Personal Deposit Accounts Fee Schedule

R-FS-2.0 | Effective 03/29/2024

1

Truist Bank, Member FDIC. ©2024 Truist Financial Corporation. Truist and the Truist logo are service marks of Truist Financial Corporation.

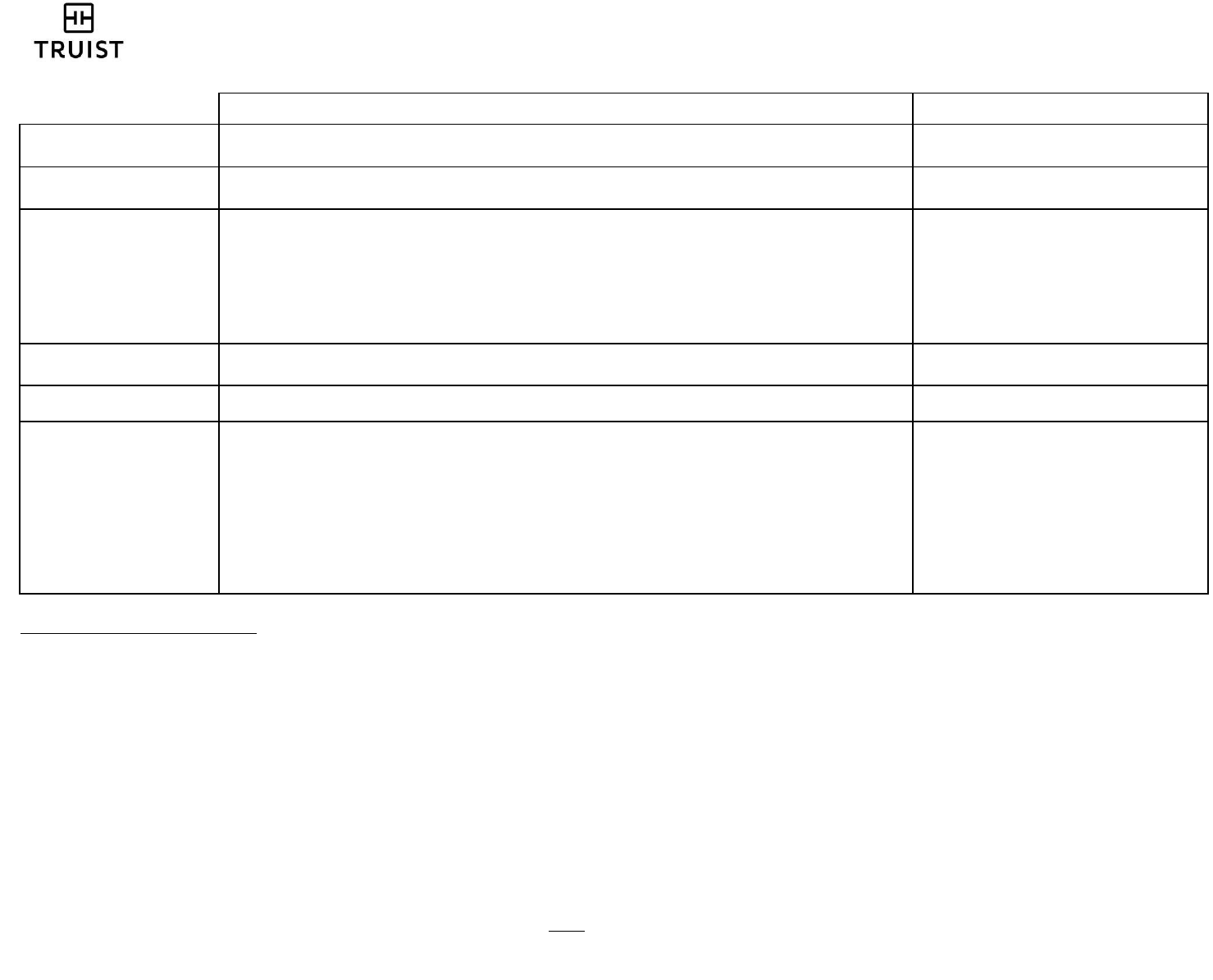

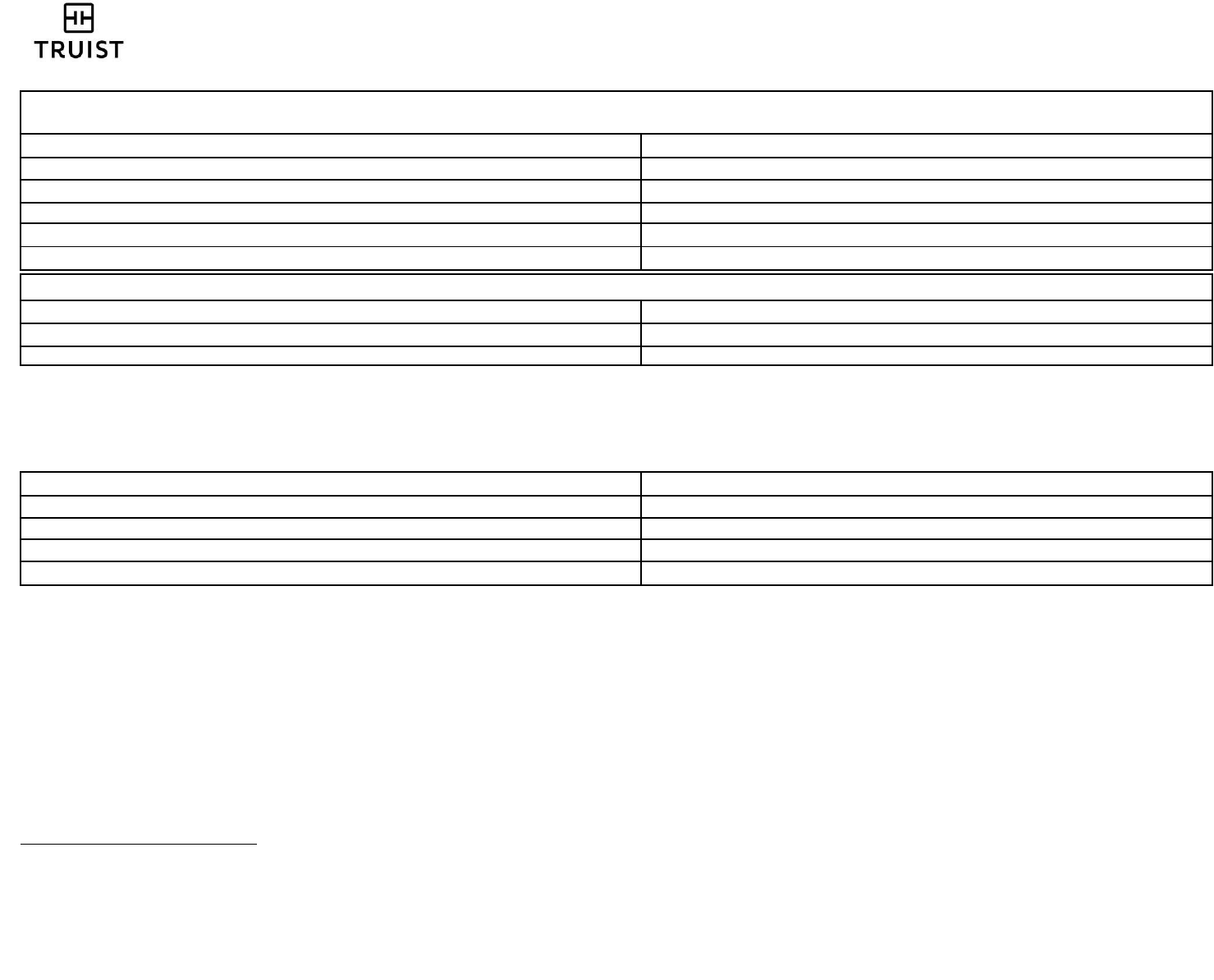

PERSONAL CHECKING ACCOUNTS

Truist One Checking Account

Truist Confidence Account

Minimum Opening

Deposit

$50

$25

Monthly Maintenance

Fee

$12.00

$5.00

Avoiding the Monthly

Maintenance Fee

Make

$500

or more in total qualifying Direct Deposits

1

per statement cycle

OR

Maintain a total combined ledger balance

2

,

3

of

$500

or more in Truist related accounts

4

across

personal deposits (excluding Truist HSA) and all investments as reflected on the business day before

your statement cycle end date

OR

Have a related Truist personal credit card, mortgage, or consumer loan, excluding LightStream®

OR

Have a linked Small Business Checking account

5

OR

Primary client is a student under the age of 25

6

OR

Primary client is age 62 and older

6

Make

$500

or more in total deposits

per

statement cycle

OR

Make 10 or more qualifying transactions

per statement cycle

7

OR

Primary client is a student under the age

of 25

6

OR

Primary client is age 62 and older

6

Monthly Paper

Statement Fee

No charge

for Paper Statement or Paperless Online Statement

8

No charge for Paper Statement or Paperless

Online

Statement

8

Interest Calculation

Truist One Checking is a non-interest-bearing account

Truist Confidence Account is a non-interest-

bearing account

Additional Information

Truist One Checking is a multi-level

9

checking account based on your balance relationship level. The Truist

One Checking levels are: Level 1: $0 - $9,999.99; Level 2: $10,000 - $24,999.99; Level 3: $25,000 –

$49,999.99; Level 4: $50,000 - $99,999.99; Level Premier: $100,000 or more

Truist One Checking also offers the Delta SkyMiles® Debit Card. Annual Fee May Apply

10

Relationship Pricing: The Truist One Checking account is eligible for additional related

4

Truist One

Checking and or Truist One Savings Account(s) with no monthly maintenance fee based on the following

levels: Level 1: One (1) savings account; Level 2: One (1) checking account and one (1) savings account;

Level 3: Two (2) checking accounts and one (1) savings account; Level 4: Three (3) checking accounts and

one (1) savings account; Level Premier: Unlimited checking accounts and savings accounts. The monthly

maintenance fee waiver and any other associated benefits can take up to two (2) business days to take effect

Not applicable

1

Direct Deposit: A qualifying Direct Deposit is an electronic credit via ACH deposited to your account during the current statement cycle. Pre-authorized transfers made from one account to another or deposits made via a

branch, ATM, online transfer, mobile device, debit card/prepaid card number or the mail are not eligible to meet this requirement.

2

Total Combined Balance: The sum of all balances within the Truist personal deposit accounts (checking, savings, money market or CDs), IRAs or brokerage accounts introduced through Truist Investment Services, Inc.

Truist HSA is excluded from Total Combined Balances.

3

Ledger Balance: The actual balance in your account on a specific day and does not reflect any holds or pending transactions.

4

Related Accounts: Related accounts automatically includes all applicable accounts associated with primary and secondary account holders.

5

Linked Small Business Checking Account: Eligible Small Business account types to be linked include: Truist Dynamic Checking, Business Interest Checking, Simple Business Checking and Business Value 200.

6

Monthly Maintenance Fee (MMF): Waiver for clients aged 62 and older requires that they are listed as the primary owner. Waiver for a student under the age of 25 requires that they are listed as the primary owner. The

waiver is applied automatically at account opening and expires on the 25th birthdate of the student or their stated graduation date, whichever comes later. On this date, the account is subject to all applicable fees, including

the Monthly Maintenance Fee unless at least one waiver criterion is satisfied.

7

Qualifying transactions are these specific debits to your account: ATM withdrawals, ATM payments, ATM transfers, Debit Card payments (one time and recurring), Debit Card purchase transactions including PIN Point of

Sale (POS), Debit Card signature-based purchases, and Zelle® payments. These transactions must be posted to your account during the statement cycle. Bank fees are not included.

8

Paperless Online Statement: Electronic/Online Statement provided through Online Banking each statement cycle. Clients may select the option to no longer receive paper account statements through U.S. mail. Online

Banking is required to access Paperless Online Statements.

9

Truist One Checking Levels: Most Truist One Checking accounts start in Level 1 upon account opening and can begin increasing Levels following the first month. Truist One Checking levels are determined by the balance in

your Truist One Portfolio (“Portfolio”). Your Portfolio includes all eligible Truist consumer deposit balances in your checking accounts, savings (excluding Truist HSA), Certificates of Deposit, IRAs and/or all investments

through Truist Investments Services, Inc. where you are the primary or secondary account owner. For each of your accounts used in the Portfolio, we use the monthly average ledger balance. We then take the sum of all of

these accounts to determine the Portfolio balance for the month. Each month, your Level is based on the highest Portfolio value of the three previous months. Note: Accounts that are opened with a company ID code

through a company sponsored Financial Wellness program start at Level 2; Clients identified as Premier and Wealth start at Level Premier. Note: Truist Dynamic Business Checking linkage will be checked on the 2nd

business day of the month when levels are calculated. If clients have a linked Dynamic Business Checking account, they will be granted Level Premier. All Truist One Checking account levels will receive a $25 Annual Fee

Discount on any size safe deposit box, subject to availability.

10

Delta SkyMiles® Debit Card Annual Fee: See the Delta SkyMiles® Debit Card Annual Fee section on Page 7 for more details.

Personal Deposit Accounts Fee Schedule

R-FS-2.0 | Effective 03/29/2024

2

Truist Bank, Member FDIC. ©2024 Truist Financial Corporation. Truist and the Truist logo are service marks of Truist Financial Corporation.

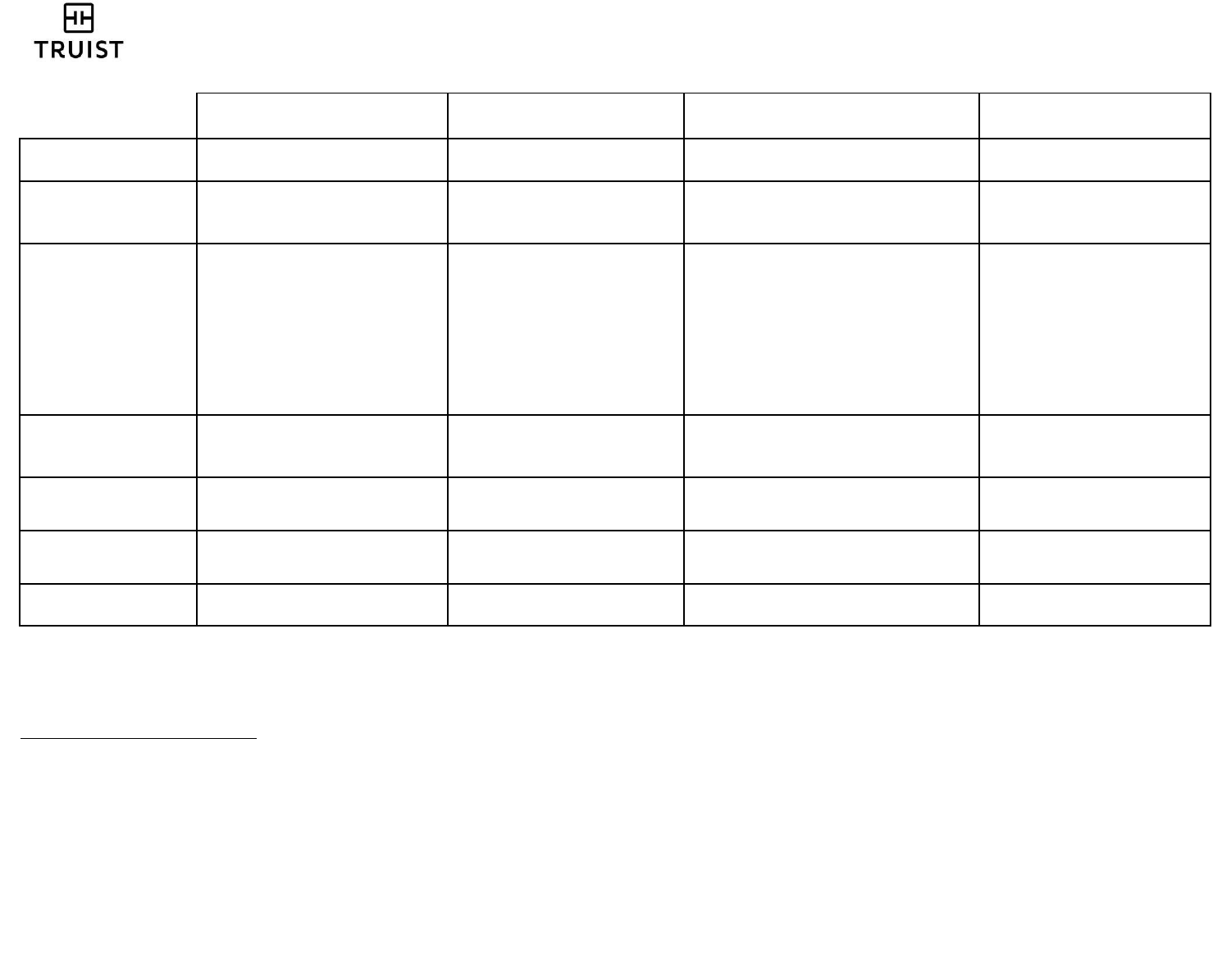

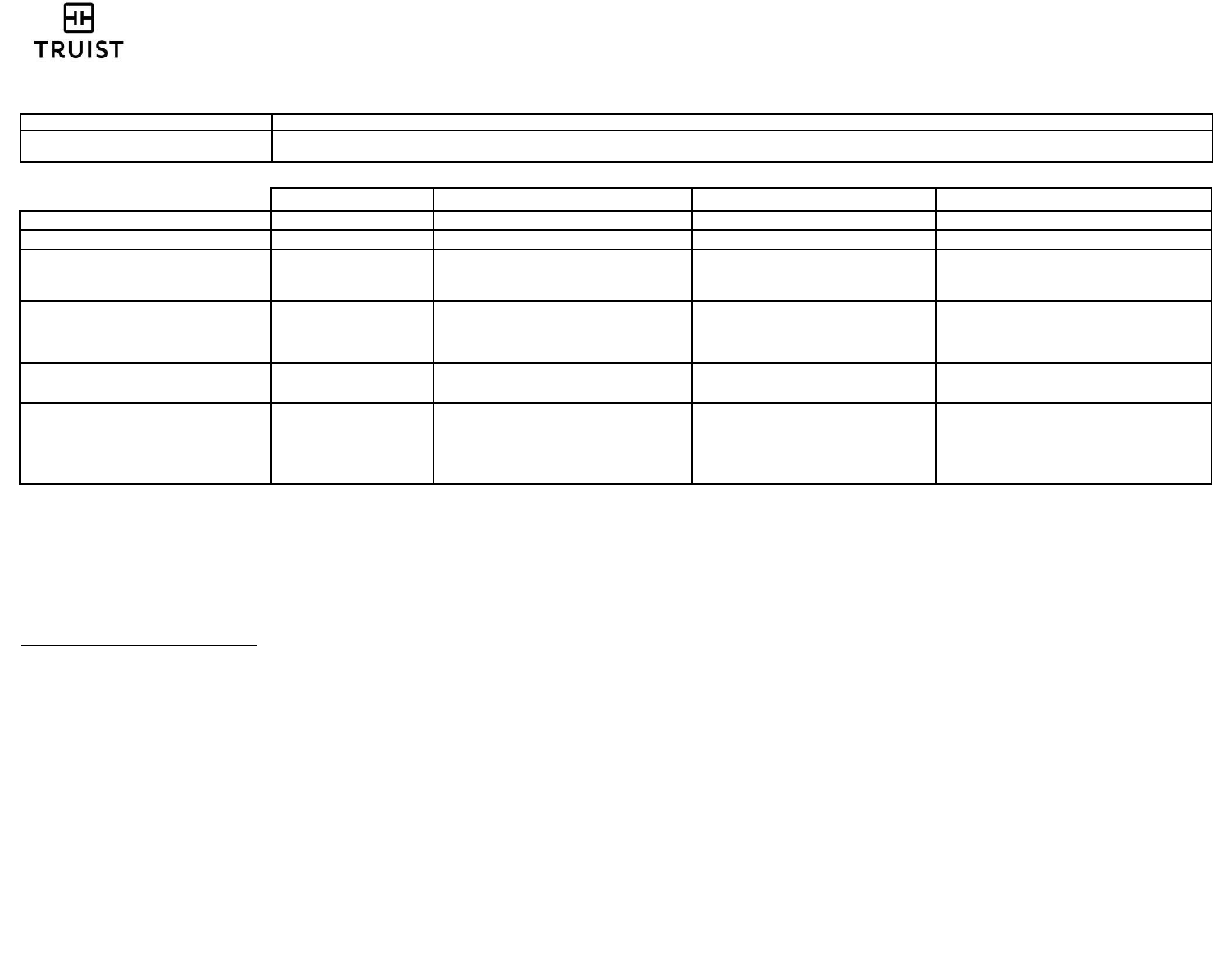

TRUIST WEALTH ACCOUNTS

Truist Wealth Checking

1

Truist Asset Management Account

(AMA)

Truist Wealth Money Market Account

Minimum Opening

Deposit

$100

$100

$100

Monthly Maintenance

Fee

$50.00 (Annual Fee) –

will be charged 3 months

after account opening and each year thereafter on

the service charge anniversary date

$0

$25.00

Avoiding the Monthly

Maintenance Fee

(Annual Fee)

Maintain a minimum daily ledger balance

2

of

$25,000

in your Truist Wealth Checking or your Truist

Wealth Money Market account

OR

$100,000

or more in the sum of all current balances from

Truist related accounts

3

across personal deposits

(excluding Truist HSA), all investments

4

, Trust

5

, personal

mortgage, consumer loan/lines (excluding

LightStream®), personal credit card or Truist Ready

Now Credit Line accounts

Not Applicable

Maintain a minimum daily ledger balance

2

of

$25,000

or more

Interest Calculation

Truist Wealth Checking is an interest-bearing account

6

Truist AMA is an interest-bearing account

6

Truist Wealth Money Market is an interest-

bearing account

6

Withdrawal Limit Fee

Not applicable

Not applicable

$15

per withdrawal over six with a maximum

of six withdrawal limit fees

7

per statement

cycle

Additional Information

Truist Wealth Checking is available to clients with

$1,000,000 or more in qualifying personal investments

with Truist. Truist Wealth Checking offers the Wealth

Debit Card or Delta SkyMiles® Debit Card

(Annual

Fee May Apply )

8

Choose any personal check design at no charge.

Truist AMA combines the ease and

convenience of a checking account with the

investment opportunities of a full-service

brokerage account. Truist AMA offers the

AMA Debit or Delta SkyMiles® Debit Card

(Annual Fee May Apply

8

)

Choose any

personal check design at no charge.

Truist Wealth Money Market account is a

savings option available to clients with

$1,000,000 or more in qualifying personal

investments with Truist.

Truist Wealth Money Market offers checks at

no charge

Brokerage

Commission and Fee

Investment and

Insurance Products

Refer to your Truist Investment Services, Inc. Commission and Fee Schedule for commissions and fees that may apply.

Investment and Insurance Products: Are Not FDIC or Any Other Government Agency Insured • Are Not Bank Guaranteed • May Lose Value

Truist Wealth is a marketing name used by Truist Financial Corporation. Services provided by the following affiliates of Truist Financial Corporation (Truist):

Banking products and services, including loans and deposit accounts, are provided by Truist Bank, Member FDIC. Trust and investment management services are

provided by Truist Bank, and Truist Delaware Trust Company. Securities, brokerage accounts and /or insurance (including annuities) are offered by Truist

Investment Services, Inc., and/or P.J. Robb Variable Corp., which are SEC registered broker-dealers, members FINRA SIPC, and a licensed insurance agency

where applicable. Investment advisory services are offered by Truist Advisory Services, Inc., GFO Advisory Services, LLC, Sterling Capital Management, LLC,

and Precept Advisory Group, LLC, each SEC registered investment advisers. Sterling Capital Funds are advised by Sterling Capital Management, LLC. Insurance

products and services are offered through McGriff Insurance Services, Inc. Life insurance products are offered through Truist Life Insurance Services, a division of

Crump Life Insurance Services, Inc., AR license #100103477. Both McGriff and Crump are wholly owned subsidiaries of Truist Insurance Holdings, Inc.

1

Truist Wealth Checking: If linked to an eligible Truist Investment Services, Inc. brokerage account, the Truist Asset Management Account pricing will apply. If the linked brokerage account relationship is removed, then the

account will revert to the standard Truist Wealth Checking pricing.

2

Ledger Balance: The actual balance in your account on a specific day and does not reflect any holds or pending transactions.

3

Related Accounts: Related accounts automatically includes all applicable accounts associated with primary and secondary account holders.

4

Investments: For Truist Wealth Checking and Truist AMA, investments include assets held in a traditional brokerage account, fee-based assets under management, annuities and IRAs.

5

Trust balances: Balances that are held in the Truist Trust Department or Truist Advisory Services, Inc., an SEC registered investment adviser, provides discretionary asset management services to the client in a fiduciary

capacity.

6

Interest-bearing account: Interest is calculated and compounded daily on the collected balance and credited to your account monthly. Fees may reduce earnings. Interest rates are variable and can change at any time at the

bank's discretion. All interest rates have a corresponding Annual Percentage Yield (APY).

7

Withdrawal Limit Fee: The withdrawal limit fee applies, regardless of the balance, to all withdrawals and transfers made from a Truist personal savings and/or money market account including those made at a branch, ATM,

by mail or through any electronic means.

8

Delta SkyMiles® Debit Card Annual Fee: See the Delta SkyMiles® Debit Card Annual Fee section on Page 7 for more details.

Personal Deposit Accounts Fee Schedule

R-FS-2.0 | Effective 03/29/2024

3

Truist Bank, Member FDIC. ©2024 Truist Financial Corporation. Truist and the Truist logo are service marks of Truist Financial Corporation.

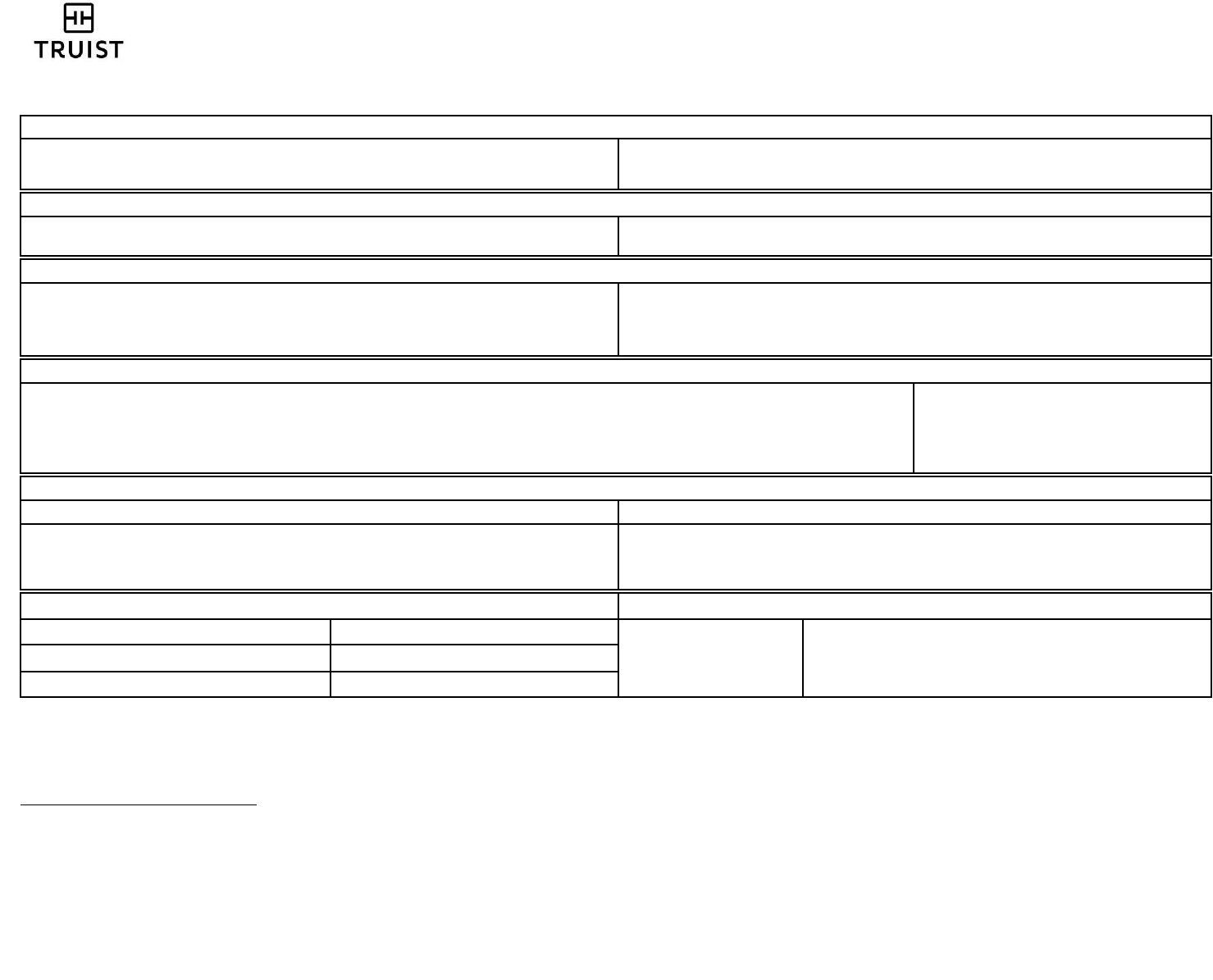

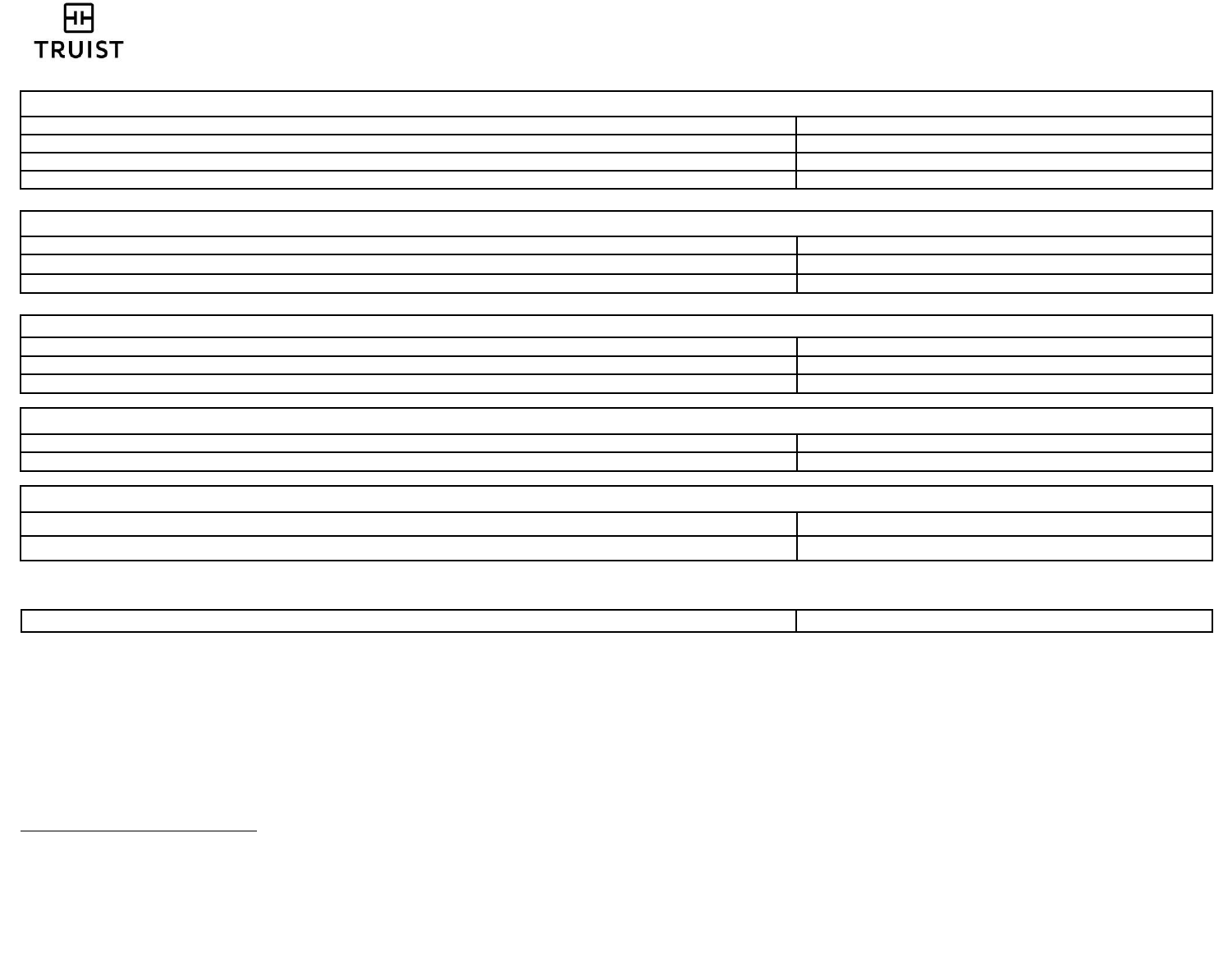

PERSONAL SAVINGS AND MONEY MARKET ACCOUNTS

Truist One Savings

Truist Confidence Savings

Truist One Money Market Account

Secured Credit Card

Savings

1

Minimum Opening

Deposit

$50

2

$25

$50

$400

Monthly

Maintenance

Fee

$5.00

$0

$12.00

$0

Avoiding the

Monthly

Maintenance Fee

Maintain a minimum daily ledger

balance

3

of

$300 OR

Schedule a recurring preauthorized

internal transfer of

$25

or more per

statement cycle into the Truist One

Savings Account

OR

Waived for a minor under the age of

18

4

OR

Waived with ANY related

5

Truist

checking product

Not applicable

Maintain a minimum daily ledger balance

3

of

$1,000

or more

Not applicable

Monthly/Quarterly

Paper Statement

Fee

No charge

for Paper Statement or

Paperless Online Statement

6

No charge

for Paper Statement or

Paperless Online Statement

6

No charge

for Paper Statement or

Paperless Online Statement

6

No charge

for Paper Statement

or Paperless Online Statement

6

Withdrawal Limit

Fee

$5 per withdrawal over six with a

maximum of six withdrawal limit fees

per statement cycle

7

$5 per withdrawal over six with a

maximum of six withdrawal limit

fees per statement cycle

7

$15 per withdrawal over six with a

maximum of six withdrawal limit fees per

statement cycle

7

Withdrawals not allowed; funds

are held as collateral for the

Truist Secured Credit Card

8

Interest Calculation

Truist One Savings is an interest-

bearing account

9

Truist Confidence Savings is an

interest-bearing account

9

Truist One Money Market Account is an

interest-bearing account

9

Truist Secured Credit Card

Savings is an interest-bearing

account

9

Additional

Information

Not applicable

Not applicable

Truist One Money Market Account is not

intended to be set up as a minor account

Only opened as collateral for a

Truist Secured Credit Card

8

1

Secured Credit Card Savings (“Secured Savings Account”): Please refer to the Secured Consumer Credit Card Agreement you received when opening your Truist Secured Credit Card for additional details.

2

Minimum Opening Deposit: Must maintain a balance of $0.01 to avoid account closure and to obtain the required interest rate and Annual Percentage Yield (APY) as described in the APY Disclosure.

3

Daily Ledger Balance: The actual balance in your account on a specific day and does not reflect any holds or pending transactions.

4

Monthly Maintenance Fee (MMF): Waiver for an account holder under age 18 (minor) requires that the Minor is listed as the primary owner. The waiver is applied automatically at account opening and expires on the 18

th

birthdate of the minor. On the date when the minor turns the age of 18, the account is subject to all applicable fees, including the Monthly Maintenance Fee unless at least one waiver criterion is satisfied.

5

Related Accounts: Related accounts automatically includes all applicable accounts associated with primary and secondary account holders. Note: The Truist Confidence Account is not an eligible product to waive the MMF

for the Truist One Savings account.

6

Paperless Online Statement: Electronic/Online Statement provided through Online Banking each statement cycle. Clients may select the option to no longer receive paper account statements through U.S. mail. Online

Banking is required to access Paperless Online Statements.

7

Withdrawal Limit Fee: The withdrawal limit fee applies, regardless of the balance, to all withdrawals and transfers made from a Truist personal savings and/or money market account including those made at a branch, ATM,

by mail or through any electronic means.

8

Truist Secured Credit Card: Truist Secured Credit Cards are subject to credit approval. Please see your Truist Secured Credit Card Agreement for more information.

9

Interest-bearing account: Interest is calculated and compounded daily on the collected balance and credited to your account monthly. Fees may reduce earnings. Interest rates are variable and can change at any time at the

bank's discretion. All interest rates have a corresponding Annual Percentage Yield (APY).

Personal Deposit Accounts Fee Schedule

R-FS-2.0 | Effective 03/29/2024

4

Truist Bank, Member FDIC. ©2024 Truist Financial Corporation. Truist and the Truist logo are service marks of Truist Financial Corporation.

MISCELLANEOUS SERVICES AND FEES

DEPOSIT SERVICES

Check Orders

Truist One Checking Level 1

Free first order (10-Pack)

Truist One Checking Level 2

Free first order (10-Pack) and 50% reorder discount

Truist One Checking Levels 3, 4, and Premier

Free first order (10-Pack) and Free reorders

Fees for statements with check images

Check Images with Statement

1

$4.00 per statement cycle (five (5) front and back images per page)

Enhanced Check Images with Statement

1

$5.00 per statement cycle (three (3) larger images per page)

Overdraft Fees

Overdraft (OD) Fee

2

Truist will limit total Overdraft Fees to three (3) per day

Truist will waive Overdraft Fees on transactions that are less than $5

$36.00 per item, per occurrence

Note: This Fee does not apply to Truist One Checking, Truist One Savings, Truist One Money Market

Account, Truist Confidence Account, Truist Confidence Savings, Secured Credit Card Savings, Truist

Wealth Checking, or Truist Wealth Money Market Account

Overdraft Protection

Overdraft Protection Transfer

•

For all accounts linked to a checking, savings, money market account, credit card or line of credit, the amount transferred is the exact

amount of the overdraft (based on balance availability)

•

For accounts linked to a line of credit or credit card, funds advanced for Overdraft Protection are subject to fees and finance charges

under your line of credit or credit card agreement. Please see your agreement for more information

No Overdraft Protection Transfer fee

Availability Options for Funds Deposited

Standard availability

3

No charge

Immediate availability

4

•

Mobile check deposits only

•

A single check deposit that is less than $5 is not eligible for immediate availability

If immediate availability service is offered and accepted, the fee will be 2% of each check

amount equal to or over $100. For each check under $100, a $1 fee will apply. The fee

amount is disclosed prior to acceptance

Other Account Related Fees

Returned Deposited Item/ Cashed Item Fee

No charge

Stop Payment Fee

5

$35.00 each

Check Copy Fee

6

$5.00 per copy

Closed Account Processing

Charged-Off Account Fee

$30.00

Note: This Fee does not apply to the Truist Confidence Account and

Truist Confidence Savings.

1

Check Images and Enhanced Check Images with Statement: This fee will be waived for Truist Wealth Checking and Asset Management Accounts. Note: Truist Confidence Account and Truist Confidence Savings Account

are not eligible for Image statements.

2

Overdraft (OD) Fee: One Overdraft Fee will be waived per month for Truist Asset Management Accounts. This fee applies to overdrafts created by checks, in-person withdrawals, ATM withdrawals, or other electronic means.

3

Standard Availability: Transactions are processed each banking day (Monday through Friday except federal holidays) during nightly processing and are posted to your account. Check deposits will be posted to your account

and available for use after nightly processing unless a hold is placed.

4

Immediate Availability: Transactions are processed each banking day (Monday through Friday except federal holidays) during nightly processing. If accepted, your available balance will be increased by the amount of the

deposited item, minus the applicable fee, at the time the deposit is made. Currently available for Mobile Check Deposits only.

5

Stop Payment Fee: There is no Stop Payment Fee for Truist Wealth Checking accounts.

6

Fee is charged for each copy of individual items requested such as a check or deposit slip. No charge for Truist Wealth or Truist Wealth Money Market accounts.

Personal Deposit Accounts Fee Schedule

R-FS-2.0 | Effective 03/29/2024

5

Truist Bank, Member FDIC. ©2024 Truist Financial Corporation. Truist and the Truist logo are service marks of Truist Financial Corporation.

RESEARCH SERVICES

Bonds

Returned Bond / Coupons

$35.00 per envelope

Bond Redemption

$20.00

Coupon Collection

$10.00

Domestic Collections

Outgoing Collections

1

No Truist Fee; Domestic/ Intermediary Paying Bank Fees only

2

Check Collection

No Truist Fee; Domestic/ Intermediary Paying Bank Fees only

2

Returned Item (Domestic Collections)

No Truist Fee; Domestic/ Intermediary Paying Bank Fees only

2

International Collections

Foreign Check Collection

$75.00 per item plus Foreign/ Intermediary Paying Bank Fees

2

Foreign Check Returned Item

No Truist Fee; Foreign/ Intermediary Paying Bank Fees

only

2

Tracers/Telex Inquiries

$20.00 per inquiry

Verification

Account Verification Fees

3

$30.00 standard processing

TRUIST MONEY SERVICES

Check Cashing

Truist will assess an $8 fee ($0 for NJ) for cashing a Truist check for any non-Truist client or Truist client without a checking (including Truist Confidence Account), savings or money

market account. This fee will not be assessed if the face value of the check is $50 or less. Truist Premier and Wealth clients are excluded from this fee. Truist will not cash non-Truist

checks from non-clients unless the check is on the check cashing agreement list.

1

Outgoing Domestic Collections: There is no charge on bonds, oil and gas leases or dealer drafts.

2

Domestic and International Collections: The net amount paid to you or Credited to your account may be less than the face value of the item, due to fees being charged by the domestic or foreign paying bank and

intermediary banks. Fees may vary.

3

No charge for Account Verification for Truist Wealth Checking accounts.

Personal Deposit Accounts Fee Schedule

R-FS-2.0 | Effective 03/29/2024

6

Truist Bank, Member FDIC. ©2024 Truist Financial Corporation. Truist and the Truist logo are service marks of Truist Financial Corporation.

WIRE TRANSFER SERVICES

Truist Teammate Assisted

Incoming/Outgoing

Incoming Domestic

1

$15.00 per transfer

Incoming International

1

$20.00 per transfer

Outgoing Domestic

2

$30.00 per transfer

Outgoing International

2

$65.00 per transfer

Incoming Funds Transfer

1

$5.00 per transfer

Outgoing Book Transfer

2

$5.00 per transfer

Wire Transfer Notification

Mail (Hard copy confirmation)

$7.00

Wire Repair

$10.00

Wire Investigations

$25.00

Note:

If transactions are in a currency other than U.S. dollars, the exchange rate for the transaction currency used by Truist for processing such foreign transactions is either (a) a rate selec ted by Truist from the

range of rates available in wholesale currency markets for the applicable transaction processing date, which may vary from the rate Truist itself receives or (b) the government mandated rate in effect for the

applicable transaction processing date, increased by up to three percent (3%). If a credit is subsequently given for a transa ction, it will be decreased by up to three percent (3%). If the credit has a different

transaction processing date, then the exchange rate of the credit can be greater/less than that of the original transaction. The currency conversion rate on the day before the transaction processing date may differ

from the rate in effect at the time of the transaction or on the date the transaction is posted on the account. The converted amount shall be provided in U.S. dollars for deposit in your Truist account.

MISCELLANEOUS DEPOSIT SERVICES

Official Check

3

$10.00 per item

Money Order

3

$5.00 per item

International Bank Draft

$30.00 per item

Temporary Checks (for select branches)

$4.00 for four checks (a minimum of four checks is required)

Legal Process (IRS levy, state levy or writ of garnishment)

$125.00 per notice (or maximum amount allowed under the law, whichever is less)

1

Incoming Domestic Wire, Incoming International Wire, & Incoming Funds Transfer: No fee for incoming domestic wires, incoming international wires, and incoming funds transfers for Truist Wealth Checking, Truist Wealth

Money Market Account, and Truist Asset Management Account. Truist One Checking account receives one no-fee incoming domestic wire, or one no-fee incoming international wire, or one no-fee incoming funds transfer

per calendar month. However, intermediary financial institutions may deduct fees from incoming international wires, reducing the amount of proceeds credited to your account. Fees may vary.

2

Outgoing Domestic Wire, Outgoing International Wires, & Outgoing Book Transfer: No fee for outgoing domestic wires, outgoing international wires, & outgoing book transfers for Truist Wealth Checking and Truist Wealth

Money Market accounts.

3

Official Checks and Money Orders: There is no charge for Truist Wealth Checking, Truist Asset Management, and Truist One Checking accounts.

Personal Deposit Accounts Fee Schedule

R-FS-2.0 | Effective 03/29/2024

7

Truist Bank, Member FDIC. ©2024 Truist Financial Corporation. Truist and the Truist logo are service marks of Truist Financial Corporation.

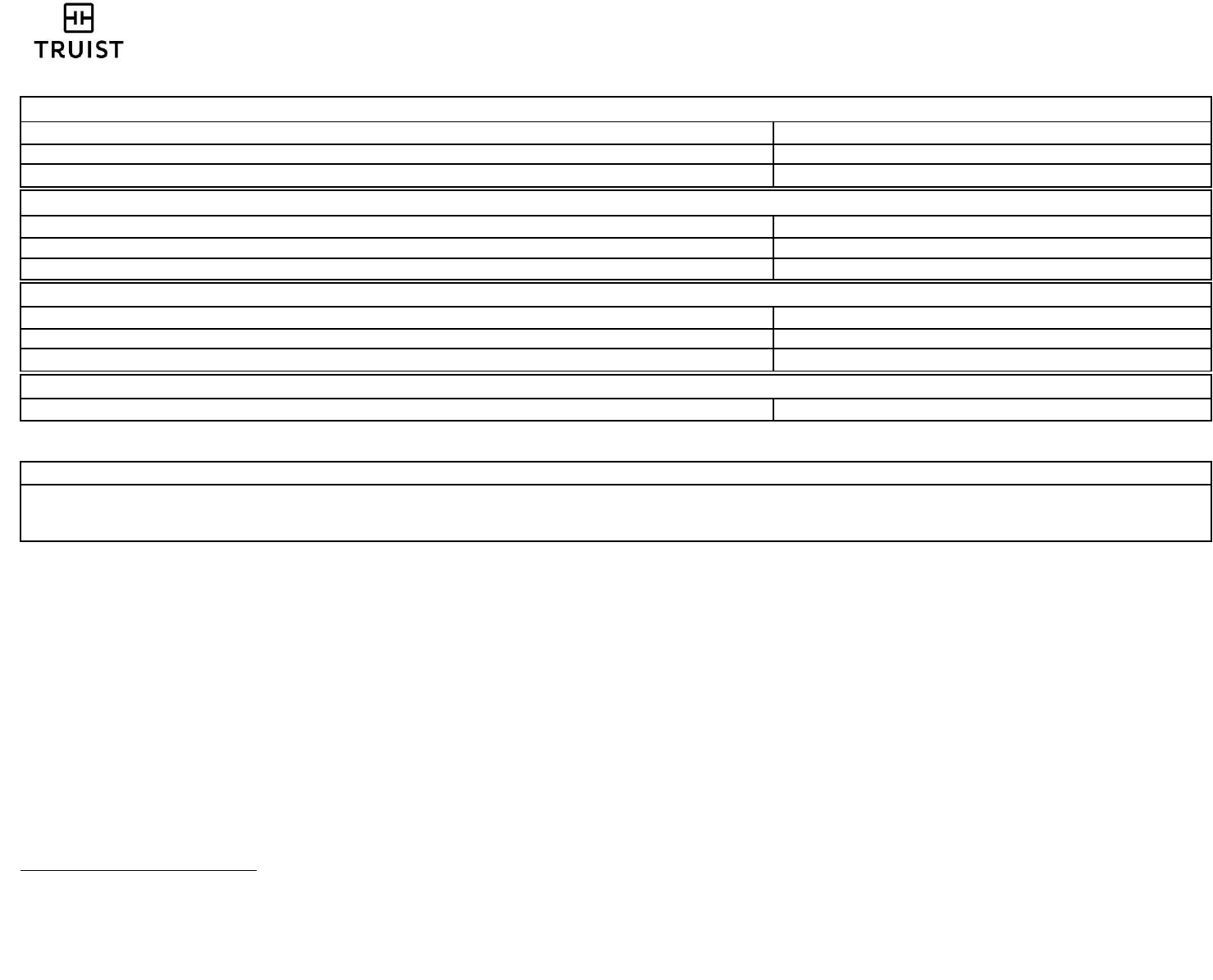

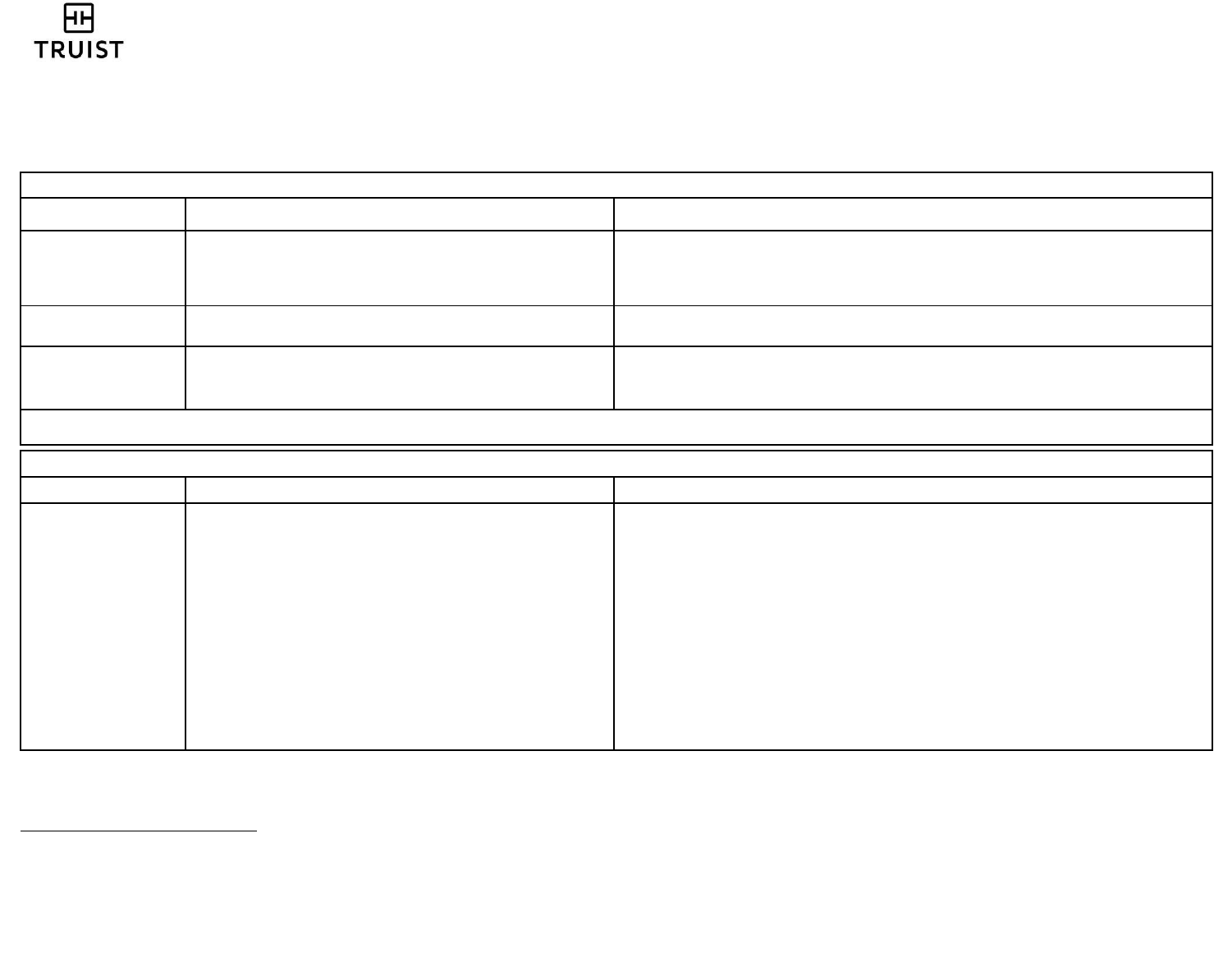

ELECTRONIC BANKING SERVICES

TRUIST DEBIT CARD AND AUTOMATED TELLER MACHINES (ATM) FEES

Withdrawal, balance inquiry or transfer

No fee when using a Truist ATM

Replacement Card - Rush Fee

$30 (Temporary cards cannot be rushed); there is no charge for the replacement card that is sent via Regular Mail. Note: This fee is $15 for Truist Confidence

Account and Truist Confidence Savings Account

TRUIST DEBIT CARDS AND AUTOMATED TELLER MACHINES (ATM) ADDITIONAL INFORMATION

ATM Card

1,2

Debit

3,2

Wealth / AMA Debit

4

Delta SkyMiles

®

Debit Card

5

Non-Truist ATM Fee

6

$3.00 per transaction

7

$3.00 per transaction

7

,

8

No Fee

$3.00 per transaction

8

,

9

Non-Truist International ATM Fee

6

$5.00 per transaction

$5.00 per transaction

No Fee

$5.00 per transaction

9

International Point of Sale (POS),

ATM and Cash Advance; International

Service Assessment Fee

6

3% POS and 3% ATM

3% POS and 3% ATM

3% POS and 3% ATM for AMA

No Fee for Truist Wealth

3% POS and 3% ATM

Daily Withdrawal Limit

$500

$500 Truist One Checking Levels 1 and 2

and all other accounts

$2,500 Truist One Checking Levels 3, 4,

and Premier

$2,000 Truist AMA

$3,000 Truist Wealth

$500 Truist One Checking Levels 1 & 2

$2,500 Truist One Checking Levels 3, 4, &

Premier, Wealth Checking and AMA

Daily Point of Sale Limit

$3,000

$3,000

$10,000 Truist AMA

$25,000 Truist Wealth

$3,000 Truist One Checking

$35,000 Truist Wealth and AMA

Annual Fee

No Fee

No Fee

No Fee

Levels Annual Fee

10

Levels 1 & 2 $95

Levels 3 & 4 $75

Level Premier $25

Wealth Checking and AMA $0

Note

: 1.) Truist reserves the right (either directly or through processors) to provide new debit card numbers (issued due to replacemen t/lost/stolen/natural expiration) to merchants you have authorized to utilize

your current debit card account f or recurring transactions. 2.) Temporary Debit Cards are issued at the branch with the same limits and waivers as the permanent Debit Card .

Note:

If the card (including ATM and debit cards) is used for transactions in a currency other than U.S. dollars, the exchange rate be tween the transaction currency and the billing currency used by VISA® for

processing such foreign transactions is either (a) a rate selected by VISA® from the range of rates available in wholesale currency markets for the applicable transaction processing date, which rate may vary

from the rate VISA® itself receives or (b) the government mandated rate in effect for the applicable transaction processing date, increased by up to three percent (3%). If a credit is subsequently given for a

transaction, it will be decreased by up to three percent (3%). If the credit has a different transaction processing date, the n the exchange rate of the credit can be greater/less than that of the original

transaction. The currency conversion rate on the day before the transaction processing date may differ from the rate in effec t at the time of the transaction or on the date the transaction is posted on the

account. Wealth Checking accounts are exempt from the 3% fee. AMA Checking accounts are subject to the 3% fee. The converted amount shall be provided in U.S. dollars. Plus and Interlink are VISA®

network brands and transactions processed on these networks are also subject to rates detailed above.

1

These limits apply to an ATM card added to any personal savings account. An ATM card may also be added, upon request, to a personal checking account and in lieu of a debit card, and then follows the applicable checking

account limits.

2

Secured Credit Card Savings is not eligible to be used with either Truist Debit or Truist ATM Cards.

3

The Truist Debit card can be added to the following accounts: Truist One Checking, Truist One Money Market and Truist Confidence Accounts.

4

Wealth/AMA Debit Card can be added to the Truist Wealth or Truist AMA Checking accounts to receive unlimited no fee non-Truist fee waivers and surcharge rebates. There is no limit on the surcharge rebates.

5

Delta SkyMiles® Debit Card can be added to Truist One Checking, Truist Wealth Checking and Truist AMA accounts.

6

The non-Truist ATM transaction fee is charged per withdrawal, balance inquiry or transfer when using a non-Truist ATM.

7

Truist Confidence Account and Truist Confidence Savings non-Truist ATM fee is $2.50 per transaction; Truist Confidence Account and Truist Confidence Savings non-Truist ATM fee for balance inquiries is $1.00 per inquiry.

8

Fee waivers for non-Truist ATM Fees for Truist One Checking: Level 1 – no fee waivers and no surcharge rebates; Level 2 – 1 non-Truist ATM fee waivers and 1 surcharge rebates (max $3 each); Level 3 – 3 non-Truist

ATM fee waivers and 3 surcharge rebates (max $3 each); Level 4 – 5 non-Truist ATM fee waivers and 5 surcharge rebates (max $3 each); Level Premier – Unlimited non-Truist ATM fee waivers and surcharge rebates (max

$3 each). Waivers and rebates are per statement cycle for all accounts except Dimension and Truist One Checking which are per calendar month.

9

No Non-Truist ATM Fee or Non-Truist International ATM fee for Truist Wealth Checking and Truist AMA accounts.

10

The Delta SkyMiles® Debit Card annual fee is charged 45 days after the open date of the card. For Truist One Checking accounts, the initial annual fee will be based on the sum of highest monthly average ledger balance

of your combined eligible Truist consumer deposit balances on that date. Eligible Truist consumer deposit balances include all checking, savings, Certificate of Deposit, Individual Retirement Account and/or all consumer

investments through Truist Investment Services, Inc. titled in the owner or the co-owner’s name. Thereafter, for Truist One Checking we will use the highest average monthly ledger balance of the 3 most previous months to

determine your annual fee. Annual fee levels for Truist One Checking are defined as follows: Level 1 & 2) highest 3-month average ledger balance of less than $25,000 is charged an annual fee of $95; Level 3) highest 3-

month average ledger balance of $25,000 and less than $50,000 is charged an annual fee of $75; Level 4) highest 3-month average ledger balance of $50,000 and less than $100,000 is charged an annual fee of $75; Level

Premier) highest 3-month average ledger balance of $100,000 or more is charged an annual fee of $25. Annual fee will be calculated at the end of the month prior to the annual fee being charged. For Truist Wealth and

Truist Asset Management Checking account clients, the annual fee will be discounted to $0. For Delta SkyMiles® cards opened before July 15, 2015, and not associated with a Truist One Checking, Truist Dimension

Checking, or Signature Advantage Checking Account, the annual fee is $95. For clients whose relationship segment changes, the annual fee will be adjusted upon the next annual fee billing date. For more details, please

see the Delta SkyMiles® Terms and Conditions.

Personal Deposit Accounts Fee Schedule

R-FS-2.0 | Effective 03/29/2024

8

Truist Bank, Member FDIC. ©2024 Truist Financial Corporation. Truist and the Truist logo are service marks of Truist Financial Corporation.

ONLINE BANKING AND QUICKEN

Online Banking with Bill Pay

Online Banking

No charge

Bill Pay (Standard)

No charge

Expedited Bill Pay – Same Day Bill Pay (available for select clients)

$4.95

Expedited Bill Pay – Overnight Check (available for select clients)

$14.95

Online External Transfers

1

Transfer from your accounts at other financial institutions

No charge

Standard transfer to your accounts at other financial institutions

$3.00 per transfer

Next day transfer to your accounts at other financial institutions

$6.00 per transfer

Online Wire Transfer Services

2

Wire Service

3

(see Wire Transfer Services for other related fees)

No charge

Outgoing Domestic Wire Transfer

3

$20.00 per transfer

Outgoing Book Transfer

3

$12.00 per transfer

Online Zelle

®

(Person to Person) Transfers

4

Send (Money Transfer to Other People)

No charge

Request (Money Request Sent to Other People)

No charge

Quicken

Quicken

®

- Personal accounts

5

$7.95 per month

Quicken

®

– Combination (used for clients that combine Business and Personal accounts)

$9.95

per

month

CUSTOMER SERVICE

Telephone Banking

844-4TRUIST (844-487-8478)

1

No fee for Truist clients that meet Wealth relationship eligibility requirements.

2

This service is only available for Truist Wealth relationships.

3

Outgoing Domestic Wire & Outgoing Book Transfers: No fee for outgoing domestic wire and outgoing book transfers for Truist Wealth Checking and Truist Wealth Money Market accounts.

4

Must have a bank account in the U.S. to use Zelle®. Transactions typically occur in minutes between enrolled users. If a recipient is not enrolled with Zelle®, it could take one to three business days to receive the money

once the enrollment is completed. To receive money in minutes, the recipient’s email address or U.S. mobile number must already be enrolled with Zelle®. The minimum payment required is $1. Other limitations may apply.

Money transfer transactions that are in process cannot be cancelled or stopped. However, if a recipient is not yet enrolled with Zelle® you may have the opportunity to stop the transaction.

5

No fee Quicken® access for Wealth Checking and Truist AMA accounts. Quicken® is a product of Intuit, Inc.

Personal Deposit Accounts Fee Schedule

R-FS-2.0 | Effective 03/29/2024

9

Truist Bank, Member FDIC. ©2024 Truist Financial Corporation. Truist and the Truist logo are service marks of Truist Financial Corporation.

Addendum to Truist Personal Deposit Accounts Fee Schedule

As of April 25, 2022, the fees noted below have been updated to reflect the new pricing. Although the references to fees may not have been updated in Online and Mobile banking, your

account will be charged in accordance with the pricing below.

For more information about these fees, please visit your local Truist branch or call us at 844.4TRUIST (844-487-8478).

Overdraft Fees

Fee Changes Starting April 25

th

Fee Structure Prior to April 25

th

Overdraft (OD)

$36.00 per item, per occurrence

1

•

Truist will limit total Overdraft Fees to three (3) per day.

•

Truist will waive Overdraft Fees on transactions that are less than $5.

$36.00 per item, per occurrence

2

•

Truist will limit total Overdraft / Returned Item Fees to six (6) per day.

•

Truist will waive Overdraft / Returned Item Fees on transactions that are less than $5.

Negative Account

Balance Fee

No charge

$36.00

3

Returned Item Fee

No charge

$36.00

•

Truist will limit total Overdraft / Returned Item Fees to six (6) per day.

•

Truist will waive Overdraft / Returned Item Fees on transactions that are less than $5.

These fees do not apply to Truist One Checking, Truist One Savings, Truist One Money Market, Truist Confidence, and Truist Confidence Savings accounts.

Overdraft Protection

Starting April 25

th

Prior to April 25

th

Overdraft Protection

Transfer

No Transfer Fee

•

For all accounts linked to a checking, savings, money market

account, credit card or line of credit, the amount transferred is the

exact amount of the overdraft. (Based on balance availability).

•

For accounts linked to a line of credit or credit card, funds advanced

for Overdraft Protection are subject to fees and finance charges

under your line of credit or credit card agreement.

$12.50 transfer fee (charged to the protected account)

•

Maximum one (1) fee charged per day per linked protected account.

•

For all accounts linked to a checking, savings, money market account, credit card or line of

credit, the amount transferred is the exact amount of the overdraft plus the Overdraft Protection

Transfer fee (based on balance availability).

•

For accounts linked to a line of credit or credit card, funds advanced for Overdraft Protection are

subject to fees and finance charges under your line of credit or credit card agreement, in addition

to the Overdraft Protection Transfer fee. Please see your agreement for more information.

•

Two Overdraft Protection Transfers at no charge for Truist Focus Checking per statement cycle

and the fee is then discounted to $9.00 (instead of the $12.50) per transfer during the same

statement cycle.

•

Dimension Select (Tier 2) receives one no-fee overdraft transfer per statement cycle. Dimension

Premier (Tier 3), Truist Wealth Checking and Truist AMA receive unlimited no fee overdraft

transfers.

1

Overdraft (OD) Fee: This fee applies to overdrafts created by checks, in-person withdrawals, ATM withdrawals, or other electronic means. Truist Wealth Checking and Truist Wealth Money Market accounts are not charged.

One Overdraft fee will be waived per statement cycle for Truist Asset Management Accounts.

2

Overdraft (OD)/Returned Item Fee: This fee applies to overdrafts created by checks, in-person withdrawals, ATM withdrawals, or other electronic means. Truist Wealth Checking and Truist Wealth Money Market accounts

are not charged. One Overdraft/Returned Item will be waived per month for Truist Asset Management Accounts.

3

Negative Account Balance Fee: This fee will be imposed one time when y our posted (ledger) account balance remains overdrawn for seven consecutive calendar days. Truist starts counting on the day your posted (ledger)

balance becomes negative. If the 7th calendar day falls on any non-bank processing day, the fee will be charged on the next posting day. For clients that decline Overdraft Coverage, this fee can still be charged, but

excludes ATM and everyday debit card transactions. Truist Wealth Checking and Truist Wealth Money Market accounts are not charged.

Personal Deposit Accounts Fee Schedule

10

Truist Overdraft Decision Notice

This Notice is only applicable for consumer deposit accounts.

Note: This Notice does not apply to Truist One and Truist Confidence Deposit Accounts

What You Need to Know about Overdrafts and Overdraft Fees

An overdraft occurs when you do not have enough money (available balance ) in your account to cover a transaction, but the bank pays it as a courtesy. Truist can cover your overdrafts in

two different ways:

1

1. We have standard overdraft practices that come with your account.

2. We also offer Overdraft Protection plans, such as a link to a savings, money market, or another checking account, line of credit, or credit card, which may be less expensive than our

standard overdraft practices.

The remainder of this notice explains our standard overdraft practices.

What are the standard overdraft practices that come with my account?

Unless you request this specific Overdraft Coverage service, Truist Will not be allowed to pay overdrafts and asses a fee for:

•

ATM Transactions

•

Everyday debit card transactions

2

(also known as one-time debit card transactions)

Your request allows Truist to consider paying the overdraft for which you will incur a fee. This is your choice. If you do not request this service, or if Truist chooses not to authorize the

overdraft, your transaction will be declined.

The following types of transactions are not affected by your request. We may authorize and pay overdrafts on these transactions and fees may be incurred.

•

Checks and other transactions made using your checking account number

•

Automatic Bill Payments

Truist pays overdrafts at its discretion, which means that we do not guarantee that we will always authorize and pay any type of transaction. If we do not authorize and pay an overdraft,

your transaction will be declined or returned.

What fees will I be charged if Truist pays my overdraft?

Under Truist’s Overdraft Coverage service:

•

Truist will charge you an Overdraft Fee of $36 each time we pay an overdraft on your behalf.

•

Truist limits the total number of Overdraft fees to three (3) per day.

•

Truist will waive overdraft item fees for transactions that are less than $5.00.

Truist Bank, Member FDIC. ©2024 Truist Financial Corporation. Truist and the Truist logo are service marks of Truist Financial Corporation.

R-FS-2.0 | Effective 03/29/2024

How do I change my decision for Overdraft Coverage?

To change your Overdraft Coverage decision at any time, you may submit a request in one of the following ways:

•

Log in to Truist Mobile - Select the applicable account, tap on More, Manage overdraft options, and go to Overdraft Coverage to make your Overdraft Coverage decision

•

Log in to online banking at Truist.com - Select the applicable account, click More, Overdraft services, and go to Manage Overdraft Coverage to make your Overdraft Coverage

decision

•

Call 844-4TRUIST - For touch-tone users, choose options 1, 6 and follow the prompts, or if you’re using speech, simply say “Overdraft Coverage”

Your decision will be effective the next business day. Your decision will be effective until you make another decision for this account.

If you do not request Overdraft Coverage, we will automatically decline all of your ATM transactions and everyday debit card transactions that would overdraw your account.

1

Your available balance is the money in your checking or savings account that is currently available to you to make purchases, withdrawals, etc. It reflects any processed and pending transactions, as well as any holds. For

more information about how your available balance is calculated and when/how overdraft fees may be assessed, please visit Truist.com/thefacts.

2

We rely on transaction coding sent to us by the merchant or other third-party to determine whether your debit card transaction is one-time or recurring, which affects whether or not we would authorize these transactions at

our discretion and whether fees may be assessed.