California

Low

Cost

Automobile

Insurance

Program

STATE

OF

(~

l

~J

~~

~~

!

LOW

COST

AUTO

il:F11l,tJ:t3~

Report to the Legislature

and

Consumer Education

and Outreach Plan

California Low Cost Automobile

Table of Contents

Insurance Program

Report to the Legislature and Consumer

Education and Outreach Plan

Introduction.......................................................................................

2

Program and Policy Overview............................................................

3

Outreach Funding Source..................................................................

5

2004 – The Year in Review....................................................................

6

Performance Measures and Statistics................................................

16

Commissioner’s Determination of Success........................................

18

2005 Outreach Plan Summary...........................................................

20

Conclusion..........................................................................................

27

California Low Cost Automobile Insurance Program

Report to the Legislature and Consumer Education and Outreach Plan

1

Introduction

The California Low Cost Automobile Insurance (CLCA) pilot program was enacted in

1999 (SB 171 Escutia, SB 527 Speier) to create an affordable insurance option for low-

income, good drivers in Los Angeles County and the City and County of San Francisco

to comply with California’s nancial responsibility law.

Legislative modication and enhancement of the program occurred in 2002, with the

enactment of SB 1427 (Escutia/Speier). Among other things, the bill established the

requirement for an annual report to the Senate and Assembly Committees on Insurance

detailing the Insurance Commissioner’s plan to inform the public about the availability

of the CLCA pilot program. In 2004, SB 1500 (Speier), added additional requirements for

the Commissioner to report on the success of the program, based on specied criteria.

Insurance Commissioner Garamendi shares the Legislature’s commitment to reduce the

number of uninsured drivers on California’s roads and to make affordable insurance

available to all consumers. As such, the Commissioner has made the California Low

Cost Automobile Insurance program a key component of his Emerging Communities

Initiative. This initiative is a series of California Department of Insurance programs and

activities that focus on improving access to and availability of insurance services in low-

income communities.

In January 2004, Commissioner Garamendi reorganized the California Department of

Insurance to focus resources and expertise on the Emerging Communities Initiative, with

a critical focus on the California Low Cost Automobile Insurance program.

The report that follows includes the Commissioner’s assessment of the success of the

program, details the activities and accomplishments of the past year, recommends and

proposes solutions to improve the program and reduce barriers to successful growth of

the program, and outlines the 2005 CLCA Outreach Plan.

California Low Cost Automobile Insurance Program

Report to the Legislature and Consumer Education and Outreach Plan

2

Program and Policy Overview

The CLCA program creates an affordable auto insurance option for low-income, good

drivers in Los Angeles County and the City and County of San Francisco.

The California Automobile Assigned Risk Plan (CAARP) administers the CLCA

program. CAARP assigns CLCA applications to auto insurers based on each

insurer’s share of the California voluntary auto insurance market. Only producers

(agents/brokers) certied by CAARP are authorized to submit program applications.

Currently, there are approximately 8,500 producers in Los Angeles and San Francisco

counties that are certied by CAARP.

Policy Features

The basic CLCA liability policy, as prescribed by state law, is $10,000/20,000/3,000;

providing up to $10,000 for bodily injury or death per person in an accident, a

maximum of $20,000 for bodily injury or death per accident, and up to $3,000

property damage for each accident.

The annual base premium rate for a CLCA liability policy is currently $347 in Los

Angeles County and $314 in the City and County of San Francisco. There is a 25

percent premium surcharge for unmarried male drivers ages 19 through 24. Several

installment payment options are available, with a down payment as low as 15

percent of the total cost.

Optional rst-party coverage is available at additional cost. These optional coverages

include $1,000 medical payments coverage and uninsured motorist bodily injury

coverage of $10,000/$20,000. Currently premiums for optional coverage are set at:

• Medical payments coverage: $26 in Los Angeles and $24 in San Francisco

• Uninsured motorist coverage: $64 in Los Angeles and $39 in San Francisco

Eligibility Requirements

By statute, the applicant’s annual household income may not exceed 250 percent of

the federal poverty level. Currently, the annual gross income threshold is $23,275

for a one-person household and $47,125 for a four-person household.

Applicants must be at least 19 years of age and a resident of Los Angeles County or

San Francisco City and County.

California Low Cost Automobile Insurance Program

Report to the Legislature and Consumer Education and Outreach Plan

3

Additional eligibility criteria include:

• The applicant must be a “good driver,” dened as having no more than one at-fault

property damage accident, or no more than one “point” for a moving violation,

but not both, and no at-fault accident involving bodily injury or death in the

past three years; and no felony or misdemeanor convictions for a violation of the

California Vehicle Code

• The value of the vehicle to be insured shall not exceed $12,000

• The applicant must have been continuously licensed to drive for the previous three

years. In meeting the three year standard, up to 18 months of foreign licensure is

acceptable, providing the applicant was licensed to drive in the US or Canada for

the preceding 18 months

• A CLCA policyholder shall not purchase a non-CLCA liability policy for any vehicle

in the household

• Each household is limited to a maximum of two CLCA policies

3’ x 10’ Banner

California Low Cost Automobile Insurance Program

Report to the Legislature and Consumer Education and Outreach Plan

4

OOuuttrreeaach Fch Fuunnddiinng Sog Souurrccee

The original 1999 legislation that created the CLCA program did not address the need for,

nor provide funding for, consumer education and outreach. In 2000, the Department

initiated a consumer education and awareness campaign to inform consumers of the

availability of the program.

The Department has used a portion of its SB 940 (Speier) funds to pay for CLCA outreach

efforts. SB 940 (Speier) requires insurers to pay an annual fee of 30 cents per vehicle

insured in California to fund consumer services related to automobile insurance, ten

cents of which may be used for consumer education.

The Department has not requested, nor has the Legislature appropriated, funds

specically for the CLCA program. SB 1427 (Escutia/Speier), as amended by SB 1500

(Speier), requires that the Commissioner submit an outreach plan to the Senate and

Assembly Committees on Insurance and Transportation to be eligible for funding

through the budget process.

In scal year 2004-05, the Department allocated $655,000 of SB 940 (Speier) funds for

CLCA program outreach activities. Given the challenge of the current economic and

scal climate, the Department is not expecting, nor requesting, additional funding

through the budget process at this time. The Department proposes to use $700,000 of

SB 940 (Speier) funds to pay for outreach activities in FY 2005-06. However, it must be

noted that SB 940 (Speier) is slated to sunset on January 1, 2007, thus eliminating the

only source of funding for outreach for the CLCA program. The Department is proposing

legislation this session to eliminate the sunset.

Newspaper advertisement

California Low Cost Automobile Insurance Program

Report to the Legislature and Consumer Education and Outreach Plan

5

2004 – The Year in Review

Commissioner Garamendi’s January 2004 reorganization of the Department created

the new Community Relations Branch

to focus departmental resources and expertise

on the CLCA program, as well as other components of the Emerging Communities

Initiative. The new Community Relations Branch immediately undertook an

extensive assessment of the CLCA program.

Program Assessment

In the rst four months of 2004, the Department conducted a detailed review of all

outreach activities since the inception of the program, an analysis of program statistics

and an evaluation of previously conducted consumer studies. Additionally, input was

solicited from the program administrator, the California Automobile Assigned Risk

Plan. The purpose of this review was to assess the effectiveness of outreach activities

and to evaluate the various strengths and weaknesses of the program.

Components of the assessment included:

• Review of outreach methodologies used

• Analysis of program participation and utilization

• Evaluation of reasons for applicant ineligibility

• Review of consumer inquiries by zip code

• Review of advertisements and public service announcements

• Analysis of consumer research studies

To gain insight into the successes and failures of the program, a series of meetings

were convened with insurance producers experienced in selling CLCA insurance and

with producers who serve low-income and underserved communities. More than 50

producers participated in these meetings. Participating producers were ethnically and

geographically diverse, and included independent agents as well as larger agencies.

Finally, to ensure the assessment was comprehensive, a series of meetings were

held with community-based organizations, faith-based organizations, and labor

organizations, whose primary mission or services are directed at low-income

communities and individuals. These meetings solicited feedback about the program

and ideas about methods to efciently and cost-effectively market the program.

California Low Cost Automobile Insurance Program

Report to the Legislature and Consumer Education and Outreach Plan

6

Assessment Findings

The assessment revealed that previous efforts to promote the program had not

been successful. Signicant barriers to the success of the program were identied,

including several inhibitors to potentially eligible individuals qualifying for the

program and numerous operational obstacles that undermine the willingness of

insurance producers to promote the program and write CLCA policies.

Among the key ndings of the assessment was that from the inception of the program

through December 31, 2003, only 9,692 policies had been assigned. Materials that

had been developed to promote the program lacked a clear and concise message and

did not reect the cultural awareness and sensitivity necessary to successfully market

the program in low-income minority communities.

Outreach Plan Development and Implementation

Based on the assessment ndings, a new comprehensive grassroots outreach

campaign to promote the CLCA program was developed. The campaign focuses on

specically targeting eligible constituencies, in volume, through community-based

organizations, faith-based organizations, labor organizations and other governmental

agencies serving low-income communities. It was determined that outreach

conducted through groups and organizations that serve low-income communities

would yield a larger volume of program eligible consumers than through direct

individual outreach efforts.

Implementation of the outreach plan was scheduled to begin in Los Angeles County

in August 2004 and the City and County of San Francisco in January 2005.

California Low Cost Automobile Insurance Program

Report to the Legislature and Consumer Education and Outreach Plan

7

Partnership Development

Meetings were convened with dozens of organizations to create outreach partnerships

for the CLCA program. Plans were developed to promote the program through

townhall-style and informational meetings with these organizations, newsletter

advertisements and features, inserts in union-member’s paychecks and other low-

cost means of communication. The Department provided outreach materials for

distribution to the organizations’ members and constituents.

The following is a partial list of organizations included in partnership development

efforts:

Community-Based Organizations

• Alliance for Better Community

• Brotherhood Crusade

• EL RESCATE

• Mexican American Legal Defense and Education Fund

• Mexican American Opportunity Foundation

• Mothers In Action

• Pico Union Westlake Cluster Incorporated

• Salvadoran American Leadership and Educational Fund

• Southern Christian Leadership Conference – Los Angeles

Faith-Based Organizations

• Baptist Ministers Conference

• Clergy and Laity United for Economic Justice (CLUE)

• Crenshaw Christian Center

• First AME Church of Los Angeles

• United Methodist Church of Hollywood

• West Los Angeles Church of God and Christ

Labor Organizations

• Service Employees International Union – Local 99 (Classied School Employees)

• Service Employees International Union – Local 434B (Home Care Workers)

• Service Employees International Union – Local 1877 (Janitors, Security Guards)

California Low Cost Automobile Insurance Program

Report to the Legislature and Consumer Education and Outreach Plan

8

Message and Material Development

Utilizing an existing contract the Department has with the rm of Ogilvy Public

Relations Worldwide for consumer outreach and education, key written and

graphic consumer messages were developed. Message development was based on

information obtained in the program assessment and in the various community and

producer meetings.

These messages were tested in focus groups composed of eligible, low-income,

uninsured drivers, including African Americans and Latinos. The focus groups were

convened in an effort to develop culturally sensitive and relevant consumer messages

and materials. The groups were specically designed to ensure

that all participants were actually eligible for the CLCA program

and were representative of targeted constituencies.

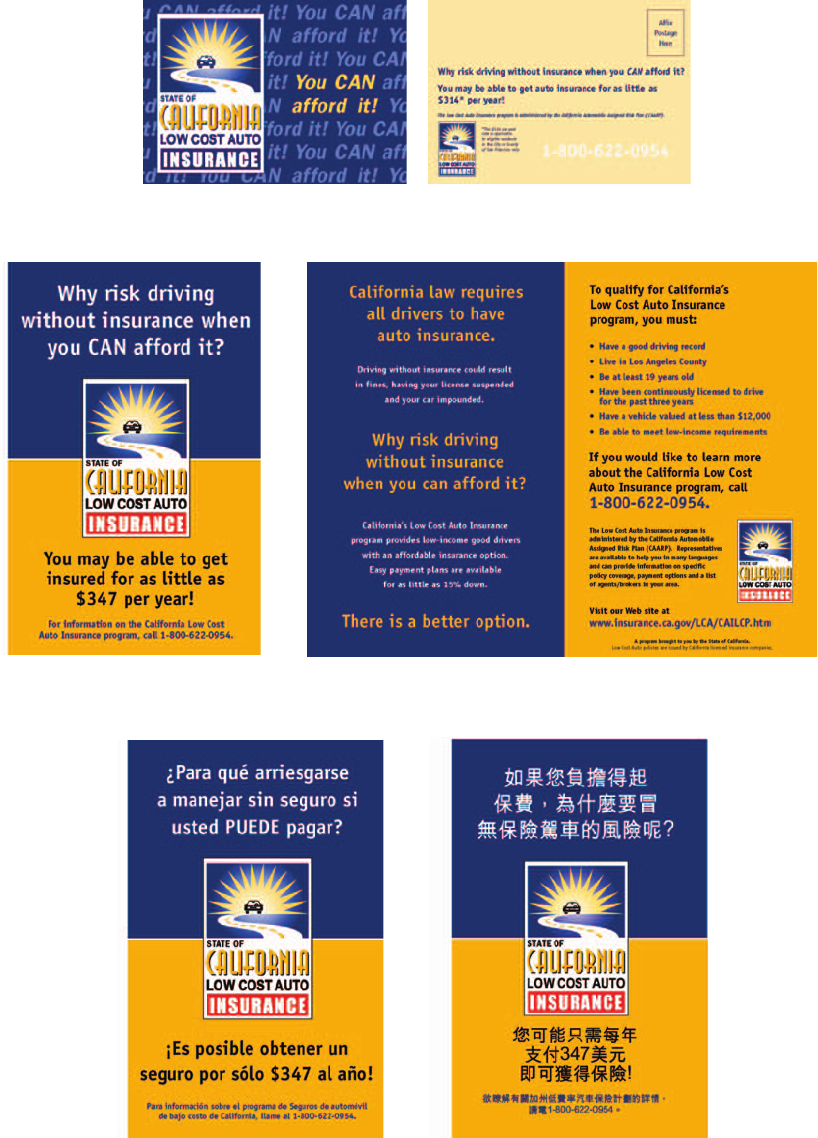

In addition to written messages, an array of graphic logos were

tested. The selected logo received an overwhelming positive

response from the group participants.

Additional testing was done to determine the best type of

spokespeople for promoting the program. Overwhelmingly,

participants preferred “ordinary people” to celebrities,

politicians, or law enforcement ofcials.

The focus groups revealed two key ndings:

1) every participant clearly understood that driving without insurance was a

violation of state law with signicant consequences; and,

2)

when informed about the availability and cost of CLCA insurance participants

demonstrated universal interest and an enthusiastic response.

As a result of participant reaction a simple two-sentence message was developed:

“Why risk driving without insurance when you can afford it?”

“You may be able to get insured for as little $347 per year!”

This message generated a strong and positive reaction both in English and when

translated into Spanish.

California Low Cost Automobile Insurance Program

Report to the Legislature and Consumer Education and Outreach Plan

9

Outreach materials were developed utilizing the newly tested message and graphics,

including informational brochures, postcards and palm cards.

Palm card

English-language brochure

Spanish-language brochure

Chinese-language brochure

California Low Cost Automobile Insurance Program

Report to the Legislature and Consumer Education and Outreach Plan

10

Outreach Plan Launch

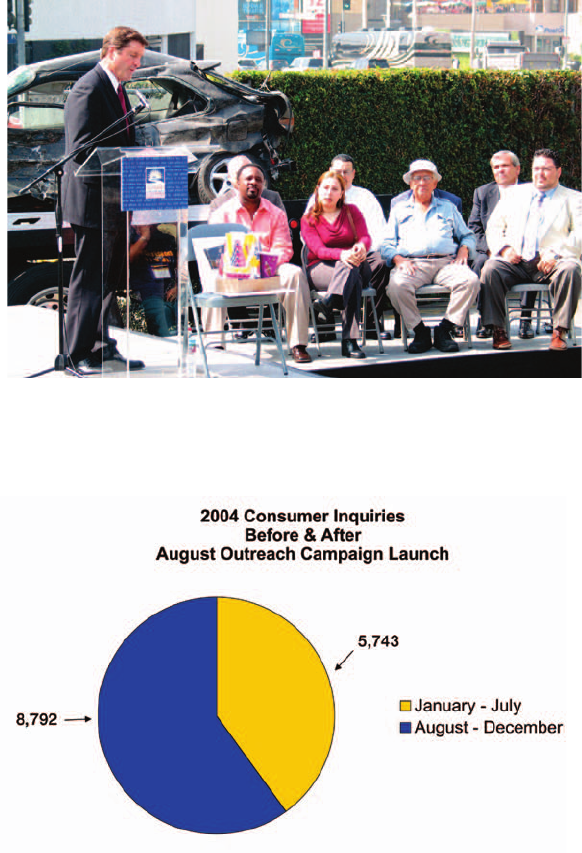

In August 2004, the Commissioner ofcially launched the Department’s new outreach

campaign, incorporating the various elements identied during the assessment,

message development and planning phases. The kick-off included press events and

stories featuring CLCA policyholders, producers committed to selling CLCA policies

and organizations representing low-income communities.

The press coverage generated a signicant spike in consumer interest, as evidenced

by a dramatic increase in inquiry calls to the CAARP hotline.

Building on the increased public awareness resulting from the press coverage,

Department efforts were directed at implementing partnership activities, as

previously described.

The Mexican American Opportunity Foundation became the rst partner organiza-

tion to host a townhall meeting showcasing the CLCA program and to make CLCA

materials available to their clients. Plans were developed to conduct similar events

over the course of the next year with other partner organizations.

California Low Cost Automobile Insurance Program

Report to the Legislature and Consumer Education and Outreach Plan

11

Governmental Agency Collaboration

Efforts to integrate the CLCA program with other governmental agencies serving low-

income communities were begun, focusing initially on the California Department of

Motor Vehicles, the Los Angeles County Department of Public Social Services, and

the Housing Authority City of Los Angeles. Initial activities included:

Department of Motor Vehicles

The DMV has placed CLCA materials in many of its ofces in Los Angeles and San

Francisco. Additionally, DMV staffs have been trained to refer inquiring consumers

to the CAARP hotline for further information on the program.

Los Angeles County Department of Public Social Service

A partnership was formed with LA-DPSS to coordinate the distribution of CLCA

outreach materials through their 42 district ofces. Department staff attended

LA-DPSS’s regional directors meeting, to educate district ofce directors on the

CLCA program and its benets for their clientele. Subsequently, the Department

was invited to attend regional meetings to train frontline DPSS staff on the CLCA

program, as well as to participate in monthly community information meetings.

Housing Authority City of Los Angeles

Department staff participated in quarterly tenant’s informational meetings,

providing tenants with informational material and an overview of the program. The

Housing Authority has invited the Department staff to participate in future outreach

opportunities.

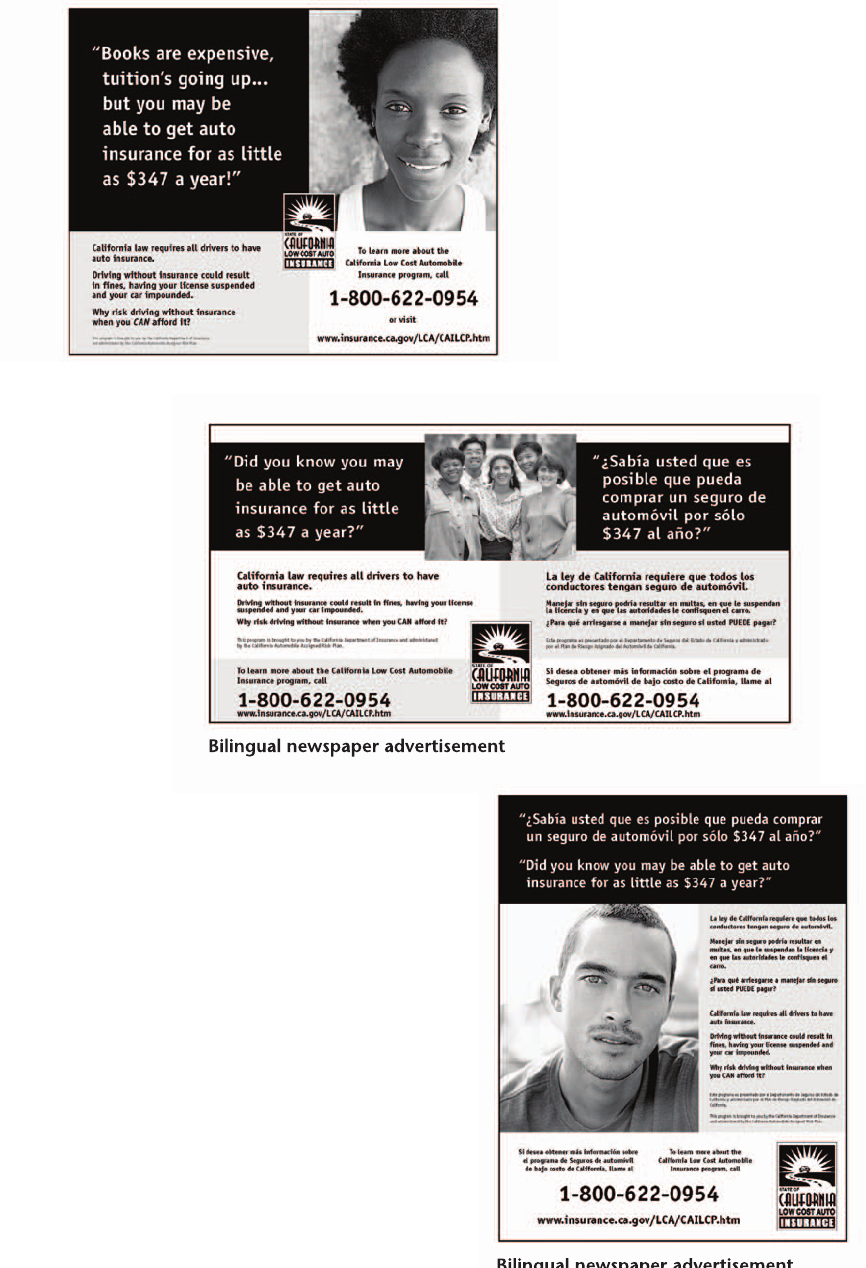

Advertising Campaign: Community-based and Ethnic-specialty media

In an effort to cost-effectively reach the largest audience within targeted communities,

the Department selected to advertise in community-based and ethnic-specialty press.

These ads enable the Department to promote consumer awareness across a broad

spectrum of communities and to amplify outreach efforts.

With the assistance of Ogilvy Public Relations Worldwide, the Department placed ads

in the following publications, from September 2004 to December 2004:

• IN Los Angeles Magazine

• La Opinión

• LA Sentinel

• The Recycler

• Revista Adelante

To evaluate the effectiveness of advertisements, the Department reviews referral-

source statistics provided by CAARP each month.

California Low Cost Automobile Insurance Program

Report to the Legislature and Consumer Education and Outreach Plan

12

Community-Based and Ethnic-Speciality Media

Newspaper advertisement targeting specic audience

Bilingual newspaper advertisement

Bilingual newspaper advertisement

Bilingual newspaper advertisement

California Low Cost Automobile Insurance Program

Report to the Legislature and Consumer Education and Outreach Plan

13

Community-Based and Ethnic-Speciality Media (continued)

(%*'&(*(-,,"

%# (*'#(/(+,-,(&(#%

'+-*')*(!*&%%

(*.#+#,

///#'+-*'!(.",&

1"0*#+$*#.#'!

/#,"(-,#'+-*'

/"'0(-

(*#,2

%# (*'#+(/(+,-,(&(#%

'+-*')*(!*&)*(.#+

%(/#'(&!((*#.*+/#,"

(*%#'+-*'

(-&0%,(!,-,(#'+-*'

(*+%#,,%+)*0*

Newspaper advertisement targeting specic audience

35,+/9,,$ -",-

'( %,-$(- "/,)

-$/-. *",4

&*,)",' "/,)- /.)';0$& %))-.)

&$!),($,$(&)*$;( - "/,) -$&

&)-/ ()-)(/.), -)(%)-$(", -)-

2-*)-$& ). ( ,/(- "/,) /.)';0$&

*),-;&)&:)

)0$-$.

111$(-/,( ")0#.'

"/,)- /.)';0$& %)

)-.) &$!),($&&' &

$ - ). ( ,'8-$(!),'$;(

-), &*,)",'

Spanish language newspaper advertisement

3")./.)

$(-/,( !),

2 ,

)/(.))4

&$!),($&1, +/$, -&&,$0 ,-.)#0

/.)$(-/,(

,$0$("1$.#)/.$(-/,( )/&, -/&.

$(!$( -#0$("2)/,&$ (- -/-* (

(2)/,,$'*)/(

#2,$-%,$0$("1$.#)/.$(-/,(

1# (2)/ !!),$.

)& ,('), )/..#

&$!),($)1)-./.)')$&

(-/,( *,)",'&&

),0$-$.

111$(-/,( ")0#.'

Newspaper advertisement targeting specic audience

California Low Cost Automobile Insurance Program

Report to the Legislature and Consumer Education and Outreach Plan

14

Producer Outreach

The initial program assessment made clear that producer participation and

cooperation was vital to the success of the program. Continuing the outreach begun

in the assessment phase, meetings were held with a variety of producers serving low-

income communities, as well as with selected producer trade associations.

The purpose of these meetings was to raise producer awareness about the CLCA

program, to solicit feedback about their experiences with the CLCA program and

to solicit additional ideas on program marketing. A standardized needs assessment

questionnaire was created to gather producer input and feedback.

The producers emphasized that the lengthy application process and paperwork

burden, combined with the low commission rate, were serious disincentives to

producers who might otherwise sell and promote the CLCA program.

As a result of producer input, the Department committed to make changes to the

program designed to reduce barriers to producer participation.

Operational Improvements

Issues, problems and proposed solutions identied through producer meetings were

categorized by type of authority necessary for implementation.

Key issues that could be resolved without legislative or statutory changes centered

on the application process. The following operational changes were implemented in

November 2004:

•

On-line

On-line

application

application

– This change reduces the time required to complete the

application as well as the associated paperwork burden

•

On-line

On-line

binding

binding

authority

authority

– This function allows producers to obtain on-line

binding authority, a policy binding number and effective date, thereby providing

clear evidence of binding

•

On-line

On-line

DMV

DMV

driving

driving

record

record

veri

veri

cation

cation

– Permits producers to immediately verify

whether or not an applicant meets the good driver standard, eliminating the

uncertainty of delayed verication of driver qualication

The Commissioner communicated with all CAARP certied producers in targeted

areas about the renewed focus on the CLCA program and the newly implemented

operational changes designed to reduce barriers to producer participation.

Legislation to eliminate barriers that require statutory changes was introduced in

December 2004 by Senator Martha Escutia (SB 20). This legislation is detailed in the

2005 outreach plan summary at the end of this document.

California Low Cost Automobile Insurance Program

Report to the Legislature and Consumer Education and Outreach Plan

15

Performance Measures and Statistics

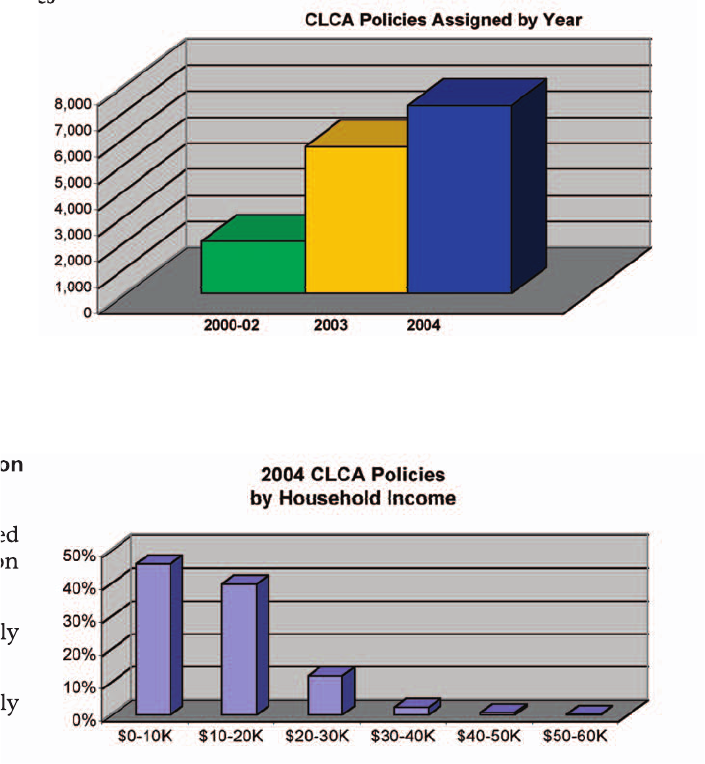

The following data sets provide key performance statistics demonstrating the growth

of the program since inception. Rapid acceleration in growth is noted since the

August 2004 outreach campaign launch.

Program Performance Following August 2004 Outreach Campaign Kick-off

• Generated 8,792 new inquiries in ve months – compared to 5,743 in the previous

seven months

• Averaged 1,758 new inquiries per month – compared to an average of 820 per

month for the previous seven months

• Assigned 3,337 new applications

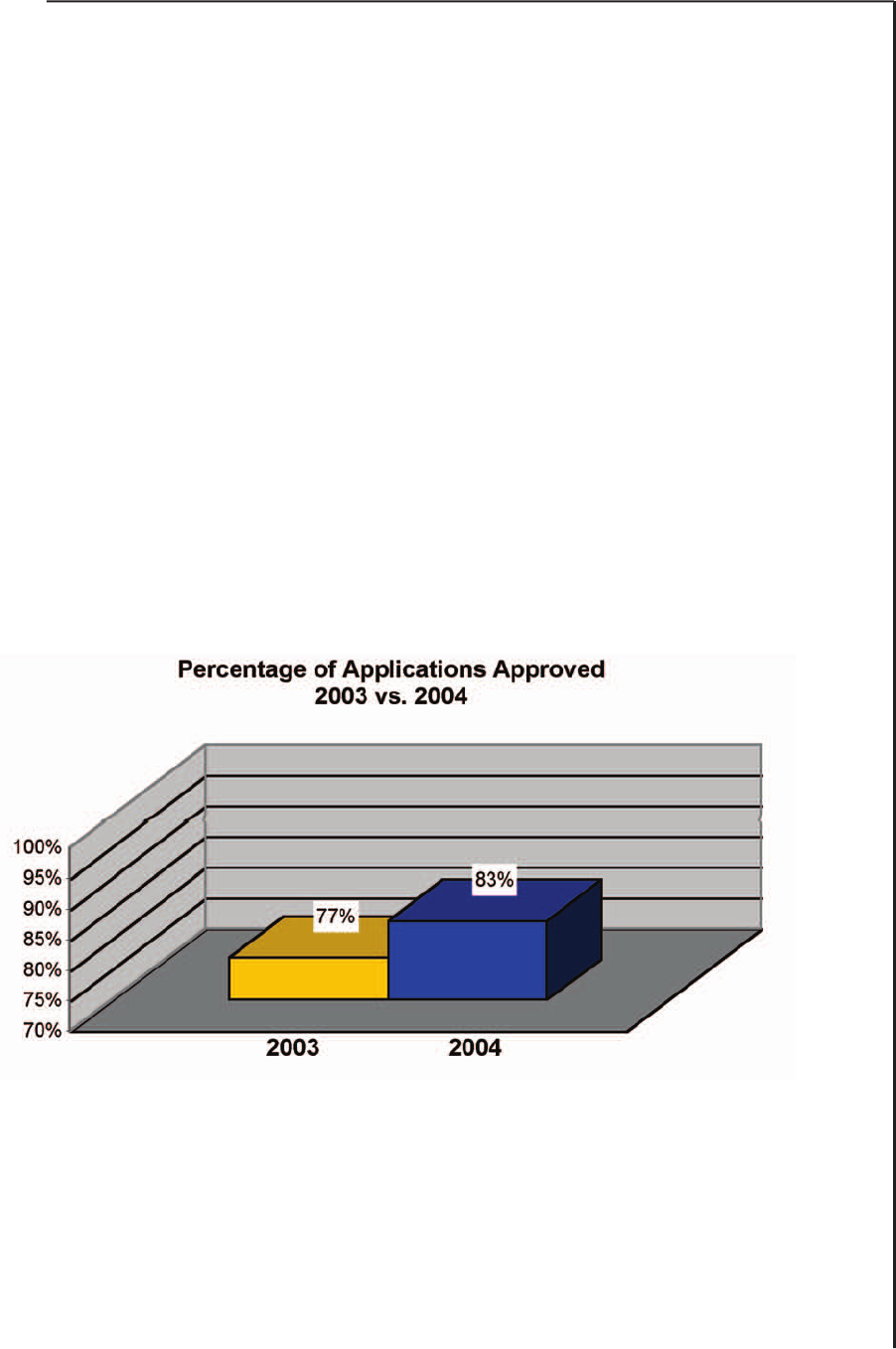

• Approved 83% of new applications received, compared to 77% in 2003

• Assigned applications in 84 additional low-income zip codes where no policies had

previously been assigned

California Low Cost Automobile Insurance Program

Report to the Legislature and Consumer Education and Outreach Plan

16

Program Statistics since Inception

16,893 policies assigned

since program inception

• Over 9,000 policies currently

• Renewal rate approximately

2004 Calendar Year Program Statistics

• Generated 14,535 new inquiries

• Received 8,767 applications

• Assigned 7,202 policies

• Achieved a 27% increase in

policies assigned compared

to 2003 performance

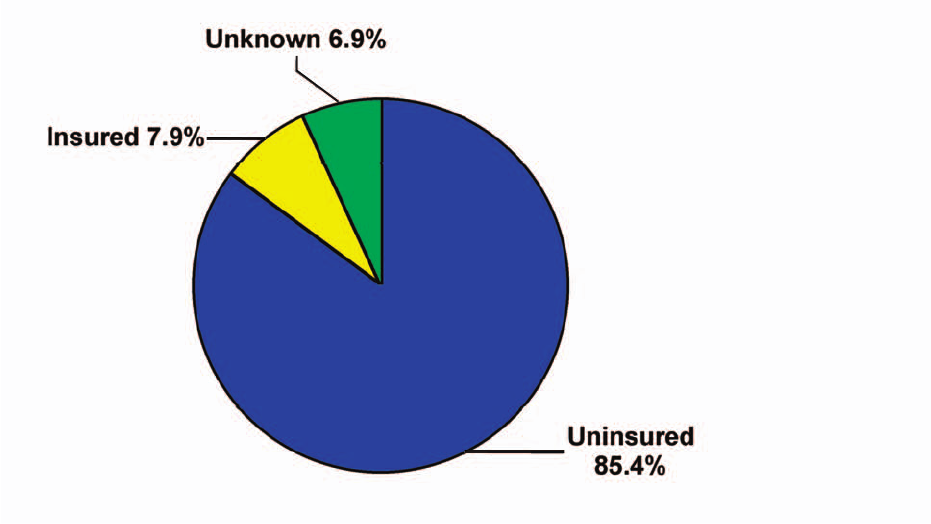

• 85.4% of program policy as-

signments were for appli-

cants who were uninsured at

the time of application (see

Figure 1.)

• Generated 14,535 new inquiries

Figure 1.

Program Statistics since Inception

•

16,893 policies assigned

since program inception

through 12/31/04

• Over 9,000 policies currently

in force

• Renewal rate approximately

55%

•

84.1% of policyholder’s an-

nual income is less than

$20,000 (see Figure 2)

•

The greatest number of policyholders are in the 40-59 age group

• Fewer than 5% of policies sold are to unmarried males ages 19-25

• 36% of policyholders also purchase uninsured motorists coverage

• 19% purchase both uninsured motorists and medical payment coverage

Figure 2.

California Low Cost Automobile Insurance Program

Report to the Legislature and Consumer Education and Outreach Plan

17

Commissioner’s Determination of Success

The Commissioner has determined that the CLCA program was successful in meeting

each of the measurements of success specied in California Insurance Code section

11629.85, as amended by SB 1500 (Speier).

1 – Rates Were Sufcient to Meet Statutory Rate-Setting Standards

The Insurance Code species that rates shall be sufcient to cover losses and expenses

incurred by policies issued under the pilot programs. Rate-setting standards also

require that rates shall be set so as to result in no subsidy of the program or subsidy

of policyholders in one pilot program by policyholders in the other pilot program.

The program rates in 2004 generated sufcient premiums, based on the rate-setting

criteria.

In determining any adjustment to rates, the Commissioner held a public hearing

to consider a rate recommendation by CAARP, as required each year by statute.

In 2004, CAARP recommended maintaining all rates. The Commissioner carefully

considered CAARP’s recommendation and comments submitted during the public

hearing period, and the Department’s independent actuarial review of the loss and

expense data. As a result, the Commissioner adopted CAARP’s recommendation to

maintain rates in 2004, nding that the current rates and surcharge were adequate

and consistent with the rate-setting standards of California Insurance Code sections

11629.72(c) and 11629.92(c).

In January 2005, CAARP will submit an annual rate recommendation and updated

loss and expense data. As loss experience warrants, the Commissioner will make

necessary rate adjustments, consistent with the rate-setting standards and procedures,

to insure success of the program.

2 – The Program Served Underserved Communities

While the term “underserved communities” is not dened in statute, the Department

believes it is meeting this goal, as evidenced by the following:

•

CAARP statistics document 84.1% of policies issued in 2004 were issued to

applicants whose income was at or below $20,000 per year.

• Many zip codes with high concentrations of low-income consumers show dramatic

increases in policies assigned.

• The average number of policies assigned per month increased from 561 per month

in the ve months preceding the outreach campaign kick-off, to over 667 per

month following the kick-off in August 2004.

• The average number of policies assigned per month increased from 469 per month

in 2003 to 600 per month in 2004.

California Low Cost Automobile Insurance Program

Report to the Legislature and Consumer Education and Outreach Plan

18

3 – Reduced the Number of Uninsured Drivers

CAARP tracks the number of program applicants who were uninsured at the time of

application.

• CAARP’s 2004 report shows that 85.4% of program policies assigned were to

applicants that were uninsured at the time of application, therefore, in 2004, at

least 6,150 previously uninsured motorists are no longer uninsured

Status at Time of Application - Uninsured v. Insured

4 – Administrative Costs

The Department allocated approximately $655,000 of SB 940 (Speier) funds for FY

2004-05 CLCA outreach activities. Since the CLCA program is administered by

CAARP, administrative costs are reected in CAARP’s budget. These administrative

costs are detailed in a separate report to the legislature by CAARP

California Low Cost Automobile Insurance Program

Report to the Legislature and Consumer Education and Outreach Plan

19

2200005 O5 Ouuttrreeaach Pch Pllaan Sn Suummmmaarryy

The California Low Cost Automobile Insurance Program 2005 Outreach Campaign

has been crafted to incorporate and expand upon the revised 2004 outreach plan,

which was initiated in August 2004.

The key objective of the plan during 2005 is to continue to raise consumer awareness

of the CLCA program and further increase the volume of program inquiries. This

will be accomplished through ongoing grassroots outreach activities, conducted in

partnership with various community-based organizations, faith-based organizations,

labor organizations and governmental agencies, including the Department of Motor

Vehicles and local social service agencies.

In addition, the program will expand its use of community-based and ethnic-

specialty press print advertising and implement a “public service announcement”

program, to maximize the use of limited SB 940 (Speier) funds, while reaching the

greatest number of uninsured drivers in low-income communities.

Outreach Program Goals

• Ensure sustained increases in inquiry volume, with resultant increased volume in

new policy issuance, through ongoing outreach efforts

• Eliminate barriers to participation by simplifying the program’s qualication

requirements and enrollment process

• Recommend appropriate modications to the program to enhance accessibility and

improve consumer and producer participation and satisfaction

• Broaden the geographic availability of the program, thereby decreasing the number

of uninsured motorists on the roads of California

San Francisco Component - Outreach Development and Implementation

(1) Kick-off media event in San Francisco

(2)

Implement grassroots outreach campaign, including:

• Prepare culturally sensitive and relevant materials for distribution, including

Chinese language materials

• Selectively identify and recruit individuals and organizations in the City and

County of San Francisco interested in partnering in the program outreach

effort

California Low Cost Automobile Insurance Program

Report to the Legislature and Consumer Education and Outreach Plan

20

San Francisco Component - Outreach Development and Implementation (continued)

•

Community-based organizations and consumer groups:

-

Faith-based organizations

-

Labor organizations

-

Producers

-

Governmental agencies providing services to low-income communities

•

Utilize paid advertising and features in the newsletters or bulletins of participat-

ing organizations or groups

(3) Begin radiobroadcast of informational public service announcements in English

and Spanish in targeted media outlets and markets.

•

Utilize cable television shows that target ethnic and low-income communities

to promote the CLCA program

•

Promote the CLCA program through targeted print advertising in community-

based and ethnic-specialty press, i.e., African American, Spanish-language,

Asian Pacic Islander community, and LGBT community publications

Los Angeles Component - Outreach Program Expansion

Expand the 2004 Los Angeles grassroots campaign to additional organizations, groups

and partners in an effort to reach increasing numbers of uninsured low-income good

drivers.

(1)

Continue developing new program partners and expand partnerships to include:

•

Colleges and adult education:

-

Community colleges

-

California State Universities

-

University of California

-

Los Angeles Unied School District Adult Education Programs

•

Retail or “boutique” marketing opportunities

California Low Cost Automobile Insurance Program

Report to the Legislature and Consumer Education and Outreach Plan

21

Los Angeles Component - Outreach Program Expansion (continued)

•

Government programs focused on low income constituents

-

CalWorks

-

Lifeline (telephone)

-

LIHEAP (energy)

-

California Healthy Families

•

Legislators and local elected ofcials

•

Governmental agencies

-

DMV

-

Board of Equalization

-

Los Angles County Department of Public Social Services

-

Housing Authority City of Los Angeles

•

Expand current partnerships with community-based organizations, faith-based

organizations, and labor organizations to include informational meetings,

townhall meetings, newsletter features, newsletter advertising and mailings

•

Develop CAARP certied producer communiqués providing updates on

administrative changes, success stories, and information on upcoming events

to solicit participation

(2)

Expand media campaign, to include:

•

Begin broadcast of informational public service announcements in English and

Spanish in targeted media outlets and markets

•

Utilize cable television shows that target ethnic and low-income communities

to promote the CLCA program

•

Promote the CLCA program through targeted print advertising in community

and specialty press, i.e., African American, Spanish-language and Asian Pacic

Islander community publications and other publications targeting low-income

communities

•

Conduct specialty media roundtables

California Low Cost Automobile Insurance Program

Report to the Legislature and Consumer Education and Outreach Plan

22

Producer Outreach Component

Promote increased participation by and collaboration with CAARP certied producers:

•

Contact CAARP certied producers with a record of participation in the

program to solicit their involvement in community information events

•

Attend producer trade organization meetings to disseminate information

regarding the changes implemented and to solicit participation in outreach

efforts

•

Meet with newly certied CAARP producers to inform them of outreach

opportunities

Evaluation Component

•

Assess progress through weekly and monthly performance reports and revise

the plan as needed

• Evaluate effectiveness of media campaign and revise as needed

• Identify additional opportunities to eliminate barriers to eligibility, simplify

the application process and improve the CLCA program

• Consider additional regulatory and statutory changes to improve and enhance

the program

Tracking Impact of Outreach Efforts

CAARP compiles the following program data reports which track program results and

correlates performance with outreach activities:

• Weekly calls generated by a particular outreach method

•

Monthly reports on the number of callers “qualied” to apply for the program

• Monthly number of applications assigned, returned, or rejected

• Monthly reports on the number of calls by referral source

• Monthly number of calls by zip code

• Quarterly reports on the number of policy renewals and cancellations

• Monthly reports on the percentage of previously uninsured drivers assigned

and other demographic detail

California Low Cost Automobile Insurance Program

Report to the Legislature and Consumer Education and Outreach Plan

23

Statutory Revision Component (Proposed Statutory Changes)

Based on information gleaned from the CLCA program assessment and input from

producers, a legislative proposal was developed by the Department and introduced

by Senator Martha Escutia (SB 20) in December 2004.

This legislation modies certain qualication requirements, eliminates the program

sunset date and expands the geographic availability of the program.

Key components of proposed legislation (SB 20):

Eliminate Program Sunset Date

Eliminate Program Sunset Date

The CLCA program is currently scheduled to sunset on January 1, 2007. The

program has proved that it can pay for itself, and does not require subsidy from

other policyholders, the government, or insurance companies. The circumstances

that created the need for this program have not changed. Financial responsibility

laws are still in effect, the state still has a large population of uninsured drivers, and

our low-income consumers are still unable to afford standard insurance premiums.

Elimination of the planned sunset will continue to make this much-needed program

available to California’s low-income consumers.

Expand Program to Additional Counties

Expand Program to Additional Counties

The need to expand the CLCA program into additional targeted counties is quantied

by three indicators: number of inquiries to CAARP, uninsured vehicle rate, and

income data.

The data analyzed indicates that the following six counties have a demonstrated

need for the CLCA program. Each of the recommended Counties includes low-

income communities, with a high percentage of both uninsured vehicles and

population living below the poverty level, with a demonstrated interest in access to

the program.

County

*Number of

Percentage

**Percentage

Uninsured Vehicles

Rate of

of Population

Uninsured

Below Poverty

Motorists

Motorists

Orange

200,056

10.29

10.3

San Bernardino

105,482

10.38

15.8

Alameda

121,434

12.27

11.0

Riverside

87,097

9.37

14.2

San Diego

165,016

8.72

12.4

Fresno

77,933

17.27

22.9

*

Source: The California Department of Insurance website – Estimated Rate of Uninsured MotoristReport 2000.

**

This is the percentage of the population below the federal poverty level. Income eligibility for the CLCA program is 250 percent

of the Federal Poverty Level. Source: 2000 Federal Census.

California Low Cost Automobile Insurance Program

Report to the Legislature and Consumer Education and Outreach Plan

24

Eliminate Maximum Number of Policies per Household

Eliminate Maximum Number of Policies per Household

Currently, only two CLCA policies are permitted per household. Many low-income

California households are multi-generational, often consisting of three or more

generations. These households may have more than two vehicles, making them

ineligible for the program. The household policy limit has been identied as a major

cause of ineligibility for the program through CAARP’s inquiry screening process.

Eliminate Maximum Vehicle Value

Existing law sets the vehicle value threshold for program eligibility at $12,000.

Because a CLCA policy is liability only and does not provide collision coverage,

the vehicle value is not relevant and should be eliminated. Vehicle value has been

identied as a major cause of ineligibility for the program through CAARP’s inquiry

screening process.

Newspaper advertisement

California Low Cost Automobile Insurance Program

Report to the Legislature and Consumer Education and Outreach Plan

25

FY 2005-2006 CLCA Outreach Budget

Elements

Cost

Partnership Outreach

Using partnerships with community-based organizations, faith-

based organizations, and labor organizations to reach potential

participants in CLCA consumer education and outreach activities.

• Purchasing ads in organizational bulletins and newsletters

• Postage, mail processing, and bulk distribution of materials

• CLCA application technical assistance

• Project management and stafng

$230,000

Outreach Materials (Including Ogilvy & EDD)

Develop integrated CLCA educational materials: yers, postcards,

posters, inserts, brochures, and press kits.

• Graphic design, layout and copywriting

• Design of materials to be developed for use in outreach efforts

with organizations and governmental agencies

• Update and rene CLCA targeted mailing list

• Printing

• Project management

$210,000

Co

mmunity Events

• Attend and/or arrange conferences, workshops, community

events, and education fairs

• Conduct CLCA presentations, workshops, or seminars

• Related travel expenses

$25,000

CLCA Internet Web Page

• Project management

$10,000

Media – Print, Radio and Public Service Announcements

• Creative and production

• Air time and ad space purchase

• Project management

$200,000

Miscellaneous Outreach Activities

$25,000

Total

$700,000

California Low Cost Automobile Insurance Program

Report to the Legislature and Consumer Education and Outreach Plan

26

Conclusion

The Commissioner is committed to the success of the California Low Cost

Automobile Insurance Program and believes the activities implemented in 2004

show great promise for future success and for a signicant reduction in the number

of uninsured drivers on the roads of Los Angeles County and the City and County of

San Francisco.

Through the elements described in our 2005 Outreach Plan, the Department expects

to further raise consumer awareness and increase the volume of program inquiries

and CLCA insurance policies assigned.

The California Department of Insurance is committed to making the California Low

Cost Automobile Insurance program the best of its kind in the nation.

California Low Cost Automobile Insurance Program

Report to the Legislature and Consumer Education and Outreach Plan

27