Underwriting guide | 1

Personal Finance

Underwriting

Guide.

• First charge mortgages

• Second charge mortgages

• Consumer buy-to-let mortgages

• Regulated bridging

July 2023

Underwriting guide | 2

Applicants

Address history 4

Age 4

Number of applicants 4

Marital status 4

First time buyers 4

Lending in retirement - Retired Applicants 4

Lending into retirement- Employed / Self Employed 4

Vulnerable applicants 5

Gifted deposits and gifted equity 5

Proof of residency 5

Non UK residents / passport holders 5

Know Your Customer Requirements (KYC) 5

Direct Debit Mandates 6

Income and Aordability

Universal Credit 12

Benefits for children 12

Maternity pay 12

Child maintenance 12

Industrial Injuries Benefit/War Pensions 13

Job Seekers Allowance/Income Support/Employment and Support Allowance 13

Unacceptable benefits 13

Assessing aordability 13

Automated aordability model 14

Plausibility 14

Income 14

Sustainability 14

Using benefit income 14

Credit profile and demerits

Demerit point 6

First Charge Applications 6

Second charge applications 6

Payday loans & Home Lender loans 7

Debt management, bankruptcy, IVAs, & CVAs 7

Debt consolidation 7

Previous mortgage or rental history 8

Income and Aordability

Income and aordability proof 8

Self-Employed income 9

Applicants who employ an Accountant 9

Applicants who who do not have an Accountant 10

Rental income for Consumer Buy-to-Let 10

Using additional rental income for residential mortgages & secured loans 11

Retired applicants 11

Temporary contract workers 12

Zero hours contracts 12

Unemployed applicants 12

Underwriting guide | 3

The loan

Disbursement of funds 15

Equitable Charges 15

Execution Only 15

Maximum loan amounts 15

Loan purpose 15

Right-to-buy 16

Shared ownership 16

Secured loans 16

Consumer buy-to-let 16

Regulated bridging 16

Interest only 16

Interest rollup 16

First charge mortgagees/lenders - secured loans

Acceptable first charge mortgagees/lenders 17

Unacceptable first charge mortgagees/lenders 17

Lending behind nonstandard first charge mortgages 17

Mortgage reference & redemption figure bypass scheme 17

Qualifying contracts 17

Repayment Strategies 18

Regulated bridging 18

Responsible Lending 18

Properties

Acceptable securities 19

Additional securities 19

Buildings Insurance 19

Property types 19

New builds 19

Shared ownerships 19

Ex-council properties 20

CBTL 20

Help to buy 20

Self-build properties and developments 20

Tenure 20

Valuations 20

Prepaid fees 21

Redemption Administration Fee 21

Title insurance & solicitors costs 21

Legal advice

Solicitors to Witness and Advise 22

Conveyancing Requirements 22

Solicitors acting 22

Fraud prevention

22

Underwriter referral

22

Contact us

23

Submitting an application to us

24

Underwriting guide | 4

Applicants

Address history

Minimum of 3 years address history is required for all applicants.

Age

The minimum applicant age is 18. For all residential mortgages and regulated

bridging applications, the loan term should end before the applicants 85th birthday.

Second charges the loan term should end before the applicants 80th birthday.

There is no maximum age restriction for consumer buy-to-let (CBTL) applicants where

rental income meets or exceeds the required interest coverage ratio. If you are using

Rental Income verified by an Estate or Letting Agent’s rental projection, 90% of the

rental income must meet or exceed the required interest coverage ratio.

Number of

applicants

The maximum number of applicants accepted on a case is 4.

Marital status

When an applicant is married, in a civil partnership, or in a couple living together

in excess of 12 months (whether on the title or not) the application must be in joint

names.

First time buyers

First time buyers are accepted on all products. They must have no declining unsecured

credit.

Lending in

retirement - Retired

Applicants

Retired applicants are accepted on all products. Where an aordability assessment is

required, aordability must be assessed based on pension income and expenditure at

the point of completion.

Lending into

retirement-

Employed / Self

Employed

For employed and self-employed applicants the Lending into Retirement Policy applies

if the term of the mortgage exceeds the applicant’s intended retirement age or the age

of 70; whichever is earliest.

We may lend beyond the applicant’s retirement age subject to the following:

If the applicant is greater than or equal to 10 years from the agreed retirement age

then:

• The applicants lending into retirement must be captured in My broker venue. It

must confirm how they plan to meet the repayments post retirement;

• Where pension income is intended to be used to meet payments post retirement

then the existence of a plausible pension provision must be evidenced by sustained

contribution into a pension by way of pay slips or current year’s pension statement.

If there is a concern over the level of pension payment being made then a full

illustration of projected benefits may be required.

Where an applicant is aged 56 years or older and the application takes the applicant

beyond their stated retirement age or where the applicant is within 10 years of the

agreed retirement age, we may proceed on a referral basis.

In addition to the above, a full assessment of aordability post retirement must be

completed based on:

• The expected income post retirement;

• Expenditure may be adjusted to reflect known changes in income such as maturity

of a first charge loan or other committed loan payments or a reduction in number of

dependents.

Please ensure that the Aordability Assessment Form, aordability assessment post

retirement form, lending into retirement declaration and any relevant proofs are sent

as part of the referral.

If the applicant is retired at the point of funding aordability must be assessed based

on pension income and expenditure at the point of completion.

Underwriting guide | 5

Applicants

Vulnerable customer

A Vulnerable customer is someone who, due to their personal circumstance is

especially susceptible to detriment. They are therefore at greater risk of experiencing

harm.

Should you have any reason to believe that an applicant is vulnerable for any reason,

perhaps they have declared they have a mental health issue, are recently bereaved or

they appear to have diculty in understanding the loan application process, then you

should take additional care to ensure that they understand the transaction and make

us aware if you have any concerns about them and their loan application.

You are required to declare this via our data capture fields on my broker venue.

Gifted deposits and

gifted equity

Gifted deposits are only accepted from the following close relatives of the applicant(s):

• Parent/Step-Parent/Parent-in-Law

• Sibling/Child/Step-Child/Son-in-Law/Daughter-in-Law

• Grandparent/Grandchild

• Aunt/Uncle

Gifted Deposit letters will be required on all applications prior to funding, these will

be obtained post oer. In addition to the signed letter, we need proof of identification

from the Donor to include proof of name and proof of current residence but this does

not need to be a certified copy.

Gifted equity is acceptable up to a max of 65%, equity being gifted must be from a close

relative (see gifted deposit) and where there is no declining credit.

Proof of residency

Required when an applicant does not pass EID.

For a full list of what we accept as proof of residency please see page 25 in the

Underwriting guide.

Non UK residents /

passport holders

All applicants must be UK residents, except for consumer buy-to-let applications.

• Any applicants who do not have a UK Passport are subject to underwriter referral.

• All applicants must be UK residents, hold permanent rights to reside, be paid in

pounds sterling and have a UK bank account.

Know Your Customer

Requirements (KYC)

Together has implemented procedures to protect itself and others from financial crime.

It is a requirement that brokers and lenders verify identification for every customer. As

part of that process we must take reasonable steps to establish that a customer is who

he/she claims to be by obtaining sucient evidence of identity.

In most cases Electronic Identification (EID) will satisfy our Know Your Customer

(KYC) requirements. The EID result must be a ‘pass’ and the applicant must be on

the voters roll, which will satisfy KYC for that applicant. In cases where full KYC

requirements are needed certified copies of documents will be acceptable from

Accredited and FCA Authorised brokers. We will also accept documents certified by the

applicant’s solicitor provided they are registered with the Law Society.

As a broker you must (if applicable):

Follow our KYC requirements by providing clearly certified documents from our

acceptable list of documents for proof of name and proof of residency.

For a full list of what we accept as proof of ID, please see page 25 in the Underwriting

guide.

Underwriting guide | 6

Applicants

Direct Debit

Mandates

In order for Together to remain compliant with Direct Debit scheme rules, we need

to ensure that all applications are submitted with a BACS compliant Direct Debit

mandate. As a reminder we wanted to make you aware of the following:

The mandatory information that must be completed in full by the customer is as

follows:

• Full name of the account holder.

• Correct Bank account number and sort code.

• Name and Address of the account holders bank.

• Reference number (My Broker Venue submission reference).

• Account holders preferred telephone number.

• All Signature(s) and date.

All direct debit mandates must be completed in full and produced via My Broker Venue

rather than using locally stored PDFs. This ensures you are always using the up to date

version. We do not accept photographs of this document.

Credit profile and demerits

Demerit point

Demerit points are defined as arrears, a CCJ or a default. For CCJs and default

definitions please see individual product cards. Any CCJs or defaults that require an

underwriter approval will count as a demerit.

Arrears demerit points are based on the highest number of months in arrears of any

secured lending in the last 12 months.

We do not accept regulated bridging applications where the applicant has any secured

arrears.

First Charge

Applications

For Purchases, Right-to-Buy & Shared Ownership applications, applicants must have

no declining unsecured credit in the last 6 months.

For Remortgages declining unsecured credit is accepted for downsizing and deeds

cases only where a plausible explanation is obtained and there is a clear benefit, bank

statements may be required.

Second charge

applications

The unsecured payment profile will be taken into account. Please refer the case if the

client’s unsecured credit profile is declining or if there have been issues with unsecured

payments in the past few months, plausible explanations and bank statements may be

required, a clear benefit to the loan must also be documented.

Underwriting guide | 7

Credit profile and demerits

Payday loans & Home

Lender loans

Applicants with more than one active payday loan will not be considered. The only

exception to this that may be considered is where an applicant is a home mover and

will be redeeming all credit from the sale proceeds of their existing property.

Applicants with one active payday loan will be considered however the payday loan

must be redeemed from our new mortgage (Remortgages, deed cases and secured

loans only).

Together will accept up to 3 settled payday loans in the last 12 months

Applicants with an existing payday loan and a declining credit profile will be

considered by referral only.

A plausible explanation is required from the applicant detailing why the payday loan(s)

were required.

Any applicants with Home Lender loans within the last 12 months will need to provide

a written explanation and will be subject to underwriter approval.

Debt management,

bankruptcy, IVAs, &

CVAs

Where an applicant has been discharged from a bankruptcy / IVA or DMP for a

minimum of 2 or more years, these can be considered on a referral basis, this is

applicable for all charges.

Debt consolidation

Clearing loans secured against the applicant’s home

Redemption figure(s) must be provided for any secured loans that are being repaid,

these must be addressed to Together or the broker. The lender must provide a full

undertaking to remove there charge upon receipt of cleared funds.

Clearing fixed term unsecured credit, CCJs and defaults

For any unsecured fixed term credit, default or CCJ being repaid from the loan (e.g.

unsecured loans, hire purchase agreements), up-to-date redemption statements

must be provided. These will need to be obtained and submitted with the full case at

underwriting.

We will make electronic payments directly to the creditors to repay these loans if the

creditor provides their bank details with the redemption statement, this must be on

company letter headed paper.

We will make a cheque payable to the creditor when bank details are not provided, to

send to the applicant to promptly forward to the creditor in order to redeem and close

the account.

Reference numbers must be un redacted.

Clearing revolving credit e.g. credit cards

For revolving credit items such as credit cards, store cards and mail orders:

• Provide a recent, full statement for each item of revolving credit being repaid,

including the creditor’s relevant bank details on company letter headed paper.

• Where full statements are provided we will pay the balance of the revolving credit

directly to the creditor by electronic payment.

Please note that up-to-date balances will be confirmed in the Binding Oer document

issued to the applicant(s). It will remain the applicants’ responsibility to meet any

additional expenditure or liability that has been incurred but is not included in the

figures stated in the Binding Oer.

For CBTL applications the balance required for debt consolidation will be paid to

directly the applicant.

Underwriting guide | 8

Credit profile and demerits

Ground rent and service charges

When the security is a leasehold property we will require confirmation in writing from

the freeholder/management company that all ground rent and/or service charges are

paid and up to date. Where there are arrears these will cleared from the advance and

we will require authority from the applicant(s) that they understand and authorise

them to be disbursed from the loan.

Any significant service charge or ground rent arrears will be considered when assessing

the customer’s aordability of the proposed loan, and where there are concerns the

loan may be rejected.

On right-to-buy applications we will also take into account any future costs and/or

ground rent/service charge that the applicant will be liable for within the aordability

calculation.

Where an application is an automated aordability pass, any leasehold or future

leasehold costs (ground rent or service charge) must be indicated on my broker venue.

Previous mortgage or

rental history

If the applicant has a mortgage we will require proof of the last 12 months payment

history.

For residential mortgage applications, if the applicant has been a private or public

sector tenant then we will require proof from the landlord that the last 12 rent

payments have been made.

Income and Aordability

Income and

aordability proof

Where an applicant(s) income can be verified through our system, payslips or evidence

of benefits may not be required. Where Universal credit is being used, we still require

last 3 statements. We do not accept housing element of universal credit.

ONS Expenditure is automatically calculated, where applications pass ONS there are

five additional area’s relating to possible costs which are not covered as part of the

automated assessment:

• Childcare costs / school fees

• Ground rent and service charges

• Care costs

• Child / spouse maintenance payment

• Other committed expenditure

Where bank statements are received please ensure to cross reference all regular

transactions / payments on the statements to the declared expenditures.

Eligibility for regulated bridging is based solely on the customer having a valid

repayment strategy (as per criteria) in place.

Where an applicant is employed by a family member, in addition to payslips, a letter

from the company accountant will be required or a bank statement which confirms the

income stated on the payslips.

We will require proof of income from the current employer in all cases where the

applicant is employed (except for regulated bridging and CBTL applications). This

can be in the form of payslips or our ‘Employer’s Confirmation Form’ if the required

amount of payslips cannot be provided. Please note when an applicant is paid in cash

or via cheque we will need an ‘Employer’s Confirmation Form’ in all cases (completed

by the employer).

Underwriting guide | 9

Income and Aordability

If the applicant receives payslips they should include year-to-date totals, be

computerised/printed and should confirm the applicant’s name.

• If the applicant is paid monthly/4-weekly/fortnightly we require three of the last five

payslips.

• If the applicant is paid weekly we require four payslips from the last six weekly

payslips.

• If the applicant does not receive payslips then an Employers Confirmation form must

be provided, which is available on MyBrokerVenue.

Only bonuses, commission and overtime paid on a monthly basis, showing on all

payslips and are a consistent amount may be used as income, it will also need to tally

with year to date figures to be acceptable.

Probationary period is ignored.

Where an applicant has a second job, we will accept 100% of this income subject to it

being plausible that it is sustainable for the term of the loan.

If the applicant has had a second job for less than 6 months, please refer.

There is no minimum time requirement with the current employer however the

applicant will need to have been in continuous employment for the last 12 months.

This doesn’t have to be in the same line of work. If an applicant has not been working,

and/or has been claiming unemployment benefit, this will not be classed as continuous

employment. If the applicant is starting their first job they must be in their current

position for a minimum of 6 months.

Self-Employed

income

The minimum trading period for self-employed applicants is 12 months.

Applicants will be considered self-employed if they are a:

• Sole Trader (including those who sub-contract on an individual or multiple basis)

• Partner who is currently in a Partnership or Limited Liabilities Partnership

• Shareholder in a limited company owning 20% or more of any shares issued

Applicants

who employ an

Accountant

If the applicant has an Accountant, we require a copy of the Accountant’s Certificate.

This must be completed by an Accountant who holds a current practicing certificate

and is a member of an accepted accounting body. For confirmation of the accepted

accounting bodies please see the current Accountant’s Certificate.

The net income figure used to complete the Aordability Assessment is the amount

shown on the certificate in the relevant box titled ‘Total Net Income’ divided by the

account period (normally 12 months) - this can be used providing the figure is less

than 6 months old.

Average Net Income is:

__________Net income figure__________

Divided by the relevant period e.g. 12 months

If the information is greater than 6 months old then the lesser of the amount detailed

on the Accountant’s Certificate or the projected earnings will be used.

If the applicant’s projected earnings are higher than the year-to-date figures we will

require a plausible reason for the increase in net income and confirmation that the

increase is sustainable.

Underwriting guide | 10

Income and Aordability

The Accountant should enter this information into the relevant section of the

Accountant’s Certificate.

Where an applicant has received SEISS or JRS grant, obtain an explanation and then

please refer.

Applicants who

do not have an

accountant

If the applicant doesn’t have an Accountant then we will accept the applicant’s last two

SA302s provided the latest SA302 is dated within the last 18 months. If we are using

internet printed SA302s we will also require both Tax Overviews to accompany these.

The net monthly income will be calculated from the last SA302 and the previous one

will be reviewed in relation to sustainability.

We will also accept the last two 100% Submitted Tax Calculations from HMRC along

with the matching Tax Overviews provided the latest Tax Calculation is dated within

the last 18 months. The net monthly income will be calculated from the latest Tax

Calculation and the previous one will be reviewed in relation to sustainability.

If an applicant is not evidencing their income via an accountant, we will also require

their latest three months business bank statements to be reviewed in relation to

sustainability, and will help support that the income levels from the latest SA302 are

still plausible.

The net monthly income from the SA302 will be calculated using the following

method:

Average Net Income is:

Income for tax purposes - (Income Tax + NI Contributions due for the year)

Divided by 12

If the applicant doesn’t have an Accountant, or is unable to provide two SA302s,

they will need to employ the services of an Accountant, who can then provide an

Accountant’s Certificate.

Rental income for

Consumer Buy-to-Let

For CBTL applications, proof of rental income is required in all cases. Rental income

must be verified via an Assured Shorthold Tenancy agreement (AST) or via an agent

assessed projection, the total rent received must be equivalent to a minimum of 125%

of the total secured lending repayments as detailed below.

We will be using the following Interest Coverage Ratios when assessing aordability on

consumer buy-to-let applications:

• Individual applicants that pay basic rate tax: 125%

• Individual applicants that pay higher rate tax: 145%

• Individual applicants that pay additional rate tax: 165%

Where rental income is verified by an Assured Shorthold Tenancy agreement (AST),

100% of the rental income must cover the required 125% / 145% / 165% of the total

secured lending repayments; where rental income has been verified by an Estate or

Letting Agent’s rental projection, 90% of the rental income must cover the required

125% / 145% / 165% of the total secured lending repayments.

In addition to obtaining proof of rental income, the total gross income of all applicants

must be entered into the total annual taxable income (including rental) field in the

CBTL aordability tab.

Underwriting guide | 11

Income and Aordability

Where the interest coverage is less than 165% you will need to provide proof of gross

income, using one of the following:

Employed applicants –most recent payslip or latest P60

Self-Employed applicants – Accountant’s certificate or letter from accountant

confirming income or latest SA302.

Retired applicants – most recent pension advice slip or pension statement.

Using additional

rental income for

residential mortgages

& secured loans

Where an applicant has a rental property which is jointly owned with another party

who is not associated with our application, please refer to an underwriter.

Where accountant certificate or SA302 is submitted as proof of self-employed income

and rental income is included, this can be considered. We need to ensure the rental

declared on any accountant certificate is a net figure. If we have verified the rental

figure is net of any costs, mortgage payment and tax liability then the buy to let

mortgage can be ignored.

Where an applicant has a background but to let and they are employed, if there is

no accountant certificate or SA302 as they have acquired the property less than 12

months ago, current signed assured shorthold tenancy agreement will be required. The

BTL mortgage payment will need to be captured in My Broker Venue and all applicable

fields completed.

Where rent is received from a family member, this cannot be considered for income

purposes.

Retired applicants

The net monthly income for the relevant income is calculated using the following

method:

Average Net Income is:

Income for tax purposes - Income Tax

Divided by the relevant period

Private pensions are accepted as income, with the following proof required:

• Annual pension - the last annual award statement or P60

• Monthly pension - two private pension payslips dated within the last three months

If the applicant doesn’t have the requirements above, the following are acceptable:

• Annual pension – bank statement entry showing the amount credited

• Monthly pension - two bank statement entries dated within the last 3 months which

shows the credit to their account

State Pension, Pension Credit, Disability Living Allowance, Child Tax Credit, Working

Tax Credit, Child Benefit, Widowed Parent’s Allowance, Carer’s Allowance, and

Attendance Allowance are also accepted as income, with the following proof required:

• Award statement for the current year, or

• Two bank statement entries dated within the last three months

Underwriting guide | 12

Income and Aordability

Temporary contract

workers

Applicants on a fixed term, long term, or renewable contract will be considered on

a referral basis. Evidence of their contract must be provided in conjunction with the

required relevant proof of income. Short term contracts are not acceptable. Seasonal

work is not acceptable.

Zero hours contracts

Applicants on zero hour contracts are accepted provided they have been in their

current employment for a minimum of 6 months. 6 months’ payslips are required as

proof of income if paid monthly. If paid weekly then 3 months’ payslips are required.

Applicants in a probationary period will not be accepted.

Unemployed

applicants

Incapacity Benefit and Employment and Support Allowance after 2008

Accepted, with the following proof required:

• Award letter dated within the last six months, or

• Two bank statements dated within the last 3 months, with confirmation that it will

continue to be awarded throughout the term of the loan

Universal Credit

Universal credit is replacing the following benefits:

• Jobseekers allowance

• Housing benefit

• Working tax credit

• Child tax credit

• Employment and support allowance

• Income support

We require a minimum of last 3 months full online payslips from DWP. We do not

accept housing element of universal credit, this must be excluded from income

calculations.

Benefits for Children

Accepted in the following circumstances:

• The income will not cease during the term of the loan, as the children may attain an

age during the term of the loan that makes them ineligible for the benefit

• The applicant provides a letter detailing a satisfactory and plausible explanation that

describes how they can sustain the payments once the benefit ceases

• Latest award letter (most recent year) or last 2 months bank statements confirming

amount received.

Maternity pay

Where an employed applicant is on maternity leave, we will use lowest maternity

pay the applicant receives (evidence required) or Statutory, where the applicant

is returning to work imminently we will need confirmation from the employer the

applicant is returning to work and confirmation if the applicants salary has changed.

Please also consider if the applicants expenditure is correct e.g. childcare costs.

Child maintenance

Accepted in the following circumstances:

• Arrangements must be made via the Child Support Agency (CSA) or by Court Order

• The terms of the arrangements must be assessed by the broker before submitting the

case to the lender

• In both arrangements the ages of the children must be established and the terms of

the CSA Agreement or Court Order reviewed to assess for future aordability as the

terms may vary

Underwriting guide | 13

Income and Aordability

A certified copy of the CSA Agreement or Court Order must be provided as proof of

income.

Average Net Income is:

_____Confirmed Income_____

Divided by the relevant period

Industrial Injuries

Benefit/War Pensions

Accepted, with the following proof required:

• Award letter dated within the last 6 months, or

• Two bank statements dated within the last 3 months

Job Seekers

Allowance/Income

Support/Employment

and Support

Allowance

Only accepted as income for the second or subsequent applicant where the first

applicant is working and is a joint owner of the security.

ESA is accepted for single applicants where they are in receipt of Personal

Independence Payment (PIP).

Unacceptable benefits

The following benefits are not accepted:

• Bereavement Allowance

• Bereavement Payments

• Health in Pregnancy

• Sure Start Maternity Grant

This list is not exhaustive – please refer any applications that have not been detailed

above as we may be able to accept them.

Lodger income not acceptable.

Assessing

aordability

An aordability assessment will be required for all residential mortgage and secured

loan applications. The aordability assessment required will dier depending on

the mortgage’s regulation. An aordability assessment is not required for regulated

bridging applications.

It is important that the broker and the lender assess an applicant’s aordability

thoroughly to ensure that they can aord the loan both now and in the known

future. To assist you in making this assessment, applications will be assessed using

an aordability assessment model which takes into account the applicant’s income,

expenditure and credit commitments.

The Aordability Assessment Calculator is completed on My Broker Venue and will

provide a Maximum Aordable Monthly Repayment (MAMR) that Together will accept

based on the information provided.

As well as assessing an applicant’s income and expenditure, there are three key

elements that need to be considered:

• Is the income or expenditure stated plausible?

• Is the loan payment aordable now?

• Is the loan payment sustainable for the full term of the loan?

The Aordability Assessment Calculator has been built to consider plausibility and

sustainability when determining the MAMR however there are some points that you

will need to verify and challenge with the applicant.

Underwriting guide | 14

Income and Aordability

Automated

aordability model

Our aordability calculator will now assess applicant’s income and expenditure against

our automated aordability model before requiring you to provide customer stated

expenditure. This is using the Oce of National Statistics data combined with the

household demographic and location. There are only two outcomes -

Automated Pass:

If the outcome of the assessment is pass, then there will be no further information

required from the applicant(s) and you will not have to provide line by line expenditure

items. If the applicant(s) are consolidating any items of credit from the advance they

will need to sign the “aordability assessment form”.

Automated Fail:

If the outcome of the assessment fails, you will need to ‘Opt-In’ to providing customer

stated expenditure. A full aordability assessment will be required and the customer

will be required to sign this form to confirm their expenditure. This will be assessed by

our underwriting team as part of our standard process.

You will not be able to move an application back to automated pass once you have

triggered customer stated expenditure.

Plausibility

All expenditure declared by the applicant(s) should be a realistic reflection of their

general spending. You should advise the applicant to use bills, invoices and receipts

to help them complete the aordability assessment. Where the expenditure appears

unrealistic or lower than we would expect, we will require a plausible explanation from

the applicant as to why their expenditure appears to be low for that particular item.

We reserve the right to contact an applicant to confirm their declared expenditure for

plausibility to enable the loan to proceed. Bank statements or previous bills/statements

may also be requested if the underwriting team deems this necessary to support low

declared expenditure.

Income

Income, in UK currency only, must be appraised to ensure that it appears to be relevant

to the occupation that has been stated by the applicant, particularly for self-employed

applicants. Employment and accountant verification calls may be required and may be

completed by the Underwriter.

Sustainability

It is essential that an applicant can aord the loan throughout the whole term. It is

therefore important that the income they have declared will be sustainable for the full

term of the loan, taking into account that the monthly cost of their debts may rise and

other household emergencies may happen during the term of the loan.

Using benefit income

Where the term of the proposed loan will extend beyond the period in which the

applicant will receive particular benefits (e.g. Child Tax Credits), the applicant should

provide a plausible explanation as to how the income will be replaced and advice of

any expenditures related to that benefit that will be no longer applicable.

The explanation will be assessed for sustainability and plausibility and in some cases

we may require proof.

Underwriting guide | 15

The loan

Disbursement of

funds

Funds are disbursed using next day BACS as standard unless the customer requests a

Telegraphic Transfer (TT). A TT fee is not charged.

Equitable Charges

Equitable charges are not accepted.

Execution Only

Execution only is accepted for the following reasons:

• High net worth

• Mortgage professional

• Business loans

Execution only is not accepted for right-to-buy, debt consolidation, or regulated

bridging applications.

Max term

See product plans

Max LTV

See product plans

Maximum loan

amounts

Purchases & remortgages

Maximum loan amount includes the net loan amount, lender acceptance fees and all

broker/intermediary/third party fees that are added to the loan.

Any fees that are prepaid by the applicant are not included in the maximum loan

amount.

Right-to-buy & shared ownership

Maximum loan amount includes the net loan amount only.

Lender acceptance fees, insurances, broker/intermediary/third party fees, and any fees

that are prepaid by the applicant are not included in the maximum loan amount.

Secured loans

Maximum loan amount includes the net loan amount, plus all broker/intermediary

fees that are added to the loan.

Lender acceptance fees, third party fees, and any fees that are prepaid by the applicant

are not included in the maximum loan amount.

Please note that applications where the secured loan amount is greater than the first

charge mortgage balance must be referred for underwriter approval.

Consumer buy-to-let

Maximum loan amount includes the net loan amount, lender acceptance fees, and all

broker/intermediary/third party fees that are added to the loan.

Any fees that are prepaid by the applicant are not included in the maximum loan

amount.

Regulated bridging

Maximum loan amount includes the net loan amount, rolled-up interest and all

broker/intermediary/third party fees that are added to the loan.

Any fees that are prepaid by the applicant are not included in the maximum loan

amount.

Loan purpose

Any legal purpose is accepted however this must be clearly detailed on the application/

enquiry form on day 1 as the purpose may aect the terms and conditions applied to

the loan. Should Together establish at any stage that the incorrect documentation has

been issued, we will request that the correct documentation be issued and the relevant

regulation be applied.

For regulated bridging applications consolidation of unsecured credit and

consolidation of CCJs and defaults is not accepted.

Underwriting guide | 16

The loan

We do not accept any level of consolidation where an application is a second charge

and is interest only.

Right-to-buy

LTVs are based on the OMV. Maximum LTV includes the net loan plus any broker/

intermediary fees; any fees that are prepaid by the applicant are not included in the

maximum LTV.

Shared ownership

LTVs are based on the OMV multiplied by the applicants’ share. Maximum LTV

includes the net loan only as long as gross loan is covered by Mortgagee Protection

Clause (MPC); any fees that are prepaid by the applicant are not included in the

maximum LTV.

Secured loans

LTVs are based on the OMV and the priority charge redemption figure and our

advance.

Maximum LTV includes the net loan only plus any broker/intermediary fees; any fees

that are prepaid by the applicant are not included in the maximum LTV.

Consumer buy-to-let

CBTL re-mortgage LTVs are based on the OMV.

CBTL second charge LTVs are based on the OMV, the priority charge redemption

figure–and our advance. Maximum LTV includes the net loan plus any broker/

intermediary fees; any fees that are prepaid by the applicant are not included in the

maximum LTV.

Regulated bridging LTVs are based on the open market value (OMV) or purchase price, whichever is

the lower.

Maximum LTV includes the net loan amount plus any broker/intermediary fees, plus

all rolled up interest. Any fees that are prepaid by the applicant are not included in the

maximum LTV.

Interest only

Interest only is available across selected products and is strictly subject to the

plausibility of the repayment strategy.

We do not accept any level of consolidation where an application is interest only and

the application is second charge.

Interest only explanation must be captured in My Broker Venue.

Interest rollup

All regulated bridging products are on an interest roll-up basis only. There are no

monthly repayments; interest is compounded on a monthly basis and the full balance

of the loan, including all rolled-up interest and any fees added to the loan, is payable

upon redemption.

Underwriting guide | 17

First charge mortgagees/lenders – secured loans

Acceptable first

charge mortgagees/

lenders

We will lend behind most high street banks and building societies, and will consider

secured loans behind most non-conforming lenders. Where applicants have an

existing mortgage with a non-conforming lender, they must be with same lender for a

minimum of 12 months.

Unacceptable first

charge mortgagees/

lenders

We will not lend behind the following lenders or associated companies. Please note this

list is not exhaustive and subject to change at any time:

If the lender is not referred to here, please refer to underwriter, copies of the mortgage

oer may be required.

We will not lend behind any fringe lenders and will not secure a third charge behind

other Lenders.

Lending behind non-

standard first charge

mortgages

We will consider lending behind fixed rate, daily interest, flexible, credit reserve,

open plan, and other “non-standard” mortgage types. In certain circumstances, first

charge lenders have an “obligation to make further advances” on the security. Before

we are able to complete the secured loan we require a signed deed of postponement

or confirmation of what the maximum liabilities are and that it is capped at this level.

(This is the Maximum Liabilities Confirmation). The Loan to Value will be based on the

Maximum Liability not the mortgage balance and may be reduced. Where the security

is in Scotland and the mortgage lender is predominately known to oer flexible, open

plan mortgages, a mortgage reference and maximum liabilities/deed of postponement

will be required.

Mortgage reference

& redemption figure

bypass scheme

The mortgage balance on the Equifax search is accepted to calculate the Loan to Value.

Consent and confirmation of arrears may still be required. Last update is required

within 30 days before completion. Consent to register and redemption figures (if

applicable - see plans) are required for lenders placing restrictions at HM Land Registry

and for non-conforming lenders. A reference may be required if the applicants have re-

mortgaged within the last 6 months.

If arrears are showing on Equifax/Experian, confirmation of arrears will be required

from the lender. If the lender will only provide conditional consent, then the full

amount to grant consent will be needed.

Landmark Mortgages, Northern Rock, NRAM, Virgin Money and flexible or open plan

type mortgages are not accepted on bypass schemes and a full mortgage reference will

be required.

Qualifying contracts Consumer buy-to-let

An application will be considered a consumer buy to let (CBTL) on the basis of the

following statements. The statements are in priority order, so for example if someone

owns a BTL property already (No 4) and inherits a further property (No 7) the

application will be unregulated due to the priority given to the statements.

• 5D

• Armative

• Associates

• Base

• Black Horse

• Black Horse / Cedar

Holdings

• Central Trust

• Churchhouse Trust

• Davenport Securities

• Interbay

• London Mortgage

Corporation (pre Oct

2004)

• London & Scottish Bank

• Norton Finance

• Ocean Money

• Prestige (Sheldon

and Stern, Barex,

Lawnbourne, etc.)

• Private Mortgages

(dependant on terms)

• Shawbrook

• Sherringtons

• Swift Group

• Wave Lending

• Welcome

• Webb Resolutions

• Wood berry Securities

Underwriting guide | 18

First charge mortgagees/lenders – secured loans

1. If the borrower or a ‘related person’ does not occupy any part of the property

2. The borrower is an Individual, Partnership of 3 or less persons or an unincorporated

body

3. The loan purpose is not to purchase the security

4. The borrower does not own any other properties which are rented out

5. The transaction is a ‘Let to Buy’ transaction

6. The borrower or a ‘related person’ has lived in the property since it was last

purchased

7. The property was inherited

We can consider a CBTL if an applicant lives abroad and meets the required Interest

Coverage Ratio. The applicant must hold a UK bank account in their name and the rent

must be received in sterling and paid into a UK bank account.

Repayment Strategies Interest only residential mortgages & secured loans

Acceptable repayment strategies are the sale of owner occupied property (downsizing)

and / or the sale of second UK property, where there is sucient equity to make this

strategy plausible.

Other repayment strategies that may be considered include tax free cash from a

suitable pension plan, endowment policies and stocks & shares ISAs. Proof may be

required.

The following repayment strategies are not accepted – sale of property to move into a

rental property, cash savings (including cash ISA), switching to a capital repayment

mortgage, remortgage, inheritance, increase in house prices, sale of property abroad

and sale of business.

Interest only explanation must be captured in My Broker Venue.

Regulated bridging

Eligibility for regulated bridging is based solely on the customer having a valid

repayment strategy in place and an assessment of income and aordability will not be

undertaken. Proof of income is not required in most cases as this will not be used to

assess aordability.

Acceptable repayment strategies include the sale of owner occupied property or

inheritance where a grant of probate has been issued.

For sale of owner occupied property the property must be on the market and sales

particulars must be provided. For inheritance where a grant of probate has been issued

we require confirmation that the grant of probate has been approved. We also require

details of the applicant’s solicitor and a copy of the will which has been verified by the

applicant’s solicitor. Where the grant of probate was provided to the applicant within

the last six months this must be reviewed by an Underwriter.

Responsible Lending

If a client is re-mortgaging or redeeming a second charge it must be in the client’s best

interests and to their benefit.

Please check the following before submitting your application:

• It must be evident from the credit search that the Customer’s financial position is

stable or improving

• The expenditure stated on the aordability assessment form should be reflective

of any evidence you have seen (such as bank statements or utility bills) before

submitting the case to us

Underwriting guide | 19

First charge mortgagees/lenders – secured loans

We would expect the stated expenditure and aordability to reflect the last 12 months

credit profile; for example, we wouldn’t expect low expenditure and a high relative

MAMR if the customer is using payday loans, they are not servicing current credit

commitments, or they have credit card balances which are close to their credit limits.

These circumstances may suggest that the stated expenditure is inaccurate as the

credit profile infers that there is a strain on their current aordability and you should

review this with all the evidence that you have and challenge the customer where their

responses do not seem plausible.

Properties

Acceptable securities

All property structures, re considered in England, Scotland and Wales.

High Rise flats are by referral only, we will require the following: construction type, if

cladding is present and number of floors.

Fire Risk Assessment and Cladding for Flats:

For all flats in blocks (both above and below six storeys) an up to date Fire Risk

Assessment (FRA) must be in place, a copy must be provided and must be acceptable to

Together for us to proceed.

Additional securities

For Regulated Bridging applications, an additional property can be used as security

where required – either a first or second charge can be taken against the additional

security. Where a second charge is being taken, the second charge nominal rate will

apply to the full loan amount. Second charge LTV is based on the redemption figure

for the priority charge. Applications which are lower than 50% LTV do not require a

redemption figure.

Where using multiple securities, all properties must be in the same legal jurisdiction

(e.g. both properties must be in England/Wales, or both properties must be in

Scotland).

Buildings Insurance

A current building insurance policy will be required on all non-purchase applications.

Please complete the relevant section on MBV.

Property types

For definition of property types please see individual plans for details.

New builds

We do not accept builder incentives on new build properties other than white goods

Where at time of oer the property is incomplete a reinpsection will be require prior

to funding, this will be noted in the oer and at the cost of the applicant. Where a new

build is in excess of 3 months from completion of the build, please do not submit.

Shared ownerships

For shared ownership purchases, the housing association need to confirm and agree

the following to enable completion, where the information is not satisfied we will not

be able to proceed:

• Details of percentage owned

• Details of monthly rent available

• Details that Together personal finance limited is an approved lender by the housing

association and Together will be covered for the gross loan.

Underwriting guide | 20

Properties

Ex-council properties

England & Wales - ignore all pre-emption.

We will only lend a maximum of the discounted purchase price within the first 12

months of the pre-emption period

Scotland – we do not lend on ex-council properties in Scotland within the pre-emption

period.

CBTL

All CBTL applicants must provide proof of an energy performance certificate rating of

“E” or better for their rental property.

Help to buy

We do not oer help to buy mortgages. Other shared equity can be considered by

referral only with the relvant documentation about the scheme being available.

Self-build properties

and developments

Self-build properties and developments are accepted strictly by underwriter approval

only and each application is considered on its own merits. Applicants must have

NHBC, Zurich or Premier Guarantee, or Architect’s Certificates along with a copy of the

architect’s indemnity details.

Stage advances for self-build properties are not considered.

Tenure

A minimum of 50 years must be remaining at the end of the loan term for all leasehold

properties.

Valuations

The open market valuation (OMV) and projected 90 day market valuation (PMV)

should not have more than a 10% dierence between them. If the dierence is greater

than 10%, underwriter approval is required.

If the property is currently for sale with an estate agent, please supply a copy of the

sales particulars along with the valuation.

Where a property is confirmed to sit in 1 acre or more the surveyor must receive a

copy of the title plan and confirm that the area highlighted corresponds to what the

surveyor has valued

Specialist reports

Where the surveyor insists on specialist reports to confirm valuations, this must be

obtained at a cost the applicant, upon receipt the surveyor will need to confirm they

are acceptable. Please note LTV may be reduced accordingly.

Where the surveyor “advises” reports should be obtained, please refer to an

underwriter.

Residential mortgages

First Charges, Secured loans & Consumer Buy-to-Let

Our Residential Valuation Panel is available from your Business Development

Executive. All valuers must be based within a 15 mile radius of the property. A specific

valuer is required in some postcode areas surrounding London. If the valuation report

is not completed by our specific valuer, we may refer the report for their comments.

Please refer to the valuation panel on My Broker Venue.

Valuations must be dated within the last 3 months and we require original valuations

with no amendments. If amendments have been made we require all previous versions

of the valuation; the case will be referred and is strictly subject to Credit Committee

approval.

All property valuations of £1,000,000 or more are strictly subject to underwriter

approval. We will contact any valuers or other appropriate sources regarding the

valuation of a property. Should any further information be discovered which is not

reflected in the valuation or may have a detrimental eect on the value of the property,

we reserve the right to reduce the loan amount or decline the case.

Underwriting guide | 21

Properties

Regulated bridging

A full valuation is required for each property being used as security.

Our Residential Valuation Panel is available from your Business Development

Executive. All valuers must be based within a 15 mile radius of the property. A specific

valuer is required in some postcode areas surrounding London. If the valuation report

is not completed by our specific valuer, we may refer the report for their comments.

Please refer to the valuation panel on my broker venue.

Valuations must be dated within the last 3 months and we require original valuations

with no amendments. If amendments have been made we require all previous versions

of the valuation; the case will be referred and is strictly subject to Credit Committee

approval.

All property valuations of £1,000,000 or more are strictly subject to underwriter

approval. We will contact any valuers or other appropriate sources regarding the

valuation of a property. Should any further information be discovered which is not

reflected in the valuation or may have a detrimental eect on the value of the property,

we reserve the right to reduce the loan amount or decline the case.

Audit valuations may be required if the property valuation is greater than £1,500,000.

Underwriting guide | 22

Legal advice

Solicitors to Witness

and Advise

Independent legal advice should be recommended to all customers and will be

required in all instances on the types of applications listed below:

• Loan amount > £500k (gross)

• Applicant(s) aged 70 years or older

• Parent and Child Borrowers

• English is not the applicants first language

• The mortgage/loan is for business purposes and the business only relates to one of

the applicants

• Divorced/separated couples

• Some Purchases and Transfers of Equity

The solicitor giving advice should be registered with the Law Society. The solicitor

must explain the terms and conditions of the mortgage oer and legal charge, witness

the legal charge and complete our Solicitor’s Advice Certificate.

If the applicant(s) do not speak English as their first language in addition to the above

the solicitor should confirm their advice has been provided in the applicant(s) first

language and establish that the applicant(s) will have support throughout the life of

the loan to help interpret any correspondence we many send to them.

Properties

Valuation bypass schemes

Valuation bypass schemes will be subject to audit controls and underwriter approval,

and must be used in conjunction with all other criteria. All maximum loan amounts

and LTVs on bypass schemes are inclusive of broker/intermediary fees being added to

the loan.

Scheme not available on new build properties. -

For a small percentage of bypass valuations a comparison between schemes will be

conducted. Should this show a disparity between the valuations we may require a full

valuation from a panel valuer; we will meet 50% of the valuation costs incurred (if

applicable).

Prepaid fees

Where an applicant requests to pay any of the lender fees as detailed in the Mortgage

Illustration up front, we will contact them prior to completion for payment. All fees

include VAT where applicable.

If the applicant has requested to pay any other fees up front (e.g. broker or third party

fees) this will be by separate arrangement with the relevant third party involved.

Redemption

Administration Fee

On redemption a fee of £100 is charged for all residential products.

Title insurance &

solicitors costs

Title insurance is not charged on any residential products.

Applicants are responsible for paying their own legal costs. Together legal costs are not

charged on residential products.

Underwriting guide | 23

Fraud prevention

Cases will be reviewed for the purpose of identifying potential fraud. This will include

income and valuation fraud. Should, in our opinion, any case you present be deemed

to be fraudulent the case will be rejected and action taken, which will ultimately result

in your Accreditation being revoked.

Underwriter referral

We will consider applications that don’t meet our standard criteria; please use

the ‘referral information form’ on My Broker Venue along with any supporting

documentation regarding the referral e.g. credit search, land registry etc. Please refer

on MBV or email newbusinessteam@togethermoney.com

Contact us

New enquiries

For new enquiries or a query about My Broker Venue, call us on

0161 933 7101

or email: newbusinessteam@togethermoney.com

Broker Relationship

Team

For submitted applications only call us on

0161 933 7042

For updates on a full application you’ve submitted to us please review case

tracking on My Broker Venue

Legal advice

Conveyancing

Requirements

For all non-Purchase or non-Transfer of Equity applications under £200,000 we will

complete the mortgage using our in house legal team or our Scottish Solicitor (Wilson

McKendrick). Where necessary the Independent Legal Advice requirements will

still remain the same. Applications above £300k will be completed by our in house

solicitors Priority Law.

Solicitors acting

Where a solicitor has been instructed to act for an applicant, the solicitor must have 2

or more partners within the practice and 2 or more years of law society membership. If

the solicitor does not meet these requirements please refer to the underwriter.

Solicitors must act for the applicant in the following instances (this list is not

exhaustive):

• Transfer of Equity

• All property purchases

Underwriting guide | 24

Submitting an application to us

To ensure we deliver the best service, we have recognised the importance of a

thorough and accurate day 1 completed by our underwriters. In order to achieve this

we need to ensure that our underwriting team are are reviewing applications with

adequate information, please review the personalised submission requirements for the

application by clicking on the checklist tile on my broker venue case hub. You will need

to do this before you submit the application to us.

Make sure you upload all of the required items, do not use “send by post” unless you

are sending it via post.

Where the purchase is right to buy we will also require the following:

• Section 125

Where the purchase is shared ownership, we will require the following:

• Memorandum of sale

Proof of name

and address (only

required if E-Id

unsuccessful).

Together has procedures in place to protect itself and others from financial crime.

It is our practice to verify identification for every customer.

As part of that process we must take reasonable steps to establish that a customer

is who he/she claims to be by obtaining sucient evidence of identity. We will also

conduct Electronic Identification ( E-Id) and Credit Searches. If either applicant does

not pass E-Id you will need to revert to our standard KYC procedures.

Identification of the following nature is therefore required if the application fails E-Id

Underwriting guide | 25

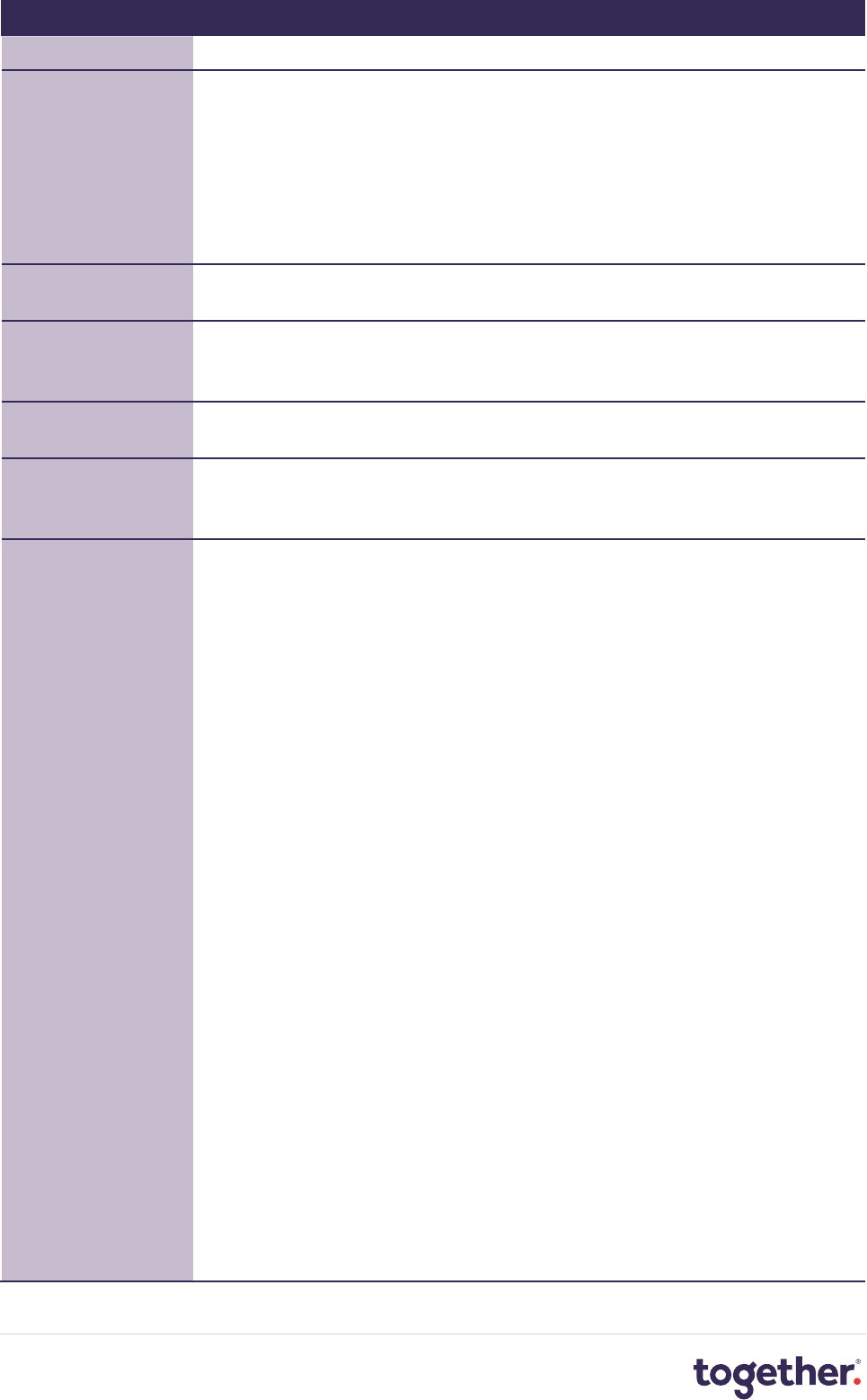

Acceptable forms of evidence to prove a customer’s Identity

Document Type Document requirements

Current signed UK/EU/EEA Passport

• Must be currently valid and include customer’s full name, date of birth, picture

and signature.

Current signed Non UK/EU/EEA passport

– must be accompanied with evidence of

permanent right to reside in the UK

• Must be currently valid and include customer’s full name, date of birth, picture

and signature.

• Where the evidence of permanent right to reside is in an old passport, the old

passport must also be provided.

Current EEA National Identity Card

• Must be currently valid and include customer’s full name, date of birth, picture

and signature.

Current signed UK Travel Document

(looks like a UK passport but states Titre de

voyage’)

• Must be currently valid and include customer’s full name, date of birth, picture

and signature.

• Further evidence of right to reside in the UK is not required.

Current UK/EU Photo Driving License

• Must be currently valid and include the customer’s full name, date of birth,

picture and signature.

• Must be registered at the customer’s current correspondence address.

• May be used as evidence of Address or Name, but not both.

• Full or provisional license accepted.

Current Full UK Driving License

(old paper style)

• Must be currently valid and include customer’s full name, date of birth and

signature.

• Must be registered at the customer’s current correspondence address.

• May be used as evidence of Address or Name, but not both.

• Full license only accepted not provisional licenses.

HMRC Tax Code Notification

(this document confirms the tax code for the

forthcoming tax year)

• Must be issued by HMRC.

• Must include customers full name, current address and National Insurance

Number or Date of Birth.

• A 45 or P60 is not acceptable.

• The document must be dated within the current tax year (normally issued in

April each year).

• May be used as evidence of Address or Name, but not both.

State Pension or Benefits Book/Notification

Letter

• Must include customer’s full name, current address and National Insurance

Number or Date of Birth.

• The document must be dated within the current tax year.

• May be used as evidence of Address or Name, but not both.

Firearms certificate or Shotgun license

• Issued by the Police.

• Must be currently valid (normally valid for 5 years).

• Must include customers full name, current address and picture.

Underwriting guide | 26

Acceptable Forms of Proof of Residency:

It is essential that each customer is able to prove that he/she currently resides at their stated residential address.

Document Type Document requirements

Current UK/EU Photo Driving License

• Must be currently valid and include the customer’s full name, date of birth, picture

and signature.

• Must be registered at the customer’s current correspondence address.

• May be used as evidence of Address or Name, but not both.

• Full or provisional license accepted.

Current Full UK Driving License

(old paper style)

• Must be currently valid and include customer’s full name, date of birth and

signature.

• Must be registered at the customer’s current correspondence address.

• May be used as evidence of Address or Name, but not both.

• Full license only accepted not provisional licenses.

HMRC Revenue Tax Code Notification

• Must be issued by HMRC - this is the letter issued each year to confirm the

individuals tax code for the following year.

• Must include customers full name, current residential address and National

Insurance Number or Date of Birth.

• A P45 or P60 is not acceptable.

• The document must be dated within the current tax year (normally issued in April

each year).

• May be used as evidence of Address or Name, but not both.

State Pension or Benefits Book/Notification

Letter

• Must include customers full name, current address and National Insurance

Number or Date of Birth.

• The document must be dated within the current tax year.

• May be used as evidence of Address or Name, but not both.

Current Tax Awards Letter

• Such as Child or Working Tax Credits or Pension Credits.

• Must include the applicants full name, current residential address and National

Insurance Number or date of birth.

• The document must be dated within and relevant to the current tax year

(normally issued in April each year).

Current Council Tax Bill/Statement

• Must include the applicants full name.

• Must relate to the applicants current residential address (and not a Buy to Let

property).

• Must be dated within and relevant to the current tax year at the time of

certification (normally issued in April).

• Must not be printed o the internet.

Mortgage Statement

• Must include the applicants full name.

• Must include the applicants current residential address.

• This must be the most recent statement and dated within last12 months.

• Must not be printed o the internet .

Bank/Building Society/Credit Card/Credit

Union Statement

• Must include the applicants full name.

• Must include the applicants current residential address.

• Must be issued by a FCA/PRA regulated sector firm in the UK (or equivalent).

• Must be dated within the last 3 months.

• Must not be printed o the internet or printed in branch.

• Must be a statement and not a letter such as in relation to overdraft increases.

Utility Bill

• •Gas, Electric, Water or Landline Phone only (not mobile or broadband bills)

• Must include the applicants full name

• Must include the applicants current residential address

• Must be dated within the last 3 months

• Must not be printed o the internet

• Must be a full statement and not a letter such as in relation to an account being set

up

Current Local Authority rent card or tenancy

agreement

• Must include the applicants full name

• Must include the applicants current residential address

• Must be dated within the last 12 months

Underwriting guide | 27