The IRS Independent Office of Appeals Mission

To resolve Federal tax controversies without litigation on a basis which is fair and impartial to both the

Government and the taxpayer, promotes a consistent application and interpretation of, and voluntary

compliance with, the Federal tax laws, and enhances public confidence in the integrity and efficiency of the

Service.

Introduction

Your Appeal Rights and

How to Prepare a Protest

if You Disagree

Publication 5 (Rev. 4-2021) Catalog Number 46074I Department of the Treasury Internal Revenue Service www.irs.gov

This publication explains actions you should take

prior to requesting an administrative appeal of

your tax case if you don’t agree with the Internal

Revenue Service’s (IRS) proposed changes or

findings. It also provides an overview of your

administrative appeal rights within the IRS and a

summary of your rights to have your case heard in

the United States Federal Courts.

While this publication mainly focuses on disputes

resulting from an examination of a tax return or

claim for refund or credit, the information on how

to prepare a protest also applies to disputes

resulting from many other types of IRS actions,

including, but not limited to the following:

Denial of a request for certain penalty

abatement

Denial of a request for innocent spouse relief

Rejection of an offer in compromise

Determination that you owe a penalty

Determination affecting tax-exempt status

Determination affecting qualication of a

retirement plan

These actions result in a proposed change to your

Federal tax liability, a denial of your request to

change your Federal tax liability, or a change to

your reporting requirements. This publication refers

to all these actions as proposed changes.

The Taxpayer Bill of Rights states you have the

right to appeal an IRS decision in an independent

forum. You are entitled to a fair and impartial

administrative appeal of most IRS decisions,

including many penalties, and have the right to

receive a written response regarding the IRS

Independent Office of Appeals’ (hereinafter,

Appeals) decision. You also generally have the right

to take your case to court. For more information on

the Taxpayer Bill of Rights, see Publication 1, Your

Rights as a Taxpayer.

2

Additional Resources

For some types of cases, the appeals process

and available court actions are different than a

tax deficiency or claim disallowance case, which

are overwhelmingly the most common disputes

in Appeals. See www.irs.gov/appeals for more

information. The letter that you received from the

IRS proposing the changes may contain important

information about the appeal rights available to

you for your specific type of case, including how

to request an appeal and what will happen if you

decide not to appeal.

If your case involves one of the issues listed in

the table on this page, refer to the appropriate

publication for specific guidance. Visit www.irs.

gov/forms-instructions or call 800-TAX-FORM

(800-829-3676) for IRS Publications.

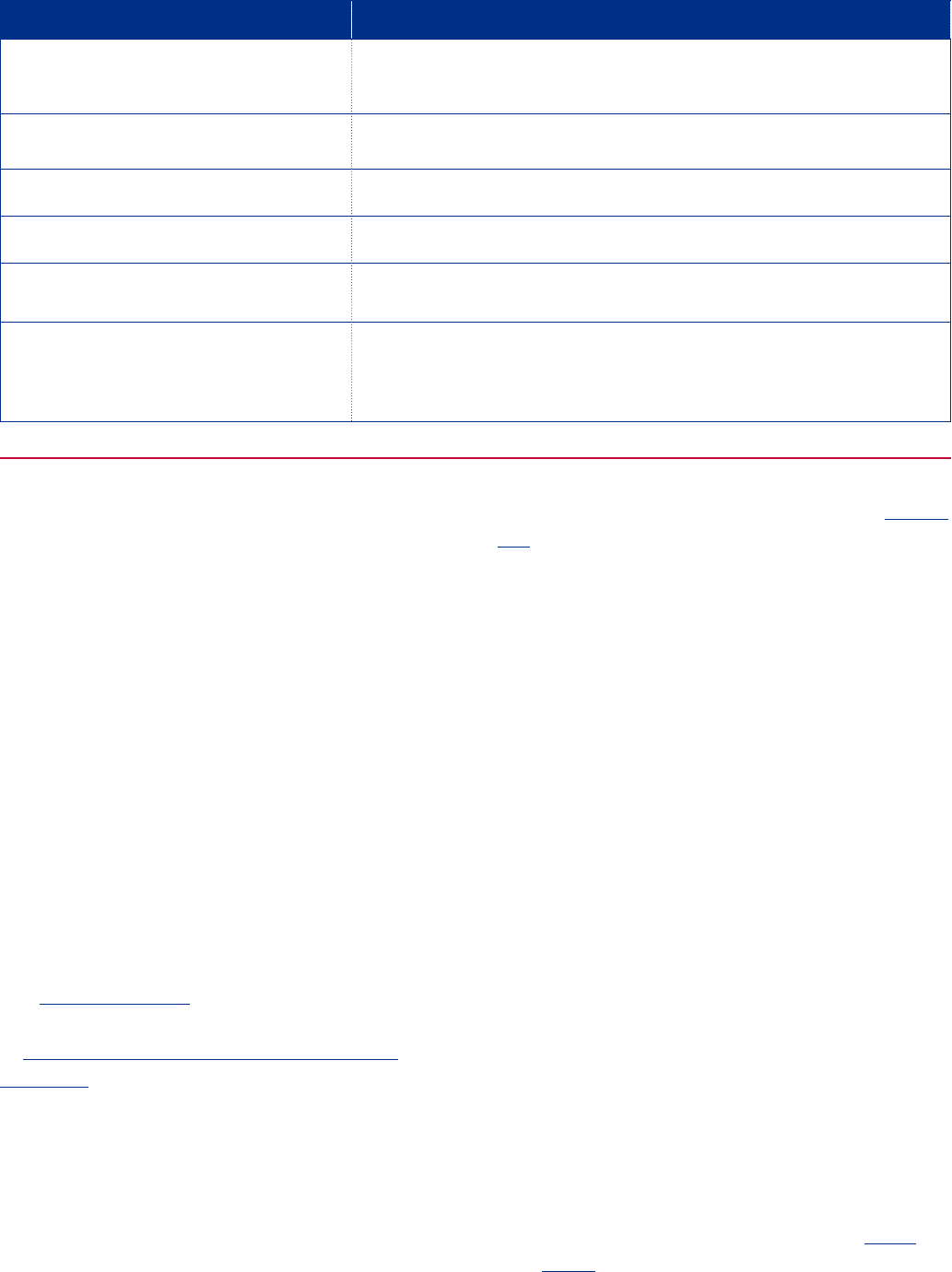

If your case involves… Refer to…

A change in tax-exempt

status

Publication 892, How to Appeal

an IRS Determination on Tax-

Exempt Status

An employee plans

examination change

Publication 1020, Appeal

Procedures Employee Plans

Examinations

An employment tax

examination change

Publication 5146, Employment

Tax Returns: Examinations and

Appeal Rights

Disqualification of a

retirement plan

Publication 5153, Appeal

Procedures: Adverse

Determination Letter on

Qualification of a Retirement Plan

If You Don’t Agree

Before you request an appeal, make sure that

you have provided the IRS employee handling

your case with any information, documents, and

explanations that the employee requested, or that

you would like the IRS to consider. If you have

not submitted this information, contact the IRS

employee identified in the letter you received and

provide this information within the specified time

limit. If you provide new information or raise new

issues to Appeals that the IRS has not previously

considered, it may first need to be considered

by an IRS employee, which will likely delay

the resolution of your case. See The Appeals

Conference on page 5.

If you don’t agree with the changes proposed

by the IRS, you may contact the IRS employee

identified in the letter you received to discuss

the issues. Generally, if you cannot reach an

agreement with the IRS employee, you may

request a discussion with the employee’s

supervisor. If you still don’t agree after your

attempts to resolve the matter with the IRS

employee and/or supervisor, you may request Fast

Track Settlement (FTS) if your case qualifies, or an

administrative appeal with Appeals. See Protests

on page 3 for more information on how to request

an administrative appeal.

If You Do Nothing…

And Your Case Is… The IRS Will…

An examination of your income, estate

(and generation-skipping transfer), gift (and

generation-skipping transfer), or certain excise

taxes or penalties, with a proposed deficiency

Send you a notice of deficiency allowing you a limited time to petition the U.S. Tax

Court for redetermination. If you don’t timely petition the U.S. Tax Court, the IRS will

send you a bill for the amount due.

An examination of your employment tax

liabilities

Send you a bill for the amount due relating to issues not reviewable by the U.S.

Tax Court. In certain instances, you may receive a Notice of Employment Tax

Determination Under IRC 7436 which affords you a limited time to petition the U.S.

Tax Court. If you don’t timely petition the U.S. Tax Court, the IRS will send you a bill

for the amount due relating to the issues included in that notice. Refer to Publication

5146, Employment Tax Returns: Examinations and Appeal Rights; and Publication

3953, Questions and Answers About Tax Court and the Notice of Employment Tax

Determination Under IRC § 7436.

3

And Your Case Is… The IRS Will…

A denial of a claim for refund Send you a notice of claim disallowance explaining that you have a limited time to

file suit with the appropriate U.S. District Court or the U.S. Court of Federal Claims.

You may have already received this notice.

A proposal of a trust fund recovery penalty or

certain information return penalties

Send you a bill for the amount due.

A rejection of an offer in compromise (OIC)

based on doubt as to liability.

Continue collection action after the expiration of a 30 day period following the

rejection, as warranted.

A denial of a penalty abatement Close your case without abating the penalty.

A denial of a request for innocent spouse relief Generally send you a final determination letter regarding your request allowing you a

limited time to petition the U.S. Tax Court.

A determination on tax-exempt status or on

qualification of a retirement plan

Send you a final adverse determination letter. In general, if you do not file a protest

to the proposed adverse letter, you cannot appeal the final adverse determination

letter. In addition, you must have exhausted your administrative remedies to be able

to seek a declaratory judgment in court.

In certain IRS cases, you may request an

expedited dispute resolution process called Fast

Track Settlement (FTS). The disputed issue must

be fully developed and the IRS must agree to

participate in this process. During FTS, your case

remains in the examiner’s jurisdiction while a

specially trained Appeals employee serves as a

neutral party using dispute resolution techniques

to facilitate an agreement between you and the

IRS. You may withdraw from the FTS process at

any time. You will retain your usual appeal rights if

any issues remain unresolved.

To request FTS, inform the IRS employee handling

your case that you are interested in FTS. If the

examination division agrees to participate in this

process, they will work with you to jointly complete

the necessary form to start the process.

See Publication 4167 or the Appeals Mediation

- Alternative Dispute Resolution (ADR) website

at www.irs.gov/appeals/appeals-mediation-

programs for more information on FTS and other

Appeals’ ADR programs.

Protests

You must submit a written protest to request

an Appeals conference. The Appeals employee

assigned to your case will use your protest to

prepare for the Appeals conference. Refer to Notice

609, Privacy Act Notice, for more information about

how the IRS uses information you provide.

Send your protest to the IRS address in the letter

you received within the time limit specified in the

letter. A formal protest is required in all cases

unless you qualify for a small case request, as

discussed below, or another appeal procedure.

Small Case Request

If the total amount of tax and penalties for each

tax period involved is $25,000 or less in the letter

you received, you may make a small case request

instead of filing a formal written protest. See under

“Formal Written Protest” for cases that are not

eligible for small case requests. In computing

the total amount, include a proposed increase or

decrease in tax (including penalties), or claimed

refund. For an offer in compromise, the entire

amount for each tax period includes total unpaid

tax, penalty and interest due. For a small case

request, you may either:

Prepare a brief written statement listing the

disputed issues and why you disagree, or

Complete the appeal request form included

with the letter you received proposing the

change, if applicable, or you can use Form

12203, Request for Appeals Review.

Appeals Mediation Programs

4

Formal Written Protest

A formal written protest is required if the proposed

change to the total amount of tax and penalties

for any tax period is more than $25,000 in the

letter you received. The total amount includes

the proposed increase or decrease in tax and

penalties or claimed refund. If more than one tax

period is involved and any tax period exceeds the

$25,000 threshold, you must file a formal written

protest for all periods involved. For an offer in

compromise, include total unpaid tax, penalties

and interest due. A formal written protest is also

required in the following cases:

Employee plan and exempt organization cases

regardless of the dollar amount.

Partnership and S Corporation cases

regardless of the dollar amount.

In all other cases, unless you qualify for

the small case request procedure, or other

special appeal procedures, such as requesting

Appeals consideration of liens, levies, seizures,

or installment agreements. See Publication

1660, Collection Appeal Rights, for more

information on special collection appeals

procedures.

In your formal protest, include a statement that you

want to appeal the changes proposed by the IRS

and include all of the following:

Your name, address, and a daytime telephone

number.

List of all disputed issues, tax periods or years

involved, proposed changes, and reasons you

disagree with each issue.

Facts supporting your position on each

disputed issue.

Law or authority, if any, supporting your

position on each disputed issue.

Penalties of perjury statement, as follows:

“Under penalties of perjury, I declare to the best

of my knowledge and belief, the information

contained in this protest and accompanying

documents is true, correct, and complete.”

Note: Representatives who submit the protest

must use the applicable penalties of perjury

statement below, based upon whether they have

personal knowledge regarding the information

stated in the protest and accompanying

documents:

Personal Knowledge:

“Under penalties of perjury, I declare that I

submitted the protest and accompanying

documents, and to the best of my personal

knowledge and belief, the information

stated in the protest and accompanying

documents is true, correct, and complete.”

No Personal Knowledge:

“Under penalties of perjury, I declare that

I submitted the protest and accompanying

documents, and I have no personal

knowledge concerning the information

stated in the protest and accompanying

documents.”

Your (or your representative’s) signature under

the penalties of perjury statement.

IRS Independent Office of Appeals

Appeals is an independent function of the IRS,

separate from the division of the IRS that proposed

the changes. It is the only level of administrative

appeal within the IRS. Appeals employees fairly

and impartially settle disputes between taxpayers

and other divisions of the IRS by considering the

arguments made by both sides, and then applying

the relevant tax law (including court decisions and

other legal authorities) to the facts of the case.

Most disputes can be settled informally at the

Appeals level without litigation.

As an administrative function of the IRS, Appeals

can only consider your arguments if they are

based on tax laws. Appeals cannot consider

your arguments if they are based only on moral,

religious, political, constitutional, conscientious, or

similar objections to the assessment or payment of

Federal taxes.

The IRS is legally required to assess proposed tax

by a certain date in most cases. We refer to this

date as the statute of limitations. Generally, before

5

an examination case is received in Appeals, IRS

policy for originating functions may require greater

than 365 days remain on the statute of limitations.

The IRS will ask you to agree to extend this date

if additional time is needed to meet the required

number of days. If you choose not to extend the

date, Appeals will not accept your case. Note that

docketed U.S. Tax Court cases do not have the

statute of limitation concerns that non-docketed

cases do.

The Appeals Conference

Appeals conferences are held in an informal

manner. Appeals will contact you and/or your

authorized representative to arrange a conference

at a convenient time.

You may represent yourself at your appeals

conference, or you may appoint a person

authorized to practice before Appeals to

represent you such as an attorney, certified public

accountant, or enrolled agent. See Circular No.

230, Regulations Governing Practice Before the

Internal Revenue Service, for more information

on qualifications to practice before Appeals. You

may include a person who doesn’t meet these

qualifications in your appeals conference as a

witness, but they may not represent you before

Appeals.

If you want your representative to participate in

an appeals conference without you, you must

provide a properly completed power of attorney

to the IRS before the representative can receive

or inspect confidential information. You can use

Form 2848, Power of Attorney and Declaration

of Representative, or any other properly written

power of attorney or authorization for this purpose.

If you can’t afford representation, a Low Income

Taxpayer Clinics (LITC) may be able to represent

you if you qualify. In addition, LITCs also provide

assistance to taxpayers who speak English as a

second language to help taxpayers understand

their rights and responsibilities. You can find

more information about LITCs in Publication

4134, Low Income Taxpayer Clinic List. LITCs are

independent from the IRS. You can get copies of

Form 2848 or Publication 4134 from www.irs.gov,

an IRS office, or by calling 800-TAX-FORM (800-

829-3676).

You or your authorized representative should be

fully prepared to discuss all disputed issues and

the reasons you disagree with each issue at the

conference. If you submit new information or

raise a new issue requiring additional analysis,

Appeals will generally return the case to the

originating IRS office for its determination

on the new information. You will receive the

originating office’s comments, have an opportunity

to respond, and can continue to pursue your

appeal rights.

Court Actions

If you do not appeal your case within the IRS, or

were unable to reach a settlement with Appeals,

you may be able to take your case to one of the

following courts if you satisfy the court’s procedural

and jurisdictional requirements:

United States Tax Court

United States Court of Federal Claims

United States District Court in the judicial

district where you reside or have your principal

place of business

You can obtain rules from each court. These

courts are independent judicial bodies and have no

connection with the IRS.

U.S. Tax Court

You may be able to file a petition with the U.S. Tax

Court to review the changes proposed by the IRS.

The U.S. Tax Court is generally a “prepayment”

forum, which means you can petition the U.S.

Tax Court before making full payment, but its

jurisdiction is limited. You generally cannot petition

the U.S. Tax Court unless you have received a

notice or determination letter that informs you that

you have the right to do so. However, you may also

petition the Tax Court if you have not received a

notice or determination involving: a determination

of tax-exempt status under IRC 7428 if the IRS

has not made a determination after 270 days; the

6

abatement of interest if the IRS has not mailed a

final determination within 180 days of a claim for

abatement under IRC 6404; or an innocent spouse

relief request if the IRS has not issued a final

determination letter after six months since filing

Form 8857, Request for Innocent Spouse Relief.

You must file your petition with the U.S. Tax Court

within the timeframe specified in the notice, usually

90 days (or 150 days if the notice is addressed to a

person outside the United States). There is a filing

fee, but the fee may be waived if you qualify. The

law sets the time to file your petition; the IRS or the

U.S. Tax Court cannot change this time period. You

have only the timeframe specified to petition the

court, even if you continue to talk to IRS examiners

or Appeals.

You can get more information about the U.S. Tax

Court’s procedures and other matters on the

court’s website at www.ustaxcourt.gov or by

writing to:

U.S. Tax Court

Attn: Office of the Clerk of the Court

400 Second Street, N.W.

Washington, DC 20217-0002

If you timely petition the Tax Court, and you did not

previously appeal your case within the IRS, you will

normally have an opportunity to attempt settlement

with Appeals while you are waiting for your trial. The

Tax Court will still follow its normal procedures to

schedule your case for trial, but you may not need

to appear at trial if you settle your case before the

trial date. If unable to settle, you may appear pro

se (by yourself) at Tax Court or by a representative

admitted to the Tax Court that you appointed.

Caution: If the Tax Court determines that your case

is intended primarily to cause a delay, or that your

position is frivolous or groundless, the court can

impose a penalty against you of up to $25,000 in its

decision.

District Court and the U.S. Court of

Federal Claims

You can take your case to your U.S. District Court

or the U.S. Court of Federal Claims, but generally

only after you have fully paid the amount and timely

filed a claim for refund with the IRS. If you are a

nonresident alien, you may seek relief in the U.S.

Court of Federal Claims, but you generally cannot

take your case to a U.S. District Court because

you are not a resident of any United States judicial

district.

If you filed a timely claim for a refund with the IRS

but haven’t received a written response on your

claim within 6 months from the date you filed it, you

can file suit for a refund in your U.S. District Court

or the U.S. Court of Federal Claims. Certain types

of cases, such as those involving some employment

tax issues or manufacturers’ excise taxes, can only

be heard by these courts.

Note: You have 2 years from the date of the notice

of claim disallowance to file a refund suit. Appeals’

consideration of a disallowed claim doesn’t extend

the 2-year period for filing suit. However, it may be

extended by mutual agreement.

You can get information about procedures for filing

suit in either court on their websites:

U.S. District Courts website: www.uscourts.

gov

Court of Federal Claims website: www.cofc.

uscourts.gov

Innocent Spouse Appeals

If you are the spouse who filed Form 8857,

Request for Innocent Spouse Relief, requesting

innocent spouse relief (the “requesting spouse”),

you can generally request an appeal if the IRS

denies your request in whole or in part. If you are

a non-requesting spouse, you can request an

appeal if the IRS grants innocent spouse relief

in whole or in part to your requesting spouse (or

former spouse). However, a non-requesting spouse

cannot appeal an IRS decision to deny relief to

the requesting spouse (or former spouse). Your

appeal request must be submitted in writing. You

can use Form 12509, Innocent Spouse Statement

of Disagreement, to explain why you disagree

with the IRS’s proposed determination concerning

your request or your (current or former) spouse’s

request for innocent spouse relief.

If you are the requesting spouse, you can petition

the U.S. Tax Court to review your request for

innocent spouse relief if:

7

Pass-Through Entity Appeals (BBA)

The Bipartisan Budget Act of 2015 (BBA), as

amended, repealed the Tax Equity and Fiscal

Responsibility Act of 1982 (TEFRA) partnership

procedures and electing large partnership

provisions and replaced them with an entirely

new centralized partnership audit regime. BBA is

generally effective for tax years beginning 1/1/2018,

with allowances for early elect-in for tax periods

beginning after 11/2/2015.

If the entity and tax year(s) at issue are covered

by BBA, the entity has appeal rights. At the

end of the Appeals process, Appeals will issue

a Notice of Proposed Partnership Adjustment

(NOPPA) for all proposed adjustments, whether

agreed or unagreed. In response to the NOPPA,

the partnership may request modification and an

opportunity for a modification Appeals hearing.

However, in a modification Appeals hearing,

Appeals will not reconsider an issue that was

previously disputed and considered by Appeals.

If a Notice of Final Partnership Adjustment (FPA)

is issued, the partnership may elect to “push-out”

an imputed underpayment to its partners to take

into account, file a petition for judicial review of the

adjustments, or both.

See www.irs.gov/businesses/partnerships/bba-

partnership-audit-process, for more information.

Recovering Administrative and Litigation Costs

You may be able to recover your reasonable

administrative and litigation costs if you are

the prevailing party and if you meet the other

requirements. For example, you must exhaust your

administrative remedies within the IRS including

participating in the Appeals process, and you must

not unreasonably delay the administrative or court

proceedings.

Administrative costs are costs incurred for

administrative proceedings on or after the

date you receive the rst letter of proposed

deciency giving you an opportunity for review

in Appeals, the Appeals decision letter, or the

notice of deciency, whichever is earliest.

Litigation costs are costs incurred for court

proceedings.

Recoverable litigation or administrative

costs may include:

In general, attorney fees that do not exceed

a maximum hourly rate, which changes from

year to year. Fees in excess of the maximum

can be awarded in limited circumstances.

Reasonable amounts for court costs or any

administrative fees or similar charges by the

IRS.

Reasonable expenses of expert witnesses.

Reasonable costs of studies, analyses, tests,

or engineering reports that are necessary to

prepare your case.

To qualify as a prevailing party, you must

Substantially prevail on the amount in

controversy or the most signicant issue(s)

presented, or obtain a nal judgment that is

less than or equal to a “qualied offer” that the

IRS rejected, AND

Meet the applicable net worth and size

requirements.

Net worth and size limitations:

For individuals, estates, or trusts, net worth

cannot exceed $2,000,000.

Charities and certain cooperatives must not

have more than 500 employees.

1. Six months have passed since you filed

Form 8857 and you have not received a final

determination letter from the IRS; or

2. You have received a final determination letter

denying relief in full or in part and you petition the

U.S. Tax Court no later than 90 days after the IRS

sent you that letter.

If you petition the U.S. Tax Court for relief, the Tax

Court’s scope of review will be limited to the IRS’s

administrative record established at the time of the

determination (the date of the final determination

letter), and any newly discovered or previously

unavailable evidence. Therefore, it is important for

both the requesting and non-requesting spouse to

provide all relevant, available evidence to the IRS

before it issues its final determination.

8

A partnership, corporation, association, unit of

local government, or organization must have a

net worth of $7,000,000 or less and must not

have more than 500 employees.

In TEFRA partnership proceedings, both the

partnership and the requesting partner must

meet relevant net worth and size limitations.

You are not the prevailing party if:

The United States establishes that its position was

substantially justified. If the IRS does not follow

applicable published guidance, the United States

is presumed to not be substantially justified. This

presumption is rebuttable. Applicable published

guidance means regulations, revenue rulings,

revenue procedures, information releases, notices,

announcements, and, if they are issued to you,

private letter rulings, technical advice memoranda

and determination letters. The determination

of whether the Government’s position was

substantially justified will also consider the

outcome of the same issue(s) or position(s) in other

cases the Government has already litigated.

In the context of administrative proceedings,

Appeals will determine who is the prevailing party.

You must file your claim for administrative costs

no later than the 90th day after the IRS mails (or

otherwise furnishes) you the final determination of

tax, penalty or interest. This means that you may

receive administrative costs from the IRS without

going to court. If your application for administrative

costs is denied, you may appeal the determination

to the U.S. Tax Court no later than the 90th day

after the IRS mailed you the denial letter.

In the context of court proceedings, a court will

decide who is the prevailing party. You must

follow applicable court rules when filing your claim

for costs.

Taxpayer Advocate Service (TAS) Assistance

The TAS is an independent organization within the

IRS that helps taxpayers and protects taxpayers’

rights. TAS can offer free help if your tax problem

is causing a financial difficulty, you’ve tried but are

unable to resolve your issues with the IRS or you

believe an IRS system, process or procedure isn’t

working as it should. If you believe you are eligible

for TAS assistance or would like more information,

call the TAS at 877-777-4778, TTY/TDD 800-829-

4059, go to www.taxpayeradvocate.irs.gov, or

refer to Publication 1546, Taxpayer Advocate

Service – We Are Here to Help You.

Report IRS Actions

You can confidentially report misconduct, waste,

fraud, or abuse by an IRS employee to Treasury

Inspector General for Tax Administration (TIGTA)

by calling 800-366-4484 (800-877-8339 for TTY/

TDD). You can remain anonymous.

Small Business Ombudsman

A small business entity can participate in the

regulatory process and comment on enforcement

actions of IRS by calling 888-REG-FAIR (888-

734-3247), TTY/TDD 800-877-8339, or by visiting

https://www.sba.gov/ombudsman.

For General Information:

Appeals Website: IRS Website:

www.irs.gov/appeals www.irs.gov

IRS Toll Free Phone Numbers:

800-829-1040 (for individuals)

800-829-4933 (for businesses)

800-829-4059 /TDD

IRS Forms and Publications:

www.irs.gov/forms-instructions

800-TAX FORM (800-829-3676)

Taxpayer Advocate Service:

TaxpayerAdvocate.irs.gov

877-777-4778