Simplified Guideline

Real Estate Transaction Tax

Fifth Version | 3 May 2024

Real Estate Transactions Tax (RETT)

RETT

2

The Zakat, Tax and Customs Authority issued this guide to clarify some matters relevant to the

implementation of regulatory provisions applicable on the day of its issuance. The content of

this guide is not considered an amendment to any of the provisions of regulations and bylaws

in effect in the Kingdom.

The authority asserts that it applies the illustrative treatments stated in this guide, where

applicable, in light of relevant regulatory texts. In the event that any clarification or content

stated in this guide relevant to a non-amended regulatory text is amended, the updated

illustrative treatment shall be applied to transactions that are carried out after the date of

publishing the updated version of this guide on the authority’s website.

,

3

What Is the Real Estate Transactions Tax?

Difference Between the Value-Added Tax (VAT) and Real Estate Transactions Tax

(RETT)

VAT: Before and After

Real Estate Transactions Subject to Real Estate Transactions Tax

Exceptions from Real Estate Transactions Tax

Violations and Fines

Mechanism of Objection to the Real Estate Transactions Tax

04

06

31

34

36

51

53

Contents

4

What Is the Real Estate Transactions Tax?

5

What is the real estate transactions tax?

Real estate transactions tax, which was announced as per Royal Decree No. (A/84), dated 14

Safar, 1442 A.H., with the aim of supporting citizens and licensed real estate developers, started

to be applied on Sunday, 17 Safar, 1442 A.H. In accordance with the Royal Decree and executive

decisions, the sale of real estate is exempted from value-added tax, instead of imposing it at

a rate of 15%, and the real estate transactions tax is imposed on the sale of real estate and the

like at a rate of 5% of the value of the property. This is in addition to raising the amount that the

Kingdom shall bear, instead of Saudi citizens, of the value of the real estate transactions tax to

1,000,000 (one million Saudi riyals) from the purchase price of the first dwelling, instead of

850,000 (eight hundred and fifty thousand Saudi riyals) which are associated with value-added

tax.

The real estate transactions tax is a tax that is imposed at a rate of 5% on all real estate

transactions, including:

● Sale

● Bequest

● Financial leasing

● Lease-to-own process

● Long-term usufruct contracts whose duration is more than 50 years.

The real estate transactions tax is calculated according to the price agreed upon between the

seller and the buyer and should not be less than the fair market value at the time when the

transaction takes place. The seller is obliged to pay it before or during the conveyance process.

6

Difference Between the Value-Added Tax (VAT)

and Real Estate Transactions Tax (RETT)

7

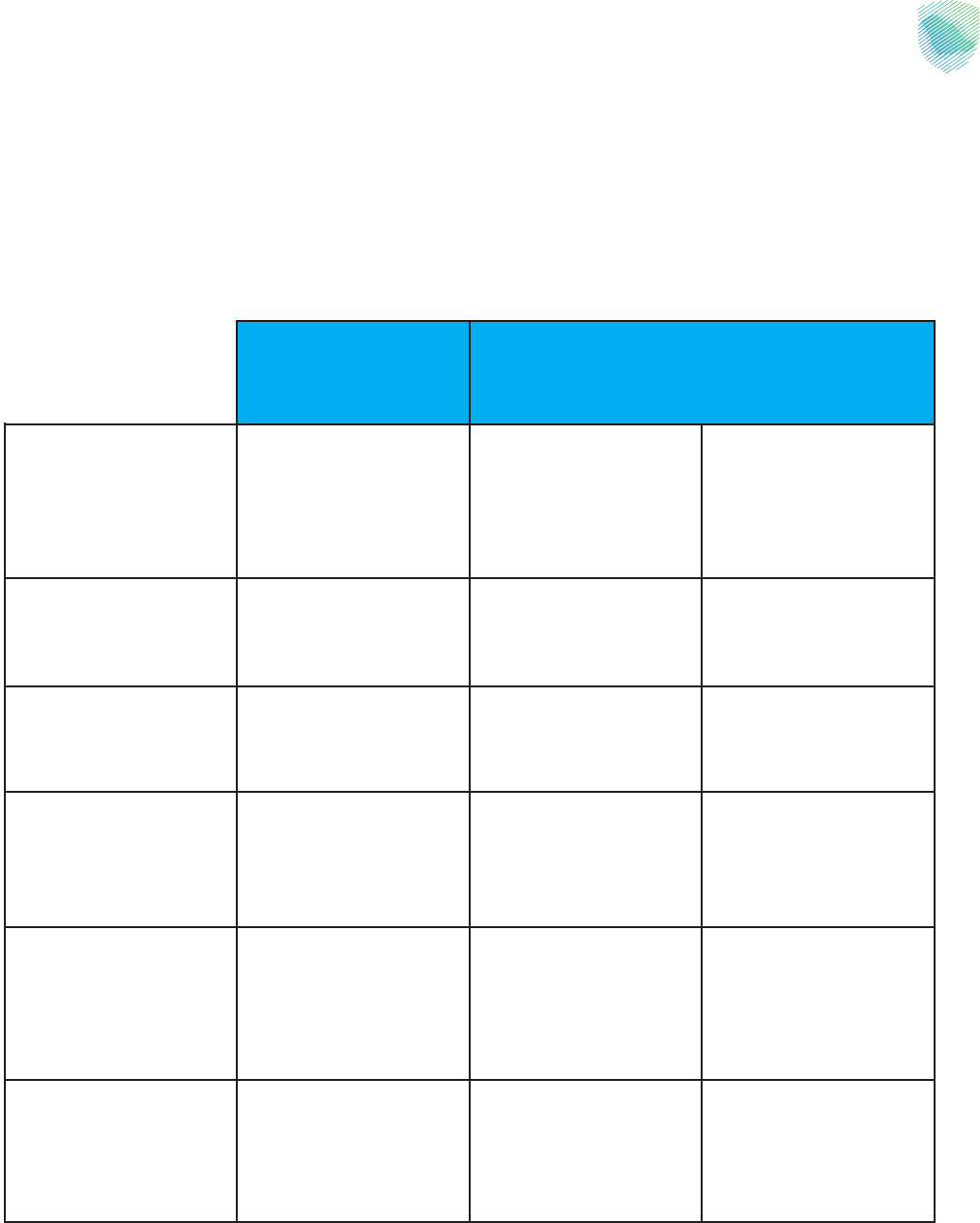

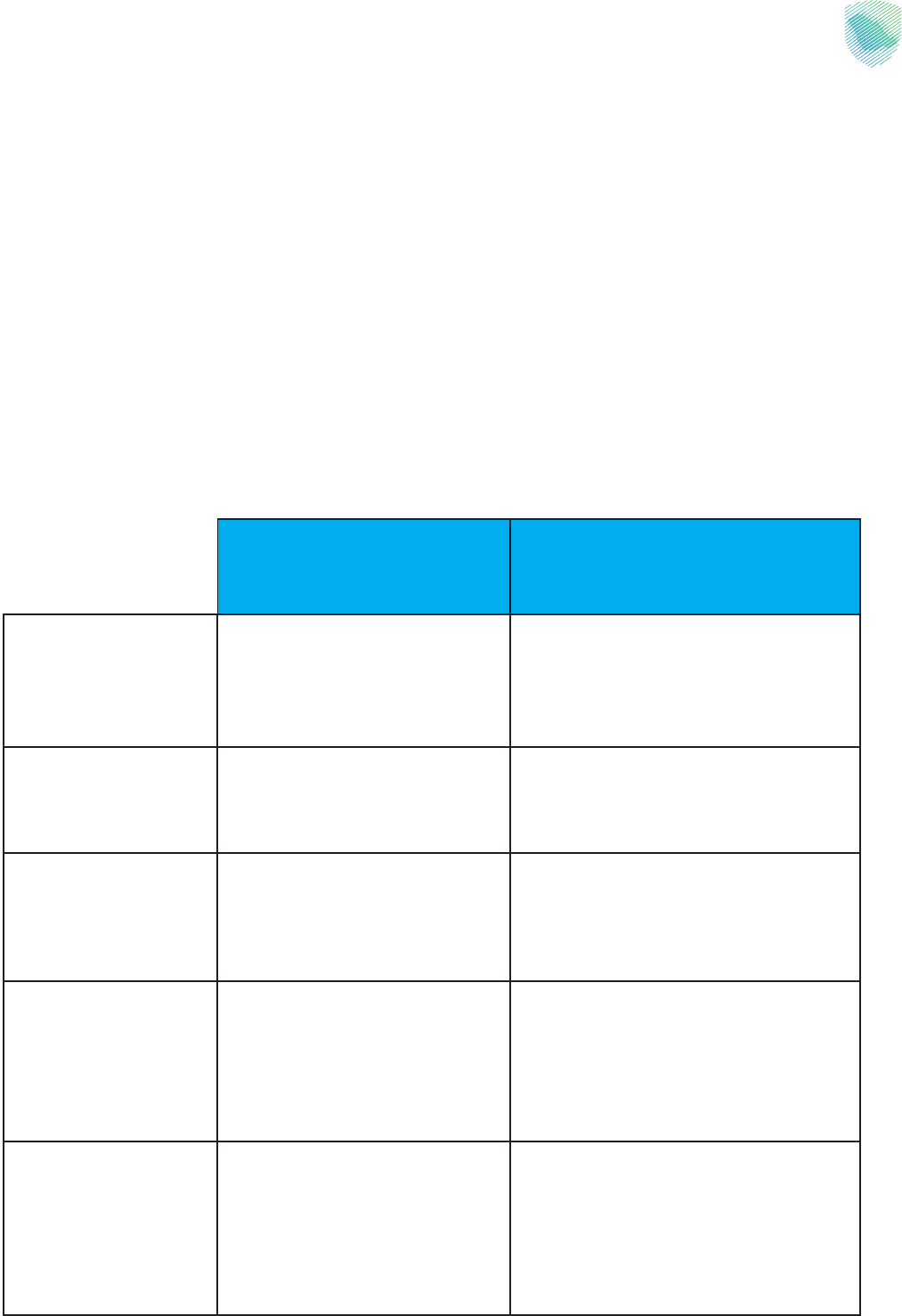

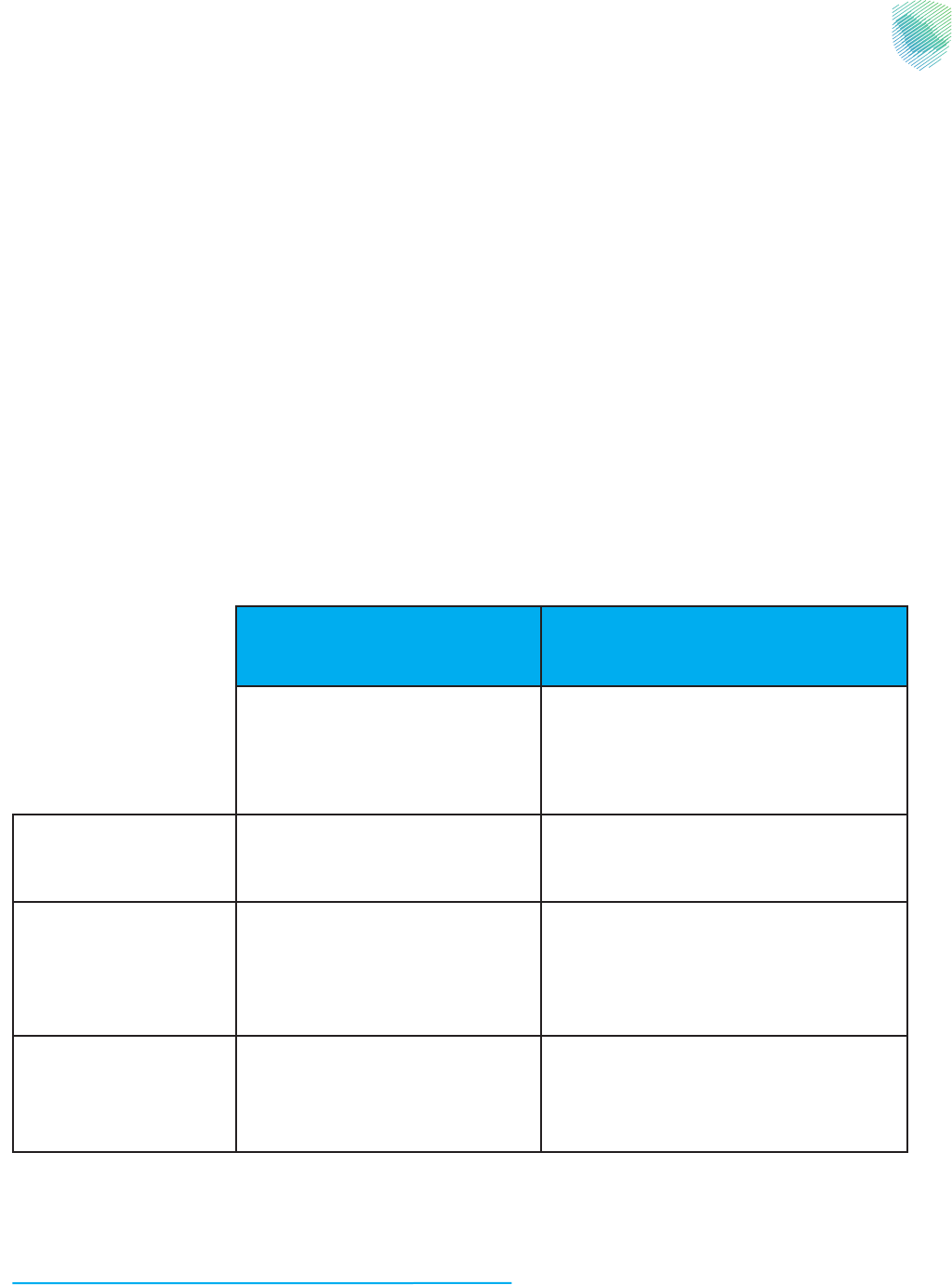

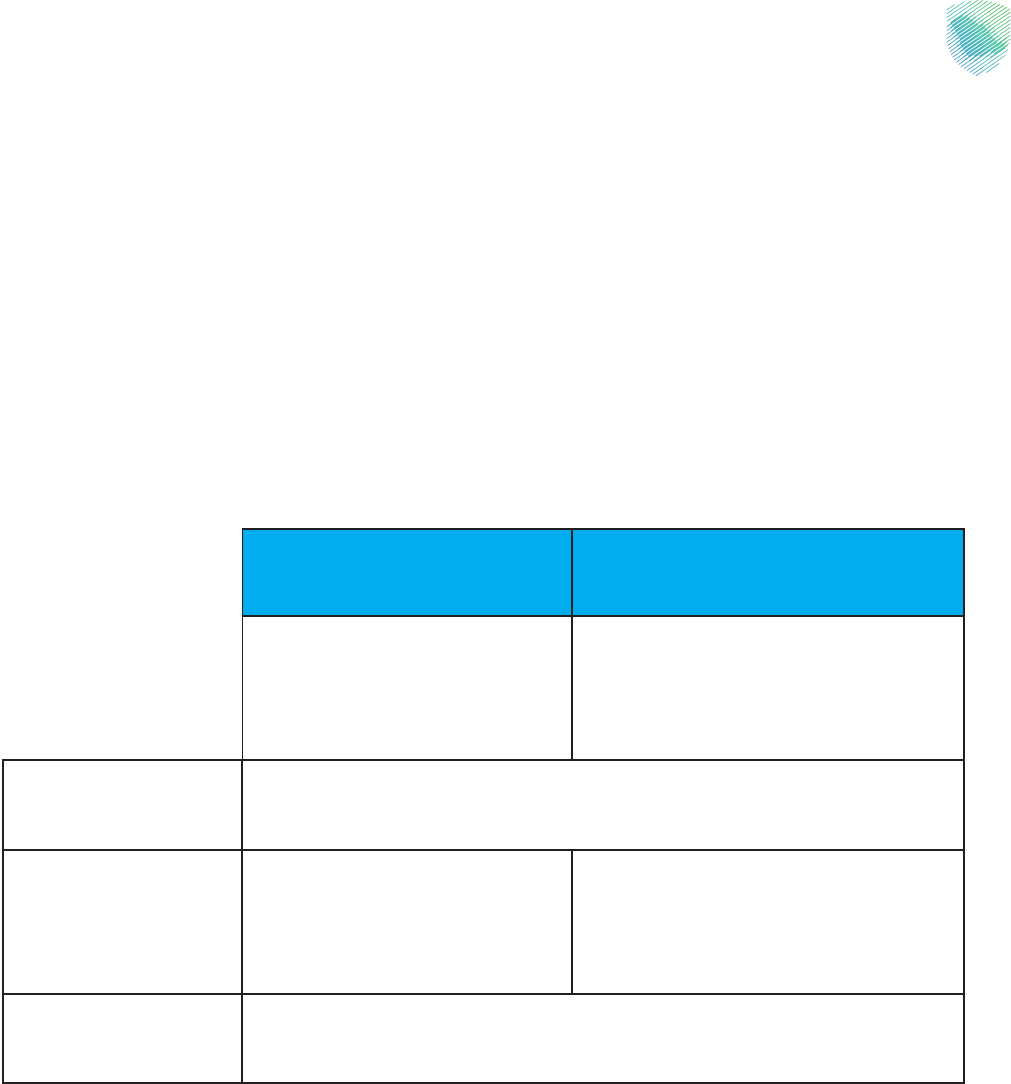

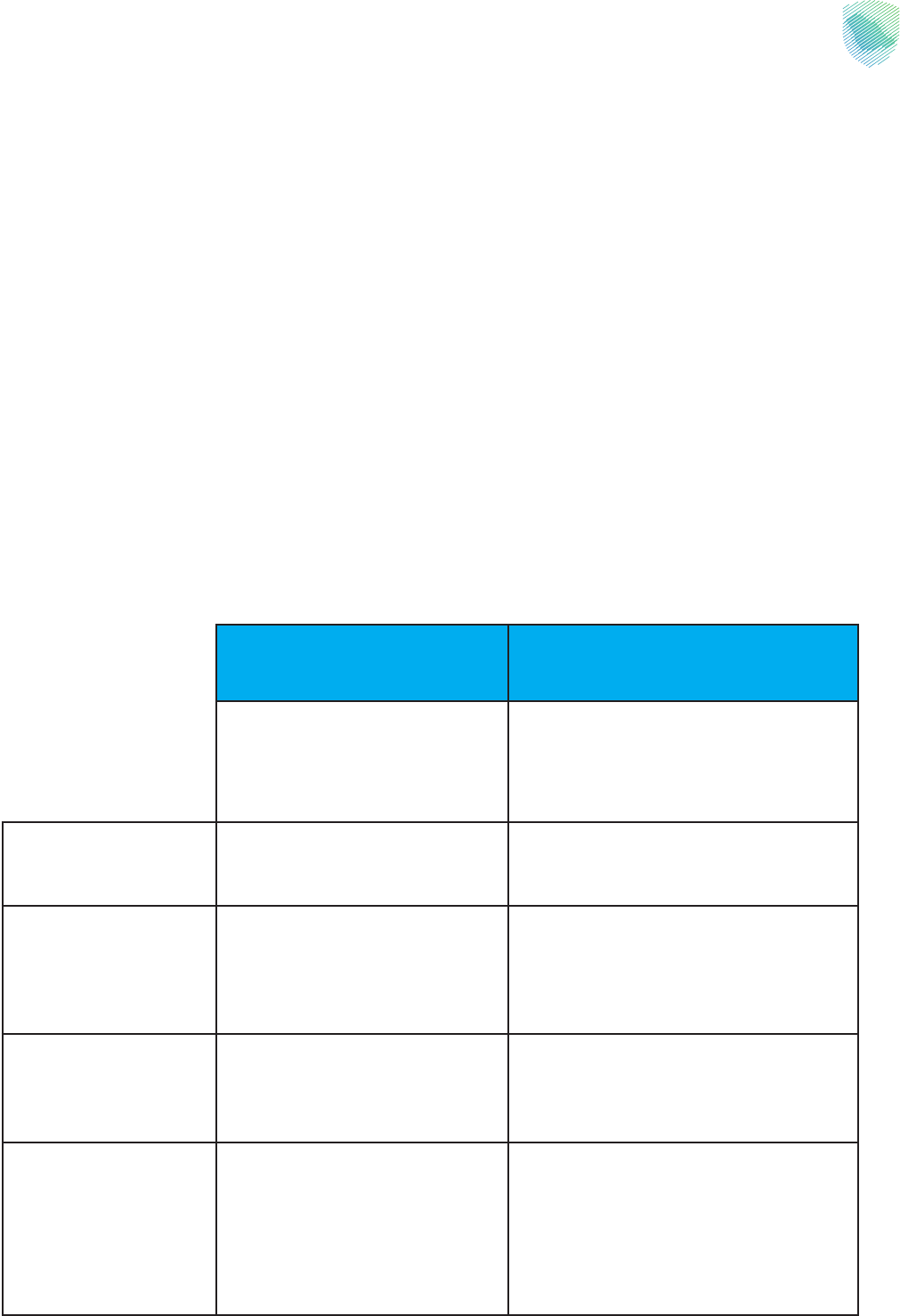

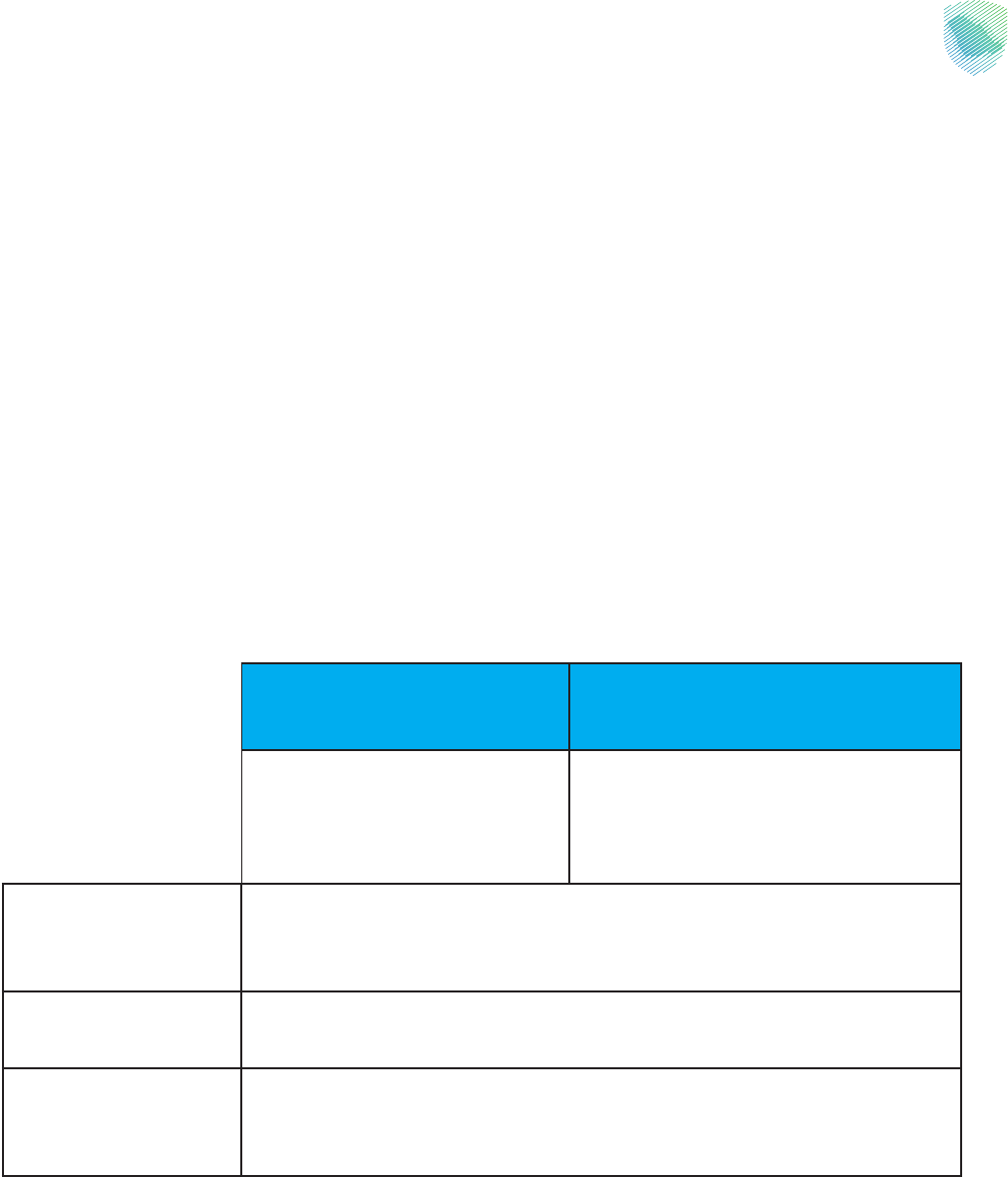

Difference between the value-added tax (VAT) and real estate transactions tax

(RETT)

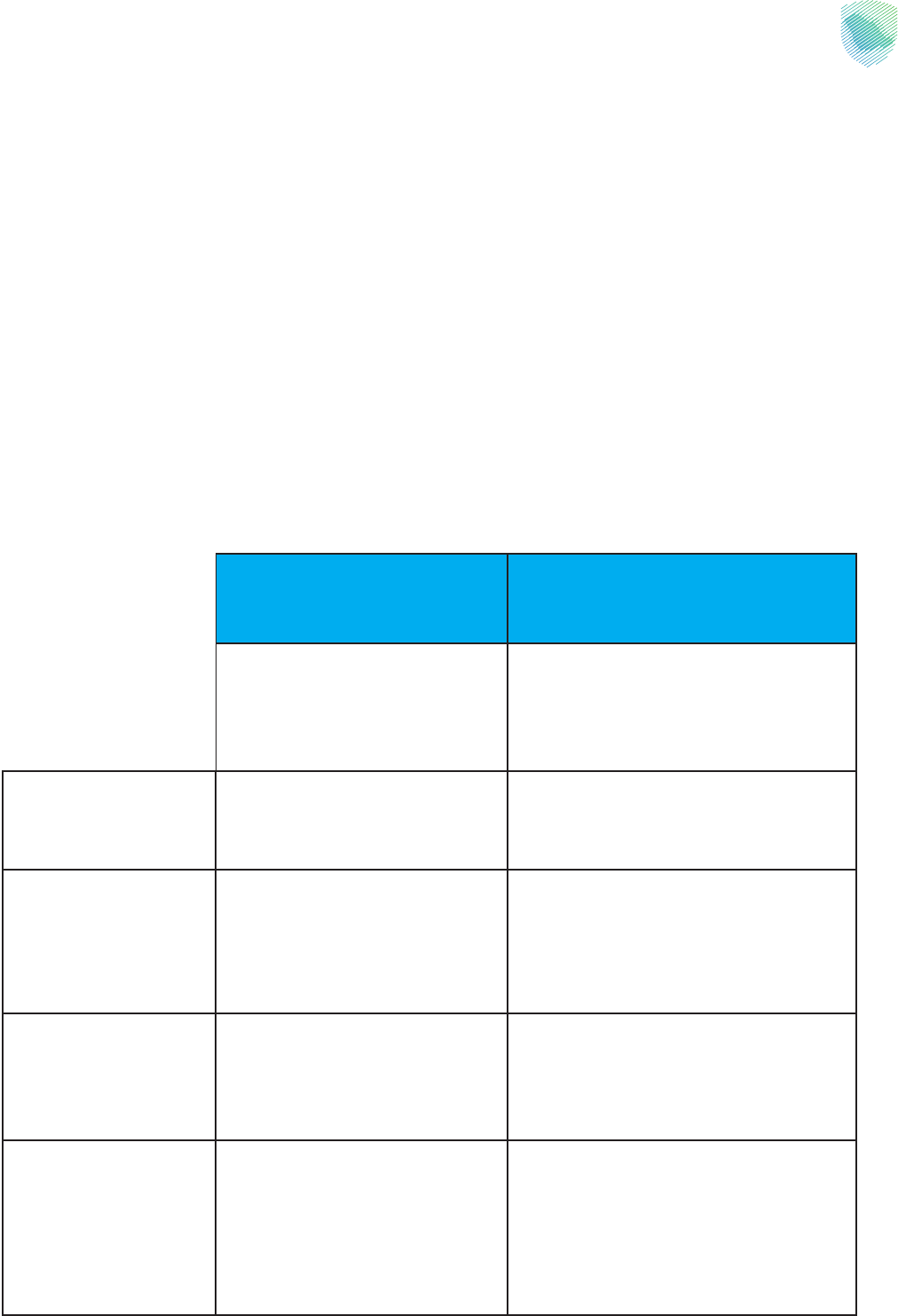

Previously Currently

Status VAT before the

issuance of the Royal

Decree

VAT after the

issuance of the Royal

Decree

Real estate

transactions tax

Sale of a residential

property

%15 Exempted %5

Sale of a commercial

property

%15

Exempted %5

Sale of a residential,

commercial, or

agricultural of land

%15 Exempted %5

Leasing a residential

property for less than

50 years

Exempted Exempted Not applicable

Leasing a commercial

property for less than

50 years

%15 %15 Not applicable

8

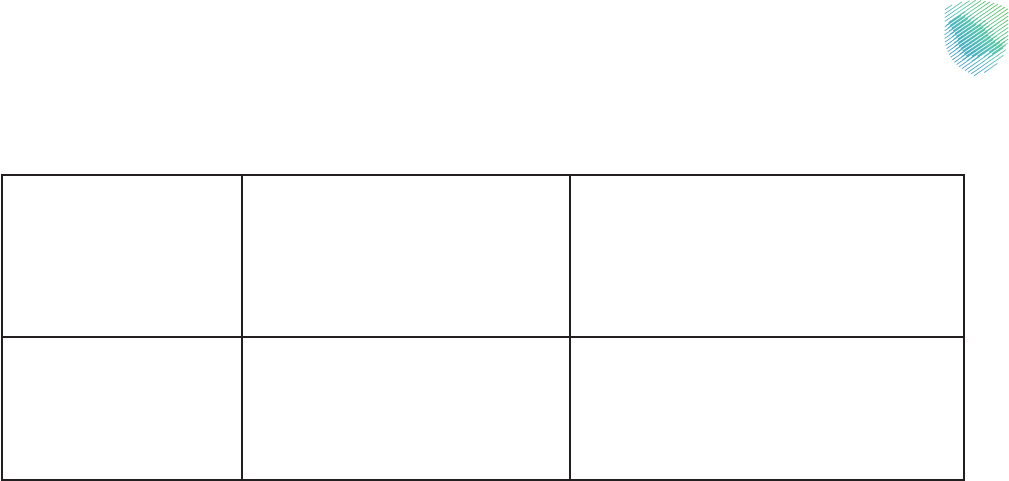

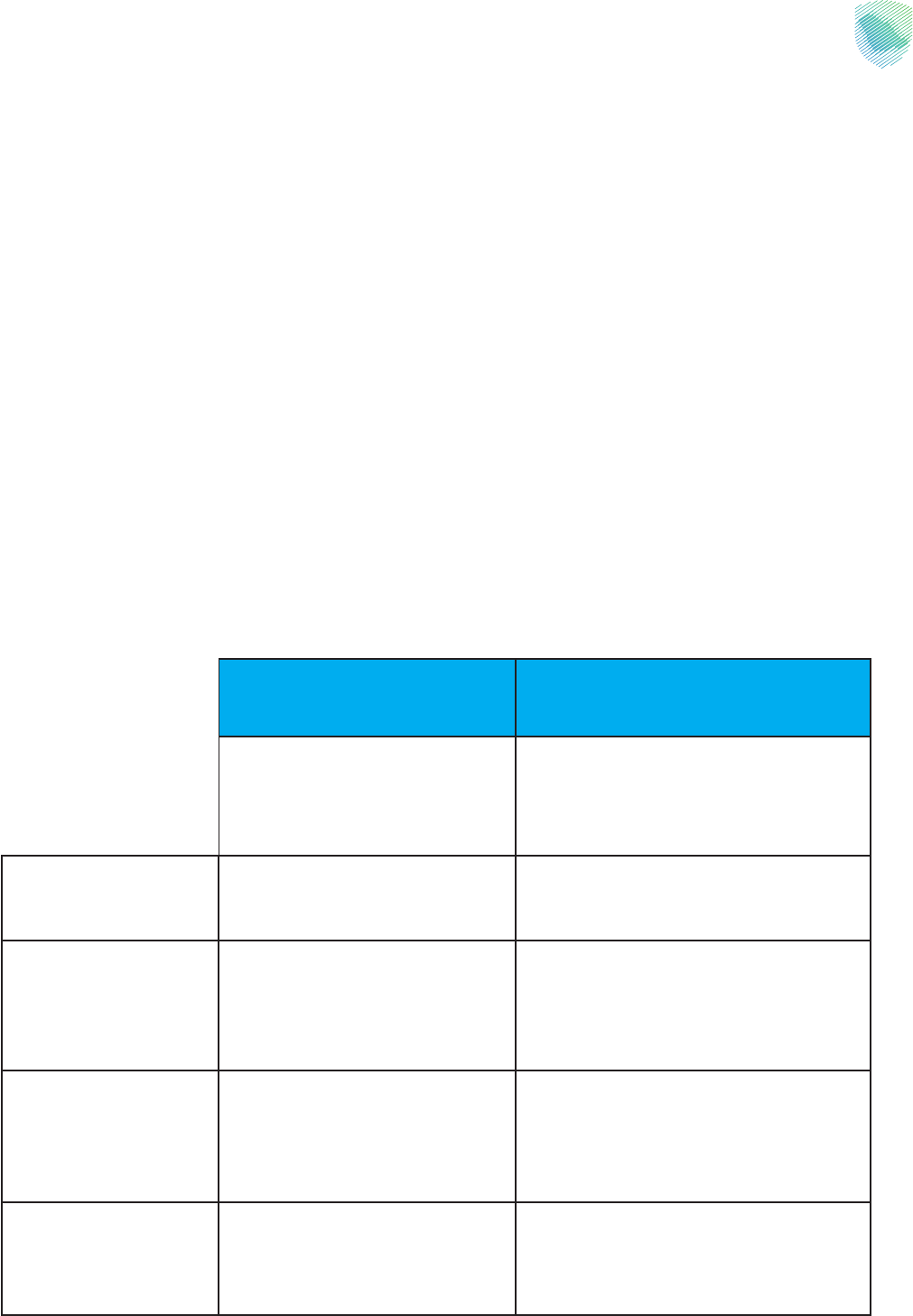

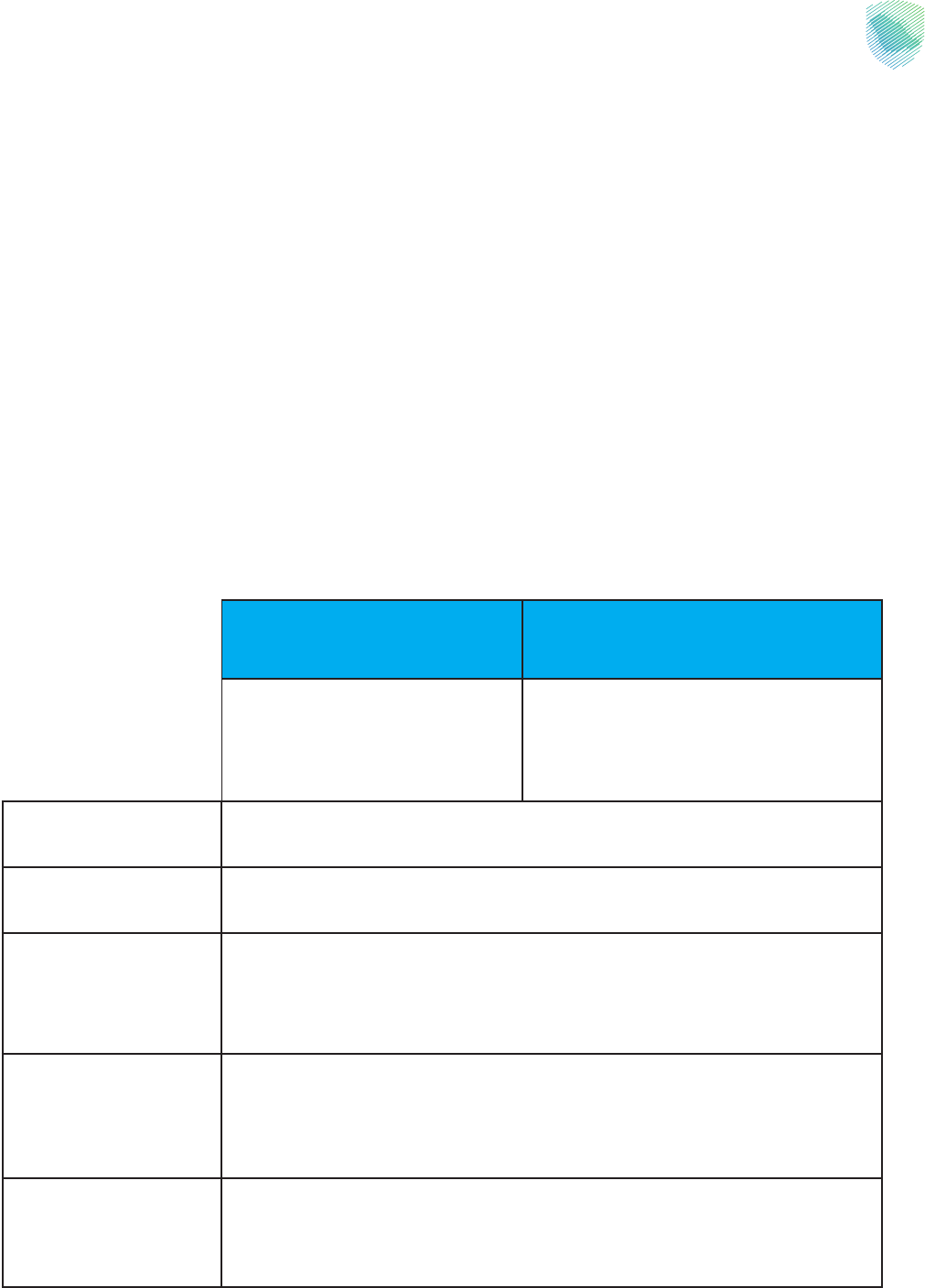

The first dwelling

for citizens (villa

apartment housing

unit)

The kingdom

bears the tax due

on an amount not

exceeding 850,000

(eight hundred and

fifty thousand Saudi

riyals) of the value of

the property

Exempted The kingdom

bears the tax due

on an amount not

exceeding 1,000,000

(one million Saudi

riyals) of the value of

the property

Sale of a property to a

government entity

%15 Exempted Excluded and not

subject to the tax

Sale of a property by a

government entity in

its capacity as a public

authority

out of the scope of

tax

out of the scope of

tax

Excluded and not

subject to the tax

Sale of a property by

a government entity

for commercial or

investment purposes

%15 Exempted %5

Sale of a property to

a diplomatic entity

or an accredited

international

organization

%15 Exempted Excluded and not

subject to the tax

Granting a property

as a gift to a husband,

wife, or up to third-

degree relatives

out of the scope of

tax

out of the scope of

tax

Excluded and not

subject to the tax

Granting a property as

a gift to any party

%15 Exempted %5

9

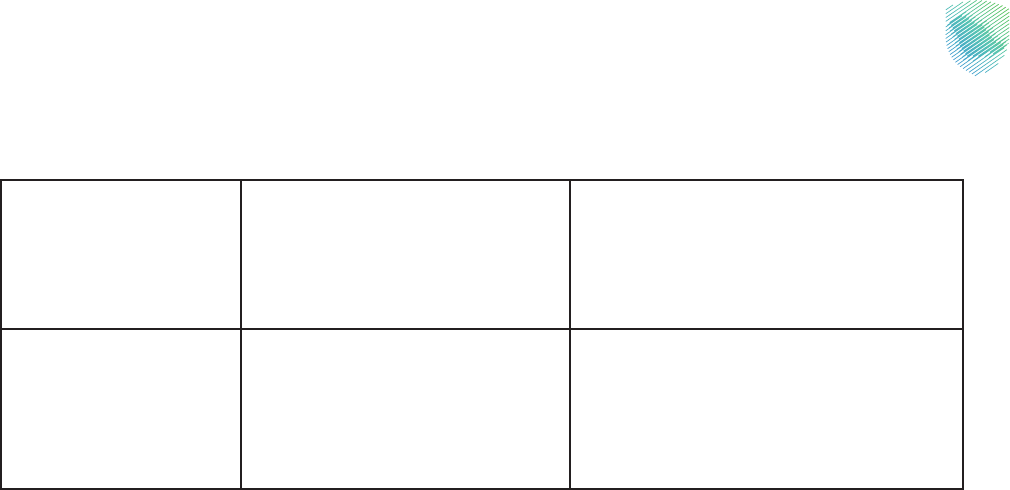

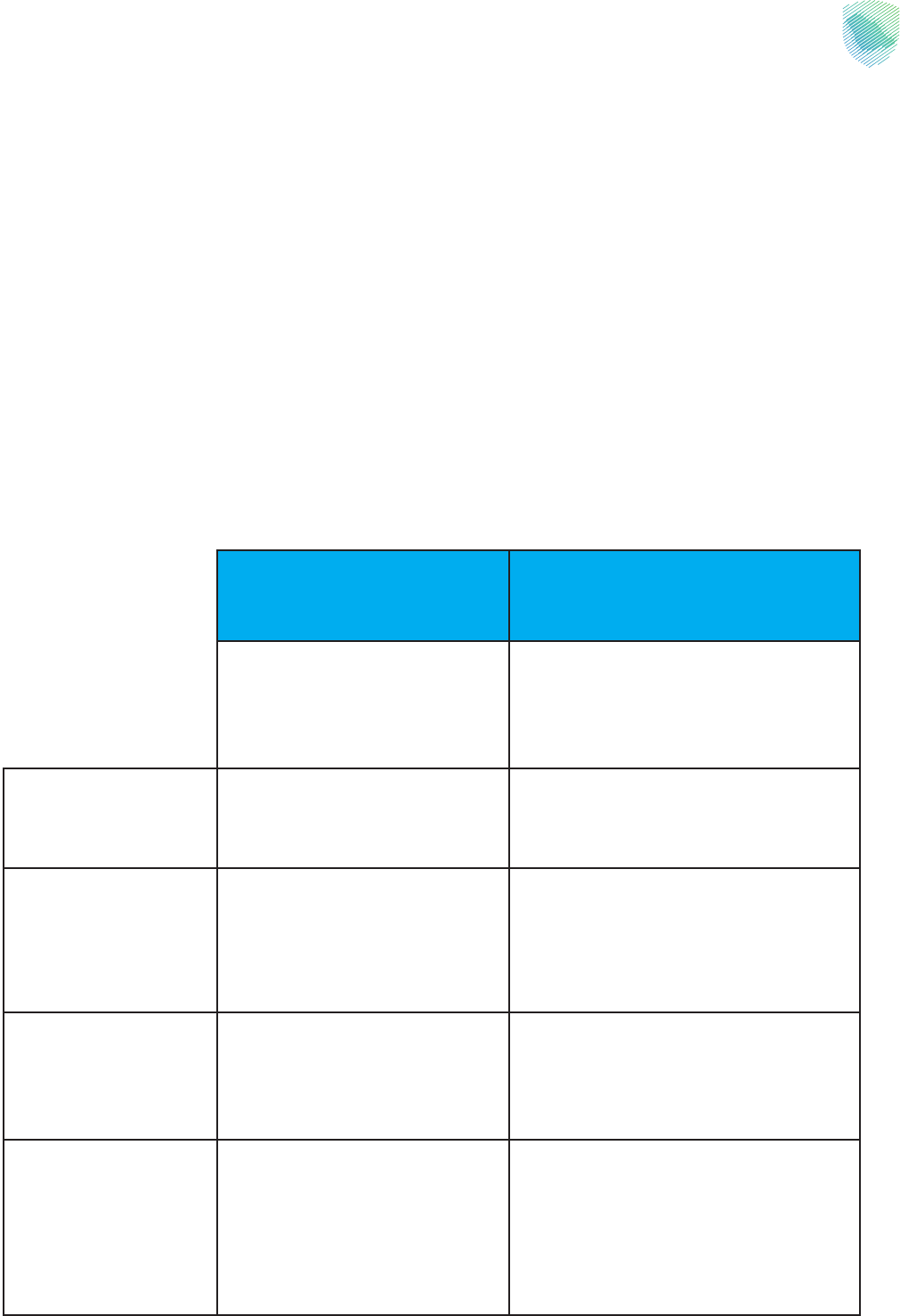

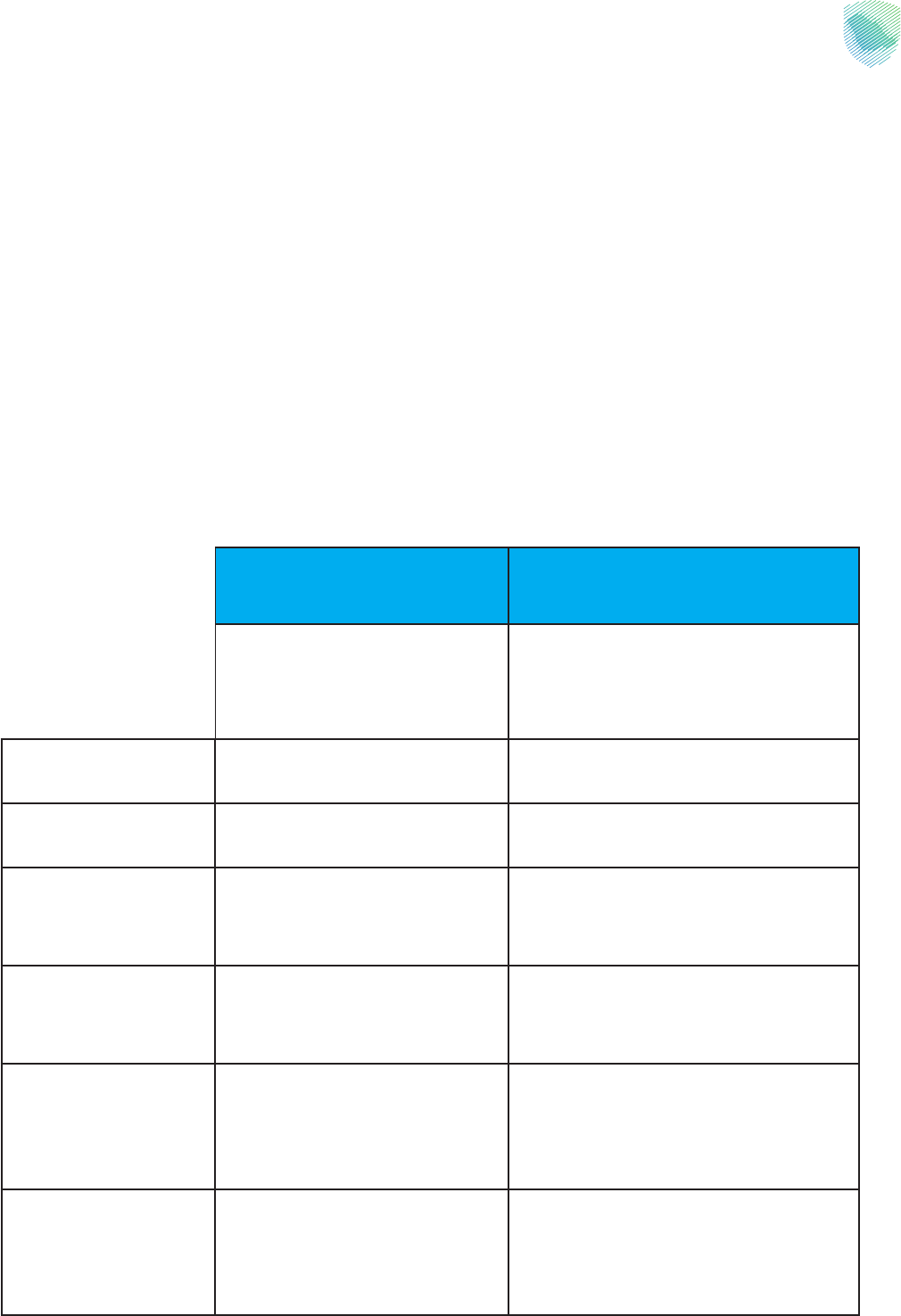

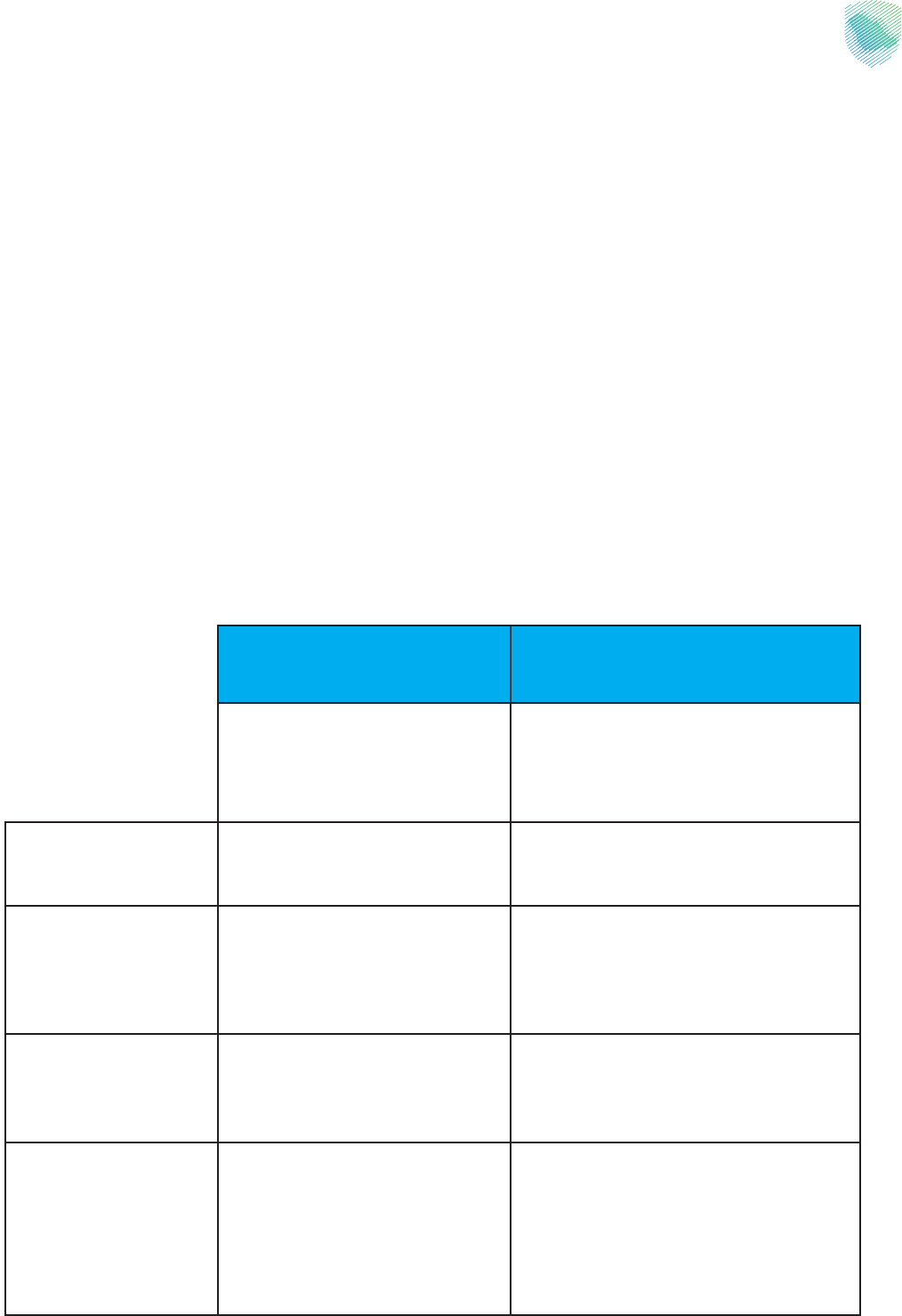

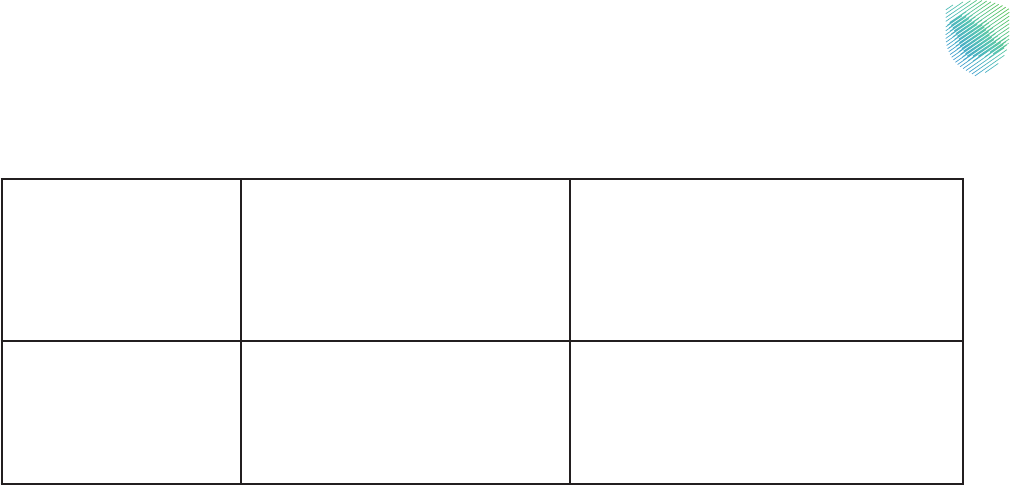

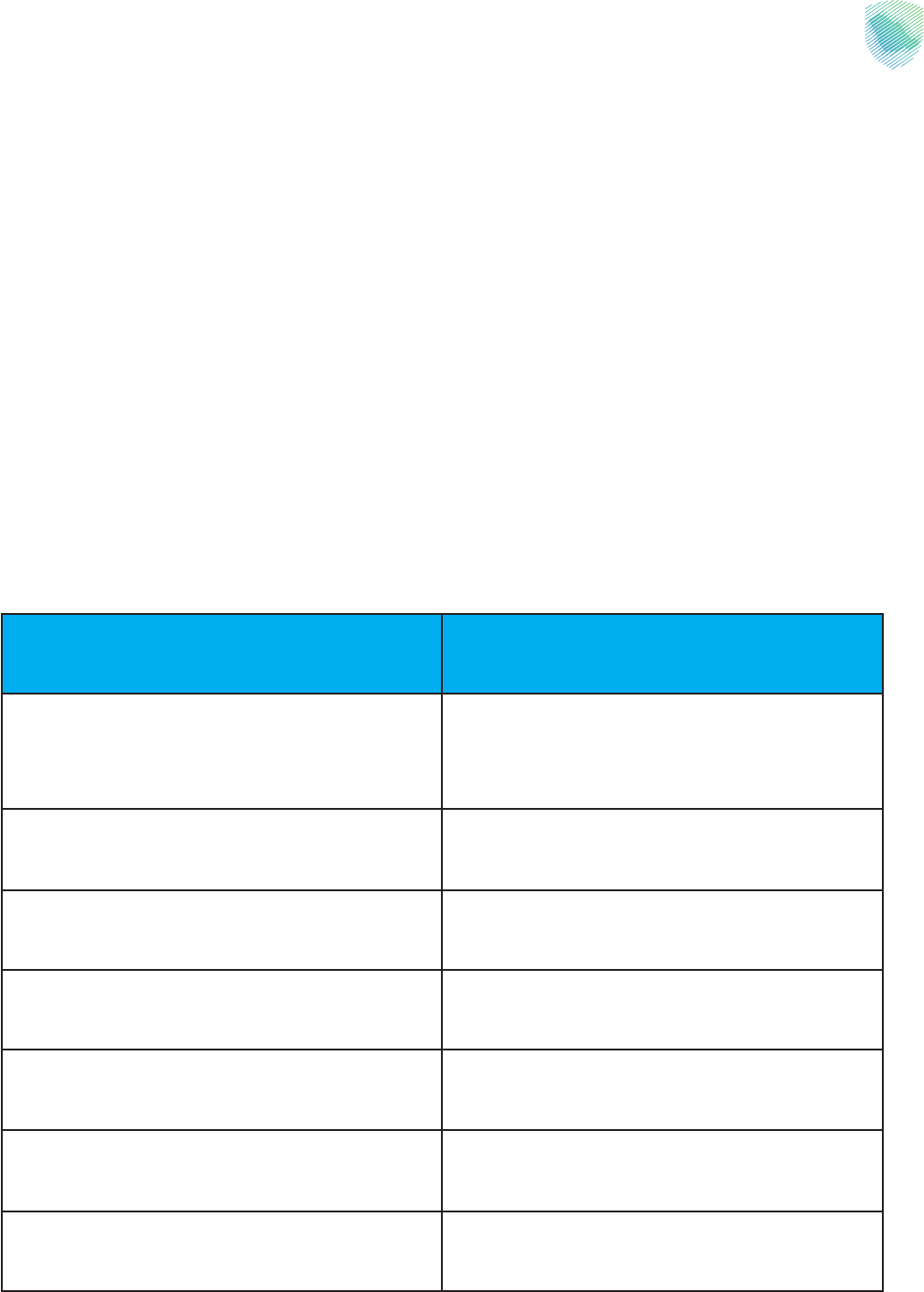

Expropriation of a

property for public

benefit

%15

Exempted Excluded and not

subject to the tax

Provision of a

property as an in-

kind share in the

capital of a company

established in the

kingdom while

retaining the shares

or stocks of the

company for five

years

%15 Exempted Excluded and not

subject to the tax

Usufruct right over a

property for a period

exceeding 50 years

%15

15% and registrant

is entitled to get a

refund of this amount

%5

Input related to

construction, such as

building materials and

the like

٪15 ٪15

Not applicable

Getting a refund of

the input tax on the

sale of real estate

Input tax shall be

deducted by virtue of

tax declarations

Input tax shall not be

deducted by virtue of

tax declarations

Non-refundable

*Only real estate developers eligible for a refund are entitled to receive a refund of the VAT paid on purchases related to

real estate exempted from VAT (such as construction

materials and the like).

10

Sale of a residential property

Villa - Apartment - Housing Unit

Example:

A person offered a villa for sale at a value of 1,000,000 (one million Saudi riyals). How can the

tax be calculated when the villa is sold? When should the tax be paid after the issuance of the

royal decree on the real estate transactions tax?

Explanation:

Previously Currently

VAT before exemption

becomes applicable

Real estate transactions tax after the

issuance of the royal decree

Tax rate %15 %5

Tax value

150,000 (one hundred and

fifty thousand Saudi riyals)

50,000 (fifty thousand riyals)

Registration in the

Zakat, Tax and

Customs Authority

The concerned person and the

transaction shall be registered.

The transaction shall be registered

before the conveyance or

notarization of the contract.

Tax payment date It shall be paid through the tax

declaration submitted by the

registrant.

The tax shall be paid on or before the

date of notarization by a notary public

or an accredited notary.

11

Date of application

From the beginning of 2018

until 3 October, 2020 A.C.,

and exemption starts from 4

October, 2020 A.C.

From 4 October, 2020 A.C.

The person required

to pay the tax to the

authority

Seller Seller

12

First (equipped) dwelling for citizens

Villa - Apartment - Housing Unit

Example:

A citizen wished to buy a house for 1,000,000 (one million Saudi riyals) from a real estate

developer. This house is the citizen’s first dwelling and he has a certificate from the Ministry of

Municipal, Rural and Housing Affairs to that effect. How can the real estate transactions tax be

calculated in this case?

Explanation:

Previously Currently

VAT before exemption

becomes applicable

Real estate transactions tax after the

issuance of the royal decree

Tax rate %15 %5

The amount which

the kingdom bears

in relation to the tax

imposed on the first

dwelling

Up to 850,000 (eight hundred

and fifty thousand Saudi riyals)

from the purchase price of the

house

Up to 1,000,000 (one million Saudi

riyals)

from the purchase price of the house

Due tax value after

deducting the amount

born by the kingdom

22,500 (twenty-two thousand

and five hundred Saudi riyals)

Zero*

Registration in the

Zakat, Tax and

Customs Authority

The concerned person and the

transaction shall be registered.

The transaction shall be registered

before the conveyance or

notarization of the contract.

13

Tax payment date It shall be paid through the tax

declaration submitted by the

registrant.

The tax shall be paid on or before the

date of notarization by a notary public

or an accredited notary.

Date of application From the beginning of 2018

until 3 October, 2020 A.C.,

and exemption starts from 4

October, 2020 A.C.

From 4 October, 2020 A.C.

The person required

to pay the tax to the

authority

Seller Seller

* The due tax value, after deducting the amount borne by the Kingdom, is “zero” because the value of the property

does not exceed 1,000,000 (one million Saudi riyals).

14

Mechanism for benefiting from the Kingdom bearing the tax imposed on the first

dwelling instead of the citizen

1. The buyer issues a certificate proving that the Kingdom shall bear the real estate

transactions tax imposed on the first dwelling, from the website of the Ministry of

Municipal, Rural and Housing Affairs.

2. The buyer submits the certificate to the seller.

3. The seller visits the website of the Zakat, Tax and Customs Authority and selects the

“Real Estate Transactions Tax” service. Then he accesses the real estate transactions

platform and registers a new real estate transaction, and choose the choice of a real

estate disposal excluded from the list of exceptions, specifying the exception as related

to the state’s bearing of the first housing tax for citizens..

After entering the data of the property and the buyer, the authority makes sure that the buyer is

eligible for government subsidy, and excludes the tax value from the selling price, provided that

it does not exceed 1,000,000 (one million Saudi riyals). The authority imposes a tax at a rate of

5% on the amount that exceeds this value.

15

Sale of a Commercial Property

Building - Commercial Unit - Land

Example:

A person offered a store for sale at a value of 1,000,000 (one million Saudi riyals) and wished

to transfer the ownership of the store to the buyer. How can the tax be calculated when selling

the store? When should the tax be paid after the issuance of the royal decree on the real estate

transactions tax?

Explanation:

Previously Currently

VAT before exemption

becomes applicable

Real estate transactions tax after the

issuance of the royal decree

Tax rate %15 %5

Tax value

150,000 (one hundred and

fifty thousand Saudi riyals)

50,000 (fifty thousand Saudi riyals)

Registration in the

Zakat, Tax and

Customs Authority

The concerned person and the

transaction shall be registered.

The transaction shall be registered

before the conveyance or

notarization of the contract.

Tax payment date It shall be paid through the

periodic tax declaration

submitted by the registrant.

The tax shall be paid on or before the

date of notarization by a notary public

or an accredited notary.

16

Date of application

From the beginning of 2018

until 3 October, 2020 A.C.,

and exemption starts from 4

October, 2020 A.C.

From 4 October, 2020 A.C.

The person required

to pay the tax to the

authority

Seller Seller

17

Sale of Land

Residential - Commercial - Agricultural

Example:

A person or an establishment has a land in the kingdom, which is offered for sale at a value of

500,000 (five hundred thousand Saudi riyals), and wishes to transfer the ownership of the

land to the buyer. How can the tax be calculated when selling the land? When should the tax be

paid after the issuance of the royal decree on the real estate transactions tax?

Explanation:

Previously Currently

VAT before exemption

becomes applicable

Real estate transactions tax after the

issuance of the royal decree

Tax rate %15 %5

Tax value

75,000 (seventy-five

thousand Saudi riyals)

25,000 (twenty-five thousand Saudi

riyals)

Registration in the

Zakat, Tax and

Customs Authority

The concerned person and the

transaction shall be registered.

The transaction shall be registered

before the conveyance or

notarization of the contract.

Tax payment date IIt shall be paid through the

periodic tax declaration

submitted by the registrant.

The tax shall be paid on or before the

date of notarization by a notary public

or an accredited notary.

18

Date of application

From the beginning of 2018

until 3 October, 2020 A.C.,

and exemption starts from 4

October, 2020 A.C.

From 4 October, 2020 A.C.

The person required

to pay the tax to the

authority

Seller Seller

19

Granting a property as a gift to a husband, wife, or up to third-degree

relatives*

Transfer of the ownership of a property as a gift from a husband to his wife, from a wife to her

husband, or up to a third-degree relative.

Example:

A property owner granted his nephew of a land, whose market value is 700,000 (seven

hundred thousand Saudi riyals), without compensation. He wanted to transfer the ownership of

the piece of land to his nephew at the Ministry of Justice. How can the tax be calculated?

Explanation:

Previously Currently

VAT before exemption

becomes applicable

Real estate transactions tax after the

issuance of the royal decree

Tax rate %15 %5

Tax value

out of the scope of tax

according to certain conditions

It shall not be subject to the tax if it

meets the requirements stated in

the regulations of the real estate

transactions tax.

Registration in the

Zakat, Tax and

Customs Authority

In the event that the disposer

is not subject to tax, no action

is required

The transaction shall be registered

before the conveyance or

notarization of the contract.

*”Up to third-degree relatives” means:

The first degree: father, mothers, grandparents, grandmothers, etc.

The second degree: sons and daughters and their descendants.

The third degree: brothers and sisters, siblings, or for a father or a mother, their children and their grandchildren.

20

Granting a property as a gift to any without compensation

The real estate transactions tax is imposed at a rate of 5% on all real estate transactions that

are carried out through sale and the like, including the conveyance of any property without

compensation (unless it is not exempted according to the executive regulations of the real

estate transactions tax).

Example:

A person wished to grant his cousin a land, whose market value is 250,000 (two hundred and

fifty thousand Saudi riyals), without compensation and wished to transfer its ownership to him

at the Ministry of Justice.

Explanation:

Previously Currently

VAT before exemption

becomes applicable

Real estate transactions tax after the

issuance of the royal decree

Tax rate %15 %5

Tax value

37,000 (thirty-seven

thousand Saudi riyals)

12,500 (twelve thousand and five

hundred Saudi riyals)

Registration in the

Zakat, Tax and

Customs Authority

The concerned person and the

transaction shall be registered

If the person is subject to

tax and registered with the

Authority.

The transaction shall be registered

before the conveyance or

notarization of the contract.

Tax payment date It shall be paid through the

periodic tax declaration

submitted by the registrant.

The tax shall be paid on or before the

date of notarization by a notary public

or an accredited notary.

21

Sale of a Property to a Government Entity

Conveyance of a property from a person or an establishment to a government entity

Example:

A person offered a land for sale at a value of 500,000 (five thousand Saudi riyals) and a

government entity wished to buy this property. How can the tax be calculated when selling the

land? When should it be paid?

Explanation:

Previously Currently

VAT before exemption

becomes applicable

Real estate transactions tax after the

issuance of the royal decree

Tax rate %15 %5

Tax value

75,000 (seventy-five

thousand Saudi riyals)

Excluded and not subject to the tax

Registration in the

Zakat, Tax and

Customs Authority

The concerned person and the

transaction shall be registered.

The transaction shall be registered

before the conveyance or

notarization of the contract.

Tax payment date It shall be paid through the

periodic tax declaration

submitted by the registrant.

No due tax

Date of application From the beginning of 2018

until 3 October, 2020 A.C.,

and exemption starts from 4

October, 2020 A.C.

From 4 October, 2020 A.C.

The person required

to pay the tax to the

authority

Seller No due tax

22

Sale of a property to a diplomatic entity or an accredited international

organization

Conveyance of a property from or to a diplomatic entity or an accredited international

organization in the kingdom, on condition of reciprocity

Example:

A person wished to sell a residential building at a value of 200,000 (two hundred thousand

Saudi riyals) to an embassy of a foreign country accredited by the Ministry of Foreign Affairs.

This embassy wished to buy this building to be used by its employees. Exemption is applicable

to this transaction on condition of reciprocity. How can the tax be calculated when selling the

building? When should the tax be paid?

Explanation:

Previously Currently

VAT before exemption

becomes applicable

Real estate transactions tax after the

issuance of the royal decree

Tax rate %15 %5

Tax value

30,000 (thirty thousand Saudi

riyals)

Excluded and not subject to the tax

Registration in the

Zakat, Tax and

Customs Authority

The concerned person and the

transaction shall be registered.

The transaction shall be registered

before the conveyance or

notarization of the contract.

Tax payment date It shall be paid through the

periodic tax declaration

submitted by the registrant.

The diplomatic entity may be

refunded as a person eligible

to receive a refund.

No due tax

23

Date of application

From the beginning of 2018

until 3 October, 2020 A.C.,

and exemption starts from 4

October, 2020 A.C.

From 4 October, 2020 A.C.

The person required

to pay the tax to the

authority

Seller No due tax

24

Sale of a property by a government entity in its capacity as a public authority

Example:

A government entity wished to sell a property to a person or an establishment in the kingdom in

its capacity as a public authority. The sale was outside the economic, investment, or commercial

scope. How can the tax be calculated when selling this property? When should the tax be paid

after the issuance of the royal decree on the real estate transactions tax?

Explanation:

Previously Currently

VAT before exemption

becomes applicable

Real estate transactions tax after the

issuance of the royal decree

Tax rate It is not subject to the tax.

Registration in the

Zakat, Tax and

Customs Authority

Registration of the government

entity is not required.

The transaction shall be registered

at the Zakat, Tax and Customs

Authority.

Tax payment date No due tax

25

Sale of a property by a government entity for commercial or investment

purposes

Conveyance of a property from a government entity to individuals or establishments for

commercial or investment purposes while competing with the private sector

Example:

A government entity wished to invest in one of its properties by marketing or selling it for

1,000,000 (one million Saudi riyals) to some companies working in the kingdom. How can the

tax be calculated when selling this property? When should the tax be paid after the issuance of

the royal decree on the real estate transactions tax?

Explanation:

Previously Currently

VAT before exemption

becomes applicable

Real estate transactions tax after the

issuance of the royal decree

Tax rate %15 %5

Tax value

150,000 (one hundred and

fifty thousand Saudi riyals)

50,000 (fifty thousand Saudi riyals)

Registration in the

Zakat, Tax and

Customs Authority

The government entity

should be registered with the

authority

The transaction shall be registered

at the Zakat ,Tax , and Customs

Authority

Tax payment date It shall be paid through the

periodic tax declaration

submitted by the registrant.

It must be registered on or before the

date of notarization by a notary public

or an accredited notary.

26

Date of application

From the beginning of 2018

until 3 October, 2020 A.C.,

and exemption starts from 4

October, 2020 A.C.

From 4 October, 2020 A.C.

The person required

to pay the tax to the

authority

Seller Seller

27

Expropriation of a property for the public benefit

Conveyance of a property as per a decision issued by a competent authority to the effect of

expropriating it for the public benefit

Example:

An effective administrative decision was issued according to the Law of expropriation ofA

commercial building owned by a company for the public benefit and compulsory temporary

ownership of real estate in force in the kingdom to expropriate a residential building for the

public benefit, in the interest of a government entity. The building was valued at 500,000 (five

hundred thousand Saudi riyals). How can the tax be calculated?

Explanation:

Previously Currently

VAT before exemption

becomes applicable

Real estate transactions tax after the

issuance of the royal decree

Tax rate %15 %5

Tax value

75,000 (seventy-five

thousand Saudi riyals)

Excluded and not subject to the tax

Registration in the

Zakat, Tax and

Customs Authority

The company that owns the

expropriated property is

registered with the authority

The transaction shall be registered

at the Zakat, Tax and Customs

Authority.

Tax payment date It shall be paid through the

periodic tax declaration

submitted by the registrant.

No due tax

28

Date of application

From the beginning of 2018

until 3 October, 2020 A.C.,

and exemption starts from 4

October, 2020 A.C.

From 4 October, 2020 A.C.

The person required

to pay the tax to the

authority

Expropriated No due tax

29

Provisions of a property as an in-kind share in the capital of a company

established in the Kingdom

Conditions:

● The respective companies should not dispose of the shares or stocks corresponding

to the property disposed of for a period of five years from the date of registering or

owning the shares or stocks of the property.

● The respective companies should keep the financial statements audited by an accredited

external auditor throughout this period.

Example:

A person has a commercial building with an estimated value of 500,000 (five hundred thousand

Saudi riyals) and wishes to enter into partnership with a group of shareholders by considering

the building he owns an asset contributed as in-kind share in the capital of a joint stock company.

How can the tax be calculated? When should the tax be paid?

Explanation:

Previously Currently

VAT before exemption

becomes applicable

Real estate transactions tax after the

issuance of the royal decree

Tax rate %15 %5

Registration in the

Zakat, Tax and

Customs Authority

The individual who

transferred the property to the

company is registered as a

share in kind

The transaction shall be registered

with the authority.

30

Tax payment date It shall be paid through the

periodic tax declaration

submitted by the registrant.

No due tax if the aforementioned

conditions have been met.

Date of application

From the beginning of 2018

until 3 October, 2020 A.C.,

and exemption starts from 4

October, 2020 A.C.

From 4 October, 2020 A.C.

The person required

to pay the tax to the

authority

Seller No due tax if the aforementioned

conditions have been met.

When the company retains the shares or stocks for a period not less than five years or keeps the financial statements

audited by an accredited external auditor throughout this period.

31

VAT: Before and After

32

Leasing a residential property

Villa - Apartment - Housing Unit

Example:

A person wished to lease a residential apartment to another person in the kingdom for 20,000

(twenty thousand Saudi riyals) annually. How can the VAT be calculated at the time of leasing

the apartment? When should the tax be paid after the issuance of the royal decree on the real

estate transactions tax?

Explanation:

Previously Currently

VAT before exemption

becomes applicable

Real estate transactions tax after the

issuance of the royal decree

Tax rate Exempted from the VAT

Tax value No due tax

Date of application For all transactions, starting from January, 2018 A.C. onwards

33

Leasing a commercial property

Building - Commercial Unit - Land

Example:

A person subject to the VAT wished to lease a commercial property in the kingdom for 375,000

(three hundred and seventy five thousand Saudi riyals) to another person or establishment.

How can the VAT be calculated at the time of leasing the apartment? When should the tax be

paid after the issuance of the royal decree on the real estate transactions tax?

Explanation:

Previously Currently

VAT before exemption

becomes applicable

Real estate transactions tax after the

issuance of the royal decree

Tax rate %15

Tax value 56,250 (fifty-six thousand and two hundred and fifty Saudi riyals)

Zakat, Tax and

Customs Authority

Registration with the authority should take place if the mandatory

registration limit is reached, according to normal procedures.

Registration may become optional if supplies reach the threshold

allowed for optional registration.

Tax payment date The VAT shall be paid through the periodic tax declaration submitted

by the registrant.

Date of application For all transactions, from January 2018 onwards

34

Real Estate Transactions Subject to Real Estate

Transactions Tax

35

The real estate transactions tax applies to all real estate transactions that take place by way of

sale and the like, such as transfer of the ownership of a property, gift, bequest,

Financial leasing ending with ownership, lease-to-own process, Islamic Murabaha (sale with

an agreed profit margin), long-term usufruct contracts whose duration is more than 50 years.

This tax applies regardless of the status, appearance, or usage of the property at the time of the

transaction (sale). The tax applies to the land and the buildings constructed or established on

it, whether the transaction occurs before or after the construction of the buildings and whether

the transaction covers the entire property or any part of it. The tax also applies whether the

property is divided or undivided, is disposed of as a housing unit or any other type of property,

and whether this transaction is notarized or not. A large number of real estate transactions are

exempted from the tax and are stated in the executive regulations of the real estate transactions

tax.

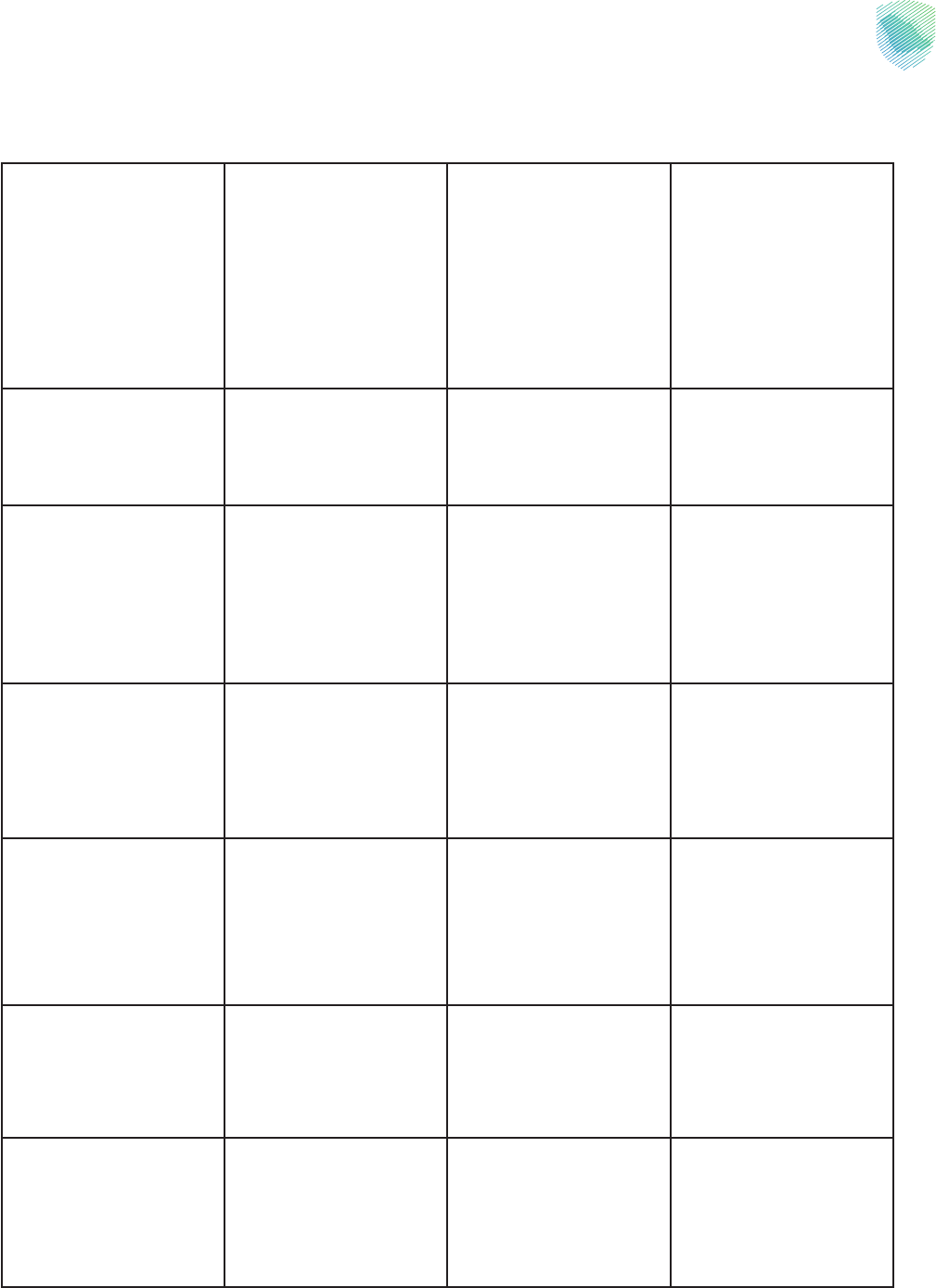

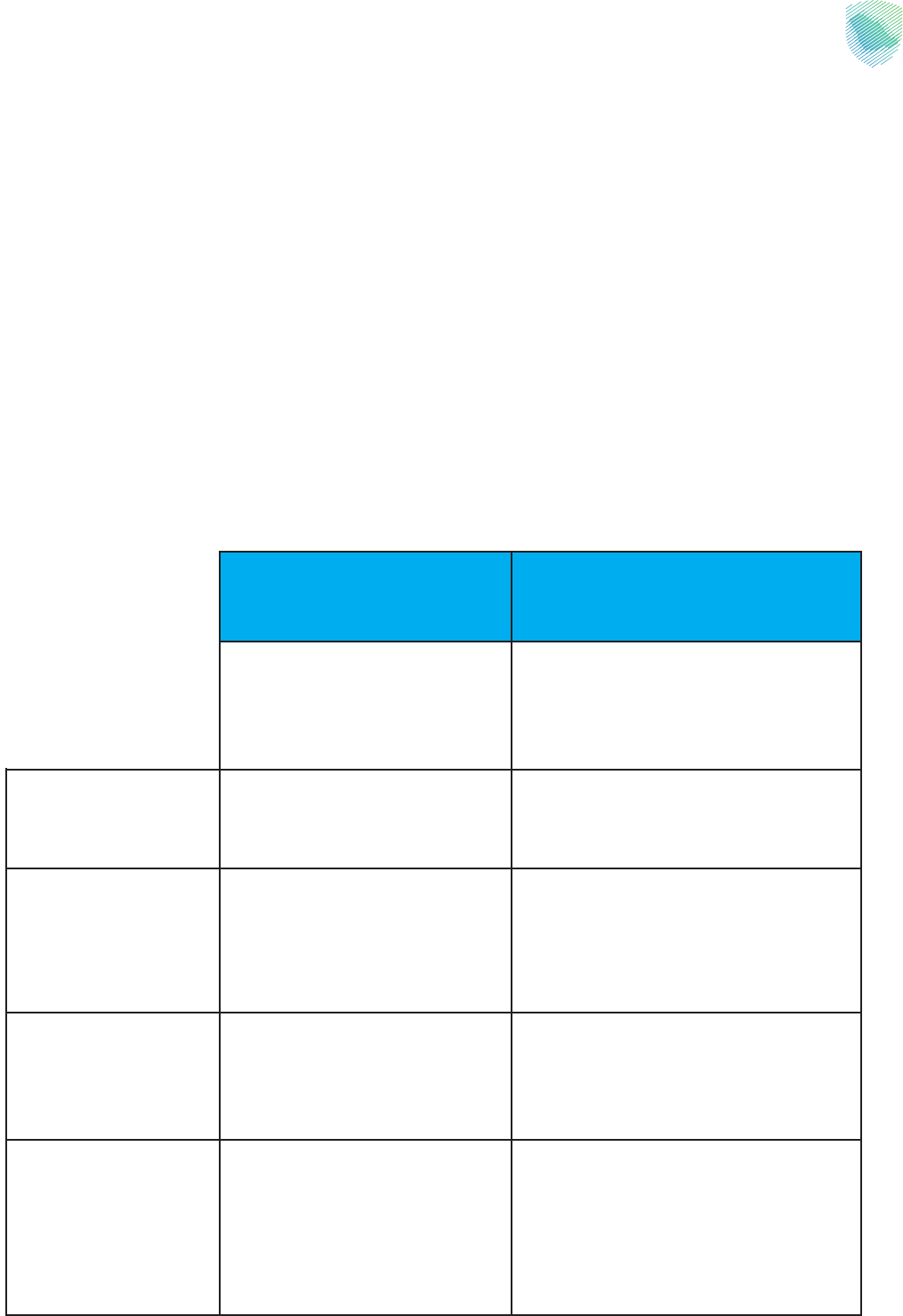

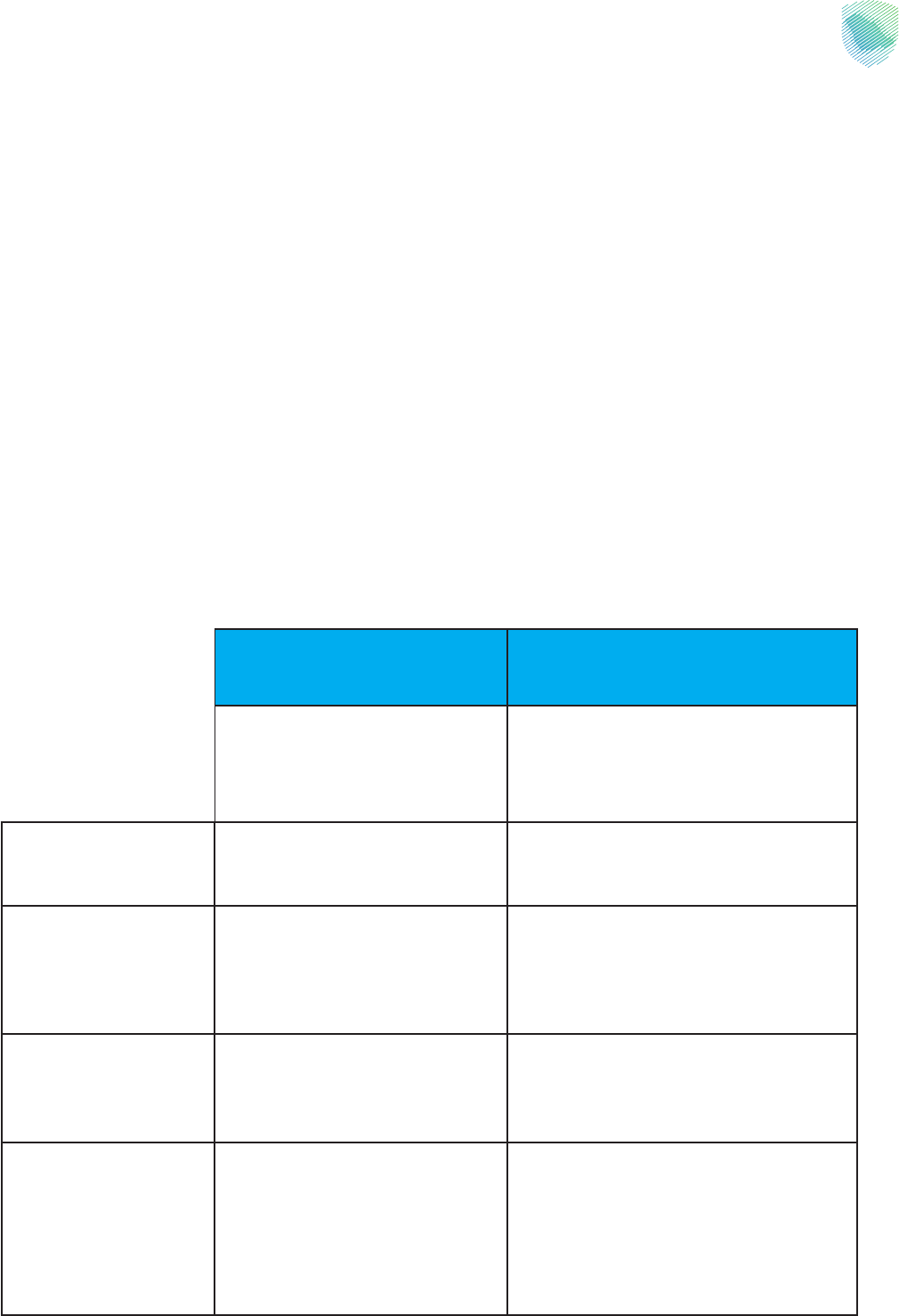

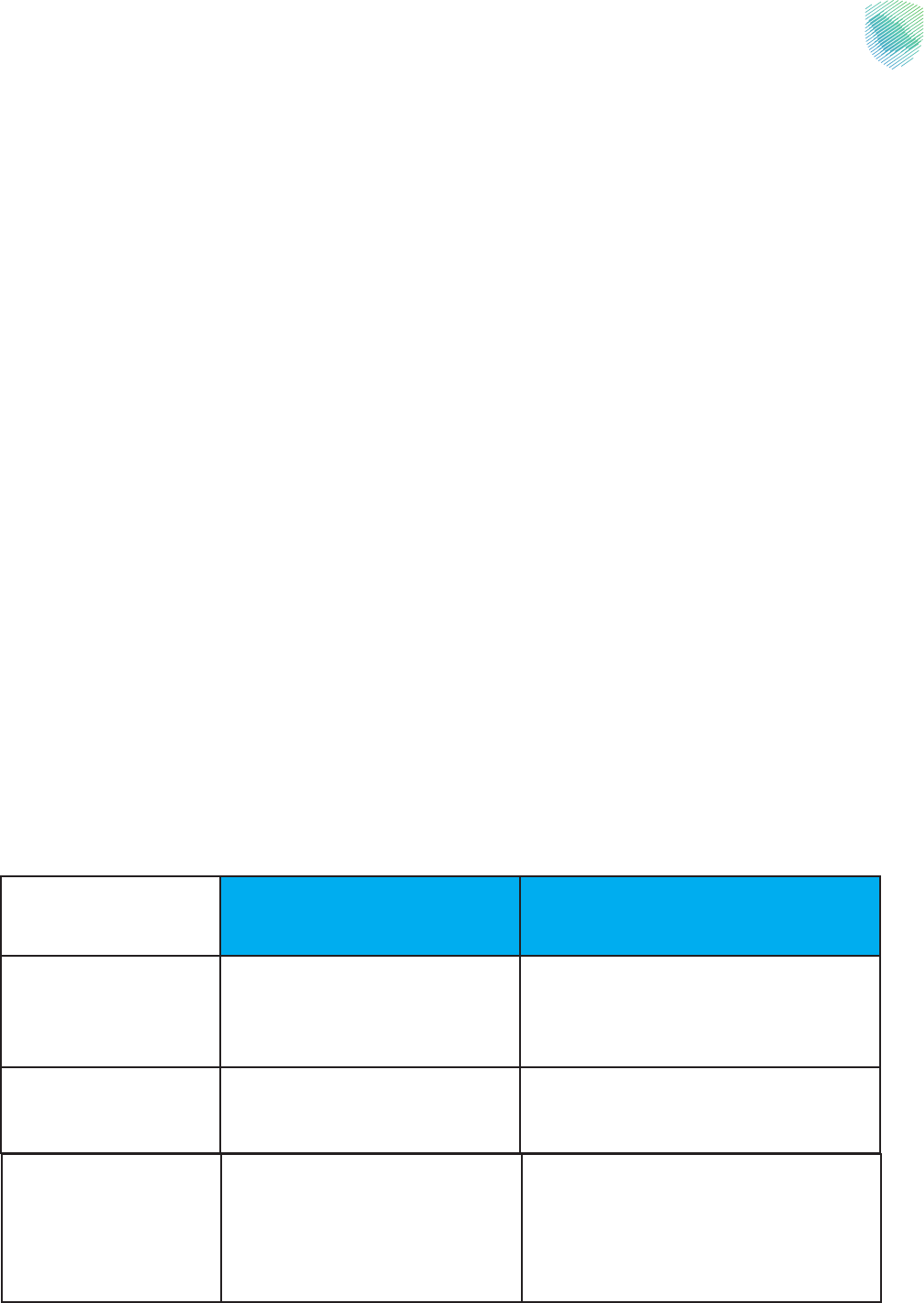

Transaction type Payment date

Sale of a property notarized by a notary public or

legally accredited notarization entity

On or before the date of notarization by a

notary public or an accredited notary

Notarization of a property given as a gift and not

exempted from the tax

On or before the date of notarization by a notary

public or an accredited notary

Lease-to-own contracts and financial leasing

contracts

On or before the date of notarization

Long-term usufruct contracts whose duration is

more than 50 years

On or before the date of notarization

Notarization of the sale of a property at an

auction, whether transaction is commercial or

forced sale

On or before the date of notarization by a notary

public or an accredited notary

Waiving lease-to-own or long-term usufruct

rights

On or before the date of notarization; signing the

assignment contract serves as notarization in the

event that notarization is not carried out.

Off-plan sale On or before the date of notarization by a

notary public or an accredited notary

36

Exceptions from Real Estate Transactions Tax

37

1. Disposal of real estate in cases of division of inheritance or distribution

The transfer of ownership of the property is exempt from the tax when distributing the

inheritance among its beneficiaries, according to their legal shares, provided that the tax is paid

when selling the property.

Example:

A person died and his inheritance was distributed among his heirs and their shares were from

the inheritance, according to the proportions specified by Sharia.

Explanation:

In this case, this disposal is exempt from the real estate transactions tax when the property is

vacated, with the obligation to register the real estate transaction in the Zakat, Tax and Customs

Authority to obtain evidence of the exemption from paying the real estate transactions tax, as

the conveyance process will not be accepted in the Ministry of Justice without registration.

If the heir sells the property after distributing the inheritance, the sale is subject to the real

estate transactions tax. In addition, if the property is sold by the heirs before distributing the

inheritance for the purposes of dividing its cash among them, the sale is subject to the real

estate transactions tax.

2. Disposal of real estate with no financial gain to a family or charitable

endowment or licensed charitable association

The transfer of ownership of the property, with no financial gain, to a family, civil or charitable

endowment or a licensed charitable association is exempt from the tax.

Example:

Land whose owner wants to donate to a licensed charitable association.

Explanation:

This disposal is exempt from the real estate transactions tax in this case, with the necessity

of registering the real estate transaction in the Zakat, Tax and Customs Authority before the

conveyance or documentation process to obtain evidence of the exemption from paying the

real estate transactions tax.

38

3. Disposal of real estate to a government entity or to public legal persons or

entities and projects of public benefit

The transfer of ownership of real estate to a government entity, public bodies and institutions,

and entities and projects of public benefit are exempt from paying the tax under the Law of Civil

Society Associations and Organizations.

Example:

One of the government agencies bought a property from one of the people for use in the

activities of that agency.

Explanation:

This disposal is exempt from the real estate transactions tax in this case, with the necessity of

registering the real estate transaction in the Zakat, Tax and Customs Authority before starting

the conveyance process in the Ministry of Justice. This is to obtain evidence of the exemption

from paying the real estate transactions tax.

4. Disposal of a real estate by a government entity as a public authority

The transfer of ownership of real estate by a government entity as a public authority outside the

framework of practicing a commercial, investment or economic activity is exempt from the real

estate transactions tax.

Example:

One of the government agencies sold a property to one of the people in the context of exercising

its function as a public authority, and not for the purpose of practicing a commercial, investment

or economic activity or as a competitor to the private sector.

Explanation:

This disposal is exempt from the real estate transactions tax, with the necessity of registering

the real estate transaction in the Zakat, Tax and Customs Authority before starting the

conveyance process in the Ministry of Justice. This is to obtain evidence of the exemption from

paying the real estate transactions tax.

39

5. Disposal of real estate by force in cases of expropriation for public benefit

or temporary seizure of the property

The transfer of ownership of real estate (conveyance) by force for the public benefit is exempt

from the real estate transactions tax by virtue of a decision of expropriation issued by a

competent authority in accordance with the laws in force in the Kingdom.

Example:

The decision of the administrative authority was issued regarding the expropriation of a

property for the public benefit.

Explanation:

This disposal is exempt from the real estate transactions tax, with the obligation to register

the real estate transaction in the Zakat, Tax and Customs Authority to obtain evidence of the

exemption from paying the real estate transactions tax.

6. Disposal of real estate as a documented gift with the competent authority

for the spouse, wife or relatives up to the third degree*

The transfer of ownership of the property with no financial gain, as a documented gift, to the

competent authority is exempt from the tax, if it is from the husband to his wife, from the wife to

her husband, or to one of the relatives up to the third degree. This is provided that the disposer

does not re-dispose of the gift of the property to a person who would not have been subject to

this exception if the property had been given to him directly from the first donor, for a period of

three years from the date of documenting the gift.

Example:

A person donated his land to his niece, and the land was conveyed into her name in the Ministry

of Justice.

40

Explanation:

The disposer (the donor) is exempt from paying the real estate transactions tax on the value

of the land before the real estate conveyance process because the disposer donated the land

to the daughter of his sister, who is one of the relatives up to the third degree. The real estate

transaction has to be registered in the Zakat, Tax and Customs Authority before the conveyance

process to obtain evidence of the exemption from paying the real estate transactions tax.

7. Disposal of real estate by virtue of a documented legal will

The transfer of ownership of real estate with no financial gain in execution of a legal will

documented by the competent authority is exempt from the real estate transactions tax

.

Example:

One of the people, in case of his death, bequeathed a piece of land, for no financial gain, to one of

his relatives who do not inherit by virtue of a legal will documented by the competent authority.

Explanation:

The disposer is exempt from the real estate transactions tax on that land, with the obligation

to register the real estate transaction in the Zakat, Tax and Customs Authority before the real

estate conveyance process to obtain evidence of the exemption from paying the real estate

transactions tax.

*”Up to third-degree relatives” means:

The first degree: father, mothers, grandparents, grandmothers, etc.

The second degree: sons and daughters and their descendants.

The third degree: brothers and sisters, siblings, or for a father or a mother, their children and their grandchildren.

41

8. Temporary transfer of ownership of the property as a guarantee for

financing or a credit

The temporary transfer of ownership of the property by its owner as part of a legitimate financial

product or as a guarantee related to financing is exempt from the tax. In this case the property

ownership is waived by its owner until he fulfills his obligations towards the financing entity,

after which the property returns to his ownership again.

Example:

An individual wanted to obtain a personal loan from one of the financial institutions, and the

institution required that the property be mortgaged or transferred into its name as a guarantee

until the person pays the full value of the loan in addition to the credit interest.

Explanation:

The individual is exempt from paying the real estate transactions tax as in this case the property

is transferred only temporarily until the debt due to the financing entity is paid, after which it

returns to the owner again. This process should be registered with the Zakat, Tax and Customs

Authority before the real estate conveyance process to obtain evidence of the exemption from

paying the real estate transactions tax.

9. Transfer of ownership of the property in implementation of lease-to-own

contracts and financial lease contracts concluded before the effective date of the

real estate transactions tax

The transfer of ownership of real estate (conveyance) that was previously held by the buyer

under lease contracts or financial lease contracts concluded before the date of the effective date

of the real estate transactions tax is exempt from the tax.

Example:

One of the individuals bought a property under the Islamic lease system in 2012, and in 2022 that

property was conveyed in his favor after paying the full installments due on the property.

42

Explanation:

The conveyance of that property is exempt from the real estate transactions tax as the lease

contract and possession of the property were concluded before the effective date of the real

estate transactions tax. This process should be registered in the Zakat, Tax and Customs

Authority before the real estate conveyance process to obtain evidence of the exemption from

paying the real estate transactions tax.

10. The real estate transaction that was previously subject to value-added tax,

provided that no change occurs with the parties of the transaction or the value and

terms of the contract

The transactions that were subject to the value-added tax and were documented after the

effective date of the real estate transactions tax are exempt from the tax, and that they were

due and paid for the value-added tax in full before the date of documentation.

Example:

One of the companies concluded a sale contract for a property with one of the individuals by

transferring the possession of the property to him in early 2020, and the due value-added tax

was paid in full on the date of transfer of possession.

Explanation:

The conveyance of that property, by the same seller to the same buyer, is exempt from the real

estate transactions tax as the same transaction was previously subject to the value-added tax on

the full value of the property, subject to the conveyance. This process should be registered in the

Zakat, Tax and Customs Authority before the real estate evacuation process to obtain evidence

of the exemption from paying the real estate transactions tax.

43

11. Temporary disposal of real estate for the purpose of transferring it between

a fund and a custodian or vice versa or between custodians of the same fund

The transfer of ownership of the property or its conveyance from a real estate fund to a statutory

custodian affiliated with it or vice versa or between custodians of the same fund shall be exempt

from the real estate transactions tax in accordance with the provisions of the Capital Market Law

and the regulations and instructions issued pursuant to it. Such a transaction should be registered

with the Zakat, Tax and Customs Authority before the real estate evacuation process to obtain

evidence of exemption from paying the real estate transactions tax.

12. Submitting the property as in - kind share in the capital of a company

established in the Kingdom, except for undisclosed partisanship companies

The transfer of ownership of the property by using it as a in - kind share in the capital of any

company established in the Kingdom, except for undisclosed partnership companies, shall be

exempt from the real estate transactions tax, provided that the shares or shares corresponding

to the property are not disposed of for a period of five years from the date of their registration

or ownership. These companies should retain audited financial statements by an external

auditor throughout this period, and the transaction should be registered with the Zakat, Tax and

Customs Authority before the real estate conveyance process to obtain evidence of exemption

from paying the real estate transactions tax.

13. Real estate transactions involving a foreign government, an international

organization or body, a diplomatic or military mission, or a member of the

diplomatic, consular or military corps accredited in the Kingdom

The transfer of ownership of the property shall be exempt from the real estate transactions tax

if one of the parties to the transaction is a foreign government, an international organization or

body, a diplomatic or military mission, or a member of the diplomatic, consular or military corps

accredited in the Kingdom, provided that they are treated on a reciprocal basis. Such transaction

should be registered with the Zakat, Tax and Customs Authority before the real estate conveyance

process to obtain evidence of exemption from paying the real estate transactions tax.

44

14. Disposal of the property by the any person in the company by transferring

the property into the name of the company

The transfer of ownership of a property by a partner in the company or whoever was a partner.

to that company shall be exempt from the real estate transactions tax provided that the property

is listed in the company’s assets before the effective date of the real estate transactions tax.

The disposer (the partner) should submit audited financial statements or a certified certificate

from a licensed legal accountant proving the inclusion of the property in the company’s assets

before the effective date of the real estate transactions tax and until the date of disposal. The

transaction should be registered with the Zakat, Tax and Customs Authority before the real estate

conveyance process to obtain evidence of exemption from paying the real estate transactions

tax.

Example (A):

A partner in one of the companies transferred the ownership of one of his properties to this

company in November 2020, knowing that this partner had submitted a certificate from a

licensed legal accountant confirming the inclusion of the property in the company’s assets since

2019 and until the present.

Example (B):

A former partner in a company transferred the ownership of one of the properties he owns to

that company in which he was a partner, noting that this former partner submitted a certificate

from a licensed public accountant confirming the listing of the property among the company’s

assets since 2019

Explanation:

This transaction is exempt from the real estate transactions tax in this case because the property

was listed within the company’s assets before the effective date of the real estate transactions

tax.

15. Disposal of the property by submitting it as in- kind contribution to the capital

of a real estate investment fund

The submission of properties as in- kind contribution to the capital of real estate investment

funds and in accordance with the provisions of the Capital Market Law and the regulations

and instructions issued pursuant to it. Provided that the units of the Fund or the corresponding

45

shares shall not be disposed of until the date of termination or liquidation of the Fund, or for

a period of five years from the date of acquisition of the units or shares, whichever is earlier,

This transaction should be registered with the Zakat, Tax and Customs Authority before the

real estate conveyance process to obtain evidence of exemption from paying the real estate

transactions tax.

Example:

One of the persons submitted one of the properties he owns as in - kind contribution to one of

the real estate investment funds which was established for the purpose of developing and

Explanation:

This transaction is exempt from the real estate transactions tax in this case because the

investment fund to which the property was invested was being established at that time

and its goal was to develop properties for resale With the necessity of achieving the time

restriction related to the condition of not disposing of the Fund’s units or shares corresponding

to the real estate disposal.

16. Real estate transaction by a natural person to a company or an investment

fund that owns directly or indirectly all the stocks of the company or the shares or

units of the fund

The disposal of the property by a natural person(s) to a company or an investment fund

established in the Kingdom, for which the person(s) owns directly or indirectly all its stocks,

shares or units of the fund shall be exempt from the real estate transactions tax provided that

there has been no change in his/their ownership percentage in the company or the fund for a

period of not less than five years from the date of the real estate transaction. This includes:

The case when there is a match in the full ownership percentage(s) of the natural person(s) in

the property and the company or the fund to which the property was disposed.

Example 1:

One of the individuals transferred the ownership of one of his properties to a company or fund

in which he owns 100% of the shares, and there is a continuation of his full ownership in the

company or the fund to which he transferred the property, without any change in this for a period

of 5 years from the date of the real estate transaction; such a transaction is exempt from being

subject to the real estate transactions tax due to the full ownership of the company or the fund

and the expiration of the time limit.

46

Example 2:

Ahmad and Abdullah both own 50% of the shares of the same property, and they transferred

the ownership of the property to a company owned by the two of them in full by the same

percentage as their ownership of the property, i.e. both own 50% of the shares in the company.

Thus, this transaction is exempt from being subject to the real estate transactions tax because of

the match in the percentages for the same owners and the expiration of the time limit.

Explanation:

The person is exempt in this case from paying the real estate transactions tax as the conditions

required for exemption are fulfilled, which are owning all the stocks or shares in the company

or owning all the units of the fund, and the full ownership percentage in the company or the fund

transferred to which the property was transferred had not changed for a period of 5 years from

the date of the real estate transaction.

17. Real estate transaction between a company and another company

established in the Kingdom, one of which owns directly or indirectly all the stocks

of the other company or its shares; real estate transaction between a company and

an investment fund established in the Kingdom when the company owns directly

or indirectly all the units of the fund; real estate transaction between companies

or investment funds established in the Kingdom for which all their stocks, shares

or units are owned directly or indirectly by the same persons

The following cases are exempt from the real estate transactions tax: the disposal of the property

between a company and another company established in the Kingdom, one of which owns all

the stocks or shares of the other company; the real estate transaction between a company and

an investment fund established in the Kingdom when the company owns all the units of the

fund; and the real estate transaction between companies that are owned by the same persons.

The exemption depends on the ownership of the companies directly or indirectly provided that

the ownership percentage of that person in the company or the fund to which the property was

disposed has not changed for a period of not less than five years from the date of the real estate

transaction. The exception aims to encourage people to restructure their business without

incurring financial burdens as a result.

47

Example 1:

Company (A), which is a company that owns 100% of company (B), transferred a property to

company (B), with the full ownership of company (A) in company (B) continuing without change

for a period of 5 years from the date of the real estate transaction. Thus, this transaction is exempt

from being subject to the real estate transactions tax due to the ownership in the company to

which the property was disposed has not changed and the expiration of the time limit.

Explanation

Company (A) is exempt in this case from paying the real estate transactions tax as the real

estate transaction was made with the company that is fully owned by it, with the condition that

the ownership of the company has not changed for a period of 5 years starting from the date of

the real estate transaction.

Example 2:

Company (A) transferred a property to an investment fund in which it owns all the units, without

this ownership of the fund changing for a period of 5 years from the date of the real estate

transaction. Thus, this transaction is exempt from being subject to the real estate transactions

tax due to company (A) having full ownership of the fund’s units and the expiration of the time

limit.

Explanation

Company (A) is exempt in this case from paying the real estate transactions tax as the real estate

transaction was made to the fund that it fully owns, with the condition that the full ownership of

the fund’s units has not changed for a period of 5 years, starting from the date of the real estate

transaction.

Example 3:

Company (A) owns all the shares in company (B) and company (C), and the real estate transaction

was made between company (B) and company (C) while the full ownership of company (A) in

company (C) did not change for a period of 5 years from the date of the real estate transaction.

Thus, this transaction is exempt from being subject to the real estate transactions tax because

of the full ownership of the two companies (the disposer and the disposed to) and the expiration

of the time limit.

48

Explanation:

Company (B) is exempt in this case from paying the real estate transactions tax as the real estate

transaction was made between two companies that are fully owned by the same person, in

addition to the fact that the ownership of all the shares in company (C) by that person of company

(A) did not change throughout a period of 5 years from the date of the real estate transaction.

18. Disposal of the property by any person to a licensed real estate developer to

practice off-plan sale and lease activities

The disposal of the property by any person to a licensed real estate developer to practice off-plan

sale and lease activities in accordance with the systems, regulations, controls and instructions

in force in the Kingdom shall be exempt from the real estate transactions tax provided that the

property is allocated to one of the off-plan sale projects and a decision has been issued from the

Off-Plan Sale and Lease Committee to license the sale.

Example:

One of the persons disposed of a property that he owns to one of the licensed real estate

developers from the Off-Plan Sale and Lease Committee, and a decision was issued to license

the sale on the map regarding the property which is the subject of the disposal.

Explanation:

This transaction is exempt from the real estate transactions tax in this case as the transaction

was made to a real estate developer licensed by the Off-Plan Sale Committee and the property

was licensed for and allocated to one of the sale projects on the map.

49

19. Disposal of the property with no financial gain to a company established in

the Kingdom for which all of its stocks or shares are owned directly or indirectly

by a family or charitable endowment

The disposal of the property with no financial gain to a company established in the Kingdom

for which all of its stocks or shares are owned directly or indirectly by a family or charitable

endowment, provided that the ownership percentage of the endowment in the company that to

which the property was disposed has not changed for a period of five years from the date of the

transaction. This exemption aims to not impose any taxes on endowments due to the existence

of exemptions in force for them in accordance with the exception number (2) of this guide.

Example:

One of the persons disposed of a property, with no financial gain, to a company established in the

Kingdom for which all of its stocks and shares are owned by a family or charitable endowment,

provided that the ownership percentage of the endowment in the company to which the

property was disposed has not changed for a period of five years from the date of the real estate

transaction.

Explanation:

This transaction is exempt from the real estate transactions tax in this case because the

transaction of transferring the ownership of the property was with no financial gain and it was

transferred to a company that is 100% owned by a family or charitable endowment while the

percentage ownership of the endowment in the company to which the property was transferred

did not decrease from 100% for a period of 5 years from the date of the real estate transaction.

20. Returning the property to its previous owner as a result of canceling the

documented real estate transaction at the notary public or the accredited notary

by mutual consent between its parties

The return of the property to its previous owner as a result of canceling the documented real

estate transaction at the notary public or the accredited notary, by mutual consent between its

parties, shall be exempt from the real estate transactions tax provided that there is no change in

the description of the property and there was a return of its full value.

50

Example:

Yusuf (the disposer) sold a property to Muhammad (the person disposed to or the collector).

However, after a period of one month from the date of documenting the real estate transaction,

both the disposer and the collector canceled the documented real estate transaction and agreed

to return the property, without any change in its descriptions and its value.

Explanation:

This real estate transaction, which is the return of the property by the collector to the disposer, is

exempt from the real estate transactions tax if the real estate transaction is canceled by mutual

consent between its parties and within 90 days from the date of documenting the real estate

transaction, provided that the property is returned without any change in its descriptions at the

time of documenting, and there was a return of its full value. The tax paid for the canceled real

estate transaction is also refunded.

21. The transaction is subject to the real estate transactions tax only once when

the unity of the parties of the transaction, the property and the value is achieved

It is not permissible for the real estate transaction to be subject to the tax more than once when

the unity of the parties of the transaction, the property and the value are achieved. This excludes

transactions related to Islamic leasing and its equivalents.

Example:

One of the individuals purchased a property under the Islamic leasing system after the entry into

force of the real estate transactions tax, and the seller paid the real estate transactions tax that

was due (5%) on the date of the seller’s conveyance to the financing party.

Explanation

The conveyance process, from the financing party to the final beneficiary, is exempt from the

real estate transactions tax as the first conveyance of the same transaction was subject to the

tax and the tax due on it was paid on the date of the first conveyance. This process should be

registered in the Zakat, Tax and Customs Authority before the real estate evacuation process to

obtain what proves the exemption from the real estate transactions tax.

51

Violations and fines

52

5%

The delay penalty is calculated at an amount equal to 5% of the unpaid tax amount for each

month or part thereof for which the tax has not been paid.

10,000 SR

A fine of not less than 10 thousand riyals and not exceeding the value of the tax is due for violating

the provisions of the real estate transactions tax, such as in the event of a failure to disclose

details in a timely manner, failure to disclose details accurately, providing an inaccurate value

for the property, or other violations mentioned in the Real Estate Transactions Tax Regulations.

The amount of tax due

The tax evasion penalty reaches a financial fine of not less than the value of the tax due and not

exceeding three times of its value.

**Violations fall on the seller and he is responsible for paying the tax value to the Authority.

53

Mechanism of Objection to the Real Estate

Transactions Tax

54

Mechanism of Objection to the Real Estate

Transactions Tax

Watch the video:

https://youtu.be/tkPmEw0WiwQ

55

Contact us

For more information on any transaction subject to the real estate transactions tax, please visit

the website:

Zatca.gov.sa

Or contact us at the following number:

19993

56

Scan this code to view the last

version and all published documents

Or visit the website zatca.gov.sa