20232023

Auto Insurance Auto Insurance

Cost Comparison SurveyCost Comparison Survey

North Dakota

Insurance

Department

Safeguarding Promises. Fostering Fairness.

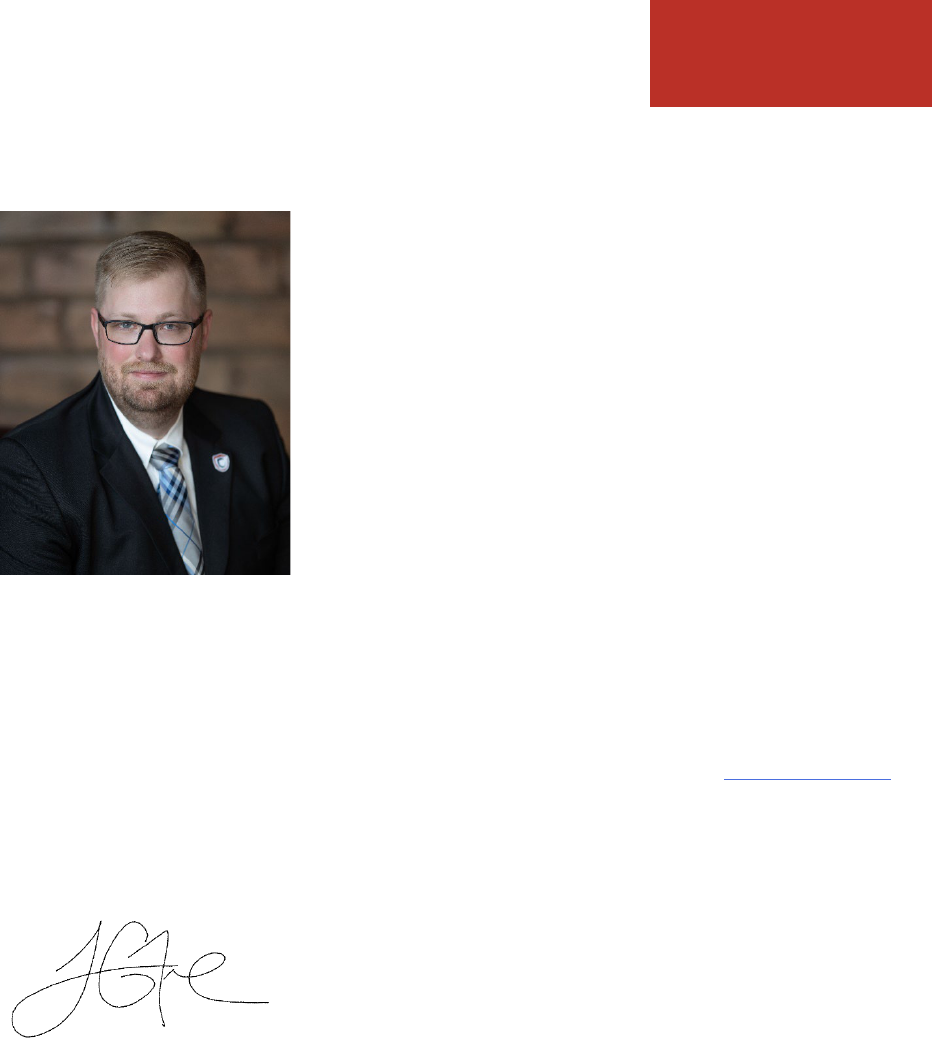

Jon Godfread, Commissioner

April 2023

North Dakota Insurance Department | 1

Welcome

Since taking office in 2017, one of my primary goals as

Insurance Commissioner has been providing consumers with

more significant education and information access. This annual

survey is a small step in achieving the Department's mission.

Each year, we release this report to paint a picture for

consumers on the varying costs of auto insurance – encouraging

motorists to shop around for policies that best fit their needs

and wallets. Getting multiple quotes from a licensed agent and

discussing your insurance needs never hurts and is something

I'd highly encourage.

Several factors play into the cost of auto insurance, including

driving history, age, vehicle make and model, zip code, and credit score. The best advice I can

give anyone when purchasing an insurance policy is to not look solely at price. God forbid you

ever need to use your insurance policy; you should have a policy that will protect you and your

family. If you purchase a low-cost policy, it may be unreliable when you need it most.

As always, if you have questions or need assistance with an insurance policy, do not hesitate to

contact the North Dakota Insurance Department at (701)328-2440 or visit insurance.nd.gov.

We're here to help!

Yours,

Jon Godfread

Insurance Commissioner

North Dakota Insurance Department | 2

ISSUE #36

AUTOMOBILE INSURANCE COST COMPARISON SURVEY

April 2023

Our survey shows how much "Good" drivers, and "Higher Risk" drivers will pay for a six month

auto insurance policy, in five different areas of the state.

We invited 20 Auto insurance companies to take part in our survey. The companies listed in

our survey sell more than 80 percent of the auto insurance purchased in North Dakota.

THE AUTO INSURANCE COMPANIES INCLUDED IN THIS SURVEY WERE CHOSEN BASED ON

THEIR VOLUME OF BUSINESS IN NORTH DAKOTA. BEING ON THIS LIST IS NOT A

"RECOMMENDATION" BY THE INSURANCE COMMISSIONER'S OFFICE. YOU SHOULD NOT

LIMIT YOUR SHOPPING TO THE COMPANIES ON OUR LIST.

Examples 1, 2, 3 and 4 are "good" drivers, who will be accepted by most low-cost companies.

They have excellent driving records, drive an average number of miles per year, and have

"family-type" cars. We list only the low cost companies that will insure these drivers.

Examples 5 and 6 also have "good" drivers, but have an additional youthful driver. For these

examples, we list both the low and high cost companies that will accept these drivers.

Example 7 shows how much an elderly driver with a clean driving record will pay for insurance.

Examples 8, 9 and 10 have less than perfect driving records, drive a "sports car", or are younger,

and they pay more for auto insurance. Only “higher risk" companies agreed to insure these

drivers.

Example 11 and 12 show examples of drivers that are “gig” workers, that transport people or

goods.

Insurance companies have different methods of rating each driver, so one company may have

the lowest price for one of our examples, and yet be comparatively higher in another. Many

factors, such as where you live, your age, sex, marital status, driving record, credit score, use of

vehicle, discounts and surcharges, make and model of car can affect how much you pay for

auto insurance. That's why it pays to "shop around" for auto insurance.

North Dakota Insurance Department | 3

HOW TO UNDERSTAND THIS SURVEY

The prices shown in our survey are the amounts paid every six months as of January 1, 2023.

We describe "important company differences" that affect the quoted prices, on the last two

pages of our survey. We would also like to caution that this survey represents the rates that

were in effect as of a certain point in time. Since the publication of this survey, rates may have

changed.

WHAT THE COVERAGES MEAN

LIABILITY covers someone else's losses if you are legally responsible. BODILY INJURY covers

sickness, injury or death of another person. PROPERTY DAMAGE covers damage, destruction,

or loss of use of another person's property. Our survey uses a "split limit" coverage, which

provides separate limits for bodily injury and property damage.

PERSONAL INJURY PROTECTION (PIP) is a form of "no-fault" insurance. PIP covers medical

expenses, wage loss and other costs, no matter who caused the accident.

UNINSURED MOTORIST (UM) coverage will pay for a bodily injury claim that you sustain caused

by a driver without insurance.

UNDERINSURED MOTORIST (UIM) coverage will pay for a bodily injury claim caused by a driver

whose liability coverage is less than the amount of underinsured motorist coverage you carry.

COLLISION covers damage to your car caused by hitting something.

COMPREHENSIVE covers damage to your car if the loss isn't caused by a collision, but by other

unforeseeable causes such as hail, wind, fire, etc.

COVERAGE LIMITS - EXAMPLES 1 through 8

LIABILITY - BODILY INJURY: $100,000 limit for injury to another person/$300,000 limit for

injuries to all persons.

LIABILITY - PROPERTY DAMAGE: $50,000 limit.

UNINSURED MOTORIST (UM) - BODILY INJURY: $100,000 limit for injury to one person/

$300,000 limit for injuries to all persons.

UNDERINSURED MOTORIST (UIM) - BODILY INJURY: Limits equal to the Uninsured Motorist

limit.

PERSONAL INJURY PROTECTION (PIP): $30,000 limit.

North Dakota Insurance Department | 4

COLLISION: $500 Deductible.

COMPREHENSIVE: $250 Deductible.

COVERAGE LIMITS – EXAMPLES 9 though 12

LIABILITY - BODILY INJURY: $25,000 limit for injury to another person/$50,000 limit for injuries

to all persons.

LIABILITY - PROPERTY DAMAGE: $25,000 limit.

UNINSURED MOTORIST (UM) - BODILY INJURY: $25,000 limit for injury to one person/ $50,000

limit for injuries to all persons.

UNDERINSURED MOTORIST (UIM) - BODILY INJURY: Limits equal to the Uninsured Motorist

limit.

PERSONAL INJURY PROTECTION (PIP): $30,000 limit.

The following examples show each company's six month premium and include discounts for

multi-car and safe driver when appropriate.

North Dakota Insurance Department | 5

EXAMPLE NUMBER 1: Single Male, Age 25. Drives 2014 Ford F150 XLT four miles each way to

work, five days per week. Annual mileage = 15,000. Clean driving record for three years and

excellent credit history. There are no other drivers in household.

Bismarck/ Remainder

Company Name Fargo Mandan Grand Forks Minot of State

Allstate $961 $1,158 $915 $925 $907

American Family $470 $534 $445 $499 $454

Center Mutual $702 $681 $629 $592 $614

Country Financial $348 $349 $333 $349 $294

Garrison Prop & Cas $669 $664 $627 $630 $731

GEICO $641 $727 $638 $739 $876

Grinnell Select $465 $502 $489 $537 $451

Farmers Property $798 $914 $786 $872 $861

Mid Century $497 $562 $488 $619 $561

Nat’l Farmers Union $452 $673 $516 $785 $680

Nationwide Mutual $658 $732 $671 $761 $746

Nodak Mutual $345 $451 $415 $425 $398

North Star Mutual $454 $524 $427 $430 $426

Progressive Direct $282 $321 $289 $335 $332

Progressive NW $348 $419 $399 $449 $442

Safeco $825 $999 $823 $868 $921

State Farm Fire $765 $811 $717 $861 $941

State Farm Mutual $643 $684 $604 $726 $803

USAA $555 $556 $512 $519 $616

USAA Casualty $563 $565 $528 $526 $615

North Dakota Insurance Department | 6

EXAMPLE NUMBER 2: Single Female, Age 30. Drives 2014 Acura TL four miles each way to

work, five days per week. Annual mileage = 10,000. Clean driving record for three years and

excellent credit history. There are no other drivers in household.

Bismarck/ Remainder

Company Name Fargo Mandan Grand Forks Minot of State

Allstate $827 $959 $780 $790 $777

American Family $471 $541 $445 $514 $466

Center Mutual $760 $686 $662 $630 $677

Country Financial $335 $362 $330 $359 $332

Garrison Prop & Cas $523 $525 $493 $501 $592

GEICO $549 $633 $548 $641 $793

Grinnell Select $459 $498 $496 $542 $461

Farmers Property $760 $876 $764 $801 $813

Mid Century $467 $563 $486 $615 $556

Nat’l Farmers Union $420 $650 $481 $761 $669

Nationwide Mutual $562 $637 $581 $662 $664

Nodak Mutual $356 $509 $442 $473 $463

North Star Mutual $529 $608 $493 $493 $500

Progressive Direct $297 $359 $312 $364 $378

Progressive NW $349 $471 $406 $459 $471

Safeco $753 $853 $940 $761 $804

State Farm Fire $640 $685 $611 $743 $857

State Farm Mutual $538 $578 $515 $627 $735

USAA $521 $529 $485 $493 $599

USAA Casualty $520 $530 $491 $492 $592

North Dakota Insurance Department | 7

EXAMPLE NUMBER 3: Married couple, both age 35. Husband drives 2011 Dodge Ram 4X4

1500 to work 5 miles each way, five days per week. Annual mileage = 12,000. Wife drives 2012

Ford Taurus to work 2 miles each way, five days per week. Annual mileage = 7,000. Both have a

clean record for last three years and excellent credit history. There are no other drivers in

household.

Bismarck/ Remainder

Company Name Fargo Mandan Grand Forks Minot of State

Allstate $799 $758 $753 $733 $912

American Family $497 $583 $450 $511 $473

Center Mutual $939 $839 $831 $758 $740

Country Financial $413 $444 $406 $442 $408

Garrison Prop & Cas $613 $617 $581 $582 $680

GEICO $659 $749 $657 $760 $911

Grinnell Select $556 $607 $589 $645 $554

Farmers Property $707 $804 $708 $766 $766

Mid Century $618 $723 $620 $786 $718

Nat’l Farmers Union $450 $711 $513 $798 $728

Nationwide Mutual $787 $901 $814 $922 $957

Nodak Mutual $455 $634 $561 $586 $571

North Star Mutual $522 $605 $494 $494 $494

Progressive Direct $279 $332 $295 $339 $350

Progressive NW $314 $387 $365 $409 $415

Safeco $722 $808 $877 $719 $761

State Farm Fire $652 $705 $626 $762 $907

State Farm Mutual $608 $660 $586 $715 $863

USAA $604 $615 $564 $571 $683

USAA Casualty $624 $637 $592 $589 $698

North Dakota Insurance Department | 8

EXAMPLE NUMBER 4: Married couple, both aged 65 and retired. Husband drives 2016 Ford F-

150 SuperCrew pickup. Annual mileage = 10,000. Wife drives 2012 Toyota Prius Hybrid.

Annual mileage = 4,000. Both have clean records and excellent credit history. There are no

other drivers in household.

Bismarck/ Remainder

Company Name Fargo Mandan Grand Forks Minot of State

Allstate $831 $941 $784 $788 $771

American Family $498 $577 $463 $527 $482

Center Mutual $785 $715 $726 $647 $626

Country Financial $418 $441 $408 $439 $397

Garrison Prop & Cas $586 $594 $557 $560 $660

GEICO $629 $736 $630 $734 $951

Grinnell Select $594 $649 $629 $691 $592

Farmers Property $908 $1,041 $912 $961 $975

Mid Century $710 $854 $720 $925 $857

Nat’l Farmers Union $413 $667 $473 $755 $686

Nationwide Mutual $723 $826 $748 $843 $881

Nodak Mutual $373 $526 $461 $488 $475

North Star Mutual $598 $693 $559 $563 $571

Progressive Direct $283 $342 $299 $348 $362

Progressive NW $313 $395 $367 $414 $427

Safeco $825 $964 $1,072 $839 $902

State Farm Fire $620 $663 $589 $711 $811

State Farm Mutual $575 $617 $548 $663 $766

USAA $582 $597 $545 $553 $668

USAA Casualty $603 $621 $575 $572 $685

North Dakota Insurance Department | 9

EXAMPLE NUMBER 5: Married couple ages 46 & 44 with Youthful driver. Husband, age 46,

drives 2015 Chevrolet Silverado pickup to work 8 miles each way, five days per week. Annual

mileage = 15,000. Wife, age 44, drives 2012 Subaru Outback to work 5 miles each way, 5 days

per week. Annual mileage = 10,000. Youthful driver, male, age 16, is a junior in High School, is

an 'A' average student, and drives the pickup on an occasional basis. All drivers have clean

records. Husband and wife have excellent credit history. The teenage driver has no credit

history.

Bismarck/ Remainder

Company Name Fargo Mandan Grand Forks Minot of State

Allstate $1,362 $1,487 $1,280 $1,280 $1,240

American Family $799 $897 $782 $879 $776

Center Mutual $1,075 $995 $974 $932 $929

Country Financial $1,179 $1,115 $1,102 $1,124 $869

Garrison Prop & Cas $1,660 $1,574 $1,524 $1,536 $1,684

GEICO $1,390 $1,575 $1,387 $1,616 $1,893

Grinnell Select $1,189 $1,256 $1,258 $1,377 $1,125

Farmers Property $1,629 $1,860 $1,595 $1,595 $1,754

Mid Century $1,182 $1,330 $1,182 $1,476 $1,315

Nat’l Farmers Union $546 $828 $625 $960 $843

Nationwide Mutual $1,245 $1,388 $1,273 $1,452 $1,405

Nodak Mutual $952 $1,308 $1,168 $1,226 $1,164

North Star Mutual $883 $1,014 $822 $827 $824

Progressive Direct $384 $426 $389 $452 $437

Progressive NW $440 $507 $501 $552 $526

Safeco $1,885 $2,000 $2,110 $1,837 $1,898

State Farm Fire $1,509 $1,588 $1,402 $1,677 $1,768

State Farm Mutual $1,392 $1,469 $1,295 $1,550 $1,653

USAA $1,299 $,1256 $1,185 $1,196 $1,362

USAA Casualty $1,305 $1,266 $1,204 $1,201 $1,354

North Dakota Insurance Department | 10

EXAMPLE NUMBER 6: Single Female, Age 48 with Youthful driver drives 2012 Buick LaCrosse

CXL to work 3 miles each way, five days per week. Annual mileage = 18,000. Youthful driver,

male, age 16, is a junior in High School, is an 'A' average student, and drives the car on an

occasional basis. All drivers have clean records. The female driver has excellent credit history.

The youthful driver has no credit history.

Bismarck/ Remainder

Company Name Fargo Mandan Grand Forks Minot of State

Allstate $1,029 $1,062 $964 $955 $921

American Family $540 $578 $547 $589 $522

Center Mutual $712 $665 $657 $635 $597

Country Financial $880 $801 $810 $811 $591

Garrison Prop & Cas$1,338 $1,232 $1,209 $1,218 $1,301

GEICO $1,084 $1,222 $1,079 $1,258 $1,453

Grinnell Select $845 $872 $893 $977 $769

Farmers Property $1,375 $1,618 $1,362 $1,489 $1,484

Mid Century $764 $866 $786 $971 $861

Nat’l Farmers Union $524 $740 $598 $880 $746

Nationwide Mutual $916 $1,005 $934 $1,060 $995

Nodak Mutual $439 $611 $547 $586 $578

North Star Mutual $550 $629 $514 $517 $508

Progressive Direct $296 $320 $297 $343 $325

Progressive NW $323 $364 $365 $401 $376

Safeco $1,490 $1,537 $1,592 $1,435 $1,465

State Farm Fire $1,265 $1,326 $1,167 $1,388 $1,430

State Farm Mutual $1,061 $1,115 $981 $1,166 $1,213

USAA $942 $881 $849 $851 $945

USAA Casualty $982 $922 $890 $888 $974

North Dakota Insurance Department | 11

EXAMPLE NUMBER 7: Single Female, Age 72 drives 2013 Lincoln Town Car. Annual mileage =

5,000. Clean driving record for three years and excellent credit history.

Bismarck/ Remainder

Company Name Fargo Mandan Grand Forks Minot of State

Allstate $591 $636 $556 $555 $541

American Family $300 $331 $292 $319 $291

Center Mutual $586 $554 $570 $503 $583

Country Financial $285 $272 $284 $239 $284

Garrison Prop & Cas $404 $391 $375 $379 $427

GEICO $423 $489 $422 $491 $620

Grinnell Select $394 $411 $416 $456 $365

Farmers Property $633 $732 $632 $675 $681

Mid Century $338 $386 $344 $433 $394

Nat’l Farmers Union $381 $586 $434 $672 $601

Nationwide Mutual $530 $591 $547 $619 $606

Nodak Mutual $301 $413 $370 $393 $364

North Star Mutual $435 $499 $405 $406 $411

Progressive Direct $221 $250 $226 $260 $260

Progressive NW $255 $307 $293 $329 $327

Safeco $589 $632 $674 $581 $601

State Farm Fire $522 $552 $490 $590 $644

State Farm Mutual $437 $463 $412 $495 $548

USAA $389 $387 $366 $368 $426

USAA Casualty $414 $406 $384 $383 $440

North Dakota Insurance Department | 12

EXAMPLE 8: Married couple, both age 25, with 2 young children at home. Husband drives

2010 Toyota Corolla eight miles to work each way, five days per week. Annual mileage =

12,000. Wife drives 2011 Ford Focus SE six miles to daycare and work each day, five days per

week. Annual mileage = 10,000. The husband had an accident one year ago, causing $7,000

damage to another party. The wife has a speeding ticket (45mph in a 35mph zone).

Bismarck/ Remainder

Company Name Fargo Mandan Grand Forks Minot of State

Allstate $982 $1,022 $918 $912 $881

American Standard $631 $723 $596 $675 $610

Center Mutual $1,029 $884 $857 $817 $873

Garrison Prop & Cas $801 $782 $746 $744 $850

GEICO $983 $1,101 $972 $1,123 $1,298

Grinnell Mutual $863 $806 $901 $988 $806

Farmers Property $1,594 $1,834 $1,590 $1,736 $1,735

Mid Century $1,099 $1,238 $1,110 $1,377 $1,233

Nat’l Farmers Union $795 $1,179 $905 $1,356 $1,195

Nationwide Mutual $1,174 $1,313 $1,201 $1,354 $1,343

Nodak Mutual $670 $896 $811 $841 $792

North Star Mutual $696 $797 $650 $657 $645

Progressive Direct $449 $491 $455 $525 $509

Progressive NW $549 $625 $620 $682 $649

Safeco $853 $928 $995 $843 $879

State Farm Fire $988 $1,050 $927 $1,102 $1,208

State Farm Mutual $774 $826 $726 $867 $960

USAA $834 $821 $899 $767 $899

USAA Casualty $804 $798 $750 $742 $860

USAA General Ind $748 $740 $689 $692 $813

North Dakota Insurance Department | 13

EXAMPLE NUMBER 9: Single male, age 21. Drives 2009 Ford Mustang five miles each way to

work, five days per week. Annual mileage = 12,000. He has a speeding violation two years old

(75mph in a 55 mph zone), a speeding violation one year old (45mph in a 25mph zone), and an

"At Fault" accident causing $9,500 damage to a third party six months ago. Driver has excellent

credit history. There are no other drivers in the household. DRIVER IS LOOKING FOR A

“LIABILITY ONLY” POLICY.

Bismarck/ Remainder

Company Name Fargo Mandan Grand Forks Minot of State

Allstate $801 $709 $773 $707 $647

American Standard $430 $422 $458 $425 $378

Center Mutual $430 $308 $315 $286 $317

Garrison Prop & Cas $699 $599 $610 $578 $565

GEICO $716 $717 $682 $759 $630

Grinnell Select $610 $593 $545 $620 $411

Famers Property $1,231 $1,408 $1,173 $1,454 $1,413

Mid Century $883 $917 $866 $1,004 $810

Nat’l Farmers Union $948 $1,052 $1,068 $1,247 $950

Nationwide Mutual $880 $863 $839 $864 $704

Nodak Mutual $197 $175 $202 $171 $129

Progressive Direct $234 $218 $226 $247 $214

Progressive NW $289 $280 $316 $327 $270

Safeco $501 $465 $423 $443 $446

State Farm Fire $879 $906 $760 $841 $669

USAA $599 $511 $515 $493 $485

USAA Casualty $582 $506 $506 $483 $469

USAA General Ind $525 $451 $452 $432 $429

North Dakota Insurance Department | 14

EXAMPLE NUMBER 10: Single male, age 40. Drives 2013 Chevrolet Impala 10 miles each way

to work, five days per week. Annual mileage = 15,000. Last month he was convicted of Driving

Under the Influence (DUI). He needs to make an "SR-22" filing to get his license back. Driver

has excellent credit history. There are no other drivers in the household. DRIVER IS LOOKING

FOR A “LIABILITY ONLY” POLICY.

Bismarck/ Remainder

Company Name Fargo Mandan Grand Forks Minot of State

Allstate $455 $412 $439 $407 $379

American Standard $265 $261 $280 $263 $237

Center Mutual $316 $218 $213 $213 $197

Garrison Prop & Cas $356 $305 $311 $294 $290

Grinnell Select $257 $248 $229 $230 $171

Famers Property $668 $768 $651 $783 $772

Mid Century $444 $468 $440 $506 $418

Nat’l Farmers Union $146 $162 $163 $187 $156

Nationwide Mutual $488 $482 $471 $479 $409

Nodak Mutual $201 $177 $205 $174 $131

Progressive Direct $139 $132 $136 $146 $130

Progressive NW $132 $128 $142 $147 $125

Safeco $279 $259 $239 $259 $250

USAA $322 $275 $277 $265 $262

USAA Casualty $323 $281 $282 $268 $262

USAA General Ind $259 $224 $224 $214 $213

EXAMPLE NUMBER 11: Single male, age 28. Drives 2018 Ford Edge (VIN#: 2FMPK3K9XJ) and

is a GIG driver for a Transportation Network Company (TNC). Annual mileage = 60,000. Clean

driving record for 3 years and excellent credit history. There are no other drivers in household.

DRIVER IS LOOKING FOR A “LIABILITY ONLY” POLICY.

Bismarck/ Remainder

Company Name Fargo Mandan Grand Forks Minot of State

Allstate $938 $1,181 $906 $906 $886

American Standard $195 $193 $201 $193 $182

Garrison Prop & Cas $185 $160 $163 $155 $152

Famers Property $345 $394 $328 $406 $396

Mid Century $203 $220 $207 $239 $196

Nat’l Farmers Union $137 $151 $152 $176 $144

Progressive Direct $132 $127 $130 $139 $124

Progressive NW $126 $122 $137 $141 $119

Safeco $210 $196 $180 $188 $189

State Farm Fire $205 $211 $177 $196 $155

State Farm Mutual $179 $184 $155 $171 $136

USAA $165 $143 $144 $138 $136

USAA Casualty $167 $147 $147 $140 $137

USAA General Ind $147 $128 $128 $128 $122

North Dakota Insurance Department | 15

EXAMPLE NUMBER 12: Single female, age 35. Drives 2016 Chevrolet Traverse (VIN#:

1GNKRGKD5G) and is a GIG driver but only deliveries food or other goods and does not take on

passengers. Annual mileage = 40,000. Clean driving record for 3 years and excellent credit.

DRIVER IS LOOKING FOR A “LIABILITY ONLY” POLICY.

Bismarck/ Remainder

Company Name Fargo Mandan Grand Forks Minot of State

Allstate $766 $922 $740 $729 $708

American Standard $181 $179 $188 $180 $168

Center Mutual $182 $129 $127 $127 $117

Garrison Prop & Cas $167 $144 $147 $139 $138

Grinnell Select $172 $167 $154 $175 $115

Famers Property $317 $359 $307 $361 $364

Mid Century $166 $180 $170 $195 $161

Nat’l Farmers Union $129 $143 $144 $164 $139

Progressive Direct $114 $109 $111 $117 $107

Progressive NW $110 $107 $118 $122 $102

Safeco $214 $199 $182 $190 $192

State Farm Fire $181 $186 $156 $173 $137

State Farm Mutual $158 $163 $136 $151 $120

USAA $149 $129 $130 $124 $124

USAA Casualty $155 $136 $136 $129 $128

USAA General Ind $143 $124 $125 $118 $120

North Dakota Insurance Department | 16

THE AUTOMOBILE INSURANCE "ASSIGNED RISK" PLAN

Some drivers cannot buy insurance from the companies listed in our survey. If you cannot buy

insurance in the open market from either a low cost or a high risk company, you may be eligible

for the "assigned risk" plan. This plan was designed to make insurance available for any driver

who wants to buy it, regardless of their driving record.

You are eligible for coverage through the assigned risk plan, if:

* You are a resident of North Dakota.

* Your vehicle is registered in North Dakota.

* You have a current, valid North Dakota drivers license.

* You have no unpaid automobile insurance premiums in the last twelve months.

The cost of the auto insurance through the assigned risk plan is usually higher, but coverage is

available for all drivers who meet the eligibility requirements. If you cannot get insurance on

the open market, ask your agent or broker for assistance in contacting the North Dakota Auto

Insurance Plan Office at:

North Dakota Automobile Insurance Plan

1 East Wacker Drive, Suite 3120

Chicago, IL 60601

Phone: (888) 706 – 6100

Fax: (312) 494 – 1750

Email: [email protected]

Website: www.aipso.com/nd

IMPORTANT COMPANY DIFFERENCES

Mid-Century

Electronic Funds (EFT) discount and ePolicy discount.

National Farmers Union Insurance

All examples assume paid-in-full premiums. Pro-active discount applied in all examples.

Nodak Mutual Insurance Company

Nodak files annual rates; the six month premiums quoted in the examples are arrived at

by dividing the rates in half. All risks were quoted on the EFT Payment Plan.

Progressive Direct/Progressive NorthwesternInsurance Companies

“Snapshot” and paid-in-full discount applied to all rating examples