Userid: CPM Schema: tipx Leadpct: 100% Pt. size: 10

Draft Ok to Print

AH XSL/XML

Fileid: … ons/P529/202012/A/XML/Cycle07/source (Init. & Date) _______

Page 1 of 18 11:09 - 4-Jan-2021

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

Department of the Treasury

Internal Revenue Service

Publication 529

(Rev. December 2020)

Cat. No. 15056O

Miscellaneous

Deductions

Get forms and other information faster and easier at:

• IRS.gov (English)

• IRS.gov/Spanish (Español)

•

IRS.gov/Chinese (中文)

•

IRS.gov/Korean (한국어)

• IRS.gov/Russian (Pусский)

• IRS.gov/Vietnamese (TiếngViệt)

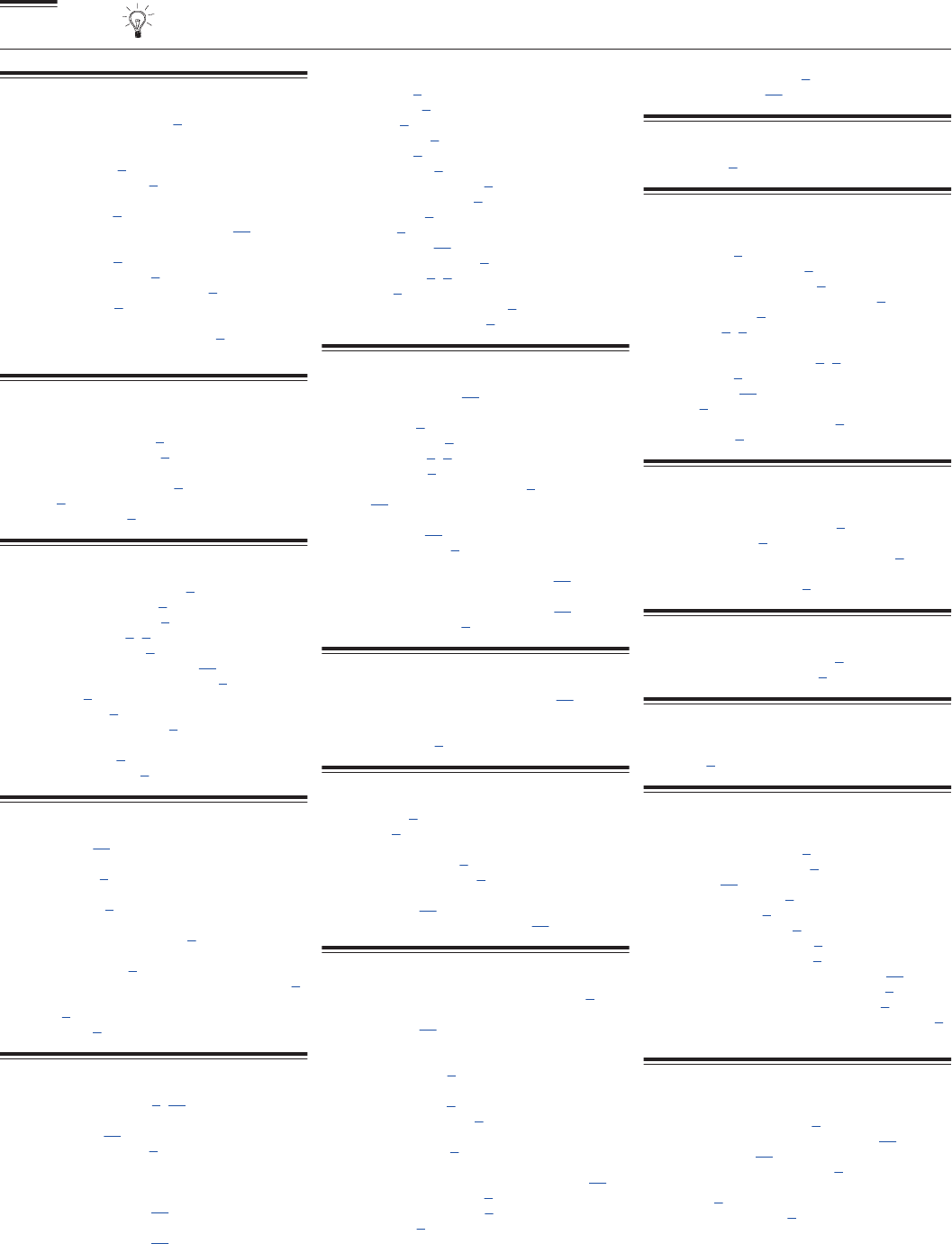

Contents

Reminders ............................... 1

Introduction .............................. 1

Deductions for Unreimbursed Employee

Expenses ............................. 2

Unreimbursed Employee Expenses ........... 2

Expenses You Can’t Deduct .................. 3

Miscellaneous Deductions Subject to the 2%

AGI Limit ............................ 4

Nondeductible Expenses .................. 6

Expenses You Can Deduct ................... 9

How To Report ........................... 11

Example ............................. 12

How To Get Tax Help ...................... 12

Index .................................. 17

Reminders

Future developments. For the latest information about

developments related to Pub. 529, such as legislation

enacted after it was published, go to IRS.gov/Pub529.

Photographs of missing children. The IRS is a proud

partner with the National Center for Missing & Exploited

Children® (NCMEC). Photographs of missing children se-

lected by the Center may appear in this publication on pa-

ges that would otherwise be blank. You can help bring

these children home by looking at the photographs and

calling 1-800-THE-LOST (1-800-843-5678) if you recog-

nize a child.

Introduction

This publication explains that you can no longer claim any

miscellaneous itemized deductions, unless you fall into

one of the qualified categories of employment claiming a

deduction relating to unreimbursed employee expenses.

Miscellaneous itemized deductions are those deductions

that would have been subject to the 2%-of-adjus-

ted-gross-income (AGI) limitation. You can still claim cer-

tain expenses as itemized deductions on Schedule A

(Form 1040), Schedule A (1040-NR), or as an adjustment

to income on Form 1040 or 1040-SR. This publication

covers the following topics.

•

Deductions for Unreimbursed Employee Expenses.

•

Expenses you can't deduct.

•

Expenses you can deduct.

•

How to report your deductions.

Note. Generally, nonresident aliens who fall into one of

the qualified categories of employment are allowed de-

ductions to the extent they are directly related to income

Jan 04, 2021

Page 2 of 18 Fileid: … ons/P529/202012/A/XML/Cycle07/source 11:09 - 4-Jan-2021

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

which is effectively connected with the conduct of a trade

or business within the United States.

You must keep records to verify your deductions.

You should keep receipts, canceled checks, sub-

stitute checks, financial account statements, and

other documentary evidence.

Comments and suggestions. We welcome your com-

ments about this publication and suggestions for future

editions.

You can send us comments through IRS.gov/

FormComments. Or, you can write to the Internal Reve-

nue Service, Tax Forms and Publications, 1111 Constitu-

tion Ave. NW, IR-6526, Washington, DC 20224.

Although we can’t respond individually to each com-

ment received, we do appreciate your feedback and will

consider your comments and suggestions as we revise

our tax forms, instructions, and publications. Do not send

tax questions, tax returns, or payments to the above ad-

dress.

Getting answers to your tax questions. If you have

a tax question not answered by this publication or the How

To Get Tax Help section at the end of this publication, go

to the IRS Interactive Tax Assistant page at IRS.gov/

Help/ITA where you can find topics by using the search

feature or viewing the categories listed.

Getting tax forms, instructions, and publications.

Visit IRS.gov/Forms to download current and prior-year

forms, instructions, and publications.

Ordering tax forms, instructions, and publications.

Go to IRS.gov/OrderForms to order current forms, instruc-

tions, and publications; call 800-829-3676 to order

prior-year forms and instructions. The IRS will process

your order for forms and publications as soon as possible.

Do not resubmit requests you’ve already sent us. You can

get forms and publications faster online.

Useful Items

You may want to see:

Publication

463 Travel, Gift, and Car Expenses

525 Taxable and Nontaxable Income

535 Business Expenses

587 Business Use of Your Home (Including Use by

Daycare Providers)

946 How To Depreciate Property

Form (and Instructions)

Schedule A (Form 1040) Itemized Deductions

Schedule A (Form 1040-NR) Itemized Deductions

2106 Employee Business Expenses

See How To Get Tax Help at the end of this publication for

information about getting these publications and forms.

RECORDS

463

525

535

587

946

Schedule A (Form 1040)

Schedule A (Form 1040-NR)

2106

Deductions for Unreimbursed

Employee Expenses

You can no longer claim any miscellaneous itemized de-

ductions that are subject to the 2%-of-AGI limitation, in-

cluding unreimbursed employee expenses. However, you

may be able to deduct certain unreimbursed employee

business expenses if you fall into one of the following cat-

egories of employment listed under Unreimbursed Em-

ployee Expenses next, or are an eligible educator as de-

fined under Educator Expenses, later.

Unreimbursed Employee Expenses

You can no longer claim a deduction for unreimbursed

employee expenses unless you fall into one of the follow-

ing categories of employment, or have certain qualified

educator expenses.

•

Armed Forces reservists.

•

Qualified performing artists.

•

Fee-basis state or local government officials.

•

Employees with impairment-related work expenses.

Unreimbursed employee expenses for individuals in

these categories of employment are deducted as adjust-

ments to gross income. Qualified employees listed in one

of the categories above must complete Form 2106 to take

the deduction. Certain qualified educator expenses are

also deducted as an adjustment to gross income but you

are not required to complete Form 2106.

You can deduct only unreimbursed employee expen-

ses that are paid or incurred during your tax year, for car-

rying on your trade or business of being an employee, and

ordinary and necessary.

An expense is ordinary if it is common and accepted in

your trade, business, or profession. An expense is neces-

sary if it is appropriate and helpful to your business. An

expense doesn't have to be required to be considered

necessary.

Categories of Employment

You can deduct unreimbursed employee expenses only if

you qualify as an Armed Forces reservist, a qualified per-

forming artist, a fee-basis state or local government offi-

cial, or an employee with impairment-related work expen-

ses.

Armed Forces reservist (member of a reserve com-

ponent). You are a member of a reserve component of

the Armed Forces of the United States if you are in the

Army, Navy, Marine Corps, Air Force, or Coast Guard Re-

serve; the Army National Guard of the United States; or

the Reserve Corps of the Public Health Service.

Armed Forces reservists traveling more than 100

miles from home. If you are a member of a reserve

Page 2 Publication 529 (December 2020)

Page 3 of 18 Fileid: … ons/P529/202012/A/XML/Cycle07/source 11:09 - 4-Jan-2021

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

component of the Armed Forces of the United States and

you travel more than 100 miles away from home in con-

nection with your performance of services as a member of

the reserves, you can deduct some of your travel expen-

ses as an adjustment to gross income. The amount of ex-

penses you can deduct as an adjustment to gross income

is limited to the regular federal per diem rate (for lodging,

meals, and incidental expenses) and the standard mile-

age rate (for car expenses) plus any parking fees, ferry

fees, and tolls. The balance, if any, is reported on Sched-

ule A.

For more information on travel expenses, see Pub.

463.

Qualified performing artist. You are a qualified per-

forming artist if you:

1. Performed services in the performing arts as an em-

ployee for at least two employers during the tax year,

2. Received from at least two of the employers wages of

$200 or more per employer,

3. Had allowable business expenses attributable to the

performing arts of more than 10% of gross income

from the performing arts, and

4. Had adjusted gross income of $16,000 or less before

deducting expenses as a performing artist.

If you are a qualified performing artist, you can deduct

your employee business expenses as an adjustment to in-

come rather than as a miscellaneous itemized deduction.

For example, musicians and entertainers can deduct the

cost of theatrical clothing and accessories that aren't suit-

able for everyday wear. If you are an employee, complete

Form 2106. See Pub. 463 for more information.

Fee-basis state or local government official. You are

a qualifying fee-basis official if you are employed by a

state or political subdivision of a state and are compensa-

ted, in whole or in part, on a fee basis.

If you are a fee-basis official, you can claim your expen-

ses in performing services in that job as an adjustment to

income rather than as a miscellaneous itemized deduc-

tion. See Pub. 463 for more information.

Employee with impairment-related work expenses.

Impairment-related work expenses are the allowable ex-

penses of an individual with physical or mental disabilities

for attendant care at his or her place of employment. They

also include other expenses in connection with the place

of employment that enable the employee to work. See

Pub. 463 for more details.

If you have a physical or mental disability that limits

your being employed, or substantially limits one or more of

your major life activities, such as performing manual

tasks, walking, speaking, breathing, learning, and work-

ing, you can deduct your impairment-related work expen-

ses.

Impairment-related work expenses are ordinary and

necessary business expenses for attendant care services

at your place of work and other expenses in connection

with your place of work that are necessary for you to be

able to work.

Educator Expenses

If you were an eligible educator for the tax year, you may

be able to deduct qualified expenses you paid as an ad-

justment to gross income on your Schedule 1 (Form

1040), rather than as a miscellaneous itemized deduction.

See the Instructions for Forms 1040 and 1040-SR for

more information.

Eligible educator. An eligible educator is a kindergarten

through grade 12 teacher, instructor, counselor, principal,

or aide in school for at least 900 hours during a school

year.

Qualified expenses. Qualified expenses include ordi-

nary and necessary expenses paid in connection with

books, supplies, equipment (including computer equip-

ment, software, and services), and other materials used in

the classroom. An ordinary expense is one that is com-

mon and accepted in your educational field. A necessary

expense is one that is helpful and appropriate for your

profession as an educator. An expense doesn’t have to be

required to be considered necessary.

Qualified expenses also include those expenses you

incur while participating in professional development cour-

ses related to the curriculum in which you provide instruc-

tion. It also includes those expenses related to those stu-

dents for whom you provide that instruction.

Qualified expenses don’t include expenses for home

schooling or for nonathletic supplies for courses in health

or physical education. You must reduce your qualified ex-

penses by the following amounts.

•

Excludable U.S. series EE and I savings bond interest

from Form 8815.

•

Nontaxable qualified state tuition program earnings.

•

Nontaxable earnings from Coverdell education sav-

ings accounts.

•

Any reimbursements you received for those expenses

that weren’t reported to you on your Form W-2, box 1.

Expenses You Can’t Deduct

In addition to the expenses that are no longer deductible

as a miscellaneous itemized deduction, there are expen-

ses that are traditionally nondeductible under the Internal

Revenue Code. Both categories of deduction are dis-

cussed next.

Publication 529 (December 2020) Page 3

Page 4 of 18 Fileid: … ons/P529/202012/A/XML/Cycle07/source 11:09 - 4-Jan-2021

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

Miscellaneous Deductions Subject to

the 2% AGI Limit

Unless you qualify for an exception, you generally can't

deduct the following expenses, even if you fall into one of

the qualified categories of employment listed earlier.

•

Appraisal fees for a casualty loss or charitable contri-

bution.

•

Casualty and theft losses from property used in per-

forming services as an employee.

•

Clerical help and office rent in caring for investments.

•

Credit or debit card convenience fees.

•

Depreciation on home computers used for invest-

ments.

•

Fees to collect interest and dividends.

•

Hobby expenses, but generally not more than hobby

income.

•

Indirect miscellaneous deductions from pass-through

entities.

•

Investment fees and expenses.

•

Legal fees related to producing or collecting taxable

income or getting tax advice.

•

Loss on deposits in an insolvent or bankrupt financial

institution.

•

Loss on traditional IRAs or Roth IRAs, when all

amounts have been distributed to you.

•

Repayments of income.

•

Repayments of social security benefits.

•

Safe deposit box rental, except for storing jewelry and

other personal effects.

•

Service charges on dividend reinvestment plans.

•

Tax advice fees.

•

Trustee's fees for your IRA, if separately billed and

paid.

Appraisal Fees

Appraisal fees you pay to figure a casualty loss or the fair

market value of donated property are miscellaneous item-

ized deductions and can no longer be deducted.

Casualty and Theft Losses

Damaged or stolen property used in performing services

as an employee is a miscellaneous deduction and can no

longer be deducted. For more information on casualty and

theft losses, see Pub. 547, Casualties, Disasters, and

Thefts.

Clerical Help and Office Rent

Office expenses, such as rent and clerical help, you pay in

connection with your investments and collecting taxable

income on those investments are miscellaneous itemized

deductions and are no longer deductible.

Credit or Debit Card Convenience Fees

The convenience fee charged by the card processor for

paying your income tax (including estimated tax pay-

ments) by credit or debit card is a miscellaneous itemized

deduction and is no longer deductible.

Depreciation on Home Computer

If you use your home computer to produce income (for ex-

ample, to manage your investments that produce taxable

income), the depreciation of the computer for that part of

the usage of the computer is a miscellaneous itemized de-

duction and is no longer deductible.

Fees To Collect Interest and Dividends

Fees you pay to a broker, bank, trustee, or similar agent to

collect your taxable bond interest or dividends on shares

of stock are miscellaneous itemized deductions and can

no longer be deducted.

Fines or Penalties

No deduction is allowed for fines and penalties paid to a

government or specified nongovernmental entity for the vi-

olation of any law except in the following situations.

•

Certain amounts that constitute restitution.

•

Certain amounts paid to come into compliance with

the law.

•

Amounts paid or incurred as the result of certain court

orders in which no government or specified nongo-

vernmental agency is a party.

•

Amounts paid or incurred for taxes due.

Nondeductible amounts include an amount paid in set-

tlement of your actual or potential liability for a fine or pen-

alty (civil or criminal). Fines or penalties include amounts

paid such as parking tickets, tax penalties, and penalties

deducted from teachers' paychecks after an illegal strike.

No deduction is allowed for the restitution amount or

amount paid to come into compliance with the law unless

the amounts are specifically identified in the settlement

agreement or court order. Also, any amount paid or incur-

red as reimbursement to the government for the costs of

any investigation or litigation are nondeductible.

Hobby Expenses

A hobby isn’t a business because it isn’t carried on to

make a profit. If you receive income for an activity that you

don’t carry out to make a profit, the expenses you pay for

the activity are miscellaneous itemized deductions and

can no longer be deducted. See Not-for-Profit Activities in

chapter 1 of Pub. 535. You must still report the income

you receive on your Schedule 1 (Form 1040).

Page 4 Publication 529 (December 2020)

Page 5 of 18 Fileid: … ons/P529/202012/A/XML/Cycle07/source 11:09 - 4-Jan-2021

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

Indirect Deductions of Pass-Through

Entities

Pass-through entities include partnerships, S corpora-

tions, and mutual funds that aren't publicly offered. De-

ductions of pass-through entities are passed through to

the partners or shareholders. The partner’s or sharehold-

er’s share of passed-through deductions for investment

expenses are miscellaneous itemized deductions and can

no longer be deducted.

Nonpublicly offered mutual funds. These funds will

send you a Form 1099-DIV, or a substitute form, showing

your share of gross income and investment expenses.

The investment expenses reported on Form 1099-DIV are

a miscellaneous itemized deduction and are no longer de-

ductible.

Investment Fees and Expenses

Investment fees, custodial fees, trust administration fees,

and other expenses you paid for managing your invest-

ments that produce taxable income are miscellaneous

itemized deductions and are no longer deductible.

Legal Expenses

Legal expenses that you incur in attempting to produce or

collect taxable income or that you pay in connection with

the determination, collection, or refund of any tax are mis-

cellaneous itemized deductions and are no longer deduc-

tible.

You can deduct legal expenses that are related to

doing or keeping your job, such as those you paid

to defend yourself against criminal charges aris-

ing out of your trade or business.

You can deduct expenses of resolving tax issues relat-

ing to profit or loss from business reported on Schedule C

(Form 1040), Profit or Loss From Business (Sole Proprie-

torship), from rentals or royalties reported on Schedule E

(Form 1040), Supplemental Income and Loss, or from

farm income and expenses reported on Schedule F (Form

1040), Profit or Loss From Farming, on that schedule. Ex-

penses for resolving nonbusiness tax issues are miscella-

neous itemized deductions and are no longer deductible.

Loss on Deposits

A loss on deposits can occur when a bank, credit union, or

other financial institution becomes insolvent or bankrupt. If

you can reasonably estimate the amount of your loss on

money you have on deposit in a financial institution that

becomes insolvent or bankrupt, you can generally choose

to deduct it in the current year even though its exact

amount hasn't been finally determined.

If none of the deposit is federally insured, you could de-

duct the loss as a nonbusiness bad debt. Report it on your

Schedule D (Form 1040). You can no longer deduct the

TIP

loss as an ordinary loss or as a casualty loss on your

Schedule A (Form 1040).

Loss on IRA

A loss on your traditional IRA (or Roth IRA) investment is

a miscellaneous itemized deduction and can no longer be

deducted.

Repayments of Income

Generally, repayments of amounts that you included in in-

come in an earlier year is a miscellaneous itemized de-

duction and can no longer be deducted. If you had to re-

pay more than $3,000 that you included in your income in

an earlier year, you may be able to deduct the amount.

See Repayments Under Claim of Right, later.

Repayments of Social Security Benefits

If the total amount shown in box 5 of all of your Forms

SSA-1099 and RRB-1099 is a negative figure, you may be

able to deduct part of this negative figure if the figure is

more than $3,000. If the figure is less than $3,000, it is a

miscellaneous itemized deduction and can no longer be

deducted. See Pub. 915, Social Security and Equivalent

Railroad Retirement Benefits, for additional information.

Safe Deposit Box Rent

Rent you pay for a safe deposit box you use to store taxa-

ble income-producing stocks, bonds, or investment rela-

ted papers is a miscellaneous itemized deduction and can

no longer be deducted. You also can't deduct the rent if

you use the box for jewelry, other personal items, or

tax-exempt securities.

Service Charges on Dividend

Reinvestment Plans

Service charges you pay as a subscriber in a dividend re-

investment plan are a miscellaneous itemized deduction

and can no longer be deducted. These service charges

include payments for:

•

Holding shares acquired through a plan,

•

Collecting and reinvesting cash dividends, and

•

Keeping individual records and providing detailed

statements of accounts.

Tax Preparation Fees

Tax preparation fees on the return for the year in which

you pay them are a miscellaneous itemized deduction and

can no longer be deducted. These fees include the cost of

tax preparation software programs and tax publications.

They also include any fee you paid for electronic filing of

your return.

Publication 529 (December 2020) Page 5

Page 6 of 18 Fileid: … ons/P529/202012/A/XML/Cycle07/source 11:09 - 4-Jan-2021

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

Trustee's Administrative Fees for IRA

Trustee's administrative fees that are billed separately and

paid by you in connection with your IRA are a miscellane-

ous itemized deduction and can no longer be deducted.

Nondeductible Expenses

In addition to the miscellaneous itemized deductions dis-

cussed earlier, you can't deduct the following expenses.

List of Nondeductible Expenses

•

Adoption expenses.

•

Broker's commissions.

•

Burial or funeral expenses, including the cost of a

cemetery lot.

•

Campaign expenses.

•

Capital expenses.

•

Check-writing fees.

•

Club dues.

•

Commuting expenses.

•

Fees and licenses, such as car licenses, marriage li-

censes, and dog tags.

•

Fines or penalties.

•

Health spa expenses.

•

Hobby losses—but see Hobby Expenses, earlier.

•

Home repairs, insurance, and rent.

•

Home security system.

•

Illegal bribes and kickbacks—see Bribes and kick-

backs in chapter 11 of Pub. 535.

•

Investment-related seminars.

•

Life insurance premiums paid by the insured.

•

Lobbying expenses.

•

Losses from the sale of your home, furniture, personal

car, etc.

•

Lost or misplaced cash or property.

•

Lunches with co-workers.

•

Meals while working late.

•

Medical expenses as business expenses other than

medical examinations required by your employer.

•

Personal disability insurance premiums.

•

Personal legal expenses.

•

Personal, living, or family expenses.

•

Political contributions.

•

Professional accreditation fees.

•

Professional reputation improvement expenses.

•

Relief fund contributions.

•

Residential telephone line.

•

Stockholders’ meeting attendance expenses.

•

Tax-exempt income earning/collecting expenses.

•

The value of wages never received or lost vacation

time.

•

Travel expenses for another individual.

•

Voluntary unemployment benefit fund contributions.

•

Wristwatches.

Adoption Expenses

You can't deduct the expenses of adopting a child but you

may be able to take a credit for those expenses. For de-

tails, see Form 8839, Qualified Adoption Expenses.

Commissions

Commissions paid on the purchase of securities aren't de-

ductible, either as business or nonbusiness expenses. In-

stead, these fees must be added to the taxpayer's cost of

the securities. Commissions paid on the sale are deducti-

ble as business expenses only by dealers.

Campaign Expenses

You can't deduct campaign expenses of a candidate for

any office, even if the candidate is running for reelection to

the office. These include qualification and registration fees

for primary elections.

Legal fees. You can't deduct legal fees paid to defend

charges that arise from participation in a political cam-

paign.

Capital Expenses

You can't currently deduct amounts paid to buy property

that has a useful life substantially beyond the tax year or

amounts paid to increase the value or prolong the life of

property. If you use such property in your work, you may

be able to take a depreciation deduction. See Pub. 946. If

the property is a car used in your work, also see Pub. 463.

Check-Writing Fees on Personal Account

If you have a personal checking account, you can't deduct

fees charged by the bank for the privilege of writing

checks, even if the account pays interest.

Club Dues

Generally, you can't deduct the cost of membership in any

club organized for business, pleasure, recreation, or other

social purpose. This includes business, social, athletic,

luncheon, sporting, airline, hotel, golf, and country clubs.

You can't deduct dues paid to an organization if one of

its main purposes is to:

•

Conduct entertainment activities for members or their

guests, or

Page 6 Publication 529 (December 2020)

Page 7 of 18 Fileid: … ons/P529/202012/A/XML/Cycle07/source 11:09 - 4-Jan-2021

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

•

Provide members or their guests with access to enter-

tainment facilities.

Dues paid to airline, hotel, and luncheon clubs aren't

deductible.

Commuting Expenses

You can't deduct commuting expenses (the cost of trans-

portation between your home and your main or regular

place of work). If you fall into one of the qualified catego-

ries of employment discussed under Unreimbursed Em-

ployee Expenses, earlier, and you haul tools, instruments,

or other items in your car to and from work, you can de-

duct only the additional cost of hauling the items, such as

the rent on a trailer to carry the items.

Fines or Penalties

No deduction is allowed for fines and penalties paid to a

government or specified nongovernmental entity for the vi-

olation of any law except in the following situations.

•

Certain amounts that constitute restitution.

•

Certain amounts paid to come into compliance with

the law.

•

Amounts paid or incurred as the result of certain court

orders in which no government or specified nongo-

vernmental agency is a party.

•

Amounts paid or incurred for taxes due.

Nondeductible amounts include an amount paid in set-

tlement of your actual or potential liability for a fine or pen-

alty (civil or criminal). Fines or penalties include amounts

paid such as parking tickets, tax penalties, and penalties

deducted from teachers' paychecks after an illegal strike.

No deduction is allowed for the restitution amount or

amount paid to come into compliance with the law unless

the amounts are specifically identified in the settlement

agreement or court order. Also, any amount paid or incur-

red as reimbursement to the government for the costs of

any investigation or litigation are nondeductible.

Health Spa Expenses

You can't deduct health spa expenses, even if there is a

job requirement to stay in excellent physical condition,

such as might be required of a law enforcement officer.

Home Security System

You can't deduct the cost of a home security system as a

miscellaneous deduction. However, you may be able to

claim a deduction for a home security system as a busi-

ness expense if you have a home office. See Home Office

under Expenses You Can Deduct, later, and Pub. 587.

Investment-Related Seminars

You can't deduct any expenses for attending a conven-

tion, seminar, or similar meeting for investment purposes.

Life Insurance Premiums

You can't deduct premiums you pay on your life insur-

ance. You may be able to deduct, as alimony, premiums

you pay on life insurance policies assigned to your former

spouse. See Pub. 504, Divorced or Separated Individuals,

for information on alimony.

Lobbying Expenses

You generally can't deduct amounts paid or incurred for

lobbying expenses. These include expenses to:

1. Influence legislation;

2. Participate, or intervene, in any political campaign for,

or against, any candidate for public office;

3. Attempt to influence the general public, or segments

of the public, about elections, legislative matters, or

referendums; or

4. Communicate directly with covered executive branch

officials in any attempt to influence the official actions

or positions of those officials.

Lobbying expenses also include any amounts paid or

incurred for research, preparation, planning, or coordina-

tion of any of these activities.

Covered executive branch official. A covered execu-

tive branch official, for the purpose of (4) above, is any of

the following officials.

•

The President.

•

The Vice President.

•

Any officer or employee of the White House Office of

the Executive Office of the President, and the two

most senior level officers of each of the other agen-

cies in the Executive Office.

•

Any individual serving in a position in Level I of the Ex-

ecutive Schedule under section 5312 of title 5, United

States Code, any other individual designated by the

President as having Cabinet-level status, and any im-

mediate deputy of one of these individuals.

Dues used for lobbying. If a tax-exempt organization

notifies you that part of the dues or other amounts you pay

to the organization are used to pay nondeductible lobby-

ing expenses, you can't deduct that part.

Exceptions. You can deduct certain lobbying expenses

if they are ordinary and necessary expenses of carrying

on your trade or business.

•

You can deduct in-house expenses for influencing

legislation or communicating directly with a covered

executive branch official if the expenses for the tax

Publication 529 (December 2020) Page 7

Page 8 of 18 Fileid: … ons/P529/202012/A/XML/Cycle07/source 11:09 - 4-Jan-2021

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

year aren't more than $2,000 (not counting overhead

expenses).

•

If you are a professional lobbyist, you can deduct the

expenses you incur in the trade or business of lobby-

ing on behalf of another person. Payments by the

other person to you for lobbying activities can't be de-

ducted.

Lost or Mislaid Cash or Property

You can't deduct a loss based on the mere disappearance

of money or property. However, an accidental loss or dis-

appearance of property can qualify as a casualty if it re-

sults from an identifiable event that is sudden, unexpec-

ted, or unusual. See Pub. 547.

Lunches With Co-Workers

You can't deduct the expenses of lunches with co-work-

ers, except while traveling away from home on business.

See Pub. 463 for information on deductible expenses

while traveling away from home.

Meals While Working Late

You can't deduct the cost of meals while working late.

However, you may be able to claim a deduction for 50% of

the cost of the meals if you are traveling away from home.

See Pub. 463 for information on deductible expenses

while traveling away from home.

Personal Legal Expenses

You can't deduct personal legal expenses such as those

for the following.

•

Custody of children.

•

Breach of promise to marry suit.

•

Civil or criminal charges resulting from a personal re-

lationship.

•

Damages for personal injury (except certain whistle-

blower claims and unlawful discrimination claims). For

more information about unlawful discrimination claims,

see Expenses You Can’t Deduct, earlier.

•

Preparation of a title (or defense or perfection of a ti-

tle).

•

Preparation of a will.

•

Property claims or property settlement in a divorce.

You can't deduct these expenses even if a result of the

legal proceeding is the loss of income-producing property.

Political Contributions

You can't deduct contributions made to a political candi-

date, a campaign committee, or a newsletter fund. Adver-

tisements in convention bulletins and admissions to din-

ners or programs that benefit a political party or political

candidate aren't deductible.

Professional Accreditation Fees

You can't deduct professional accreditation fees such as

the following.

•

Accounting certificate fees paid for the initial right to

practice accounting.

•

Bar exam fees and incidental expenses in securing in-

itial admission to the bar.

•

Medical and dental license fees paid to get initial li-

censing.

Professional Reputation

You can't deduct expenses of radio and TV appearances

to increase your personal prestige or establish your pro-

fessional reputation.

Relief Fund Contributions

You can't deduct contributions paid to a private plan that

pays benefits to any covered employee who can't work

because of any injury or illness not related to the job.

Residential Telephone Service

You can't deduct any charge (including taxes) for basic lo-

cal telephone service for the first telephone line to your

residence, even if it is used in a trade or business.

Stockholders' Meetings

You can't deduct transportation and other expenses you

pay to attend stockholders' meetings of companies in

which you own stock but have no other interest. You can't

deduct these expenses even if you are attending the

meeting to get information that would be useful in making

further investments.

Tax-Exempt Income Expenses

You can't deduct expenses to produce tax-exempt in-

come. You can't deduct interest on a debt incurred or con-

tinued to buy or carry tax-exempt securities.

If you have expenses to produce both taxable and

tax-exempt income, but you can't identify the expenses

that produce each type of income, you must divide the ex-

penses based on the amount of each type of income to

determine the amount that you can deduct.

Travel Expenses for Another Individual

You generally can't deduct travel expenses you pay or in-

cur for a spouse, dependent, or other individual who ac-

companies you (or your employee) on personal or busi-

ness travel unless the spouse, dependent, or other

individual is an employee of the taxpayer, the travel is for

a bona fide business purpose, and such expenses would

otherwise be deductible by the spouse, dependent, or

Page 8 Publication 529 (December 2020)

Page 9 of 18 Fileid: … ons/P529/202012/A/XML/Cycle07/source 11:09 - 4-Jan-2021

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

other individual. See Pub. 463 for more information on de-

ductible travel expenses.

Voluntary Unemployment Benefit Fund

Contributions

You can't deduct voluntary unemployment benefit fund

contributions you make to a union fund or a private fund.

However, you can deduct contributions as taxes if state

law requires you to make them to a state unemployment

fund that covers you for the loss of wages from unemploy-

ment caused by business conditions.

Wristwatches

You can't deduct the cost of a wristwatch, even if there is

a job requirement that you know the correct time to prop-

erly perform your duties.

Expenses You Can Deduct

You can deduct the items listed below as itemized deduc-

tions. Report these items on your Schedule A (Form

1040), or your Schedule A (Form 1040-NR).

List of Deductions

•

Amortizable premium on taxable bonds.

•

Casualty and theft losses from income-producing

property.

•

Excess deductions (including administrative expen-

ses) allowed a beneficiary on termination of an estate

or trust.

•

Federal estate tax on income in respect of a dece-

dent.

•

Fines or penalties.

•

Gambling losses up to the amount of gambling win-

nings.

•

Impairment-related work expenses of persons with

disabilities.

•

Losses from Ponzi-type investment schemes.

•

Repayments of more than $3,000 under a claim of

right.

•

Unlawful discrimination claims.

•

Unrecovered investment in an annuity.

•

An ordinary loss attributable to a contingent payment

debt instrument or an inflation-indexed debt instru-

ment (for example, a Treasury Inflation-Protected Se-

curity).

Amortizable Premium on Taxable Bonds

In general, if the amount you pay for a bond is greater than

its stated principal amount, the excess is bond premium.

You can elect to amortize the premium on taxable bonds.

The amortization of the premium is generally an offset to

interest income on the bond rather than a separate deduc-

tion item.

Pre-1998 election to amortize bond premium. Gener-

ally, if you first elected to amortize bond premium before

1998, the above treatment of the premium doesn't apply

to bonds you acquired before 1988.

Bonds acquired after October 22, 1986, and before

1988. The amortization of the premium on these bonds is

investment interest expense subject to the investment in-

terest limit, unless you chose to treat it as an offset to in-

terest income on the bond.

Bonds acquired before October 23, 1986. The am-

ortization of the premium on these bonds is deducted as

an itemized deduction on your Schedule A (Form 1040).

Deduction for excess premium. On certain bonds

(such as bonds that pay a variable rate of interest or that

provide for an interest-free period), the amount of bond

premium allocable to a period may exceed the amount of

stated interest allocable to the period. If this occurs, treat

the excess as an itemized deduction on your Schedule A

(Form 1040). However, the amount deductible is limited to

the amount by which your total interest inclusions on the

bond in prior periods exceed the total amount you treated

as a bond premium deduction on the bond in prior peri-

ods.

If any of the excess bond premium can't be deducted

because of the limit, this amount is carried forward to the

next period and is treated as bond premium allocable to

that period. If there is a bond premium carryforward as of

the end of the accrual period in which the bond is sold, re-

tired, or otherwise disposed of, treat the carryforward as

an itemized deduction on your Schedule A (Form 1040).

Pre-1998 choice to amortize bond premium. If

you made the choice to amortize the premium on

taxable bonds before 1998, you can deduct the

bond premium amortization that is more than your interest

income only for bonds acquired during 1998 and later

years.

More information. For more information on bond pre-

mium, see Bond Premium Amortization in chapter 3 of

Pub. 550.

Casualty and Theft Losses of

Income-Producing Property

You can deduct a casualty or theft loss as an itemized de-

duction on your Schedule A (Form 1040), if the damaged

or stolen property was income-producing property (prop-

erty held for investment, such as stocks, notes, bonds,

gold, silver, vacant lots, and works of art). First report the

loss on Form 4684. You may also have to include the loss

on Form 4797, Sales of Business Property, if you are oth-

erwise required to file that form. To figure your deduction,

add all casualty or theft losses from this type of property

included on Form 4684, or Form 4797. For more informa-

tion on casualty and theft losses, see Pub. 547.

CAUTION

!

Publication 529 (December 2020) Page 9

Page 10 of 18 Fileid: … ons/P529/202012/A/XML/Cycle07/source 11:09 - 4-Jan-2021

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

Excess Deductions of an Estate or Trust

Generally, if an estate or trust has an excess deduction re-

sulting from total deductions being greater than its gross

income, in the estate’s or trust's last tax year, a beneficiary

can deduct the excess deductions, depending on its char-

acter. The excess deductions retain their character as an

adjustment to arrive at adjusted gross income on Sched-

ule 1 (Form 1040), as a non-miscellaneous itemized de-

duction reported on Schedule A (Form 1040), or as a mis-

cellaneous itemized deduction. For more information on

excess deductions of an estate or trust, see the Instruc-

tions for Schedule K-1 (Form 1041) for a Beneficiary Filing

Form 1040 or 1040-SR.

Federal Estate Tax on Income in Respect of

a Decedent

You can deduct the federal estate tax attributable to in-

come in respect of a decedent that you as a beneficiary

include in your gross income. Income in respect of the de-

cedent is gross income that the decedent would have re-

ceived had death not occurred and that wasn't properly in-

cludible in the decedent's final income tax return. See

Pub. 559 for information about figuring the amount of this

deduction.

Fines or Penalties

Generally, a deduction is allowed for fines and penalties

paid to a government or specified nongovernmental entity

for the violation of any law in the following situations.

•

Certain amounts that constitute restitution.

•

Certain amounts paid to come into compliance with

the law.

•

Amounts paid or incurred as the result of certain court

orders in which no government or specified nongo-

vernmental agency is a party.

•

Amounts paid or incurred for taxes due.

Nondeductible amounts include an amount paid in set-

tlement of your actual or potential liability for a fine or pen-

alty (civil or criminal). Fines or penalties include amounts

paid such as parking tickets, tax penalties, and penalties

deducted from teachers' paychecks after an illegal strike.

No deduction is allowed for the restitution amount or

amount paid to come into compliance with the law unless

the amounts are specifically identified in the settlement

agreement or court order. Also, any amount paid or incur-

red as reimbursement to the government for the costs of

any investigation or litigation are nondeductible.

Gambling Losses Up to the Amount of

Gambling Winnings

You must report the full amount of your gambling winnings

for the year on your Schedule 1 (Form 1040). You deduct

your gambling losses for the year on your Schedule A

(Form 1040). Gambling losses include the actual cost of

wagers plus expenses incurred in connection with the

conduct of the gambling activity, such as travel to and

from a casino. You can't deduct gambling losses that are

more than your winnings. Generally, nonresident aliens

can't deduct gambling losses on your Schedule A (Form

1040-NR).

You can't reduce your gambling winnings by your

gambling losses and report the difference. You

must report the full amount of your winnings as in-

come and claim your losses (up to the amount of win-

nings) as an itemized deduction. Therefore, your records

should show your winnings separately from your losses.

Diary of winnings and losses. You must keep

an accurate diary or similar record of your losses

and winnings.

Your diary should contain at least the following informa-

tion.

•

The date and type of your specific wager or wagering

activity.

•

The name and address or location of the gambling es-

tablishment.

•

The names of other persons present with you at the

gambling establishment.

•

The amount(s) you won or lost.

Proof of winnings and losses. In addition to your diary,

you should also have other documentation. You can gen-

erally prove your winnings and losses through Form

W-2G, Certain Gambling Winnings; Form 5754, State-

ment by Person(s) Receiving Gambling Winnings; wager-

ing tickets; canceled checks; substitute checks; credit re-

cords; bank withdrawals; and statements of actual

winnings or payment slips provided to you by the gam-

bling establishment.

For specific wagering transactions, you can use the fol-

lowing items to support your winnings and losses.

These recordkeeping suggestions are intended

as general guidelines to help you establish your

winnings and losses. They aren't all-inclusive.

Your tax liability depends on your particular facts and cir-

cumstances.

Keno. Copies of the keno tickets you purchased that

were validated by the gambling establishment, copies of

your casino credit records, and copies of your casino

check-cashing records.

Slot machines. A record of the machine number and

all winnings by date and time the machine was played.

Table games (twenty-one (blackjack), craps,

poker, baccarat, roulette, wheel of fortune, etc.). The

number of the table at which you were playing. Casino

credit card data indicating whether the credit was issued

in the pit or at the cashier's cage.

Bingo. A record of the number of games played, cost

of tickets purchased, and amounts collected on winning

CAUTION

!

RECORDS

CAUTION

!

Page 10 Publication 529 (December 2020)

Page 11 of 18 Fileid: … ons/P529/202012/A/XML/Cycle07/source 11:09 - 4-Jan-2021

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

tickets. Supplemental records include any receipts from

the casino, parlor, etc.

Racing (horse, harness, dog, etc.). A record of the

races, amounts of wagers, amounts collected on winning

tickets, and amounts lost on losing tickets. Supplemental

records include unredeemed tickets and payment records

from the racetrack.

Lotteries. A record of ticket purchases, dates, win-

nings, and losses. Supplemental records include unre-

deemed tickets, payment slips, and winnings statements.

Home Office

If you use a part of your home regularly and exclusively to

conduct business, you may be able to deduct a part of the

operating expenses and depreciation of your home.

You can claim this deduction for the business use of a

part of your home only if you use that part of your home

regularly and exclusively:

•

As your principal place of business for any trade or

business;

•

As a place to meet or deal with your patients, clients,

or customers in the normal course of your trade or

business; or

•

In the case of a separate structure not attached to

your home, in connection with your trade or business.

Principal place of business. If you have more than one

place of business, the business part of your home is your

principal place of business if:

•

You use it regularly and exclusively for administrative

or management activities of your trade or business,

and

•

You have no other fixed location where you conduct

substantial administrative or management activities of

your trade or business.

Otherwise, the location of your principal place of busi-

ness generally depends on the relative importance of the

activities performed at each location and the time spent at

each location.

You should keep records that will give the infor-

mation needed to figure the deduction according

to these rules. Also keep canceled checks, sub-

stitute checks, or account statements and receipts of the

expenses paid to prove the deductions you claim.

More information. See Pub. 587 for more detailed infor-

mation and a worksheet for figuring the deduction.

Losses From Ponzi-Type Investment

Schemes

These losses are deductible as theft losses of in-

come-producing property on your tax return for the year

the loss was discovered. You figure the deductible loss in

Section B of Form 4684. See the Form 4684 instructions

RECORDS

and Pub. 547, Casualties, Disasters, and Thefts, for more

information.

Repayments Under Claim of Right

If you had to repay more than $3,000 that you included in

your income in an earlier year because at the time you

thought you had an unrestricted right to it, you may be

able to deduct the amount you repaid, or take a credit

against your tax. See Repayments in Pub. 525 for more

information.

Unlawful Discrimination Claims

You may be able to deduct, as an adjustment to income

on your Schedule 1 (Form 1040), attorney fees and court

costs for actions settled or decided after October 22,

2004, involving a claim of unlawful discrimination, a claim

against the U.S. Government, or a claim made under sec-

tion 1862(b)(3)(A) of the Social Security Act. However, the

amount you can deduct on your Schedule 1 (Form 1040),

is limited to the amount of the judgment or settlement you

are including in income for the tax year. See Pub. 525 for

more information.

Unrecovered Investment in Annuity

A retiree who contributed to the cost of an annuity can ex-

clude from income a part of each payment received as a

tax-free return of the retiree's investment. If the retiree

dies before the entire investment is recovered tax free,

any unrecovered investment can be deducted on the retir-

ee's final income tax return. See Pub. 575, Pension and

Annuity Income, for more information about the tax treat-

ment of pensions and annuities.

How To Report

Claim most deductions as an itemized deduction on your

Schedule A (Form 1040), or Schedule A (Form 1040-NR).

However, see Schedule 1 (Form 1040), later.

Reporting employee business expenses. As descri-

bed earlier in Unreimbursed Employee Expenses, there

are four categories of employees who can claim deduc-

tions for unreimbursed employee expenses.

Employees in the following categories can claim their

unreimbursed employee expenses.

•

Armed Forces reservists.

•

Qualified performing artists.

•

Fee-basis state or local government officials.

•

Employees with impairment-related work expenses.

Generally, nonresident aliens who fall into one of

the qualified categories of employment are al-

lowed deductions to the extent they are directly

related to income which is effectively connected with the

conduct of a trade or business within the United States.

CAUTION

!

Publication 529 (December 2020) Page 11

Page 12 of 18 Fileid: … ons/P529/202012/A/XML/Cycle07/source 11:09 - 4-Jan-2021

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

Form 2106. If you have deductible employee business

expenses, you must usually file Form 2106.

You must file Form 2106 if any of the following applies

to you.

1. You are a qualified performing artist claiming perform-

ing-artist-related expenses.

2. You are a fee-basis state or local government official

claiming expenses in performing that job.

3. You are an individual with a disability and are claiming

impairment-related work expenses. See Employees

with impairment-related work expenses, later.

4. You have travel expenses as a member of the Armed

Forces reserves that you can deduct as an adjust-

ment to gross income.

5. You are claiming job-related vehicle, travel, transpor-

tation, or non-entertainment meal expenses. See the

Instructions for Form 2106 for more information.

Depreciation. Use Form 4562, to claim the depreciation

deduction for a computer you placed in service after 2018.

Complete Form 4562, if you are claiming a section 179

deduction.

Don't use Form 4562 to claim the depreciation deduc-

tion for a computer you placed in service before 2019 and

used only in your home office, unless you are otherwise

required to file Form 4562. Instead, report the deprecia-

tion directly on the appropriate form.

Employees with impairment-related work expenses.

Most of the categories of employees who are able to claim

deductions for unreimbursed employees report these de-

ductions as an adjustment to income on Schedule 1

(Form 1040), discussed next. However, employees with

impairment-related work expenses on Form 2106 report

these expenses on Schedule A (Form 1040).

Enter impairment-related work expenses on Form

2106. Enter on your Schedule A (Form 1040); or your

Schedule A (Form 1040-NR), that part of the amount on

Form 2106, that is related to your impairment. Those em-

ployment-related expenses not related to your impairment

are a miscellaneous itemized deduction and are no longer

deductible.

If you are self-employed, enter your impairment-related

work expenses on the appropriate Form (Schedule C, E,

or F) used to report your business income and expenses.

Example. You are blind. You must use a reader to do

your work. You use the reader both during your regular

working hours at your place of work and outside your reg-

ular working hours away from your place of work. The

reader's services are only for your work. You can deduct

your expenses for the reader as impairment-related work

expenses.

Schedule 1 (Form 1040)

Most deductible employee business expenses on Form

2106 are reported as an adjustment to income on your

Schedule 1 (Form 1040). However, certain other expen-

ses are deducted on Schedule A (Form 1040).

Educator expenses. Certain qualified expenses of eligi-

ble educators can be deducted on your Schedule 1 (Form

1040).

Unlawful discrimination claims. You can deduct cer-

tain attorney fees and court costs for unlawful discrimina-

tion claims, described earlier, on your Schedule 1 (Form

1040).

Example

Debra Smith is an army reservist stationed 110 miles from

her home. She makes this trip once each month. In addi-

tion to her travel expenses, she pays for her own uniforms

and for the cost of cleaning those uniforms.

In addition to her employee business expenses as an

army reservist, she has gambling losses from her trips to

the casino and race track. She has gambling winnings of

$5,400 and gambling losses of $5,700.

Debra completes Form 2106. She enters her transpor-

tation expenses of $500 as a reservist and she enters the

amount of her expenses for the purchase of uniforms and

their cleaning, $250. She then completes the form, enter-

ing the $750 as her total expenses. Only the transporta-

tion expenses for travel as a reservist are deductible as an

adjustment on her Schedule 1 (Form 1040). The $250 is a

miscellaneous itemized deduction and is not deductible.

Debra claims her gambling losses that don’t exceed

her gambling winnings as an itemized deduction. Debra

enters her allowable loss ($5,400) on her Schedule A

(Form 1040).

How To Get Tax Help

If you have questions about a tax issue, need help prepar-

ing your tax return, or want to download free publications,

forms, or instructions, go to IRS.gov and find resources

that can help you right away.

Preparing and filing your tax return. After receiving all

your wage and earnings statements (Form W-2, W-2G,

1099-R, 1099-MISC, 1099-NEC, etc.); unemployment

compensation statements (by mail or in a digital format) or

other government payment statements (Form 1099-G);

and interest, dividend, and retirement statements from

banks and investment firms (Forms 1099), you have sev-

eral options to choose from to prepare and file your tax re-

turn. You can prepare the tax return yourself, see if you

qualify for free tax preparation, or hire a tax professional to

prepare your return.

Free options for tax preparation. Go to IRS.gov to see

your options for preparing and filing your return online or

Page 12 Publication 529 (December 2020)

Page 13 of 18 Fileid: … ons/P529/202012/A/XML/Cycle07/source 11:09 - 4-Jan-2021

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

in your local community, if you qualify, which include the

following.

•

Free File. This program lets you prepare and file your

federal individual income tax return for free using

brand-name tax-preparation-and-filing software or

Free File fillable forms. However, state tax preparation

may not be available through Free File. Go to IRS.gov/

FreeFile to see if you qualify for free online federal tax

preparation, e-filing, and direct deposit or payment op-

tions.

•

VITA. The Volunteer Income Tax Assistance (VITA)

program offers free tax help to people with

low-to-moderate incomes, persons with disabilities,

and limited-English-speaking taxpayers who need

help preparing their own tax returns. Go to IRS.gov/

VITA, download the free IRS2Go app, or call

800-906-9887 for information on free tax return prepa-

ration.

•

TCE. The Tax Counseling for the Elderly (TCE) pro-

gram offers free tax help for all taxpayers, particularly

those who are 60 years of age and older. TCE volun-

teers specialize in answering questions about pen-

sions and retirement-related issues unique to seniors.

Go to IRS.gov/TCE, download the free IRS2Go app,

or call 888-227-7669 for information on free tax return

preparation.

•

MilTax. Members of the U.S. Armed Forces and

qualified veterans may use MilTax, a free tax service

offered by the Department of Defense through Military

OneSource.

Also, the IRS offers Free Fillable Forms, which can

be completed online and then filed electronically re-

gardless of income.

Using online tools to help prepare your return. Go to

IRS.gov/Tools for the following.

•

The Earned Income Tax Credit Assistant (IRS.gov/

EITCAssistant) determines if you’re eligible for the

earned income credit (EIC).

•

The Online EIN Application (IRS.gov/EIN) helps you

get an employer identification number (EIN).

•

The Tax Withholding Estimator (IRS.gov/W4app)

makes it easier for everyone to pay the correct amount

of tax during the year. The tool is a convenient, online

way to check and tailor your withholding. It’s more

user-friendly for taxpayers, including retirees and

self-employed individuals. The features include the

following.

–

Easy to understand language.

–

The ability to switch between screens, correct pre-

vious entries, and skip screens that don’t apply.

–

Tips and links to help you determine if you qualify

for tax credits and deductions.

–

A progress tracker.

–

A self-employment tax feature.

–

Automatic calculation of taxable social security ben-

efits.

•

The First Time Homebuyer Credit Account Look-up

(IRS.gov/HomeBuyer) tool provides information on

your repayments and account balance.

•

The Sales Tax Deduction Calculator (IRS.gov/

SalesTax) figures the amount you can claim if you

itemize deductions on Schedule A (Form 1040).

Getting answers to your tax questions. On

IRS.gov, you can get up-to-date information on

current events and changes in tax law.

•

IRS.gov/Help: A variety of tools to help you get an-

swers to some of the most common tax questions.

•

IRS.gov/ITA: The Interactive Tax Assistant, a tool that

will ask you questions on a number of tax law topics

and provide answers.

•

IRS.gov/Forms: Find forms, instructions, and publica-

tions. You will find details on 2020 tax changes and

hundreds of interactive links to help you find answers

to your questions.

•

You may also be able to access tax law information in

your electronic filing software.

Need someone to prepare your tax return? There are

various types of tax return preparers, including tax prepar-

ers, enrolled agents, certified public accountants (CPAs),

attorneys, and many others who don’t have professional

credentials. If you choose to have someone prepare your

tax return, choose that preparer wisely. A paid tax pre-

parer is:

•

Primarily responsible for the overall substantive accu-

racy of your return,

•

Required to sign the return, and

•

Required to include their preparer tax identification

number (PTIN).

Although the tax preparer always signs the return,

you're ultimately responsible for providing all the informa-

tion required for the preparer to accurately prepare your

return. Anyone paid to prepare tax returns for others

should have a thorough understanding of tax matters. For

more information on how to choose a tax preparer, go to

Tips for Choosing a Tax Preparer on IRS.gov.

Coronavirus. Go to IRS.gov/Coronavirus for links to in-

formation on the impact of the coronavirus, as well as tax

relief available for individuals and families, small and large

businesses, and tax-exempt organizations.

Tax reform. Tax reform legislation affects individuals,

businesses, and tax-exempt and government entities. Go

to IRS.gov/TaxReform for information and updates on

how this legislation affects your taxes.

Employers can register to use Business Services On-

line. The Social Security Administration (SSA) offers on-

line service at SSA.gov/employer for fast, free, and secure

online W-2 filing options to CPAs, accountants, enrolled

Publication 529 (December 2020) Page 13

Page 14 of 18 Fileid: … ons/P529/202012/A/XML/Cycle07/source 11:09 - 4-Jan-2021

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

agents, and individuals who process Form W-2, Wage

and Tax Statement, and Form W-2c, Corrected Wage and

Tax Statement.

IRS social media. Go to IRS.gov/SocialMedia to see the

various social media tools the IRS uses to share the latest

information on tax changes, scam alerts, initiatives, prod-

ucts, and services. At the IRS, privacy and security are

paramount. We use these tools to share public informa-

tion with you. Don’t post your SSN or other confidential in-

formation on social media sites. Always protect your iden-

tity when using any social networking site.

The following IRS YouTube channels provide short, in-

formative videos on various tax-related topics in English,

Spanish, and ASL.

•

Youtube.com/irsvideos.

•

Youtube.com/irsvideosmultilingua.

•

Youtube.com/irsvideosASL.

Watching IRS videos. The IRS Video portal

(IRSVideos.gov) contains video and audio presentations

for individuals, small businesses, and tax professionals.

Online tax information in other languages. You can

find information on IRS.gov/MyLanguage if English isn’t

your native language.

Free interpreter service. Multilingual assistance, provi-

ded by the IRS, is available at Taxpayer Assistance Cen-

ters (TACs) and other IRS offices. Over-the-phone inter-

preter service is accessible in more than 350 languages.

Getting tax forms and publications. Go to IRS.gov/

Forms to view, download, or print all of the forms, instruc-

tions, and publications you may need. You can also down-

load and view popular tax publications and instructions

(including the Instructions for Forms 1040 and 1040-SR)

on mobile devices as an eBook at IRS.gov/eBooks. Or

you can go to IRS.gov/OrderForms to place an order.

Access your online account (individual taxpayers

only). Go to IRS.gov/Account to securely access infor-

mation about your federal tax account.

•

View the amount you owe, pay online, or set up an on-

line payment agreement.

•

Access your tax records online.

•

Review your payment history.

•

Go to IRS.gov/SecureAccess to review the required

identity authentication process.

Using direct deposit. The fastest way to receive a tax

refund is to file electronically and choose direct deposit,

which securely and electronically transfers your refund di-

rectly into your financial account. Direct deposit also

avoids the possibility that your check could be lost, stolen,

or returned undeliverable to the IRS. Eight in 10 taxpayers

use direct deposit to receive their refunds. The IRS issues

more than 90% of refunds in less than 21 days.

Getting a transcript of your return. The quickest way

to get a copy of your tax transcript is to go to IRS.gov/

Transcripts. Click on either “Get Transcript Online” or “Get

Transcript by Mail” to order a free copy of your transcript.

If you prefer, you can order your transcript by calling

800-908-9946.

Reporting and resolving your tax-related identity

theft issues.

•

Tax-related identity theft happens when someone

steals your personal information to commit tax fraud.

Your taxes can be affected if your SSN is used to file a

fraudulent return or to claim a refund or credit.

•

The IRS doesn’t initiate contact with taxpayers by

email, text messages, telephone calls, or social media

channels to request personal or financial information.

This includes requests for personal identification num-

bers (PINs), passwords, or similar information for

credit cards, banks, or other financial accounts.

•

Go to IRS.gov/IdentityTheft, the IRS Identity Theft

Central webpage, for information on identity theft and

data security protection for taxpayers, tax professio-

nals, and businesses. If your SSN has been lost or

stolen or you suspect you’re a victim of tax-related

identity theft, you can learn what steps you should

take.

•

Get an Identity Protection PIN (IP PIN). IP PINs are

six-digit numbers assigned to eligible taxpayers to

help prevent the misuse of their SSNs on fraudulent

federal income tax returns. When you have an IP PIN,

it prevents someone else from filing a tax return with

your SSN. To learn more, go to IRS.gov/IPPIN.

Checking on the status of your refund.

•

Go to IRS.gov/Refunds.

•

The IRS can’t issue refunds before mid-February 2021

for returns that claimed the EIC or the additional child

tax credit (ACTC). This applies to the entire refund,

not just the portion associated with these credits.

•

Download the official IRS2Go app to your mobile de-

vice to check your refund status.

•

Call the automated refund hotline at 800-829-1954.

Making a tax payment. The IRS uses the latest encryp-

tion technology to ensure your electronic payments are

safe and secure. You can make electronic payments on-

line, by phone, and from a mobile device using the

IRS2Go app. Paying electronically is quick, easy, and

faster than mailing in a check or money order. Go to

IRS.gov/Payments for information on how to make a pay-

ment using any of the following options.

•

IRS Direct Pay: Pay your individual tax bill or estima-

ted tax payment directly from your checking or sav-

ings account at no cost to you.

•

Debit or Credit Card: Choose an approved payment

processor to pay online, by phone, or by mobile de-

vice.

Page 14 Publication 529 (December 2020)

Page 15 of 18 Fileid: … ons/P529/202012/A/XML/Cycle07/source 11:09 - 4-Jan-2021

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

•

Electronic Funds Withdrawal: Offered only when filing

your federal taxes using tax return preparation soft-

ware or through a tax professional.

•

Electronic Federal Tax Payment System: Best option

for businesses. Enrollment is required.

•

Check or Money Order: Mail your payment to the ad-

dress listed on the notice or instructions.

•

Cash: You may be able to pay your taxes with cash at

a participating retail store.

•

Same-Day Wire: You may be able to do same-day

wire from your financial institution. Contact your finan-

cial institution for availability, cost, and cut-off times.

What if I can’t pay now? Go to IRS.gov/Payments for

more information about your options.

•

Apply for an online payment agreement (IRS.gov/

OPA) to meet your tax obligation in monthly install-

ments if you can’t pay your taxes in full today. Once

you complete the online process, you will receive im-

mediate notification of whether your agreement has

been approved.

•

Use the Offer in Compromise Pre-Qualifier to see if

you can settle your tax debt for less than the full

amount you owe. For more information on the Offer in

Compromise program, go to IRS.gov/OIC.

Filing an amended return. You can now file Form

1040-X electronically with tax filing software to amend

2019 Forms 1040 and 1040-SR. To do so, you must have

e-filed your original 2019 return. Amended returns for all

prior years must be mailed. See Tips for taxpayers who

need to file an amended tax return and go to IRS.gov/

Form1040X for information and updates.

Checking the status of your amended return. Go to

IRS.gov/WMAR to track the status of Form 1040-X amen-

ded returns. Please note that it can take up to 3 weeks

from the date you filed your amended return for it to show

up in our system, and processing it can take up to 16

weeks.

Understanding an IRS notice or letter you’ve re-

ceived. Go to IRS.gov/Notices to find additional informa-

tion about responding to an IRS notice or letter.

Contacting your local IRS office. Keep in mind, many

questions can be answered on IRS.gov without visiting an

IRS Taxpayer Assistance Center (TAC). Go to IRS.gov/

LetUsHelp for the topics people ask about most. If you still

need help, IRS TACs provide tax help when a tax issue

can’t be handled online or by phone. All TACs now pro-

vide service by appointment, so you’ll know in advance

that you can get the service you need without long wait

times. Before you visit, go to IRS.gov/TACLocator to find

the nearest TAC and to check hours, available services,

and appointment options. Or, on the IRS2Go app, under

the Stay Connected tab, choose the Contact Us option

and click on “Local Offices.”

The Taxpayer Advocate Service (TAS)

Is Here To Help You

What Is TAS?

TAS is an independent organization within the IRS that

helps taxpayers and protects taxpayer rights. Their job is

to ensure that every taxpayer is treated fairly and that you

know and understand your rights under the Taxpayer Bill

of Rights.

How Can You Learn About Your Taxpayer

Rights?

The Taxpayer Bill of Rights describes 10 basic rights that

all taxpayers have when dealing with the IRS. Go to

TaxpayerAdvocate.IRS.gov to help you understand what

these rights mean to you and how they apply. These are

your rights. Know them. Use them.

What Can TAS Do For You?

TAS can help you resolve problems that you can’t resolve

with the IRS. And their service is free. If you qualify for

their assistance, you will be assigned to one advocate

who will work with you throughout the process and will do

everything possible to resolve your issue. TAS can help

you if:

•

Your problem is causing financial difficulty for you,

your family, or your business;

•

You face (or your business is facing) an immediate

threat of adverse action; or

•

You’ve tried repeatedly to contact the IRS but no one

has responded, or the IRS hasn’t responded by the