CBO

A

S T U D Y

The Economics of Climate Change:

A Primer

April 2003

The Congress of the United States

# Congressional Budget Office

Note

Cover photo courtesy of the National Aeronautics and Space Administration.

Preface

A scientific consensus is emerging that rising atmospheric concentrations of greenhouse

gases are gradually changing the Earth’s climate, although the magnitude, timing, and effects

of the alteration remain very uncertain. The prospect of longterm climate change raises a variety

of domestic and international economic policy issues on which there is little accord. Considerable

disagreement exists about whether to control greenhouse gas emissions, and if so, how and by

how much; and whether to coordinate climaterelated polices at the international level, and if

so, through what mechanisms.

This Congressional Budget Office (CBO) study—prepared at the request of the Ranking Member

of the House Committee on Science—presents an overview of issues related to climate change,

focusing primarily on its economic aspects. The study draws from numerous published sources

to summarize the current state of climate science and provide a conceptual framework for

addressing climate change as an economic problem. It also examines public policy options and

discusses the potential complications and benefits of international coordination. In keeping with

CBO’s mandate to provide impartial analysis, the study makes no recommendations.

Robert Shackleton of CBO’s Macroeconomic Analysis Division wrote the study. CBO staff

members Robert Dennis, Terry Dinan, Douglas Hamilton, Roger Hitchner, Arlene Holen, Kim

Kowalewski, Mark Lasky, Deborah Lucas, David Moore, John Sturrock, Natalie Tawil, and

Thomas Woodward provided valuable comments and assistance, as did Henry Jacoby of the

Massachusetts Institute of Technology and Thomas Schelling of the University of Maryland at

College Park. The comments of Chris Webster and John Reilly of the Massachusetts Institute

of Technology and Mort Webster of the University of North Carolina at Chapel Hill were

particularly helpful in developing the discussion of uncertainty.

Leah Mazade edited the study, and Christine Bogusz proofread it. Kathryn Winstead prepared

the study for publication, and Annette Kalicki produced the electronic versions for CBO’s Web

site.

Douglas HoltzEakin

Director

April 2003

This study and other CBO publications

are available at CBO's Web site:

www.cbo.gov

1

2

3

4

CONTENTS

Summary and Introduction 1

Common Resources: Addressing a Market Failure 1

Balancing Competing Uses 2

Policy Options 3

International Coordination 3

The Scientific and Historical Context 5

The Greenhouse Effect, the Carbon Cycle,

and the Global Climate 5

Historical Emissions and Climate Change 9

What the Future May Hold 15

Potential Responses 19

Types of Uncertainty 20

The Economics of Climate Change 23

Common Resources and Property Rights 23

Economic TradeOffs 25

Distributional Issues 33

Trade-Offs Among Policy Options 35

Taxes and Permits: Similarities and Differences 36

The Distributional Effects of Regulation 37

Alternative Uses of Revenues 39

Regulation and Innovation 41

Ancillary Benefits of Greenhouse Gas Restrictions 42

vi THE ECONOMICS OF CLIMATE CHANGE: A PRIMER

5

International Coordination of Climate Policy 43

International Policy Considerations 43

International Institutions to Address Climate Change 46

Actions by the United States 49

Alternative Approaches 49

Appendix

Economic Models and Climate Policy 53

References 57

CONTENTS vii

Figures

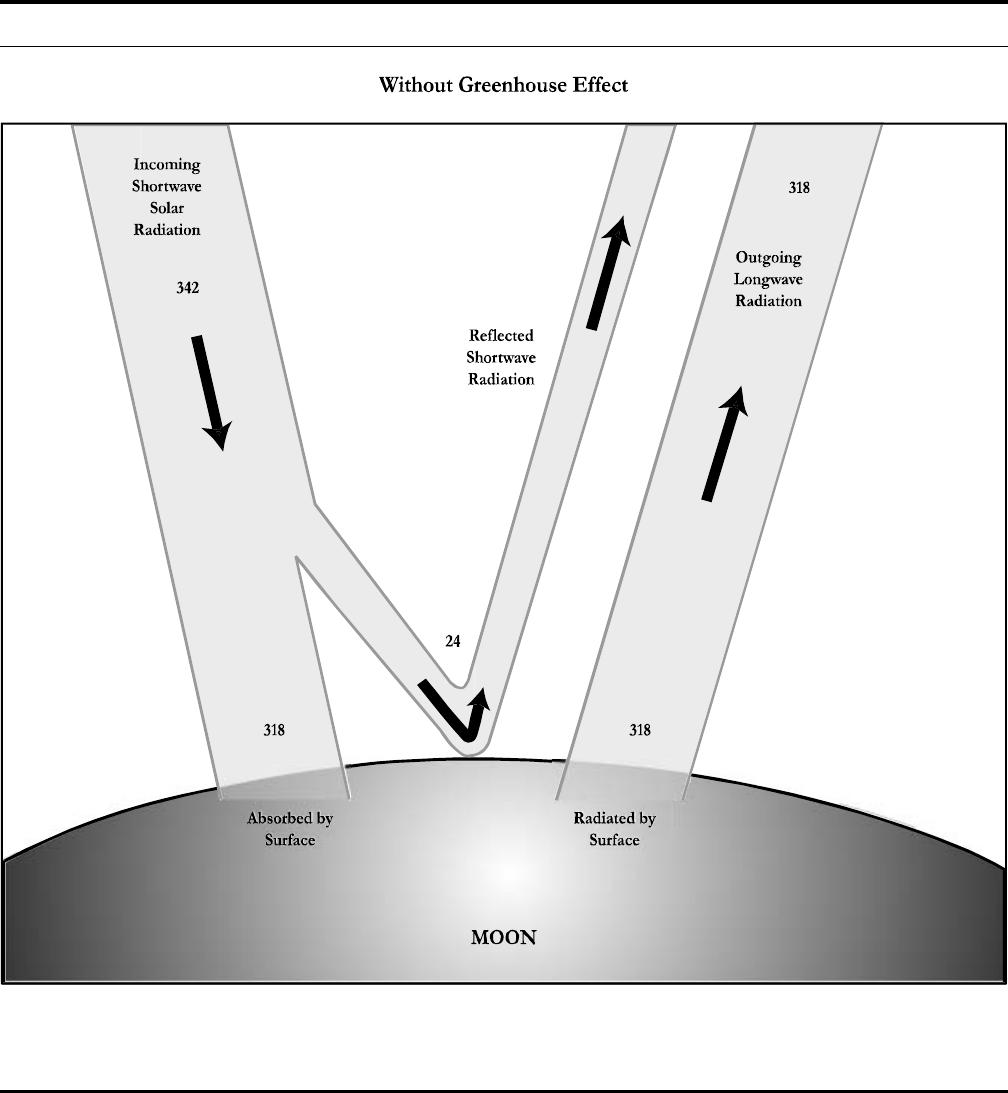

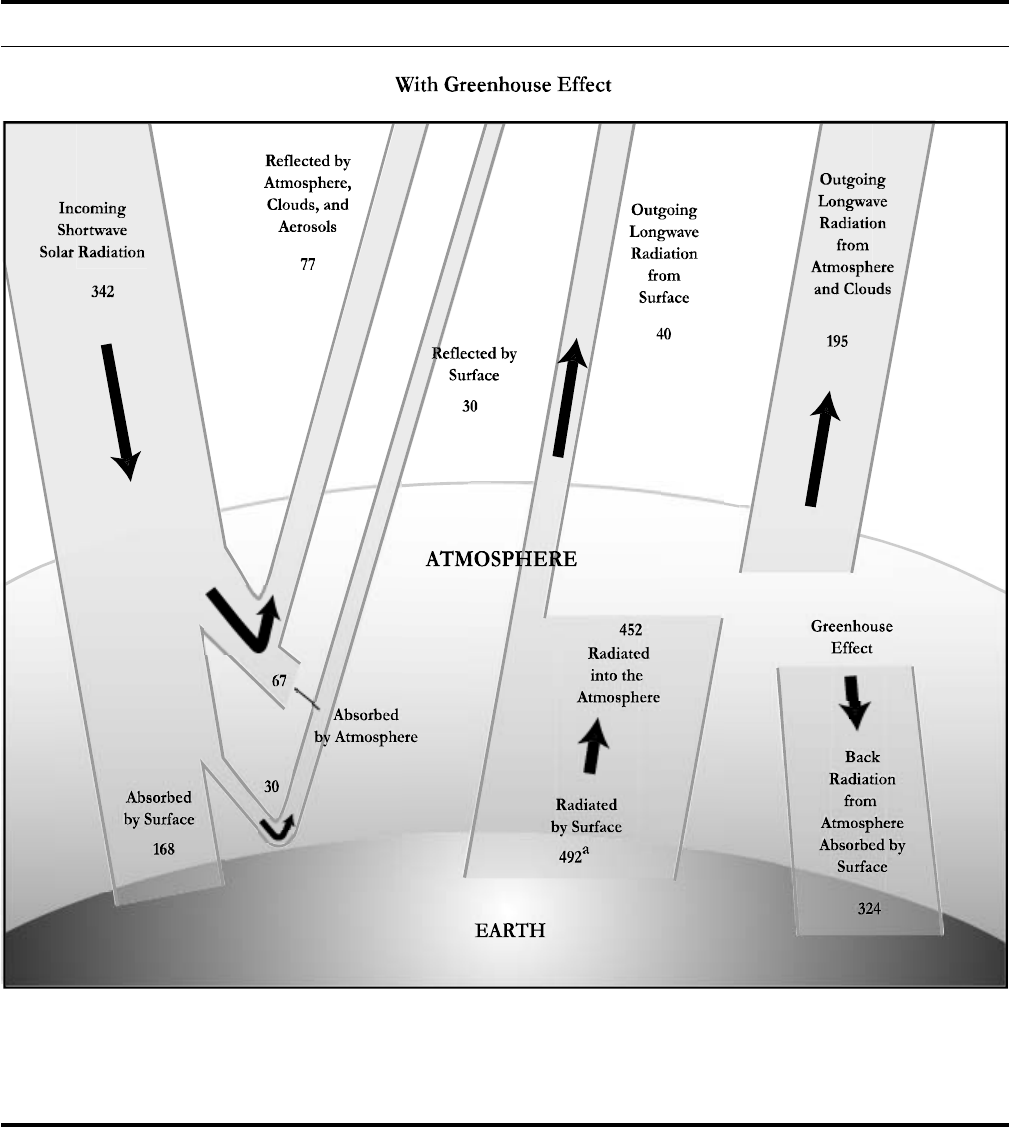

1. The Atmospheric Energy Budget and the Greenhouse Effect 6

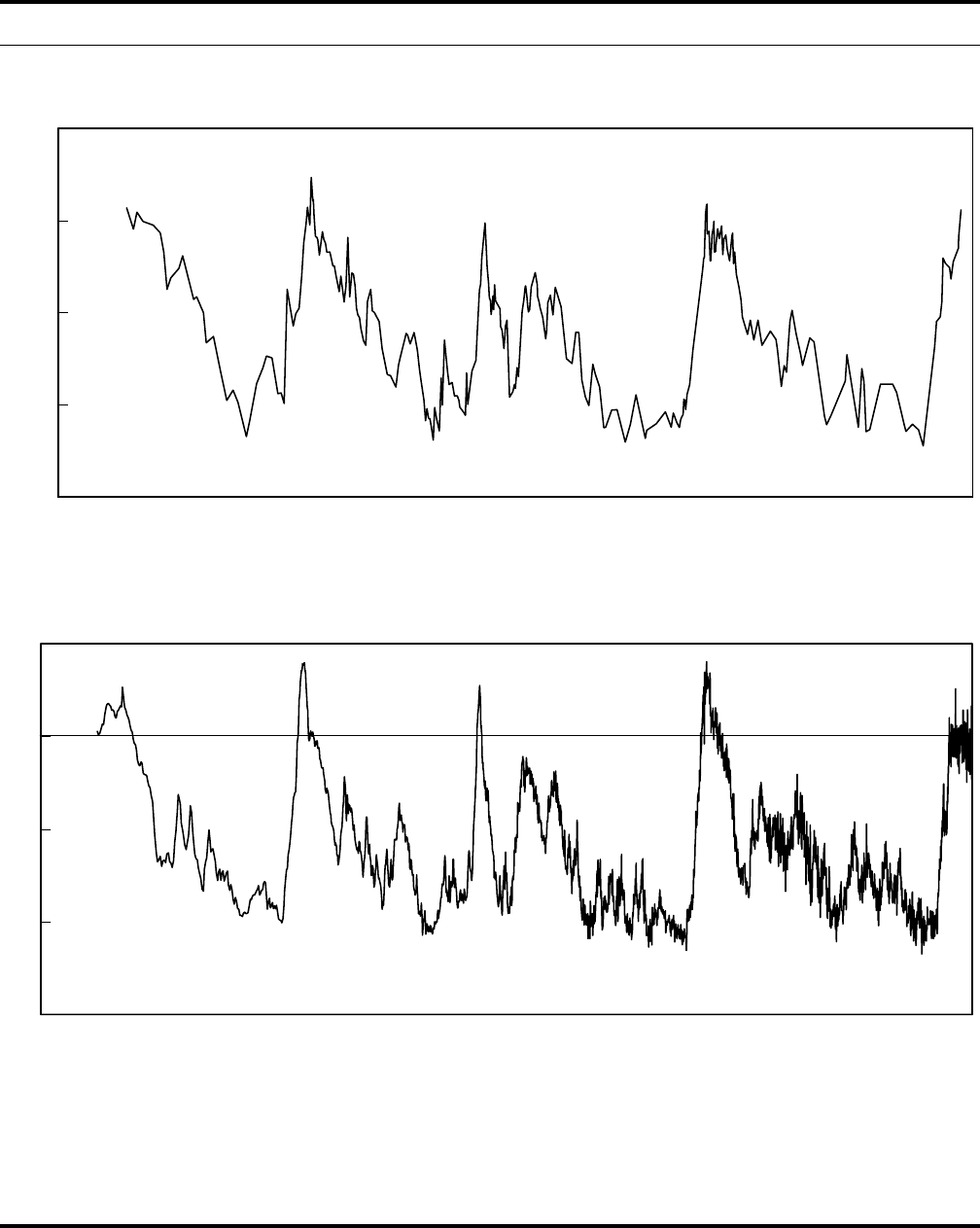

2. Carbon Dioxide and Temperature 8

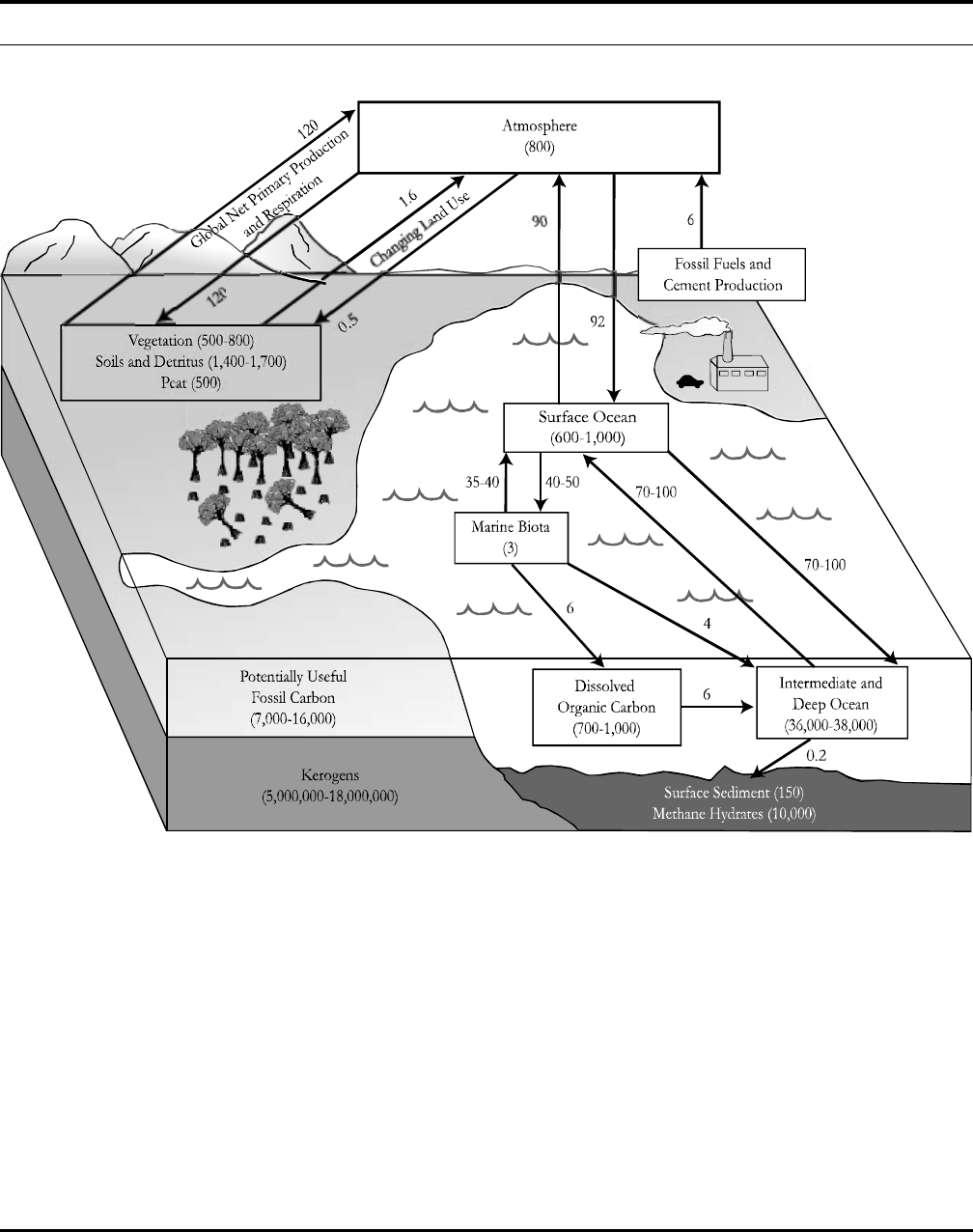

3. The Carbon Cycle 10

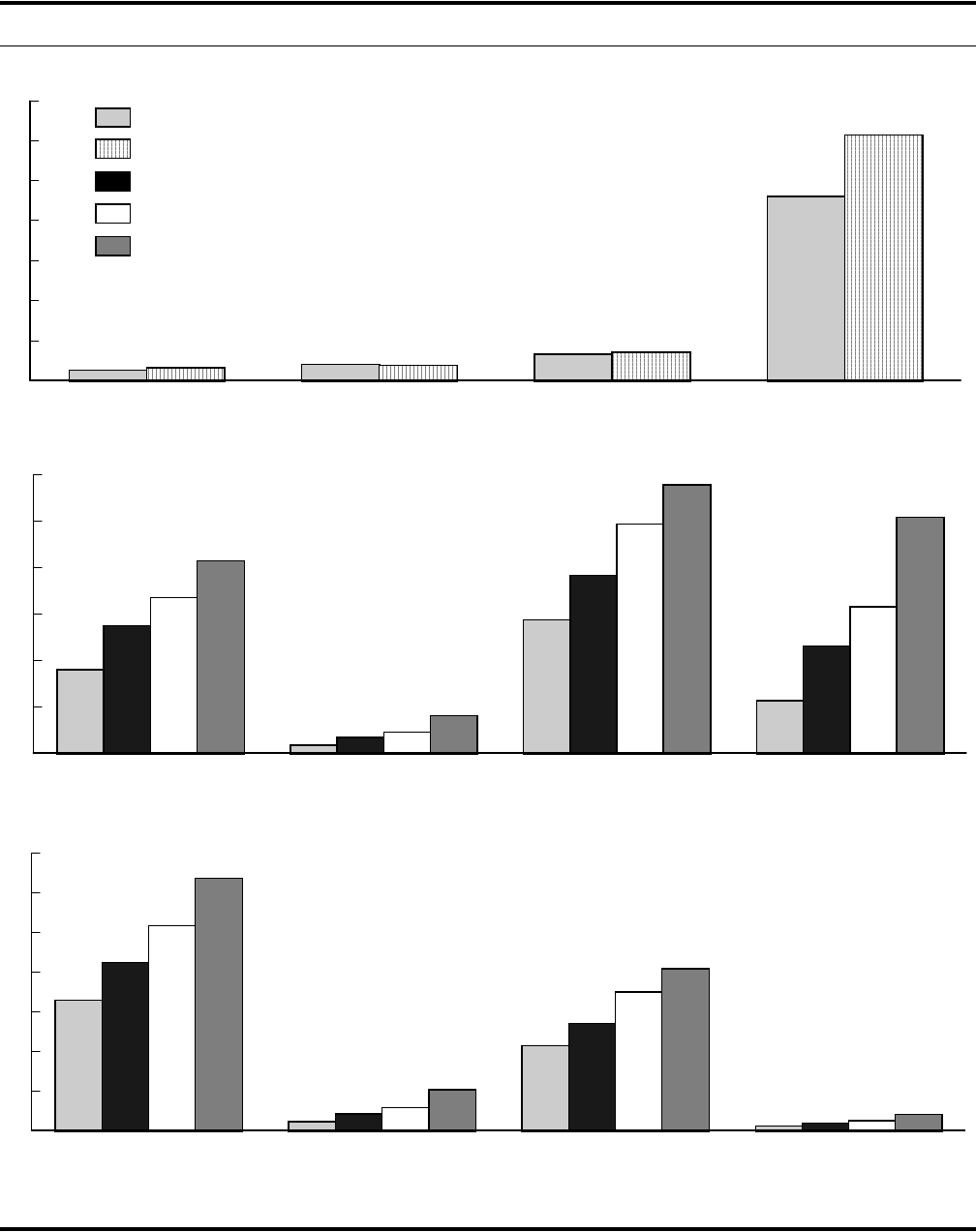

4. Uncertainty in Projections of Regional Population

and Economic Growth 13

5. Uncertainty in Projections of Regional Carbon Dioxide

Emissions and Emissions Intensity 14

6. Range of Uncertainty in Economic and Carbon Dioxide

Emissions Projections 16

7. Historical and Projected Climate Change 17

Boxes

1. Discounting and the Distant Future 28

2. An Example of Integrated Assessment 30

1

Summary and Introduction

Human activities—mainly deforestation and the

burning of fossil fuels—are releasing large quantities of

what are commonly known as greenhouse gases. The

accumulation of those gases is changing the composition

of the atmosphere and is probably contributing to a grad

ual warming of the Earth’s climate—the characteristic

weather conditions that prevail in various regions of the

world. Scientists generally agree that continued population

growth and economic development over the next century

will result in substantially more greenhouse gas emissions

and further warming unless measures are taken to con

strain those emissions.

Despite the general consensus that some amount of warm

ing is highly likely, extensive scientific and economic un

certainty makes predicting and evaluating its effects ex

tremely difficult. Because climate is generally a regional

phenomenon, the effects of warming would vary by re

gion. Moreover, some effects could be positive and some

negative. Some could be relatively minor and some severe

in their impact: warming could raise sea levels; expand

the potential range of tropical diseases; disrupt agriculture,

forestry, and natural ecosystems; and increase the vari

ability and extremes of regional weather. There is also

some possibility of unexpected, abrupt shifts in climate.

Actual outcomes will probably be somewhere in the mid

dle of the range of possibilities, but the longer that

emissions grow unchecked, the larger the effects are likely

to be.

A variety of technological options are available to restrain

the growth of emissions, including improvements in the

efficiency of people’s use of fossil energy, alternative energy

technologies such as nuclear or renewable power, methods

for removing greenhouse gases from smokestacks, and

approaches to sequestering gases in forests, soils, and

oceans. But those alternatives are likely to be costly, and

they are unlikely to be widely implemented unless mea

sures are taken to lower their price or to raise the price of

greenhouse gas emissions.

This Congressional Budget Office (CBO) study presents

an overview of the issue of climate change, focusing

primarily on its economic aspects. The study draws from

many published sources to summarize the current state

of climate science. It also provides a conceptual framework

for considering climate change as an economic problem,

examines public policies and the tradeoffs among them,

and discusses the potential complications and benefits of

international coordination.

Common Resources: Addressing

a Market Failure

The Earth’s atmosphere is a global, openaccess resource

that no one owns, that everyone depends on, and that

absorbs emissions from an enormous variety of natural

and human activities. As such, it is vulnerable to overuse,

and the climate is vulnerable to degradation—a problem

known as the tragedy of the commons. The atmosphere’s

global nature makes it very difficult for communities and

nations to agree on and enforce individual rights to and

responsibilities for its use.

With rights and responsibilities difficult to delineate and

agreements a challenge to reach, markets may not develop

to allocate atmospheric resources effectively. It may there

fore fall to governments to develop alternative policies for

CHAPTER

2 THE ECONOMICS OF CLIMATE CHANGE: A PRIMER

addressing the risks from climate change. And because

the causes and consequences of such change are global,

effective policies will probably require extensive coopera

tion among countries with very different circumstances

and interests.

However, governments may also fail to allocate resources

effectively, and international cooperation will be extremely

hard to achieve as well. Developed countries, which are

responsible for the overwhelming bulk of emissions, will

be reluctant to take on increasingly expensive unilateral

commitments while there are inexpensive opportunities

to constrain emissions in developing countries. But devel

oping nations, which are expected to be the chief source

of emissions growth in the future, will also be reluctant

to adopt policies that constrain emissions and thereby

limit their potential for economic growth—particularly

when they have contributed so little to the historical rise

in atmospheric greenhouse gas concentrations and may

suffer disproportionately more of the negative effects if

nothing is done.

Balancing Competing Uses

The atmosphere and climate are part of the stock of

natural resources available to people to satisfy their needs

and wants over time. From an economic point of view,

climate policy involves measuring and comparing the

values that people place on resources, across alternative

uses and at different points in time, and applying the

results to choose a course of action. An effective policy

would balance the benefits and costs of using the atmos

phere and distribute those benefits and costs among people

in an acceptable way.

Uncertainty about the scientific aspects of climate change

and about its potential effects complicates the challenge

of developing policy by making it difficult to estimate or

balance the costs of restricting greenhouse gas emissions

and the benefits of averting climate change. (Some of the

risks involved, moreover, may be effectively impossible

to evaluate or balance in pecuniary terms.) Nevertheless,

assessments of the potential costs and benefits of a warm

ing climate typically conclude that the continued growth

of emissions could ultimately cause extensive physical and

economic damage. Many studies indicate significant bene

fits from undertaking research to better understand the

processes and economic effects of climate change and to

discover and develop new and better technologies to re

duce or eliminate greenhouse gas emissions.

At the same time, such studies typically find relatively

small net benefits from acting to reduce greenhouse gas

emissions in the near term. In balancing alternative invest

ments, they conclude that if modest restrictions on emis

sions were implemented today, they would yield net bene

fits in the future; however, moreextensive restrictions

would crowd out other types of investment, reducing the

rate of economic growth and affecting current and future

generations’ material prosperity even more than the

averted change would. As income and wealth grow and

technology improves, the studies say, future generations

are likely to find it easier to adapt to the effects of a chang

ing climate and to gradually impose increasingly strict

restraints on emissions to avoid further alteration.

Those conclusions greatly depend, among other things,

on how one balances the welfare of current generations

against that of future generations. In assessments of costs

and benefits occurring at different points in time, that

process of weighting is typically achieved by using an

interest, or discount, rate to convert future values to pres

ent ones. But there is little agreement about how to dis

count costs and benefits over the long time horizons

involved in analyzing climate change.

Whatever weighting scheme is chosen, consistency calls

for applying it to all longterm investment alternatives.

For example, applying a lower discount rate to give more

weight to the welfare of future generations implies that

society should reduce its current consumption and increase

its overall rate of investment in productive physical and

human capital of all kinds—not only those involved in

ensuring a beneficial future climate.

Government polici es that deal w ith us e of the atm osphere

inevitably affect the distribution of resources. Inaction

benefits people who are alive today while potentially harm

ing future generations. Reducing emissions now may

benefit future generations while imposing costs on the

current population and may benefit countries at relatively

higher risk of adverse effects from warming while hurting

those that stand to gain from it. Restraints on emissions

would impose costs on nearly everyone in the global

CHAPTER ONE SUMMARY AND INTRODUCTION 3

economy, but they would affect energyproducing and

energyintensive industries, regions, and countries much

more than they would others. However, many studies of

the costs and benefits of climate change fail to highlight

the extent to which differences in geographic and eco

nomic circumstances complicate the balancing of interests.

Policy Options

Governments may respond to climate change by adopting

a “waitandsee” approach, by pursuing research programs

to improve scientific knowledge and develop technological

options, by regulating greenhouse gas emissions, or by

engaging in a combination of research and regulation. The

United States has invested in research and subsidized the

development of carbonremoval and alternative energy

technologies. Furthermore, some programs that were in

tended to achieve other goals, such as pollution reduction,

energy independence, and the limitation of soil erosion,

also discourage emissions or encourage the removal of

greenhouse gases from the atmosphere. However, other

programs have opposing effects.

Should a government decide to control emissions, it may

choose from a broad menu of regulatory approaches. One

option is direct controls, which set emissions standards

for equipment and processes, require households and busi

nesses to use specific types of equipment, or prohibit them

from using others. A government could also adopt more

indirect, incentivebased approaches, either singly or in

combination—for example, by restricting overall quanti

ties of emissions through a system of permits or by raising

the price of emissions through fees or taxes. Incentive

based approaches are generally more costeffective than

direct controls as a means of regulating greenhouse gas

emissions.

Uncertainty about the costs and benefits of regulation

affects the relative advantages of different incentivebased

approaches. Some research indicates that such uncertainty

gives a system of emissions pricing economic advantages

over a quota system that fixes the quantity of emissions.

Those advantages stem from two facts: both the costs and

benefits of reducing greenhouse gas emissions are uncer

tain; and the incremental costs—the additional costs of

reducing an additional ton of emissions—can be expected

to rise much faster than the incremental benefits fall.

Under those circumstances, the cost of guessing wrong

about the appropriate level of taxes—and, perhaps, of fail

ing to reduce emissions enough in any given year—is likely

to be fairly low. But the cost of miscalculating the appro

priate level of emissions—and perhaps imposing an overly

restrictive and hence expensive limit—could be quite high.

A system of emissions pricing has several other advantages

over one of emissions quotas. Pricing could raise signifi

cant revenues that could be used to finance cuts in distor

tionary taxes—such as those on income—that discourage

work and investment. Moreover, emissions pricing more

effectively encourages the development of technologies

that reduce or eliminate emissions than direct controls

or strict limits on emissions do.

Restricting greenhouse gas emissions would tend to reduce

emissions of some conventional pollutants as well, yielding

a variety of ancillary benefits, such as improvements in

health from betterquality air and water. Those additional

benefits would partly offset the costs of greenhouse gas

regulations, particularly in developing countries that have

significant problems with local pollution.

The distributional effects of emissions regulations would

depend on the type and stringency of the regulations and

could be very large relative to how much the policy im

proved people’s wellbeing. Those potential effects might

spur the affected parties to engage in rentseeking—vying

for regulatory provisions that would provide them with

tax exemptions, access to permits, and so on. An emissions

pricing system (based either on taxes or on auctioned per

mits) would benefit different groups in different ways,

depending on how the government returned the receipts

to the economy. Certain ways of using the revenues could

offset some—but probably not all—of the costs of regula

tion. (For example, if the government issued permits free

of charge, even permit recipients who were heavily regu

lated could benefit from the regulation.)

International Coordination

Because the causes and consequences of climate change

are global in nature, effective policies to deal with it will

probably require extensive international coordination

among countries with very different circumstances and

interests. Coordination may involve formal treaties or

4 THE ECONOMICS OF CLIMATE CHANGE: A PRIMER

nonbinding agreements and could range from modest

commitments to engage in research to moreextensive

programs to restrict emissions, monitor compliance, and

enforce penalties.

Effective international agreements typically involve

straightforward commitments and distribute costs in a

way that is acceptable to participating countries. Binding

commitments with explicit penalties may be more likely

than nonbinding ones to ensure compliance, but nonbind

ing agreements may also significantly affect a nation’s ac

tions. Many factors will influence the effectiveness of inter

national cooperation, particularly the size and distribution

of the costs and benefits of mitigating climate change and

the strength of conflicting interests. Successful cooperation

would entail frequent interaction among national repre

sentatives and link discussion of climate issues with that

of related problems.

An international system of emissions controls could draw

on the same set of options that domestic regulation em

ploys—direct controls, emissions taxes or permits, or a

hybrid system—or it could allow each country to choose

its own independent system. Much of the international

debate in recent years has focused on strictly limiting

emissions through national quotas, with or without the

international trading of emissions rights. However, quan

titative limits are likely to prove more costly than ap

proaches that affect emissions indirectly by raising their

price. And because there are lowcost opportunities to

reduce emissions throughout the world and because fossil

fuels can be transported relatively easily, a system that

raised the price of emissions everywhere would probably

be more costeffective than one that applied only to a

limited set of countries.

International cooperation on the issue of climate change

has been developing since the Intergovernmental Panel

on Climate Change was created in 1988. And nearly all

nations, including the United States, are signatories to the

United Nations Framework Convention on Climate

Change, which commits them to undertake research and

prevent dangerous changes in the Earth’s climate. In 1997,

negotiators signed the Kyoto Protocol (a draft treaty) to

the convention, under which developed countries agreed

to limit emissions while developing countries remained

exempt from restrictions. However, subsequent negotia

tions collapsed in 2000 over details of implementation,

and the United States withdrew from the talks in 2001.

Ironically, that withdrawal made some of the positions

that the United States had advocated much more attractive

to the remaining parties and helped them reach agreement

on nearly all outstanding implementation issues. The

European Union and Japan ratified the protocol in mid

2002; it will go into force if Russia follows suit.

The protocol’s implementation would establish a complex

set of emissions rights for a limited set of developed coun

tries for the period 2008 through 2012. It would also put

into place institutions to oversee international financial

transfers amounting to several billion dollars per year for

the purchase of emissions allowances, mainly among the

developed countries. However, the protocol would limit

participating countries’ overall emissions by only a small

amount and would have essentially no effect on the growth

of emissions in the United States and in developing coun

tries.

Analysts have proposed a variety of alternatives to the pro

visions of the Kyoto Protocol to try to improve the poten

tial effectiveness of international cooperation and broaden

its appeal. Each alternative simultaneously addresses the

problems of limiting emissions and distributing the bur

den of regulation, which remain the crucial sources of dis

agreement. Each option reflects a distinct interpretation

of the available evidence about the net benefits of averting

climate change in different regions and for different gen

erations, as well as practical concerns about how climate

policy would affect the global economy.

Some analysts argue for a laissezfaire approach because

they believe that the amount of warming is likely to be

small and its effects largely benign, or that nearterm

action is unwarranted in the light of scientific uncertainty.

Other researchers have proposed systems of emissions taxes

or tradable emissions permits that would be auctioned at

fixed prices. In general, the permits would apply to devel

oped countries and exempt developing nations on the

grounds of equity. Still other analysts have proposed com

plex systems that are intended to impose roughly uniform

emissions prices throughout the world yet ensure that

developed countries bear most of the cost.

2

The Scientific and Historical Context

Scientists have gradually realized that a variety of

human activities are changing the composition of the at

mosphere and may significantly affect the global climate.

1

During the past decade, scientific research has greatly im

proved the state of knowledge about climate change, but

substantial uncertainty about critical aspects of climate

science remains and will persist in spite of continued prog

ress. That uncertainty contributes to differences of opinion

within the scientific community about the potential for

significant climate change and about its possible effects.

The Greenhouse Effect, the Carbon

Cycle, and the Global Climate

As the Earth absorbs shortwave radiation from the Sun

and sends it back into space as longwave radiation, natur

ally occurring gases in the atmosphere absorb some of the

outgoing energy and radiate it back toward the surface

(see Figure 1). That phenomenon, which is called the

“greenhouse” effect, currently warms the surface by an

average of about 60º Fahrenheit (F), or 33º Celsius (C),

creating the conditions for life as it exists on Earth. Water

vapor is by far the most abundant greenhouse gas and

accounts for most of the warming effect. However, several

other trace gases also play a pivotal role in maintaining

the current climate because they not only act as greenhouse

gases themselves but also enhance the amount of water

vapor in the atmosphere and thus amplify the effect. Those

trace gases include carbon dioxide, methane (which also

contains carbon), and nitrous oxide, as well as the man

made halocarbons, which contribute to the breakdown

of stratospheric ozone and which, molecule for molecule,

are very powerful greenhouse gases.

2

The geologic record reveals dramatic fluctuations in green

house gas concentrations and in the Earth’s climate, on

scales as long as millions of years and as short as just a few

years. The record suggests a complicated relationship

between greenhouse gas concentrations and the Earth’s

climate. Warmer climates have usually been associated

with higher atmospheric concentrations of greenhouse

gases and cooler climates with lower concentrations.

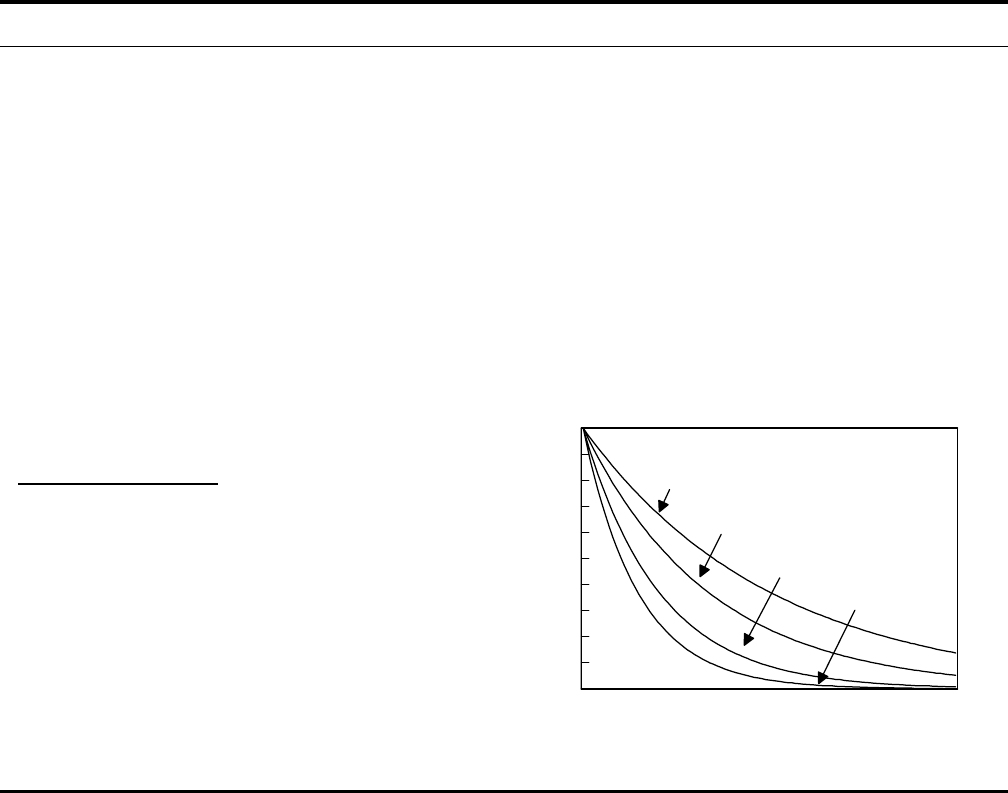

(Figure 2 illustrates how carbon dioxide concentrations

and the antarctic climate have varied together over roughly

the past halfmillion years.) However, the climate has oc

1. The discussion in this chapter is drawn mainly from a series of

reports prepared by the Intergovernmental Panel on Climate

Change, which summarize the current state of scientific and tech

nical knowledge in that area. The most recent set of reports, which

are cited in detail in the reference list beginning on page 57, are

Houghton and others (2001); McCarthy and others (2001); Metz

and others (2001); and Watson and others (2001). Other sources

are specifically noted. The Congressional Research Service (2001)

provides another summary. For a short history of scientific research

on climate change, see Weart (1997).

2. Greenhouse gases differ in their ability to trap energy; they interact

with each other, and they stay in the atmosphere for different and

varying lengths of time. By convention, scientists apply a standard

metric to the gases by comparing their 100year global warming

potentials, or GWPs (the amount of warming that an incremental

quantity of a given gas would cause over the course of a century),

with that of carbon dioxide. The convention is somewhat rough

because the GWP of each gas is affected by the quantity of other

gases, but it is used in international negotiations because of its sim

plicity. GWPs range from 1 for carbon dioxide to many thousands

for halocarbons. Using 100year GWPs, scientists convert quantities

of other greenhouse gases to metric tons of carbon equivalent, or

mtce.

CHAPTER

6 THE ECONOMICS OF CLIMATE CHANGE: A PRIMER

Figure 1.

The Atmospheric Energy Budget and the Greenhouse Effect

Source: Congressional Budget Office adapted from J.T. Houghton and others, eds., Climate Change 2001: The Scientific Basis (Cambridge, U.K.: Cambridge University

Press, 2001).

CHAPTER TWO THE SCIENTIFIC AND HISTORICAL CONTEXT 7

Figure 1.

Continued

Note: Numbers represent watts per meter squared (W/m

2

). With an atmosphere, 492 W/m

2

(instead of 318 W/m

2

) reach the Earth’s surface because the atmosphere

absorbs radiation from the Earth and radiates it back. That process constitutes the greenhouse effect.

a. Includes thermals and evapotranspiration.

8 THE ECONOMICS OF CLIMATE CHANGE: A PRIMER

160

200

240

280

320

-450 -400 -350 -300 -250 -200 -150 -100 -50 0

Thousands of Years Before the Present

-12

-8

-4

0

4

-450 -400 -350 -300 -250 -200 -150 -100 -50 0

Thousands of Years Before the Present

Atmospheric Carbon Dioxide

Carbon Dioxide Concentration (Parts per million)Carbon Dioxide Concentration (Parts per million)

Temperature Over Antarctica

a

Temperature Relative to Present Climate (°C)

Figure 2.

Carbon Dioxide and Temperature

Source: Congressional Budget Office based on J. M. Barnola, C. Lorius Raynaud, and N.I. Barkov, “Historical CO

2

Record from the Vostok Ice Core,” and J.R. Petit

and others, “Historical Isotopic Temperature Record from the Vostok Ice Core,” in Department of Energy, Oak Ridge National Laboratory, Carbon Dioxide

Information Analysis Center, Trends: A Compendium of Data on Global Change (2003), available at http://cdiac.esd.ornl.gov/trends/trends.htm.

a. Variations in antarctic temperatures are roughly double average global variations.

CHAPTER TWO THE SCIENTIFIC AND HISTORICAL CONTEXT 9

casionally been relatively warm while concentrations were

relatively low and cool while they were high. Moreover,

climate change has occurred without alterations in green

house gas concentrations. Nevertheless, significant changes

in concentrations appear to be nearly always accompanied

by changes in climate.

3

The link between greenhouse gases and climate is greatly

complicated by a variety of physical processes that obscure

the direction of cause and effect. Variations in the Sun’s

brightness and the Earth’s orbit affect the climate by

changing the amount of radiation that reaches the Earth.

Clouds, dust, sulfates, and other particles from natural

and industrial sources affect the way radiation filters in

and out of the atmosphere. Snow, ice, vegetation, and soils

control the amount of solar radiation that is directly re

flected from the Earth’s surface. And the Earth’s vast ocean

currents, themselves partly driven by solar radiation,

greatly influence climate dynamics. Moreover, the climate

system exhibits socalled threshold behavior: just as a

minor change in balance can flip a canoe, relatively small

changes sometimes can abruptly trigger a shift from one

stable global pattern to a noticeably different one (Alley

and others, 2003).

Fluctuations in those physical processes affect the complex

balance among the reservoirs of carbon dioxide and

methane in the atmosphere and the larger reservoirs of

carbon in the biosphere—which comprises soils, vegeta

tion, and creatures—and in the oceans. Large quantities

of carbon flow back and forth between those reservoirs,

regulated by the seasons, winds, and ocean currents.

4

The

flows maintain a rough equilibrium among the reservoirs,

which all gradually adjust to other influences—and to

influxes of carbon—over periods of decades to centuries.

Other greenhouse gases, such as nitrous oxide, are part

of similarly complex cycles.

In the absence of human activity, other, even larger res

ervoirs of carbon adjust only over thousands to millions

of years. They include fossil deposits of coal, oil, and

natural gas, which hold 10 to 20 times as much carbon

as the atmosphere; deposits of methane hydrate in the

ocean floors, which contain perhaps 12 times as much

carbon; and rocks that contain much more carbon than

all of the surface reservoirs, or “sinks,” combined (see Fig

ure 3).

Over the past million and a half years, the Earth has ex

perienced a period of “ice ages”—hundredthousandyear

cycles of cooling and warming that are governed mainly

by variations in the Earth’s orbit around the Sun. That

period, which is unusual in geologic history, has been ac

companied by changes in greenhouse gas concentrations

that interact with and magnify the effects of the orbital

variations (Shackleton, 2000). Geologically speaking, the

most recent ice age just ended: less than 20,000 years ago,

large parts of North America and Eurasia were covered

by huge glaciers. Atmospheric concentrations of carbon

dioxide were only half of what they are today; average

global temperatures were roughly 7ºF to 9ºF (4ºC to 5ºC)

lower; and the global climate was apparently drier and

much more variable (Broecker and Hemming, 2001;

Crowley, 1996; and Ganopolski and Rahmstorf, 2001).

In addition, the trees and soils of the biosphere held per

haps onethird less carbon than they do now; tropical

forests were much less extensive; and sea level was hun

dreds of feet lower.

All of recorded human history, as well as the development

of agriculture, has occurred during a temporary interglacial

period that began about 12,000 years ago and that has

been warmer and unusually stable by comparison with

the preceding cold period. Even during that stable interval,

however, minor climatic changes have had substantial ef

fects on preindustrial economies throughout the world.

(For an extensive description of the effects of climate

change over history, see Lamb, 1995.)

Historical Emissions and

Climate Change

With the onset of the industrial revolution more than two

centuries ago, people have begun to change the carbon

cycle significantly, increasing the amount of carbon diox

ide in the atmosphere by about a third, or from roughly

3. See Falkowski and others (2000); Veizer, Godderis, and François

(2000); Crowley and Berner (2001); and Zachos and others (2001).

4. Quantities of carbon in gases and elsewhere are measured in metric

tons of carbon, or mtc. Mtc differs from mtce, which measures

warming potential rather than quantities of carbon.

10 THE ECONOMICS OF CLIMATE CHANGE: A PRIMER

Figure 3.

The Carbon Cycle

Source: Congressional Budget Office adapted from D. Schimel and others, "Radiative Forcing of Climate Change," Chapter 2 in J.T. Houghton and others, eds., Climate

Change 1995: The Science of Climate Change (Cambridge, U.K.: Cambridge University Press, 1996). The figure draws on data from Mustafa Babiker and

others, The MIT Emissions Prediction and Policy Analysis (EPPA) Model: Revisions, Sensitivities, and Comparisons of Results, Report no. 71 (Cambridge,

Mass.: Massachusetts Institute of Technology Joint Program on the Science and Policy of Global Change, 2001); Department of Energy, Energy Information

Administration, Annual Energy Review 2000, DOE/EIA-0384(2000) (November 2001); P. Falkowski and others, “The Global Carbon Cycle: A Test of Our

Knowledge of Earth as a System,” Science, vol. 290, no. 5490 (October 13, 2000), pp. 291-296; J.T. Houghton and others, eds., Climate Change 2001: The

Scientific Basis (Cambridge, U.K.: Cambridge University Press, 2001); R.A. Houghton and David L. Skole, “Carbon,” in B.L. Turner II and others, eds., The

Earth as Transformed by Human Action: Global and Regional Changes in the Biosphere over the Past 300 Years (Cambridge, U.K.: Cambridge University

Press, 1990), pp. 393-408; Keith A. Kvenvolden, “Potential Effects of Gas Hydrate on Human Welfare,” Proceedings of the National Academy of Sciences,

vol. 96 (March 1999), pp. 3420-3426; Bert Metz and others, eds., Climate Change 2001: Mitigation (Cambridge, U.K.: Cambridge University Press, 2001);

Edward D. Porter, Are We Running Out of Oil? Discussion Paper no. 81 (Washington, D.C.: American Petroleum Institute, December 1995); and World Energy

Council, Survey of Energy Resources, 19th ed. (London: World Energy Council, 2001), available at www.worldenergy.org/wec-geis/publications.

Note: Reservoirs of carbon are in billions of metric tons (shown in parentheses); flows of carbon (shown as arrows) are in billions of metric tons per year.

CHAPTER TWO THE SCIENTIFIC AND HISTORICAL CONTEXT 11

600 billion to 800 billion metric tons of carbon (mtc)—

the highest amount in at least 400,000 years.

5

About 30

percent of the increase has come from cutting timber and

clearing land for agriculture; the rest stems from extracting

coal, oil, and natural gas from the fossil reservoir and

burning them.

6

Atmospheric concentrations of methane

and nitrous oxide have also risen over the past two cen

turies—by about 150 percent and 16 percent, respectively

—as a result of various agricultural and industrial activi

ties. More recently, halocarbons have begun to accumulate

as well. The combined effect of these additions to the

atmosphere has been to enhance the greenhouse effect

slightly by raising the amount of radiation at the Earth’s

surface by about 0.5 percent—with perhaps half of that

impact offset by the effects of other human activities, such

as the cooling influence of sulfate emissions.

Current evidence indicates that since the mid19th cen

tury, the average surface temperature of the Earth has risen

by between 0.7ºF and 1.4ºF (0.4ºC and 0.8ºC). The

warming trend has been most pronounced during the past

decade and in higher latitudes. Ocean temperatures are

also rising, expanding the volume of water, and that ex

pansion, combined with water from melting glaciers, has

raised global sea level by about four to 10 inches (10 to

20 centimeters) over the past century.

Scientists generally agree that the observed warming is

roughly consistent with the expected effects of changing

concentrations of greenhouse gases and other emissions.

However, other phenomena also appear to be influencing

the Earth’s climate—for example, variations in the Sun’s

brightness and magnetic field, and poorly understood

fluctuations in the circulation of the oceans. As a result,

although scientists have dramatically improved their

understanding of the atmosphere, oceans, and climate in

recent years, they are uncertain about how much of the

observed warming is due to greenhouse gas emissions.

They are even more uncertain about whether the warming

that has occurred has caused moreextreme weather, such

as more and bigger hurricanes, floods, and droughts.

However, some evidence suggests that unusually warm

conditions may have contributed to persistent droughts

in North America, Europe, and Asia between 1998 and

2002 (Hoerling and Kumar, 2003).

Some researchers believe that if people immediately halted

emissions of greenhouse gases, gradual warming of the

oceans would ultimately contribute to an additional warm

ing of the atmosphere of between 0.9ºF and 2.7ºF, or

0.5ºC and 1.5ºC (Mahlman, 2001, p. 8). Over the follow

ing centuries, the climate would return nearly to its pre

industrial state, as the oceans gradually absorbed most of

the extra carbon dioxide from the atmosphere and other

greenhouse gases broke down.

However, as the world’s population grows and the global

economy continues to industrialize, the pace of emissions

—particularly of carbon dioxide—is accelerating. The

period since World War II has seen 80 percent of all car

bon dioxide ever emitted from the burning of fossil fuels

—and twothirds of the entire increase in atmospheric

concentrations (Marland, Boden, and Andres, 2002). Dur

ing the 1990s, annual global emissions of greenhouse gases

ran at about 10 billion metric tons of carbon equivalent

(mtce; see footnote 2), and carbon dioxide concentrations

grew by more than 4 percent. Fossil fuels accounted for

about 6 billion mtc per year; of that total, oil claimed a

share of 45 percent, natural gas, 20 percent; and coal, 35

percent.

7

Net deforestation contributed roughly 1 billion

to 2 billion mtc annually (Watson and others, 2000,

p. 32). About 2½ billion to 3 billion mtce per year of

other greenhouse gases, mostly methane, came from a wide

variety of sources, mainly agricultural activities but also

5. Atmospheric concentrations of carbon dioxide are usually measured

in parts per million (ppm). In those terms, atmospheric carbon

dioxide has increased from about 280 ppm to about 370 ppm.

6. Estimates of emissions and reabsorption of carbon from land use

are based on data for 1850 to 1990 from R.A. Houghton of the

Woods Hole Research Center and an extrapolation based on data

from Houghton and Skole (1990). Estimates of emissions from

fossil fuels are from Marland, Boden, and Andres (2002). Much

of the available data on greenhouse gas emissions, changes in

atmospheric concentrations, and changes in temperature is available

from the Carbon Dioxide Information Analysis Center at http://

cdiac.esd.ornl.gov/pns/pns_main.html. For a discussion of recent

research, see Schimel and others (2001).

7. Coal contains about 80 percent more carbon per unit of energy

than gas does, and oil contains about 40 percent more. For the

typical U.S. household, a metric ton of carbon equals about 10,000

miles of driving at 25 miles per gallon of gasoline or about one year

of home heating using a natural gasfired furnace or about four

months of electricity from coalfired generation.

12 THE ECONOMICS OF CLIMATE CHANGE: A PRIMER

fossil fuel production, diverse industrial processes, and

landfills.

The international distribution of emissions from fossil

fuels largely reflects the global pattern of economic devel

opment because fossil fuels have powered the dramatic

increase in industrial output and material wellbeing that

has taken place in many nations over the past two cen

turies. In the United States, for instance, fossil fuels pro

vided nearly 90 percent of all energy used in the 20th

century, and they account for about 85 percent of the

energy used today. Developed, industrialized countries—

the members of the Organisation for Economic Co

operation and Development (OECD) and of the former

Soviet bloc—are responsible for nearly 80 percent of

historical carbon emissions, even though they have only

about 20 percent of the world’s population. Historically

speaking, people in developed countries have emitted

roughly 10 times more carbon per person than people in

developing countries. Indeed, it is the technological access

to energy from fossil fuels that has helped make them

roughly 10 times wealthier.

Yet the relationship between the use of fossil energy and

economic prosperity is not a strict one. Countries that

have significant reserves of nonfossil energy, that rely on

imports for much of their fuel supply, or that tax the

consumption of fuel tend to have lower emissions levels.

Some highincome countries have emissions levels per

person that are quite low: for instance, Sweden maintains

roughly the same standard of living as the United States

does but emits only 30 percent as much carbon per person,

largely by relying extensively on hydroelectric and nuclear

power. In contrast, countries that have large reserves of

fossil fuels or that subsidize their population’s consump

ti on o f f ue l t end to ha ve h ig her p er capita em is sions levels.

Such nations include oilexporting countries and members

of the former Soviet bloc.

Nor is the relationship between economic growth and

emissions a smooth one. Developing countries in the ini

tial stages of industrialization tend to have fairly high levels

of emissions per dollar of output, because a large share

of their economic activity involves the energyintensive

manufacturing of metals, cement, and other basic com

modities. In contrast, developed countries devote an in

creasing share of their resources to the production of less

energy intensive outputs, including services. Economic

development therefore tends to involve rising energy in

tensity in its initial stages and falling energy intensity as

the efficiency of energy use and the service sector’s share

of economic activity grow (HoltzEakin and Selden,

1995). In the United States, for example, per capita emis

sions of carbon dioxide from fossil fuels grew nearly seven

fold between 1870 and 1920 but have grown by less than

onethird since then and are roughly the same now as they

were 30 years ago.

On a perperson basis, OECD countries currently burn

about 3 mtc of fossil fuels per year—three times the world

average—with national figures ranging from over 5½ mtc

per person for the United States to less than 1 mtc for

Mexico and Turkey.

8

The former Soviet bloc countries

had very high per capita emissions levels before their eco

nomic collapse but now average about 2 mtc per person—

the figures range from nearly 3 mtc for Russia to less than

a third of a ton for Armenia. Developing countries average

only ½ mtc per capita annually—or onesixth the OECD

average and only onetenth that of the United States. The

poorest 2 billion people—onethird of the world’s popu

lation—average less than a fifth of a ton annually, or the

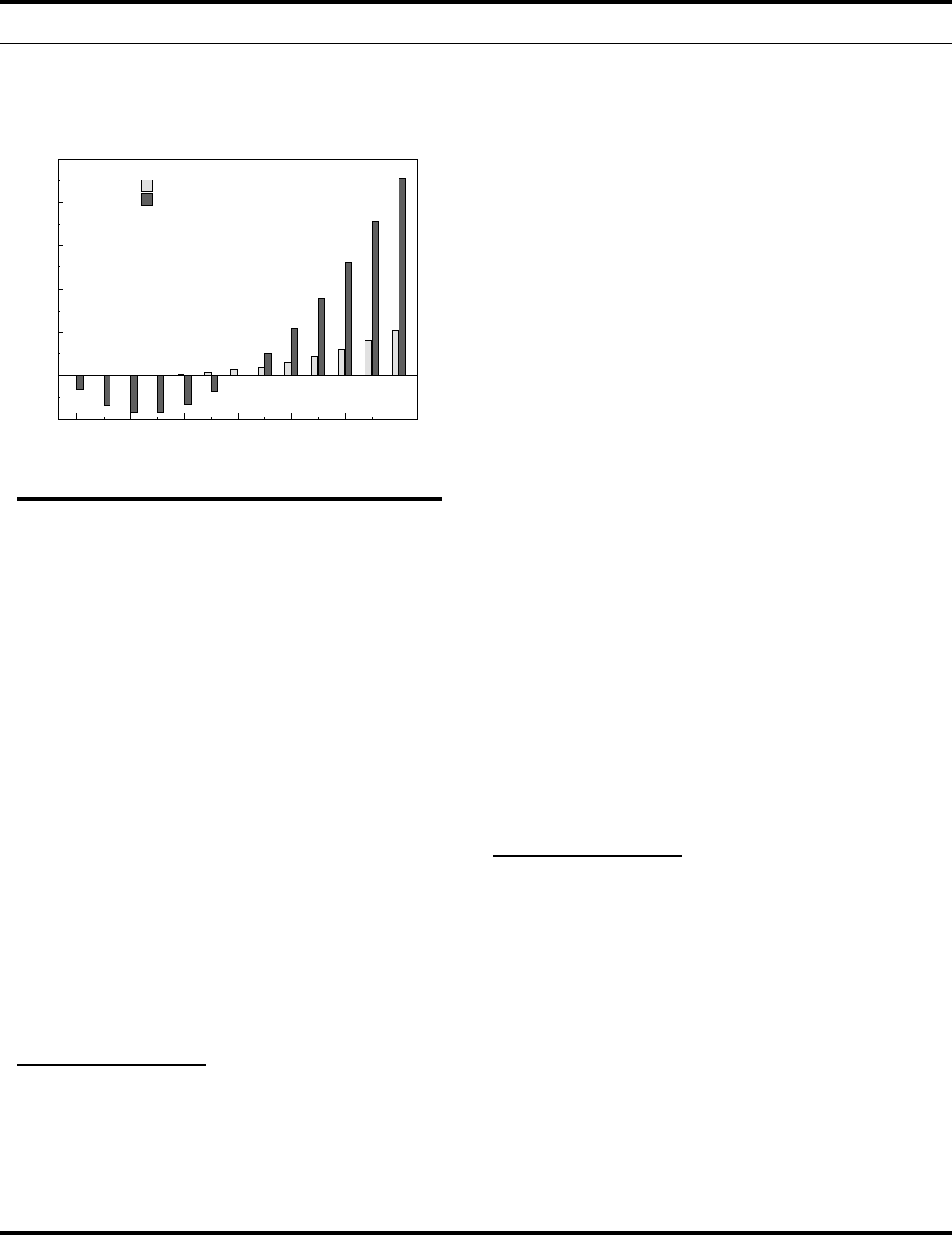

equivalent of about 80 gallons of gasoline. (Figures 4 and

5 compare different regions’ populations, per capita eco

nomic activity, and per capita emissions, as well as ranges

of uncertainty about those factors’ future growth.)

Because of their greater reliance on subsistence farming

and forestry, developing countries currently account for

most of the world’s carbon dioxide and methane emissions

from land use. Even so, on a per capita basis, people in

developing countries are responsible for far fewer green

house gas emissions than are their counterparts in the in

dustrialized countries, and their total emissions levels are

lower as well.

8. The United States accounts for nearly as many emissions as the

former Soviet bloc, the Middle East, Central and South America,

and Africa combined. Use of fossil fuel in the United States is split

roughly into three categories: commercial and residential buildings

and appliances, industry, and transportation. More than a third

of that fuel is used to generate electricity, twothirds of which goes

to buildings and onethird to industry (see Department of Energy,

2002a). Other developed countries have somewhat different con

sumption patterns for fossil fuel, depending on their income levels,

climates, and other factors.

CHAPTER TWO THE SCIENTIFIC AND HISTORICAL CONTEXT 13

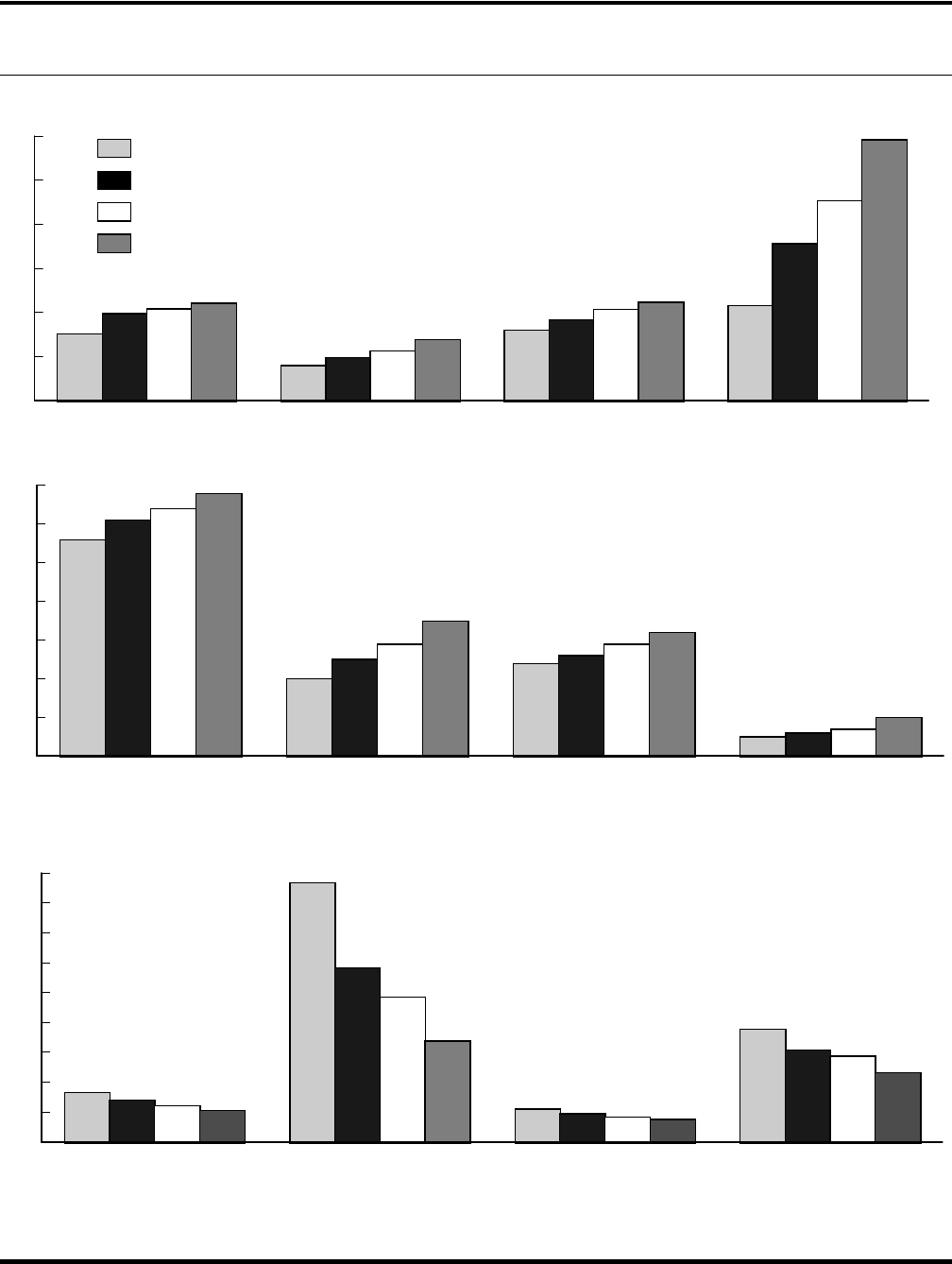

Figure 4.

Uncertainty in Projections of Regional Population and Economic Growth

Source: Congressional Budget Office based on Department of Energy, Energy Information Administration, International Energy Outlook 2002, DOE/EIA-0484

(2002).

United States Former Soviet Bloc Other Developed Countries Developing Countries

0

1

2

3

4

5

6

7

Population

United States Former Soviet Bloc Other Developed Countries Developing Countries

0

5

10

15

20

25

30

United States Former Soviet Bloc Other Developed Countries Developing Countries

0

10

20

30

40

50

60

70

Gross Domestic Product

GDP per Capita

1999

2020

2020 Low Economic Growth

2020 Base-Case Economic Growth

2020 High Economic Growth

Billions

Trillions of 1997 Dollars

Thousands of 1997 Dollars

14 THE SCIENTIFIC AND HISTORICAL CONTEXT

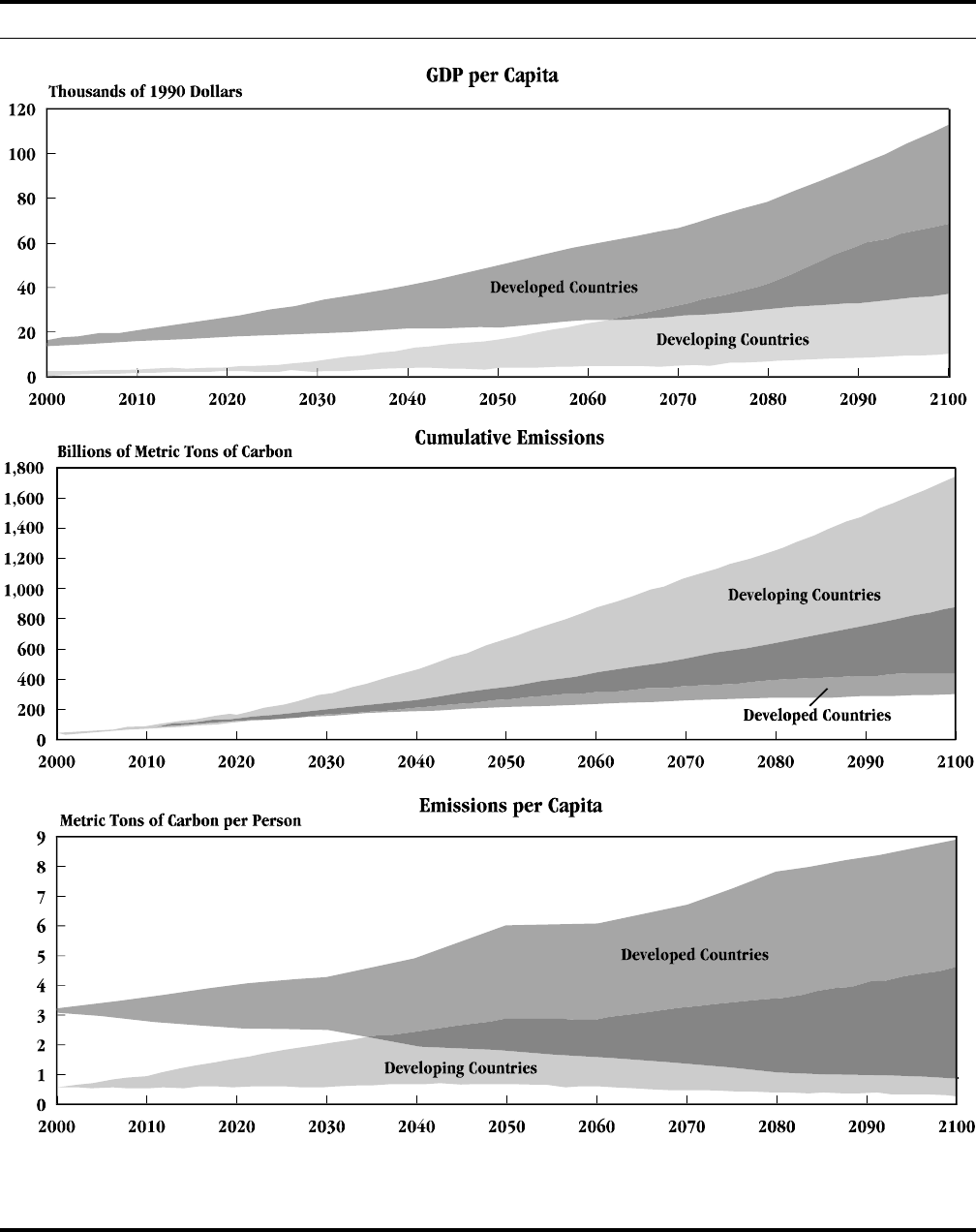

Figure 5.

Uncertainty in Projections of Regional Carbon Dioxide Emissions and

Emissions Intensity

Source: Congressional Budget Office based on Department of Energy, Energy Information Administration, International Energy Outlook 2002, DOE/EIA-0484

(2002).

Note: All emissions are from fossil fuels.

Total Emissions

Emissions Intensity

1999

2020 Low Economic Growth

2020 Base-Case Economic Growth

2020 High Economic Growth

Billions of Metric Tons of Carbon

Metric Tons of Carbon Dioxide Emissions

per Thousand 1997 Dollars of GDP

Metric Tons of Carbon per Person

Emissions per Capita

United States Former Soviet Bloc Other Developed Countries Developing Countries

0

0.1

0.2

0.3

0.4

0.5

0.6

0.7

0.8

0.9

United States Former Soviet Bloc Other Developed Countries Developing Countries

0

1

2

3

4

5

6

7

United States Former Soviet Bloc Other Developed Countries Developing Countries

0

1

2

3

4

5

6

CHAPTER TWO THE SCIENTIFIC AND HISTORICAL CONTEXT 15

What the Future May Hold

Recent studies have estimated that the average global

temperature is likely to rise by between 0.5ºF and 2.3ºF

(0.3ºC and 1.3ºC) during the next 30 years (Zwiers,

2002). Most of the warming during that period will be

due to emissions that have already occurred. Over the

longer term, the degree and pace of warming will depend

mainly on future emissions. Given current trends in popu

lation, economic growth, and energy use, global emissions

are likely to increase substantially. The populations and

economies of developing countries are growing rapidly,

and their total greenhouse gas emissions could surpass

those of developed countries over the next generation or

so—although on a perperson basis, emissions from devel

oping countries will continue at much lower levels than

emissions from developed countries for a long time to

come.

Even with substantial research, development, and adoption

of alternative energy technologies, fossil fuels are likely

to remain among the cheapest abundant energy resources

for many years. There are roughly 1,500 billion to 1,700

billion mtc in proven coal, oil, and natural gas reserves

that can be extracted using current technology, along with

an estimated 7,000 billion to 16,000 billion mtc in re

sources that might ultimately be recovered using advanced

technology—not including reservoirs of methane hydrate

under the ocean.

9

Without some sort of intervention, in

creasing levels of emissions—mainly of carbon dioxide

from the use of fossil fuels—will continue to raise atmo

spheric concentrations of greenhouse gases for the foresee

able future.

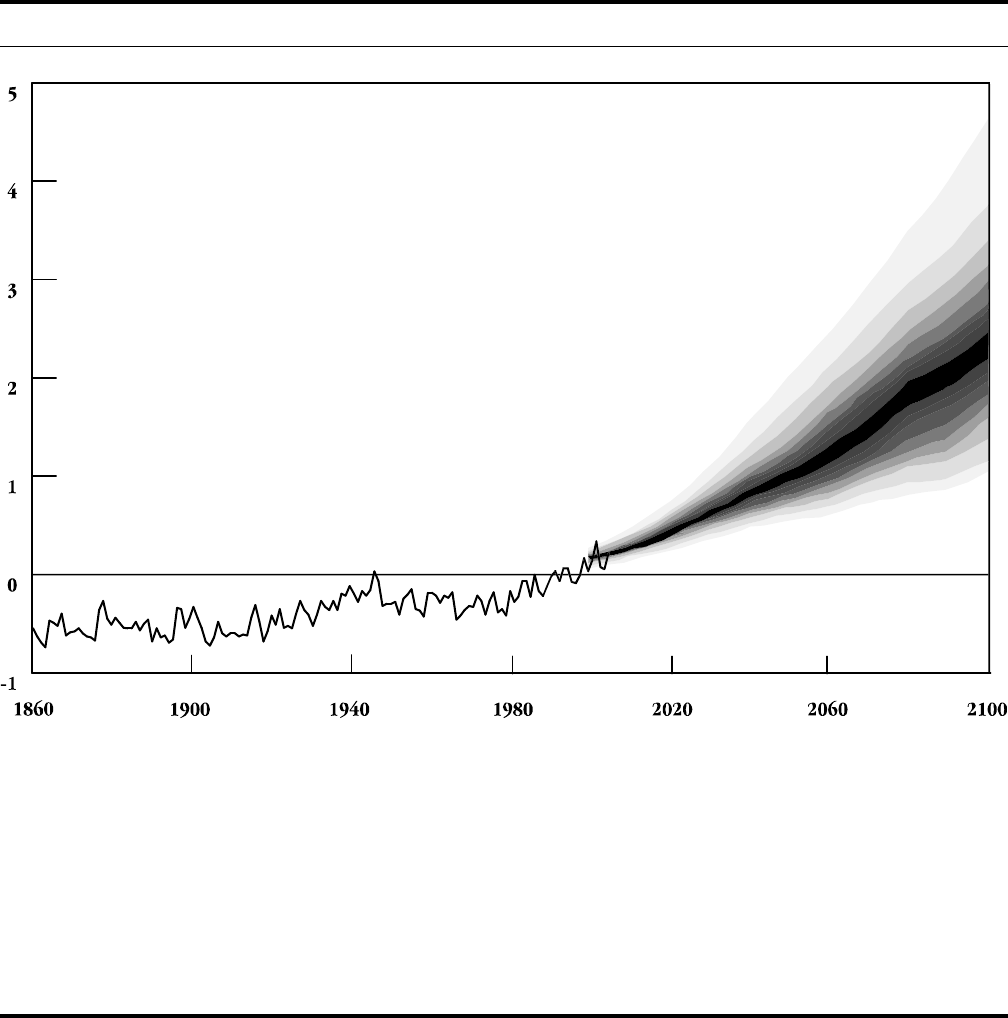

To illustrate how concentrations might change over the

next century, a study for the Intergovernmental Panel on

Climate Change presented a series of scenarios of green

house gas emissions, with cumulative carbon dioxide

emissions from both developed and developing countries

ranging from under 700 billion mtc to nearly 2,500 bil

lion mtc (Naki

ƒenoviƒ and Swart, 2000; see Figure 6). By

2100, under the scenario with the lowest levels of emis

sions, atmospheric concentrations of carbon dioxide would

be about onethird more than today’s levels; under the

highemissions scenario, concentrations would be nearly

triple today’s. Under the more likely scenarios in the

middle of the range, carbon dioxide concentrations could

ro ug hl y d oubl e d ur ing the nex t c entu ry, to leve ls no t s ee n

in over 20 million years (Pearson and Palmer, 2000).

Concentrations of other greenhouse gases are also likely

to grow by a considerable amount. Under the above range

of emissions projections—to which the authors do not

assign any probabilities—the average global temperature

could rise over the next century by about 2ºF (1ºC) or

by more than 9ºF (5ºC).

10

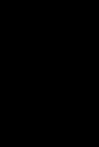

Other researchers have explicitly addressed a variety of

uncertainties in economic and climate forecasting; one

recent study projected an increase in the average global

temperature of 4.3ºF (2.4ºC) between 1990 and 2100,

with a 95 percent chance that the change will be between

1.8ºF (1.0ºC) and 8.8ºF (4.9ºC) (Webster and others,

2002; see Figure 7). The economic and physical factors

included in the study accounted for roughly similar shares

of the uncertainty surrounding the human contribution

to warming by 2100. Other factors, including variations

in solar radiation and volcanic activity, could also influ

enc e the f uture clim ate in ways that are hard er to qu an ti fy ,

but those factors were not included in the study.

At the low end of the projected range, the effects of climate

change would probably be relatively mild—although even

modest warming might trigger an abrupt, largerthan

expected shift in weather patterns. At the high end of the

range—an unlikely but possible prospect—the world

could face an abrupt change in climate that would be

roughly as large as the one at the end of the last ice age

but much more rapid. In the more plausible middle of

the range, the effects of climate change might still be quite

significant. Moreover, even if emissions were eliminated

before the end of the century, the oceans would continue

to warm—and thus further warm the climate—for cen

turies thereafter. And, of course, continued emissions be

9. Those estimates are derived from Babiker and others (2001),

Department of Energy (2001), Metz and others (2001), Porter

(1995), and World Energy Council (2001).

10. The economic projections for developing countries that underly

those scenarios were criticized in an article appearing in the Febru

ary 15, 2003, issue of The Economist. The criticism appears to be

valid but does not undermine the study’s main conclusions about

the range of possible climate change.

16 THE ECONOMICS OF CLIMATE CHANGE: A PRIMER

Figure 6.

Range of Uncertainty in Economic and Carbon Dioxide Emissions Projections

Source: Congressional Budget Office based on Nebojša Nakiƒenoviƒ and Rob Swart, eds., Emission Scenarios (Cambridge, U.K.: Cambridge University Press, 2000).

Note: All emissions are from fossil fuels.

CHAPTER TWO THE SCIENTIFIC AND HISTORICAL CONTEXT 17

Figure 7.

Historical and Projected Climate Change

(Average Global Temperature (°C) Relative to 1986-1995 Average)

Source: Congressional Budget Office. Historical data are from the Hadley Centre for Climate Prediction and Research, available at www.met-office.gov.uk/research/

hadleycentre/CR_data/Annual/land+sst_web.txt and described primarily in C.K. Folland and others, “Global Temperature Change and Its Uncertainties Since

1861,” Geophysical Research Letters, vol. 28 (July 1, 2001), pp. 2621-2624. The projection is based on data provided by Mort Webster, University of North

Carolina at Chapel Hill, in a personal communication, December 11, 2002; the results are discussed in Mort Webster and others, Uncertainty Analysis of

Climate Change and Policy Response, Report no. 95 (Cambridge, Mass.: Massachusetts Institute of Technology Joint Program on the Science and Policy

of Global Change, December 2002).

Note: The projection, which is interpolated from decadal averages beginning in 1995, shows the possible distribution of changes in average global temperature as

a result of human influence, relative to the 1986-1995 average and given current understanding of the climate. Under the Webster study’s assumptions, the

probability is 10 percent that the actual global temperature will fall in the darkest area and 90 percent that it will fall within the whole shaded area. However,

actual temperatures could be affected by factors that were not addressed in the study (such as volcanic activity and the variability of solar radiation) and whose

effects are not included in the figure.

yond the next hundred years would contribute to addi

tional warming.

The potential effects of any particular amount or rate of

climate change over the next few centuries are very un

certain. Research on the connection between the climate

and economic wellbeing yields particularly ambiguous

co nclus ions. Hu mans gener al ly ap pe ar to ha ve p ros pe re d

during warmer (or warming) periods and suffered during

colder (or cooling) ones. People did not—perhaps could

not—begin farming until after the last ice age ended.

Agriculture spread rapidly 6,000 to 8,000 years ago, when

the Sahara was largely grassland instead of desert and

average global temperatures were warmer than they are

today by perhaps a degree Celsius. Conversely, numerous

episodes of cooling seem to have disrupted cultures

18 THE ECONOMICS OF CLIMATE CHANGE: A PRIMER

throughout history. Europe prospered during a warm

period that occurred in the Middle Ages, but it suffered

during the colder Little Ice Age of between 300 and 800

years ago.

Yet the past effects of climate change on preindustrial

societies may not provide much information about its

future effects on technologically advanced societies—

especially the effects of significantly greater warming.

11

Researchers who study the sources of economic growth

consistently find that at least during the past halfcentury,

regions in temperate climates tended to prosper more than

regions in tropical ones, even after differences in levels of

income and education, rates of saving and investment,

and other factors were taken into account. (For example,

Masters and McMillan, 2000, and SalaiMartin, 1997,

discuss the positive correlation between temperate climate

and economic development.)

When considered as a whole, the historical and statistical

evidence suggests that a warmer global climate—as well

as the period during which warming occurred—could

have both beneficial and harmful effects. One global effect

would be generally harmful: sea levels would rise as glaciers

melted and the oceans warmed and expanded. The gradual

inundation of seashores would create problems for coun

tries (particularly lowlying island nations), regions, and

cities that were mostly near sea level. In the middle of the

range of climate change described earlier, sea level would

rise by up to 1½ feet (50 centimeters) over the next cen

tury. And even if emissions were eliminated after 2100,

thermal expansion of the oceans could ultimately raise sea

level by roughly 6 feet (2 meters) over a few centuries.

Because climate is generally a regional phenomenon, how

ever, the effects of climate change would vary by region—

and be even more uncertain than the effects globally. If

warming followed recent patterns, it would tend to be

concentrated in colder areas and periods—near the poles,

in the winter, and at night—but daylight temperatures

in the tropics during the summer would also rise.

12

A

somewhat w ar mer Ea rth w ou ld pro ba bly hav e m or e rai n

fall, and the resulting moderately warmer, wetter climate

—combined with more carbon dioxide in the atmosphere

—would probably improve global agricultural produc

tivity overall. Nevertheless, dramatic warming could

reduce the yields of important food crops in most of the

world. Shifts in weather patterns would probably cause

more heat waves and droughts in some regions, which

would substantially reduce their crop yields and supplies

of drinking water as well as exacerbate the effects of urban

air pollution. Other areas would experience more flooding.

Moreover, as Alley and others (2003) discuss, the climate’s

response to rising concentrations of greenhouse gases could

involve unexpectedly large and abrupt shifts, which would

be much more disruptive and costly to adapt to than

would gradual changes.

People in developing countries are probably more vul

nerable to the damaging effects of climate change than

are people in developed countries, in large part because

they have fewer resources for coping with the impacts. In

addition, a number of developing countries have large

populations that are either concentrated in lowlying

regions vulnerable to a rise in sea level or flooding or that

subsist on marginal agricultural lands vulnerable to

drought.

In contrast, industrial economies can draw on many more

resources to ease the adaptation to changes in climate.

Moreover, recent comprehensive study of the potential

impacts of climate change suggests that for a 4.5

/F (2.5/C)

increase in average global temperature, some developed

countries could actually experience economic benefits

because warming would improve climates for agriculture

(Nordhaus and Boyer, 2000). The United States could

experience a loss of about half a percent of total income;

the poorest developing countries could experience losses

of more than 2.5 percent—and from much lower levels

of income per person than those of developed countries.

11. Moore (1998) describes the potentially beneficial effects of warm

climates. Richerson and others (2001) discuss the relationship

between warming and the development of farming. Lamb (1995)

addresses the broader effects of climate over human history.

12. Until recently, evidence from fossils indicated that tropical weather

was relatively insensitive to global climate change. However, re

search by Kump (2001) suggests that tropical regions are, indeed,

affected.

CHAPTER TWO THE SCIENTIFIC AND HISTORICAL CONTEXT 19

But point estimates like those conceal a great deal of un

certainty. As an example, estimates of the effects on the

United States of a rise of 4.5

/F (2.5/C) in average global

temperature range from a loss of 1.5 percent of gross

domestic product to a gain of 1.0 percent.

13

For particular

temperate regions of the United States, the likely changes

in temperature and rainfall and the possible intensity of

extreme weather conditions are very poorly understood.

For example, recent reviews of the potential regional ef

fects of climate change in the United States (National

Assessment Synthesis Team, 2000, and Department of

State, 2002) found that rainfall and summer soil moisture

might rise significantly in much of the Midwest, or it

might fall significantly.

In addition, some researchers fear that climate change

might occur so rapidly that some types of plants—most

notably, in marginal ecosystems such as alpine meadows

and barrier islands and in immobile ecosystems such as

coral reefs—would not be able to adapt to the altered cli

mate and would disappear. Migratory animals, birds, and

insects could be similarly affected.

14

Moreover, warming

would probably increase the natural range of insectborne

diseases that are now found mainly in warmer regions.

Finally, among the most worrisome possible consequences

of rising greenhouse gas concentrations is the potential

disruption of deep ocean currents that strongly influence

the global climate. Those currents are directed partly by

thermohaline circulation; that is, the evaporation or freez

ing of seawater in various regions leaves the remaining

water increasingly salty, and therefore dense, and it sinks

into the deep. Warmer weather could slow or even stop

the current pattern of thermohaline circulation by increas

ing rainfall and reducing the formation of sea ice in the

North Atlantic.

Northern Europe appears to be particularly vulnerable

to such a change because its relatively warm, rainy weather

depends on the northerly flow of warm water from the

Gulf Stream, which in turn is linked to thermohaline

circulation in the North Atlantic. An abrupt halt of that

circulation—such as the halt that occurred after the last

ice age, as the climate warmed up—could seriously disrupt

the flow of warm water into the North Atlantic, leading

to much colder weather in parts of North America and

Europe for decades or centuries coupled with greater

warming elsewhere in the world. (Clark and others, 2001,

discuss that scenario.) Most climate models project that

the North Atlantic thermohaline circulation will weaken

during the next century because of higher levels of rainfall

in a warmer climate. However, they do not predict a

complete shutdown over that period.

Potential Responses

To control the longrun growth of greenhouse gas con

centrations in the atmosphere, countries could either limit

emissions or develop means of drawing greenhouse gases

back out of the atmosphere after they were emitted. One

significant remedy would be to control the longrun

growth of fossil fuel use. There are many alternatives to

current patterns of energy use, including technologies that

could make that use more efficient and others that could

exploit alternative energy sources—for example, solar en

ergy, wind, biomass, and hydroelectric and nuclear power.

However, expanding the reliance on any of those alterna

tives is relatively expensive compared with the market cost

of using fossil fuels. Restrictions on such use would there

fore impose economic costs—costs that would rise with

the stringency of the restrictions and would climb particu

larly quickly if extensive controls were imposed in the

short run. Over the longer term, control of fossil fuel use

will depend on the development of relatively inexpensive

alternative energy technologies (Edmonds, 2002).

Because plants absorb carbon dioxide from the atmos

phere, countries could sequester carbon by planting and

growing trees and partly offset emissions from the burning

of fossil fuels. (Scholes and Noble, 2001, and McCarl and

Schneider, 2001, discuss the role of sequestration in limit

ing carbon dioxide emissions.) In theory, the potential

for sequestration in forests is very large: if people could

replant all of the forest land around the world that has

13. Nordhaus (1994, 1998a,b), Nordhaus and Boyer (2000),

Mendelsohn and Neumann (1999), and Moore (1998) discuss

those cost estimates.

14. That problem could be aggravated by the environmental stresses

of population growth and industrialization. As Field (2001)

discusses, under an intermediate definition of appropriation, human

beings already appropriate an estimated 10 percent to 55 percent

of the energy transferred from plants to other life on Earth, and

that fraction is expected to grow in the future.

20 THE ECONOMICS OF CLIMATE CHANGE: A PRIMER

been cleared in the past two centuries and then leave the

forests alone, the trees and soils could eventually trap

much of the carbon that has accumulated in the atmo

sphere since the beginning of the industrial revolution.

In practice, though, reforestation on that scale is infeasible:

people need much of the land to grow crops and to live

on. Furthermore, people would continue to use fossil fuels,

and all of the carbon sequestered in trees over several

decades would be replaced in the atmosphere by the con

tinued emissions. So carbon sequestration in forests and

agricultural soils can only partially offset past and future

carbon emissions from fossil fuels.

But forests can offer a partial alternative to fossil fuels as

a source of energy. Although burning wood releases carbon

into the atmosphere (and is relatively dirty and expensive

as well), the carbon is removed again as another tree grows

in place of the one cut down, a cycle that could be re

peated over and over. Thus, a wood lot capable of pro

ducing 1 mtc of renewable biomass fuel every 20 years

or so could, over a century, replace 5 mtc from fossil fuels

that would otherwise be emitted into the atmosphere.

Engineers have developed technologies to remove carbon

dioxide from the exhaust of a combustion process and to

store it underground or in the ocean. Those carbon

capture technologies appear to be relatively straightforward

for large emissions sources such as electric power gen

erating plants, but they also significantly increase the cost

of generating power (Department of Energy, 1997).

15

Geoengineering solutions, such as adding iron to oceans

to fertilize the absorption of carbon by plankton, have also

been advanced. Some research suggests that iron fertiliza

tion may help reduce atmospheric concentrations of car

bon dioxide, although its effectiveness and cost are very

uncertain, as are its potential side effects (Boyd and others,

2000). Other geoengineering technologies, such as remov

ing greenhouse gases directly from the atmosphere, are

extremely expensive.

Some relatively simple and inexpensive options are avail

able for controlling some emissions of greenhouse gases

other than carbon dioxide. However, controlling those

gases in a costeffective manner is considerably compli

cated by the fact that they come from so many different

and widespread agricultural, industrial, and other activities

(Reilly, Jacoby, and Prinn, 2003).

Types of Uncertainty

As the preceding discussion emphasized, scientists and

economists are very uncertain about the potential eco

nomic threat posed by a changing climate. Some of the

uncertainty is scientific. For a given amount of greenhouse

gas emissions, what portion will accumulate in the atmos

phere? How much will a given change in those concen

trations affect the global climate? How will that global

change be distributed throughout the world, and how

rapidly will it occur? How much will regional climate

change affect sea level, agriculture, forestry, fishing, water

resources, disease risks, and natural ecosystems? Will rising

greenhouse gas concentrations increase the probability of

threshold effects, which could suddenly shift the climate

into a significantly different global pattern?

Other sources of uncertainty are essentially economic.

How rapidly will the world’s population and economies

grow? How energy and landintensive will human activi

ties be, and how much of the energy used for those ac

tivities will come from fossil fuels? How will policies to

control emissions of greenhouse gases or to encourage

technological developments affect the accumulation of

gases in the atmosphere? And how much will those policies

cost? At a deeper level, how will future generations value

the effects of averting climate change? Future generations

ar e likely to be wealthier, o n average, than people are today

and thus better able to adjust to changes in climate. But

they might also have been willing to forgo some of their

affluence to have their natural surroundings and climate

preserved.

Researchers’ increased understanding of climate change

has often uncovered areas of inquiry whose importance

had previously gone unrecognized. In that respect, greater

knowledge has sometimes served to expand the range of

scientific and economic unknowns, even as it has resolved

15. An extensive discussion of technological options and the costs of

capturing and sequestering carbon dioxide from power plants can

be found at the Web site of the International Energy Agency’s

Greenhouse Gas Research and Development Programme at

www.ieagreen.org.uk/index.htm.

CHAPTER TWO THE SCIENTIFIC AND HISTORICAL CONTEXT 21

specific issues (see Kerr, 2001, pp. 192194). Because of

that tendency, policymakers for the foreseeable future will

continue to face great uncertainty in determining the

potential costs and effects of different policies to address

the problem of climate change. Furthermore, policies that

explicitly take into account that range of uncertainty are

likely to be more effective than policies that do not.

16

16. See Heal and Kriström (2002) for a more extensive discussion of

uncertainty and climate change.

3

The Economics of Climate Change

The Earth’s atmosphere and climate are part of the

stock of natural resources that are available to people to

satisfy their needs and wants over time. From an economic

point of view, climate policy involves measuring and com

paring people’s valuations of climate resources, across

alternative uses and at different points in time, and apply

ing the results to choose a best course of action. Effective

climate policy would balance the benefits and costs of

using the atmosphere and climate and would distribute

them among people in an acceptable way.

Common Resources and Property Rights

Prosperity depends not only on technological advances

but also on developing legal, political, and economic insti

tutions—such as private property, markets, contracts, and

courts—that encourage people to use resources to create

wealth without fighting over or, in the case of renewable

resources, significantly degrading them. The effectiveness

of those institutions depends in part on characteristics of

the resources. Market institutions do not work well when

resources have the characteristics of public goods—that

is, when it is difficult to prevent people from using the

resources without paying for them (consumption is “non

excludable”) and when the incremental cost of allowing

more users is near zero (consumption is “nonrival”).

Market failures also arise when the many people using a

resource affect each others’ use—for instance, when rush

hour drivers create congestion and air pollution. (In that

case, consumption is nonexcludable but rival.) Those

characteristics make property rights for public goods diffi

cult to create and enforce. Private industry finds it rela

tively unprofitable to produce such goods, and consumers

have relatively little incentive to maintain them.

The Earth’s oceans and air are particularly hard to carve

up into private property, and in the ongoing process of

attempting to develop effective institutions to manage

them, access to those resources has largely remained open

—for the most part, no one owns them, anyone can use

them, and no one has to pay. For most of human history,

open access to the oceans and air was appropriate because

the world’s population was too small and its technologies

too limited to deplete stocks of fish, degrade air quality,

or affect the climate.

But population growth and advances in technology have

changed the way people use natural resources and made

them vulnerable to overuse, depletion, and degradation.

If resources are free for the taking, people will tend to

overuse them; if nobody owns them, nobody will take care

of them. That phenomenon is referred to as the tragedy

of the commons: everyone wants to use free resources but

will degrade them if they do, to the detriment of all.

In the case of climate, people want to use the atmosphere

to absorb greenhouse gases so that they may benefit from

cheap food and timber and from plentiful fossil energy.

In the long run, however, that use may significantly de

grade the climate.

An Example: Common Fishing Resources

To keep from overusing a common resource, people must

negotiate and agree on rules about who may use it and

how much of which types of uses are acceptable. Fisheries

provide a common, straightforward example of the prob

lem: a fishing community may have to determine the sus

tai nable l evel of fishing for each kind of f is h a nd then li mi t

catches to those levels. Limits on fishing will reduce the

CHAPTER

24 THE ECONOMICS OF CLIMATE CHANGE: A PRIMER

market supply of fish and raise their market value. People

who are allowed to keep fishing will reap a windfall profit

on the fish they can legally catch. (Cheaters, or “free

riders,” who catch more than their allowance will also get

windfall profits.) In the meantime, anyone whose fishing

is restricted is likely to sustain a loss.

1

The community’s