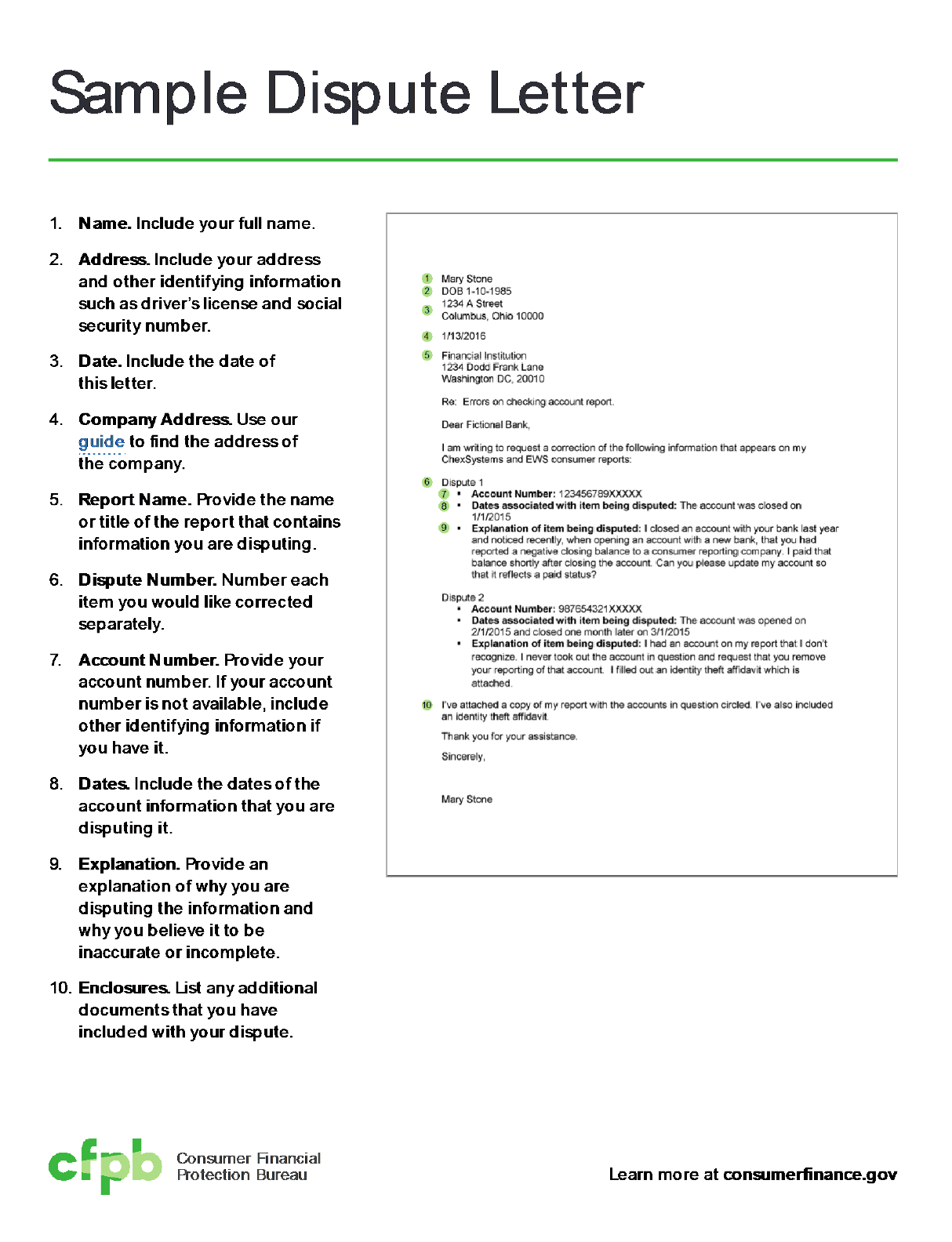

Sample letter to your bank or credit union to

dispute information it provided about your

checking account history

You’re saying: “My consumer report for checking accounts contains

inaccurate information. I want a correction or update from the bank or credit

union that provided the information.”

Use the sample letter if you believe that your checking account report contains information that is

inaccurate or incomplete. It is important to dispute inaccurate information with both the

consumer reporting company that created the report and the financial institution that provided

the inaccurate information. Use this letter with the bank or credit union. We’ve created another

letter to dispute information with the checking account reporting company.

How to use this sample:

1. Read the background below.

2. Fill in your personal information below. Edit the information in [brackets] to address the

specific inaccuracies that you are disputing. If you need to dispute several items, provide all of

the information below about each one in a numbered list.

3. Print and mail the letter. You may consider using “return receipt requested,” for proof that the

bank or credit union received it. Keep a copy of the letter for your records. If you send any

information with the letter, send copies and keep your originals.

4. Ensure the error has been removed by requesting confirmation from the consumer reporting

company.

Background

This letter provides the bank or credit union with enough information to identify you and the

specific accounts that you are disputing. When disputing an item of information about an account

that you have had, consider including a copy of your checking account report

. This will make

identifying the items that you are disputing easier. You can mark or circle the items on the report

that you think are wrong. Your letter will explain why they are wrong. You may also want to

include copies of additional supporting documentation.

All companies that report information to consumer reporting companies—including reporting

companies focused on checking accounts—are required to accept disputes from consumers. You

can send your dispute to the address for the bank or credit union found in your consumer report or

you can call customer service for the bank that reported the information about you to find out

where to send the dispute. Financial institutions may require additional documents for requests

involving identity theft. If your complaint involves identity theft, you should contact the financial

institution in question to determine their identity theft procedures and be prepared to make copies

of relevant identifying documents which may include a copy of your state-issued license or social

security card. You can visit www.identitytheft.gov to find more resources to combat identity theft.

Sample letter begins on the next page.

[Your name]

[Account Number at Institution if available]

[Date of birth or other identifying information requested by company]

[Your return address] [Date]

[Financial Institution Name]

[Financial Institution address for receipt of direct disputes]

Re: Error[s] on consumer checking account screening report.

Dear [Name of financial institution],

I am writing to request a correction of the following information that appears on my [name of checking

account reporting company] consumer report:

Dispute 1 [The following examples are meant to be helpful, include all disputes that apply]

Account Number or other information to identify account to the company: [Insert account number or

other information such as account holder names and past addresses. This is important especially if

you have had multiple accounts with the same company.]

Dates associated with item being disputed: [Insert the date that appears on your report. This helps

ensure that the correct account is identified by the financial institution and to identify which aspects

of the report are being disputed. You can still file a dispute if you don’t have this date.]

Explanation of item being disputed: [Insert a detailed explanation of why the information is

inaccurate. Choose one of the choices below if it fits, or add your own description.]

The report shows I owed money to the bank that I have already repaid. [Give info about when

you paid, and attach a copy of any proof that you have.]

The report shows that I was suspected of fraudulent activity but I was the victim of a scam and

not the perpetrator.

I’m the victim of identity theft and I don’t recognize one or more of the accounts on my report.

[You may wish to include a copy of the FTC identity theft affidavit describing the identity theft.]

Other [Describe what is wrong with the report. You may include copies of any additional

supporting documentation that you have.]

Dispute 2 [Continue numbering for each disputed item on your report and include the same information]

Thank you for your assistance.

Sincerely,

[Your name]