Vehicles and Vessels: Use Tax

Please read the appendix

if you are registering …

Commercial deep-sea fishing vessels.

Equipment used to produce and harvest agricultural

products or used in commercial timber harvesting.

Contents

Introduction

Overview 1

Who is required to pay California use tax? 1

Exchange of information between states 1

If I am required to pay use tax, how is the tax amount calculated? 1

If I qualify for an exemption, do I need to obtain a use tax clearance? 2

If I did not pay the use tax at DMV, what should I do? 2

Entering into a payment plan with CDTFA 3

Where can I get help? 3

Vehicles and Vessels Transferred to Individuals

Received as a gift 4

Purchased from a family member 5

Involuntary transfer of ownership (court order, inheritance) 5

Dissolution of a corporation, limited liability company, or partnership 5

Purchased or delivered out-of-state 6

Assistance with your questions on out-of-state purchases 7

Vehicles 7

Vessels 7

How to calculate your use tax liability 9

Military personnel 9

Purchased from the U.S. government 9

Private party purchase for out-of-state use, one-trip permit 10

Purchased by a Native American for use on a reservation 10

Vehicles and Vessels Transferred to a Corporation, Limited Liability

Company, or Partnership

Transfers to existing corporations 12

Intercompany transfers 12

Contributions to commencing corporations, limited liability companies, or partnerships 13

Transfers to substantially similar corporations, limited liability companies, or partnerships 13

Involuntary transfer of ownership (court order or repossession) 14

Vehicles and Vessels Transferred into Revocable Living Trusts

Transfers into revocable living trusts 15

Appendix 1

Commercial Deep-Sea Fishing Vessels 16

Appendix 2

Partial Tax Exemption for Qualified Farm Equipment or Timber

Harvesting Equipment and Machinery 17

Appendix 3

Charged the Incorrect Tax Rate on Vehicles and Vessels? 19

Appendix 4

Vehicles and Undocumented Vessels Purchased for Use in Interstate and Foreign Commerce 21

Vessels Used to Transport Persons or Property for Hire—Regulation 1594 21

Electronic Logging Device 22

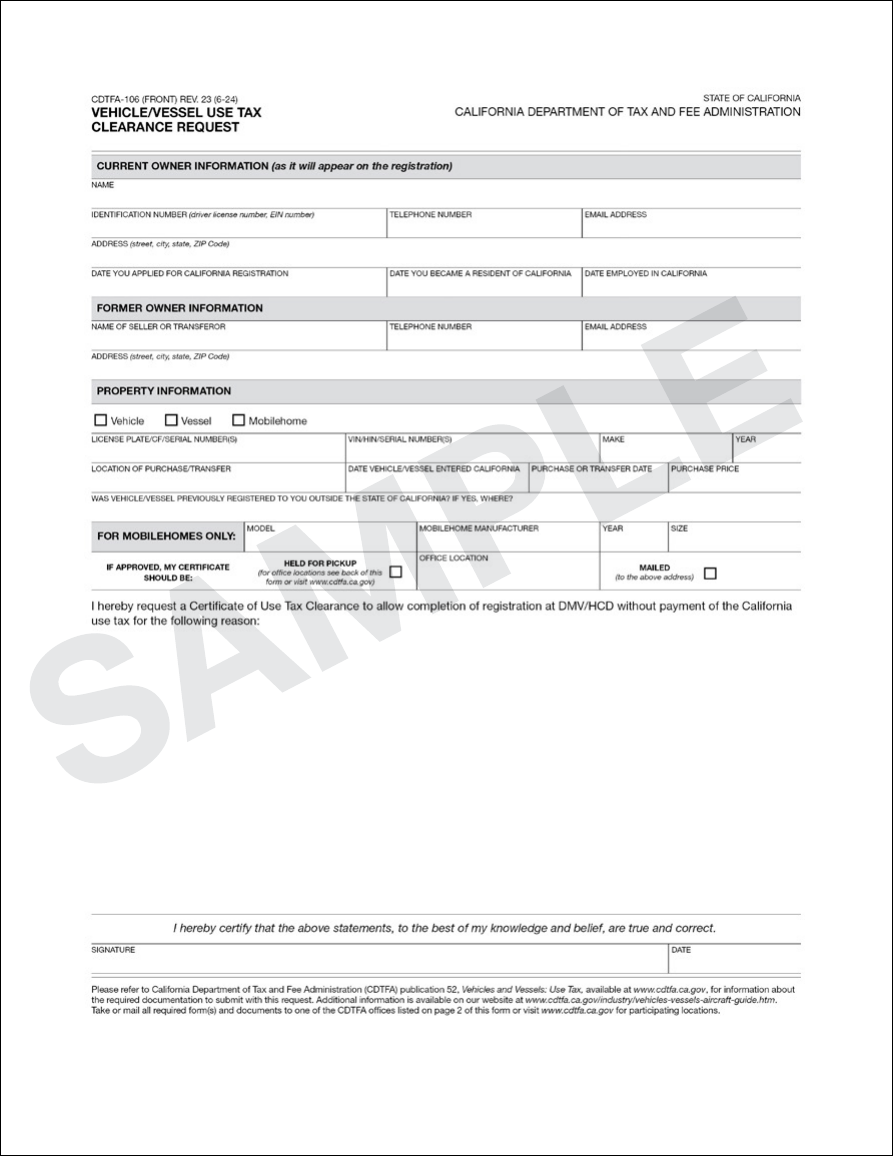

Sample CDTFA-106, Vehicle/Vessel Use Tax Clearance Request 23

For More Information 25

Regulations, Forms, and Publications 26

MAY 2024

|

VEHICLES AND VESSELS: USE TAX

Introduction

Overview

This publication provides examples of vehicle and vessel transfers that are not subject to California use tax.

You will also find instructions on how to apply for a “use tax clearance” issued by the California Department of Tax and Fee

Administration (CDTFA). There are two types of certificates, CDTFA-111, Certificate of Vehicle, Mobilehome or Commercial

Coach Use Tax Clearance and CDTFA-111-B, Certificate of Vessel Use Tax Clearance.

A use tax clearance is a document issued by CDTFA stating that you qualify for a specific exemption and that you may

register your vehicle or vessel without payment of use tax.

This publication addresses only the more common exemptions. If you think you may qualify for an exemption that is not

described here, please call or write CDTFA to discuss your situation (see If I qualify for an exemption, do I need to obtain a

use tax clearance?).

If you purchased a trailer for use in interstate and foreign commerce and think it may be exempt from California use tax,

please review Appendix 4. You may also contact our Consumer Use Tax Section at 1-916-445-9524 prior to obtaining a

Permanent Trailer Identification at the California Department of Motor Vehicles (DMV).

This publication does not apply to documented vessels that are registered with the U.S. Coast Guard. For information

on exemptions for the purchase and use of documented vessels, please refer to publication 40, Watercraft Industry, or

call our Customer Service Center at 1-800-400-7115 (CRS:711). You can also contact our Consumer Use Tax Section at

1-916-445-9524 for more information.

Who is required to pay California use tax?

Unless an exemption applies, either sales or use tax applies to the

purchase of vehicles or vessels for use in California.

If you buy a vehicle or vessel from someone who is engaged in

business in California as a vehicle or vessel dealer, that person is

responsible for reporting and paying sales tax.

However, if you buy a vehicle or vessel—or receive one as

compensation—from someone who is not a California dealer, you

are generally required to pay use tax for the use of the property in

this state.

As explained in this publication, your purchase may qualify for an

exemption and may not be subject to use tax.

Exchange of information between states

CDTFA may forward the documentation from a use tax clearance request (for a vehicle or vessel) to other states, in

accordance with agreements for reciprocal exchange of information between states. Please contact our Consumer Use

Tax Section at 1-916-445-9524 for additional information.

If I am required to pay use tax, how is the tax amount calculated?

The tax rate for use tax is the same as that for sales tax, but it is determined by the address where the vehicle is registered

or the vessel is moored.

1

The use tax is based on the total purchase price of the vehicle or vessel. The total purchase price includes cash, the

payment or assumption of a loan or debt, and the fair market value of any property and/or services traded or exchanged

for the vehicle or vessel.

1

If DMV charges you an incorrect tax rate, see Appendix 3.

VEHICLES AND VESSELS: USE TAX

|

MAY 2024

If I qualify for an exemption, do I need to obtain a use tax clearance?

A use tax clearance is a document issued by CDTFA stating that you qualify for a specific exemption and that you may

register your vehicle or vessel without payment of use tax.

DMV can process many nontaxable transfers without requiring that you obtain a use tax clearance from CDTFA. For example,

transfers of vehicles between qualified family members may not require a certificate of use tax clearance.

If you are asked by DMV to obtain a use tax clearance for a vehicle or vessel, follow the procedures listed below. If you

have questions regarding these procedures, please contact CDTFA or DMV.

To avoid penalty charges, be sure to pay your DMV transfer fee on time. The transfer fee must be paid timely, even

if you have not yet received a reply from CDTFA about your request for a use tax clearance. If you apply for a use tax

clearance, DMV will return your registration application to you and ask that you re-submit it to them after you have

received a reply from CDTFA. If CDTFA issues you a CDTFA-111 or a CDTFA-111-B, submit it to DMV along with the

registration application to complete your registration of the vehicle or vessel.

To apply for a use tax clearance, use CDTFA's Online Services and under Limited Access Functions, select Request

Use Tax Clearance for Registration with DMV/HCD. Or, you may submit a CDTFA-106, Vehicle/Vessel Use Tax Clearance

Request to CDTFA.

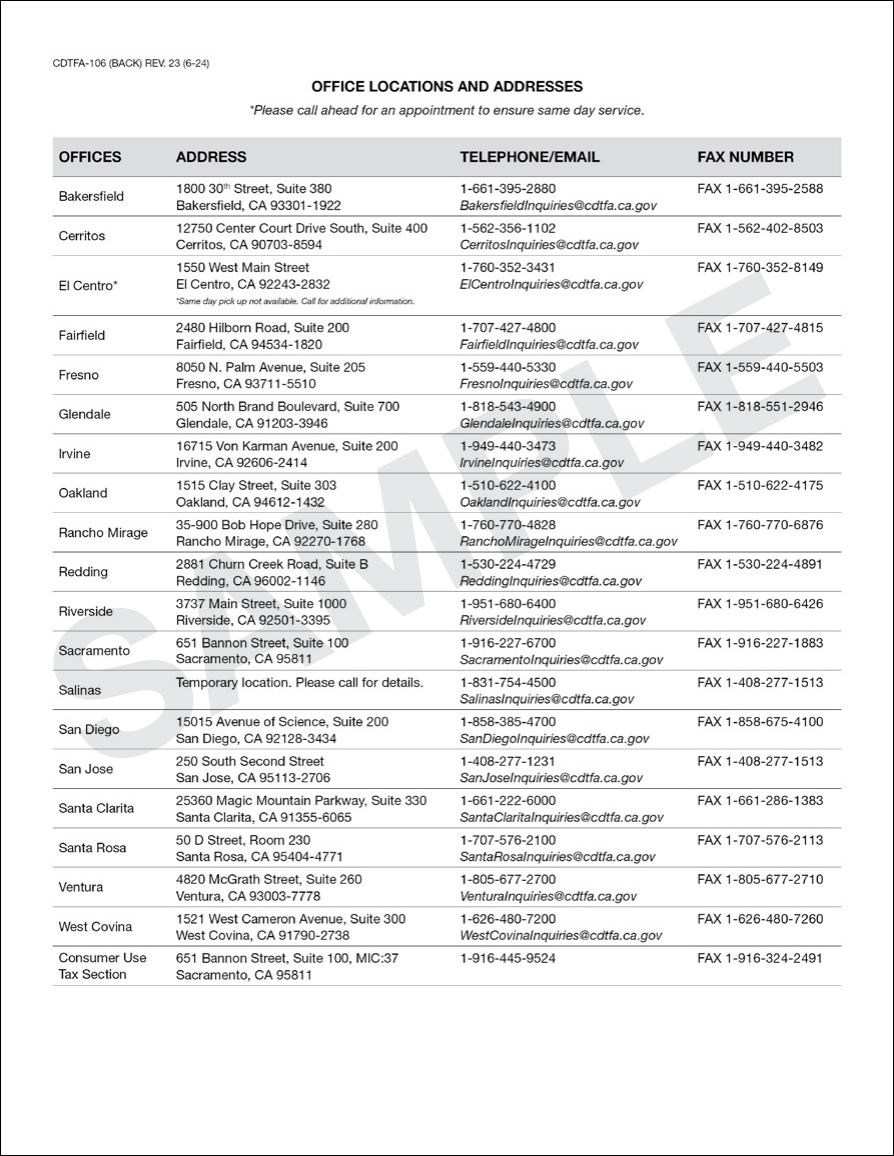

You may mail, fax, or submit CDTFA-106 to your local CDTFA office or the Consumer Use Tax Section in Sacramento. For a list

of addresses, fax, and telephone numbers for local CDTFA offices, visit our Office Locations and Addresses page.

To mail your application with copies of supporting documentation directly to our Consumer Use Tax Section, please

send them to:

Consumer Use Tax Section MIC:37

California Department of Tax and Fee Administration

PO Box 942879

Sacramento, CA 94279-0037

If your request is approved, CDTFA will issue you a CDTFA-111, Certificate of Vehicle, Mobilehome, or Commercial Coach

Use Tax Clearance for a vehicle or a CDTFA-111-B, Certificate of Vessel Use Tax Clearance, for a vessel. Return your DMV

registration application, along with the original CDTFA-111 or CDTFA-111-B, to DMV. (Make a copy of DMV application

and the use tax clearance certificate for your records.)

Please note: In some cases, CDTFA may ask for additional information before deciding on whether to approve a use

tax clearance request. If you are asked to provide supporting documentation, as indicated in this publication, please

provide photocopies. Please do not send original documents.

If your request is denied, the use tax is due and must be paid to DMV. If you disagree with CDTFA's findings, you must

still pay the tax to DMV. However, you may file a claim for refund with CDTFA, please see publication 117, Filing a Claim

for Refund.

Claims for refund should be sent to:

Audit Determination and Refund Section MIC:39

California Department of Tax and Fee Administration

PO Box 942879

Sacramento, CA 94279-0039

Please contact our Consumer Use Tax Section at 1-916-445-9524 or a local CDTFA office if you have additional questions

regarding denied exemption requests. For other contact options, please visit our How to Contact Us page.

If I did not pay the use tax at DMV, what should I do?

If you did not pay or make your full use tax payment to DMV on your vehicle or undocumented vessel at the time of

registration, you should:

Report and pay the use tax directly to CDTFA on our website at www.cdtfa.ca.gov by selecting the Register button, then

by selecting Pay Use Tax or File an Exemption for a Vehicle, Vessel, Aircraft, or Moblie Home.

MAY 2024

|

VEHICLES AND VESSELS: USE TAX

Report your purchases of vehicles or undocumented vessels subject to use tax in person at any of our field offices.

Additionally, CDTFA has two mobile applications for taxpayers to do their business on the go.

To pay online, please have the following information available:

Name and address of both the purchaser and seller

Identification number of the property purchased such as the vehicle’s identification number (VIN), license plate

number, the vessel’s California registration number (CF), or hull identification number (HIN)

Make, model, and year of property

Date of purchase

Total purchase price

Address where the vehicle will be registered or where the undocumented vessel will be routinely moored or stored

Entering into a payment plan with CDTFA

If you are not able to pay the full amount of your use tax to DMV, you may be eligible to make smaller payments by

applying for a payment plan online with CDTFA. If you qualify, you may be able to pay your liability in weekly or monthly

installments. The amount of your payments will generally depend on the amount you owe and your ability to pay. You

can easily apply for a payment plan or find more information by visiting our website and clicking on

Online Services and then Payment Plan.

If your payment plan is approved, CDTFA will issue you a use tax clearance that can be taken to DMV at the time of

registration.

After CDTFA issues the use tax clearance, a bill (Notice of Determination) will be sent to you for the use tax due based on

the total purchase price plus any penalty and interest charges. Interest will continue to accrue on any unpaid tax until

paid in full. However, if you comply with the terms of the payment plan, the 10 percent finality penalty may be relieved

under certain circumstances.

For more information regarding applying for a payment plan with CDTFA, please contact the Tax Collections Bureau at

1-916-309-8150.

Where can I get help?

California Department of Tax and Fee Administration

For general questions regarding use tax exemptions

Please call our Customer Service Center at 1-800-400-7115 (CRS:711).

For questions regarding use tax clearances already filed

If you filed your request (CDTFA-106) you can call your local CDTFA office directly or our Consumer Use Tax Section at

1-916-445-9524 for help.

Department of Motor Vehicles

Please contact your local DMV field office. For a listing of local offices, visit www.dmv.ca.gov.

VEHICLES AND VESSELS: USE TAX

|

MAY 2024

Vehicles and Vessels Transferred to Individuals

Received as a gift

If you received a vehicle or vessel as a gift, you are not required to

pay California use tax on that gift.

However, the vehicle or vessel is not considered a gift if:

You paid cash, traded property, provided services, or assumed a

liability in exchange for the vehicle or vessel; or

Your employer gave you the vehicle or vessel as a form of

compensation (for example, a vehicle given to an employee as a

bonus).

Examples of transfers that do not qualify as gifts:

A friend gives you a vehicle and you agree to take over the loan payments. You must pay use tax computed on the

balance of the loan still owed to the lender and any other consideration given to acquire the vehicle.

You are a shareholder and are given a vehicle or vessel by the corporation as a dividend. Use tax applies to the value

reported by the corporation as a dividend on its income tax return.

How to file a request for a use tax clearance (CDTFA-111 or CDTFA-111-B)

In most cases DMV will not ask you to provide a use tax clearance for a gift. However, if DMV does, you must submit a

CDTFA-106, Vehicle/Vessel Use Tax Clearance Request, to CDTFA to request a use tax clearance. If you are registering more

than one vehicle or vessel, you can attach a list to the form. Include copies of the following documentation:

A copy of the certificate of title or the current registration if title is not available.

Include on CDTFA-106 a written statement signed by you indicating that you did not pay for the vehicle or vessel, trade

other property for it, assume a debt in exchange for it, or receive it as a dividend, or compensation from an employer.

Include the vehicle’s identification number (VIN) or license plate number, or the vessel’s California registration number

(CF) or hull identification number (HIN).

If the gift is from an individual, provide a signed, written statement from that person indicating the property was given

to you as a gift. While a notarized statement is preferable, it is not required. The statement must contain the vehicle’s

identification number (VIN), license plate number, vessel’s California registration number (CF), or hull identification

number (HIN) along with the donor’s mailing address and telephone number.

If the donor is a corporation, Limited Liability Company (LLC), partnership, or similar business organization, provide

a copy of the business or corporate minutes from a meeting of the Board of Directors or governing body, showing

authorization of the gift. The minutes should include information that clearly describes the vehicle or vessel, such as

the vehicle’s identification number (VIN) or license plate number, or the vessel’s California registration number (CF),

or hull identification number (HIN). If minutes are not available, a signed statement from an officer/member of the

corporation, limited liability company, partnership will be accepted provided there is an accurate description of the

item and the name of the person receiving the gift is identified as the claimant. A notarized statement is preferable, but

is not required. The statement should also include the donor’s mailing address and telephone number.

If the transfer is to or from a trust, provide copies of the title page and signature or execution pages of the trust, plus

the applicable pages—referring to the vehicle or vessel.

If you received the vehicle or vessel as a gift from a licensed vehicle or vessel dealer, obtain a copy of the bill of sale or

a statement from the dealer stating that the tax will be paid to the state. This document should include the dealer’s

business name and address and California seller’s permit number.

You may be required to provide additional information.

MAY 2024

|

VEHICLES AND VESSELS: USE TAX

Purchased from a family member

You are not required to pay use tax on the purchase of a vehicle or vessel from a parent, grandparent, grandchild, child,

spouse, or domestic partner. If you are a minor (under age 18) and purchase a vehicle or vessel from a minor brother or

sister (related to you by blood or adoption), you are not required to pay use tax. Otherwise, tax applies.

Please note: The tax exemption does not apply if:

The vehicle or vessel is purchased from a family member who is a licensed vehicle or vessel dealer in California.

The vehicle or vessel is being transferred from a revocable living trust to a family member who is not a trustee of the trust.

The vehicle or vessel is purchased from a stepparent, step-grandparent, step-grandchild, stepsibling (if both parties are

minors), or stepchild (there must be a legal adoption for these relations to fall under the exemption).

How to file a request for a use tax clearance (CDTFA-111 or CDTFA-111-B)

In most cases, DMV will not ask you to provide a use tax clearance. However, if DMV does, you must request the use tax

clearance from CDTFA by submitting a CDTFA-106, Vehicle/Vessel Use Tax Clearance Request. If you are registering more than

one vehicle or vessel, you can attach a list to the form. Include copies of the following documentation:

Documents that show proof of the relationship (and age if the transfer is between minors), such as a marriage

license, or a Franchise Tax Board tax return showing the parties as spouses, a Certificate of Registration of Domestic

Partnership, a birth certificate, or an adoption certificate.

A copy of the certificate of title or current registration if title is not available.

Involuntary transfer of ownership (court order, inheritance)

If you have assumed ownership as the result of an involuntary transfer of ownership, you are not required to pay use tax on

the transferred vehicle or vessel. An involuntary transfer is one in which you assume ownership of a vehicle or vessel due to

circumstances beyond your control. For example, you may have acquired the vehicle or vessel as the result of a court order, a

property settlement in a divorce, an inheritance from an estate, or the repossession of a vehicle or vessel you sold.

How to file a request for a use tax clearance (CDTFA-111 or CDTFA-111-B)

To file a request for a use tax clearance, submit your completed CDTFA-106, Vehicle/Vessel Use Tax Clearance Request, to

CDTFA. If you are registering more than one vehicle or vessel, you can attach a list to the form.

Include copies of the following documentation:

A copy of the certificate of title or properly endorsed documents from the court or DMV.

Official court property settlement documents or a certificate of repossession. The documents should include

information that clearly describes the vehicle or vessel, such as the vehicle’s identification number (VIN) or license plate

number, or the vessel’s California registration number (CF) or hull identification number (HIN). If they do not provide

adequate information, you may need to obtain additional documentation.

Dissolution of a corporation, limited liability company, or partnership

You may have received a vehicle or vessel as the result of the distribution of assets upon the dissolution of a corporation,

limited liability company, or partnership. If the vehicle or vessel was given to you solely as a liquidation distribution

and no consideration was given for the property (for example, the payment of cash or the assumption of a liability), the

transfer is not subject to use tax.

How to file a request for a use tax clearance (CDTFA-111 or CDTFA-111-B)

To file a request for a use tax clearance, submit your completed CDTFA-106, Vehicle/Vessel Use Tax Clearance Request to

CDTFA. If you are registering more than one vehicle or vessel, you can attach a list to the form.

Include copies of the following documentation:

A copy of the certificate of title or copy of the current registration if title is not available.

Business or corporate minutes from a meeting of the Board of Directors or governing body authorizing the

distribution of assets. The minutes should include information that clearly describes the vehicle or vessel, such as

VEHICLES AND VESSELS: USE TAX

|

MAY 2024

the vehicle’s identification number (VIN) or license plate number, or the vessel’s California registration number (CF)

or hull identification number (HIN). If minutes are not available, a signed statement from an officer/member of the

corporation, limited liability company, or partnership will be accepted provided there is an accurate description of

the item and the name of the person receiving the property is identified as the claimant. If the corporation is closely

held, a statement containing the above information, signed by the officers, will suffice. While a notarized statement is

preferable, it is not required.

Dissolution documents, which carry a filing stamp verifying certification by the Secretary of State. The documents

should indicate that the liabilities of the corporation, limited liability company, or partnership have been satisfied.

You may be required to provide additional information.

Purchased or delivered out-of-state

The applicable test period used to establish whether a vehicle or vessel purchased or delivered out-of-state is presumed to

have been purchased for use in this state generally depends upon the purchase date of the vehicle or vessel.

If you purchase a vehicle or vessel outside of California but first functionally used it in California, the exclusion does not

apply and the purchase and use is subject to use tax.

A vehicle or vessel purchased outside of California, first functionally used outside of California, and brought into California

within 12 months from the date of its purchase is also presumed to have been purchased for use in California and subject

to tax if any of the following conditions occur:

Purchased by a California resident as defined in section 516 of the California Vehicle Code

1

, or

In the case of a vehicle, subject to California vehicle registration during the first 12 months of ownership, or

In the case of a vessel, subject to property tax in California during the first 12 months of ownership, or

Used or stored in California for more than one-half of the time during the first 12 months of ownership.

Please note: A California resident is defined to include a closely held corporation or limited liability company if 50 percent

or more of the shares or membership interests are held by members who are residents of California as defined in section

516 of the Vehicle Code.

The four conditions listed above are independent conditions under which the presumption of purchase for use in

California may arise. Only one of the conditions needs to be met for the presumption to apply.

The presumption may be rebutted if the purchaser provides sufficient documentation as evidence to prove the vehicle or

vessel was purchased for use outside California during the first 12 months of ownership. This evidence may include, but is

not limited to, proof of registration of the vehicle or vessel with the proper out-of-state authority; whether the purchaser

had a residence out-of-state; the location that the vehicle or vessel was insured for; the amount of time the vehicle or

vessel was in California; and whether the purchaser’s move to California was voluntary or involuntary.

If a purchaser brings a vehicle or vessel to California during the first 12 months of ownership and provides evidence

that, at the time of the purchase, the purchaser had no intention that the vehicle or vessel would be used in California,

this alone is sufficient to establish that it was purchased for use outside California. For example, a purchaser voluntarily

moving to California within 12 months of the purchase date does not automatically prevent the purchaser from

overcoming the rebuttable presumption. Instead, a voluntary move is one factor to consider, along with all the other facts

and circumstances, when determining whether a vehicle or vessel was purchased for use outside of California.

Please note: If your purchase is subject to tax, you may be eligible to take a credit for sales or use tax paid to another state

at the time you purchased the vehicle. Please provide DMV with a copy of the purchase agreement showing the amount

of sales or use tax you paid to another state. If the tax paid to another state is lower than the use tax due to California, you

will owe the difference. DMV can handle this credit directly.

1

Vehicle Code section 516 provides in part that a “resident” means any person

2

who shows an intent to live or be located in California on more than a

temporary basis. Presence in California for six months or more in any 12-month period creates a rebuttable presumption of residency, as evidenced by

factors including the address where the resident is registered to vote and the location of his or her place of employment or business.

MAY 2024

|

VEHICLES AND VESSELS: USE TAX

Assistance with your questions on out-of-state purchases

The Sales and Use Tax Law can be complex, and you are encouraged to put your tax questions in writing. Not only

will that give us more information on which to base our advice to you, it may protect you from owing tax, interest, or

penalties if we should give you erroneous information. Such protection is not provided for advice given to you verbally,

in person, or on the telephone. Requests for written advice can be emailed to the California Department of Tax and Fee

Administration at www.cdtfa.ca.gov/email/ or mailed directly to the local CDTFA office nearest you. For instructions on

how to get your tax questions in writing, please see CDTFA-8, Get It in Writing.

Also, please see Frequently Asked Questions—Use Tax on Purchases of Vehicles, Vessels, and Aircraft.

Vehicles

CDTFA may request any documentation that demonstrates out-of-state delivery and use of the vehicle outside of

California during the applicable test period. Such documentation may include, but is not limited to:

A signed and notarized CDTFA-448, Statement of Delivery Outside California;

A copy of the purchase agreement or contract;

Documents that show delivery outside of California and who contracted for that delivery (buyer or seller);

Documents to show the first functional use outside of California;

Receipts for meals;

Receipts for lodging or campground receipts;

Receipts for fuel;

Receipts for transportation;

Documentation to show the use and location of the vehicle outside of California during the applicable qualifying

period (12 months or 90 days);

Cell phone bills that show the purchaser outside of California during the qualifying period;

Registration or title documents for the vehicle or vessel in another state;

Credit card receipts/bank statements;

Insurance documents which indicate the location and time period of coverage of vehicle; and

Any other documents that would show the location and use of the vehicle outside of California during the qualifying period.

Vessels

Types of documents that should be retained to support your claim that a vessel was not purchased for use in California include:

Mooring receipts;

Service/fuel receipts;

Credit card receipts/bank statements;

Miscellaneous receipts (incidentals, meals, or toll receipts);

A copy of the purchase agreement or contract;

Documents that show delivery outside of California and who contracted for that delivery (buyer or seller);

Documents to show the first functional use outside of California;

Insurance documents which indicate the location and time period of coverage of vessel and its navigational limits;

Receipts for lodging; and

Any other documents showing the location of your vessel during the appropriate test period after purchase.

All documentary evidence must be retained for at least eight years.

VEHICLES AND VESSELS: USE TAX

|

MAY 2024

For a purchaser to qualify for this exclusion from use tax, the vehicle or vessel must be delivered to the purchaser outside

of California. Generally, when the vehicle or vessel is delivered to the purchaser or their representative in California, tax

applies. However, if the contract for sale requires the vehicle or vessel to be shipped out of state, and it is shipped out of

state by the facilities of the seller or by delivery to a common carrier, whether hired by the purchaser or seller, then the

sale occurs outside of California and no tax is due. If, however, regardless of the contract, the vehicle or vessel is diverted

to the purchaser or their representative in California, then tax applies. For example, if a purchaser asks a friend or agent to

deliver the property from California to the purchaser himself or herself at an out-of-state location, use tax applies.

For additional information, please refer to Regulation 1620, Interstate and Foreign Commerce.

Limited Exclusion for Vehicles

California law provides a use tax exclusion for vehicles purchased outside California and brought into this state during the

first 12 months of ownership for the exclusive purpose of warranty or repair work provided the vehicle was used or stored

in this state for that purpose for 30 days or less. The 30-day period begins on the date the vehicle enters California and

includes any travel time to and from the repair facility and ends when the vehicle is returned to a point outside the state.

Limited Exclusion for Vessels

A vessel purchased out of state and brought into California during the first 12 months of ownership for the limited

purpose of repair, retrofit, or modification is not presumed to have been purchased for use in California if the purchaser,

or agent of the purchaser, logged no more than 25 hours of sailing

time on that vessel in California for incidental or other use. The

calculation of sailing time logged does not include sailing time

logged after the completion of the vessel’s repair, retrofit, or

modification for the sole purpose of returning or delivering the

vessel to a point outside California.

Effective January 1, 2010, the provision allowing a vessel purchased

out of state to be brought into California during the first 12

months of ownership for the limited purpose of repair, retrofit, or

modification was changed to remove the sailing time limitation and

to provide that the vessel may only enter California for the exclusive

purpose of the repair, retrofit, or modification performed by any

one of the following:

A county licensed repair facility;

A city licensed repair facility;

A city and county licensed repair facility; or

A repair facility located within a county that has no licensing requirement.

Therefore, a vessel that enters California during the first 12 months of ownership for the purpose of repair, retrofit, or

modification performed by an unlicensed repair facility in a county with a licensing requirement will be presumed to have

been purchased for use in California.

Qualifying repair examples:

Mr. Jones brings his boat into California for an engine modification. The repair facility has a business license from the

county of Los Angeles and Mr. Jones delivers his boat to the repairer’s facility. At the repair facility, the engine is modified

to run more efficiently. This repair would qualify for the limited exclusion for vessels.

Mr. Smith sails in a boat he has owned for six months to California for a repair. Mr. Smith uses a repair facility with a

business license from Sacramento County. The licensed facility makes the repair at the marina where Mr. Smith moored

his boat. Although the repair was not made at the repair facility, the repair was made by a repairer who works for a repair

facility and would qualify for the limited use exclusion for vessels.

MAY 2024

|

VEHICLES AND VESSELS: USE TAX

Nonqualifying repair example:

Mr. Lee brings a boat to Los Angeles, California to have his brother-in-law make some repairs and modifications to

the boat. Mr. Lee is going to have him add some special lighting and make some other retrofits with more updated

equipment. Mr. Lee’s brother-in-law does handyman work as a side job but he is not associated with a licensed repair

facility. As the retrofits are not made by a licensed repair facility, bringing the vessel into California for this repair/retrofit

would not qualify for the limited use exclusion and the vessel would be considered purchased for use in California and

subject to use tax.

How to calculate your use tax liability

If your purchase is taxable, you may be eligible for a credit for sales or use tax paid to another state when you purchased

the vehicle or vessel. For example, if you properly paid $150 sales or use tax to another state and the California use tax

due is $200, DMV will credit you for the $150 and charge you $50 for the balance of the use tax due. Conversely, if you

paid a $200 sales or use tax payment to another state and the California use tax due is $150, you will not be charged an

amount for California use tax.

Please provide DMV with a copy of the purchase agreement or other document that shows proof of payment and the

amount of sales or use tax paid to the other state.

Please see Frequently Asked Questions—Vehicles, Vessels, and Aircraft.

Military personnel

If a vehicle purchased by an active duty service member is delivered

to or received at a location outside California, sales tax or use tax may

not apply if the service member moved to California, and brought the

vehicle into California, because of an official transfer to the state and

the contract to purchase the vehicle is made before the service member

receives the official transfer orders to California. If the vehicle is purchased

after the service member receives transfer orders, tax applies unless

the vehicle purchased was not intended for use in California. Please see

Purchased or delivered out-of-state—not intended for use in California, for

more details.

Please note: If at the time the contract to purchase the vehicle is made the service member arranges to take delivery of

the vehicle in California, the service member will be considered to have made an independent determination to use the

vehicle in California and tax will apply.

How to file a request for a use tax clearance (CDTFA-111 or CDTFA-111-B)

To file a request for a use tax clearance, submit a CDTFA-106, Vehicle/Vessel Use Tax Clearance Request, to CDTFA. If you are

registering more than one vehicle, you can attach a list to the form. Include copies of the following documentation:

A copy of the certificate of title or the current registration if title is not available;

Purchase contract, showing the date of purchase; and

Your official military transfer orders.

Purchased from the U.S. government

If you purchase a vehicle or vessel from the U.S. government, your purchase may or may not be exempt from California use

tax. Specific conditions must be met in order for the exemption to apply.

Please note: Exemptions that apply to purchases made from the U.S. government do not extend to purchases from the

State of California or local governments, such as cities and counties.

Purchases not subject to tax. If you purchase a vehicle or vessel from a U.S. Marshal as part of a sale ordered by a federal

court, you are not liable for use tax. Likewise, sales made in accordance with the following U.S. Code sections are not

subject to use tax:

United States Code, Title 8, section 1324 (Aliens and Nationality);

VEHICLES AND VESSELS: USE TAX

|

MAY 2024

United States Code, Title 19, section 1595a (Custom Duties);

United States Code, Title 21, section 881 (Food and Drugs); and

United States Code, Title 40, section 481(c) (Public Buildings, Property and Works).

Your receipt will usually identify the section under which the property was sold.

Purchases subject to tax. The U.S. government often holds auctions to sell property it has seized as part of a lien

enforcement or as the result of a loan default. For example, the Internal Revenue Service may sell property it has

seized for tax collection purposes (in accordance with Internal Revenue Code, section 6335). The Small Business

Administration may sell property that had been used to secure loans which later defaulted (in accordance with

the Uniform Commercial Code). The federal government may hold an auction to dispose of surplus property (in

accordance with United States Code, Title 40, section 484, “Disposal of Surplus Property”). Sales made in this manner

are subject to use tax unless another exemption applies.

How to file a request for a use tax clearance (CDTFA-111 or CDTFA-111-B)

To file a request for a use tax clearance, submit a CDTFA-106, Vehicle/Vessel Use Tax Clearance Request, to CDTFA. If

you are registering more than one vehicle or vessel, you can attach a list to the form. Include copies of the following

documentation:

Vehicle or vessel transfer documents issued by the U.S. government;

The purchase invoice, which should include information that clearly describes the vehicle or vessel, such as the

vehicle’s identification number (VIN) or license plate number, or the vessel’s California registration number (CF) or hull

identification number (HIN). If the invoice does not provide adequate information, you may need to provide additional

documentation; and

Documentation indicating the authority under which the property was sold (United States Code, Title, and section).

If the purchase invoice shows this authority, no additional documentation is needed. Otherwise, you may need to

request a letter from the federal government verifying the authority. Contact the selling agency or contact the General

Services Administration at 1-844-GSA-4111 for this information.

Private party purchase for out-of-state use, one-trip permit

The purchase of a vehicle from a person in California, who is not required to hold a dealer’s license or a seller’s permit

(private party), is generally subject to use tax at the time the vehicle is registered with DMV. However, a purchaser is not

required to pay California use tax if the only use of the vehicle purchased from a private party in California is to remove

it from the state and it will be used solely thereafter outside this state. This exclusion from use tax requires that no other

use can be made of the vehicle in this state. A One-Trip Permit may be issued by DMV in lieu of registration, for operating

certain vehicles while being moved or operated unladen for one continuous trip from a place within this state to another

place outside this state. This exclusion does not apply to sales tax.

Purchased by a Native American for use on a reservation

The sale of a vehicle or vessel by an off reservation

1

retailer is generally not subject to tax when the vehicle or vessel is

purchased by a Native American

2

who resides on a reservation, and delivery is made to the purchaser on a reservation

and the ownership transfers on the reservation to the Native American.

This exemption also applies to purchases by “Indian organizations” and “Indian couples as defined below:”

“Indian organizations” include Indian tribes and tribal organizations.

Partnerships qualify as “Indian organizations” for California sales and use tax purposes only when all of the

partners are Indians.

Corporations and limited liability companies qualify as Indian organizations only if they are organized under tribal

authority and wholly owned by Indians.

1

Reservation includes reservations, rancherias, and any land held by the United States in trust for any Indian tribe or individual Native American.

2

Indian means any person of Native American descent who is entitled to receive services as a Native American from the United States Department of

the Interior.

MAY 2024

|

VEHICLES AND VESSELS: USE TAX

“Indian couples” include a married couple or a registered domestic partnership for exemption purposes when it

consists of two Indians or of an Indian and a non-Indian that have entered into officially recognized family relationships

under California law or tribal law. This generally includes a married couple or a domestic partnership. Tribes have

the authority to establish their own laws and regulations regarding such unions. If either California law or tribal law

recognizes the family relationship, and at least one member of the couple is an Indian, the couple qualifies as an Indian

couple.

Use tax does not apply if a vehicle or vessel is used on a reservation more than one-half of the time during the first 12 months

after it was purchased. A vehicle or vessel is used off a reservation when it is used or stored off a reservation. Use tax, if

due, is payable by the Native American purchaser directly to CDTFA.

Please see publication 146, Sales to Native Americans and Sales on Indian Reservations.

How to file a request for a use tax clearance (CDTFA-111 or CDTFA-111-B)

To file a request for a use tax clearance, submit a CDTFA-106, Vehicle/Vessel Use Tax Clearance Request, to CDTFA. If

you are registering more than one vehicle or vessel, you can attach a list to the form. Include copies of the following

documentation:

A copy of the certificate of title or current registration if title is not available;

Purchase invoice, showing the date you took title of the vehicle or vessel and showing the date and place the vehicle or

vessel was delivered to you; and

Documentation showing you are a Native American residing on a reservation. This may include any one of the

following:

Either a proof-of-residency letter from your Tribal Council, or

Your tribal ID card, or

A letter from the U.S. Department of the Interior to show the purchaser is a Native American.

VEHICLES AND VESSELS: USE TAX

|

MAY 2024

Vehicles and Vessels Transferred to a Corporation,

Limited Liability Company, or Partnership

Transfers to existing corporations

The transfer of a vehicle or vessel to an existing corporation is not subject to use tax if the property is transferred to the

corporation for no consideration.

Examples of consideration include cash, credits, shares in the corporation, promissory notes, the fair market value of any

trade (including “even” trades), the cancellation of a debt, or the assumption of a loan.

If the corporation gives consideration for the vehicle or vessel, the transfer is subject to use tax based on the value of the

consideration given.

Intercompany transfers

The transfer of a vehicle or vessel from one corporation or limited liability company (LLC) to another corporation or LLC

for consideration is a sale without regard to whether the entities are related or not. If a subsidiary transfers tangible

personal property for consideration to another subsidiary, or to the parent company (or vice versa), provided that the

subsidiary and parent are separate persons for sales and use tax purposes, it is a sale subject to tax unless otherwise

exempt.

The purchase price subject to tax would include cash, the market value of any property given in trade, the payment or

assumption of a liability, an intercompany debt, the cancellation of indebtedness, the receipt of additional shares or

ownership interests, or any other valuable consideration given by the transferee to the transferor in exchange for the

property.

When one entity carries tangible personal property on its books as an asset, and that property is then transferred to a

related entity, the transfer must be accounted for in some manner in the books of the transferor. The transferee must

also account in its books for the transfer received and the resulting increase in its assets. If this is done by creating an

inter-company debt, for example, the transferor shows a credit due from the transferee and the transferee shows a

corresponding debt owed to the transferor, consideration has been paid. The amount of that consideration is subject to

tax unless the sale and use of the property is otherwise exempt.

“Bargain sales” or donations to a nonprofit organization.

In some cases, a seller will “donate” a portion of the selling price of a vehicle or vessel as a charitable donation for income

tax purposes and ask for consideration, such as cash, for the remaining value of the vehicle or vessel. Use tax is based on

the actual consideration given to the seller—not the donated portion of the selling price.

How to file a request for a use tax clearance (CDTFA-111 or CDTFA-111-B)

To file a request for a use tax clearance, submit a CDTFA-106, Vehicle/Vessel Use Tax Clearance Request, to CDTFA. If

you are transferring more than one vehicle or vessel, you can attach a list to the form. Include copies of the following

documentation:

A copy of the certificate of title or the current registration if title is not available.

A written statement signed by a representative of the company, indicating that the corporation did not pay for the

vehicle or vessel or assume a debt in exchange for it. While a notarized statement is preferable, it is not required. The

statement should contain the vehicle’s identification number (VIN) or license plate number, or the vessel’s California

registration number (CF) or hull identification number (HIN).

A written statement from the donor indicating he or she received no consideration for the property and the

property was not given as part of a contractual agreement. Again, while a notarized statement is preferable, it is not

required. The statement should include information that clearly describes the vehicle or vessel, such as the vehicle’s

identification number (VIN), license plate number, the vessel’s California registration number (CF), or hull identification

number (HIN) along with the donor’s mailing address and telephone number. If the statement does not provide

adequate information, you may need to obtain additional documentation.

MAY 2024

|

VEHICLES AND VESSELS: USE TAX

Please note: If the donor is a corporation, limited liability company, partnership, or similar business, it must also provide

documentation showing that the person signing the above written statement is authorized to sign for the donor.

You may be required to provide additional information.

Contributions to commencing corporations, limited liability companies, or

partnerships

If a commencing corporation, limited liability company, or partnership has received a vehicle or vessel solely in exchange

for the first issue of stock in the commencing corporation or for an ownership interest in a commencing limited liability

company or partnership, the transfer is nontaxable. However, if the corporation, limited liability company, or partnership

assumed a liability or paid any other consideration, it must pay use tax based on the liability assumed and any other

consideration given or paid to acquire the vehicle or vessel. A lienholder on the title generally indicates an assumption of

liabilities.

How to file a request for a use tax clearance (CDTFA-111 or CDTFA-111-B)

To file a request for a use tax clearance, submit a CDTFA-106, Vehicle/Vessel Use Tax Clearance Request, to CDTFA. If

you are registering more than one vehicle or vessel, you can attach a list to the form. Include copies of the following

documentation:

A copy of the certificate of title or a copy of the current registration if title is not available;

Corporate minutes or other written document of the commencing corporation, limited liability company, or

partnership authorizing acceptance of the vehicle or vessel in exchange for a first issue of stock or membership or

partnership interest. The document should include information that clearly describes the vehicle or vessel, such as the

vehicle’s identification number (VIN) or license plate number, or the vessel’s California registration number (CF) or hull

identification number (HIN). If the minutes do not provide adequate information, you may need to obtain additional

documentation; and

A written statement by the transferor that the transfer is solely in exchange for stock or membership or partnership

interest in the commencing corporation, limited liability company, or partnership. As stated above, while a notarized

statement is preferable, it is not required.

A copy of the original statement of partnership or articles of incorporation or organization carrying a filing stamp

showing they have been filed as certified by the Secretary of State.

You may be required to provide additional information.

Transfers to substantially similar corporations, limited liability companies, or

partnerships

A transfer of a vehicle or vessel to a similarly owned corporation, limited liability company, or partnership is not subject to

use tax if:

The total property transfer, including the vehicle or vessel, represents at least 80 percent of the property used by the

transferring entity in its business endeavor; and

The real or ultimate ownership of the resulting corporation, limited liability company, or partnership is substantially

similar (80 percent) to the ownership of the corporation, limited liability company, or partnership that transferred the

vehicle or vessel.

The 80 percent threshold is based upon the monetary value of the assets held by the transferring entity, not the number

of assets. Additionally, the vehicle or vessel must have been used by the transferring entity in a business activity in order

for the exemption to apply.

VEHICLES AND VESSELS: USE TAX

|

MAY 2024

How to file a request for a use tax clearance (CDTFA-111 or CDTFA-111-B)

To file a request for a use tax clearance, submit a CDTFA-106, Vehicle/Vessel Use Tax Clearance Request, to CDTFA. If

you are registering more than one vehicle or vessel, you can attach a list to the form. Include copies of the following

documentation:

A copy of the certificate of title or a copy of the current registration if title is not available;

Articles of incorporation or organization, statement of partnership, or similar documentation filed with the Secretary of

State;

Proof of previous ownership of the corporation, limited liability company, or partnership and a list of its assets, such as

a recent income tax return with depreciation schedules; and

Corporate stock register or comparable documentation that identifies owners, shareholders, members, or partners and

percentage of ownership.

You may be required to provide additional information.

Involuntary transfer of ownership (court order or repossession)

An “involuntary transfer” is a transfer in which a transferee, because of circumstances beyond the transferee’s control,

assumes ownership. For example, a corporation may receive a vehicle as the result of a court order or the repossession of

a vehicle or vessel previously sold by it.

Use tax does not normally apply if title to the property changes due to an involuntary transfer.

How to file a request for a use tax clearance (CDTFA-111 or CDTFA-111-B)

To file a request for a use tax clearance, submit a CDTFA-106, Vehicle/VesselUse Tax Clearance Request, to CDTFA. If

you are registering more than one vehicle or vessel, you can attach a list to the form. Include copies of the following

documentation:

A copy of the certificate of title or a copy of the current registration if title is not available;

Minutes of the Board of Directors or governing body, showing receipt of the involuntary transfer. If minutes cannot

be provided, a signed letter from the transferee accepting the property will suffice. Either document must contain the

vehicle identification number (VIN) or the vessel‘s California registration number (CF) or hull identification number

(HIN); and

Official court property settlement documents or certificates of repossession. These documents must contain the

vehicle’s identification number (VIN) or license plate number, or the vessel’s California registration number (CF) or hull

identification number (HIN).

You may be required to provide additional information.

MAY 2024

|

VEHICLES AND VESSELS: USE TAX

Vehicles and Vessels Transferred Into Revocable Living Trusts

Subject to the conditions listed below, the transfer of a vehicle or vessel into a revocable living trust is not subject to use tax.

Please note: There is no exemption in the law for transfers to irrevocable trusts.

Transfers into revocable living trusts

The transfer of a vehicle or vessel into a revocable trust is not subject to tax if all of the following conditions are met:

The trustees of the living trust have the unrestricted power to revoke the trust;

The transfer does not result in any change in the beneficial ownership of the property (the people who actually use or

benefit from the use of the vehicle or vessel);

The trust provides that upon revocation of the trust, the vehicle or vessel will revert wholly to the transferor; and

The only consideration for the transfer is the assumption by the trust of an existing loan for which the tangible personal

property being transferred is the sole collateral.

How to file a request for a use tax clearance (CDTFA-111 or CDTFA-111-B)

To file a request for a use tax clearance, submit a CDTFA-106, Vehicle/Vessel Use Tax Clearance Request, to CDTFA. If you are

registering more than one vehicle or vessel, you can attach a list to the form. In your request for exemption, be sure to

cover the elements listed above.

Include copies of documentation such as:

The certificate of title or current registration if title is not available;

Certificate of Trust or other proof of existence of the trust, such as copies of the title page and the signature or

execution page;

Sections of the trust relating to transfers of property;

Loan assumption papers; and

Documentation verifying the donor’s relationship to the trust.

You may be required to provide additional information.

VEHICLES AND VESSELS: USE TAX

|

MAY 2024

Appendix 1

Commercial Deep-Sea Fishing Vessels

The information in this section applies to vessels that are registered with DMV. It does not apply to vessels that are documented,

or registered, with the U.S. Coast Guard. If you are claiming an exemption for such a vessel, please contact CDTFA's Consumer

Use Tax Section for more information at 1-916-445-9524.

Exempt use of deep-sea fishing vessels

Use tax does not apply to vessels registered with DMV if the vessel is used in commercial deep sea fishing operations

outside the territorial waters of California by a person who is regularly engaged in commercial deep sea fishing. To qualify,

the vessel must be used by persons who are regularly engaged in commercial deep sea fishing and, the vessel itself must

actually be used principally (more than 50 percent) in commercial deep-sea fishing operations outside the territorial

waters of this state, using a test period of 12 consecutive months beginning with the first operational use of the vessel.

To qualify for exemption, you must retain evidence that the vessel was used principally (more than 50 percent of its

activity) in commercial deep-sea fishing operations outside the territorial waters of California and the person claiming the

exemption is a person who is regularly engaged in commercial deep sea fishing.

It shall be reputably presumed that “persons who are regularly engaged in commercial deep sea fishing” do not include

persons who have gross receipts from commercial deep sea fishing operations that total less than $20,000 a year. If the

person purchasing the vessel was not previously engaged in commercial deep sea fishing at the time of purchase then

the first 12-month period after the first functional use of the vessel shall be used to determine the gross receipts. If the

person is already engaged in commercial deep sea fishing operations, the person will not be considered to be regularly

engaged in the business of commercial deep sea fishing unless receipts from commercial deep sea fishing operations

aggregate at least $20,000 during any consecutive 12-month period.

Please note: Tax applies with respect to vessels used in commercial deep sea fishing operations if the vessel is used more

than 50 percent or more of the time within the territorial waters of California, using a test period of 12 consecutive

months beginning with the first operational use of the vessel.

The following are examples of documentation to retain as evidence:

Receipts for commercial sales (fish tickets);

Copies of the individual’s and vessel’s commercial fishing license(s);

Vessel logs showing Loran or GPS (global positioning system) readings

and engine hours;

Copy of income tax return(s); and

Photographs of the entire vessel.

How to file a request for a use tax clearance (CDTFA-111-B)

To file a request for a use tax clearance, submit a CDTFA-106, Vehicle/Vessel Use Tax Clearance Request, to CDTFA. If you are

registering more than one vessel, you can attach a list to the form. In your request, be sure to state the expected primary

usage of the vessel.

If you purchased the vessel from a vessel dealer, include copies of the following documentation with your form:

The Statement of Origin, including the hull identification number (HIN); and

Purchase invoice, showing the vessel’s price and its expected delivery date.

If you purchased the vessel from someone who is not a vessel dealer (a private party, for example), include:

A copy of the bill of sale or purchase invoice showing the vessel’s price and delivery date.

If you are issued a CDTFA-111-B, Certificate of Use Tax Clearance, you must take it to DMV to complete your registration.

CDTFA will contact you approximately one year after issuance of the CDTFA-111-B to obtain records that verify the use of

the vessel qualifies for the exemption. If the use of the vessel does not qualify for the exemption, CDTFA will advise you of

your use tax liability.

MAY 2024

|

VEHICLES AND VESSELS: USE TAX

Appendix 2

Partial Tax Exemption for Qualified Farm Equipment and Machinery or Timber

Harvesting Equipment and Machinery

Introduction

The following information applies to the registration of farm equipment and machinery or timber harvesting

equipment and machinery purchased for use in California with the Department of Motor Vehicles (DMV). For more

information please see publication 66, Agricultural Industry, or request a copy from our Customer Service Center at

1-800-400-7115 (CRS:711).

You may be eligible for a partial tax exemption if you purchased farm equipment and machinery or timber harvesting

equipment and machinery that will be used primarily to produce and harvest agricultural products or used in commercial

timber harvesting.

To claim the partial exemption all of the following must apply:

You must be a “qualified person;”

You must purchase qualifying equipment and machinery; and

You must primarily use the equipment and machinery in a

qualifying manner. Some types of equipment and machinery

must be exclusively used to qualify.

To determine whether the partial exemption applies, visit the

websites listed below:

Farm equipment and machinery:

www.cdtfa.ca.gov/sutax/exemptfem.htm

Timber harvesting equipment and machinery:

www.cdtfa.ca.gov/sutax/exemptthar.htm

If you are planning to, or have purchased qualifying equipment and machinery, you will not be required to pay a portion

of the sales and use tax rate.

Effective January 1, 2017, the current partial exemption rate is 5.00 percent.

If your purchase qualifies for the partial tax exemption

You can:

Pay the amount of tax actually due (after claiming the partial exemption) directly to CDTFA; or

Pay the tax—not reduced by the partial exemption—to DMV at the time you register and file a claim for refund with

CDTFA for the overpayment.

If you choose to pay CDTFA directly, in order to register the equipment and machinery with DMV without paying any

additional tax, you must complete a use tax clearance request CDTFA-106, Vehicle/Vessel Use Tax Clearance Request, and

submit it to any CDTFA office. If approved, CDTFA will issue you a certificate of use tax clearance that must be filed with

DMV at the time of registration.

If you choose to pay the tax to DMV, you may file a claim for refund of the partially exempt amount with CDTFA in order to

claim the partial exemption amount. DMV also has special registration procedures for some types of farm equipment and

machinery. Please refer to www.dmv.ca.gov for more information.

VEHICLES AND VESSELS: USE TAX

|

MAY 2024

To request a refund or credit for overpaid use tax on qualifying equipment and machinery purchases, you must timely

write a letter or submit a completed CDTFA-101-DMV, Claim for Refund or Credit for Tax Paid to DMV, form with your

supporting documentation to any CDTFA office or to the Consumer Use Tax Section at the following address:

Consumer Use Tax Section MIC:37

California Department of Tax and Fee Administration

PO Box 942879

Sacramento, CA 94279-0037

Generally, you must file a claim for refund or credit no later than three years from the last day of the month following the

close of the reporting period for which the overpayment was made, or six months from the date of payment, whichever

period expires later. After this deadline has passed, we generally cannot refund you for any overpayments regardless of

the reason.

When requesting a refund, provide the following documentation:

A copy of the certificate of title or current registration if title is not available;

A copy of written evidence of being engaged in an industry categorized as one of the required Standard Industrial

Classification codes (for example, a copy of a current income tax return including Schedule F, which shows an

equivalent NAICS Code; or a copy of an employment or service contract);

A copy of the bill of sale or purchase invoice; and

A completed partial exemption certificate supporting the claimed partial exemption.

You may download copies from:

Farm equipment certificate

www.cdtfa.ca.gov/formspubs/cdtfa230d.pdf

Timber harvesting equipment certificate

www.cdtfa.ca.gov/formspubs/cdtfa230h.pdf

If your request is approved, CDTFA will mail you a refund check.

Pay the tax—reduced by the partial exemption—directly to CDTFA and receive a tax clearance from CDTFA to submit

to DMV.

To file a request for a CDTFA-111, Certificate of Vehicle, Mobilehome or Commercial Coach Use Tax Clearance or a

CDTFA-111-B, Certificate of Vessel Use Tax Clearance, you must submit a CDTFA-106, Vehicle/Vessel Use Tax Clearance

Request to CDTFA. If you are registering more than one vehicle, you can attach a list to one single form.

Mail your application (CDTFA-106) with copies of supporting documentation directly to our Consumer Use Tax

Section at:

Consumer Use Tax Section MIC:37

California Department of Tax and Fee Administration

PO Box 942879

Sacramento, CA 94279-0037

In your request, please indicate that you are claiming a partial tax exemption. Include with your request the

documentation listed in the previous section.

MAY 2024

|

VEHICLES AND VESSELS: USE TAX

Appendix 3

Charged the Incorrect Tax Rate on Vehicles and Vessels?

Introduction

In California, the sales and use tax rate can vary across cities and counties because they have special tax districts that impose an

additional tax. If you register a vehicle or vessel at DMV to an address within a special tax district, the district tax is included as

part of the total tax collected.

If you purchase a vehicle or vessel through a private-party sale (not at a registered dealer) you are required to register it

with DMV. Typically, DMV will charge use tax on the transaction based upon the address of the location where the vehicle

or vessel is registered. In some cases, the wrong tax rate may be charged when the address is based upon a zip code that

crosses city and county lines.

To verify your tax rate, use our interactive map at https://maps.cdtfa.ca.gov/ and enter the address where the vehicle or

vessel will be registered. Compare this rate to the rate you were charged when you registered the vehicle or vessel. If you

were charged the wrong amount, you may file a claim for refund with CDTFA, please see publication 117, Filing a Claim for

Refund.

California City and County Sales and Use Tax Rates, provides information about errors which can occur when using a zip

code or mailing address to determine a sales tax rate, explains recent tax rate changes, the history of sales and use tax

rates, rates and effective dates of district taxes, and the combined sales, use, and district tax rate in certain cities and

communities in California.

Additionally, some cities have developed a database of addresses available at www.cdtfa.ca.gov/taxes-and-fees/cityaddresses.htm

to assist retailers and consumers in identifying addresses located within the special taxing jurisdictions. In cooperation

with these cities, our website provides links to their address databases. If you have questions about the addresses, you

should contact the cities directly.

Please contact CDTFA's Local Revenue and Allocation Unit at 1-916-324-3000 if you have any question regarding this

information.

Example: You register your car at your home in Fresno County. You live near, but not in, the City of Reedley, which has

a special tax district. Homes in the City of Reedley have the same zip code you do. If the use tax rate charged by DMV

includes the Reedley district tax, you are not liable for that district tax.

If DMV charges you a district tax that you are not liable for, as described above, you have two options.

You can:

Pay the correct tax at a CDTFA office and obtain a tax clearance before you register your vehicle, or

Pay the tax requested by DMV and file a claim for refund for the district tax with CDTFA.

Please see publication 117, Filing a Claim for Refund, or call our Customer Service Center at 1-800-400-7115 (CRS:711) for

assistance.

If you choose to pay your use tax liability directly to CDTFA

You can write to CDTFA's Consumer Use Tax Section or visit a CDTFA office to pay use tax on your vehicle or vessel.

For expedited service, we recommend that you visit a CDTFA office to make your payment or visit our website at

www.cdtfa.ca.gov for all other contact information. Additionally, CDTFA has two mobile applications to make it fast, easy and

convenient for tax and fee payers to do their business and pay their use tax on the go. It’s convenience at your fingertips.

After you have paid the use tax, CDTFA will give you a CDTFA-111 or CDTFA-111-B to submit to DMV when you register

your vehicle or vessel. DMV will not collect use tax since the clearance will indicate that you have already paid your use

tax liability.

Whether you write or visit CDTFA, you need to provide a completed CDTFA-106, Vehicle/Vessel Use Tax Clearance Request. If

you are registering more than one vehicle or vessel, you can attach a list to the form.

VEHICLES AND VESSELS: USE TAX

|

MAY 2024

Include copies of documentation which should include, but not limited to:

The certificate of title or current registration if title is not available;

Your property tax statement or assessment showing the physical address and parcel number; or

A utility bill showing your name and address.

If you choose to pay the tax at DMV and then request a refund

You may request a refund from CDTFA by timely writing a letter or submitting a completed CDTFA-101-DMV,

Claim for Refund or Credit for Tax Paid to DMV:

If you submit a letter to CDTFA, please indicate the amount of tax you paid and explain why you are entitled to a refund.

With your request, include copies of the following documentation:

The certificate of title or current registration if the title is not available; and

Your property tax statement or assessment showing the physical address and parcel number (if applicable); and

A utility bill showing your name and address.

Submit your letter or CDTFA-101-DMV, Claim for Refund or Credit for Tax Paid to DMV, and supporting documentation to

any CDTFA office or the Consumer Use Tax Section at:

Consumer Use Tax Section MIC:37

California Department of Tax and Fee Administration

PO Box 942879

Sacramento, CA 94279-0037

Please see publication 117, Filing a Claim for Refund, which includes a CDTFA-101-DMV, Claim for Refund or Credit for Tax

Paid to DMV. For assistance, call our Customer Service Center at 1-800-400-7115 (CRS:711).

Please note: There are time limitations for filing a claim for refund. In general a claim for refund of use tax you paid on a

vehicle or vessel you registered at DMV must be filed no later than three years from the last day of the month following

the close of the reporting period for which the overpayment was made, or six months from the date of overpayment—

whichever period expires later. See publication 17, Appeals Procedures: Sales and Use Taxes and Special Taxes, for more

information.

MAY 2024

|

VEHICLES AND VESSELS: USE TAX

Appendix 4

Vehicles and Undocumented Vessels Purchased for Use in Interstate and Foreign

Commerce

The following information applies to the purchase and registration of vehicles (including trailers) or undocumented

vessels that are intended for use in interstate or foreign commerce. If the property is a vehicle, use tax will not apply if

one-half or more of the miles traveled by the vehicle during the six month period immediately following its entry into this

state are commercial miles traveled in interstate or foreign commerce. If the property is a vessel, use tax will not apply if

one-half or more of the nautical miles, traveled by the vessel during the six-month period immediately following its entry

into the state are commercial miles traveled in interstate or foreign commerce.

To support an interstate and foreign commerce exemption, the following documentary evidence must be retained:

1. Verification of delivery outside the State of California;

2. Verification that the first functional use of the vehicle or vessel was outside of California prior to its initial entry into

California. “First functional use” of a commercial vehicle or vessel generally occurs when the vehicle or vessel is first

used to carry cargo or passengers, or when the vehicle or vessel is dispatched to pick up a specific load of cargo or

group of passengers;

3. Documentation that establishes the date the vehicle or vessel initially entered California; and

4. Documentation that validates the location and/or use of the vehicle or vessel from the out-of-state delivery date

through the qualifying period; the date the vehicle/vessel initially entered California and for the subsequent six

months.

If a vehicle or vessel initially enters California deadheaded (without a load or passengers) and not dispatched to pick up a

load of cargo or passengers, the first functional use will be considered to have taken place in California.

Please note: Sailing in part on the high seas while traveling to and from California ports does not, by itself, qualify a vessel

for the exemption. To be considered as a trip in interstate or foreign commerce, the vessel must actually enter another

state or country. The fact that a vessel travels outside of the three mile limit and back into California is not considered to

be interstate or foreign commerce.

Vessels Used to Transport Persons or Property for Hire—Regulation 1594

Use tax also does not apply to undocumented vessels if they are used principally to transport persons or property for hire

from this state to another state or foreign country, or vice-versa.

Under certain conditions, barges, tugboats, ferry boats, and water taxis that operate entirely within the state may qualify

for the exemption. Their principal use must be:

Transporting cargo moving in interstate or foreign commerce;

Towing, or helping to move, vessels used principally to transport passengers or cargoes in interstate or foreign

commerce; or

Water-taxis that are engaged in the transportation of harbor pilots to or from vessels for the purpose of navigating or

aiding those vessels in the completion or commencement of their voyages to or from points outside of California.

To demonstrate the vessel is used to transport people or property for hire, the vessel must usually generate a certain

amount of gross income from this activity during its first 12 months of operation. The annual gross receipts from

such transportation services must be greater than 10 percent of the cost of the watercraft to the purchaser or lessor,

or $25,000, whichever is less (all gross receipts from transporting passengers or property for hire may be included).

If gross income from a vessel you own or lease is less than the required amount, CDTFA will presume that it is not

used to transport people or property for hire, unless you can clearly establish otherwise. Watercraft not used for hired

transportation services do not qualify for the interstate and foreign commerce principal use exemption.

VEHICLES AND VESSELS: USE TAX

|

MAY 2024

Electronic Logging Device

How to file a request for a use tax clearance (CDTFA-111 or CDTFA-111-B)

To file a request for a use tax clearance, submit a CDTFA-106, Vehicle/Vessel Use Tax Clearance Request, to CDTFA. If you

are registering more than one vehicle or vessel please attach a list to the form. The following documentation should be

submitted with your request:

A copy of the certificate of title or certificate of origin

A copy of the purchase agreement or bill of sale

Documents confirming delivery outside of California

Documents confirming the first functional use outside of California, for example, bill of lading or passenger manifest

Driver’s/vessel logs (from the purchase date through the present-day)

*

Receipts for fuel (from the purchase date through the present-day)

Bills of lading, delivery invoices, passenger lists or manifests (from the purchase date through the present-day)

If you are issued a CDTFA-111 or CDTFA-111-B, Certificate of Use Tax Clearance, by CDTFA you must take it to DMV to

complete your registration of the vehicle or vessel with them.

CDTFA will contact you at the end of the qualifying period to obtain additional documentation to support and verify the

use of the vehicle or vessel for interstate or foreign commerce. Additional documentation should include:

Driver’s/vessel log books

*

Bills of lading or invoices

Receipts for fuel

Any other similar documents showing the origin and destination of each load or passenger trip during the first six

months following entry into California

*

Please note: In order to ensure you have adequate documentation to support an exemption claim, you should retain copies of all relevant records for a

minimum of eight years. This includes records of motor carriers and drivers who are required to use an electronic logging device.

MAY 2024

|

VEHICLES AND VESSELS: USE TAX

For More Information

For additional information or assistance, please take advantage of the resources listed below.

INTERNET

www.cdtfa.ca.gov