included Advertising Fund expenses of $12.6 million, compensation expense of

$11.8 million, operational costs of corporately owned restaurants of $6.3 million, other costs associated with

services provided to franchised Boston Pizza Restaurants of $5.8 million, depreciation and amortization of

$4.2 million, and management fees for services rendered by companies under common control of $0.4 million. This

was partially offset by the amortization of deferred gain on the sale of BP Rights to Royalties LP of $2.1 million.

The decrease in operating expenses excluding Royalty expense and Distribution expense of $9.6 million YTD was

attributed to a decrease in restaurant operating costs resulting from the closure of two corporately owned

restaurants, a decrease in other expenses including reduced bad debt expense and decreased travel as a measure

to reduce costs, a decrease in Advertising Fund expenses due to timing of advertising activity, a decrease in

compensation and management fees, and a decrease in depreciation and amortization.

MANAGEMENT’S DISCUSSION AND ANALYSIS

BOSTON PIZZA INTERNATIONAL INC.

For the three-month and nine-month periods ended September 30, 2021

- 8 -

YTD, BPI recognized $3.7 million of government financial assistance under the CEWS and CERS programs (2020

– $3.8 million).

Earnings before Interest and Fair Value Gain (Loss)

Period

BPI’s earnings before interest and fair value gain (loss) was $6.7 million for the Period compared to $1.7 million for

the third quarter of 2020. The $5.0 million increase in earnings before interest and fair value gain (loss) for the

Period was principally due to an increase in revenues and a decrease in operating expenses, partially offset by

increases in Royalty and Distribution expenses.

YTD

BPI’s earnings before interest and fair value gain (loss) was $9.2 million YTD compared to $0.7 million year-to-date

in 2020. The $8.5 million increase in earnings before interest and fair value gain (loss) YTD was principally due to

a decrease in operating expenses, partially offset by a decrease in revenues.

Net Interest Expense

Period

BPI’s net interest expense during the Period was $0.1 million, comprised mainly of $0.5 million of interest expense

on debt and financing costs, $0.1 million of interest expense on lease obligations and nominal interest expense on

payables owed to the Fund, partially offset $0.5 million of interest income received by BPI on its Class B general

partner units of Royalties LP (“Class B Units”). BPI’s net interest expense for the third quarter of 2020 was

$0.7 million, comprised mainly of $0.5 million of interest expense on the debt and financing fees, $0.1 million of

interest expense on payables owed to the Fund and $0.1 million of interest expense on lease obligations. The $0.6

million decrease in net interest expense for the Period was primarily due to the increase in interest income on the

Class B Units attributable to the Fund not declaring distribution on Fund Units during the third quarter of 2020.

YTD

BPI’s net interest expense was $0.4 million YTD, comprised mainly of $1.5 million of interest expense on debt and

financing costs, $0.2 million of interest expense on lease obligations and $0.1 million of interest expense on

payables owed to the Fund, partially offset $1.5 million of interest income received by BPI on its Class B

Units. Year-to-date in 2020, BPI’s net interest expense was $1.1 million, comprised mainly of $1.4 million of interest

expense on the debt and financing fees, $0.3 million of interest expense on lease obligations and $0.1 million of

interest expense on payables owed to the Fund, partially offset by $0.7 million of interest income received by BPI

on the Class B Units. The $0.7 million decrease in net interest expense YTD was primarily due to the increase in

interest income on the Class B Units attributable to the Fund not declaring distribution on Fund Units during the

second and third quarters of 2020.

Fair Value Gain (Loss)

Period

During the Period, BPI recognized a fair value gain of $2.2 million compared to $7.1 million for the same period in

2020. The change in fair value was principally due to the change in the price of Fund Units into which the Class B

Units are exchangeable and upon which the Class 2 LP Units liability is measured.

BPI estimates the fair value of the Class B Units by multiplying the number of Fund Units that BPI would be entitled

to receive if it exchanged all of the Class B Units (including the Class B Holdback) held by BPI at the end of the

Period by the closing price of a Fund Unit on the last business day of the Period. As at September 30, 2021, the

Fund’s closing price was $13.38 per Fund Unit (June 30, 2021 – $14.10 per Fund Unit) and the number of Fund

Units BPI would be entitled to receive if it exchanged all of the Class B Units (including the Class B Holdback) held

MANAGEMENT’S DISCUSSION AND ANALYSIS

BOSTON PIZZA INTERNATIONAL INC.

For the three-month and nine-month periods ended September 30, 2021

- 9 -

by BPI was 2,430,823 (June 30, 2021 – 2,430,823). Consequently, the Class B Units were calculated to be valued

at $32.5 million (June 30, 2021 – $34.3 million), resulting in a fair value loss of $1.8 million. In general, the value

of the Class B Units will increase as the market price of Fund Units increase and vice versa. In addition, the value

of the Class B Units increases as the number of Fund Units BPI would be entitled to receive if it exchanged all of

the Class B Units (including the Class B Holdback) increases and vice versa.

The Class 1 LP Units are entitled to distributions determined with respect to the interest cost paid by the Fund on

the credit facility of the Fund drawn on at the time of the 2015 Transaction to pay for the Fund’s indirect investment

in Class 1 LP Units of BP Canada LP. BPI estimates the fair value of the Class 1 LP Units liability using a market-

corroborated input, being the interest rate on the applicable credit facility. Consequently, BPI estimated the fair

value of Class 1 LP Units liability as at September 30, 2021 to be $33.3 million (June 30, 2021 – $33.3 million),

resulting in no fair value adjustment for the Period.

BPI estimates the fair value of the Class 2 LP Units liability by multiplying the number of Class 2 LP Units indirectly

held by the Fund at the end of the Period by the closing price of a Fund Unit on the last business day of the Period.

As at September 30, 2021, the Fund indirectly held 5,455,762 Class 2 LP Units (June 30, 2021 – 5,455,762) and

the Fund’s closing price was $13.38 per Fund Unit (June 30, 2021 – $14.10 per Fund Unit). Consequently, BPI

estimated the fair value of the Class 2 LP Units liability as at September 30, 2021 to be $73.0 million (June 30, 2021

– $76.9 million), resulting in a fair value gain of $3.9 million for the Period. In general, the fair value of the Class 2

LP Units liability will increase as the market price of Fund Units increases and vice versa.

YTD

YTD, BPI recognized a fair value loss of $7.7 million compared to a fair value gain of $24.0 million for the same

period in 2020. The change in fair value was principally due to the change in the price of Fund Units into which the

Class B Units are exchangeable and upon which the Class 2 LP Units liability is measured.

As at December 31, 2020, the Fund’s closing price was $10.83 per Fund Unit and the number of Fund Units BPI

would be entitled to receive if it exchanged all of the Class B Units (including the Class B Holdback) held by BPI

was 2,430,381. The Class B Units were calculated to be valued at $26.3 million as at December 31, 2020. As

discussed above, the Class B Units at the end of the Period were valued at $32.5 million. The difference between

the value of the Class B Units on December 31, 2020 and at the end of the Period is an increase of $6.2 million,

comprised of a fair value gain of $6.2 million and a nominal adjustment of Class B Additional Entitlements received

by BPI in February 2021 related to the January 1, 2020 Adjustment Date.

Holdings LP acquired the Class 1 LP Units on May 6, 2015 for $33.3 million. As discussed above, BPI estimates

the fair value of the Class 1 LP Units as at September 30, 2021 to be $33.3 million (December 31, 2020 –

$33.3 million), resulting in no fair value adjustment YTD.

As at December 31, 2020, the Fund indirectly held 5,455,762 Class 2 LP Units and the Fund’s closing price was

$10.83 per Fund Unit. Consequently, BPI estimated the fair value of the Class 2 LP Units liability as at

December 31, 2020 to be $59.1 million. As discussed above, BPI estimated the fair value of the Class 2 LP Units

liability as at September 30, 2021 to be $73.0 million, resulting in a fair value loss of $13.9 million YTD.

Earnings before Income Taxes

Period

Given the combined effects of the above-noted factors, BPI had earnings before income taxes of $8.8 million for

the Period compared to $8.1 million for the third quarter of 2020. The $0.7 million increase in earnings before

income taxes was primarily due to an increase in earnings before interest and fair value gain (loss) and a decrease

in net interest expense, partially offset by the decrease in fair value gain.

MANAGEMENT’S DISCUSSION AND ANALYSIS

BOSTON PIZZA INTERNATIONAL INC.

For the three-month and nine-month periods ended September 30, 2021

- 10 -

YTD

Given the combined effects of the above-noted factors, BPI had earnings before income taxes of $1.1 million YTD

compared to $23.6 million year-to-date in 2020. The $22.5 million decrease in earnings before income taxes YTD

was primarily due to increase in fair value loss, partially offset by an increase in earnings before interest and fair

value gain (loss) and a decrease in net interest expense.

Income Tax Expense (Recovery)

Period

BPI recognized $1.3 million current income tax expense for the Period compared to $0.6 million for the third quarter

of 2020. The $0.7 million increase in current income tax expense for the Period is primarily due to higher earnings

before interest and fair value gain (loss).

BPI recognized $0.6 million deferred income tax expense for the Period compared to $1.8 million deferred income

tax recovery for the third quarter of 2020. The $2.4 million increase in deferred income tax expense is primarily due

to the valuation allowance recorded on the Class B Units for the Period. For the same period in 2020, the deferred

income tax recovery includes the tax impact of the change in fair value of the Class B Units for that period.

YTD

BPI recognized $1.8 million current income tax expense YTD compared to $1.6 million year-to-date in 2020. The

$0.2 million increase in current income tax expense YTD is primarily due to higher earnings before interest and fair

value gain (loss).

BPI recognized a $0.5 million deferred income tax expense YTD compared to $6.6 million deferred income tax

recovery year-to-date in 2020. The $7.1 million increase in deferred income tax expense is primarily due to the

valuation allowance recorded on the Class B Units YTD. For the same period in 2020, the deferred income tax

recovery includes the tax impact of the change in fair value of the Class B Units for that period and loss carry

forwards recognized for corporately owned restaurants.

Net and Comprehensive Income (Loss)

Period

BPI’s net and comprehensive income during the Period was $6.9 million compared to $9.3 million for the third

quarter of 2020. The decrease of $2.4 million in net and comprehensive income for the Period is primarily due to

the increase in income tax expense compared to the same period in 2020, partially offset by the increase in earnings

before income taxes.

YTD

BPI’s net and comprehensive loss YTD was $1.2 million compared to net and comprehensive income of

$28.5 million year-to-date in 2020. The decrease of $29.7 million in net and comprehensive income YTD is primarily

due to a decrease in earnings before income taxes and an increase in income tax expense.

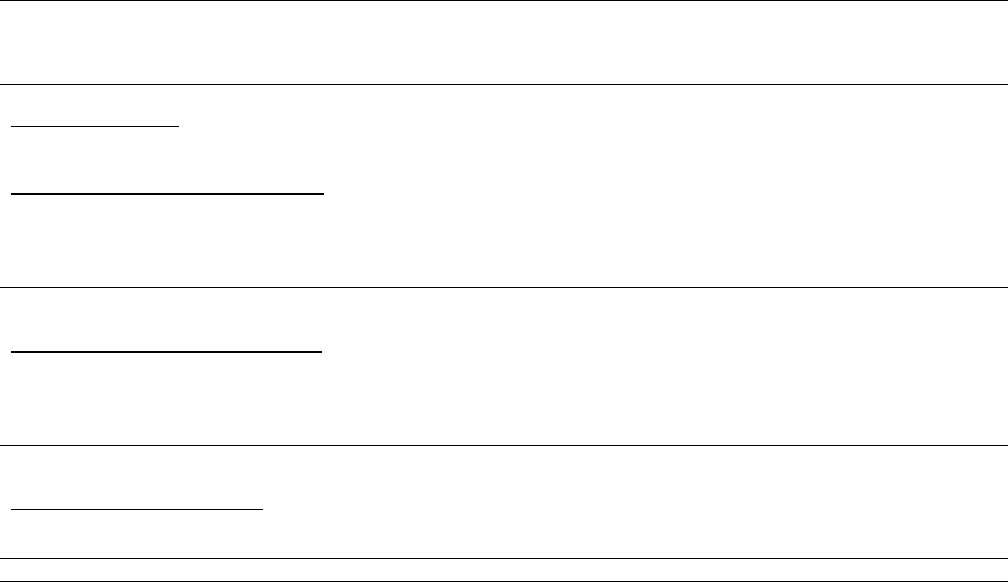

Fund Units Outstanding

The following table sets forth a summary of the outstanding Fund Units. BPI owns 100% of the Class B Units and

1% of the ordinary general partner units of Royalties LP. BPI also owns 100% of the Class 2 GP Units, and 100%

of the Class 3, Class 4, Class 5 and Class 6 general partnership units of BP Canada LP. The Class B Units and

Class 2 GP Units are exchangeable for Fund Units. References to “Class B Additional Entitlements” and “Class 2

Additional Entitlements” in the table below refer to the number of Fund Units into which the Class B Units and

Class 2 GP Units, respectively, are exchangeable as of the dates indicated.

MANAGEMENT’S DISCUSSION AND ANALYSIS

BOSTON PIZZA INTERNATIONAL INC.

For the three-month and nine-month periods ended September 30, 2021

- 11 -

Issued and Outstanding

Fund Units and Additional

Entitlements

Issued and Outstanding

Fund Units, Additional

Entitlements and Holdback

Fund Units Outstanding

Issued and Outstanding Fund Units as of September 30, 2021

21,521,463

21,521,463

Class B Additional Entitlements Outstanding

Class B Additional Entitlements – Outstanding as of December 31, 2020

2,423,886

2,423,886

Class B Additional Entitlements – Issued as of January 1, 2021

-

-

(1)

Class B Holdback Created January 1, 2021

N/A

-

(1)

Class B Additional Entitlements – Issued in respect of 2020 after the audit

6,937

6,937

(2)

Total Class B Additional Entitlements as of November 10, 2021

2,430,823

2,430,823

Class 2 Additional Entitlements Outstanding

Class 2 Additional Entitlements – Outstanding as of December 31, 2020

828,753

828,753

Class 2 Additional Entitlements – Issued as of January 1, 2021

-

-

(1)

Class 2 Holdback Created January 1, 2021

N/A

-

(1)

Class 2 Holdback – Issued in respect of 2020 after the audit

2,601

2,601

(2)

Total Class 2 Additional Entitlements as of November 10, 2021

831,354

831,354

Summary as of November 10, 2021

Total Issued and Outstanding Fund Units

21,521,463

21,521,463

Total Additional Entitlements

3,262,177

3,262,177

Fully Diluted Fund Units

24,783,640

24,783,640

BPI’s Percentage Ownership

13.2%

13.2%

(1) Additional Entitlements to which BPI is entitled for adding to the Royalty Pool on January 1, 2021 additional Royalty and Distributions from

the two New Restaurants less the Royalty and Distributions lost from the 11 Closed Restaurants. Since a Deficiency existed, this amount

is nil.

(2) Additional Entitlements from the five New Restaurants added to the Royalty Pool on January 1, 2020 less the six Closed Restaurants

removed from the Royalty Pool on January 1, 2020 determined in 2021 once audited results of the five New Restaurants and the actual

effective tax rate paid by the Fund were known, and the adjustment for the seasonal Boston Pizza Restaurant that re-opened in 2020.

BPI directly and indirectly holds 100% of the special voting units (the “Special Voting Units”) of the Fund, which

entitle BPI to one vote in respect of matters to be voted upon by Unitholders for each Fund Unit that BPI would be

entitled to receive if it exchanged all of its Class B Units and Class 2 GP Units for Fund Units. As of November 10,

2021, BPI was entitled to 3,262,177 votes, representing 13.2% of the aggregate votes held by holders of Fund Units

and Special Voting Units. The number of Fund Units that BPI is entitled to receive upon the exchange of its Class B

Units and Class 2 GP Units and the number of votes that BPI is entitled to in respect of its Special Voting Units is

adjusted periodically to reflect any additional Boston Pizza Restaurants that were added to the Royalty Pool.

LIQUIDITY & CAPITAL RESOURCES

BPI is an entirely franchised business except for three corporate Boston Pizza Restaurants that it currently owns.

For 2021, BPI has forecasted capital requirements of approximately $2.3 million, which consist mainly of the

development of software applications and digital platforms, computer equipment, and leasehold improvements. BPI

believes it has sufficient cash and capital resources to cover forecasted expenditures, capital requirements,

commitments and repayments for 2021. BPI constantly monitors its operations and cash flows to ensure that

current and future obligations will be met. BPI believes its current sources of liquidity are sufficient to cover its

currently known short and long-term obligations. BPI manages its working capital with the Operating Line (defined

below), BCAP Loan (defined below) and the BDC Facilities (defined below).

MANAGEMENT’S DISCUSSION AND ANALYSIS

BOSTON PIZZA INTERNATIONAL INC.

For the three-month and nine-month periods ended September 30, 2021

- 12 -

Indebtedness

BPI Credit Facilities

BPI has credit facilities with a Canadian chartered bank (the “Bank”) in the amount of up to $35.7 million (originally

$43.3 million) expiring on December 31, 2022 (the “Credit Facilities”). The Credit Facilities are comprised of: (i) a

$10 million committed revolving facility to cover BPI’s day-to-day operating requirements if needed (the “Operating

Line”); and (ii) a $25.7 million (originally $33.3 million) committed non-revolving term facility that was used to

finance the reorganization of BPI and its shareholders that completed on September 30, 2017 (the “Term Loan”).

The Credit Facilities bear interest at variable rates, as selected by BPI. In the case of Canadian prime rate loans,

the interest rate is equal to the Bank’s prime rate plus between 1.50% and 2.50% (depending on the total funded

net debt to EBITDA ratio) and, in the case of bankers’ acceptances and Canadian dollar offered rate loans, the

interest rate is equal to a variable interest rate based on the Bank’s bankers’ acceptance rates or Canadian dollar

offered rates plus between 2.75% and 3.75% (depending on the total funded net debt to EBITDA ratio). The Term

Loan and the principal amount drawn on the Operating Line are due and payable upon maturity. The principal

amount drawn on the Term Loan must be reduced by quarterly payments, which permanently reduce the amount

available under the Term Loan.

The Credit Facilities are guaranteed by all of BPI’s subsidiaries except BP Canada LP, and BPI and each of those

subsidiaries have granted general security over their assets to secure their obligations under the Credit Facilities

and such guarantees. No security has been given by BP Canada LP in respect of the Credit Facilities. BPI and

each of BPI’s subsidiaries (including BP Canada LP) have also granted Royalties LP security over their assets to

secure BPI’s and BP Canada LP’s obligations to pay Royalty and Distributions. The Bank and Royalties LP entered

into a second amended and restated priority agreement dated April 11, 2018 to set forth their relative priorities to

such security, full details of which are described in the Fund’s Annual Information Form dated February 9, 2021, a

copy of which is available on www.sedar.com.

The principal financial covenant under the Credit Facilities is that BPI’s trailing 12-month EBITDA must not be less

than certain specified values and will be tested on a quarterly basis. The first amended and restated credit

agreement dated January 24, 2020 between BPI and the Bank, as amended by the first supplemental credit

agreement dated June 22, 2020 governing the Credit Facilities contains certain covenants and restrictions,

including the requirement for BPI to have sufficient trailing 12-month EBITDA as previously described. A failure of

BPI to comply with these covenants and restrictions could entitle the Bank to demand repayment of the outstanding

balance drawn on the Credit Facilities prior to maturity. BPI was in compliance with all of its financial covenants

and financial condition tests at September 30, 2021. As of September 30, 2021, no amount was drawn on the

Operating Line and $25.7 million was outstanding on the Term Loan.

BCAP Loan

On June 22, 2020, the Bank loaned BPI $6.25 million under Export Development Canada’s business credit

availability program (the “BCAP Loan”). The BCAP Loan may be used to provide additional liquidity to finance

operations, and may not be used (i) to repay or refinance existing debt obligations, (ii) to make distributions; or

(iii) to pay any bonuses or increases to executive compensation. The BCAP Loan has a term of one year, which

may be extended annually at the request of BPI for up to five years subject to compliance with certain requirements.

On June 22, 2021, BPI extended the BCAP Loan for one year. The BCAP Loan requires interest only payments

for the first year and is repayable in monthly blended payments of principal and interest amortized over four years

commencing after the first year of the term, with any remaining balance outstanding being due upon expiry of the

term. The BCAP Loan bears interest at the Bank’s prime rate plus 2.5% and is subject to an annual fee equal to

1.8% of the total amount of credit available (i.e. $6.25 million). The BCAP Loan is guaranteed by all of BPI’s

subsidiaries except BP Canada LP, and is secured by the same security that secures the Credit Facilities to the

Bank. That security shares priority with the general security agreements granted by BPI and its subsidiaries to the

Bank under the Credit Facilities. As of September 30, 2021, $5.9 million was drawn on the BCAP Loan.

MANAGEMENT’S DISCUSSION AND ANALYSIS

BOSTON PIZZA INTERNATIONAL INC.

For the three-month and nine-month periods ended September 30, 2021

- 13 -

BDC Facilities

On July 7, 2020, Business Development Bank of Canada (“BDC”) loaned BPI $2.0 million under the federal

government’s COVID-19 relief programs (the “BDC Facilities”). The BDC Facilities may be used for working capital

purposes, have a term of three years and are repayable in a combination of monthly payments commencing after

the first year of the term and a balloon payment upon maturity. The BDC Facilities bear interest at Business

Development Bank of Canada’s floating base rate (currently 4.55% per annum) less 1.75% (i.e. currently 2.80%).

The BDC Facilities are secured by a subordinate charge over all of BPI’s assets and are guaranteed by all of BPI’s

subsidiaries except BP Canada LP. All of BPI’s subsidiaries other than BP Canada LP have granted BDC a

subordinate charge over all of their assets to support such guarantees. The security held by BDC is subordinate to

the security held by the Bank to secure the Credit Facilities with the Bank and the security held by the Fund to

secure BPI’s obligation to pay Royalty and Distributions. As of September 30, 2021, $1.8 million was drawn on the

BDC Facilities.

Acquired Restaurant Credit Facility

In 2016 and 2017, a subsidiary of BPI established a $4.2 million credit facility with the Bank for the purposes of

funding a portion of the acquisition cost for a Boston Pizza Restaurant that such subsidiary purchased from a former

franchisee of BP Canada LP in June 2016 (the “Acquired Restaurant”) and making renovations to the Acquired

Restaurant. On June 22, 2020, that credit facility was amended, among other things, to reduce the available credit

to approximately $3.3 million and change the expiry date to March 31, 2022 (such facility as amended, the

“Acquired Restaurant Credit Facility”). BPI has guaranteed the Acquired Restaurant Credit Facility to the Bank.

As of September 30, 2021, $2.6 million was drawn on the Acquired Restaurant Credit Facility. As the Acquired

Restaurant Credit Facility is due March 31, 2022, the loan has been classified as a current liability. BPI intends to

either refinance or repay this credit facility upon maturity.

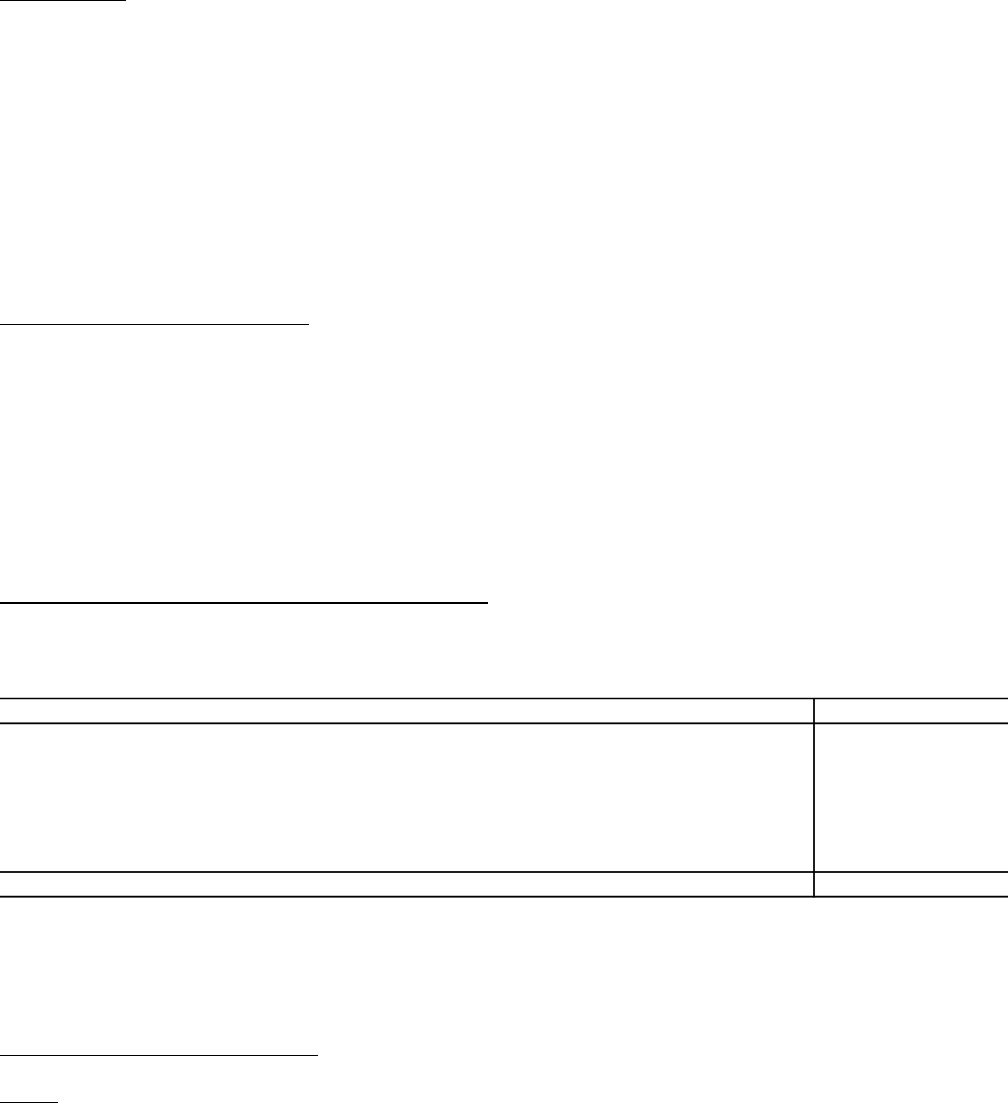

Contractual Obligations and Commercial Commitments

A summary of the estimated amount and estimated timing of cash flows related to BPI’s contractual obligations and

commercial commitments as at September 30, 2021 is as follows:

Note:

1) Includes estimated interest on long-term debt and excludes deferred financing costs of $0.4 million.

2) Represents minimum annual rental payments under lease contracts for office space, restaurants space and equipment.

Cash Flows

Cash Flow from Operating Activities

Period

During the Period, operating activities generated $5.0 million of cash compared to $7.0 million during the third

quarter of 2020. The decrease in cash generated of $2.0 million during the Period was primarily due to a decrease

in changes in working capital and a decrease in income tax received, partially offset by an increase in net income

after adjustments for non-cash items.

(in thousands of dollars) Within 1 year 2 - 3 years 4 - 5 years Over 5 years Total Book Value

Accounts payable and accrued liabilities

and income taxes payable 8,049 - - - 8,049 8,049

Royalty and distributions payable to the Fund 4,191 - - - 4,191 4,191

Debt

1

8,607 28,306 1,276 - 38,189 35,984

Other long-term liabilities - 1,152 - - 1,152 1,152

Lease obligations

2

1,365 1,810 1,210 1,835 6,220 5,145

22,212 31,268 2,486 1,835 57,801 54,521

MANAGEMENT’S DISCUSSION AND ANALYSIS

BOSTON PIZZA INTERNATIONAL INC.

For the three-month and nine-month periods ended September 30, 2021

- 14 -

YTD

YTD, operating activities generated $9.0 million of cash compared to $0.2 million year-to-date in 2020. The

increase in cash generated of $8.8 million YTD was primarily due to an increase in net income after adjustments

for non-cash items and an increase in changes in working capital, partially offset by an increase in net income taxes

paid.

Cash Flow from Financing Activities

Period

During the Period, financing activities used $2.3 million of cash compared to cash generated of $0.4 million during

the third quarter of 2020. The increase in cash used of $2.7 million during the Period was primarily due to proceeds

received from capital contribution from BPI’s parent company and debt in the third quarter of 2020 and higher lease

obligations paid in the current Period, partially offset by decrease in repayment of debt and BPI not having to repay

the Operating Line.

YTD

YTD, financing activities used $6.0 million of cash compared to cash generated of $7.8 million year-to-date in

2020. The increase in cash used of $13.8 million YTD was primarily due to proceeds received from capital

contribution from BPI’s parent company and debt in the second and third quarters of 2020 and higher lease

obligations paid YTD, partially offset by a decrease in repayment of debt and BPI not having to repay the Operating

Line and shareholder loan.

Cash Flow from Investing Activities

Period

During the Period, investing activities used $0.1 million of cash compared to $0.3 million during the third quarter of

2020. Cash used from investing activities typically represents purchases of property and equipment as well as

intangible assets. Cash generated from investing activities typically represents distributions received by BPI on the

Class B Units. The decrease in cash used of $0.2 million during the Period was primarily due to an increase in

distributions received on Class B Units, partially offset by a higher purchase of intangible assets.

YTD

YTD, investing activities generated $1.5 million of cash compared to $0.2 million year-to-date in 2020. The increase

in cash generated of $1.3 million YTD was primarily due to an increase in distributions received on Class B Units,

partially offset by a higher purchase of intangible assets.

MANAGEMENT’S DISCUSSION AND ANALYSIS

BOSTON PIZZA INTERNATIONAL INC.

For the three-month and nine-month periods ended September 30, 2021

- 15 -

Related Party Transactions

BPI’s related party balances owing at the end of the period and related party transactions for the Period were as

follows:

(1) On June 22, 2020, BPI received $5.0 million of capital from its parent company. On September 24, 2020,

BPI received $5.0 million of additional capital from its parent company.

(2) The Fund is considered to be a related party of BPI by virtue of common officers and directors of BPI and

Boston Pizza GP Inc., the managing general partner of Royalties LP. The Fund has engaged Royalties LP,

its administrator, to provide certain administrative services on behalf of the Fund (“Administrative

Services”). In turn, certain of the Administrative Services are performed by BPI as a general partner of

Royalties LP. Under the terms of the partnership agreement governing Royalties LP, BPI is entitled to be

reimbursed for certain out-of-pocket expenses incurred in performing the Administrative Services. The total

amount paid to BPI in respect of these services for the Period was $0.1 million (Q3 2020 – $0.1 million). BPI

and Royalties LP agreed to limit the annual amount of out-of-pocket expenses for which BPI is entitled to be

reimbursed to not more than $0.4 million for each of 2020, 2021 and 2022, with such limit increasing by not

more than the percentage change in the Canadian Consumer Price Index (as calculated by Statistics Canada)

in the calendar year prior thereafter.

Other related party transactions and balances are referred to elsewhere in this MD&A.

CHANGES IN INTERNAL CONTROL OVER FINANCIAL REPORTING

During the Period, there was no change in BPI’s internal control over financial reporting that materially affected, or

is reasonably likely to materially affect, BPI’s internal controls over financial reporting. BPI complies with the

Committee of Sponsoring Organizations of the Treadway Commission Internal Control – Integrated

Framework: 2013.

CRITICAL ACCOUNTING ESTIMATES AND JUDGMENTS

The preparation of BPI’s consolidated financial statements in accordance with IFRS requires estimates and

judgments to be made that affect the reported amounts of assets and liabilities, earnings and expenses, and related

disclosures. These estimates are based on historical experience and knowledge of economics, market factors and

(in thousands of dollars)

September

30, 2021

September

30, 2020

Accounts receivables due from associated companies $

809 $ 3,349

Accounts payable due to associated companies

38 48

Royalty payable to Royalties LP

3,187 6,418

Distributions payable to Holdings LP

1,004 2,027

Additional capital from parent company

(1)

- 10,000

(in thousands of dollars)

Q3 2021 Q3 2020 YTD 2021 YTD 2020

Revenues from a company under common control

$ 872 $ 769 $ 1,951 $ 1,827

Fees charged to the Fund in respect of administrative services

(2)

100 100 300 300

Royalty expense to the Fund

8,522 7,417 19,075 18,666

Distribution expense to the Fund

2,815 2,452 6,329 6,168

Management fees paid for services rendered to companies

under common control - - - 409

Management fees paid to companies under common control

included in compensation expense - - - 216

MANAGEMENT’S DISCUSSION AND ANALYSIS

BOSTON PIZZA INTERNATIONAL INC.

For the three-month and nine-month periods ended September 30, 2021

- 16 -

the restaurant industry along with various other assumptions that are believed to be reasonable under the

circumstances.

BPI believes that the following selected accounting policies are critical to understanding the estimates, assumptions

and uncertainties that affect the amounts reported and disclosed in BPI’s consolidated financial statements and

related notes:

Estimate – Investment in Royalties LP

BPI’s investment in Royalties LP is principally comprised of the Class B Units. The value of New Restaurants rolled

into the Royalty Pool is also recognized within BPI’s investment in Royalties LP through BPI’s right to receive

Class B Additional Entitlements. The value of the Class B Additional Entitlements that BPI will be entitled to as a

result of adding New Restaurants to the Royalty Pool is determined on a formula basis that is designed to estimate

the present value of the cash flows due to the Fund as a result of the New Restaurants being added to the Royalty

Pool. As such, the calculation is dependent on a number of variables including the estimated long-term sales of

the New Restaurants and a discount rate. The value of the Class B Additional Entitlements that BPI will be entitled

to as a result of adding New Restaurants to the Royalty Pool could differ from actual results and may impact the

investment in Royalties LP and deferred gains line items.

Estimate – Accounts Receivable

BPI provides an allowance for uncollectable trade receivables based on a customer-by-customer basis using

estimates for past and current performance, aging, arrears status, the level of allowance already in place, and

management’s interpretation of economic conditions specific to BPI’s customer base. If certain judgments or

estimates prove to be inaccurate, BPI’s results of operations and financial position may be impacted.

Estimate – Class B Units, Class 1 LP Units, and Class 2 LP Units

BPI must classify fair value measurements according to a hierarchy that reflects the significance of the inputs used

in performing such measurements. BPI’s fair value hierarchy comprises the following levels:

• Level 1 – quoted prices are available in active markets for identical assets or liabilities as of the reporting

date. Active markets are those in which transactions occur in sufficient frequency and volume to provide

pricing information on an ongoing basis.

• Level 2 – pricing inputs are other than quoted in active markets included in Level 1. Prices in Level 2 are

either directly (i.e. as prices) or indirectly (i.e. derived from prices) observable as of the reporting date.

• Level 3 – valuations in this level are those with inputs for the asset or liability that are not based on

observable data.

The fair values of the Class B Units, Class 1 LP Units liability and Class 2 LP Units liability are all determined using

Level 2 inputs and are measured on a recurring basis.

(i) Class B Units

BPI has elected under IFRS to measure the Class B Units as a financial asset at fair value through profit and

loss. This requires that BPI use a valuation technique to determine the value of BPI’s investment in BP Royalties

LP at each reporting date. The Class B Units are exchangeable for Fund Units, and thus, it is estimated that the

value of the Class B Units approximates the number of Fund Units into which they are exchangeable. The Fund

estimates the fair value of the Class B Units liability by multiplying the issued and outstanding Class B Additional

Entitlements (including Class B Holdback) held by BPI at the end of the period by the closing price of the Fund Units

on the last business day of the period.

MANAGEMENT’S DISCUSSION AND ANALYSIS

BOSTON PIZZA INTERNATIONAL INC.

For the three-month and nine-month periods ended September 30, 2021

- 17 -

This valuation technique may not represent the actual value of the financial asset should such units be extinguished

and changes in the distribution rate on the Class B Units and the yield of the Fund Units could materially impact

BPI’s financial position and net and comprehensive income.

(ii) Class 1 LP Units Liability and Class 2 LP Units Liability

The Class 1 LP Units liability and Class 2 LP Units liability are classified as financial liabilities measured at fair value

through profit or loss because the entitlements to distributions are considered embedded derivatives to the limited

partnership units. BPI measures the Class 1 LP Units liability and Class 2 LP Units liability at fair value using

Level 2 inputs, which may result in a fair value adjustment on the BP Canada LP units liability line on the statements

of financial position, and the fair value loss (gain) line on the statements of comprehensive income and a

corresponding non-cash adjustment line on the statements of cash flows.

The fair value of the Class 1 LP Units liability for BPI mirrors the fair value of the investment in Class 1 LP Units

asset recognized by the Fund for any particular period. The Class 1 LP Units are entitled to distributions with

respect to the interest payable by the Fund on the credit facility to pay for the Fund’s indirect investment in Class 1

LP Units of BP Canada LP. BPI estimates the fair value of Class 1 LP Units liability using a market-corroborated

input, being the interest rate on the applicable credit facility. Consequently, BPI estimates the fair value of Class 1

LP Units liability at carrying value adjusted for interest rate risk.

The fair value of the Class 2 LP Units liability for BPI mirrors the fair value of the investment in Class 2 LP Units

asset recognized by the Fund for any particular period. The Class 2 LP Units have similar cash distribution

entitlements and provisions to the Class 2 GP Units held by BPI, which are exchangeable for Fund Units. The fair

value of the Class 2 LP Units is determined using a market approach, which involves using observable market

prices for similar instruments. The fair value of the Class 2 LP Units is determined by multiplying the issued and

outstanding Class 2 LP Units indirectly held by the Fund at the end of the period by the closing price of a Fund Unit

on the last business day of the period.

These valuation techniques may not represent the actual value of the Class 1 LP Units liability and Class 2 LP Units

liability should such liabilities be extinguished. Changes in the distribution rates on the Class 1 LP Units and Class 2

LP Units and the yield of Fund Units could materially impact BPI’s financial position and net income.

Judgment – Consolidation

Applying the criteria outlined in IFRS 10, judgment is required in determining whether BPI controls Royalties LP

and BP Canada LP. Making this judgment involves taking into consideration the concepts of power over

Royalties LP and BP Canada LP, exposure and rights to variable returns, and the ability to use power to direct the

relevant activities of Royalties LP and BP Canada LP so as to generate economic returns. With respect to Royalties

LP, using these criteria, management has determined that BPI does not ultimately control Royalties LP. With

respect to BP Canada LP, using these criteria, management has determined that BPI ultimately controls BP Canada

LP through its ability to direct relevant activities to generate economic returns from BP Canada LP and its

governance as managing general partner of BP Canada LP.

SHORT-TERM OUTLOOK

The information contained in this “Short-Term Outlook” section is forward-looking information. Please see the “Note

Regarding Forward-Looking Information” and “Risks & Uncertainties” sections of this MD&A for a discussion of the

risks and uncertainties in connection with forward-looking information.

COVID-19 had sudden, unexpected and unprecedented impacts on the general economy, the restaurant industry

and has specifically caused significant disruption to the business of the Fund, BPI and BP Canada LP. The focus

of BPI’s management is to continue to: (i) monitor carefully the continuously evolving COVID-19 situation; (ii) modify

the operating procedures of Boston Pizza Restaurants to ensure the safety of guests and staff of BP Canada LP’s

franchisees; (iii) responsibly and safely operate the dining rooms, sports bars and patios of Boston Pizza

Restaurants across Canada as permitted by applicable provincial health authorities; (iv) maximize the opportunity

to grow its take-out and delivery business; and (v) review and adapt current and future plans to responsibly address

MANAGEMENT’S DISCUSSION AND ANALYSIS

BOSTON PIZZA INTERNATIONAL INC.

For the three-month and nine-month periods ended September 30, 2021

- 18 -

the challenges and opportunities presented by COVID-19. Management of BPI anticipates that sales levels for the

second half of 2021 may be favourable compared to the first half of 2021 due to the easing of governmental

restrictions in June 2021, however, COVID-19 will continue to have a negative and volatile impact on the business

of Boston Pizza Restaurants during the remainder of 2021.

RISKS & UNCERTAINTIES

Risks Related to the Business of BPI and BP Canada LP

Canada Emergency Wage Subsidy and Canada Emergency Rent Subsidy

The Canada Emergency Wage Subsidy (“CEWS”) was a program that provided a subsidy of up to 75% of

remuneration paid by an employer to each eligible employee up to a maximum of $847 per week. The Canada

Emergency Rent Subsidy (“CERS”) was a program available to Canadian businesses, non-profit organizations, or

charities who saw a drop in revenue during the COVID-19 pandemic to cover part of their commercial rent or

property expenses. The CEWS and CERS programs expired on October 23, 2021. On October 21, 2021, the

federal government introduced The Tourism and Hospitality Recovery Program, which will provide additional

support to companies in the tourism and hospitality industry experiencing at least a 40% revenue reduction, with

the program expected to extend until May 7, 2022.

A number of Boston Pizza Restaurants were receiving CEWS and/or CERS. Fewer Boston Pizza Restaurants may

be eligible for the Tourism and Hospitality Recovery Program than were eligible for CEWS and/or CERS. It is

unknown to what extent the replacement of the CEWS and CERS programs with the Tourism and Hospitality

Recovery Program will affect the financial condition of Boston Pizza Restaurants. If fewer Boston Pizza Restaurants

are eligible to participate in the Tourism and Hospitality Recovery Program than CEWS and/or CERS, it may

decrease their profitability, thereby increasing risks of Boston Pizza Restaurants closing.

Supply Chain Disruption / Labour Availability

As economies reopen, the global recovery from the economic impacts of COVID-19 is disrupting supply chains

around the world. In addition, multiple economic sectors reopening simultaneously is creating a temporary but

significant labour shortage throughout North America. While Boston Pizza currently has a stable supply chain, it is

possible that the global supply chain disruption caused by COVID-19 could result in supply interruptions, commodity

unavailability or increased commodity costs for Boston Pizza Restaurants. In addition, the current labour shortage

may impede Boston Pizza Restaurants’ ability to attract and retain sufficient numbers of qualified staff. If Boston

Pizza Restaurants are unable to source sufficient raw materials and labour at reasonable prices, it may: (i) limit

their ability to generate Franchise Sales, and/or (ii) decrease their profitability, thereby increasing risks of Boston

Pizza Restaurants closing.

For more information on risks and uncertainties related to BPI and the Fund, please refer to the Fund’s and BPI’s

MD&As for the year-ended December 31, 2020 available on SEDAR at www.sedar.com.

ADDITIONAL INFORMATION

Additional information relating to BPI, the Fund, Royalties LP, Boston Pizza GP Inc., BPCHP, Boston Pizza Holdings

Trust, Holdings LP, Boston Pizza Holdings GP Inc. and BP Canada LP, including the Fund’s Annual Information

Form dated February 9, 2021, is available on SEDAR at www.sedar.com and on the Fund’s website at

www.bpincomefund.com.

NOTE REGARDING FORWARD-LOOKING INFORMATION

Certain information in this MD&A constitutes “forward-looking information” that involves known and unknown risks,

uncertainties, future expectations and other factors which may cause the actual results, performance or

achievements of BPI, the Fund, Boston Pizza Holdings Trust, Royalties LP, Holdings LP, Boston Pizza Holdings

GP Inc., Boston Pizza GP Inc., BPCHP, BP Canada LP, Boston Pizza Restaurants, or industry results, to be

materially different from any future results, performance or achievements expressed or implied by such forward-

MANAGEMENT’S DISCUSSION AND ANALYSIS

BOSTON PIZZA INTERNATIONAL INC.

For the three-month and nine-month periods ended September 30, 2021

- 19 -

looking information. When used in this MD&A, forward-looking information may include words such as “anticipate”,

“estimate”, “may”, “will”, “should”, “expect”, “believe”, “plan”, “forecast” and other similar terminology. This

information reflects current expectations regarding future events and operating performance and speaks only as of

the date of this MD&A.

Forward-looking information in this MD&A includes, but is not limited to, such things as:

All statements, other than statements of historical facts, included herein that address events or developments that

management of BPI expects or anticipates will or may occur in the future are forward-looking information. Forward-

looking information in this MD&A includes, but is not limited to, such things as:

• future distributions and dates distributions are to be paid or payable;

• how changes in distributions will be implemented;

• how distributions will be funded;

• management anticipates that sales levels for the second half of 2021 may be favourable compared to the

first half of 2021 due to the easing of governmental restrictions in June 2021, however, COVID-19 will

continue to have a negative and volatile impact on the business of Boston Pizza Restaurants during the

remainder of 2021;

• Boston Pizza Restaurants will close for two to three weeks to complete a renovation and experience an

incremental sales increase in the year following the re-opening;

• impact of seasonality on Franchise Sales;

• the “Four Pillars” strategy will continue to focus BPI’s and BP Canada LP’s efforts to develop new markets

and strengthen Boston Pizza’s position as Canada’s number one casual dining brand;

• estimates relating to the amount and timing of cash flows related to BPI’s contractual obligations and

commercial commitments;

• adjustments to Additional Entitlements that are to occur in the future and when such adjustments will occur;

• belief that BPI has sufficient cash and capital resources for 2021, and that its current sources of liquidity

are sufficient to cover its currently known short and long-term obligations;

• BPI constantly monitoring its operations and cash flows to ensure that current and future obligations will be

met;

• that BPI’s strategy is to divest itself from the remaining three corporately owned Boston Pizza Restaurants

and exclusively focus on strengthening the brand and its franchised business;

• that the global supply chain disruption caused by COVID-19 could result in supply chain interruptions,

commodity unavailability or increased commodity costs for Boston Pizza Restaurants;

• that the current labour shortage may impede Boston Pizza Restaurants’ ability to attract and retain sufficient

numbers of qualified staff;

• that fewer Boston Pizza Restaurants may be eligible for the Tourism and Hospitality Recovery Program

than were eligible for CEWS and/or CERS, which may result in a decrease to their profitability, thereby

increasing risks of Boston Pizza Restaurants closing;

• that in the event Boston Pizza Restaurants are unable to source sufficient raw materials and labour at

reasonable prices, it may (i) limit their ability to generate Franchise Sales; and/or (ii) decrease their

profitability, increasing risks of Boston Pizza Restaurants closing;

• BPI and BP Canada LP aggressively enhancing and promoting the Boston Pizza brand;

• that BPI intends to either refinance or repay the Acquired Restaurant Credit Facility upon its maturity;

• BPI continuing to: (i) monitor carefully the continuously evolving COVID-19 situation; (ii) modify the

operating procedures of Boston Pizza Restaurants to ensure the safety of guests and employees of

BP Canada LP’s franchisees; (iii) responsibly and safely re-open the dining rooms and sports bars of

Boston Pizza Restaurants across Canada as permitted by applicable provincial health authorities; (iv)

maximize the opportunity to grow its take-out and delivery business; and (v) review and adapt current and

future plans to responsibly address the challenges and opportunities presented by COVID-19; and

• BPI making responsible adjustments to its business as circumstances warrant.

The forward-looking information disclosed herein is based on a number of assumptions including, among other

things:

MANAGEMENT’S DISCUSSION AND ANALYSIS

BOSTON PIZZA INTERNATIONAL INC.

For the three-month and nine-month periods ended September 30, 2021

- 20 -

• absence of amendments to material contracts;

• no strategic changes of direction occurring;