Department of Defense

INSTRUCTION

NUMBER 1400.25-V810

April 12, 2005

Administratively reissued April 16, 2009

USD(P&R)

SUBJECT: DoD Civilian Personnel Management System: Injury Compensation

References: See Enclosure 1

1. PURPOSE

a. Instruction. This Instruction is composed of several Volumes, each containing its own

purpose. The purpose of the overall Instruction is to establish and implement policy, establish

procedures, provide guidelines and model programs, delegate authority, and assign

responsibilities regarding civilian personnel management within the Department of Defense.

b. Volume. This Volume of this Instruction implements DoD policy, prescribes procedures,

and delegates authority on implementing the DoD injury compensation program under the

“Federal Employees’ Compensation Act” (FECA), section 8101 of title 5, United States Code

(U.S.C.), (Reference (a)) which provides benefits to civilian employees of the Federal

Government for disability due to personal injury, disease, or death arising from or within the

scope of their employment.

2. APPLICABILITY

. This Volume applies to OSD, the Military Departments, the Office of the

Chairman of the Joint Chiefs of Staff and the Joint Staff, the Combatant Commands, the Office

of the Inspector General of the Department of Defense, the Defense Agencies, the DoD Field

Activities, and all other organizational entities in the Department of Defense (hereafter

collectively referred to as the “DoD Components”).

3. DEFINITIONS. See Glossary.

DoDI 1400.25-V810, April 15, 2005

2

4. POLICY. It is DoD policy under Reference (b) to:

a. Ensure that DoD employees are entitled to a safe and healthful work environment that

complies with the DoD safety and health policies identified in Reference (c).

b. Provide prompt medical attention and full assistance in claiming just compensation for

injuries or occupational illnesses incurred in the performance of their duties. Supervisors and

managers shall:

(1) Create a culture of safety consciousness.

(2) Make every effort through light duty programs and reemployment.

(3) Ensure that all involved in the program, including private sector medical personnel,

are aware of these programs.

(4) Investigate and take appropriate action on fraud and abuse in the program.

5. RESPONSIBILITIES. See Enclosure 2.

6. PROCEDURES. See Enclosure 3.

7. RELEASABILITY. UNLIMITED. This Volume is approved for public release and is

available on the Internet from the DoD Issuances Web Site at

http://www.dtic.mil/whs/directives.

8. EFFECTIVE DATE

. This Volume is effective immediately.

Enclosures:

1. References

2. Responsibilities

3. Procedures

Glossary

DoDI 1400.25-V810, April 15, 2005

3 CONTENTS

TABLE OF CONTENTS

REFERENCES ................................................................................................................................6

RESPONSIBILITIES ......................................................................................................................7

CIVILIAN PERSONNEL MANAGEMENT SERVICE (CPMS) ............................................7

SUPPORTING DoD LIAISONS ...............................................................................................7

ORGANIZATIONS ONE LEVEL ABOVE INSTALLATION LEVEL AND

COMPARABLE ORGANIZATIONS .................................................................................8

ACTIVITY COMMANDER .....................................................................................................8

ACTIVITY MEDICAL SERVICE ............................................................................................8

ACTIVITY SAFETY OFFICES ................................................................................................9

ACTIVITY INVESTIGATIVE SERVICE ..............................................................................10

FIRST-LINE SUPERVISORS .................................................................................................10

CIVILIAN EMPLOYEES .......................................................................................................11

INJURY COMPENSATION PROGRAM ADMINISTRATOR (ICPA) ...............................12

PROVIDING COUNSEL AND ASSISTANCE .....................................................................15

FIGURES .................................................................................................................................17

PROCEDURES ..............................................................................................................................24

AUTHORITIES .......................................................................................................................24

CLAIMS AND RECORDS MANAGEMENT ........................................................................31

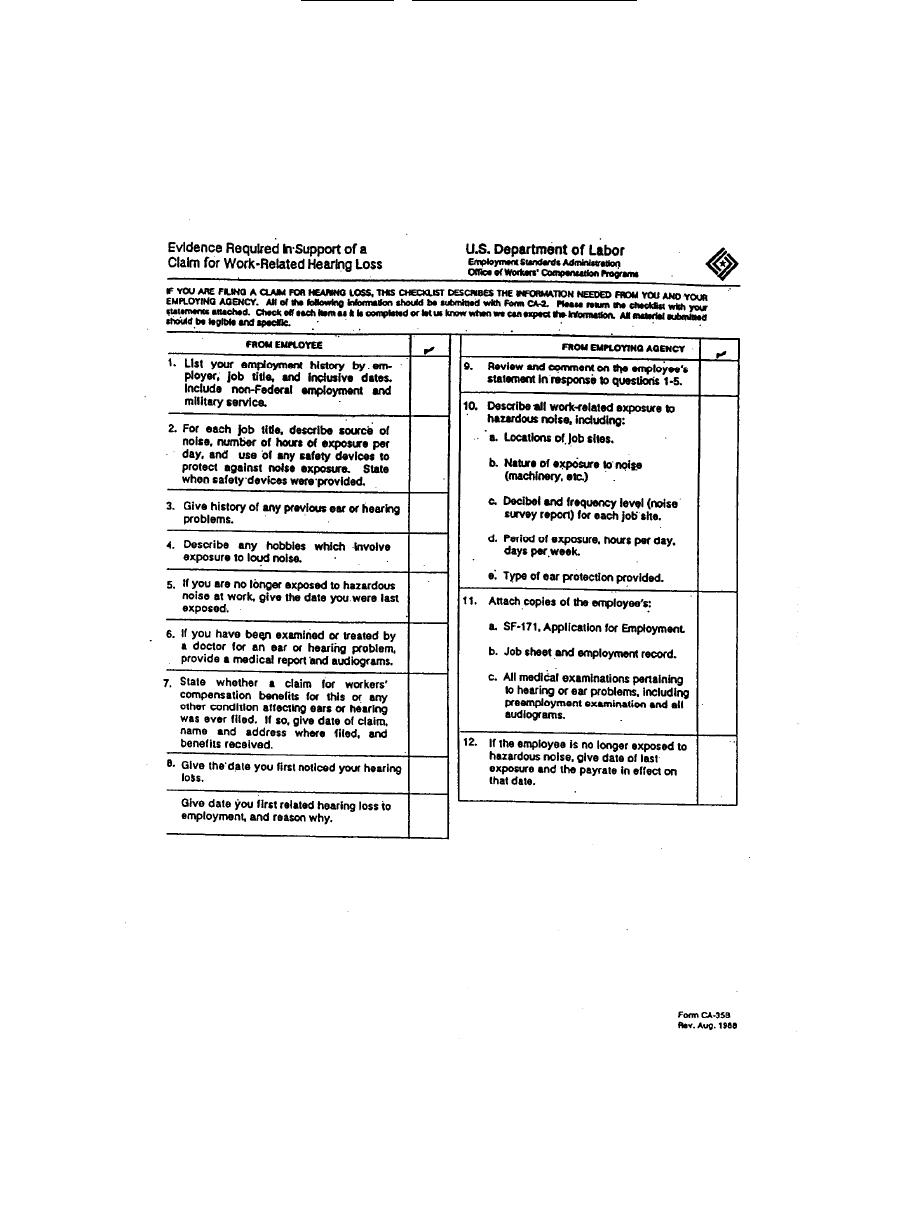

OCCUPATIONAL ILLNESS OR DISEASE CLAIMS AND REQUIRED AGENCY

DOCUMENTATION ........................................................................................................45

CONTINUATION OF PAY AND ACCOUNTING PROCEDURES ....................................50

CONTROVERSION OF CLAIMS ..........................................................................................55

PAY RATES USED FOR COMPENSATION AND OTHER PAY RELATED ISSUES .....60

RETENTION, REEMPLOYMENT AND REHABILITATION ............................................65

FRAUD AND ABUSE ............................................................................................................75

THIRD PARTY LIABILITY ..................................................................................................79

THE INJURY COMPENSATION CHARGEBACK SYSTEM .............................................82

MISCELLANEOUS PROVISIONS ........................................................................................86

FIGURES .................................................................................................................................99

GLOSSARY ................................................................................................................................250

FIGURES

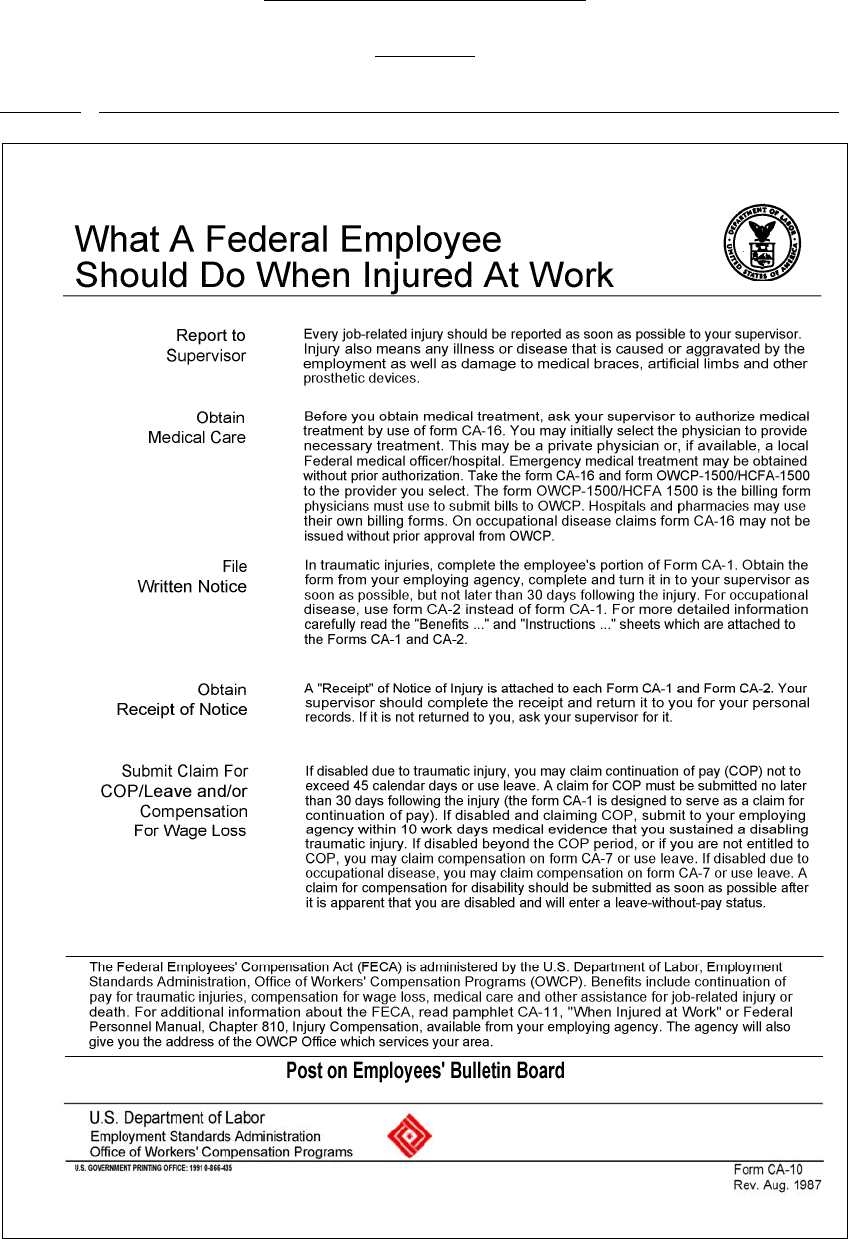

1. Form CA-10 “What a Federal Employee Should Do When Injured at Work” ..................17

2. “Authorization of Release Information” Form ...................................................................18

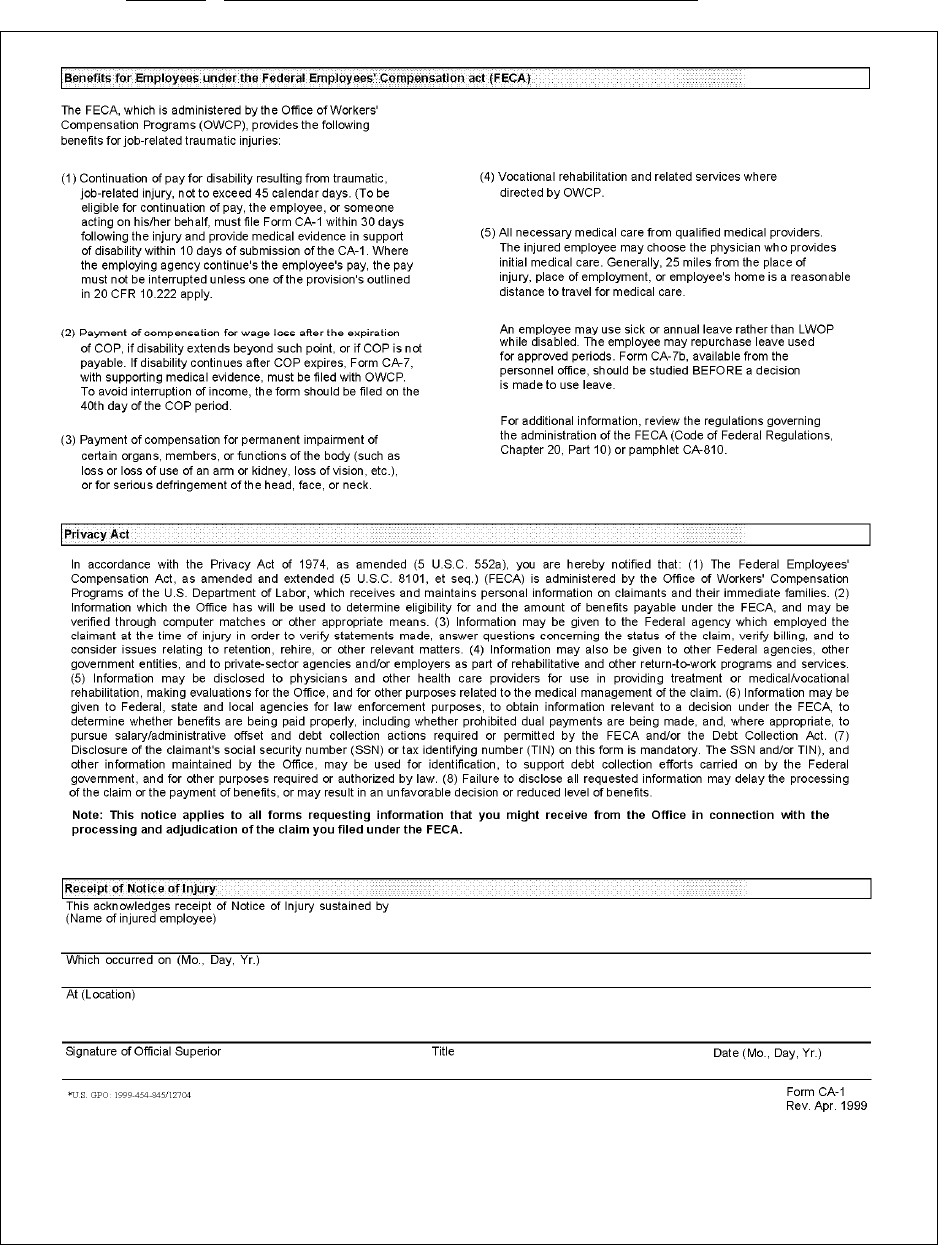

3. “Comparison-Workers Compensation vs. Disability Retirement” .....................................22

DoDI 1400.25-V810, April 15, 2005

4 CONTENTS

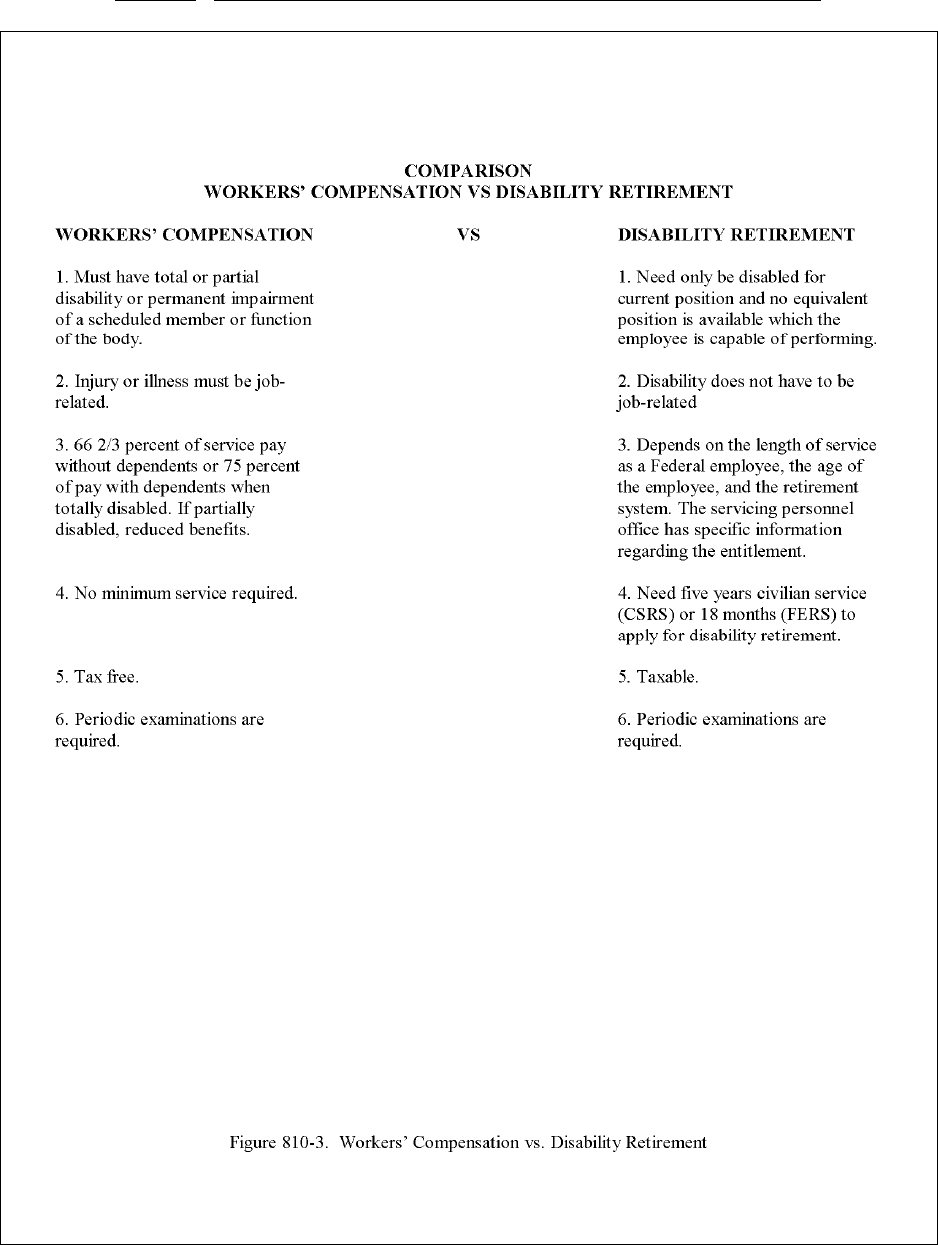

4. “Notice to Individuals with Funds in the Civil Service Retirement System (CSRS)

or Federal Employees Retirement System (FERS)” ..........................................................23

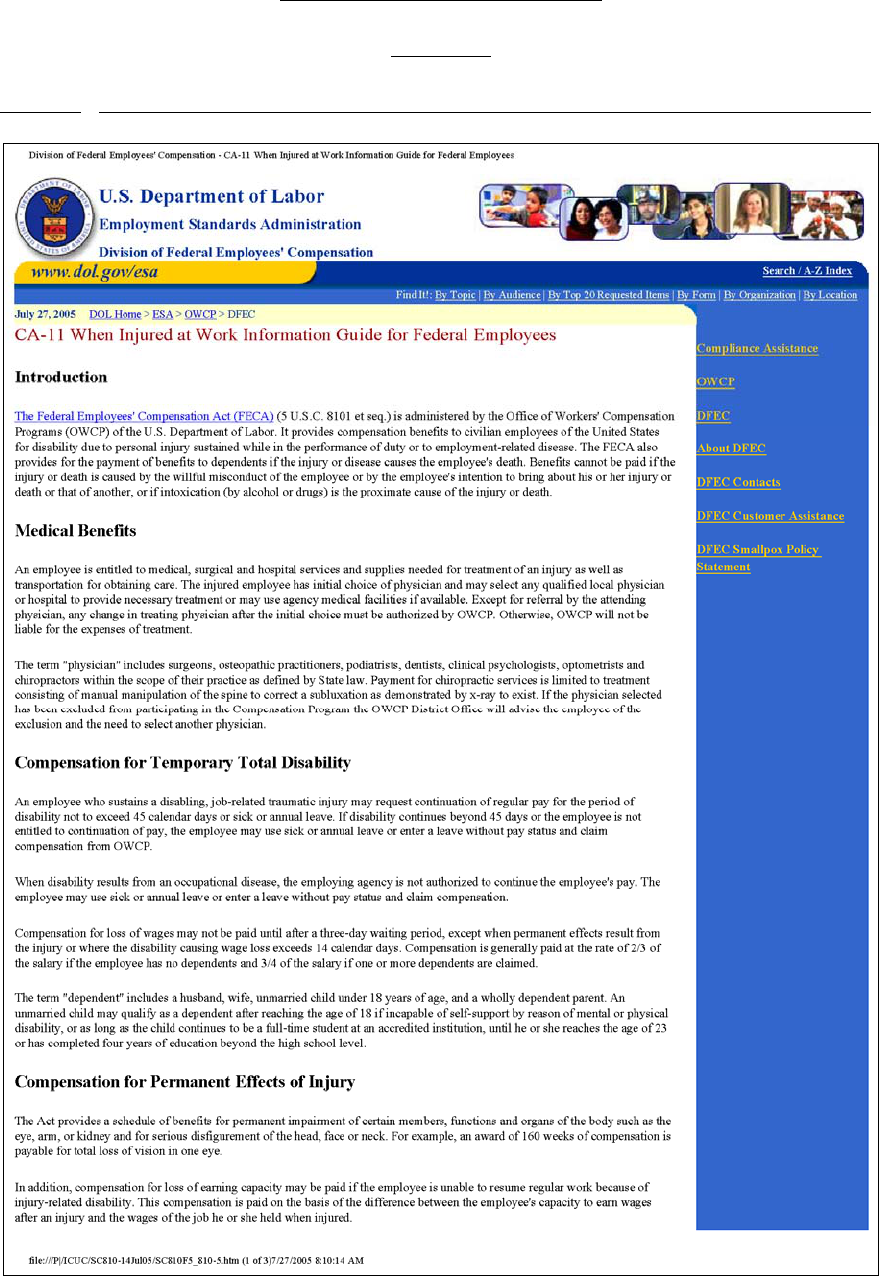

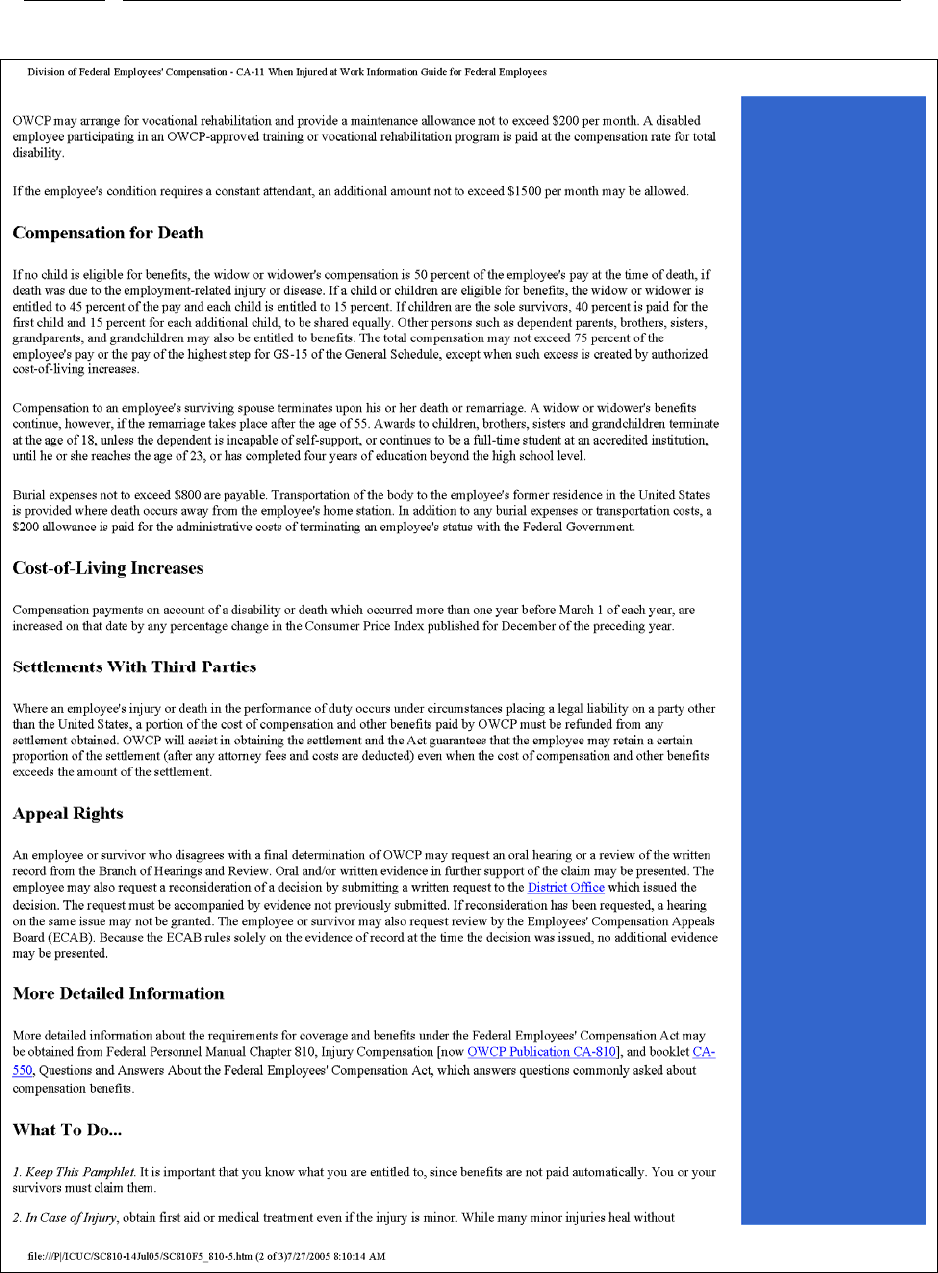

5. Form CA-11 “When Injured at Work Information Guide for Federal Employees” ...........99

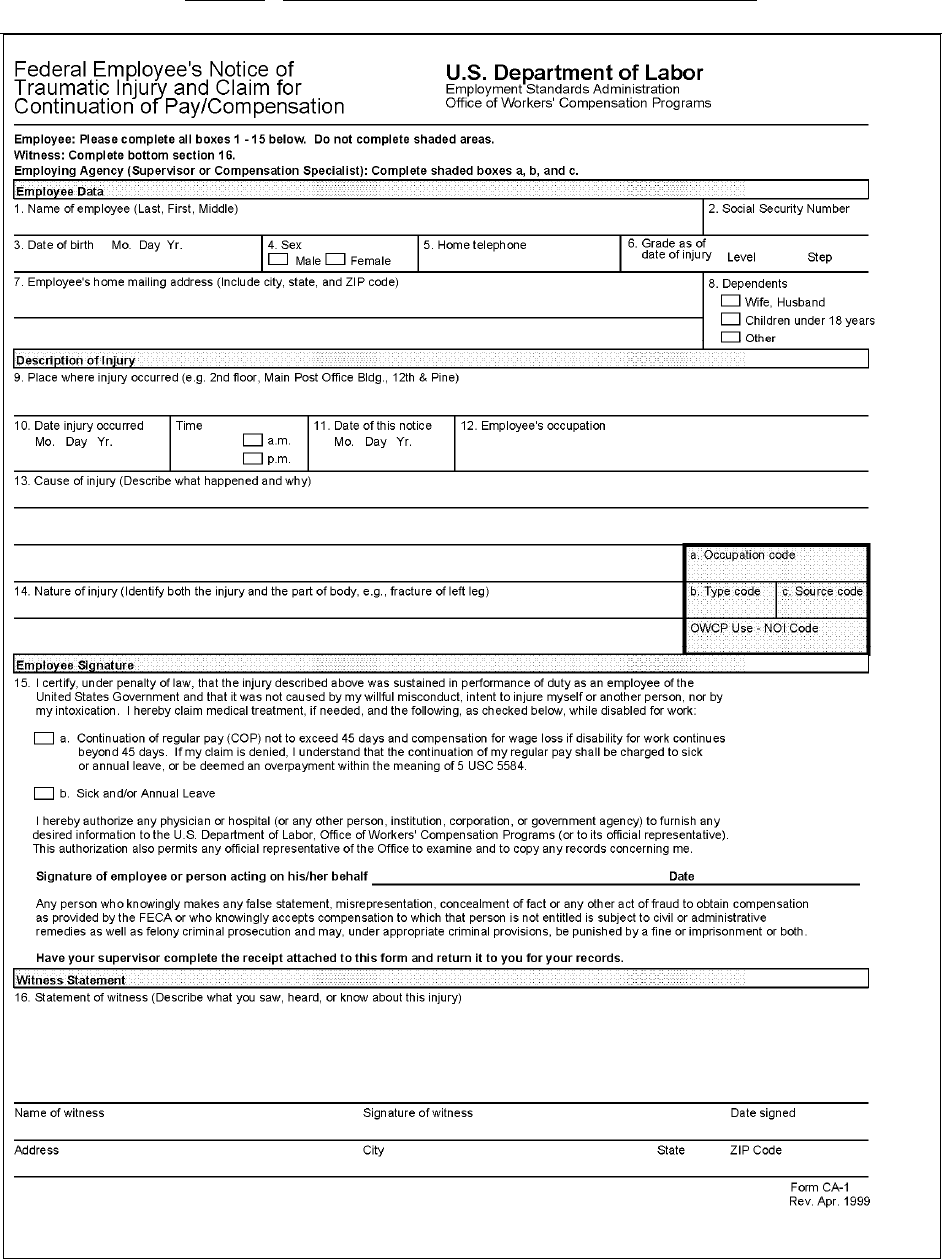

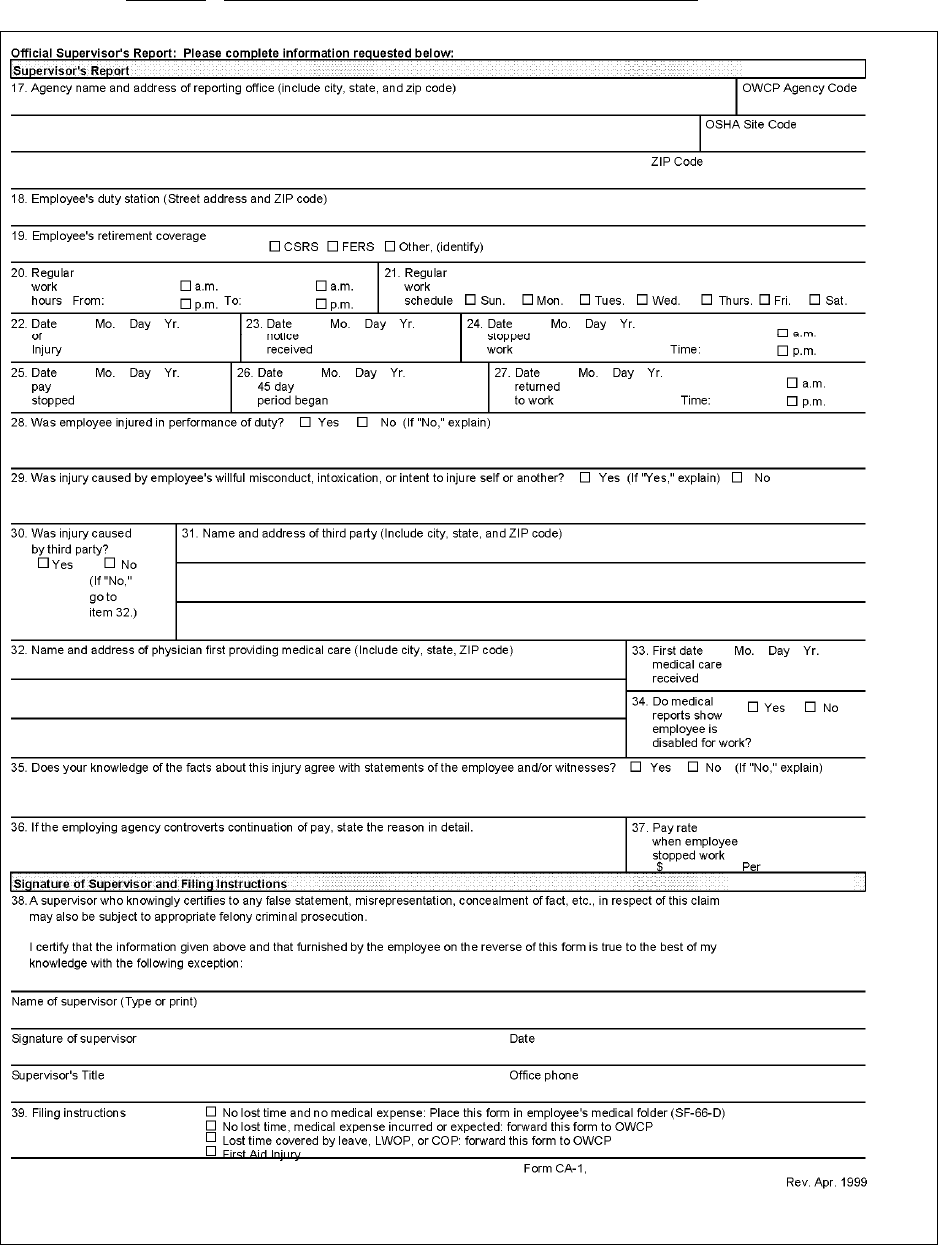

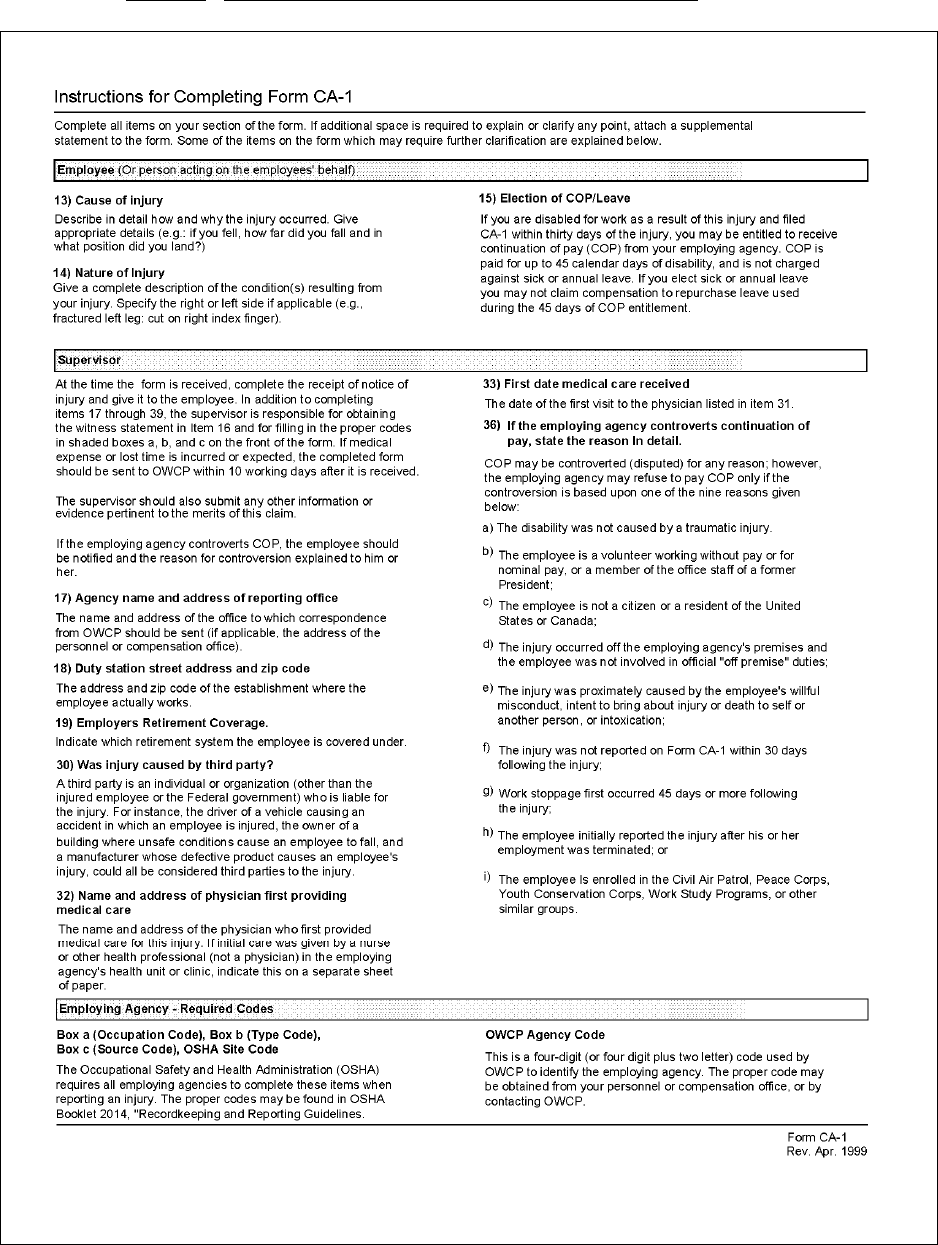

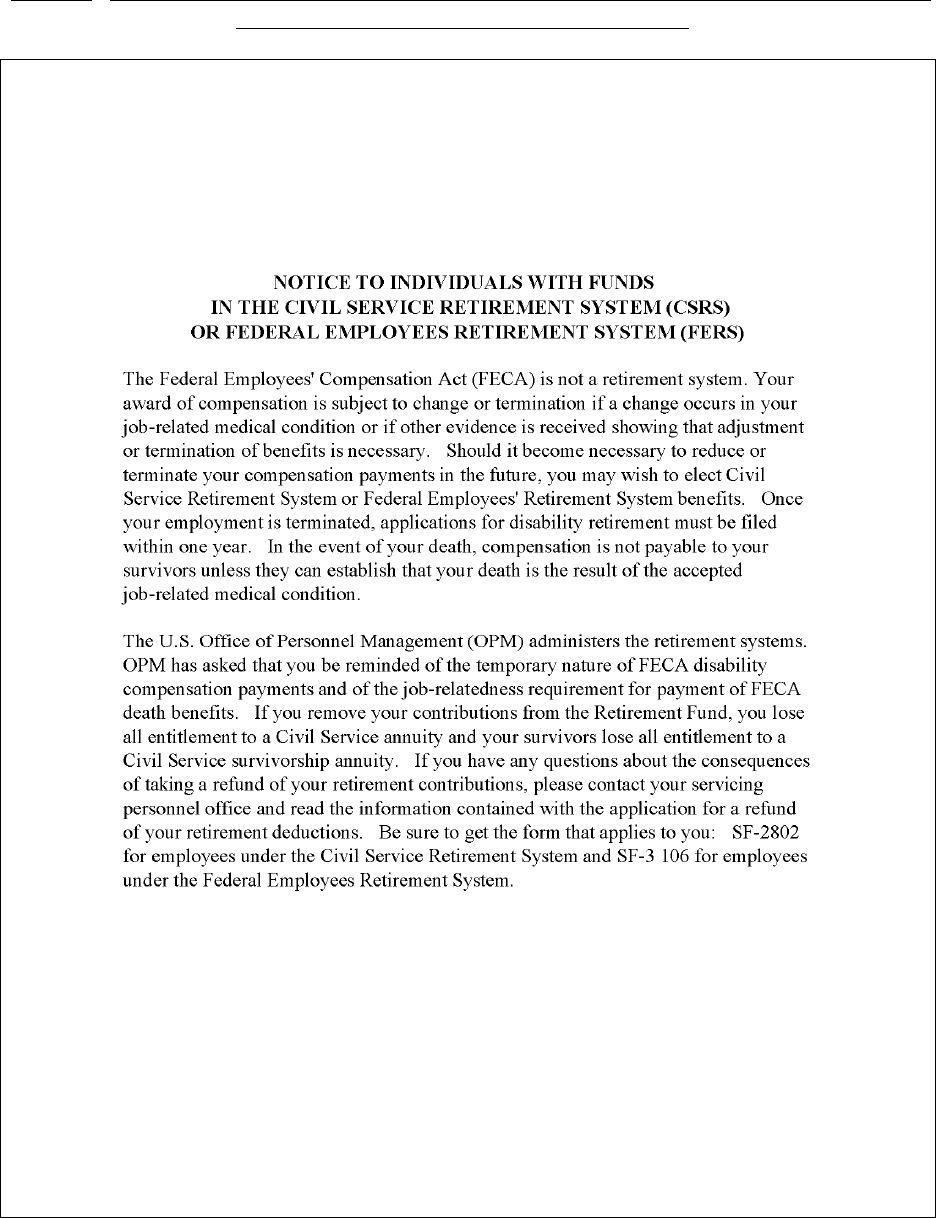

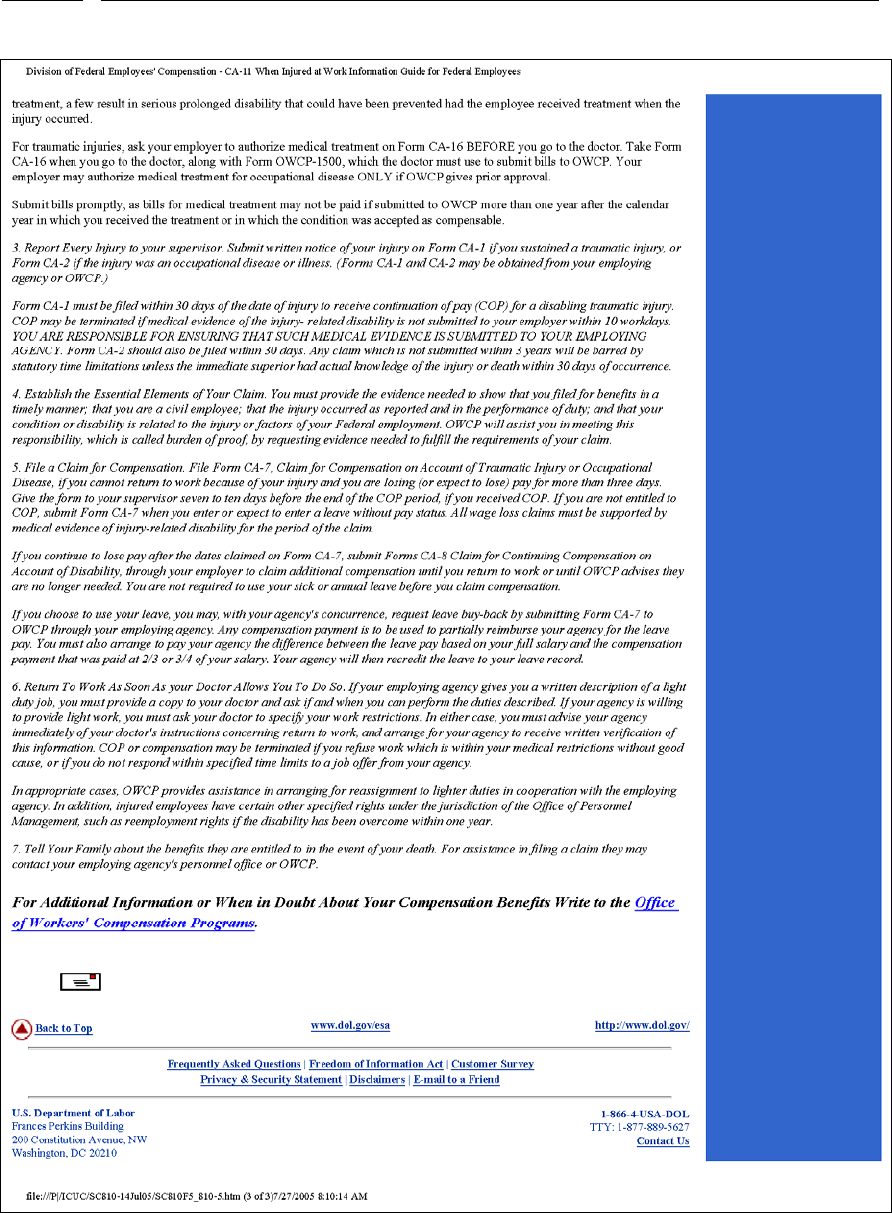

6. Form CA-1 “Federal Employee's Notice of Traumatic Injury and Claim for

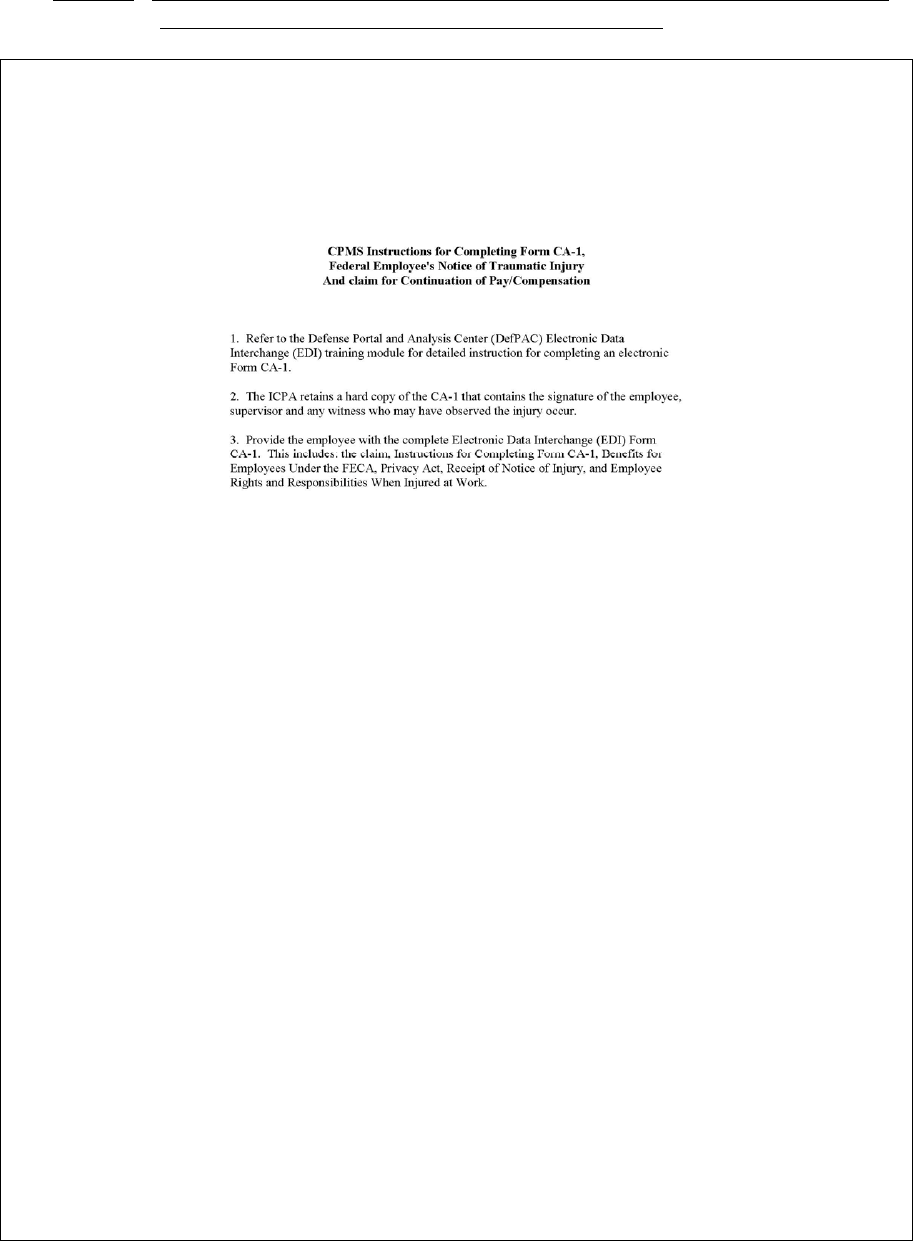

Continuation of Pay/Compensation,” With Instructions .................................................103

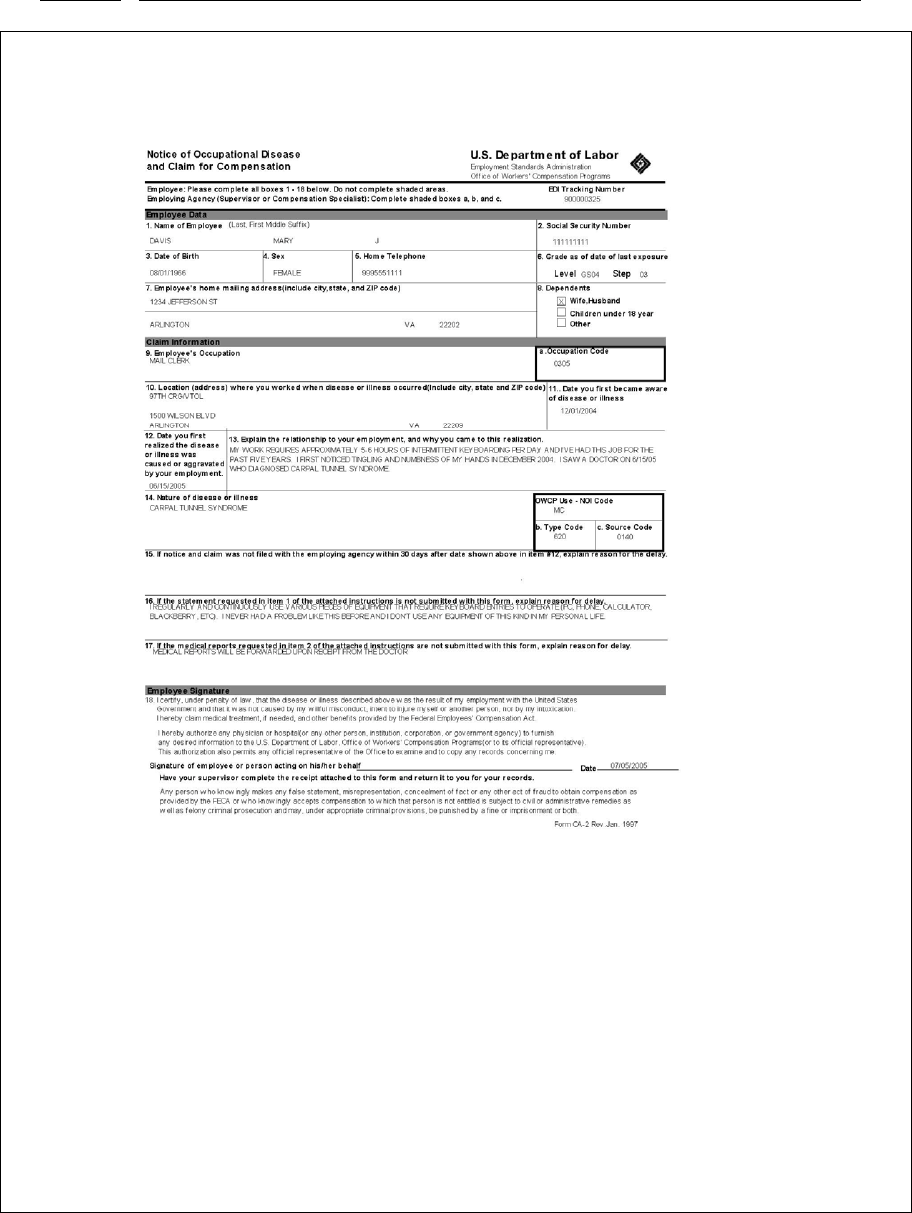

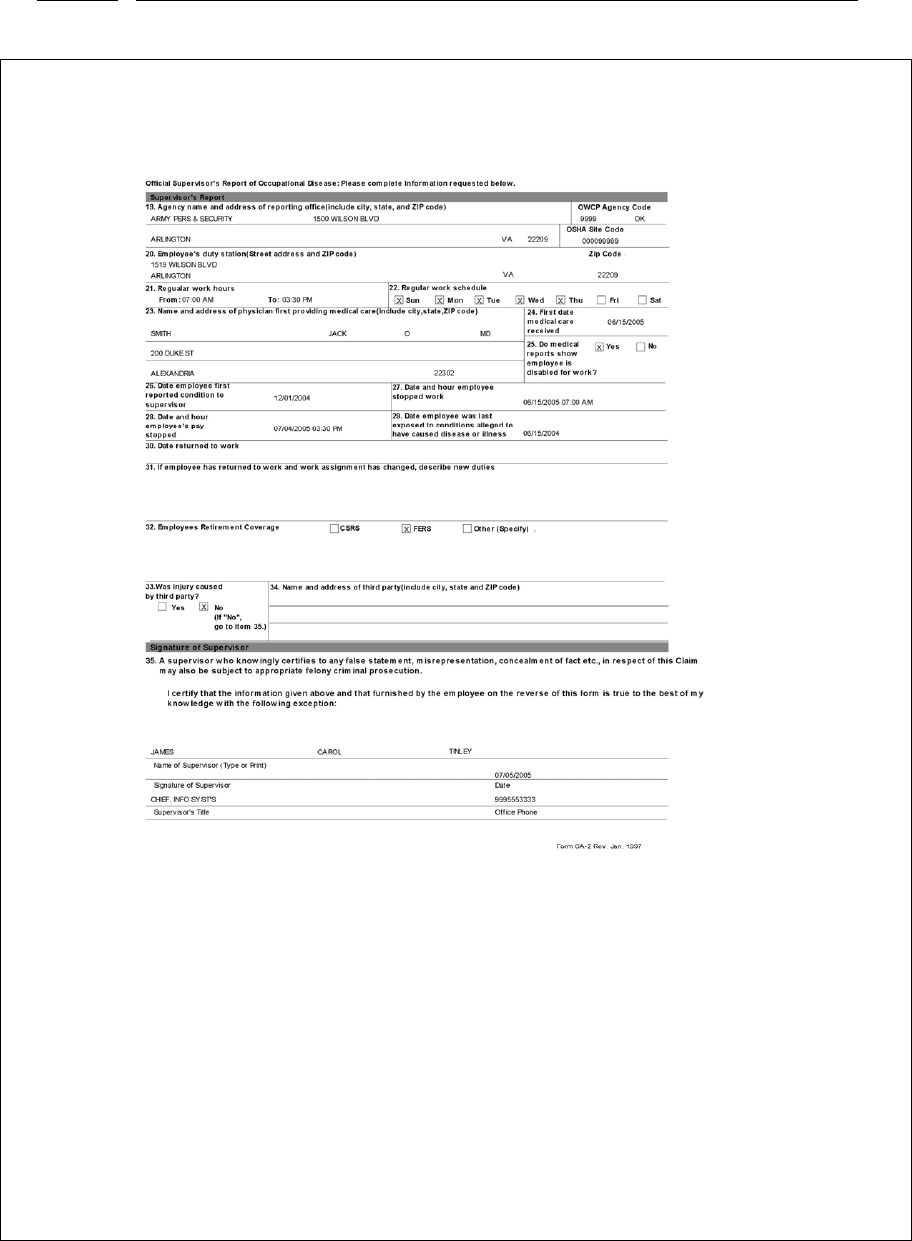

7. Form CA-2 “Notice of Occupational Disease and Claim for Compensation” .................112

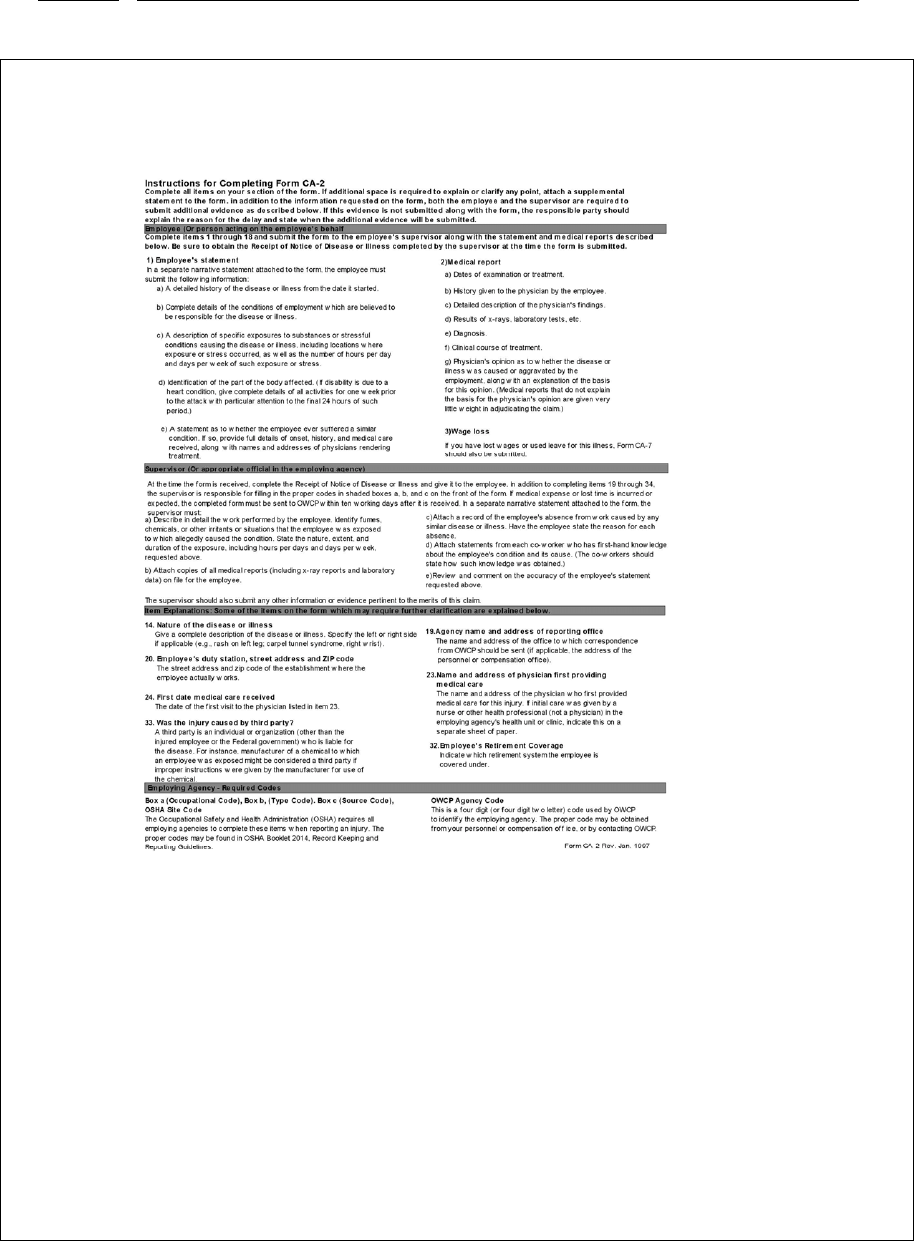

8. Instructions for Completing Form CA-2...........................................................................120

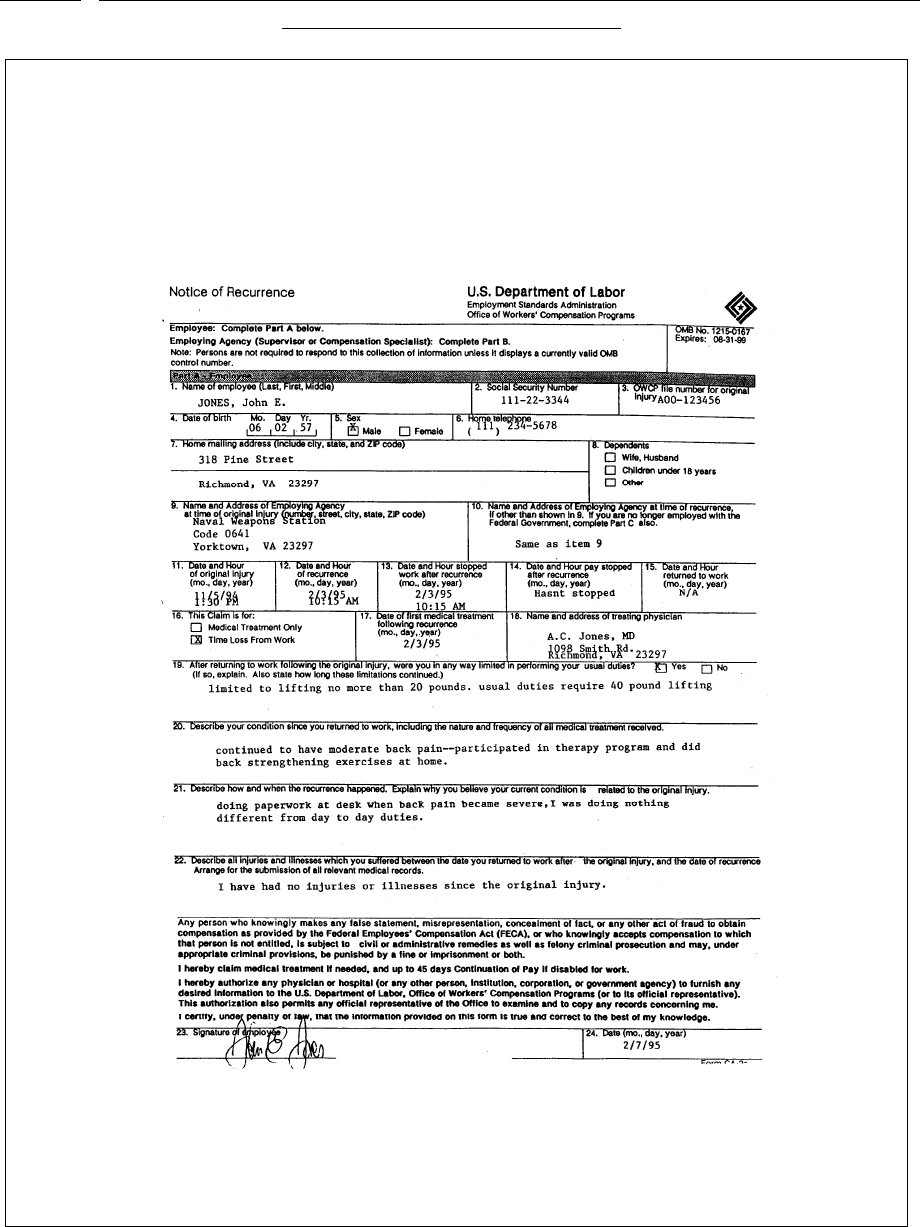

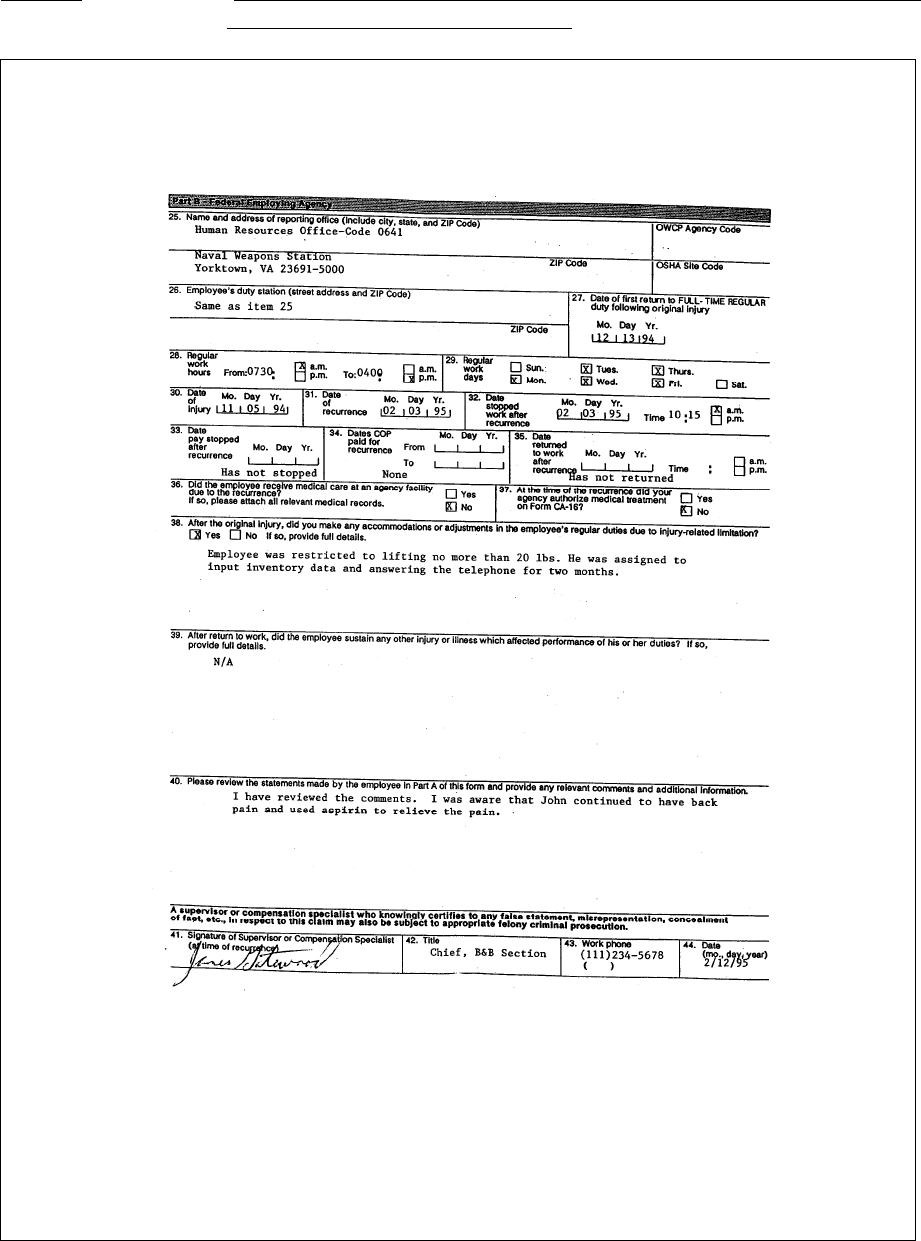

9. Form CA-2a “Federal Employee's Notice of Recurrence of Disability and Claim for

Continuation of Pay/Compensation,” With Instructions .................................................121

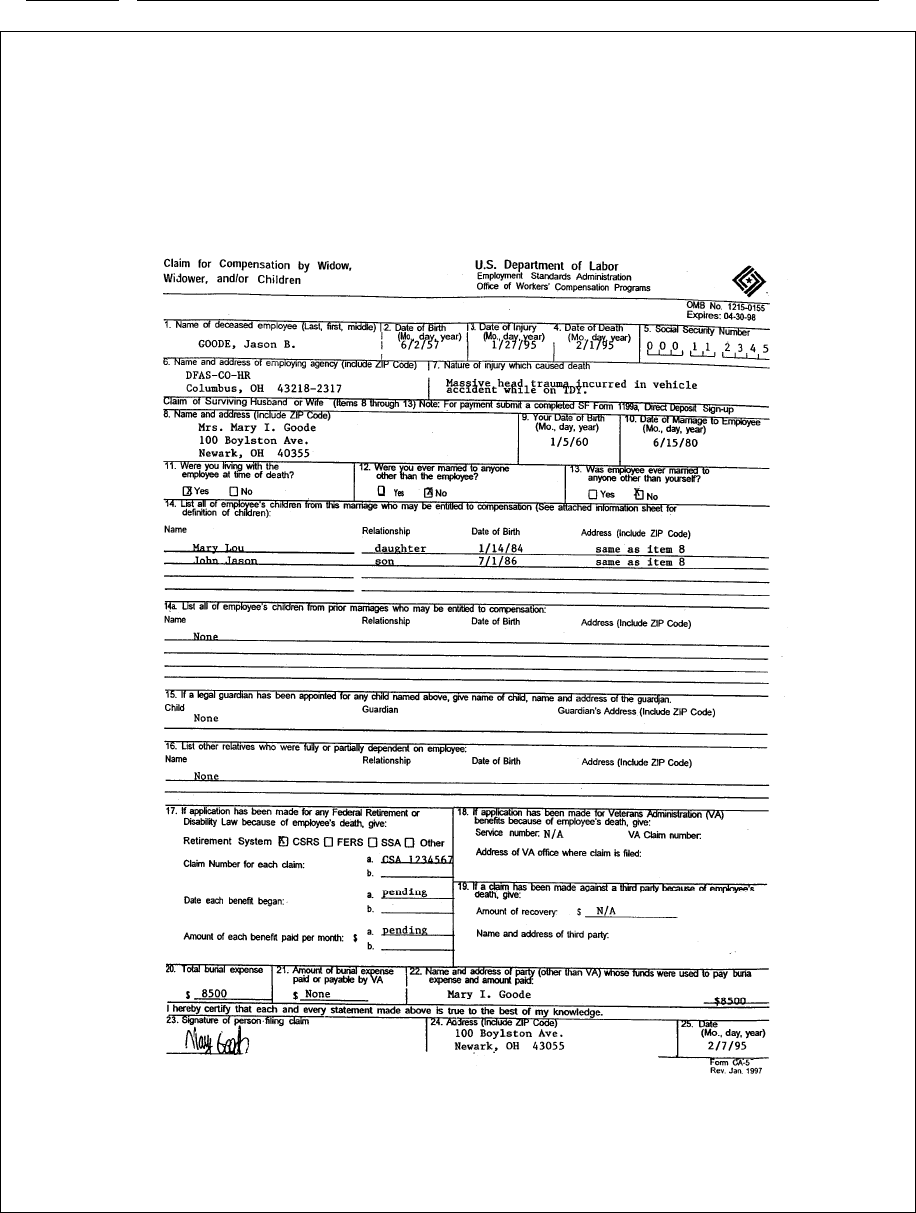

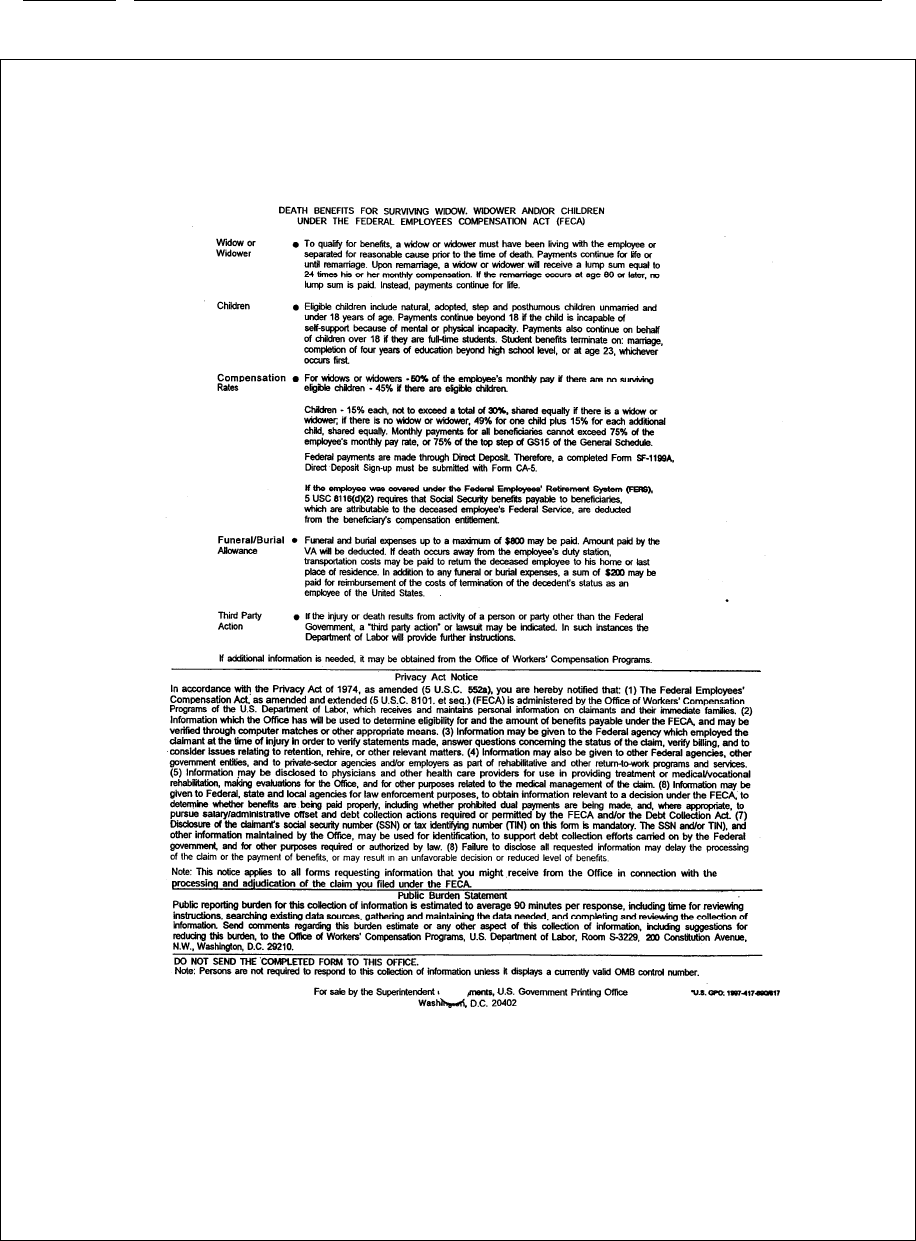

10. Form CA-5 “Claim for Compensation by Widow, Widower and/or Children” ..............123

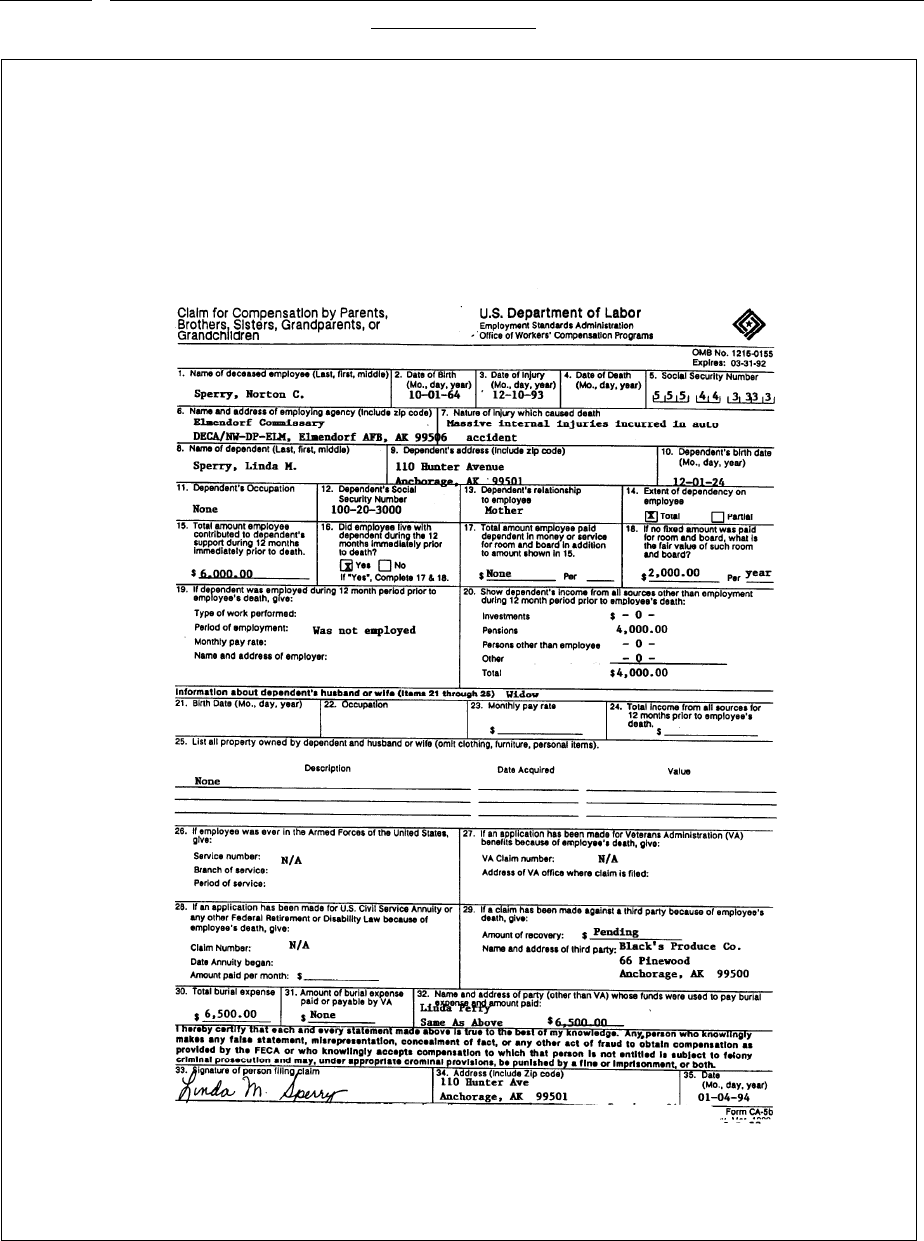

11. Form CA-5b “Claim for Compensation by Parents, Brothers, Sisters, Grandparents,

or Grandchildren” ............................................................................................................126

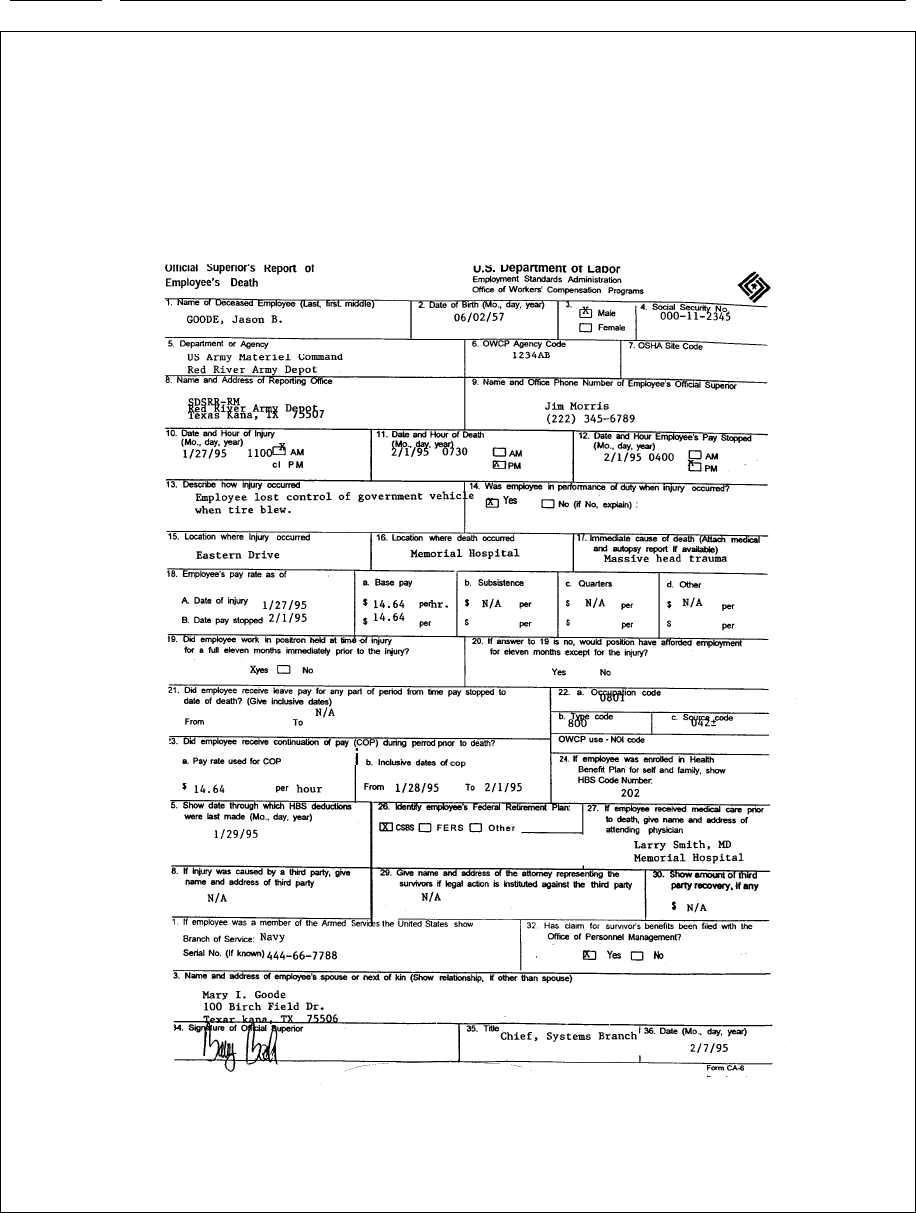

12. Form CA-6 “Official Superior’s Report of Employee's Death,” With Instructions .......130

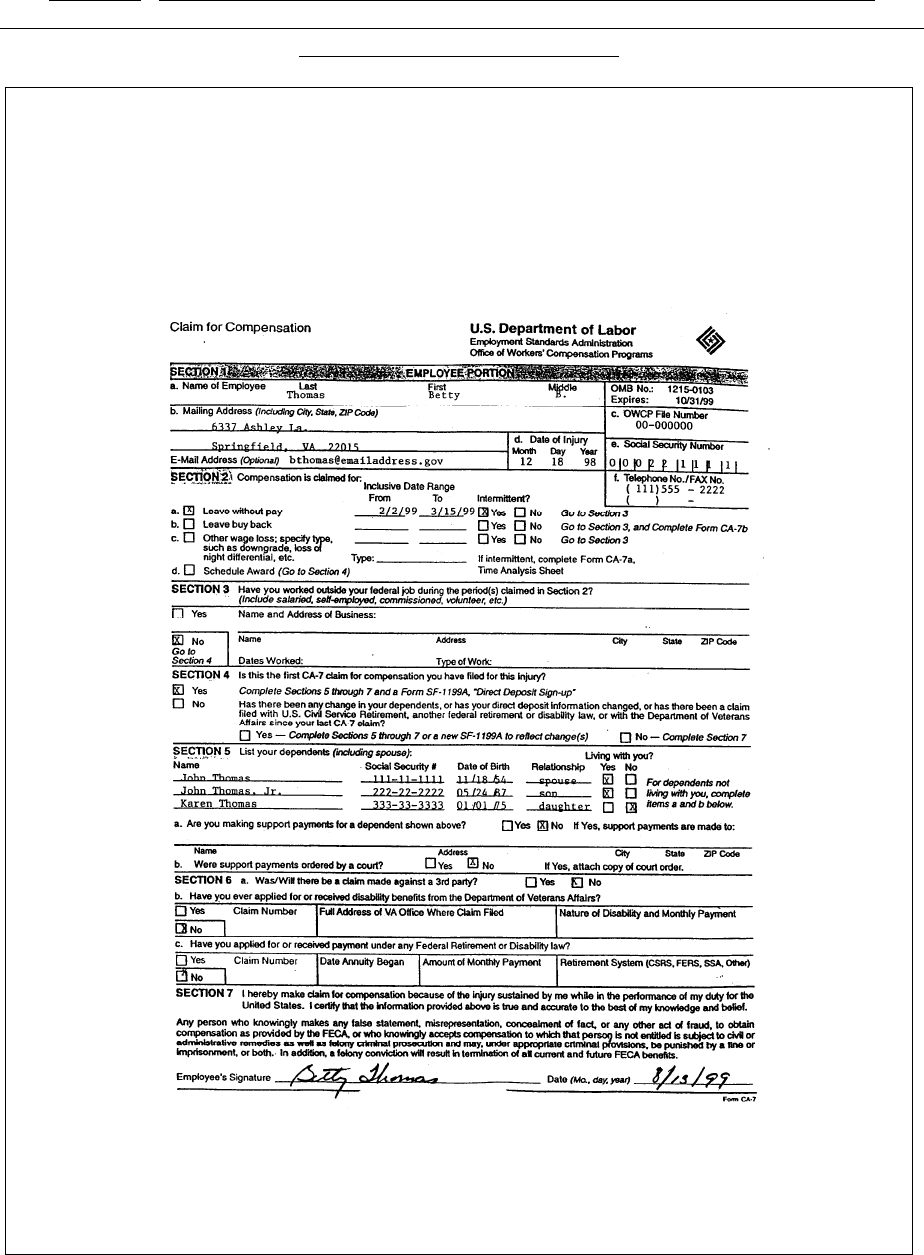

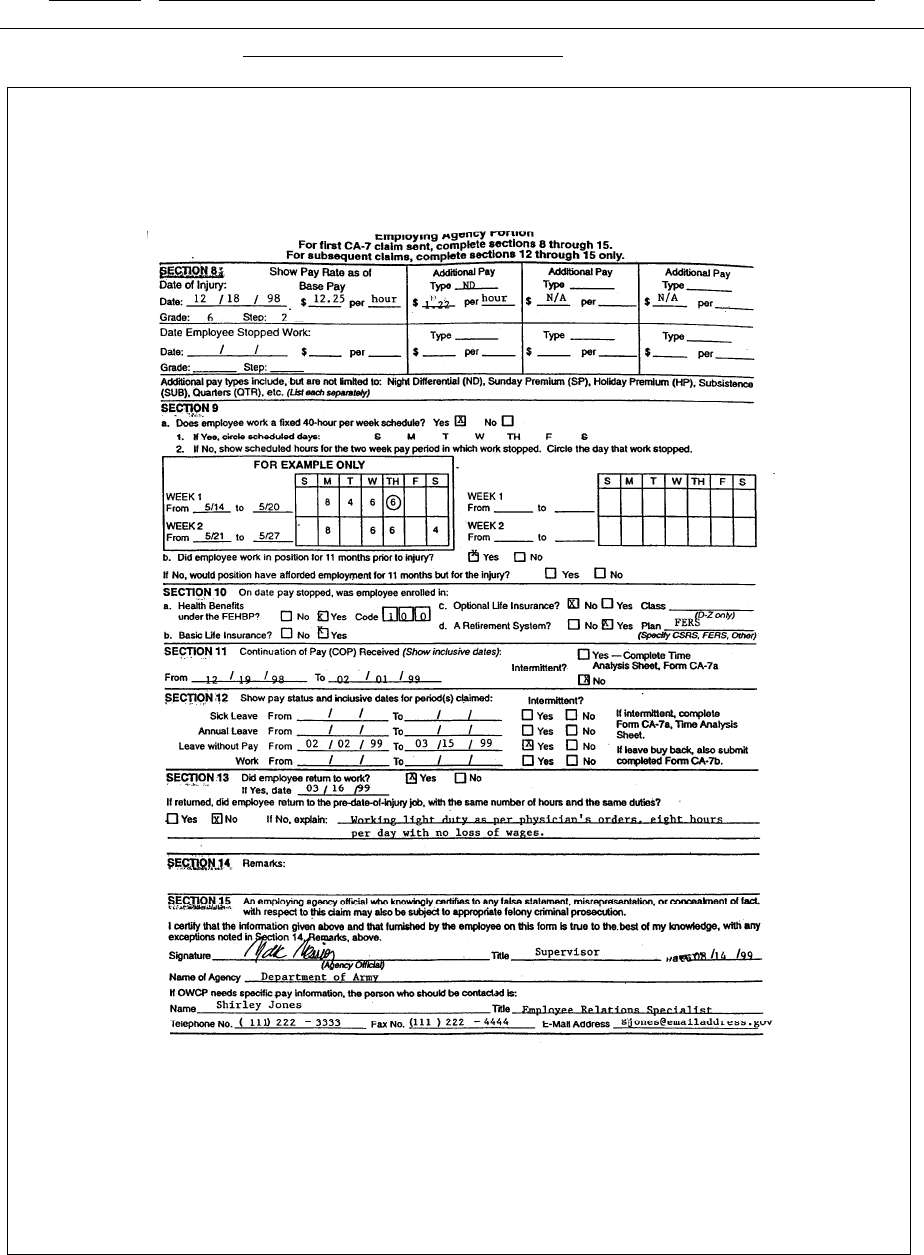

13. Form CA-7 “Claim for Compensation on Account of Traumatic Injury or

Occupational Disease With Attached CA-20, Attending Physician's Report

(Example of CA-7 for Occupational Injury) ....................................................................133

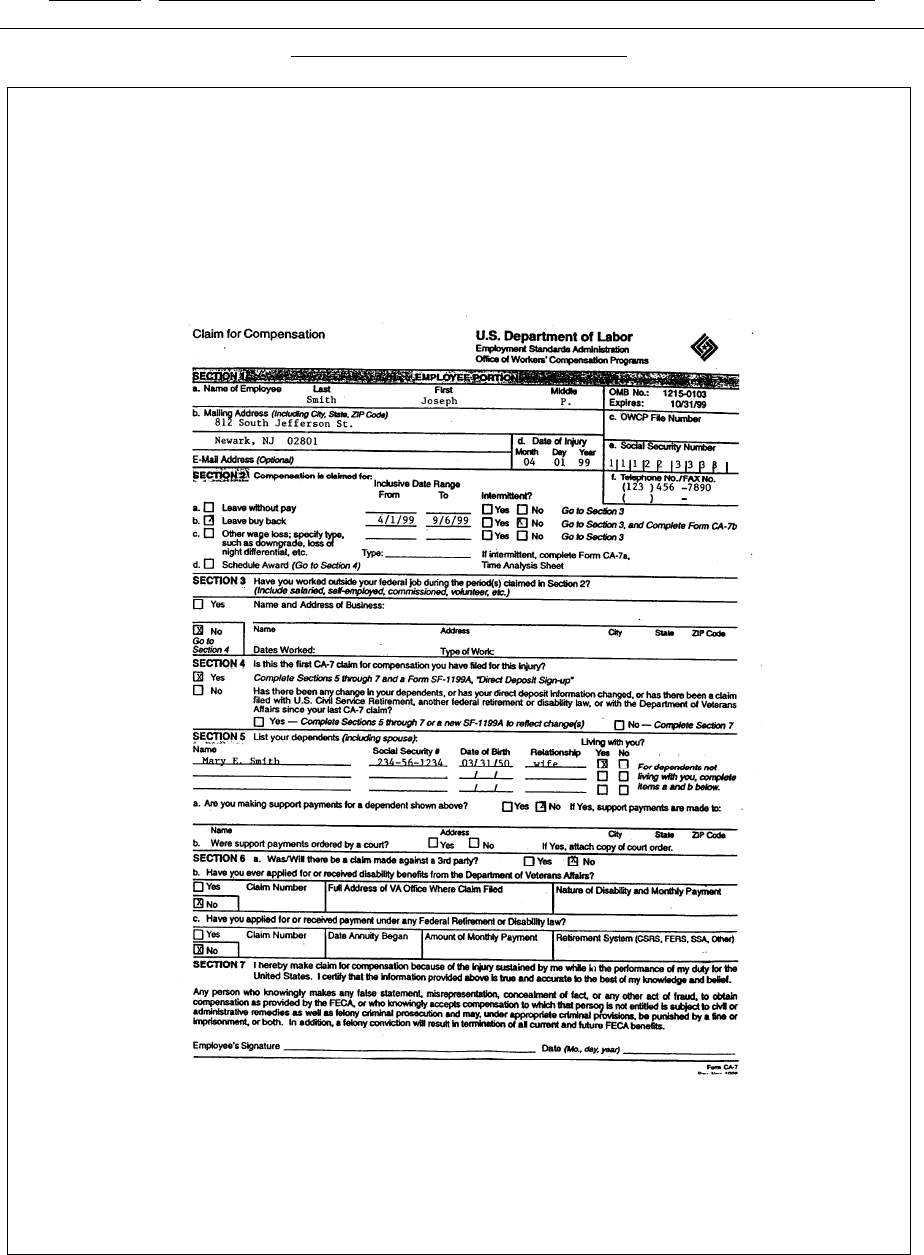

14. Form CA-7 “Claim for Compensation on Account of Traumatic Injury or

Occupational Disease with Attached CA-20, Attending Physician's Report”

(Example of CA-7 for Occupational Disease) .................................................................136

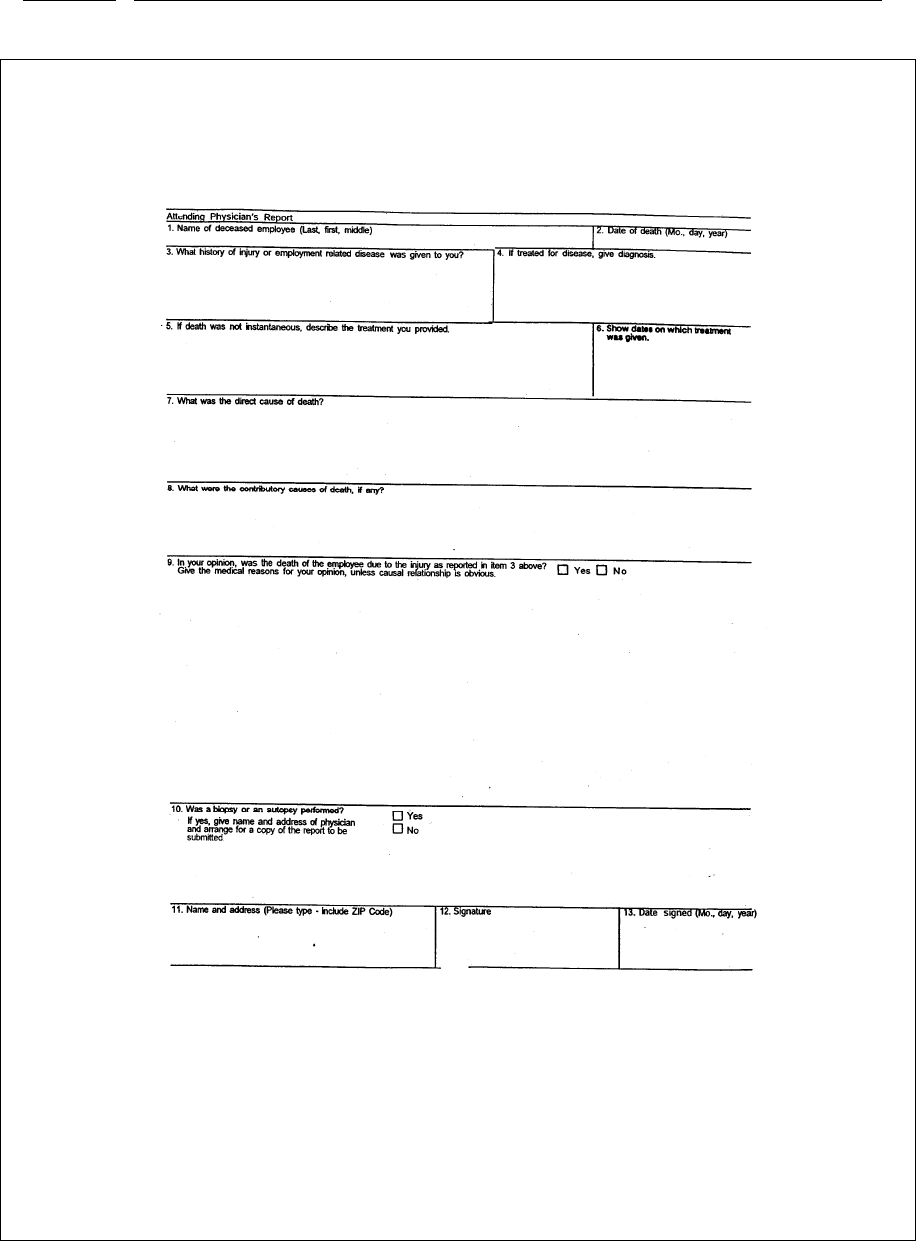

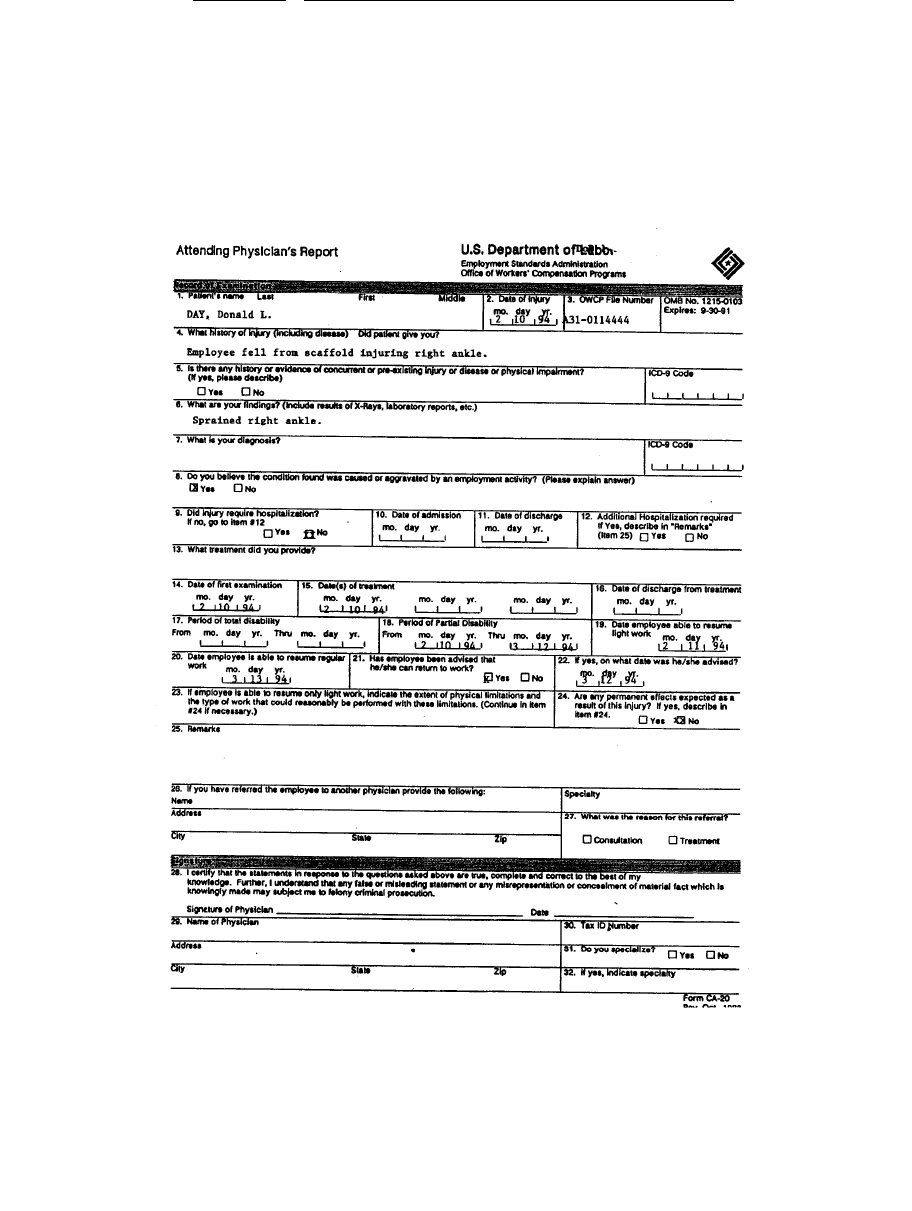

15. Form CA-20 “Attending Physician's Report” .................................................................139

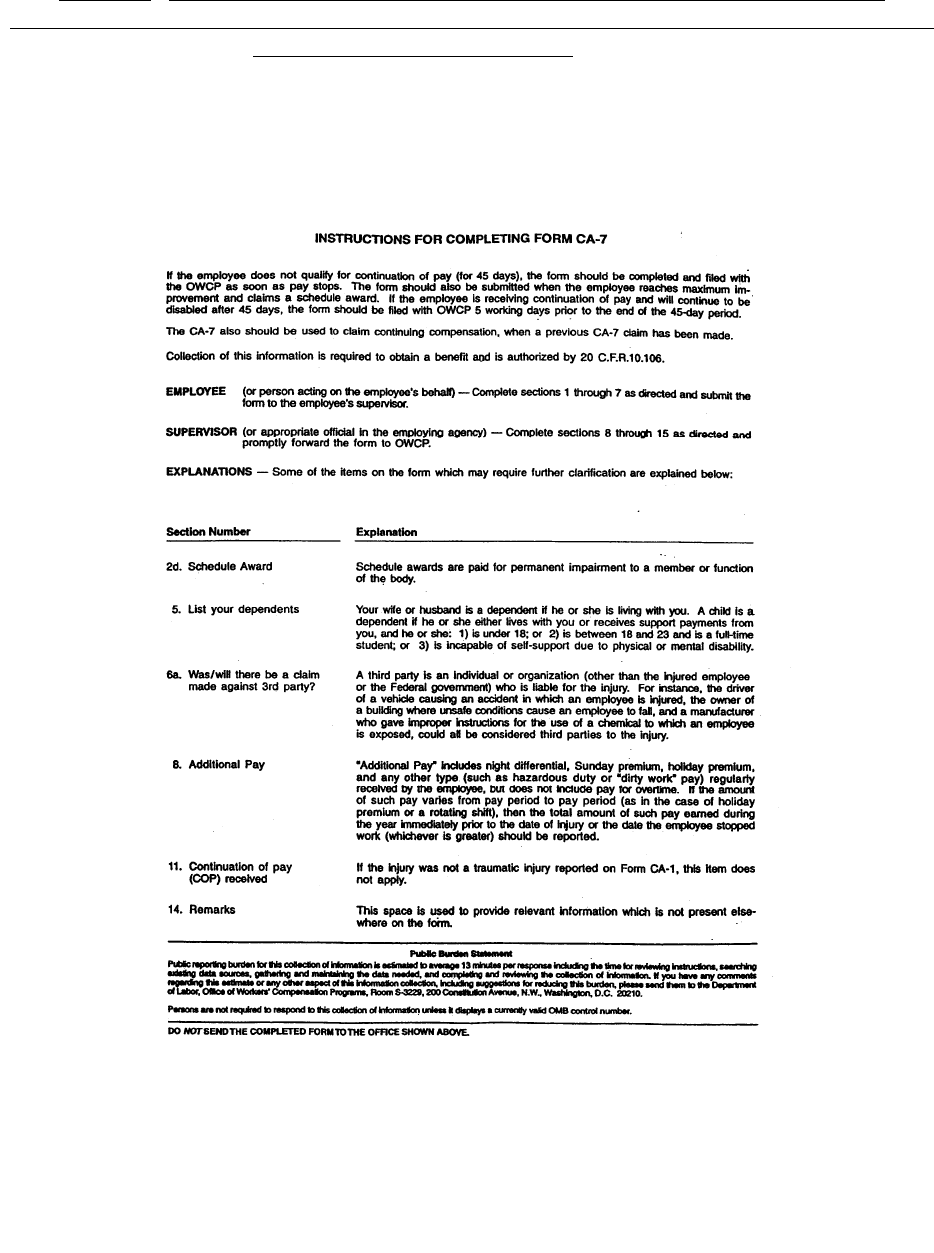

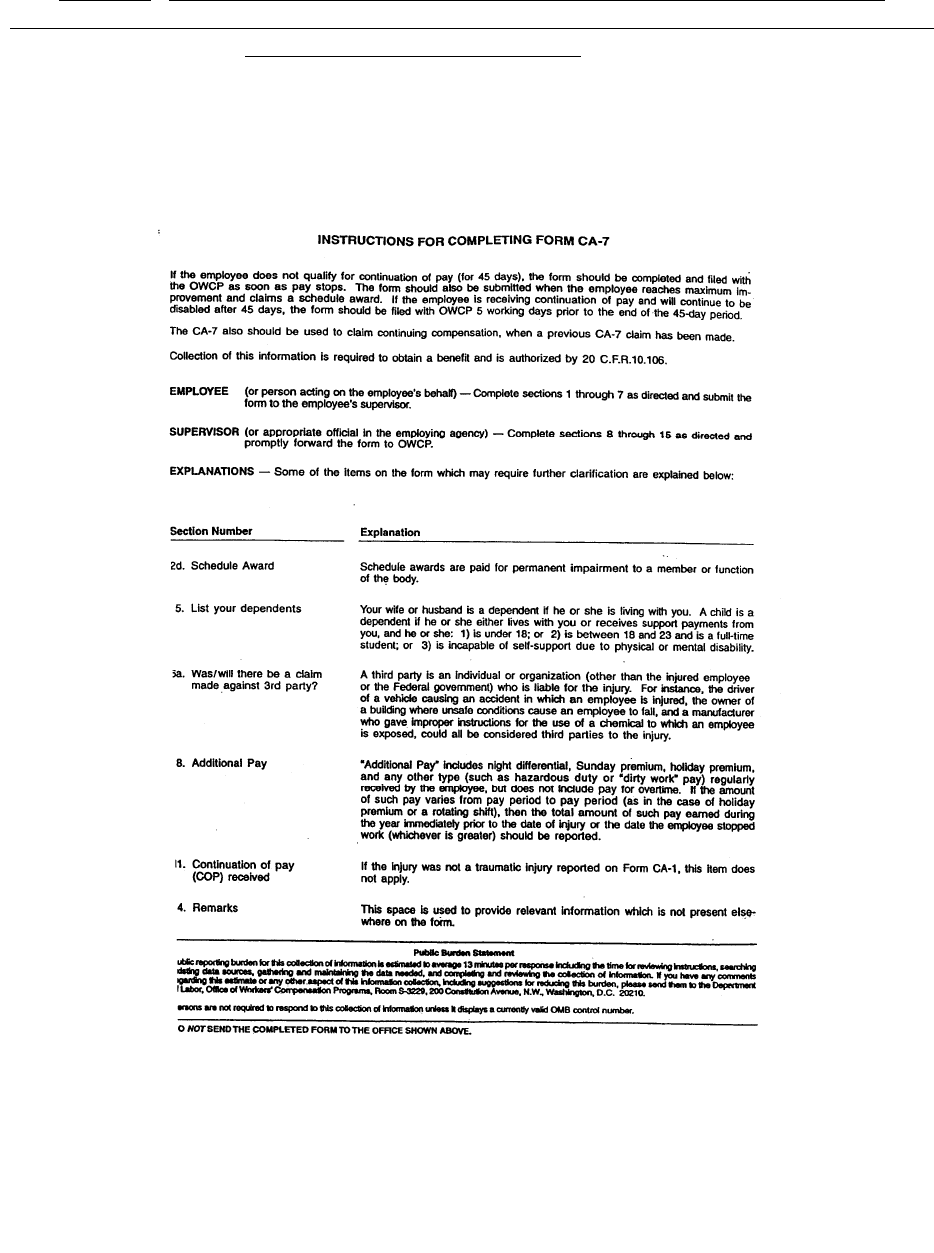

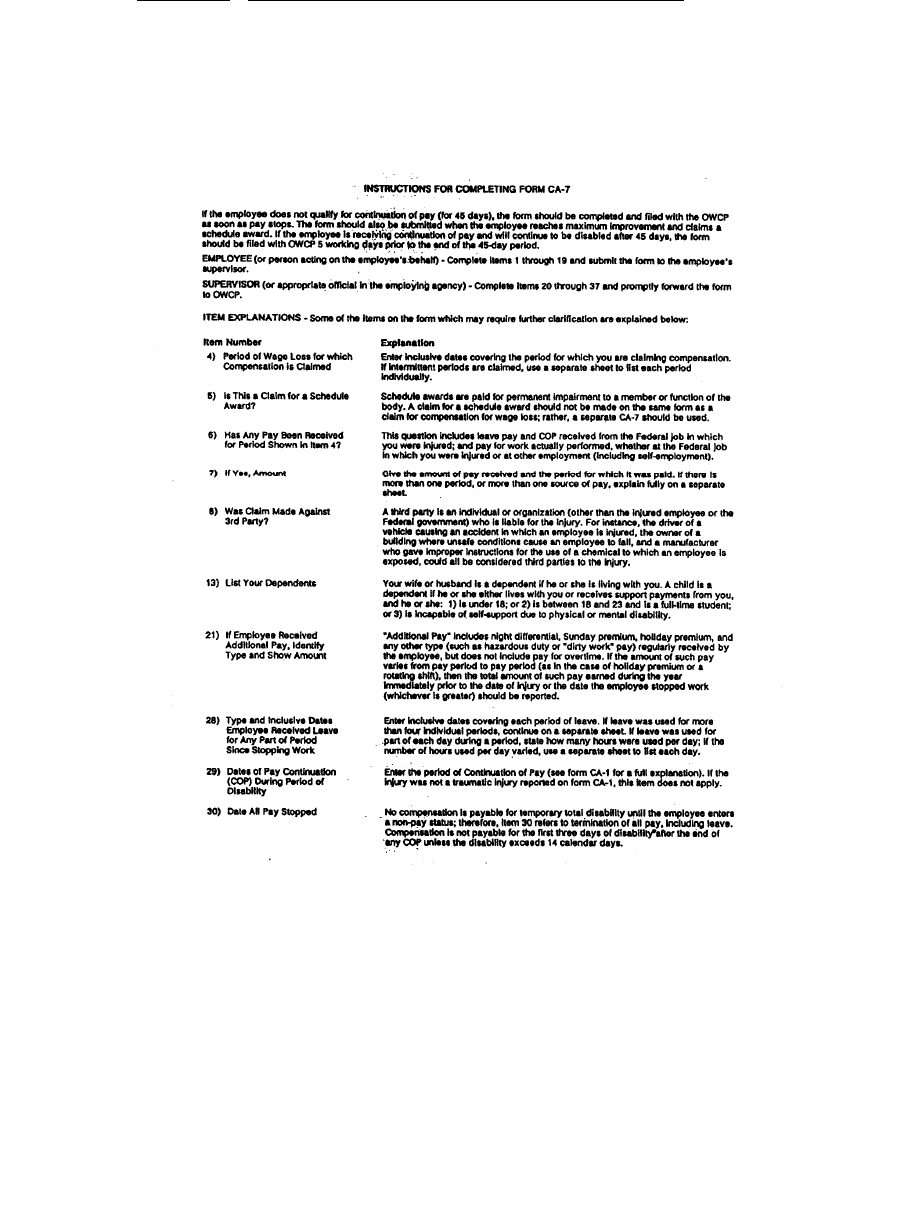

16. Instructions for Completing CA-7 ..................................................................................143

17. Sample Letter to Physician Forwarding CA-16 ..............................................................148

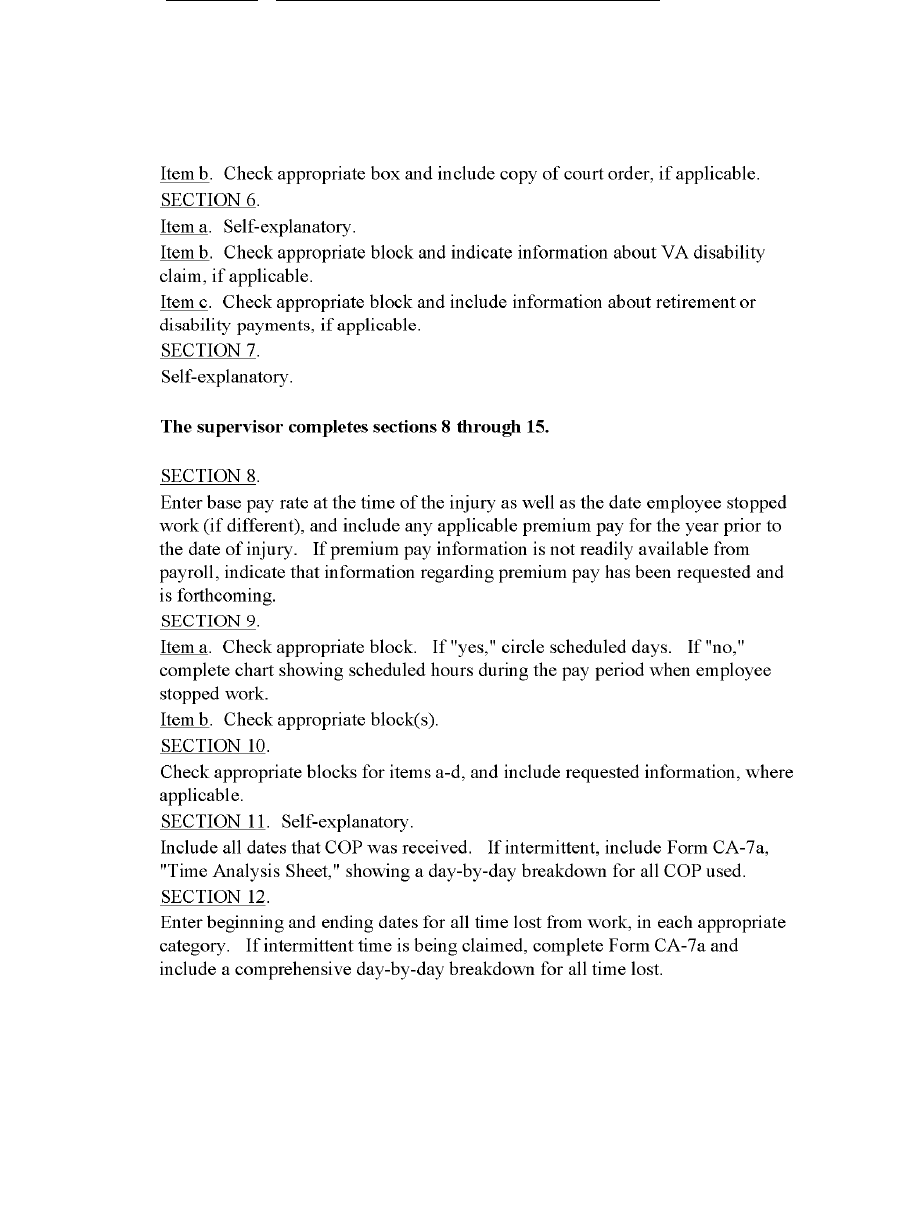

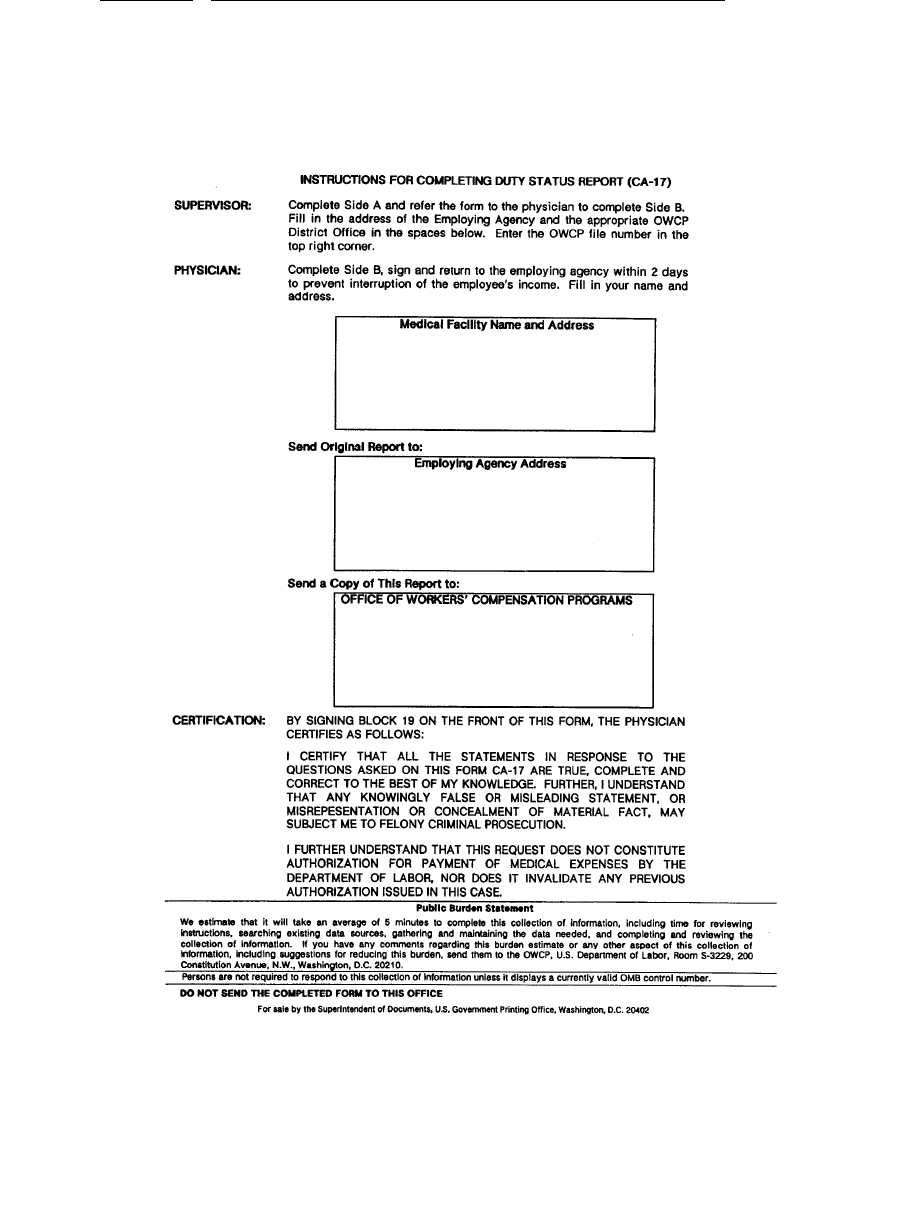

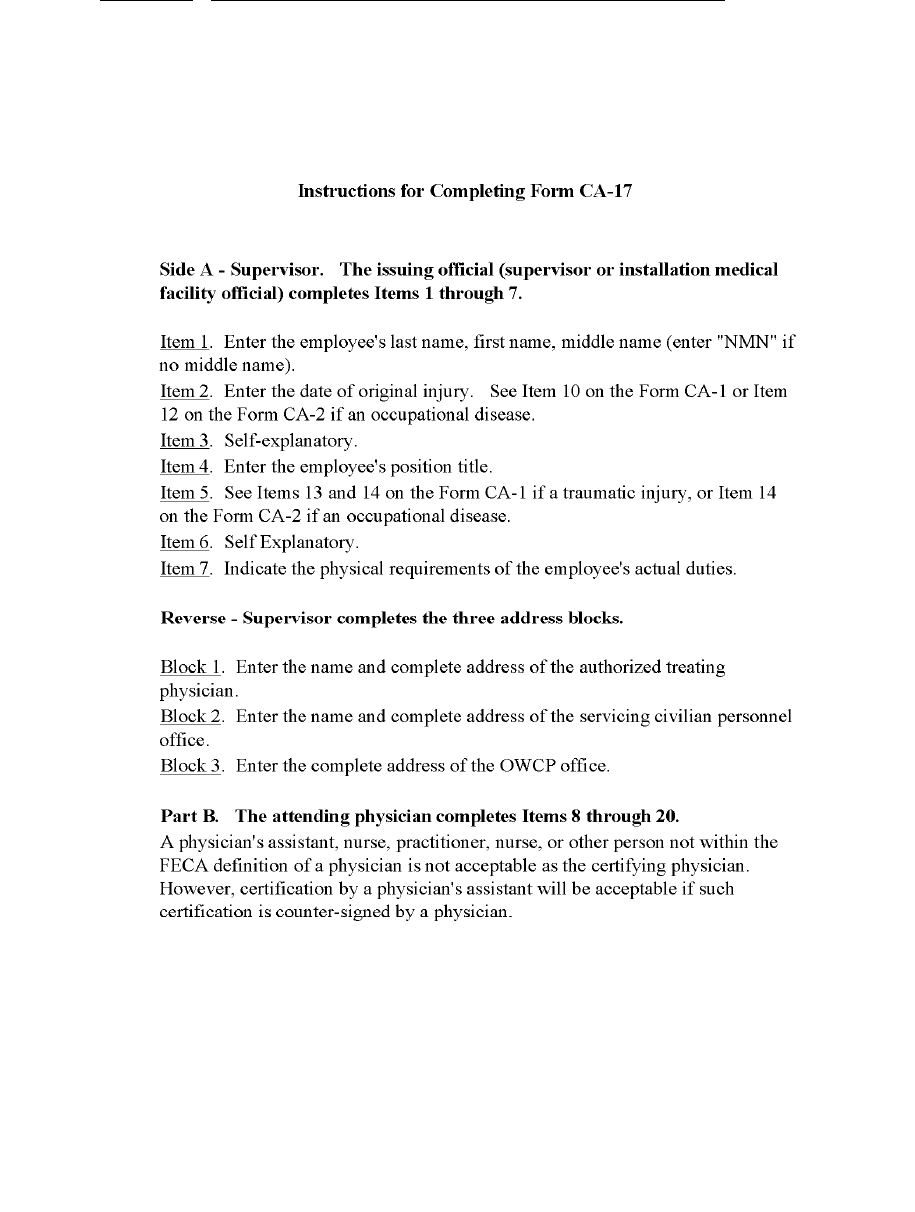

18. Form CA-17 “Duty Status Report,” With Instructions ...................................................150

19. Sample Letter to Physician Forwarding CA-17 ..............................................................153

20. Letter to Physician Requesting Duty Status on Long-Term Claimant ...........................155

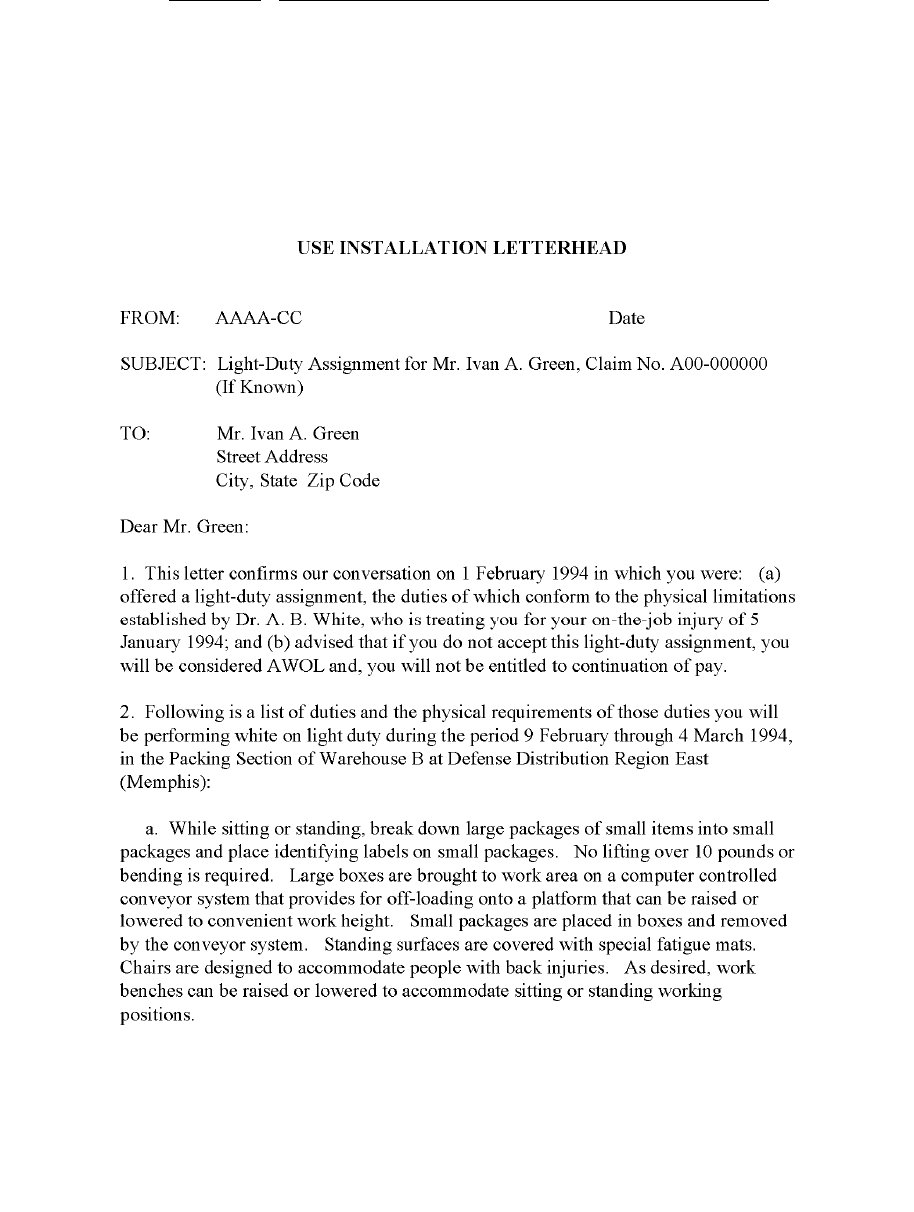

21. Sample Letter on Light Duty on Current Employee .......................................................157

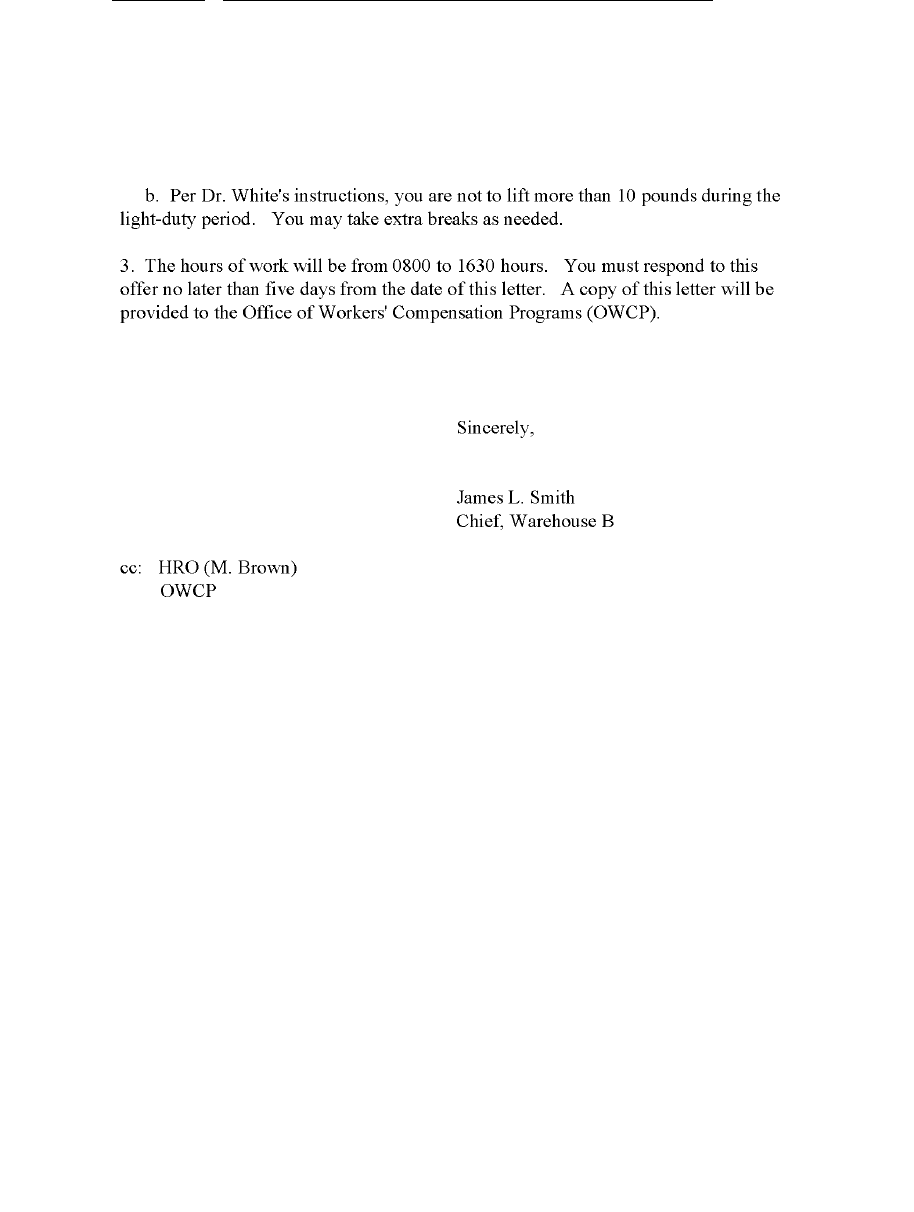

22. Hearing Loss Checklist ...................................................................................................159

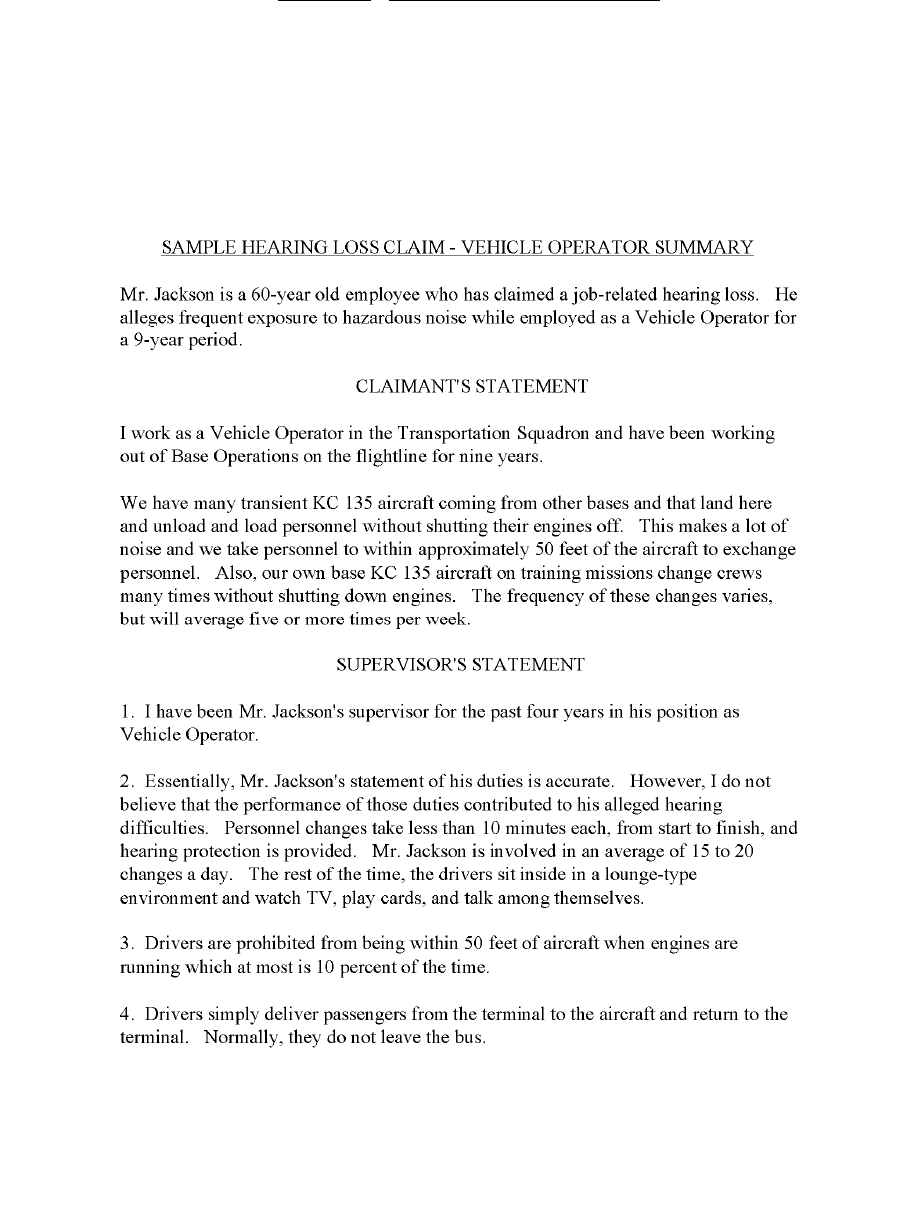

23. Sample Hearing Loss Claim ............................................................................................161

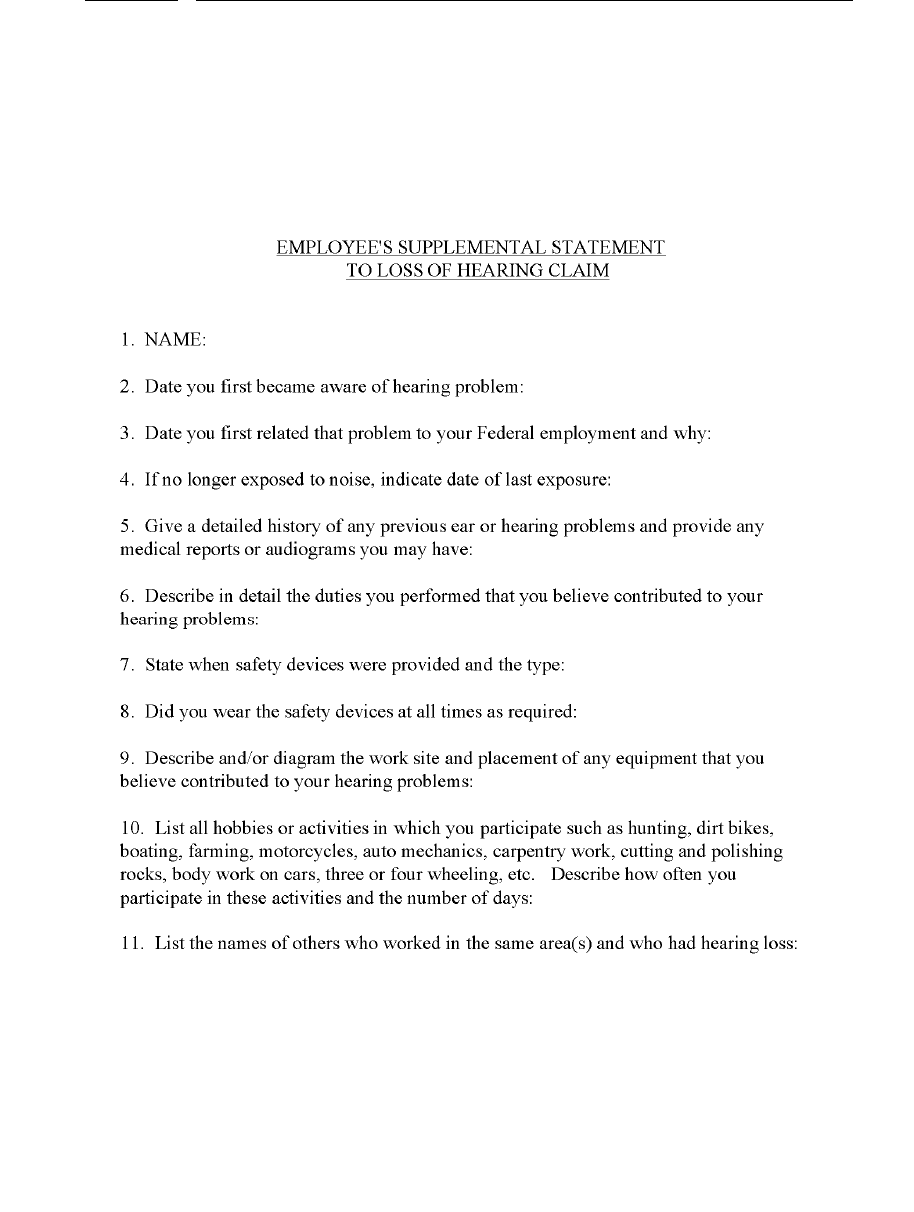

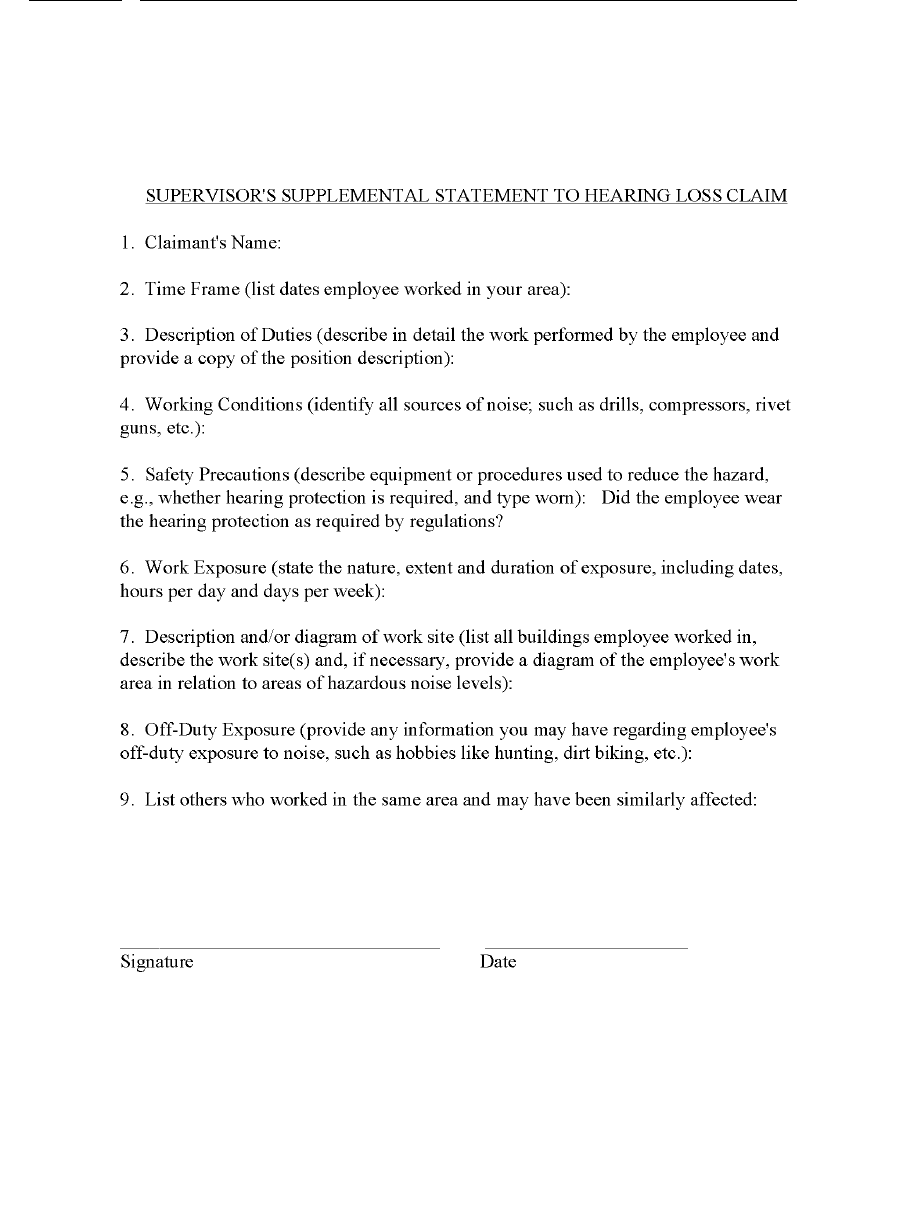

24. Sample Employee's Supplemental Statement to Hearing Loss ......................................163

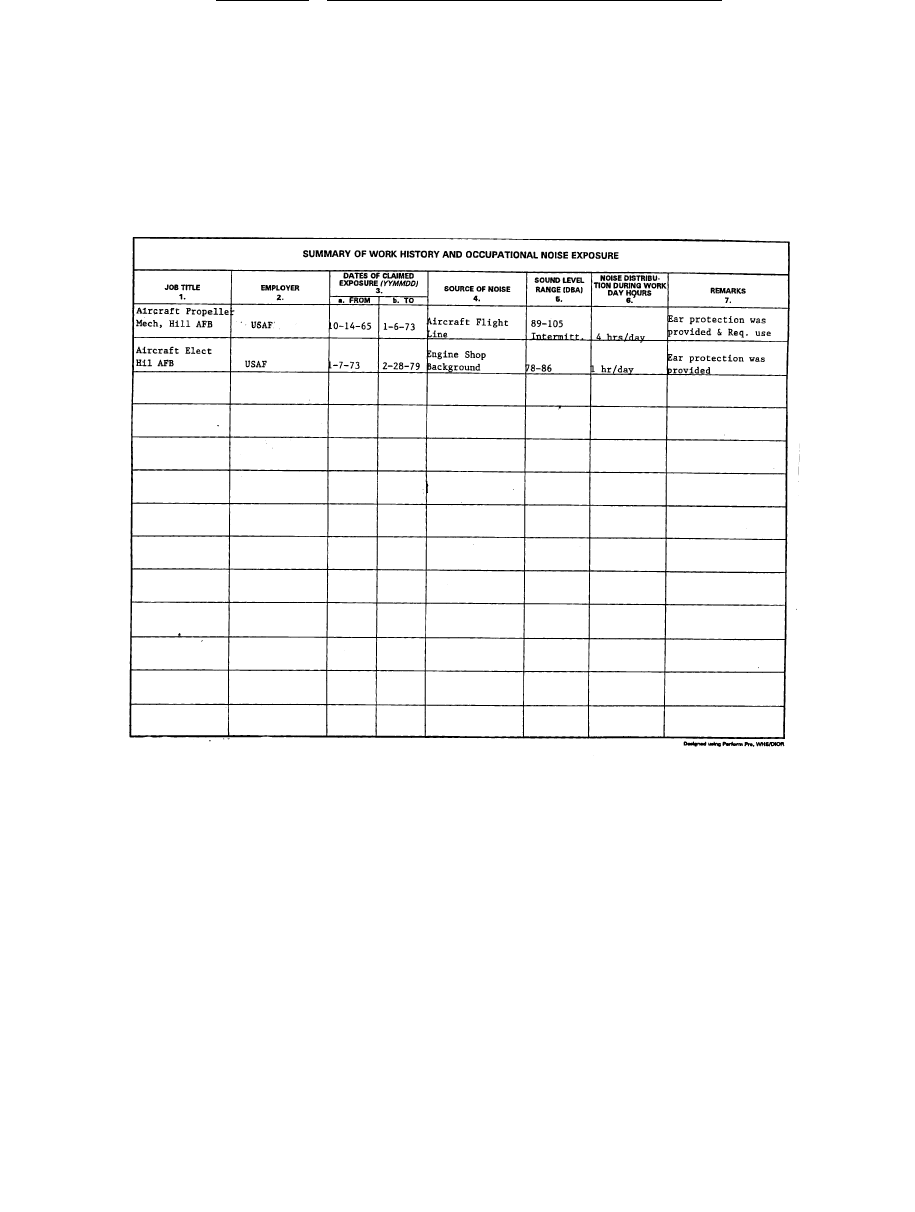

25. Sample of Noise Exposure Work History .......................................................................166

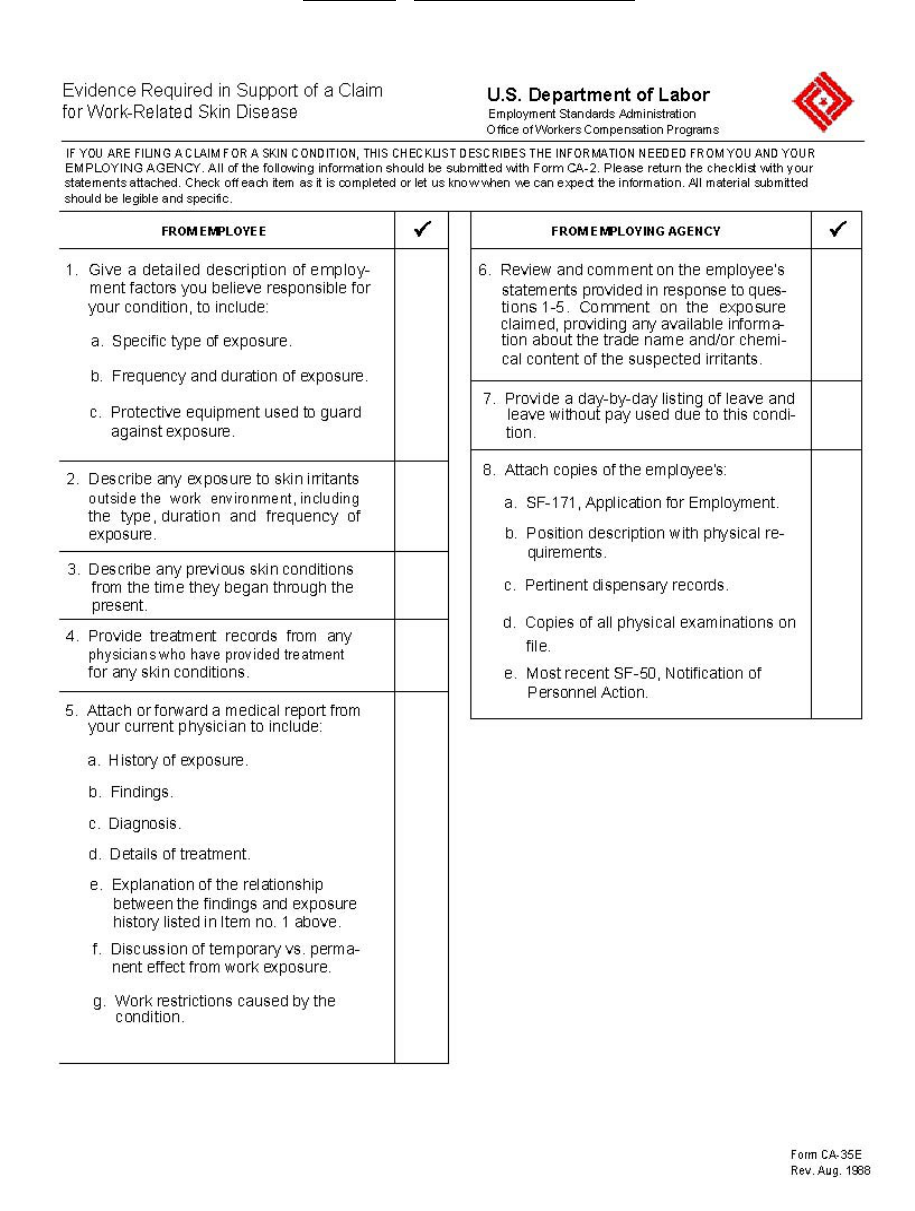

26. Skin Disease Checklist ....................................................................................................167

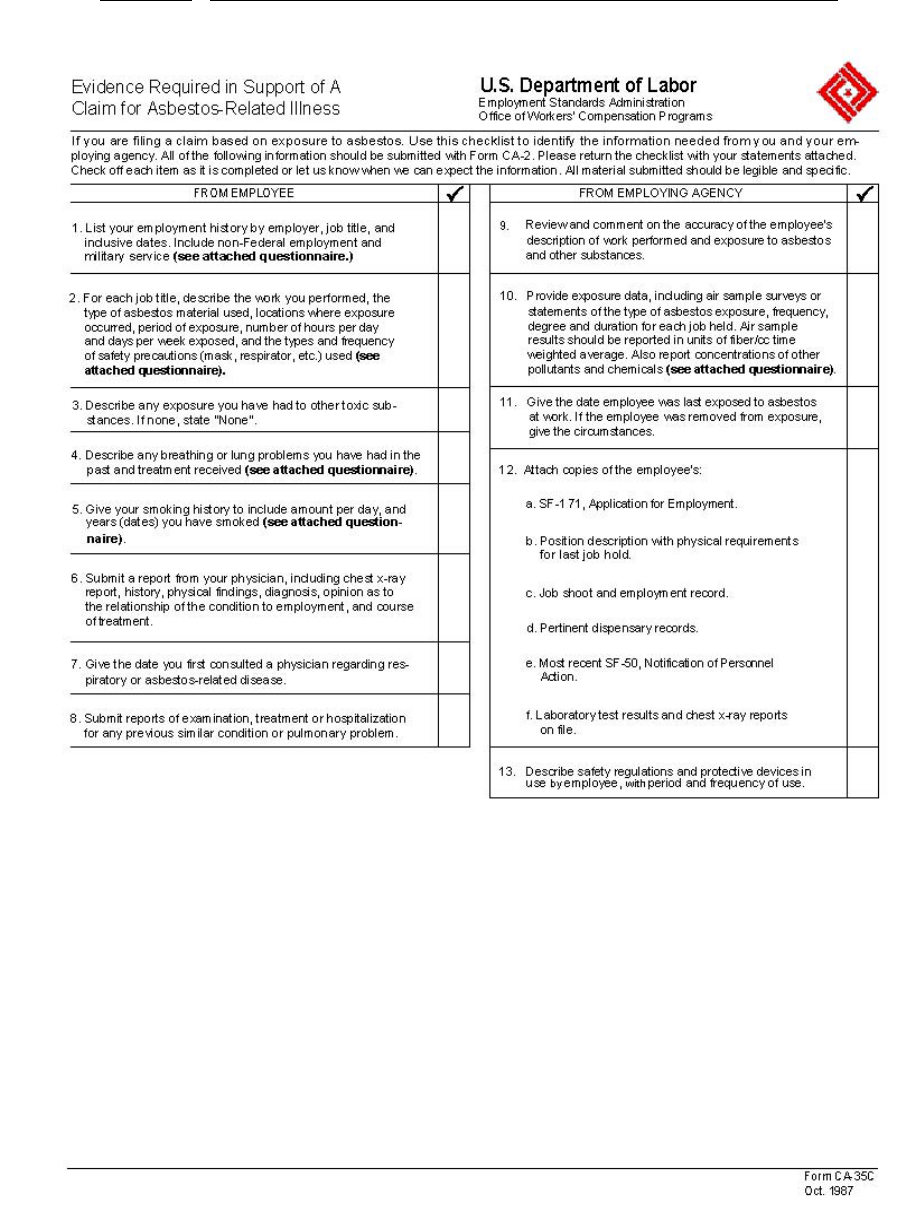

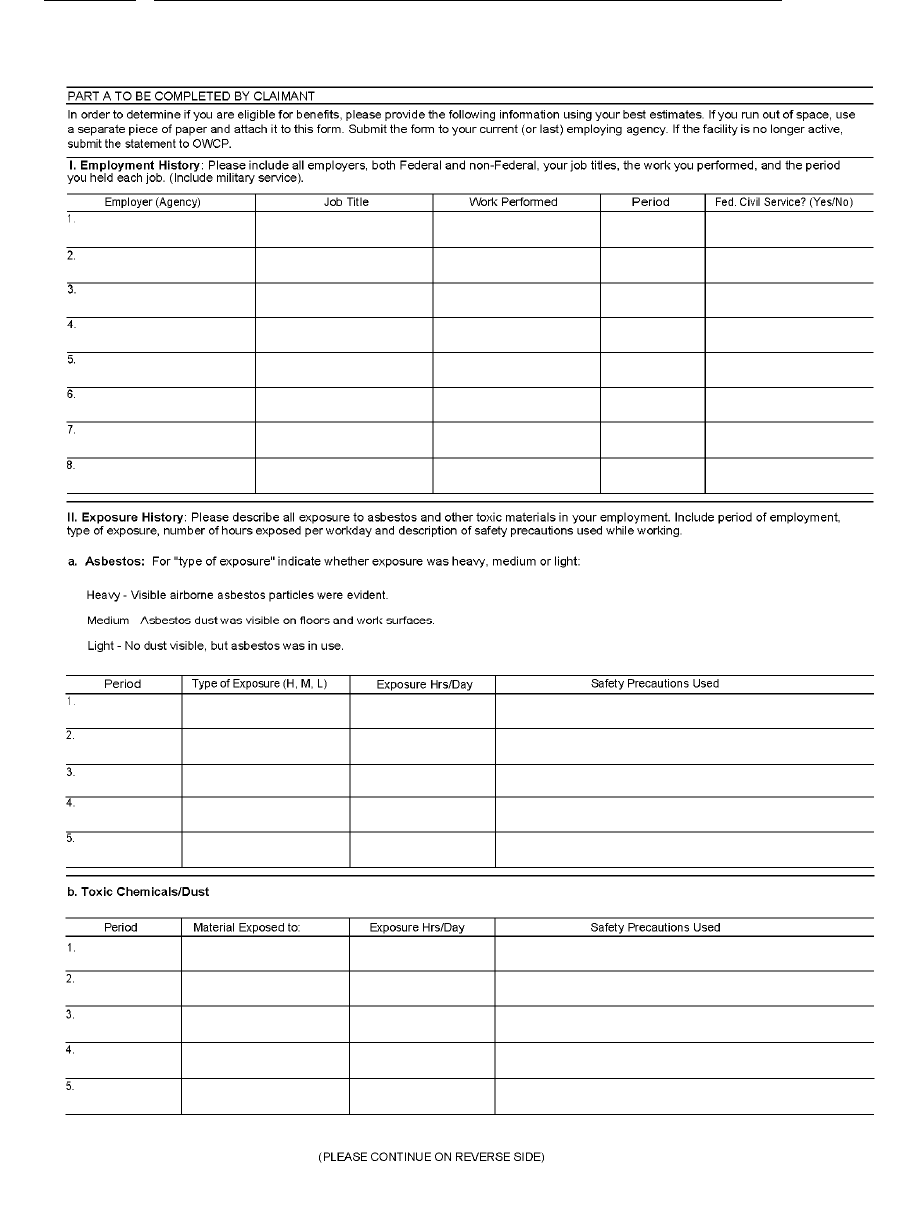

27. Asbestos-Related Illness Check List ...............................................................................168

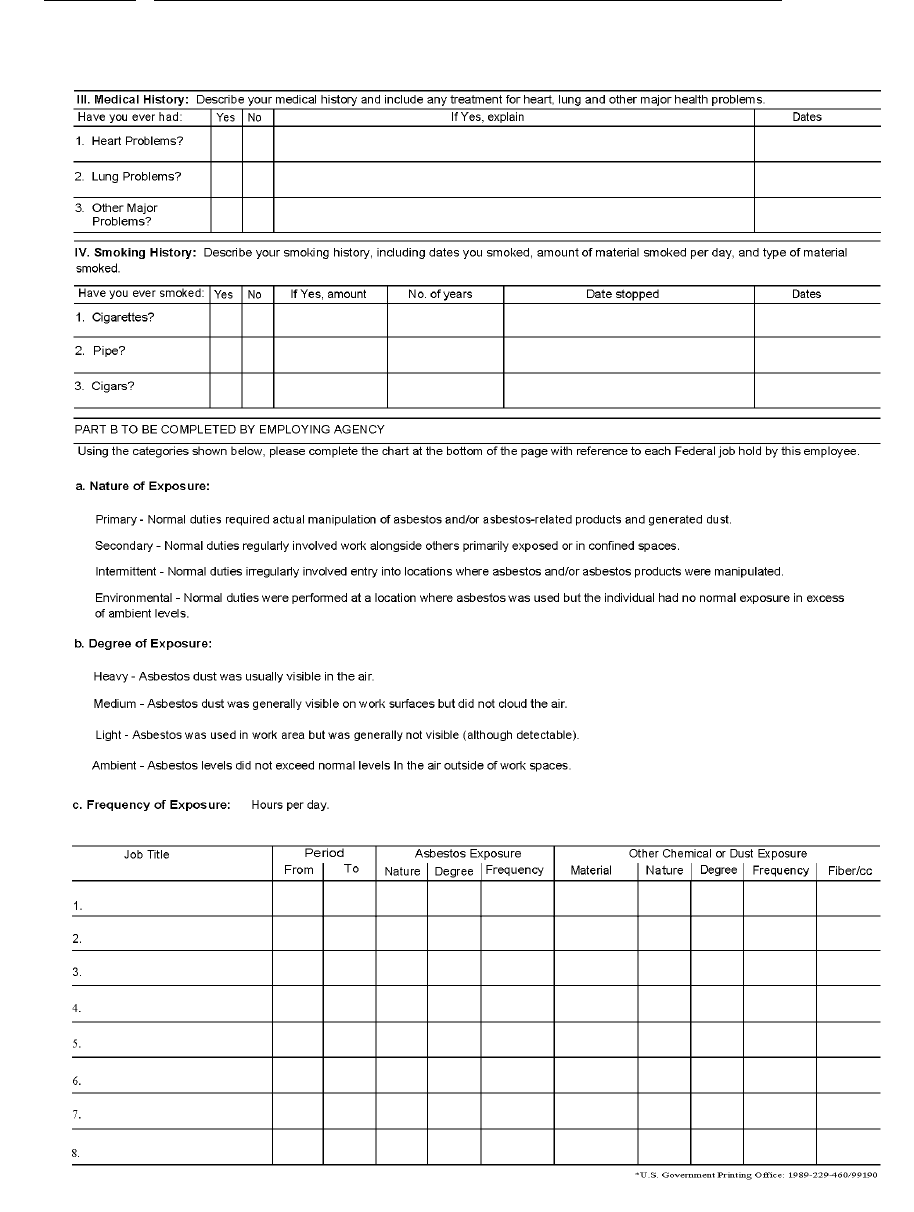

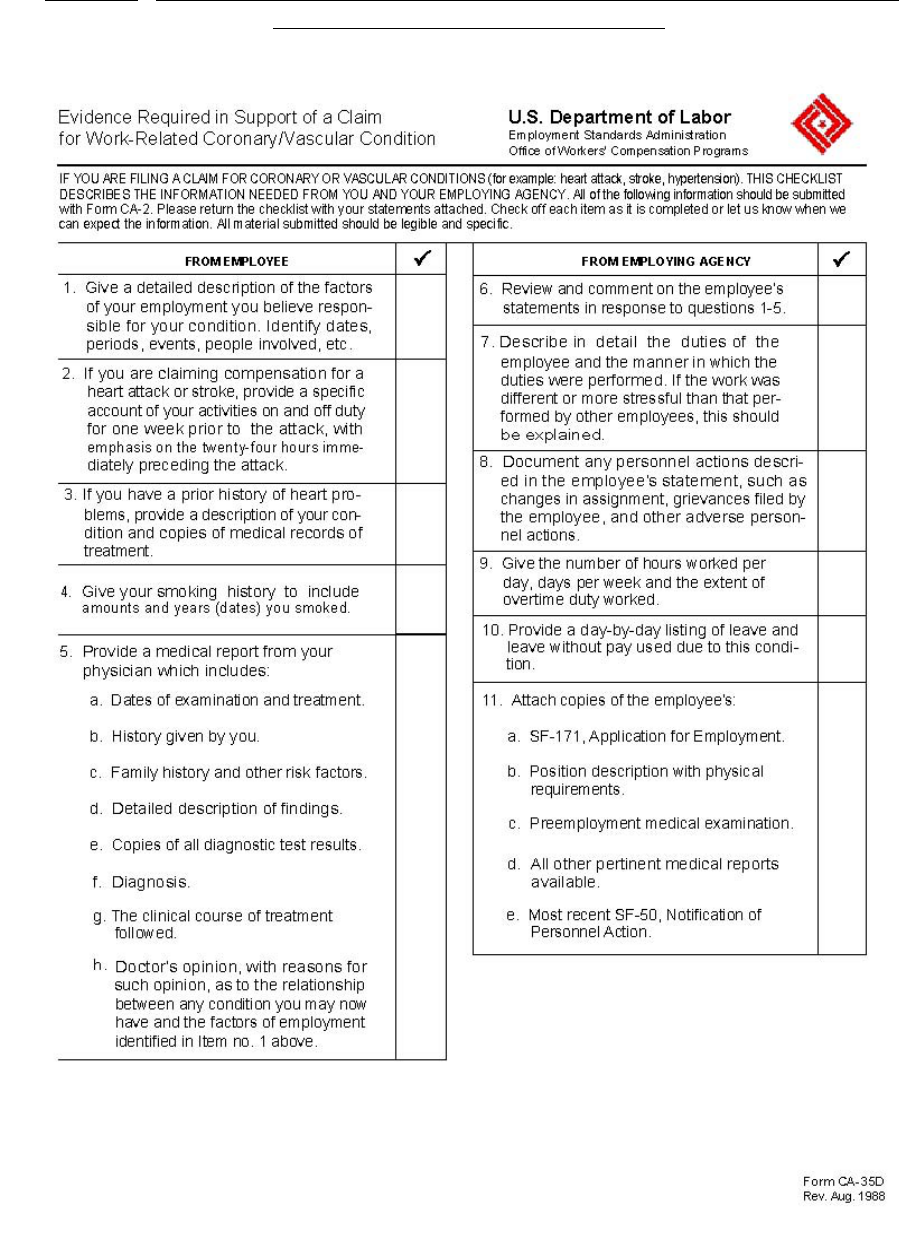

28. Form CA-35D “Evidence Required in Support of a Claim for Work-Related

Coronary/Vascular Condition: Checklist .........................................................................174

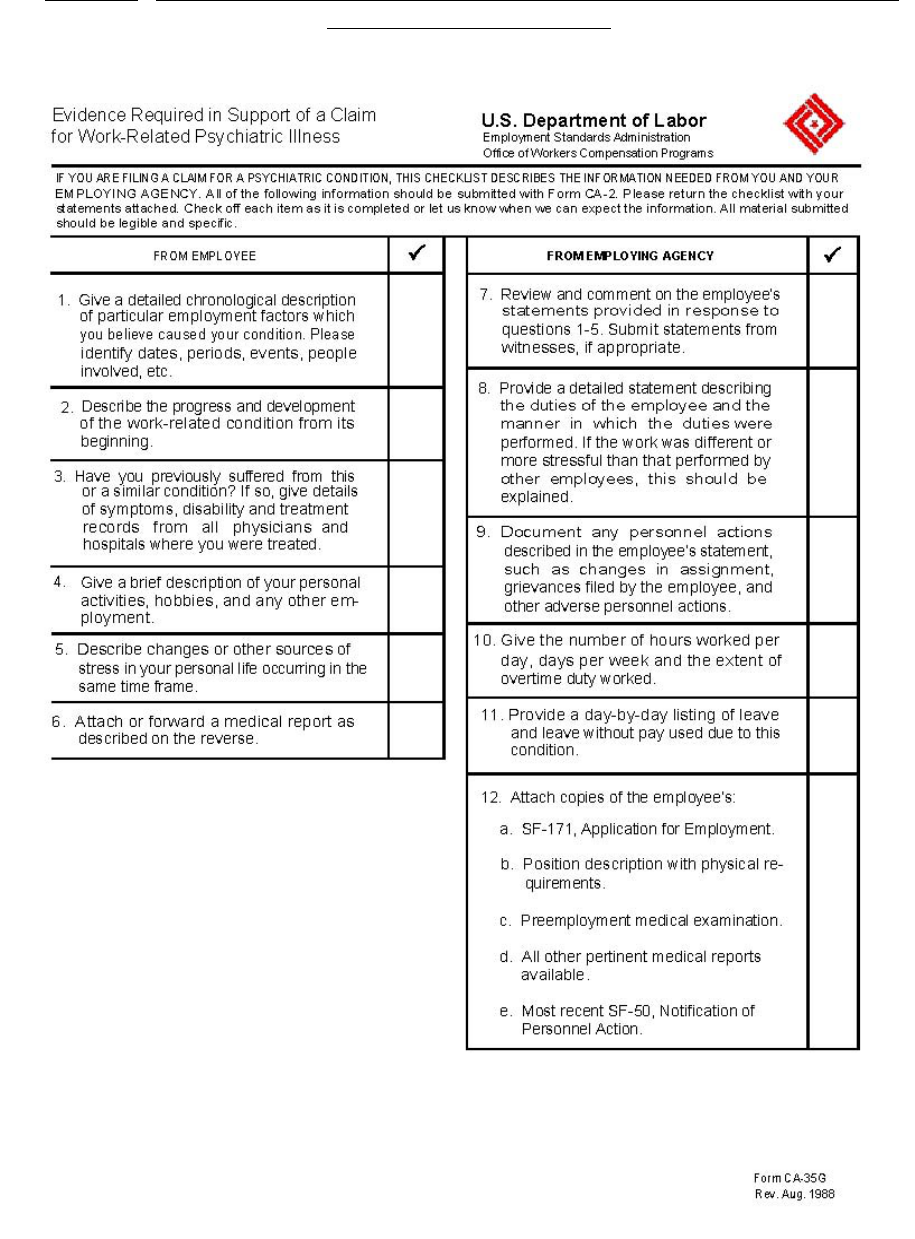

29. Form CA-35G “Evidence Required in Support of a Claim for Work Related

Psychiatric Illness” Checklist ..........................................................................................176

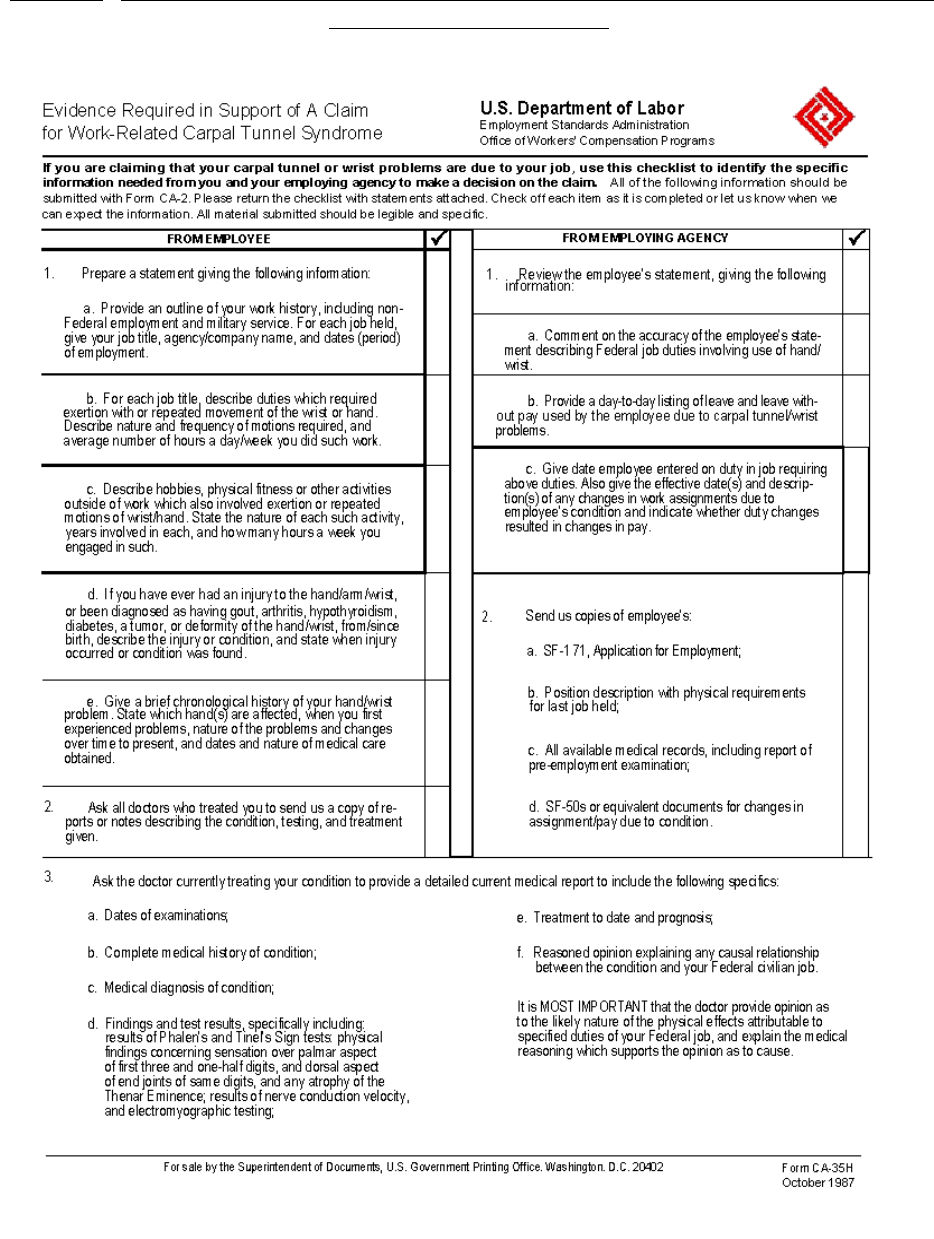

30. Form CA-35H “Evidence Required in Support of a Claim for Work Related

Carpal Tunnel Syndrome” Checklist ...............................................................................178

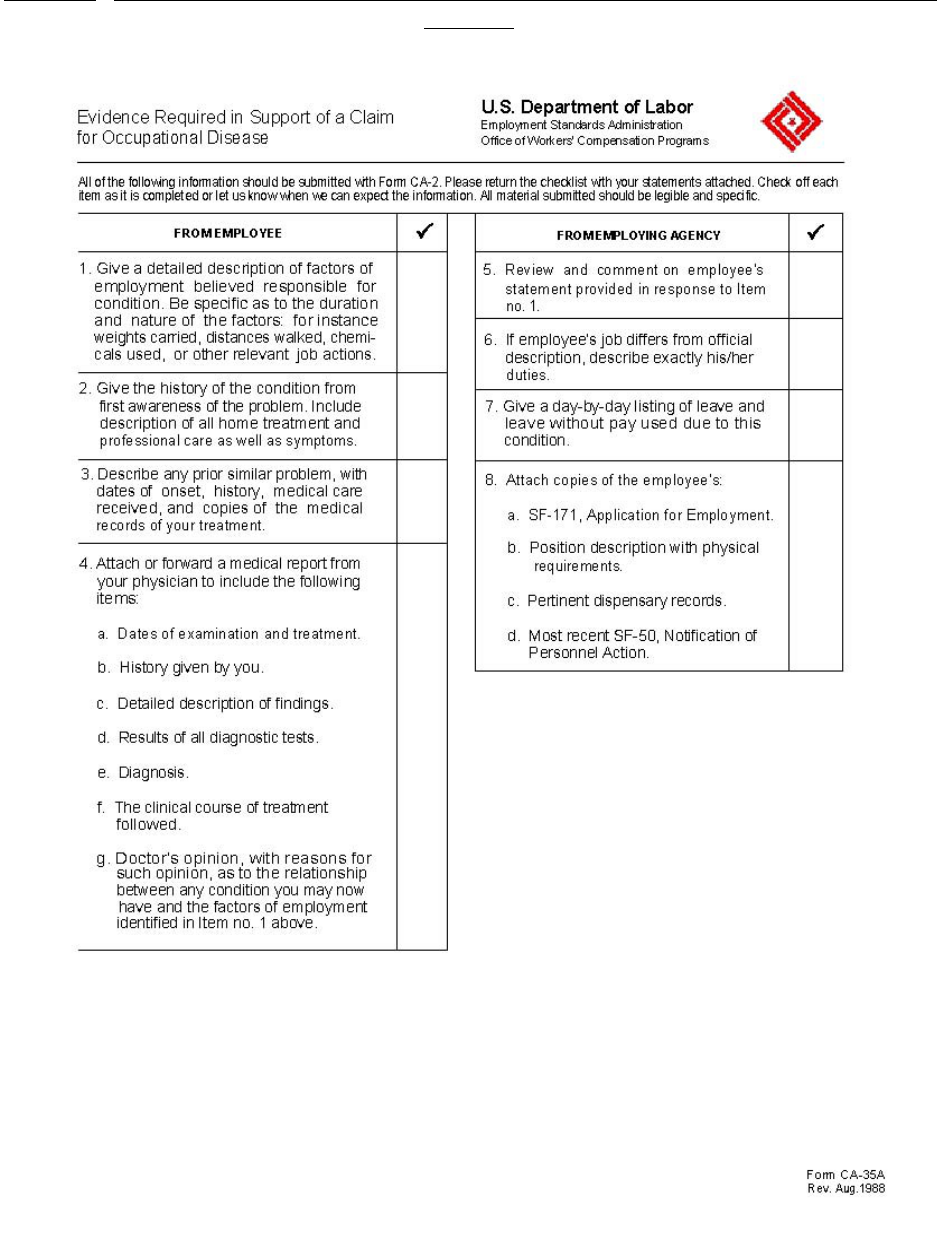

31. Form CA-35A “Evidence Required in Support of a Claim for Occupational

Disease” Checklist ...........................................................................................................180

32. Sample Letter to OWCP Regarding Claimant No Longer Employed ............................182

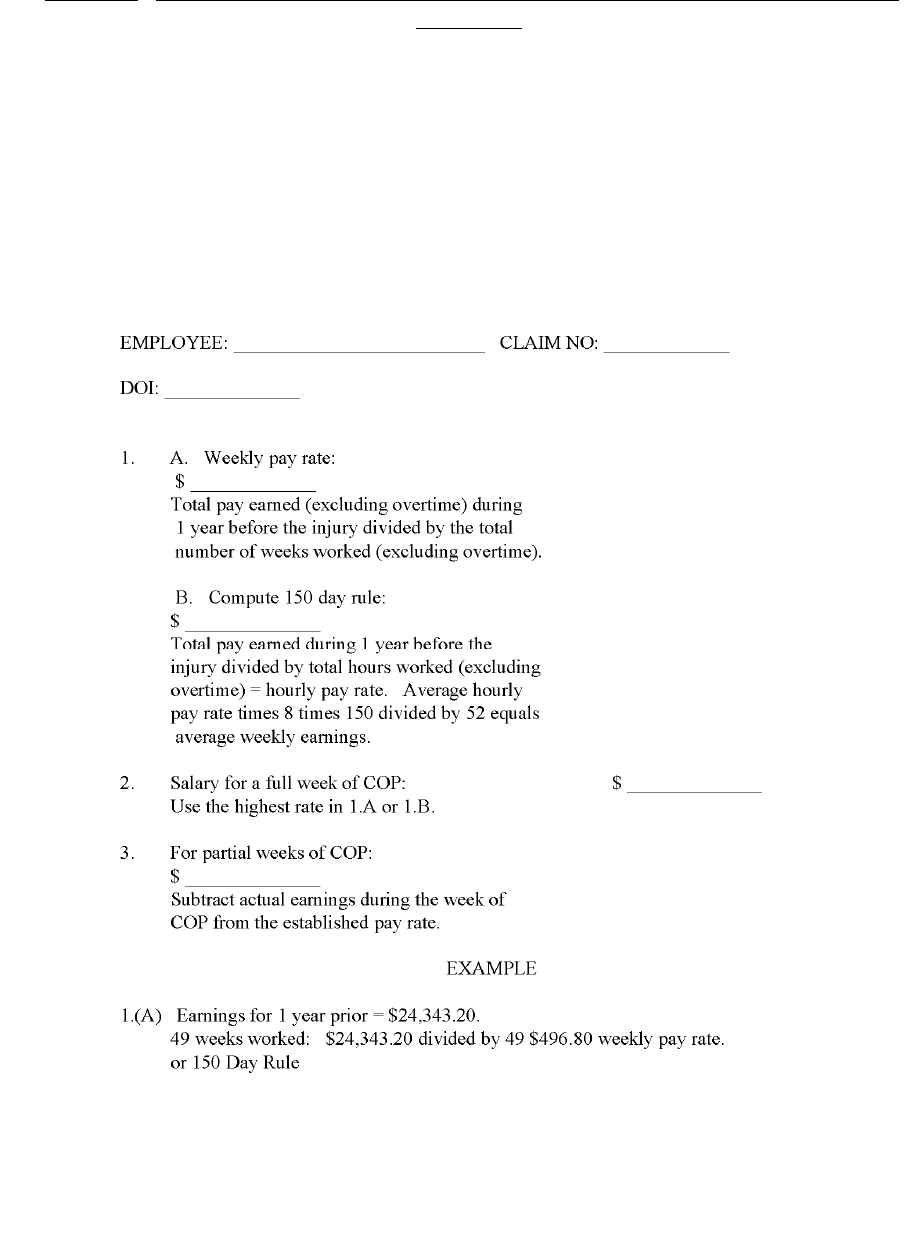

33. Sample Worksheet for Computing COP for Intermittent, WAE, or Part-Time

Employees ........................................................................................................................185

34. Sample Letter to OWCP-Occupational Disease vs. Traumatic Injury ...........................187

35. Sample Controversion Letter-Traumatic Injury Not Reported Within 30-Day Time

Period ...................................................................................................................................189

DoDI 1400.25-V810, April 15, 2005

5 CONTENTS

36. Sample Controversion Letter-Work Stoppage Occurred After 45-Day Time Period ....191

37. Sample Controversion Letter- Injury Reported After Employee Was Terminated ........193

38. Sample Controversion Letter- Diagnosis Not Compatible With Injury .........................195

39. Sample Controversion Letter- Injury Not in Performance of Duty ................................197

40. Sample Controversion Letter- Occupational Disease Not Related to Employment .......199

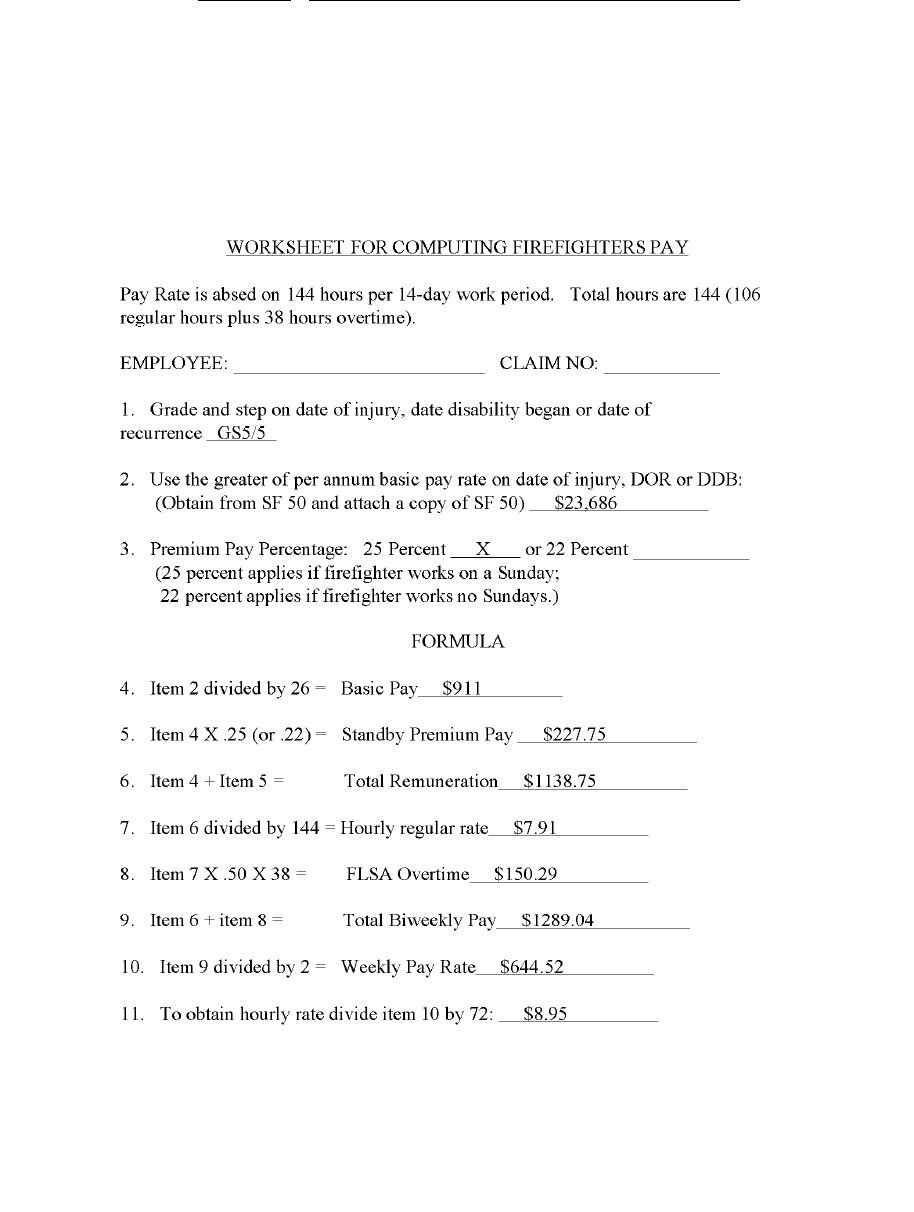

41. Sample Firefighters Computation Worksheet .................................................................201

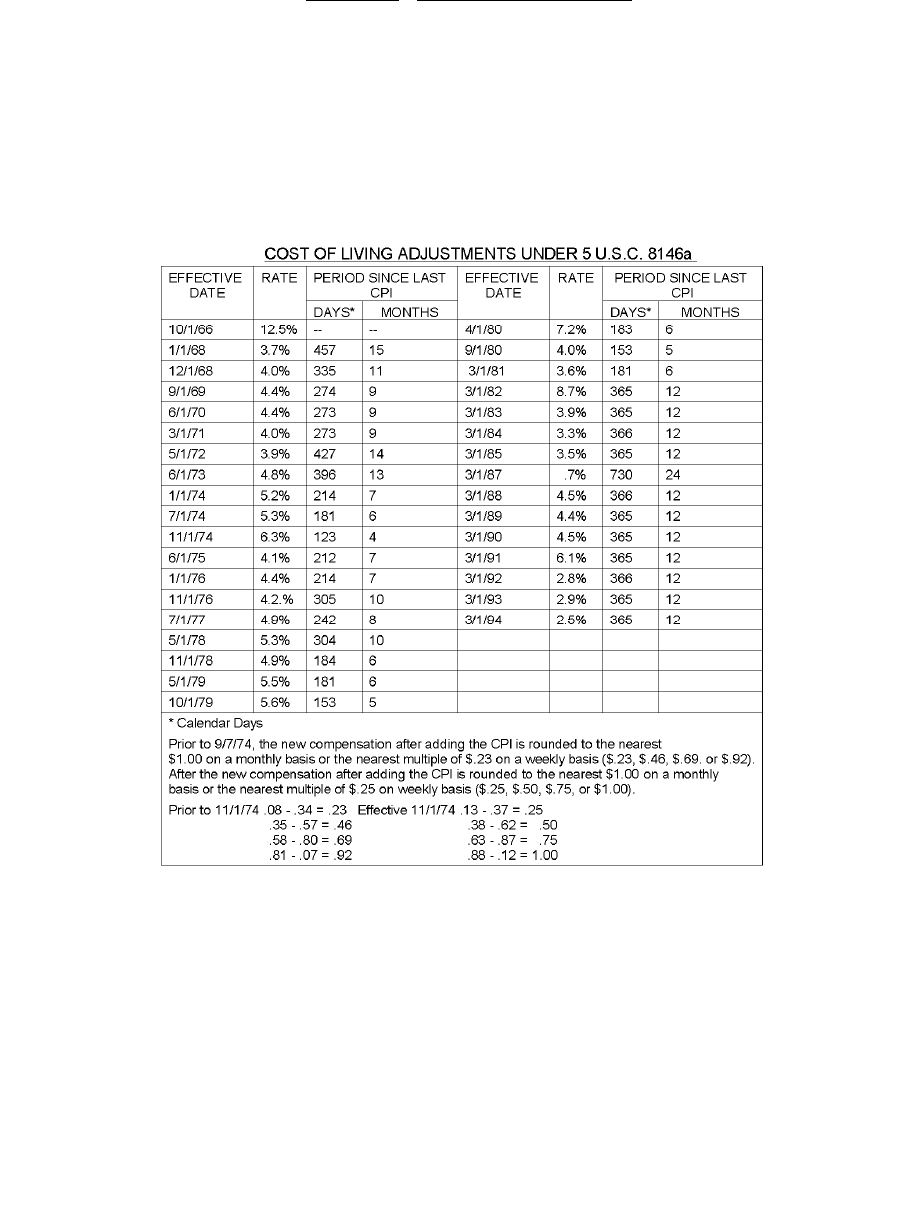

42. Consumer Price Index .....................................................................................................203

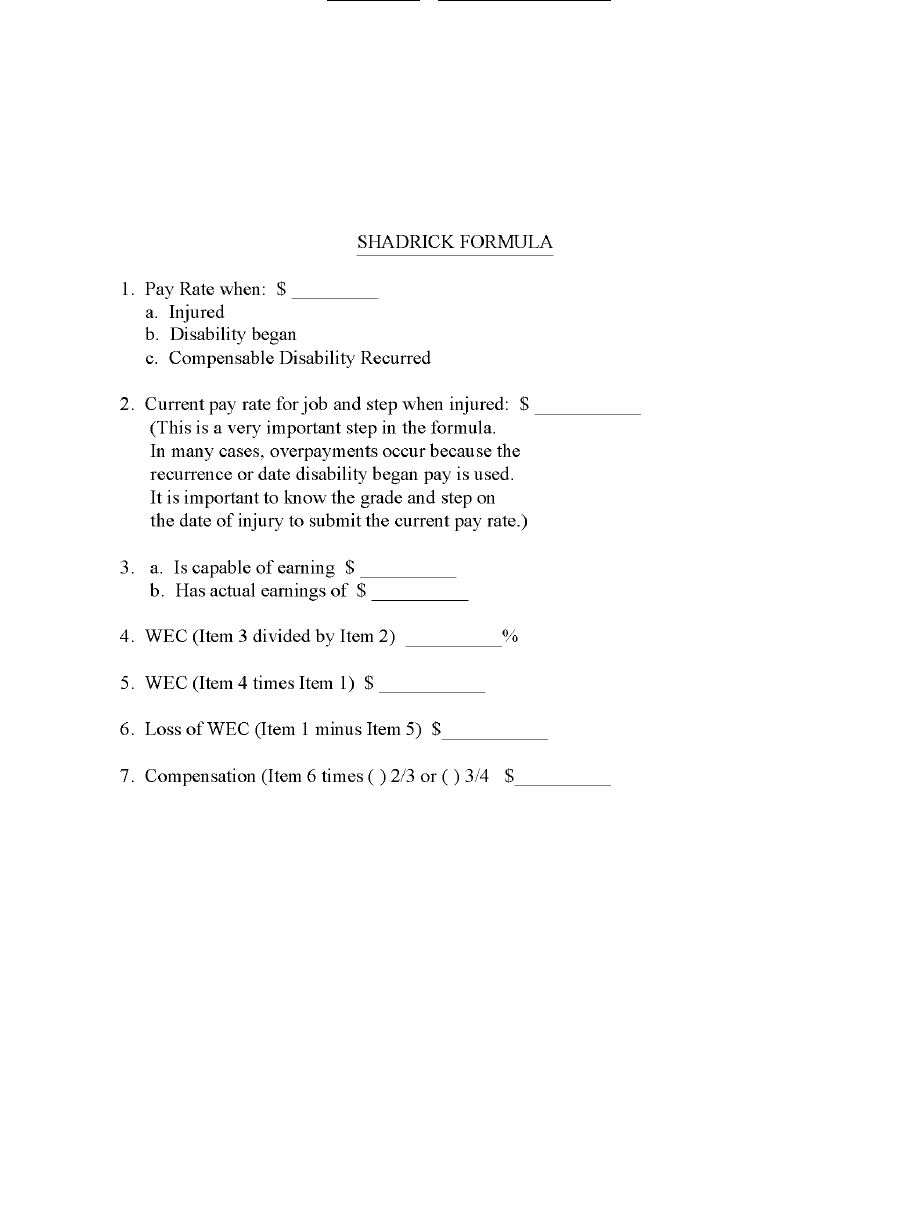

43. Shadrick Formula ............................................................................................................204

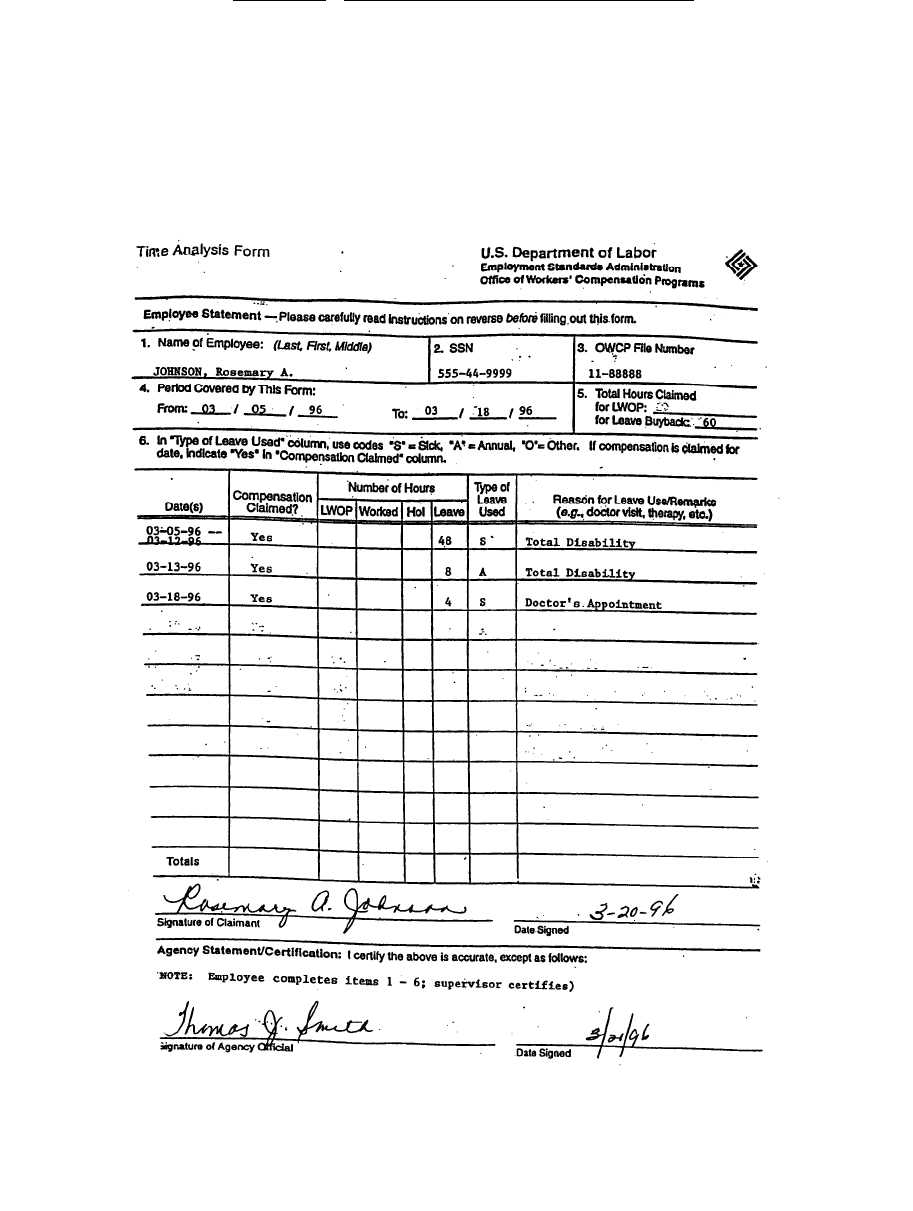

44. Form CA-7a, “Time Analysis Form” ..............................................................................205

45. Instructions for Completing CA-7a ................................................................................206

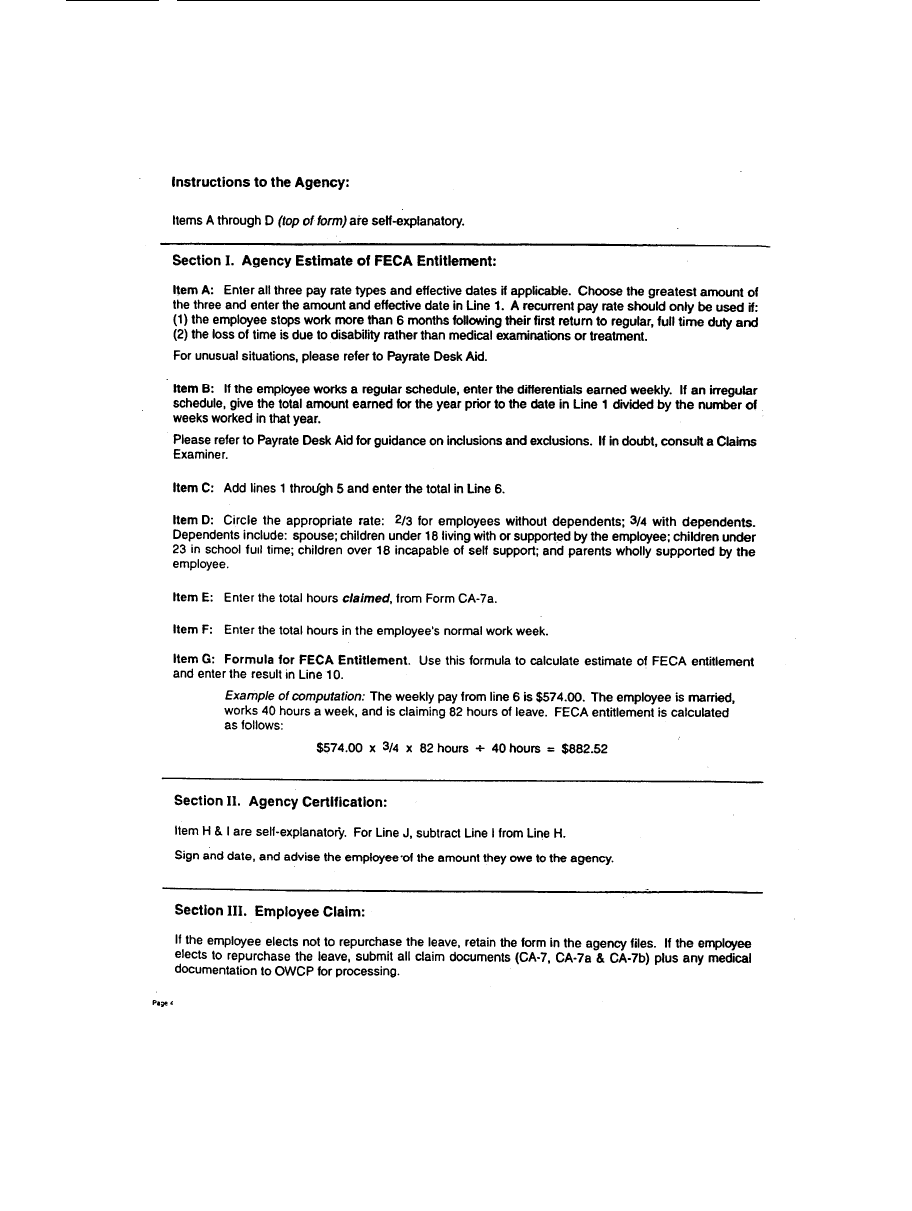

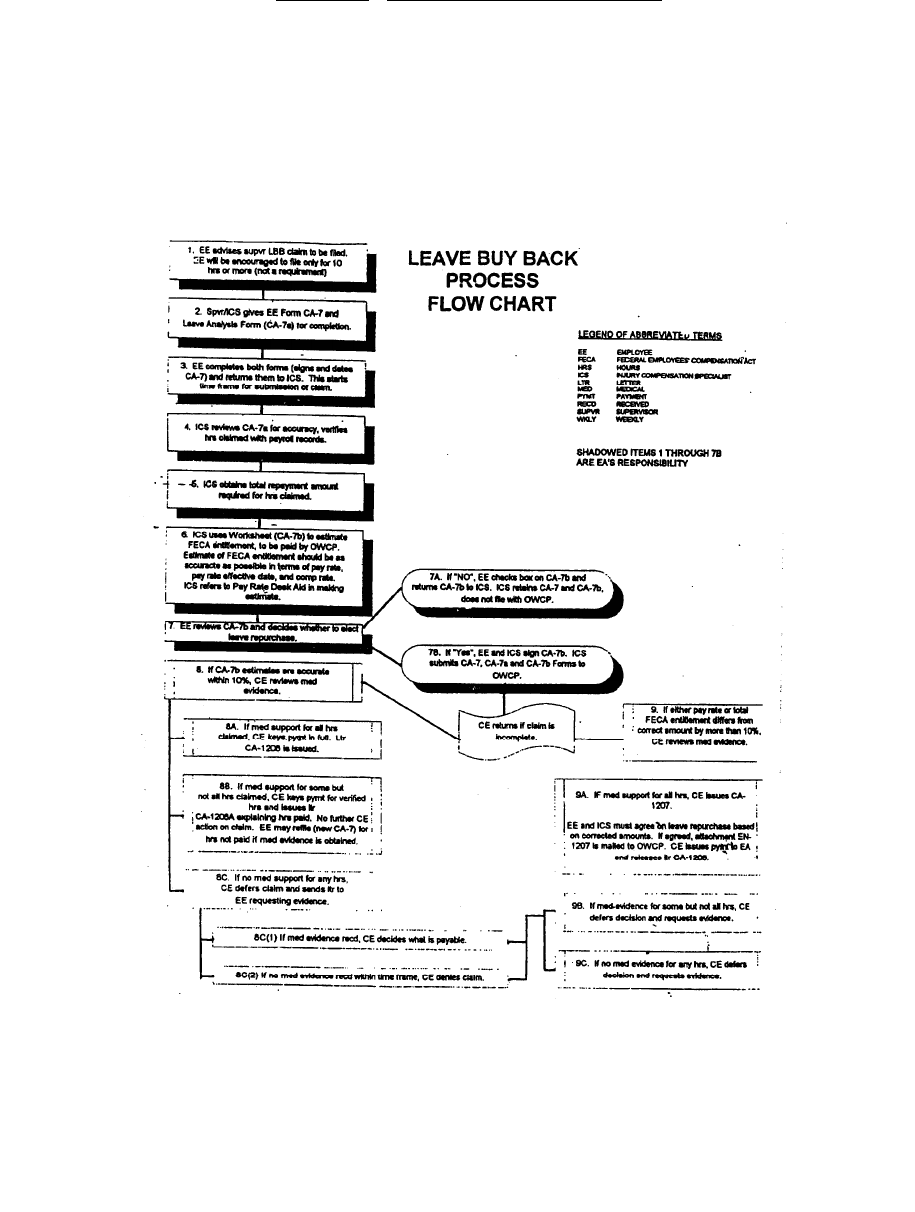

46. Leave Buy Back Worksheet/Certification and Election Form .......................................207

47. Leave Buy Back Flow Chart ...........................................................................................211

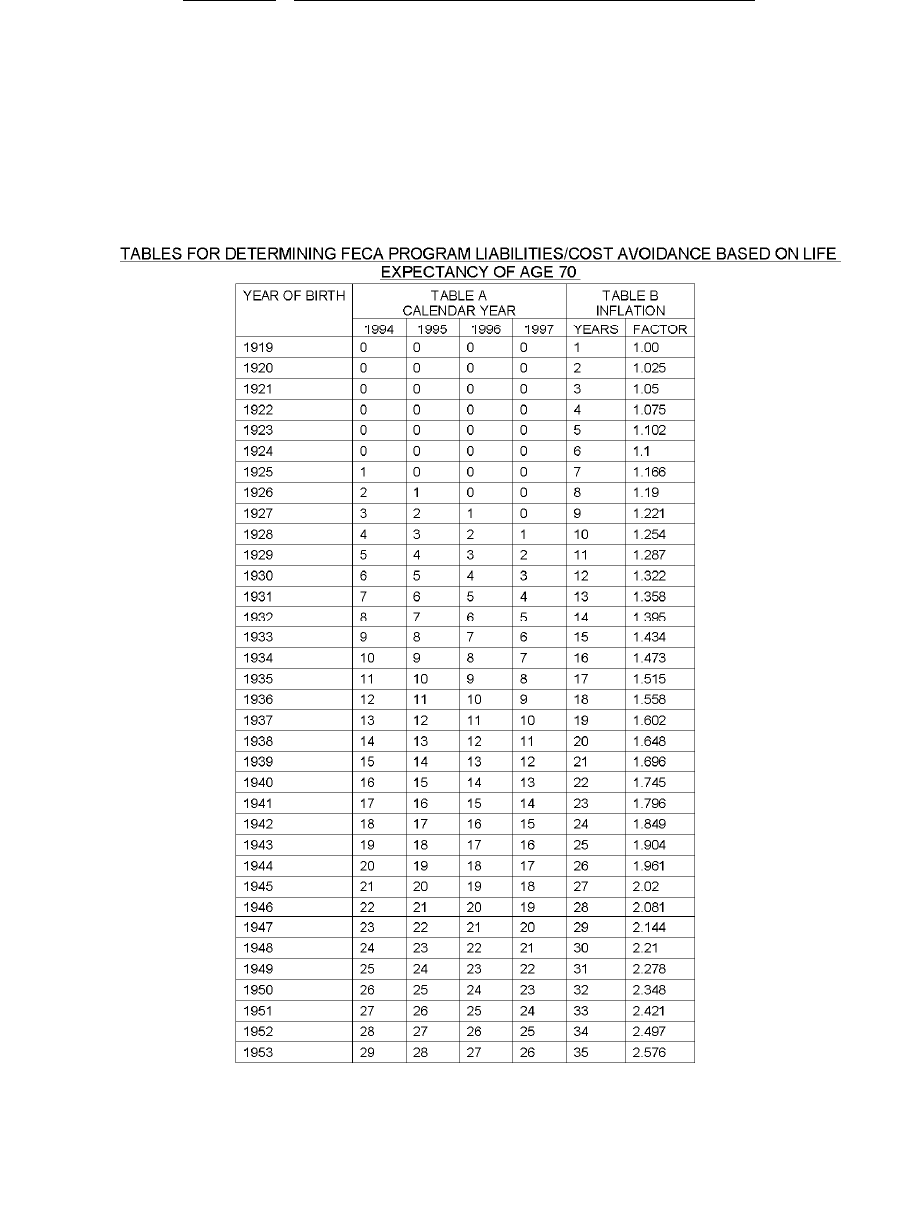

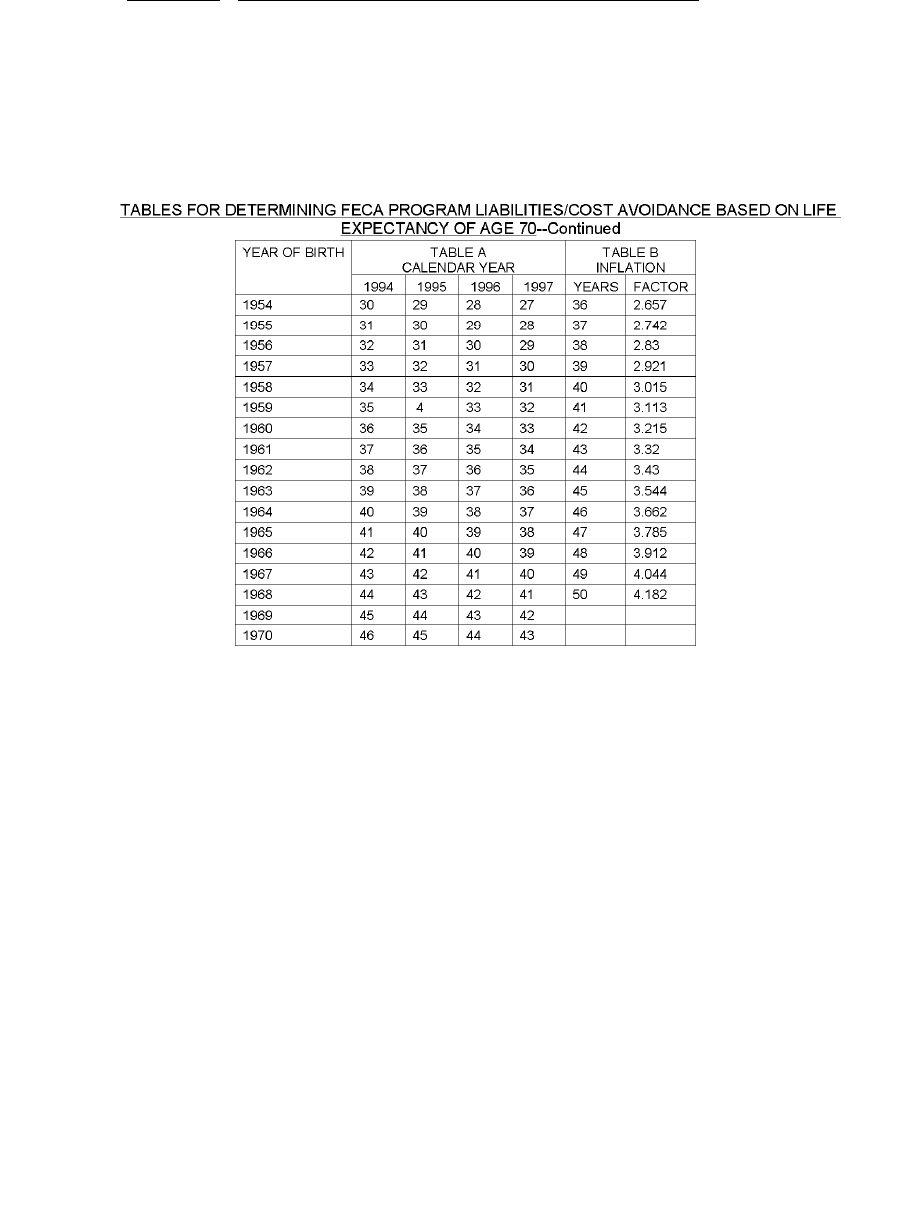

48. Instructions for Using Tables to Compute Program Costs/Savings ...............................212

49. Tables for Computing Lifetime Cost Avoidance ............................................................213

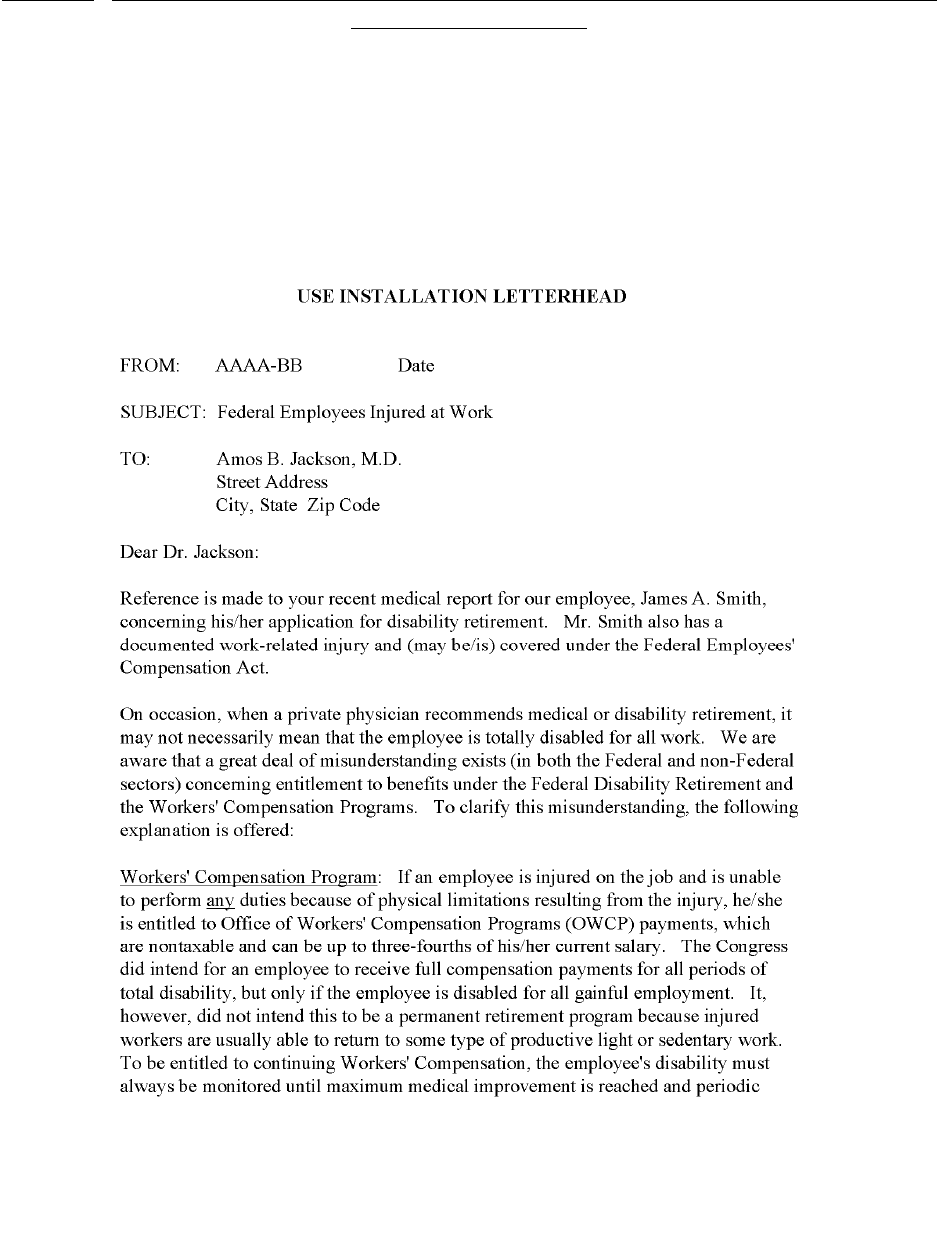

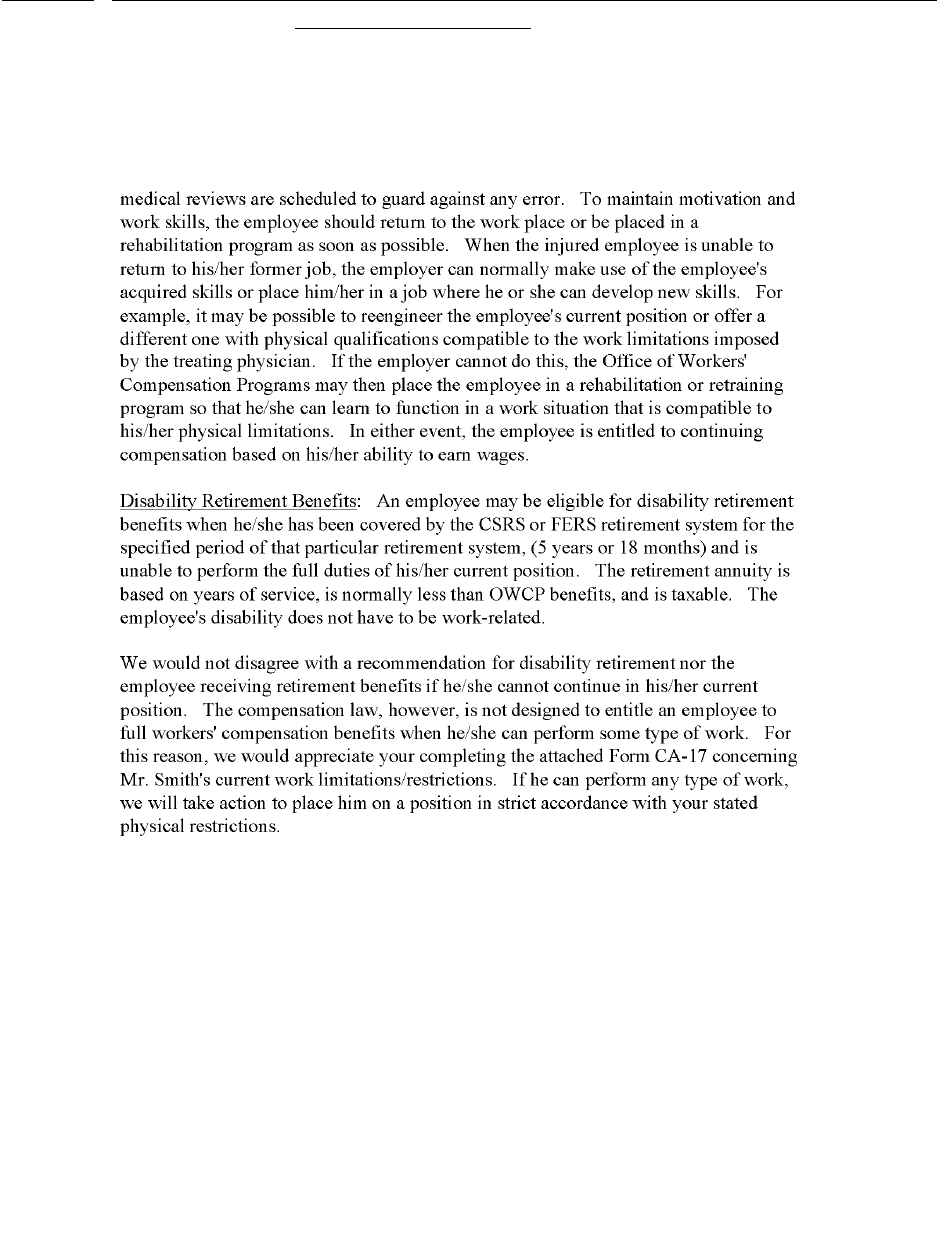

50. Sample Letter to Physician Explaining Difference Between Disability Retirement

and Workers' Compensation ............................................................................................215

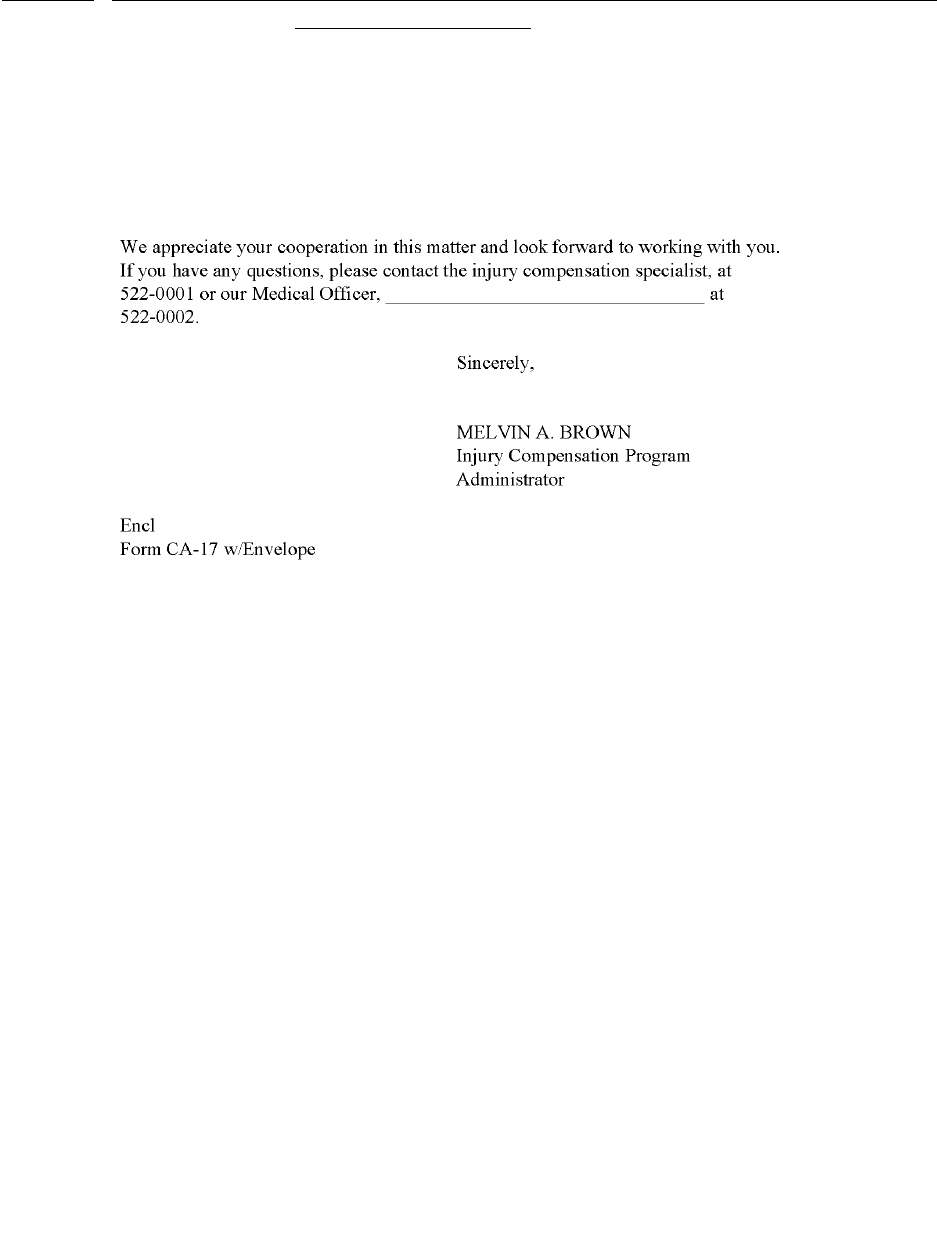

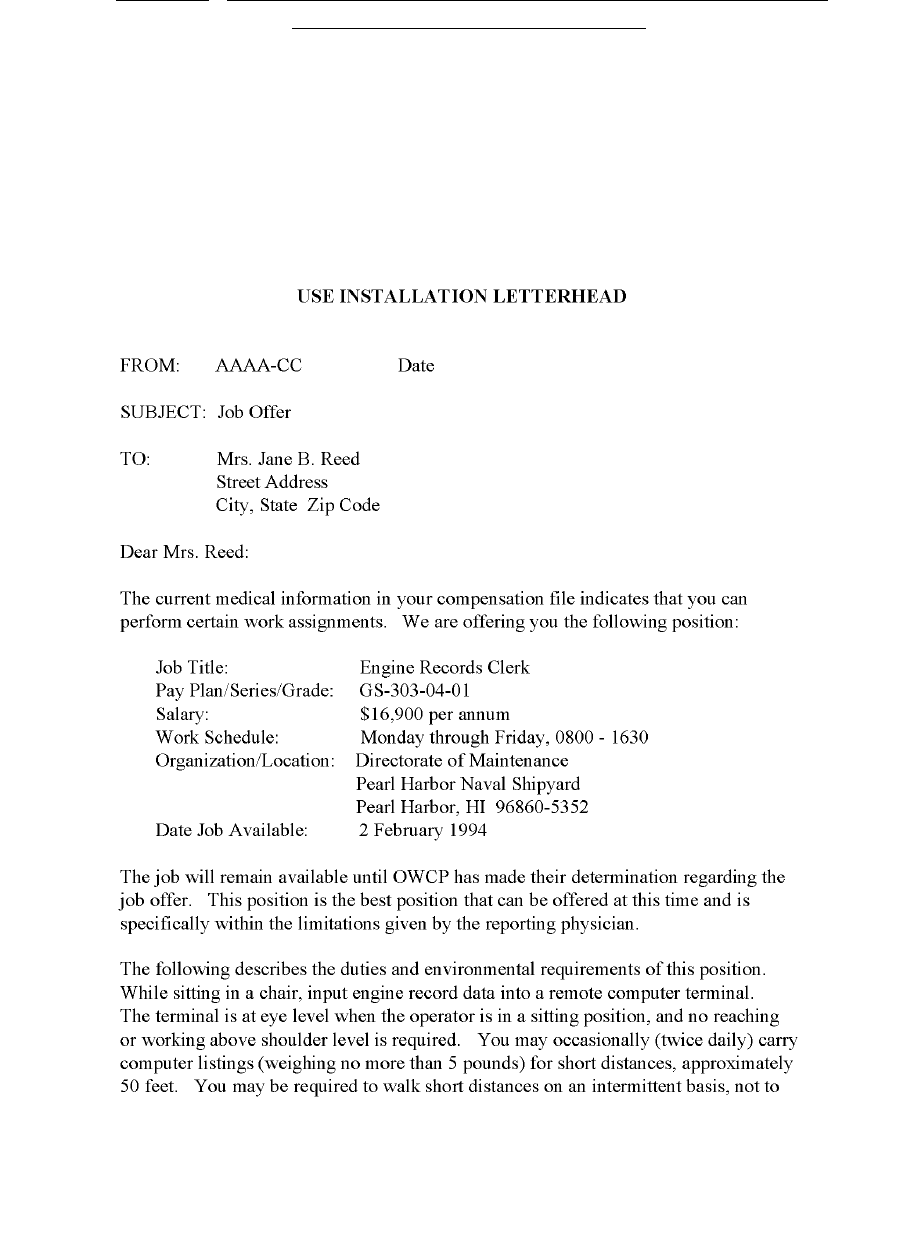

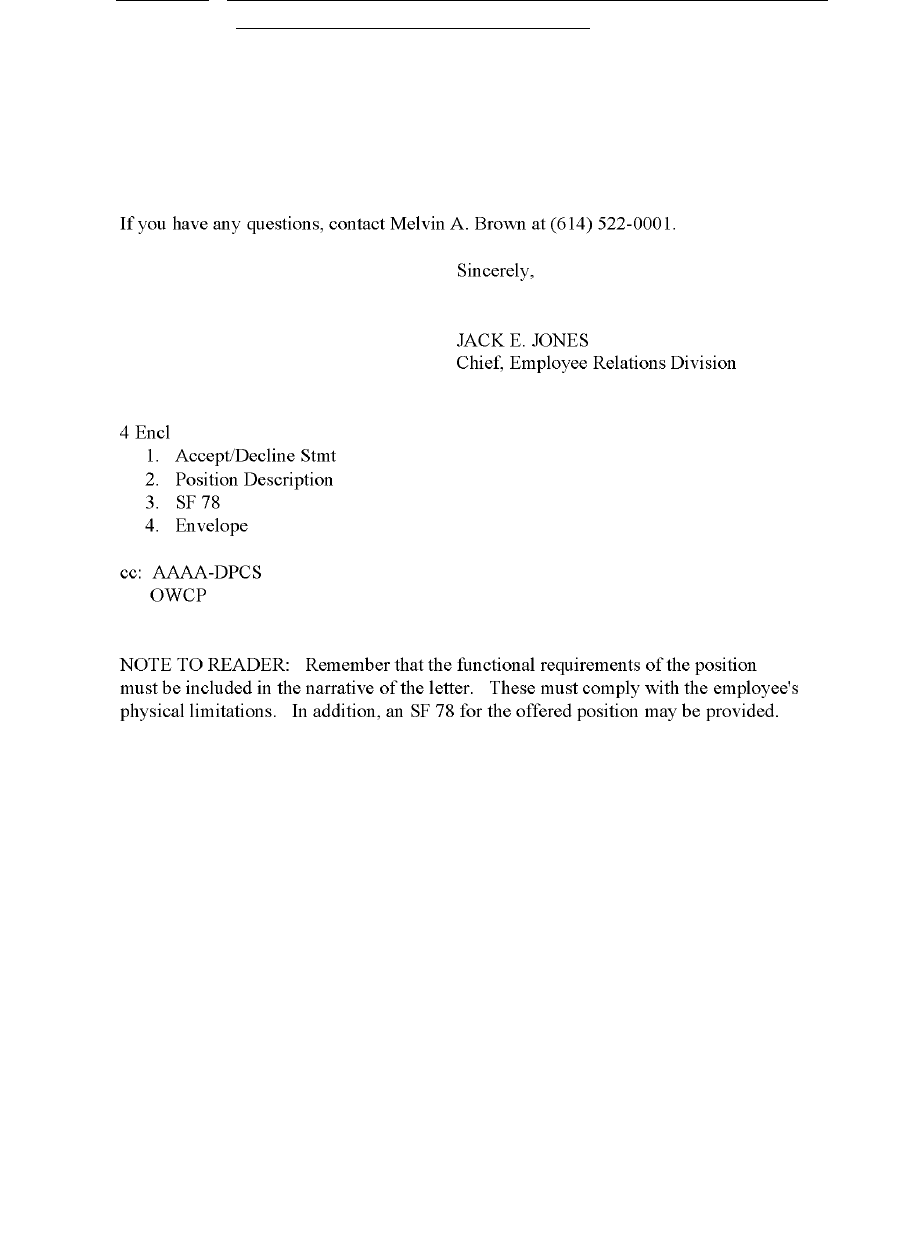

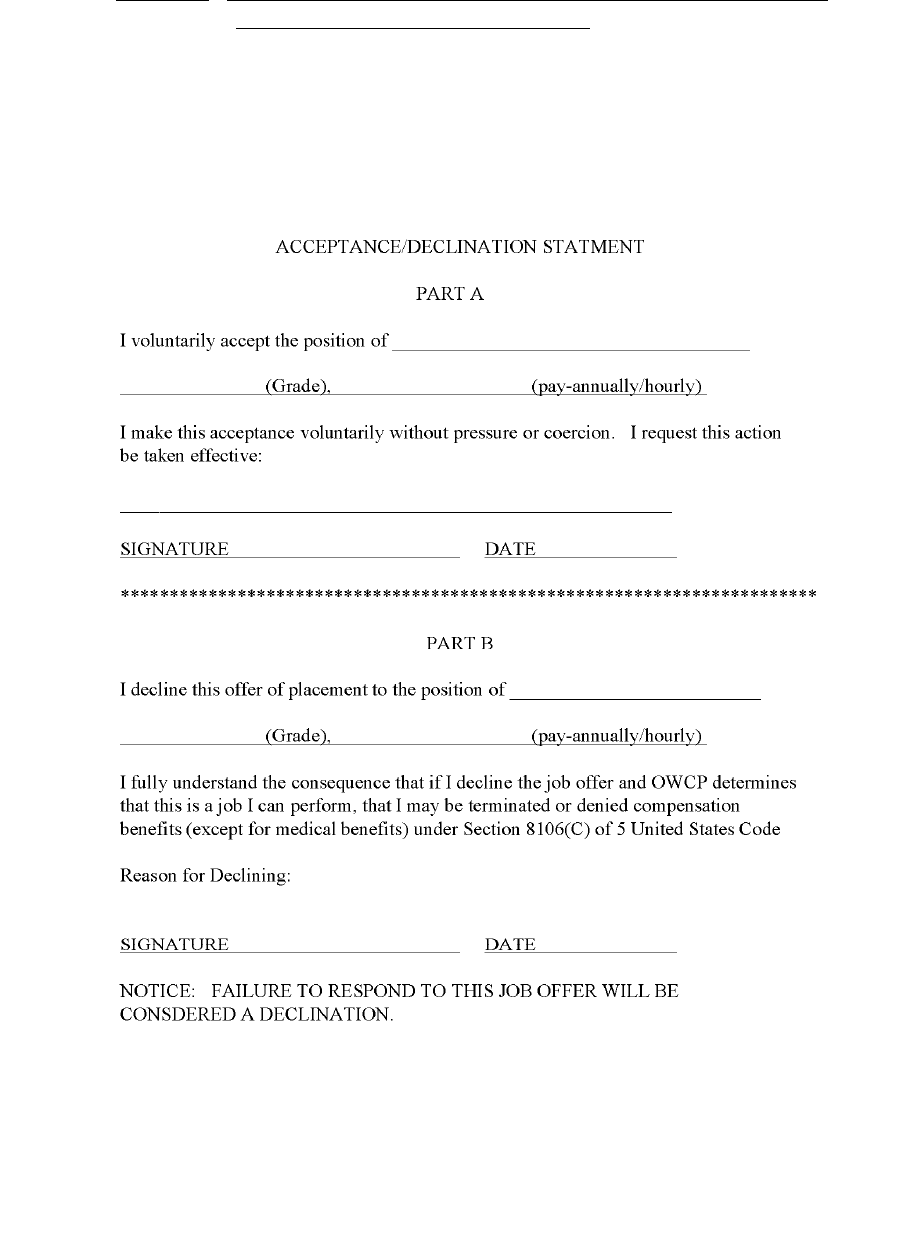

51. Sample Letter to Former Employee of Job Offer With Copy of Acceptance/

Declination of Job Offer ..................................................................................................218

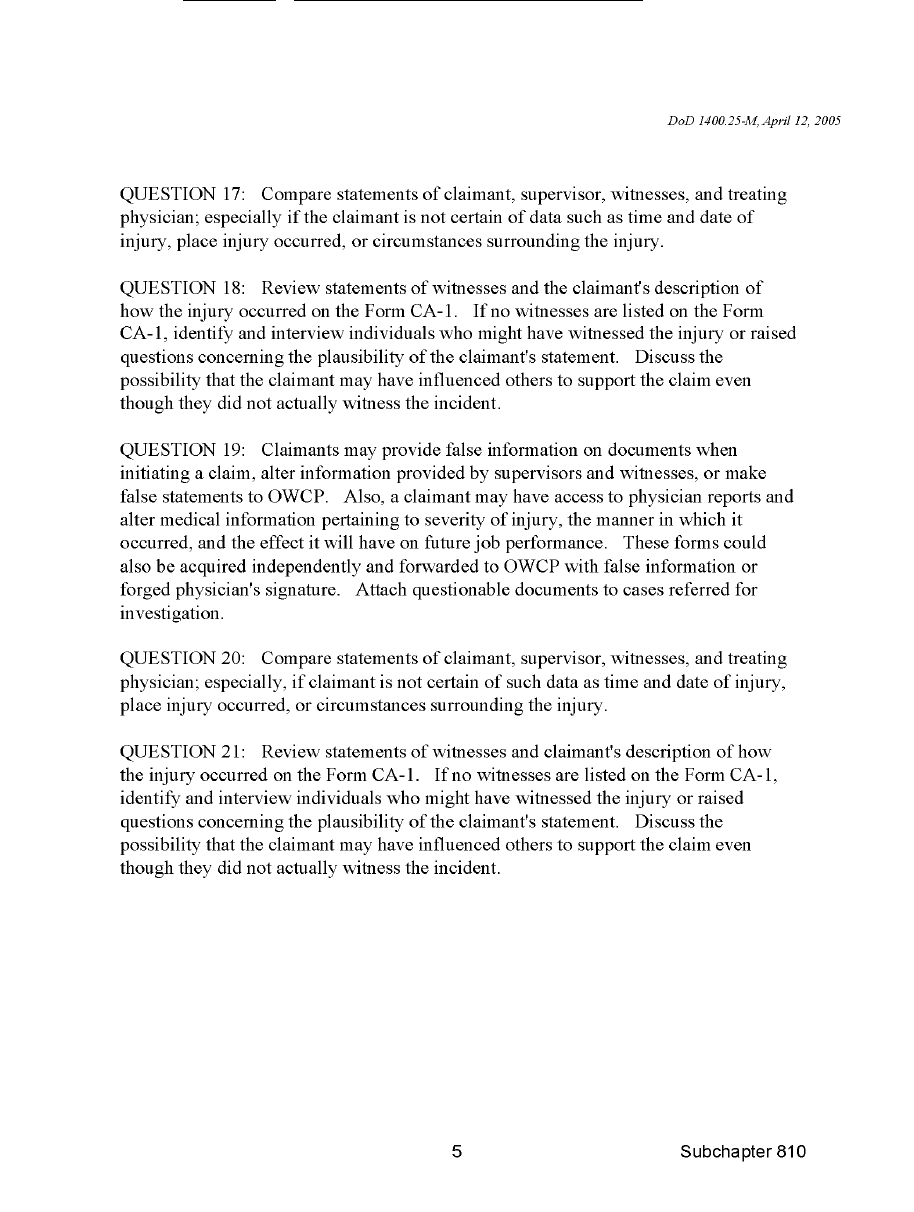

52. Suspected Fraudulent FECA Claims ..............................................................................222

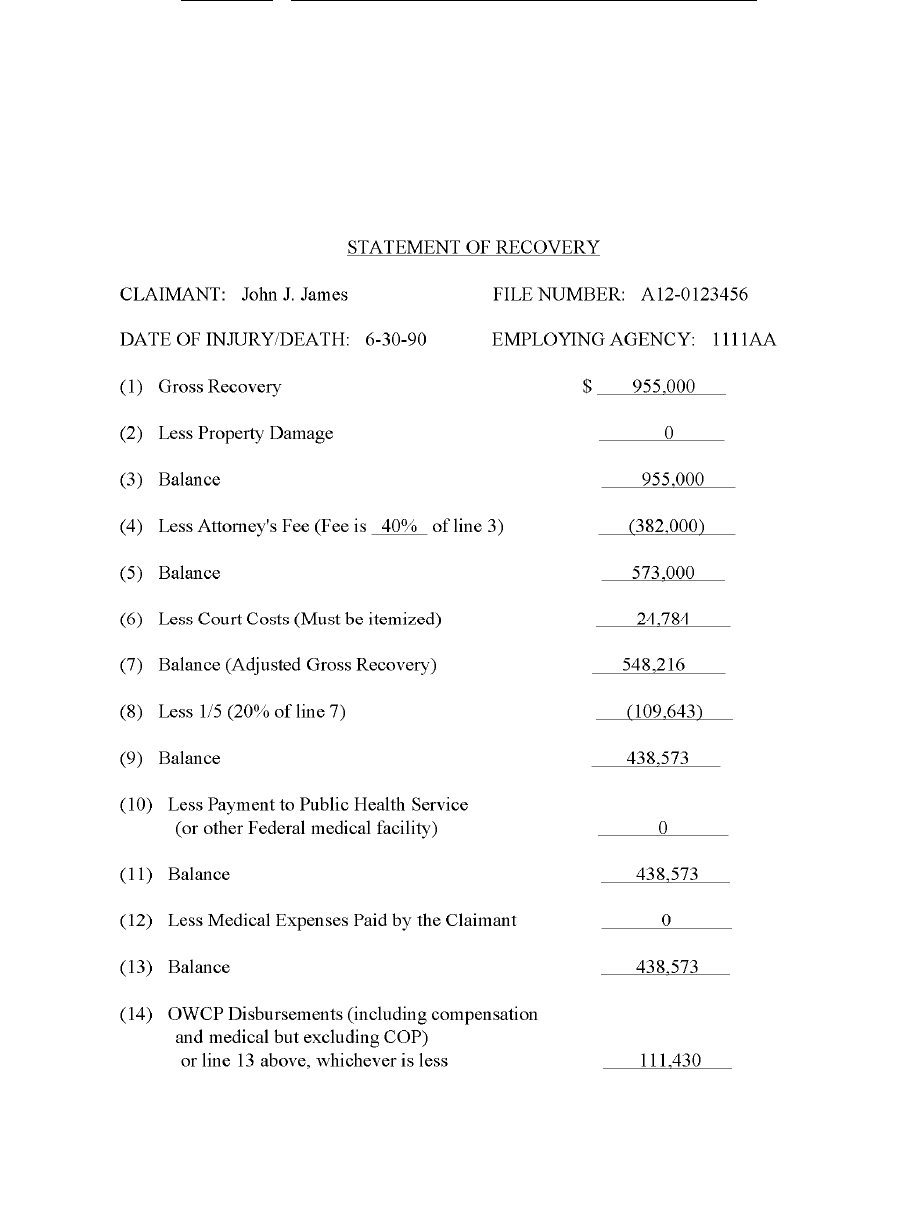

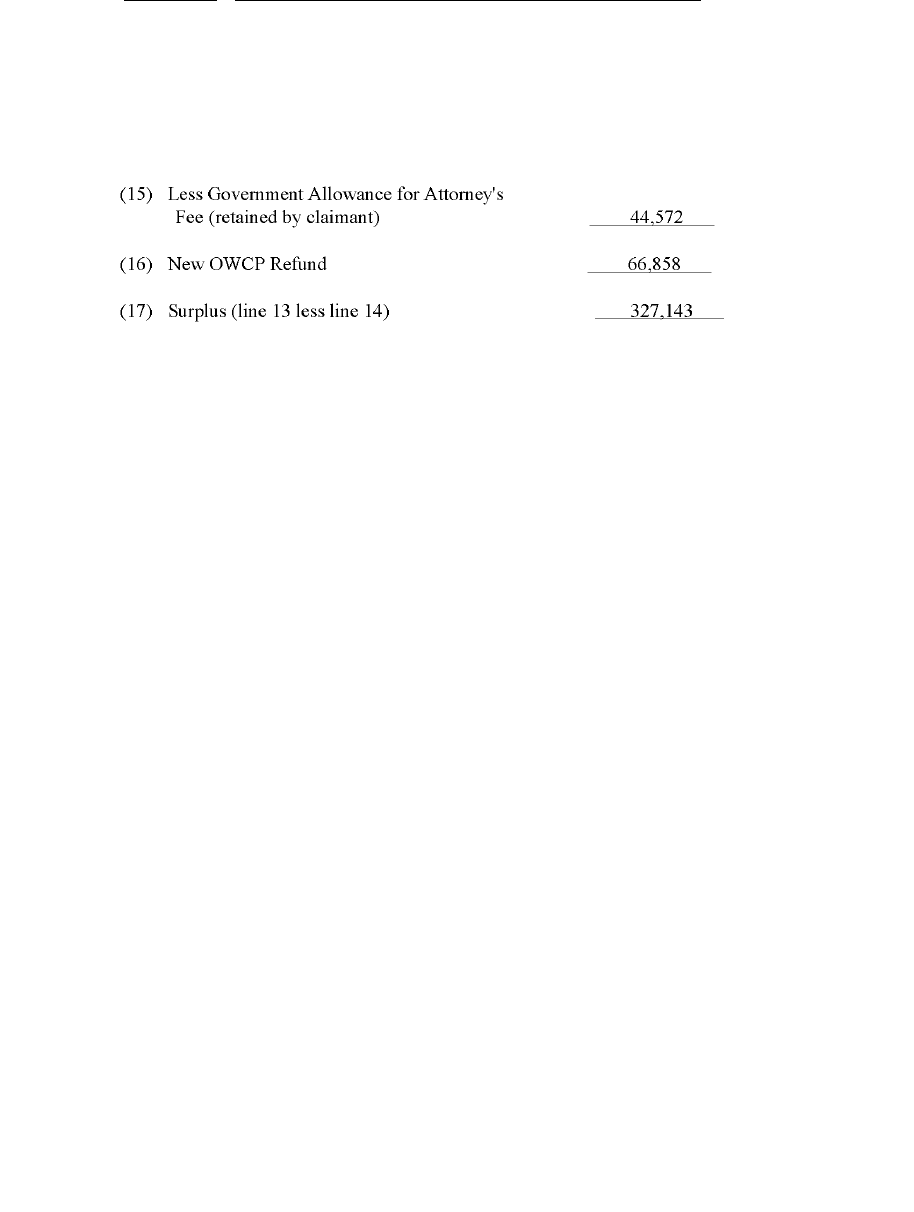

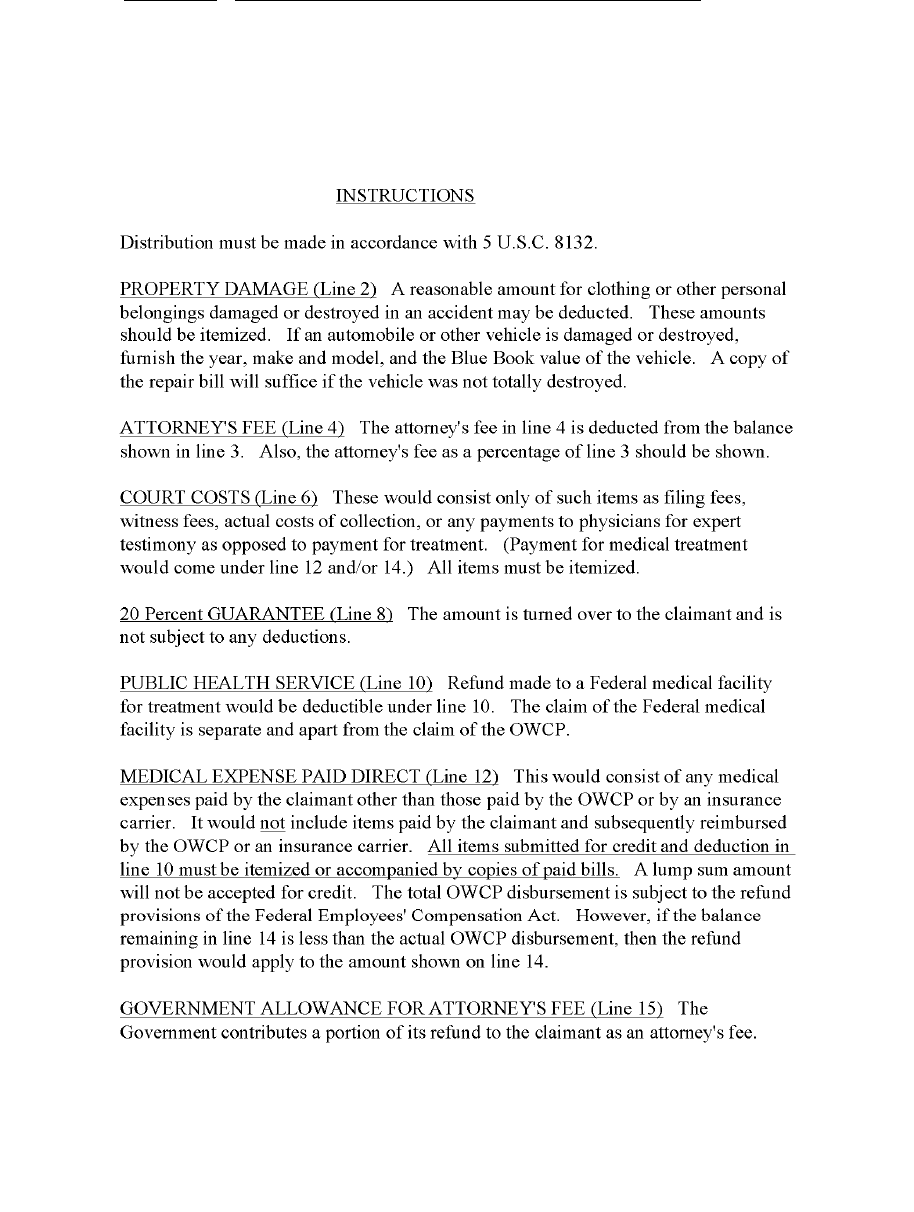

53. Sample Statement of Recovery With Instructions ..........................................................227

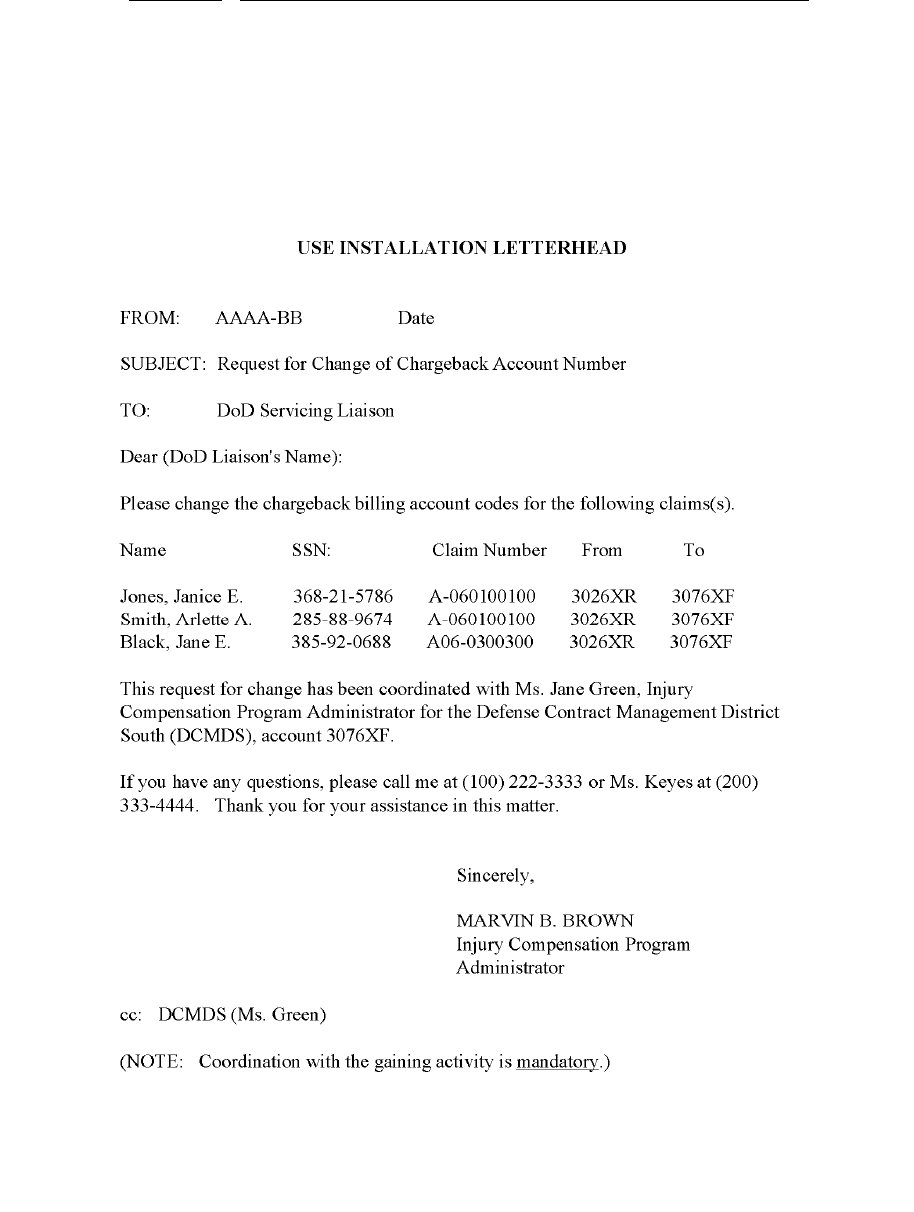

54. Sample Letter Requesting Change of Chargeback Numbers ..........................................231

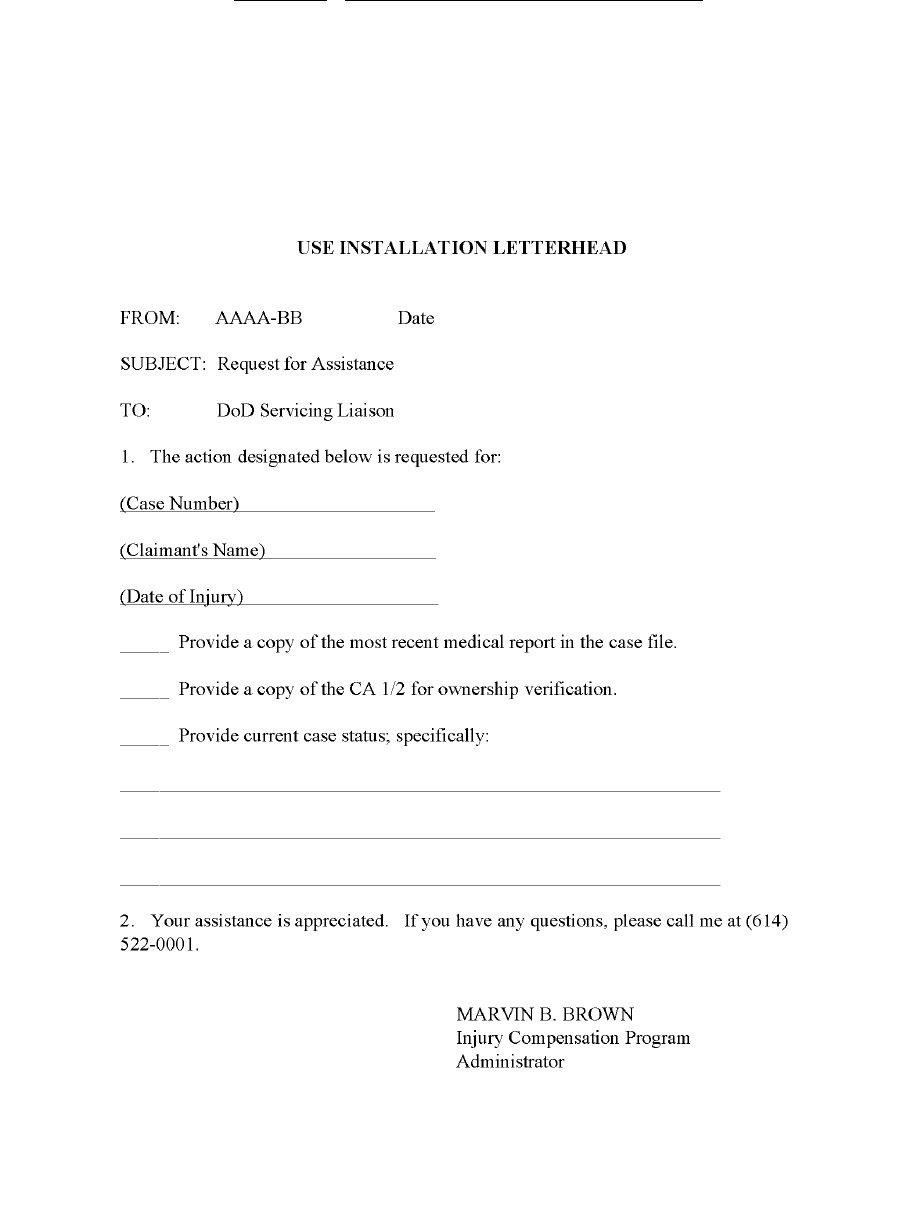

55. Sample Letter Requesting Assistance .............................................................................232

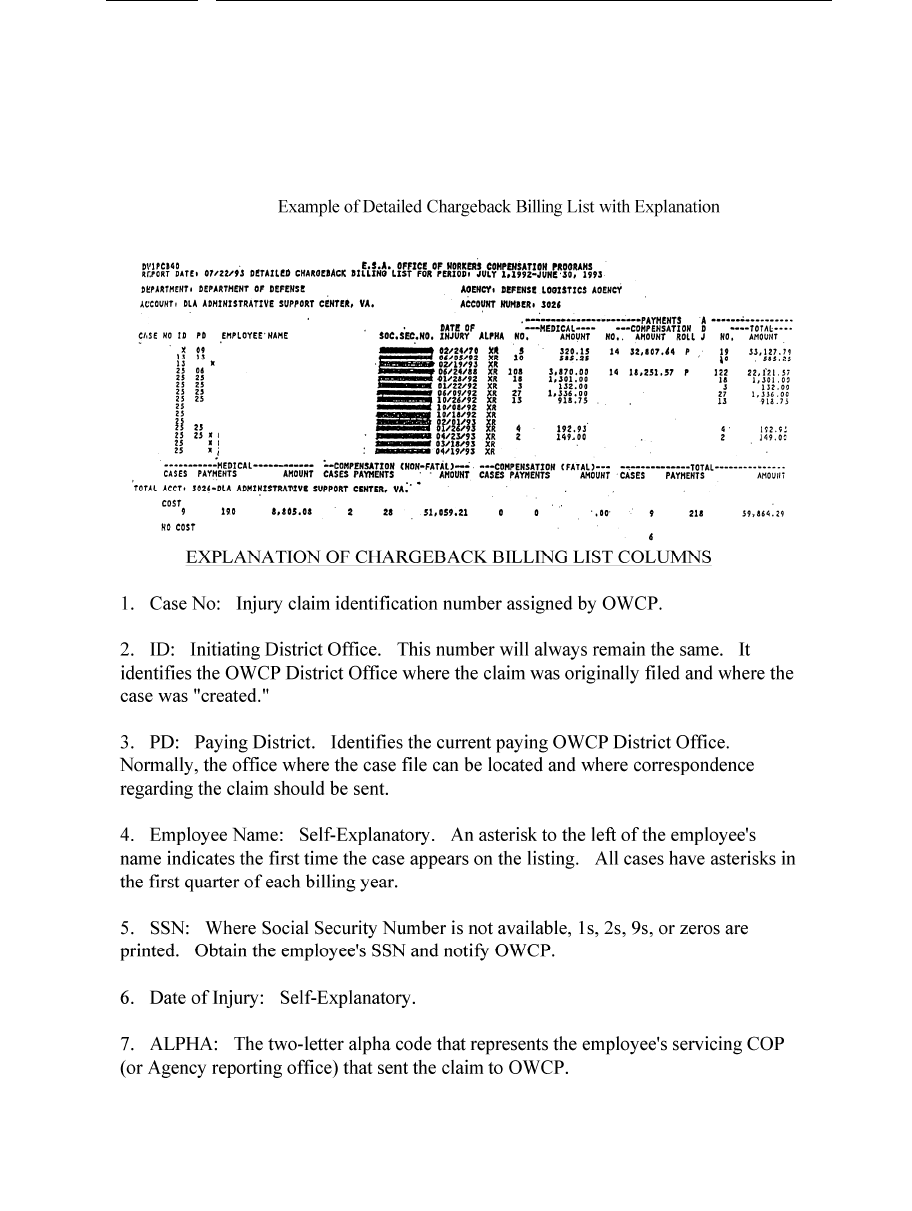

56. Example of Detailed Chargeback Billing List With Explanations .................................233

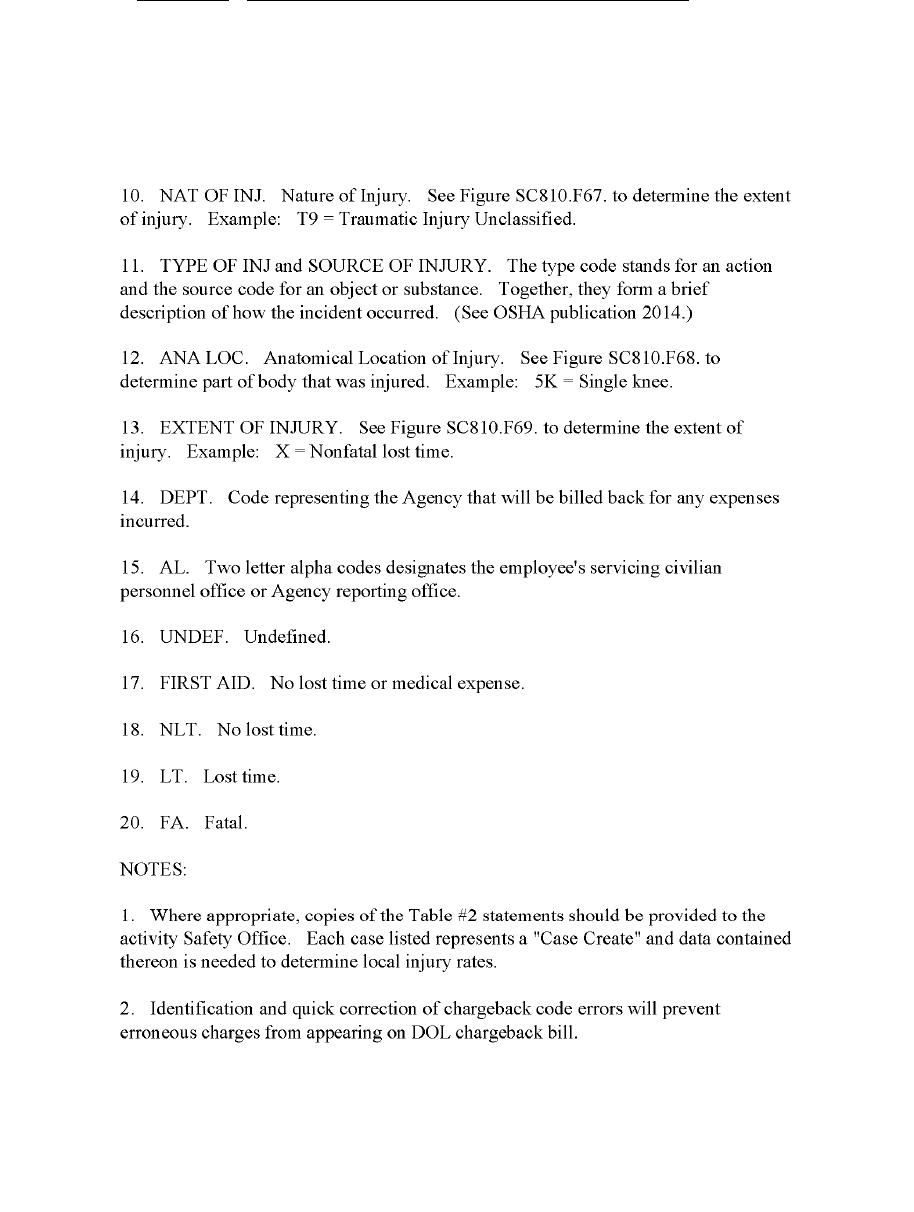

57. FECA Monthly Statements With Explanations ..............................................................235

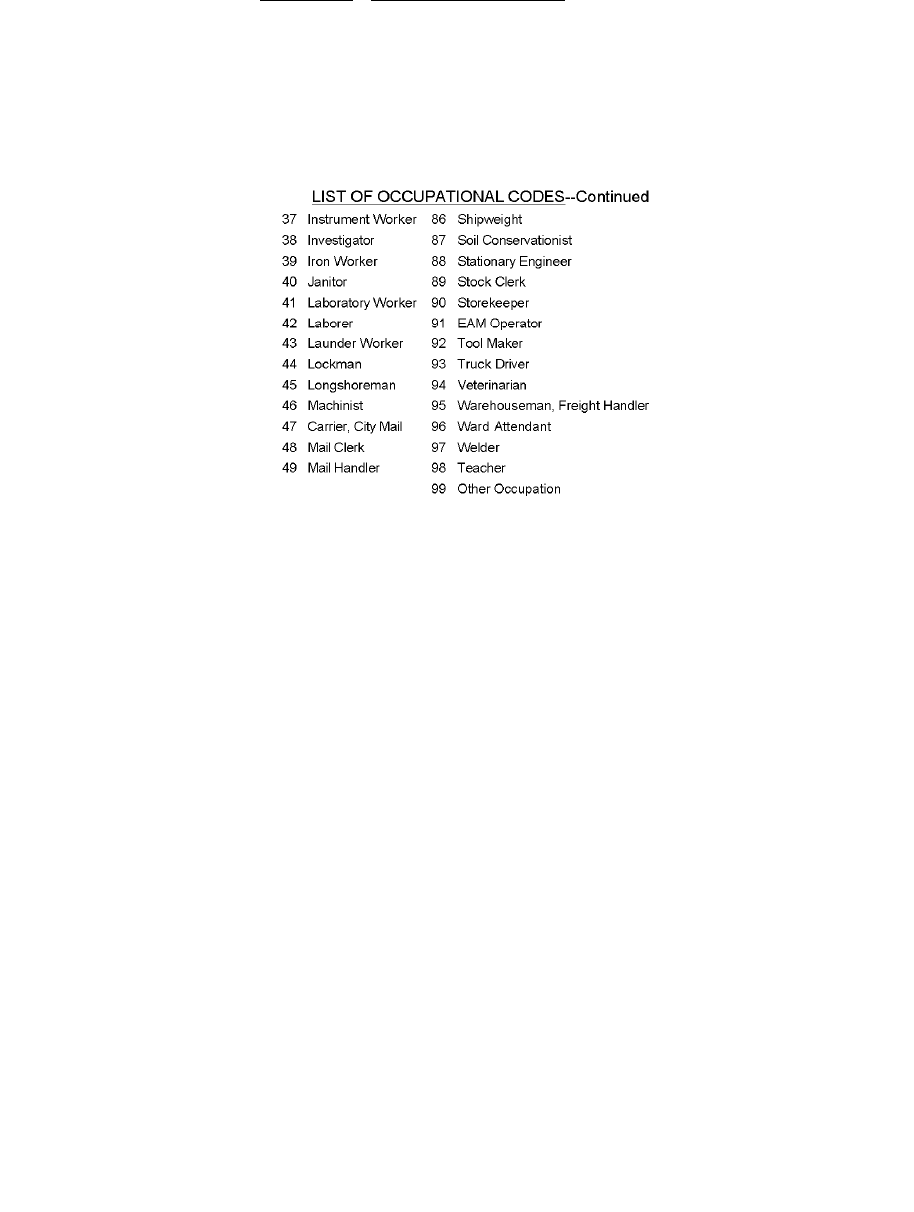

58. Occupational Codes ........................................................................................................237

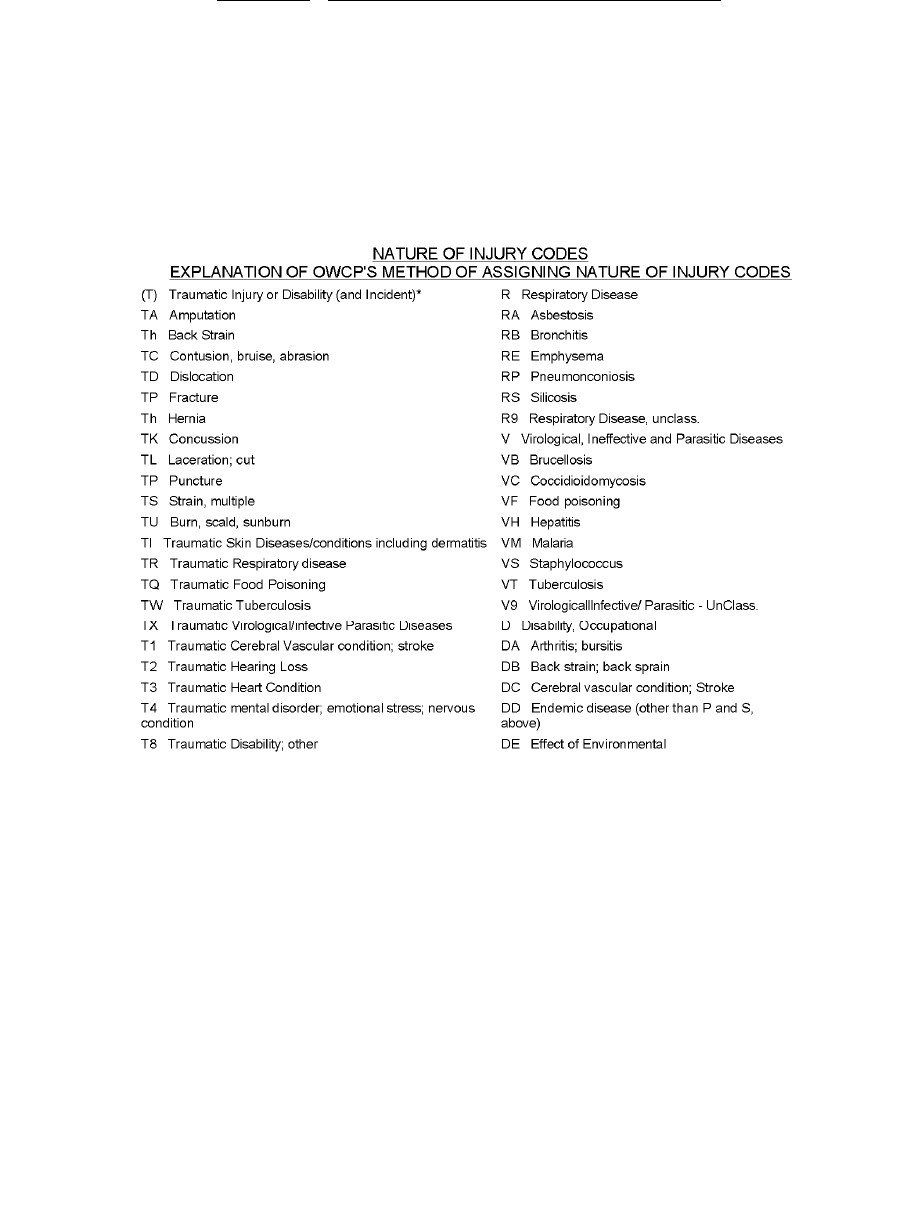

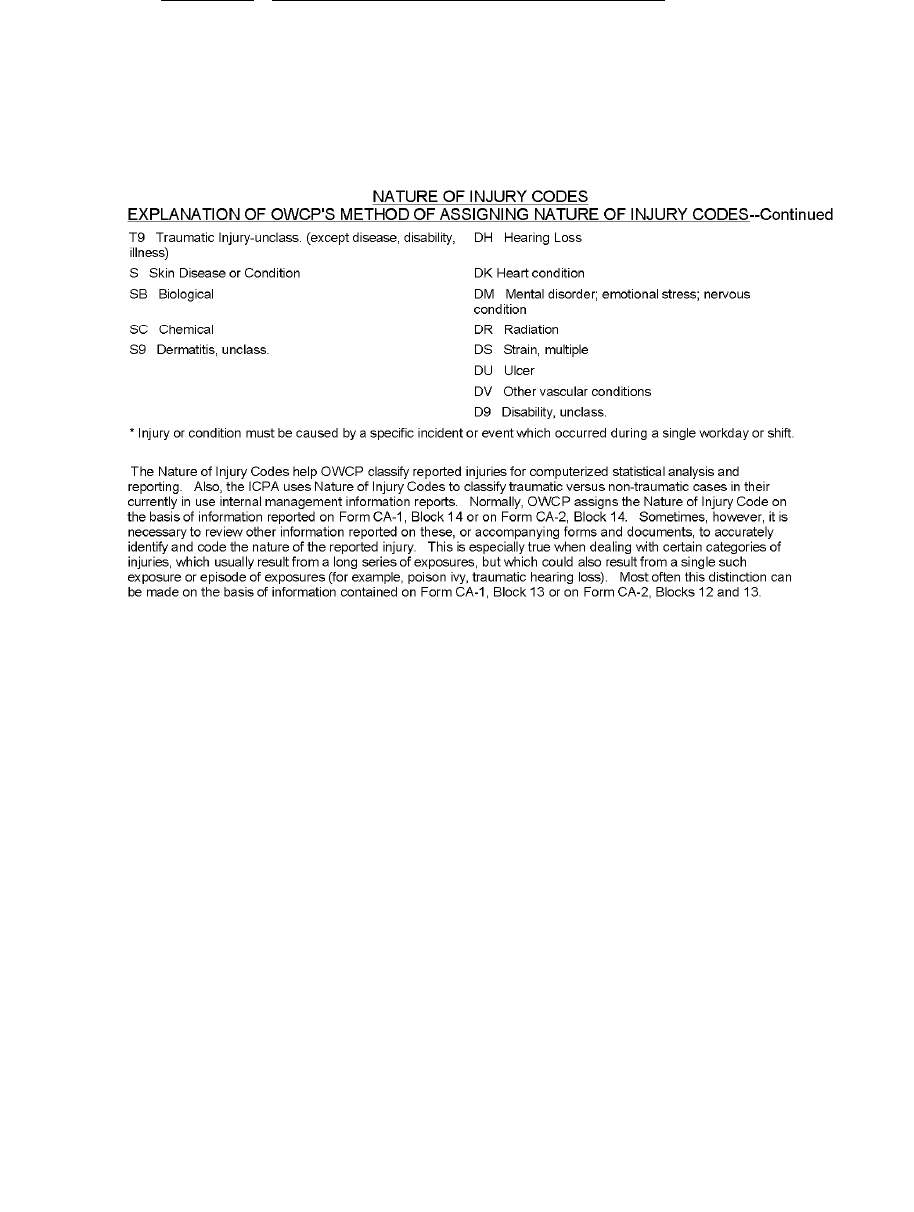

59. Nature of Injury Codes with Explanation .......................................................................239

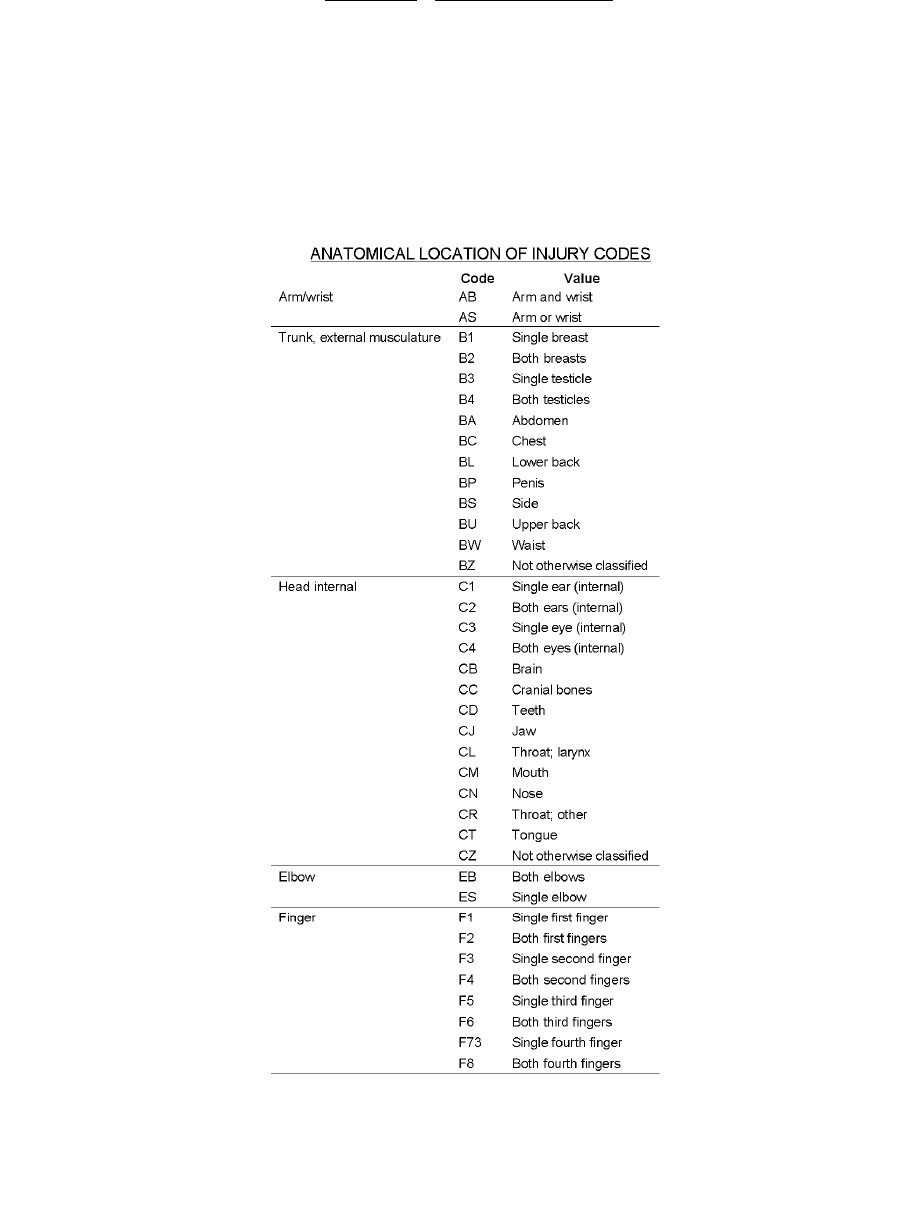

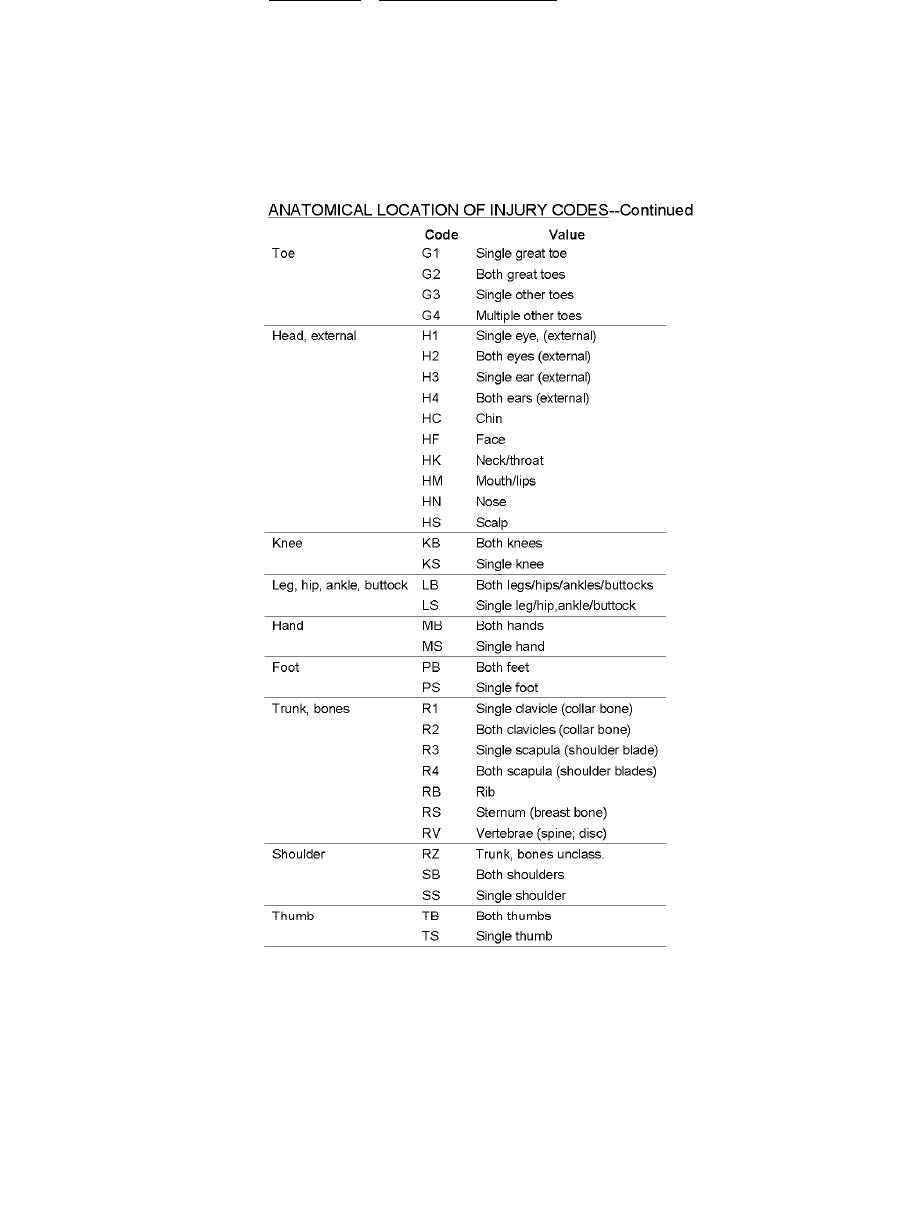

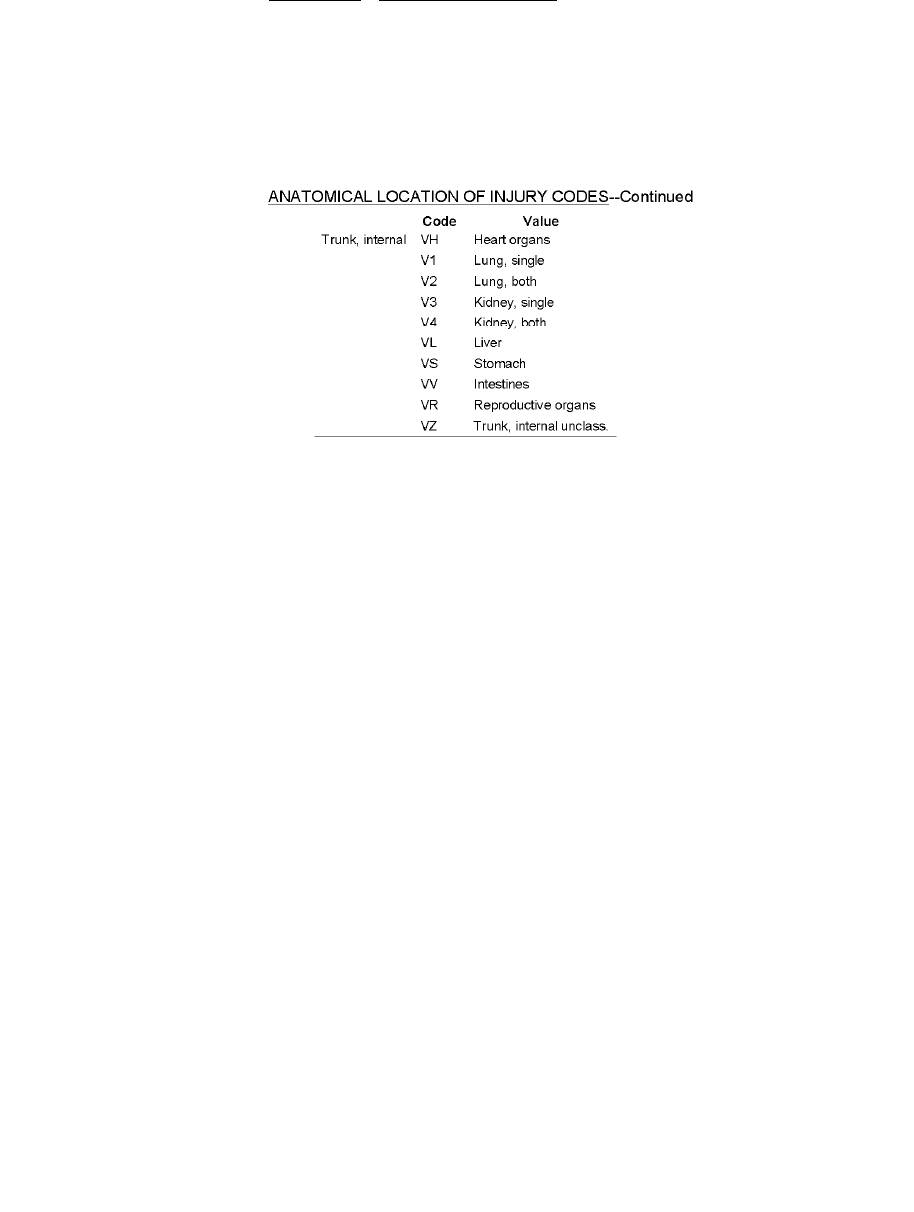

60. Anatomical Codes ...........................................................................................................241

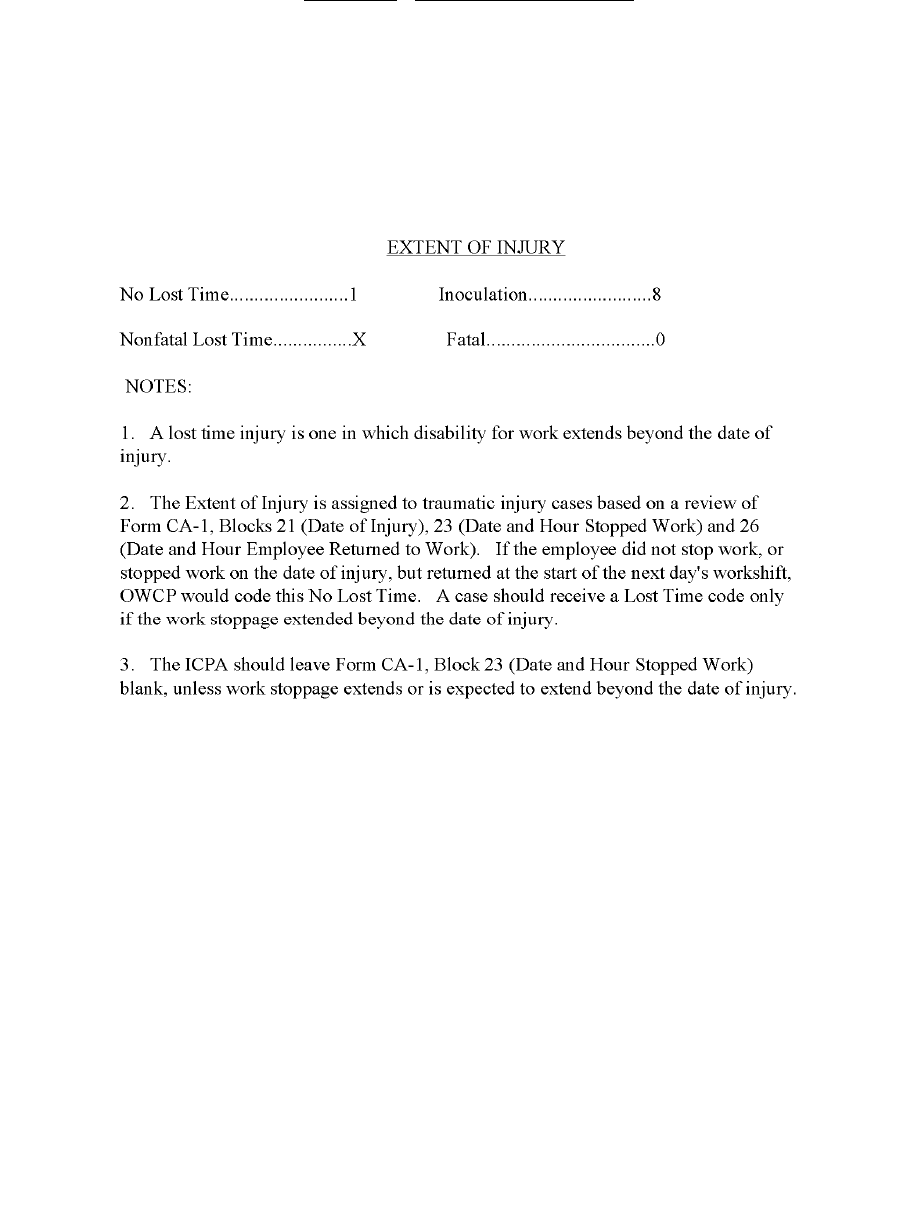

61. Extent of Injury Codes ....................................................................................................244

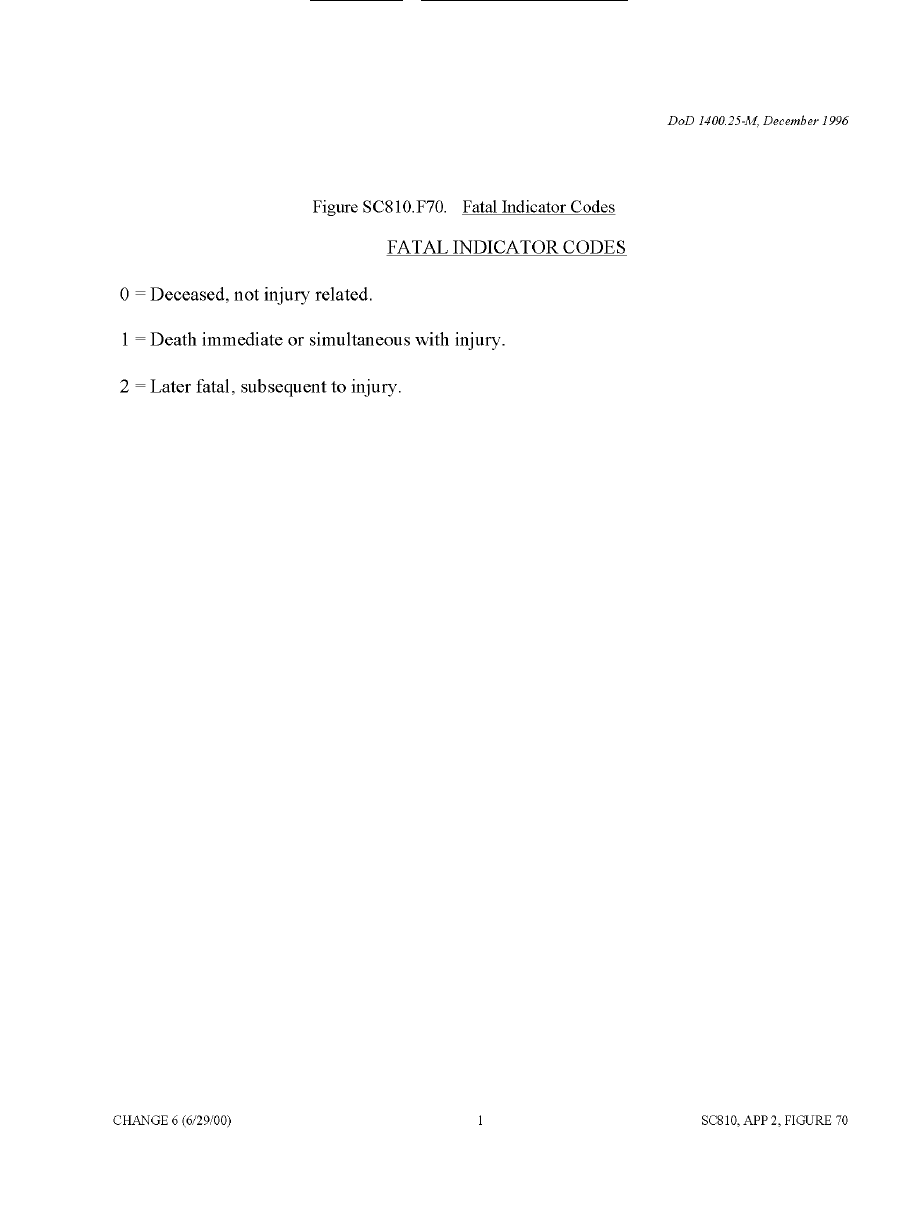

62. Fatal Indicator Codes ......................................................................................................245

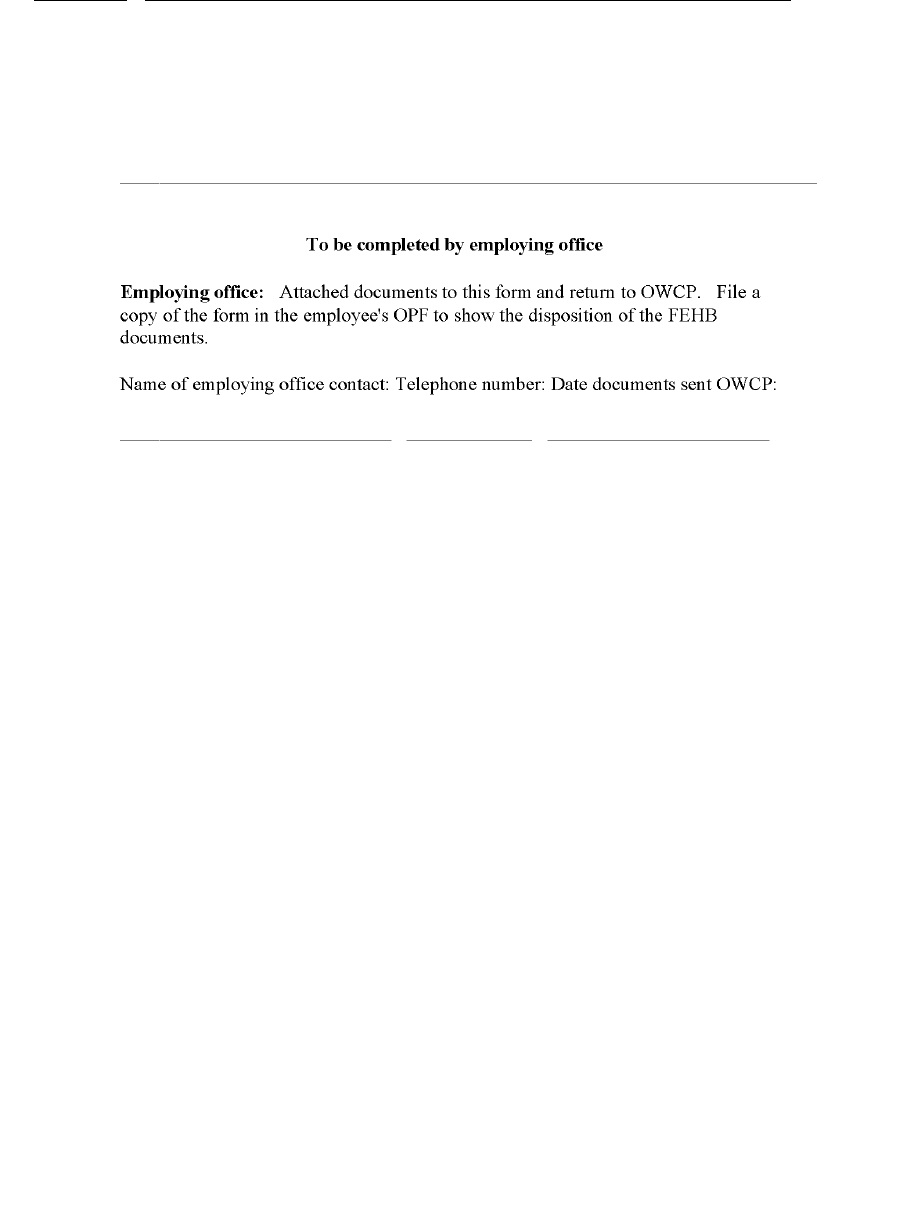

63. Sample letter from OWCP Requesting Transfer of Health Benefits ..............................246

64. Sample Letter Forwarding Health Benefits to OWCP ....................................................248

TABLE

Permissible Noise Exposure as of July 1, 2003 .......................................................................47

.

DoDI 1400.25-V810, April 15, 2005

6 ENCLOSURE 1

ENCLOSURE 1

REFERENCES

(a) Sections 552a, 5545, 5546, 8101, 8105, 8106, 8107, 8112, 8115, 8119, 8122, 8124, 8128,

8129, 8131, 8133, 8134, 8140, 8147, 8148, 8149, 8344, and 8468 of title 5, United States

Code

(b) DoD Directive 1400.25, “DoD Civilian Personnel Management System,” November 25,

1996

(c) DoD Instruction 6055.1, “DoD Occupational Safety and Health Program,” August 19, 1998

(d) Title 20, Code of Federal Regulations, current edition

(e) Sections 5545, 8344, and 8468 of title 5, United States Code

(f) Section 651 of Public Law 104-208, September 30, 1996

(g) Deputy Assistant Secretary of Defense/Civilian Personnel Policy Memorandum,

November 8, 1996, “Death Gratuity Payment” (hereby canceled)

(h) Sections 286, 287, and 1001 of title 18, United States Code

(i) Under Secretary of Defense for Personnel and Readiness Memorandum, “Injury

Compensation Program Administration,” June 13, 2003 (hereby canceled)

(j) Title 29, Code of Federal Regulations, Part 20, Subpart D, sections 1614 and 1910.95,

current edition

(k) Under Secretary of Defense for Personnel and Readiness Memorandum, “Injury

Compensation Automated Data Systems,” July 23, 2003 (hereby canceled)

(l) OPM “Guide to Processing Personnel Actions,” December 31, 1998

(m) Section 1910.95 of title 29, Code of Federal Regulations, “Occupational Noise Exposure,”

current edition

(n) Section 5546, title 5, United States Code

(o) Title 5, Code of Federal Regulations, Parts 550 and 551, current edition

(p) Title 5, Code of Federal Regulations, Part 550, Subpart M, “Pay Administration (General),”

current edition

(q) “FECA Procedure Manual,” April 1995

(r) Title 29, Code of Federal Regulations, Part 20, Subpart D, “Federal Claims Collection,”

current edition

(s) OPM Operating Manual, Section 102 of the Civil Service Retirement System and Federal

Employees Retirement System Handbook for Personnel and Payroll Offices, April 1998

DoDI 1400.25-V810, April 15, 2005

7 ENCLOSURE 2

ENCLOSURE 2

RESPONSIBILITIES

1. CIVILIAN PERSONNEL MANAGEMENT SERVICE (CPMS). The CPMS is responsible

for:

a. Providing operational guidance, advice, and assistance concerning injury compensation

matters.

b. Developing, enhancing, and maintaining a standard enterprise-wide civilian HR system

for injury compensation program management (June 13, 2003 "Injury Compensation Program

Administration" memorandum, (Reference (i)) that:

(1) Uses standardized processes and procedures to streamline operations and ensure data

integrity.

(2) Contains appropriate safeguards for the protection of sensitive medical, personnel,

and payroll data.

c. Reviewing and approving in advance any plans from DoD Components to incorporate

workers’ compensation data elements into new or existing automated reporting systems

(Reference (i)).

2. SUPPORTING DoD LIAISONS. The supporting DoD liaisons, in or near the 12 OWCP

district offices, shall:

a. Establish and nurture a good working relationship with DOL.

b. Provide assistance and guidance to serviced activities, as needed.

c. Serve as central point of contact between serviced activities and the OWCP district

offices, and other concerned offices.

d. Review OWCP case files for accuracy, legitimacy, medical evidence, reemployment

potential and questionable case status.

e. Conduct staff assistance visits to activities within assigned districts.

f. Assist in the training of ICPAs.

g. Provide assistance in activity reemployment efforts by reviewing job offers and

advocating approval by DOL.

DoDI 1400.25-V810, April 15, 2005

8 ENCLOSURE 2

h. Attempt to resolve disagreements between DOL and serviced activities informally.

i. Participate in installation FECA meetings.

j. Receive and execute all chargeback corrections from DoD Installations.

k. Coordinate and arrange for all district office file review visits by ICPAs.

3. ORGANIZATIONS ONE LEVEL ABOVE INSTALLATION LEVEL AND

COMPARABLE ORGANIZATIONS. Organizations one level above installation level (i.e.,

MACOMS (Army), Major Claimants (Navy), MAJCOMs (Air Force)) and comparable

organizations that have a directorate of civilian personnel or human resources assigned must

ensure that the injury compensation program is effectively administered in CPOs/HROs. A staff

member is designated as the ICPA. Headquarters level ICPAs monitor numbers and types of

injuries and associated costs (including COP). The ICPA coordinates with higher headquarters’

level safety and medical offices for technical advice and assistance in improving work

environments and developing cost containment initiatives.

4. ACTIVITY COMMANDER. The Activity Commander ensures:

a. The CPO/HRO, as well as the appropriate regional service center, has a staff member

designated as the ICPA.

b. Management responsibilities under the commander’s authority are timely fulfilled with

delays held to a minimum.

c. Employees are advised of their rights and responsibilities under the Injury Compensation

Program and that compensation claim forms are made available to employees.

d. Maximum effort is made to keep injured employees on the job and that light duty

positions are made available.

e. Maximum effort is made to restructure positions for employees who have been

permanently or partially disabled because of a job-related injury or illness. The “reasonable

accommodation” (see Glossary for definition) provisions of 29 CFR 1614 (Reference (j)) apply

to the Injury Compensation Program.

f. The FECA Working Group meets periodically (usually quarterly) to analyze FECA costs,

trends, plans, etc., and develop cost containment initiatives. FECA Working Groups shall

consist of management, safety, personnel, medical, and investigative services staffs. FECA

Working Groups are mandatory.

DoDI 1400.25-V810, April 15, 2005

9 ENCLOSURE 2

5. ACTIVITY MEDICAL SERVICE

a. Medical Officers. Medical officers review all reported cases of occupational illness and

take or recommend action. Upon the ICPA’s request, they:

(1) Provide medical information to be sent to OWCP to support or to controvert a claim

for an occupational illness or work-related injury.

(2) Communicate with the employee’s personal physician, in writing, to clarify medical

evidence when ICPA's attempts fail.

(3) Conduct a medical review of controversial and complex cases.

(4) With the treating physician’s recommendations, participate with the CPO/HRO in

returning employees to duty as soon as medically feasible.

(5) Assist the ICPA in informing the local medical community of FECA program and

problems being experienced.

(6) Review, evaluate, and recommend light-duty assignments and make

recommendations on employee placements involving work limitations.

(7) Advise the attending physician, in writing, that the medical facility may give

supportive treatment such as physical therapy, under his or her direction (arrangements should be

made with the concurrence of the employee and attending physician).

(8) Provide a representative to actively participate in the activity FECA Working Group.

b. Occupational Heath Officials. Occupational health officials (industrial hygiene, public

health, epidemiology, etc.) shall:

(1) Receive notice that an occupational disease or illness claim has been filed. This

notice must not compromise the protection of sensitive medical, personnel, or payroll data.

(2) Provide workplace exposure monitoring and epidemiology data appropriate for

investigation.

(3) Advise workplace managers and supervisors of the result of the exposure monitoring,

and recommended workplace practices to control worker exposure (i.e., process changes,

material substitution, engineering controls, personal protective equipment, administrative

controls, and worker training).

(4) Provide a representative to actively participate in the activity FECA Working Group.

DoDI 1400.25-V810, April 15, 2005

10 ENCLOSURE 2

6. ACTIVITY SAFETY OFFICES. The Activity Safety Offices shall:

a. Investigate all reported job-related injuries and prepare required reports.

b. When requested by the ICPA, provide information to be sent to OWCP to support or to

controvert a claim for compensation.

c. Provide a representative to actively participate in the activity FECA Working Group.

d. Provide safety training, as required.

e. In conjunction with the CPO/HRO, identify positions/duties for light duty assignments.

7. ACTIVITY INVESTIGATIVE SERVICE. Activity Investigative Service personnel assigned

to the activity shall:

a. When requested by the ICPA through appropriate channels, conduct an investigation of

the specified claim to determine and document evidence of fraud.

b. Provide a written report of findings of the investigation through appropriate channels to

the ICPA.

c. Provide a representative to actively participate in the activity FECA Working Group.

8. FIRST-LINE SUPERVISORS. First-line supervisors shall:

a. Enforce safety and health regulations.

b. Ensure that the location and telephone number of emergency medical facilities are made

known at the work site.

c. Ensure that employees know when and how to report occupational injuries and illnesses.

d. Obtain training in, and have a good understanding of, the Electronic Data Interchange

(EDI) application when filing claims for injuries and illnesses under FECA (July 23, 2003,

“Injury Compensation Automated Data Systems” memorandum (Reference (k)).

e. Ensure that employees know they have the freedom to choose a treating physician (see

paragraph 11.j. of Enclosure 2), and send injured employees for medical treatment when a

traumatic injury is reported. If an employee refuses treatment, document the facts of the

situation as reported and investigate as necessary;

f. Ensure COP is reported accurately and completely for time and attendance purposes.

DoDI 1400.25-V810, April 15, 2005

11 ENCLOSURE 2

g. In conjunction with the CPO/HRO’s staffing employment division, identify positions or

duties to make light duty offers.

h. Ensure doctors are notified in writing of possible duty accommodations.

i. Report all injuries and illnesses promptly to the ICPA.

j. Promptly complete injury compensation forms and send them to the ICPA.

k. Report injuries and illnesses as required by governing safety regulations.

l. Make decisions regarding whether to controvert COP based on information available.

m. Maintain continued personal contact with the injured employee as the disability warrants.

n. Enforce safety regulations and the wearing of required protective equipment and clothing

and take appropriate disciplinary action against employees for failure to comply.

9. CIVILIAN EMPLOYEES. Civilian employees shall:

a. Promptly and accurately report all job-related injuries or illnesses to their supervisors,

unless prevented from doing so by the severity of the injury. If an employee is unable to report

an injury or illness, anyone, such as a friend, relative, co-worker, or supervisor may report for

the employee. Employees on TDY should report job-related injuries or illnesses to their

servicing CPO/HRO by the best available means. If that is impossible, they may report them to

the nearest DoD CPO/HRO.

b. Observe all safety instructions, procedures, and regulations to include the proper use of

personal protective equipment and clothing.

c. Report for medical examination or treatment as described by established procedures or as

directed by their supervisors.

d. Advise the treating physician of light duty programs.

e. Advise supervisor when they are medically released for light duty.

f. Provide medical documentation as soon as possible, but no later than 10 working days, or

COP may be discontinued.

g. Return to regular or light duty as soon as medically feasible.

h. Participate in vocational and job related training designed to provide suitable alternate

employment when job-connected injury or illness precludes return to previous type of work.

DoDI 1400.25-V810, April 15, 2005

12 ENCLOSURE 2

10. INJURY COMPENSATION PROGRAM ADMINISTRATOR (ICPA). The ICPA serves as

the focal point in all aspects of the program, coordinating efforts of safety officials, occupational

health officials, medical officials, supervisors and other management officials, and local labor

representatives, as appropriate. To ensure optimum effectiveness in the administration of the

program, it is imperative that the ICPA maintain a professional and cooperative relationship in

his or her contacts with the OWCP district offices, supporting DoD liaisons, activity personnel

and the injured worker. The ICPA shall:

a. Provide training and operational guidance to supervisors and employees concerning their

responsibilities within the injury compensation program.

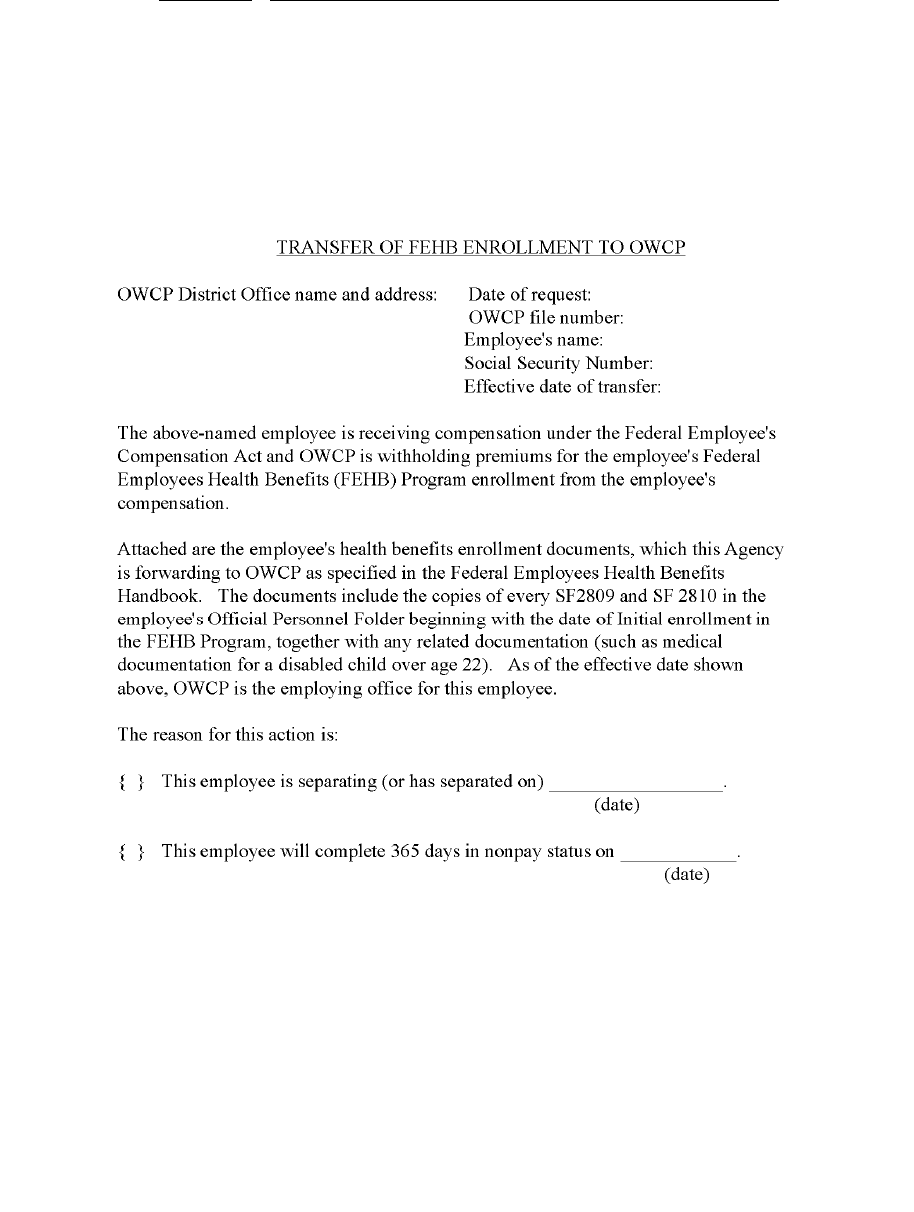

b. Ensure that Form CA-10 (poster), “What a Federal Employee Should Do When Injured at

Work” (Figure 1) is posted at the work site.

c. Maintain a working knowledge of the Electronic Data Interchange (EDI) application,

ensure that supervisors are trained in, and have a good understanding of the application, and

utilize EDI when filing claims for injuries and illnesses under FECA (Reference (k)).

d. When notified about a job-related injury or illness or an actual or potential claim, give

prompt help to the supervisor and the employee. The ICPA shall ensure that pertinent forms are

properly and timely completed. (The ICPA is not responsible for the accuracy of information

provided and entered on forms by the employee, supervisor, or witnesses, but must obtain

clarification of conflicting or confusing statements.) NOTE: The ICPA has the final

responsibility for the technical adequacy of all documents sent to OWCP.

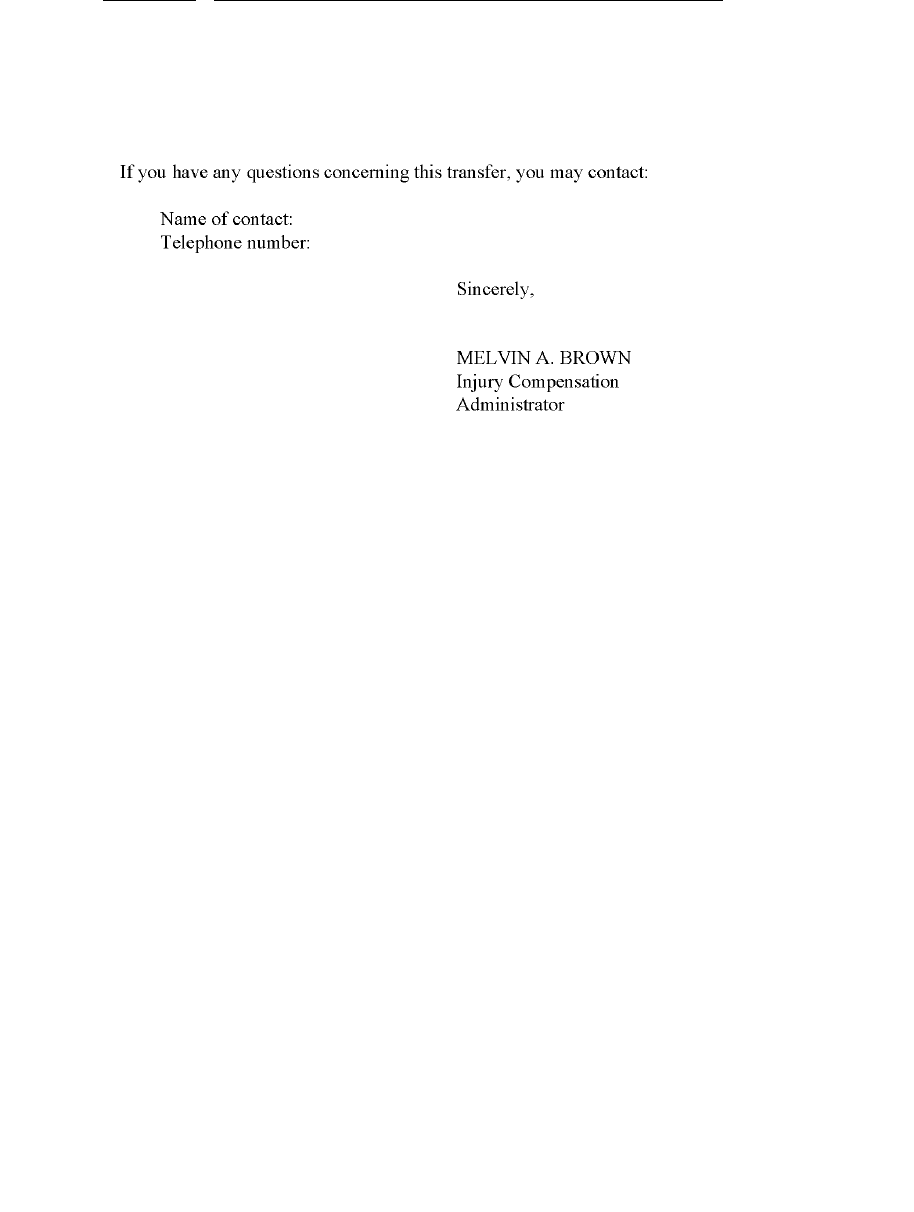

e. Upon receipt of a Form CA-1 or Form CA-2, check the form for completeness. If there is

any doubt about the information shown on the form, the ICPA will resolve the matter before

further processing. The electronic version of Forms CA-1 and CA-2 contain an Authorization

for Release of Information. If necessary, the ICPA can require the employee to sign and date an

Authorization for Release of Information. A sample is at Figure 2. Because there is a short-time

limit (10 working days or less) on processing injury compensation forms, any necessary action

should be taken on a priority basis.

f. When appropriate, the ICPA will request that safety or medical services furnish, in

writing, a report on the claim and include this information with the claim when sending it to

OWCP. If this would cause an undue delay, this information can be sent to OWCP at a later

date. Both safety and medical services officials may, of their own volition, initiate letters or

other documents to accompany claims. After determining that all forms are correct and reflect

the correct chargeback account code, the ICPA sends them to OWCP.

g. If the injury results in no medical expense and no lost time, the Form CA-1 or Form CA-2

is permanently filed in the Employee Medical File (EMF) and no copy is sent to the OWCP. The

ICPA should send notification to the activity safety office that a traumatic injury or occupational

disease or illness claim has been filed. This notice must not compromise the protection of

sensitive medical, personnel, and payroll data.

DoDI 1400.25-V810, April 15, 2005

13 ENCLOSURE 2

h. In prolonged COP cases, the ICPA will ensure that a Form CA-7 is completed and sent to

the OWCP, no later than 5 calendar days before the COP period expires (if the claimant wishes

to file for compensation).

i. When the injured employee is absent from duty, the supervisor, ICPA, and medical

officials estimate the earliest date that the employee should be reasonably able to return to full-

time or part-time light or regular duty based on medical evidence deemed appropriate by OWCP.

On that date, if the employee has not returned, and the employee has not provided medical

evidence to support continued absence, the supervisor contacts the employee to learn the reason.

The ICPA shall contact the attending physician in writing to inquire about restrictions and

estimated return to light duty and/or the servicing OWCP office for an expected date of return to

duty. If the employee is still not able to return to duty, a new estimated return date is

established, and the procedure is repeated until the employee is returned to duty. It is important

for physicians to understand that supervisors can and will accommodate restrictions imposed by

medical officials.

j. Assist supervisors and employees in all aspects of the Injury Compensation Program,

including, electronic and paper forms completion and case follow-up with the OWCP.

k. Maintain adequate records to administer the program and reconstruct claim files, if

necessary. A copy of all documents sent to OWCP should be retained in the activity claims file.

l. Monitor COP days to ensure they do not extend beyond the 45-calendar day period.

m. Periodically, compare COP payments in the civilian pay activity with the claim status

shown in the ICPA’s records to assure accuracy.

n. Establish procedures to ensure that all claims (CA forms) and related documents are

processed to or through the office of the ICPA.

o. If light duty is a possibility, ensure that job requirements and environmental conditions

are made known to physicians when injured or ill employees or former employees are scheduled

for examinations.

p. Notify OWCP and furnish documentation of any pre-existing medical condition that

might be useful in adjudicating a claim.

q. Refer suspected fraud cases through channels to the proper military investigative

authority, DOL Inspector General (IG), or other investigative services. Contact the supporting

DoD liaison for any needed assistance.

r. Notify the selective placement coordinator of employees requiring placement assistance.

s. Coordinate with the activity legal office on claims that appear to involve third-party

liability.

DoDI 1400.25-V810, April 15, 2005

14 ENCLOSURE 2

t. Ensure that an ample supply of required forms is maintained and available to employees

and supervisors, as needed.

u. If an employee dies as the result of a job-related injury, immediately notify OWCP, by

telephone, fax, or telegraph, and send a completed Form CA-6, “Official Supervisor's Report of

Employee's Death,” to OWCP within 30 calendar days from the date death occurred.;

v. Attend pre-scheduled meetings of the Occupational Safety and Health Council or other

similar activity. The ICPA must be prepared to discuss the Injury Compensation Program.

w. Annually, initiate requests for review of selected long-term claim files and request

current medical reports from the supporting DoD liaison to:

(1) Ensure that claimants receive compensation benefits for which they are entitled.

(2) Identify claimants who can return to work. Those claimants who have been formally

determined by OWCP as having no wage-earning capacity or reemployment potential for the

indefinite future are identified by OWCP as a PN status case. PN claimants are required by

OWCP to furnish medical documentation of continued disability once every 3 years; therefore,

copies of medical reports for these claimants should be requested on a 3-year basis instead of an

annual basis. Claimants receiving payments for loss of wage-earning capacity are required to

furnish medical documentation every 2 years. Note: OWCP makes PN status determinations. It

is inappropriate and costly for agencies to request OWCP to change the pay status of a case to

PN without a sound and clearly defined basis. All such requests must be sent with

accompanying justification to the supporting DoD liaison who will assist with agency requests.

x. Maintain a file of names of physicians who have been excluded from payment under

FECA. (The OWCP makes this determination and provides the list.) The ICPA shall ensure that

activity officials who issue Form CA-16 are kept informed of the names and changes on that list.

y. Work with rehabilitation counselors and the activity staffing function on reemployment

referrals and work with OWCP-directed field nurses on return to duty under the Nurse

Intervention Program.

z. Verify claimant information received from OWCP in the “Defense Injury &

Unemployment Compensation System (DIUCS)”(see paragraph 2.d.(3) of Enclosure 3),

electronic notifications through EDI, and on Form CA-801, “Acknowledgment of Receipt of

Claim.” Immediately ask OWCP to correct erroneous information. All erroneous chargeback

code corrections should be requested through the supporting DoD liaison.

aa. Verify program reporting information and certify the accuracy of all charges and

chargeback codes received from OWCP using “Defense Injury & Unemployment Compensation

System (DIUCS)” reports (see paragraph 2.d.(3) of Enclosure 3), and the “Defense Portal

Analysis Center (DefPAC).” Immediately request that supporting DoD liaisons coordinate the

correction of erroneous data with OWCP.

DoDI 1400.25-V810, April 15, 2005

15 ENCLOSURE 2

ab. Certify the accuracy of all charges and chargeback codes on the DOL Quarterly

Chargeback Billing Lists and report any errors to the supporting DoD liaison. (Detailed

instructions for correcting erroneous data is further explained in section 10 of Enclosure 3, “The

Injury Compensation Chargeback System.”).

ac. Serve as a chairperson or as an active participant in the activity FECA Working Group.

ad. Contact the supporting DoD liaisons for assistance with unique and unusual problematic

issues.

11. PROVIDING COUNSEL AND ASSISTANCE. One of the primary functions of the ICPA

is to provide counsel and assistance to injured employees as well as to supervisors. When an

employee sustains a job-related injury or illness, the ICPA shall explain to the employee the

basic benefits provided under FECA:

a. Entitlement to compensation for injuries or illnesses sustained in the performance of duty:

66-2/3 percent of basic salary for employees without dependents; 75 percent for employees with

dependents.

b. The importance of providing written notice of injury and timely submission of forms and

related documentation.

c. Entitlement to COP for a traumatic injury up to a maximum of 45 calendar days. If the

injury extends or is expected to extend beyond the 45-day COP period, the employee should be

informed of the proper procedure to claim wage loss (Form CA-7). Explain the 3-day waiting

period (see Glossary for definition).

d. The difference between use of sick and annual leave versus COP for Form CA-1, item 15;

who approves COP and how COP days are counted. If COP is disallowed by OWCP, explain

that money paid is considered a debt and is subject to recovery.

e. The difference between benefits under workers' compensation and Federal disability

retirement, if eligible (Figure 3).

f. For employees separating from employment, the consequence of withdrawing retirement

contributions. Provide the employee a copy of the notice to individuals with funds in the civil

service retirement system (Figure 4).

g. Adjudication of claims by the Department of Labor, OWCP. The employing activity acts

only as an intermediary in gathering information pertinent to the claim and submitting it to

OWCP. Decisions made by OWCP can be appealed by the employee.

DoDI 1400.25-V810, April 15, 2005

16 ENCLOSURE 2

h. Leave buyback procedures when an employee does not wish to immediately file for

compensation, the claim has been approved by OWCP, and the COP period has expired or there

is no entitlement to COP. If applicable, explain the 3-day waiting period.

i. The penalties provisions as detailed in paragraph 1.k. of Enclosure 3, ”Penalties for

Employees and Supervisors.”

j. An employee has the right to select his or her own physician, as long as the physician is

located within 25 miles of the employee's place of employment or residence and is not on the list

of excluded medical providers. However, if the employee wants to change the physician, after

the initial selection has been made, written justification must be provided and prior approval

obtained from OWCP.

k. The importance (requirement) that OWCP authorization is needed before extensive tests,

hospitalization, or surgery.

l. Procedures for filing for medical and travel expenses.

m. Death benefits to survivors in fatality cases.

Appendix

Figures

DoDI 1400.25-V810, April 15, 2005

17 APPENDIX TO ENCLOSURE 2

APPENDIX TO ENCLOSURE 2

FIGURES

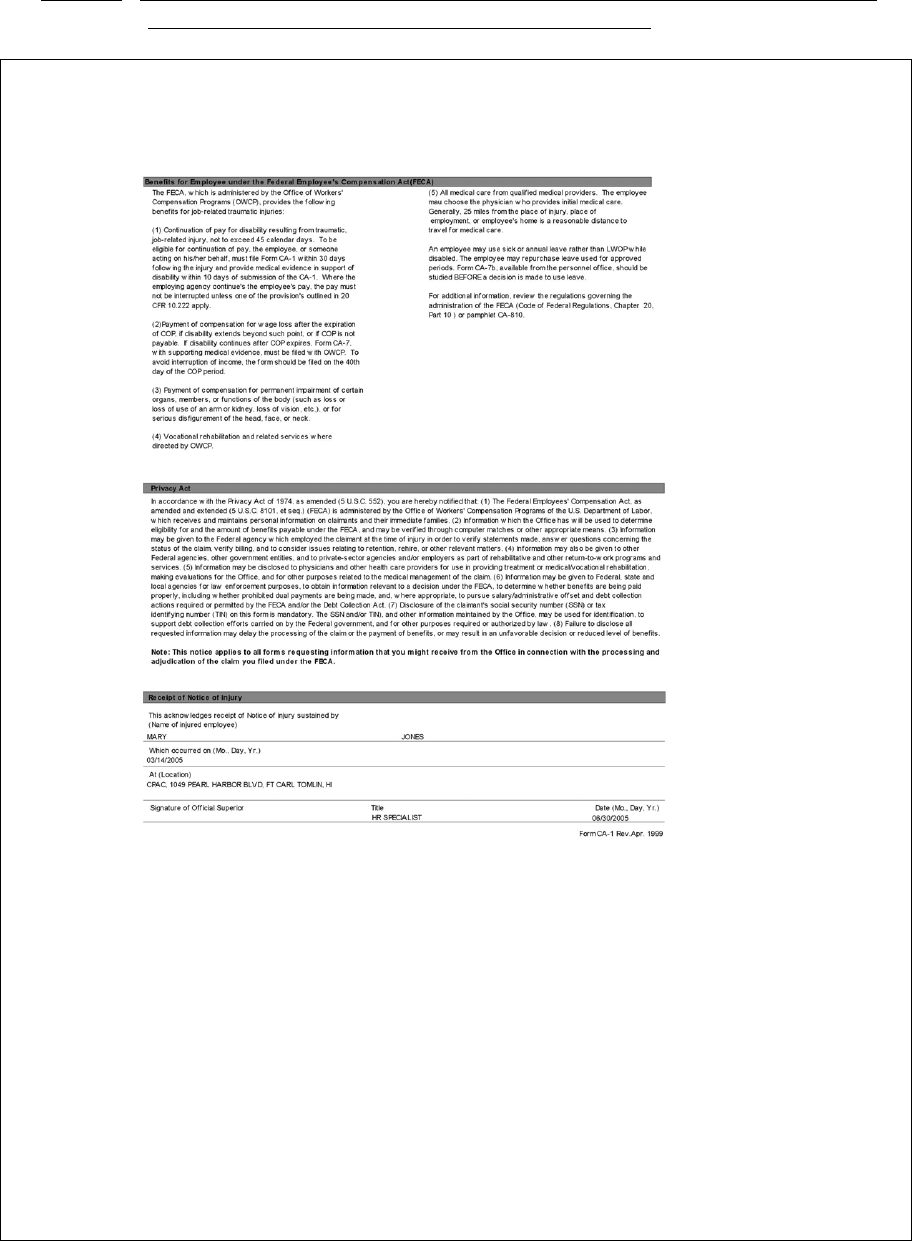

Figure 1. Form CA-10, “What A Federal Employee Should Do When Injured At Work”

DoDI 1400.25-V810, April 15, 2005

18 APPENDIX TO ENCLOSURE 2

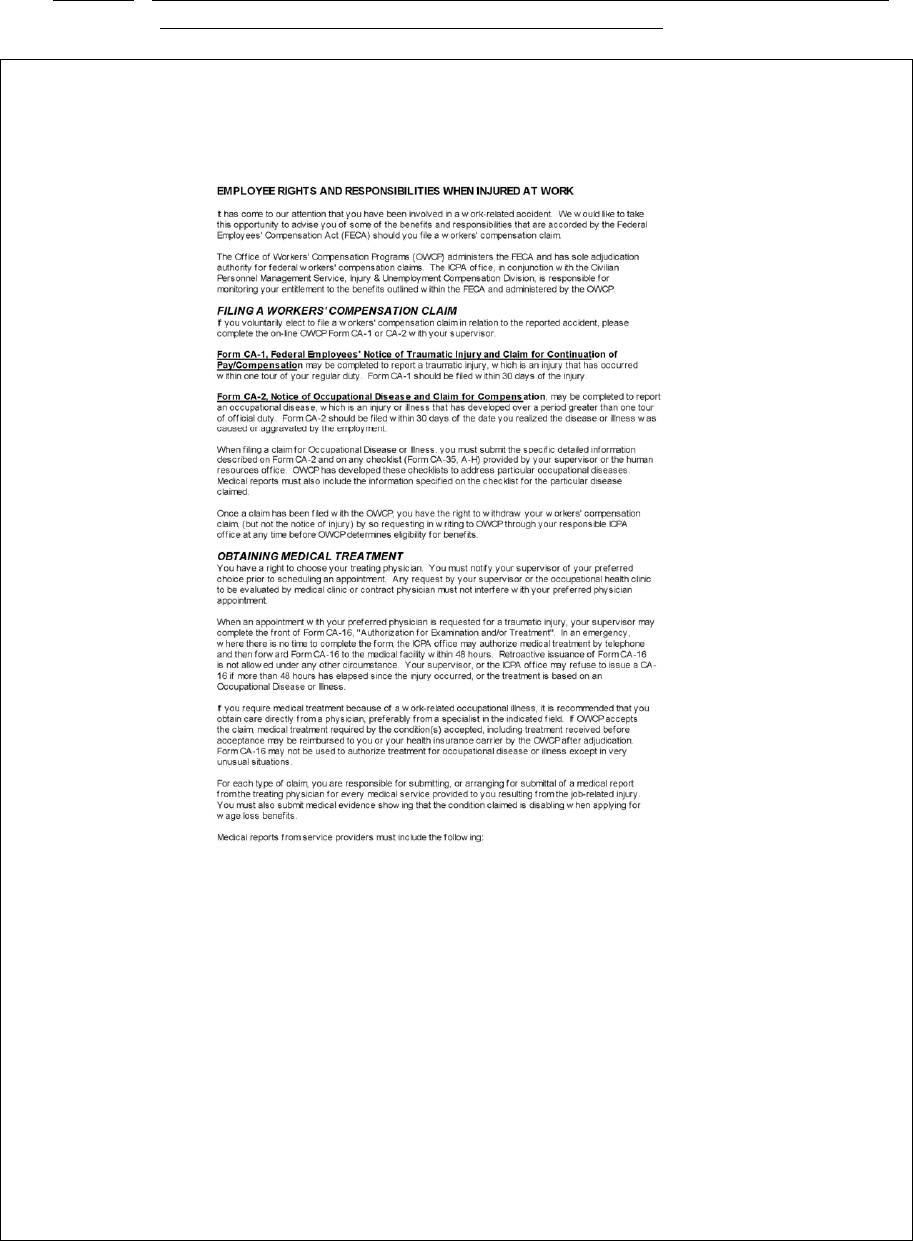

Figure 2. “Authorization for Release of Information” Form

DoDI 1400.25-V810, April 15, 2005

19 APPENDIX TO ENCLOSURE 2

Figure 2. “Authorization for Release of Information” Form, Continued

DoDI 1400.25-V810, April 15, 2005

20 APPENDIX TO ENCLOSURE 2

Figure 2. “Authorization for Release of Information” Form, Continued

DoDI 1400.25-V810, April 15, 2005

21 APPENDIX TO ENCLOSURE 2

Figure 2. “Authorization for Release of Information” Form, Continued

DoDI 1400.25-V810, April 15, 2005

22 APPENDIX TO ENCLOSURE 2

Figure 3. Comparison-Workers’ Compensation vs. Disability Retirement

DoDI 1400.25-V810, April 15, 2005

23 APPENDIX TO ENCLOSURE 2

Figure 4. “Notice to Individuals with Funds in the Civil Service Retirement System (CSRS) or

Federal Employees Retirement System (FERS)”

DoDI 1400.25-V810, April 15, 2005

24 ENCLOSURE 3

ENCLOSURE 3

PROCEDURES

1. AUTHORITIES

a. Statutory Authorities. The DoD Injury Compensation Program is based on FECA and the

rules and regulations of the U.S. Department of Labor Office of Workers' Compensation

Programs under 20 CFR (Reference (d)). Claim forms referred to herein are covered by the

Privacy Act of 1974 (Reference (a)). Records are authorized by FECA.

b. The Federal Employees’ Compensation Act (FECA), as amended. FECA provides

monetary compensation, medical care and assistance (attendant allowances), vocational

rehabilitation, and reemployment rights to Federal employees who sustain disabling injuries as a

result of their Federal employment. FECA also provides for a fixed payment for the deceased

employee's funeral expenses and for compensation benefits to qualified survivors of the decedent

in cases of employment-related death. In 1974, FECA was amended, increasing benefits and

significantly changing the law by adding provisions such as continuation of pay (COP) and

claimant's choice of physician.

c. Federal Employees’ Compensation Program Financing. FECA program is financed by the

Employees' Compensation Fund, which consists of funds appropriated by Congress directly, or

indirectly, through a chargeback to the various agencies. Each year, the Secretary of Labor

furnishes a statement to each DoD Component of payments made from the Fund. These costs

are charged back to each DoD Component. The DoD Components include FECA costs in their

budget requests and use the resulting sums to reimburse the Fund for these charges.

d. Department of Labor (DOL) Involvement. In 1908, President Theodore Roosevelt signed

legislation to provide workers’ compensation for certain Federal employees in unusually

hazardous jobs. The scope of the law was very restricted and its benefits were quite limited.

However, it was the first workers’ compensation law to pass the constitutionality test of the

United States Supreme Court. FECA, enacted in 1916, superseded the 1908 statute. An

independent quasi-judicial Employees’ Compensation Commission was created to administer the

law. In 1950, DOL assumed administrative responsibility for FECA. FECA is now

administered by the Office of Workers’ Compensation Programs (OWCP), Employment

Standards Administration, U.S. Department of Labor.

e. DoD Involvement

. As costs of workers’ compensation benefits continue to grow, the

need for a consolidated approach by all DoD Agencies to reduce costs and to improve program

management has become necessary. Each Civilian Personnel Office /Human Resources Office

(CPO/HRO) will designate a staff member as Injury Compensation Program Administrator

(ICPA) to oversee the program, to coordinate the efforts of all involved management officials,

and to ensure optimum effectiveness in program administration.

DoDI 1400.25-V810, April 15, 2005

25 ENCLOSURE 3

f. Basic FECA Requirements. To qualify for benefits, the employee or employee’s survivors

must establish that the injury or employee’s death met the requirements:

(1) Time. For injuries and deaths which occurred before September 7, 1974, different

provisions apply with respect to timeliness. ICPAs are to contact the supporting DoD liaison to

obtain assistance before making a pre-September 7, 1974, timeliness determination. For injuries

or deaths on or after September 7, 1974, Reference (a) requires that a claim for compensation

must be filed within 3 years of the injury or death. Even if the claim is not filed within 3 years,

compensation may still be allowed if written notice of injury was given in 30 days or the

immediate supervisor had actual knowledge of the injury or death within 30 days of occurrence.

(2) Civil Employee. If the claim is timely filed, it must be determined whether the

injured employee or deceased employee was an employee within the meaning of the law. It

covers all civilian Federal employees, whether permanent or temporary, except for

nonappropriated fund employees. Federal employees who are not citizens or residents of the

United States or Canada are covered subject to certain special provisions governing their pay

rates and computation of compensation payments. Determinations for other employees must be

made on a case-by-case basis once a claim is filed.

(3) Fact of Injury. It must be established whether the employee in fact sustained an

injury or disease. Two factors are involved in this third determination. Did the employee

actually experience the accident, event, or employment factor which is alleged to have occurred?

Did the accident or employment factor result in an injury or disease?

(4) Performance of Duty. If the first three criteria have been accepted, it must be

determined whether the employee was engaged in the performance of duty when the injury

occurred. The question of where and when the accident, event, or employment factor(s) leading

to filing of a claim occurred must be studied.

(5) Causal Relationship. After the four factors aforementioned are considered, causal

relationship between the condition claimed and the injury or disease sustained is examined. This

factor is based entirely on medical evidence provided by physicians who have examined and

treated the employee. Sometimes the circumstances of a case raise the issues of willful

misconduct, intention to bring about the injury or death of oneself or another, or intoxication. If

any of these factors is established as the cause of the injury or death, benefits must be denied.

g. FECA Benefits. Employees may be eligible for six basic types of benefits under FECA:

Medical benefits (including transportation expenses incurred); Continuation of Pay; Disability

compensation; Schedule awards; Vocational rehabilitation; and, Death benefits that include

allowable funeral benefits and survivor compensation. The program applies to any disability

(temporary or permanent, partial or total) incurred as a result of a job-related disease or

condition, as well as an on-the-job traumatic injury.

(1) Medical Benefits. Payment may be made for any medical services needed for

treatment or to counteract or minimize the effects of any condition, disease, or injury determined

to be causally related to employment with the Federal Government. There is no limit on the

DoDI 1400.25-V810, April 15, 2005

26 ENCLOSURE 3

extent of medical treatment payable, nor is there a time limit for which they are payable if the

need for medical treatment can be substantiated and connected to the employment-related injury

or disease. However, fee schedules do apply to many charges and balances from fee reductions

cannot be collected from the employee. Payment will be made for first aid, medical treatment,

hospitalization, physician's fees, drugs, appliances, or other supplies directed for use by a

qualified physician. Bills must be submitted within 1 year of the date of service, 1 year beyond

the calendar year in which the expense was incurred, or 1 year beyond the calendar year in which

the claim was accepted, whichever is later, or they will not be paid. The employee may elect to

be treated by a government physician (if available) or by a duly qualified physician of his or her

choice who is not excluded. Although payment for preventative treatment is generally not

provided, payment may be made for certain specified conditions even though such treatment is

designed, in part, to prevent further injury. The specific conditions when payment may be made

include: complications of preventative measures which are provided or sponsored by the agency,

such as an adverse reaction to a prophylactic immunization; actual or probable exposure to a

known contaminant due to an injury, thereby requiring disease specific measures against

infection such as tetanus antitoxin or booster toxoid injections for puncture wounds; conversion

of tuberculin reaction from negative to positive following exposure to tuberculosis in the

performance of duty; and where injury to one eye has resulted in loss of vision, periodic

examination of the uninjured eye to detect possible sympathetic involvement of the uninjured

eye at an early stage. There shall be no charge for occupational health or OWCP care for DoD

employees treated at Federal government medical facilities. However, DoD Components shall

continue to bill, at the interagency rate, for OWCP care provided to non-DoD employees by a

DoD medical treatment facility. The interagency rate charge shall be processed through the

OWCP Revolving Fund.

(2) COP. An employee who sustains a disabling, job-related traumatic injury is entitled,

under certain circumstances, to COP for a period not to exceed 45 calendar days pending

OWCP's determination of the employee's claim for compensation under FECA. To qualify for

COP, the traumatically injured employee or someone authorized to act on his or her behalf must

file written notice of injury on a Form CA-1, “Federal Employees' Notice of Traumatic Injury

and Claim for Continuation of Pay/Compensation,” within 30 calendar days after the date of

injury. COP is not compensation for FECA purposes and is subject to all applicable taxes and

payroll deductions. The injured employee or someone authorized to act on his or her behalf must

provide written medical evidence to support the disability within 10 calendar days of submitting

the CA-1. COP is not applicable for occupational illnesses and diseases claims. The employee

must make a separate claim for monetary compensation on a Form CA-7, “Claim for

Compensation on Account of Traumatic Injury or Occupational Disease,” with Form CA-20,

“Attending Physician's Report,” if the disability exceeds 45 calendar days or results in any

permanent disability.

(3) Disability Compensation

. Employees may be eligible for one or more of several

types of wage loss compensation. Disability benefits are classified based on the nature and

extent of disability incurred and are categorized as temporary total, temporary partial, permanent

total, or permanent partial.

DoDI 1400.25-V810, April 15, 2005

27 ENCLOSURE 3

(a) Compensation Rates. Generally, in cases of total disability, an employee is

entitled to compensation equivalent to two-thirds of the weekly salary if there are no dependents,

or three-fourths of the salary if there are one or more dependents (see Glossary for definition of

dependents). Compensation is tax free. In establishing a person’s wage rate, the law recognizes

certain additional amounts that may be included in salary, such as premium pay, night and

Sunday differential, holiday pay, hazard pay, dirty work pay, quarters allowances and post

differential for overseas employees. Overtime pay is not included except for administratively

uncontrollable work covered under 5 U.S.C. 5545(c)(2) (Reference (a)). Under Reference (a)

the maximum compensation rate may not exceed more than 75 percent of the monthly pay of the

maximum rate of basic pay for GS-15 (excluding locality pay).

(b) Duration of Compensation. Compensation payments for total disability may

continue as long as the disability continues and suitable modified work is not available; in some

instances, for the lifetime of the employee. As with medical care, there is no total dollar

maximum or time limitation.

(c) Loss of Wage-Earning Capability (LWEC). When an injured person suffers a

wage loss because of disability that is less than total, compensation may be paid for this partial

loss of wages or wage-earning capacity. Provisions of Reference (a) govern the determination of

wage-earning capacity. When a claimant has completed 60 days of employment in a suitably

modified, formally classified position, the agency should complete a LWEC worksheet and

request that a formal LWEC rating be issued. If the position carries a pay rate less than that of

the date of injury, compensation will be payable for a loss of wage earning capacity. Such a

formal rating can be changed only under very limited circumstances.

(d) Schedule Awards. Reference (a) also provides for payment of compensation for

permanent loss or loss of use (either partial or total) of certain internal and external organs;

members or functions of the body such as arms, legs, hands, feet, fingers, toes, eyes; or loss of

hearing or loss of vision. Each extremity or function has been rated for a specific number of

weeks of compensation that can be paid in addition to full salary. If a serious disfigurement of

the head, face, or neck results from a job-related injury, an award may also be made for such

disfigurement, not to exceed $3,500. Multiple schedule awards may be paid concurrently for

different body parts or paid concurrently with the Office of Personnel Management (OPM)

retirement benefits. Employees can receive schedule award payments concurrently while

receiving severance pay for involuntary separation from their employment. Schedule awards can

be paid even if the employee returns to work. However, employees cannot receive wage loss

compensation and schedule award benefits concurrently for the same injury.

(e) Vocational Rehabilitation

. If the injured employee suffers a vocational handicap

due to the injury and cannot resume usual employment, OWCP-directed vocational rehabilitation

may be arranged to assist in training for work that the employee can do. The cost for

rehabilitation is paid from the Employees’ Compensation Fund and charged back to the DoD

Component. Rehabilitation service is supervised by OWCP, but is usually provided in

cooperation with state and private rehabilitation agencies. In addition to the cost of

rehabilitation, an employee may qualify for a monthly allowance of up to $200 necessary for his

or her personal maintenance. Employees are also entitled to collect total disability payments

DoDI 1400.25-V810, April 15, 2005

28 ENCLOSURE 3

during their rehabilitation period. When the rehabilitation program is completed, the claimant is

expected to actively seek employment. Vocational rehabilitation is not confined to formal

retraining. It includes the employment efforts of vocational rehabilitation counselors and

compensation specialists. An offer of a position (employment or reemployment) for which an

injured employee is medically qualified is usually the more expedient and less costly method of

rehabilitation.

(f) Death Benefits. If the employee’s death was due to the job-related injury,

dependents are entitled to benefits.

1. Widow or Widower and No Eligible Child. The widow or widower is eligible

for 50 percent of the deceased employee’s regular pay.

2. Widow or Widower with Eligible Children. The widow or widower is eligible

for 45 percent of the deceased employee’s regular pay, plus an additional 15 percent for each

child, to a maximum not to exceed 75 percent of the deceased employee’s regular pay.

3. Eligible Children and No Widow or Widower. An orphaned child is eligible

for 40 percent of the deceased employee's regular pay, plus 15 percent for each additional

orphan, not to exceed 75 percent of the deceased employee’s regular pay. Benefits are divided

among the children, share and share alike.

4. Surviving Legal Dependents. If a deceased employee leaves no widow,

widower, or child, benefits are paid to the surviving legal dependents of this employee as

specified in Reference (a).

5. Remarriage or Death. Widows and widowers receive benefits until death, or

remarriage, if they are under age 55. If a widow or widower under age 55 remarries, a lump-sum

payment equal to 24 times the monthly compensation he or she is receiving at the time of

remarriage is made. If the widow or widower is age 55 or older, compensation continues as long

as he or she lives, regardless of remarriage.

6. Orphaned Children. Orphaned children receive benefits until they die, marry,

or reach the age of 18. If a surviving child pursues higher education on a full-time basis

(generally 12 semester hours), payments will continue until he or she has completed 4 years of

study beyond the high school level or until he or she is 23 years of age. Payment will not extend

beyond the semester or enrollment period in which the surviving child reaches 23 or completes

his or her fourth year of higher education, whichever occurs first.

7. Funeral Expenses. Up to $800 is paid for a deceased employee’s funeral

expenses. If the employee dies away from home, the cost of transporting the body to the place of

burial will be paid in full. Also, an additional sum of $200 is paid to the personal representative

of the decedent for reimbursement of the expense of terminating the deceased employee’s

Federal employment status.

DoDI 1400.25-V810, April 15, 2005

29 ENCLOSURE 3

8. Death Gratuity Payment. Reference (f) authorizes a death gratuity payment

when a civilian employee dies from a traumatic injury sustained in the line of duty on or after

August 2, 1990 (November 8, 1996, “Death Gratuity Payment” memorandum, (Reference (g)).

This gratuity is payable by the DoD Component, and is payable only when OWCP has approved

the death claim. The $10,000 death gratuity (Reference (f)) is payable minus the $200 payable

under Reference (a) and the $800 payable under Reference (a) by OWCP.

h. Third-Party Liability. When the circumstances of the employment-related injury or

illness create a legal liability on a third party other than an employee or activity of the Federal

Government, the government has a subrogation interest (that is, the right to recover any payment

it makes should the claimant collect money from another source). The injured employee or

survivor is required by Reference (a) to pursue such recovery or assign the right to recover to

OWCP. Failure to do so can result in a loss of all benefits.

i. Hearings and Appeals. If an employee (or an employee’s survivors) disagree with a final

determination of the OWCP, either may request a reconsideration or review. The employee or

survivor has the right to a hearing before the OWCP. Further, he or she has the right to appeal

any decision to the Employees’ Compensation Appeals Board (ECAB), a separate entity in the

DOL. The time limits for filing such requests for hearings or appeals vary, and are strictly

enforced.

j. Exclusiveness of Remedy. Except for third party rights, FECA is the sole legal avenue by

which a Federal employee (or survivors) may recover damages due to an injury or death that is

causally related to Federal employment, as noted in Reference (a). FECA is the exclusive

remedy; therefore, employees may not sue the U.S. Government for damages on their own.

k. Penalties for Employees and Supervisors

(1) An employee who knowingly makes or knowingly certifies to any false statement,

misrepresentation, concealment of fact, or any other act of fraud with respect to a claim under

FECA, or who knowingly accepts compensation to which that person is not entitled, is subject to

criminal prosecution and may, under appropriate U.S. Criminal Code (18 U.S.C. 287 and 1001

(Reference (h)), be punished by a fine of not more than $10,000 or imprisonment of not more

than 5 years, or both.

(2) Any employee, beneficiary, official superior, representative, or other person who,

with respect to a claim under FECA, enters into any agreement, combination, or conspiracy to

defraud the United States by obtaining or aiding to obtain the payment or allowance of any false,

fictitious or fraudulent claim is subject to criminal prosecution and may, under appropriate U.S.

Criminal Code provisions (Reference (h)), be punished by a fine of not more than $10,000 or

imprisonment for not more than 10 years, or both.

(3) Any beneficiary who pleads guilty to or is found guilty on Federal or State criminal

charges of defrauding the Federal Government in connection with a claim for benefits will have

his or her benefits terminated effective the date the guilty plea is accepted or a verdict of guilty is

returned after trial, for any injury occurring on or before the date of such plea or verdict.

DoDI 1400.25-V810, April 15, 2005

30 ENCLOSURE 3

(4) Any beneficiary who is incarcerated in a State or Federal jail, prison, penal

institution, or other correctional facility due to a State or Federal felony conviction forfeits all

right to compensation during the period of incarceration, and right to benefits is not restored after

such incarceration ends, although payment of compensation benefits may resume. Eligible

dependents will receive compensation at a reduced rate during the period of incarceration,

according to the percentages laid out in Reference (a).

(5) Any claimant convicted of fraud related to FECA claims on or after October 1993

will lose entitlement to FECA benefits under Reference (a).

(6) Any claimant convicted of a felony and imprisoned as a result to claims under FECA

will have benefits suspended effective date of imprisonment in accordance with Reference (a).

(7) An officer or employee of the Federal Government responsible for making reports

(such as an “official superior”) who willfully fails, neglects, or refuses to make a report of injury

or files a false report may be fined not more than $500, be imprisoned not more than 1 year, or

receive both penalties.

(8) A partially disabled employee who refuses to seek suitable work or refuses to accept

work after it is offered is not entitled to any compensation except for medical benefits.

(9) If an employee refuses to submit to or obstructs an examination by a Federal medical

officer or by a qualified private physician as required by OWCP, the employee’s right to

compensation under FECA will be suspended until the refusal or obstruction ceases. The action

of the employee’s representative is considered to be the action of the employee for the purposes

of this section. The period of refusal or obstruction will be deducted from the period for which

compensation is payable to the employee.

(10) An individual who, without good cause, fails to undergo vocational rehabilitation,

when directed by DOL, may have his or her compensation reduced.

(11) An employee who fails to make an affidavit about his or her employment (including

unremunerated work performed in furtherance of a business) when required, or knowingly omits

or understates any part of his or her earnings, forfeits his or her right to compensation with

respect to any period for which the affidavit or report was required. Compensation forfeited,

under Reference (a), if already paid, will be recovered by a deduction from additional

compensation payable, if any, or otherwise recovered under Reference (a) unless recovery is

waived.

(12) An employee who refuses to assign or prosecute an action in his or her own name

against a third party when required is not entitled to compensation.

DoDI 1400.25-V810, April 15, 2005

31 ENCLOSURE 3

2. CLAIMS AND RECORD MANAGEMENT

a. Handling and Controlling Claims

(1) General Information. For proper injury case management, it is essential to closely

monitor the completion and control of claims and establish an administrative system that

accurately reflects the status of all claims at all times.

(a) The supervisor notifies the ICPA/CPO/HRO immediately or as soon as possible

after an injury has been reported.

(b) The supervisor works with the employee to file the claim form through the EDI

application, which forwards all claim forms to the ICPA on completion. The ICPA is

responsible for processing all injury or occupational illness or disease forms and submitting the

claim form to the appropriate OWCP district office in the most expeditious manner.

(c) Injury compensation personnel properly monitor claims to ensure that employees’

rights are protected, that appropriate management options are timely exercised, and that workers’

compensation costs are effectively controlled.

(2) Advising Employees of Program Benefits. The DOL provides publications for

agencies to use in telling their employees about the compensation program and how they may

obtain benefits.

(a) The pamphlet, CA-11, “When Injured at Work,” is issued by the DOL and

provides facts about compensation for civilian employees of the Federal Government. The

CPO/HRO issues a CA-11 to each employee at the time of appointment (see Figure 5).

(b) When notified that an injury, occupational illness or disease, or a recurrence of a

documented injury has occurred, the employee’s immediate supervisor should take time to

discuss with the employee the nature of the injury, how, when, and where the injury or

recurrence occurred and obtain the names and statements of any witnesses. Also, refer to

paragraph 11.b of this enclosure, for information about injuries sustained under special

circumstances.

(3) Authorizing Medical Examination and Treatment for Traumatic Injuries

(a) If an employee requests medical care, the supervisor should:

1

. Advise the employee that he or she has the initial choice of physician;

2. Prepare and issue Form CA-17, “Duty Status Report;” and,

3. Offer to refer the employee to the activity medical services, if available, for

examination and recording of the injury in the employee’s medical record. Referral to the

DoDI 1400.25-V810, April 15, 2005

32 ENCLOSURE 3

activity medical services is not mandatory on the employee’s part, nor shall it be construed as the

initial choice of the attending physician.

(b) The supervisor, or activity medical services, or activity hospital/clinic or ICPA

(as required locally):

1. Makes an appointment with the physician of the employee’s choice.

2. Informs the employee that he or she should make another choice if the

physician is not available or is excluded from payment under FECA.

3. Issues Form CA-16, “Authorization for Examination and/or Treatment,” to a

physician willing to provide treatment. Informs the employee that a change of physician

requires prior OWCP approval or referral by his or her attending physician. The injured

employee should receive the Form CA-16 within 4 hours of request. If an employee has reported

an injury several days after the fact, or did not request medical treatment within 24 hours, the

supervisor may still authorize medical care using form CA-16. The supervisor may, however,

refuse to issue a CA-16 if more than a week has passed since the injury on the basis that the need

for immediate treatment would normally have become apparent in that period of time;

4. Instructs the employee to contact the supervisor immediately after examination

and treatment.

5. Informs the employee that it is the employee’s responsibility to provide

medical evidence as to his or her duty status and to advise the physician of the fact that light duty

is available should the employee be physically able to perform such duty.

(c) The employee should:

1. Advise the supervisor or activity physician of his or her choice of physician

(who may be an activity medical officer).

2. Choose a physician who is eligible and willing to give timely examination and

treatment, if initial choice of the physician is not available to give examination or is on the

excluded list;

3. Inform the physician of the availability of light duty, if the employee has been

informed that light duty is available.

4. Notify the supervisor of duty status immediately following treatment and

regularly after that.

DoDI 1400.25-V810, April 15, 2005

33 ENCLOSURE 3

(4) Filing the Claim

(a) The supervisor will ensure the completeness and, to the extent possible, accuracy

of each claim prepared before submitting it to the ICPA.

(b) Immediately on notification that an injury has occurred, the immediate supervisor

should investigate the claim. The ICPA/CPO/HRO or safety office should also investigate, if

necessary. The investigation should either substantiate the claim or show doubt about the

validity of the claim. Some sources and expertise available during the investigation are:

1. Injured employee.

2. Witnesses (or others in the area who heard, saw, or have knowledge).

3. Immediate supervisor.

4. Treating physician.

5. Safety staff.

6. Employee’s injury compensation case file(s).

7. Official personnel folder.

8. Activity physician and employee’s medical file. If review of the medical

records shows evidence to dispute the claim or shows that the injury may have only caused an

aggravation of a preexisting condition, such evidence or a memo signed by the activity physician

to include the name of doctors and hospitals where the employee was treated is sent to the ICPA

for forwarding to OWCP.

(c) Based on the results of the investigation, the supervisor shall decide whether to

controvert the claim. If the supervisor is confident that there is no basis for controversion, he or

she shall immediately print and submit the claim and all supporting documentation to the

ICPA/CPO/HRO for forwarding to OWCP. If the investigation reveals that there are

questionable circumstances surrounding the claim, the supervisor contacts the ICPA.

(d) The ICPA develops a controversion package in accordance with section 5 of this

enclosure, “Controversion of Claims,” and if possible, forwards it with the claim to the OWCP.

The supervisor notifies the employee verbally or in writing that the claim has been controverted.

Either a copy of the notice or a memorandum for record should state that the employee was

notified of the controversion.

1

. If it is decided that either the traumatic injury or occupational disease claim, or

any portion of it should be challenged, the ICPA shall enter the reasons in Block 35 of either the

CA-1 or CA-2 claim form.

DoDI 1400.25-V810, April 15, 2005

34 ENCLOSURE 3

2. If it is decided that the entitlement to all or a portion of COP resulting from a

traumatic injury claim should be controverted, the ICPA shall enter the reasons for controversion

in Block 36 of the CA-1 claim form.

(e) In either a challenged or controverted case, the ICPA must ensure that any

supporting documentation, such as signed witnesses’ statements, investigative reports, and

photographs, are forwarded to OWCP once a claim number is assigned on the case.

(f) The supervisor shall notify the employee verbally or in writing that the claim has

been controverted. Either a copy of the notice or a memorandum for record should state that the

employee was notified of the controversion.

b. Completing OWCP Forms

(1) Form CA-1, “Federal Employee’s Notice of Traumatic Injury and Claim for

Continuation of Pay/Compensation.” Use this form for traumatic injury cases only. A traumatic

injury is defined as “a wound or other condition of the body caused by external force, including

stress or strain.” It must be identifiable as to time and place of occurrence and member or

function of the body affected. It must be caused by a specific event or incident, or series of

events or incidents within a single day or work shift. (See Glossary for definition of traumatic

injury.) The Form CA-1 provides official notice to the employee's supervisor and to OWCP that

a traumatic injury has occurred. (Figure 6 contains a sample Form CA-1, an information sheet,

and instructions for completing the form.)

(a) Time Requirement. The employee should complete and submit the Form CA-1

as soon as possible after the injury, but no later than 30 days after the date of injury. To be

eligible for COP, the employee must file the Form CA-1 within 30 days from the date of injury.

Statutory time requirements for other FECA benefits will be met if the Form CA-1 is filed no

later than 3 years after the injury. Someone acting in the employee’s behalf (that is, a co-worker,

a relative, or the supervisor) may complete the Form CA-1.

(b) General Procedures

1. The employee’s CPO/HRO, supervisor, or activity’s medical service provides

the employee with a Form CA-1, or provides access to the electronic CA-1 form through the EDI

Application.

2. The employee completes items 1 through 15. The CPO/HRO, supervisor, or

activity’s medical service should complete items 17 through 38 on the Form CA-1, print the

completed form, sign the completed form, and request that the employee sign the completed

form.

3. If the employee is eligible for COP, but elects annual or sick leave, the

supervisor or ICPA explains COP to the employee.

DoDI 1400.25-V810, April 15, 2005

35 ENCLOSURE 3

4. The supervisor gives the employee or the employee’s representative a signed

receipt.

5. The supervisor forwards the Form CA-1 to the ICPA.

(c) Forwarding to the OWCP. The ICPA receives electronic notification of the

completed form and reviews the Form CA-1 for accuracy and completeness. The ICPA must

code the appropriate items on the form.

1. If the employee has lost time from work or incurred medical expenses, the

ICPA prints a hard-copy of the completed form, approves, and submits the electronic form to

OWCP within 10 working days from the date of first notice. The ICPA files one copy of the

CA-1 in the EMF and one copy in the working folder for this claim. The ICPA shall send

notification to the agency Safety Officer that an injury has been claimed.

2. If the employee does not lose time from work and has no medical expenses,

the ICPA files the original Form CA-1 in the EMF and sends notification to the agency Safety

Officer that an injury has been claimed.

3. If the employee later seeks medical treatment, loses time from work, or both,

the ICPA will retrieve the claim from the EDI application, correctly recode the claim, print,

approve, and then submit Form CA-1 to OWCP.

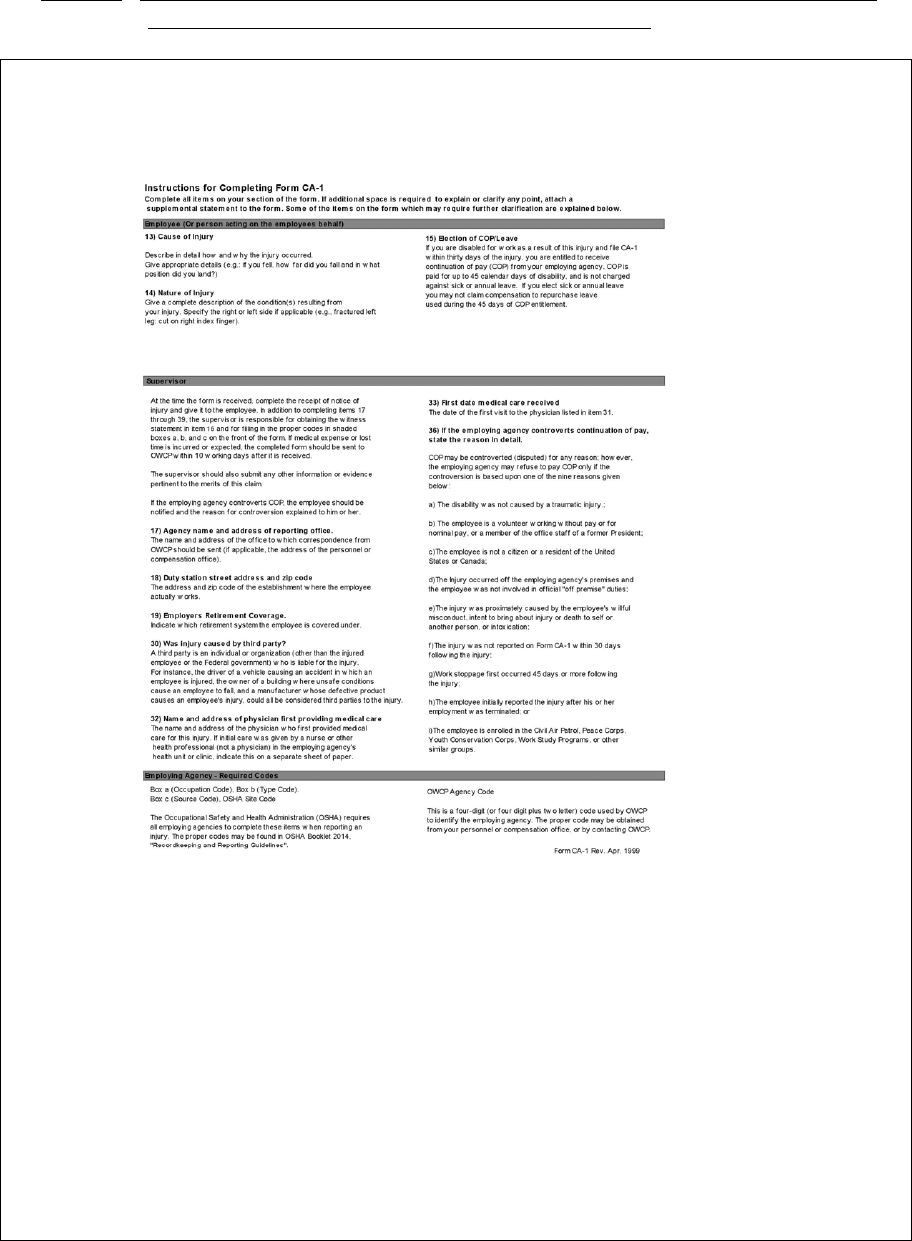

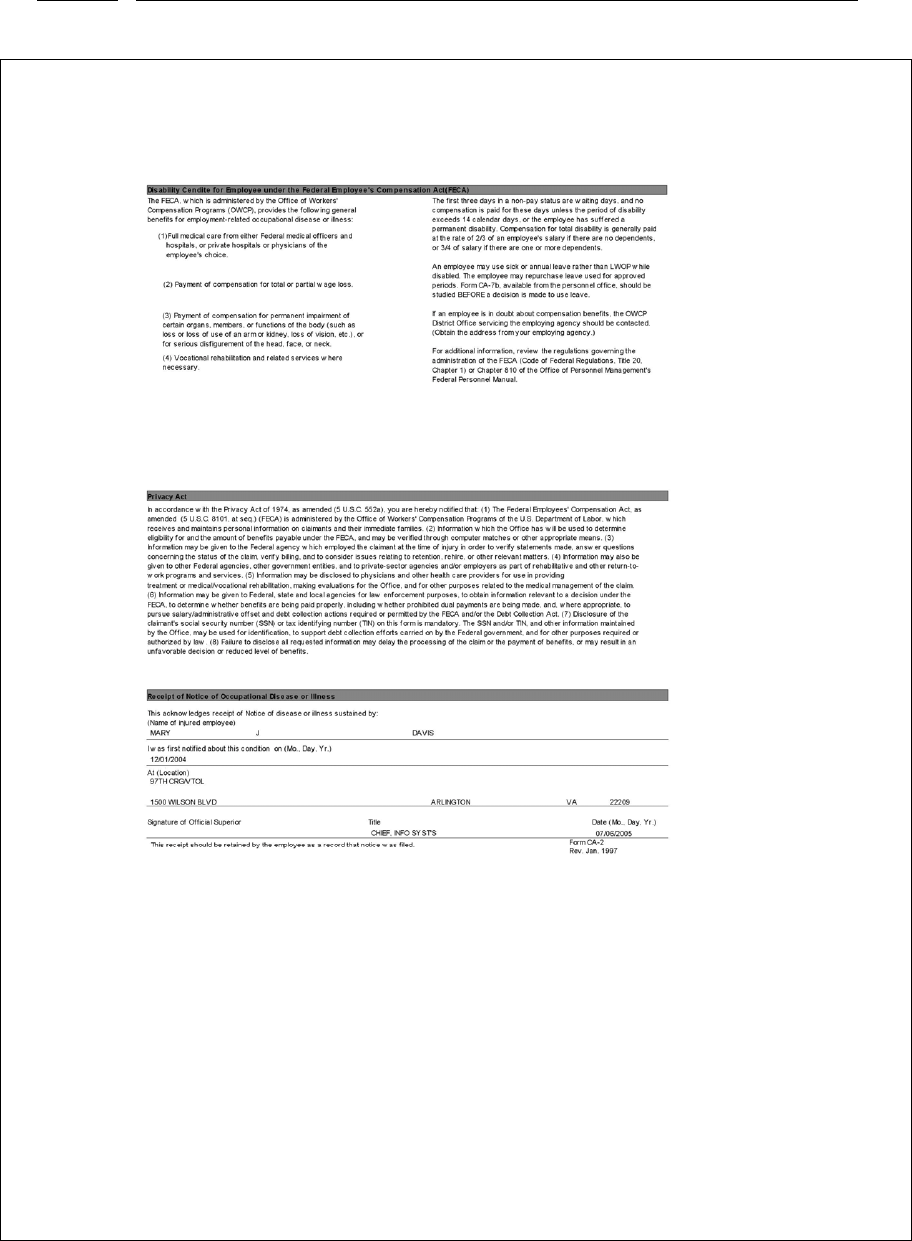

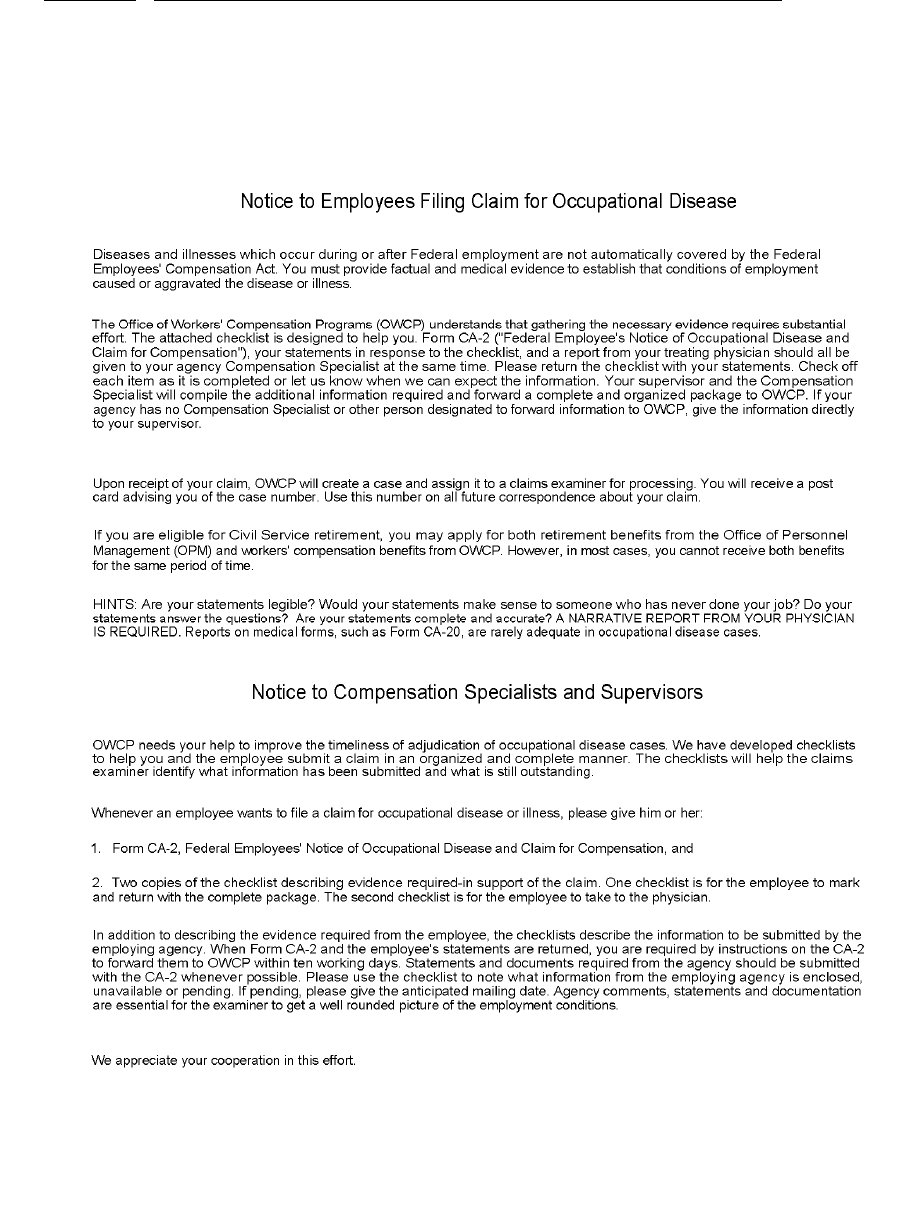

(2) Form CA-2, “Notice of Occupational Disease and Claim for Compensation.” The

Form CA-2 provides official notice to an employee's supervisor and OWCP of an occupational

illness or disease caused or aggravated by factors of employment. (Figure 7 contains a sample of

a completed Form CA-2 and an information sheet. (Instructions for completing the Form CA-2

are at Figure 8)). Besides submitting this form, the employee must furnish a narrative statement

and supporting documentation - explaining how the ailment is related to the work environment

(see section 3 of this enclosure).

(a) Time Requirement

. The injured employee or someone acting on his or her behalf