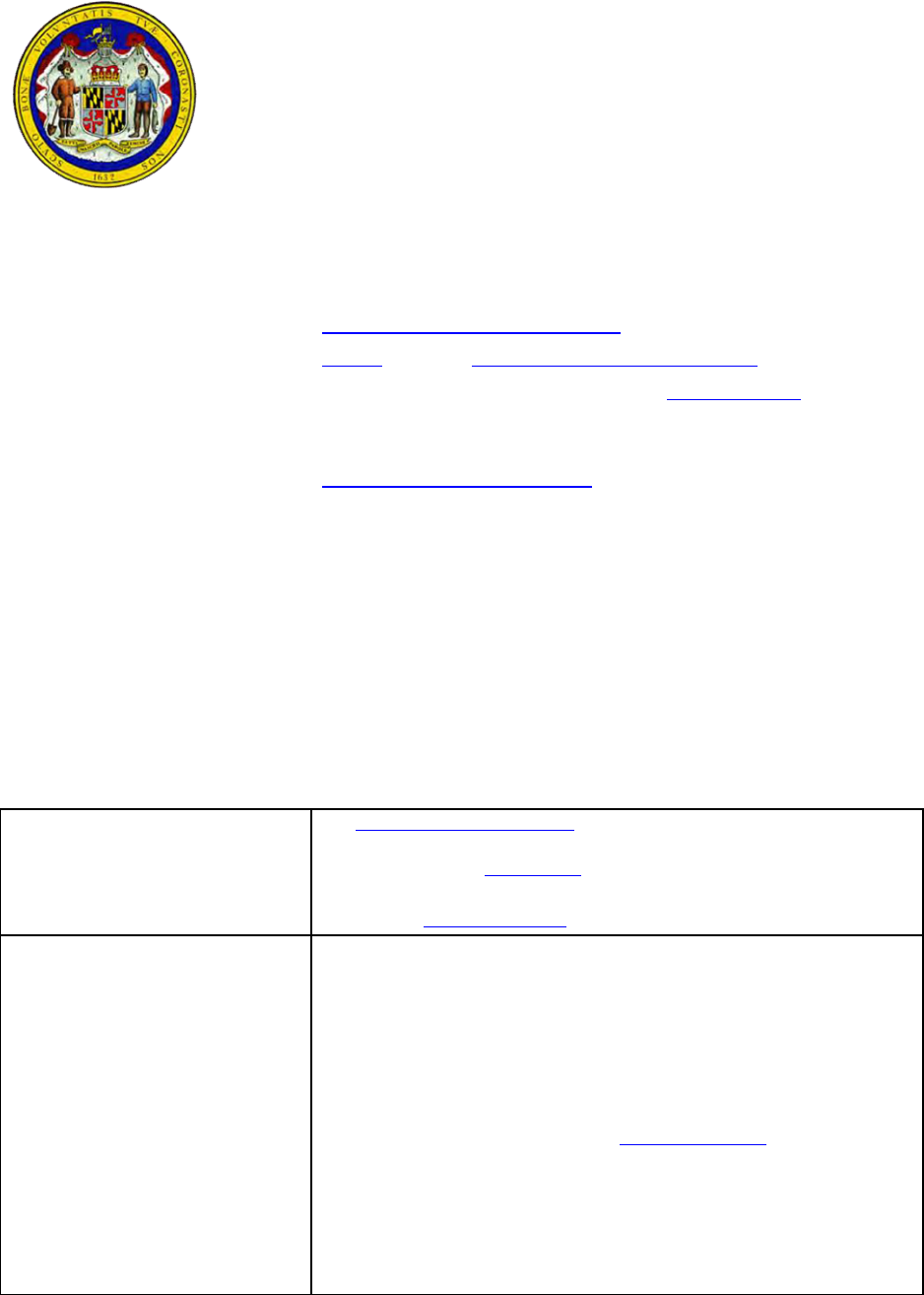

2022 Edition

(For Tax Year 2021)

STATE TAX GUIDE

For use by U.S. Military VITA/ELF Programs

Originally prepared by:

NR Administrative Law & U.S. Navy Office of the Judge Advocate General,

Legal Assistance Policy Division (Code 16)

Updated and revised by:

The American Bar Association Section of Taxation

Questions and updates can be directed to:

On behalf of the ABA Tax Section, we recognize with deep gratitude the editor and the team of

contributors from our membership and from our organizational partners who spent hours researching,

revising, and drafting the

2022 Tax Season Guide for each state.

Editor: James G. Steele, III

Organizational Partners:

Morgan, Lewis & Bockius LLP

Nelson Mullins

Kostelanetz & Fink, LLP

University of South Carolina

School of Law

Individual Contributors:

Brian Balduzzi

Tyler DeWitt

Qiva Dinuri

Shailana Dunn-Wall

Jennifer Gardiner

Christopher Goss

Andrea Herman

Teresa Hinze

Sukita Johnson

Adam Johnston

Karl Kurzatkowski

Scott Lee

Philip Lupton

Jonathan Moon

Jacob Oksman

Nic Perkins

Shawn Richter

Laura Robinson

Pamela Robinson

Catherine S. Yao

Max Seferian

Franklin Shen

Teri Shugart

Angela Siener

Lauren Smith

Colleen Spain

Bobby Streisel

Melissa Wiley

Jiayi Ye

Jamie Zug

Clint Wallace

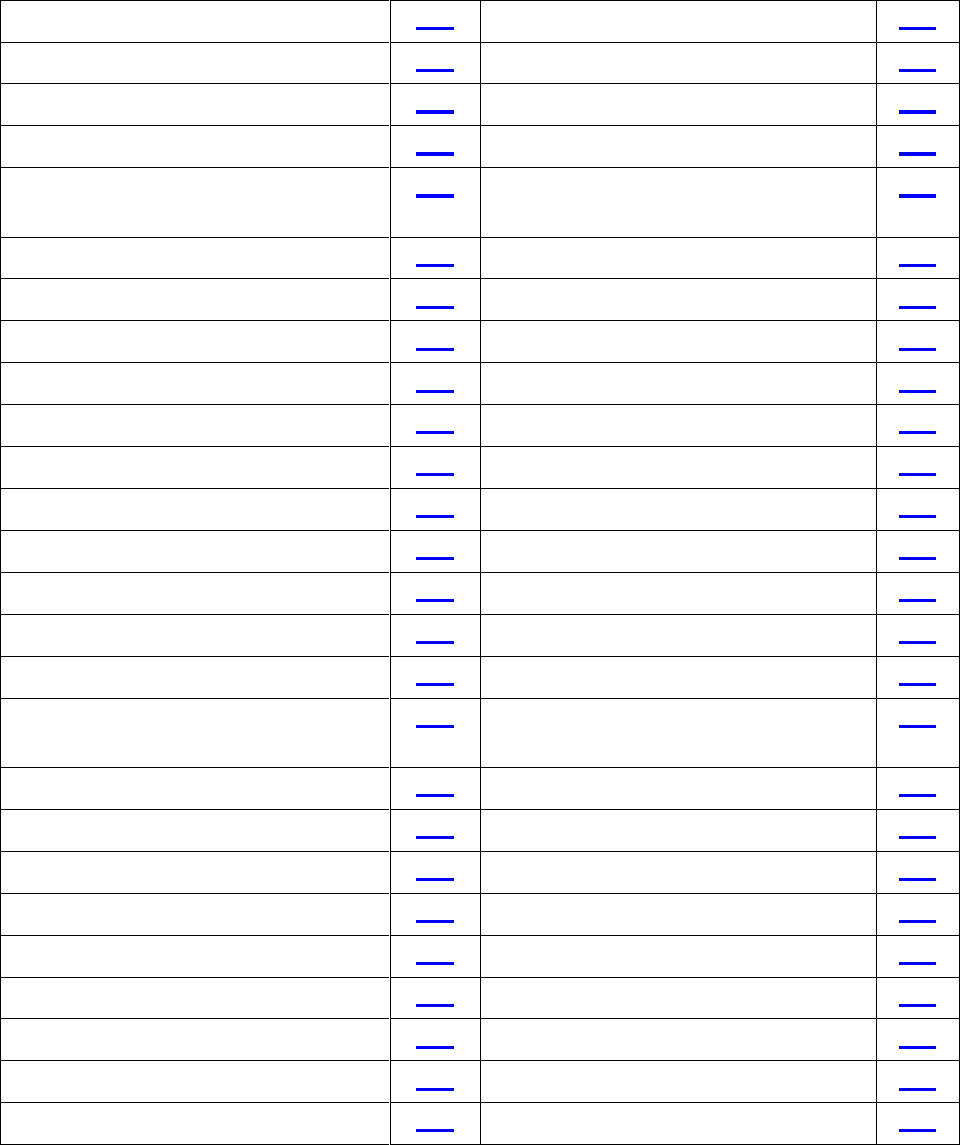

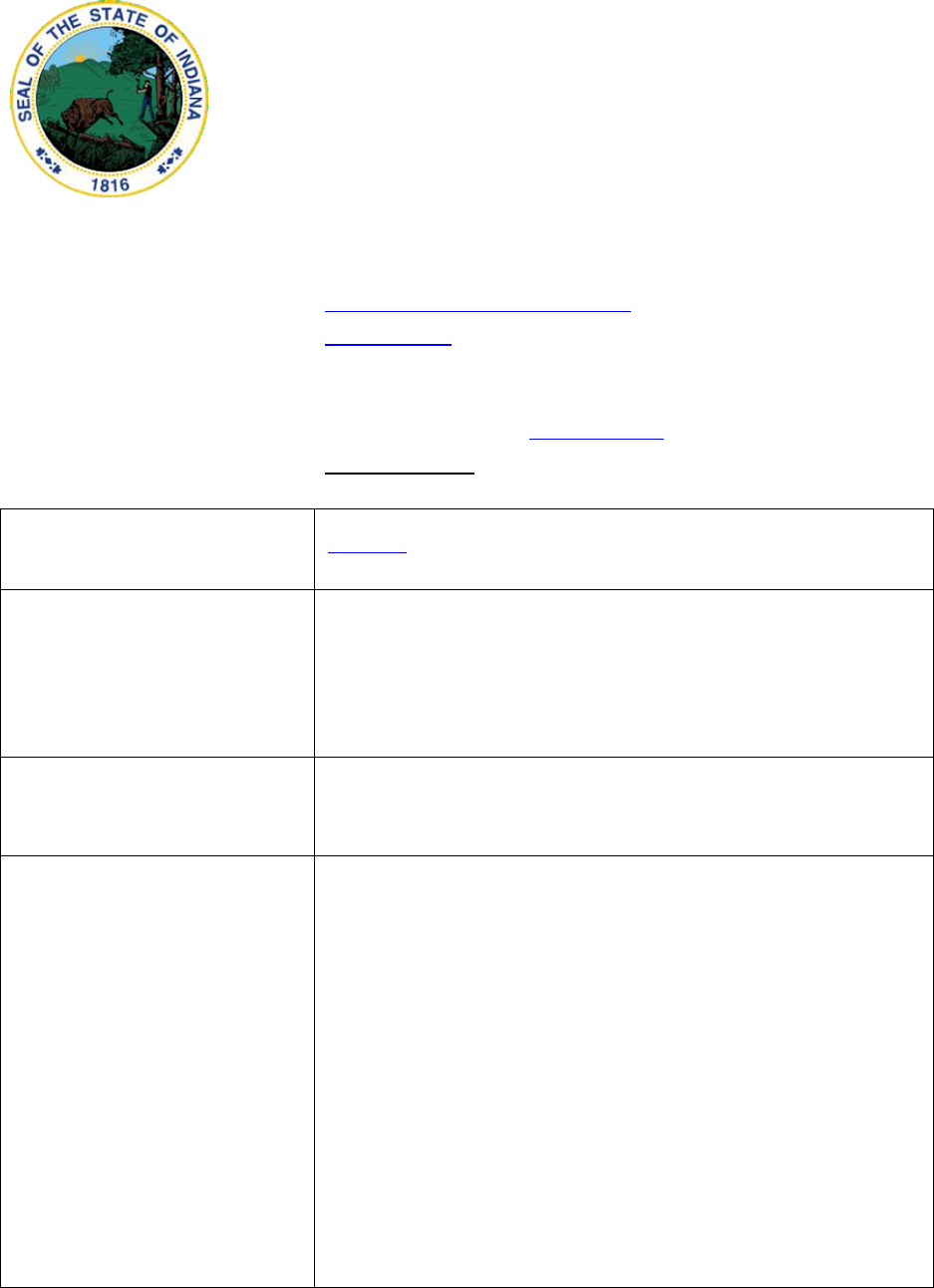

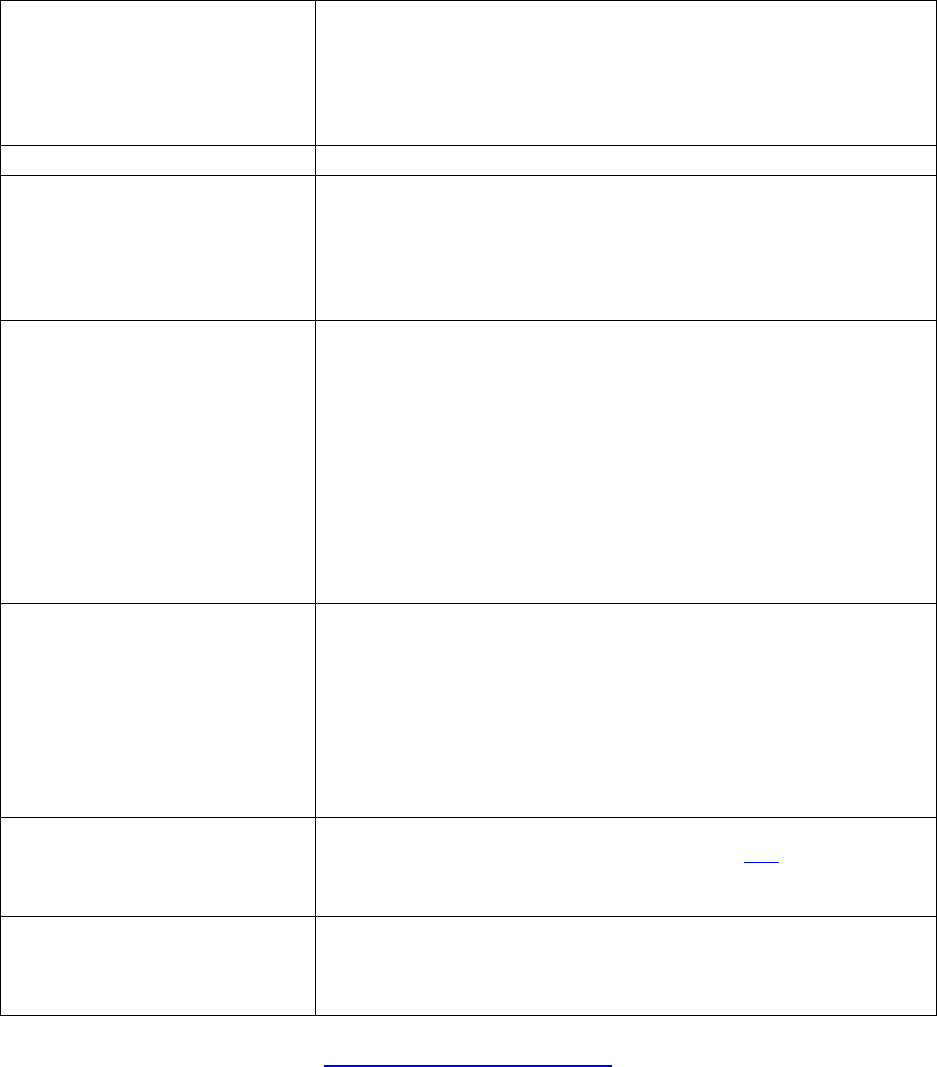

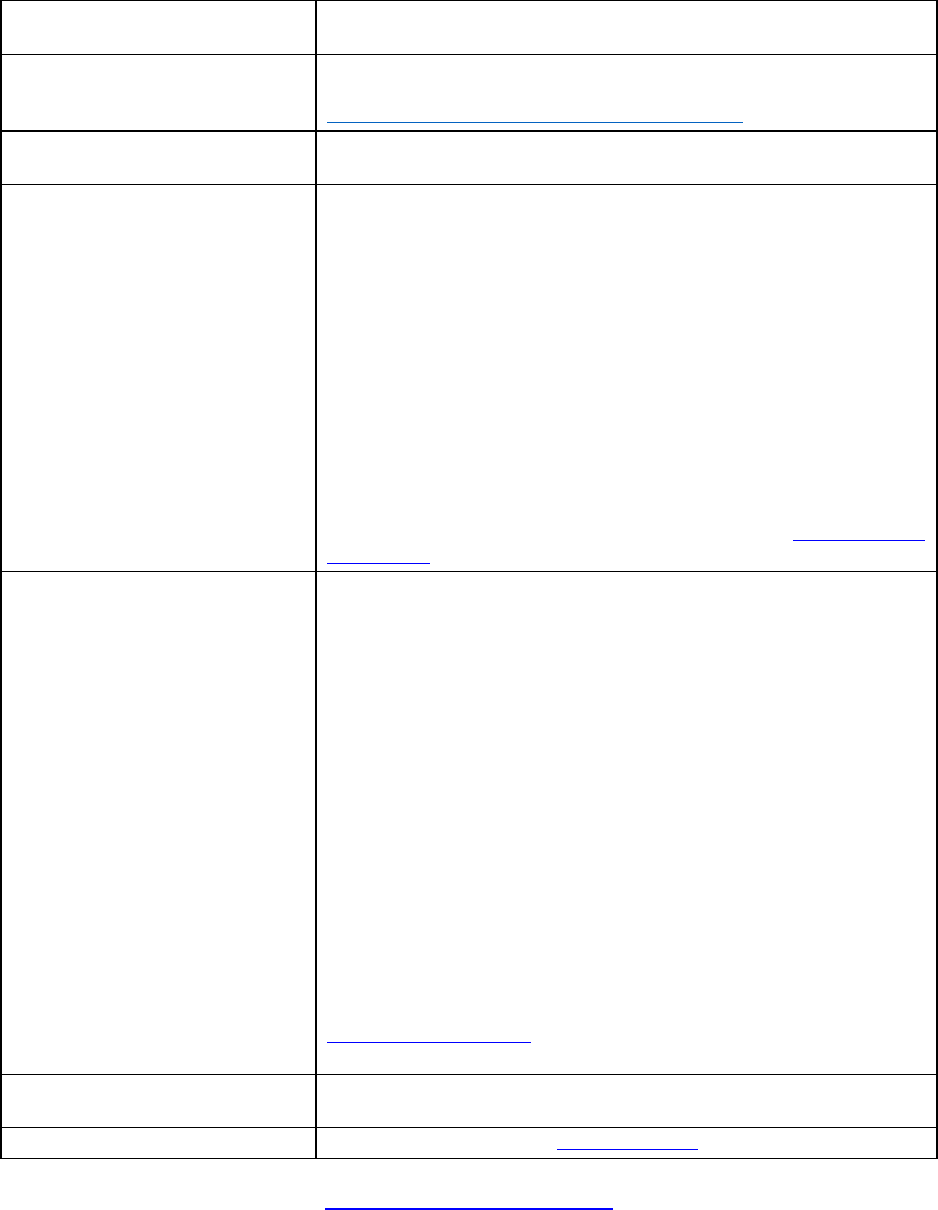

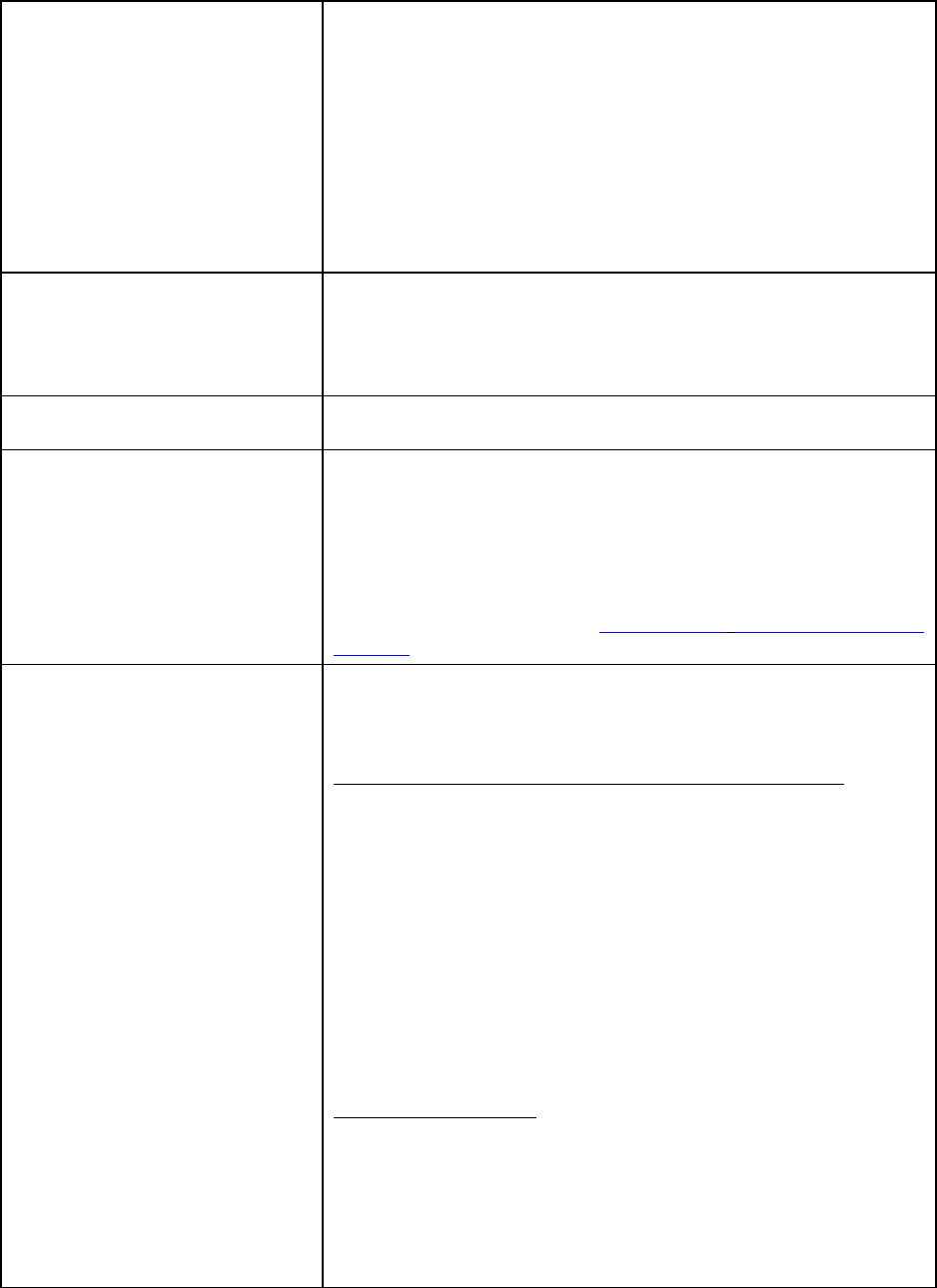

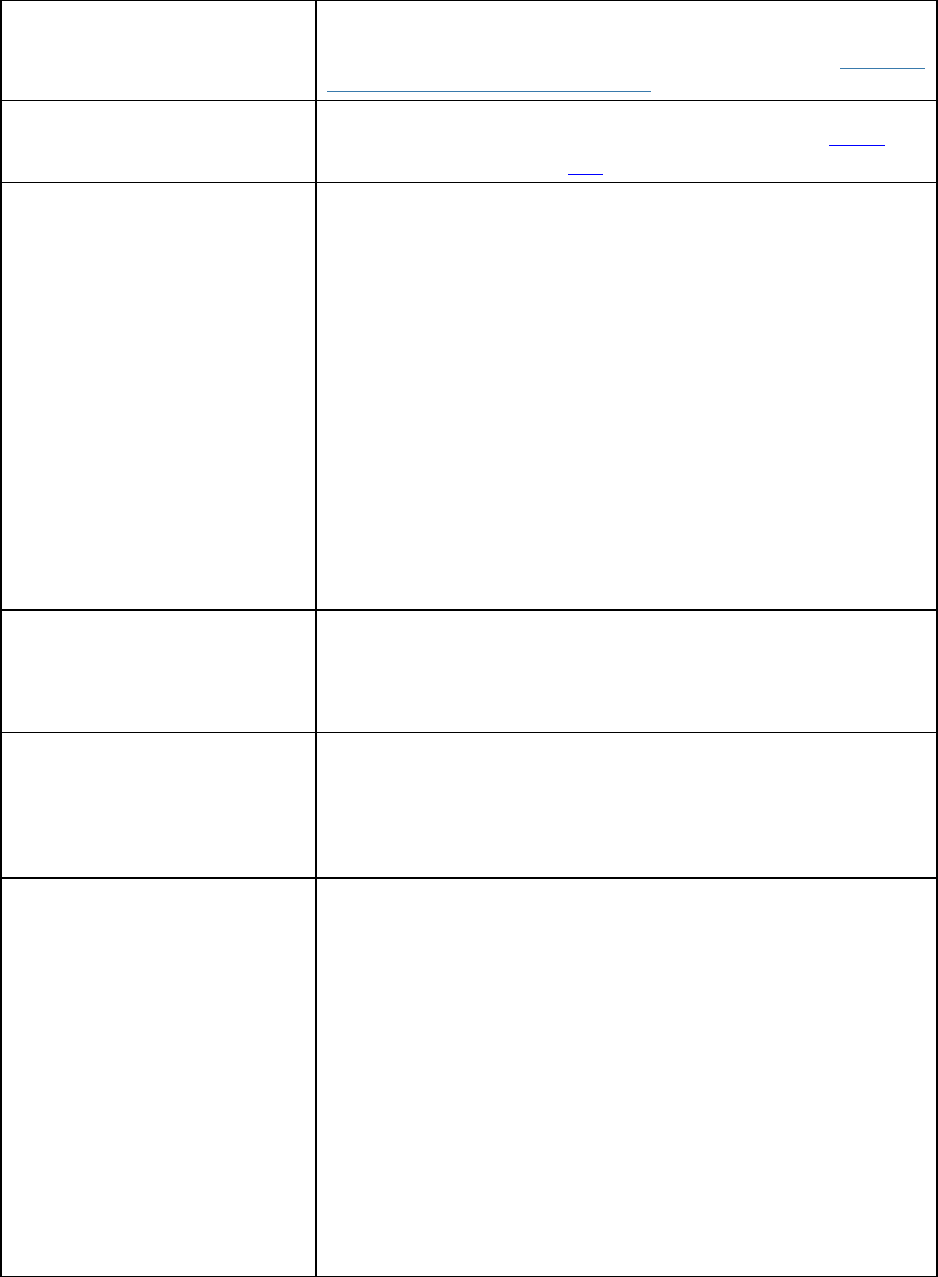

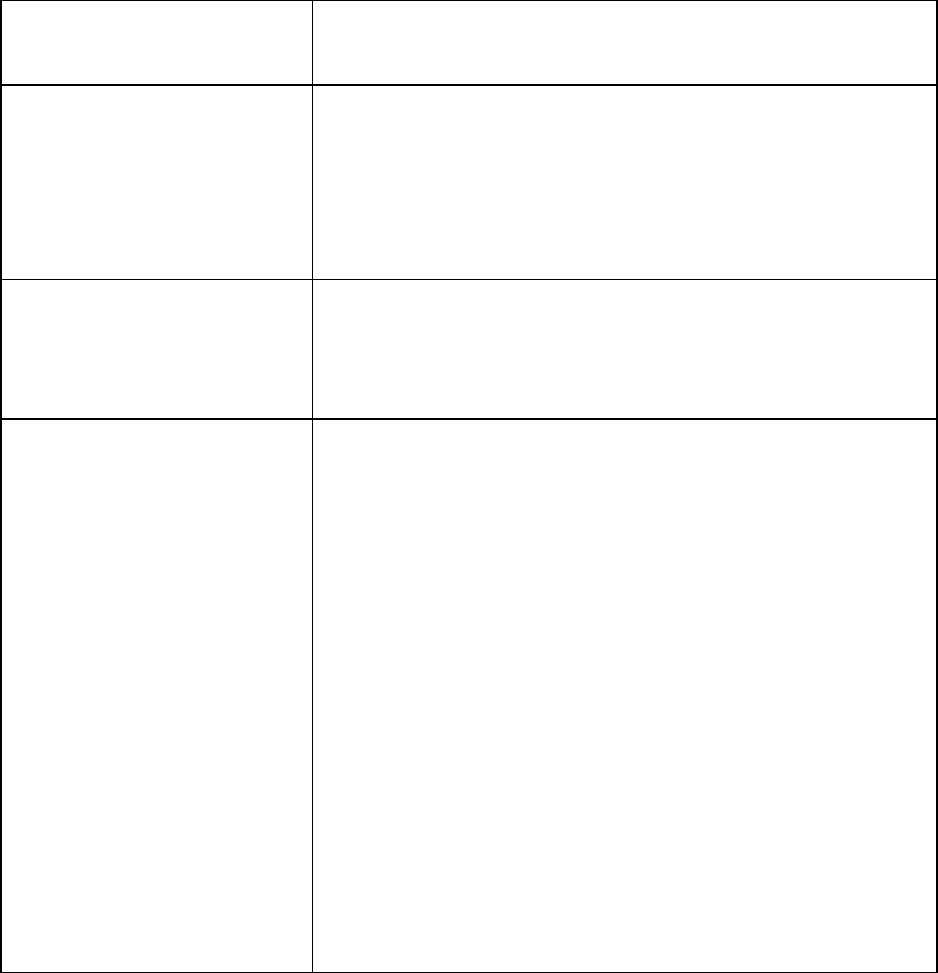

TABLE OF CONTENTS

INTRODUCTION

GO

MISSOURI

GO

ALABAMA

GO

MONTANA

GO

ALASKA [No Income Tax]

GO

NEBRASKA

GO

ARIZONA

GO

NEVADA

[No Income Tax]

GO

ARKANSAS

GO

NEW HAMPSHIRE [No Earned

Income Tax]

GO

CALIFORNIA

GO

NEW JERSEY

GO

COLORADO

GO

NEW MEXICO

GO

CONNECTICUT

GO

NEW YORK

GO

DELAWARE

GO

NORTH CAROLINA

GO

DISTRICT OF COLUMBIA

GO

NORTH DAKOTA

GO

FLORIDA

[No Income Tax]

GO

OHIO

GO

GEORGIA

GO

OKLAHOMA

GO

HAWAII

GO

OREGON

GO

IDAHO

GO

PENNSYLVANIA

GO

ILLINOIS

GO

RHODE ISLAND

GO

INDIANA

GO

SOUTH CAROLINA

GO

IOWA

GO

SOUTH DAKOTA [No Income

Tax]

GO

KANSAS

GO

TENNESSEE

[No Income Tax]

GO

KENTUCKY

GO

TEXAS [No Income Tax]

GO

LOUISIANA

GO

UTAH

GO

MAINE

GO

VERMONT

GO

MARYLAND

GO

VIRGINIA

GO

MASSACHUSETTS

GO

WASHINGTON

[No Income Tax]

GO

MICHIGAN

GO

WEST VIRGINIA

GO

MINNESOTA

GO

WISCONSIN

GO

MISSISSIPPI

GO

WYOMING [No Income Tax]

GO

Introduction

This guide is intended as a reference for U.S. Military VITA/ELF programs. It is not a

comprehensive legal analysis of state tax law; rather, it provides basic information and contact

points for each income-tax-levying state. Sites should contact state assistance numbers, or use

state websites, for further information!

There are nine states that do not levy any tax on earned income: Alaska, Florida, Nevada, New

Hampshire, South Dakota, Tennessee, Texas, Washington, and Wyoming. New Hampshire does

tax certain types of investment income. Earned income tax information about the aforementioned

states is not included in this guide.

General Residency Rules: The general rule is that legal residency is established when an individual

is physically present in a state AND has the intent to permanently reside in the state. “Intention to

permanently reside” can be shown through a combination of several factors: ownership of real

property; registering to vote; registering a vehicle; obtaining a driver’s license; and declaring of

legal residency on legal documents (including DD Form 2058: State of Legal Residence

Certificate). One of these factors by itself would probably not be enough to change residency, but

if a service member moved to a state and registered to vote, bought a house, registered her car,

obtained a new driver’s license, and registered her children in the local schools, she would most

likely be considered to be a resident of the new state. For example, if you were a legal resident of

Delaware when you entered the Armed Forces, you remain a legal resident of Delaware for

Delaware state income tax purposes unless you voluntarily abandoned your Delaware residency

and established a new legal domicile in another state. A change in legal residence is documented

by filing DD Form 2058 and DD Form 2058-1 (State Income Tax Exemption Test Certificate)

with your military personnel office.

SCRA Protections for Active Duty Members: Pursuant to the Servicemembers Civil Relief Act

(SCRA), active duty service members are able to maintain legal residency in one state while

physically stationed in another state. Thus, the SCRA protects service members from having their

military income taxed by both their state of legal residence and the state where they are stationed.

(However, if a military member has non-military income, the state in which he or she lives and

works may tax that income, even if the military member is a legal resident of a different state).

MSRRA Protections for Dependent Spouses: Pursuant to the Military Spouse Residency Relief

Act (MSRRA), military spouses may also maintain their established domicile or residence for tax

purposes, but the domicile or residence must be the same as the service member spouse. However,

the applicability of and eligibility under the MSRRA is very fact-specific, and many states have

differing guidance on application of the MSRRA.

For further information or questions about residency for tax purposes, please contact your local

Legal Service Office.

Credit Card Payment Options: Many states have made it easier for individuals to pay their taxes

via credit card. Go to Official Payments or call 1-800-2PAY-TAX. They will accept AMEX,

Discover/Novus, Master Card or Visa. You can do a Zip Code search to determine which states

allow payments to be made online.

2

Note: Internet links are provided in this guide for your convenience, and every effort was made to

provide the most current versions of forms. However, at the time of the publishing of this

document, not all states had released the current-year forms. For links to Adobe Acrobat.pdf files

online, after clicking on the link through this guide, you may also need to highlight the link in your

web browser and double click for the document to appear.

EVERY EFFORT HAS BEEN MADE TO ENSURE THAT THE INFORMATION IN THIS

GUIDE IS ACCURATE, HOWEVER, THE USER SHOULD CONFIRM ANY

QUESTIONABLE INFORMATION WITH THE STATE WEBSITE!

Return to Table of Contents

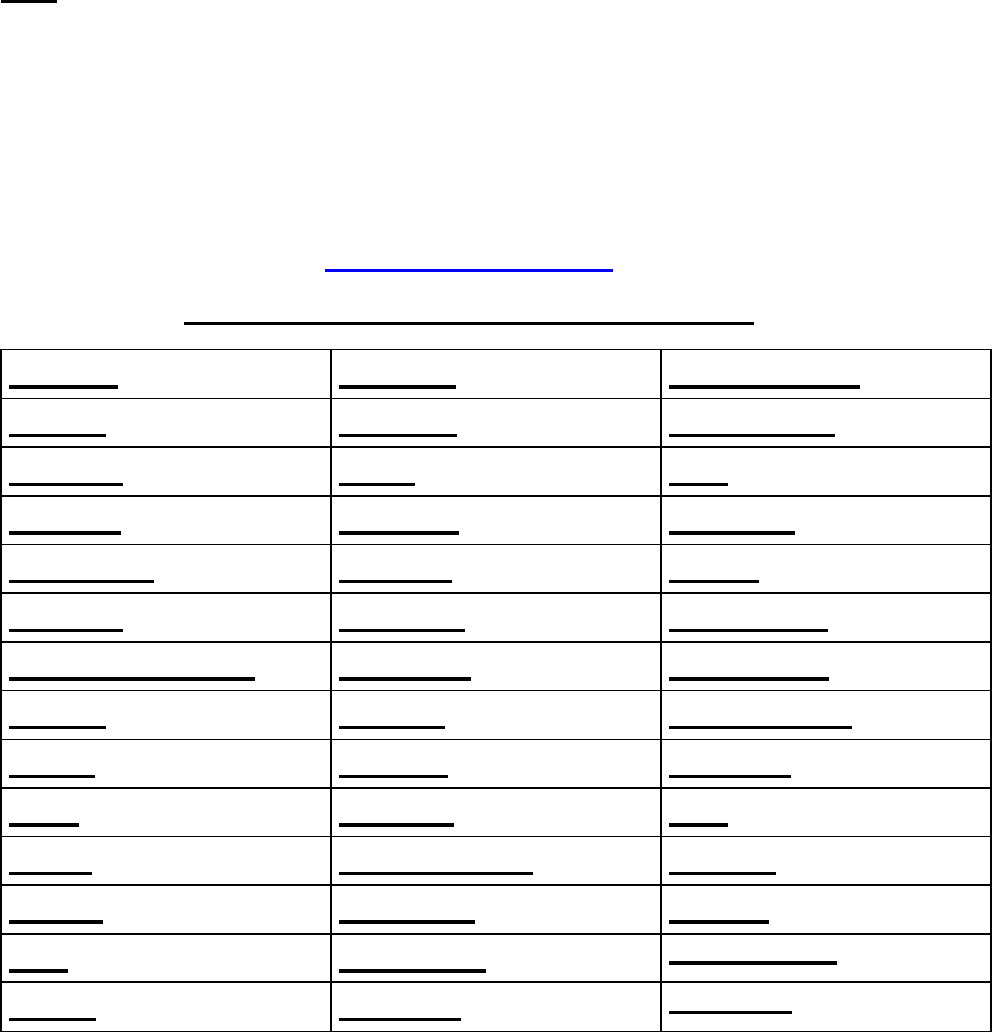

States Participating in the Federal/State e-File Program

Alabama Kentucky North Carolina

Arizona Louisiana North Dakota

Arkansas Maine Ohio

Colorado Maryland Oklahoma

Connecticut Michigan Oregon

Delaware Minnesota Pennsylvania

District of Columbia Mississippi Rhode Island

Georgia Missouri South Carolina

Hawaii Montana Tennessee

Idaho Nebraska Utah

Illinois New Hampshire Vermont

Indiana New Jersey Virginia

Iowa New Mexico

West Virginia

Kansas New York

Wisconsin

3

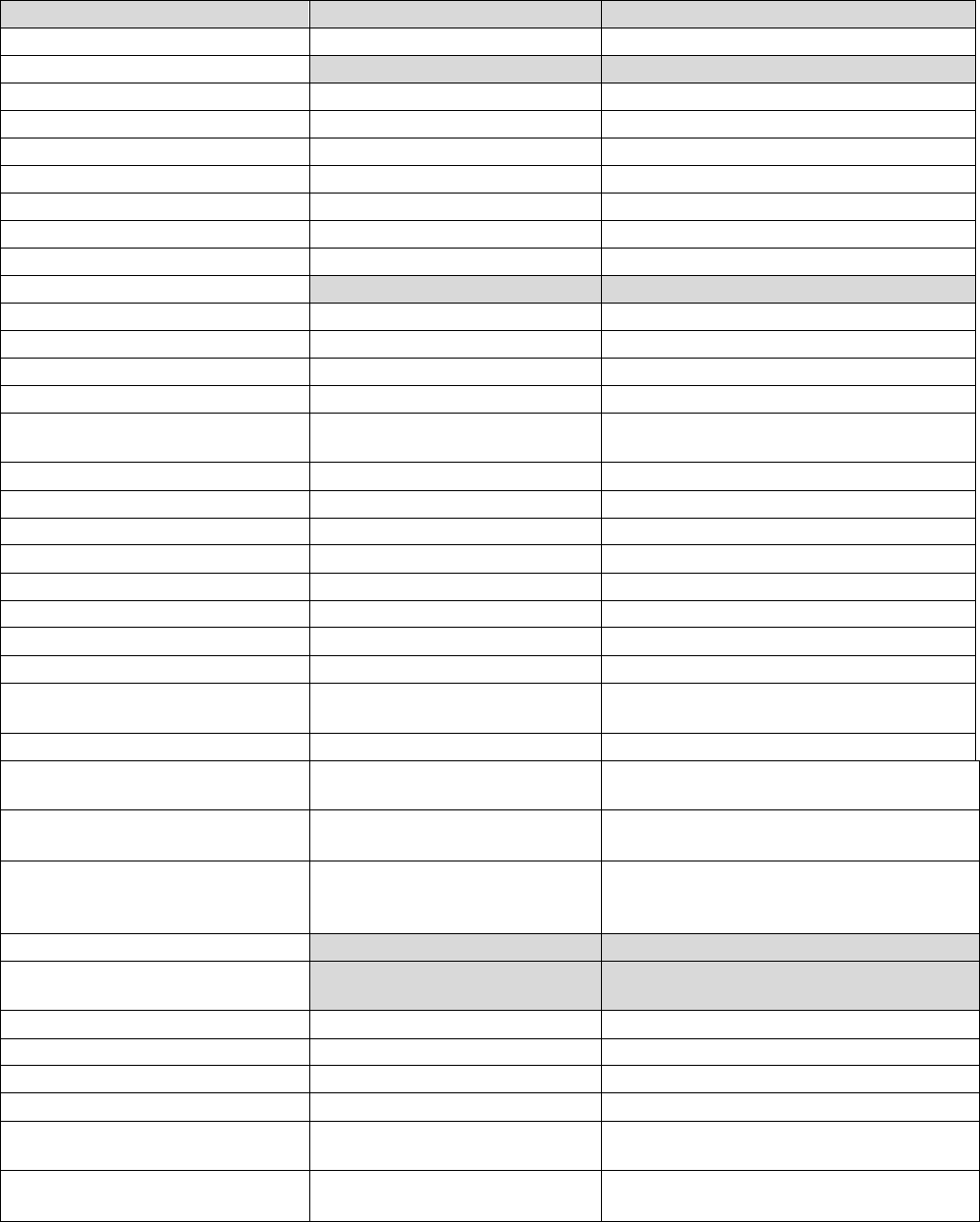

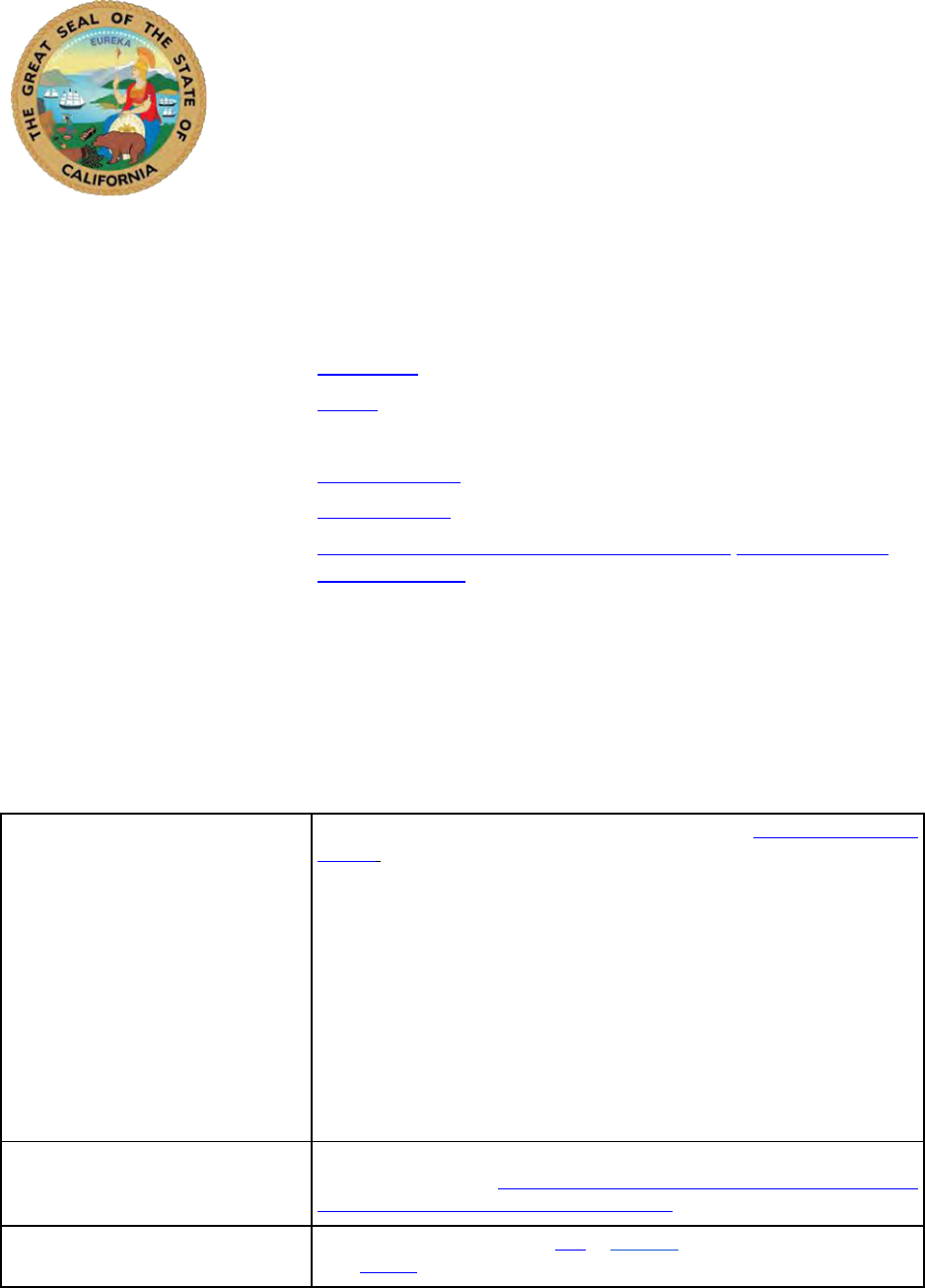

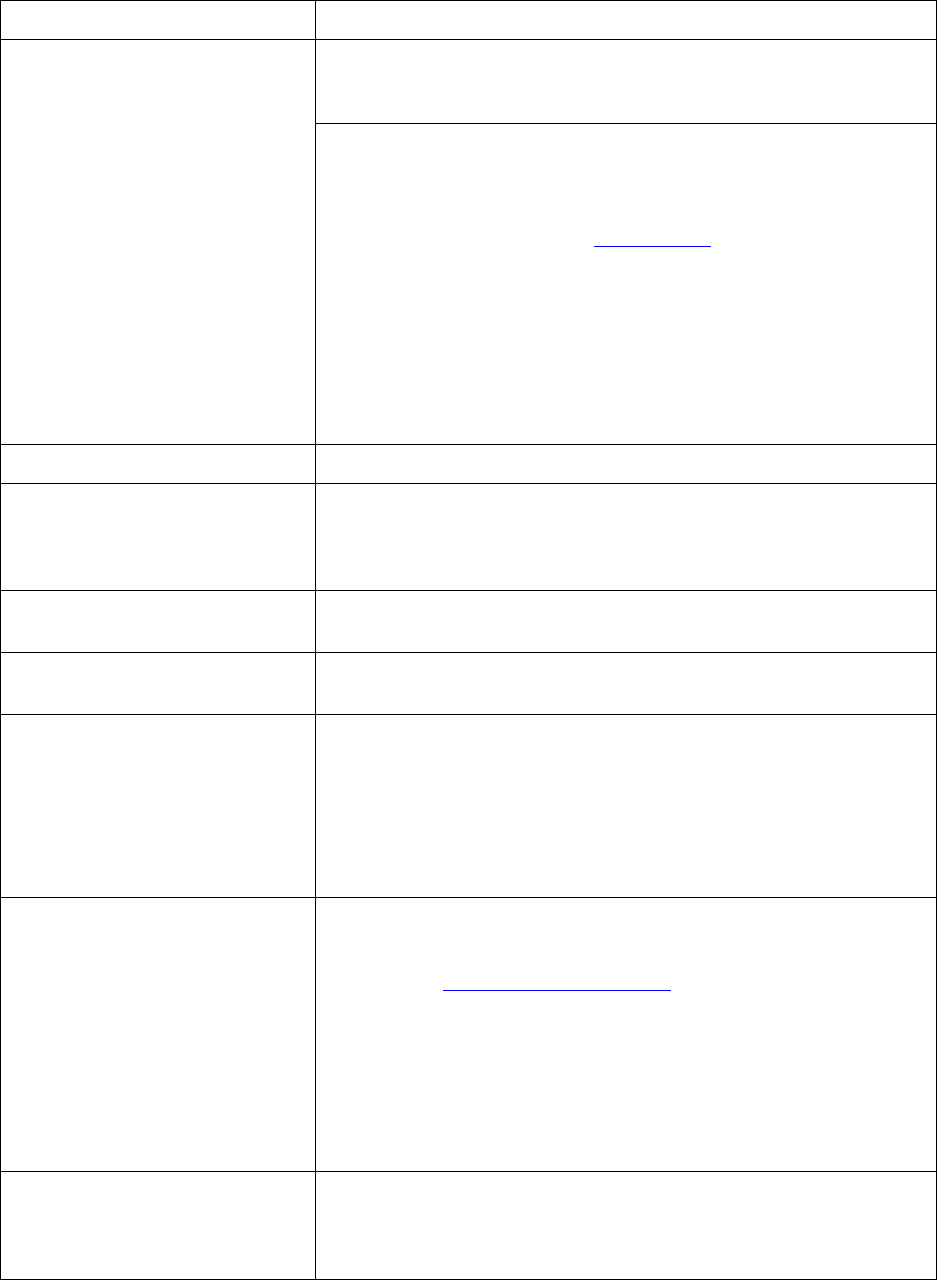

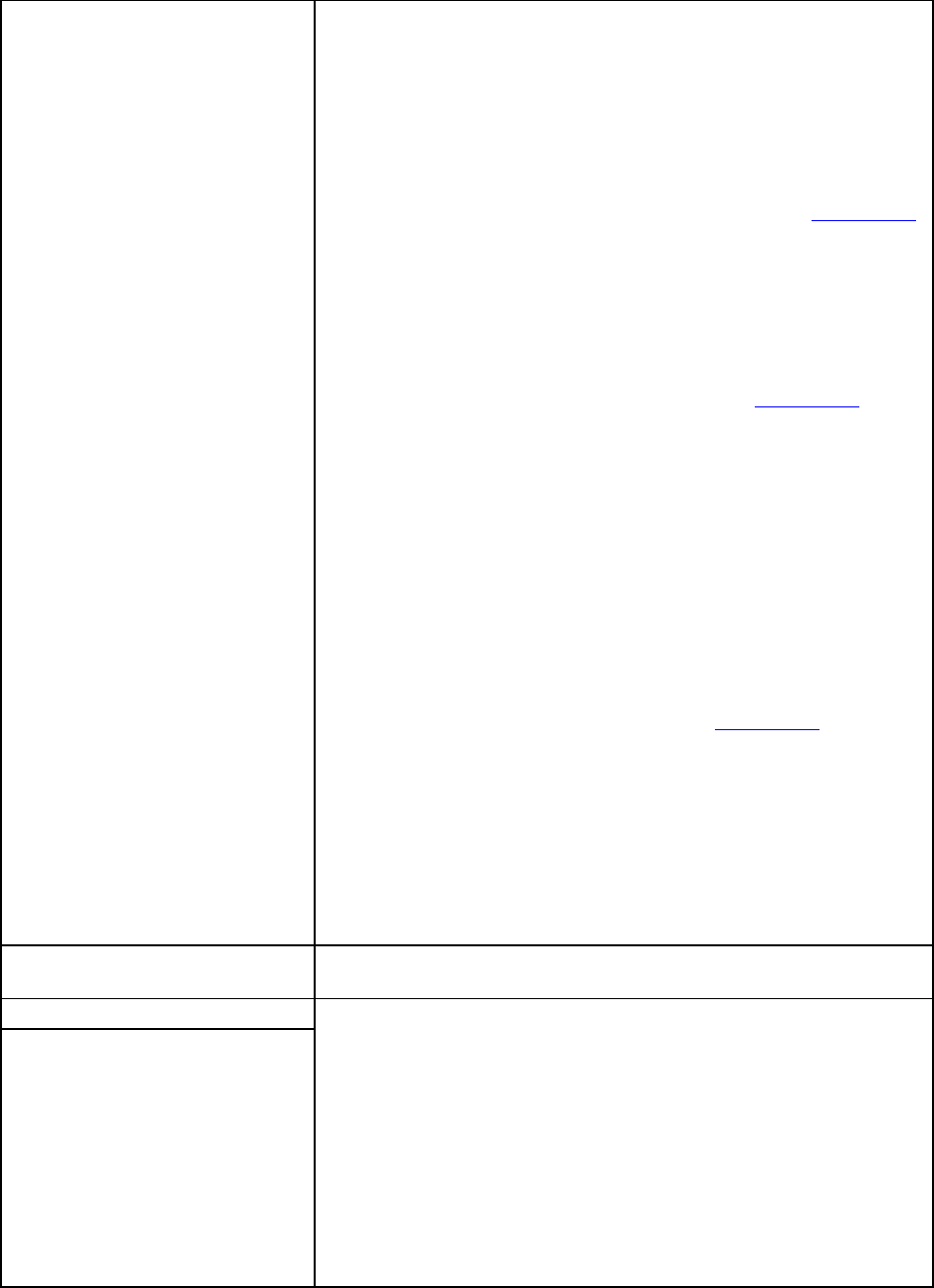

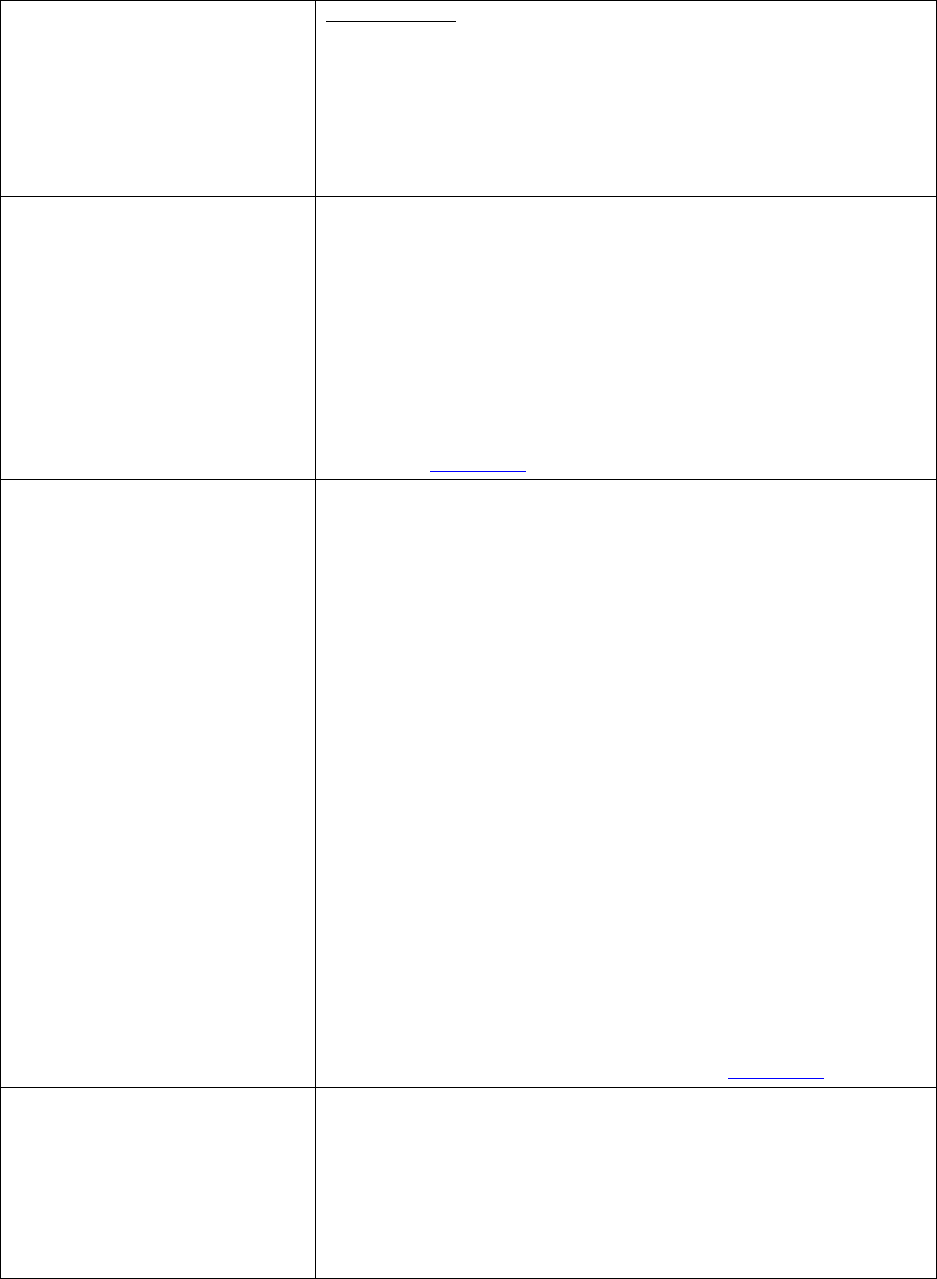

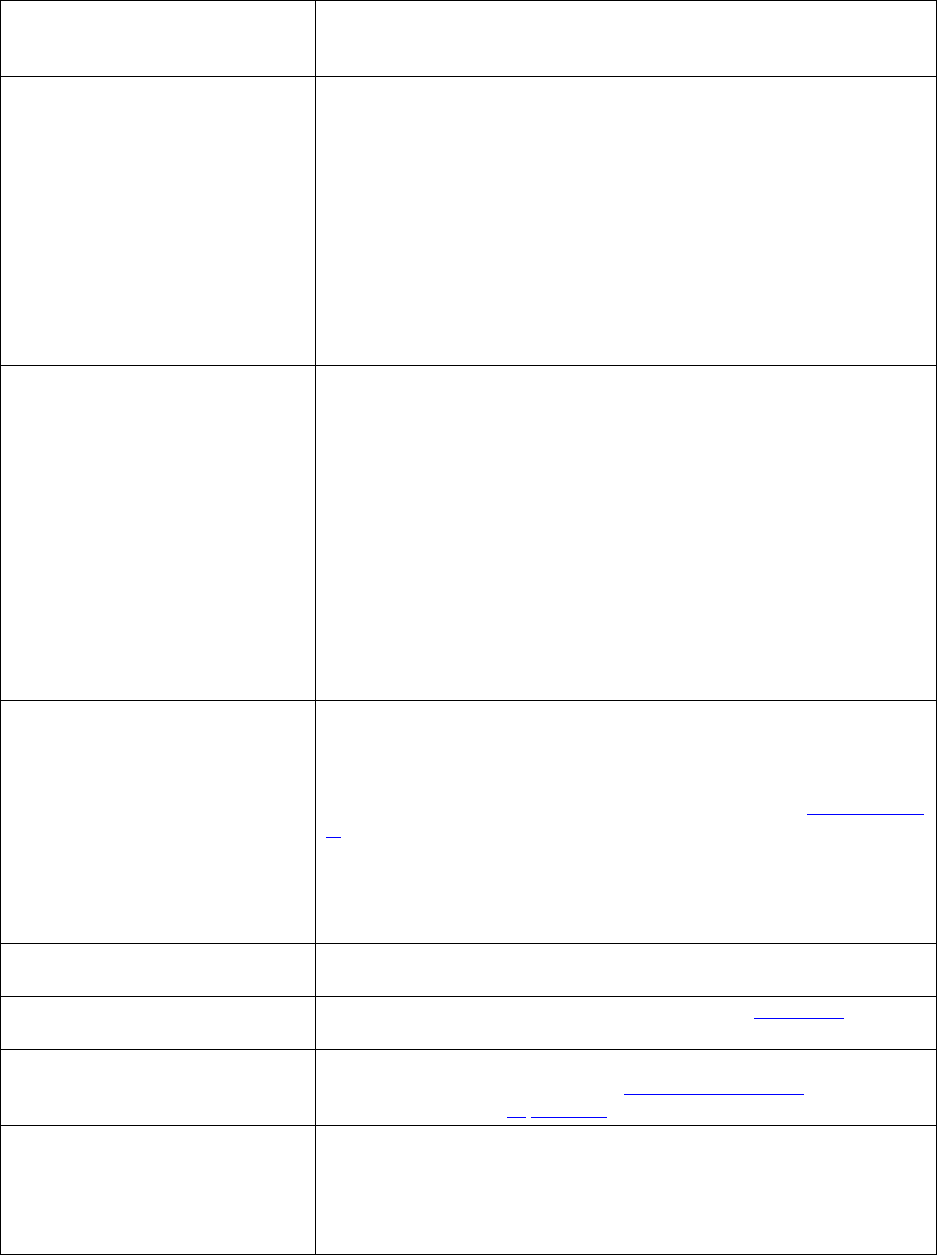

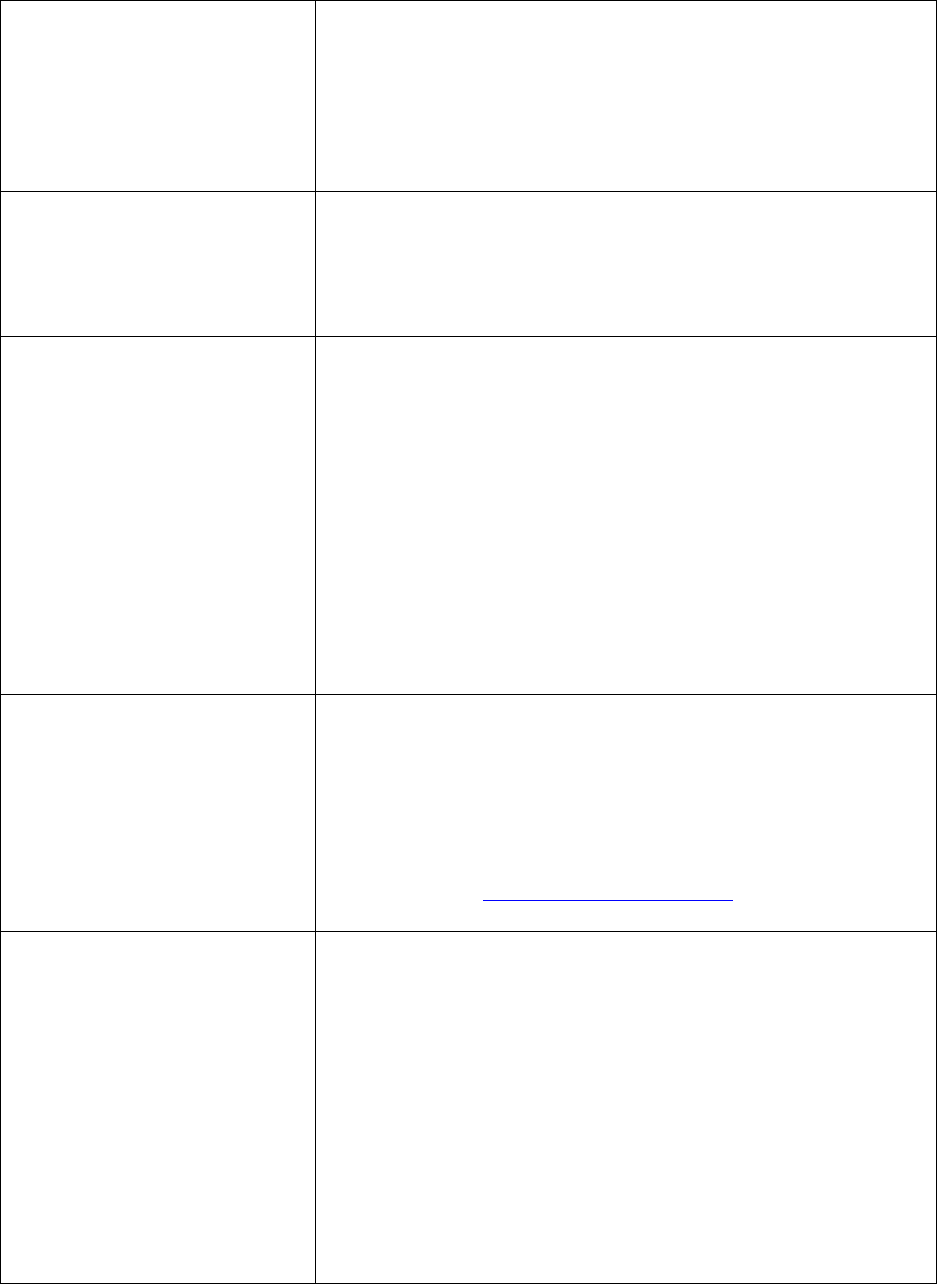

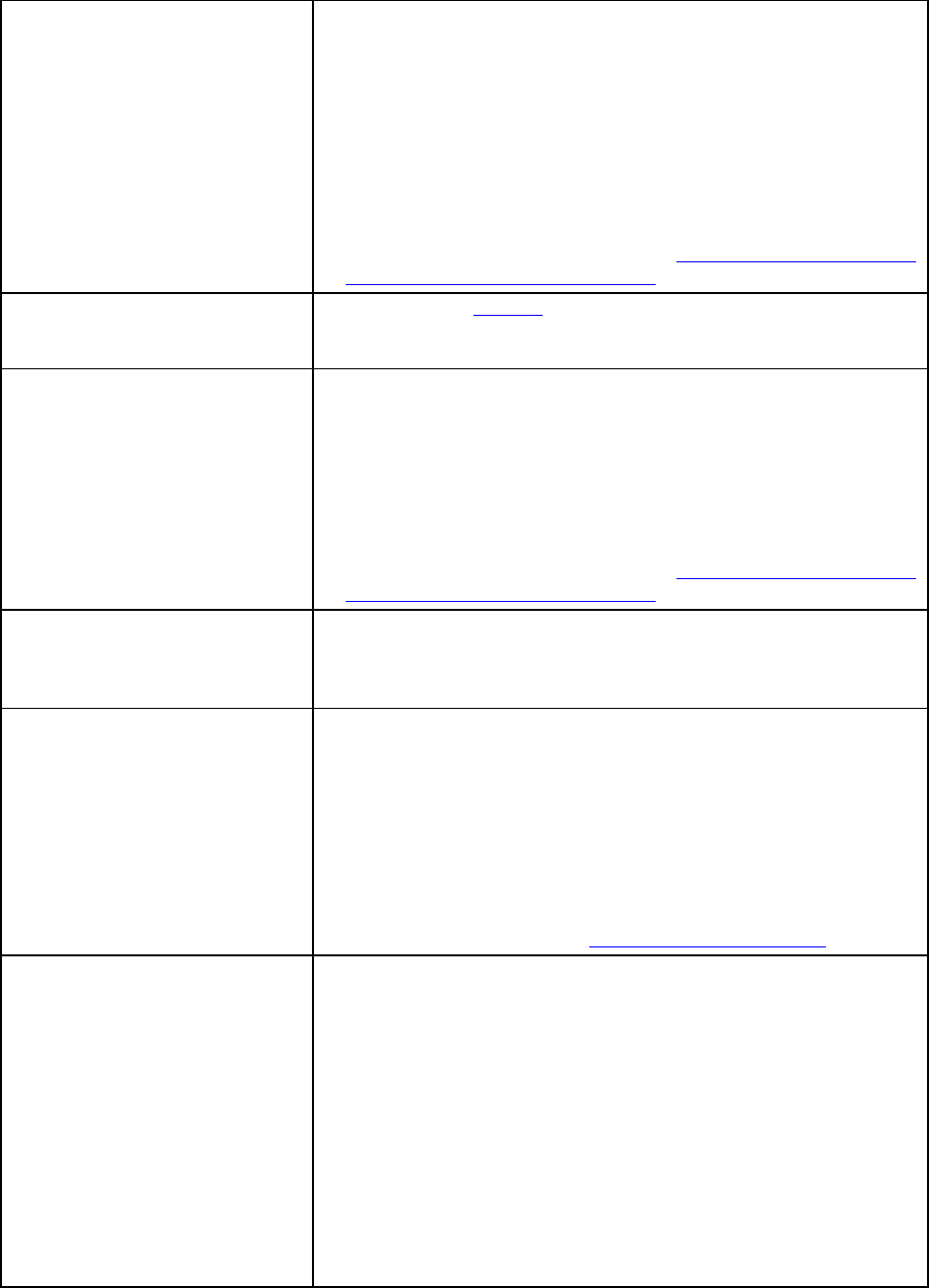

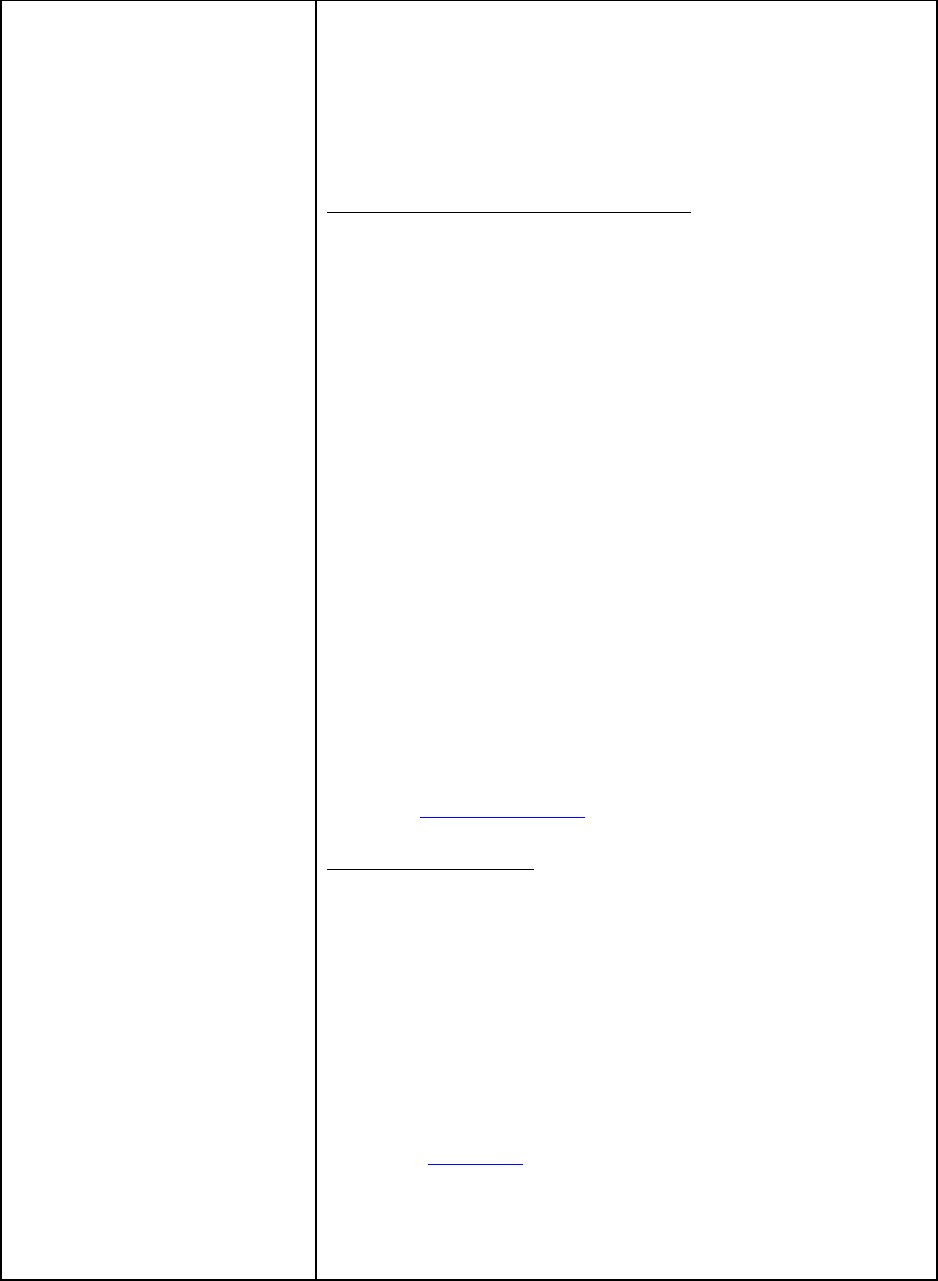

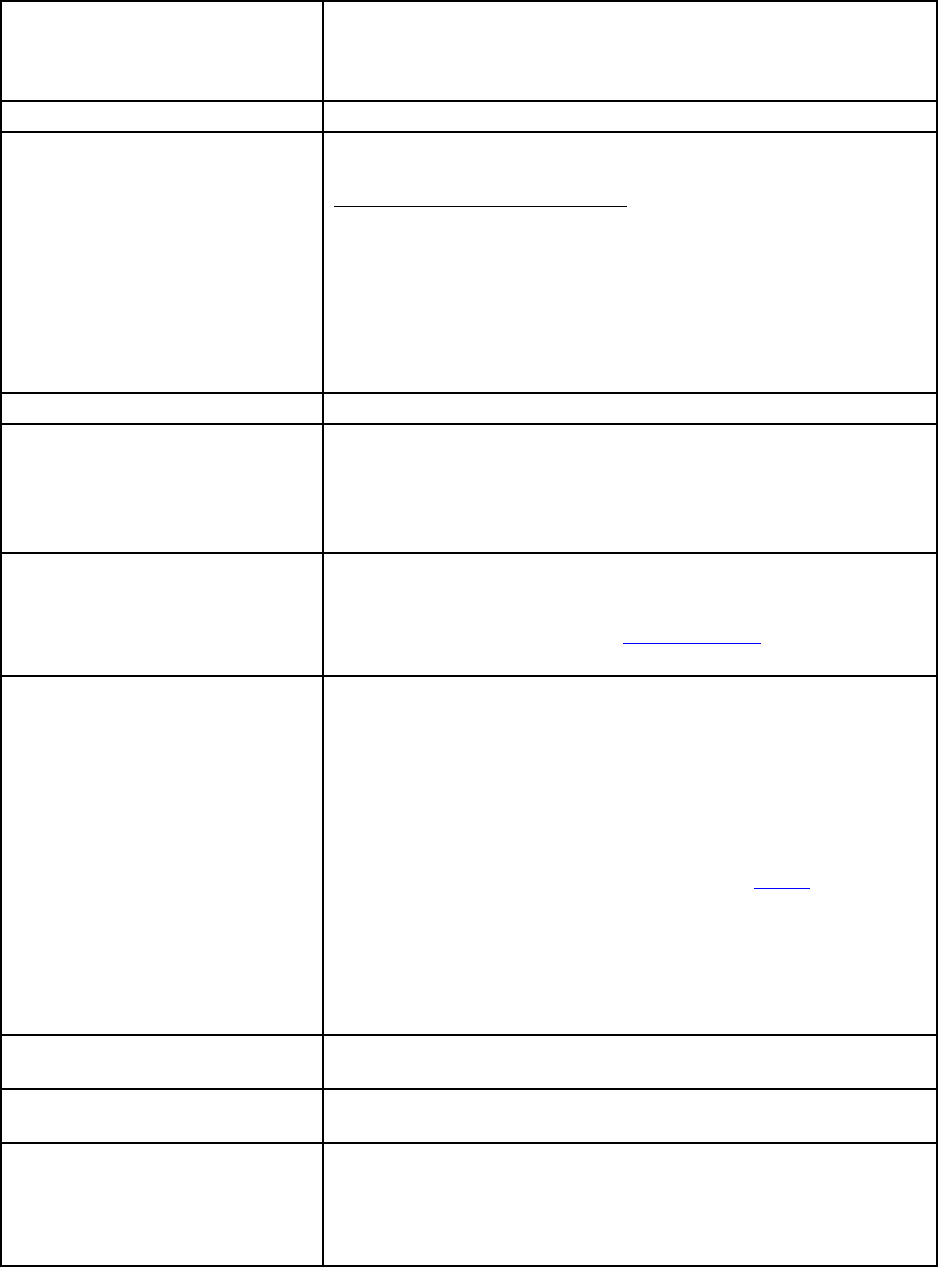

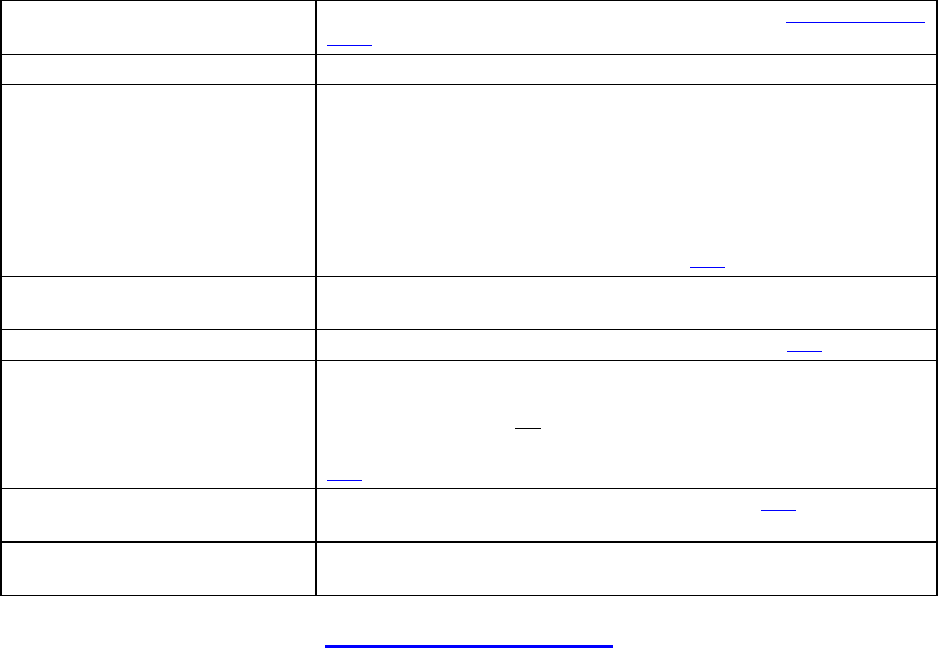

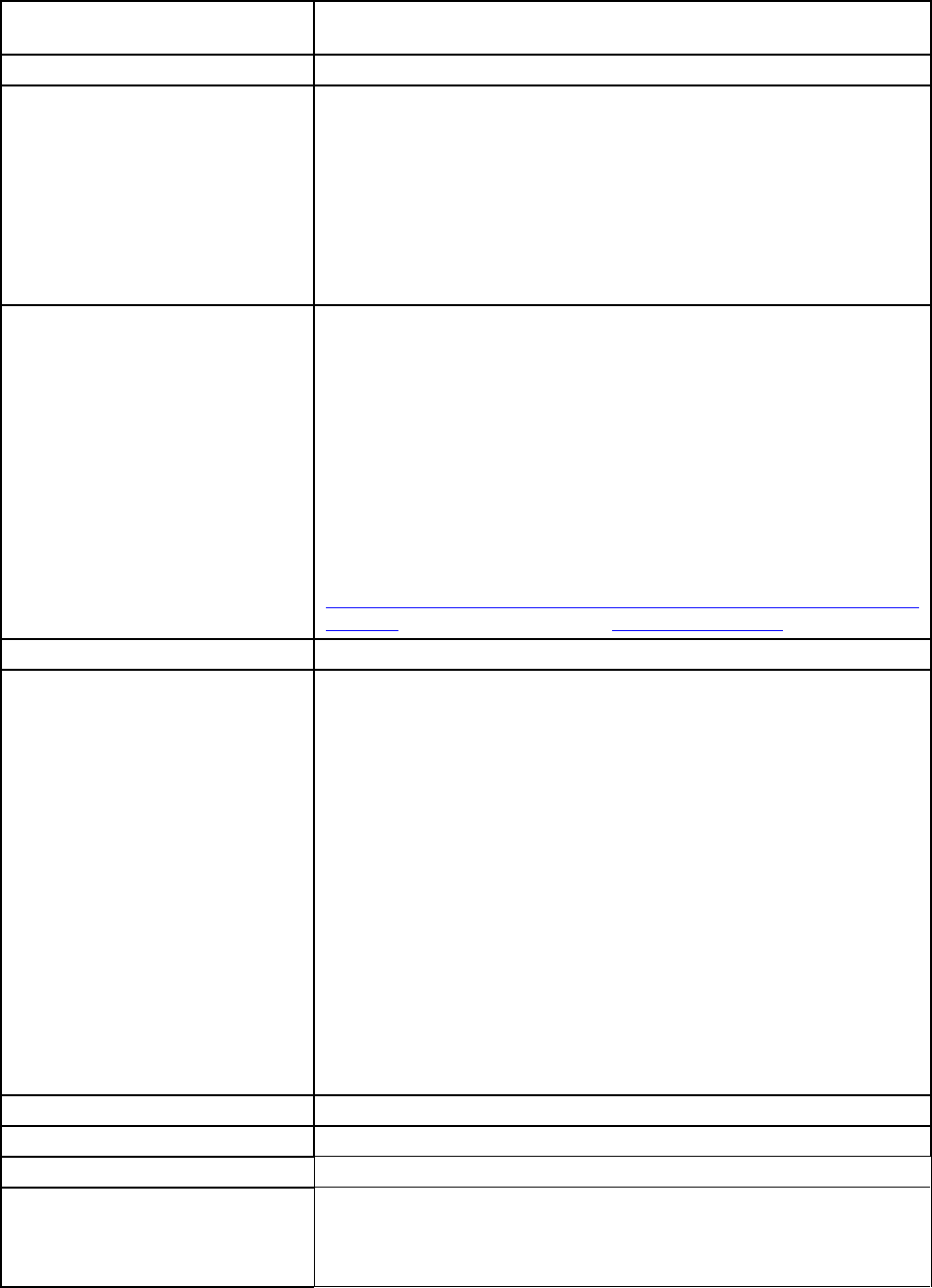

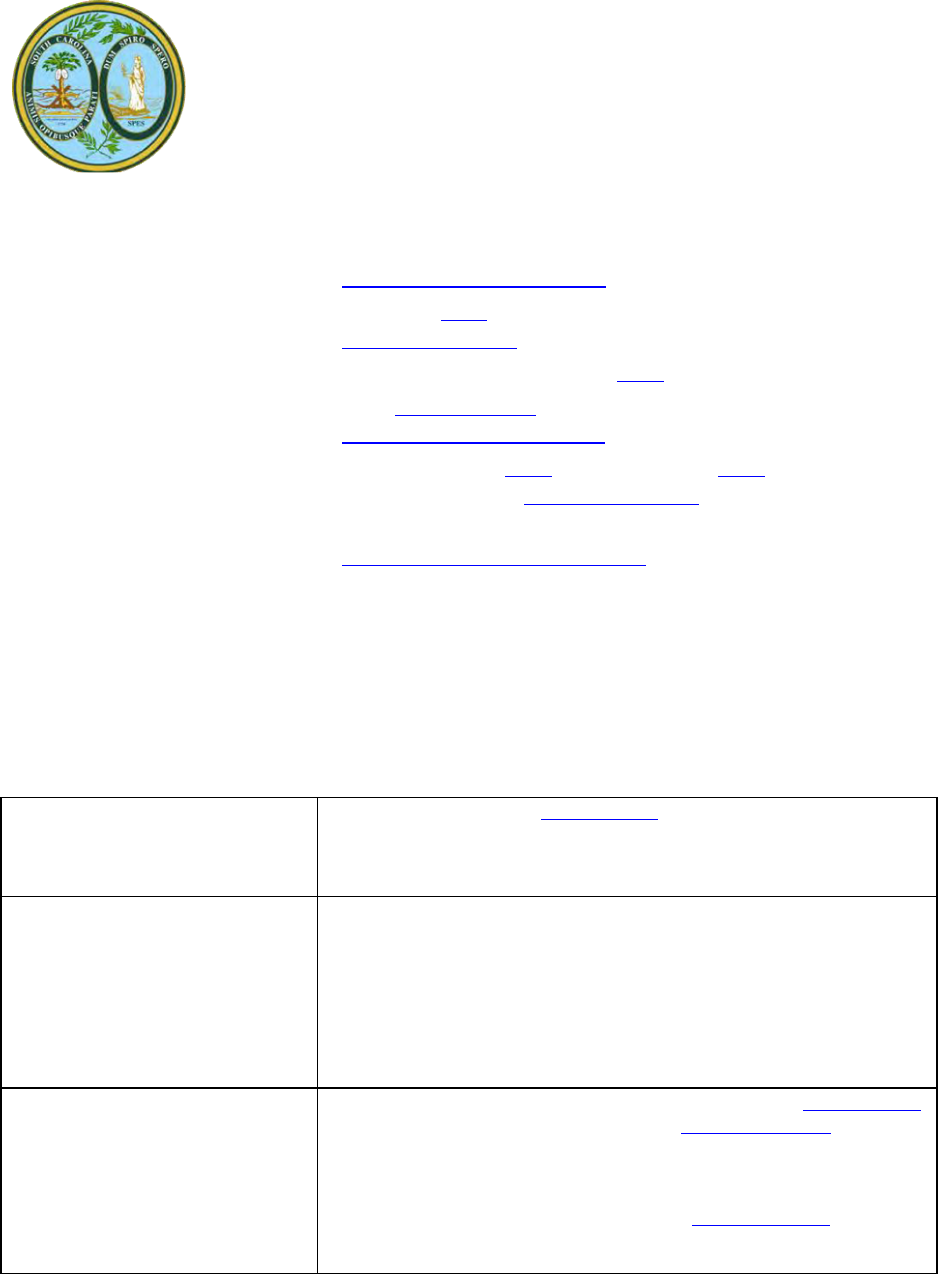

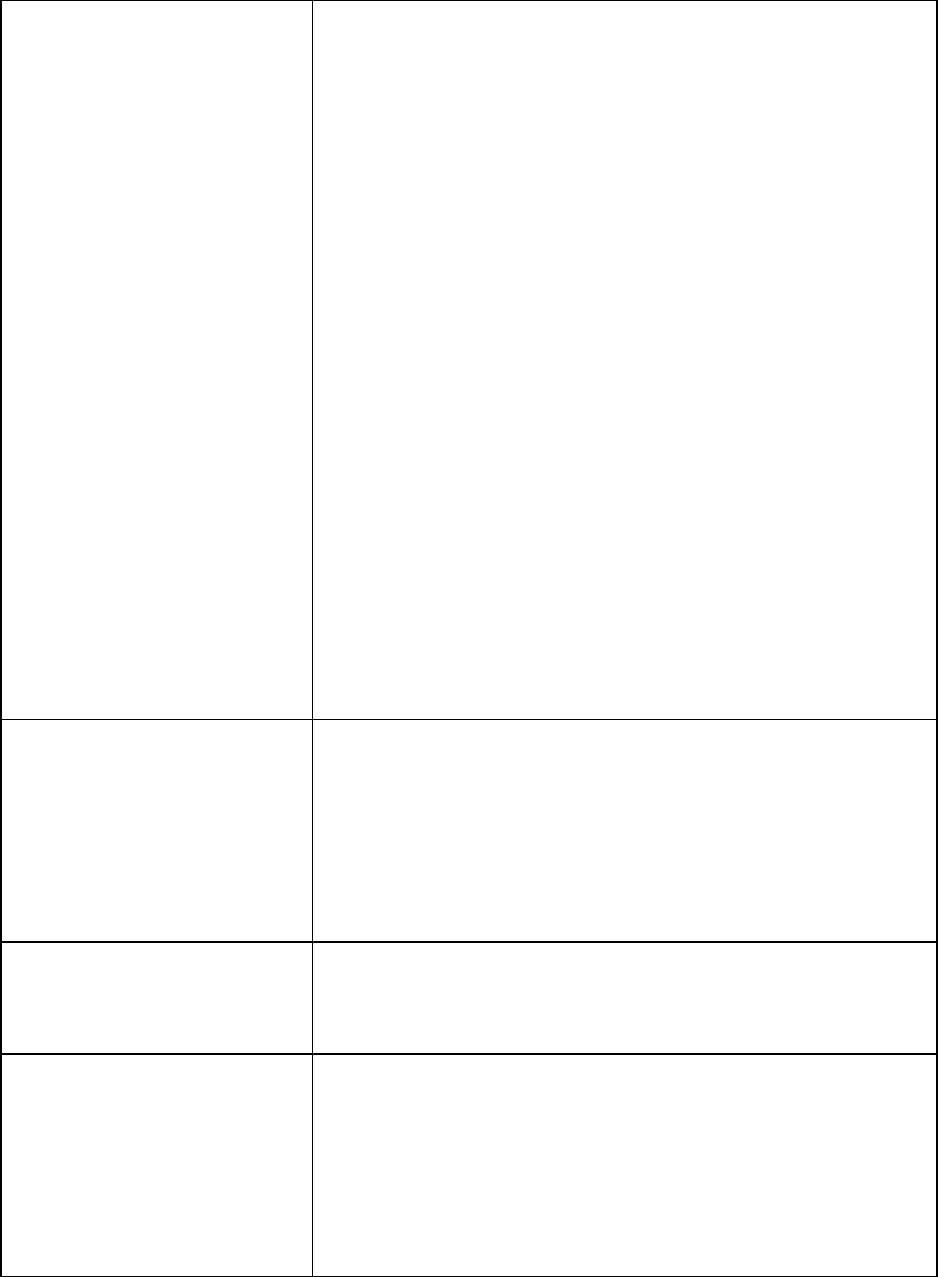

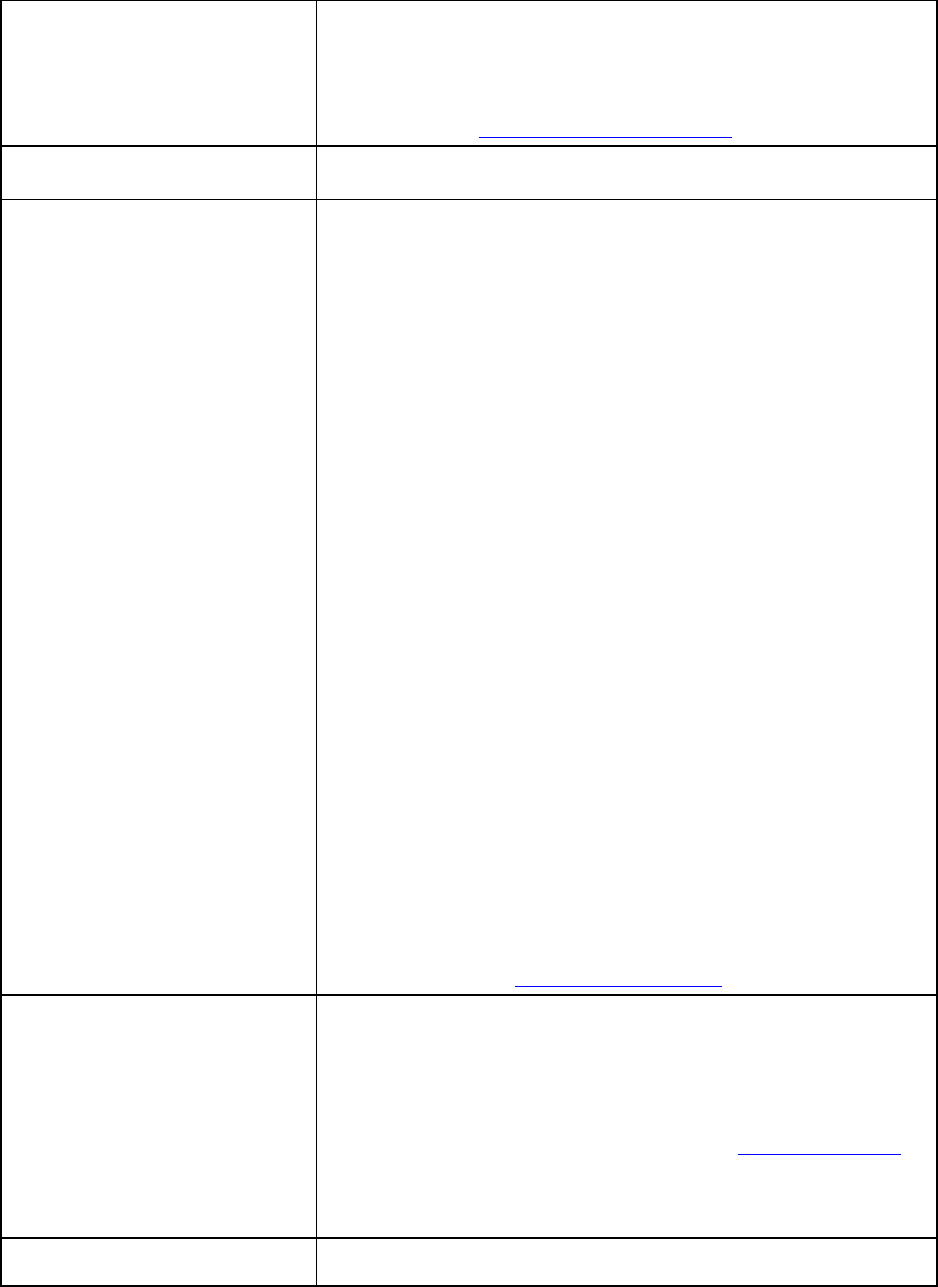

State Electronic Filing Record Retention Requirements

State Record Retention Requirements

Alabama AL8453 3 years

Alaska (No Income Tax)

Arizona AZ-8879 4 years

Arkansas AR8453 3 years.

California FTB 8453 or FTB 8879 4 years

Colorado DR 8453 4 years

Connecticut No separate e-form is required. 3 years

Delaware DE-8453 3 years

District of Columbia D-40E 3 years

Florida (No Income Tax)

Georgia GA-8453 3 years

Hawaii No separate e-form is required.

Idaho No separate e-form is required. 3 years

Illinois IL-8453 3 years

Indiana IT-8879

3 years from Dec. 31 of the year the return was

filed

Iowa IA 8453 3 years

Kansas No separate e-form is required. Retain information for 3 years.

Kentucky 8879-K 3 years

Louisiana LA -8453 3 years

Maine No separate e-form is required. Retain supporting documentation for 3 years.

Maryland EL 101 3 years

Massachusetts M-8453 3 years

Michigan MI-8453 6 years

Minnesota No separate e-form is required. EROs must retain all supporting documents

for

one year.

Mississippi MS 8453 OL 3 years

Missouri No separate e-form is required. ERO must give the taxpayer all of the forms,

and the taxpayer must retain them for 3 years

Montana No separate e-form is required. Taxpayers should retain all supporting

documents for five years.

Nebraska No separate e-form is required. No retention requirement; Code 16 requires

retention until Dec. 31

st

of the year the return

was filed.

Nevada (No Income Tax)

New Hampshire (No Earned Income

Tax)

New Jersey No separate e-form is required.

New Mexico PIT-8453 3 years

New York TR-579-IT 3 years

North Carolina No separate e-form is required. 3 years.

North Dakota No separate e-form is required. A minimum of 3 years and 3 months, but to

protect against audit, retain for 6 years.

Ohio No separate e-form is required. At least 4 years, though Ohio recommends

retaining for 10 years.

4

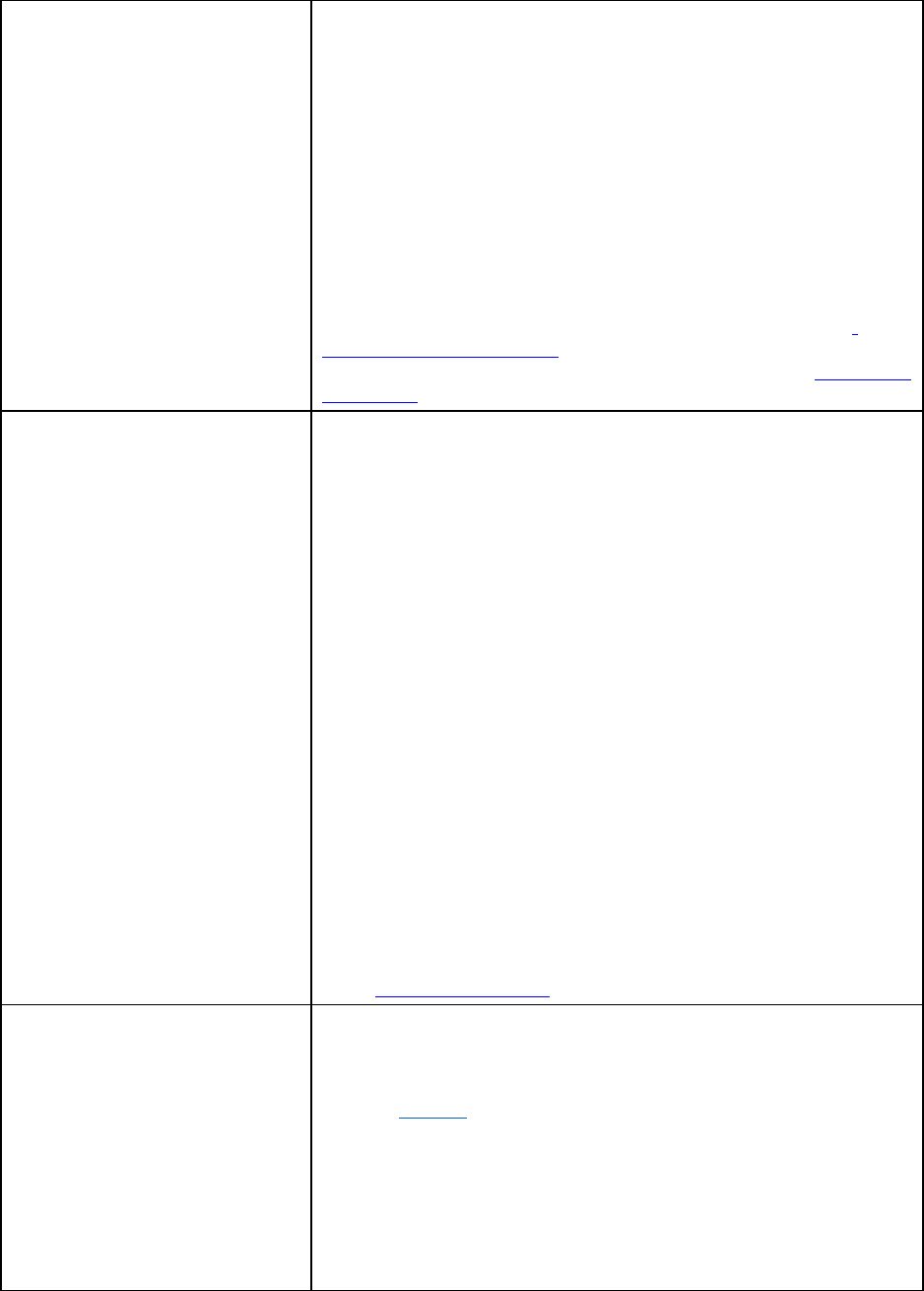

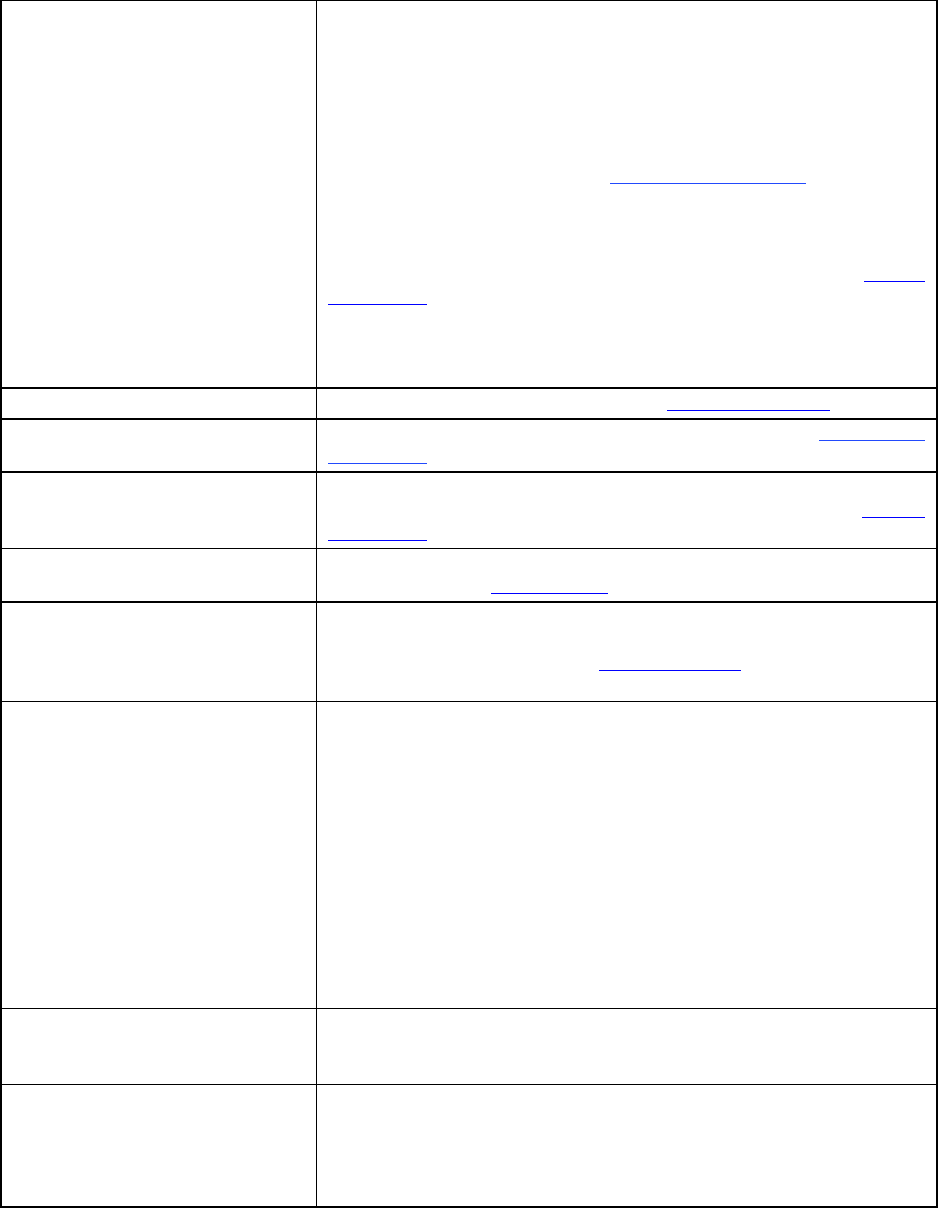

State Record Retention Requirements

Oklahoma OK-511-EF No retention requirement; Code 16 requires

retention until Dec. 31

st

of the year the return

was filed.

Oregon No separate e-form is required. 3 years

Pennsylvania PA-8453 or PA-8453 3 years

Rhode Island

No

separate e-form is required.

South Carolina SC-8453 3 years

South Dakota (No Income Tax)

Tennessee (No Earned Income Tax)

Texas (No Income Tax)

Utah No separate e-form is required. 3 years

Vermont No separate e-form is required. 3 years

Virginia VA-8453 or VA-8879 3 years

Washington (No Income Tax)

West Virginia WV-8453 3 years

Wisconsin No separate e-form is required. 4 years from the due date of the return or the

date filed, whichever is later.

Wyoming (No Income Tax)

5

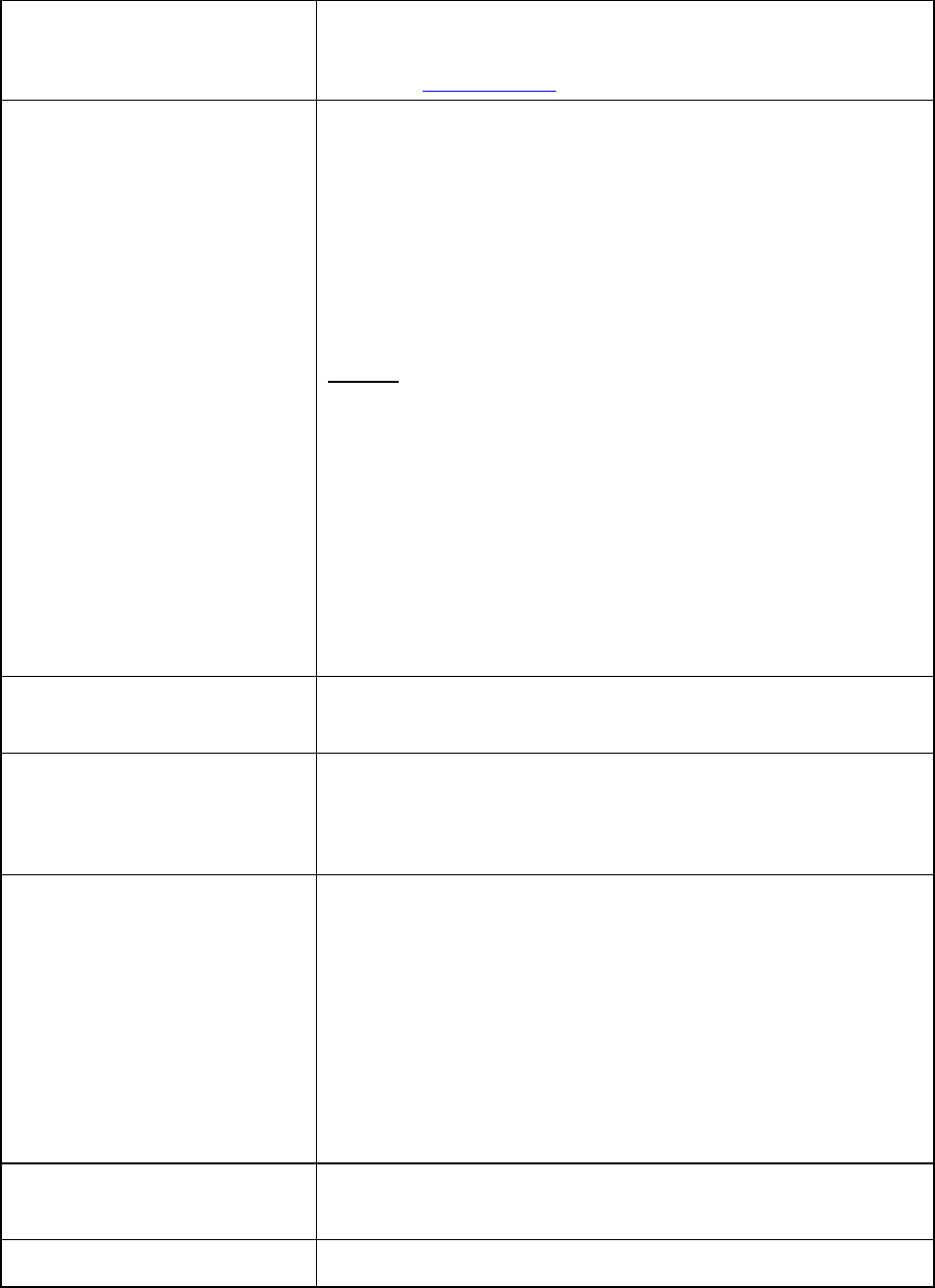

ALABAMA

Alabama Department of Revenue

Individual and Corporate Tax Division

50 N. Ripley Street

Montgomery, AL 36104

Member of Federal/State E-File program

General Information: 334-242-1170 (Individual Income Tax Question)

Website: Alabama Department of Revenue

Refund Hotline / website: 1-855-894-7391;

My Alabama Taxes website (click on “Where’s My Refund”)

To complete returns online: My Alabama Taxes website (register and sign in)

Forms: All Forms (note: not all 2021 forms are available);

2021 Filing Season Form 40 Booklet

To contact the state, must register and sign in to the My Alabama Taxes website

State filing addresses:

Payment enclosed: Receiving a Refund

Alabama Department of Revenue

P.O. Box 2401

Montgomery, AL 36140 -0001

Alabama Department of Revenue

P.O. Box 154

Montgomery, AL 36135-0001

Not Receiving a Refund or Making a

Payment

Alabama Department of Revenue

P.O Box 327469

Montgomery, AL 36132-7469

Basic information on military

personnel (Army, Navy, Marine, Air

Force, Merchant Marine, and Coast

Guard)

Nonresidents: Nonresident military personnel merely having a duty station

within Alabama (whose legal residence is not Alabama) are not required to

file an Alabama income tax return unless they have earned income from

Alabama sources other than military pay. If they have earned income in

Alabama other than military pay, they are required to file Alabama Form

40NR. A married nonresident military person with income earned in

Alabama may file either a separate return claiming himself or herself only,

or a joint return claiming the total allowable personal exemption.

Residents: Military personnel (Army, Navy, Marine, Air Force, Merchant

Marine, and Coast Guard) whose legal residence is Alabama, are subject to

Alabama income tax on all income regardless of the source or where earned

unless specifically exempt by Alabama law. Military personnel who were

residents of Alabama upon entering military service remain residents of

Alabama for income tax purposes, regardless of the period of absence or

actual place of residence, until proof as to change of home of record has been

Alabama

6

made. The burden of proof is on the taxpayer though he owns no property,

earns no income, or has no place of abode in Alabama. Under the provisions

of the Soldiers’ and Sailors’ Civil Relief Act, military personnel are not

deemed to have lost their permanent residence in any state solely because

they are absent in compliance with military orders. In addition, persons are

not deemed to have acquired permanent residence in another state when they

are required to be absent from their home state by virtue of military orders.

E-File Information

The Alabama Department of Revenue (ADOR)’s online system linked

above, My Alabama Taxes (“MAT”), allows for electronic filing free of

charge, checking status of refund, paying taxes, viewing accounts, and

printing letters and tax return within one’s account.

Although it is unnecessary to mail to ADOR such d

ocuments as FORM

AL8453 (the transmittal form for e-filing), tax practitioners are expected to

retain this record as well as other AL and IRS forms for 3 years. In addition,

there is an Armed Forces Tax Council (all military branches) and OJAG,

Code 16 (Navy) requirement to retain this form and necessary documents at

VITA centers until December 31 of the year the return was filed.

For information on how to use MAT website, see the MAT Frequently Asked

Questions.

Who must file? Single: full-year or part-year residents with gross income of $4,000 or more;

Head of Household: full-year or part-year residents with gross income of

$7,700 or more;

Married filing jointly: full-year or part-year residents with gross income of

$10,500 or more;

Married filing separately: full-year or part-year residents with gross income

of $5,250 or more.

Nonresidents who received taxable income from Alabama sources within

Alabama and have a gross income that exceeds the prorated personal

exemption allowance (see below).

What forms to file? Residents: Form 40 or 40A. Nonresidents: 40NR. All available here (but

note: some 2021 forms not yet available as of Jan. 21, 2022).

Residency See above “Basic information on military personnel (Army, Navy, Marine,

Air Force, Merchant Marine, and Coast Guard).”

Additionally, the “Military Spouses Residency Relief Act” (Public Law 111-

97) states that the income for services performed by the spouse of a service

member shall not be deemed to be income for services performed or from

sources within a tax jurisdiction of the United States if the spouse is not a

resident of the jurisdiction in which the income is earned because the spouse

is in the jurisdiction solely to be with the service member serving in

compliance with military orders.

If the husband and wife are both in military service, each could be a resident

of a different state under the Soldiers’ and Sailors’ Civil Relief Act. A spouse

not in military service has the same domicile as the military spouse unless

proven otherwise.

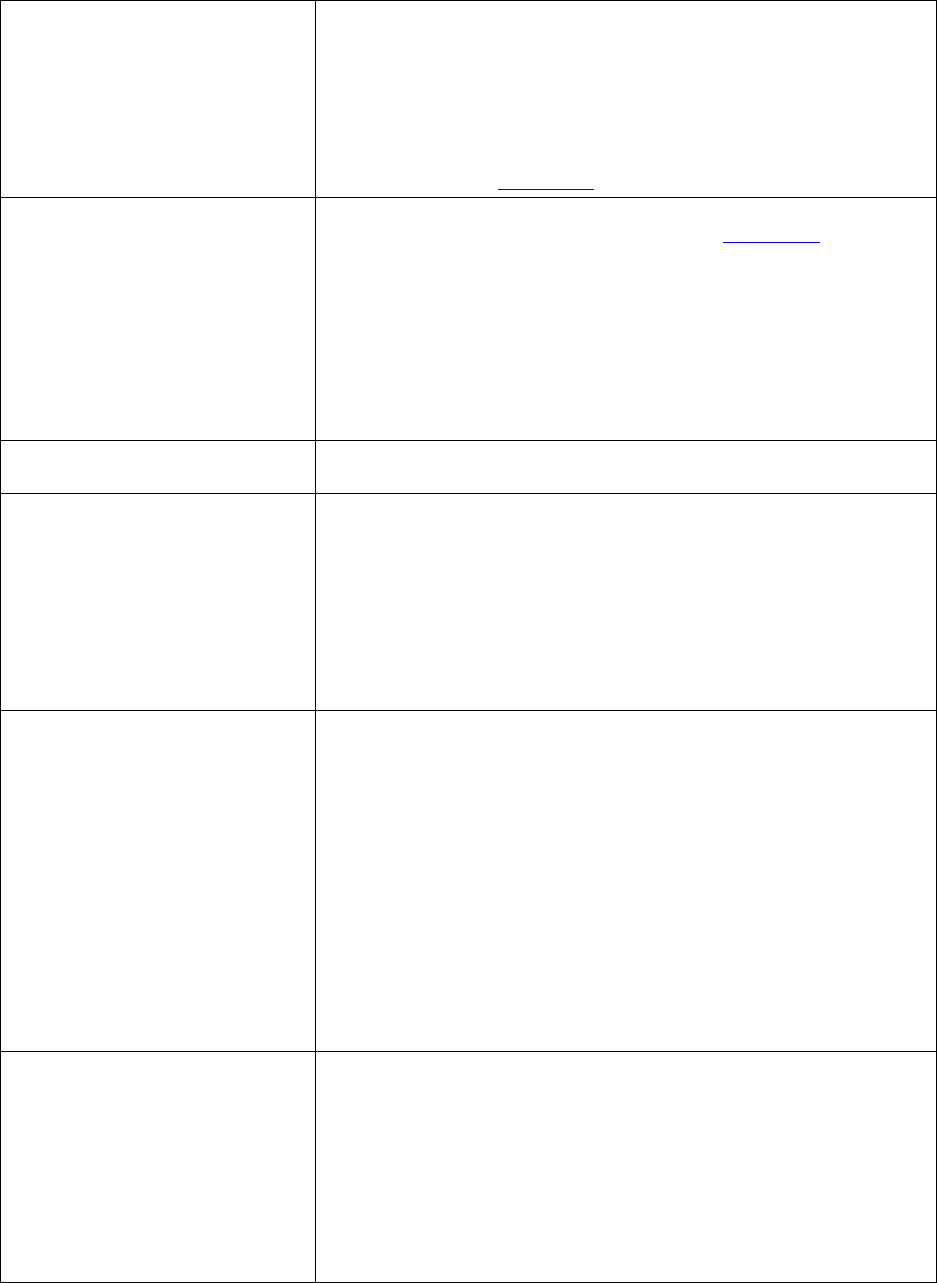

Exemptions $1,500 for single taxpayers and $3,000 for married couples filing jointly.

Alabama

7

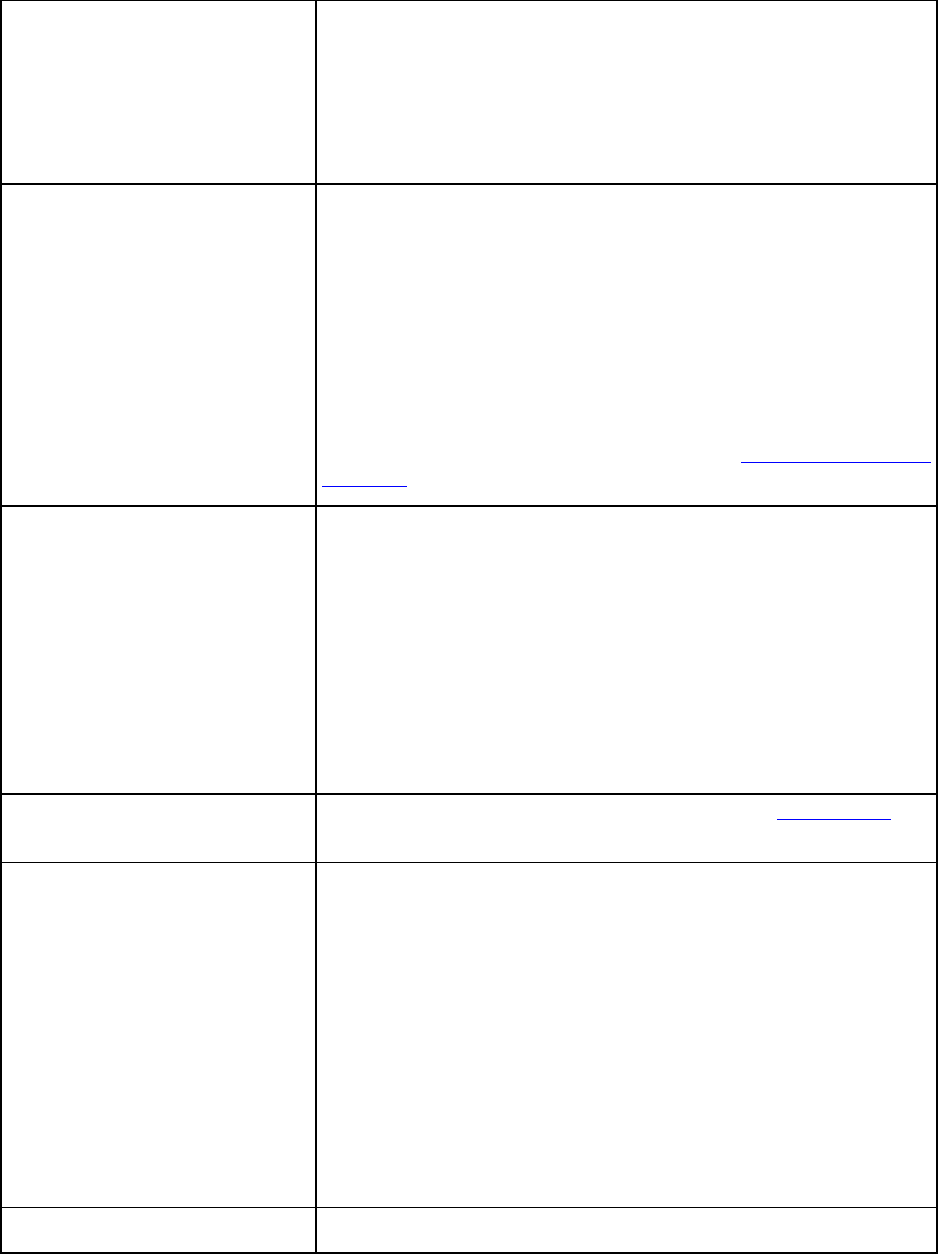

Dependent exemptions are based on Adjusted Gross Income. A “dependent”

as defined under Alabama law is an individual other than the taxpayer and

his or her spouse who received over 50% of his or her support from the

taxpayer during the tax year Use the following table to determine the per-

dependent exemption amount:

Amount on Page 1, Line 10 Dependent Exemption

$0

–

$20,000

$1,000

$20,001

–

$100,000

$500

Over $100,000

$300

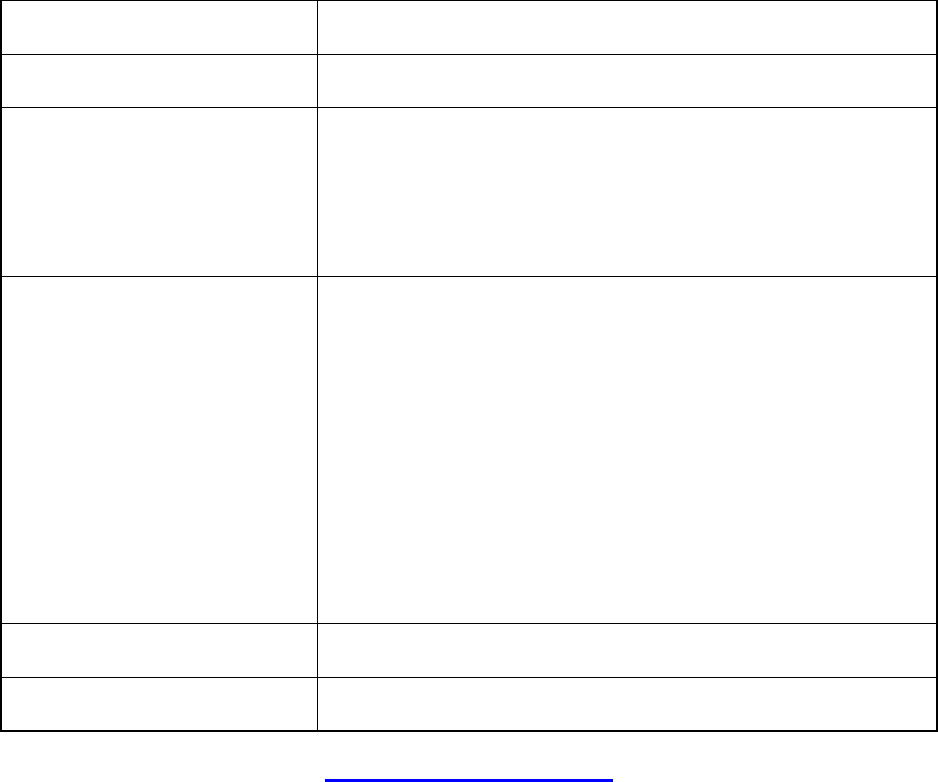

Military Pay Military pay of an Alabama resident is taxable except for compensation

received for active service in a designated combat zone. Military personnel,

whose legal residence is Alabama, are subject to Alabama income tax on all

income regardless of the source or where earned unless specifically exempt

by Alabama law. See page 7 of the 2021 Form 40 Booklet.

Spouses and Community Property Alabama is not a community property state, but the income of a spouse who

lives in a Community Property state (i.e., Arizona, California, Idaho,

Louisiana, Nevada, New Mexico, Texas, Washington, or Wisconsin) may be

taxable (Check with the relevant Community Property state. See also IRS

Publication 555, “Community Property”). When one spouse is a resident and

the other a nonresident, they may not file a joint return. Spouses filing jointly

may use Spouse Tax Adjustment, which adjusts tax-rate disadvantage from

joint filing.

A military spouse is exempt from tax on income by a state in which he or she

lives only in order to live with the service member in compliance with orders,

per the Military Spouses Residency Relief Act (MSSRA). Qualifying

spouses under the MSRRA working in Alabama should complete and give

to their employer a new Form A4 with the appropriate box checked claiming

exemption under the “Military Spouses Residency Relief Act”. Taxpayers

filing an Alabama income tax return under this Act must use the following

procedures to complete their tax return:

Taxpayer must file a Form 40NR. The Alabama withholding tax must be

entered on page 1, line 5, column A. All wages (both spouses if a joint return)

must be entered on page 1, line 5, column B. All Alabama wages including

those of the qualifying spouse must be entered on page 1, line 5, column C.

On page 2, Part I, line 8, column C enter the Alabama wages of the qualifying

spouse as a negative figure. Also write or type “Military Spouses Residency

Relief Act” in the space provided on line 8. Complete the rest of the return

as per the instructions in the tax booklet or form. A copy of Form DD2058

indicating the state of legal residence of the spouse in the military must be

attached. Instructions for this form can be found in the 2021 Form 40

Booklet.

Income Exclusions Combat pay, income received from the Department of Defense as a result of

a member of the Military killed in action in a designated combat zone;

income earned by military spouse in the year of death of a member of the

Military who was killed in action in a designated combat zone, military

retirement pay; federal retirement pay; Social Security benefits; military

allowances paid to active duty military, National Guard, and active reserves

for quarters, subsistence, uniforms, and travel, income of non-resident

spouses (see “Spouses and Community Property,” above). See expanded list

on page 7 of the 2021 Form 40 Booklet.

Alabama

8

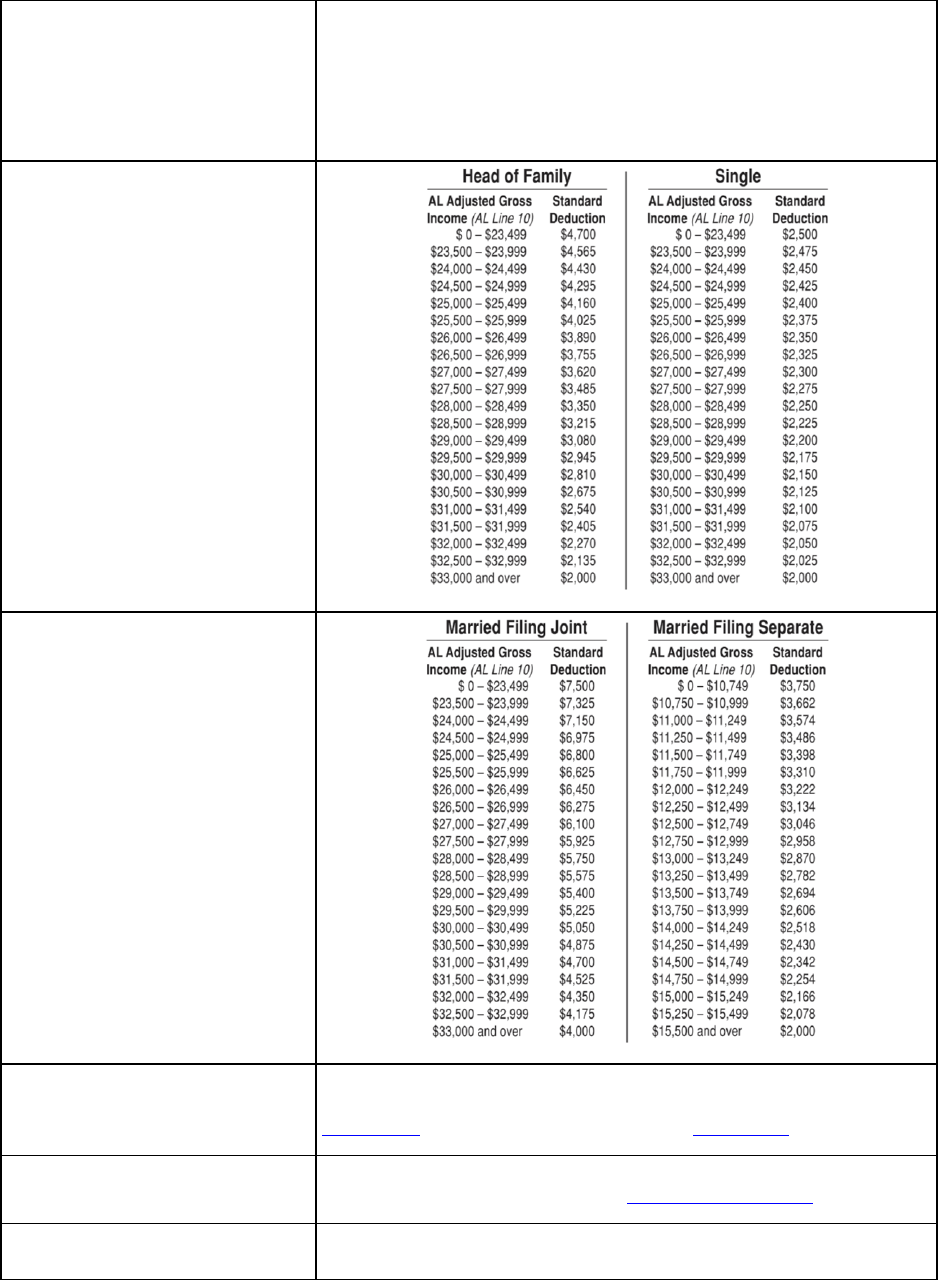

Income Deductions Standard deduction is based on Adjusted Gross Income. You have the option

to either itemize your deductions or you may claim the optional Standard

Deduction. You should compute your deduction both ways to determine the

option that gives you the larger deduction. If you elect to claim the Standard

Deduction, you must check box b on line 11 and use the Standard Deduction

Tables below to determine your allowable deduction.

Capital Gains/Losses Gain from the sale of personal residence is taxable to the same extent as

reported on the federal return. All other capital gains are taxable. Use

Schedule D Form 40. Non-residents report on Form 40NR.

Retirement Income Military retired pay, in addition to various state and federal pensions, is not

reported as income. See page 7 of the 2021 Form 40 Booklet.

Filing Deadline / Extensions No later than the Federal return. This year, without an extension, that is April

18, 2022

. Alabama gives an auto

matic single six

-

month extension up to

Alabama

9

October 17, 2022 to file, with no need to file a request for an extension. No

extensions beyond 6 months shall be granted except for taxpayers abroad.

During an extension, no penalty shall be incurred, but interest shall accrue

on taxes owed. To avoid such accrual, pay an estimate of the amount owed

using a payment voucher (Form 40V).

Alabama Use Tax A rate of 4% applies to all purchases of merchandise, except where a different

rate of tax is expressly provided (the rate is 2% for purchases of automotive

vehicles that are not titled or registered by the county licensing official and

1.5 percent for farm equipment and manufacturing machinery. Also see page

10 of the 2021 Form 40 Booklet.

Filing Status

Married taxpayers may choose to file in Alabama jointly or separately,

regardless of their filing status on the federal return. Married taxpayers must

file separately if their spouse is a resident of another state, unless either

spouse is in the military.

Same-Sex Marriage Per the Supreme Court in Obergefell v Hodges, June 26, 2015, same-sex

married filers have same filing options as heterosexual married filers.

Return to Table of Contents

10

ALASKA –

NO INCOME TAX

Alaska Department of Revenue

550 W 7

th

Avenue, Suite 500

Anchorage, AK 99501

General Information: Telephone: 907-269-6620

Forms: Alaska Tax Division Forms

Special Military Processing: None

Filing requirements based

on Federal Filing Status:

None

Miscellaneous: If the service member received a dividend from the Alaska

Permanent Fund, this must be reported on his or her Federal

return.

Return to Table of Contents

11

ARIZONA

Arizona Department of Revenue Customer Care

P.O. Box 29086

Phoenix, AZ 85038-9086

All other departments:

1600 W. Monroe

Phoenix, AZ 85007-2650

Member of Federal/State E-File program

General Information: 602-255-3381

800-352-4090 (toll-free if within Arizona)

Website:

Arizona Department of Revenue

Forms: Arizona Tax Forms

Taxpayer Education: AZ Taxpayer Education; AZ VITA Quick Reference Guide

(2021)

Electronic Filing: Electronic Filing Services; 602-255-3381

Refund Status: Check Refund Status; 602-255-3381

State filing addresses:

Plain Paper Returns Bar Coded Returns

Payment enclosed: Payment enclosed:

Arizona Department of Revenue

P.O. Box 52016

Phoenix, AZ 85072-2016

Arizona Department of Revenue

P.O. Box 29204

Phoenix, AZ 85038

Refund expected or no payment: Refund expected or no payment:

Arizona Department of Revenue

P.O. Box 52138

Phoenix, AZ 85072-2138

Arizona Department of Revenue

P.O. Box 29205

Phoenix, AZ 85038

E-File Information Retain all documents for four years following the return due date, per

Arizona Revised Statutes ARS 42-1105(E). To E-file, select the Free File

link from a vendor on the AZ DOR website.

Who must file? All Arizona taxpayers, whether full-year or part-

year residents, must file a

return if they are:

Single individuals with gross income of $12,550 or more;

Married filing jointly with gross income of $25,100 or more;

Married filing separately with gross income of $12,550 or more; or

Heads of household with gross income of $18,800 or more.

See AZ Personal Income Tax Booklet.

Arizona

12

What forms to file? Residents: 140 EZ, 140 or 140A; Part-Year Residents: 140PY; Nonresidents:

140NR. All forms are available here.

Part-year Resident Part-year residents are subject to tax on: 1) any income earned during the tax

year while a AZ resident, and 2) any income earned from an AZ source

before moving to or after leaving the state. See 140PY.

Exemptions

Only available if taxpayer is age 65 or over, blind, or caring for a “qualifying

parent or grandparent.”

Dependent Tax Credit

Arizona provides a $100 dependent tax credit per dependent under 17 years

of age, and $25 for dependents 17 and older. The credit is phased out for

federal adjusted gross income (AGI) greater than $200,000 for single,

married filing separate, and head of household; and phased out for federal

AGI of $400,000 for married filing joint.

Military Pay Active duty military pay is not taxed in Arizona.

Military members need not file an Arizona return if: (1) the taxpayer is an

active duty member of the United States Armed Forces; (2) the taxpayer’s

only income for the taxable year is compensation received for active duty

military service; and (3) no Arizona tax was withheld from the taxpayer’s

active duty military pay.

If Arizona tax was withheld from the taxpayer’s active duty military pay,

the taxpayer must file an Arizona income tax return to claim any refund that

may be due from that withholding. Military taxpayers must also file an

Arizona income tax return if they have any other income besides

compensation received for active duty military service.

For more information see the instructions for Form 140 and Arizona

Department of Revenue Publication 704, Taxpayers in the Military.

Spouses and Community Property Arizona is a community property state. Under the Federal Military Spouses

Residency Relief Act (MSRRA), a spouse of a servicemember may be

exempt from Arizona tax on income from services performed there if: (1) the

servicemember is present in Arizona in compliance with military orders; (2)

the spouse is there solely to be with the servicemember; and (3) the spouse

maintains domicile in another state, which is the same state of residence of

the servicemember. Arizona Department of Revenue Publication 705

Spouses of Active Duty Military Members provides a detailed discussion of

military spouses and how Arizona applies the MSRRA.

Income Exclusions

Arizona does not tax interest from U.S. government obligations (e.g., savings

bonds or treasury bills); pay received for active service in the U.S. Armed

Forces, Reserves or National Guard; certain contributions to 529 or 529A

savings plans; or certain retirement benefits (see retirement income section

for more details). For a complete list of exclusions from income see the

instructions to Arizona Form 140.

Standard Deductions For 2021, the standard deduction for a single taxpayer or a married taxpayer

filing a separate return is $12,550; the standard deduction for married filing

jointly is $25,100; and the standard deduction for filing head of household is

$18,800.

Taxpayers who choose to itemize must use Schedule A. See form instructions

for state-specific adjustments to federal itemized deductions.

Arizona

13

Capital Gains/Losses A subtraction is allowed for a percentage of any net long-term capital gain

included in federal AGI that is derived from an investment in an asset

acquired after December 31, 2011. For 2021, the percentage is 25%.

Taxpayers may also subtract the amount of any net capital gain included in

federal AGI from investment in a qualified small business as determined by

the Arizona Commerce Authority (ACA) pursuant to A.R.S. § 41-1518.

Retirement Income Arizona does not tax: Social security benefits received under Title II of the

Social Security Act; railroad retirement benefits received under the Railroad

Retirement Act; or benefits, annuities or pensions received as retired or

retainer pay of the uniformed services of the United States.

A taxpayer who receives a federal, state or local government pension may

subtract up to $2,500 of such income for Arizona tax purposes. If both the

taxpayer and spouse receive government pensions, each spouse may subtract

up to $2,500.

Deadline/Extensions Returns may be filed any time after January 1, 2022, but no later than April

18, 2022. A six (6) month filing extension until October 17, 2022 may be

granted if timely requested. Arizona will recognize a federal extension for

the period covered by the federal extension. Arizona does not have a state-

specific extension for military overseas or military on deployment in support

of contingency operations, but will respect any applicable federal extension.

Even if an extension is requested, at least 90% of the tax due must be paid

by the original due date of April 18, 2022. If 90% of the tax due is not timely

paid, interest and extension underpayment penalties will apply. To apply for

a state extension, file Arizona Form 204 by April 18, 2022.

Return to Table of Contents

14

ARKANSAS

Arkansas Department of Finance and Administration

Individual Income Tax Section

Ledbetter Building

1816 W 7th Street, Rm 2300

Little Rock, AR 72201

Member of Federal/State E-File program

General Information: (501) 682-1100, fax (501) 682-7692

Income Tax Hotline: (501) 682-1100,

(800) 882-9275,

or for Spanish (866) 656-1842

Web site: Arkansas DFA Website

Forms: Arkansas Forms Website

Taxpayer access point: 877-280-2827 (toll free), 501-683-2827 (Little Rock area)

(501) 682-1100

Arkansas Taxpayer Access Point: www.atap.arkansas.gov,

email: [email protected]

Electronic Filing: (501) 682-7925; 7075; 7926 (Numbers for Tax Officer use

only)

Refund Status: AR Refund Status

State filing address:

Tax Due Return: Refund return: No tax due return

Arkansas State Income Tax

P.O. Box 2144

Little Rock, AR 72203-2144

Arkansas State Income Tax

P.O. Box 1000

Little Rock, AR 72203-1000

Arkansas State Income Tax

P.O. Box 8026

Little Rock, AR 72203-8026

E-File Information A taxpayer who files an Arkansas income tax return is required to retain

records to prove the accuracy of the return for six (6) years. The Armed

Forces Tax Council (all military branches) and OJAG, Code 16 (Navy)

requires the retention of this form and necessary documents at military VITA

centers until December 31

st

of the year the return was filed. If forms are

rejected, see guidance for “Reject Codes” at AR 2020 Reject Codes.

Beginning in tax year 2021, tax return preparers who file their clients’ federal

return electronically must file the Arkansas return electronically.

Taxpayers may use IRS Free File Delivered by TaxAct®, but this is only

available for taxpayers:

With adjusted gross income (AGI) of $65,000 or less, or

Eligible for the Earned Income Tax Credit, or

Active Military with adjusted gross income of $73,000.00 or less.

Arkansas

15

The following companies provide FREE preparation and electronic filing

services for both Arkansas and Federal individual income taxes, but have

lower income qualifications:

IRS Free File Delivered by TaxAct®

OLT.com

TaxSlayer

FreeTaxUSA

If a taxpayer chooses to electronically file their State of Arkansas tax return

by using one of the online web providers, the taxpayer is required to complete

the form AR8453-OL. Effective tax year 2011, the completed AR8453-OL

along with the AR1000F or AR1000NR any W-2’s or schedules are to be

kept in the taxpayer’s files.

Technical Support: Caroline Glover, Fiscal Division Manager & e-File

Coordinator, (501) 682-7925, (f) (501) 682-7393, E-Mail

caroline.g[email protected]ansas.gov

1099 Refund ID Number: Some tax preparation software applications require

the ID number of the pay or for State of Arkansas Income Tax Refunds to be

entered. This ID number is: 71-0847443.

Who must file? All Arkansas military personnel must file a tax return according to the

following, even if the military pay is excluded.

Full Year Residents—must file if gross income is at least:

Single: $13,055

Married Filing Jointly (1 or no deps): $22,016

Married Filing Jointly (2 or more deps): $26,497

Qualifying Widow(er) in 2019 or 2020 and not remarried in 2021 (1 or

no deps): $18,561

Qualifying Widow(er) in 2019 or 2020 and not remarried in 2021 (2 or

more deps): $22,126

Married Filing Separately: $8,500

Head of Household (1 or no deps): $18,561

Head of Household (2 or more deps): $22,126

Part Year Residents—must file if any gross income while an AR resident.

Nonresidents—must file if any gross income from AR sources.

See special rules for military pay below.

What forms to file? Full Year Residents file AR1000F; Part-Year and Nonresidents file

AR1000NR.

Residency Taxpayer is a FULL YEAR resident if they lived in AR for all of 2021 or

maintained a domicile or a home of record in AR during the tax year. PART

YEAR residents are those that moved into or out of AR during 2021.

Exemptions Arkansas uses a Personal Tax Credit of $29 per dependent, rather than an

exemption.

Military personnel stationed in Arkansas with a Home of Record in another

state are treated as nonresidents. Their military wages are not reported

anywhere on the Arkansas return. These nonresident military personnel file

AR-NRMILITARY (Non-Resident Military Personnel Exemption Form).

Arkansas

16

Military Pay Military Pay Exemption: Military pay is entered on line 9, but automatically

excluded from the computation of taxable income. There is a 100%

exemption from income tax for service pay or allowance received by an

active-duty member of the armed forces. “Active duty member of the armed

forces”

includes all members of the armed forces of the United States,

including the National Guard and Reserve Units, including full-time training

duty, annual training duty, and attendance while in the active military service

at a service school. Excludes a military technician (dual status), the National

Oceanic and Atmospheric Administration Commissioned Officer Corps, and

the United States Commissioned Corps of the Public Health Service.

Member of “armed services” (i.e., a person not qualifying under the 100%

exemption) can exclude first $9,000 of service pay or allowance. Note:

exempted military pay is included in gross income.

If AR is taxpayer’s home of record and taxpayer is stationed outside AR,

taxpayer must file AR1000F reporting all of taxpayer’s income even if

exempt military pay.

If taxpayer’s home of record is not Arkansas, do not report to Arkansas

taxpayer’s income or taxpayer’s nonresident spouse’s income. Instead, fill

out and submit AR-NRMILITARY Form to have a note put on taxpayer’s

account that taxpayer is not required to file a return.

However, if spouse had AR income tax withheld, he/she will need to file a

return to receive a refund (see below).

Military Family Tax Relief Act: excludes from income “qualified military

benefits” provided to members of the US military, determined by reference

to I.R.C. § 134 as in effect on January 1, 2009. “Qualified military benefits”

include, for example, veteran’s benefits authorized under 38 U.S.C. § 5301

(e.g., payments made by the VA under the compensated work therapy

program), certain dependent care assistance programs, and travel benefits

provided under 10 U.S.C. § 2613.

Military reserves expenses can be taken as an adjustment on Form AR

1000ADJ.

Spouses and Community Property Arkansas is not a community property state. Non-military spouses with

Arkansas income must file the appropriate form, State of Arkansas Tax

Exemption Certificate for Military Spouse, found at AR Military Spouse Tax

Exemption Certificate (AR-MS).

The Military Spouses Residency Relief Act exempts a military spouse’s

income from Arkansas tax if the service member’s Home of Record is not

Arkansas and the spouse’s domicile is the same as the service member’s

Home of Record. (Write the words “military spouse” at top of tax return,

attach a completed Form AR-MS, and attach a copy of service member’s

LES to verify Home of Record.) For future tax year purposes, the nonmilitary

spouse must submit a new payroll withholding form, ARW-4MS to his/her

employer each year to exempt future income from Arkansas tax withholding.

Income Exclusions IRS economic impact payments, Social Security benefits, VA benefits,

Workers’ Compensation, Life insurance proceeds based on death of the

individual, Railroad Retirement benefits, 2020 and 2021 unemployment

benefits, and related supplemental benefits are exempt from tax.

Income Deductions

Standard Deductions are $4,400 for Married Filing Jointly; $2,200 for all

others. May itemize; categories follow federal rules. The deduction for

teacher’s classroom expenses was increased to $500 for individuals, $1000

for married taxpayers.

Arkansas

17

Capital Gains/Losses For tax year 2021 the capital gain exemption is 50% for net gains for the

entire year. Capital loss is limited to $3,000 for filing status 1, 2, 3, and 6,

and $1,500 per taxpayer if filing status 4 or 5 See AR1000D.

Retirement Income Taxpayers may also exclude up to $6,000 from certain retirement plans.

Military Retirement Exemption (Act 141 of 2017): Beginning with tax year

2018, military retirement benefits received by a member of the uniformed

services are exempted from income tax. See pages 9-10 of the Arkansas

Individual Income Tax Forms and Instructions (note that the 2020 forms and

instructions were not out as of the publication of this document) . Taxpayers

may not take both exemptions on the same return.

Deadline/Extensions April 18, 2022 (conforms to federal deadline)

All Arkansas taxpayers have the right to request an extension before the filing

deadline. If you have already filed a federal extension request, the State of

Arkansas will honor the federal extension request as well; your due date on

the Arkansas return will then be the same as the federal return, October 15.

If you have filed the federal extension request, you do not have to file a

separate state extension request; mark a block on the State of Arkansas

return. Except in the case of deferment under the Service members Civil

Relief Act (see Miscellaneous), interest and a failure-to-pay penalty will be

assessed if any tax due is not paid by the original due date, April 18

th

.

If you do not file a federal extension, you can file an Arkansas extension

using Form AR1055-IT before the filing due date of April 18th. This form

must state a reason for the extension and be postmarked on or before April

18

th

. Inability to pay will not be honored as a valid reason for an extension of

time to file. Inability to pay is not a valid reason to request an Arkansas

extension. Send your request to:

Individual Income Tax Section

P.O. Box 8149

Little Rock, AR 72203-8149

Arkansas does not appear to have a state specific filing extension for military

overseas or for military on deployment in support of contingency operations.

Payments Complete AR1000V and attach a check or money order to your return. Write

the tax year and your Social Security Number or account number on the

check or money order, and make your check payable in U.S. dollars to the

Department of Finance and Administration. Mail on or before April 18, 2022.

If the payment is for an amended return, mark the box yes on Form AR1000V

for “Is Payment for an Amended Return”.

Credit card payments may be made by calling ACI Payments, Inc., at 1-800-

2PAY-TAX (1-800-272-9829), or by visiting www.officialpayments.com

and clicking on the “State Payments” link.

Credit card payments will be processed by ACI Payments, Inc., a private

credit card payment services provider. A convenience fee will be charged to

your credit card for the use of this service. The State of Arkansas does not

receive this fee. You will be informed of the exact amount of the fee before

you complete your transaction. After you complete your transaction, you will

be given a confirmation number to keep with your records.

Sales Tax Taxpayers have two (2) options for filing and paying Arkansas Sales Tax:

File online. File online using the Arkansas Taxpayer Access Point (ATAP).

You can remit your payment through this online system.

Arkansas

18

File by mail. You can use Form ET-1, file, and pay through the mail. Contact

501-682-7104 to request ET-1 forms and the forms will be mailed to your

business in two to three weeks. For faster service, file your Sales and Use

Tax Returns online (see above).

Miscellaneous Under the Servicemembers Civil Relief Act (SCRA), the IRS and state and

local taxing authorities must defer a military member’s income taxes due

before or during his military service if his ability to pay the income tax is

materially affected by military service. No interest or penalty can be added

because of this type of deferral.

Filing requirements based on Federal

Filing Status

SVCMs may choose to file MFS-AR or MFJ-AR regardless of filing status

on the federal return.

Same-Sex Marriage

Per the Supreme Court in Obergefell v Hodges, June 26, 2015, same-sex

married filers have same filing options as heterosexual married filers.

Return to Table of Contents

19

CALIFORNIA

Franchise Tax Board

P.O. Box 942840

Sacramento, CA 94240-0040

(correspondence)

Member of Federal/State E-File program

General Information: (800) 338-0505 Automated Service

(Automated Taxpayer Assistance Line)

(916) 845-6500 (outside of the US)

Website: Tax Board

Forms: Forms

Order forms by phone: (800) 338-0505

Order forms online: Forms Request

Refund status: Refund Status

Tax payments online: Pay here or call (800) 272-9829 (code 1555 or press 2 (ACI

Payments, Inc.)

State filing addresses:

Payment enclosed: Refund or no Amount Due:

Franchise Tax Board

PO Box 942867

Sacramento, CA 94267-0001

Franchise Tax Board

PO Box 942840

Sacramento, CA 94240-0001

E-File Information Please see the E-Filing website for information on California’s E-filing

options.

If you need acknowledgement or need to know the status of your

electronically filed tax return, contact your e-file provider or tax professional.

Do not mail tax documents to the FTB. Tax sites no longer retain paper copy

of FTB 8453, however, California requires that the taxpayer keep this form

with a copy of the tax return for four years from the due date of the return or

the date it was filed, whichever is later. There is an Armed Forces Tax

Council (all military branches) and OJAG, Code 16 (Navy) requirement to

retain this form and necessary documents until December 31

st

of the year the

return was filed.

Re-submit rejected returns (not part of federal/state e-file program). If return

is repeatedly rejected, call the e-file help desk for instructions.

Who must file? California residents and part-year residents with income more than the

amount defined in the charts (note that at the time of the publication of this

document, only the 2020 link was available).

What forms to file? Full Year Residents file Form 540 or 540 2EZ. Part year or Nonresidents file

Form540NR. Links added.

California

20

Residency Must file return if CA-source income and income from all sources exceeds

threshold amounts. Follows general residency test. See FTB Publication

1031 2021 Guidelines to Determine Resident Status.

Income Exemptions / Deductions Adoption, child care expenses, renting, and joint custody can result in tax

credits, The standard deductions in California are as follows: $4,803 for

single or married RDP filing separately; $9,606 for married/RDP filing

jointly, head of household or qualifying widow/widower; the dependent

exemption credit is $400. Note: prior entry had references to outdated

materials. New links added. Standard deduction information is on pg. 7 of

linked document.

Military Pay

Servicemembers domiciled outside of California, and their spouses, may

exclude the Servicemember’s military compensation from gross income

when computing the tax rate on nonmilitary income. Requirements for

military Servicemembers domiciled in California remain unchanged.

Military Servicemembers domiciled in California must include their military

pay in total income. In addition, they must include their military pay in

California source income when stationed in California. However, military

pay is not California source income when a Servicemember is permanently

stationed outside of California.

Military service members domiciled in California and stationed in California

are considered residents of CA. They must include their military pay in

California source income. For more information, see Guidelines for

Determining Residency, FTB Publication 1031 and for Tax Information for

Military Personnel, see FTB Publication 1032.

Spouses and Community Property

California is a community property state; if one spouse is a California-

resident, must include one-half of non-resident spouse’s pay. If a non-

resident spouse is a resident in a community property state (AZ, CA, ID, LA,

NV, NM, TX, WA, WI) then California does require that military pay be split

equally between spouses. Please consult FTB Publication 1032 for a detailed

discussion on how a spouse’s income may or may not be taxable in

California.

Under the Federal Military Spouses Residency Relief Act (MSRRA), the

income of a non-military spouse of a military Servicemember for services

performed in California is not considered to be from sources within

California if the spouse is not a California resident because the spouse is in

California solely to be with Servicemember solely in compliance with

military orders and both have the same out-of-state domicile.

Note: California may require nonmilitary spouses of Servicemembers to

provide proof that they meet the criteria for California personal income tax

exemption as set forth in the MSRRA.

Income Exclusions Military Family Tax Relief Act (see page 3-4 of FTB Publication 1032)

allows the following:

Exclusion of Gain on Sale of a Principal Residence - A taxpayer on

qualified official extended duty in the U.S. Armed, Uniformed, or

Foreign Services may suspend, for up to 10 years of such duty time, the

running of the 5-year ownership-and-use period before the sale of a

residence. This applies when the duty station is at least 50 miles from

the residence - or while the person is residing under orders in

government housing - for a period of more than 90 days or for an

indefinite period.

California

21

Exclusion from Gross Income of Federal Death Gratuity Payments– A

federal death gratuity payment to a survivor of a member of the Armed

Forces is excludable from gross income.

Combat Zone Extensions Expanded to Contingency Operations– The

various extensions granted to combat zone participants to file tax returns

or pay taxes apply to those serving in Contingency Operations, as

designated by the Secretary of Defense.

Deduction for Overnight Travel Expenses of National Guard and

Reserve Members – Reservists who stay overnight more than 100 miles

away from home while

in service (e.g., for a drill or meeting) may deduct unreimbursed travel

expenses (transportation, meals, and lodging).

Capital Gains/Losses Generally, follows federal tax rules; however, there are continuing

differences between California and Federal law. Additional information can

be found in FTB Publication 1001, Supplemental Guidelines to California

Adjustments, the instructions for California Schedule CA (540 or 540NR):

Schedule CA 540, California Adjustments - Residents and Schedule D.

Disaster Relief You may deduct any loss caused by a disaster located in a California area

designated by the President or the Governor to be in a state of emergency

beginning on or after January 1, 2014 and before January 1, 2024. California

law generally follows federal law regarding the treatment of losses incurred

as a result of a casualty or a disaster. You may qualify for a casualty loss if

you were not compensated for the damage to or loss of their property due to

a sudden unexpected, or unusual earthquake, fire, flood, or similar event. You

may also claim a disaster loss in the taxable year the disaster occurred or in

the taxable year immediately before the disaster occurred. The Disaster Loss

Deduction page explains the tax treatment of disaster losses.

Retirement Income Generally, follows federal tax rules; however, there are some differences

between California and Federal law that may cause the amount on your

California distribution income to differ from the amount reported for federal

purposes. For more information, see FTB Publication 1005 (note that at the

time of the publication of this document, only the 2019 link was available).

Deadline/Extensions April 18, 2022. Extensions: California gives you an automatic filing

extension through October 17, 2022. You don’t need to apply for one.

Remember, an extension to file is not an extension to pay. If you can’t file

by April 18, 2022:

You are due a refund - File your return by October 17, 2022. Choose

e-file and direct deposit for the fastest refund.

You have a balance due - Pay the amount you owe by April 18, 2022

to avoid penalties and interest (note: you can avoid such charges if in

combat zone, see page 8 of FTB Publication 1032. Use Form 3519.)

You’re not sure if you have a balance due - Use the worksheet on

Form 3519.

In 2021, the IRS extended the tax deadlines for 2020 taxes from April to

May, due to COVID-19. At this time, it is unknown whether this will happen

again for 2021 taxes (due in 2022).

Other credits Child and Dependent Care Expenses Credit – California allows a non-

refundable credit for child and dependent care expenses. The law allows

military pay to be included for the Child and Dependent Care Expenses

credit. Use FTB Form 3506.

California

22

Nonrefundable Renter’s Credit can be used to offset your tax liability.

More information can be found

here

.

Special Military Processing While stationed outside of CA on PCS Orders, a SVCM is not subject to tax

on military wages, but is required to file a CA return if SVCM has CA

sourced income, such as rental income in California.

See page 8 of FTB Publication 1032. Military personnel on duty outside the

United States or in a designated combat zone or in a qualified hazardous duty

area (QHDA) are allowed a filing extension of up to 180 days to file their

California income tax returns and pay their tax, without interest or penalties

as described below:

If you were in a designated combat zone, contingency operation or in

a QHDA anytime during the tax year or filing period (January 1 to April

15), you are entitled to an extension to file and pay, without interest and

penalties, of up to 180 days after leaving the combat zone or QHDA. In

addition, you are entitled to an additional extension of the number of

days you were in a combat zone or QHDA during the filing period.

If you served outside the United States, but not in a designated combat

zone, contingency operation or QHDA, you are entitled to an

extension of time to file and pay without interest and penalties, of up to

180 days after returning from overseas.

How do I indicate that I qualify for the extension to file and pay?

If you were serving in the military overseas, write “MILITARY

OVERSEAS” at the top of your tax return in BLUE INK.

If you served in a designated combat zone or QHDA write “

COMBAT

ZONE” and the area you served in at the top of your tax return in

BLUE INK.

You must also write the date you were deployed overseas or entered

a designated combat zone or QHDA and the date you returned from

overseas or from a designated combat zone or QHDA.

If both you and your spouse were in the military, write the information

for both of you and indicate which is your information and which is your

spouse’s information.

The extensions apply to the Servicemember and spouse regardless of whether

a joint return or separate returns are filed.

Filing requirements based on Federal

Filing Status

Use the same filing status for California that you used for your federal

income tax return, unless you are in a registered domestic partnership (RDP).

Exception: If you file a joint tax return for federal purposes, you may file

separately for California if either spouse was an active member of the United

States armed forces or any auxiliary military branch during 2021 or a

nonresident for the entire year and had no income from California sources

during the year.

Some special rules apply to RDPs. Some RDPs are not recognized for federal

filing purposes, but are recognized in California. See FTB Publication 737.

(form not yet updated for 2021 as of the publication of this guide).

Miscellaneous The refundable California Earned Income Tax Credit (EITC) is available to

taxpayers who earned wage income in California. This credit is similar to the

Federal EITC but with different income limitations. EITC reduces California

tax obligation or allows a refund if no California tax is due. You don’t need

a child to qualify but must file a California tax return to claim the credit. Use

FTB Form 3514. If your earned income was higher in 2020 than in 2021, you

can use the 2020 amount to figure your EITC for 2021.

California

23

The federal

Heroes Earnings Assistance and Relief Tax (HEART) Act of

2008 permits the rollover of a federal military death gratuity payment or

Servicemembers’ Group Life Insurance proceeds into a Roth IRA or

Coverdell education savings account (ESA), without regard to otherwise

applicable contribution limits.

California conforms to the Heroes Earned Retirement Opportunity Act that

allows members of the Armed Forces serving in a combat zone to make

contributions to their individual retirement plans even if compensation on

which such contributions is based is excluded from gross income. California

also conforms to the exceptions from the penalty on early withdrawals from

retirement plans from qualified distributions paid after September 11, 2001

to reservists while serving on active duty for at least 180 days. See page 4 of

FTB Publication 1032.

Return to Table of Contents

24

COLORADO

Colorado Department of Revenue

Denver, CO 80261

Member of Federal/State E-File program

General Information:

(303) 238

-

7378

Email:

Website:

Individual Income Tax Information

Forms:

Individual Income Tax Forms

FYI Publications:

Individual Income Tax Guides and Publications

Refund Status:

Use

Revenue Online

or

(303) 238

-

7378

Online Customer Support:

Contact Us

Taxpayer Service Centers:

Local Taxpayer Service Centers. Appointments are available

and highly encouraged. Walk-ins are welcome, but wait times

vary.

Mailing Address Info:

Mailing Addresses vary based on form being mailed or

purpose of mailing.

State filing address without payment: State filing address with payment:

Colorado Department of Revenue

Denver, Colorado 80261

-

0005

Colorado Department of Revenue

Denver, Colorado 80261

-

0006

E-File Information

Free e-filing is available through Revenue Online. No login is required to file

a return, but you can create a login to view your income tax account info in

Revenue Online. Learn How to E-File or Get Help with Revenue Online.

You can also e-file through a paid tax professional or using purchased tax

software. View Accepted Tax Software.

Who must file? You must file a Colorado income tax return if during the year you were a

full-year resident of Colorado, or a part-year resident of Colorado with

taxable income during that part of the year you were a resident, or a

nonresident of Colorado with Colorado source income; AND you are

required to file a federal income tax return, or you have a Colorado income

tax liability for the year. See Income Tax Filing Requirements.

There is no minimum income threshold for filing a Colorado income tax

return. You must file a Colorado income tax return regardless of age or

residency status if you wish to receive a refund on wage withholding

reported on your W-2 form.

What forms to file? Full year residents, file Form 0104; Part year or nonresidents file both Form

0104 and 0104PN. Current year forms found at Individual Income Tax

Forms.

Requirements for Residency Follows the general residency test.

Colorado

25

Spouses of service members can elect to have the same state of residence as

the service member. (See “Spouses” section below for more information for

working spouses).

If a service member who is a Colorado resident is stationed outside the U.S.

for 305 days of the tax year, the service member may elect to file as a non-

resident for Colorado income tax purposes. A spouse who accompanies the

service member for at least 305 days can also make this election. See FYI

Income 21 or Active Duty Service Members for military-specific residency

rules.

Military Pay Resident service members: A service member who is a full-year resident is

taxed in the same manner as any Colorado resident. To the extent that

military pay is included in the service member’s federal taxable income,

Colorado tax will apply to that income. Active duty pay for service in a

combat zone is not subject to Colorado income tax to the extent it qualifies

for a federal exemption.

Non-resident service members: Non-resident service members are not

required to report their military income to Colorado. However, any non-

military pay must be reported and will be subject to Colorado tax.

Re-establishing Colorado residency: Service members whose home of record

is Colorado, who acquired residency in another state, and who re-acquire

residency in Colorado can exclude from Colorado income tax any active duty

service pay that is included in their federal taxable income after reacquiring

Colorado residency. See FYI Income 21 or Active Duty Service Members.

Retirement The amount of military retirement income that can be subtracted depends on

a person’s age on December 31st of the tax year. See: Retired Service

Members and Retirees.

Under 55 years of age: For 2021, a person can subtract up to $10,000 of

military retirement benefits, but not non-military retirement benefits,

included in their federal taxable income. The amount of this subtraction will

increase to $15,000 in 2022 and 2023.

Between 55 to 64 years of age: a person can subtract up to $20,000 of their

retirement benefits, including military retirement benefits and other

retirement benefits, that were included in their federal taxable income.

65 years of age or older: a person can subtract up to $24,000 of their

retirement benefits, including military retirement benefits and other

retirement benefits., that were included in their federal taxable income.

Spouses and Community Property Colorado is not a community property state.

Non-resident spouses: Colorado conforms to the Military Spouses Residency

Relief Act. For tax years beginning on or after January 1, 2009, wages and

tips of a qualifying non-resident spouse can be excluded from Colorado

taxable income. A qualifying spouse must: (1) Have moved to Colorado from

another state and be working in Colorado, and (2) Be in Colorado solely to

accompany their active duty service member spouse who is stationed in

Colorado on military orders. A qualifying spouse can submit Affidavit of

Exemption for Non-resident Spouse of a US Servicemember (DR 1059) to

their employer so the employer does not withhold Colorado income tax from

wages paid. A copy of the DR 1059, the spouse’s dependent military ID card,

and a copy of the service member’s orders must be included when filing the

Colorado income tax return.

Exemptions Form 0104 automatically uses federal personal exemption amounts. For tax

years 2018 through 2025 the federal personal exemption amount is zero.

Colorado

26

Income Tax Subtractions

(Exclusions and Deductions)

Colorado allows the following Income Tax Subtractions from Federal

taxable income: qualifying Colorado-sourced capital gain, state income tax

refunds, U.S. government interest, active duty pay for service members

reacquiring Colorado residency, Military Family Relief Fund grants, certain

military retirement income, certain retirement pensions and annuities,

earnings of non-resident disaster relief workers, earnings of tribal members

on reservations.

In addition, subtractions are allowed for certain charitable contributions,

medical savings account contributions, contributions to CollegeInvest 529

plans, first-time home buyer savings account interest, catastrophic health

insurance premiums, and expenses of wildfire mitigation measures not

deducted in determining Federal taxable income. This is a non-exhaustive

list.

Federal Add Backs

Colorado requires that certain federal deductions be added back in

determining Colorado taxable income. These include: state income taxes,

business interest expense, excess business losses, certain net operating

losses, and other items. These items are discussed in detail in the Individual

Income Tax Guide.

Income Tax Credits Colorado has several Income Tax Credits, including: child care contribution

credits, child care expense credits, and earned income tax credits.

Capital Gains/Losses Taxed at same rate as regular income. Qualifying Colorado-sourced capital

gains can be excluded from income. See: FYI Income 15.

Deadline / Extensions The 2021 tax year filing deadline is April 18, 2022. An automatic extension

to file a return is granted until October 15, 2022. There is no need to apply

for the extension to file. Note that while there is an automatic extension

to file a return, there is no extension for payment of tax due; late

payment will incur late fees and interest. To avoid late fees, taxpayer must

pay at least 90% of their income tax liability by April 18, 2022. If at least

90% of the liability is paid by April 18, 2022, any amount outstanding will

be subject only to interest. Taxpayers can make the required payment

through Revenue Online, or by filing a 2020 Extension Payment for

Colorado Individual Income Tax (DR 0158-I).

Special Military Processing Colorado law allows military and support personnel stationed in a combat

zone, as declared by the president, to postpone filing and paying state income

taxes until 180 days after their assignment in the combat zone ends. Interest

and penalty are deferred during this period. If the return is filed under the

180- day extension, write the name of the applicable combat zone across the

top of the Colorado Form 0104. See FYI Income 21. Because most Colorado

taxpayers receive a refund, affected taxpayers may want to plan ahead to

authorize someone else to file their income tax returns for them using a

Power of Attorney Form (DR 0145).

Filing requirements based on Federal

Filing Status

A service member’s Colorado income tax filing status must be the same

status as that used on federal income tax return (e.g., single, head of

household, married filing separate, married filing joint).

Same-Sex Marriage Per the Supreme Court in Obergefell v Hodges, June 26, 2015, same-sex

married filers have same filing options as heterosexual married filers.

Return to Table of Contents

27

CONNECTICUT

Department of Revenue Services

Taxpayer Services Division

450 Columbus Blvd.

Hartford, CT 06103

Member of Federal/State E-File program

General Information: (860) 297-5962 or (800) 382-9463

Forms: Income Tax Forms

Website: DRS Website

E-file help desk: (860) 297-4713

State filing addresses:

Payment enclosed: Not making a Payment:

Department of Revenue Services

State of Connecticut

PO BOX 2977

Hartford CT 06104-2977

Department of Revenue Services

State of Connecticut

PO BOX 2976

Hartford CT 06104-2976

E-File Information Resident, nonresident, and part-year resident taxpayers may file

electronically via the Taxpayer Service Center (TSC) at portal.ct.gov/TSC

Taxpayers should not mail a paper copy of their electronically filed return

with payment.

Recordkeeping Taxpayers should retain required documentation until the statute of

limitation has expired for that return, which is usually three years from the

date the return was due or filed.

Who must file? Residents of Connecticut must file if they were a resident the entire year

and any of the following is true: they had Connecticut taxes withheld, made

estimated tax payments or payment with Form CT-1040 EXT, or met the

following gross income test: $15,000 if filing single; $12,000 if filing

married filing separately (MFS); $19,000 if filing head of household; and

$24,000 if filing married filing jointly or a qualifying widow(er).

Individuals who had a federal alternative minimum tax liability or who

claimed the Connecticut earned income tax credit must also file.

Military personnel and their spouses who claim Connecticut as a residence

but are stationed elsewhere must file unless they meet the conditions present

in Group A or Group B below:

Group A

1) they did not maintain a permanent place of abode in CT for the entire

taxable year,

2) they maintained a place of abode outside of CT for the entire taxable

year, AND

3) they did not spend more than 30 days in the aggregate in CT during the

tax year; or

Connecticut

28

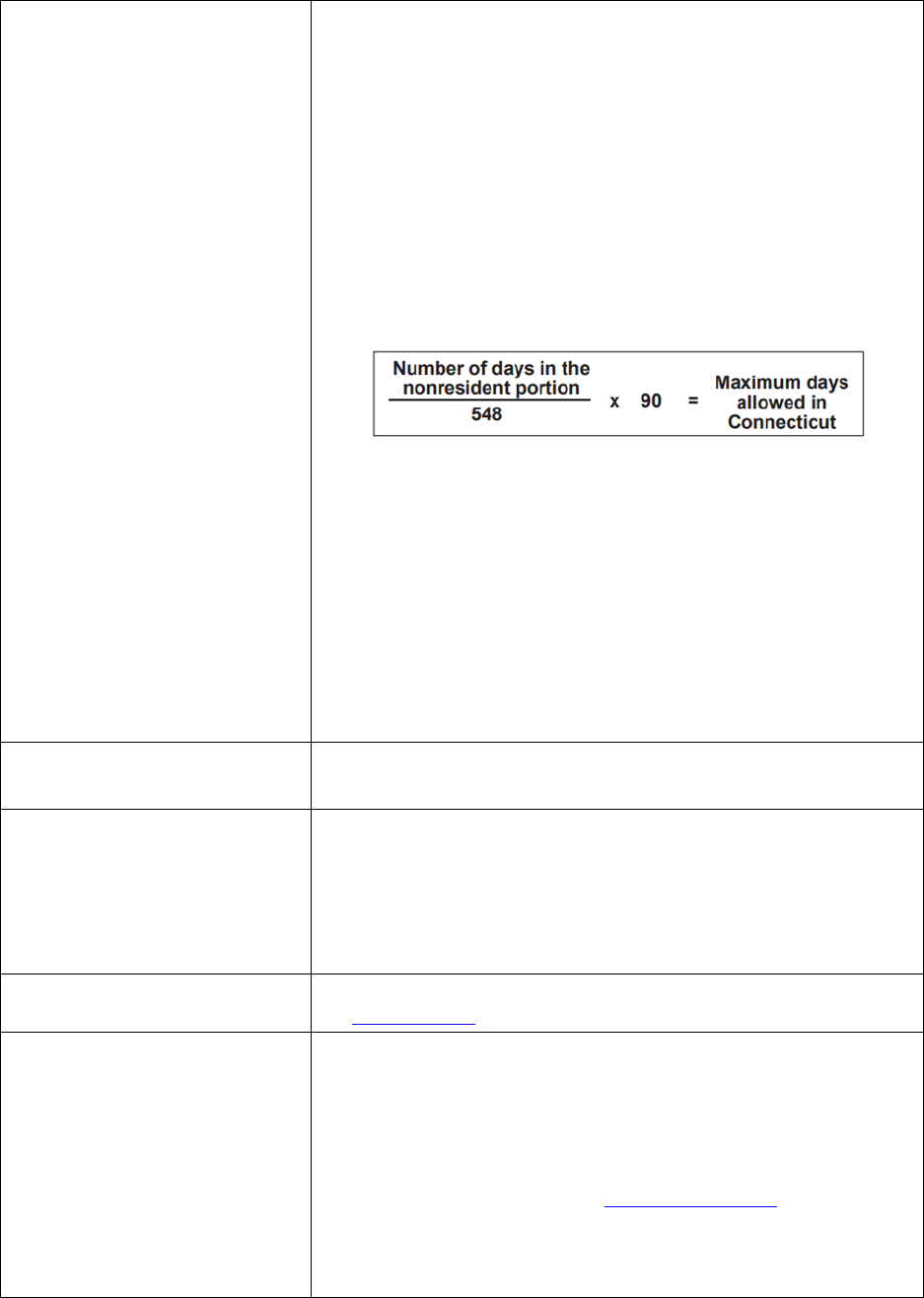

Group B

1) they were in a foreign country for at least 450 days during any period

of 548 consecutive days,

2) during this period of 548 consecutive days, they did not spend more than

90 days in CT and they did not maintain a permanent place of abode in

CT at which the spouse or minor children spent more than 90 days

3) during the nonresident portion of the taxable year in which the 548-day

period begins, and during the nonresident portion of the taxable year in

which the 548-day period ends, they were present in CT for no more

than the number of days that bears the same ratio to 90 as the number of

days in the portion of the taxable year bears to 548. This calculation can

be seen below:

Connecticut generally imposes a statewide sales and use tax. Connecticut

sales and use tax is imposed at a rate of 6.35%, though the rate may vary

on the based on the type of good or service being purchased.

Use tax is required to be paid when taxable goods or services on which sales tax

was not paid to a retailer are used in Connecticut. Together, the sales and use

taxes ensure that taxable goods and services used in Connecticut are treated

equally and fairly.

The use tax must be paid by April 15 for purchases made during the

preceding calendar year. For specific information regarding Use Tax, please

see an informational publication released on the individual use tax

What forms to file? Full Year residents: Form CT-1040.

Part-Year or Nonresidents: Form CT-1040NR/PY.

Requirements for Residency

Connecticut defines a resident as any natural person who is 1) domiciled in

Connecticut for the entire taxable year, or 2) who is not domiciled but

maintains a permanent place of abode in Connecticut and is in Connecticut

for an aggregate of more than 183 days of the taxable year (unless such

person is in active service in the U.S. armed forces whereas Connecticut

follows federal in that members of the military do not lose their domicile

while on orders).

Exemptions and Credits

Exemptions and credits are based on a sliding scale and filing status.

See

Form CT

-

1040

.

Military Pay Follows federal rules except for those individuals that satisfy the special non-

residency test. In that case they are treated as non-residents and their military

pay is not taxable.

There is a modification on CT-1040 NR/PY on schedule 1, Line 49 "Other",

to subtract military pay received by nonresident military from federal adjusted

gross income and military pay received during the non-residency portion of

the year for part-year residents. See Booklet 1040 NR/PY.

Combat Zone Extension: The income tax return of any individual in the U.S.

Armed Forces serving in a combat zone or injured and hospitalized while

serving in a combat zone is due 180 days after returning. There

will

be no

Connecticut

29

penalty or interest charged. For any individual who dies while on active duty

in a combat zone or as a result of injuries received in a combat zone, no

income tax or return is due for the year of death or for any prior taxable year

ending on or after the first day serving in a combat zone. If any tax was

previously paid for those years, the tax will be refunded to the legal

representative of the estate or to the surviving spouse upon the filing of a

return on behalf of the decedent. In filing the return on behalf of the

decedent, the legal representative or the surviving spouse should enter zero

tax due and attach a statement to the return along with a copy of the death

certificate.

Members of the U.S. Armed Forces serving a combat zone as designated by

an Executive Order or a qualified hazardous duty area as designated by the

federal government are eligible for the 180-day extension allowed to

individuals serving in a combat zone. Spouses of military personnel and

civilians supporting the military in these regions that are away from their

permanent duty stations, but are not within the designated combat zone, are

also eligible for the extension. Individuals requesting an extension under

combat zone provisions should print both the name of the combat zone and

the operation they served with at the top of their Connecticut tax return.

This is the same combat zone or operation name provided on their federal

income tax return. See, IP 2019(5) Connecticut Income Tax information for

Armed Forces Personnel and Veterans (note at the time of the publication of

this document only the 2019 version was available).

If a member is not in a combat zone, but is serving outside the United States

and Puerto Rico, CT gives the filer a six-month extension. However, the

amount of tax owed is due on or before the original due date of the return.

See IP 2019(5), linked above.

Spouses and Community Property

Not a community property state. If member is a non-resident, military pay

not included in spouse’s income for tax purposes.

Military Spouses Residency Relief Act: The Military Spouses Residency

Relief Act (MSRRA) provides that, effective for taxable years beginning on

or after January 1, 2009, where a service member’s spouse (spouse) is in

Connecticut solely to be with the service member serving in compliance with

military orders, income from services performed by the spouse in

Connecticut shall not be deemed to be income derived from or connected

with Connecticut sources unless the spouse’s state of residence is

Connecticut. If a spouse had income for services performed in Connecticut

and had Connecticut income tax withheld from wages or made estimated

payments for the taxable year, then he or she may file a Connecticut income

tax return and request a refund. If a military spouse did not claim that refund

for the 2020 tax year, the military spouse should contact the Connecticut

Department of Revenue as soon as possible to see if they can still claim a

possible refund Connecticut’s application of the MSSRA.

Income Exclusions Sliding scale for social security income.

Income Deductions Connecticut does not offer standard or itemized deductions.

Capital Gains/Losses

Connecticut taxes capital gains at specified graduated rates, as provided

under Conn. Gen. Stat. § 12-506(a)(2).

Retirement Income

100% of military retirement pay is exempt from Connecticut individual

income tax.

Connecticut

30

Deadline/Extensions April 15, 2022. However, since, the due date for filing a Connecticut

Income Tax Return falls on a legal holiday in the District of Columbia

(Emancipation Day), returns (and payment) will be considered timely if

filed on or before Monday, April 18, 2022.

Extensions may be requested using Form CT-1040EXT; however, the

extension only extends the time to file the return and you must pay 100% of

the tax owed on or before the due date.

You do NOT have to file Form CT-1040EXT if you filed a federal

extension request AND you do not owe CT income tax; or if you pay

your owed CT income tax on or before the due date.

For extensions based on military service overseas, see “Military Pay” above.

Special Military Processing CT does not require filing a tax return if the resident: (1) did not maintain a

permanent place of abode in CT, (2) maintained a permanent place of

abode outside of CT, and (3) was not physically present in CT for more

than 30 days in 2020.

If all three of the above conditions are met, the person is considered a

nonresident of Connecticut for the taxable year.

You do not have to file a Connecticut income tax return unless you had

Connecticut tax withheld or you had any income from Connecticut sources

(consult the CT-1040 Booklet to determine if the amount of CT source

income requires a tax return to be filed and to determine what form(s) must

be filed).

Military personnel and their spouses who claim Connecticut as a residence

but are stationed elsewhere are subject to Connecticut income tax. If

servicemember enlisted in the service as a Connecticut resident and have

not established a new domicile (permanent legal residence) elsewhere,

servicemember is required to file a resident income tax return unless

servicemember meets all of the conditions of a nonresident. If

servicemember’s permanent home (domicile) was outside Connecticut

when servicemember entered the military, Servicemember does not

become a Connecticut resident because Servicemember is stationed and

live in Connecticut. As a nonresident, servicemember’s military pay is not

subject to Connecticut income tax. However, income servicemember

receives from Connecticut sources while servicemember is a nonresident