Time-Loss Compensation – August 2019 Page 1 of 27

Time-Loss Compensation

Self-Insurance Claims Adjudication Guidelines

Page

Time-Loss Compensation ...................................................................................................... 3

Family Status and Dependents ............................................................................................... 3

Registered Domestic Partnership ........................................................................................... 3

Time-Loss Compensation Formula ................................................................................... 5

Determining the Child’s Portion ............................................................................................ 6

Maximum Time-Loss Compensation Rate ..................................................................... 6

Determining the Child’s Portion When Worker is at Maximum Time-Loss Rate ................ 7

Minimum Time-Loss Compensation Rate ...................................................................... 8

Minimum Time-Loss Rate for Dates of Injury on or After July 2, 2008 .............................. 8

Reporting and Communication Requirements ........................................................... 14

Statement of Benefits ........................................................................................................... 14

Underpayments and Overpayments ..................................................................................... 14

Cost of Living Adjustments ................................................................................................ 14

Date of Injury and the First Three Days after the Date of Injury ....................... 16

Date of First Treatment ....................................................................................................... 16

Timely Payment of Time-Loss Benefits ......................................................................... 17

Payment of Ongoing Time-Loss ....................................................................................... 18

Kept on Salary ........................................................................................................................ 20

Buy-Back Policies ................................................................................................................... 21

Payment to Minor Workers ............................................................................................... 22

Volunteers ................................................................................................................................. 22

Retired Workers ..................................................................................................................... 22

Time-Loss Compensation – August 2019 Page 2 of 27

Incarceration ........................................................................................................................... 23

Registered Apprentices or Trainees ................................................................................ 24

Disability Benefits From Other Jurisdictions .............................................................. 24

Provisional Time-Loss Payments ..................................................................................... 24

Unemployment Compensation .......................................................................................... 25

DSHS – Division of Child Support Liens ...................................................................... 25

Out of State Liens .................................................................................................................. 25

DSHS – Office of Financial Recovery Liens ................................................................. 26

Deductions from Time-Loss Compensation Payments ............................................ 26

Social Security Offset ........................................................................................................... 26

Time-Loss Compensation – August 2019 Page 3 of 27

Time-Loss Compensation

Family Status and Dependents

RCW 51.32.010, RCW 51.32.060, RCW 1.16.100

A worker receives a percentage of wages based upon family status and number of dependents at

the time of injury. A worker is entitled to 60% of their gross monthly wage. An additional 5% is

added for a spouse and 2% for each dependent child, up to five children.

Example:

Erica is married with three dependent children on the date of injury.

She is entitled to:

60% for herself

5% for spouse

6% for children (3 children x 2%)

71% total percent

Registered Domestic Partnership

RCW 1.16.100, RCW 26.60.100, RCW 51.08.900

For claims with dates of injury or occupational disease on or after December 3, 2009, a worker

who has a registered domestic partner will have the same rights and benefits as a worker with a

spouse. References to spouse, marriage, marital, husband, wife, widow, widower, next of kin,

and family shall be interpreted as applying equally to state registered domestic partnerships.

Same sex marriages became legal in Washington State effective December 6, 2012.

Effective June 30, 2014, domestic partnerships registered in Washington automatically converted

to marriages unless:

At least one partner was 62 years old on or before June 30, 2014. These couples can

continue their registered domestic partnership, or they can marry if they wish.

The couple had already legally married.

The couple had legally dissolved the domestic partnership or had started a legal

proceeding to dissolve the partnership by June 30, 2014.

Time-Loss Compensation – August 2019 Page 4 of 27

Definition of Child

RCW 51.08.030

“Child" means every natural born child, posthumous child, stepchild, child legally adopted prior

to the injury, child born after the injury where conception occurred prior to the injury, and

dependent child in the legal custody and control of the worker, all while under the age of

eighteen years, or under the age of twenty-three years while permanently enrolled at a full time

course in an accredited school, and over the age of eighteen years if the child is a dependent as a

result of a physical, mental, or sensory handicap.

A child conceived prior to the date of injury but born after the date of injury entitles the

worker to an additional 2% of the gross monthly wage effective the date of the child’s

birth.

Compensation for dependent children continues until 18 years or until 23 years if

enrolled in a full-time accredited school. If the child is 18 years old and is a full time

student at an accredited school, the child’s portion is paid directly to the child up to the

age of 23. (RCW 51.32.025)

Note: A student enrolled in a school but not attending classes during summer, winter, or

spring break is still entitled to their portion of time-loss.

Compensation is continued without regard to age if the child is a “dependent invalid

child”. The dependent portion in the case of an invalid child is paid directly to the legal

guardian. (RCW 51.32.025)

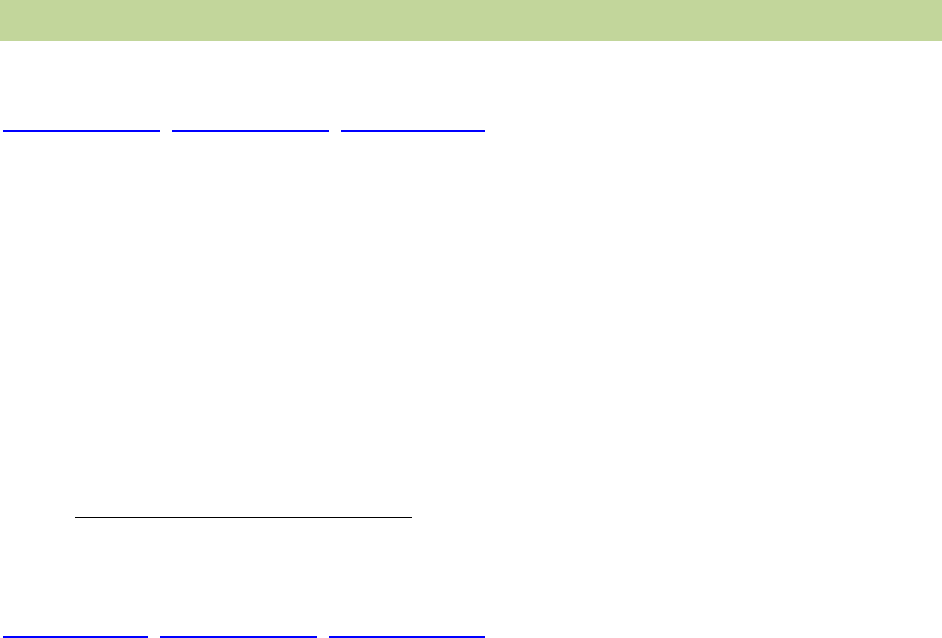

The following table lists the percentages of the gross monthly wage an injured worker is entitled

to for each conjugal status:

Single with no dependents

60%

Single with one dependent

62%

Single with two dependents

64%

Single with three dependents

66%

Single with four dependents

68%

Single with five dependents

70%

Married with no dependents

65%

Married with one dependent

67%

Married with two dependents

69%

Married with three dependents

71%

Married with four dependents

73%

Married with five dependents

75%

The following is a list of variations in family/dependent status upon which time-loss

compensation rates are based:

Time-Loss Compensation – August 2019 Page 5 of 27

1. Single on date of injury – pay as single.

2. Married after date of injury – pay as single.

3. Married after date of injury and children conceived and born after injury – pay as single

with no dependent.

4. Married prior to date of injury – pay as married

5. Married with dependent children on date of injury – pay as married with 2% for each

dependent child up to five children.

6. Legally separated but not divorced on date of injury – pay as married.

7. Divorced prior to date of injury – pay as single.

8. Divorced after date of injury – pay as married.

9. Married and spouse dies after date of injury – pay as married.

10. Married with no dependent children on date of injury, both husband and wife have

compensable claims – both are paid as married.

11. Married with dependent children on date of injury, both husband and wife have

compensable claims – both are paid as married; only the worker with the higher time-loss

rate receives allowance for children’s portion.

12. Married at the time of injury, after injury adopts children – pay as married.

13. Married at the time of injury, child conceived prior to the date of injury and born after the

date of injury – pay as married. Pay for dependents portion beginning with date of birth.

14. Married at the time of injury with one child over 18 who is an invalid and dependent on

worker – pay as married with one dependent.

15. Married at time of injury with one child of any age who is an invalid who is being cared

for in a state institution – married if the worker is not contributing to the institution for

the child’s care. Pay as married with one child if the worker is making payment to the

institution.

Time-Loss Compensation Formula

For dates of injury on or after July 1, 1971, the time-loss compensation rate is based on the

worker’s gross wage, family status and number of dependent children on the date of injury.

Time-Loss Compensation – August 2019 Page 6 of 27

Once the worker’s gross monthly wage, family status and number of dependent children have

been determined, the monthly time-loss compensation rate can be computed. The following

formula is used in making this calculation.

Monthly Time-Loss Compensation Rate

Gross Monthly

Wage

X

Marital/Dependent

Percentage

=

Monthly Time-Loss

Compensation Rate

Example:

Fran’s gross monthly wage is $4,500.00; she is married with three dependents at the time of

injury.

$4,500.00

X

71%

=

$3,195.00

Gross Monthly

Wage

Marital/Dependent

Percentage

Monthly Time-Loss

Compensation Rate

Determining the Child’s Portion

When the identity of the custodial parent is unclear, children should still be assigned to the claim,

however the claim manager should withhold the children’s portion when making payment. Once

the custodial parent has been identified, the payment must be released to the custodial parent.

The child’s portion is paid to the parent/guardian with legal custody (RCW 51.32.010).

Example:

On his SIF-2, Jim lists divorced with two dependents and indicates he does not have custody.

His gross monthly wage is $4,000.00.

$4,000.00 x 60% = $2400.00 (Jim’s portion of time-loss)

$4,000.00 x 4% = $160.00 (children’s portion of time-loss paid to the guardian with legal

custody)

Maximum Time-Loss Compensation Rate

RCW 51.32.060(5), RCW 51.32.090(9)

Maximum time-loss compensation rates are based on a percentage of the statewide average

monthly wage for the previous calendar year. The Employment Security Department computes

the statewide average wage. (See Maximum Time-Loss Rates Chart.)

The percentage of the statewide average monthly wage used to calculate maximum time-loss

compensation rates has changed from time to time over the years, so the actual rate depends

upon the date of injury.

Time-Loss Compensation – August 2019 Page 7 of 27

For injuries occurring between 7-1-71 and 6-30-88, the maximum rate a worker can

receive per month is not greater than 75% of the statewide average monthly wage.

For injuries occurring between 7-1-88 and 6-30-93, the maximum rate a worker can

receive per month is not greater than 100% of the statewide average monthly wage.

For injuries occurring between 7-1-93 and 6-30-94, the maximum rate a worker can

receive per month is not greater than 105% of the statewide average monthly wage.

For injuries occurring between 7-1-94 and 6-30-95, the maximum rate a worker can

receive per month is not greater than 110% of the statewide average monthly wage.

For injuries occurring between 7-1-95 and 6-30-96, the maximum rate a worker can

receive per month is not greater than 115% of the statewide average monthly wage.

For injuries occurring on or after 7-1-96, the maximum rate a worker can receive per

month is not greater than 120% of the statewide average monthly wage.

Changes in the maximum time-loss rate are applied July 1 of each year. A worker receiving

the maximum time-loss is entitled to receive any increase in the maximum without regard

to the COLA freeze on July 1, 2011, or the COLA skipped the first year for injuries on or

after July 1, 2011. (See Court of Appeals decision Crabb v. DLI.)

Determining the Child’s Portion When Worker is at Maximum

Time-Loss Rate

If a worker is entitled to time-loss compensation at the maximum rate the following formula is

used to determine the dependent’s portion:

(children’s %) ÷ (total %) x (max. TL rate) = children’s portion

Example:

On her SIF-2, Jessica lists single with two dependents and circles she does not have custody.

She is at the maximum monthly time-loss rate of $4,472.10.

.04

÷

.64

x

$4,472.10

=

$279.51

(children’s %)

(total %)

(max. TL rate)

(children’s portion)

$4,472.10 (max. TL rate) - $279.51 (children’s portion) = $4,192.59 (worker’s portion)

Time-Loss Compensation – August 2019 Page 8 of 27

Minimum Time-Loss Compensation Rate

RCW 51.32.060(5), RCW 51.32.090(9)

The Minimum Time Rates Chart shows the minimum time-loss rate workers are entitled to

receive depending on the date of injury.

Minimum Time-Loss Rate for Dates of Injury on or After

July 2, 2008

For dates of injury on or after July 2, 2008, the minimum time-loss rate is 15 percent of the

state’s average monthly wage plus $10 if the worker has a spouse and $10 for each dependent

child up to five children. If the worker’s gross monthly wage is less than 15% of the state’s

average monthly wage, then the worker is entitled to a time-loss rate equal to 100% of their gross

monthly wage or the minimum rate in effect prior to July 2, 2008, whichever is higher.

You can use the Minimum Time-Loss Calculation Worksheet to help determine the benefit the

worker is entitled to.

Example - 15% of the State’s Average Monthly Wage:

Allison was injured on September 14, 2008. She was earning $9.50 an hour and worked 3

hours per day, Monday through Friday. She was married with two dependents at the time of

injury.

$9.50 x 3 = $28.50

$28.50 x 22 (per RCW) = $627.00 (gross monthly wage)

$627.00 x .69 = $432.63 (standard time-loss formula)

$589.01 ($559.01 state’s average wage minimum for date of injury, plus $10.00 for spouse

and $20.00 for two dependents.)

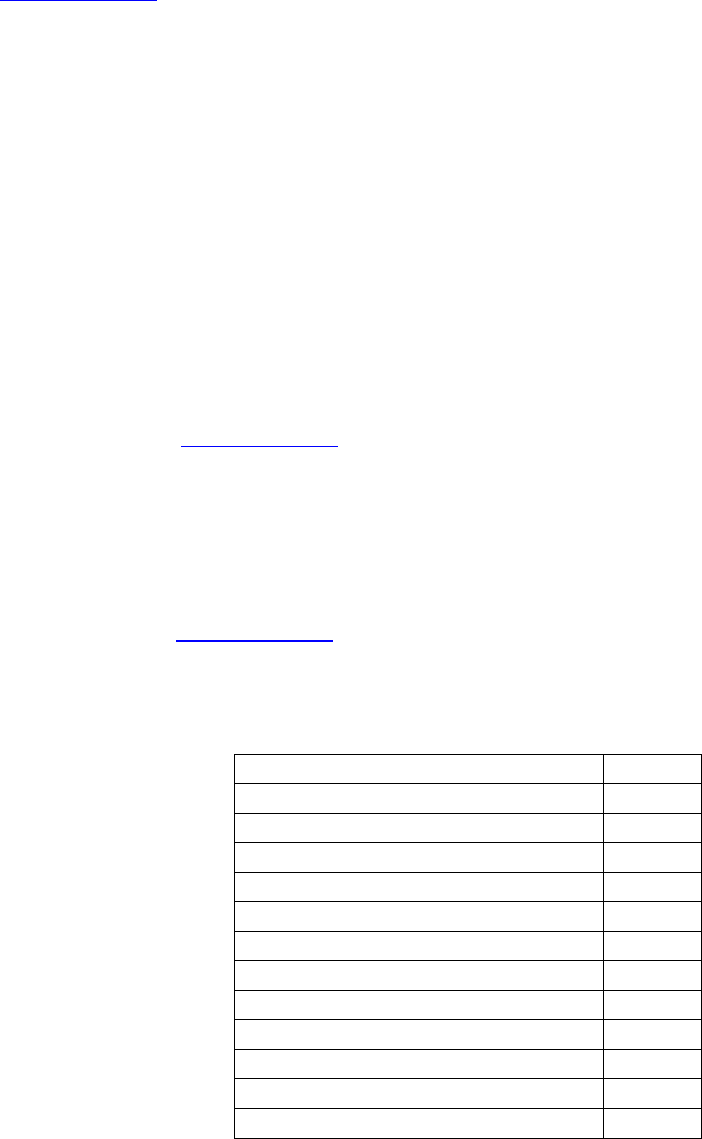

Minimum Time-Loss Calculation Worksheet

For use when the standard time-loss calculation is less than SAW

Calculate gross monthly wage (GMW) $_______________________

Calculate new minimum (SAW) + $10 for $_______________________

spouse and each dependent

Old minimum from chart $_______________________

If SAW is less than GMW pay SAW .

If SAW is more than GMW pay GMW or old minimum whichever is

greater.

Time-Loss Compensation – August 2019 Page 9 of 27

Answer: $589.01 (minimum time-loss rate)

The standard calculation for time-loss ($432.63) is less than the minimum time-loss rate of

$589.01. Since her gross monthly wage is more than that minimum time-loss rate, she is

entitled to the minimum time-loss rate of $589.01.

Alternate Recipient Calculation

In the above example, if the worker’s two dependents were in the custody of an alternate

recipient, you would pay the dependent’s portion to the alternative recipient. Pay the worker

15% of the state’s average monthly wage, plus $10.00 for the spouse. Pay the alternate

recipient $20.00 ($10.00 for each dependent).

$589.01 Total time-loss compensation rate

-$20.00 Alternate recipient portion

$569.01 Worker’s portion

Increases in the Minimum Time-Loss Rate of 15 Percent of the State’s Average Wage

RCW 51.32.060 says “in no event shall the monthly payments provided in this section” “…. be

less than fifteen percent of the average monthly wage in the state as computed under RCW

51.08.018….” Workers whose compensation rate is set at this minimum must always continue to

be paid at no less than 15 percent of the current average monthly wage for the state.

These workers aren’t entitled to a cost of living adjustment (COLA) for the first July after the

date of injury. However, they are entitled to an increase in their time-loss rate if there is an

increase in the state’s average monthly wage on July 1

st

.

Minimum Time-Loss Calculation Worksheet

For use when the standard time-loss calculation is less than SAW

Calculate gross monthly wage (GMW) $_____627.00____________

Calculate new minimum (SAW) + $10 for $_____589.01____________

spouse and each dependent

Old minimum from chart $_____283.00____________

If SAW is less than GMW pay SAW .

If SAW is more than GMW pay GMW or old minimum whichever is

greater.

Time-Loss Compensation – August 2019 Page 10 of 27

Example 1

Reese was injured on February 15, 2012. He was single with 2 dependents at the time of his

injury. His time-loss rate for the date of injury was established to be $622.03 ($602.03 +

$20.00 for 2 dependents).

On July 1, 2012 he was not entitled to a COLA on his time-loss rate since it was the 1

st

July

after the date of injury. However, 15 percent of the state’s average monthly wage plus

dependents had increased to $643.68. Since his minimum monthly payment cannot be less

than 15 percent of the average monthly wage, he was entitled to a time-loss rate adjustment

based on that amount.

February 15, 2012 (DOI) – June 30, 2012

monthly time-loss rate

15% of the DOI SAW ($602.03)

plus $20.00 for dependents

$622.03

July 1, 2012

monthly time-loss rate

15% of the new SAW ($623.68)

plus $20.00 for dependents

$643.68

On July 1, 2013, the second July 1

st

after his date of injury, Reese was entitled to a COLA on

his time-loss rate.

July 1, 2012 – June 30, 2013

monthly time-loss rate

7/1/2013 COLA

July 1, 2013

monthly time-loss rate

$643.68

x

1.03409

=

$665.62

The July 1, 2013 COLA on his time-loss keeps his time-loss rate above 15 percent of the July

1, 2013 state’s average wage (644.94 + $20.00 for 2 dependents = $664.94).

On claims with earlier dates of injury, the annual July 1

st

COLA kept workers’ time-loss rates at

or above 15 percent of the state’s average wage. On July 1

st

2011, there was a COLA freeze on

all time-loss. Effective July 1

st

2011, workers with rates originally set at 15 percent of the state’s

average wage were not entitled to a COLA, but their minimum time-loss rate was bumped up to

15 percent of the state’s average wage for July 1, 2011.

Example 2

Chloe was injured on August 15, 2008. She was married with 3 dependents at the time of her

injury. Her time-loss rate at the date of injury was established to be $599.01 ($559.01 +

$40.00 for spouse and 3 dependents).

She was entitled to a COLA on her time-loss rate on every July 1

st

after her date of injury

until July 1, 2011, when there was a freeze on all COLAs. Since RCW 51.32.060 says “in no

event shall the monthly payments provided in this section” “… be less than fifteen percent of

the average monthly wage in the state as computed under RCW 51.08.018,” on July 1, 2011,

she became entitled to the 15% of the state’s average wage minimum time-loss rate in effect

on that date, plus $40.00 for her spouse and three dependents ($642.03).

Time-Loss Compensation – August 2019 Page 11 of 27

Dates TL Rate

August 15, 2008 (DOI) - June 30, 2009 $599.01

July 1, 2009 $599.01 x 1.03432 (COLA) = $619.57

July 1, 2010 $619.57 x 1.01939 (COLA) = $631.58

July 1, 2011 COLA Freeze – New Rate = $602.03 + $40.00 = $642.03

July 1, 2012 $642.03 x 1.03596 = $665.12

July 1, 2013 $665.12 x 1.03408 = $687.79

July 1, 2014 $687.79 x 1.02016 = $701.66

July 1, 2015 $701.66 x 1.0416832906 = $730.91

Note: Incremental COLAs, not cumulative should always be used to calculate time-loss for

workers whose time-loss rate is set at 15 percent of the state’s average wage.

100% of Worker’s Gross Monthly Wage

If the worker’s gross monthly wage is less than 15% of the state’s average wage then the worker

is entitled to a time-loss rate equal to 100% of their gross monthly wage or the “old” minimum

rate (the rate in effect prior to July 2, 2008), whichever is higher.

Example of 100% of the Worker’s Gross Monthly Wage:

Amanda was injured on August 4, 2008. She was earning $8.75 an hour and worked six

hours per day on Mondays and Tuesdays. She was married with two dependents at the time

of injury.

$8.75 x 6 = $52.50

$52.50 x 9 (per RCW) = $472.50 (gross monthly wage)

$472.50 x 69% = $326.03 (standard time-loss formula)

$589.01 ($559.01 – state’s average wage minimum for date of injury, plus $10.00 for spouse

and $20.00 for two dependents)

$283.00 (“old” minimum time-loss rate, prior to 7/2/08)

Time-Loss Compensation – August 2019 Page 12 of 27

Answer: $472.50 (gross monthly wage is time-loss rate)

Since Amanda’s gross monthly wage, $472.50 is less than $589.01, the minimum time-loss

rate for her date of injury, she is entitled to either her gross monthly wage as time-loss or the

“old minimum time-loss rate” of $283.00 whichever is higher. Her gross monthly wage is

higher so that will be her time-loss rate.

Alternate Recipient Calculation

In the above example if the worker’s two dependents were in the custody of an alternate

recipient, you would pay the dependent’s portion to the alternative recipient. The calculation

for the alternate recipient is to subtract 2% for each dependent’s portion of the worker’s rate.

The worker’s time-loss is 100% of their gross monthly wage of $472.50. The alternate

recipient is entitled to 4% of the $472.50.

$472.50 x 4% = $18.90 Alternate recipient portion

$472.50 – 18.90 = $453.60 Worker’s portion of time-loss

Minimum Time-Loss Rate in Effect Prior to July 2, 2008

If the worker’s gross monthly wage is less than 15% of the state’s average wage then the worker

is entitled to a time-loss rate equal to 100% of their gross monthly wage or the “old” minimum

time-loss rate, whichever is higher.

Example of Minimum Time-loss Rate in Effect Prior to July 2, 2008:

Aaron was injured on February 12, 2009. He was earning $9.00 per hour and worked 2 hours

every Saturday. He was single with 2 dependents at the time of injury.

Minimum Time-Loss Calculation Worksheet

For use when the standard time-loss calculation is less than SAW

Calculate gross monthly wage (GMW) $____472.50____________

Calculate new minimum (SAW) + $10 for $____589.01____________

spouse and each dependent

Old minimum from chart $____283.00____________

If SAW is less than GMW pay SAW .

If SAW is more than GMW pay GMW or old minimum whichever is

greater.

Time-Loss Compensation – August 2019 Page 13 of 27

$9.00 x 2 = $18.00

$18.00 x 5 (per RCW) = $90.00 (gross monthly wage)

$90.00 x 64% = $57.60 (standard time-loss formula)

$579.01 (minimum time-loss rate for single with 2 dependents)

$253.00 (“old” or minimum time-loss rate prior to 7/2/08)

Answer: $253.00 (“old” or minimum time-loss rate prior to 7/2/08)

Since Aaron’s gross monthly wage, $90.00 is less than $579.01, the minimum time-loss rate

for his date of injury, he is entitled to either his gross monthly wage as time-loss or the “old

minimum time-loss rate” of $253.00 whichever is higher. The “old” minimum time-loss rate

is higher so that will be his time-loss rate.

Alternate Recipient Calculation

The alternate recipient portion is the difference between the rate the worker is entitled to with

all the dependents and the rate the worker is entitled to without the dependents in the custody

of the alternate recipient.

$253.00 – $185.00 = $68.00 Rate at single with two dependents minus rate at single with

no dependents.

$68.00 Alternate recipient portion.

$185.00 Worker’s portion of time-loss

Minimum Time-Loss Calculation Worksheet

For use when the standard time-loss calculation is less than SAW

Calculate gross monthly wage (GMW) $____$90.00____________

Calculate new minimum (SAW) + $10 for $____$579.01___________

spouse and each dependent

Old minimum from chart $____$253.00___________

If SAW is less than GMW pay SAW .

If SAW is more than GMW pay GMW or old minimum whichever

is greater.

Time-Loss Compensation – August 2019 Page 14 of 27

Reporting and Communication Requirements

WAC 296-15-340, WAC 296-15-420, WAC 296-15-425

Within five days of starting time-loss compensation, the self-insurer must send the Starting

Compensation Benefits template (form F207-224-000) to the worker. A copy of the template

must be sent to the department, along with the SIF-2. If it has not already been done, the self-

insurer must also send the Calculation of Monthly Wage as a Basis for Time-Loss Compensation

template (form F207-227-000) to the worker with a copy of the SIF-5A.

If the worker is kept on salary (KOS), report this to the department when claim allowance is

requested. On the Claim Allowance Request form, indicate that the worker is KOS, and include

an attachment which documents the amount of time-loss the worker would have been paid. Send

this form to the department with the SIF-5A within five working days of the date the first time-

loss payment would have been due (WAC 296-15-425).

Statement of Benefits

Effective July 1, 2019, WAC 296-15-340(2) requires self-insurers to send a statement of benefits

to the worker with each payment, including the type of benefit being paid and the date span. This

statement may be provided electronically if authorized by the worker.

Underpayments and Overpayments

If benefits are determined to be underpaid and an adjustment is payable, the self-insurer must

send the Assessment of Underpayment template (form F207-223-000) to the worker within five

days of knowledge of the underpayment.

Alternatively, if benefits have been overpaid, the self-insurer must send the Assessment of

Overpayment template (form F207-222-000) to the worker with five days of knowledge. More

information about Overpayments is available in the Miscellaneous Claims Issues chapter.

Cost of Living Adjustments

RCW 51.32.075

Between July 1, 1971 and June 30, 2011, all workers receiving time-loss benefits were entitled to

automatic cost of living adjustments (COLAs) effective each July 1

st

. Workers receiving the

minimum and maximum time-loss compensation rates are also entitled to COLA adjustments.

Effective July 1, 2011, there was a freeze on all COLAs through June 30, 2012.

Example:

Kari was injured on February 21, 2011. Her time-loss rate at the time of injury was

$2,400.00. Since there was no COLA on July 1, 2011, her time-loss rate remains $2,400.00

until the July 1, 2012 COLA.

Time-Loss Compensation – August 2019 Page 15 of 27

For workers with dates of injury or manifestation on or after July 1, 2011, no COLA adjustments

shall be made until the second July 1

st

following the date of injury or manifestation.

Example:

Karlee was injured on August 12, 2011. She will not be entitled to a COLA until

July 1, 2013.

See the Maximum Time-Loss Compensation Rate and Minimum Time-Loss Compensation Rate

sections of this chapter for more information on COLAs regarding the July 1, 2011 freeze or

skipping the first COLA after a July 1, 2011 date of injury.

There are two methods to calculate COLAs.

Yearly increment (inc) factors:

To use the Cost of Living Adjustment (COLA) Chart, 5-decimal increments or Cost of Living

Adjustment (COLA) Chart, 10 decimal increments to compute the July 1 COLA on a year to

year basis:

Compute the monthly time-loss rate as of the date of injury.

Multiply the time-loss rate by the increment (inc) factor for the July 1 after the date of

injury.

Exception: Skip the first COLA for claims with dates of injury or manifestation on or

after July 1, 2011.

Multiply that figure by the increment (inc) factor of the next July 1

st

to compute the time-

loss rate after the second COLA and so on until all the COLA’s have been computed.

Example:

Brenda was injured on May 2, 2007. Her time-loss rate at the time of injury was $930.00. To

compute her time-loss rate as of July 1, 2007:

$930.00 x 1.05445 (7/1/07 COLA) = $980.64

To compute her time-loss rate as of July 1, 2008:

$980.64 x 1.05018 (7/1/08 COLA) = $1,029.85

To compute her time-loss rate as of July 1, 2015

$1186.66 x 1.0416832906 (7/1/15 COLA) = $1236.12

Time-Loss Compensation – August 2019 Page 16 of 27

Cumulative factors:

To use the Cost of Living Adjustment (COLA) Chart to compute the July 1 COLA from the date

of injury to several years after without having to compute it year by year:

Note: Incremental COLAs, not cumulative should always be used to calculate time-loss for

workers whose time-loss rate is set at 15 percent of the state’s average wage.

Compute the monthly time-loss rate as of the date of injury.

Multiply the date of injury time-loss rate by the cumulative (cum.) COLA factor of the

July 1 year you are updating to.

Example:

Kay was injured on December 6, 2003. Her claim was closed on April 16, 2005. She applied

for reopening of her claim and it was granted effective September 1, 2008. She was unable to

work and was entitled to time-loss benefits from September 1, 2008. Her time-loss rate as of

the date of injury (DOI) was $900.00.

To compute the time-loss rate as of September 1, 2008:

$900.00

x

1.17870

=

$1,060.83

(DOI time-

loss rate)

(7/1/08 cum. factor

for 12/6/03 DOI)

$1,060.83 would be the September 1, 2008 monthly time-loss rate for Kay’s date of injury.

Date of Injury and the First Three Days after the Date

of Injury

RCW 51.32.090

Injured workers are never entitled to time-loss for the date of injury.

Workers are not entitled to time-loss compensation or loss of earning power (LEP) for the first

three days following the date of injury unless the worker remains disabled on the 14

th

day

following the date of injury. If the worker remains disabled on the 14

th

day, either on time-loss or

LEP, they are entitled to compensation for the first three days. Attempts to return to work do not

break the continuity.

Date of First Treatment

If a worker seeks treatment within the first 3 days following the injury and would otherwise be

entitled to time-loss benefits prior to the date of first treatment, benefits must be paid. If the

Time-Loss Compensation – August 2019 Page 17 of 27

worker delays seeking treatment until the 4

th

day or more following an injury, begin payment of

time-loss compensation on the date of first treatment.

Timely Payment of Time-Loss Benefits

RCW 51.32.190, WAC 296-15-266

Time-loss compensation resulting from an injury or occupational disease must be paid within 14

calendar days of receipt of notice of a claim. Notice of a claim is defined as written

documentation of all the following:

Description of the incident (or occupational disease).

Worker’s signed application for benefits.

Diagnosis

Treatment or treatment recommendations.

When computing whether or not the first payment of time-loss was paid within fourteen days,

day one would be the date following the date the notice of a claim is received.

Example 1:

Notice of a claim received: January 16, 2013

First time-loss paid: January 30, 2013

In the scenario, time-loss was paid on the fourteenth day.

Example 2:

Notice of a claim received: January 16, 2013

First time-loss paid: January 31, 2013

In this scenario, time-loss was paid on the fifteenth day.

Continuing benefits will be based on certification from the attending provider. They are to be

paid at regular semi-monthly or biweekly intervals to ensure speedy financial relief during the

worker’s disability. (Biweekly: Paying on a schedule of every 14 days. With this schedule, pay

the daily time-loss rate. Semi-monthly: Paying on a schedule of twice a month. With this

schedule, divide the monthly rate in half and pay twice a month.)

Sometimes a condition will not be disabling until surgery is performed (a hernia, for example).

In these instances, time-loss compensation becomes payable effective the date of surgery unless

otherwise medically justified. Payment of time-loss must be made within 14 days of the date of

surgery or the date of receipt of other medical certification.

Time-Loss Compensation – August 2019 Page 18 of 27

Payment of Ongoing Time-Loss

RCW 51.36.060, RCW 51.32.190, WAC 296-20-06101, WAC 296-15-340

When an industrial injury or occupational disease prevents a worker from returning to gainful

employment on an ongoing basis, time-loss compensation must be paid at regular biweekly or

semi-monthly intervals. In order to be eligible for continuing time-loss compensation, the injured

worker must be receiving regular curative treatment.

The attending medical provider must certify that the worker’s ongoing inability to work is the

result of the accepted medical condition(s). If an insurer is aware that a worker is off work and

that it may be related to an industrial injury or occupational disease, they should ask the provider

whether the worker’s inability to work is related to their injury.

The attending medical provider must submit medical reports at approximately 60 day intervals to

support ongoing time-loss. The certification must include the objective medical findings which

support time-loss from work. A treatment plan must also indicate prognosis for recovery and the

treatment plan should be curative not palliative.

If a worker is participating in formal vocational rehabilitation services they are eligible for

continuing time-loss benefits. When the approved plan involves on-the-job training and earnings,

the worker is eligible for loss of earning power benefits.

Dual Claim Benefits

Policy 4.71

Workers may receive time-loss compensation under 2 or more claims, State Fund and/or self-

insured. They are entitled to benefits equal to the amount entitled under the claim with the

highest compensation rate.

The payments should be divided between the claims. If the claims have different compensation

rates, the payment is prorated between all the claims.

Example 1:

Betty has 2 claims and is eligible for time-loss compensation under both claims. The

compensation rate is equal on both claims.

Pay 50% of the benefits under each claim.

Example 2:

James has 2 claims and is eligible for time-loss compensation under both claims. His

compensation rate on the first claim is $1,000.00 per month. The compensation rate on his

second claim is $1,300.00 per month. His total entitlement is $1,300.00.

Time-Loss Compensation – August 2019 Page 19 of 27

First claim: pay 50% of the entitlement on this claim. $500.00

Second claim: pay the balance of the total entitlement on this claim . $800.00

Total paid: $1,300.00

If the worker has a self-insured claim as well as a State Fund claim, the self-insurer should

contact the State Fund adjudicator to determine which claim has the highest benefit and the

proportioning of benefits between the claims.

The payment of loss of earning power (LEP) benefits would be handled the same.

Example 3:

Lucy has 2 claims and is eligible for LEP on both claims. Her LEP entitlement is $300.00 on

the first claim and $450.00 on the second claim. Her total entitlement is $450.00.

First claim: pay 50% of the entitlement on this claim $150.00

Second claim: pay the balance of the total entitlement on this claim $300.00

Total paid: $450.00

Terminating Time-Loss Compensation

WAC 296-15-425

Once the payment of time-loss benefits has begun, the benefits must be continued until one of

the following occurs:

Released for Full Duty – When a worker is given a full release to the job of injury, time-

loss benefits may be terminated.

Note: If a worker is released for work on the same day they see their provider, time-loss

is payable through the end of that day (i.e. worker has an appointment with their provider

on January 17

th

, at the appointment the provider signs a release for work as of January

17

th,

the same day as their appointment, the worker is eligible for time-loss through the

17

th

).

Found Employable – When a vocational assessment is conducted and a worker is

determined to be employable, time-loss may be terminated after the determination of

employability is made.

Returns to Work – When a worker returns to work, they are not eligible for time-loss

benefits. If the worker’s earning capacity has decreased as a result of the injury or

occupational disease they may be entitled to loss of earning power benefits.

Within five days of stopping time-loss benefits, the worker must be notified using the Stop or

Deny Compensation Benefits template (form F207-225-000) as required by WAC 296-15-425.

Time-Loss Compensation – August 2019 Page 20 of 27

Vacation, Sick Leave, Etcetera While on Time-Loss

Receipt of holiday pay, vacation pay, sick leave, or other similar benefits does not take away

from a worker’s entitlement to time-loss benefits. A worker who is unable to work due to an

industrial injury or occupational disease and is not being kept on salary is entitled to time-loss

compensation even if they are also being paid vacation, sick leave, or other similar benefits.

Workers who are entitled to paid sick leave cannot be required to use accrued leave while

waiting for time-loss benefits. This includes leave programs that combine paid sick leave

accruals under the state’s requirements with other forms of leave, such as a paid time off (PTO)

program. Accrued paid sick leave is a worker’s right and the worker can choose to use it. Some

employers offer other forms of leave (for example, vacation) or other sick leave accruals as an

additional benefit that is separate from accrued paid sick leave. Employers who provide these

types of leave may require workers to use the leave while waiting for time-loss benefits.

Employer and/or union contracts may mandate whether an employee can use earned benefits

such as vacation and sick leave while a worker is on time-loss.

The department will direct payment of time-loss when a worker is entitled, regardless of any

earned benefits that may be paid.

Kept on Salary

RCW 51.32.090, RCW 51.32.190, WAC 296-15-420, RCW 49.46.210

The self-insured employer will not pay time-loss if a worker is kept on salary (KOS).

KOS means:

The worker must receive 100% of the wages he or she was receiving from all

employment on the date of injury. This includes outside employment is documented by

the worker. Payment of anything less does not qualify as KOS and the insurer must pay

time-loss benefits.

The wages must include any compensation the worker would have received if he or she

had continued to work including but not limited to:

o Board, housing, fuel and contributions to health care benefits.

o Compensation for multiple rates of pay, such as shift differentials.

o Compensation for any established pattern of overtime hours.

o Tips and bonuses.

Time-Loss Compensation – August 2019 Page 21 of 27

Exception: If the worker doesn’t normally receive wages for an employer’s established

holiday, for example, July 4th, the employer is not required to pay the worker for that

date.

The employer may not reduce the worker’s gross pay through deductions except for those

required by state or federal law, or for other deductions at the request of the worker.

The employer must pay the worker’s wages on regularly established paydays at no longer

than monthly payment intervals, including the first 3 days of disability following the date

injury.

If an employer requires a worker to use earned benefits such as vacation, sick leave or paid time

off (PTO), the worker is not considered KOS and is due time-loss. RCW 51.32.090(8) precludes

employers from mandating that workers use their sick leave to keep from paying time-loss

compensation.

When requesting claim allowance from the department, self-insurers must report if the worker is

KOS. On the Claim Allowance Request form, check the KOS box, and attach documentation of

the time-loss that would have been due if the worker had not been KOS.

Buy-Back Policies

Buy back policies are voluntary. The insurer must pay time-loss when the worker is entitled

regardless of any employer buy back agreement. Employers and entitled workers may enter into

buy-back agreements if there is a written agreement in advance. These agreements are

completely voluntary for workers.

Accrued paid sick leave under RCW 49.46.210 is a worker’s right, and it is ultimately the choice

of the worker to use their accrued paid sick leave. An employer may include a buy-back

agreement in a CBA or contract of hire, as long as the language provides workers with the option

to accept or decline participation in the buy-back agreement. Employers who offer other forms of

leave (for example, vacation) or additional sick leave as a benefit separate from the accrued paid

sick leave may require workers to use such leave for the purposes described.

Example:

Jeff chooses the option of sick leave buy-back. His normal gross monthly wage is $5,000.00

per month. While on time-loss, he also uses his sick leave so he receives his full $5,000.00

per month salary. In turn, he signs his time-loss check over to his employer to buy back part

of the sick leave benefit he used for that month.

Paid Family Medical Leave

Time-Loss Compensation – August 2019 Page 22 of 27

Paid Family Medical Leave (PFML) is a new benefit for Washington workers effective January

1, 2020. This program is administered by Employment Security Department (ESD). Workers’

who are receiving workers’ compensation benefits may not receive a wage replacement under

the PFML program. PFML is not considered KOS. Additional information can be found at

https://paidleave.wa.gov/employers/.

Payment to Minor Workers

RCW 51.04.070

The law requires that any disability payments becoming due to a worker under the age of 18

years “…shall be paid to his or her parent, guardian, or other person having legal custody.” The

parent or guardian can, with written authorization, allow payments to be made directly to the

minor worker.

Volunteers

RCW 51.12.035, RCW 51.12.170, WAC 296-17-930

A volunteer is defined as a person who performs any assigned or authorized duties for an

employer by choice, receives no wages and is registered and accepted as a volunteer. A worker

could still be considered a volunteer even if they receive maintenance and reimbursement for

actual expenses necessarily incurred in performing their authorized duties. In most cases,

volunteers injured in the course of employment are only entitled to medical aid benefits.

Under RCW 51.12.140, volunteer law enforcement officers may be covered for all applicable

death, disability and medical aid benefits under this title if the municipal corporation maintaining

and operating the law enforcement department elects to cover all of its volunteer law

enforcement officers and files written notice of coverage to the director.

Retired Workers

WAC 296-14-100

If a worker has removed themselves from the labor market by voluntarily retiring, time-loss

benefits are not payable. This is true even if the worker becomes temporarily unable to work as a

result of the industrial injury or occupational disease after voluntarily retiring. However, it must

be documented that the retirement was voluntary, as a worker is entitled to time-loss benefits

when the retirement is caused by the effects of the industrial injury or occupational disease.

Voluntary retirement is most commonly encountered in reopened claims and in new claims filed

for occupational diseases which have a prolonged incubation period (such as asbestosis). A

worker will be considered retired and no longer attached to the work force if all the following

conditions are met:

Time-Loss Compensation – August 2019 Page 23 of 27

The worker is not receiving income, salary, or wages from any gainful employment,

The worker has provided no evidence to show a bona fide attempt to return to work after

retirement, and

The injury or occupational disease was not a proximate cause of the decision to retire.

Once it is determined that a worker has voluntarily retired from the work force, the self-insurer

cannot reinstate benefits.

Exception: If, following the voluntary retirement, the worker was re-employed at bona fide

continuous employment, the department will no longer consider the worker voluntarily

retired. If the worker then becomes unable to work due to the industrial injury, the worker

would be entitled to time-loss.

Incarceration

RCW 51.32.040

Worker Incarcerated After Date of Injury

No time-loss is payable directly to workers incarcerated and under sentence while:

Confined in an institution.

On a home monitoring program and sentenced to remain at home.

Beneficiaries of workers who were incarcerated after the date of injury should receive the

workers time-loss compensation benefits while the worker is confined. If no beneficiary exists,

no time-loss compensation benefits are paid.

Workers may again become eligible for time-loss compensation benefits under the following

circumstances, once:

No longer confined.

Released or paroled.

Released to a half-way house.

On work release unless both:

o Their participation is canceled, and

o The worker is returned to full confinement.

Time-Loss Compensation – August 2019 Page 24 of 27

Workers Injured While Performing Community Service or

Restitution

RCW 51.12.045

Workers who are injured while performing community service or restitution may be eligible for

time-loss.

Registered Apprentices or Trainees

RCW 51.12.130

All persons registered as apprentices or trainees with the state apprenticeship council and

participating in supplemental and related instruction classes conducted by a school district, a

community college, a vocational school, or a local joint apprenticeship committee, shall be

considered as workers of the state apprenticeship council and subject to the provisions of Title 51

RCW for the time spent in actual attendance at such supplemental and related instruction classes.

For computing time-loss compensation payments, the actual wage rate during employment

should be used.

Disability Benefits From Other Jurisdictions

RCW 51.12.120

It is possible for a claim to be filed for the same injury in two different jurisdictions. This is most

common in cases when a worker is temporarily working in a different state. Some jurisdictions

allow workers to file an industrial injury claim in their state regardless of where the injury

occurred. The Washington State Industrial Insurance Laws do not preclude this. However, it is

appropriate under these circumstances to reduce any benefits received in Washington State by

the benefits received from another jurisdiction.

Provisional Time-Loss Payments

RCW 51.32.190, RCW 51.32.210, WAC 296-15-420(2)(3)

When a determination regarding claim allowance cannot be made immediately, usually because

the employer is still investigating validity, or when a decision cannot be made immediately

regarding reopening a claim, the self-insured employer is required to make provisional payments

of time-loss compensation when it is otherwise appropriate. The payment of provisional time-

loss is not considered a binding determination on the self-insurer, department or worker.

Provisional payments must be made as long as appropriate until a determinative order is issued.

The self-insured employer has the right to recover provisional time-loss paid if the claim is

denied or the reopening application is denied. All provisional time-loss payments should contain

Time-Loss Compensation – August 2019 Page 25 of 27

notification to the worker that the self-insurer will recover any monies paid if the claim is denied

or the reopening is denied.

Occasionally a claim will be received from a worker for an injury or occupational disease which

occurred months prior to filing of the claim. In many of these instances, more information will be

needed prior to a determination regarding claim allowance. If the worker is contending

temporary total disability from the time of injury, consider payment of provisional time-loss

compensation from the date notice of the claim is received. This action should only be taken on

claims which a significant delay has transpired in the filing of the claim and a decision regarding

allowance cannot be made immediately. If the claim is later allowed, the claim manager must

then consider time-loss benefits for the previous periods.

Provisional time-loss cannot be paid on open, allowed claims.

Unemployment Compensation

The receipt of unemployment compensation does not necessarily mean that a worker is not

entitled to time-loss compensation. Although effective June 11, 1986, an individual is not

entitled to both time-loss and unemployment compensation, there are times an injured worker

may have collected unemployment benefits when they should actually have been collecting time-

loss benefits due to an industrial injury. If a worker who has collected unemployment benefits

will now be receiving time-loss benefits, it is important that Employment Security is notified so

they can decide whether to issue an overpayment.

DSHS – Division of Child Support Liens

RCW 74.20A.030, RCW 74.20A.100, RCW 74.20A.260

When a lien is received from Division of Child Support (DCS; formerly Office of Support

Enforcement), it must be acted upon immediately. DCS liens are payable after the claim manager

makes the following deductions: Social Security offset, overpayments and alternate recipient

payments. DCS liens apply to time-loss, loss of earning power and permanent partial disability

awards. A DCS lien filed against a worker’s benefits requires self-insurers or the department to

withhold a monthly dollar amount or up to 50 percent of time-loss or loss of earning power

benefits and up to 50 percent of a permanent partial disability award.

When the Office of Financial Recovery (OFR) also makes a lien, the lien for DCS is honored

first.

Any lien received after claim closure still applies to any remaining permanent partial disability

payments.

Out of State Liens

The department does not recognize out of state liens. If an out of state lien request is received,

notify the requesting party out of state liens are not honored and refer the requester to:

Time-Loss Compensation – August 2019 Page 26 of 27

Division of Child Support

PO Box 11520

Tacoma, WA 98411

(360) 664-5321

(800) 922-4306

www.DSHS.WA.Gov/DCS

DSHS – Office of Financial Recovery Liens RCW 43.20B.720,

RCW 43.20B.730, RCW 43.20B.735, RCW 43.20B.745

When the Office of Financial Recovery (OFR) is advised by the department or by the worker that

they are or may be receiving time-loss benefits during a period where they were also receiving

public assistance benefits, OFR may file a lien.

OFR liens are payable after the claim manager makes the following deductions: Social Security

offset, overpayments, alternate recipient payments and Division of Child Support liens.

OFR liens apply to time-loss, loss of earning power, and permanent partial disability benefits

awards.

Deductions from Time-Loss Compensation Payments

Except as provided in RCW 43.20B.720, RCW 72.09.111, RCW 74.20A.260, RCW 51.32.240

and RCW 51.32.380, no other deductions may be made from time-loss or LEP compensation.

RCW 51.32.040 prohibits any other creditors from garnishing workers’ disability benefits and

prohibits workers from voluntarily assigning their benefits to any other creditors.

Deductions cannot be taken from time-loss or LEP compensation benefits for car payments,

disability insurance, healthcare insurance, etc.

Social Security Offset

RCW 51.32.220, RCW 51.32.225, RCW 51.32.230

If a worker receiving monthly compensation benefits also begins receiving Social Security

Benefits, the worker or self-insurer should immediately notify the Social Security Offset Section.

Future benefits may be reduced depending on the effective date of the offset. The total amount

from both agencies will not be less than the worker would be entitled to receive from time-loss

alone.

Social Security Offset Benefit Specialists determine the amount of any reduction, correlating

state industrial insurance laws with federal laws. Then, they apply the reduction to the workers

Time-Loss Compensation – August 2019 Page 27 of 27

monthly compensation benefits and monitor state and federal rates for any necessary

adjustments.

Self-insurers are to provide the following in their request for a Social Security offset review:

We received acknowledgment of the worker’s application for and/or receipt of Social

Security benefits, on __/__/__ (include the referenced documentation).

The current ongoing monthly compensation benefits began __/__/__ and continue.

Submit printout of the claims benefit payment history, e.g., time-loss, LEP and

permanent partial disability. Include the beginning and ending dates of each payment, the

date of the payment, and the payment amount.

The self-insured employer intends to instate monthly compensation benefits for the

period beginning __/__/__ through __/__/__, and continue payments.

This claim is currently in litigation, with a possibility of payment of compensation

benefits. The self-insured employer has been advised of the worker’s application and/or

receipt of Social Security benefits. Please verify the worker’s approval of Social Security

benefits.

A wage order was issued on __/__/__. The self-insured employer’s monthly contribution

to health care benefits continues. (Or) The self-insured employer’s monthly contribution

to health care benefits has been terminated.

Note: List the date the self-employer’s contribution to health care benefits ended and

the end date of each coverage type (medical, dental, vision).

No wage order has been issued.

Note: Provide completed SIF-5A wage forms for worker’s work pattern and earnings,

along with documentation required in accordance with the SIF-5A wage forms

submitted. List the date the employer’s contribution to health care benefits ended and

the end date of each coverage type (medical, dental, vision).