Civilian Contract Audit Services

CIVILIAN

CONTRACT

AUDIT SERVICES

Ordering Guide for Contract Audit

Related Services Under the

GSA Multiple Award Schedule (MAS)

This Ordering Guide sets forth the procedures for issuing

task orders against the Multiple Award Schedule (MAS),

Special Item Number (SIN) 541211 Auditing Services.

U.S. General Services Administration

Professional Services and Human Capital Categories (PSHC)

Revised May 2023

Civilian Contract Audit Services

1 | Page

Table of Contents

INTRODUCTION ................................................................................................................... 3

SCOPE OF THE ORDERING GUIDE ....................................................................................... 3

WHO IS THIS GUIDE WRITTEN FOR? .................................................................................... 3

THE EMERGING NEED .......................................................................................................... 4

HOW THIS DOCUMENT IS ORGANIZED ............................................................................... 4

SECTION 1. CONTRACT AUDIT SERVICES – UNIQUE CHARACTERISTICS ........................... 5

Areas and Types of Contract Audit Services ...................................................................................... 5

Contract Audit Services throughout the Procurement Lifecycle ........................................................ 5

Qualified Private Auditor ....................................................................................................................... 6

Inherently Governmental Functions ........................................................................................................ 6

Cognizance and Coordination ............................................................................................................... 7

SECTION 2. PROCUREMENT BEST PRACTICES ..................................................................... 8

Align Mission Requirements .................................................................................................................. 8

Determine Accurate Estimates ............................................................................................................. 8

Select Pricing Architecture .................................................................................................................... 8

Develop Requirements .......................................................................................................................... 9

Selection Methodology/Criteria ...................................................................................................... 11

IN DETERMINING THE PROCUREMENT METHOD, IT IS HIGHLY RECOMMENDED THAT ORDERING

AGENCIES CONSIDER AND UTILIZE THE BEST VALUE PROCUREMENT METHOD AS STATED IN FAR PART

8.404(D) AND 8.405-4. ..................................................................................................... 12

SECTION 3: MEASUREMENT OF A SUCCESSFUL AUDIT .................................................... 12

SECTION 4: AN INDUST

RY PERSPECTIVE .......................................................................... 13

DEVELOPING REQUIREMENTS ......................................................................................................... 14

EVALUATING SOLICITATIONS ......................................................................................................... 15

APPENDIX A: VERIFICATION OF LICENSURE .................................................................... 15

APPENDIX B SAMPLES QUALITATIVE EVALUATION FACTORS ....................................... 17

DEPARTMENT OF HOMELAND SECURITY – RFQ HSHQDC-16Q-00081 ............................ 18

Factor 1: Technical Experience/Understanding and Capabilities ............................................... 18

Factor 2: Management Approach ...................................................................................................... 18

Factor 3: Past Performance ................................................................................................................. 18

PENSION BENEFIT GUARANTEE CORPORATION – RFQ PBGC01-RQ-16-0068 ................ 19

Factor 1: Technical Approach.............................................................................................................. 19

Factor 2: Past Performance ................................................................................................................. 19

Factor 3: Business Management Approach....................................................................................... 19

Factor 4: Key Personnel and Staffing Plan

......................................................................................

19

U.S. AGENCY FOR INTERNATIONAL DEVELOPMENT (USAID) - SPECIAL INSPECTOR GENERAL FOR

AFGHANISTAN RECONSTRUCTION - RFQ 16-233-SOL-00641 ......................................... 20

Factor 1: U.S. Government Audit Capability ................................................................................... 20

Factor 2: Experience with USAID or USAID and Department of State Contracts ..................... 20

Revised May 2023

Civilian Contract Audit Services

2 | Page

Factor 3: Afghan-specific Capability ................................................................................................ 20

Factor 4: Past Performance ................................................................................................................. 20

U.S. AGENCY FOR INTERNATIONAL DEVELOPMENT (USAID) - RFQ SOL-267-16-00000820

Factor 1: Past Performance ................................................................................................................. 20

Factor 2: Technical ................................................................................................................................. 20

NATIONAL AERONAUTICS AND SPACE ADMINISTRATION SHARED SERVICES CENTER SOLICITATION

NNX16ZXD040R ............................................................................................................... 21

Factor 1: Technical – Product Work Samples with Corresponding Audit Program .................. 21

Factor 2: Past Performance ................................................................................................................. 21

APPENDIX C.1. SAMPLE CONTRACTOR EMPLOYEE NON-DISCLOSURE AGREEMENT (NDA) 22

APPENDIX C.2. ATTACHMENT TO EMPLOYEE NON-DISCLOSURE AGREEMENT – PRIVACY ACT 25

APPENDIX D. SAMPLE COST ACCOUNTING STANDARDS BOARD DISCLOSURE STATEMENT 27

APPENDIX E. CONTRACT AUDIT WORKING GROUP AGENCIES AND OFFICES ............... 28

OTHER RESOURCES ........................................................................................................... 29

Revised May 2023

Civilian Contract Audit Services

3 | Page

Information to assist customer

agencies in using this Guide is

available online at

www.gsa.gov/Schedules

This Guide includes examples of

solicitation excerpts, lists of

industry partners and many

other useful documents.

Civilian Contract Audit Services

O R D E R I N G G U I D E F O R C O N T R A C T A U D I T R E L A T E D S E R V I C E S U N D E R

T H E P R O F E S S I O N A L S E R V I C E S S C H E D U L E

INTRODUCTION

Thank you for choosing the Multiple Award Schedule (MAS) offering of Auditing Services (SIN 541211) to

fulfill your contract audit services requirement. This Ordering Guide, also referred to as The Guide hereafter,

will help the ordering office effectively use SIN 541211 to deliver contract audit solutions for mission need.

MAS is an indefinite delivery/indefinite quantity (IDIQ) vehicle, providing direct access to a variety of

professional services. Using the streamlined procurement procedures in the Federal Acquisition Regulations

(FAR) Subpart 8.4

Federal Supply Schedules, MAS offers federal agencies access to experienced

contractors who provide a range of commercial professional services at discounted and competitive prices.

SIN 541211 is defined by the General Services Administration as “Financial-related audits, performance

audits, recovery audits, transportation audits, and contract audits in accordance with Generally Accepted

Government Auditing Standards (GAGAS) and non-GAGAS.

Perform an independent assessment of an audited entity's financial

statements in conformity with generally accepted accounting principles,

financial information, adherence to financial compliance requirements and

internal controls, or organization or program performance to identify

areas for improvement.”

Qualified contractors participating under SIN 541211 have been

pre-screened to ensure they are a licensed Certified Public Accounting

(CPA) firm. Appendix A

provides a list of states, territories and/or

foreign countries and associated websites to check the most up-to-date licensure status.

It is important to note that Federal contract audits must: 1) perform in accordance with GAGAS and 2) be

peer reviewed. Not all companies under this SIN perform engagements requiring compliance with GAGAS, or

have been peer reviewed. Therefore, both compliance with GAGAS and peer review should be considered

and included as a requirement when developing the Request for Quotation (RFQ) and evaluation criteria.

SCOPE OF THE ORDERING GUIDE

The Guide is intended to provide guidance on contract audits and procuring contract audit related services

through qualified contract auditing firms and their staff. For these services, using SIN 541211 is highly

recommended. Contract Audits and related services fall under the North American Industry Classification

System (NAICS) 541211 and Product Service Code (PSC) R704.

WHO IS THIS GUIDE WRITTEN FOR?

This Guide is a result of a cross-agency collaboration seeking to maximize efficiencies within the civilian

contract audit procurement process.

Revised May 2023

Civilian Contract Audit Services

4 | Page

The Guide is an information resource and starting point for acquisition professionals seeking contract audit

support through the GSA MAS program. The Guide highlights best practices and suggests recommendations

to consider when securing a contractor savvy in the discipline and delivery of contract audit services.

Procuring and conducting Federal contract audits are different from standard financial audits. This Guide

addresses concepts unique to acquiring Federal contract audits and contract audit related services. It

presumes the ordering Contracting Officer is proficient in his or her duties. It will not address general

contracting issues or concepts unless necessary for complete understanding.

THE EMERGING NEED

While the Defense Contract Audit Agency (DCAA) primarily serves the Department of Defense as the executor

of contract audits for cost reimbursable contracts, it also serves the civilian agency community. There are,

however, instances when the DCAA may be unable to fulfill the needs of civilian agencies so certified public

accounting firms provide a good alternative.

This Guide is intended to help civilian agencies that cannot use or chose not to use DCAA as their contract

audit provider.

HOW THIS DOCUMENT IS ORGANIZED

This document is broken into three sections:

Section 1. Unique Characteristics of Contract Audits. This section provides an overview of the qualification

requirements Certified Public Accountants (CPA) to perform contract audits for the Federal government and

looks at the types of contract audits normally conducted. It highlights the intersection of inherently

governmental and non- inherently governmental functions as well as addresses the critical subject of

cognizance and coordination.

Section 2. Best Practices in Contract Audit Acquisitions. This section outlines key considerations in developing

your acquisition plan and preparing the task order solicitation.

Section 3. Measurement of a Successful Contract Audit. The measurement of a successful contract audit boils

down to performing an impartial evaluation of compliance with applicable regulation and statutory

requirements. This section discusses the critical elements that will increase the likelihood of quality audit

deliverables and findings.

Additionally, several Appendices provide additional information and examples:

• Appendix A. Verification of Certified Public Accountants (CPA) Licensure – This appendix includes a list

of websites that allow Contracting Officers to verify contract licensure.

• Appendix B. Qualitative Evaluation Factors – This appendix provides examples of contract audit

solicitations created by DHS, PBGC, USAID, and NASA. These solicitations provide strong examples of

u

sing qualitative criteria to secure qualified contract audit services providers. Because contract audits a

re

h

eavily driven by regulation it is imperative providers are able to offer specifics about their success an

d

prov

en processes and procedures.

• Appendices C.1 and C.2 – These appendices include a sample Contractor Employee Non-Disclosure

Agreement and sample Privacy Act Compliance Statement–These samples are useful in creating these

Agreement

s and creating a complete RFQ packag

e.

• Appendix D. Sample Cost Accounting Standards Board (CAS) Disclosure Statement

• Appendix E. Cross-Agency Membership and Respective Agency Offices

Revised May 2023

Civilian Contract Audit Services

5 | Page

SECTION 1. CONTRACT AUDIT SERVICES – UNIQUE CHARACTERISTICS

While there are many considerations that set the conduct and delivery of contract audit services apart from

financial audits, the following factors are valuable in planning targeted procurements.

Areas and Types of Contract Audit Services

The provision of contract audit services differs from the standard

financial audit in some key ways. Major areas of emphasis include:

1. Business Systems

2. Management Policies and Procedures

3. Cost Estimating and Forecasting

4. Internal Controls

5. Compliance with FAR Cost Principles (FAR Part 31)

6. Cost Accounting Standards

7. Pricing Policy (FAR Part 15.4)

Contract audits are independent, professional compliance

assertions (i.e., proposals, claims, or submissions) made by

contractors. The sidebar outlines the types of contract audit

services in the areas of pre- and post-award services, business

systems audits, and negotiations assistance.

The term ‘contract audit’ or ‘audit’ is used throughout this guide as

a generic term to cover all types of engagements to include

financial audits, examinations, reviews, agreed-upon procedures,

and performance audits, however ordering agencies should

exercise caution and diligence in selecting terminology for their

requirement.

For a fuller description of the different audits, consult the

DCAA’s Directory of Audit Programs.

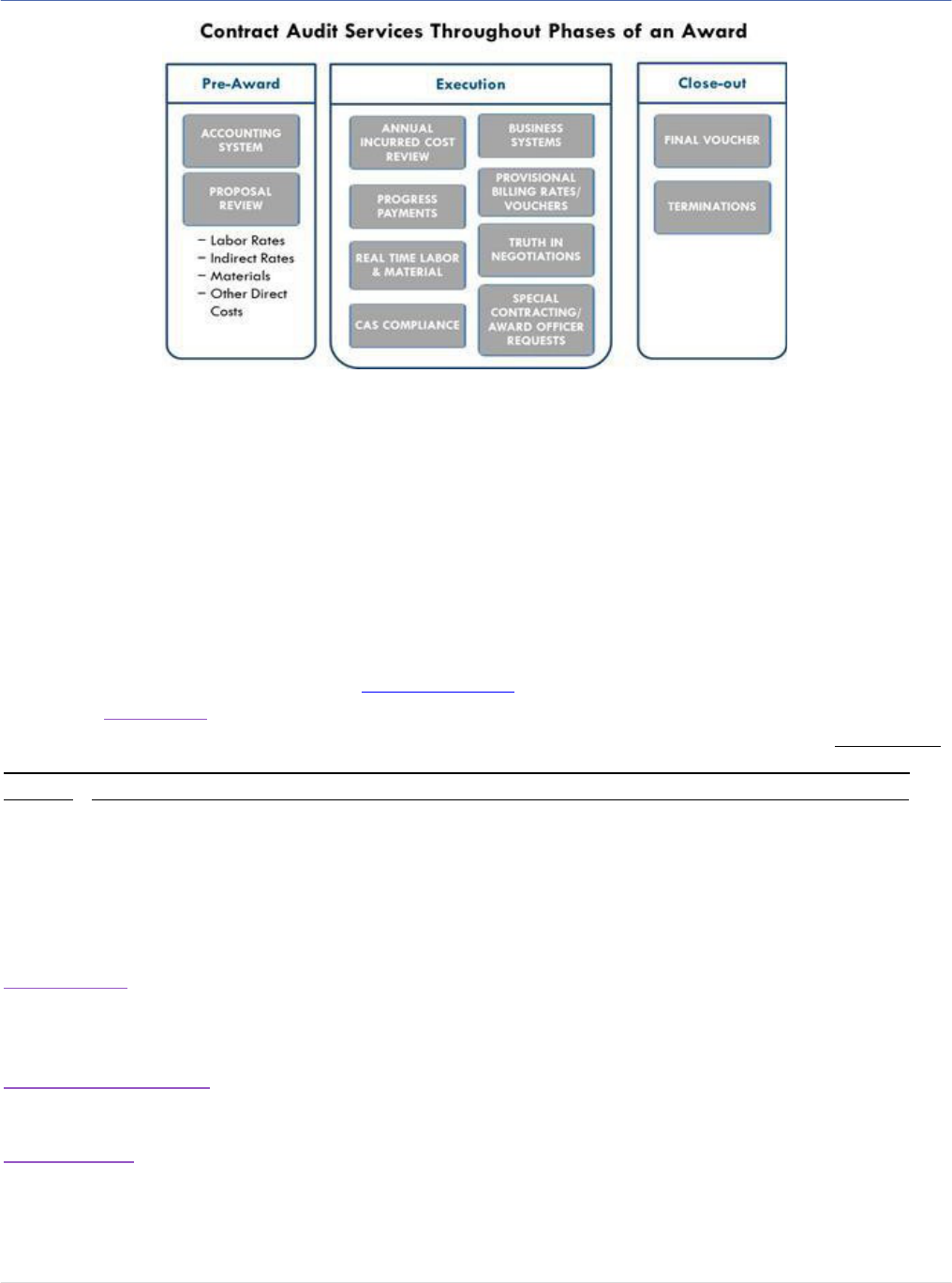

Contract Audit Services throughout the Procurement Lifecycle

It is also helpful to understand the variety of contract audit services which relate to each phase of the contract

lifecycle. Below is a graphical depiction of the services throughout.

PRE-AWARD CONTRACT AUDIT SERVICES

•

Pre-Award Contract Audit Services

•

Contract Price/Cost Proposal Reviews

•

Forward Pricing Rate Proposal

Reviews

POST-AWARD CONTRACT AUDIT SERVICES

•

Provisional Billing Rate

Recommendations

•

Incurred Costs/Final Overhead Rate

Reviews

•

CAS Compliance & Adequacy

Reviews

•

Penalty Assessment

BUSINESS SYSTEM AUDITS

•

Accounting

•

Estimating

NEGOTIATION ASSISTANCE

•

Fact-finding and analysis of

contractor information after audit

report is issued

Revised May 2023

Civilian Contract Audit Services

6 | Page

Qualified Private Auditor

A qualified commercial auditor must be—

− GAGAS Compliant. The auditor performs audits in accordance with GAGAS of the Comptroller

General of the United States.

− Peer Reviewed. The purpose of a peer review is to ensure a CPA firm does quality work in

accordance with industry standards and regulations. The CPA firm must provide a copy of its most

recently completed peer review report, as well as any internal documents issued to address corrective

action for noted deficiencies.

Qualified contractors participating under MAS SIN 541211 have been screened to ensure they are licensed

CPA firms. (Appendix A provides a resource to confirm current licensure. It provides websites of states,

territories, and/or foreign countries an ordering agency can check up-to-date licensure statuses.) As the scope

of SIN 541211 covers financial-related audits, performance audits, and contract audits, not all companies

under this SIN will perform contract audits as some may focus on audits of financial statements exclusively.

Inherently Governmental Functions

The subject of inherently governmental functions must be understood and carefully managed during the

procurement and execution of the contract audit services. The following provides guidance regarding this

important subject.

FAR 15.404-1 provides that Contracting Officers have the sole responsibility to determine fair and

reasonable prices, however FAR 15.404-1(a)(5) provides that ’the contracting officer may request the advice

and assistance of other experts to ensure that an appropriate analysis is performed.’

FAR 7.503 (c )(12) (vii) bars contractors from “Determining whether contract costs are reasonable, allocable,

and allowable; and …

FAR 42.101(a) provides guidance regarding contract auditor responsibilities. Briefly, contract auditors

provide Contracting Officers with pricing information or audit services in support of the government’s

independent decisions and determinations. In 42.101(a) the contract auditor’s responsibilities are outlined as:

Revised May 2023

Civilian Contract Audit Services

7 | Page

(1) Submitting information and advice to the requesting activity,

based on the auditor's analysis of the contractor's financial and

accounting records or other related data as to the acceptability

of the contractor's incurred and estimated costs;

(2) Reviewing the financial and accounting aspects of the

contractor's cost control systems; and

(3) Performing other analyses and reviews that require access to

the contractor's financial and accounting records supporting

proposed and incurred costs.

After the audit report is received, the Contracting Officer must

perform an analysis of the report to determine the Government’s

position. This is frequently done in a pre-negotiation objectives memorandum. The Contracting Officer must

perform the independent analysis to ensure inherently Governmental responsibilities are not being delegated

to the auditor.

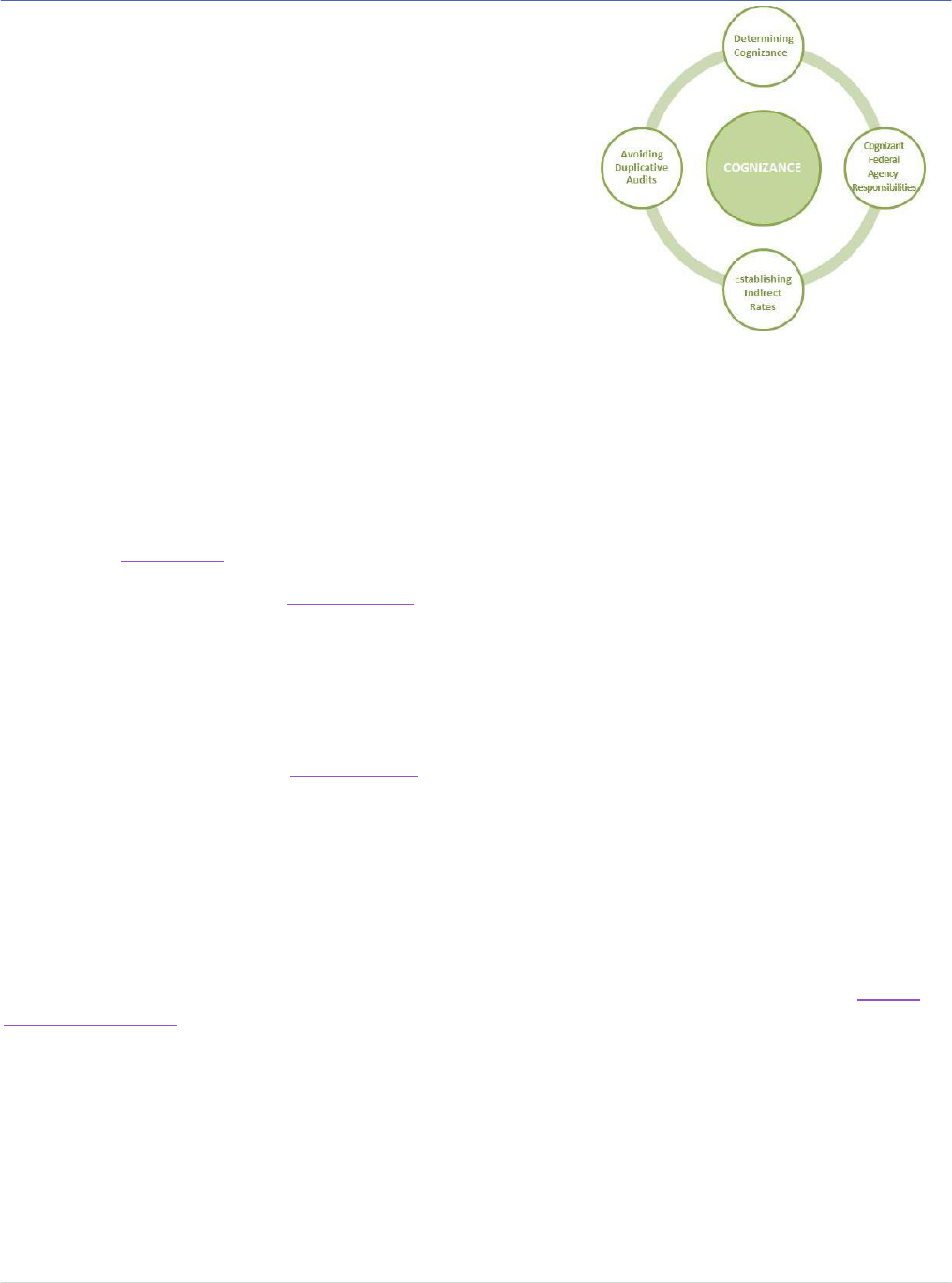

Cognizance and Coordination

There are several locations in the FAR that reference cognizance, Cognizant Federal Agency and the

responsibilities of the Cognizant Federal Agency. The need to coordinate through inter-agency agreements is

addressed in FAR 42.002.

Determining Who is Cognizant. FAR 42.003(a) states “the Cognizant Federal agency normally will be the

agency with the largest dollar amount of negotiated contracts, including options. For educational institutions

(defined as institutions of higher education in the OMB Uniform Guidance at 2 CFR part 200, subpart A, and 20

U.S.C. 1001) and nonprofit organizations (as defined in the OMB Uniform Guidance at 2 CFR part 200), the

Cognizant Federal agency for indirect costs is established according to the OMB Uniform Guidance at 2 CFR part

200, appendices III and IV, respectively”.

Contract Audit Services. Further, FAR 42.101(b)

specifies “Normally, for contractors other than educational

institutions and nonprofit organizations, the Defense Contract Audit Agency (DCAA) is the responsible

Government audit agency. However, there may be instances where an agency other than DCAA desires

cognizance of a particular contractor. In those instances, the two Agencies shall agree on the most efficient and

economical approach to meet contract audit requirements. For educational institutions (defined as institutions of

higher education in the OMB Uniform Guidance at 2 CFR part 200, subpart A, and 20 U.S.C. 1001) and

nonprofit organizations (as defined in the OMB Uniform Guidance at 2 CFR part 200), audit cognizance will be

determined according to the provisions of the OMB Uniform Guidance at 2 CFR part 200, subpart F.”

Cost Accounting Standards and Cognizant Federal Agency Responsibilities. The requirements of 48 CFR

Section 9903.201-7 shall, “to the maximum extent practicable, be administered by the Cognizant Federal

Agency responsible for a particular contractor organization or location, usually the Federal agency responsible

for negotiating indirect cost rates on behalf of the Government. The Cognizant Federal agency should take the

lead role in administering the requirements of Part 9903 and coordinating CAS administrative actions with all

affected Federal agencies. When multiple CAS-covered contracts or more than one Federal agency are involved,

Agencies should discourage Contracting Officers from individually administering CAS on a contract-by-contract

basis. Coordinated administrative actions will provide greater assurances that individual contractors follow their

cost accounting practices consistently under all their CAS-covered contracts and those changes in cost accounting

practices or CAS noncompliance issues are resolved, equitably, in a uniform overall manner.”

Revised May 2023

Civilian Contract Audit Services

8 | Page

Establishing Indirect Rates. Indirect rates are established in accordance with FAR 42.7, however it is

important to note that per FAR 42.703-1(a),

“a single agency shall be responsible for the establishment of the

final indirect cost rates for each business unit. These rates shall be binding on all Agencies and their

Contracting Officers, unless otherwise specifically prohibited by statute”. It is imperative that the Contracting

Officer validate whether or not another Agency has cognizance and has already established indirect rates

with a business unit prior to establishing their own indirect rates.

Avoiding Duplicative Audits. FAR Part 42.002 This sub-part supports the need for a primary Agency to

conduct contract audits on behalf of itself and other Agencies that might have similar interests and needs. It

provides that “Agencies shall avoid duplicate audits, reviews, inspections, and examinations of contractors or

subcontractors, by more than one agency, through use of interagency agreements”. To do otherwise, generates

administrative cost and inefficiency in the acquisition system. This approach recognizes the value of focusing

the contract audit on the adequacy of management and financial systems and controls, along with transaction

testing across all business activities, rather than conducting contract-by-contract audits. It also lays the

foundation for the need to coordinate contract audit activities with relevant agencies.

SECTION 2. PROCUREMENT BEST PRACTICES

Based on feedback from Price-Cost Analysts, Procurement Contracting Officers (PCOs), Administrative

Contracting Officers (ACOs), and Inspectors General (IG) planning the features of your audit is a necessary

first step. The time spent in planning the procurement of contract audit services pays dividends throughout the

lifecycle of the procurement –contract award, administration, and closeout.

The task order RFQ should provide instructions to the Offerors on how to identify and call attention to the

intent to use the specialized skill set. Key considerations to address in developing your acquisition plan and

preparing the task order RFQ include:

Align Mission Requirements

Align mission objectives with the statutory audit records requirements; determine necessary contract audit and

financial advisory services needed; conduct market research/perform due diligence to identify which

agencies, organizations, or companies are best suited to provide the necessary and timely financial advisory

services; and identify assumptions.

Determine Accurate Estimates

It is incumbent upon the ordering office to determine accurate estimates based on identified variables and

constraints specific to the provided requirements and to the agency itself. Estimates should be based on

historical data and realistic internal agency analysis to the maximum extent possible. Clearly identified and

stated variables and constraints enable you to set boundaries of any activity and the associated deliverables.

They help create the backdrop – they tell how much you can afford to do; how long you can afford to take.

For each activity and deliverable, there should be some tailored estimates.

Select Pricing Architecture

It is incumbent upon the agency to identify accurate assumptions and constraints about the audit to get best

estimates.

Determining the appropriate contract type requires the exercise of sound judgment. Here are a few

considerations as you develop your strategy.

Revised May 2023

Civilian Contract Audit Services

9 | Page

Agency Responsibility

Notes/Comments

Firm-Fixed

Price

Estimate types of audits

and generic delivery

timeframes for each audit

type

Establishes a clear, specific,

agreed upon price up front to be

paid for acceptable services

received

Time and

Materials

Establish a ceiling for level

of effort

See FAR 8.404(h).

Develop Requirements

Contract audit services themselves cover a broad range of actions. As part

of your Request for Quote (RFQ) evaluation, GSA recommends that you

specifically address both corporate and individual experience for the type

of contract audit service required.

Ordering agencies should consider reviewing cognizance and coordinating with other agencies, to include

DCAA (DCAA[email protected]

) prior to placing a task order to ensure the agency’s

intentions are clear and that there is no duplication of effort. They should also review their internal

requirements and notify their agency IG prior to placing a task order for contract audit services if required.

By informing the IG of the intent to order auditing services, the ordering office can mitigate potential concerns

and issues from the IG after award and ensure task orders meet agency policies. Briefly, the ordering office

should consider the following:

− Organizational Conflicts of Interest (OCI). Per FAR Subpart 3.11, FAR Part 9.5 and Schedule Clause

C-FSS-370(f), Contractor Tasks/Special Requirements (November 2003)

− Non-disclosure Agreements

− Security Clearance requirements

− Inherently Governmental Functions - Requirements official should provide the Operational Contracting

Officer (OCO) with a written determination that these are not included in the scope

− Data Security – how will data be secured and transferred between the Agency and CPA firm

− GAGAS Compliance

− CPA Licensure

− Deliverable format/s

− Types, numbers, and frequencies of contract audits to be conducted

− Applicable regulations to the time period of the audit

It’s important to note that “Yellow Book” audits encompass many types of audits for which not all CPA firms

have technical expertise. These include audits of not-for-profits and audits of the government itself, as well as

contract audit services. Specific experience in contract audit within Yellow Book should be considered when

evaluating requirements rather than a standard Yellow Book audit compliance requirement.

Additionally, ordering agencies should consider the American Institute of Certified Public Accountants (AICPA)

standards and Generally Accepted Government Auditing Standards (GAGAS) have defined words to have

specific meanings and to carry much weight when it comes to the type of report and the level of assurance the

Government wishes to receive, as well as the Level of Effort (LOE) for the Offeror, therefore words such as

“examination,” “audit,” and “review” should not be considered interchangeable.

Create Quality Assurance Surveillance Plan

FAR Part 3, Government

business must also prohibit

personal conflicts of interest

and shall be conducted in a

manner above reproach

and, except as authorized

by statute or regulation,

with complete impartiality

and with preferential

treatment for none. The

general rule is to avoid

strictly any conflict of

interest or even the

appearance of a conflict of

interest in Government-

contractor relationships

Revised May 2023

Civilian Contract Audit Services

11 | Page

Effective and frequent two-way, face-to-face communication between the CO and contractors including audit

planning, performance, and reporting is imperative.

− Identify applicable performance metrics

− Establish deadlines for the completion of requested audits. For example, the optimal timeline would be

xx days from claim submission of incurred cost proposals. Once audit has begun, establish a

preliminary deadline for completion but maintain open communication to identify and solve and

potential delays or issues.

− Determine if quality control testing is required and how it will be executed.

The standards of audit quality should be set early. It is only through consistency that auditors know the

Agency’s requirements.

Develop Efficient Audit Management Practices

Risk management is the foundation for implementation of an efficient audit or any oversight management

process. Simply stated, risk management is the identification, assessment, and prioritization of risks, followed

by the coordinated and economical application of resources to minimize the impact of those risks.

Performance Standards in the FAR 1.102-2(c)(2) state: “To achieve efficient operations, the System must shift its

focus from ‘risk avoidance’ to one of ‘risk management’. The cost to the taxpayer of attempting to eliminate all

risk is prohibitive. The Executive Branch will accept and manage the risk associated with empowering local

procurement officials to take independent action based on their professional judgment.”

To begin, establish definable and measurable auditing criteria, materiality, and acceptable time frames by

audit type:

-

Materiality Thresholds – Consistent with industry standards, audit firms establish their own materiality

thresholds to obtain the auditor’s independent position on the item being audited. However, the

Government has ability to ask the auditor to report all instances of non-compliance, regardless of the

dollar amount involved.

-

Mitigation – Consider the specific measures designed to reduce the extent of exposure to a risk by

reducing the severity of consequences or reducing the probability of the risk’s occurrence.

-

Work of Others – The GAO’s Government Auditing Standards state that determinations should be

made whether other auditors have conducted, or are conducting, audits that could be “relevant” to the

current audit objectives. It also includes guidance on procedures that may be performed to use the

work, thereby avoiding duplication of efforts and expense.

Firmly Established Due Dates – Efficient audit management is consequential for both the government and the

auditor to maximize the investment of both Government and contractor resources. The Contracting Officer

can request a milestone schedule in the RFQ as part of the technical proposal and then incorporate the

agreed upon schedule into the task order award. Coordinating with the auditee ahead of time will help to

ensure there are no major conflicting priorities that could impact the timeline of the Government and/or the

auditor on any proposed audit schedules.

The establishment of a risk-based, time-phased audit process with a firm schedule, milestones and due dates

will support the delivery of quality and timely contract audits. In addition to efficient audit management

practices, performing audit activities on a concurrent basis throughout the year positively impacts the success

of the audit program.

Assemble Request for Quote (RFQ) Package.

The contractors under MAS SIN 541211 have already been confirmed to have their CPA license at time of

the award of the schedule contract. Ordering agencies may want to request, as part of the evaluation

Revised May 2023

Civilian Contract Audit Services

12 | Page

BEST PRACTICE

Cognizance and Coordination

– to ascertain there is no

duplication of audit efforts,

request the subject contractor

being audited to specify other

agencies they work with. In

many instances the contractor

will have easy access to this

information.

criteria, a confirmation statement from the contractor that they are still a licensed CPA firm and ask for a

copy of the active license(s).

MAS SIN 541211 contractors were also asked before award of the Schedule contract to submit a peer

review report and any internal documents to explain what corrective action has been taken regarding any

deficiencies. Ordering agencies may wish to ask for an updated report as part of the evaluation to document

any changes since time of original award.

Ordering offices may wish to ask for specific information on both corporate and individual experience for the

type of contract audit services you are buying.

Determine cognizance and coordinate to ascertain there is no duplication of audit efforts by other buying

offices in your organization, DCAA, or with other agencies. Request the subject contractor undergoing the

audit, to specify any intra-agency work underway or identify other agencies/components they work with. The

subject contractor should know which agency/entity is cognizant of their firm.

Agency can provide and/or ask respondents to provide an estimate of the number of hours to complete a

given audit, by audit type. This practice serves as a point of comparison

between proposals and provides the agency insight to evaluate level of effort.

Attachments to Include in RFQ

− Sample of the audit report format/s the successful qualified auditor

will use

− Sample contractor employee non-disclosure agreement for awarded

contractor to use (See Attachment C.1)

− Sample organizational conflict of interest document for contractor to

submit as part of their proposal

References to Include in RFQ

− DCAA Contract Audit Manual (CAM) DCAA Manual 7640.1 available at www.dcaa.mil; under

Guidance, select CAM

− DCAA standard audit programs available at www.dcaa.mil , Directory of Audit Programs

− Government Auditing Standards (The Yellow Book )

− Federal Acquisition Regulation, including FAR Part 30 Cost Accounting Standards, FAR Part 31

Contract Cost Principles and Procedures, FAR Part 42 Contract Administration and Audit Services

− Agency Supplemental References as applicable

Selection Methodology/Criteria

− Contractor assumptions for performing the audit – are they the right assumptions? (Supports ability to

validate price/risk)

− Contractor’s list of risk assumptions and financial impact summary of those assumptions

Are those assumptions acceptable/or not?

− Price reasonableness analysis

Relevan

t experience providing Federal contract/grant and/or subcontract/sub-grant aud

its,

inclu

ding tangible evidence. Sample work products such as description of project planning and audit

methodology

− Considering requiring additional quality standards such as ISO9001Past direct performance

(Individual and Corporate performance as well as Prime or Sub-contractor role)

May consider CPARS reviews /assessmen

ts

− experience using GAGAS and GAGAS compliance when using it

Revised May 2023

Civilian Contract Audit Services

12 | Page

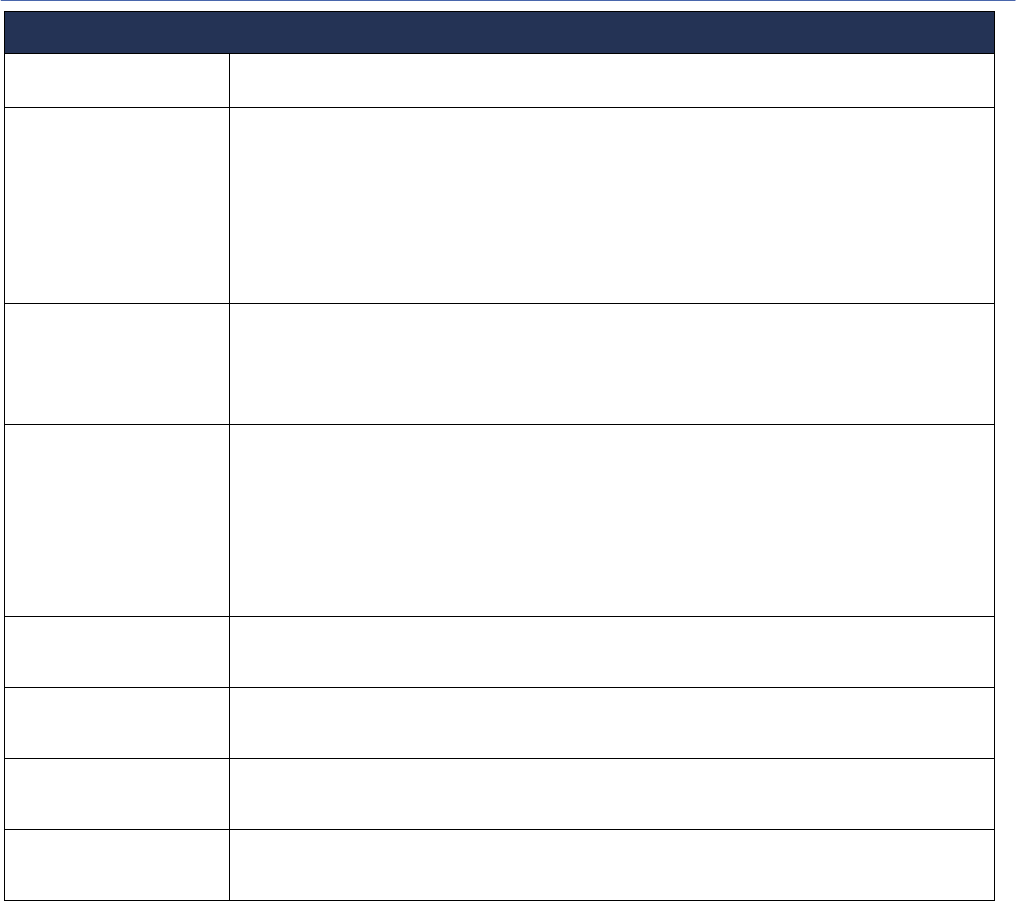

PEER REVIEW RATINGS

There are three ratings:

1. “Pass”

2. “Pass with Deficiencies”, and

3. “Fail.”

There may be limited

circumstances where a more

permissive standard would be

beneficial (e.g. small or

underserved markets).

−

CPA Licensure

− Peer Review Rating Acceptability (see box).

− Pre-Qualified Items

Organizational Conflicts of Interest (OCI) - A qualified private auditor is one that certifies no conflict of

interest in performing specified contract audit.

Did the Contractor identify and thoroughly evaluate all potential conflicts of interest? Did they

recuse themselves for work for which they might have a conflict? (i.e., they cannot evaluate a

Federal contractor with whom they already have an

agreement or are under contract with as their client)

- In

accordance with FAR 2.101(b), if the Contractor (and any

subcontractors, consultants, or teaming partners) has or is

currently providing support or anticipates providing support

to the Government that creates or represents an actual or

potential OCI, the Contractor shall immediately disclose this

actual or potential OCI in accordance with FAR Subpart 9.5.

The Contractor is also required to complete and sign an OCI

Statement in which the Contractor (and any subcontractors,

consultants, or teaming partners) agrees to disclose

information concerning the actual or potential conflict with

any proposal for any solicitation relating to any work in the

task order. All actual or potential OCI situations shall be

identified and addressed in accordance with FAR Subpart 9.5.

Non-Disclosure Agreements

IN DETERMINING THE PROCUREMENT METHOD, IT IS HIGHLY RECOMMENDED THAT ORDERING

AGENCIES CONSIDER AND UTILIZE THE BEST VALUE PROCUREMENT METHOD AS STATED IN FAR PART

8.404(D) AND 8.405-4.

SECTION 3: MEASUREMENT OF A SUCCESSFUL AUDIT

Success measures for audits differ, based on whether the audit is conducted pre-award or post-award. Pre-

award, success includes reasonably projecting and quantifying risk in a timely manner. Post-award success

involves accurately verifying and/or evaluating cost/price for compliance with contract terms and regulations

in a timely manner. It is critical that the contracting office establish definable and measurable auditing

criteria, materiality, and acceptable time frames by audit type. The design and implementation of proper

performance metrics will increase the likelihood of quality audit deliverables and findings.

Assessing Audit Quality

Risk Assessment

The auditor will identify the risk(s) associated with the requirements being examined. Once

identified, the experienced audit team will scope the risks and develop procedures to test

how the identified risks are affecting the requiring activity.

Planning and

Coordination

Audits will be properly planned and coordinated with the Requestor/Contracting Officials to

ensure the end state meets the need of the agency. Auditors should have a thorough

knowledge of the contractual matters and circumstances affecting audits. Auditors will work

with the requesting official to ensure requirements are clearly identified.

Audit Contents

A quality audit is one that is well documented. The auditor will clearly document answers to

the following questions in the working papers:

−

What procedures were performed?

−

Why were those procedures performed?

−

How were those procedures performed and how do they support the conclusions?

Revised May 2023

Civilian Contract Audit Services

Assessing Audit Quality

−

When were those procedures performed?

−

How does the gathered evidence support the findings and conclusions?

Transaction Testing

Transaction testing is focused on the areas with the highest risk. Transaction Tests will be

designed and tailored to gather evidence related to the risk areas identified during risk

assessment. In addition, Transaction Testing also serves to identify other areas that

potentially require the scope to be expanded, which will require the Risk Assessment to be

modified. In some cases tests for allowability, allocability, and reasonableness of the cost

incurred in accordance with FAR Part 31 terms and conditions of the contract and/or other

applicable federal regulations will apply.

Evidence/Work Papers

The evidence gathered through these procedures must be sufficient and appropriate to

support the findings and conclusions. There is no set amount as to how much evidence is

sufficient – an audit team will apply best judgment based on prior successful experience in

relation to the assertion being audited.

Experience and

Technical Knowledge

The staff assigned to perform the audit must collectively possess adequate professional

competence needed to address the audit objectives and perform the work in accordance with

GAGAS.

The staff assigned to conduct an audit in accordance with GAGAS should collectively possess

the technical knowledge, skills, and experience necessary to be competent for the type of

work being performed before beginning work on that audit.

Consistent Conclusions

If the contract audit is performed well, a similarly situated auditor, with the same evidence

and applied procedures would reach the same conclusions.

Timeliness

Audits should be performed and reports provided to the agency before their need expires,

such as contract period or statute of limitations.

Contract Audit

Compliance

The contract audit must be in accordance with GAGAS and will be compliant with the

contract terms and applicable government acquisition regulations.

GAGAS Compliance

Contract audits are required to comply with GAGAS. The GAGAS provides guidelines that

an audit team must follow when performing an audit.

Judgment, based on experience and a deep understanding of the requirement and the adherence to statutory

regulations plays heavily into the quality of the contract audit. The documentation in the working papers must

be clear and explicit as to what, how, and why the procedures performed support the findings and

conclusions.

There is no universal checklist for ascertaining the quality of an audit; some professional judgment is

necessary. GAGAS 3.68 states, “Professional judgment does not mean eliminating all possible limitations or

weaknesses associated with a specific audit, but rather identifying, assessing, mitigating, and explaining them.”

Thus, the documentation in the working papers must be clear and explicit as to how and why the procedures

performed support the findings and conclusions.

In summary, the success of an audit is essentially judged by whether the audit is provided in conformance with

professional standards and applicable regulations, meets the needs of the ordering office, and is completed

in a timely manner.

SECTION 4: AN INDUSTRY PERSPECTIVE

Industry partners who have performed audit services in the government marketplace collaborated with the

Working Group and provided the following key insights for ordering agencies to consider when developing

Revised May 2023

Civilian Contract Audit Services

their requirements, evaluating their solicitations, and administering their awards.

DEVELOPING REQUIREMENTS

- Considering requiring additional quality standards such as ISO9001

Pricing Considerations

The following assumptions should be considered when applying a fixed-price strategy:

− Agency Support. Auditors require the support of the Agency personnel to achieve timely completion

of the project. Support includes the collection of relevant documents (paper or electronic) and the

scheduling of interviews and coordination of meetings.

− Project Management. The requesting Agency will designate a management-level individual to

oversee the conduct of this project, including coordination of the resources needed and review of draft

deliverables. The personnel assigned to the project will review draft deliverables on a timely basis.

− Consistent with Government Auditing Standards, the Agency’s management is responsible for making

an informed judgment on performance audits results and agree to:

Designate a suitably skilled, knowledgeable, and experienced management-level individual to

be responsible and accountable for overseeing the performance audits

Establish, maintain, and monitor the progress of the performance audits to make certain that they

meet management’s objectives

Make all management decisions and perform all management functions related to the

performance audit and accept full responsibility for such

Evaluate the adequacy of the services performed and findings that result

− Agency management should also agree

that all records, documentation, and information the auditor requests in connection with

performance audits will be made available as well as assist with any issues encountered in

obtaining contractor (auditee) records requested,

that all material information will be disclosed

that the auditor will have the full cooperation of contractor personnel. In completing the

performance audits, or other types of audits the requesting Federal agencies may request,

The auditor will make specific inquiries of contractor management and request documentary

evidence regarding the performance audit objectives and, where appropriate, the effectiveness

of internal control and obtain a representation letter from contractor management about these

matters.

Cost Savings Measures

-

In developing Acquisition Strategies and forming contract vehicles, consider flexible options such as a

Blanket Purchase Agreement to achieve time-saving and financial efficiencies of ordering audits for

multiple contractors and multiple similar engagements under one task order, as opposed to issuing

various task orders by individual audit. Ordering agencies may have Contract Line Items (CLIN) by

contractor or by individual audit under one award. This will lead to a lesser contract administration

burden on the Government and will aid in reducing overall cost because vendors can maximize

efficiencies by using economies of scale and staffing task orders accordingly.

-

Efficiencies in allowing for multiple-purpose reports; for example, by grouping a contractor’s incurred

cost audits in two-to-four Fiscal Year (FY) increments or by grouping multiple business systems of the

Revised May 2023

Civilian Contract Audit Services

same contractor in one report. This reduces the cost of planning and reporting on multiple years/items

separately and gives Contracting Officers (CO) more information in the appropriate context and

form.

-

Consider the use and authorization of teaming arrangements. Often teaming arrangements can assist

in applying the appropriate safeguards when a vendor has an Organizational Conflict of Interest

(OCI) while still being able to bid on a task order that might contain many other non-conflicted audits.

However, ordering agencies should note and enforce that teaming partners and subcontractors must

still meet the requirements of the “Qualified Private Auditor” section.

-

Concepts of materiality, using the work of others, and report/engagement efficiency expectations are

critical elements that make large differences in Level of Effort (LOE)

SOW Development

-

If an agency does not have a standard report format they prefer, it may be beneficial to ask the

Offeror to submit a report template used by their firm for evaluation.

-

Although GAGAS incorporates by reference the American Institute of Certified Public Accountants

(AICPA) standards, such as the Statements on Auditing Standards (SAS) and the AICPA’s Statements on

Standards for Attestation Engagements (SSAE), it is a good practice to identify the most important

AICPA standards (GAAS or SSAE) that should be taken into consideration in the RFP. This would

provide a better understanding to the CPA (Offeror) when preparing the technical portion of the RFQ.

EVALUATING SOLICITATIONS

− Depending on the contents of a Non-Disclosure Agreement, Offerors may not be able to provide

actual work products without significant redactions

Revised May 2023

Civilian Contract Audit Services

APPENDICES

Revised May 2023

Civilian Contract Audit Services

15 | Page

APPENDIX A: VERIFICATION OF LICENSURE

STATE

WEBSITES TO VERIFY CPA LICENSURE

Alaska

https://www.commerce.alaska.gov/web/cbpl/ProfessionalLicensing/BoardofPublicAccountancy.aspx

Arizona

http://www.azaccountancy.gov/CPADirectory/CPASearch.aspx

Arkansas

https://www.ark.org/asbpa_olr/app/search.html

California

https://www.dca.ca.gov/cba/consumers/license-lookup.shtml#:~:text=Welcome%20to%20the%

20California%20Board,CPA%20or%20California%20Accounting%20Firm

Colorado

https://apps.colorado.gov/dora/licensing/Lookup/LicenseLookup.aspx

Connecticut

https://www.elicense.ct.gov/Lookup/LicenseLookup.aspx

Delaware

https://dpronline.delaware.gov/mylicense%20weblookup/Search.aspx

District of Columbia

https://dlcp.dc.gov/node/1617636#:~:text=The%20public%20is%20encouraged%20to,Accountancy%20to%20a%

20central%20database.

Florida

https://www.myfloridalicense.com/wl11.asp?mode=0&SID=

Georgia

http://sao.georgia.gov/gsba-services

Hawaii

https://pvl.ehawaii.gov/pvlsearch/

Idaho

https://dopl.idaho.gov/boa/

Illinois

https://online-dfpr.micropact.com/lookup/licenselookup.aspx

Indiana

https://mylicense.in.gov/everification/Search.aspx

Iowa

https://ia-plb.my.site.com/LicenseSearchPage

Kansas

http://oitsapps.ks.gov/boa/SearchforFirms.aspx

Kentucky

https://secure.kentucky.gov/FormServices/CPA/FirmRenewal/Search

Louisiana

https://elicense.cpaboard.la.gov/Lookup/LicenseLookup.aspx

Maine

https://www.pfr.maine.gov/almsonline/almsquery/welcome.aspx?board=4110

Maryland

https://www.dllr.state.md.us/cgi-

bin/ElectronicLicensing/OP_search/OP_search.cgi?calling_app=CPA::CPA_qselect

Massachusetts

https://elicensing21.mass.gov/CitizenAccess/GeneralProperty/PropertyLookUp.aspx?isLicensee=Y

Michigan

https://www.lara.michigan.gov/colaLicVerify/

Minnesota

https://boa.state.mn.us/findCPA.html

Mississippi

https://www.msbpa.webapps.ms.gov/publicView/PublicDefault.aspx

Missouri

https://pr.mo.gov/accountancy-licensee-search.asp

Montana

https://ebizws.mt.gov/PUBLICPORTAL/searchform?mylist=licenses

Nebraska

http://www.nbpa.ne.gov/search/

Nevada

http://www.nvaccountancy.com/

Revised May 2023

Civilian Contract Audit Services

16 | Page

STATE WEBSITES TO VERIFY CPA LICENSURE

New Hampshire https://forms.nh.gov/licenseverification/

New Jersey https://newjersey.mylicense.com/verification/Search.aspx

New Mexico

https://www.rld.nm.gov/about-us/public-information-hub/consumer-protection/verify-a-license/

New York http://www.op.nysed.gov/opsearches.htm

North Carolina

https://nccpaboard.gov/welcome/search-the-database/

North Dakota

https://cpaverify.org/

Ohio https://elicense.ohio.gov/oh_verifylicense

Oklahoma https://www.ok.gov/oab_web/Departments/Licensing/index.html

Oregon http://licenseesearch.oregonboa.com/

Pennsylvania https://www.pals.pa.gov/

Rhode Island https://elicensing.ri.gov/Lookup/LicenseLookup.aspx

South Carolina

https://verify.llronline.com/LicLookup/Acct/Acct.aspx?div=15

South Dakota

https://apps.sd.gov/ld01DOL/Template/main.aspx?templateid=22

Tennessee http://verify.tn.gov/

Texas http://www.tsbpa.state.tx.us/general/database-search.html

Utah

https://secure.utah.gov/llv/search/index.html

Vermont

Virginia https://cpaportal.boa.virginia.gov/Verification/

Washington

https://data.wa.gov/Consumer-Protection/CPA-Search-Board-of-Accountancy/pqu3-uhwj

Wisconsin https://app.wi.gov/licensesearch

West Virginia

https://apps.wv.gov/accountancy/licensure/LicenseVerification/Default.aspx

Wyoming https://cpaboard.wyo.gov/public-info/verify-a-cpa-or-cpa-firm

Revised May 2023

https://secure.professionals.vermont.gov/prweb/PRServletCustom/app/NGLPGuestUser_/

V9csDxL3sXkkjMC_FR2HrA*/!STANDARD?UserIdentifier=LicenseLookupGuestUser

National Association of State Boards of Accountancy (NASBA): https://cpaverify.org/

Note: Missing the States of Delaware, Hawaii, Utah, and Wisconsin; Includes Guam, Puerto Rico, and U.S. Virgin Islands

Civilian Contract Audit Services

17 | Page

APPENDIX B

SAMPLES

QUALITATIVE EVALUATION

FACTORS

Revised May 2023

Civilian Contract Audit Services

18 | Page

Lesson Learned: “The samples were

beneficial – reading of sample reports

we were able to identify which firms

had experience in contract audits

verses financial audits. However, a

lesson learned - - we were

overwhelmed by the responses and

since each company submitted their

“best” reports – they submitted

lengthy, complex examples. This was

time consuming for the evaluation

team. Suggest less than three samples

unless you are sure you are not

receiving a lot of quotes.”

Lesson Learned: “We allowed too many pages for the technical volume. Limit the pages – a firm should be able

to summarize their quality control process and ability to respond to multiple geographically disbursed

assignments in a few pages. Once again, the volume of responses and multiple pages in the technical quote was

unnecessarily time consuming for the technical team.”

DEPARTMENT OF HOMELAND SECURITY – RFQ HSHQDC-16Q-00081

Factor 1: Technical Experience/Understanding and Capabilities

The Government will evaluate the degree to which the Quoter possesses experience and capability in performing contract

audit and review services, including the audit/review services as specified in

the Statement of Work (SOW), Audit Requirements. The evaluation will

consider the type of work performed and relevancy to the SOW requirements,

the demonstration of corporate and staff experience, the scope of the

engagement(s), and how recently the engagement was performed.

The Government will evaluate the degree to which the Quoter demonstrates

an understanding of the Audit Reporting Requirements in the Statement of

Work (Attachment 2), through the content and structure of submitted work

samples. The evaluation will assess the redacted work product samples for

clarity in findings and recommendations. The evaluation will assess whether the

audit opinion and findings are well supported by the specific evidence

obtained during the audit, the applicable law and regulations, and/or the

auditee’s own policies and procedures.

The Government will be reviewing the work sample to see if the findings and

recommendations are clearly stated and supported.

Factor 2: Management Approach

The Government will evaluate the Quoter’s approach to managing the customer relationship, establishing quality control checks

for work products, and integrating any teaming/subcontracting efforts with the prime contractor’s effort, including methods to

ensure personnel affiliation with either the prime or the subcontractor is transparent. The Government will also evaluate the

Quoter’s plan to perform simultaneous contract audit and review services at Government/Contractor locations that are

geographically disbursed.

The Government will evaluate the Quoter’s plans to recruit, retain, and manage qualified personnel and ensure sufficient levels

of staffing throughout the contract performance period, including during periods of work load fluctuation.

Factor 3: Past Performance

The Government will evaluate the extent to which the Quoter’s Past Performance demonstrates its capability to deliver high

quality products and services similar in size, scope, and complexity to the requirements listed in the RFQ either as a prime

Contractor or Subcontractor. Only work performed within the past three years and of similar complexity and magnitude to the

work identified in the SOW will be evaluated.

Each Quoter will be evaluated on their Past Performance under existing and prior contracts. The Government will focus its

evaluation on the information submitted by the Quoter in response to the instructions provided in this RFQ, and the Past

Performance Information, Contractor Performance Customer Survey Questionnaire, Attachment 3, sent directly to the

Contracting Officer that demonstrates the quality of the Past Performance relative to the size, scope, complexity, and

relevancy to the procurement under consideration. Also, related Past Performance information may be sought and utilized by

DHS for the purpose of evaluating the Quoter’s Past Performance from a variety of sources including the PPIRS/CPARS

database, other Government contracting activities, evaluator first-hand knowledge, the Excluded Parties List System (EPLS),

and other Government reports. If the Quoter does not have a record of past performance, then it will not be evaluated

favorably or unfavorably with respect to past performance and will receive a neutral rating.

Revised May 2023

Civilian Contract Audit Services

19 | Page

PENSION BENEFIT GUARANTEE CORPORATION – RFQ PBGC01-RQ-16-0068

Factor 1: Technical Approach

The Offeror’s technical approach shall be evaluated to the extent to which they demonstrate the ability to accomplish the

requirements described in all sections of the Performance Work Statement (PWS). Offerors will be evaluated on their technical

analysis of work areas in the PWS and on the extent to which capability to perform the work is demonstrated, being both

onsite and offsite, and with respect to the backlog and to ongoing requirements, as required in the PWS.

Factor 2: Past Performance

The Offeror shall provide at least three (3) past performance references. If an Offeror submits more than three references, the

agency will evaluate three references of its own choosing. Each effort shall be recent (performed within 3 years) and relevant

to PBGC’s present requirement (e.g., finding temporary attorney services for other Federal agencies to perform tasks similar

to those listed in the performance work statement).

Past performance references must include: the name of the agency for which the services were provided, a point of contact for

the effort at the agency (including telephone number or e-mail address), the date the services were performed, and a

description of the services provided. Offerors should ensure that points of contact are still employed by the agencies and that

contact information is current. Reference responses will be evaluated based upon the timeliness (e.g., degree to which the

Offeror promptly responded to and fulfilled client service requests), quality (e.g., degree to which temporary personnel

satisfactorily performed their assignments), and responsiveness (e.g., degree to which Offeror accommodated client

requirements).

An Offeror without a record of relevant past performance or for whom information on past performance is not available will

not be evaluated favorable or unfavorable on past performance. Offerors without a record of relevant past performance will

be given a neutral rating.

Factor 3: Business Management Approach

The Government shall evaluate the proposed Offeror’s ability to the extent to which they can demonstrate successful

performance under the PWS and its attention to initial and continually improved quality assurance.

Factor 4: Key Personnel and Staffing Plan

The Offeror shall be evaluated on the extent, depth and quality of the Key Personnel’s relevant work experience, as well as

the quality and applicability of their education, and technical experience in accordance with the requirements of Section 4,

Special Contract Requirements.

Offeror shall be evaluated to the extent to which they demonstrate ability to provide non-key personnel as required.

Revised May 2023

Civilian Contract Audit Services

20 | Page

U.S. AGENCY FOR INTERNATIONAL DEVELOPMENT (USAID) - SPECIAL

INSPECTOR GENERAL FOR AFGHANISTAN RECONSTRUCTION - RFQ 16-233-

SOL-00641

Factor 1: U.S. Government Audit Capability

In this evaluation factor the Government will evaluate the degree to which the offeror demonstrates capability of performing

a financial audit of a government contractor in compliance with U.S. Government policies, procedures, laws, and regulations.

Factor 2: Experience with USAID or USAID and Department of State Contracts

In this evaluation factor the Government will evaluate the degree to which the offeror demonstrates:

−

An understanding of the U.S. Agency for International Development or Department of State’s contract lifecycle

process, preference given for experience with U.S. Agency for International Development or U.S. Agency for

International Development and Department of State Contingency Contracting

−

Prior experience auditing U.S. Agency for International Development or Department of State contracts, preference

given for experience performing incurred –cost audits

Factor 3: Afghan-specific Capability

In this evaluation factor the Government will evaluate the degree to which the offeror demonstrates:

−

Prior international audit experience and ability to travel internationally

−

A physical presence in or access to an international affiliate able to work in Afghanistan

−

Experience working in conflict environments (e.g. Afghanistan, Iraq, Sudan, etc.)

−

Prior experience with Federal agencies implementing development programs in Afghanistan

−

Experience evaluating costs incurred in Afghanistan

−

Competence with written communications in English and staff with a knowledge of Dari and Pashto languages with the

ability to read, speak and translate those languages and English

Factor 4: Past Performance

The government will review the projects that the offeror is currently performing, or performed (at least in part) during the

thirty-six months preceding the date that quotes are due. If subcontractors are included in the quote, their single project

reference (one for each subcontractor proposed) will also be included in the overall past performance evaluation.

***************************************************************************************************

U.S. AGENCY FOR INTERNATIONAL DEVELOPMENT (USAID) - RFQ SOL-267-

16-000008

Factor 1: Past Performance

Past performance will be evaluated based on the implementation of projects or engagements similar in scope, size and

complexity as evidenced by performance records and the testimony of clients. Vendors without evidence or record of relevant

past performance will be evaluated neutrally for this criterion.

Factor 2: Technical

−

Ability to provide sufficient and qualified personnel to meet the needs of the statement of work and achieve the

dates in the audit milestone plan.

−

Provide a realistic, achievable audit milestone plan that completes all audits within 18 months.

Revised May 2023

Civilian Contract Audit Services

21 | Page

NATIONAL AERONAUTICS AND SPACE ADMINISTRATION SHARED SERVICES

CENTER SOLICITATION NNX16ZXD040R

Factor 1: Technical – Product Work Samples with Corresponding Audit Program

The Government will evaluate the Offeror’s product work samples to ensure each sample addresses all four elements

identified below:

1.

The objectives, scope, and methodology of the audit;

2.

The audit results, including findings, conclusions, and recommendations, as appropriate;

3.

A statement about the auditors’ compliance with GAGAS;

4.

A summary of the views of responsible contractor official(s)

Factor 2: Past Performance

The Government will not award to an Offeror that receives a rating of Very Low Level of Confidence in this factor. Past

Performance will be evaluated based on the results of work performed that is determined to be relevant to this requirement.

−

Offerors will also be evaluated on the quality of same/similar work performed as a prime contractor or a

subcontractor/teaming partner within the last FIVE (5) years, using the supporting documentation provided by the

Offeror.

−

Offerors are cautioned to take extreme care in identifying past and current contracts for reference that are both

relevant and accurately reflect the Offeror’s past experience.

Revised May 2023

Civilian Contract Audit Services

22 | Page

APPENDIX C.1. SAMPLE CONTRACTOR EMPLOYEE NON-DISCLOSURE

AGREEMENT (NDA)

CONTRACTOR EMPLOYEE NON-DISCLOSURE AGREEMENT

Contract Audit Sow – Attachment #

Contract #

AGENCY NAME

REFERENCES: 48 CFR (Federal Acquisition Regulation (FAR)) Section 3.104, 5.401, 24.102 and relevant corresponding

sections of the Agency Acquisition Regulation (AAR).

NON-DISCLOSURE OF PROPRIETARY/CONFIDENTIAL DATA

While employed by the (Insert Contractor’s name), hereinafter referred to as “Contractor,” in support of Contract (Insert Contract

number), hereinafter referred to as “Contract,” you may have, or have access to, information or data of a personal nature about an

individual, or proprietary information or data submitted by or pertaining to an institution or organization. Such information may be

nonpublic, sensitive, confidential, privileged, and proprietary or contain Personally Identifiable Information (PII) and is hereinafter

referred to as “confidential information/records.”

This Non-Disclosure Agreement (NDA) -

-

Addresses terms used herein;

-

Explains how confidential information/records shall be handled;

-

Describes the potential penalties for inappropriately disclosing confidential information/records obtained under the Contract;

-

Requires you to affirm -

▪ You agree to take all necessary steps to prevent disclosure, dissemination, publication or distribution of confidential

information/records to any party outside the Government, unless otherwise authorized; and,

▪ That all confidential information/records obtained or generated under Contract shall:

* Not be disclosed, except as authorized by law or under the terms of the Contract;

* Be used exclusively in the performance of this Contract; and,

* Not be used to engage in any other actions, venture or employment where the confidential

information/records will be used for the profit of any party.

Please also see the Attachment to this NDA, entitled Chapter 5 of the Code of Federal Regulation (CFR) § 2635.703(b), “Standards of

Ethical Conduct for Employees of the Executive Branch.” For the purposes of this NDA and work on this Contract, FAR Part 24,

Protection of Privacy and Freedom of Information, the Privacy Act requirements identified in the Attachment apply to Contractor

employees working on the Contract.

Your employer is required to restrict access to confidential information/records to the minimum number of employees necessary for

performance of the Contract and instruct employees who will have access to the same, as to the -

-

Proprietary nature of the information;

-

Relationship under which they have possession; and

-

How to administer such information.

DEFINITIONS

CONFIDENTIAL INFORMATION: As used in the Agency Acquisition Regulation (AAR) ###.##.#, Confidential Information, “…means

information or data of a personal nature about an individual, or proprietary information or data submitted by or pertaining to an

institution or organization.”

NONPUBLIC INFORMATION is information that an employee gains by reason of Contract employment and that he/she knows or

reasonably should know is not available to the general public. It includes information that -

− Is protected under the Privacy Act of 1974 and is routinely exempt from disclosure under the Freedom of Information Act or

otherwise protected from disclosure by statute, Executive order, law, or regulation;

− Is designated as “confidential” by (AGENCY NAME); or

− Has not actually been disseminated to the general public and is not authorized to be made available to the public on

request. (See Standards of Ethical Conduct for Employees of the Executive Branch, 5 C.F.R. § 2635.703(b).)

Revised May 2023

Civilian Contract Audit Services

23 | Page

CONTRACTOR EMPLOYEE NON-DISCLOSURE AGREEMENT - AGENCY NAME (continued)

PRIVILEGED OR PROPRIETARY INFORMATION: Information related to trade secrets, processes, operations, style of work, or

apparatus, or the identity of confidential statistical data, amount or source of any income, profits, losses, or expenditures of any person,

firm, partnership, corporation, or association. This type of information could include, but is not limited to, certain types of information

submitted as part of the acquisition process or Contractor proprietary information. Federal law prohibits the unauthorized disclosure of

trade secrets, or commercial or financial information. (See Procurement Integrity Act, 41 U.S.C. § 423, also protects this type of information

and carries criminal and civil penalties, such as fines, imprisonment of 5 years or less, or adverse personnel actions; and Trade Secrets Act, 18

U.S.C. § 1905.)

USE OF CONFIDENTIAL INFORMATION/RECORDS, NONPUBLIC OR PRIVILEGED/PROPRIETARY INFORMATION

All information gained under this Contract shall be held confidential until such time as the information is made available to the public, as

authorized. This is not intended to restrict the rights of third parties such as law enforcement agencies, courts/administrative tribunals of

proper jurisdiction, or congressional committees, from securing the release of protected information pursuant to their legal authority. No

confidential information shall be provided to the public unless it is already available to the public, such as through a public web page or

another publication, except through the (AGENCY NAME) Freedom of Information Office.

For any Confidential, Nonpublic or Privileged/Proprietary Information/records that may be furnished to you or that you gain access to in

the course of your official duties under this Contract, you should:

− Use this information only for the purpose of performing official Contract duties;

− Refrain from disclosing or discussing the information with any person who does not need the information for purposes of

performing official Contract duties;

− Refrain from copying, for other than official purposes, all or part of this information that may be provided to you in the course

of your official (AGENCY NAME) duties, and when finished reviewing or utilizing such information for official Contract duties,

store or dispose of such materials as specifically directed; and

− Advise your Supervisor immediately if any non-disclosable information that is/was maintained by, or in the possession of, the

Contractor is disclosed, whether intentionally or unintentionally, or if this information is used or handled in a manner inconsistent

with this NDA.

USE OF CONFIDENTIAL INFORMATION FOR FINANCIAL GAIN IS PROHIBITED:

Under applicable ethical standards (See Standards of Ethical Conduct for Employees of the Executive Branch, 5 C.F.R. § 2635.703), you

shall not engage in a financial transaction using confidential information/records or nonpublic information, nor allow the improper use of

such information to further your own private interest or the interests of another person, whether through advice or recommendation, or by

knowingly disclosing such information.

REQUESTS FOR CONFIDENTIAL INFORMATION/RECORDS

Before disclosing any information that may constitute nonpublic information, or if you have any questions about what constitutes nonpublic

information, please also consult with your Supervisor. Any response to a request for confidential information/records that is related to

this Contract shall also be referred to your Supervisor. In the event that Supervisors have legal questions regarding these issues, they

should promptly contact the Contractor Program Manager/Director, who will contact the Contracting Officer or Contracting Officer’s

Representative (COR).

POST EMPLOYMENT RESTRICTIONS

All confidentiality obligations identified herein apply even after the employee no longer possesses the confidential information/records

and/or has left the Contractor’s employ. The unauthorized disclosure of such information may result in fines and/or imprisonment for up

to one (1) year and removal from office or employment.

Page 2

Revised May 2023

Civilian Contract Audit Services

24 | Page

CONTRACTOR EMPLOYEE NON-DISCLOSURE AGREEMENT - AGENCY NAME

AFFIRMATION

I, the undersigned, as a condition of being granted access to work on the Contract, do hereby affirm -

− The information provided by the Government, obtained from the Contractor(s) or generated under this Contract, may be

considered confidential, nonpublic, and/or privileged, or proprietary;

− The information obtained or generated under contract shall be used exclusively in the performance of this Contract and all

necessary steps will be taken to prevent disclosure, dissemination, publication or distribution of such information to any party

outside the Government, unless otherwise authorized;

− Proprietary information will not be used to engage in any other actions, venture or employment where it will be used for the

profit of any party;

− My Supervisor will be contacted if I have any questions concerning this matter;

− I have read the Attachment to this Non-Disclosure Agreement entitled “Privacy Act, 5 CFR § 2635.703(b), Employee

Standards of Conduct; and,

− The making of a false, fictitious, or fraudulent affirmation may render the maker subject to prosecution under title 18, United

States code, Section 1001.

These provisions are consistent with and do not supersede, conflict with, or otherwise alter the employee obligations, rights, or liabilities

under law or regulation.

/

Signature of Employee/ Date Type individual’s name and title

/

Signature of Witness/ Date Type witness name and title

Page 3

Revised May 2023

Civilian Contract Audit Services

25 | Page

APPENDIX C.2. ATTACHMENT TO EMPLOYEE NON-DISCLOSURE AGREEMENT

– PRIVACY ACT

PRIVACY ACT

References: 5 CFR § 2635.703(b)

EMPLOYEE STANDARDS OF CONDUCT

(a) General. All employees are required to be aware of their responsibilities under the Privacy Act (the Act) of 1974, 5 U.S.C.

552a. Regulations implementing the Act are set forth in 45 CFR 5b. Instruction on the requirements of the Act and regulation shall be

provided to all new employees of the Department. In addition, supervisors shall be responsible for assuring that employees who are

working with systems of records or who undertake new duties which require the use of systems of records are informed of their

responsibilities. Supervisors shall also be responsible for assuring that all employees who work with such systems of records are