2BDoD 7000.14-R Financial Management Regulation Volume 9, Chapter 3

*August 2011

3-1

VOLUME 9, CHAPTER 3: “DEPARTMENT OF DEFENSE GOVERNMENT

TRAVEL CHARGE CARD (GTCC)”

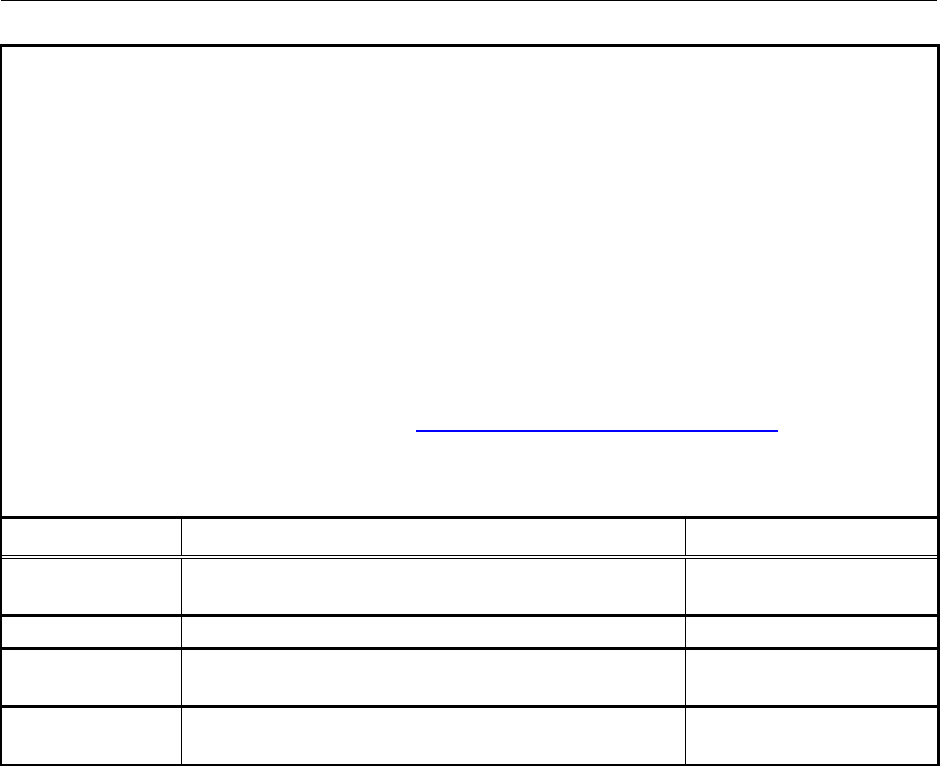

SUMMARY OF MAJOR CHANGES

All changes are denoted by blue font.

Substantive revisions are denoted by an * symbol preceding the section, paragraph,

table, or figure that includes the revision.

Unless otherwise noted, chapters referenced are contained in this volume.

Hyperlinks are denoted by bold, italic, blue and underlined font.

The previous version dated August 2010 is archived.

PARAGRAPH

EXPLANATION OF CHANGE/REVISION

PURPOSE

030202

Added mailing address for Defense Travel

Management Office.

Add

031001

Corrected reference to read 10 U.S.C. 2784a.

Update

031004

Change reference from Public Law 107 to

10 U.S.C. 2784a.

Update

All

Updated hyperlinks and format to comply with

current guidance.

Update

2BDoD 7000.14-R Financial Management Regulation Volume 9, Chapter 3

*August 2011

3-2

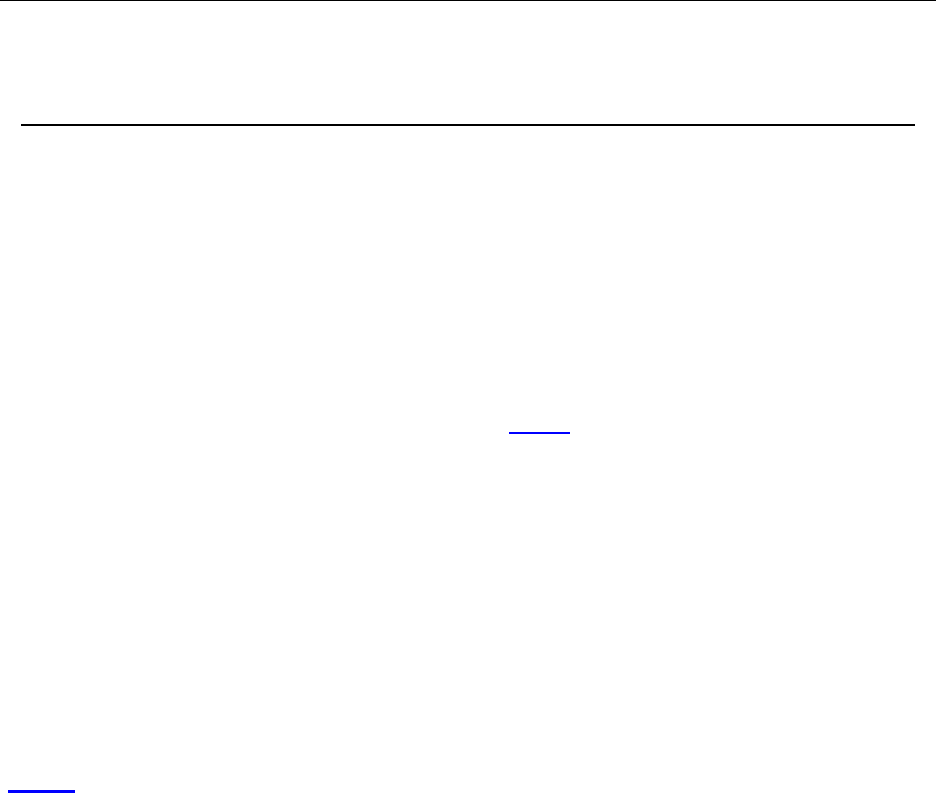

Table of Contents

VOLUME 9, CHAPTER 3: “DEPARTMENT OF DEFENSE GOVERNMENT TRAVEL

CHARGE CARD (GTCC)” ............................................................................................................ 1

0301 POLICY AND PURPOSE ............................................................................................. 5

030101. Overview .............................................................................................................. 5

030102. GTCC Applicable ................................................................................................. 5

030103. Compliance........................................................................................................... 5

0302 RESPONSIBILITIES ..................................................................................................... 5

030201. General Services Administration (GSA) .............................................................. 5

*030202. Under Secretary of Defense (Personnel and Readiness) (USD (P&R))............... 6

030203. The Defense Travel Management Office (DTMO) .............................................. 6

030204. Defense Finance and Accounting Service (DFAS) .............................................. 6

030205. Comptrollers ......................................................................................................... 6

030206. DoD Component Heads/Defense Agency Directors ............................................ 7

030207. CBA Managers ..................................................................................................... 7

030208. Travel Cardholders ............................................................................................... 7

0303 GENERAL GTCC INFORMATION ............................................................................ 8

030301. Individually Billed Accounts (IBAs) ................................................................... 8

030302. Centrally Billed Accounts (CBAs) ....................................................................... 8

030303. Disputes ................................................................................................................ 9

030304. Electronic Access System (EAS) ....................................................................... 10

030305. Automated Teller Machine (ATM) Use ............................................................. 10

030306. Merchant Category Codes (MCCs) .................................................................... 10

030307. Rebates ............................................................................................................... 10

0304

GTCC ELIGIBILITY ................................................................................................... 11

030401. DoD Personnel ................................................................................................... 11

030402. Foreign Nationals ............................................................................................... 11

030403. Non-appropriated Fund Instrumentality (NAFI) Employees ............................. 11

030404. Recruiting Personnel .......................................................................................... 11

030405. DoD Contractors ................................................................................................ 11

0305 USE OF THE GTCC .................................................................................................... 11

030501. Requirement ....................................................................................................... 11

030502. Failure to Use GTCC.......................................................................................... 12

030503. Statement Notifying Traveler of the Requirements of TTRA............................ 12

2BDoD 7000.14-R Financial Management Regulation Volume 9, Chapter 3

*August 2011

3-3

Table of Contents (Continued)

0306 EXEMPTIONS............................................................................................................. 12

030601. GSA Exemptions from the Mandatory Use of GTCC ....................................... 12

030602. DoD Exemptions from Mandatory Use of the GTCC........................................ 13

030603. Exemptions of Mandatory Use for Expenses ..................................................... 14

030604. Additional Exemptions ....................................................................................... 14

*030605. Notifications of Exemptions............................................................................... 14

030606. Payment Methods Authorized When Exempt .................................................... 14

0307 NON-MANDATORY USE OF THE GTCC ............................................................... 15

030701. Card Use ............................................................................................................. 15

030702. Local Travel ....................................................................................................... 15

0308 GTCC TRAINING ....................................................................................................... 15

030801. APC Training ..................................................................................................... 15

030802. Cardholder (IBA) Training................................................................................. 15

030803. Records Retention .............................................................................................. 16

0309 APPLYING FOR A GTCC .......................................................................................... 16

030901. IBA Applications................................................................................................ 16

030902. Issuance of Cards by Contractor (IBA) .............................................................. 17

030903. CBA Applications .............................................................................................. 17

0310

PROGRAM MANAGEMENT CONTROL ................................................................ 18

031001. Requirement for Credit Checks .......................................................................... 18

031002. Non-Qualifying Applicants ................................................................................ 18

031003. Misuse ................................................................................................................ 18

031004. Split Disbursement ............................................................................................. 19

031005. Program Review ................................................................................................. 19

031006. Data Mining........................................................................................................ 19

0311 AGENCY PROGRAM COORDINATOR (APC) DUTIES ........................................ 19

031101. General ............................................................................................................... 19

031102. Maintain Records ............................................................................................... 20

031103. Hierarchy Structure ............................................................................................ 20

031104. Procedures in the GTCC Training Guides ......................................................... 20

031105. Closure of GTCC Cardholders ........................................................................... 20

031106. Monitor and Reporting Delinquencies ............................................................... 20

031107. Review Reports to Identify Accounts for Closure ............................................. 21

031108. GTCC Training .................................................................................................. 21

2BDoD 7000.14-R Financial Management Regulation Volume 9, Chapter 3

*August 2011

3-4

Table of Contents (Continued)

0312 TRAVELER REIMBURSEMENT AND PAYMENT RESPONSIBILITIES ............ 21

031201. Timely Reimbursement of Travel Expenses ...................................................... 21

031202 Responsibilities of Travelers for Payments ........................................................... 22

0313 DELINQUENCY MANAGEMENT ........................................................................... 24

031301. Pre-suspension Notification for Accounts 45 Days Past Billing ....................... 24

031302. Suspension of Accounts 61 Days Past Billing ................................................... 24

031303. 90-Day Delinquency Notification to Supervisors .............................................. 24

031304. Cancellation of Accounts 120 Days Past Billing ............................................... 24

031305. Cancellation of IBAs Suspended Two Times .................................................... 25

031306. Mission-Critical Travel (IBA) ............................................................................ 25

031307. Exception Status (CBA) ..................................................................................... 25

0314 MANAGEMENT REPORTS PROVIDED BY THE GTCC CONTRACTOR .......... 25

031401. General ............................................................................................................... 25

031402. Aging Analysis Report ....................................................................................... 26

031403. Cardholder Account Listing Report ................................................................... 26

031404. Delinquency Report............................................................................................ 26

031405. Pre-Suspension Report ....................................................................................... 26

031406. Suspension/Pre-cancellation Report ................................................................... 26

031407. Account Renewal Report ................................................................................... 26

031408. Weekend/Holiday Activity Exceptions Report .................................................. 26

031409. Non-Travel Activity Exceptions Report ............................................................ 26

031410. Account Activity Report .................................................................................... 27

031411. Authorizations/Declines ..................................................................................... 27

031412. Exceptions/Returned Checks.............................................................................. 27

031413. Blocked MCCs ................................................................................................... 27

ANNEX 1: STATEMENT OF UNDERSTANDING ................................................................ 1

ANNEX 2: SAMPLE 61 DAY DELINQUENCY MEMORANDUM (IBA) ........................... 2

ANNEX 3: SAMPLE 91 DAY DELINQUENCY MEMORANDUM (IBA) ........................... 3

ANNEX 4: SAMPLE 121 DAY DELINQUENCY MEMORANDUM (IBA) ......................... 4

2BDoD 7000.14-R Financial Management Regulation Volume 9, Chapter 3

*August 2011

3-5

CHAPTER 3

DEPARTMENT OF DEFENSE GOVERNMENT TRAVEL CHARGE CARD (GTCC)

0301 POLICY AND PURPOSE

030101. Overview

The Department of Defense (DoD) policy is that the Government Travel Charge Card

(GTCC) will be used by all DoD personnel to pay for all costs related to official Government

travel. Official government travel is defined as travel under competent orders while performing

duties pertaining to official government assignments such as temporary duty (TDY) and

permanent change of station (PCS) (where applicable). Refer to the Travel and Transportation

Reform Act of 1998 (TTRA), Public Law 105-264 (TTRA) for additional information regarding

mandatory use of the GTCC.

030102. GTCC Applicable

GTCC policies are applicable to all DoD employees and uniformed members.

030103. Compliance

It is the responsibility of commanders and supervisors at all levels to ensure compliance.

A. Military personnel who violate the specific prohibitions contained in this

Regulation can be prosecuted under Article 92 of the Uniform Code of Military Justice (UCMJ)

(UCMJ) for failure to obey a lawful order or regulations, as well as any other applicable article

of the UCMJ based on the nature of the misconduct involved.

B. Civilian personnel who misuse or abuse the GTCC may be subject to

appropriate administrative or disciplinary action up to, and including, removal from Federal

service.

C. Willful misuse of the GTCC by either military personnel or civilian

employees may constitute a crime punishable under Federal or State law.

0302 RESPONSIBILITIES

030201. General Services Administration (GSA)

The GSA is responsible for issuing government-wide GTCC policies and procedures for

implementation of the TTRA, and awards and administers a master contract for the GTCC

program, which is part of the “GSA SmartPay® Program.” Through these contracts, agencies

can obtain several types of charge card products and services to support their mission needs. The

DoD tailored task order which further outlines DoD requirements for the GTCC is managed at

the DoD level.

2BDoD 7000.14-R Financial Management Regulation Volume 9, Chapter 3

*August 2011

3-6

*030202. Under Secretary of Defense (Personnel and Readiness) (USD (P&R))

The USD (P&R) will establish DoD wide policies for the DoD GTCC program through

the Defense Travel Management Office. Questions concerning travel policy, exceptions or

deviations should be addressed to:

Defense Travel Management Office

ATTN: Enterprise Operations Division

4800 Mark Center Drive

Suite 04J25-01

Alexandria, VA 22350-9000

NOTE: Questions related to travel and transportation allowances should be addressed to

“ATTN: Enterprise Operations Division.” For other travel questions, please contact

1-888-Help1Go (888-435-7146) to connect you with the Travel Assistance Center. From

overseas dial DSN 312-564-3950 or commercial 809-463-3376 (wait for the beep) then dial

1-888-Help1Go. Travelers may submit a help desk ticket through the tickets section of Travel

Explorer (TraX) http://www.defensetravel.dod.mil/Sections/HD_Main.cfm.

030203. The Defense Travel Management Office (DTMO)

The DTMO is the Travel Card Program Manager for DoD Components and awards and

manages the GTCC DoD tailored task order. The DTMO provides guidance, policy, and overall

management of the DoD GTCC program. The DTMO acts as a liaison to GSA, the travel card

provider/contractor and DoD Component Heads/Component Program Managers (CPMs) on

GTCC related issues. The DTMO will meet regularly with the CPMs to discuss and make

critical decisions concerning travel card administration throughout the DoD. The DTMO will

also ensure that GTCC program training materials are made available throughout the

Department.

030204. Defense Finance and Accounting Service (DFAS)

The DFAS will facilitate traveler determination of any late payment fees or charges that

may be payable to a traveler under the TTRA as indicated in subparagraph 031201.C below.

030205. Comptrollers

The Military Department Assistant Secretaries (Financial Management and Comptroller)

and Defense Agency Comptrollers, or equivalents, will ensure program management

responsibilities are accomplished within their respective Component, and will designate a

Component Program Manager. The CPM will be designated in writing and identified both to the

DTMO and the GTCC contractor.

2BDoD 7000.14-R Financial Management Regulation Volume 9, Chapter 3

*August 2011

3-7

030206. DoD Component Heads/Defense Agency Directors

The heads of the DoD Components are responsible for developing TTRA implementation

strategy for use in that Component. The Component Heads will also ensure all personnel, to

include Agency Program Coordinators (APCs), Centrally Billed Account (CBA) Managers, and

cardholders, are properly trained on travel card use and policy.

A. DoD Component Program Managers (CPMs). The CPMs are responsible

for establishing and managing their GTCC program in accordance with this regulation. Each

CPM is also responsible for establishing and maintaining the Component's organizational

structure ("hierarchy") and notifying the DTMO and the GTCC contractor of any changes in

organizational structure that affect the GTCC program. The CPMs will conduct periodic

hierarchy level reviews, to include validating hierarchy level structure and verifying point of

contact information. This process may be delegated down to lower hierarchy levels. The CPMs

will also ensure that Individually Billed Accounts (IBAs) and Centrally Billed Accounts (CBAs)

are properly approved; reasonable credit limits are established and maintained; and annual

reviews are performed to monitor credit limits and card utilization.

B. Agency Program Coordinators (APCs). An APC is an individual

(uniformed member, employee, contractor, or foreign national) designated in writing by a

commander or director as responsible for the management of the travel card program. APCs are

responsible to their respective DoD CPM’s for program execution and management for the day-

to-day operations of the DoD GTCC program. Detailed APC duties can be found in section

0311.

030207. CBA Managers

A CBA manager is an individual (uniformed member, employee, contractor, or foreign

national) designated in writing by a commander or director as responsible for the management of

CBAs. Account managers are responsible for day-to-day management and reconciliation of

CBAs. Account managers must be familiar with their designated payment office and designated

billing office points of contact. Contractors and foreign national employees may be CBA

managers but neither are authorized to certify CBAs for payment.

030208. Travel Cardholders

A cardholder is a government employee (civilian or military) who has been issued a

GTCC for use while performing official government travel. Cardholders must adhere to the

procedures set forth in this Regulation and applicable DoD Component guidance, to include the

GTCC contractor’s cardholder agreement and terms and conditions of use. Cardholders are

required to submit travel vouchers within 5 business days of completion of travel, use split

disbursement to pay the outstanding balance, and are responsible for payment in full of all

undisputed amounts due in the monthly billing statement from the GTCC contractor by the due

date, regardless of the status of their travel reimbursement. Cardholders are responsible for

providing a signed Statement of Understanding (SOU) (Annex 1) and certificate of training to

their APC. An electronic version of the SOU can be found at www.defensetravel.dod.mil under

2BDoD 7000.14-R Financial Management Regulation Volume 9, Chapter 3

*August 2011

3-8

the travel card section. Cardholders whose accounts become delinquent may be subject to

disciplinary or administrative action.

0303 GENERAL GTCC INFORMATION

030301. Individually Billed Accounts (IBAs)

An IBA is an account issued to an individual uniformed member or DoD civilian. The

cardholder receives the billing statement directly from the contractor at the address on file with

the GTCC contractor. It is the cardholder’s responsibility to notify the APC and the GTCC

contractor of changes in contact information such as a new address, name change, new employer,

or change in email address. The individual cardholder is liable for payment of the full

undisputed amount indicated on the billing statement by the due date, regardless of the status of

his/her travel reimbursement.

A. Standard GTCC. Standard cards are issued to individuals with a

qualifying credit score (FICO score of 660+). The credit, automatic teller machine (ATM), and

retail limits will be as prescribed by the Department. Standard accounts are activated upon

verification of receipt of the card. The APC, CPM, or DTMO have the authority to increase the

limits on a temporary basis, as needed/when requested, to meet mission requirements.

Commanders and supervisors must validate the requirement to increase the limit. Limits are

raised on a temporary basis not to exceed 12 months and can be accomplished within the GTCC

contractor’s electronic access system or by contacting the GTCC contractor. Approval

authority/limits within the Department are communicated to the GTCC contractor through the

DTMO.

B. Restricted GTCC. Restricted cards are issued to individuals with a non-

qualifying credit score (FICO score of 500-659), individuals with no credit history, or to selected

individuals as directed by their commander or supervisor. Individuals who do not consent to a

credit check will be issued a restricted card. Restricted GTCCs are the same in appearance as

standard cards; however, they may remain inactive after receipt verification of the card. When

the cardholder is scheduled for travel, he/she requests the APC to activate the card for the

specified travel event. The credit, ATM, and retail limits will be as prescribed by the

Department. In the same manner as standard cards, APCs, CPMs and the DTMO are authorized

to raise these limits temporarily in order to meet mission requirements. Limits are raised on a

temporary basis not to exceed six months and can be accomplished within the GTCC

contractor’s electronic access system.

030302. Centrally Billed Accounts (CBAs)

A CBA is a GTCC issued to a DoD activity. CBAs are issued to make travel

arrangements and must be used in lieu of issuing a Government Transportation Request (SF

1169) for payment purposes. Payments are subject to the “Prompt Payment Act of 1982,”

(Prompt Payment Act) as amended. These accounts contain a unique prefix that identifies the

account as a CBA for official federal government travel. This prefix also identifies the account

as eligible for government travel rates, including city pair rates, and tax exemption. The APC

2BDoD 7000.14-R Financial Management Regulation Volume 9, Chapter 3

*August 2011

3-9

must forward any request to establish a CBA or increase a credit limit to the cognizant CPM for

approval. The CPMs will also ensure that annual reviews are performed to monitor credit limits

and card utilization. CBAs are issued for the following purposes:

A. Transportation Accounts. Transportation GTCC accounts (CBAs) are

issued to DoD activities for use in purchasing transportation, including airline tickets, bus tickets,

and rail tickets. Transportation accounts will be used when a traveler has not been issued an IBA

or is exempt from mandatory use of the GTCC. These purchases are made through a Commercial

Travel Office (CTO) directly with the travel service provider or their agent (e.g., charter bus or

air companies). The transportation office, or other designated DoD activity, receives and is

responsible for reconciling the transportation charges appearing on the invoice and for

verifying/certifying the invoices for payment. The transportation office, or other designated

DoD activity, will forward verified/certified invoices to the designated entitlement office (i.e.,

vendor pay) for computation and subsequent transmittal to designated disbursement office. This

will be completed in a manner that allows payment to be made within the 30-day limitation

prescribed in the “Prompt Payment Act” thus avoiding any interest penalties.

B. Unit Travel Charge Cards. DoD Components may use unit travel charge

cards for group travel requirements only when it is cost effective, in the best interest of the

mission, and authorized by the CPM. Categories of travelers whose travel expenses may be

charged to unit travel charge cards include, but are not limited to, new recruits and employees

who do not yet have IBAs, prisoners, DoD group travelers, and foreign nationals participating in

support of official DoD sponsored programs or activities. Components will limit the issuance of

unit travel charge cards whenever possible and maximize the use of IBAs. ATM withdrawals

against unit cards will also be limited. The GTCC contractor must receive written approval from

the cognizant CPM before issuing a unit travel charge card. Upon receipt of each invoice, the

designated unit cardholder is responsible for reconciling the GTCC charges and promptly

providing the reconciled copy of the statement to the unit account coordinator. The unit account

coordinator is responsible for reconciling the charges appearing on the summary account

monthly statement which is a composite (rollup) of all charges from all cards assigned to that

organization. The unit account coordinator is also responsible for filing any disputes with the

GTCC contractor. Once the billing statement is reconciled, the unit account coordinator will

obtain fund certification from the cognizant resource management office before forwarding

certified billing statements, with any required supporting documentation, to the designated

entitlement office (i.e., vendor pay) for computation and subsequent transmittal to the designated

disbursement office.

030303. Disputes

In the event that the billing statement includes charges that the account holder considers

questionable, the cardholder will first contact the merchant to try to resolve the questionable

charge. If unsuccessful, he or she will obtain a dispute form from the APC (IBA), account

manager (CBA), or from the GTCC contractor’s website. The cardholder will complete and send

the form to the GTCC contractor. All disputes must be filed within 60 days of the date on the

billing statement which the erroneous charge first appeared. It is the responsibility of the

cardholder to ensure the dispute form has been received by the GTCC contractor. Once the

2BDoD 7000.14-R Financial Management Regulation Volume 9, Chapter 3

*August 2011

3-10

dispute notification has been received by the GTCC contractor, the contractor will issue a

provisional credit for the amount of the dispute pending resolution. Formally disputed charges

will not age and the account will not suspend for lack of payment. Any disputed charge

identified in the reconciliation process will be resolved in the manner prescribed in the GSA

SmartPay® Master Contract.

030304. Electronic Access System (EAS)

The GTCC contractor provides an EAS for GTCC program management. The EAS is

accessed via the Internet and will be used by CPMs, APCs, cardholders, and other authorized

users to assist in the management of their GTCC accounts by displaying account and transaction

data and by providing reporting capability. Individuals with access to the EAS will use the

system to the maximum extent possible. The CPMs will inform the GTCC contractor of any

organizations (e.g., major commands, major subordinate commands, bases or installations) that

are unable to access the EAS. In cases where access to the GTCC contractor’s EAS is not

available, reports may be provided by the vendor with approval of the CPM or the DTMO.

030305. Automated Teller Machine (ATM) Use

Travelers should use the GTCC IBA at ATMs to obtain cash needed to pay for “out-of-

pocket” travel-related expenses. Valid “out-of-pocket” travel-related expenses are those that

cannot be charged on the GTCC (see 030602 for examples). The cardholder will contact the

GTCC contractor to establish a personal identification number to gain ATM access. ATM

advances will not be obtained more than three working days before the scheduled departure date

of any official travel. The GTCC contractor will charge the cardholder a transaction fee for

ATM use. This charge, which appears on the cardholder’s billing statement, is a reimbursable

expense and should be included on the traveler’s voucher. In addition, ATM owners may charge

a service fee for ATM access; this fee also is reimbursable and should be included on the

traveler’s voucher. A travel advance from DoD disbursing offices may not be authorized for

personnel who have been or are eligible to be issued an individual GTCC. Commanders and

supervisors may authorize, in writing, a travel advance from a DoD disbursing office in

situations where necessary to meet mission requirements.

030306. Merchant Category Codes (MCCs)

An MCC is a four-digit number assigned to a business by MasterCard® or VISA® when

the business first starts accepting one of these cards as a form of payment. The MCC is used to

classify a business by the type of goods or services provided. The Department blocks some

MCCs to prevent inappropriate card use. MCC Blocks may be modified for unit cards based on

mission needs during the initial setup of the account.

030307. Rebates

A rebate is a benefit the DoD receives for the use, and timely payment of, the GTCC.

Two types of rebates, sales and productivity, are available from the GTCC contractor. Sales

rebates are based on charge volume and productivity rebates are based on payment performance.

2BDoD 7000.14-R Financial Management Regulation Volume 9, Chapter 3

*August 2011

3-11

The rebates are computed and distributed on a quarterly basis. The formula used to compute

these rebates varies depending on the type of rebate. Each Component will ensure the rebates

are properly recorded. The heads of DoD Components will determine the distribution of rebates

within their organizations.

0304 GTCC ELIGIBILITY

030401. DoD Personnel

All DoD personnel (military and civilian), unless otherwise exempt, who perform travel

as part of their duties will obtain and use the individually billed GTCC. DoD personnel will be

issued only one GTCC. If a DoD employee is a member of a Reserve/Guard unit, the GTCC will

be issued through the individual’s civilian agency, not his/her Reserve/Guard unit. When a

Reserve/Guard member is required to perform training or active duty, a copy of his/her military

orders must be provided to his/her DoD agency. When an individual is not a DoD employee, but

is a member of a Reserve Component, a DoD issued GTCC is authorized and should be issued

by the Reserve Component.

030402. Foreign Nationals

Foreign nationals are not authorized to possess or use GTCCs. Travel expenses for

foreign nationals traveling in support of official DoD sponsored programs or activities may be

placed on a CBA or an alternative card product.

030403. Non-appropriated Fund Instrumentality (NAFI) Employees

NAFI employees of the DoD are authorized to use GTCCs.

030404. Recruiting Personnel

Military personnel assigned to recruiting duty are authorized to use GTCCs for official

reimbursable expenses in their local recruiting areas in addition to any official travel away from

their duty stations.

030405. DoD Contractors

DoD contractors are not authorized to use GTCCs, regardless of the type of contract they

are operating under.

0305 USE OF THE GTCC

030501. Requirement

Unless otherwise exempt (see paragraph 0306), all DoD personnel are required to use the

GTCC for all authorized expenses relating to official government travel. Official government

2BDoD 7000.14-R Financial Management Regulation Volume 9, Chapter 3

*August 2011

3-12

travel is defined as travel under competent orders while performing duties pertaining to official

Government assignments such as TDY and PCS (where applicable).

030502. Failure to Use GTCC

Failure to use the GTCC will not be used as a basis for refusal to reimburse the traveler

for appropriate charges. However, failure to use the GTCC may subject the traveler to

appropriate administrative or disciplinary action.

030503. Statement Notifying Traveler of the Requirements of TTRA

All travel orders/authorizations will include the following statement notifying travelers of

the requirements of the TTRA: “The TTRA stipulates that the GTCC will be used by all U.S.

Government personnel, civilian and military, to pay for costs incident to official Government

travel unless specifically exempt.” Travel orders/Authorizations will also include:

A. Whether the traveler does, or does not, have a GTCC.

B. If the traveler has a GTCC, indicate whether the traveler is exempt from

mandatory use under TTRA. This statement also authorizes alternative payment methods.

C. That individuals with a GTCC will obtain cash for those official expenses

that cannot be placed on the GTCC, as authorized, through automated teller machines (ATMs),

rather than obtaining cash advances from a DoD disbursing office.

D. Whether a CBA or an IBA will be used to purchase airline tickets in

accordance with paragraph U2015 of the Joint Federal Travel Regulation (JFTR)

and paragraph

C1100-B of the Joint Travel Regulation (JTR).

0306 EXEMPTIONS

030601. GSA Exemptions from the Mandatory Use of GTCC

The General Services Administration (GSA) has exempted the following classes of

personnel from the mandatory use of the GTCC:

A. Employees who have an application pending for the GTCC.

B. Individuals traveling on an invitational travel order/authorization.

C. New appointees/recruits.

D. Infrequent Travelers – Within the DoD, those who travel two times or less

in a 12-month period.

2BDoD 7000.14-R Financial Management Regulation Volume 9, Chapter 3

*August 2011

3-13

030602. DoD Exemptions from Mandatory Use of the GTCC

In addition to the government-wide GSA exemptions, the DoD as further exempted the

following classes of personnel from mandatory use of the card:

A. Members of the Reserve Officers Training Corps and military personnel

undergoing initial entry or initial skill training prior to reporting to their first permanent duty

station.

B. Individuals who are denied GTCCs or who’s GTCCs have been canceled

or suspended by the GTCC contractor or the cardholder’s agency/organization, for financial

irresponsibility or for other specific reasons. This exemption does not apply to military members

and DoD civilian personnel who are denied GTCCs because they do not accept the terms and

conditions of the cardholder agreement, such as refusing to: (1) complete (to include SSN and

residential mailing address) and sign the account application form, (2) permit a credit check, or

(3) certify to their creditworthiness. The exemption also does not apply when military members

and DoD civilian personnel cancel their cards, for whatever reason, to include disagreement with

existing or revised terms and conditions of the cardholder agreement.

C. Hospital patients.

D. Prisoners.

E. Military members or DoD civilian personnel as approved by the Head of a

DoD Component during: (1) a period of war, (2) a national emergency declared by the President

or the Congress, or (3) mobilization, deployment, or contingency operations.

F. Military members or DoD civilian personnel who use the card only for

travel en route to a point of departure for deployment and cannot file a voucher prior to their

deployment.

G. Military members or DoD civilian personnel traveling to or in a foreign

country where the political, financial, or communications infrastructure does not support the use

of the GTCC.

H. Military members or DoD civilian personnel whose use of the GTCC, due

to operational, security, or other requirements of a mission, would pose a threat to national

security, endanger the life or physical safety of themselves or others, or would compromise a law

enforcement activity.

I. Individuals employed or appointed on a temporary or intermittent basis

upon a determination by the individual’s supervisor or other appropriate official that the duration

of the employment or appointment or other circumstances pertaining to such employment or

appointment does not justify issuance of a GTCC to such individual.

2BDoD 7000.14-R Financial Management Regulation Volume 9, Chapter 3

*August 2011

3-14

030603. Exemptions of Mandatory Use for Expenses

The following expenses are exempt from the mandatory use of the individually billed

GTCC. However, cardholders are encouraged to use the GTCC to the greatest extent possible to

pay for these expenses, where practicable.

A. Expenses incurred at a vendor that does not accept the GTCC.

B. Meal charges when the use of the card is impractical.

C. All expenses covered by the “incidentals” portion of the per diem

allowance.

D. All official local and long distance telephone calls.

E. Relocation allowances for DoD civilians, except en route travel and house

hunting trip expenses as prescribed in the GSA Federal Travel Regulation, Chapter 302 (FTR),

official local, and long distance telephone calls.

030604. Additional Exemptions

DoD Component Heads, or their designees, may exempt additional expenses from the

mandatory use requirement of the GTCC. Those exemptions covering classes of expenses or

personnel (vice exemptions for individuals) will be approved by the Director, DTMO prior to

implementation.

*030605. Notifications of Exemptions

The TTRA permits the head of a DoD Component/Agency (or designee) to exempt

any payment, person, type or class of payments, or type or class of personnel from mandatory

use if it is determined the exemption is necessary in the interest of the Department. Not later

than 30 days after granting an exemption, the head of Component (or designee) will notify the

Administrator of the GSA in writing of such exemption stating the reasons for the exemption.

Notifications will be submitted directly to the Administrator of the General Services

Administration, Attention: MTT, 1800 F Street, NW, Washington, D.C. 20405. A copy of each

notification will be provided to the Defense Travel Management Office, ATTN: Enterprise

Operations Division, 4800 Mark Center Drive, Suite 04J25-01, Alexandria, VA 22350-9000.

030606. Payment Methods Authorized When Exempt

When an exemption is granted from the mandatory use of the IBA, one, or a combination

of, the following may be authorized for payment of travel expenses:

A. Personal funds, including cash or a personal credit card.

B. Travel advances and CBAs.

2BDoD 7000.14-R Financial Management Regulation Volume 9, Chapter 3

*August 2011

3-15

C. Alternative card products.

D. Government transportation requests (GTRs) (SF 1169). GTRs are used on

an “exception only” basis when no other payment method (above) is available.

City pair contractors (airlines that provide services under the GSA City-Pair Program), however,

are not required to accept the types of payments listed above with the exception of the CBA.

Charge cards issued under the GSA SmartPay® program contract contain a unique numeric

prefix that identifies the account as an official GTCC. This prefix identifies the account as being

eligible for government travel rates, including city pair rates, and tax exemption when permitted

under state law.

0307 NON-MANDATORY USE OF THE GTCC

030701. Card Use

If an individual is exempt from mandatory use of the GTCC, he/she may elect to apply

for and use the GTCC on a voluntary basis. The Department’s policy on split disbursement of

travel reimbursement applies to any voluntary use of the GTCC.

030702. Local Travel

The GTCC (IBA) may be used for local travel expenses, but such use is not required

under the TTRA. Local travel is also considered official travel when the individual is

performing official duties in and around the area of the permanent duty station. Use of the

GTCC for local travel is at the discretion of the Component/Agency. Use of the GTCC to

purchase meals while in this status is not permitted.

0308 GTCC TRAINING

030801. APC Training

When an individual is appointed as a new APC, it is mandatory that he/she complete the

APC training course that is available on the DTMO Travel Explorer (TraX) website

(www.defensetravel.dod.mil/passport). APCs will ensure a copy of the certification of

completion is retained or can be found in TraX. Refresher training is required every three years

and may be obtained from other sources, as approved by the CPM. A certificate of refresher

training will be retained by the APC, either electronically or in hard copy. APCs are encouraged

to attend training on the use of the EAS provided by the GTCC contractor, to include the annual

GSA SmartPay® Conference.

030802. Cardholder (IBA) Training

When an individual receives a GTCC for the first time, it is mandatory that he/she

completes the cardholder training course that is available on the TraX website

(www.defensetravel.dod.mil/passport). Cardholders will ensure a copy of the certificate of

2BDoD 7000.14-R Financial Management Regulation Volume 9, Chapter 3

*August 2011

3-16

completion is retained by the APC or can be found in TraX. Refresher training is required every

three years and may be completed using other sources as approved by the applicable CPM.

Refresher training will be documented and retained either electronically or in hard copy by the

APC.

030803. Records Retention

Copies of all training certificates must be maintained until “superseded or obsolete, or

upon separation or transfer of employee” pursuant to U.S. National Archives and Records

Administration (NARA) requirements, “General Records Schedule 1,” Item 10a (NARA).

0309 APPLYING FOR A GTCC

030901. IBA Applications

Application forms (either electronic or hard copy) for an IBA are available via the GTCC

contractor’s EAS or from an APC. An APC will provide an applicant with a GTCC application

along with appropriate program information and the “DoD Statement of Understanding for

Travel Cardholders,” (See Annex 1) which an applicant must complete. An electronic version of

the Statement of Understanding can be found at www.defensetravel.dod.mil under the travel card

section. No card will be issued without both the application and the signed Statement of

Understanding.

A. Routine Applications. The APC will request that the GTCC contractor

establish a new IBA upon receipt of a properly completed application. The applicant, the

applicant’s supervisor, and the APC will sign the application. The APC will complete the billing

hierarchy information on the application before submitting to the GTCC contractor. Within 3

days of receipt, the APC will process the completed application and forward it to the GTCC

contractor. The APC will monitor the contractor’s EAS regarding application status.

B. Emergency/Expedited Applications

1. Use of the emergency application process will be determined by

the APC and will normally be processed and the card shipped within 24 hours.

2. Expedited applications will be used for personnel who are

scheduled to travel within 5 working days. Individuals should be reminded to plan ahead and

apply for a GTCC far enough in advance to avoid the need for an expedited application.

3. The GTCC contractor will include a fee, which will be on the

cardholder’s initial billing statement, for emergency/expedited delivery. This fee may be

reimbursable and should be claimed on the travel voucher. If, for any reason, the scheduled

travel does not occur, cardholders may claim reimbursement for the expedited delivery fee on a

SF 1164, “Claim for Reimbursement for Expenditures on Official Business,” (SF 1164

) or a

Defense Travel System (DTS) local voucher. The fee will not apply to expedited delivery for

2BDoD 7000.14-R Financial Management Regulation Volume 9, Chapter 3

*August 2011

3-17

emergency replacement of cards lost, stolen, or otherwise unusable by travelers who are in a

travel status.

4. Cards that are shipped within 24 hours will be delivered in an

active state and do not require the APC to phone the GTCC contractor to activate the card. The

cardholder is responsible for verifying receipt of the card.

C. Reapplying for IBA. If an individual is denied a GTCC, they may not

reapply for a card for 24 months.

030902. Issuance of Cards by Contractor (IBA)

Upon receipt of a properly completed and approved application, the GTCC contractor

will issue the GTCC and cardholder agreement within three business days. The contractor will

mail the card to the individual cardholder’s residential mailing address on file with the GTCC

contractor, temporary duty location, or otherwise as directed by the APC. The GTCC contractor

will allow the cardholder the option to establish his or her personal identification number. IBAs

may be issued in three different designs:

A. Standard Card Design. Standard cards will be embossed, at a minimum,

with the great seal of the United States, the words “United States of America” and “For Official

Government Use Only.”

B. Quasi-Generic Card Design. Quasi-Generic cards are used by

agencies/organizations to support travel requirements for which an association with the U.S.

Government should be protected. Quasi-Generic cards are issued with the contractor’s

commercial design, but do not contain any association with the DoD other than the account

number. The issue and use of Quasi-Generic cards must be approved by the APC and are subject

to the same terms and conditions as all GTCCs.

C. Generic Card Design. Generic cards may be used by

agencies/organizations to support travel requirements for which an association with the U.S.

Government may not be revealed. Generic cards are issued with the contractor’s commercial

design, showing no association with the Government. The account number is indistinguishable

from non-government personal cards. The issue and use of Generic cards must be approved by

the CPM and are subject to the same terms and conditions as all other GTCCs.

030903. CBA Applications

All requests for CBAs must be forwarded to the cognizant CPM for approval. Once

approval has been granted by the CPM for establishment of a CBA account, the hard copy

application form will be used. The requesting command must complete the application form and

submit it to the CPM for signature. The CPM will submit the application to the contractor for

processing and monitor the contractor's EAS regarding application status. The CPM is

responsible for providing the billing hierarchy information, the appropriate Bank Identification

Number (BIN) assignment and establishing and maintaining reasonable credit limits.

2BDoD 7000.14-R Financial Management Regulation Volume 9, Chapter 3

*August 2011

3-18

0310 PROGRAM MANAGEMENT CONTROL

031001. Requirement for Credit Checks

Title 10 U.S.C. 2784a requires the evaluation of creditworthiness before issuing a GTCC

(IBA only). To meet this requirement, the GTCC contractor performs a credit check on each

new card applicant who agrees to the credit check. Depending on the credit score, applicants are

eligible for a standard card, a restricted card, or may not be eligible for a card. At no time and in

no case will the GTCC contractor provide credit check results to the APC. If the applicant

agrees to a credit check, the fact that a credit check has been performed will appear on the credit

bureau’s record for the applicant and will be evident to subsequent credit grantors who request a

credit check. The issuance of a GTCC and the credit limit on the card are not reported to credit

bureaus. This process is similar to instances when the applicant personally applies for credit,

except the only information evident to subsequent credit grantors is that an inquiry was made.

There is little impact on an individual’s credit score unless the account remains

delinquent/unpaid for 210 days; after this time, the account may be charged off and the GTCC

contractor may report the delinquency to credit bureaus.

031002. Non-Qualifying Applicants

Personnel who are denied a GTCC (IBA) due to their credit score are exempt from

mandatory use of the card. However, personnel who refuse to authorize a credit check or who

cancel their own cards, for whatever reason, to include disagreement with existing or revised

terms and conditions of the cardholder agreement, may not be eligible for a travel advance and

may be subject to administrative/disciplinary action. Commanders/supervisors may authorize an

advance in situations where performance of the mission could be put at risk.

031003. Misuse

Misuse of the GTCC will not be tolerated. Commanders/supervisors will ensure GTCCs

are issued only for official travel related expenses. Examples of misuse include, but are not

limited to: (a) expenses related to personal, family or household purposes, (b) cash withdrawals

from ATMs or banks when not related to official Government travel requirements, (c) intentional

failure to pay undisputed charges in a timely manner, and (d) ATM cash withdrawals taken more

than three days prior to official Government travel. Cardholders who misuse their GTCC may be

subject to administrative or disciplinary action, as appropriate. Commanders and supervisors

will ensure that Component guidelines are followed in administering disciplinary actions, when

appropriate. Although the GTCC may generally be used only for expenses associated with

official Government travel, the following expenses (while not reimbursable) are considered to be

incidental to official travel. The traveler will pay for non-reimbursable expenses listed below as

part of the normal payment process. Therefore, the GTCC may be used for the following

purposes:

Incidental Expenses. The cardholder, while in a travel status, may use the GTCC

for non-reimbursable incidental travel expenses such as in-room movie rentals, personal

telephone calls, exercise fees, and beverages, when these charges are part of a room billing and

2BDoD 7000.14-R Financial Management Regulation Volume 9, Chapter 3

*August 2011

3-19

are reasonable. Additional expenses incurred for spousal occupancy (hotel room) and meals may

be included if inherent to the traveler’s billing statement even if the additional expense is not

reimbursable. Separate charges for airfare, hotel rooms, rental cars or meals for spouses or

family members are not authorized to be charged on the GTCC.

031004. Split Disbursement

All DoD personnel are required to split disburse all undisputed charges against the

GTCC. Payment for all GTCC (IBA) charges will be sent directly to the GTCC contractor. It is

the traveler’s responsibility to pay their GTCC contractor directly for any outstanding charges

not split disbursed. To support the split disbursement requirement, the DTS will automatically

split disburse airline, hotel, rental vehicle, and other miscellaneous expenses identified by the

traveler as charged to the GTCC (IBA) directly to the GTCC contractor. Approving officials are

responsible for ensuring that split disbursement amounts are properly annotated and should

return any travel vouchers that do not comply for correction and resubmission. For additional

information regarding split disbursement, refer to Title 10 U.S.C. 2784a.

031005. Program Review

Commanders and Agency Heads will ensure that periodic internal control reviews are

conducted for their GTCC programs. Reviews should include: (a) processing of travel claims as

it directly relates to delinquency issues associated with the GTCC, (b) ensuring credit limits are

appropriate to mission requirements, (c) ensuring unused accounts are closed, and (d) ensuring

that travelers file their vouchers in a timely manner. Findings of significant weaknesses should

be reported to the CPM in addition to the command or agency head.

031006. Data Mining

APCs should use the GTCC contractor provided data mining tool to gather and analyze

travel card data and to identify incidents of suspected misuse.

0311 AGENCY PROGRAM COORDINATOR (APC) DUTIES

031101. General

An APC plays an important role in the proper management of the GTCC program.

Commanders/supervisors should consider the volume of workload associated with the APC

responsibilities in determining how many personnel may be needed to manage their GTCC

programs. The frequency of travel and the delinquency rate of the organization should also be

taken into account. Individuals appointed as APCs must have the skills necessary to properly

manage the travel card programs and access the EAS where reports are provided. APCs have

access to sensitive information and relay this information to the chain of command for

determination of appropriate action when necessary. Commanders/supervisors should consider

assignment of APC duties to civilian personnel where practical in order to avoid the loss of

knowledge of program responsibilities in high turnover military positions.

2BDoD 7000.14-R Financial Management Regulation Volume 9, Chapter 3

*August 2011

3-20

031102. Maintain Records

APCs will maintain all pertinent records, such as the cardholder application and

Statement of Understanding, certificates of training, delinquency notices, etc., for cardholders

while they are assigned to their hierarchy. Due to the sensitivity of the data contained in these

files, the data must be maintained in a secure container or area that precludes unauthorized

access. Records will be retained until “superseded or obsolete, or upon separation or transfer of

employee” pursuant to the NARA requirements, “General Records Schedule 1,” Item 10a

(NARA). Each APC, in conjunction with the GTCC contractor, will maintain an up-to-date list

of current cardholders and accounts, to include information such as account names, account

numbers, addresses, and telephone numbers. APCs maintaining these records must ensure they

are marked and protected IAW the provisions of the Privacy Act.

031103. Hierarchy Structure

The APC is responsible for maintaining his/her organizational hierarchy structure. This

hierarchy is the link that identifies cardholder accounts to correct organizations within a

Component. The APC is responsible for tracking arriving and departing cardholders through the

check-in/out process to maintain the validity of the organizational hierarchy and the contractor

reporting information. The establishment of a new hierarchy requires the approval of the APC

who has administrative rights over that hierarchy.

031104. Procedures in the GTCC Training Guides

The APC will follow the procedures published in the GTCC contractor’s training guides

for using the electronic access system to transfer cardholders with open accounts, to include

accounts that are in a suspended status. Travelers attending formal training en route to their next

assignment will remain in the hierarchy of the losing organization until completion of training.

The receiving agency/component must accept the account regardless of account status. The

CPMs will ensure that personnel in-process and out-process through their unit level APCs.

031105. Closure of GTCC Cardholders

The APC will close a GTCC upon a cardholder’s retirement, separation, termination, or

death. Also, if applicable, the APC will terminate the cardholder’s access to the GTCC

contractor’s electronic access system.

031106. Monitor and Reporting Delinquencies

The APC will monitor and report all delinquencies to appropriate personnel and take

appropriate actions as described in the delinquency management section. APCs are also

responsible for monitoring all accounts for proper use of the GTCC and to report accounts with

unauthorized transactions to commanders and/or supervisors for action, as appropriate.

2BDoD 7000.14-R Financial Management Regulation Volume 9, Chapter 3

*August 2011

3-21

031107. Review Reports to Identify Accounts for Closure

On a periodic basis, the APC will review any reports provided or made available by the

GTCC contractor to identify accounts for potential closure. Accounts not used in a 12-month

period may be closed with an option to reopen without a new application if the need for travel

arises.

031108. GTCC Training

APCs are encouraged to attend training provided by the GTCC contractor on the use of

the electronic access system available for account management. They are also highly

encouraged to attend the annual GSA SmartPay® Conference.

0312 TRAVELER REIMBURSEMENT AND PAYMENT RESPONSIBILITIES

031201. Timely Reimbursement of Travel Expenses

A. Reimbursement Within 30 Days. Agencies will reimburse DoD personnel

for authorized travel expenses no later than 30 days after submission of an accurate and complete

travel claim to the office where the claim is to be approved. Therefore, a satisfactory

recordkeeping system will be maintained by the approving official to track submission and

receipt of travel claims. For example, travel claims submitted by mail could be annotated with

the date of receipt by the office where the claim is to be approved. Travel claims submitted

electronically to the approving official could be considered to have been received on the

submission date indicated on the email, or on the next business day if submitted after normal

working hours. For fully automated travel applications, such as the DTS, the Department tracks

DTS Voucher Payment Time (VPT) as a measure of customer satisfaction. VPT is the time from

when a traveler signs a properly completed travel claim to the time the traveler is paid. Consider

the travel claim to be received when the traveler signs the claim within the travel system.

B. Travel Claim Errors. A travel claim with an omission or an error will be

returned to the traveler within a 7 day period. The notification will include the reason(s) why the

travel claim is not correct. Receipt of a corrected travel claim by the paying office begins the

30-day payment period in which the government must make payment or pay a late fee.

C. Late Payment Fees and Charges. Should payment of the travel settlement

take longer than 30 days following receipt by the office where the claim is approved, that office

may be required to pay a late payment fee. This fee is payable, using the Prompt Payment Act

interest rate, beginning on the 31

st

day after the submission of a proper travel claim and ending

on the date that the payment is disbursed by the government. The only exception to the

requirement for this payment is that no payments are required for amounts less than $1.00.

Interest payment funding instructions can be found in Volume 10, Chapter 7. In addition, the

traveler will be paid an amount equal to any late payment charge that the card contractor would

have been able to charge had the traveler not paid the bill. The Internal Revenue Service has

determined that the late payment fee is reportable as interest and that the payment equal to the

late payment charge is to be reported as additional wages. In addition, travelers may be

2BDoD 7000.14-R Financial Management Regulation Volume 9, Chapter 3

*August 2011

3-22

reimbursed for late fees imposed by the GTCC contractor if the non-payment that incurred the

late fee was a result of the government’s untimely processing of the travel voucher. Late fees do

not incur until 75 days following the billing statement.

D. Systems Modifications. As necessary, DoD Component travel systems

will be modified to capture the date of submission of a proper travel claim and compute

entitlement for late payment fees due as a result of untimely settlement.

E. Claims for Late Payment Fees. Payment of late fees should be calculated

and paid at the time the voucher is processed. Travelers who believe that late payment fees were

not included in the calculation of their travel vouchers may submit supplemental travel claims for

late payment fees. Each supplemental travel claim will be submitted through the office where

the claim is to be approved. That office will annotate the claim with the date that the original

travel claim was received.

031202 Responsibilities of Travelers for Payments

A. Monthly Statements. Cardholders are responsible for payment in full of

the undisputed amount stated on the monthly billing statement by the due date indicated on the

statement. Accounts are considered past due at 30 days past billing and delinquent if unpaid

60 days after the billing date. Cardholders are responsible for payment regardless of the status of

their travel reimbursements.

B. Long-term Travel. While in a long-term travel status, the traveler will file

interim vouchers every 30 days (for DTS travel, use scheduled partial payments procedures) in

order to receive partial payments and will use split disbursement as the means of settlement.

Long-term travel is defined as travel that lasts more than 45 days.

C Disputed Charges. In the event that the billing statement amount contains

charges that are disputed by the traveler, he/she will first contact the merchant to try and resolve

the incorrect charge. If unsuccessful, he/she will obtain a dispute form from the APC. The

cardholder will complete and send the form to the GTCC contractor using instructions provided

by the APC. All disputes must be filed within 60 days of the billing statement date on which the

disputed charge first appeared. It is the responsibility of the cardholder to ensure the dispute

form has been received by the bank. Once the dispute notification has been received by the

GTCC contractor, the contractor will issue a provisional credit for the amount of the dispute

pending resolution. Formally disputed charges will not age and the account will not suspend for

lack of payment.

D. Fees Chargeable by the Contractor. The following fees may be charged

by the GTCC contractor:

1. Non-Sufficient Funds (NSFs) Fee. The NSF fee is non-

reimbursable and is applied when the GTCC contractor receives a payment where sufficient

funds are not available. An account is subject to closure by the GTCC contractor if there are

more than three (3) NSFs during a 12-month period.

2BDoD 7000.14-R Financial Management Regulation Volume 9, Chapter 3

*August 2011

3-23

2. Reinstatement Fee. The reinstatement fee is non-reimbursable.

Refer to paragraph 031202F.

3. Late Fees. Late fees may be reimbursable if the delinquency

resulted in an error or late reimbursement (more than 30 days per the Prompt Payment Act) by

the DoD. Late fees are applied at 75 days past billing and every cycle thereafter until payment in

full is received.

4. Salary Offset Fees. Salary offset fees are non-reimbursable. Refer

to paragraph 031202E.

5. Fixed Pay Plan Fee. The GTCC contractor may offer a fixed pay

plan on which a fee will be assessed. However, the fixed pay fee is non-reimbursable.

6. Cash Advance (ATM Withdrawal) Fee. The cash advance fee is

reimbursable. Additional ATM administrative and service fees that may be applied by the ATM

owner for each withdrawal are reimbursable.

7. Expedited Delivery Fee. The expedited delivery fee may be

reimbursable. This fee is applied when a card is delivered via overnight delivery.

E. Salary Offset. Upon written request of the GTCC contractor, the

Department will, on behalf of the GTCC contractor, begin the process of salary offset. Salary

offset is the collection (by deduction from the amount of pay owed to the cardholder) of any

amount the cardholder owes to the GTCC contractor as a result of undisputed delinquencies.

Specifics on the procedures of salary offset are contained in Volume 7A, Chapter 43 for military

members and Volume 8, Chapter 8 for civilian employees and retirees.

F. Reinstatement of Cancelled Accounts. Accounts that have been cancelled

due to delinquency may be eligible for reinstatement. In order to be approved for reinstatement,

cardholders must meet set criteria: A new application is required, the individual must consent to

a credit check, and a reinstatement fee is required. The account cannot have been charged off as

a bad debt; the balance must have been paid in full for a minimum of 60 days; there have been no

payments returned for nonsufficient funds (NSF) in the previous 12 months, and there were no

more than three NSF payments in the life of the account. If the reinstated account is

subsequently canceled, the cardholder will not be considered for reinstatement a second time.

G. Account Upgrade. An account upgrade is a process by which a cardholder

may request to “upgrade” a restricted account to a standard account. Applicants must agree to a

new credit check and must meet the credit score requirement for a standard account.

2BDoD 7000.14-R Financial Management Regulation Volume 9, Chapter 3

*August 2011

3-24

0313 DELINQUENCY MANAGEMENT

031301. Pre-suspension Notification for Accounts 45 Days Past Billing

At 45 days past billing, the contractor will make pre-suspension reports available. APCs

will notify the cardholder (or the CBA Manager for CBAs) and the cardholder’s supervisor that

the account will be suspended in 15 days if the contractor does not receive full payment of all

undisputed amounts. For IBAs, the APC will request that the supervisor notify the APC, within

15 days, of any reason why the account should not be suspended. The APC will keep a record of

the supervisor’s notification and related correspondence.

031302. Suspension of Accounts 61 Days Past Billing

At 61 days past billing, the APC will notify the cardholder (or the CBA Manager for

CBAs) and the cardholder’s supervisor (by email where possible) that the account has been

suspended due to nonpayment (see Annex 2 for a sample letter). The APC will keep a record of

each notification. The GTCC contractor will block charging privileges, to include ATM access,

until payment is received. Commanders/supervisors should determine whether the individual has

properly filed a claim for reimbursement of travel expenses and has been reimbursed; whether

DoD policy on split disbursement was adhered to; and whether further administrative or

disciplinary action is required.

031303. 90-Day Delinquency Notification to Supervisors

At 90 days past billing, the APC will notify the cardholder (or the CBA Manager for

CBAs), the cardholder’s supervisor, and the second level supervisor (by email where possible)

that the account is still delinquent (see Annex 3 for a sample letter). The APC will keep a record

of each notification. The individual cardholder will receive notice from the GTCC contractor

that his/her account will be cancelled and referred for salary offset within 30 days if the balance

is not paid in full.

031304. Cancellation of Accounts 120 Days Past Billing

At 120 days past billing, the GTCC contractor will make available cancellation reports.

The APC will notify the cardholder (or the CBA Manager for CBAs), the cardholder’s

supervisor, and the cardholder’s chain of command (by e-mail where possible) that the

cardholder’s account will be cancelled at 126 days past billing if the contractor does not receive

full payment of the undisputed amounts (see Annex 4 for a sample letter.) The APC will keep a

record of each notification. If no action is taken toward payment of the IBA debt, collection

action will be initiated by the GTCC contractor beginning on the 126

th

day past billing. Once

canceled, an account may be reinstated only when: (1) the account is paid in full and (2) the

commander or director requests the GTCC contractor in writing to reinstate the account. The

contractor reserves the right to deny the reinstatement request. Previously charged off accounts

will not be reinstated without DTMO approval. The Contractor reserves the right to deny the

reinstatement request.

2BDoD 7000.14-R Financial Management Regulation Volume 9, Chapter 3

*August 2011

3-25

031305. Cancellation of IBAs Suspended Two Times

Cancellation of an IBA may also occur if the account has been suspended two times

during a 12-month period for nonpayment of undisputed amounts and again becomes past due.

Accounts that have been suspended twice during a 12-month period will be considered (for

cancellation purposes) past due for the third time at 45 days past billing.

031306. Mission-Critical Travel (IBA)

When an individual is in a travel situation that precludes filing of travel vouchers

(including interim vouchers) and prompt payment of GTCC bills, the APC is authorized (with

the approval of the cardholder’s supervisor) to place the account in a mission critical status.

Mission-critical travel is defined as travel performed by DoD personnel under competent orders

and performing duties that, through no fault of their own, prevent the traveler from filing travel

vouchers and paying the GTCC bills. Mission-critical status must be reflected on the travel

orders/authorizations in order for the traveler to be reimbursed for any late charges incurred

while in this status. An individual charge card account must be placed in mission critical status

before the account is suspended. Should there be outstanding balance at the time the cardholder

is removed from Mission Critical status, the balance must be paid within 45 days of removal

from this status. Expenses incurred prior to a deployment should be processed for payment

through split disbursement before the individual departs for his/her assignment. Mission-critical

status will not be authorized in cases where the individual is in a location where he/she is able to

file timely vouchers.

031307. Exception Status (CBA)

When a CBA is nearing suspension (approaching 61 days past billing), account managers

may request the account be placed in an exception status to avoid account suspension. A

payment against the account must have been initiated and expected to be made shortly. Repeated

requests for exception must be approved by the CPM or DTMO. The GTCC contractor reserves

the right to deny such requests. If approved, accounts are normally placed in exception status for

a period not to exceed 10 days.

0314 MANAGEMENT REPORTS PROVIDED BY THE GTCC CONTRACTOR

031401. General

Reports are considered primary program management tools and are made available via

the GTCC contractor’s electronic access system. The GTCC contractor will make reports

available to the APC to help in identifying upcoming suspensions or cancellations of delinquent

accounts within specified timeframes. Due to the sensitive nature of all GTCC reports, the

reports and all information contained therein must be properly safeguarded at all times. APCs

will run the following mandatory reports at least monthly (2 days after cycle date).

2BDoD 7000.14-R Financial Management Regulation Volume 9, Chapter 3

*August 2011

3-26

031402. Aging Analysis Report

This report identifies summary-level delinquency information by Component hierarchy.

APCs will use this report to get a snapshot of their delinquencies.

031403. Cardholder Account Listing Report

This report identifies cardholder names, addresses, telephone numbers, and account numbers

assigned under the APC’s organization. APCs will use this report to ensure correct information

is on file with the GTCC contractor.

031404. Delinquency Report

This report identifies delinquent accounts and ages the delinquencies by time frame (i.e.,

30, 60, 90, 120, or more days). APCs will use this report to aggressively work all delinquencies.

031405. Pre-Suspension Report

This report lists accounts eligible for suspension and identifies account names, account

numbers, status, balances past due, and the number of days that each account is past due. APCs

will use this report to ensure accounts do not suspend.

031406. Suspension/Pre-cancellation Report

This report lists accounts that have been suspended and are nearing cancellation and

identifies account names, account numbers, status (suspended or canceled), date of status,

balances past due, and the number of days that each account is past due. APCs will use this

report to notify leadership of the potential cancellation of an account.

031407. Account Renewal Report

This report identifies those cardholders whose cards are coming due for renewal. APCs

will review the information on this report monthly and take appropriate action.

031408. Weekend/Holiday Activity Exceptions Report

This report identifies cardholders with transaction activity, such as lodging and car

rental, when checkout is on a Sunday, Monday, or a federal holiday. APCs will use this report to

flag potential misuse of the GTCC.

031409. Non-Travel Activity Exceptions Report

This report identifies cardholders with transaction activity (such as cash, fuel, or food)

occurring without other associated travel activity (such as airline, car rental, or lodging). APCs

will use this report to flag potential misuse of the GTCC.

2BDoD 7000.14-R Financial Management Regulation Volume 9, Chapter 3

*August 2011

3-27

031410. Account Activity Report

This report displays all transaction activity for a specified billing cycle. APCs will use

the report to do a spot check of transactions to ensure there is no misuse.

031411. Authorizations/Declines

This report lists all transactions attempted against an account and details reasons for

decline and type of purchase (mail order, ATM, purchase, or cash). APCs will use this report to

determine where transactions failed and the reason for the decline.

031412. Exceptions/Returned Checks

This report provides a list of all cardholders that incur payment reversal transactions

within a specified hierarchy level and time frame. APCs will use this report to determine where

account holders have made payments with insufficient funds.

031413. Blocked MCCs

A list of all transactions made against MCCs that are blocked from charges against the GTCC.

APCs will use this report to see where charges were made against blocked MCCs.

2BDoD 7000.14-R Financial Management Regulation Volume 9, Chapter 3

*August 2010

Annex-2