Due to government and regulatory differences in the U.S., you can expect

a few differences in the mortgage process from what you are used to in

Canada with TD Canada Trust. For instance, the mortgage process will take

longer and also you or a Power of Attorney must be present in the U.S.

for the Closing. So to make the process as comfortable and stress free as

possible, TD Bank

®

, America’s Most Convenient Bank will be with you every

step of the way.

Congratulations! You’re buying a home in the U.S.

If you are a Canadian resident, you will need to

provide the following documents

1

when applying

for and/or Closing a Mortgage in the U.S.:

• Valid Passport and Drivers License (for applications and also ensure that

you bring both to Closing in the U.S.)

• Confirmation of Income with the Notice of Assessment for the past two

years along with the following:

– Salaried: T4s + current pay stub showing past 30 days income

– Self Employed: T1 General or Notice of Assessment

– Retired: Pension Statements (including proof of income will continue

three or more years), plus T1 General

• Purchase & Sale Agreement

• Confirmation of Down Payment from non-borrowed sources

(one or more of the following):

– Deposit on Offer

– Canadian bank account statements (past two months)

– Liquid or other Assets

– Gift Letter (if a financial gift has been used for the Down Payment)

• Insurance (required at Closing)

– Home owner’s insurance binder/policy

– Flood/hurricane/wind insurance policy if required

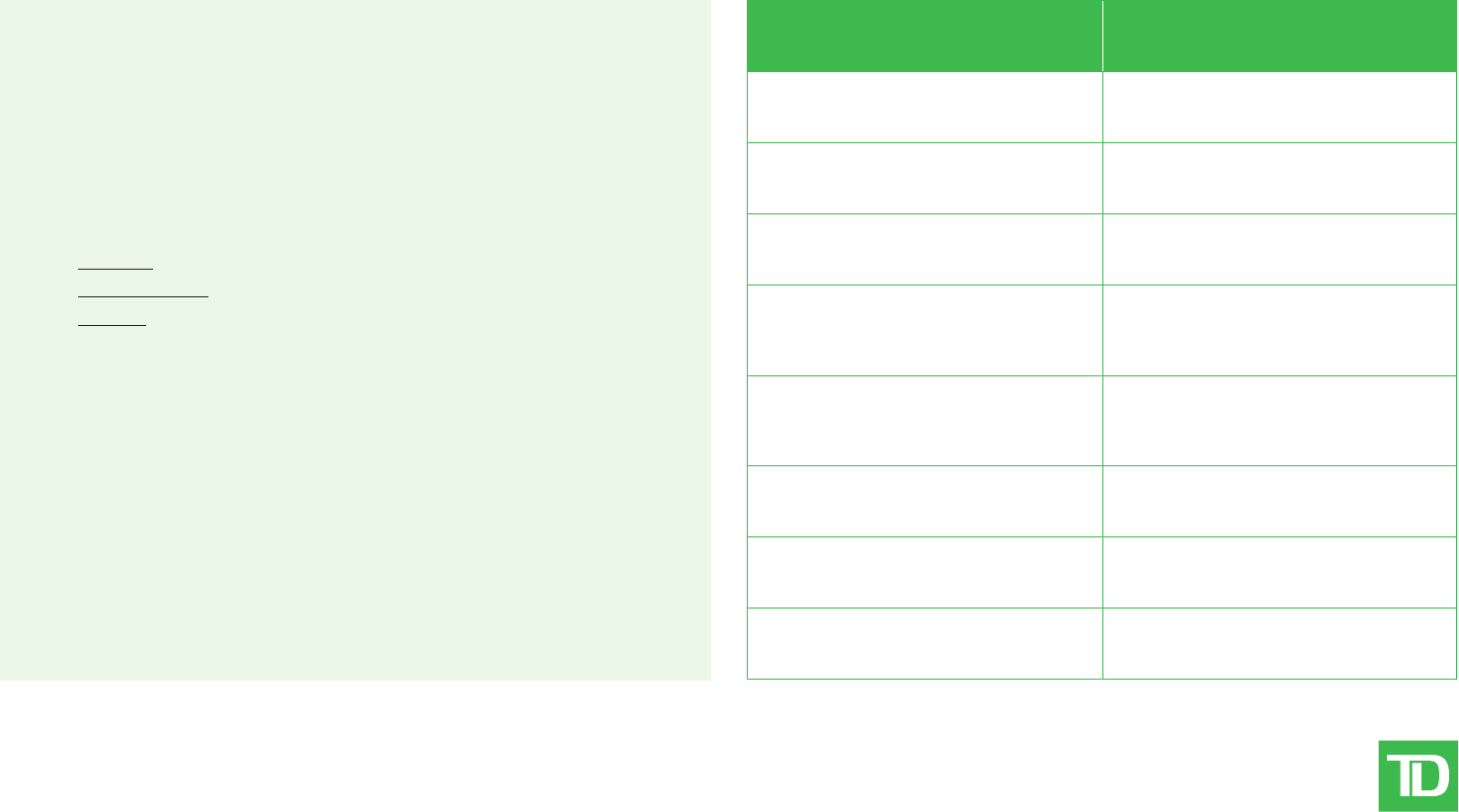

Canadian Documents U.S. Equivalent

T4 Statement of Remuneration W2 Wage & Tax Statement

T1 Personal Tax Return Form

and/or Notice of Assessment

1040 Individual Tax Return Form

T2 Corporate Tax Return Form 1120 Corporate Business Return Form

T2125 Statement of Business &

Professional Activities

1040 Schedule C Net Profit/Loss

from Business, and/or

1065 K1 Partner’s Share of Income

T5 Statement of Investment Income

1040 Schedule B Interest & Ordinary

Dividends, and/or

Schedule D Capital Gains & Losses

T776 Statement of Real Estate Rental

Income

1040 Schedule E Supplemental

Income & Loss for Partnership/LLC

T5013 Statement of Partnership Income 1065 Partnership Income Form

T4A Statement of Pension,

Retirement, Annuity & Other Income

Social Security or

Awards Pension Letter

1

If documents are in French, they must be presented with an English translation.

®

The TD logo and other trade-marks are the property of The Toronto-Dominion Bank.

0415

TD Canada Trust

Are you a Canadian resident

looking to purchase a home or

investment property in the U.S.

2

?

Here’s what to expect from the mortgage process…

For more information or to start an application

for a U.S. mortgage offered by TD Bank, visit

one of TD Bank’s nearly 1,300 locations in

the U.S. or call the TD Cross-Border Banking

Support Line at 1-877-700-2913.

3

TD Bank, America’s Most Convenient Bank, is TD Bank, N.A., a wholly-owned U.S. subsidiary (a separate bank) owned by The Toronto-Dominion Bank.

2

Subject to credit approval and other conditions. Mortgages limited to property located in U.S. states where TD Bank, N.A. has locations. Equal Housing Lender .

3

TD Bank, N.A. is located in the United States and its support line, Stores, products and services are primarily serviced in English.

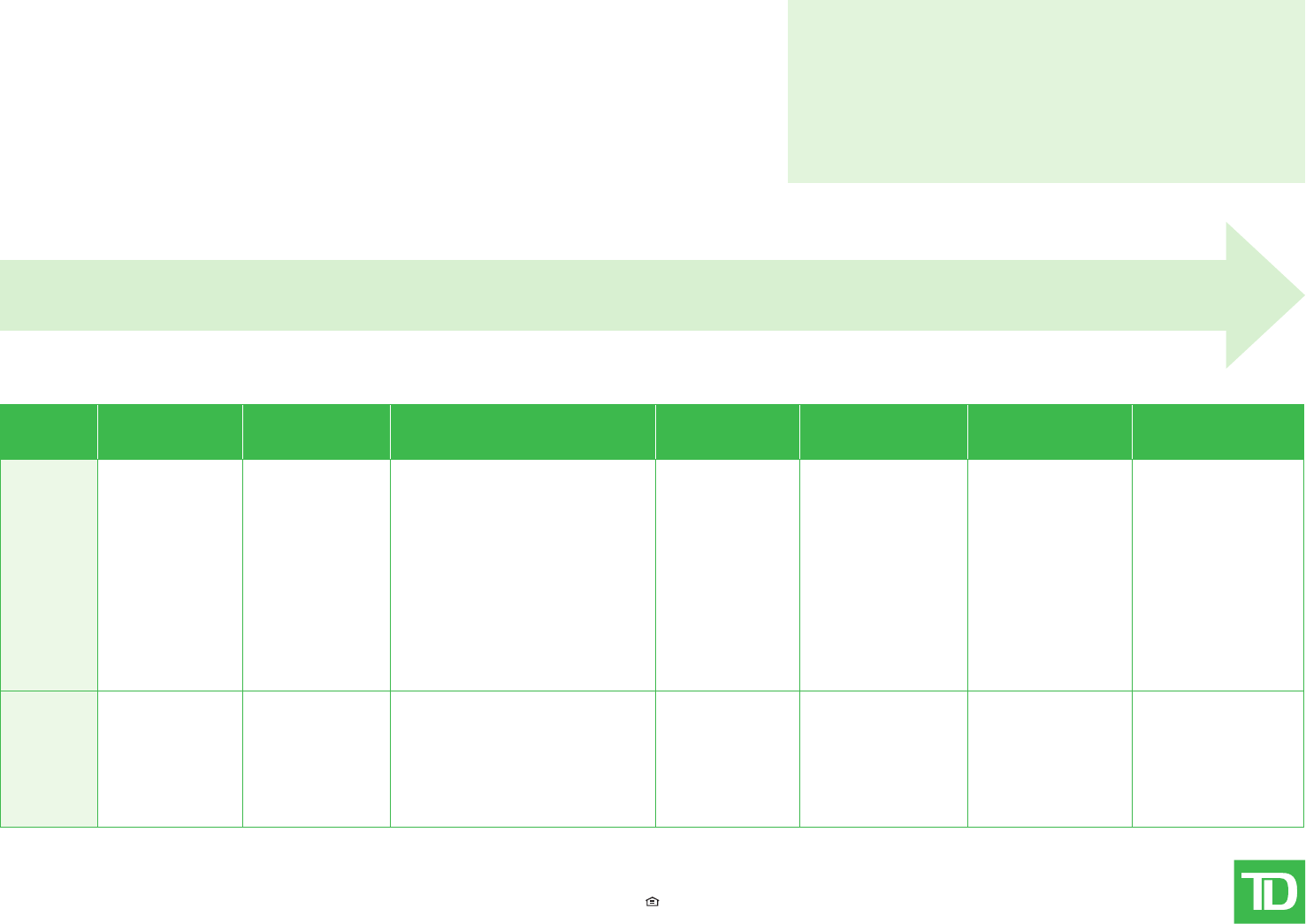

45 – 60 days

Application

Conditional

Decision

Welcome Call Appraisal Processing Underwriting Closing

What to

expect

You can meet

with a U.S.

TD Mortgage

Loan Officer face

to face or over the

phone. Just visit

a TD Bank Store

in the U.S., or call

the Cross-Border

Banking Customer

Support Line.

Within 24 business

hours your U.S.

TD Mortgage

Originator will

contact you via

phone or email

with a Conditional

Decision. You

will also receive a

letter in the mail.

Within 48 business hours of your

Conditional Decision, you will receive

a call from a U.S. TD Mortgage

Processor to review your loan

conditions, documentation, how to

enroll in e-disclosures and next steps.

A licensed home

appraiser will

contact your

realtor (or you) to

book a time for an

appraisal to verify

property value.

Your U.S.

TD Mortgage

Processor will gather

the documents you

have sent. When

received, your

documents will be

forwarded to the U.S.

TD Underwriter.

The U.S.

TD Underwriter will

verify the documents

to ensure they meet

TD Bank, America’s

Most Convenient

Bank, conditions of

approval.

When the loan is

ready you will be

contacted to schedule

the Closing. You (or

a Power of Attorney),

must be in the

U.S. with the Closing

Agent at their office.

Documents

you will

need to

provide

Purchase & Sale

Agreement

N/A

1

See list of documents required on

reverse. Note: You don’t have to be

in the U.S. until the Closing Date.

There are a number of convenient

options available for sending

documents from the U.S. to Canada.

N/A Send your documents

by the date on your

conditional approval

letter. (14 days from

Conditional Decision)

Be sure to provide

any additional

information if

requested, in order

to finalize your

application.

Bring your Passport

and Driver’s License

to the Closing and

any other documents

advised.

TD Canada Trust