SBTi CORPORATE

NET-ZERO STANDARD

Version 1.2

March 2024

ABOUT SBTi

The Science Based Targets initiative (SBTi) is a corporate climate action organization that

enables companies and financial institutions worldwide to play their part in combating the

climate crisis.

We develop standards, tools and guidance which allow companies to set greenhouse gas

(GHG) emissions reductions targets in line with what is needed to keep global heating below

catastrophic levels and reach net-zero by 2050 at latest.

The SBTi is incorporated as a charity, with a subsidiary which will host our target validation

services. Our partners are CDP, the United Nations Global Compact, the We Mean Business

Coalition, the World Resources Institute (WRI), and the World Wide Fund for Nature (WWF).

Science Based Targets Initiative is a registered charity in England and Wales (1205768) and a limited company registered in England and Wales (14960097). Registered

address: First Floor, 10 Queen Street Place, London, England, EC4R 1BE. SBTI Services Limited is a limited company registered in England and Wales (15181058).

Registered address: First Floor, 10 Queen Street Place, London, England, EC4R 1BE. SBTI Services Limited is a wholly owned subsidiary of Science Based Targets

Initiative. © SBTi 2024

DISCLAIMER

Although reasonable care was taken in the preparation of this document, the Science Based

Targets initiative (SBTi) affirms that the document is provided without warranty, either

expressed or implied, of accuracy, completeness or fitness for purpose. The SBTi hereby

further disclaims any liability, direct or indirect, for damages or loss relating to the use of this

document to the fullest extent permitted by law.

The information (including data) contained in the document is not intended to constitute or

form the basis of any advice (financial or otherwise). The SBTi does not accept any liability

for any claim or loss arising from any use of or reliance on any data or information in the

document.

This document is protected by copyright. Information or material from this document may be

reproduced only in unaltered form for personal, non-commercial use. All other rights are

reserved. Information or material used from this document may be used only for the

purposes of private study, research, criticism, or review permitted under the Copyright

Designs & Patents Act 1988 as amended from time to time ('Copyright Act'). Any

reproduction permitted in accordance with the Copyright Act shall acknowledge this

document as the source of any selected passage, extract, diagram, content or other

information.

The SBTi reserves the right to revise this document according to a set revision schedule or

as advisable to reflect the most recent emissions scenarios, regulatory, legal or scientific

developments, and GHG accounting best practices.

“Science Based Targets initiative” and “SBTi” refer to the Science Based Targets initiative, a

private company registered in England number 14960097 and registered as a UK Charity

number 1205768.

© SBTi 2024

SBTi Corporate Net-Zero Standard V1.2 March 2024 | 3

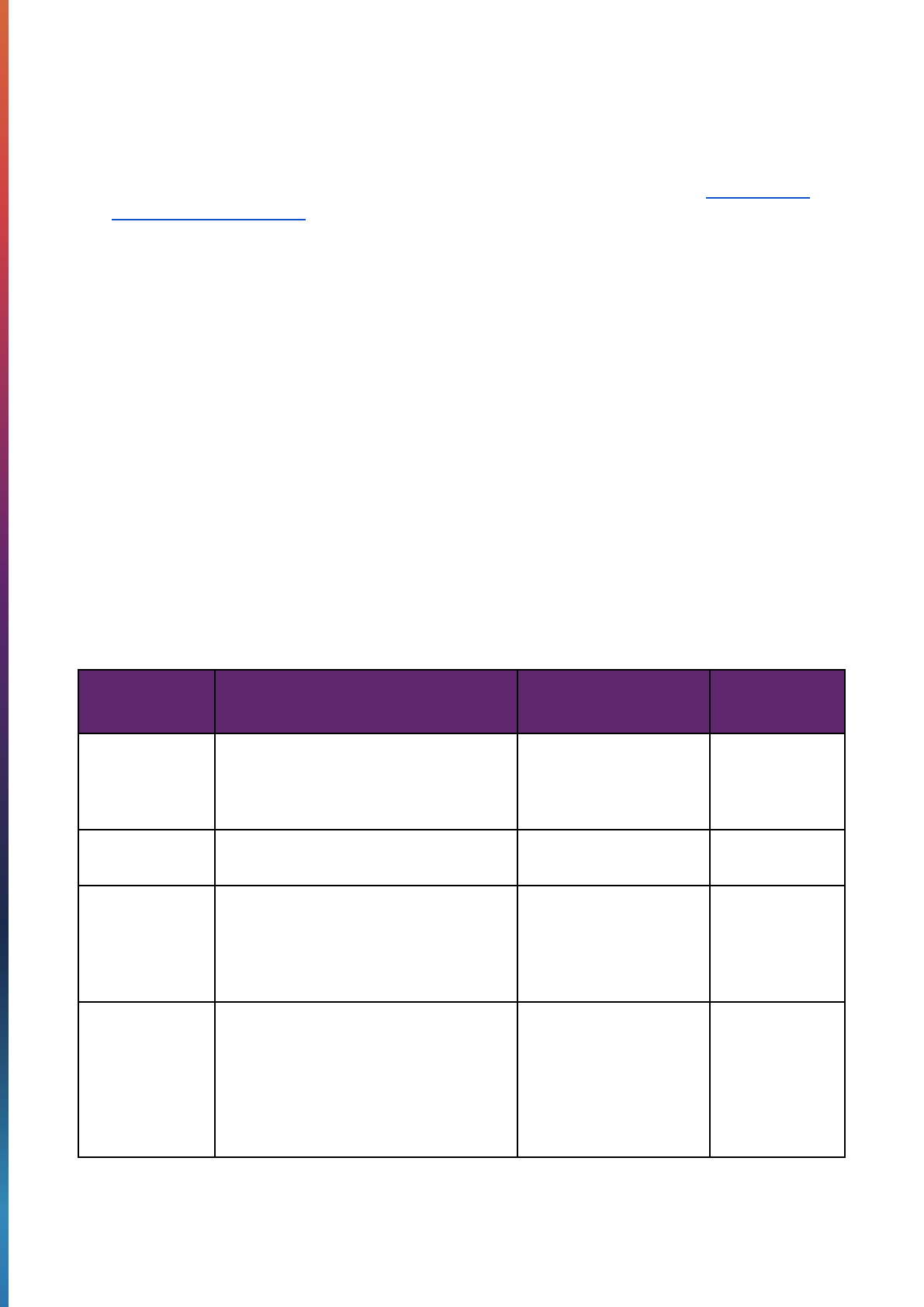

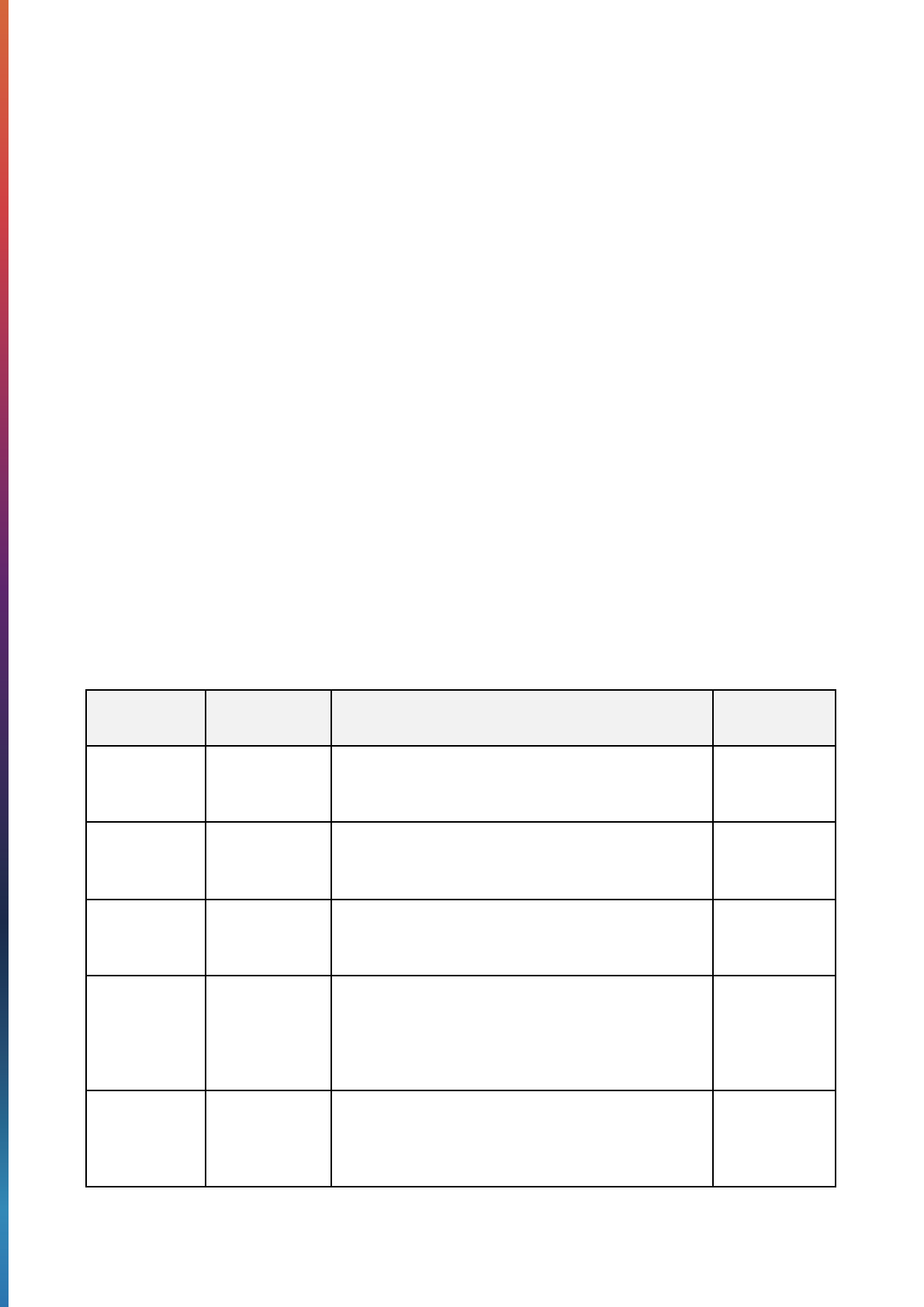

VERSION HISTORY

Version

Update description

Release date

Effective dates

1.0 Corporate

Net-Zero

Standard

28 October

2021

28 October 2021

to 10 April 2023

1.1 Corporate

Net-Zero

Standard

Non-substantive revision. For a detailed list

of revisions made in V1.1, please refer to

Annex I of the Main Changes document for

V1.2 of the Corporate Net Zero Standard.

11 April 2023

From 11 April

2023 to 12 March

2024

1.2 Corporate

Net-Zero

Standard

Non-substantive revision. Relevant elements

of the Target Validation Protocol and

Corporate Manual (both retired) have been

consolidated into this version of the

Corporate Net-Zero Standard. For a detailed

list of revisions made in V1.2, please refer to

Table 1 of the Main Changes document for

V1.2 of the Corporate Net Zero Standard.

13 March

2024

From 13 March

2024

SBTi Corporate Net-Zero Standard V1.2 March 2024 | 4

CONTENTS

ABOUT SBTi........................................................................................................................... 2

DISCLAIMER...........................................................................................................................3

VERSION HISTORY................................................................................................................ 4

CONTENTS............................................................................................................................. 5

GLOSSARY............................................................................................................................. 8

1. BACKGROUND TO THE CORPORATE NET-ZERO STANDARD..................................... 8

1.1 The Science Based Targets initiative........................................................................... 8

1.2 Purpose of the Corporate Net-Zero Standard.............................................................. 9

1.3 Who should use the Corporate Net-Zero Standard?....................................................9

1.4 The Corporate Net-Zero Standard Development process............................................9

1.5 How the Standard relates to other key SBTi documents............................................10

2. THE NET-ZERO STANDARD FRAMEWORK...................................................................12

2.1 Near-term science-based targets...............................................................................14

2.2 Long-term science-based targets...............................................................................14

2.3 Neutralization............................................................................................................. 14

2.4 Beyond value chain mitigation....................................................................................14

3. MITIGATION PATHWAYS IN THE NET-ZERO STANDARD.............................................16

3.1 The science behind science-based net-zero targets..................................................16

3.2 How mitigation pathways are used to inform science-based targets......................... 17

3.3 Overview of pathways and which companies should use them................................. 18

3.4 Transformative mitigation is required from all sectors................................................19

4. PROCESS TO SET SCIENCE-BASED TARGETS........................................................... 21

4.1 Select a base year......................................................................................................21

4.2 Calculate your company’s emissions......................................................................... 22

4.2.1 Develop a full GHG emissions inventory...........................................................22

4.2.2 Calculate emissions reported separately from the GHG inventory................... 24

4.3 Set target boundaries.................................................................................................24

4.3.1 Near-term science-based target boundary (scopes 1, 2, and 3)....................... 24

4.3.2 Long-term science-based target boundary (scopes 1, 2, and 3).......................24

4.3.3 Additional requirements for science-based target coverage............................. 25

4.3.4 Meeting SBTi boundary criteria with several targets......................................... 27

4.3.5 Setting a single scope 3 target or multiple scope 3 targets...............................27

4.4 Choose a target year..................................................................................................28

4.5 Target setting methods...............................................................................................29

4.6 Calculating near and long-term SBTs.........................................................................29

4.7 Target wording and communication............................................................................32

4.7.1 Overarching net-zero target.............................................................................. 32

4.7.2 Near-term and long-term science-based target wording................................... 33

4.7.3 Communicating targets..................................................................................... 33

5. THE CORPORATE NET-ZERO STANDARD CRITERIA AND RECOMMENDATIONS... 34

5.1 Background to the Corporate Net-Zero Standard Criteria..........................................34

5.1.1 Terminology.......................................................................................................34

SBTi Corporate Net-Zero Standard V1.2 March 2024 | 5

5.1.2 Effective dates of updated criteria..................................................................... 35

5.2 General criteria...........................................................................................................35

5.2.1 Target boundary................................................................................................ 35

5.2.1.1 Organizational boundary.......................................................................... 35

5.2.1.2 GHG coverage..........................................................................................35

5.2.1.3 Scope coverage........................................................................................35

5.2.1.4 Emissions coverage................................................................................. 35

5.2.2 Method validity (near and long-term targets).....................................................36

5.2.3 Emissions accounting requirements..................................................................36

5.3 Net-zero target formulation.........................................................................................38

5.3.1 Net-zero definition............................................................................................. 38

5.3.2 Structure............................................................................................................38

5.3.3 Timeframe......................................................................................................... 38

5.3.4 Ambition............................................................................................................ 39

5.3.4.1 Scope 1 and 2 (near- and long-term targets)........................................... 39

5.3.4.2 Scope 3 (near- and long-term targets)..................................................... 39

5.3.4.3 Combined targets (near- and long-term targets)...................................... 40

5.3.4.4 Renewable electricity targets (near- and long-term targets).....................40

5.3.5 Beyond value chain mitigation...........................................................................41

5.3.6 Neutralization.................................................................................................... 41

5.3.7 Target formulation..............................................................................................41

5.4 Reporting, recalculation and target validity................................................................ 42

5.4.1 Reporting...........................................................................................................42

5.4.2 Recalculation and target validity........................................................................42

5.5 Sector-specific guidance............................................................................................ 43

5.5.1 Fossil fuel sales, distribution, and other business............................................. 43

6. SECTOR-SPECIFIC REQUIREMENTS.............................................................................45

7. ACKNOWLEDGEMENTS..................................................................................................52

ANNEX A: SUPPLEMENTARY GUIDANCE ON GHG ACCOUNTING................................54

ANNEX B: SUPPLEMENTARY GUIDANCE ON TARGET-SETTING METHODS............... 59

B.1 Cross-sector absolute reduction (all scopes).............................................................59

B.2 Sector-specific absolute reduction (all scopes)..........................................................59

B.3 Sector-specific intensity convergence (i.e., SDA, all scopes)....................................60

B.4 Renewable electricity (scope 2).................................................................................61

B.5 Physical intensity reduction (scope 3)........................................................................62

B.6 Economic intensity reduction (scope 3)..................................................................... 63

B.7 Supplier and/or customer engagement targets (scope 3)..........................................64

ANNEX C: CLASSIFICATION OF TARGET TEMPERATURE ALIGNMENT.......................65

C.1 Target classification rules...........................................................................................65

ANNEX D: REPORTING GUIDANCE................................................................................... 67

D.1 Where to disclose...................................................................................................... 67

D.2 Reporting guiding principles...................................................................................... 68

D.3 GHG emissions inventory..........................................................................................69

D.3.1 Full GHG inventory........................................................................................... 69

SBTi Corporate Net-Zero Standard V1.2 March 2024 | 6

D.3.2 Data limitations................................................................................................. 69

D.3.3 Verification of GHG inventory........................................................................... 69

D.3.4 Worked example: GHG emissions inventory.................................................... 70

D.4 Target description...................................................................................................... 72

D.4.1 Description of the target....................................................................................72

D.4.2 Different levels of ambition by scope and/or activity.........................................73

D.4.3 Exclusions from emissions inventory and/or target boundary.......................... 73

D.4.4 Worked example: Target description.................................................................73

D.5 Target progress..........................................................................................................74

D.5.1 Progress in the reporting year.......................................................................... 74

D.5.2 Level of disaggregation.....................................................................................75

D.5.3 Worked example: Target progress....................................................................76

D.6 Substantial emission variations and changes in targets............................................77

D.6.1 Base year recalculation policy and threshold................................................... 77

D.6.2 Reasons for variation in emissions................................................................... 78

D.6.3 Worked example: substantial emission variations and changes in targets.......79

D.6.3 Recalculated and revalidated targets............................................................... 79

D.7 Actions towards meeting SBTs.................................................................................. 79

D.7.1 Information on emission reduction projects...................................................... 79

D.7.2 Information on contractual instruments (for scope 2 targets)........................... 80

D.7.3 Decarbonization pathway................................................................................. 80

D.7.4 Planned milestones and/or near-term investments for neutralization...............80

D.7.5 Planned actions or investments to mitigate climate change beyond your value

chain...........................................................................................................................80

D.7.6 Use of carbon offset credits and avoided (product-level) emissions.................81

D.7.7 Climate transition plan...................................................................................... 81

D.7.8 Worked example: actions towards meeting SBTs.............................................82

ANNEX E: GUIDANCE FOR COMPANIES IN LAND-INTENSIVE SECTORS.....................85

E.1 Background on FLAG emissions............................................................................... 85

E.2 SBTi FLAG Guidance................................................................................................ 85

E.3 Greenhouse Gas Protocol Land Sector and Removals Guidance.............................86

E.4 Which companies are required to set FLAG targets?................................................86

SBTi Corporate Net-Zero Standard V1.2 March 2024 | 7

GLOSSARY

Terms, definitions and acronyms used within this document can be found in the SBTi

Glossary.

1. BACKGROUND TO THE CORPORATE NET-ZERO

STANDARD

The Intergovernmental Panel on Climate Change’s (IPCC) Special Report on Global

Warming of 1.5°C (SR15, 2018), was widely accepted as a warning that we must limit global

temperature rise to 1.5°C above pre-industrial levels and reach net-zero carbon dioxide

(CO

2

) emissions by 2050 for the best chance of avoiding catastrophic climate breakdown.

More recently, the IPCC’s Sixth Assessment Report (2021) has confirmed that climate

change is already affecting every region on Earth, its impacts increasingly visible in the form

of extreme weather, worsened droughts and heightened risk of forest fires.

Against this backdrop, companies are increasingly adopting net-zero targets. The number of

businesses committing to reach net-zero emissions has grown rapidly, but not all net-zero

targets are equal. Without adhering to a common definition, net-zero targets can be

inconsistent, and their collective impact is strongly limited.

While the growing interest in net-zero targets represents an unparalleled opportunity to drive

corporate climate action, it has also created a pressing need for a common understanding of

‘net-zero’ in a corporate context. Business leaders need a robust, science-based framework

for setting net-zero targets. Otherwise, they risk continuing to invest in business models that

are inconsistent with the goals of the Paris Agreement.

The Science Based Targets initiative (SBTi) developed the first global science-based

standard for companies to set net-zero targets, published in 2021. The SBTi Corporate

Net-Zero Standard gives business leaders confidence that their greenhouse gas (GHG)

mitigation targets are aligned with what is needed for a habitable planet, and it provides

clarity on business climate action to a wide range of stakeholders.

1.1 The Science Based Targets initiative

The Science Based Targets initiative (SBTi) is a corporate climate action organization that

enables companies and financial institutions worldwide to play their part in combating the

climate crisis.

We develop standards, tools and guidance which allow companies to set greenhouse gas

(GHG) emissions reductions targets in line with what is needed to keep global heating below

catastrophic levels and reach net-zero by 2050 at latest.

The SBTi is incorporated as a charity, with a subsidiary which will host our target validation

services. Our partners are CDP, the United Nations Global Compact, the We Mean Business

Coalition, the World Resources Institute (WRI), and the World Wide Fund for Nature (WWF).

SBTi Corporate Net-Zero Standard V1.2 March 2024 | 8

1.2 Purpose of the Corporate Net-Zero Standard

The SBTi’s Corporate Net-Zero Standard (also referred to as the ‘Net-Zero Standard’)

contains guidance, criteria, and recommendations to support corporates in setting net-zero

targets to be validated by the SBTi. The main objective of this standard is to provide a

consistent and robust approach for corporates to set net-zero targets aligned with climate

science.

It is important to note that while the SBTi does provide some supplementary guidance on

GHG accounting, companies should refer to the suite of corporate Greenhouse Gas Protocol

standards on this topic.

1.3 Who should use the Corporate Net-Zero Standard?

The intended audience for this document is companies that wish to commit to setting and

submitting science-based net-zero targets for validation through the SBTi. This document

does not cover net-zero targets for financial institutions. The SBTi is developing a separate

Net-Zero Standard for Financial Institutions.

Small and medium-sized enterprises (SMEs) have the option to set targets using the

Corporate Net-Zero Standard or the streamlined SME route (where some of the details

contained within this document are not applicable). SMEs should refer to the SME definition

and the SME FAQ for more information.

Please note that the Corporate Net-Zero Standard should and in some cases must (e.g., for

companies with forest, land and agriculture activities) be complemented with SBTi sector

guidance whenever the sector and/or activity covered by the sector guidance is relevant to

the company. For example, a company with aviation, maritime, and financial services

activities is encouraged to set separate sector-specific targets for each of the activities

relevant to them based on SBTi sector guidance.

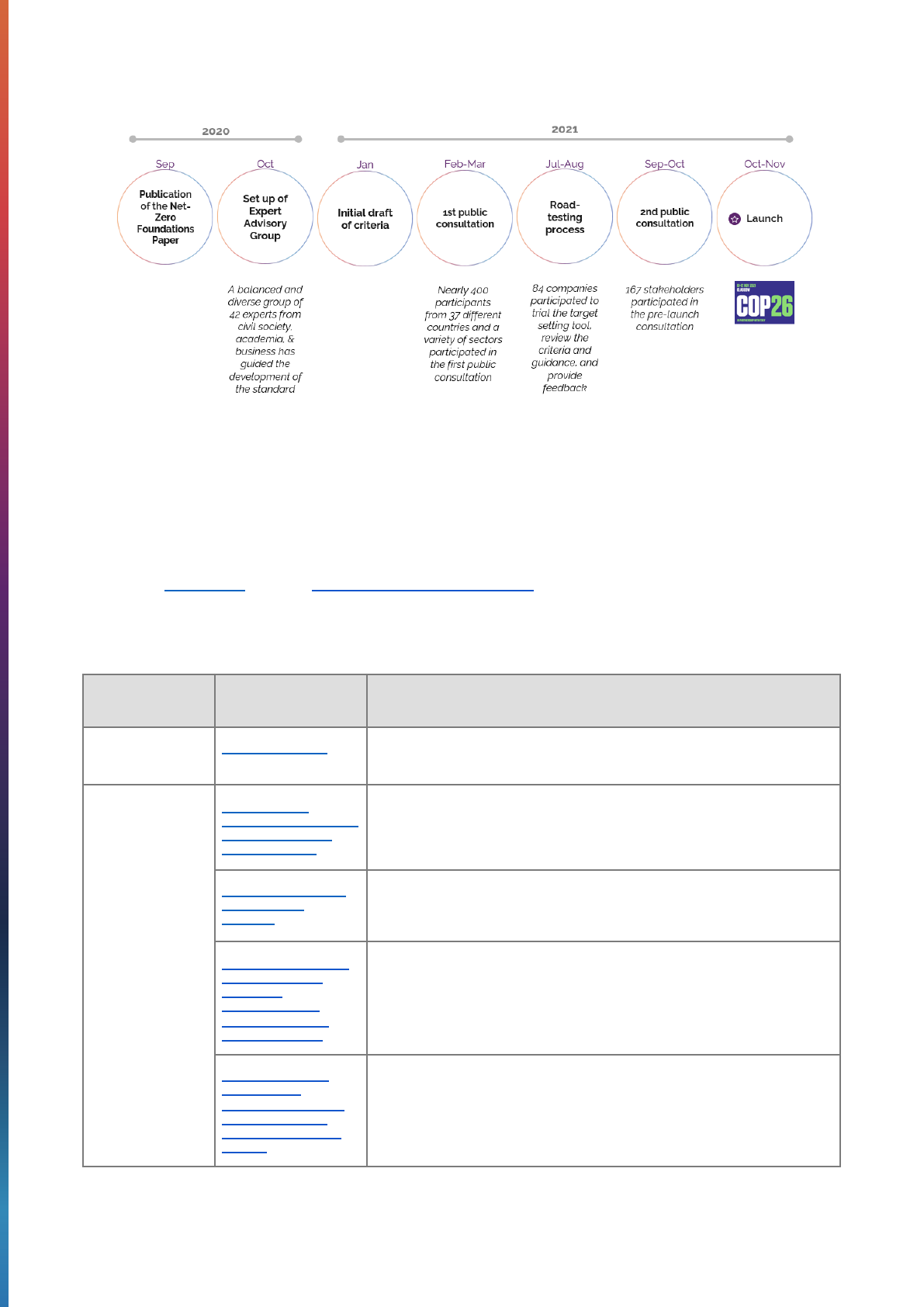

1.4 The Corporate Net-Zero Standard Development process

The SBTi initiated a scoping phase of work in 2019 to develop a framework enabling

companies to set robust and credible net-zero targets in line with a 1.5°C future. The

standard development process formally began after the SBTi’s publication of Foundations for

Science-Based Net-Zero Target Setting in the Corporate Sector in September 2020. After

publication, the SBTi convened a dedicated Net-Zero Expert Advisory Group (EAG), which

was to be the main consensus building body for the project.

The SBTi then developed detailed criteria and guidance in regular consultation with the EAG,

as well as the SBTi’s Scientific and Technical Advisory Groups. The SBTi requested

feedback from stakeholders to improve the standard through two public consultations and a

company road test. The standard was launched on 28 October 2021. Further detail on this

process can be found on the SBTi website.

SBTi Corporate Net-Zero Standard V1.2 March 2024 | 9

Figure 1. An outline of key milestones in the Corporate Net-Zero Standard development

process.

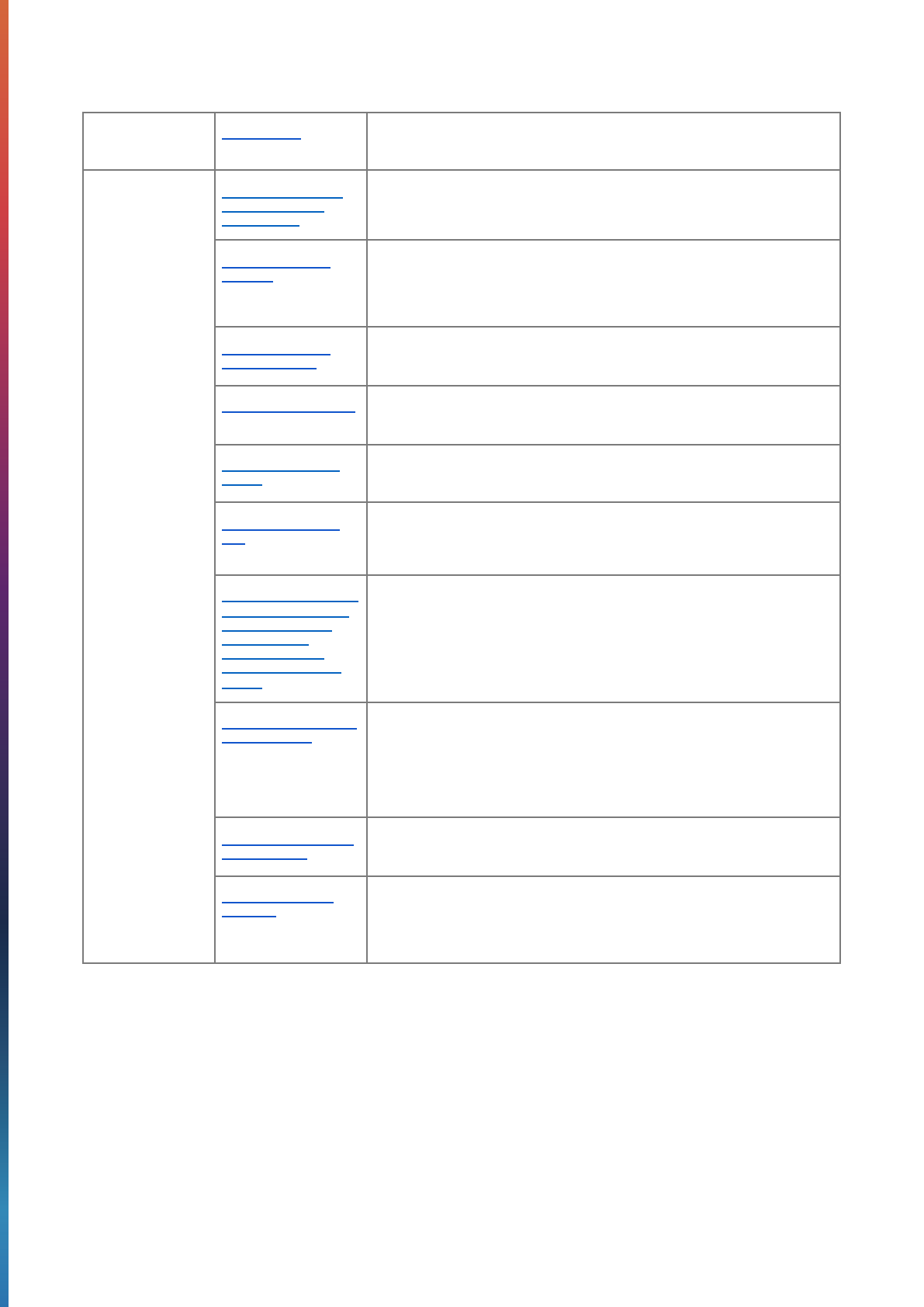

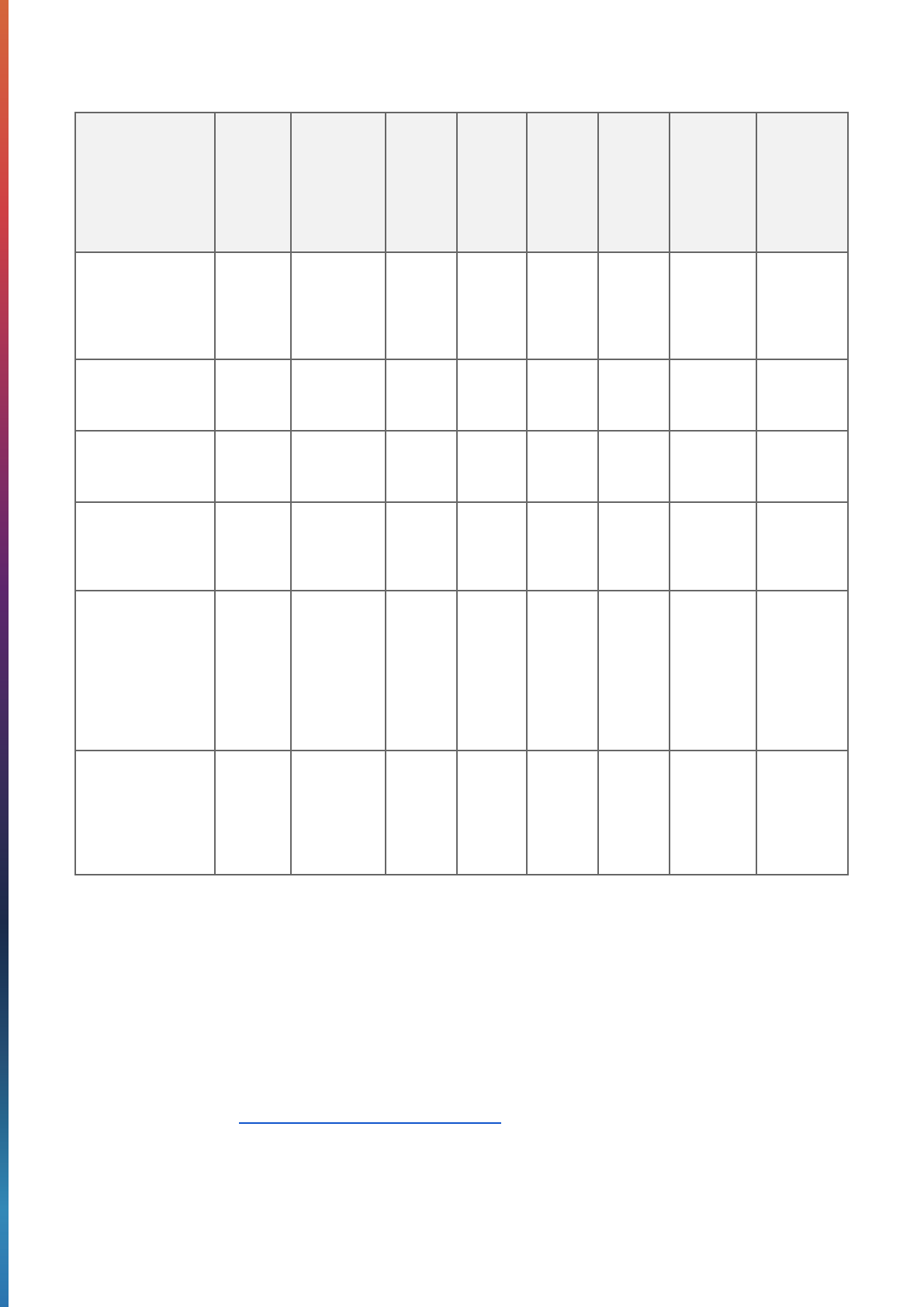

1.5 How the Standard relates to other key SBTi documents

The table below describes some of the key SBTi resources companies may find useful when

going through the target setting process. All resources, including translations, can be found

on the Resources and the Corporate Net-Zero Standard sections of the SBTi website.

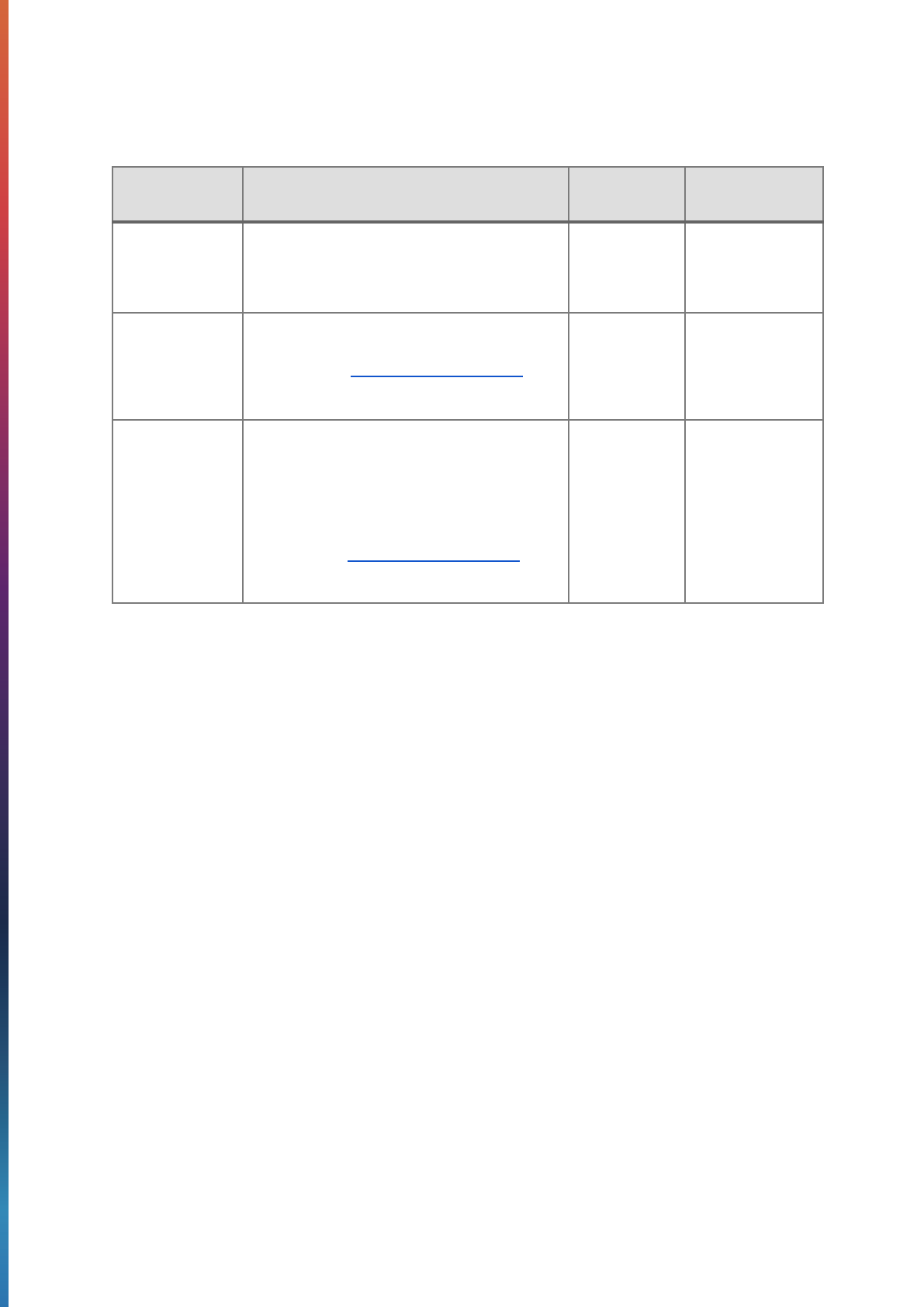

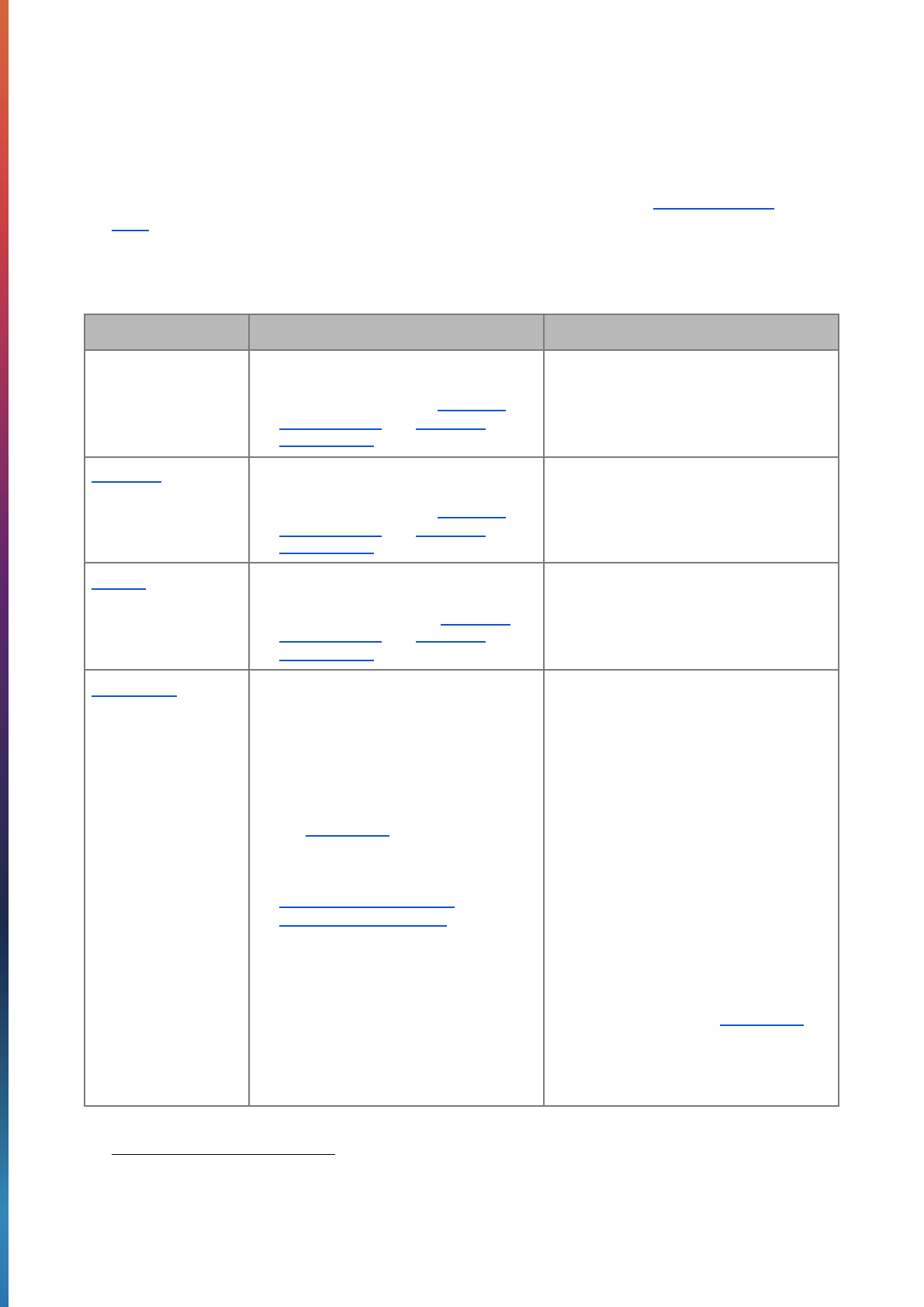

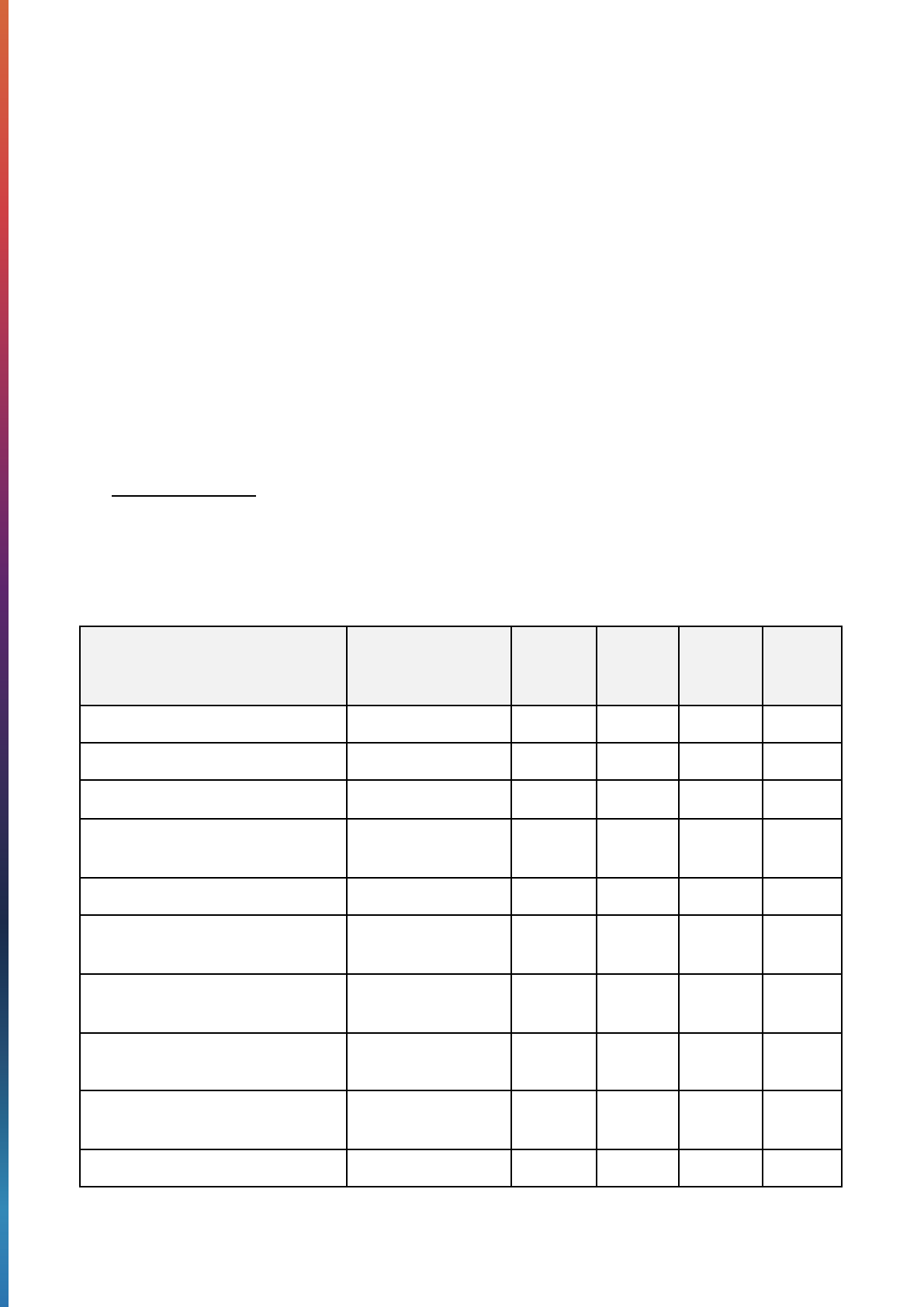

Table 1. A mapping of key SBTi resources that companies should refer to when setting

science-based net-zero targets.

Topic

Document

Description

Target

commitments

Commitment Letter

Companies wishing to set targets through the SBTi – both for near-term and

net-zero commitments – should complete and submit the commitment letter.

Background and

technical

resources

Foundations for

Science-Based Net-Zero

Target Setting in the

Corporate Sector

This paper lays out the conceptual foundations for credible, science-based net-zero

targets for the corporate sector.

Pathways to Net-Zero:

SBTi Technical

Summary

Produced in collaboration with more than a dozen pioneering academics, IPCC

lead authors and mitigation experts, this technical summary provides an overview

of how the SBTi selected mitigation pathways to steer action.

Above and Beyond: An

SBTi report on the

design and

implementation of

beyond value chain

mitigation (BVCM)

This report provides suggestions to support the BVCM recommendation (R9)

included within the Corporate Net-Zero Standard. Its purpose is to support

companies in the design and implementation of BVCM strategies to accelerate

progress towards global net-zero.

Raising the Bar: An

SBTi report on

accelerating corporate

adoption of beyond

value chain mitigation

(BVCM)

This report draws upon SBTi research to consider both the barriers that limit private

sector adoption of BVCM, as well as the positive incentives that have the potential

to accelerate adoption. Based on the research findings, this report provides

recommendations for different actors, offering a shared vision and “theory of

change” for scaling corporate climate finance into BVCM over the coming decades.

SBTi Corporate Net-Zero Standard V1.2 March 2024 | 10

SBTi Glossary

This document provides a list of terms, definitions, and acronyms used within all

SBTi technical resources, including the Corporate Net-Zero Standard.

Setting targets

Getting Started Guide

for Science-Based

Target Setting

A simple, step-by-step flowchart helping companies understand how to set

science-based targets in their specific situation.

Corporate Net-Zero

Standard

This document, providing guidance, criteria, and recommendations to support

corporates in setting net-zero targets through the SBTi. The Corporate Net-Zero

Standard criteria, with which companies must conform to achieve validation, are

set out in Chapter 7 of this document.

Corporate Net-Zero

Standard Criteria

The criteria companies' net-zero targets must conform to to achieve validation. This

is a standalone version of chapter 7 of this document.

Corporate Net-Zero Tool

Target-setting tool to calculate long-term science-based targets in line with the

Corporate Net-Zero Standard.

Corporate Near-Term

Criteria

The criteria companies must meet to have their near-term targets approved as

science-based by the SBTi. These criteria are also included within this document.

Corporate Near-Term

Tool

Target-setting tool to calculate near-term science-based targets in line with the

Corporate Near-Term Criteria and the Corporate Net-Zero Standard criteria (for the

near-term element).

Engaging Supply Chains

on the Decarbonization

Journey: A Guide to

Developing and

Achieving Scope 3

Supplier Engagement

Targets

Guidance for companies that are considering or are already implementing their

SBTi scope 3 supplier engagement targets. Also relevant for companies that are

interested in exploring different supplier engagement tactics to address scope 3

emissions reduction.

SME Streamlined Target

Validation Route

SMEs have the option to use a streamlined process to set targets in line with

climate science for both near-term and net-zero targets. This route enables SMEs

to bypass the initial step of committing to set a science-based target and the

regular target validation process and to immediately set near-term science-based

targets for scope 1 and 2 emissions, and, optionally, net-zero targets by choosing

from one of several predefined target options.

Procedure for Validation

of SBTi Targets

This document provides a detailed explanation of the SBTi target validation

procedure. This is to be used in conjunction with other key resources.

Criteria Assessment

Indicators

The Criteria Assessment Indicators provide verifiable control points which will be

evaluated during the target validation process. Conformity with these indicators

determines companies’ compliance with the SBTi Standard(s) under which they are

submitting targets.

SBTi Corporate Net-Zero Standard V1.2 March 2024 | 11

2. THE NET-ZERO STANDARD FRAMEWORK

As described in more detail in Foundations for Science-Based Net-Zero Target Setting in the

Corporate Sector, there are many different transition pathways to help achieve global

net-zero emissions, each with different implications for our climate, nature and society.

Considering these implications, the Corporate Net-Zero Standard was developed with the

intention of guiding corporates towards a state of net-zero in a way that is consistent with

societal climate and sustainability goals and within the biophysical limits of the planet.

To reach a state of net-zero at the corporate level, companies must deeply reduce emissions

and counterbalance the impact of any emissions that remain. The SBTi Net-Zero Standard

defines corporate net-zero as:

● Reducing scope 1, 2, and 3 emissions to zero or a residual level consistent with

reaching net-zero emissions at the global or sector level in eligible 1.5°C-aligned

pathways; and

● Permanently neutralizing any residual emissions at the net-zero target year and

any GHG emissions released into the atmosphere thereafter.

To contribute to societal net-zero goals, companies are strongly encouraged to go further

than their science-based abatement targets to mitigate emissions beyond their value chains

(known as “beyond value chain mitigation”).

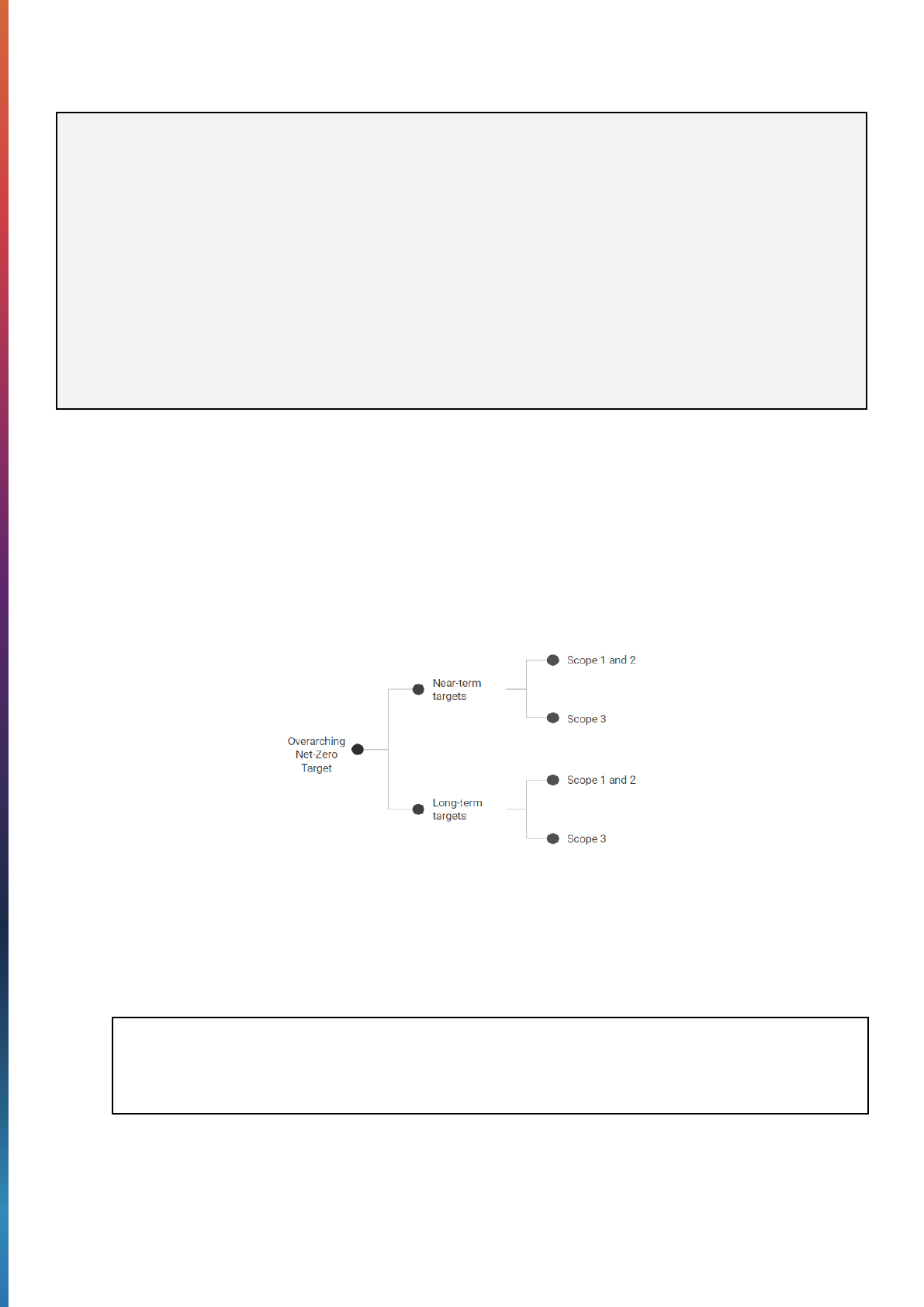

The Corporate Net-Zero Standard sets out four key elements that make up a corporate

net-zero target as depicted in Figure 2:

● Near-term science-based target

● Long-term science-based target

● Neutralization of any residual emissions

● Beyond value chain mitigation (BVCM).

SBTi Corporate Net-Zero Standard V1.2 March 2024 | 12

Figure 2. Key elements of the Corporate Net-Zero Standard.

SBTi Corporate Net-Zero Standard V1.2 March 2024 | 13

2.1 Near-term science-based targets

What: These are 5-10 year GHG mitigation targets in line with 1.5°C pathways.

1

When

companies reach their near-term target date, they must calculate new near-term

science-based targets to serve as milestones on the path towards reaching their long-term

science-based target.

Why: Near-term targets galvanize the action required for significant emissions reductions to

be achieved by around 2030. Near-term emissions reductions are critical to not exceeding

the global emissions budget and are not interchangeable with long-term targets.

2

2.2 Long-term science-based targets

What: These targets show companies how much they must reduce value chain emissions to

align with reaching net-zero at the global or sector level in eligible 1.5°C pathways by 2050

or sooner.

Why: Long-term targets drive economy-wide alignment and long-term business planning to

reach the level of global emissions reductions needed to meet climate goals based on

science.

2.3 Neutralization

What: Measures companies take to remove carbon from the atmosphere and permanently

store it, counterbalancing the impact of emissions that remain unabated after the long-term

science-based target is achieved. Emissions that were excluded from the long-term target

boundary and GHG emissions inventory must also be neutralized.

Why: Although most companies will reduce emissions by at least 90% through their

long-term science-based targets, not all companies will be able to achieve complete

decarbonization and therefore some residual emissions may remain. These emissions must

be neutralized to reach net-zero emissions and a state of no impact on the climate from

GHG emissions.

A company cannot claim to have reached net-zero until the long-term science-based

target for all scopes is achieved and the company has neutralized residual emissions.

2.4 Beyond value chain mitigation

What: Mitigation action or investments that fall outside of a company’s value chain. This

includes activities that avoid or reduce GHG emissions, and those that remove and store

GHGs from the atmosphere.

Why: The climate and ecological crises require bold and decisive action from companies.

Decarbonizing a company’s value chain in line with science and reaching net-zero emissions

by 2050 is increasingly becoming the minimum societal expectation for companies.

Businesses can play a critical role in accelerating the net-zero transition and addressing the

ecological crisis by investing in mitigation action beyond their value chains. Additional

2

Despite this, if a company sets a long-term science-based target to reach the level of decarbonization required

to reach net-zero at a global or sectoral level in 1.5°C pathways within a 10 year timeframe, the long-term

science-based target is not required.

1

Since July 2022, the SBTi has required near-term targets covering scope 1 and 2 emissions to be aligned with

1.5°C pathways and scope 3 targets to be aligned with well-below 2°C pathways.

SBTi Corporate Net-Zero Standard V1.2 March 2024 | 14

investments like these could help increase the likelihood the global community stays within a

1.5˚C carbon budget but are not a substitute for the rapid and deep reduction of a company’s

own value chain emissions.

Please see the Beyond Value Chain Mitigation page on our website, the “Above and

Beyond: An SBTi report on the design and implementation of beyond value chain mitigation”

report and the “Raising the Bar: An SBTi report on accelerating corporate adoption of

beyond value chain mitigation (BVCM)” report for more information and guidance.

SBTi Corporate Net-Zero Standard V1.2 March 2024 | 15

3. MITIGATION PATHWAYS IN THE NET-ZERO

STANDARD

Through the Paris Agreement, parties and signatories committed to “holding the increase in

global average temperature to well below 2°C above pre-industrial levels and pursuing

efforts to limit the temperature increase to 1.5°C above pre-industrial levels.”

In the years since the Paris Agreement was signed, the need to limit warming to 1.5°C has

become even stronger. Against the backdrop of increasingly frequent and destructive

climate-related disasters, the IPCC’s SR15 report delivered a harrowing scientific

consensus: while impacts to human health, society, and nature associated with 1.5°C of

warming are worse than previously acknowledged, the risks associated with exceeding

1.5°C are far higher. To mitigate these risks, SR15 highlighted pathways that limit warming to

1.5°C with no or limited overshoot (overshoot <0.1°C).

3.1 The science behind science-based net-zero targets

As described in SR15, scenarios that limit warming to 1.5°C with no or limited overshoot

reach net-zero CO

2

emissions around 2050, accompanied by rapid reductions in non-CO

2

GHG emissions. These scenarios entail profound transitions in the global energy, industry,

urban and land systems that involve:

● Full or near-full decarbonization for energy and industrial CO

2

emissions achieving

a zero-emissions energy supply system by mid-century.

● Eliminating CO

2

emissions associated with agriculture, forestry, and land-use.

● Deep reductions in non-CO

2

emissions from all sectors.

● Removing CO

2

from the atmosphere to neutralize residual emissions and,

potentially, sustain net negative emissions that reduce cumulative CO

2

in the

atmosphere over time.

The different system transformations in 1.5°C mitigation scenarios occur simultaneously and

all of them are needed for society to reach net-zero emissions and limit warming to 1.5°C.

An understanding of the synergies and trade-offs between different climate change

mitigation scenarios and sustainable development should inform climate action.

Pathways used by the SBTi aim to steer voluntary climate action and contribute to achieving

the 1.5°C objective of the Paris Agreement and the Sustainable Development Goals (SDGs),

reaching net-zero CO

2

emissions at the global level by 2050 and net-zero GHG emissions in

2050 or later.

3

In aggregate, 1.5°C-aligned pathways used by the SBTi stay within a 500

gigatonne carbon budget under the assumption of about 20-40 gigatonnes of cumulative

CO

2

removal by 2050.

For a detailed overview of how the SBTi determines 1.5°C-aligned pathways for calculating

SBTs, please see Pathways to Net-Zero: SBTi Technical Summary.

3

Energy efficiency improvements, infrastructural innovation, and phasing-out fossil fuels—characteristic of IPCC

“low energy demand” scenarios—can help meet the 1.5°C goal with the fewest adverse impacts. The IPCC

states with high confidence that low energy demand scenarios have the most pronounced synergies with

sustainable development and the SDGs (IPCC SR15, Summary for Policymakers D.4.2). They also reduce

dependence on CO

2

removal, which can pose risks to biodiversity, food security, water resources and human

rights.

SBTi Corporate Net-Zero Standard V1.2 March 2024 | 16

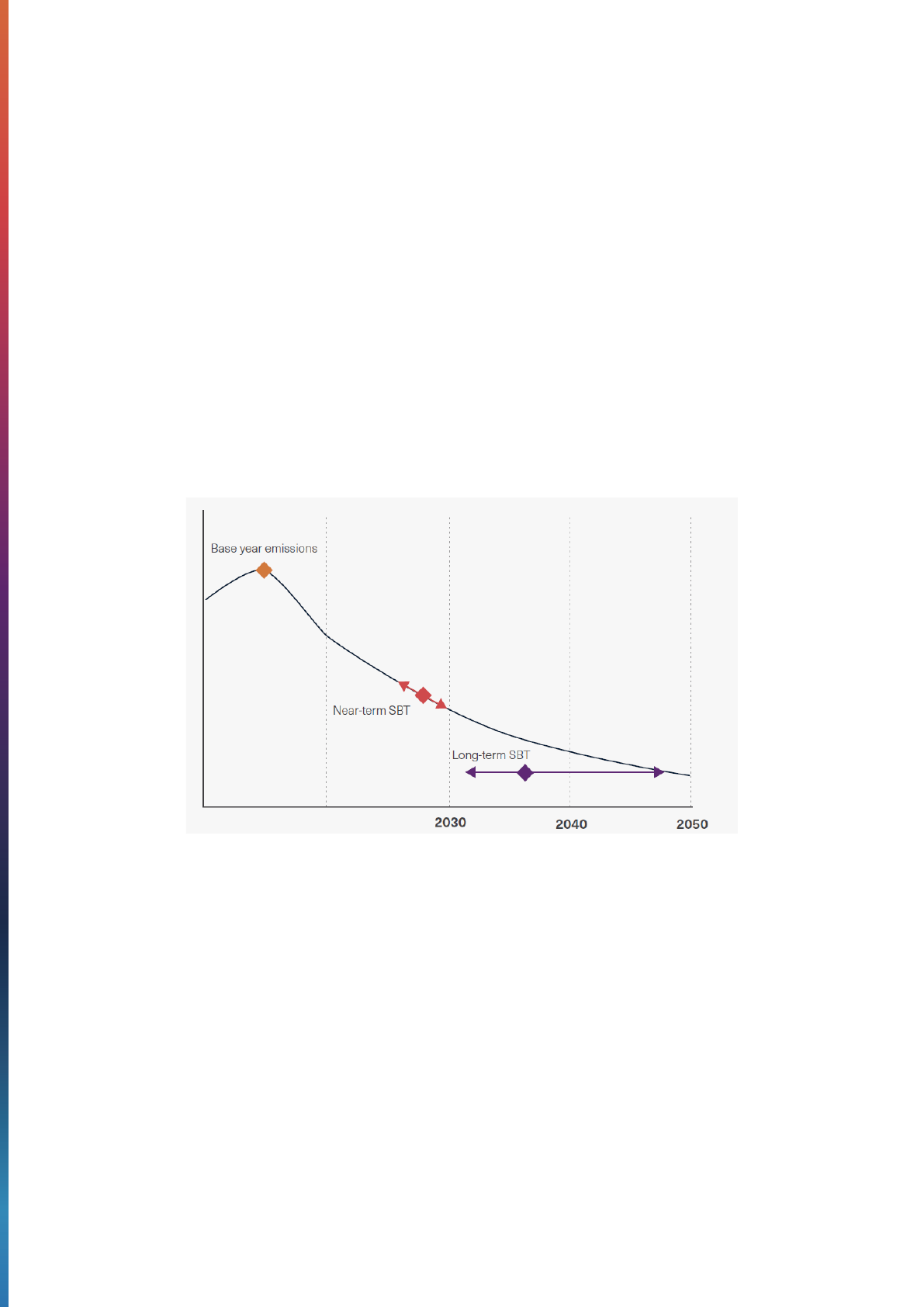

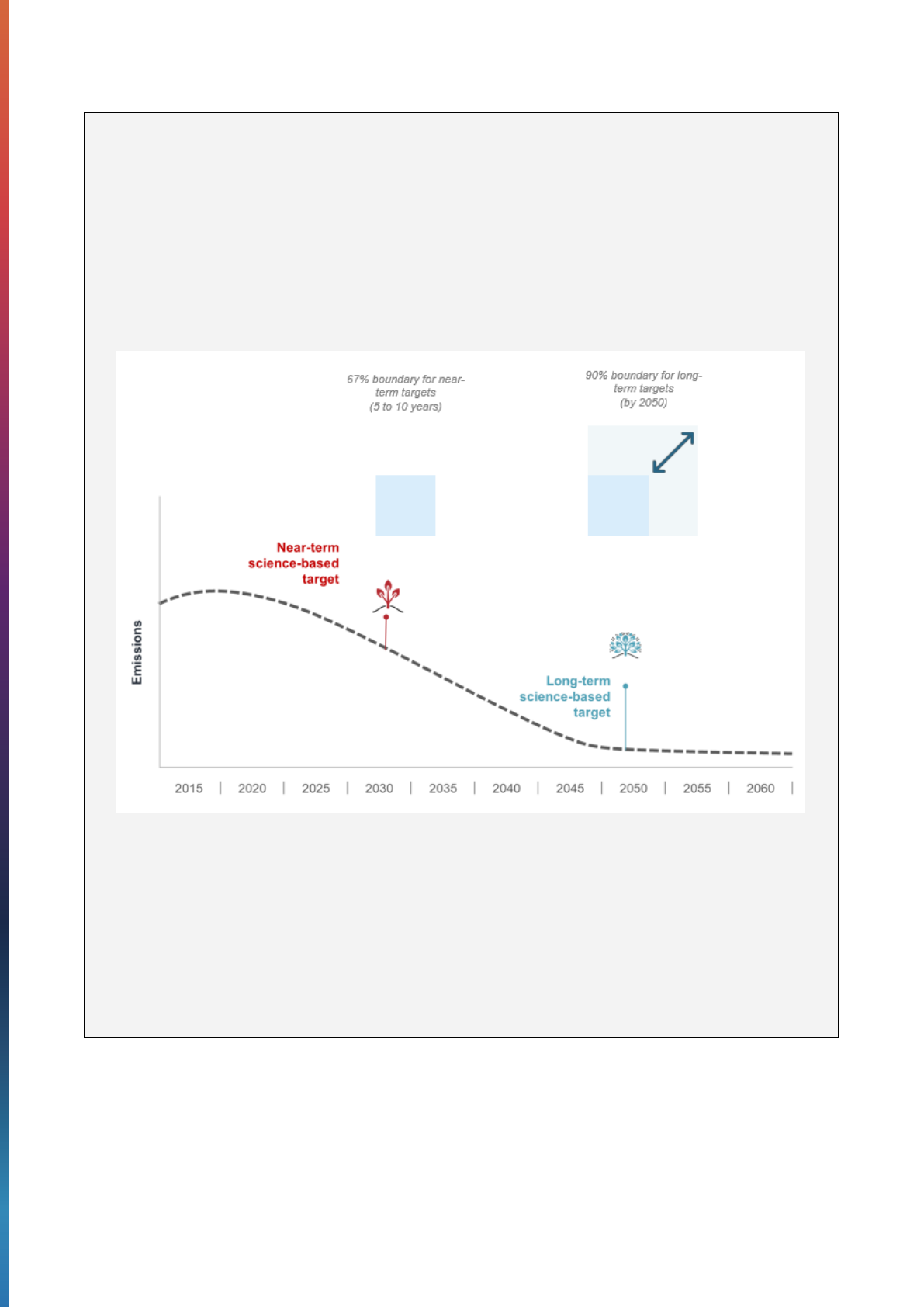

3.2 How mitigation pathways are used to inform science-based targets

Mitigation pathways play a key role in setting science-based targets. For near-term

science-based targets, mitigation pathways inform the rate of emissions reductions or

emissions intensity reductions that are needed. For long-term science-based targets, they

inform the overall emissions reduction or convergence intensity that must be reached to be

aligned with net-zero at the global or sector level.

Because of this, near-term science-based targets are target year dependent, while long-term

science-based targets are target year independent. This means that a company’s reduction

target will differ depending on the target year for its near-term targets, but the reduction

target will not differ depending on the target year for its long-term targets. This is illustrated

in Figure 3 below. Because of this, companies will model long-term targets, and then set

their net-zero and long-term target date depending on when they aim to achieve the required

emissions reductions. Companies can select a target year of 2050 or earlier for long-term

targets, which depends on how quickly it aims to reduce its emissions.

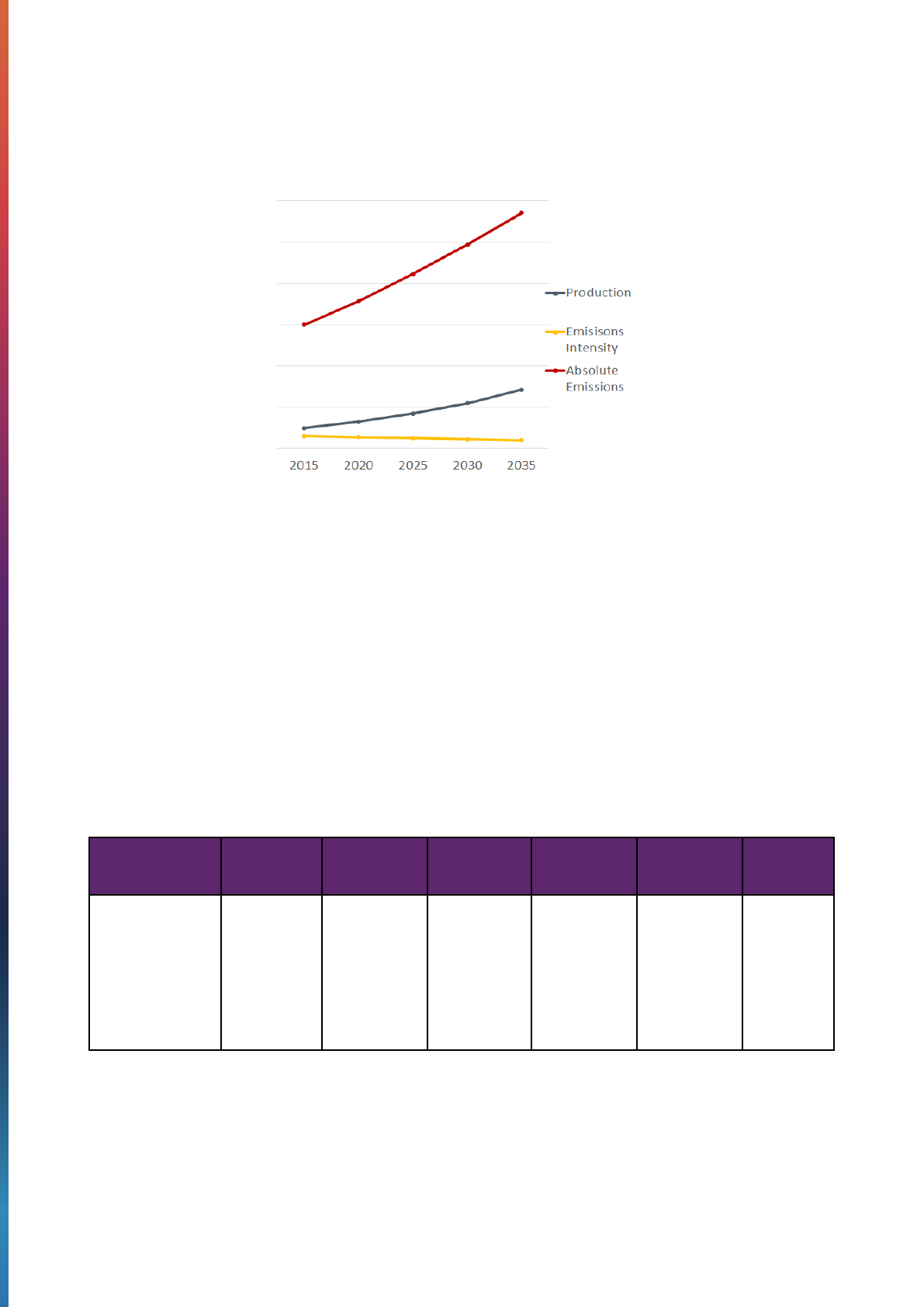

Figure 3. Graph showing target year dependency of near-term science-based targets in

comparison to the target year independency of long-term science-based targets.

SBTi Corporate Net-Zero Standard V1.2 March 2024 | 17

Box 1. How are residual emissions determined for different sectors of the economy?

Residual emissions levels are grounded in what is needed to achieve net-zero CO

2

emissions at the global

level by 2050, limit warming to 1.5°C, and contribute to achieving the SDGs. In pathways used by the SBTi,

residual emissions at the cross-sector level reflect the 2020-2050 emissions reduction needed. At the

sector level, residual emissions reflect a sector-specific 2020-2050 emissions reduction or a 2050

convergence emissions intensity (except for the power and maritime transport sectors which use 2040

instead of 2050 due to an earlier net-zero year). The same pathways are used to calculate near-term SBTs

and residual emissions levels for long-term SBTs and together they:

1. Stay within the remaining carbon budget for a 50% likelihood of limiting warming to 1.5°C.

2. Reduce energy and industrial process CO

2

and methane (CH

4

) emissions by an amount roughly

consistent with the International Energy Agency’s (IEA) Net-Zero Emissions (NZE) scenario.

3. Mitigate forest, land and agriculture (FLAG) sector GHG emissions by an amount consistent with

the detailed land-sector roadmap Contribution of the land sector to a 1.5°C world (Roe et al., 2019).

4. Reach global net-zero CO

2

emissions by 2050, assuming at least low/medium CO

2

removal (1-4

gigatonne CO

2

/year), and net-zero GHG emissions in 2050 or later, depending on CO

2

removal

levels and different mitigation choices across pathways.

To meet these conditions, an economy-wide emissions reduction of at least 90% by 2050 from a 2020 base

year informs the level of residual emissions for most companies, as shown by the cross-sector pathway.

The IEA’s NZE scenario, which reduces energy and industrial process CO

2

emissions 95% between 2020

and 2050, has been an important reference for this calculation; but ultimately, SBTi’s approach to

developing the cross-sector pathway was holistic, building from an expansive body of literature and iterative

development with the SBTi’s Scientific Advisory Group. For more information on the cross-sector pathway

and sector-specific pathways used by the SBTi, please see the SBTi’s Technical Summary on Pathways to

Net-Zero.

3.3 Overview of pathways and which companies should use them

The SBTi offers a cross-sector pathway and sector-specific pathways for setting

science-based targets. Companies in the power generation sector and the FLAG sectors are

required to set SBTs using sector-specific pathways. Other companies can choose to use

either the cross-sector pathway or, if available, sector-specific pathways. Please see Table 4

in this document for further information on eligible pathways for each sector or activity.

Using the cross-sector pathway, companies can set near-term targets that reduce emissions

at a linear annual rate that is base year dependent. For scope 1 and 2 targets, if the base

year is on or before 2020, companies need to, at a minimum, reduce absolute emissions at

an annual linear reduction rate of 4.2% over the target period.

4

If the base year is after 2020,

companies will need to reduce at a higher rate that is at least the same amount overall as

targets with a 2020 base year and is consistent with limiting warming to 1.5°C. For example,

if a company is setting an absolute scope 1 and 2 target with a base year of 2022 and a

target year of 2030, the minimum linear reduction over the target period is 42% over the 8

4

The SBTi’s modeled pathways outline the minimum ambition required to meet a given temperature scenario.

Companies are encouraged to set targets that are more ambitious than the minimum required reduction.

SBTi Corporate Net-Zero Standard V1.2 March 2024 | 18

year period, and the minimum annual reduction is 5.25%.

5

Please refer to the Corporate

Near-Term Tool for further details. Some sector-specific pathways vary significantly from the

cross-sector pathway in the near-term, requiring steeper or more gradual emissions

reductions depending on the sector. Please refer to each applicable sector guidance for

details.

In the long-term, emissions in the cross-sector pathway are reduced by at least 90% and

most sector-specific pathways also reduce CO

2

emissions by 90% or more from 2020 levels.

Consequently, long-term science-based targets will be equivalent to at least a 90% absolute

reduction across scopes for many companies, regardless of whether the cross-sector

pathway or sector-specific pathways are used. For details on the eligible pathway and

methods for each sector, please refer to Table 4 in this document and the Getting Started

Guide for Science-based Target Setting.

Companies in heavy-emitting sectors often use sector-specific pathways to calculate both

near-term and long-term intensity targets. Other companies with scope 3 emissions from

heavy-emitting sector activities often use a mix of approaches to calculate targets. For

example, a real estate development company may have significant scope 3 emissions

attributed to both the steel and cement sectors. When setting targets that cover upstream

scope 3 emissions, these companies may use a sector-specific pathway to set intensity

targets as long as the pathway reflects both supply-side and demand-side mitigation where

relevant (see sector-specific guidance for more information). Companies are encouraged to

use the cross-sector pathway and reduce emissions on an absolute basis if emissions can

be mitigated by reducing demand for these products and services.

6

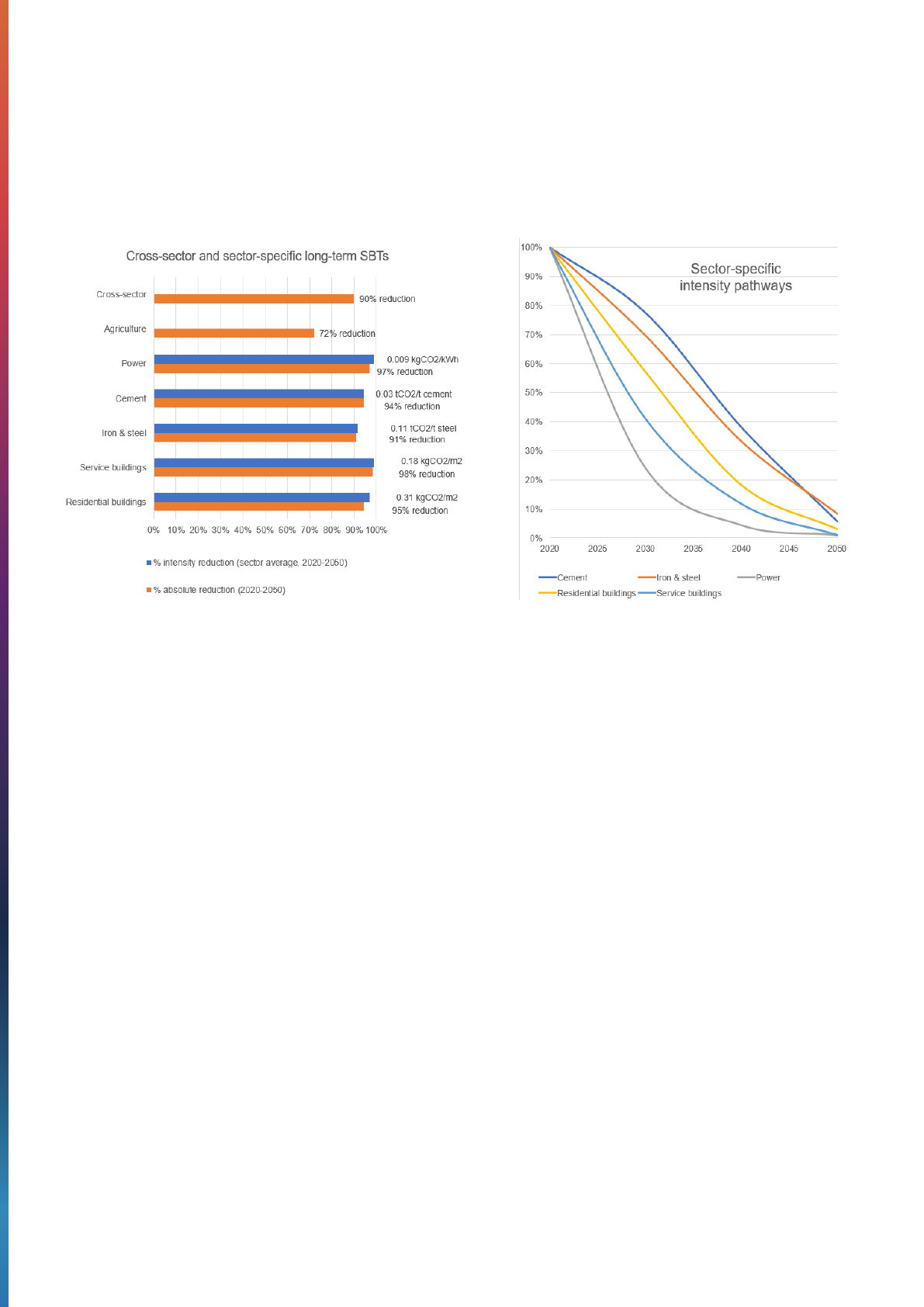

3.4 Transformative mitigation is required from all sectors

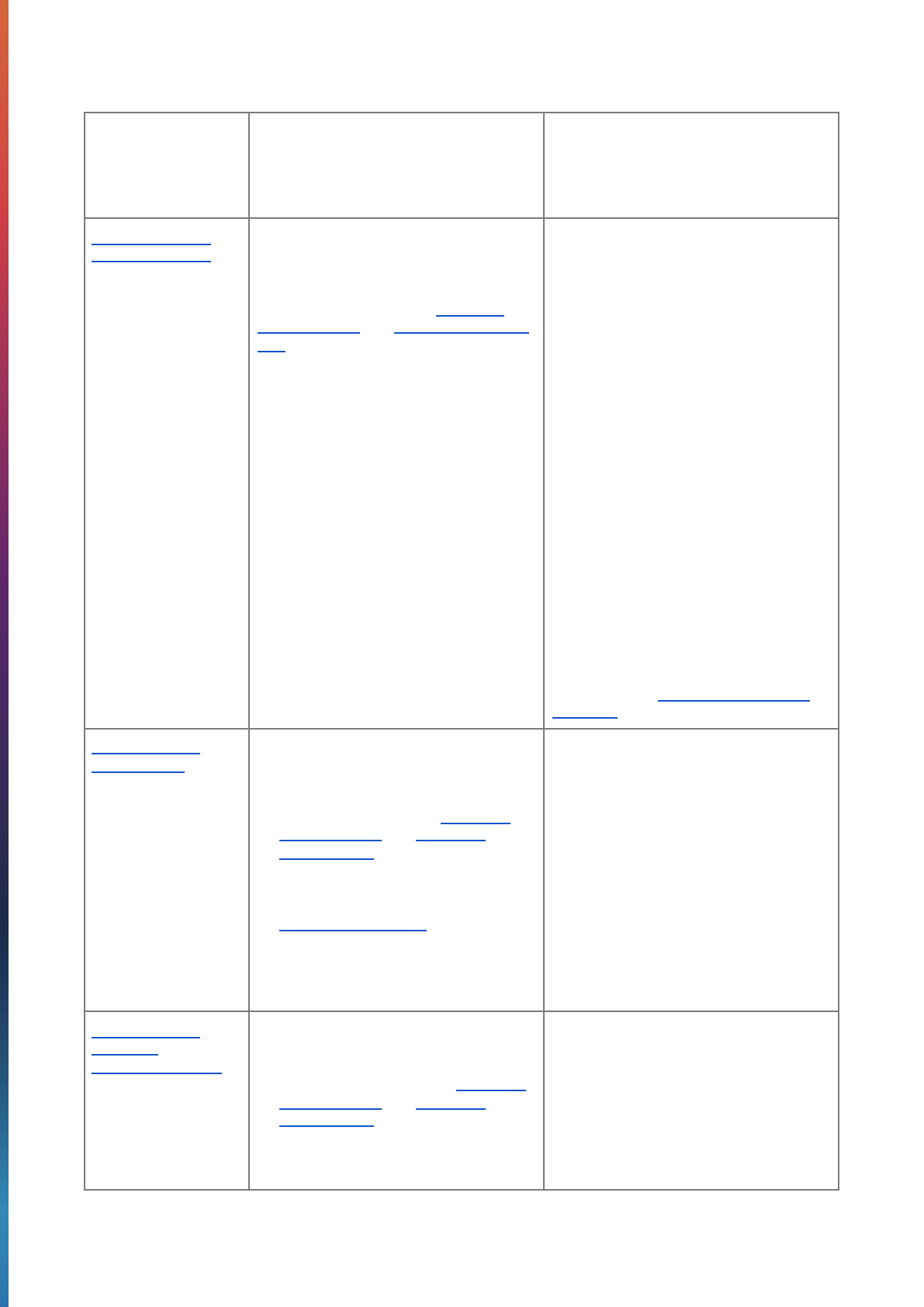

The figures below (4a and 4b) show the ambition of the cross-sector pathway and

sector-specific pathways used to calculate near-term and long-term SBTs. Figure 4a shows

the cross-sector and sector-specific long-term SBTs included in the Corporate Net-Zero

Standard. At the company level, absolute targets are based on the sector’s 2020-2050

absolute emissions reduction (orange bars and data labels), and intensity targets are based

on the 2050 convergence intensity (data labels only). For the power sector and maritime

transport sector, long-term SBTs are calculated based on 2040 instead of 2050 due to an

earlier net-zero year. Blue bars show the 2020-2050 sector average intensity reduction,

which may differ from company targets. Figure 4b shows sector-specific intensity pathways

(2020-2050) for the different sectors.

Companies – except those in the power generation or FLAG sectors – can generally opt to

use the cross-sector pathway. Please see Table 4 for details. Companies with activities in

sectors where emissions are reduced more in the sector-specific pathway (e.g., buildings,

6

For example, a consultancy company should not set intensity targets on its aviation transport emissions

because they have other means to reduce these emissions from the demand-side, e.g. reduce air travel.

5

In December 2021, the SBTi released guidance on base year adjustment calculations for companies with base

years in 2021 or later. This is due to the fact that the linear annual reduction (LAR) requirements for temperature

classifications (e.g., absolute 4.2% LAR for 1.5°C temperature classification and 2.5% LAR for well-below 2°C

temperature classification) were based on carbon budgets that were assigned in 2020. For that reason, for

companies that have a base year in 2021 or later, the SBTi requires the minimum ambition to be based on the

equation: % LAR x (Target year-2020). This equation accounts for the shortfall in emissions reductions relative to

the carbon budget modeled in 2020. This base year adjustment has been incorporated into the latest version of

the tool and criteria.

SBTi Corporate Net-Zero Standard V1.2 March 2024 | 19

cement, and steel) can still use the cross-sector pathway for two main reasons: (1) the

difference is small (<10% of base year emissions) and (2) companies are required to

neutralize unabated emissions regardless, which aims to counteract the impact of any

residual emissions and incentivize continued abatement once net-zero is reached.

Figure 4a (on the left): Cross-sector and sector-specific long-term SBTs included in the

Corporate Net-Zero Standard.

Figure 4b (on the right): Sector-specific intensity pathways (2020-2050) for different sectors.

SBTi Corporate Net-Zero Standard V1.2 March 2024 | 20

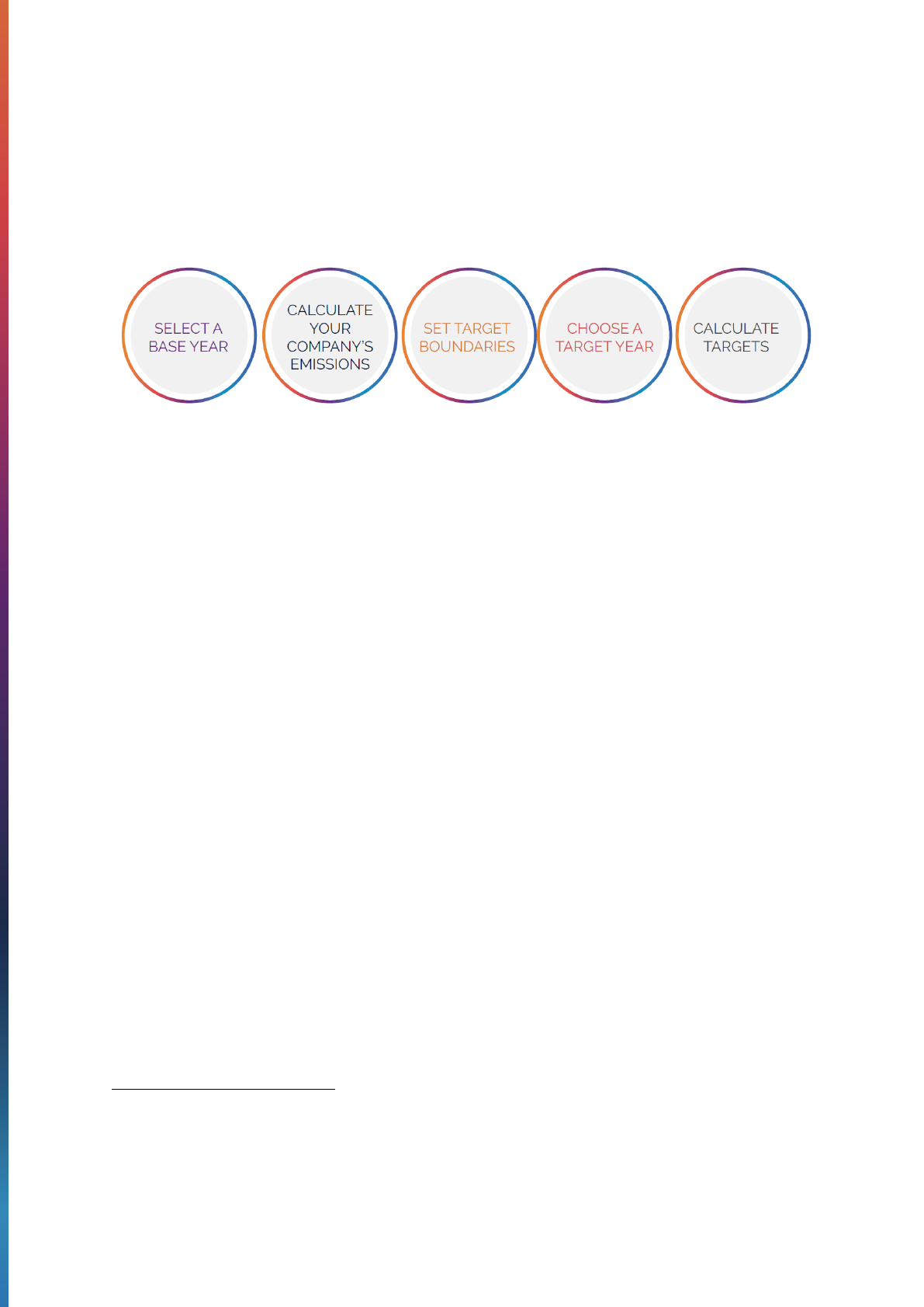

4. PROCESS TO SET SCIENCE-BASED TARGETS

Companies can take a variety of approaches to developing near-term and long-term

science-based targets; however, the SBTi recommends following the five steps described in

this section.

Figure 5. The SBTi recommends a five-step approach to setting science-based targets.

4.1 Select a base year

Companies need to establish a base year to track emissions performance consistently and

meaningfully over the target period. The following considerations are important for selecting

a base year:

1. Scope 1, 2, and 3 emissions data should be accurate and verifiable.

2. Base year emissions should be representative of a company’s typical GHG profile.

7

3. The base year must be no earlier than 2015.

4. Companies that have already set near-term science-based targets must use the

same base year for their long-term science-based target.

5. If more than one target is set, companies should use the same base year for all

targets within the target timeframe.

8

6. Scope 1 and scope 2 targets must use the same base year.

7. Scope 3 targets are recommended but not required to use the same base year as

scope 1 and scope 2 targets. For example, if scope 3 data is exceptionally difficult to

obtain or if the company has a historical scope 1 and 2 base year, it is permissible

that scope 1 and 2 targets use a different base year from scope 3 targets.

8. Base years across different scope 3 targets must be the same.

9. The SBTi does not accept multi-year average base years, unless this is specified in

the sector-guidance relevant to the company.

Various factors including, but not limited to, mergers, divestments, business function change,

and geographical implications may necessitate recalculations of the base year inventory

(and of the targets set) to ensure continued relevance and alignment to the GHG Protocol

8

This best practice is most applicable to emission reduction targets, i.e., absolute and intensity targets.

Companies’ renewable electricity, supplier engagement and customer engagement targets may and sometimes

must have different target years than emission reduction targets.

7

Companies must provide all the relevant GHG inventory data including a most recent year GHG inventory. For

submissions in 2024, a recent year inventory must be provided that is no earlier than 2022 i.e., allowable most

recent years are 2022 and 2023.

SBTi Corporate Net-Zero Standard V1.2 March 2024 | 21

Corporate Standard GHG accounting requirements and SBTi requirements. See Annex D of

this document ‘Reporting Guidance’ for further information.

4.2 Calculate your company’s emissions

4.2.1 Develop a full GHG emissions inventory

Companies are required to have a comprehensive emissions inventory that covers at least

95% of company-wide scope 1 and 2 GHG emissions and includes a complete scope 3

inventory.

9

The following points are important for aligning with the GHG Protocol Corporate

Standard and SBTi criteria.

Data quality: Companies should select data that is the most complete, reliable, and

representative in terms of technology, time, and geography. Companies should collect

high-quality primary data from suppliers and other value chain partners for scope 3 activities

deemed most relevant and targeted for GHG reductions. Secondary data is permissible but it

is better suited for scope 3 categories that are not significant in magnitude as it limits a

company’s ability to track performance. Please refer to Chapter 7 of the GHG Protocol

Corporate Value Chain (Scope 3) Standard for further guidance on data quality issues.

Ensure the target boundary is aligned with the GHG inventory boundary: A company

must select a single consolidation approach as outlined in the GHG Protocol Corporate

Standard (operational control, financial control or equity share) to (i) determine its

organizational boundary, (ii) calculate its GHG emissions inventory and (iii) define its

science-based target boundaries.

10

The organizational boundary should align with the

company’s financial reporting. Both the emissions inventory and target boundary must cover

all seven GHGs or classes of GHGs covered by the United Nations Framework Convention

on Climate Change (UNFCCC) and Kyoto Protocol, namely: carbon dioxide (CO

2

), methane

(CH

4

), nitrous oxide (N

2

O), hydrofluorocarbons (HFCs), perfluorocarbons (PFCs), sulfur

hexafluoride (SF

6

), and nitrogen trifluoride (NF

3

).

For more information on organizational boundary setting, please see the GHG Protocol

Corporate Standard (WRI & WBCSD, 2004).

Determine how to treat complex business relationships (e.g., subsidiaries, joint

ventures, etc.): Complex business relationships can complicate how the GHG inventory and

thus the target boundary are drawn. The SBTi allows both parent companies and

subsidiaries to submit targets. Parent companies are required to include emissions from

subsidiary operations in their GHG inventory and target boundary according to the selected

consolidation approach, regardless of whether the subsidiary has approved SBTs. For more

information on subsidiaries, please see page 19 of the GHG Protocol Corporate Standard.

Include all mandatory scope 3 emissions: Companies must develop a complete scope 3

inventory based on the GHG Protocol Corporate Value Chain (Scope 3) Accounting and

Reporting Standard (WRI & WBCSD, 2011) and the Scope 3 Calculation Guidance. The

scope 3 inventory must include all relevant categories and all emissions sources categorized

as the minimum boundary in Table 5.4 (page 34) in the Scope 3 Standard. A complete scope

10

Using proxy data i.e., applying one reporting year's data to another reporting year is not permitted. For

example, a company may not apply base year emissions to the most recent year.

9

Exclusions in the GHG inventory and target boundary combined must not exceed 10% of total scope 3

emissions.

SBTi Corporate Net-Zero Standard V1.2 March 2024 | 22

3 inventory is critical for identifying emissions hotspots, reduction opportunities, and areas of

risk up and down the value chain.

Companies are expected to account for all scope 3 categories including downstream

emissions from intermediate products and services, where relevant. In the instance that a

company faces barriers to calculating emissions from one category of scope 3, the company

should demonstrate its best efforts to calculate these emissions, and this shall not preclude it

from providing reasonable estimates of emissions in other categories.

One approach to calculating scope 3 emissions is to first calculate a high-level screening

inventory that is typically based on secondary financial data. Many companies use a scope 3

screening tool as a first step in completing their scope 3 inventory. Over time, companies

should develop complete inventories and improve data quality, particularly for high-impact

categories (e.g., collect primary data from suppliers and other value chain partners), to better

track progress against targets. Emission factors must be representative of the corresponding

activities (i.e., country-specific emission factors should be used as a minimum) and the

potential uncertainty of the adopted average data should be clearly disclosed along with

planned actions to improve data quality over time. For more information on calculating a

scope 3 emissions inventory, please see the GHG Protocol’s Corporate Value Chain (Scope

3) Accounting and Reporting Standard. Several publications and calculation tools on the

GHG Protocol’s calculation tools and guidance page also offer help in calculating emissions

from various scope 3 categories.

Determine how to treat optional scope 3 emissions: Optional scope 3 emissions or

reductions are not counted towards the required target boundary for science-based targets

i.e., emissions within the “minimum boundary”.

11

Despite this, if companies have significant

optional scope 3 emissions and have levers to address them, they are encouraged to

calculate these emissions and set optional targets in addition to the mandatory scope 3

target(s).

More information on optional scope 3 emissions can be found in “Table 5.4 Description and

boundaries of scope 3 categories” in the GHG Protocol’s Corporate Value Chain (Scope 3)

Accounting and Reporting Standard.

Review relevant sector-specific guidance: For some sectors or activities, separate

sector-specific methodologies, frameworks, requirements, and tools apply. For more

information, visit the sector guidance webpage and please refer to Table 4 in this document.

Exclude the use of carbon credits: Carbon credits must be reported separately from the

GHG inventory and do not count as reductions toward meeting near-term or long-term

science-based targets. Carbon credits may only be considered as an option for neutralizing

residual emissions or to finance additional climate mitigation beyond their science-based

emission reduction targets.

Exclude avoided emissions: Companies are often interested in understanding the GHG

impacts of their products, relative to the situation where those products do not exist. Positive

impacts are commonly referred to as “avoided emissions”. Avoided emissions occur outside

of the product’s life cycle and therefore do not count as a reduction of a company’s scope 1,

11

For near-term science-based targets, companies must include 67% of mandatory scope 3 emissions, and for

long-term science-based targets companies must include 90% of mandatory scope 3 emissions. Optional

emissions do not count towards these thresholds.

SBTi Corporate Net-Zero Standard V1.2 March 2024 | 23

2 and 3 inventory. Please refer to the World Resources Institute’s paper on avoided

emissions for more information on avoided emissions.

4.2.2 Calculate emissions reported separately from the GHG inventory

Bioenergy: Companies that use bioenergy must report direct CO

2

emissions from biomass

combustion, processing, and distribution, as well as the land-use emissions and removals

associated with bioenergy feedstock. These emissions are reported separately from the

company’s GHG inventory, in line with Greenhouse Gas Protocol guidance.

Fossil fuels: Companies that sell, transmit or distribute fossil fuels are required to report the

use-phase emissions associated with those fossil fuels in scope 3 category 11 “use of sold

products” and cover the emissions from the combustion of the sold, transmitted, or

distributed fossil fuels with a target. For companies that transport or distribute, but do not

sell, fossil fuels, these emissions must be calculated and covered by a target but are

typically reported outside a company’s GHG inventory.

4.3 Set target boundaries

4.3.1 Near-term science-based target boundary (scopes 1, 2, and 3)

Near-term science-based targets must cover at least 95% of company-wide scope 1 and 2

emissions. When scope 3 emissions make up 40% or more of total emissions (scope 1, 2,

and 3 emissions), companies must set one or more emission reduction targets and/or

supplier or customer engagement targets that collectively cover(s) at least 67% of total

scope 3, considering the minimum boundary of each category in conformance with the GHG

Protocol Corporate Value Chain (Scope 3) Accounting and Reporting Standard. Companies

in certain heavy-emitting sectors are required to include specific emissions sources or scope

3 categories in their science-based target boundary, please see Table 4 for a detailed list of

sector-specific requirements.

Using a scope 3 inventory, companies can identify which categories should be included in

the boundary of a scope 3 target(s) to meet the 67% threshold for near-term SBTs. The

relative importance of different scope 3 categories will vary by sector. Scope 3 categories

likely to be important (in terms of emissions magnitude) for companies in specific sectors

include:

● Consumer packaged goods: purchased goods and services (category 1)

● Food processing: purchased goods and services (category 1)

● Logistics: upstream transportation and distribution (category 4)

● Automotive: use of sold products (category 11)

● Electronics: use of sold products (category 11)

● Gas distribution and retail: use of sold products (category 11)

● Chemicals: end of life treatment of sold products (category 12)

4.3.2 Long-term science-based target boundary (scopes 1, 2, and 3)

Long-term SBTs must cover at least 95% of company-wide scope 1 and 2 emissions and

90% of scope 3 emissions. See Box 2 for more information.

SBTi Corporate Net-Zero Standard V1.2 March 2024 | 24

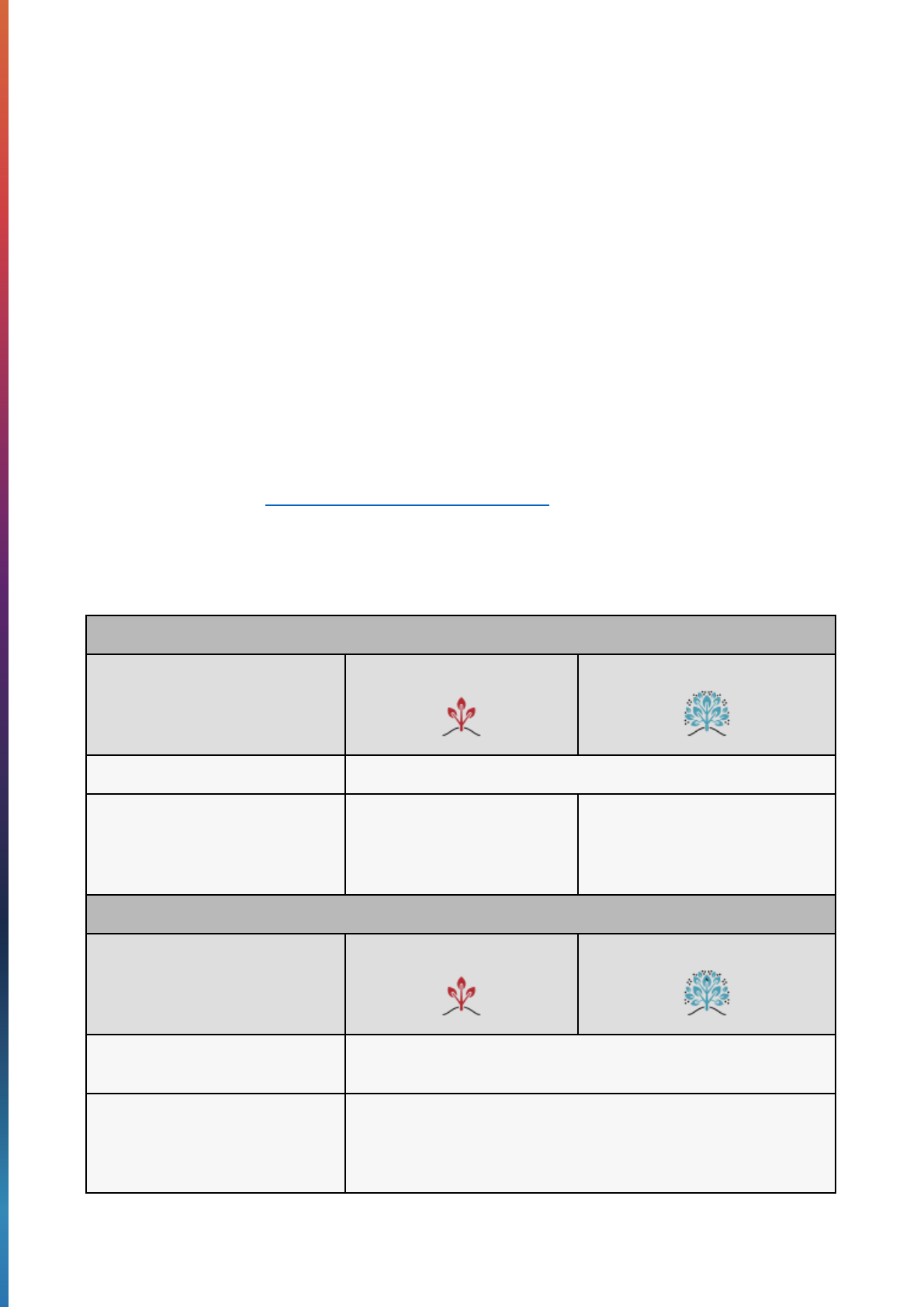

Box 2. The ‘expansive boundary’ approach for scope 3

A comprehensive target boundary is necessary for companies to make credible net-zero claims. However,

acknowledging the challenges that companies encounter with scope 3, the Corporate Net-Zero Standard

follows an expansive boundary approach and a gradual increase in ambition.

In the near-term (5 to 10 years), a scope 3 target is required when a company's scope 3 emissions

represent more than 40% of their total emissions. Near-term scope 3 targets need to cover 67% of scope 3

emissions and align with well-below 2°C ambition at a minimum. For long-term targets, the target

boundary increases to cover all material sources of emissions in the value chain (materiality threshold of

90%), decarbonizing in line with 1.5°C scenarios.

Figure 6. A visual representation of the ‘expansive boundary’ approach the Corporate Net-Zero

Standard takes to scope 3 target boundaries.

Increasing scope 3 target boundary coverage from 67% for near-term SBTs to 90% for long-term SBTs may

be challenging, but it will drive major opportunities to collaborate across the value chain to support

suppliers and customers to decarbonize. Through the expansive boundary scope 3 approach from the near

to long-term, companies have time to work through the complexity of scope 3 and long-term scope 3

reductions, focusing on their most material emissions sources in the near-term.

4.3.3 Additional requirements for science-based target coverage

Bioenergy and fossil fuels: Companies using bioenergy must include direct CO

2

emissions

from biomass combustion, processing, and distribution, as well as the land-use emissions

and removals associated with bioenergy feedstock within their target boundary, even though

SBTi Corporate Net-Zero Standard V1.2 March 2024 | 25

these emissions are reported outside a company’s GHG inventory. Similarly, companies

transporting or distributing fossil fuels must include use-phase emissions in their target

boundary, even though these emissions may not typically be reported in a company's GHG

inventory.

FLAG targets: The SBTi requires companies that meet either of the following two conditions

to set a FLAG specific target separate from their target(s) for other emissions:

● Companies from the following SBTi-designated sectors are required to set a FLAG

target: forest and paper products (forestry, timber, pulp and paper, rubber); food

production (agricultural production); food production (animal source); food and

beverage processing; food and staples retailing; and tobacco.

● Companies in any other sector with FLAG-related emissions that total more than

20% of overall emissions across scopes 1, 2, and 3. The 20% threshold should be

accounted for as gross emissions, not net emissions (gross minus removals).

Companies meeting either of the above conditions must include emissions from land-use

change (LUC) using either direct LUC or statistical LUC, as aligned with the Greenhouse

Gas Protocol’s draft Land Sector and Removals Guidance.

A summary of near-term and long-term science-based targets required coverage is shown in

Table 2.

Table 2. Minimum boundary coverage for near-term targets and long-term targets.

MINIMUM % BOUNDARY COVERAGE BY SCOPE

GHG inventory scope

Near-term targets

Long-term targets

Scopes 1 and 2

95% minimum coverage

Scope 3

67% minimum coverage (if

scope 3 emissions are at least

40% of total scope 1, 2 and 3

emissions)

90% minimum coverage (all

companies)

SPECIAL BOUNDARY COVERAGE REQUIREMENTS BY EMISSIONS SOURCE

Emissions source

Near-term targets

Long-term targets

Use-phase emissions from sold or

distributed fossil fuels

Must be covered by a separate absolute reduction target

Direct CO

2

emissions from

biomass combustion, processing

and distribution, as well as

land-use emissions and carbon

Must be included in target boundary

SBTi Corporate Net-Zero Standard V1.2 March 2024 | 26

removals from bioenergy feedstock

Sector-specific target boundary

requirements

See Table 4 for a detailed list of sector-specific requirements

Biogenic emissions and removals

FLAG companies are required to account for land-related emissions

(gross biogenic land CO

2

emissions and removals). This includes all

emissions from direct land use change (LUC) and land management

(biogenic CO

2

, N

2

O and CH

4

) related to on-farm activities.

Companies with land emissions below the 20% FLAG threshold (as

per FLAG-C1) that choose not to set a separate FLAG target must

account for gross biogenic land emissions separately but include

these emissions in the traditional (non-FLAG) target boundary.

Removals shall not be used in this case.

Companies with bioenergy emissions in scopes 1, 2 and 3 are

required to account for the biogenic emissions as per the SBTi C11

criteria (non-FLAG) criteria. This includes all emissions from direct

land use change (LUC) and land management (biogenic CO

2

, N

2

O

and CH

4

) related to on-farm activities.

4.3.4 Meeting SBTi boundary criteria with several targets

Companies often set several targets that collectively meet the boundary requirements

described above. Companies may consider setting targets covering emissions from various

sectors or different scope 3 categories. This approach is valid to meet SBTi requirements.

4.3.5 Setting a single scope 3 target or multiple scope 3 targets

In addition to targets covering scope 1 and 2 emissions, companies can choose to set

multiple, category-specific targets or a single target covering all relevant scope 3 categories.

They may also choose to set a single target covering total scope 1, 2, and 3 emissions. Each

type of target boundary has advantages and disadvantages.

1) A single target for total scope 1, 2 and 3 emissions

Example: Company A commits to reduce absolute scope 1, 2 and 3 GHG emissions

55% by 2030 from a 2017 base year.

Advantages:

● May provide more comprehensive management of emissions across the

entire value chain.

● Simple to communicate to stakeholders.

● Does not require base year recalculation for shifting activities between

scopes (e.g., outsourcing).

Disadvantages:

● May provide less transparency for each scope 3 category’s emissions and

reporting on progress.

● Requires the same base year for the different scopes, which may be difficult if

scope 1 and 2 base years have already been established.

2) A single target for total scope 3 emissions

SBTi Corporate Net-Zero Standard V1.2 March 2024 | 27

Example: Company B commits to reduce absolute scope 3 GHG emissions 60% by

2030 from a 2019 base year.

Advantages:

● May provide greater flexibility on how to achieve GHG reductions across all

scope 3 categories.

● Relatively simple to communicate to stakeholders.

Disadvantages:

● May provide less transparency for each scope 3 category’s emissions and

reporting on progress.

● May require base year recalculation for shifting activities between scopes

(e.g., outsourcing).

3) Separate targets for individual scope 3 categories

Example: Company C commits to reduce absolute scope 3 purchased goods and

services GHG emissions 50% by 2030 from a 2019 base year. Company C further

commits to reduce scope 3 business travel and employee commuting GHG

emissions 55% per employee within the same timeframe.

Advantages:

● Allows customization of targets for different scope 3 categories based on

different circumstances.

● Provides more transparency for each scope 3 category.

● Adjustments to other scope 3 categories outside the specific target boundary

would not trigger a target recalculation.

● Easier to track progress of specific activities.

Disadvantages:

● More complicated to communicate to stakeholders.

● May require base year recalculation for outsourcing or insourcing.

● May result in shifting of emissions to other scope 3 categories, unless those

categories also have their own targets.

4.4 Choose a target year

Near-term targets must have a target year 5-10 years from the date of submission to the

SBTi, while long-term targets must have a target year of 2050 or sooner (2040 for targets

using the power and maritime transport sector pathways).

12

Because the ambition of long-term science-based targets is target year independent,

companies should begin by choosing any eligible target year. Based on the results of their

target calculation, the company may adjust their chosen target year depending on its ability

to achieve its long-term target.

12

Companies using the maritime transport sector guidance and its associated sector-specific pathway cannot

have a target year for near-term targets before 2030.

SBTi Corporate Net-Zero Standard V1.2 March 2024 | 28

4.5 Target setting methods

Science-based target methods are used to calculate near-term and long-term targets based

on a mitigation pathway and company inputs. Companies may choose from the methods

described in Annex B.

13

When using SBTi tools and resources to model targets, companies should note that the

outputs are minimum requirements. Companies are encouraged to set targets that are more

ambitious than the minimum percentage reduction values resulting from the tool. In some

cases, the minimum target ambition output will vary by different methods for a given

company. This is due to the differences in target formulation and variation among the

acceptable reduction pathways. For example, the minimum ambition required for a sector by

the intensity convergence method (i.e., SDA) may require more or less emission reductions

than the absolute reduction rate. To support the global transition to net-zero and

demonstrate leadership, companies should screen the available methods and choose those

that lead to the earliest reductions and the least cumulative emissions.

Certain types of target setting methods are not permitted because of the difficulty in

establishing whether these targets result in the necessary reductions as they do not

transparently demonstrate changes in emissions performance. In particular, targets to

reduce emissions by a specified mass of GHGs (e.g., “to reduce emissions by 5 million

tonnes by 2030”). Please see Annex B for a list of permitted target-setting methods.

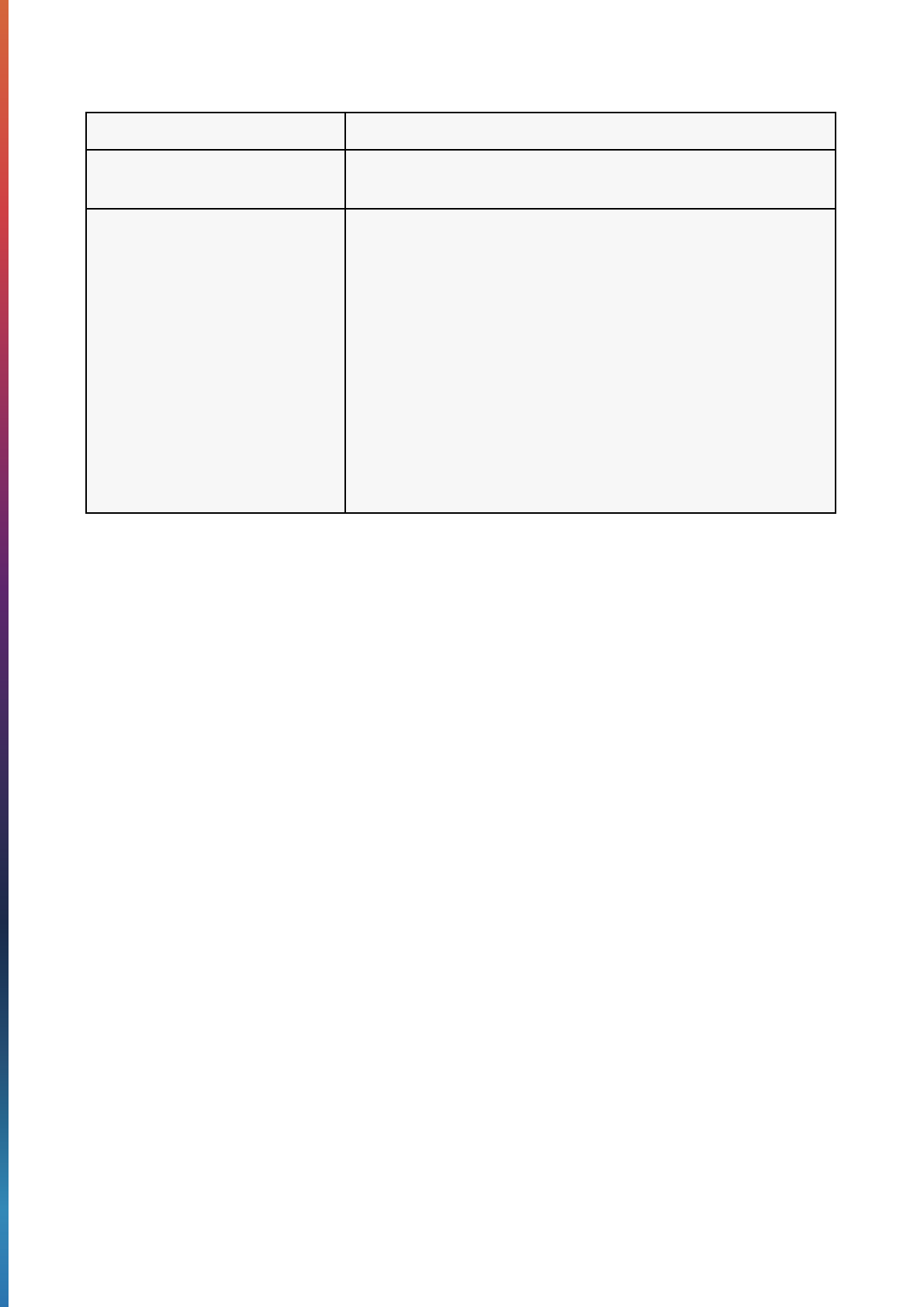

4.6 Calculating near and long-term SBTs

There are important differences when setting near-term and long-term science-based

targets, as summarized in Table 3 below.

When calculating near-term targets, target ambition depends on the chosen base year and

target year. When a company uses a base year later than 2020, a base year adjustment

must be applied to calculate near-term target ambition (see Table 7 in Annex C). Additionally,

for companies using a base year earlier than the most recent year, scope 1 and/or scope 2

targets must also have sufficient forward-looking ambition (FLA) (see Box 3 for an

explanation on FLA).

On the other hand, calculating long-term targets does not depend on the chosen target year.

Companies must either use the Corporate Net-Zero Tool to calculate long-term

science-based targets, or, in some cases the relevant sector-specific tool. For example,

companies with aviation, maritime and steel activities may also choose to use the respective

sector-specific tools to calculate their long-term science-based targets.

13

This section does not cover methods that are specific to financial institutions. Please refer to Table 4 in this

document and to the Financial Sector Science-Based Targets Guidance for information on methods for financial

institutions.

SBTi Corporate Net-Zero Standard V1.2 March 2024 | 29

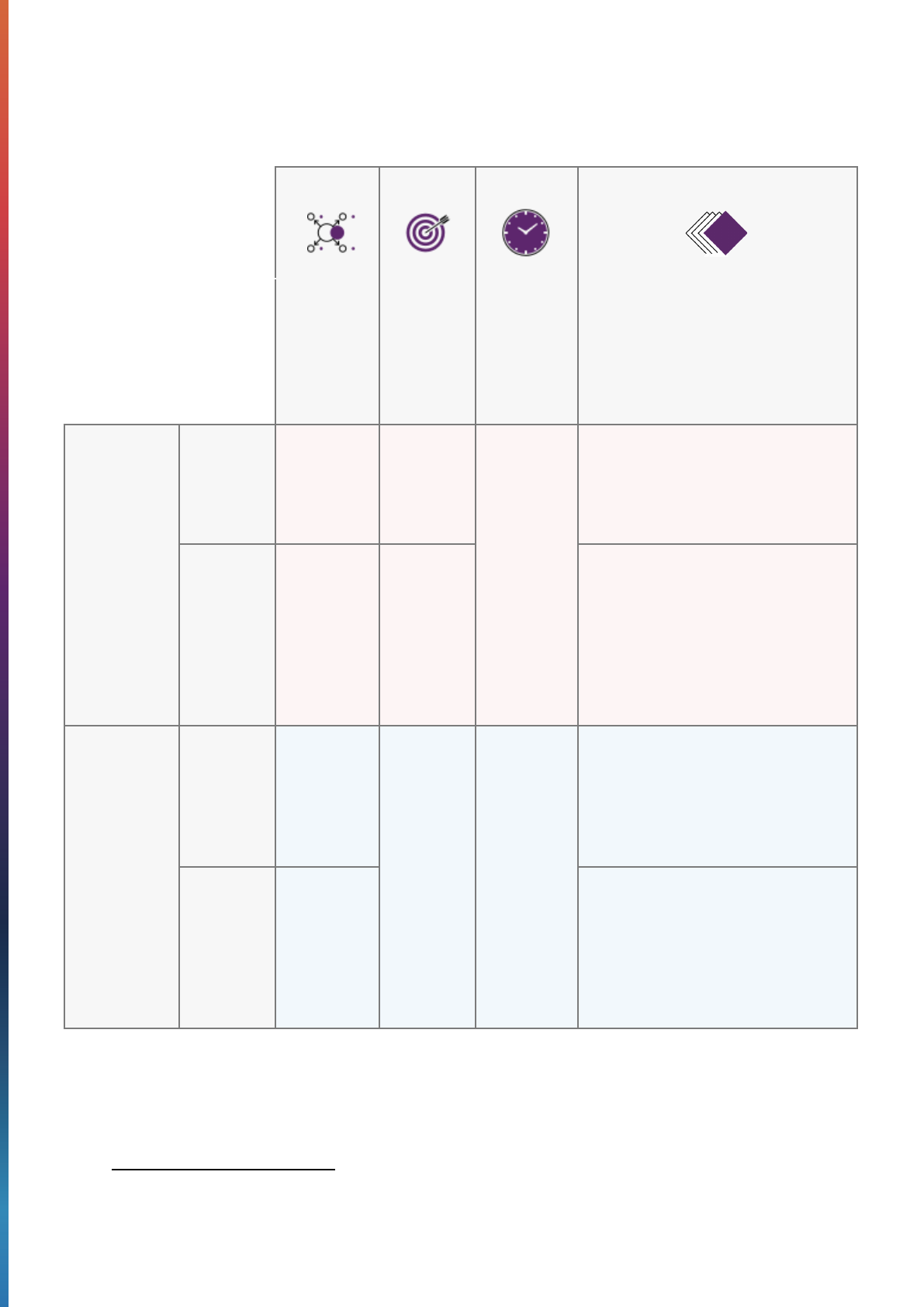

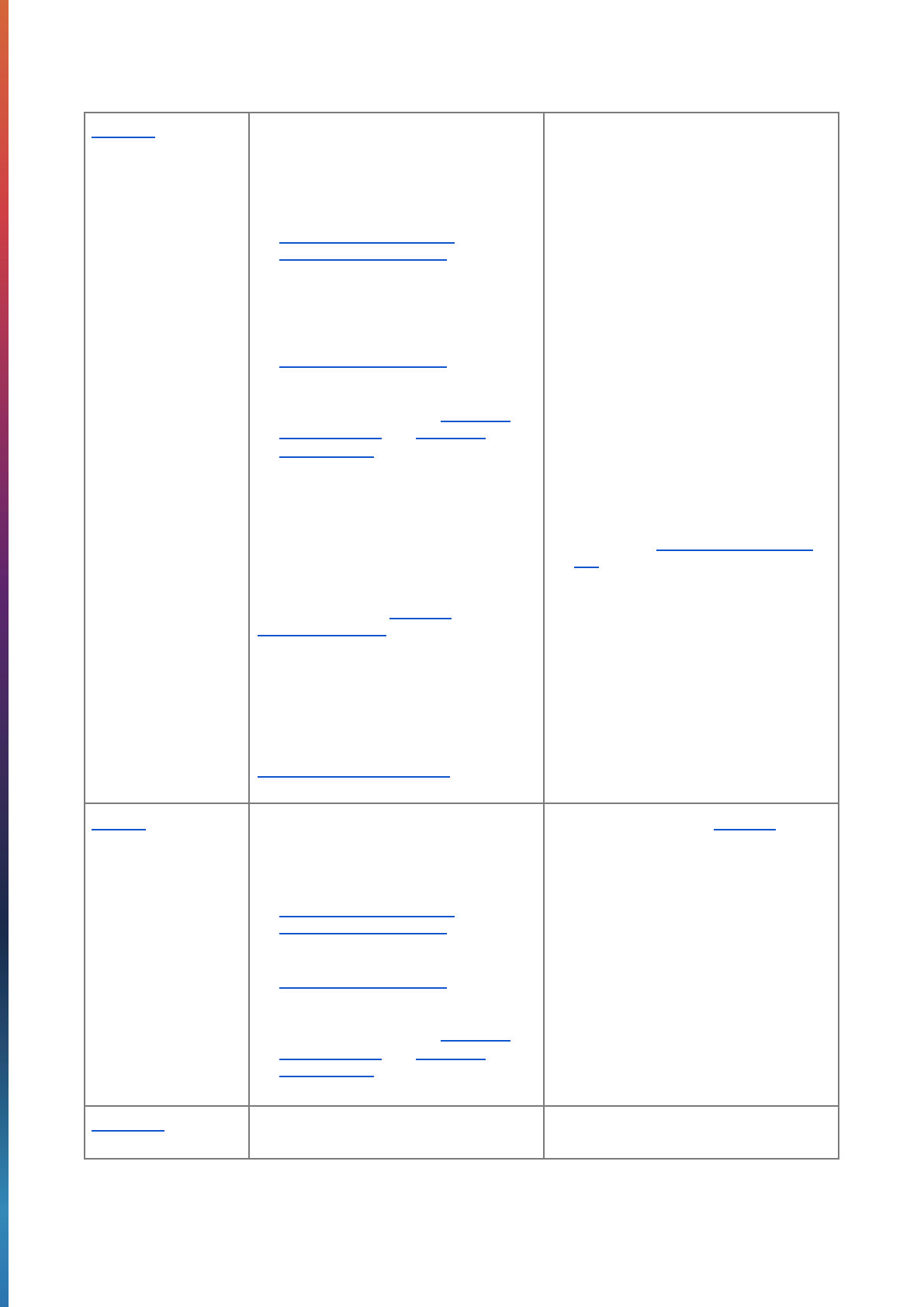

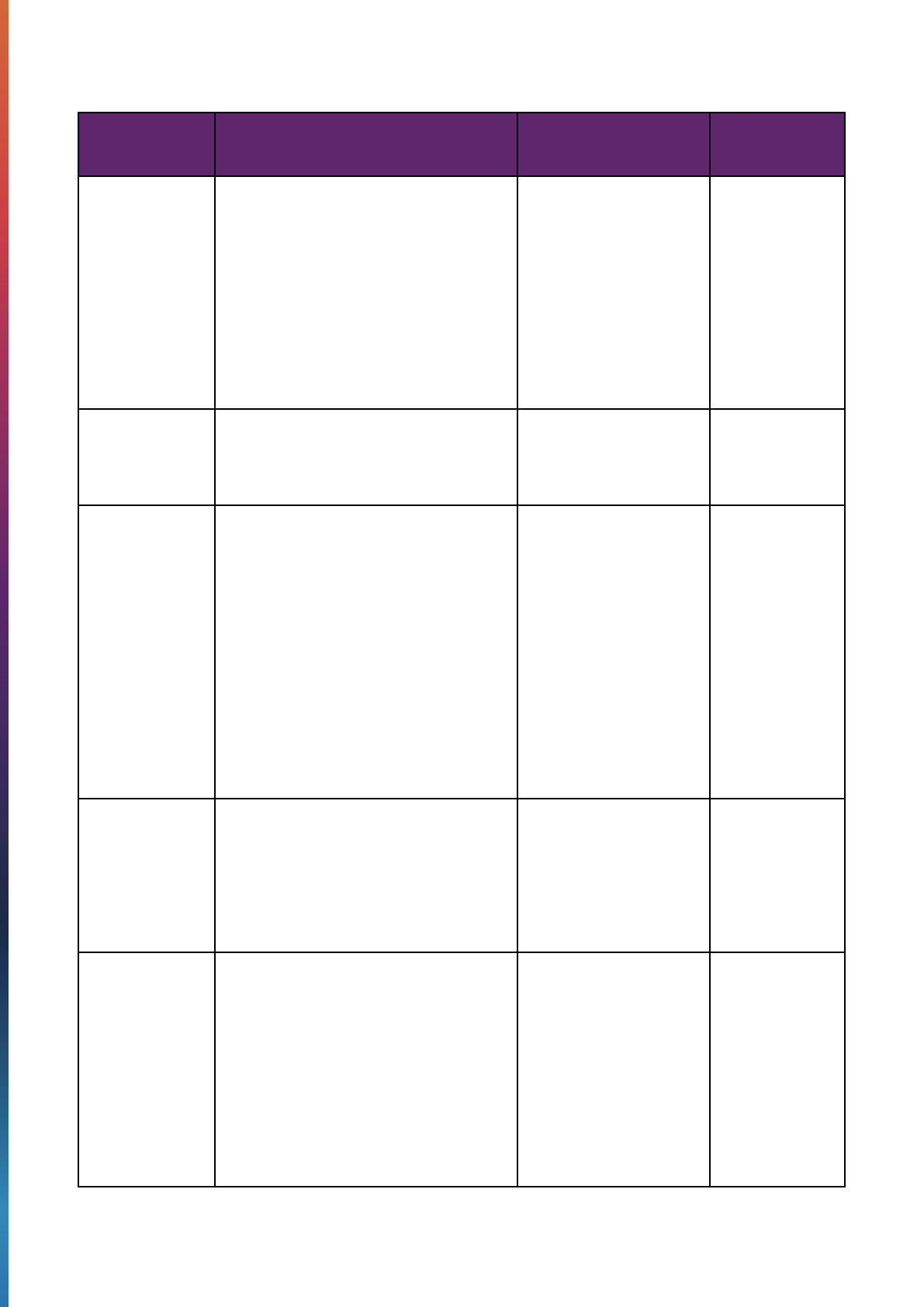

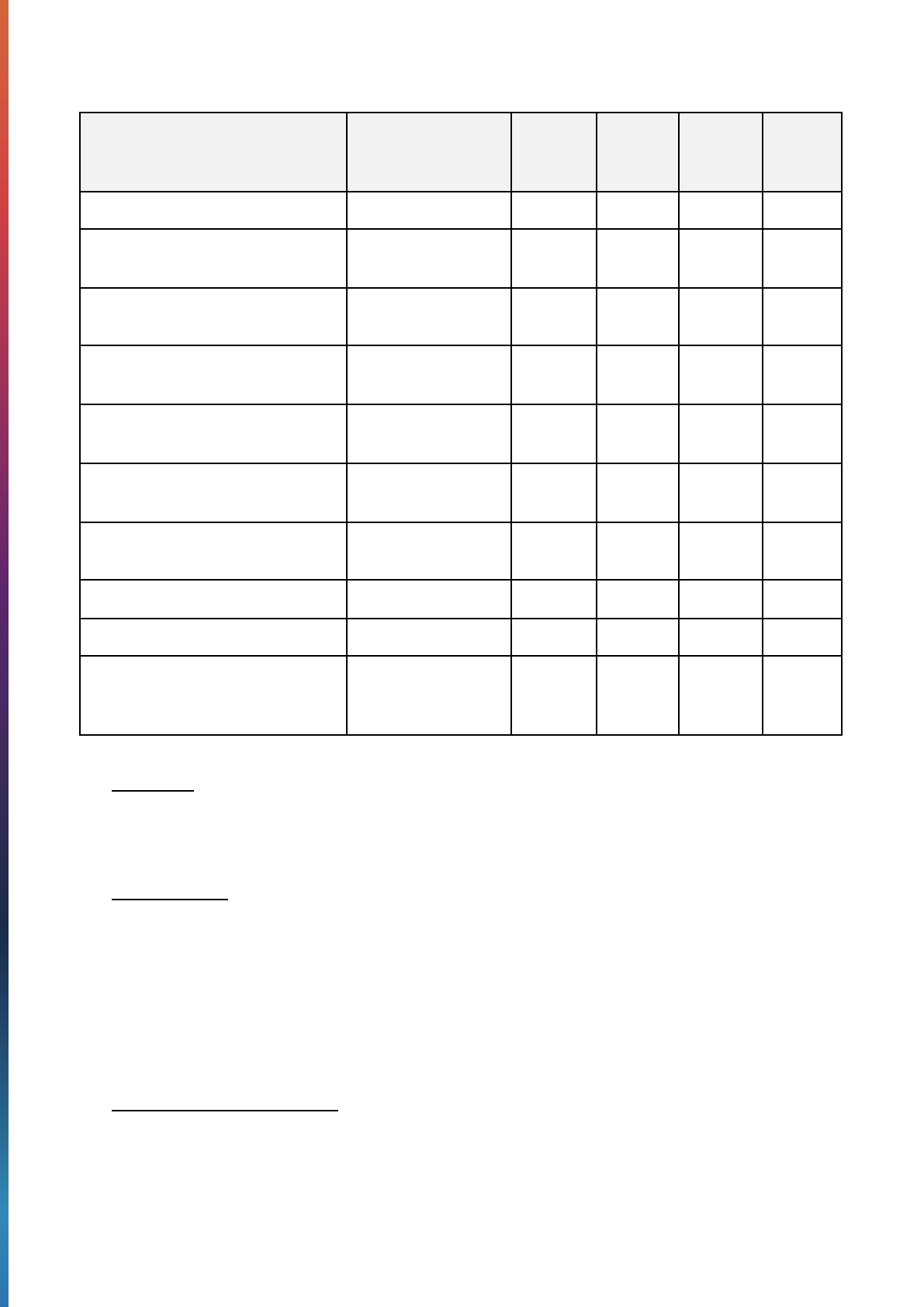

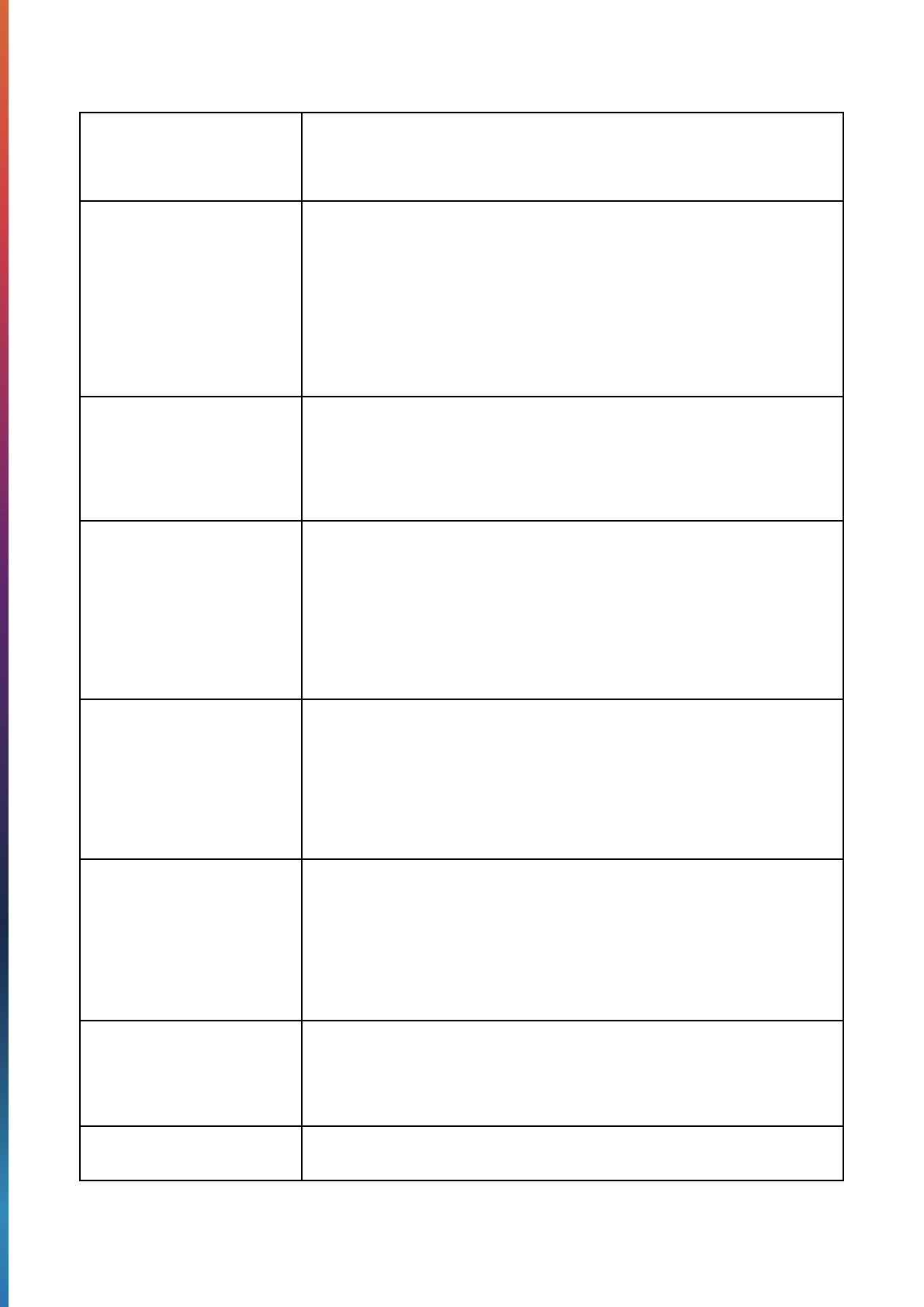

Table 3. A comparison of boundary, ambition, timeframe, and methods between near and

long-term targets.

Boundary

Ambition

Timeframe

Methods

What

percentage is

required for

the emissions

inventory

coverage?

What is the

ambition

level of

limiting

temperature

rise?

What is the

timeframe to

meet targets?

What are the eligible methods to set

targets?

Near-term

SBTs

Scope 1

and 2

95%

1.5°C

5-10 years

14

Cross-sector absolute reduction

Sector-specific absolute reduction

Sector-specific intensity

convergence (i.e., SDA)

Renewable electricity

Scope 3

If >40% of

total

emissions,

67%

coverage

Well-below

2°C

Cross-sector absolute reduction

Sector-specific absolute reduction

Sector-specific intensity

convergence (i.e., SDA)

Supplier/customer engagement

Scope 3 economic intensity

reduction

Scope 3 physical intensity reduction

Long-term

SBTS

Scope 1

and 2

95%

1.5°C

2050 latest

(2040 for

the power

and

maritime

transport

sectors)

Cross-sector absolute reduction

Sector-specific absolute reduction

Sector-specific intensity

convergence (i.e., SDA)

Renewable electricity (maintenance

target)

Scope 3

90%

Cross-sector absolute reduction

Sector-specific absolute reduction

Sector-specific intensity

convergence (i.e., SDA)

Scope 3 economic intensity

reduction

Scope 3 physical intensity reduction

14

The maritime transport sector cannot have a target year for near-term targets before 2030.

SBTi Corporate Net-Zero Standard V1.2 March 2024 | 30

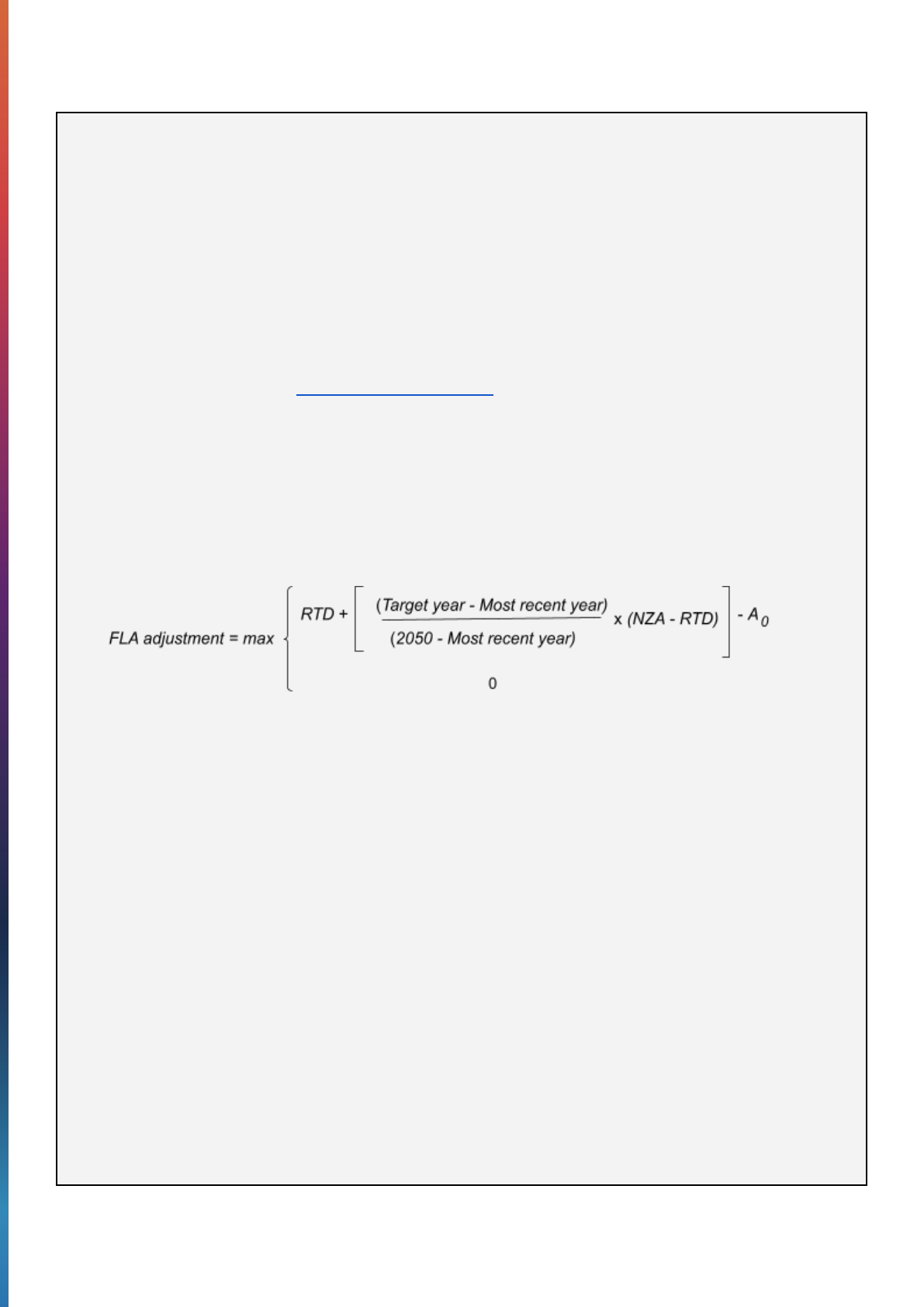

Box 3. Forward-looking ambition adjustment for near-term scope 1 and scope 2 SBTs

The forward-looking ambition (FLA) adjustment is an adjustment that must be applied to calculate the

ambition of near-term scope 1 and 2 absolute and intensity targets that do not use the most recent

reporting year as the base year. It is a mechanism that rewards early action and ensures targets drive

continued mitigation during a company’s transition to net-zero, consistent with the Corporate Net-Zero

Standard. The “FLA adjustment” prevents companies from setting targets that have already been

achieved and at the same time it allows them to count past emissions reductions toward achieving

near-term SBTs. This incentivizes companies to reduce their emissions as soon as possible and ensures

that there is a science-based minimum ambition requirement available for companies that have taken

early action.

The FLA adjustment only applies to companies that do not use the most recent year as a base year, and

is automatically applied by the Corporate Near-Term Tool. If a base year earlier than the most recent year

is chosen, the tool will calculate minimum target ambition requirements and apply the FLA adjustment

accordingly.

The FLA adjustment may be applied to scope 1 and 2 near-term targets that use the cross-sector

absolute reduction method, the sector-specific absolute reduction method, and the sector-specific

intensity convergence method.