Federal Communications Commission FCC 01-389

Before the

Federal Communications Commission

Washington, D.C. 20554

In the Matter of

Annual Assessment of the Status of

Competition in the Market for the

Delivery of Video Programming

)

)

)

)

)

CS Docket No. 01-129

EIGHTH ANNUAL REPORT

Adopted: December 27, 2001 Released: January 14, 2002

By the Commission: Commissioner Martin issuing a statement.

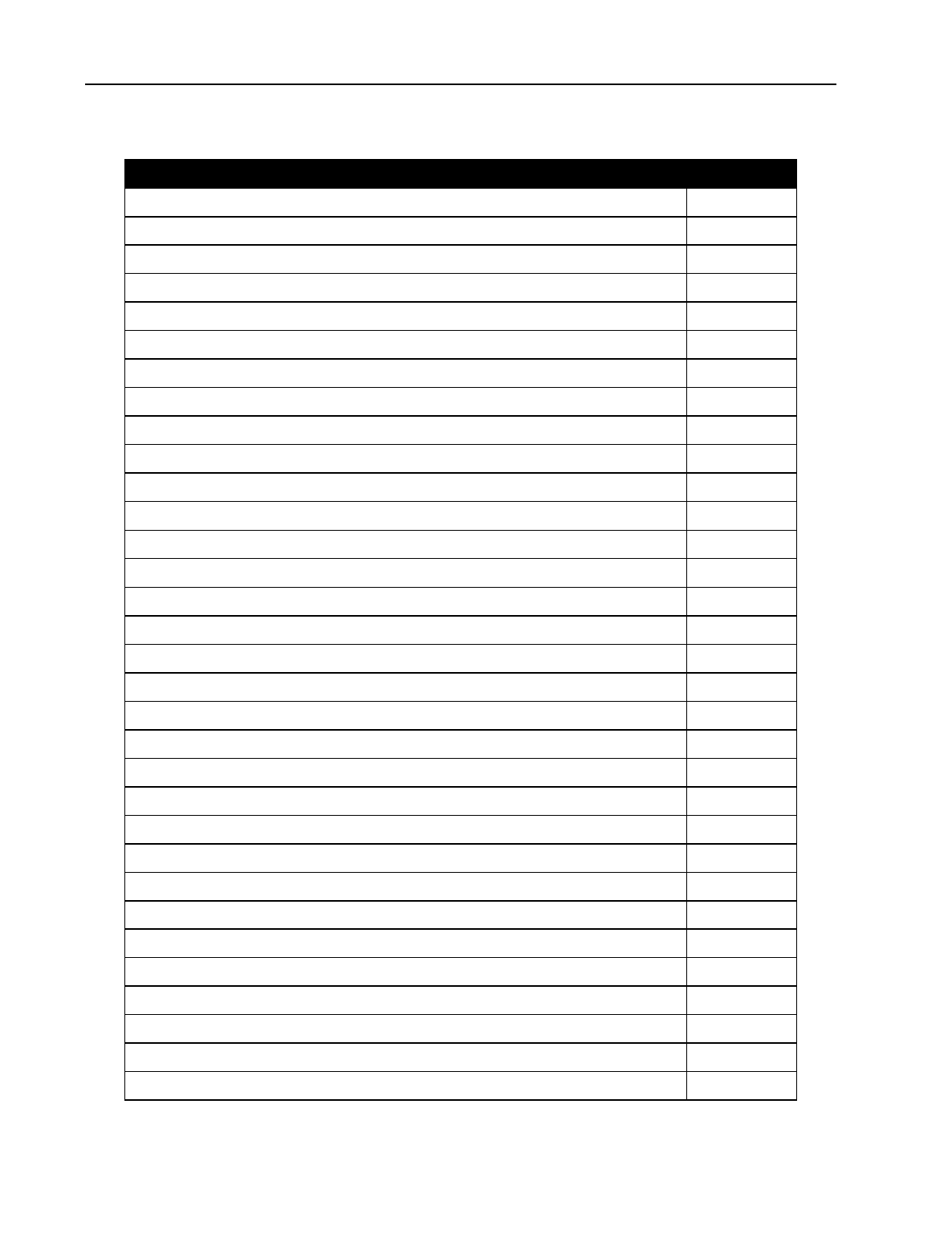

Table of Contents

Paragraph

I. Introduction ............ ................................................................................................... 1

A. Scope of this Report ............................................................................................. 2

B. Summary of Findings............................................................................................ 5

II. Competitors in the Market for the Delivery of Video Programming..................................... 15

A. Cable Industry.. ................................................................................................... 15

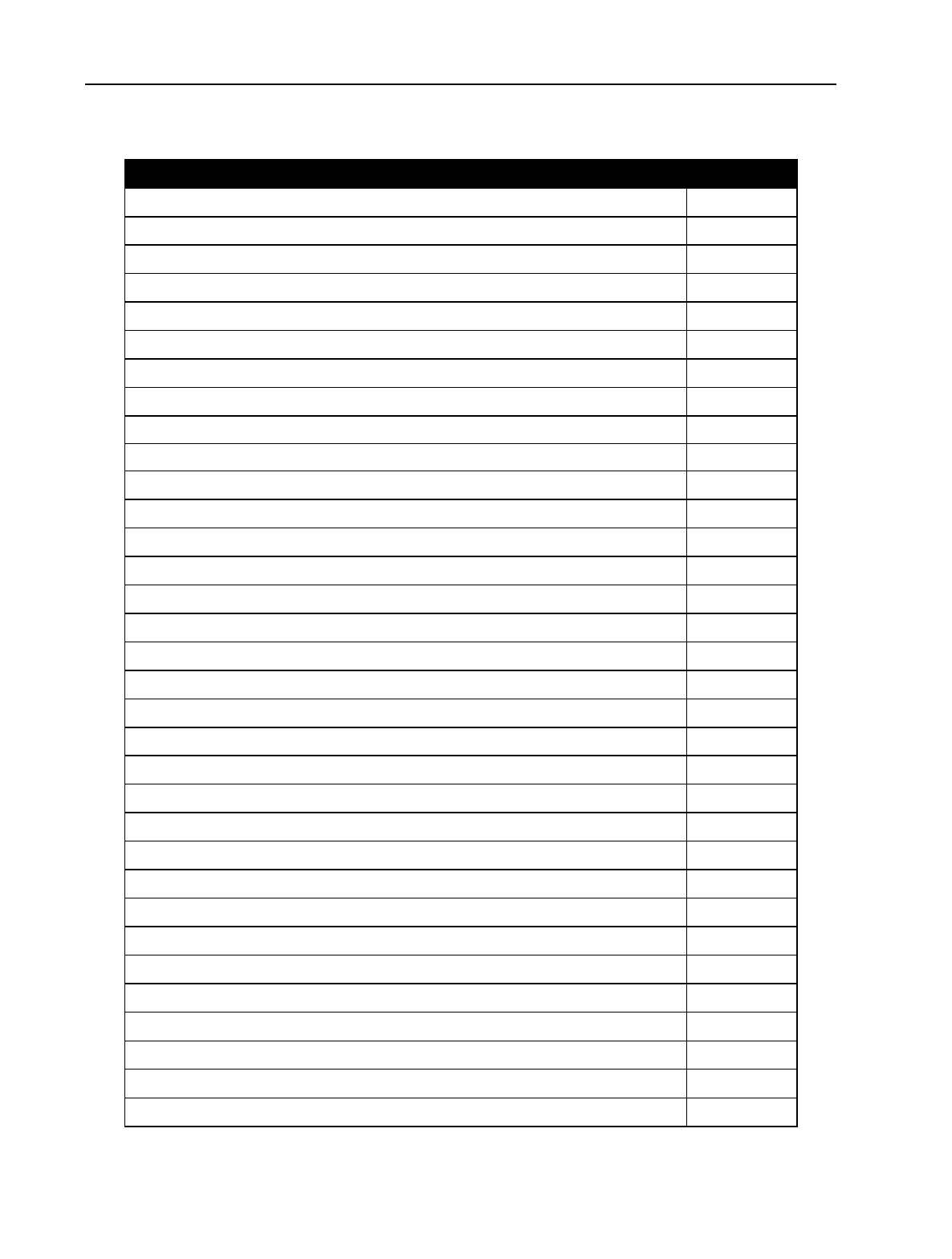

1. General Performance................................................................................ 16

2. Financial Performance.............................................................................. 23

3. Capital Acquisition and Disposition.......................................................... 30

4. Provision of Advanced Broadband Services .............................................. 34

B. Direct-to-Home Satellite Services ......................................................................... 55

1. Direct Broadcast Satellite Service............................................................. 55

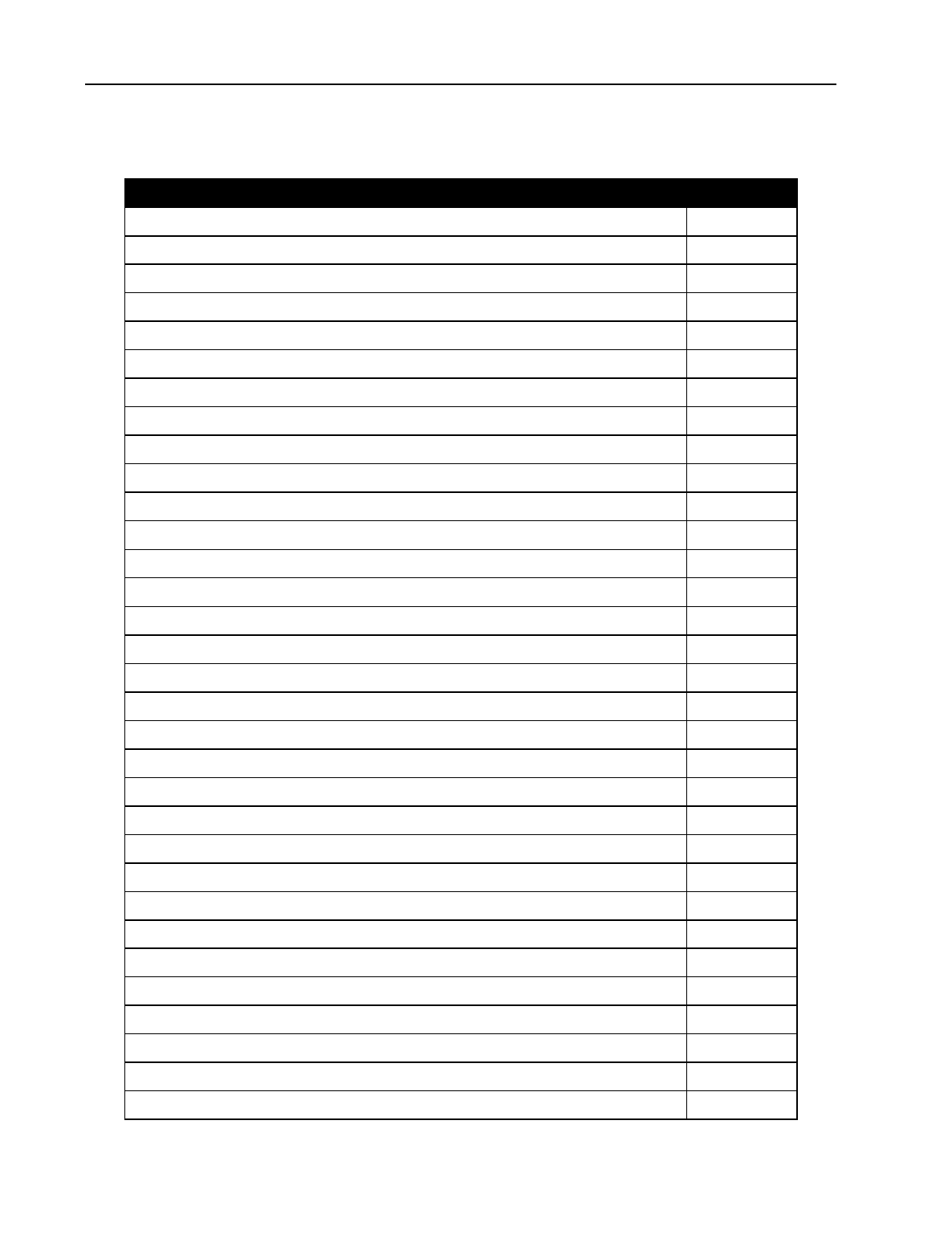

2. Home Satellite Dishes .............................................................................. 67

C. Multichannel Multipoint Distribution Service........................................................ 68

D. Satellite Master Antenna Television Systems......................................................... 73

E. Broadcast Television Service ................................................................................ 78

F. Other Entrants.. ................................................................................................... 89

1. Internet Video.......................................................................................... 89

2. Home Video Sales and Rentals................................................................. 95

Federal Communications Commission FCC 01-389

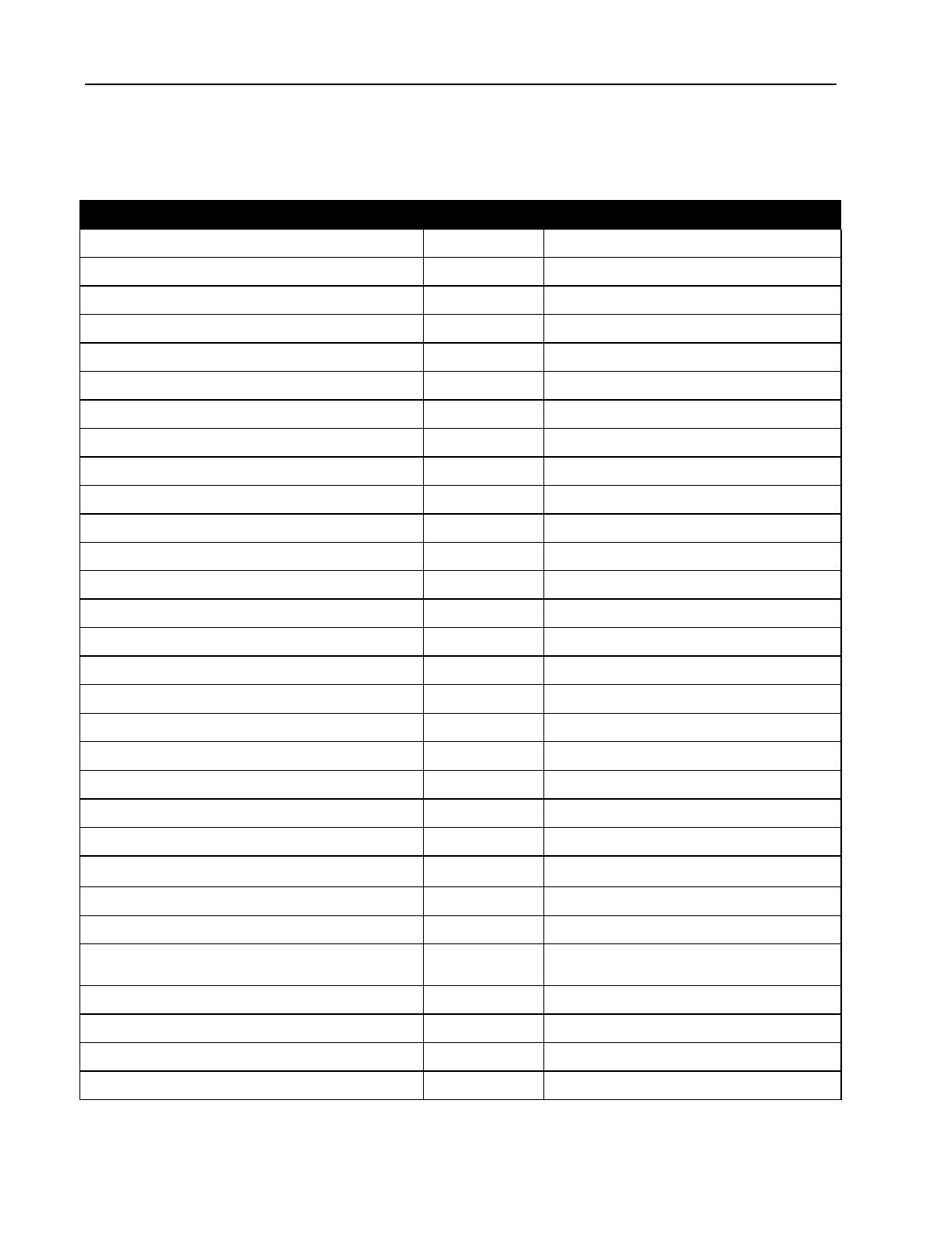

2

G. Local Exchange Carriers....................................................................................... 99

H. Electric and Gas Utilities....................................................................................... 104

I. Broadband Service Providers, Open Video System Operators, and Overbuilders..... 107

III. Market Structure and Conditions Affecting Competition..................................................... 116

A. Horizontal Issues in the Market for the Delivery of Video Programming................. 116

1. Competitive Issues in the Market for the Delivery of Video Programming.. 118

2. Competitive Issues in the Market for the Purchase of Video Programming . 137

B. Vertical Integration and Other Programming Issues ............................................... 156

1. Status of Vertical Integration .................................................................... 156

2. Other Programming Issues ....................................................................... 161

C. Technical Issues ................................................................................................... 186

1. Interactive Television............................................................................... 187

2. Navigation Devices.................................................................................. 191

3. Cable Modems......................................................................................... 194

IV. Competitive Responses . ................................................................................................... 196

V. Administrative Matters.. ................................................................................................... 210

Appendices

A. List of Commenters

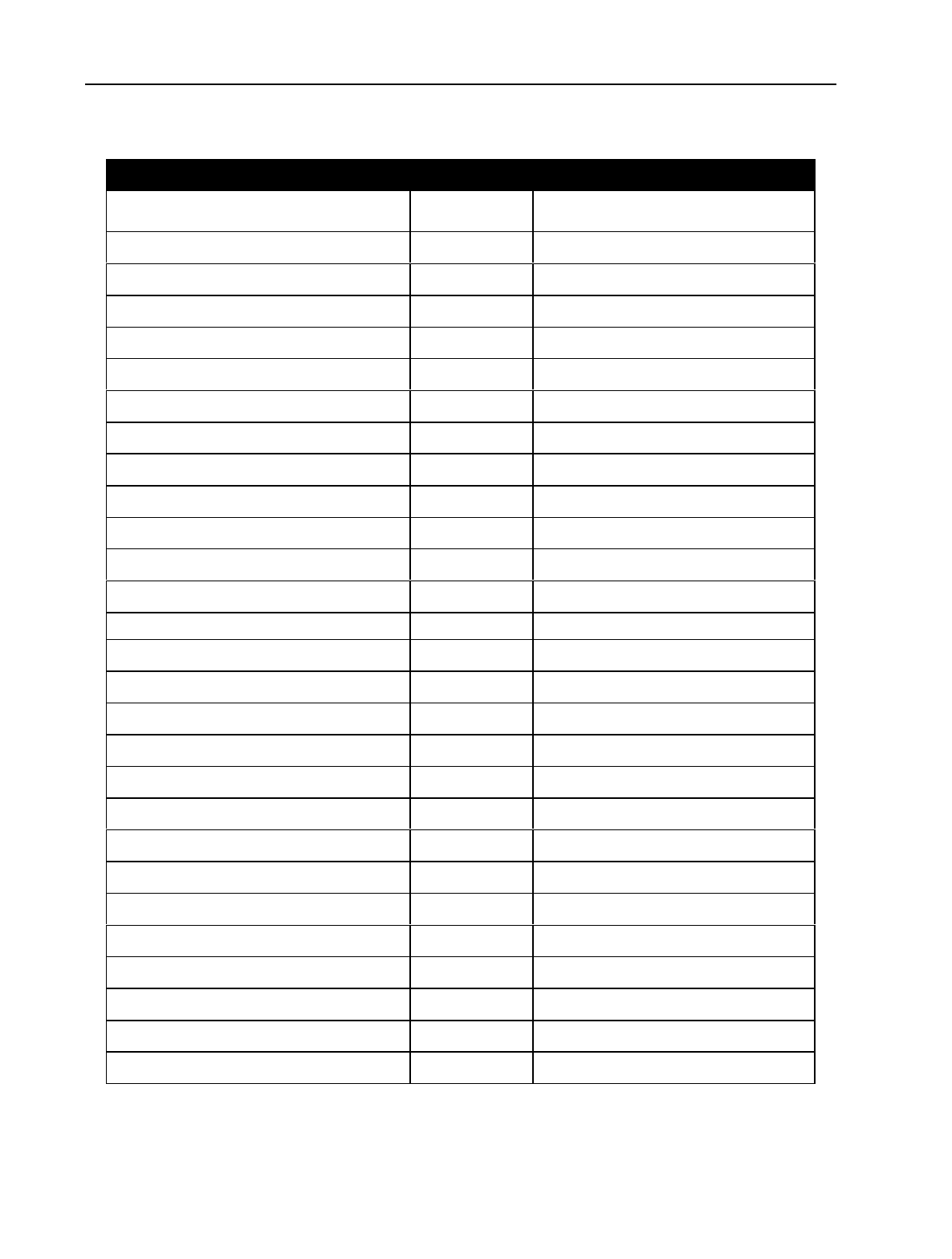

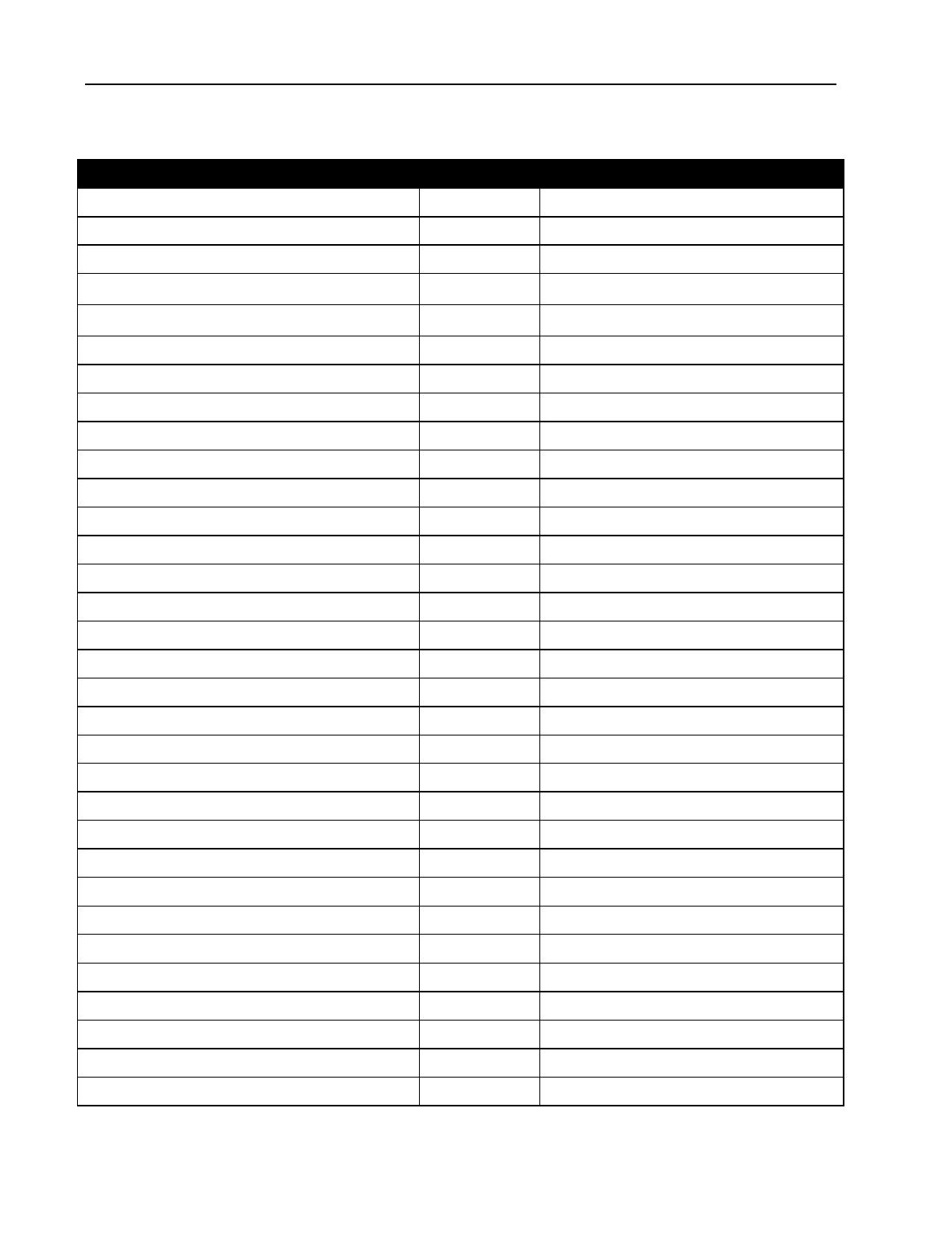

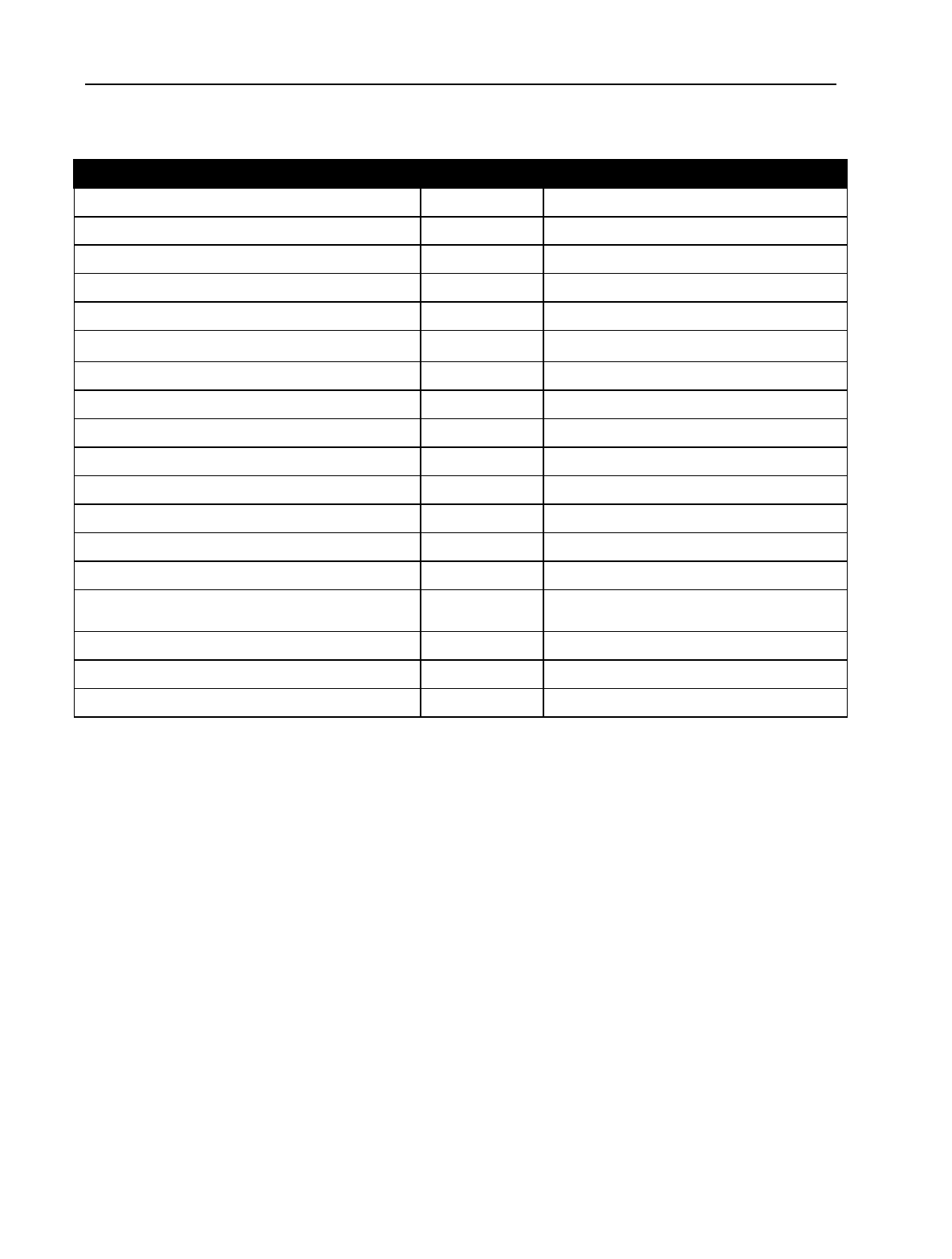

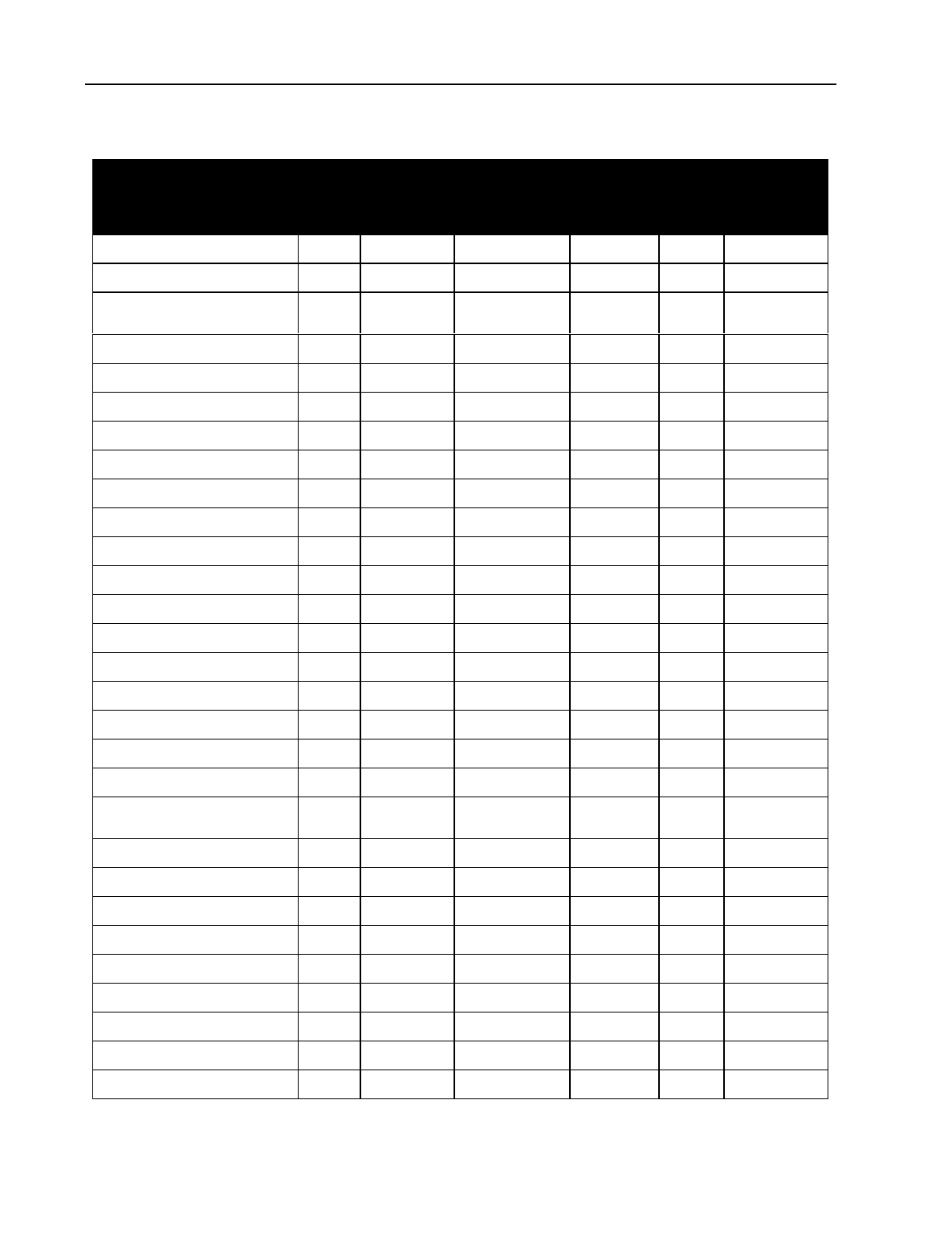

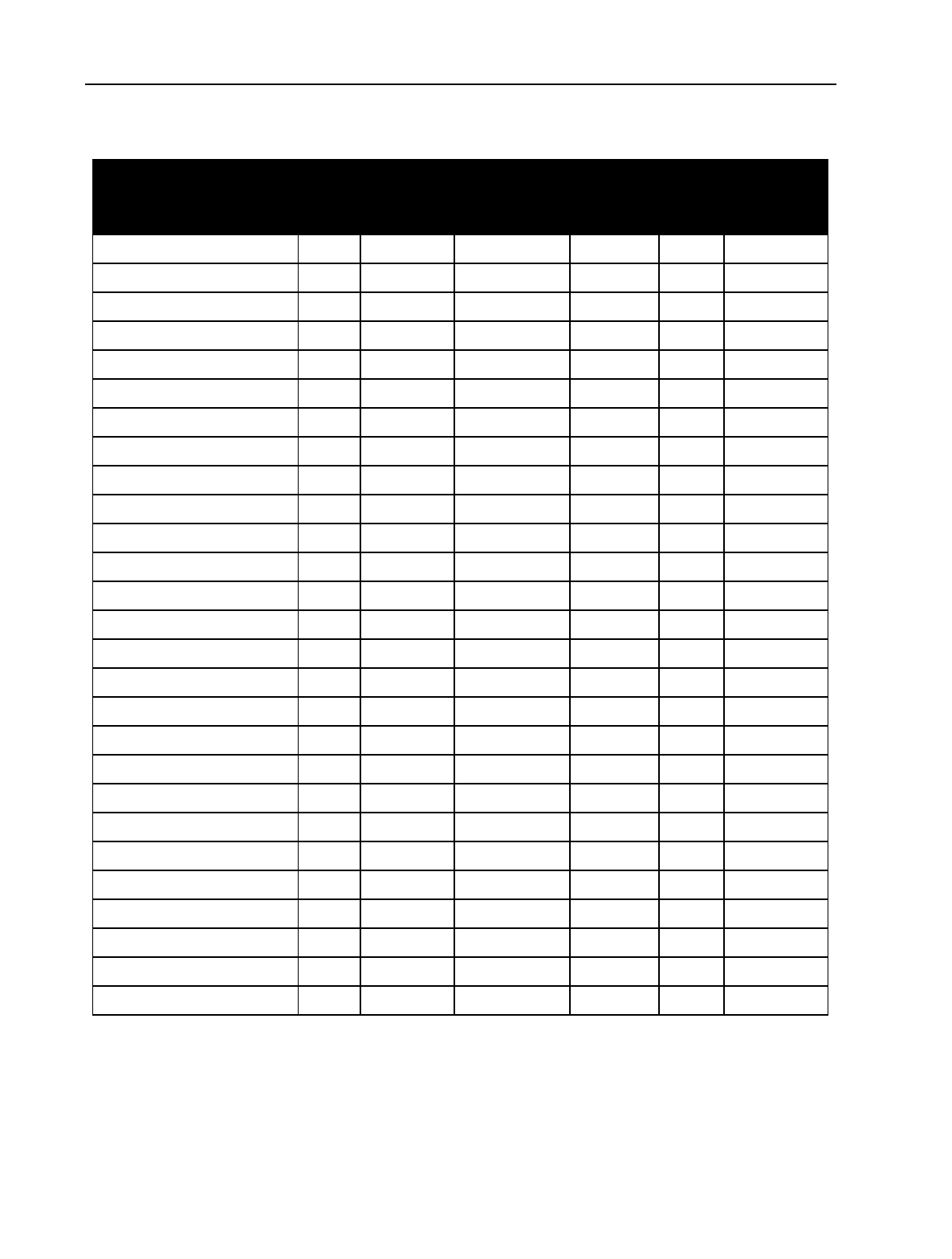

B Cable Industry Tables

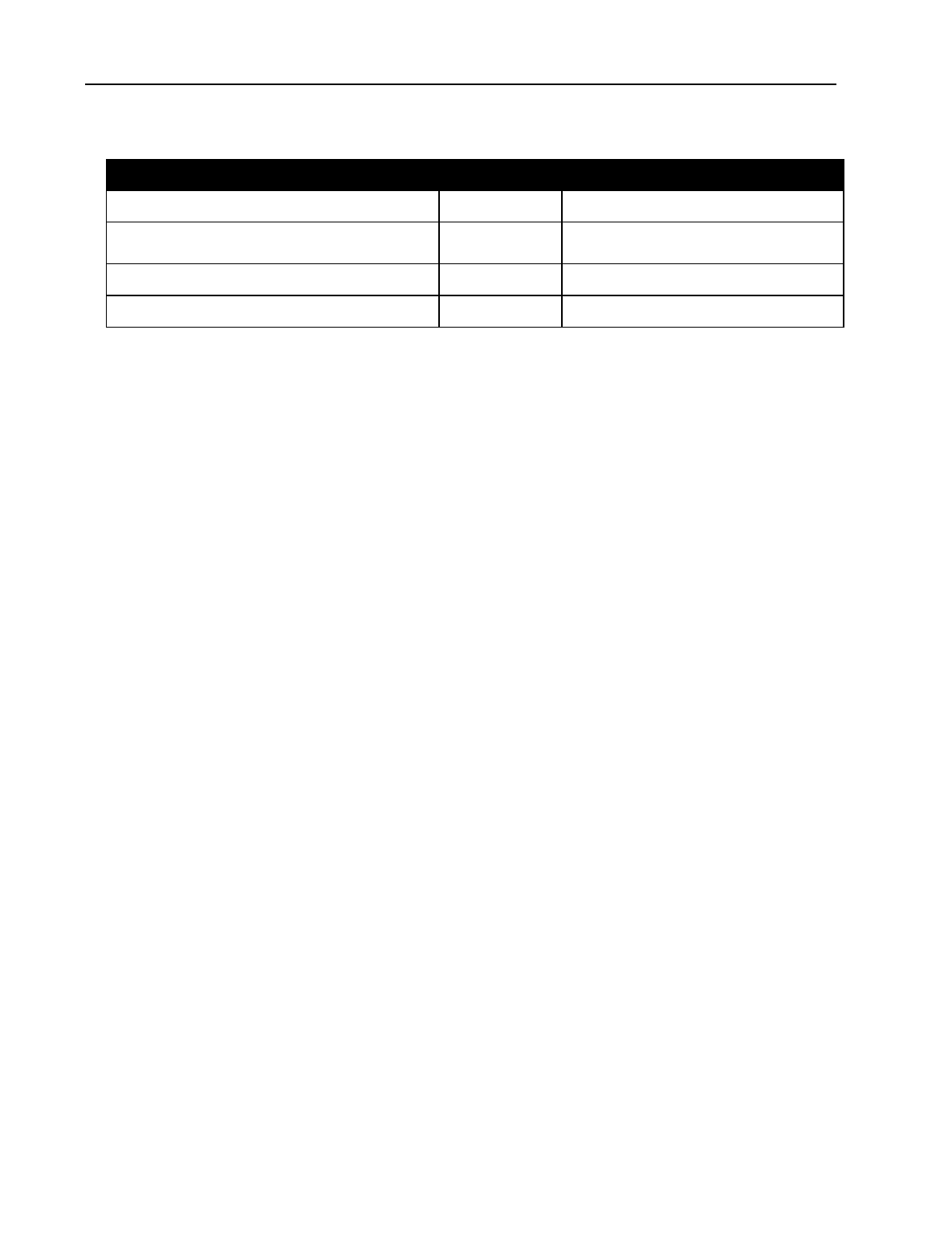

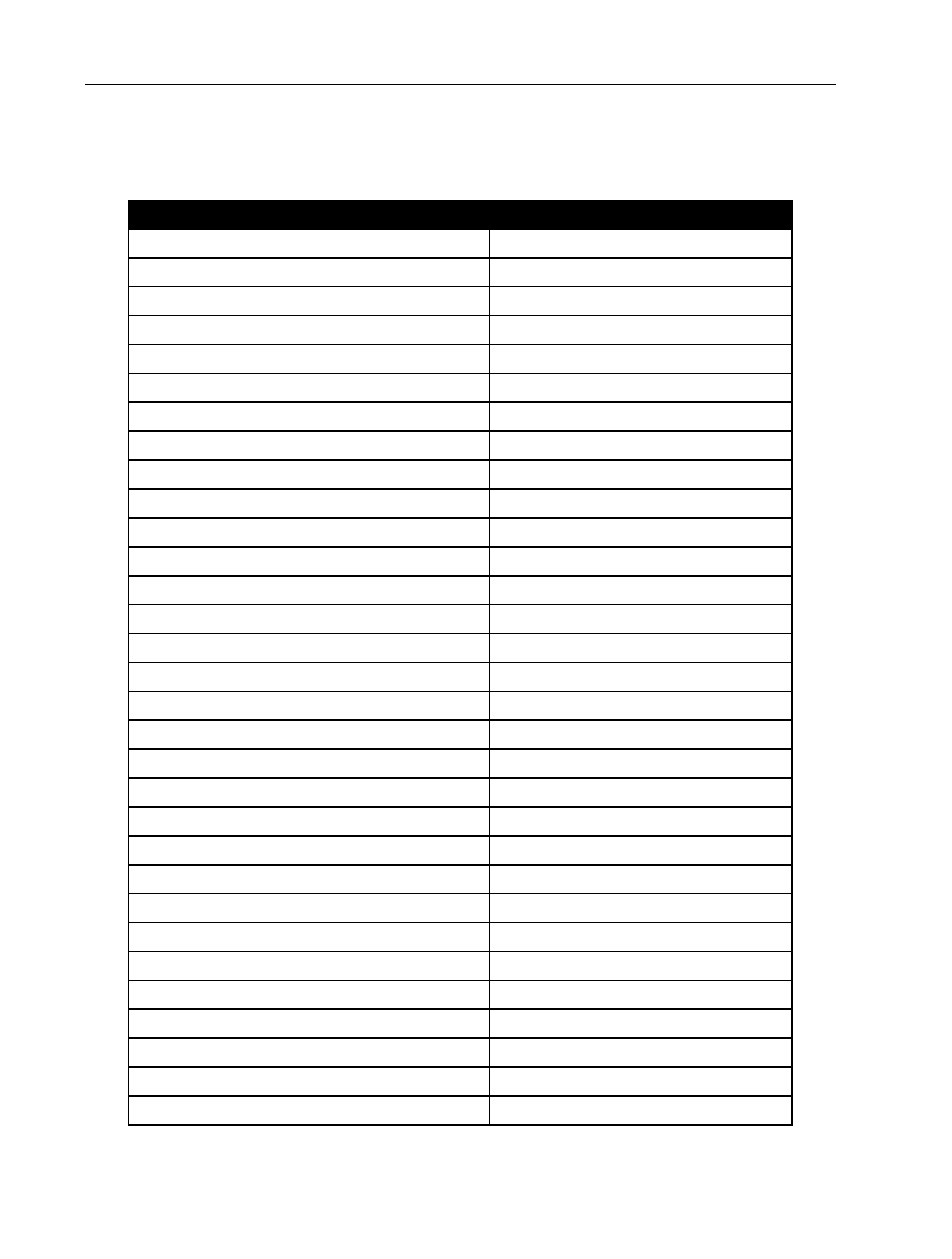

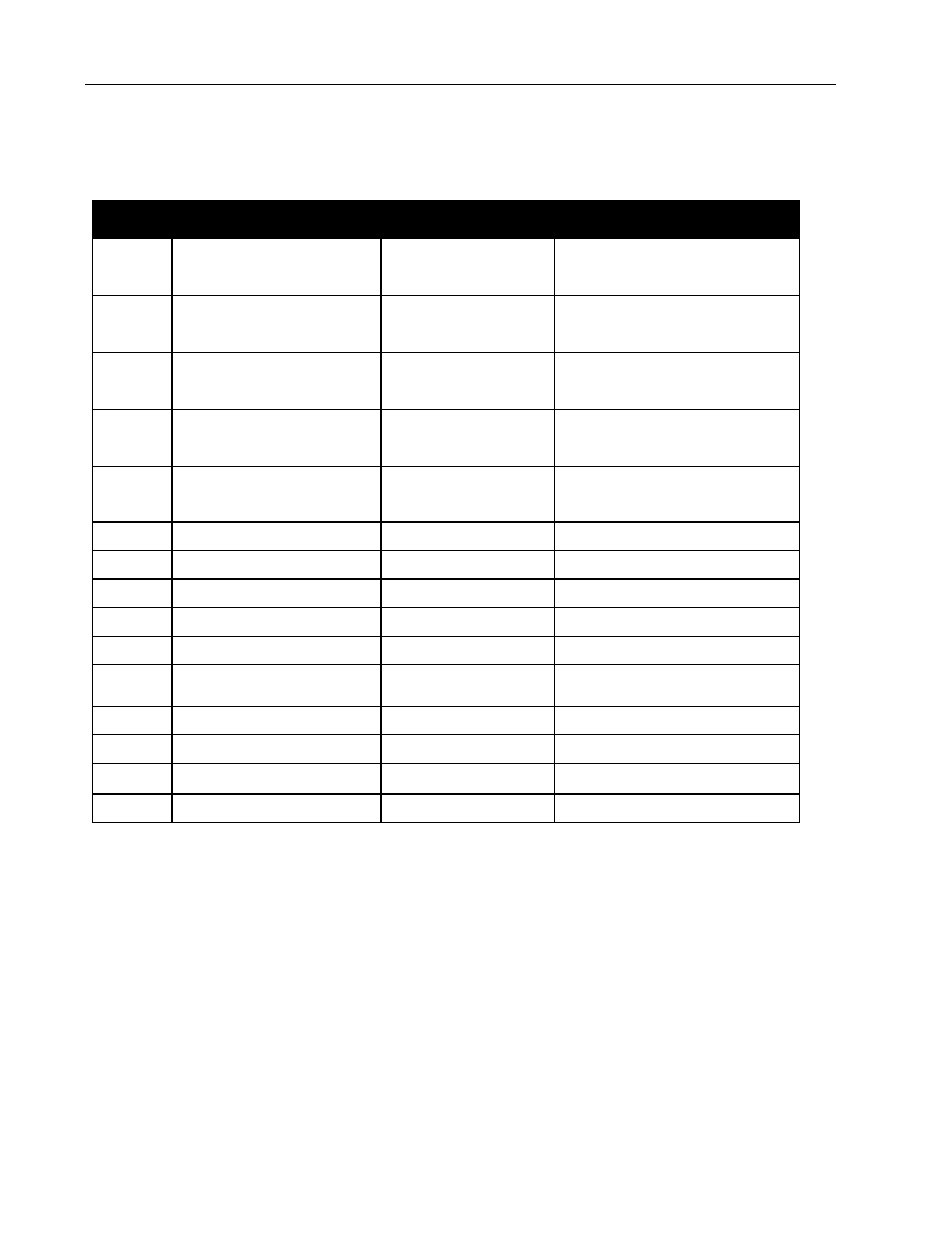

C. Horizontal Issues

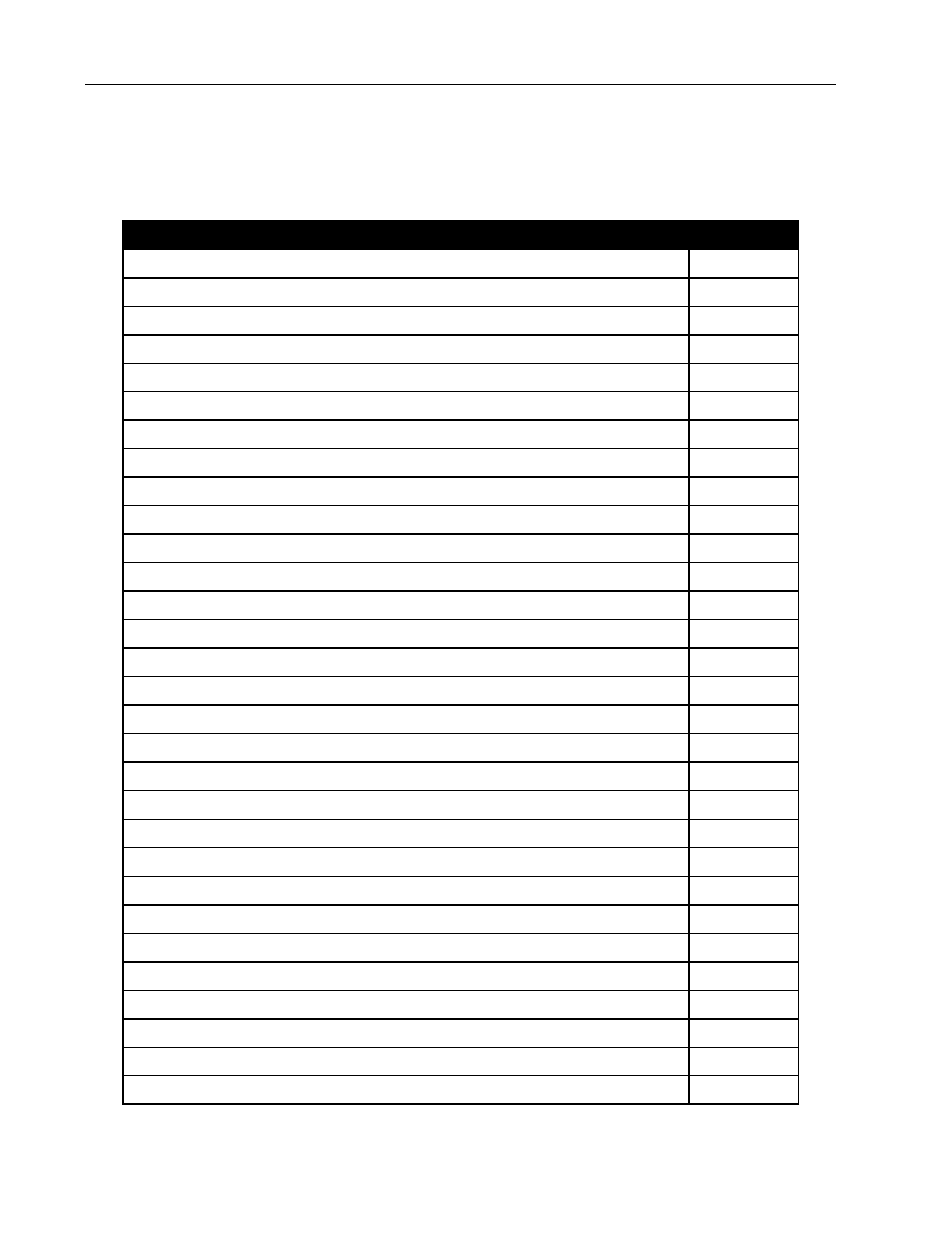

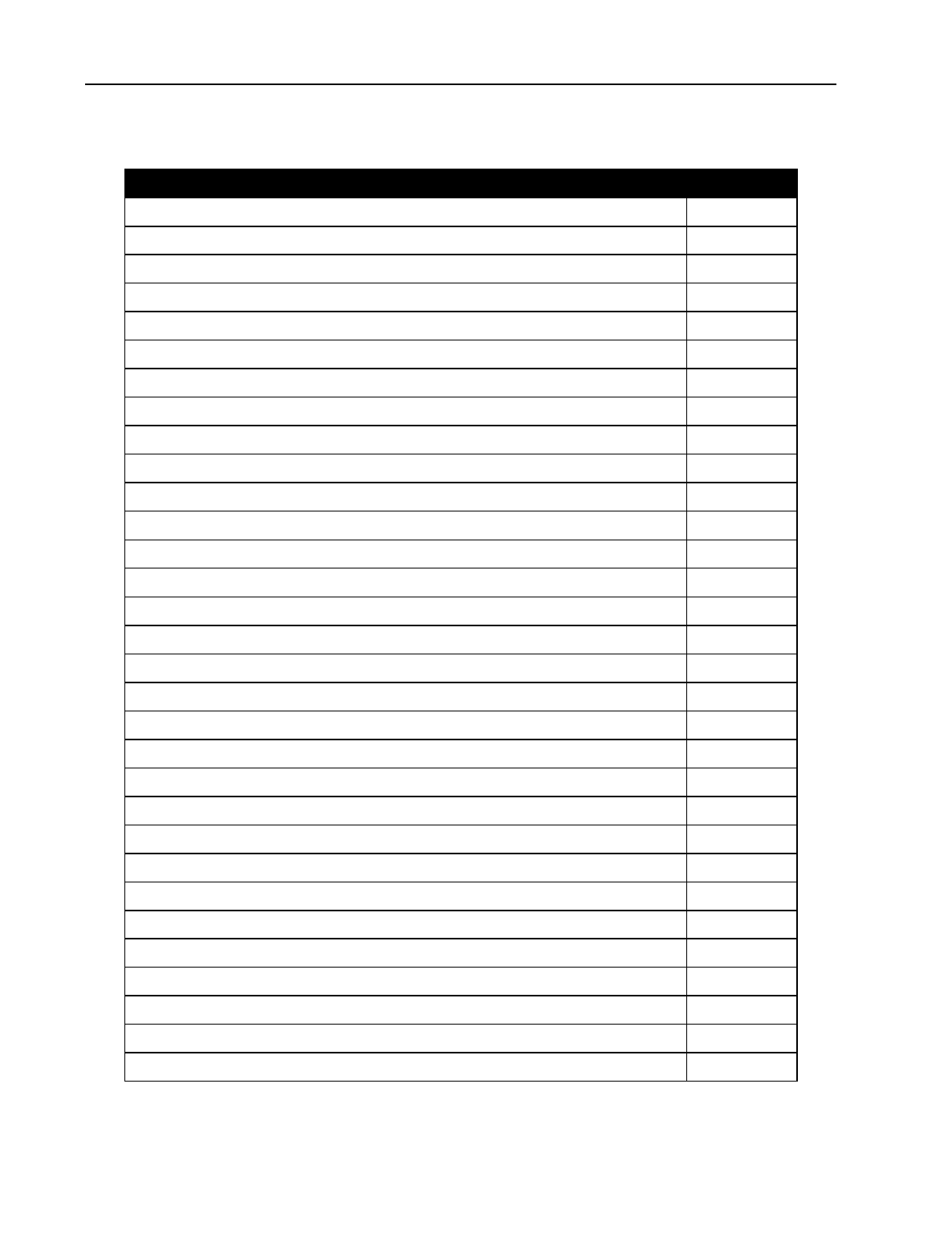

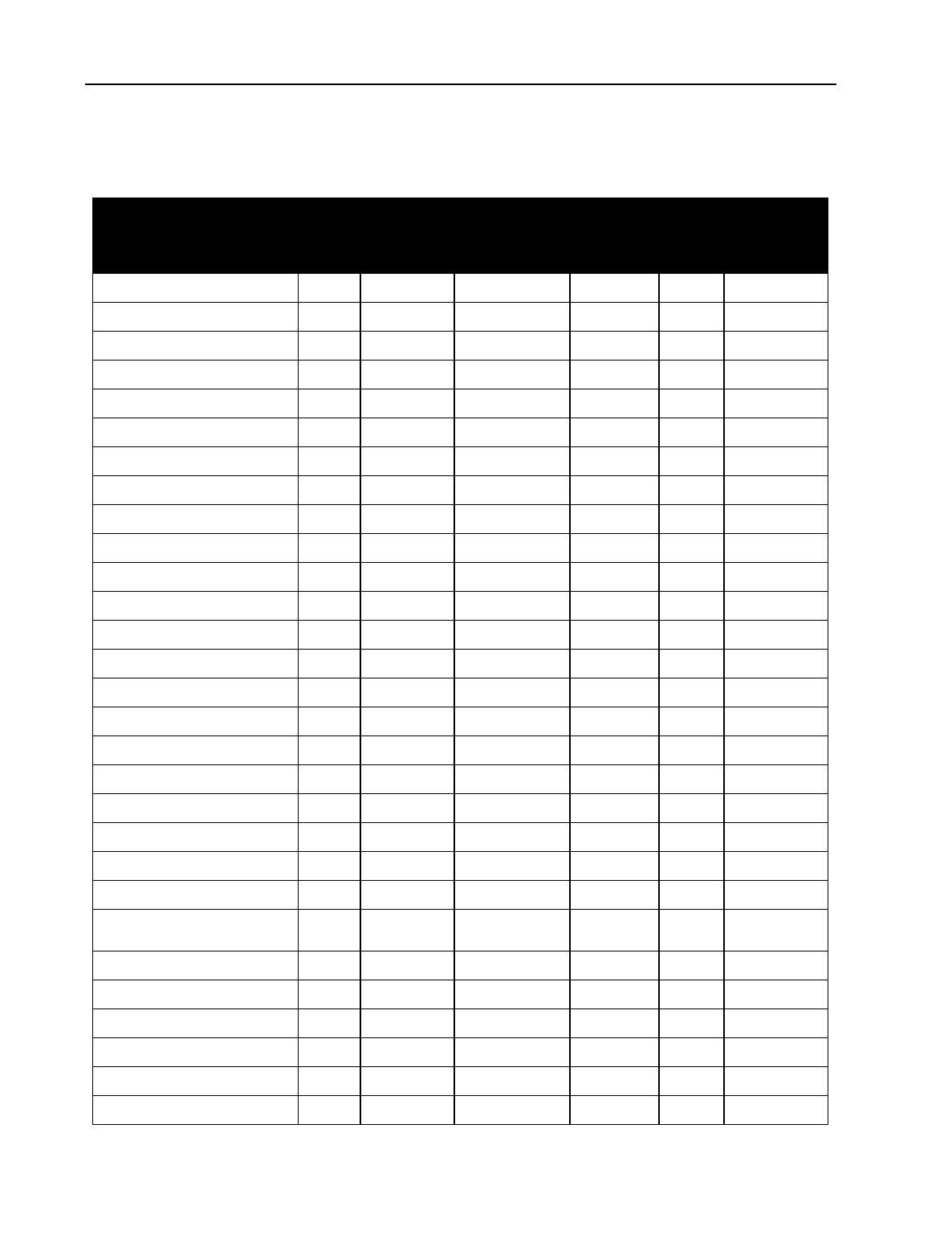

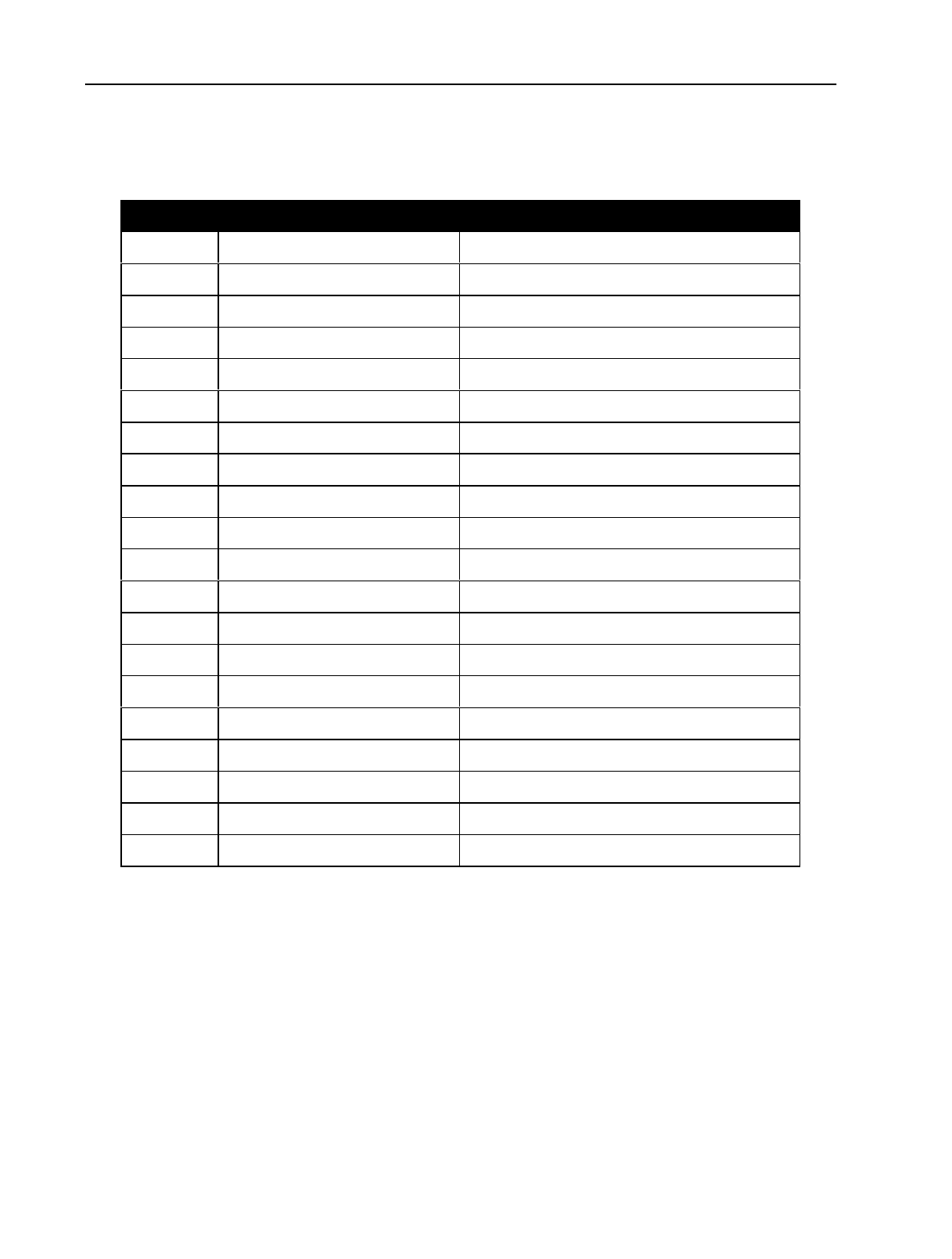

D. Vertical Integration Tables

Federal Communications Commission FCC 01-389

3

I. INTRODUCTION

1.

This is the Commission’s eighth annual report (“

2001 Report

”) to Congress on the status of

competition in the market for the delivery of video programming.

1

Section 628(g) of the

Communications Act of 1934, as amended (“Communications Act”), requires the Commission to report

annually to Congress on the status of competition in the market for the delivery of video programming.

2

Congress imposed this annual reporting requirement in the Cable Television Consumer Protection and

Competition Act of 1992 (“1992 Cable Act”)

3

as a means of obtaining information on the competitive

status of markets for the delivery of video programming.

4

A. Scope of this Report

2.

The

2001 Report

updates the information in our previous reports and provides data and

information that summarize the status of competition in the market for the delivery of video

programming. The information and analysis provided in this report are based on publicly available data,

filings in various Commission proceedings, and information submitted by commenters in response to a

Notice of Inquiry

(

“Notice”

) in this docket.

5

To the extent that information provided in previous annual

reports is still relevant, we do not repeat that information in this report other than in an abbreviated

fashion, and provide references to the discussions in prior reports.

3.

In Section II, we examine the cable television industry, existing multichannel video

programming distributors (“MVPDs”) and other program distribution technologies and potential

competitors to cable television. Among the MVPD systems or techniques discussed are direct broadcast

satellite (“DBS”) services and home satellite dishes (“HSDs”), wireless cable systems using frequencies

in the multichannel multipoint distribution service (“MMDS”), private cable or satellite master antenna

1

The Commission’s previous reports appear at:

Implementation of Section 19 of the 1992 Cable Act (Annual

Assessment of the Status of Competition in the Market for the Delivery of Video Programming)

, CS Docket No. 94-

48, First Report (“

1994 Report

”), 9 FCC Rcd 7442 (1994);

Annual Assessment of the Status of Competition in the

Market for the Delivery of Video Programming

, CS Docket No. 95-61, Second Annual Report (“

1995 Report

”),

11 FCC Rcd 2060 (1996);

Annual Assessment of the Status of Competition in the Market for the Delivery of Video

Programming

, CS Docket No. 96-133, Third Annual Report (“

1996 Report

”), 12 FCC Rcd 4358 (1997);

Annual

Assessment of the Status of Competition in Markets for the Delivery of Video Programming

, CS Docket No. 97-141,

Fourth Annual Report (“

1997 Report

”), 13 FCC Rcd 1034 (1998);

Annual Assessment of the Status of Competition

in Markets for the Delivery of Video Programming

, CS Docket No. 98-102, Fifth Annual Report (“

1998 Report

”),

13 FCC Rcd 24284 (1998);

Annual Assessment of the Status of Competition in Markets for the Delivery of Video

Programming

, CS Docket No. 99-230, Sixth Annual Report (“

1999 Report

”), 15 FCC Rcd 978 (2000); and

Annual

Assessment of the Status of Competition in the Market for the Delivery of Video Programming

, CS Docket No. 00-

132, Seventh Annual Report (“

2000 Report

”), 16 FCC Rcd 6005 (2001).

2

Communications Act of 1934, as amended, § 628(g), 47 U.S.C. § 548(g).

3

Pub. L. No. 102-385, 106 Stat. 1460 (1992).

4

One of the purposes of Title VI of the Communications Act is to “promote competition in cable communications

and minimize unnecessary regulation that would impose an undue economic burden on cable systems.” 47 U.S.C.

§ 521(6).

5

Annual Assessment of the Status of Competition in the Market for the Delivery of Video Programming

, CS Docket

No. 00-129, Notice of Inquiry (

“Notice”

), 16 FCC Rcd 13330 (2001). Appendix A provides a list of commenters

and the abbreviations by which they are identified herein.

Federal Communications Commission FCC 01-389

4

television (“SMATV”) systems as well as broadcast television service. We also consider other existing

and potential distribution technologies for video programming, including the Internet, home video sales

and rentals, local exchange carriers (“LECs”), and electric and gas utilities. In addition, for the first time

this year, we address broadband service providers (“BSPs”), a new category of entrant into the video

marketplace.

4.

In Section III of this report, we examine market structure and competition. We evaluate

horizontal concentration in the multichannel video marketplace and vertical integration between cable

television systems and programming services. We also discuss competitors serving multiple dwelling

unit (“MDU”) buildings. We further address programming issues and technical advances. In Section IV,

we report on the competitive effects in communities where consumers have a choice between an

incumbent cable operator and at least one other MVPD and provide several examples of the incumbent

cable operator’s response to such competition.

B. Summary of Findings

5.

In the

2001 Report

, we examine the status of competition in the market for the delivery of

video programming, discuss changes that have occurred in the competitive environment over the last year,

and describe barriers to competition that continue to exist. Overall, the Commission finds that

competitive alternatives continue to develop. Cable television still is the dominant technology for the

delivery of video programming to consumers in the MVPD marketplace, although its market share

continues to decline. As of June 2001, 78 percent of MVPD subscribers received their video

programming from a franchised cable operator, compared to 80 percent a year earlier.

6.

The total number of subscribers to both cable and non-cable MVPDs continues to increase.

A total of 88.3 million households subscribe to multichannel video programming services as of June

2001, up 4.6 percent over the 84.4 million households subscribing to MVPDs in June 2000. This

subscriber growth accompanied a 2.7 percentage point increase in MVPDs’ penetration of television

households to 86.4 percent as of June 2001.

6

7.

Since the

2000 Report

, the number of cable subscribers continued to grow, reaching almost

69 million as of June 2001, up about 1.9 percent from the 67.7 million cable subscribers in June 2000.

The total number of non-cable MVPD subscribers grew from 16.7 million as of June 2000 to 19.3 million

as of June 2001, an increase of more than 15 percent.

8.

The growth of non-cable MVPD subscribers continues to be primarily due to the growth of

DBS. DBS appears to attract former cable subscribers and consumers not previously subscribing to an

MVPD. The continued growth of DBS is, in part, attributable to the authority granted to DBS operators

to distribute local broadcast television stations in their local markets by the Satellite Home Viewer

Improvement Act of 1999 (“SHVIA”). Between June 2000 and June 2001, the number of DBS

subscribers grew from almost 13 million households to about 16 million households, which is nearly two

and a half times the cable subscriber growth rate. DBS subscribers now represent 18.2 percent of all

MVPD subscribers. Over the last year, the number of subscribers to, and market shares of, MMDS,

6

The number of MVPD households reported here, and the associated percentages, may be as much as two million

households too high because a household that subscribes to more than one MVPD (e.g., cable and DBS) is included

as a subscriber to both services.

See

Centris,

Digital Cable Subscriber Order 4x as Many PPV Movies and 2x as

Many PPV Events as Analog Households; 50% More Events than DBS Households

(press release), Mar. 20, 2001, at

http://www.centris.com/announcements/re1032001.htm.

Federal Communications Commission FCC 01-389

5

SMATV, and OVS have remained relatively stable. However, the number of HSD subscribers continues

to decline.

9.

During the period under review, cable rates rose faster than inflation. According to the

Bureau of Labor Statistics, between June 2000 and June 2001, cable prices rose 4.24 percent compared to

a 3.25 percent increase in the Consumer Price Index (“CPI”), which measures general price changes.

Concurrently with these rate increases, capital expenditures for the upgrading of cable facilities increased,

the number of video and non-video services offered increased, and programming costs increased. We

also note that cable operators’ pricing decisions may be affected by direct competition. Available

evidence indicates that when an incumbent cable operator faces “effective competition,” as defined by the

Communications Act, it responds in a variety of ways, including lowering prices or adding channels

without changing the monthly rate, as well as improving customer service and adding new services such

as interactive programming.

10.

The Telecommunications Act of 1996 (“1996 Act”)

7

removed barriers to LEC entry into the

video marketplace to facilitate competition between incumbent cable operators and telephone companies.

At the time of the 1996 Act, it was expected that LECs would compete in the video delivery market and

that cable operators would provide local telephone exchange service. We previously reported that there

had been an increase in the amount of video programming provided to consumers by telephone

companies, although the expected technological convergence that would permit use of telephone facilities

for video service had not yet occurred.

8

This year, we find that incumbent local exchange carriers

(“ILECs”) have largely exited the video business, instead mainly reselling DBS service. A few smaller

LECs offer, or are preparing to offer, MVPD service over existing telephone lines. Some competitive

local exchange carriers (“CLECs”) continue to pursue MVPD entry and competition. Alternatively,

several cable MSOs offer telephone service. Circuit-switched telephony is still the only type of

commercially deployed cable telephony, but trials continue for cable-delivered IP telephony. MSOs, such

as Cox and AT&T, continue to deploy circuit-switched cable telephony. Others, like Cablevision and

Comcast, continue to offer cable telephony where it has already been deployed, but generally are waiting

for Internet Protocol (“IP”) technology to become widely available before accelerating their rollout of

telephone service. AT&T, AOL Time Warner, Comcast, and Charter currently are testing IP telephony,

while Cox has plans for IP telephony trials in 2002.

11.

The most significant convergence of service offerings continues to be the pairing of Internet

service with other service offerings. There is evidence that a wide variety of companies throughout the

communications sector are providing multiple services, including data access. Cable operators continue

to expand the broadband infrastructure that permits them to offer high-speed Internet access. The most

popular way to access the Internet over cable is still through the use of a cable modem and personal

computer, though a small number of users continue to access the Internet through their television and a

specially designed set-top box, rather than the personal computer. Virtually all of the major MSOs offer

Internet access via cable modems in portions of their service areas. Like cable, the DBS industry is

developing ways to bring advanced services to their customers. For example, DirecTV currently offers a

satellite-delivered high-speed Internet access service with a telephone return path called DirecPC.

EchoStar now offers its subscribers a similar service, called Starband, in cooperation with a subsidiary of

Gilat. Many SMATV operators offer local and long distance telephone service, and Internet access along

with video service. In addition, digital technology makes it possible for MMDS operators, who provide

7

Pub. L. No. 104-104, 110 Stat. 56 (1996).

8

2000 Report, 16 FCC Rcd at 6009.

Federal Communications Commission FCC 01-389

6

video service in limited areas, to offer two-way services, such as high-speed Internet service and

telephony. Broadband service providers are building advanced systems specifically to offer a bundle of

services, including video, voice, and high-speed Internet access.

12.

Non-cable MVPDs continue to report that regulatory and other barriers to entry limit their

ability to compete with incumbent cable operators. Non-cable MVPDs continue to experience some

difficulties in obtaining programming from vertically integrated cable programmers and from unaffiliated

programmers which continue to make exclusive agreements with cable operators. In MDUs, potential

entry may be discouraged or limited because an incumbent video programming distributor has a long-

term and/or exclusive contract. In addition, non-cable MVPDs report problems obtaining franchises from

local governments and difficulties in gaining access to utility poles needed to build out their systems.

13.

Our findings as to particular distribution mechanisms operating in markets for the delivery of

video programming including the following:

Cable Systems: Since the 2000 Report, the cable television industry has

continued to grow in terms of subscribership (a 1.9 percent increase from June

2000), revenues (an approximate 3.7 percent increase between 1999 and 2000),

audience ratings (non-premium cable viewership rose from an approximate 46

share in June 2000 to slightly over a 48 share in 2001), and expenditures on

programming. The number of national satellite-delivered video programming

services, which declined slightly last year, increased from 281 to 294, between

June 2000 and June 2001.

The cable industry has continued to invest in improved facilities. As a result,

there have been increases in channel capacity, the deployment of digital

transmissions, and non-video services such as Internet access. Cable operators

also offer telephony, although the use of integrated facilities remains primarily

experimental.

Direct-to-Home (“DTH”) Satellite Service (DBS and HSD): Video service is

available from high power DBS satellites that transmit signals to small DBS dish

antennas installed at subscribers’ premises, and from low power satellites

requiring larger antennas. DBS has over 16 million subscribers, an increase of

approximately 24 percent since the 2000 Report. Between June 2000 and June

2001, the number of HSD subscribers, measured as the number of HSD users that

actually purchase programming packages, declined from 1.5 million to one

million, a decrease of 32 percent. DirecTV and EchoStar are each among the ten

largest providers of multichannel video programming service. In June 2001,

DBS represented a 18.2 percent share of the national MVPD market and HSD

represented another 1.1 percent of that market.

Wireless Cable Systems: Currently, the wireless cable industry (“MMDS”)

provides competition to the cable industry in limited areas. MMDS

subscribership remained at approximately 700,000 subscribers between June

2000 and June 2001. With the advent of digital MMDS and the Commission’s

authorization of two-way MMDS service, it appears that most MMDS spectrum

eventually will be used to provide high-speed data services. Wireless cable

represented a 0.8 percent share of the national MVPD market in June 2001.

Federal Communications Commission FCC 01-389

7

SMATV Systems: SMATV systems, also know as private cable operators, use

some of the same technology as cable systems, but do not use public rights-of-

way, and focus principally on serving subscribers living in MDUs. As of June

2001, SMATV subscribership remained unchanged from last year at 1.5 million

subscribers, representing approximately 1.7 percent of national MVPD

subscribership.

Broadcast Television: Broadcast networks and stations are competitors to

MVPDs in the advertising and program acquisition markets. Broadcast networks

and stations also are suppliers of content for distribution by MVPDs. In addition,

they supply video programming directly to those television households that are

not MVPD subscribers and to television sets in MVPD households that are not

connected to such service. In this regard, one study estimates that 81 million, or

approximately 30 percent of the nation’s 267 million television sets, receive

broadcast signals over-the-air. Since the

2000 Report

, the broadcast industry has

continued to grow in the number of operating stations (from 1,663 in 2000 to

1,678 in 2001) and in advertising revenues ($41 billion in 2000, a 12.2 percent

increase over 1999). Audience levels, however, continue to decline. During the

2000-2001 television season, the seven television networks accounted for a 57

percent share of prime time viewing for all television households, compared to a

59 share a year earlier. Broadcast television stations continue to deploy digital

television (“DTV”) service. Eighty-three percent of the more than 1,300

commercial television stations have been granted a DTV construction permit or

license and 229 are on the air with DTV operation.

LEC Entry: The 1996 Act expanded opportunities for LECs to enter the market

for the delivery of video programming. In the

2000 Report

, we noted that even

the most aggressive LECs were reducing or terminating their efforts in the video

marketplace. This year, we find that ILECs have largely exited the video

business, instead mainly reselling DBS service. The exceptions to this trend are

BellSouth, which, in addition to reselling DBS service, continues to operate some

overbuild cable systems, and a number of smaller LECs that are offering, or

preparing to offer, MVPD service over telephone lines. Some CLECs, most

notably RCN, continue to pursue MVPD entry. Previously, Ameritech, now

owned by SBC, was the most significant LEC provider of in-region cable service.

In the past year, SBC sold these systems to WideOpenWest, which we consider a

BSP and discuss below. Qwest Communications International (formerly US

West) continues to offer video, high-speed Internet access, and telephone service

over existing copper telephone lines using very high-speed digital subscriber line

(“VDSL”) in Omaha and Phoenix. Reports indicate that 40 to 50 LECs, mostly

small, also are using VDSL to offer a bundle of services, including video, over

telephone lines.

Open Video Systems: In the 1996 Act, Congress established a new framework

for the delivery of video programming -- the open video system (“OVS”). Under

these rules, a LEC or other entrant may provide video programming to

subscribers, although the OVS operator must provide non-discriminatory access

to unaffiliated programmers on a portion of its channel capacity. Several BSPs,

including some that are CLECs, operate open video systems, hold OVS

Federal Communications Commission FCC 01-389

8

certifications, or hold local OVS franchises. RCN is by far the largest OVS

operator in the country.

Broadband Service Providers: In this year’s

Report

, we add a new section to

recognize the growing importance of providers that are overbuilding existing

cable systems with state-of-the-art systems that offer a bundle of

telecommunications services, including video, voice, and high-speed Internet

access. BSPs are carefully selecting which communities to serve, based on

factors such as favorable demographics and high population density. Their

strategy is to increase per subscriber revenue and decrease churn. Yet, BSPs face

considerable challenges inherent in entering markets with entrenched

competitors. RCN is the largest BSP, serving approximately 443,000 subscribers

in New York City, Washington, D.C., and surrounding suburbs, South San

Francisco, Boston and its suburbs, Northern New Jersey, and suburbs of

Philadelphia. WideOpenWest (“WOW”) recently became the second largest

BSP with its acquisition of the former Ameritech cable systems, which serve

about 300,000 subscribers. In addition, WOW is constructing systems in selected

metropolitan Denver communities. The third largest BSP is Knology, which

operates or is building systems in the Southeast, and currently serves 110,000

subscribers.

Internet Video: As of July 2001, 58 percent of the U.S. population has Internet

access at home. Real-time and downloadable video accessible over the Internet

continues to become more widely available and the amount of content also is

increasing. Despite the evidence of increased interest in Internet video

deployment and use, the medium is still not seen as a direct competitor to

traditional video service. Broadcast quality Internet video requires a high-speed

broadband connection at speeds which most current broadband providers cannot

guarantee.

Home Video Sales and Rentals: We consider the sale and rental of home video,

including videocassettes, DVDs, and laser discs, part of the video marketplace

because they provide services similar to the premium and pay-per-view offering

of MVPDs. About 90 percent of all U.S. households have at least one VCR. The

number of homes with DVD players has grown rapidly since their introduction,

with the number of homes with DVD players expected to reach 25 million by the

end of 2001. The newest home video is the personal video recorder (“PVR”).

One source reports that 500,000 PVRs have been sold since they were introduced

two years ago.

Electric and Gas Utilities: Several electric and gas utilities continue to move

forward with ventures involving multichannel video programming distribution.

Some of their characteristics, such as ownership of fiber optic networks and

access to public rights-of-way, make them competitively significant. Some

utilities offer telecommunications services on their own, while others partner

with broadband service providers, such as Starpower, RCN’s joint venture with

PEPCO. It also appears that utilities, particularly municipal utilities in rural

areas, are willing to build advanced telecommunications networks to offer a full

range of services where incumbent cable operators and telephone companies are

Federal Communications Commission FCC 01-389

9

not. Reports indicate that 357 public power systems offer communications

services.

14.

We also find that:

Consolidations within the cable industry continue as cable operators acquire and

trade systems. The ten largest operators now serve close to 87

percent of all U.S.

cable subscribers. In terms of one traditional economic measure, national

concentration among the top MVPDs has decreased since last year as the largest

MSOs have become more equal in size, and it remains below the levels reported

in earlier years.

9

DBS operators DirecTV and EchoStar rank among the ten

largest MVPDs in terms of nationwide subscribership along with eight cable

multiple system operators (“MSOs”). As a result of acquisitions and trades,

cable MSOs have continued to increase the extent to which their systems form

regional clusters whereby the largest MSOs concentrate their operations in

specific geographic areas. Currently, close to 55 million of the nation’s cable

subscribers are served by systems that are included in regional clusters. By

clustering their systems, cable operators may be able to achieve efficiencies that

facilitate the provision of cable and other services, such as telephony.

The number of satellite-delivered programming networks has increased by 13,

from 281 in 2000 to 294 in 2001. Vertical integration of national programming

services between cable operators and programmers remained at 35 percent after

several years of decline. Although AT&T spun off its Liberty Media

programming interests, Liberty Media is still included in this percentage since it

owns several cable systems in Puerto Rico. In 2001, four of the top seven cable

MSOs held ownership interests in satellite-delivered programming services.

Sports programming warrants special attention because of its widespread appeal

and strategic significance for MVPDs. The

2001 Report

identifies 80 regional

networks, 29 of which are sports channels, many owned at least in part by MSOs.

There are also 29 regional and local news networks that compete with local

broadcast stations and national cable networks.

The program access rules adopted pursuant to the 1992 Cable Act were designed

to ensure that other MVPDs can access vertically-integrated satellite delivered

programming on non-discriminatory terms. We recognize that the terrestrial

distribution of programming, including in particular regional sports

programming, could have an impact on the ability of alternative MVPDs to

compete in the video marketplace.

Cable operators and other MVPDs continue to develop and deploy advanced

technologies, especially digital compression techniques, to increase capacity and

enhance the capabilities of their transmission platforms. These technologies

9

Traditional economic measures (e.g., the Herfindahl-Hirschman Index or HHI) are based on market shares or the

squaring of market shares such that large companies are weighed more heavily than small companies. The HHI (and

apparent levels of concentration) decline with rising equality among any given number of companies in terms of

market shares even if these firms individually have larger shares of the markets.

Federal Communications Commission FCC 01-389

10

allow MVPDs to deliver additional video options and other services (e.g., data

access, telephony, and interactive services) to subscribers. As reported last year,

MVPDs are beginning to develop and deploy interactive television (“ITV”)

services. In particular, this year, cable operators and other MVPDs have devoted

most of their attention to the development of video-on-demand services.

In the last year, there have been a number of developments regarding navigation

devices and cable modems used to access a wide range of services offered by

MVPDs. Most notably, cable operators are favoring less powerful and less

expensive set-top boxes. It is unclear how these modified plans will affect

advance service offerings. CableLabs is continuing its efforts to develop next

generation navigation devices with its initiative for the OpenCable Application

Platform (“OCAP”) or “middleware” specification. The Consumer Electronics

Association maintains that until this software standard is complete,

manufacturers will not be able to build advanced set-top boxes for a retail

market. In another effort intended to facilitate retail availability of set-top boxes,

cable operators announced an initiative to encourage their set-top box suppliers

to make their digital set-top boxes with embedded security available at retail.

II. COMPETITORS IN THE MARKET FOR THE DELIVERY OF VIDEO

PROGRAMMING

A. Cable Industry

15.

This section addresses the performance of franchised cable system operators during the past

year.

10

We address four different areas of performance. First, we report figures of general performance

including subscriber levels, availability of basic services, and viewership. Second, we discuss the cable

industry’s financial performance, including its revenue, cash flow status, stock valuations, and system

transactions. Third, we examine the cable industry’s acquisition and disposition of capital, including the

amount of funds raised, and how these funds are being used to upgrade physical plant and to acquire new

systems. Lastly, we address the growth of advanced broadband services, including cable modem service,

digital video services, and broadband telephony.

1. General Performance

16.

Since our last

Report

, the cable industry has continued to grow in terms of homes passed,

11

basic cable subscribership,

12

premium service subscriptions,

13

basic cable viewership, and channel

10

A franchise is an authorization supplied by a federal, state, or local government entity to own or construct a cable

system in a specific area. 47 U.S.C. §§ 522(9), 522(10). A cable system operator is "any person or group of persons

(A) who provides cable service over a cable system, and directly or through one or more affiliates owns a significant

interest in such cable system; or (B) who otherwise controls or is responsible for, through any arrangement, the

management and operation of such a cable system." 47 U.S.C. § 522(5).

11

Homes passed is the total number of households capable of receiving cable television service.

12

We refer to all cable programming networks offered as a part of program packages or tiers as "basic cable

networks." The primary level of cable television service is commonly referred to as "basic service" and must be

taken by all subscribers. The content of basic service varies widely among cable systems but, pursuant to the

Communications Act, must include all local television signals and public, educational, and governmental access

channels and, at the discretion of the cable operator, may include satellite delivered cable programming channels

(continued.…)

Federal Communications Commission FCC 01-389

11

capacity.

14

Basic cable penetration, the ratio of the number of cable subscribers to the total number of

households passed by the system, has declined slightly since our last report. Deployment of advanced

broadband service offerings, however, continued during 2000 and the first half of 2001. These services

include offerings of digital video, Internet access through cable, interactive cable,

15

and facilities-based

broadband telephony.

17.

Cable’s Capacity to Serve Television Households

. The number of U.S. homes with at least

one television ("TV households") was reported as 100.8 million during the 1999-2000 television season.

16

During the 2000-2001 television season the number of TV households was reported as 102.2 million, an

increase of 1.4 percent.

17

The number of homes passed by cable was approximately 96.6 million at the

end of 1999, 103.2 million at the end of 2000, and by the end of June 2001 was estimated to be 104

million.

18

The most widely used industry measurement of cable availability, however, is the

number of

homes passed expressed as a percentage of TV households. Based on data from Paul Kagan Associates,

homes passed as a percentage of TV households was estimated to be 97.1 percent as of June 2001.

19

In its

comments, NRTC once again proposes that this figure is flawed.

20

This statistic, it notes, varies

depending on the estimate of homes passed and whether the comparison is based on TV households, all

households, all occupied housing units, or all housing units in the United States, as some have

(…continued from previous page)

carried on the system. One or more expanded tiers of service, known as cable programming service (“CPS”) tiers

for purposes of rate regulation, and often known as expanded basic, also may be offered to subscribers. These

expanded tiers of service usually include additional satellite delivered cable programming channels. 47 U.S.C.

§§ 543(b)(7), 543(l)(2).

13

Premium services are cable networks provided by a cable operator on a per channel basis for an extra monthly fee.

Pay-per-view (“PPV”) services are cable networks provided on a per program basis. PPV service is a separate

category from premium service. 47 U.S.C. §§ 543(b)(7), 543(l)(2).

14

Channel capacity is defined as the maximum number of 6 MHz video channels that a system can carry

simultaneously. Video channel capacity can be decreased on any given system simply by using bandwidth for other

services such as connectivity to the Internet.

15

The interactive cable services discussed here include video-on-demand (“VOD”), interactive guides, and

interactive programming.

16

Nielsen Media Research, U.S. Television Household Estimates September 2000, DMA Rankings. Nielsen Media

Research estimates the number of television households annually, and industry practice is to use this figure

throughout the television broadcast season, which begins in September and ends in August of the following calendar

year. Thus, the figure for TV households in June 2001 is the same as the figure for December 2000. In App. B, Tbl.

B-1, we report the number of television households as of year-end 2000 and June 2001. These figures are from Paul

Kagan Associates, and we use these estimates of television households for consistency with the remainder of

reported figures in this section.

17

Nielsen Media Research, U.S. Television Household Estimates September 2001, DMA Rankings. See also App.

C, Tbl. C-1.

18

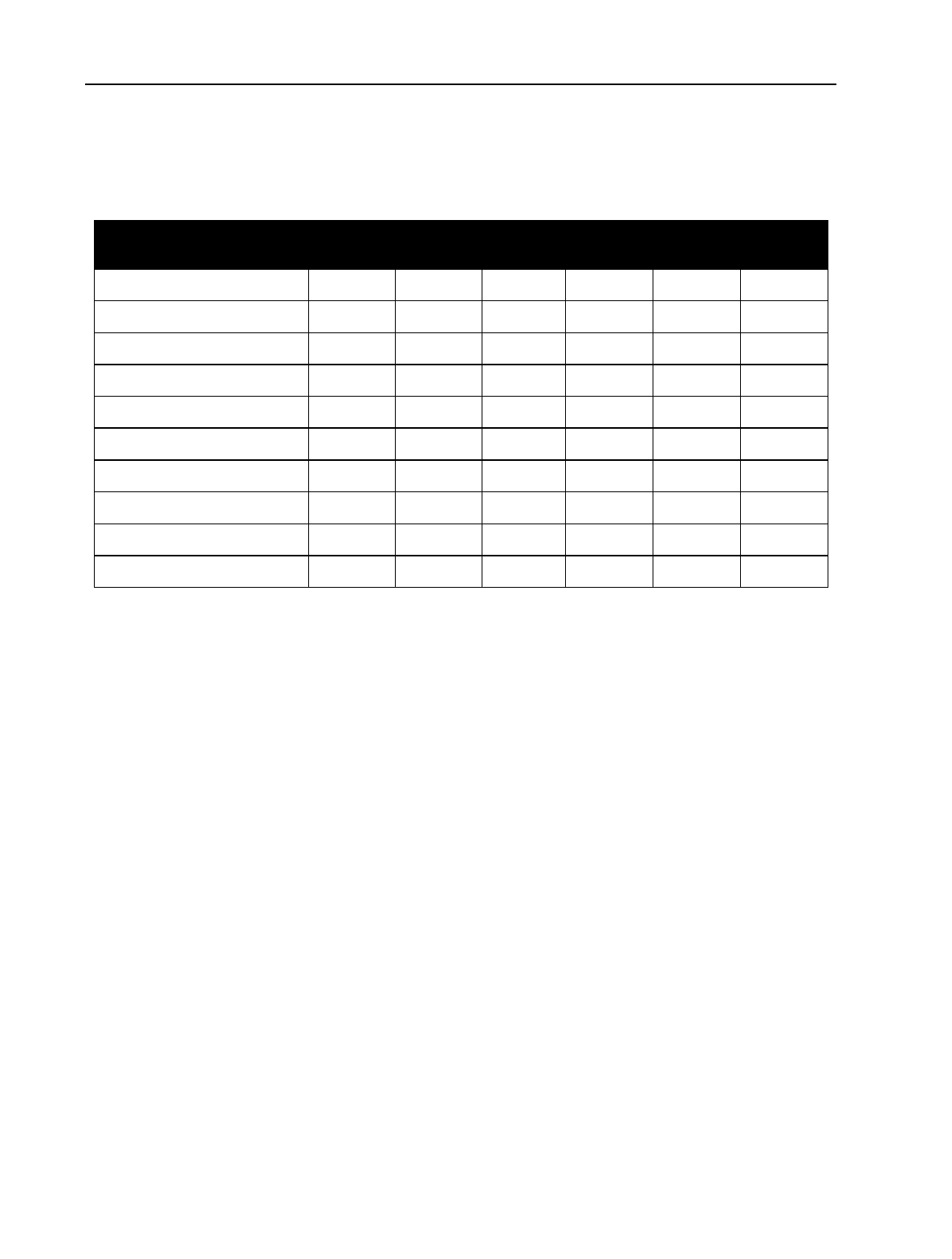

See App. B, Tbl. B-1.

19

Id.

20

See 2000 Report, 16 FCC Rcd at 6016-7.

Federal Communications Commission FCC 01-389

12

suggested.

21

NRTC suggests again this year that the number of homes passed as a percentage of TV

households could be as low as 81 percent.

22

18.

Subscribership

. Cable television subscribership grew from 67.3 million subscribers at the

end of 1999 to 68.5 million subscribers at the end of 2000, an increase of 1.8 percent.

23

It continued to

grow to an estimated 69 million subscribers by June 2001, a six month increase of approximately 0.7

percent.

24

Cable penetration declined between 1999 and 2000, decreasing from 69.7 percent at the end of

1999 to 66.4 percent at the end of 2000, and 66.3 percent by June 2001.

25

The percentage of TV

households subscribing to cable also decreased over the last year, declining from 67.3 percent in 1999 to

64.4 percent of all TV households by the end of 2000 and June 2001.

26

The number of homes subscribing

to one or more premium cable services increased from 35.5 million homes at the end of 1999 to 36.8

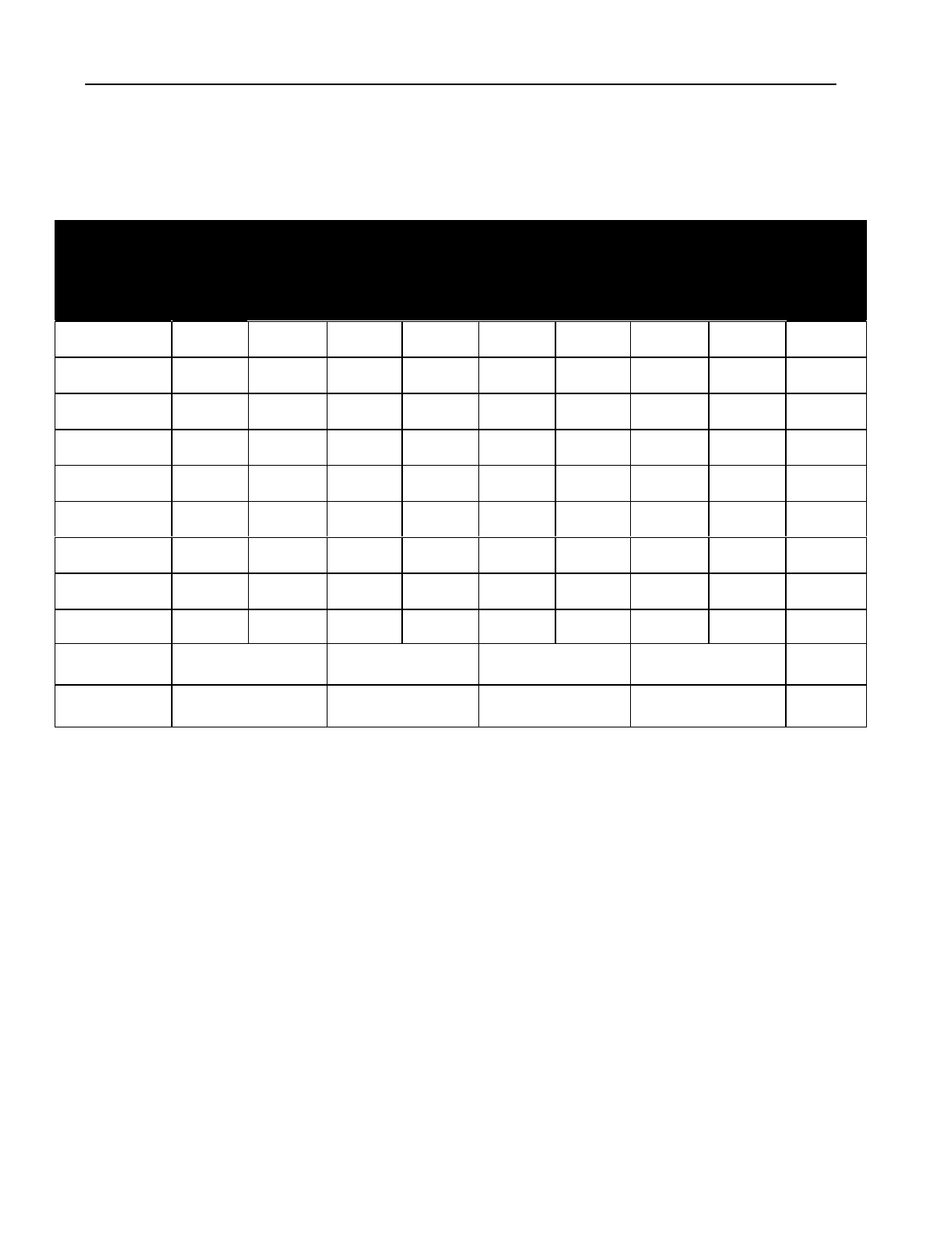

million homes at the end of 2000, an increase of 3.7 percent.

27

For the first half of 2001, premium cable

subscribers increased again, reaching 37.2 estimated subscribers, a six-month increase of about one

percent.

28

The number of premium services to which homes are subscribing (known as "premium units")

increased 4.9 percent by the end of 2000 to 55.6 units and by June 2001, to 56.4 units.

29

19.

Channel Capacity

. As part of its consideration of issues relating to the carriage of DTV

stations by cable operators, the Commission conducted a survey of, among other things, cable system

channel capacity.

30

Preliminary results from the survey revealed that 48.8 million subscribers, or

approximately 87 percent of all subscribers served by cable MSOs included in the survey are served by

systems that provided bandwidth of 550 MHz or higher, and more than 76 percent are served by systems

that provided bandwidth of 750 MHz or higher.

31

Cable operators have allocated this bandwidth in a

21

Id. See also National Telecommunications and Information Administration, United States Department of

Commerce and Rural Utilities Service, United States Department of Agriculture, Advanced Telecommunications in

Rural America, The Challenge of Bringing Broadband Service to All Americans (“NTIA/RUS Report”), April 2000.

22

NRTC Comments at 6-11; see also 2000 Report, 16 FCC Rcd at 6016-7.

23

See App. B, Tbl. B-1.

24

Id.

25

Id.

26

Id. The percentage of TV households subscribing to cable is the ratio of the number of cable subscribers to the

total number of households with at least one television.

27

See App. B, Tbl. B-2.

28

Id.

29

Id.

30

See Carriage of Digital Television Broadcast Signals, Amendment to Part 76 of the Commission’s Rules,

Implementation of the Satellite Home Viewer Improvement Act of 1999: Local Broadcast Signal Carriage Issues,

Application of Network Non-Duplication, Syndicated Exclusivity and Sports Blackout Rules to Satellite

Retransmission of Broadcast Signals, CS Docket Nos. 98-120, 00-96, 00-2, First Report and Order and Further

Notice of Proposed Rulemaking (“DTV Signal Carriage Proceeding”), 16 FCC Rcd 2598 (2001).

31

MSOs surveyed included the top twelve cable operators, and four other relatively large operators, comprising

approximately 90 percent of all cable subscribers (AT&T Broadband, Time Warner, Comcast, Charter, Cox,

Adelphia, Cablevision, Insight, Mediacom, CableOne, RCN, Armstrong Cable, Classic Communications, Service

Electric Cable TV, BellSouth, and Northland). Results are based on responses provided by twelve MSOs. Not all

MSOs were included in the results due to lack of response or quality of data submitted.

Federal Communications Commission FCC 01-389

13

variety of ways, using a portion of this bandwidth for the provision of analog video, and a portion for the

provision of digital video, with the remainder allocated for services such as Internet access and telephony.

For example, systems with 750 MHz system capacity on average allocated 478 MHz or approximately 80

channels to analog video. Also, on average, 750 MHz systems allocated 140 MHz for downstream digital

video, which may yield a range of channels, depending on the modulation technique and compression

ratio employed.

20.

Viewership

. As reported last year, viewership shares of non-premium cable networks have

continued to grow over the past decade, while viewership shares of broadcast television stations have

steadily declined. This trend continues. Audience share statistics for Monday through Sunday, 24 hours

a day, show that non-premium cable audience shares rose 5.7 percent from an average 45.5 share

32

between July 1999 through June 2000, to an average 48.1 share between July 2000 and June 2001.

33

Broadcast television audience shares decreased 4.7

percent from an average 59.6 share from July 1999

through June 2000, to an average 56.8 share between July 2000 and June 2001.

34

21.

Cable Networks

. Although the number of cable networks, on average, increased in 2000,

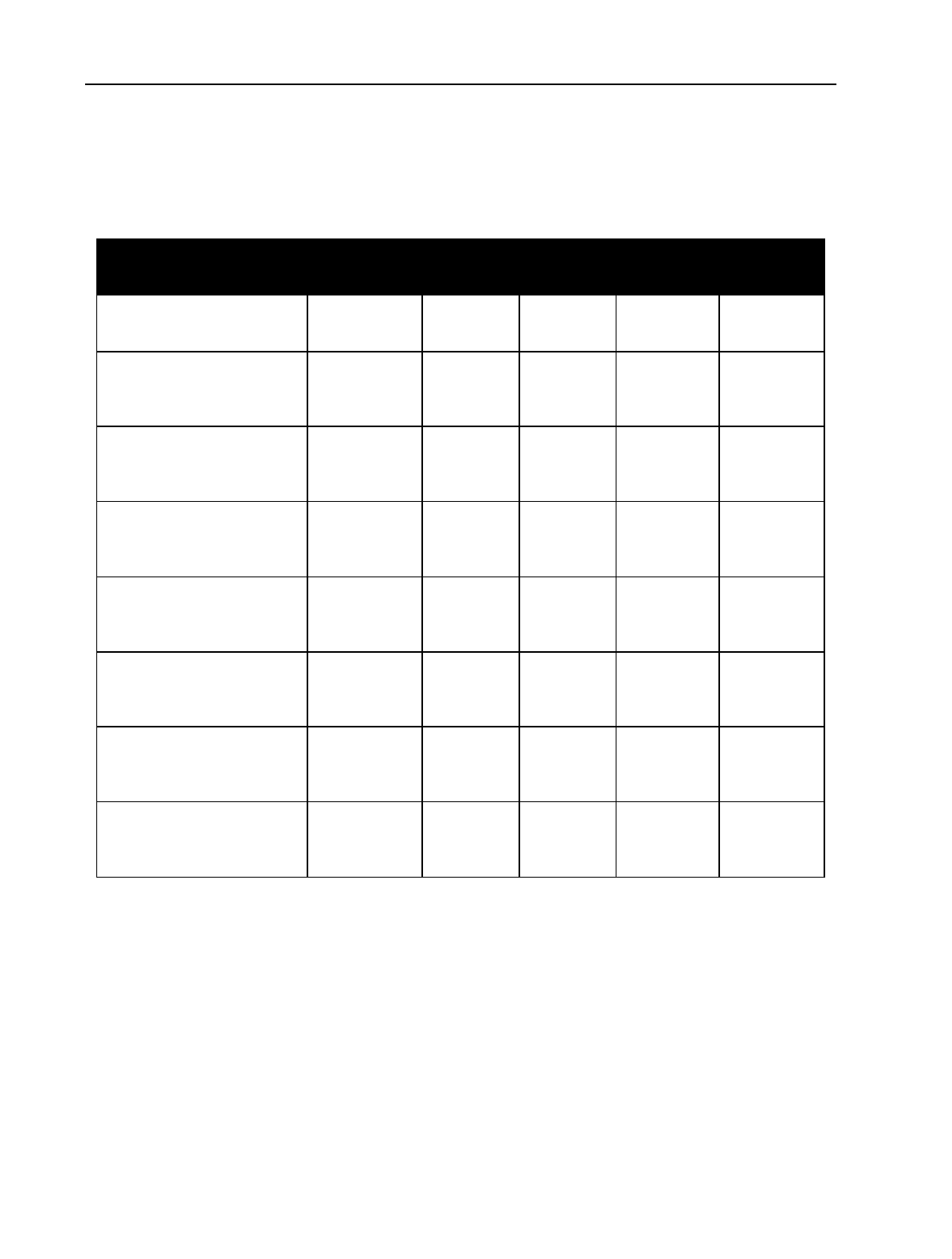

several categories of networks decreased. For example, in 2000, the number of non-premium cable

networks decreased from 147 to 130, an 11.6 percent decline.

35

The number of premium networks also

decreased during 2000, from 43 at year-end 1999 to 40 at year-end 2000.

36

These decreases were

coordinated to make room for the addition of digital tier channels for which there were, on average, none

recorded in 1999, but 39 reported for 2000.

37

The number of pay-per-view (“PPV”) services increased

4.8 percent in 2000 from 9 to 11 networks.

38

22.

Programming Costs

. Cable operators incurred expenses of approximately $8.9 billion for

producing and acquiring programming in 2000.

39

Approximately $6.4 billion of these expenses were

license fees paid by the basic cable networks to obtain programming, and approximately $2.2 billion were

license fees paid by premium cable services.

40

Approximately $148 million of these expenses were for

the production of original programming.

41

Programming expenses incurred by cable operators for

32

A share is the percent of all households using television during the time period that are viewing the specified

station(s) or network(s). The sum of reported audience shares exceeds 100 percent due to multiple set viewing.

33

Nielsen Media Research, Total Day 24 Hours 6 am - 6 am: Total US Ratings By Viewing Source July 2000-June

2001, Oct. 2001. Nielsen reports non-premium, basic cable viewership as "Ad Supported Cable" and “All Other

Cable.” Premium services are classified as “Premium Pay.”

34

Id. “Broadcast” shares include network affiliates, independent, and public television stations.

35

These statistics regarding types of cable networks are from NCTA, National Cable Video Networks By Type of

Service: 1980-1999, Cable Television Developments 2001, at 8. These totals differ from those reported in the

Vertical Integration Section of this report. In that section, the information on cable networks is from NCTA

Developments and additional sources. See App. B, Tbl. B-3.

36

See App. B, Tbl. B-3.

37

Id.

38

Id.

39

NCTA Comments at 20.

40

Telephone interview with Gregory Klein, Senior Director of Economic and Policy Analysis, NCTA (Oct. 31,

2001).

41

Id.

Federal Communications Commission FCC 01-389

14

copyright fees for broadcast signal carriage pursuant to Section 111 of the Copyright Act amounted to

approximately $112 million in 2000.

42

As of November 7, 2001,

43

copyright fees paid by cable system

operators or broadcast signal carriage for the period January 1, 2000, to June 30, 2000, were $53.2

million.

44

For the period July 1, 2000, through December 31, 2000, fees collected were $59.6 million.

Reported estimates indicate that these programming network expenses will total $9 billion by year-end

2001.

45

Thus far, for the period January 1, 2001, to June 30, 2001, copyright fees collected were $53.9

million.

46

2. Financial Performance

23.

Data concerning cable industry revenue, cash flow, and stock prices indicate that the cable

industry growth slowed significantly in the past year. Relative to major market indices, cable stocks, as

represented by the Kagan MSO Index, performed below average in 2000 and in the first half of 2001.

47

24.

Cable Industry Revenue

. Annual cable industry revenue grew 3.7 percent in 2000 over

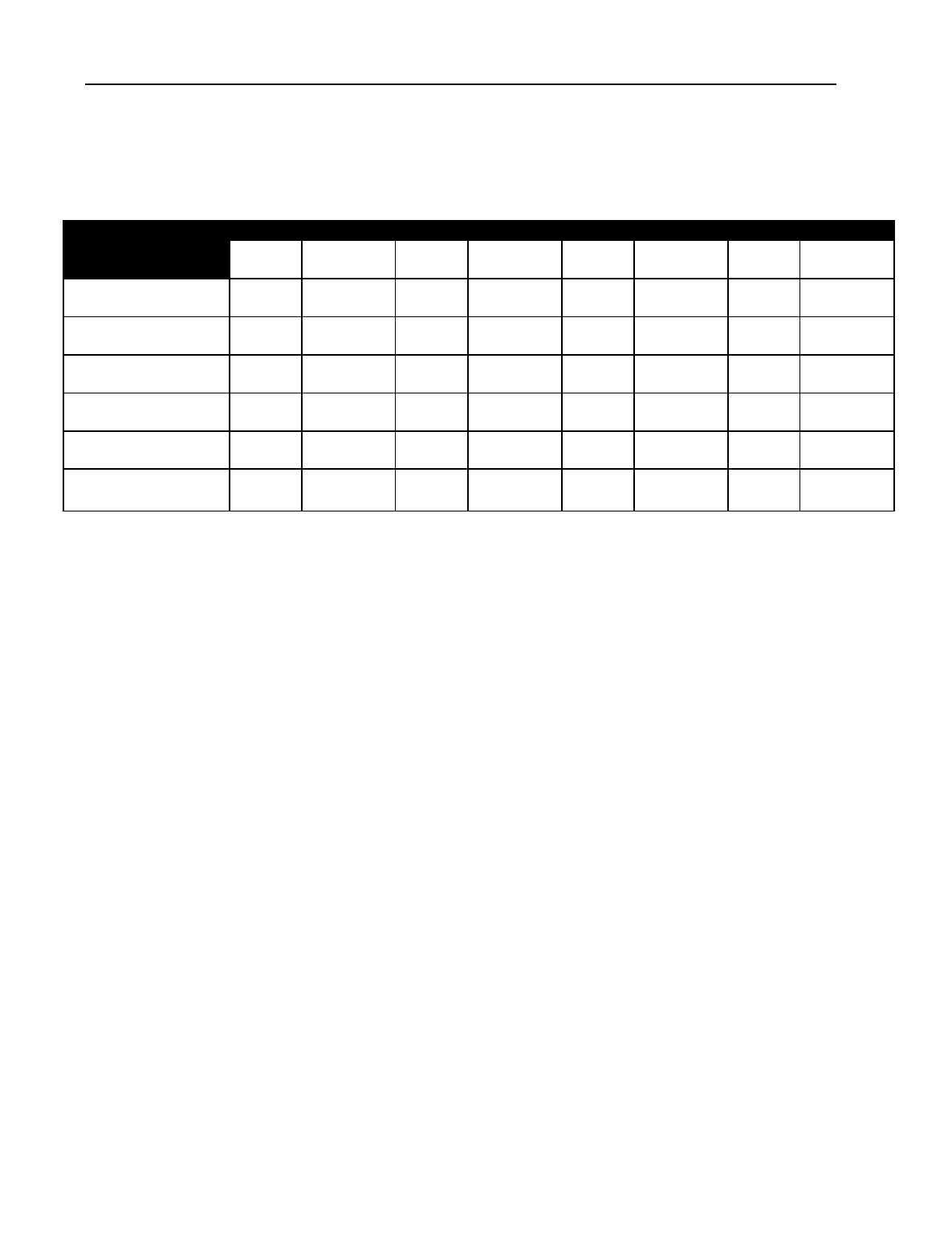

1999, reaching $38.1 billion.

48

By the end of 2000, revenue per subscriber grew almost two percent to

$561.38 per subscriber per year, or $46.78 per subscriber per month.

49

Analysts estimate that 2001 year-

end total revenue will reach nearly $44 billion, an estimated 15.4 percent increase over 2000,

50

and that

revenue per subscriber per year will reach approximately $637.33, or $53.11 per subscriber per month.

51

25.

When cable system revenue is classified by source, home shopping revenue demonstrated the

greatest percent increase in 2000.

52

Commissions from home shopping increased nearly 30 percent in

2000, from $185 million in revenue in 1999 to $239 million in 2000.

53

Advanced video services

42

Copyright Act, 17 U.S.C. § 111 et seq.

43

Copyright fees, though technically due on a specific date, are collected on a rolling basis. We report the most

current figures available.

44

Copyright Office, Library of Congress, Licensing Division Report of Receipts, Nov. 7, 2001. Date of "collection"

indicates the date the Copyright Office has deposited payments made by cable operators.

45

Id.

46

Id.

47

Cable industry stocks underperformed the NASDAQ in 2000, but performed slightly better in the first quarter of

2001. See Paul Kagan Assocs., Inc., Kagan Cable MSO Average vs. NASDAQ, The Broadband Cable Financial

Databook 2001 (“2001 Cable Databook”), July 2001, at 83; Jessica Reif Cohen and Nathalie Brochu, Q2/Q3

Preview (“Merrill Lynch – Q2/Q3 Preview”), Merrill Lynch, July 30, 2001, at 9.

48

See App. B, Tbl. B-4.

49

Id.

50

Id.

51

Id.

52

Id. The “advanced video services” category includes both analog video services and digital video services.

Advanced analog services provide users with certain two-way capabilities such as PPV and VOD. Digital video

services can provide superior video picture quality and increased channel capacity. Both digital and advanced

analog services require the use of a set-top box.

53

See App. B, Tbl. B-4.

Federal Communications Commission FCC 01-389

15

increased 3.7 percent in 2000 after having experienced 338 percent growth in 1999.

54

Analysts expect

advanced video services to grow nearly 175 percent in 2001 to reach just over $5.5 billion in revenues for

the year.

55

The PPV sector, typically volatile, demonstrated a 20 percent decline in revenues in 2000, but

analysts expect PPV revenue to increase in 2001, growing an estimated 44 percent, to over $1 billion in

annual revenue.

56

Equipment and installation revenue declined over 13 percent in 2000, from $2.8 billion

in annual revenue in 1999 to a little more than $2.4 billion in 2000.

57

Industry analysts predict this

revenue sector will increase slightly in 2001 to an estimated $2.5 billion.

58

Annual revenue from local

advertising increased from $2.7 billion in 1999 to $3.2 billion in 2000, a 20.7 percent increase, and

analysts expect local advertising revenue to increase 13 percent over the next year to reach $3.7 billion in

revenues by year-end 2001.

59

Revenue from the basic service tier (“BST”) and from the cable

programming service tier (“CPST”) combined grew from $23.1 billion in 1999 to $24.7 billion in 2000, a

6.9 percent increase, and analysts expect these revenues to increase to $26.1 billion by year-end 2001.

60

26.

Cable Industry Cash Flow

. Cash flow is often used to assess the financial position of cable

firms. Cash flow is generally expressed as “EBITDA” (earnings before interest, taxes, depreciation, and

amortization). Financial analysts reported that industry-wide cash flow increased 6.5 percent between the

end of 1999 and the end of 2000, from $15.6 billion to $16.6 billion.

61

Cash flow will increase an

estimated 10 percent, reaching $18.3 billion by year-end 2001.

62

In 2000, the cable industry generated

$244.64 in annual cash flow per subscriber, $10.76 higher per subscriber than the $233.88 per subscriber

generated in 1999.

63

Analysts estimate that in 2001, cash flow per subscriber per year will increase by

$20.17, reaching $264.81.

64

The ratio of cash flow to revenue (“cash flow margin”) increased from 42.4

percent in 1999 to 43.6 percent in 2000, and is expected to decrease to 41.5 percent by year-end 2001.

65

27.

Stock Prices

.

After reaching its all-time high in January 2000, cable stock values, as

represented by the Kagan MSO Stock Index, declined throughout 2000 and the first half of 2001.

66

Unlike past years, when there were many precipitating events causing the sell-off of cable stocks, cable’s

54

Id.

55

Id.

56

Id.

57

Id.

58

Id.

59

Id.

60

Id.

Basic cable rates are regulated at the local level. CPST rate regulation ended in March 1999.

See

47 U.S.C.

§ 543 (c)(3), (c)(4).

61

See

App. B, Tbl. B-4.

62

Id.

63

Id.

64

Id.

65

Id.

Cash flow margin is a commonly-used financial analysis tool for determining a cable operator’s operating

efficiency, profitability, and liquidity.

66

See The Public Market

, 2001 Cable Databook, at 82;

Kagan Cable MSO Average vs. NASDAQ

, 2001 Cable

Databook, at 83.

Federal Communications Commission FCC 01-389

16

current downturn seems to be more in step with the overall trends of the economy.

67

But despite currently

depressed stock prices, analysts are optimistic about cable’s future as the cable companies have proven

that they can successfully roll out new services with the synergistic effects of bundling.

68

Even in the face

of competition from DBS, analysts are encouraged by continued advanced service revenue growth.

69

28.

Cable System Transactions.

Over the last several years, the number of acquisitions and

exchanges between MSOs has declined, though there have been a number of mergers among large

operators. The number of systems sold decreased between 1998 and 1999 from 119 to 92 systems.

70

Between 1999 and 2000, the number of systems sold decreased from 92 to 47 systems, and between

January and June 2001, there were 23 transactions.

71

The total number of subscribers affected by system

transactions and the average size of systems sold (measured by the number of subscribers per system)

continues to vary greatly from year to year. Smaller cable operators, however, are often unable to take

advantage of the efficiencies that come from clustering, and thus are more susceptible to financial

difficulties. In the past year, small operators Galaxy Telecom, Inc., and Classic Communications faced

such difficulties often seen among small MSOs.

72

The assets of these operators were sold to larger

MSOs, further consolidating the industry.

29.

While the number of subscribers affected by system transactions decreased between 1999 and

2000, from 18.3 million to 10.5 million, the average size of traded systems increased from approximately

199,000 subscribers per system sold in 1999 to approximately 223,000 subscribers per system sold in

2000.

73

Between January and June 2001, the number of subscribers affected by system transactions

reached approximately four million, with an average number of subscribers per system transaction at

approximately 176,000.

74

The total dollar value of transactions decreased between 1999 and 2000 from

$73 billion at year-end 1999 to $62.1 billion at the end of 2000.

75

The total dollar value of transactions

between January 2001 and June 2001 was approximately $15 billion.

76

3. Capital Acquisition and Disposition

30.

Industry Financing

. The cable industry typically has relied on combinations of private and

public financing, with the distribution of these combinations varying greatly from year to year. These

67

Id.

68

Id.

at 82;

Kagan Cable MSO Average vs. NASDAQ

, 2001 Cable Databook, at 83;

Analysts Bullish on Cable Stocks

Despite Slumping Prices

, Comm. Daily, Dec. 7, 2000, at 4. Bundling in this context merely means the co-marketing

and co-billing of these products.

69

Analysts Bullish on Cable Stocks Despite Slumping Prices

, Comm. Daily, Dec. 7, 2000, at 4.

70

This includes all systems bought and sold.

See

App. B, Tbl. B-5.

71

Id.

72

Mike Farrell,

Bondholders OK Galaxy Plan

, Multichannel News, Oct. 1, 2001; Classic Communications, Inc.,

Classic Communications to Restructure Operations Under Chapter 11; Company to Continue to Conduct Business

as Usual

(press release), Nov. 13, 2001, at http://www.classic-cable.com/pages/Framesets/InvestorFrameset.html.

73

See

App. B, Tbl. B-5

.

74

Id.

75

Id.

76

Id.

Federal Communications Commission FCC 01-389

17

year-to-year fluctuations in financing sources appear to be based on the availability of acceptable

financing rates through private investors or capital lending institutions, and the attractiveness of debt and

equity offerings.

31.

During 2000, the cable industry acquired approximately $380 million in public equity

offerings (i.e., sale of stock), $101 million in private equity (i.e., financing from individuals, private

corporations, venture capital firms and investment banks), $2.8 billion in private debt (i.e., banks and

other borrowings), and $4.2 billion in public debt (i.e., sale of public bonds).

77

Between January and June

2001, the cable industry acquired approximately $2.5 billion in public equity offerings, $94 million in

private equity, $8.6 billion in private debt, and $8.1 billion in public debt.

78

32.

Capital Expenditures/Capital Investment

. In 2000, the cable industry spent a total of $15.5

billion on the construction of new plant, upgrades, rebuilds, new equipment, and maintenance of new and

existing equipment.

79

This represents a 45.9 percent increase over the $10.6 billion spent in 1999.

80

Analysts expect that operators will spend an estimated $14.7 billion in 2001, a decrease of 5.2 percent

over 2000.

81

Of the $14.7 billion to be spent industry-wide, approximately $850 million will be spent on

new builds, $2.4 billion on rebuilds, $4.4 billion on upgrades, $4.4 billion on equipment and $2.6 billion

on maintenance.

82

33.

MSOs continue to spend substantially on maintenance, upgrades, rebuilds, and new services.

In the case of Time Warner, AT&T, Comcast, and Cox, some or all of the expenditures in 2000 and the

first half of 2001 were associated with commitments made by those MSOs pursuant to social contracts

with the Commission.

83

As of June 2001, AOL Time Warner had spent $1.1 billion and is expected to

77

See App. B, Tbl. B-6.

78

Id.

79

Estimated Capital Flows in Cable TV, 2001 Cable Databook, at 138. "New builds" are the construction of new

cable plant where none existed before, primarily newly built homes. "Rebuilds" are improvements to existing

systems that do not retain much of the old system plant and equipment. Instead, they consist of mostly new plant

and equipment. "Upgrades" are improvements to existing cable systems that do not require the replacement of the

entire existing plant and equipment.

80

Id.

81

Id.

82

Paul Kagan Assocs., Inc., Estimated Capital Flows in CableTV: Total Raised and Spent 1996-2001, Cable TV

Finance, June 28, 2001, at 2.

83

The social contract with Time Warner committed that MSO to spend $4 billion on upgrades over a five-year

period and to provide 100 percent of its subscribers with 550 MHz service and 50 percent of its subscribers with 750

MHz service. Social Contract for Time Warner, 11 FCC Rcd 2788 (1995). Time Warner’s final annual social

contract implementation report indicates that the MSO has met its commitment under the Social Contract.

Letter

from Arthur Harding to Royce Sherlock, Cable Services Bureau, May 3, 2001, attaching Time Warner Cable Social

Contract Progress Report 2000

.

The social contract originally agreed upon with Continental Cablevision, now

administered by AT&T and Cox, commits that MSO to spend $1.7 billion on upgrades over a four-year period

ending December 31, 2000, and also to provide 100 percent of its subscribers with 550 MHz service and 50 percent

of its subscribers with 750

MHz service. Social Contract for Continental Cablevision, Inc. (subsequently

MediaOne), 13 FCC Rcd 11118 (1996). In its final report, AT&T indicates that it met its commitment under the

Social Contract. Letter from Richard D. Treich, Senior Vice President, AT&T Broadband, LLC. to Magalie Roman

Salas, Secretary, FCC, May 4, 2001, attaching Annual Report for In re Social Contract for Continental Cablevision.

Cox submits that it has met its commitment under the Social Contract. Letter from Peter H. Feinberg, Attorney,

(continued.…)

Federal Communications Commission FCC 01-389

18

spend $2.2 billion by year-end.

84

Comcast reported cable-related capital expenditures of $1.2 billion in

2000, and is expected to spend approximately $1.8 billion by the end of 2001.

85

AT&T’s broadband unit

reported capital expenditures of $4.2 billion in 2000, of which approximately $1.6 billion were related to

the launch of new services and $1.3 billion for plant upgrades.

86

AT&T Broadband plans to spend $3.6

billion in capital in 2001, with the majority focused on providing advanced services and plant upgrades.

87

Adelphia reported capital expenditures of approximately $1.5 billion in 2000.

88

As of June 2001,

Adelphia had spent $1.1 billion and expects that by year-end 2001, it will have spent a total of $2

billion.

89

Cox reported total capital spending of $2.2 billion in 2000.

90

As of June 2001, Cox had spent

approximately $1.1 billion, and expects that by year-end it will have spent a total of $2 billion.

91

Cablevision reported capital expenditures of about $912 million in 2000 and is expected to spend $1.1

(…continued from previous page)

Dow, Lohnes & Albertson, PLLC, to Magalie Roman Salas, Secretary, FCC, April 2, 2001, attaching Annual Report

for Social Contract for Continental Cablevision. The Social Contract agreed to by Comcast commits the MSO to

provide free cable connections, Internet, and modems to schools and libraries for certain systems covered under the

contract. The Fifth Annual Progress Report for the Social Contract with Comcast reports that as of Apr. 2, 2001,

Comcast continues to provide services and materials in accordance with the terms of the Social Contract and that it

has completed its upgrade obligations under the contract. Social Contract for Comcast Cable Communications, Inc.,

13 FCC Rcd 3612 (1997); Letter from Peter H. Feinberg, Attorney, Dow, Lohnes & Albertson, PLLC, to Magalie

Roman Salas, Secretary, FCC, April 2, 2001, attaching Fifth Annual Progress Report pursuant to the Comcast Social

Contract.

84

AOL Time Warner, Inc., SEC Form 10-Q for the Quarter Ended June 30, 2001, at 15.

85

Comcast Reply Comments at 13. As a result of these capital expenditures, Comcast reports that as of June 30,

2001, 86 percent of its customers were served by systems of 550 MHz or greater, and 70 percent of its systems were

served by 750 MHz or greater. It expects that by year-end, 94 percent of customers will be served by 550 MHz or

greater and 85 percent with 750 MHz or greater. Comcast Reply Comments at 13.

86

AT&T Corp., AT&T Fourth Quarter Pro Forma Revenue Increases 2.5 Percent (press release), Jan. 29, 2001.

AT&T’s investments have resulted in the upgrade of over 71 percent of its cable plant to at least 550MHz, with 56

percent of the network upgraded to 750 MHz. AT&T Comments at 14-15

87

AT&T Corp., AT&T Details Results and Outlines Growth Plans for Broadband Business (press release), July 24,

2001.

88

Adelphia Communications Corp., SEC Form10-K for the Year Ended December 31, 2000, at 31.

89

Adelphia Communications Corp., SEC Form10-Q for the Quarter Ended June 30, 2001, at 20.

90

Cox Communications, Inc., SEC Form 10-K for the Year Ended December 31, 2000, at 35 and 44. These

expenditures were primarily directed at upgrading and rebuilding its network. Id. at 35. At the end of 2000, Cox

had upgraded 70 percent of its networks to a bandwidth capacity of 750 MHz or greater and anticipates that

approximately 83 percent of its networks will have bandwidth capacity of 750 MHz or greater by the end of 2001.

Id. at 1.

91

Cox Communications, Inc., SEC Form 10-Q for the Quarter Ended June 30, 2001, at 20. By the end of 2000,

Cox had upgraded 70 percent of its networks to a bandwidth capacity of 750 MHz or greater. Cox expects by year-

end 2001, 83 percent of its networks will have bandwidth capacity of 750 MHz or greater. Cox Communications,

Inc., SEC Form 10-K for the Year Ended December 31, 2001, at 1.

Federal Communications Commission FCC 01-389

19

billion in 2001.

92

Charter reported cable-related capital expenditures of almost $2.83 billion in 2000, and

is expected to spend approximately $2.9 billion during 2001.

93

4. Provision of Advanced Broadband Services

34.

Advanced services continue to be deployed at a rapid pace. With most systems able to

deliver digital video, and many systems able to deliver cable modem and/or cable telephone service,

MSOs are beginning to experiment with the deployment of other advanced service offerings such as

video-on-demand (“VOD”) and Internet protocol (“IP”) telephony over cable systems.

35.

Digital Video Services.

Most major cable operators currently offer a selection of digital

video packages offered on the expanded capacity of cable systems that have converted to digital. The

basic digital tier typically includes about 40 additional channels of audio and video. In addition, some

MSOs have chosen to offer digital tiers of different genres, such as family, sports, or movie channels.

36.

As we have discussed in past

Reports

, subscriber reception of digital video requires a set-top

device to decompress and decode incoming digital signals and to translate the signals into the signals used

by current television sets. While its primary purpose is to convert digital signals to analog form, these

digital set-top boxes can allow cable operators to offer such additional services as PVRs, games, home

networking, and e-commerce.

94

The next generation set-top box was scheduled to be deployed in 2001,

but its release has been delayed and analysts expect it will be deployed in 2002.

95

37.

Cable operators are still providing set-top boxes to the consumer for a monthly fee; though

the Commission has undertaken a proceeding to facilitate retail availability of these devices to

consumers.

96

The Commission continues to evaluate its rules to determine whether changes are required

to meet the statutory objective of creating a retail market for navigation devices.

97

92

Cablevision Systems Corp.,

Cablevision Systems Corporation Reports Second Quarter 2001 Financial Results for

Cablevision NY Group and Rainbow Media Group

(press release), Aug. 9, 2001.

93

Charter Communications, Inc.,

SEC Form 10-K for the Year Ended December 31, 2001

, at 39. As a result of

these expenditures, more than 54 percent of Charter subscribers were served by systems with broadband capacity of

750 MHz or greater. Charter expects by year-end 2001, nearly 68 percent of its subscribers will be served by

systems with broadband capacity of 750 MHz or greater.

Id

. at 15.

94

Merrill Lynch - Q2/Q3 Preview, at 16.

95

Richard Bilotti, Benjamin Swinburne, and Megan Lynch,

Industry Review: An Early Look at 2005

(“Morgan

Stanley – Industry Review”),

Morgan Stanley Dean Witter, Jan. 2, 2001, at 16; Michael Lafferty,

Taking a Look at

the Thick and the Thin of It,

CED, Sept. 2001, at 29.

96

See 2000 Report,

16 FCC Rcd at 6026-7. Section 629 of the Communications Act requires that the Commission

adopt regulations to assure the commercial availability of navigation devices. In 1998, the Commission adopted

rules to implement Section 629.

See

47 U.S.C. § 549;

see also Implementation of Section 304 of the

Telecommunications Act of 1996, Commercial Availability of Navigation Devices

, CS Docket No. 97-80, Report and

Order (“

Navigation Report and Order

”), 13 FCC Rcd 14775 (1998)

; Implementation of Section 304 of the

Telecommunications Act of 1996, Commercial Availability of Navigation Devices

, CS Docket 97-80, Order on

Reconsideration (“

Navigation Reconsideration

”), 14 FCC Rcd 7596 (1999).

97

Implementation of Section 304 of the Telecommunications Act of 1996 - Commercial Availability of Navigation

Devices

, CS Docket No. 97-80,

Further Notice of Proposed Rule Making and Declaratory Ruling, 15 FCC Rcd

(continued.…)

Federal Communications Commission FCC 01-389

20

38.

As of year-end 2000, it was estimated that there were more than 8.7 million digital video

subscribers.

98

As of June 2001, there were an estimated 12 million digital cable subscribers industry-

wide.

99

Some predict that digital video subscriptions will reach 15.1 million by the end of 2001.

100

39.

As of year-end 2000, Cox reported approximately 840,000 digital video subscribers.

101

As of

June 2001, Cox reported approximately one million digital video subscribers.

102

Analysts estimate that by

year-end 2001, Cox will have as many as 1.3 million subscribers.

103

As of June 2001, Comcast reported

1.8 million digital video subscribers and expects to end the year with as many as 2.2 million digital video

subscribers.

104

As of June 2001, Adelphia had approximately 1.5 million digital video subscribers with a

target of 1.8 million digital video subscribers by year-end.

105

As of year-end 2000, AOL Time Warner

had more than 1.7 million digital video subscribers.

106

By June 2001, AOL Time Warner had as many as

2.5 million subscribers and analysts expect that by year-end 2001, AOL Time Warner will have more than

three million digital video subscribers.

107

As of June 2001, AT&T reported 3.1 million digital video

subscribers.

108

Analysts expect AT&T will have as many as 3.5 million digital video subscribers as of

year-end 2001.

109

Charter Communications provided digital video service to approximately 1.6 million

subscribers as of June 2001, and analysts expect that by year-end it will serve as many as two million

subscribers.

110

As of June 2001, Cablevision was only conducting technical trials of digital video service,

(…continued from previous page)

18199 (2000); Compatibility Between Cable Systems And Consumer Electronics Equipment, PP Docket No. 00-67,

Report and Order, 15 FCC Rcd 17568 (2000).

98

Richard Bilotti, Benjamin Swinburne, and Megan Lynch, Industry Review: The Marquis de Broadbandbury:

Parte Deux, (“Morgan Stanley – Broadband Parte Deux”), Morgan Stanley Dean Witter, July 3, 2001, at 22.

99

NCTA Comments at 26.

100

Megan Larson, Digital Dollar Downward, MediaWeek Online, June 18, 2001; Morgan Stanley – Industry

Review, at 14.

101

Cox Communications, Inc., SEC Form 10-K for the Year Ended December 31, 2000, at 4.

102

Cox Communications, Inc., Cox Communications Announces Third Quarter Financial for 2001 (press release),

Oct. 25, 2001.

103

Merrill Lynch – Q2/Q3 Preview, at 53; Raymond Lee Katz, Gloria Radeff, Bryan Goldberg, Cable TV &

Broadband, Bear Stearns, May 2001, at 145.

104

Comcast Comments at 9; Comcast Reply Comments at 7.

105

Adelphia Communications Corp., Adelphia Communications Announces Second Quarter 2001 Results (press

release), Aug. 14, 2001.

106

AOL Time Warner, Inc., SEC Form 10-K For the Transition Period from July 1, 2000 to December 31, 2000, at

I-10.

107

AOL Time Warner, Inc., SEC Form 10-Q for the Quarter Ended June 30, 2001, at 15.

108

AT&T Comments at 15.

109

Morgan Stanley – Broadband Parte Deux, at 22.

110

Charter Communications, Inc., Charter Communications Exceeds Revenue, Operating Cash Flow Guidance

(press release), July 30, 2001.

Federal Communications Commission FCC 01-389

21

but it expects to offer the service commercially by October 2001.

111

Analysts expect that by year-end

2001, Cablevision will have as many as 50,000 digital video subscribers.

112

40.

Video-on-Demand.

113

VOD services allow subscribers to view movies at any time or on a

time-staggered basis from a library of options. Many of the top MSOs are conducting trials of VOD or

have moved to commercial offerings in some markets. According to one analysis, VOD will generate

revenues of more than $65 million by year-end 2001 and $420 million in 2002.

114

41.

Cox continues to test VOD in its Hampton Roads Market, and has begun a market rollout in

its San Diego markets.

115

Comcast is currently conducting trials of VOD service in four markets and

expects to offer VOD to as many as two million customers by year-end 2001.

116

Adelphia has also been

testing VOD in its Cleveland Heights, Ohio, market, covering an initial 1000 suburban Cleveland homes,

with a planned commercial roll out to all its Cleveland area systems encompassing 284,000 cable

subscribers.

117

Charter has deployed VOD service in several of its major markets and expects that, by

year-end 2001, it should have VOD available to almost 40 percent of its customer base.

118

Charter

expects to complete VOD rollout in all its markets by year-end 2002.

119

Time Warner Cable is continuing

the trials it started last year in Tampa Bay/St. Petersburg, Florida, Honolulu, Hawaii; and Austin,

Texas.

120

The company is also conducting a subscription VOD trial in its Columbia, South Carolina,

111

Cablevision Reply Comments at 4.

112

Morgan Stanley – Broadband Parte Deux, at 22.

113

See

¶¶ 187, 188

infra

.

114

Yankee Group,

Video-on-Demand Will Generate Revenues of Nearly $2 Billion in 2005

(press release), June 25,

2001.

115

Cox Communications, Inc.,

Cox Communications Launches Entertainment-On-Demand in Hampton Roads,

Virginia

(press release),Nov. 29, 2001; Cox Communications, Inc.,

Cox Communications Launches Movies--On-

Demand Service in San Diego

(press release), Sept. 25, 2000; Merrill Lynch – Q2/Q3 Preview,

at 53; Michael

Grotticelli and Ken Kerschbaumer,

Slow and Steady

, Broadcasting & Cable, July 9, 2001, at 38-40 (“

Grotticelli

”).

116

Comcast Reply Comments, at 15; NCTA Comments at 28; Andrew Grossman,

Comcast’s VOD System First to

Link With Gemstar

, Hollywood Reporter, Oct. 5, 2001, at http://www.hollywoodre…display.jsp?vnu_content_id=1

070446; Craig Leddy,

Sneaking a Peek at Comcast’s ITV Plans

, Multichannel News, Aug. 27, 2001.

117

Morgan Stanley – Broadband Parte Deux, at 82;

Rigas and Sie Mark Inaugural S-VOD Launch for Adelphia and

Starz Encore

, C-Net Investor, Oct. 9, 2001.

118

Charter Communications, Inc.,

SEC Form 10-K for the Year Ended December 31, 2001

, at 12;

Cable Insiders

Weigh in on ITV’s Promise

, Multichannel News, July 23, 2001. Charter credits the introduction of VOD and high