No. 255

COMPANY ANNOUNCEMENT

11 August 2015

INTERIM REPORT FOR Q2 2015

PANDORA INCREASES REVENUE WITH 41.4% DRIVEN BY A STRONG

DEVELOPMENT ACROSS ALL REGIONS

• Group revenue in Q2 2015 was DKK 3,598 million, an increase of 41.4% or 25.8% in

local currency, compared with Q2 2014:

• Americas increased by 43.8% (19.4% increase in local currency)

• Europe increased by 38.0% (32.0% increase in local currency)

• Asia Pacific increased by 44.1% (26.9% increase in local currency)

• Revenue from concept stores increased by 54.7% and corresponded to 59.3% of

the total revenue

• The gross margin increased to 71.5% in Q2 2015, compared with 70.7% in Q2 2014

•

EBITDA increased by 46.8% to DKK 1,311 million in Q2 2015, corresponding to an

EBITDA margin of 36.4%, compared with 35.1% in Q2 2014

• Net profit for the quarter was DKK 910 million, compared to a net profit of DKK 662

million in Q2 2014

• Free cash flow was DKK -268 million in Q2 2015 (or DKK 374 million excluding tax and

interest expenses of DKK 642 million relating to settlement of transfer pricing audit)

compared with DKK 547 million in Q2 2014

• During Q2 2015, PANDORA bought back 1,433,607 own shares at a total value of DKK

982 million as part of the ongoing DKK 3.9 billion share buyback programme,

corresponding to 1.2% of the total share capital.

FINANCIAL GUIDANCE FOR 2015

Based on the strong performance in the second quarter, as well as favourable exchange

rate fluctuations, PANDORA has decided to increase revenue guidance to more than DKK

16.0 billion (previously more than DKK 15.0 billion). Growth will be driven by like-for-like

growth in existing stores as well as expansion of the store network, with network

expansion contributing slightly more to growth (previously expected to contribute

equally). Assuming current exchange rates, PANDORA expects a full year tailwind effect

from currencies on revenue of around 12% compared to 2014. This compares to a tailwind

of around 10% anticipated in May 2015 in connection with the announcement of the Q1

2015 interim report. The EBITDA margin expectation is unchanged, and is expected to be

approximately 37%. All expectations are based on current exchange rates.

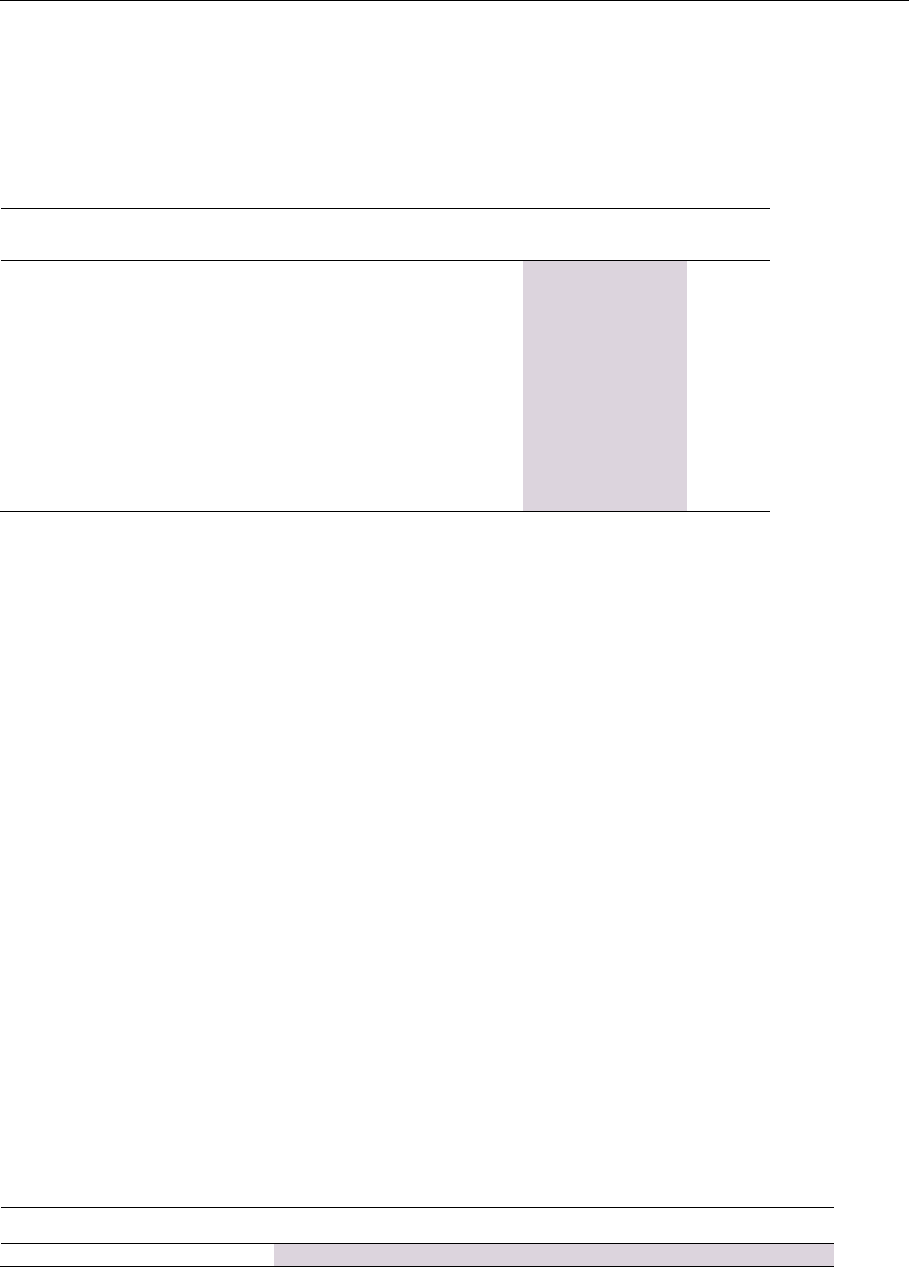

FY 2015

New guidance

FY 2015

Previous guidance

FY 2014

Actual

Revenue, DKK billion

>16.0

>15.0

11.9

EBITDA margin

approx. 37%

approx. 37%

36.0%

CAPEX, DKK million

approx. 900

approx. 900

455

Effective tax rate

approx. 30%

approx. 30%

20%

PANDORA plans to continue to expand the store network and now expects to add more

than 375 new concept stores in 2015 (versus previously expected more than 325).

PANDORA COMPANY ANNOUNCEMENT

11 August 2015 | COMPANY ANNOUNCEMENT No. 255 | page

2 | 30

In connection with the Q2 2015 results Anders Colding Friis, CEO of PANDORA, stated:

“We are very pleased to report yet another strong quarter, both in terms of top line

development and profitability. All major regions once again delivered double digit revenue

growth and our focus on concept stores continues to pay off, with revenue growth in the

quarter of more than 50%. Growth was driven by a combination of network expansion and

strong like-for-like growth, supported by revenue enhancing initiatives such as the

continued roll out of our eSTORE and our collaboration with Disney.”

CONFERENCE CALL

A conference call for investors and financial analysts will be held today at 10.00 CET and

can be joined online at www.pandoragroup.com. The presentation for the call will be

available on the website one hour before the call.

The following numbers can be used by investors and analysts:

DK: +45 3271 1659

UK (International): +44 (0) 2034 271 901

US: +1 212 444 0412

To help ensure that the conference begins in a timely manner, please dial in 5 minutes

prior to the scheduled starting time. Participants will have to quote confirmation code

“Pandora” when dialling into the conference.

ABOUT PANDORA

PANDORA designs, manufactures and markets hand-finished and contemporary jewellery

made from high-quality materials at affordable prices. PANDORA jewellery is sold in more

than 90 countries on six continents through approximately 9,500 points of sale, including

more than 1,500 concept stores.

Founded in 1982 and headquartered in Copenhagen, Denmark, PANDORA employs more

than 14,200 people worldwide of whom approximately 10,000 are located in Gemopolis,

Thailand, where the company manufactures its jewellery. PANDORA is publicly listed on the

NASDAQ Copenhagen stock exchange in Denmark. In 2014, PANDORA’s total revenue was

DKK 11.9 billion (approximately EUR 1.6 billion).

CONTACT

For more information, please contact:

INVESTOR RELATIONS

Morten Eismark

VP Group Investor Relations

Phone +45 3673 8213

Mobile +45 3045 6719

MEDIA RELATIONS

Kristian Lysgaard

Director, Group Communications

Phone +45 4323 1774

Mobile +45 2556 8561

Magnus Thorstholm Jensen

Investor Relations Officer

Phone +45 4323 1739

Mobile +45 3050 4402

PANDORA COMPANY ANNOUNCEMENT

11 August 2015 | COMPANY ANNOUNCEMENT No. 255 | page

3 | 30

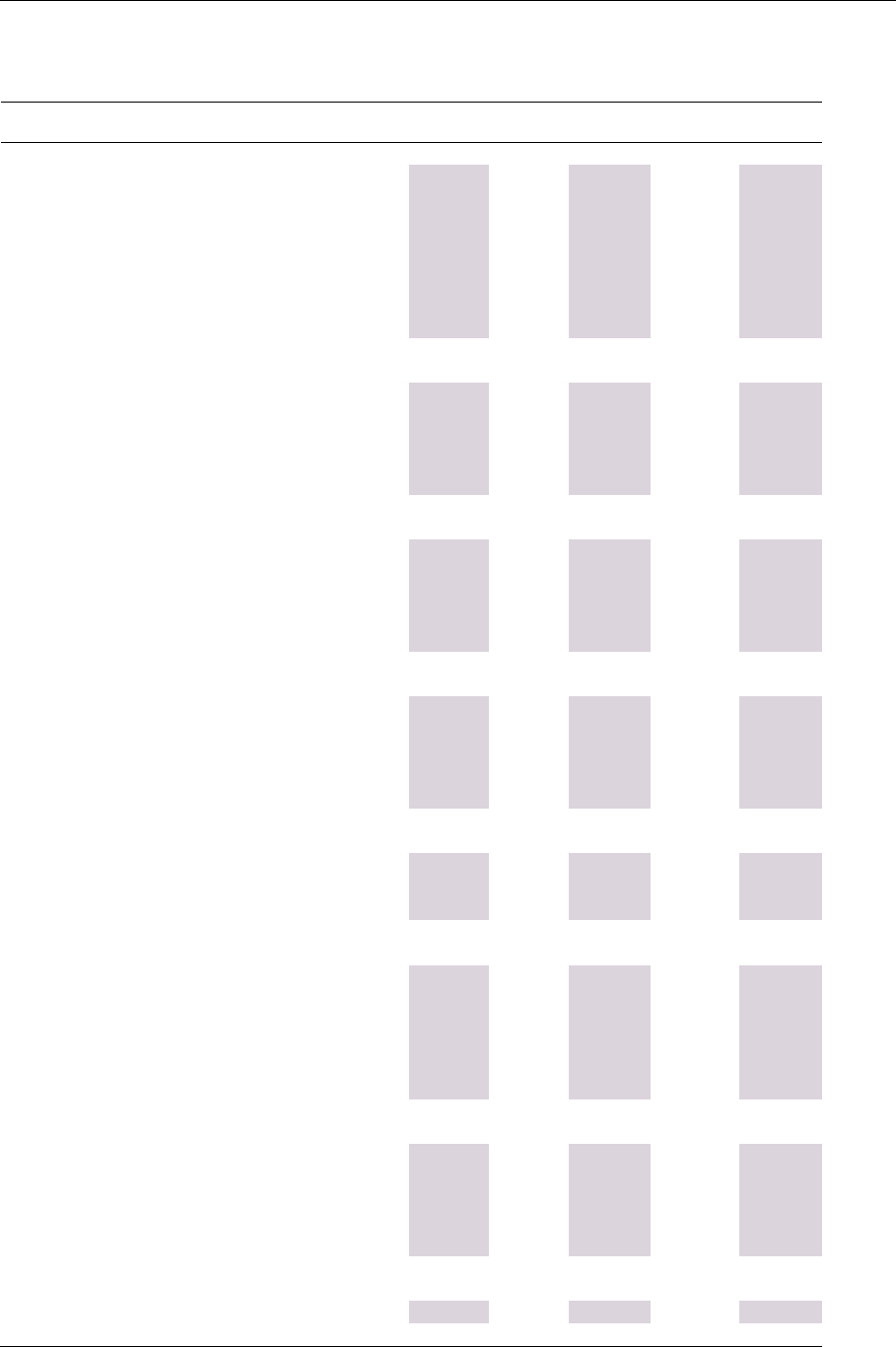

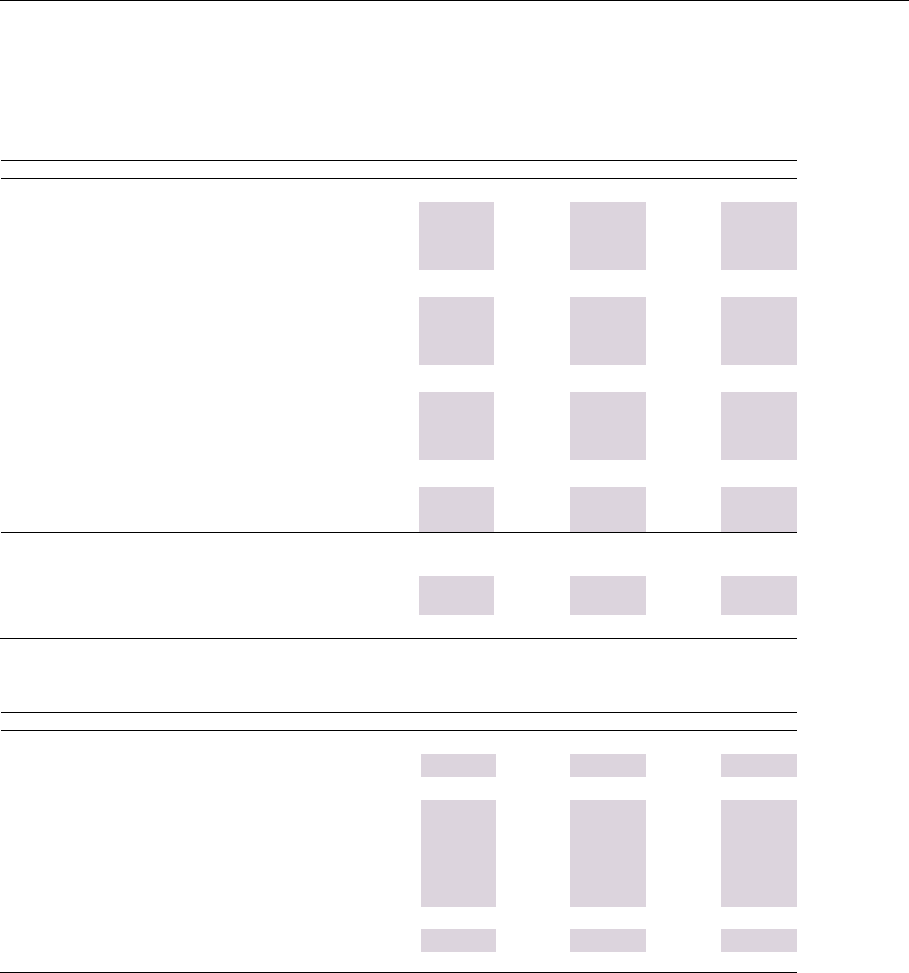

FINANCIAL HIGHLIGHTS

* Ratios are based on 12 months rolling EBITDA and EBIT, respectively.

DKK million

Q2 2015

Q2 2014

H1 2015

H1 2014

FY 2014

Consolidated income statement

Revenue

3,598

2,544

7,145

5,136

11,942

Gross profit

2,573

1,798

5,095

3,589

8,423

Earnings before interest, tax, depreciations and

amortisations (EBITDA)

amortisations (EBITDA)

1,311

893

2,616

1,830

4,294

Operating profit (EBIT)

1,235

841

2,473

1,728

4,072

Net financials

-69

-13

-350

-21

-200

Profit before tax

1,166

828

2,123

1,707

3,872

Net profit

910

662

1,293

1,366

3,098

Consolidated balance sheet

Total assets

11,781

9,231

11,781

9,231

10,556

Invested capital

7,359

5,851

7,359

5,851

6,080

Net working capital

939

729

939

729

434

Net interest-bearing debt (NIBD)

1,030

-440

1,030

-440

-1,121

Equity

6,097

6,274

6,097

6,274

7,032

Consolidated cash flow statement

Cash flows from operating activities

-93

637

1,071

1,744

4,322

Cash flows from investing activities

-330

-92

-641

-163

-632

Free cash flow

-268

547

722

1,596

3,868

Cash flows from financing activities

419

-662

-953

-1,814

-3,259

Net increase (decrease) in cash for the period

-4

-117

-523

-233

431

Growth ratios

Revenue growth, %

41.4%

31.7%

39.1%

30.6%

32.5%

Gross profit growth, %

43.1%

41.1%

42.0%

38.7%

40.4%

EBITDA growth, %

46.8%

68.5%

43.0%

56.0%

49.0%

EBIT growth, %

46.8%

74.1%

43.1%

59.7%

51.9%

Net profit growth, %

37.5%

53.6%

-5.3%

57.2%

39.5%

Margins

Gross margin, %

71.5%

70.7%

71.3%

69.9%

70.5%

EBITDA margin, %

36.4%

35.1%

36.6%

35.6%

36.0%

EBIT margin, %

34.3%

33.1%

34.6%

33.6%

34.1%

Other ratios

Tax rate, %

22.0%

20.0%

39.1%

20.0%

20.0%

Equity ratio, %

51.8%

68.0%

51.8%

68.0%

66.6%

NIBD to EBITDA *

0.2

-0.1

0.2

-0.1

-0.3

Return on invested capital (ROIC), %*

65.5%

56.9%

65.5%

56.9%

67.0%

Capital expenditure (CAPEX), DKK million

239

86

406

144

455

Cash conversion, %

-29.5%

82.6%

55.8%

116.8%

124.9%

Share information

Dividend per share, DKK

-

-

-

-

9.00

Total payout ratio (incl. share buyback), %

-

-

-

-

112.7%

Earnings per share, basic, DKK

7.6

5.3

10.8

10.9

25.0

Earnings per share, diluted, DKK

7.5

5.3

10.7

10.8

24.7

Share price at end of period, DKK

719.0

417.5

719.0

417.5

504.5

Other key figures

Average number of employees

13,378

9,514

12,661

9,156

9,957

PANDORA COMPANY ANNOUNCEMENT

11 August 2015 | COMPANY ANNOUNCEMENT No. 255 | page

4 | 30

IMPORTANT EVENTS IN Q2 2015

SHARE BUYBACK PROGRAMME FOR 2015

In connection with the Annual Report 2014, PANDORA launched a share buyback

programme under which PANDORA expects to buy back own shares to a maximum

consideration of DKK 3,900 million. The share buyback programme is implemented in

accordance with the provisions of the European Commission’s regulation no. 2273/2003 of

22 December 2003 (‘safe harbour’), which protects listed companies against violation of

insider legislation in connection with share buybacks. The programme will end no later than

31 December 2015.

As of 30 June 2015, a total of 2,377,275 shares had been bought back, corresponding to a

transaction value of DKK 1,552 million. As of 30 June 2015, PANDORA held a total of

3,056,517 treasury shares, corresponding to 2.5% of the share capital.

PANDORA may use the shares purchased under the programme to meet potential

obligations arising from employee share option programmes. As of 30 June 2015, the total

potential obligation under these programmes amounted to 838,447 shares.

US eSTORE

On 21 April 2015, PANDORA launched an e-commerce platform in the US

(estore-us.pandora.net). The launch is part of the Company's aim to offer PANDORA

jewellery online globally.

REDUCTION OF PANDORA A/S' SHARE CAPITAL

At the Company's Annual General Meeting on 18 March 2015, it was decided to reduce the

share capital by a nominal amount of DKK 5,818,651 through cancellation of a nominal

amount of DKK 5,818,651 treasury shares of DKK 1. After reduction of the share capital, the

Company’s share capital is nominally DKK 122,297,169 divided into shares of DKK 1.

Following the share capital reduction, PANDORA owns less than 5% of the total share

capital and the total voting rights in the Company.

TRANSFER PRICING TAX AUDIT CLOSED

On 7 May, PANDORA made a settlement with the Danish Tax Authorities (SKAT) regarding a

transfer pricing audit for the period 2009 to 2014. SKAT and PANDORA did not agree on the

applicable pricing methodology within the Group. Following a dialogue with SKAT,

PANDORA decided to make a settlement whereby, PANDORA will recognise a higher

proportion of the Group’s profit in Denmark for 2009-2014 as well as going forward.

According to the settlement, PANDORA will pay a sum of DKK 995 million to SKAT covering

tax payments and interest for the 6 year period. DKK 642 million has been paid in Q2 2015.

The remaining amount will be paid in Q4 2015.

PANDORA accrues for estimated tax expenses, and had as of 31 December 2014 made an

accrual for DKK 610 million related to these specific payments. The additional DKK 385

million impacted the income statement in Q1 2015, specified with 364 million as income tax

expense and 21 million as financial expenses, respectively.

PANDORA COMPANY ANNOUNCEMENT

11 August 2015 | COMPANY ANNOUNCEMENT No. 255 | page

5 | 30

MAJOR SHAREHOLDER ANNOUNCEMENT

On 10 June, PANDORA announced that the Company had been notified by BlackRock

Investment Management (UK) Limited that BlackRock, Inc. had increased its holding of

shares in PANDORA A/S at 9 June 2015 to 6,234,764 shares, corresponding to 5.1% of the

share capital and the voting rights.

EVENTS AFTER THE REPORTING PERIOD

TAKE OVER OF DISTRIBUTION IN SINGAPORE, MACAU AND THE PHILIPPINES

On 11 August, PANDORA made an agreement with Norbreeze Group (Norbreeze), to

acquire its PANDORA store network in Singapore and Macau on 1 January 2016, when

Norbreeze’s distribution rights to PANDORA jewellery in the two countries expire. At the

same time, PANDORA will regain ownership of the distribution rights in the Philippines, also

currently owned by Norbreeze. PANDORA will pay a total amount of SGD 30 million

(approximately DKK 149 million) to Norbreeze, related to the agreement. The agreement

will be effective as of 1 January 2016 and is subject to certain conditions to be fulfilled.

PANDORA COMPANY ANNOUNCEMENT

11 August 2015 | COMPANY ANNOUNCEMENT No. 255 | page

6 | 30

REVENUE DEVELOPMENT

Total revenue for Q2 2015 was DKK 3,598 million, an increase of 41.4% (25.8% in local

currency) compared with Q2 2014.

Volumes increased by 15.8% compared with Q2 2014 and the average sales price (ASP)

recognised by PANDORA in Q2 2015 was DKK 168, compared with DKK 138 in Q2 2014. The

increase in ASP was primarily driven by currency increases, which represented around 60%

of the increase, as well as a proportionally higher share of revenue from PANDORA owned

and operated stores. Prices in local currencies for each individual product were virtually

unchanged compared with Q2 2014.

Revenue growth continued across the three major regions, with all geographies showing

double-digit growth rates. Growth was driven by a combination of like-for-like growth

across most markets, contributing with roughly 40% of the growth, as well as the

continued expansion of the store network, contributing with the remaining 60%. The like-

for-like growth was among other things driven by a continued high demand for the Spring

collection, launched in Q1 2015, as well as a positive reception of the High Summer

collection, launched in stores during Q2 2015. The Mother’s Day collection, launched in

most markets in April, was performing slightly weaker than last year, primarily due to

around 25% less design variations compared to last year’s collection. In Q2 2015, around

50% of sales were generated by products launched within the last 12 months, which is

similar to Q2 2014. Products across all categories launched more than 12 months ago

continue to support revenue growth.

Revenue from PANDORA’s owned and operated stores, including all PANDORA eSTOREs,

increased by 131% to DKK 891 million and corresponded to around 25% of total revenue

compared to around 15% in Q2 2014. The growth in retail revenue was driven by strong in-

store execution resulting in positive like-for-like growth as well as the addition of 219 new

owned and operated stores in the last 12 months, including net 51 concept stores and 16

shop-in-shops, converted from franchisee stores, to a total of 357 concept stores and 96

shop-in-shops owned and operated by PANDORA. The net effect of converting wholesale

revenue from the franchisee stores now owned and operated by PANDORA to retail

revenue is approximately DKK 80 million compared to Q2 2014. Since Q2 2014, PANDORA

has established eSTOREs in Italy, Poland, Sweden, and the US and now has eSTOREs in 9

countries in total.

At the end of Q2 2015, sales return provisions corresponded to approximately 7% of 12

months’ rolling revenue value, compared with 8% and 7% for Q1 2015 and Q2 2014,

respectively.

Based on data from concept stores, which have been operating for more than 12 months,

like-for-like sales-out in four of PANDORA’s major markets (the US, the UK, Germany and

Australia) continued to be positive. The positive development was driven by a successful

product portfolio with continuous relevant products, increased awareness through regional

marketing campaigns as well as generally better in-store execution, increasing store traffic

in most stores.

PANDORA COMPANY ANNOUNCEMENT

11 August 2015 | COMPANY ANNOUNCEMENT No. 255 | page

7 | 30

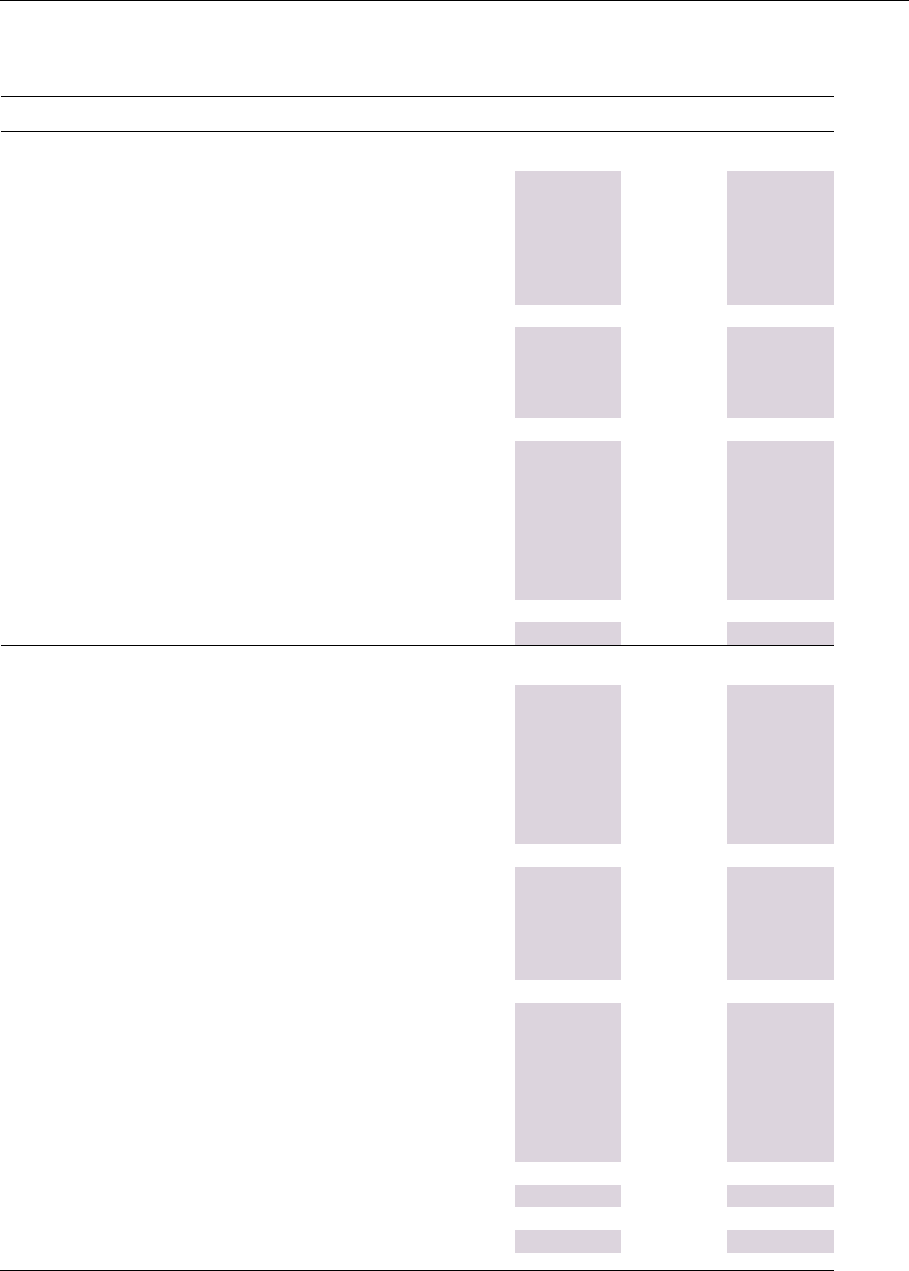

REVENUE BREAKDOWN BY GEOGRAPHY

In Q2 2015, 43.9% of revenue was generated in Americas (43.1% in Q2 2014), 40.8% in

Europe (41.8% in Q2 2014) and 15.3% in Asia Pacific (15.1% in Q2 2014).

Distribution of revenue

DKK million

Q2 2015

Q2 2014

Growth

Growth in

local

currency

FY 2014

US

1,171

824

42.1%

13.7%

3,629

Other Americas

407

273

49.1%

36.3%

1,330

Americas

1,578

1,097

43.8%

19.4%

4,959

UK

418

285

46.7%

31.2%

1,654

Germany

110

107

2.8%

2.8%

578

Other Europe

940

672

39.9%

37.2%

3,072

Europe

1,468

1,064

38.0%

32.0%

5,304

Australia

247

183

35.0%

29.0%

806

Other Asia Pacific

305

200

52.5%

25.0%

873

Asia Pacific

552

383

44.1%

26.9%

1,679

Total

3,598

2,544

41.4%

25.8%

11,942

AMERICAS

Revenue for the second quarter in Americas was DKK 1,578 million, an increase of 43.8%

(19.4% in local currency) compared with Q2 2014. The increase was driven by a positive

development across main markets, including the US, Canada and Brazil. A high demand for

the Disney collection, which was launched in North America in November 2014, continued

to support growth. During the quarter, the distribution of the Disney collection was

expanded to include shop-in-shops and gold stores.

Revenue in the US was DKK 1,171 million, an increase of 42.1% (13.7% in local currency)

compared with Q2 2014. Growth was driven by network expansion (including the launch of

a PANDORA eSTORE) as well as regional strong like-for-like growth rates, which was

fuelled by the continued success of the PANDORA Disney products. Furthermore, the focus

on Rings in the US continues to support growth as revenue from the category increased

significantly compared to Q2 2014, and is approaching 10% of US revenue. Finally,

converting wholesale revenue to retail revenue, from the 22 concept stores acquired from

Hannoush Jewelers in September 2014, has added around DKK 30 million to revenue in the

US in Q2 2015 compared to Q2 2014.

Like-for-like sales-out in Q2 2015, based on concept stores in the US - which have been

operating for more than 12 months - increased by 8.1% compared with Q2 2014. Growth

in the Northeast region, where a process to refresh the network is on-going, remained

slightly negative for the quarter, while all other major US regions grew by high-single digit

like-for-like rates or more compared to Q2 2014.

Concept stores* sales-out growth

Q2 2015

vs. Q2 2014

Q1 2015

vs. Q1 2014

Q4 2014

vs. Q4 2013

Q3 2014

vs. Q3 2013

Q2 2014

vs. Q2 2013

US

8.1%

8.9%

4.7%

3.7%

1.7%

* Concept stores that have been operating for more than 12 months

Revenue from Other Americas was DKK 407 million in Q2 2015, an increase of 49.1%

(36.3% in local currency) compared with the same quarter last year, with growth primarily

driven by a positive development in Canada and Brazil. Revenue from Canada increased by

PANDORA COMPANY ANNOUNCEMENT

11 August 2015 | COMPANY ANNOUNCEMENT No. 255 | page

8 | 30

35% (around 20% in local currency) and represented around 50% of revenue from Other

Americas in Q2 2015. Brazil continues to perform well, driven by double digit like-for-like

growth rates as well as an expansion of the store network. PANDORA now has 51 concept

stores in Brazil compared to 22 at the end of Q2 2014.

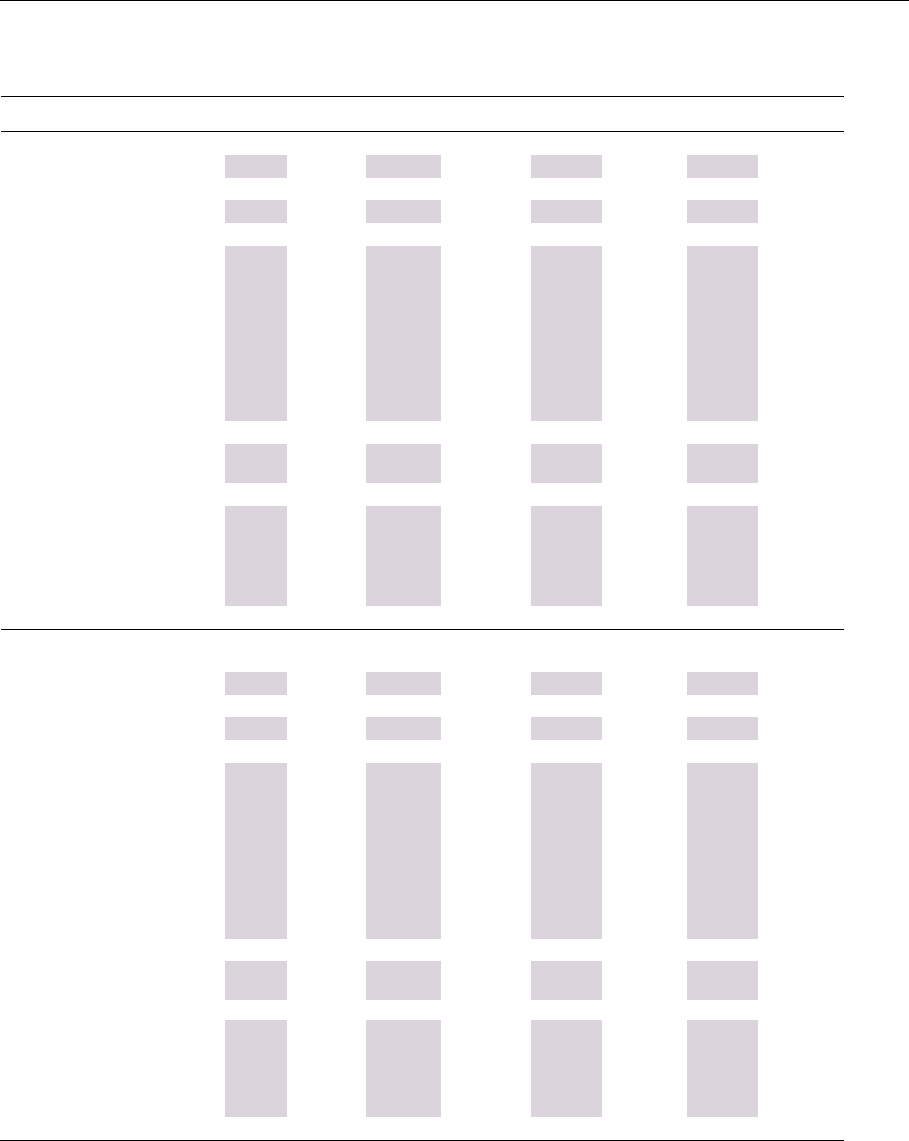

Store network, number of points of sale - Americas

Number of PoS

Q2 2015

Number of PoS

Q1 2015

Number of PoS

Q2 2014

Growth

Q2 2015

/Q1 2015

Growth

Q2 2015

/Q2 2014

Concept stores

447

424

369

23

78

- hereof PANDORA owned

69

59

20

10

49

Shop-in-shops

664

672

612

-8

52

- hereof PANDORA owned

2

2

2

-

-

Gold

913

874

859

39

54

Branded

2,024

1,970

1,840

54

184

Branded as % of total

63.3%

60.3%

56.0%

Silver

932

1,023

1,054

-91

-122

White and travel retail

240

274

394

-34

-154

Total

3,196

3,267

3,288

-71

-92

PANDORA continues to develop the branded store network and during Q2 2015, 23 new

concept stores were opened in Americas. In Q2 2015, the number of branded points of

sale (PoS) in the region increased by 54 stores. PANDORA owned and operated concept

stores in Americas increased by 10 to 69 at the end of Q2 2015. The increase compared to

Q2 2014 is mainly due to PANDORA’s acquisition of net 22 concept stores from Hannoush

Jewelers in Q3 2014, as well as the addition of 17 owned and operated concept stores in

Brazil. As part of the continued focus on the branded part of the network, unbranded

stores are being closed and during the quarter 125 unbranded stores, almost all located in

the US, were closed in Americas.

EUROPE

Revenue in Europe was DKK 1,468 million in Q2 2015, an increase of 38.0% (32.0% in local

currency) compared with Q2 2014. The growth was mainly driven by the UK, France and

Italy, whereas revenue from Russia declined in the quarter.

Revenue in the UK was DKK 418 million in Q2 2015, an increase of 46.7% (31.2% in local

currency) compared with the same quarter last year. Growth was driven by a positive

sales-out development, as well as the expansion of the store network, including 38 new

concept stores opened since Q2 2014, to a total of 169 concept stores. Furthermore,

growth was supported by the introduction of the PANDORA Rose collection in the UK

stores during the quarter (as the only country in Europe), following the successful launch

of the collection in the US last year. The Rings category continued to support growth with

revenue from the category increasing by more than 20% compared to Q2 2014. For the

quarter around 19% of revenue was generated by Rings. Finally, the UK eSTORE continues

to perform well and contributed with around 10% to UK revenue in Q2 2015.

Like-for-like sales-out in Q2 2015, based on concept stores in the UK - which have been

operating for more than 12 months - increased by 11.4% compared with Q2 2014. The

growth was supported by all product categories, in particular Rings, Earrings and

Necklaces, as well as the launch of PANDORA Rose.

PANDORA COMPANY ANNOUNCEMENT

11 August 2015 | COMPANY ANNOUNCEMENT No. 255 | page

9 | 30

Concept stores*

sales-out growth

Q2 2015

vs. Q2 2014

Q1 2015

vs. Q1 2014

Q4 2014

vs. Q4 2013

Q3 2014

vs. Q3 2013

Q2 2014

vs. Q2 2013

UK

11.4%

20.6%

20.6%

20.6%

26.2%

*

Concept stores that have been operating for more than 12 months

Revenue in Germany was DKK 110 million corresponding to an increase of 2.8% compared

with Q2 2014. As a consequence of the planned acceleration of the network optimisation

in Germany, revenue in Q2 2015 was negatively impacted by a provision for returned

goods of DKK 53 million related to the closure of a number of multibranded accounts,

corresponding to around 275 stores. Excluding the provision, revenue in Germany

increased by 53% compared with Q2 2014. As a part of the effort to improve the store

network, PANDORA agreed in January 2015 to assume 77 commercial leaseholds in

Germany, where PANDORA will open owned and operated concept stores. Including

relocation of existing stores, the transaction is expected to add net 60 new concept stores

in 2015. During the quarter, 25 owned and operated concept stores were opened to a

total of 33 on the locations. In total, 32 owned and operated concept stores were added

during the quarter. At the end of Q2 2015, PANDORA owned and operated 110 concept

stores out of a total of 124 concept stores in Germany.

Like-for-like sales-out in Q2 2015, based on concept stores in Germany - which have been

operating for more than 12 months - increased by 9.0% compared with Q2 2014. The

growth was driven by a positive development across all product categories. The

anticipated negative impact on the like-for-like growth from the above mentioned store

openings has not materialised.

Concept stores* sales-out growth

Q2 2015

vs. Q2 2014

Q1 2015

vs. Q1 2014

Q4 2014

vs. Q4 2013

Q3 2014

vs. Q3 2013

Q2 2014

vs. Q2 2013

Germany

9.0%

3.8%

2.3%

8.5%

10.0%

* Concept stores that have been operating for more than 12 months

Revenue from Other Europe was DKK 940 million in Q2 2015, an increase of 39.9%

compared with Q2 2014. Revenue from Other Europe was primarily driven by a positive

development in Italy and France, with increasing revenue in both countries of more than

50%. Italy and France represented around 30% and 15%, respectively, of revenue from

Other Europe in Q2 2015. Revenue from Russia decreased 40% in Q2 2015 and

represented around 8% of revenue from Other Europe in Q2 2015. The decrease was

driven by low double digit negative like-for-like sales out growth in Q2 2015, impacted by

the decreasing consumer spend in Russia, and consequently a more cautious purchasing

behaviour from PANDORA’s local distributor in Russia. There is currently some uncertainty

surrounding the long-term ownership of ZAO PanClub (PanClub), PANDORA’s local

distributor in Russia. PanClub is performing relatively well in a difficult business

environment. PANDORA is monitoring the situation closely, and it is PANDORA’s

assessment that the uncertainty regarding the long-term ownership of PanClub has not had

any impact on the daily operations of the stores in Russia. Finally, revenue from Other

Europe was positively impacted by around DKK 15 million from converting third party

revenue to retail revenue in the Middle East following the acquisition of the local

distributor.

PANDORA COMPANY ANNOUNCEMENT

11 August 2015 | COMPANY ANNOUNCEMENT No. 255 | page

10 | 30

Store network, number of points of sale - Europe

Number of PoS

Q2 2015

Number of PoS

Q1 2015

Number of PoS

Q2 2014

Growth

Q2 2015

/Q1 2015

Growth

Q2 2015

/Q2 2014

Concept stores

882

811

663

71

219

- hereof PANDORA owned

250

201

130

49

120

Shop-in-shops

715

681

651

34

64

- hereof PANDORA owned

82

76

57

6

25

Gold

1,449

1,369

1,320

80

129

Branded

3,046

2,861

2,634

185

412

Branded as % of total

53.6%

50.2%

43.1%

Silver

1,438

1,452

1,933

-14

-495

White and travel retail

1,204

1,382

1,545

-178

-341

Total

*

5,688

5,695

6,112

-7

-424

*

Includes for Q2 2015 relating to 3rd party distributors: 141 concept stores, 203 shop-in-shops, 381 gold, 262 silver and 465 white stores.

During Q2 2015, the number of branded stores in Europe increased by 185 stores to a total

of 3,046 stores, in line with PANDORA’s overall strategy to increase branded sales. Net 71

concept stores were opened in Q2, mainly in Germany (33), the UK (9), Spain (7), Italy (5),

France (4), Russia (4) and Turkey (4). During the quarter, 49 owned and operated concept

stores were added net, of which 32 were added in Germany.

In Europe, PANDORA offers eSTOREs in Austria, France, Germany, Italy, the Netherlands,

Poland, Sweden (opened in Q2 2015) and the UK.

ASIA PACIFIC

Revenue in Asia Pacific was DKK 552 million in Q2 2015, an increase of 44.1% (26.9% in

local currency) compared with Q2 2014.

Revenue in Australia was DKK 247 million in Q2 2015, an increase of 35.0% (29.0% in local

currency) compared with Q2 2014. The growth was primarily driven by a continued strong

sales-out growth, as well as 14 new concept stores opened since Q2 2014, to a total of 96

concept stores in Australia. Growth for the quarter was supported by all product

categories, with Charms and Charm bracelets doing particular well. Revenue from the

Rings category increased 23% compared to Q2 2014 and represented around 15% of

revenue for the quarter similar to Q2 2014.

Like-for-like sales-out in Q2 2015, based on concept stores in Australia - which have been

operating for more than 12 months - increased by 35.7% compared with Q2 2014, and

Australia thereby experienced the ninth quarter in a row with more than 20% like-for-like

growth rates. The positive development was a result of growth across all product

categories driven by a continued strong retail execution.

Concept stores*

sales-out growth

Q2 2015

vs. Q2 2014

Q1 2015

vs. Q1 2014

Q4 2014

vs. Q4 2013

Q3 2014

vs. Q3 2013

Q2 2014

vs. Q2 2013

Australia

35.7%

24.6%

20.0%

22.9%

33.0%

*Concept stores that have been operating for more than 12 months

Revenue from Other Asia Pacific was DKK 305 million in Q2 2015, corresponding to an

increase of 52.5% (25.0% in local currency) compared with Q2 2014. The growth was

primarily driven by a positive development in Hong Kong and China. Revenue in Hong Kong

increased around 50% in local currency, primarily driven by expansion of the store

PANDORA COMPANY ANNOUNCEMENT

11 August 2015 | COMPANY ANNOUNCEMENT No. 255 | page

11 | 30

network. Since Q2 2014, 10 new concept stores have been opened to a total of 20 concept

stores in Hong Kong. Revenue in China more than doubled compared to Q2 2014, however

from low levels.

Store network, number of points of sale – Asia Pacific

Number of PoS

Q2 2015

Number of PoS

Q1 2015

Number of PoS

Q2 2014

Growth

Q2 2015

/Q1 2015

Growth

Q2 2015

/Q2 2014

Concept stores

225

212

182

13

43

- hereof PANDORA owned

38

32

25

6

13

Shop-in-shops

196

195

180

1

16

- hereof PANDORA owned

12

11

-

1

12

Gold

135

138

144

-3

-9

Branded

556

545

506

11

50

Branded as % of total

82.0%

81.1%

78.3%

Silver

78

71

73

7

5

White and travel retail

44

56

67

-12

-23

Total

678

672

646

6

32

At the end of Q2 2015, PANDORA had 556 branded stores in Asia Pacific compared with

506 at the end of Q2 2014. During the quarter 13 new concept stores were added in the

region, including 5 in Australia and 4 in Hong Kong.

PANDORA expects to launch the first eSTOREs in the Asia Pacific region in Australia and

Hong Kong in the second half of 2015.

SALES CHANNELS

PANDORA’s focus on expanding the concept store network continues and in Q2 2015,

PANDORA opened net 107 new concept stores, including 23 in Americas, 71 in Europe and

13 in Asia Pacific. During the quarter, PANDORA added 65 owned and operated concept

stores to the network, including 32 in Germany and 7 in Brazil. Finally, 7 new owned and

operated shop-in-shops were added during the quarter. Please refer to note 10 for a

detailed overview of concept stores per country.

During the quarter, PANDORA opened eSTOREs in the US and Sweden and now offers

eSTOREs in nine countries. Revenue from the eSTOREs is recognised as concept store

revenue.

PANDORA has increased the branded store network by 646 points of sale since the end of

Q2 2014. Underperforming unbranded stores, across all regions, are being closed in order

to improve the quality of revenue and focus on branded store performance. As a

consequence the number of unbranded points of sale was reduced by 1,130 stores in the

last 12 months.

At the end of Q2 2015, the total number of points of sale was 9,562, a decrease of 484

compared with Q2 2014.

PANDORA COMPANY ANNOUNCEMENT

11 August 2015 | COMPANY ANNOUNCEMENT No. 255 | page

12 | 30

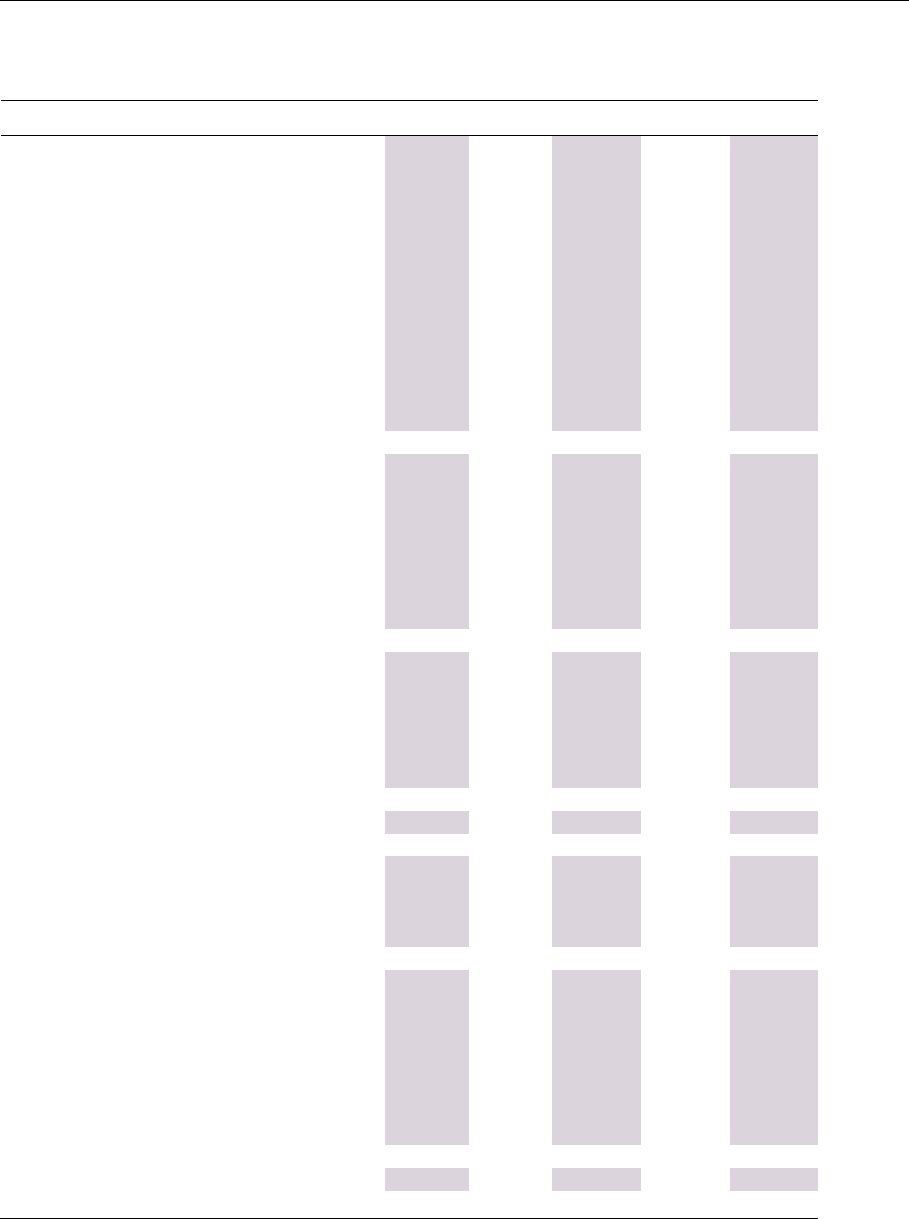

Store network, number of points of sale – Group

Number of PoS

Q2 2015

Number of PoS

Q1 2015

Number of PoS

Q2 2014

Growth

Q2 2015

/Q1 2015

Growth

Q2 2015

/Q2 2014

Concept stores

1,554

1,447

1,214

107

340

- hereof PANDORA owned

357

292

175

65

182

Shop-in-shops

1,575

1,548

1,443

27

132

- hereof PANDORA owned

96

89

59

7

37

Gold

2,497

2,381

2,323

116

174

Branded

5,626

5,376

4,980

250

646

Branded as % of total

58.8%

55.8%

49.6%

Silver

2,448

2,546

3,060

-98

-612

White and travel retail

1,488

1,712

2,006

-224

-518

Total

*

9,562

9,634

10,046

-72

-484

*

Includes for Q2 2015 relating to 3rd party distributors: 141 concept stores, 203 shop-in-shops, 381 gold, 262 silver and 465 white stores.

Revenue from concept stores increased by 54.7% to DKK 2,132 million, and represented

59.3% of revenue in Q2 2015 compared to 54.2% in Q2 2014. Branded revenue in Q2 2015

increased by 44.8% to DKK 3,171 million and represented 88.2% of revenue compared

with 86.1% in Q2 2014. The increase in branded sales is driven by an increasing share of

branded points of sale, including owned and operated stores, as well as relative higher

revenue in existing branded stores.

Revenue per sales channel

DKK million

Q2 2015

Q2 2014

Growth

Share of

total

revenue

FY 2014

Concept stores

2,132

1,378

54.7%

59.3%

6,741

Shop-in-shops

641

454

41.2%

17.8%

2,008

Gold

398

358

11.2%

11.1%

1,471

Total branded

3,171

2,190

44.8%

88.2%

10,220

Silver

216

175

23.4%

6.0%

791

White and travel retail

102

104

-1.9%

2.8%

538

Total unbranded

318

279

14.0%

8.8%

1,329

Total direct

3,489

2,469

41.3%

97.0%

11,549

3rd party

109

75

45.3%

3.0%

393

Total revenue

3,598

2,544

41.4%

100.0%

11,942

PRODUCT OFFERING

PANDORA’s core categories Charms and Bracelets and Rings continue to perform well

driven by continued newness across the categories, as well as tailor-made promotions,

focusing on the core categories.

Product mix

DKK million

Q2 2015

Q2 2014

Growth

Share of

total

revenue

FY 2014

Charms

2,456

1,705

44.0%

68.3%

7,933

Silver and gold charm bracelets

360

262

37.4%

10.0%

1,427

Rings

382

273

39.9%

10.6%

1,192

Other jewellery

400

304

31.6%

11.1%

1,390

Total revenue

3,598

2,544

41.4%

100.0%

11,942

Revenue from Charms was DKK 2,456 million in Q2 2015, an increase of 44.0% compared

with Q2 2014, while revenue from Silver and gold charm bracelets increased by 37.4%. The

two categories represented 78.3% of total revenue in Q2 2015 compared with 77.4% in Q2

2014. Revenue from both categories was driven by a continued high demand for both new

and existing products.

PANDORA COMPANY ANNOUNCEMENT

11 August 2015 | COMPANY ANNOUNCEMENT No. 255 | page

13 | 30

Revenue from Rings was DKK 382 million, an increase of 39.9% compared with Q2 2014.

The category continues to do well, driven by continued use of revenue generating

initiatives in most markets including more emphasis on rings in staff training, improved in-

store focus on rings, as well as tailor-made rings campaigns. The Rings category

represented 10.6% of total revenue in Q2 2015 compared with 10.7% in Q2 2014.

Revenue from Other jewellery was DKK 400 million, an increase of 31.6% compared with

Q2 2014. The growth was driven by revenue from Earrings and Necklaces, increasing by

around 70% and 80%, respectively, compared to Q2 2014. Revenue from Other bracelets

was negatively impacted by the discontinuation of a number of products in the category

and increased by 4% in Q2 2015. Other jewellery represented 11.1% of total revenue in Q2

2015 compared with 11.9% in Q2 2014.

COSTS

Total costs in Q2 2015, including depreciation and amortisation, were DKK 2,363 million,

an increase of 38.8% compared with Q2 2014. Total costs corresponded to 65.7% of

revenue in Q2 2015 compared with 66.9% in Q2 2014.

Cost development

DKK million

Q2 2015

Q2 2014

Growth

Share of

total

revenue

Q2 2015

Share of

total

revenue

Q2 2014

FY 2014

Cost of sales

1,025

746

37.4%

28.5%

29.3%

3,519

Gross profit

2,573

1,798

43.1%

71.5%

70.7%

8,423

Sales and distribution expenses

662

457

44.9%

18.4%

18.0%

1,957

Marketing expenses

319

219

45.7%

8.9%

8.6%

1,143

Administrative expenses

357

281

27.0%

9.9%

11.0%

1,251

Total costs

2,363

1,703

38.8%

65.7%

66.9%

7,870

GROSS PROFIT

Gross profit in Q2 2015 was DKK 2,573 million corresponding to a gross margin of 71.5%

compared with 70.7% in Q2 2014. The increase was mainly driven by tailwind from more

favourable raw material prices, market mix and an increase in revenue from owned and

operated stores. The increase was partially offset by unfavourable currency rates.

COMMODITY HEDGING

It is PANDORA’s policy to hedge approximately 100%, 80%, 60% and 40%, respectively, of

expected gold and silver consumption in the following four quarters. The hedged prices for

the following four quarters for gold are USD 1,214/oz, USD 1,187/oz, USD 1,204/oz and

USD 1,186/oz and for silver USD 17.81/oz, USD 16.54/oz, USD 17.00/oz and USD 16.35/oz.

However, current inventory means a delayed impact of the hedged prices on cost of sales.

The average realised purchase price in Q2 2015 was USD 1,215/oz for gold and USD

18.07/oz for silver.

Excluding hedging and the time lag effect from the inventory, the underlying gross margin

would have been approximately 73% based on the average gold (USD 1,192/oz) and silver

(USD 16.39/oz) market prices in Q2 2015. Under these assumptions, a 10% deviation in

quarterly average gold and silver prices would impact our gross margin by approximately

+/- 1 percentage points.

PANDORA COMPANY ANNOUNCEMENT

11 August 2015 | COMPANY ANNOUNCEMENT No. 255 | page

14 | 30

OPERATING EXPENSES

Operating expenses in Q2 2015 were DKK 1,338 million compared with DKK 957 million in

Q2 2014, representing 37.2% of revenue in Q2 2015 compared with 37.6% in Q2 2014. All

operating expenses were impacted in Q2 2015 by exchange rate fluctuations compared to

Q2 2014 (primarily USD, GBP, AUD and THB), with a total negative impact of around DKK

100 million.

Sales and distribution expenses were DKK 662 million in Q2 2015, an increase of 44.9%

compared with Q2 2014, and corresponding to 18.4% of revenue compared with 18.0% in

Q2 2014. The increase in sales and distribution expenses was mainly driven by higher

revenue, as well as an increase in the number of PANDORA owned stores (from 234 in Q2

2014 to 453 in Q2 2015). The higher costs in owned and operated stores are mainly

related to property and employee expenses, having a negative impact of around 2

percentage points compared to Q2 2014. The increase in the sales and distribution ratio

(sales and distribution expenses/revenue) was partially offset by improved cost efficiency

in all store types.

Marketing expenses were DKK 319 million in Q2 2015 compared with DKK 219 million in

Q2 2014, corresponding to 8.9% of revenue, compared with 8.6% in Q2 2014. The increase

was mainly driven by higher PR and media expenses.

Administrative expenses in Q2 2015 increased by 27.0% to DKK 357 million, representing

9.9% of revenue, compared with 11.0% of Q2 2014 revenue. The absolute increase in

administrative costs was primarily due to an increase in employee expenses.

EBITDA

EBITDA for Q2 2015 increased by 46.8% to DKK 1,311 million resulting in an EBITDA margin

of 36.4% compared with 35.1% in Q2 2014. Compared to Q2 2014, the EBITDA margin for

Q2 2015 was negatively impacted by around 0.5 percentage points from to exchange rate

fluctuations. The overall improvement was mainly due to an improved gross margin.

Regional EBITDA margins

Q2 2015

Q2 2014

Q2 2015

vs. Q2 2014

(%-pts)

Americas

44.4%

46.3%

-1.9%

Europe

38.6%

39.3%

-0.7%

Asia Pacific

51.3%

46.7%

4.6%

Unallocated costs

-6.7%

-8.3%

1.6%

Group EBITDA margin

36.4%

35.1%

1.3%

The EBITDA margin for Americas in Q2 2015 decreased from 46.3% to 44.4%. The

improvement in the gross margin was more than offset by market mix, as well as an

increase in number of employees, primarily related to the increase in owned and operated

stores in the region.

The EBITDA margin for Europe decreased from 39.3% in Q2 2014 to 38.6% in Q2 2015. The

margin in Europe was negatively impacted by the decision to close down a number of

multibranded accounts in Germany and the negative revenue development in Russia,

which more than offset the improved gross margin.

PANDORA COMPANY ANNOUNCEMENT

11 August 2015 | COMPANY ANNOUNCEMENT No. 255 | page

15 | 30

EBITDA margin for the Asia Pacific region increased to 51.3% compared with 46.7% in Q2

2014. The improvement was primarily driven by increasing revenue in the region as well as

the improved gross margin.

EBIT

EBIT for Q2 2015 increased to DKK 1,235 million, an increase of 46.8% compared with Q2

2014, resulting in an EBIT margin of 34.3% for Q2 2015 compared to 33.1% in Q2 2014

.

NET FINANCIALS

In Q2 2015, net financials amounted to a loss of DKK 69 million. Of the total amount, DKK

44 million is a net exchange rate gain, mainly related to unrealised gain on intercompany

loans in US dollars. Net interest expenses and other costs were DKK 113 million, including

loss on commodity and foreign exchange contracts. This compared with a net financial loss

of DKK 13 million in Q2 2014.

INCOME TAX EXPENSES

Income tax expenses were DKK 256 million in Q2 2015. The effective tax rate in Q2 2015

was 22.0% compared with 20.0% for Q2 2014. The increase was due to the settlement

made in May with the Danish Tax Authorities, according to which PANDORA will recognise a

higher proportion of the Group’s profit in Denmark.

NET PROFIT

Net profit in Q2 2015 increased to DKK 910 million from DKK 662 million in Q2 2014.

BALANCE SHEET AND CASH FLOW

In Q2 2015, PANDORA generated free cash flow of DKK -268 million compared with DKK

547 million in Q2 2014. Free cash flow for the period was negatively impacted by tax and

interest expenses of DKK 642 million related to a settlement made with the Danish Tax

Authorities regarding the period 2009 to 2014, cf. Company announcement no. 237.

Excluding the one-off impact free cash flow was DKK 374 million in Q2 2015.

Operating working capital (defined as inventory and trade receivables less trade payables)

at the end of Q2 2015 corresponded to 15.7% of the last twelve months revenue,

compared with 18.0% at the end of Q2 2014 and 16.0% at the end of Q1 2015.

Inventory was DKK 2,161 million at the end of Q2 2015, corresponding to 15.5% of

preceding 12 months revenue compared to 16.5% in Q2 2014 and 14.9% in Q1 2015. The

increase compared to Q1 2015 was mainly due to inventory build-up ahead of the launch

of the Pre-autumn and the Autumn collections. The nominal increase compared to Q2

2014 was mainly due to higher activity, acquisition of stores and currency development.

Compared with Q2 2014, gold and silver prices affected inventory value with a decrease of

approximately 14%.

Inventory development

DKK million

Q2 2015

Q1 2015

Q4 2014

Q3 2014

Q2 2014

Inventory

2,161

1,925

1,684

2,126

1,684

Share of the last 12 months’ revenue

15.5%

14.9%

14.1%

19.7%

16.5%

PANDORA COMPANY ANNOUNCEMENT

11 August 2015 | COMPANY ANNOUNCEMENT No. 255 | page

16 | 30

Trade receivables increased to DKK 1,009 million at the end of Q2 2015 (7.2% of preceding

12 months revenue) compared with DKK 792 million at the end of Q2 2014 (7.8% of the

preceding 12 months revenue) and DKK 1,093 million at the end of Q1 2015 (8.5% of

preceding 12 months revenue). The relative decrease in trade receivables was primarily

due to a continued strong cash collection as well as the increase in revenue from owned

and operated stores, where no trade receivables are recognised.

Trade payables at the end of the quarter were DKK 979 million compared with DKK 633

million at the end of Q2 2014 and DKK 954 million at the end of Q1 2015. The increase is

primarily due to increasing activity.

Other payables were DKK 626 million at the end of the quarter compared with DKK 918

million at the end of Q1 2015. The decrease was primarily due to withholding taxes of DKK

251 million paid out in Q2 2015 related to the annual ordinary dividend paid in Q1 2015.

CAPEX was DKK 239 million in Q2 2015 compared to DKK 86 million in Q2 2014. The

increase in CAPEX was mainly related to an increase in opening of owned and operated

stores and an acceleration of investments in the production facilities in Thailand. In Q2

2015, CAPEX represented 6.6% of revenue.

During the quarter, a total of DKK 982 million was used to purchase own shares related to

the share buyback programme for 2015. As of 30 June 2015, PANDORA held a total of

3,056,517 treasury shares, corresponding to 2.5% of the share capital.

Total interest-bearing debt was DKK 1,641 million at the end of Q2 2015, compared with

DKK 17 million at the end of Q2 2014, and cash amounted to DKK 611 million compared

with DKK 457 million at the end of Q2 2014. The increase in debt was primarily due to the

ongoing share buyback programme, inventory build-up and the above mentioned payment

to the Danish Tax Authorities.

Net interest-bearing debt (NIBD) at the end of Q2 2015 was DKK 1,030 million

corresponding to a NIBD/EBITDA of 0.2x of the last twelve months EBITDA, compared with

DKK -440 million at the end of Q2 2014 corresponding to a NIBD/EBITDA of -0.1x.

PANDORA COMPANY ANNOUNCEMENT

11 August 2015 | COMPANY ANNOUNCEMENT No. 255 | page

17 | 30

DEVELOPMENT IN FIRST HALF 2015

For detailed comments on Q1 2015 development, refer to the Q1 2015 interim report.

REVENUE

Total revenue increased by 39.1% to DKK 7,145 million in H1 2015 compared to H1 2014.

Excluding foreign exchange movements the underlying revenue growth was 24.0%.

The geographical distribution of revenue in H1 2015 was 44.1% for Americas (44.2% in H1

2014), 40.4% for Europe (41.4% in H1 2014) and 15.5% for Asia Pacific (14.4% in H1 2014).

COSTS

Gross profit was DKK 5,095 million in H1 2015 compared to DKK 3,589 million in H1 2014,

resulting in a gross margin of 71.3% in H1 2015 compared to 69.9% in H1 2014.

Sales, distribution and marketing expenses increased to DKK 1,907 million in H1 2015

compared to DKK 1,301 million in H1 2014, corresponding to 26.7% of revenue in H1 2015

and 25.3% in H1 2014. Administrative expenses amounted to DKK 715 million in H1 2015

versus DKK 560 million H1 2014, representing 10.0% compared to 10.9% of H1 2015 and

H1 2014 revenue, respectively.

EBITDA

EBITDA for H1 2015 increased by 43.0% to DKK 2,616 million resulting in an EBITDA margin

of 36.6% in H1 2015 versus 35.6% in H1 2014.

Regional EBITDA margins for H1 2015 before allocation of central costs were 43.4% in

Americas (45.3% in H1 2014), 41.0% in Europe (39.5% in H1 2014) and 50.8% in Asia Pacific

(48.4% in H1 2014). Unallocated costs were 7.0% of revenue in H1 2015 (7.7% in H1 2014).

EBIT

EBIT for H1 2015 was DKK 2,473 million – an increase of 43.1% compared to H1 2014,

resulting in an EBIT margin of 34.6% in H1 2015 versus 33.6% in H1 2014.

NET FINANCIALS

Net financials amounted to a loss of DKK 350 million in H1 2015 versus DKK 21 million in

H1 2014.

INCOME TAX EXPENSES

Income tax expenses were DKK 830 million in H1 2015, implying an effective tax rate for

the Group of 39.1% for H1 2015. Tax expenses for the first half were impacted by the

earlier mentioned settlement with the Danish Tax Authorities, which had an impact of DKK

364 million in the first quarter. Excluding the additional expense, the effective tax rate

would have been 22.0%, compared with 20.0% for H1 2014.

NET PROFIT

Net profit in H1 2015 was DKK 1,293 million compared to DKK 1,366 million in H1 2014.

CASH FLOW ITEMS

In H1 2015, PANDORA generated free cash flow of DKK 722 million corresponding to a cash

conversion of 55.8% compared to 116.8% in H1 2014.

PANDORA COMPANY ANNOUNCEMENT

11 August 2015 | COMPANY ANNOUNCEMENT No. 255 | page

18 | 30

MANAGEMENT STATEMENT

The Board of Directors and the Executive Board have reviewed and approved the interim

report of PANDORA A/S for the period 1 January - 30 June 2015.

The interim report, which has not been audited or reviewed by the Company’s auditor, has

been prepared in accordance with IAS 34 ‘Interim Financial Reporting’, as adopted by the

EU, and additional Danish interim reporting requirements for listed companies.

In our opinion, the interim report gives a true and fair view of the PANDORA Group’s assets,

liabilities and financial position at 30 June 2015, and of the results of the PANDORA Group’s

operations and cash flow for the period 1 January - 30 June 2015.

Further, in our opinion the Management’s review p. 1-17 gives a true and fair review of the

development in the Group’s operations and financial matters, the result of the PANDORA

Group for the period and the financial position as a whole, and describes the significant

risks and uncertainties pertaining to the Group.

Copenhagen, 11 August 2015

EXECUTIVE BOARD

Anders Colding Friis Peter Vekslund

Chief Executive Officer Chief Financial Officer

BOARD OF DIRECTORS

Peder Tuborgh

Chairman

Christian Frigast Allan Leighton

Deputy Chairman Deputy Chairman

Andrea Alvey Per Bank

Anders Boyer-Søgaard Bjørn Gulden

Michael Hauge Sørensen Ronica Wang

PANDORA COMPANY ANNOUNCEMENT

11 August 2015 | COMPANY ANNOUNCEMENT No. 255 | page

19 | 30

FINANCIAL STATEMENTS

Consolidated income statement

DKK million

Notes

Q2 2015

Q2 2014

H1 2015

H1 2014

FY 2014

Revenue

3

3,598

2,544

7,145

5,136

11,942

Cost of sales

-1,025

-746

-2,050

-1,547

-3,519

Gross profit

2,573

1,798

5,095

3,589

8,423

Sales, distribution and marketing expenses

-981

-676

-1,907

-1,301

-3,100

Administrative expenses

-357

-281

-715

-560

-1,251

Operating profit

1,235

841

2,473

1,728

4,072

Finance income

44

1

46

9

14

Finance costs

-113

-14

-396

-30

-214

Profit before tax

1,166

828

2,123

1,707

3,872

Income tax expense

-256

-166

-830

-341

-774

Net profit for the period

910

662

1,293

1,366

3,098

Earnings per share

Earnings per share, basic (DKK)

7.6

5.3

10.8

10.9

25.0

Earnings per share, diluted (DKK)

7.5

5.3

10.7

10.8

24.7

Consolidated statement of comprehensive income

DKK million

Q2 2015

Q2 2014

H1 2015

H1 2014

FY 2014

Net profit for the period

910

662

1,293

1,366

3,098

Exchange rate differences on translation of foreign

subsidiaries

-261

54

392

78

537

Value adjustment of hedging instruments

-47

37

-2

138

-18

Tax on other comprehensive income

8

5

10

1

5

Other comprehensive income, net of tax

-300

96

400

217

524

Total comprehensive income for the period

610

758

1,693

1,583

3,622

PANDORA COMPANY ANNOUNCEMENT

11 August 2015 | COMPANY ANNOUNCEMENT No. 255 | page

20 | 30

Consolidated balance sheet

DKK million

2015

30 June

2014

30 June

2014

31 December

ASSETS

Goodwill

2,335

1,933

2,080

Brand

1,057

1,053

1,053

Distribution network

231

284

268

Distribution rights

1,069

1,042

1,047

Other intangible assets

514

335

411

Total intangible assets

5,206

4,647

4,859

Property, plant and equipment

941

556

711

Deferred tax assets

592

411

407

Other non-current financial assets

144

64

99

Total non-current assets

6,883

5,678

6,076

Inventories

2,161

1,684

1,684

Financial instruments

109

11

99

Trade receivables

1,009

792

1,110

Tax receivable

236

49

52

Other receivables

772

560

404

Cash

611

457

1,131

Total current assets

4,898

3,553

4,480

Total assets

11,781

9,231

10,556

EQUITY AND LIABILITIES

Share capital

122

128

128

Share premium

1,173

1,229

1,229

Treasury shares

-1,804

-1,255

-2,679

Reserves

1,129

422

729

Proposed dividend

-

-

1,088

Retained earnings

5,477

5,750

6,537

Total equity

6,097

6,274

7,032

Provisions

134

58

61

Loans and borrowings

1,350

-

-

Deferred tax liabilities

463

556

430

Other non-current liabilities

55

4

-

Total non-current liabilities

2,002

618

491

Provisions

663

532

678

Loans and borrowings

291

17

10

Financial instruments

285

24

268

Trade payables

979

633

804

Income tax payable

838

769

643

Other payables

626

364

630

Total current liabilities

3,682

2,339

3,033

Total liabilities

5,684

2,957

3,524

Total equity and liabilities

11,781

9,231

10,556

PANDORA COMPANY ANNOUNCEMENT

11 August 2015 | COMPANY ANNOUNCEMENT No. 255 | page

21 | 30

Consolidated statement of changes in equity

DKK million

Share

capital

Share

Premium

Treasury

shares

Translation

reserve

Hedge

reserve

Proposed

dividend

Retained

earnings

Total

equity

Equity at 1 January 2015

128

1,229

-2,679

885

-156

1,088

6,537

7,032

Net profit for the period

-

-

-

-

-

-

1,293

1,293

Exchange rate differences on

translation of foreign

subsidiaries

-

-

-

392

-

-

-

392

Value adjustment of hedging

instruments

-

-

-

-

-2

-

-

-2

Tax on other comprehensive

income

-

-

-

-

10

-

-

10

Other comprehensive income,

net of tax

-

-

-

392

8

-

-

400

Total comprehensive income

for the period

-

-

-

392

8

-

1,293

1,693

Share-based payments

-

-

266

-

-

-

-254

12

Purchase of treasury shares

-

-

-1,552

-

-

-

-

-1,552

Reduction of share capital

-6

-56

2,161

-

-

-

-2,099

-

Dividend paid

-

-

-

-

-

-1,088

-

-1,088

Equity at 30 June 2015

122

1,173

-1,804

1,277

-148

-

5,477

6,097

Equity at 1 January 2014

130

1,248

-738

348

-143

823

4,794

6,462

Net profit for the period

-

-

-

-

-

-

1,366

1,366

Exchange rate differences on

translation of foreign

subsidiaries

-

-

-

78

-

-

-

78

Value adjustment of hedging

instruments

-

-

-

-

138

-

-

138

Tax on other comprehensive

income

-

-

-

-

1

-

-

1

Other comprehensive income,

net of tax

-

-

-

78

139

-

-

217

Total comprehensive income

for the period

-

-

-

78

139

-

1,366

1,583

Share-based payments

-

-

35

-

-

-

-11

24

Purchase of treasury shares

-

-

-975

-

-

-

-

-975

Reduction of share capital

-2

-19

423

-

-

-

-402

-

Dividend paid

-

-

-

-

-

-823

3

-820

Equity at 30 June 2014

128

1,229

-1,255

426

-4

-

5,750

6,274

PANDORA COMPANY ANNOUNCEMENT

11 August 2015 | COMPANY ANNOUNCEMENT No. 255 | page

22 | 30

Consolidated cash flow statement

DKK million

Q2 2015

Q2 2014

H1 2015

H1 2014

FY 2014

Profit before tax

1,166

828

2,123

1,707

3,872

Finance income

-44

-1

-46

-9

-14

Finance costs

113

14

396

30

214

Amortisation, depreciation and impairment losses

76

52

143

102

222

Share-based payments

23

13

38

24

71

Change in inventories

-335

-91

-289

-168

91

Change in receivables

106

84

-104

279

63

Change in payables and other liabilities

-504

-205

202

-119

795

Other non-cash adjustments

117

47

-338

90

-208

Interest etc. received

-

1

1

1

7

Interest etc. paid

-77

-3

-83

-13

-30

Income tax paid

-734

-102

-972

-180

-761

Cash flows from operating activities

-93

637

1,071

1,744

4,322

Acquisitions of subsidiaries and activities, net of cash

acquired

-78

-

-239

-3

-174

Divestment of businesses

-

-

29

-

19

Purchase of intangible assets

-82

-24

-136

-47

-164

Purchase of property, plant and equipment

-157

-62

-270

-97

-291

Change in other non-current assets

-16

-7

-37

-17

-45

Proceeds from sale of property, plant and equipment

3

1

12

1

23

Cash flows from investing activities

-330

-92

-641

-163

-632

Capital increase including share premium, net

1

-

1

-

-

Dividend paid

-

-

-1,088

-820

-820

Purchase of treasury shares

-983

-658

-1,552

-975

-2,402

Proceeds from loans and borrowings

1,554

-

1,804

10

560

Repayment of loans and borrowings

-153

-4

-118

-29

-597

Cash flows from financing activities

419

-662

-953

-1,814

-3,259

Net increase (decrease) in cash

-4

-117

-523

-233

431

Cash at beginning of period

644

571

1,131

686

686

Net exchange differences

-29

3

3

4

14

Net increase (decrease) in cash

-4

-117

-523

-233

431

Cash at end of period

611

457

611

457

1,131

Cash flows from operating activities

-93

637

1,071

1,744

4,322

- Interest etc. received

-

-1

-1

-1

-7

- Interest etc. paid

77

3

83

13

30

Cash flows from investing activities

-330

-92

-641

-163

-632

- Acquisition of subsidiaries and activities, net of cash

acquired

78

-

239

3

174

- Divestment of businesses

-

-

-29

-

-19

Free cash flow

-268

547

722

1,596

3,868

Unutilised credit facilities

3,937

3,919

3,937

3,919

3,677

The above cannot be derived directly from the income statement and the balance sheet.

PANDORA COMPANY ANNOUNCEMENT

11 August 2015 | COMPANY ANNOUNCEMENT No. 255 | page

23 | 30

NOTES

NOTE 1 – Accounting policies

The present unaudited interim financial report has been prepared in accordance with IAS 34 ‘Interim

Financial Reporting’ as endorsed by the European Union and accounting policies set out in the

Annual Report 2014 of PANDORA.

Furthermore, the interim financial report and Management’s review are prepared in accordance

with additional Danish disclosure requirements for interim reports of listed companies.

PANDORA has adopted all new or amended standards (IFRS) and interpretations (IFRIC) as endorsed

by the EU and which are effective for the financial year 2015. These IFRSs have not had any

significant impact on the Group’s interim financial report.

NOTE 2 – Significant accounting estimates and judgements

In preparing the consolidated financial statements, Management makes various accounting

estimates and assumptions, which form the basis of presentation, recognition and measurement of

PANDORA’s assets and liabilities.

All significant accounting estimates and judgements are consistent with the description in the Annual

Report 2014. See descriptions in the individual notes to the consolidated financial statement in the

Annual Report 2014.

NOTE 3 - Operating segment information

PANDORA’s segment reporting is based on geography. The three reporting segments are Americas,

Europe and Asia Pacific. Europe includes export to countries in Africa, India and the Middle East.

Each country in which PANDORA has an office is an operating segment. Based on the management

structure the operating segments have been aggregated into three reporting segments. In all

segments PANDORA sell jewellery for women crafted in the Thai facilities and use franchises and/or

distributors as appropriate. The operating segments within each reporting segment are deemed to

have similar economic characteristics i.e. are expected to have similar average gross margins in the

long term.

For information on revenue from the different products and sale channels reference is made to the

Management Review.

Management monitors the segment profit of the operating segments separately for the purpose of

making decisions about resource allocation and performance management. Segment profit is

measured consistently with the operating profit in the consolidated financial statements before non-

current assets are amortised/depreciated (EBITDA).

PANDORA COMPANY ANNOUNCEMENT

11 August 2015 | COMPANY ANNOUNCEMENT No. 255 | page

24 | 30

NOTE 3 - Operating segment information, continued

DKK million

Americas

Europe

Asia

Pacific

Unallocated

costs

Total

Group

Q2 2015

External revenue

1,578

1,468

552

-

3,598

Segment profit (EBITDA)

701

567

283

-240

1,311

Amortisation, depreciation and impairment losses

-76

Consolidated operating profit (EBIT)

1,235

Q2 2014

External revenue

1,097

1,064

383

-

2,544

Segment profit (EBITDA)

508

418

179

-212

893

Amortisation, depreciation and impairment losses

-52

Consolidated operating profit (EBIT)

841

DKK million

Americas

Europe

Asia

Pacific

Unallocated

costs

Total

Group

Half year 2015

External revenue

3,151

2,885

1,109

-

7,145

Segment profit (EBITDA)

1,366

1,184

563

-497

2,616

Amortisation, depreciation and impairment losses

-143

Consolidated EBIT

2,473

Half year 2014

External revenue

2,267

2,128

741

-

5,136

Segment profit (EBITDA)

1,026

841

359

-396

1,830

Amortisation, depreciation and impairment losses

-102

Consolidated EBIT

1,728

DKK million

Q2 2015

Q2 2014

H1 2015

H1 2014

Revenue per product group

Charms

2,456

1,705

4,837

3,489

Silver and gold charm bracelets

360

262

782

574

Rings

382

273

787

493

Other jewellery

400

304

739

580

Total revenue

3,598

2,544

7,145

5,136

NOTE 4 – Seasonality of operations

Due to the seasonal nature of the jewellery business, higher revenue is historically realised in the

second half of the year.

NOTE 5 – Financial risks

PANDORA’s overall risk exposure and financial risks, including risks related to commodity prices,

foreign currency, credit, liquidity and interest rate, are unchanged compared to the disclosures in

note 4.4 in the consolidated financial statement in the Annual Report 2014.

NOTE 6 – Financial instruments

Financial instruments are measured at fair value and in accordance with level 2 in the fair value

PANDORA COMPANY ANNOUNCEMENT

11 August 2015 | COMPANY ANNOUNCEMENT No. 255 | page

25 | 30

hierarchy (IFRS 7), see note 4.3 to the consolidated financial statement in the Annual Report 2014.

NOTE 7 - Business combinations

Preliminary purchase price allocation has been prepared for the business combinations since 1

January 2015 and these might change as they are being finalised within the 12 months following the

individual business combinations. No significant changes are expected.

Acquisitions in 2015

Japan

On 1 January 2015, PANDORA acquired assets related to the distribution of PANDORA jewellery in

Japan from Bluebell in a business combination. In addition to the distribution rights, assets included

1 concept store and 9 shop-in-shops. The acquisition was part of a strategic alliance with Bluebell in

Japan with the intent to jointly distribute PANDORA jewellery in Japan.

The agreement initially has a five-year term. On termination of the agreement, PANDORA will take

over the full distribution of PANDORA jewellery in Japan. The total amount to be paid to Bluebell will

depend on the realised revenue in 2019. The discounted fair value of the earn-out is DKK 58 million.

Intangible assets comprise reacquired distribution rights (with remaining lifespan of approximately

three years) of DKK 30 million. The fair value is based on comparison of peer markets similar to the

Japanese market and the EBITDA that can be expected from similar stores in these markets.

Inventories of DKK 6 million have been measured at market value based on the saleability of the

individual items. Goodwill, DKK 20 million, is attributable to the expected synergies from combining

PANDORA’s willingness and ability to invest in the Japanese market with Bluebell’s in-depth

knowledge of the Japanese retail market, Japanese consumers and insight into the Japanese real

estate market, to build a considerable presence in Japan. None of the goodwill recognised is

deductible for income tax purposes.

Middle East

On 16 January 2015, PANDORA acquired 100% of the shares in Pan Me A/S. Pan Me A/S holds the

rights to distribute PANDORA jewellery in the United Arab Emirates (UAE), Bahrain, Qatar and Oman.

PANDORA has paid the purchase price of DKK 112 million primarily related to the rights to distribute

PANDORA jewellery in the UAE, Bahrain, Qatar and Oman, as well as non-current assets and

inventories related to 11 concept stores and 3 shop-in-shops in the UAE.

Intangible assets comprise reacquired distribution rights (with a remaining lifespan of approximately

one year) of DKK 5 million. The fair value is based on comparison of peer markets and the EBITDA

that can be expected from similar stores in these markets.

Inventories of DKK 25 million have been measured at market value based on the saleability of the

individual items. Receivables mainly consist of prepayments and receivables from sales which are

recognised at the value of the expected cash inflow. Goodwill, DKK 54 million, is attributable to the

expected synergies from PANDORA’s direct involvement in the region and establishing Dubai as the

future hub for PANDORA’s activities in the Middle East and North Africa. None of the goodwill

recognised is deductible for income tax purposes.

UK

On 1 April 2015, PANDORA acquired 100% of the shares in four Evernal companies. The Evernal

companies comprise concept stores in Liverpool, Blackpool, Trafford and Arndale. PANDORA has

paid the purchase price of DKK 70 million. Assets acquired mainly consist of inventory, and other

assets and liabilities relating to the stores. Of the purchase price, DKK 74 million was allocated to

goodwill. Goodwill is attributable to the increased margins from owning these already well

performing stores. None of the goodwill recognised is deductible for income tax purposes.

PANDORA COMPANY ANNOUNCEMENT

11 August 2015 | COMPANY ANNOUNCEMENT No. 255 | page

26 | 30

Other business combinations in 2015

PANDORA acquired concept stores in the US and Germany in 2015. These were accounted for as

business combinations. Assets acquired mainly consist of inventory and other assets relating to the

stores. Of the purchase price, DKK 34 million was allocated to goodwill. None of the goodwill

recognised is deductible for income tax purposes.

The impact on revenue and net profit for 2015 from the acquired stores was insignificant. If the

stores had been owned from the beginning of the year, the impact on PANDORA’s revenue and net

profit would have been equally insignificant.

Acquisitions 2015

DKK million

Japan

Middle East

UK

Other

Total

Other intangible assets

30

5

-

-

35

Property, plant and equipment

2

7

-

2

11

Other non-current receivables

-

3

3

-

6

Receivables

-

25

5

10

40

Inventories

6

25

5

40

76

Cash

-

21

-

-

21

Assets acquired

38

86

13

52

189

Non-current liabilities

-

1

2

1

4

Payables

-

27

9

1

37

Other non-current liabilities

-

-

6

6

12

Liabilities assumed

-

28

17

8

53

Total identifiable net assets acquired

38

58

-4

44

136

Goodwill arising from the acquisition

20

54

74

34

182

Purchase consideration

58

112

70

78

318

Cash movements on acquisition:

Purchase consideration transferred

-58

-112

-70

-78

-318

Deferred payment (earn out)

58

-

-

-

58

Cash acquired

-

21

-

-

21

Net cash flow on acquisition

-

-91

-70

-78

-239

Cash flow from sale of businesses *

-

-

-

29

29

Net cash flow from business combinations

-

-91

-70

-49

-210

* The sale of business included mainly inventories and goodwill

Acquisitions after the reporting period

China

On 1 July 2015, PANDORA initiated an agreement about joint distribution of PANDORA jewellery in