TOWN OF CORTLANDT

OFFICE OF THE SUPERVISOR

TOWN HALL

1 HEADY STREET

CORTLANDT MANOR, N.Y. 10567-1251

(914) 734-1002

(914) 734-1003 fax

www.townofcortlandt.com

RICHARD H. BECKER, M.D.

TOWN SUPERVISOR

TOWN BOARD

JAMES F. CREIGHTON

FRANCIS X. FARRELL

CRISTIN JACOBY

ROBERT E. MAYES

2024 PROPOSED BUDGET

TOWN OF CORTLANDT

CONTINUING THE TRADITION OF TAX AND SPENDING CONTROL

2024 Supervisor’s Budget

Richard H. Becker, M.D.

October 31, 2023

MAINTAINING 1% ON AVERAGE TOWN TAX LEVY INCREASE

KEY POINTS

1. Percentage Tax Increase:

•Unincorporated Cortlandt - TOV 2.66% (approximately $ .83/week*) (75% of the Town)

•General Fund Taxes Increased by 5% (approximately $ .24/week**) (Includes the Villages of Croton & Buchanan)

2. Thirty three (33) years of only a 1% Town Tax Increase on average supported by now Supervisor, Richard H.

Becker, M.D. for 13 years while on the Town Board (2008-2021), and continued as Supervisor.

3. The Town Tax is 10% of the overall annual tax bill. Another 13% is Westchester County tax and 72% is from

the School District, (of which the Town government has no jurisdiction on either). Also, 5% for special districts (e.g.

drainage, street lighting, ambulance, sewer, ALS, etc.).

4. The Town has met the New York State Tax Cap mandate on the allowable tax levy limit for 2024. A portion of

the unused funds will be carried over for use in future years. The Town has met the mandated Tax Cap every year

since enactment of the law in 2011.

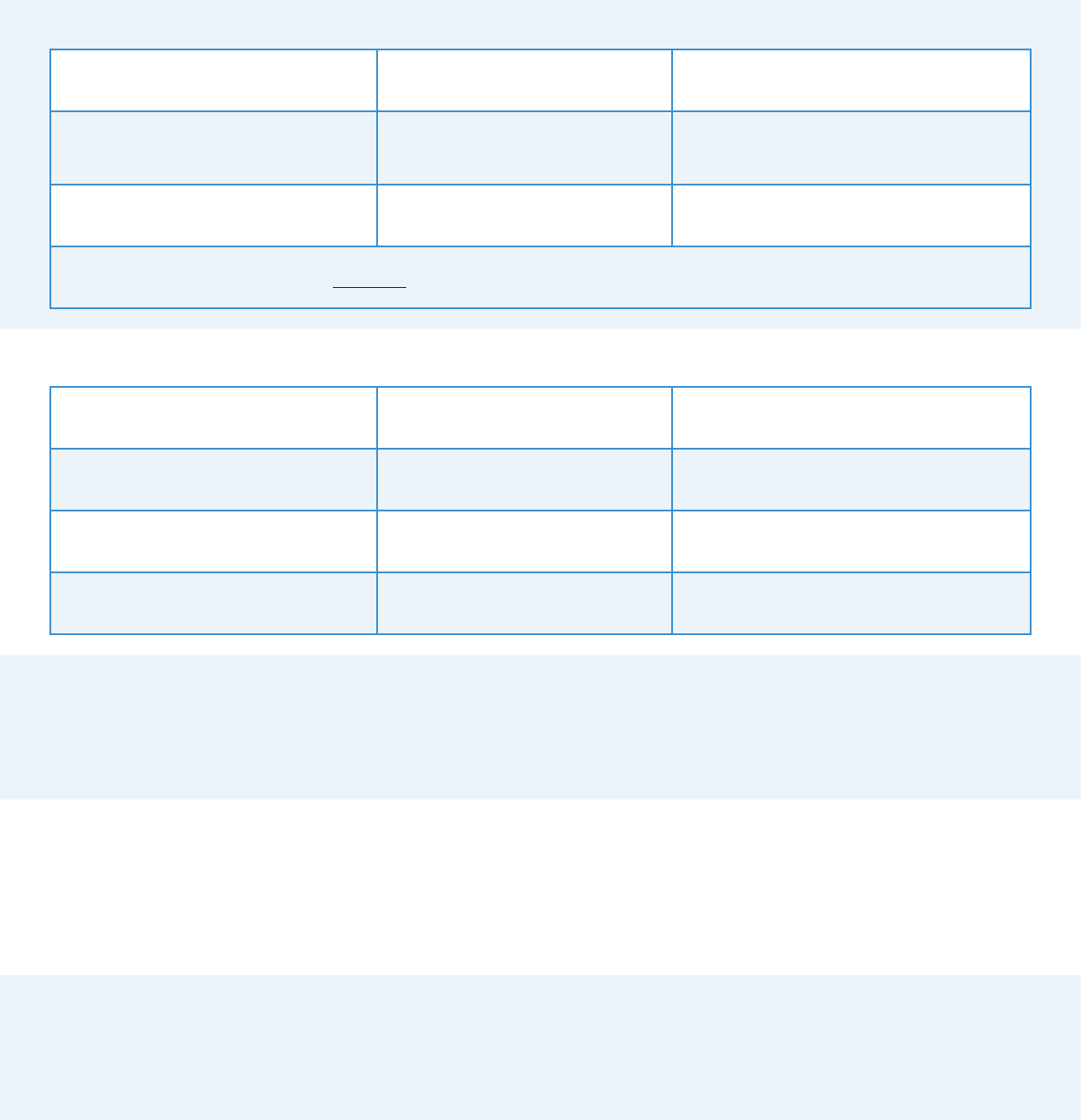

5. The Tax Rates: (average assessment based on $7,500/$5,000 Buchanan:

NYS Allowable Tax Levy Increase for Town of Cortlandt 2024 is 4.7%

2024 Proposed Tax Levy Increase is 2.51%

Sections of Town Tax Rate Average Annual Town Tax

TOV(with Water District)

$245.76 = per $1,000

2024 Increase of $42.97/year

= $1,843.20

TOV(without Water District)

$230.58 = per $1,000

2024 Increase of $43.27/year

= $1,729.35

Buchanan

$41.02 = per $1,000

2024 Increase of $8.15/year

= $205.10

Croton-on-Hudson

$33.50 = per $1,000

2024 Increase of $12.22/year

$251.25

6. C.P.I. (Consumer Price Index) is 3.7% for the last 12 months as of Sept. ‘23

The Town tax increases have been only 1% on average for 33 years, with three of the last four years resulting in no tax

increase.

7. The Town has increased and maintained its savings. For the scal year ended December 31, 2022:

8. Fiscally Conservative Revenue Projections for 2024:

9. Interest Amounts on Accounts – Interest rates dropped to near zero in 2020 and 2021, generating only $23,900 in

interest revenue for 2020 and $12,000 in 2021. Recently interest rates have increased to over 5% for Treasuries, in

which the Town invests. The Town anticipates receiving over $1m in interest in 2023. While rates are expected to either

staylevelorincreasefurther,theTownisscallyconservativeandwillcontinuethisapproachtoitsnances.The2024

proposedbudgetreects$708,000.

10. Grants – Millions of dollars each year from the State, Federal or County Governments have been received by the Town

to assist with the operating costs and capital projects. We actively pursue and apply for grants that have assisted

the Town in completing its larger projects. The Town was awarded a Federal Economic Development (EDA) grant

for $3.2 million with the help of former Congresswoman Nita Lowey, for infrastructure improvements and other

riverfront projects in the hamlet of Verplanck. Close to $2,400,000 was received in operating and capital grants in 2022,

alone, including $580,863 from ARPA. The Town was awarded a total of $3,278,567 from the American Rescue Act

of 2021 (ARPA) to be used for infrastructure for sewers and water projects and other general government expenses.

11. The Towns’ bond rating was upgraded to Aa1 by Moody’s at the end of 2019 due to an excellentnancialevaluation

andproactivemeasurestoosetthefuturelossofPILOTrevenuesfromtheimpendingclosureofIndianPointnuclear

plant. We are one of only a few Towns in the County to have this superior bond rating. The Aa1 bond rating was

renewed in 2023andhasremainedstrongeveninrecentandpastdicult,nationalandregionaleconomies.

Fund Balance

$19,658,324

Includes surpluses of funds,

excluding the Capital Projects Fund

Capital Projects Fund

$5,217,404

Note: $6,870,000 was added to Fund

Balance when the Town bonded for various

projects in 2023.

Total Funds

including Capital Projects Fund

$14,440,920

Note: Tax Stabilization Funds = $600,000 (to oset revenues lost due to closure of Indian Point Nuclear Power Plant)

Sales Tax

$7,600,000 2023 was budgeted $7,100,000

Mortgage Tax Revenue

$1,200,000 2023 was budgeted $1,500,000

State Revenue Sharing

$189,450

AIM related payment

remains the same from 2023

Consolidate Highway

Improvement Program (CHIPS)

$463,000

including some Pave NY funds (2023 was

budgeted $383,000 for CHIPS only)

12. 2023 Town-Wide Debt (Bonds) $14,365,000. (Only about 2.38% of our borrowing capacity per NYS) In 2023 the Town

bonded $6.87 million: $5,470,000 for Cortlandt Crossing Central and West Sewer Improvement, and $1,400,000 for the

Croton Ave. Water Main Replacement. In 2022 the Town bonded $2,845,000 for the Cook Pool Bath House, completed

in 2021. This generates revenue to the Capital Fund, increasing Fund Balance. In 2020 the Town took advantage of

low interest rates and refunded $2.2m in outstanding serial bonds from 2004 and 2010 at a true interest rate of

.57%., resulting in a savings of over $250,000 for the remaining life of the bonds. The 2004 and 2010 bonds were

for the purpose of purchasing property for the Department of Environmental Services (DES), and the construction of

the Youth Center at Memorial Drive. Combined water and sewer infrastructure make up about $9.6 million of the current

outstanding debt. In 2016, $1.4 million was borrowed for the purchase of real property including the quarry. Overall, the

Town has very little debt compared to the allowable borrowing capacity of $506 million. The capacity is based on the

constitutional debt limits established by NYS. The Town’s low use of debt contributes to its excellent Aa1 bond rating

status set by Moody’s.

13. Open Space - Land acquisition, donations and conservation easements have increased over 100% (from 2,729 acres

to 6,582 acres) in the last 30 years. Approximately 3,850 additional acres have been preserved as open space. The

Town has paid cash (no borrowing and no tax increases to reach this goal) during these years. The only exception

has been ($1.4 m) half of the cost for 100 acres previously owned by Con Edison on the Hudson River. See the award

winning Envision Cortlandt, 2016 Sustainable Comprehensive Plan for more information about open space and land

conservation.

14. Open Space Account Designated for Conservation is currently $41,191. In 2022 we used $380,000 of this fund to

conserve an additional 33 acres of open space. We previously used part of this fund to purchase 100 acres in 2019,

105 acres for conservation in 2017, and in 2018 the Town purchased and preserved an additional 26 acres of this

environmentally sensitive land known as Dickerson Hill, or formerly Abee Rose.

15. Recreation and Parkland Fund (money in lieu of Land) is currently $101,682, earmarked for improvements at the

Cortlandt Waterfront Park. The source of this fund is from new development. Combined with the Open Space account,

in 2019 we used part of this fund to conserve an additional 100 acres of open space. Other uses for these funds have

included improvements at Lake Meahagh Park, a new playground, a new outdoor basketball court, a Veteran’s Park, a

publicboatlaunchatCortlandtWaterfrontPark,andneweldsatSproutBrookPark.

16. Environmental Fund for the replanting of trees is currently $90,550 and was set up in 2020 to collect money from

developers who remove trees and allow the Town to replenish the tree stock.

17. Capital Improvement Projects:

Once again, an impressive list of completed and future projects has not impacted our tax record or our taxpayers.

Annually, the Town Board adopts its 5-year Capital Improvement Plan (CIP). There are currently 35 capital projects

listed for 2023 in the CIP plan, that are either completed, in progress, or in the early planning stages. Some of these

projects include:

•Pickleball courts (2023) and synthetic ice-skating rink (completed in 2022) at Memorial Drive

•Annsville Creek sanitary sewer study and design

•Annsville Creek rezoning study

•Croton Avenue water main replacement (completed 2022)

•Croton Park Colony water main replacement (2023)

•Furnace Woods sewer main – planning phase

•Baseball Field and Softball Field improvements

•Quarry Park improvements – study and design phases

•Cortlandt Riverfront Park stage and walking trails

•Highland Drive Culvert replacement

•Root Street water main replacement – design

•Dickerson Pond Sewer Plant upgrades

•Improvements at Westbrook Drive skate park, basketball courts and future pickleball courts – design phase

In 2021 the Town completed the construction of a new bath house facility, ticket booth, snack bar, and playground at

the Charles Cook Pool campus.

Additionally, since 2013 the Town has invested approximately $20 million in road resurfacing and paving. This

includes $1.8 million spent in 2022 on paving, and another $1.7 million in 2023.

Copies of budgets are available in the Comptroller’s oce (914) 734-1070 or email [email protected]

or in the Town Clerk’s Oce (914) 734-1020 or e-mail [email protected].

Note: All of the information will be on-line on the Town’s website –

www.townofcortlandt.com and the Town’s Facebook page.

Thank you.

Richard H. Becker, M.D.

Supervisor

Final Note: The Town of Cortlandt has met the New York State tax cap limit for the tax levy

for 2023. There is only a 2.5% increase to the Town tax levy, maintaining a 1% increase

on average per year.