Exit Strategies from Quantitative Easing:

The role of the fiscal-monetary policy mix

∗

Florencia S. Airaudo

†

January 15, 2023

Please download here the most recent version of this paper

Abstract

As a consequence of the policy responses to the COVID-19 crisis, central bank bal-

ance sheets, public debt, and liquidity increased in many developed economies. As the

economies recover and inflation far exceeds the target, central banks face a challenge

in how to manage their balance sheet. I study the macroeconomic effects of reducing

the central bank balance sheet size, i.e., Quantitative Tightening (QT). I construct a

Regime-Switching New Keynesian DSGE model calibrated to the US economy. The

economy fluctuates between a monetary-led regime, a fiscally-led regime, and the zero

lower bound on the monetary policy interest rate. The macroeconomic effects of QT

crucially depend on the fiscal-monetary policy mix. In a monetary-led regime, QT

effectively reduces inflation at the cost of increasing the government debt-to-GDP ra-

tio. In contrast, unwinding the central bank balance sheet in a fiscally-led regime has

little impact on inflation. The negative demand effect driven by QT is not enough to

counteract the stimulative impact of negative real interest rates and fiscal stimulus.

Keywords: Monetary Policy; Fiscal and monetary policy mix; Quantitative Easing;

Quantitative Tightening

JEL Classification: E31, E52, E58, E62, E63

∗

I am indebted to Hernán Seoane for his invaluable support and guidance and to Evi Pappa and Ulf

Söderström for insightful discussions. For helpful comments and suggestions, I am grateful to Carlo Galli,

Andrew Foerster, David Vestin, Roberto Billi, Anna Rogantini Picco, the Economics department of Univer-

sidad Carlos III, especially the participants of the Macroeconomics Reading group, and the Macro Work in

Progress. I thank the members of the Research Division at the Riksbank and the participants of the First

Ph.D. Workshop in Money and Finance at the Riksbank, the Doctoral Workshop on Quantitative Dynamic

Economics at the University of Konstanz, the Annual Meeting of the AAEP, Simposio de la Asociacion

Española de Economia 2022, members of the RedNIE, and participants of the ENTER Seminar at the Uni-

versity College London. I thank financial support by PID2019-107161GB-C31/AEI/10.13039/501100011033

and Ministerio de Asuntos Económicos y Transformación Digital through grant Number ECO2016-76818-C3-

1-P, and to Álvaro Escribano Sáez for his financial support through the Ministerio de Ciencia e Innovación

(Spain), grant RTI2018-101371-B-I00.

†

Department of Economics, Universidad Carlos III de Madrid, Calle Madrid 126, 28903 Getafe, Madrid,

1

“...I would just stress how uncertain the effect is of shrinking the balance sheet..."

J. Powell, Federal Reserve Chairman, press conference May 2022.

1 Introduction

In the Great Recession and the COVID-19 crisis, short-term interest rates in the US ap-

proached the zero lower bound (ZLB), leaving the Federal Reserve without its conventional

monetary policy instrument. Due to this, the Federal Reserve began applying unconven-

tional monetary policies, such as Quantitative Easing (QE), to stimulate the economy by

lowering long-term interest rates.

1

QE consists of expanding the central bank balance sheet

by purchasing large amounts of assets and paying by issuing reserves.

2

At the same time,

the government embarked on a fiscal expansion that increased debt-to-GDP ratios to levels

not seen since World War II.

As the economy recovers and inflation reaches levels not seen in forty years, the Federal

Reserve faces the challenge of how to combine its two main policy tools (short-term interest

rate and balance sheet size) to stabilize the inflation rate. In this paper, I quantify the impact

of reducing the central bank balance sheet size on macroeconomic and financial variables such

as inflation, public debt, and yield spreads. To this end, I construct a Regime-Switching

New Keynesian Dynamic Stochastic General Equilibrium (NK-DSGE) model where fiscal

and monetary authorities are subject to regime changes in their policy rules.

The main contribution of this paper is to show that the macroeconomic impact of QT

depends on how the public debt will be stabilized, i.e., through fiscal surpluses or inflation.

When the fiscal authority adjusts taxes to stabilize the debt, QT reduces inflation, even

under smaller increases in the short-term interest rate. However, shrinkage of the central

bank balance sheet has little impact on inflation if there is no appropriate fiscal framework

to stabilize government debt.

1

Other central banks in developed economies, like the Bank of England, the central bank of Sweden, and

the ECB, among others, implemented similar policies.

2

In practice, QE includes distinct policies. In this paper, QE consists of central bank purchases of

long-term public bonds by selling short-term assets (bank reserves). The main objective of this policy is

to stimulate output and inflation by lowering long-term yields. This policy was defined as QE-type 2 by

Ricardo Reis in his talk “The original sin of QE."

2

The distinctive features of my model rely on the design of the financial intermediaries

and the fiscal and monetary authorities. The model exhibits market segmentation in the

public debt market and a leverage constraint for financial intermediaries, as in Elenev et al.

(2021). The fiscal authority issues long and short-term bonds, while the central bank issues

reserves. The central bank does conventional monetary policy, which consists in setting the

short-term interest rate, and unconventional monetary policy, which consists of central bank

purchases of long-term government bonds, paid by issuing reserves.

QE operates through two channels in this model. First, bank reserves and deposits

increase when the central bank expands its balance sheet. Second, the long-term yield falls

due to the central bank’s intervention in the long-term bond market. This yield decline

gives households incentives to rebalance their portfolio, selling long-term bonds in exchange

for deposits. QE transmits into the economy as a positive demand shock. The portfolio

revaluation effect provides households with a wealth effect, increasing consumption demand.

The fall in savings return generates a substitution effect from savings to consumption. Both

channels operate by increasing aggregate demand. The extent to which QE increases output

and inflation depends on the fiscal-monetary policy mix.

Conventional monetary and fiscal policies consist of a Taylor rule for the short-term

interest rate (the return on short-term public bonds and reserves) and a fiscal rule for taxes.

These rules switch between three policy regimes, as in Bianchi and Melosi (2017) and Bianchi

and Melosi (2022): a monetary-led regime, a fiscal-led regime, and the ZLB regime. In the

first regime, the central bank reacts strongly to inflation deviations from the target, and the

fiscal authority adjusts the primary fiscal surplus to stabilize the public debt.

3

The opposite

happens in the second regime, where the fiscal authority does not adjust the fiscal surplus

enough to stabilize the debt. As a result, the monetary authority allows the inflation rate to

deviate from the target to stabilize debt in real terms. Finally, the ZLB regime represents a

crisis regime, where the monetary authority is constrained by the effective lower bound.

3

This behaviour was characterized as active monetary policy and passive fiscal policy in Leeper (1991)

and the following literature. The opposite happens in the fiscally-led regime, where monetary policy is

passive and fiscal policy active. The literature has also called the regimes monetary dominance and fiscal

dominance, respectively. These regimes represent, in a parsimonious way, the outcome of a game between

fiscal and monetary authorities.

3

The economy presents recurrent regime switches following a transition matrix. Differently

from Bianchi and Melosi (2017) and Bianchi and Melosi (2022), the transition to and from

the ZLB regime is endogenous and depends on macroeconomic conditions. This endogeneity

allows agents to form rational expectations regarding the occurrence of this regime based on

their knowledge of macroeconomic variables such as inflation, output, and nominal interest

rates. The endogenization of this transition probability constitutes one of the contributions

of this paper.

I calibrate the model for the US economy and show it can match volatility and cyclicality

features in the data. Thus, I use it as a laboratory to study central bank balance sheet

policies. I simulate a crisis that resembles the COVID-19 pandemic and the policy response.

I show that a QE program that increases central bank long term bonds purchases by 10p.p.

of GDP reduces the severity of the crisis. Output growth falls around 1p.p. less than without

the program and recovers much faster, allowing a shorter duration of the ZLB regime. QE

also has expansionary effects in terms of inflation. Prices fall by 2.5p.p. less than without

the central bank’s intervention, at the cost of more significant inflationary dynamics during

the recovery, where annualized inflation reaches a peak of 8.1. Without QE, inflation would

have still overshot the target, but with a lower peak of 6.6%.

I show that how the central bank balance sheet’s size is reduced matters for inflation,

output, and debt dynamics. In the crisis recovery, I study different strategies regarding

the size of the central bank balance sheet: 1) maintaining the enlarged size after the crisis

(tapering), 2) decreasing the balance sheet size: a) by letting the bonds that mature, run off

the balance sheet (Quantitative Tightening (QT)), and b) at a faster speed by selling bonds

(Aggressive QT ).

When the central bank reduces its purchases of long-term public bonds, it triggers a fall

in their price and an increase in long-term yields. Increased returns result in a substitution

effect from consumption to savings, reducing aggregate demand and output. At the same

time, public debt issuance increases for three reasons. First, the increase in interest rates

increases debt service. The fall in output triggers automatic stabilizers that increase the

fiscal deficit. The fall in long-term bonds price reduces central bank remittances to the

treasury.

4

In the monetary-led regime, the increase in debt causes a rise in taxes due to the fiscal

rule. This exacerbates the fall in aggregate demand and disinflationary effects of Quantitative

Tightening. In this regime, inflation falls even with lower increases in the policy rate. In the

fiscally-led regime, public debt increases actual and expected inflation, exacerbating the rise

in yield spreads and mitigating the disinflationary effects of QT.

In a fiscally-led regime, thus, there are no clear advantages in reducing the balance sheet

size since it increases debt and spreads without helping to stabilize inflation. The negative

demand shock generated by QT is not enough to counteract the stimulative effect of real

negative interest rates and fiscal deficits.

Related Literature. This paper contributes to several strands of the literature. In

particular, it contributes to the literature that studies the real and inflationary effects of

QE through different channels.

4

Many authors studied the transmission mechanisms of QE

in general equilibrium models, either with financial frictions, like in Gertler and Karadi

(2011), Sims and Wu (2021), Sims et al. (2020), Del Negro et al. (2017), among others; with

market segmentation or portfolio adjustment costs as the main mechanisms to break the

non-arbitrage condition between short-term and long-term bonds, as in Chen et al. (2012),

Harrison (2017), or information frictions as in Gaballo and Galli (2022). Furthermore, a

recent paper by Cui and Sterk (2021) studies the liquidity effects of asset purchase programs

in a model with heterogeneous agents. The main contribution to this strand of the literature

is allowing the fiscal-monetary policy mix to play a role in shaping the macroeconomic effects

of QE and showing alternative scenarios where fiscal and monetary policy interact.

In a related paper, Elenev et al. (2021) ask whether monetary policy can create fiscal

capacity. In their setting, fiscal capacity depends on the probability of shifting fiscal policy

from active to passive. In this sense, I share with them the objective of studying the effects

of unconventional monetary policies while allowing fiscal policy to shift between regimes.

The main difference with this paper is that Elenev et al. (2021) assume and estimate a fiscal

limit beyond which the Treasury starts increasing taxes to ensure debt sustainability. At

the same time, the conventional monetary policy is active at all periods. These assumptions

prevent inflationary dynamics from arising in the model since all the agents in the economy

4

See Bhattarai and Neely (Forthcoming) and Kuttner (2018) for reviews of this literature.

5

are rational and know the government will never inflate away part of the debt. My main

contribution here is to study QT when fiscal and monetary authorities can follow a different

policy configuration.

By giving a central role to the interaction or coordination of fiscal and monetary policies,

this paper also relates to the literature that studies fiscal-monetary policy mix, as in Sims

(1994), Leeper (1991), Schmitt-Grohe et al. (2007), Leeper and Leith (2016), Reis (2017),

Bassetto and Sargent (2020), Barthélemy et al. (2021), among others, and to the literature

of the Fiscal Theory of the Price Level as in Sargent et al. (1981), Bassetto (2002), Cochrane

(2001), Sims (2016), Cochrane (2021), Brunnermeier et al. (2020). Allowing the policy mix

to alternate, this paper also relates to the literature on regime switches in policy rules, as in

Bianchi (2013), Bianchi and Melosi (2017), Bianchi and Melosi (2022), among others. The

contribution to this branch of the literature is the study of unconventional monetary policies

together with the conventional Taylor rule on short-term interest rates. By considering an

endogenous transition probability to get in and out of the ZLB, this paper relates to the

literature that studies monetary policy rules that depend on endogenous variables, as in

Barthélemy and Marx (2017), Davig and Leeper (2008).

This paper focuses on the macroeconomic effects of reducing the central bank balance

sheet. In a broad sense, I share the question with, for example, Wen et al. (2014), Harrison

(2017), Sims et al. (2020), Bonciani and Oh (2021), Hall and Reis (2016), Foerster (2015)

and Benigno and Benigno (2022). However, this paper differs from these in many aspects.

In Wen et al. (2014), the focus relies on the impact on firms, while there is no role for the

fiscal authority. Harrison (2017) studies the optimal QE policy in a DSGE-NK model with

portfolio adjustment costs, and Sims et al. (2020) studies optimal simple and implementable

QE rules through minimizing a quadratic loss-function in a DSGE-NK model with financial

frictions. Bonciani and Oh (2021) extends the work of Sims et al. (2020) by showing that

the central bank’s loss function depends on its asset purchase volatility. Crucial differences

are that these articles focus on central bank purchases of corporate/ private sector bonds,

assume a limited role in fiscal policy, and do not allow for changes in the conduct of the fiscal

policy rule. Hall and Reis (2016) study how different strategies for the exit from quantitative

easing in the face of interest-rate risk, as I do. However, the authors’ main objective is to

6

study the implications on central bank financial stability, and they assume a passive fiscal

policy. Foerster (2015) examines the macroeconomic effects of unwinding the central bank

balance sheet during and after a financial crisis. He shows that private agents’ expectations

about the exit strategy from a QE program impact the initial effectiveness of the policy in

a MS-DSGE model with a financial sector. However, there is no role for parameter switches

in conventional policy rules, abstracting from the possibility of alternative fiscal-monetary

policy interactions, which is the main contribution of this paper.

Finally, in a recent related paper, Benigno and Benigno (2022) study monetary policy

normalization, defined as the combination of lifting the policy rate and reducing the size of

central bank balance sheets. They study how these monetary policies interact and how they

depend on the behavior of the fiscal authority. However, they focus on optimal policy analysis

and does not account for policy uncertainty in the configuration of fiscal and monetary policy

interactions, which constitutes a central contribution of this paper.

The remainder of the paper is as follows. In the following section, I provide motivating

evidence of the importance of the fiscal and monetary policies interaction during Quantitative

Easing programs, looking at data for the US during the COVID-19 crisis. Section 3 presents

the model, Section 4 discusses the calibration, functional forms, and solution method. In

Section 5, I present the quantitative results of the model, and in Section 6 explain the main

transmission mechanism of QE. Section 7 presents the paper’s main results, where I simulate

the crisis and present the different exit strategies from QE. Finally, Section 8 concludes.

2 COVID-19 crisis and policy response in the US

This section provides data on the COVID-19 crisis and the policy response in the US. The

objective is to show the behavior of the main players in the bonds market, which motivates

some model decisions.

In March 2020, the COVID-19 pandemic hit economies worldwide, generating an unprece-

dented macroeconomic crisis. As a response, central banks in leading developed economies,

particularly the US, started to stimulate the economy through cuts in short-term interest

rates until they hit the zero lower bound. As a result, central banks began Quantitative

7

Easing programs. They consisted of purchasing assets, mainly government bonds of long

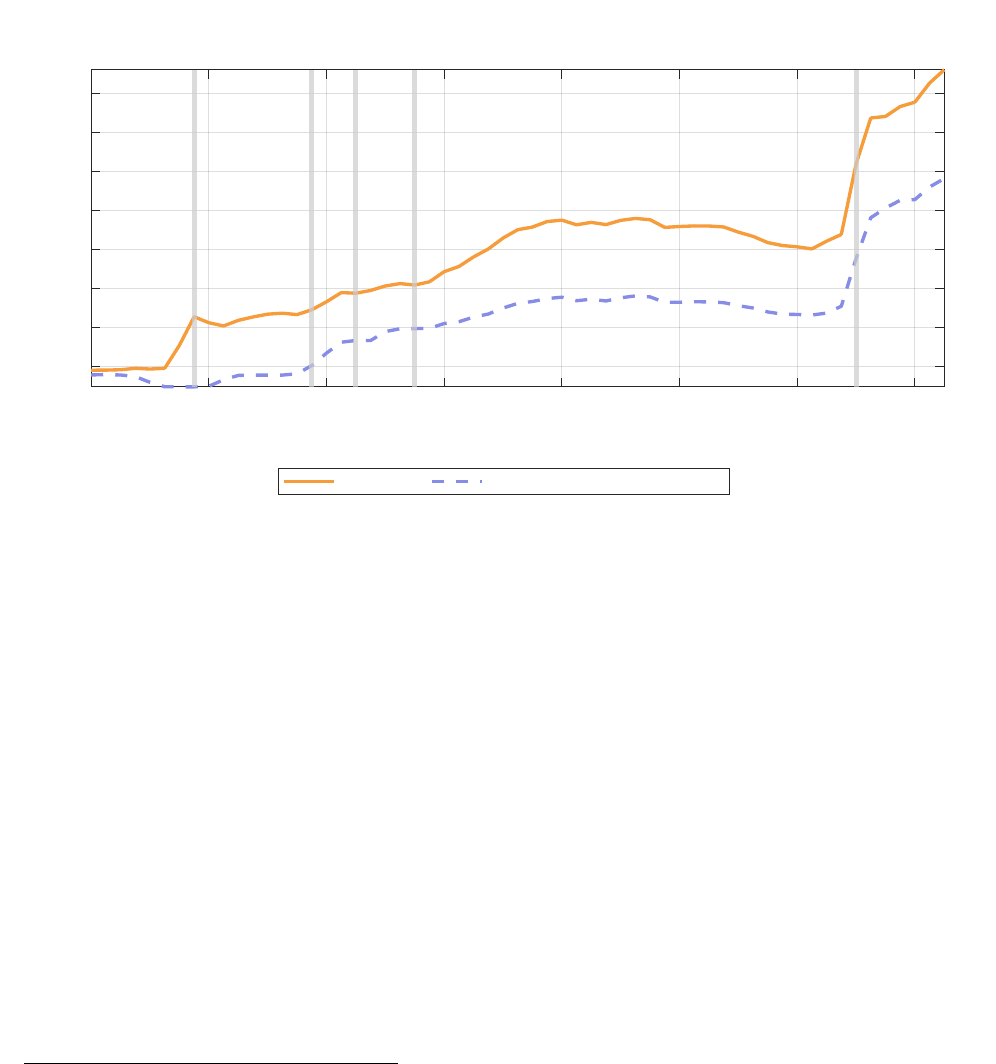

maturity, expanding their balance sheets at a breakneck speed. As shown in figure 1, the

assets in the Federal Reserve increased from $4 trillion in the third quarter of 2019 to over

$8 trillion one year later. Treasuries are the main component of this assets’ expansion at the

Federal Reserve, which increased from about $2 to $6 trillion in less than two years.

2007Q1 2009Q1 2011Q1 2013Q1 2015Q1 2017Q1 2019Q1 2021Q1

1

2

3

4

5

6

7

8

Trillions USD

Fed Assets Treasuries in Fed balance sheet

Figure 1: Federal Reserve Balance Sheet

Assets in the Federal Reserve balance sheet (orange line) and treasuries in the balance sheet

(dotted light-blue line). Variables in trillions of dollars. Source: FRED and US Financial

Accounts. Grey vertical lines show the start of a Quantitative Easing program.

The Quantitative Easing program took place with a substantial expansion in total debt

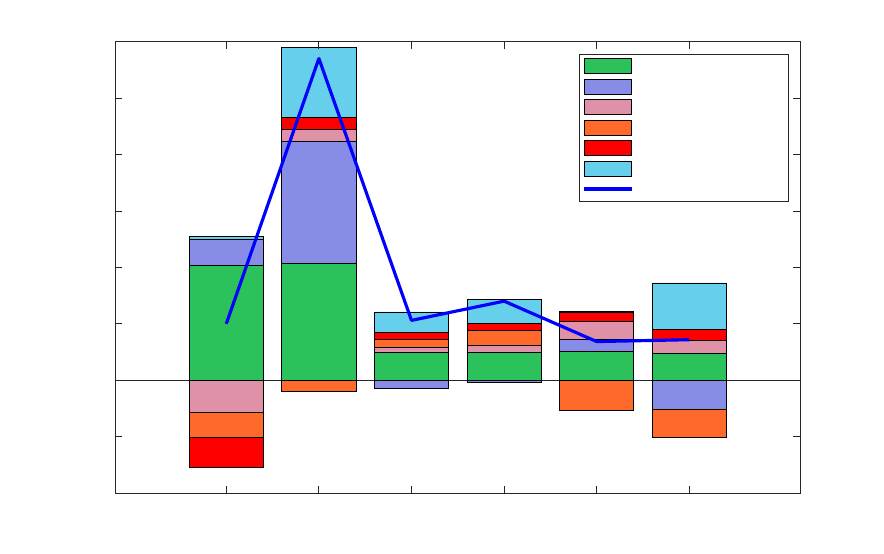

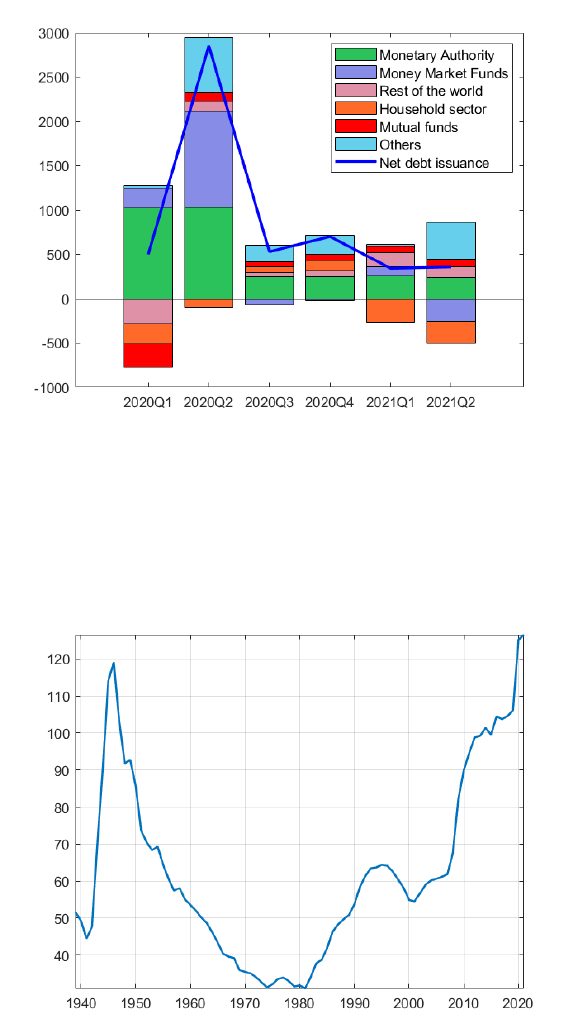

issuance from the Treasury. Figure 2 shows net purchases of treasuries from the start of the

COVID-19 crisis. They are net flows of treasuries, i.e., net of revaluation effects that take

into account the change in treasuries’ prices.

5

Different colors represent different agents in

the economy. When the bar is above zero, the agent had net purchases of treasuries during

the period, while if it is below zero, it represents net sales. The blue line represents the net

5

The conclusions do not change when we consider changes in treasuries. See Appendix, section 9.1.

8

debt issuance from the US Treasury, which is the sum of all the bars in a corresponding

period.

The figure shows the significant increment in debt issuance during the whole period.

Furthermore, the monetary authority’s purchases of government bonds played a vital role

during this period, sustaining the demand for treasuries when private sectors like households,

mutual funds, and the rest of the world were selling their bond holdings.

2020Q1 2020Q2 2020Q3 2020Q4 2021Q1 2021Q2

-1000

-500

0

500

1000

1500

2000

2500

3000

Monetary Authority

Money Market Funds

Rest of the world

Household sector

Mutual funds

Others

Net debt issuance

Figure 2: Net purchases of treasuries

Source: US Financial Accounts. Data in billions of dollars. Flows, net of revaluation effects.

Who sells treasuries to the central bank during a QE operation has implications regarding

the primary macroeconomic aggregates in the economy. When the Federal Reserve performs

quantitative easing policies, it purchases assets. The counterpart of this operation is the

issuance of bank reserves (or money in commercial banks’ hands) that increases the central

bank’s liabilities, expanding the central bank’s balance sheet. If commercial banks were the

original owners of the bonds (case 1), this operation would leave its balance sheet unchanged

since they increase one asset (reserves) while decreasing another (treasuries). However, sup-

pose the original owner of the bond was the non-bank private sector (case 2), like households

9

or mutual funds. In that case, the bank is a intermediary of this policy. The result would

be an increase in deposits or currency (money in private hands), together with an increase

in reserves and the central bank’s balance sheet. As a result, different measures of money

increase after quantitative easing policies under different cases; either bank money in the

form of reserves (case 1) or non-bank private money (case 2).

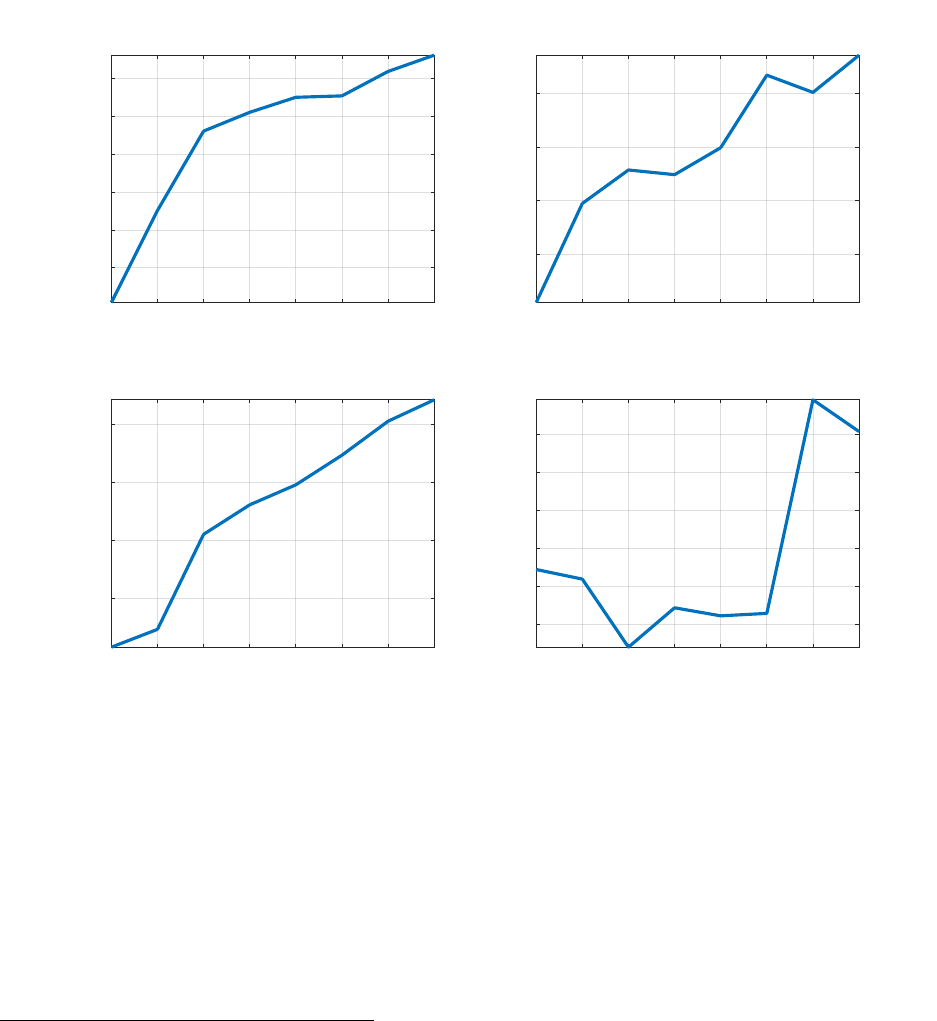

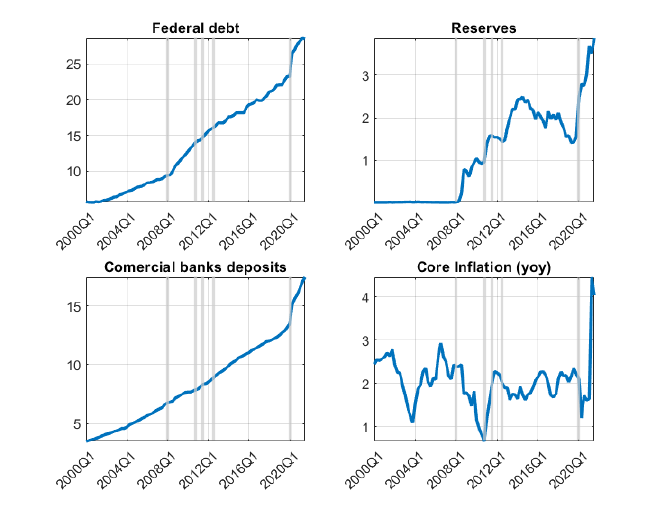

2019Q4

2020Q1

2020Q2

2020Q3

2020Q4

2021Q1

2021Q2

2021Q3

3

3.5

4

4.5

5

5.5

Debt purchases by FED

2019Q4

2020Q1

2020Q2

2020Q3

2020Q4

2021Q1

2021Q2

2021Q3

2

2.5

3

3.5

Reserves

2019Q4

2020Q1

2020Q2

2020Q3

2020Q4

2021Q1

2021Q2

2021Q3

14

15

16

17

Comercial banks deposits

2019Q4

2020Q1

2020Q2

2020Q3

2020Q4

2021Q1

2021Q2

2021Q3

1.5

2

2.5

3

3.5

4

Core Inflation (yoy)

Figure 3: Macroeconomic variables: public debt, liquidity, inflation

US Federal Debt, Reserves and Deposits, in trillions of dollars. Core inflation in %. Source

debt, deposits, and inflation data: FRED. Source reserves: US financial accounts, released

December 2021.

In figure 3, we can see a great expansion in liquidity, both in the form of bank reserves

and deposits.

6

Other measures of monetary aggregates present significant increases during

6

In the appendix, section 9.1, I show this last feature differs from what happened after the Quantitative

Easing programs after the Great Recession.

10

this period too. Some of these variables, like public debt, are at values over GDP not seen

since the Second World War.

7

As economies recover and face inflationary dynamics not seen in the last 40 years, it is

unclear how to unwind the stimulus injected during the crisis. The combination of high infla-

tion rates, large debt-to-GDP ratios, elevated liquidity, and expanded central bank balance

sheet presents an extra challenge for policymakers.

In the following section, I present a model able to generate the comovements that we ob-

served in aggregate macroeconomic variables during the COVID-19 crisis and the consequent

policy response and use it as a laboratory to study balance sheet policies.

3 Model

The model is a NK-DSGE model with five agents: Firms, households, Monetary Authority,

Fiscal Authority, and financial intermediaries (FI). There are three assets in the economy:

Short-term public bonds B

S

t

with one-period maturity and price Q

S

t

; deposits D

t

which

provide liquidity services to households and with price Q

D

t

; and long-term public bonds: B

L

t

,

with geometrically decaying maturity δ, as in Hatchondo and Martinez (2009), that pay a

coupon κ every period, and their price is Q

L

t

.

As is standard in the literature that assesses the transmission mechanisms of quantitative

easing policies, there is segmentation in bond markets.

8

I follow Elenev et al. (2021) in as-

suming that households cannot invest in short-term public bonds, which are held exclusively

by financial intermediaries and the central bank. In contrast, financial intermediaries do

not invest in long-term public bonds. These assumptions align with the data presented in

section 2.

Short-term bonds in the model stand for treasury bills and central bank reserves indis-

tinctly since both assets share liquidity and return properties. The only difference between

them is which governmental institution issues them (i.e., central bank or treasury). The

7

See section 9.1 for a historical plot of this variable.

8

See, for instance, Chen et al. (2012), and Bhattarai and Neely (Forthcoming) for a comprehensive

analysis on different mechanisms to break the non-arbitrage condition between different assets in the economy,

and thus, the neutrality result from Wallace (1981).

11

assumption that financial intermediaries exclusively hold them in the model makes this asset

close to “money in banks’ hands.”

Market segmentation interacts in the model with the following frictions. First, prices are

sticky, as in Rotemberg (1982) and the New-Keynesian literature. Second, households pay

a portfolio adjustment cost when purchasing long-term public bonds, and financial interme-

diaries pay a convex cost when they raise new equity. Finally, financial intermediaries are

subject to a leverage constraint that states that their debt (deposits) cannot be larger than

their assets (reserves and treasury bills). On top of this, the real value of deposits provides

liquidity services to households increasing their utility, as in the tradition of Money in the

Utility (MIU) function models. Including variables that stand for reserves and monetary

aggregates in the model, together with the frictions above, allows the model to generate the

main macroeconomic effects of QE policies highlighted in the empirical literature and the

comovements in macroeconomic aggregates that we observed in section 2.

Two authorities constitute the government: the treasury and the central bank. Each

authority has its budget constraint and policy instrument(s). The presence of the two gov-

ernmental sectors allows the model to generate realistic policy interactions, which are at the

center of macroeconomic dynamics. I follow Bianchi and Melosi (2017), and Bianchi and

Melosi (2022) and assume that parameters in policy rules for conventional monetary policy,

the Taylor rule, and fiscal rule alternate between regimes.

Next, I describe each agent and its optimization problem.

3.1 Households

There is a continuum of measure one of homogeneous households that live infinite periods

in the economy. A representative agent chooses consumption c

t

, labor n

t

, deposits D

H

t

, and

long-term public bonds B

L,H

t

to maximize its lifetime utility:

E

0

∞

X

t=0

ν

t

β

t

U

c

t

,

D

H

t

P

t

, n

t

ν

t

is a preference shock that follows an AR(1) process. Deposits are the most liquid asset

that a household can purchase. I assume agents derive utility from the liquidity services

12

this asset provides. The utility function is a monotone increasing function in consumption

and deposits, a monotone decreasing function in labor, and satisfies Inada conditions on all

variables.

Long-term bonds pay geometrically decaying coupons, as in Hatchondo and Martinez

(2009). A bond B

L

t

issued at time t pays the sequence of coupons: κ, κ(1 − δ), κ(1 − δ)

2

, ...,

where κ > 0 and δ ∈ (0, 1). This last parameter controls the debt maturity, where δ = 1

corresponds to a short-term bond (i.e., 1-period maturity), and δ = 0 represents a consol.

This maturity specification reduces the number of state variables in the model. A bond

issued at time j − k is equivalent to (1 − δ)

k

bonds issued at period t, and hence the state

variable B

L

t−1

represents total long-term debt in equivalent newly issued long-term bonds.

Their price at period t is Q

L

t

.

9

Every period, the representative household pays lump-sum taxes τ

t

, receives nominal

dividend payments from financial intermediaries Div

t

, firm’s profits since households are

the owners Π

f

t

, and rebates

˜

Π

t

. When she invests in long-term bonds, she pays a portfolio

adjustment cost of Φ(.) on top of the asset’s price.

10

The optimization problem of a representative household is the following.

max

c

t

,n

t

,D

H

t

,B

L,H

t

E

0

∞

X

t=0

β

t

ν

t

U

c

t

,

D

H

t

P

t

, n

t

P

t

c

t

+ Q

D

t

D

H

t

+ B

L,H

t

Q

L

t

+ Φ

L

B

L,H

t

P

t

!

P

t

= W

t

n

t

+ D

H

t−1

+ · · ·

+B

L,H

t−1

κ + (1 − δ)Q

L

t

+ Π

f

t

+ Div

t

+

˜

Π

t

− τ

t

P

t

(1)

D

H

t

≥ 0

B

L,H

t

≥ 0

9

Notice that the deflated number of nominal bonds by the price level,

B

L,H

t

P

t

= b

L,H

t

is not the real value

of public debt. Instead, the real value of public bonds held by households is Q

L

t

B

L,H

t

P

t

. As discussed in Leeper

et al. (2021), introducing the variable b

L,H

t

allows to dispose of one variable, by working with b

L,H

t

instead

of P

t

and B

L,H

t

.

10

This assumption helps the model generate a positive term premium in long-term public bonds.

13

where P

t

is the price level, and W

t

is the nominal wage. Under this specification, the expected

return on a long-term bond purchased at period t is R

L

t,t+1

= E

t

κ+(1−δ)Q

L

t+1

Q

L

t

.

Notice that the non-negativity condition on deposits does not bind at the optimum even

if they pay a lower return, given the assumption that deposits increase utility. Finally, the

last constraint is the non-negativity conditions for public bonds since the household cannot

go short on them.

Associate the multiplier β

t

λ

t

to the budget constraint. The system of equilibrium condi-

tions that characterize the households’ optimization problem solution is the following:

−U

n

c

t

,

D

H

t

P

t

, n

t

U

c

c

t

,

D

H

t

P

t

, n

t

=

W

t

P

t

Q

D

t

= E

t

M

t,t+1

+

U

d

c

t

,

D

H

t

P

t

, n

t

P

t

U

c

c

t

,

D

H

t

P

t

, n

t

Q

L

t

+ Φ

′

L

B

L,H

t

P

t

!

= E

t

M

t,t+1

κ + (1 − δ)Q

L

t+1

Where M

t,t+1

is the stochastic discount factor between period t and t + 1.

M

t,t+1

= β

λ

t+1

λ

t

= β

ν

t+1

ν

t

U

c

c

t+1

,

D

H

t+1

P

t+1

, n

t+1

U

c

c

t

,

D

H

t

P

t

, n

t

1

π

t+1

Together with the budget constraint (1), they characterize the solution to the household’s

optimization problem.

11

Define π

t

=

P

t

P

t−1

as the inflation rate of period t. Notice that

a spread will exist between the prices of deposits and long-term bonds even without the

presence of portfolio adjustment cost. Households are willing to invest in deposits, even

though they provide a lower return, because they derive utility from them. The presence

of portfolio adjustment costs in bonds generates a term spread and prevents the household

from fully exploiting the arbitrage opportunities in the assets’ markets. The literature has

shown this feature is vital for the transmission mechanism of QE policies.

11

The non-negativity condition in public bond purchases ensures the transversality condition is satisfied.

14

For future reference, it is convenient to define the return on a risk-free private asset in

this economy, which is in zero net supply, as given by:

R

N

t

= E

t

1

M

t,t+1

This expression is defined as the natural interest rate in Benigno and Benigno (2022),

which differs from the policy rate, and is key in the consumption-savings trade-off.

3.2 Firms

The productive sector comprises two levels: final goods and intermediate goods producers.

3.2.1 Final good producer

A representative firm produces the domestic final good y

t

from varieties y

i

, for i ∈ [0, 1].

y

t

=

Z

1

0

y

ε−1

ε

i,t

di

ε

ε−1

Where ε is the elasticity of substitution between varieties. The optimization problem of the

representative firm is the following:

max

y

t

,{y

i,t

}

i∈[0,1]

P

t

y

t

−

Z

1

0

P

i,t

y

i,t

di

s.t y

t

=

Z

1

0

y

ε−1

ε

i,t

di

ε

ε−1

And the optimal demand function for variety i is given by the following expression:

y

i,t

= y

t

P

i,t

P

t

−ε

(2)

15

3.2.2 Intermediate goods firms

Intermediate goods firms are monopolistically competitive in the goods market. Each firm

produces a variety i according to a linear production function:

y

i,t

= z

t

n

i,t

(3)

Where z

t

is a mean reverting TFP shock, common to all varieties, with the law of motion:

ln (z

t

) = ρ

z

ln (z

t−1

) + σ

z

ε

z

t

, ε

z

t

∼ N(0, 1)

When changing prices, firm i is subject to a quadratic adjustment cost in prices, as in

Rotemberg (1982):

ϕ

P

2

P

i,t

P

i,t−1

− π

∗

2

y

t

Where ϕ

P

measures the degree of nominal price rigidity, and y

t

is aggregate output, given

by:

y

t

=

Z

1

0

y

i,t

di

The nominal profit of firm i at period t, transferred to households, is given by:

Π

f

i,t

= P

i,t

y

i,t

− W

t

n

i,t

−

ϕ

P

2

P

i,t

P

i,t−1

− π

∗

2

y

t

P

t

(4)

Firms maximize the discounted sum of profits using the households’ discount factor, and

subject to technology 3, and demand 2.

16

Their optimization problem is the following:

max

P

i,t

,n

i,t

E

0

∞

X

k=0

M

t,t+k

Π

f

i,t+k

s.t. y

i,t

= z

t

n

i,t

y

i,t

= y

t

P

i,t

P

t

−ε

Π

f

i,t

= P

i,t

y

i,t

− W

t

n

i,t

−

ϕ

P

2

P

i,t

P

i,t−1

− π

∗

2

P

t

y

t

In equilibrium, all firms behave symmetrically, and we have P

i,t

= P

t

. Thus, aggregate

profits are given by:

Π

f

t

= P

t

y

t

− W

t

n

t

−

ϕ

P

2

(π

t

− π

∗

)

2

y

t

P

t

Their optimization problem is characterized by the following conditions, where MC

t

is

the multiplier of equation 2, and it is the marginal cost.

1 − ε + ε

MC

t

P

t

= ϕ

P

(π

t

− π

∗

) π

t

− ϕ

P

E

t

M

t,t+1

y

t+1

y

t

π

2

t+1

(π

t+1

− π

∗

)

(5)

W

t

= MC

t

z

t

(6)

The first condition is the New-Keynesian Phillips curve.

3.3 Financial intermediaries

In this section, I follow a simplified version of the financial intermediaries’ description in

Elenev et al. (2021).

A representative agent in this sector starts the period t with a net worth of W

I

t

. Every

period, it pays a fraction τ

I

of its net worth to households and raises new equity from them,

A

t

. The net payout to shareholders is then:

Div

t

= τ

I

W

I

t

− A

t

(7)

17

This agent can invest in short-term public bonds B

S,I

t

for the price Q

S

t

. B

S,I

t

is the

sum of treasury bills (treasuries with a maturity of up to a year, B

S

t

) and central bank

reserves (B

S,CB

t

). The reason for adding these assets into one variable is that they have the

same risk and return properties in the model, being perfect substitutes from the financial

intermediaries’ point of view. Its liabilities are given by deposits from households D

I

t

. The

following expression then gives the balance sheet:

(1 − τ

I

)W

I

t

+ A

t

− Φ

A

(A

t

) + Q

D

t

D

I

t

= Q

S

t

B

S,I

t

(8)

Where Φ

A

(.) is a convex cost of issuing new equity, rebated lump-sum to Households. This

cost prevents financial intermediaries from raising funds only through equity, going to a

corner solution with D

I

t

= 0.

The net wealth at period t is:

W

I

t

= B

S,I

t−1

− D

I

t−1

(9)

In line with Basel regulation, financial intermediaries are subject to a leverage constraint.

It states that their debt (in this case, deposits) can be, at most, a fraction ζ of its assets.

12

D

I

t

≤ ζB

S,I

t

(10)

The optimization problem of a financial intermediary consists of maximizing the dis-

counted sum of dividends subject to restrictions 8, 9, and 10. I assume the financial inter-

mediary discounts its future flows using the household’s stochastic discount factor.

12

I assume the financial intermediary sector’s assets are composed only of treasury bills and central bank

reserves for simplicity. In a more complicated model, they could also purchase firms’ bonds or provide loans

to firms to finance capital purchases. This is the case in Elenev et al. (2021), and Benigno and Benigno

(2021). The qualitative conclusions of this paper do not change when considering a more complicated version

of the model, reducing to quantitative differences.

18

max

A

t

,D

I

t

,B

S,I

t

E

0

∞

X

k=0

M

t,t+k

τ

I

W

I

t+k

− A

t+k

s.t. (1 − τ

I

)W

I

t

+ A

t

− Φ

A

(A

t

) + Q

D

t

D

I

t

= Q

S

t

B

S,I

t

W

I

t

= B

S,I

t−1

− D

I

t−1

D

I

t

≤ ζB

S,I

t

Define η

t

as the Balance sheet multiplier and µ

t

as the Leverage constraint multiplier.

Using the first order condition to equity A

t

to substitute out the multiplier η

t

, we obtain

the system of equations that characterize the financial intermediary’s optimization problem,

together with 7, 8, 9, 10:

13

Q

D

t

= E

t

˜

M

t,t+1

+ µ

t

(1 − Φ

′

A

(A

t

)) (11)

Q

S

t

= E

t

˜

M

t,t+1

+ ζµ

t

(1 − Φ

′

A

(A

t

)) (12)

Where

˜

M

t,t+1

is the stochastic discount factor for financial intermediaries, defined as:

˜

M

t,t+1

≡ M

t,t+1

(1 − Φ

′

A

(A

t

))

τ

I

+

1 − τ

I

1 − Φ

′

A

(A

t+1

)

Notice that the spread between deposits and short-term bonds is a function of the leverage

constraint multiplier µ

t

. Since ζ < 1, the return on short-term bonds is higher than the

short-term bonds when the leverage constraint binds. If the leverage constraint does not

bind, then we get Q

S

t

= Q

D

t

, and from the Households’ problem, this could only be possible

in a situation where liquidity services are zero.

3.4 Monetary Authority

The Central Bank performs conventional and unconventional monetary policies. The con-

ventional monetary policy sets the short-term nominal interest rate R

t

, subject to a ZLB

13

See appendix, section 9.2 for further details.

19

restriction. This rate is the inverse of the short-term public debt price:

R

t

≡

1

Q

S

t

(13)

The unconventional monetary policy consists of central bank balance sheet policies. In

particular, the central bank purchases long-term government debt B

L,CB

t

in exchange for

reserves (B

S,CB

t

), as in the data since the Great Recession. The rules for setting these two

instruments are provided in a following section.

The following expression gives the Central Bank’s budget constraint:

B

S,CB

t−1

P

t

+

B

L,CB

t−1

P

t

κ + (1 − δ)Q

L

t

= Q

S

t

B

S,CB

t

P

t

+ Q

L

t

B

L,CB

t

P

t

+ Λ

CB

t

where Λ

CB

t

are central bank remittances to the fiscal authority. I assume that profits Λ

CB

t

are transferred to the fiscal authority.

14

Finally, the central bank is subject to a revenue neutrality constraint, which is in line with

the data. It states that when the central bank increases its assets by purchasing long-term

bonds, it has to offset the operation by decreasing its net position of short-term assets.

Q

L

t

B

L,CB

t

+ Q

S

t

B

S,CB

t

= 0 (14)

When it performs QE, we have B

S,CB

t

< 0, representing the increase in reserves issuance.

3.5 Fiscal Authority

The treasury consumes g

t

and obtains resources from three different sources. It collects tax

revenues from households in a lump-sun fashion, τ

t

, receives dividends from the central bank

Λ

CB

t

, and issues debt, whose total real value is

B

t

P

t

. This debt comprises short-term bonds

14

For simplicity, in this paper, I abstract from asymmetries in the transfer of the central bank’s profits to

the treasury, like the ones discussed in Hall and Reis (2016).

20

B

S

t

and long-term bonds B

L

t

. The total debt issuance is:

15

B

t

= Q

S

t

B

S

t

+ Q

L

t

B

L

t

(15)

The period budget constraint of the fiscal authority, in real terms, is:

τ

t

− g

t

| {z }

≡s

t

+

B

t

P

t

+ Λ

CB

t

=

B

S

t−1

P

t

+

B

L

t−1

P

t

κ + (1 − δ)Q

L

t

Where s

t

is the real primary fiscal surplus of period t. Replacing Λ

CB

t

from the central

bank balance sheet and using 14, I obtain a consolidated budget constraint:

s

t

+

B

t

P

t

=

B

S

t−1

− B

S,CB

t−1

P

t

| {z }

A

+

B

L

t−1

− B

L,CB

t−1

P

t

| {z }

B

κ + (1 − δ)Q

L

t

(16)

The terms’ A’ and ‘B’ are the outstanding short and long-term public debt in the private’s

hands. Notice that through the purchases of long-term public bonds, the central bank relaxes

the budget constraint for the consolidated government. However, this is not necessarily

the case when considering the net position of short-term assets. For instance, if B

S,CB

t

<

0, implying reserves issuance, then the consolidated government debt of short maturity is

increasing with this policy. In this sense, quantitative easing policies can be interpreted as

a maturity swap, exposing the government to interest rate risk.

The following expression gives government consumption:

g

t

= θ(y

∗

− y

t

) + (1 − ρ

g

)¯g + ρ

g

g

t−1

+ σ

g

ε

g

t

, ε

g

t

∼ N(0, 1)

0 < θ < 1 represents the government spending reaction to output deviations from its

steady state. This term generates a counter-cyclical behavior of government consumption,

introducing fiscal stimulus when the economy is in a recession. Government consumption

goods are thrown into the ocean. Finally, the maturity composition of newly issued govern-

ment debt is constant in book value terms, with a fraction ¯µ of debt being long-term.

15

Notice that the real amount of short-term bonds is Q

S

t

B

S

t

P

t

and the one of long-term bonds is Q

L

t

B

L

t

P

t

.

21

B

S

t

B

L

t

=

1 − ¯µ

¯µ

(17)

3.6 Market clearing conditions

Market clearing conditions are the following:

c

t

+ g

t

+

ϕ

P

2

(π

t

− π

∗

)

2

y

t

= y

t

D

H

t

= D

I

t

B

S

t

− B

S,CB

t

= B

S,I

t

B

L

t

= B

L,H

t

+ B

L,CB

t

And households’ rebates by other agents in the model are equal to:

˜

Π

t

= Φ

L

b

L,H

t

+ Φ

A

(A

t

)

3.7 Policy rules

To close the model, I assume that fiscal and monetary authorities follow policy rules to set

their instruments: τ

t

, R

t

, and b

L,CB

t

. First, I assume that central bank purchases of long-term

bonds follow an AR(1) process:

b

L,CB

t

= (1 − ρ

QE

)b

L,CB

∗

+ ρ

QE

b

L,CB

t−1

+ σ

QE

ϵ

QE

t

(18)

Where b

L,CB

∗

is the average amount of long-term bonds at the steady state. Increases in

the central bank balance sheet are random and unrelated to the economic conditions. I follow

this assumption for two reasons. First, this paper aims to study the effects of QE policies

under different interactions of conventional fiscal and monetary policies. Second, there is

no evidence or consensus of a clear rule for central bank purchases, a policy with a great

discretionary component. This assumption implies that QE constitutes a complementary

policy instrument of the central bank and not necessarily a substitute, in line with what we

22

observe in the data. Furthermore, it prevents the instrument from altering the determinacy

properties of the model.

I follow the literature on fiscal-monetary policy interactions and assume that fiscal and

monetary authorities follow rules to determine the conventional policy instruments. In par-

ticular, the nominal short-term interest rate follows the Taylor rule 20, reacting to output

and inflation deviations from its steady state values, together with an autoregressive pa-

rameter ρ

R

and a monetary shock ϵ

m

t

with standard deviation σ

m

t

. The monetary shock

stands for interest rate deviations from the reaction function. The intensity of interest rate

reaction to output and inflation deviations are characterized by policy parameters α

y

and

α

π

, respectively. Finally,

¯

R is the mean of the nominal interest rate.

For fiscal policy, I assume that taxes τ

t

react to total real debt deviations from its steady

state value b

∗

and have an autoregressive coefficient ρ

τ

, as in 19. The elasticity of tax

deviations to debt deviations is characterized by the parameter γ.

16

τ

t

− τ

∗

= ρ

τ

(ξ

t

) (τ

t−1

− τ

∗

) + (1 − ρ

τ

(ξ

t

)) γ (ξ

t

) (b

t−1

− b

∗

) (19)

R

t

¯

R (ξ

t

)

=

R

t−1

¯

R (ξ

t

)

α

R

(ξ

t

)

"

π

t

π

∗

α

π

(ξ

t

)

y

t

y

∗

α

y

(ξ

t

)

#

1−α

R

(ξ

t

)

e

σ

M

(ξ

t

)ϵ

M

t

(20)

The parameters above depend on a discrete shock ξ

t

that follows a Markov process. I fol-

low Bianchi and Melosi (2017) and assume that this shock can take three values, representing

the three regimes through which the economy fluctuates.

The first regime, the monetary-led (M) regime, is characterized by a strong interest rate

reaction to inflation deviations (high α

π

) and a strong tax reaction to debt (high enough

γ).

17

This regime is associated to an active monetary policy and passive fiscal policy, in

Leeper (1991) terminology. Under this regime, the monetary authority adjusts the nominal

16

Assuming the fiscal rule reacts to real public debt in private hands, i.e., Q

L

t

b

L,H

t

+ Q

S

t

b

S,I

t

does not

change the conclusions in this paper. These results are available under request.

17

In Appendix, I present, for a given calibration, the combinations of values α

π

and γ that give rise

to determinacy at each regime. Notice, however, that the global stability of the system does not require

determinacy at each regime.

23

interest rate more than proportionally to changes in the inflation rate to stabilize inflation.

At the same time, the treasury passively adjusts taxes to stabilize the real debt.

The second regime is the fiscally-led regime (F) where the fiscal authority does not adjust

taxes enough to stabilize the real debt (low γ). Then, the central bank allows the inflation

rate to deviate from the target to stabilize debt in real terms. This regime can be defined

as passive monetary policy and active fiscal policy in the sense of Leeper (1991).

The third regime is the Zero Lower Bound regime (ZLB). It is characterized by an un-

reactive nominal short-term interest rate that remains fixed at its effective lower bound and

by a fiscal policy that is unreactive to the real debt level. This regime is an extreme form

of the fiscally led regime since we have α

π

= γ = 0. As in Bianchi and Melosi (2017), this

regime represents a crisis regime, where the economy enters due to the realization of bad

shocks that drive the economy to a recession. However, differently from Bianchi and Melosi

(2017), the economy enters the ZLB regime endogenously, as I explain in the next section.

3.8 Transition probabilities

Assume the Markov-switching shock ξ

t

depends on the realization of two random variables

ξ

P

t

and ξ

C

t

. When ξ

C

t

= 1, the economy suffers a crisis and moves to the ZLB regime. When

ξ

C

t

= 0, the government can set fiscal and monetary policies without restriction. In this

case, the variable ξ

P

t

determines the regime in place stochastically. ξ

P

t

= M stands for the

monetary-led regime, ξ

P

t

= F for the fiscally-led regime, and it evolves according to the

transition matrix:

P =

p

mm

1 − p

mm

1 − p

ff

p

ff

where p

ij

= P

ξ

P

t+1

= j|ξ

P

t

= i

.

As seen from the transition matrix P, the probability of being in one regime or another

is constant and entirely exogenous. The realization of this shock represents, in a simplified

way, the outcome of a policy game between the fiscal and the monetary authority, where the

winner is the active authority.

24

Define q as the probability of entering to the ZLB regime, q = P (ξ

C

t+1

= 1|ξ

C

t

= 0) and r

as the probability of moving out of the crisis regime q = P (ξ

C

t+1

= 0|ξ

C

t

= 1).

The transition matrix for ξ

t

is then:

T =

(1 − q)P q[1; 1]

r[p

zm

; (1 − p

zm

)] (1 − r)

Where p

zm

is the probability of exiting the ZLB regime towards a monetary-led regime. q

and r are endogenous processes. The probability of entering the ZLB regime is a decreasing

function of the nominal interest rate:

q = P (ξ

C

t+1

= 1|ξ

C

t

= 0) = f (R

t

)

Intuitively, it is a function that generates zero probability of switching when the gross

nominal interest rate is higher than one, and it increases as R

t

approaches the value of 1.

The probability of leaving the crisis regime, r, is a function of a shadow interest rate R

S

t

:

r = P (ξ

C

t+1

= 0|ξ

C

t

= 1) = g(R

S

t

)

The shadow interest rate represents the interest rate that would hold in the economy if

this were always in the monetary-led regime, without a lower bound restriction:

R

t

¯

R

ξ

P

t

= M

=

R

t−1

¯

R

ξ

P

t

= M

!

α

R

(

ξ

P

t

=M

)

"

π

t

π

∗

α

π

(

ξ

P

t

=M

)

y

t

y

∗

α

y

(

ξ

P

t

=M

)

#

1−α

R

(

ξ

P

t

=M

)

e

σ

M

(

ξ

P

t

=M

)

ϵ

M

t

(21)

This assumption reflects that the probability of leaving the ZLB regime is not independent of

the economic conditions. For instance, when output and(or) inflation recovers, the Shadow interest

rate increases, increasing the likelihood that the central bank would start raising interest rates.

Endogenous transition probabilities to and out of the ZLB matter for agents’ expectations.

Contrary to an entirely exogenous transition matrix model, agents know the likelihood of tightening

monetary policy increases with output and inflation, even at the ZLB.

25

4 Functional forms, calibration and solution

4.1 Functional forms

In this section, I present the functional forms assumed in the numerical exercise. I assume the

following CRRA utility function for households, which depends positively on consumption and

deposits and negatively on labor.

U(c

t

, d

H

t

, n

t

) =

h

c

1−φ

t

d

H

t

φ

i

1−σ

1 − σ

− ψ

n

η

t

η

Where d

H

t

=

D

H

t

P

t

are deposits deflated by the price level.

The portfolio adjustment cost for long-term bonds is quadratic:

Φ

L

b

L,H

t

=

ϕ

L

2

b

L,H

t

b

L,H

!

2

where b

L,H

t

=

B

L,H

t

P

t

, and b

L,H

is the steady state value of public long-term bonds held by

households.

The convex cost of issuing equity is the following:

Φ

A

(A

t

) =

χ

2

A

2

t

P

t

Finally, the endogenous transition probabilities to and out of the ZLB regime are assumed to

follow a logistic distribution as in Benigno et al. (2020), and Bocola (2016). As in their models, the

economy’s transition between regimes is a logistic function of a subset of the model’s endogenous

variables. In this case, they are given by the following expressions:

q = P (ξ

C

t+1

= 1|ξ

C

t

= 0) =

exp {−γ

q

(R

t

− 1)}

1 + exp {−γ

q

(R

t

− 1)}

where γ

q

> 0 is a constant. And,

r = P(ξ

C

t+1

= 0|ξ

C

t

= 1) =

exp

−γ

r

R

S

t

− 1

1 + exp

−γ

r

R

S

t

− 1

with γ

r

< 0.

26

4.2 Calibration

I work with quarterly data for the US. In this section, I present the calibration. In table 1, I present

the calibration of structural parameters with their source or target. Some parameters have direct

counterparts in the data. For instance,

¯

R, the average gross short-term nominal interest rate is set

equal to 1.011, as in quarterly data for the period 1980-2020.

18

The average of long-term public

bonds purchased by the central bank, b

L,CB

∗

is set to 0.014 to match the average 7% annual ratio

of Federal Reserve total treasuries to output ratio, in market value terms, for the period 1980-2020.

Finally, the parameter that characterizes the collateral ratio in the financial intermediaries’ leverage

constraint, ζ, is set to 0.97 as in the Basel regulation.

19

Some parameters are taken from the literature. For instance, the risk aversion parameter σ is

set to 2, as is standard in the literature. The inverse of Frisch elasticity η, is set to 3 as in Leeper

et al. (2021), ¯µ, that is the proportion of long-term bonds in book values issued by the treasury,

is 0.67 as in Elenev et al. (2021) and θ, that is 0.27 as in Bianchi and Melosi (2017). The convex

cost of issuing equity for financial intermediaries, χ is 22 as in Elenev et al. (2021). The coupon

payment of long-term bonds, κ, that includes the interest and the matured part fraction of bonds

is normalized to 1.

Other parameters are calibrated to match first-order moments in the data. β takes the value

0.996 to match the average return of a real risk-free asset from Jordà et al. (2017). δ is set to 0.0357

to roughly match the average maturity of public bonds with a maturity longer than one year, seven

years. The parameter that characterizes the quadratic portfolio adjustment cost of long-term bonds,

ϕ

L

is calibrated to 0.0039 to match the average spread between long and short-term bonds of 0.32%

in the period 1980Q1-2020Q1 at the steady state.

20

18

Notice that, in the data, this value corresponds to the average quarterly nominal interest rate, including

periods where the interest rate was at the effective lower bound.

19

In the data, the balance sheet of financial intermediaries includes a broader set of assets that can be

used as collateral, than the ones included in the model (T-bills and central bank reserves). This assumption,

although restrictive since it introduces a tight relationship between deposits and reserves, is maintained for

simplicity.

20

This spread in the model is the difference between the return on the long-term bond R

L

=

κ+(1−δ)Q

L

Q

L

and the short-term interest rate .

27

Description Value Source or target

σ Risk aversion 2 Standard

η Inverse Frisch elasticity 3 Leeper et al. (2021)

κ Coupon Payment 1 Normalization

χ Equity cost 22 Elenev et al (2021)

θ Government spending 0.27 Bianchi and Melosi (2017)

ζ Leverage constraint FI 0.97 Basel regulation

ψ Preference parameter 1.339 Normalization labor

β Discount factor 0.996 Av. Inflation rate

R

∗

Average interest rate 1.011 Av. E. Fed Funds

¯µ Proportion of long-debt 0.67 Elenev et al. (2021)

δ Maturity parameter 0.0357 Maturity long bonds (7 years)

ϕ

L

Portfolio adjustment cost 0.004 10-year yield

φ Preference parameter 0.0023 Debt/GDP

b

4y

= 68%

τ

I

Dividends distribution 0.84 Spread T-bill to deposits

ϕ

P

Prices adjustment cost 150 Inflation volatility

ϵ Elasticity of subst. varieties 7 Markup 17%

b

L,CB

∗

Average CB Balance sheet 0.0140

Q

L

b

LC,B

∗

4y

= 7%

Table 1: Calibration: model parameters

The preference parameter φ is set to 0.0023 to generate a simulated mean of annualized debt

to GDP ratio as in the average data before the COVID-19 crisis, around 70% until 2020Q1. The

fraction of financial intermediaries’ wealth paid to households as dividends is calibrated to 0.84 to

match the average spread between short-term interest rate and deposits of 0.31% from Drechsler

et al. (2017)

21

. The elasticity of substitution between varieties ϵ is set to 7, generating an average

markup of 17%, and the parameter ϕ

P

that characterizes Rotemberg adjustment costs is set to 150

to roughly match the average inflation standard deviation during the period 1980-2020. Finally, the

preference parameter ψ is calibrated to normalize labor to one at the steady state.

Table 2 presents the calibration for persistence and standard deviation of the exogenous processes

in the model. They were jointly calibrated to match some second-order moments in the data for

the period 1980-2020. The comparison between moments in the data with the simulated moments

is presented in the following section.

21

The model does not prevent the net return on deposits to be negative at the zero lower bound regime.

This could be motivated by the data, with the fact that during this period, although banks did not charge

fees on deposits, some of them increased their account maintenance charges to customers.

28

Parameter Description Value

ρ

QE

Persistence QE 0.9

ρ

ν

Persistence preference 0.89

ρ

z

Persistence TFP 0.92

ρ

G

Persistence gov. spending 0.96

σ

QE

Dispersion QE 0.0025

σ

ν

Dispersion preference 0.008

σ

z

Dispersion TFP 0.0021

σ

G

Dispersion gov. spending 0.0026

Table 2: Calibration: exogenous processes

Table 3 presents the regime-switching parameters correspondent to the fiscal and monetary

policy rules from section 3.7. The first set of parameters corresponds to the Taylor rule 20, and

the correspondent parameters at each regime. The second set corresponds to the parameter values

for the Shadow interest rate 21. Parameters in the Shadow interest rate are equal to the Taylor

rule’s parameters at the monetary regime, and they are not regime-dependent. They were included

in the table for completeness. The third set of parameters in this table corresponds to the fiscal

rule 19. The parameters in this table, with the exception of mean interest rates in all regimes,

come from Bianchi and Melosi (2017). Since a parameter estimation goes beyond the scope of this

paper, I take the parameters correspondent to conventional fiscal and monetary policy rules from

this article that presents the same regimes and performs a Bayesian Estimation of the correspondent

parameters using data for the US until the Great Recession. The average interest rate out of the

ZLB is

¯

R, explained in table 1. At the zero lower bound, I set the average interest rate to 1.0005,

as the average quarterly Effective federal funds rate observed in the period: 2008Q4-2017Q1 and

2020Q1-2022Q1.

29

Description MD FD ZLB

α

R

Taylor rule 0.86 0.67 0.2

α

π

Taylor rule 1.6 0.64 0

α

y

Taylor rule 0.51 0.27 0

σ

M

Taylor rule 0.25/100 0.25/100 0.25/1000

R Taylor rule R

∗

R

∗

1.0005

α

R,s

Shadow R - - 0.86

α

π,s

Shadow R - - 1.6

α

y

Shadow R - - 0.9

σ

M,s

Shadow R - - 0.0025

R

S

Shadow R R

∗

R

∗

R

∗

γ Fiscal rule 0.0712 0 0

α

τ

Fiscal rule 0.96 0.69 0.69

Table 3: Calibration: regime-dependent policy parameters .

Table 4 presents parameters relative to transition probabilities between regimes. Exogenous

parameters from matrix P, p

mm

and p

ff

come from Bianchi and Melosi (2022). The probability of

exiting the ZLB towards a monetary-led regime, p

zm

, is set to 0.7031, and it comes from Bianchi

and Melosi (2022). In this paper, the authors show that this probability significantly decreased after

the COVID-19 crisis. Since this paper aims to study the exit strategies from the crisis and policies

applied during that period, I considered the latest value of this estimated probability. However, the

results do not significantly differ in a model with lower p

zm

.

Parameters γ

r

and γ

q

give the steepness of the logistic function. They were calibrated to obtain

a similar ergodic probability of the ZLB regime as in Bianchi and Melosi (2022) and to minimize

the cases in which the economy is at this regime with a gross interest rate below one.

Parameter Value Source or target

p

mm

0.9923 Bianchi and Melosi (2022)

p

ff

0.9923 Bianchi and Melosi (2022)

p

zm

0.7031 Bianchi and Melosi (2022)

γ

q

500 Average prob. of ZLB regime

γ

r

-200 Average prob. of ZLB regime

Table 4: Calibration: transition probabilities

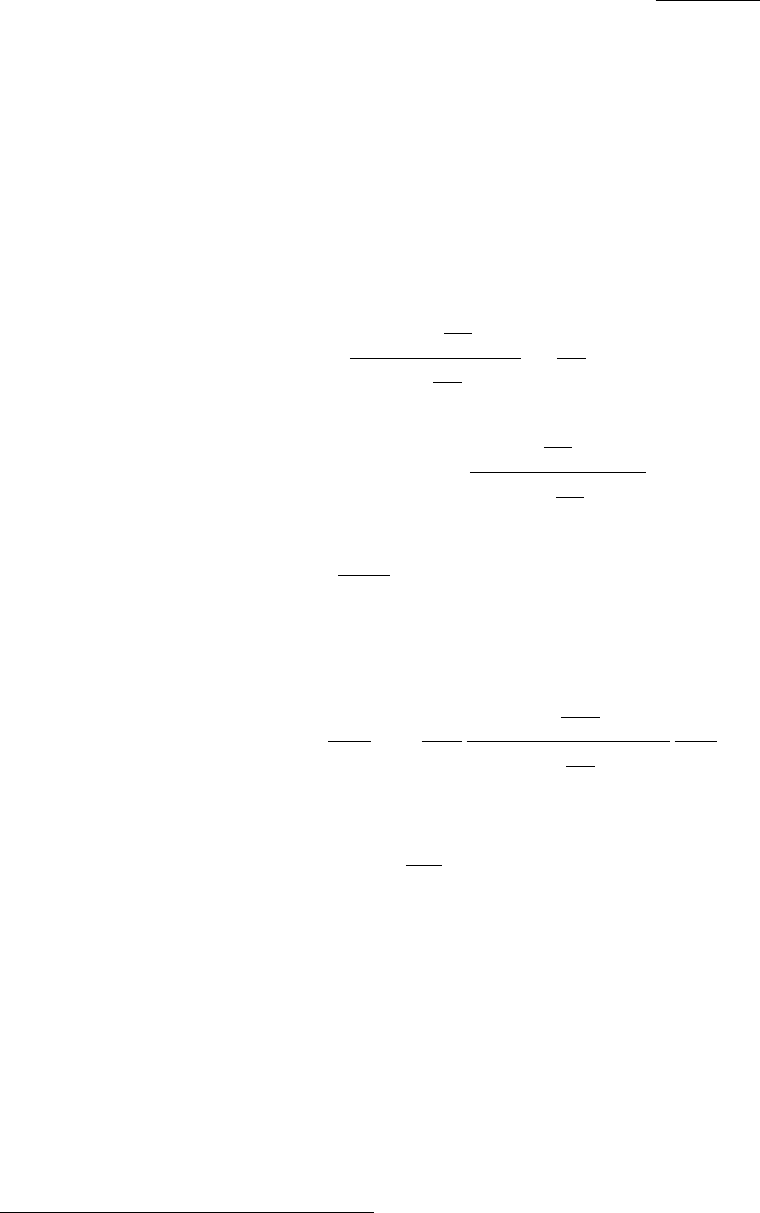

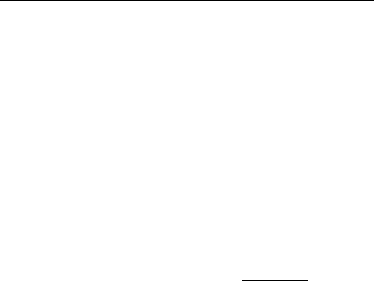

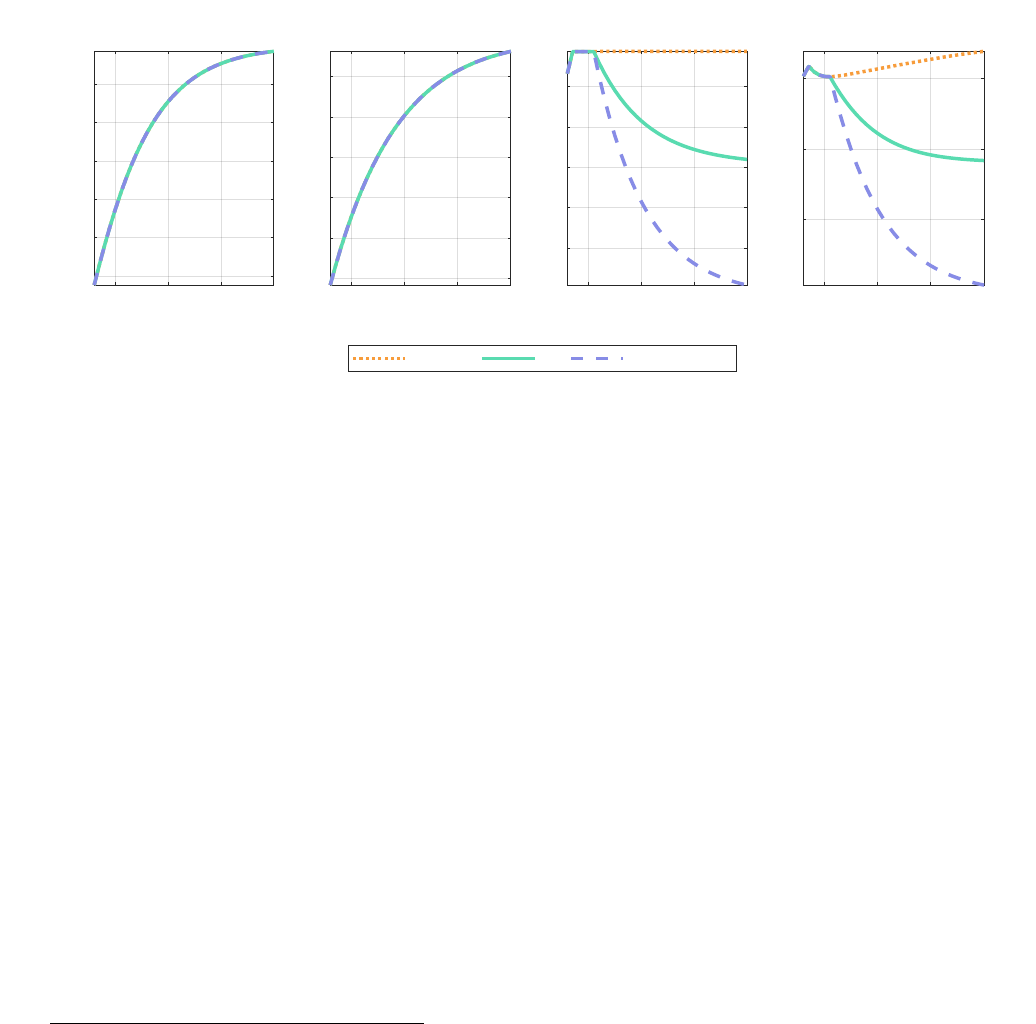

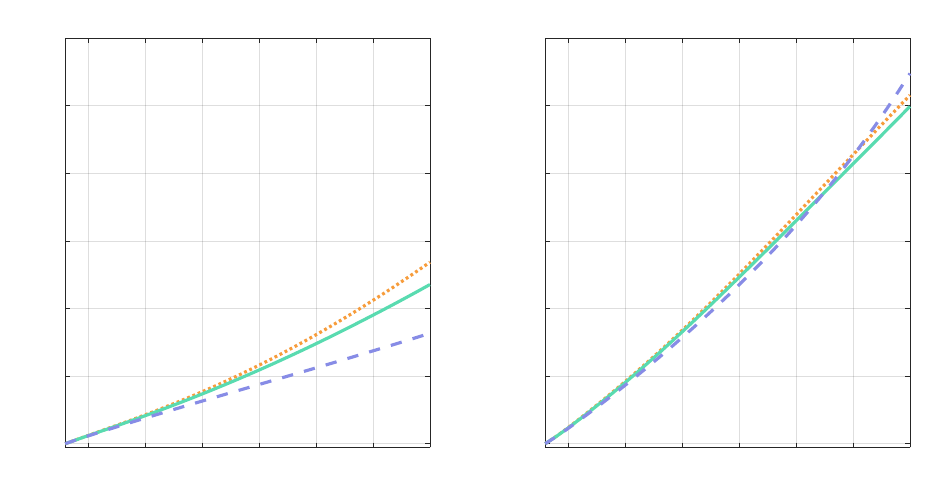

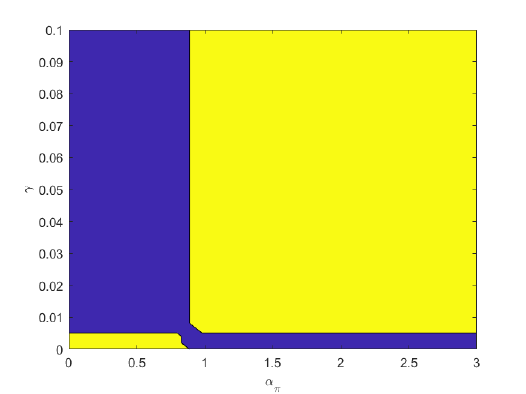

Figure 4 shows the corresponding probabilities for values of the nominal interest rate (left) or

shadow interest rate (right) between 0.95 and 1.02. A positive value for γ

q

generates a higher

probability of entering the ZLB when the interest rate is below one and lower when it is above one.

30

Notice that for this calibration, the probability of entering this regime when R is 0.987 or lower is

one.

0.96 0.98 1 1.02

R

0.1

0.2

0.3

0.4

0.5

0.6

0.7

0.8

0.9

q=P(

t+1

C

=1|

t

C

=0)

0.96 0.98 1 1.02

R

S

0.1

0.2

0.3

0.4

0.5

0.6

0.7

0.8

0.9

r=P(

t+1

C

=0|

t

C

=1)

Figure 4: Endogenous transition probabilities to and out the zero lower bound.

For the probability of exiting the zero lower bound, the parameter γ

r

is negative, generating a

monotone increasing probability of leaving the crisis regime when the Shadow interest rate is higher.

4.3 Solution method

I solve the model in real terms through second-order perturbation methods for endogenous Markov

Switching DSGE models, following Benigno et al. (2020). In the solution, I assume the leverage

constraint for financial intermediaries is binding in all regimes. The approximation point for the

solution method consists of a weighted average of steady states in different regimes, as authors in

Benigno et al. (2020) explain. The weights are the ergodic means of corresponding regimes. In

appendix 9.4, I present the steady state equations and describe the approximation point.

31

5 Quantitative Results

5.1 Second order moments

In this section, I present some second-order moments for selected variables to evaluate how the model

performs in terms of generated volatility and cyclical properties. Data variables were demeaned to

make them comparable with their model counterpart, where there is no growth. Empirical moments

were calculated using quarterly data for the period 1980Q2-2020Q1. NIPA variables are real and per

capita. Debt, inflation, and interest rate are annualized, both in the model simulations and in the

data. Data moments were calculated from a simulation of one million periods, and they correspond

to the averages of the three regimes.

The following table compares the standard deviation (in %) and correlation with output growth.

Output and public debt are logarithmic differences.

∆GDP ∆ public debt Bal. Sheet Inflation Spread

Standard deviation (in %)

Data 0.8 1.7 3.7 2.8 1.6

Model 0.7 1.5 3.1 2.4 1.5

Correlation with ∆GDP

Data - -0.33 0.71 0.44 -0.11

Model - -0.27 0.22 0.25 -0.04

Selected second-order moments in data and model

Note: Growth rates for output and debt. Inflation is gross and annualized. The term spread is

the annualized difference between the 10-year treasury yield and the federal funds rate. Model

moments were obtained from a simulation with one million periods.

As can be seen from the table, the model generates the correct ranking in volatilities and

standard deviations similar to the ones in the data for the main endogenous variables. In terms

of cyclical properties, the model generates the correct sign in correlation with output for all the

variables in the table and close magnitudes to the empirical ones.

5.2 Conditional second order moments at different regimes

Table 5 show means and volatility measures for debt to GDP ratio, inflation, nominal short-term

interest rate (R

t

) and nominal return on long-term bonds (R

t

), conditional on regimes. They reflect

32

features typically highlighted by the literature that studies fiscal-monetary policy mix.

22

The fiscal

regime is characterized by higher debt to GDP ratio, interest rates, and more volatile inflation and

interest rate. Real debt to GDP, on the contrary, is more volatile in the monetary-led regime. The

ZLB is characterized by a very stable short-term interest rate close to one and almost nil inflation

but quite volatile (standard deviation 2.7%).

M F ZLB

Mean Std(%) Mean Std(%) Mean Std(%)

Debt to GDP 72% 7.0 80% 3.8 74% 5.9

Inflation 1.02 1.7 1.02 3.8 1.01 2.7

Interest rate (R) 1.03 1.5 1.04 2.5 1.00 0.2

Long-run return (R

L

) 1.04 1.5 1.05 3.1 1.02 1.8

Table 5: Data moments conditional on regimes

Note: Data generated moments, from a sample of one million periods. The model is simulated

for a long sample where the regime is stochastic. Moments at each regime are obtained condi-

tioning the economy being on the corresponding regime at a given period. Debt to GDP is

b

4y

,

inflation, and returns are annualized since the model is solved quarterly.

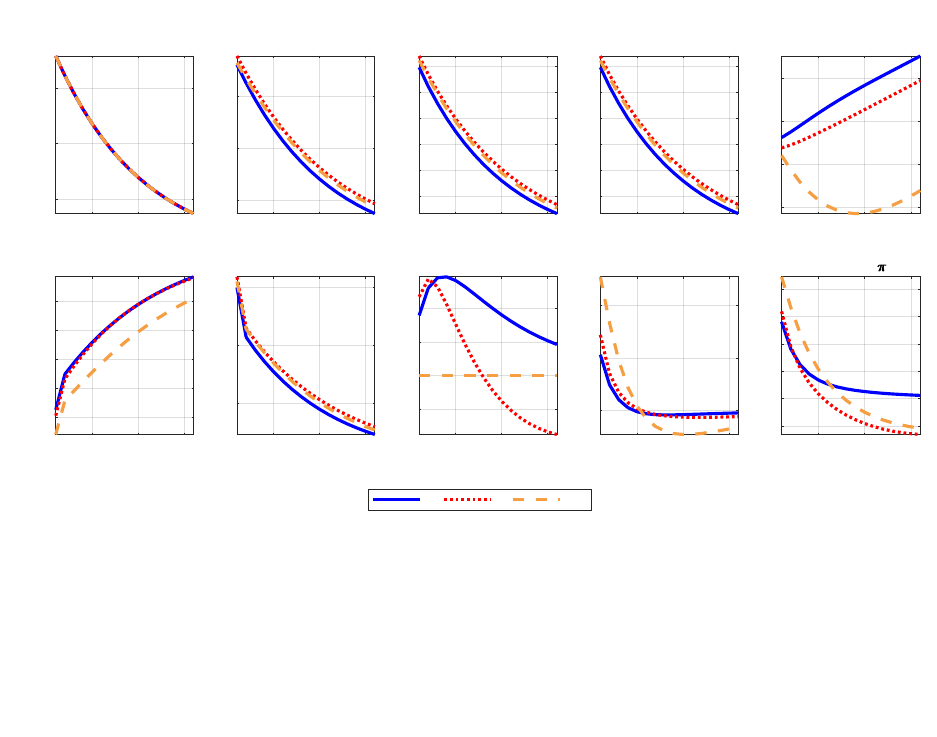

6 The transmission mechanism of Quantitative Easing

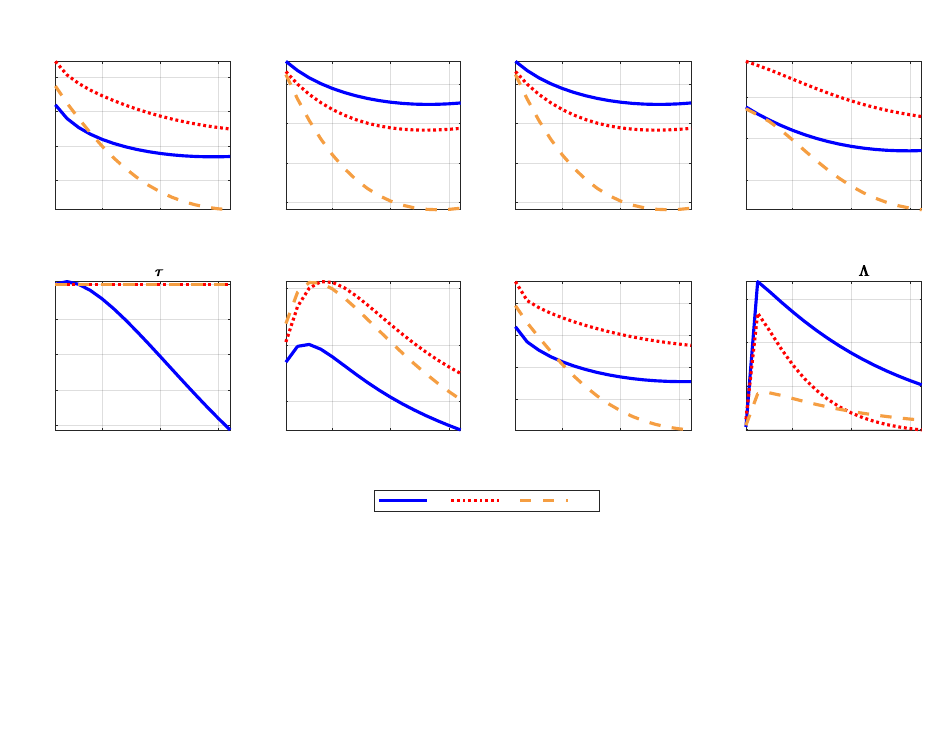

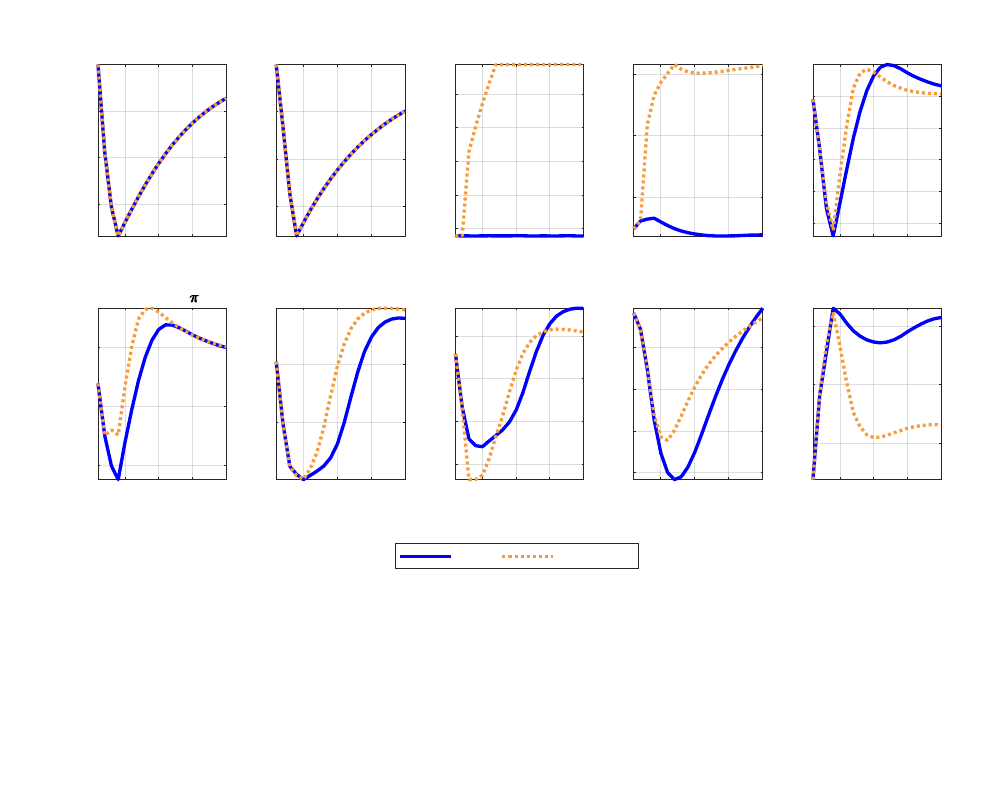

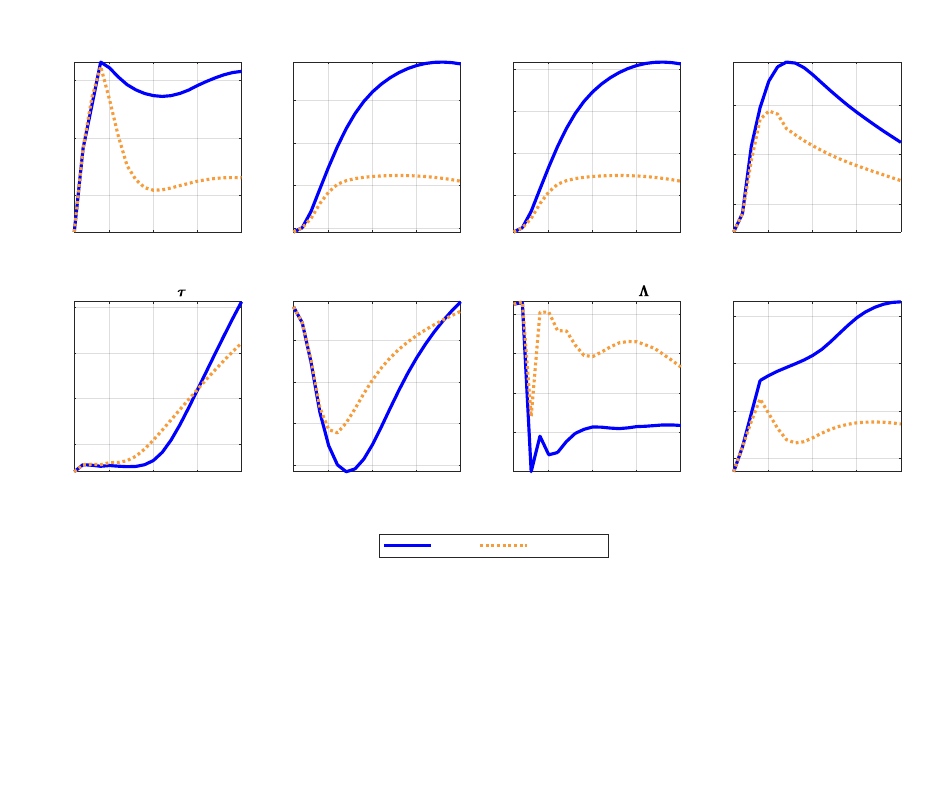

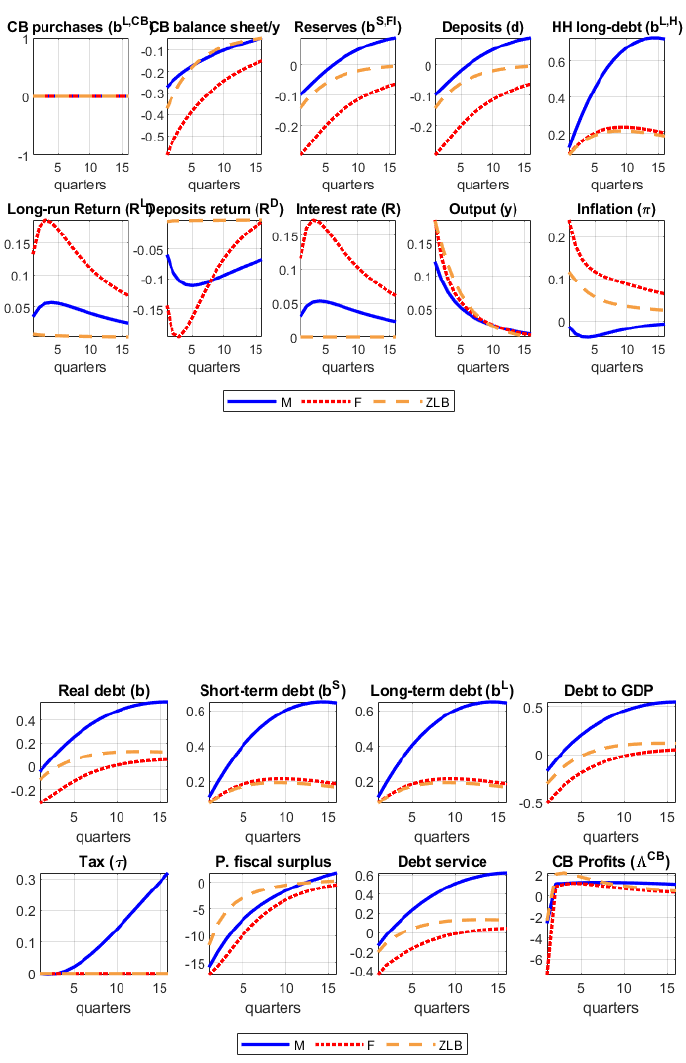

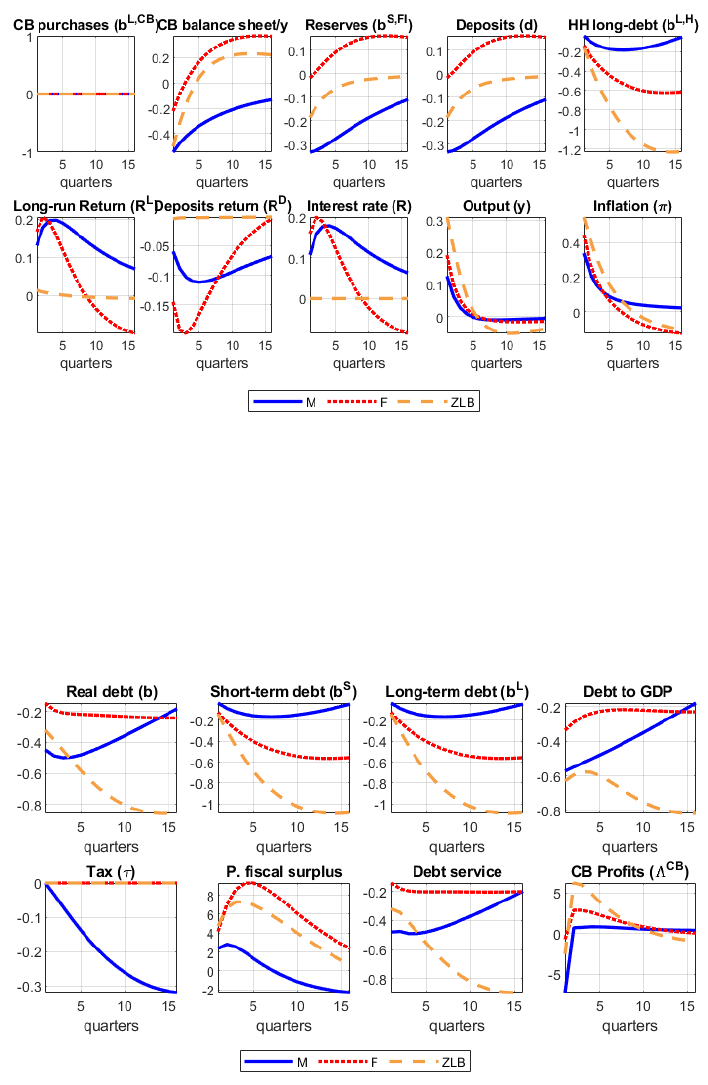

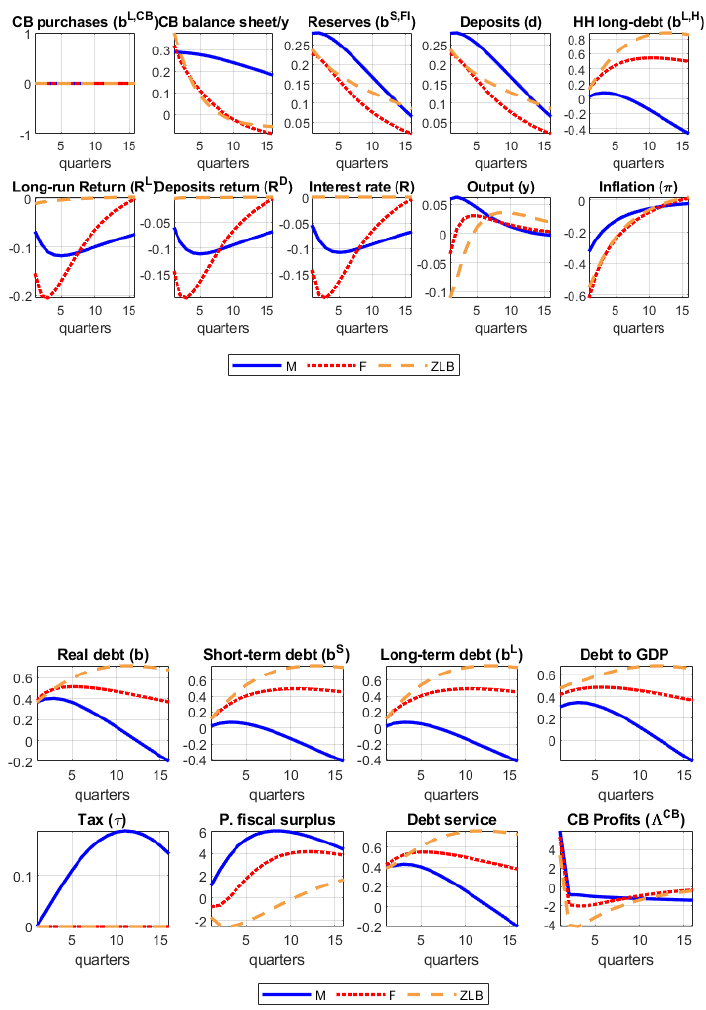

This section sheds light on the model’s transmission mechanism of an increase in central bank bond

purchases, b

L,CB

t

, given by an exogenous shock ϵ

QE

t

, following 18. I show the log deviations (in

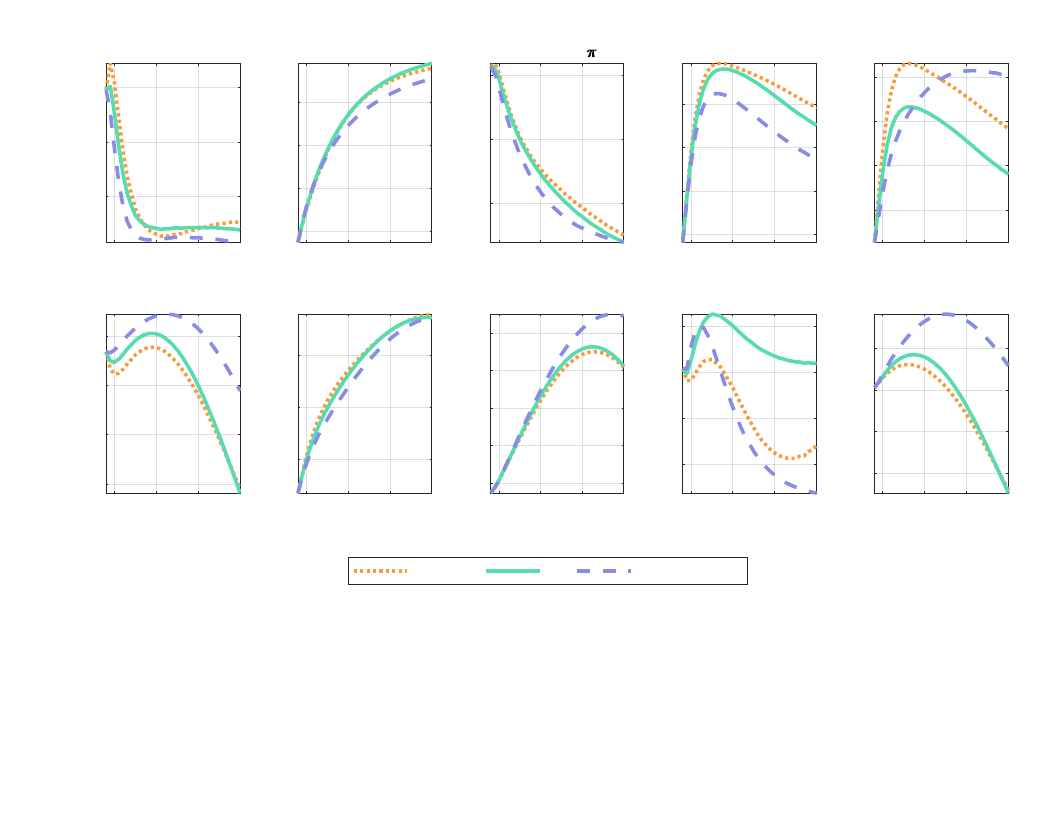

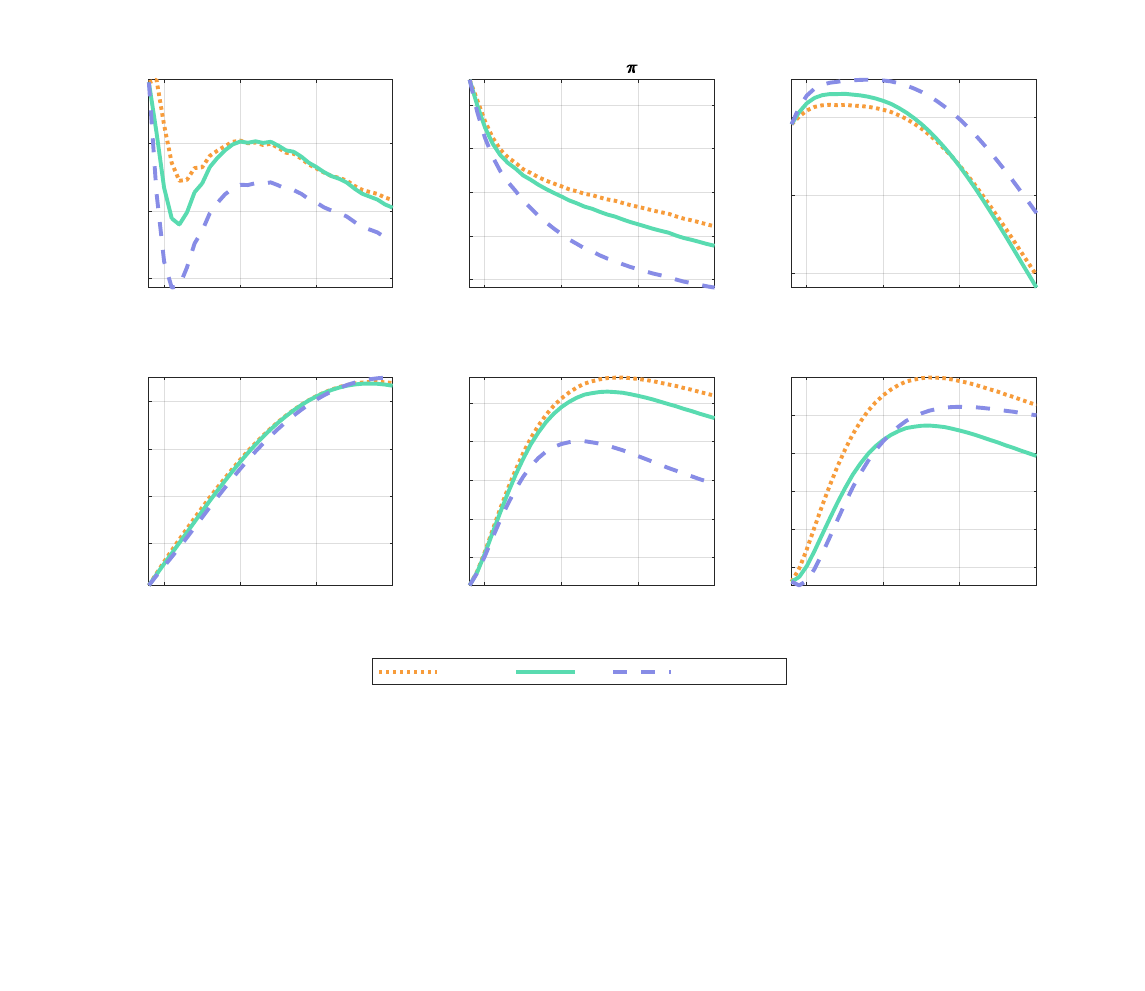

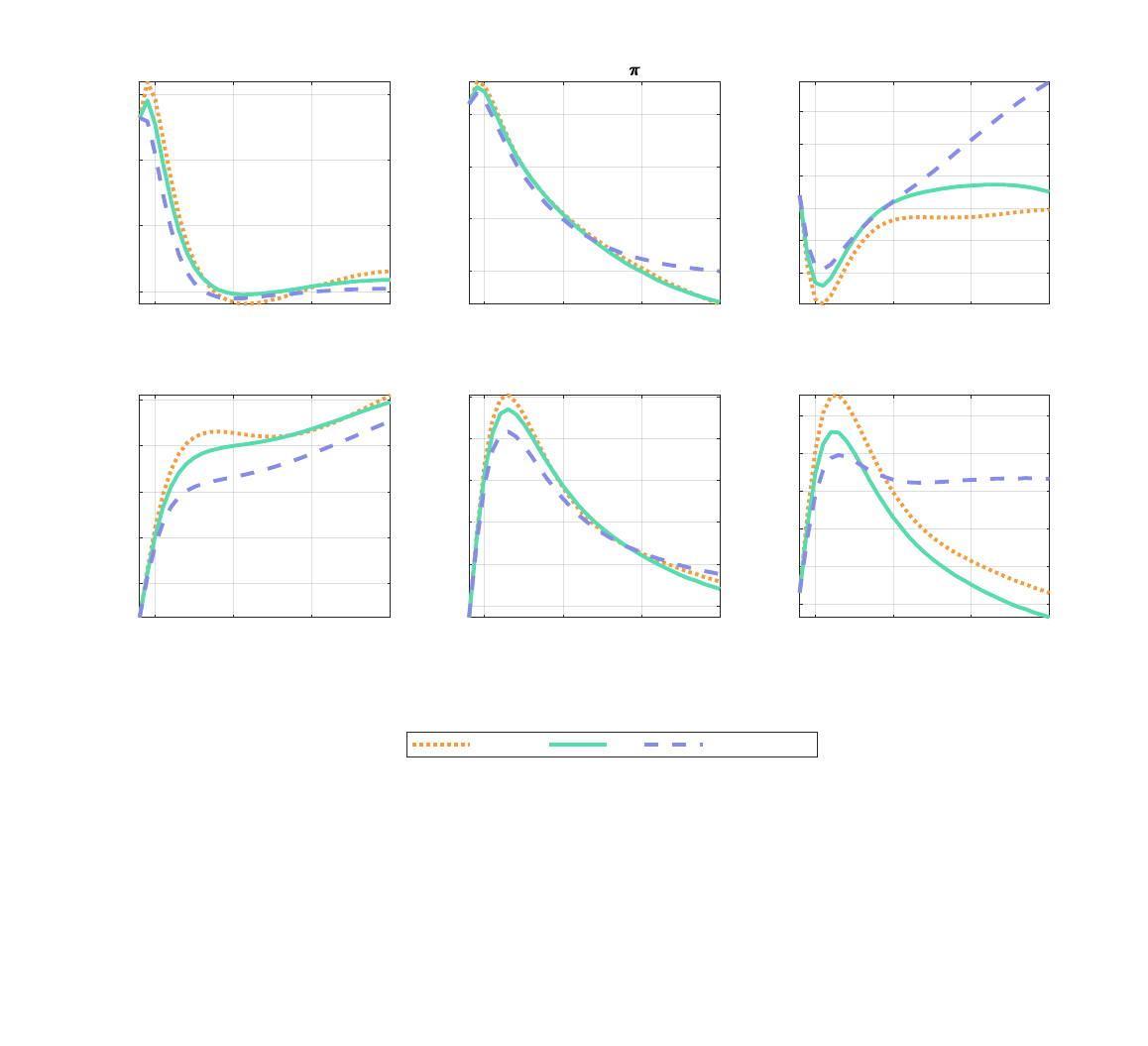

%) of a simulated path for endogenous variables when there is a one standard deviation shock in

the central bank purchases of long-term bonds to a counterfactual without the shock. This shock

implies increasing the real balance sheet to GDP ratio by 1.3p.p., i.e., rising from its steady state

of 7% to 8.3%, a conservative shock. I consider three different scenarios, where the economy is at a

given regime and remains at the same regime for 16 quarters in both paths (with and without the

shock). Even though there is no regime change in the simulation exercise, agents in the economy

expect the economy to evolve according to the transition matrix 3.8.

22

See, for instance Bianchi et al. (2020), where the authors estimate a Markov-Switching VAR with three

regimes for the period 1960-2014.

33