2014 Annual Report

CVS Health, One CVS Drive, Woonsocket, RI 02895 | 401.765.1500 | cvshealth.com

WE ARE

A pharmacy innovation company

OUR STRATEGY

Reinventing pharmacy

OUR PURPOSE

Helping people on their

path to better health

OUR VALUES

Innovation

Collaboration

Caring

Integrity

Accountability

CVS Health 2014 Annual Report

The CVS Health 2014 Annual Report

achieved the following results by printing

on paper containing 10 percent post-

consumer recycled content. FSC

®

is not

responsible for any calculations of results

from choosing this paper.

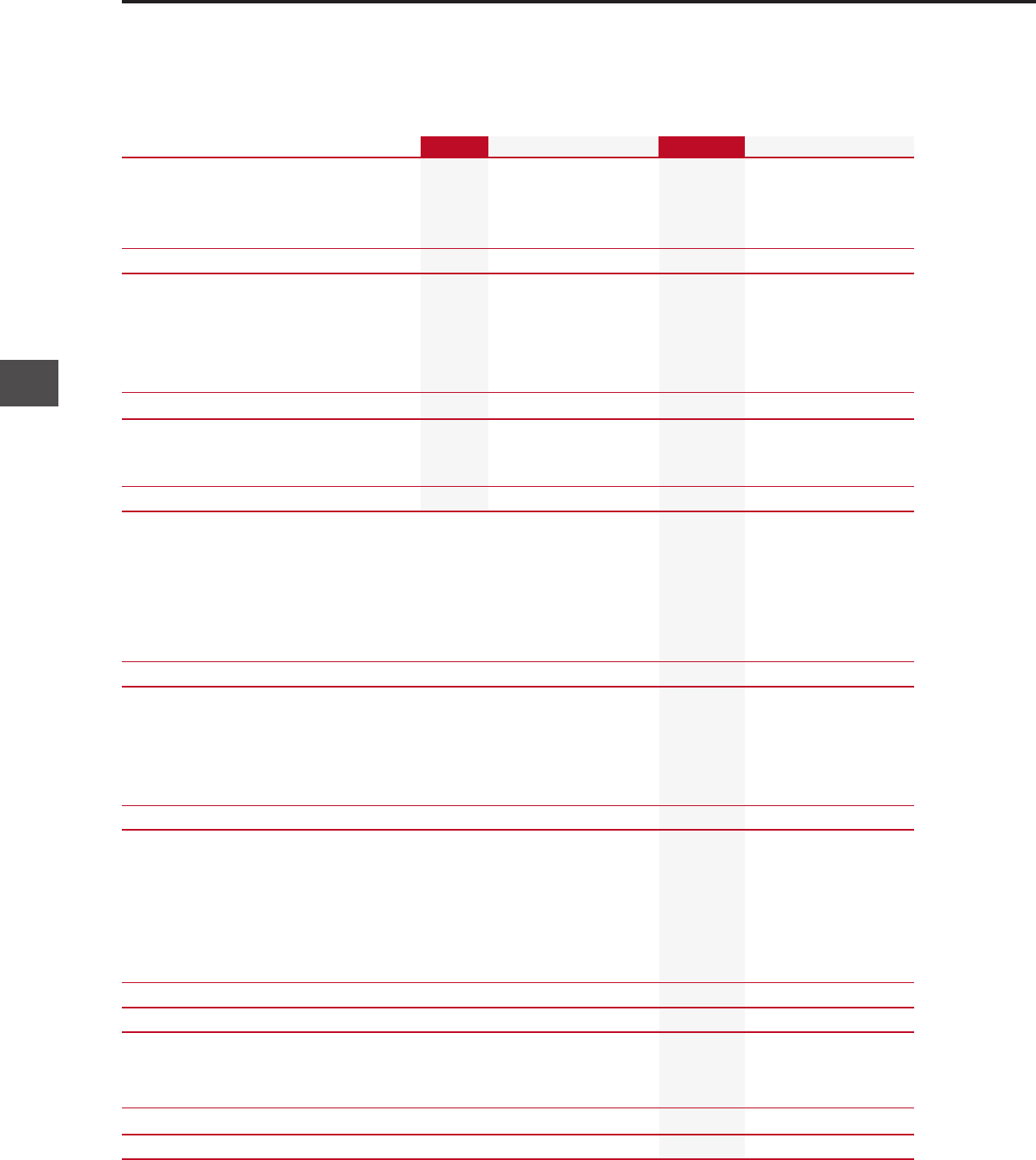

Trees

Saved

Water

Saved

Energy

Saved

Solid Waste

Not Produced

Greenhouse Gases

Not Produced

104

fully grown

48,208

gallons

47,000,000

MM BTUs

3,227

pounds

8,889

pounds

Waterborne Waste

Not Produced

30

pounds

157033_CVRS.indd 1 3/11/15 7:08 PM

157033_CVRS.indd 1 3/12/15 5:02 PM

1 Health is Everything

14 Financial Highlights

15 Letter to Shareholders

20 Prescription for a Better World

21 2014 Financial Report

Shareholder Information

designed and produced by see see eye

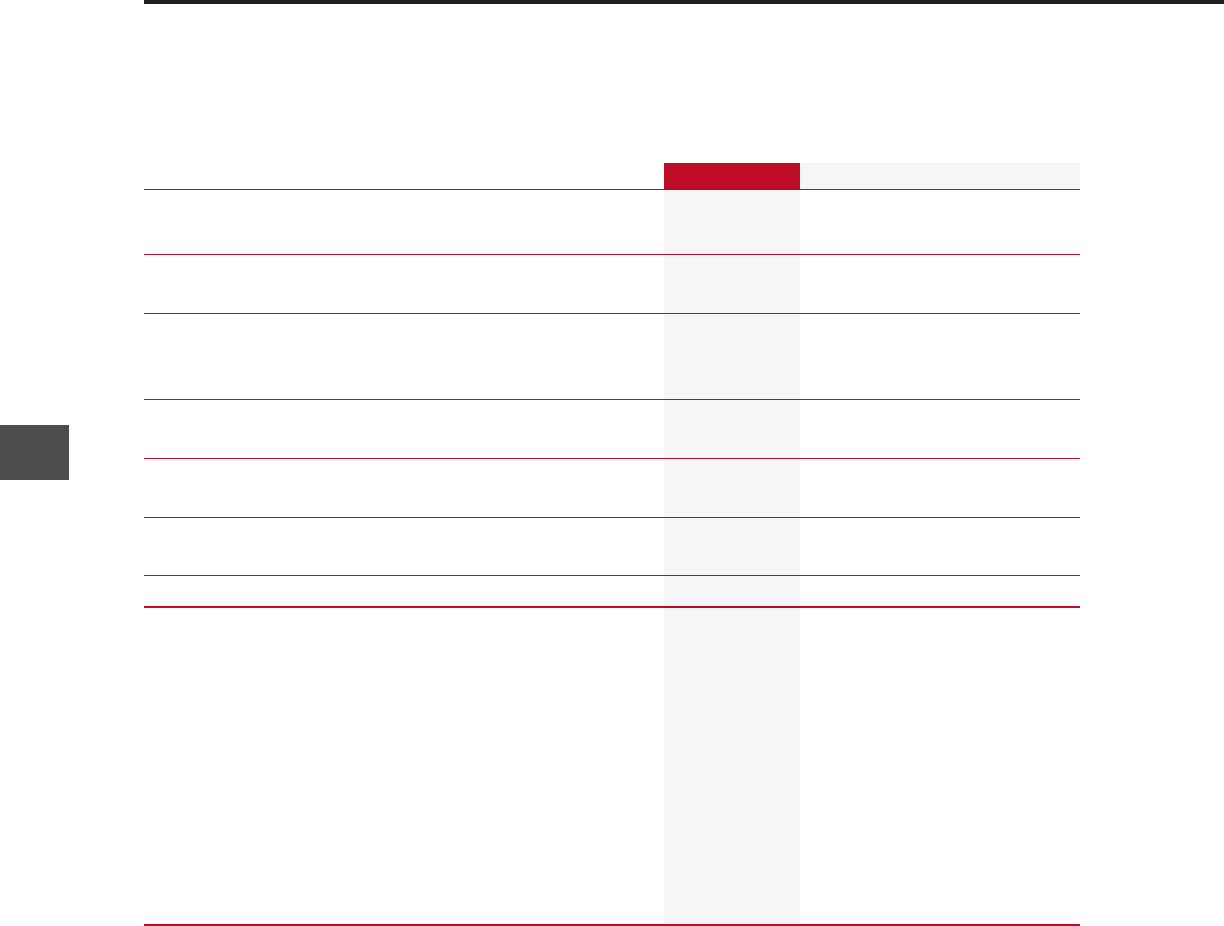

Larry J. Merlo

President and Chief Executive Officer

Lisa G. Bisaccia

Executive Vice President and

Chief Human Resources Officer

Troyen A. Brennan, M.D.

Executive Vice President and

Chief Medical Officer

David M. Denton

Executive Vice President and

Chief Financial Officer

Helena B. Foulkes

Executive Vice President and

President – CVS/pharmacy

Stephen J. Gold

Executive Vice President and

Chief Information Officer

J. David Joyner

Executive Vice President,

Sales and Account Services –

CVS/caremark

Per G.H. Lofberg

Executive Vice President

Thomas M. Moriarty

Executive Vice President, Chief Health

Strategy Officer and General Counsel

Jonathan C. Roberts

Executive Vice President and

President – CVS/caremark

Andrew J. Sussman, M.D.

Executive Vice President and Associate Chief

Medical Officer; President – CVS/minuteclinic

Eva C. Boratto

Senior Vice President – Controller

and Chief Accounting Officer

John M. Buckley

Senior Vice President and

Chief Compliance Officer

Nancy R. Christal

Senior Vice President – Investor Relations

Carol A. DeNale

Senior Vice President and

Treasurer

John P. Kennedy

Senior Vice President and Chief Tax Officer

Colleen M. McIntosh

Senior Vice President and

Corporate Secretary

Thomas S. Moffatt

Vice President and Assistant Secretary

OFFICERS’ CERTIFICATIONS

The Company has filed the required certifications

under Section 302 of the Sarbanes-Oxley Act

of 2002 regarding the quality of our public

disclosures as Exhibits 31.1 and 31.2 to our

annual report on Form 10-K for the fiscal year

ended December 31, 2014. After our 2014

annual meeting of stockholders, the Company filed

with the New York Stock Exchange the CEO certi-

fication regarding its compliance with the NYSE

corporate governance listing standards as required

by NYSE Rule 303A.12(a).

Officers

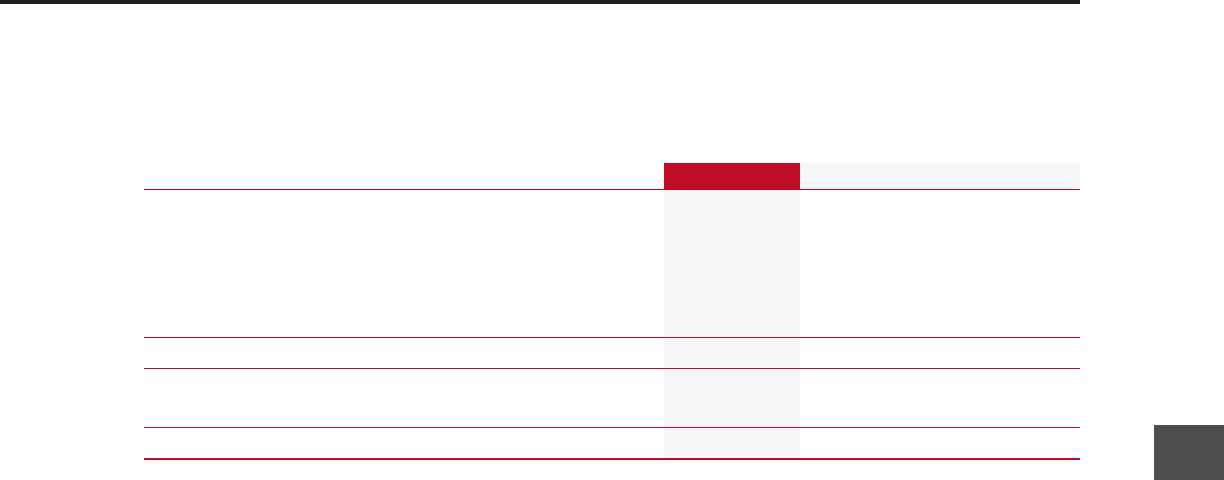

Richard M. Bracken

(3)

Former Chairman and Chief

Executive Officer

HCA Holdings, Inc.

C. David Brown II

(1) (2)

Chairman of the Firm

Broad and Cassel

Alecia A. DeCoudreaux

President

Mills College

Nancy-Ann M. DeParle

(3)

Partner

Consonance Capital Partners, LLC

David W. Dorman

(1) (2)

Chairman of the Board

CVS Health Corporation

Anne M. Finucane

(2)

Global Chief Strategy and Marketing Officer

Bank of America Corporation

Larry J. Merlo

President and Chief Executive Officer

CVS Health Corporation

Jean-Pierre Millon

(3)

Former President and Chief

Executive Officer

PCS Health Services, Inc.

Richard J. Swift

(3)

Former Chairman, President and

Chief Executive Officer

Foster Wheeler Ltd.

William C. Weldon

(1) (2)

Former Chairman and Chief

Executive Officer

Johnson & Johnson

Tony L. White

(1) (3)

Former Chairman, President and

Chief Executive Officer

Applied Biosystems, Inc.

(1) Member of the Management Planning

and Development Committee

(2) Member of the Nominating and

Corporate Governance Committee

(3) Member of the Audit Committee

Directors

Corporate Headquarters

CVS Health Corporation

One CVS Drive, Woonsocket, RI 02895

(401) 765-1500

Annual Shareholders’ Meeting

May 7, 2015

CVS Health Corporate Headquarters

Stock Market Listing

The New York Stock Exchange

Symbol: CVS

Transfer Agent and Registrar

Questions regarding stock holdings,

certificate replacement/transfer, dividends

and address changes should be directed to:

Wells Fargo Shareowner Services

P.O. Box 64874

St. Paul, MN 55164-0874

Toll-free: (877) CVS-PLAN (287-7526)

International: +1 (651) 450-4064

Email: [email protected]

Website: www.shareowneronline.com

Direct Stock Purchase/Dividend

Reinvestment Program

Shareowner Services Plus Plan

SM

provides a

convenient and economical way for you to

purchase your first shares or additional

shares of CVS Health common stock. The

program is sponsored and administered by

Wells Fargo Bank, N.A. For more information,

including an enrollment form, please contact

Wells Fargo Bank, N.A. at (877) 287-7526.

Financial and Other Company

Information

The Company’s Annual Report on Form 10-K

will be sent without charge to any share-

holder upon request by contacting:

Nancy R. Christal

Senior Vice President – Investor Relations

CVS Health Corporation

670 White Plains Road – Suite 210

Scarsdale, NY 10583

(800) 201-0938

In addition, financial reports and recent

filings with the Securities and Exchange

Commission, including our Form 10-K,

as well as other Company information,

are available via the Internet at

investors.cvshealth.com.

Shareholder Information

157033_CVRS.indd 2 3/6/15 1:18 PM

1 Health is Everything

14 Financial Highlights

15 Letter to Shareholders

20 Prescription for a Better World

21 2014 Financial Report

Shareholder Information

designed and produced by see see eye

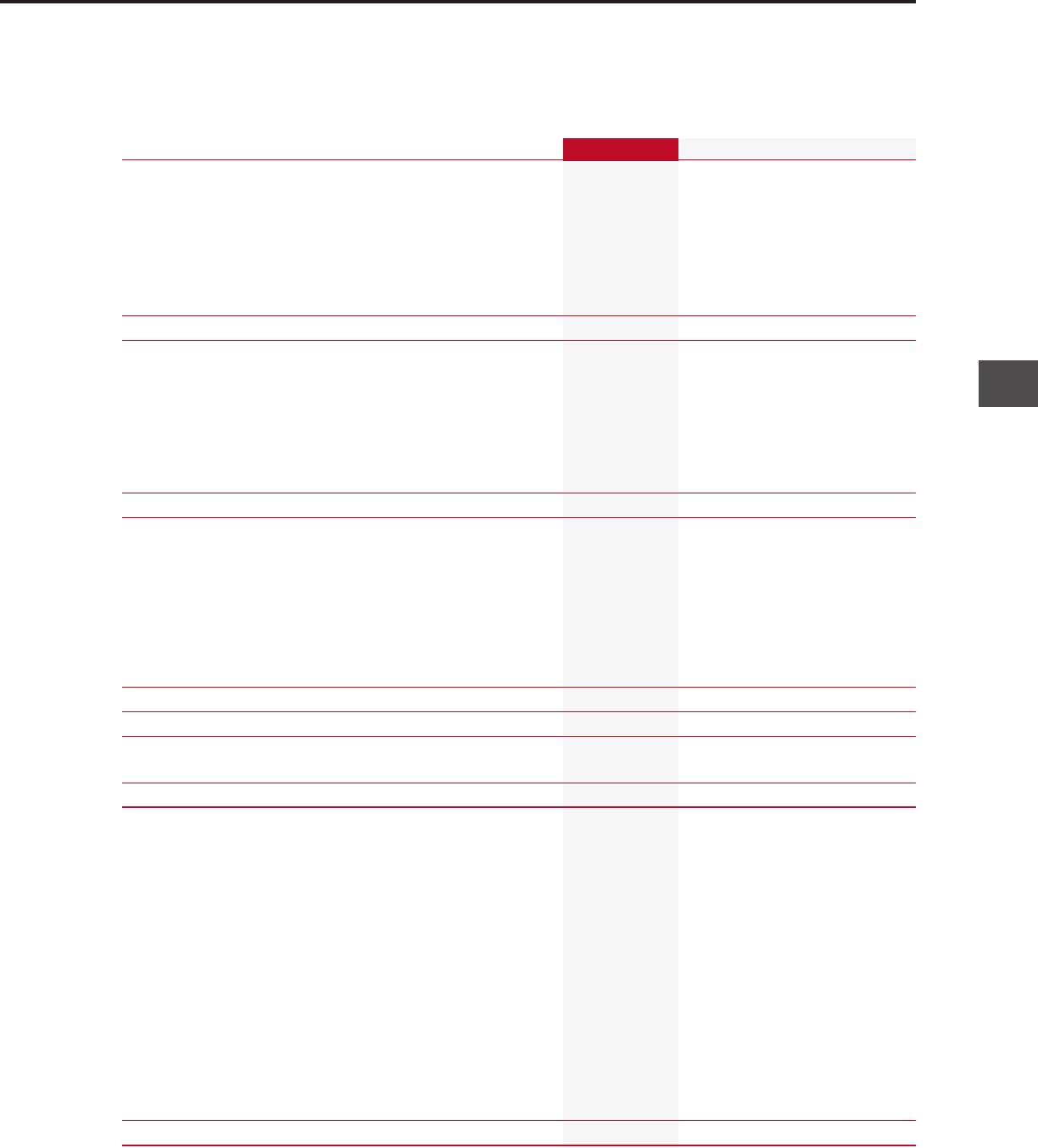

Larry J. Merlo

President and Chief Executive Officer

Lisa G. Bisaccia

Executive Vice President and

Chief Human Resources Officer

Troyen A. Brennan, M.D.

Executive Vice President and

Chief Medical Officer

David M. Denton

Executive Vice President and

Chief Financial Officer

Helena B. Foulkes

Executive Vice President and

President – CVS/pharmacy

Stephen J. Gold

Executive Vice President and

Chief Information Officer

J. David Joyner

Executive Vice President,

Sales and Account Services –

CVS/caremark

Per G.H. Lofberg

Executive Vice President

Thomas M. Moriarty

Executive Vice President, Chief Health

Strategy Officer and General Counsel

Jonathan C. Roberts

Executive Vice President and

President – CVS/caremark

Andrew J. Sussman, M.D.

Executive Vice President and Associate Chief

Medical Officer; President – CVS/minuteclinic

Eva C. Boratto

Senior Vice President – Controller

and Chief Accounting Officer

John M. Buckley

Senior Vice President and

Chief Compliance Officer

Nancy R. Christal

Senior Vice President – Investor Relations

Carol A. DeNale

Senior Vice President and

Treasurer

John P. Kennedy

Senior Vice President and Chief Tax Officer

Colleen M. McIntosh

Senior Vice President and

Corporate Secretary

Thomas S. Moffatt

Vice President and Assistant Secretary

OFFICERS’ CERTIFICATIONS

The Company has filed the required certifications

under Section 302 of the Sarbanes-Oxley Act

of 2002 regarding the quality of our public

disclosures as Exhibits 31.1 and 31.2 to our

annual report on Form 10-K for the fiscal year

ended December 31, 2014. After our 2014

annual meeting of stockholders, the Company filed

with the New York Stock Exchange the CEO certi-

fication regarding its compliance with the NYSE

corporate governance listing standards as required

by NYSE Rule 303A.12(a).

Officers

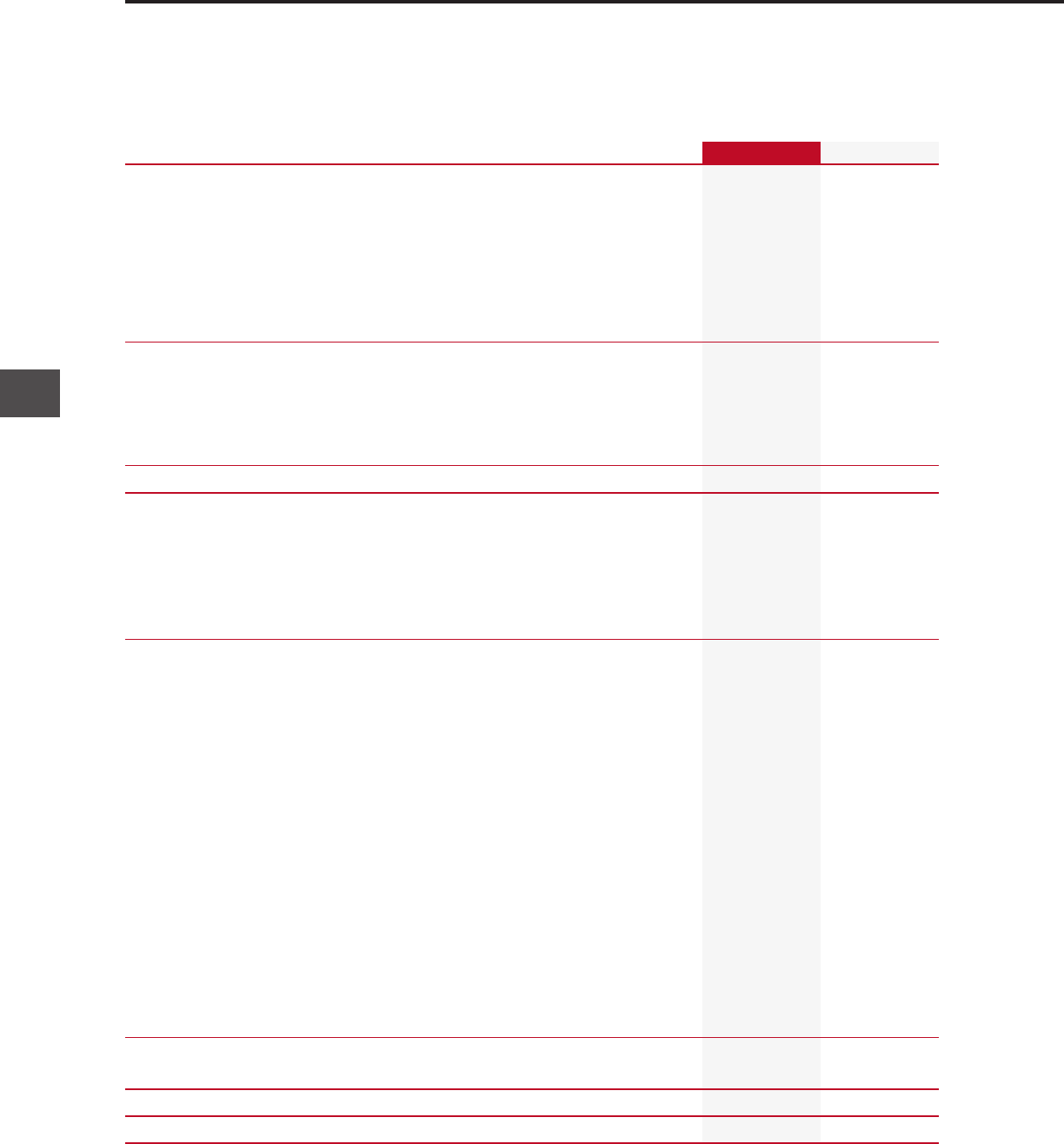

Richard M. Bracken

(3)

Former Chairman and Chief

Executive Officer

HCA Holdings, Inc.

C. David Brown II

(1) (2)

Chairman of the Firm

Broad and Cassel

Alecia A. DeCoudreaux

President

Mills College

Nancy-Ann M. DeParle

(3)

Partner

Consonance Capital Partners, LLC

David W. Dorman

(1) (2)

Chairman of the Board

CVS Health Corporation

Anne M. Finucane

(2)

Global Chief Strategy and Marketing Officer

Bank of America Corporation

Larry J. Merlo

President and Chief Executive Officer

CVS Health Corporation

Jean-Pierre Millon

(3)

Former President and Chief

Executive Officer

PCS Health Services, Inc.

Richard J. Swift

(3)

Former Chairman, President and

Chief Executive Officer

Foster Wheeler Ltd.

William C. Weldon

(1) (2)

Former Chairman and Chief

Executive Officer

Johnson & Johnson

Tony L. White

(1) (3)

Former Chairman, President and

Chief Executive Officer

Applied Biosystems, Inc.

(1) Member of the Management Planning

and Development Committee

(2) Member of the Nominating and

Corporate Governance Committee

(3) Member of the Audit Committee

Directors

Corporate Headquarters

CVS Health Corporation

One CVS Drive, Woonsocket, RI 02895

(401) 765-1500

Annual Shareholders’ Meeting

May 7, 2015

CVS Health Corporate Headquarters

Stock Market Listing

The New York Stock Exchange

Symbol: CVS

Transfer Agent and Registrar

Questions regarding stock holdings,

certificate replacement/transfer, dividends

and address changes should be directed to:

Wells Fargo Shareowner Services

P.O. Box 64874

St. Paul, MN 55164-0874

Toll-free: (877) CVS-PLAN (287-7526)

International: +1 (651) 450-4064

Email: [email protected]

Website: www.shareowneronline.com

Direct Stock Purchase/Dividend

Reinvestment Program

Shareowner Services Plus Plan

SM

provides a

convenient and economical way for you to

purchase your first shares or additional

shares of CVS Health common stock. The

program is sponsored and administered by

Wells Fargo Bank, N.A. For more information,

including an enrollment form, please contact

Wells Fargo Bank, N.A. at (877) 287-7526.

Financial and Other Company

Information

The Company’s Annual Report on Form 10-K

will be sent without charge to any share-

holder upon request by contacting:

Nancy R. Christal

Senior Vice President – Investor Relations

CVS Health Corporation

670 White Plains Road – Suite 210

Scarsdale, NY 10583

(800) 201-0938

In addition, financial reports and recent

filings with the Securities and Exchange

Commission, including our Form 10-K,

as well as other Company information,

are available via the Internet at

investors.cvshealth.com.

Shareholder Information

157033_CVRS.indd 2 3/6/15 1:18 PM

157033_CVRS.indd 2 3/12/15 5:02 PM

Health is everything. And CVS Health is

rethinking the way health care is delivered

in the United States to increase access,

lower costs, and improve outcomes.

Our new name reflects this broader health care commitment as well as our

understanding of the challenges faced by patients, payors, and providers. We’re

addressing concerns about cost and helping people on their path to better health

through a suite of integrated services, health system affiliations, and the strengths

of the following enterprise assets:

CVS/pharmacy

®

, our retail segment with more than 7,800 retail drug stores across

the United States and in Brazil;

CVS/caremark

™

, a leading pharmacy benefit manager (PBM) and mail service

pharmacy serving more than 2,000 clients and their 65 million plan members;

CVS/minuteclinic

™

, the nation’s largest walk-in medical clinic provider with nearly

1,000 clinics located in our retail drugstores; and

CVS/specialty

™

, home to our specialty pharmacy management services,

Accordant

®

care management, NovoLogix

®

automated claims review, Coram

®

infusion services, and other offerings for patients who require treatment for rare

or complex conditions.

CVS Health solutions leverage the capabilities of our more than 26,000 pharmacists,

nurses, nurse practitioners, and physician assistants. No matter how health care

reform unfolds in the coming years, we have the breadth of assets and the expertise

to play a significant and supportive role.

1

2014 Annual Report

157033_NAR.indd 1 3/9/15 10:55 AM

“ Ever since we turned our daughter’s care over to you all, our

quality of life has never been better,” writes a mother to her

Coram team. Coram’s ability to provide infusion services in

the home has made all the difference for this family, allowing

treatment to suit their daughter’s lifestyle instead of the other

way around. “The rest of our family has been liberated, too. No

more days spent at the clinic waiting. No more putting her sisters

on hold while she gets her care. You provide much more than

medical care. You contribute immeasurably to the quality of life

of your patients and all the others who populate their lives!”

†

2

CVS Health

Putting care within easy reach. We are making it easier for patients to

obtain their medications and the care they need. And that will help reduce the $300 billion in avoidable

costs due to medication non-adherence the U.S. health care system faces each year. For example,

our infusion services through Coram enable us to provide patients with more convenient, low-cost

alternatives to hospital infusions, whether at the physician’s office, at one of our national network of retail

infusion sites, or even the patient’s home. With the number of CVS/minuteclinic locations on the rise,

we’re also making it easier for patients with acute illnesses and certain chronic conditions to receive

care. Maintenance Choice

®

, one of the many integrated solutions that only CVS Health offers, gives

CVS/caremark plan members the option of receiving 90-day maintenance prescriptions in the way that

suits them best—through our mail order pharmacies or at any of our CVS/pharmacy locations. Specialty

Connect™ provides a similar in-store pickup option for CVS/specialty patients while our expert specialty

pharmacists provide disease state-specific counseling.

†

Throughout this section you will see stories based on actual feedback. Identifying details have been omitted to protect privacy.

157033_NAR.indd 2 3/9/15 10:55 AM

3

2014 Annual Report

157033_NAR.indd 3 3/9/15 10:55 AM

Greater access by

the numbers

CVS Health is uniquely positioned to provide access to care that’s most convenient for

each patient with our unmatched breadth of assets and channel-agnostic approach.

The company is a market leader in retail pharmacy, pharmacy benefits management,

specialty pharmacy, and retail medical clinics—and very well-positioned in an era of

consumer-directed health care.

1.7

billion

prescriptions filled

or managed annually

CVS Health has captured one third of

total U.S. prescription growth since 2008.

7,800+

retail drug stores

in 44 states, the District of

Columbia, Puerto Rico, and Brazil

4

CVS Health

65+ million

PBM plan members

Currently in 98 of the top 100 U.S. drugstore markets.

157033_NAR.indd 4 3/9/15 10:55 AM

50%

2013

$22

2012

$19

2011

$12

2014

$31

Approaching

1 ,000

MinuteClinic

locations with a

target of 1,500

locations by 2017

Nearly

50

health system

affiliations

of Specialty Connect

patients choose

CVS/pharmacy for pick up

Specialty Drug Revenue

in billions

CVS Health includes the largest

U.S. specialty pharmacy with

$31 billion in revenues.

With 10,000 baby boomers

turning 65 every day, the

Medicare-eligible population

is increasing. We are well-

positioned to serve this market

through our retail pharmacies,

PBM, and SilverScript

®

,

currently the No. 2 Medicare

Part D prescription drug plan.

2013 2019E

69

49

Growth in Medicare lives

lives in millions

5

2014 Annual Report

23

+

million

patient visits

since 2000

~5 million

customers per day in our

retail pharmacies

More than

24,000

pharmacists

across our

enterprise

157033_NAR.indd 5 3/9/15 10:55 AM

6

CVS Health

Reduce costs, not care. With U.S. health care and prescription drug spending

on the rise, CVS/caremark offers comprehensive solutions that help clients manage this trend without

sacrificing patient care. With one large health plan client, our entire enterprise is involved and collaborating

with its patient-centered medical home (PCMH) model. At CVS/pharmacy, we provide face-to-face

adherence counseling and provide information directly into the patient’s electronic health record at the

PCMH. CVS/minuteclinic helps providers by combining high-quality care with affordable pricing across a

range of services that include acute care, smoking cessation counseling, and support for chronic conditions

such as diabetes. CVS/caremark provides comprehensive medication reviews for patients identified as

vulnerable and offers recommendations on ways to assist them such as simplifying their medication

regimen or providing multi-dose packaging. Our Specialty Care teams at CVS/specialty, which include

rare disease management nurses, function as extensions of the clinical team for patients with complex

conditions. CVS Health is uniquely able to support and deliver value to plans, providers, and patients who

work within these models by creating innovative solutions that leverage all of our enterprise assets.

“ We have more than 3 million members and one of the largest

patient-centered medical homes in the country,” explains

the CEO of a leading U.S. health plan. “We are very excited

about finding innovative ways to help our clients and mem-

bers lower their costs and improve quality. Collaboration with

CVS Health has been helping us do just that. We’ve been

focused on integrating CVS Health pharmacists and nurses

into our medical home model. That will enhance coordination

of care and quality. As for costs, with this relationship, we’ve

come to see pharmacy as a key area to drive savings and help

control overall health spending. We’re at the beginning stages

of health reform, but we’re making real strides to achieve its

goals with CVS Health.”

157033_NAR.indd 6 3/9/15 10:55 AM

7

2014 Annual Report

157033_NAR.indd 7 3/9/15 10:55 AM

8

CVS Health

Formulary

management strategy

expected to drive

total incremental

client savings of

$

3.5

billion

from 2012 through 2015

Reduced co-pay at

CVS/minuteclinic

can lower overall

health care costs by

8%

for patients who use

our walk-in medical

clinics

Formed

#

1

in the U.S. through

Red Oak Sourcing venture

with Cardinal Health

generic

sourcing

entity

in branded drug sales currently

expected to come off patent

from 2015 through 2017

$

40

+

billion

Generic substitution remains one of the best ways to save patients and

payors money. Our generic substitution rate exceeded 80% in 2014, and

more opportunities are on the way.

CVS Health is pioneering new strategies to lower

costs for health plans and their members, which

include CVS/minuteclinic utilization and innovative

formulary strategies. We are also participating in

narrow or restricted pharmacy networks.

Generics help

manage costs

New ways to save

Expanding opportunities

to reduce spend

157033_NAR.indd 8 3/9/15 10:55 AM

CVS Health lowers overall health care costs for clients and patients through

sophisticated plan designs, unmatched clinical programs, and our knowledge,

expertise, and purchasing scale in the United States. Programs ranging from

formulary management to generic substitution to step therapies and more all work

together to achieve results. The company’s loyalty program also provides customers

with significant savings and value.

9

2014 Annual Report

Specialty made up

38%

of total client drug

spend in 2014

and is expected to

grow to 50% by 2018

$

4 billion

in potential savings

delivered to our customers

through personalized

promotions with ExtraCare

in 2014

~70 million

active ExtraCare

members

We continue to save consumers money and improve their shopping experience

through the ExtraCare card. ExtraCare is the industry’s longest-running and

most successful loyalty program.

Managing specialty

cost growth trend

CVS Health is the largest

player in the rapidly growing

U.S. specialty market.

We are using our broad

capabilities to reinvent

specialty, which will help

reduce client spending and

improve patient care.

ExtraCare

®

drives savings

We have a unique suite of capabilities

to help clients mitigate growth in

specialty costs—from prior authori-

zation to medical claims editing to

site of care and formulary manage-

ment, to name a few. Combined,

they could reduce an illustrative

20% cost growth trend to just 4%.

Illustrative

trend

20%

Remaining

trend

4%

16%

reduction

157033_NAR.indd 9 3/9/15 10:55 AM

10

CVS Health

Helping people to stay healthy. Our focus on improving outcomes can

be seen across CVS Health, from our decision to stop selling tobacco products to our clinical programs,

unique specialty capabilities, MinuteClinic locations, and our affiliations with nearly 50 health systems. In

specialty, we provide clinical support and drive superior outcomes through our unparalleled capabilities

to holistically manage the patient, not just the drug. Our innovative solutions work together to support

a better patient experience. Whether the patient chooses to receive a prescription by mail or pick it up

at a local CVS/pharmacy, we provide centralized clinical support from a CareTeam of pharmacists and

nurses that are disease-specific experts to help patients achieve optimal outcomes. Among our other

clinical programs, Pharmacy Advisor

®

has provided more than 10 million counseling interventions since

its inception. These interventions help identify adherence gaps and counsel patients to get them back on

their medications. Through our health system affiliations, we’re working to share information seamlessly

and electronically to improve patient care. We are also expanding our digital capabilities to create an

integrated pharmacy experience so customers can manage their prescription needs from anywhere and

receive them through their preferred channel.

“ A really good specialty pharmacy makes my job easier by

staying one or two steps ahead of me and my staff,” explains

a prominent rheumatologist. “I think that CVS/specialty

is doing a wonderful job for us.” In addition to the logistical

support given to her staff, this doctor values the help our

specialty pharmacists and nurses provide her patients. “I’ve

heard nothing but positive feedback about the interactions

that they have had. Or a new patient will tell me that a cousin,

relative, or friend used CVS/specialty and ask, ‘Will you be

using that for me?’”

157033_NAR.indd 10 3/9/15 10:55 AM

11

2014 Annual Report

157033_NAR.indd 11 3/9/15 10:55 AM

The path to

better health

CVS Health is making staying healthy easier through unique programs that help to

improve adherence such as Pharmacy Advisor, Specialty Connect, and our Patient

Care Initiative. We have introduced programs that provide an earlier, easier, and more

effective approach to engaging patients in behaviors that help to improve their health

and saves lives. We are also making bold decisions, such as removing tobacco and

promoting smoking cessation, to help people on their path to better health.

12

CVS Health

46%

of all patients do not

understand prescription

dosing instructions

1in 3

prescriptions written

are never filled

Nearly

50%

of people prescribed a

chronic medication stop

taking it within the first year

The adherence problem

Non-adherence costs everyone

$

300

billion

annually

Lack of adherence costs

the U.S. health care

system an estimated

157033_NAR.indd 12 3/9/15 10:55 AM

13

2014 Annual Report

Goal:

By 2017, increase adherence by

5%

to

15%

through new interventions

1

st

Once you quit

smoking, it only takes

20 minutes

for the body to begin

healing

Outreach is the solution

The results are clear

89%

of pharmacists

believe counseling

their customers is as

important as filling

their prescriptions

88%

of pharmacists said

customers who receive

first-hand counseling from

their pharmacist were

more likely to be adherent

91%

of patients said having

cost-effective alternatives

to more expensive

therapies improves

medication adherence

Face-to-face counseling

by a pharmacist is

2x

to

3x

more effective at

increasing patient

adherence than other

interventions

Embedded Accordant

nurse care for specialty

pharmacy can increase

patient engagement by

13x

That can translate to an 11%

reduction in total health care

costs for managed conditions.

Medication

reconciliation at

home can cut hospital

readmissions by

50%

for at-risk patients

Pharmacy Advisor programs

achieve industry-leading

adherence at CVS/pharmacy

CVS/pharmacy

Top 3 retail pharmacies

Hypertension

Therapy

75%

83%

Diabetes

Therapy

71%

79%

Cholesterol

Therapy

73%

81%

national pharmacy

chain to remove

tobacco products

from shelves

157033_NAR.indd 13 3/10/15 3:15 PM

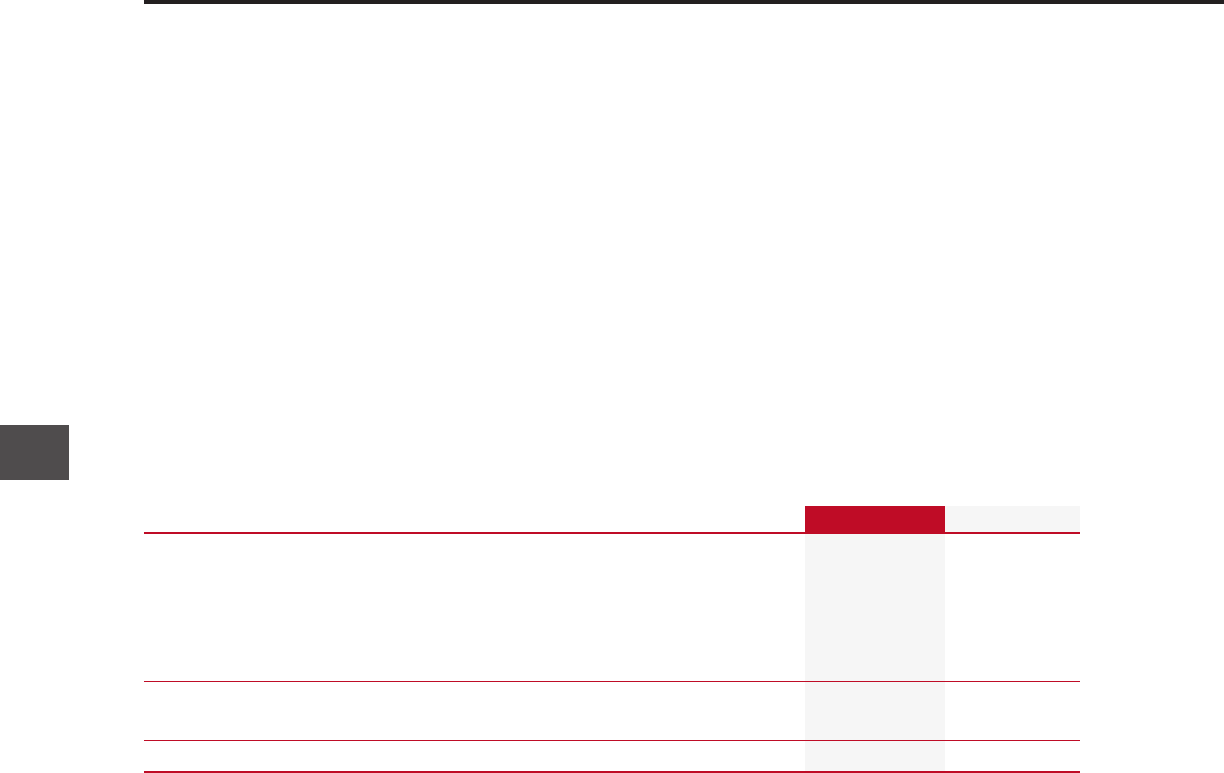

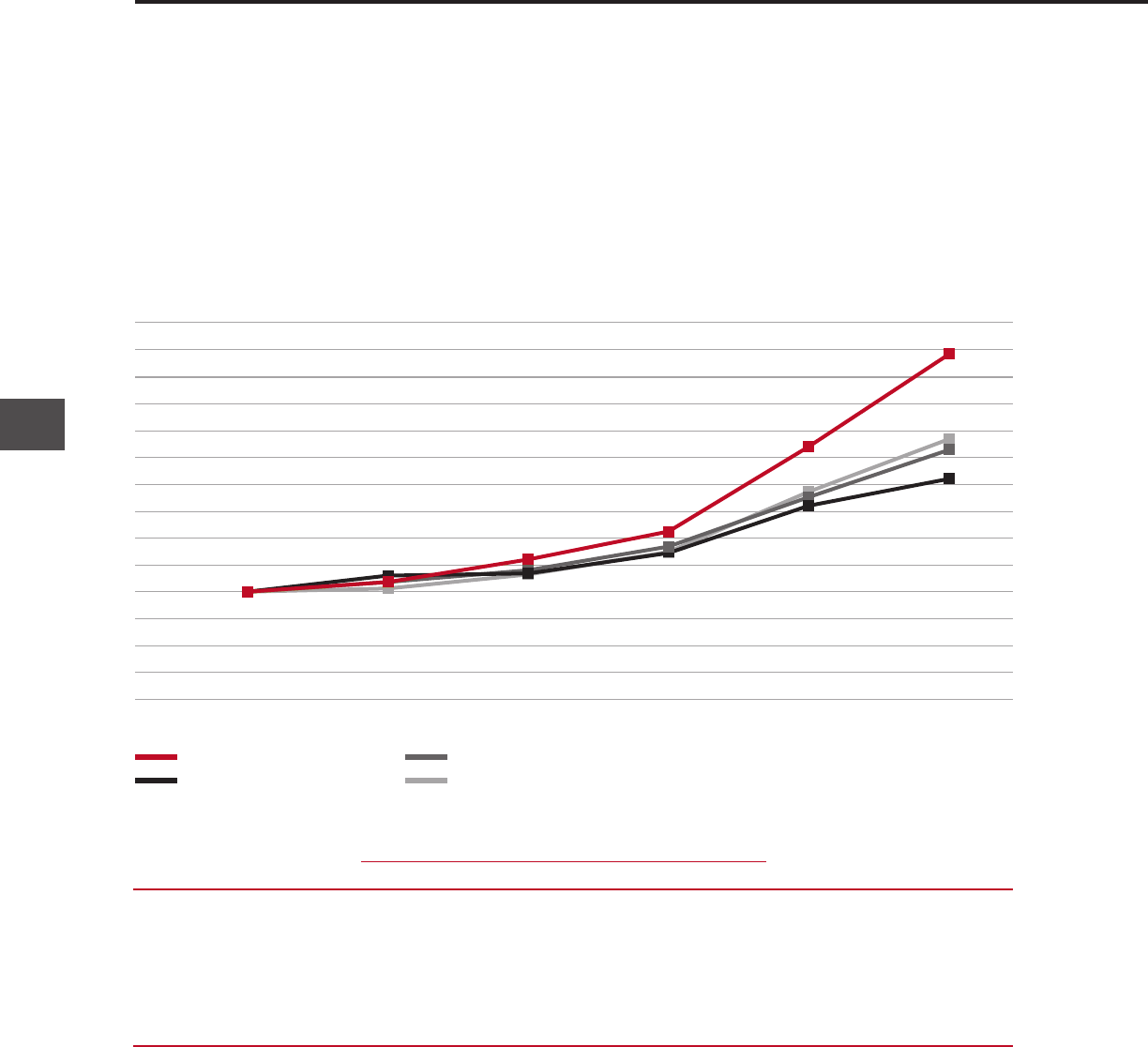

Net revenues $ 139,367 $ 126,761 9.9%

Operating profit $ 8,799 $ 8,037 9.5%

Net income $ 4,644 $ 4,592 1.1%

Diluted EPS from continuing operations $ 3.96 $ 3.75 5.5%

Free cash flow

*

$ 6,516 $ 4,399 48.1%

Stock price at year-end $ 96.31 $ 71.57 34.6%

Market capitalization at year-end $ 109,800 $ 84,437 30.0%

*

Free cash flow is defined as net cash provided by operating activities less net additions to properties and equipment (i.e., additions to property and equipment

plus proceeds from sale-leaseback transactions).

Financial highlights

(in millions, except per share figures) 2014 2013 % change

Net revenue

in billions of dollars

139.4

126.8

123.1

107.1

95.8

10 11 12 13 14 10 11 12 13 14 10 11 12 13 14

3.96

3.75

3.02

2.59

2.49

Diluted EPS from

continuing operations

in dollars

1.10

0.90

0.65

0.50

0.35

Annual cash dividends

in dollars per common share

14

CVS Health

157033_NAR.indd 14 3/9/15 10:55 AM

Dear Fellow Shareholders:

The past year has been a milestone year for our company as

we continued to broaden our role as a pharmacy innovation

company. The evidence can be seen everywhere—from the

outstanding selling season of our pharmacy benefit manager

(PBM) and formation of new health care alliances to the

ongoing expansion of our retail pharmacies and the

elimination of tobacco products from our stores.

Importantly, we have changed our corporate name

to CVS Health.

Our company is at the forefront of an evolving health care

landscape, and our new name underscores our commitment to

helping people on their path to better health. We are delivering

breakthrough products and services to increase access to care,

improve health outcomes, and lower overall health care costs.

We foresaw many of the changes occurring in health care, and

we began assembling an unmatched suite of integrated assets

back in 2007 that have positioned us to capitalize on the

opportunities created, both now and in the future. CVS Health

remains a one-of-a-kind company. Ours is the only integrated

pharmacy model with a deep understanding of the diverse

needs of consumers, payors, and providers, and these

insights inform our innovative, channel-agnostic solutions.

We met our 2014 financial targets while creating

significant shareholder value

Before expanding on these and other topics, I want to provide

a brief overview of our strong financial performance in 2014.

Once again, we met or exceeded all our key financial targets

through our ongoing focus on the three pillars that we consider

essential to maximizing shareholder value: driving productive,

long-term growth; generating significant free cash flow; and

optimizing capital allocation.

Net revenues for the year increased nearly 10 percent to a record

$139 billion, while adjusted earnings per share from continuing

operations rose to $4.49—up 13.5 percent (excluding the loss

Larry J. Merlo

President and Chief Executive Officer

15

2014 Annual Report

157033_NAR.indd 15 3/9/15 10:55 AM

on early extinguishment of debt in 2014 and the gain

from a legal settlement in 2013). And we achieved this

strong growth even after forgoing approximately 8 cents

in earnings per share from exiting the tobacco category.

We’ve benefited from a number of growth drivers,

especially our ability to increase enterprise share of

prescriptions dispensed through our many channels.

We also filled more than 80 percent of prescriptions

using generic equivalents, which are more cost effective

for patients and payors and are more profitable for

us than branded drugs. Looking ahead, more than

$40 billion of branded drugs are expected to lose

patent protection and effectively be replaced by generic

equivalents between 2015 and 2017. Furthermore,

we completed the formation of our Red Oak Sourcing

venture with Cardinal Health to create the largest generic

sourcing entity in the United States. Our combined

scale, along with our knowledge and expertise, should

lead to even greater savings for our clients, their

members, and CVS Health.

We generated $6.5 billion in free cash flow in 2014 and

once again returned more than $5 billion to shareholders

through dividends and share repurchases. Our board of

directors increased our quarterly dividend by 22 percent

last year and recently approved a 27 percent increase

for 2015. That marks our 12th consecutive year of

increases and keeps us solidly on track toward our

dividend payout ratio target of 35 percent by 2018.

With our December 2014 announcement of a new

$10 billion share repurchase program, we began 2015

with approximately $12.7 billion available to repurchase

CVS Health shares when we identify favorable oppor-

tunities. More than $7 billion is expected to be returned

to our shareholders through dividends and share

repurchases in 2015.

CVS Health shares produced a total return of 36.6 per-

cent in 2014. Over the same period, the S&P 500

Index and the Dow Jones Industrial Average returned

13.7 percent and 10.0 percent, respectively. We have

outperformed these indices on a three-, five-, and

10-year basis as well. Our 2014 stock performance

also outpaced the 25.3 percent return of the S&P 500

Health Care Index.

Our core strengths and integrated offerings drove

another successful PBM selling season

Our CVS/caremark PBM offers competitive pricing, high

levels of service and execution, and unmatched services

that continue to resonate with payors. As a result, 2014

revenues increased by 16 percent to $88 billion in our

Pharmacy Services segment. After a successful selling

season, we started 2015 with $7.0 billion in gross new

business spread among health plans, government

payors, and employers. With a 96 percent retention rate,

net new business for 2015 totaled $3.6 billion.

Clients value the strength of CVS/caremark’s adherence

programs, specialty services, and advanced formulary

strategies. Pharmacy Advisor, Maintenance Choice,

Specialty Connect, and our other integrated offerings

have played an increasingly important role in our ability to

win and retain business. At present, no other PBM can

offer these differentiated services and capabilities.

Pharmacy Advisor, our industry-leading clinical program

for plan members with chronic diseases, currently

addresses diabetes, cardiovascular conditions, and

eight other disease states. Now available to our

Medicare and Medicaid plans as well, it is helping them

improve the clinical star measures that impact their

reimbursement rates.

With more than 20 million plan members enrolled in

Maintenance Choice in 2015, growth in participation has

exceeded 85 percent in just three years. We are also

seeing growing interest in our new Specialty Connect

delivery option. Similar to Maintenance Choice, it offers

specialty patients the flexibility to receive their prescrip-

tions by mail or at one of our stores.

CVS/caremark’s retail network claims have risen

significantly over the past six years, from about 575 mil-

lion to 930 million prescriptions. Over the same period,

CVS/pharmacy’s share of the CVS/caremark book of

business has grown from 19 percent to approximately

31 percent. We are gaining a growing share of a

growing business, highlighting the success of our chan-

nel-agnostic approach and the power of our integrated

business model.

PBM clients are also increasingly incorporating

CVS/minuteclinic services into their plans, improving

member access to health care while lowering overall

costs. For example, our pilot plan to reduce or eliminate

co-payments for plan members now covers 1.2 million

lives. That’s up from 88,000 in 2012.

We are reinventing specialty with a unique suite

of assets to address rising costs

Our specialty pharmacy business continues to grow

rapidly, with revenues from the specialty drugs we

dispensed and managed across the enterprise totaling

$31 billion in 2014. The overall specialty market is

projected to reach $235 billion and 50 percent of total

drug spend by 2018—compared with just 38 percent

this past year—as utilization of costly new therapies

16

CVS Health

157033_NAR.indd 16 3/9/15 10:55 AM

increases. Hepatitis C drugs such as Sovaldi

®

and

Harvoni

™

as well as PCSK9 inhibitors, an anticipated

new class of drugs for lowering cholesterol, are notable

examples of high-cost therapies expected to drive the

rapid growth in specialty pharmacy.

This trend imposes a substantial burden on both patients

and payors as they seek ways to control costs. Our

clients count on us to manage these expensive specialty

medications to ensure appropriate utilization through a

combination of prior authorization, formulary manage-

ment, and other innovative clinical programs. That’s why

we’ve been working hard to reinvent specialty pharmacy.

In specialty, we led the market in 2013 with formulary

strategies using clinically appropriate and cost-effective

solutions and we continued to lead in 2014. We also

have unparalleled capabilities to manage specialty

patients holistically, not just their drug costs, and our

clinical support and site-of-care management helps drive

superior outcomes. We’ve integrated our Accordant rare

disease care management services to enhance care

and reduce costs, rolled out Specialty Connect, and

made key acquisitions such as Coram and NovoLogix

to broaden our portfolio.

CVS/pharmacy posted solid results despite exit from

tobacco category and continued to gain share

CVS/pharmacy continued to gain market share in both

the pharmacy and the front of the store in 2014 even

as consumers remained cost conscious. Our core

pharmacy business has grown three times faster than

that of other drug chains over the same period, and we

hold a 21 percent share of the U.S. retail prescription

drug market.

For the year, same-store sales rose 2.1 percent, with

the pharmacy up 4.8 percent and the front of the store

down 4.0 percent. Our underlying front store growth

was obscured by the negative impact on revenue from

exiting the tobacco category. It has now been five

months since we became the first national pharmacy

chain to eliminate cigarettes and other tobacco products

from our shelves, a move that reflects our corporate

purpose and is expected to help drive long-term growth.

As expected, exiting the tobacco category will cost us

approximately $2 billion in revenues on an annualized

basis—$1.5 billion from tobacco sales specifically and

approximately another $500 million from the rest of those

shoppers’ baskets. That amounted to about 8 cents in

earnings per share in 2014, and it is expected to cost

an incremental 8 to 9 cents per share in 2015 for a total

annual impact of approximately 17 cents per share. Yet

our decision better aligns us with payors and providers

as they search for ways to improve health outcomes

and control costs. That should make us a more attractive

partner for dispensing and other services, ultimately

helping us recapture this lost revenue elsewhere across

the enterprise.

Health and beauty remained key drivers of front store

sales in 2014, with market shares rising to 36 and

40 percent, respectively. Our store brands continued

to generate profitable sales growth, accounting for

19 percent of front store sales. Given our success,

we’ve set a new goal of increasing store brand

penetration to 25 percent of front store sales. Like

generic drugs in the pharmacy, store brands provide

significantly higher margins than national brands while

also saving our customers money. The past year saw

our successful launch of the Makeup Academy™

and radiance

®

PLATINUM lines as well as more than

40 items under the new Gold Emblem Abound™

healthy snack brand.

As we look to the future, we will continue to provide our

customers with additional healthy options. Our goal is to

make CVS/pharmacy the convenience destination for

more, better, and healthier choices. In research we have

conducted since the tobacco announcement, custom-

ers have made healthy food their number one choice

among offerings they would like to see added. More-

over, these products are less sensitive to promotion,

which aligns with our strategy to drive profitable growth.

Our adherence programs and partnerships

are providing value to our PBM and non-PBM

patients alike

Our channel-agnostic pharmacy care model has played

a key role in enhancing member services and driving

share gains. Plan members are embracing our unique

offerings, and we’ve also endeavored to improve our

value to our retail customers who are covered by other

PBMs. They are benefiting from our best-in-class clinical

17

2014 Annual Report

FOCUS ON SHAREHOLDER VALUE

More than $7 billion is

expected to be returned to

our shareholders through

dividends and share

repurchases in 2015.

157033_NAR.indd 17 3/9/15 10:55 AM

programs to help treat chronic conditions as well as

from the innovative partnerships we have forged with

providers and payors.

Adherence to prescription drug regimens is critical

to improving patient health and reducing costs, and

CVS/pharmacy’s adherence rates lead the industry. For

example, our medication possession ratios for custom-

ers undergoing therapy for diabetes, high cholesterol, or

high blood pressure are eight percentage points higher

than those of our top three retail competitors. That

translates into lower mortality rates, fewer heart attacks

and strokes, better quality of life, and a reduction in

overall health care costs.

Among our partnerships, we’re working with hospital

providers to ensure that patients have the proper

outpatient medications in hand before discharge. We

follow up after patients return home to answer questions

and confirm medication adherence. With the rise of

consumerism driven in large part by the increasing

numbers of individuals in consumer-driven health plans,

what we’re calling the retailization of health care,

CVS/pharmacy has also partnered with a number of

health plan clients on a variety of initiatives that help

them reach out to consumers directly. For example,

we host in-store events to drive member acquisition

and have launched a solution that enables health plan

members to pay their insurance premiums at their local

CVS/pharmacy. We’ve also introduced HeathTag

®

,

which allows us to deliver messages from our health

plan partners to patients, such as a reminder to get an

A1C blood sugar screening when picking up a prescrip-

tion. Importantly, these relationships position us to be

anchors in their limited or preferred networks.

We continue to enter new markets and use

ExtraCare to drive profitable growth

The vast majority of the U.S. population lives within a

few miles of a CVS/pharmacy, and we’ve continued

to expand our footprint in existing markets as well as

by entering new markets such as Seattle. Overall, we

opened or acquired 184 new stores in 2014. Factoring

in closings, net units increased by 162 stores. That

equates to two percent retail square footage growth for

the year, in line with our annual goal.

Our September 2014 acquisition of Miami-based

Navarro Discount Pharmacy

®

has strengthened our

position in the Hispanic marketplace, the fastest growing

demographic in the United States. Over the next decade,

the U.S. Hispanic population is expected to increase by

25 percent to 71 million lives. Navarro has been serving

Hispanic consumers for more than 50 years and now

has 33 retail drugstore locations. We are leveraging

its expertise to help make CVS/pharmacy stores in

Hispanic neighborhoods across the country even more

relevant to the customers we serve every day.

In all our locations, the ExtraCare loyalty program con-

tinues to play an indispensable role in driving profitable

front store sales. The industry’s longest-running loyalty

program is now in its 17th year and was used in more

than 80 percent of front store sales in 2014. It has

allowed us to gather critical consumer insights that we

use every day to enhance the CVS/pharmacy shopping

experience and to invest in those customers who

provide the most value.

For example, we’re now leveraging the knowledge

we’ve gained through ExtraCare to deliver personalized

offers to our 70 million active cardholders. This includes

25 million e-mails a week and 90 million mail pieces

annually. In 2014, cardholders redeemed a total of 38

million personalized coupons. The ongoing decline in

newspaper circulation will only increase our advantage

over competitors who rely more heavily on circulars

to drive trips to their stores. As always, cardholders

also get 2 percent back on purchases every day and

received $4 billion in ExtraBucks

®

savings and rewards

in 2014.

CVS Health’s robust digital strategy empowers consum-

ers to navigate their pharmacy experiences and manage

their conditions through our online and mobile tools.

This includes the ability to get next-in-line text alerts

at CVS/minuteclinic and, in the future, the ability to

schedule appointments. Our mobile app has received

critical acclaim for ease of use, while our text message

program has experienced significant growth.

CVS/minuteclinic excels at customer

satisfaction while broadening its preventative

and chronic care offerings

CVS/minuteclinic continued its rapid growth, ending

the year with more than 970 clinics in 31 states and

the District of Columbia, up from 800 clinics in the prior

year. Since its inception, CVS/minuteclinic’s 2,700 nurse

practitioners and physician assistants have provided

care for more than 23 million patient visits. We will

continue to add more locations and enter new markets

in 2015 and remain on track to reach 1,500 locations by

the end of 2017.

Along with our rapid growth, we have continued to

deliver the high levels of satisfaction and quality for

which CVS/minuteclinic is known. Our net promoter

score, a third-party measure of how likely it is that

18

CVS Health

157033_NAR.indd 18 3/9/15 10:55 AM

our services would be recommended to friends or

colleagues, has grown over the past two years. Among

health care organizations, our scores are unmatched.

Our own research published in the October 2014 edition

of The American Journal of Managed Care shows that

CVS/minuteclinic’s quality performance matches or

exceeds that of other ambulatory care settings for three

common health conditions.

Although CVS/minuteclinic is largely known for treating

sore throats, ear infections, and other acute conditions,

we are focused on expanding its scope of services.

That includes adding chronic disease monitoring and

treatment for conditions such as hypertension and

hyperlipidemia. We have expanded our biometric

monitoring, tobacco cessation, and weight loss pro-

grams. We undertake chronic care only when working

with primary care doctors to complement the services

they offer. Our affiliations with major health systems

throughout the United States—and two-way integration

of our electronic medical records—heighten our ability to

provide collaborative care. We added 19 health systems

in 2014, ending the year with 49 such affiliations.

Growth of government programs and

exchanges presents significant opportunities

across our enterprise

Government programs represent a tremendous growth

opportunity for us, and we have strong positions in both

the Medicare and Medicaid markets. The United States

is in the midst of what we are calling a “silver tsunami,”

with some 10,000 baby boomers turning 65 every day.

This means that more than 17 million new people will

be eligible for Medicare by 2019. CVS Health serves

this market through our SilverScript Medicare Part D

prescription drug plan, as the PBM for our health

plan Medicare clients, and through Employer Group

Waiver Plans.

As a result of the Affordable Care Act, we have seen

significant growth in Medicaid over the past year with

states expanding eligibility. This growth will likely continue

as more states evaluate their Medicaid expansion

decisions. At the same time, the growth of managed

Medicaid over traditional fee-for-service models has

been fueled by states seeking cost savings opportuni-

ties. CVS/caremark participates in managed Medicaid

through health plan clients, and our 19 percent share

makes us an industry leader. Medicaid also currently

accounts for 14 percent of prescriptions dispensed

at CVS/pharmacy locations. Our retail footprint and

capabilities give us an opportunity to gain even greater

share as managed Medicaid providers narrow their retail

pharmacy networks to save costs.

The next several years are expected to bring continued

growth in the number of people seeking insurance

through the public exchanges. Additionally, we believe

some employers will explore private exchanges as a

viable option to reduce health care spending for their

retirees. CVS/caremark participates on the public and

private exchanges on a carve-in basis with health plan

clients. On the private exchanges, we also participate on

a carve-out basis as a standalone PBM where we offer

prescription benefits directly. We expect the growth in

exchange lives to provide an incremental lift to our retail

pharmacy as utilization increases.

Clearly, we are seeing tremendous opportunities for

growth throughout the enterprise, and I believe that our

integrated model will allow us to take full advantage of

them. In closing, I want to thank our board of directors

and the 217,000 colleagues who work so diligently

across CVS Health. They have committed themselves

to our unique model of pharmacy care and have given

us a compelling advantage in today’s marketplace. To

my fellow shareholders, thank you for your continued

confidence in our strategy.

Sincerely,

Larry J. Merlo

President and Chief Executive Officer

February 10, 2015

19

2014 Annual Report

NEWLY INSURED LIVES WILL DRIVE UTILIZATION

By 2019, the total number of insured is expected

to increase by 36 million through individual

exchanges and other government programs.

2013 2019E

300

264

Growth in U.S.

insured lives

lives in millions

157033_NAR.indd 19 3/9/15 10:55 AM

20

CVS Health

Prescription for a better world

In 2014, we launched our new corporate social responsibility (CSR) roadmap,

Prescription for

a Better World,

which charts our CSR course for the future and is focused on three key areas.

We see each of these areas not only as essential ingredients for a better world, but areas we

can help support by leveraging the scale, expertise, and innovative spirit of our company.

Health in Action

Building healthier

communities

Health in Action centers on

improving patient outcomes and

providing quality, affordable, and

accessible health care to the

people and communities we

serve. We strive to deliver on

these priorities by continuously

improving our services and prod-

uct offerings and by leveraging

our integrated business model as

well as our philanthropic support.

Planet in Balance

Protecting the planet

Our purpose as a company is

helping people on their path to

better health, which is intrinsically

linked to the sustainability of our

planet. We have made Planet in

Balance a strategic priority and

are working to mitigate climate

change, reduce our resource

use, and embed sustainability into

our products and supply chain.

Leader in Growth

Creating economic

opportunities

Through Leader in Growth, we

leverage the power and scale of

our business to create economic

opportunities and value for our

employees, customers, suppliers,

and investors. This pillar focuses

on our priority to invest in our

people, operate with integrity, and

conduct business responsibly.

More than

$

90

million

in donations,

volunteer hours,

and other

charitable

efforts in 2014

More than

$

1.35

million

in volunteer

hours donated

by our

colleagues

62

million

people lack

access to

primary care

1.2

million

U.S. children

lack access to

medical care

due to financial

hardship

In 2014, our energy-

efficient pilot store in

West Haven, Connecticut,

received the U.S. Green

Building Council’s Leadership in

Energy and Environmental Design

(LEED) platinum certification

In 2014 we received a number

of awards and recognitions,

including the following:

n

Named to Dow Jones

Sustainability Index

n

Platinum rating for Carbon

Disclosure Project’s S&P 500

Climate Performance Leadership

Index

n

Among top 40 on Newsweek’s

Green Ranking of America’s

Greenest Companies

n

Among DiversityInc’s Top 25

Noteworthy Companies; A Top

10 Company for Veterans and

Employee Resource Groups

n

Among the top tier of companies

listed on the Center for Political

Accountability (CPA) Zicklin Index

of Corporate Political Disclosure

and Accountability

n

Corporate Responsibility

Magazine named CVS Health

President and CEO Larry Merlo

as the 2014 Responsible CEO

of the Year

9%

reduction achieved in our

carbon footprint from our

2010 baseline and on pace

to achieve our goal of 15%

by 2018

Total Carbon

Footprint

84% Electricity

5% Refrigerants

5% Product Deliveries

4% Natural Gas & Other Fuels

2% Business Travel

157033_NAR.indd 20 3/9/15 10:55 AM

2014 Annual Report

21

2014

Financial

Report

22 Management’s Discussion and Analysis of

Financial Condition and Results of Operations

50 Management’s Report on Internal Control Over

Financial Reporting

51 Report of Independent Registered Public

Accounting Firm

52 Consolidated Statements of Income

53 Consolidated Statements of Comprehensive

Income

54 Consolidated Balance Sheets

55 Consolidated Statements of Cash Flows

56 Consolidated Statements of Shareholders’ Equity

57 Notes to Consolidated Financial Statements

88 Five-Year Financial Summary

89 Report of Independent Registered Public

Accounting Firm

90 Stock Performance Graph

157033_FIN.indd 21 3/2/15 3:14 PM

Management’s Discussion and Analysis

of Financial Condition and Results of Operations

22

CVS Health

The following discussion and analysis should be read in conjunction with our audited consolidated financial state-

ments and Cautionary Statement Concerning Forward-Looking Statements that are included in this Annual Report.

Overview of Our Business

CVS Health Corporation, together with its subsidiaries (collectively “CVS Health,” the “Company,” “we,” “our” or

“us”), is a pharmacy innovation company helping people on their path to better health. At the forefront of a changing

health care landscape, the Company has an unmatched suite of capabilities and the expertise needed to drive

innovations that will help shape the future of health.

We are currently the only integrated pharmacy health care company with the ability to impact consumers, payors,

and providers with innovative, channel-agnostic solutions. We have a deep understanding of their diverse needs

through our unique integrated model, and we are bringing them innovative solutions that help increase access to

quality care, deliver better health outcomes, and lower overall health care costs.

Through our 7,800 retail pharmacies, more than 900 walk-in medical clinics, a leading pharmacy benefits manager

(PBM) with more than 65 million plan members, and expanding specialty pharmacy services, we enable people,

businesses, and communities to manage health in more effective ways. We are delivering breakthrough products

and services, from advising patients on their medications at our CVS/pharmacy

®

locations, to introducing unique

programs to help control costs for our clients at CVS/caremark

TM

, to innovating how care is delivered to our

patients with complex conditions through CVS/specialty

TM

, or by expanding access to high-quality, low-cost care

at CVS/minuteclinic

TM

.

We currently have three reportable segments: Pharmacy Services, Retail Pharmacy and Corporate.

Overview of Our Pharmacy Services Segment

Our Pharmacy Services business generates revenue from a full range of PBM services, including plan design and

administration, formulary management, Medicare Part D services, mail order, specialty pharmacy and infusion

services, retail pharmacy network management services, prescription management systems, clinical services,

disease management services and medical spend management.

Our clients are primarily employers, insurance companies, unions, government employee groups, health plans,

Managed Medicaid plans and other sponsors of health benefit plans, and individuals throughout the United States.

A portion of covered lives, primarily within the Managed Medicaid, health plan and employer markets have access

to our services through public and private exchanges.

As a pharmacy benefits manager, we manage the dispensing of pharmaceuticals through our mail order pharmacies,

specialty pharmacies and national network of more than 68,000 retail pharmacies, consisting of approximately

41,000 chain pharmacies (which includes our CVS/pharmacy

®

stores) and 27,000 independent pharmacies, to

eligible members in the benefit plans maintained by our clients and utilize our information systems to perform,

among other things, safety checks, drug interaction screenings and brand to generic substitutions.

Our specialty pharmacies support individuals that require complex and expensive drug therapies. Our specialty

pharmacy business includes mail order and retail specialty pharmacies that operate under the CVS/caremark

TM

,

CarePlus CVS/pharmacy

®

and Navarro Health Services

®

names. Substantially all of our mail service specialty

pharmacies have been accredited by The Joint Commission, which is an independent, not-for-profit organization

that accredits and certifies health care organizations and programs in the United States. In January 2014, we

enhanced our offerings of specialty infusion services and began offering enteral nutrition services through Coram

LLC and its subsidiaries (collectively, “Coram”), which we acquired on January 16, 2014. We completed the roll out

157033_FIN.indd 22 3/2/15 3:14 PM

23

2014 Annual Report

of Specialty Connect

TM

in May 2014, which integrates our specialty pharmacy mail and retail capabilities, providing

members with disease-state specific counseling from our experienced specialty pharmacists and the choice to bring

their specialty prescriptions to any CVS/pharmacy location. Whether submitted through our mail order pharmacy or

at CVS/pharmacy, all prescriptions are filled through the Company’s specialty mail order pharmacies, so all revenue

from this specialty prescription services program is recorded within the Pharmacy Services Segment. Members then

can choose to pick up their medication at their local CVS/pharmacy or have it sent to their home through the mail.

We also provide health management programs, which include integrated disease management for 17 conditions,

through our Accordant

®

rare disease management offering. The majority of these integrated programs are accredited

by the National Committee for Quality Assurance.

In addition, through our SilverScript Insurance Company (“SilverScript”) subsidiary, we are a national provider of

drug benefits to eligible beneficiaries under the federal government’s Medicare Part D program. We currently provide

Medicare Part D plan benefits to approximately 4.4 million beneficiaries through SilverScript, including our individual

and employer group waiver plans.

The Pharmacy Services Segment operates under the CVS/caremark

TM

Pharmacy Services, Caremark

®

, CVS/caremark

TM

,

CarePlus CVS/pharmacy

®

, RxAmerica

®

, Accordant

®

, SilverScript

®

, Coram

®

, CVS/specialty

TM

, NovoLogix

®

and

Navarro

®

Health Services names. As of December 31, 2014, the Pharmacy Services Segment operated 27 retail

specialty pharmacy stores, 11 specialty mail order pharmacies, four mail order dispensing pharmacies, and 86

branches and six centers of excellence for infusion and enteral services located in 40 states, Puerto Rico and the

District of Columbia.

Overview of Our Retail Pharmacy Segment

Our Retail Pharmacy Segment sells prescription drugs and a wide assortment of general merchandise, including

over-the-counter drugs, beauty products and cosmetics, personal care products, convenience foods, photo

finishing, seasonal merchandise and greeting cards through our CVS/pharmacy

®

, CVS

®

, Longs Drugs

®

, Navarro

Discount Pharmacy

®

and Drogaria Onofre

TM

retail stores and online through CVS.com

®

, Navarro.com

TM

and

Onofre.com.br

TM

. Our Retail Pharmacy Segment derives the majority of its revenues through the sale of prescription

drugs, which are dispensed by our nearly 24,000 retail pharmacists. The role of our retail pharmacists is shifting

from primarily dispensing prescriptions to also providing services, including flu vaccinations as well as face-to-face

patient counseling with respect to adherence to drug therapies, closing gaps in care, and more cost-effective drug

therapies. Our integrated pharmacy services model enables us to enhance access to care while helping to lower

overall health care costs and improve health outcomes.

Our Retail Pharmacy Segment also provides health care services through our MinuteClinic

®

health care clinics.

MinuteClinics are staffed by nurse practitioners and physician assistants who utilize nationally recognized protocols

to diagnose and treat minor health conditions, perform health screenings, monitor chronic conditions, and deliver

vaccinations. We believe our clinics provide high-quality services that are affordable and convenient.

Our proprietary loyalty card program, ExtraCare

®

, has approximately 70 million active cardholders, making it one of

the largest and most successful retail loyalty card programs in the country.

As of December 31, 2014, our Retail Pharmacy Segment included 7,822 retail drugstores (of which 7,765 operated

a pharmacy) located in 44 states, the District of Columbia, Puerto Rico and Brazil operating primarily under the

CVS/pharmacy

®

, CVS

®

, Longs Drugs

®

, Navarro Discount Pharmacy

®

and Drogaria Onofre

TM

names, 17 onsite

pharmacies primarily operating under the CarePlus CVS/pharmacy

®

, CarePlus

®

and CVS/pharmacy

®

names, and

971 retail health care clinics operating under the MinuteClinic

®

name (of which 963 were located in CVS/pharmacy

stores), and our online retail websites, CVS.com

®

, Navarro.com

TM

and Onofre.com.br

TM

.

157033_FIN.indd 23 3/2/15 3:14 PM

Management’s Discussion and Analysis

of Financial Condition and Results of Operations

24

CVS Health

Overview of Our Corporate Segment

The Corporate Segment provides management and administrative services to support the Company. The Corporate

Segment consists of certain aspects of our executive management, corporate relations, legal, compliance, human

resources, corporate information technology and finance departments.

Results of Operations

Summary of our Consolidated Financial Results

YEAR ENDED DECEMBER 31,

IN MILLIONS, EXCEPT PER COMMON SHARE AMOUNTS 2014 2013 2012

Net revenues

$ 139,367

$ 126,761 $ 123,120

Cost of revenues

114,000

102,978 100,632

Gross profit

25,367

23,783 22,488

Operating expenses

16,568

15,746 15,278

Operating profit

8,799

8,037 7,210

Interest expense, net

600

509 557

Loss on early extinguishment of debt

521

— 348

Income before income tax provision

7,678

7,528 6,305

Income tax provision

3,033

2,928 2,436

Income from continuing operations

4,645

4,600 3,869

Loss from discontinued operations, net of tax

(1)

(8) (7)

Net income

4,644

4,592 3,862

Net loss attributable to noncontrolling interest — — 2

Net income attributable to CVS Health

$ 4,644

$ 4,592 $ 3,864

Diluted earnings per common share:

Income from continuing operations attributable to CVS Health

$ 3.96

$ 3.75 $ 3.02

Loss from discontinued operations attributable to CVS Health

$ —

$ (0.01) $ (0.01)

Net income attributable to CVS Health

$ 3.96

$ 3.74 $ 3.02

Net revenues

increased $12.6 billion in 2014 compared to 2013, and increased $3.6 billion in 2013 compared to

2012. As you review our performance in this area, we believe you should consider the following important information:

• During 2014, net revenues in our Pharmacy Services Segment increased 16.1% and net revenues in our Retail

Pharmacy Segment increased 3.3% compared to the prior year.

• During 2013, net revenues in our Pharmacy Services Segment increased by 3.8% and net revenues in our Retail

Pharmacy Segment increased 3.1% compared to the prior year.

• The increase in our generic dispensing rates in both of our operating segments continued to have an adverse

effect on net revenue in 2014 as compared to 2013, as well as in 2013 as compared to 2012. In 2014, the

Pharmacy Services Segment had a greater impact from net new business as compared to 2013.

Please see the Segment Analysis later in this document for additional information about our net revenues.

157033_FIN.indd 24 3/2/15 3:14 PM

25

2014 Annual Report

Gross profit

increased $1.6 billion, or 6.7% in 2014, to $25.4 billion, as compared to $23.8 billion in 2013. Gross

profit increased $1.3 billion, or 5.8% in 2013, to $23.8 billion, as compared to $22.5 billion in 2012. Gross profit as

a percentage of net revenues declined to 18.2%, as compared to 18.8% in 2013 and 18.3% in 2012.

• During 2014, gross profit in our Pharmacy Services Segment and Retail Pharmacy Segment increased by 12.6%

and 5.8%, respectively, compared to the prior year. For the year ended December 31, 2014, gross profit as a

percent of net revenues in our Pharmacy Services Segment and Retail Pharmacy Segment was 5.4% and 31.4%,

respectively.

• During 2013, gross profit in our Pharmacy Services Segment and Retail Pharmacy Segment increased by 11.3%

and 5.3%, respectively, compared to the prior year. For the year ended December 31, 2013, gross profit as a

percent of net revenues in our Pharmacy Services Segment and Retail Pharmacy Segment was 5.6% and 30.6%,

respectively.

• The increased weighting toward the Pharmacy Services Segment, which has a lower gross profit than the Retail

Pharmacy Segment, resulted in a decline in consolidated gross profit as a percent of net revenues in 2014 as

compared to 2013. In addition, gross profit for 2014, 2013 and 2012 has been negatively impacted by the efforts

of managed care organizations, pharmacy benefit managers and governmental and other third-party payors to

reduce their prescription drug costs.

• Our gross profit continued to benefit from the increased utilization of generic drugs (which normally yield a higher

gross profit rate than equivalent brand name drugs) in both the Pharmacy Services and Retail Pharmacy segments

for 2012 through 2014, offsetting the negative impacts described above.

Please see the Segment Analysis later in this document for additional information about our gross profit.

Operating expenses

increased $822 million, or 5.2% in the year ended December 31, 2014, as compared to the

prior year. Operating expenses as a percent of net revenues declined to 11.9% in the year ended December 31,

2013 compared to 12.4% in the prior year. The increase in operating expense dollars in the year ended December 31,

2014 was primarily due to incremental store operating costs associated with a higher store count, as well as legal

costs and strategic initiatives as compared to the prior year. Additionally, the year ended December 31, 2013

included a $72 million gain on a legal settlement. The improvement in operating expenses as a percent of net

revenues in 2014 is primarily due to expense leverage from net revenue growth and disciplined expense control.

Operating expenses increased $468 million in the year ended December 31, 2013 as compared to the prior year.

Operating expenses as a percent of net revenues remained flat at 12.4% in the year ended December 31, 2013.

The increase in operating expense dollars in the year ended December 31, 2013 was primarily due to incremental

store operating costs associated with a higher store count as compared to the prior year, as well as strategic

initiatives. The increase was partially offset by a $72 million gain on a legal settlement.

Please see the Segment Analysis later in this document for additional information about operating expenses.

Interest expense, net

for the years ended December 31 consisted of the following:

IN MILLIONS 2014 2013 2012

Interest expense

$ 615

$ 517 $ 561

Interest income

(15)

(8) (4)

Interest expense, net

$ 600

$ 509 $ 557

157033_FIN.indd 25 3/2/15 3:14 PM

Management’s Discussion and Analysis

of Financial Condition and Results of Operations

26

CVS Health

Net interest expense increased $91 million during the year ended December 31, 2014, primarily due to the issuance of

$4 billion of debt in December 2013 and $1.5 billion of debt in August 2014. During 2013, net interest expense decreased

by $48 million, to $509 million compared to 2012, which resulted from lower average interest rates during 2013.

Loss on Early Extinguishment of Debt —

During the year ended December 31, 2014, the Company completed a

$2.0 billion tender offer and repurchase of certain Senior Notes. The Company paid a premium of $490 million in

excess of the debt principal in connection with the repurchase of the Senior Notes, wrote off $26 million of unamor-

tized deferred financing costs and incurred $5 million in fees, for a total loss on early extinguishment of debt of

$521 million. During the year ended December 31, 2012, the Company completed a $1.3 billion tender offer and

repurchase of certain Senior Notes and incurred a total loss on the early extinguishment of debt of $348 million.

See Note 5 to the consolidated financial statements.

Income tax provision —

Our effective income tax rate was 39.5%, 38.9% and 38.6% in 2014, 2013 and 2012,

respectively. The effective income tax was higher in 2014 than in 2013 primarily due to certain permanent items in

2014. These same items were the principal factors for the increase in the effective income tax rate in 2013 compared

to 2012.

Income from continuing operations

increased $45 million or 1.0% to $4.6 billion in 2014. Income from continuing

operations increased $731 million or 18.9% to $4.6 billion in 2013 as compared to $3.9 billion in 2012. The 2014 and

2013 increases in income from continuing operations were primarily related to increases in generic dispensing rates

and increased prescription volume for both operating segments. In addition, as discussed previously, income from

continuing operations included a $521 million and $348 million loss on early extinguishment of debt in 2014 and 2012,

respectively, which positively impacted the growth rate in 2013 and negatively impacted the growth rate in 2014.

Loss from discontinued operations —

In connection with certain business dispositions completed between 1991

and 1997, the Company retained guarantees on store lease obligations for a number of former subsidiaries, includ-

ing Linens ‘n Things, which filed for bankruptcy in 2008. The Company’s loss from discontinued operations includes

lease-related costs required to satisfy its Linens ‘n Things lease guarantees. We incurred a loss from discontinued

operations, net of tax, of $1 million, $8 million and $7 million in 2014, 2013 and 2012, respectively.

See Note 1 “Significant Accounting Policies — Discontinued Operations” to the consolidated financial statements

for additional information about discontinued operations and Note 11 “Commitments and Contingencies” for

additional information about our lease guarantees.

Net loss attributable to noncontrolling interest

of $2 million for the year ended December 31, 2012 represents the

minority shareholders’ portion of the net loss of our subsidiary, Generation Health, Inc. (“Generation Health”). We

acquired the remaining 40% interest of Generation Health in June 2012 and as a result, there was no longer a

noncontrolling interest in Generation Health for the years ended December 31, 2014 and 2013. For the year ended

December 31, 2014, the Company had immaterial noncontrolling interests in two consolidated entities.

Net income attributable to CVS Health

increased $52 million or 1.1% to $4.6 billion (or $3.96 per diluted share)

in 2014. This compares to $4.6 billion (or $3.74 per diluted share) in 2013 and $3.9 billion (or $3.02 per diluted share)

in 2012. As discussed previously, the 2014 increase in net income attributable to CVS Health was primarily related

to increased generic drug dispensing and increased prescription volume in both operating segments. The increase

in net income attributable to CVS Health per diluted share was also driven by increased share repurchase activity

in 2014 and 2013. The increase in net income attributable to CVS Health and per diluted share in 2014 includes a