By Danyell A. Punelli, 651-296-5058

Long-Term Care

Workforce Incentives

April 2024

Executive Summary

The state of Minnesota has experienced a workforce shortage in the area of long-term care.

This shortage impacts the entire range of services from nursing facilities to home and

community-based care. This workforce shortage is occurring at a time when the number of

people over the age of 65 is growing.

In mid-2022, job vacancy rates for nursing assistants was 17.4 percent and for home health

and personal care aides, 8.3 percent, according to the Minnesota Department of

Employment and Economic Development (DEED).

The Minnesota Legislature has attempted to deal with this issue in recent years by:

creating incentive grant programs designed to increase the workforce;

increasing payment rates for home and community-based services in an effort to

raise wages for direct support professionals; and

instituting loan forgiveness and grant programs for health care personnel working in

underserved areas of the state or in certain long-term care settings.

This publication summarizes the various ways that have been established in law to address

the long-term care workforce shortage in Minnesota. It also includes an overview of the

current state of the long-term care workforce and demographic trends.

Contents

Factors Influencing the Workforce Shortage .......................................................... 2

Workforce Incentive Grant Programs ..................................................................... 4

Long-Term Services and Supports Workforce Incentive Grants ....................... 5

New American Legal, Social Services, and Long-Term Care Workforce Grant

Program .......................................................................................................... 6

Nursing Facility Workforce Incentive Grant Program ....................................... 7

Payment Rate Increases .......................................................................................... 7

Disability Waiver Rate System .......................................................................... 8

Personal Care Assistance and Community First Services and Supports ........... 9

Elderly Waiver ................................................................................................. 10

Other Home and Community-Based Services ................................................ 10

Long-Term Care Workforce Incentives

Minnesota House Research Department Page 2

Loan Forgiveness Programs .................................................................................. 11

Home and Community-Based Services Employee Scholarship Grant and Loan

Forgiveness Program ................................................................................... 11

Health Professional Education Loan Forgiveness Program ............................ 12

Factors Influencing the Workforce Shortage

The long-term care workforce shortage impacts the entire range of services from nursing

facilities to home and community-based care as these facilities and providers struggle to recruit

and retain direct support professionals to assist older adults, people with disabilities, and

people with mental health care needs. According to the Department of Human Services (DHS),

“the workforce crisis prevents access to services, can be a factor in abuse, neglect and injury

incidents, and contributes to people living in facilities.”

1

According to DEED, from 2020 to 2022, job vacancy rates for these jobs ranged from 5.2

percent to 23.2 percent, and median hourly wage offers ranged from $12.99 for a personal care

aide during the fourth quarter of 2020 to $16.83 for a nursing assistant during the second

quarter of 2022. Job vacancy rates as of the second quarter of 2022 were 8.3 percent for home

health aides and personal care aides, and 17.4 percent for nursing assistants.

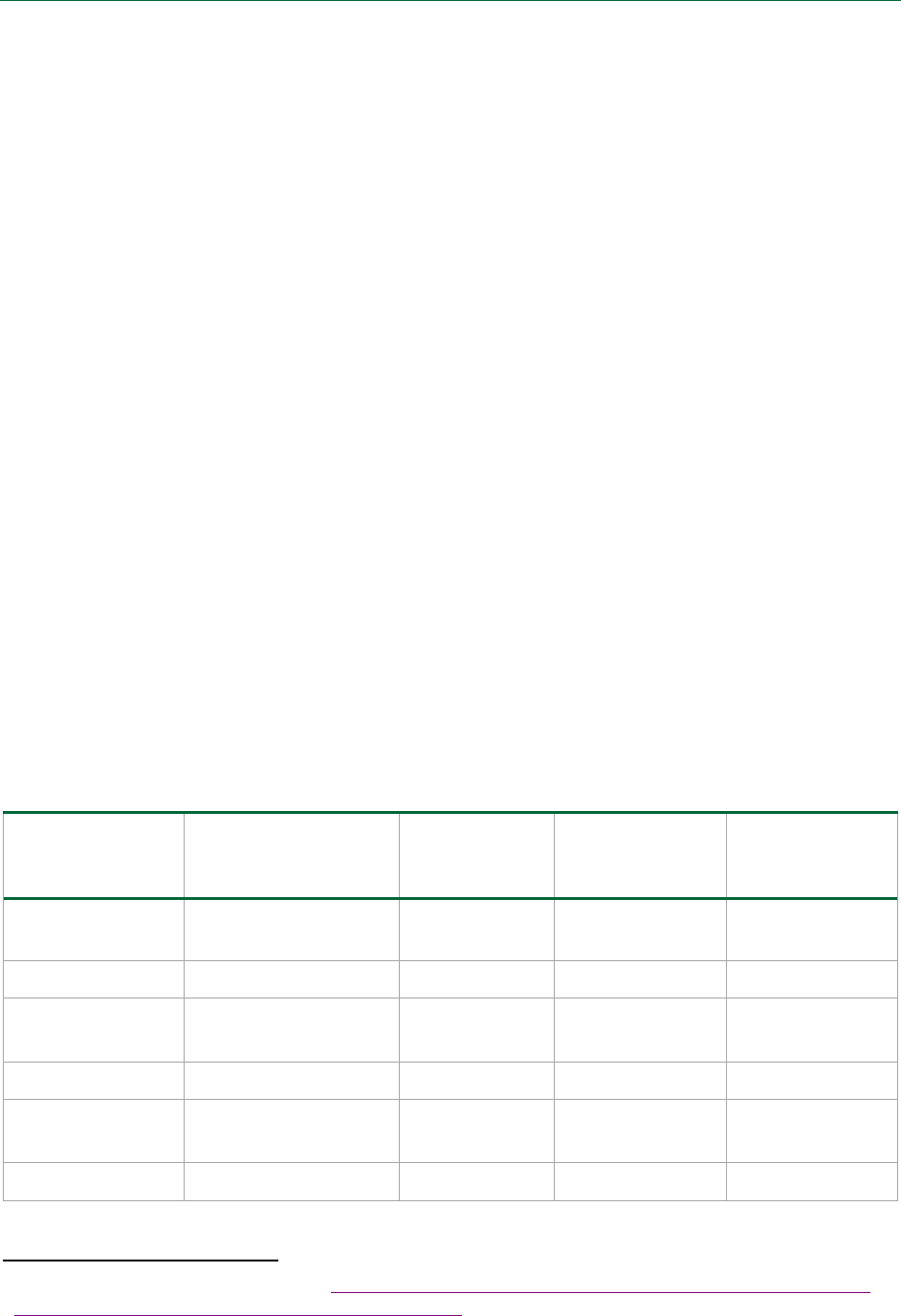

The table below shows the number of job vacancies and median wage offers for home health

aides, personal care aides, and nursing assistants from 2020 to 2022.

Job Vacancy Rates and Median Wage Offers

for Certain Long-Term Care Occupations in Minnesota, 2020-2022

Quarter Occupation

No. of Job

Vacancies

Job Vacancy

Rate

Median Hourly

Wage Offer

2022 2nd Quarter

Home health aides

Personal care aides

9,067*

8.3%*

$15.46

$14.98

—

Nursing assistants

4,416

17.4%

$16.83

2021 4th Quarter

Home health aides

Personal care aides

9,110*

8.4%*

$14.96

$14.99

—

Nursing assistants

5,878

23.2%

$16.75

2021 2nd Quarter

Home health aides

Personal care aides

9,259*

9.0%*

$13.34

—

Nursing assistants

6,001

21.2%

$15.49

1

Department of Human Services website, https://mn.gov/dhs/partners-and-providers/news-initiatives-reports-

workgroups/long-term-services-and-supports/workforce/.

Long-Term Care Workforce Incentives

Minnesota House Research Department Page 3

Quarter Occupation

No. of Job

Vacancies

Job Vacancy

Rate

Median Hourly

Wage Offer

2020 4th Quarter

Home health aides

Personal care aides

5,383*

5.2%*

$14.43

$12.99

—

Nursing assistants

3,990

13.1%

$15.00

2020 2nd Quarter

Home health aides

Personal care aides

8,805*

8.5%*

$13.68

$13.36

—

Nursing assistants

2,755

9.1%

$15.01

* Data combined for home health aides and personal care aides

Source: Minnesota Employment and Economic Development, Job Vacancy Survey and Occupational Employment

and Wage Statistics data

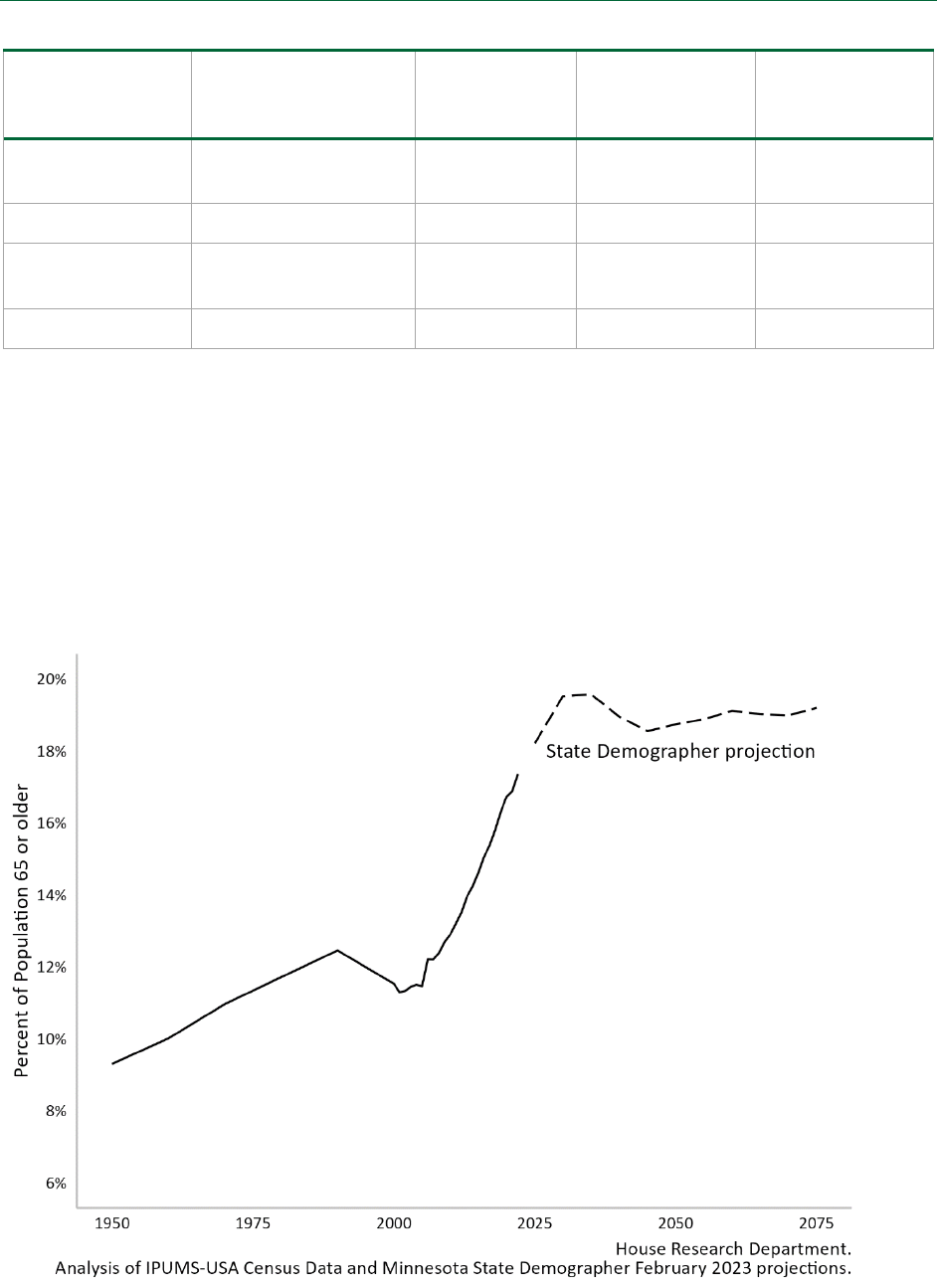

Compounding the workforce shortage are demographic trends. As the following graph shows,

the percentage of the population age 65 and older has increased sharply from about 9.0

percent in 1950 to a projected high of about 19.6 percent in 2035 and then a plateau of around

19.0 percent thereafter.

Percent of Minnesota Population Age 65 or Older, 1950 to 2075

Note: Graph derived from House Research analysis of Census Bureau microdata obtained from IPUMS-

USA. Estimates from 1950 to 1990 used 1 percent national sample data; estimates from 2001 and later

Long-Term Care Workforce Incentives

Minnesota House Research Department Page 4

used American Community Survey national random sample data. Estimates for 2025 and later were

obtained from the February 2023 Minnesota State Demographer population projections

.

According to the Minnesota State Demographer, “Minnesotans of retirement age (65) and

above numbered 930,000 in 2020. This number is expected to roll over to 1.26 million by 2075.

Minnesota’s oldest residents—those aged 85 and above—are expected to rapidly increase…”

2

The U.S. Department of Health and Human Services longitudinal data shows that “70 percent of

adults who survive to age 65 develop severe [long-term services and supports] needs before

they die and 48 percent receive some paid care over their lifetime.”

3

Workforce Incentive Grant Programs

The Minnesota Legislature has recently created workforce incentive grant programs to address

the workforce shortage. These programs are described below and include the long-term

services and supports workforce incentive grants; new American legal, social services, and long-

term care workforce incentive grants; and the nursing facility workforce incentive grant

program. These programs are administered by the Department of Human Services.

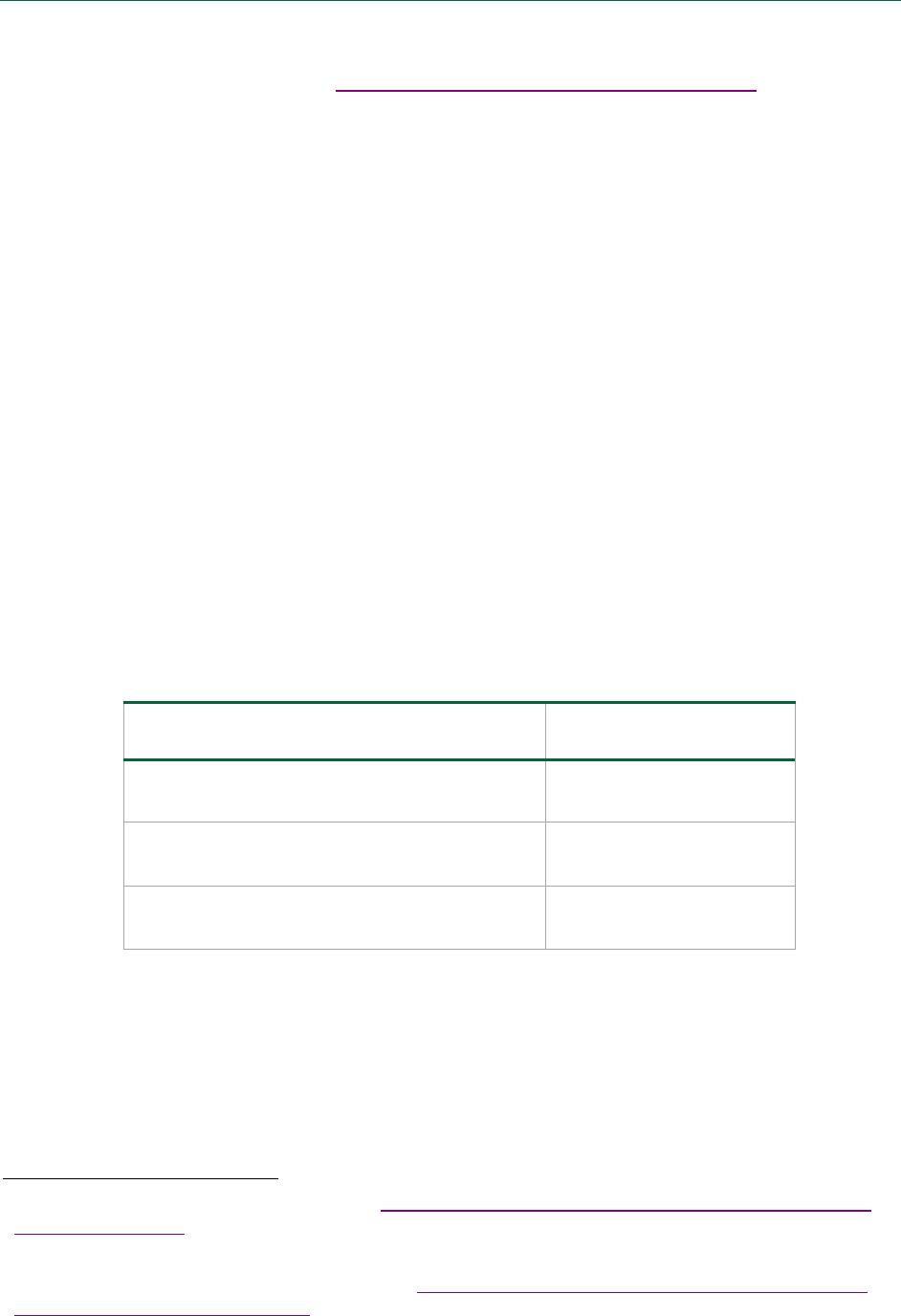

The 2023 Legislature appropriated more than $193 million to three separate grant programs.

The following table shows the workforce incentive grant programs and the fiscal year 2024

appropriations for each program.

Workforce Incentive Grant Program Appropriations for FY 2024

Program FY 2024 Appropriation

Long-term services and supports workforce

incentive grants

$83,560,000

New American legal, social services, and long-

term care workforce incentive grant program

$35,316,000

Nursing facility workforce incentive grant

program

$74,500,000

Note: The appropriations for the long-term services and supports workforce incentive grants

and the nursing facility workforce incentive grant program are available until June 30, 2029. The

appropriation for the new American legal, social services, and long-term care workforce

incentive grant program is available until June 30, 2027.

2

Minnesota State Demographic Center website, https://mn.gov/admin/demography/data-by-topic/population-

data/our-projections/.

3

“What is the Lifetime Risk of Needing and Receiving Long-Term Services and Supports?” April 3, 2019, U.S.

Department of Health and Human Services website, https://aspe.hhs.gov/reports/what-lifetime-risk-needing-

receiving-long-term-services-supports.

Long-Term Care Workforce Incentives

Minnesota House Research Department Page 5

Long-Term Services and Supports Workforce Incentive Grants

The long-term services and supports workforce incentive grants were established in 2023 to

assist long-term services and supports providers with recruiting and retaining direct support

professionals.

4

Eligible grant recipients. Employers eligible to participate in the grant program include

organizations that are enrolled in a Minnesota health care program that are:

home and community-based services providers;

certified intermediate care facilities for persons with developmental disabilities;

nursing facilities;

personal care assistance services providers;

community first services and supports providers;

early intensive developmental and behavioral intervention services providers;

home care services providers;

certain financial management services providers; or

customized living services providers.

Allowable uses of grant funds. Grantees must use grant money to provide payments to eligible

workers for the following purposes:

retention, recruitment, and incentive payments

postsecondary loan and tuition payments

child care costs

transportation-related costs

personal care assistant background study costs

other costs associated with retaining and recruiting workers, as approved by the

commissioner

Eligible workers are workers who earn $30 per hour or less and are currently employed or

recruited to be employed by an eligible employer.

Grant awards are not considered income, assets, or personal property for purposes of

determining eligibility or recertifying eligibility for a variety of income assistance and health

care programs. In addition, grant awards are subtracted from a recipient’s income for tax

purposes.

Appropriations. In fiscal year 2024, $83,560,000 was appropriated for the long-term services

and supports workforce incentive grants. This appropriation is available until June 30, 2029, and

is a onetime appropriation.

4

Minn. Stat. § 256.4764.

Long-Term Care Workforce Incentives

Minnesota House Research Department Page 6

New American Legal, Social Services, and Long-Term Care

Workforce Grant Program

The new American legal, social services, and long-term care workforce grant program was

established in 2023 for organizations that serve and support new Americans: (1) in seeking or

maintaining legal or citizenship status to legally obtain or retain employment in any field or

industry; or (2) to provide specialized services and supports to new Americans to enter the

long-term care workforce.

5

A “new American” is defined as an individual born abroad and the

individual’s children, irrespective of immigration status.

Eligible grant recipients. Eligible grantees include governmental units, federally recognized

Tribal nations, nonprofit organizations, for-profit organizations, and legal services organizations

specializing in obtaining visas for health care workers. Eligible applicants seeking to provide

supports for new Americans to obtain or maintain employment must demonstrate expertise

and capacity to provide training, peer mentoring, supportive services, workforce development,

and other services to develop and implement strategies for recruiting and retaining qualified

employees.

Allowable uses of grant funds. Allowable uses of grant money include:

intake, assessment, referral, orientation, legal advice, or representation to new

Americans to seek or maintain legal or citizenship status and secure or maintain

legal authorization for employment;

social services designed to help eligible populations meet their immediate basic

needs during the process of seeking or maintaining legal status and legal

authorization for employment; or

specialized activities targeted to individuals to support recruitment and connection

to long-term care employment opportunities, including:

o developing connections to employment with long-term care employers and

potential employees;

o providing recruitment, training, guidance, mentorship, and other support

services necessary to encourage employment, employee retention, and

successful community integration;

o providing career education, wraparound support services, and job skills

training in high-demand health care and long-term care fields;

o paying for program expenses related to long-term care professions; or

o repaying student loan debt directly incurred as a result of pursuing a

qualifying course of study or training.

Appropriations. In fiscal year 2024, $35,316,000 was appropriated for the new American legal,

social services, and long-term care workforce grant program. This appropriation is available

until June 30, 2027, and is a onetime appropriation.

5

Laws 2023, ch. 61, art. 1, § 60.

Long-Term Care Workforce Incentives

Minnesota House Research Department Page 7

Nursing Facility Workforce Incentive Grant Program

The nursing facility workforce incentive grant program was established in 2023 to assist nursing

facilities with recruiting and retaining eligible workers.

6

Eligible grant recipients. An eligible worker is a worker who earns $30 per hour or less and is

currently employed or recruited to be employed by a nursing facility.

Allowable uses of grant funds. Nursing facilities must use grant money to provide payments to

eligible workers for the following purposes:

retention, recruitment, and incentive payments

employee-owned benefits, such as health savings accounts, HRSA, and flexible

spending accounts

employee contributions to a 401k account

education, professional development, and financial counseling

child care, meals, transportation, and housing

health and wellness

other flexible needs related to workforce challenges as determined by the

commissioner

Each eligible worker may receive payments of up to $3,000 per year from the workforce

incentive grant account and all other state money intended for the same purpose.

Grant awards are not considered income, assets, or personal property for purposes of

determining eligibility or recertifying eligibility for a variety of income assistance and health

care programs. In addition, grant awards are subtracted from a recipient’s income for tax

purposes.

Appropriations. In fiscal year 2024, $74,500,000 was appropriated for the nursing facility

workforce incentive grant program. This appropriation is available until June 30, 2029, and is a

onetime appropriation.

Payment Rate Increases

The legislature approved various payment rate increases for home and community-based

services in an effort to increase wages for direct support professionals, including payment rate

increases under the Disability Waiver Rate System (DWRS), personal care assistance (PCA) and

community first services and supports (CFSS) services, elderly waiver, and various other home

and community-based services. These programs are administered by the Department of Human

Services.

The programs described in this section are all part of Medical Assistance (MA), the state’s

Medicaid program. The federal government pays a share of the cost of MA expenditures. This is

6

Minn. Stat. § 256.4766.

Long-Term Care Workforce Incentives

Minnesota House Research Department Page 8

referred to as the federal medical assistance percentage (FMAP). Minnesota’s FMAP for

covered services is 51.49 percent. Minnesota pays the remaining 48.51 percent for most

services (some services have a county share).

7

Disability Waiver Rate System

The DWRS is Minnesota’s uniform, statewide methodology to determine reimbursement rates

for home and community-based services provided under the four Medicaid (MA) disability

waivers: the community alternative care (CAC) waiver, the community access for disability

inclusion (CADI) waiver, the developmental disability (DD) waiver, and the brain injury (BI)

waiver.

8

Effective January 1, 2024, the DWRS payment rate methodology was modified by increasing the

value of the competitive workforce factor for the following services:

1) community residential services

2) family residential services

3) integrated community supports

4) adult day services

5) day support services

6) prevocational services

7) unit-based services with programming

8) unit-based services without programming

The competitive workforce factor supports direct care worker compensation for workers that

provide services under the DWRS.

In addition, the DWRS was modified to require that certain providers with rates determined

under the DWRS use a specified minimum percentage of the revenue generated by the DWRS

rate framework for direct care staff compensation.

9

The minimum percentage that must be

used for direct care staff compensation varies by provider type from 45 percent to 66 percent.

Compensation includes items such as:

1) wages;

2) taxes and workers' compensation;

3) health, dental, vision, and life insurance;

4) short- and long-term disability insurance;

5) retirement spending;

7

For example, counties are responsible for 20 percent of the cost of nursing facility placements of persons with

disabilities under age 65 that exceed 90 days. For this and other required county shares, see Minnesota Statutes,

section 256B.19, subdivision 1.

8

Minn. Stat. § 256B.4914.

9

Minn. Stat. § 256B.4914, subd. 10d.

Long-Term Care Workforce Incentives

Minnesota House Research Department Page 9

6) tuition reimbursement;

7) wellness programs;

8) paid vacation time;

9) paid sick time; or

10) other items of monetary value provided to direct care staff.

These changes to the DWRS rate methodology were intended to increase wages for direct

support professionals who provide these services.

Personal Care Assistance and Community First Services and

Supports

Personal care assistants provide assistance and support to persons with disabilities, the elderly,

and others with special health care needs living independently in the community.

The CFSS program

10

was created by the 2013 Legislature and will replace the PCA program and

consumer support grants. CFSS will be available statewide to eligible individuals to provide

assistance and support to persons with disabilities, the elderly, and others with special health

care needs living independently in the community. CFSS will be phased in beginning in June

2024.

The PCA/CFSS payment rate methodology was modified in 2023 to update the base wage index,

modify the implementation components to have a greater percentage of the rates based on the

new payment methodology, and add a worker retention component. The changes to the base

wage index and implementation components are effective January 1, 2024, and the addition of

the worker retention component is effective January 1, 2025. In addition, a new contract was

ratified for self-directed workers, which includes personal care assistants working under the

direction of a participant or participant’s representative.

11

These changes are intended to

increase payment rates, and thereby wages, for personal care assistants and support workers.

The PCA and CFSS programs currently include a requirement that a minimum of 72.5 percent of

the revenue generated by Medical Assistance must be used for personal care assistant and

support worker wages and benefits for services provided under the PCA program and the CFSS

agency-provider model.

12

The new contract that was ratified includes a minimum wage of $19 per hour for self-directed

workers as of January 1, 2024, and an additional increase to $20 per hour as of January 1, 2025.

10

Minn. Stat. § 256B.85.

11

Minn. Stat. § 256B.0711.

12

Minn. Stat. § 256B.0659, subds. 20 and 21, and § 256B.85, subds. 11 and 12.

Long-Term Care Workforce Incentives

Minnesota House Research Department Page 10

Elderly Waiver

The elderly waiver (EW) provides home and community-based services not normally covered

under MA to MA enrollees who are at risk of nursing facility placement. In addition, EW

recipients are eligible for all standard MA covered services.

The elderly waiver payment rate methodology was modified by: repealing the phase-in to the

new rate methodology (thereby basing rates entirely on the new rate methodology going

forward), changing the base wage index calculations for various services provided under the

elderly waiver, adjusting the values of various rate setting factors and establishing new rate

setting factors, establishing a floor for the elderly waiver adjusted base wage of $16.68, and

changing various component rate calculations. These changes are effective January 1, 2024, or

upon federal approval, whichever is later.

In addition, except for certain customized living services, the elderly waiver payment rate

methodology was modified to require at least 80 percent of the marginal increase in revenue

from implementing any elderly waiver rate adjustments to be used to increase compensation-

related costs for employees directly employed by the provider.

13

Compensation-related costs

include items such as:

1) wages and salaries;

2) the employer’s share of various taxes, workers' compensation, and mileage

reimbursement;

3) the employer's paid share of health and dental insurance, life insurance, disability

insurance, long-term care insurance, uniform allowance, pensions, and contributions to

employee retirement accounts; and

4) benefits that address direct support professional workforce needs above and beyond

what employees were offered prior to the implementation of any elderly waiver rate

adjustments.

All of the elderly waiver payment rate methodology changes were intended to increase direct

support professional compensation, with a floor set at $16.68 per hour.

Other Home and Community-Based Services

Several other home and community-based services will receive rate increases as a result of

legislation that was enacted in 2023.

14

The programs that will receive rate increases include

home care services, services provided under MA waivers that are not reimbursed through the

DWRS or elderly waiver payment rate methodologies, and certain services provided to

individuals who reside in intermediate care facilities for persons with developmental

disabilities.

13

Minn. Stat. § 256S.211, subd. 4.

14

Laws 2023, ch. 61, art. 1, §§ 68 and 71-73, and art. 2, § 40.

Long-Term Care Workforce Incentives

Minnesota House Research Department Page 11

Effective January 1, 2024, or upon federal approval, whichever is later, the following home and

community-based services will receive payment rate increases as indicated below:

home health agency services: 14.99 percent

home care nursing: 25 percent

chore services and home-delivered meals provided under the MA disability waivers:

14.99 percent

early intensive developmental and behavioral intervention benefit services: 14.99

percent

day training and habilitation services provided by intermediate care facilities for

persons with developmental disabilities: 14.99 percent

community living assistance and family caregiver services provided under the

alternative care, essential community supports, and elderly waiver programs: 14.99

percent

These rate changes were intended to increase wages for the direct support professionals who

provide these services.

Loan Forgiveness Programs

The Minnesota Department of Health (MDH) administers loan forgiveness and grant programs

to health care personnel working in underserved areas of the state or in certain health care

settings. Two of these programs are available to personnel working in long-term care settings:

the home and community-based services employee scholarship grant and loan forgiveness

program and the health professional education loan forgiveness program.

Home and Community-Based Services Employee Scholarship Grant

and Loan Forgiveness Program

The home and community-based services (HCBS) employee scholarship grant and loan

forgiveness program

15

has two components:

providing grants for scholarships and educational programming for HCBS workers;

and

providing loan forgiveness to HCBS workers nominated by their employers.

To be eligible for grants, and for their employees to be eligible for loan forgiveness and

scholarships, an HCBS provider must primarily provide services to individuals age 65 and older

in home and community-based settings and must be located in Minnesota.

Scholarships and educational programs. Under the scholarship program, the commissioner

provides grants to eligible HCBS providers. An HCBS provider that receives a grant must

establish an HCBS employee scholarship program and provide educational programs or award

15

Minn. Stat. § 144.1503.

Long-Term Care Workforce Incentives

Minnesota House Research Department Page 12

scholarships to employees who are enrolled in courses leading to career advancement with the

provider or in long-term care, and who work an average of at least ten hours per week for the

provider. The commissioner may also provide scholarships to individual HCBS workers who

meet these requirements.

An HCBS worker who receives a scholarship from their employer or from the commissioner

must use the money for the costs of a course of study leading to career advancement with the

provider or in long-term care, including home care, care of people with disabilities, nursing, or

as an assisted living director.

Loan forgiveness. To obtain loan forgiveness, an HCBS worker’s employer must submit

employee names to the commissioner, and those employees may apply to the commissioner.

When awarding grants, the commissioner must select employees based on their suitability for

practice and must give preference to employees close to completing their training. The

commissioner, in collaboration with HCBS stakeholders, may establish priority areas for loan

forgiveness if needed due to the volume of applications.

If an employee receives loan forgiveness, the employee must agree to work at least 32 hours

per week for at least two years for an eligible provider. Each year the employee maintains

eligibility, up to four years, the commissioner makes a payment to the employee of 15 percent

of the average educational debt for indebted graduates in their profession in the year closest to

the employee’s selection for the loan forgiveness program for which information is available.

Loan forgiveness payments must not exceed the balance of the employee’s educational loans.

Appropriations. $1,450,000 in fiscal year 2024 and $1,450,000 in fiscal year 2025 were

appropriated for this program.

At least two-thirds of the money appropriated for this program must be used for

employee scholarships. In fiscal year 2023, a total of $967,136.14 was awarded to 12

HCBS providers for employee scholarship programs.

Up to one-third of the money appropriated for this program may be used for loan

forgiveness. In fiscal year 2023, loan forgiveness awards were made to 32 employees

of 12 HCBS providers.

16

Health Professional Education Loan Forgiveness Program

Under the health professional education loan forgiveness program,

17

the commissioner awards

loan forgiveness to health professionals working in certain underserved areas or in certain

health care settings. This program is not targeted to professionals working in long-term care

settings. Some health professionals working in designated rural areas or, for some professions,

underserved urban communities may work in any setting, including a long-term care setting,

while receiving loan forgiveness under this program. However, some loan forgiveness for

nurses under this program is targeted to nurses who work in certain long-term care settings—a

16

https://www.health.state.mn.us/facilities/ruralhealth/funding/grants/docs/2023hcbsawards.pdf.

17

Minn. Stat. § 144.1501.

Long-Term Care Workforce Incentives

Minnesota House Research Department Page 13

nursing home, intermediate care facility for persons with developmental disabilities, or assisted

living facility—or for a home care provider.

18

To be eligible for loan forgiveness under this program, a health professional must agree to

practice in a location specified for that profession in statute and must commit to the service

obligation for that profession in statute. Most professionals must agree to serve at least three

years, and nurses must agree to serve at least two years.

Each year a health professional maintains eligibility, up to four years, the commissioner makes a

payment to the professional of 15 percent of the average educational debt for indebted

graduates in their profession in the year closest to the professional’s selection for the loan

forgiveness program for which information is available. Loan forgiveness payments must not

exceed the balance of the professional’s educational loans. The professional must verify to the

commissioner that the professional applied the loan repayment amount received toward the

professional’s educational loans.

In fiscal year 2023, $1,115,334 was awarded as loan forgiveness to nurses working in long-term

care settings.

19

Minnesota House Research Department provides nonpartisan legislative, legal, and

information services to the Minnesota House of Representatives. This document

can be made available in alternative formats.

www.house.mn.gov/hrd/ | 651-296-6753 | 155 State Office Building | St. Paul, MN 55155

18

Loan forgiveness is also available to nurses who work in a nonprofit hospital setting, nurses who agree to teach

in the nursing field, and nurses working as public health nurses.

19

Information provided by Department of Health staff, Dec. 21, 2023.