This project was supported in part by grant #90SAPG0102-03-00, from the U.S. Administration

for Community Living, Department of Health and Human Services, Washington, D.C. 20201

Because the best choice is an educated choice

Comparison Guide

Updated 10.4.22

MEDICAREMEDICARE

SUPPLEMENTSUPPLEMENT

PREMIUMPREMIUM

2022

2023

CHICAGOAREA

2

2021-2022 MEDICARE SUPPLEMENT PREMIUM COMPARISON GUIDE CHICAGO AREA

NOTICE REGARDING THE AFFORDABLE CARE ACT (ACA)

MARKETPLACE PLANS

If you have Medicare, you are already covered. You do not have to buy more health

coverage, and a Marketplace Plan is not appropriate for you. The Marketplace does not

sell Medicare Advantage plans or Medicare Supplemental Coverage.

Medicare supplement premiums for the Chicago area are applicable to

the counties of Cook, DuPage, Kane, Lake, McHenry and Will.

Important Phone Numbers

IL Department on Aging

Senior Health Insurance

Program (SHIP)

1-800-252-8966;

711 (TRS)

Free Medicare counseling;

Aging-related information and

referral services

Social Security Administration 1-800-772-1213

Medicare eligibility and

enrollment

Medicare

(1-800-MEDICARE)

1-800-633-4227

Medicare claims, appeals,

drug plan information

Oce of Consumer Health

Insurance (OCHI)

1-877-527-9431

Consumer complaints,

information and referral

services

Healthcare & Family Services

Health Benets Hotline

1-800-226-0768 Medicaid questions

The rates in this Guide are provided by the insurance companies to the Illinois Department of

Insurance, eective August 2022. Always check with the insurance company you choose to

get an accurate price quote for your individual situation.

3

2021-2022 MEDICARE SUPPLEMENT PREMIUM COMPARISON GUIDE CHICAGO AREA

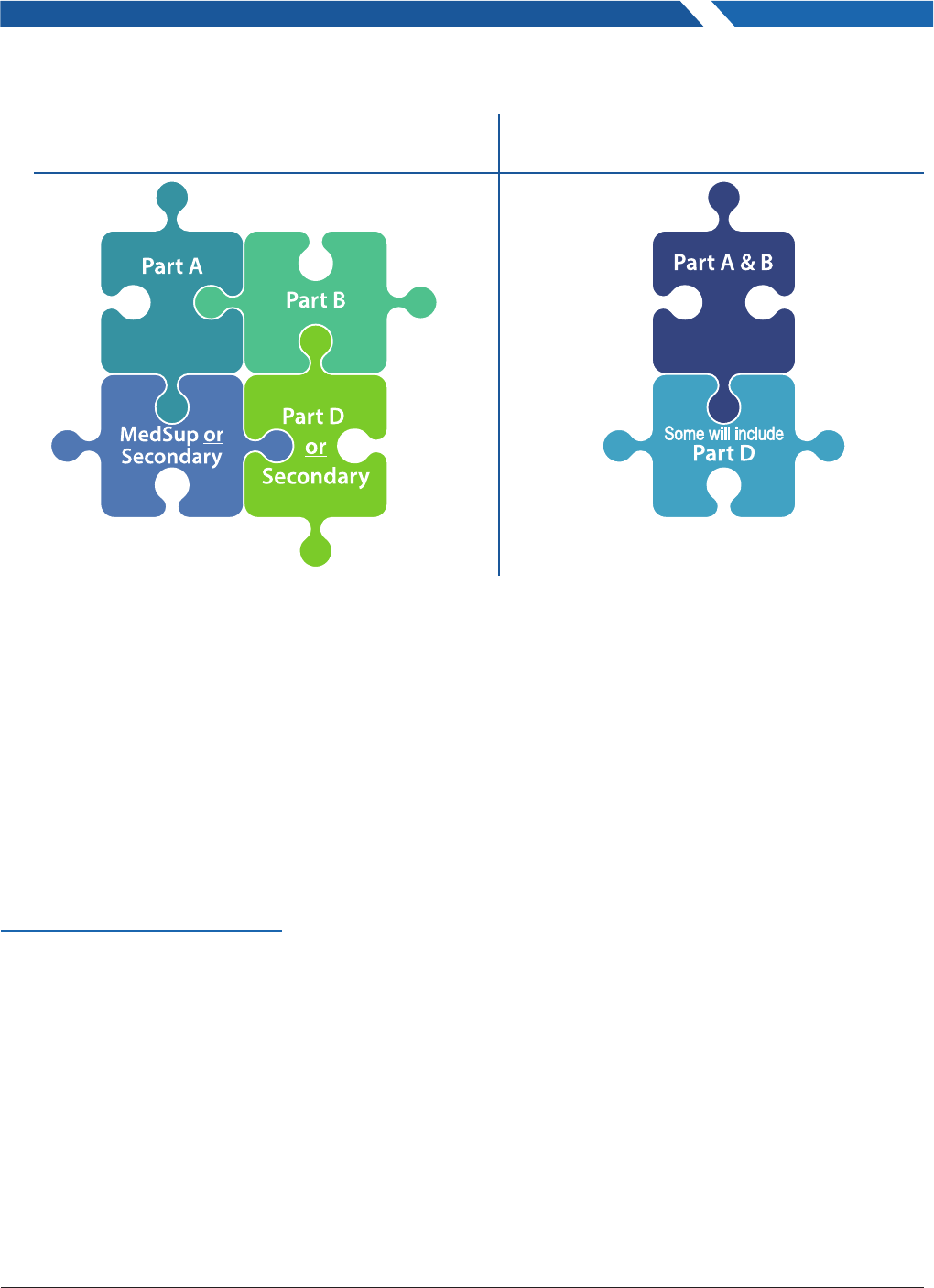

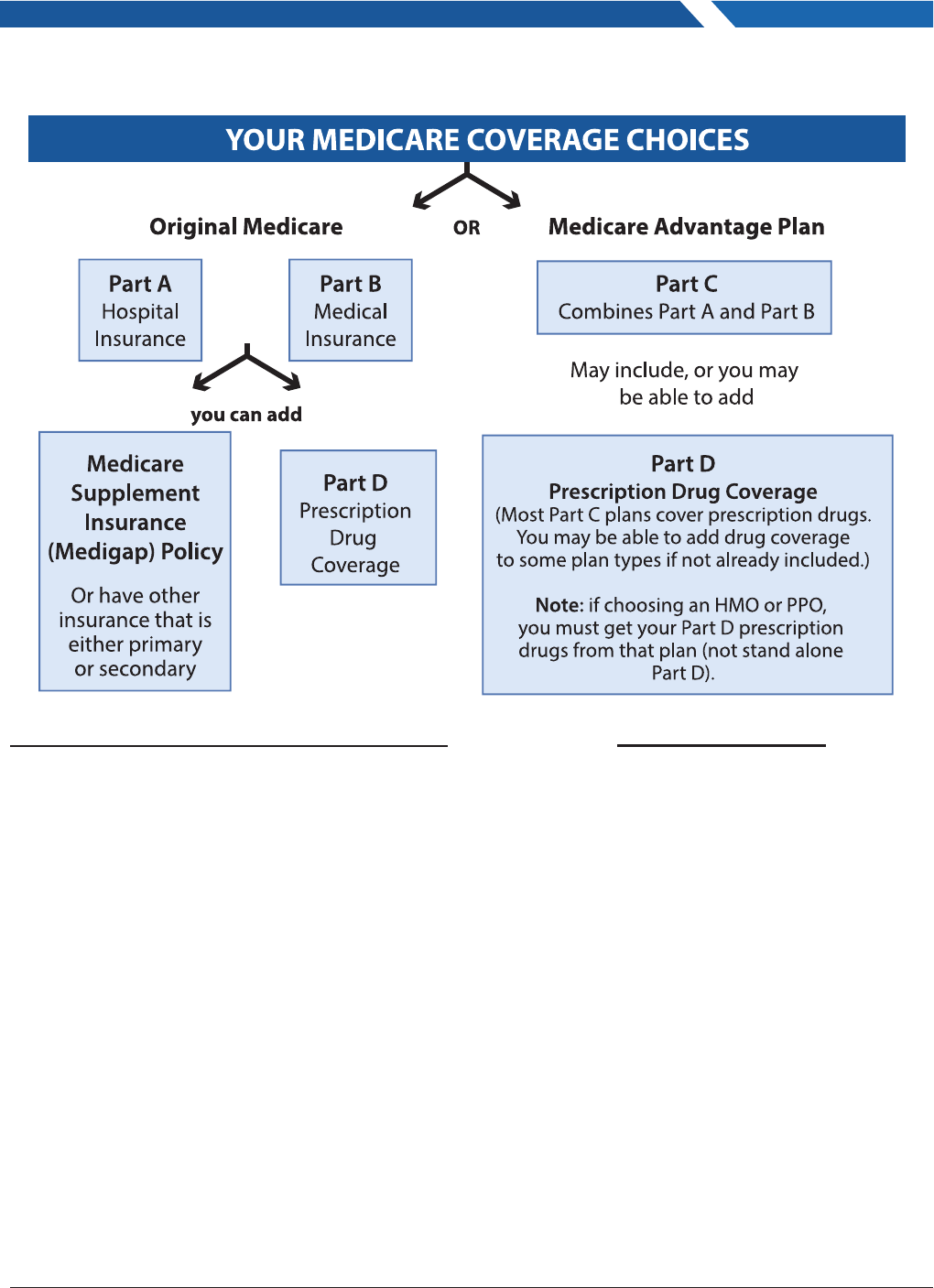

THE PIECES OF MEDICARE

Original Medicare

Medicare Advantage

(also known as Part C)

Part A (Hospital Insurance)

helps cover:

• Inpatient care in hospitals

• Skilled nursing facility care following a hospital stay

• Hospice care

• Home health care

Part B (Medical Insurance)

helps cover:

• Services from doctors and other health care providers

• Outpatient care

• Home health care

• Durable medical equipment (like wheelchairs, walkers, hospital beds, and other equipment)

• Many preventive services (like screenings, shots or vaccines, and yearly “Wellness”

visits—

you typically pay 20% of the Medicare approved amounts for most of these services.)

ADDITIONAL COVERAGE

Part D (Drug coverage):

Helps cover the cost of prescription drugs (including many

recommended shots or vaccines). Plans that oer Medicare drug coverage (Part D) are run by

private insurance companies that follow rules set by Medicare.

Medicare Supplement Policy also known as Medigap:

A Medicare supplement policy

is insurance coverage sold by a private insurance company designed to pay the major benet

gaps in Original Medicare, such as deductibles and copayments.

Medicare Advantage (also known as Part C):

Medicare Advantage is a Medicare-

approved plan

from a private company that oers an alternative to Original Medicare for your

health and drug coverage. These “bundled” plans include Part A, Part B, and usually Part D

and may include additional benets such as vision, hearing and dental. In some cases, you’ll

need to use doctors who are in the plan’s network. (Medicare Advantage plans will be

discussed in more detail later in this guide.)

4

2021-2022 MEDICARE SUPPLEMENT PREMIUM COMPARISON GUIDE CHICAGO AREA

How to Use this Guide

This Guide has been prepared to assist you in making an informed decision about purchasing a

Medicare supplement insurance policy, sometimes referred to as “Medigap.” A Medicare

supplement policy is insurance coverage sold by a private insurance company designed to pay

the major benet gaps in Original Medicare, such as deductibles and copayments. A Medicare

supplement is NOT managed care, such as an HMO, PPO, etc., or coverage provided by an

employer. By law, all Medicare supplement plans currently available must follow a

standardized benet structure, but may oer enhanced benets if approved by the

Illinois Department of Insurance (IDOI). So, comparison for price is important! Not all

insurance companies sell all plans.

Medigap law changed on June 1, 2010. Therefore, if you purchased a Medigap plan prior to

June 1, 2010, your plan benets may look dierent than the current benets oered for sale

today. You do NOT have to replace an older Medigap policy. You may keep your current

Medigap policy and it will continue to pay benets according to its policy guidelines. The charts

on pages 7, 8 and 9 list the plans available for sale now and the benets oered under each

plan. In addition to the regular Medicare Supplement Plans A through N, Plan F and Plan G are

also available as High-Deductible plans (see page 11). Additionally, you may have the option

of choosing a Medicare SELECT plan, which is explained on page 10.

Please note that Medigap policies must be clearly identied as “Medicare supplement

insurance.” Each rate chart lists the insurance companies licensed to sell those specic

insurance plans in Illinois, and the approximate amount they charge by age when you

purchase the policy. Rates are quoted based on a regional zip code.

Medigap policies currently sold cannot contain prescription drug benets because of

Medicare’s prescription drug coverage, Medicare Part D, which began in 2006. However,

if you had a Medigap policy with prescription drug coverage prior to 2006, you may keep that

policy. Medicare Part D coverage is provided through private insurance companies and/or

Medicare Advantage plans oering prescription drugs.

The premiums listed in this Guide were approved and are on le with the Illinois Department of

Insurance. These premiums were eective as of August 2022 but may change during the year.

You can contact the company for accurate premium information specic to your situation.

Licensed insurance companies that sell only to groups and not individuals may not be included

in this guide.

SHIP Counselors have access to real time quotes utilizing the Medigap Plan Finder within the

SHIP Technical Assistance Center (SHIP TA Center). The tool is updated weekly with the latest

plan information received directly from the plan via CSG Actuarial, and allows for customized

searches based on gender, age, tobacco status and other criteria. It is made possible by grant

funding from the U.S. Administration for Community Living (ACL) and is created and supported

by CSG Actuarial in Omaha, Nebraska.

Please take time to read the valuable information printed in this shopping Guide.

If you have any questions about this Guide, Medicare supplement insurance in general,

Medicare prescription drug plans, or want a real time quote, you may contact the Illinois

Department on Aging, Senior Health Insurance Program (SHIP) at: 1-800-252-8966; 711 (TRS);

or email SHIP at: [email protected]

5

2021-2022 MEDICARE SUPPLEMENT PREMIUM COMPARISON GUIDE CHICAGO AREA

Denition of Terms and Special Provisions

Open Enrollment Period: A person of any age going onto Medicare Part B for the

rst time has six (6) months from the date their Part B coverage takes eect to shop for

a Medicare supplement policy. During this open enrollment period, you cannot be

refused coverage for any reason. Unless you have prior creditable and continuous

coverage (see denition below), the company may impose a waiting period for coverage

of pre-existing conditions for up to six (6) months, but it cannot refuse to sell you a policy

if you apply within your open enrollment period.

30-Day Free Look: You have 30 days after you receive a Medicare supplement

policy to review the policy, cancel if you choose, and get a full refund of premium (less

any Policy Fee charged at the time of sale). If you wish to cancel, it is recommended that

you return the policy directly to the company (not the insurance agent) by certied mail,

return receipt requested.

Creditable Coverage: There are certain types of previous health insurance coverage

that can be used to shorten or eliminate a pre-existing condition waiting period under a

Medigap policy. However, to qualify as Continuous Coverage, you cannot have more

than a 63-day break in coverage between the previous health insurance coverage and

your Medicare coverage.

Guaranteed Renewability: All standardized Medicare supplement plans are

guaranteed renewable for life. This means that the company cannot cancel your policy

unless you do not pay the premiums, or you falsify information on your application.

Medical Underwriting: The process by which an insurance company determines

insurability due to medical diagnosis of any pre-existing health conditions.

Pre-existing Waiting Period: Unless you have creditable and continuous coverage,

a Medigap company may look back no more than six months of health records and impose

a waiting period of up to six (6) months for any pre-existing health condition you may have.

Each company’s waiting period appears in the company information on the rate charts.

Policy Application Fee: Companies may charge a one-time fee when you rst apply

for a policy within the 30-day free look period. The company does not have to refund this

fee if you choose to cancel your policy within this 30-day period.

Standardized Coverage: Medigap policies sold in Illinois after 1992 are identical in

coverage from company to company. For example, a Plan G sold by ABC Insurance

Company has the same benets as a Plan G that is sold by XYZ Insurance Company,

with the exception of any innovative benets approved by the Illinois Department of

Insurance. Examples of innovative benets could include, but not limited to, vision

benets, dental benets, or routine hearing exams. See the notes on the rate tables for

any plans with enhancements.

6

2021-2022 MEDICARE SUPPLEMENT PREMIUM COMPARISON GUIDE CHICAGO AREA

*NEW EFFECTIVE JANUARY 1, 2022*

If an individual is at least 65 years of age, but no more than 75 years of age, and has

an existing Medicare supplement policy the individual is entitled to a New Medicare

Supplement Annual Open enrollment period. This New Medicare Supplement Annual

Open Enrollment period begins on the individuals birthdate each year and lasts for 45

days. The individual may purchase any Medicare Supplement policy with the same

company/issuer that oers benets equal to or lesser than those provided by the

previous coverage. During this open enrollment period, if an individual currently has

a Medicare supplement policy then the policy cannot deny or place conditions on the

individual holding the policy or eectiveness of Medicare supplemental coverage, nor

discriminate in the pricing of coverage, because of health status, claims experience,

receipt of health care, or a medical condition of the individual.

Info for Medicare Supplements effective on or after 2020

As of January 1, 2020, Medicare Supplement Plans C and F are no longer available to

newly eligible Medicare beneciaries. Anyone who was eligible for Medicare prior to

this date may still purchase a Plan C or F after this date. Any person currently owning

a Plan C or F can keep it – there is no need to change to a dierent plan.

Information for Disabled Individuals on Medicare:

In Illinois, people under the age of 65 on Medicare due to a disability have

the same Open Enrollment rights as people 65 and older. Additionally,

when you turn 65 you will be eligible for another six (6) month Medicare

supplement open enrollment period due to age. This will give you the

opportunity to purchase a Medigap policy based on the age of 65, which may reduce your

monthly premium.

PLEASE NOTE: If you are under 65 and receive notication of your Medicare Part B

eligibility retroactively, your six (6) month Open Enrollment Period starts on the date

you receive that notication.

Please note if you are under 65, disabled and on Medicare and did not purchase a

Medigap policy during your initial six (6) month open enrollment period, you will be

able to purchase a Medigap policy from Blue Cross/Blue Shield from October 15 to

December 7.

Guaranteed Issue Policies from a Guaranteed Issue Company

For persons aged 65 or older and NOT in their Open Enrollment Period (see Page 5)

or any Special Enrollment Periods (see pages 13 & 14) there is still an option to get a

Supplemental plan. In Illinois, we have one Medicare Supplement insurer that oers

policies to anyone over the age of 65 in ANY health condition, throughout the year

at the same premium rate as anyone in the same policy class. That company is

Blue Cross Blue Shield of Illinois. See the listing in the rate table for contact and

rate information. Starting April 1, 2022, BC/BS released secure Medicare plans A, F,

G, and N. These plans oer the same benet as standard (Guaranteed Issue) plans

but may lower rates if you can pass a series of health-related questions.

7

2021-2022 MEDICARE SUPPLEMENT PREMIUM COMPARISON GUIDE CHICAGO AREA

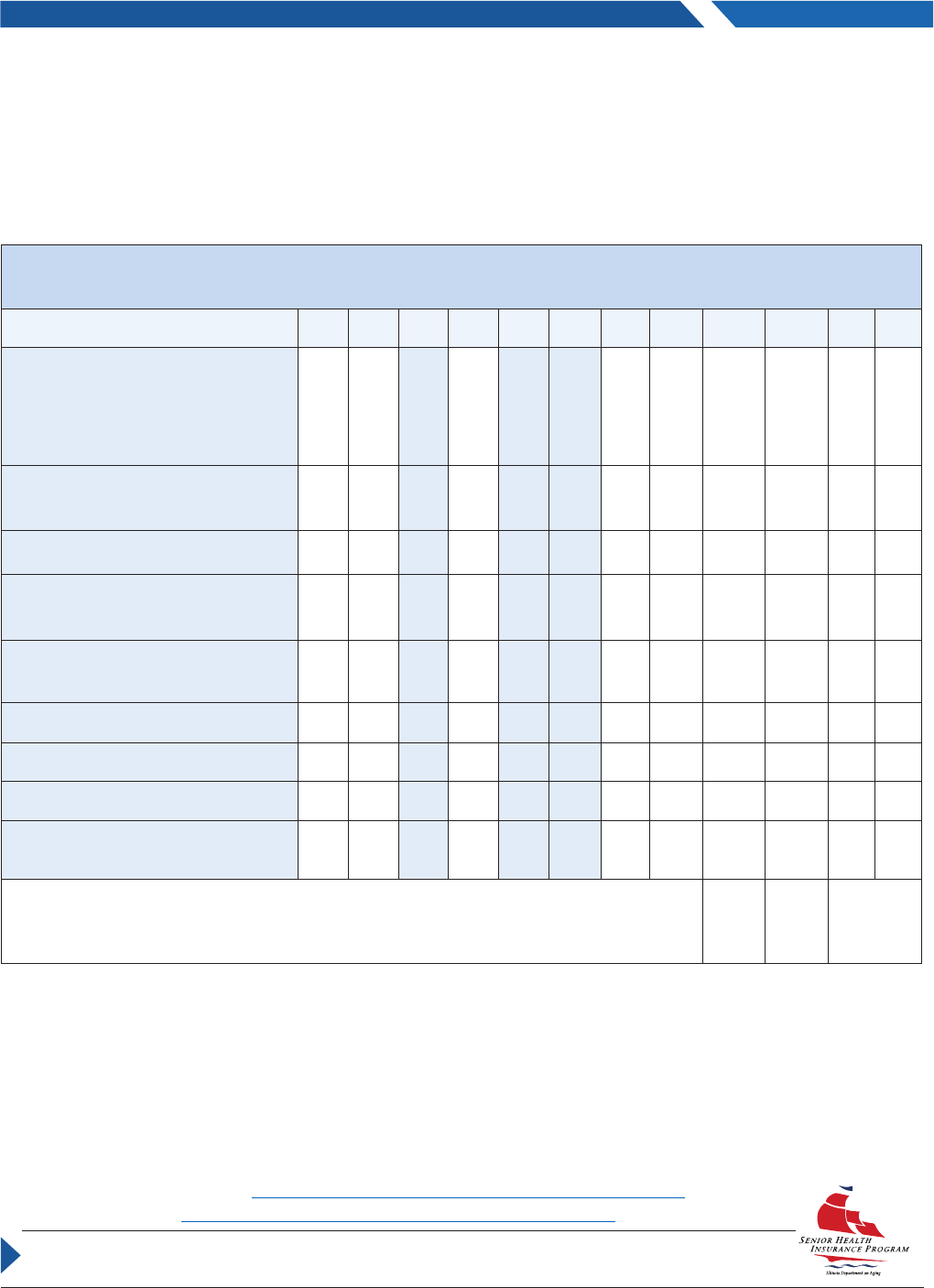

Medicare Supplement Benets

This chart indicates the benets included in each of the standardized Medicare

Supplement plans. If a percentage appears, the Medigap plan covers that

percentage of the benet, and you’re responsible for the rest.

2023 Medicare Supplement Plans

Benets A B C D F FHD

G GHD

K L M N

Medicare Part A coinsurance and

inpatient hospital costs (up to an

additional 365 days after

Medicare benets are used)

√ √ √ √ √ √ √ √ √ √ √ √

Medicare Part B coinsurance or

copayment

√ √ √ √ √ √ √ √

**50% **75%

√ √***

Blood (rst 3 pints, if charged)

√ √ √ √ √ √ √ √

**50% **75%

√ √

Part A hospice care coinsurance

or copayment

√ √ √ √ √ √ √ √

**50% **75%

√ √

Skilled nursing facility care

coinsurance

√ √ √ √ √ √

**50% **75%

√ √

Part A deductible

√ √ √ √ √ √ √

**50% **75% 50%

√

Part B deductible

√ √ √

Part B excess charges

√ √ √ √

Foreign travel emergency (up to

plan limits)

80% 80% 80% 80% 80% 80% 80% 80%

2023 Out-of-Pocket Limits

$6,940 $3,470

Plans F & G are also offered as a high-deductible plan by some insurance companies. If you choose this option, this

means you must pay for Medicare-covered costs (coinsurance, copayments, and deductibles) up to the deductible amount of

$2,700 in 2023 before your policy pays anything.

**For Plans K and L, after you meet your out-of-pocket yearly limit and your yearly Part B deductible; the Medigap plan

pays 100% of covered services for the rest of the calendar year.

***Plan N pays 100% of the Part B coinsurance, except for a copayment of up to $20 for some ofce visits and up to a

$50 copayment for emergency room visits that don’t result in an inpatient admission.

Reference for Plan F-HD and G-HD: https://www.cms.gov/Medicare/Health-Plans/Medigap/FandJ.html

Reference for Plan K & L: https://www.cms.gov/Medicare/Health-Plans/Medigap/KandL.html

Your monthly premium will depend on plan selected, company

purchased from, any discounts offered, etc.

Plans C and F are only available

to those eligible for Medicare

prior to 01/01/20.

√ = 100%

1-800-252-8966

711 (TRS)

8

2021-2022 MEDICARE SUPPLEMENT PREMIUM COMPARISON GUIDE CHICAGO AREA

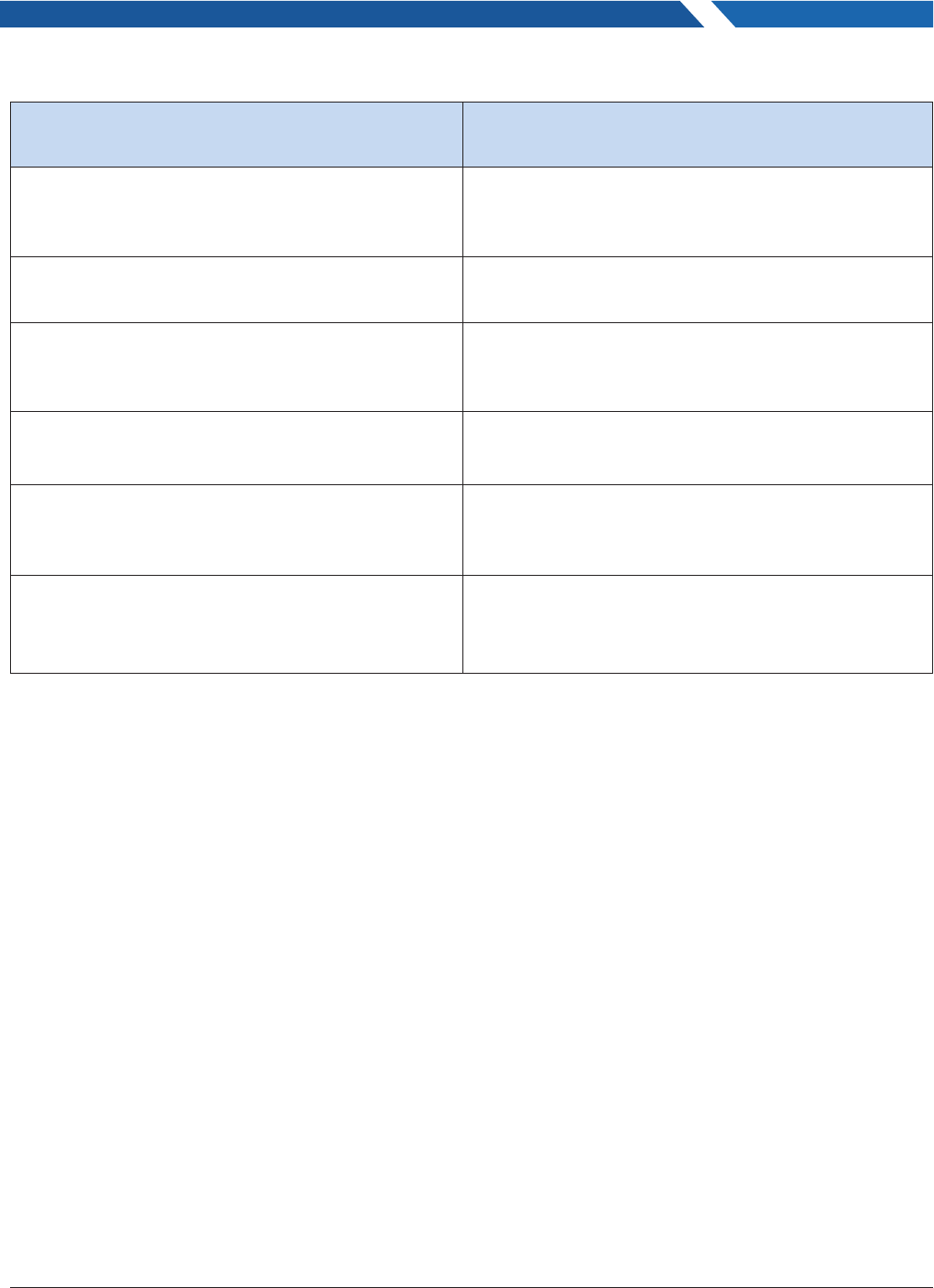

Core Benets for Plans K & L

Medigap Plan K % plan pays Medigap Plan L % plan pays

Medicare Part A Coinsurance and

Hospital Benets: Days 61 – 150 (100%)

Medicare Part A Coinsurance and

Hospital Benets: Days 61 – 150 (100%)

Medicare Part A Deductible

(50%)

Medicare Part A Deductible (75%)

Medicare Part B Coinsurance or

Copayment (50%)

Medicare Part B Coinsurance or

Copayment (75%)

Blood Deductible (50%) Blood Deductible (75%)

Hospice Care Coinsurance or

Copayment (50%)

Hospice Care Coinsurance or

Copayment (75%)

Skilled Nursing Facility

Coinsurance (50%)

Skilled Nursing Facility Coinsurance (75%)

Medigap Plans K and L provide dierent cost-sharing amounts for items and

services than Medigap Plans A, B, C, D, F, G, M, and N. You will have to pay

some out-of-pocket costs for some covered services until you meet the yearly

out-of-pocket limit (Plan K is $6,940 and Plan L is $3,470 in 2023). After the

annual out-of-pocket limit is reached, the Medigap policy will cover 100% of

Medicare Part A and B coinsurance amounts for the remainder of the

calendar year.

9

2021-2022 MEDICARE SUPPLEMENT PREMIUM COMPARISON GUIDE CHICAGO AREA

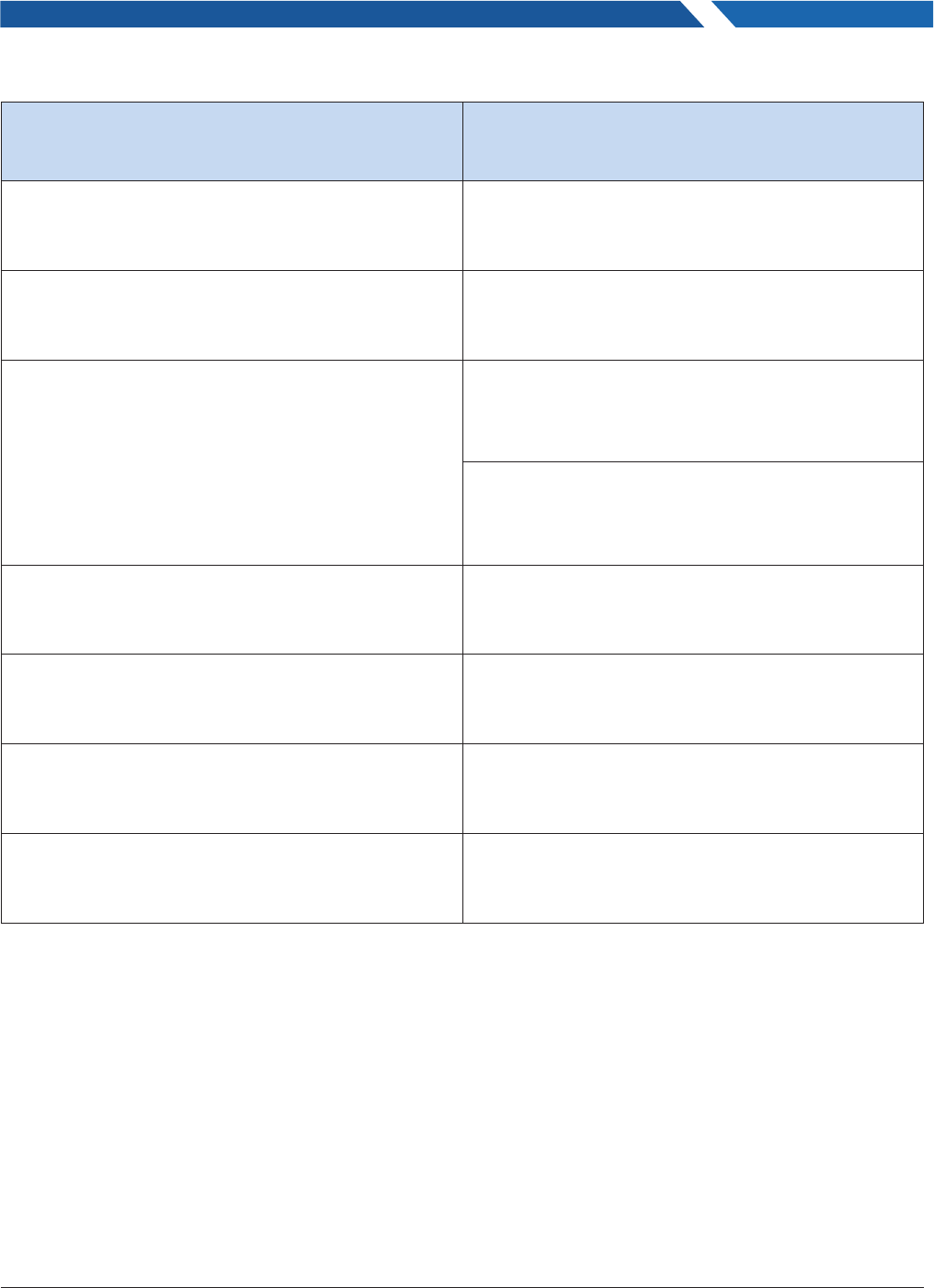

Core Benets for Plans M and N

Medigap Plan M % plan pays Medigap Plan N % plan pays

Medicare Part A Coinsurance and

Hospital Benets: Days 61 – 150 (100%)

Medicare Part A Coinsurance and Hospital

Benets: Days 61 – 150 (100%)

Medicare Part A Deductible (50%) Medicare Part A Deductible (100%)

Medicare Part B Coinsurance or

Copayment (100%)

Medicare Part B Coinsurance or

Copayment: For Part B services except

“Oce Visits,” Plan N will pay (100%)

You pay up to $20 for each service

dened as an “Oce Visit” and $50 per

Emergency Room visit.

Blood Deductible (100%) Blood Deductible (100%)

Hospice Care Coinsurance or

Copayment (100%)

Hospice Care Coinsurance or

Copayment (100%)

Skilled Nursing Facility

Coinsurance (100%)

Skilled Nursing Facility

Coinsurance (100%)

Foreign Travel Emergency (80% after

$250 deductible within rst 60 days of travel)

Foreign Travel Emergency (80% after

$250 deductible within rst 60 days of travel)

Medigap Plans M and N will be the same as Plan D with the following exceptions:

• Plan M will cover 50% of the Medicare Part A deductible; and

• Plan N pays 100% of the Medicare Part B Coinsurance or Copayment, except for

a copayment up to $20 per oce visit and $50 per Emergency Room visit.

Emergency Room visit copayment will be waived if admitted into the hospital.

10

2021-2022 MEDICARE SUPPLEMENT PREMIUM COMPARISON GUIDE CHICAGO AREA

Medicare SELECT

Medicare SELECT is another type of Medicare supplement policy.

Medicare SELECT companies have the right to require you to use specic hospitals

and doctors. This requirement does not apply in the case of an emergency. It is

important to call the company to nd out if they have a Medicare SELECT plan

available in your area and that your preferred hospital is included before you decide

to purchase this type of Medicare SELECT policy.

Medicare SELECT plans must be one of the standardized plans. If you do not

follow the Medicare SELECT provisions, Medicare will pay its portion, but the

Medicare SELECT company is not required to pay your inpatient hospital

deductible or copayments.

Please review your plan for specic guidelines. Medicare SELECT premiums will be

lower than that same company’s standardized Medicare supplement premiums. If you

have had a Medicare SELECT policy for at least six (6) months and then cancel it, you

will have the right to buy a standardized Medicare supplement policy from the same

company with comparable or lesser benets regardless of your health status. Also,

depending on your health status and the company’s underwriting standards, you may

be able to purchase a Medicare supplement plan with greater benets.

Rates for Medicare SELECT plans are shown on separate rate tables. They are

located directly behind those of the regular Medicare supplement rate charts on

page 33.

NOTICE REGARDING THE AFFORDABLE CARE ACT (ACA) MARKETPLACE PLANS

If you have Medicare, you are already covered. You do not have to buy

additional primary health coverage, and a Marketplace Plan is not

appropriate for you. The Marketplace does not sell Medicare Advantage

plans or Medicare Supplemental coverage.

11

2021-2022 MEDICARE SUPPLEMENT PREMIUM COMPARISON GUIDE CHICAGO AREA

Medicare Supplement High-Deductible Option

Another

variation of a Medicare supplement policy available to you is a “high-deductible

option” on Plan F or G. Generally, the premium for a high-deductible Plan F or G will be

lower than that company’s same Medicare supplement plan without the higher

deductible. The benets for a high-deductible Plan F or G are identical to any other Plan

F or G. The only dierence is that the plan will not pay benets until you have met the

deductible (the amount you must pay out of your pocket) for that calendar year.

The deductible for 2023 is $2,700. This deductible is adjusted each year to reect

the change in the Consumer Price Index.

In addition to the $2,700 deductible for Plan F or G, there is also a separate

$250 per year deductible for the foreign travel emergency benet.

For those eligible for Medicare prior to January 1, 2020, Plan FHD is available.

For those eligible for Medicare on or after January 1, 2020, Plan GHD will be the

only high deductible plan available.

Rates for Medicare supplement high-deductible plans being sold in Illinois can be

found immediately following the Standard Plan F or G rates as indicated by FHD

or GHD.

Further Information Available

You may want to check the nancial condition of any insurance company from which

you would like to purchase a policy. The Illinois Department of Insurance does not

rate the nancial condition of insurance companies. There is a fact sheet on their

website titled Illinois Insurance Facts, Finding a Reputable Insurance Company –

Using Financial Rating Agencies, listing ve (5) of the independent rating services,

their phone numbers and website addresses. The IDOI website is:

http://insurance.illinois.gov.

12

2021-2022 MEDICARE SUPPLEMENT PREMIUM COMPARISON GUIDE CHICAGO AREA

Explanation of Medicare Supplement Benets

Part A Deductible (Found in Plans B through N)

• Pays the $1,600 (2023) Medicare Part A inpatient hospital deductible in each

benet period.

Skilled Nursing Coinsurance (Found in Plans C through N)

• Pays the $200/day (2023) coinsurance amount for days 21–100 in each

benet period.

• Must be in a Medicare-certied Skilled Nursing Facility.

Part B Deductible (Found in Plans C and F)

• Pays the $226 (2023) Medicare Part B deductible each calendar year.

• The Part B deductible only applies to Medicare-approved charges.

Foreign Travel Emergency (Found in Plans C, D, F, G, M and N)

• Pays 80% of actual charges for medically necessary emergency care received

in a foreign country. The following restrictions apply:

◊ Expenses must be incurred during the rst 60 days of the trip;

◊ $250 calendar year deductible;

• Lifetime maximum of $50,000.

Part B Excess (Found in Plans F and G)

• Pays for the dierence between the Medicare-approved amount and the doctor’s

actual charge up to 15% over the Medicare-approved amount when you use

providers who do not accept Medicare assignment.

Oce Visit and Emergency Room Copayments (Found in Plan N)

• You pay up to $20 for each oce visit you incur;

• You pay $50 for each Emergency Room visit you incur;

• The Emergency Room visit copay is waived if you are admitted into the hospital

pursuant to your ER visit;

• The Medigap plan will not reimburse you for these copayment amounts. They are

your responsibility to pay.

Prescription drugs are no longer available under Medigap plans unless you

retained an H, I or J policy issued prior to January 1, 2006. Medicare Part D provides

prescription drug coverage through private insurance companies via stand-alone

prescription drug

plans (PDPs) or through Medicare Advantage plans oering a

prescription drug benet (MAPDs). The At Home Recovery and the Preventive

Care benets are no longer oered in any Medigap plan sold after June 1, 2010.

13

2021-2022 MEDICARE SUPPLEMENT PREMIUM COMPARISON GUIDE CHICAGO AREA

MEDICARE SUPPLEMENT: GUARANTEED ISSUE RIGHTS

This chart describes the situations under federal and Illinois law that give you a right to buy a

policy without any pre-existing condition exclusions, the kind of policy you can buy, and when

you can or must apply for it.

You Have a Guaranteed

Issue Right if….

You Have the Right to

Buy….

You Can/Must Apply

for a Medigap Policy.…

You’re in a Medicare

Advantage Plan (like an

HMO or PPO), and your

plan is leaving Medicare

or stops giving care in your

area, or you move out of the

plan’s service area.

Medigap Plan A, B, C, F, FHD,

K, or L from any insurance

company if you were eligible

for Medicare prior to 1/1/20.

For those newly eligible for

Medicare after 1/1/20, the

Medigap Guarantee Plans are

A, B, D, G, GHD, K or L.

You only have this right if you

switch to Original Medicare

rather than join another

Medicare Advantage Plan.

As early as 60 calendar days

before the date your health

care coverage will end, but

no later than 63 calendar

days after your health care

coverage ends.

Medigap coverage can’t

start until your Medicare

Advantage Plan coverage

ends.

You have Original Medicare and

an employer group health plan

(including retiree or COBRA

coverage) or union coverage that

pays after Medicare pays and

that plan ceases to provide all

such supplemental benets.

NOTE: If your employer-

provided retiree plan is

secondary to Medicare and

you voluntarily elect to

disenroll, you have no

guaranteed issue rights.

Medigap Plan A, B, C, F, FHD,

K, or L from any insurance

company if you were eligible

for Medicare prior to 1/1/20.

For those newly eligible for

Medicare after 1/1/20, the

Medigap Guarantee Plans are

A, B, D, G, GHD, K or L.

If you have COBRA coverage,

you can either buy a Medigap

policy right away or wait until

the COBRA coverage ends.

No later than 63 calendar

days after the latest of these

3 dates:

1. Date the coverage ends.

2. Date on the notice you

get telling you that

coverage is ending (if

you get one).

3. Date on a claim denial,

if this is the only way you

know that your coverage

ended.

You have Original Medicare and

a Medicare SELECT policy.

You move out of the Medicare

SELECT policy’s service area.

Call the Medicare SELECT

insurer for more information

about your options.

Medigap Plan A, B, C, F, FHD,

K, or L from any insurance

company if you were eligible

for Medicare prior to 1/1/20.

For those newly eligible for

Medicare after 1/1/20, the

Medigap Guarantee Plans are

A, B, D, G, GHD, K or L.

As early as 60 calendar

days before the date your

Medicare SELECT coverage

will end, but no later than

63 calendar days after your

Medicare SELECT coverage

ends.

(Trial right) You joined a

Medicare Advantage Plan

(like an HMO or PPO) when

you were

rst eligible for

Medicare Part A

at or after age

65 and enroll in Part B, and you

decide you want

to switch to

Original Medicare

within the rst

year of joining.

Any Medigap policy that’s sold

in Illinois by any insurance

company, dependent on the

year you become eligible for

Medicare.

As early as 60 calendar

days before the date your

coverage

will end, but no

later than 63

calendar days

after your

coverage ends.

14

2021-2022 MEDICARE SUPPLEMENT PREMIUM COMPARISON GUIDE CHICAGO AREA

You Have a Guaranteed

Issue Right if….

You Have the Right to

Buy….

You Can/Must Apply

for a Medigap Policy...

(Trial right) You dropped a

Medigap policy to join a

Medicare Advantage Plan

(or to switch to a Medicare

SELECT policy) for the rst

time, you’ve

been in the plan

less than a year, and you

want to switch back.

The Medigap policy you had

before you joined the Medicare

Advantage Plan or Medicare

SELECT policy, if the same

insurance company you had

before still sells it.

If your former Medigap policy isn’t

available, you can buy Medigap

Plan A, B, C, F, FHD, K, or L from

any insurance company if you

were eligible for Medicare prior to

1/1/20. For those newly eligible for

Medicare after 1/1/20, the

Medigap Guarantee Plans are

A, B, D, G, GHD, K or L.

As early as 60 calendar

days before the date your

coverage

will end, but no

later than 63

calendar

days after your coverage

ends.

Your Medigap insurance

company goes bankrupt and

you lo

se your coverage, or

your Medigap policy coverage

otherwise ends through no

fault of your own.

Medigap Plan A, B, C, F, FHD, K,

or L from any insurance company

if you were eligible for Medicare

prior to 1/1/20. For those newly

eligible for Medicare after 1/1/20,

the Medigap Guarantee Plans are

A, B, D, G, GHD, K or L.

No later than 63 calendar

days from the date your

coverage

ends.

You leave a Medicare

Advantage Plan or drop a

Medigap policy because the

company hasn’t followed the

rules, or it misled you.

Medigap Plan A, B, C, F, FHD, K,

or L from any insurance company

if you were eligible for Medicare

prior to 1/1/20. For those newly

eligible for Medicare after 1/1/20,

the Medigap Guarantee Plans are

A, B, D, G, GHD, K or L.

No later than 63 calendar

days from the date your

coverage

ends.

Suspension of Coverage

Medicaid—If you become entitled to benets under Medicaid, you have the right to

suspend your Medicare supplement policy for up to 24 months; meaning that the policy

cannot be cancelled, and you cannot be charged a premium during the suspension period.

If you b

ecome ineligible for Medicaid benets during this 24-month period and therefore

need your Medicare supplement policy again, your Medicare supplement policy must be

reinstated without penalty and you will not have a pre-existing waiting period as long as

you notify your insurer within 90 days of the date of your Medicaid ineligibility.

Under 65 with a EGHP (Employer Group Health Plan)—You can also

suspend your Medicare supplement policy if you are under age 65 and have insurance

coverage with an employer-sponsored group health plan due to your employment or

that of your spouse (or parents in the case of a disabled person). There is no limit to the

amount of time your Medicare supplement policy can be suspended.

15

2021-2022 MEDICARE SUPPLEMENT PREMIUM COMPARISON GUIDE CHICAGO AREA

Premium Calculation Methods

The rates quoted in this Guide are for male non-smokers in specic regions of the state

by zip code. Rates may vary depending on gender and the city in which you live. Rates

listed are those in eect with the Illinois Department of Insurance in August 2022.

For persons under 65 who become eligible to purchase a Medigap policy,

companies may not charge a rate higher than the highest rate on the company’s

current rate schedule led with the Illinois Department of Insurance. The rates

contained in this guide are provided for general guidance. The actual rates for

individuals under age 65 may vary from the highest rate in this guide. Please

contact the company directly to get the actual rates.

Premium Calculation Methods: Insurance companies use three (3) dierent methods

of pricing policies based on age.

• Attained Age: Your premium will increase as you grow older. Additional increases

due

to higher medical costs or higher than expected claim costs are also possible.

For example, if you buy a policy at age 65, when you turn 70, you will pay whatever the

company is charging for a person 70 years old. However, any rate increase that occurs

must apply to the entire class of policyholders in which you are categorized, not just to

you as an individual.

◊

Most companies in this guide use the Attained Age Rating Method.

• Issue Age: Y

our premium will always be based on your age at the time you

purchased the plan. Any increases will be due to higher medical costs or higher

than expected claim costs for the entire class of policyholders you are in. Even though

you will have increases in you

r policy premium, the premium will not increase just

because you are

growing older.

• No Age (Community) Rating: The premium for a specic policy is the same for

everyone over the age of 65, regardless of their age.

RATES: IF YOU APPLY FOR A MEDICARE SUPPLEMENT POLICY AFTER YOUR OPEN ENROLLMENT

PERIOD HAS EXPIRED, SOME COMPANIES MAY CHARGE A HIGHER RATE FOR SMOKERS.

16

2021-2022 MEDICARE SUPPLEMENT PREMIUM COMPARISON GUIDE CHICAGO AREA

ADDITIONAL OPTIONS FOR PEOPLE ON MEDICARE

Medicare Advantage (MA) plan

, also known as Part C of Medicare, is an

alternative to Original Medicare. These types of Medicare health plans must accept

anyone who applies for coverage, As of January 1, 2021, Medicare Advantage Plans

are required to cover people that have End Stage Renal Disease.

Five (5) types of Medicare Advantage plans are available to Illinois residents who have

Medicare, depending on where they live. Medicare Advantage Plans cover Parts A & B

of Medicare and may oer Part D prescription drug coverage as well. Please note that

you do not lose or give up your Medicare coverage.

Individuals who have their Medicare contracted through a Medicare Advantage plan

do not need a Medicare Supplement Policy, as all their Medicare services must be

obtained through their MA plan. The ve (5) types of Medicare Advantage Plans are:

• Health Maintenance Organizations (HMOs)

are only available in certain zip

code areas and counties. HMOs utilize a network of providers, doctors, and hospitals,

which have contracted with the HMO to provide services to their members. In order to

utilize specialists, a referral must be arranged through a prima

ry care physician. Please

note that if you use an out-of-network provider in a non-emergency situation, no

payment will be made by the HMO or Medicare, which means that you will be

responsible for the entire cost of those services.

17

2021-2022 MEDICARE SUPPLEMENT PREMIUM COMPARISON GUIDE CHICAGO AREA

HMO Point of Service (POS) option is identical to HMOs dened above with the

exception of allowing specied health care services outside the HMO

network. Enrollees may face higher co-pays for these POS services.

• Preferred Provider Organizations (PPOs)

are also only available in certain

counties in Illinois. PPOs may allow members to seek services outside of the PPO

network and may charge higher copayments for these benets.

• Private Fee-For-Service (PFFS)

plans are available in Illinois and dier from

HMOs and PPOs in that they do not utilize a network of contracted providers.

People in a PFFS may obtain services from any provider that accepts the plan’s terms

and conditions. Contact your providers before purchasing a PFFS plan to

see if they will accept this type of insurance. If the provider does not agree to

accept the plan, the insured person is responsible for all charges associated

with the service.

• Special Needs Plans (SNPs)

are plans which focus on individuals with special

needs. Special Needs Plans may target enrollment to 1. people with Medicare and

Medicaid; 2. those who are institutionalized; and/or 3. individuals with severe or

disabling chronic conditions.

• Medicare Savings Accounts

are a non-network high-deductible health plan

combined with a savings account that receives an annual tax-free deposit from

Medicare. The member can use this account for health expenses until the annual

high deductible is met. Any money unused each year rolls over to the next year and

can be used for any health-related expense.

Medicare Cost Plan

, is a type of Medicare health plan available in certain, limited

areas of the country.

• In general, you can join even if you only have Part B.

• If you have Part A and Part B and go to a non-network provider, Original

Medicare covers the services. You’ll pay the Part A and Part B coinsurance

and deductibles.

• You can join any time the Cost Plan is accepting new members.

• You can leave any time and return to Original Medicare.

• You can join a separate Medicare drug plan, or you can get drug coverage

from the Cost Plan (if oered). Even if the Cost Plan oers drug coverage,

you can choose to get drug coverage from a separate Medicare drug plan.

To inquire whether Medicare Advantage plans or Medicare Cost Plans are available

in your area or to obtain additional information about these plans, call

SHIP at

1-800-252-8966

. A list of the plans available in Illinois can be found in the back of

your current Medicare & You Handbook. You may also call Medicare at any time at

1-800-Medicare (1-800-633-4227), or use the online tools at www.Medicare.gov,

Find Health and Drug Plans.

18

2021-2022 MEDICARE SUPPLEMENT PREMIUM COMPARISON GUIDE CHICAGO AREA

Illinois Department on Aging

Senior Health Insurance Program (SHIP)

One Natural Resources Way, #100

Springeld, IL 62702-1271

1-800-252-8966

; 711 (TRS)

Website: https://ilaging.illinois.gov/

E-mail: [email protected]

This guide was produced in collaboration with the Illinois Department of Insurance,

without whose eorts the publication of this guide would be impossible.

WHAT IS SHIP?

• The Senior Health Insurance Program (SHIP) is a free insurance counseling service

for people with Medicare and their caregivers. The Illinois Department on Aging

administers SHIP. This service, oered statewide, is available to people of all ages

with Medicare.

• SHIP is not aliated with any insurance company.

• SHIP counselors do not sell or solicit any type of insurance.

• SHIP counselors are trained by the Illinois Department on Aging to:

◊ Assist in ling appeals regarding Medicare, Medicare Advantage plans,

and Medicare supplement insurance claims;

◊ Assist individuals with the medicare.gov plan nder to compare

Medicare Advantage plans or Medicare Part D plans;

◊ Educate and assist consumers with questions about Medicare, Medicare

supplement plans, Medicare Advantage plans, Medicare Part D plans, Extra

Help for Part D, Medicare Savings Programs, long-term care insurance, and

other health insurance plans.

Pre-ex = # of months of waiting period for coverage of a pre-existing

condition

Chicago Area - Zip Code 60639

App Fee = one-time charge at the time you apply for a

policy

Crossover: Yes = claims sent electronically; no paper

ling

19

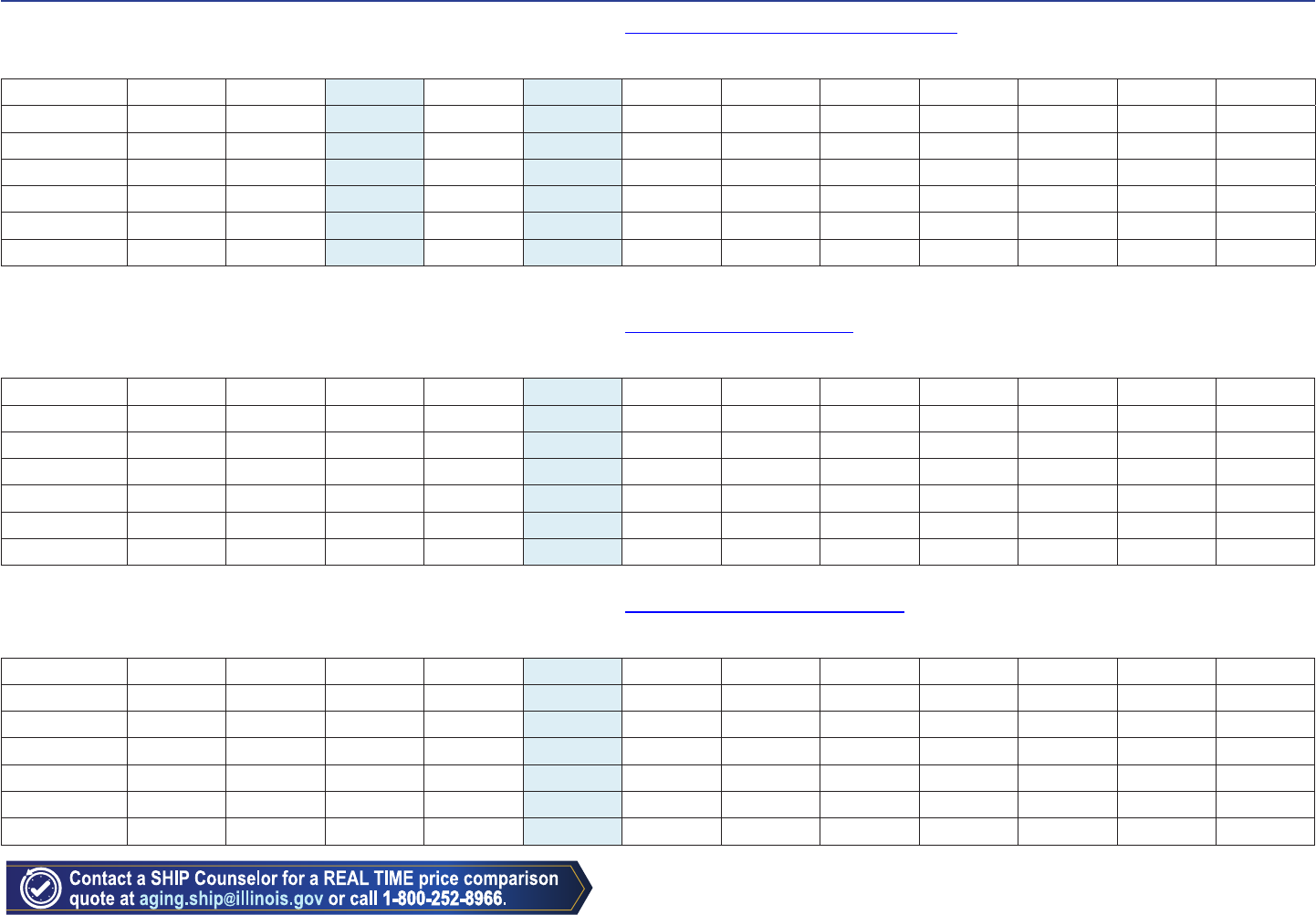

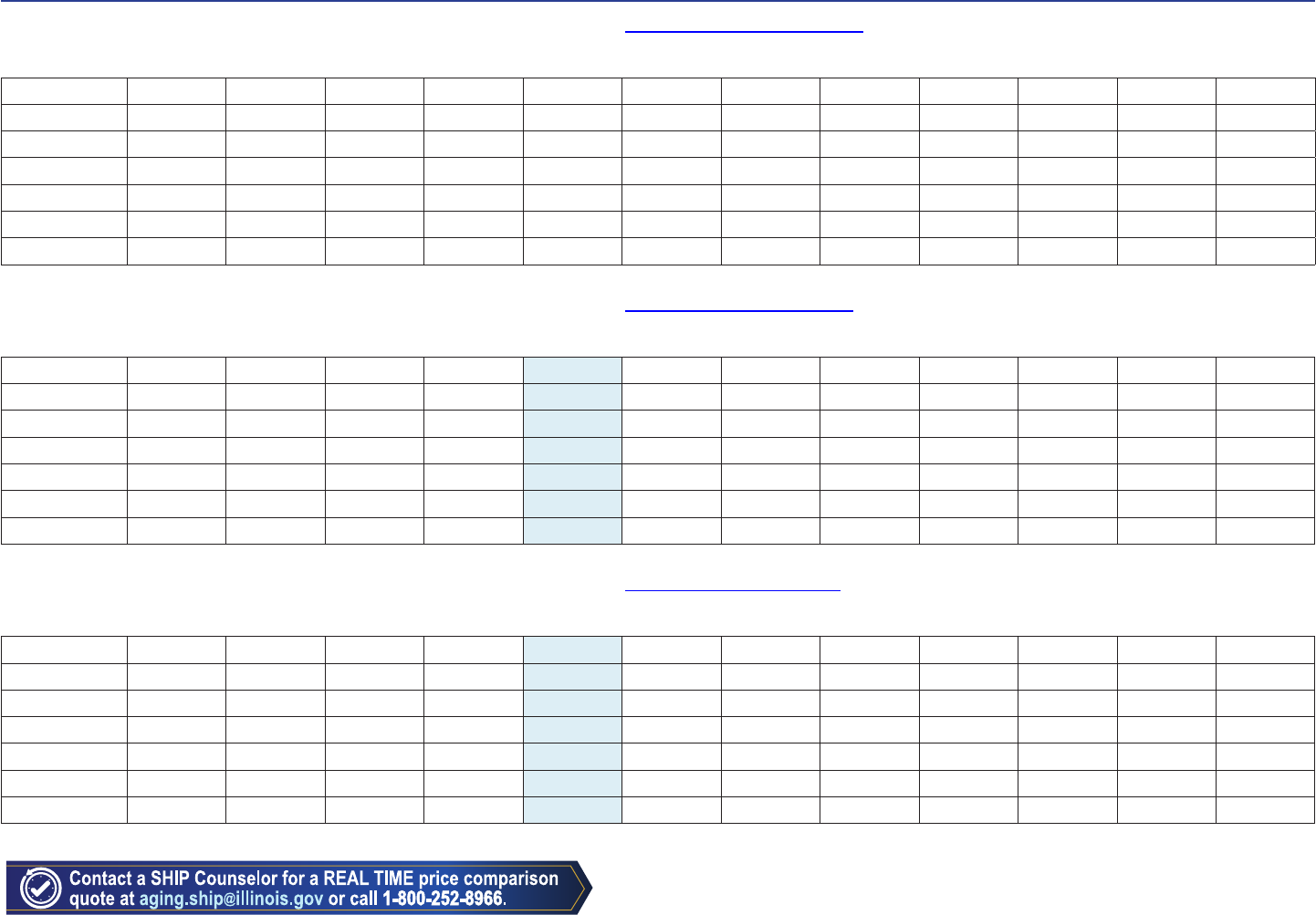

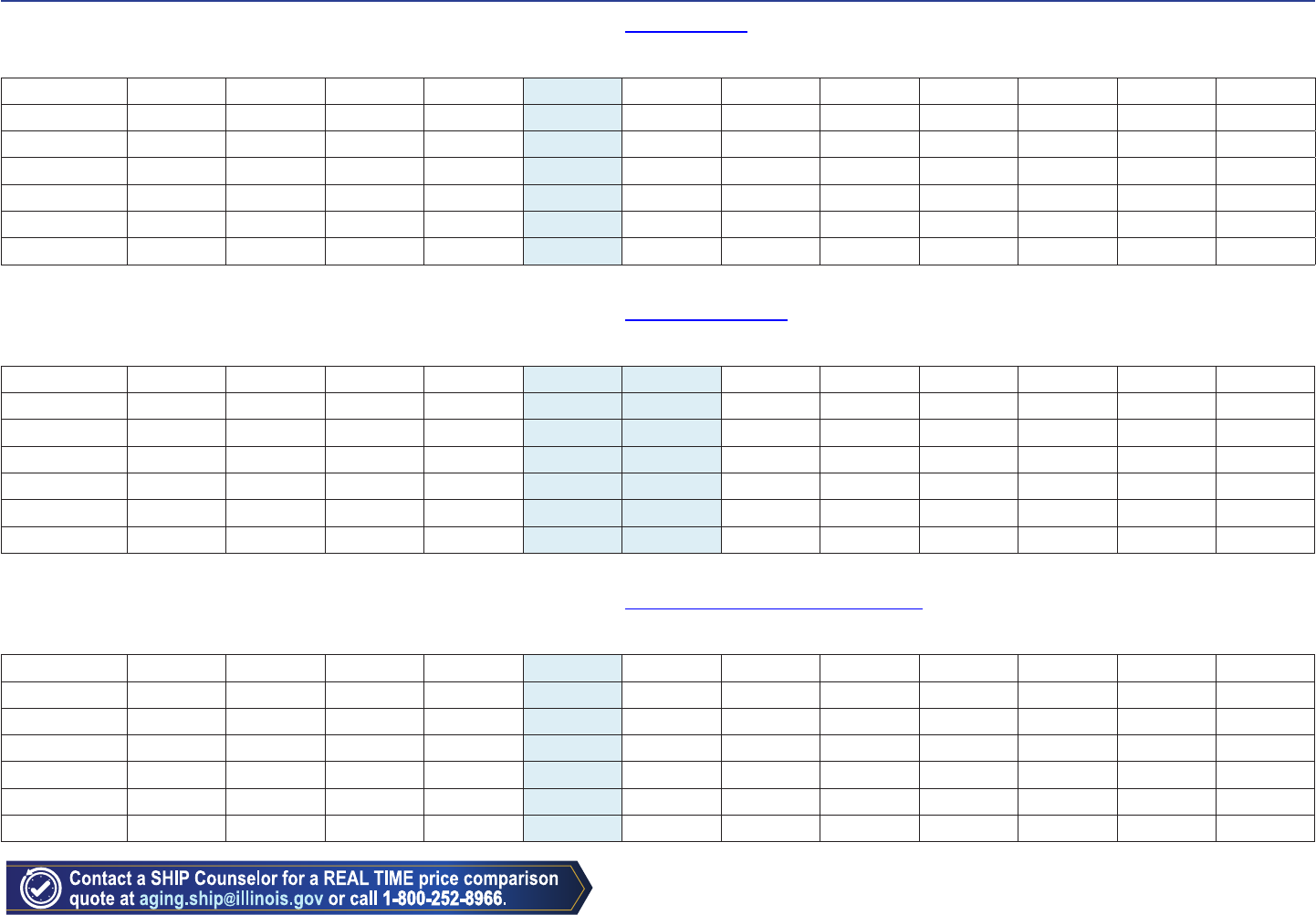

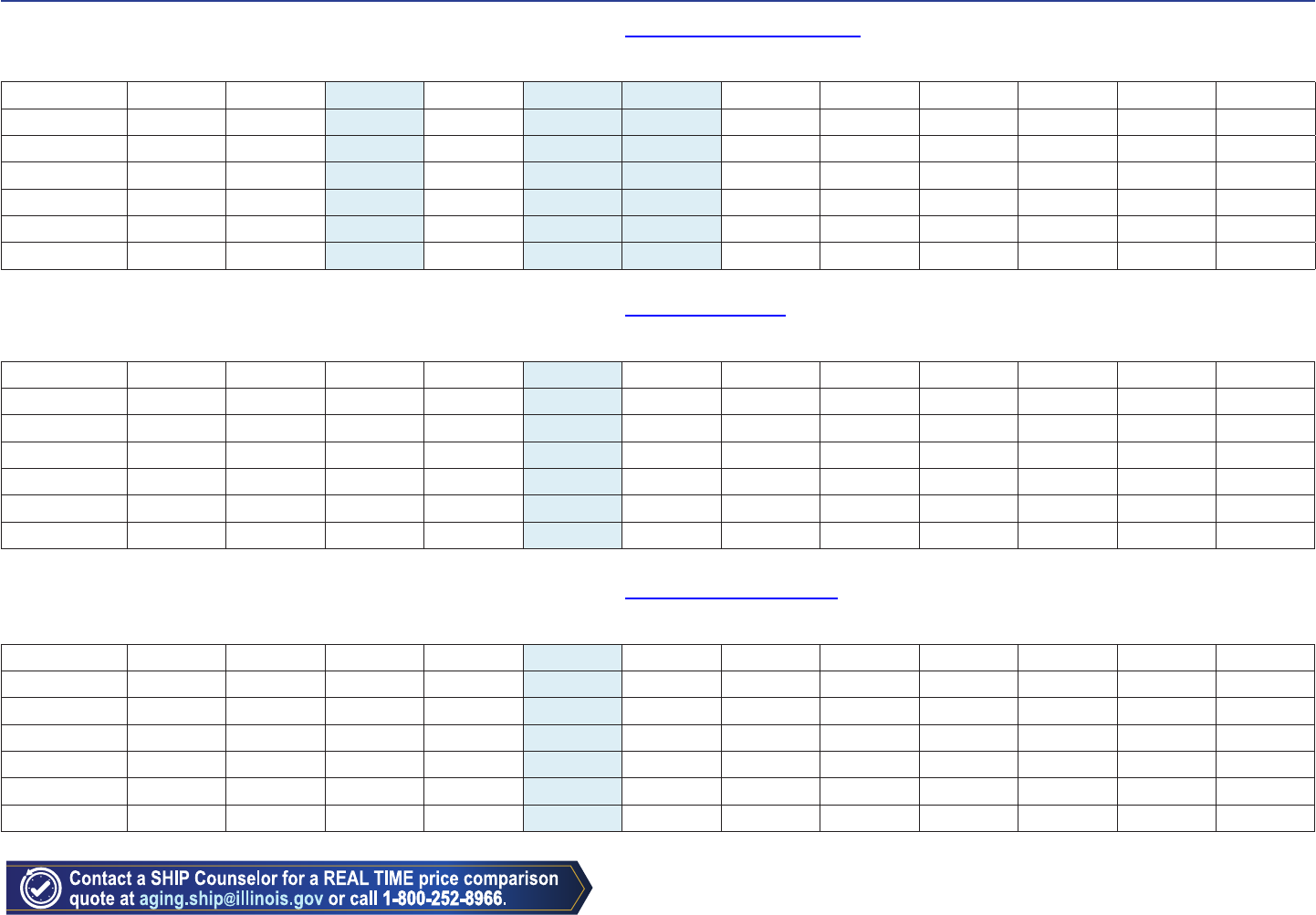

Plans highlighted in BLUE only available to those

eligible for Medicare prior to 2020

Standardized Medicare Supplement Plans Available - Annual Premium

AARP/UNITEDHEALTHCARE INSURANCE COMPANY www.aarpmedicaresupplement.com/ (800) 523-5800

Pre-ex: 3 App Fee: $0 Innovave Benet: No Crossover: Yes Premium Calc Method: No Age (Community)

Age A B C D F FHD G GHD K L M N

64 & Under $2,898 $4,230 $5,346 $5,373 $5,067 $1,930 $3,010 $3,847

65 $1,179 $1,720 $2,174 $2,185 $1,680 $785 $1,224 $1,565

70 $1,294 $1,889 $2,388 $2,400 $1,845 $862 $1,345 $1,719

75 $1,584 $2,312 $2,922 $2,937 $2,258 $1,055 $1,646 $2,103

80 $1,874 $2,735 $3,457 $3,474 $2,671 $1,248 $1,947 $2,488

85 $1,932 $2,820 $3,564 $3,582 $2,754 $1,287 $2,007 $2,565

AARP/United Healthcare ulizes a two-ered community rang, which oers a lower premium for people who apply for a Medigap policy within the rst 36 months of their enrollment in Part B

of Medicare.

ACCENDO INSURANCE COMPANY aetnaseniorproducts.com (800) 264-4000

Pre-ex: 0 App Fee: $25 Innovave Benet: No Crossover: Yes Premium Calc Method: Aained Age

Age A B C D F FHD G GHD K L M N

64 & Under $4,156 $5,439 $4,437 $3,323

65 $1,673 $2,189 $1,785 $1,263

70 $1,775 $2,323 $1,894 $1,415

75 $2,085 $2,728 $2,227 $1,672

80 $2,458 $3,217 $2,623 $1,965

85 $2,869 $3,756 $3,062 $2,293

AETNA HEALTH INSURANCE COMPANY www.aetnaseniorproducts.com (800) 264-4000

Pre-ex: 0 App Fee: $20 Innovave Benet: No Crossover: Yes Premium Calc Method: Aained Age

Age A B C D F FHD G GHD K L M N

64 & Under $3,861 $4,158 $5,189 $4,326 $1,586 $3,260

65 $1,554 $1,675 $2,088 $1,742 $639 $1,240

70 $1,648 $1,775 $2,216 $1,847 $678 $1,390

75 $1,938 $2,088 $2,604 $2,171 $797 $1,641

80 $2,281 $2,458 $3,068 $2,557 $939 $1,929

85 $2,665 $2,872 $3,582 $2,987 $1,097 $2,251

Pre-ex = # of months of waiting period for coverage of a pre-existing

condition

App Fee = one-time charge at the time you apply for a

policy

Crossover: Yes = claims sent electronically; no paper

ling

20

Chicago Area - Zip Code 60639

Standardized Medicare Supplement Plans Available - Annual Premium

Plans highlighted in BLUE only available to those

eligible for Medicare prior to 2020

AMERICAN BENEFIT LIFE INSURANCE COMPANY www.lbig.com/ (800) 731-4300

Pre-ex: 0 App Fee: $25 Innovave Benets: No Crossover: Yes Premium Calc Method: Aained Age

Age A B C D F FHD G GHD K L M N

64 & Under $3,449 $6,573 $5,930 $4,961

65 $1,676 $2,101 $1,685 $1,260

70 $1,724 $2,191 $1,733 $1,376

75 $2,100 $2,629 $2,111 $1,721

80 $2,556 $3,173 $2,569 $2,148

85 $3,316 $3,934 $3,333 $2,777

AMERICO FINANCIAL LIFE & ANNUITY INSURANCE COMPANY www.americo.com (888) 220-7074

Pre-ex: 0 App Fee: $0 Innovave Benet: No Crossover: Yes Premium Calc Method: Aained Age

Age A B C D F FHD G GHD K L M N

64 & Under $4,238 $6,071 $4,931 $6,147 $1,377 $5,052 $4,149

65 $2,361 $2,406 $1,861 $3,002 $641 $2,353 $1,861

70 $2,672 $2,534 $1,977 $3,357 $694 $2,663 $2,100

75 $3,131 $2,993 $2,374 $3,909 $829 $3,145 $2,485

80 $3,428 $3,525 $2,821 $4,416 $960 $3,582 $2,852

85 $3,691 $4,267 $3,439 $4,966 $1,101 $4,054 $3,268

BANKERS FIDELITY ASSURANCE COMPANY www.bankersdelity.com (866) 458-7504

Pre-ex: 0 App Fee: $25 Innovave Benet: No Crossover: Yes Premium Calc Method: Aained Age

Age A B C D F FHD G GHD K L M N

64 & Under $5,350 $7,404 $5,010 $6,653 $1,389 $3,300

65 $2,726 $3,118 $2,087 $2,758 $579 $1,375

70 $3,067 $3,519 $2,275 $3,123 $630 $1,499

75 $3,528 $4,144 $2,705 $3,690 $750 $1,782

80 $3,933 $4,793 $3,223 $4,280 $893 $2,123

85 $4,326 $5,531 $3,728 $4,951 $1,033 $2,456

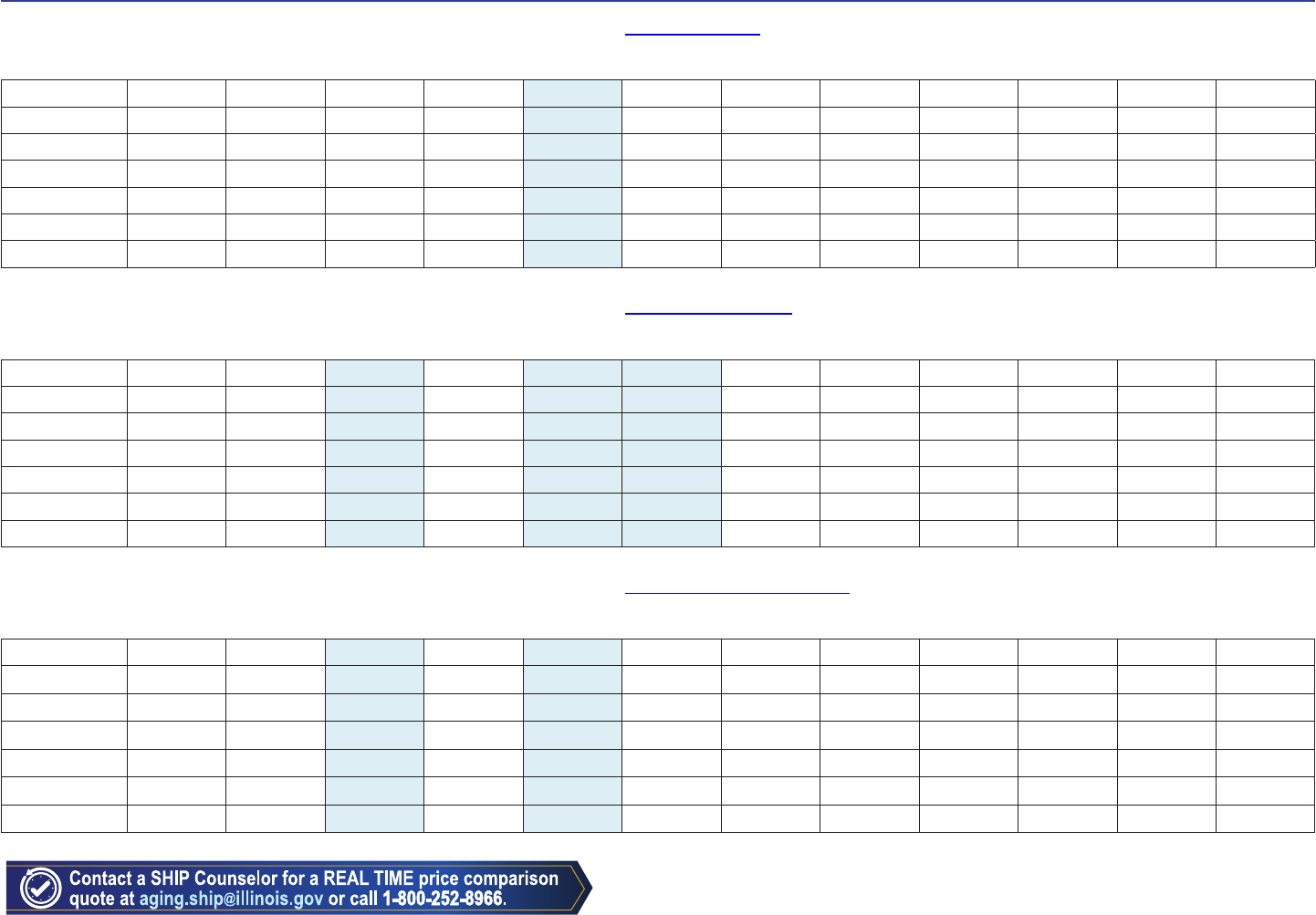

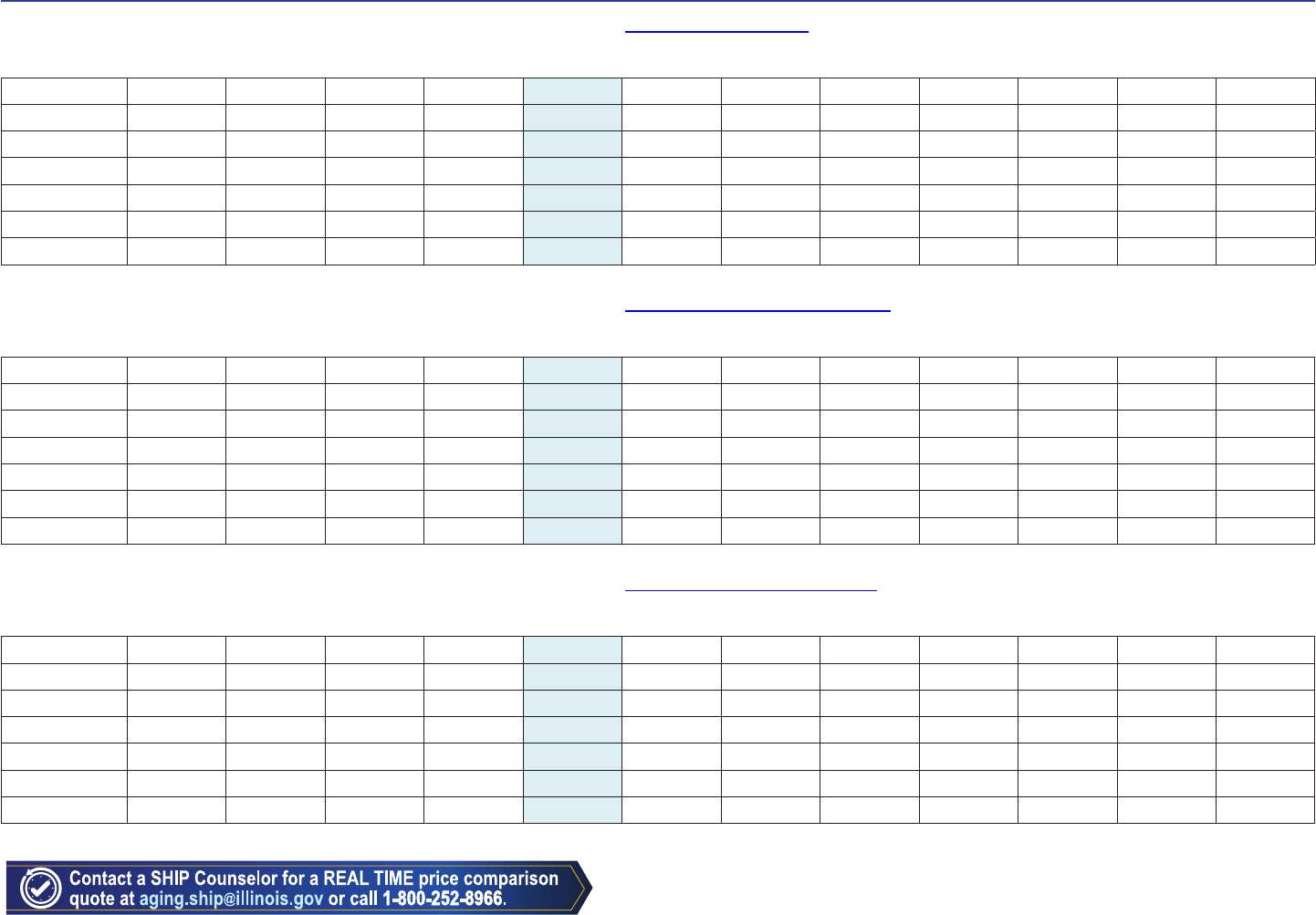

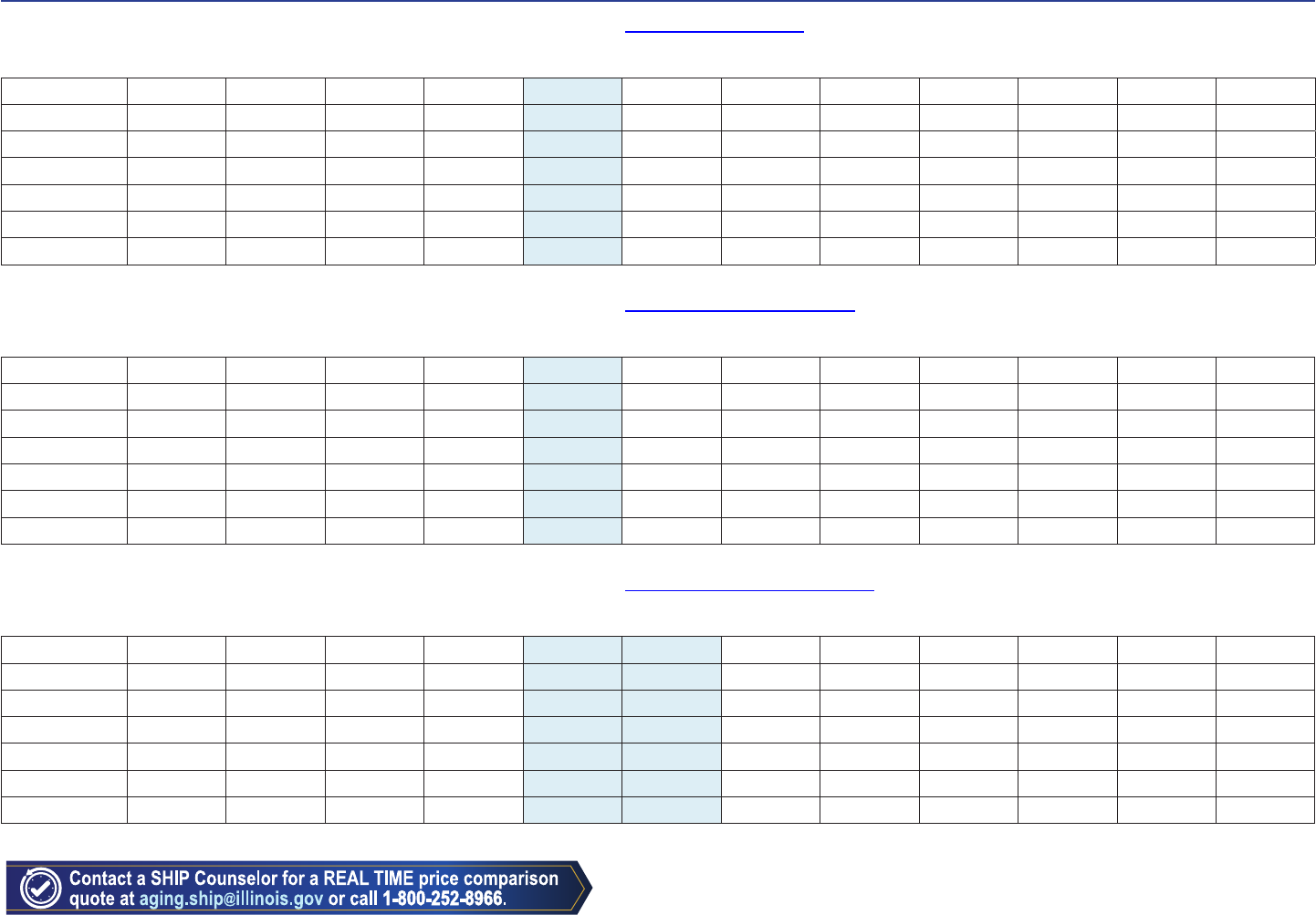

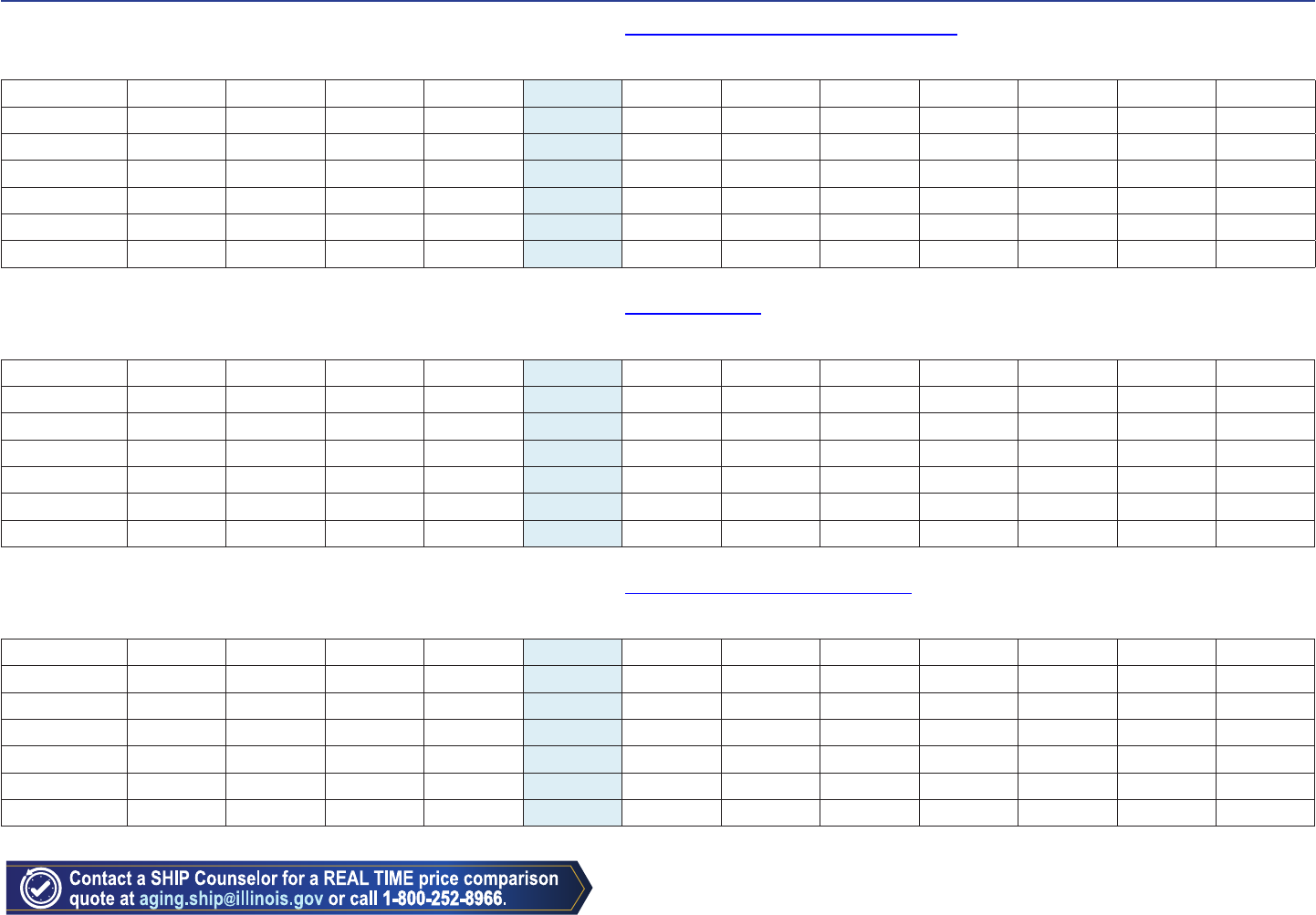

Pre-ex = # of months of waiting period for coverage of a pre-existing

condition

Chicago Area - Zip Code 60639

App Fee = one-time charge at the time you apply for a

policy

Crossover: Yes = claims sent electronically; no paper

ling

21

Plans highlighted in BLUE only available to those

eligible for Medicare prior to 2020

Standardized Medicare Supplement Plans Available - Annual Premium

BANKERS FIDELITY LIFE INSURANCE COMPANY www.bankersdelity.com (866) 458-7504

Pre-ex: 0 App Fee: $25 Innovave Benet: No Crossover: Yes Premium Calc Method: Aained Age

Age A B C D F FHD G GHD K L M N

64 & Under $4,202 $5,648 $878 $5,568 $1,919 $4,114

65 $2,795 $3,200 $472 $3,049 $1,039 $1,953

70 $3,141 $3,579 $550 $3,619 $1,226 $2,203

75 $3,530 $4,168 $649 $4,309 $1,478 $2,608

80 $3,816 $4,794 $757 $4,833 $1,666 $3,047

85 $3,977 $5,507 $881 $5,270 $1,798 $3,566

BANKERS RESERVE LIFE INSURANCE CO. OF WISCONSIN wellcare.com (833) 441-1565

Pre-ex: 0 App Fee: $25 Innovave Benets: No Crossover: Yes Premium Calc Method: Aained Age

Age A B C D F FHD G GHD K L M N

64 & Under $3,630 $4,587 $4,075 $3,409

65 $1,694 $1,864 $1,575 $1,199

70 $1,816 $1,983 $1,631 $1,312

75 $2,103 $2,316 $1,938 $1,592

80 $2,526 $2,861 $2,441 $2,003

85 $2,954 $3,480 $3,007 $2,464

BLUE CROSS BLUE SHIELD OF IL/HEALTH CARE SERVICE CORP. www.bcbsil.com (800) 646-3000

Pre-ex: 0 App Fee: $0 Innovave Benets: Yes Crossover: Yes Premium Calc Method: Aained Age

Age A B C D F FHD G GHD K L M N

64 & Under $3,684 $4,845 $5,925 $5,788 $1,663 $4,674 $1,583 $2,908 $4,085 $4,216

65 $1,469 $1,932 $2,363 $2,308 $663 $1,752 $632 $1,160 $1,629 $1,580

70 $1,908 $2,508 $3,067 $2,997 $861 $2,330 $820 $1,505 $2,115 $2,102

75 $2,305 $3,031 $3,707 $3,621 $1,040 $2,854 $991 $1,819 $2,556 $2,575

80 $2,662 $3,501 $4,281 $4,182 $1,201 $3,325 $1,144 $2,101 $2,952 $3,000

85 $2,979 $3,917 $4,790 $4,679 $1,344 $3,743 $1,280 $2,351 $3,303 $3,377

Plan G and Plan G HD have Innovative Benet Options including vision, dental, tness, and hearing.

Pre-ex = # of months of waiting period for coverage of a pre-existing

condition

App Fee = one-time charge at the time you apply for a

policy

Crossover: Yes = claims sent electronically; no paper

ling

22

Chicago Area - Zip Code 60639

Standardized Medicare Supplement Plans Available - Annual Premium

Plans highlighted in BLUE only available to those

eligible for Medicare prior to 2020

CAPITOL LIFE INSURANCE COMPANY www.lbig.com (800) 731-4300

Pre-ex: 0 App Fee: $25 Innovave Benets: No Crossover: Yes Premium Calc Method: Aained Age

Age A B C D F FHD G GHD K L M N

64 & Under $4,210 $7,640 $6,705 $4,944

65 $1,756 $2,297 $1,774 $1,299

70 $1,847 $2,395 $1,865 $1,481

75 $2,251 $2,876 $2,274 $1,863

80 $2,743 $3,475 $2,771 $2,353

85 $3,460 $4,313 $3,600 $3,014

CENTRAL STATES HEALTH & LIFE CO. OF OMAHA www.cso.com (866) 887-9323

Pre-ex: 0 App Fee: $25 Innovave Benets: No Crossover: Yes Premium Calc Method: Aained Age

Age A B C D F FHD G GHD K L M N

64 & Under $5,055 $6,209 $5,259 $5,923 $4,415

65 $1,838 $2,265 $1,918 $1,857 $1,337

70 $1,983 $2,304 $1,952 $2,003 $1,439

75 $2,368 $2,707 $2,292 $2,392 $1,722

80 $2,876 $3,306 $2,800 $2,953 $2,140

85 $3,444 $4,084 $3,459 $3,716 $2,724

CIGNA HEALTH AND LIFE INSURANCE COMPANY www.cigna.com/medicare/supplemental (866) 459-4272

Pre-ex: 6 App Fee: $0 Innovave Benets: No Crossover: Yes Premium Calc Method: Aained Age

Age A B C D F FHD G GHD K L M N

64 & Under $4,817 $6,275 $1,289 $4,535 $3,722

65 $2,486 $3,076 $632 $2,232 $1,769

70 $2,689 $3,327 $684 $2,437 $1,901

75 $3,134 $3,878 $797 $2,848 $2,211

80 $3,589 $4,542 $933 $3,291 $2,637

85 $3,875 $5,048 $1,037 $3,605 $2,921

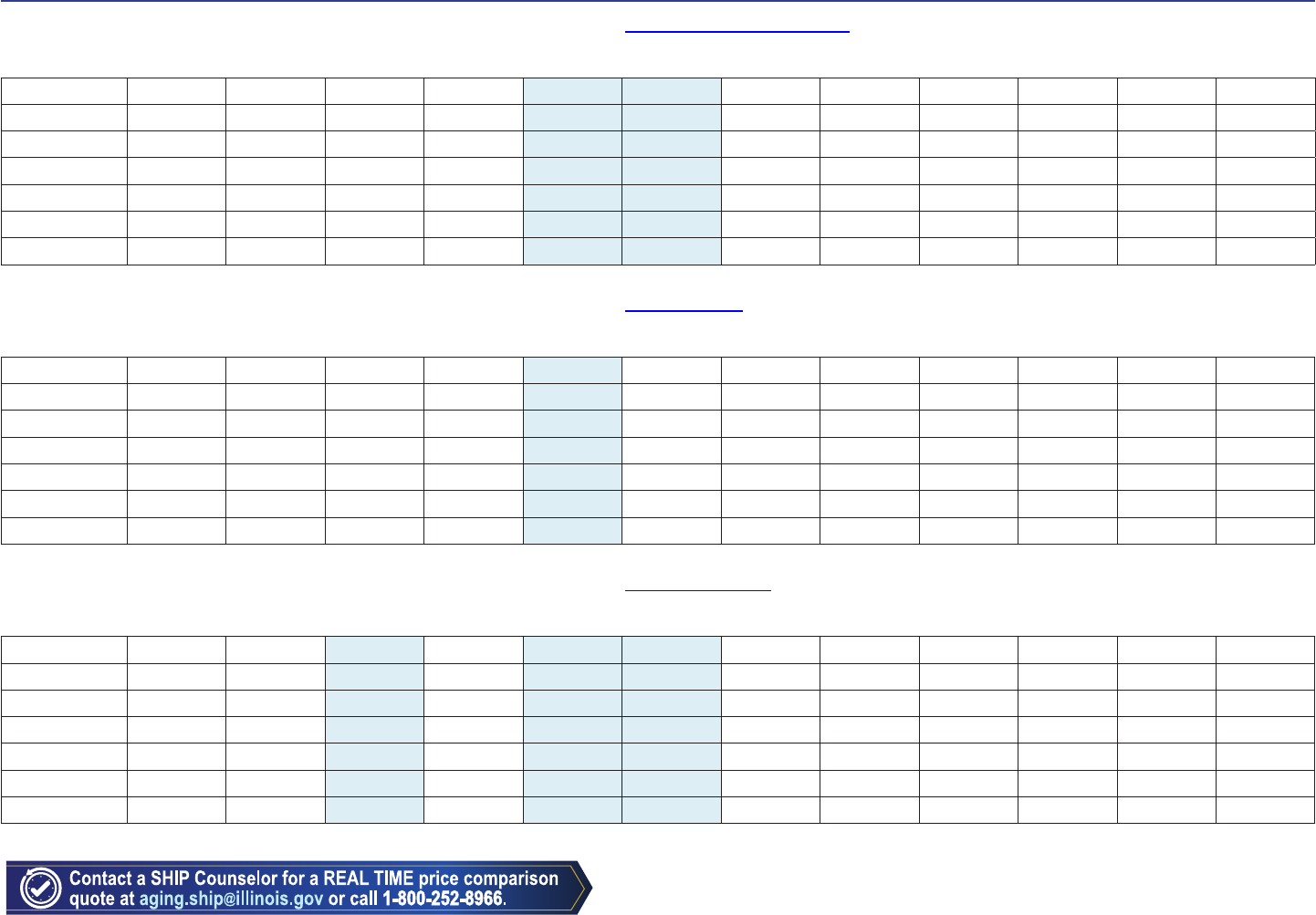

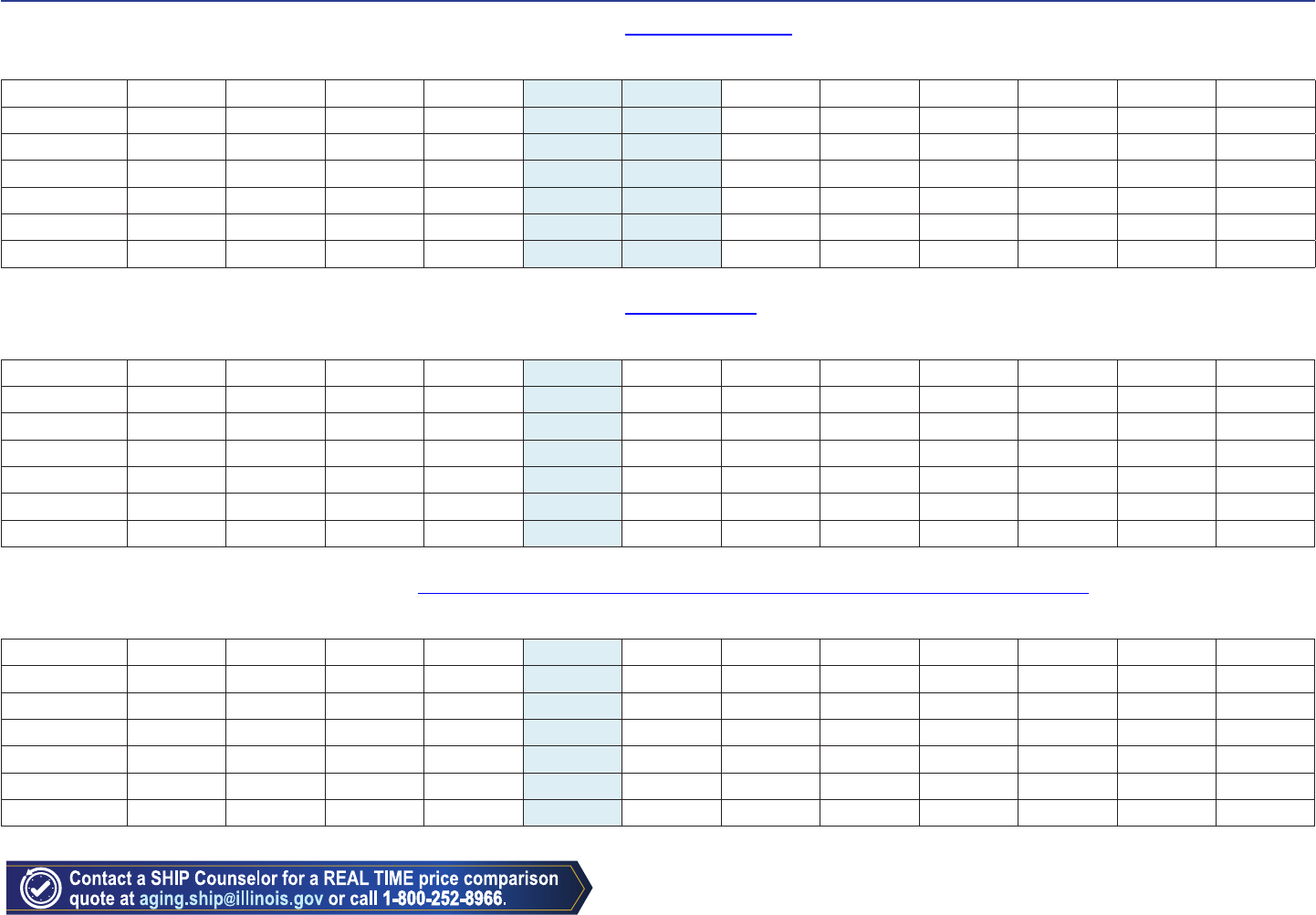

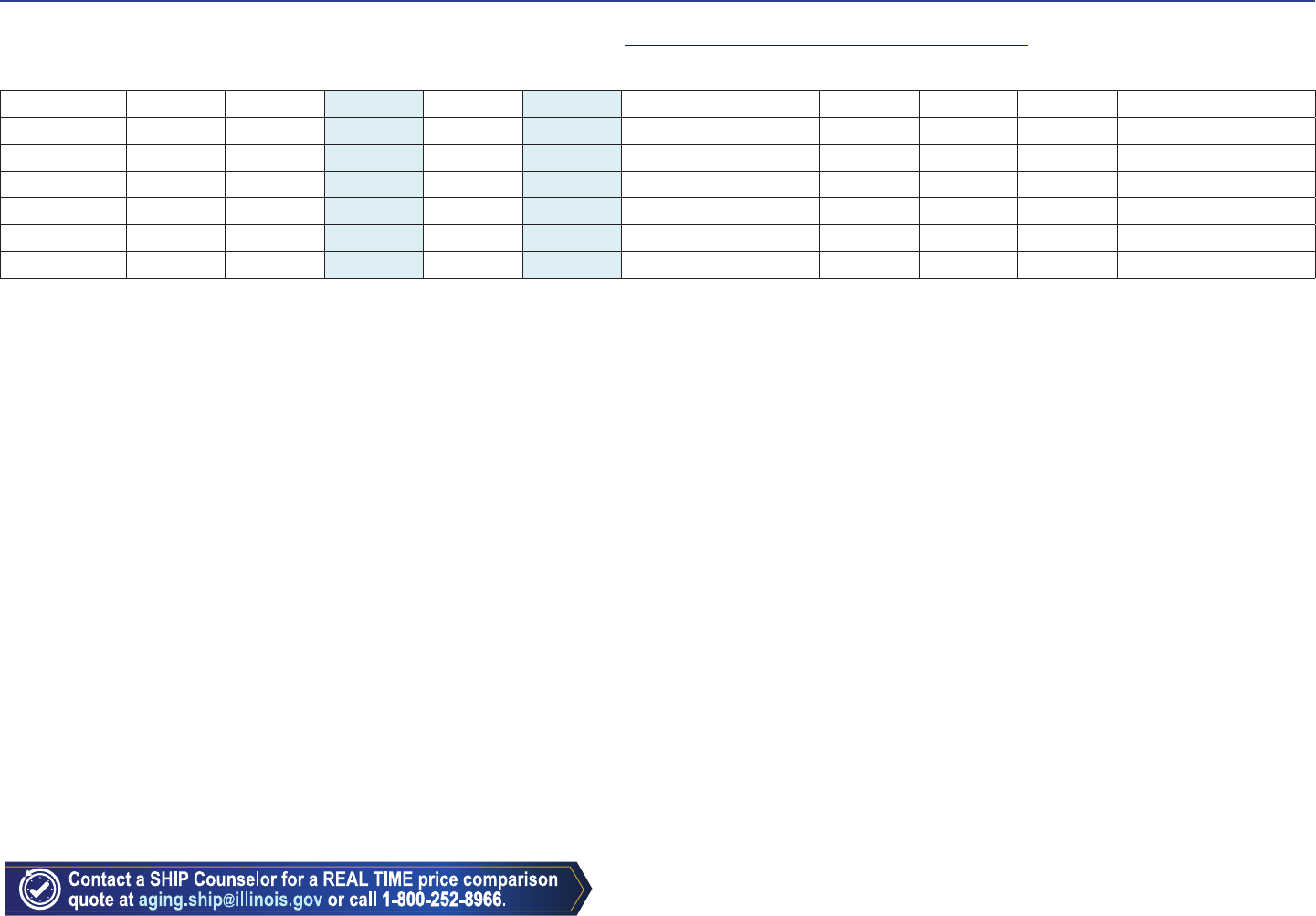

Pre-ex = # of months of waiting period for coverage of a pre-existing

condition

Chicago Area - Zip Code 60639

App Fee = one-time charge at the time you apply for a

policy

Crossover: Yes = claims sent electronically; no paper

ling

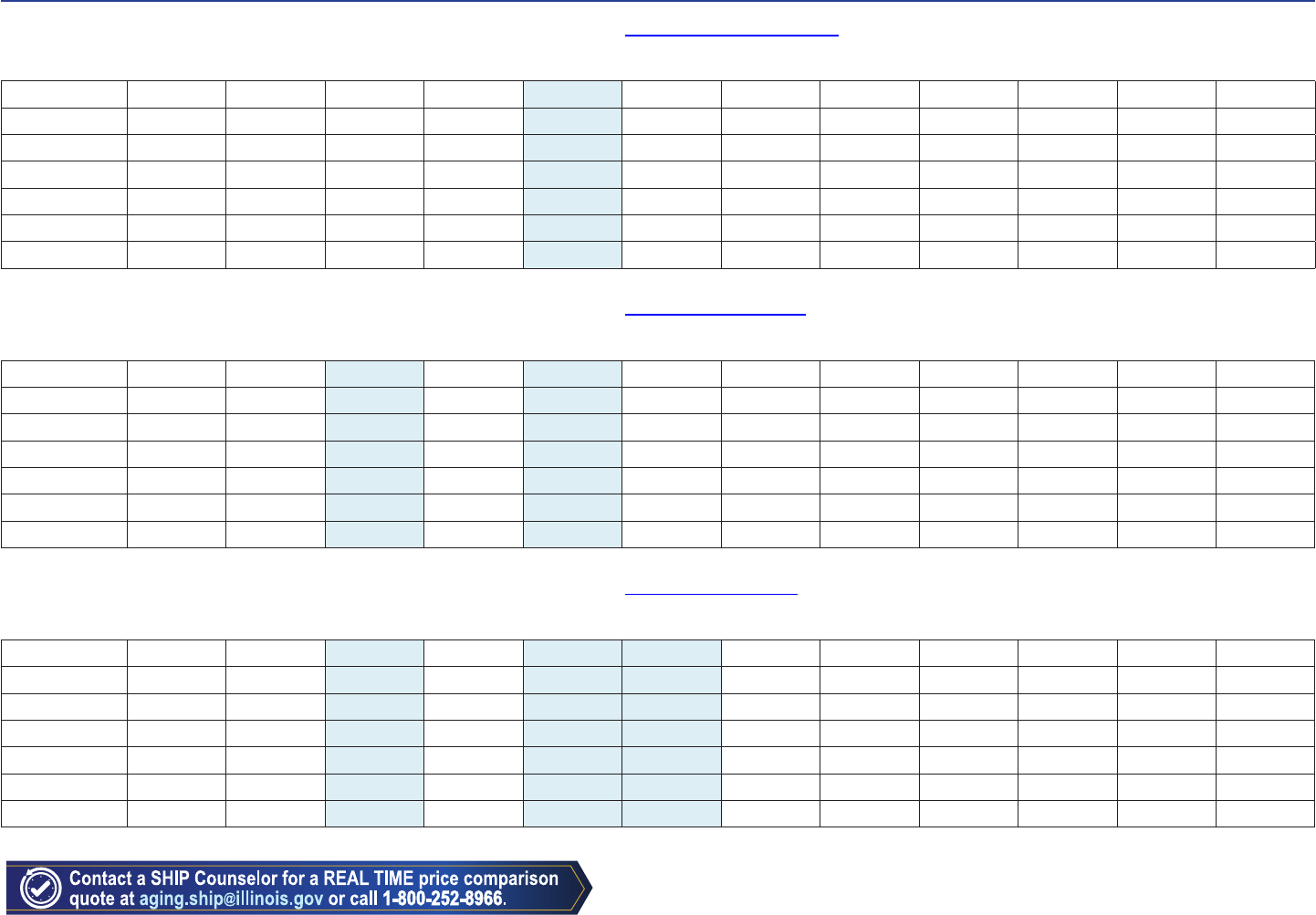

23

Plans highlighted in BLUE only available to those

eligible for Medicare prior to 2020

Standardized Medicare Supplement Plans Available - Annual Premium

COUNTRY LIFE INSURANCE COMPANY www.countrynancial.com (866) 856-4760

Pre-ex: 6 App Fee: $0 Innovave Benets: No Crossover: Yes Premium Calc Method: Aained Age

Age A B C D F FHD G GHD K L M N

64 & Under $2,795 $4,349 $4,531 $1,452

65 $1,265 $1,792 $1,842 $542

70 $1,482 $2,385 $2,444 $716

75 $1,737 $2,986 $3,231 $907

80 $2,058 $3,514 $3,808 $1,110

85 $2,422 $3,958 $4,206 $1,296

ELIPS LIFE INSURANCE COMPANY www.elipslife.lumico.com (855) 771-4491

Pre-ex: 0 App Fee: $25 Innovave Benet: No Crossover: Yes Premium Calc Method: Aained Age

Age A B C D F FHD G GHD K L M N

64 & Under $5,154 $6,302 $5,201 $2,081 $4,140

65 $1,611 $1,970 $1,627 $651 $1,255

70 $1,708 $2,090 $1,727 $692 $1,371

75 $2,020 $2,471 $2,041 $816 $1,622

80 $2,445 $2,991 $2,471 $989 $1,963

85 $2,978 $3,638 $3,005 $1,201 $2,388

ERIE FAMILY LIFE INSURANCE COMPANY www.erieinsurance.com (800) 458-0811

Pre-ex: 0 App Fee: $0 Innovave Benet: No Crossover: Yes Premium Calc Method: Aained Age

Age A B C D F FHD G GHD K L M N

64 & Under $4,743 $6,555 $4,419 $3,858

65 $2,163 $2,680 $1,897 $1,703

70 $2,362 $2,979 $1,987 $1,775

75 $2,770 $3,440 $2,334 $2,115

80 $3,169 $4,032 $2,709 $2,465

85 $3,581 $4,696 $3,150 $2,834

.

Pre-ex = # of months of waiting period for coverage of a pre-existing

condition

App Fee = one-time charge at the time you apply for a

policy

Crossover: Yes = claims sent electronically; no paper

ling

24

Chicago Area - Zip Code 60639

Standardized Medicare Supplement Plans Available - Annual Premium

Plans highlighted in BLUE only available to those

eligible for Medicare prior to 2020

FEDERAL LIFE INSURANCE COMPANY www.federallife.com (888) 747-3760

Pre-ex: 0 App Fee: $25 Innovave Benet: No Crossover: Yes Premium Calc Method: Aained Age

Age A B C D F FHD G GHD K L M N

64 & Under $3,420 $4,133 $3,648 $1,317 $2,785

65 $1,431 $1,758 $1,529 $552 $1,173

70 $1,581 $1,875 $1,686 $609 $1,279

75 $1,892 $2,286 $2,018 $729 $1,541

80 $2,183 $2,637 $2,328 $841 $1,777

85 $2,431 $2,938 $2,593 $936 $1,980

GLOBE LIFE AND ACCIDENT INSURANCE CO. www.globecaremedsupp.com (800) 801-6831

Pre-ex: 2 App Fee: $25 Innovave Benet: No Crossover: Yes Premium Calc Method: Aained Age

Age A B C D F FHD G GHD K L M N

64 & Under $3,295 $5,126 $3,810 $1,232 $3,221

65 $1,753 $2,158 $1,559 $518 $1,316

70 $2,103 $2,417 $1,746 $581 $1,473

75 $2,279 $2,774 $2,105 $667 $1,777

80 $2,454 $3,248 $2,417 $780 $2,038

85 $2,628 $3,782 $2,776 $908 $2,327

Rates quoted are Male Preferred during Open Enrollment/Guaranteed Issue Periods. Other rates will apply outside OE/GI and may be based on other factors.

GPM HEALTH AND LIFE INSURANCE www.gpmhealthandlife.com (877) 844-1036

Pre-ex: 0 App Fee: $25 Innovave Benet: No Crossover: Yes Premium Calc Method: Aained Age

Age A B C D F FHD G GHD K L M N

64 & Under $4,076 $5,957 $4,146 $2,711

65 $2,046 $2,990 $2,085 $1,360

70 $2,261 $3,304 $2,300 $1,504

75 $2,706 $3,955 $2,752 $1,799

80 $3,122 $4,562 $3,175 $2,076

85 $3,477 $5,081 $3,536 $2,312

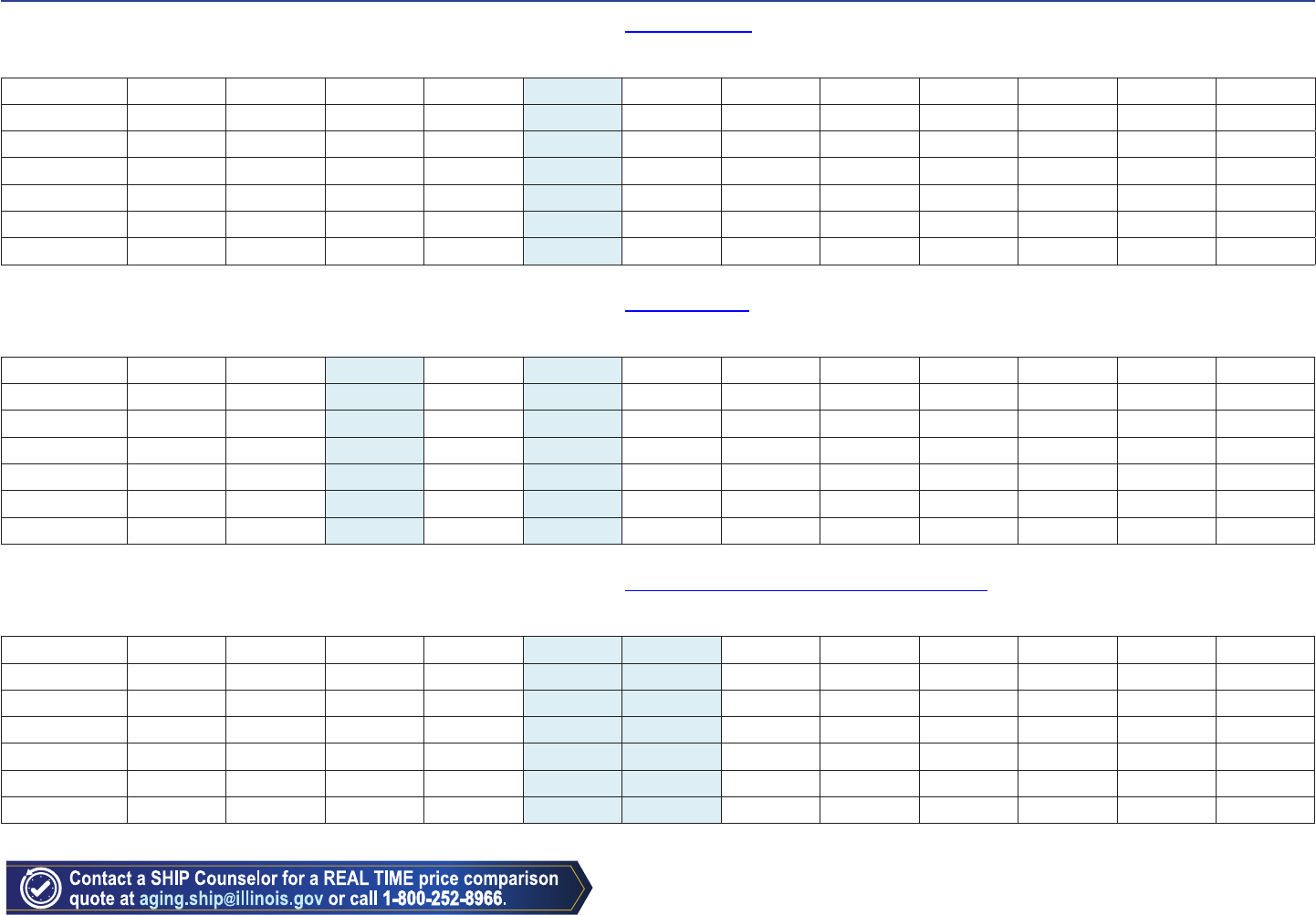

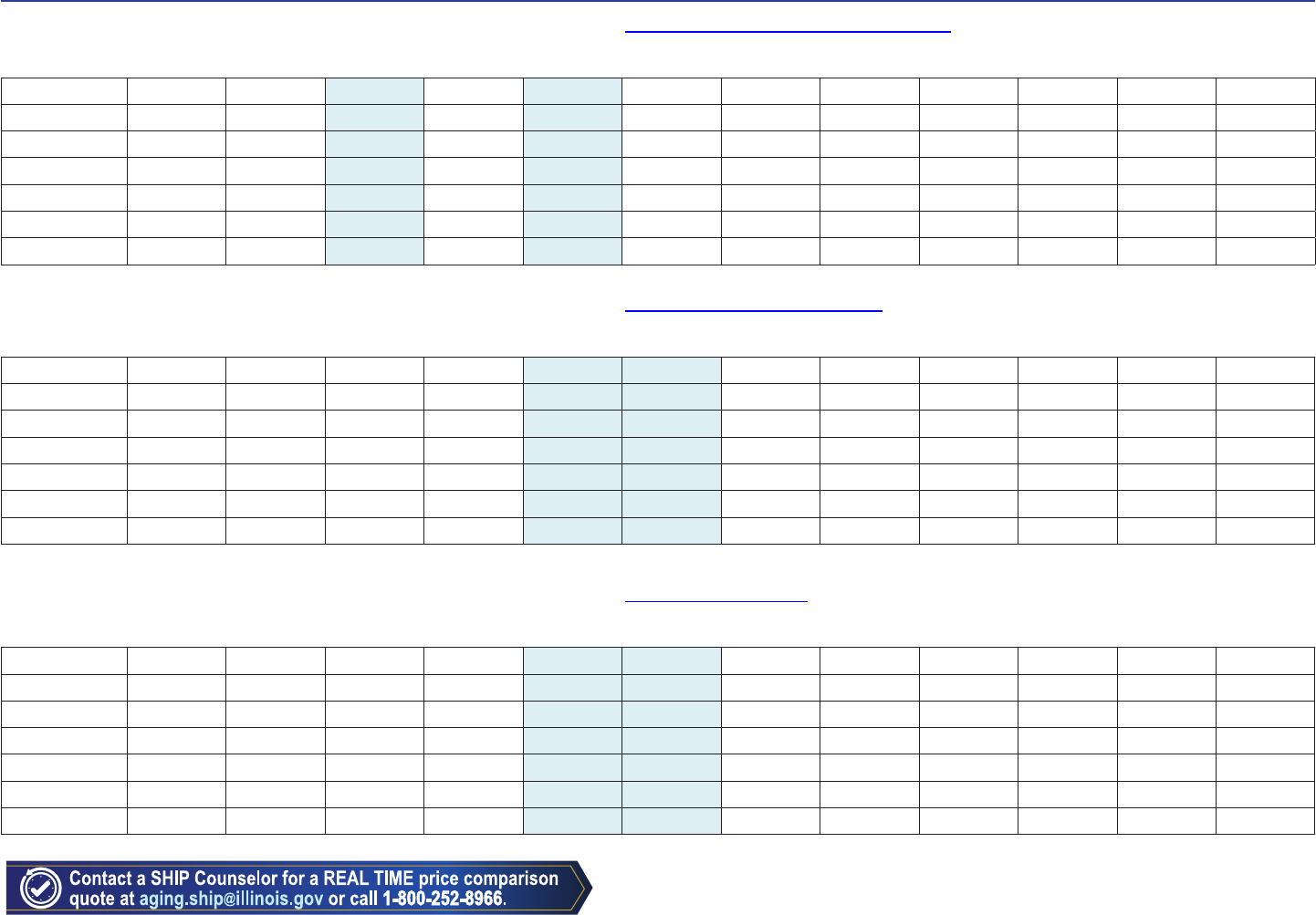

Pre-ex = # of months of waiting period for coverage of a pre-existing

condition

Chicago Area - Zip Code 60639

App Fee = one-time charge at the time you apply for a

policy

Crossover: Yes = claims sent electronically; no paper

ling

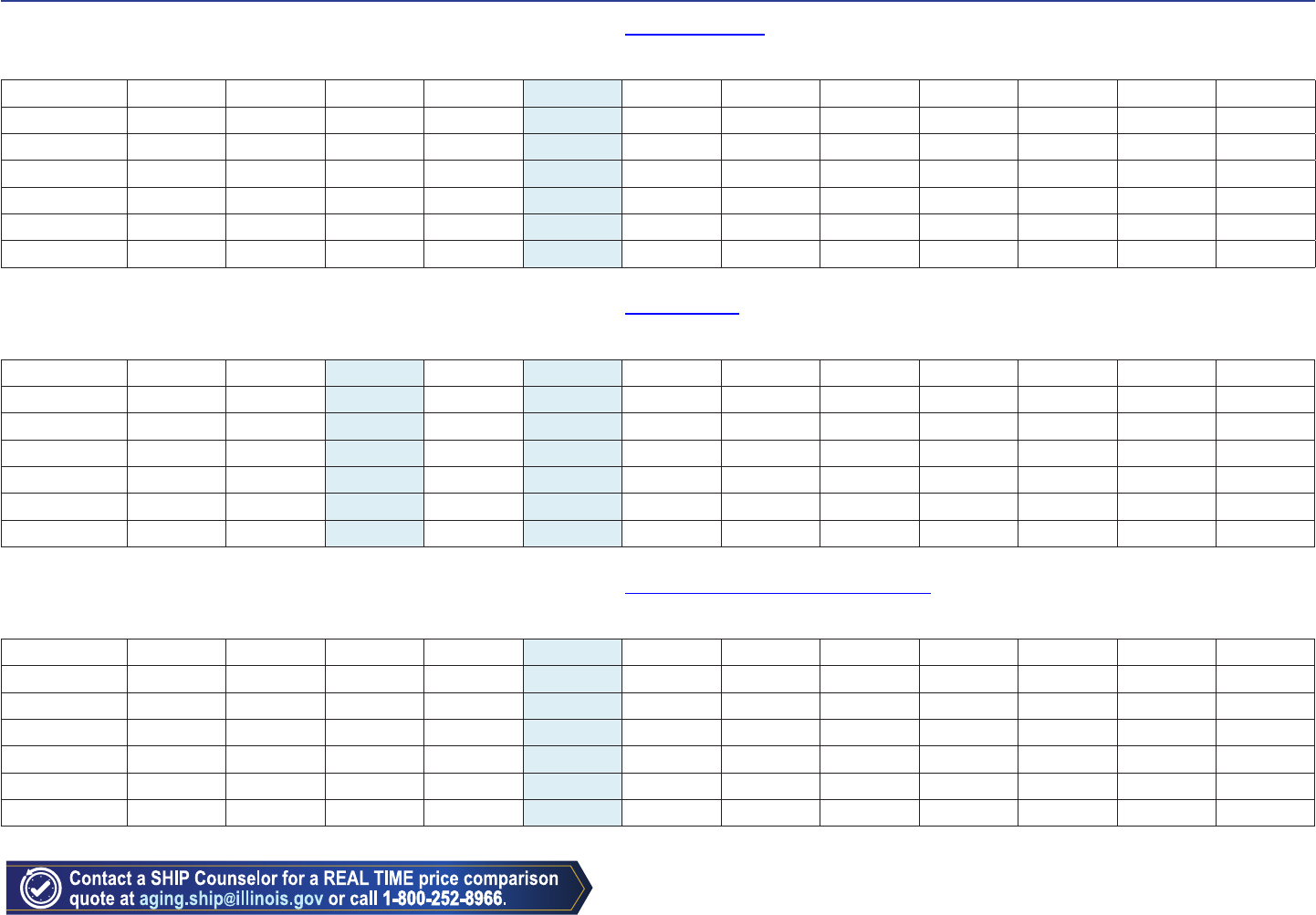

25

Plans highlighted in BLUE only available to those

eligible for Medicare prior to 2020

Standardized Medicare Supplement Plans Available - Annual Premium

GREAT SOUTHERN LIFE INSURANCE COMPANY www.americo.com (800) 220-7074

Pre-ex: 0 App Fee: $25 Innovave Benet: No Crossover: Yes Premium Calc Method: Aained Age

Age A B C D F FHD G GHD K L M N

64 & Under $4,683 $5,867 $1,193 $5,145 $4,230

65 $2,049 $2,240 $525 $1,954 $1,461

70 $2,167 $2,359 $568 $1,954 $1,548

75 $2,533 $2,787 $678 $2,345 $1,862

80 $3,038 $3,383 $825 $2,923 $2,337

85 $3,549 $4,126 $953 $3,590 $2,903

GUARANTEE TRUST LIFE INSURANCE COMPANY www.gtlic.com (800) 338-7452

Pre-ex: 0 App Fee: $25 Innovave Benet: No Crossover: Yes Premium Calc Method: Aained Age

Age A B C D F FHD G GHD K L M N

64 & Under $3,745 $5,587 $4,493 $3,505

65 $2,343 $2,970 $2,389 $1,863

70 $2,581 $3,269 $2,629 $2,050

75 $2,929 $3,885 $3,125 $2,437

80 $3,398 $4,860 $3,909 $3,049

85 $3,678 $5,471 $4,400 $3,432

HCSC INSURANCE SERVICES COMPANY www.bcbsil.com/medicare/blue-cross-medicare-opons/med-supp-opons (877) 213-1821

Pre-ex: 0 App Fee: $0 Innovave Benet: No Crossover: Yes Premium Calc Method: Aained Age

Age A B C D F FHD G GHD K L M N

64 & Under $3,339 $4,559 $4,193 $3,529

65 $1,465 $2,004 $1,730 $1,437

70 $1,715 $2,288 $2,028 $1,691

75 $2,095 $2,838 $2,545 $2,133

80 $2,374 $3,294 $2,984 $2,511

85 $2,671 $3,686 $3,358 $2,826

Pre-ex = # of months of waiting period for coverage of a pre-existing

condition

App Fee = one-time charge at the time you apply for a

policy

Crossover: Yes = claims sent electronically; no paper

ling

26

Chicago Area - Zip Code 60639

Standardized Medicare Supplement Plans Available - Annual Premium

Plans highlighted in BLUE only available to those

eligible for Medicare prior to 2020

HEALTH ALLIANCE MEDICAL PLANS, INC. www.healthalliance.org/supplement (888) 382-9771; TTY: 711

Pre-ex: 6 App Fee: $0 Innovave Benet: No Crossover: Yes Premium Calc Method: Aained Age

Age A B C D F FHD G GHD K L M N

64 & Under $3,060 $5,064 $5,112 $4,464 $1,596 $3,852

65 $1,188 $1,968 $1,980 $1,716 $624 $1,464

70 $1,656 $2,748 $2,772 $2,424 $876 $2,076

75 $2,076 $3,432 $3,468 $3,024 $1,080 $2,592

80 $2,436 $4,008 $4,056 $3,552 $1,272 $3,036

85 $2,772 $4,584 $4,620 $4,044 $1,440 $3,468

HUMANA INSURANCE COMPANY www.humana-medicare.com (888) 310-8487

Pre-ex: 3 App Fee: $0 Innovave Benet: Yes Crossover: Yes Premium Calc Method: Aained Age

Age A B C D F FHD G GHD K L M N

64 & Under $4,232 $7,158 $2,143 $2,829 $4,957

65 $1,969 $3,262 $1,048 $1,350 $2,290

70 $2,356 $3,929 $1,235 $1,603 $2,746

75 $2,827 $4,741 $1,464 $1,911 $3,302

80 $3,308 $5,571 $1,696 $2,226 $3,869

85 $4,232 $7,158 $2,143 $2,829 $4,957

Includes Dental and Vision Benets

MEDICO CORP LIFE INSURANCE COMPANY www.gomedico.com (800) 228-6080

Pre-ex: 0 App Fee: $0 Innovave Benet: No Crossover: No Premium Calc Method: Aained Age

Age A B C D F FHD G GHD K L M N

64 & Under $4,165 $5,425 $1,628 $4,858 $1,546 $4,096

65 $1,596 $1,804 $541 $1,490 $514 $1,157

70 $1,640 $1,847 $554 $1,538 $526 $1,206

75 $1,900 $2,158 $648 $1,828 $615 $1,464

80 $2,302 $2,688 $806 $2,307 $766 $1,866

85 $2,858 $3,470 $1,041 $3,025 $989 $2,516

Pre-ex = # of months of waiting period for coverage of a pre-existing

condition

Chicago Area - Zip Code 60639

App Fee = one-time charge at the time you apply for a

policy

Crossover: Yes = claims sent electronically; no paper

ling

27

Plans highlighted in BLUE only available to those

eligible for Medicare prior to 2020

Standardized Medicare Supplement Plans Available - Annual Premium

NASSAU LIFE INSURANCE COMPANY OF KANSAS www.nfg.com (800) 420-5382

Pre-ex: 6 App Fee: $25 Innovave Benet: No Crossover: Yes Premium Calc Method: Aained Age

Age A B C D F FHD G GHD K L M N

64 & Under $4,251 $6,768 $6,035 $4,223

65 $1,810 $1,895 $1,649 $1,236

70 $1,904 $2,050 $1,734 $1,323

75 $2,321 $2,387 $2,114 $1,621

80 $2,717 $2,814 $2,511 $1,939

85 $3,129 $3,683 $3,259 $2,506

NATIONAL HEALTH INSURANCE COMPANY natgenhealth.com (833) 976-2628

Pre-ex: 0 App Fee: $25 Innovave Benet: No Crossover: Yes Premium Calc Method: Aained Age

Age A B C D F FHD G GHD K L M N

64 & Under $4,352 $5,428 $1,727 $4,533 $3,717

65 $1,868 $2,330 $743 $1,948 $1,598

70 $1,986 $2,477 $790 $2,070 $1,698

75 $2,303 $2,871 $914 $2,399 $1,967

80 $2,668 $3,329 $1,060 $2,781 $2,281

85 $3,077 $3,838 $1,222 $3,205 $2,630

OMAHA INSURANCE COMPANY www.mutualofomaha.com/states (800) 667-2937

Pre-ex: 0 App Fee: $0 Innovave Benet: No Crossover: Yes Premium Calc Method: Aained Age

Age A B C D F FHD G GHD K L M N

64 & Under $4,098 $5,110 $4,244 $1,484 $3,269

65 $1,632 $2,035 $1,672 $618 $1,193

70 $1,723 $2,148 $1,767 $689 $1,340

75 $2,014 $2,512 $2,079 $815 $1,602

80 $2,417 $3,014 $2,512 $950 $1,945

85 $2,792 $3,482 $2,910 $1,079 $2,239

Pre-ex = # of months of waiting period for coverage of a pre-existing

condition

App Fee = one-time charge at the time you apply for a

policy

Crossover: Yes = claims sent electronically; no paper

ling

28

Chicago Area - Zip Code 60639

Standardized Medicare Supplement Plans Available - Annual Premium

Plans highlighted in BLUE only available to those

eligible for Medicare prior to 2020

OXFORD LIFE INSURANCE COMPANY www.oxfordlife.com (866) 641-9999

Pre-ex: 0 App Fee: $15 Innovave Benet: No Crossover: Yes Premium Calc Method: Aained Age

Age A B C D F FHD G GHD K L M N

64 & Under $4,627 $11,873 $4,438 $7,105

65 $2,769 $4,489 $1,716 $2,601

70 $3,293 $5,304 $1,849 $3,097

75 $3,902 $6,283 $2,160 $3,726

80 $4,267 $7,269 $2,548 $4,385

85 $4,450 $8,327 $3,076 $5,176

PEKIN LIFE INSURANCE COMPANY www.pekininsurance.com (800) 322-0160

Pre-ex: 0 App Fee: $0 Innovave Benet: No Crossover: Yes Premium Calc Method: Aained Age

Age A B C D F FHD G GHD K L M N

64 & Under $4,442 $6,178 $3,840 $3,088

65 $2,876 $2,659 $1,681 $1,302

70 $3,396 $3,502 $2,215 $1,715

75 $3,758 $4,545 $2,883 $2,231

80 $3,978 $5,204 $3,318 $2,566

85 $4,124 $5,693 $3,642 $2,819

PHYSICIANS LIFE INSURANCE COMPANY www.physiciansmutual.com (800) 228-9100

Pre-ex: 0 App Fee: $0 Innovave Benet: Yes Crossover: Yes Premium Calc Method: Aained Age

Age A B C D F FHD G GHD K L M N

64 & Under $2,085 $3,237 $1,547 $2,767 $1,509

65 $2,085 $2,309 $732 $1,974 $714

70 $2,085 $2,491 $800 $2,130 $780

75 $2,085 $2,888 $996 $2,469 $972

80 $2,085 $3,150 $1,241 $2,692 $1,211

85 $2,085 $3,237 $1,547 $2,767 $1,509

Pre-ex = # of months of waiting period for coverage of a pre-existing

condition

Chicago Area - Zip Code 60639

App Fee = one-time charge at the time you apply for a

policy

Crossover: Yes = claims sent electronically; no paper

ling

29

Plans highlighted in BLUE only available to those

eligible for Medicare prior to 2020

Standardized Medicare Supplement Plans Available - Annual Premium

SBLI USA LIFE INSURANCE COMPANY, INC. www.prosperitylife.com (877) 990-7225

Pre-ex: 0 App Fee: $25 Innovave Benet: No Crossover: Yes Premium Calc Method: Aained Age

Age A B C D F FHD G GHD K L M N

64 & Under $3,510 $5,066 $4,958 $3,700

65 $1,501 $1,683 $1,516 $1,116

70 $1,505 $1,865 $1,520 $1,230

75 $1,683 $2,148 $1,700 $1,441

80 $2,216 $2,740 $2,238 $1,839

85 $2,860 $3,367 $2,889 $2,319

STATE FARM MUTUAL AUTOMOBILE INSURANCE COMPANY www.statefarm.com Contact Local State Farm Agent

Pre-ex: 0 App Fee: $0 Innovave Benet: No Crossover: Yes Premium Calc Method: Aained Age

Age A B C D F FHD G GHD K L M N

64 & Under $2,278 $4,831 $4,536 $4,882 $4,541 $3,725

65 $1,212 $2,569 $1,696 $2,597 $1,699 $1,314

70 $1,528 $3,240 $2,243 $3,272 $2,247 $1,727

75 $1,771 $3,751 $2,705 $3,789 $2,711 $2,086

80 $1,988 $4,215 $3,126 $4,257 $3,131 $2,434

85 $2,072 $4,394 $3,500 $4,439 $3,507 $2,766

STATE MUTUAL INSURANCE COMPANY hps://pltnm.com/ (877) 822-0582

Pre-ex: 0 App Fee: $25 Innovave Benet: No Crossover: Yes Premium Calc Method: Aained Age

Age A B C D F FHD G GHD K L M N

64 & Under $4,023 $4,561 $5,013 $4,129 $5,116 $1,481 $4,184 $3,492 $3,200

65 $1,563 $1,770 $1,947 $1,603 $1,987 $575 $1,625 $1,357 $1,244

70 $1,709 $1,936 $2,127 $1,753 $2,169 $628 $1,776 $1,483 $1,358

75 $1,980 $2,245 $2,467 $2,033 $2,517 $728 $2,058 $1,718 $1,573

80 $2,294 $2,600 $2,858 $2,355 $2,917 $844 $2,385 $1,992 $1,825

85 $2,660 $3,015 $3,314 $2,731 $3,382 $979 $2,766 $2,310 $2,115

Pre-ex = # of months of waiting period for coverage of a pre-existing

condition

App Fee = one-time charge at the time you apply for a

policy

Crossover: Yes = claims sent electronically; no paper

ling

30

Chicago Area - Zip Code 60639

Standardized Medicare Supplement Plans Available - Annual Premium

Plans highlighted in BLUE only available to those

eligible for Medicare prior to 2020

THE AMERICAN HOME LIFE INSURANCE COMPANY amhlifeco.com/ (833) 504-0334

Pre-ex: 0 App Fee: $25 Innovave Benet: No Crossover: Yes Premium Calc Method: Aained Age

Age A B C D F FHD G GHD K L M N

64 & Under $3,945 $5,067 $4,339 $3,564

65 $1,676 $1,955 $1,684 $1,199

70 $1,706 $2,048 $1,715 $1,370

75 $2,106 $2,533 $2,117 $1,706

80 $2,637 $3,145 $2,650 $2,114

85 $3,291 $3,899 $3,308 $2,666

THE ORDER OF UNITED COMMERCIAL TRAVELERS OF AMERICA www.uct.org (800) 848-0123

Pre-ex: 0 App Fee: $0 Innovave Benet: No Crossover: Yes Premium Calc Method: Aained Age

Age A B C D F FHD G GHD K L M N

64 & Under $5,776 $7,473 $7,922 $7,274 $7,822 $6,513 $5,375

65 $3,017 $3,908 $4,368 $3,804 $4,415 $3,407 $3,034

70 $3,776 $4,885 $5,441 $4,756 $5,376 $4,259 $3,694

75 $4,410 $5,709 $6,256 $5,556 $6,178 $4,978 $4,245

80 $4,858 $6,291 $6,767 $6,122 $6,686 $5,481 $4,594

85 $5,182 $6,711 $7,185 $6,530 $7,095 $5,845 $4,875

UNION SECURITY INSURANCE COMPANY www.usiccares.com/unionsecurity (833) 552-0827

Pre-ex: 0 App Fee: $25 Innovave Benet: No Crossover: Yes Premium Calc Method: Aained Age

Age A B C D F FHD G GHD K L M N

64 & Under $4,333 $6,174 $5,061 $3,914

65 $1,986 $2,423 $1,890 $1,354

70 $2,096 $2,546 $2,004 $1,514

75 $2,457 $3,017 $2,414 $1,891

80 $2,864 $3,624 $2,926 $2,213

85 $3,267 $4,317 $3,511 $2,686

.

Pre-ex = # of months of waiting period for coverage of a pre-existing

condition

Chicago Area - Zip Code 60639

App Fee = one-time charge at the time you apply for a

policy

Crossover: Yes = claims sent electronically; no paper

ling

31

Plans highlighted in BLUE only available to those

eligible for Medicare prior to 2020

Standardized Medicare Supplement Plans Available - Annual Premium

UNITED AMERICAN INSURANCE COMPANY www.unitedamerican.com (800) 755-2137

Pre-ex: 2 App Fee: $0 Innovave Benet: No Crossover: Yes Premium Calc Method: Aained Age

Age A B C D F FHD G GHD K L M N

64 & Under $2,494 $3,163 $5,190 $5,016 $5,949 $912 $4,283 $912 $2,201 $3,094 $4,260

65 $1,918 $2,261 $3,278 $3,082 $3,766 $433 $2,635 $433 $1,392 $1,957 $2,542

70 $2,349 $2,828 $4,145 $3,959 $4,754 $578 $3,384 $578 $1,858 $2,611 $3,291

75 $2,494 $3,104 $4,703 $4,527 $5,395 $721 $3,865 $721 $2,068 $2,909 $3,788

80 $2,494 $3,163 $5,190 $5,016 $5,949 $912 $4,283 $912 $2,201 $3,094 $4,260

85 $2,494 $3,163 $5,190 $5,016 $5,949 $912 $4,283 $912 $2,201 $3,094 $4,260

UNITED INSURANCE COMPANY OF AMERICA www.kemper.com (800) 654-9106

Pre-ex: 0 App Fee: $15 Innovave Benet: No Crossover: Yes Premium Calc Method: Aained Age

Age A B C D F FHD G GHD K L M N

64 & Under $3,732 $3,855 $4,862 $3,894 $1,508 $3,222

65 $1,631 $1,685 $2,125 $1,702 $659 $1,409

70 $1,782 $1,841 $2,322 $1,860 $720 $1,539

75 $2,060 $2,128 $2,684 $2,150 $832 $1,779

80 $2,334 $2,411 $3,041 $2,435 $942 $2,015

85 $2,641 $2,728 $3,441 $2,755 $1,067 $2,281

UNITED STATES FIRE INSURANCE COMPANY www.mycfmedigap.com

(866) 926-3237

Pre-ex: 0 App Fee: $25 Innovave Benet: No Crossover: Yes Premium Calc Method: Aained Age

Age A B C D F FHD G GHD K L M N

64 & Under $3,880 $4,751 $5,715 $3,863 $1,476 $1,914 $2,411 $3,067

65 $1,599 $1,846 $1,919 $1,593 $575 $766 $966 $1,193

70 $1,649 $2,020 $2,108 $1,640 $627 $813 $1,024 $1,303

75 $1,910 $2,339 $2,503 $1,902 $727 $943 $1,187 $1,509

80 $2,215 $2,712 $2,973 $2,205 $842 $1,092 $1,376 $1,750

85 $2,566 $3,142 $3,531 $2,555 $977 $1,265 $1,595 $2,028

Pre-ex = # of months of waiting period for coverage of a pre-existing

condition

App Fee = one-time charge at the time you apply for a

policy

Crossover: Yes = claims sent electronically; no paper

ling

32

Chicago Area - Zip Code 60639

Standardized Medicare Supplement Plans Available - Annual Premium

Plans highlighted in BLUE only available to those

eligible for Medicare prior to 2020

UNITEDHEATHCARE INSURANCE COMPANY OF AMERICA www.aarpmedicaresupplement.com/ (888) 708-3258

Pre-ex: 6 App Fee: $0 Innovave Benet: No Crossover: Yes Premium Calc Method: No Age (Community)

Age A B C D F FHD G GHD K L M N

64 & Under $4,326 $5,627 $5,350 $5,085

65 $1,566 $2,149 $1,635 $1,216

70 $1,736 $2,384 $1,813 $1,349

75 $2,021 $2,775 $2,110 $1,570

80 $2,334 $3,204 $2,437 $1,813

85 $2,761 $3,791 $2,883 $2,144

USAA LIFE INSURANCE COMPANY www.usaa.com (800) 531-8722

Pre-ex: 0 App Fee: $0 Innovave Benet: No Crossover: Yes Premium Calc Method: Aained Age

Age A B C D F FHD G GHD K L M N

64 & Under $2,530 $3,935 $3,886 $2,844

65 $1,418 $2,205 $1,846 $1,595

70 $1,652 $2,581 $2,003 $1,867

75 $1,975 $3,078 $2,413 $2,224

80 $2,291 $3,568 $3,005 $2,583

85 $2,530 $3,935 $3,886 $2,844

WASHINGTON NATIONAL INSURANCE COMPANY www.bankerslife.com/products/ (800) 852-6285

Pre-ex: 0 App Fee: $0 Innovave Benet: No Crossover: Yes Premium Calc Method: Aained Age

Age A B C D F FHD G GHD K L M N

64 & Under $6,942 $7,113 $6,456 $1,375 $4,628

65 $1,881 $2,529 $1,750 $489 $1,254

70 $2,432 $3,065 $2,262 $592 $1,622

75 $3,117 $3,719 $2,899 $718 $2,078

80 $3,902 $4,437 $3,629 $857 $2,601

85 $4,756 $5,219 $4,424 $1,008 $3,171

Pre-ex = # of months of waiting period for coverage of a pre-existing

condition

Chicago Area - Zip Code 60639

App Fee = one-time charge at the time you apply for a

policy

Crossover: Yes = claims sent electronically; no paper

ling

33

Plans highlighted in BLUE only available to those

eligible for Medicare prior to 2020

Standardized Medicare Supplement Plans Available - Annual Premium

WISCONSIN PHYSICIANS SERVICE INSURANCE CORP. hps://wpshealth.com/medsupp/index.shtml

(800) 236-1448

Pre-ex: 6 App Fee: $0 Innovave Benet: No Crossover: Yes Premium Calc Method: Aained Age

Age A B C D F FHD G GHD K L M N

64 & Under $2,699 $3,761 $3,768 $3,256 $1,963 $2,569 $2,817

65 $1,366 $1,904 $1,907 $1,648 $993 $1,300 $1,426

70 $1,638 $2,283 $2,287 $1,977 $1,191 $1,560 $1,710

75 $1,934 $2,696 $2,700 $2,334 $1,407 $1,841 $2,019

80 $2,230 $3,109 $3,114 $2,691 $1,622 $2,123 $2,328

85 $2,699 $3,761 $3,768 $3,256 $1,963 $2,569 $2,817

Chicago Area - Zip Code 60639

34

Pre-ex = # of months of waiting period for coverage of a pre-existing

condition

App Fee = one-time charge at the time you apply for a

policy

Crossover: Yes = claims sent electronically; no paper

ling

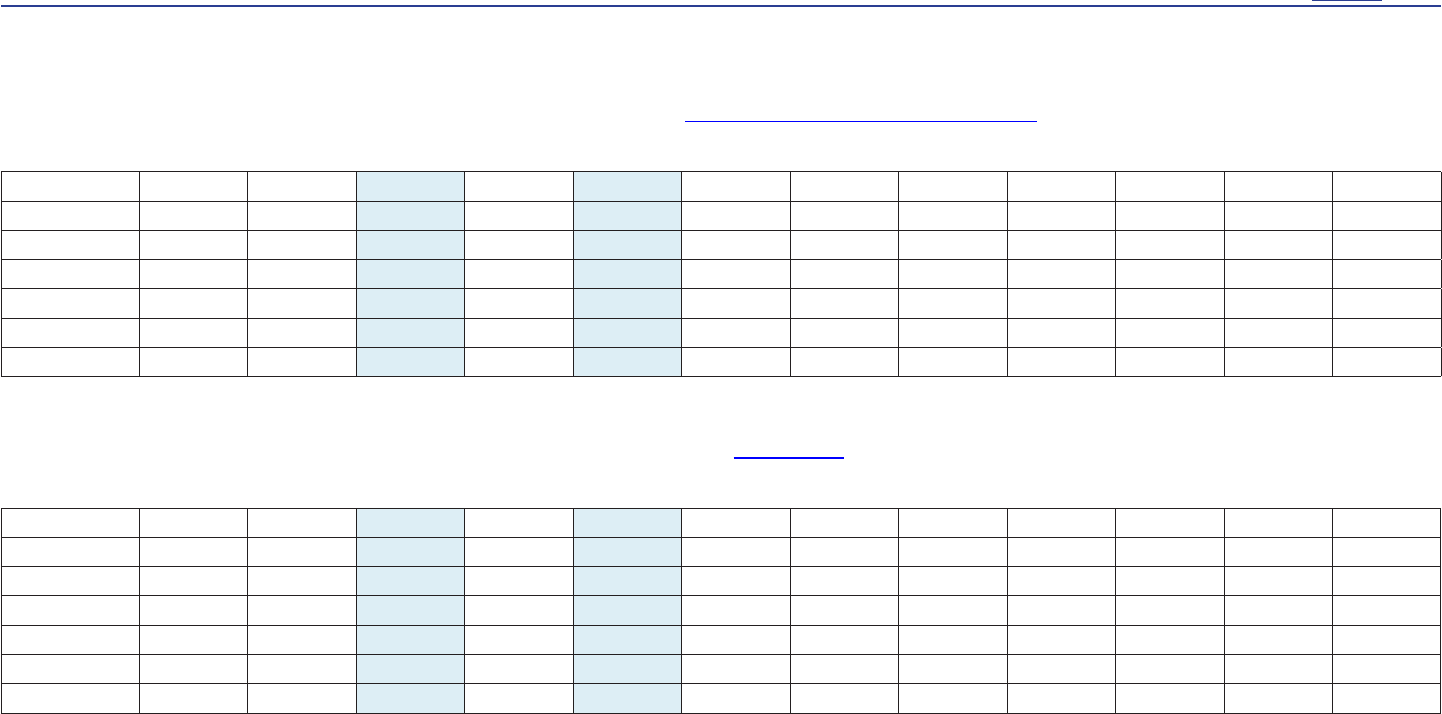

Plans highlighted in BLUE only available to those

eligible for Medicare prior to 2020

SELECT

Standardized Medicare SELECT Plans

AARP/UNITEDHEALTHCARE INSURANCE COMPANY www.aarpmedicaresupplement.com

(800) 523-5800

Pre-ex: 3 App Fee: $0 Innovave Benet: No Crossover: Yes Premium Calc Method: No Age (Community)

Age A B C D F FHD G GHD K L M N

64 & Under $4,311 $4,329 $4,189 $3,802

65 $1,753 $1,760 $1,345 $1,254

70 $1,926 $1,934 $1,477 $1,377

75 $2,357 $2,367 $1,808 $1,685

80 $2,788 $2,799 $2,139 $1,993

85 $2,874 $2,886 $2,205 $2,055

AARP/United Healthcare ulizes a two-ered community rang, which oers a lower premium for people who apply for a Medigap policy within the rst 36 months of their enrollment in Part B

of Medicare.

BLUE CROSS BLUE SHIELD OF ILLINOIS/HEALTH CARE SERVICE CORP www.bcbsil

(877) 213-1821

Pre-ex: 0 App Fee: $0 Innovave Benet: Yes Crossover: Yes Premium Calc Method: Aained Age

Age A B C D F FHD G GHD K L M N

64 & Under $4,312 $5,273 $5,151 $4,160 $2,748 $3,748 $3,753

65 $1,719 $2,103 $2,054 $1,559 $1,096 $1,495 $1,407

70 $2,232 $2,730 $2,667 $2,074 $1,423 $1,940 $1,871

75 $2,698 $3,299 $3,223 $2,540 $1,719 $2,345 $2,292

80 $3,116 $3,810 $3,722 $2,959 $1,985 $2,708 $2,670

85 $3,486 $4,263 $4,165 $3,331 $2,222 $3,030 $3,005

Plan G Select has an opon with innovave benets that include dental, vision, tness, and hearing.

Chicago Area

The Illinois Department on Aging does not discriminate against any individual because of his or her race, color, religion,

sex, national origin, ancestry, age, order of protection status, marital status, physical or mental disability, military status,

sexual orientation, gender identity, pregnancy, or unfavorable discharge from military service in admission to programs or

treatment of employment in programs or activities. If you feel you have been discriminated against, you have a right to le a

complaint with the Illinois Department on Aging. For information call the Senior HelpLine: 1-800-252-8966; 711 (TRS).

Printed by Authority of the State of Illinois, Illinois Department on Aging

(Rev. 10/22 – 1,500)

State of Illinois

Department on Aging

One Resources Way, #100

Springeld, Illinois 62702-1271

ilaging.illinois.gov

SENIOR HEALTH INSURANCE PROGRAM (SHIP)

1-800-252-8966