©2016, Paymentech, LLC. All rights reserved. | commercesolutions.jpmorganchase.com | chasepaymentech.ca | jpmorgancommercesolutions.co.uk |

2

DISCLAIMER

The information herein or any document attached hereto does not take into account individual

client circumstances, objectives or needs and is not intended as a recommendation of a

particular product or strategy to particular clients and any recipient shall make its own

independent decision. This downloadable document and the information provided herein may

not be copied, published, or used, in whole or in part, for any purpose other than expressly

authorized by Chase. Paymentech, LLC, Chase Paymentech Solutions, LLC and Chase

Paymentech Europe Limited, respectively trading as Chase, Chase Paymentech and J.P. Morgan

are subsidiaries of JPMorgan Chase & Co. ( JPMC). Chase Paymentech Europe Limited is

regulated by the Central Bank of Ireland. Registered Office: JP Morgan House, 1 George’s Dock,

I.F.S.C., Dublin 1, D01 W213, Ireland. Registered in Ireland with the CRO under. No. 474128.

Directors: Catherine Moore (UK), Carin Bryans, Michael Passilla (US), Dara Quinn, Steve Beasty

(US).

© 2018 JPMorgan Chase & Co. All rights reserved.

©2016, Paymentech, LLC. All rights reserved. | commercesolutions.jpmorganchase.com | chasepaymentech.ca | jpmorgancommercesolutions.co.uk | 3

ONLINE RETRIEVAL REQUEST

&

CHARGEBACK PROCESSING

THROUGH PAYMENTECH ONLINE

A MERCHANT USER GUIDE

© 2018 JPMorgan Chase & Co. All

Rights Reserved

8181 Communications Parkway Plano,

TX 75024 www.chase.com

©2016, Paymentech, LLC. All rights reserved. | commercesolutions.jpmorganchase.com | chasepaymentech.ca | jpmorgancommercesolutions.co.uk |

4

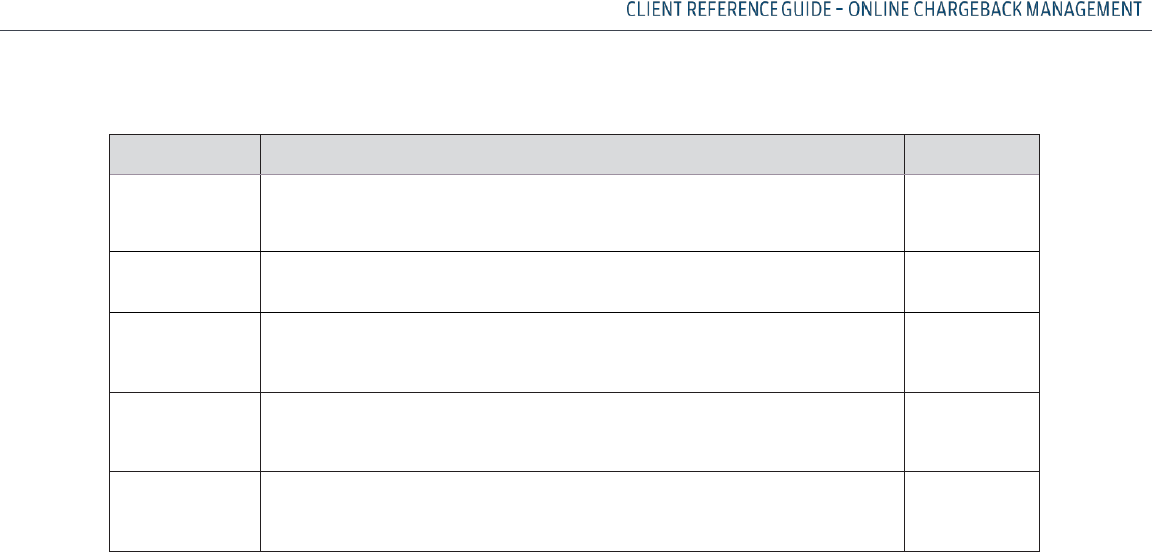

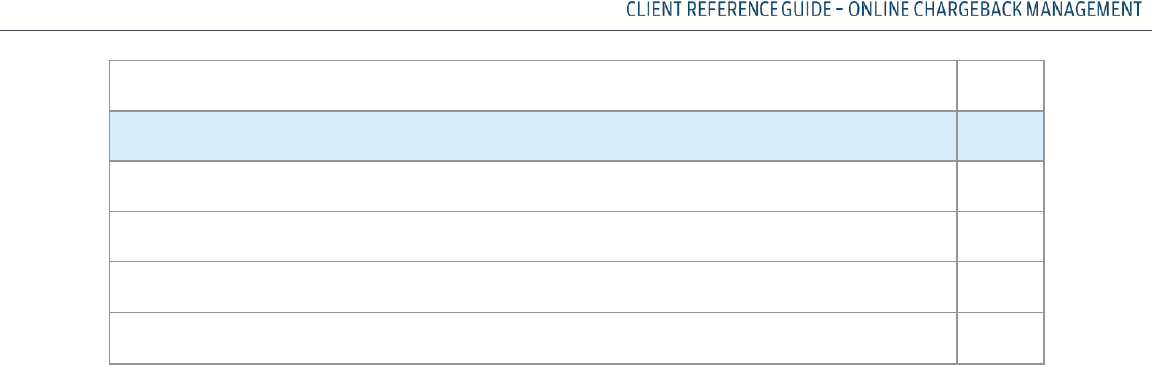

REVISION HISTORY

Date

Revision Summary

Page(s)

03/23/2022

Added new section on Merchant Initiated Debit Adjustments within CBIS

updated page numbers in table of contents, Updated supporting document

requirements

Throughout

08/16/2019

Changed Commerce Solutions Reference to Merchant Services

Throughout

08/17/2018

Updates made for AMEX supporting document file size

65

02/26/2018

Updates made for Visa Claims Resolution (VCR)

All

01/26/2016

Created new online chargeback management guide

All

©2016, Paymentech, LLC. All rights reserved. | commercesolutions.jpmorganchase.com | chasepaymentech.ca | jpmorgancommercesolutions.co.uk | 5

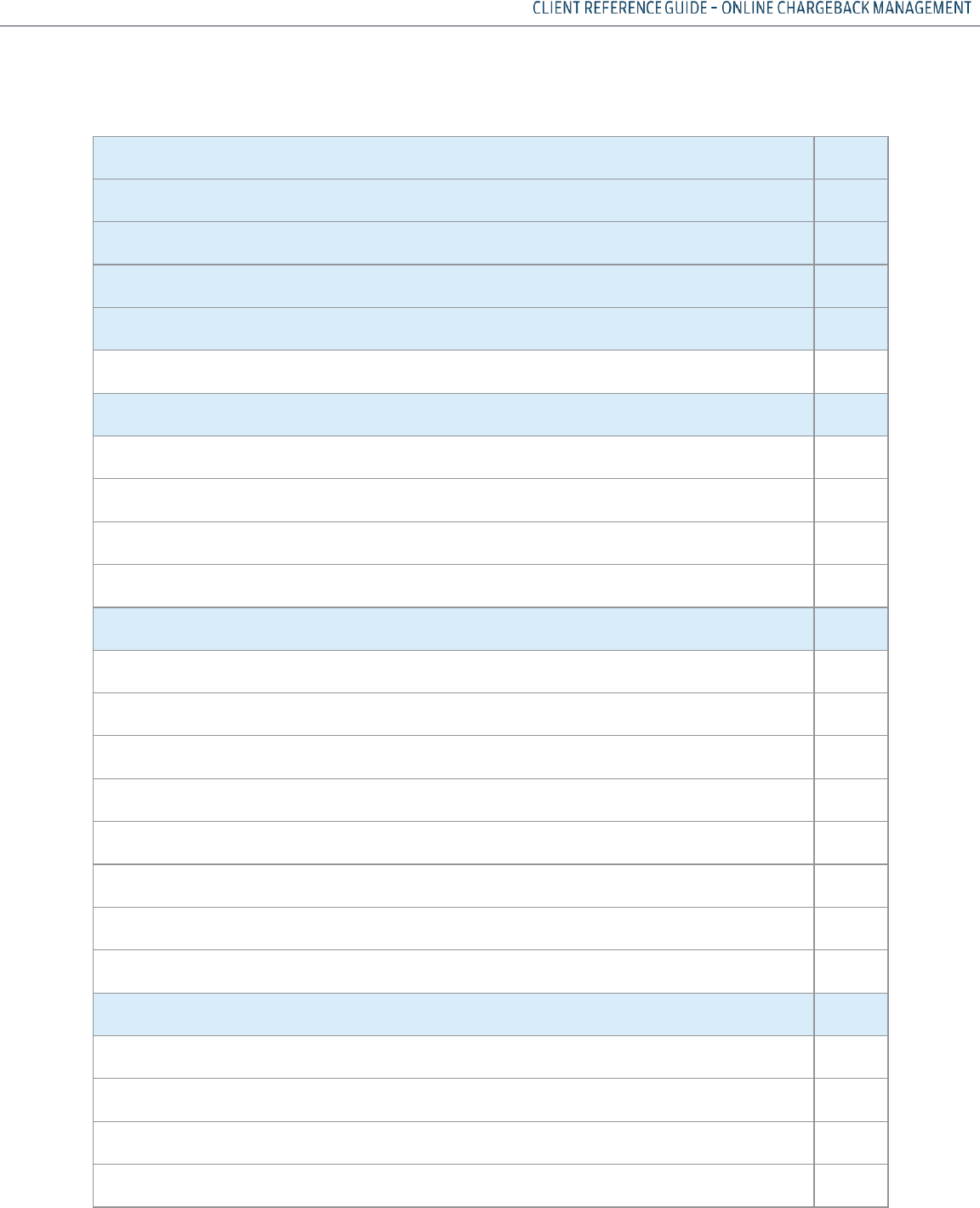

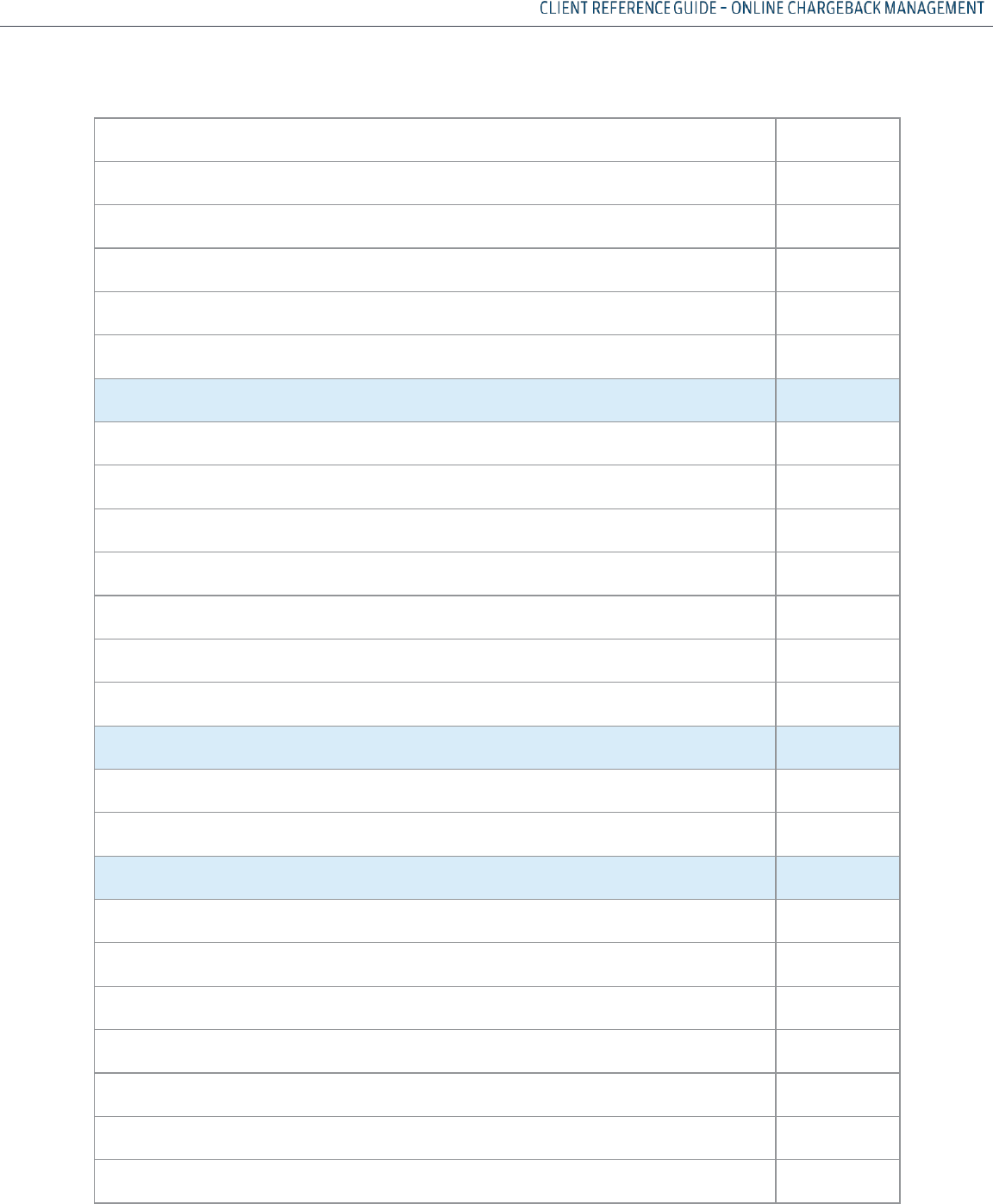

TABLE OF CONTENTS

DISCLAIMER

2

REVISION HISTORY

4

INTRODUCTION

12

OVERVIEW

12

SYSTEM REQUIREMENTS & SUPPORTED DOCUMENT FORMATS

13

OPTIONAL MULTIPLE DOCUMENT UPLOAD FUNCTIONALITY

15

CONTACT ROLES

16

ACCESSING YOUR RETRIEVAL REQUESTS AND CHARGEBACKS

17

DEFAULT SCREEN

18

EXCEL CSV DOWNLOAD

19

PRINT DOWNLOAD

20

RETRIEVAL REQUESTS

22

PROCESSING FLOW – OVERVIEW

23

DISCOVER CNP PROCESSING FLOW

24

RETAIL RETRIEVAL REQUEST PROCESSING FLOW

25

RESPONDING TO A RETRIEVAL REQUEST

26

QUERY RESULT SCREEN COMPONENTS – LEVEL 1 DATA – FUNCTIONAL COMPONENTS

27 -28

QUERY RESULT SCREEN COMPONENTS – LEVEL 1 DATA – INFORMATIONAL COMPONENTS

29

QUERY RESULT SCREEN COMPONENTS – LEVEL 2 DATA – FUNCTIONAL COMPONENTS

30-31

QUERY RESULT SCREEN COMPONENTS – LEVEL 2 DATA – INFORMATIONAL COMPONENTS

32

WORKING RETRIEVALS - THE MRQA ROLE

33

ASSIGNING CASES TO AN MRA

33

MRQA ROLE - CREATING AUTO-DECISION RULES

34-35

MRQA ROLE - EDITING OR DELETING A RULE

36-37

MRQA ROLE – ACCEPTING RETRIEVALS FROM LEVEL 1

38

©2016, Paymentech, LLC. All rights reserved. | commercesolutions.jpmorganchase.com | chasepaymentech.ca | jpmorgancommercesolutions.co.uk |

6

MRQA ROLE – ACCEPTING RETRIEVALS FROM LEVEL 2

39

WORKING RETRIEVALS – THE MRA ROLE

40

ACCESSING DETAILED RETRIEVAL REQUEST INFORMATION

41

VIEWING SUPPORTING DOCUMENTS

41

ACCEPTING A RETRIEVAL CASE

42

REQUEST FULFILLMENT OF A CASE

43

TABLE OF CONTENTS (CONTINUED)

©2016, Paymentech, LLC. All rights reserved. | commercesolutions.jpmorganchase.com | chasepaymentech.ca | jpmorgancommercesolutions.co.uk |

7

FULFILLING A RETRIEVAL

45

RETRIEVAL QUERIES

45

RETRIEVALS SEARCH QUERIES

46

SEARCH SCREEN AND FIELD DEFINITIONS

47

RUNNING ADVANCE RETRIEVAL SEARCH QUERIES

48

RUNNING ADVANCE RETRIEVAL SEARCH QUERIES – USING ADDITIONAL SEARCH CRITERIA

49

HEALTHCARE IIAS RETRIEVALS REQUESTS

50

OVERVIEW

51

IIAS TRANSACTIONS IN THE ONLINE CHARGEBACK MANAGEMENT SYSTEM

52

TRANSACTIONS – VISA LEVEL 1

52

TRANSACTIONS – MASTERCARD

®

LEVEL 1

52

FULFILLING IIAS RETRIEVAL REQUESTS

52

VISA IIAS TRANSACTION RETRIEVAL REQUEST

53

MASTERCARD

®

IIAS TRANSACTION RETRIEVAL REQUEST

54

RETRIEVAL WORK TRACKER

55

WORK TRACKER

55-57

SEARCH RESULTS

58

CREDIT CHARGEBACKS

59

OVERVIEW

60

VISA AND MASTERCARD

®

CHARGEBACK CATEGORIES

61

TECHNICAL CHARGEBACK WORKFLOW

62-63

CUSTOMER DISPUTE CHARGEBACK WORKFLOW

64-65

DISCOVER CHARGEBACK CATEGORIES

66

RETURN TO MERCHANT WORKFLOW

67-68

CHARGEBACK LIFECYCLES

69-71

TABLE OF CONTENTS (CONTINUED)

©2016, Paymentech, LLC. All rights reserved. | commercesolutions.jpmorganchase.com | chasepaymentech.ca | jpmorgancommercesolutions.co.uk |

8

SECOND CHARGEBACK NOTES

72

QUERY RESULT SCREEN COMPONENTS – LEVEL 1 DATA – FUNCTIONAL COMPONENTS

73

QUERY RESULT SCREEN COMPONENTS – LEVEL 1 DATA – INFORMATIONAL COMPONENTS

74-75

QUERY RESULT SCREEN COMPONENTS – LEVEL 2 DATA – FUNCTIONAL COMPONENTS

76

QUERY RESULT SCREEN COMPONENTS – LEVEL 2 DATA – INFORMATIONAL COMPONENTS

77-78

CHARGEBACK FUNCTIONS

79

WORKING CHARGEBACKS – THE IQA ROLE

80

ASSIGNING CASES TO AN MCA

81

IQA ROLE – CREATING AUTO–DECISION RULES

82-84

IQA ROLE – EDITING OR DELETING A RULE

85

IQA ROLE – ACCEPTING CHARGEBACKS FROM LEVEL 1

86

IQA ROLE – ACCEPTING CHARGEBACKS FROM LEVEL 2

87

WORKING CHARGEBACKS – THE MCA ROLE

88

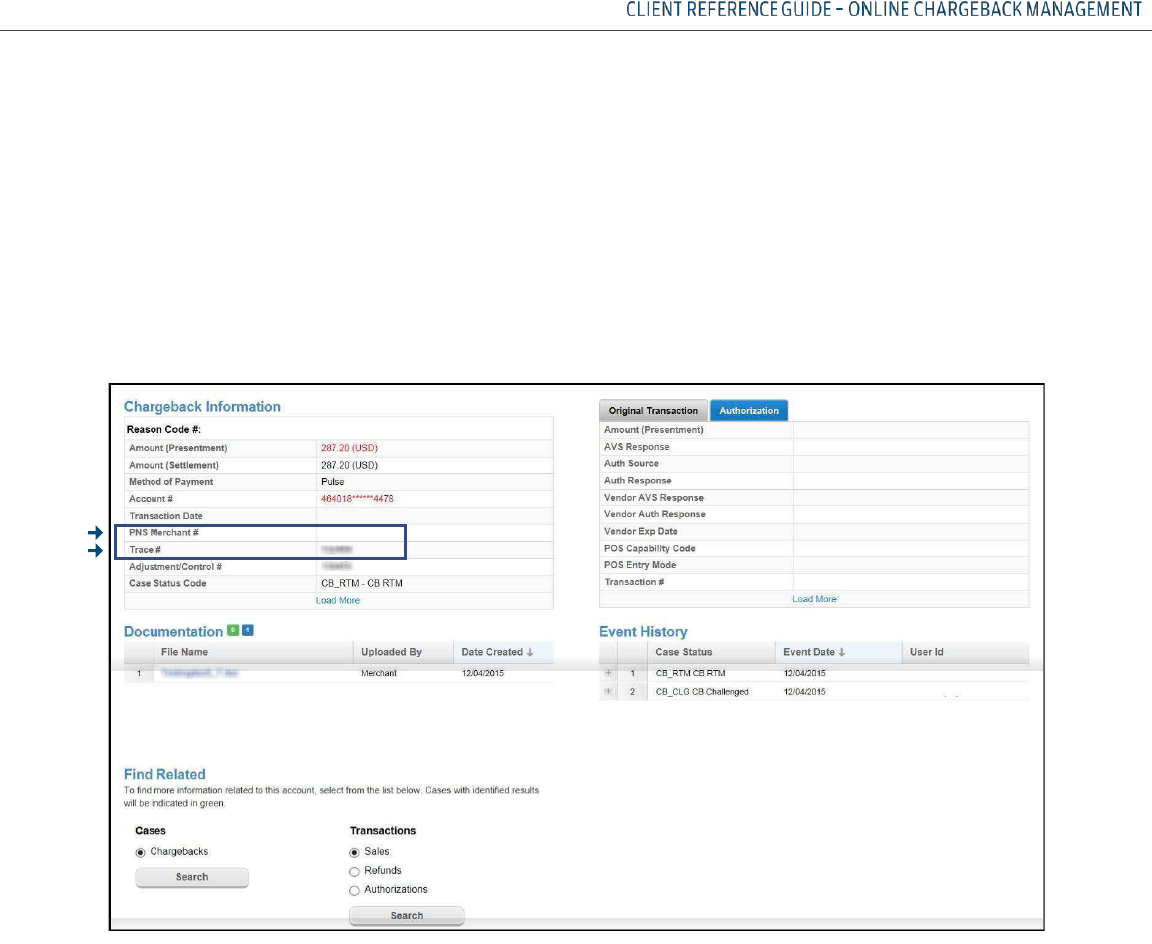

MCA ROLE – ACCESSING DETAILED CHARGEBACK INFORMATION

89-90

MCA ROLE – VIEWING SUPPORTING DOCUMENTS

91

MCA ROLE – ACCEPTING A CHARGEBACK

92

MCA ROLE – CHALLENGING A CHARGEBACK

93-94

MCA ROLE – SUBMIT INFO

95-96

CHARGEBACK QUERIES

97

CHARGEBACK SEARCH QUERIES

98

CHARGEBACK SEARCH SCREEN AND FIELD DEFINITIONS

99-101

RUNNING ADVANCE CHARGEBACK SEARCH QUERIES

102

TABLE OF CONTENTS (CONTINUED)

©2016, Paymentech, LLC. All rights reserved. | commercesolutions.jpmorganchase.com | chasepaymentech.ca | jpmorgancommercesolutions.co.uk |

9

RUNNING ADVANCE CHARGEBACK SEARCH QUERIES – USING ADDITIONAL SEARCH CRITERIA

103

CHARGEBACK WORK TRACKER

104

WORK TRACKER

104-107

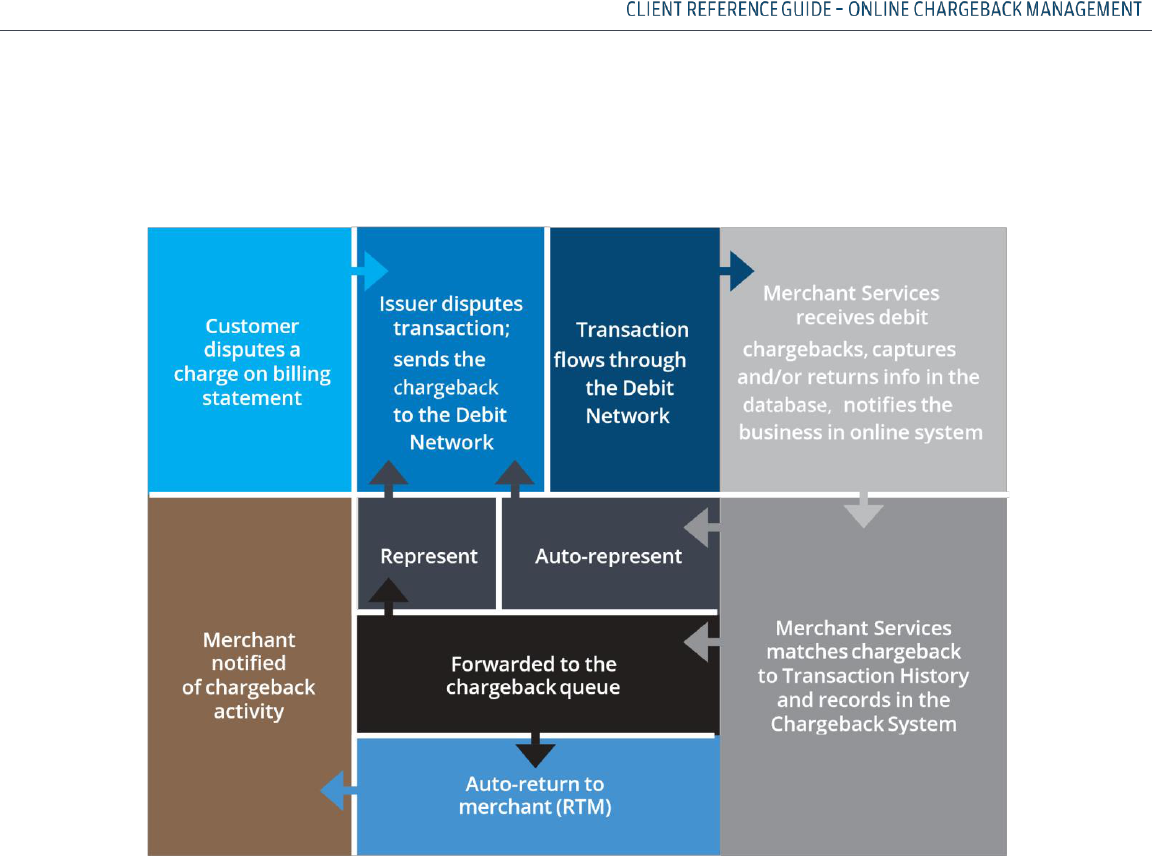

DEBIT CHARGEBACK

108

OVERVIEW

109-110

TECHNICAL DEBIT CHARGEBACK WORKFLOW

111-112

CUSTOMER DISPUTE DEBIT CHARGEBACK WORKFLOW

113-114

RETURN TO MERCHANT WORKFLOW

115

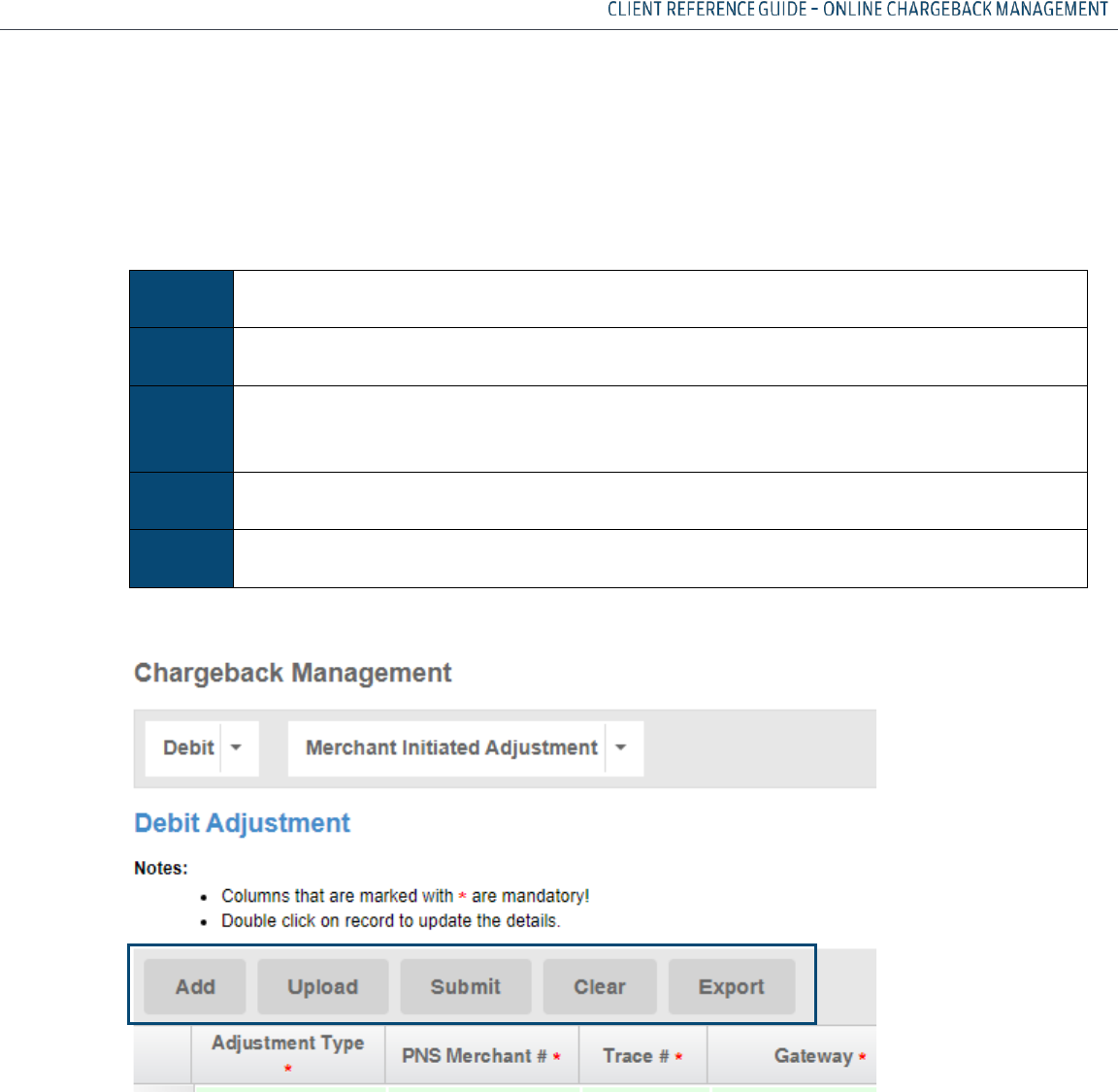

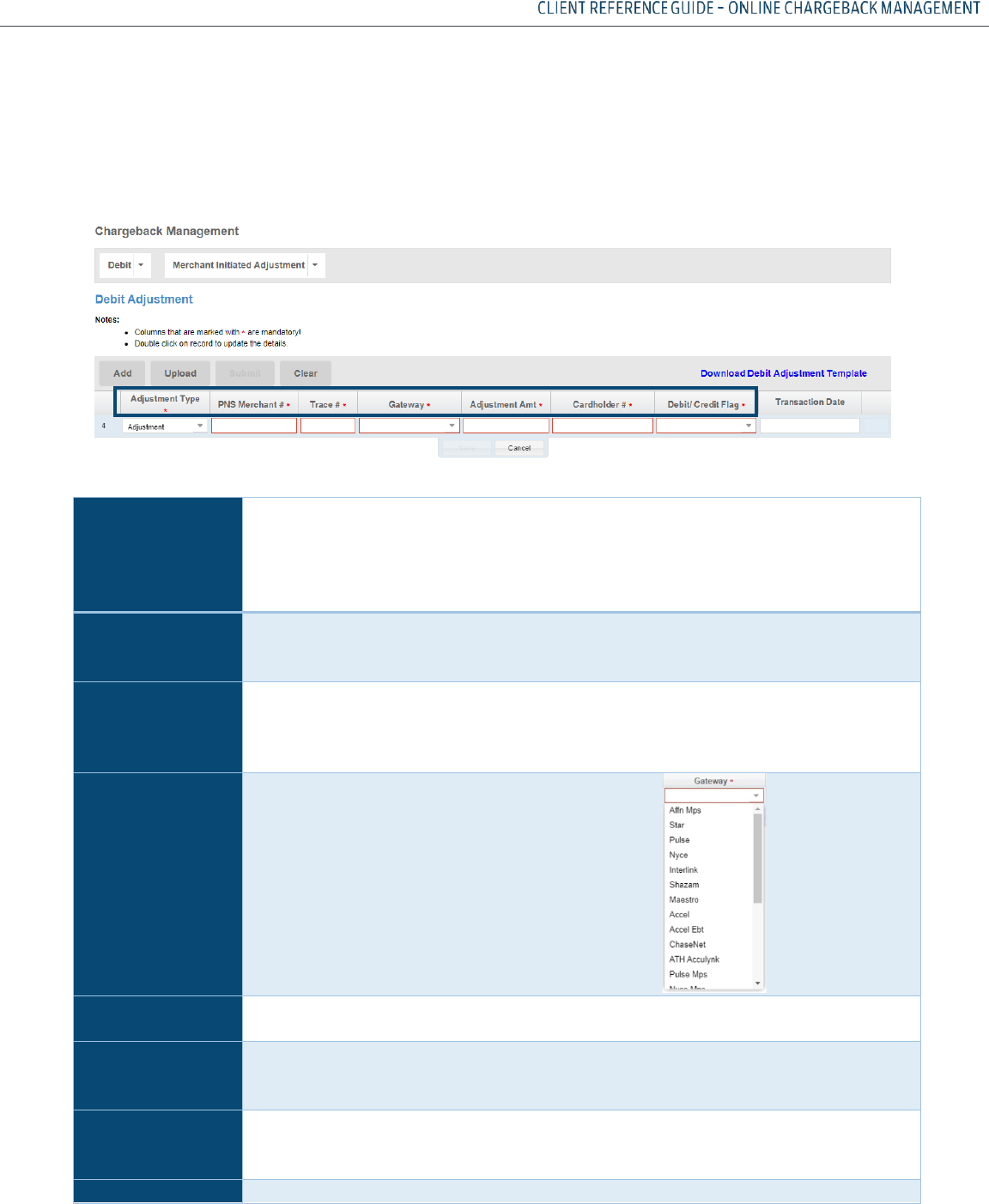

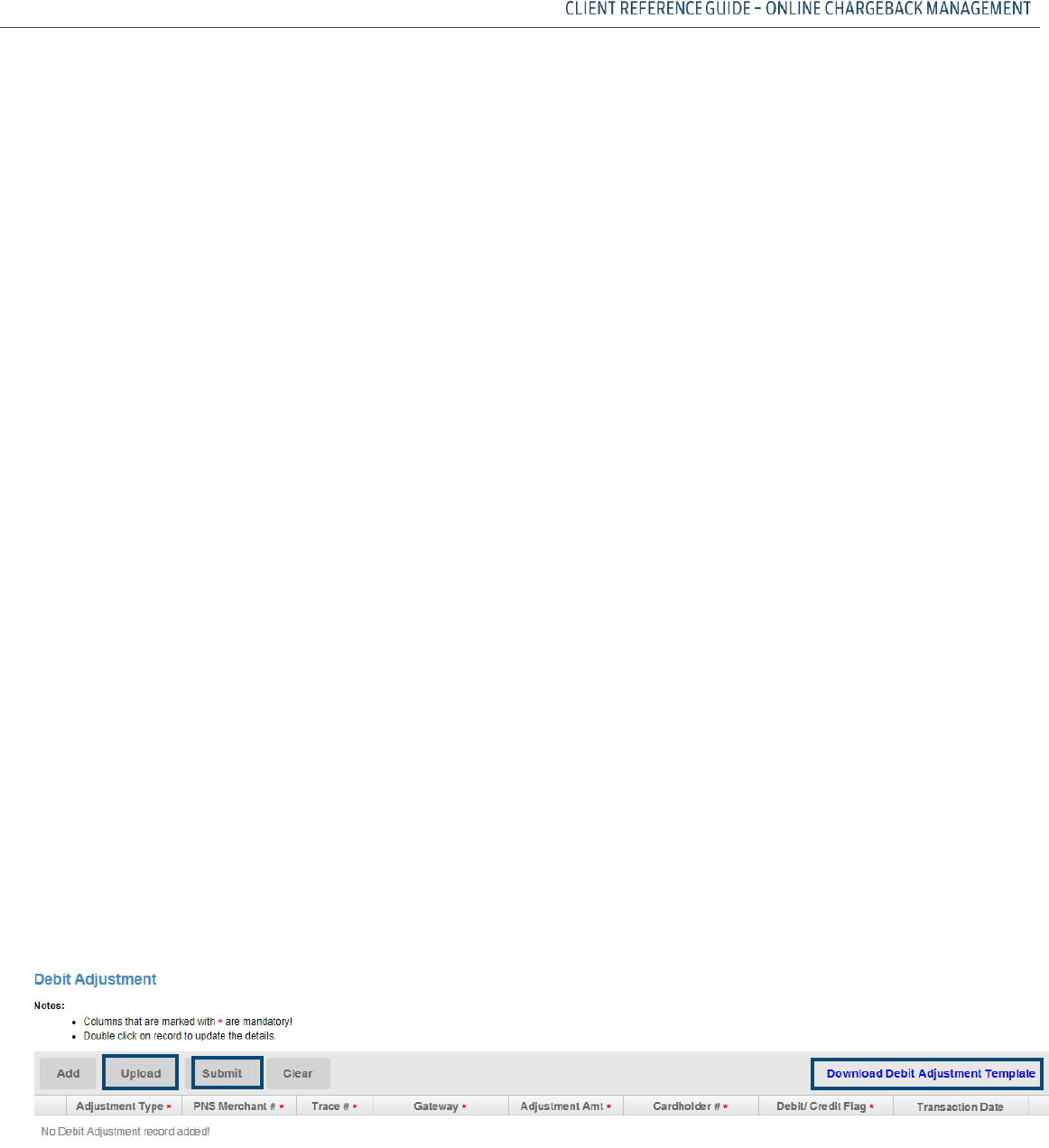

MERCHANT INITAITED DEBIT ADJUSTMENTS

116-120

QUERY RESULT SCREEN COMPONENTS – LEVEL 1 DATA – FUNCTIONAL COMPONENTS

121

QUERY RESULT SCREEN COMPONENTS – LEVEL 1 DATA – INFORMATIONAL COMPONENTS

121-122

QUERY RESULT SCREEN COMPONENTS – LEVEL 2 DATA – FUNCTIONAL COMPONENTS

123

QUERY RESULT SCREEN COMPONENTS – LEVEL 2 DATA – INFORMATIONAL COMPONENTS

124

EXCEPTION PROCESSING

125

INTRODUCTION

125

INCOMING PRE-ARBITRATION/ ARBITRATION – VISA, DISCOVER & MASTERCARD

126

OUTGOING ARBITRATION - DISCOVER

126

OUTGOING COLLECTION – VISA & MASTERCARD

®

126

PRE-COMPLIANCE – INCOMING AND OUTGOING – VISA & MASTERCARD

®

127

CHARGEBACK ANALYSIS REPORTING

129

INTRODUCTION

129

PDE-0017 – CHARGEBACK ACTIVITY – MONTHLY VERSION

129

PDE-0039 – CHARGEBACKS WON/LOST SUMMARY

129

APPENDIX A

130

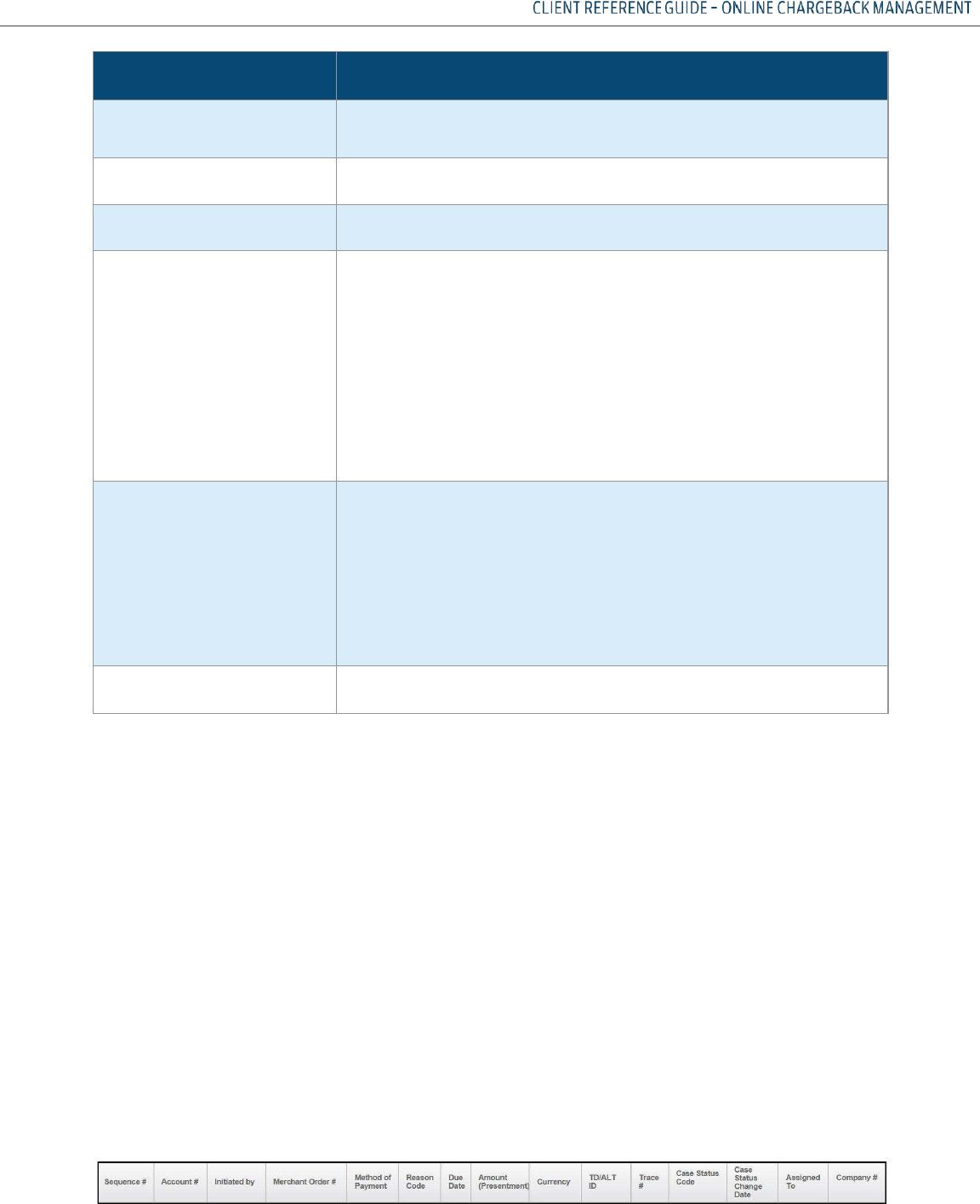

CASE STATUS CODES

130-134

TABLE OF CONTENTS (CONTINUED)

©2016, Paymentech, LLC. All rights reserved. | commercesolutions.jpmorganchase.com | chasepaymentech.ca | jpmorgancommercesolutions.co.uk |

10

APPENDIX B

135

REPORTING OVERVIEW

135

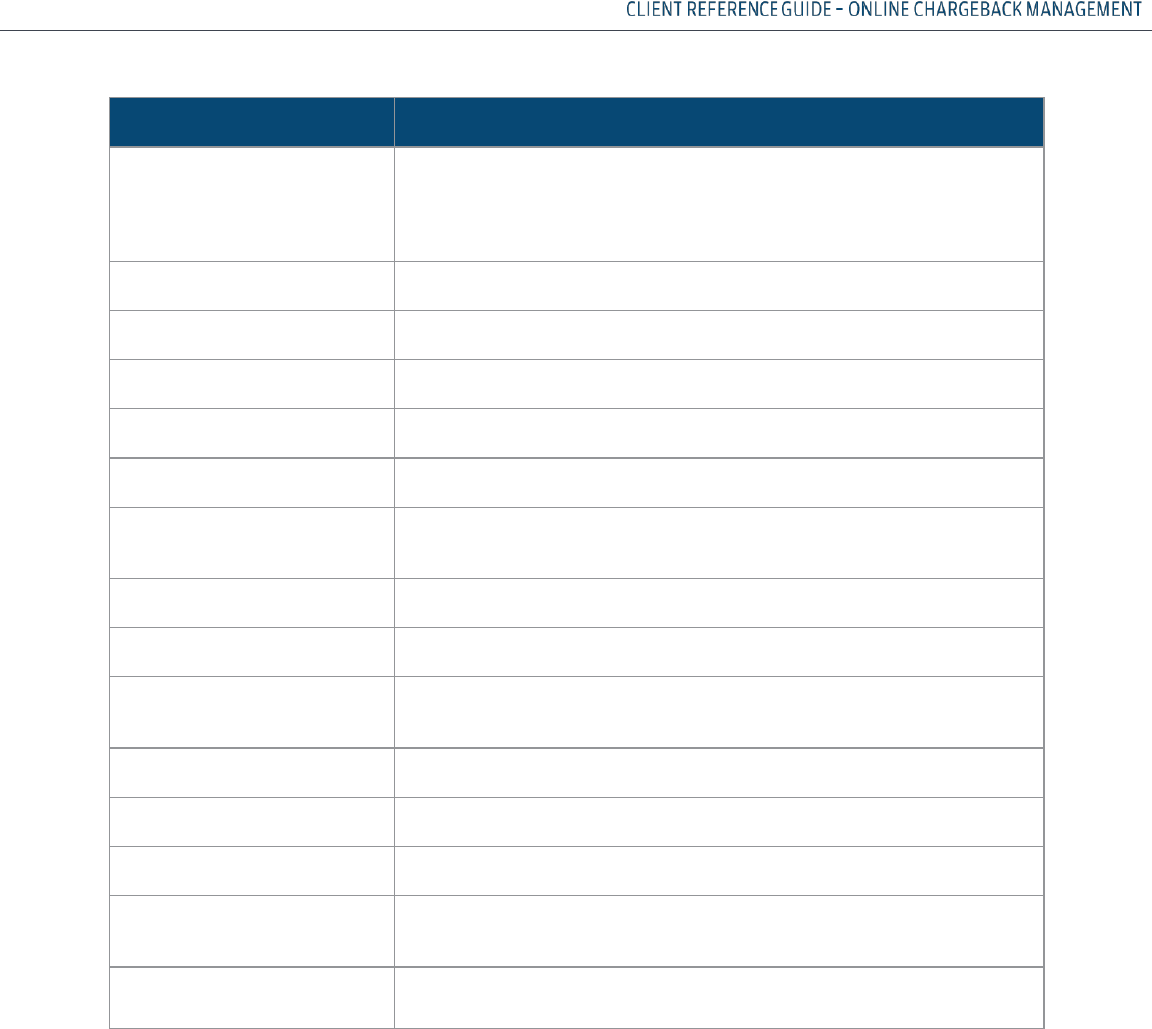

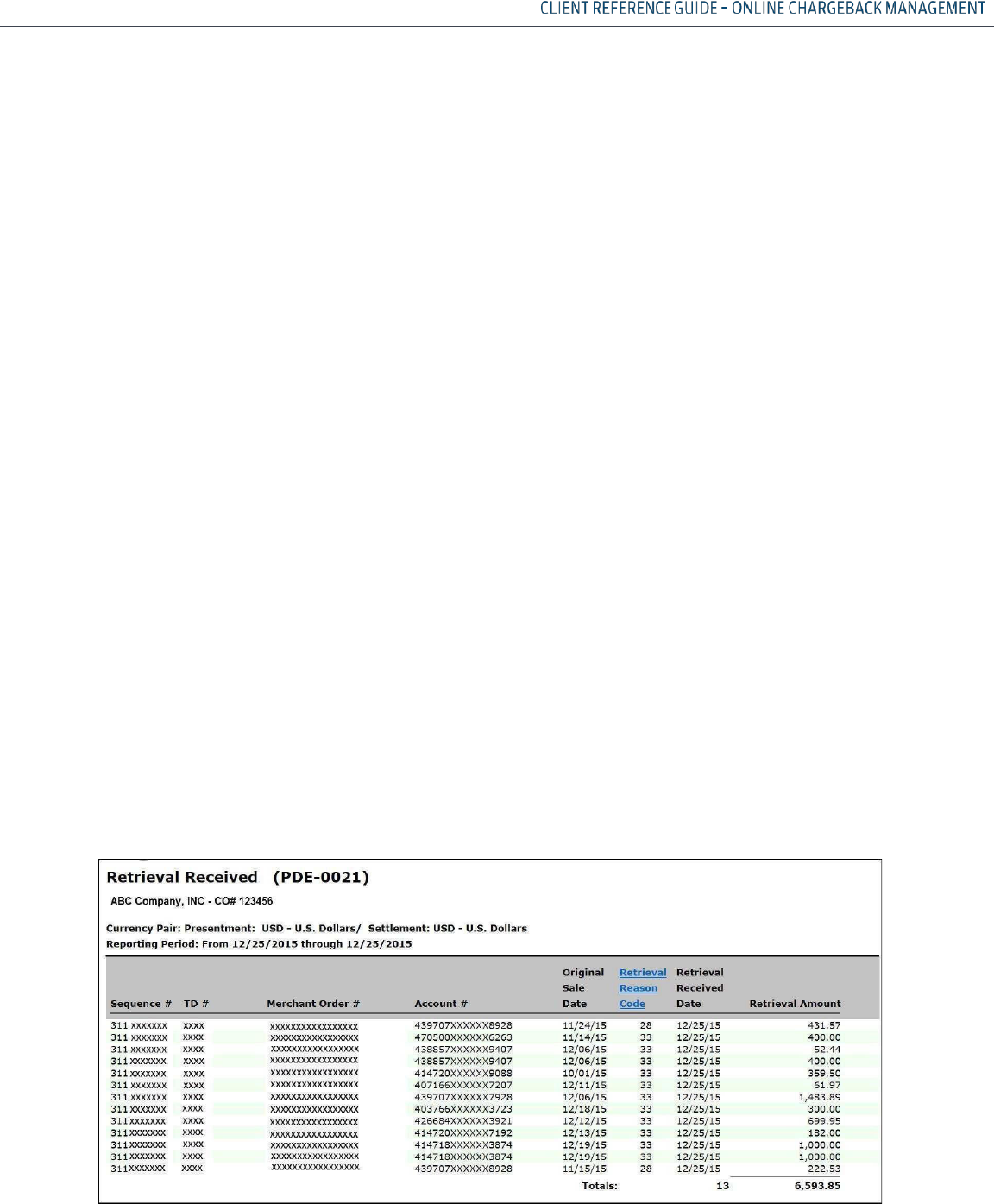

RETRIEVALS RECEIVED (PDE-0021) – FIELD DEFINITIONS

135-136

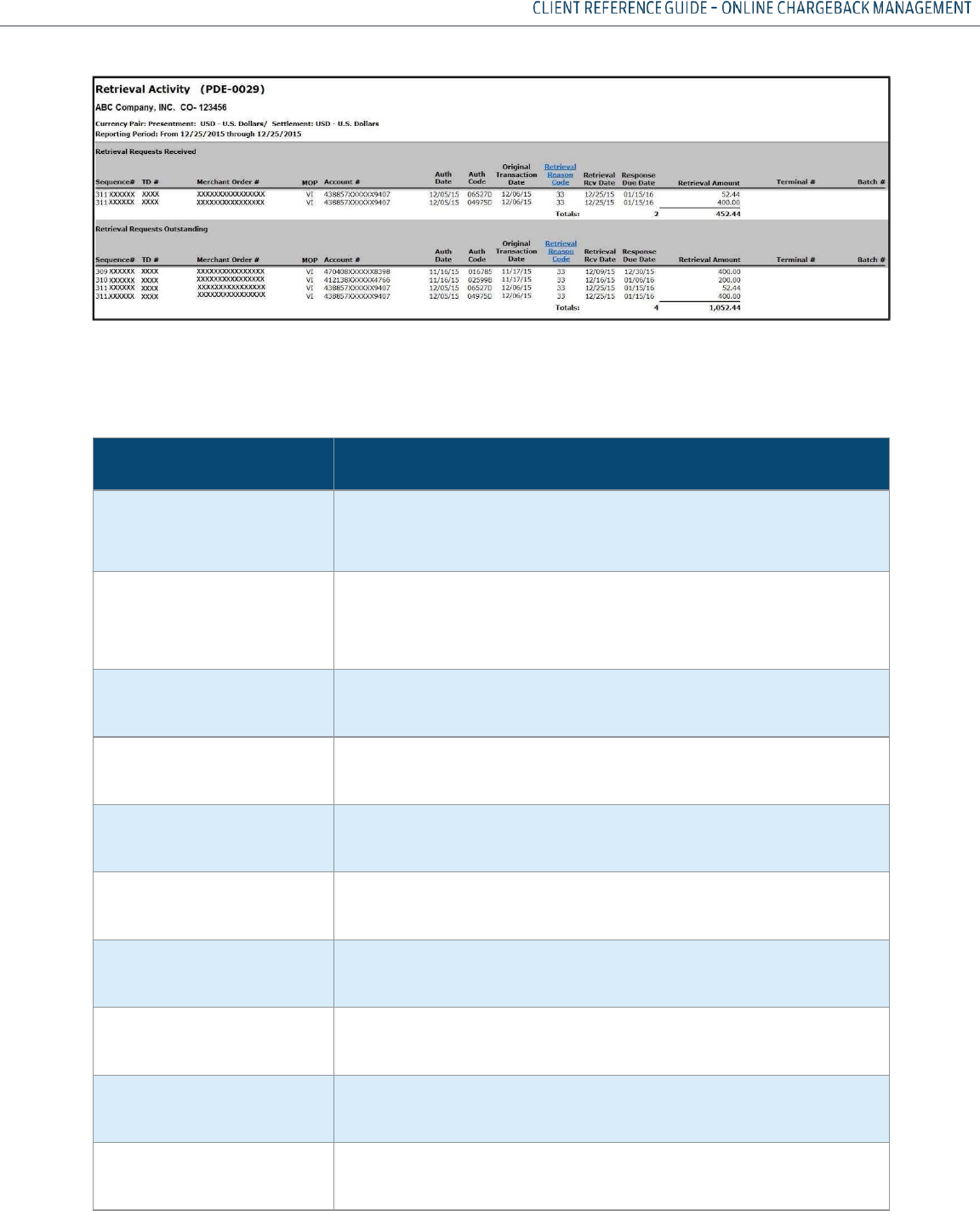

RETRIEVAL ACTIVITY (PDE-0029) – DESCRIPTION & USE

136

RETRIEVALS ACTIVITY (PDE-0029) – FIELD DEFINITIONS

136-137

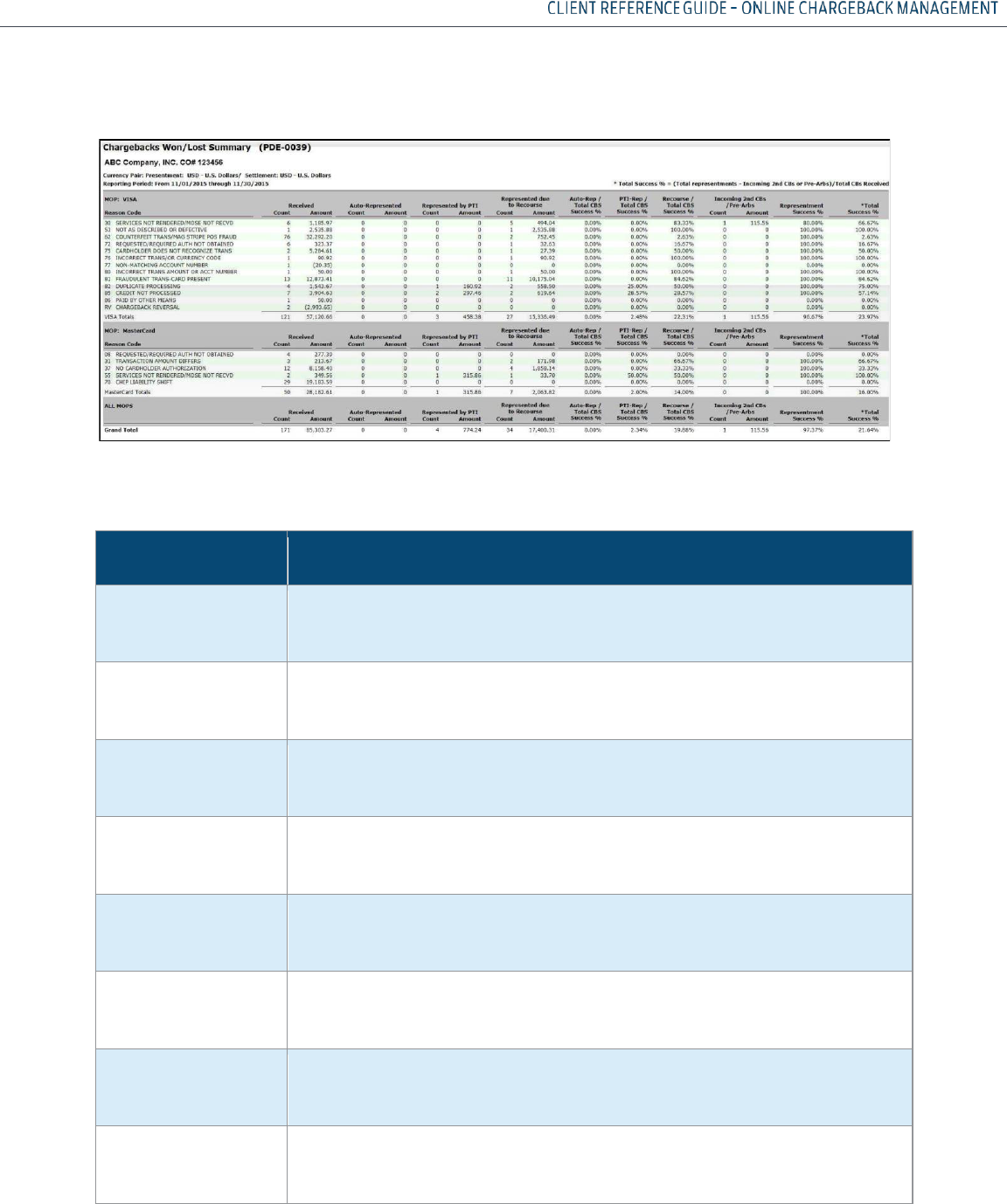

CHARGEBACKS WON/LOST SUMMARY (PDE-0039) – DESCRIPTION & USE

138

CHARGEBACKS WON/LOST SUMMARY (PDE-0039) – REPORT SAMPLE

139

CHARGEBACKS WON/LOST SUMMARY (PDE-0039) – FIELD DEFINITIONS

139-140

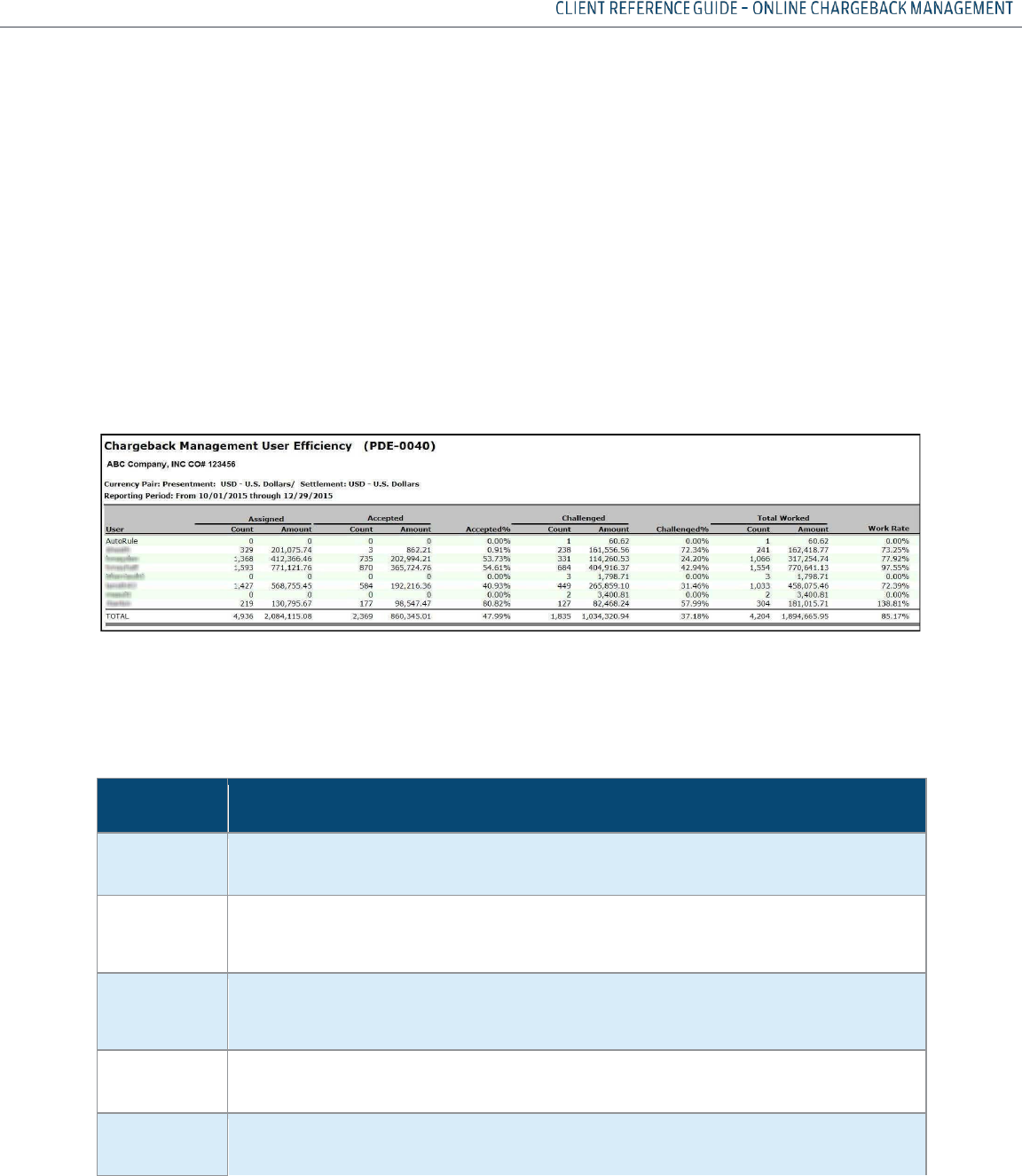

CHARGEBACK MANAGEMENT USER EFFICIENCY (PDE-0040) – DESCRIPTION & USE

141

CHARGEBACK MANAGEMENT USER EFFICIENCY (PDE-0040) – REPORT SAMPLE

141

CHARGEBACK MANAGEMENT USER EFFICIENCY (PDE-0040) – FIELD DEFINITIONS

141-142

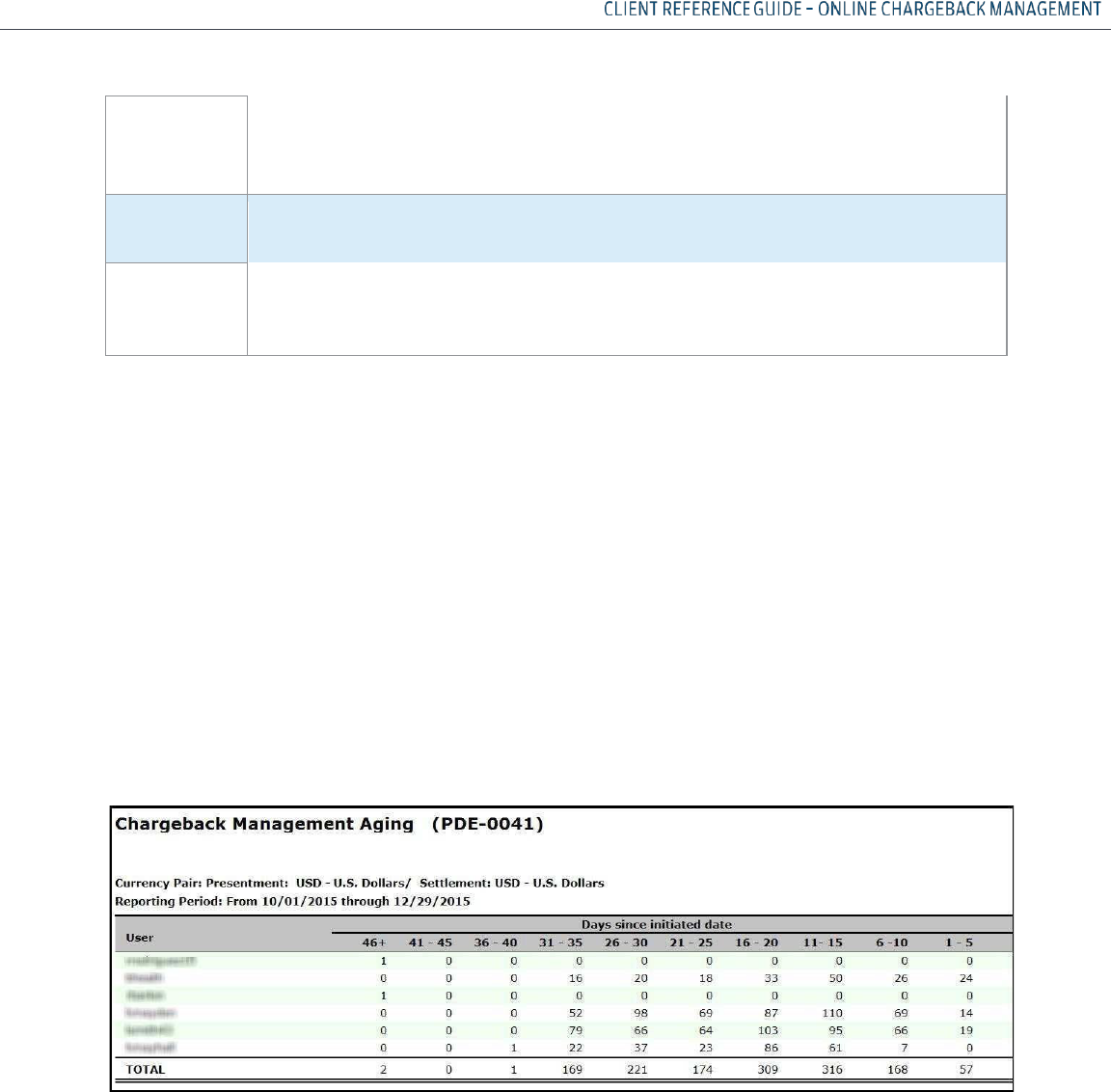

CHARGEBACK MANAGEMENT AGING (PDE-0041) – DESCRIPTION & USE

142

CHARGEBACK MANAGEMENT AGING (PDE-0041) – REPORT SAMPLE

142

CHARGEBACK MANAGEMENT AGING (PDE-0041) – FIELD DEFINITIONS

143

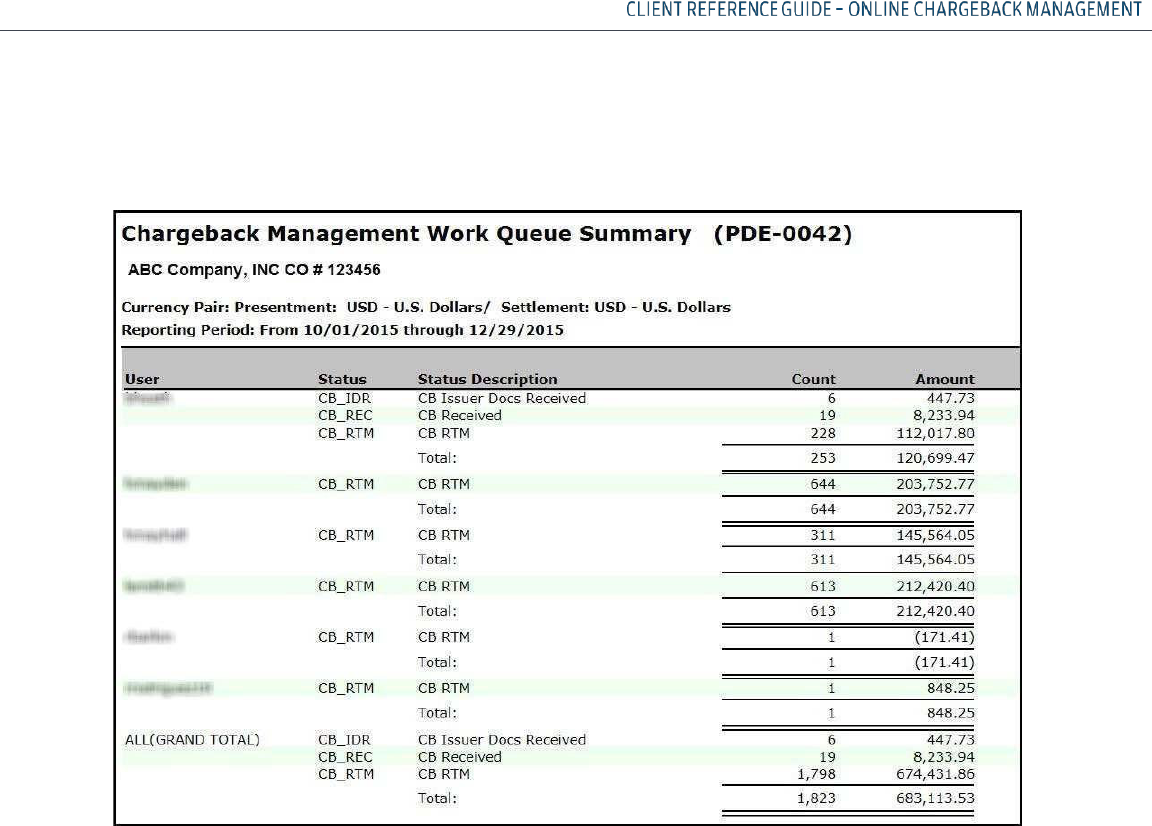

CHARGEBACK MANAGEMENT WORK QUEUE SUMMARY (PDE-0042) – DESCRIPTION & USE

143

CHARGEBACK MANAGEMENT WORK QUEUE SUMMARY (PDE-0042) – REPORT SAMPLE

144

CHARGEBACK MANAGEMENT WORK QUEUE SUMMARY (PDE-0042) – FIELD DEFINITIONS

145

PRE-DISPUTE DETAIL REPORT (PDE-0065) DESCRIPTION & USE

146

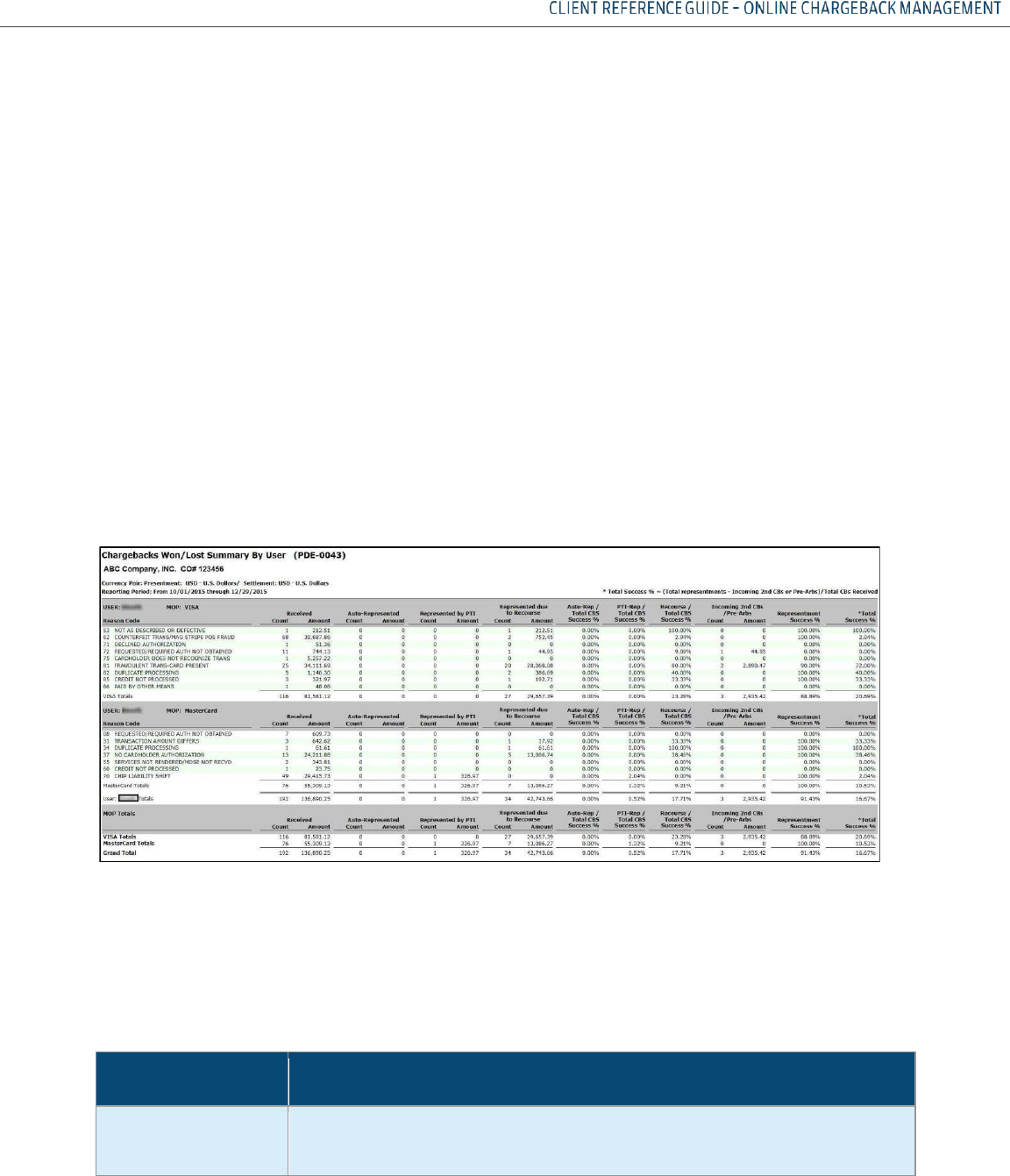

CHARGEBACKS WON/LOST SUMMARY BY USER (PDE-0043) – DESCRIPTION & USE

146

CHARGEBACKS WON/LOST SUMMARY BY USER (PDE-0043) – REPORT SAMPLE

147

CHARGEBACKS WON/LOST SUMMARY BY USER (PDE-0043) – FIELD DEFINITIONS

147

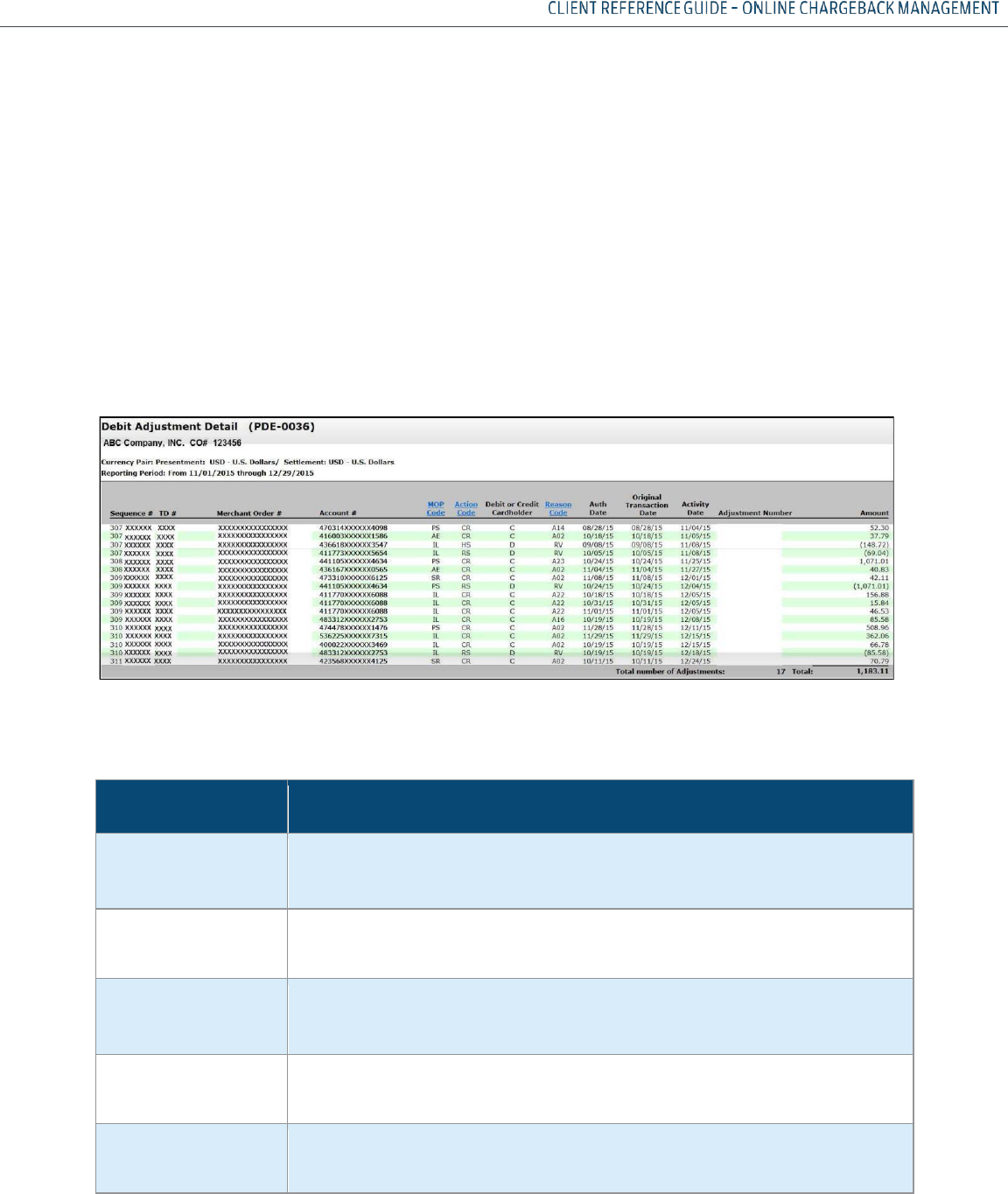

DEBIT ADJUSTMENT DETAIL (PDE-0036) – DESCRIPTION & USE

148

TABLE OF CONTENTS (CONTINUED)

©2016, Paymentech, LLC. All rights reserved. | commercesolutions.jpmorganchase.com | chasepaymentech.ca | jpmorgancommercesolutions.co.uk |

11

DEBIT ADJUSTMENT DETAIL (PDE-0036) – REPORT SAMPLE

148

DEBIT ADJUSTMENT DETAIL (PDE-0036) – FIELD DEFINITIONS

148-149

GLOSSARY

150

A – CH

150-151

CO – RE

151 -152

RE – W

152-153

©2016, Paymentech, LLC. All rights reserved. | commercesolutions.jpmorganchase.com | chasepaymentech.ca | jpmorgancommercesolutions.co.uk |

12

INTRODUCTION

CHARGEBACK MANAGEMENT - A JOINT EFFORT

As a business you do all you can to ensure customer satisfaction with your product or service. All

sales transactions are submitted accurately and refund transactions are processed in a timely

fashion. You take measures to avoid fraudulent transactions by using address verification, card

security codes and employing a well-educated and aware customer service staff. Even with all your

efforts, your customers may question items on their billing statement and this may result in a

retrieval request or chargeback being sent to Merchant Services.

We take an active role in working with you to minimize the number of chargebacks and the effect

on your company’s bottom line. Efficient and successful recovery of monies for chargeback

transactions involves careful attention to paperwork, prompt action, communication with your

Chargeback Analyst, and in some instances, your customer.

Card companies and debit networks provide rules and regulations for retrieval and chargeback

processing which define the number of times and the reasons a transaction may be charged back

and/ or represented. The rules specify certain time frames within which retrieval request and

chargeback processing may take place. In the event a dispute cannot be resolved through normal

retrieval and chargeback processing channels, alternative processes may be available. In certain

situations Pre-Arbitration, Arbitration, Good Faith Collection and Pre-Compliance efforts can be

made.

This user guide provides detailed information to help you successfully work your retrievals and

chargebacks using the channels established and regulated by the card companies and debit

networks.

CHARGEBACK MANAGEMENT SYSTEM FOR ONLINE PROCESSING

OVERVIEW

The online chargeback management system within Paymentech Online streamlines retrieval

requests and chargebacks through a user-friendly interface that supports:

• Electronic capture, storage and exchange of retrieval and chargeback related documents between

Merchant Services, Clients and endpoints such as VISA

®

and MasterCard

®

and other Card-Issuers

• Online case management allowing Clients and Merchant Services Analysts to view retrieval and

chargeback activity, conduct research, and make decisions necessary for resolution

• Decreasing timeframes for dispute resolution

• Reduction in mailing and handling costs

The online chargeback management system is an interactive web-based tool available through

Paymentech Online as an accompaniment to the Report Center and Transaction History Applications.

©2016, Paymentech, LLC. All rights reserved. | commercesolutions.jpmorganchase.com | chasepaymentech.ca | jpmorgancommercesolutions.co.uk |

13

Chargeback Management allows Clients to monitor and respond to retrieval requests and

chargebacks. It also provides for uploading electronic documents to Merchant Services for viewing

by the Chargeback Analyst, thereby significantly reducing delivery time of the documents.

Clients may use any scanner or other device and related software of their choosing for converting

paper documents to an image in a supported format.

Access to the online chargeback management system is granted as part of the security login system

for Paymentech Online.

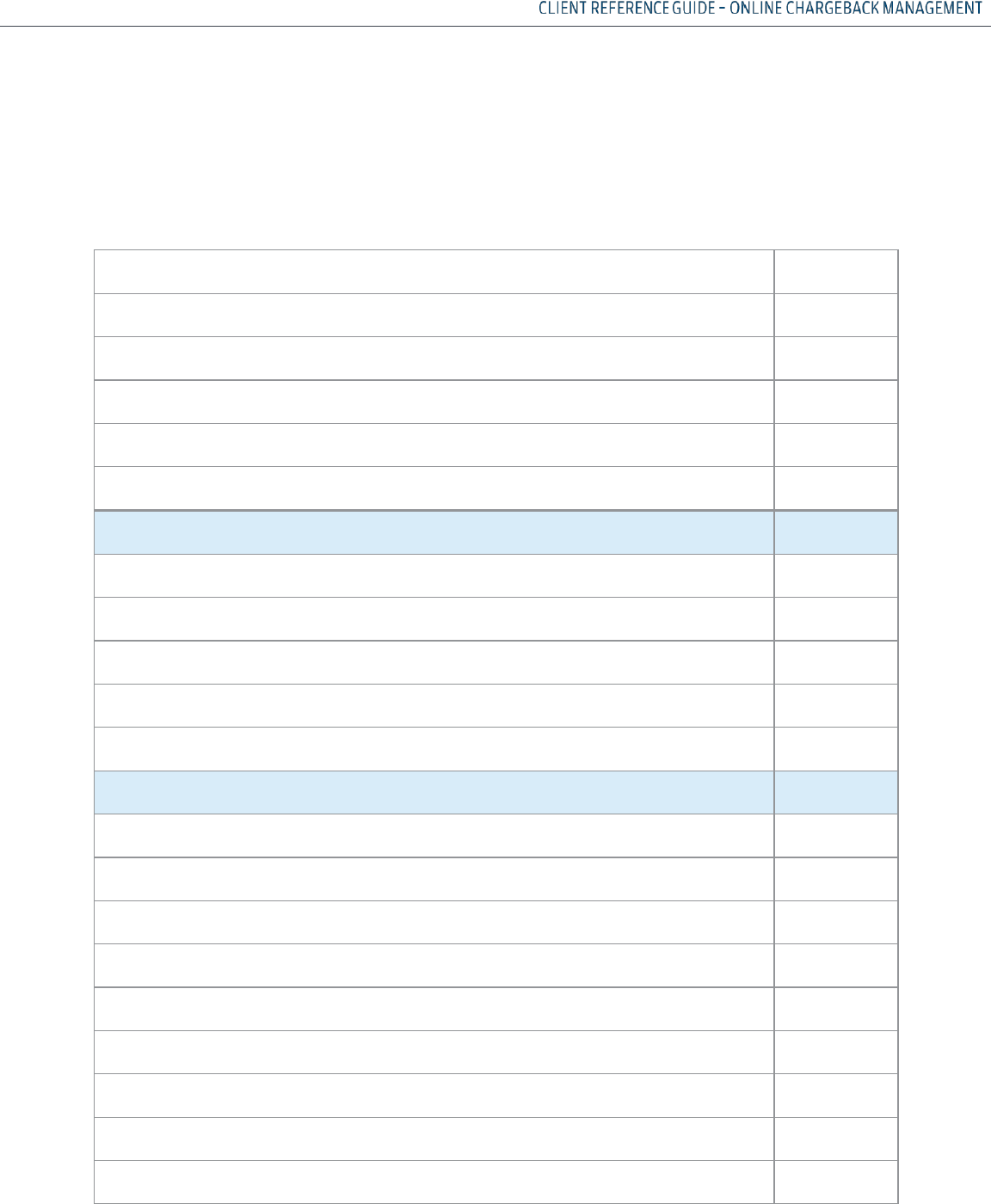

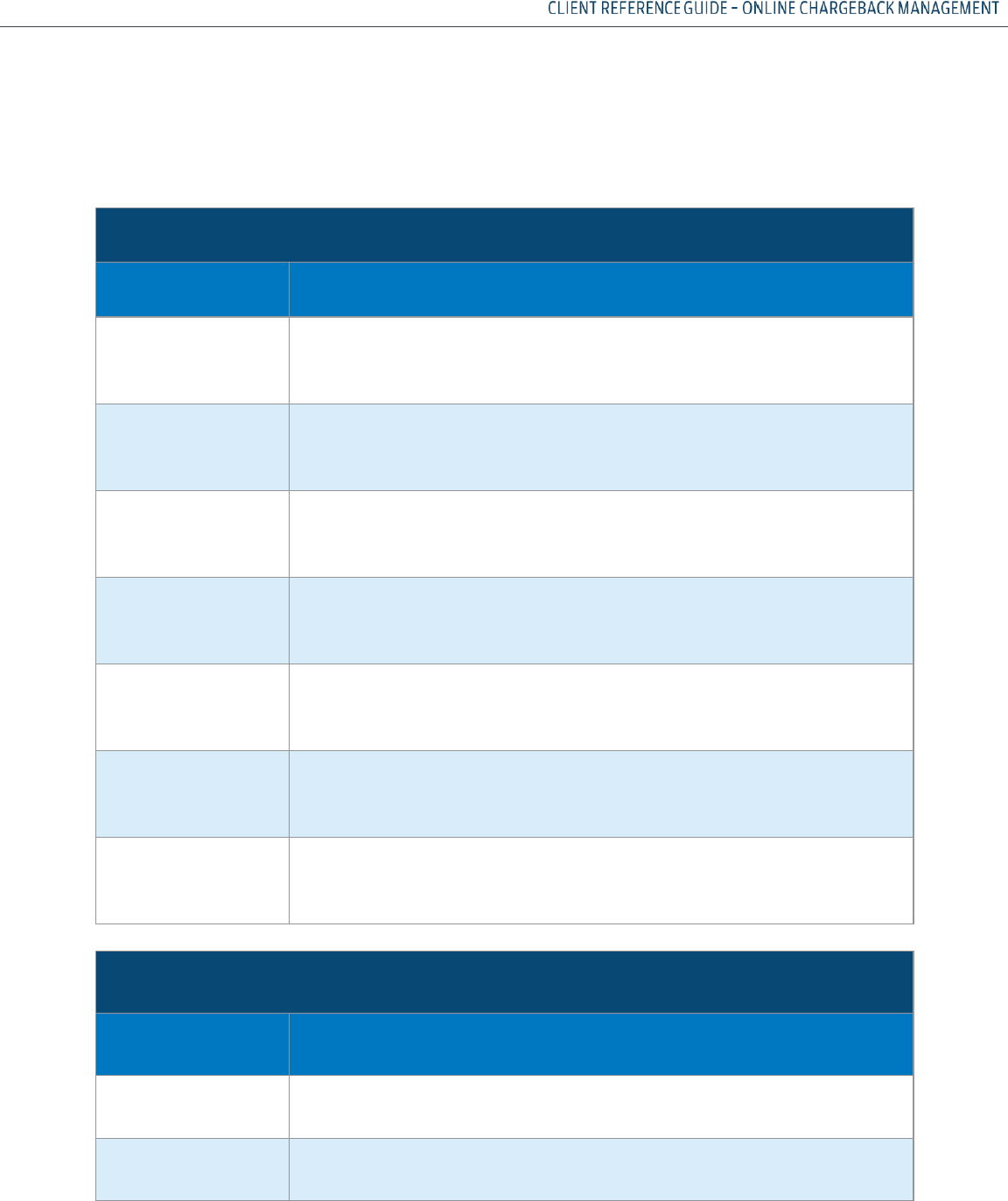

SYSTEM REQUIREMENTS & SUPPORTED DOCUMENT FORMATS

Please refer to the Paymentech Online User Guide for system requirements.

o Documents submitted in response to a retrieval request, a chargeback or an Analyst’s request for

information may be in the following formats: pdf and tif. These are the ONLY file formats that

can be accepted

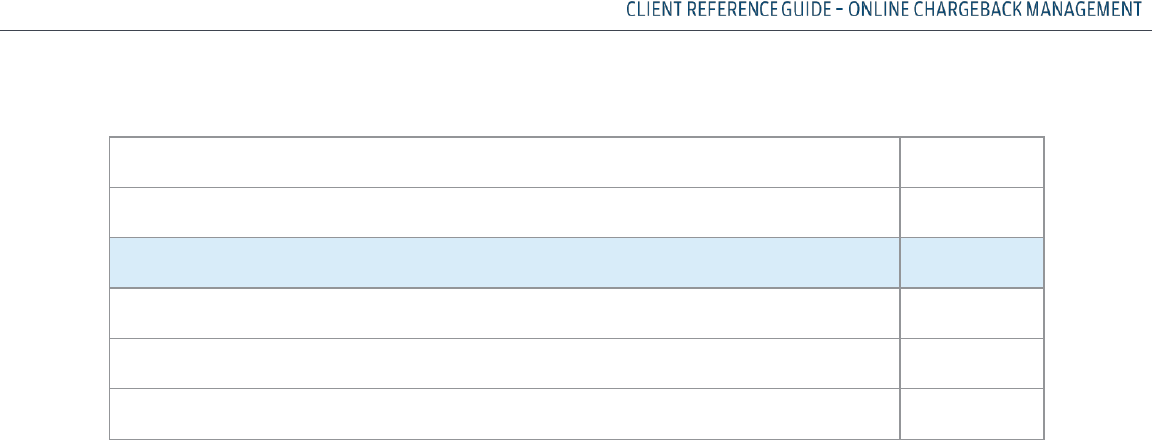

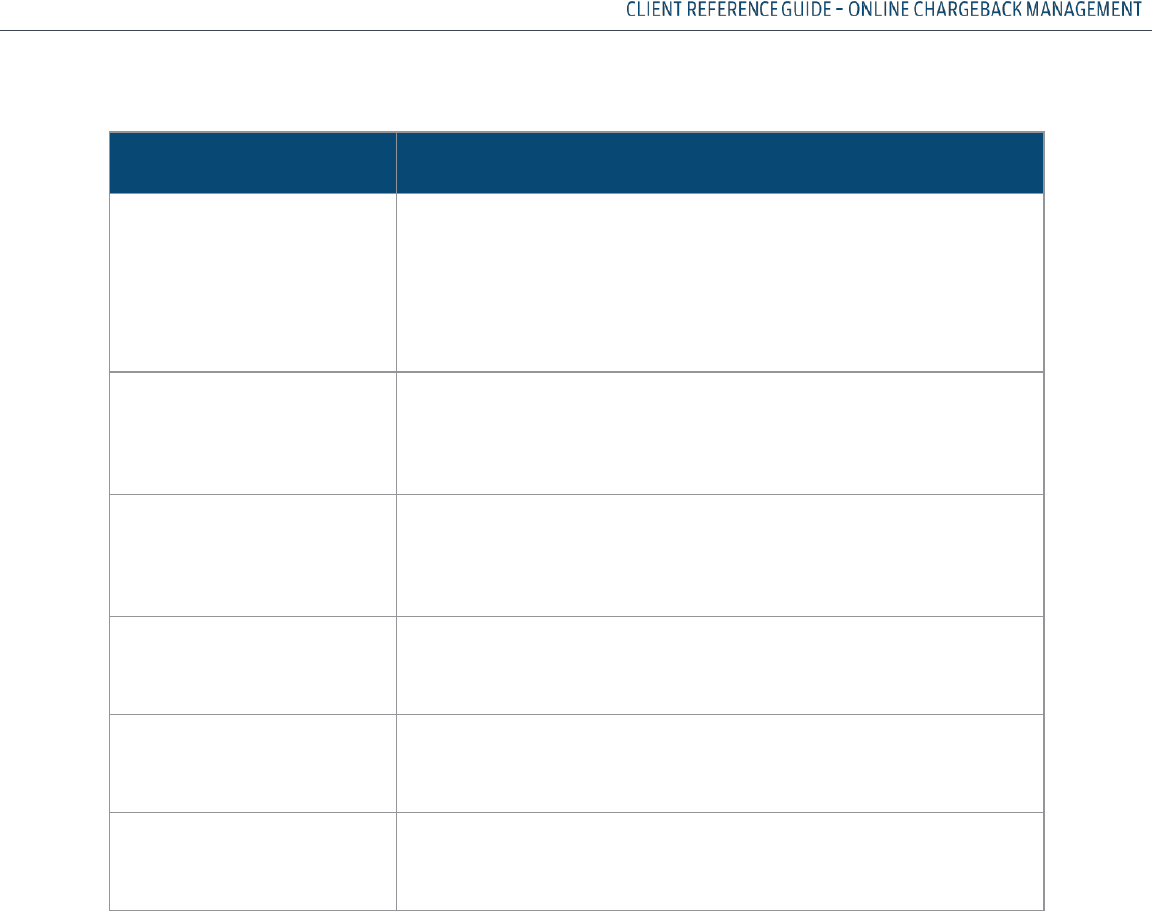

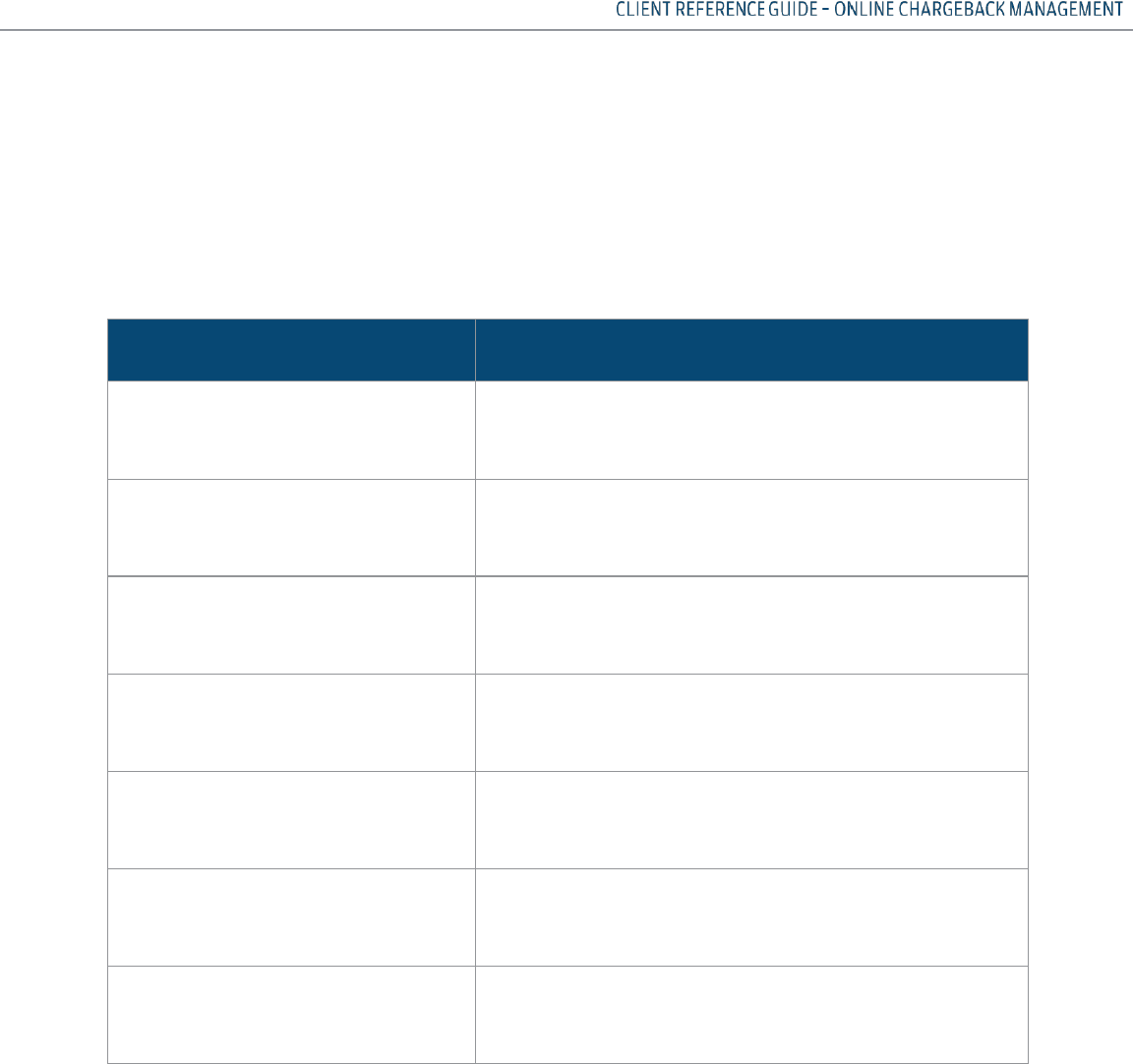

See the table below for document format and size

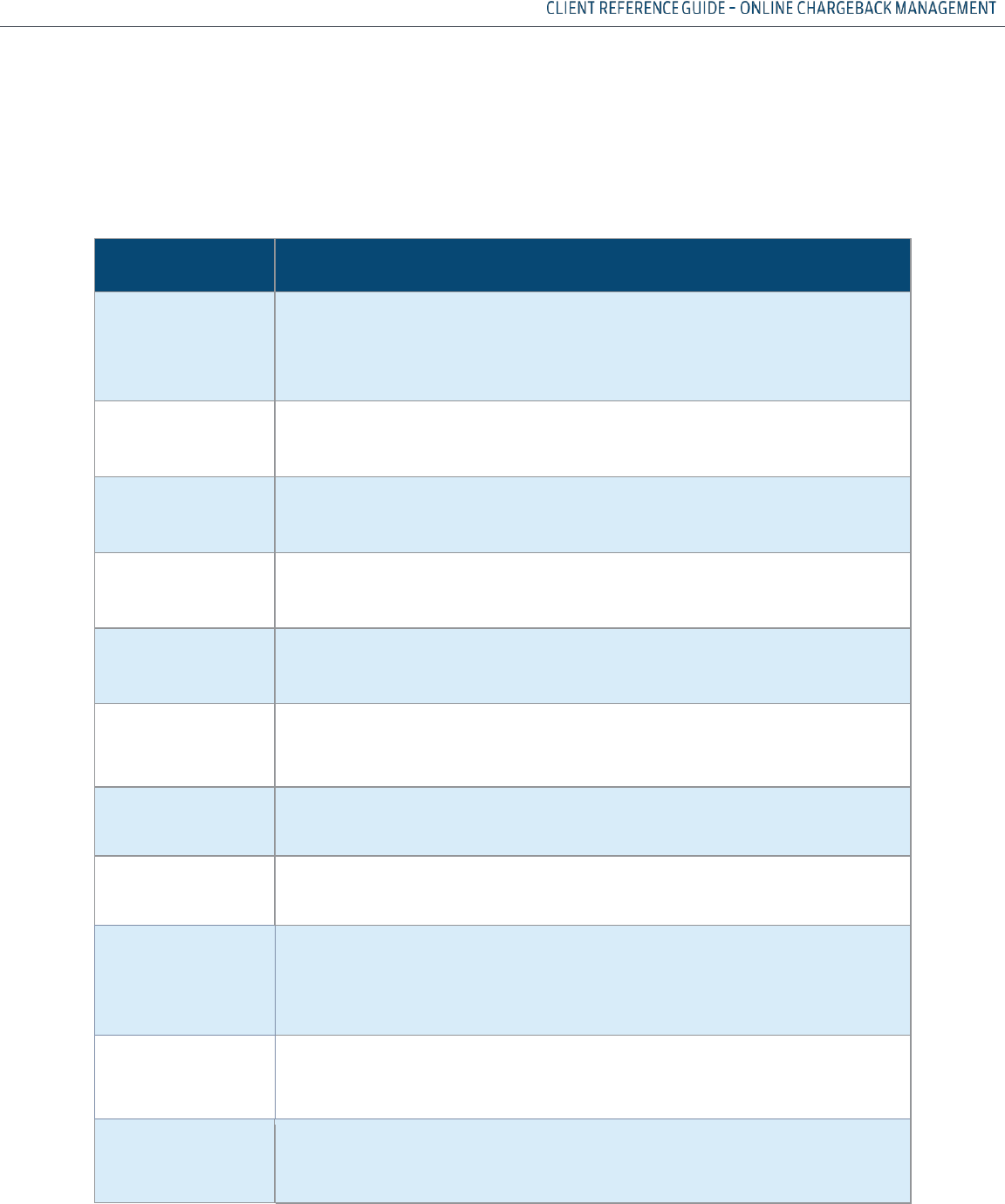

Network

Image

Format

Color Mode

Allowed by

Network

Individual

File Size

Resolution and

Dimensions

Visa

.pdf

Color, BW

2 MB

200 X 200

MasterCard

.pdf

Color, BW

14 MB

300 X 300

Discover

.pdf

Color, BW

14 MB

200 X 200

Amex

.pdf

Color, BW

1MB

200 X 200

• To ensure successful uploads, all files uploaded to the chargeback system must conform to the

following standards:

o File names may only contain:

A through Z (uppercase and lowercase permitted)

0 through 9

Dash (-)

Underscore (_)

File name length including path of 220 characters or less

Period (.)

o It is suggested that image files be sent in black and white. Color files do not

always transmit correctly, leaving images blurred and illegible. Illegible files

can be declined by the card brands.

Attempts to upload files that fall outside of this parameter will result in an error message.

©2016, Paymentech, LLC. All rights reserved. | commercesolutions.jpmorganchase.com | chasepaymentech.ca | jpmorgancommercesolutions.co.uk |

14

It is the client’s responsibility to check all uploaded documents to ensure they can be opened

and viewed and that they contain the appropriate information.

**DO NOT UPLOAD PASSWORD PROTECTED DOCUMENTS**

Document Upload Methods

Documents may be submitted using two different methods:

• Manually uploading document and attaching it to the case in the online chargeback management

system

• Electronic File Submission

For more information on Electronic File Submission, please contact your Account Executive.

©2016, Paymentech, LLC. All rights reserved. | commercesolutions.jpmorganchase.com | chasepaymentech.ca | jpmorgancommercesolutions.co.uk |

15

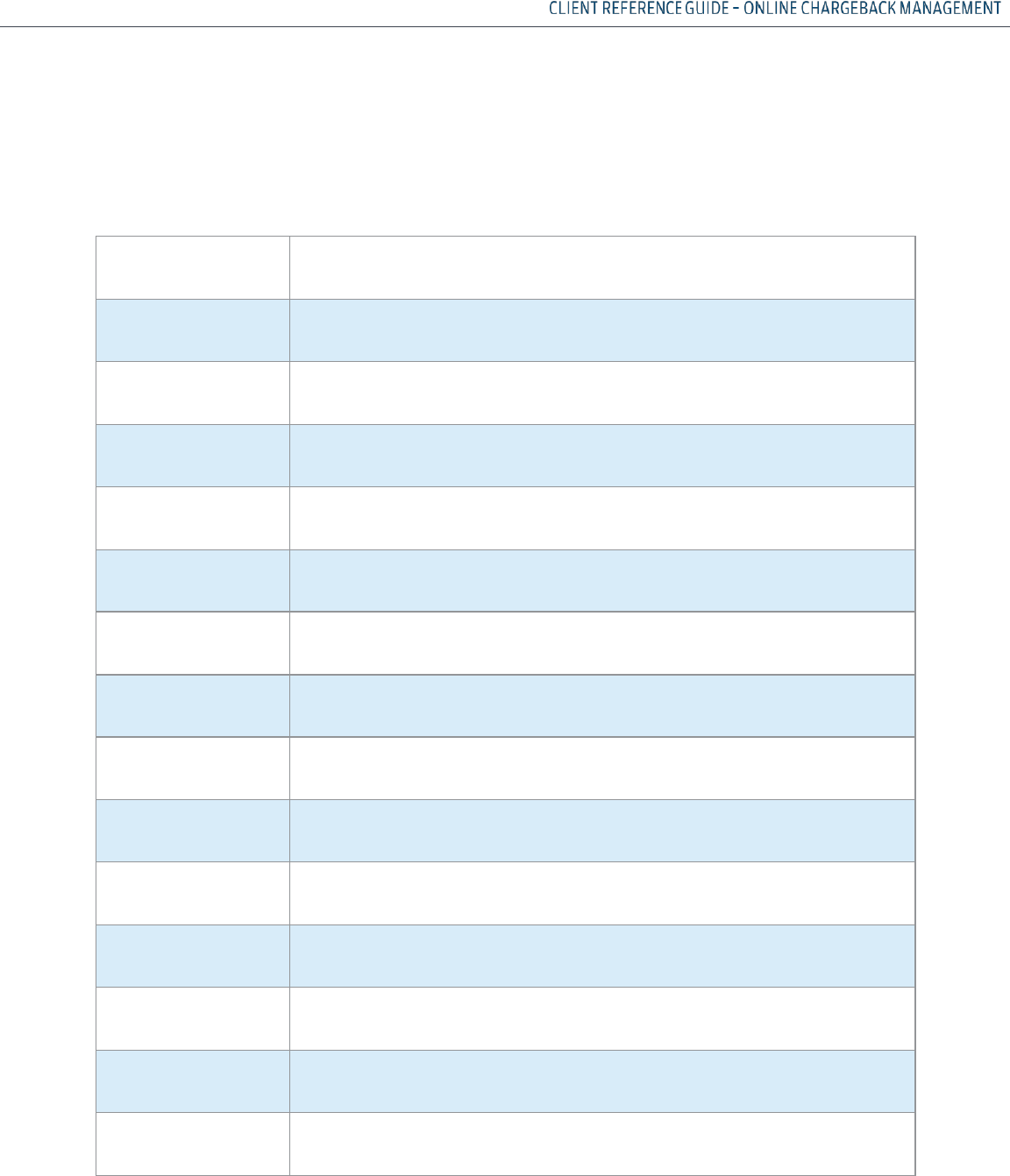

OPTIONAL MULTIPLE DOCUMENT UPLOAD FUNCTIONALITY

You can submit chargeback and retrieval document files electronically, which are matched up

with the chargeback or retrieval cases that reside within the online chargeback management

system. This eliminates the need to manually upload documents when challenging a case or

responding to a retrieval.

Documents can be submitted using the following supported protocols: FTP, S-FTP, FTP-S and

NDM. Only .tif formats are accepted.

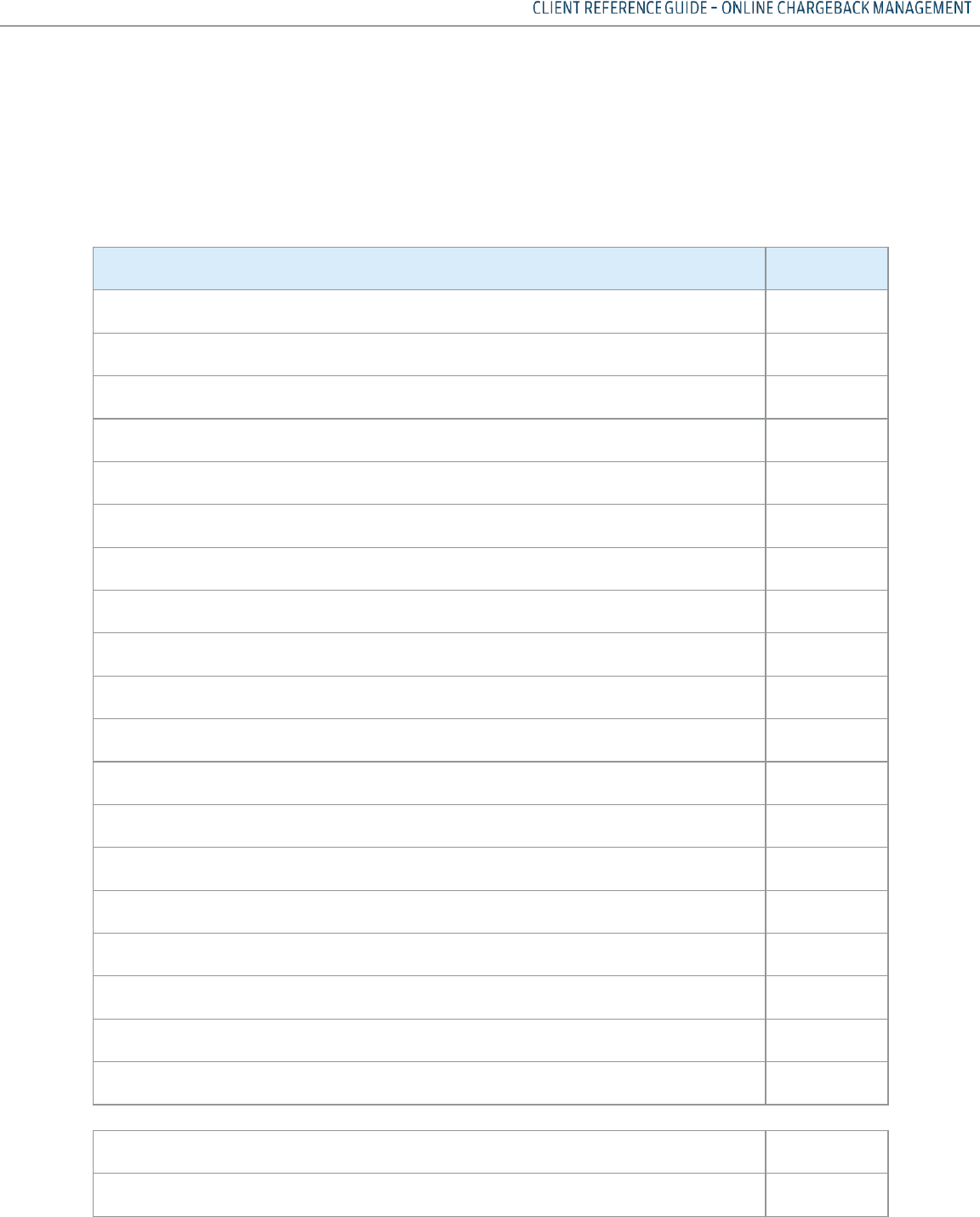

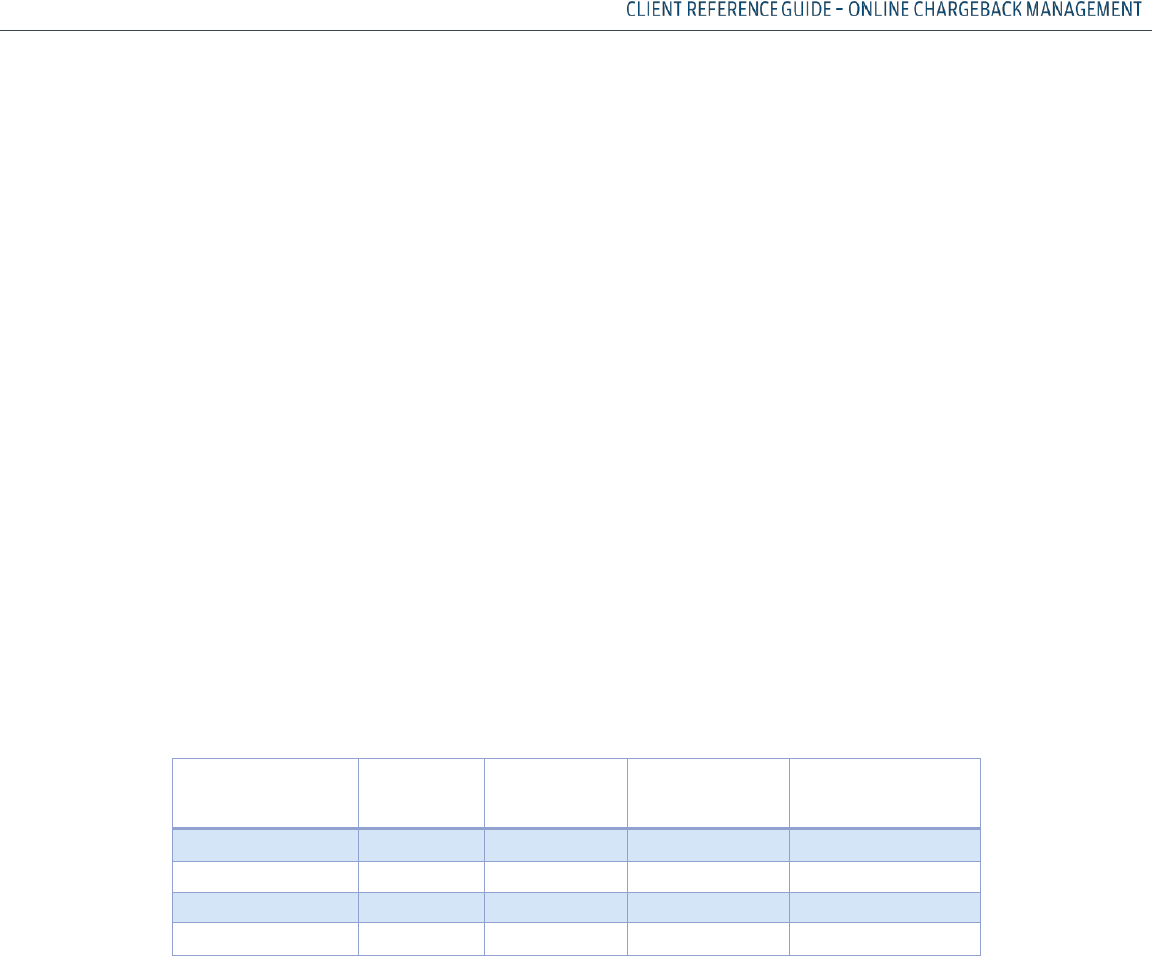

See the table below for document format and size

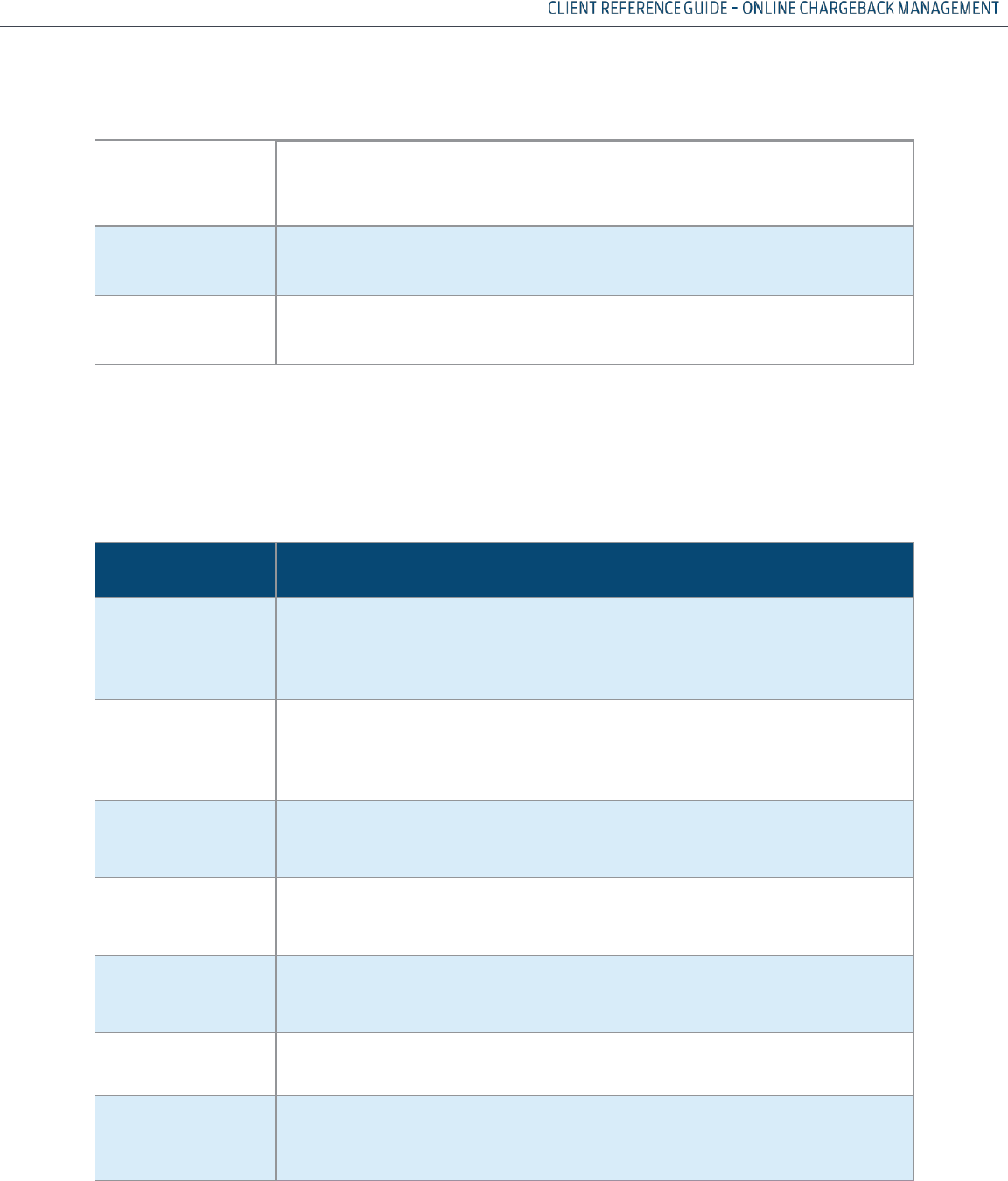

Network

Image

Format

Color Mode

Allowed By

Network

Individual

File Size

Resolution and Dimensions

Visa

.tif

Color, Grayscale,

BW

10 MB

200 X 200; Resolution Unit 2 or 3; 8.64 inches X 14

inches

.pdf

Color, BW

2 MB

200 X 200

Mastercard

.tif

Color, BW

14 MB

300 X 300

.pdf

Color, BW

14 MB

300 X 300

Discover

.tif

Color, Grayscale,

BW

14 MB

200 X 200

.pdf

Color, BW

14 MB

200 X 200

Amex

.tif

BW

1MB

200 X 200; 8.5 inches X 11 inches; CCITT Group IV

TIFF, BW, BitsPerSample 1

.pdf

Color, BW

1MB

200 X 200

1. To take advantage of this feature, you must code to the chargeback multiple document

upload specification.

2. You will receive the E-Image Upload Exception Report (ACT-0062). This report will provide

you with detailed information for exceptions that did not upload correctly to the online

chargeback management system. The report is available daily with prior day exceptions

and can be run on demand.

Merchant Services recommends the DFR version of the PDE-0017 Chargeback Activity

Report, in which data fields can be used to submit documents using the new multiple

document upload functionality.

©2016, Paymentech, LLC. All rights reserved. | commercesolutions.jpmorganchase.com | chasepaymentech.ca | jpmorgancommercesolutions.co.uk |

16

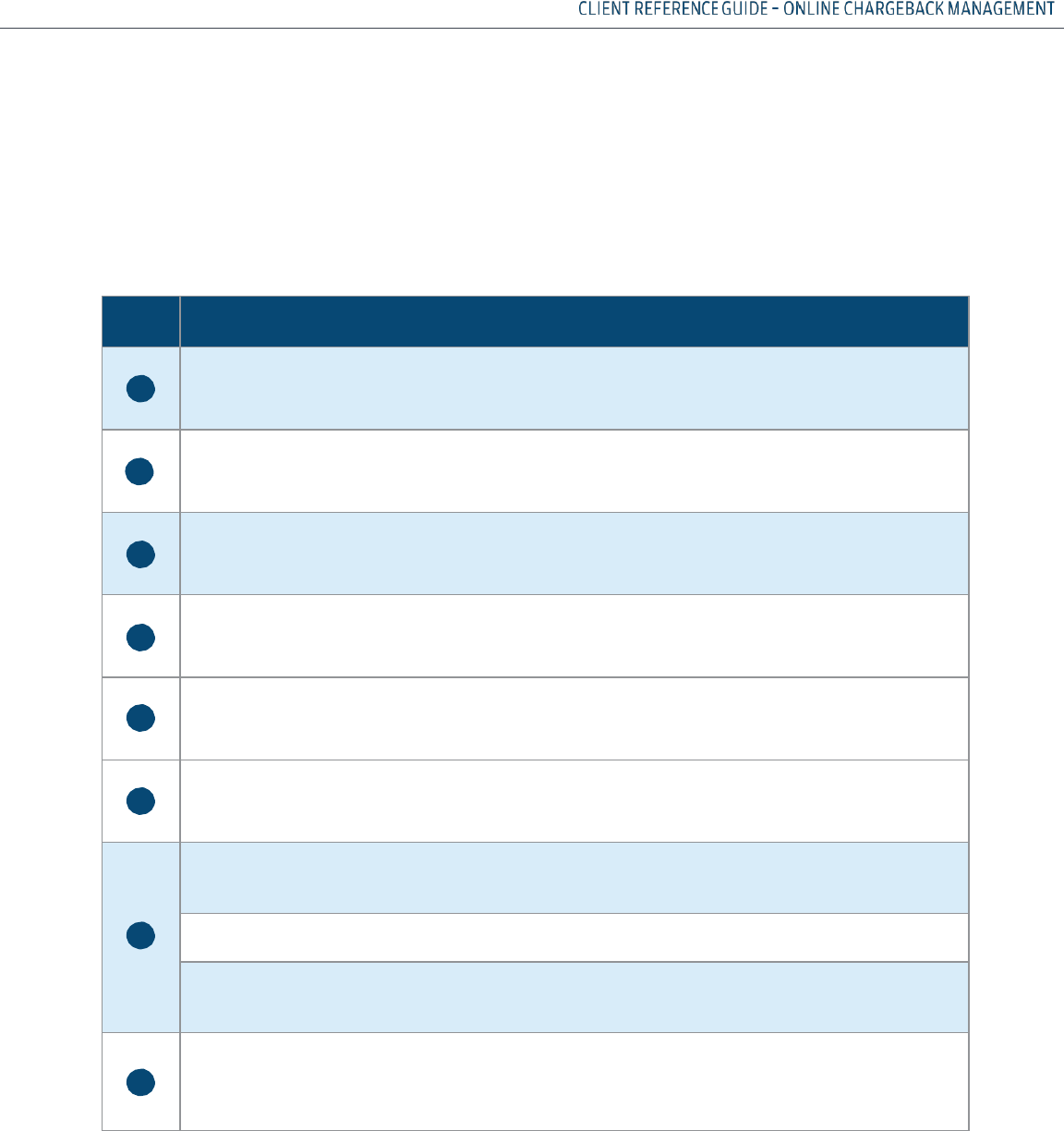

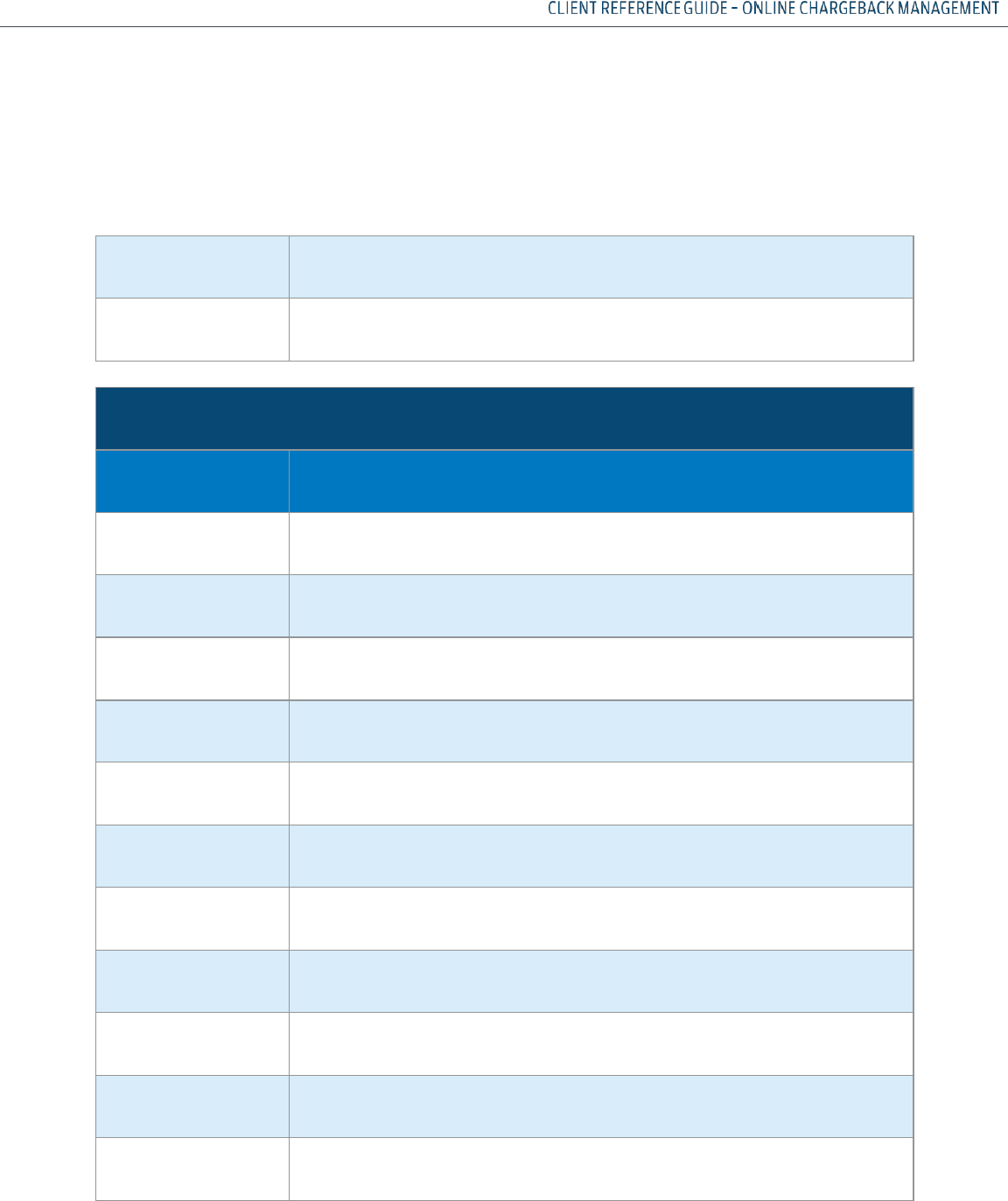

CONTACT ROLES

Client’s contacts that have access to the application are assigned certain roles depending on

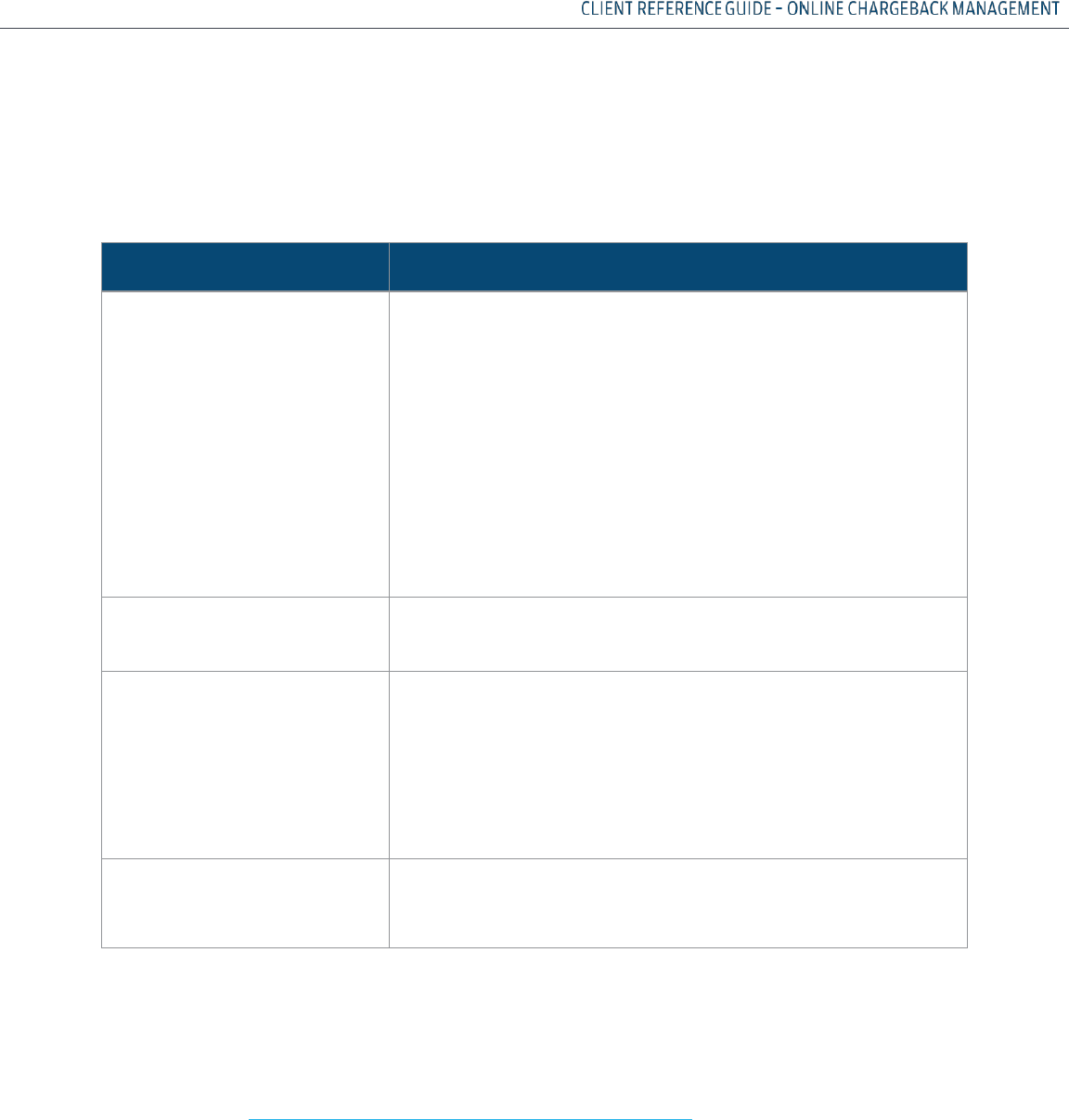

the person’s function in the retrieval and chargeback handling process. The chart below

defines these roles and their functions.

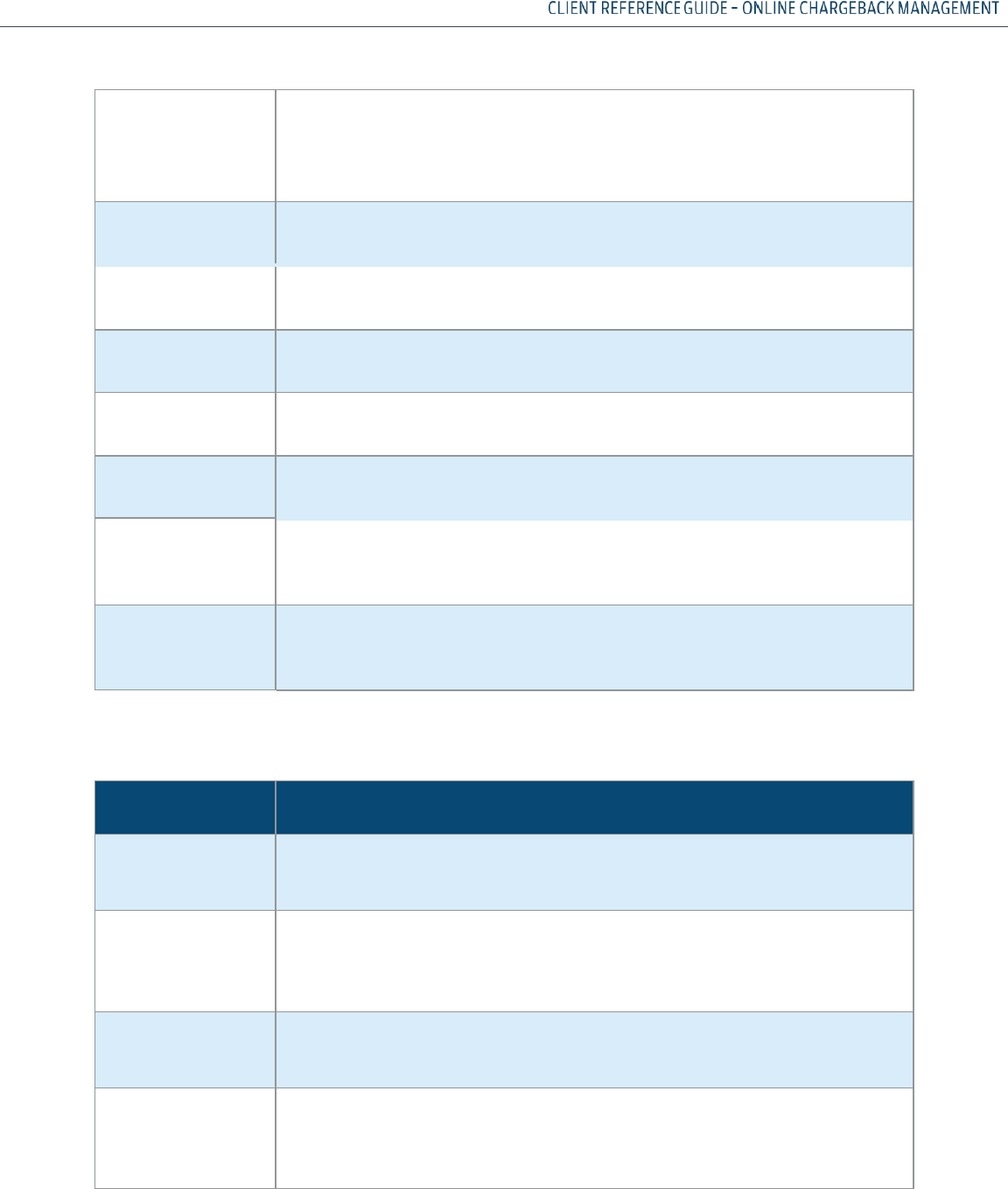

ROLE

DESCRIPTION & FUNCTIONS

Merchant Retrieval Queue

Administrator (MRQA)

• Typically someone in an administrative or supervisory role

who is responsible for distributing the retrieval request

workload

• A contact at the client that assigns retrieval request cases

to the MRA (Merchant Retrieval Analyst) to be worked

• Sets auto-decision rules

If the MRQA wishes to view the Work Queue of a

specific MRA when there are multiple MRAs at a

company, a Retrieval Search must be run using the

specific MRA’s Paymentech Online User ID in the

Merchant Retrieval Analyst

(MRA)

A contact at the client who works and submits the signed sales

drafts for the assigned retrieval request cases

Imaging Queue

Administrator (IQA)

• Typically someone in an administrative or supervisory role

who is responsible for distributing the chargeback

workload

• A contact at the client that assigns chargebacks to the MCA

(Merchant Chargeback Analyst) to be worked

• Sets auto-decision rules

Merchant Chargeback

Analyst

(MCA)

A contact at the client that works and decisions the chargeback

cases assigned to them

Any additions or deletions to the contact roles must be requested by the Executive or

Financial Contact from the client’s office. If you are unsure who fulfills these roles at your

company, please contact Client Services at:

• 1-866-428-4962

• or via email at CPS-Merchant_Services@chasepaymentech.com

If the situation warrants, the same person(s) may be assigned both the MRQA and MRA roles

and IQA and MCA roles

©2016, Paymentech, LLC. All rights reserved. | commercesolutions.jpmorganchase.com | chasepaymentech.ca | jpmorgancommercesolutions.co.uk |

17

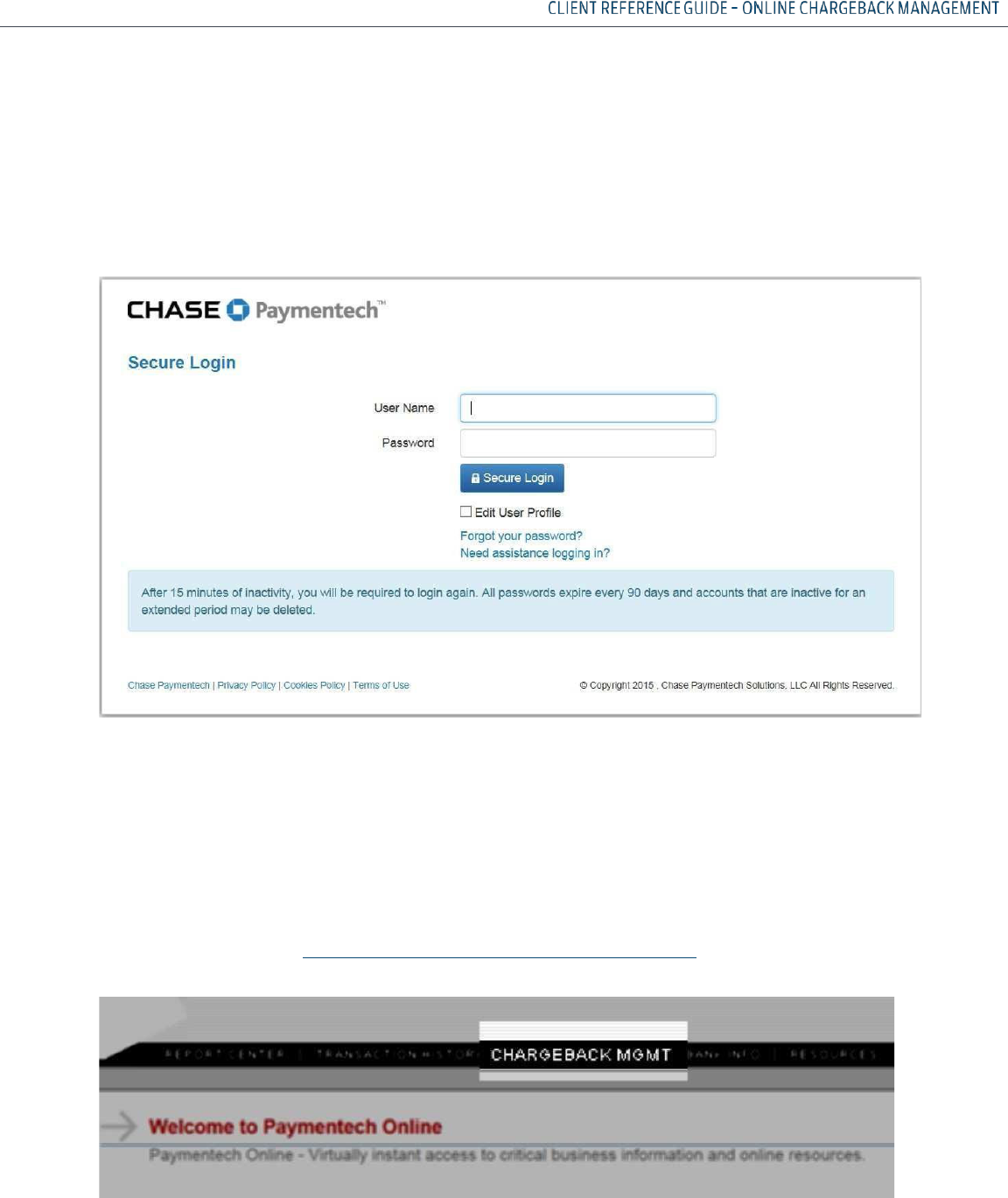

ACCESSING YOUR RETRIEVAL REQUESTS AND CHARGEBACKS

To view and/or work your retrievals and chargebacks, logon to Paymentech Online with your

User ID and Password

Refer to the Paymentech Online User Guide section called “Getting Started” for logon

instructions OR See the Paymentech Online Tutorial for a walk through.

Once you are on the Paymentech Online home page, select the CHARGEBACK MGMT tab on the

Paymentech Online navigation bar.

You MUST have access to the application for this tab to appear. If you do not see this tab, please

contact Client Services at CPS-Merchant_Services@chasepaymentech.com.

©2016, Paymentech, LLC. All rights reserved. | commercesolutions.jpmorganchase.com | chasepaymentech.ca | jpmorgancommercesolutions.co.uk |

18

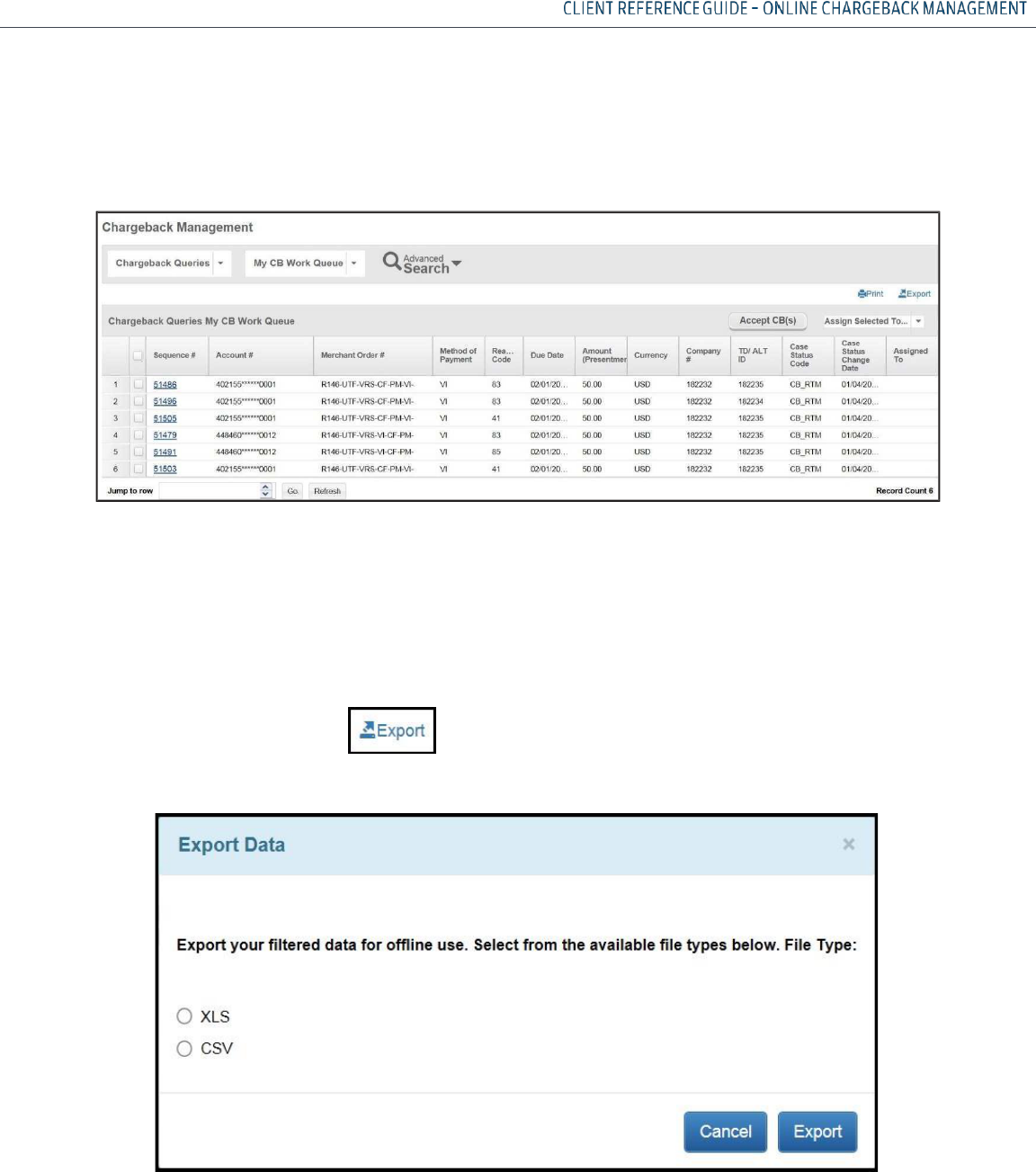

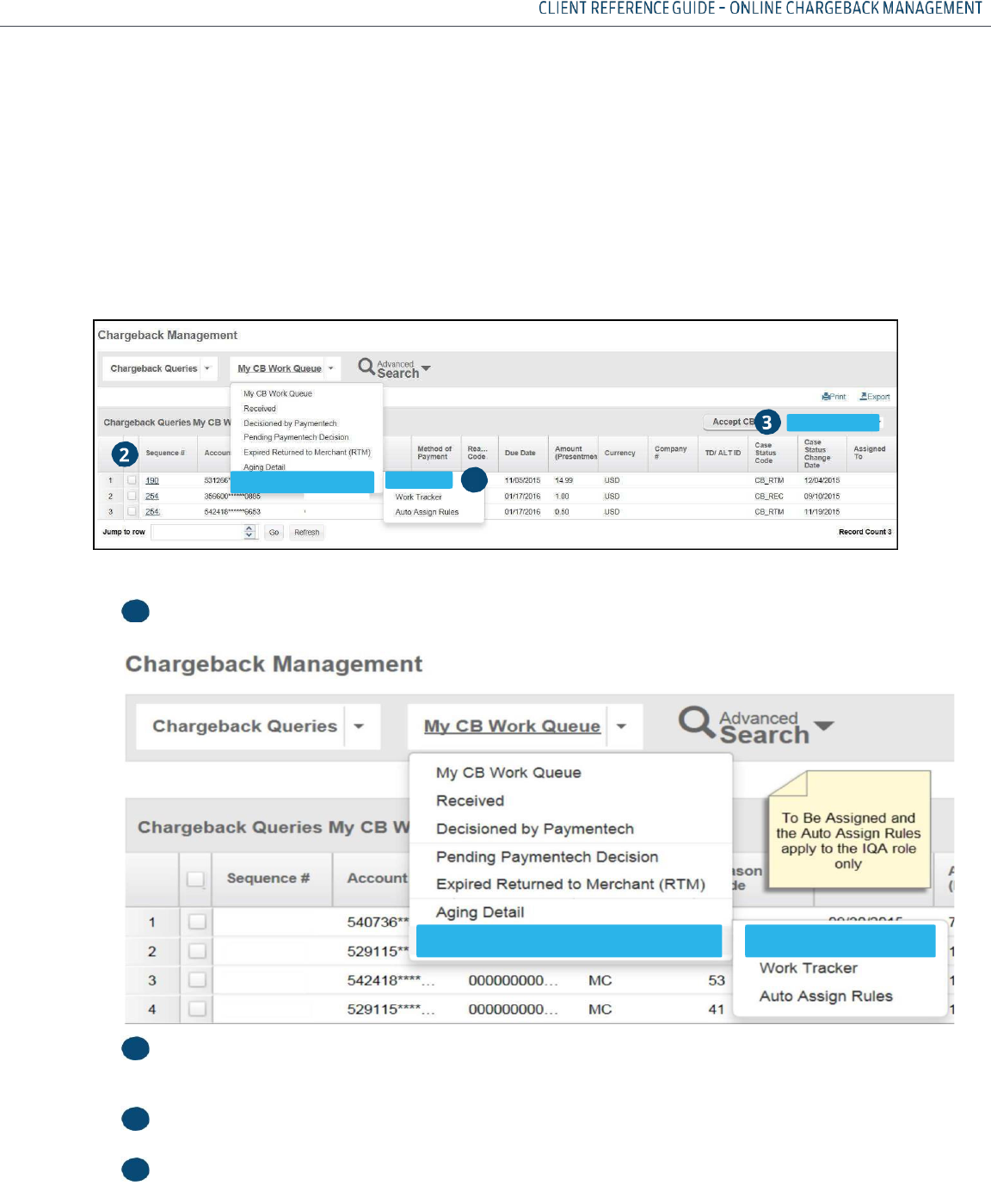

DEFAULT SCREEN

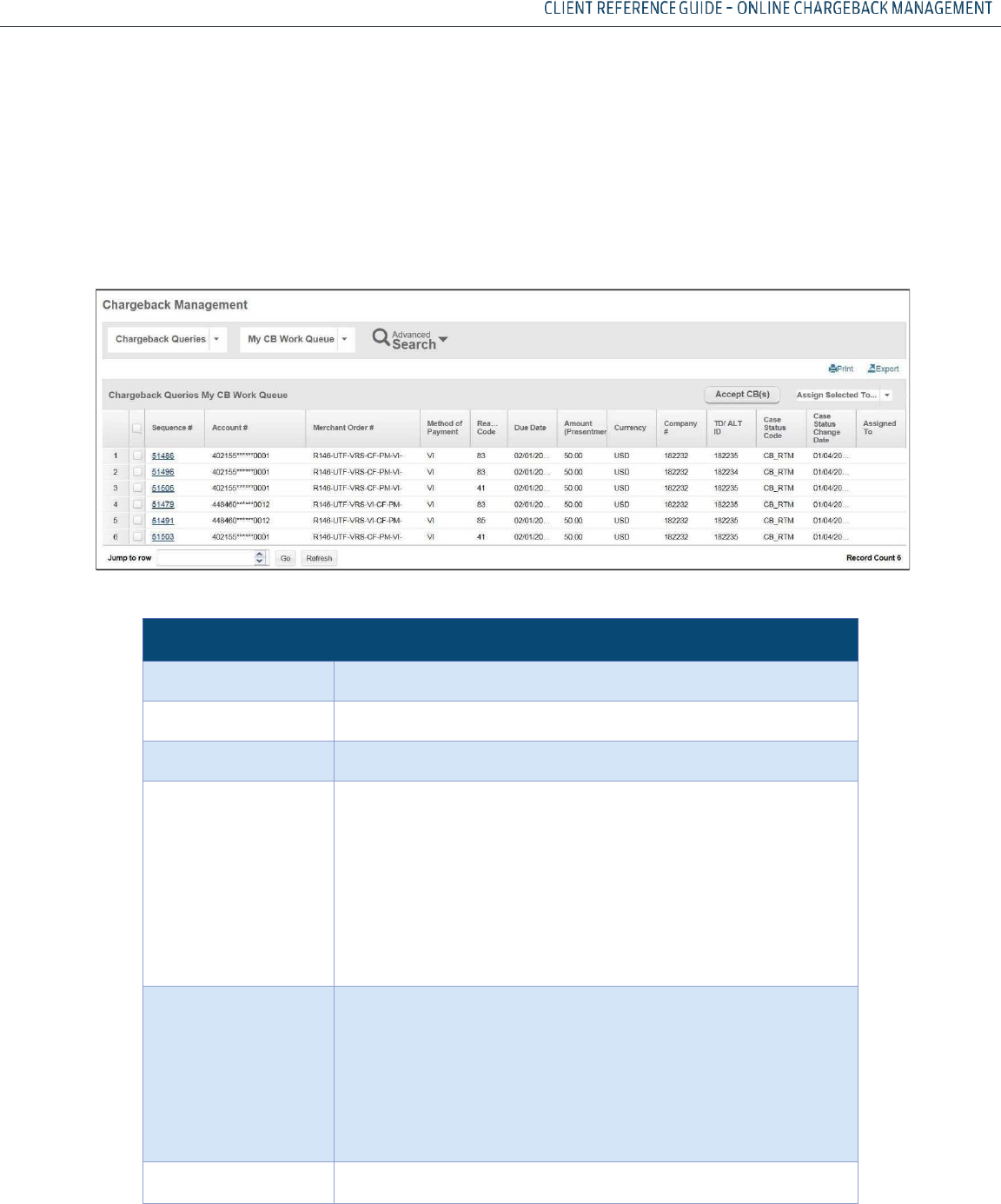

The online chargeback management system default screen is the Chargeback Queries and My CB

Work Queue Query for all contact roles.

If there are already assigned cases in the MCA’s or MRA’s work queue, the Level 1 data will display

upon log on by either contact role.

EXCEL AND CSV DOWNLOAD

Where you see this symbol on your screen is a place where you can download the

information that you see on the screen into an Excel spreadsheet or CSV file.

©2016, Paymentech, LLC. All rights reserved. | commercesolutions.jpmorganchase.com | chasepaymentech.ca | jpmorgancommercesolutions.co.uk |

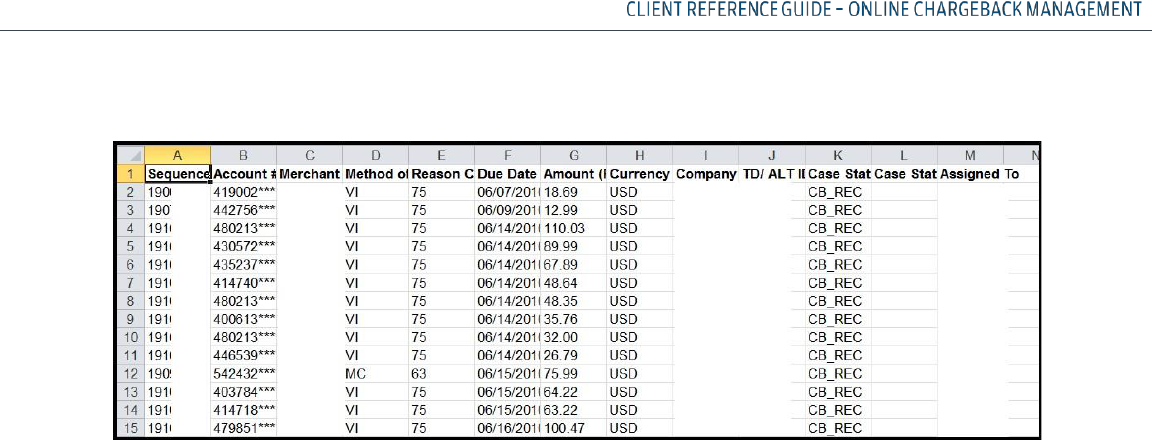

19

The spreadsheet that you download into Excel will have all of the information in the same

columns as the Level 1 screen but now you are able to manipulate it as you need to reconcile

your company records to the information we have provided.

This is a great way to keep track of chargebacks that you have won!

©2016, Paymentech, LLC. All rights reserved. | commercesolutions.jpmorganchase.com | chasepaymentech.ca | jpmorgancommercesolutions.co.uk |

20

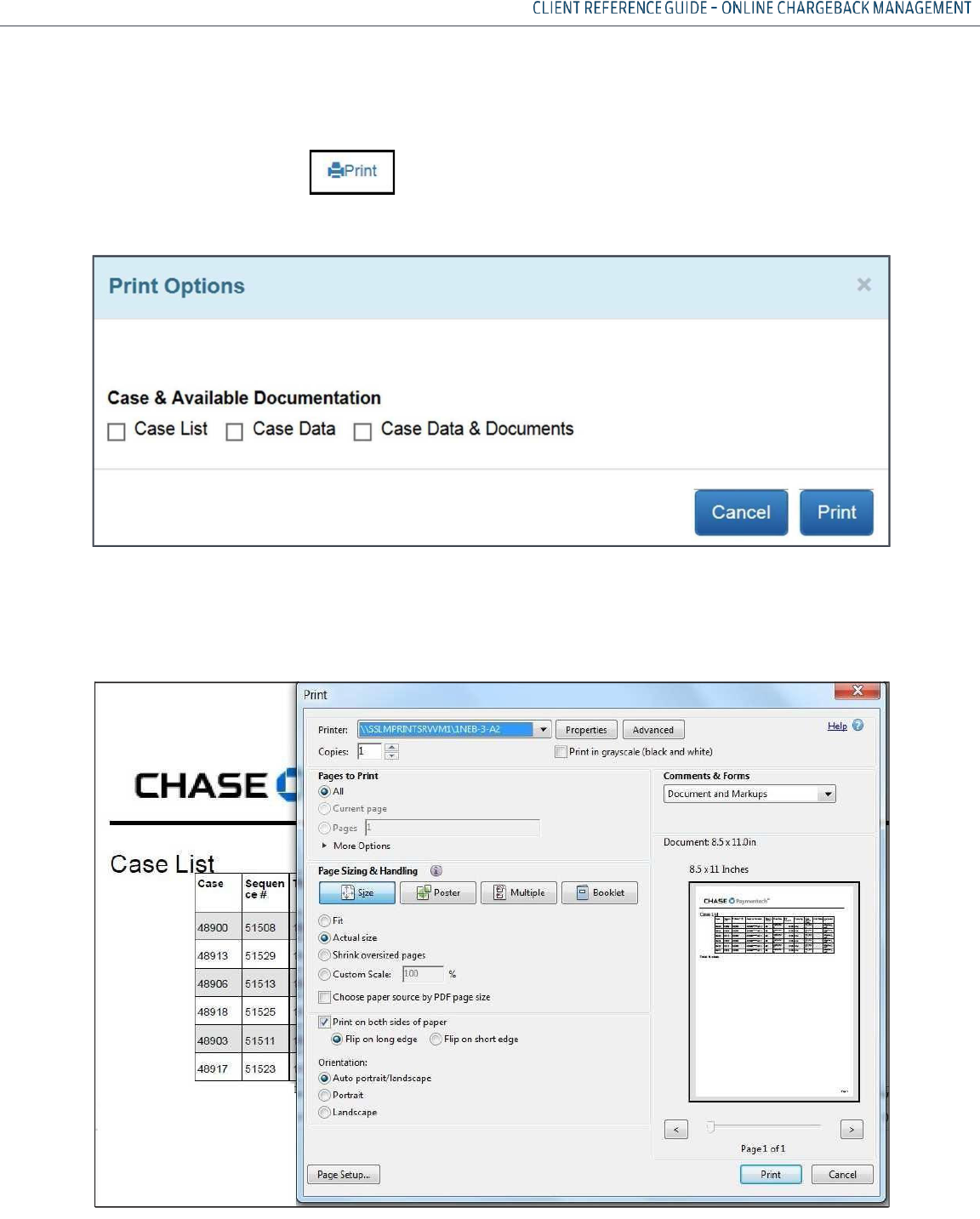

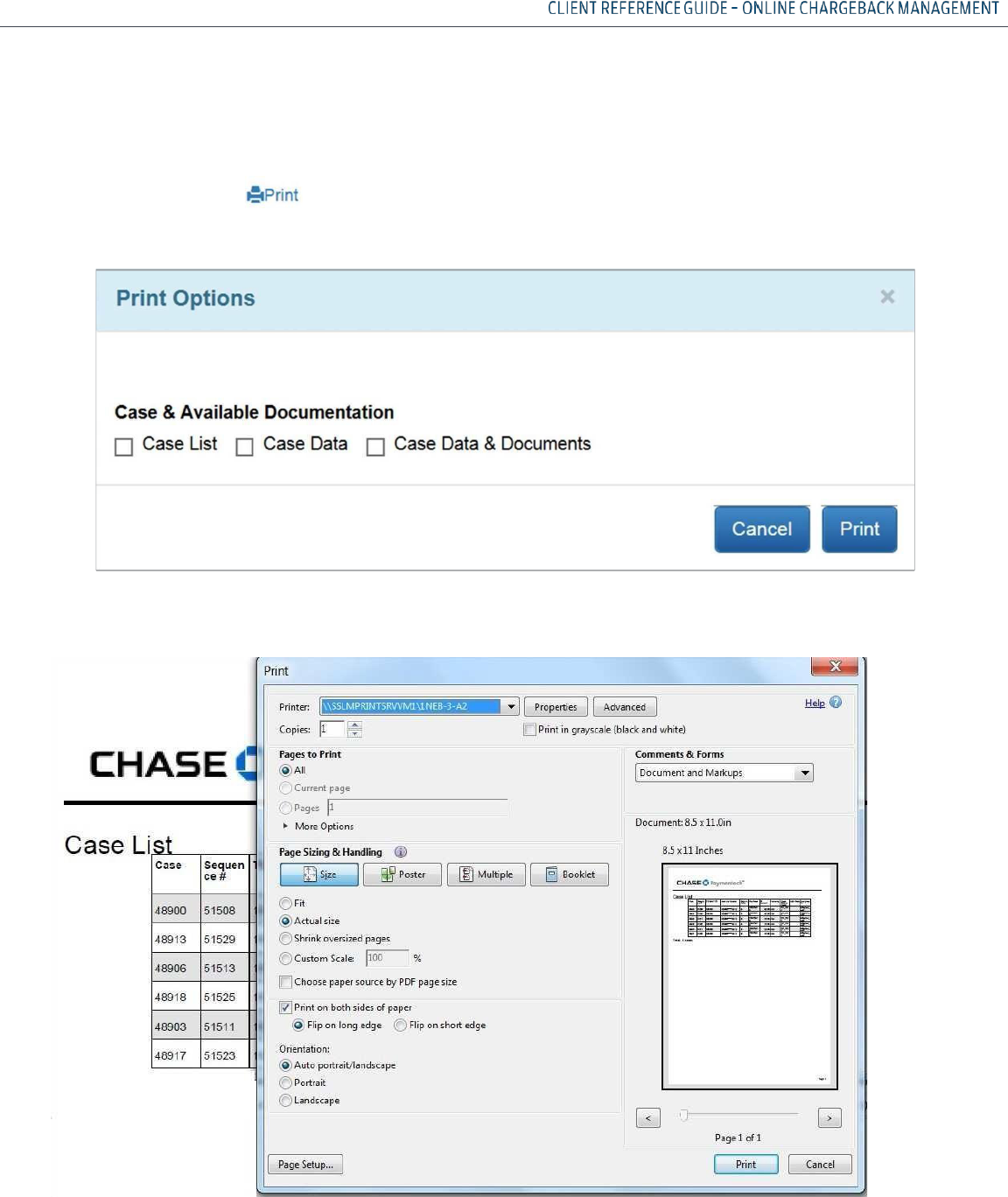

PRINT DOWNLOAD

Where you see this symbol on your screen is a place where you can print and download

Case List, Case Data, and Case Data and Documents in PDF format.

Once you make a selection you will receive a pop-up window for printing documents. The data

selected to print will appear in the background. You will also see a default Print screen.

©2016, Paymentech, LLC. All rights reserved. | commercesolutions.jpmorganchase.com | chasepaymentech.ca | jpmorgancommercesolutions.co.uk |

21

RETRIEVAL REQUESTS

©2016, Paymentech, LLC. All rights reserved. | commercesolutions.jpmorganchase.com | chasepaymentech.ca | jpmorgancommercesolutions.co.uk |

22

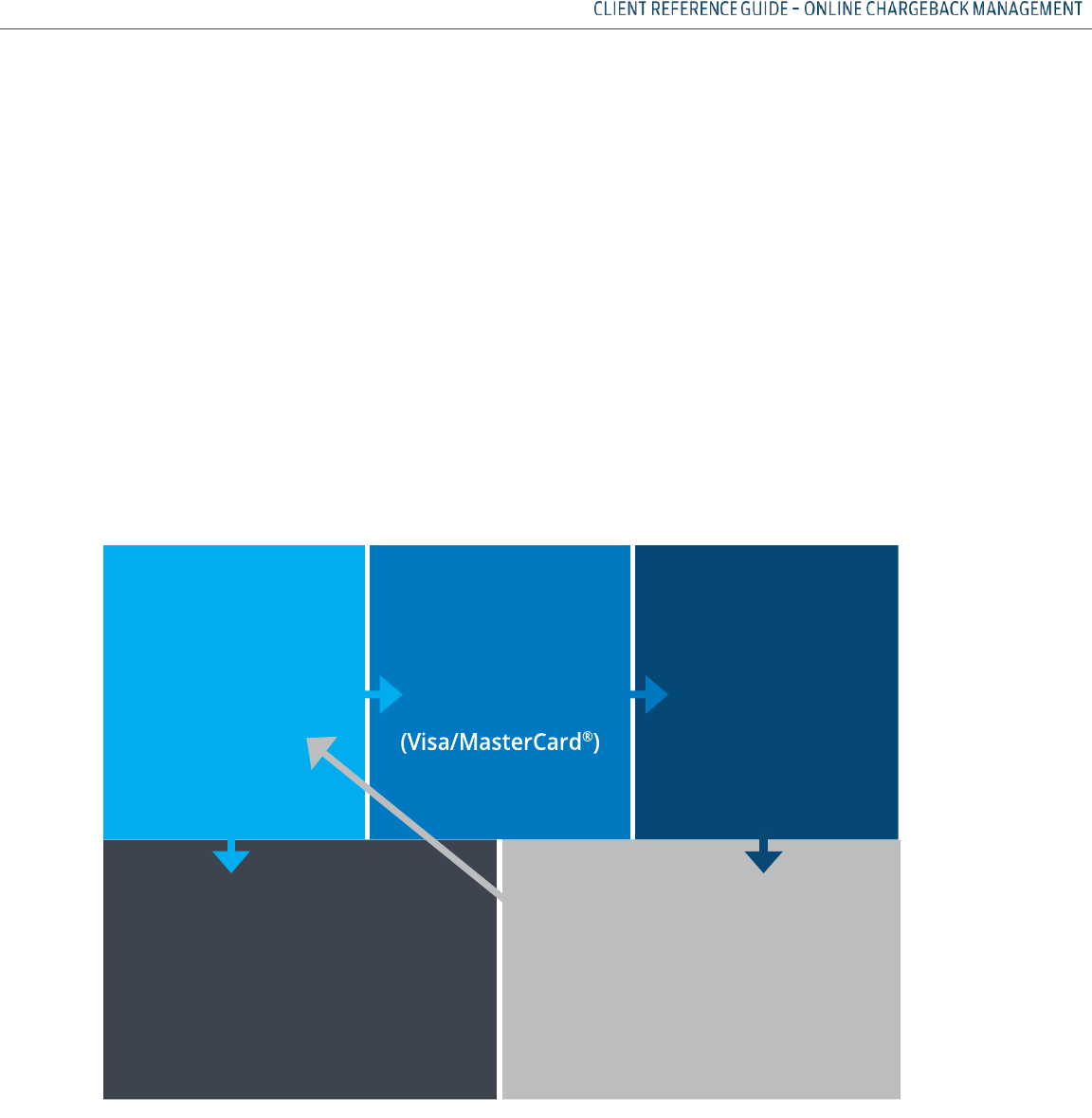

PROCESSING FLOW

OVERVIEW

A retrieval request asks for additional information for an item appearing on a cardholder’s

billing statement. The additional information is requested by an Issuer usually on behalf of a

cardholder. Requests are identified by specific Retrieval Reason Codes.

In all networks, Issuers have the right to initiate a chargeback if the response to a retrieval request

is not timely or the information received is not legible or valid or the cardholder disputes the

charge after viewing the retrieval fulfillment.

VISA AND MASTERCARD

®

CARD-NOT-PRESENT RETRIEVAL REQUEST PROCESSING FLOW

The processing flow for a VISA and MasterCard

®

retrieval request for a card-not-present transaction

is illustrated below:

1. Issuer transmits the retrieval request electronically to Merchant Services

2. Incoming request is matched to the original sale transaction information stored in our Transaction

History database

3. Facsimile of the stored information is created and sent electronically to the Issuer within 2-3

business days

4. Issuer contacts the cardholder with the additional description

Issuer

sends

retrieval

request

Transaction

flows

through

Interchange

Merchant Services

receives

retrieval

request

Merchant Services

receives

chargeback

if

cardholder

continues

dispute

Merchant Services

captures

information

in

the

database;

attaches

descriptive

info;

retrieval

requests

are

returned

to

the

Issuer

within

2

-

3

business

days

©2016, Paymentech, LLC. All rights reserved. | commercesolutions.jpmorganchase.com | chasepaymentech.ca | jpmorgancommercesolutions.co.uk |

23

5. Cardholder either agrees to accept the charge or to continue the dispute, at which point a

chargeback is initiated

DISCOVER CNP PROCESSING FLOW

The processing flow for a Discover Retrieval Request for a card-not-present

transaction is illustrated below:

1. Discover Network transmits the retrieval request electronically to Merchant Services

2. Incoming request is matched to the original sale transaction information stored in our Transaction

History database

3. Merchant Services captures the information and notifies the client via the Retrieval Activity (PDE-

0029) Report and opens a case in the online chargeback management system

4. Client sends copy of supporting documentation electronically to their Chargeback Analyst by the

Response Due Date (21 days)

5. If no response is received at Merchant Services by day 25, a facsimile of the stored information is

created and sent electronically to the Issuer

6. Issuer contacts the cardholder with the additional information

Discover

Network

Issuer

transmits

a

retrieval

request

Merchant Services

receives

the

retrieval

request

Merchant Services

captures

information

in

the

database,

notifies

the

client

on

the

Retrievals

Received

(

PDE

-

0029)

Report

Issuer

contacts

the

Cardholder

Cardholder

either

agrees

to

accept

or

initiate

a

chargeback

Merchant

Services

sends

information

from

the

client

or

stored

information

from

the database

to

Issuer

Client

sends

copy

of

supporting

documentation

electronically

to

the

CB

analyst

©2016, Paymentech, LLC. All rights reserved. | commercesolutions.jpmorganchase.com | chasepaymentech.ca | jpmorgancommercesolutions.co.uk |

24

7. Cardholder either agrees to accept the charge or to continue the dispute, at which point a

chargeback is initiated

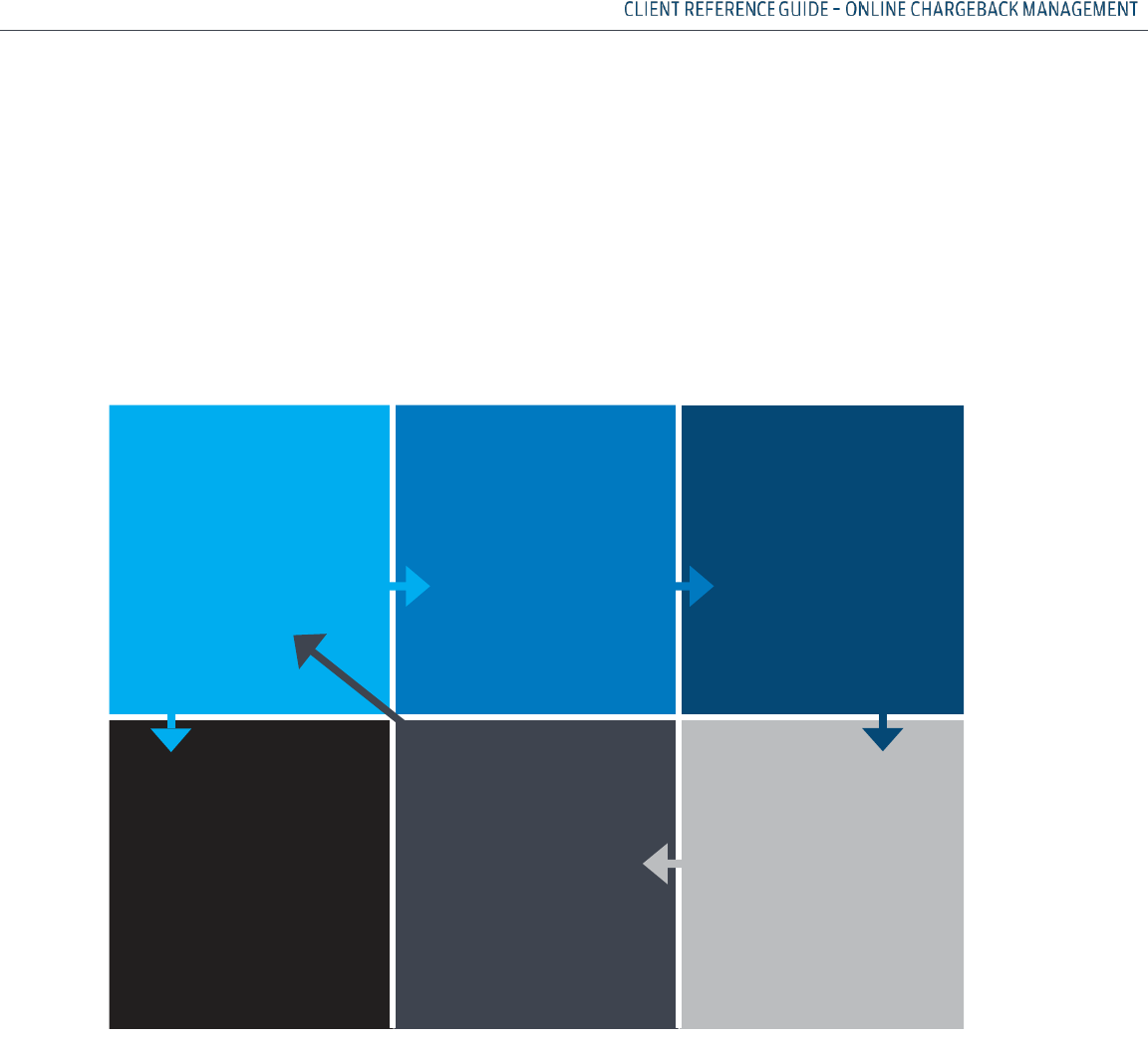

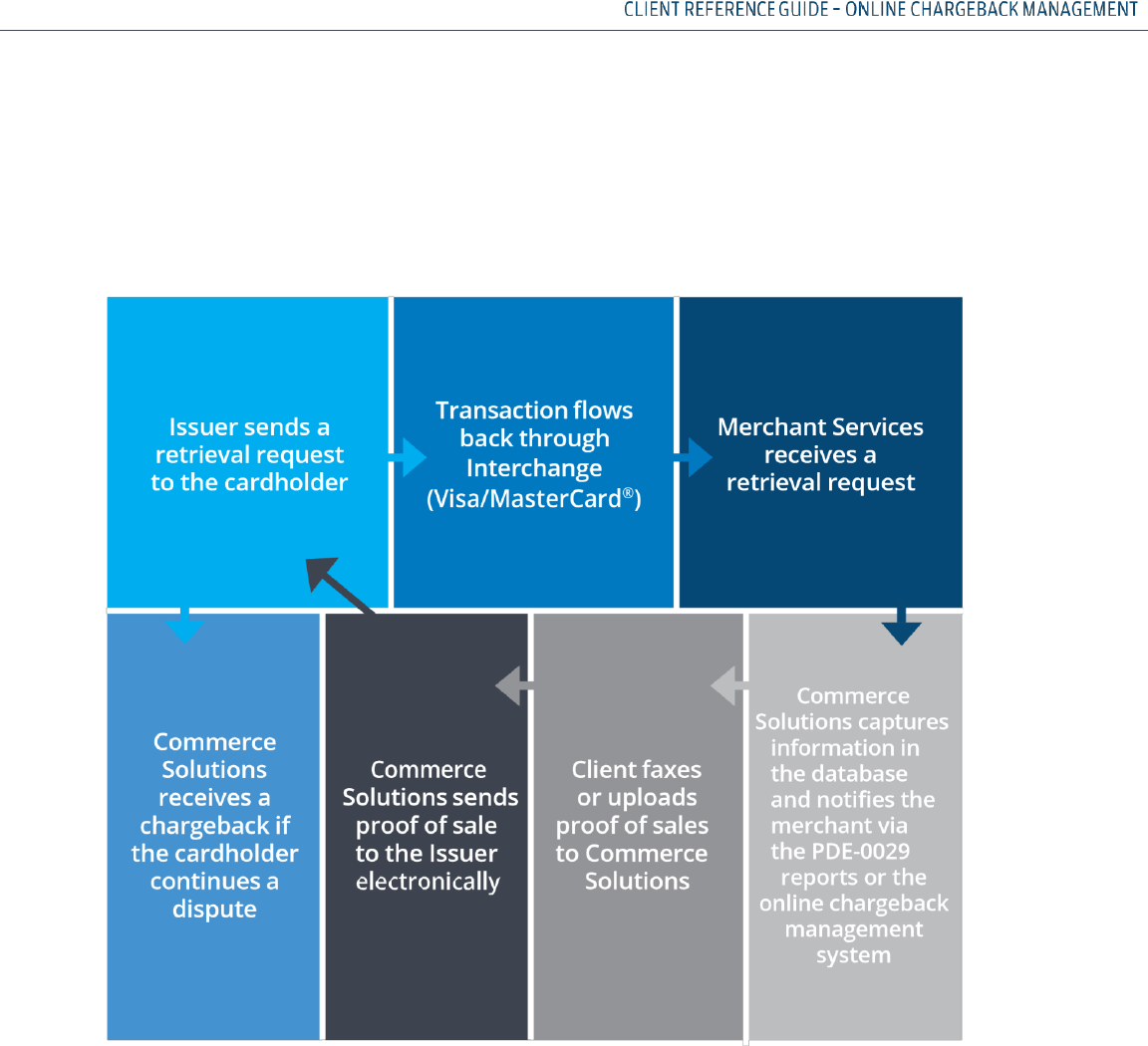

RETAIL RETRIEVAL REQUEST PROCESSING FLOW

The processing flow of a retrieval request for a retail transaction is illustrated below:

1. Issuer transmits the retail retrieval request electronically to Merchant Services

2. Incoming request is matched to the original sale transaction information stored in our Transaction

History database

3. Merchant Services captures the information in the database and notifies the client via the Retrieval

Activity (PDE-0029) Report and opens a case in the online chargeback management system

4. Merchant sends copy of sales slip (or other proof of sale) electronically to their Chargeback Analyst

by the Response Due Date

5. Response is sent to Issuer

6. Issuer notifies cardholder

©2016, Paymentech, LLC. All rights reserved. | commercesolutions.jpmorganchase.com | chasepaymentech.ca | jpmorgancommercesolutions.co.uk |

25

7. Cardholder either agrees to accept the charge or to continue to dispute it, at which point a

chargeback is initiated

RESPONDING TO A RETRIEVAL REQUEST

RETAIL MERCHANTS:

• Obtain proper documentation at the time of sale

• Retain copies of transaction documents:

• VISA – minimum of 13 months

• MasterCard

®

– minimum of 13 months

• Discover – minimum of 36 months

• Develop efficient document storage to maximize retrieval of sales slips

• Respond to retrieval requests within the 21-day time frame

• Card associations require imprint or CVV2 (Visa)/CVC2(MC) be sent in the authorization record if the

mag-stripe cannot be read

ALL MERCHANTS:

• Ensure your merchant descriptor contains a recognizable merchant name, location and/or

customer service telephone number.

Please respond to a retrieval request even if you have already

issued a credit. Include a note or comment that you have issued a

credit in your response.

©2016, Paymentech, LLC. All rights reserved. | commercesolutions.jpmorganchase.com | chasepaymentech.ca | jpmorgancommercesolutions.co.uk |

26

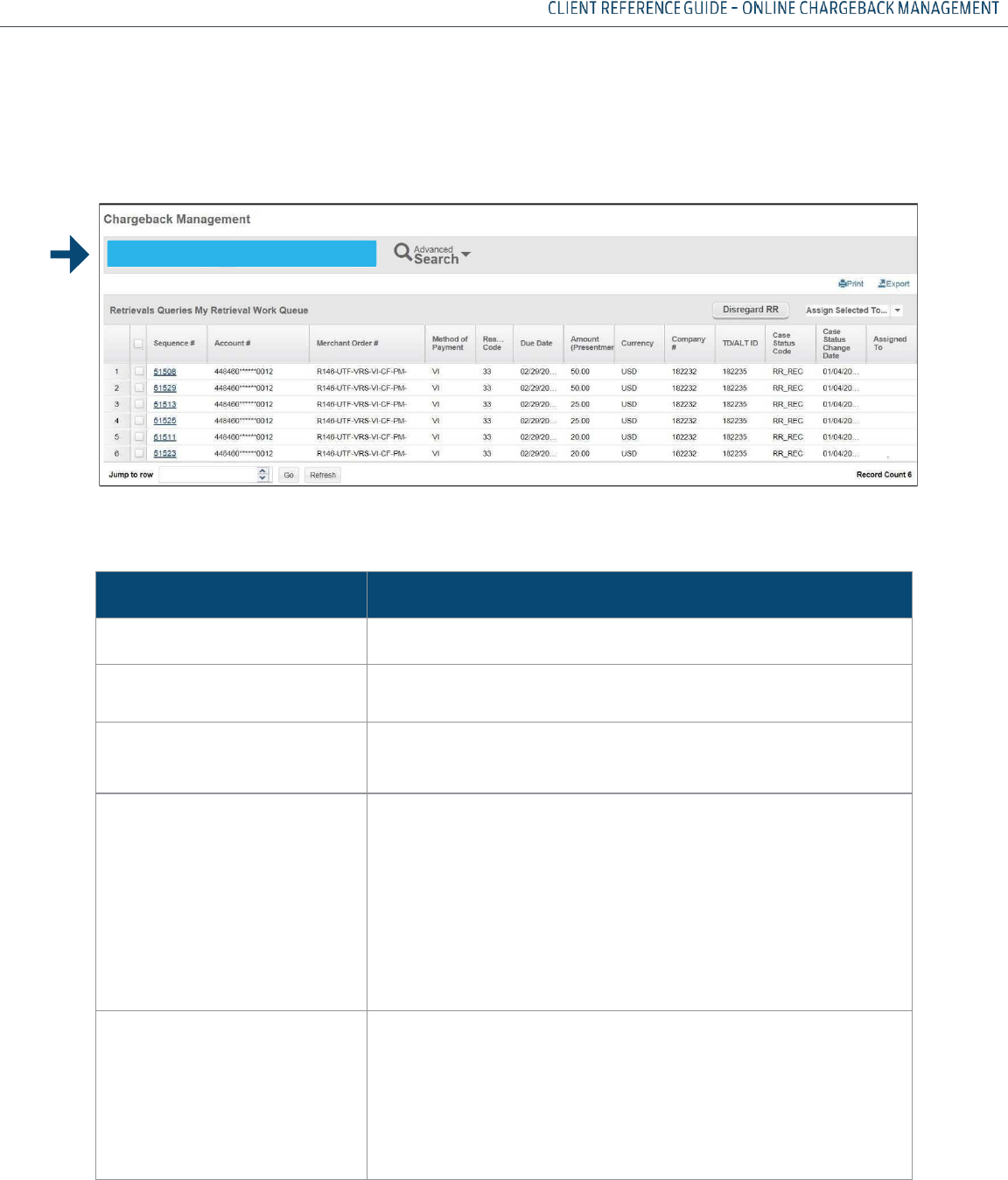

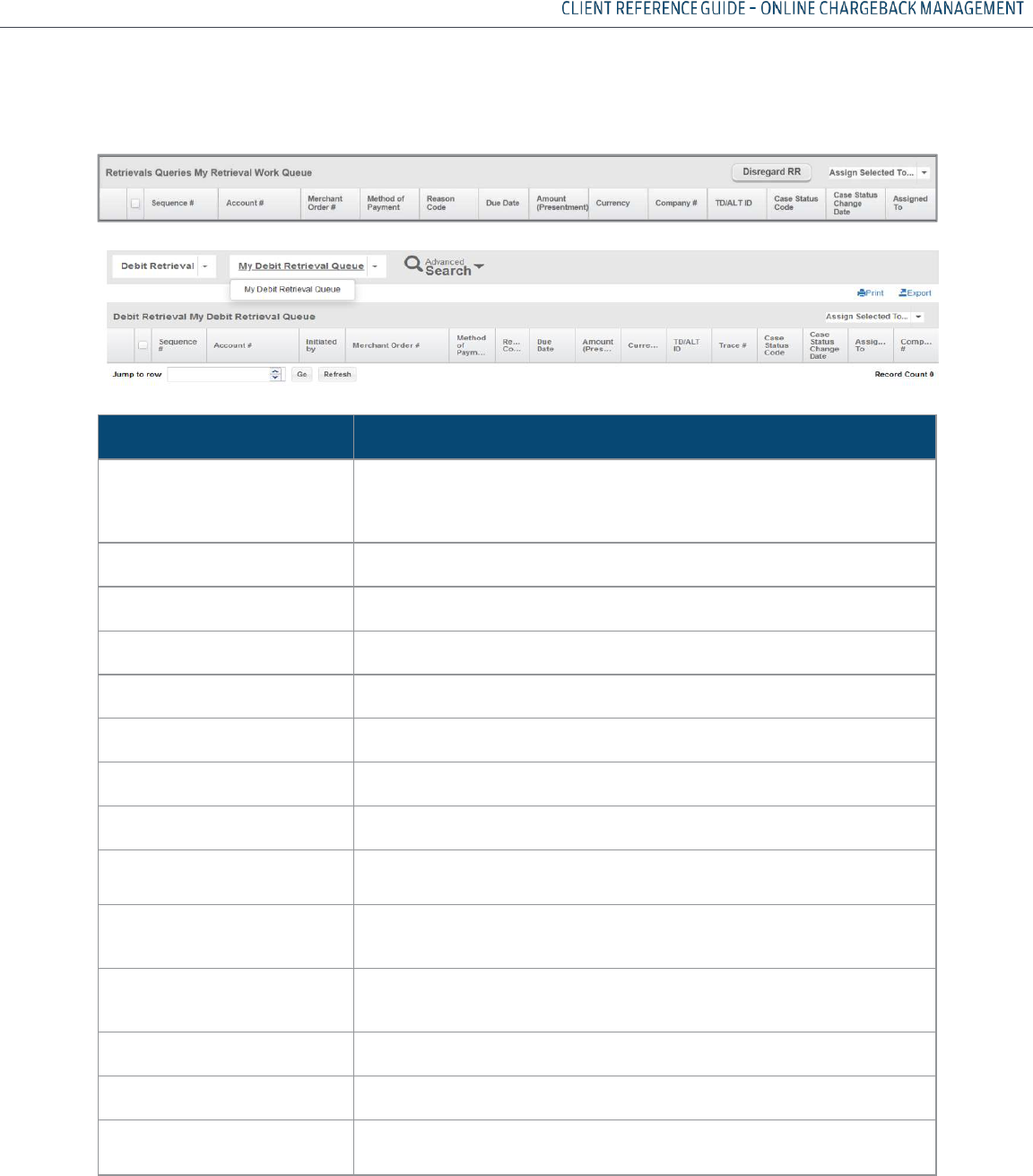

QUERY RESULT SCREEN COMPONENTS

LEVEL 1 DATA – FUNCTIONAL COMPONENTS

Queries run by either the MRQA or MRA will result in Level 1 data being displayed if there is data for

the query selected.

The functional and informational components on the Level 1 data screen include:

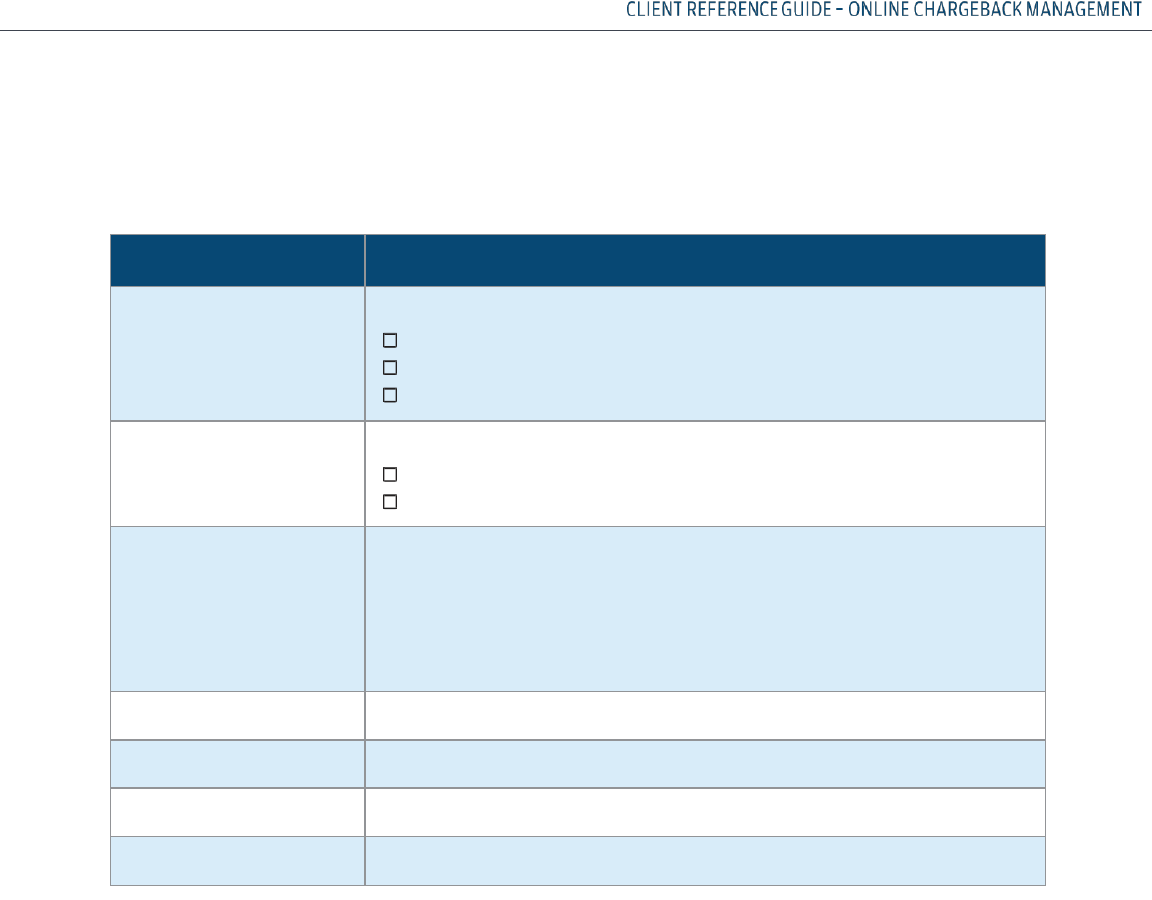

COMPONENT

DESCRIPTION

Retrieval Queries

Main menu for Retrievals based on role

My Retrieval Work

Queue

Secondary menu of available queries to run based on role

Run Query dropdown

selection box

Use to select or de-select all cases listed in the query

results

Menu of available

queries MRQA view:

My Retrieval Work Queue

Received

Decisioned by Merchant Services

Pending Merchant Services Decision

Management Queries

To Be Assigned

Work Tracker

Auto Assign Rules

Menu of available

queries MRA view:

My Retrieval Work Queue

Received

Decisioned by Merchant Services

Pending Merchant Services Decision

Management Queries

Work Tracker

©2016, Paymentech, LLC. All rights reserved. | commercesolutions.jpmorganchase.com | chasepaymentech.ca | jpmorgancommercesolutions.co.uk |

27

LEVEL 1 DATA – FUNCTIONAL COMPONENTS, CONTINUED

COMPONENT

DESCRIPTION

Print Options

Menu of available print options:

n Case List

Case Data

n Case Data & Documents

Export Options

Menu of available export options:

n XLS n

CSV

Assign Selected To

dropdown

Menu of User IDs for contacts assigned the MRA Role at your

company. For example:

aname

jdoe

gtravel

Available Actions

Option to Disregard Retrieval Request is listed

Record Count

Total number of cases returned in the query

Jump to Row (GO)

Allows user to select and move to a row within Level 1

Refresh

Resets the screen to the original default screen

©2016, Paymentech, LLC. All rights reserved. | commercesolutions.jpmorganchase.com | chasepaymentech.ca | jpmorgancommercesolutions.co.uk |

28

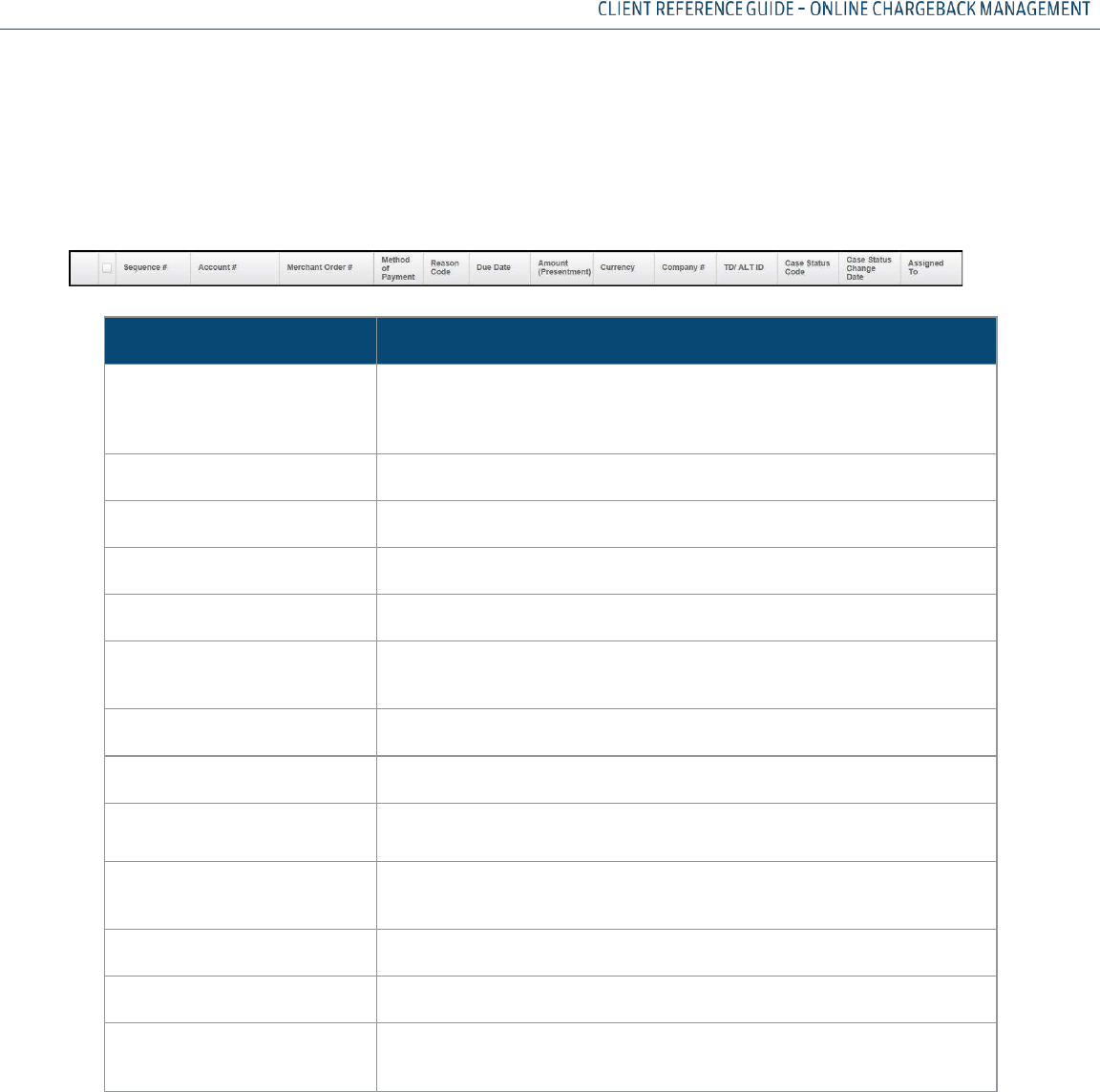

LEVEL 1 DATA– INFORMATIONAL COMPONENTS

The column headings that appear on the query results screen are described below.

COLUMN NAME

DESCRIPTION

Sequence #

Unique identifying number assigned by Merchant Services to the

retrieval request. There may be more than one case associated with a

retrieval but only one sequence # associated with a case

Account #

Credit card number

Merchant Order #

Merchant-assigned identifier

Method of Payment Code

Code indicating what Method of Payment was used in the transaction

Reason Code

Code representing the reason for the retrieval request

Due Date

Date by which the merchant must respond to the retrieval request

Amount (Presentment)

Amount of the retrieval request

Currency

Currency type designator

Company #

Identification of the Company under which the transaction was

processed

TD/ALT ID

Transaction division number under which the transaction was

processed or the Alternate ID used by some companies

Trace # (if debit RR)

A number assigned by the debit network associated to a transaction

Case Status Code

Current status of the case (See Appendix A)

Case Status Change Date

Date the current status was applied to the case

Assigned To

Merchant Retrieval Analyst (MRA) assigned to the case (blank if

unassigned)

©2016, Paymentech, LLC. All rights reserved. | commercesolutions.jpmorganchase.com | chasepaymentech.ca | jpmorgancommercesolutions.co.uk |

29

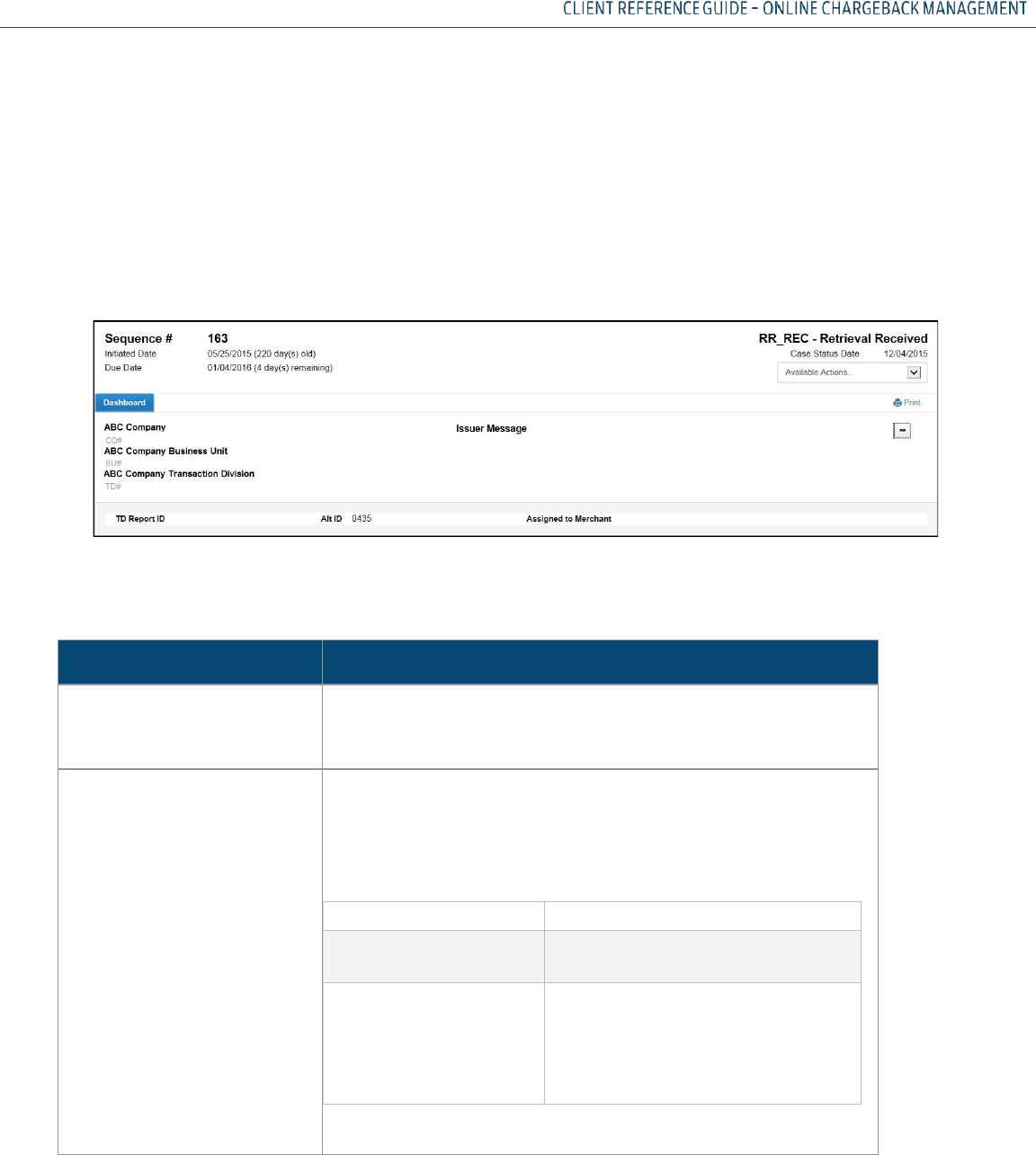

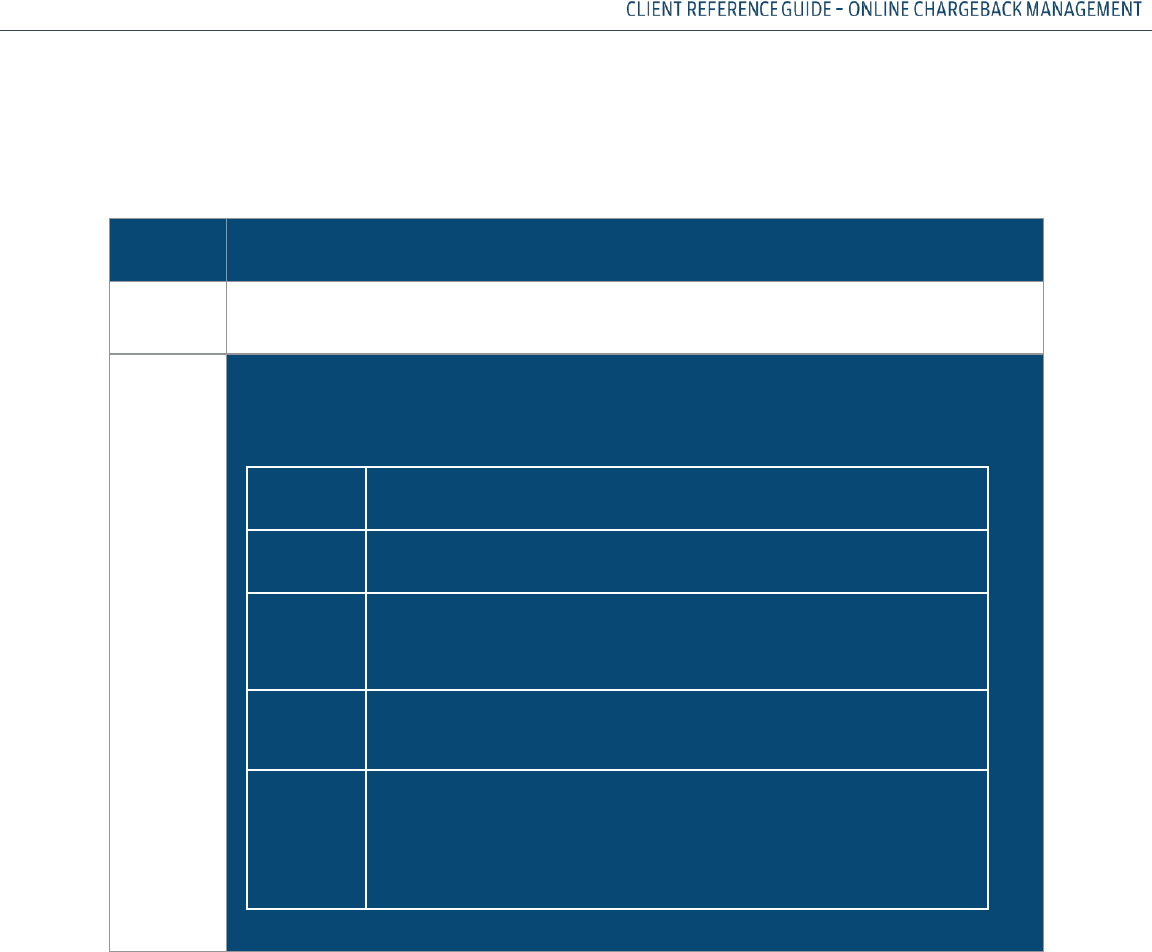

LEVEL 2 DATA – FUNCTIONAL COMPONENTS

The Level 2 level or Case Information screen contains the following:

• Print and Available Actions buttons

• Company information CO, BU and TD name and number, Issuer Message, Report ID, Alt ID #,

Assigned To Merchant (if any)

• Case details, Sequence #, Initiated Date, Due Date, Case Status Code and Case Status Date

The following functionality is available:

COLUMN NAME

DESCRIPTION

Print Option

Used by both MRQAs and MRAs - select the appropriate option

from the pull down menu to create a PDF version of the

requested information and print

Available Actions

Used by MRA - to respond to the retrieval, select the appropriate

option. This action will change the Status and update the Case

Status Change Date of the case. Only those actions allowed by

your security access and those actions appropriate to the status

code of the case will be displayed

Choose...

When you want to...

Disregard Retrieval

Request

Accept the case

Request Fulfill

Request Merchant Services to fulfill

the retrieval by forwarding the

uploaded documentation to

Merchant

Services

©2016, Paymentech, LLC. All rights reserved. | commercesolutions.jpmorganchase.com | chasepaymentech.ca | jpmorgancommercesolutions.co.uk |

30

LEVEL 2 DATA– INFORMATIONAL COMPONENTS

Details relating to the case appear below the header on the Dashboard Information screen:

• Company Number

• Business Unit Number

• Transaction Division Number

• Issuer Message

• + or - Sign to See TD Report ID, Alt ID, Assigned to Merchant User

• Retrieval Info

• Original Transaction Info

• Authorization Info

• Documentation

• Event History

• Related Transactions

The Retrieval Info, Original Transaction Information and Authorization Info all have a “Load

More” link that when clicked will expand the window with additional detail. An example of the

“Load More” information screen is displayed on the next page:

©2016, Paymentech, LLC. All rights reserved. | commercesolutions.jpmorganchase.com | chasepaymentech.ca | jpmorgancommercesolutions.co.uk |

31

LEVEL 2 DATA– INFORMATIONAL COMPONENTS, CONTINUED

©2016, Paymentech, LLC. All rights reserved. | commercesolutions.jpmorganchase.com | chasepaymentech.ca | jpmorgancommercesolutions.co.uk |

32

WORKING RETRIEVALS - THE MRQA ROLE

MRQA OPTIONS

The MRQA has the following options in the online chargeback management system:

• Assigning Retrieval cases to MRAs to be worked

• Creating rules for auto-accepting and auto-assigning cases

• Running Retrieval Request Queries

If the MRQA also has the MRA role assigned to them, they have all the MRA options

available in addition to those listed above.

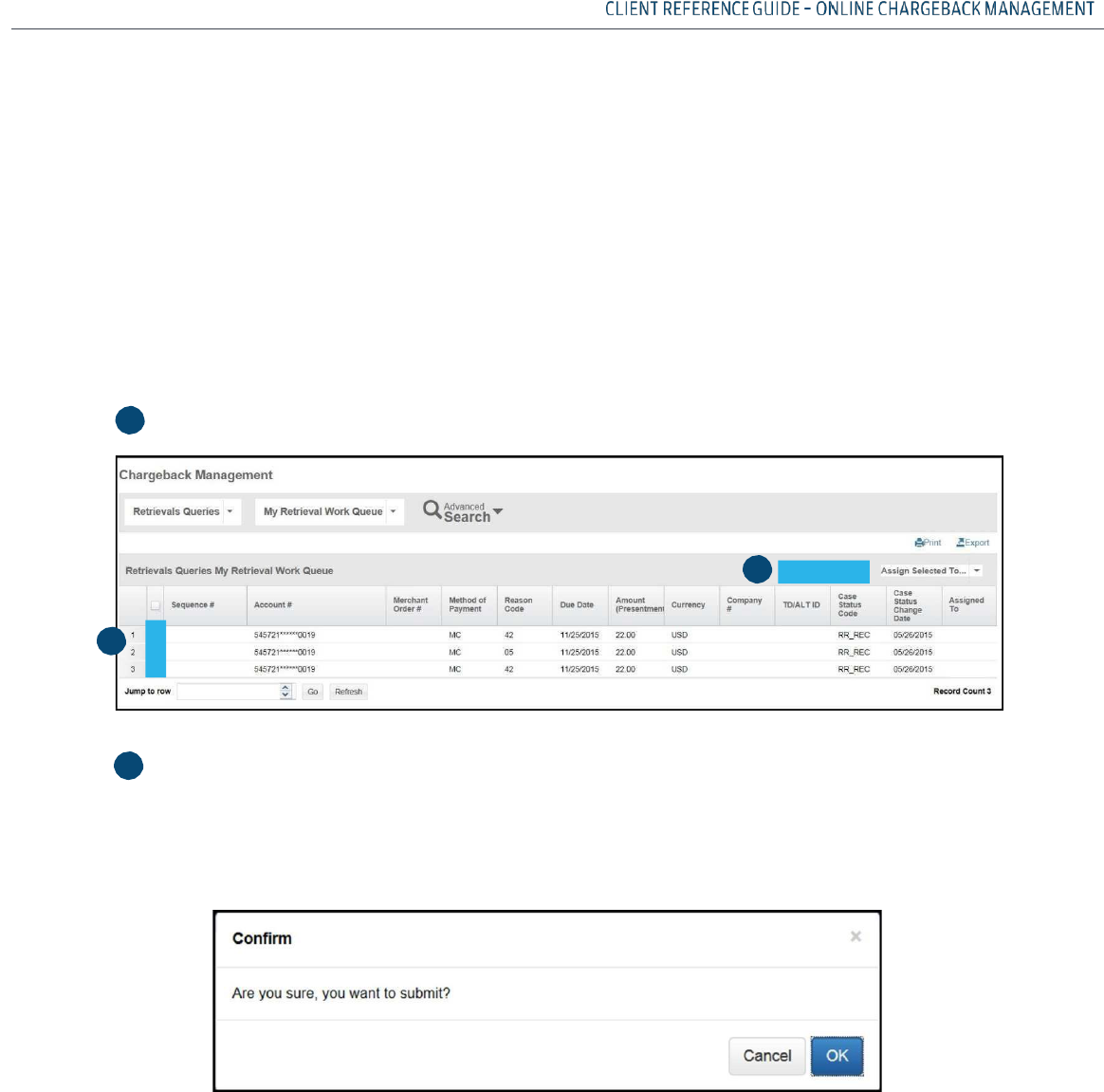

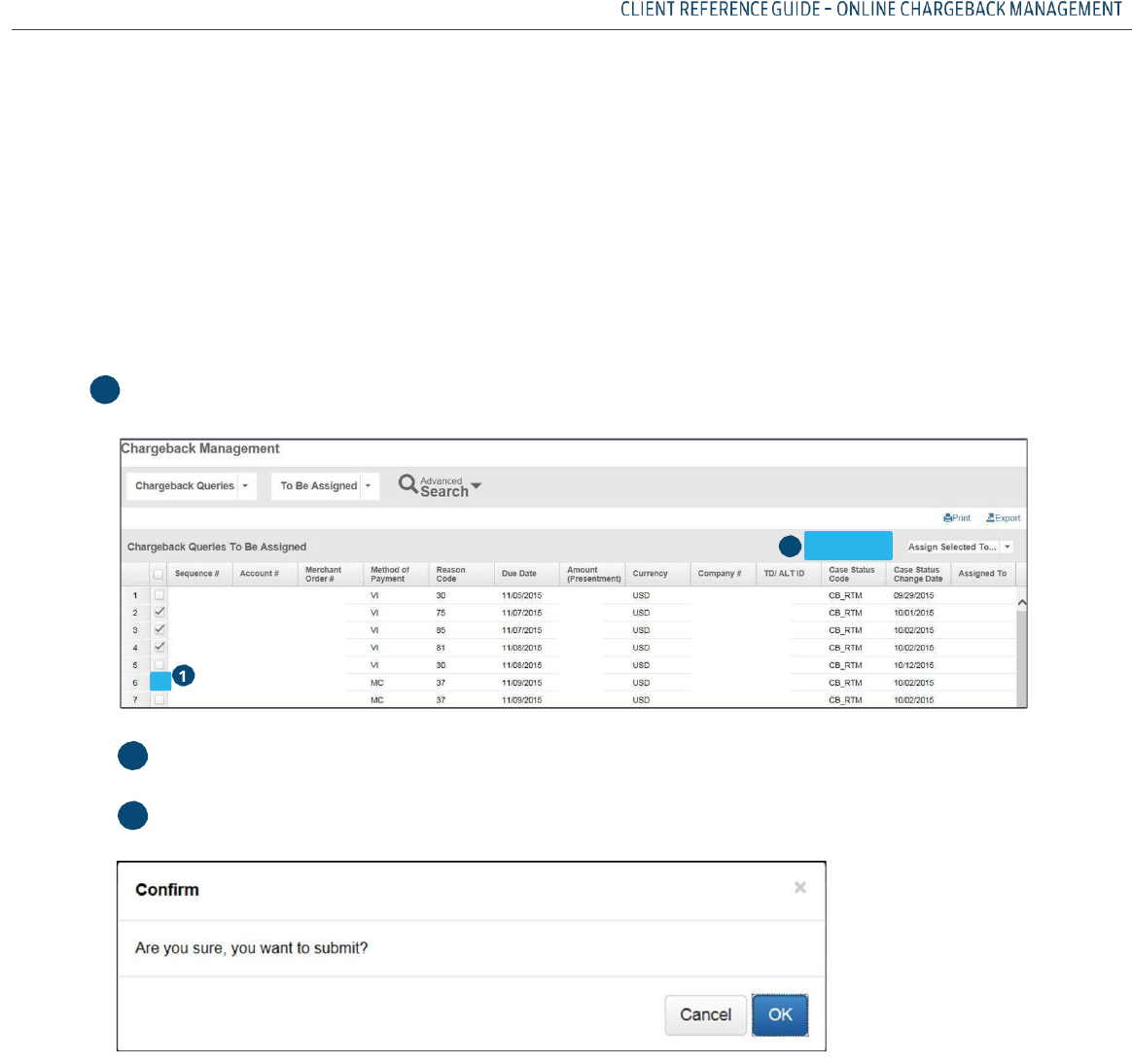

ASSIGNING CASES TO AN MRA

The MRQA assigns cases to the MRA(s) from the Management Queries, using the To Be

Assigned query. Assigned cases will be removed from the To Be Assigned list and added to the

assigned MRA’s work queue.

©2016, Paymentech, LLC. All rights reserved. | commercesolutions.jpmorganchase.com | chasepaymentech.ca | jpmorgancommercesolutions.co.uk |

33

case information

If all cases on the list are to be assigned to a single MRA, use the ALL checkbox

In the Assign Cases pull down menu, click on the User ID of the MRA to whom you are

assigning the case(s)

A verification box displays allowing you to submit the case assignment or to cancel it if

necessary

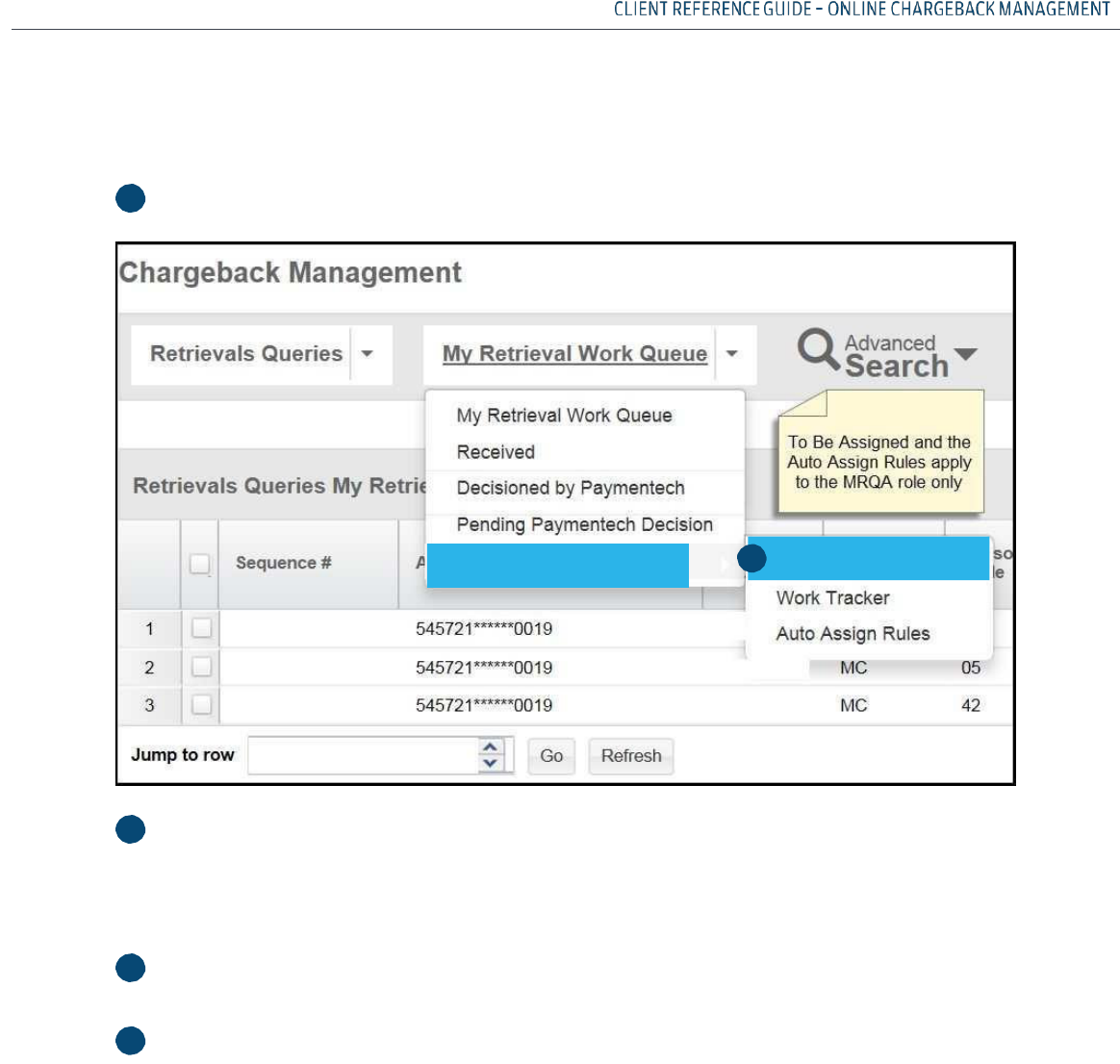

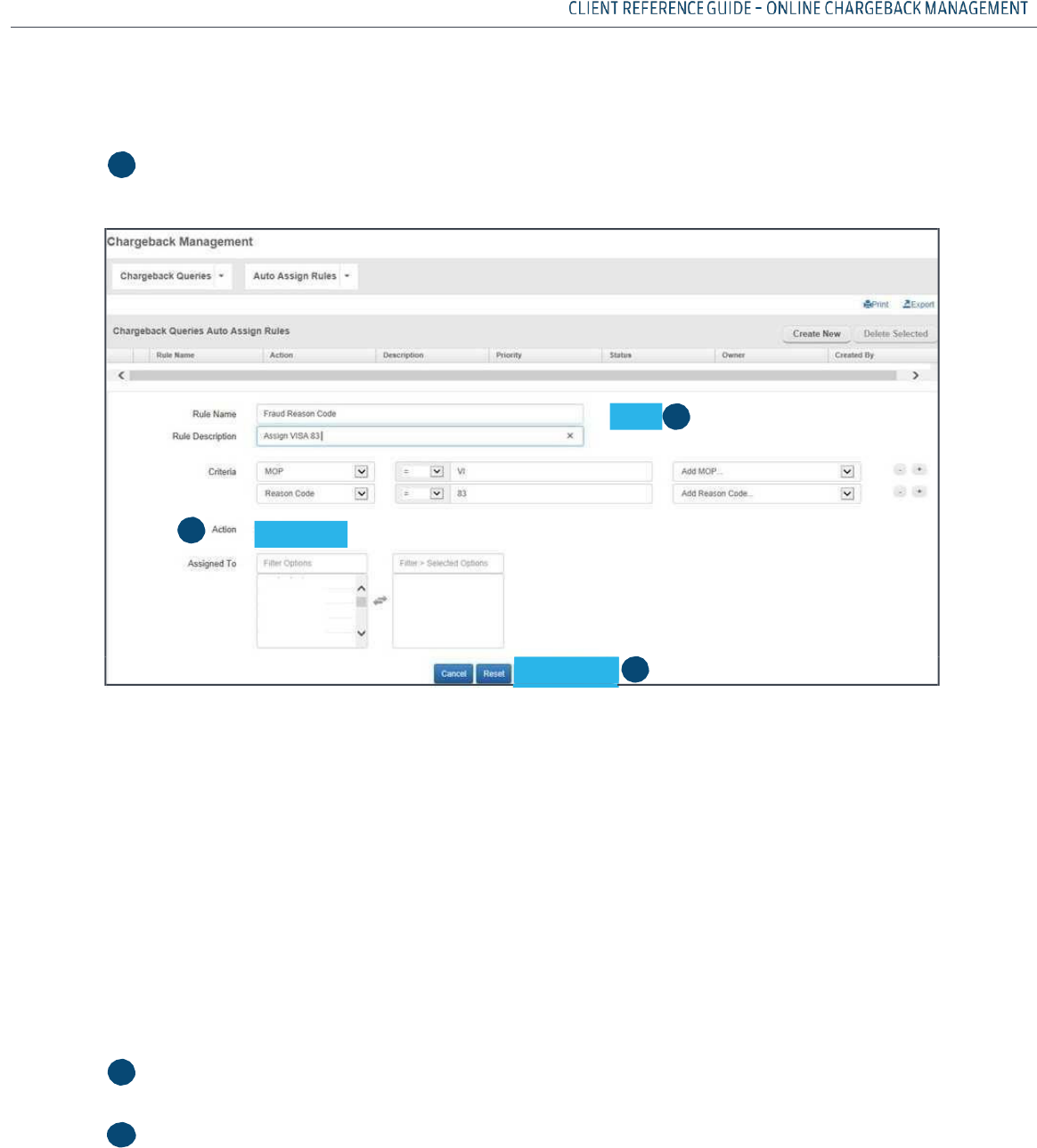

MRQA ROLE- CREATING AUTO-DECISION RULES

The MRQA is able to establish automatic rules for both accepting and assigning retrieval cases.

This action will insure timely acceptance or distribution of the retrieval cases governed by the

rules. To set-up rules, follow the steps below.

1

Follow

the

steps

below

to

assign

retrieval

cases

to

an

MRA.

Run

the

Retrievals

To

Be

Assigned

Query

Select

the

case(s)

to

be

assigned

to

an

MRA

by

clicking

on

the

box

to

the

left

of

the

1

2

4

3

©2016, Paymentech, LLC. All rights reserved. | commercesolutions.jpmorganchase.com | chasepaymentech.ca | jpmorgancommercesolutions.co.uk |

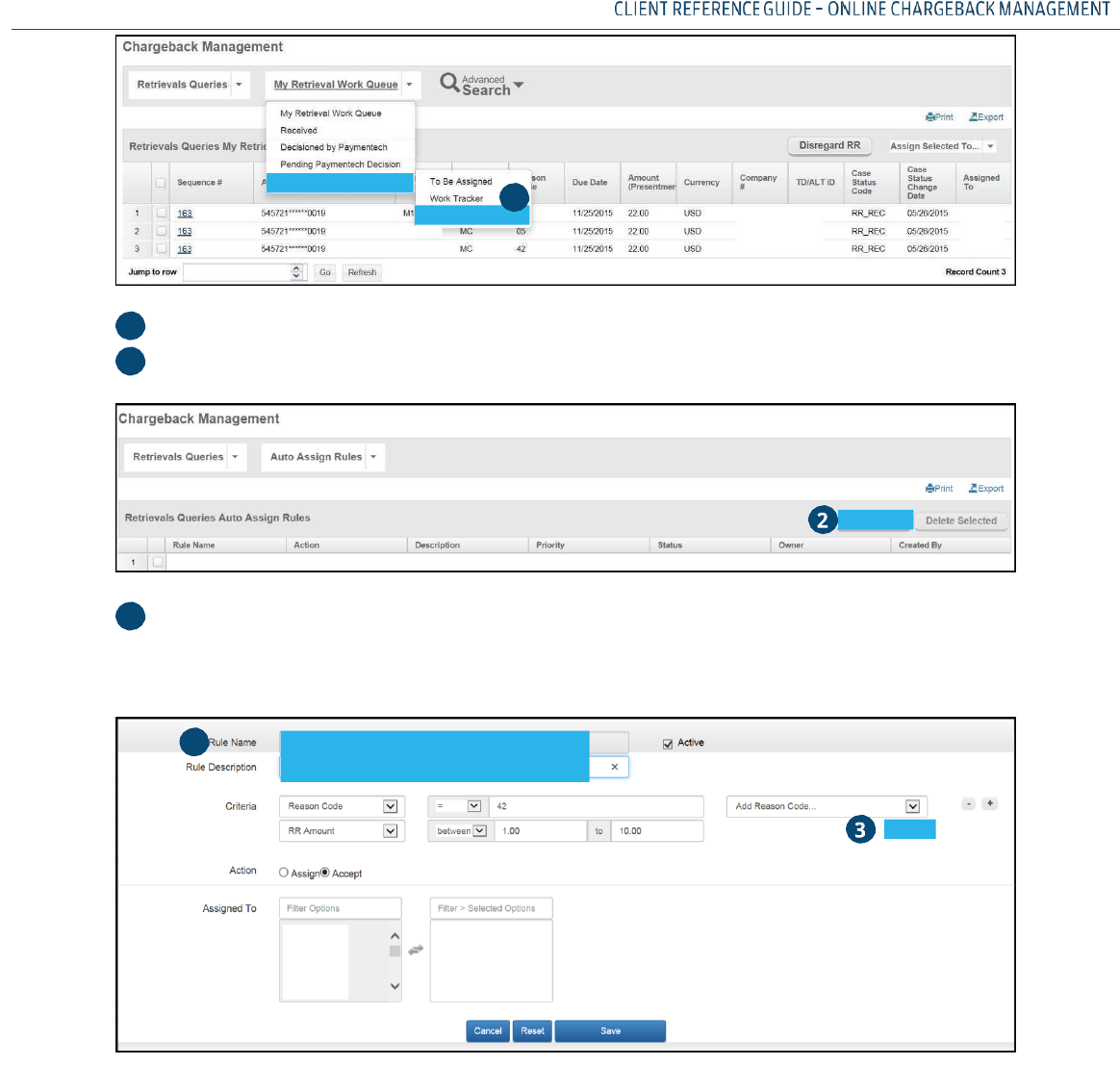

34

3

Select

Auto

Assign

Rules

from

the

Management

Queries

To

display

the

Auto

Assign

Rules

page,

click

on

Create

New

tab

Complete

the

appropriate

fields

to

establish

the

rule

Use

the

+

or

–

sign

to

add

or

remove Rule

criteria

1

1

2

3

©2016, Paymentech, LLC. All rights reserved. | commercesolutions.jpmorganchase.com | chasepaymentech.ca | jpmorgancommercesolutions.co.uk |

35

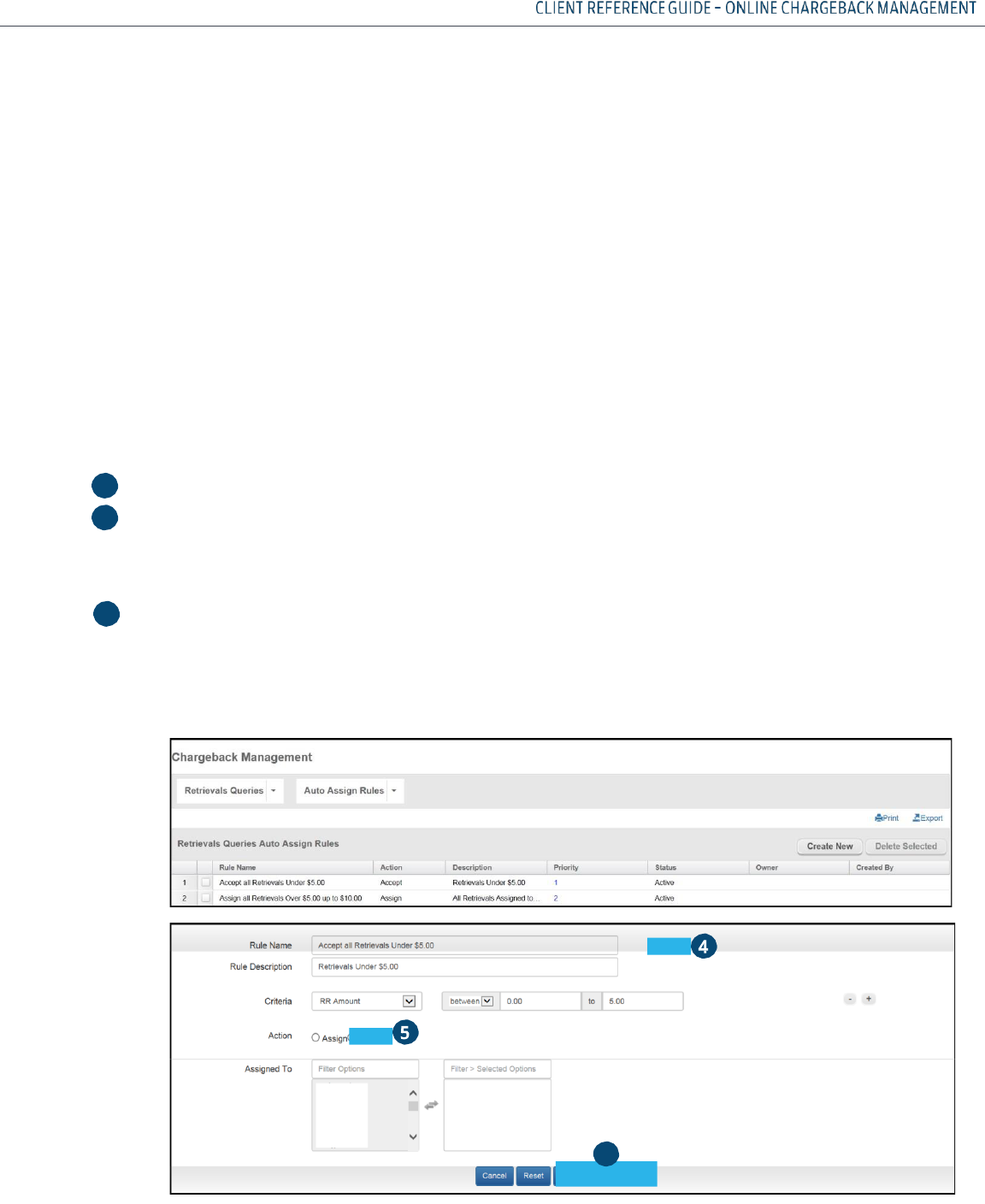

MRQA ROLE -CREATING AUTO-DECISION RULES, CONTINUED

Complete the appropriate fields to establish the rule:

• Rule Name (required)

• If the rule involves retrieval reason codes, select the codes from the drop down menu on the

Reason Code line. The selected reason codes will populate the field to the left. Multiple reason

codes may be selected. If the rule involves a Method of Payment (MOP), select the MOP from the

drop down menu on the MOP line. The selected reason codes will populate the field to the left.

Multiple MOPs may be selected

• If the rule involves an amount range, enter the beginning and ending value in the Retrieval

Amount fields

• If the person to whom cases are being auto-assigned has access rights for more than one

company, select the appropriate company number(s) from the pull down menu. The field to the

left will be populated with the selected number(s)

4 Select the Active radio button to activate the rule.

5 To apply the rule to accepting chargebacks, select the Accept radio button or to apply the rule

to assigning chargebacks, select the Assign radio button and select the MCA’s User ID from the

drop down menu. The User ID will populate the field to the right. Use the right or left arrows

to add or remove users

6 Click on Save to save the rule which will be applied on the next calendar day. The saved rules

will display on the Assign Auto Rules. Enter the run priority value for each rule.

The run priority of the established rules can be reset by entering the correct order number

in the Priority fields and clicking Update. The Cancel button will return the rules to the

original priority.

6

©2016, Paymentech, LLC. All rights reserved. | commercesolutions.jpmorganchase.com | chasepaymentech.ca | jpmorgancommercesolutions.co.uk |

36

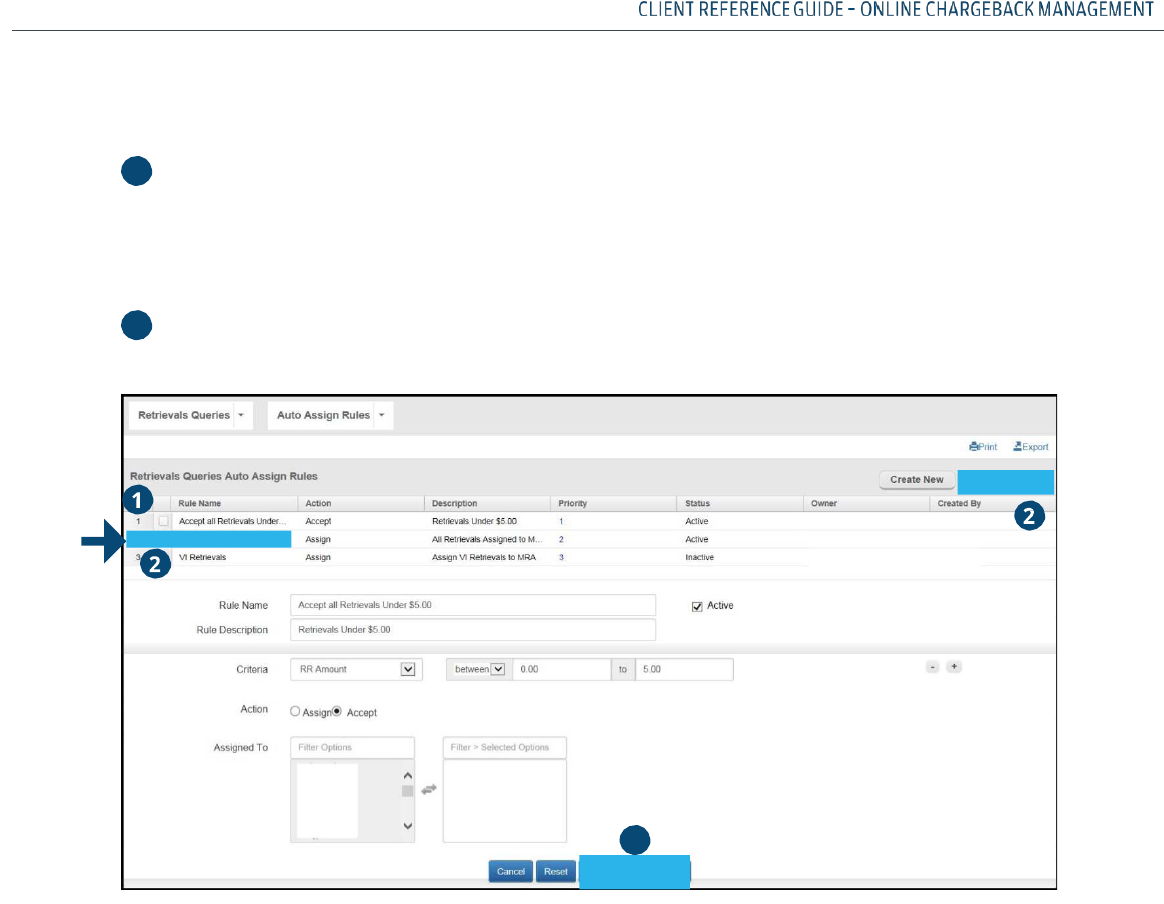

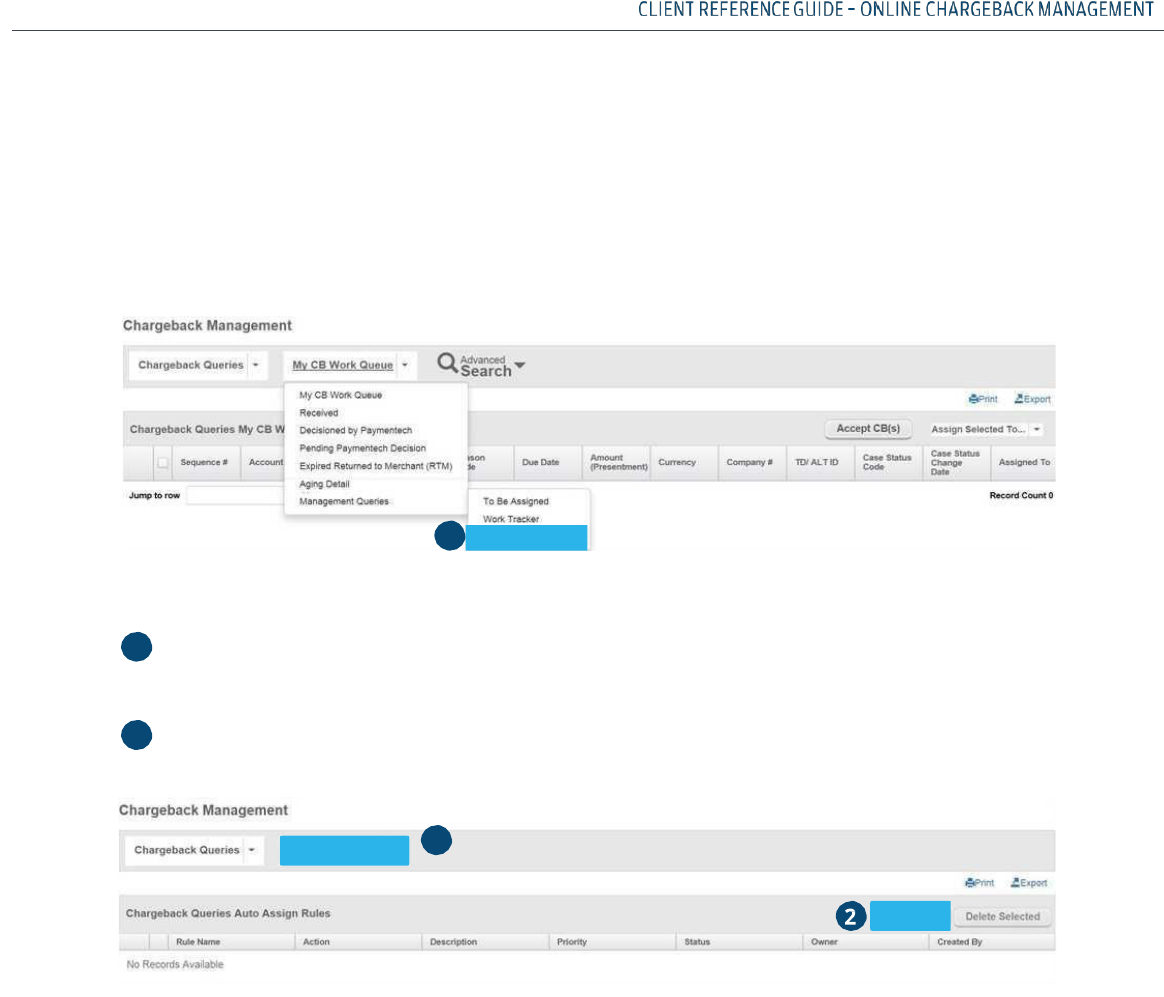

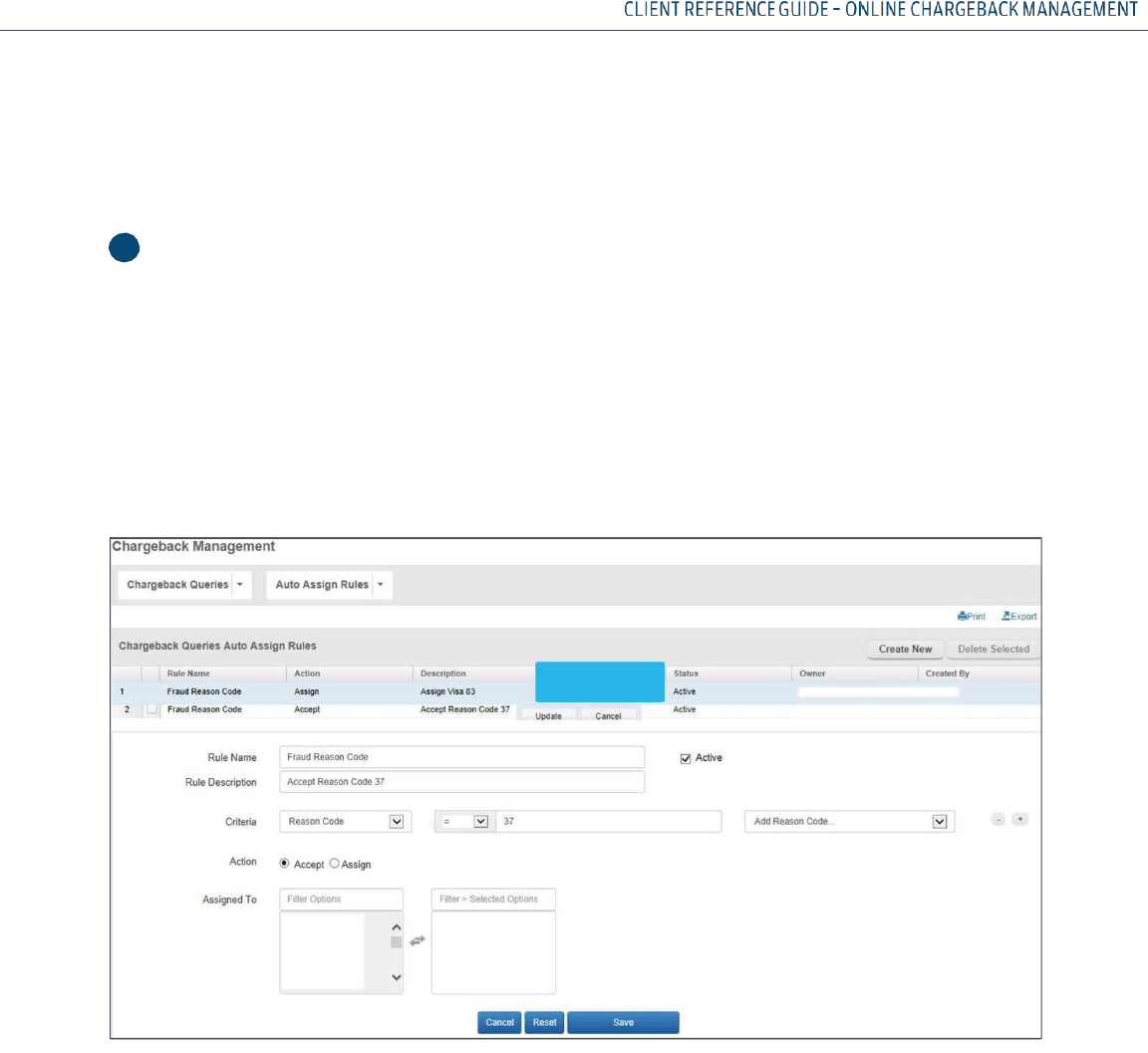

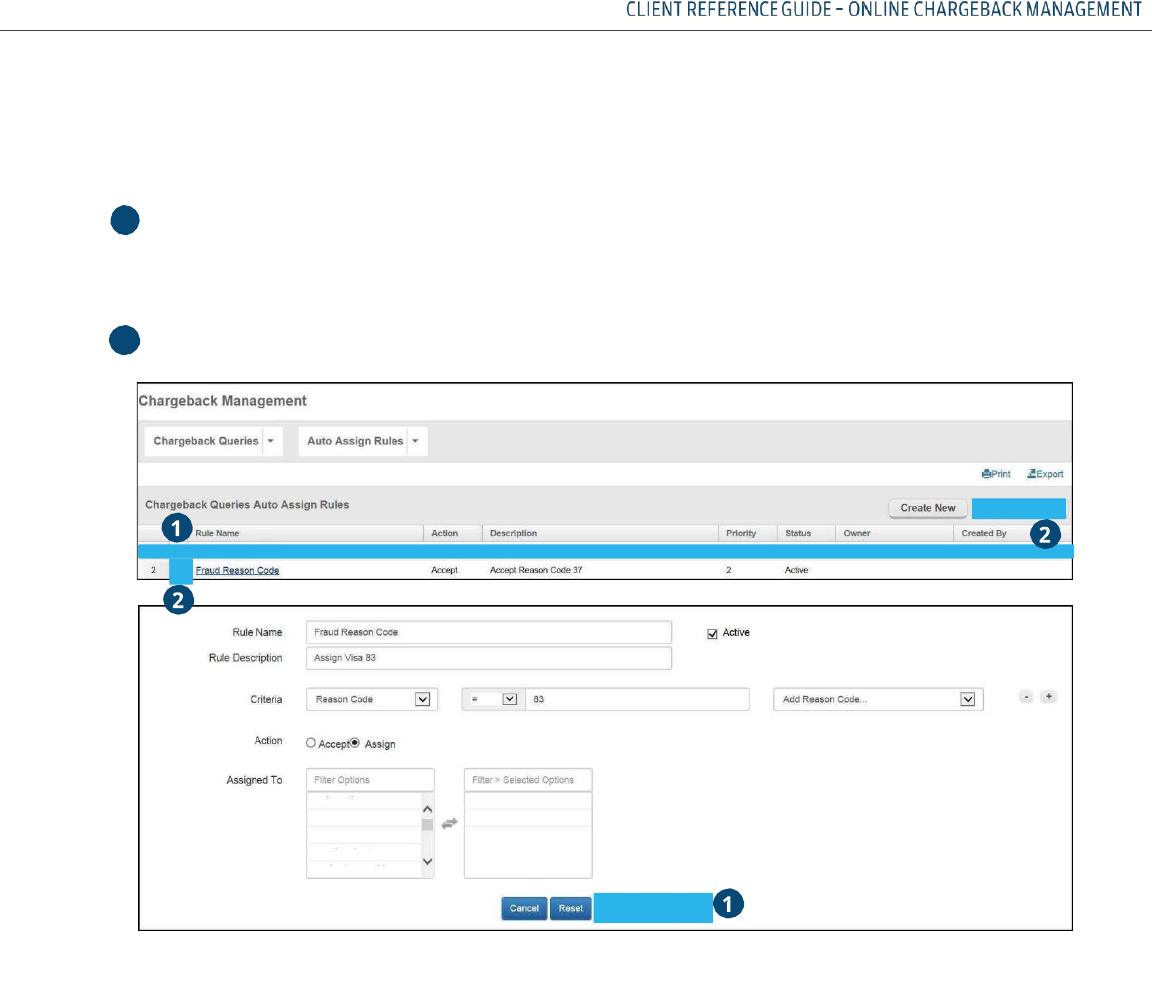

MRQA ROLE- EDITING OR DELETING A RULE

FOLLOW THE STEPS BELOW TO EDIT A RULE:

To Edit an established rule, click on the Row Number to bring up the maintenance

page.

Complete the changes to the appropriate fields and Save the changes.

FOLLOW

THE

STEPS

BELOW

TO

DELETE

A

RULE:

2

To

Delete

an

established

rule,

select

the

box

associated

to

the

Rule

and

click

the

Delete

Selected

Button.

1

1

©2016, Paymentech, LLC. All rights reserved. | commercesolutions.jpmorganchase.com | chasepaymentech.ca | jpmorgancommercesolutions.co.uk |

37

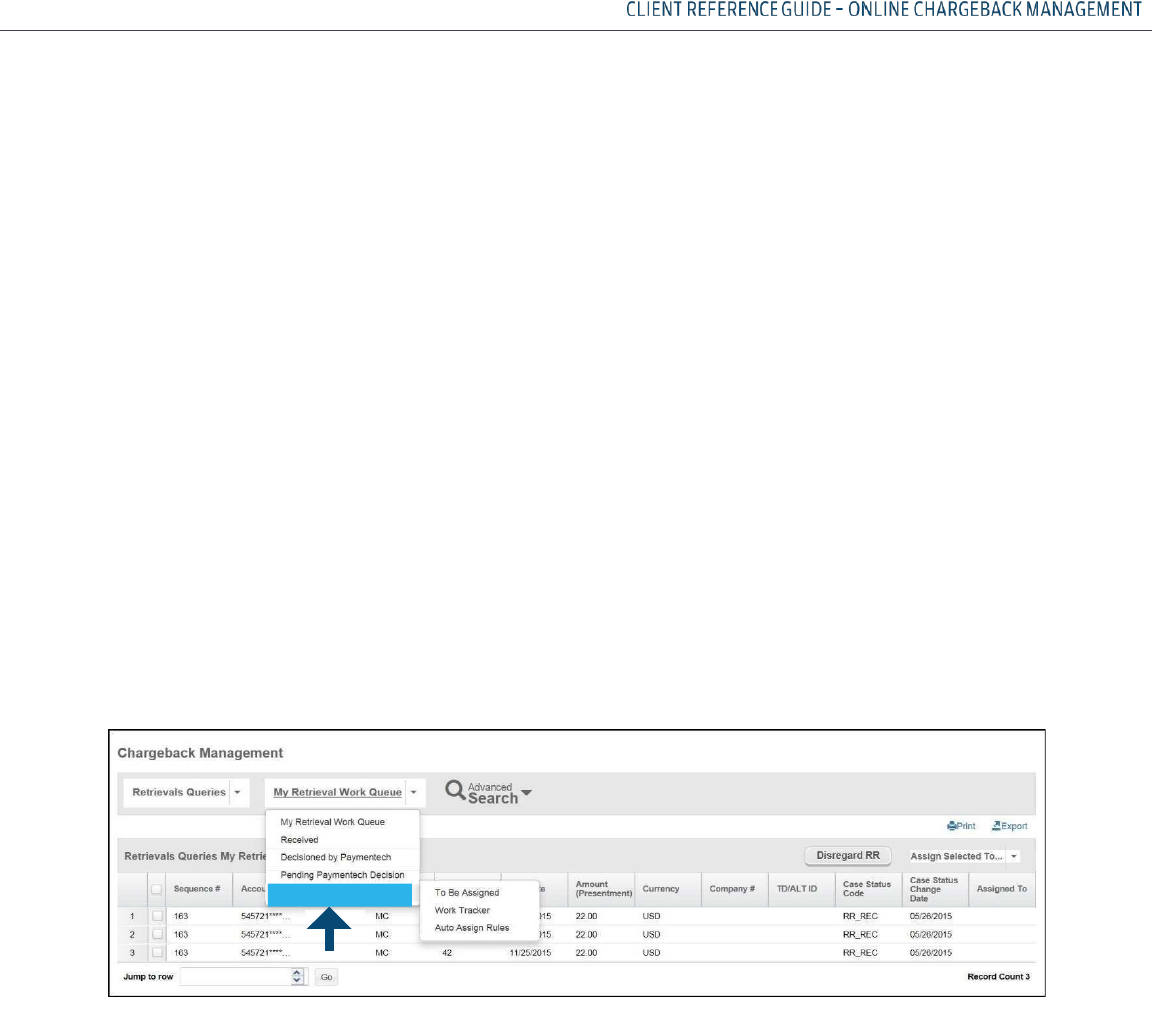

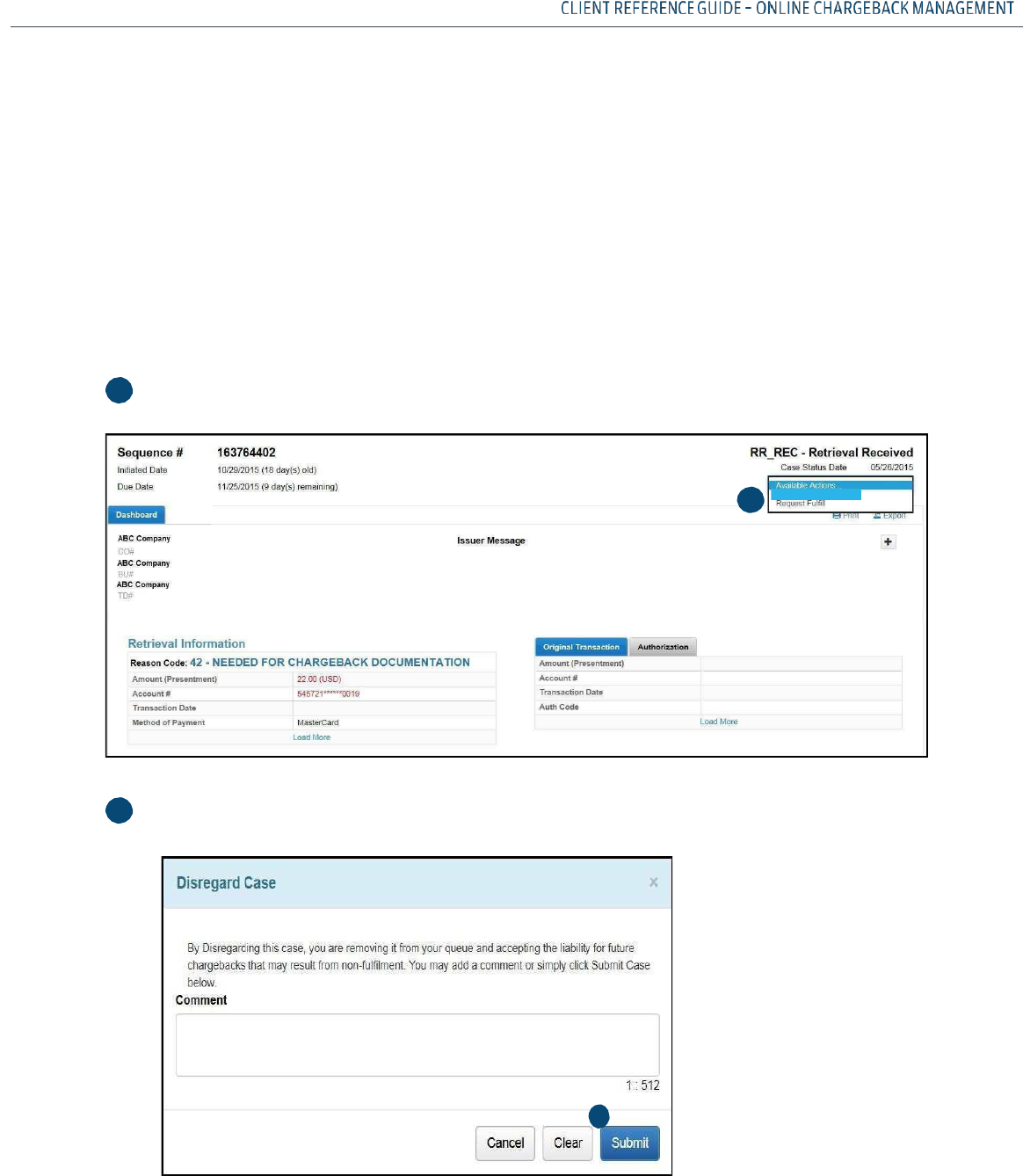

MRQA ROLE– ACCEPTING RETRIEVALS FROM LEVEL 1

If an MRQA also has the MRA role assigned to them, the MRQA can accept (Disregard RR) any or

all of the cases listed on the Retrievals To Be Assigned screen. Accepted cases will be removed

from the Retrievals To Be Assigned queue. Clients often have an internal business process that

allows them to accept certain cases without review based on such criteria as amount, reason

code or status.

FOLLOW THE STEPS BELOW TO ACCEPT A CASE FROM LEVEL 1:

A verification box displays allowing you to submit the Disregard RR action or to cancel it if necessary.

1

Select

the

case(s)

to

be

accepted

by

clicking

on

the

checkbox(es)

on

the

left

of

the

screen

Select

the

Disregard

RR(s)

option

from

the

Available

Action(s)

pull

down

menu

2

1

2

©2016, Paymentech, LLC. All rights reserved. | commercesolutions.jpmorganchase.com | chasepaymentech.ca | jpmorgancommercesolutions.co.uk |

38

MRQA ROLE– ACCEPTING RETRIEVALS FROM LEVEL 2

If an MRQA also has the MRA role assigned to them, the MRQA can accept (Disregard RR) any or all

of the cases listed on the Retrievals To Be Assigned (Merchant) screen. Accepted cases will be

removed from the Retrievals To Be Assigned queue. Clients often have an internal business process

that allows them to accept certain cases without review based on such criteria as amount, reason

code or status.

FOLLOW THE STEPS BELOW TO ACCEPT A RETRIEVAL FROM LEVEL 2:

A verification box displays allowing you to submit the Disregard Case action or to cancel it if necessary

Under

Available

Actions

-

select

Disregard

RR

Once

you

select

Disregard

RR

under

Available

Actions:

1

2

1

2

©2016, Paymentech, LLC. All rights reserved. | commercesolutions.jpmorganchase.com | chasepaymentech.ca | jpmorgancommercesolutions.co.uk |

39

WORKING RETRIEVALS – THE MRA ROLE

MRA OPTIONS

MRAs have the following options available in the Retrieval Management Application:

• Disregard RR

• Request Fulfill

• Run Retrieval Request Queries

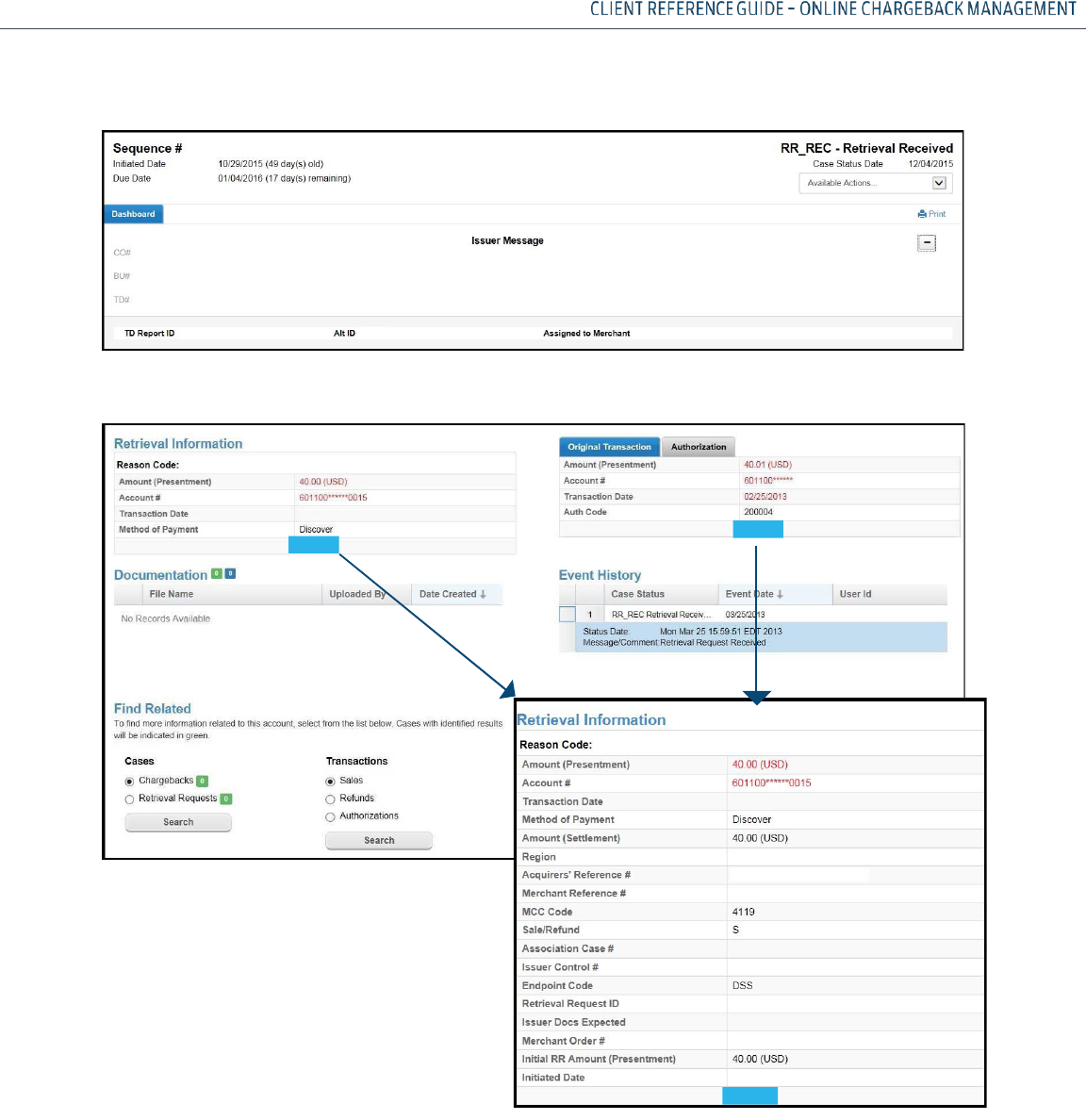

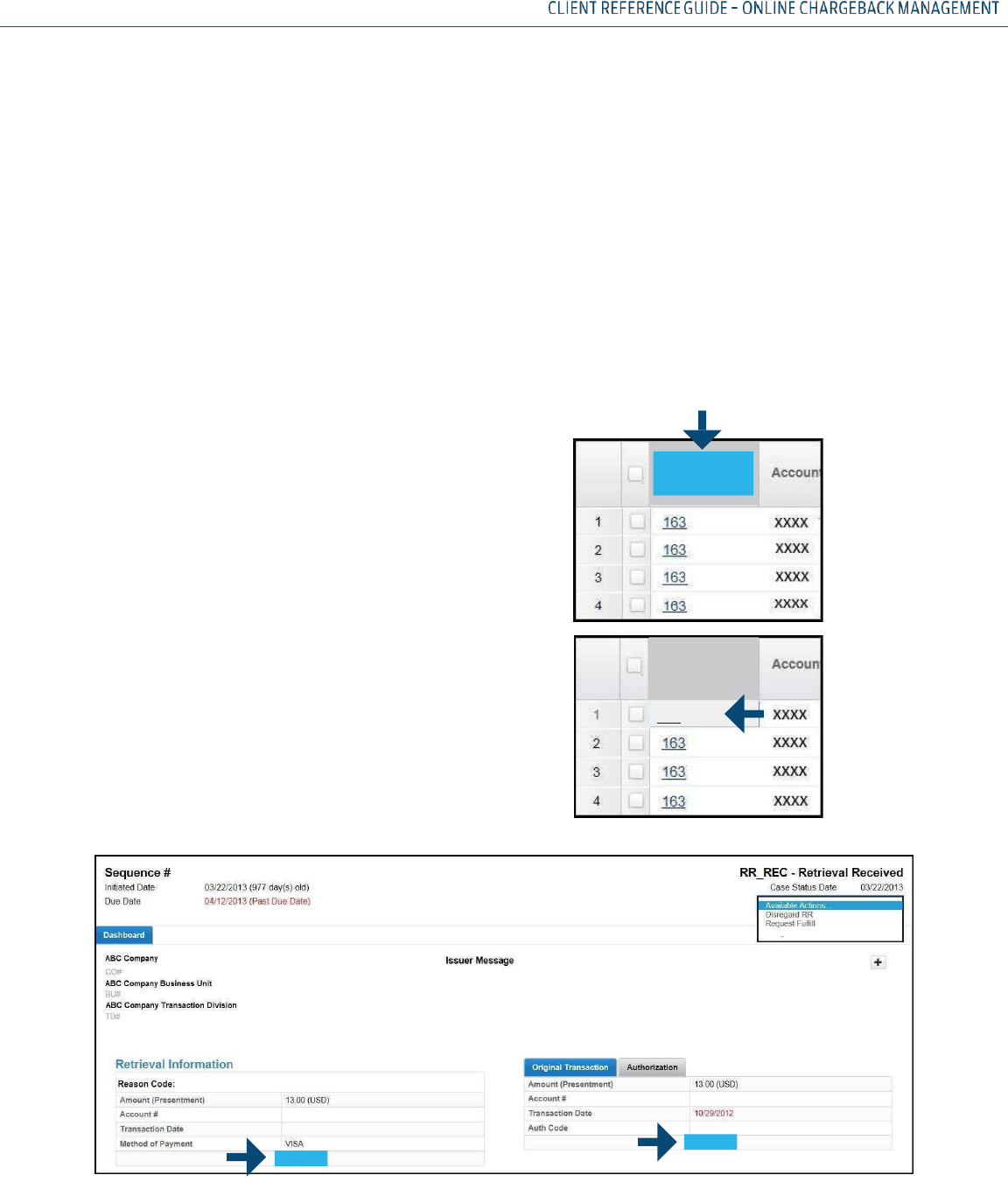

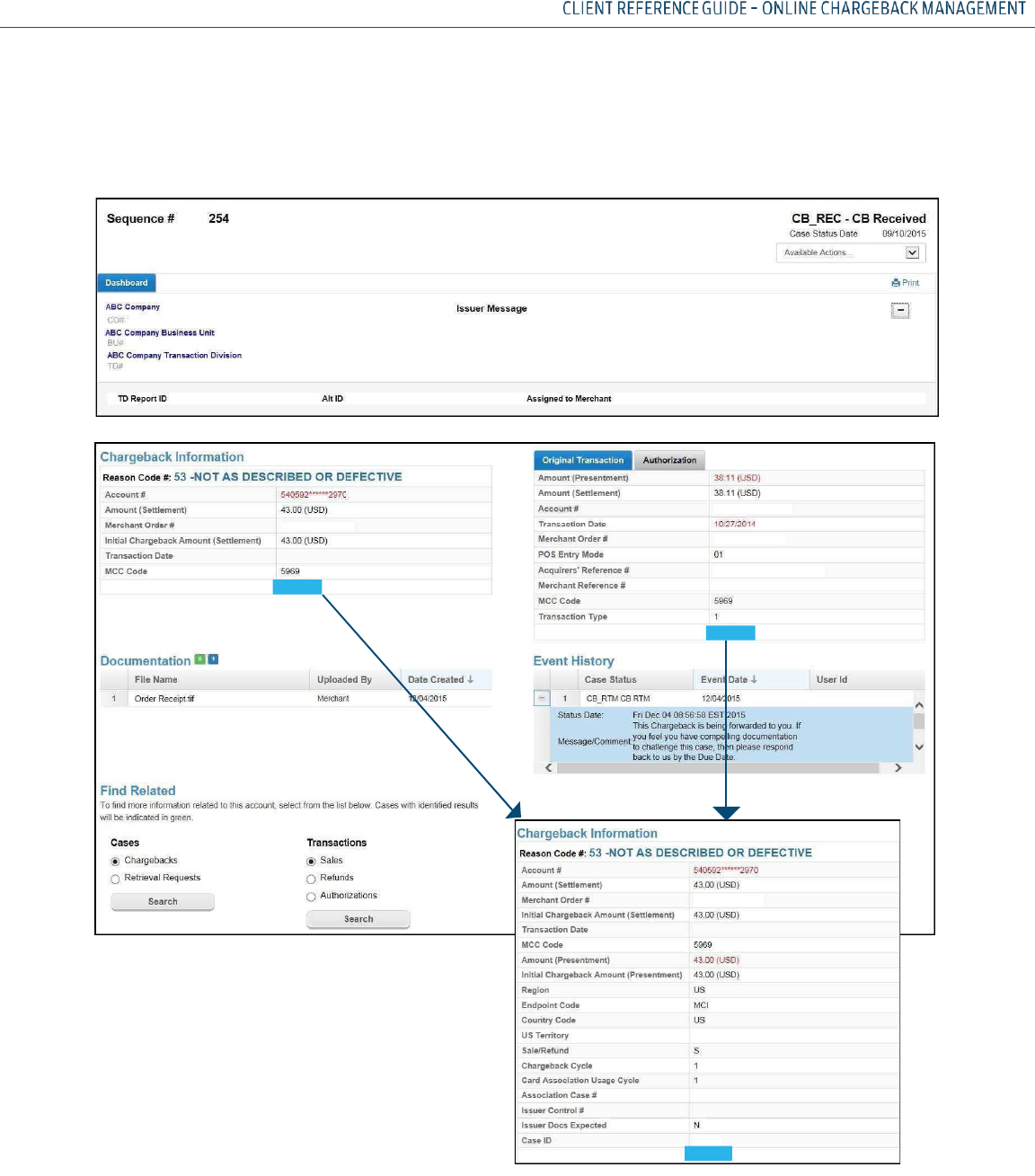

ACCESSING DETAILED RETRIEVAL REQUEST INFORMATION

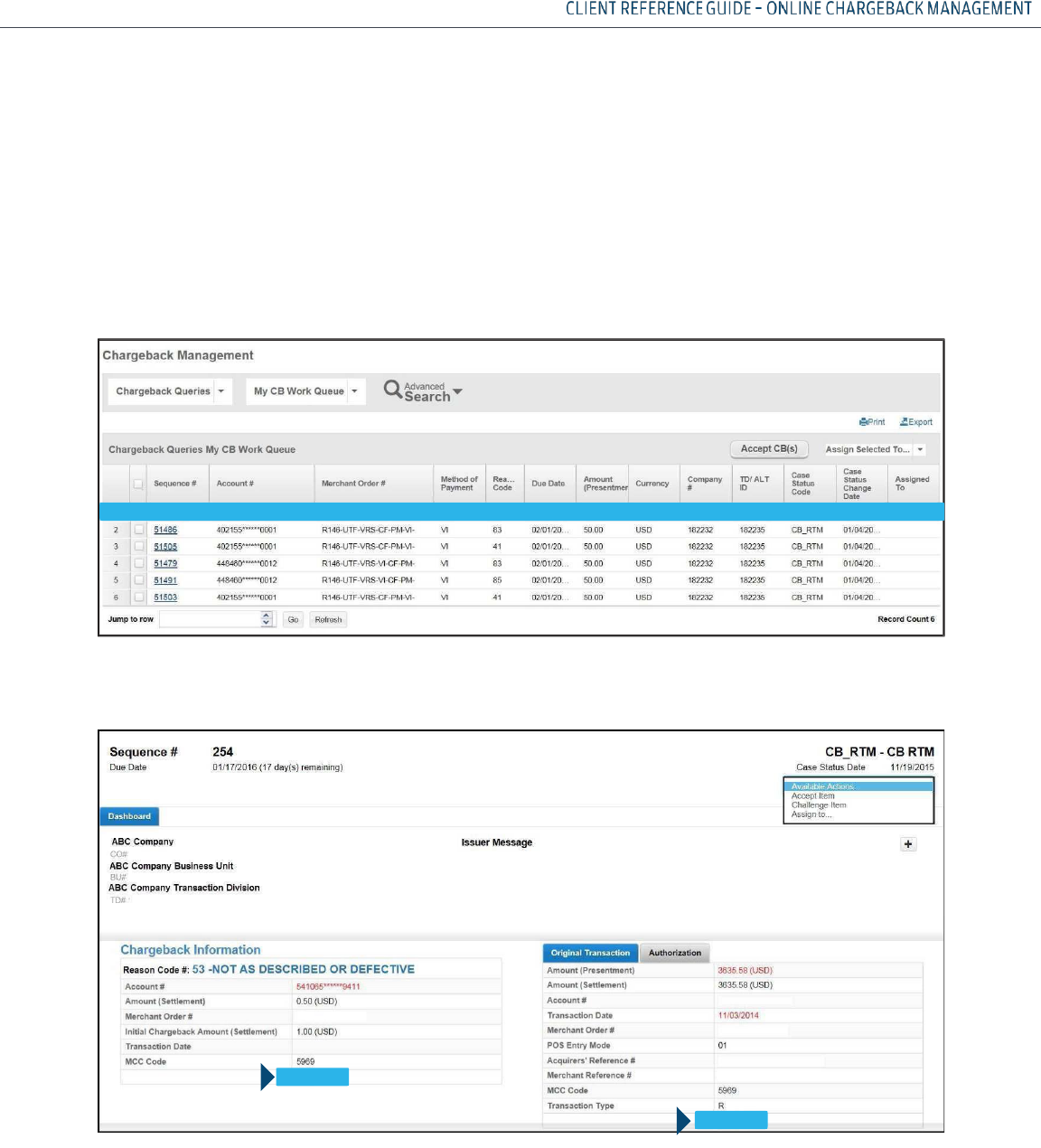

From the My Retrieval Work Queue query, select the case

to be worked by clicking on the sequence number.

After you have reviewed a case and then returned to the

Level 1 screen, the sequence numbers of the cases you

have looked at will have changed color to help you

distinguish between cases you have and have not yet

reviewed.

The Case Information screen will display detailed Level 2 data.

To view additional data related to the Case, click on the Load More links under Chargeback

Information or Original Transaction. Review the detailed information to aid in making a decision

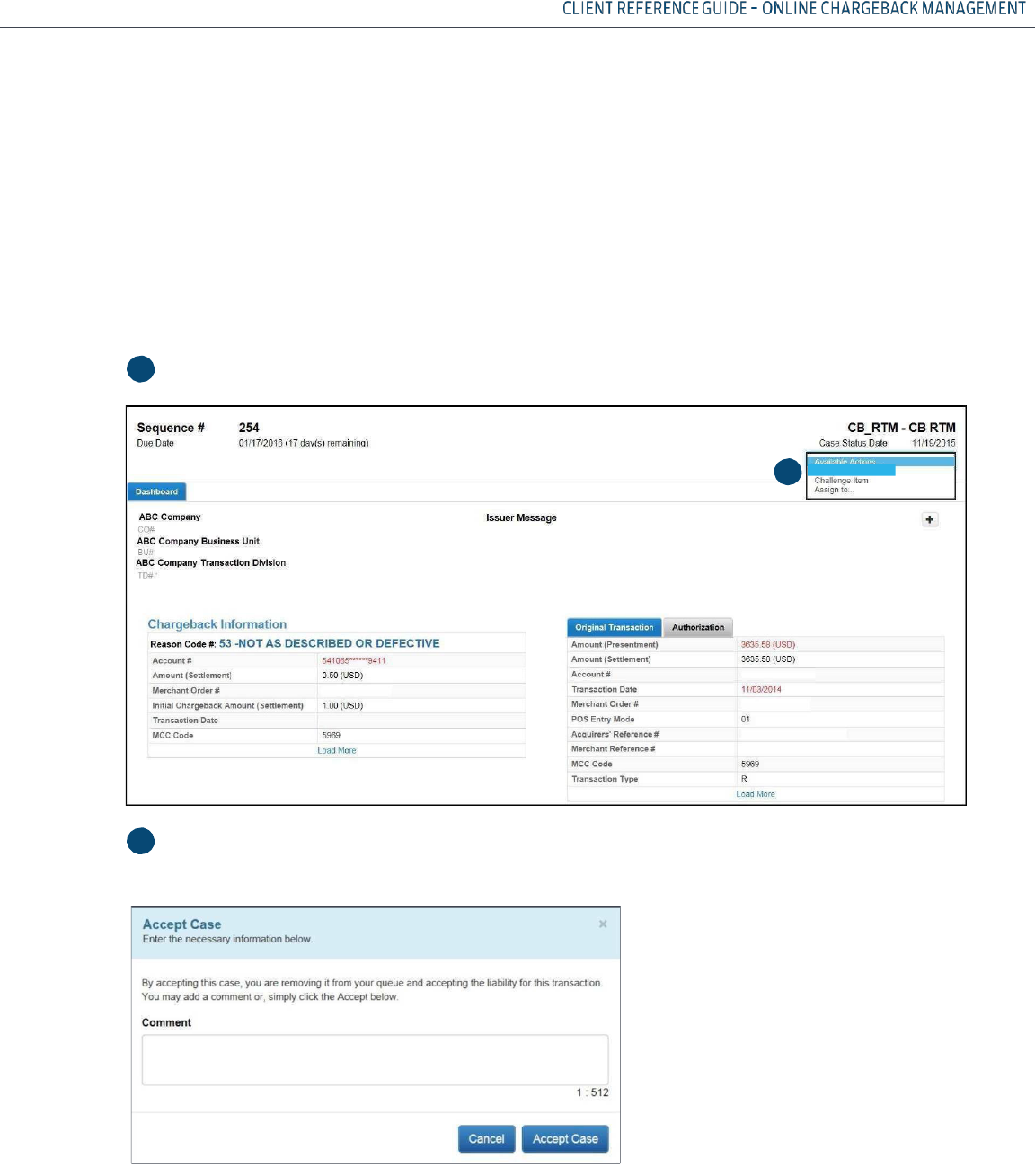

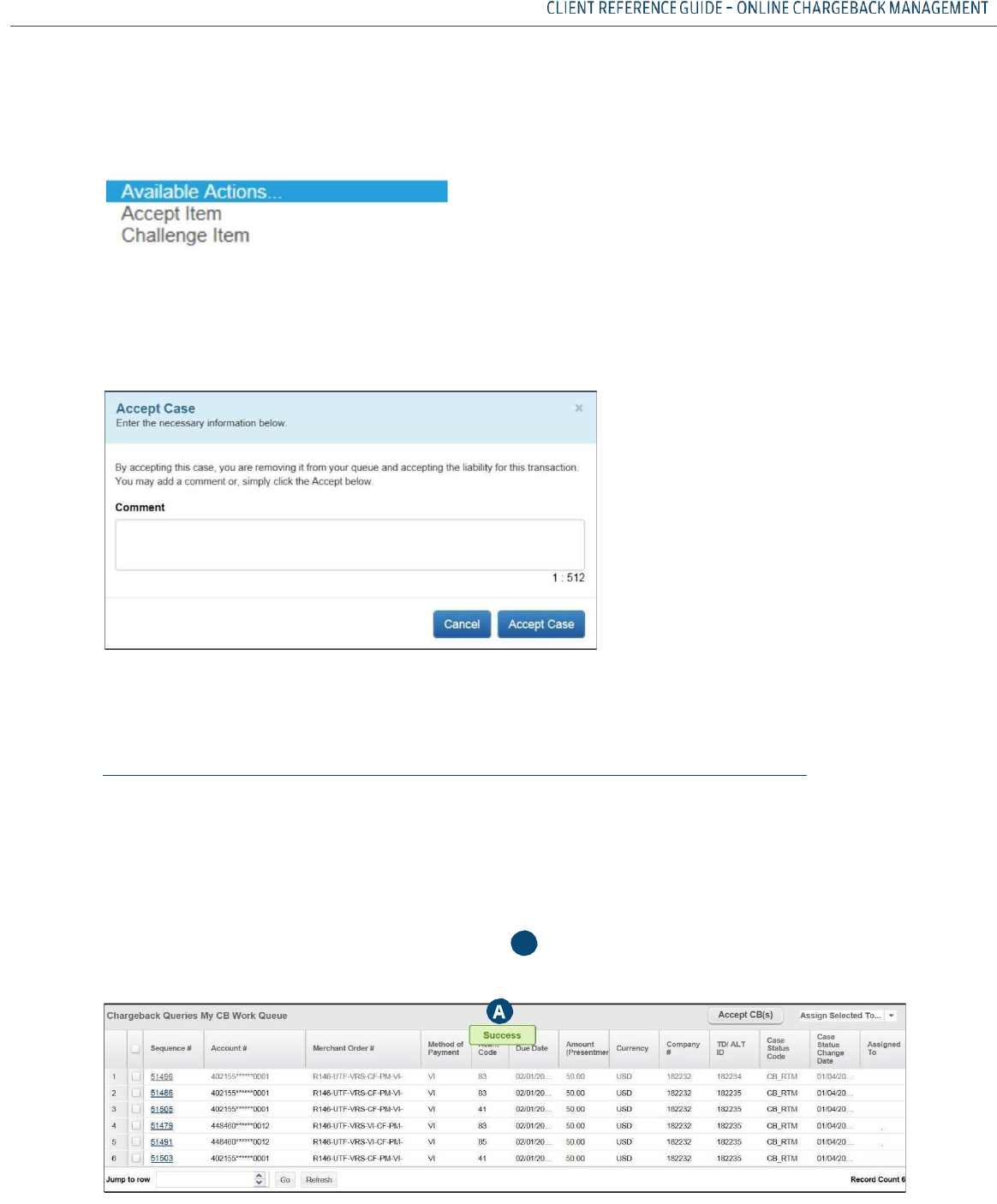

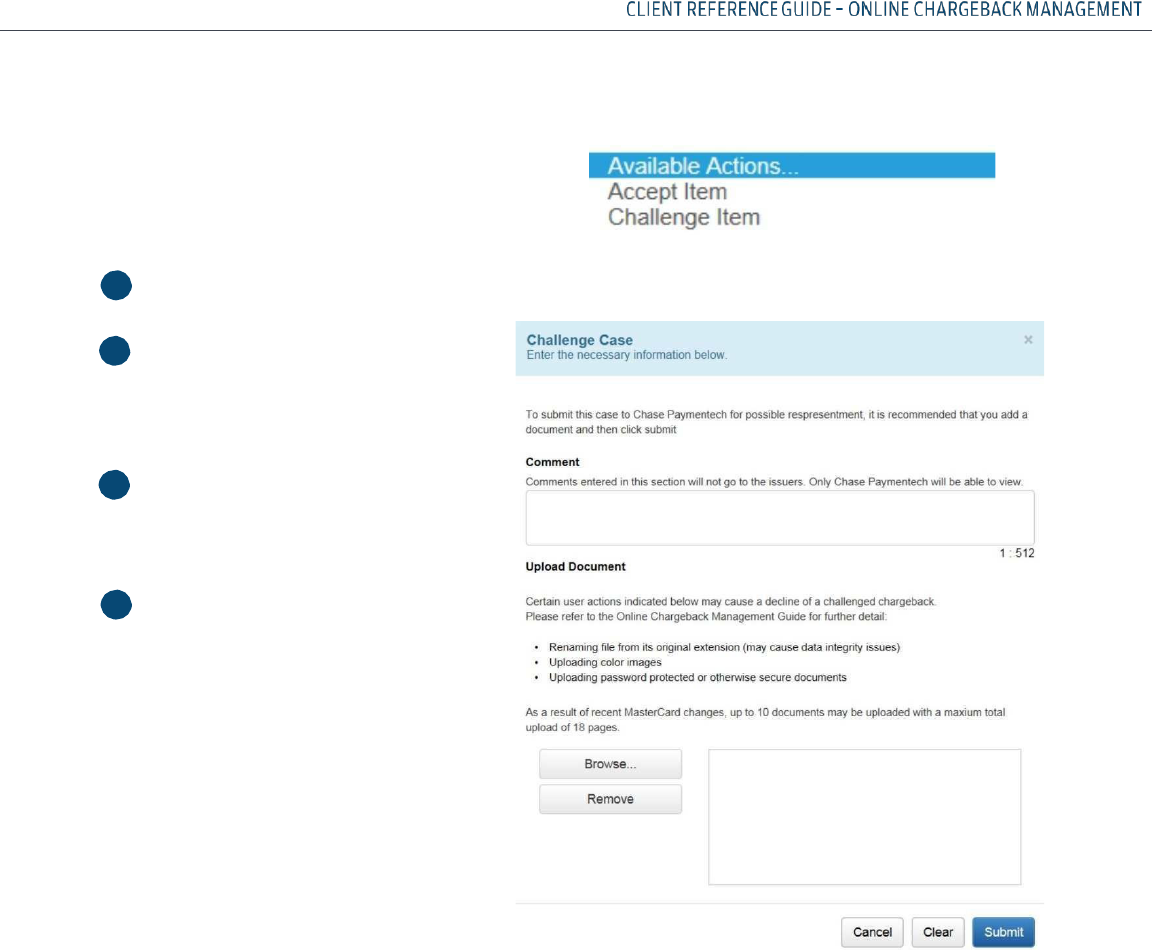

either to Disregard the RR or Fulfill.

Sequence

#

Sequence

#

163

©2016, Paymentech, LLC. All rights reserved. | commercesolutions.jpmorganchase.com | chasepaymentech.ca | jpmorgancommercesolutions.co.uk |

40

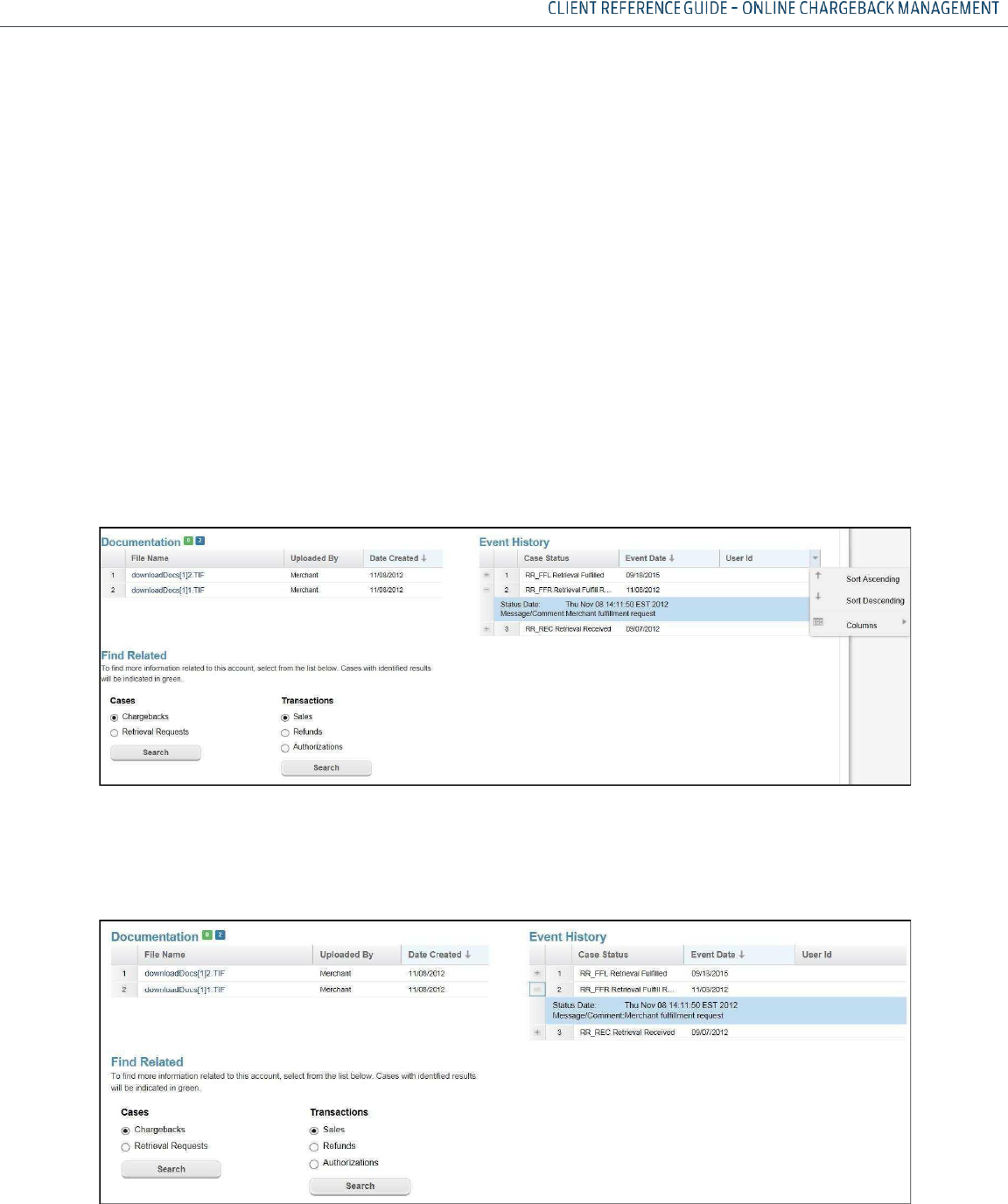

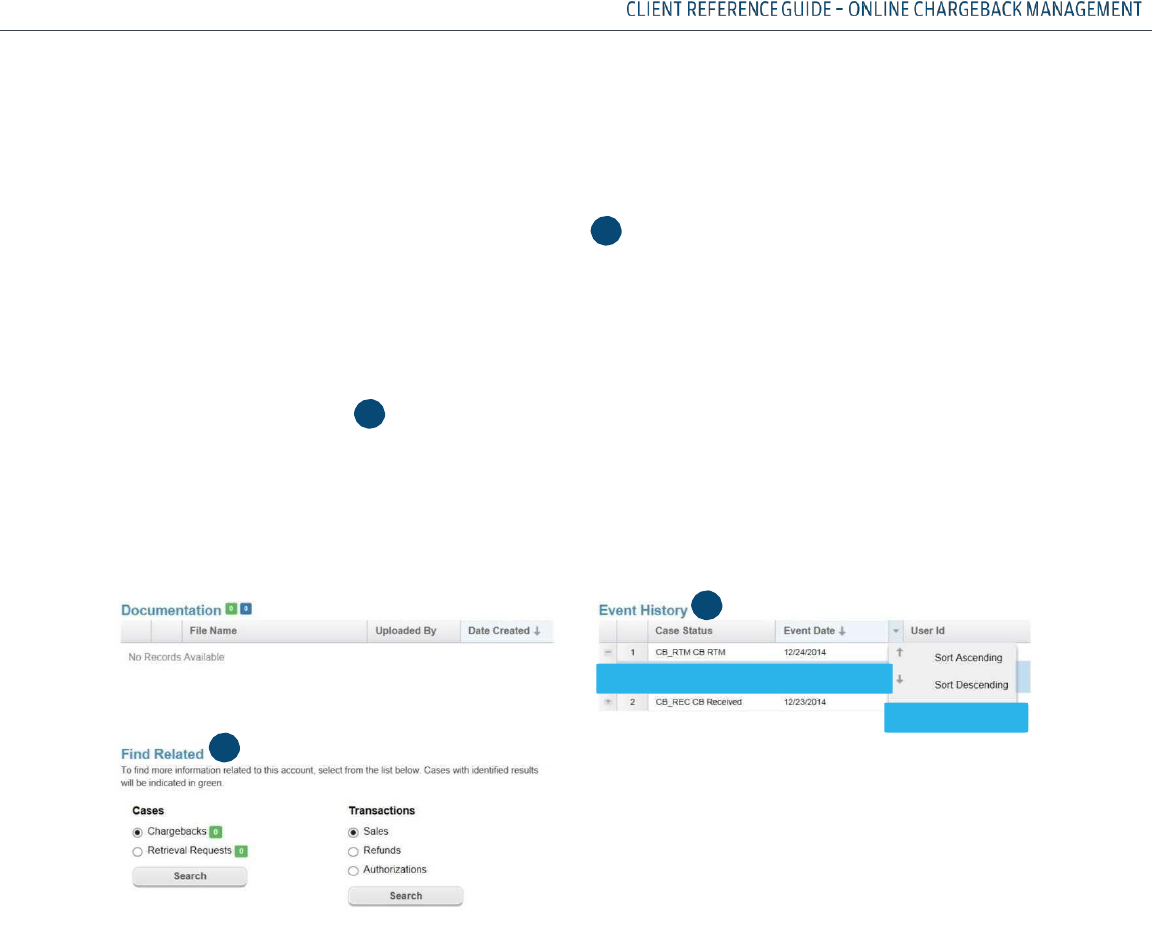

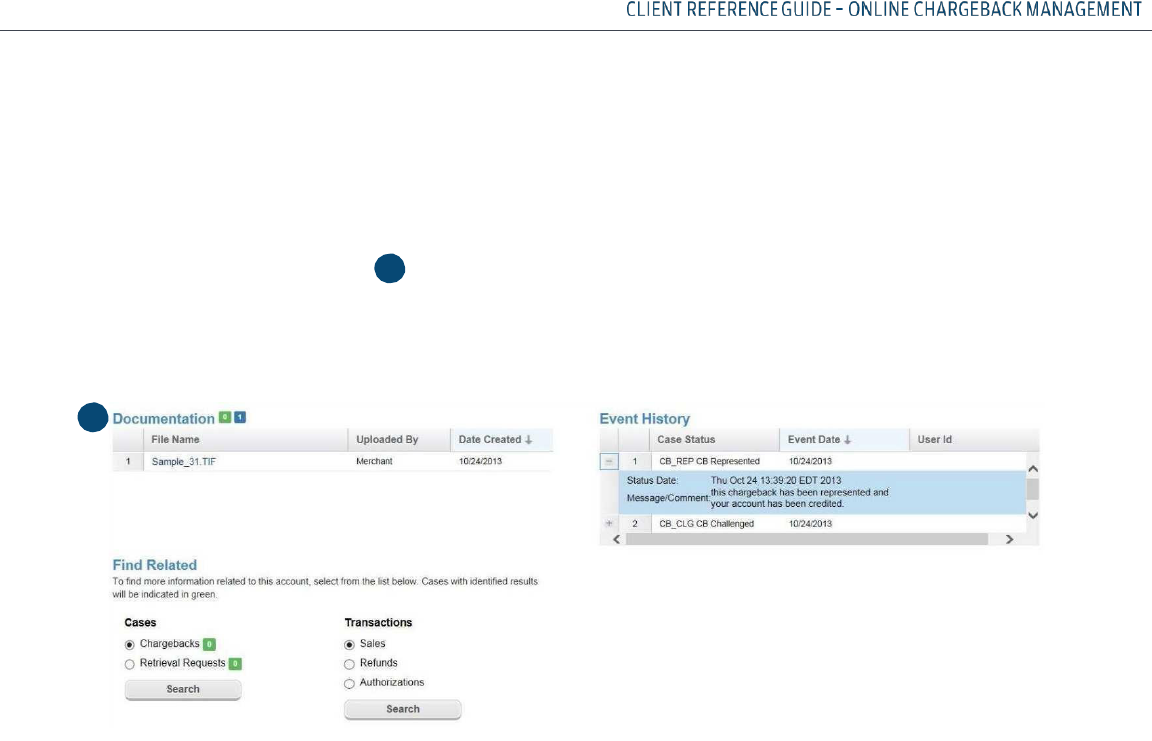

ACCESSING DETAILED RETRIEVAL REQUEST INFORMATION, CONTINUED

Review the detailed information to aid in making a decision either to accept (Disregard RR) or to

Request Fulfill.

To assist in the process, the Related Transactions section provides links to the Paymentech

Online Transaction History application for information on sales, refunds, and authorizations, by

the same company for the same account number.

The Event History section displays a reverse chronological record of what actions were taken on

the selected retrieval. However, the Event Date column allows you to change the sort by clicking

on the drop down arrow to change the order of the sort. You can also reorder the columns by

clicking on the Columns drop down.

The + or - sign allow you to expand the Case Status section to see additional comments..

VIEWING SUPPORTING DOCUMENTS

To view the supporting documents for the retrieval case, click on the File Name under the

Documentation section.

©2016, Paymentech, LLC. All rights reserved. | commercesolutions.jpmorganchase.com | chasepaymentech.ca | jpmorgancommercesolutions.co.uk |

41

The document will open in a separate browser window for viewing. To verify that your uploaded document

is correct, click on the icon in front of the file name. If the document is incorrect and or if it cannot be viewed

or opened, check to make sure it is a format type accepted by Merchant Services.

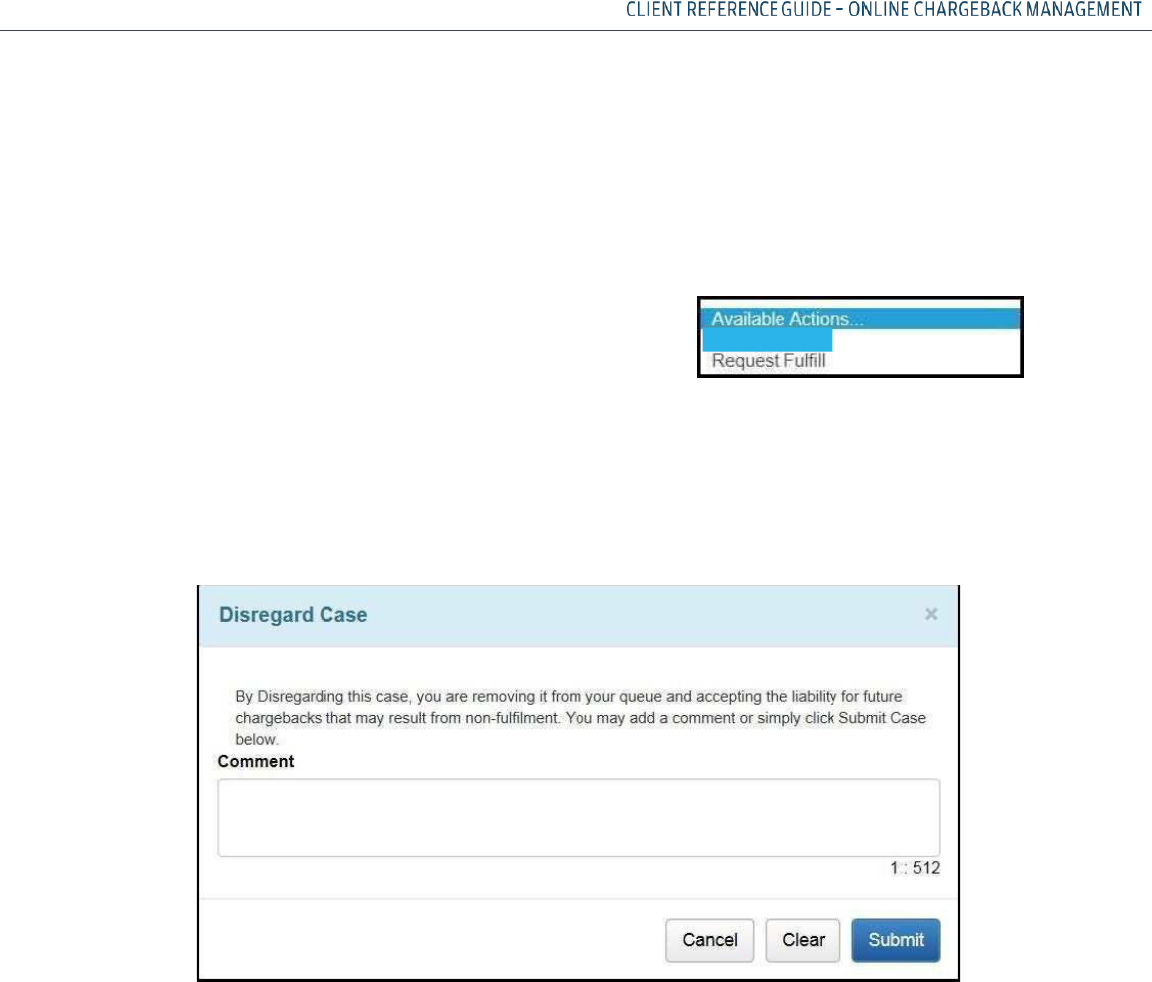

ACCEPTING A RETRIEVAL CASE

To accept a retrieval case, select Disregard RR from the

Available Actions drop down menu.

The Disregard RR screen will be displayed. As indicated on the screen, acceptance of the case removes

it from your work queue. Liability for the transaction is yours as a result of case acceptance. The

details of the case will be retained and can be viewed by doing a search query on the account number,

case ID or sequence number, among other parameters.

Comments, if any, may be entered in the Comments field prior to selecting the Submit Case button. The

Clear button will remove any comments entered. A Cancel button is available in the event it is needed.

Comments entered in the Comment Section of the Decision Screen will not go to the

Issuers. Comments are limited to 512 characters. If over the limit, a message will display.

This indicates the comment must be shortened. Only Merchant Services will be able to view

these comments. All uploaded documents will go to the Issuer. Cut and pasted comments

will be truncated and a message will be displayed.

©2016, Paymentech, LLC. All rights reserved. | commercesolutions.jpmorganchase.com | chasepaymentech.ca | jpmorgancommercesolutions.co.uk |

42

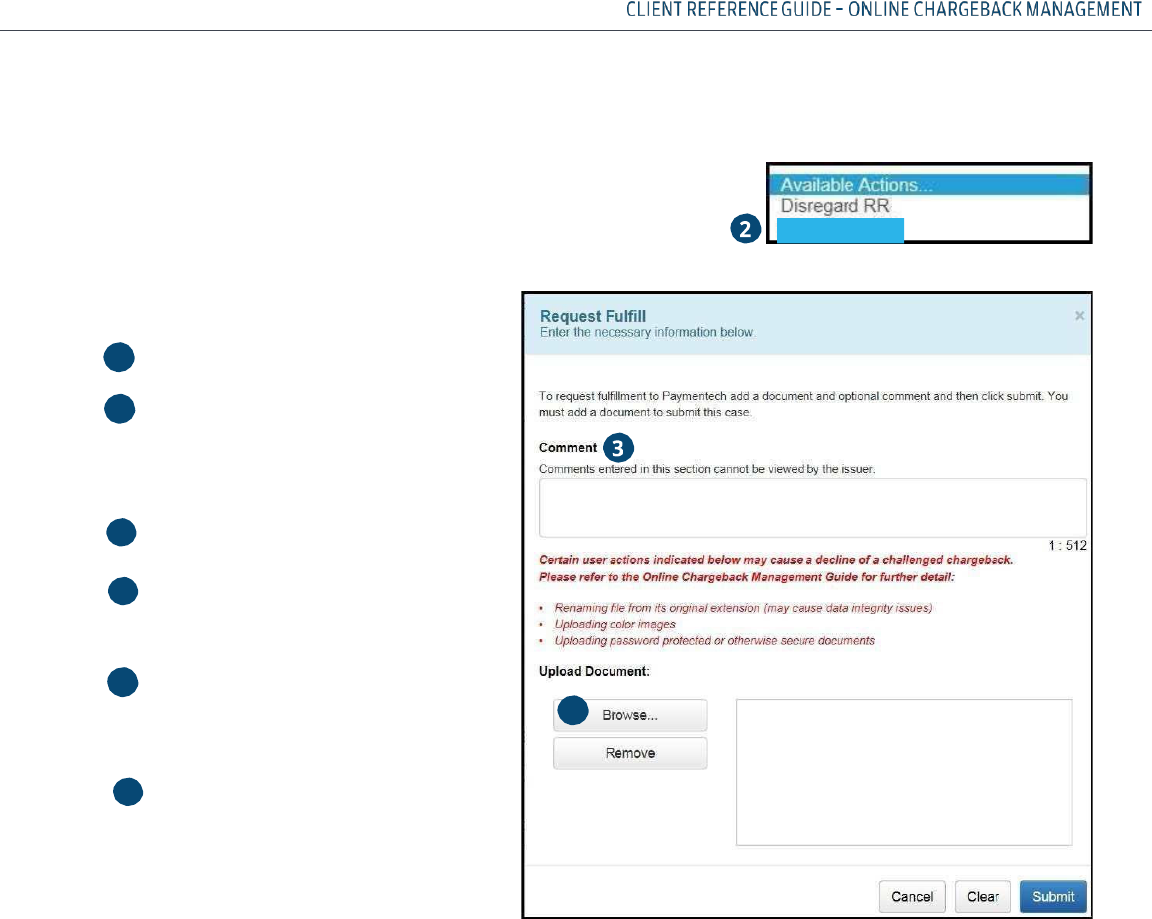

REQUEST FULFILLMENT OF A CASE

To request fulfillment of a retrieval case,

you must be viewing the Level 2 data

Retrieval Information Screen. Follow the

steps below.

1 Scan the documentation, if necessary,

that supports the challenge decision

Select Request Fulfill from the

Available Actions drop down menu to

access the Request Fulfill Case screen

Add any comment(s) to support the

challenge

Use the Browse button to locate the

document to be uploaded:

issuing bank6

Do not upload any password

protected documents as they

cannot be opened or sent to the

issuing bank

File names may only contain:

- Letters A through Z (uppercase and

lowercase permitted)

- Numbers 0-9

- Dash (-)

- Underscore (_)

- Period (.)

- File name length of 220

Characters or less

- We recommend no space or special characters

The ending of the file, which indicates the type of file format, should not be changed. It should

remain as system generated, if you change this you run the risk that your document will not be sent

back to the card holder special characters

REQUEST FULFILLMENT OF A CASE, CONTINUED

4

3

4

5

5

6

6

2

©2016, Paymentech, LLC. All rights reserved. | commercesolutions.jpmorganchase.com | chasepaymentech.ca | jpmorgancommercesolutions.co.uk |

43

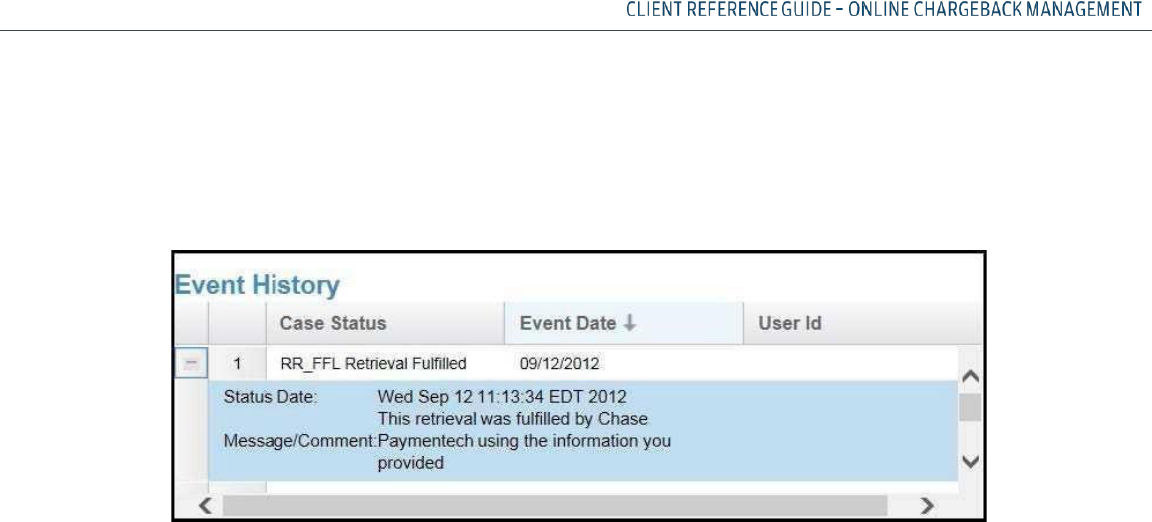

This action removes the case from the MRA’s Work Queue and notifies the Merchant Services analyst

of the request to fulfill the retrieval.

The Request Fulfill action and merchant comments, if any, are added to the Event History for the case.

WORKING A FULFILL REQUEST THAT HAS BEEN DECLINED BY MERCHANT SERVICES

Once you have requested fulfillment (FFR) of a retrieval request case, Merchant Services reviews the

uploaded documentation. If something is missing or invalid, the fulfill request will be declined and the

case status code changed to RR_DEC.

All declined cases will be listed in the Work Queue with the reason for the decline apparent in the Event

History section on the Case Information screen.

If you can correct the problem and upload the complete and valid documentation, you can

resubmit the request for fulfillment. If you cannot correct the problem, a chargeback may occur

due to non-fulfillment of the Retrieval Request.

©2016, Paymentech, LLC. All rights reserved. | commercesolutions.jpmorganchase.com | chasepaymentech.ca | jpmorgancommercesolutions.co.uk |

44

FULFILLING A RETRIEVAL

See System Requirements and Supporting Documentation Format section for Documentation formats

and size

Image files should be sent in black and white. Color files do not always transmit correctly, leaving

images blurred and illegible. Illegible files can be declined by the card brands

MasterCard

®

HAS A MAXIMUM PAGE LIMITATION OF 3 PAGES FOR RETRIEVAL REQUESTS. IF YOU

UPLOAD MORE THAN 3 PAGES, ONLY THE FIRST 3 WILL BE SENT TO THE ISSUER

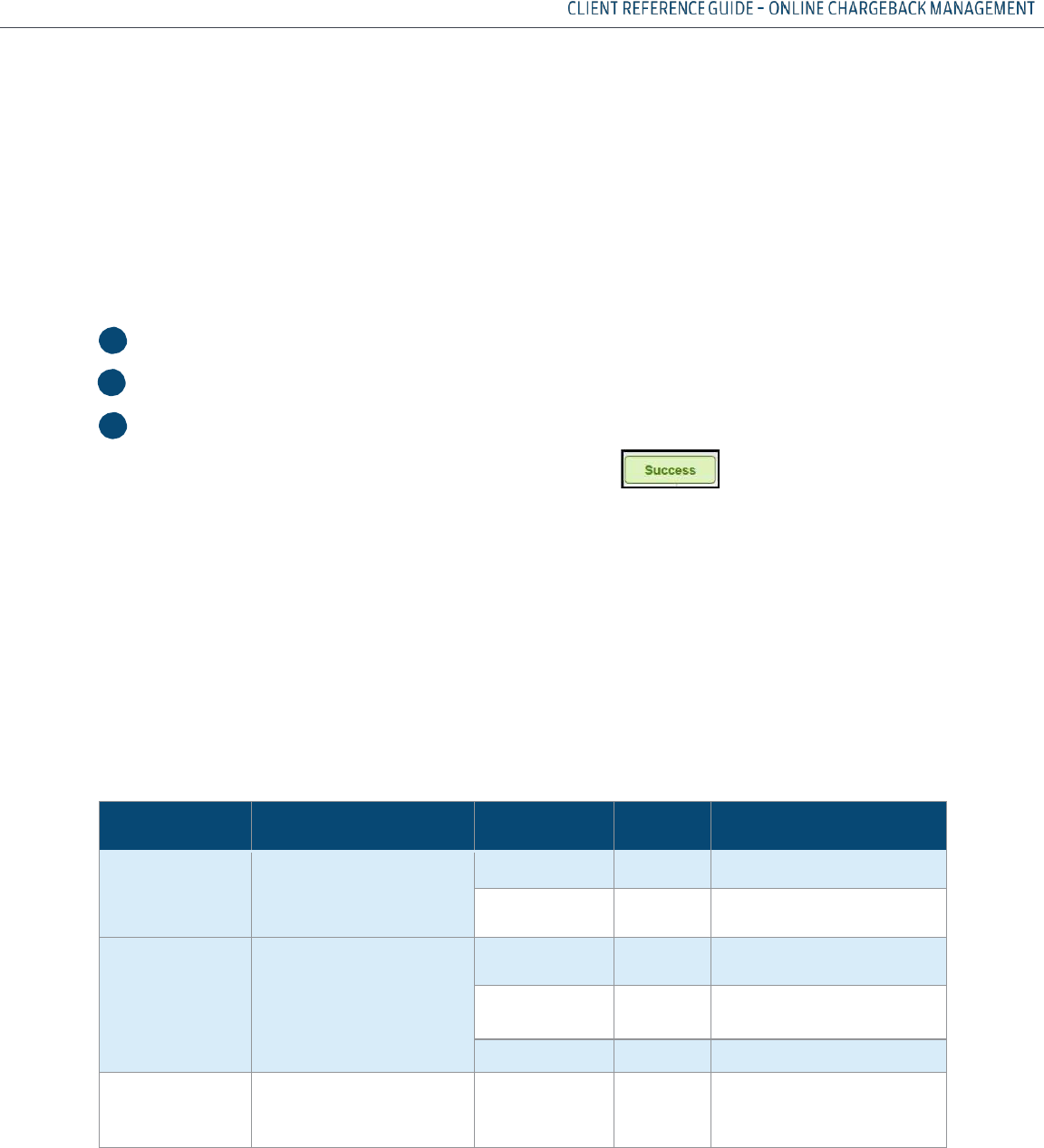

1 Select Browse to upload the document into the Chargeback Management application

2 Continue to upload any additional documents. A maximum of 3 documents can be uploaded

3 Click on Submit

ONCE THE FULFILLMENT IS SUBMITTED, A SUCCESS BUTTON WILL APPEAR AND WILL

MOVE THE USER BACK TO THE LEVEL 1 SCREEN.

Verify the uploaded document(s) can be viewed and opened and the information is appropriate.

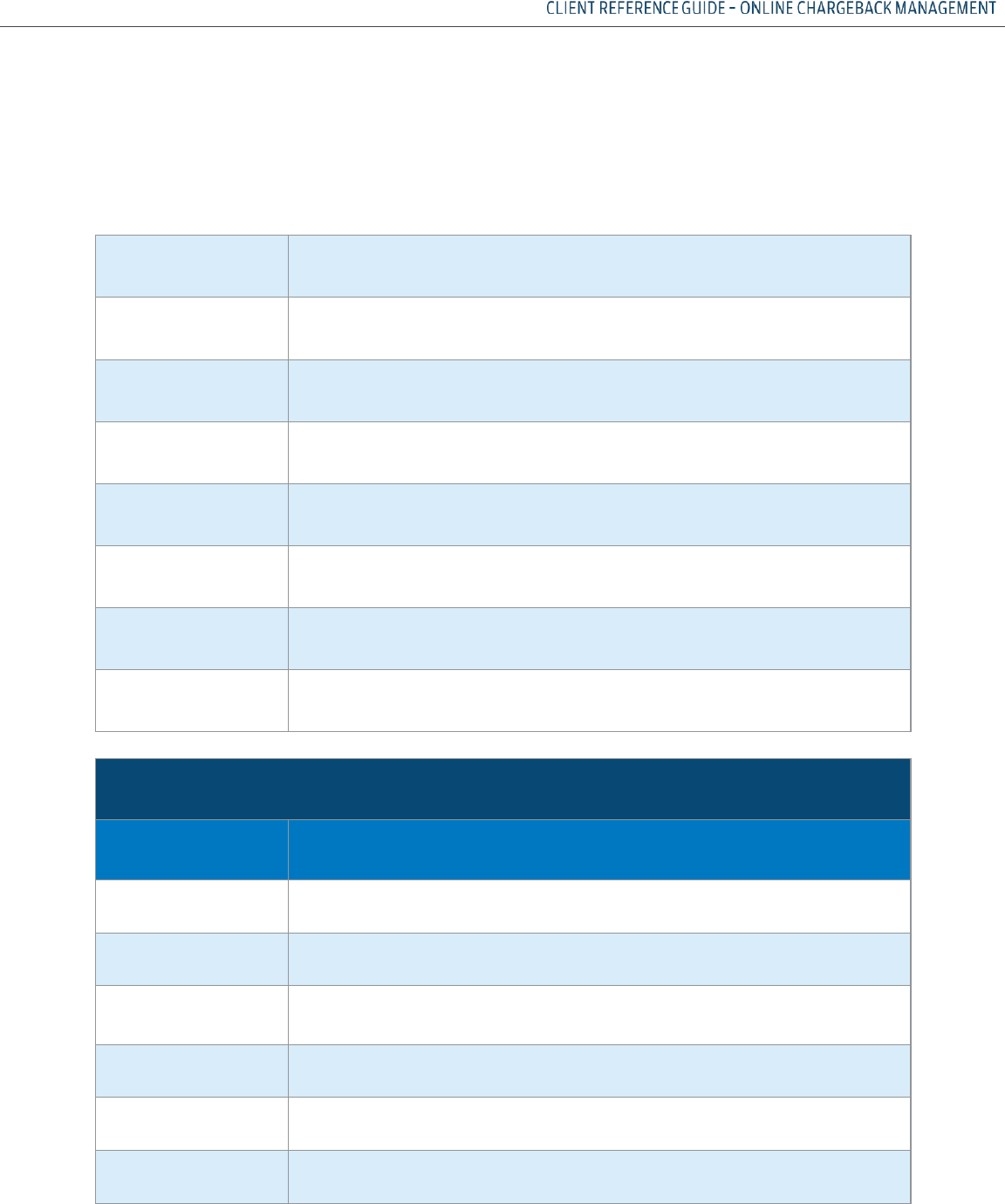

RETRIEVAL QUERIES

QUERY MENU

The chargeback management system provides you with a number of query options.

Details on Retrieval and Advanced Search are found below.

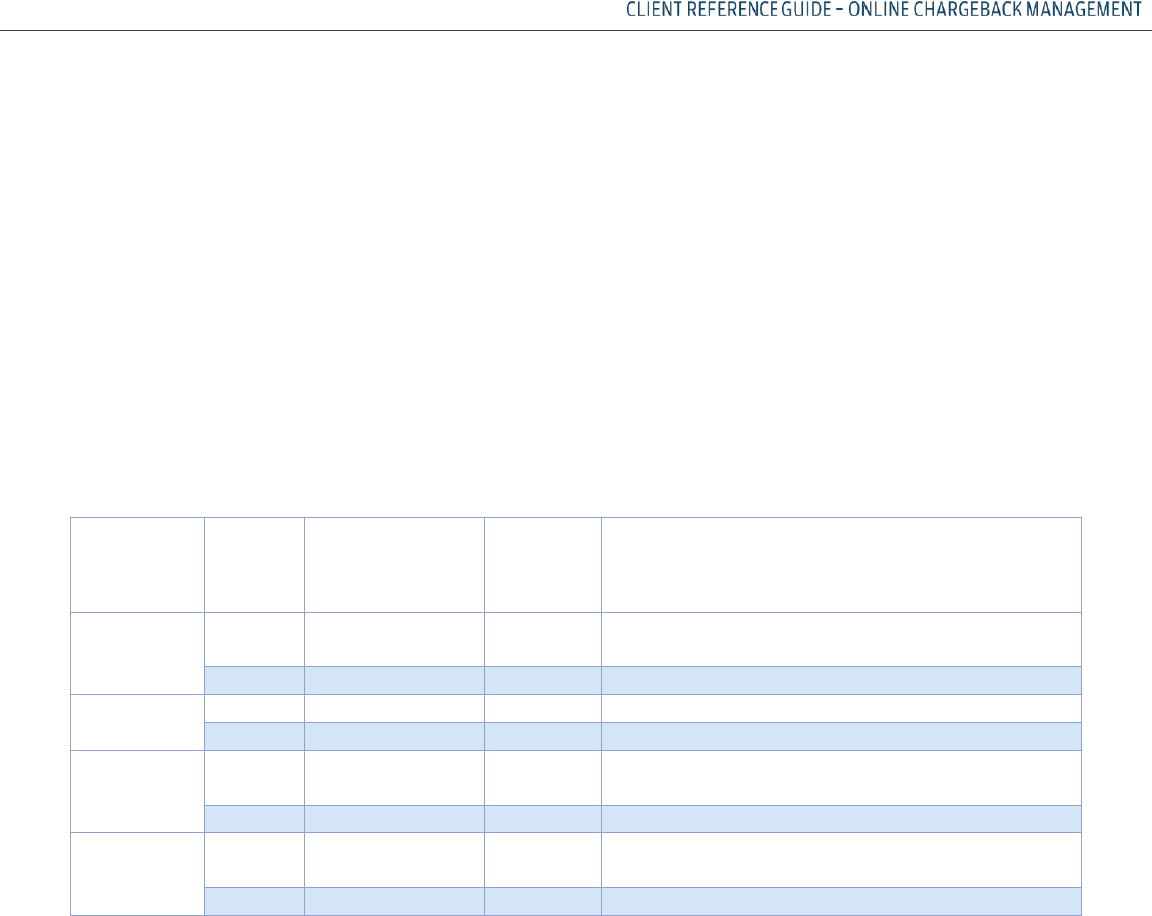

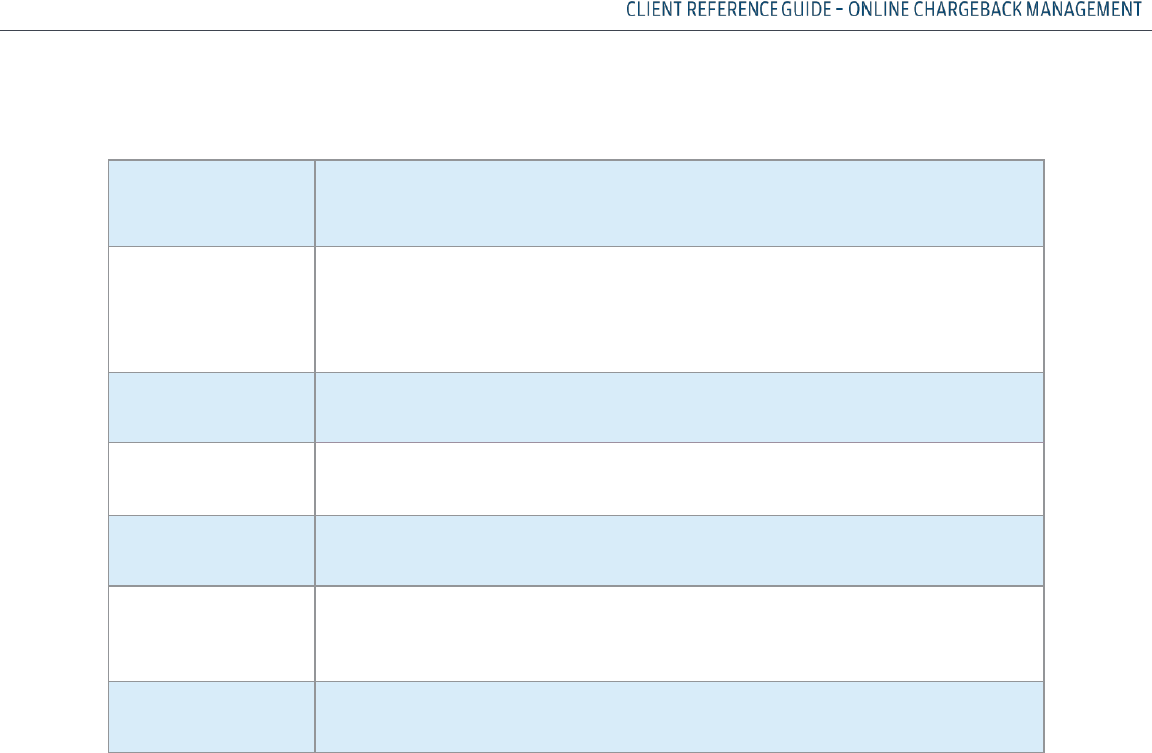

QUERY

DESCRIPTION

STATUS VIEWED

STATUS

CODE

ADDITIONAL QUERY CRITERIA

My Retrieval

Work Queue

Lists retrieval cases that

have been assigned to the

user viewing the work queue

RR Received

RR_REC

Due date has not passed

RR Declined

RR_DEC

Expiration date has not passed

Retrievals

Decisioned by

Paymentech

Displays a list of cases for

which Merchant Services has

reached a decision

RR Fulfilled

RR_FFL

Expiration date has not

passed

RR Auto Fulfilled

RR_AFL

Expiration date has not passed

RR Declined

RR_DEC

Expiration date has not passed

Retrievals Pending

Paymentech

Decision

Lists all retrieval cases

currently awaiting a decision

by Merchant Services

RR Fulfill

Requested

RR_FFR

©2016, Paymentech, LLC. All rights reserved. | commercesolutions.jpmorganchase.com | chasepaymentech.ca | jpmorgancommercesolutions.co.uk |

45

Retrievals

Received

o Lists all retrieval cases

received from Issuers

o No action has been taken

on these cases by

Merchant Services

o A client may begin to

work cases on the list

before they are assigned

to their individual work

queue

RR Received

RR_REC

Due date has not passed

Management

Query

Work Tracker for

MRA Role only

RETRIEVALS SEARCH QUERIES

The Advance Chargeback Search is used to perform a search for a particular retrieval transaction by

date or amount or for a group of like transactions, such as all transactions within a date range or

within an amount range or with a particular status code.

©2016, Paymentech, LLC. All rights reserved. | commercesolutions.jpmorganchase.com | chasepaymentech.ca | jpmorgancommercesolutions.co.uk |

46

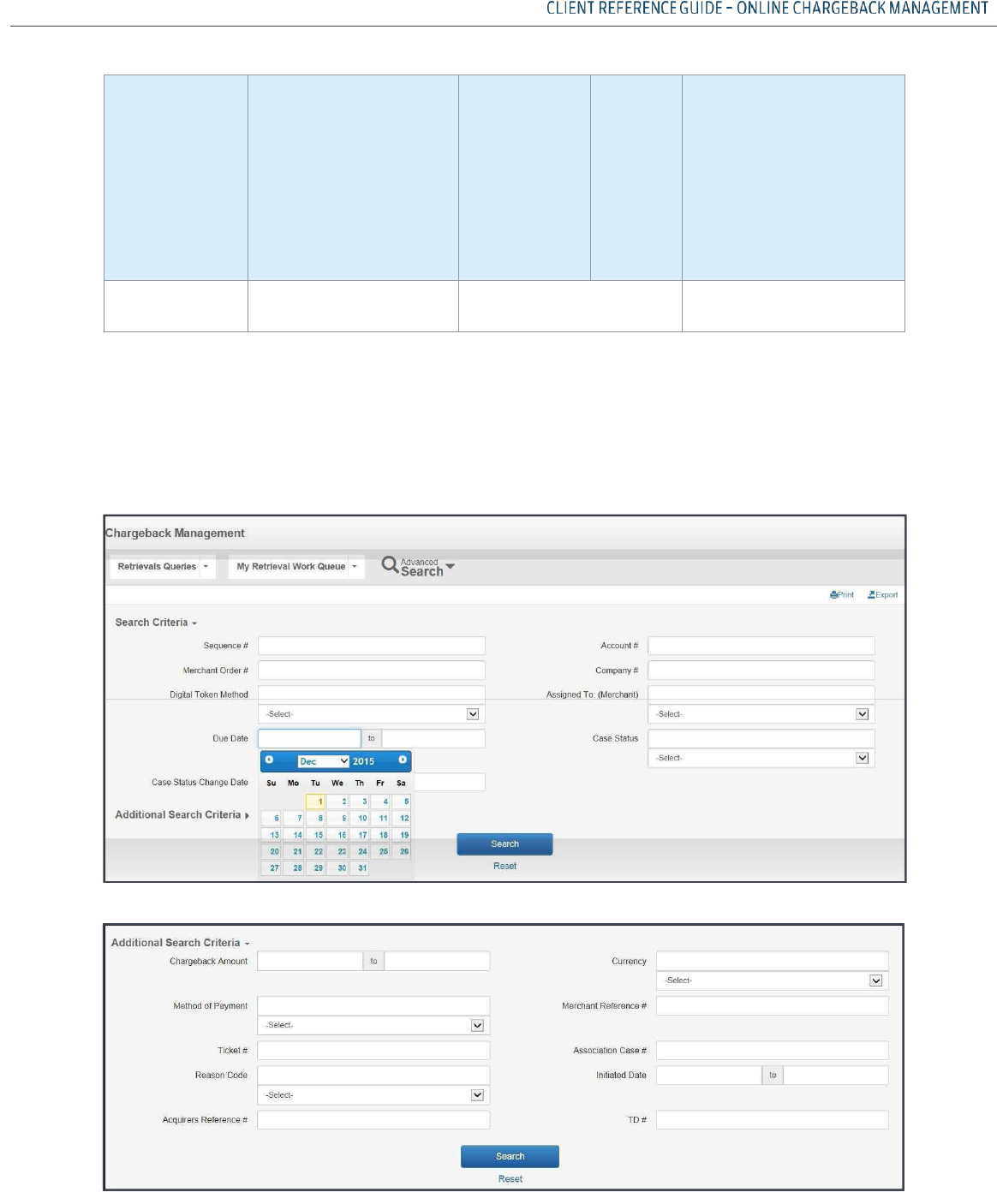

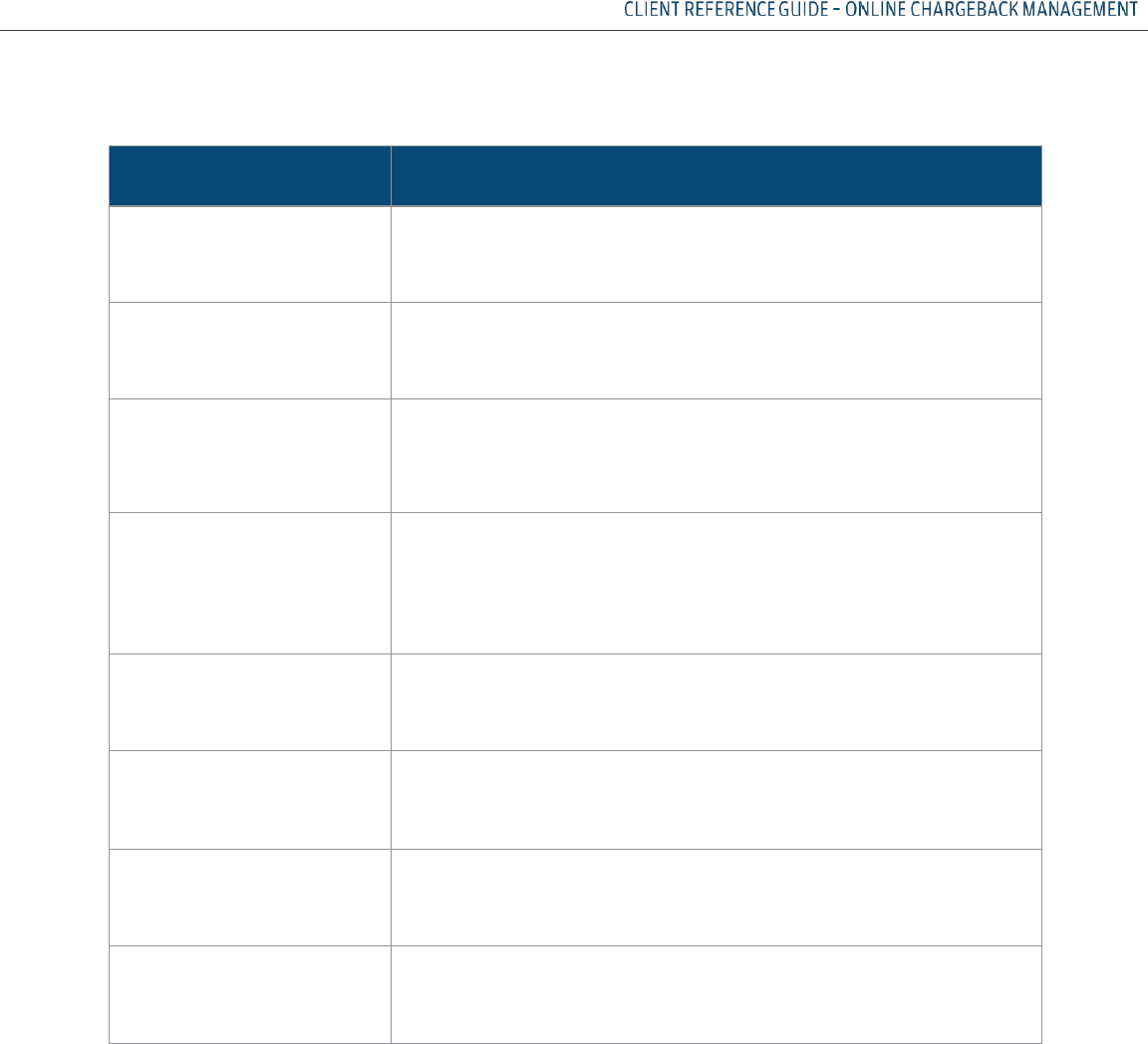

SEARCH SCREEN AND FIELD DEFINITIONS

FIELD

DESCRIPTION

Sequence #

Unique number assigned by Merchant Services that identifies the transaction in

our internal system. Input one or more, separated by commas.

Merchant Order #

Order number assigned by the client and submitted to Merchant Services

with the original transaction record. Input one or more, separated by

commas.

Digital Token Method

Replaces Account Number based on Client processing.

Due Date (to/from)

Date by which challenge to an item (if any) must be received by

Merchant Services.

Case Status Change

Date (to/from)

Most recent date on which action was taken that changed the Status Code on the

chargeback case.

Account #

Credit card number. Input one or more, separated by commas.

Company #

Number assigned to Client.

Assigned to

(Merchant)

Merchant Services Online User ID of the Merchant CB Analyst. Input one or more,

separated by commas.

Case Status

Predefined status for a chargeback case representing an action taken. A drop

down menu is provided of all possible statuses. Input one or more, separated by

commas.

Selecting statuses from the drop down will enter them into the criteria box for

you.

Chargeback Amount

Amount of chargeback in Presentment currency. Enter a single amount or a

range of amounts.

Currency

Currency Code of Presentment amount. Select one or more currency codes

from the drop down menu.

Merchant Reference #

The rolling sequential identifier assigned by the Chase Merchant Services and

embedded in the ARN.

Association Case #

Case number assigned to this chargeback item by the card association.

Examples are VISA and PayPal.

Initiated Date

Date the chargeback was initiated by the Issuer. Enter a single date or date

range.

TD

Transaction Division which chargeback applies.

Method of Payment

Method in which payment was applied for the transaction. Visa, MC, Discover,

etc.

Ticket #

Unique field for the Airline Industry to search by Ticket #.

©2016, Paymentech, LLC. All rights reserved. | commercesolutions.jpmorganchase.com | chasepaymentech.ca | jpmorgancommercesolutions.co.uk |

47

Reason Code

The code applied to the Retrieval as specified by the Payment Brands.

Acquirers Reference #

Case number assigned to this chargeback item by the card association.

Examples are VISA and PayPal.

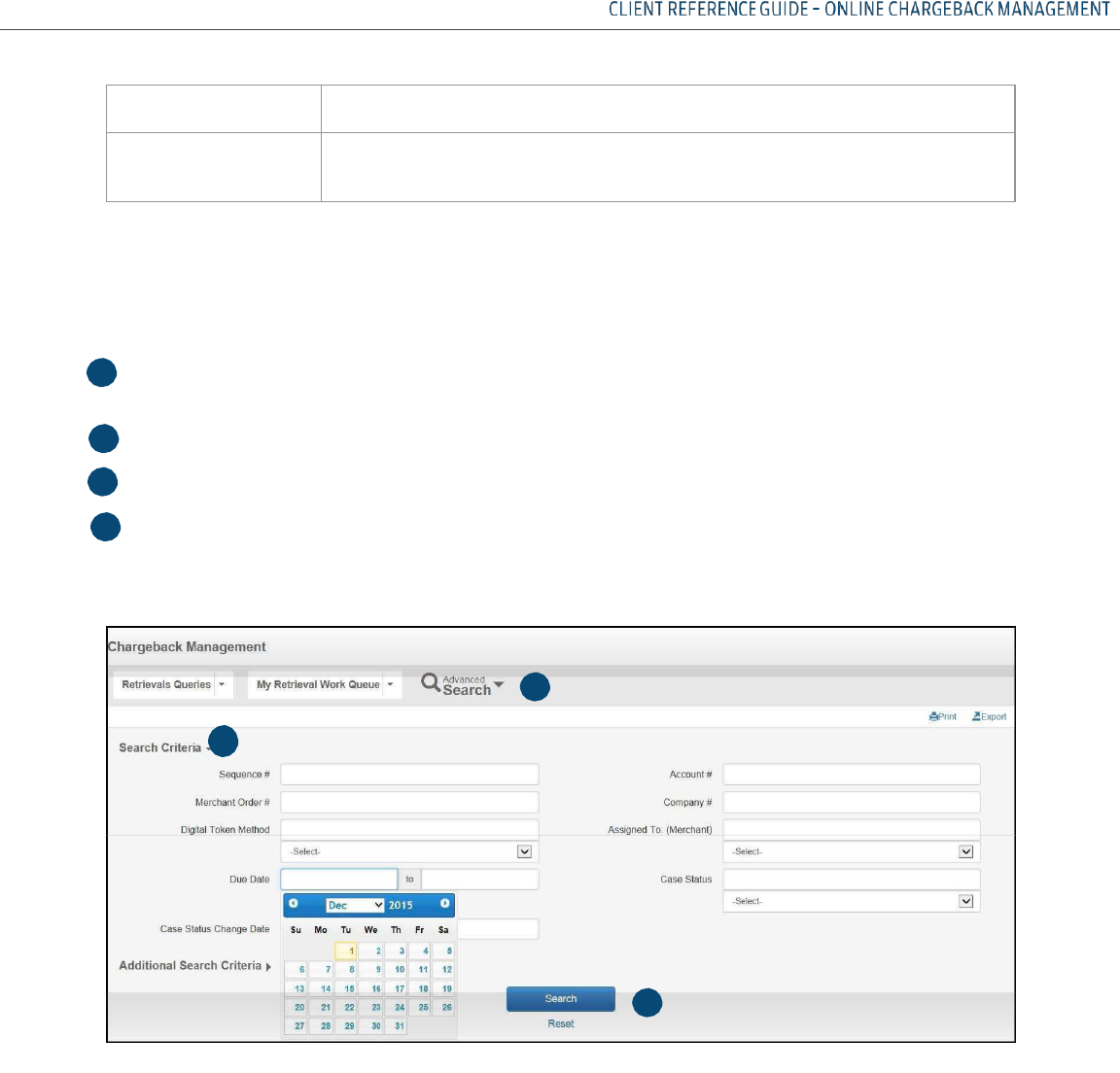

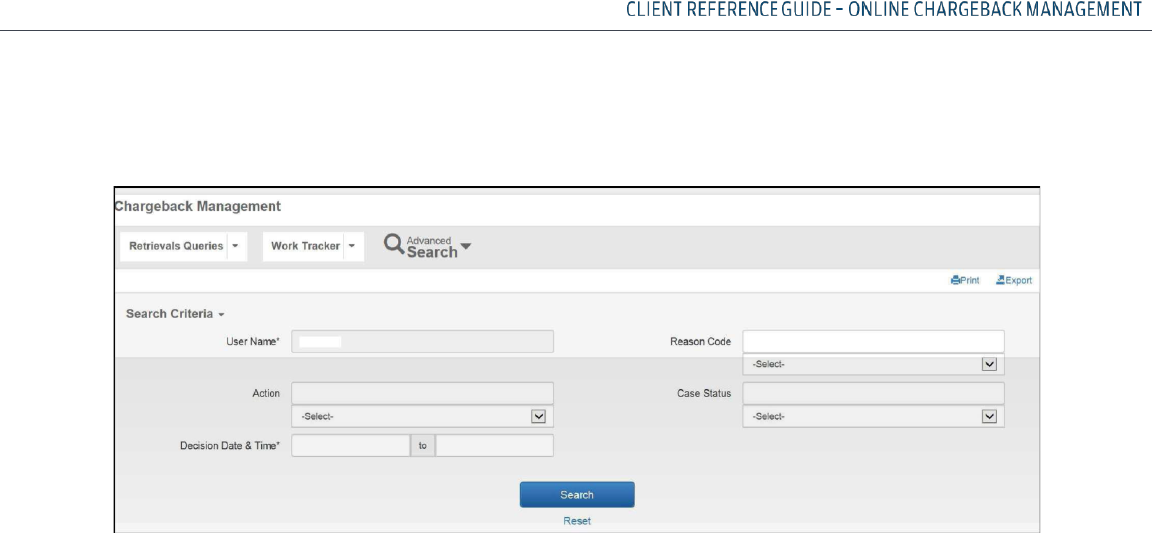

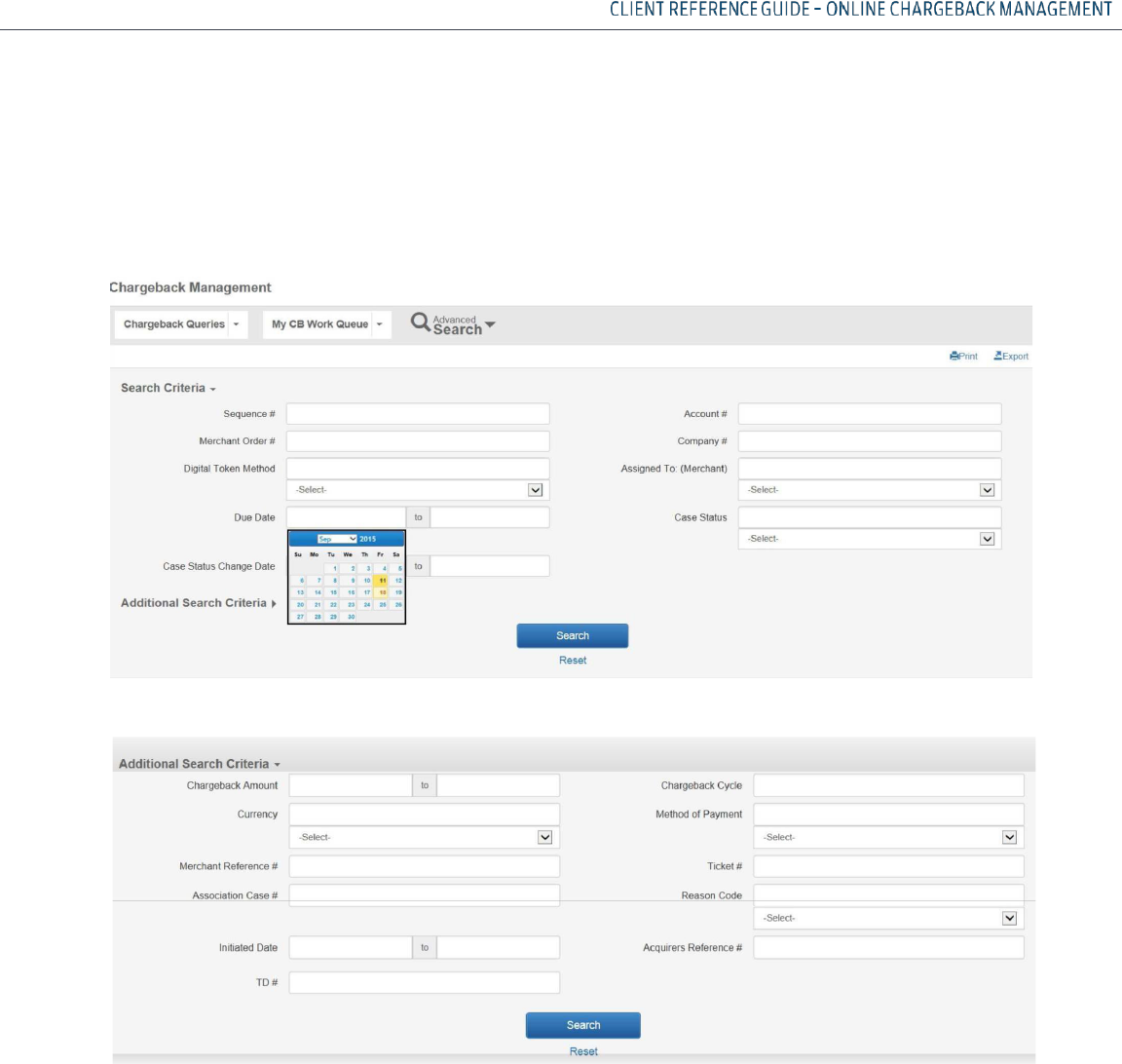

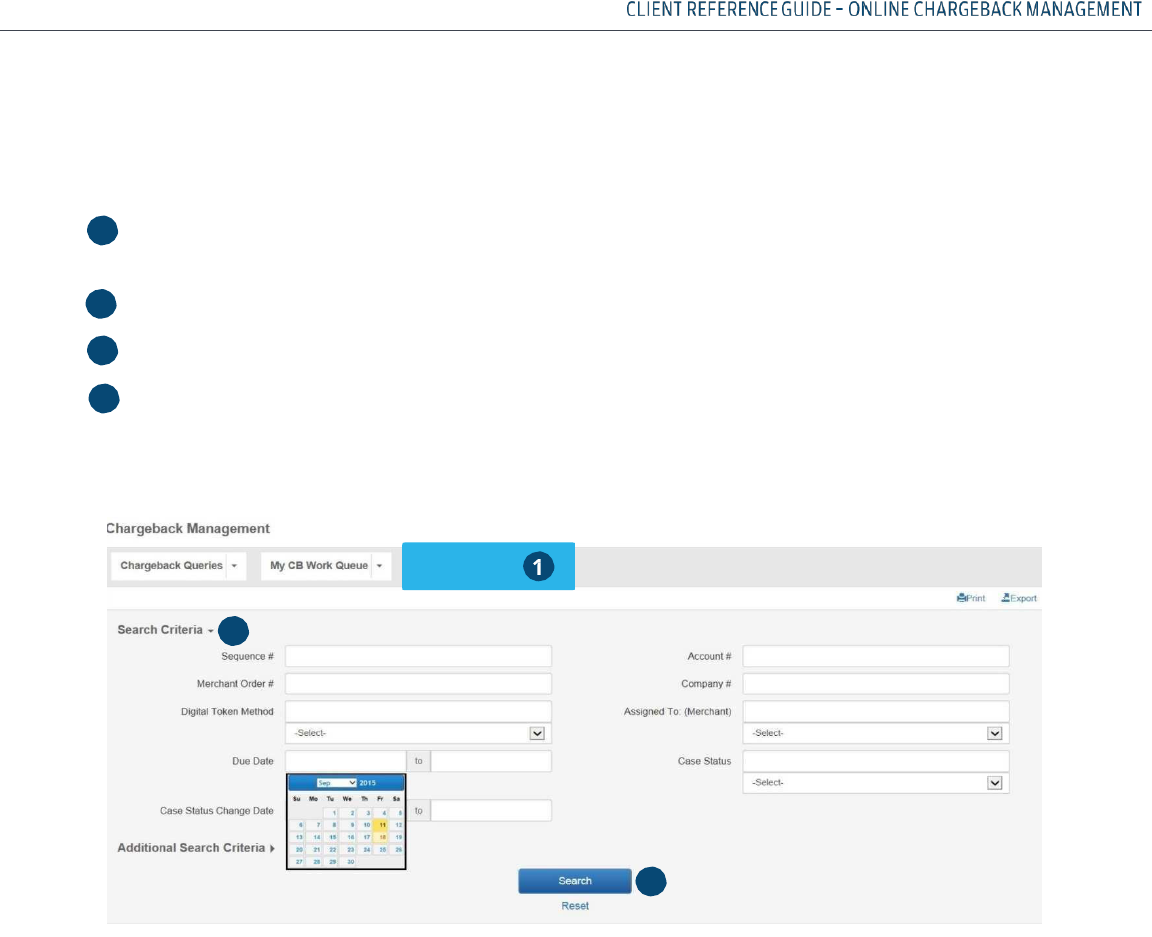

RUNNING ADVANCE RETRIEVAL SEARCH QUERIES

FOLLOW THE STEPS BELOW TO RUN AN ADVANCE SEARCH QUERY:

Click on Advanced Search drop down menu to display the Search Criteria screen

The Reset button allows you to clear information entered in the fields for the search

Enter the information in one or more fields to help narrow and define your query results

Click on Search

The query results will be displayed as Level 1 data

NOTE: To perform a new search, click on the Reset button to remove data from prior search criteria.

1

2

3

4

2

3

1

2

©2016, Paymentech, LLC. All rights reserved. | commercesolutions.jpmorganchase.com | chasepaymentech.ca | jpmorgancommercesolutions.co.uk |

48

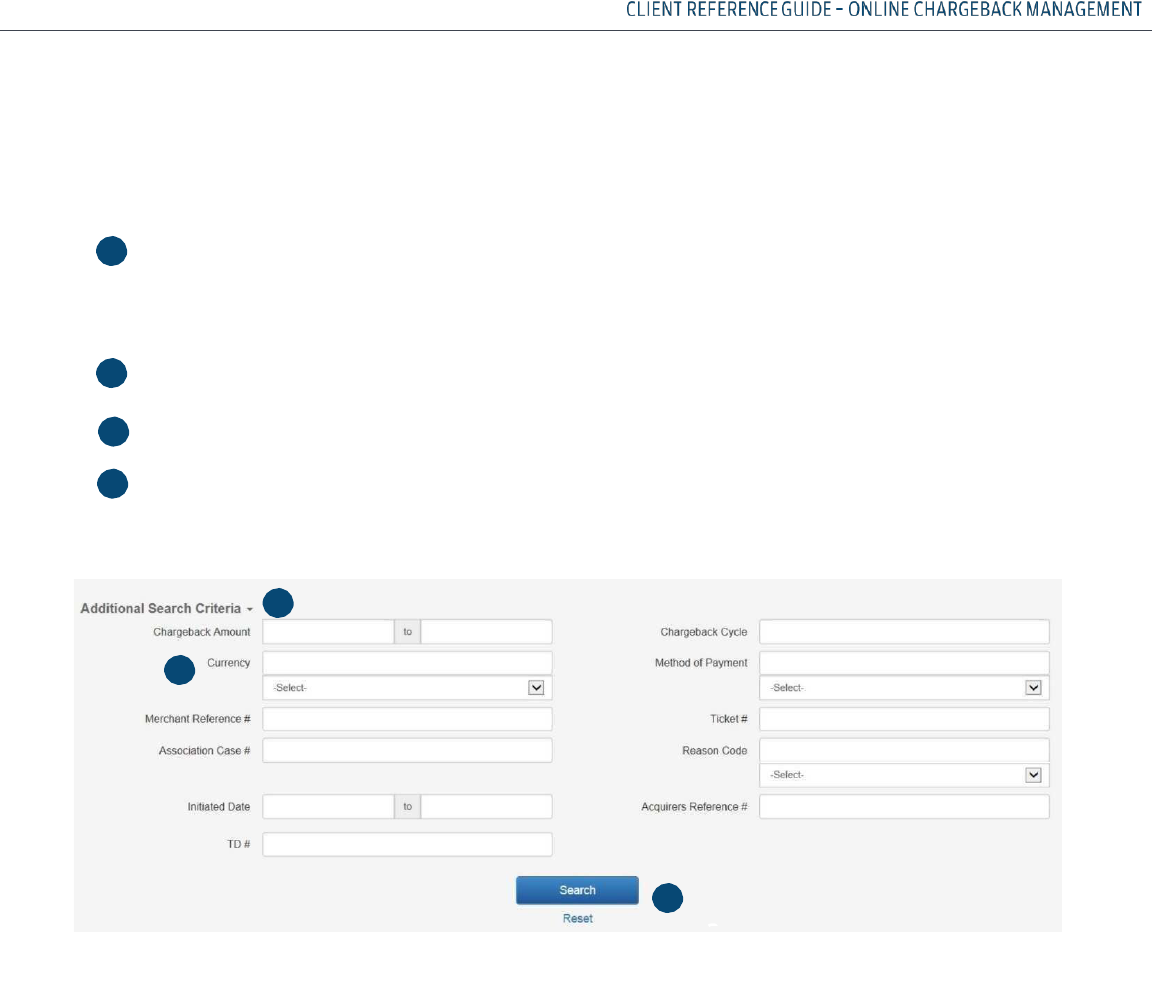

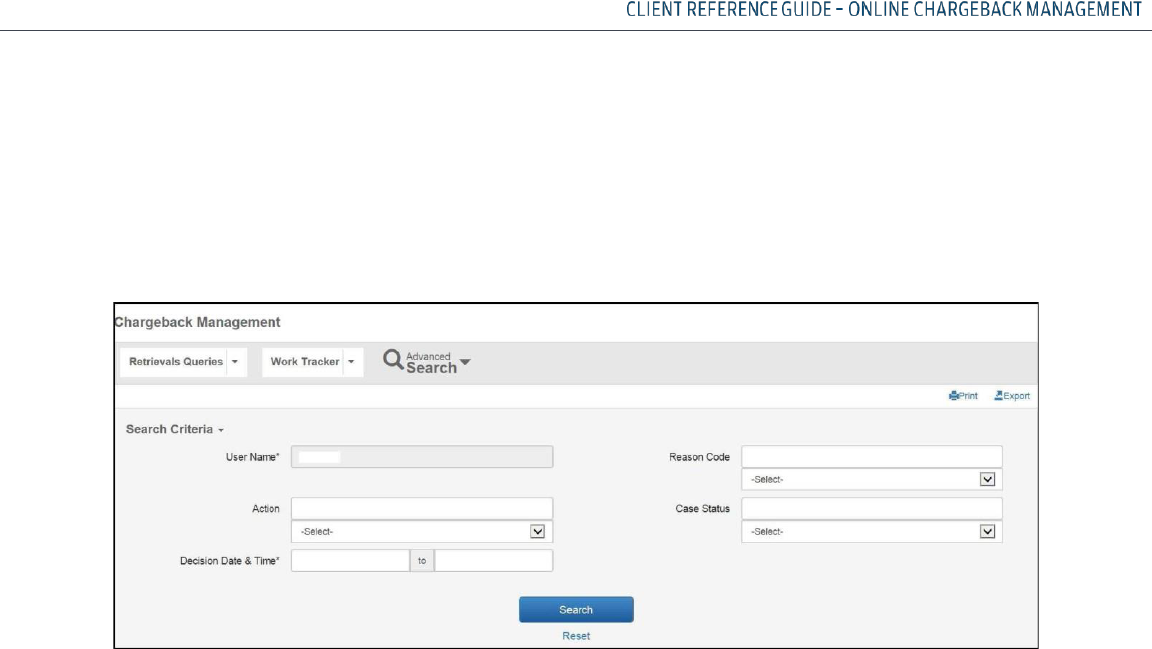

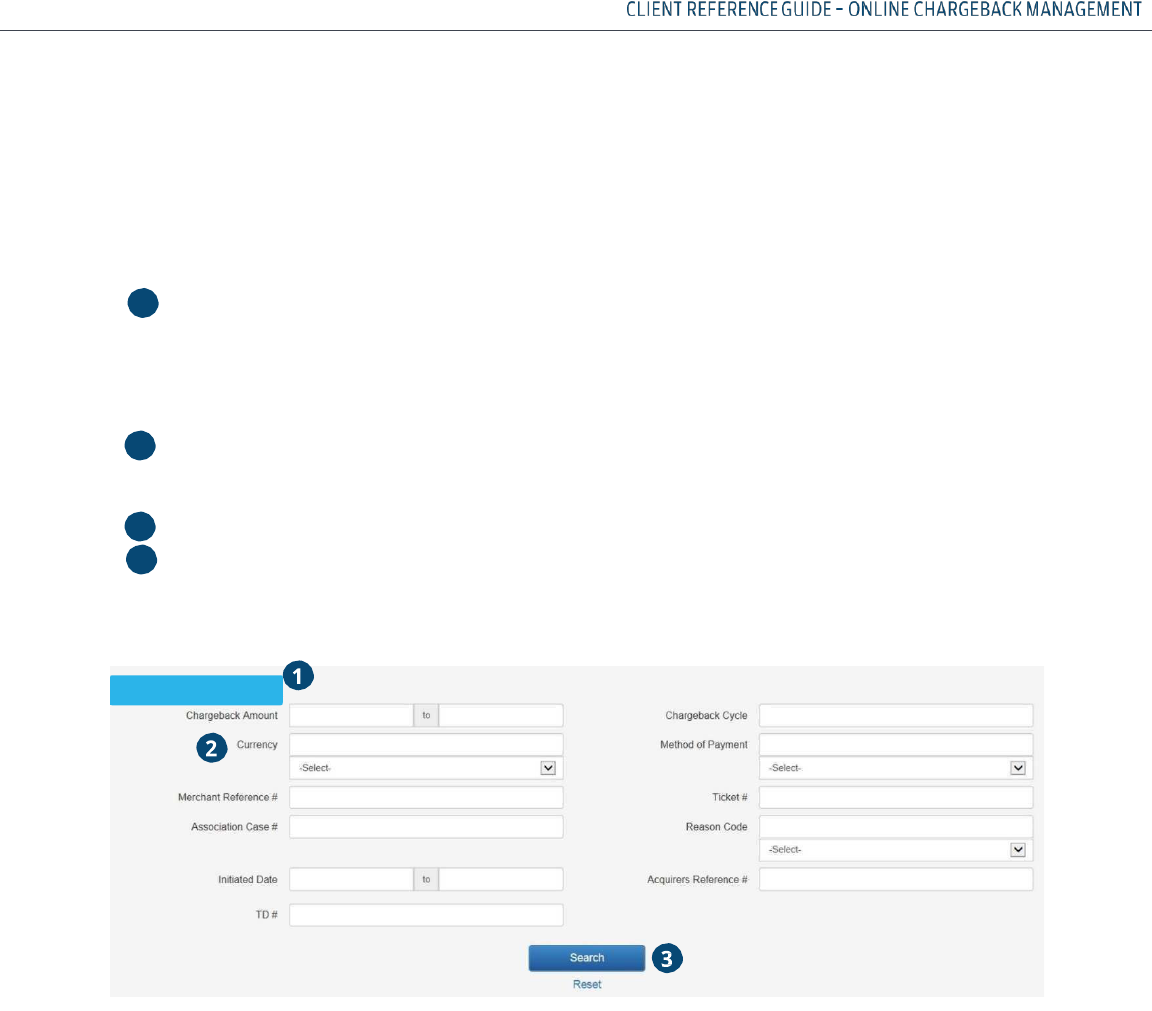

RUNNING ADVANCE RETRIEVAL SEARCH QUERIES –

USING ADDITIONAL SEARCH CRITERIA

The Advanced Search option provides many more parameters to use in narrowing your search.

Click on Advanced Search drop down menu to display the Search Criteria screen and select

Additional Search Criteria

The Reset button allows you to clear information entered in the fields for the search

2 Enter the information in one or more fields to help narrow and define your query results

Click on Search

The query results will be displayed as Level 1 data

1

2

3

4

1

2

3

©2016, Paymentech, LLC. All rights reserved. | commercesolutions.jpmorganchase.com | chasepaymentech.ca | jpmorgancommercesolutions.co.uk |

49

HEALTHCARE IIAS RETRIEVALS REQUESTS

©2016, Paymentech, LLC. All rights reserved. | commercesolutions.jpmorganchase.com | chasepaymentech.ca | jpmorgancommercesolutions.co.uk |

50

HEALTHCARE IIAS RETRIEVALS REQUESTS OVERVIEW

Healthcare benefit cards, typically referred to as FSA (Flexible Spending Account) or HRA

(Healthcare Reimbursement Account) debit cards are payment cards that consumers use for

qualifying medical expenses like prescriptions, over the counter medications, vitamins, durable

medical equipment, or medical supplies using monies allocated to special, pre-tax funded

accounts that are generally part of their employer sponsored health benefit plan.

These transactions, like regular payment card transactions are subject to retrieval requests

however, due to HIPPA and IRS rules, the requirement for storing transaction information as well

as fulfilling the request is somewhat unique.

• First, IIAS retrieval requests may occur up to 4.5 years from the date of the original transaction.

• Second, the way in which businesses are required to fulfill the request is different from typical

bankcard retrievals such that the response must go directly to the Card-Issuer and not through

Chase Commerce Solution. As a result of the IRS requirements, Chase Merchant Services has

modified its chargeback system and procedures to accommodate merchants who may be the

recipient of an IIAS retrieval request.

IIAS TRANSACTIONS IN THE ONLINE CHARGEBACK

MANAGEMENT SYSTEM

Healthcare IIAS retrieval requests will be found in the online chargeback management system in

the same manner as all other retrieval requests. They are easily recognized as IIAS transactions in

both the Tier 1 and Tier 2 screens by reviewing the Reason Codes listed. The Reason Codes 27

(VISA) and 43 (MasterCard

®

) will identify the transaction as an IIAS retrieval request.

See the screen shots below for examples of where to find these new codes.

It is important that you respond via the fax numbers for these transactions. Due to HIPPA

laws, your Chase Merchant Services Chargeback Analyst will not be reviewing these requests.

They must be sent directly to the requesting Issuer. If any information is sent to Chase

Merchant Services it will be shredded immediately due to confidentiality.

©2016, Paymentech, LLC. All rights reserved. | commercesolutions.jpmorganchase.com | chasepaymentech.ca | jpmorgancommercesolutions.co.uk |

51

IIAS TRANSACTIONS IN THE ONLINE CHARGEBACK

MANAGEMENT SYSTEM, CONTINUED

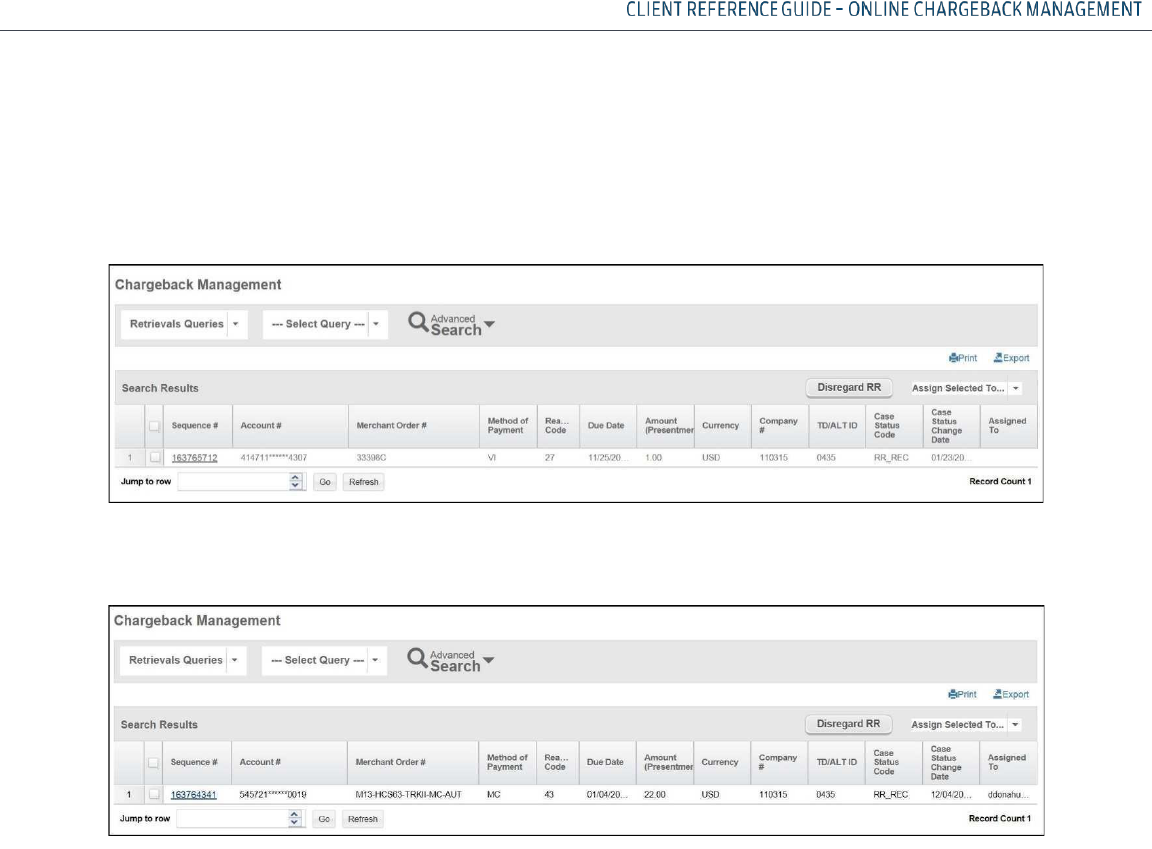

VISA LEVEL 1 SCREEN

FULFILLING IIAS RETRIEVAL REQUESTS

The Request Fulfill decision window will behave in the same manner for IIAS transactions as they

do for other transactions. There is no need to supply comments for these.

At the bottom of the Retrieval Info screen you will need to check off the “Supporting

Documentation has been faxed to the Issuer” box that will trigger the system to update the case

status. Then change the Available Actions dropdown to “Request Fulfill”. If you do not first click on

the check box you will receive the following error message “You must indicate that the Supporting

documents were faxed to the Issuer”.

If you do not check this box, the retrieval will be considered open and not fulfilled as Chase

Merchant Services has no other method of knowing if you have fulfilled the request with the

Issuer.

MASTERCARD

®

LEVEL

1

SCREEN

©2016, Paymentech, LLC. All rights reserved. | commercesolutions.jpmorganchase.com | chasepaymentech.ca | jpmorgancommercesolutions.co.uk |

52

IIAS TRANSACTIONS IN THE ONLINE CHARGEBACK

MANAGEMENT SYSTEM, CONTINUED

See the following screen shots for VISA and MasterCard

®

examples of this:

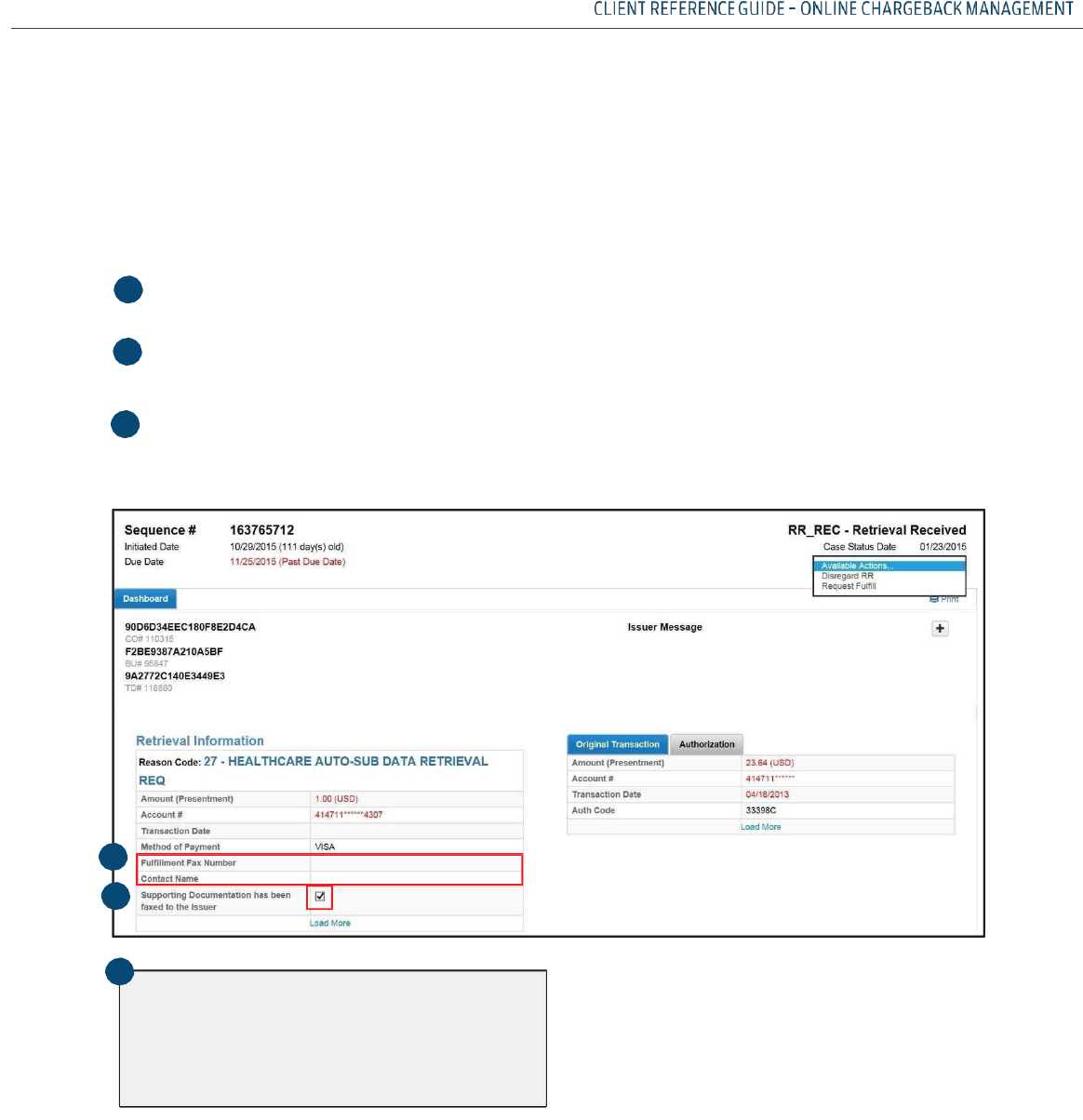

VISA IIAS TRANSACTION RETRIEVAL REQUEST:

1 The Issuer Contact Information

The check box to indicate the Supporting Documentation has been faxed to the

Issuer

2 A warning message will appear if the Supporting Documents check box is left blank

• You must indicate that the Supporting Documents were faxed to the Issuer

1

Warning:

You

must

indicate

that

the

supporting

documents

were

faxed

to

the

Issuer

1

1

2

2

3

3

©2016, Paymentech, LLC. All rights reserved. | commercesolutions.jpmorganchase.com | chasepaymentech.ca | jpmorgancommercesolutions.co.uk |

53

IIAS TRANSACTIONS IN THE ONLINE CHARGEBACK

MANAGEMENT SYSTEM, CONTINUED

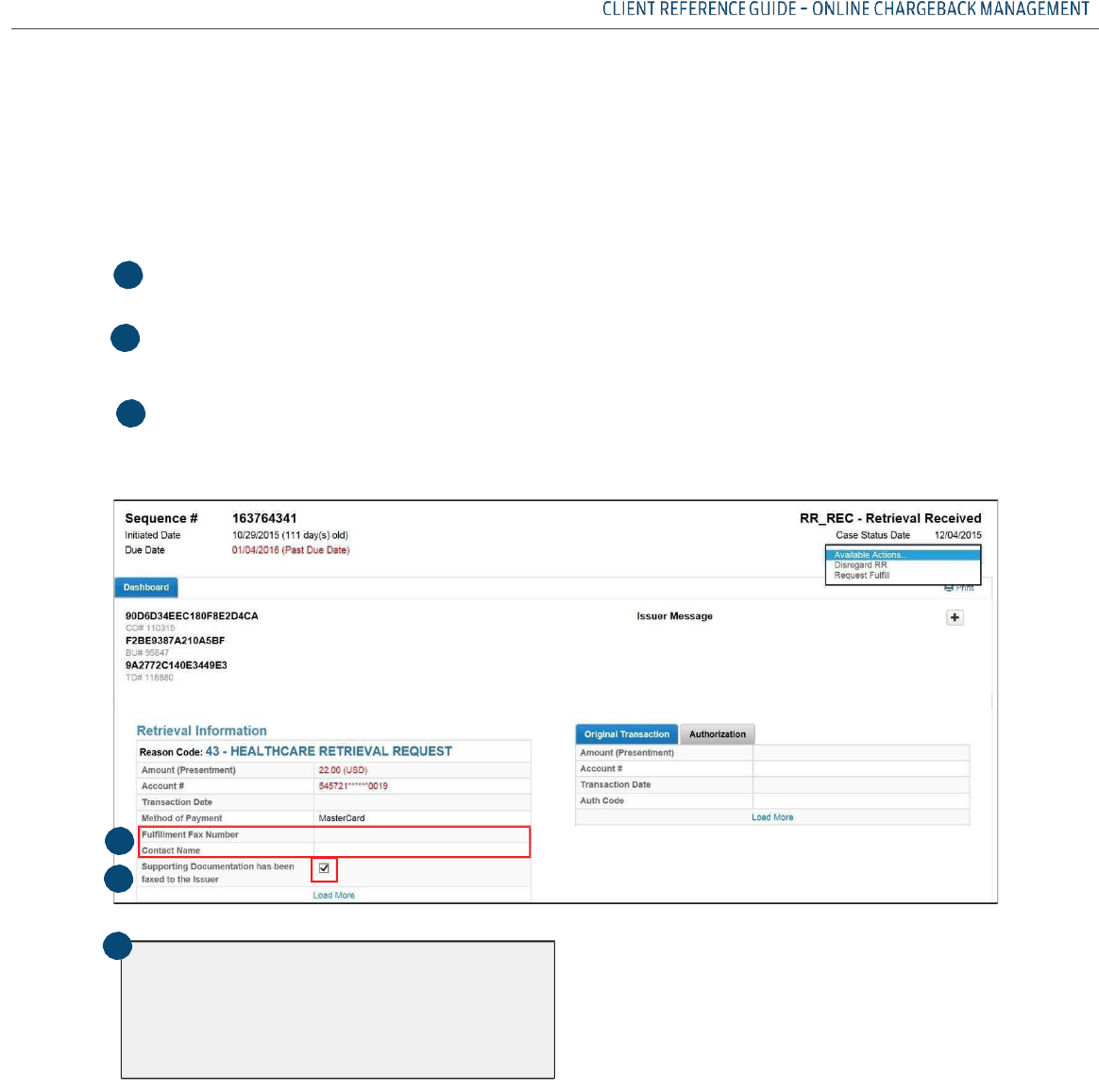

MASTERCARD

®

IIAS TRANSACTION RETRIEVAL REQUEST:

1 The Issuer Contact Information

2 The check box to indicate the Supporting Documentation has been faxed to the

Issuer

3 A warning message will appear if the Supporting Documents check box is left blank

• You must indicate that the Supporting Documents were faxed to the Issuer

Warning:

You

must

indicate

that

the

supporting

documents

were

faxed

to

the

Issuer

1

1

2

2

3

3

©2016, Paymentech, LLC. All rights reserved. | commercesolutions.jpmorganchase.com | chasepaymentech.ca | jpmorgancommercesolutions.co.uk | 54

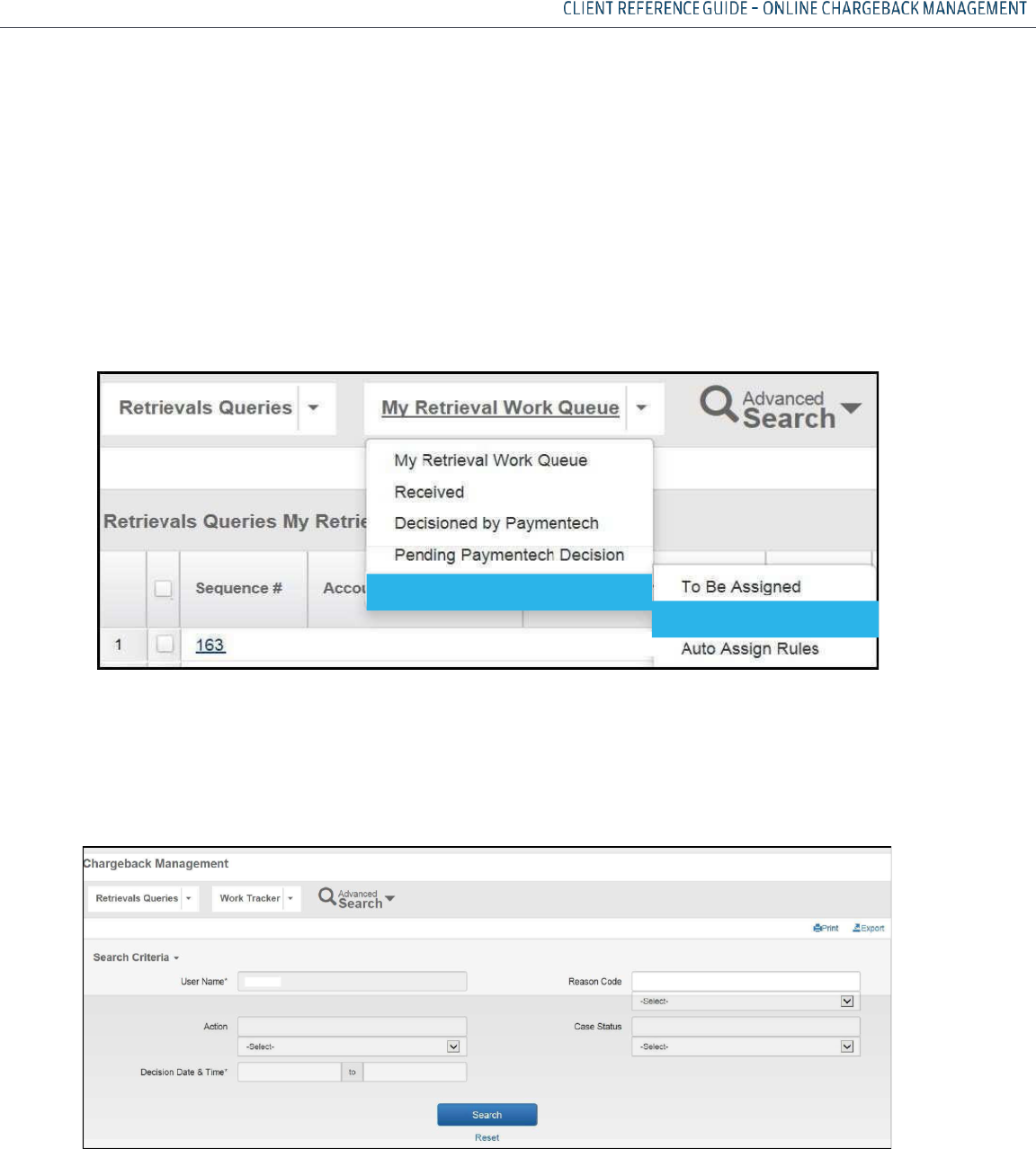

RETRIEVAL WORK TRACKER

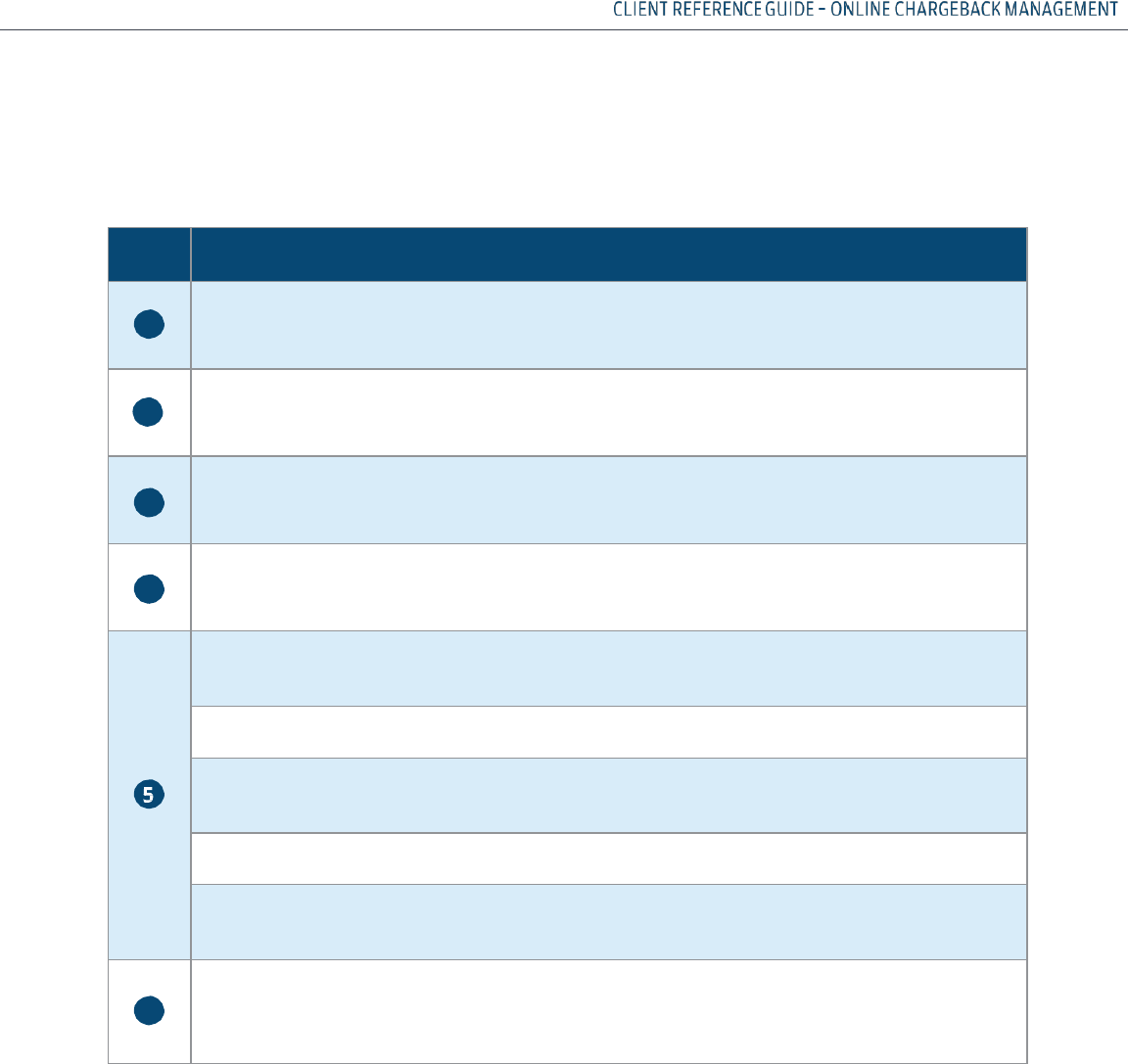

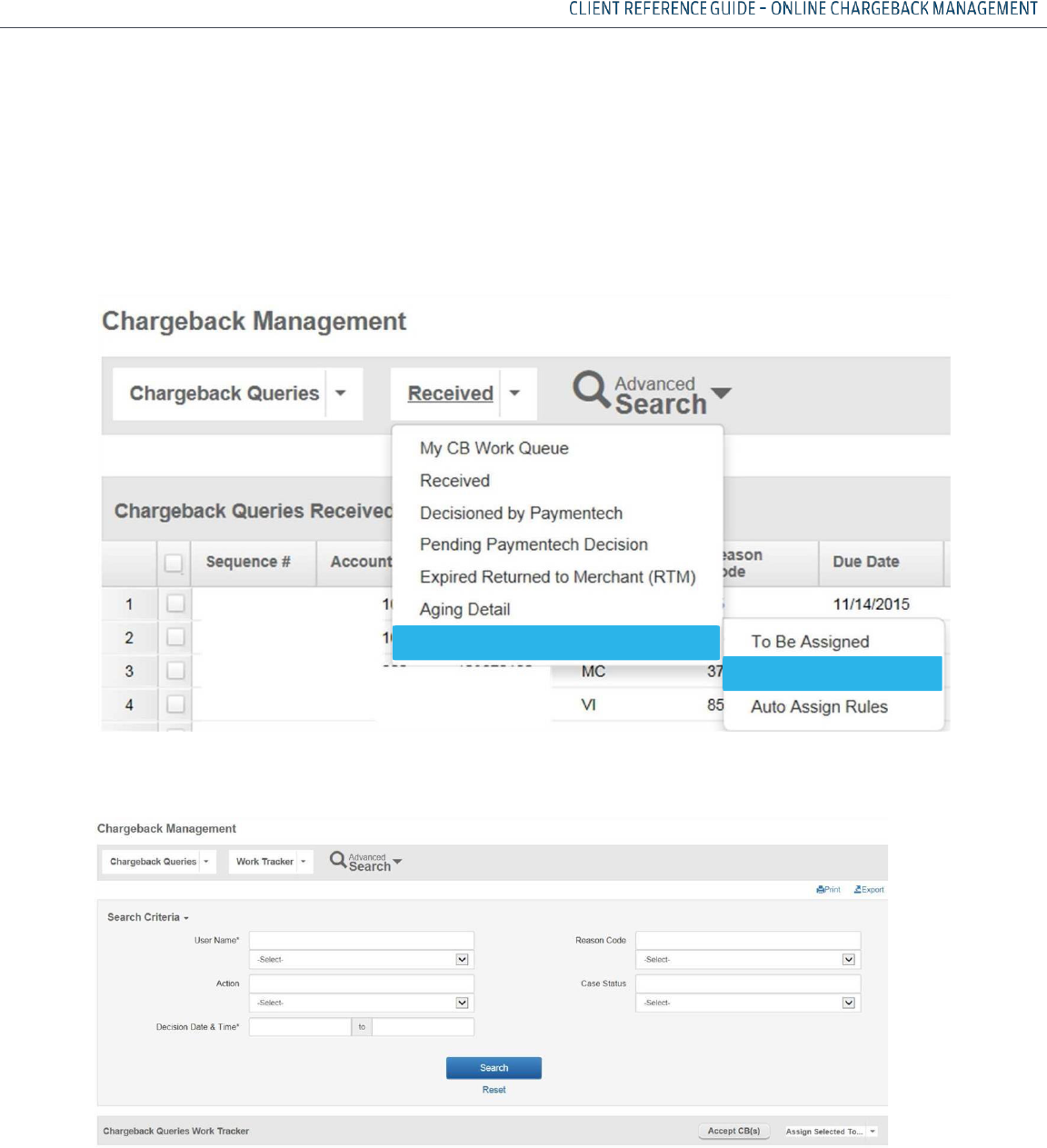

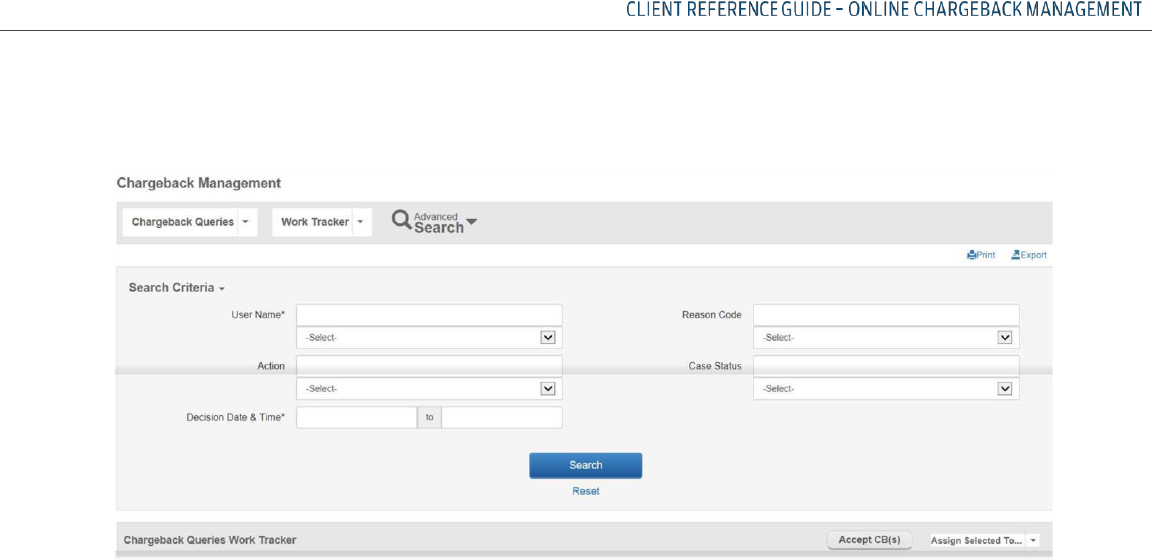

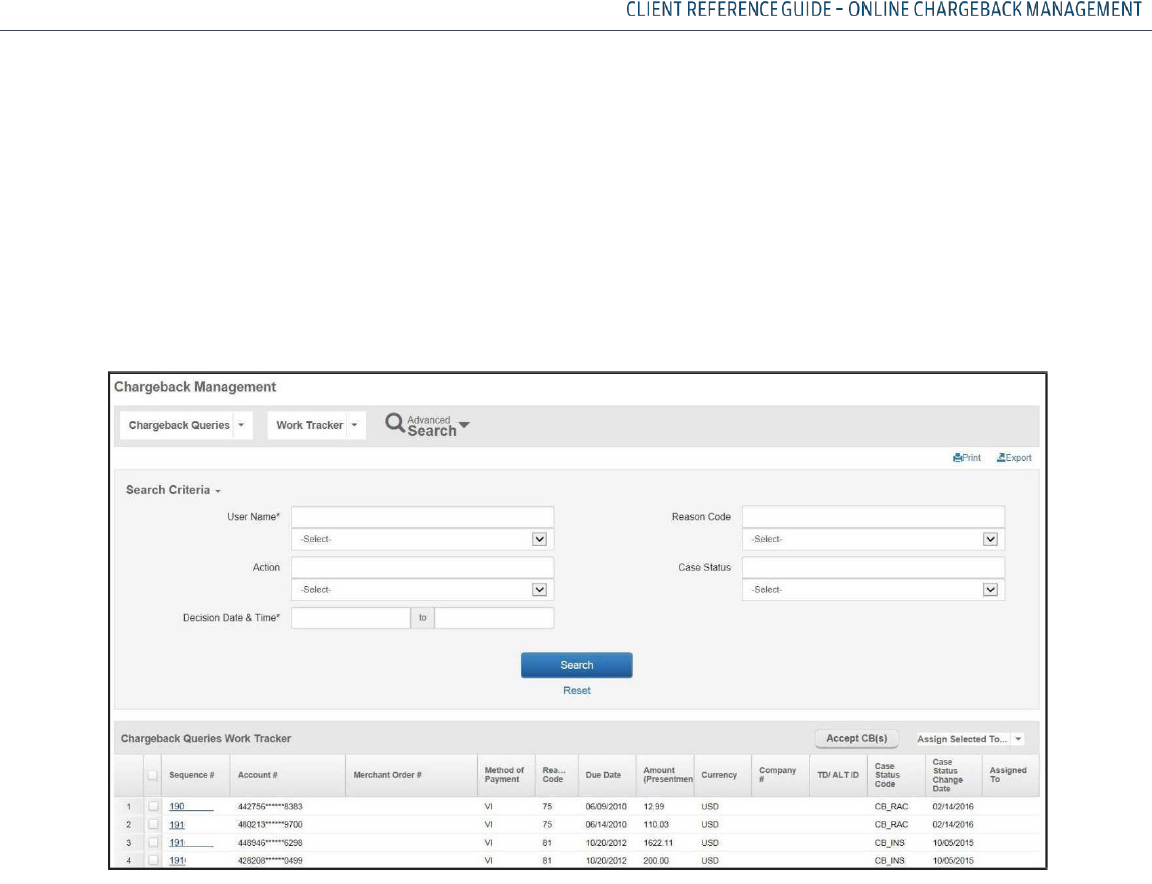

WORK TRACKER

The Work Tracker Queue allows the user to input specific data to display chargebacks that have been

worked on or responded to with a specific time period in the current day.

Input the criteria you would like applied to the query.

NOTE: For MRA Role the User ID will default under User Name field. The selection, Auto Assign Rules, only

applies to the MRQA Role

©2016, Paymentech, LLC. All rights reserved. | commercesolutions.jpmorganchase.com | chasepaymentech.ca | jpmorgancommercesolutions.co.uk | 55

RETRIEVAL WORK TRACKER, CONTINUED

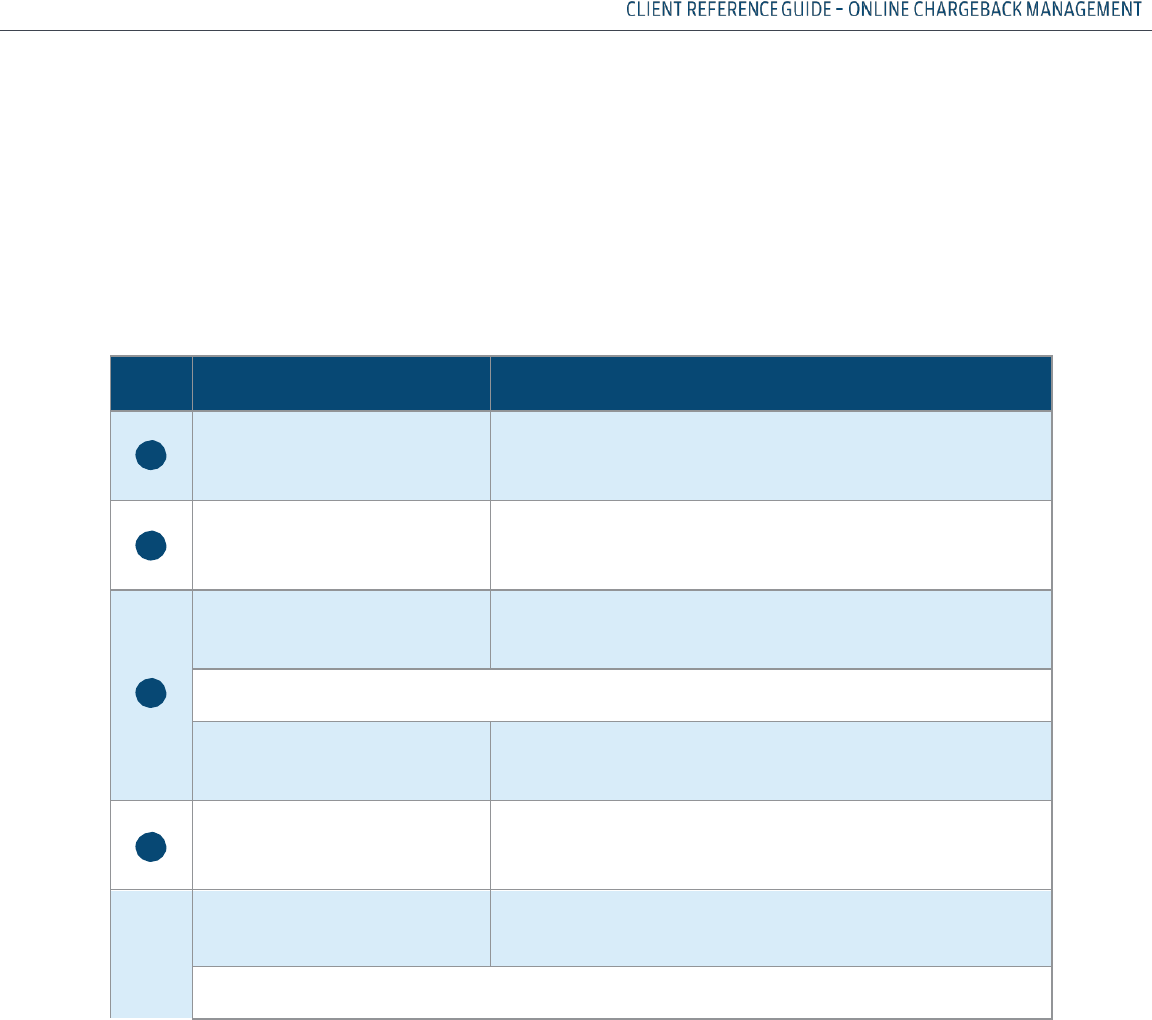

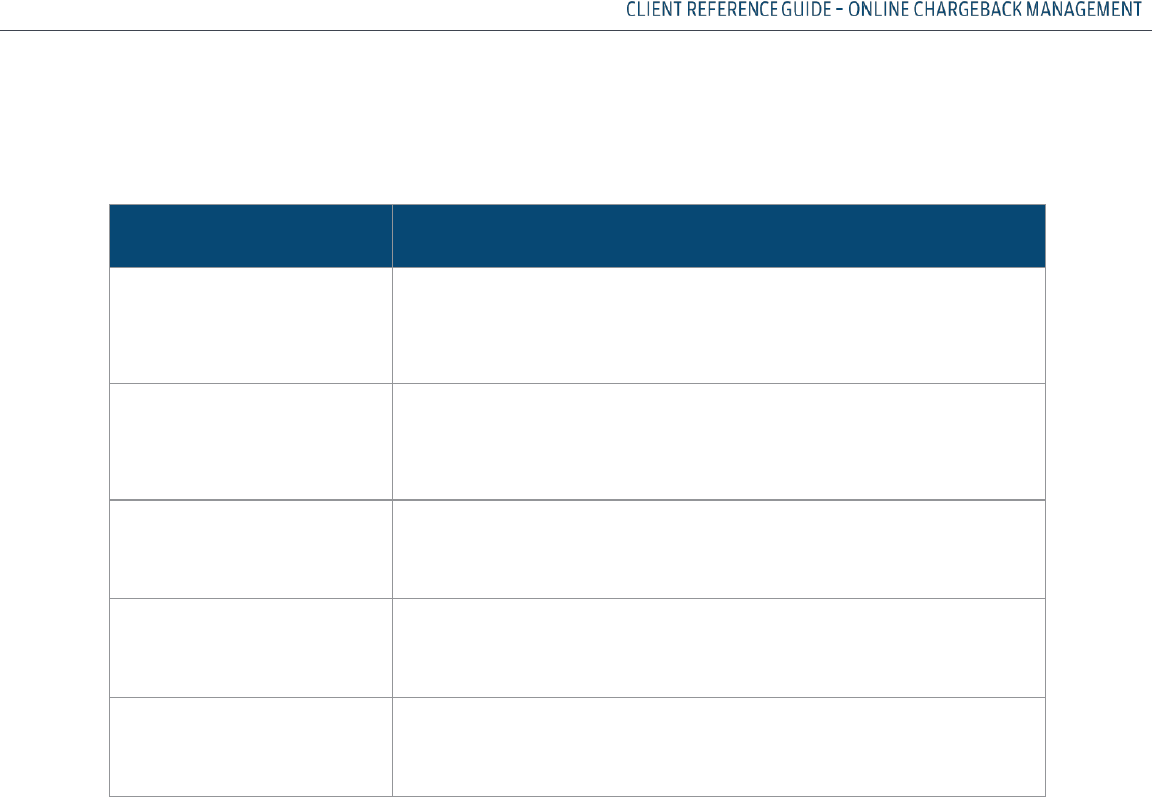

FIELD

DESCRIPTION

User Name

The name of the person who Decisioned the case, not the person

it is/was assigned to, multiple selections may be made.

This is a required field (MRA user names will auto-populate

when they utilize this query, they will not have the drop

down menu).

Decision Start

Start Date and time (if applicable) that the cases were decisioned.

If no time is provided, a time of 12:00:00 am is assumed.

This is a required field.

Decision End

Ending Date and time (if applicable) that cases were decisioned. If

no time is provided, a time of 11:59:59 pm is assumed.

This is a required field.

Reason Code

Standard list of reason codes.

Action(s)

Disregard RR and Request Fulfill.

Case Status

Write in the appropriate Case Status Code for your search.

©2016, Paymentech, LLC. All rights reserved. | commercesolutions.jpmorganchase.com | chasepaymentech.ca | jpmorgancommercesolutions.co.uk | 56

RETRIEVAL WORK TRACKER, CONTINUED

When you have entered all of the information to narrow down your search, select the “Search” button.

When doing a query, it is possible that a retrieval worked during the specified time period

could change multiple times during the time period.

Example: When searching on “aname”, you can see that “aname” fulfilled a retrieval at 9 am

even though “mmouse” fulfilled it at 2 pm.

©2016, Paymentech, LLC. All rights reserved. | commercesolutions.jpmorganchase.com | chasepaymentech.ca | jpmorgancommercesolutions.co.uk | 57

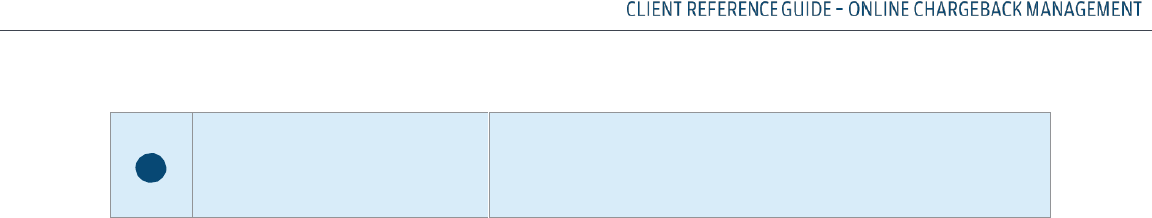

RETRIEVAL WORK TRACKER, CONTINUED

SEARCH RESULTS

From this query, you are able to review what was worked on and adjust as needed (as long as no

actions have been taken by Merchant Services on the case). Although you can work on cases from

this query, it is not recommended. Only cases that have been worked on by an MRA will be

selected to display in this query. The query will not track case assignment.

MRQA’s will have access to view all users when utilizing this feature. MRAs will have access to

their own user name only.

©2016, Paymentech, LLC. All rights reserved. | commercesolutions.jpmorganchase.com | chasepaymentech.ca | jpmorgancommercesolutions.co.uk | 58

CREDIT CHARGEBACKS

©2016, Paymentech, LLC. All rights reserved. | commercesolutions.jpmorganchase.com | chasepaymentech.ca | jpmorgancommercesolutions.co.uk | 59

CHARGEBACK OVERVIEW:

A chargeback is the reversal of a transaction that arises from a processing technicality, a customer

dispute, or fraudulent activity. It is a violation of a card association rule or regulation for which a

specific reason code has been established. Merchant Services works as your partner to help

manage and process the chargebacks you receive. A dedicated chargeback analyst is assigned to

your company when you first start sending us files. In this way, the analyst becomes familiar with

your company and you have a specific person to contact when necessary.

Associations regulate the processing of charged back transactions through their list of reason

codes and processing timeframes. They also dictate the number of times a chargeback can be

represented to the Issuer.

Detailed reporting is available on the Chargeback Activity Detail (PDE-0017) report including received,

represented, returned to merchant and successful recourse items. A financial summary provides a

snapshot of your chargeback inventory status as of the reporting date. The financial net impact of

chargeback activity is also included on your Deposit Activity Summary (FIN-0010) and any associated

charges and processing fees are found on the Service Charge Detail (FIN-0011).

There are also reports that track monthly summary data and chargebacks won and lost.

Samples and field definitions for these analysis reports are found in the Appendix B.

©2016, Paymentech, LLC. All rights reserved. | commercesolutions.jpmorganchase.com | chasepaymentech.ca | jpmorgancommercesolutions.co.uk | 60

VISA AND MASTERCARD

®

CHARGEBACK CATEGORIES

Chargebacks received from VISA and MasterCard

®

Issuers fall into two categories

• Technical

• Customer Dispute

Technical Chargebacks are initiated by the Issuer for authorization or processing related reasons

with no cardholder participation, such as:

• Information requested in a retrieval request was not received or was illegible or invalid

• Authorization number is missing or has been declined

• Invalid account number was used

• Late presentment of the original transaction

• Duplicate transactions

Customer Dispute Chargebacks result when a cardholder refuses to accept responsibility for

a charge appearing on their card billing statement. The cardholder contacts the Issuer

indicating that they:

• Are disputing a specific charge for specific reasons (such as ordered merchandise or a service was never

received, the product or service was not what was originally described, or the purchase was not authorized

by the cardholder)

• Have attempted to resolve the situation with the client (unless fraud). Once the Card-Issuer has been

contacted and received any required documents, the Card-Issuer credits the cardholder’s account and

electronically submits the chargeback transaction bearing a specific reason code to Merchant Services.

©2016, Paymentech, LLC. All rights reserved. | commercesolutions.jpmorganchase.com | chasepaymentech.ca | jpmorgancommercesolutions.co.uk | 61

TECHNICALCHARGEBACK WORKFLOW

Below is an illustration and discussion of the work flow for a technical chargeback/dispute:

Issuer

disputes

the

transaction;

sends

the

chargeback

electronically

Transaction

flows

through

the

Interchange

Merchant Services

receives

the

chargeback

Client

is

notified

of

the

chargeback

activity

Auto - represent

-

or

Auto – Pre- arbitration

Forwarded

to

Merchant Services

for

further

research

Auto

-

return

to

merchant

(

)

RTM

Merchant Services

matches

the

chargeback

to

Transaction

History

and

records

in

the

chargeback

system,

then

one

of

three

actions

occurs:

•

Auto

-

represent

•

Auto

-

Pre

-

arbitration

•

Forward

to

the

CB

queue

•

Auto

-

return

©2016, Paymentech, LLC. All rights reserved. | commercesolutions.jpmorganchase.com | chasepaymentech.ca | jpmorgancommercesolutions.co.uk | 62

TECHNICAL CHARGEBACK WORKFLOW, CONTINUED

The following action steps are taken when processing a technical chargeback/dispute:

Issuer disputes transaction for processing or authorization reasons and initiates a chargeback

electronically and sends to the debit network

Chargeback flows through card association network

Merchant Services receives the chargeback electronically

Chargeback transaction is compared to the original sale transaction information stored in

our Transaction History database

If information to support representment is located, this information is attached to the

chargeback transaction which is then returned or represented to the Issuer

If information is found that the transaction is not valid, the chargeback is auto-returned to

the merchant

If insufficient information to support representment is found, the chargeback transaction is

forwarded to your assigned analyst for further analysis

Chargeback Activity (PDE-0017) report is generated showing all chargeback activity for the

reporting period, and a case is opened in the online chargeback management system for

the item

STEP

ACTION

1

2

3

4

O

R

O

R

6

©2016, Paymentech, LLC. All rights reserved. | commercesolutions.jpmorganchase.com | chasepaymentech.ca | jpmorgancommercesolutions.co.uk | 63

CUSTOMER DISPUTE CHARGEBACK WORK FLOW

Below is an illustration and discussion of the work flow for a customer dispute chargeback:

Customer

disputes

a

charge

on

the

billing

statement

Issuer

sends

chargeback

the

e

l

e

c

tr

o

n

ica

l

l

y

Transaction

flows

through

the

Interchange

Commerce

Solutions

receives

the

chargeback

Auto

-

represent

or

Auto

-

pre

-

arb

Merchant

notified

of

chargeback

activity

Forwarded

to

the

chargeback

queue

Auto

-

return

to

merchant

(

RTM

)

Chase

Commerce

Solutions

matches

chargeback

to

Transaction

History

and

records

in

the

chargeback

system,

then

one

of

three

actions

occurs:

Auto

-

represent/pre

-

arb

Forward

to

the

CB

queue

Auto

-

return

©2016, Paymentech, LLC. All rights reserved. | commercesolutions.jpmorganchase.com | chasepaymentech.ca | jpmorgancommercesolutions.co.uk | 64

CUSTOMER DISPUTE CHARGEBACK WORK FLOW, CONTINUED

The following action steps are taken when processing a customer dispute chargeback/dispute:

Issuer obtains appropriate paperwork from customer

Issuer initiates an electronic chargeback and forwards paperwork to Merchant Services

Chargeback flows through the association Network

Chase Merchant Services receives the chargeback and appropriate Issuer

documentation

Chargeback transaction is compared to the original sale transaction information stored in

our Transaction History database

If information to support representment is located, this information is attached to the

chargeback transaction which is then returned or represented to the Issuer

If insufficient information to support representment is found, the chargeback transaction is

forwarded to your assigned analyst for further analysis

Chargeback Activity (PDE-0017) report is generated showing all chargeback activity for

the reporting period, and a case is opened in the online chargeback management system

for the item

STEP

ACTION

1

Customer disputes a transaction on their billing statement

2

3

4

5

6

7

O

R

8

©2016, Paymentech, LLC. All rights reserved. | commercesolutions.jpmorganchase.com | chasepaymentech.ca | jpmorgancommercesolutions.co.uk | 65

DISCOVER CHARGEBACK CATEGORIES

Chargebacks received from Issuers fall into three categories for Discover:

• Processing error

• Service

• Fraud

Processing Error Chargebacks are initiated by the Issuer for authorization or processing related

reasons with no cardholder participation, such as:

• Information requested in a retrieval request was not received or was illegible or invalid

• Authorization number is missing or has been declined

• Invalid account number was used

• Late presentment of the original transaction

• Duplicate transactions

Service Chargebacks result when a cardholder refuses to accept responsibility for a charge appearing

on their card billing statement. The cardholder contacts the Issuer indicating that they:

• Are disputing a specific charge for specific reasons (such as ordered merchandise or a service was never

received, or the product or service was not what was originally described)

• Have attempted to resolve the situation with the client

Once the Card-Issuer has been contacted and received any required documents, the Card-

Issuer credits the cardholder’s account and electronically submits the chargeback transaction

bearing a specific reason code to Merchant Services.

Fraud Chargebacks result when a cardholder or Issuer believes that fraudulent activity may have

been performed with the account. The cardholder contacts the Issuer indicating that they

• Are disputing a specific charge for specific reasons (such the purchase was not authorized by the

cardholder)

Fraud reason codes require the Issuer to forward documentation which might include cardholder

executed affidavits and supporting letters or secured email from the cardholder.

©2016, Paymentech, LLC. All rights reserved. | commercesolutions.jpmorganchase.com | chasepaymentech.ca | jpmorgancommercesolutions.co.uk | 66

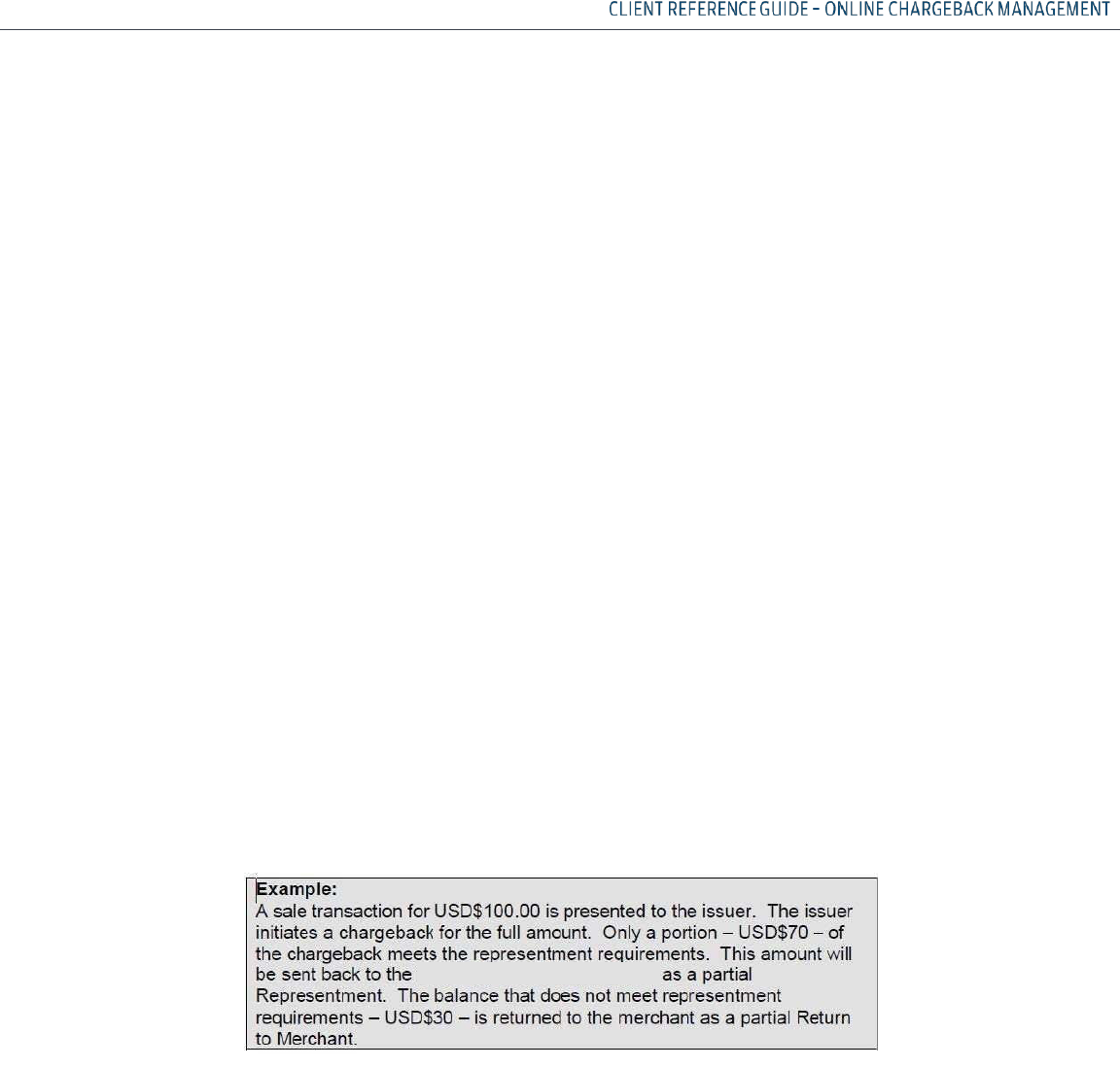

RETURN TO MERCHANT WORKFLOW

When Merchant Services has insufficient information to represent a chargeback, it is sent to your

Chargeback Analyst. Your analyst will research to determine if the chargeback can be

represented. If there is no support for representment, the chargeback is returned to the

merchant.

Recourse

When you decide to request recourse for (or challenge) a chargeback that has been returned to you,

Merchant Services recommends the following:

Prior to responding,

• Note the “Due Date” which is located near the top of the Chargeback Document. Merchant Services must

receive the recourse request by that date in order to be considered for possible representment

• Read the recommendations by reason code in the Chargeback Reason Code Reference Guide and the