Chapter 17: Pay and Step Changes

1

Chapter 17 Guide to Processing Personnel Actions

Chapter 17: Pay and Step Changes

(Natures of Action 810, 818, 819, 866,

888, 890, 891, 892, 893, 894, 896, 897,

and 899)

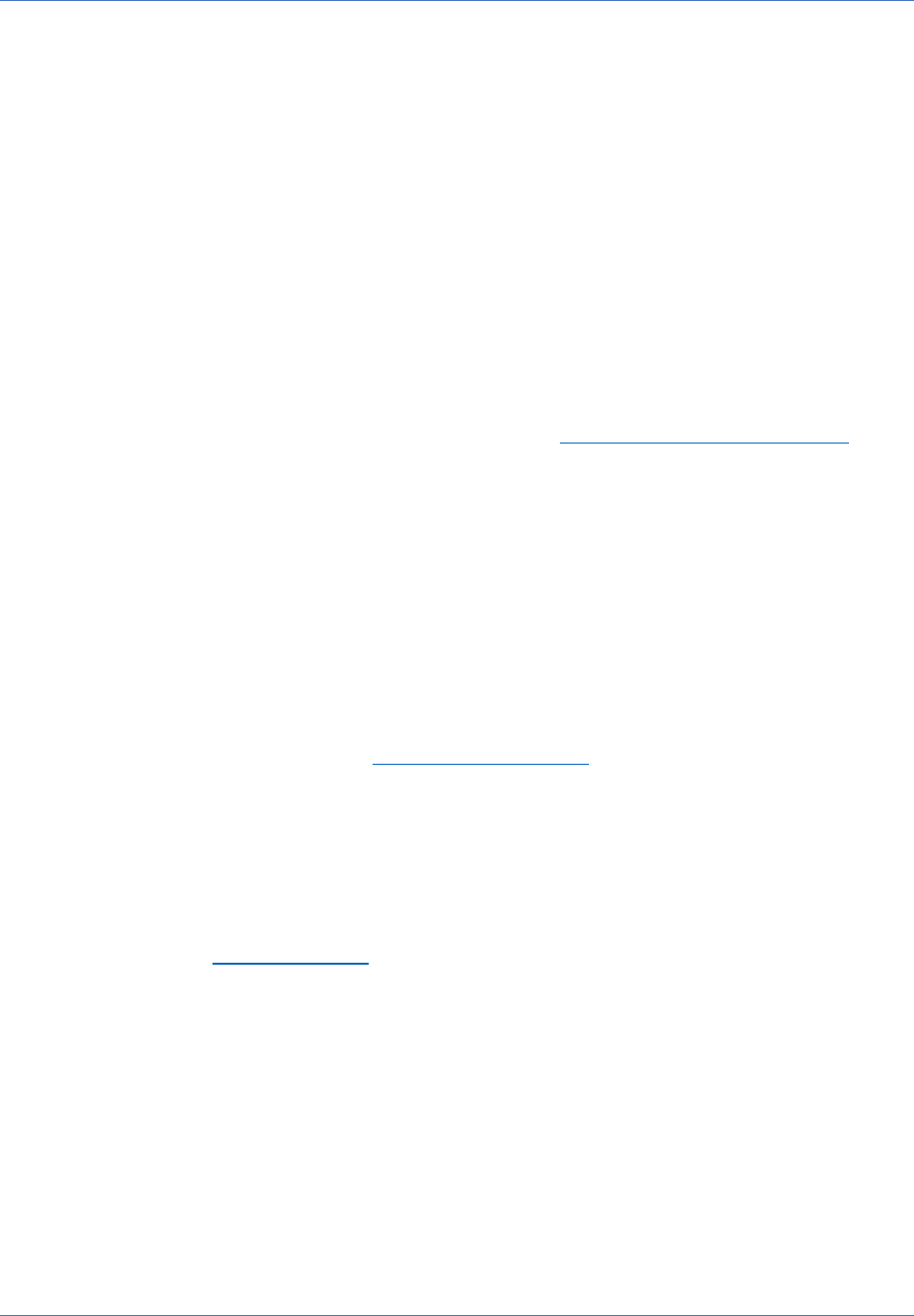

Contents

1. Coverage ...................................................................................... 2

2. Definitions ..................................................................................... 2

3. Use of Standard Form 52 ................................................................ 5

4. Documenting the Personnel Action ................................................... 5

5. Actions for Absent Employees .......................................................... 6

Job Aid ............................................................................................. 8

Instructions for Processing Personnel Actions on Pay and Step Changes ... 8

Tables ............................................................................................. 10

Table 17-A. Pay and Step Changes under the General Schedule ............ 10

Table 17-B. Pay Changes Under the Senior Executive Service (SES)……. 15

Table 17-C. Pay and Step Changes Under Prevailing Rate Systems ........ 16

Table 17-D. Pay and Step Changes Under Pay Systems Not Captured in

Tables 17-A thru 17-C .................................................................. 18

Table 17-E. Codes and Remarks for Pay and Step Changes .................. 23

New text changes and/or additions are distinguished in >dark red font

surrounded by angled brackets<. Deletion/removal of text is distinguished

with *** in green font.

Chapter 17: Pay and Step Changes

2

Chapter 17: Guide to Processing Personnel Actions

1. Coverage

a) This chapter provides instructions for processing pay related actions

that occur when there is no change in the employee's agency,

appointment status, position, or grade:

• 810—Change in Differential

• 818—Administratively Uncontrollable Overtime

• 819—Availability Pay

• 866—Termination of Grade Retention

• 888—Denial of Within-grade Increase

• 890—Miscellaneous Pay Adjustment

• 891—Performance-based Pay Increase

Provided on Regular Cycle

• 892—Performance-based Pay Increase

Provided on Irregular Basis

• 893—Within-range Increase

Provided on Regular Cycle

• 894—General Market or Structural Pay Adjustment

• 896—Group-based Pay Increase

• 897—Within-range Reduction

• 899—Step Adjustment

b) See Chapter 31 when processing actions when an employee changes

agencies; see Chapters 9-13 when appointment status changes; see

Chapter 14 for position or grade changes; and see Chapter 29 for

changes in bonuses, awards, or other incentives.

2. Definitions

a) Adjusted basic pay is the sum of an employee’s rate of basic pay

and any basic pay supplement, after applying any applicable pay cap.

A basic pay supplement is defined as a regular, fixed supplemental

payment (paid in conjunction with base pay) for non-overtime hours of

work that is creditable as basic pay for retirement purposes, excluding

any type of premium payment or differential that is triggered for

working certain hours of the day or week or for being subjected to

certain working conditions. A basic pay supplement includes, for

example, any applicable locality payment under 5 CFR part 531,

subpart F, and any special rate supplement under 5 CFR part 530,

subpart C.

Chapter 17: Pay and Step Changes

3

Chapter 17: Guide to Processing Personnel Actions

b) Administratively Uncontrollable Overtime (AUO) pay is calculated

as an increment of up to 25 percent of basic pay (including any locality

payment or special rate supplement) paid on an annual basis for

substantial amounts of overtime work that cannot be controlled

administratively and that are required on an irregular basis.

c) Availability pay is a special form of premium pay fixed at 25 percent

of basic pay (including any locality payment or special rate

supplement) that applies to criminal investigators who are required to

work, or be available to work, substantial amounts of unscheduled

overtime duty based on the needs of the employing agency. Criminal

investigators receiving availability pay are exempt from the minimum

wage and overtime pay provisions of the Fair Labor Standards Act and

may not receive administratively uncontrollable overtime pay.

d) Denial of Within-grade Increase means the decision to withhold

(not grant) a within-grade increase to an employee because of a

determination that the employee's performance is not an acceptable

level of competence.

e) GM Within-grade Increase is an agency awarded increase in rate of

basic pay, with no change in grade, to an employee who is covered

under the Performance Management and Recognition System

termination provisions of Public Law 103-89.

f) Grade Retention entitles an employee to retain for 2 years, for pay

and benefits purposes, the grade of the position from which ***>the

employee< was reduced.

g) Locality payment means a locality-based comparability payment

under ***>5 U.S.C 5304< or equivalent payment under another

authority.

h) Pay Adjustment (as used in this Guide)—Any increase or decrease in

an employee's rate of basic pay where there is no change in the duties

or responsibilities of the employee's position. For example, a pay

adjustment would include a change in the step at which the employee

is paid. A change in the pay system under which the employee is paid

is also considered a pay adjustment.

Chapter 17: Pay and Step Changes

4

Chapter 17: Guide to Processing Personnel Actions

i) Pay plan means the pay system or pay schedule under which the

employee's rate of basic pay is determined, for example, General

Schedule (GS), Executive Pay (EX), or Leader under the Federal Wage

System (WL).

j) Pay retention entitlement is an employee's right to retain, under

certain circumstances, a rate of basic pay that is higher than the

maximum rate of the grade for the position that ***>the employee<

occupies.

k) Performance Management and Recognition System (PMRS) was

the pay system established under 5 U.S.C. chapter 54 for General

Schedule employees in grades 13 through 15 in supervisory,

managerial, or management official positions.

l) Quality (Step) Increase (QSI or QI) is an increase in an employee's

rate of basic pay through an additional within-grade increase granted

under 5 U.S.C. 5336 for sustained high quality performance.

m) Rate of basic pay means the rate of pay fixed by law or

administrative action for the position held by the employee before any

deductions (such as taxes) and exclusive of additional pay of any kind

(such as overtime pay). For GS employees, a rate of basic pay is a GS

base rate, a law enforcement officer special base rate (GL), or a

retained rate – excluding any locality payment or special rate

supplement. A rate of basic pay is expressed consistent with

applicable pay basis (e.g., annual rate for GS employees or hourly rate

for wage system employees).

n) Special Rates are higher than rates under the regular pay schedule.

For example, OPM may establish higher pay rates under 5 U.S.C. 5305

for occupations in which private enterprise is paying substantially more

than the regular Government schedule, and this salary gap

significantly handicaps the Government’s recruitment or retention of

well-qualified persons. A special rate may consist of a base rate and a

special rate supplement.

o) Step means the step of the pay plan under which an employee is paid,

for example, step 2 of GS 7 or step 1 of WG 5.

Chapter 17: Pay and Step Changes

5

Chapter 17: Guide to Processing Personnel Actions

p) Step Adjustment means a change in the step of the grade at which

the employee is serving, without a change in the employee's rate of

basic pay. For example, a special rate employee may become entitled

to a retained rate (step 00) equal to the employee’s former step rate.

q) Supervisory Differential the annual total dollar amount paid, over

and above basic pay, to a General Schedule supervisor who otherwise

would be paid less than one or more of the civilian employees

supervised.

r) Within-range Increase (WRI) is an increase in an employee's rate

of basic pay within the pay range for ***>the employee’s< grade,

band, or level (excluding an increase granted automatically to keep

pace with an adjustment in pay structure). For pay systems with

scheduled steps within a pay range, a within-range increase is an

advancement from one step to a higher step (e.g., after meeting

requirements for length-of-service and performance). A GS within-

grade increase (WGI) is one type of within-range increase.

3. Use of Standard Form 52

a) The Standard Form 52, Request for Personnel Action, is used to

request and document approval of pay or step changes for employees

who are absent because of compensable injury, military duty, or

service with an international organization. For other pay and step

change actions, the agency may use either a >SF-52< or an agency

form to request actions and document approvals. For changes required

by statute or regulation, and for which no approval signature is

needed, no request document is needed.

4. Documenting the Personnel Action

Usually, personnel actions for pay and step changes will use a

Standard Form 50, Notification of Personnel Action. However, when an

action involves large numbers of employees and requires a change in

only one data item (salary), as in the case of statutory pay increase

for General Schedule employees, the change may be made in agency

data systems automatically. Each adjustment must be reported to the

***>Enterprise Human Resource Integration Data repository< In

addition, each salary adjustment or change must be documented in

the Official Personnel Folder and the employee must be notified of the

Chapter 17: Pay and Step Changes

6

Chapter 17: Guide to Processing Personnel Actions

adjustment. Employees may be notified of the adjustment by a copy of

the Official Personnel Folder document, or an agency issuance

described in Chapter 4, section 7. Either >SF-50< or one of these

alternate forms of notice may be used for Official Personnel Folder

documentation.

a) A copy of the new pay schedule containing the new rates, the

authority for the change, the date of the authority and the effective

date of the new rates may be used. Circle the employee’s new salary

and file the copy in the Official Personnel Folder on the right side.

b) A computer printed notice, showing:

• Name of employee

• Pay System

• Grade

• Step

• New ***>rate<

• Effective date of new rate

• Authority for change and date of authority; and

• Social Security Number

5. Actions for Absent Employees

a) Employees who are in nonpay status.

i) Process the following actions when they are due, regardless of

whether the employee is in pay or nonpay status on the effective

date of the action:

• pay adjustment to effect an annual General Schedule pay

adjustment, or to establish, change or terminate a locality

payment

• pay adjustment to implement, change, or discontinue a special

rate

• termination of grade retention at the expiration of the

employee's 2-year period of grade retention

• pay adjustment resulting from the termination of grade retention

• within-range increase for which employee became eligible before

a period of nonpay status began

Chapter 17: Pay and Step Changes

7

Chapter 17: Guide to Processing Personnel Actions

• within-range increase for which employee becomes eligible

during a period of nonpay status that is creditable for within-

range increase purposes.

ii) Wait to record other pay actions until the employee returns to duty.

Show the new pay or step on the return to duty personnel action

and enter in the Remarks ***>section< on that action P09—“Pay or

step adjusted (date) by (authority).”

b) Employees who have separated to enter on active military

duty—prepare the pay adjustment or step change >SF-52<, showing

the date on which, the action is due, and file it on the right side of the

employee's Official Personnel Folder. Wait to prepare and distribute the

>SF-50< until the employee exercises restoration rights, moving the

>SF-52< to the left side of the Official Personnel Folder at that time. If

the employee does not exercise restoration rights, remove and destroy

the >SF-52<.

c) Employees who have transferred to international

organizations—if the employee is serving with an international

organization, prepare and obtain necessary approvals on two copies of

a >SF-52< to record the action. File one copy on the right side of the

employee's Official Personnel Folder and send the second copy to the

payroll office; payroll needs the salary information on the form to

make the correct retirement and Federal Employees Group Life

Insurance deductions for the employee while ***>the employee<

serves with the international organization. Note the pay or step change

on the Standard Form 52 that is used to process the reemployment

action with remark P06— “Pay rate includes WGI's or other rate

changes to which employee would have been entitled had ***>the

employee< remained continuously in Federal service.

Chapter 17: Pay and Step Changes

8

Chapter 17 Guide to Processing Personnel Actions

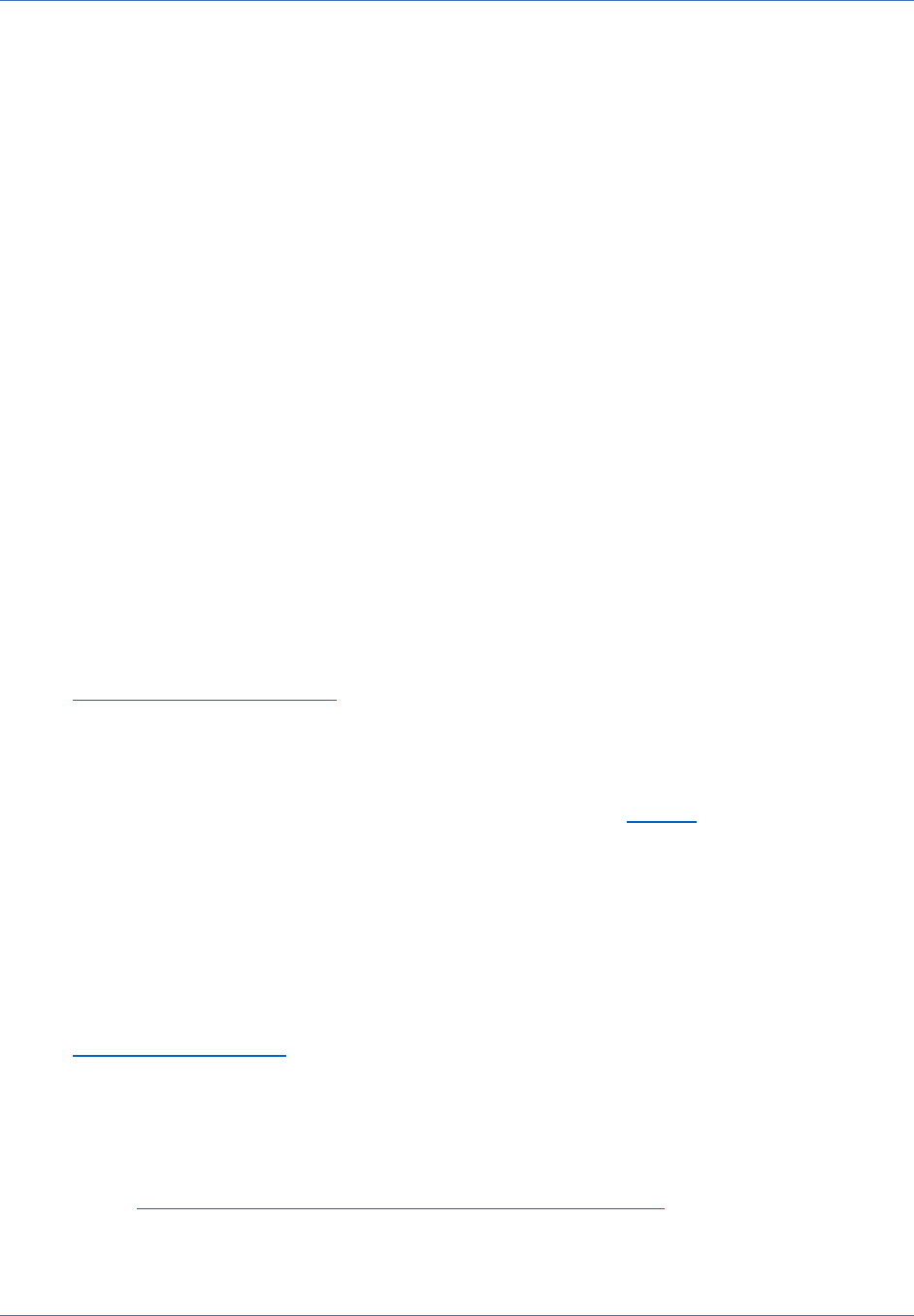

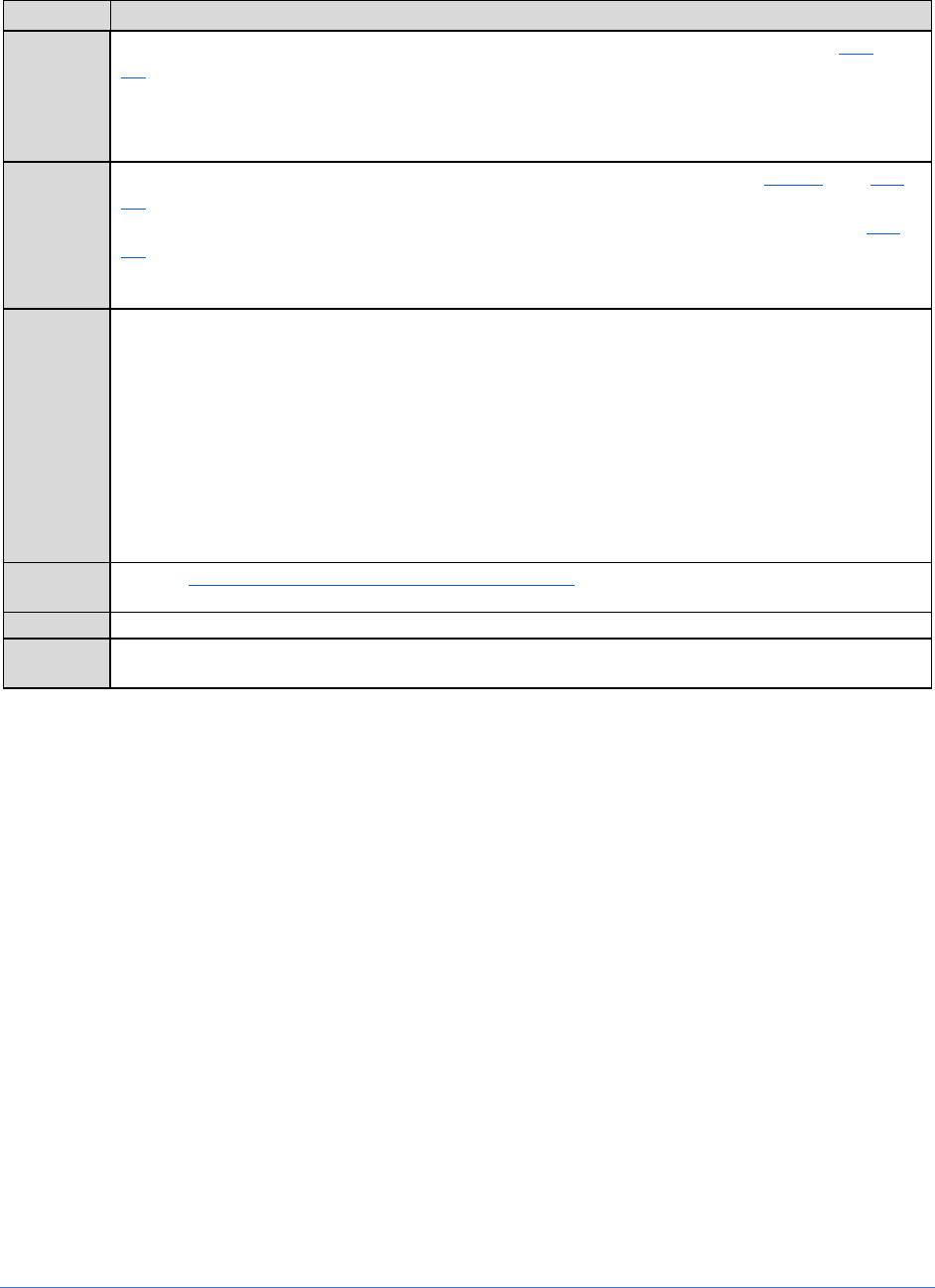

Job Aid

Instructions for Processing Personnel Actions on Pay and Step

Changes

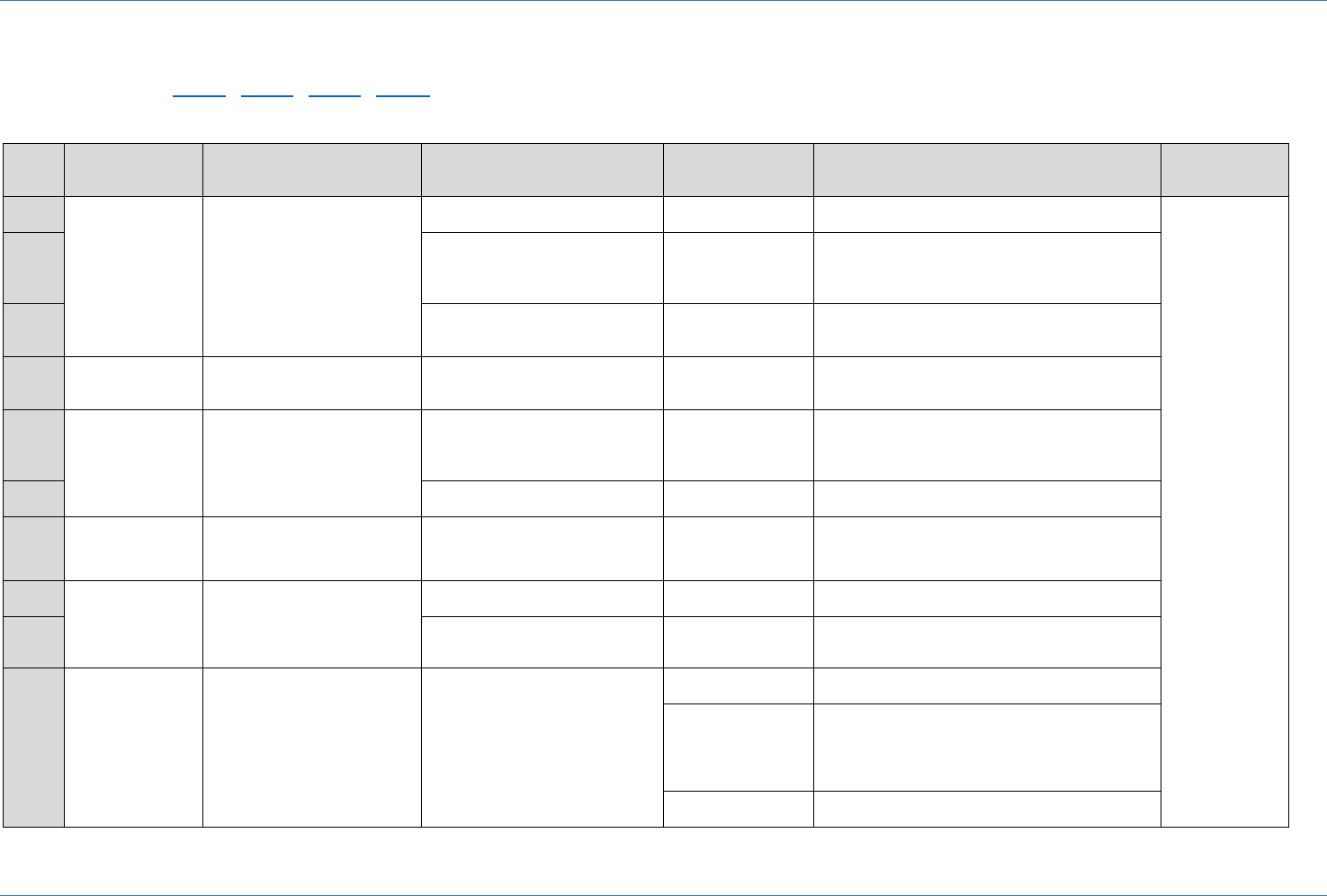

Step

Action

1

Use the below ***>information and< applicable pay plan to select the nature

of action and authority:

Pay Plan and Table to Reference

• General Schedule (GS), including employees covered by the

Performance Management and Recognition System termination

provisions of P.L. 103-89 (GM pay plan code) and law enforcement

officers at grades 3-10 (GL pay plan code), but excluding

***>physicians, podiatrists, and dentists< receiving title 38 market

pay (GP or GR pay plan code) – Reference Table 17-A

• Senior Executive Service Pay System – Reference Table 17-B

• Prevailing Rate Systems – Reference Table 17-C

• Other Pay Systems (including General Schedule ***>physicians,

podiatrists, and dentists< with GP or GR pay plan code) –

Reference Table 17-D

Enter nature of action and authority in blocks 5A-F of the Standard Form 52 or

in the appropriate place on the agency form used to request and approve the

action.

If the action is being taken under an authority that is unique to your

department or agency, cite that authority (along with the authority code

approved by the Office of Personnel Management) instead of the authority and

code shown in this chapter.

2

Use ***Table 17- >E< to select remarks/remarks codes required by the Office

of Personnel Management for the action as necessary and enter them in Part F

of the >SF-52< or in the appropriate place on the agency form used to request

and approve the action.

Also enter any additional remarks/remarks codes that are required by your

agency's instructions or that are necessary to explain the action.

3

Complete the >SF-52< as required by instructions in Chapter 4 of this Guide;

follow your agency's procedures to complete an agency request document.

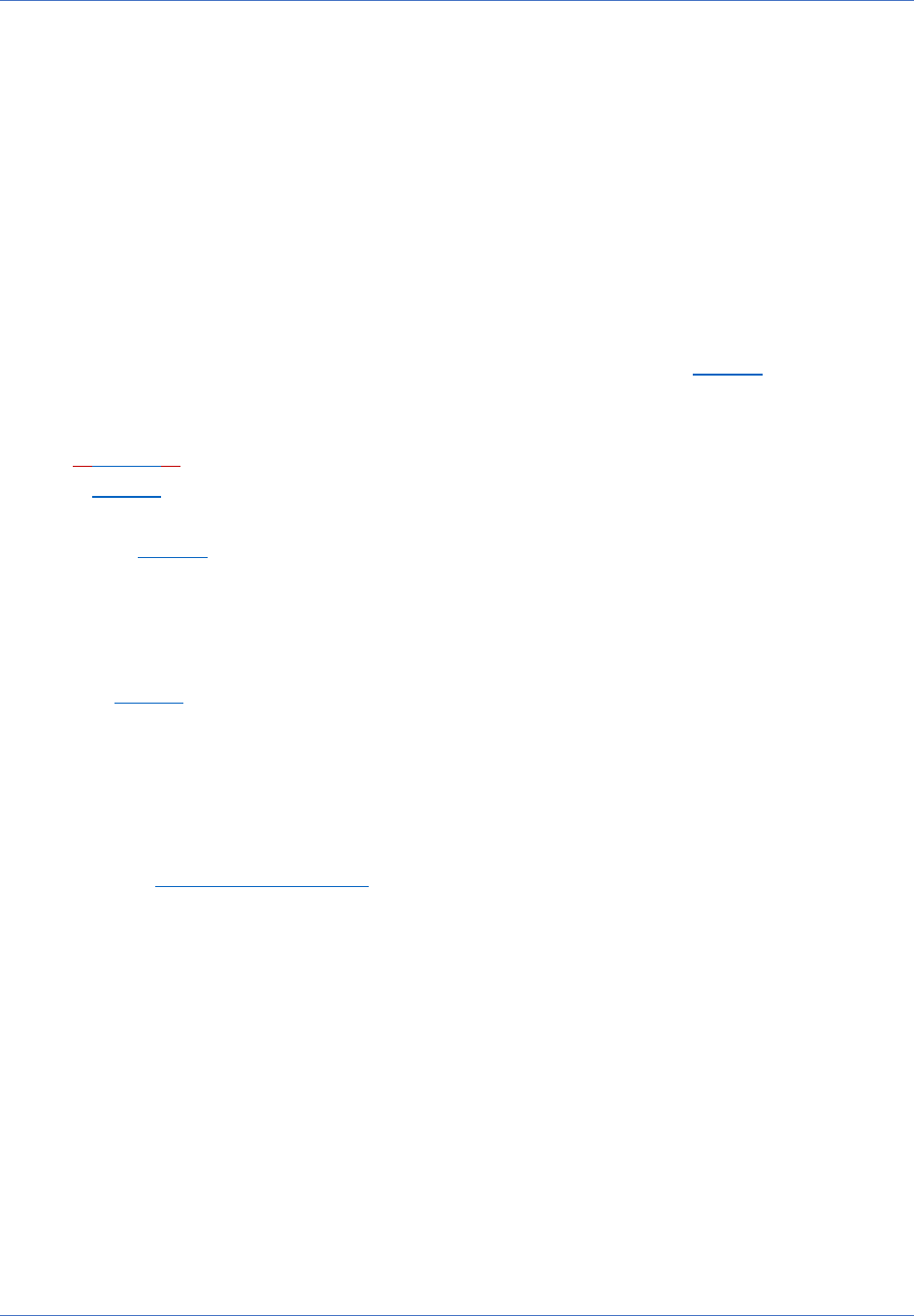

Instructions for Processing Personnel Actions on Pay and Step Changes, Continued

9

Chapter 17: Guide to Processing Personnel Actions

Step

Action

4

Follow your agency's procedures to get the approval signature on the >SF-

52<or the form your agency uses to request action. No approval is needed for

a pay adjustment or a change in differential that results from a statutory or

regulatory change in rates or an Executive Order.

5

Follow instructions in Chapter 4 of this Guide to complete the >SF-50<. >SF-

50< must be signed or authenticated for all pay and step changes except for

those actions that are required by statute or regulation (and for which a >SF-

50<or an alternate form of notice may be used). On actions for which a

signature or authentication is required, follow your agency's instructions to

obtain it.

6

Enter or update suspense or remainder dates in your service record system

and in any other tickler system your agency uses.

These dates include:

— date eligible for next within-range increase,

— grade retention expiration date, and

— date on which next performance determination must be made (when

within-range increase has been denied).

7

Check The Guide to Personnel Recordkeeping to decide how to file the

documents related to the action.

8

Reserved

9

Follow your agency’s instructions to distribute documentation of the personnel

action.

Chapter 17: Pay and Step Changes

10

Chapter 17 Guide to Processing Personnel Actions

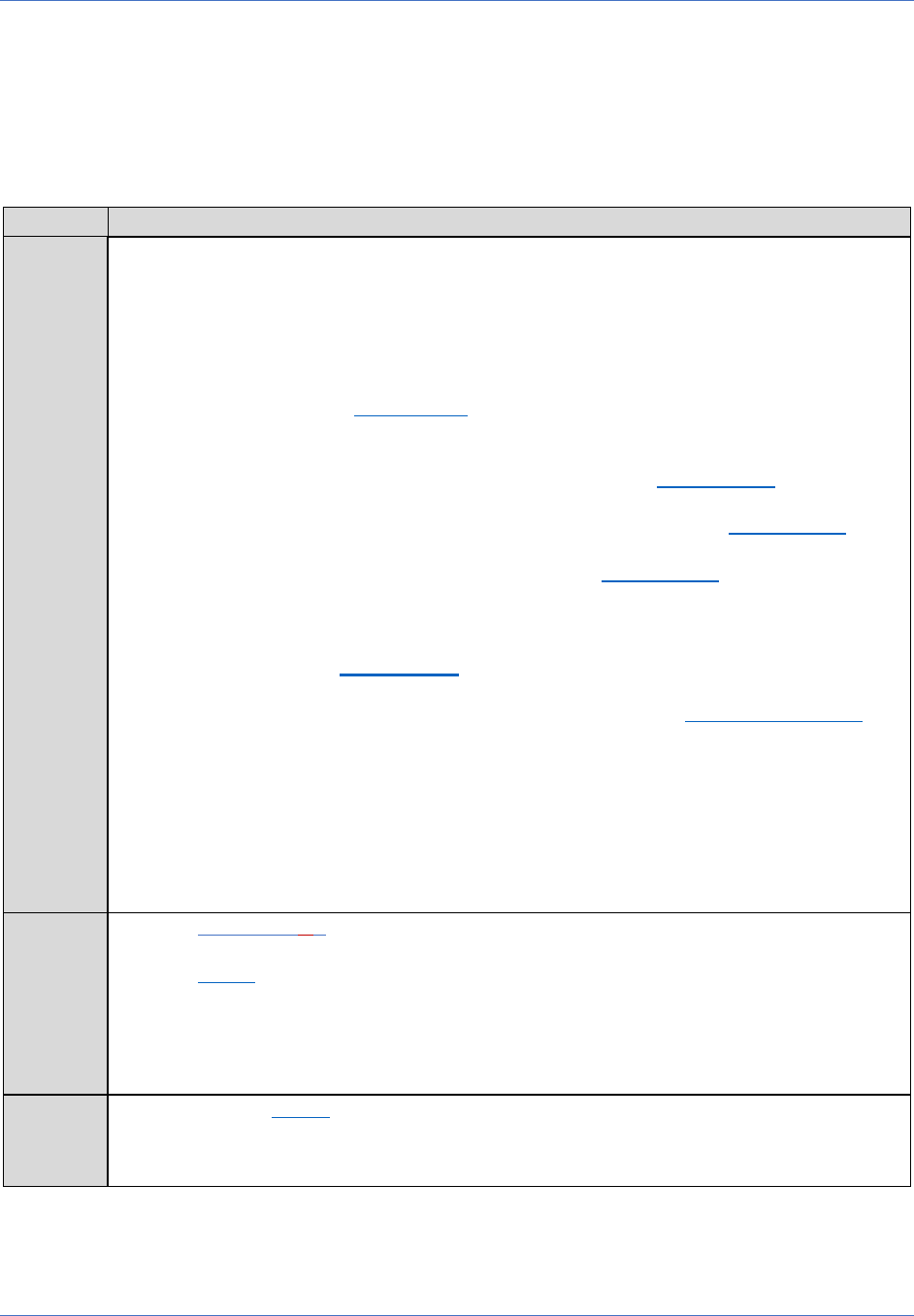

Tables

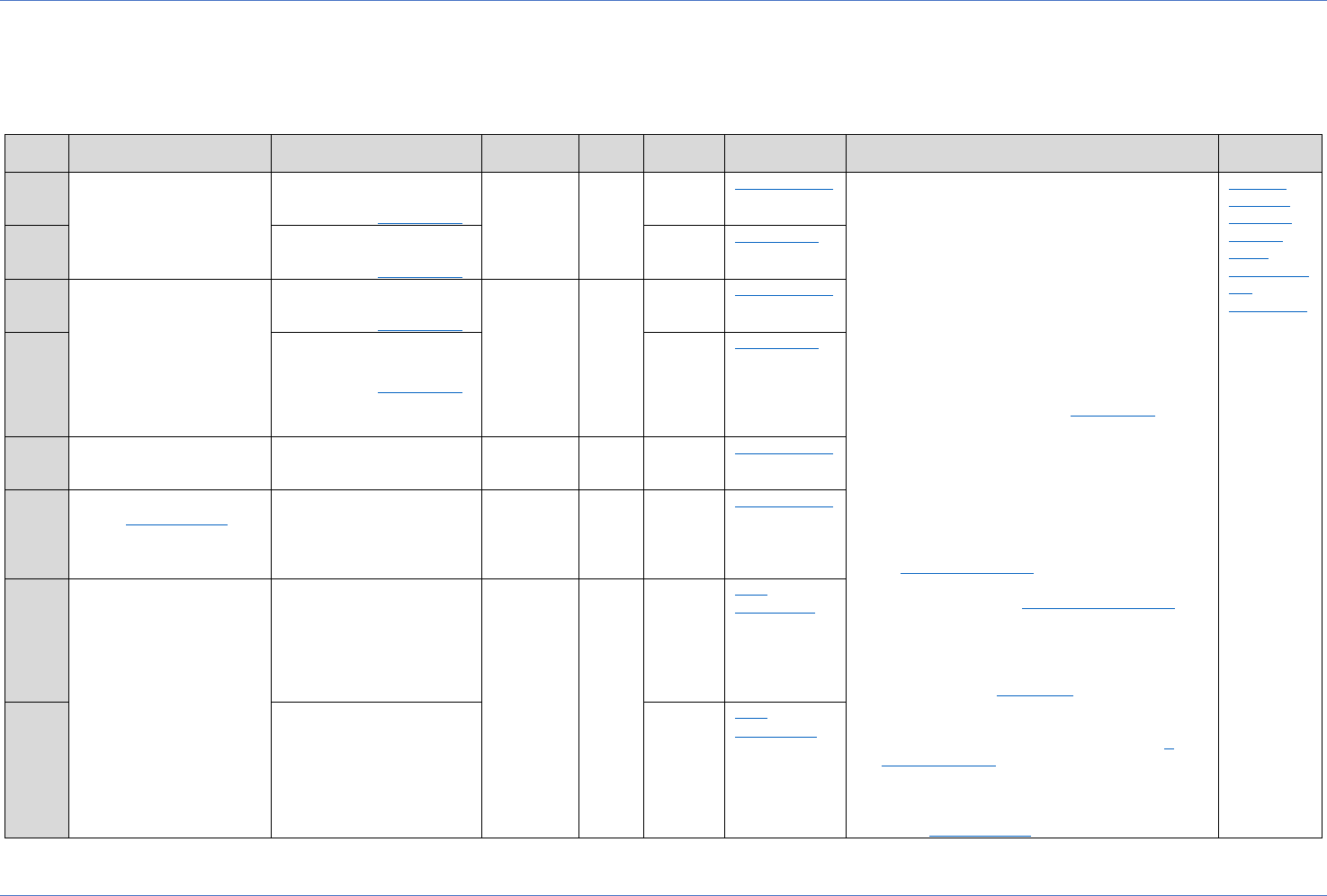

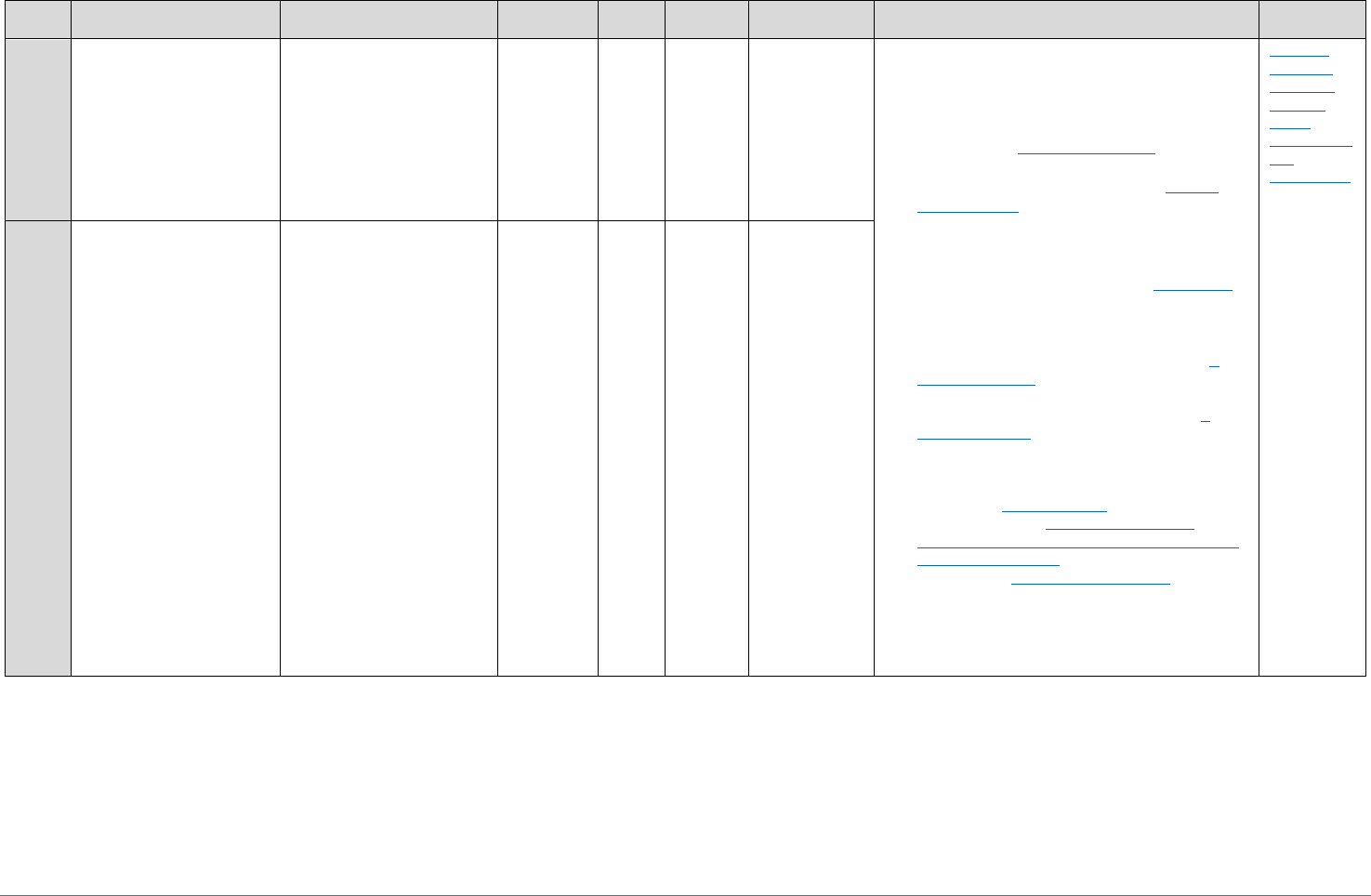

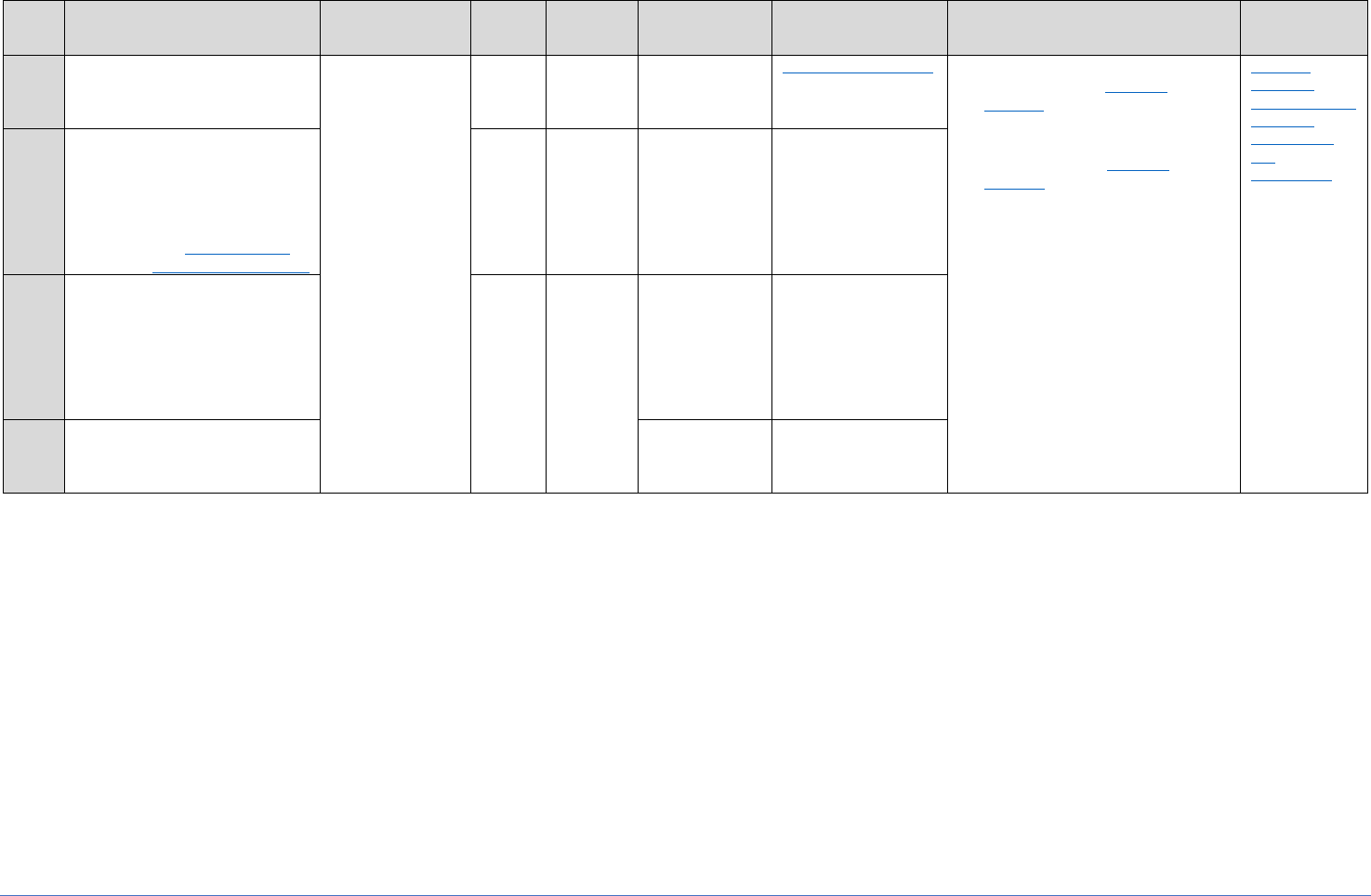

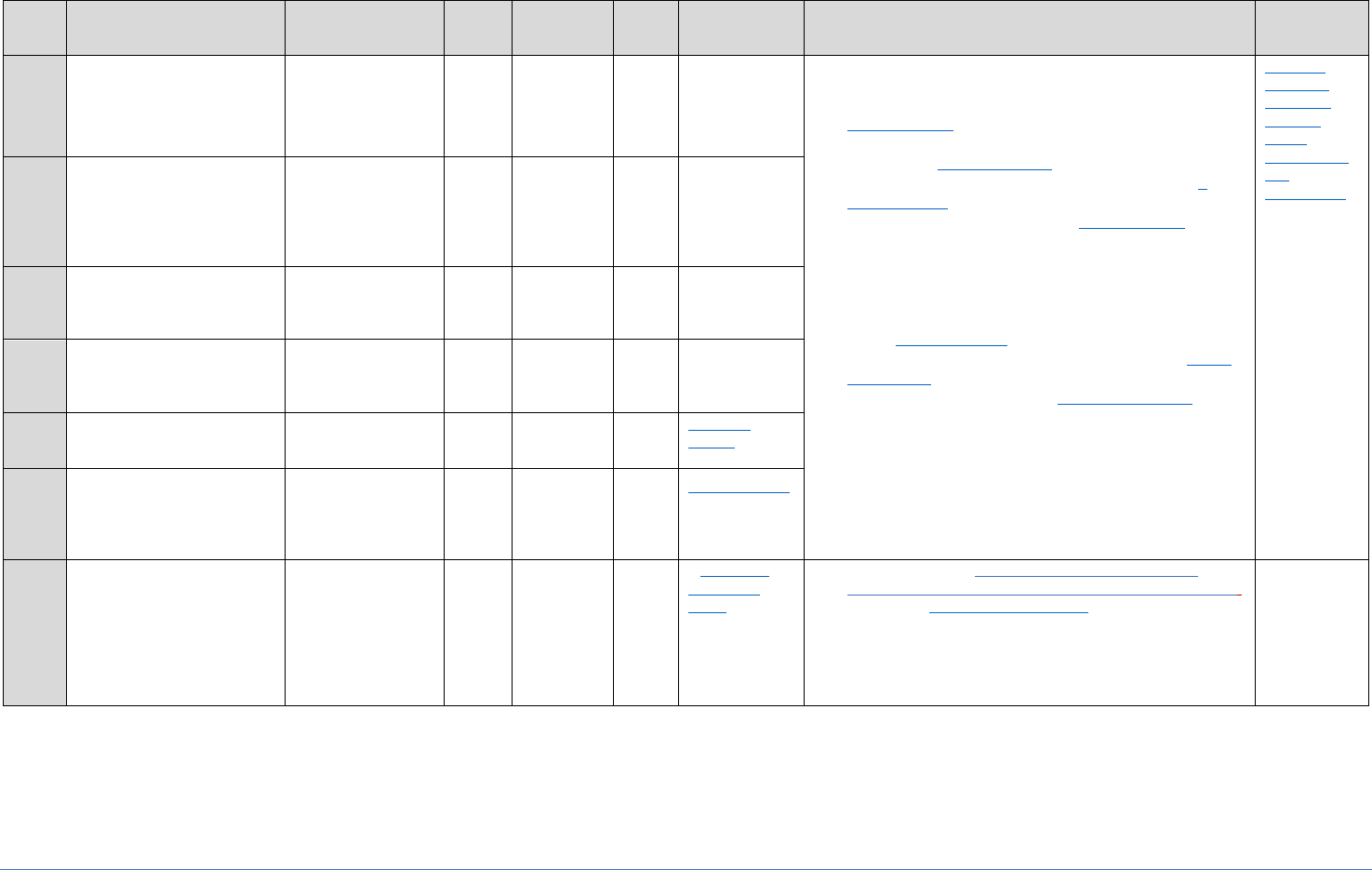

Table 17-A. Pay and Step Changes under the General Schedule (See note 3 of this table)

>Notes and Remarks columns have been added<

Rule

If Basis for Action is

And

Then

NOAC is

NOA

is

Auth

Code is

Authority is

Notes

Remarks

1

Within-grade increase

based on employee’s

meeting length of

service and performance

requirements (See note

1)

Employee is not covered

by the PMRS Termination

Provisions of P.L. 103-89

893

Reg

WRI

Q7M

Reg. 531.404

(See note 6)

1. When a within grade increase action is

effective on the same date as a quality step

increase or a promotion, the actions may be

documented on the same SF 52/50 or on

separate ones. When a single SF 52/50 is

used, document the within grade increase

(NOA “893”) in blocks 5A-F of the SF 52/50

and the other action in blocks 6A-F.

2. Show in “TO” block of SF 52/50 the step and

salary currently held by the employee. Do

not show the step and salary being denied

or withheld. Show “00" in block 19 if

employee is subject to the PMRS

Termination Provisions of P.L. 103-89.

Show as the effective date the date on

which the increase would have been

effective.

3. In addition to covering employees with a GS

pay plan code, this table applies to General

Schedule employees who are (1) covered by

the Performance Management and

Recognition System termination provisions

of Public Law 103-89 (GM pay plan code)

and (2) receiving LEO special base rates at

grades 3-10 under section 403 of FEPCA (GL

pay plan code). This table does not apply to

General Schedule *** >physicians,

podiatrists, and dentists< who are receiving

title 38 market pay (GP or GR pay plan

code); instead, table 17-D applies to those

*** >physicians, podiatrists, and dentists<.

6. If employee is entitled to grade retention, a

second authority may be cited: VLJ - 5

U.S.C. 5362(c).

8. Legal authority codes QJP, QHP, QKP, QMP,

QLP, QLM and QUB are applicable only when

an employee is receiving a special rate

under 5 U.S.C. 5305.

Jump to

listing of

Remarks

(Use as

many

remarks as

are

applicable)

2

Employee is covered by

the PMRS Termination

Provisions of P.L. 103-89

Z2P

P.L. 103-89

3

Decision to withhold

within-grade increase

Employee is not covered

by the PMRS Termination

Provisions of P.L. 103-89

888

Denial

of

WGI

(See

note

2)

Q5M

Reg. 531.409

(See note 6)

4

Employee is covered by

the PMRS Termination

Provisions of P.L. 103-89

Z2P

P.L. 103-89

5

Quality increase based

on employee’s high-

quality performance

892

Ireg

Perf

Pay

RBM

Reg. 531.501

(See note 6)

6

Pay adjustment effective

under 5 U.S.C. 5303

894

Gen

Adj

QWM

and

ZLM

Reg. 531.207

and (Cite

E.O. that

established

new rates)

7

Initial establishment of

or increase in special

rates schedule

Pay is adjusted on the

basis of employee's

existing pay retention

entitlement

894

Gen

Adj

QJP

(See

note 8)

and

ZLM

Reg.

530.322(c)

and (Cite

OPM issuance

that

published

new rates)

8

Employee is not entitled

to pay retention

QHP

(See

note 8)

and

ZLM

Reg.

530.322(a)

and (Cite

OPM issuance

that

published

new rates)

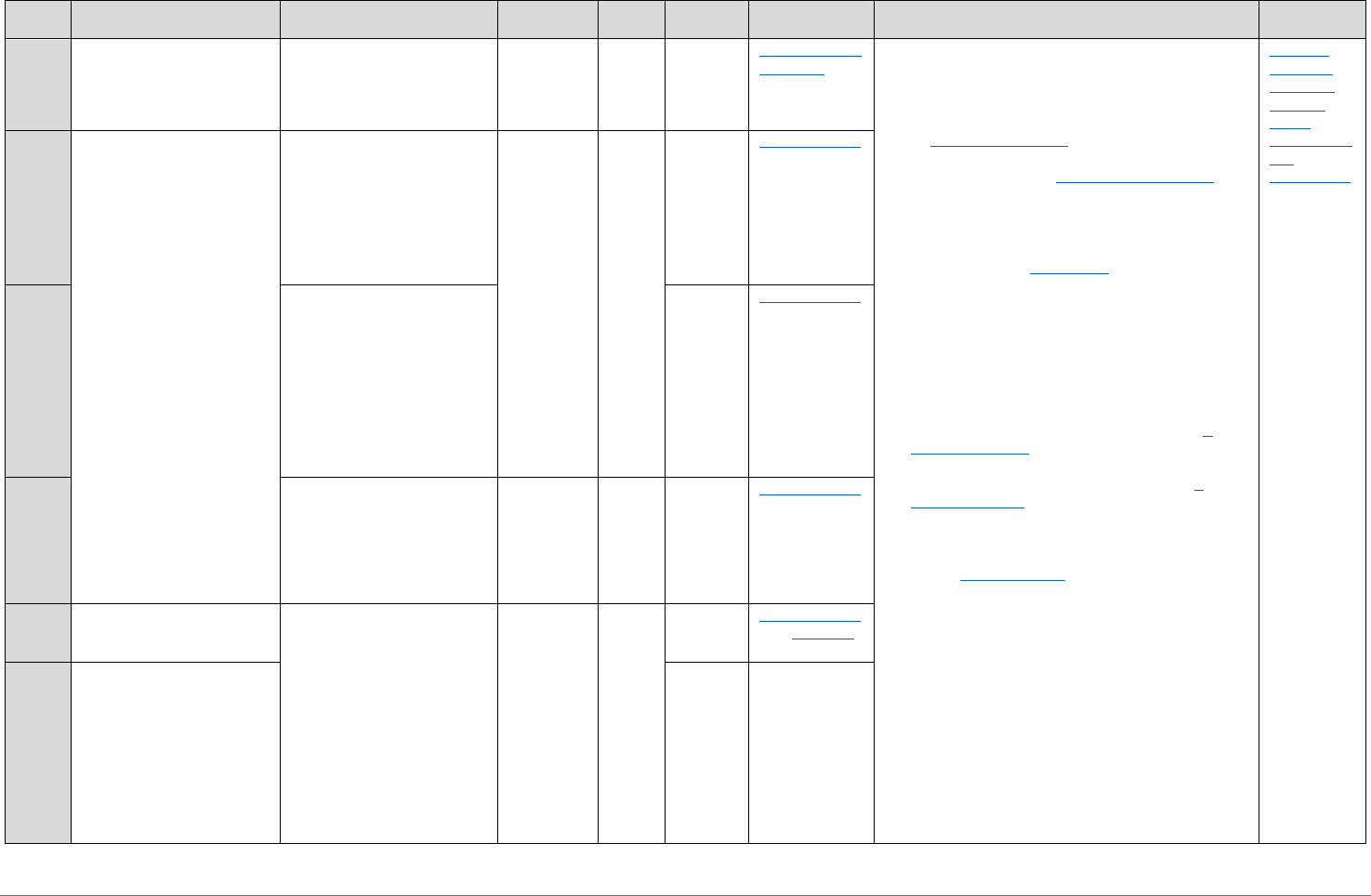

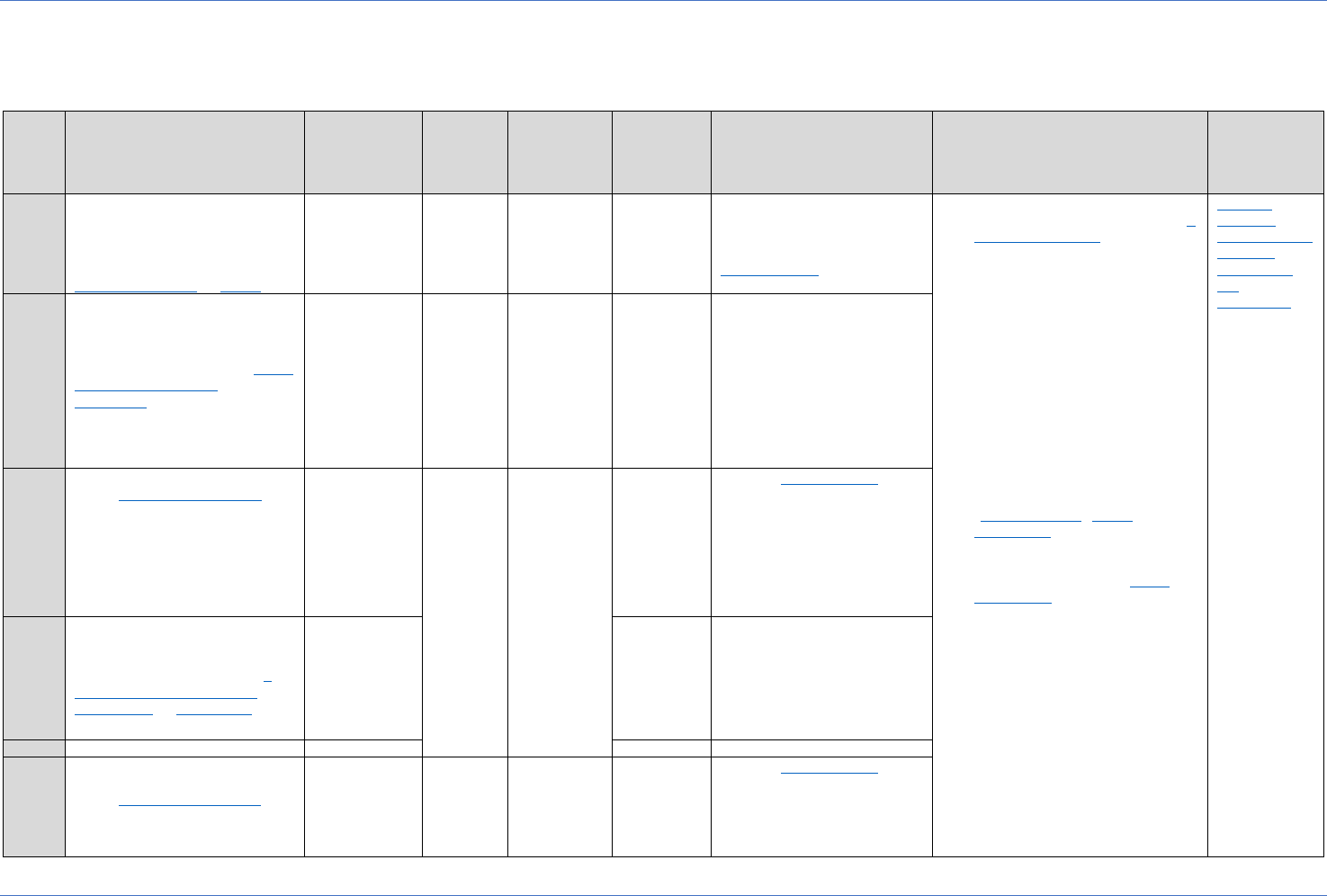

Table 17-A: Pay and Step Changes under the General Schedule, Continued

11

Chapter 17: Guide to Processing Personnel Actions

Rule

If Basis for Action is

And

Then

NOAC is

NOA

is

Auth

Code is

Authority is

Notes

Remarks

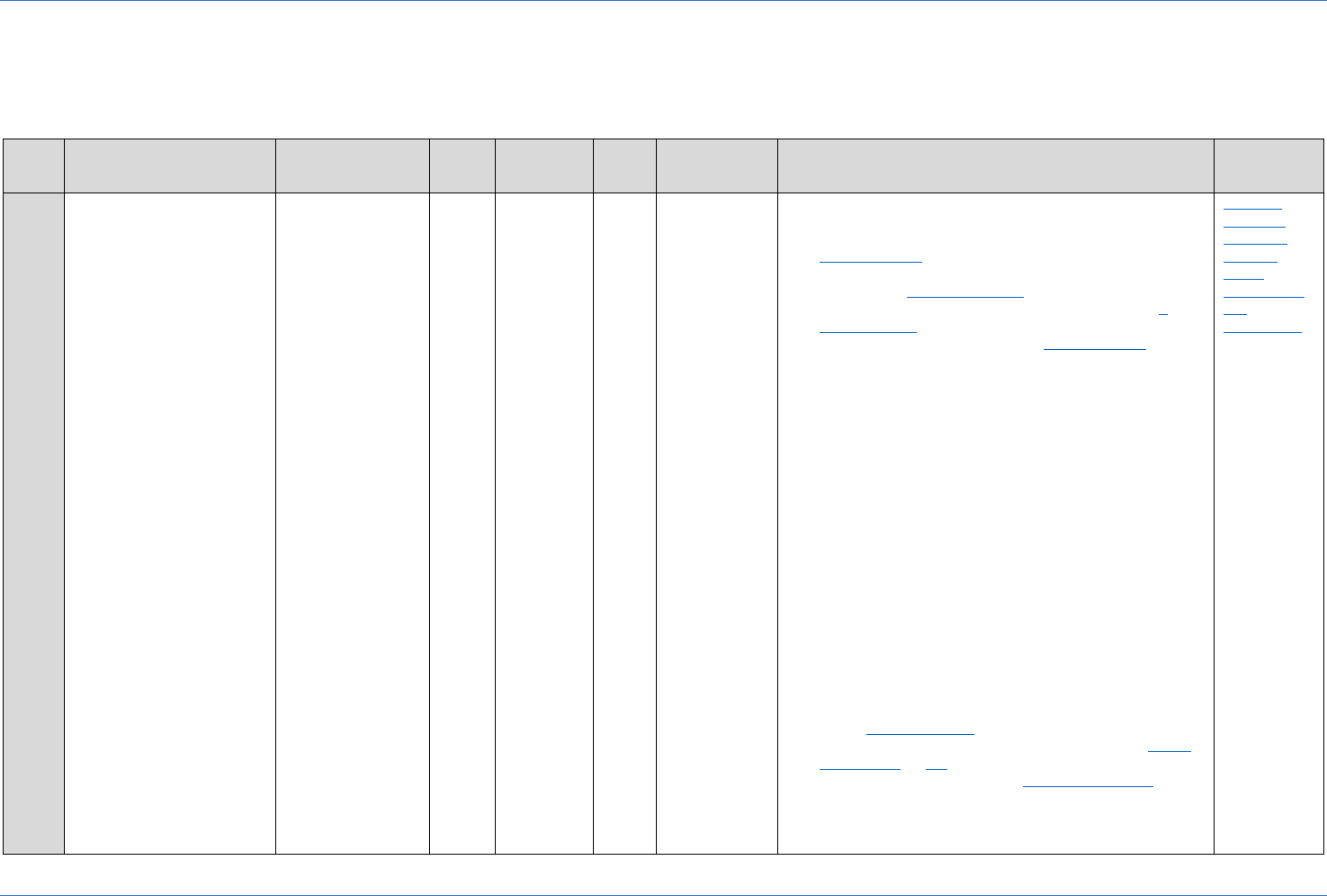

9

Initial establishment of,

or change in, special

base rate for a law

enforcement officer (GL

pay plan code)

894

Gen

Adj

ZTW

P.L. 101-509,

Sec. 403

3. In addition to covering employees with a GS

pay plan code, this table applies to General

Schedule employees who are (1) covered by

the Performance Management and

Recognition System termination provisions

of Public Law 103-89 (GM pay plan code)

and (2) receiving LEO special base rates at

grades 3-10 under section 403 of FEPCA (GL

pay plan code). This table does not apply to

General Schedule ***>physicians,

podiatrists, and dentists< who are receiving

title 38 market pay (GP or GR pay plan

code); instead, table 17-D applies to those

***>physicians, podiatrists, and dentists<

4. When an action involves a change in

employee's position or grade, follow the

instructions in Chapter 14; when it involves

a change in employee's agency or

appointment status, follow the instructions

in Chapters 9-13.

6. If employee is entitled to grade retention, a

second authority may be cited: VLJ - 5

U.S.C. 5362(c).

7. If employee is entitled to pay retention, a

second authority may be cited: VSJ - 5

U.S.C. 5363(a).

8. Legal authority codes QJP, QHP, QKP, QMP,

QLP, QLM and QUB are applicable only when

an employee is receiving a special rate

under 5 U.S.C. 5305.

Jump to

listing of

Remarks

(Use as

many

remarks as

are

applicable)

10

Decrease in or

discontinuance of special

rate schedule in case of

employee (1) for whom

the special rate is the

highest pay entitlement

and (2) who is eligible

for pay retention. (See

rule 27 for an employee

who meets the first

condition, but not the

second condition – e.g.,

employee ineligible for

pay retention because of

temporary or term

appointment.)

(See rule 28 in the case

of an employee whose

special rate entitlement

is terminated due to

entitlement to a higher

rate of pay – e.g.,

locality rate becomes

higher than special

rate.)

Employee's existing

special rate is equal to

one of the rates in the

new highest applicable

rate range for the

employee’s grade or level

899

Step

Adj

QKP

(See

note 8)

and

ZLM

Reg. 530.323

and (Cite

OPM issuance

that

published

new rates)

11

Employee’s existing

special rate is greater

than the maximum rate

of the new highest

applicable rate range for

the employee’s grade or

level (i.e., converted to

retained rate equal to

special rate)

QMP

(See

note 8)

and

ZLM

Reg. 530.323

and (Cite

OPM issuance

that

published

new rates)

12

Employee’s existing

special rate is between

two rates in the new

highest applicable rate

range for the employee’s

grade or level.

890

Misc

Pay

Adj

QLP

(See

note 8)

and

ZLM

Reg. 530.323

and (Cite

OPM issuance

that

published

new rates)

13

Employee loses GM

status (pay plan code

changed from GM to GS)

890

Misc

Pay

Adj

QUA

and

QUM

Reg. 531.241

and 531.242

14

Employee's position is

brought under the

General Schedule (See

note 4)

ZLM

(Cite E.O.,

Law, or Reg

that brought

position

under the

General

Schedule)

and (See

notes 6 and

7)

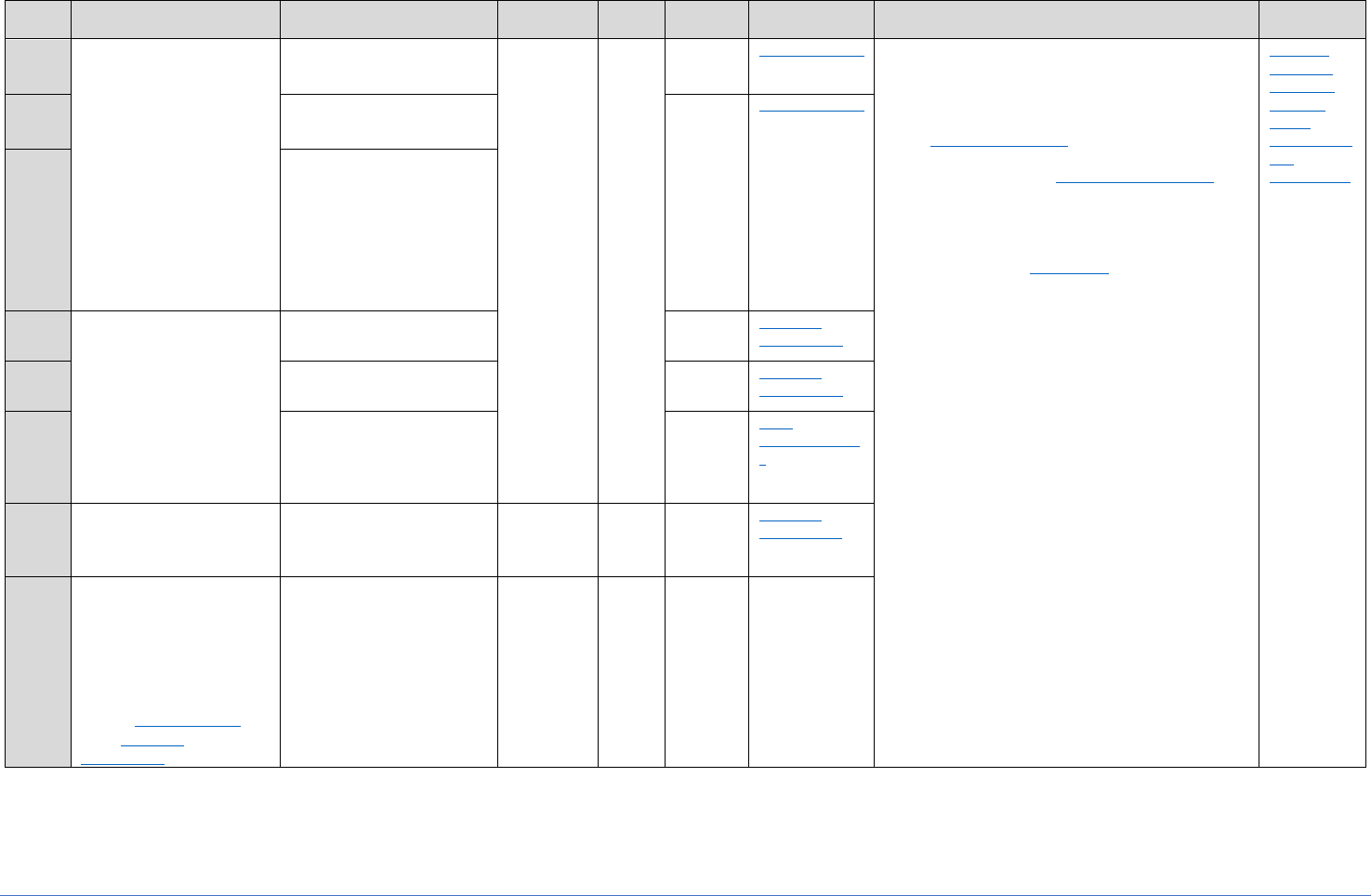

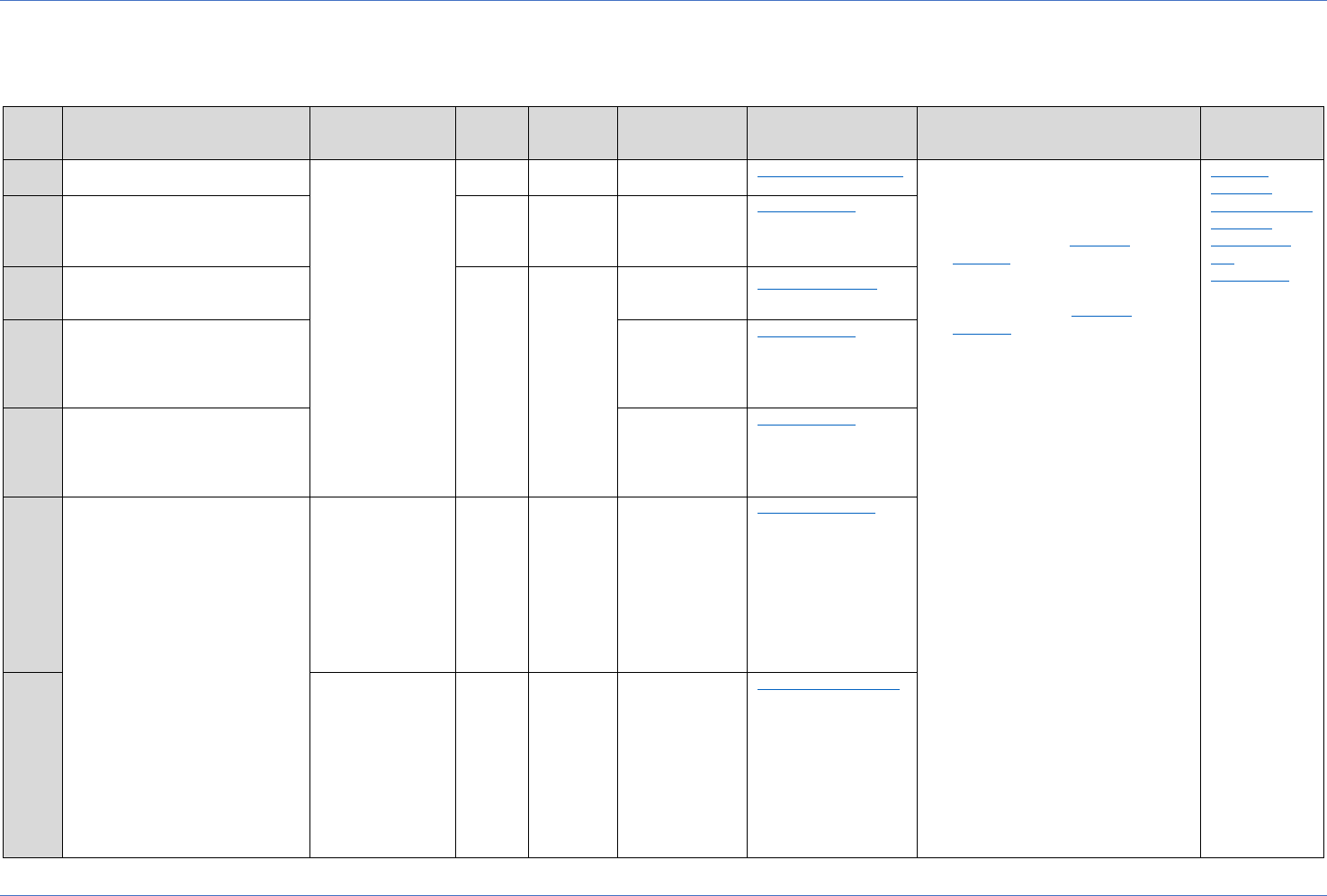

Table 17-A: Pay and Step Changes under the General Schedule, Continued

12

Chapter 17: Guide to Processing Personnel Actions

Rule

If Basis for Action is

And

Then

NOAC is

NOA

is

Auth

Code is

Authority is

Notes

Remarks

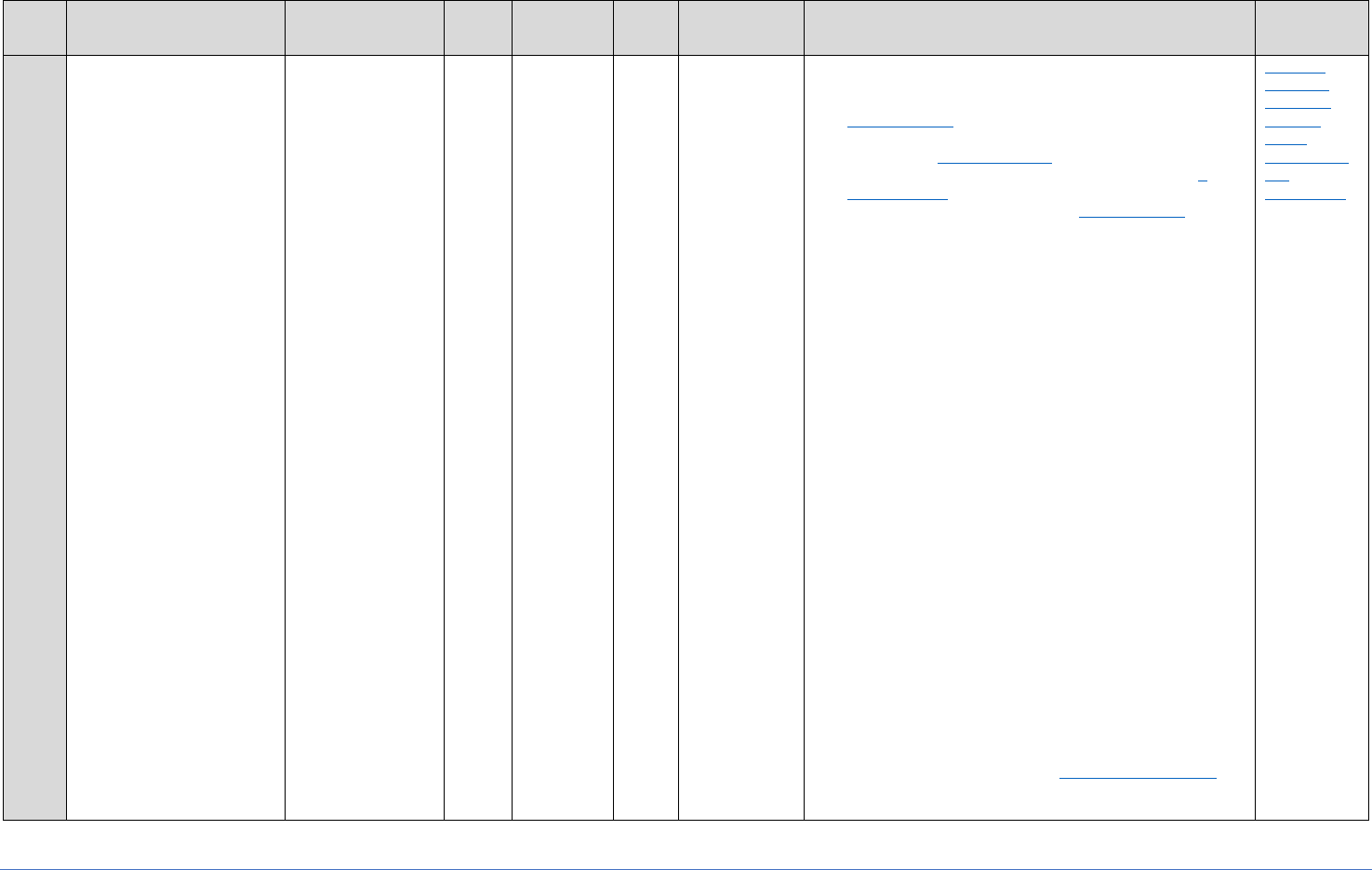

15

Termination of grade

retention benefits

because 2-year period

has expired

Employee is entitled to

complete another period

of grade retention

866

Termi

nation

of

Grade

Reten

tion

VKJ

5 U.S.C. 5362

3. In addition to covering employees with a GS

pay plan code, this table applies to General

Schedule employees who are (1) covered by

the Performance Management and

Recognition System termination provisions

of Public Law 103-89 (GM pay plan code)

and (2) receiving LEO special base rates at

grades 3-10 under section 403 of FEPCA (GL

pay plan code). This table does not apply to

General Schedule ***>physicians,

podiatrists, and dentists< who are receiving

title 38 market pay (GP or GR pay plan

code); instead, table 17-D applies to those

***>physicians, podiatrists, and dentists<

Jump to

listing of

Remarks

(Use as

many

remarks as

are

applicable)

16

Employee is entitled to a

retained rate under pay

retention

VRJ

5 U.S.C. 5363

17

Employee is entitled to a

rate of basic pay that is

equal to or higher than

>the employee’s<***

existing rate, which rate

can be accommodated

within the range of the

employee’s grade

18

Termination of grade

retention with no further

grade or pay retention

entitlement

Employee declined a

reasonable offer

VNJ

5 U.S.C.

5362(d)(3)

19

Employee elected to

terminate benefits

VPL

5 U.S.C.

5362(d)(4)

20

Employee failed to comply

with agency's priority

placement program's

requirements

RLM

Reg.

536.207(b)(2

)

21

Termination of pay

retention because

employee declined a

reasonable offer

890

Misc

Pay

Adj

VTJ

5 U.S.C.

5363(e)(2)

22

Termination of pay

retention because of pay

schedule adjustment

under which employee

becomes entitled to a

higher rate of pay than

that to which entitled

under 5 U.S.C. 5363

(See 5 U.S.C.

5363(e)(2))

894

Gen

Adj

ZLM

(Other

citation (Law,

E.O, Reg.))

Table 17-A: Pay and Step Changes under the General Schedule, Continued

13

Chapter 17: Guide to Processing Personnel Actions

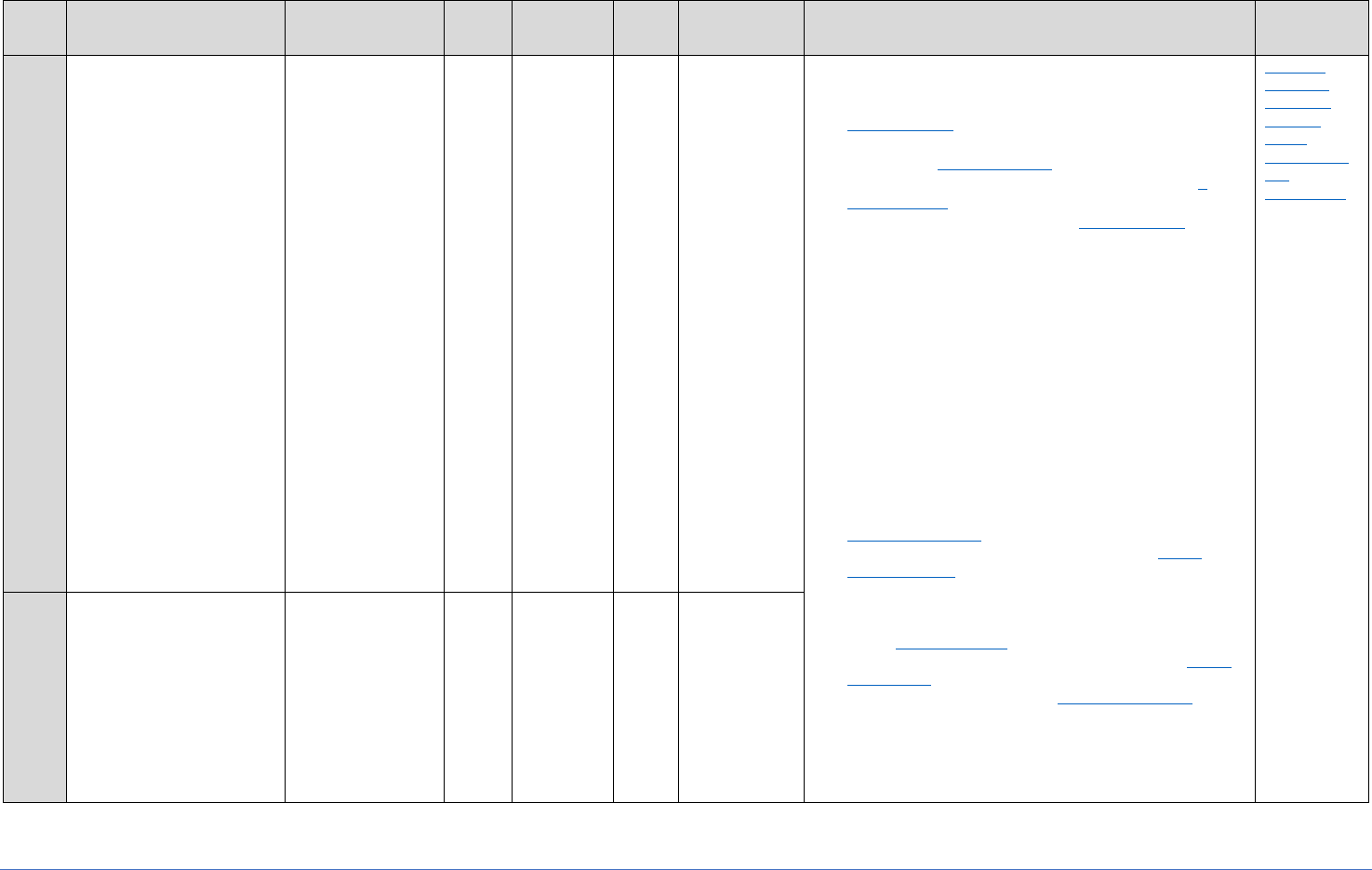

Rule

If Basis for Action is

And

Then

NOAC is

NOA

is

Auth

Code is

Authority is

Notes

Remarks

23

Establishment, change in

percentage, or termination

of locality-based

comparability payment

894

Gen

Adj

VGR

5 U.S.C. 5304

3. In addition to covering employees with a GS pay

plan code, this table applies to General Schedule

employees who are (1) covered by the

Performance Management and Recognition System

termination provisions of Public Law 103-89 (GM

pay plan code) and (2) receiving LEO special base

rates at grades 3-10 under section 403 of FEPCA

(GL pay plan code). This table does not apply to

General Schedule ***>physicians, podiatrists, and

dentists< who are receiving title 38 market pay

(GP or GR pay plan code); instead, table 17-D

applies to those ***>physicians, podiatrists, and

dentists<.

8. Legal authority codes QJP, QHP, QKP, QMP, QLP,

QLM and QUB are applicable only when an

employee is receiving a special rate under 5 U.S.C.

5305.

Jump to

listing of

Remarks

(Use as

many

remarks as

are

applicable)

24

Establishment, change in

percentage, or termination

of supervisory differential

810

Chg in

Diff

VPH

5 U.S.C. 5755

25

Establishment, change in

percentage, or termination

of administratively

uncontrollable overtime

entitlement

818

AUO

RMM

Reg. 550.151

26

Establishment or

termination of availability

pay

819

Availa

bility

Pay

Z2S

5 U.S.C. 5545a

27

Decrease in or

discontinuance of special

rate schedule in case of

employee (1) for whom the

special rate is the highest

pay entitlement and (2) who

is not eligible for pay

retention (e.g., employee

with temporary or term

appointment)

Employee is not entitled to

pay retention under 5 CFR

part 536

894

Gen

Adj

QLM

(See

note 8)

and ZLM

Reg.

530.323(c) and

(Cite OPM

issuance that

published new

rates)

28

Employee’s special rate is

terminated because the

employee is entitled to a

higher rate of basic pay

(e.g., locality rate surpasses

special rate.) (e.g., see 5

U.S.C. 5305(h).) (It is

possible that the special rate

range or schedule that

formerly applied to

employee may be

discontinued at the same

time; however, rules 10-12

and 27 do not apply, since

the special rate is not the

employee’s highest pay

entitlement.)

Special rate is terminated

because the employee is

entitled to a higher rate of

basic pay

ZLM And

QUB

(See

note 8)

Other citation

(Law, E.O,

Reg.), and Reg.

530.303(d)

Table 17-A: Pay and Step Changes under the General Schedule, Continued

14

Chapter 17: Guide to Processing Personnel Actions

Rule

If Basis for Action is

And

Then

NOAC is

NOA

is

Auth

Code is

Authority is

Notes

Remarks

29

An adjustment in

employee's basic rate of

pay that is not described

in Rules 1-28 (e.g., GS

pay increases under

maximum payable rate

rule; adjustments

resulting from a change

in employee’s pay

system, etc.)

890

Misc

Pay

Adj

ZLM

(Cite

authority for

the

adjustment)

(See notes 6

and 7)

3. In addition to covering employees with a

GS pay plan code, this table applies to

General Schedule employees who are (1)

covered by the Performance Management

and Recognition System termination

provisions of Public Law 103-89 (GM pay

plan code) and (2) receiving LEO special

base rates at grades 3-10 under section

403 of FEPCA (GL pay plan code). This

table does not apply to General Schedule

***>physicians, podiatrists, and dentists<

who are receiving title 38 market pay (GP

or GR pay plan code); instead, table 17-D

applies to those ***>physicians,

podiatrists, and dentists<.

6. If employee is entitled to grade retention, a

second authority may be cited: VLJ - 5

U.S.C. 5362(c).

7. If employee is entitled to pay retention, a

second authority may be cited: VSJ - 5

U.S.C. 5363(a).

8. Legal authority codes QJP, QHP, QKP, QMP,

QLP, QLM and QUB are applicable only

when an employee is receiving a special

rate under 5 U.S.C. 5305.

9. >Refer to OPM’s Information on New

Overseas Locality Pay for DETO employees

dated 02/17/2023.

10. >As section 9717 of P.L. 117-263 changes

the authority under which DETO employees

receive locality pay, NOAC 894/LAC ZLM

must be used to process the action,

regardless of whether the locality payment

amount changes or remains the same.<

Jump to

listing of

Remarks

(Use as

many

remarks as

are

applicable)

>30<

Establishment, change in

percentage, or

termination of overseas

locality payment for a

Domestic Employee

Teleworking Overseas

(DETO)

894

Gen

Adj

Z2Y

>P.L. 117-

263, Sec.

9717 - DETO

Locality

Payment.

(See Notes

9 and 10)<

Chapter 17: Pay and Step Changes

15

Chapter 17 Guide to Processing Personnel Actions

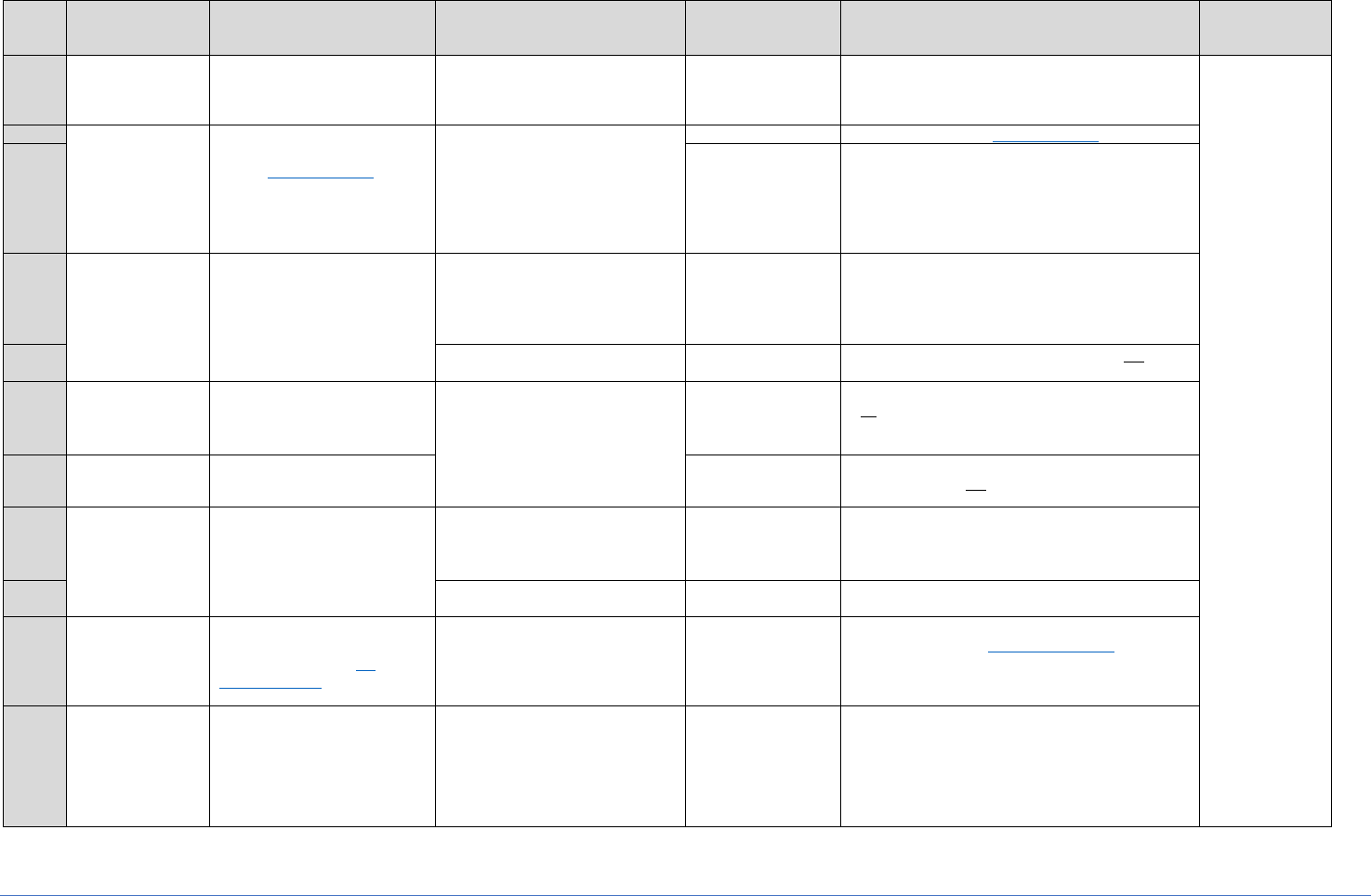

Table 17-B. Pay Changes Under the Senior Executive Service (SES) Pay System

>Notes and Remarks columns have been added.<

Rule

If Basis for Action is

>Then

Impact to

SES 12-

Month Rule

is<

Then

NOAC is

NOA is

Auth Code

Authority is

Notes

Remarks

1

Performance-based pay

increase ***>provided through

regular application of agency’s

annual appraisal and pay

adjustment cycle< (e.g., under

5 CFR 534.404(d) or (e)(1))

>Begins new

12-month

period for SES

member<

891

Reg Perf

Pay

Q3A

(Cite appropriate law, E.O.,

or regulation that authorizes

the action)

>5 CFR

534.404(b)(3)

(See Note 2) <

1. If an SES member is granted a

retroactive pay increase under 5

CFR 534.404(f)(1), the increase

may be a combination of

increases under rules 1 and 3.

The increases must be

separately documented, just as

they would have been if the

increases had been put into

effect at earlier time.

2. ***>Increases in senior

executive pay must be based on

the employee’s performance

and/or contribution to the

agency’s performance, as

determined by the agency

through the administration of its

performance management

system for its senior executives

(5 CFR 534.401; 5 CFR

430.312(a)).<

3. ***

4. If an SES member receives a

pay adjustment under 5 CFR

534.404(h) upon transfer,

document the action using rule

15 or 16, as appropriate, in

Chapter 13, Table 13-A.

5. ***

Jump to

listing of

Remarks (Use

as many

remarks as

are

applicable)

2

Performance-based pay

increase ***>that is not

covered by Rule 1 and begins a

new 12-month period for the

SES member (e.g., under 5 CFR

534.404(c)(4)(i)-(iv) or

534.404(i))<

>If within 12

months of last

pay

adjustment,

requires

agency head

or oversight

official to

approve

exception<

892

Irreg Perf

Pay

Q3B

(Cite appropriate law, E.O.,

or regulation that authorizes

the action)

> (See Note 2) <

3

***>An increase provided

under 5 CFR 534.404(b)(4)

which does not exceed the

amount necessary to maintain

relative position of executive’s

pay rate within the SES rate

range and is not considered a

pay adjustment for purposes of

the 12 month rule.<

>Does not

require an

exception or

affect an

ongoing 12-

month

period<

890

Misc Pay

Adj

Q3C

>5 CFR 534.404(b)(4)

(See Note 2)<

4

Other pay increase ***>that is

not considered a pay

adjustment for purposes of the

12-month rule (e.g., under 5

CFR 534.404(c)(3)(i)-(vii),

534.404(f), or 534.406(c))<

>Does not

require an

exception or

affect an

ongoing 12-

month

period<

Q3D

(Cite appropriate law, E.O.,

or regulation that authorizes

the action)

5

***

***

***

***

6

Rate reduction for performance

or disciplinary reasons (i.e.,

under 5 CFR 534.404(b)(6))

Does not

require an

exception or

affect an

ongoing 12-

month period

897

Pay Reduct

Q3F

>5 CFR 534.404(b)(6)<

Chapter 17: Pay and Step Changes

16

Chapter 17 Guide to Processing Personnel Actions

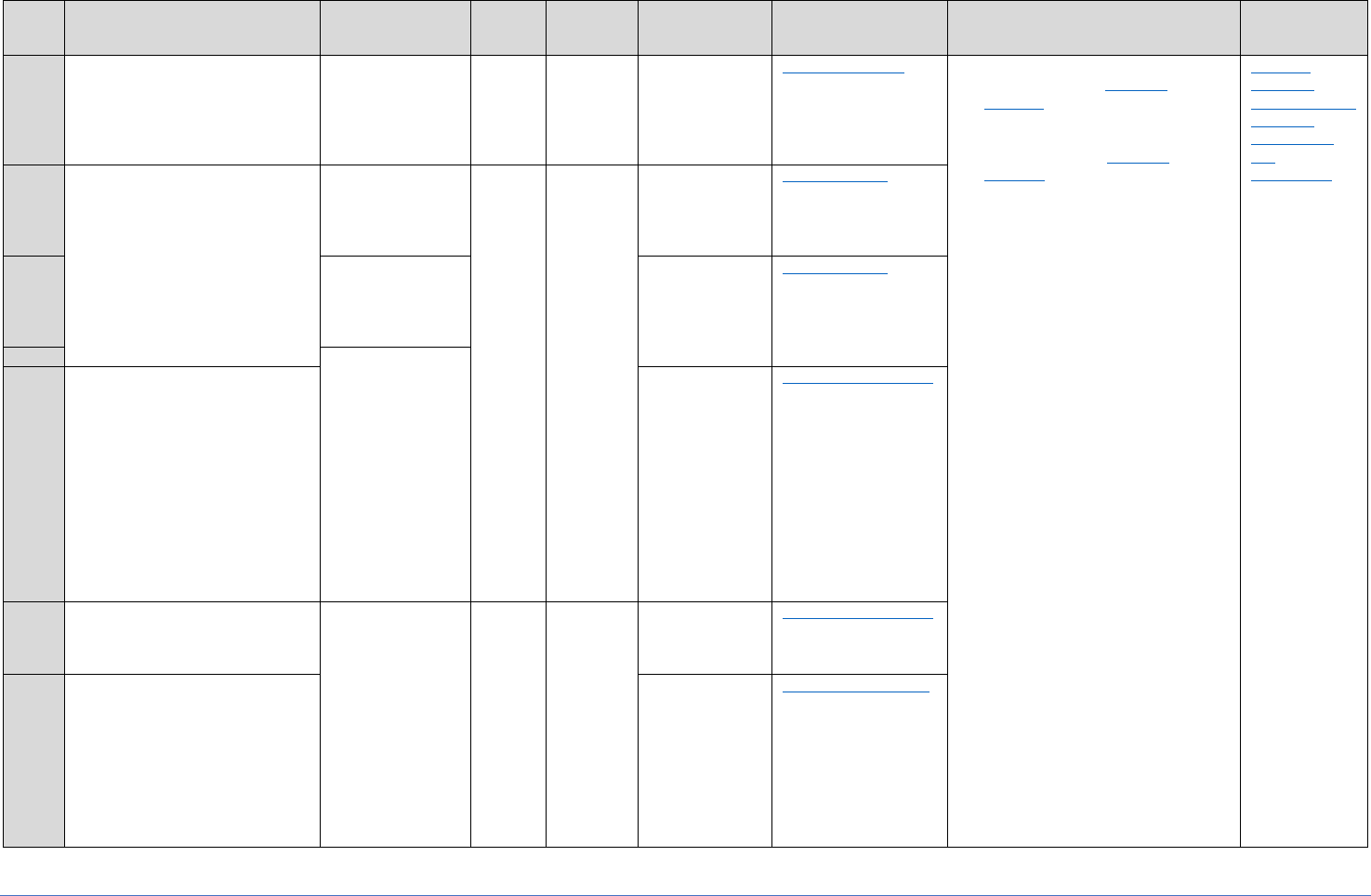

Table 17-C. Pay and Step Changes Under Prevailing Rate Systems

>Notes and Remarks columns have been added.<

Rule

If Employee

And

Then

NOAC

is

NOA is

Auth code is

(See notes 2

and 3)

Auth is

Notes

Remarks

1

Receives a within-grade

increase

893

Reg WRI

VUL

5 U.S.C. 5343(e)(2)

1. Be sure to change the step to

“00” and to change the Pay Rate

Determinant (PRD).

2. If employee is entitled to grade

retention, VLJ - 5 U.S.C.

5362(c) may be cited as the

second authority.

3. If employee is entitled to pay

retention, VSJ - 5 U.S.C.

5363(a) may be cited as the

second authority.

Jump to

listing of

Remarks (Use

as many

remarks as

are

applicable)

2

Occupies a position that

changed from the General

Schedule to a Prevailing Rate

System

890

Misc Pay

Adj

FEM

Reg. 532.405

3

Occupies a position in a wage

area that is consolidated with

another wage area

894

Gen Adj

FTM

Reg. 532.415(a)

4

Has basic rate of pay adjusted

by application of special rates

or schedules authorized by

OPM for recruitment and

retention

FGM

Reg. 532.251

5

Has basic rate of pay adjusted

because special rates range is

established for leader,

supervisor or production

facilitating positions

F8M

Reg. 532.253

6

Is subject to a reduction in a

prevailing rate schedule

resulting from the findings of a

wage survey

Employee's

existing rate is

higher than the

new maximum

rate allowed for

employee's

grade level and

employee is

entitled to pay

retention

899

Step Adj

(See

note 1)

FNM

Reg. 532.415(c)

7

Employee's

existing rate falls

between two

rates in the new

schedule and

employee's pay

will be set at the

higher rate

890

Misc Pay

Adj

RJR

Reg. 536.304(b)(1)

Table 17-C: Pay and Step Changes under Prevailing Rate Systems, Continued

17

Chapter 17: Guide to Processing Personnel Actions

Rule

If Employee

And

Then

NOAC

is

NOA is

Auth code is

(See notes 2

and 3)

Auth is

Notes

Remarks

8

Has basic rate of pay adjusted

by application of a new or

revised wage schedule not

covered in Rules 3-7 (e.g., to

implement results of an annual

wage survey)

894

Gen Adj

FNM

Reg. 532.415(c)

2. If employee is entitled to grade

retention, VLJ - 5 U.S.C.

5362(c) may be cited as the

second authority.

3. If employee is entitled to pay

retention, VSJ - 5 U.S.C.

5363(a) may be cited as the

second authority.

Jump to

listing of

Remarks (Use

as many

remarks as

are

applicable)

9

Is subject to termination of

grade retention benefits

because 2-year period has

expired

Employee is

entitled to

complete

another period of

grade retention

866

Terminati

on of

Grade

Retention

VKJ

5 U.S.C. 5362

10

Employee is

entitled to a

retained rate

under pay

retention

VRJ

5 U.S.C. 5363

11

Employee is

entitled to a rate

of basic pay that

is equal to or

higher than

***>their<

existing rate,

which rate can

be

accommodated

within the range

of the

employee's

grade

12

Is subject to termination of

grade retention because

employee declined a

reasonable offer

VNJ

5 U.S.C. 5362(d)(3)

13

Is subject to termination of

grade retention because

employee elected to terminate

benefits

866

Terminati

on of

Grade

Retention

VPL

5 U.S.C. 5362(d)(4)

14

Is subject to termination of

grade retention benefits

because employee failed to

enroll in or comply with

agency's priority placement

program requirements

RLM

Reg. 536.207(b)(2)

Table 17-C: Pay and Step Changes under Prevailing Rate Systems, Continued

18

Chapter 17: Guide to Processing Personnel Actions

Rule

If Employee

And

Then

NOAC

is

NOA is

Auth code is

(See notes 2

and 3)

Auth is

Notes

Remarks

15

Is subject to termination of

pay retention because

employee declined a

reasonable offer

890

Misc Pay

Adj

VTJ

5 U.S.C. 5363(e)(2)

2. If employee is entitled to grade

retention, VLJ - 5 U.S.C.

5362(c) may be cited as the

second authority.

3. If employee is entitled to pay

retention, VSJ - 5 U.S.C.

5363(a) may be cited as the

second authority.

Jump to

listing of

Remarks (Use

as many

remarks as

are

applicable)

16

Is subject to termination of

pay retention because of pay

schedule adjustment under

which employee becomes

entitled to a higher rate of pay

than that to which employee is

entitled under 5 U.S.C. 5363

(e.g., see 5 U.S.C. 5363(e)(2))

894

Gen Adj

ZLM

Other citation (Law,

E.O, Reg.)

17

Has rate of basic pay adjusted

as a result of the termination

of grade retention

890

Misc Pay

Adj

(Enter same

code as was

used for the

866/

Termination of

Grade

Retention

action)

(Enter same

authority as was

used for the 866/

Termination of

Grade Retention

action)

18

Is subject to an adjustment in

basic rate of pay that is not

described in

Rules 1-17

ZLM

(Enter E.O., Law or

Reg. that adjusted

pay)

Chapter 17: Pay and Step Changes

19

Chapter 17 Guide to Processing Personnel Actions

Table 17-D. Pay and Step Changes Under Pay Systems Not Captured in Tables 17-A thru 17-C

(including General Schedule ***>physicians, podiatrists, and dentists< with pay plan codes GP or GR who

are receiving market pay) >Notes and Remarks columns have been added<.

Rule

If Basis for Action is

And

Then

NOAC

is

NOA is

Auth

Code

is

Authority is

(See note 1)

Notes

Remarks

1

General market or

structural pay adjustment

(including employee pay

adjustment linked to rate

range adjustment; labor

market adjustment; and

establishment of or

adjustment to basic pay

supplement based on

location, occupation or

other factors)

(See note 2 and

5)

894

Gen Adj

ZLM

Other Citation

(Law, E.O.,

Reg).

1. For agency determined changes, the authority for

employees in senior-level (pay plan SL) and

scientific and professional (pay plan ST) positions is

5 U.S.C. 5376; for employees in Agency Board of

Contract Appeals positions (pay plan CA), the

authority is 5 U.S.C. 5372a; for administrative

appeals judges (pay plan AA), the authority is 5

U.S.C. 5372b; and for administrative law judges

(pay plan AL), the authority is 5 U.S.C. 5372. For

employees in positions under other pay plans, cite

the authority that established the pay plan.

2. Increases under rule 1 are generally the same for all

employees within a category without regard to the

level of performance, except that the increase may

be denied to employees rated unacceptable or below

fully successful. No action is processed if an

employee does not receive a general pay

adjustment. However, if a zero pay adjustment at

the time of an increase in the pay range minimum

causes an employee’s rate of basic pay to fall below

that range minimum, an 800 action must be

processed to document the change to pay rate

determinant code “T”, consistent with rule 7 of Table

28-A in Chapter 28 (refer to note 4 for guidance on

documenting zero pay adjustments for employees in

senior-level (pay plan SL) and scientific and

professional (pay plan ST) positions).

5. For employees in senior-level (pay plan SL) and

scientific and professional positions (pay plan ST),

rule 4 applies to off-cycle increases authorized

under 5 CFR 534.510, rule 8 applies to voluntary

reductions in basic pay, e.g., as described in 5 CFR

534.508(c) or (d), and rule 2 applies to an increase

in basic pay required under 5 CFR 534.507(g) to

ensure the employee’s rate of basic pay does not fall

below the minimum rate of the applicable rate range

for an SL or ST employee.

Jump to

listing of

Remarks

(Use as

many

remarks as

are

applicable)

Table 17-D. Pay and Step Changes Under Pay Systems Not Captured in Tables 17A thru 17-C (Including General Schedule

***>physicians, podiatrists, and dentists< with pay plan codes GP or GR who are receiving Title 38 market pay, Continued

20

Chapter 17: Guide to Processing Personnel Actions

Rule

If Basis for Action is

And

Then

NOAC

is

NOA is

Auth

Code

is

Authority is

(See note 1)

Notes

Remarks

2

Within-range increase

provided on a regular

cycle

The system (with

or without steps)

provides within-

range increases

on a regular cycle

where all

employees rated

fully successful or

higher get the

same within-

range increases

on same regular

cycle (See note

3)

893

Reg WRI

ZLM

Other Citation

(Law, E.O.,

Reg).

1. For agency determined changes, the authority for

employees in senior-level (pay plan SL) and

scientific and professional (pay plan ST) positions is

5 U.S.C. 5376; for employees in Agency Board of

Contract Appeals positions (pay plan CA), the

authority is 5 U.S.C. 5372a; for administrative

appeals judges (pay plan AA), the authority is 5

U.S.C. 5372b; and for administrative law judges

(pay plan AL), the authority is 5 U.S.C. 5372. For

employees in positions under other pay plans, cite

the authority that established the pay plan.

3. While the applicability of rule 2 is based on the

treatment of employees rated fully successful or

higher, the rule is not limited to those employees. A

given pay system may provide within-range

increases on a regular time cycle to employees rated

below fully successful, and those increases may be

equal to or less than the increases given to those

rated fully successful or higher. As long a such a

pay system provides equal increases to employees

rated fully successful or higher, rule 2 also applies to

any regular within-range increases received by

employees in that system who are rated below fully

successful. (Also See note 4 ).

4. While the applicability of rule 3 is based on the

treatment of employees rated fully successful or

higher, the rule is not limited to those employees. A

performance-based pay system may provide within-

range increase on a regular time cycle to employees

rated below fully successful. As long as such a pay

system provides at least two levels of regular pay

increases for employees rated fully successful or

higher, rule 3 also applies to any regular pay

increases received by employees in that system who

are rated below fully successful. For employees in

senior-level (pay plan SL) and scientific and

professional (pay plan ST) positions rule 3 applies to

annual increases in basic pay under 5 CFR

534.507(a), including those zero-pay adjustments

meeting the requirement of 5 CFR 534.507(a)(2).

Jump to

listing of

Remarks

(Use as

many

remarks as

are

applicable)

Table 17-D. Pay and Step Changes Under Pay Systems Not Captured in Tables 17A thru 17-C (Including General Schedule

***>physicians, podiatrists, and dentists< with pay plan codes GP or GR who are receiving Title 38 market pay, Continued

21

Chapter 17: Guide to Processing Personnel Actions

Rule

If Basis for Action is

And

Then

NOAC

is

NOA is

Auth

Code

is

Authority is

(See note 1)

Notes

Remarks

3

Performance-based pay

increase provided on a

regular cycle (e.g.,

annual, certain zero pay

adjustments for SL and

ST employees, etc.) (See

note 4)

There are at least

two levels of

performance-

based pay

increases for

employees rated

fully successfully

or higher

891

Reg Perf

Pay

Q3A

(Cite

appropriate

law, E.O., or

regulation

that

authorizes

the action)

1. For agency determined changes, the authority for

employees in senior-level (pay plan SL) and

scientific and professional (pay plan ST) positions is

5 U.S.C. 5376; for employees in Agency Board of

Contract Appeals positions (pay plan CA), the

authority is 5 U.S.C. 5372a; for administrative

appeals judges (pay plan AA), the authority is 5

U.S.C. 5372b; and for administrative law judges

(pay plan AL), the authority is 5 U.S.C. 5372. For

employees in positions under other pay plans, cite

the authority that established the pay plan.

4. While the applicability of rule 3 is based on the

treatment of employees rated fully successful or

higher, the rule is not limited to those employees. A

performance-based pay system may provide within-

range increases on a regular time cycle to

employees rated below fully successful. As long as

such a pay system provides at least two levels of

regular pay increases for employees rated fully

successful or higher, rule 3 also applies to any

regular pay increases received by employees in that

system who are rated below fully successful. For

employees in senior-level (pay plan SL) and

scientific and professional (pay plan ST) positions

rule 3 applies to annual increases in basic pay under

5 CFR 534.507(a), including those zero pay

adjustments meeting the requirement of 5 CFR

534.507(a)(2).

5. For employees in senior-level (pay plan SL) and

scientific and professional positions (pay plan ST),

rule 4 applies to off-cycle increases authorized

under 5 CFR 534.510, rule 8 applies to voluntary

reductions in basic pay, e.g., as described in 5 CFR

534.508(c) or (d), and rule 2 applies to an increase

in basic pay required under 5 CFR 534.507(g) to

ensure the employee’s rate of basic pay does not fall

below the minimum rate of the applicable rate range

for an SL or ST employee.

Jump to

listing of

Remarks

(Use as

many

remarks as

are

applicable)

4

Performance-based pay

increase provided on an

irregular basis (See note

5)

892

Irreg Perf

Pay

Q3B

(Cite

appropriate

law, E.O., or

regulation

that

authorizes

the action)

Table 17-D. Pay and Step Changes Under Pay Systems Not Captured in Tables 17A thru 17-C (Including General Schedule

***>physicians, podiatrists, and dentists< with pay plan codes GP or GR who are receiving Title 38 market pay, Continued

22

Chapter 17: Guide to Processing Personnel Actions

Rule

If Basis for Action is

And

Then

NOAC

is

NOA is

Auth

Code

is

Authority is

(See note 1)

Notes

Remarks

5

Base pay increase for a

group of employees in

recognition of group

performance/contributions

896

Group Inc

ZLM

Other Citation

(Law, E.O.,

Reg).

1. For agency determined changes, the authority for

employees in senior-level (pay plan SL) and

scientific and professional (pay plan ST) positions is

5 U.S.C. 5376; for employees in Agency Board of

Contract Appeals positions (pay plan CA), the

authority is 5 U.S.C. 5372a; for administrative

appeals judges (pay plan AA), the authority is 5

U.S.C. 5372b; and for administrative law judges

(pay plan AL), the authority is 5 U.S.C. 5372. For

employees in positions under other pay plans, cite

the authority that established the pay plan.

5. For employees in senior-level (pay plan SL) and

scientific and professional positions (pay plan ST),

rule 4 applies to off-cycle increases authorized

under 5 CFR 534.510, rule 8 applies to voluntary

reductions in basic pay, e.g., as described in 5 CFR

534.508(c) or (d), and rule 2 applies to an increase

in basic pay required under 5 CFR 534.507(g) to

ensure the employee’s rate of basic pay does not fall

below the minimum rate of the applicable rate range

for an SL or ST employee.

Jump to

listing of

Remarks

(Use as

many

remarks as

are

applicable)

6

Reduction in an

employee’s base rate of

pay within a salary range

based on unacceptable

performance and/or

conduct

897

Pay

Reduct

ZLM

Other Citation

(Law, E.O.,

Reg).

7

Step adjustment that

does not result in a pay

adjustment (in a step-

based pay system)

899

Step Adj

ZLM

Other citation

(Law, E.O.,

Reg.)

8

Other miscellaneous pay

adjustment not covered

by rules 1-7 above (See

note 1 and 5)

890

Misc Pay

Adj

ZLM

Other citation

(Law, E.O.,

Reg.)

9

Establishment or

termination of availability

pay

819

Availability

Pay

Z2S

5 U.S.C.

5545a

10

Establishment, change in,

or termination of

administratively

uncontrollable overtime

entitlement

818

AUO

RMM

Reg. 550.151

>11<

Establishment, change in

percentage, or

termination of overseas

locality payment for a

Domestic Employee

Teleworking Overseas

(DETO)

894

Gen Adj

Z2Y

>P.L. 117-

263, Sec.

9717 - DETO

Locality

Payment.

(See Notes

6 and 7)<

6. >Refer to OPM’s Information on New Overseas

Locality Pay for DETO employees dated 02/17/2023.

7. As section 9717 of P.L. 117-263 changes the

authority under which DETO employees receive

locality pay, NOAC 894/LAC ZLM must be used to

process the action, regardless of whether the

locality payment amount changes or remains the

same.<

Chapter 17: Pay and Step Changes

23

Chapter 17 Guide to Processing Personnel Actions

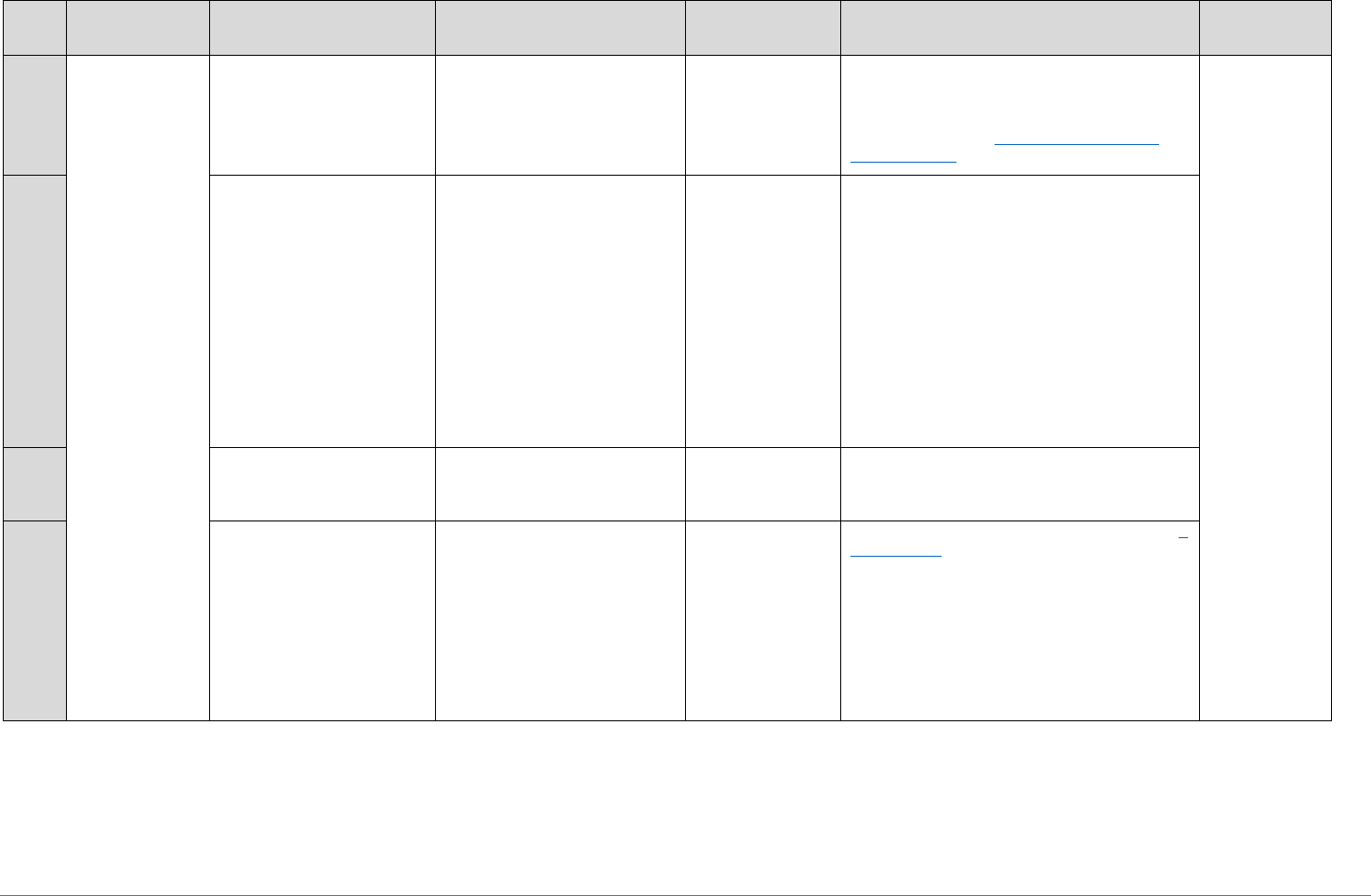

Table 17-E. Codes and Remarks for Pay and Step Changes (*Use as many remark codes as apply)

Return to table 17-A, 17-B, 17-C, 17-D

>Notes column has been added.<

Rule

>If Basis for

the Action is<

If

And

Then Remark

Code Is

And Remark Is

Notes

1

Action is a within-grade

increase (WGI)

P14

Work performance is at an acceptable level

of competence.

>Reserved for

Future Use<

2

The amount of time the

employee was in nonpay

status requires that the due

date for the WGI be set back

P13

Effective date adjusted due to excess time in

nonpay status of (number) hours.

3

Granted to an employee who

is entitled to grade retention

X46

Action gives employee within-grade

increase/quality increase to step [number]

of [pay plan and grade], retained grade.

4

Action is a quality step

increase

Granted to a GS employee

who is entitled to grade

retention

X46

Action gives employee within-grade

increase/quality increase to step [number]

of [pay plan and grade], retained grade.

5

Decision is made to

withhold WGI to GS

employee

Employee is not entitled to

grade retention

P15

Within-grade increase to step [number]

denied because your work is not at an

acceptable level of competence. You remain

at GS [number], step [number].

6

Employee is entitled to grade

retention

X47

Action denies within-grade increase to step

[number] of employee’s retained grade.

7

Decision is made to

withhold WGI to GM

employee

P91

Within-grade increase denied because your

work is not at an acceptable level of

competence. Your salary does not change.

8

Action is a 890/Misc Pay

Adj or 894/Gen Adj

Employee is entitled to pay

retention

X40

Employee is entitled to pay retention.

9

Employee is entitled to grade

retention

X44

Employee is entitled to grade retention

10

Employee is entitled to

grade retention

X37

Employee is entitled to retain grade of [pay

plan and grade] through [date].

X45

Retained grade will be used to determine

employee’s pay, retirement and insurance

benefits, and promotion and training

eligibility.

X61

Retained grade will not be used for

reduction-in-force purposes.

Table 17-E. Codes and Remarks for Pay and Step Changes, Continued

24

Chapter 17: Guide to Processing Personnel Actions

Rule

>If Basis for

the Action is<

If

And

Then Remark

Code Is

And Remark Is

Notes

11

Employee is entitled to pay

retention

X67

Employee receiving retained rate in excess

of maximum adjusted rate of basic pay for

employee’s grade; not entitled to locality

payment or special rate supplement.

>Reserved for

Future Use<

12

Action terminates

employee’s entitlement to

grade retention

Eligibility has expired for

current period, and employee

not entitled to new period of

grade retention

X43

Expiration of grade retention period as [pay

plan and grade].

13

Employee elected to terminate

grade retention entitlement

X39

Employee elected to terminate grade

retention entitlement.

14

Action terminates

employee’s entitlement to

grade retention

Employee declined position

offered

X48

Declined offer of [position title; pay plan;

series; and grade, level, or band].

15

Employee didn’t comply with

priority placement program

requirements

X50

Failed to comply with priority placement

program requirements.

16

No further entitlement to

grade or pay retention

X36

Grade retention entitlement terminated. No

further entitlement to grade or pay

retention.

17

Employee is entitled to begin

pay retention

X40

Employee is entitled to pay retention.

18

Employee entitled to begin

another period of grade

retention

X37

Employee is entitled to retain grade of [pay

plan and grade] through [date].

X45

Retained grade will be used to determine

employee’s pay, retirement and insurance

benefits, and promotion and training

eligibility.

X61

Retained grade will not be used for

reduction-in-force purposes.

19

Employee becomes entitled

to pay retention

Initial retained rate is equal to

applicable cap - 150% of

maximum rate for grade to

which assigned or level IV of

Executive Schedule

X41

Employee is now entitled to retained rate.

Salary is equal to applicable cap on retained

rates - 150% of maximum rate of grade to

which assigned or level IV of the Executive

Schedule.

20

Action is terminating pay

retention

Adjustment in pay schedule

results in employee being

entitled to a rate of pay equal

to or higher than that to

which entitled under pay

retention (5 U.S.C.

5363(e)(2))

X42

Pay retention entitlement terminated.

Table 17-E. Codes and Remarks for Pay and Step Changes, Continued

25

Chapter 17: Guide to Processing Personnel Actions

Rule

>If Basis for

the Action is<

If

And

Then Remark

Code Is

And Remark Is

Notes

21

Action is terminating pay

retention

Employee declined position

offered

X48

Declined offer of [position title; pay plan;

series; and grade, level, or band].

>Reserved for

Future Use<

22

Employee is being paid a

special rate established

under 5 U.S.C. 5305

P05

Special rate under 5 U.S.C. 5305.

23

P07

Special rate table _______.

24

Employee’s total salary

includes payment for AUO

Action is an 818/AUO that

establishes/changes percent

paid for AUO

P73

Block 20 shows the percent of your rate of

adjusted basic pay which is paid to you for

the substantial, irregular overtime work you

perform which cannot be controlled

administratively.

25

Action is other than an

818/AUO

P81

Salary in block 20 includes AUO of $ .

26

Total salary includes

availability pay

P99

Salary in block 20 includes availability pay of

$ .

27

Total salary includes

supervisory differential

P72

Salary in block 20 includes supervisory

differential of $ .

28

Action is an 894/Gen Adj

Special rate exceeds the

locality rate of pay

P93

Special rate exceeds the locality rate of pay;

employee receives higher special rate

supplement (in block 20B) instead of locality

payment.

29

Rule 28 does not apply

P92

Salary includes a locality-based payment of

____% (in block 20B).

30

Employee is subject to the

post-employment

restrictions under 18

U.S.C. 207(c).

M97

Employee subject to post-employment

restrictions under 18 U.S.C. 207(c).

31

Employee is a GS law

enforcement officer

entitled to special base

rate at grades 3 through

10 (GL pay plan code)

P11

Basic pay in block 20A is law enforcement

officer special base rate, which is higher

than normal GS rate.

Table 17-E. Codes and Remarks for Pay and Step Changes, Continued

26

Chapter 17: Guide to Processing Personnel Actions

Rule

>If Basis for

the Action is<

If

And

Then Remark

Code Is

And Remark Is

Notes

>32<

>Establishment,

change in

percentage, or

termination of

overseas

locality

payment for a

Domestic

Employee

Teleworking

Overseas

(DETO)<

>Employee is commencing

a temporary assignment

working under a DETO

agreement<

>Employee is commencing to

receive DETO locality pay<

>P21<

>Employee is commencing a temporary

assignment working under a Domestic

Employee Teleworking Overseas (DETO)

Agreement and commencing to receive

DETO locality pay (section 9717 of Public

Law 117-263).<

>Reserved for

Future Use<

>33<

>The percentage amount

of the DETO locality

payment is changing due

to (1) a change in the

locality pay percentage for

the employee’s former

U.S. location, (2) a change

in the DC locality pay

percentage, or (3) a

change in relationship

between locality pay in the

former U.S. location and

locality pay in DC (i.e., a

change in which one those

rates is lesser)<

>Rate of pay needs to be

adjusted due to locality

changes<

>P22<

>Employee’s DETO locality payment has

been adjusted due to changes in the payable

locality pay percentage.<

>34<

>The overseas locality

payment for a DETO is

terminated for any

reason.<

>Domestic Employee

Teleworking Overseas (DETO)

Agreement expires<

>P23<

>Employee is no longer entitled to locality

pay in connection with a Domestic Employee

Teleworking Overseas (DETO) Agreement.<

>35<

>When an employee’s

DETO locality pay is

terminated via a General

Adjustment (NOAC

894/LAC ZLM)<

>The employee will be

receiving locality pay under 5

U.S.C. 5304, then an

additional General Adjustment

must be processed, with the

same effective date, returning

the employee to locality pay

under 5 U.S.C. 5304 (NOAC

894/LAC VGR – see rule 23 of

Table 17-A, GPPA Chapter

17).<

>P24<

>Employee is entitled to locality pay under 5

U.S.C. 5304.<