Chargeback Guide

Merchant Edition

30 April 2024

Contents

Summary of Changes, 30 April 2024.................................................................................... 22

Chapter 1: General Information................................................................................................24

Network Processing...............................................................................................................................25

Definitions...............................................................................................................................................25

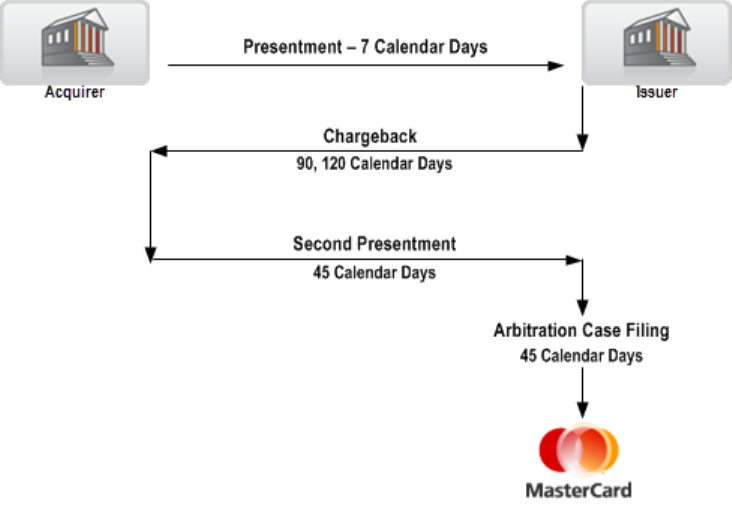

Chargeback Cycles and Arbitration Case Filing...............................................................................25

Disputes of a Third Party Processed Transaction.......................................................................25

Overview of the Single and Dual Message System Chargeback Cycles and Arbitration

Case Filing......................................................................................................................................... 26

Compliance Case Filing.........................................................................................................................27

Reversals..................................................................................................................................................28

Rights and Obligations..........................................................................................................................28

Hardship Variances................................................................................................................................29

Related Documentation....................................................................................................................... 30

Chapter 2: Dual Message System Chargebacks............................................................ 31

Overview..................................................................................................................................................35

Authorization-related Chargeback.....................................................................................................35

Chargeback.......................................................................................................................................37

Required Authorization Not Obtained.................................................................................... 37

Expired Chargeback Protection Period...................................................................................40

Multiple Authorization Requests..............................................................................................41

CAT 3 Device................................................................................................................................42

Transit First Ride Risk (FRR) Claims........................................................................................ 44

Second Presentment.......................................................................................................................45

Required Authorization Obtained............................................................................................46

Expired Chargeback Protection Period...................................................................................47

Multiple Authorization Requests..............................................................................................48

One Authorization with Multiple Clearing Records...............................................................49

CAT 3 Device ...............................................................................................................................50

Credit Previously Issued.............................................................................................................50

Additional Second Presentment Options...............................................................................52

Cardholder Dispute Chargeback ........................................................................................................53

Chargeback.......................................................................................................................................55

Goods or Services Were Either Not as Described or Defective.......................................... 55

Goods or Services Not Provided...............................................................................................57

Travel/Entertainment Services Not Provided/Not as Described and Merchant

Voucher Issued.............................................................................................................................61

Failed Travel Merchant-Intra-EEA and Domestic European Transactions Only.............. 63

Contents

©

2024 Mastercard. Proprietary. All rights reserved.

Chargeback Guide Merchant Edition— • 30 April 2024

2

Digital Goods Purchase of USD 25 or Less............................................................................65

Credit Not Processed................................................................................................................. 67

Travel/Entertainment Services Cancelled/Returned and Credit Not Processed............ 71

Counterfeit Goods......................................................................................................................74

Cardholder Dispute of a Recurring Transaction....................................................................75

Issuer Dispute of a Recurring Transaction..............................................................................76

Addendum Dispute.....................................................................................................................78

“No-Show” Hotel Charge...........................................................................................................80

Transaction Did Not Complete.................................................................................................81

Timeshares...................................................................................................................................82

Credit Posted as a Purchase.....................................................................................................83

Second Presentment.......................................................................................................................83

General Second Presentment...................................................................................................83

Failed Travel Merchant-Intra-EEA and Domestic European Transactions Only.............. 84

Digital Goods Purchase of USD 25 or Less............................................................................85

Credit Previously Issued.............................................................................................................86

Additional Second Presentment Options...............................................................................89

Fraud-related Chargebacks.................................................................................................................90

No Cardholder Authorization.........................................................................................................90

Chargeback..................................................................................................................................93

No Cardholder Authorization..............................................................................................93

Second Presentment..................................................................................................................96

Two or More Previous Fraud-related Chargebacks......................................................... 97

Fraud-related Chargeback Counter Exceeds Threshold.................................................98

Not Reported to the Fraud and Loss Database.............................................................. 99

Contactless Transaction Unattended Terminals...........................................................100

PIN Transaction...................................................................................................................100

Authenticated Transaction................................................................................................101

Authenticated Transaction – Mainland China Domestic Transactions Only............ 102

Account Takeover................................................................................................................103

Addendum Charges............................................................................................................103

Address Verification Service (AVS) Transaction............................................................104

Compelling Evidence for Airline Transactions................................................................ 105

Compelling Evidence for Recurring and Installment-based Repayment

Transactions.........................................................................................................................105

Compelling Evidence for E-commerce and MO/TO Transactions.............................. 107

Invalid Chargeback............................................................................................................. 109

Guaranteed Reservation Service (“No-show")..............................................................109

Chip Liability Shift.............................................................................................................. 110

Chip/PIN Liability Shift......................................................................................................111

Credit Previously Issued..................................................................................................... 111

Additional Second Presentment Options....................................................................... 114

Questionable Merchant Activity .................................................................................................115

Contents

©

2024 Mastercard. Proprietary. All rights reserved.

Chargeback Guide Merchant Edition— • 30 April 2024

3

Chargeback............................................................................................................................... 116

Questionable Merchant Audit Program (QMAP).......................................................... 116

Coercion Program...............................................................................................................117

Second Presentment............................................................................................................... 118

Not Considered in Violation of Mastercard Rule for Coercion Claim.........................118

Late First Chargeback Submission..................................................................................119

Improper Fraud Reporting.................................................................................................120

Ineligible Fraud.................................................................................................................... 120

Not Listed in Mastercard Announcement.......................................................................121

Credit Previously Issued..................................................................................................... 122

Additional Second Presentment Options....................................................................... 124

Chip Liability Shift......................................................................................................................... 125

Chargeback............................................................................................................................... 130

Chip Liability Shift.............................................................................................................. 131

Second Presentment .............................................................................................................. 133

Two or More Previous Fraud-related Chargebacks.......................................................133

Fraud-related Chargeback Counter Exceeds Threshold.............................................. 134

Not Reported to the Fraud and Loss Database............................................................135

Issuer Authorized Transaction.......................................................................................... 135

Technical Fallback............................................................................................................... 136

Chip Transaction-DE 55 Not Provided-Did Not Require Online Authorization........ 137

Chip Transaction-Offline Authorized...............................................................................137

DE 55 Was Provided...........................................................................................................138

Invalid Chargeback............................................................................................................. 138

Credit Previously Issued..................................................................................................... 139

Additional Second Presentment Options....................................................................... 141

Chip Liability Shift-Lost/Stolen/Never Received Issue (NRI) Fraud......................................142

Chargeback............................................................................................................................... 148

Lost/Stolen/NRI Fraud Chip Liability Shift.................................................................... 148

Second Presentment............................................................................................................... 149

Two or More Previous Fraud-related Chargebacks.......................................................150

Fraud-related Chargeback Counter Exceeds Threshold.............................................. 150

Not Reported to the Fraud and Loss Database............................................................151

Authorized Online Transaction......................................................................................... 151

Technical Fallback............................................................................................................... 152

Chip Transaction-DE 55 Not Provided-Did Not Require Online Authorization........ 152

DE 55 Was Provided in the First Presentment/1240 Message..................................153

Invalid Chargeback............................................................................................................. 153

Credit Previously Issued..................................................................................................... 153

Additional Second Presentment Options....................................................................... 156

Point-of-Interaction Error..................................................................................................................157

Chargeback.....................................................................................................................................158

Cardholder Debited More than Once for the Same Goods or Services..........................158

Contents

©

2024 Mastercard. Proprietary. All rights reserved.

Chargeback Guide Merchant Edition— • 30 April 2024

4

Transaction Amount Differs...................................................................................................159

ATM Disputes............................................................................................................................ 161

Charges for Loss, Theft, or Damages...................................................................................162

Currency Errors.........................................................................................................................163

Merchant Credit Correcting Error Resulting in Cardholder Currency Exchange Loss.. 164

Improper Merchant Surcharge (Select Countries only).....................................................165

Unreasonable Amount (EEA, Gibraltar, United Kingdom)................................................ 166

Second Presentment.....................................................................................................................166

Cardholder Debited More than Once for the Same Goods or Services .........................167

Cardholder Debited More than Once for the Same Goods or Services-PIN

Transaction................................................................................................................................167

Transaction Amount Differs...................................................................................................168

ATM Disputes............................................................................................................................ 169

Charges for Loss, Theft, or Damages...................................................................................170

Late Presentment-Corrected Transaction Date.................................................................170

Currency Errors.........................................................................................................................171

Unreasonable Amount (EEA, Gibraltar, United Kingdom)................................................ 171

Credit Previously Issued...........................................................................................................172

Improper Merchant Surcharge (Intra-European and Inter-European transactions

only)............................................................................................................................................ 174

Additional Second Presentment Options.............................................................................175

Cardholder Dispute-Not Elsewhere Classified (U.S. Region Only)............................................. 176

Installment Billing Dispute (Participating Countries Only)..........................................................176

Domestic Chargeback Dispute (Europe Region Only).................................................................. 176

Requirements for Issuer’s First Chargeback and Acquirer’s Second Presentment............ 176

Improper Use of Message Reason Code 4999..........................................................................176

Arbitration Case Filing..................................................................................................................176

Additional Processing Notes..............................................................................................................176

Chargeback Message Reason Codes............................................................................................... 177

First Chargeback: MTI 1442.........................................................................................................177

Second Presentment: MTI 1240..................................................................................................177

Technical Return........................................................................................................................177

Documentation Return............................................................................................................177

Substance Return.....................................................................................................................177

Second Presentment/1240 (Function Codes 205 or 282) Message Reason Code

Usage...............................................................................................................................................178

Chapter 3: Single Message System Chargebacks.......................................................182

Overview...............................................................................................................................................184

Exception Transaction Types............................................................................................................. 184

Supporting Documentation...............................................................................................................184

Acquirer Adjustment Reason Codes.................................................................................................184

Contents

©

2024 Mastercard. Proprietary. All rights reserved.

Chargeback Guide Merchant Edition— • 30 April 2024

5

Message Reason Code 06-Correction of a Representment...................................................185

Acquirer Correction..................................................................................................................185

Issuer Chargeback....................................................................................................................186

Message Reason Code 10-Correct a Terminal Malfunction...................................................186

Acquirer Correction..................................................................................................................186

Issuer Chargeback....................................................................................................................187

Message Reason Code 20-Returned Item (U.S. Shared Deposits Only)..............................187

Message Reason Code 24-Empty Deposit Envelope (U.S. Shared Deposits Only)............187

Message Reason Code 25-Error in Addition (U.S. Shared Deposits Only)...........................187

Message Reason Code 26-Error in Settlement (U.S. Shared Deposits Only)..................... 187

Message Reason Code 28-Non-Cash Item Deposited (U.S. Shared Deposits Only)......... 187

Message Reason Code 29-Foreign/Counterfeit Currency Deposited (U.S. Shared

Deposits Only)................................................................................................................................187

Message Reason Code 30-Cardholder Disputed Amount (U.S. Shared Deposits Only)...187

Message Reason Code 85-Adjustment Reversal......................................................................187

Acquirer Adjustment................................................................................................................187

Issuer Chargeback....................................................................................................................188

Chargeback Reason Codes................................................................................................................188

Correction of a Chargeback.........................................................................................................189

Issuer Correction.......................................................................................................................189

Acquirer Representment......................................................................................................... 189

Cash Dispute-ATM Only................................................................................................................189

Issuer Chargeback....................................................................................................................189

Acquirer Representment (Second Presentment)................................................................190

Mastercard Automated Reversal...........................................................................................191

Cardholder Disputed Amount (U.S. Shared Deposits Only)...................................................192

Defective/Not as Described-Intra-U.S. Region and U.S. Territories Only............................ 192

Chip Liability Shift......................................................................................................................... 192

Issuer Chargeback....................................................................................................................192

Counterfeit Fraud...............................................................................................................192

Lost, Stolen, or Never Received Fraud.............................................................................193

Chip Liability Shift Program for Domestic and Intraregional Transactions............. 194

Chip Liability Shift Program for Interregional Transactions........................................197

Improper Use for Issuer Chargeback.....................................................................................198

Acquirer Representment (Second Presentment)................................................................199

Transaction Amount Differs.........................................................................................................200

Issuer Chargeback....................................................................................................................200

Acquirer Representment (Second Presentment)................................................................201

Mastercard Automated Reversal...........................................................................................201

Duplicate Transaction...................................................................................................................202

Issuer Chargeback....................................................................................................................202

Acquirer Representment (Second Presentment)................................................................202

Mastercard Automated Reversal...........................................................................................203

Contents

©

2024 Mastercard. Proprietary. All rights reserved.

Chargeback Guide Merchant Edition— • 30 April 2024

6

No Cardholder Authorization.......................................................................................................204

Issuer Chargeback....................................................................................................................204

Acquirer Representment (Second Presentment)................................................................205

Mastercard Automated Reversal...........................................................................................206

Credit Not Received.......................................................................................................................206

Issuer Chargeback....................................................................................................................206

Acquirer Representment (Second Presentment)................................................................208

Mastercard Automated Reversal...........................................................................................209

Goods or Services Not Provided..................................................................................................209

Issuer Chargeback....................................................................................................................209

Acquirer Representment (Second Presentment)................................................................212

Mastercard Automated Reversal...........................................................................................212

Late Presentment..........................................................................................................................213

Issuer Chargeback....................................................................................................................213

Acquirer Representment (Second Presentment)................................................................213

Mastercard Automated Reversal...........................................................................................214

Invalid Adjustment-Account Closed............................................................................................214

Issuer Chargeback....................................................................................................................214

Acquirer Representment (Second Presentment)................................................................215

Invalid Adjustment-Insufficient Funds....................................................................................... 215

Issuer Chargeback....................................................................................................................215

Acquirer Representment (Second Presentment)................................................................215

Chapter 4: Single Message System Chargebacks for Non-Mastercard

BIN Maestro Card-Not-Present (CNP) Debit Transactions.................................. 216

Overview...............................................................................................................................................219

Authorization-related Chargeback.................................................................................................. 219

Chargeback.....................................................................................................................................220

Required Authorization Not Obtained..................................................................................220

Second Presentment.....................................................................................................................221

Required Authorization Obtained..........................................................................................221

Credit Previously Issued...........................................................................................................221

Duplicate Chargeback.............................................................................................................222

Invalid Chargeback...................................................................................................................223

Arbitration Case Filing..................................................................................................................223

Cardholder Dispute Chargeback...................................................................................................... 223

Chargeback.....................................................................................................................................225

Goods or Services Were Either Not as Described or Defective........................................225

Goods or Services Not Provided.............................................................................................226

Travel/Entertainment Services Not Provided/Not as Described and Merchant

Voucher Issued.......................................................................................................................... 229

Digital Goods Purchase of USD 25 or Less..........................................................................230

Contents

©

2024 Mastercard. Proprietary. All rights reserved.

Chargeback Guide Merchant Edition— • 30 April 2024

7

Credit Not Processed...............................................................................................................231

Travel/Entertainment Services Cancelled/Returned and Credit Not Processed.......... 233

Counterfeit Goods....................................................................................................................234

Cardholder Dispute of a Recurring Transaction..................................................................235

Issuer Dispute of a Recurring Transaction........................................................................... 235

Addendum Dispute.................................................................................................................. 236

“No-Show” Hotel Charge........................................................................................................ 237

Transaction Did Not Complete...............................................................................................238

Timeshares.................................................................................................................................239

Credit Posted as a Purchase...................................................................................................239

Second Presentment.....................................................................................................................240

General Second Presentment................................................................................................ 240

Credit Previously Issued...........................................................................................................240

Duplicate Chargeback.............................................................................................................242

Past Chargeback Time Limit..................................................................................................242

Chargeback Documentation Not Provided..........................................................................242

Chargeback Documentation was Illegible........................................................................... 243

Invalid Chargeback...................................................................................................................243

Arbitration Case Filing..................................................................................................................244

Fraud-related Chargebacks...............................................................................................................244

No Cardholder Authorization.......................................................................................................244

Chargeback............................................................................................................................... 245

No Cardholder Authorization............................................................................................245

Second Presentment............................................................................................................... 246

Two or More Previous Fraud-related Chargebacks.......................................................246

Fraud-related Chargeback Counter Exceeds Threshold.............................................. 246

Not Reported to the Fraud and Loss Database............................................................247

Account Takeover................................................................................................................248

Addendum Charges............................................................................................................248

Address Verification Service (AVS) Transaction............................................................249

Compelling Evidence for Airline Transactions................................................................ 249

Compelling Evidence for Recurring Transactions.......................................................... 250

Compelling Evidence for E-commerce and MO/TO Transactions.............................. 250

Invalid Chargeback............................................................................................................. 251

Guaranteed Reservation Service (“No-show")..............................................................252

Credit Previously Issued..................................................................................................... 252

Duplicate Chargeback........................................................................................................253

Past Chargeback Time Limit.............................................................................................254

Chargeback Documentation Not Provided.................................................................... 254

Chargeback Documentation was Illegible......................................................................254

Arbitration Case Filing.............................................................................................................255

Questionable Merchant Activity..................................................................................................255

Chargeback............................................................................................................................... 256

Contents

©

2024 Mastercard. Proprietary. All rights reserved.

Chargeback Guide Merchant Edition— • 30 April 2024

8

Questionable Merchant Audit Program (QMAP).......................................................... 256

Coercion Program...............................................................................................................256

Second Presentment............................................................................................................... 257

Not Considered in Violation of Mastercard Rule for Coercion Claim.........................257

Late First Chargeback Submission..................................................................................258

Improper Fraud Reporting.................................................................................................258

Ineligible Fraud.................................................................................................................... 258

Not Listed in Mastercard Announcement.......................................................................259

Credit Previously Issued..................................................................................................... 259

Duplicate Chargeback........................................................................................................260

Past Chargeback Time Limit.............................................................................................261

Arbitration Case Filing.............................................................................................................261

Point-of-Interaction Error..................................................................................................................261

Chargeback.....................................................................................................................................262

Cardholder Debited More than Once for the Same Goods or Services..........................262

Transaction Amount Differs...................................................................................................263

ATM Disputes............................................................................................................................ 263

Charges for Loss, Theft, or Damages...................................................................................263

Second Presentment.....................................................................................................................264

Cardholder Debited More than Once for the Same Goods or Services..........................264

Transaction Amount Differs...................................................................................................264

ATM Disputes............................................................................................................................ 265

Charges for Loss, Theft, or Damages...................................................................................265

Credit Previously Issued...........................................................................................................265

Duplicate Chargeback.............................................................................................................267

Past Chargeback Time Limit..................................................................................................267

Chargeback Documentation Not Provided..........................................................................267

Chargeback Documentation was Illegible........................................................................... 268

Invalid Chargeback...................................................................................................................268

Arbitration Case Filing..................................................................................................................268

Chapter 5: Pre-Arbitration and Arbitration Case Filing.......................................... 269

Overview...............................................................................................................................................271

Processing Platform............................................................................................................................272

Time Frames and Requirements.......................................................................................................272

Single Message System Arbitration Case Filing.......................................................................273

Dual Message System and Non-Mastercard BIN Maestro Card-Not-Present (CNP)

Debit Card Transactions...............................................................................................................281

Authorization-related..............................................................................................................281

Invalid Second Presentment............................................................................................. 281

Documentation Received with Second Presentment was Illegible or Scanning

Error.......................................................................................................................................288

Contents

©

2024 Mastercard. Proprietary. All rights reserved.

Chargeback Guide Merchant Edition— • 30 April 2024

9

Required Documentation Not Received to Support Second Presentment...............294

Acquirer Reference Data (ARD) Does Not Match or is Invalid.................................... 300

Change of Chargeback Reason to an Authorization-related Chargeback...............305

Cardholder Dispute..................................................................................................................310

Cardholder Reasserts Their Claim................................................................................... 310

Invalid Second Presentment............................................................................................. 317

Documentation Received with Second Presentment was Illegible or Scanning

Error.......................................................................................................................................322

Required Documentation Not Received to Support Second Presentment...............327

Acquirer Reference Data (ARD) Does Not Match or is Invalid.................................... 332

Change of Reason within the Cardholder Dispute Chargeback.................................336

Change of Chargeback Reason to a Cardholder Dispute Chargeback .................... 340

No Cardholder Authorization................................................................................................. 345

Invalid Second Presentment............................................................................................. 345

Compelling Evidence for Airline, Recurring, Installment-based Repayment, E-

Commerce, and MO/TO Transactions.............................................................................350

Addendum Disputes...........................................................................................................356

Address Verification Services (AVS) Transaction.......................................................... 362

Guaranteed Reservation Service (“No-show”).............................................................. 368

New Merchant Location.................................................................................................... 374

Documentation Received with Second Presentment was Illegible or Scanning

Error ......................................................................................................................................380

Required Documentation Not Received to Support Second Presentment ..............384

Acquirer Reference Data (ARD) Does Not Match or is Invalid ................................... 389

Change of Chargeback Reason to a No Cardholder Authorization Chargeback.... 393

Questionable Merchant Activity ........................................................................................... 398

Invalid Second Presentment............................................................................................. 398

Documentation Received with Second Presentment was Illegible or Scanning

Error.......................................................................................................................................403

Required Documentation Not Received to Support Second Presentment...............407

Acquirer Reference Data (ARD) Does Not Match or is Invalid.................................... 412

Change of Chargeback Reason to a Questionable Merchant Chargeback..............417

Chip Liability Shift....................................................................................................................421

Invalid Second Presentment............................................................................................. 421

Documentation Received with Second Presentment was Illegible or Scanning

Error.......................................................................................................................................426

Required Documentation Not Received to Support Second Presentment...............431

Acquirer Reference Data (ARD) Does Not Match or is Invalid.................................... 436

Chip Liability - Lost/Stolen/Never Received Issue (NRI) Fraud........................................441

Invalid Second Presentment............................................................................................. 441

Documentation Received with Second Presentment was Illegible or Scanning

Error.......................................................................................................................................446

Required Documentation Not Received to Support Second Presentment ..............451

Contents

©

2024 Mastercard. Proprietary. All rights reserved.

Chargeback Guide Merchant Edition— • 30 April 2024

10

Acquirer Reference Data (ARD) Does Not Match or is Invalid.................................... 456

Point-of-Interaction Error.......................................................................................................461

Transaction Amount Differs (Gratuity Disputes Only).................................................461

ATM Disputes.......................................................................................................................466

ATM Dispute-Required Second Presentment Supporting Documentation Not

Received (Europe Issuers only)..........................................................................................473

Invalid Second Presentment............................................................................................. 478

Documentation Received with Second Presentment was Illegible or Scanning

Error.......................................................................................................................................483

Required Documentation Not Received to Support Second Presentment...............487

Acquirer Reference Data (ARD) Does Not Match or is Invalid.................................... 492

Change of Chargeback Reason to a Point-of-Interaction (POI) Error Chargeback496

Mastercard Review Process...............................................................................................................500

Appeals..................................................................................................................................................500

Time Frames...................................................................................................................................500

How to File an Appeal...................................................................................................................500

Appeal Review Process............................................................................................................501

Chapter 6: Domestic South Africa Disputes.................................................................. 502

Overview...............................................................................................................................................504

Domestic Transaction.........................................................................................................................504

Adjustments Initiated on or after 8 January 2024....................................................................... 504

Correct a Terminal Malfunction...................................................................................................504

Acquirer submission of a pre-compliance case.........................................................................504

Issuer Response to the Pre-Compliance Case...........................................................................505

Disputes Initiated on or before 7 January 2024............................................................................505

Acquirer submission of a second presentment pre-compliance case................................... 505

Issuer Response to the Pre-Compliance Case...........................................................................508

Acquirer Escalation to a Compliance Case................................................................................508

Issuer Response to the Compliance Case..................................................................................508

Disputes Initiated on or after 8 January 2024.............................................................................. 509

Cash Dispute-ATM Only................................................................................................................509

Issuer submission of a pre-compliance case........................................................................509

Acquirer Response to the Pre-Compliance Case.................................................................510

Issuer Escalation to a Compliance Case...............................................................................511

Acquirer Response to the Compliance Case........................................................................512

Transaction Amount Differs.........................................................................................................512

Issuer submission of a pre-compliance case........................................................................512

Acquirer Response to the Pre-Compliance Case.................................................................513

Issuer Escalation to a Compliance Case...............................................................................514

Acquirer Response to the Compliance Case........................................................................514

Duplicate Transaction...................................................................................................................515

Contents

©

2024 Mastercard. Proprietary. All rights reserved.

Chargeback Guide Merchant Edition— • 30 April 2024

11

Issuer submission of a pre-compliance case........................................................................515

Acquirer Response to the Pre-Compliance Case.................................................................516

Issuer Escalation to a Compliance Case...............................................................................516

Acquirer Response to the Compliance Case........................................................................517

No Cardholder Authorization.......................................................................................................517

Issuer submission of a pre-compliance case........................................................................518

Acquirer Response to the Pre-Compliance Case.................................................................518

Issuer Escalation to a Compliance Case...............................................................................519

Acquirer Response to the Compliance Case........................................................................520

Credit Not Received.......................................................................................................................520

Issuer submission of a pre-compliance case........................................................................521

Acquirer Response to the Pre-Compliance Case.................................................................522

Issuer Escalation to a Compliance Case...............................................................................523

Acquirer Response to the Compliance Case........................................................................524

Goods or Services Not Provided..................................................................................................525

Issuer submission of a pre-compliance case........................................................................525

Acquirer Response to the Pre-Compliance Case.................................................................527

Issuer Escalation to a Compliance Case...............................................................................527

Acquirer Response to the Compliance Case........................................................................529

Late Presentment..........................................................................................................................529

Issuer submission of a pre-compliance case........................................................................529

Acquirer Response to the Pre-Compliance Case.................................................................530

Issuer Escalation to a Compliance Case...............................................................................531

Acquirer Response to the Compliance Case........................................................................531

Invalid Adjustment-Account Closed............................................................................................532

Issuer submission of a pre-compliance case........................................................................532

Acquirer Response to the Pre-Compliance Case.................................................................532

Issuer Escalation to a Compliance Case...............................................................................533

Acquirer Response to the Compliance Case........................................................................533

Invalid Adjustment-Insufficient Funds....................................................................................... 534

Issuer submission of a pre-compliance case........................................................................534

Acquirer Response to the Pre-Compliance Case.................................................................534

Issuer Escalation to a Compliance Case...............................................................................535

Acquirer Response to the Compliance Case........................................................................535

Mastercard Review Process...............................................................................................................536

Appeals..................................................................................................................................................536

Appeal Review Process.......................................................................................................................537

Chapter 7: Compliance Case Filing.......................................................................................538

Overview...............................................................................................................................................539

Processing Platform............................................................................................................................540

Compliance Case Processing.............................................................................................................542

Contents

©

2024 Mastercard. Proprietary. All rights reserved.

Chargeback Guide Merchant Edition— • 30 April 2024

12

Timeframes and Requirements.........................................................................................................544

Case Filing Requirements...................................................................................................................545

Missing, Invalid, or Inaccurate Authorization Data..................................................................545

Inaccurate Clearing Data That Restricts Chargeback Cycles................................................547

Valid Chargeback Exceeding System Availability.....................................................................550

Invalid Subsequent First Presentment.......................................................................................552

Same Day Processing of Chargeback Reversal and Second Presentment..........................554

Fee Collection/1740 Message.....................................................................................................556

ATM Dynamic Currency Conversion............................................................................................557

Merchant Not Listed or Improperly Listed on MATCH............................................................ 560

Unspent Gift Card Funds..............................................................................................................562

Acquirer Request for Cardholder Statement of Fraud........................................................... 564

Refund Transactions and Corrections........................................................................................566

MoneySend Originating Institution.............................................................................................569

MoneySend Receiving Institution or Payment Transactions.................................................. 571

Invalid Return of Processed Adjustment (Mainland China Domestic Only)........................ 574

Interchange Discrepancy (Non—Brazil Domestic)....................................................................575

All Other Rules Violations - Third-Party Processed Transactions.......................................... 578

All Other Rules Violations............................................................................................................. 580

Mastercard Review Process...............................................................................................................581

Appeals..................................................................................................................................................582

Time Frames...................................................................................................................................582

How to File an Appeal...................................................................................................................582

Appeal Review Process..................................................................................................................583

Chapter 8: Mastercard Merchant Presented QR........................................................584

Overview...............................................................................................................................................585

How to File, and Respond to, Disputes through the Compliance Case Filing Process............585

Dispute Reasons..................................................................................................................................587

Goods or Services were Either not as Described or Defective...............................................587

Pre-Compliance Case.............................................................................................................. 587

Compliance Case......................................................................................................................589

Goods or Services were not Provided.........................................................................................590

Pre-Compliance Case.............................................................................................................. 590

Compliance Case......................................................................................................................594

Credit not Processed.....................................................................................................................597

Pre-Compliance Case.............................................................................................................. 597

Compliance Case......................................................................................................................600

Paid by Other Means.....................................................................................................................602

Pre-Compliance Case.............................................................................................................. 602

Compliance Case......................................................................................................................603

Billed an Incorrect Amount...........................................................................................................605

Contents

©

2024 Mastercard. Proprietary. All rights reserved.

Chargeback Guide Merchant Edition— • 30 April 2024

13

Pre-Compliance Case.............................................................................................................. 605

Compliance Case......................................................................................................................606

Duplicate Transaction...................................................................................................................607

Pre-Compliance Case.............................................................................................................. 607

Compliance Case......................................................................................................................609

Chapter 9: Chargebacks-Mastercard Europe ATM Transactions

(Mastercard, Maestro, and Cirrus)........................................................................................611

Overview...............................................................................................................................................613

Clearing.................................................................................................................................................613

Processing Cycles.................................................................................................................................613

Processing Cycle for ATM Transactions......................................................................................613

Presentment...................................................................................................................................614

Reversals....................................................................................................................................614

Chargebacks...................................................................................................................................615

Second Presentment.....................................................................................................................615

Chip Transactions...........................................................................................................................616

Message Reason Codes......................................................................................................................616

Message Reason Code 4804-Multiple Processing....................................................................617

Proper Use of Message Reason Code 4804.........................................................................617

Improper Use of Second Presentment................................................................................. 617

Message Reason Code 4808-Transaction Not Authorized.....................................................617

Proper Use of Message Reason Code 4808.........................................................................618

Proper Use for Issuer’s First Chargeback.............................................................................618

Proper Use for Acquirer’s Second Presentment..................................................................618

Expired Payment Guarantee.............................................................................................618

Transaction Authorized......................................................................................................619

Message Reason Code 4809-Transaction Not Reconciled......................................................619

Proper Use of Message Reason Code 4809.........................................................................619

Improper Use of Acquirer’s Second Presentment...............................................................620

Message Reason Code 4811-Stale Transaction.......................................................................620

Proper Use of Message Reason Code 4811.........................................................................620

Improper Use of Acquirer’s Second Presentment...............................................................620

Message Reason Code 4834-Duplicate Processing of Transaction......................................620

Proper Use of Message Reason Code 4834.........................................................................620

Proper Use for Issuer’s First Chargeback.............................................................................620

Proper Use for Acquirer’s Second Presentment..................................................................621

Transaction Authorized (For Intra-European and Inter-European Transactions

Only)......................................................................................................................................621

Credit Previously Issued (For Intra-European and Inter-European Transactions

Only)......................................................................................................................................621

Chargeback Remedied.......................................................................................................621

Contents

©

2024 Mastercard. Proprietary. All rights reserved.

Chargeback Guide Merchant Edition— • 30 April 2024

14

Invalid Data Record.............................................................................................................622

Message Reason Code 4842-Late Presentment..................................................................... 622

Proper Use of Message Reason Code 4842.........................................................................622

Proper Use for Issuer’s First Chargeback.............................................................................622

Improper Use for Issuer’s First Chargeback.........................................................................622

Proper Use for Acquirer’s Second Presentment..................................................................623

Correct Transaction Date Provided................................................................................. 623

Account not Permanently Closed.....................................................................................623

Message Reason Code 4846-Currency Errors.......................................................................... 623

Proper Use for Issuer’s First Chargeback.............................................................................623

Second Presentment............................................................................................................... 625

Message Reason Code 4859-ATM Dispute............................................................................... 625

Proper Use of Message Reason Code 4859.........................................................................625

Improper Use of Message Reason Code 4859.................................................................... 625

Proper Use for Issuer’s First Chargeback.............................................................................626

Proper Use For Acquirer’s Second Presentment.................................................................626

Message Reason Code 4870-Chip Liability Shift.....................................................................628

Proper Use of Message Reason Code 4870.........................................................................628

Improper Use of Message Reason Code 4870.................................................................... 629

Proper Use for Issuer’s First Chargeback.............................................................................630

Proper Use for Acquirer’s Second Presentment..................................................................630

Chargeback Invalid............................................................................................................. 630

Fraud-related Chargeback Counter Exceeds Threshold.............................................. 631

Message Reason Code 4880-Late Presentment..................................................................... 631

Proper Use of Intra-European or Inter-European Message Reason Code 4880........... 631

Improper Use for Issuer’s First Chargeback.........................................................................631

Proper Use for Acquirer’s Second Presentment..................................................................632

Chapter 10: Chargebacks-Maestro POS Transactions............................................633

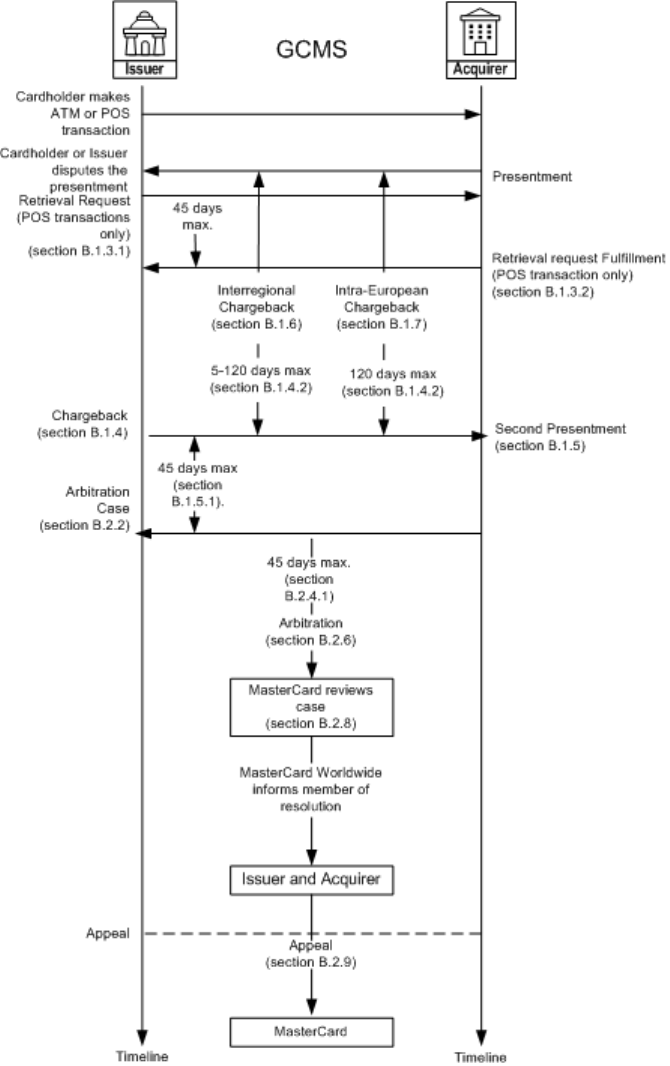

Overview...............................................................................................................................................637

Exception Item Processing.................................................................................................................639

Exception Transaction Types........................................................................................................639

Reversals..........................................................................................................................................639

Retrieval Requests......................................................................................................................... 639

Acquirer Requirements............................................................................................................ 639

Chip Transactions...........................................................................................................................640

Chargebacks...................................................................................................................................640

Chargeback Procedures.......................................................................................................... 640

Supporting Documentation for a Chargeback................................................................... 640

Second Presentment Procedures................................................................................................641

Supporting Documentation for a Second Presentment................................................... 641

Message Reason Codes for Interregional Transactions................................................................642

Contents

©

2024 Mastercard. Proprietary. All rights reserved.

Chargeback Guide Merchant Edition— • 30 April 2024

15

Interregional Message Reason Code 4804-Transaction Multiple Processing......................643

Proper Use of Interregional Message Reason Code 4804.................................................643

Improper Use for Acquirer’s Second Presentment............................................................. 643

Interregional Message Reason Code 4809-Transaction Not Reconciled .............................643

Proper Use of Interregional Message Reason Code 4809.................................................643

Improper Use for Acquirer’s Second Presentment............................................................. 643

Interregional Message Reason Code 4811-Stale Transaction...............................................643

Proper Use of Interregional Message Reason Code 4811.................................................643

Improper Use of Acquirer’s Second Presentment...............................................................643

Interregional Message Reason Code 4831-Disputed Amount.............................................. 643

Proper Use of Interregional Message Reason Code 4831.................................................643

Proper Use for Issuer’s First Chargeback.............................................................................644

Proper Use for Acquirer’s Second Presentment..................................................................644

Interregional Message Reason Code 4834-Duplicate Transaction ......................................644

Proper Use of Interregional Message Reason Code 4834.................................................644

Proper Use for Issuer’s First Chargeback.............................................................................644

Proper Use for Acquirer’s Second Presentment..................................................................644

Interregional Message Reason Code 4837-No Cardholder Authorization.......................... 645

Proper Use of Interregional Message Reason Code 4837.................................................645

Improper Use of Interregional Message Reason Code 4837............................................ 645

Proper Use for Acquirer’s Second Presentment..................................................................646

Invalid Chargeback............................................................................................................. 646

Two or More Previous Fraud-related Chargebacks.......................................................646

Fraud-related Chargeback Counter Exceeds Threshold.............................................. 647

Interregional Message Reason Code 4855-Goods or Services Not Delivered.....................647

Proper Use of Interregional Message Reason Code 4855.................................................647

Improper Use for Issuer’s First Chargeback.........................................................................648

Travel/Entertainment Services Not Provided/Not as Described and Merchant

Voucher Issued.......................................................................................................................... 649

Proper Use for Acquirer’s Second Presentment..................................................................650