2

HIGHLIGHTS

02 Executive Summary

03 Financial Highlights

4

BUSINESS UPDATE

04 Business Update

07 Revenue Review

11 Profitability

14 Cash Flow & Balance Sheet

16 Financial Guidance

19 Sustainability

20 Other Events

22 Contact

23

FINANCIAL STATEMENTS

23 Financial Statements

27 Accounting Notes

37 Disclaimer

Our equity story

Pandora aims to be not only the largest, but also the most desirable jewellery brand in

the accessible luxury market, making high-quality jewellery available to the many. The

jewellery market has historically grown faster than GDP and remains highly

fragmented, with global brands set to outgrow the overall market.

Pandora’s jewellery is designed to empower self-expression and be culturally relevant.

It is hand-finished by skilled craftspeople and meets the highest sustainability

standards in the industry. Pandora’s unique business model is vertically integrated

from design and crafting to direct-to-consumer channels, and the company has built

unrivalled scale in manufacturing, retail distribution and brand presence.

Pandora’s growth strategy Phoenix leverages the company’s existing infrastructure to

pursue numerous untapped growth opportunities and gain higher market share across

geographies and jewellery categories. With its proven financial model, Pandora

expects to outgrow the market with high-single digit organic growth while achieving

best-in-class profitability. Thanks to its asset-light approach, the company also

expects to deliver significant free cash flow, of which the vast majority will be

returned to shareholders and result in mid-to-high teens EPS growth.

CONTENTS

Executive

summary

Financial

highlights

Business

update

Revenue

review

Profitability

Cash Flow &

Balance sheet

Financial

guidance

Sustainability

Other events

& Contact

Financial

statements

Accounting

notes

07 FEBRUARY 2024 | INTERIM FINANCIAL REPORT Q4 2023 | COMPANY ANNOUNCEMENT No. 841 | page

2 | 37

EXECUTIVE SUMMARY

Pandora delivers 8% organic growth in 2023 – targeting 6-9% growth in 2024

FY 2023 highlights

• The Phoenix strategy is elevating Pandora as the leading accessible jewellery brand globally. Investments

across the value chain drove solid growth in 2023 and pave the way for continued growth in 2024.

• Organic growth ended at +8% (previous guidance of “5-6%”), comprising of LFL (like-for-like) of +6% and

network expansion of +4%.

• The gross margin strengthened further during 2023 and ended at 78.6%, up 230bp Y/Y. The EBIT margin

remained solid at 25.0% (guidance of “around 25%”). EPS increased to a record-high DKK 55.5.

• Strong free cash flow saw cash conversion ending at 78% and leverage at 1.1x NIBD/EBITDA.

• Proposed dividend of DKK 18 per share and a new share buyback programme of DKK 4.0 billion to be

completed no later than 31 January 2025.

Q4 2023 highlights

• Continued brand momentum drove solid trading across Q4 2023. Organic growth accelerated to +12%,

comprising of LFL growth of +9% and network expansion of +4%.

• Broad-based LFL growth in Q4 across markets. Key markets in Europe remained solid at 5% growth, US

accelerated to +10% growth and Rest of Pandora continued double-digit growth at +16%.

• The Q4 gross margin reached another all-time high of 79.3%, +310bp vs. Q4 2022.

• The Q4 EBIT margin landed at 34.0%, +150bp vs. Q4 2022, supported by solid growth, cost efficiencies

and cost phasing, as well as some tailwind from silver prices.

Phoenix strategy highlights

• Continued brand investments drove broad-based LFL growth across collections – successful launch of

new “Loves, Unboxed” holiday campaign fuelled further brand momentum.

• Pandora concluded the first chapter of its Phoenix strategy initiated at the CMD 2021 with an organic

growth CAGR of 7.5% (5-7% target CAGR 2021-23) and EBIT margin of 25.0% (target 25-27% by 2023).

• Full transition to recycled gold and silver completed a year before plan – avoids 58,000 tonnes CO

2

p.a.

2024 Guidance and current trading

• Pandora targets another year of solid growth whilst remaining mindful of the macroeconomic climate.

Initial guidance for 2024 is “6-9%” organic growth and an EBIT margin “around 25%”.

• Current trading in Q1 2024 has so far remained healthy with LFL growth up at high single-digit levels. This

is helped by the strong brand momentum seen since mid-2023.

Alexander Lacik, President and CEO of Pandora, says:

“We are very pleased with how we ended 2023 with strong trading across the holiday season. Looking back at the

past two years since we launched the Phoenix growth strategy, we are proud of how our strategic initiatives have

come together to consistently drive strong results despite the challenging macroeconomic backdrop. In 2024, we

target continued solid and profitable growth as we execute on the next chapter of Phoenix.”

DKK million

Q4 2023

Q4 2022

FY 2023

FY 2022

FY 2024

guidance

Revenue

10,820

9,856

28,136

26,463

Organic growth, %

12%

4%

8%

7%

6-9%

Like-for-like, %

9%

-1%

6%

4%

Operating profit (EBIT)

3,674

3,206

7,039

6,743

EBIT margin, %

34.0%

32.5%

25.0%

25.5%

Around 25%

Executive

summary

Financial

highlights

Business

update

Revenue

review

Profitability

Cash Flow &

Balance sheet

Financial

guidance

Sustainability

Other events

& Contact

Financial

statements

Accounting

notes

07 FEBRUARY 2024 | INTERIM FINANCIAL REPORT Q4 2023 | COMPANY ANNOUNCEMENT No. 841 | page

3 | 37

FINANCIAL HIGHLIGHTS

DKK million

Q4 2023

Q4 2022

FY 2023

FY 2022

Financial highlights

Revenue

10,820

9,856

28,136

26,463

Organic growth, %

12%

4%

8%

7%

Like-for-like, %

1

9%

-1%

6%

4%

Earnings before interest, tax, depreciation and amortisation (EBITDA)

4,227

3,712

9,118

8,716

Operating profit (EBIT)

3,674

3,206

7,039

6,743

EBIT margin, %

34.0%

32.5%

25.0%

25.5%

Net financials

-330

-155

-805

-210

Net profit for the period

2,530

2,365

4,740

5,029

Financial ratios

Revenue growth, DKK, %

10%

9%

6%

13%

Revenue growth, local currency, %

13%

6%

9%

8%

Gross margin, %

79.3%

76.2%

78.6%

76.3%

EBITDA margin, %

39.1%

37.7%

32.4%

32.9%

EBIT margin, %

34.0%

32.5%

25.0%

25.5%

Effective tax rate, %

24.4%

22.5%

24.0%

23.0%

Equity ratio, %

23%

33%

23%

33%

NIBD to EBITDA, x

1.1

0.8

1.1

0.8

Return on invested capital (ROIC), %

2

47%

48%

47%

48%

Cash conversion incl. lease payments, %

116%

110%

78%

39%

Net working capital, % of last 12 months’ revenue

1.8%

4.2%

1.8%

4.2%

Capital expenditure, % of revenue

5.4%

4.7%

5.8%

4.9%

Stock ratios

Total payout ratio (incl. share buyback), %

30%

33%

136%

100%

Dividend per share, proposed, DKK

18

16

18

16

Dividend per share, paid, DKK

-

-

16

16

Earnings per share, basic, DKK

29.6

25.5

55.5

54.2

Earnings per share, diluted, DKK

29.4

25.2

55.1

53.7

Consolidated balance sheet

Total assets

23,798

22,013

23,798

22,013

Invested capital

15,126

13,961

15,126

13,961

Net working capital

510

1,104

510

1,104

Net interest-bearing debt (NIBD)

9,770

6,794

9,770

6,794

Equity

5,355

7,167

5,355

7,167

Consolidated statement of cash flows

Cash flows from operating activities

4,821

4,075

7,384

4,434

Capital expenditure, total

582

462

1,624

1,290

Capital expenditure, property, plant and equipment

394

349

1,176

929

Free cash flows incl. lease payments

4,277

3,538

5,489

2,602

Sustainability

Scope 1, 2 & 3 emissions, tonnes CO

2

equivalent

3

-

-

264,543

341,748

Recycled silver and gold, total, %

4

-

-

97%

61%

Leadership gender ratio, female/male, %

5

-

-

34/66

29/71

1

Like-for-like growth include sell-out from all concept stores (including partner-owned), owned and operated Shop in Shops and Pandora Online. Partner-owned other points of sale are not

included in like-for-like. The KPI includes stores which have been operating for +12 months.

2

Last 12 months’ EBIT in % of invested capital.

3

Within limited assurance scope. The scope 2 emissions are calculated as market-based emissions. All emissions are in metric tonnes, as aligned with the Greenhouse Gas Protocol. In 2023, we

have reassessed Pandora’s calculation methodology and data based on updated knowledge. This resulted in an increase in total emissions (tonnes CO2e) of 61,378 in 2022 (+22%).

4

Within limited assurance scope. As of December 2023, Pandora is purchasing 100% recycled silver and gold.

5

The Leadership Team comprises Vice Presidents, Senior Vice Presidents, members of the Executive Leadership Team and the Board of Directors.

Executive

summary

Financial

highlights

Business

update

Revenue

review

Profitability

Cash Flow &

Balance sheet

Financial

guidance

Sustainability

Other events

& Contact

Financial

statements

Accounting

notes

07 FEBRUARY 2024 | INTERIM FINANCIAL REPORT Q4 2023 | COMPANY ANNOUNCEMENT No. 841 | page

4 | 37

BUSINESS UPDATE

Strong brand momentum drives broad-based LFL growth across geographies and segments

In Q4, Pandora delivered another quarter with double-digit organic growth backed by strong LFL growth and

profitability. As witnessed in previous quarters, all elements of the Phoenix strategy came together to drive solid

growth across geographies, collections and drove further market share gains for Pandora. Growth continued to be

driven primarily by strong brand momentum combined with a successful new holiday campaign, which drove a broad-

based increase in traffic and resulted in good performance across the two key gifting occasions of Black Friday and

Christmas.

In Q4 2023, Pandora saw an acceleration in organic growth to +12% which comprised of LFL growth of +9%, network

expansion of +4% whilst lower sell-in to among others partner’s other points of sale represented small drag of -1%.

European key markets saw an improvement to +5% LFL growth with still solid brand momentum across most markets.

Germany continued its very strong trajectory with +39% LFL growth whilst France continued to build on its brand

initiatives with an improvement to +6% LFL growth. In the US, momentum further accelerated with +10% LFL growth

as many growth initiatives under the Phoenix strategy continue to gain increasing traction. Rest of Pandora continued

to deliver solid double-digit growth at +16% despite a strong comparison base with good broad-based growth across

many countries.

By channel, LFL growth was once again positive across all touchpoints with Pandora capitalising on higher traffic

trends. The trend of Pandora’s own stores outperforming partners, continued into Q4 2023 with Pandora’s own

network delivering 10% LFL vs. partners at 3%.

Pandora’s FY 2023 gross margin reached 78.6%, up 230bp Y/Y. The Q4 gross margin was a continuation of the upward

trend witnessed through the year and was up strongly to a record high of 79.3%, +310bps Y/Y. The Core segment

generated a gross margin of 78.2% (Q4 2022: 75.2%), while Fuel with more generated a gross margin of 82.7% (Q4

2022: 79.8%). The overall increase was driven by favourable channel mix as well as structural efficiencies at the

manufacturing facilities. During Q4 2023, Pandora took the opportunity to selectively reduce promotional activity

across a few markets, in line with the strategy of building the Pandora brand for the long-term.

New “Loves, Unboxed” holiday campaign ignites initial steps of brand restaging

During Q4 2023, Pandora took further steps with its refreshed marketing strategy which aims to accelerate growth

through transforming the perception of Pandora into a full jewellery brand across accessible price points. Pandora

successfully launched its new global holiday marketing campaign under the banner of “Loves, Unboxed” and this was

accompanied by a stunning immersive holiday unboxing experience as Pandora took over the Sphere, a large

entertainment venue east of the Las Vegas strip. Pandora also took centre stage at the British Fashion Awards in

December as the lead sponsor and in combination the initiatives continue to drive strong brand heat and traffic. As

in Q3, Pandora continued to compliment these initiatives with powerful social media activations which propelled

nonstop buzz around Pandora during the important holiday season. The tennis bracelet in particular gained significant

popularity through social media channels in Q4.

Pandora will now be taking its marketing message to the next level and already in early 2024 Pandora unveiled its new

“BE LOVE” multi season campaign. The new star-studded campaign introduces three new global brand ambassadors:

actress and activist Selma Blair and sisters and entertainers Halle and Chloe Bailey and marks the next step in

positioning Pandora as a full jewellery brand.

Executive

summary

Financial

highlights

Business

update

Revenue

review

Profitability

Cash Flow &

Balance sheet

Financial

guidance

Sustainability

Other events

& Contact

Financial

statements

Accounting

notes

07 FEBRUARY 2024 | INTERIM FINANCIAL REPORT Q4 2023 | COMPANY ANNOUNCEMENT No. 841 | page

5 | 37

Leveraging the brand identity to grow the core and fuel with more

In Q4 2023, Core represented 76% of total revenue and delivered LFL growth of +4%. The heartbeat of Pandora, our

Pandora Moments platform, delivered solid +4% LFL growth in Q4. In-line with the trend through the year, Pandora’s

studded chain continued to perform particularly well with the new variations of the bracelet added since September

also contributing into Q4. Pandora ME delivered another good quarter with +6% LFL as the new product designs

continued to resonate through the holiday period. The Fuel with more segment represented 24% of total revenue

and excelled with substantial like-for-like growth of +23%, as Pandora leveraged its strong full jewellery brand

marketing message through Timeless which built on its already strong momentum to further accelerate LFL growth

to +31%. Growth was broad-based growth across most categories but herbarium and classic cuts in particular drove

strong growth through the holiday period. Within the Fuel with more segment, our dedicated focus on Pandora Lab-

Grown Diamonds further fuelled our brand's momentum.

Pandora Lab-Grown Diamonds: Building momentum over Holiday period

Earlier in the year Pandora took notable strides on its journey to democratise diamonds with a notable expansion of

its lab-grown assortment which now spans four collections which are available in more than 700 stores in the US,

Canada, UK, Australia, Mexico and Brazil.

Within the quarter, total revenue for Pandora’s Lab-Grown Diamond collection reached DKK 113 million with LFL

growth +83% and Pandora noted good sequential momentum through quarter. By country, North America continued

to account for the largest proportion of revenue whilst rings continued to be the best performing category and

accounted for nearly half of the sales during the quarter. For FY 2023, Pandora’s Lab-Grown Diamond revenue

reached DKK 265 million which marks an encouraging start to Pandora’s new target of generating DKK > 1 billion in

revenue from the collection by 2026. Pandora will continue to optimise execution and take learnings going forward

as it looks to be the go-to destination for lab-grown diamonds.

REVENUE BY SEGMENT

DKK million

Q4 2023

Q4 2022

1

Like-for-

like

Share of

Revenue

FY 2023

FY 2022

1

Like-for-

like

Share of

revenue

Core

8,180

7,766

4%

76%

21,951

21,156

2%

78%

- Moments

6,880

6,469

4%

64%

18,369

17,727

2%

65%

- Collabs

965

983

1%

9%

2,681

2,614

1%

10%

- ME

335

314

6%

3%

900

815

12%

3%

Fuel with more

2,640

2,090

23%

24%

6,186

5,308

14%

22%

- Timeless

2

2,120

1,567

31%

20%

4,792

3,847

20%

17%

- Signature

407

442

-11%

4%

1,129

1,248

-11%

4%

- Pandora Lab-Grown Diamonds

113

81

83%

1%

265

213

116%

1%

Total revenue

10,820

9,856

9%

100%

28,136

26,463

6%

100%

1

Pandora has updated its collection structure by moving products from Fuel with more to Core in 2023 and comparative figures for Q4 2022 were restated accordingly

by DKK 738 million. Total restatement on comparative figures for FY 2022 were DKK 1,964 million.

2

As of Q3 2023, Pandora Timeless includes revenue from the PANDORA ESSENCE collection, amounting to DKK 2 million in Q4 2023 and DKK 5 million FY 2023.

Network expansion drives solid, profitable growth

In Q4 2023, network expansion contributed +4% to organic growth related to net 109 concept store openings and

114 Pandora owned shop-in-shop openings during the last 12 months. Within Q4 2023 alone, Pandora opened an

additional 72 new concept stores and 69 shop-in-shops. The full year organic growth contribution from network

expansion landed at +4% with the total new concept store openings of 109 in-line with guidance of 75-125 openings

and the total new Pandora owned shop-in-shops at 114, slightly ahead of the guidance of 50-100. As witnessed once

again through 2023, store openings continue to create immense value for Pandora with the EBIT margin reaching

>35% in the first year with a rapid payback of investment. With a global market share of only 1.3% and accretive

Executive

summary

Financial

highlights

Business

update

Revenue

review

Profitability

Cash Flow &

Balance sheet

Financial

guidance

Sustainability

Other events

& Contact

Financial

statements

Accounting

notes

07 FEBRUARY 2024 | INTERIM FINANCIAL REPORT Q4 2023 | COMPANY ANNOUNCEMENT No. 841 | page

6 | 37

margins and returns on new store openings, there is significant value creation ahead for Pandora by continuing to

expand the network. For 2024, Pandora targets 75-125 net concept store openings and an additional 25-50 Pandora

owned shop-in-shop openings.

The ongoing rollout of Pandora’s store concept, Evoke 2.0, marks a significant milestone, with a plan to transform

around 60% of Pandora's owned and operated stores into this innovative concept by 2026. Evoke 2.0 optimally

utilises space, providing an intuitive and engaging experience to showcase Pandora as a full jewellery brand. For the

full year, Pandora opened 55 Evoke 2.0 stores, including refurbishments, and will further scale up the roll-out in 2024,

progressing towards the targeted 1,375-1,425 Evoke 2.0 concepts stores by 2026. Early results are encouraging,

with a more intuitive customer experience leading to longer dwell times, self-browsing and good performance across

segments. The store concept has now also shown good performance over peak trading periods where traffic levels

are elevated over certain periods. The CAPEX per Evoke 2.0 store will be roughly in line with current levels.

In 2023, Pandora made strategic strides through acquisitions, taking over a total of 54 concept stores. This included

35 concept stores in the US, 14 in Colombia, and 5 in Canada. The synergies are strong, reinforcing the value of

forward integration through brand consistency and improved operational efficiency.

Proposed total cash return of DKK 5.5 billion for 2024 underpins capital allocation commitment

In 2023, Pandora announced the highest total shareholder distribution in its history of DKK 6.4 billion which was

successfully completed by 2 February 2024. Today, in line with Pandora’s history of returning significant cash back to

shareholders every year, Pandora announces a total proposed shareholder distribution of DKK 5.5 billion. This includes

a proposed dividend of DKK 18 per share, up from DKK 16 per share last year, and a new share buyback programme

of DKK 4.0 billion which will commence on 8 February 2024 and complete no later than 31 January 2025. For further

details on the share buyback programme, please refer to the separate company announcement.

Phoenix strategy yielding positive results as Pandora concludes first chapter, meeting financial targets

With the FY 2023 results, Pandora has successfully concluded the first chapter of its Phoenix strategy. Highlighting

the success of the strategy, and despite the weak consumer backdrop, Pandora delivered on its initial organic growth

target set in 2021 of 5-7% CAGR between 2021-2023 with an organic growth CAGR of 7.5% over the period.

Furthermore, despite the inflationary environment Pandora met its target of EBIT margin of 25-27% by 2023 with

the margin ending at 25.0%.

During the Capital Markets Day in October 2023, Pandora highlighted that it will now look to elevate performance to

the next level as it embarks on the next chapter of the Phoenix strategy. The four strategic growth pillars of the

Phoenix strategy remain unchanged, but within the pillars Pandora has updated its key priorities to transform the

perception of Pandora into a full jewellery brand. As part of the strategic update, Pandora announced new financial

targets:

• Organic growth 7-9% CAGR 2023-2026

• EBIT margin 26-27% by 2026

The new organic growth target represents an upgrade relative to the first chapter of Phoenix announced in 2021 and

comprises of a targeted LFL growth CAGR of 4-6% and a contribution from network expansion of around 3% CAGR.

The growth targets reflect Pandora’s improved operating model alongside a range of current and new initiatives which

will be scaled up to drive solid and sustainable growth. When combined with an expected 1% annual revenue impact

from forward integration, the targets add up to 8-10% local currency CAGR over 2023-2026.

The new EBIT margin target of 26-27% equals 100-200 bp of margin expansion compared to the 2023 results. The

Executive

summary

Financial

highlights

Business

update

Revenue

review

Profitability

Cash Flow &

Balance sheet

Financial

guidance

Sustainability

Other events

& Contact

Financial

statements

Accounting

notes

07 FEBRUARY 2024 | INTERIM FINANCIAL REPORT Q4 2023 | COMPANY ANNOUNCEMENT No. 841 | page

7 | 37

EBIT margin target will be delivered while accelerating investments in current and future growth – underpinning

Pandora’s ability to leverage its current infrastructure to drive growth.

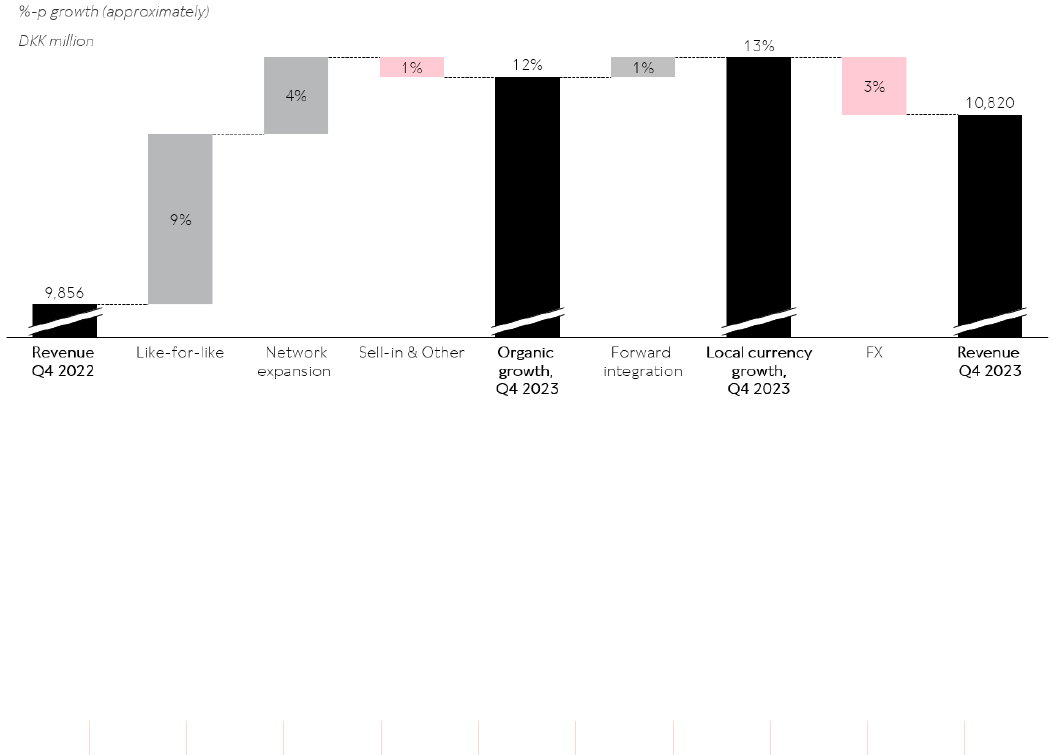

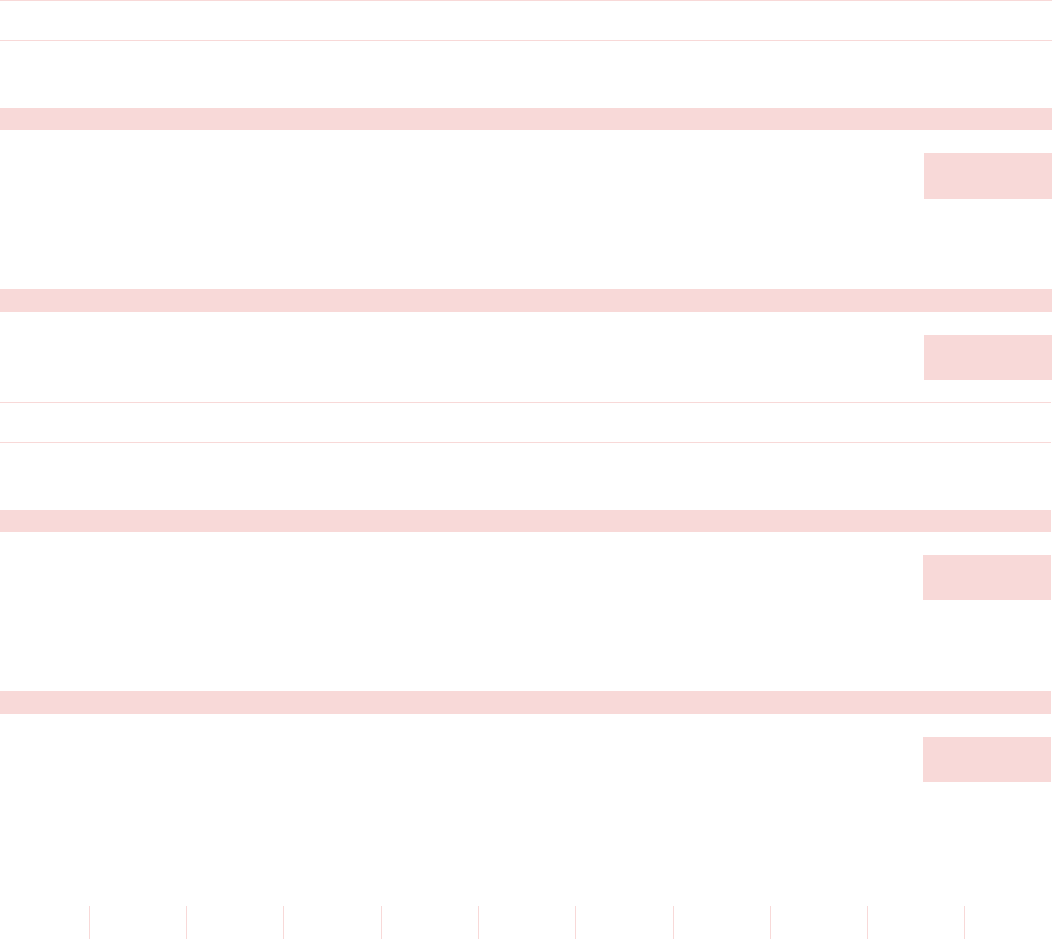

REVENUE REVIEW

Double-digit revenue growth driven by strong LFL

In Q4, Pandora delivered organic growth of +12% which comprised of strong LFL growth of +9% and network

expansion of +4%. A drag from among others sell-in to partner’s other points of sale (which is not included in LFL),

had a negative impact on organic growth of -1%.

Across its two segments, Pandora continues to grow and the strong LFL growth was underpinned by a solid Core

which grew +4% LFL, whilst the Fuel with more segment further accelerated growth with +23% LFL, with in particular

the Timeless collection continuing to perform well.

Forward integration continues to support total revenue growth, driven by the acquisition of 54 concept stores in the

US (35 stores), Colombia (14 stores) and Canada (5 stores) this year, bringing the total contribution from forward

integration to 1% in Q4 2023. Foreign exchange rates represented a net headwind of 3%, as most currencies have

depreciated vs. DKK, with in particular a weaker USD, but also a material decline in the Turkish lira.

The revenue growth development can be illustrated as follows:

Q4 2023 growth composition vs. Q4 2022

Executive

summary

Financial

highlights

Business

update

Revenue

review

Profitability

Cash Flow &

Balance sheet

Financial

guidance

Sustainability

Other events

& Contact

Financial

statements

Accounting

notes

07 FEBRUARY 2024 | INTERIM FINANCIAL REPORT Q4 2023 | COMPANY ANNOUNCEMENT No. 841 | page

8 | 37

REVIEW OF REVENUE BY KEY MARKET

Brand momentum carries into Q4 and propels LFL growth

Pandora delivered another strong performance in the fourth quarter marked by double-digit revenue growth. Growth

was propelled by the strong brand momentum which continued into the fourth quarter with strong performances

through Black Friday and Christmas. Regionally, the US accelerated to +10% LFL coupled with broadly stable

performance across key European markets. Rest of Pandora continues to grow at double-digit levels whilst the

momentum slowed slightly to +16% LFL in Q4, reflecting the tougher comparison base.

US

In the fourth quarter of 2023, the US sustained positive momentum, achieving strong LFL growth of +10%, an

improvement from +5% in Q3 2023. This performance was propelled by the strong brand momentum which is

consistently attracting higher traffic. Pandora Lab-Grown Diamonds continues to generate considerable brand

excitement, highlighted by a prominent campaign projected on the Sphere, a large entertainment venue east of the

Las Vegas strip. Additionally, the Timeless collection experienced substantial momentum, notably with the tennis

bracelet going viral on two occasions.

While LFL growth in the wholesale channel continued to improve in Q4, there remains a notable gap compared to

Pandora's owned and operated stores. Overall, the US recorded strong organic growth of +15%, fuelled by strong LFL

performance and further augmented by new store openings throughout 2023.

Key markets in Europe

LFL for the key markets in Europe continues to be solid at +5% in Q4 2023, up from +4% in Q3 2023, mainly driven

by the continued strong momentum in Germany.

In Q4 2023, the strong brand momentum in Germany continued, resulting in an accelerated LFL growth of +39%. The

shift to a more digital-centric media model, with a focus on search and digital channels has contributed to driving

significant traffic. This was further boosted by products that went viral on social media platforms, as well as services

like engraving. Overall, the strong performance, outpacing a subdued market, reflects the positive brand momentum,

effective execution and the brand being on track to be recognized as a full jewellery brand.

Despite a reduction in promotional days compared to the previous year, the UK exhibited overall stability and

reported a -2% LFL in Q4 2023. This suggests stable underlying performance despite the adverse consumer

sentiment.

Italy’s performance remained stable at -1% LFL. The brand remains healthy and with positive traffic although the

purchase power for the average Italian consumer is under pressure and converting sales has been slightly more

difficult than in prior years. However, the performance in Timeless, supported by the store concept Evoke 2.0, is

particularly encouraging and helped contribute to increased brand penetration as reflected also by its ability to

attract new customers.

France delivered another solid quarter with +6% LFL. France demonstrates strong brand momentum, with an evolving

brand perception and strengthening brand equity also marked by the reduction in promotional days. Influencer

events, and magazine features, such as a fully loaded necklace featured in Madame Figaro, continue to create buzz

and elevate the brand desirability. The wholesale channel continues to be significant a drag on performance in France

with LFL among partners in negative in Q4.

Executive

summary

Financial

highlights

Business

update

Revenue

review

Profitability

Cash Flow &

Balance sheet

Financial

guidance

Sustainability

Other events

& Contact

Financial

statements

Accounting

notes

07 FEBRUARY 2024 | INTERIM FINANCIAL REPORT Q4 2023 | COMPANY ANNOUNCEMENT No. 841 | page

9 | 37

China

The Q4 2023 performance in China fell short of expectations, recording a -11% LFL decline. Despite positive

indicators from the ongoing brand relaunch in Shanghai, the pace and extent of recovery have been subdued, not

helped by the macro uncertainty in the market.

As part of the Phoenix strategy reaffirming Pandora's dedication to success in its core markets, efforts are intensified

to revitalise the brand and regain growth in China. In light of this, David Allen has assumed the role of General Manager

for the Greater China cluster. Leveraging his distinct Pandora experience, including several years in global office

leading the EMEA region, David brings valuable expertise to drive positive change in the cluster.

Australia and Rest of Pandora

In Australia, weak consumer sentiment persisted, resulting in a -6% LFL compared to Q4 2022. Pandora's owned and

operated concept stores consistently outperformed the wholesale channel, attributed in part to urban tourism and

strategic execution in these stores, which displayed high conversion rates.

Rest of Pandora reported another double-digit quarter, achieving a +16% LFL in Q4 2023. The solid growth was

delivered despite a tougher base of comparison in many markets, such as Mexico. Overall, the growth remains broad-

based with established markets such as Spain (DKK 1.2 billion revenue in FY 2023), Mexico (DKK 1.4 billion revenue in

FY 2023), and Canada (DKK 0.8 billion revenue in FY 2023) sustaining moderate to mid-teens LFL growth, while less

penetrated markets like Austria, Poland, and Portugal exhibited solid double-digit LFL growth.

QUARTERLY REVENUE DEVELOPMENT BY KEY MARKET

DKK million

Q4 2023

Q4 2022

Like-for-like

Organic growth

Share of revenue

US

3,190

2,820

10%

15%

29%

China

1

116

143

-11%

-13%

1%

UK

1,627

1,613

-2%

0%

15%

Italy

921

913

-1%

1%

9%

Australia

461

535

-6%

-9%

4%

France

502

475

6%

6%

5%

Germany

2

662

494

39%

34%

6%

Total key markets

7,479

6,991

6%

8%

69%

Rest of Pandora

3,341

2,865

16%

20%

31%

Total revenue

10,820

9,856

9%

12%

100%

1

The preliminary LFL in China was shown as -12% in the Q4 pre-announcement. The final LFL is -11%.

2

The preliminary LFL in Germany was shown as 40% in the Q4 pre-announcement. The final LFL is 39%.

Executive

summary

Financial

highlights

Business

update

Revenue

review

Profitability

Cash Flow &

Balance sheet

Financial

guidance

Sustainability

Other events

& Contact

Financial

statements

Accounting

notes

07 FEBRUARY 2024 | INTERIM FINANCIAL REPORT Q4 2023 | COMPANY ANNOUNCEMENT No. 841 | page

10 | 37

YEAR-TO-DATE REVENUE DEVELOPMENT BY KEY MARKET

DKK million

FY 2023

FY 2022

Like-for-like

Organic growth

Share of revenue

US

8,306

7,907

2%

5%

30%

China

564

737

-9%

-18%

2%

UK

3,821

3,802

-1%

2%

14%

Italy

2,540

2,580

-3%

-2%

9%

Australia

1,120

1,271

-6%

-6%

4%

France

1,196

1,190

1%

0%

4%

Germany

1,527

1,307

26%

17%

5%

Total key markets

19,075

18,795

1%

2%

68%

Rest of Pandora

9,062

7,669

16%

21%

32%

Total revenue

28,136

26,463

6%

8%

100%

REVIEW OF NETWORK DEVELOPMENT

223 net openings in 2023 across concept stores and Pandora owned shop-in-shops

During the fourth quarter of 2023, Pandora accelerated its strategic network expansion, opening a net of 72 concept

stores and 69 Pandora owned shop-in-shops. With this contribution, for the full year 2023 net openings amounted

to 109 concept stores and 114 Pandora owned shop-in-shops. The net concept store openings have been relatively

broad-based, mainly across the Americas and Europe, while the openings of Pandora owned shop-in-shops have been

concentrated around Latin America.

In Q4 2023, network expansion drove +4% of the revenue growth. On top of that, forward integration added 1% to

revenue growth.

Network expansion is low risk, while being accretive to margins and returns. As such, Pandora continues it plans to

expand the network with 400-500 targeted net openings through 2024-2026. For FY 2024, Pandora targets net 75-

125 concept store openings and 25-50 new Pandora owned shop-in-shops.

Number of points of sale

1

Q4 2023

Q3 2023

Q4 2022

Growth

Q4 2023

/Q3 2023

Growth

Q4 2023

/Q4 2022

Concept stores

2,651

2,579

2,542

72

109

- of which Pandora owned

2

1,869

1,783

1,653

86

216

- of which franchise owned

463

486

588

-23

-125

- of which third-party distribution

319

310

301

9

18

Other points of sale

4,035

3,989

3,985

46

50

- of which Pandora owned

2

578

509

464

69

114

- of which franchise owned

3,144

3,159

3,200

-15

-56

- of which third-party distribution

313

321

321

-8

-8

Total points of sale

6,686

6,568

6,527

118

159

1

Please refer to note 14 Store network, concept store development in the accounting notes section for more details.

2

Pandora does not own any of the premises (land and buildings) where stores are operated. Pandora exclusively operates stores from leased premises.

Executive

summary

Financial

highlights

Business

update

Revenue

review

Profitability

Cash Flow &

Balance sheet

Financial

guidance

Sustainability

Other events

& Contact

Financial

statements

Accounting

notes

07 FEBRUARY 2024 | INTERIM FINANCIAL REPORT Q4 2023 | COMPANY ANNOUNCEMENT No. 841 | page

11 | 37

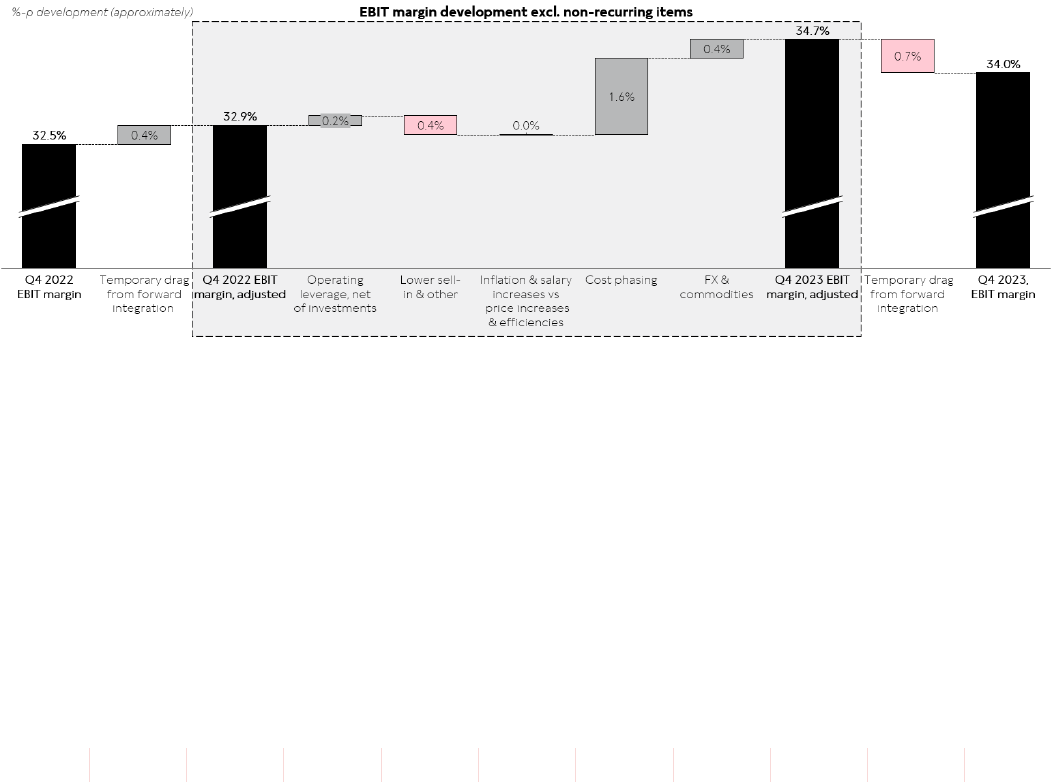

PROFITABILITY

EBIT margin in line with expectations – supported by a very strong gross margin

The EBIT margin for Q4 was 34.0%, +150bp above Q4 2022 and the full year 2023 EBIT margin ended at 25.0%, in

line with the guidance of “Around 25%”. As highlighted throughout 2023, the Q4 2023 margin beneffited from cost

phasing between the quarters. After representing a drag of 100bp in the first three quarters of 2023 cost phasing

was a tailwind of +160bp in the fourth quarter.

Operating leverage net of investments drove a small improvement in the margin of +20bps. In line with previous

quarters, Pandora continued to accelerate investments into current and future growth initiatives, including brand

initiatives as well as digital, and therefore the operating leverage from LFL growth and network expansion was largely

re-invested. Elsewhere, the drag from among others lower sell-in to partners consituted a headwind of around -40bp

whilst cost efficiencies continued to support the margin, and offset the pressure from cost inflation and salary

increases.

Foreign exchange represented a headwind of -20bp, which was more than offset by the tailwind of +60bp from

commodities. The positive impact on commodites is driven by the lower price on silver, while the headwind on

currency comes from the weakening of USD and AUD. Forward integration represented a temporary net drag of -

30bp compared to Q4 2022 related to inventory bought back by Pandora as part of acquisitions.

Executive

summary

Financial

highlights

Business

update

Revenue

review

Profitability

Cash Flow &

Balance sheet

Financial

guidance

Sustainability

Other events

& Contact

Financial

statements

Accounting

notes

07 FEBRUARY 2024 | INTERIM FINANCIAL REPORT Q4 2023 | COMPANY ANNOUNCEMENT No. 841 | page

12 | 37

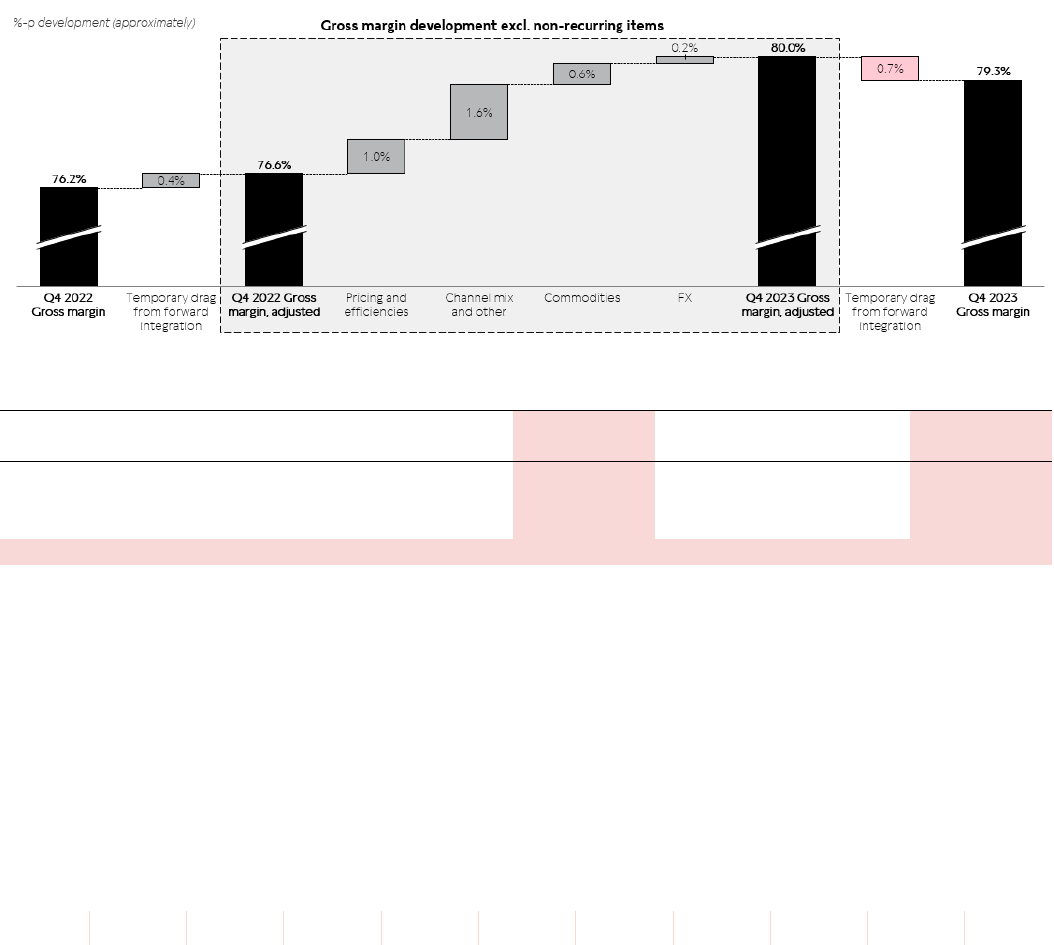

GROSS MARGIN

In Q4, Pandora achieved a record high gross margin of 79.3%, +310bp Y/Y, continuing the upward trend witnessed

over the past few years. As a result, the FY 2023 margin ended at 78.6%, up 230bp Y/Y. The Core segment generated

a gross margin of 78.2% (Q4 2022: 75.2%), while Fuel with more generated a gross margin of 82.7% (Q4 2022: 79.8%).

The overall increase in Q4 was driven by favourable channel mix as well as structural efficiencies at the manufacturing

facilities. On top of that, there was some positive help from price increases initiated in Q4 2023, albeit on a lower

scale than last year.

Foreign exchange rates provided a tailwind of +20bp, driven by the weakening of the THB and USD, whilst

commodities drove a +60bp tailwind vs. Q4 2022.

The gross margin continued to be temporarily negatively impacted by the impact from buying back inventory during

the process of forward integration. This represented a net headwind of -30bp compared to Q4 2022. Adjusting for

forward integration, the underlying gross margin improved by +340bp to 80.0% compared to Q4 2022.

GROSS MARGIN AND GROSS PROFIT

DKK million

Q4 2023

Q4 2022

Growth in

constant FX

FY 2023

FY 2022

Growth in

constant FX

Revenue

10,820

9,856

13%

28,136

26,463

9%

Cost of sales

-2,241

-2,345

-1%

-6,012

-6,273

-4%

Gross profit

8,579

7,511

17%

22,125

20,190

13%

Gross margin, %

79.3%

76.2%

78.6%

76.3%

Executive

summary

Financial

highlights

Business

update

Revenue

review

Profitability

Cash Flow &

Balance sheet

Financial

guidance

Sustainability

Other events

& Contact

Financial

statements

Accounting

notes

07 FEBRUARY 2024 | INTERIM FINANCIAL REPORT Q4 2023 | COMPANY ANNOUNCEMENT No. 841 | page

13 | 37

OPERATING EXPENSES

The operating expenses increased by 16% in constant exchange rates, measured against Q4 2022. The increase was

driven by the expansion of the profitable store network and forward integrations, having added 330 Pandora owned

and operated stores compared to Q4 last year, leading to a 18% increase in sales and distribution expenses.

On top of that, the pressure from higher-than-usual salary increases, not least to our store colleagues, continued to

represent a headwind.

Marketing expenses were up by 12% in constant exchange rates vs Q4 2022, growing broadly in-line with group

revenues. The increase in absolute marketing spend reflected, among others, investments into the brand and the new

global “Love, Unboxed” campaign. The FY 2023 marketing costs were up by 5% in constant rates, and within the

guided range of 13-15% of revenue.

Administrative expenses increased by 17% in constant exchange rates vs. Q4 2022. This reflects among others higher

bonus accruals given the strong performance and legal fees etc. related to the significant number of new stores

opened during the quarter.

QUARTERLY OPERATING EXPENSES

DKK million

Q4 2023

Q4 2022

Growth in

constant FX

Share of

revenue

Q4 2023

Share of

revenue

Q4 2022

Sales and distribution expenses

-2,790

-2,418

18%

25.8%

24.5%

Marketing expenses

-1,446

-1,301

12%

13.4%

13.2%

Administrative expenses

-668

-586

17%

6.2%

5.9%

Total operating expenses

-4,905

-4,305

16%

45.3%

43.7%

YEAR-TO-DATE OPERATING EXPENSES

DKK million

FY 2023

FY 2022

Growth in

constant FX

Share of

revenue

FY 2023

Share of

revenue

FY 2022

Sales and distribution expenses

-8,858

-7,602

19%

31.5%

28.7%

Marketing expenses

-3,849

-3,720

5%

13.7%

14.1%

Administrative expenses

-2,379

-2,125

13%

8.5%

8.0%

Total operating expenses

-15,086

-13,448

14%

53.6%

50.8%

FINANCIAL EXPENSES AND TAX

Net financials came in at a cost of DKK 330 million in Q4 2023, compared to DKK 155 million in Q4 2022. The increase

in interest rates and higher leverage compared to last year impacted the interest paid on loans, as well as the IFRS 16

related interest on lease payments. The net realised profit on foreign exchange hedging contracts represented a net

loss of DKK 58 million in Q4 2023. For the full year, net financials amounted to a cost of DKK 805 million in 2023 vs.

a cost of DKK 210 million in 2023. This increase reflected the above-mentioned increase in interest rates and higher

leverage compared to last year but also foreign exchanges rate adjustments, which had a material positive impact in

2022, but represented a small drag this year.

The effective tax rate in Q4 2023 came in at 24.4%, up by 190bp versus Q4 2022. For the full year the tax rate was

24.0%, within the 23-24% guidance range, and up by 100bp versus the full year 2022. The increase Y/Y was driven

by among others that a higher share of profits are subject to taxation in jurisdictions with tax rates exceeding the

Danish corporate tax rate of 22% as well as an increase in non-deductible expenditures.

Executive

summary

Financial

highlights

Business

update

Revenue

review

Profitability

Cash Flow &

Balance sheet

Financial

guidance

Sustainability

Other events

& Contact

Financial

statements

Accounting

notes

07 FEBRUARY 2024 | INTERIM FINANCIAL REPORT Q4 2023 | COMPANY ANNOUNCEMENT No. 841 | page

14 | 37

Pandora ended the quarter with an EPS of DKK 29.6, up notably from the DKK 25.5 achieved in Q4 2022. For the full

year, Pandora ended with a new record-high EPS of DKK 55.5. This represented an EPS growth of 10% in local currency

vs. FY 2022.

CASH FLOW & BALANCE SHEET

Continued strong free cash flow generation

Pandora delivered strong cash conversion of 116% in Q4 with the full year cash conversion up to 78% after last year’s

deliberate increase in inventory levels which temporarily impacted cash conversion in 2022. Net working capital

ended at 1.8% of revenue in 2023 vs. the 2022 level of 4.2%. The reduction of 240bp was helped by inventory levels

decreasing as a percentage of last 12 months revenue, ending the year broadly flat in absolute terms, in line with

previous communication.

Trade receivables continue to be at a healthy level and in line with last year. The wholesale Days sales outstanding

(DSO) ends at 31 days vs. 28 days in 2022 with the increase mainly reflecting geographical mix in the wholesale

channel. In line with previous communication, the temporary longer payment terms offered in a very few select

markets in Q3 2023 to help partner performance was largely reversed back to normal levels. Retail DSO were at seven

days, bringing the total DSO to 11 days, slightly lower than the 2022 DSO of 12 days.

As per normal seasonality, the cash conversion peaked in the fourth quarter ending at 116% in Q4 2023 generating a

free cash flow of DKK 4.3 billion vs DKK 3.6 billion in Q4 2022. The increase compared to 2022 was driven by the

higher absolute EBIT and improved net working capital. CAPEX came in at DKK 0.6 billion, equivalent to 5% of the

revenue, driven by continued investments into growth, and particularly the physical store network. This was in line

with the 5% CAPEX as a share of revenue in Q4 2022. For the full year, CAPEX was DKK 1.6 billion, equivalent to 6%

share of revenue, and in line with the guidance of around 6%.

ROIC continued to remain high at 47%, and broadly in line with Q4 2022. The structurally high ROIC continues to be

supported by the investments into expanding Pandora’s physical store network, as new Pandora concept stores are

ROIC accretive on a run-rate basis.

NET WORKING CAPITAL

Share of preceding 12 months' revenue

Q4 2023

Q3 2023

Q2 2023

Q1 2023

Q4 2022

Inventories

14.8%

17.8%

16.6%

16.3%

15.9%

Trade receivables

4.8%

3.4%

2.9%

3.2%

4.8%

Trade payables

-11.4%

-8.7%

-8.5%

-8.2%

-11.8%

Other net working capital elements

-6.4%

-3.3%

-2.6%

-2.4%

-4.7%

Total

1.8%

9.2%

8.4%

8.8%

4.2%

Balance Sheet

Non-current assets increased by DKK 1.5 billion to DKK 15.8 billion at the end of 2023, driven by the network

expansion increasing the right-of-use-assets as well as tangible assets and a higher CAPEX spend related to store

refurbishments.

At the end of 2023, net interest-bearing debt amounted to DKK 9.8 billion, up from DKK 6.8 billion in 2022. This

corresponds to a leverage of 1.1x by the end of 2023, up from 0.8x by the end of 2022 and broadly in line with the

mid-point of the capital structure policy range of 0.5x to 1.5x. The increase in net interest-bearing debt was driven

by the decision to increase leverage to around the mid-point of the capital structure policy. This resulted in significant

Executive

summary

Financial

highlights

Business

update

Revenue

review

Profitability

Cash Flow &

Balance sheet

Financial

guidance

Sustainability

Other events

& Contact

Financial

statements

Accounting

notes

07 FEBRUARY 2024 | INTERIM FINANCIAL REPORT Q4 2023 | COMPANY ANNOUNCEMENT No. 841 | page

15 | 37

cash returns to shareholders in 2023 through a combination of the largest share buyback in the history of Pandora

and dividends.

At the end of 2023, equity in Pandora amounted to DKK 5.4 billion, below the DKK 7.2 billion of last year. The

difference is mainly driven by the decision to increase leverage from the low end of the capital structure range to

around the mid-point. Consequently, Pandora paid out DKK 1.4 billion in ordinary dividend and bought back own

shares for a total of DKK 5.0 billion.

Executive

summary

Financial

highlights

Business

update

Revenue

review

Profitability

Cash Flow &

Balance sheet

Financial

guidance

Sustainability

Other events

& Contact

Financial

statements

Accounting

notes

07 FEBRUARY 2024 | INTERIM FINANCIAL REPORT Q4 2023 | COMPANY ANNOUNCEMENT No. 841 | page

16 | 37

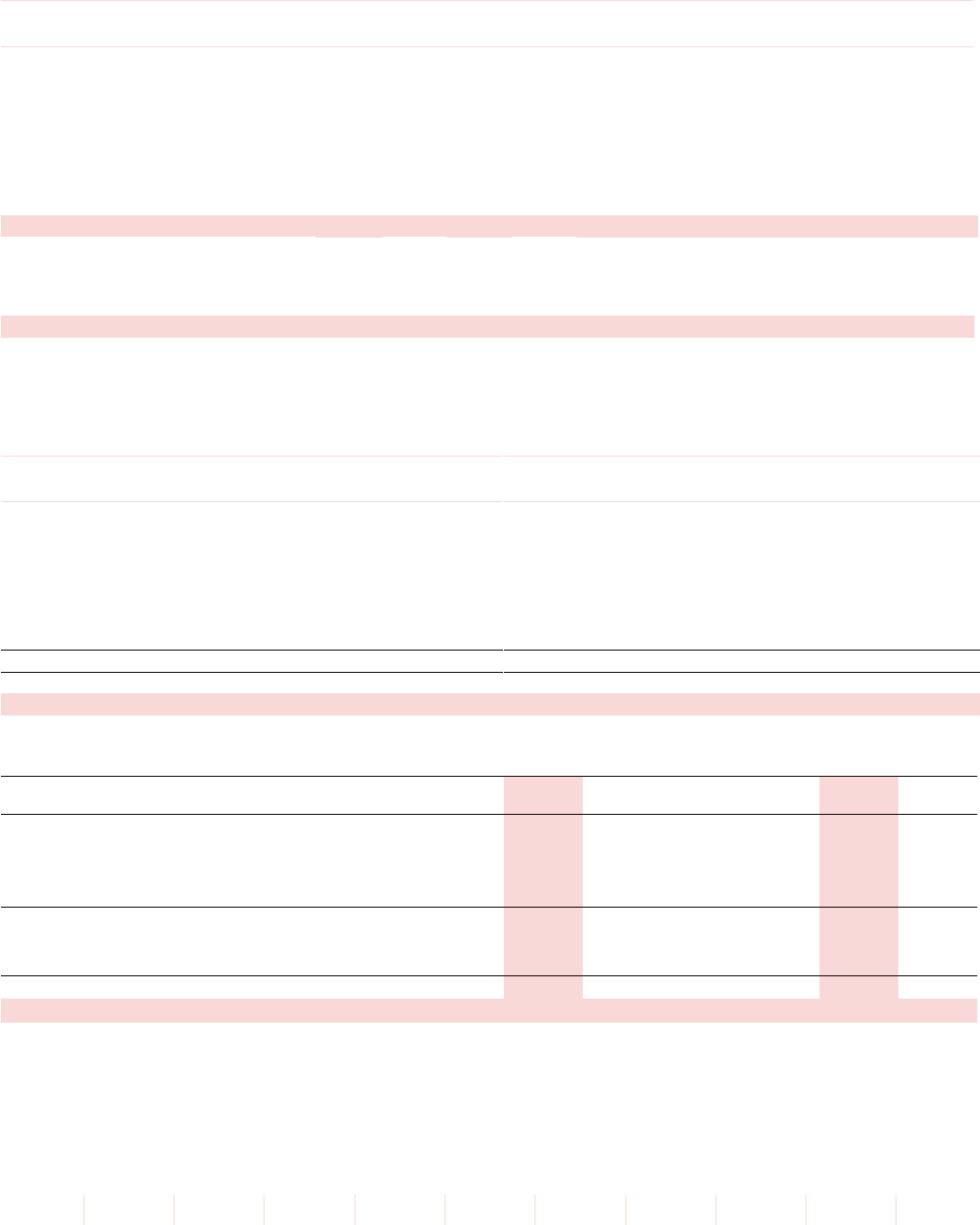

FINANCIAL GUIDANCE

Targeting another year of profitable growth

The economic outlook for 2024 continues to remain uncertain. Continued inflation and still high interest rates suggest

another challenging backdrop for consumers across many markets. Pandora will continue to execute on its Phoenix

strategy which has yielded consistently positive results despite the challenging backdrop over the past two years but

remains mindful of the uncertain macroeconomic environment. Therefore, the guidance for 2024 considers the

external environment, Pandora’s own specific Phoenix initiatives and current trading to form an initial range.

Pandora is currently targeting organic growth of +6% to +9% and an EBIT margin of around 25%. The low-end of the

guidance accounts for a worsening of macroeconomic conditions relative to that being witnessed today.

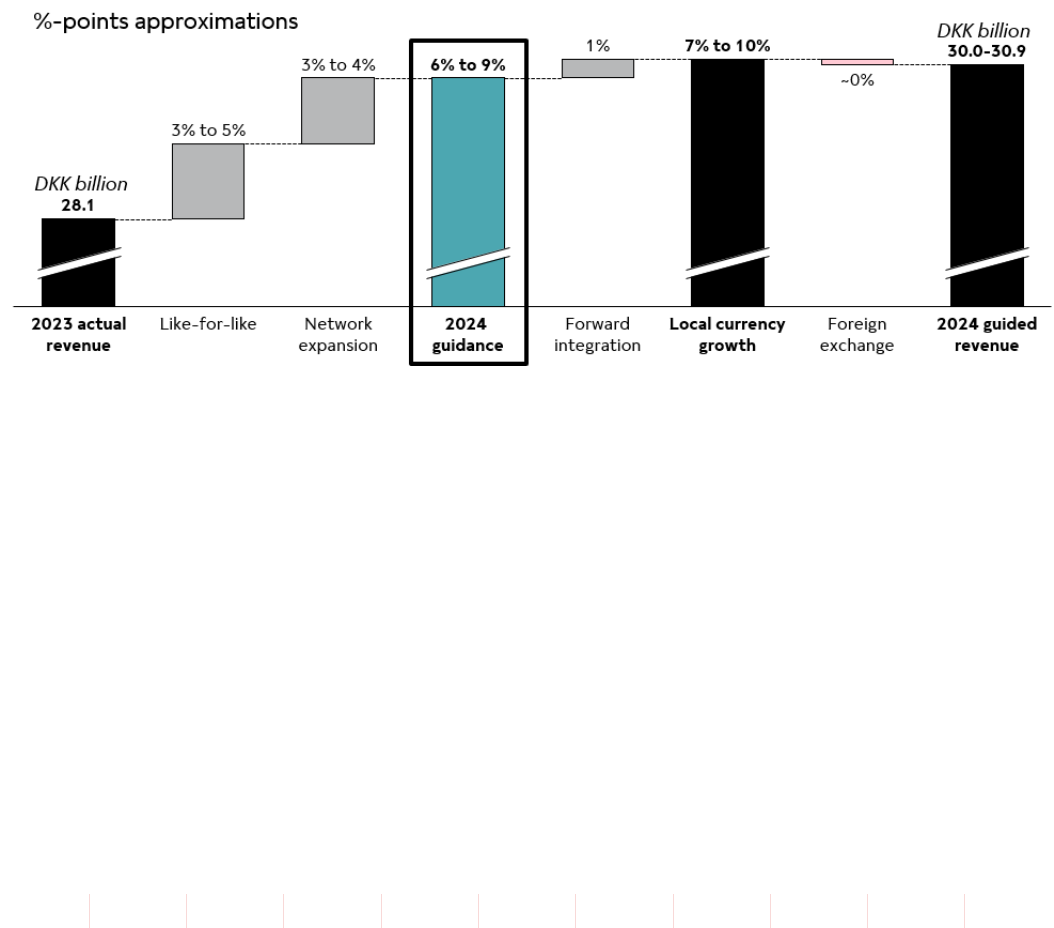

REVENUE GUIDANCE

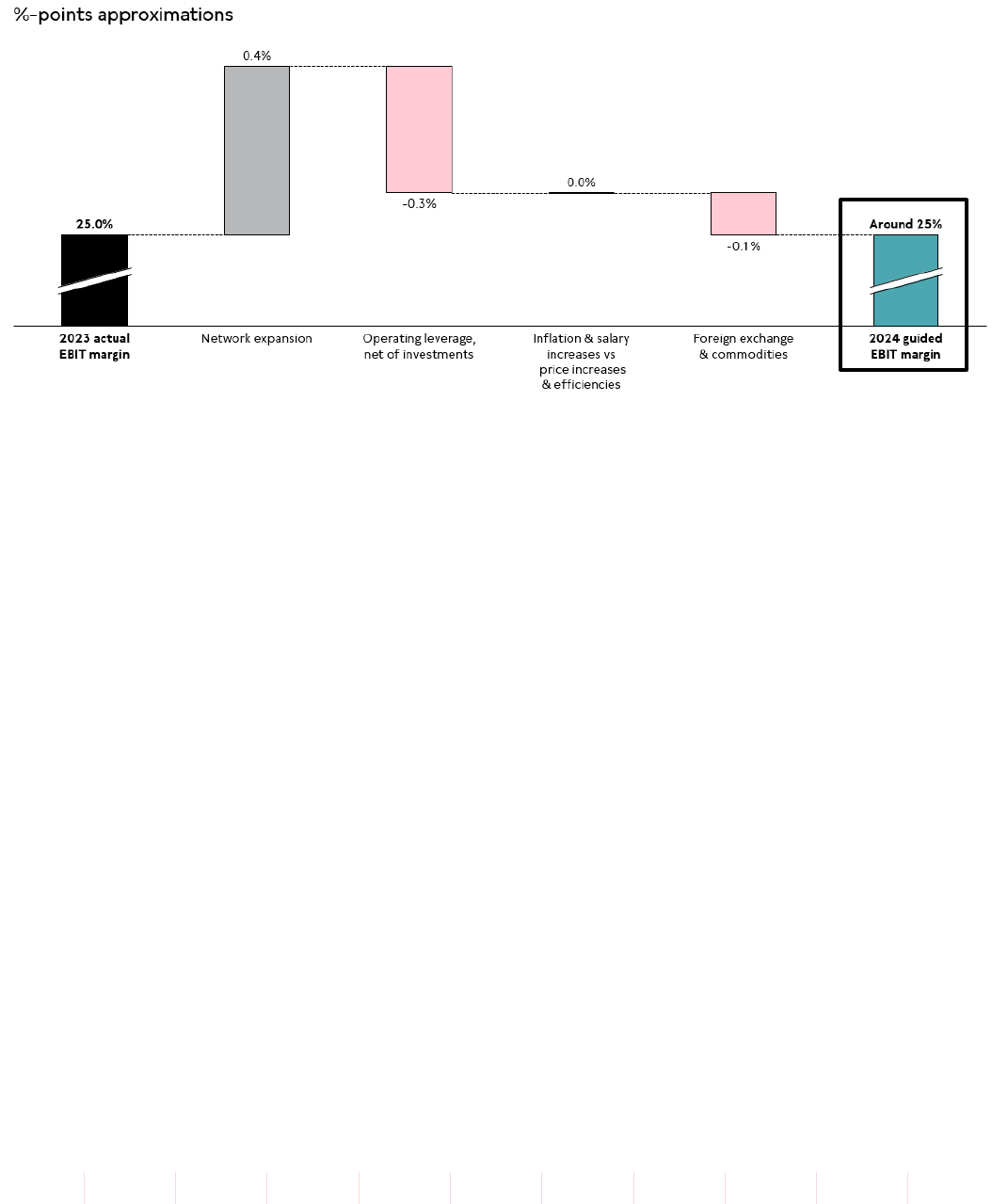

The organic growth guidance can be illustrated as follows:

Pandora is currently expecting LFL growth of +3% to +5%. Continued network expansion is expected to add +3% to

+4% to take the total organic growth to +6% to +9%. Finally, forward integration is expected to add around 1%

revenue with revenue growth in local currency ending at +7% to +10%.

Executive

summary

Financial

highlights

Business

update

Revenue

review

Profitability

Cash Flow &

Balance sheet

Financial

guidance

Sustainability

Other events

& Contact

Financial

statements

Accounting

notes

07 FEBRUARY 2024 | INTERIM FINANCIAL REPORT Q4 2023 | COMPANY ANNOUNCEMENT No. 841 | page

17 | 37

PROFITABILITY GUIDANCE

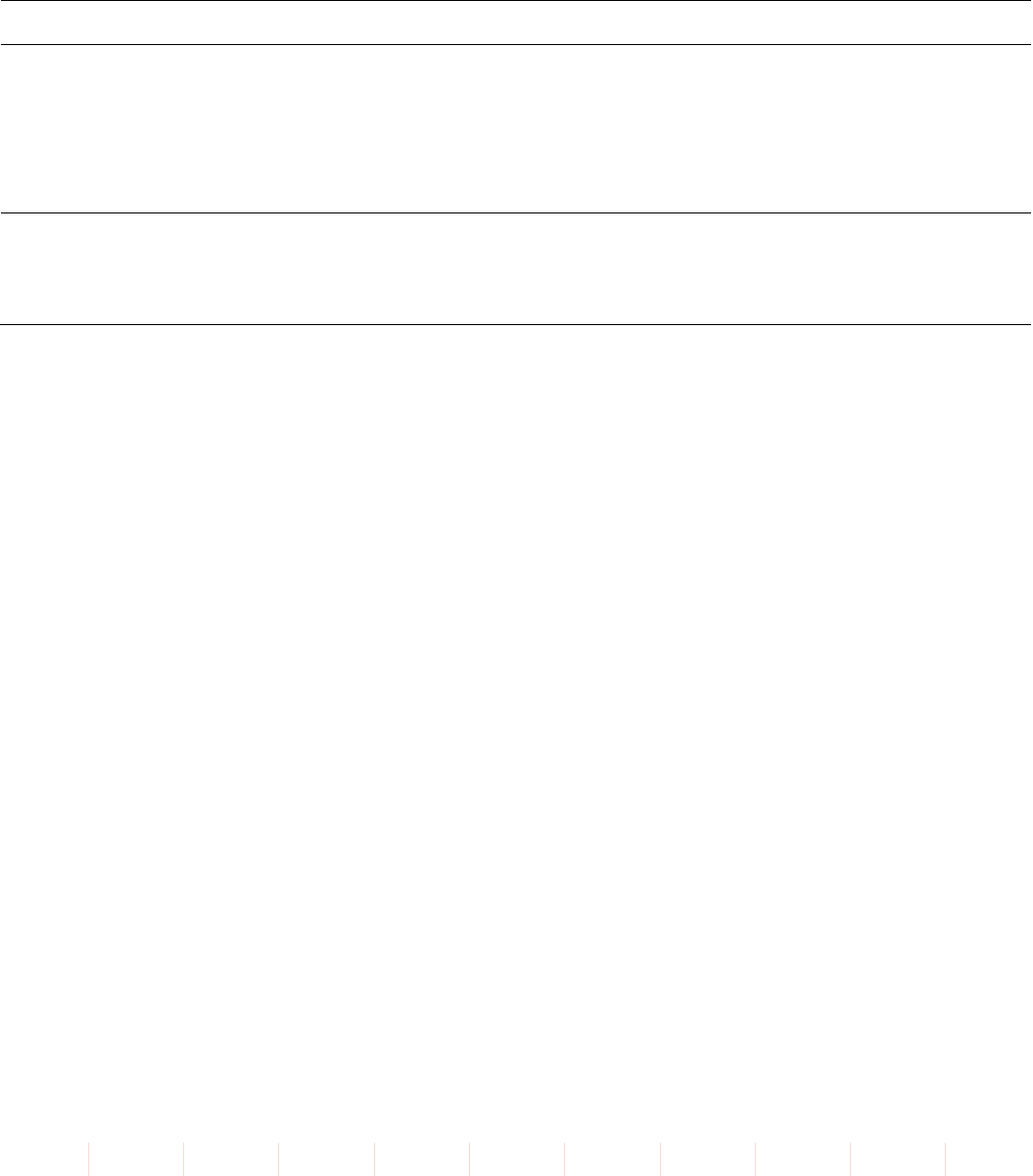

The EBIT margin guidance can be illustrated as follows:

The EBIT margin guidance for 2024 is “Around 25%”. The building blocks include a positive impact from the profitable

expansion of Pandora’s store network, expected to add +40bp.

As mentioned at the Capital Markets Day in 2023, Pandora will scale up investments to capture the vast current and

future growth opportunities. The investments include among others the restaging of the brand, roll-out of the Evoke

2.0 store concept, personalization (online as well as offline) as well as efforts to establish Pandora as the go-to

destination for Lab-Grown Diamonds. Therefore, the operating leverage from positive LFL growth net of the Phoenix

investments is expected to be a small drag at -30bp. In line with previous communication, the investments into the

Phoenix strategy remain highly flexible with Pandora being able to adjust accordingly depending on the growth

outcomes. Finally, inflationary impacts (including salary increases) are expected to be offset through price increase

and efficiencies whilst the combined impact from silver prices and foreign exchange is expected to be roughly flat at

-10bp.

Investments in growth initiatives in early 2024, including the restaging of the brand, will lead to temporary elevated

marketing expenses, impacting mostly the Q1 EBIT margin compared to the previous year.

2024 GUIDANCE – OTHER PARAMETERS

Pandora expects to open net 75-125 concept stores and 25-50 owned and operated other points of sales in 2024.

CAPEX is expected to end at 6-7% share of revenue, as Pandora continues to scale up investments into the store

network with the roll-out of Evoke 2.0 and network expansion, digital initiatives and crafting facilities.

The effective tax rate is expected to be 24-25% as the Pillar Two tax rules, released by OECD, comes into effect in

2024.

At current interest rate levels, foreign exchange rates and targeted leverage levels, Pandora expects total net financial

expenses to be around DKK 950-1,000 million in 2024.

Executive

summary

Financial

highlights

Business

update

Revenue

review

Profitability

Cash Flow &

Balance sheet

Financial

guidance

Sustainability

Other events

& Contact

Financial

statements

Accounting

notes

07 FEBRUARY 2024 | INTERIM FINANCIAL REPORT Q4 2023 | COMPANY ANNOUNCEMENT No. 841 | page

18 | 37

The guidance contains forward-looking statements, which include estimates of financial performance and targets.

These statements are not guarantees of future performance and involve certain risks and uncertainties. Therefore,

actual future results and trends may differ materially from what is forecast in this report due to a variety of factors,

please also refer to the disclaimer on page 37.

FOREIGN EXCHANGE AND COMMODITY ASSUMPTIONS AND IMPLICATIONS – As of 31 January 2024

Average 2023

Average 2024

2024 Y-Y

Financial Impact

USD/DKK

6.89

6.88

THB/DKK

0.20

0.20

GBP/DKK

8.57

8.73

CNY/DKK

0.97

0.96

AUD/DKK

4.58

4.53

Silver/USD (per ounce)

22.7

23.7

REVENUE (DKK million)

Approx. -75

EBIT (DKK million)

Approx. -50

EBIT margin (foreign exchange)

Approx. +0.3%

EBIT margin (commodities)

Approx. -0.4%

CAPITAL STRUCTURE POLICY AND CASH DISTRIBUTION

At the end of 2023, in line with expectations, Pandora’s leverage was 1.1x NIBD to EBITDA, consistent with being

broadly in line with the mid-point of the capital structure policy of 0.5x-1.5x. The increase leverage of 0.3x vs. the

end of 2022 at 0.8x reflects the decision to increase leverage from the low end of the capital structure range to

around the mid-point.

Pandora aims for a leverage ratio of approximately 1.2x NIBD to EBITDA by the end of 2024. In line with the usual

seasonality of the business, leverage will increase through the year, peaking in Q3 2024, and then fall back by year

end.

Pandoras has paid out DKK 6.4 billion to shareholders in 2023, of which DKK 1.4 billion came from an ordinary dividend

of DKK 16 per share and DKK 5.0 billion was distributed via share buybacks (DKK 0.4 billion related to the 2022

programme ending in early February 2023). For 2024, Pandora proposes a total cash distribution to shareholders of

DKK 5.5 billion. Within this, Pandora proposes to pay a dividend of DKK 18 per share which represents an absolute

amount of DKK 1.5 billion and a new share buyback amounting to DKK 4.0 billion which will commence on 8 February

2024 and be completed no later than 31 January 2025.

Executive

summary

Financial

highlights

Business

update

Revenue

review

Profitability

Cash Flow &

Balance sheet

Financial

guidance

Sustainability

Other events

& Contact

Financial

statements

Accounting

notes

07 FEBRUARY 2024 | INTERIM FINANCIAL REPORT Q4 2023 | COMPANY ANNOUNCEMENT No. 841 | page

19 | 37

SUSTAINABILITY

Sustainability is a cornerstone of our growth strategy, Phoenix.

We are pursuing ambitious targets to lower our impact on the planet, and create positive outcomes for people and

communities touched by our business.

In Q4 2023, we continued to focus our efforts to execute against our sustainability targets across our three strategic

priorities: low-carbon business, circular innovation, and inclusive, diverse and fair culture.

As we finished 2023, we are proud to announce key end-of-year results:

• Low-carbon: We decreased our total greenhouse gas emissions across Scopes 1, 2 and 3 by 27%

compared to our 2019 baseline - solid progress towards our target of halving emissions by 2030.

Reaching our climate target will not be a linear journey. We expect an emissions increase in 2024, as

emissions from the construction of our new facility in Vietnam, expansion of our store network, and store

refurbishments will not be balanced out by reductions. The increased availability of supplier-specific data

will also impact emissions calculations for some years until the data availability has matured sufficiently.

Pandora has once again been recognised for leadership in corporate transparency and performance on

climate change by global environmental non-profit CDP, securing a place on its annual ‘A List’.

• Circularity: As of December 2023, we have completed the shift of our sourcing to 100% recycled silver

and gold for all our jewellery, well ahead of our 2025 target. The average for the year is 97%. The shift

contributes significantly to Scope 3 emissions reductions, as silver has a carbon footprint of around 1/3

of newly mined silver.

• Inclusive, diverse and fair culture: We ended 2023 with 34% women in leadership positions, up from 29%

in 2022. This means we have achieved our interim 2025 target of 33% women in leadership ahead of

schedule. We will continue our work with succession plans and promotion processes to reach full gender

parity by 2030.

More information on Pandora’s 2023 sustainability performance, strategy and targets can be found in our

Sustainability Report 2023 published on 7 February 2024.

Executive

summary

Financial

highlights

Business

update

Revenue

review

Profitability

Cash Flow &

Balance sheet

Financial

guidance

Sustainability

Other events

& Contact

Financial

statements

Accounting

notes

07 FEBRUARY 2024 | INTERIM FINANCIAL REPORT Q4 2023 | COMPANY ANNOUNCEMENT No. 841 | page

20 | 37

OTHER EVENTS

FINANCIAL CALENDAR 2024

The expected dates for publication of financial announcements in 2024 for Pandora A/S are as follows:

07 February 2024 Annual Report 2023

07 February 2024 Sustainability Report 2023

07 February 2024 Remuneration Report 2023

14 March 2024 Annual General Meeting

02 May 2024 Interim Financial Report for the first quarter 2024

13 August 2024 Interim Financial Report for the second quarter 2024

06 November 2024 Interim Financial Report for the third quarter 2024

Executive

summary

Financial

highlights

Business

update

Revenue

review

Profitability

Cash Flow &

Balance sheet

Financial

guidance

Sustainability

Other events

& Contact

Financial

statements

Accounting

notes

07 FEBRUARY 2024 | INTERIM FINANCIAL REPORT Q4 2023 | COMPANY ANNOUNCEMENT No. 841 | page

21 | 37

2023 DEVELOPMENT

1

REVENUE

Total revenue increased by 9% in local currency to DKK 28,136 million in 2023 compared with 2022. Organic growth

was 8% reflecting accelerating underlying performance in the second half of the year.

Revenue from Pandora’s Core segment grew by 6% in local currency to DKK 21,951 million in 2023 from DKK 21,156

million in 2022. The segment “Fuel with more” saw revenue growth of 19% in local currency, driven by strong

performance of the Timeless collection.

GROSS PROFIT AND COSTS

Gross profit was DKK 22,125 million in 2023 (DKK 20,190 million in 2022), resulting in a gross margin of 78.6% in 2023

vs. 76.3% in 2022. The Core segment generated a gross margin of 77.8% (2022: 75.5%), while Fuel with more

generated a gross margin of 81.6% (2022: 79.6%). The increase was driven by favourable channel mix and pricing, as

well as efficiencies at our manufacturing facilities.

Sales and distribution expenses increased to DKK 8,858 million in 2023 (DKK 7,602 million in 2022), corresponding

to 31.5% of revenue in 2023 (28.7% in 2022). The increase is mainly the result of the profitable expansion of the

Pandora owned physical network.

Marketing expenses was DKK 3,849 million in 2023 (DKK 3,720 million in 2022), resulting in a share of revenue of

13.7% in 2023 compared with 14.1% in 2022. The reason for the lower share of revenue is due to last year’s global

media tender which resulted in lower advertising costs from late 2022. Consequently, Pandora is able to maintain the

media pressure at a lower cost.

Administrative expenses ended at DKK 2,379 million in 2023 compared with DKK 2,125 million in 2022,

corresponding to 8.5% of revenue in 2023 (8.0% in 2022).

EBIT

EBIT for 2023 was DKK 7,039 million, resulting in an EBIT margin of 25.0%, vs. 25.5% in 2022. The underlying EBIT

margin is unchanged, but was impacted by foreign exchange rates and commodities in 2023.

NET FINANCIALS

Net financials amounted to a cost of DKK 805 million in 2023 vs. a cost of DKK 210 million in 2022. This reflects

among others increased interest rates on loans and store leases, as well as foreign exchanges rate adjustments, which

had a material positive impact in 2022, but represented a small drag in 2023.

INCOME TAX EXPENSES

Income tax expenses were DKK 1,494 million in 2023 compared with DKK 1,504 million in 2022, implying an effective

tax rate for the Group of 24.0% in 2023, up from 23.0% in 2022, mainly driven by non-deductible costs and a higher

share of profits subject to taxation in jurisdictions with tax rates exceeding the Danish statutory rate at 22%.

NET PROFIT

Net profit in 2023 was DKK 4,740 million vs. DKK 5,029 million in 2022, with a significant negative impact from foreign

exchange rates, as net profit exceeded 2022 in constant exchange rates.

1

See Financial Review in the Annual Report 2023 for further information.

Executive

summary

Financial

highlights

Business

update

Revenue

review

Profitability

Cash Flow &

Balance sheet

Financial

guidance

Sustainability

Other events

& Contact

Financial

statements

Accounting

notes

07 FEBRUARY 2024 | INTERIM FINANCIAL REPORT Q4 2023 | COMPANY ANNOUNCEMENT No. 841 | page

22 | 37

CONTACT

CONFERENCE CALL

A conference call for investors and financial analysts will be held today at 11.00 CET and can be joined online at

www.pandoragroup.com. The presentation for the call will be available on the website before the call.

The following numbers can be used by investors and analysts:

DK: +45 78 76 84 90

SE: +46 812 410 952

NO: +47 21 95 63 42

UK: +44 203 769 6819

US: +1 646 787 0157

PIN: 837462

Link to webcast: https://pandora-events.eventcdn.net/events/annual-report-2023

ABOUT PANDORA

Pandora is the world’s largest jewellery brand. The company designs, manufactures and markets hand-finished

jewellery made from high-quality materials at accessible price points. Pandora jewellery is sold in more than 100

countries through 6,700 points of sale, including more than 2,600 concept stores.

Headquartered in Copenhagen, Denmark, Pandora employs 33,000 people worldwide and crafts its jewellery at three

facilities in Thailand. Pandora is committed to leadership in sustainability and is sourcing recycled silver and gold for

all of its jewellery, just as the company has set out to halve greenhouse gas emissions across its value chain by 2030.

Pandora is listed on the Nasdaq Copenhagen stock exchange and generated revenue of DKK 28.1 billion (EUR 3.8

billion) in 2023.

For more information, please contact:

CORPORATE COMMUNICATIONS

Mads Twomey-Madsen

SVP, Corporate Communications & Sustainability

+45 2510 0403

Executive

summary

Financial

highlights

Business

update

Revenue

review

Profitability

Cash Flow &

Balance sheet

Financial

guidance

Sustainability

Other events

& Contact

Financial

statements

Accounting

notes

07 FEBRUARY 2024 | INTERIM FINANCIAL REPORT Q4 2023 | COMPANY ANNOUNCEMENT No. 841 | page

23 | 37

FINANCIAL STATEMENTS

CONSOLIDATED INCOME STATEMENT

DKK million

Notes

Q4 2023

Q4 2022

FY 2023

FY 2022

Revenue

3

10,820

9,856

28,136

26,463

Cost of sales

-2,241

-2,345

-6,012

-6,273

Gross profit

8,579

7,511

22,125

20,190

Sales, distribution and marketing expenses

-4,237

-3,720

-12,707

-11,322

Administrative expenses

-668

-586

-2,379

-2,125

Operating profit

3,674

3,206

7,039

6,743

Finance income

42

101

251

412

Finance costs

-372

-255

-1,056

-622

Profit before tax

3,345

3,051

6,234

6,533

Income tax expense

-815

-686

-1,494

-1,504

Net profit for the period

2,530

2,365

4,740

5,029

Earnings per share, basic, DKK

29.6

25.5

55.5

54.2

Earnings per share, diluted, DKK

29.4

25.2

55.1

53.7

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

DKK million

Q4 2023

Q4 2022

FY 2023

FY 2022

Net profit for the period

2,530

2,365

4,740

5,029

Other comprehensive income:

Items that have been or may be reclassified to profit/loss for the period

Exchange rate adjustments of investments in subsidiaries

-195

-571

-149

-196

Fair value adjustment of hedging instruments

188

507

-197

297

Tax on other comprehensive income

-40

-29

39

23

Items that have been or may be reclassified to profit/loss for the period, net

of tax

-47

-93

-308

123

Items not to be reclassified to profit/loss for the period

Actuarial gain/loss on defined benefit plans, net of tax

12

12

-9

12

Items not to be reclassified to profit/loss for the period, net of tax

12

12

-9

12

Other comprehensive income, net of tax

-36

-81

-317

135

Total comprehensive income for the period

2,494

2,284

4,423

5,164

Executive

summary

Financial

highlights

Business

update

Revenue

review

Profitability

Cash Flow &

Balance sheet

Financial

guidance

Sustainability

Other events

& Contact

Financial

statements

Accounting

notes

07 FEBRUARY 2024 | INTERIM FINANCIAL REPORT Q4 2023 | COMPANY ANNOUNCEMENT No. 841 | page

24 | 37

CONSOLIDATED BALANCE SHEET

DKK million

Notes

2023

31 December

2022

31 December

ASSETS

Goodwill

9

4,914

4,822

Brand

1,057

1,057

Distribution

1,039

1,047

Other intangible assets

790

642

Total intangible assets

7,801

7,568

Property, plant and equipment

2,746

2,226

Right-of-use assets

10

3,779

2,978

Deferred tax assets

1,260

1,261

Other financial assets

215

249

Total non-current assets

15,800

14,282

Inventories

4,166

4,211

Trade receivables

7

1,342

1,262

Right-of-return assets

55

54

Derivative financial instruments

5,6

87

231

Income tax receivable

103

155

Other receivables

849

1,024

Cash

1,397

794

Total current assets

7,998

7,731

Total assets

23,798

22,013

EQUITY AND LIABILITIES

Share capital

89

96

Treasury shares

-4,353

-3,320

Reserves

610

918

Proposed dividend

1,480

1,430

Retained earnings

7,530

8,044

Total equity

5,355

7,167

Provisions

408

363

Loans and borrowings

10

9,737

3,130

Deferred tax liabilities

164

172

Other payables

80

-

Total non-current liabilities

10,389

3,665

Provisions

23

21

Refund liabilities

721

628

Contract liabilities

185

136

Loans and borrowings

10

1,430

4,458

Derivative financial instruments

5,6

128

74

Trade payables

11

3,211

3,131

Income tax payable

583

1,068

Other payables

1,773

1,666

Total current liabilities

8,053

11,181

Total liabilities

18,443

14,846

Total equity and liabilities

23,798

22,013

Executive

summary

Financial

highlights

Business

update

Revenue

review

Profitability

Cash Flow &

Balance sheet

Financial

guidance

Sustainability

Other events

& Contact

Financial

statements

Accounting

notes

07 FEBRUARY 2024 | INTERIM FINANCIAL REPORT Q4 2023 | COMPANY ANNOUNCEMENT No. 841 | page

25 | 37

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

DKK million

Share

capital

Treasury

shares

Translation

reserve

Hedging

reserve

Dividend

proposed

Retained

earnings

Total

equity

2023

Equity at 1 January

96

-3,320

797

121

1,430

8,044

7,167

Net profit for the period

-

-

-

-

-

4,740

4,740

Other comprehensive income, net of tax

-

-

-154

-154

-

-9

-317

Total comprehensive income for the period

-

-

-154

-154

-

4,731

4,423

Share-based payments

-

278

-

-

-

-103

175

Purchase of treasury shares

-

-4,998

-

-

-

-

-4,998

Cancellation of treasury shares

-7

3,687

-

-

-

-3,680

-

Dividend proposed

-

-

-

-

1,462

-1,462

-

Dividend paid

-

-

-

-

-1,412

-

-1,412

Equity at 31 December

89

-4,353

642

-33

1,480

7,530

5,355

2022

Equity at 1 January

100

-3,416

905

-110

1,516

8,007

7,001

Net profit for the period

-

-

-

-

-

5,029

5,029

Other comprehensive income, net of tax

-

-

-108

231

-

12

135

Total comprehensive income for the period

-

-

-108

231

-

5,041

5,164

Share-based payments

-

199

-

-

-

-95

104

Purchase of treasury shares

-

-3,588

-

-

-

-

-3,588

Cancellation of treasury shares

-5

3,486

-

-

-

-3,481

-

Dividend proposed

-

-

-

-

1,430

-1,430

-

Dividend paid

-

-

-

-

-1,516

2

-1,514

Equity at 31 December

96

-3,320

797

121

1,430

8,044

7,167

Executive

summary

Financial

highlights

Business

update

Revenue

review

Profitability

Cash Flow &

Balance sheet

Financial

guidance

Sustainability

Other events

& Contact

Financial

statements

Accounting

notes

07 FEBRUARY 2024 | INTERIM FINANCIAL REPORT Q4 2023 | COMPANY ANNOUNCEMENT No. 841 | page

26 | 37

CONSOLIDATED STATEMENT OF CASH FLOWS

The above cannot be derived directly from the income statement and the balance sheet.

DKK million

Notes

Q4 2023

Q4 2022

FY 2023

FY 2022

Operating profit

3,674

3,206

7,039

6,743

Depreciation and amortisation

553

506

2,079

1,973

Share-based payments

21

25

105

87

Change in inventories

585

635

210

-1,012

Change in receivables

-450

-609

56

-531

Change in payables and other liabilities

1,858

1,259

446

-559

Other non-cash adjustments

-7

-57

-55

-18

Finance income received

6

3

19

7

Finance costs paid

-256

-189

-683

-466

Income tax paid

-1,163

-704

-1,832

-1,790

Cash flows from operating activities, net

4,821

4,075

7,384

4,434

Acquisitions of subsidiaries and activities,

net of cash acquired

8

-37

-22

-349

-562

Purchase of intangible assets

-83

-104

-359

-353

Purchase of property, plant and equipment

-391

-316

-1,129

-838

Change in other assets

13

-20

37

-36

Proceeds from sale of property, plant and equipment

-

1

-

5

Cash flows from investing activities, net

-499

-462

-1,800

-1,785

Dividend paid

-

-

-1,412

-1,514

Purchase of treasury shares

-769

-774

-5,022

-3,527

Proceeds from loans and borrowings

-2,456

-198

5,927

4,994

Repayment of loans and borrowings

-260

-1,985

-3,321

-1,985

Repayment of lease liabilities

-333

-283

-1,107

-1,068

Cash flows from financing activities, net

-3,818

-3,239

-4,935

-3,100

Net increase/decrease in cash

505

373

649

-452

Cash and cash equivalents, beginning of period

713

260

595

1,043

Exchange gains/losses on cash and cash equivalents

-35

-39

-61

4

Net increase/decrease in cash

505

373

649

-452

Cash and cash equivalents, end of period

1,183

595

1,183

595

Cash balances

1,397

794

1,397

794

Overdrafts

-214

-199

-214

-199

Cash and cash equivalents, end of period

1,183

595

1,183