INFORMATION BRIEF

Minnesota House of Representatives

Research Department

600 State Office Building

St. Paul, MN 55155

Bob Eleff, Legislative Analyst

651-296-8961 November 2006

New State Cable TV Franchising Laws

Several states have enacted laws designed to increase market competition among

cable television service providers, and thereby lower cable rates. These new laws

also represent a major change in the way that cable television is regulated. This

information brief explains various aspects of the new laws.

Contents

Background......................................................................................................2

Statutory Analysis............................................................................................4

Treatment of Current Local Franchises.......................................................4

Franchise Fees..............................................................................................5

PEG Support Fees........................................................................................5

Build-out Requirements...............................................................................6

Municipal Services ......................................................................................7

PEG Channel Requirements ........................................................................8

Statutes Providing for State-Issued Franchises for Cable Video Service........9

Copies of this publication may be obtained by calling 651-296-6753. This document can be made available in

alternative formats for people with disabilities by calling 651-296-6753 or the Minnesota State Relay Service at

711 or 1-800-627-3529 (TTY). Many House Research Department publications are also available on the

Internet at: www.house.mn/hrd/hrd.htm.

House Research Department November 2006

New State Cable TV Franchising Laws Page 2

Traditionally, cable companies have had to negotiate with local municipalities in order to obtain

a franchise authorizing them to provide cable services in a community. Since 2005, seven states

have passed laws that allow cable service providers to apply for a franchise at the state level:

California, Indiana, Kansas, New Jersey, North Carolina, South Carolina, and Texas. Virginia’s

new statute still requires cable operators to negotiate with municipalities, but provides that a

standardized “default” franchise be awarded if no agreement is reached within 45 days. These

new procedures expedite the application process and virtually guarantee the cable service

providers will be granted a franchise.

The first portion of this information brief discusses factors motivating the enactment of these

new laws, including the state of competition for providing cable services and its effect on cable

rates, and the development of innovative technology to deliver cable television.

The second portion discusses the major controversial issues that surrounded the new cable laws,

including the treatment of current local franchises, franchise fees, fees to support public,

educational, and governmental (PEG) access channels, geographic scope of service (build-out

requirements), municipal services, and PEG channel requirements. The final portion of the

information brief compares in table form how individual states addressed these issues in their

laws.

Background

Cable TV Competition Has Been Minimal to Date

In 2006, seven states—California, Indiana, Kansas, New Jersey, North Carolina, South Carolina,

and Virginia

1

—joined Texas, which acted in 2005, in enacting legislation designed to promote

effective competition among cable service providers. The absence of competition is cited as a

major contributor to continually escalating monthly cable rates,

2

estimated by the Federal

Communications Commission (FCC) to have risen 7.5 percent annually between 1998 and

2004.

3

While Congress prohibited the awarding of exclusive cable franchises in 1992, and allowed

telephone companies and electric utilities to enter video markets in 1996, relatively little direct

competition resulted. Although direct broadcast satellite (DBS) companies currently account for

27.2 percent of all subscribers to multichannel video programming,

4

their presence appears to

have little effect on cable pricing.

5

In contrast, cable rates are approximately 15 percent lower in

areas where a wire-based competitor (using either traditional copper wire or new fiber-optic lines

made of glass or plastic threads) is present, but this only occurs in about 2 percent of markets.

6

The new laws, which represent a major change in the way cable television is regulated, aim to

expand the number of markets with wireline competition and thereby lower cable rates. The

means to achieve this objective is to relieve cable providers of the requirement to negotiate

individually with each municipality in which they seek to offer service, negotiations that

providers claim are unjustifiably lengthy, amounting to a significant barrier to entry. Providers

in these states will now apply at the state level to offer service in as many communities, or

House Research Department November 2006

New State Cable TV Franchising Laws Page 3

portions of communities, as they wish. Under the new laws, they are virtually guaranteed

issuance of a franchise within as few as 15 or as many as 85 days after a completed application

has been filed.

Advances in Technology Allow Telecommunications Companies to Diversify Their Services

The main advocates of these regulatory changes have been telephone companies, such as AT&T

and Verizon,

7

seeking to take advantage of competitive opportunities made possible by

technological advances that allow voice (including Internet-based VoIP, or Voice over Internet

Protocol), video, and data (high-speed Internet service) to be carried over a single fiber-optic

line, giving both cable and phone companies the ability to offer customers all three services.

To exploit these business opportunities, both telephone and cable companies have made large

investments to upgrade their networks. Verizon has invested $18 billion in fiber-optic lines that

extend into customers’ homes, reaching more than three million households in 18 states; AT&T

has spent $4.6 billion to install fiber-optic lines to carry these services to neighborhood nodes

that connect to homes via existing copper cable.

8

By the end of 2004, BellSouth had laid five

million miles of fiber passing by one million homes.

9

Cable companies have reportedly invested

$85 billion in recent years to enable them to offer not only high-speed Internet connections and

telephone service, but also high-definition TV and video-on-demand.

10

The results of these investments are most readily seen among cable operators. By May 2006,

Comcast, the nation’s largest cable TV provider, also boasted nine million broadband and 1.5

million phone customers, adding 211,000 digital voice customers in the first quarter of 2006.

11

At the end of 2005, Time Warner Cable had 1.1 million phone customers, while Cablevision

Systems Corp. passed the one-million mark by July 2006.

12

A 2006 survey estimated that the

number of VoIP subscribers grew from 1.9 million in March 2005 to 5.5 million a year later, and

is projected to reach 9.6 million by the end of 2006. Cable companies accounted for 57 percent

of VoIP subscriptions in 2006, up from 47 percent a year earlier.

13

So far, the telephone companies have been slower at marketing video services. “It’s been much

easier and much less expensive for the cable companies to add voice to their networks than for

the Bells to add TV to theirs,” according to an industry analyst.

14

Verizon only began offering

TV service in a few selected communities in six states in early 2006.

15

In Minnesota, Qwest Communications has so far preferred to offer cable to its phone customers

by reselling DirecTV, a satellite system, rather than building its own fiber-optic network, a costly

prospect. One Wall Street analyst suggested that Qwest might be waiting to see how Bell

companies that have elected to build a fiber-optic system, such as AT&T, fare before deciding to

do so.

16

Qwest currently offers cable over fiber-optic lines or copper video digital subscriber

lines in Omaha, Phoenix, and parts of Colorado, and is considering supporting a state franchise

law in Colorado like those discussed here.

17

House Research Department November 2006

New State Cable TV Franchising Laws Page 4

Statutory Analysis

The table beginning on page 10 summarizes the major issues that engendered great controversy

during the legislative process regarding the degree to which regulatory requirements under the

new statewide franchises differ from those under current municipal franchises, and whether those

differences might harm some subscribers or place incumbents, or current cable franchise license

holders, at a competitive disadvantage. Proponents and opponents of these laws wrestled with the

following questions:

• Treatment of current local franchises: Are the current cable providers, or incumbents,

required to operate under their local franchise agreements until those agreements expire,

or can they convert to a state-issued franchise and face the same regulatory regime as

their new competitors?

• Franchise fees: Will the level of franchise fees paid to municipalities by cable providers

utilizing public rights-of-way to install their equipment be reduced from current levels?

These revenues—calculated as a percentage of gross revenues from cable operations

18

—

are utilized to help support the public, educational, and governmental (PEG) access

channels.

• PEG support fees: Will state franchises require direct operator support of PEG

operations, either through grants or in-kind contributions of equipment and training, as

many local franchise agreements do?

• Build-out requirements: Are operators holding state franchises required to provide

service to all parts of a municipality, as under most negotiated franchises, or can they

choose to operate only in certain areas whose density or income level will generate the

greatest amount of revenues?

• Municipal services: Are providers holding statewide franchises required to provide cable

services to schools, libraries, and other public buildings as they are under many local

franchise agreements?

• PEG channel requirements: Are statewide franchisees required to provide a different

number of PEG channels than incumbents?

Treatment of Current Local Franchises

Several of these statutes allow existing operators the option to terminate the local franchise and

replace it with a state franchise. This was an accommodation made to defuse opposition from

incumbents who claimed that the new laws gave new entrants a regulatory advantage.

Only the Texas statute prevents local franchisees from applying for a state franchise until the

local franchise expires.

19

Indiana, New Jersey, and Virginia allow operators to make this choice

at any time and under any conditions; other states require that wireline competition be present in

House Research Department November 2006

New State Cable TV Franchising Laws Page 5

order for this option to be available. In South Carolina, North Carolina, and California, an

incumbent can apply for a state franchise once a competitor holding a state franchise enters the

incumbent’s service area. North Carolina also allows that option if a second incumbent in the

service area passes by 25 percent of the households, or if a wireline competitor that does not

require a franchise offers service in the area.

California’s law allows an incumbent to apply for a state franchise when the local franchise

expires or if the local franchising authority agrees to it, and gives a local franchiser authority to

require all local franchisees to apply for a state franchise. Kansas allows an incumbent facing

competition to request modification of its local franchise terms and agreements to those of a state

franchise, a request that the local franchiser must grant within 180 days.

20

Franchise Fees

Laws in seven states rescind the authority of municipalities to set the level of the franchise fee.

Only Kansas fully preserves municipalities’ authority to set the fee, subject to the 5 percent

ceiling established by federal law. In Indiana, this authority is reserved for areas with an

incumbent provider. In unserved areas, the fee is set at 5 percent of gross revenues. In the six

other states, the fee is set in statute and applies to all municipalities.

In California, South Carolina, and Virginia, the fee is the lesser of the existing fee or 5 percent.

Texas set its fee at 5 percent. In New Jersey, local franchisees pay municipalities 2 percent of

gross revenues, but once a provider operating under a state franchise becomes capable of serving

60 percent of households in a local service area, the local franchisee pays the same fee as a state

franchisee: 3.5 percent of gross revenues, plus a payment to the state equal to the gross revenues

paid by seniors for basic cable service. These payments are used to reduce the price of that

service for seniors.

North Carolina features a different type of fee structure, which predates the 2006 statute. The

state collects revenues from a state tax on video services—currently set at 4.5 percent of gross

revenues, to be reduced to 4 percent in July 2007—and then rebates 22.61 percent of the net

revenue to cities and counties, proportional to their population.

PEG Support Fees

Laws in five of the eight states require payments to cities specifically to support PEG channel

operations, even after the local franchise expires.

21

A Texas provider under a state franchise

must pay the same per-subscriber fee as an existing provider (“in lieu of in-kind compensation

and grants”) until the local franchise expires, after which it must pay 1 percent of gross revenues,

unless the city prefers to continue collecting the per subscriber fee. Indiana requires a provider

holding a state franchise to make the same PEG payments as an incumbent, on a per-subscriber

basis, even after the local franchise has expired.

House Research Department November 2006

New State Cable TV Franchising Laws Page 6

North Carolina’s statute specifies that the state rebate to cities and counties, in addition to the

amount cited above, must include “supplemental PEG channel support” of $25,000 per year for

each PEG channel (up to three). These funds may not exceed $2 million statewide.

22

In California, after January 1, 2007, and until an incumbent franchise expires, a provider with a

state franchise must support PEG channels at the incumbent’s current per-subscriber level. After

an incumbent franchise expires, a municipality may establish a PEG support fee of up to 1

percent of gross revenues. If a higher fee already exists on December 31, 2006, it may be

retained, up to a maximum of 3 percent.

Virginia’s law provides that a PEG capital fee (the lowest existing charge on a per-subscriber or

percentage-of-gross-revenue basis) and a PEG capital grant surcharge fee (the lower of 1.5

percent of gross revenues or the lowest amount of paid or in-kind capital contribution made by a

provider) be collected until the earliest existing local franchise expiration date. If, at that time,

the locality and the provider cannot agree on a recurring capital cost fee, the locality may impose

one by ordinance “to support the reasonable and necessary capital costs” of PEG channels, but

no greater than the earlier PEG capital fee. A PEG capital grant surcharge fee cannot be charged

once the original franchise expires.

No financial support for PEG channels is required by the statutes enacted in Kansas, New Jersey,

or South Carolina.

Build-out Requirements

Typically, cable franchise agreements with municipalities require providers to offer service

throughout an entire city, including low-income or low-density neighborhoods that might not

otherwise be served because the capital investment required to extend service to those areas may

not generate a sufficient return. A major objection of cities and incumbent cable operators to the

laws establishing state-issued cable franchises is that they allow companies to select only more

lucrative geographic areas for their operations, denying service to low-income communities and

giving an unfair regulatory advantage to state franchise operators. On the other hand, it has been

argued that a requirement to provide complete coverage may cause an entrant to abandon a

decision to offer service at all, denying competition to the community altogether, or can result in

higher prices.

23

All eight statutes prohibit income discrimination against groups of potential residential

subscribers in language virtually identical to that of federal law, which requires franchise

authorities to insure that “access to cable service is not denied to any group of potential

residential subscribers because of the income of the local area in which such group resides.”

24

However, this prohibition refers only to residents within the operator’s chosen service area. The

statutes clearly allow operators to designate selected portions of cities and counties in which to

offer service.

25

Only New Jersey’s statute gives its franchise-issuing agency authority to deny a

franchise based on a company’s selection of a service area.

26

California’s statute addresses economic discrimination most directly in its build-out

requirements. A provider with more than one million telephone customers in the state must

House Research Department November 2006

New State Cable TV Franchising Laws Page 7

insure that within three years, at least 25 percent of households with access to its video service

have an annual household income below $35,000, a proportion that increases to 30 percent after

five years.

27

Telephone companies with fewer than one million customers in the state must

“offer video service to all customers within their telephone service area within a reasonable time,

as determined by the commission.” An exception is allowed for areas where the cost of

providing service is “substantially above” the average cost of providing service in the company’s

telephone service area.

28

California’s Public Utilities Commission also has authority, in certain cases, to review a

provider’s chosen service area to insure that it was not drawn in a discriminatory manner. This

may take place under any of three conditions, which otherwise provide operators with a

rebuttable presumption that discrimination has not occurred:

• Service is provided outside a company’s telephone service area

• A provider enters an area not served by a wireline competitor

• The company is not a telephone company

In contrast to California, five states—Indiana, Kansas, North Carolina, South Carolina, and

Texas—flatly prohibit build-out requirements.

Build-out provisions in other states appear to have less potential to prevent economic

discrimination than do California’s. Virginia allows municipalities to require that video service

be provided to up to 65 percent of the residential dwelling units in a company’s telephone service

area within seven years after service has begun; this can be increased up to 80 percent after ten

years. The effectiveness of such thresholds depends, obviously, on the target percentage a

municipality requires a provider to meet and the proportion of lower income residents in a

telephone company’s service area. For example, if 20 percent of the households in a telephone

service area are categorized as low-income, Virginia’s law would not require that service be

provided to them.

New Jersey’s build-out requirements are also somewhat circumscribed in their ability to prohibit

economic discrimination. Within six years of beginning to offer service, a telephone company

providing local exchange service to more than 40 percent of the state’s telephone customers must

make video service available “throughout the residential areas” of each municipality within its

service area with a population density greater than 7,111 persons per square mile,

29

which

includes about 10 percent of the state’s municipalities, according to a staff member of New

Jersey’s Office of Legislative Services. While this provides some protection to customers, it

does not address those living in less dense areas, nor customers of telephone companies with a

smaller market share.

Municipal Services

Many municipally negotiated franchises require the provision of cable services and institutional

network capacity

30

to public buildings, including schools, at no charge. Of the new laws, only

those in three states—New Jersey, North Carolina, and Virginia—require holders of a state

franchise to provide these services free of charge in perpetuity as a condition of receiving a

House Research Department November 2006

New State Cable TV Franchising Laws Page 8

franchise. North Carolina’s statute stipulates that basic cable service must be provided to all

public buildings located within 125 feet of the system. New Jersey’s and Virginia’s requirement

is broader, applying to all government buildings without reference to proximity to equipment,

although Virginia’s requirement to provide institutional network capacity ends when the earliest

local franchise expires. New Jersey includes Internet service as well.

Three states place time limits on the continued provision of these services. In Texas, Indiana,

and California, provision of municipal services required under a local franchise must continue,

even if the local franchise converts to a state franchise, until the later of the local franchise

expiration date or until January 1, 2008 (Texas), or January 1, 2009 (Indiana and California).

Once that date has passed, a converted franchise in Texas and California must continue to

provide these services only if paid by the municipality. Indiana’s law is silent regarding whether

a local franchise that has been converted to a state franchise must continue to provide these

services free of charge.

New, as opposed to converted, state franchises are not required to provide municipal services in

Texas, California, and in previously unserved areas in Indiana. Neither state franchise type is

required to do so in Kansas and South Carolina.

PEG Channel Requirements

Laws in four states insure that subscribers suffer no loss of PEG channels under a state-issued

franchise:

• South Carolina requires operators to provide the same number of channels activated by

the incumbent. If no incumbent provides service, a municipality may request, and the

operator must provide, up to three channels.

• California specifies that a city must receive the largest number of channels activated by

any incumbent, with the same alternative as South Carolina if no incumbent exists on

January 1, 2007.

• The Texas statute requires no fewer channels than were activated by an incumbent.

Cities without an incumbent operator must be provided with three channels if the

population exceeds 50,000, or two channels if it is below that level.

• North Carolina provides that a municipality be provided with the same number of

channels activated by an incumbent as of July 1, 2006, and has identical provisions to the

Texas law if no incumbent was present on January 1, 2005. The statute also allows for

areas with fewer than seven PEG channels to gain one additional channel if all existing

channels are utilized at least eight hours daily.

Virginia requires a franchise to provide the lowest number of PEG channels presently offered

under a local franchise. If this is less than three, a city may require up to three. If existing PEG

channels are utilized more than 12 hours daily, a city may require provision of up to three

House Research Department November 2006

New State Cable TV Franchising Laws Page 9

additional channels, so long as that requirement applies to all providers in the city, and a total of

seven channels is not exceeded.

Two states specify the number of PEG channels to be provided without reference to those of an

incumbent: New Jersey provides for two (if a city desires additional channels, it must

demonstrate need), while Kansas prescribes no more than two.

31

In Indiana, the Utilities

Regulatory Commission sets the number of PEG channels.

Statutes Providing for State-Issued Franchises for Cable

Video Service

The table beginning on pages 10 and 11 describes aspects of the states’ laws for state-issued

cable franchises. It includes the following information:

• The effective date of the statute

• Who grants the franchise

• The deadline for issuing the franchise

• How current local franchises are treated

• The amount of franchise fees

• The amount of PEG support fees

• What build-out requirements are specified

• What municipal services are required

• The customer service standards

• The number of PEG channels required

House Research Department November 2006

Cable TV Franchises Page 10

Statutes Providing for State-Issued Franchises for Cable Video Service

(Texas, Kansas, Indiana, Virginia, South Carolina, North Carolina, New Jersey, and California)

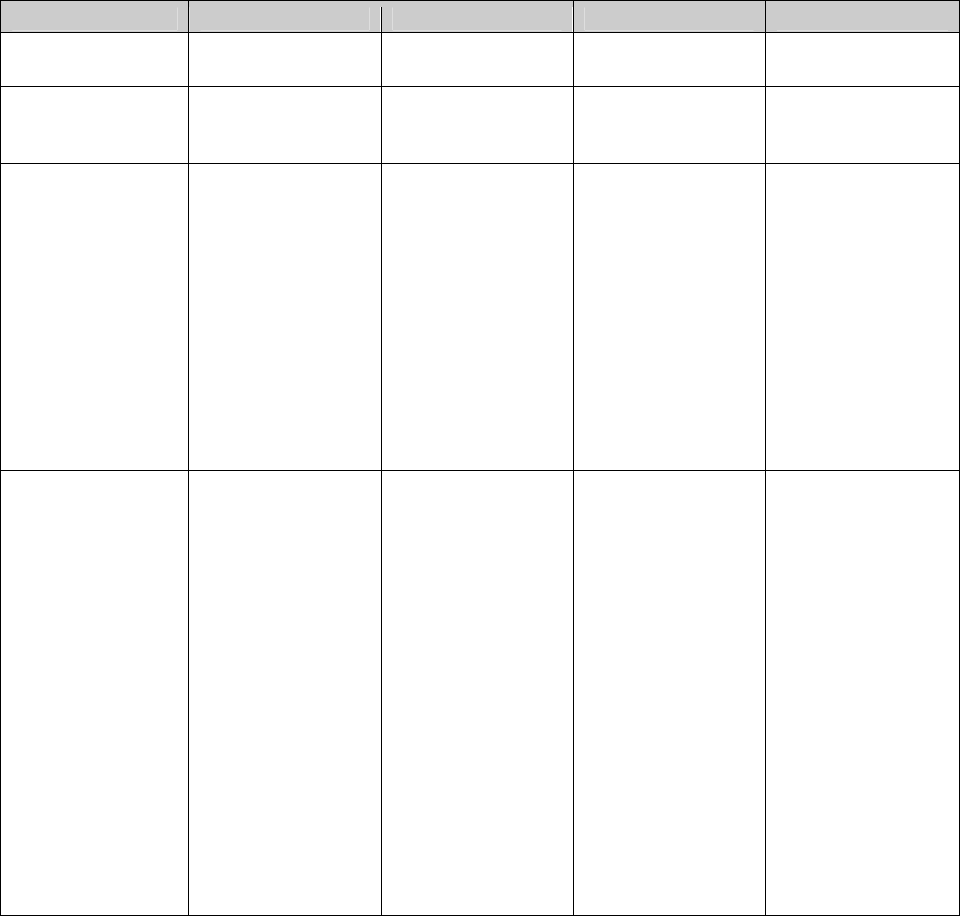

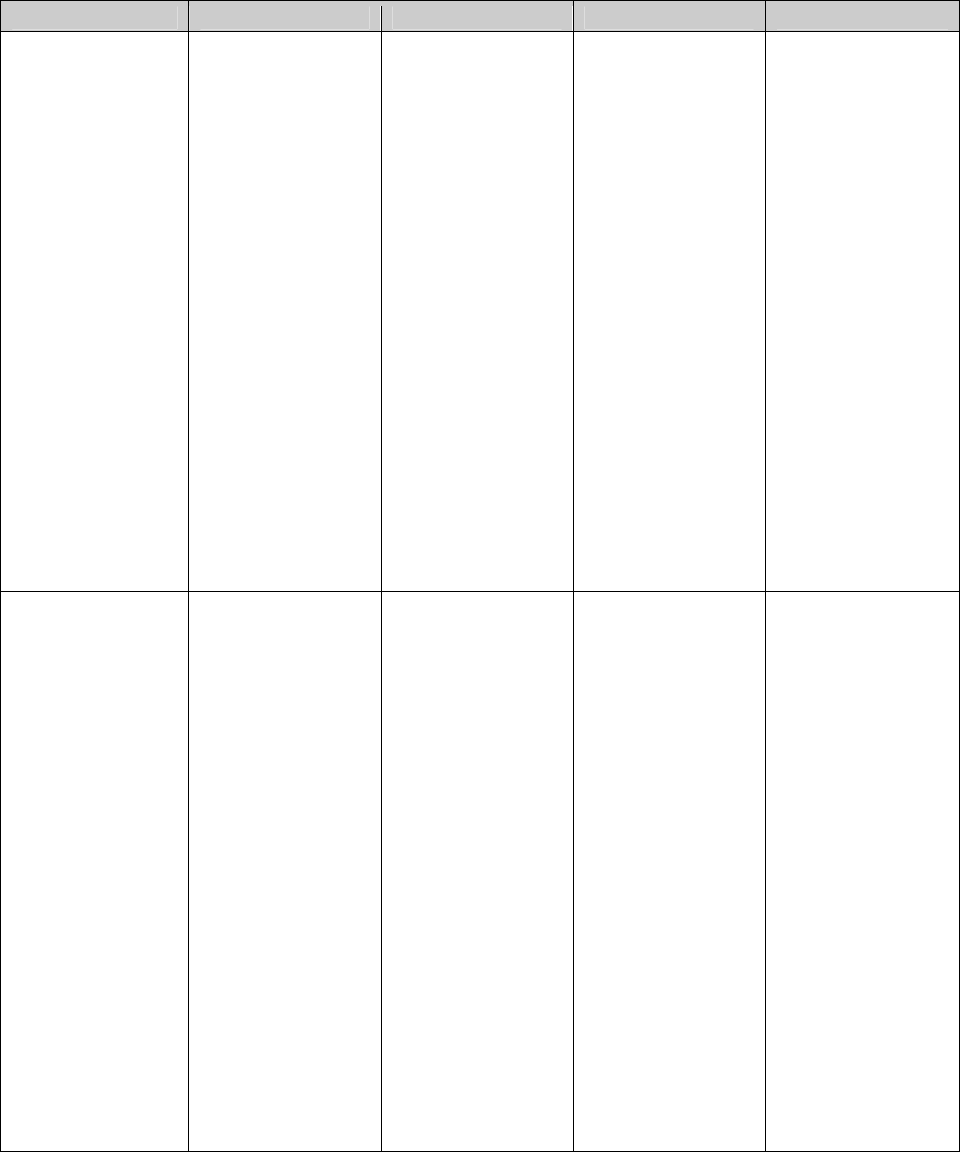

TEXAS KANSAS INDIANA VIRGINIA

Effective Date

September 1, 2005 July 1, 2006 July 1, 2006 July 1, 2006

Franchise Grantor

Public Utilities

Commission

Corporation

Commission

Utilities Regulatory

Commission

Municipalities

Franchise Issuance

Deadline

16 days after

application is

complete

30 days after

application is

complete

15 days after

application is

complete

If franchise

agreement not

negotiated within 45

days after

application received,

applicant may begin

service 30 days later,

and municipality

must award

retroactive default or

“ordinance”

franchise 90 days

after service begins

Treatment of

Current Local

Franchises

Incumbent may not

apply for state

franchise until local

franchise expires

Nonincumbent

serving less than

40% of market may

choose to terminate

local franchise and

apply for state

franchise before

1/1/06

Incumbent may

continue local

franchise until

expiration, or, if

multiple providers

exist, may request

modification of local

franchise terms and

conditions identical

to those of state

franchise, which

request municipality

must grant within

180 days

Incumbent may

continue local

franchise until

expiration or apply

for state franchise

before 11/1/06

Incumbent may

continue local

franchise or apply

for ordinance

franchise

House Research Department November 2006

Cable TV Franchises Page 11

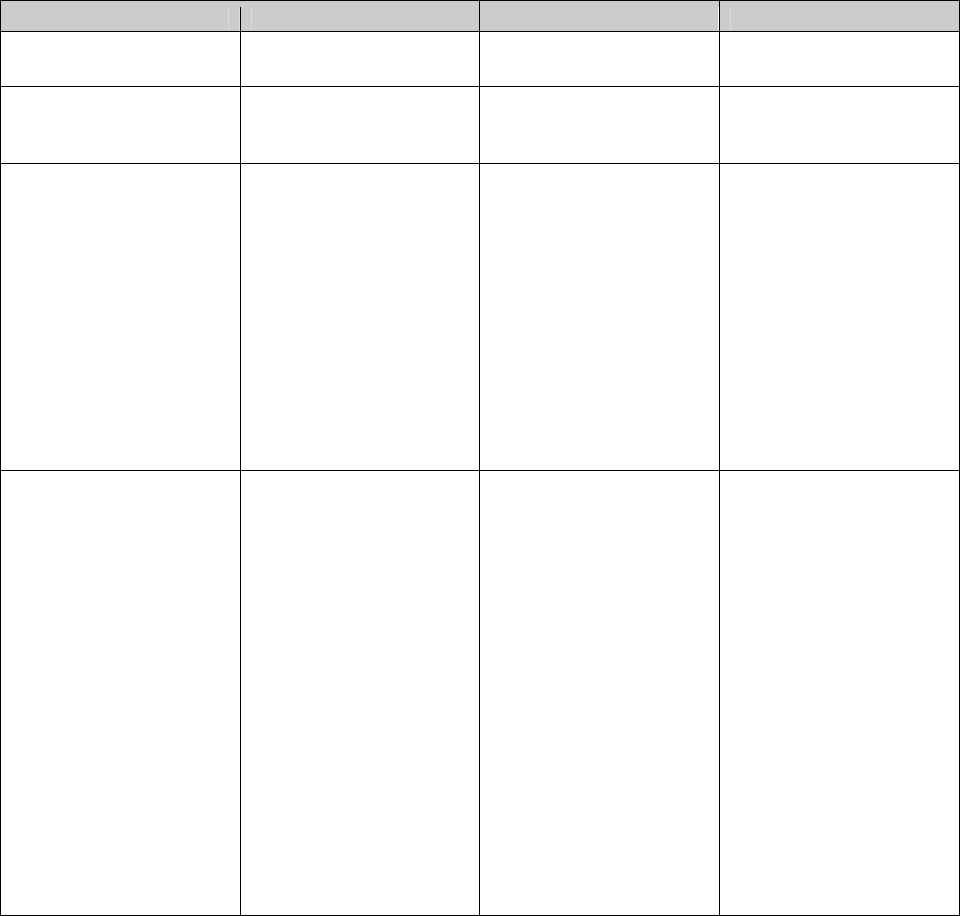

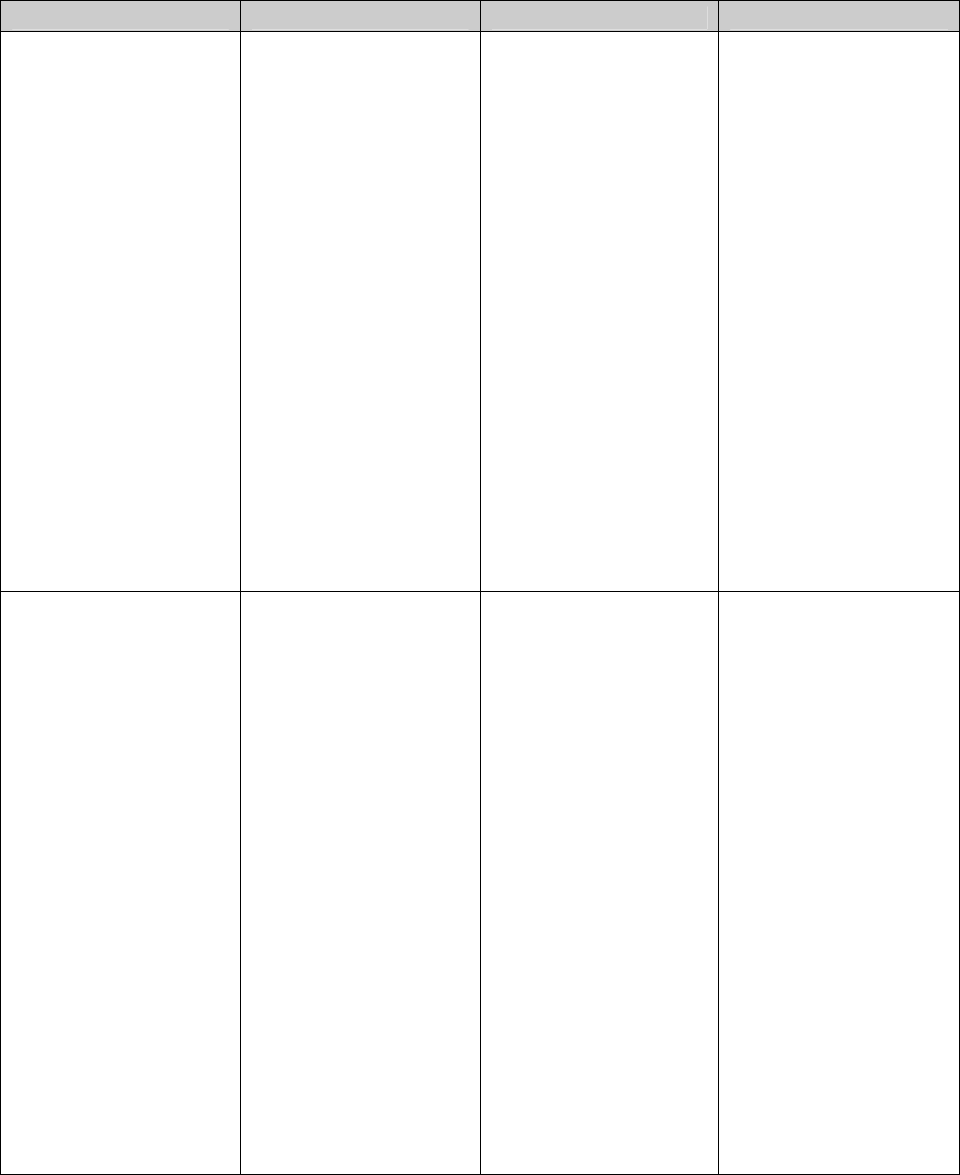

SOUTH CAROLINA NORTH CAROLINA NEW JERSEY CALIFORNIA

May 23, 2006 January 1, 2007 November 2, 2006 January 1, 2007

Secretary of State Secretary of State (but see

cell below)

Board of Public Utilities

(BPU)

Public Utilities

Commission

85 days after application is

received

32

Applicant can offer

service immediately after

filing notice of franchise

45 days after application is

received

43 days after application is

complete

Incumbent may terminate

its franchise and apply for

state franchise when a

competitor holding a state

franchise gives notice that

it will enter the same

service area

Incumbent with local

franchise on 1/1/07 may

terminate it if:

• any household is also

passed by holder of a

state franchise;

• at least 25% of

households are passed

by another provider

with a local franchise;

or

• wireline competition

is present

Incumbent may continue

local franchise or

automatically convert to

state franchise

Local franchises (through

BPU) continue to be

available

Local franchise authority

may extend expiring

franchise to 1/2/08, date

state franchise is

operational

Incumbent may apply for

state franchise when local

franchise expires, when

local authority agrees to

termination, or when

provider with state

franchise gives notice that

it will enter same service

area

Local authority may

require all incumbents to

apply for state franchise

House Research Department November 2006

Cable TV Franchises Page 12

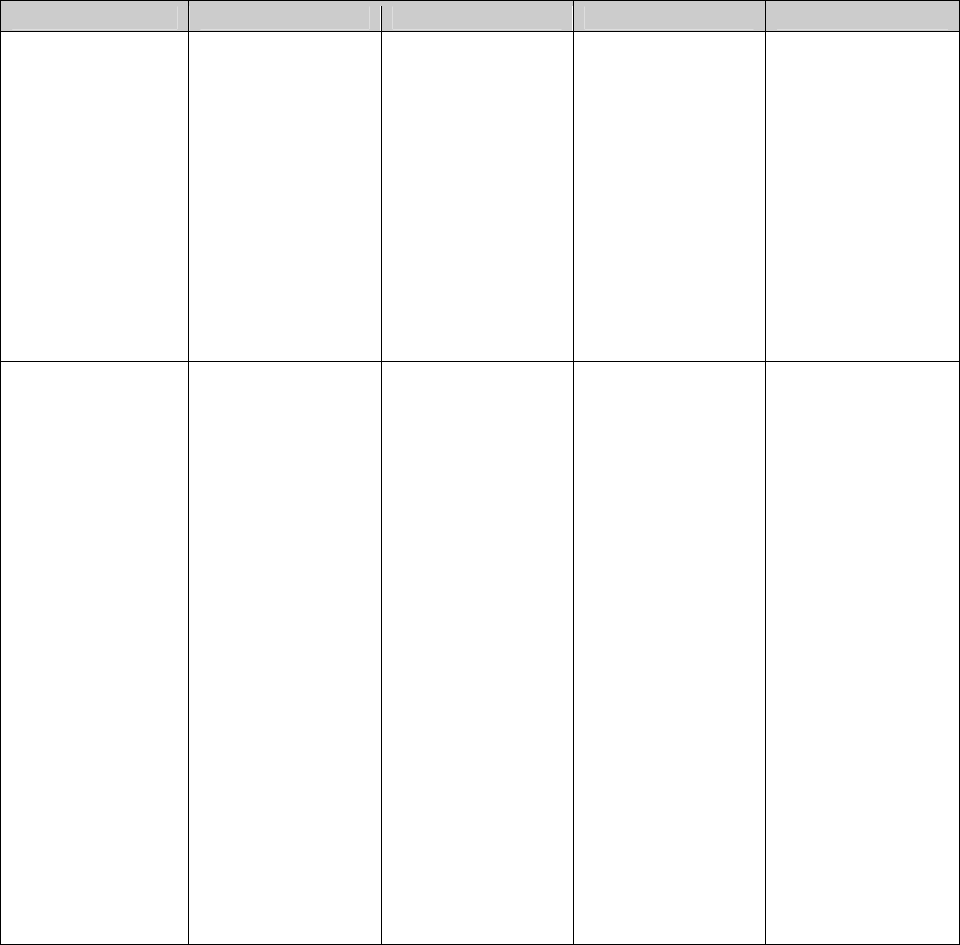

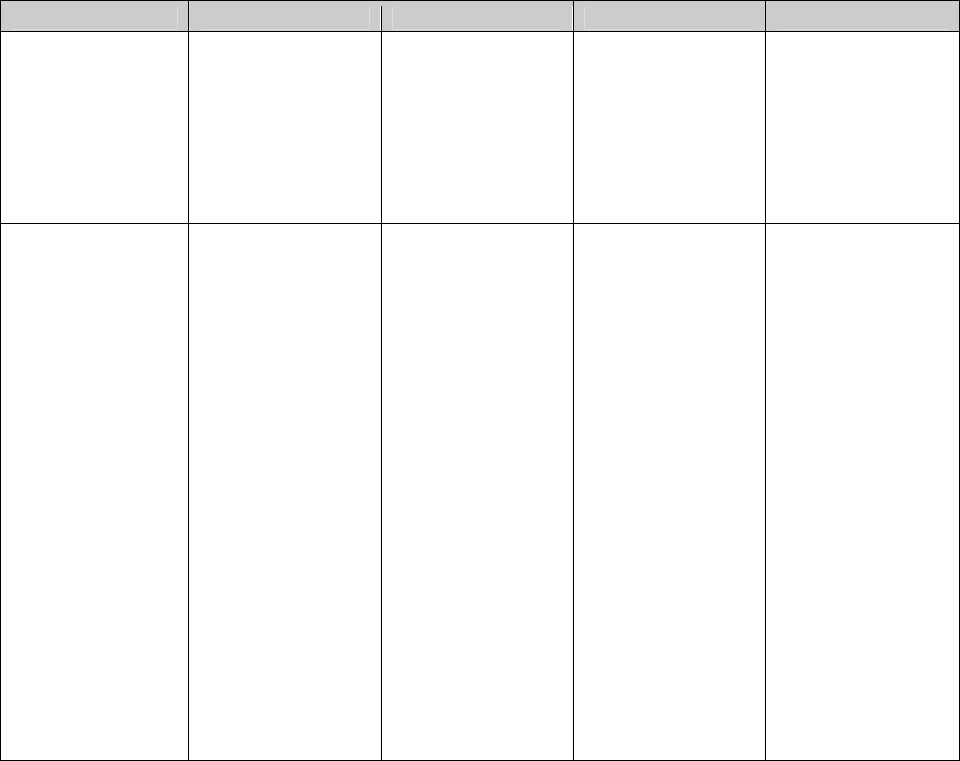

TEXAS KANSAS INDIANA VIRGINIA

Franchise Fees

33

5% of gross

revenues

5% of gross

revenues

Areas previously

unserved: 5% of

gross revenues

Municipality sets fee

in other areas, not to

exceed 5% of gross

revenues

Lowest fee paid by

existing local

franchise, not to

exceed 5% of gross

revenues

PEG Support Fees

Same per-subscriber

fee as incumbent

until expiration of

incumbent franchise.

After expiration,

state franchisee may,

at city’s discretion,

continue per-

subscriber fee or pay

1% of gross

revenues

None Same per-subscriber

fee as incumbent

If no incumbent, and

commission requires

provision of PEG

channels, it may also

set level of PEG

support

PEG capital fee:

lowest existing per-

subscriber fee or

gross revenues

percentage fee to

support PEG capital

costs

34

PEG capital grant

surcharge fee, if

existing local

franchise paid lump-

sum capital grant or

provided equipment:

lower of latter or

1.5% of gross

revenues

PEG fees collected

until earliest existing

local franchise

expiration date, after

which new fee may

be negotiated or set

by ordinance

House Research Department November 2006

Cable TV Franchises Page 13

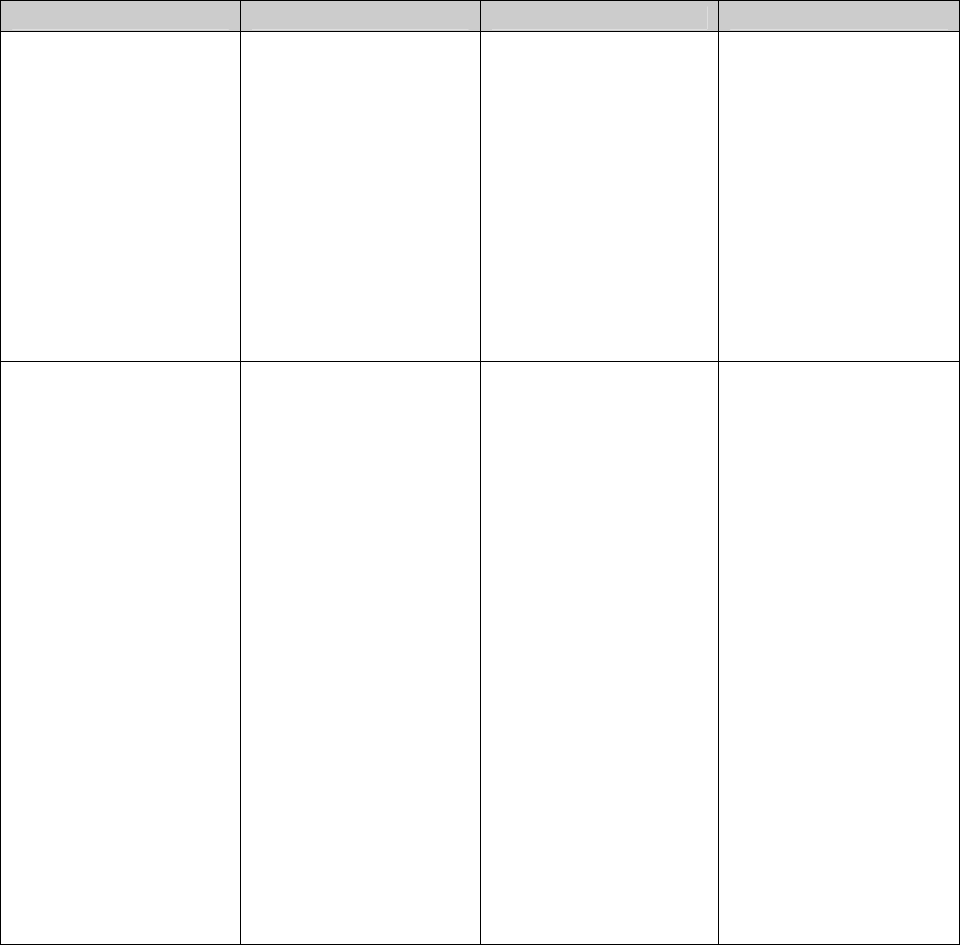

SOUTH CAROLINA NORTH CAROLINA NEW JERSEY CALIFORNIA

Lesser of fee paid by

existing local franchise or

5% of gross revenues

State rebates to cities and

counties 22.61% of net

proceeds of state tax on

cable video services (set at

4.5% prior to 7/1/07 and

4% thereafter)

proportional to

population

35

Local franchise: 2% of

gross revenues; city may

petition BPU for higher

rate. Once state franchise

is capable of serving 60%

of households, rate is

same as state franchise

State franchise:

1) 3.5% of gross revenues;

and

2) amount of gross

revenues paid by seniors

for basic cable

36

Lesser of fee paid by

existing local franchise or

5% of gross revenues

If provider leases access to

network owned by local

franchise authority, latter

may establish a different

fee

None State rebates $25,000

annually for each PEG

channel (up to 3), not to

exceed $2 million

statewide

37

None

Between 1/1/07 and later

of 1/1/09 or expiration,

level of PEG support must

be maintained through

identical per subscriber fee

on all providers. After

expiration, city may set fee

up to 1% of gross

revenues. If higher fee

existed on 12/31/06, city

may retain it, up to 3%

House Research Department November 2006

Cable TV Franchises Page 14

TEXAS KANSAS INDIANA VIRGINIA

Build-out

Requirements

Prohibited

Prohibited

Applicant must be

capable of providing

service to entire

service area within 5

years

Prohibited

Municipalities set

requirements: up to

100% of initial

service area in 3

years; up to 65% of

area where telephone

service is provided

in 7 years, which

may be increased to

80% after 10 years.

Service not required

outside of a telco’s

service area, or

where density is less

than 30 units/mile

Municipal Services

Required

Until later of 1/1/08

or existing franchise

expiration date, a

local franchisee that

converts to a state

franchise must

maintain

institutional network

capacity and cable

service to public

buildings and

schools as required

under local franchise

Afterward, a state

franchisee must

continue service

only if compensated

by city. A new state

franchisee is not

required to provide

municipal services.

Incumbent franchise

unaffected. A

converted or new

state franchisee is

not required to

provide municipal

services.

Until later of 1/1/09

or existing franchise

expiration date, a

local franchisee or

one that converted to

a state franchisee

must provide

institutional network

capacity and cable

service to public

buildings and

schools. Afterward,

service must

continue if requested

by city

State franchisee in

previously unserved

area is not required

to provide municipal

services

All operators must

provide basic cable

service to fire and

police stations,

public schools and

libraries, and other

local government

buildings, at no

charge

Institutional network

service must be

provided until

earliest local

franchise expiration

date

House Research Department November 2006

Cable TV Franchises Page 15

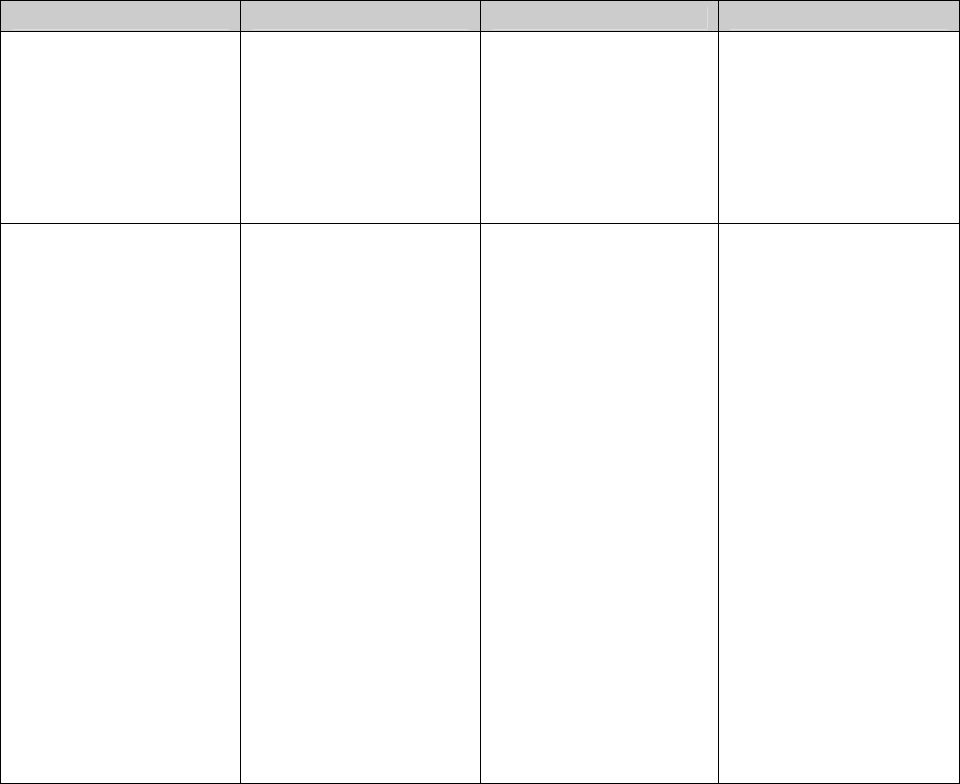

SOUTH CAROLINA NORTH CAROLINA NEW JERSEY CALIFORNIA

Prohibited

Deployment in each city

and unincorporated areas

of counties in service area

must begin within one

year of receiving franchise

Prohibited

Deployment must begin

within 120 days of filing

For cable providers

providing > 40% of local

exchange telephone

service in state: Within 3

years, must begin

servicing each county seat

and each city with

population density > 7,111

per sq/mi. Within 6 years,

must serve all residential

areas in such cities that

have a central office

38

Must match incumbent’s

extension policy and serve

all customers within 100

feet of existing plant.

Service not required

where density is less than

35 units/mile

Telco with > 1 million

telco customers: If using

fiber-optic cable, must

provide access to at least

25% of homes in telco

service area within 2

years, 40% within 5 years;

nonfiber: 35% in 3 years,

50% in 5 years

39

Also, within 3 years, at

least 25% of homes with

access must have incomes

below $35,000; 30% after

5 years

Smaller telcos must offer

video to all telco

customers within “a

reasonable time,” except

service not required in

areas where cost

“substantially” exceeds

average

Incumbent franchise

unaffected. A converted or

new state franchisee is not

required to provide

municipal services.

All operators must provide

basic cable service to

public buildings located

within 125 feet of cable

system, if requested, at no

charge

State franchisee must

provide basic cable and

Internet service to police

and fire stations, public

schools and libraries, and

other local government

buildings at no charge,

and must contract with

city to provide free

training and equipment to

PEG access users

Until later of 1/1/09 or

expiration, local franchisee

must maintain obligation

to provide institutional

networks and cable service

to public buildings, which

state franchisee must

match. Afterward,

customers must pay for

service

House Research Department November 2006

Cable TV Franchises Page 16

TEXAS KANSAS INDIANA VIRGINIA

Customer Service

Standards

40

Must comply with

standards consistent

with federal

standards until

another service

provider (excluding

satellite) enters

market

Municipality may

require franchisee,

on 90 days notice, to

comply with

standards consistent

with federal

standards

Must comply with

federal standards

Must comply with

federal standards. If

municipality

prescribes more

stringent standards,

they must be applied

to all franchisees

Number of PEG

Channels Required

No fewer than

activated under local

franchise on 1/1/05.

If none, up to 3

channels if

population exceeds

50,000; otherwise,

up to 2. To activate

additional channel,

existing channels

must be utilized 12

hrs/day with less

than 40% repeat

programming

Access to PEG

channels used less

than 8 hrs/day may

be denied to city and

programmed by

provider

No more than 2 At least number of

channels activated

by incumbent. If no

incumbent,

commission can

require provision of

PEG channels.

Commission may

require provision of

additional channels

Lowest number

required of any other

franchisee; if less

than 3, city may

require up to 3

If existing PEG

channels are used 12

hrs/day, with at least

33% nonrepeat

programming, city

may require up to 3

additional channels

in basic service tier,

with a total cap of 7.

Additional channels

may be agreed to by

operator and city, but

if used less than 8

hrs/day, shall be

denied to city and

may be programmed

by provider

For more information about cable television regulation, visit the utility regulation area of our

web site, www.house.mn/hrd/issinfo/pubutil.htm.

House Research Department November 2006

Cable TV Franchises Page 17

SOUTH CAROLINA NORTH CAROLINA NEW JERSEY CALIFORNIA

Must comply with federal

standards

Must comply with federal

standards and FCC

emergency alert

requirements

Must meet any consumer

protection provisions

required of local

franchisees

Must comply with federal

and state standards and

FCC emergency alert

requirements

Same number activated by

incumbent. If no

incumbent, municipality

may request, and operator

must provide, up to 3

channels, one of which

may be used by

municipality without

repeat program

restrictions. In both cases,

one additional channel

must be provided for

transmissions of

Educational Television

Commission

Access to PEG channels

used less than 8 hrs/day

may be denied to city and

programmed by provider

City larger than 50,000:

greater of 3 or number of

channels activated as of

7/1/06

City under 50,000 or

county: greater of 2 or

number of channels

activated as of 7/1/06

Areas with fewer than 7

channels may obtain one

additional channel if all

existing channels used at

least 8 hrs/day and no

more than 15% of content

is repeat or character-

generated programming

Two

If municipality desires

more, it must demonstrate

its cable needs require

more channels

Largest number activated

(used 8 hrs/day) by

incumbent on 1/1/07. If

less than 3, local

government may request

up to 3. One additional

channel shall be provided

to carry state public affairs

programming. If

nonduplicated local

programming exceeds 56

hrs/wk, 1 additional

channel shall be provided

Access to PEG channels

used < 8 hrs/day may be

denied to city and

programmed by provider

House Research Department November 2006

Cable TV Franchises Page 18

ENDNOTES

1

A similar bill passed by both houses of the Louisiana Legislature in 2006 (House Bill 699) was vetoed by the

governor.

2

Senate Committee on Commerce, Science, and Transportation, Statement of Edward E. Whitacre, Jr.,

Chairman and Chief Executive Officer of AT&T, Inc., February 15, 2006. http://commerce.senate.gov/pdf/whitacre-

021506.pdf.

3

Federal Communications Commission, Report on Cable Industry Prices, MM Docket No. 92-266, released

February 4, 2005, Attachment 4. The commission’s authority to regulate cable service tier prices, which began in

1992, ended on March 31, 1999, as provided in the Telecommunications Act of 1996. Local franchising authorities

(e.g., municipalities) regulate the price of the basic tier of cable service, which includes only broadcast stations and

public, educational, and government access channels. Federal Communications Commission, Fact sheet – Cable

television, June 2000, 3, 5. http://www.fcc.gov/mb/facts/csgen.html.

4

Federal Communications Commission, Annual assessment of the status of competition in the market for the

delivery of video programming, 12

th

annual report, MB Docket No. 05-255, March 3, 2006, Appendix B, Table B-1.

5

A study issued by the Government Accountability Office (GAO) in 2002 found no significant rate difference

for cable service in areas with satellite competition. (U.S. General Accounting Office, Issues in providing cable and

satellite television service, GAO-03-130, October 2002, Appendix III.) A second GAO study conducted a year later

found that a 10 percent higher penetration rate by DBS providers was associated with a rate reduction for cable

subscribers of only 15 cents. (U.S. General Accounting Office, Issues related to competition and subscriber rates in

the cable television industry, GAO-04-8, October 2003), 11. An FCC study issued in February 2005 found that

cable rates were about 3.5 percent less in areas with satellite competition. (Report on Cable Industry Prices,

Attachment 7)

6

GAO, Issues related to competition, 9, 11; FCC, Report on Cable Industry Prices, Attachments 1 and 7.

7

Telephone companies are pursuing these regulatory changes in two other public policy arenas: the Federal

Communications Commission (FCC), which in November 2005 initiated a proposed rulemaking seeking comment

on whether local franchising procedures are unreasonable and stifle competition, and the U.S. Congress, where the

House of Representatives passed a bill in June 2006 that would award cable franchises at the national level. See,

respectively, Federal Communications Commission, Notice of Proposed Rulemaking, In the Matter of

Implementation of Section 621(a)(1) of the Cable Communications Policy Act of 1984 as amended by the Cable

Television Consumer Protection and Competition Act of 1992, Docket No. MB05-311, adopted November 3, 2005;

and Arshad Mohammed, “House votes to ease cable TV licensing for phone companies,” Washington Post, June 9,

2006.

8

Ken Belson, “AT&T is calling to ask about TV service. Will anyone answer?” New York Times, July 3, 2006;

Marguerite Reardon, “Telecoms, cable firms take franchise fight to D.C.,” c/net news.com, February 15, 2006.

9

Leslie Brooks Suzukamo, “Telecom turf war,” St. Paul Pioneer Press, December 29, 2004.

10

Ken Belson and Geraldine Fabrikant, “Those Bell mergers are giving cable companies even more to worry

about,” New York Times, March 13, 2006.

11

Comcast fact sheet, http://www.corporate-ir.net/media_files/irol/14/147565/Corporate_Factsheet_Q106.pdf;

Barbara Clements, “Comcast needs new faces,” The News Tribune (Tacoma, WA), July 12, 2006.

12

Mike Farrell, “Telephony hangs up Comcast,” Multichannel Newswire, February 2, 2006; Marguerite

Reardon, “Cablevision signs up 1 millionth phone subscriber,” c/net news.com, July 18, 2006.

13

Jeff Baumgartner, “Study: VoIP revenues eclipse $1 B,” CED Magazine, May 22, 2006.

14

Jim Hu, “Verizon’s salvo on cable TV,” c/net news.com, April 20, 2005, quoting James Penhune, of Strategy

Analytics. One source suggests that telephone companies may have lagged in deploying fiber-optic lines because

they profited from the growth of dial-up Internet services, which require an expensive second phone line if the

primary voice line is to remain open. Only when cable companies began successfully offering cable modem service

as an alternative to dial-up were phone companies compelled to offer high-speed Internet services, which make

House Research Department November 2006

Cable TV Franchises Page 19

lucrative second lines unnecessary. Jonathan E. Nuechterlein and Philip J. Weiser, Digital crossroads: American

telecommunications policy in the Internet age (Cambridge: MIT Press), 2005: 143.

15

Reardon, “Telecoms, cable firms take franchise fight to D.C.”

16

Ken Belson, “Qwest beats the odds, so far,” New York Times, September 27, 2006.

17

Beth Potter, “Qwest to expand TV service,” Denver Post, July 5, 2006, http://www.denverpost.com/

business/ci_ 4011840; Joyzelle Davis and Jeff Smith, “Qwest eyes state pay-TV law,” Rocky Mountain News,

October 3, 2006, http://www.rockymountainnews.com/drmn/tech/article/0,2777,DRMN_23910_5038185,00.html.

18

Municipalities opposing these bills asserted that the definition of gross revenues in some bills is narrower

than that contained in current local franchise agreements, which could reduce the revenues municipalities receive

from cable providers operating under state franchises. This publication makes no attempt to analyze those claims.

19

That is one reason the law has been challenged by the Texas Cable and Telecommunications Association in

both state and federal court. TCTA press release, “TCTA files second telecom lawsuit against State of Texas,”

January 27, 2006.

20

If the parties have not reached an agreement after 60 days, the incumbent may again request such a

modification where there are material differences between a local and state franchise, and the municipality is

required to grant the request within 120 days.

21

Kansas allows providers to recover from subscribers “costs in providing capacity for retransmitting

community programming,” but requires no payments to municipalities. Substitute for Senate Bill No. 449, section

4, subsection (g).

22

State grants of up to $25,000 annually are also available to cities and counties. The grants must be used for

PEG capital expenditures and must be matched dollar-for-dollar by the applicant.

23

U.S. Department of Justice, In the Matter of Implementation of Section 621(a)(1) of the Cable

Communications Policy Act of 1984 as amended by the Cable Television Consumer Protection and Competition Act

of 1992, Federal Communications Commission Docket No. MB05-311, Ex Parte Submission, May 10, 2006, 5.

24

U.S. Code §541(a)(3). North Carolina’s statute also prohibits discrimination on the basis of race.

25

This option is not prohibited in any state and is made explicit in laws in three states. South Carolina requires

applicants to supply “a written description of the municipalities and . . .counties to be served, in whole or in part. . .”

[Emphasis added] (House Bill 4428, section 58-12-310(B)(2)). Kansas requires a “description of the service area

footprint to be served . . . , including any municipalities or parts thereof . . . ” [Emphasis added] (Substitute for

Senate Bill, No. 449, section 3(a)(5)). Texas requires an affidavit affirming “description of the service area footprint

to be served within the municipality, . . . ” [Emphasis added] (Texas Utilities Code, Section 66.003(b)(4)).

26

“All of the elements required to be included in the franchise application . . . shall form, in part, the

foundation for the board’s decision as to the . . . system-wide franchise.” Assembly Committee Substitute for

Assembly No. 804, section 25, paragraph (a).

27

The cable operator must also provide service to community centers in “underserved” areas, as determined by

the operator, at a ratio of one center for every 10,000 video customers. A “community center” is a 501(c)(3) or

501(d) nonprofit organization offering health care, job training or placement, or education to community residents.

28

Assembly Bill 2987, section 5890, paragraphs (a) through (c).

29

Assembly Committee Substitute for Assembly, No. 804, section 20, paragraph a. New Jersey’s law also

establishes that service is not required to be provided where density is less than 35 units per mile.

30

“Institutional network capacity” provides for one- and two-way communications services on the cable

network among institutional subscribers.

31

According to Kansas Legislative Services Department staff, very few municipalities currently have as many

as two PEG channels.

32

A state franchise is denied if a municipality or county in which the service is to be provided does not consent.

The reason is that article 8, section 15 of the South Carolina Constitution prohibits the passage of any law granting

House Research Department November 2006

Cable TV Franchises Page 20

the right to build infrastructure in a public right-of-way without consent of the local governing body. The statute

provides that an applicant may seek relief from such a denial of consent in state or federal court.

33

Federal law caps cable service franchise fees at 5 percent of gross revenues.

34

The PEG capital fee is also applied to the cost of institutional networks.

35

Cities and counties that imposed subscriber fees during the first half of fiscal year 2006-07 must allocate,

from the amount rebated, twice the amount of subscriber-fee revenue received during that period to operate and

support PEG channels. A city or county that used part of its franchise tax in fiscal year 2005-06 to support and

operate PEG channels must allocate that same level of support from the rebated amount for those purposes.

36

This amount is paid to the state, which uses it to discount the costs of these services to seniors.

37

Cities and counties may apply to a PEG Channel Fund created in the same statute for 50 percent matching

grants of up to $25,000 annually to be used for capital expenditures necessary to provide PEG channel

programming.

38

A building that houses switching and related equipment.

39

The five-year requirements may be delayed if fewer than 30 percent of households subscribe for six

consecutive months.

40

Existing federal cable TV service standards (47 CFR § 76.309) may be enforced at franchise authority’s

discretion.