1

Allied Properties Real Estate Investment Trust (“Allied”) (TSX: “AP.UN”) today announced results for the three

months ended March 31, 2023. “Despite continuing macroeconomic uncertainty, our operating income was up

14.5% in the rst quarter, in large part because of development completions and contribution from last year’s

portfolio acquisition,” said Michael Emory, President & CEO. “Our FFO per unit was slightly below forecast,

primarily because we capitalized less interest than anticipated. Our AFFO per unit was above forecast. Average

in-place net rent per occupied square foot continued to rise in the quarter, reaching $23.35 at quarter-end, and

we continued to achieve rent increases on renewal. As a result, NOI and same-asset NOI were a bit higher than

forecast for the quarter.”

FINANCIAL RESULTS

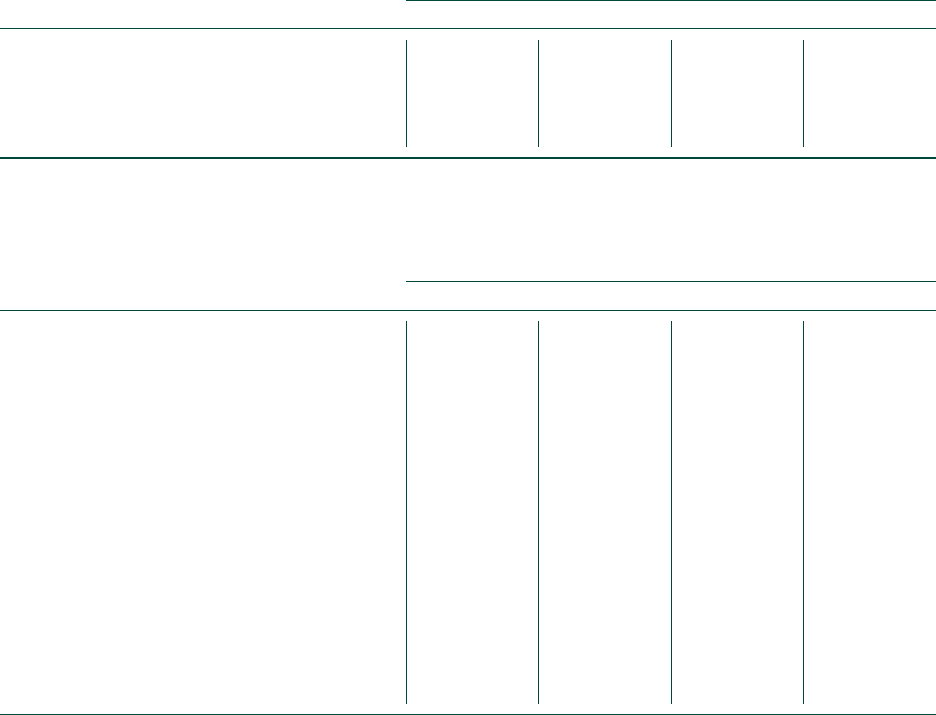

The following table summarizes GAAP nancial measures for the rst quarter:

TORONTO, APRIL 26, 2023

Allied Announces

First-Quarter Results

FOR THE THREE MONTHS ENDED MARCH 31

(In thousands) 2023 2022 CHANGE % CHANGE

Rental Revenue $138,490 $120,942 $17,548 14.5%

Property operating costs $(61,325) $(53,535) $(7,790) (14.6%)

Operating income $7 7,165 $67,407 $9,758 14.5%

Interest expense $(22,564) $(15,161) $(7,403) (48.8%)

General and administrative expenses $(6,170) $(6,882) $712 10.3%

Condominium marketing expenses $(120) $(113) $(7) (6.2%)

Amortization of other assets $(370) $(261) $(109) (41.8%)

Interest income $9,744 $7,024 $2,720 38.7%

Fair value loss on investment properties and investment

properties held for sale $(78,357) $(10,069) $(68,288) (678.2%)

Fair value (loss) gain on derivative instruments $(8,024) $19,198 $(27,222) (141.8%)

Net (loss) income from joint venture $(3,006) $7,731 $(10,737) (138.9%)

2

Allied’s operating income was up 14.5% in the rst quarter, in large part because of development completions

and contribution from the portfolio (the “Portfolio”) acquired from Choice Properties REIT at the end of the

comparable quarter last year. Despite intervening macroeconomic uncertainty, Allied made measurable progress

with the Portfolio. While occupancy is only up slightly after a year of ownership, average in-place net rent per

occupied square foot increased by 5.5% from $24.74 to $26.11, the weighted average lease term increased by 21%

from 4.3 years to 5.2 years, annualized NOI increased by 3.9% from $33.6 million to $34.9 million and the IFRS

value increased by 4.8% from $775 million to $812 million.

Considerably higher interest expense in the rst quarter put downward pressure on Allied’s FFO per unit, which

was 58 cents for the quarter, slightly below internal forecast. AFFO per unit of 53 cents was above internal

forecast.

Allied recorded a fair value loss on investment properties of $78 million in the rst quarter. $29 million is the

result of modestly higher estimated cost-to-complete of development projects in Montréal. The balance reects

the fair-value impact of longer periods of turnover vacancy in Allied’s rental portfolio.

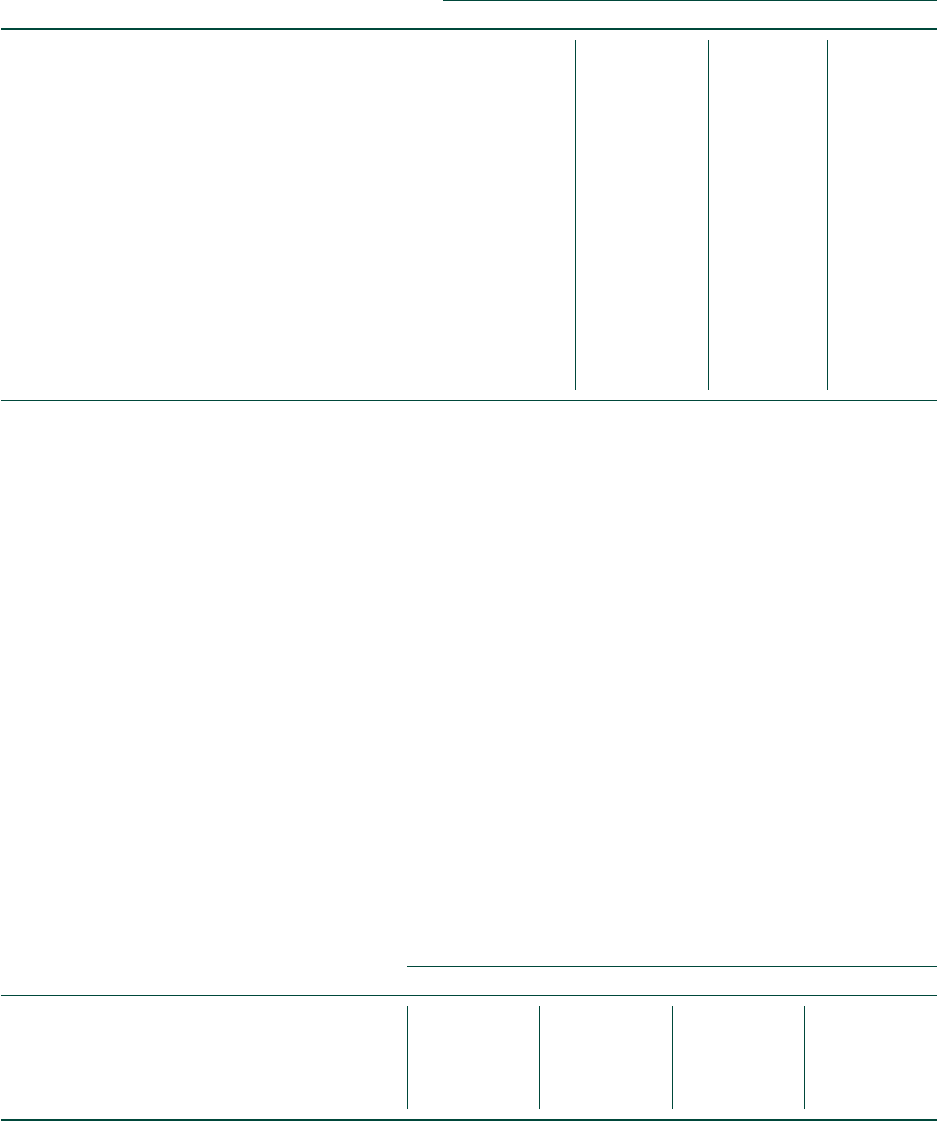

FOR THE THREE MONTHS ENDED MARCH 31

(In thousands) 2023 2022 CHANGE % CHANGE

Net (loss) income and comprehensive (loss) income from

continuing operations $(31,702) $68,874 $(100,576) (146.0%)

Net income and comprehensive income from discontinued

operations $18,019 $118,316 $(100,297) (84.8%)

Net (loss) income and comprehensive (loss) income $(13,683) $187,190 $(200,873) (107.3%)

The following table summarizes non-GAAP nancial measures for the rst quarter:

FOR THE THREE MONTHS ENDED MARCH 31

(In thousands except for per unit and % amounts)

(1)

2023 2022 CHANGE % CHANGE

Adjusted EBITDA $102,995 $91,722 $11,273 12.3%

Same asset NOI - rental portfolio $68,221 $68,086 $135 0.2%

Same Asset NOI - total portfolio $86,354 $87,367 $(1,013) (1.2%)

FFO $81,175 $77,340 $3,835 5.0%

FFO per unit (diluted) $0.581 $0.603 $(0.022) (3.6%)

FFO pay-out ratio 77.5% 72.4% — 5.1%

All amounts below are excluding condominium related

items and the mark-to-market adjustment on unit-based

compensation:

FFO $81,085 $77,573 $3,512 4.5%

FFO per unit (diluted) $0.580 $0.605 $(0.025) (4.1%)

FFO pay-out ratio 7 7.6% 72.1% — 5.5%

AFFO $74,482 $71,571 $2,911 4.1%

AFFO per unit (diluted) $0.533 $0.558 $(0.025) (4.5%)

AFFO pay-out ratio 84.4% 78.2% — 6.2%

(1) These non-GAAP measures include the results of the continuing operations and the discontinued operations (except for same asset NOI - rental

portfolio, which only includes continuing operations). Refer to the Non-GAAP Measures section below.

3

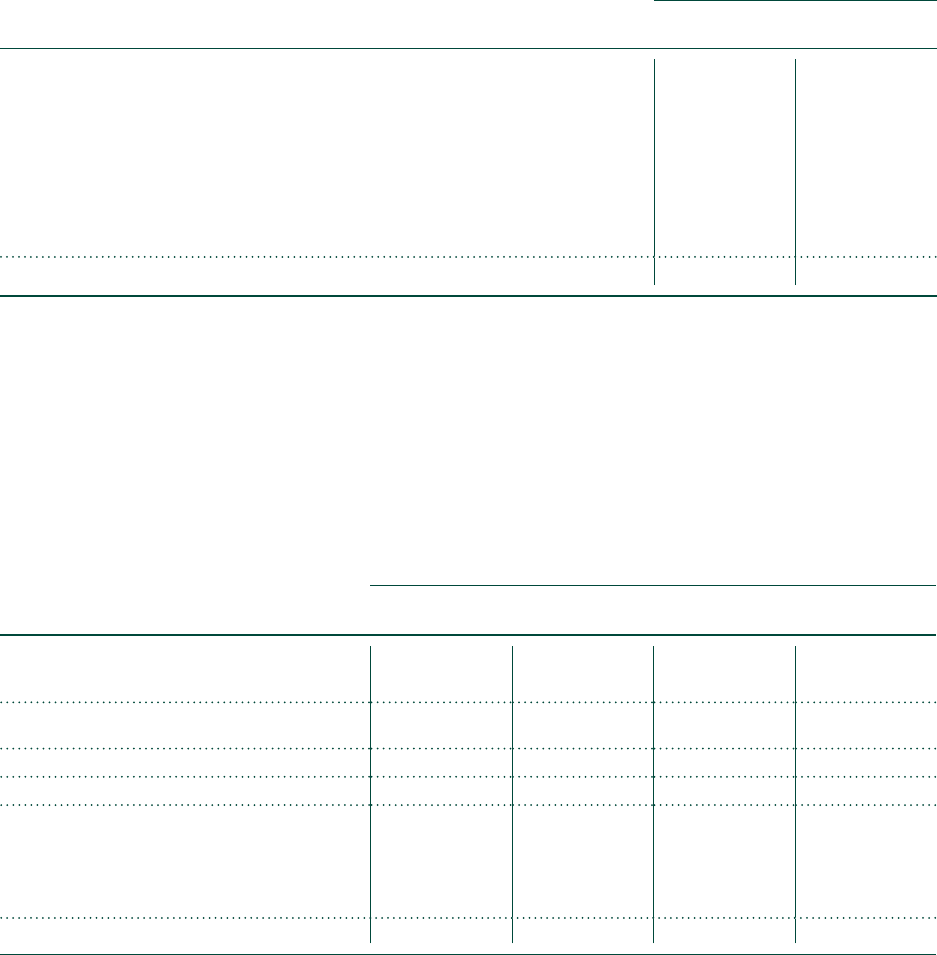

The following table summarizes other nancial measures as at March 31, 2023 and March 31, 2022:

AS AT MARCH 31

(In thousands except for per unit and % amounts) 2023 2022 CHANGE % CHANGE

Investment properties and investment properties

held for sale

(1)

$11,052,110 $10,599,738 $452,372 4.3%

Unencumbered investment properties

and investment properties

held for sale

(2)

$9,749,760 $9,369,227 $380,533 4.1%

Total Assets

(1)

$11,968,357 $11,413,692 $554,665 4.9%

Cost of PUD as a % of GBV

(2)

11.5% 10.8% — 0.7%

NAV per unit $50.41 $50.92 $(0.51) (1.0)%

Debt

(1)

$4,340,919 $3,769,606 $571,313 15.2%

Total indebtedness ratio

(2)

36.5% 33.3% — 3.2%

Annualized Adjusted EBITDA

(2)

$411,980 $366,888 $45,092 12.3%

Net debt as a multiple of Annualized Adjusted EBITDA

(2)

10.5x 10.2x 0.3x —

Interest coverage ratio including interest capitalized and

excluding financing prepayment costs - three months trailing

(2)

2.4x 3.3x (0.9x) —

Interest coverage ratio including interest capitalized and

excluding financing prepayment costs - twelve months trailing

(2)

2.8x 3.4x (0.6x) —

(1) This measure is presented on an IFRS basis.

(2) This is a non-GAAP measure, and includes the results of the continuing operations and the discontinued operations. Refer to the Non-GAAP

Measures section below.

LEASING

Allied had 243 lease tours in its rental portfolio in the rst quarter, slightly higher than the 240 in the comparable

quarter last year and considerably higher than the 226 in the prior quarter. Allied’s occupancy and leased area

declined to 88.2% and 88.8%, respectively, though they were a bit better than forecast for quarter-end. The

modest decline from the prior quarter was driven by a non-renewal in Kitchener (with a large, long-time user

moving into an owned building) and the transition of The Lougheed Building in Calgary from PUD to the rental

portfolio. Allied is advanced in replacing the Kitchener user and working with an educational organization

toward leasing The Lougheed Building in its entirety.

Average in-place net rent per occupied square foot continued to rise in the rst quarter, reaching $23.35 at

quarter-end, and Allied continued to achieve rent increases on renewal (up 11% ending-to-starting base rent and

up 18% average-to-average base rent). As a result, NOI and same-asset NOI were slightly higher than forecast for

the quarter.

The leasing metrics for the three months ended March 31, 2023, and March 31, 2022 are set out in the table

below:

AS AT MARCH 31

2023 2022 CHANGE % CHANGE

Leased area

(1)

88.8% 89.3% — (0.5%)

Occupied area

(1)

88.2% 88.3% — (0.1%)

Average in-place net rent per occupied square foot -

excluding UDC in both periods $23.35 $22.52 $0.83 3.7%

(1) This metric excludes the assets held for sale based on the assets held for sale classiication at the end of each period.

Given the scale of Allied’s rental portfolio, upgrade activity is now constant in all markets, particularly Montréal,

Toronto and Vancouver. The goal of the upgrade activity is to serve users better and boost net rent per occupied

square foot over time. At the end of the rst quarter, Allied’s rental portfolio was comprised of (i) 14,047,591

4

square feet of GLA in buildings that are largely stabilized and (ii) 375,061 square feet of GLA in buildings that are

undergoing active upgrade. The occupied area of the former was 88.8%, with leased area at 89.3%. The occupied

area of the latter was 68.7%, with leased area at 69.3%.

SALE OF UDC PORTFOLIO

Scotiabank and CBRE are well advanced in conducting a comprehensive sale process with respect to Allied’s UDC

portfolio. They contacted nearly 100 potential buyers worldwide in January, approximately 30% of which signed

Non-Disclosure Agreements and gained access to the Virtual Data Room. Allied received rst-round bids on

March 24 and narrowed the eld for the second round and again for a third round, at the end of which it expects

to receive rm bids. While Management cannot yet be certain as to the outcome, it expects a rm agreement and

closing within the parameters anticipated when Allied embarked on the process.

Allied’s principal motivation in selling the UDC portfolio is two-fold. First, Allied wants to rearm its mission

and pursue it over the next few years with low-cost capital. Second, it wants to supercharge its balance sheet and

reduce its dependence on the capital markets going forward.

Allied expects to use most of the sale proceeds to retire debt and the balance to fund current development

activity. Allied may elect to use a portion of the sale proceeds to buy back units under its NCIB. It does not expect

to use any of the proceeds to fund acquisitions, nor does it expect to engage in material acquisition activity in

2023.

OUTLOOK

Allied’s internal forecast for 2023 calls for low-to-mid-single-digit percentage growth in each of same asset NOI,

FFO per unit and AFFO per unit. Allied does not forecast NAV per unit growth in any given time period.

Allied continues to have deep condence in, and commitment to, its stratey of consolidating and intensifying

distinctive urban workspace in Canada’s major cities. Allied rmly believes that its stratey is underpinned by

the most important secular trends in Canadian and global real estate. Allied also rmly believes that it has the

properties, the nancial strength, the people and the platform necessary to execute its stratey for the ongoing

benet of its Unitholders and other constituents.

NONGAAP MEASURES

Management uses nancial measures based on International Financial Reporting Standards (“IFRS” or “GAAP”)

and non-GAAP measures to assess Allied’s performance. Non-GAAP measures do not have any standardized

meaning prescribed under IFRS, and therefore, should not be construed as alternatives to net income or cash

ow from operating activities calculated in accordance with IFRS. Refer to the Non-GAAP Measures section on

page 22 of the MD&A as at March 31, 2023, available on www.sedar.com, for an explanation of the composition

of the non-GAAP measures used in this press release and their usefulness for readers in assessing Allied’s

performance. Such explanation is incorporated by reference herein.

RECONCILIATIONS OF NONGAAP MEASURES

The following tables reconcile the non-GAAP measures to the most comparable IFRS measures for the three

months ended March 31, 2023, and the comparable period in 2022. These terms do not have any standardized

meaning prescribed under IFRS and may not be comparable to similarly titled measures presented by other

publicly traded entities.

5

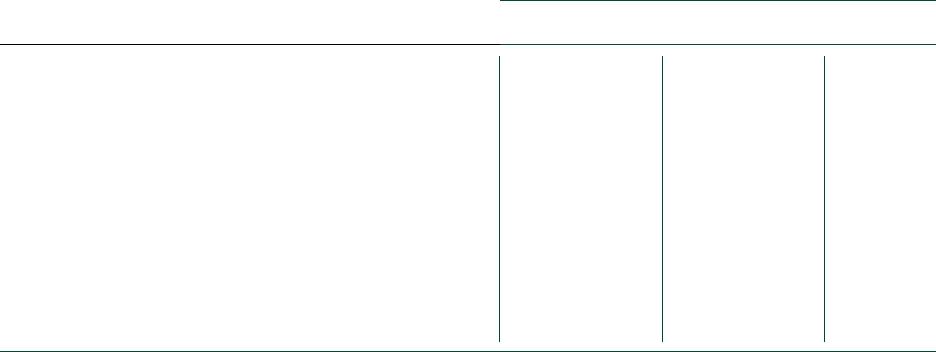

SAME ASSET NOI

Same asset NOI, a non-GAAP measure, is measured as the net operating income for the properties that Allied

owned and operated for the entire duration of both the current and comparative period. Same asset NOI of the

assets held for sale for the three months ended March 31, 2023, consists of ve investment properties.

THREE MONTHS ENDED CHANGE

MARCH 31,

2023

MARCH 31,

2022

$ %

Rental Portfolio - Same Asset NOI $68,221 $68,086 $135 0.2%

Assets Held for Sale - Same Asset NOI 13,522 16,279 (2,757) (16.9)

Rental Portfolio and Assets Held for Sale -

Same Asset NOI $81,743 $84,365 $(2,622) (3.1%)

Development Portfolio - Same Asset NOI $4,611 $3,002 $1,609 53.6%

Total Portfolio - Same Asset NOI $86,354 $87,367 $(1,013) (1.2%)

Acquisitions $9,030 $— $9,030

Dispositions — 435 (435)

Lease terminations 193 124 69

Development fees and corporate items 2,125 3,188 (1,063)

Total NOI $ 97,7 02 $91,114 $6,588 7.2%

ADJUSTED EARNINGS BEFORE INTEREST, TAXES, DEPRECIATION AND AMORTIZATION “ADJUSTED EBITDA”

The following table reconciles Allied’s net (loss) income and comprehensive (loss) income to Adjusted EBITDA, a

non-GAAP measure, for the three months ended March 31, 2023 and March 31, 2022.

THREE MONTHS ENDED

MARCH 31,

2023

MARCH 31,

2022

Net (loss) income and comprehensive (loss) income for the period $(13,683) $187,190

Interest expense 24,335 16,669

Amortization of other assets 370 261

Amortization of improvement allowances 8,368 7,900

Fair value loss (gain) on investment properties and investment properties held for sale

(1)

75,791 (101,220)

Fair value loss (gain) on derivative instruments 8,024 (19,198)

Mark-to-market adjustment on unit-based compensation (210) 120

Adjusted EBITDA

(2)

$102,995 $91,722

(1) Includes Allied’s proportionate share of the equity accounted investment’s fair value loss on investment properties of $4,023 for the three months ended March 31,

2023 (March 31, 2022 - fair value gain on investment properties of $7,292).

(2) Includes the Urban Data Centre segment which was classied as a discontinued operation starting in Q4 2022.

6

FUNDS FROM OPERATIONS “FFO” AND ADJUSTED FUNDS FROM OPERATIONS “AFFO”

The following tables reconcile Allied’s net (loss) income and comprehensive (loss) income to FFO, FFO excluding

condominium related items and the mark-to-market adjustment on unit-based compensation, AFFO, and AFFO

excluding condominium related items and the mark-to-market adjustment on unit-based compensation, which are

non-GAAP measures, for the three months ended March 31, 2023, and March 31, 2022.

THREE MONTHS ENDED

MARCH 31,

2023

MARCH 31,

2022

CHANGE

Net (loss) income and comprehensive (loss) income from continuing

operations $(31,702) $68,874 $(100,576)

Net income and comprehensive income from discontinued operations 18,019 118,316 (100,297)

Adjustment to fair value of investment properties and investment

properties held for sale 71,768 (93,928) 165,696

Adjustment to fair value of derivative instruments 8,024 (19,198) 27,222

Incremental leasing costs 2,240 2,353 (113)

Amortization of improvement allowances 8,185 7,7 67 418

Amortization of property, plant and equipment

(1)

100 — 100

Adjustments relating to joint venture:

Adjustment to fair value on investment properties 4,023 (7,292) 11,315

Amortization of improvement allowances 183 133 50

Interest expense

(2)

335 315 20

FFO $81,175 $77,340 $3,835

Condominium marketing costs 120 113 7

Mark-to-market adjustment on unit-based compensation (210) 120 (330)

FFO excluding condominium related items and the mark-to-market

adjustment on unit-based compensation $81,085 $77,573 $3,512

Amortization of straight-line rents (1,993) (209) (1,784)

Regular leasing expenditures (1,126) (3,195) 2,069

Regular maintenance capital expenditures (33) (386) 353

Incremental leasing costs (related to regular leasing expenditures) (1,568) (1,647) 79

Recoverable maintenance capital expenditures (1,835) (315) (1,520)

Adjustment relating to joint venture:

Amortization of straight-line rents (48) (250) 202

AFFO excluding condominium related items and the mark-to-market

adjustment on unit-based compensation $74,482 $71,571 $2,911

Weighted average number of units

(3)

Basic 139,765,128 128,074,012 11,691,116

Diluted 139,765,128 128,279,982 11,485,146

Per unit - basic

FFO $0.581 $0.604 $(0.023)

FFO excluding condominium related items and the mark-to-market adjust-

ment on unit-based compensation $0.580 $0.606 $(0.026)

AFFO excluding condominium related items and the mark-to-market

adjustment on unit-based compensation $0.533 $0.559 $(0.026)

7

THREE MONTHS ENDED

MARCH 31,

2023

MARCH 31,

2022

CHANGE

Per unit - diluted

FFO $0.581 $0.603 $(0.022)

FFO excluding condominium related items and the mark-to-market adjust-

ment on unit-based compensation $0.580 $0.605 $(0.025)

AFFO excluding condominium related items and the mark-to-market

adjustment on unit-based compensation $0.533 $0.558 $(0.025)

Pay-out Ratio

FFO 77.5% 72.4% 5.1%

FFO excluding condominium related items and the mark-to-market adjust-

ment on unit-based compensation 7 7.6% 72.1% 5.5%

AFFO excluding condominium related items and the mark-to-market

adjustment on unit-based compensation 84.4% 78.2% 6.2%

(1) Property, plant and equipment relates to owner-occupied property.

(2) This amount represents interest expense on Allied’s joint venture investment in TELUS Sky and is not capitalized under IFRS, but is allowed as an

adjustment under REALPAC’s deinition of FFO.

(3) The weighted average number of units includes Units and Exchangeable LP Units. The Exchangeable LP Units are classiied as equity in the

unaudited condensed consolidated inancial statements as non-controlling interests.

CAUTIONARY STATEMENTS

This press release may contain forward-looking statements with respect to Allied, its operations, stratey,

nancial performance and condition and the expected impact of the global pandemic and consequent economic

disruption. These statements generally can be identied by use of forward-looking words such as “forecast”,

“may”, “will”, “expect”, “estimate”, “anticipate”, “intends”, “believe” or “continue” or the negative thereof or

similar variations. Allied’s actual results and performance discussed herein could dier materially from those

expressed or implied by such statements. Such statements are qualied in their entirety by the inherent risks

and uncertainties surrounding future expectations, including the eect of the global pandemic and consequent

economic disruption. Important factors that could cause actual results to dier materially from expectations

include, among other things, general economic and market factors, competition, changes in government

regulations and the factors described under “Risk Factors” in Allied’s Annual Information Form which is

available at www.sedar.com. The cautionary statements qualify all forward-looking statements attributable to

Allied and persons acting on its behalf. Unless otherwise stated, all forward-looking statements speak only as of

the date of this press release, and Allied has no obligation to update such statements.

ABOUT ALLIED

Allied is a leading operator of distinctive urban workspace in Canada’s major cities and network-dense

UDC space in Toronto. Allied’s mission is to provide knowledge-based organizations with workspace that is

sustainable and conducive to human wellness, creativity, connectivity and diversity. Allied’s vision is to make a

continuous contribution to cities and culture that elevates and inspires the humanity in all people.

FOR FURTHER INFORMATION, PLEASE CONTACT:

MICHAEL EMORY

President & Chief Executive Ocer

(416) 9770643

memory@alliedreit.com

TOM BURNS

Executive Vice President &

Chief Operating Ocer

(416) 9779002

tburns@alliedreit.com

CECILIA WILLIAMS

Executive Vice President &

Chief Financial Ocer

(416) 9779002