Chubb Target Market

Determination

Combined Insurance - a division

of Chubb Insurance Australia

Limited

Accident Policy and Sickness

Policies

(For selected PDS issued from 1983 -

2015)

Chubb Target Market Determination, Combined Insurance - Accident Policy and Sickness Policies,

Australia. Published 09/2023. ©2023 Chubb Insurance Australia Limited. Chubb

®

, its logos, and

Chubb. Insured.

SM

are protected trademarks of Chubb.

2

Important Information

This Target Market Determination (TMD) is required under section 994B of the

Corporations Act 2001 (Cth) and has been prepared by the product issuer Chubb

Insurance Australia Limited (Chubb) AFSL 239687 ABN 23 001 642 020. The

TMD is designed to assist customers, distributors and Chubb staff to understand

who this product has been designed for and who it is not suitable for. The TMD

identifies triggers for Chubb to review the target market and sets out the

conditions and restrictions on distribution of the product described below. It also

sets out the reporting obligations of Chubb’s distributors. This document is not a

Product Disclosure Statement (PDS) or Supplementary Product Disclosure

Statement (SPDS) and is not a summary of the product features or terms of the

product. This document does not take into account any person’s individual

objectives, financial situation or needs and is not intended to constitute personal

advice. Persons interested in acquiring this product should carefully read the

PDS/SPDS before deciding whether to purchase this product.

This TMD is effective from the date of publication until its replacement or

withdrawal.

Where a word is capitalised in this TMD and not otherwise defined, the

definition of the word can be found in the policy wording/PDS/SPDS.

For a copy of any of your policy documents please contact Chubb.

Chubb Target Market Determination

Chubb Target Market Determination, Combined Insurance - Accident Policy and Sickness Policies, Australia. Published 09/2023.

©2023 Chubb Insurance Australia Limited. Chubb

®

, its logos, and Chubb. Insured.

SM

are protected trademarks of Chubb.

3

Target Market Determination

1. Details

Product Name/s:

Combined Insurance - Accident Policy and Sickness Policies (as listed

in Annexure A) (the Products)

Publication Date of

TMD:

Originally published 5 October 2021.

Revised: June 2022

Last reviewed: October 2023

Next Review Date:

October 2025 (2 years from date of last review)

Frequency of Product

Reviews:

Every 2 years from date of publication, subject to intervening review triggers as

outlined in section 4 of this TMD

2. Product Target Market

What are the Products?

These are personal accident and sickness insurance Products, with varying levels of cover for:

• various types of covered sicknesses or covered conditions; and/ or

• covered bodily injuries resulting from an accident.

The type and level of cover held by a customer will depend on the Products chosen and the Benefits selected

at the time of original application. Since 2016, customers have been able to continue to renew their existing

Products (policies) however customers cannot change or modify the plan or Benefits held. Customers can

cancel their Policy at any time.

Key covers/attributes

Accident Policies

Depending on the options/ plans selected, the Accident Products offer cover for:

✓ daily, or weekly or monthly benefits, for a specified period, capped at a specified amount, in the

event of partial and total disability due to bodily injury;

✓ daily, or weekly or monthly confinement benefits, for a specified period, capped at a specified

amount, due to bodily injury which results in confinement to a hospital;

✓ lump sum payments for minor and major fractures due to bodily injury;

✓ lump sum payments in the event of accidental death, paraplegia or quadriplegia or total permanent

disability due to bodily injury.

Each of the following factors will vary depending on the type of policy you hold:

• daily, weekly or monthly benefits amounts;

• length of time the benefits are paid for (can range from days, weeks to months);

• the maximum amounts payable for any benefit;

• Lump sum values payable.

Chubb Target Market Determination, Combined Insurance - Accident Policy and Sickness Policies, Australia. Published 09/2023.

©2023 Chubb Insurance Australia Limited. Chubb

®

, its logos, and Chubb. Insured.

SM

are protected trademarks of Chubb.

4

Sickness Policies

Depending on the options/ plans selected, the Accident Products may offer cover for:

✓ daily, or weekly or monthly benefits, for a specified period, capped at a specified amount, in the

event of total and partial disability due to covered sickness;

✓ daily, or weekly or monthly confinement benefits, for a specified period, capped at a specified

amount, due to covered sickness which results in confinement to a hospital;

✓ lump sum payments in the event of covered sickness and some types of cancer (excludes skin

cancer, unless specifically stated overwise).

Cancer Policies

✓ daily, or weekly or monthly benefits, for a specified period, capped at a specified amount, in the

event of some types of cancer (excludes skin cancer);

✓ daily, or weekly or monthly confinement benefits, for a specified period, capped at a specified

amount, due to some types of cancer (excludes skin cancer, unless specifically stated overwise)

which results in confinement to a hospital;

✓ lump sum payments in the event of some types of cancer (excludes skin cancer, unless specifically

stated overwise).

Each of the following factors will vary depending on the type of policy you hold:

• daily, weekly or monthly benefits amounts;

• length of time the benefits are paid for (can range from days, weeks to months);

• the maximum amounts payable for any benefit;

• Lump sum values payable

Certain specific benefits may be subject to age restrictions, such as Critical Illness and Cancer policies, that

require eligible persons to be over eighteen (18) year, rather than sixteen (16) years.

Depending on the policy you hold and the applicable terms and conditions, you may be covered for accident

or sickness, or both accident and sickness. Please refer to the relevant Policy for specific details of your

cover, including the types of bodily injuries and sicknesses covered. Please review your policy to assess

whether the benefits and the amounts payable meet your current and future objectives, financial situation

and needs. If you consider your policy to no longer meet your needs, please contact Chubb to discuss policy

cancelation.

Key exclusions or limitations of cover

Depending on the options/ plans selected, the Products may exclude claims arising from (amongst other

things):

× illness or disease (if you are only covered for accidental injury);

× bodily injury (if you are only covered for sickness, unless specifically stated);

× engagement in aviation (other than a fare-paying passenger on a commercial airline);

× professional sport;

× intentional self-injury;

Chubb Target Market Determination, Combined Insurance - Accident Policy and Sickness Policies, Australia. Published 09/2023.

©2023 Chubb Insurance Australia Limited. Chubb

®

, its logos, and Chubb. Insured.

SM

are protected trademarks of Chubb.

5

× mental or emotional disorders;

× normal and uncomplicated pregnancy or childbirth;

× pre-existing conditions/ pre-existing cancer (unless an endorsement to your policy removes this

condition

× war or civil war;

× any act of terrorism;

× bodily injury sustained while outside of Australia, New Zealand, European Union Member States,

the United States of America, the United Kingdom, or Canada. (In limited circumstances coverage

may be afforded under the Public Transport Passenger Accident Benefit);

No benefit will be payable unless medical reports and evidence are provided by one or more Medical

Practitioner(s) or hospital(s) in Australia, New Zealand, European Union Member States, the United States

of America, the United Kingdom, or Canada.

Customers the Product was designed for

These Products are only available to existing customers of Combined Insurance and is targeted at:

✓ individuals (and/or families) who want personal cover for accidental injury; and/or

✓ individuals (and/or families) who want personal cover for certain covered sicknesses (depending on

the policy chosen).

Classes of Customers

The class of customers for who these Products are targeted can be categorised as:

✓ individuals who are existing customers of Combined Insurance (Chubb) who already hold one or

more of the Products and would like to continue to renew their insurance policies.

Customer's likely objectives, financial situation, and needs

Objectives

The likely objectives of customers in this target market is to have insurance cover in the

event of accident and/ or sickness to protect against some financial losses following

accidental injury or sickness.

Financial

situation

The likely financial situation for customers in this target market is broad. Individuals in

a range of financial situations may seek to protect themselves (and their family) against

the losses that are covered by the Products. Individuals would need to be able to afford

the premium and any excess payable in the event of a claim.

Needs

Customers in this target market will likely need an insurance Product which can offer

financial benefits payable on the occurrence of certain bodily injuries and/or sickness.

Such benefits may provide them will a lump sum payment or periodical payments.

Chubb Target Market Determination, Combined Insurance - Accident Policy and Sickness Policies, Australia. Published 09/2023.

©2023 Chubb Insurance Australia Limited. Chubb

®

, its logos, and Chubb. Insured.

SM

are protected trademarks of Chubb.

6

Customers the Product was not designed for

These Products are not suitable for:

× persons in receipt of pensions or similar government welfare payments at the time of first applying;

× new customers (this Product is only offered on a renewal basis to existing customers);

× persons who undertake certain high-risk occupations (such as, off-shore fisherman, professional

sports, tree-feller, underground mining) are not eligible for Disability benefits (refer to the policy

documents for further information);

× individuals seeking:

• private health insurance;

• income protection insurance; and/ or

• life insurance.

The Products are not life insurance policies, income protection policies, nor health insurance policies. The

Products do not cover expenses that may only be covered by a health insurance policy. They provide cover

in circumstances where we are not permitted by law to provide cover.

Why the Products are consistent with the Target Market

Chubb views that the Products are likely to be consistent with the target market as the target market

comprises individuals that want cover for accidental injury and/ or sickness and the Products provide

varying levels of cover and benefits for personal accident and/or sickness.

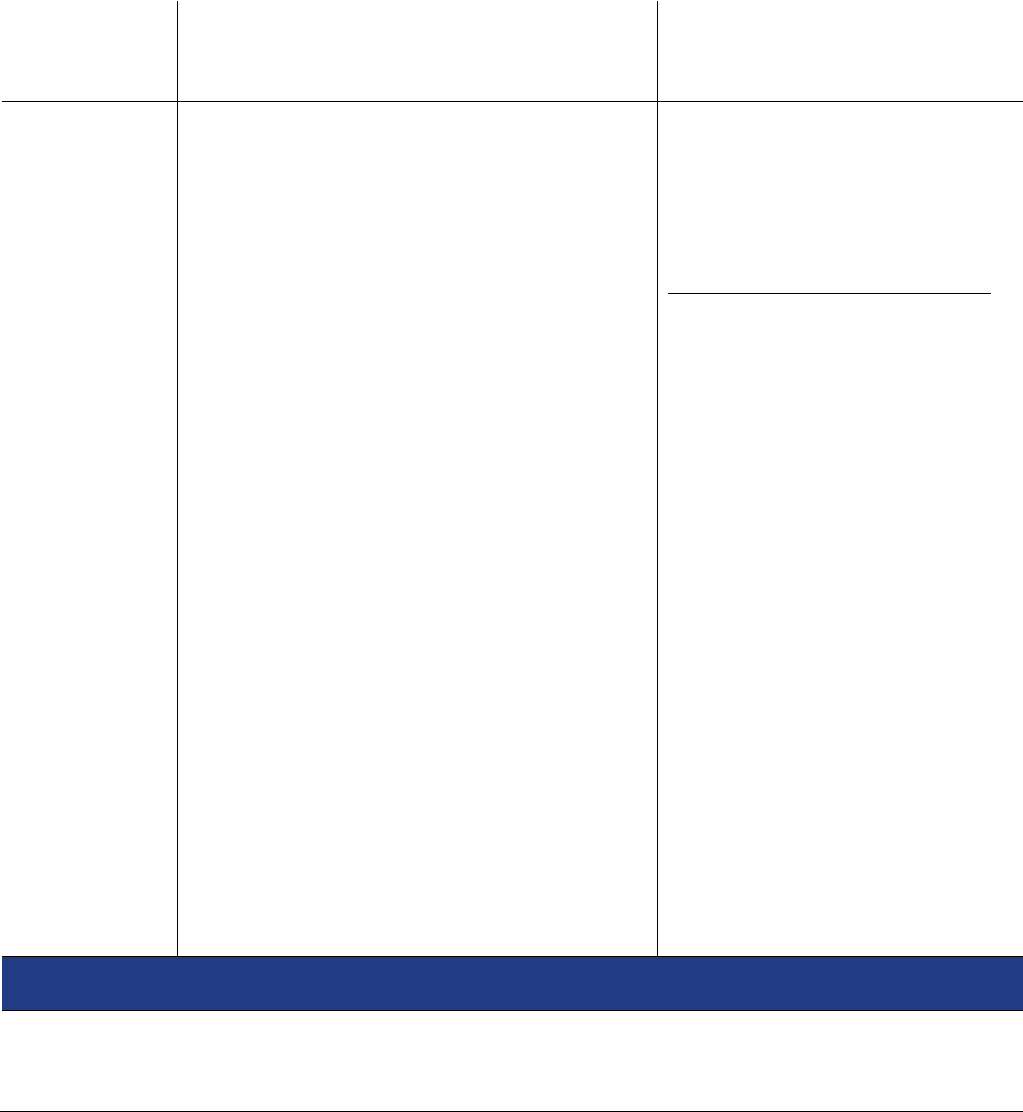

3. Conditions/Restrictions on product Distribution

Restriction/

Condition

Description

Method of

distribution

These Products may be distributed by Chubb to existing customers on an annual renewal

basis.

Chubb no longer offers the Products to new customers.

Chubb’s employees are only authorised to provide general financial product advice.

The distribution of these Products is subject to the terms of the Enforceable Undertaking

as between Chubb and the Australian Securities and Investment Commission dated

February 2016.

Promotional

Material

As the Products are not being sold to any new customers, promotional material is

limited. Any promotional material which is used by the Distributor in relation to the

Product must be pre-approved by Chubb and must contain an electronic link to this

TMD.

Distribution

in accordance

with TMD

The Product must only be distributed in accordance with this TMD.

Chubb Target Market Determination, Combined Insurance - Accident Policy and Sickness Policies, Australia. Published 09/2023.

©2023 Chubb Insurance Australia Limited. Chubb

®

, its logos, and Chubb. Insured.

SM

are protected trademarks of Chubb.

7

Explanation

Customers that obtain the Products in accordance with the distribution conditions set out above are more

likely to be in the target market for this product because the distribution of the Products will be restricted to

existing Combined Insurance customers by Chubb.

4. Product Review

Periods of

review:

Mandatory periodic reviews of the TMD will occur at least every 2 years subject to

intervening review triggers (see below).

Review triggers:

Review triggers are events that suggest the TMD may no longer be appropriate and may trigger a review

prior to periodic review as set out above. The review triggers for this product are set out below.

1.

Any material change to the Product, including a change to the PDS.

2.

Changes to relevant laws, regulatory guidance, or industry codes.

3.

Any determination of or feedback from regulators, the Australian Financial Complaints Authority, a

court or a tribunal suggesting that the target market may no longer be appropriate (including the

use of Product Intervention Powers).

4.

The nature of feedback regarding the Product, including whether complaints have increased

significantly from consumers or distributors.

5.

Distribution or purchasing of the Product in a manner significantly inconsistent with the TMD.

5. Reporting Obligations

These Products are not being sold to new customers and third parties have not distributed the Products

since 2016.

Distributor Reporting Obligations

Type of

Report

Description

Reporting Period

Complaints

If the Distributor acts under a binding authority

from Chubb, or as an Authorised Representative

of Chubb, the Distributor must provide

complaints data and information in accordance

with the existing contractual terms as agreed to

between the parties.

If the Distributor acts as a broker (agent for the

consumer), the Distributor must provide the

following complaints data:

• The number of complaints received

regarding the Product during the

Reporting Period and the nature and

details of the complaints.

Quarterly (10 business days after

the quarter has closed)

Send data to:

DisputeResolution.AU@chubb.com

Chubb Target Market Determination, Combined Insurance - Accident Policy and Sickness Policies, Australia. Published 09/2023.

©2023 Chubb Insurance Australia Limited. Chubb

®

, its logos, and Chubb. Insured.

SM

are protected trademarks of Chubb.

8

Complaint is defined in the Australian Securities

and Investment Commission (ASIC) Regulatory

Guide RG 271.

Significant

dealings

A significant dealing in the Product which is not

consistent with this TMD must be notified to

ASIC. What amounts to a "significant dealing"

will be determined by the circumstances of each

case but generally:

• regard should be had to the proportion of

customers purchasing the product who

are not in the target market, the actual or

potential harm to those customers, and

the nature and extent of the

inconsistency of distribution with the

TMD.

• distributors should have regard to

current ASIC guidelines when

determining what may constitute a

significant dealing.

• if in doubt, Distributors must report the

dealing to Chubb, so that Chubb can

undertake the necessary assessments.

The report must include:

• date(s) of the significant dealing;

• description of the significant dealing;

• why the dealing is significant;

• how the significant dealing was

identified;

• what steps, if any, have been taken in

relation to persons affected by the

significant dealing; and

• steps which have been, or will be, taken

to ensure that the significant dealing does

not occur again.

Within 1 business day of becoming

aware of the significant dealing.

Send data to:

aus.incidentreporting@chubb.com

6. Appropriateness

Chubb has assessed the Product’s key attributes and formed the view that they are likely to be consistent

with the likely objectives, financial situation and needs of consumers in the target market as described

within this TMD.

Chubb Target Market Determination, Combined Insurance - Accident Policy and Sickness Policies, Australia. Published 09/2023.

©2023 Chubb Insurance Australia Limited. Chubb

®

, its logos, and Chubb. Insured.

SM

are protected trademarks of Chubb.

9

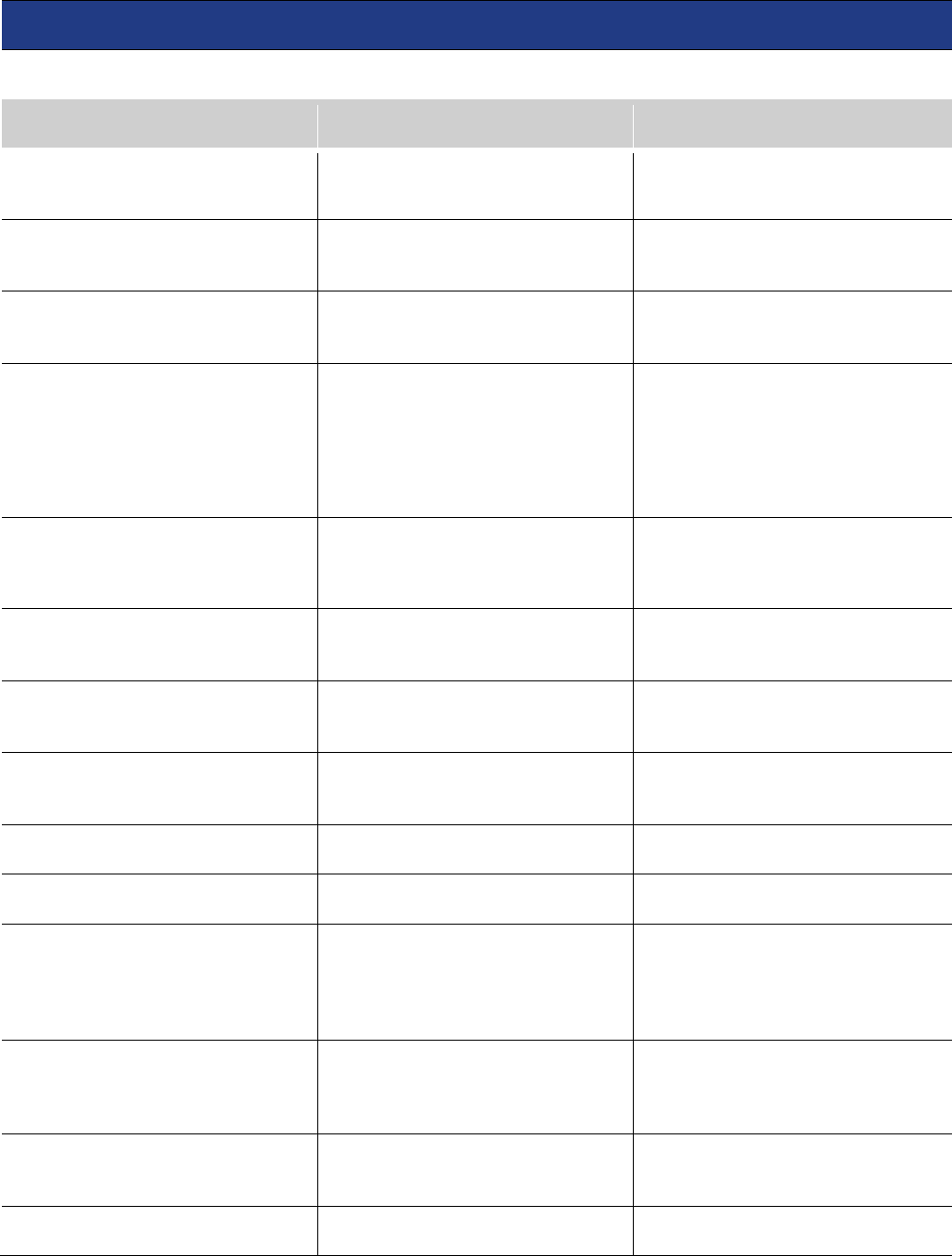

Annexure A

This TMD applies to the Products listed below, together with anyone subsequent SPDSs.

Product Name

Policy no. / Issue date

Product Code

Accident Bonus Hospital

Divisions

1987

21010, 21076, 21088, 21196, 21197

Accident Confinement Indemnity

Policy

1989

24101 & 24102

Accident Disability Plus Policy

1997 (November); 01/05/2000;

and 01/12/2001

24125, 24126, 24129, 24130,

24151, 24152 & 24293

Accident Policy

Issue No 1 (01/07/2003),

Issue No 2 (08/09/2003),

Issue No 3 (01/07/2004 &

31/03/2005),

Issue No 4 (01/10/2008) &

Issue No 5 (01/06/2009)

24165, 25113, 25114, 24169, 24171,

24167, 24164, 24170, 25117, 25116,

25113, 24168, 24166, 24131, 24197,

24161, 24162, 24163, 24159, 24160

Accident Policy

10PDSCOAC01 (13/08/10),

10PDSCOAC02 (20/07/2011) &

10PDSCIAC03 (16/01/2012)

25117, 25116, 24197, 28700 & 28701

Accidental Death &

Dismemberment Policy

1995; 1989

24108, 24109 & 24113

Accidental Hospital Indemnity

Policy

1987

21198, 21199

Bonus Accidental Death &

Dismemberment Policy

1995 (October)

24112

Cancer Aid Policy

1988

21602, 21603

Cancer Indemnity Policy

1993

24601 – 24608

Comprehensive Healthcare Policy

1996; 1997; 1998; 1999; 2001

(August)

24621 – 24635, 24225, 24731 to

24769 & 24771 to 24784, 24275,

24276 to 24288 24226 to 24262,

24245 to 24247, 24235 & 24237

Full Accident Coverage Policy

1983; 1987; 1989; 1992; 1996

(May)

21038, 21072, 21079, 21096,

21193, 24136-40, 24104, 24106,

24107, 24120, 21194, 21195, 24105

Healthcare Policy

1996; 1997; 1998; 1999; 2001

(August); 2001 (December)

24637 to 24643, 24275, 24276 to

24288, 24290 to 24292

Introductory Accident Policy

1997 (May); 2000 (May)

24123, 24124, 24127 and 2412

Chubb Target Market Determination, Combined Insurance - Accident Policy and Sickness Policies, Australia. Published 09/2023.

©2023 Chubb Insurance Australia Limited. Chubb

®

, its logos, and Chubb. Insured.

SM

are protected trademarks of Chubb.

10

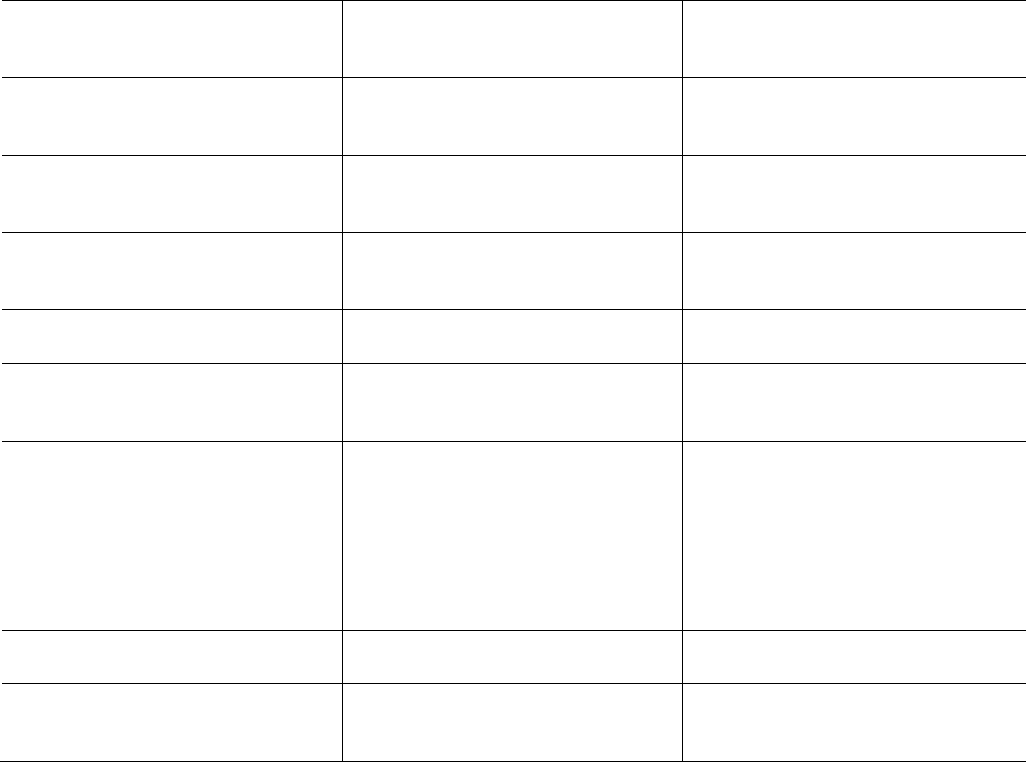

Prime Cover Accidental Death

Cover

2001 (April)

24142

Prime Cover Accidental Death

Cover (Family)

2001 (April); 2002 (June)

24143, 24148 & 24154

Prime Cover Accidental Death

Cover (Individual)

2002 (June)

24147, 24153, 24156 & 24157

Sickness Confinement Indemnity

Policy

1993

24701 to 24730

Sickness Hospital Benefit Policy

1988

21089, 21090 and 22705

Sickness Indemnity Policy

1988 and 1993

21029, 21075, 21080 to 21082,

22613, 22614, 24201 to 24211

Sickness Policy

Issue No 1 (01/07/2003),

Issue No 2 (27/10/2003 &

27/10/2009),

Issue No 3 (01/09/2005 &

01/03/2005),

Issue No 4 (19/06/2006) &

Issue No 5 (01/05/2009)

24645 to 24661, 24947, 24664,

24663, 24665, 24666, 24787,

24786, 24792, 24793, 24789,

24790, 24297, 24915, 24946, 24965

to 24966, 24914 & 24965, 24916

Travel Accident Plus Policy

1996; 2001 (August)

24134, 24135, 24149 and 24150

Travel Accident Policy

1983; 1992

21063, 21071, 23386, 24121 &

24122

Sickness and Accident PDS and policy wordings issued prior to 2003 as listed above; (Supplementary Product

Disclosure Statement (SPDS) − Legacy Policy. Published 04/2021 and Supplementary Product Disclosure

Statement (SPDS) − Accident Policy and Sickness Policy Published 04/2021; updates or adds to the Policy

Wording in the PDS as listed in the same).

This content is brought to you by Chubb Insurance Australia Limited (“Chubb”) as a convenience to readers

and is not intended to constitute advice (professional or otherwise) or recommendations upon

which a reader may rely. Chubb Insurance Australia Limited (Chubb) makes no warranty or guarantee

about the accuracy, completeness, or adequacy of the content. Readers relying on any content do so at their

own risk. It is the responsibility of the reader to evaluate the quality and accuracy of the content.

Reference in this content (if any) to any specific commercial product, process, or service, and links from this

content to other third party websites, do not constitute or imply an endorsement or recommendation by Chubb

and shall not be used for advertising or service/product endorsement purposes.

Chubb Target Market Determination, Combined Insurance - Accident Policy and Sickness Policies, Australia.

Published 09/2023. ©2023 Chubb Insurance Australia Limited ABN: 23 001 642 020 AFSL: 239687. Chubb

®

,

its logos, and Chubb. Insured.

SM

are protected trademarks of Chubb. Chubb11-596-0622

About Chubb in Australia

Chubb is the world’s largest publicly

traded property and casualty insurer.

Chubb, via acquisitions by its predecessor

companies, has been present in Australia

for 100 years. Its operation in Australia

(Chubb Insurance Australia Limited)

provides specialised and customised

coverages including Business Package,

Marine, Property, Liability, Energy,

Professional Indemnity, Directors &

Officers, Financial Lines, Utilities as well

as Accident & Health, to a broad client

base, including many of the country’s

largest companies. Chubb also serves

successful individuals with substantial

assets to insure and consumers purchasing

travel insurance.

More information can be found at

www.chubb.com/au.

Contact Us

Chubb Insurance Australia Limited

ABN: 23 001 642 020 AFSL: 239687

Grosvenor Place

Level 38, 225 George Street

Sydney NSW 2000

O +61 2 9335 3200

www.chubb.com/au