This document comprises a prospectus for the purposes of Article 6 of Regulation (EU) 2017/1129 (as it forms part of retained

European Union (“EU”) law as defined in the European Union (Withdrawal) Act 2018) (the “Prospectus Regulation”), relating to

Haleon plc (the “Company” and together with its subsidiaries, the “Group”) and has been approved by the Financial Conduct

Authority of the United Kingdom (“FCA”), as competent authority under the Prospectus Regulation, in accordance with section

87A of the Financial Services and Markets Act 2000 of England and Wales, as amended (“FSMA”), and prepared and made

available to the public in accordance with the Prospectus Regulation Rules of the FCA made under section 73A of FSMA (the

“Prospectus Regulation Rules”). The FCA only approves this Prospectus as meeting the standards of completeness,

comprehensibility and consistency imposed by the Prospectus Regulation and such approval should not be considered as an

endorsement of the issuer that is, or the quality of the securities that are, the subject of this Prospectus. Investors should make

their own assessment as to the suitability of investing in the securities. This Prospectus is not an offer or invitation to the public to

subscribe for or purchase fully paid ordinary shares in the capital of the Company (“Haleon Shares”) but is issued solely in

connection with the admission of Haleon Shares to the premium listing segment of the Official List of the FCA and to the London

Stock Exchange’s main market for listed securities (“Admission”). It is proposed that Admission will take place shortly following

the Demerger and, unless the context requires otherwise, this Prospectus has been prepared on the assumption that the

Demerger Resolution will be passed at the GSK General Meeting and that the Demerger will become effective as proposed.

Application will be made to the FCA for all Haleon Shares to be admitted to the premium listing segment of the Official List of the

FCA and to the London Stock Exchange for Haleon Shares to be admitted to trading on the London Stock Exchange’s main

market for listed securities. It is expected that Admission will become effective, and that dealings in Haleon Shares will

commence on the London Stock Exchange, at 8.00 a.m. on 18 July 2022 (International Security Identification Number:

GB00BMX86B70).

This Prospectus is issued solely in connection with Admission. This Prospectus does not constitute or form part of an

offer or invitation to sell or issue, or any solicitation of an offer to purchase or subscribe for, any securities by any

person. No offer of Haleon Shares is being made in any jurisdiction.

This Prospectus should be read in its entirety. In particular, investors should take account of the section entitled “Risk Factors”

which contains a discussion of certain risks relating to the business of the Company. Investors should not solely rely on the

information summarised in the section entitled “Summary”.

(incorporated in England and Wales under the Companies Act 2006 with registered number 13691224)

Introduction to the premium listing segment of the Official List and

admission to trading on the main market of the London Stock Exchange

Joint Sponsors

Citigroup Global Markets Limited

Goldman Sachs International

Merrill Lynch International

Citigroup Global Markets Limited (“Citi”), which is authorised by the Prudential Regulation Authority and regulated in the United

Kingdom by the Prudential Regulation Authority and the Financial Conduct Authority, is acting exclusively for the Company and

no one else in connection with Admission and the Demerger and it will not regard any other person (whether or not a recipient of

this Prospectus) as a client in relation to Admission or the Demerger and will not be responsible to anyone other than the

Company for providing the protections afforded to its clients or for providing advice in relation to Admission or the Demerger or

any other transaction, matter, or arrangement referred to in this Prospectus.

Apart from the responsibilities and liabilities, if any, which may be imposed on Citi by FSMA or the regulatory regime established

thereunder or under the regulatory regime of any other applicable jurisdiction where exclusion of liability under the relevant

regulatory regime would be illegal, void or unenforceable, neither Citi nor any of its affiliates accepts any responsibility

whatsoever for the contents of this Prospectus including its accuracy, completeness and verification or for any other statement

made or purported to be made by it, or on its behalf, in connection with the Company or its subsidiaries, Haleon Shares or

Admission or the Demerger. Citi and its affiliates accordingly disclaim, to the fullest extent permitted by applicable law, all and

any liability whether arising in tort, contract or otherwise (save as referred to above) which they might otherwise be found to have

in respect of this Prospectus or any such statement. No representation or warranty, express or implied, is made by Citi or any of

its affiliates as to the accuracy, completeness, verification or sufficiency of the information set out in this Prospectus, and nothing

in this Prospectus will be relied upon as a promise or representation in this respect, whether or not to the past or future.

Goldman Sachs International (“Goldman Sachs”), which is authorised by the Prudential Regulation Authority and regulated in

the United Kingdom by the Prudential Regulation Authority and the Financial Conduct Authority, is acting exclusively for the

Company and no one else in connection with Admission and the Demerger and it will not regard any other person (whether or

not a recipient of this Prospectus) as a client in relation to Admission or the Demerger and will not be responsible to anyone

other than the Company for providing the protections afforded to its clients or for providing advice in relation to Admission or the

Demerger or any other transaction, matter, or arrangement referred to in this Prospectus.

Apart from the responsibilities and liabilities, if any, which may be imposed on Goldman Sachs by FSMA or the regulatory regime

established thereunder or under the regulatory regime of any other applicable jurisdiction where exclusion of liability under the

relevant regulatory regime would be illegal, void or unenforceable, neither Goldman Sachs nor any of its affiliates accepts any

responsibility whatsoever for the contents of this Prospectus including its accuracy, completeness and verification or for any

other statement made or purported to be made by it, or on its behalf, in connection with the Company or its subsidiaries, Haleon

Shares or Admission or the Demerger. Goldman Sachs and its affiliates accordingly disclaim, to the fullest extent permitted by

applicable law, all and any liability whether arising in tort, contract or otherwise (save as referred to above) which they might

otherwise be found to have in respect of this Prospectus or any such statement. No representation or warranty, express or

implied, is made by Goldman Sachs or any of its affiliates as to the accuracy, completeness, verification or sufficiency of the

information set out in this Prospectus, and nothing in this Prospectus will be relied upon as a promise or representation in this

respect, whether or not to the past or future.

Merrill Lynch International (“BofA Securities”), which is authorised by the Prudential Regulation Authority and regulated in the

United Kingdom by the Prudential Regulation Authority and the Financial Conduct Authority, is acting exclusively for the

Company and no one else in connection with Admission and the Demerger and it will not regard any other person (whether or

not a recipient of this Prospectus) as a client in relation to Admission or the Demerger and will not be responsible to anyone

other than the Company for providing the protections afforded to its clients or for providing advice in relation to Admission or the

Demerger or any other transaction, matter, or arrangement referred to in this Prospectus.

Apart from the responsibilities and liabilities, if any, which may be imposed on BofA Securities by FSMA or the regulatory regime

established thereunder or under the regulatory regime of any other applicable jurisdiction where exclusion of liability under the

relevant regulatory regime would be illegal, void or unenforceable, neither BofA Securities nor any of its affiliates accepts any

responsibility whatsoever for the contents of this Prospectus including its accuracy, completeness and verification or for any

other statement made or purported to be made by it, or on its behalf, in connection with the Company or its subsidiaries, Haleon

Shares or Admission or the Demerger. BofA Securities and its affiliates accordingly disclaim, to the fullest extent permitted by

applicable law, all and any liability whether arising in tort, contract or otherwise (save as referred to above) which they might

otherwise be found to have in respect of this Prospectus or any such statement. No representation or warranty, express or

implied, is made by BofA Securities or any of its affiliates as to the accuracy, completeness, verification or sufficiency of the

information set out in this Prospectus, and nothing in this Prospectus will be relied upon as a promise or representation in this

respect, whether or not to the past or future.

The distribution of this Prospectus in certain jurisdictions may be restricted by law and therefore persons into whose possession

this Prospectus comes should inform themselves about and observe any such restrictions in relation to Haleon Shares or this

Prospectus, including those in the paragraphs that follow. Any failure to comply with these restrictions may constitute a violation

of the securities laws of any such jurisdiction. Except in the United Kingdom, no action has been taken or will be taken in any

jurisdiction that would permit possession or distribution of this Prospectus in any country or jurisdiction where action for that

purpose is required. Accordingly, this Prospectus may not be distributed or published in any jurisdiction where to do so would

breach any securities laws or regulations of any such jurisdiction or give rise to an obligation to obtain any consent, approval or

permission, or to make any application, filing or registration. Failure to comply with these restrictions may constitute a violation of

the securities laws or regulations of such jurisdictions.

Australia

This document and the offer of Haleon Shares are only made available in Australia to persons to whom an offer of securities can

be made without disclosure in accordance with applicable exemptions under the Australian Corporations Act 2001 (Cth) as

modified by ASIC Instrument 22-0413 (the “Corporations Act”). This document is not a prospectus, product disclosure

statement or any other formal “disclosure document” for the purposes of Australian law and is not required to, and does not,

contain all the information which would be required in a “disclosure document” under Australian law. This document has not been

and will not be lodged or registered with the Australian Securities & Investments Commission or the Australian Securities

Exchange and the Company is not subject to the continuous disclosure requirements that apply in Australia.

Nothing in this document should be construed as legal, business or tax advice nor as financial product advice for the purposes of

Chapter 7 of the Corporations Act. Australia resident shareholders should be aware that the offer of Haleon Shares for resale in

Australia within 12 months of their issue may, under section 707(3) of the Corporations Act, require disclosure to investors under

Part 6D.2 of the Corporations Act if none of the exemptions in section 708 of the Corporations Act apply to the re-sale.

Canada

The Haleon Shares to be delivered to Shareholders resident in Canada have not been qualified for distribution to the public in

Canada and may not be resold in Canada except pursuant to a prospectus filed with the relevant Canadian securities regulatory

authorities, or under an exemption from the prospectus requirements of applicable Canadian securities laws. No securities

commission in Canada has reviewed this document or the merits of the Demerger. Haleon is not a reporting issuer in any

province or territory of Canada and the Haleon Shares are not listed on any stock exchange in Canada, and there is currently no

public market for the Haleon Shares in Canada. Shareholders resident in Canada should consult their own advisors prior to any

resale of the Haleon Shares they receive in connection with the Demerger.

China

This document does not constitute a public offer of the Haleon Shares, whether by sale or subscription, in the People’s Republic

of China (the “PRC”). The Haleon Shares are not being offered or sold directly or indirectly in the PRC to or for the benefits of

legal or natural persons of the PRC.

Further, no legal or natural persons of the PRC may directly or indirectly purchase any of the Haleon Shares or any beneficial

interest therein without obtaining all prior PRC’s governmental approvals that are required, whether statutorily or otherwise.

Persons who come into possession of this document are required by the Company and its representatives to observe these

restrictions.

2

Hong Kong

The contents of this document have not been reviewed or approved by any regulatory authority in Hong Kong. You are advised

to exercise caution in relation to the delivery of the Haleon Shares. If you are in any doubt about any of the contents of this

document, you should obtain independent professional advice.

The Haleon Shares may not be offered or sold by means of any document other than (i) in circumstances which do not constitute

an offer to the public within the meaning of the Companies (Winding Up and Miscellaneous Provisions) Ordinance (Cap.32, Laws

of Hong Kong), or (ii) to “professional investors” within the meaning of the Securities and Futures Ordinance (Cap.571, Laws of

Hong Kong) and any rules made thereunder, or (iii) in other circumstances which do not result in the document being a

“prospectus” within the meaning of the Companies (Winding Up and Miscellaneous Provisions) Ordinance (Cap.32, Laws of

Hong Kong), and no advertisement, invitation or document relating to the Haleon Shares may be issued or may be in the

possession of any person for the purpose of issue (in each case whether in Hong Kong or elsewhere), which is directed at, or the

contents of which are likely to be accessed or read by, the public in Hong Kong (except if permitted to do so under the laws of

Hong Kong) other than with respect to Haleon Shares which are or are intended to be disposed of only to persons outside Hong

Kong or only to “professional investors” within the meaning of the Securities and Futures Ordinance (Cap. 571, Laws of Hong

Kong) and any rules made thereunder.

This document is confidential to the person to whom it is addressed and no person to whom a copy of this document is issued

may issue, circulate, distribute, publish, reproduce or disclose (in whole or in part) this document to any other person in Hong

Kong without the consent of GSK.

New Zealand

The Haleon Shares are not being offered to the public within New Zealand. In New Zealand, the Haleon Shares are being issued

only to existing security holders of GSK with registered addresses in New Zealand in reliance on the Financial Markets Conduct

(Haleon plc) Exemption Notice 2022.

This document has been prepared in compliance with the laws of the United Kingdom. This document is not a product disclosure

statement under the Financial Markets Conduct Act 2013 (the “FMC Act”) or other similar offering or disclosure document under

New Zealand law and has not been registered, filed with, or approved by any New Zealand regulatory authority or under or in

accordance with the FMC Act or any other relevant law in New Zealand. It does not contain all the information that a product

disclosure document, under New Zealand law, is required to contain.

Singapore

The offer of the Haleon Shares is made only to and directed at, and the Haleon Shares are only available to, persons in

Singapore who are existing Shareholders of the Company.

This document has not been registered as a prospectus with the Monetary Authority of Singapore. Accordingly, this document

and any other document or material in connection with the offer or sale, or invitation for subscription or purchase, of the Haleon

Shares may not be circulated or distributed, nor may the Haleon Shares be offered or sold, or be made the subject of an

invitation for subscription or purchase, whether directly or indirectly, to persons in Singapore other than: (i) to existing

Shareholders of the Company under Section 273(1)(cd)(i) of the Securities and Futures Act, 2001 of Singapore (the “SFA”); or

(ii) otherwise pursuant to, and in accordance with the conditions of, any other applicable provision of the SFA.

Switzerland

This document does not constitute a prospectus pursuant to the Swiss Financial Services Act (“FinSA”). No application has or

will be made to admit the shares to trading on any trading venue (exchange or multilateral trading facility) in Switzerland. This

document is distributed in Switzerland only relying on the exemption of article 37(1)(e) FinSA provided for demergers and only

together with the GSK Shareholder Circular.

The Company intends to file with the U.S. Securities and Exchange Commission (the “SEC”) a registration statement on Form

20-F (the “Form 20-F”) under the U.S. Securities Exchange Act of 1934, as amended (the “US Exchange Act”), with respect to

the American depositary shares each representing 2 Haleon Shares (the “Haleon ADSs”). This Prospectus does not contain all

the information included in the Form 20-F. For further information with respect to the Haleon ADSs, please refer to the Form

20-F. The Company also intends to make an application to the New York Stock Exchange (the “NYSE”) for the Haleon ADSs to

be admitted to listing and trading on the NYSE.

This Prospectus is dated 1 June 2022.

3

TABLE OF CONTENTS

SUMMARY 5

EXPECTED TIMETABLE OF PRINCIPAL EVENTS 16

RISK FACTORS 17

PRESENTATION OF FINANCIAL AND OTHER INFORMATION 46

DIRECTORS, COMPANY SECRETARY, REGISTERED OFFICE AND ADVISERS 57

PART I KEY HIGHLIGHTS AND DEVELOPMENT OF THE GROUP 59

PART II MARKET OVERVIEW 65

PART III BUSINESS OVERVIEW 71

PART IV OVERVIEW OF THE DEMERGER AND SEPARATION 115

PART V DIRECTORS, SENIOR MANAGERS, CORPORATE GOVERNANCE AND

REMUNERATION

120

PART VI SELECTED FINANCIAL INFORMATION 131

PART VII OPERATING AND FINANCIAL REVIEW 147

PART VIII CAPITALISATION AND INDEBTEDNESS 208

PART IX UNAUDITED PRO FORMA FINANCIAL INFORMATION OF THE GROUP 210

PART X REGULATORY OVERVIEW 218

PART XI TAXATION 235

PART XII ADDITIONAL INFORMATION 242

SCHEDULE I DEFINITIONS AND GLOSSARY 320

SCHEDULE II HISTORICAL FINANCIAL INFORMATION OF GLAXOSMITHKLINE

CONSUMER HEALTHCARE HOLDINGS (NO.2) LIMITED

334

SCHEDULE III PFIZER HISTORICAL FINANCIAL INFORMATION 422

4

SUMMARY

1. INTRODUCTION AND WARNINGS

1.1 Details of the issuer

The issuer is Haleon plc (the “Company”), a public limited company incorporated in England

and Wales with registered number 13691224.

The Company’s registered and head office is at 980 Great West Road, Brentford, Middlesex TW8

9GS, United Kingdom. The telephone number of the Company’s registered office is

+44 (0)20 8047 5000 and the legal entity identifier of the Company is 549300PSB3WWEODCUP19.

1.2 Details of the securities

On Admission, the Haleon Shares will be registered with an ISIN of GB00BMX86B70 and

SEDOL of BMX86B7. It is expected that the Haleon Shares will be traded on the main market

for listed securities of the London Stock Exchange under the ticker symbol “HLN”.

1.3 Identity and contact details of the competent authority approving this Prospectus

This Prospectus has been approved by the FCA, as competent authority, with its head office at

12 Endeavour Square, London E20 1JN and telephone number: +44 (0)20 7066 1000, in

accordance with the Prospectus Regulation.

This Prospectus was approved by the FCA on 1 June 2022.

1.4 Warnings

This summary has been prepared in accordance with Article 7 of the Prospectus Regulation

and should be read as an introduction to this Prospectus. Any decision to invest in the Haleon

Shares should be based on consideration of the Prospectus as a whole by the investor. Any

investor could lose all or part of their invested capital and, where any investor’s liability is not

limited to the amount of the investment, it could lose more than the invested capital.

Civil liability attaches only to those persons who have tabled the summary, including any

translation thereof, but only if the summary is misleading, inaccurate or inconsistent when read

together with the other parts of the Prospectus or if it does not provide, when read together

with the other parts of the Prospectus, key information in order to aid investors when

considering whether to invest in the Haleon Shares.

2. KEY INFORMATION ON THE ISSUER

2.1 Who is the issuer of the securities?

The Company was incorporated in England and Wales on 20 October 2021 as DRVW 2022

Limited with registered number 13691224. DRVW 2022 Limited was re-registered as a public

limited company (DRVW 2022 plc) on 23 February 2022 and changed its name to Haleon plc

on 28 February 2022. The Company is domiciled in England and Wales and its legal entity

identifier is 549300PSB3WWEODCUP19.

(A) Principal activity

Following the Demerger, the principal activity of the Company will be to act as the ultimate

holding company of the Group. The principal legislation under which the Company operates is

the Companies Act and regulations made thereunder.

5

(B) Major shareholders

The Company was incorporated in anticipation of the Demerger, and is not a member of the

GSK Group. As at the date of this Prospectus, the entire issued share capital of the Company

is held and controlled by David Redfern, Adam Walker, Victoria Whyte and Subesh Williams,

who each hold four fully paid ordinary shares of £1.25 in the capital of the Company.

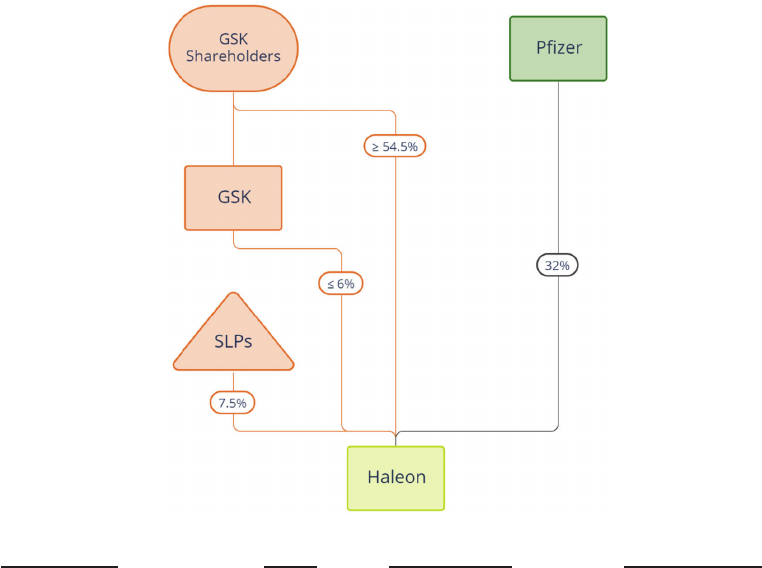

As at the Latest Practicable Date, and so far as is known to the Company by virtue of the

notifications made to GSK plc pursuant to the Companies Act, the Market Abuse Regulation

and/or the Disclosure Guidance and Transparency Rules, as a result of the Demerger and the

Share Exchanges, the following will, on Admission, be directly or indirectly interested in

3 per cent. or more of the Company’s issued share capital:

Name of shareholder Percentage of total voting rights

Pfizer 32

GSK Up to 6

SLP1* 4.74

BlackRock, Inc.** 3.60

* The other SLPs, being SLP2 and SLP3, will each have a less than 3 per cent. holding in the

Company on Admission so are not included in this table.

**BlackRock, Inc. is included in this table on the basis of its major shareholding in GSK of 6.40

per cent. (as at the date of notification to GSK).

(C) Key managing directors

The Executive Directors of the Company are:

Director Position

Brian McNamara Chief Executive Officer

Tobias Hestler Chief Financial Officer

(D) Statutory auditor

The auditor of GlaxoSmithKline Consumer Healthcare Holdings (No.2) Limited since the date

of its incorporation has been Deloitte, whose registered office is at 1 New Street Square,

London, EC4A 3HQ. Deloitte is registered to carry out audit work in the United Kingdom by the

Institute of Chartered Accountants in England and Wales. Deloitte has audited the statutory

consolidated annual accounts of GlaxoSmithKline Consumer Healthcare Holdings (No.2)

Limited as at and for the years ended 31 December 2021, 2020 and 2019.

The Company was incorporated on 20 October 2021. On 3 February 2022, the Company

appointed Deloitte as its UK statutory auditor for the year ending 31 December 2022.

In connection with the Company’s registration of securities under the U.S. Securities Exchange

Act of 1934, on 24 March 2022, the Company appointed KPMG LLP to audit the Company’s

financial statements for the year ending 31 December 2022 under the rules of the SEC and

U.S. Public Company Accounting Oversight Board (PCAOB).

The Company expects to conduct an audit tender process for the audit of the Company’s

financial statements for the year ending 31 December 2023, which would be subject to

shareholder approval at the Company’s 2023 annual general meeting.

6

2.2 What is the key financial information regarding the issuer?

Selected historical key financial information

The tables below set out selected key financial information for the Group for the financial years

ended 31 December 2021, 2020 and 2019 and for the three months ended 31 March 2022 and

31 March 2021:

Unaudited consolidated income statement

For the three months ended 31 March 2022 and 31 March 2021 2022 2021

£m £m

Revenue 2,627 2,306

Cost of sales (1,014) (904)

Gross Profit 1,613 1,402

Selling, general and administration (1,086) (1,009)

Research and development (64) (54)

Other operating income 3 9

Operating profit 466 348

Finance income 76

Finance expense (8) (4)

Net finance (costs)/income (1) 2

Profit before tax 465 350

Income tax (108) (101)

Profit after tax for the quarter 357 249

Profit attributable to shareholders 343 233

Profit attributable to non-controlling interests 14 16

Basic earnings per share (pence)

1

34,300 23,300

Diluted earnings per share (pence)

1

34,300 23,300

1

The number of shares in issue above is not representative of the number of shares in issue

in the future. For further detail, please see Note 15 of Schedule II (Historical Financial

Information of GlaxoSmithKline Consumer Healthcare Holdings (No.2) Limited).

7

Consolidated balance sheet

As at 31 March 2022 and 31 March 2021 31 March 2022 31 December 2021

£m

(unaudited)

£m

(audited)

Non-current assets

Property, plant and equipment 1,587 1,563

Right of use assets 100 99

Intangible assets 27,692 27,195

Deferred tax assets 314 312

Post-employment benefit assets 11 11

Derivative financial instruments 8 12

Other non-current assets 13 8

Total non-current assets 29,725 29,200

Current assets

Inventories 986 951

Trade and other receivables 2,415 2,207

Loan amounts owing from related parties 11,330 1,508

Cash and cash equivalents and liquid investments 383 414

Derivative financial instruments 18 5

Current tax recoverable 166 166

Total current assets 15,298 5,251

Total assets 45,023 34,451

Current liabilities

Short-term borrowings (80) (79)

Trade and other payables (3,142) (3,002)

Loan amounts owing to related parties (1,461) (825)

Derivative financial instruments (15) (18)

Current tax payable (242) (202)

Short-term provisions (86) (112)

Total current liabilities (5,026) (4,238)

Non-current liabilities

Long-term borrowings (9,363) (87)

Deferred tax liabilities (3,472) (3,357)

Pensions and other post-employment benefits (256) (253)

Derivative financial instruments (21) (1)

Other provisions (30) (27)

Other non-current liabilities (6) (8)

Total non-current liabilities (13,148) (3,733)

Total liabilities (18,174) (7,971)

Net assets 26,849 26,480

Equity

Share capital 11

Other reserves (11,502) (11,632)

Retained earnings 38,211 37,986

Shareholders’ equity 26,710 26,355

Non-controlling interests 139 125

Total equity 26,849 26,480

8

Consolidated income statement

For the years ended 31 December 2021, 31 December 2020 and 31 December 2019

£m 2021 2020 2019

Revenue 9,545 9,892 8,480

Cost of sales (3,595) (3,982) (3,678)

Gross Profit 5,950 5,910 4,802

Selling, general and administration (4,086) (4,220) (3,596)

Research and development (257) (304) (292)

Other operating income/(expense) 31 212 (17)

Operating profit 1,638 1,598 897

Finance income 17 20 24

Finance expense (19) (27) (35)

Net finance costs (2) (7) (11)

Profit before tax 1,636 1,591 886

Income tax (197) (410) (199)

Profit after tax 1,439 1,181 687

Profit attributable to shareholders 1,390 1,145 655

Profit attributable to non-controlling interests 49 36 32

Consolidated balance sheet

As at 31 December 2021, 31 December 2020 and 31 December 2019

£m 2021 2020 2019

Non-current assets 29,200 29,122 29,900

Current assets 5,251 5,008 5,811

Total Assets 34,451 34,130 35,711

Current liabilities (4,238) (4,014) (4,269)

Non-current liabilities (3,733) (3,893) (4,030)

Total liabilities (7,971) (7,907) (8,299)

Net assets 26,480 26,223 27,412

Consolidated cash flow statement

For the years ended 31 December 2021, 31 December 2020 and 31 December 2019

£m 2021 2020 2019

Cash flow from operating activities

Profit after tax 1,439 1,181 687

Adjustments reconciling profit after tax to cash generated from

operations 227 780 408

Cash generated from operations 1,666 1,961 1,095

Taxation paid (310) (554) (309)

Net cash inflow from operating activities 1,356 1,407 786

Net cash (outflow)/inflow from investing activities (33) 1,030 291

Net cash (outflow) from financing activities (1,236) (2,437) (925)

Increase in cash and bank overdrafts 87 - 152

Cash and bank overdrafts at the beginning of the year 323 329 191

Exchange adjustments (5) (6) (14)

Increase in cash and bank overdrafts 87 - 152

Cash and cash equivalents at end of year 405 323 329

(A) Selected pro forma key financial information

This Prospectus presents certain pro forma financial information for the Group to illustrate the

impact of the Notes Proceeds Loans, the receipt of related party loans, additional borrowings

and the payment of the Pre-Separation Dividends (together, the “Pro Forma Transactions”)

on the net assets of the Group as if the Pro Forma Transactions had taken place on 31 March

2022.

9

The unaudited pro forma statement of net assets of the Group has been prepared on the basis

of the unaudited interim financial information of the Group as at 31 March 2022, the date to

which the latest unaudited financial information in relation to the Group was prepared. The

unaudited pro forma statement of net assets of the Group has been prepared in accordance

with Annex 20 of the PR Regulation and pursuant to Listing Rule 13.3.3R in a manner

consistent with the accounting policies of the Company.

Because of its nature, the unaudited pro forma statement of net assets addresses a

hypothetical situation and, therefore, does not represent the Group’s actual financial position or

results. It may not, therefore, give a true picture of the Group’s financial position or results nor

is it indicative of the results that may, or may not, be expected to be achieved in the future. The

pro forma statement of net assets has been prepared for illustrative purposes only and in

accordance with Annex 20 of the PR Regulation.

Unaudited pro forma Statement of Net Assets

Pro forma adjustments related to the

Transactions

Group Net

Assets at 31

March 2022

Receipt of

Notes

Proceeds

Loans and

related party

loans

Additional

borrowings

Pre-Separation

Dividends

Transaction

costs

Unaudited

pro forma at

31 March

2022

£m

(Note 1)

£m

(Note 2)

£m

(Note 3)

£m

(Note 4)

£m

(Note 5)

£m

(Note 6)

Non-current Assets

Property, plant and equipment 1,587 - - - - 1,587

Right of use assets 100 - - - - 100

Intangible assets 27,692 - - - - 27,692

Deferred tax assets 314 - - - - 314

Post-employment benefit assets 11 - - - - 11

Derivative financial instruments 8 8

Other non-current assets 13 - - - - 13

Total non-current assets 29,725 - - - - 29,725

Current assets -

Inventories 986 - - - - 986

Trade and other receivables 2,415 - - - - 2,415

Loan amounts owing from related parties 11,330 (11,330) - - - -

Cash and cash equivalents and liquid

investments

383 9,869 1,435 (11,039) (84) 564

Derivative financial instruments 18 - - - - 18

Current tax recoverable 166 -

-

--166

Total current assets 15,298 (1,461) 1,435 (11,039) (84) 4,149

Total assets 45,023 (1,461) 1,435 (11,039) (84) 33,874

Current liabilities

Short-term borrowings (80) - - - - (80)

Trade and other payables (3,142) - - - - (3,142)

Loan amounts owing to related parties (1,461) 1,461 - - - -

Derivative financial instruments (15) - - - - (15)

Current tax payable (242) - - - - (242)

Short-term provisions (86) - - - - (86)

Total current liabilities (5,026) 1,461 - - - (3,565)

Non-current liabilities

Long-term borrowings (9,363) - (1,435) (25) - (10,823)

Deferred tax liabilities (3,472) - - - (3,472)

Pensions and other post-employment

benefits

(256) - - - (256)

Derivative financial instruments (21) (21)

Other provisions (30) - - - (30)

Other non-current liabilities (6) - - -

(6)

Total non-current liabilities (13,148) - (1,435) (25) - (14,608)

Total liabilities (18,174) 1,461 (1,435) (25) - (18,173)

Net assets 26,849 - -

(11,064) (84) 15,701

Notes

(1) The net assets of the Group as at 31 March 2022 have been extracted without material adjustment from the consolidation schedules

used to prepare the Interim Financial Information for the Group for the three months ended 31 March 2022 set out in Part VI (Selected

Financial Information).

10

(2) This adjustment reflects the receipt of the Notes Proceeds Loans and related party loans. Under the terms of the Notes Proceeds Loan

Agreements, the Notes Proceeds Loans will be repaid in full upon notice that the Demerger Resolution has been approved by GSK and

Pfizer.

Notes £m

Receipt of loan amounts owing from related parties a 11,330

Payment of loan amounts owing to related parties b

(1,461)

Total 9,869

a. Receipt of loan amounts owing from related parties includes Notes Proceeds Loans of £9,210 million and loan amounts

owing from GSK as part of the Group’s banking arrangements of £2,120 million.

b. Payment of loan amounts owing to related parties includes loan amounts owing to GSK as part of the Group’s banking

arrangements of £1,461 million.

(3) Additional borrowings to fund the payment of the Pre-Demerger Dividend, including, but not limited to, the Term Loan Facility. See also

paragraph 7.4 of Part VII (Operating and Financial Review).

(4) The Pre-Separation Dividends include the Balancing Dividend, Pre-Demerger Dividend, and the Sweep-up Dividend.

Notes £m

Balancing Dividend a 53

Pre-Demerger Dividend b 10,345

Sweep-up Dividend c 641

Pre-Separation Dividends 11,039

a. The Balancing Dividend reflects the cash dividend of £53 million to be paid by the Group to GSKCHH prior to Separation

in connection with the £25 million of Non-Voting Preference Shares issued to Pfizer recognised in long-term borrowings.

b. The Pre-Demerger Dividend reflects the cash dividend of £10,345 million to be paid by the Group to GSKCHH and

PFCHH ahead of Separation, in accordance with the terms of the Pfizer SHA, which, in summary, requires an amount

equal to the Pre-Separation Debt Proceeds of the Group less £300 million to be paid to GSKCHH and PFCHH prior to

Separation.

£m

Pre-Separation Debt Proceeds 10,645

Less £300m (300)

Pre-Demerger Dividend 10,345

c. The Sweep-up Dividend reflects the cash dividend of £641 million to be paid by the Group to GSKCHH and PFCHH, in

accordance with the terms of the Pfizer SHA which, in summary, requires all readily available cash in excess of

£300 million to be paid to GSKCHH and PFCHH prior to Separation. The actual amount paid is subject to, amongst other

things, additional cash flow generated by, or additional investments made by, or dividends paid in the ordinary course of

business by the Group up until the point of Separation. As such, the actual amount of the Sweep-up Dividend may

therefore differ from the amount referred to above.

£m

Cash and cash equivalents and liquid investments as of 31 March 2022 383

Receipt of Notes Proceeds Loans and related party loans 9,869

Additional borrowings 1,435

Payment of Pre-Demerger Dividend (10,345)

Transaction costs (84)

Balancing Dividend (53)

Less trapped cash* (264)

Less £300m (300)

Sweep-up Dividend 641

* Cash and cash equivalents that are in jurisdictions that have absolute cross-border restrictions on transfers of cash between

members of the Group.

(5) Transaction costs comprise charges for services relating to the Transactions. The Group expects to incur a cumulative total

£117 million of transaction costs in relation to the Transactions. The Group has incurred £33 million of transaction related costs as of

31 March 2022. Therefore, a transaction cost adjustment of £84 million has been made.

(6) The Pro Forma Financial Information does not reflect any changes in the trading results or financial position of the Group since

31 March 2022. None of the adjustments are expected to have a continuing effect on the Group.

11

(7) On a pro forma basis, net debt of the Group as at 31 March 2022 would have been £10,349 million.

Group net debt

at 31 March

2022

Pro forma

adjustments

Notes

Unaudited pro forma

at 31 March 2022

£m £m £m

Short-term borrowings 80 80

Long-term borrowings 9,363 1,460 a 10,823

Derivative financial liabilities 36 36

Cash and cash equivalents and liquid

investments

(383) (181) b (564)

Derivative financial assets

(26) (26)

Net debt 9,070 1,279 10,349

a. Additional borrowings to fund the payment of the Pre-Demerger Dividend, including, but not limited to, the Term Loan

Facility. See also paragraph 7.4 of Part VII (Operating and Financial Review).

b. Receipt of Notes Proceeds Loans and related party loans of £9,869 million, additional borrowings of £1,435 million,

payment of Pre-Separation Dividends of £11,039 million and the payment of Transaction costs of £84 million.

2.3 What are the key risks that are specific to the issuer?

The Group operates in a highly competitive market and failure to successfully compete with

competitors could have a material adverse effect on the Group’s business.

The Group’s success depends on its ability to anticipate and respond to changes in consumer

preferences and a failure to adapt its strategy appropriately may have a material adverse effect

on the Group’s business and/or financial condition.

The Group’s business results are impacted by the Group’s ability to manage disruptions in the

Group’s global supply chain and a failure to manage disruptions appropriately may have a

material adverse effect on the Group’s business and/or financial condition.

Increasing dependence on key retail customers, changes in the policies of the Group’s retail

customers, the emergence of alternative retail channels and the rapidly changing retail

landscape may materially and adversely affect the Group’s business.

The Group may not be able to develop and commercialise new products effectively, which may

materially and adversely affect the results of the Group’s operations and financial condition.

Failure to retain key personnel or attract new personnel may materially and adversely affect the

Group’s business.

Damage to the Group’s reputation could have a material adverse effect on the Group’s

business.

Failure to respond effectively to the challenges raised by climate change and other

sustainability matters may have a material adverse effect on the Group’s business and results

of operations.

The Group’s business is subject to legal and regulatory risks in all the markets in which it

operates, which may have a material adverse effect on the Group’s business operations and

financial condition.

The Group faces risks relating to the regulation and perception of the ingredients it uses in its

products, which could materially and adversely impact the Group’s business, prospects,

financial condition and results of operations.

The Group’s business is subject to market fluctuations and general economic conditions,

including inflationary pressures, each of which may materially and adversely affect the Group’s

business, financial condition, results of operations and prospects.

The Group may fail to realise any or all of the anticipated benefits of the Demerger and

Separation.

12

3. KEY INFORMATION ON THE SECURITIES

3.1 What are the main features of the securities?

(A) Type, class and ISIN of the securities

The Haleon Shares are fully paid ordinary shares in the capital of the Company with a nominal

value of £1.25 each (to be reduced to 1 pence following the Capital Reduction).

On Admission, the Haleon Shares will be registered with an ISIN of GB00BMX86B70 and

SEDOL of BMX86B7. It is expected that the Haleon Shares will be traded on the main market

for listed securities of the London Stock Exchange under the ticker symbol “HLN”.

(B) Currency of the securities

The Haleon Shares are and, on Admission will be, denominated in Pounds Sterling.

(C) Number of issued and fully paid securities

Immediately following completion of the Demerger, the number of Haleon Shares in issue will

be equal to the number of GSK Shares in issue at the Shareholder Record Time. As at the

Latest Practicable Date, there were 5,084,048,734 GSK Shares in issue (excluding ordinary

shares held in treasury).

Shortly after completion of the Demerger, the following share-for-share exchanges will occur:

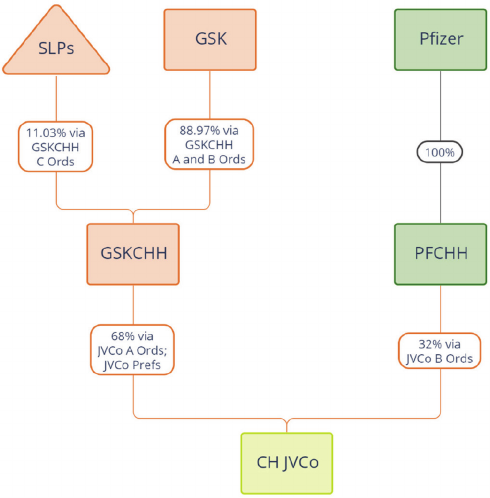

(i) GSK will transfer its entire holding of GSKCHH B Ordinary Shares,

representing an 8.01 per cent. stake in GSKCHH’s ordinary share capital, to

the Company in exchange for 502,868,434 Haleon Shares, less a number of

Haleon Shares that is equal to the number of Excess GSK Shares. As at the

Latest Practicable Date, the number of Haleon Shares expected to be held by

GSK at Admission is expected to represent up to 6 per cent. of the total issued

share capital of the Company;

(ii) the SLPs (being certain Scottish limited partnerships set up to provide a

funding mechanism pursuant to which GSK will provide additional funding for

GSK’s UK Pension Schemes) will transfer their respective holdings of

GSKCHH C Ordinary Shares, representing 11.03 per cent. (in aggregate) of

GSKCHH’s ordinary share capital, to the Company in exchange for such

number of new Haleon Shares as is required so that, on Admission, the SLPs

will together hold Haleon Shares representing 7.5 per cent. (in aggregate and

to the nearest whole Haleon Share) of the total issued share capital of the

Company; and

(iii) Pfizer will transfer its entire holding in PFCHH to the Company in exchange for:

(a) 25 million Non-Voting Preference Shares; and (b) such number of Haleon

Shares as will result in Pfizer holding, on Admission, Haleon Shares

representing 32 per cent. of the total issued share capital of the Company (to

the nearest whole Haleon Share). Pfizer will sell its entire holding in the

Non-Voting Preference Shares to one or more third party investor(s)

immediately following the share-for-share exchange with the Company

described in this paragraph 3.1(C)(iii).

Therefore, it is expected that the Company will have 9,234,573,831 Haleon Shares in issue on

Admission. The Haleon Shares have a nominal value of £1.25 each (to be reduced to 1 pence

following the Capital Reduction) and will be fully paid.

The Non-Voting Preference Shares have a nominal value of £1 each and will be fully paid. The

Non-Voting Preference Shares will not be listed on the London Stock Exchange or any other

exchanges.

13

(D) Rights attaching to the securities

All Haleon Shares will rank pari passu with all other Haleon Shares in all respects, there being

no conversion or exchange rights attaching thereto, and all Haleon Shares will have equal

rights to participate in capital, dividend and profit distributions by the Company.

Subject to the provisions of the Companies Act, any equity securities issued by the Company

for cash must first be offered to the holders of Haleon Shares in proportion to their holdings of

Haleon Shares. The Companies Act and Listing Rules allow for the disapplication of

pre-emption rights which may be waived by a special resolution of the Haleon Shareholders,

whether generally or specifically, for a maximum period not exceeding five years.

On a show of hands every Haleon Shareholder who is present in person and every person

holding a valid proxy shall have one vote and on a poll every Haleon Shareholder present in

person or by proxy shall have one vote per Haleon Share.

(E) Rank of securities in the event of insolvency

The Haleon Shares do not carry any rights with respect to capital to participate in a distribution

(including on a winding-up) other than those that exist as a matter of law. The Haleon Shares

will rank pari passu with all other Haleon Shares in all respects.

The Haleon Shares will rank behind the Non-Voting Preference Shares in the event of the

insolvency of the Company as the Non-Voting Preference Shares carry preferential rights to

participate in a distribution of capital in the event of an insolvency (including on a winding-up)

up to an amount equal to their nominal value plus accrued dividend and any arrears or

deficiency in amount of the cumulative dividend.

(F) Description of restrictions on free transferability of the securities

Holders of Haleon Shares who the Company believes are or may be Designated Persons are

not permitted to dispose of their Haleon Shares or any legal or beneficial interest in any of

them without the prior written consent of the Company. The Haleon Shares are otherwise

freely transferable and there are no restrictions on transfer.

(G) Dividend policy

Following the Demerger, the Company will adopt a dividend policy, which will reflect the long-

term earnings and cash flow potential of the Group, consistent with maintaining sufficient

financial flexibility and meeting the Group’s capital allocation priorities. The initial dividend is

expected to be at the lower end of a 30 to 50 per cent. pay-out ratio, subject to Board approval.

The Company expects to pay a dividend to Haleon Shareholders in relation to the second half

of 2022 in H1 2023, subject to Board approval and following approval of the Company’s FY

2022 results.

3.2 Where will the securities be traded?

Application will be made for all the Haleon Shares to be admitted to the premium listing

segment of the Official List of the FCA and to trading on the LSE’s main market for listed

securities. Application will also be made to the NYSE for American depositary shares each

representing 2 Haleon Shares (the “Haleon ADSs”) to be admitted to listing and trading on the

NYSE. No application has been made or is currently intended to be made for Haleon Shares to

be admitted to listing or trading on any other exchange.

3.3 What are the key risks that are specific to the securities?

There is no existing market for the Haleon Shares and an active trading market for the Haleon

Shares may not develop or be sustained.

The Pfizer Group will retain a significant interest in the Company following Admission and its

interests may differ from those of the other Haleon Shareholders.

There can be no assurance that dividends will be paid on Haleon Shares.

14

4. KEY INFORMATION ON THE ADMISSION TO TRADING ON A REGULATED MARKET

4.1 Why is this Prospectus being produced?

This Prospectus does not constitute an offer or invitation to any person to subscribe for or

purchase any shares in the Company. It has been produced in connection with the application

to be made to the FCA for the Haleon Shares to be admitted to the premium listing segment of

the Official List and to the LSE for the Haleon Shares to be admitted to trading on its main

market for listed securities. It is expected that Admission will become effective and that

dealings in the Haleon Shares will commence on the LSE by no later than 8.00 a.m. (London

time) on 18 July 2022.

Application will also be made to the NYSE for the Haleon ADSs to be admitted to listing and

trading on the NYSE.

No application has been made for admission of Haleon Shares to trading on any other stock

exchange (nor is it the current intention of the Company to make any such application in

future).

15

EXPECTED TIMETABLE OF PRINCIPAL EVENTS

The times and dates set out in the timetables below and throughout this Prospectus that fall after the

date of publication of this Prospectus are indicative only and based on the Company’s current

expectations and may be subject to change without further notice.

Event Time and date

(1)

ADS Holder Voting Record Time for determining entitlement to

attend and vote at the GSK General Meeting

(2)

5 p.m. New York City time on

27 May 2022

Publication of the GSK Shareholder Circular and this Prospectus

1 June 2022

Latest time and date for receipt of Forms of Directions

(2)

2.30 p.m. on 30 June 2022

Latest time and date for receipt by Depositary of Voting

Instruction Cards from ADS Holders on the ADR Register

12 p.m. New York City time on

30 June 2022

Latest time and date for receipt of Proxy Forms, CREST Proxy

Instruction and electronic proxy appointments

(2)

2.30 p.m. on 4 July 2022

Shareholder Voting Record Time for determining entitlement

to attend and vote at the General Meeting

6.30 p.m. on 4 July 2022

(3)

GSK General Meeting 2.30 p.m. on 6 July 2022

Announcement of the results of the GSK General Meeting 6 July 2022

(after the GSK General Meeting)

Closing of the GSK ADS issuance and cancellation books

(4)

8 a.m. New York City time on

14 July 2022

Latest time and date for transfers of GSK Shares to be

registered on the Register at the Shareholder Record Time

6 p.m. on 15 July 2022

Shareholder Record Time for determining the entitlement to

the Demerger Dividend

6 p.m. on 15 July 2022

ADS Holder Record Time for determining the entitlement to

the Demerger Dividend

5 p.m. New York City time on

15 July 2022

Demerger Dividend to Qualifying GSK Shareholders After 6 p.m. on 15 July 2022

Completion of Share Exchanges 17 July 2022

Admission and commencement of dealings in Haleon Shares

on the LSE

8 a.m. on 18 July 2022

CREST accounts credited in respect of Haleon Shares in

uncertificated form

As soon as practicable after 8 a.m.

on 18 July 2022

Admission and commencement of dealings in Haleon ADSs

on the NYSE

9.30 a.m. New York City

time on 22 July 2022

Opening of the GSK ADS issuance and cancellation books

(4)

8 a.m. New York City time on

25 July 2022

Latest date for despatch of definitive share certificates (where

applicable) for Haleon Shares in certificated form to Qualifying

GSK Shareholders on the Register

By 1 August 2022

Latest date for despatch of opening statement for Haleon CSN

(5)

By 1 August 2022

Notes

(1) Unless otherwise indicated, all references to time in this timetable are to UK time.

(2) If you hold GSK Shares or GSK ADSs via a bank, broker or nominee you should contact your respective bank, broker or

nominee service provider for further information on the appropriate dates and times relevant for your particular holding.

(3) If the GSK General Meeting is adjourned for any reason, the Shareholder Voting Record Time for the adjourned meeting

will be 2.30 p.m. UK time on the date that is two business days before the date set for the adjourned meeting. The

Depositary will inform ADS Holders of any change to the ADS Holder Voting Record Time.

(4) The Depositary will suspend the issuance and cancellation of GSK ADSs from 14 July 2022 until 25 July 2022. This means

that during this time, you will not be able to convert your GSK ADSs into GSK Shares, surrender your GSK ADSs and

receive underlying GSK Shares, or deposit your GSK Shares and receive GSK ADSs. However, the closing of the issuance

and cancellation books does not impact trading, and you may continue to trade your GSK ADSs during this period.

(5) Subject to the timing of the Capital Reduction.

16

RISK FACTORS

The risks and uncertainties relating to the Haleon Shares, the Group’s business and the industry in

which it operates, described below, together with all other information contained in this Prospectus,

should be carefully considered in light of Admission.

The risks and uncertainties relating to the Haleon Shares, the Group’s business and the industry in

which it operates summarised in the part of this Prospectus headed “Summary” are the risks that the

Directors believe to be the most essential to an assessment of Haleon Shares. However, as the risks

which the Group faces relate to events and depend on circumstances that may or may not occur in the

future, you should consider not only the information on the key risks summarised in the part of this

Prospectus headed “Summary” but also, among other things, the risks and uncertainties described

below.

The risks and uncertainties described below represent those the Directors consider to be material as at

the date of this Prospectus. However, these risks and uncertainties are not the only ones facing the

Group. Additional risks and uncertainties not presently known to the Directors, or that the Directors

currently consider to be immaterial, may individually or cumulatively also materially and adversely

affect the business, results of operations, financial condition and/or prospects of the Group. If any or a

combination of these risks actually occurs, the business, results of operations, financial condition and/

or prospects of the Group could be materially and adversely affected. In such case, the market price of

Haleon Shares could decline. You should carefully consider the information in this Prospectus in light

of your personal circumstances.

1. RISKS RELATING TO THE GROUP’S BUSINESS AND INDUSTRY

1.1 The Group operates in a highly competitive market and failure to successfully compete

with competitors could have a material adverse effect on the Group’s business

The Group faces substantial and increasing competition in all of its product categories and

geographic markets. There are relatively low barriers to entry in certain product categories in

many of the markets in which the Group operates (particularly in the VMS category) and

accordingly the Group’s businesses compete with companies of all sizes on many different

fronts, including cost-effectiveness, product effectiveness and quality, brand recognition and

loyalty, technological innovations, consumer convenience, promotional activities, new product

introductions and expansion into new markets and channels.

The Group expects to continue to see heightened activity from its competitors worldwide,

including an increase in the introduction and aggressive marketing of new products in high

demand healthcare areas. In particular, the Group expects to experience: (i) increasing and

aggressive competition from smaller, high growth companies which often operate on a regional

basis, and may disrupt existing route-to-market models; (ii) increasing competition from

multinational corporations moving for the first time into, or expanding or focusing their presence

(whether through acquisitions, disposals, demergers or other means) in the global consumer

healthcare market in order to benefit from the higher profit margins on offer and greater

consumer interest in health products and services; and (iii) continuing competition from “private

label” products, which are brands sold exclusively by a particular retailer.

Some of the Group’s competitors may spend more aggressively on, or have more effective,

advertising and promotion activities than the Group does, introduce competing products more

quickly and/or respond more effectively to business and economic conditions and changing

consumer preferences, including by launching innovative new products. The Group’s ability to

compete also depends on the strength of its brands and on its ability to enforce and defend its

intellectual property against infringement and legal challenges by competitors.

The Group may be unable to anticipate the timing and scale of the threats posed by the many

competitors across its markets or to successfully respond to them, which could harm the

Group’s business. In addition, the cost of responding to the increasingly significant and

17

widespread competition worldwide, including management time, out-of-pocket expenses and

price reductions, may materially and adversely affect the Group’s performance. Ultimately, a

prolonged failure by the Group to compete effectively in its key markets could have a material

adverse effect on the Group’s business, prospects, results of operations and financial

condition.

1.2 The Group’s success depends on its ability to anticipate and respond to changes in

consumer preferences and a failure to adapt its strategy appropriately may have a

material adverse effect on the Group’s business and/or financial condition

As a consumer products business, the Group relies on its ability to leverage its existing brands

and products to drive increased sales and profits. This in turn depends on the Group’s ability to

identify and offer products at attractive prices that appeal to consumer tastes and preferences,

which are difficult to predict and evolve over time. The Group’s ability to implement this

strategy depends on, among other things, its ability to:

• continue to offer products that consumers want at competitive prices;

• develop and maintain consumer interest in its brands and increase its brand recognition

and loyalty;

• innovate successfully on its existing products; and

• effectively utilise a range of distribution channels in its key markets.

The Group may not be able to execute this strategy successfully, which could have a material

adverse effect on the Group’s business, prospects, results of operations and/or financial

condition.

In addition, any reduction in consumer demand for the types of products which the Group

offers as a result of changes in consumer lifestyle, environmental concerns, economic

downturns or other considerations could have a material adverse effect on the Group’s

business, prospects, financial condition and results of operations. For example, in recent years,

there is increasing awareness of the environmental impact and sustainability of practices and

products in the market (see paragraph 1.8 of Risk Factors below).

1.3 The Group’s business results are impacted by the Group’s ability to manage disruptions

in the Group’s global supply chain and a failure to manage disruptions appropriately

may have a material adverse effect on the Group’s business and/or financial condition

The Group is engaged in manufacturing and sourcing of products and materials on a global

scale. The Group’s operations and those of its suppliers, contract manufacturers and logistics

providers have been and may continue to be disrupted by a number of factors, including, but

not limited to:

• increased and/or changing regulation, as well as regulatory compliance issues;

• environmental events, including natural disasters (such as fires, floods and earthquakes)

and any potential effect of climate change;

• widespread health emergencies, such as COVID-19 or other pandemics or epidemics,

leading to delays in deliveries and constraints on shipping and logistics due to local

lockdowns, such as the recent lockdowns in China that may impact the delivery to and

from China of the Group’s products, as well as resources required for its products;

• strikes and other labour disputes;

• disruptions in logistics;

18

• cybersecurity failures or incidents;

• loss, impairment, closure or disruption of key manufacturing sites;

• loss of key suppliers or contract manufacturers;

• supplier capacity constraints;

• raw material and product quality or safety issues (on which see further risk factor 1.10

below);

• industrial accidents or other occupational health and safety issues;

• the impact on the Group’s suppliers of tighter credit or capital markets;

• the lack of availability of qualified personnel;

• global shipping, logistics, transport and warehousing constraints;

• governmental incentives and controls (including import and export restrictions, such as

new or increased tariffs, sanctions, quotas or trade barriers);

• acts of war (on which see further risk factor 2.7 below) or terrorism, political unrest or

uncertainty, fires or explosions, and other external factors over which the Group has no

control; and

• increases in ingredient, commodity and oil prices.

While the product ranges of the Group’s leading brands are manufactured by multiple sources,

some of the Group’s products are currently primarily manufactured at a single location. The

loss of the use of all or a portion of any of the Group’s manufacturing facilities or the loss of the

use of key suppliers could have a material adverse effect on the Group’s business, financial

condition and results of operations.

In addition, the Group purchases certain raw and packaging materials from single-source

suppliers or a limited number of suppliers and new suppliers may have to be qualified under

industry, governmental and its own standards, which can require additional investment and

take a significant period of time.

Although the Group has contingency plans in place, such as dual sourcing programmes and

alternative supply arrangements, those plans may not be sufficient to mitigate manufacturing or

supplier interruptions, and the Group may also be limited in its ability to pass on any price

increases in the prices it charges for its products. For example, the Group has entered into,

and may in the future enter into, fixed price contracts or hedging arrangements in order to

address increases in commodity prices and their effect on the Group’s ability to source

materials for its products. However, if prices decrease, the Group will be unable to realise the

benefit of the decrease due to fixed price contracts in place.

A significant disruption to the manufacturing or sourcing of products or materials for any

reason, including those mentioned above, could interrupt product supply and, if not remedied,

could lead to litigation or regulatory action, product delistings by retailers, financial penalties,

and reputational damage that could materially and adversely affect the Group’s business,

results of operations and financial condition.

19

1.4 Increasing dependence on key retail customers, changes in the policies of the Group’s

retail customers, the emergence of alternative retail channels and the rapidly changing

retail landscape may materially and adversely affect the Group’s business

The Group’s products are sold in a highly competitive global marketplace which has

experienced increased trade concentration and the growing presence of large-scale retailers,

including pharmacies, as well as discounters and e-commerce retailers. With the growing trend

towards retail trade consolidation, increased cross-border trade, the rapid growth of

e-commerce and the integration of traditional and digital operations at key retailers, the Group

is increasingly dependent on certain retailers, and some of these retailers have and may

continue to have greater bargaining strength than the Group does. For example, similar to its

competitors, while the Group maintains relationships with a variety of significant retailers

across its key markets, sales attributable to its top five largest retailers account for over half of

the Group’s revenue in the US market.

The Group’s large-scale retail customers, including pharmacies, may use their leverage to

demand higher trade discounts, allowances, display fees or increased investment, including

through display media, paid search, preparation fees and other programmes, which could lead

to reduced sales or profitability. The loss of a key retailer or a significant reduction in sales to a

key retailer could materially and adversely affect the Group’s business, prospects, results of

operations and financial condition. The Group’s business might also be negatively affected by

the growing presence and bargaining strength of customers who operate internationally and

retail buying alliances (horizontal alliances of retailers, retail chains or entire retailer groups that

cooperate in pooling their resources) and the enhanced leverage that such alliances possess.

The Group has also been and may continue to be negatively affected by changes in the

policies or practices of the Group’s retail trade and pharmacy customers, such as inventory

de-stocking, limitations on access to shelf space, delisting of the Group’s products, or

environmental, sustainability, supply chain or packaging initiatives and other conditions. For

example, a determination by a key retailer that any of the Group’s ingredients should not be

used in certain consumer products or that the Group’s packaging does not comply with certain

environmental, supply chain or packaging standards or initiatives could materially and

adversely impact the Group’s business, prospects, results of operations and financial condition.

“Private label” products sold by the Group’s retail customers, which are typically sold at lower

prices than branded products, are a source of competition for certain of the Group’s products.

In addition, the retail landscape in many of the Group’s markets continues to evolve as a result

of the rapid growth of e-commerce retailers (who are able to generate “private label” products

and capitalise on access to data) and price comparison sites, changing consumer preferences

(as consumers increasingly shop online), and, in certain categories (particularly VMS), the

increased presence of alternative retail channels, such as subscription services, sales through

social media platforms and direct-to-consumer businesses (especially those which specialise in

rapid distribution). The strong growth in e-commerce and the emergence of alternative retail

channels may create pricing and margin pressures and/or adversely affect the Group’s

relationships with key retailers. If the Group is not able to successfully manage and adapt to

these changes in the retail landscape, the Group’s business, prospects, results of operations

and financial condition could be materially and adversely affected.

1.5 The Group may not be able to develop and commercialise new products effectively,

which may materially and adversely affect the results of the Group’s operations and

financial condition

The future growth of the Group is to a significant extent dependent on its ability to develop new

products or new formulations of existing products. The Group’s ability to launch new products

and to expand into adjacent categories, channels of distribution or markets is affected by

whether the Group can successfully:

• identify, develop and fund technological innovations;

• obtain and maintain necessary intellectual property protection and avoid infringing

intellectual property rights of others;

20

• obtain and maintain approvals and registrations of regulated products, including from the

FDA, the EMA, the NMPA and other regulatory bodies in the countries in which the Group

has business operations, including in relation to Rx-to-OTC switches;

• anticipate, quickly respond to, and benefit from the needs and preferences of consumers

and customers by, among other things, effectively utilising digital technology and marketing

and data analytics to gain new commercial insights and develop relevant marketing and

advertising to identify new products that will align with consumer preferences; and

• successfully compete to in-license products.

The identification, development and introduction of innovative new products that drive

incremental sales involves considerable costs and effort, and any new product may not

generate sufficient customer and consumer interest and sales to become a profitable product

or to cover the costs of its development and promotion. The Group’s ability to achieve a

successful launch of a new product could also be adversely affected by pre-emptive actions

taken by competitors in response to the launch, such as increased promotional activities and

advertising. In addition, new products may not be accepted quickly or significantly in the

marketplace.

The product development process is both time-consuming and costly and involves a high

degree of business risk. In particular, the Group’s OTC products, including those in respect of

which it is undertaking an Rx-to-OTC switch, are subject to lengthy development programmes

and regulatory approval periods which can restrict the Group’s ability to innovate in this product

area. The Group must develop, test and manufacture products to meet its own internal

specifications and standards as well as all applicable regulatory and safety requirements, and it

is possible that a new product can fail to make it to market at any stage of this process. Whilst

the Group has a good track record of developing new products and executing Rx-to-OTC

switches, there can be no guarantee that the Group will continue to be able to develop and

commercialise new products at the rate required to retain or grow market share or that suitable

opportunities for further Rx-to-OTC switches will become available to the Group. Any failure to

develop and commercialise new products in a timely fashion may decrease revenue and/or

increase R&D costs and, consequently, may materially and adversely affect the results of the

Group’s operations and financial condition.

1.6 Failure to retain key personnel or attract new personnel may materially and adversely

affect the Group’s business

The Group relies upon a number of key executives and employees who have an in-depth

understanding of the consumer healthcare industry and the Group’s technologies, products,

programmes, collaborative relationships and strategic goals. While the Group follows a

disciplined, ongoing succession planning process and has succession plans in place for Senior

Management and other key executives, these do not guarantee that the services of qualified

senior executives will continue to be available to the Group at all times. Competition for such

personnel in the consumer healthcare industry is intense, and there can be no assurance that

the Group will be able to continue to attract and retain such personnel, particularly as

competitors may attempt to recruit them.

Further, the Group’s ability to implement its strategy depends on the ability and experience of

its Senior Management and other key employees. If the Group is unable to recruit, attract and

retain talented, highly qualified Senior Management and other key people, including through

competitive remuneration and benefits packages, appropriate career development, employee

resilience and engagement programmes, the Group’s business, prospects, results of

operations and financial condition could be materially and adversely affected. The Group is

also working to advance cultural change through the implementation of diversity, equality and

inclusion initiatives and through the implementation of a new purpose, strategy and culture

programme throughout the organisation. If the Group does not (or is perceived not to)

successfully implement these plans and initiatives, its ability to recruit, attract and retain talent

may be materially and adversely impacted, which may in turn materially and adversely affect

the Group’s business, results of operations and financial condition.

21

1.7 Damage to the Group’s reputation could have a material adverse effect on the Group’s

business

Maintaining the Group’s strong reputation and trust with consumers and the Group’s customers

globally is critical to selling the Group’s branded products. Negative publicity about the Group,

the Group’s industry, the Group’s brands and products, the Group’s advertising and promotion

practices, the Group’s use, storage and securing of technology and data, including personal

data, the Group’s supply chain, the Group’s ingredients, the Group’s packaging, the Group’s

research practices, threatened or pending litigation or regulatory proceedings, the Group’s

public policy engagement, the Group’s environmental, social and governance practices,

including as they relate to diversity, equality and inclusion, the health, safety and welfare of

employees or other stakeholders, or relations with the Group’s employees, or regulatory

infractions, violations of sanctions or anti-bribery rules, whether or not deserved, could

jeopardise the Group’s reputation and/or expose it to adverse press and social media attention.

The Group’s reputation may also be adversely affected if third parties with whom the Group

contracts, including its suppliers, manufacturers and customers, fail to maintain high ethical,

social and environmental standards, comply with local laws and regulations or become subject

to other negative events or adverse publicity. Such third parties may also enter into

relationships with or be acquired by other third parties whose values, business practices and/or

reputation expose the Group to the risk of adverse publicity and damage to its existing

relationships by association. While the Group has policies and procedures for managing third

party relationships, it may not be possible to fully ensure that third parties adhere to the same

standards and values as the Group or to replace third party relationships in a timely and/or

cost-effective manner.

In addition, widespread use of digital and social media by consumers has greatly increased the

accessibility of information and the speed of its dissemination. Negative publicity, posts or

comments on social media about the Group, the Group’s brands, the Group’s products,

including any ingredients used in its products, the Group’s packaging or the Group’s

employees, whether true or untrue, could damage the Group’s brands and its reputation and/or

lead to boycotts of its products. For example, during the COVID-19 pandemic, sales of Advil

(an ibuprofen-based product) were adversely impacted by negative media coverage regarding

the use of ibuprofen products in treating the symptoms of COVID-19. Moreover, the Group’s