National Average Cost for Car Insurance Skyrockets 26% From Last

Year, Averaging $2,543

Drivers in Detroit spend the largest share of income on auto insurance each year, while Seattle

drivers spend the least

NEW YORK - February 5, 2024 - Despite a slowdown in inflation across various

sectors, car insurance costs are skyrocketing in 2024, according to Bankrate’s annual

True Cost of Auto Insurance Report.

● The national average cost for full coverage car insurance is $2,543 per year,

which is 3.41% of the median household income. This surge is up from $2,014 in

2023 and $1,771 in 2022.

● The percentage of income spent on auto insurance varies among

metro-statistical areas, with Detroit drivers facing an average annual expense of

$5,687 for full coverage car insurance (7.98% of their median household

income), while Seattle drivers spend an average of $1,759 per year on full

coverage car insurance (1.65% of their median household income).

● The national average premium for drivers with poor credit scores is $4,338 for full

coverage insurance, which is about $1,795 more than drivers with good credit

with the same level of coverage.

● Adding a teen driver to a policy can be the most expensive life event for auto

insurance consumers, costing drivers an average increase of $2,878, a 21.03%

increase from 2023. This brings the average auto insurance premium for these

drivers to $5,421, up 23.43% from 2023.

*Rates for adding a teen driver are based on a married couple with a 16-year-old driver

on their full coverage policy.

For the full report, click here:

https://www.bankrate.com/insurance/car/the-true-cost-of-auto-insurance-in-2024/

Bankrate analyzed the average total percentage of household income spent on car

insurance to determine the true cost of car insurance for 26 metro-statistical areas

(MSAs).

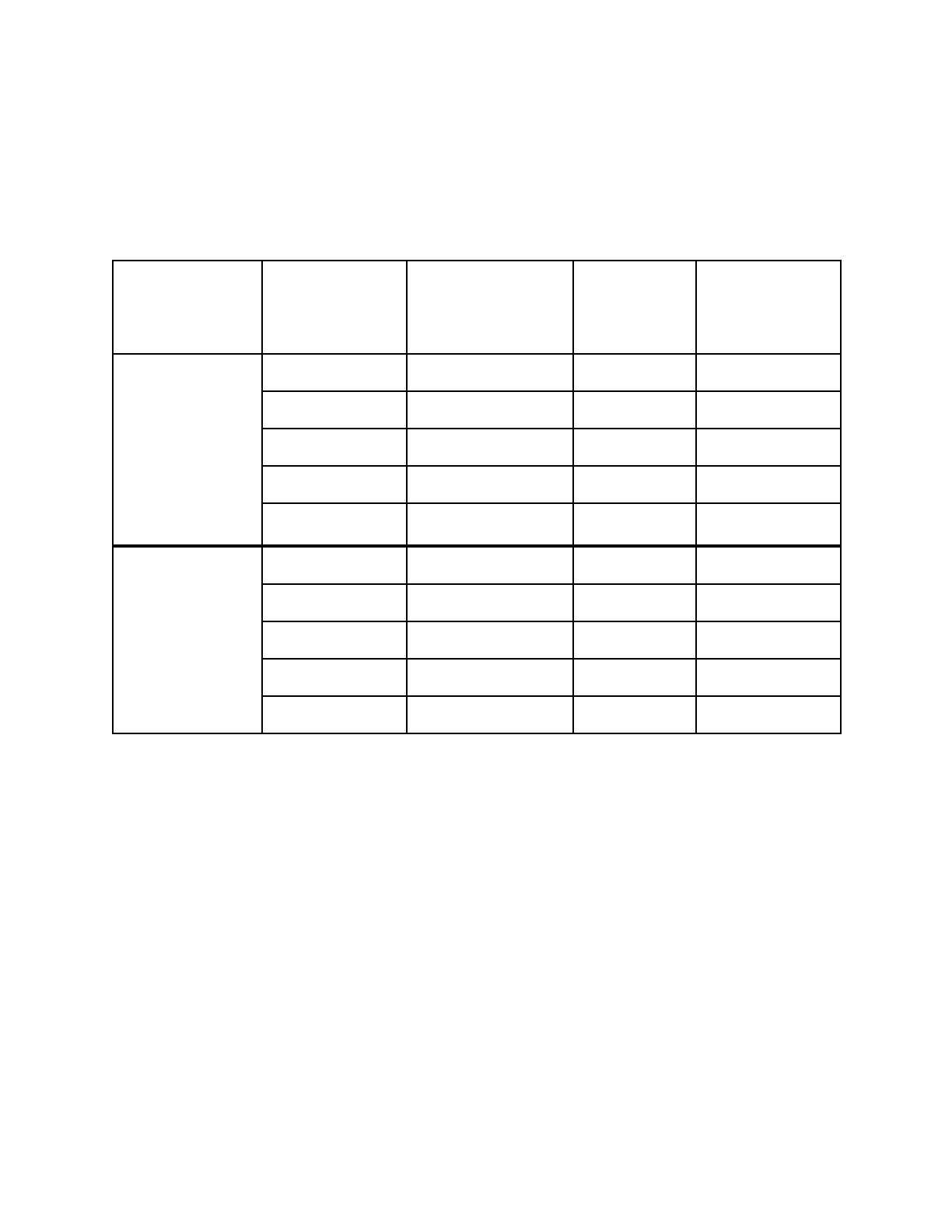

Most and Least Expensive Metros for Auto Insurance

True Cost

Rank*

Metro Statistical

Area (MSA)

Average

Premium

% of Household

Income Spent on

Car Insurance

Least Expensive

Metros

1

Seattle

$1,759

1.65%

2

Boston

$2,094

2.01%

3

Washington D.C.

$2,430

2.07%

4

Portland

$1,976

2.21%

5

Minneapolis

$2,044

2.24%

Most Expensive

Metros

22

Las Vegas

$3,626

5.12%

23

Philadelphia

$4,753

5.65%

24

Tampa

$4,078

5.89%

25

Miami

$4,213

5.95%

26

Detroit

$5,687

7.98%

*Bankrate utilized current data from Quadrant Information Services to understand the average cost of

auto insurance for every U.S. state and metro statistical area. Each location was assigned a “True Cost

Rank” — a score between one and 50 for states and one and 26 for most populous metro areas. The

lower the ranking, the smaller percentage of total income drivers spend on car insurance premiums.

“The rate of full coverage car insurance increased 26 percent from 2023, and while we

hope to see rates stabilize soon, that likely won't happen until at least 2025,” said

Bankrate Analyst Shannon Martin. “While inflation is slowing down, insurance

companies are reassessing their risk models to account for the post-pandemic rise in

car crashes, the increase of claims from extreme weather and the sustained elevated

cost of vehicle repairs. Remember that base rate increases can only be implemented at

the renewal period, so some policyholders are still paying for the increase from 2023

and have yet to be hit with potentially higher 2024 rate renewals.”

Bankrate’s True Cost of Auto Insurance Report outlines how everyday life events impact auto

insurance premiums in all 50 states and the top 26 largest metro-statistical areas. While adding

a teen driver to a policy is notably the most expensive life event for drivers (adding $2,878 to the

average annual premium), other life events such as being involved in a car accident, getting a

speeding ticket and decreasing credit scores can add up quickly as well:

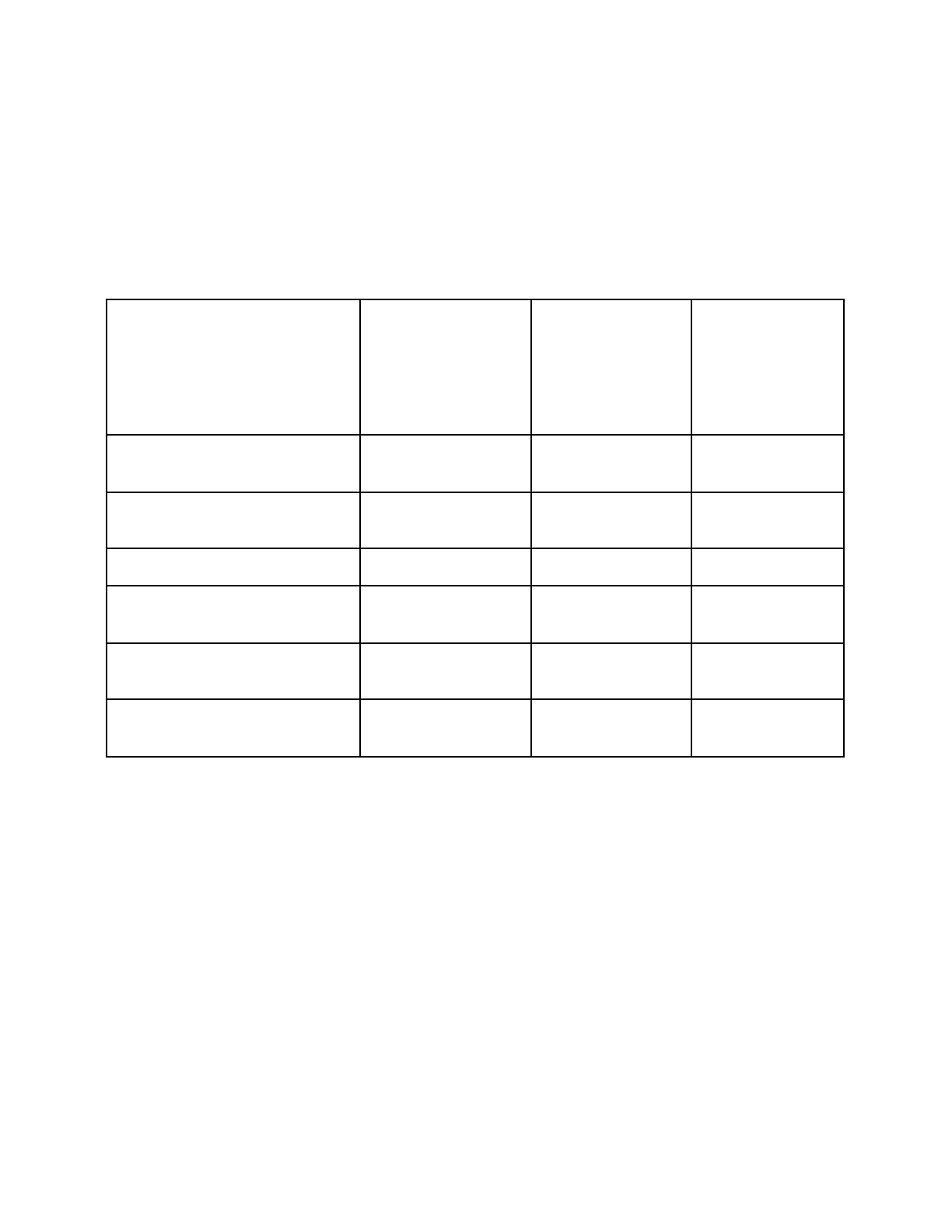

Most and Least Expensive Metros for “Life Event” Premium Changes:

Life Event

Added Average

Cost in the U.S.

Added Cost to

Premium in

Most

Expensive Metro

Added Cost to

Premium in

Least

Expensive Metro

Credit score decreases from

‘good’ to ‘poor’

$1,795

New York - $5,305

Seattle - $306**

Receives a speeding ticket

$523

Detroit - $1,489

San Antonio -

$269

Involved in a car accident

$1,034

Detroit - $2,849

New York - $494

Has a lapse in auto insurance

coverage

$276

Tampa - $818

Charlotte - $117**

Convicted of a DUI

$2,247

Detroit - $8,585

Washington, D.C.

- $1,171

Adds a teenage driver to policy

$2,878

Detroit - $8,366

Minneapolis -

$2,049

**These locations are part of states that prohibit or have prohibited auto insurance carriers from changing

premiums in the past year due to these life events. Rates may be affected due to state laws changing.

“We are seeing especially high rate increases when drivers engage in high-risk behavior

like speeding or causing an accident,” added Martin. “For example, drivers in Charlotte

pay, on average, $5,069 more per year for full coverage car insurance with a DUI on

their record than drivers with a clean record. Asking about discounts and comparison

shopping your policy may help you find a lower rate, but focusing on long-term financial

impacts, such as improving your driving record and boosting your credit score (in most

states), may also pay off down the line.”

Methodology

Bankrate utilizes Quadrant Information Services to analyze 2024 rates for ZIP codes

and carriers in all 50 states and Washington, D.C. Rates are weighted based on the

population density in each geographic region. Quoted rates are based on a 40-year-old

male and female driver with a clean driving record, good credit and the following full

coverage limits:

$100,000 bodily injury liability per person

$300,000 bodily injury liability per accident

$50,000 property damage liability per accident

$100,000 uninsured motorist bodily injury per person

$300,000 uninsured motorist bodily injury per accident

$500 collision deductible

$500 comprehensive deductible

To determine minimum coverage limits, Bankrate used minimum coverage that meets

each state’s requirements. Our base profile drivers own a 2022 Toyota Camry, commute

five days a week and drive 12,000 miles annually.

These are sample rates and should only be used for comparative purposes.

Credit-based insurance scores: Rates were calculated based on the following

insurance credit tiers assigned to our drivers: “poor, average, good (base) and

excellent.” For ‘credit score decreased,’ rates were assessed when the drivers’ score

went from ‘good’ to ‘poor.’ Insurance credit tiers factor in your official credit scores but

are not dependent on that variable alone. Four states prohibit or restrict the use of

credit-based insurance scores as a rating factor in determining auto insurance rates:

California, Hawaii, Massachusetts, and Michigan. In Michigan, insurers are allowed to

use information that contributes to your credit score but not the score itself.

Incidents: Rates were calculated by evaluating our base profile with the following

incidents applied: clean record (base), at-fault accident, single speeding ticket, single

DUI conviction and lapse in coverage.

Model: To determine cost by vehicle type, we evaluated our base profile with the

following vehicles applied: BMW 330i, Ford F-150, Honda Odyssey, Toyota Prius and

Toyota Camry (base).

Teens: Rates were determined by adding a 16-year-old teen to a 40-year-old married

couple’s policy. Age is not a contributing rating factor in Hawaii and Massachusetts due

to state regulations, although Massachusetts allows insurers to use a driver’s years of

driving experience.

Income data: Median annual income data was calculated using 2022 data, the most

recent available, provided by the U.S. Census Bureau. 2024 calculations for the

percentage of income spent on auto insurance use the most recent median income data

from the U.S. Census. All previous True Cost of Auto Insurance reports utilized average

income data from the U.S. Census. Bankrate chose to switch to median income data in

2024 as a more representative statistic of what people earn in a given geographic area.

About Bankrate:

Bankrate has guided savers and spenders through the next steps of their financial

journeys since 1976. Whether it's rates or information on mortgages, investing, credit

cards, personal loans, insurance, taxes or retirement, the company offers various free

resources to help consumers reach their goals. From product comparison tools to

award-winning editorial content, Bankrate provides objective information and actionable

next steps. Bankrate also aggregates rate information from over 4,800 institutions on

more than 300 financial products, with coverage in more than 600 local markets. It’s

why over 100 million people put their trust in Bankrate every year.

For more information:

Julie Guacci

Public Relations Manager, Bankrate

917-368-8673