Legislative Council Sta

Nonpartisan Services for Colorado’s Legislature

Marijuana Handbook

2024 | Research Publication No. 810

A Colorado Legislative Council Staff Publication

Jeanette Chapman Senior Research Analyst

Emily Dohrman Economist

Anna Gerstle Senior Fiscal Analyst

Alexa Kelly Research Analyst

Clayton Mayfield Fiscal Analyst

Louis Pino Principal Economist

Erin Reynolds Deputy Fiscal Notes Manager

January 2024

3 Colorado Marijuana Handbook

Table of Contents

Section 1: Marijuana Law ............................................................................................................. 4

Medical Marijuana ...................................................................................................................................................... 4

Retail Marijuana .......................................................................................................................................................... 7

Regulated Marijuana ................................................................................................................................................. 8

Criminal Penalties Related to Marijuana ............................................................................................................ 8

Driving Laws.................................................................................................................................................................. 9

Where Marijuana Consumption is Permitted................................................................................................... 9

Marijuana on School Property ............................................................................................................................ 10

Marijuana-Related Studies and Reports ......................................................................................................... 11

Marijuana-Related Education Efforts ............................................................................................................... 12

Marijuana-Related Grant Programs .................................................................................................................. 13

Institute of Cannabis Research, Colorado State University...................................................................... 15

Pesticides .................................................................................................................................................................... 15

Section 2: Marijuana Licensing .................................................................................................. 17

Licensing Process ..................................................................................................................................................... 17

General Licensing Provisions ............................................................................................................................... 18

Licensee Requirements .......................................................................................................................................... 22

Business License and Permit Types ................................................................................................................... 25

Sunset Review ........................................................................................................................................................... 30

Local Ordinances...................................................................................................................................................... 31

Section 3: Marijuana in the State Budget ................................................................................. 34

Taxes on Marijuana ................................................................................................................................................. 34

Marijuana Tax Collections .................................................................................................................................... 35

Marijuana Tax Revenue Distribution Formulas............................................................................................. 36

Expenditures of Marijuana Revenue ................................................................................................................. 38

Section 4: Colorado Regulations ............................................................................................... 41

Code of Colorado Regulations ........................................................................................................................... 41

Section 5: Federal Law and Jurisdictional Issues ...................................................................... 43

Section 6: Additional Resources ................................................................................................ 47

Appendix A……………………………………………………………………………………………………….48

4 Colorado Marijuana Handbook

The open and public

consumption of

marijuana is

prohibited under

Colorado law.

Section 1: Marijuana Law

Medical Marijuana

Coloradans initiated and approved a constitutional amendment, Amendment 20, to legalize

medical marijuana in 2000.

1

Amendment 20 legalized the acquisition, use, possession,

production, and transportation of medical marijuana for patients and caregivers by creating an

affirmative defense to the state’s criminal marijuana laws.

Registration required. The state's Department of Public Health and Environment (CDPHE)

maintains the confidential medical marijuana patient registry. In order to apply for the medical

marijuana patient registry and to receive a registry identification card, a patient must reside in

Colorado and possess written documentation from a licensed physician stating that the patient

has been diagnosed with a debilitating medical condition and may benefit from the medical use

of marijuana.

Debilitating and disabling medical conditions. Medical marijuana may be used to treat the

following debilitating medical conditions: cancer; glaucoma; HIV/AIDS; and chronic or

debilitating diseases or medical conditions such as cachexia, severe pain, severe nausea,

seizures, and persistent muscle spasms. The CDPHE may also approve other medical conditions

to be treated by medical marijuana, but has not added any conditions to date. Additionally, the

state legislature created a statutory right to use medical marijuana for the treatment of

post-traumatic stress disorder as a disabling medical condition in 2017. Autism spectrum

1

Colo. Const. art. XVIII, § 14.

5 Colorado Marijuana Handbook

disorder and a condition for which a physician could prescribe an opioid for pain were added as

disabling medical conditions in 2019.

Caregivers. Once a patient receives a registry identification card from the CDPHE, a patient may

designate one primary caregiver on the medical marijuana registry, and may update this

designation regularly. The law defines a "primary caregiver" as a person who is 18 years of age

or older who has significant responsibility for managing the well-being of the patient. Primary

caregivers may be a parent, advising caregiver, transporting caregiver, or cultivating caregiver.

Beginning December 1, 2020, patients under the age of 18 may have both parents or guardians

designated as caregivers.

2

Cultivating and transporting caregivers must register with the

Marijuana Enforcement Division within the Department of Revenue and may not serve as a

caregiver for more than five patients.

Registry identification cards. Registry identification cards must be renewed annually. If a

patient receives a diagnosis that their medical condition requiring medical marijuana is cured,

the registry identification card must be returned to the CDPHE within 24 hours of receiving that

diagnosis. Under Senate Bill 19-218, the CDPHE promulgated rules to allow a physician to set

the expiration date for a registry identification card issued to a patient with a disabling medical

condition to no less than 60 days and no more than one year from issuance.

3

This may enable a

patient using medical marijuana instead of an opioid for pain to receive a registry card that is

effective for the duration of the disabling medical condition. The bill also authorized dentists

and advanced practice practitioners with prescriptive authority, acting within the scope of their

practice, to recommend medical marijuana for disabling medical conditions.

Possession. Patients may possess up to two ounces of a usable form of medical marijuana

(including the seeds, leaves, buds, and flowers) and no more than six marijuana plants, with

three or fewer being mature flowering plants. However, patients and primary caregivers may

claim that amounts in excess of this are medically necessary to address a patient’s debilitating

medical condition. Patients may not engage in the medical use of marijuana in a way that

endangers the health or well-being of any person or in plain view of, or in a place open to, the

public. Employers are not required to accommodate the medical use of marijuana in the

workplace, and health insurance providers are not required to provide reimbursement for the

medical use of marijuana.

Minors. The law specifies additional provisions for the medical use of marijuana for patients

under the age of 18. These include requiring two physicians to provide a diagnosis of a

debilitating or disabling medical condition and requiring at least one of these physicians to

explain the possible risks and benefits of the medical use of marijuana to the patient and each

of the patient’s parents residing in Colorado.

2

Section 25-1.5-106 (8)(b)(I) C.R.S.

3

5 CCR 1006-2 (3.B.3)

6 Colorado Marijuana Handbook

Patients aged 18 to 20. Except for patients who had a medical marijuana registry identification

card prior to the age of 18, patients aged 18 to 20 are not eligible for a registry identification

card unless the following conditions are met:

• two physicians from separate medical practices have diagnosed the patient with a disabling

or debilitating medical condition after an in-person consultation, unless the patient is

homebound;

• one of the physicians has explained the risks and benefits of medical marijuana use and has

provided written documentation of the diagnosis and recommendation; and

• the patient attends follow-up appointments every six months with one of the physicians.

Physician certification of medical marijuana. House Bill 21-1317 added several requirements

for a physician certifying that a patient has a debilitating or disabling medical condition that

would benefit from the use of medical marijuana. A physician must do the following:

• have a bona fide relationship with the patient applying for the medical marijuana program;

• complete an in-person assessment;

• review the patient’s mental health history, and determine whether a health issue could be

exacerbated by the use of medical marijuana;

• not charge a fee to patients for recommending an extended plant count or for making a

recommendation that exceeds requirements in state law;

• take a continuing education course on the topic for at least five hours every two years;

• include certain information on a patient’s medical marijuana certification, including the

patient and physician’s names and addresses, the maximum of tetrahydrocannabinol (THC)

potency level recommended, the recommended product, if any, the patient’s daily

authorized quantity if it exceeds the statutory limits, and directions for use; and

• maintain a record-keeping system for all patients that the physician has authorized the

medical use of marijuana.

CDPHE is required to report the number of physicians who made medical marijuana

recommendations the previous year, the number of recommendations each physician made, and

the aggregate number of homebound patients aged 18 to 20 in the registry on or before

January 31 each year.

Reference library. The CDPHE must maintain a marijuana laboratory testing reference library.

This reference library must include a library of methodologies for marijuana testing in the areas

of potency, homogeneity, contaminants, and solvents, and make these materials available to the

public. The reference library is located at: https://www.colorado.gov/pacific/cdphe/marijuana-

reference-library.

Statutory implementation. While the state legalized medical marijuana in 2000, medical

marijuana business licensing and enforcement was not codified until 2010 when the Marijuana

Enforcement Division within the Department of Revenue was created in law. A temporary

statewide moratorium on new medical marijuana licenses was in place from August 1, 2010, and

7 Colorado Marijuana Handbook

June 30, 2012, to allow local governments to adopt a resolution or ordinance related to the

licensing, regulation, or prohibition of the operation of licensed medical marijuana businesses in

their jurisdiction.

Retail Marijuana

In 2012, Coloradans initiated and approved a constitutional amendment, Amendment 64, to

legalize the use and possession of marijuana for recreational purposes (retail marijuana) for

persons 21 years of age or older.

4

Retail marijuana must be taxed and regulated in a manner similar to alcohol in several specific

ways, including:

• requiring individuals to show proof of age before purchasing marijuana;

• prohibiting the sale of marijuana to minors;

• prohibiting driving under the influence of marijuana; and

• requiring that marijuana be sold by legitimate businesses and be labeled in a way that

informs and protects consumers.

For persons 21 years of age or older in Colorado, the following acts are lawful:

• possessing, using, displaying, purchasing, or transporting up to one ounce of marijuana;

• growing no more than six marijuana plants in an enclosed and locked space, with three or

fewer being mature, flowering plants;

• transferring up to one ounce of retail marijuana to another person who is 21 years of age or

older without remuneration;

• consuming marijuana, though not openly, publicly, or in a manner that endangers others;

and

• assisting another person who is 21 years of age or older with any of the above.

Local governments may not limit an individual’s right to possess, grow, and use marijuana. A

local government may enact ordinances or regulations governing aspects of retail marijuana

establishment operations or prohibit the operation of retail marijuana businesses through the

enactment of an ordinance or through an initiated or referred measure. Any initiated or referred

measure to prohibit the operation of these establishments must appear on a general election

ballot during an even-numbered year.

Additional constitutional provisions specify that:

• employers may have policies restricting the use of marijuana by employees and are not

required to permit or accommodate employees’ engagement with marijuana in the

workplace;

4

Colo. Const. art. XVIII, § 16.

8 Colorado Marijuana Handbook

• any person or entity that occupies, owns, or controls a property may prohibit or otherwise

regulate the possession, consumption, use, display, transfer, distribution, sale, transportation,

or growing of marijuana on or in that property; and

• the Department of Revenue is required to manage marijuana licensing and enforcement

statewide.

Regulated Marijuana

Senate Bill 19-224 addressed recommendations from 2018 sunset reports, which included

integrating the medical and retail codes into a single code, the Colorado Regulated Marijuana

Code.

5

The bill continued the regulation of medical and retail marijuana until September 1, 2028,

with changes that included harmonizing the former Medical Marijuana Code and the Retail

Marijuana Code.

Criminal Penalties Related to Marijuana

The criminal penalties for marijuana range from class 5 felonies for prohibited acts related to the

collection of marijuana taxes; all levels of drug felonies, misdemeanors, and petty offenses for the

sale or possession of quantities of marijuana or marijuana concentrate above the legal limit; and

misdemeanors for fraud related to medical marijuana identification cards. For a complete listing

of criminal penalties related to marijuana, see the Legislative Council Staff Crime Classification

Guide.

6

Pardons related to marijuana.

7

House Bill 20-1424 allows the Governor to grant pardons to a

class of defendants who were convicted of the possession of up to two ounces of marijuana. On

October 1, 2020, Governor Polis issued Executive Order C 2020-004, which granted full and

unconditional pardons to individuals convicted of a petty offence, misdemeanor, or felony for

the possession of one ounce or less of marijuana.

House Bill 21-1090 legalized the possession of two ounces of marijuana or less in the State of

Colorado. On December 30, 2021, Governor Polis issued Executive Order C 2021-019, which

granted full and unconditional pardons for convictions for possession of two ounces or less of

marijuana.

5

Section 44-10-101 et. seq., C.R.S.

6

Online at: https://leg.colorado.gov/sites/default/files/crime_classification_guide_combined_for_posting.pdf.

7

Retrieved from: https://cbi.colorado.gov/sections/biometric-identification-and-records-unit/marijuana-pardons.

9 Colorado Marijuana Handbook

Driving Laws

Driving under the influence. Under Colorado law, drivers with five nanograms or more of THC

per milliliter in whole blood can be prosecuted for driving under the influence (DUI) or driving

while ability impaired (DWAI).

8

Open marijuana containers. Persons in a motor vehicle who use or consume marijuana or have

an open marijuana container in their possession commit a Class A traffic infraction. This

prohibition does not apply to:

• passengers in the back seat(s) of a vehicle that is used for the transportation of people for

compensation;

• passengers in the living quarters of a house coach, house trailer, motor home, or trailer

coach;

• open marijuana containers that are located in the area behind the last upright seat, or other

areas that are not normally occupied, of a motor vehicle that is not equipped with a trunk.

9

Where Marijuana Consumption is Permitted

The open and public consumption of marijuana is prohibited under Colorado law.

10

This

prohibition applies regardless of the form in which the marijuana is consumed (smoking, eating,

vaping, etc.). Any use of marijuana in a manner that endangers others is also prohibited.

Examples of public places where marijuana may not be consumed include, but are not limited

to: parks, sidewalks, ski resorts, concert venues, businesses, restaurants, bars, and common areas

of apartment buildings or condominiums. As an exception, House Bill 19-1230 authorized

marijuana hospitality and hospitality and sales licenses that allow marijuana to be consumed on

a licensed premises, if approved by a local government. In addition to marijuana, these

businesses may sell food, but may not sell alcohol or manufacture or sell food items with

marijuana.

Marijuana may only be used on private property in a manner that is not open and public.

Property owners may choose to restrict the ability of persons on their property to possess or

consume marijuana.

11

For example, many hotels, apartments, rental properties, businesses,

hospitals, and other entities ban the possession and/or consumption of marijuana on their

property. Consumption of marijuana is also prohibited on federal land, including national parks

and wilderness areas.

8

Section 42-4-1301 (6)(a)(IV), C.R.S.; https://cannabis.colorado.gov/legal-marijuana-use/driving-and-traveling.

9

Section 42-4-1305.5, C.R.S.

10

Colo. Const., Art. XVIII, Section 16 (3), Section 44-10-702 (1), C.R.S.

11

Colo. Const., Art. XVIII, Section 16 (6)(d).

10 Colorado Marijuana Handbook

Local governments. Local governments may enact laws affecting where marijuana may be

consumed.

12

For example, in 2016, voters in Denver approved Initiative 300, which allows the

city and county of Denver to issue permits for designated cannabis consumption areas.

Under

this measure, businesses that meet certain criteria and receive a permit may operate a

consumption area where persons over the age of 21 may consume marijuana products.

Marijuana on School Property

Medical marijuana possession and administration. State law requires that schools treat

nonsmokeable medical marijuana that is legally recommended by a physician in the same way

that prescribed medication is treated. School districts are required to adopt policies allowing for

the administration and storage of medical marijuana on school grounds, on a school bus, or at

any school-sponsored event. Medical marijuana must be administered according to a written

plan agreed to by the school principal and the student’s parents and consistent with instructions

from the recommending physician.

Students are prohibited from possessing or self-administering medical marijuana on school

grounds, with some exceptions. Primary caregivers and school personnel are allowed to possess

and administer medical marijuana in a nonsmokeable form to an enrolled student, consistent

with the student’s written plan. School personnel may volunteer to administer medical marijuana

and may not be disciplined or retaliated against for administering it in accordance with a

student’s administration plan. Primary caregivers and school personnel are prohibited from

administering the medical marijuana in a manner that creates disruption or causes exposure to

other students.

13

Schools are not required to comply with medical marijuana administration provisions in state

law if the school can demonstrate a reasonable, documented expectation of losing federal

funding and if the school posts a statement of its decision not to comply on its website; or if a

student participates in a school activity that takes place outside of Colorado.

Retail marijuana on school property. Colorado law requires school district boards of

education to adopt appropriate policies and rules that mandate a prohibition against the use of

all tobacco

products and all retail marijuana or retail marijuana products on all school property

by students, teachers, staff, and visitors

.

14

12

Section 44-10-702 (2), C.R.S.

13

Section 22-1-119.3 (3), C.R.S.

14

Section 25-14-103.5 (3), C.R.S.

11 Colorado Marijuana Handbook

Marijuana-Related Studies and Reports

Several departments and other entities are required to perform marijuana-related studies. These

studies are described below, with links to the most recent findings where available.

Report on marijuana health effects. The General Assembly charged the CDPHE with

appointing the Retail Marijuana Public Health Advisory Committee to monitor the health effects

of marijuana and publish biennial reports.

15

These reports contain data from four state health

surveys, data from hospitals and the poison control center, a scientific literature review, public

health and evidence statements, and public health recommendations, and identifies gaps in

research regarding marijuana use and its health effects. More information is available here.

Study of high-potency THC marijuana concentrates. The Colorado School of Public Health

(SPH) is required to review and report on available evidence-based research on the possible

physical and mental health effects of high potency THC marijuana concentrates, and convene a

scientific review council to review the report and make recommendations to the General

Assembly. The SPH was required to provide a report to the General Assembly on any research

gaps and the funding and timeline needed to complete necessary studies by July 1, 2022.

Subject to available appropriations, the SPH may conduct and must report on any additional

research. The SPH may not accept gifts, grants, or donations for this research.

16

The reports

generated by the SPH can be found here.

Report on the THC concentration in marijuana. In a footnote in the 2019 Long Bill, the

General Assembly directed the CDPHE to review and study data on the THC potency of

marijuana and any related health effects.

17

The Retail Marijuana Public Health Advisory

Committee released its report on July 31, 2020.

Emergency room intake report. CDPHE is required to create a report from hospital and

emergency room discharge data and present it during its annual SMART Act hearing. The report

must include hospital and emergency room discharge data of patients presenting with

conditions or diagnosis that reflect marijuana use.

18

Toxicology screening report. The association representing coroners must establish a working

group to study methods to test for scheduled drugs and THC in individuals under age 25 in a

case of non-natural death.

19

The association’s recommendations are available in its reporting.

Beginning January 1, 2022, for each case of a non-natural death, excluding homicide, of a

person under age 25, coroners are required to order a toxicology screening, which must test for

15

Section 25-1.5-110, C.R.S.

16

Section 23-20-143, C.R.S.

17

Senate Bill 19-207, Department of Public Health and Environment, Footnote 88a.

18

Section 25-3-127, C.R.S.

19

Section 30-10-624, C.R.S.

12 Colorado Marijuana Handbook

THC, alcohol, and scheduled drugs. The coroner must share the results of the screening with

CDPHE to be included in the Colorado Violent Death Reporting System. In the event of a death

in a hospital, the treating clinician must order a toxicology screening and document the results

of the screening to the Health Information Exchange. The information in these screenings is not

subject to Colorado Open Records Act, with limited exceptions. CDPHE must report the results

of toxicology screenings conducted by coroners by January 2, 2023, and annually each year

thereafter.

Study of law enforcement activity related to marijuana. The General Assembly tasked the

Division of Criminal Justice in the Department of Public Safety with conducting a two-year

scientific study of law enforcement activity related to the implementation of Amendment 64.

20

The division is also required to report annually certain data concerning substance-affected

driving citations that occurred in the previous year.

21

Information about these reports is available

here: https://ors.colorado.gov/ors-mjimpacts.

Marijuana-Related Education Efforts

High-potency THC effects. The Colorado School of Public Health is required to produce a

public education campaign for the general public regarding the effect of high-potency THC

marijuana on the developing brain and on physical and mental health. The campaign must be

based on the research and findings from the above studies conducted by the Colorado School

of Public Health and must be approved by the Colorado School of Public Health Scientific

Review Council.

22

Concentrate educational resource. House Bill 21-1317 required the Marijuana Enforcement

Division to convene a stakeholder work group to develop a tangible educational resource

regarding the use of regulated marijuana concentrate.

23

Reporting and educational resources

are available on this Colorado School of Public Health website.

Marijuana Educational Oversight Committee and educational materials. Senate Bill 13-283

required the Governor to designate a state agency to establish an educational oversight

committee composed of members with relevant experience in marijuana issues. The committee

must develop and implement recommendations for education of all necessary stakeholders on

issues related to marijuana use, cultivation, and any other relevant topics. The bill also required

the Governor to designate a state agency to establish educational materials regarding

appropriate retail marijuana use and prevention of marijuana use by those under 21 years of

20

Section 24-33.5-516, C.R.S.

21

Section 24-33.5-520, C.R.S.

22

Section 23-20-143 (3), C.R.S.

23

Section 44-10-202 (8)(a)(II), C.R.S.

13 Colorado Marijuana Handbook

age. Executive Order D 2013-007 established the Governor's Office as the designated agency for

these two initiatives.

24

Marijuana resource bank. Senate Bill 17-025 required the Department of Education, with

assistance from the CDPHE and the Marijuana Educational Oversight Committee, to create and

maintain a resource bank of evidence-based, research-based, and promising program materials

and curricula pertaining to marijuana, which may be used in elementary and secondary schools

.

The resource bank must be provided free of charge, and can be accessed here:

www.cde.state.co.us/healthandwellness/marijuana.

In addition, the Department of Education, upon request, must provide technical assistance to a

school district, charter school, or board of cooperative educational services regarding the

development of curricula on marijuana use.

25

Statewide marijuana education campaign. Senate Bill 14-215 required the CDPHE to develop,

implement, and evaluate an ongoing statewide prevention and education campaign to address

the long-term marijuana education needs in the state.

26

Through this effort, the CDPHE

launched the Good to Know and Protect What’s Next campaigns, and the state’s marijuana

website.

27

Colorado Department of Transportation education campaign. The Colorado Department of

Transportation has developed several education campaigns related to the dangers of

marijuana-impaired driving. Two of these recent campaigns have included “Drive High, Get a

DUI” and “Uncomfortable High.” More information can be found on the CDOT website.

28

Marijuana-Related Grant Programs

Behavioral Health Care Professional Matching Grant Program. Senate Bill 14-215 created

the Behavioral Health Care Professional Matching Grant Program in the Department of

Education.

29

The grant program is intended to provide funding to education providers to

increase the presence of school health professionals and training and resources for school staff

to provide substance use or misuse and other behavioral health care services and education to

students. The grant program is funded with money from the Marijuana Tax Cash Fund.

Gray and Black Market Marijuana Enforcement Grant Program. House Bill 17-1221 created

the Gray and Black Market Marijuana Enforcement Grant Program within the Department of

24

Section 24-20-112 (4) and (5), C.R.S.

25

Section 22-2-127.7, C.R.S.

26

Section 25-3.5-1001, et seq., C.R.S.

27

Online at: https://cannabis.colorado.gov/.

28

Online at: https://www.codot.gov/safety/impaired-driving/druggeddriving.

29

Section 22-96-103, C.R.S.

14 Colorado Marijuana Handbook

Local Affairs.

30

The grant program is intended to award grants to local law enforcement agencies

and district attorneys to cover investigation and prosecution costs associated with unlicensed

marijuana cultivation or distribution operations conducted in violation of state law. The grant

program is funded with money from the Marijuana Tax Cash Fund.

Medical Assistance Act grants. The Department of Health Care Policy and Financing awards

Medical Assistance Act grants to organizations to operate a substance abuse screening, brief

intervention, and referral to treatment practice.

31

One of the requirements of receiving a grant is

that the organization must campaign to increase public awareness of the risks related to alcohol,

marijuana, tobacco, and drug use and to reduce any stigma associated with treatment. The grant

program is funded with money from the Marijuana Tax Cash Fund.

Medical Marijuana Health Research Grant Program. Senate Bill 14-155 created the Medical

Marijuana Health Research Grant Program in the CDPHE.

32

The grant program funds research to

ascertain the general medical efficacy and appropriate administration of marijuana and its

component parts. The Medical Marijuana Scientific Advisory Council submits recommendations

for research grants to the State Board of Health for approval. The grant program is funded with

money from the Health Research Subaccount in the Medical Marijuana Program Cash Fund.

Information about the research grants that have been approved can be found here:

https://www.colorado.gov/pacific/cdphe/marijuana-research

School-based Health Center Grant Program. House Bill 18-1003 created the School-based

Health Center Grant Program in the CDPHE.

33

The grant program assists with the establishment,

expansion, and ongoing operations of school-based health centers in the state. Grants may be

used for a variety of purposes, including the expansion of behavioral health services and

education, intervention, and prevention services for opioid, alcohol, and marijuana, and other

substance use disorders. The grant program is funded with money from the Marijuana Tax Cash

Fund.

School-based Substance Abuse Prevention and Intervention Grant Program.

Senate Bill 14-215 created the School-based Substance Abuse Prevention and Intervention

Grant Program in the Department of Health Care Policy and Financing.

34

The grant program

awards competitive grants to eligible entities to provide school-based prevention and

intervention programs for individuals 12 to 19 years of age, with a primary focus on reducing

marijuana use, but also including strategies and efforts to reduce alcohol use and prescription

drug misuse. Entities eligible to receive grants include schools, school districts, boards of

30

Section 24-32-119, C.R.S.

31

Section 25.5-5-208, C.R.S.

32

Section 25-1.5-106.5, C.R.S.

33

Section 25-20.5-503, C.R.S.

34

Section 25.5-1-206, C.R.S.

15 Colorado Marijuana Handbook

cooperative educational services, nonprofits, not-for-profit community-based organizations, and

community-based behavioral health organizations.

Tony Grampsas Youth Services Program. Senate Bill 14-215 allowed funding from the

Tony Grampsas Youth Services Program to be used for community-based programs specifically

related to the prevention and intervention of adolescent and youth marijuana use.

35

The

Department of Human Services administers the grants awarded by the Tony Grampsas Youth

Services Board and monitors the effectiveness of programs that receive grant funding. The grant

program is partially funded with money from the Marijuana Tax Cash Fund.

Institute of Cannabis Research, Colorado State University

Senate Bill 16-191 established the Institute of Cannabis Research at the Colorado State

University at Pueblo. The institute supports and conducts research related to marijuana,

including clinical research, biotechnologies, clinical studies, the efficacies of medical marijuana,

and economic development. The institute also hosts a multidisciplinary national cannabis

conference, and publishes the peer-reviewed multidisciplinary Journal of Cannabis Studies. The

institute’s website is: www.csupueblo.edu/institute-of-cannabis-research/index.html.

House Bill 19-1311 established the institute’s mission in statute, created a governing board to

oversee the institute, and set parameters on awarding research funds. Research funds may be

awarded to Colorado-based nonprofits and institutions of higher education, including research

entities associated with the institution and marijuana research and development licensees

working with institutions. The institute receives funding from the Marijuana Tax Cash Fund, and

may receive revenue from gifts, grants, donations, fees, or the sale or licensing of intellectual

property.

Pesticides

The use of pesticides in Colorado is regulated under the Pesticide Applicator’s Act, which is

administered by the state's Department of Agriculture. In addition, the U.S. Environmental

Protection Agency administers the Federal Insecticide, Fungicide, and Rodenticide Act, which

requires that all pesticides distributed or sold in the United States must be registered by the

Environmental Protection Agency. Because marijuana falls within the definition of a raw

agricultural commodity, the Colorado Food and Drug Act authorizes the CDPHE to deem a

marijuana crop unsafe if the crop is contaminated with pesticides. Regulation is complicated by

marijuana's designation as a Schedule I controlled substance under federal law and by the many

ways in which marijuana can be consumed — inhaled, ingested, or topically applied.

The Colorado Department of Agriculture has developed rules for determining which pesticides

can be used on marijuana crops and maintains a list of these pesticides on its website.

36

These

35

Section 26-6.8-102, C.R.S.

36

Online at: https://ag.colorado.gov/plants.

16 Colorado Marijuana Handbook

products have not been tested to determine their health effects, and the department makes no

assurances of their safety or effectiveness when used on marijuana. The department educates

the marijuana industry on the proper use of pesticides on marijuana crops.

17 Colorado Marijuana Handbook

A local licensing

authority may determine

its own licensing

requirements and forms,

and must also consider

the minimum licensing

requirements set forth by

the state.

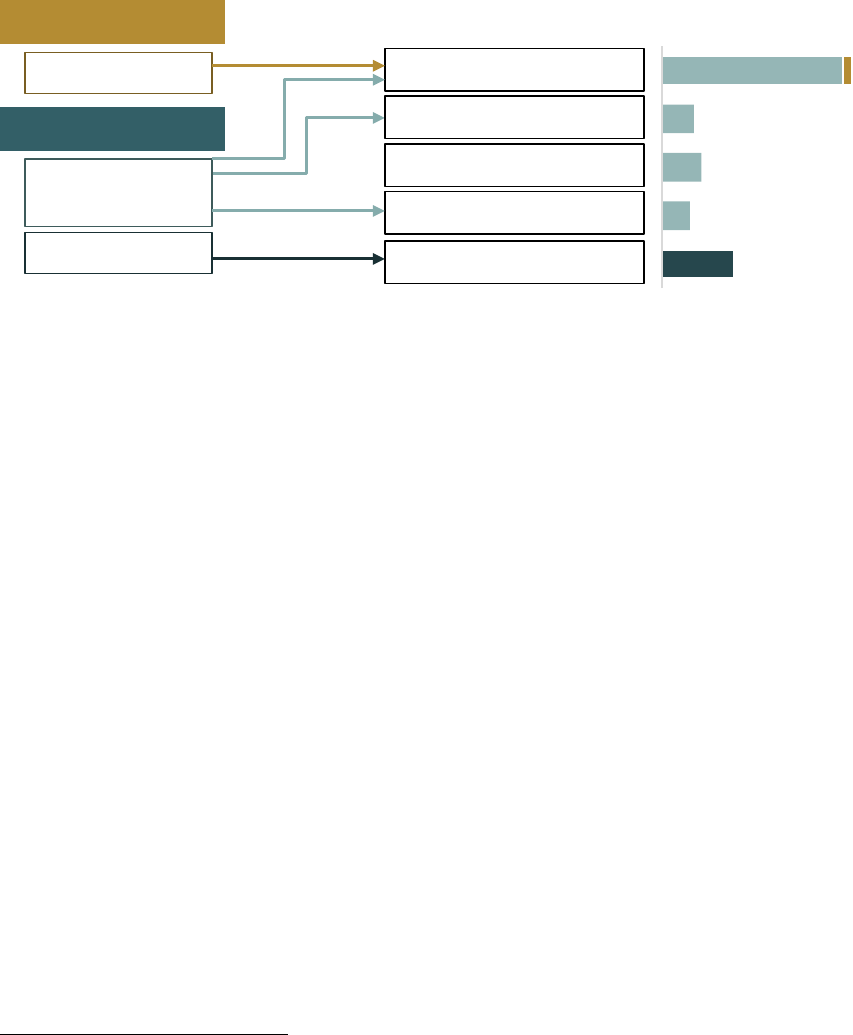

Section 2: Marijuana Licensing

Licensing Process

Medical and retail marijuana businesses must be licensed by both the state and local licensing

authorities.

State licensing authority. The Marijuana Enforcement Division in the Department of Revenue

serves as the state licensing authority, overseeing the licensing of medical and retail marijuana

businesses. The division has the following functions:

• applications and licensing;

• investigations, hearings, and enforcement;

• developing forms, applications, and licenses;

• developing identification badges for owners and employees;

• maintaining a seed-to-sale tracking system that tracks marijuana from the seed or immature

plant stage to when it is sold to a customer, with an exception for marijuana transferred for

research purposes;

• promulgating rules related to the operation of medical and retail marijuana businesses,

including security requirements for licensed premises, labeling and packaging standards, and

restrictions related to advertising by marijuana businesses;

• data collection and maintenance; and

• annual reporting.

Local licensing authority. A local licensing authority is an authority designated by municipal or

county charter, ordinance, or resolution, or the governing body of a municipality, city and

county, or the board of county commissioners of a county if no such authority is designated. A

local licensing authority may determine its own licensing requirements and forms, and must also

consider the minimum licensing requirements set forth by the state. State law suggests

considerations related to distance restrictions between licensed premises, premises size

18 Colorado Marijuana Handbook

restrictions, and other requirements that ensure control of premises and ease of enforcement.

Local governments may enact regulations based on local government zoning, health, safety, and

public welfare laws that are more restrictive than state law. Local governments may also prohibit

the operation of medical or retail marijuana businesses.

Public hearing. For each new license, the local government may schedule a public hearing to

take place within 30 days of the application date. If a hearing is scheduled, it must meet public

notice requirements, both in publications and posted at the proposed location. If a public

hearing is held, the local licensing authority must provide its findings to the applicant at least

five days prior to the hearing.

Application investigation results and decision. A local licensing authority must approve or

deny an application within 30 days after the public hearing, if applicable, or upon completion of

the application investigation. Licensing decisions must be in writing and sent via certified mail.

Once an application is approved, the license may not be issued until the building is ready for

occupancy and has passed a premises inspection performed by either licensing authority

(applicants are required to file plans and specifications for the interior of the building with their

application). A license may be denied by either the state or local licensing authority.

Radius restrictions and impact on competition (only applies to medical marijuana

businesses). Licensed medical marijuana businesses may not be located within 1,000 feet of a

school; alcohol or drug treatment facility; the principal campus of a college, university, or

seminary; or a residential child care facility. The state and local licensing authorities may not

approve an application for a second or additional medical marijuana business license for the

same licensee or the same owner of another licensed medical marijuana business if the effect

would restrain competition.

General Licensing Provisions

A separate license is required for each specific business or business entity and each

geographical location.

License issuance. Applications for a state medical marijuana or retail marijuana business license

must be made to the Marijuana Enforcement Division on division forms and include the name

and address of the applicant, required disclosures, and all other information deemed necessary

by the division. State approval is predicated on the satisfactory completion of the applicable

criminal history background check and is conditioned on local licensing authority approval. If

the local licensing authority does not approve the application within one year of state approval,

the state license may be renewed for up to one year and remains conditional on local licensing

authority approval. If the local licensing authority denies an application, the state license is

revoked.

License validity and renewal. Retail marijuana licenses are valid for a period of one year after

the date of issuance unless revoked or suspended. Medical marijuana licenses are valid for a

19 Colorado Marijuana Handbook

period not to exceed two years after the date of issuance unless revoked or suspended. The

state or local licensing authority may revoke or elect not to renew any license for good cause

subject to judicial review, or if it determines that the licensed premises have been inactive,

without good cause, for at least one year. The Marijuana Enforcement Division must notify

licensees prior to an upcoming license expiration, and renewal applications must be submitted

to the state and local licensing authorities prior to the date of expiration. If a licensee submits a

timely and sufficient renewal application, the licensee may continue to operate until the

application is acted upon by the division.

Limited access areas. Marijuana must be grown, cultivated, stored, weighed, displayed,

packaged, sold, or possessed for sale in a limited access area of the licensed premises, with

access limited to persons licensed by the Marijuana Enforcement Division and visitors escorted

by these licensees.

Inspections. Licensed premises and transaction records are subject to inspection by the

Marijuana Enforcement Division at any time during business hours. Transaction records must be

kept for a period of three years.

Unlawful acts. Under the Regulated Marijuana Code, among other provisions, it is unlawful for:

• with the exception of marijuana hospitality businesses and hospitality and sales businesses,

any person to consume regulated marijuana or regulated marijuana products in a licensed

medical or retail marijuana business and for licensees to provide public premises for the

purpose of consumption of regulated marijuana or marijuana products;

• any person to buy, sell, transfer, give away, or acquire regulated marijuana or regulated

marijuana products except as permitted by the state constitution or statute;

• a medical marijuana patient, with knowledge, to permit or fail to prevent the use of their

registry card by another person for the unlawful purchase of medical marijuana;

• a person to have certain ownership or financial interests without making proper disclosures;

• a person to knowingly adulterate or alter or attempt to adulterate or alter regulated

marijuana or regulated marijuana products to circumvent testing results;

• licensees to display signs that are inconsistent with local laws or regulations;

• licensees to use advertising that is misleading, deceptive, or false, or that is designed to

appeal to minors;

• medical marijuana licensees to sell medical marijuana to a person without a valid registry

identification card;

• retail marijuana licensees to sell to a person under 21 years of age (class 1 misdemeanor);

• retail marijuana licensees to distribute directly to another person using a mobile distribution

store;

• a physician who makes referrals to a licensed medical marijuana store to receive anything of

value from the store or for the licensee to offer anything of value to a physician for making

referrals.

Except where noted otherwise, these unlawful acts are class 2 misdemeanors. For violations that

also constitute a violation of Title 18 of the Colorado Revised Statutes, those violations are to be

charged and prosecuted pursuant to Title 18.

20 Colorado Marijuana Handbook

Disciplinary actions. The Marijuana Enforcement Division has the authority to suspend or

revoke a license after an investigation and public hearing. The division or local licensing

authority has the power to administer oaths and issue subpoenas. State law outlines procedures

and fine amounts, as well as the process for disposition of unauthorized marijuana or

marijuana-infused products. All decisions made by the division or local licensing authority are

subject to judicial review. In calendar year 2020, the division levied penalties (fines and fees) of

$1.4 million.

Sales limits – medical. State law sets sales limits for different types of medical marijuana. Sales

limits for medical marijuana stores are listed in Table 1 below.

Table 1

Medical Marijuana Sales Limits

37

Limit (per person per day)

Exception

Medical marijuana

two ounces of medical marijuana

A store may sell more than two ounces if an extended

ounce count is recommended by the patient’s

recommending physician.

Immature plants

six immature plants

A store may sell more than six immature plants, if an

extended plant count is recommended by the

patient’s recommending physician, but may not

exceed over half the recommended plant count.

Medical marijuana

flower

combined total of two ounces

A store may sell more medical marijuana flower to a

patient who has a physician recommendation for

more than two ounces of flower and is registered

with the medical marijuana store.

Medical marijuana

products

combined total of 20,000 milligrams

A store may sell medical marijuana products in an

amount that exceeds this only to a patient who has a

physician exemption from the sales limitation and is

registered with the medical marijuana store.

Medical marijuana

concentrates

combined total of eight grams of

medical marijuana concentrate, or

two grams to a patient between 18

and 20 years old.

These limits do not apply if:

• the patient is homebound and has physician

authorization for a higher amount;

• it would be a significant physical or geographic

hardship to make a daily purchase; or

• if the patient had a medical marijuana registry

card prior to the age of 18.

Sales limits—retail. A retail marijuana store may not sell more than one ounce of retail

marijuana or its equivalent in retail marijuana products, during a single transaction to a person.

Retail marijuana stores also may not sell more than eight grams of retail marijuana concentrate

to a person in a single day. The sales limit does not include nonedible, nonpsychoactive retail

37

Section 44-10-501, C.R.S.

21 Colorado Marijuana Handbook

marijuana products such as ointments, lotions, balms, and other nontransdermal topical

products.

Seed-to-sale tracking system. The Marijuana Enforcement Division maintains a seed-to-sale

tracking system that tracks marijuana from the seed or immature plant stage to when it is sold

to a customer, with an exception for marijuana transferred for research purposes. Medical

marijuana stores are required to immediately record each sales transaction in the seed-to-sale

tracking system in order to allow the system to:

• identify discrepancies with a patient’s daily authorized quantity limits and THC potency

authorizations; and

• based, on the patient’s identification number, respond with a user error message if a sale to

a patient or caregiver will exceed the patient’s daily authorized quantity limit for that

business day or THC potency authorization.

Product labeling and packaging requirements. State law requires the Marijuana Enforcement

Division to promulgate rules establishing labeling requirements for regulated marijuana and

regulated marijuana products that are sold by medical and retail marijuana businesses. These

labels must include:

• warning labels;

• the amount of THC per serving and the number of servings per package for regulated

marijuana products;

• a universal symbol indicating that the package contains marijuana; and

• the potency of the regulated marijuana and regulated marijuana products.

38

Edible marijuana products must be clearly identifiable, when practicable, with a standard symbol

indicating that they contain marijuana and are not for consumption by children.

39

The law also

prohibits edible marijuana products from being in the shape of a human, animal, or fruit.

40

Marijuana must be placed in child-proof packaging that is placed in an opaque and resealable

exit package or container prior to exiting the store.

41

Single servings of edible and liquid retail marijuana products may not contain more than

10 milligrams of active THC. A sealed package of edible and liquid retail marijuana may not

contain more than a total of 100 milligrams of active THC.

42

Multi-serving liquid retail marijuana

products must be packaged in a structure that uses a single mechanism to achieve both child-

38

Section 44-10-203 (2)(f), C.R.S.

39

Section 44-10-203 (2)(y), C.R.S.

40

Section 44-10-203 (3)(g), C.R.S.

41

Section 44-10-203 (3)(b), C.R.S.

42

Section 44-10-203 (3)(d), C.R.S.

22 Colorado Marijuana Handbook

resistance and accurate pouring measurement of each serving in increments equal to or less

than 10 milligrams of active THC.

43

The Marijuana Enforcement Division is required to promulgate rules establishing requirements

for medical and retail marijuana concentrate to promote consumer health and awareness,

including a recommended serving size, visual representation of one recommended serving,

labeling requirements, and may include a measuring device that may be used to measure one

recommended serving.

44

Advertising prohibitions. Marijuana businesses are prohibited from:

• engaging in mass-market advertising or marketing campaigns that have a high likelihood of

reaching persons under 18 years of age for medical marijuana (21 years of age for retail

marijuana);

• making health or physical benefit claims in advertising, merchandising, and packaging;

• engaging in unsolicited pop-up advertising on the internet;

• placing banner ads on mass-market websites;

• engaging in opt-in marketing that does not permit an easy and permanent opt-out feature;

• engaging in marketing directed toward location-based devices, including cell phones; or

• violating other limitations that may be adopted in rule.

The Marijuana Enforcement Division is required to promulgate rules establishing requirements

that any advertising or marketing specific to medical or retail marijuana concentrate include a

notice regarding the potential risks of medical or retail marijuana concentrate

overconsumption.

45

Licensee Requirements

Background check requirements. All owners, with the exception of indirect financial interest

holders, officers, managers, and employees of a regulated marijuana business must pass a

fingerprint-based criminal history record check as required by the Marijuana Enforcement

Division and obtain the required identification prior to being associated with, managing,

owning, or working at the operation.

Persons prohibited as licensees. Among other criteria, state law prohibits medical and retail

marijuana licenses from being issued to or held by:

• a person until the licensing fee has been paid;

• a person under 21 years of age;

43

Section 44-10-603 (4)(b), C.R.S.

44

Section 44-10-203 (2)(ii), C.R.S.

45

Section 44-10-203 (3)(a), C.R.S.

23 Colorado Marijuana Handbook

• a person who is not of good moral character themselves or is financed by a person not of

good moral character;

• a person who fails to meet the qualifications for licensure;

• a person applying for a license at a location currently licensed as a retail food establishment

(does not apply to persons applying for a marijuana hospitality or hospitality and sales

license);

• a person with a financial interest organized or formed under a country that provides support

for terrorism;

• a person considered a bad actor or ineligible issuer under federal securities law;

• a person, who during a period of licensure, failed to file and pay applicable taxes, interest

and penalties;

• a person who was convicted of a felony in the three years immediately preceding their

application date, except for an accelerator license;

• a person currently subject to a deferred judgement or sentence for a felony; or

• a sheriff, deputy sheriff, police officer, or prosecuting officer, or an officer or employee of the

state licensing authority or a local licensing authority.

In addition, medical marijuana licenses may not be issued to or held by a licensed physician

making patient recommendations or by a person whose authority to be a primary caregiver has

been revoked by the CDPHE.

46

Business owner requirements. There are three ownership categories for a marijuana business:

• controlling beneficial owners;

• passive beneficial owners, and;

• indirect financial interest holders.

All persons applying to become a controlling beneficial owner or passive beneficial owner are

required to receive a finding of suitability or an exemption from the Marijuana Enforcement

Division.

Controlling beneficial owner. A controlling beneficial owner means a natural person, a domestic

or foreign entity that is organized under the laws of and for which its principal place of business

is located in one of the states or territories of the United States or District of Columbia, a

publicly traded corporation, or a qualified private fund that is not otherwise licensed as a

qualified institutional investor:

• that owns or acquires beneficial ownership (voting power) of 10 percent or more of a

marijuana business;

• that is an affiliate that controls a marijuana business;

• that is otherwise in a position to control the marijuana business; or

46

Section 44-10-307, C.R.S.

24 Colorado Marijuana Handbook

• a qualified institutional investor that owns or acquires beneficial ownership of 30 percent or

more of the securities of a marijuana business.

Indirect financial interest holder. This type of investor is a person that is not an affiliate, a

controlling beneficial owner, or a passive beneficial owner of a marijuana business and that:

• holds a commercially reasonable royalty interest in exchange for a marijuana business's use

of the person's intellectual property;

• holds a permitted economic interest issued prior to January 1, 2020, that has not been

converted into an ownership interest;

• is a contract counterparty; or

• is identified by the division as an indirect financial interest holder.

Passive beneficial owner. The passive beneficial owner is a person owning or acquiring any

interest in a regulated marijuana business that is not otherwise a controlling beneficial owner or

in control.

47

Social equity licensees. Social equity licensees may hold any regulated marijuana business

license or permit and may be eligible for grants, loans, and technical assistance through the

Cannabis Business Office in the Office of Economic Development and International Trade. To

qualify as a social equity licensee, the applicant must:

• be a Colorado resident;

• not have been the owner of a revoked marijuana license;

• hold at least 51 percent of the beneficial ownership of a regulated marijuana business, either

individually or collectively with other social equity licensees; and

• have demonstrated at least one of the following:

o resided for at least 15 years between 1980 and 2010 in an area designated as an

opportunity zone, or as a disproportionate impacted area as defined in rule by

Marijuana Enforcement Division;

o the applicant or the applicant's immediate family was arrested for or convicted of a

marijuana offense or was subject to civil asset forfeiture related to a marijuana

investigation; or

o the applicant's household income in the previous year did not exceed an amount

determined by the Marijuana Enforcement Division.

48

47

Sections 44-10-308 through 44-10-310, C.R.S.

48

Section 44-10-308 (4), C.R.S.

25 Colorado Marijuana Handbook

More information about the Cannabis Business Office is online at its website.

49

More information

about social equity licenses can be found on the Department of Revenue’s Social Equity

website.

50

Business License and Permit Types

Medical marijuana license and permit types. The following sections outline medical marijuana

license and permit types. The number of licenses issued in each category as of September 2023,

is shown in Table 2.

• Medical marijuana store license. These licenses may be issued to persons selling medical

marijuana to medical marijuana patients. Medical marijuana stores may sell medical

marijuana products that are prepackaged and labeled in a way that clearly indicates that the

product contains medical marijuana; that the product is manufactured without any

regulatory oversight for health, safety, or efficacy; and that there may be health risks

associated with the consumption or use of the product. Medical marijuana stores may also

sell immature plants (nonflowering and no taller than 8 inches and no wider than 8 inches).

o Medical marijuana delivery permit. A medical marijuana delivery permit may be

issued to a licensed medical marijuana store, thereby authorizing the store to deliver

medical marijuana and medical marijuana products to patients or parents or

guardians at private residences. A one-dollar surcharge must be assessed on each

delivery, to be remitted to the local municipality where the store is located to assist

with local law enforcement costs. The Marijuana Enforcement Division began issuing

delivery permits on January 2, 2020.

• Medical marijuana cultivation facility license. These licenses may be issued to persons

cultivating medical marijuana for sale and distribution to licensed medical marijuana stores,

medical marijuana product manufacturers, and other medical marijuana cultivation facilities.

The Marijuana Enforcement Division is required to create a statewide licensure class system

for cultivation facility licenses, with classifications based on square footage of the facility;

lights, lumens, or wattage; lit canopy; the number of cultivating plants; other reasonable

metrics; or any combination of these.

o Centralized distribution permit. A centralized distribution permit may be issued to a

licensed medical marijuana cultivation facility. Permit holders may provide for the

temporary storage of medical marijuana concentrate and medical marijuana products

received from a medical marijuana product manufacturer on its licensed premises for

the sole purpose of these products being transferred to the permit holders’

commonly owned medical marijuana stores. These products may not be stored for

more than 90 days.

49

Online at: https://oedit.colorado.gov/cannabis-business-office.

50

Online at: https://sbg.colorado.gov/med/social-equity.

26 Colorado Marijuana Handbook

• Medical marijuana products manufacturer license. These licenses may be issued to

persons manufacturing medical marijuana products and are required to manufacture

cannabinoid products derived from marijuana. Medical marijuana products must be

prepared on a licensed premises that is used exclusively for the manufacture and

preparation of medical marijuana products and using equipment that is used exclusively for

the manufacture and preparation of medical marijuana products. A medical marijuana

products manufacturer may sell its products to any licensed medical marijuana store or any

licensed medical marijuana products manufacturer. There are specific limitations related to

medical marijuana products manufacturers’ use or imitation of trademarked food products.

• Medical marijuana business operator license. These licenses may be issued to entities or

persons operating a licensed medical marijuana business and those who receive a portion of

the profits as compensation.

• Medical marijuana occupational licenses and registrations. These licenses and

registrations are required for owners, managers, operators, employees, contractors, and

other support staff employed by, working in, or having access to restricted areas of the

licensed premises, as determined by the Marijuana Enforcement Division.

• Marijuana research and development license. These licenses allow persons to grow,

cultivate, possess, and transfer, by sale or donation, marijuana for limited research purposes.

These research purposes include: testing chemical potency and composition levels;

conducting clinical investigations of marijuana-derived medicinal products; conducting

research on the efficacy and safety of administering marijuana as part of medical treatment;

conducting genomic, horticultural, or agricultural research; and conducting research on

marijuana-affiliated products or systems. Research conducted with a public institution or

with public money must be reviewed by the Colorado Medical Marijuana Scientific Advisory

Council.

• Medical marijuana testing facility license. These licenses may be issued to persons

performing testing and research on medical marijuana, medical marijuana products, and

industrial hemp products for medical marijuana licensees, patients, and caregivers. State law

limits interests that a medical marijuana testing facility licensee may have with other medical

and retail licensees.

• Medical marijuana transporter license. These licenses may be issued to persons providing

logistics, distribution, delivery, and storage of medical marijuana and medical marijuana

products. These licensees may maintain a licensed premises for temporary storage needs

and to use as a centralized distribution location.

o Medical marijuana delivery permit. A medical marijuana delivery permit may be

issued to a licensed medical marijuana transporter, thereby authorizing the licensee

to deliver medical marijuana and medical marijuana products to patients or parents

or guardians at private residences. The Marijuana Enforcement Division began issuing

delivery permits to medical marijuana transporter licensees on January 2, 2021.

27 Colorado Marijuana Handbook

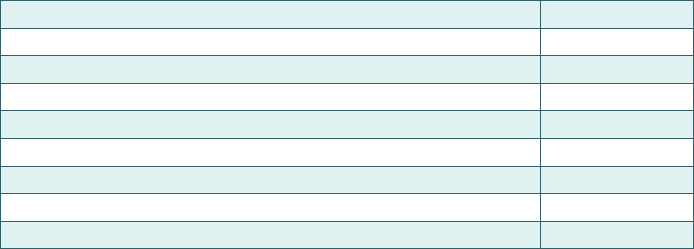

Table 2

Number of Licensed Medical Marijuana Businesses

As of September 2023

License Type

Number

Medical Marijuana Stores

371

Medical Marijuana Cultivation Facilities

341

Medical Marijuana Product Manufacturers

192

Medical Marijuana Business Operators

8

Medical Marijuana Research and Development Cultivations

1

Medical Marijuana Testing Facilities

7

Medical Marijuana Delivery

13

Medical Marijuana Transport Businesses

9

Source: Marijuana Enforcement Division, Department of Revenue.

Retail marijuana license and permit types. The following sections outline retail marijuana

license and permit types. The number of licenses issued in each category as of September 2023,

is shown in Table 3.

• Retail marijuana store license. These licenses may be issued to persons selling retail

marijuana or retail marijuana products. Licensees may only sell retail marijuana, retail

marijuana products, marijuana accessories, nonconsumable products such as apparel,

industrial hemp products, and marijuana-related products, such as childproof packaging

containers. Licensees are prohibited from selling or giving away any consumable product,

including cigarettes, alcohol, and edible products that do not contain marijuana. A licensee

may either sell its own marijuana, if it also has a retail marijuana cultivation facility license, or

sell marijuana purchased from a licensed cultivator. Store employees must verify that a

purchaser is 21 years of age or older with a valid identification card.

o Retail marijuana delivery permit. A retail marijuana delivery permit may be issued to a

licensed retail marijuana store, thereby authorizing the store to deliver retail

marijuana and retail marijuana products to individuals at private residences. A

one-dollar surcharge must be assessed on each delivery, to be remitted to the local

municipality where the store is located to assist with local law enforcement costs. The

Marijuana Enforcement Division began issuing retail marijuana delivery permits on

January 2, 2021.

o Retail marijuana accelerator store license. A retail marijuana accelerator store license

may be issued to a social equity licensee qualified to operate a retail marijuana store

on the site of a retail marijuana store with an accelerator endorsement. The licensee

may receive technical assistance and financial support from the retail marijuana store

licensee.

• Retail marijuana cultivation facility license. These licenses may be issued to persons who

cultivate retail marijuana for sale and distribution to other retail marijuana licensees. The

Marijuana Enforcement Division is required to create a statewide licensure class system for

cultivation facility licenses, with classifications based on square footage of the facility; lights,

28 Colorado Marijuana Handbook

lumens, or wattage; lit canopy; the number of cultivating plants; other reasonable metrics; or

any combination of these.

o Centralized distribution permit. A centralized distribution permit may be issued to a

licensed retail marijuana cultivation facility. Permit holders may provide for the

temporary storage of retail marijuana concentrate and retail marijuana products

received from a retail marijuana business on its licensed premises for the sole

purpose of these products being transferred to the permit holders’ commonly owned

retail marijuana stores. These products may not be stored for more than 90 days.

o Retail marijuana accelerator cultivator license. A retail marijuana accelerator cultivator

license may be issued to a social equity licensee qualified to operate a cultivation

operation on the site of a retail marijuana cultivation facility with an accelerator

endorsement. The licensee may receive technical assistance and financial support

from the retail marijuana cultivation facility licensee.

• Retail marijuana products manufacturer license. These licenses may be issued to persons

manufacturing retail marijuana products and are required to manufacture cannabinoid

products derived from marijuana. Retail marijuana products must be prepared on a licensed

premises that is used exclusively for the manufacture and preparation of retail marijuana or

retail marijuana products and using equipment that is used exclusively for the manufacture

and preparation of retail marijuana products. There are specific limitations related to retail

marijuana products manufacturers’ use or imitation of trademarked food products.

o Retail marijuana accelerator manufacturer license. A retail marijuana accelerator

manufacturer license may be issued to a social equity licensee qualified to operate a

retail marijuana products manufacturing operation on the site of a retail marijuana

products manufacturing facility with an accelerator endorsement. The licensee may

receive technical assistance and financial support from the retail marijuana products

manufacturer licensee.

• Retail marijuana business operator license. These licenses may be issued to persons

operating a licensed retail marijuana business, owners of such businesses, and those who

receive a portion of the profits as compensation.

• Marijuana hospitality business license. If allowed by local government ordinance or

resolution, these licenses may be issued to persons operating a licensed premises where

marijuana may be consumed. These licensees may be mobile. These licensees may not sell

retail or medical marijuana. Additionally, these licensees may not admit anyone under the

age of 21, allow free samples of marijuana to be distributed, permit the use or consumption

of marijuana by a patron who displays any visible signs of intoxication, allow on-duty

employees to consume marijuana, allow alcohol to be consumed on the premises, or allow

tobacco products to be smoked on the premises, among other restrictions. Employees of the

business must have a valid responsible vendor designation. Licensees must provide

informational materials regarding the safe consumption of marijuana. Retail food

29 Colorado Marijuana Handbook

establishments may operate a licensed marijuana hospitality business in an isolated portion

of the premises.

• Retail marijuana hospitality and sales business license. If allowed by local government

ordinance or resolution, these licenses may be issued to persons operating a licensed

premises where marijuana may be sold and consumed. These licensees may not admit

anyone under the age of 21, allow free samples of marijuana to be distributed, sell or serve

marijuana to a patron who displays any visible signs of intoxication, allow on-duty

employees to consume marijuana, allow alcohol to be consumed on the premises, allow

tobacco products to be smoked on the premises, among other restrictions. Employees of the

business must have a valid responsible vendor designation. Licensees must provide

informational materials regarding the safe consumption of marijuana. Retail food

establishments may operate a licensed marijuana hospitality and sales business in an

isolated portion of the premises.

• Retail marijuana occupational licenses and registrations. These licenses and registrations

are required for owners, managers, operators, employees, contractors, and other support

staff employed by, working in, or having access to restricted areas of the licensed premises,

as determined by the Marijuana Enforcement Division.

• Retail marijuana testing facility license. These licenses may be issued to persons

performing testing and research on retail marijuana, industrial hemp, and industrial hemp

products. State law limits interests that a retail marijuana testing facility licensee may have

with other medical and retail marijuana licensees.

• Retail marijuana transporter license. These licenses may be issued to persons providing

logistics, distribution, delivery, and storage of retail marijuana and retail marijuana products.

These licensees may maintain a licensed premises for temporary storage needs and to use as

a centralized distribution location.

o Retail marijuana delivery permit. A retail marijuana delivery permit may be issued to a

licensed retail marijuana transporter, thereby authorizing the licensee to deliver retail

marijuana and retail marijuana products to individuals at private residences. The

Marijuana Enforcement Division began issuing delivery permits to retail marijuana

transporter licensees on January 2, 2021.

30 Colorado Marijuana Handbook

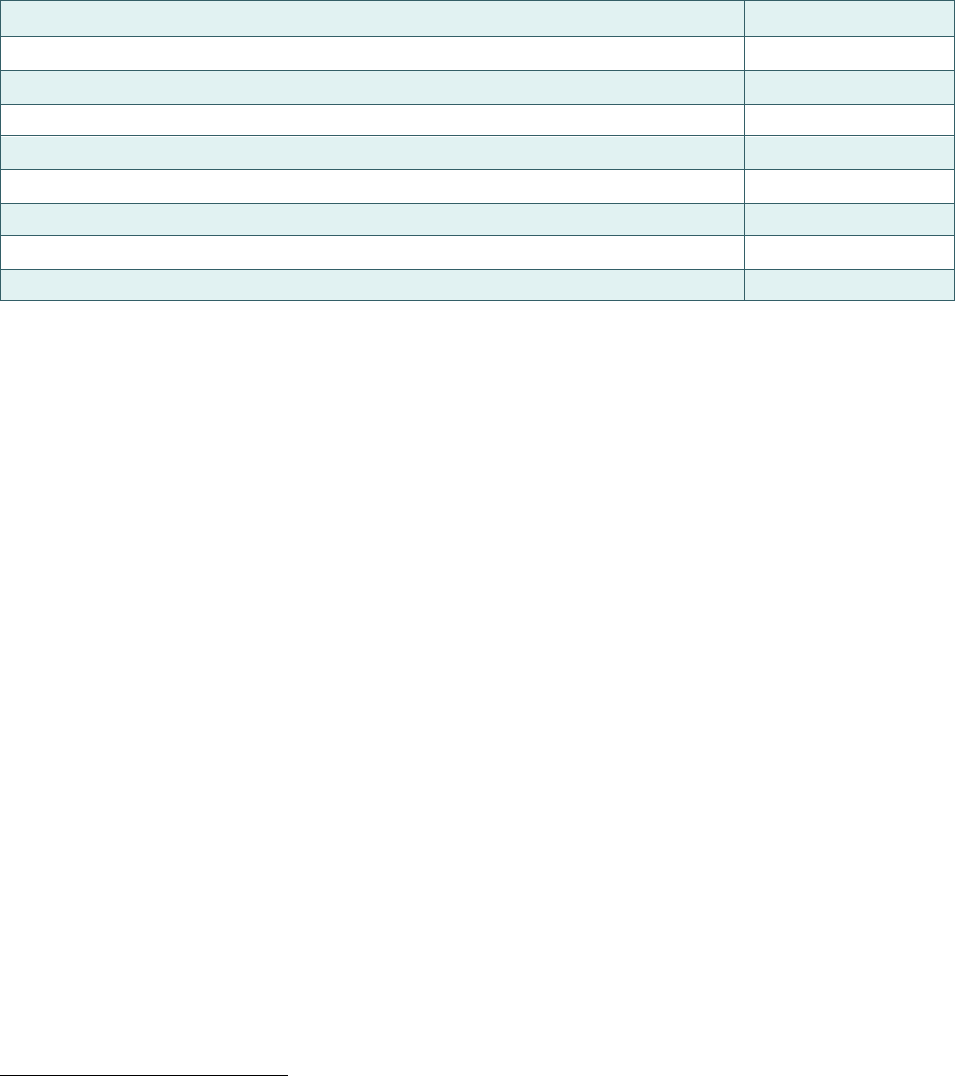

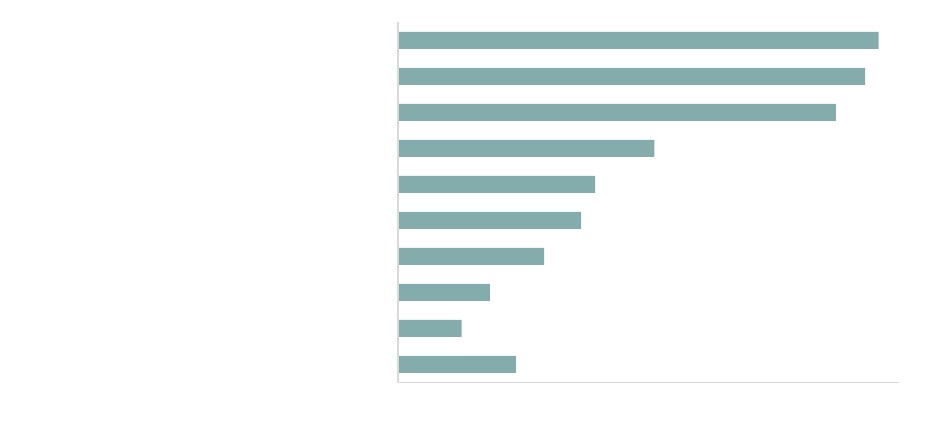

Table 3

Number of Licensed Retail Marijuana Businesses

As of September 2023

Source: Marijuana Enforcement Division, Department of Revenue.

Licensed marijuana testing facilities. Marijuana testing facilities must receive a business

license and certification from the Marijuana Enforcement Division. The CDPHE is responsible for

inspecting facilities to determine whether they qualify for certification as a marijuana testing

facility by the Marijuana Enforcement Division. The CDPHE also maintains a reference library to

provide guidance to testing facilities on testing methodologies. Medical and retail marijuana

testing facilities must be accredited pursuant to the International Organization for

Standardization/International Electrotechnical Commission 17025:2005 standard that stipulates

general requirements for the competence of testing and calibration laboratories. Marijuana

samples are tested for potency and the presence of contaminants such as pesticides, solvents

and mold. In addition to listing which pesticides growers may use on marijuana and regulating

pesticide use, the Department of Agriculture lab tests marijuana for pesticide residue and the

presence of prohibited pesticides.

Sunset Review

In Colorado, a program subject to the sunset review process is set to repeal on a specific date

unless the General Assembly affirmatively acts to extend it. The Regulated Marijuana Code and

the Medical Marijuana Program are subject to the sunset review process conducted by the

Department of Regulatory Agencies. The first review for the former Medical Marijuana Code is

available at Medical Marijuana Sunset 2014,

51

and the first review for the former Retail Marijuana

Code is available at Retail Marijuana Sunset 2015.

52

The Medical Marijuana Program at the

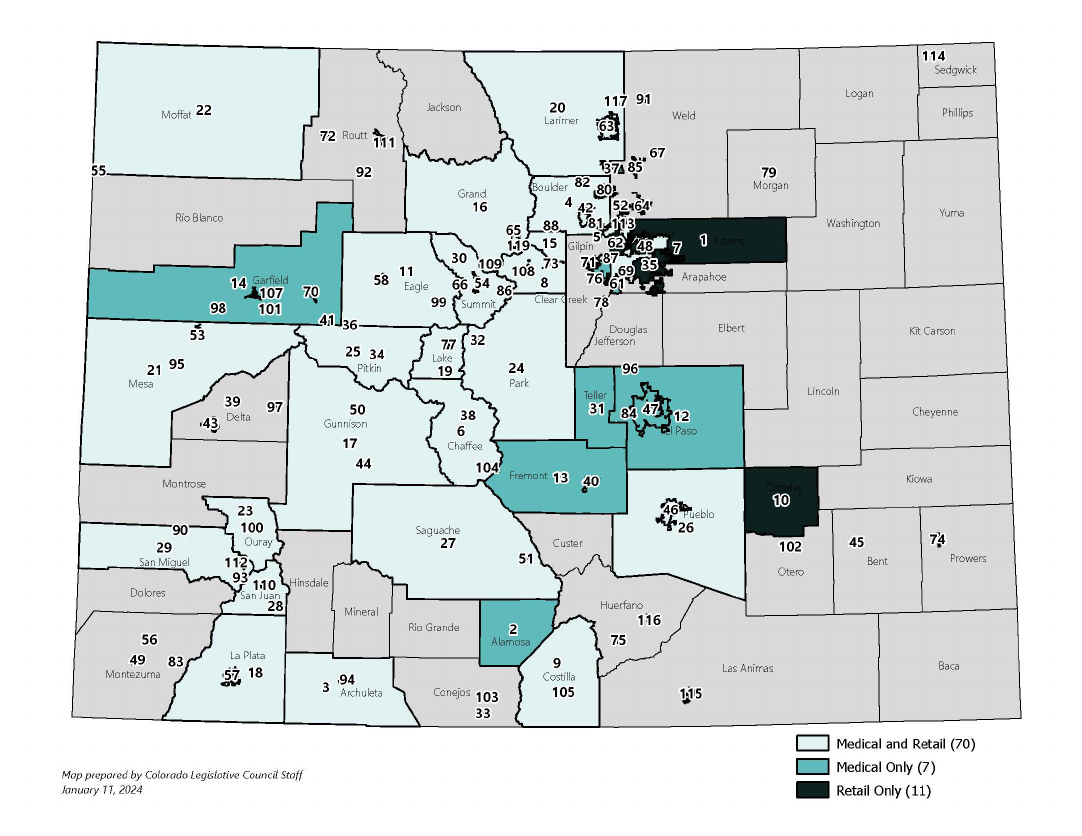

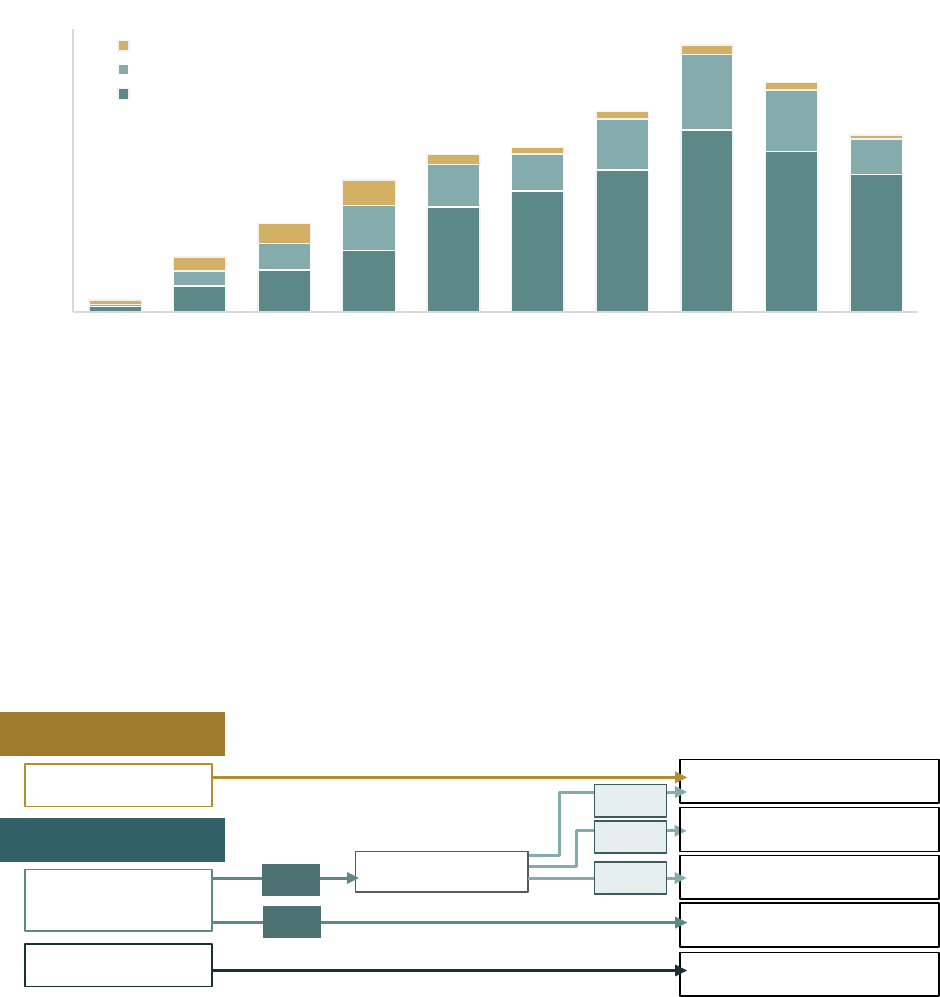

CDPHE was subject to sunset review beginning in 2018 and the repeal dates for both codes and