3 February 2022

ESMA50-165-1948

EU Alternative

Investment Funds

ESMA Annual Statistical Report 2022

ESMA Annual Statistical Report on EU Alternative Investment Funds 2022 2

ESMA Annual Statistical Report on EU Alternative Investment Funds

2022

© European Securities and Markets Authority, Paris, 2022. All rights reserved. Brief excerpts may be reproduced or translated

provided the source is cited adequately. The reporting period of this document is 31 December 2020, unless indicated otherwise.

Legal reference of this report: Regulation (EU) No 1095/2010 of the European Parliament and of the Council of 24 November

2010 establishing a European Supervisory Authority (European Securities and Markets Authority), amending Decision

No 716/2009/EC and repealing Commission Decision 2009/77/EC, Article 32 ‘Assessment of market developments’, 1. ‘The

Authority shall monitor and assess market developments in the area of its competence and, where necessary, inform the

European Supervisory Authority (European Banking Authority), and the European Supervisory Authority (European Insurance

and Occupational Pensions Authority), the ESRB and the European Parliament, the Council and the Commission about the

relevant micro-prudential trends, potential risks and vulnerabilities. The Authority shall include in its assessments an economic

analysis of the markets in which financial market participants operate, and an assessment of the impact of potential market

developments on such financial market participants.’ This report contributes to ESMA’s risk assessment activities. The report and

its contents do not prejudice or impair ESMA’s regulatory, supervisory or convergence activities, nor the obligations of market

participants thereunder. Charts and analyses in this report are based on data provided by national competent authorities to ESMA

under the Alternative investment fund managers directive (AIFMD). ESMA uses these data in good faith and does not take

responsibility for their accuracy or completeness. ESMA is committed to constantly improving its data sources and reserves the

right to alter data sources at any time.

European Securities and Markets Authority (ESMA)

Risk Analysis and Economics Department

201-203 rue de Bercy

FR–75012 Paris

risk.analysis@esma.europa.eu

ESMA Annual Statistical Report on EU Alternative Investment Funds 2022 3

Table of contents

Executive summary 4

Market monitoring 8

EU AIF market 9

Brexit implications for AIF statistics 16

Funds of Funds 19

Real Estate Funds 24

Hedge Funds 28

Private Equity Funds 32

Other AIFs 35

Non-EU AIFs (NPPR) 40

Statistics 45

EU AIF market 46

Funds of Funds 52

Real Estate Funds 55

Hedge Funds 59

Private Equity Funds 63

‘Other AIFs’ 67

Non-EU AIFs (NPPR) 71

Annex 75

EU AIFMD data reporting 76

Data inventory 78

List of abbreviations 80

ESMA Annual Statistical Report on EU Alternative Investment Funds 2022 4

Executive summary

Market structure and developments

The EU Alternative Investment Funds (AIF) market: The size of the EU AIF universe (using data from

the 30 members of the European Economic Area, EEA30) continued to expand to reach EUR 5.9tn in

net asset value (NAV) at the end of 2020, an 8% increase from 2019. The growth of the AIF market

results from the launch of new AIFs in 2019 and positive valuation effects. Overall, AIFs accounted for

one-third of the EEA30 fund industry at the end of 2020. Among AIF types, Funds of Funds (FoFs)

account for 15% of the NAV, followed by Real Estate (RE) funds (13%), Private Equity (PE) funds (5%)

and Hedge Funds (HFs) (2%). The small share of HFs compared with 2019 is explained by the fact that

UK data have not been included (see editorial note for an explanation of Brexit implications for this

report), while in 2019 UK AIFs accounted for 75% of HFs NAV. The category of ‘other AIFs’ accounts

for 62% of the NAV, pointing to continued classification issues for Alternative Investment Fund

Managers (AIFMs). Professional investors own most of the shares of AIFs, yet retail investor share is

significant at 14% of the NAV, with more retail participation in RE funds (24%) and FoFs (19%). AIFs

invest predominantly in the EEA and across a broad range of asset classes (securities, derivatives and

funds). At the aggregate level, adjusted leverage declined to 128% of NAV (compared with 145% in

2019). Overall, there are signs of potential liquidity mismatch, as the liquidity offered to investors is

generally greater than the liquidity of the assets, especially for RE funds. While at aggregate level this

mismatch is unlikely to materialise, it indicates that AIFs with a liquidity deficit would face challenges if

large redemptions were to occur.

Funds of Funds: FoFs account for 15% of the NAV of EEA30 AIFs, at around EUR 0.9tn (+4% compared

with 2019). Among AIF types, FoFs have the second largest retail investor participation at 20% of NAV.

Open-ended FoFs remain exposed to significant liquidity mismatch across all time horizons, including

FoFs investing mainly in UCITS. The potential liquidity shortage for FoFs with a liquidity deficit is 16%

of their NAV in the short term (i.e. within one week).

Real Estate Funds: RE funds account for 13% of the NAV of EEA30 AIFs, at EUR 766bn. RE funds

continued to grow in 2020, albeit at a more moderate pace (+9% compared with 2019). The proportion

of retail investors has continued to grow to reach 24%, the highest among AIF types. While leverage

remains limited, liquidity risk in RE funds is a concern: around 54% are open-ended, and 40% of

Commercial Real Estate (CRE) funds by NAV offer daily liquidity to investors. At the aggregate level,

RE funds face liquidity mismatch across all time periods, an indication of a structural vulnerability as

the maturities of assets and liabilities are not aligned.

Hedge Funds: With the departure of the UK from the EU, the size of the EEA30 HF sector has

plummeted to only EUR 89bn (2% of the NAV of all AIFs), from EUR 354bn in 2019 (including the UK).

EEA30 HFs have widespread access to the EU passport and are mainly domiciled in Ireland and

Luxembourg. Leverage is very high, particularly for some strategies highly reliant on derivatives. HFs

using derivatives tend to maintain large, unencumbered cash positions, possibly to meet future margin

calls relating to derivatives positions. HFs are exposed to limited liquidity mismatch, as their assets can

be liquidated quickly to meet investor redemptions. However, HFs are exposed to financing risk, as for

some strategies more than half of their funding is overnight, implying potential rollover risk.

Private Equity Funds: PE funds account for 6% of the NAV of all EEA30 AIFs, or EUR 363bn. Among

AIF types, PE funds contributed remarkably to the growth of the AIF sector in 2020 (+29% compared

with 2019), together with ‘other AIFs’. They follow a range of strategies and are almost exclusively sold

to professional investors. PE funds invest mainly in illiquid securities (unlisted securities), but liquidity

risk is limited given that PE funds are overwhelmingly closed-ended.

Other AIFs: ‘Other AIFs’ account for 62% of the NAV of EEA30 AIFs, at around EUR 3,650bn (+4%

compared with 2019). This category of the AIFMD reporting regime covers a range of strategies, with

fixed income and equity strategies accounting for 68% of the NAV and an additional residual category

amounting to 28%. ‘Other AIFs’ are mainly sold to professional investors, although there is a significant

retail investor presence in the residual category. They make little use of financial or synthetic leverage.

ESMA Annual Statistical Report on EU Alternative Investment Funds 2022 5

Although most types of ‘other AIFs’ have a limited liquidity risk at aggregate level, some funds in this

residual category may be subject to liquidity deficits.

AIFs managed by Non-EU AIFMs: EU Member States can allow non-EU asset managers to market

alternative funds at national level under the National Private Placement Regime (NPPR), even though

such funds cannot be passported to other EU Members States. The market for such non-EU funds is

comparatively large: The NAV of non-EU AIFs marketed under NPPR rules amounts to EUR 1.3tn, i.e.

more than one-fifth of the AIF market. NPPR fund marketing is concentrated in a small number of

Member States, and more than 99% of investors are professional investors. Hedge funds marketed

under the NPPR are predominantly domiciled in the Cayman Islands, while ‘other AIFs’ marketed under

the NPPR are predominantly US-based exchange-traded funds (ETFs). Overall, risk profiles for NPPR

funds are comparable to EEA30 AIFs. However, the geographical investment focus is different as NPPR

funds invest predominantly in non-EU areas.

Editorial note

Brexit implications for EU AIF statistics: The UK asset management industry was an important part of

the EU single financial market, and with that also of the EU AIF market. Statistics presented in this

report fall after the withdrawal of the United Kingdom from the EU on 31 January 2020. Although the

EU laws continued to apply to the UK until the end of the transition period on 31 December 2020, it was

not possible to collect data covering this period. Since this report uses end-year data, all the data used

were transmitted to ESMA during the course of 2021, i.e. after the departure of the UK from the EU,

making the transmission of UK data not feasible. Therefore, our statistics are constructed from data

reports provided by entities authorised or registered in the Member States of the EEA post-Brexit

(calculated on a constant perimeter of EEA30). Starting with this edition of this ASR series, we show

statistics of the EU AIF market after Brexit. All the data in this report refer to EEA30 (EU27 and Iceland,

Liechtenstein and Norway) and therefore exclude the UK, including for years before 2020. All time

series have been adjusted retroactively and the UK is counted out consistently over time. Comparisons

with statistics we had published in earlier editions are, therefore, limited. A dedicated section discusses

the implications of Brexit for AIF statistics.

ESMA Annual Statistical Report on EU Alternative Investment Funds 2022 6

EEA30 AIFs: Essential statistics

Funds of

Funds

Real

Estate

Hedge

Funds

Private

Equity

Other

AIFs

Total

Size

Number of funds

(Absolute number)

5,362

3,978

930

4,992

14,324

30,035

Number of leveraged funds

(Absolute number)

250

1,439

345

136

2,124

4,345

Net Asset Value

(EUR bn)

873

766

89

363

3,652

5,899

Average fund size

(EUR mn per fund)

163

190

96

73

255

195

Proportion of total market

(NAV % of all AIFs)

15%

13%

2%

6%

62%

Distribution

EU passport

(% of total)

90%

84%

76%

51%

86%

80%

Retail participation

(% of total)

19%

23%

10%

6%

10%

13%

Exposures

Main exposures

(Asset type)

CIU

PA

IRD

S

S

DER

Main exposures

(% of exposures)

72%

69%

40%

84%

64%

24%

Leverage

Gross leverage

(% of NAV)

120%

141%

548%

117%

154%

151%

Adjusted leverage

(% of NAV)

119%

138%

327%

116%

141%

139%

Borrowing

(% of NAV)

9%

12%

250%

5%

22%

21%

Liquidity

Open ended AIFs

(% of total NAV)

69%

56%

76%

4%

78%

70%

Monthly portfolio liquidity

(% of NAV)

56%

3%

34%

2%

68%

55%

Monthly investor liquidity

(% of NAV)

70%

17%

37%

14%

72%

61%

Note: All values refer to AIFs managed and/or marketed by EEA30 AIFMs at the end of 2020, AIFs reported to ESMA by National Competent

Authorities (NCAs). AIFs sold under a National Private Placement Regime (NPPR) are excluded. Statistics for all EEA30 AIFs include 449 funds

with no predominant type, for which NAV amounts to EUR 155bn. Leveraged funds are identified using the AIF reporting code as specified in the

Annex 2 of ESMA guidelines on AIFMD reporting obligations. Open ended AIFs are funds that issue shares which are redeemable on demand by

investors. CIU=collective investment units; PA=Physical assets; IRD=Interest rate derivatives; S=Securities. DER=Derivatives. Data for the EEA30.

Sources: AIFMD database, National Competent Authorities, ESMA.

ESMA Annual Statistical Report on EU Alternative Investment Funds 2022 7

EEA30 AIFs: Gross notional exposures

Asset class

Asset type

2019

EUR bn

2020

EUR bn

Share

% of 2020 exposures

Securities

3,553

3,754

48%

Among which

Non-financial listed equities

777

847

11%

EU sovereign bonds

672

697

9%

IG financial bonds

336

341

4%

IG corporate bonds

311

301

4%

Loans

289

297

4%

Other cash and cash equivalent

274

295

4%

Unlisted equities

172

236

3%

Non-investment-grade financial bonds

86

130

2%

Financial listed equities

123

103

1%

Non-G10 sovereign bonds

101

101

1%

Deposits

73

83

1%

Leveraged loans

78

76

1%

G10 sovereign bonds

61

53

0.7%

Other structured products

41

47

0.6%

MBS

48

35

0.5%

Non-investment-grade corporate bonds

29

29

0.4%

Non-financial convertible bonds

17

20

0.3%

CDO/CLO

18

22

0.3%

Municipal bonds

20

21

0.3%

ABS

18

15

0.2%

Financial convertible bonds

8

4

0.1%

Derivatives

2,769

1,950

25%

Among which

Foreign exchange derivatives

618

686

9%

Interest rate derivatives

735

671

9%

Fixed income derivatives

241

223

3%

Equity derivatives

233

152

2%

Credit derivatives

117

124

2%

Other derivatives

785

58

0.8%

Commodity derivatives

40

36

0.5%

Collective Investment Undertakings

1,241

1,311

17%

Among which

Investment funds (excl. ETFs and

MMFs)

1102

1143

15%

ETFs

69

92

1%

MMFs

70

76

1%

Physical assets

547

641

8%

Among which

Physical real estate

539

629

8%

Other physical assets

9

12

0.2%

Other assets

96

134

2%

Total exposures

8,206

7,791

100%

Note: Gross notional exposures represent the gross market exposure of a fund which is calculated by summing the absolutes values of the notional

amounts of a fund’s derivatives and the value of the fund’s other investments. Exposures can be long (when an increase in price leads to an

increase in the NAV of the fund) or short (when an increase in price leads to a decrease in the NAV of the fund). Gross exposures measure the

investment funds’ absolute exposures (long and short). All values refer to AIFs managed and/or marketed by EEA30 AIFMs at the end of 2020,

AIFs reported to ESMA by National Competent Authorities (NCAs). AIFs sold under a National Private Placement Regime (NPPR) are excluded.

Statistics for all EEA30 AIFs include 449 funds for which no fund type has been specified by the AIFM, for a NAV of EUR 155bn. Data for the

EEA30.

Sources: AIFMD database, National Competent Authorities, ESMA.

ESMA Annual Statistical Report on EU Alternative Investment Funds 2022 8

Market monitoring

ESMA Annual Statistical Report on EU Alternative Investment Funds 2022 9

EU AIF market

Summary

The size of the EU AIF universe (using data from the 30 members of the European Economic Area,

EEA30) continued to expand to reach EUR 5.9tn in net asset value (NAV) at the end of 2020, an 8%

increase from 2019. The growth of the AIF market results from the launch of new AIFs in 2019 and

positive valuation effects. Overall, AIFs accounted for one-third of the EEA30 fund industry at the end

of 2020. Among AIF types, Funds of Funds (FoFs) account for 15% of the NAV, followed by Real Estate

(RE) funds (13%), Private Equity (PE) funds (5%) and Hedge Funds (HFs) (2%). The small share of

HFs compared with 2019 is explained by the fact that UK data have not been included, while in 2019

UK AIFs accounted for 75% of HFs NAV. The category of ‘other AIFs’ accounts for 62% of the NAV,

pointing to continued classification issues for Alternative Investment Fund Managers (AIFMs).

Professional investors own most of the shares of AIFs, yet retail investor share is significant at 14% of

the NAV, with more retail participation in RE funds (24%) and FoFs (19%. AIFs invest predominantly in

the EEA and across a broad range of asset classes (securities, derivatives and funds). At the aggregate

level, adjusted leverage declined to 128% of NAV (compared with 145% in 2019). Overall, there are

signs of potential liquidity mismatch, as the liquidity offered to investors is generally greater than the

liquidity of the assets, especially for RE funds. While at aggregate level this mismatch is unlikely to

materialise, it indicates that AIFs with a liquidity deficit would face challenges if large redemptions were

to occur..

Market size and structure

All the data in this report refer to the EEA30

(EU27 and Iceland, Liechtenstein and Norway),

hence UK data are excluded, also for years

before Brexit. The AIF industry continued to

expand in 2020 in the EEA30, with an 8%

increase from 2019, to reach a NAV of around

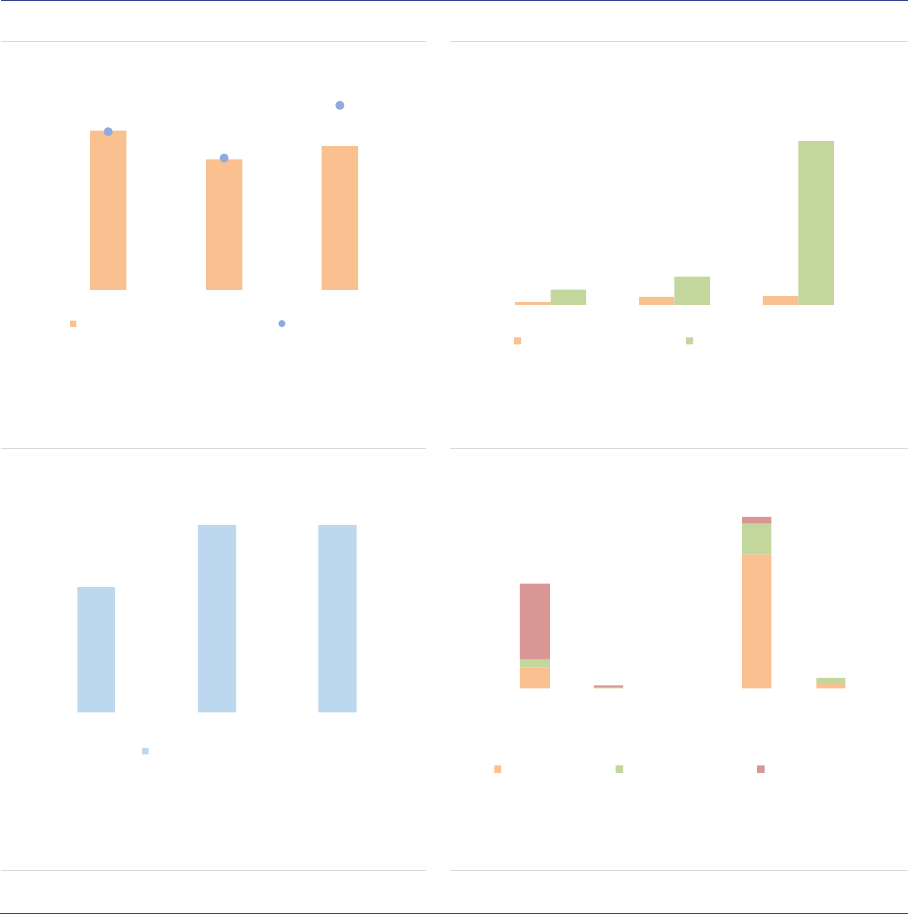

EUR 5.9tn at the end of 2020 (ASR-AIF.1). By

comparison, the NAV of Undertakings for the

Collective Investment in Transferable Securities

(UCITS) amounted to EUR 11.6tn at the end of

2020, according to the European Fund and Asset

Management Association (EFAMA). Overall,

AIFs therefore account for one-third of the EEA30

fund industry.

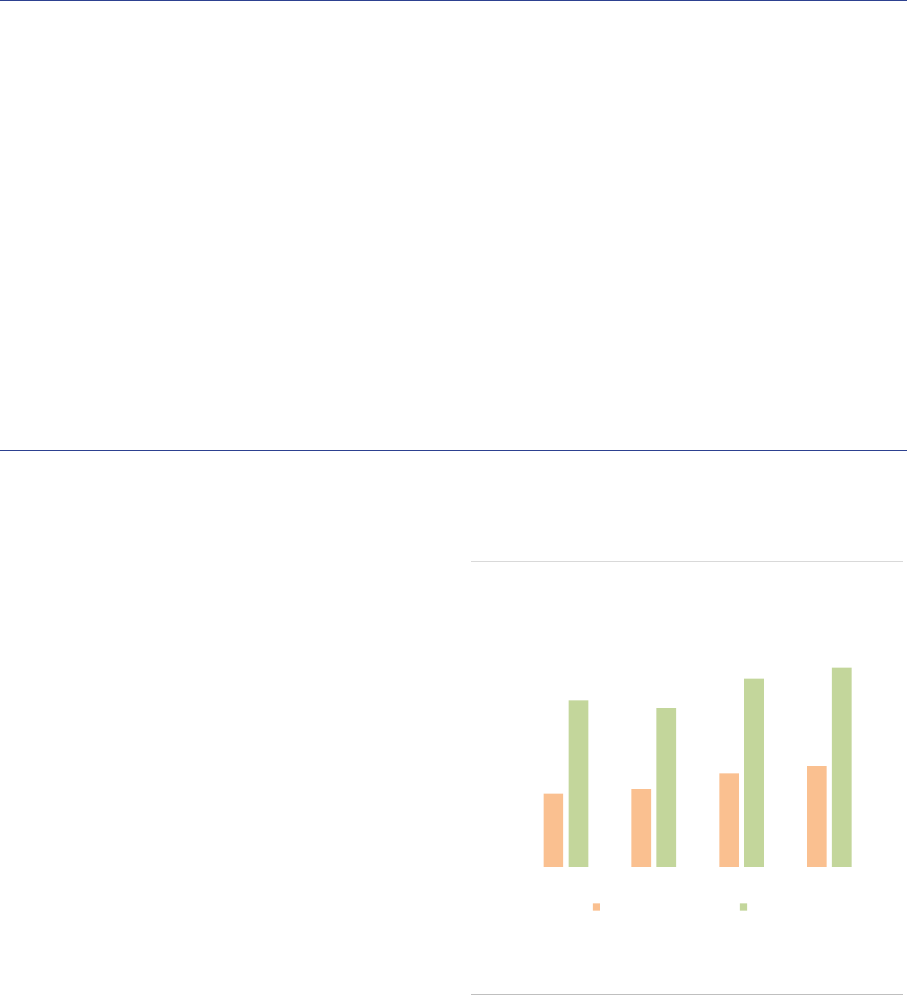

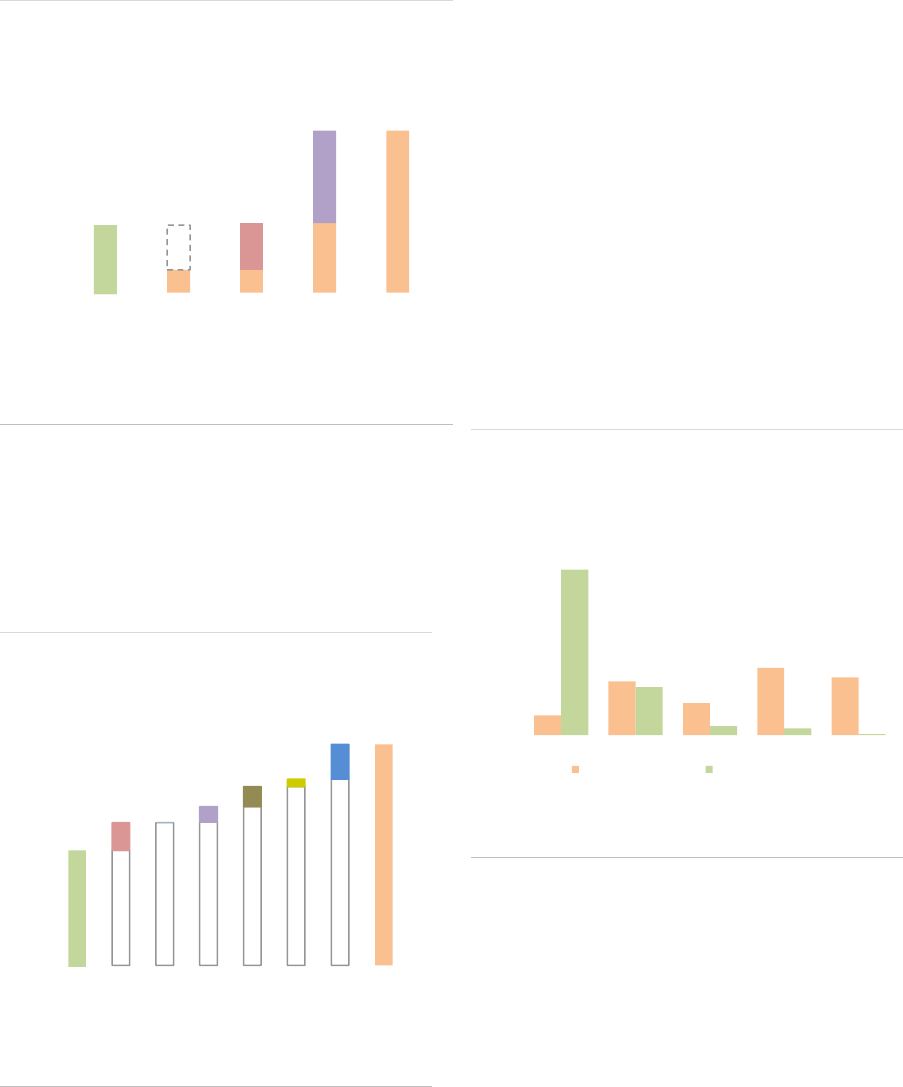

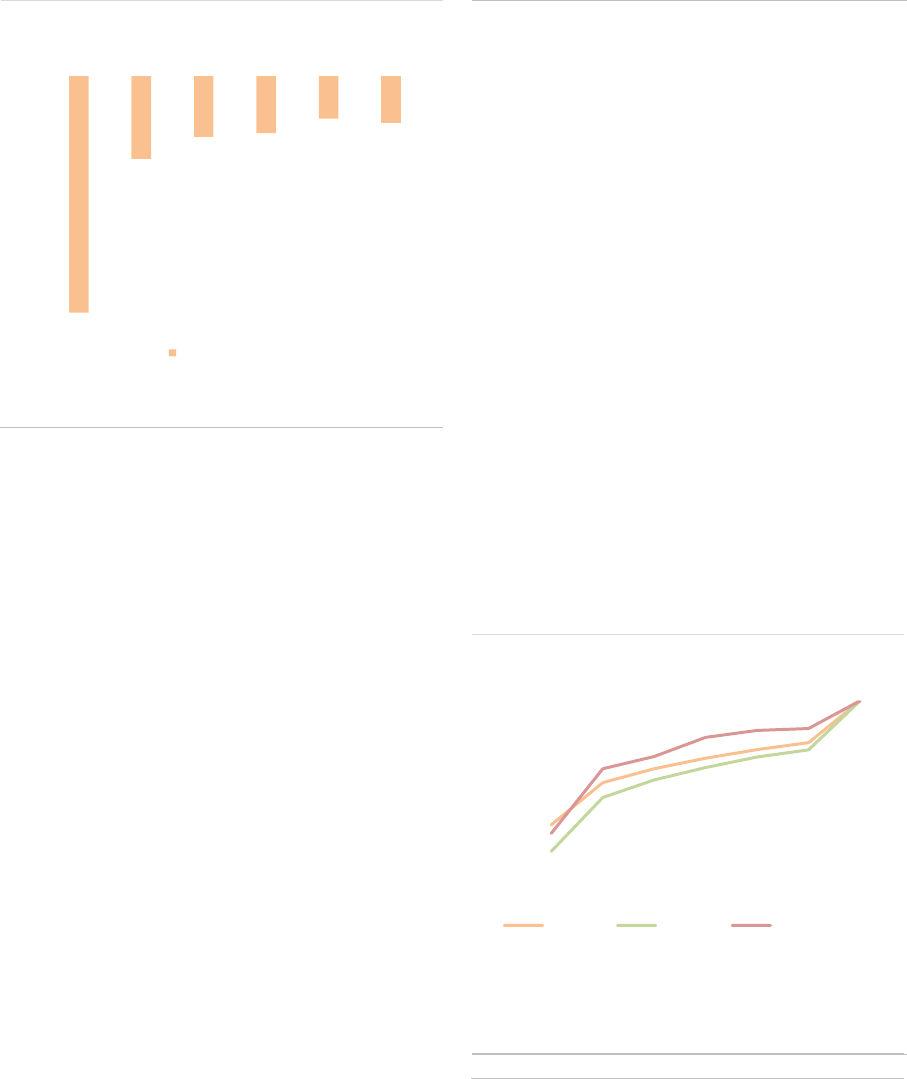

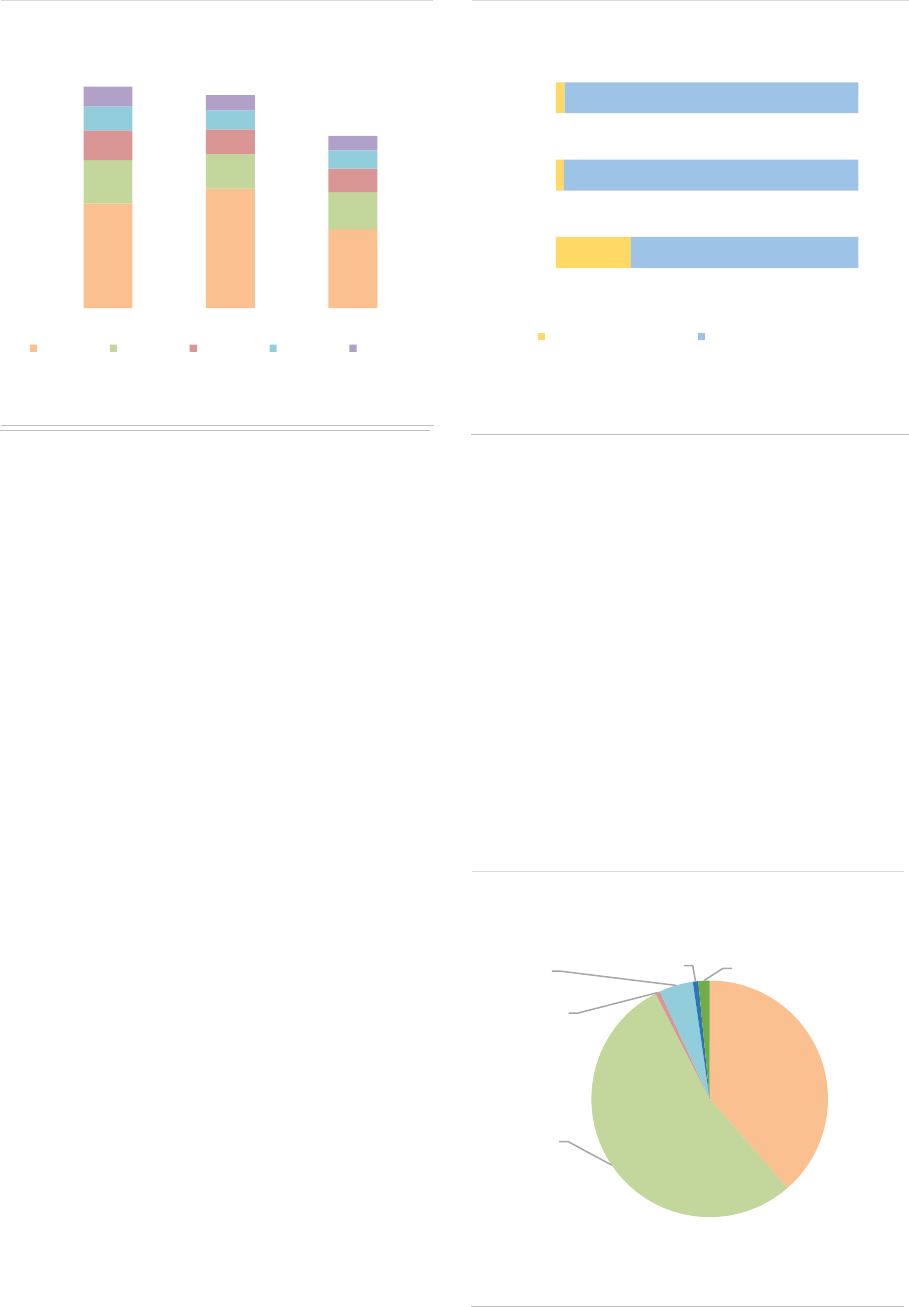

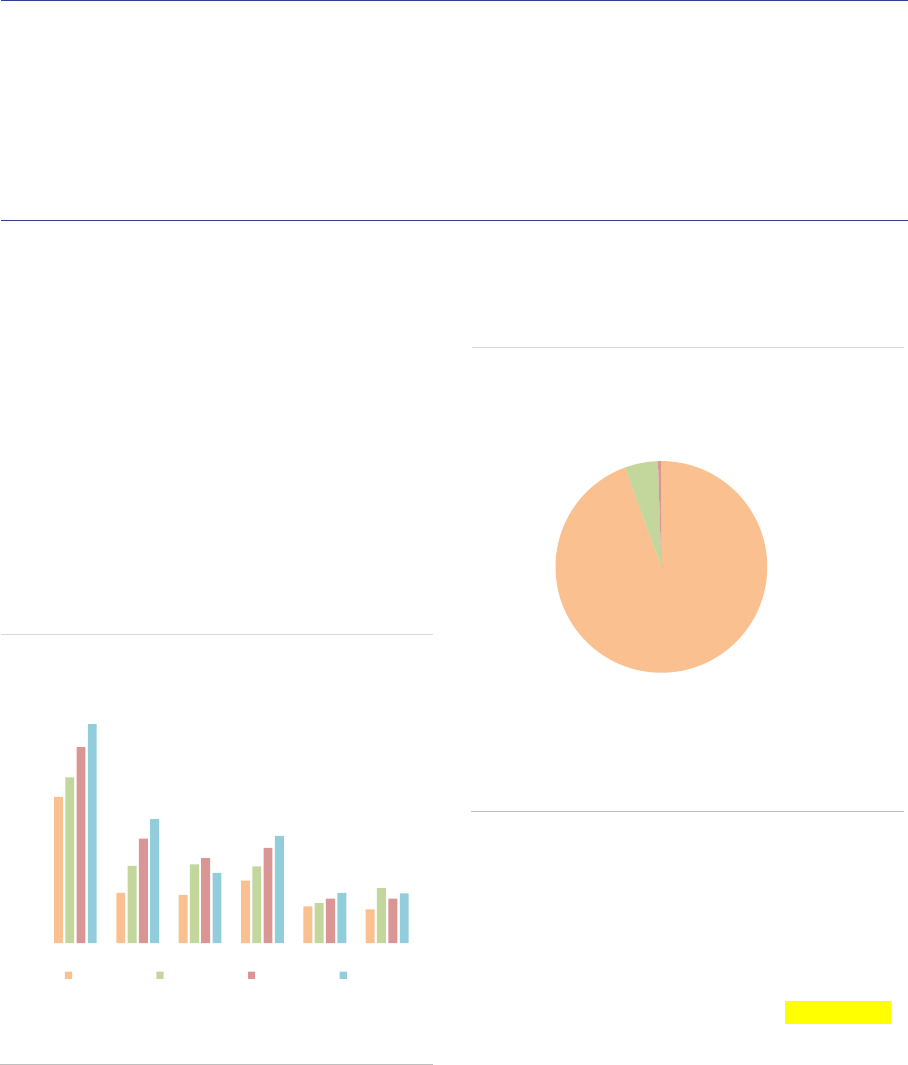

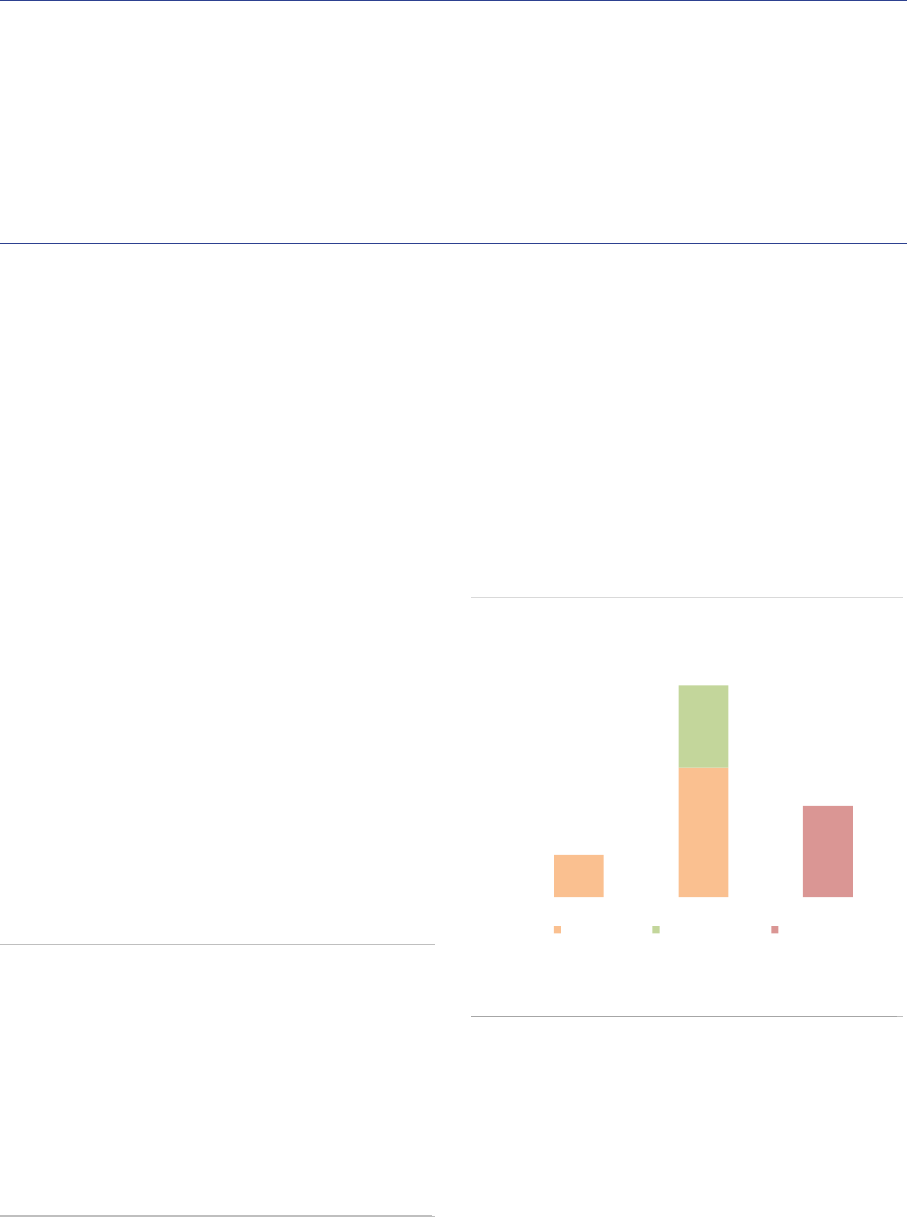

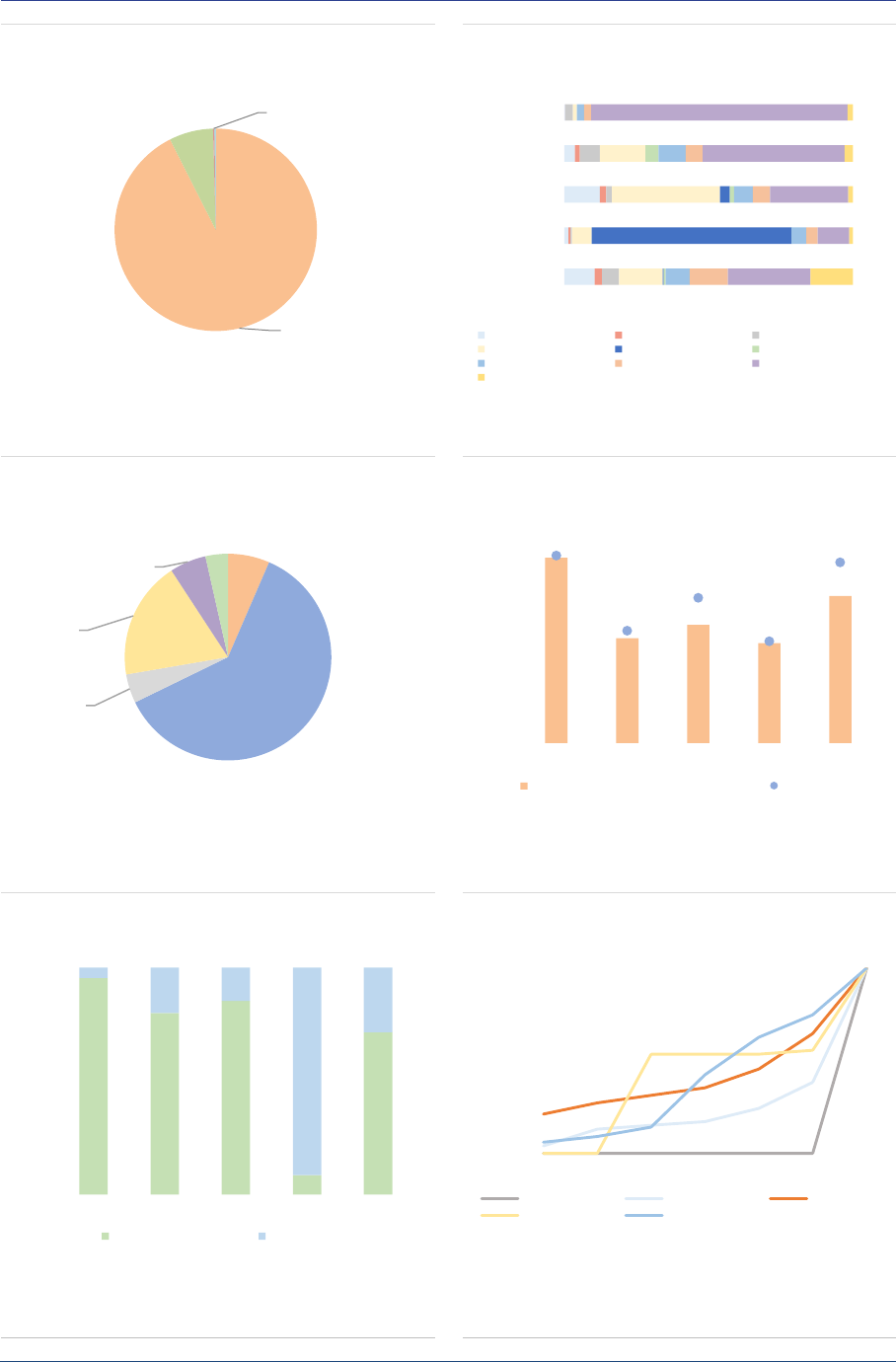

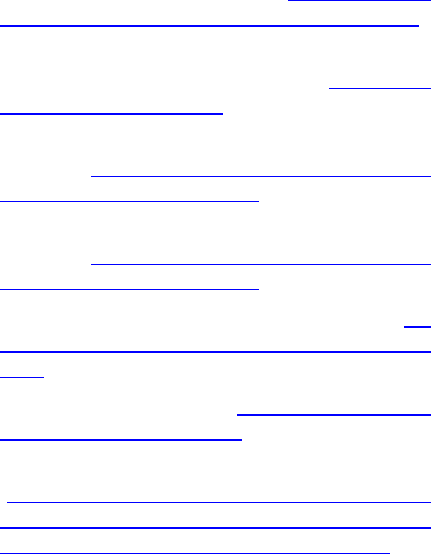

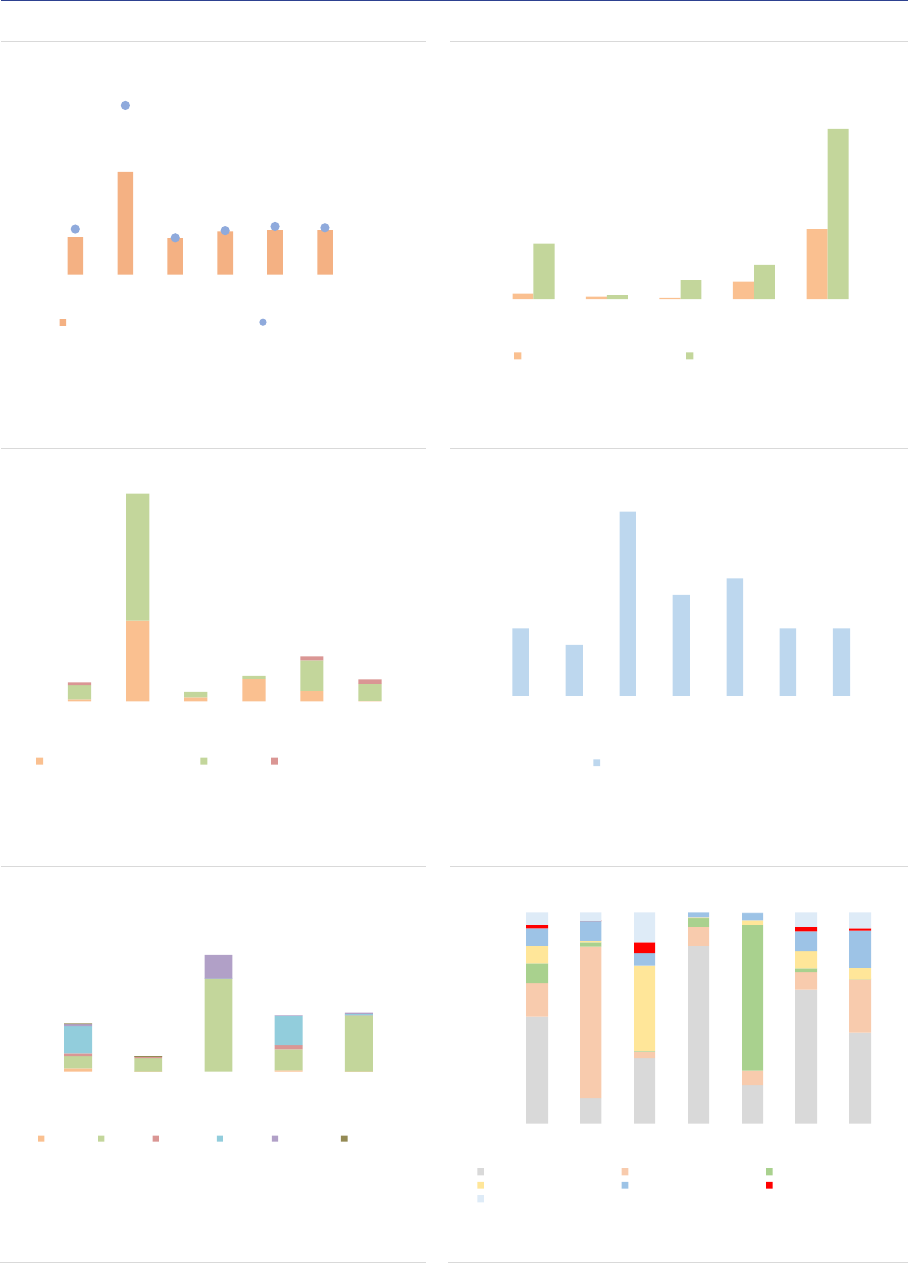

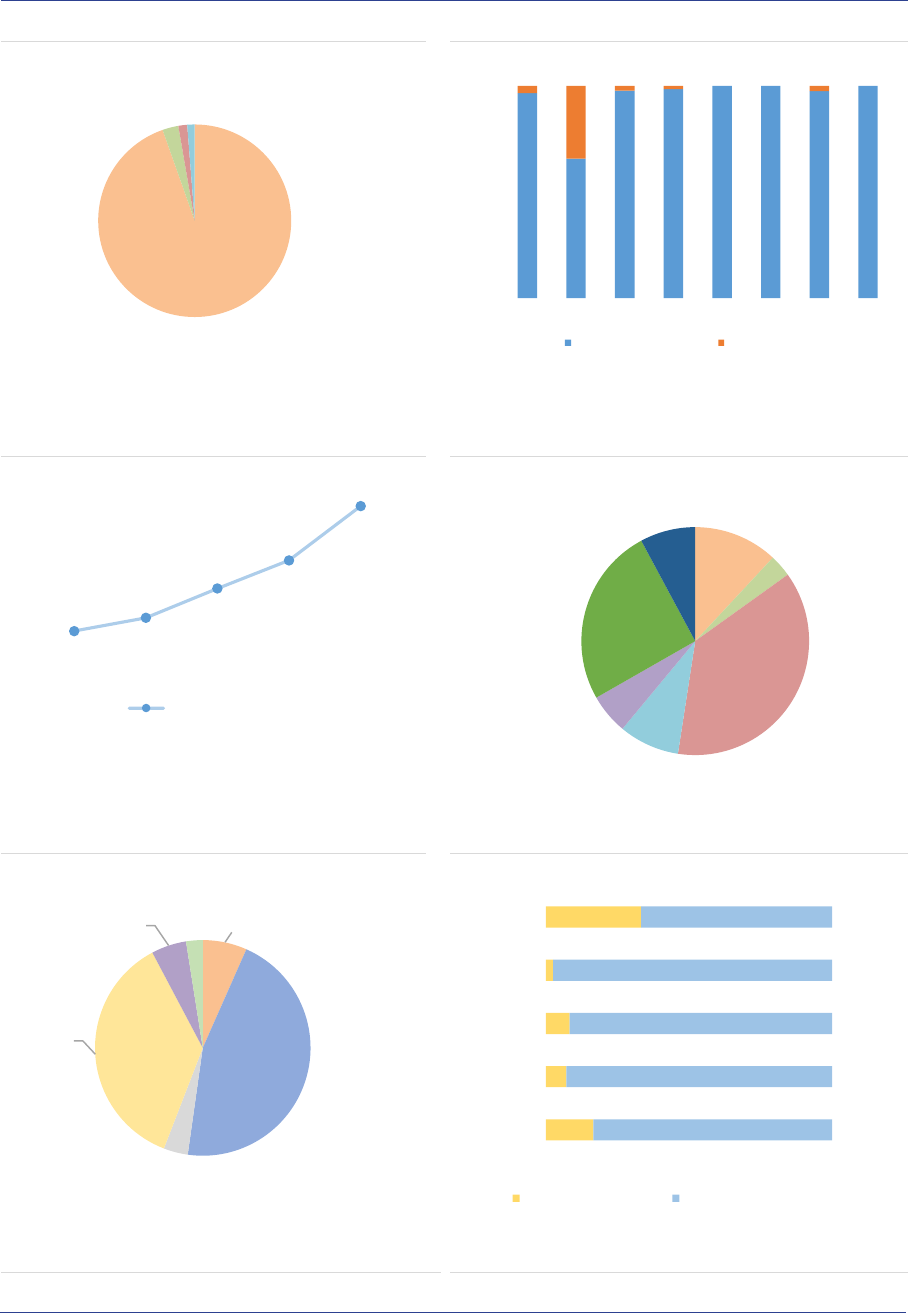

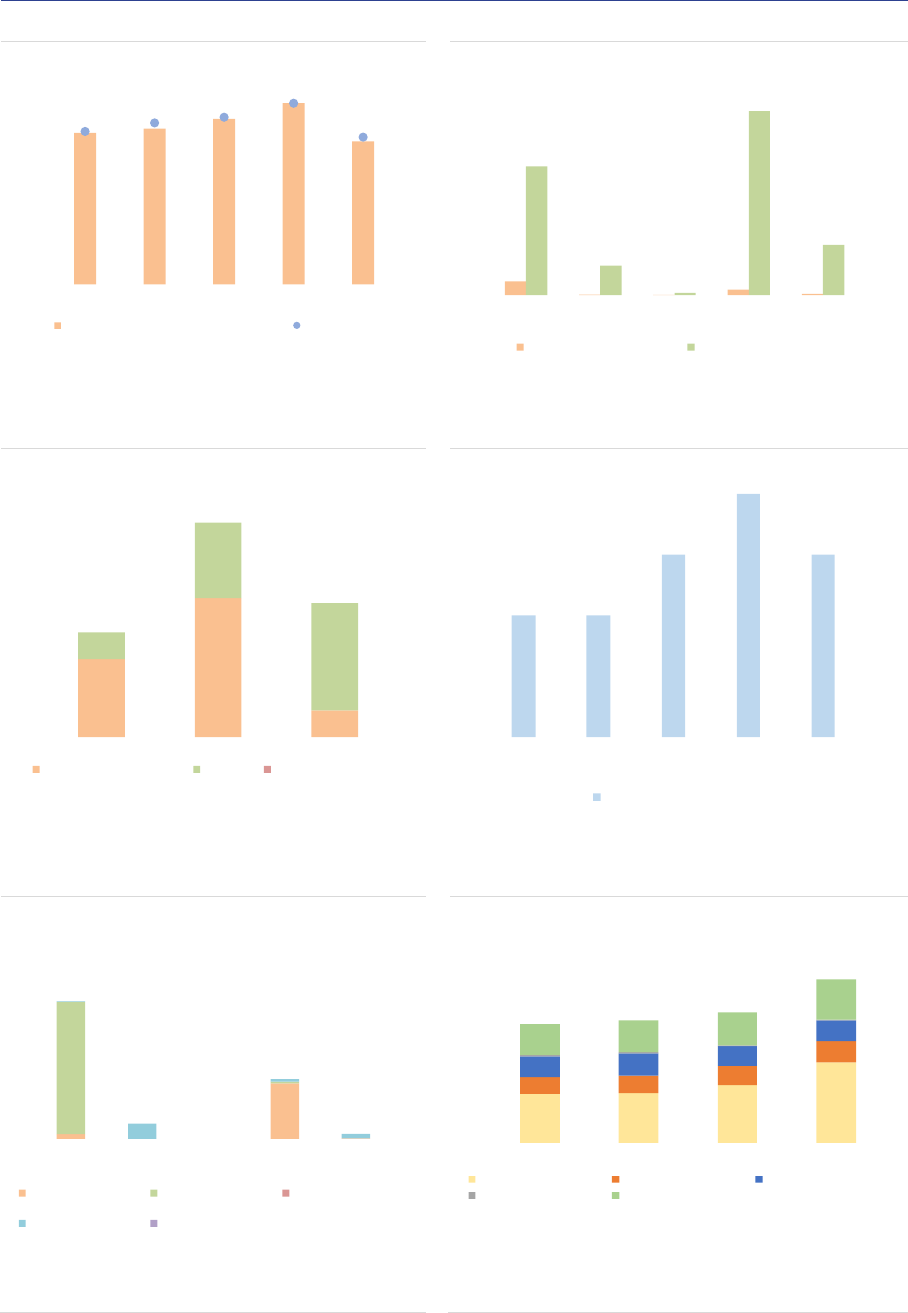

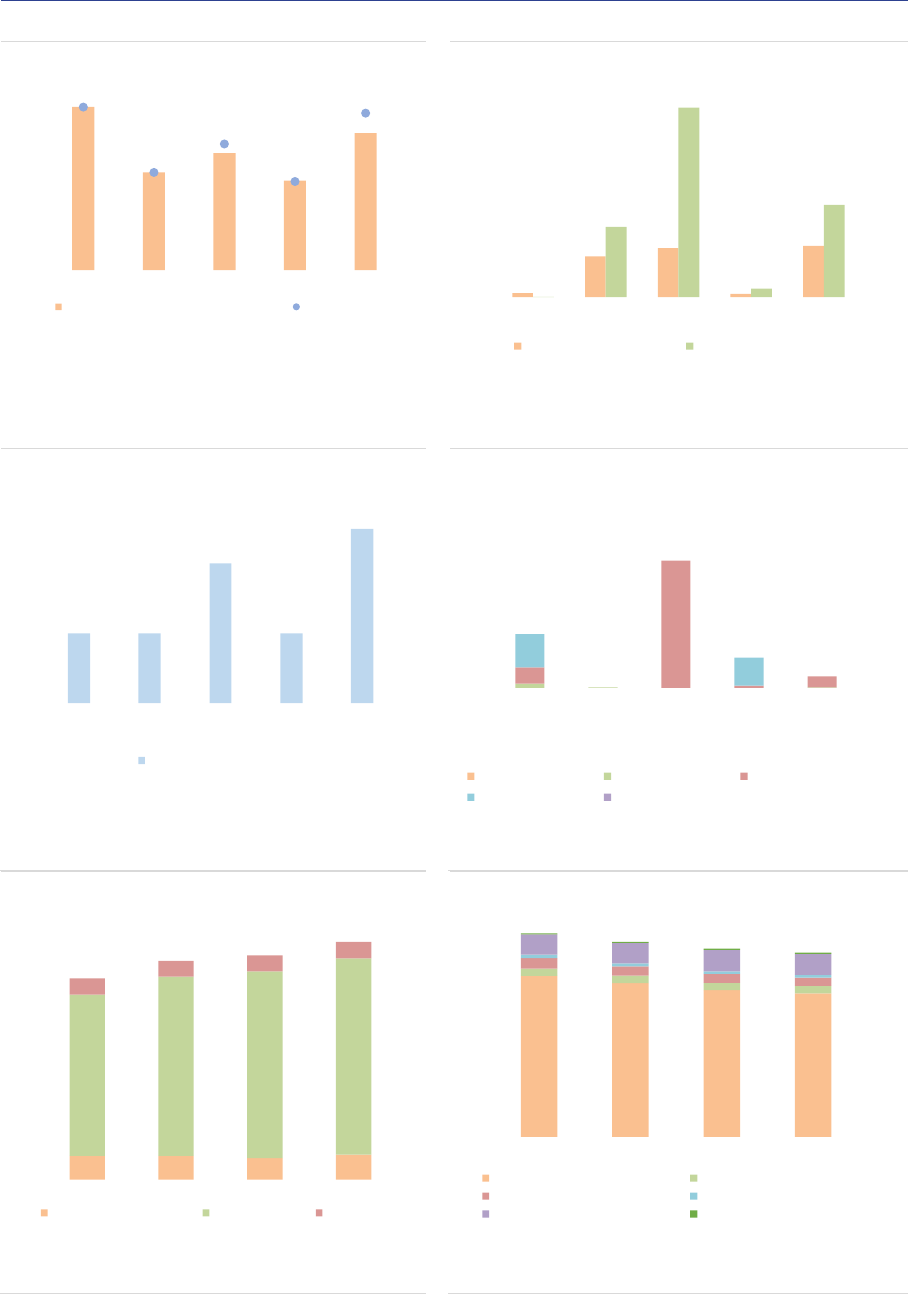

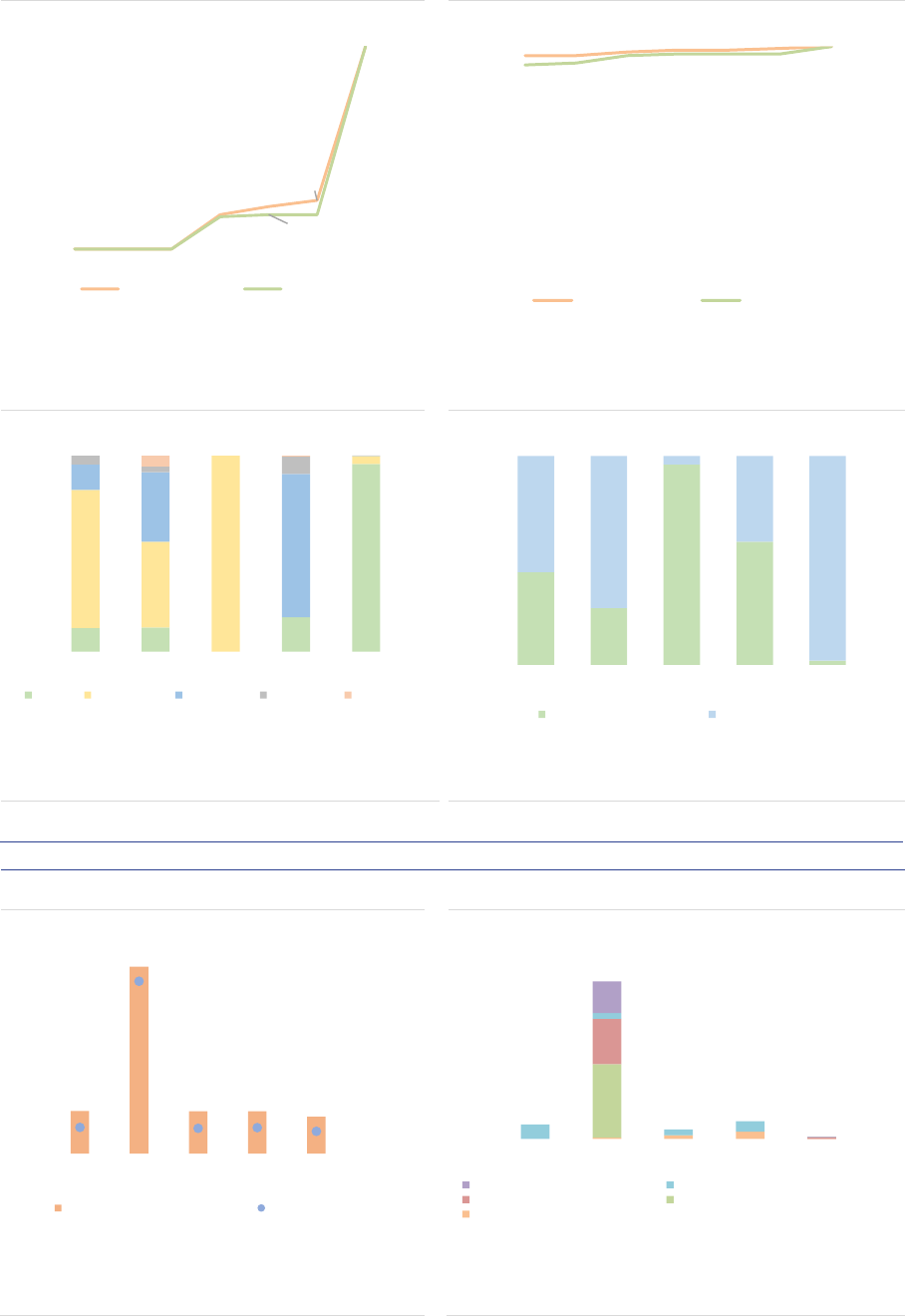

ASR-AIF.1

EEA30 fund industry

Significant growth in 2019

The growth in the EEA30 AIF market is

attributable to the launch of new AIFs in 2020

(EUR 514bn), and positive valuation and flow

effects (EUR 256bn), which compensated for the

decline of EUR 248bn related to the liquidation of

funds in 2020 (ASR-AIF.2).

4.3

4.6

5.5

5.9

9.7

9.3

11.0

11.6

0

2

4

6

8

10

12

14

2017 2018 2019 2020

AIFs UCITS

Note: NAV by type of AIF managed and/or marketed by authorized AIFMs and

sub-threshold managers registered only in national jurisdictions, in EUR bn.

Data for the EEA30.

Sources: AIFMD database, National Competent Authorities, EFAMA, ESMA.

ESMA Annual Statistical Report on EU Alternative Investment Funds 2022 10

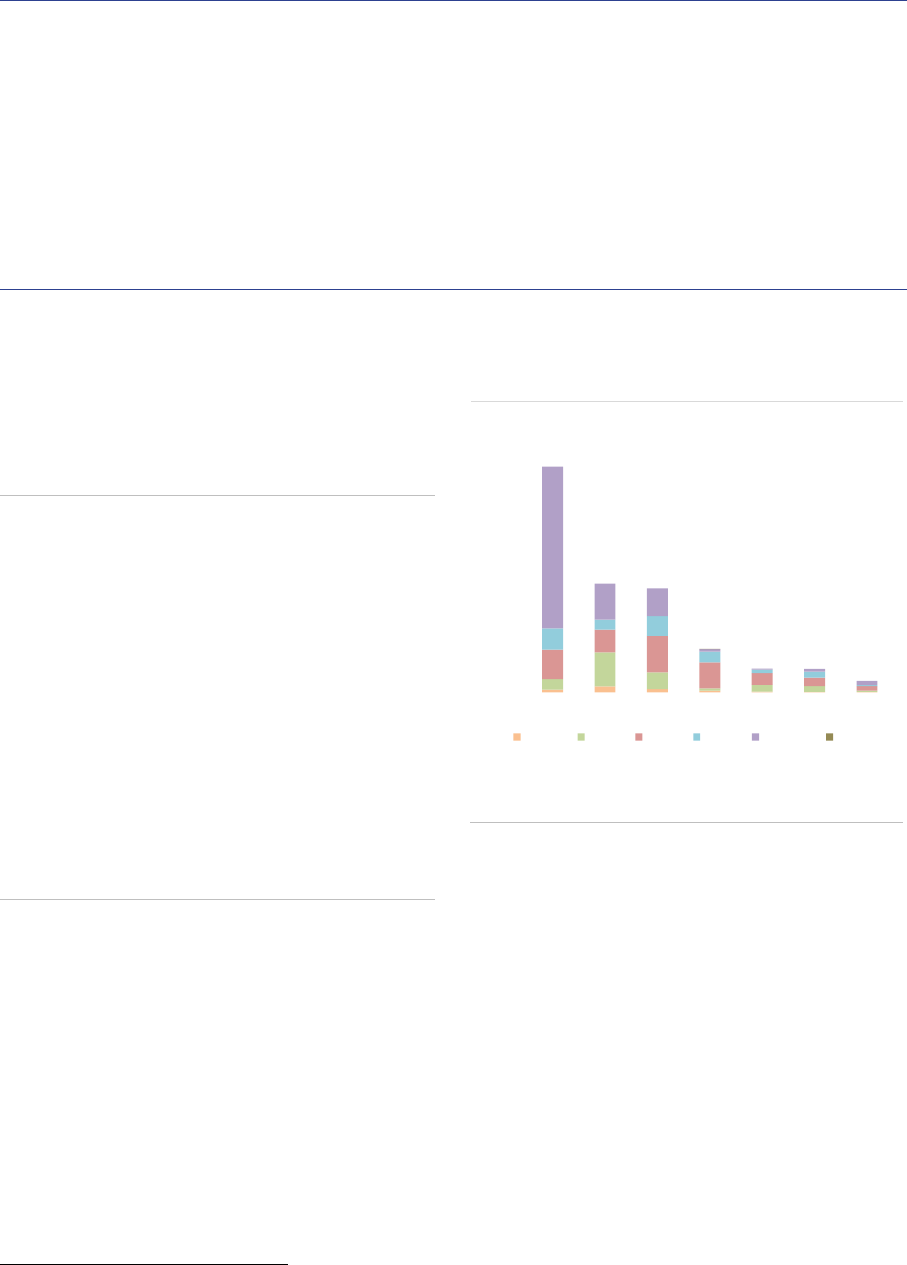

ASR-AIF.2

EEA30 AIFs growth decomposition

Growth owing to new AIFs, flows, valuation effects

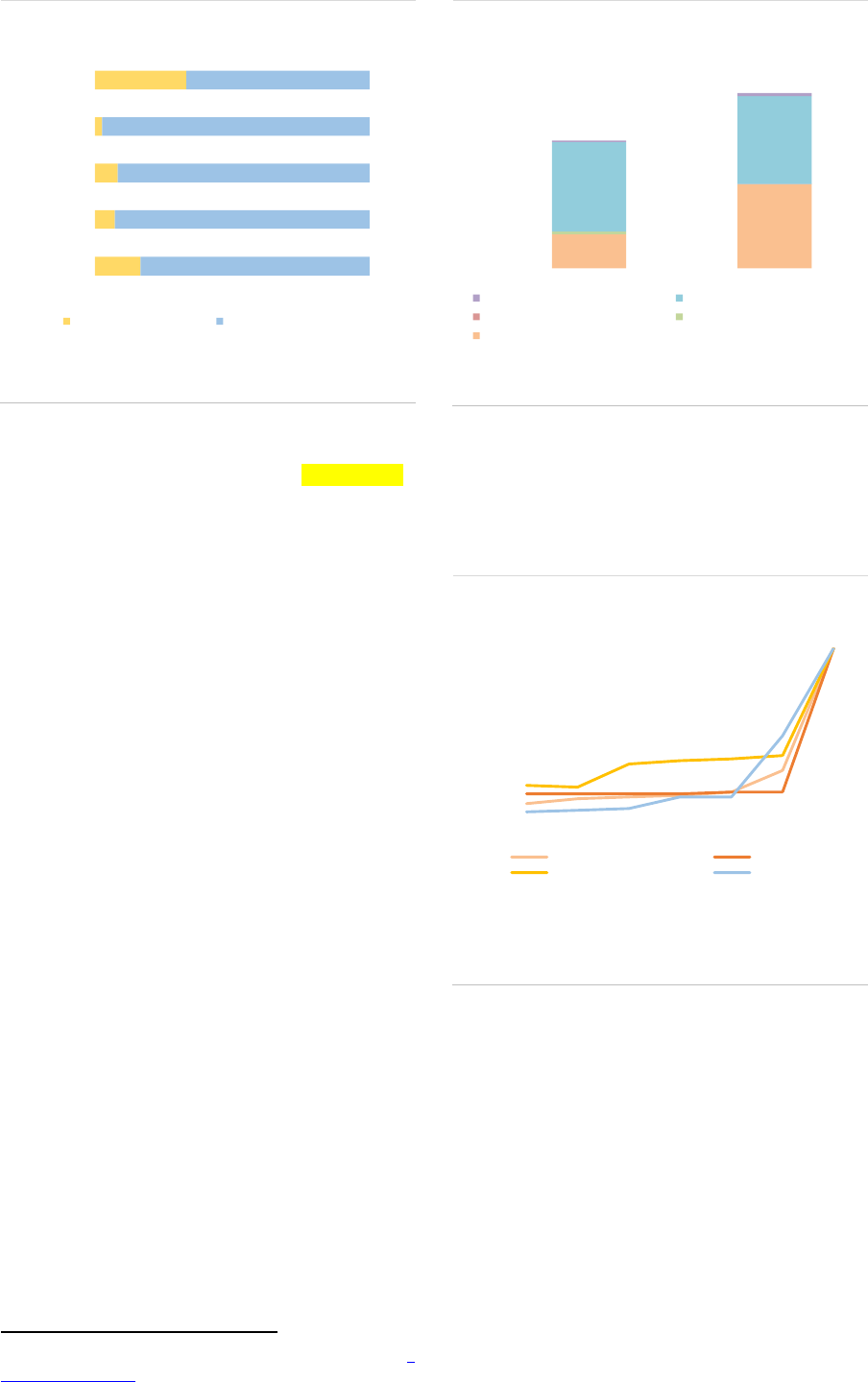

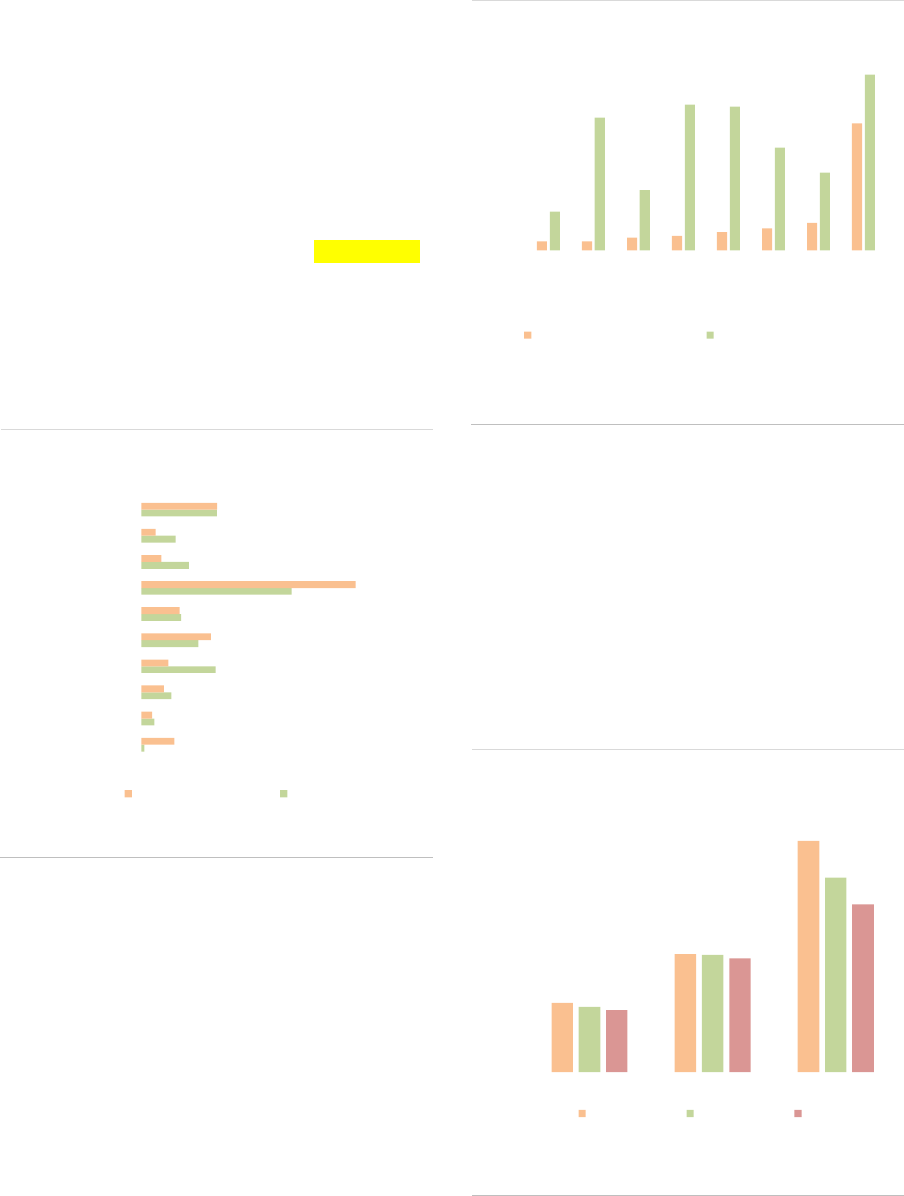

By AIF types, ‘other AIFs’, PE and funds with no

predominant strategy (‘none’) contributed most to

the growth of the AIF sector (ASR-AIF.3). For the

AIFs with no predominant strategy, the rise in

NAV is explained by a change in classification for

one country: AIFs that were previously classified

as ‘Other AIFs’ changed to the ‘none’ category.

ASR-AIF.3

EEA30 AIF growth decomposition by types

Growth in ‘other AIFs’, PE, no predominant

strategy

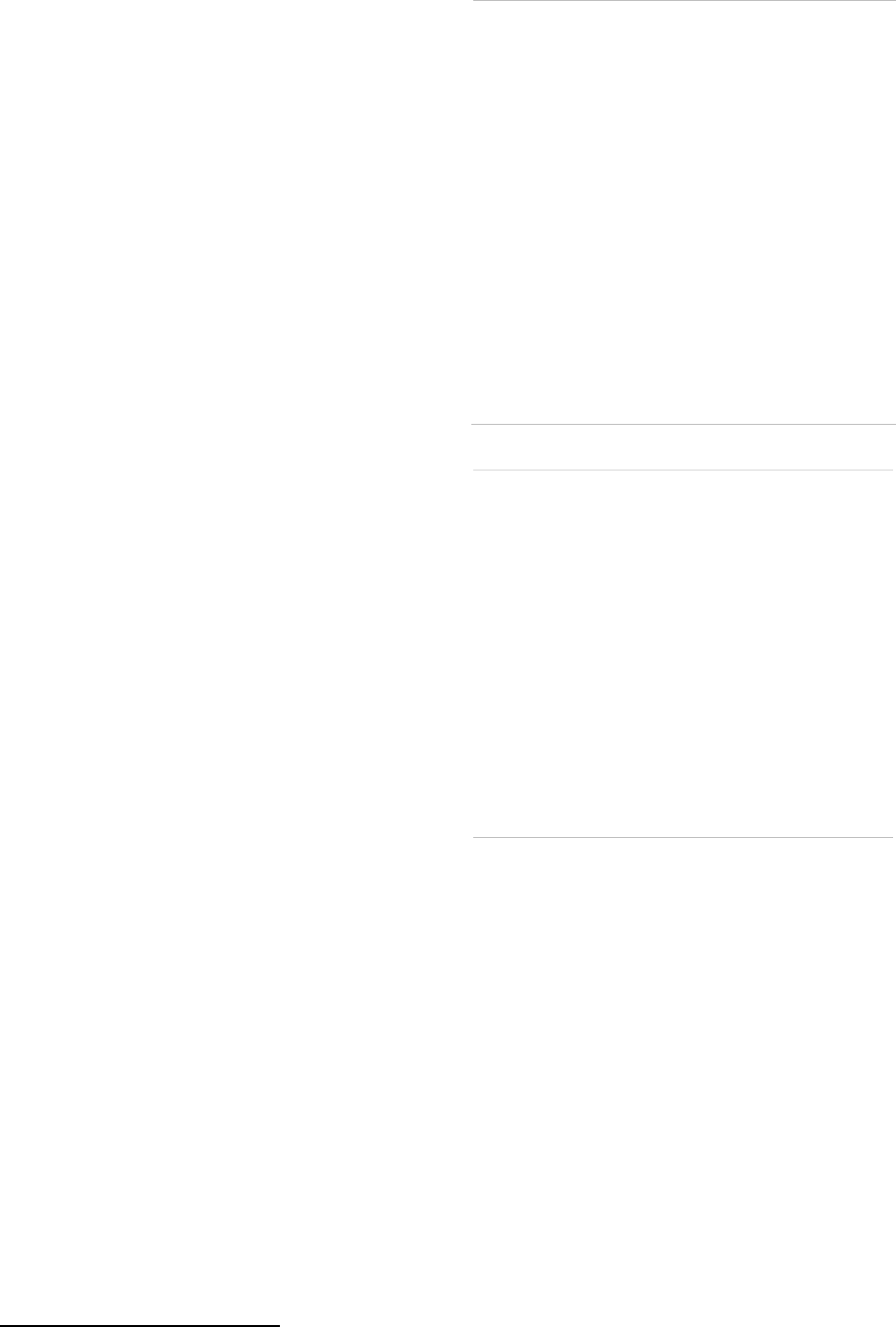

AIF types: The composition of the AIF market by

type was broadly stable in 2020. FoFs account for

15% of the NAV (stable compared with 2019),

followed by RE funds (13%), PE funds (5%,

+1pp), funds with no predominant strategy (3%,

+2pp) and HFs (2%). The very small share of HFs

is related to Brexit, since UK AIFMs had

accounted for around 75% of the EU HF market

before the country left the EU. Finally, ‘other AIFs’

remain by far the largest type, accounting for 62%

of NAV (ASR-AIF.16). Within this category,

around 30% of NAV is attributed to a residual

category (which amounts to 17% of the NAV of all

AIFs), pointing to continued classification issues

for AIFMs, as detailed in the ‘Other AIF section’.

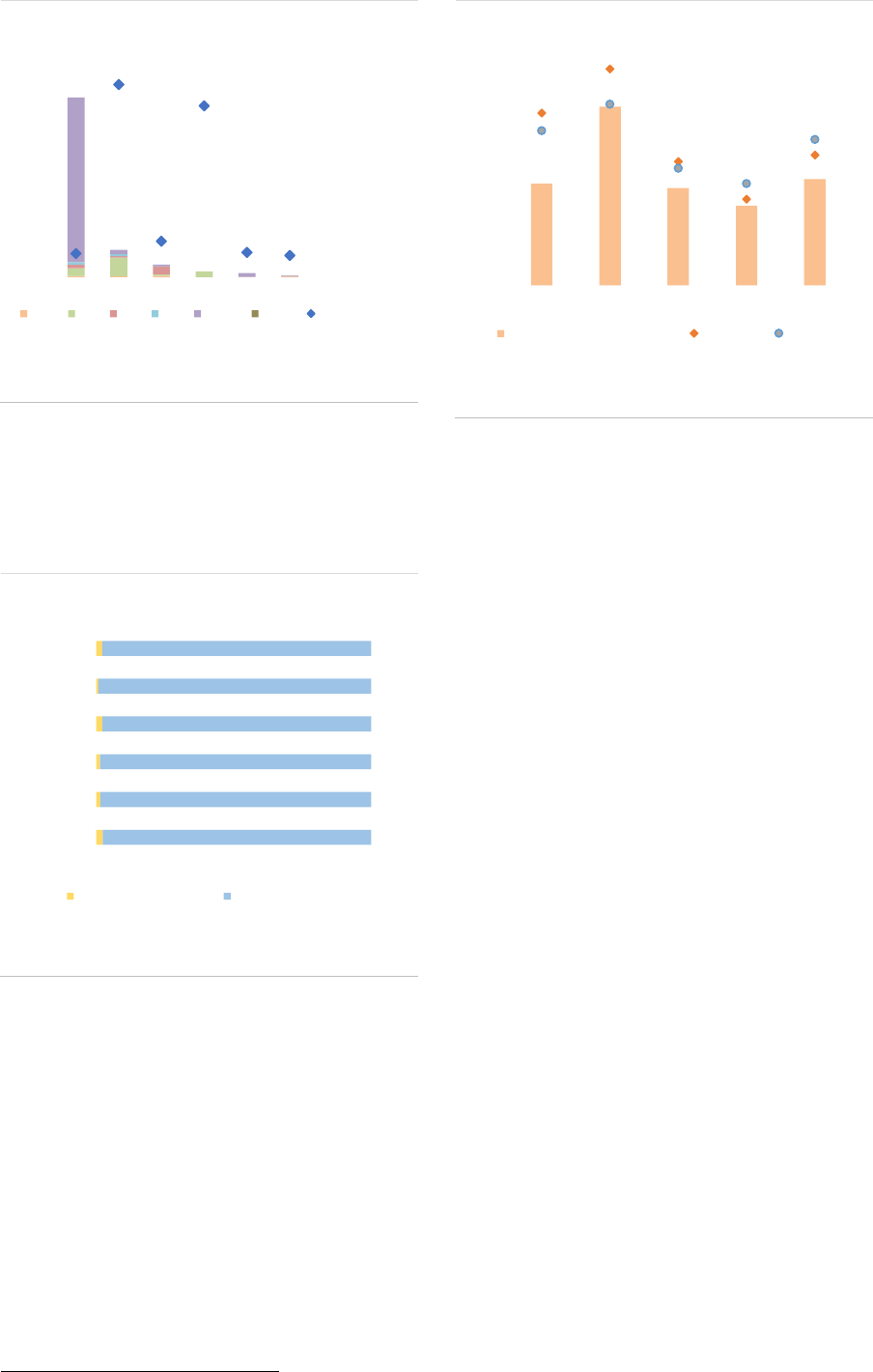

AIF size: The AIF market remains highly

concentrated, with a few large AIFs accounting

for most of the market. In 2020, AIFs with a NAV

larger than EUR 1bn accounted for less than 3%

of all AIFs but for 54% of the NAV (ASR-AIF.4).

Smaller AIFs (NAV lower than EUR 500mn)

account for 93% of all AIFs but only 32% of NAV.

The large concentration implies that by focusing

on the largest AIFs, one should be able to monitor

a dominant part of the market at a relatively high

frequency (as reporting requirements are

quarterly for funds from AIFMs with Assets under

management (AuM) above EUR 1bn).

ASR-AIF.4

Size and number of AIFs

High concentration among a few large AIFs

AIF domicile and distribution: In terms of

domicile of the AIFM, the AIF industry is

concentrated in a few countries, with the top five

accounting for 90% of the NAV (ASR-AIF.18). In

2020, Germany remained the country with the

largest AIF industry in the EEA30 (37%, +1pp),

followed by Luxembourg (16%, stable), the

Netherlands (15%, stable), France (13%, -1pp)

and Ireland (9%). Compared to 2019, the size of

the AIF industry expanded by 14% in

Luxembourg and 13% in Ireland, 8% in Germany,

5% in the Netherlands and 3% in France (ASR-

AIF.5).

5,899

5,374

514

5,000

5,300

5,600

5,900

6,200

2019 data Liquidated

after 2019

Valuation

and flow

effects

Newly

reported

AIFs

2020 data

Note: Decomposition of NAV by reporting and surviving AIFs, EUR bn. Newly

reported funds including AIFs incepted in 2020. Data for the EEA30.

Sources: AIFMD database, National Competent Authorities, ESMA.

-248

256

5,468

113

3

62

82

30

141

5,000

5,100

5,200

5,300

5,400

5,500

5,600

5,700

5,800

5,900

6,000

2019

data

None HF RE PE FoF Other 2020

data

Note:NAV by type of AIF managed and/or marketed by authorized AIFMs and

sub-threshold managers registered only in national jurisdictions, in EUR bn.

Data for the EEA30.

Sources: AIFMD database, National Competent Authorities, ESMA.

5,899

0%

25%

50%

75%

100%

<100mn 100-500mn 500mn-1bn 1-5bn >5bn

NAV Number of AIFs

Note: Share of AIFs by size, end of 2020, in %. AIFs managed and/or marketed by

authorised AIFMs and sub-threshold managers registered only in national

jurisdictions. Data for the EEA30.

Sources: AIFMD database, National Competent Authorities, ESMA.

ESMA Annual Statistical Report on EU Alternative Investment Funds 2022 11

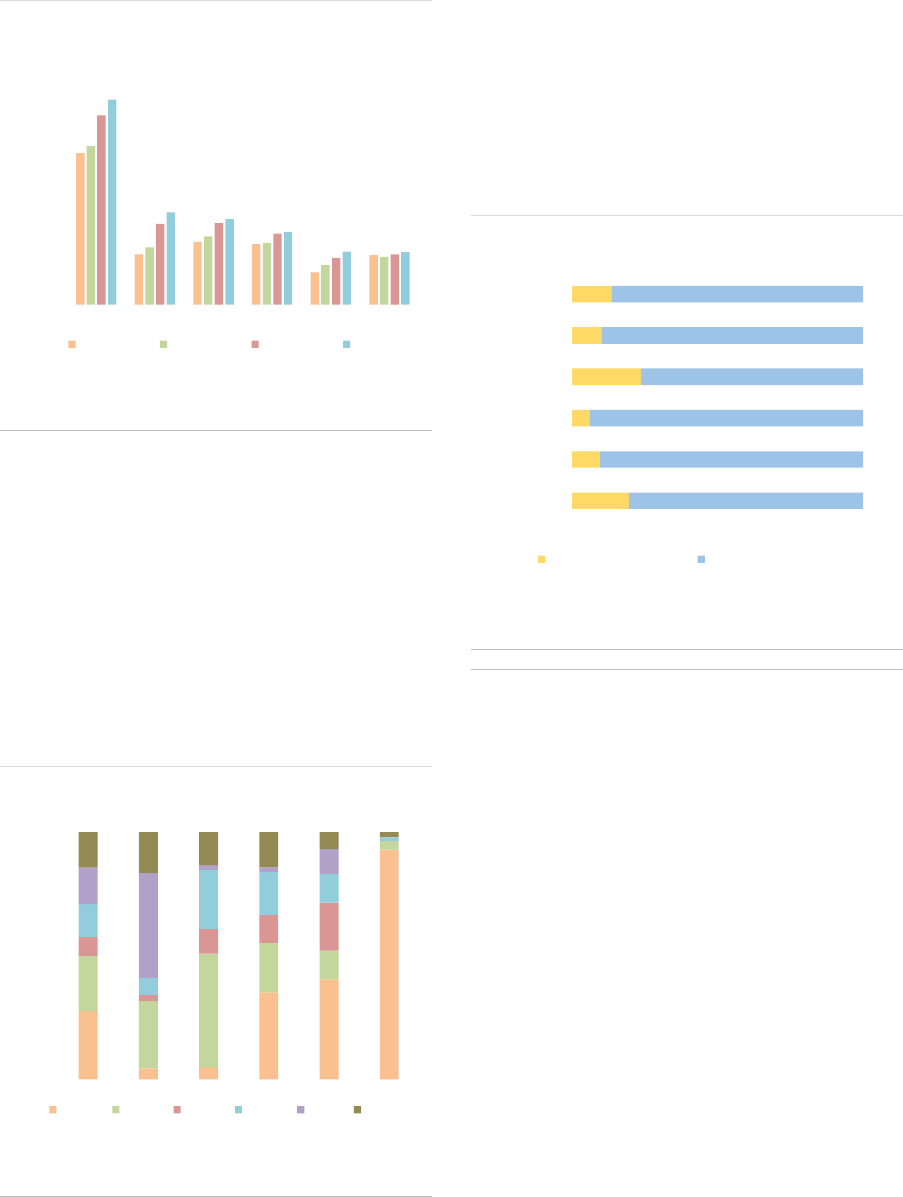

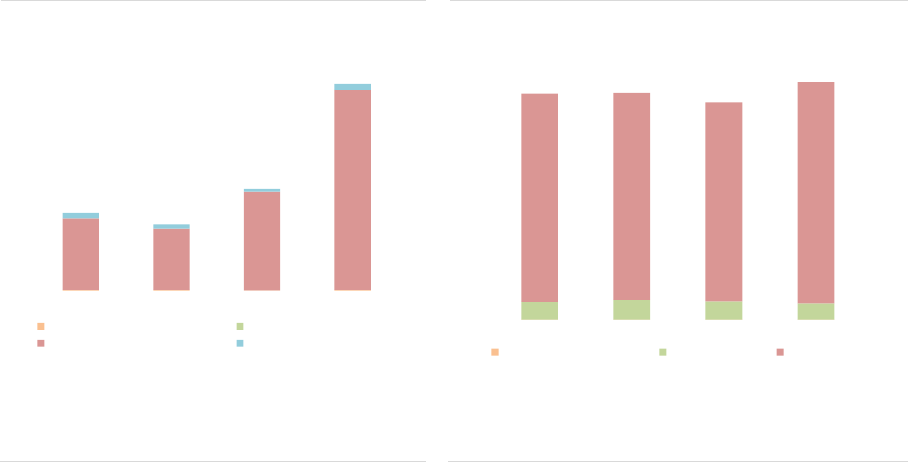

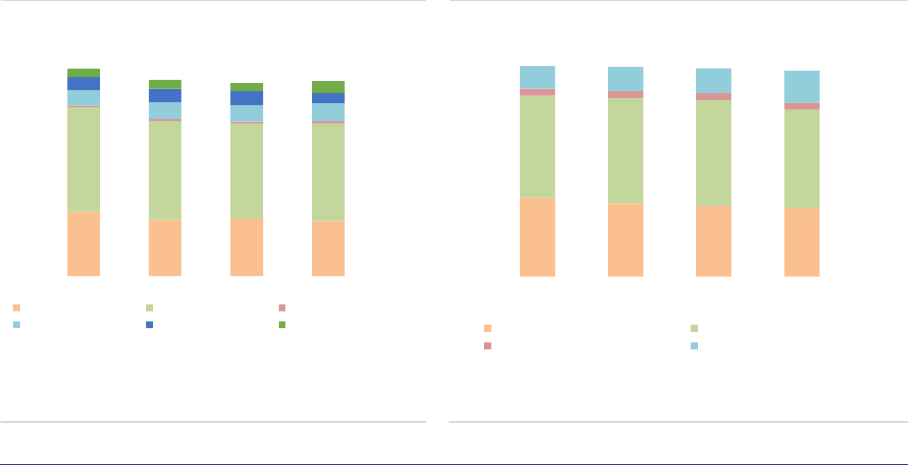

ASR-AIF.5

AIF size by country

More growth in LU and IE

FoFs are mainly domiciled in countries with a

large asset management industry such as

Germany, France, Ireland and Luxembourg, with

those four countries accounting for 78% of the

NAV (ASR-AIF.6). The HF industry is heavily

concentrated in Luxembourg and Ireland (70% of

NAV). Managers of PE funds are mainly

domiciled in Luxembourg and France (70% of

NAV). In contrast, RE funds and ‘other AIFs’ are

spread out across several countries. In most EU

Member States, ‘other AIFs’ account for the

majority of the NAV.

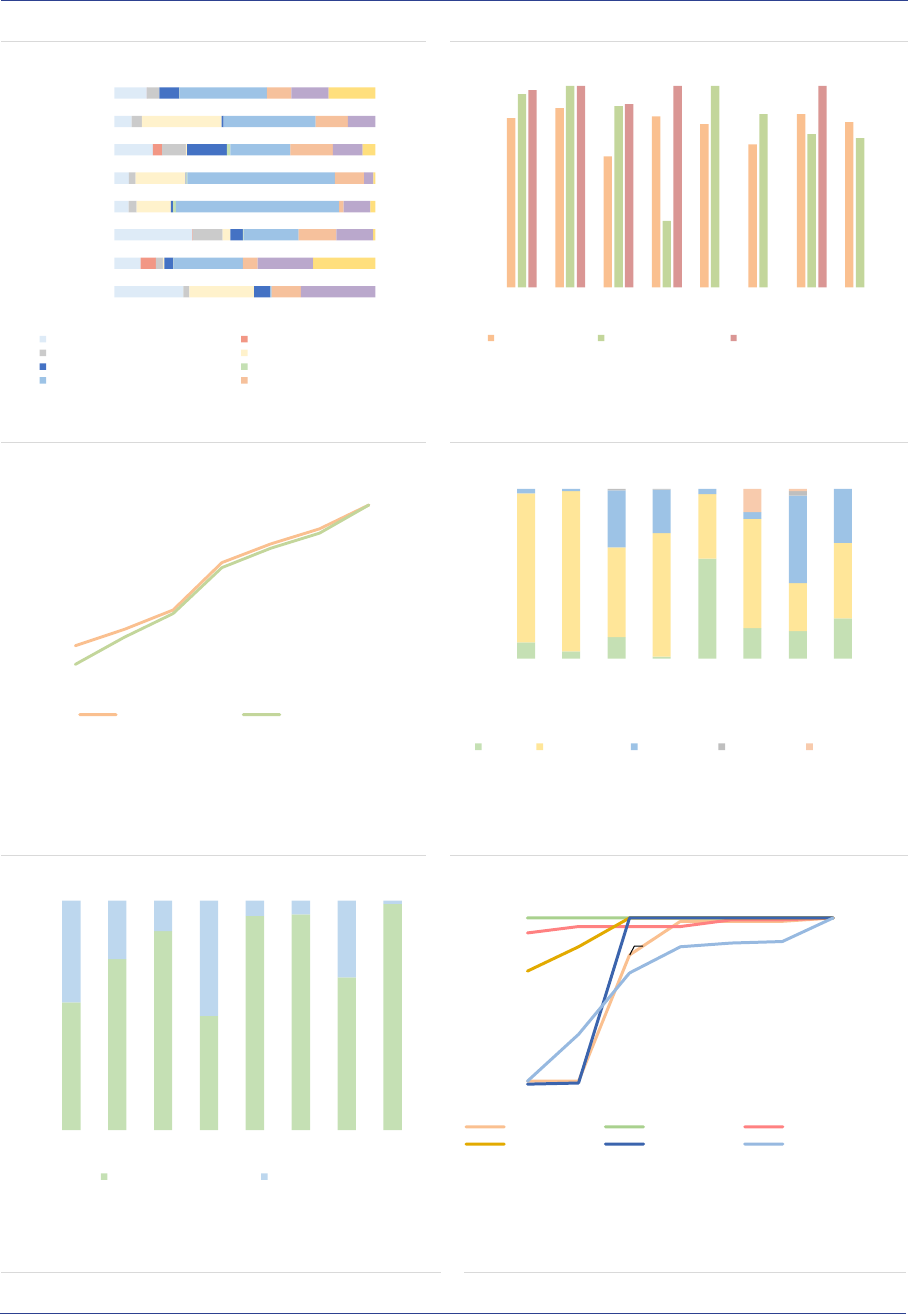

ASR-AIF.6

Country share by AIF type

Heterogeneity across AIF types

Most AIFs have access to the EU passport

(78%), allowing AIFs to be sold throughout the

EU (ASR-AIF.19).

AIF investors: The AIFMD provides the

regulatory framework for marketing AIFs primarily

to professional investors, rather than retail

investors. The marketing of AIFs to retail

investors remains at the discretion of each

Member State. Professional investors account for

around 86% of the NAV, and direct retail

investors’ participation is slightly declining but

remains significant at 14% of the NAV overall

(ASR-AIF.7), and amounts to 24% of NAV for RE.

Retail investor participation might be

underestimated since they could purchase

banking or insurance products that are invested

in AIFs.

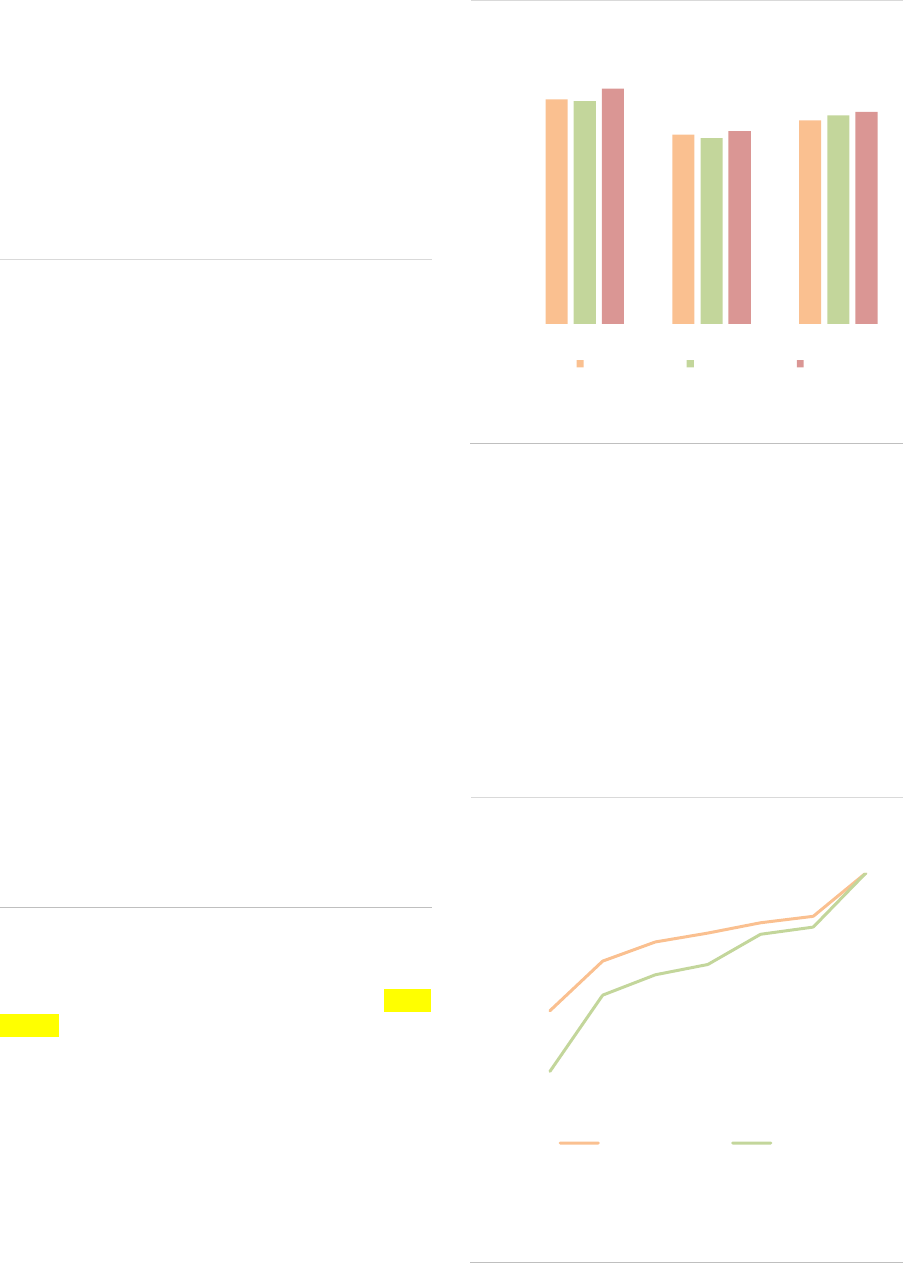

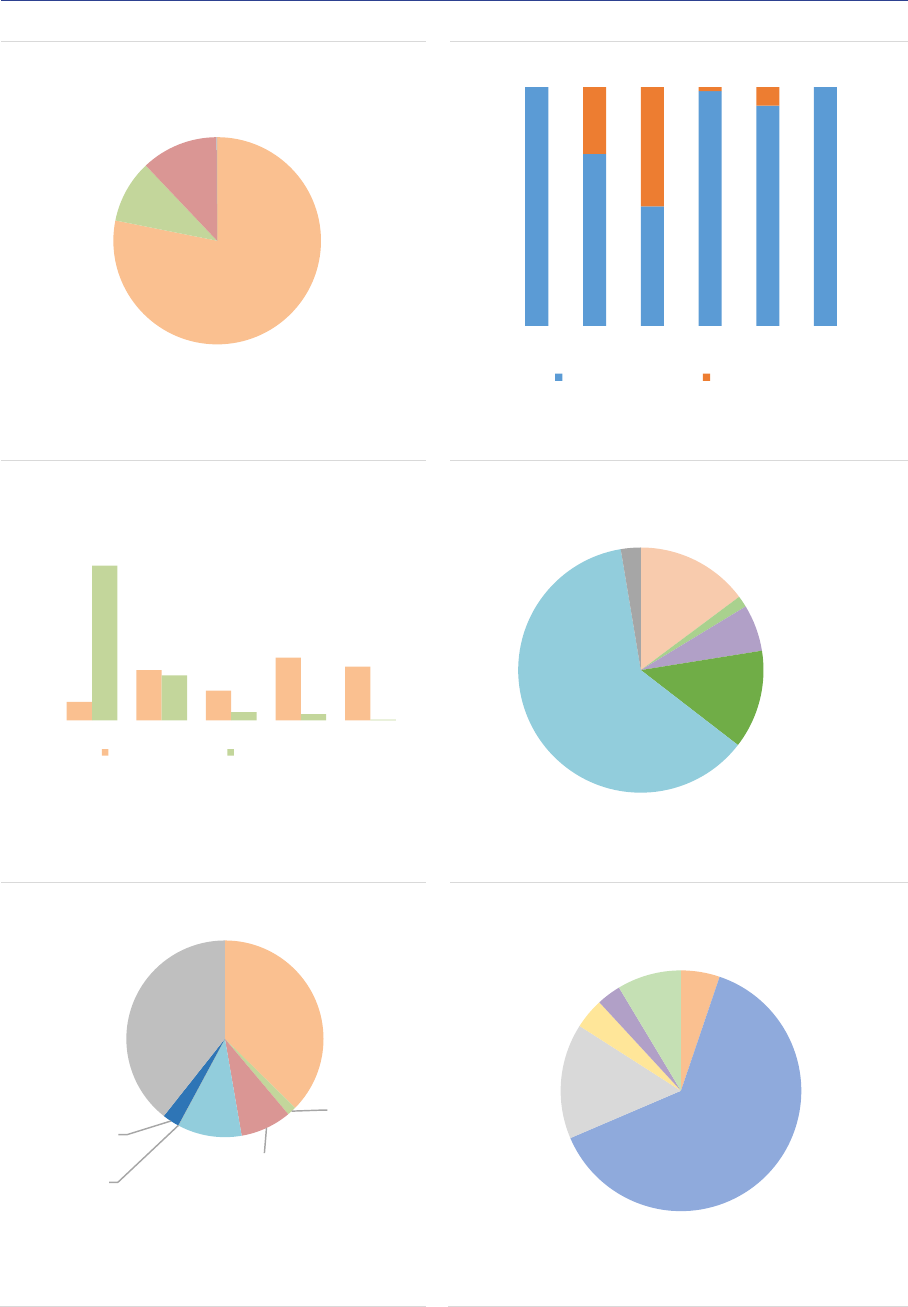

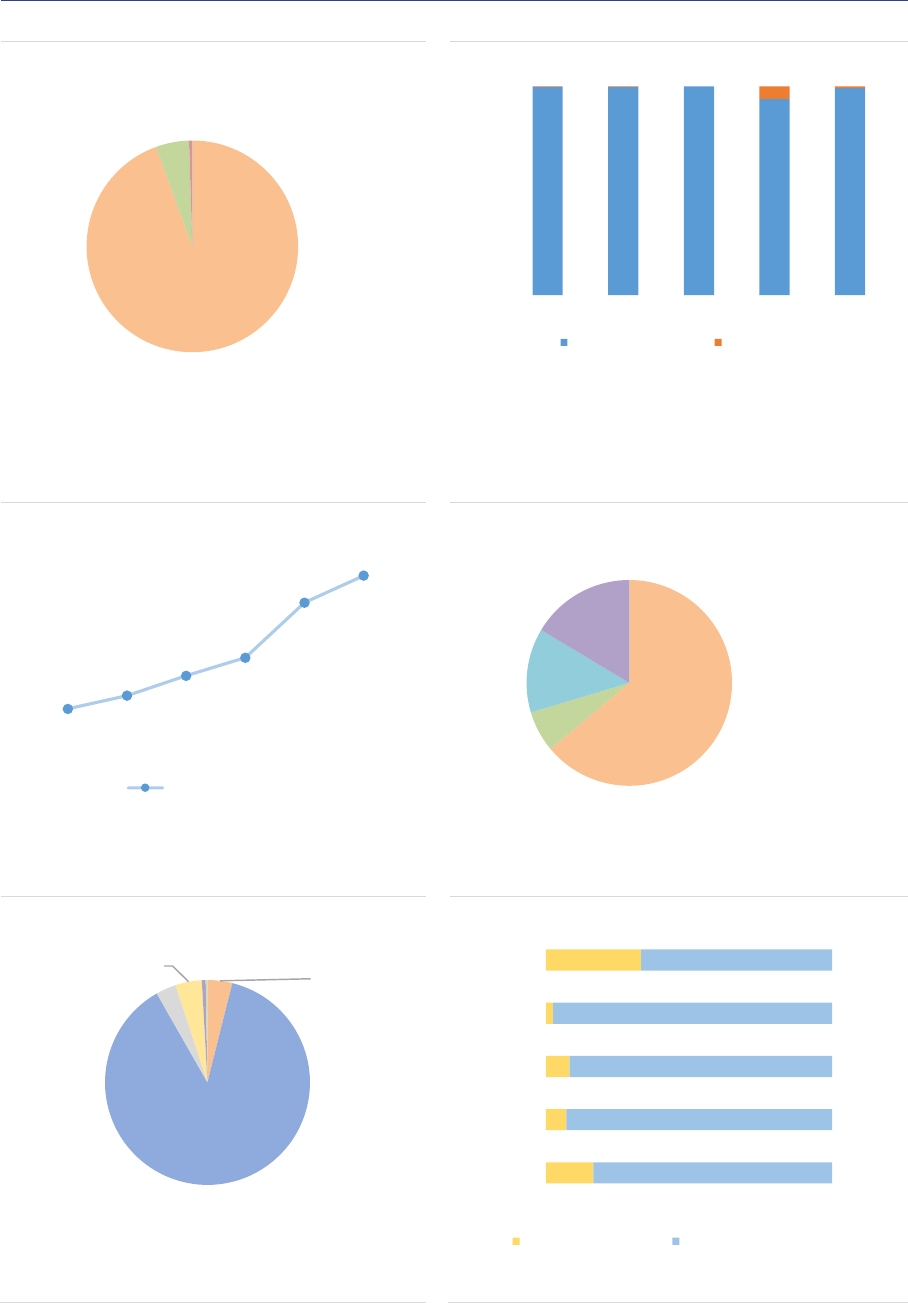

ASR-AIF.7

AIF investors

Mainly professional investors

Among professional investors, unitholders are

diversified across AIF types (ASR-AIF.8).

Pension funds and insurance companies are the

main investors as they own close to 50% of the

NAV of AIFs (with 29% and 19% of the NAV

respectively). Banks account for 7%, other

financial institutions for 8%, and funds for 10%.

Non-profit organisations own 10% of the NAV,

and households 6%. The share of unknown

investors has declined from 11% to 5% of NAV,

indicating improvements in data reported. Still,

the relatively large proportion of banks might

indicate a lack of look-through approach by some

AIFMs, since they should report the ultimate

owners of the AIF shares.

-

500

1,000

1,500

2,000

2,500

DE LU NL FR IE Other

2017 2018 2019 2020

Note: NAV by type of AIF managed and/or marketed by authorized AIFMs and

sub-threshold managers registered only in national jurisdictions, in EUR bn.

Data for the EEA30.

Sources: AIFMD database, National Competent Authorities, ESMA.

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

FoF HF PE RE Other None

DE LU NL FR IE Other

Note: Share of NAV by type of AIF managed and/or marketed by authorized

AIFMs and sub-threshold managers registered only in national jurisdictions, in

EUR bn. Data for the EEA30.

Sources: AIFMD database, National Competent Authorities, ESMA.

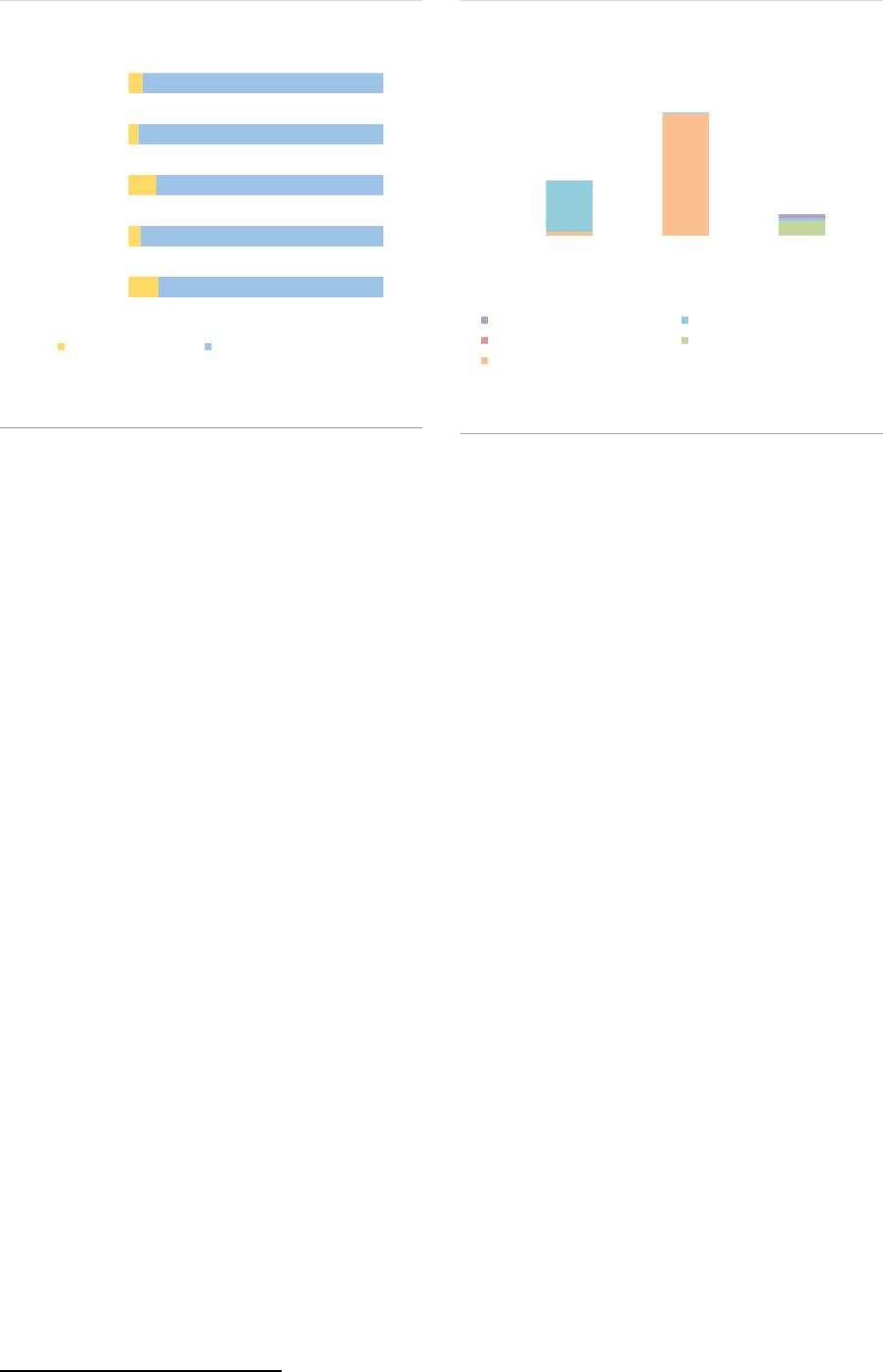

0% 20% 40% 60% 80% 100%

FoF

Hedge fund

Private equity

Real estate

Other AIF

Total EU

Retail investors Professional investors

Note: Clients of AIFs managed and/or marketed by authorised AIFMs and

sub-threshold managers registered only in national jurisdictions, end of 2020,

in % of NAV. FoF=Fund of funds. Data for the EEA30.

Sources: AIFMD database, National Competent Authorities, ESMA.

ESMA Annual Statistical Report on EU Alternative Investment Funds 2022 12

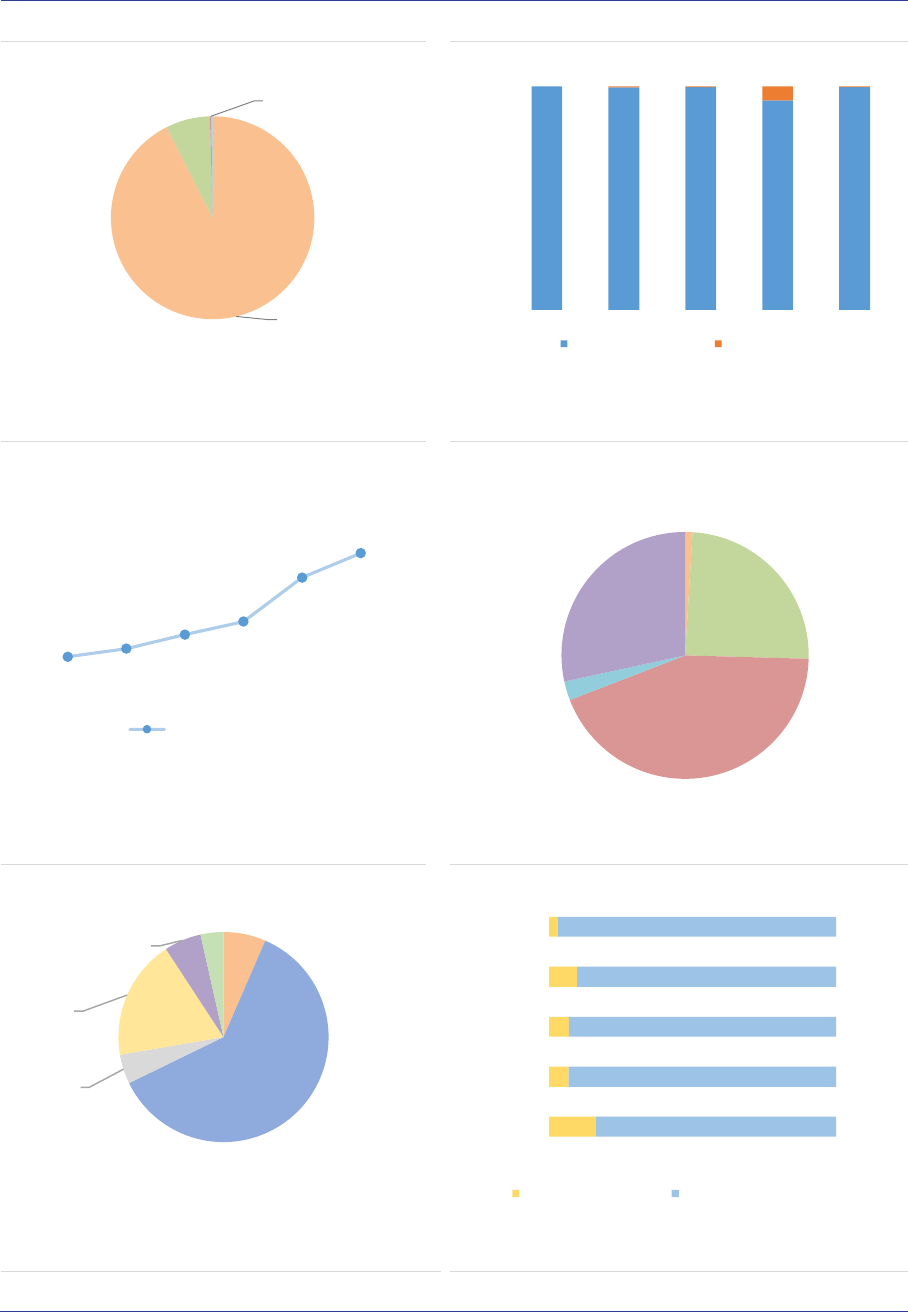

ASR-AIF.8

AIF investor types

Diversified investor base

AIF shares: The ownership of AIFs continues to

be highly concentrated: the top five investors

account for more than 75% of the NAV across AIF

types. More than 50% of all AIFs are entirely held

by their top five investors, as indicated by the

median of 100% for all AIF types (except PE

funds, where ownership is more diversified). The

high ownership concentration is explained by the

dominant role played by institutional investors. In

some cases, AIFs can be set up for a single

institutional investor that prefers to hold all of the

AIF shares, as the fund can be set up to fulfil its

specific investment objective.

AIF geographical investment focus: AIFs

invest mainly in the EEA (63%, +3pp), followed

by North America (15%) and supranational

issuers (9%), with the last category also including

investments without predominant geographical

focus. Other regions account for around 13% of

the NAV (ASR-AIF.9).

ASR-AIF.9

Regional investment focus

Most exposures towards the EEA

Leverage and liquidity risks

Gross exposures: AIFs are exposed to a wide

range of asset classes, with variation across AIF

types corresponding to their investment policies

(ASR-AIF.10). RE funds, PE funds and FoFs are

by construction heavily exposed to the underlying

assets (physical assets for RE funds, (unlisted)

securities for PE funds and collective investment

units for FoFs). HF exposures are

overwhelmingly biased towards interest rate

derivatives (IRDs), because exposures are

reported using gross notional values. The

exposures of ‘other AIFs’ are more diversified,

reflecting the range of strategies used in this

residual category.

ASR-AIF.10

Gross exposures

Diverse exposures by AIF type

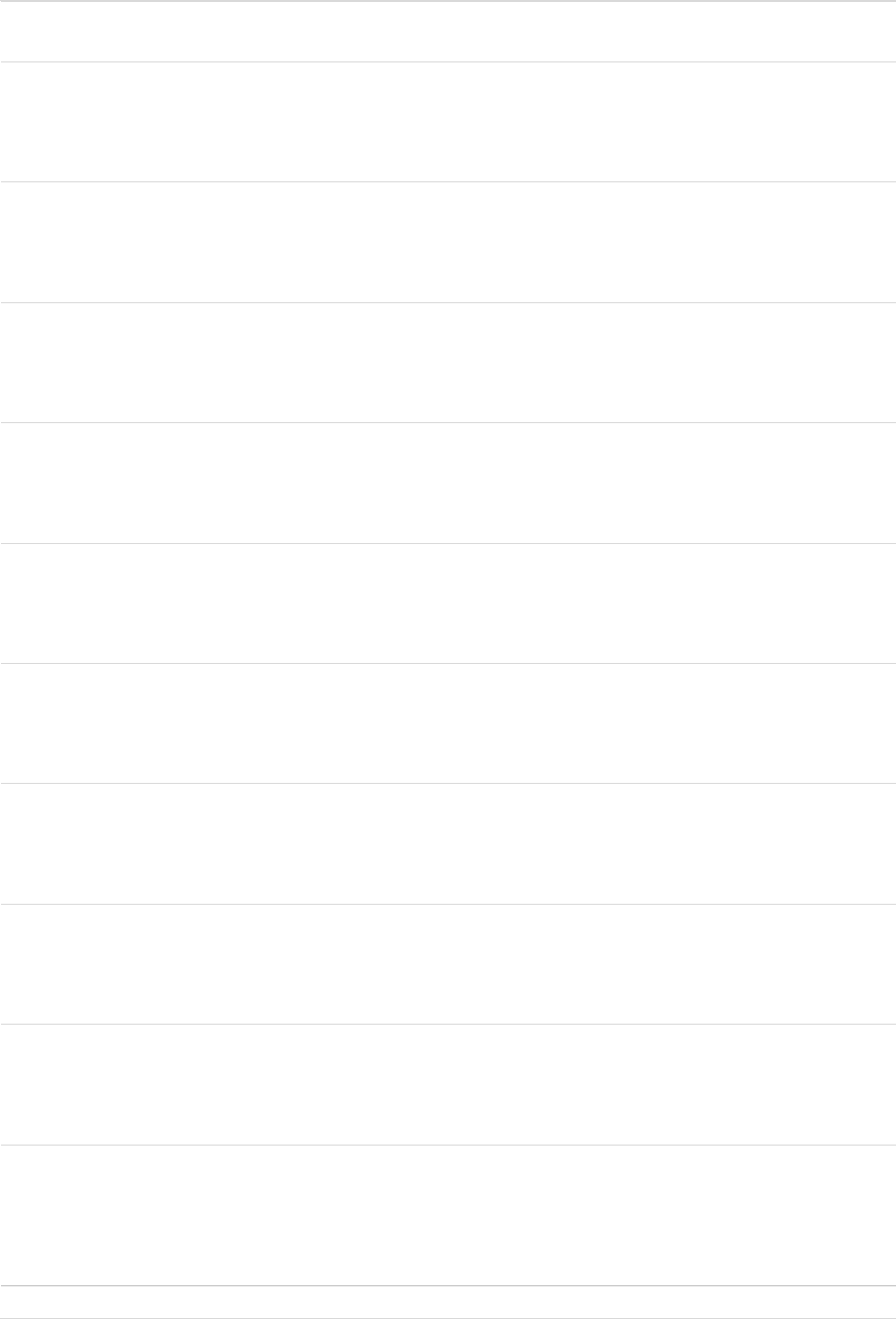

Leverage: Leverage declined at the aggregate

level (ASR-AIF.20). Using the adjusted measure

(calculated as gross exposures to NAV excluding

IRDs and FX derivatives used for hedging

0% 5% 10% 15% 20% 25% 30% 35%

None

General gov.

Households

Banks

Oth. fin. institutions

Non-profit

Oth. CIU

Unknown

Insurances

Pension funds

2019 2020

Note: Ownership of units in AIFs managed and/or marketed by authorised

AIFMs, in % of NAV. Data for the EEA30.

Asia

5%

EEA

63%

North

America

16%

Other

Europe

4%

Rest

3%

Supra National

9%

Note: Regional investment focus of AIFs managed and/or marketed by

authorised AIFMs and sub-threshold managers registered only in national

jurisdictions, end of 2020, in % of NAV. Geo-focus determined according to

the domicile of investments, supra national category including investments

without predominant geo-focus. Data for the EEA30.

Sources: AIFMD database, National Competent Authorities, ESMA.

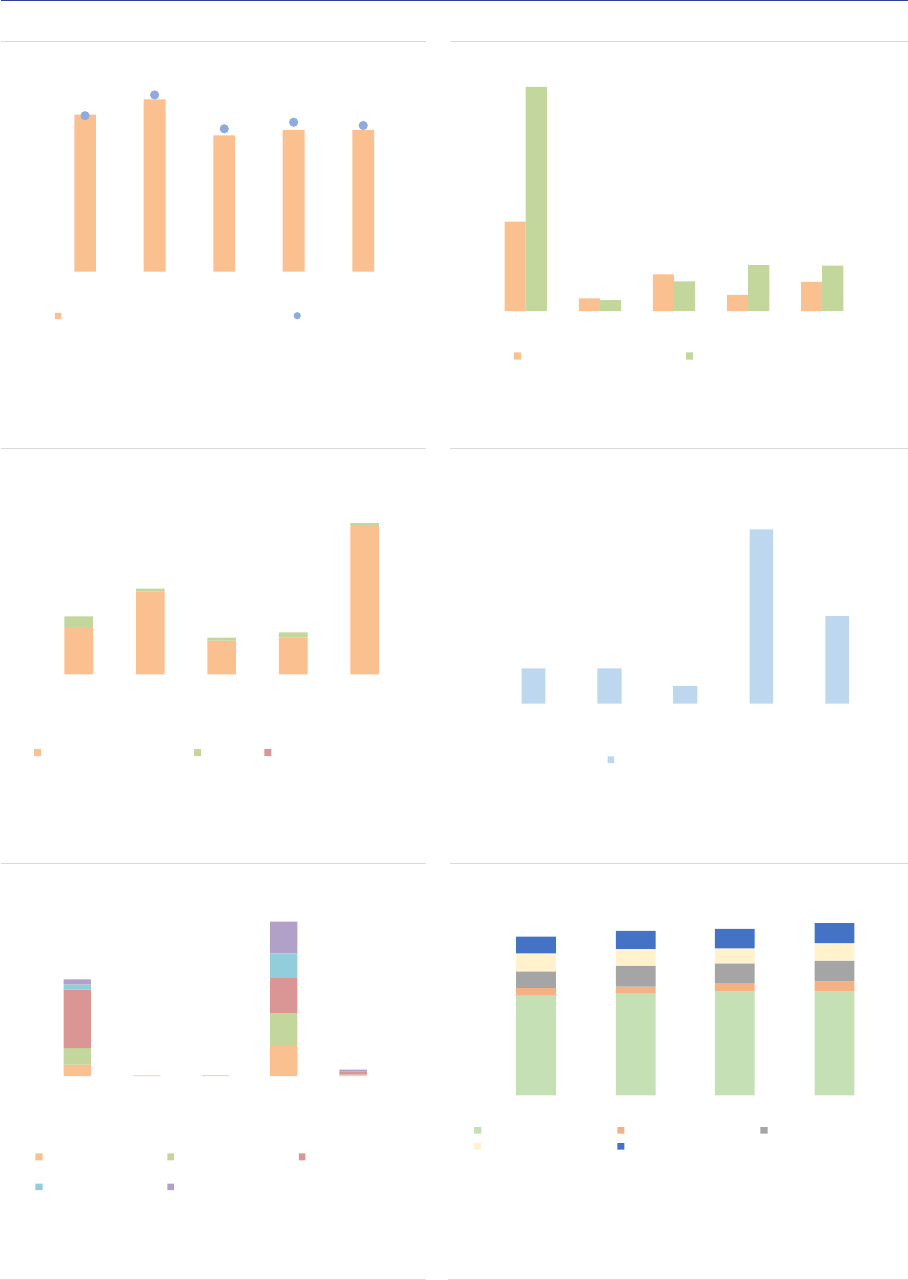

0%

25%

50%

75%

100%

Total EU FoF Hedge

fund

Private

equity

Real

estate

Other AIF

Securities CIUs Physical assets

IRDs FX CDS

Other derivatives

Note: NAV of AIFs managed and/or marketed by authorized AIFMs and sub-

threshold managers registered only in national jurisdictions, in EUR bn. Data for

the EEA30.

Sources: AIFMD database, National Competent Authorities, ESMA.

ESMA Annual Statistical Report on EU Alternative Investment Funds 2022 13

purposes), leverage declined to 128% of NAV

compared with 145% in 2019. Similarly, leverage

measured by the ratio of AuM to NAV points to a

decline from 169% to 151%. Compared to

previous reports, both measures are relatively

close because HFs exposures, the main driver of

leverage at the aggregate level, plummeted. The

large decline in HFs exposures is explained by

the fact that UK data were not included in this

report, and that UK HFs accounted for 70% of all

AIFs exposures in 2019. Still, the aggregate

measure does not reflect important differences

across AIFs, with HF adjusted leverage at 312%

while for all other AIF types leverage is below

150% (ASR-AIF.11). The high leverage of HFs

stems mainly from the use of derivatives

(synthetic leverage) rather than outright

borrowing (financial leverage). In addition,

aggregate measures of leverage are upward

biased due to extreme outliers: the median

adjusted leverage for HFs remains around 120%,

while the 10% highest levered HFs have a

measure above 600%.

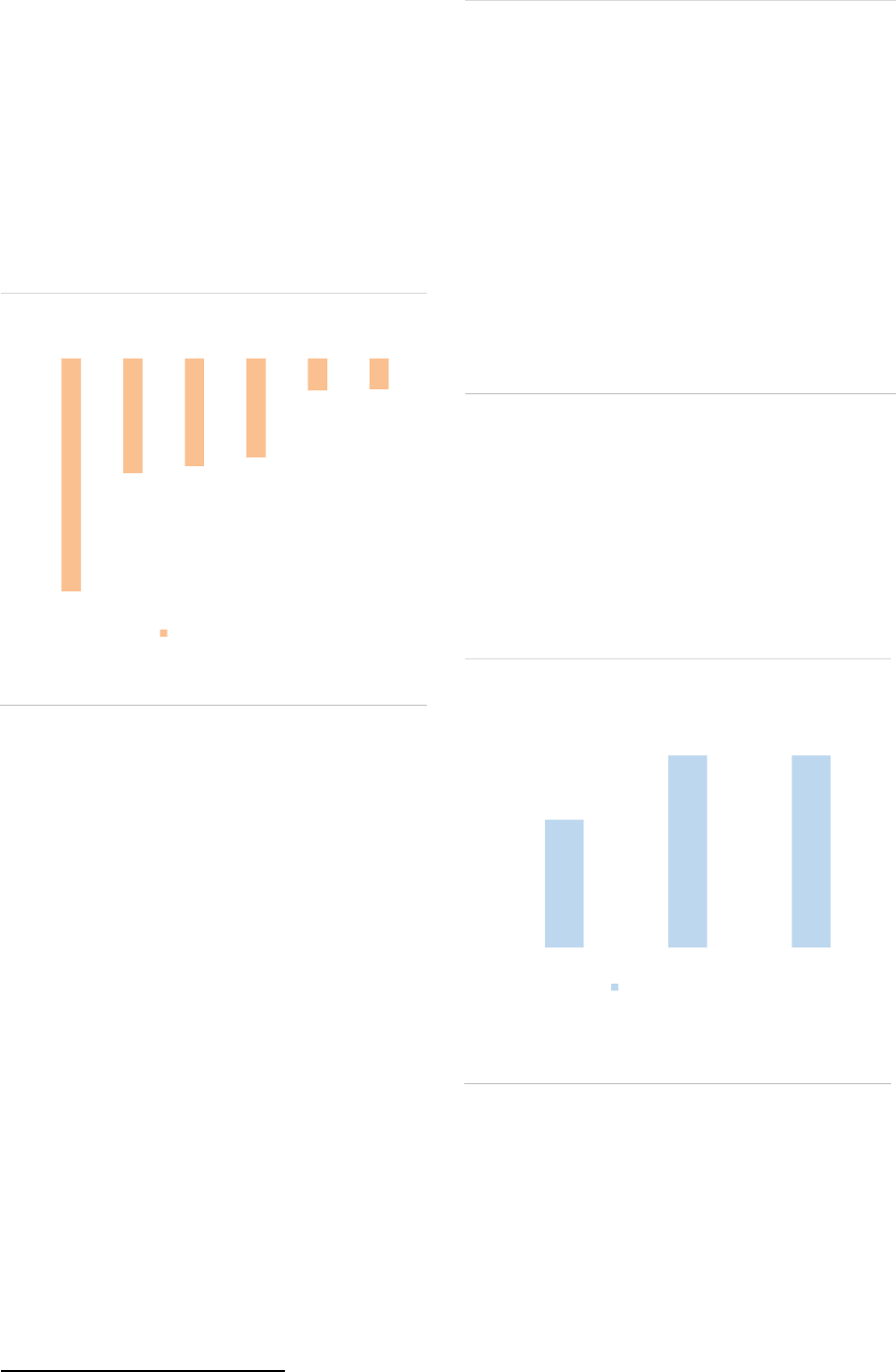

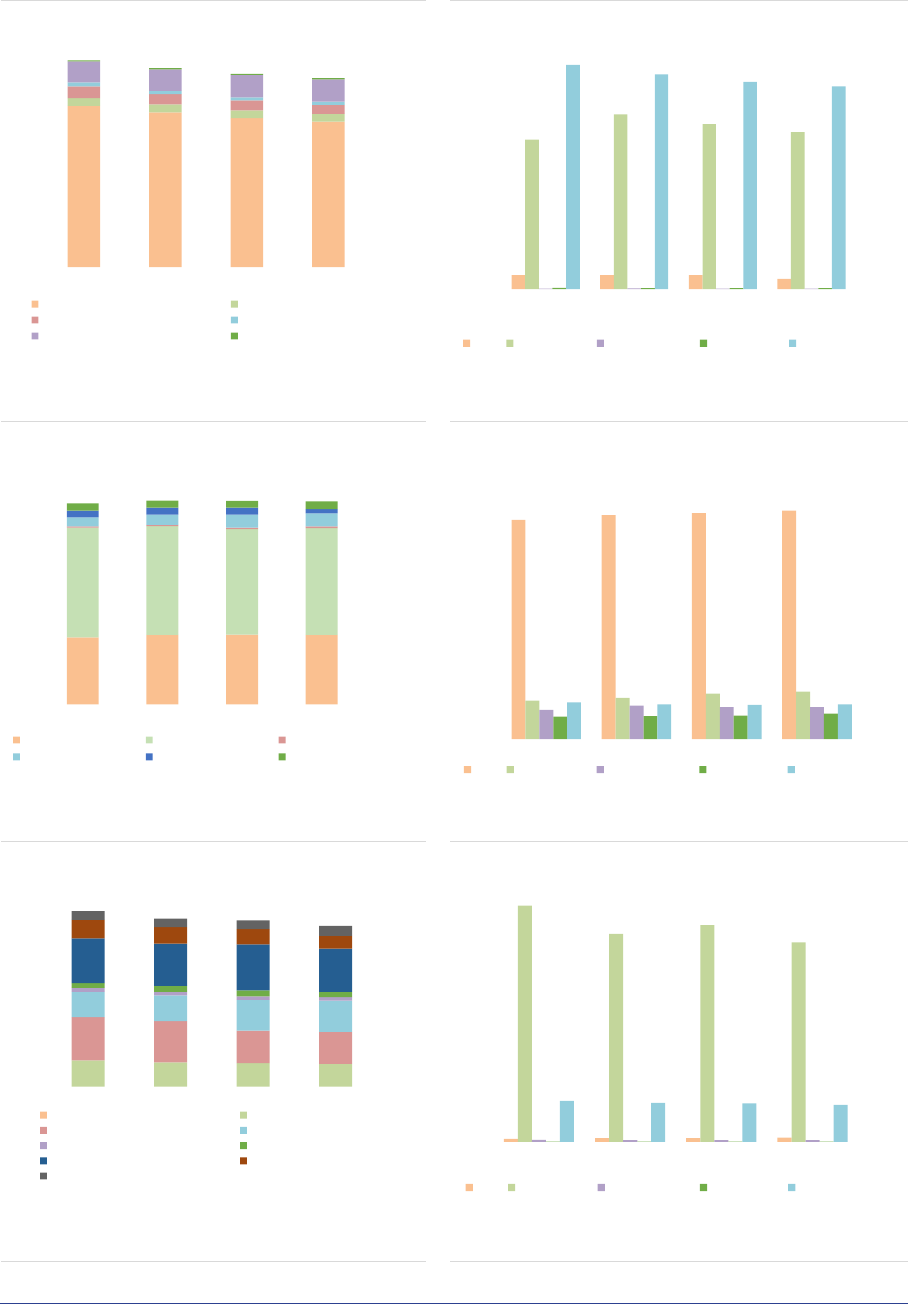

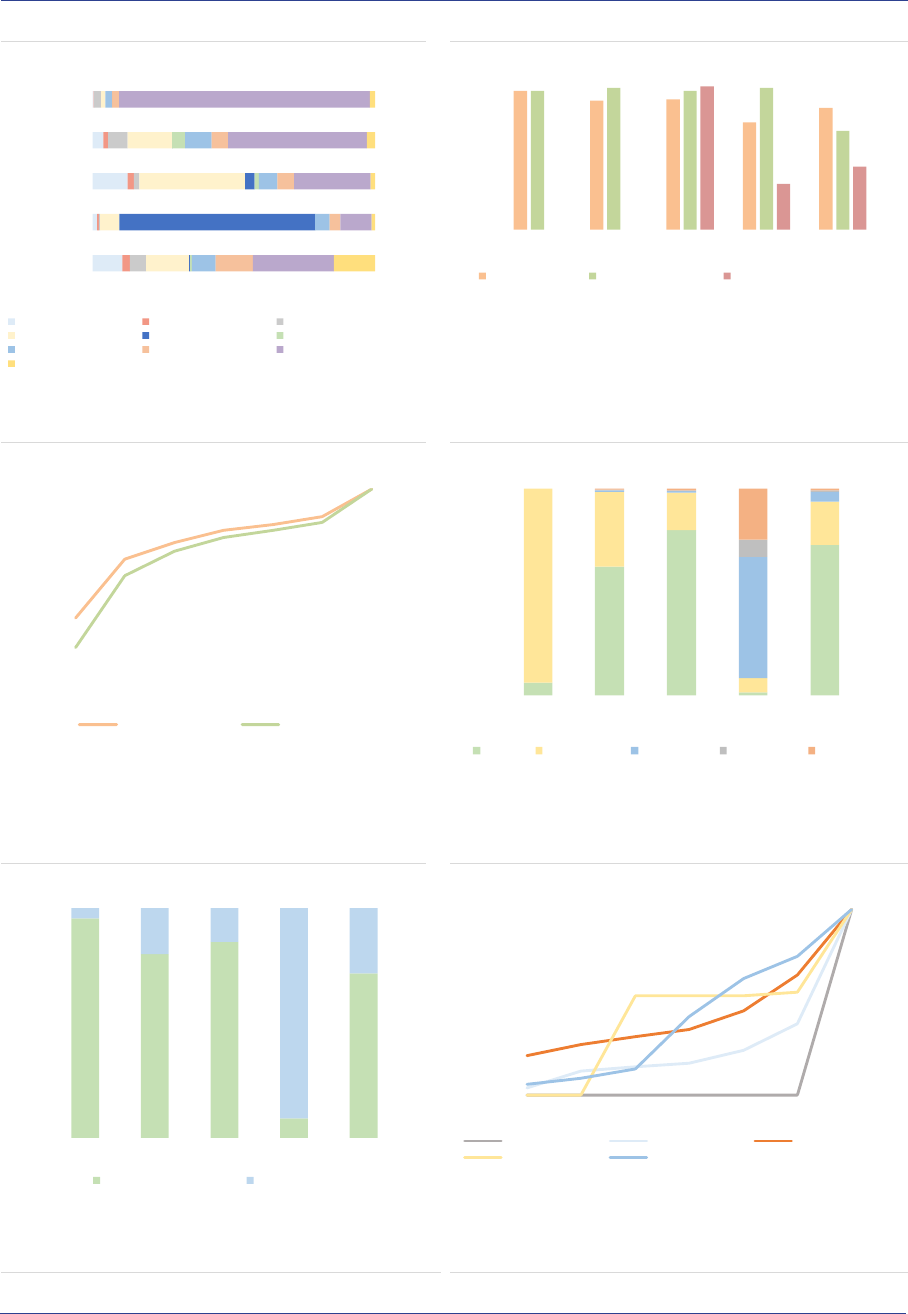

ASR-AIF.11

Adjusted leverage by AIF type

High leverage for HFs

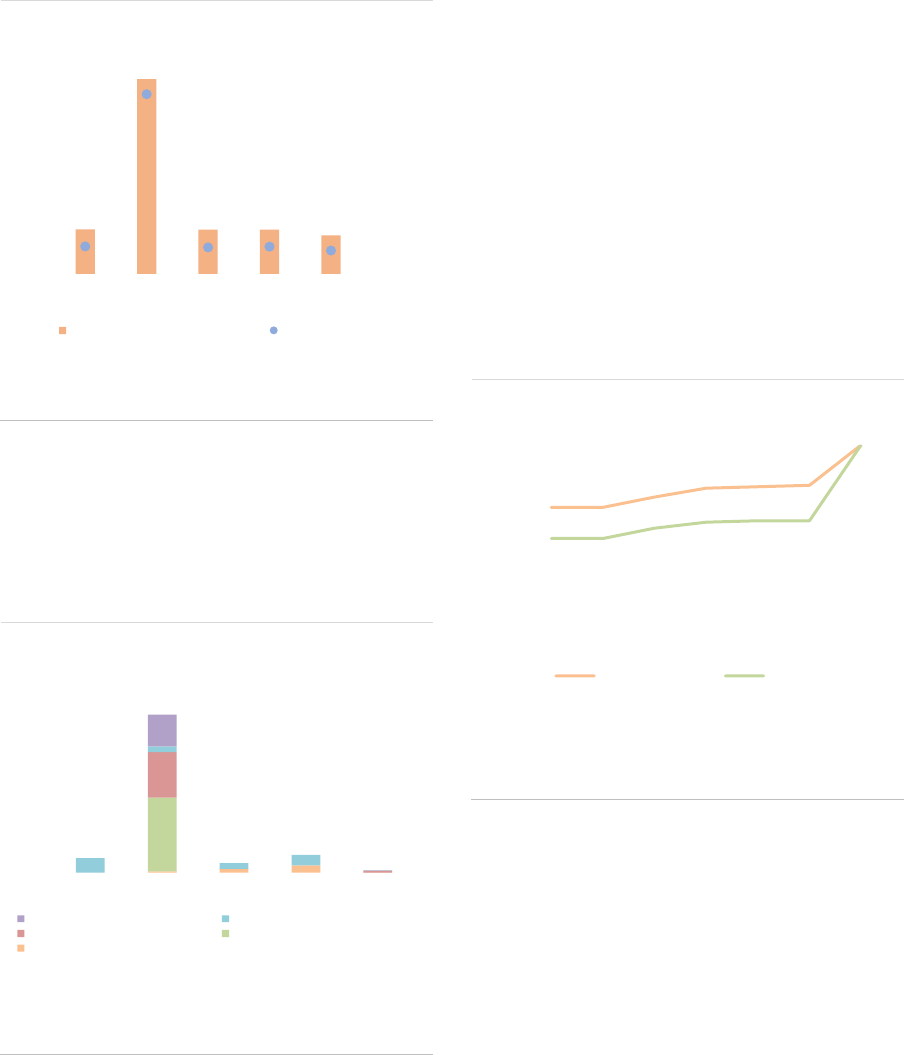

Liquidity risk: Most AIFs are open-ended funds

(70% of NAV, +4pp compared with 2019), with

variation across types (ASR-AIF.21)

1

. Within

open-ended funds, around 68% offer daily

liquidity to investors, and 25% offer weekly to

monthly redemptions.

At the aggregate level, the liquidity profile of

AIFs points to potential liquidity risk at all

horizons: within a week, investors can redeem up

1

The flag for open or closed-ended structure of AIFs is not

a mandatory field for AIFMs. Around 72% of AIFs report

this information, accounting for 86% of NAV.

2

Since the new methodology is more conservative than the

previous one, liquidity indicators in this report cannot be

compared with previous reports.

to 54% of the NAV, whereas only 45% of the

assets can be liquidated within this time frame

(ASR-AIF.12). Compared with previous reports,

the liquidity mismatch is more pronounced due to

changes in methodologies (ASR-AIF.14)

2

. At the

aggregate level, this mismatch would materialise

only if very large redemptions were to take place

(higher than 45% of NAV). For funds with a

liquidity mismatch

3

, the liquidity shortage

amounts to around 20% of the NAV of all AIFs

over a one-day horizon (more than EUR 800bn,

ASR-AIF.13). Over longer time horizons, the

liquidity shortage declines significantly, edging

below 7% over one week.

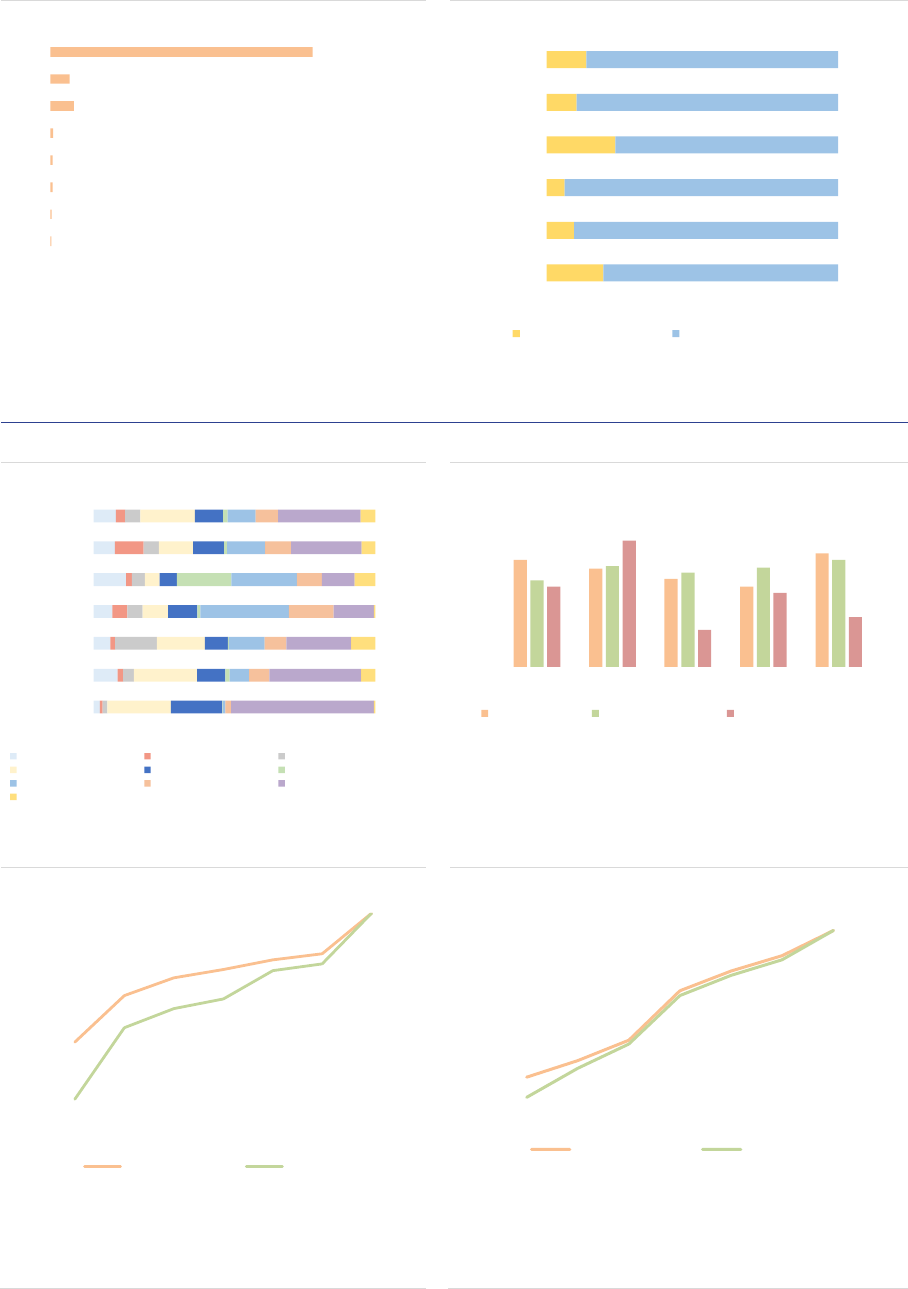

ASR-AIF.12

Liquidity profile

Liquidity mismatch at aggregate level

3

While reflecting a structural misalignment in portfolio and

investor liquidity, the observed mismatch may be further

reduced through the imposition of notice periods to

investors for redeeming their shares.

0%

90%

180%

270%

360%

450%

All AIFs FoF Private

equity

Real

estate

Other

AIF

None Hedge

fund

2018 2019 2020

Note: Adjusted leverage by AIF tyoe in % of NAV. AIFs managed and/or

marketed by full scope AIFMs and sub-threshold managers registered only

in national jurisdictions. Data for the EEA30.

Sources: AIFMD database, National Competent Authorities, ESMA.

31%

54%

61%

67%

71%

76%

100%

14%

45%

55%

61%

67%

71%

0%

25%

50%

75%

100%

1 day or

less

2-7 d 8-30 d 31-90 d 91-180 d 181-365

d

> 365 d

Investor Portfolio

Note: Portfolio and investor liquidity profiles of AIFs managed and/or marketed

by authorised AIFMs, end of 2020. Portfolio liquidity defined as the

percentage of the funds’ assets capable of being liquidated within each

specified period, investor liquidity defined as the shortest period for which

investors can redeem. EEA30 and non EEA30 AIFs by authorised AIFMs

marketed, respectively, w/ and w/o passport. d= Days. Data for the EEA30.

Sources: AIFMD database, National Competent Authorities, ESMA.

ESMA Annual Statistical Report on EU Alternative Investment Funds 2022 14

ASR-AIF.13

Liquidity shortage

Significant shortage at the short end

ASR-AIF.14

Liquidity profile

Comparing investor and portfolio liquidity

Aggregating liquidity profiles across funds is challenging. As

explained in the 2020 Annual Statistical Report (ESMA, 2020),

the method was revised to avoid having funds with excess

liquidity compensating for liquidity mismatch in other funds, i.e.

where the investor liquidity is higher than the portfolio liquidity.

Another challenge relates to the way portfolio and investor

liquidity are reported. Investor liquidity is reported in % of NAV

while portfolio liquidity is assessed for all assets, including

those acquired through the use of leverage which can bias

liquidity measures for AIFs . When leverage is used, the size

of the portfolio will be larger than the NAV, making the

comparison of investor and portfolio liquidity challenging.

In addition, the use of leverage entails that, in case of stress,

the fund might be in the position of using part of the portfolio

liquidity to satisfy borrowings and/or margin calls on

derivatives or securities financing transactions if no

unencumbered cash is at disposal. In that case, not all the

portfolio liquidity would be available to investors,

Therefore, a conservative approach is used whereby we

consider that the portfolio liquidity reported by AIFMs is

expressed in % of NAV and not AuM. This more conservative

approach is adopted here to assess potential liquidity

mismatch.

The chart below, using end-2019 data, shows the difference

between the two measures of portfolio liquidity: when using

AuM, AIFs would only show a liquidity mismatch at the very

short end (1 day or less), while when using NAV the liquidity

mismatch is visible over all time horizons.

ASR-AIF.15

Liquidity mismatch

Different liquidity profiles

-20

-15

-10

-5

0

1 day or

less

2-7

d

8-30

d

31-90

d

91-180

d

181-365

d

Liquidity shortage

Note: Liquidity shortage of AIFs, % of NAV. Liquidity shortage is defined as

the sum of liquidity deficits at the level of the funds, as non compensated by

liquidity surplus. Data for the EEA30.

Sources: AIFMD database, National Competent Authorities, ESMA.

0%

25%

50%

75%

100%

1 day or

less

2-7 d 8-30 d 31-90 d 91-180 d 181-365

d

> 365 d

Investor Portfolio Portfolio by AuM

Note: Portfolio and investor liquidity profiles of AIFs managed and/or

marketed by authorised AIFMs, end of 2019. Portfolio liquidity defined as the

percentage of the funds’ assets capable of being liquidated within each

specified period, investor liquidity defined as the shortest period for which

investors can redeem. EEA30 and non-EEA30 AIFs by authorised AIFMs

marketed, respectively, w/ and w/o passport. d= Days. Data for the EEA30.

Sources: AIFMD database, National Competent Authorities, ESMA.

ESMA Annual Statistical Report on EU Alternative Investment Funds 2022 15

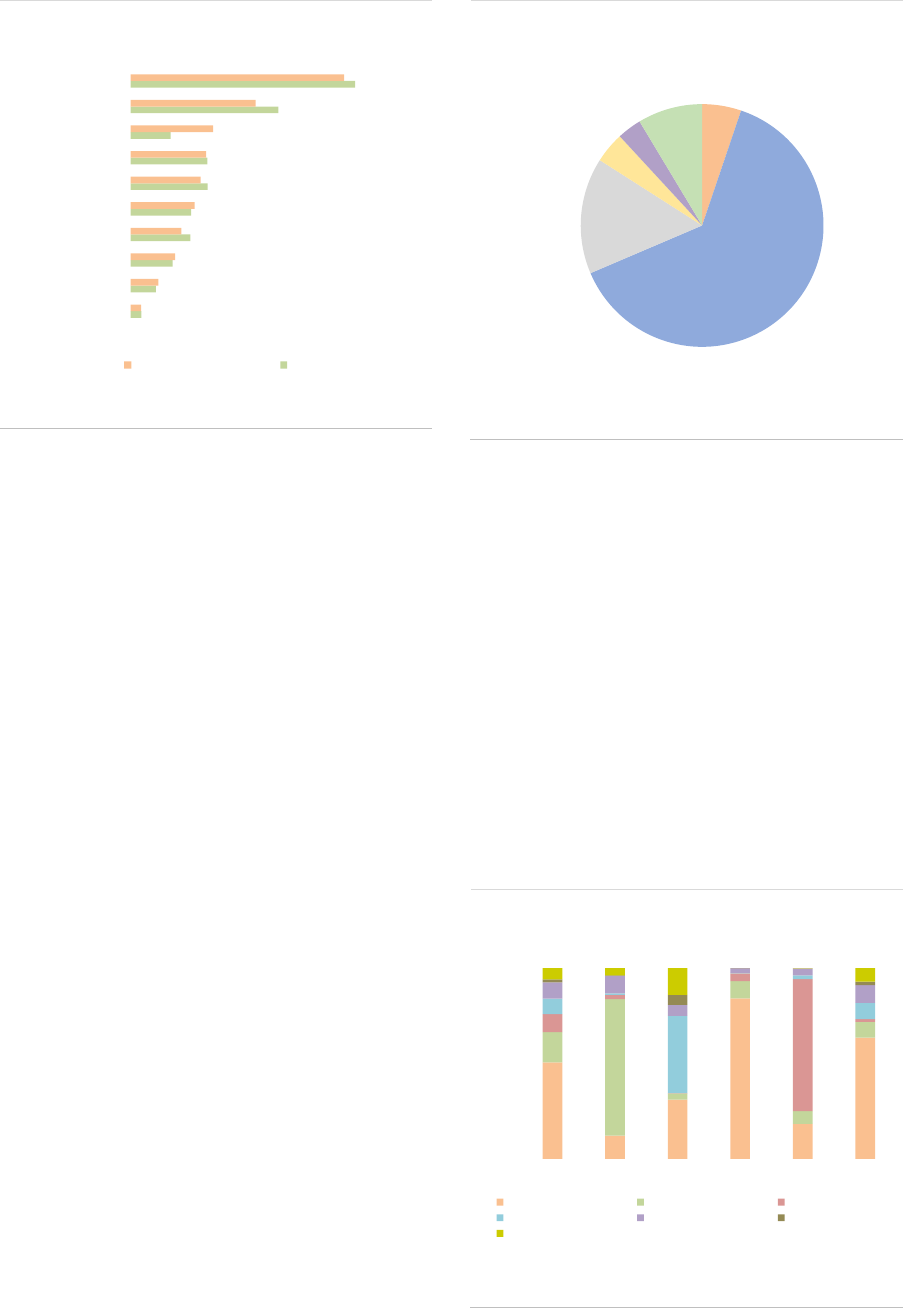

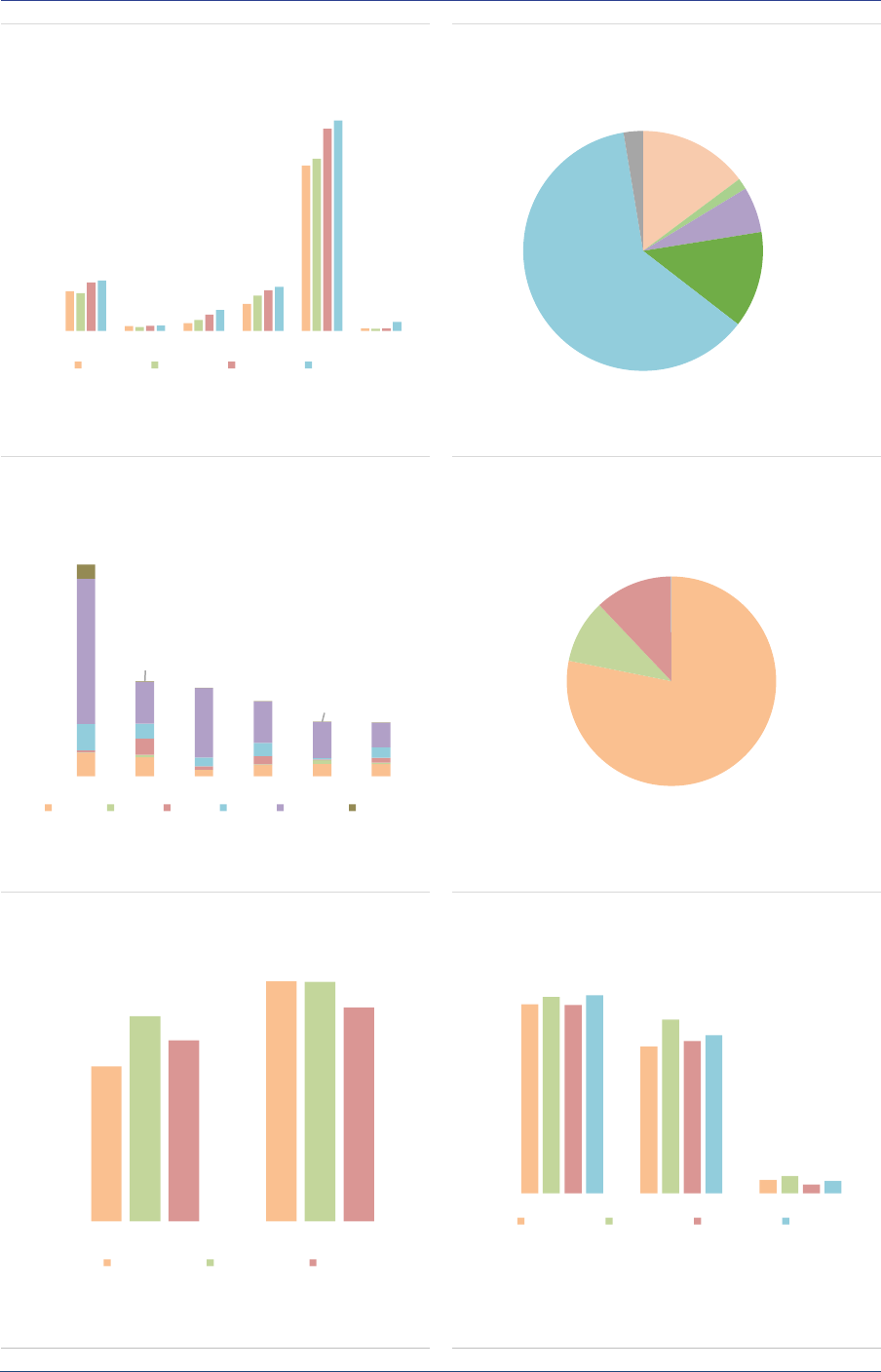

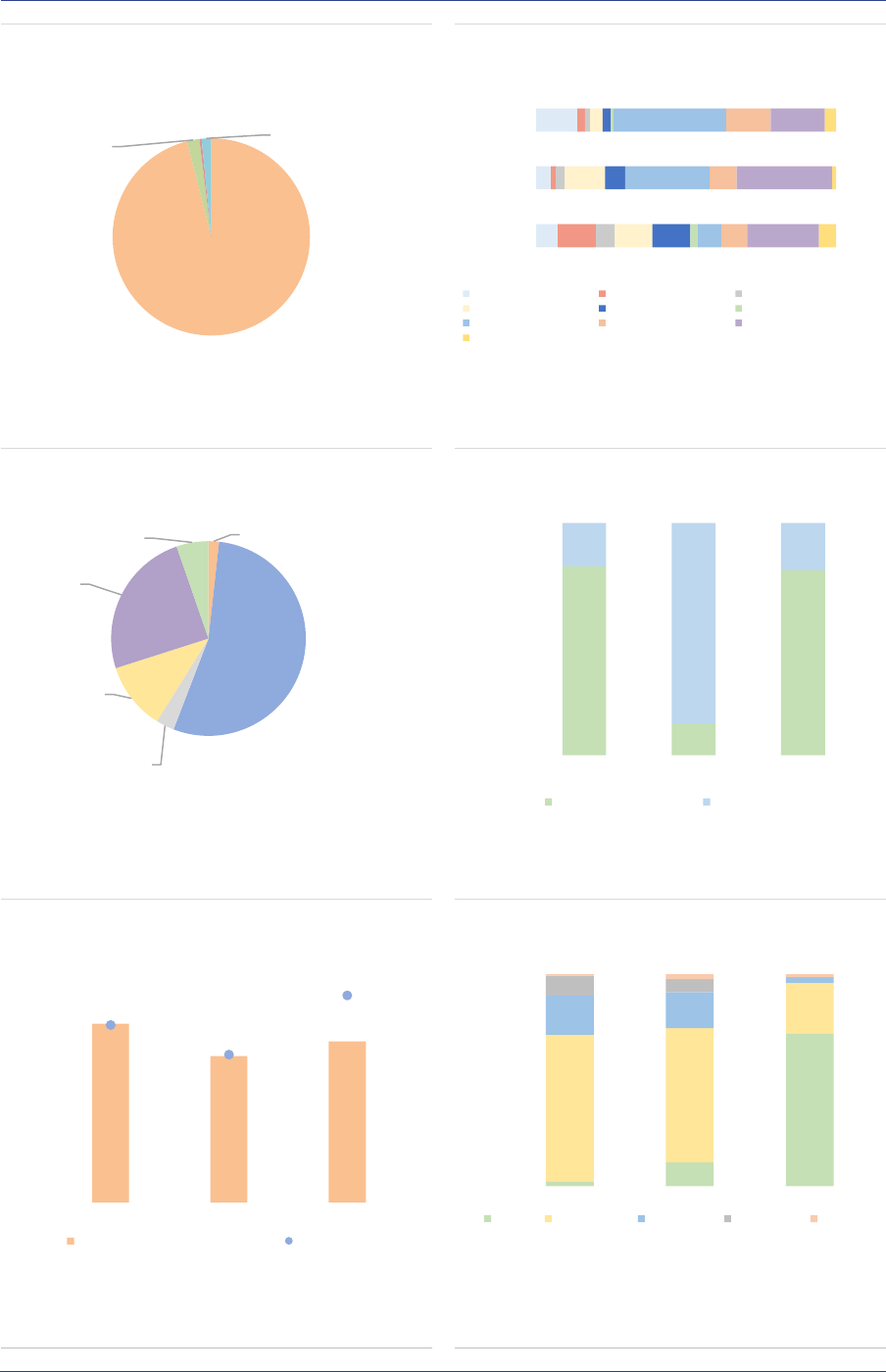

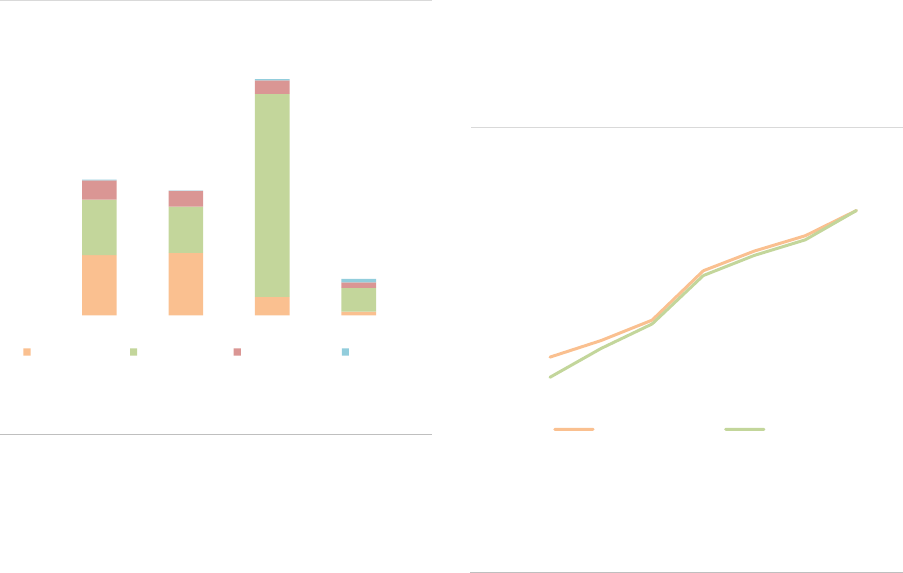

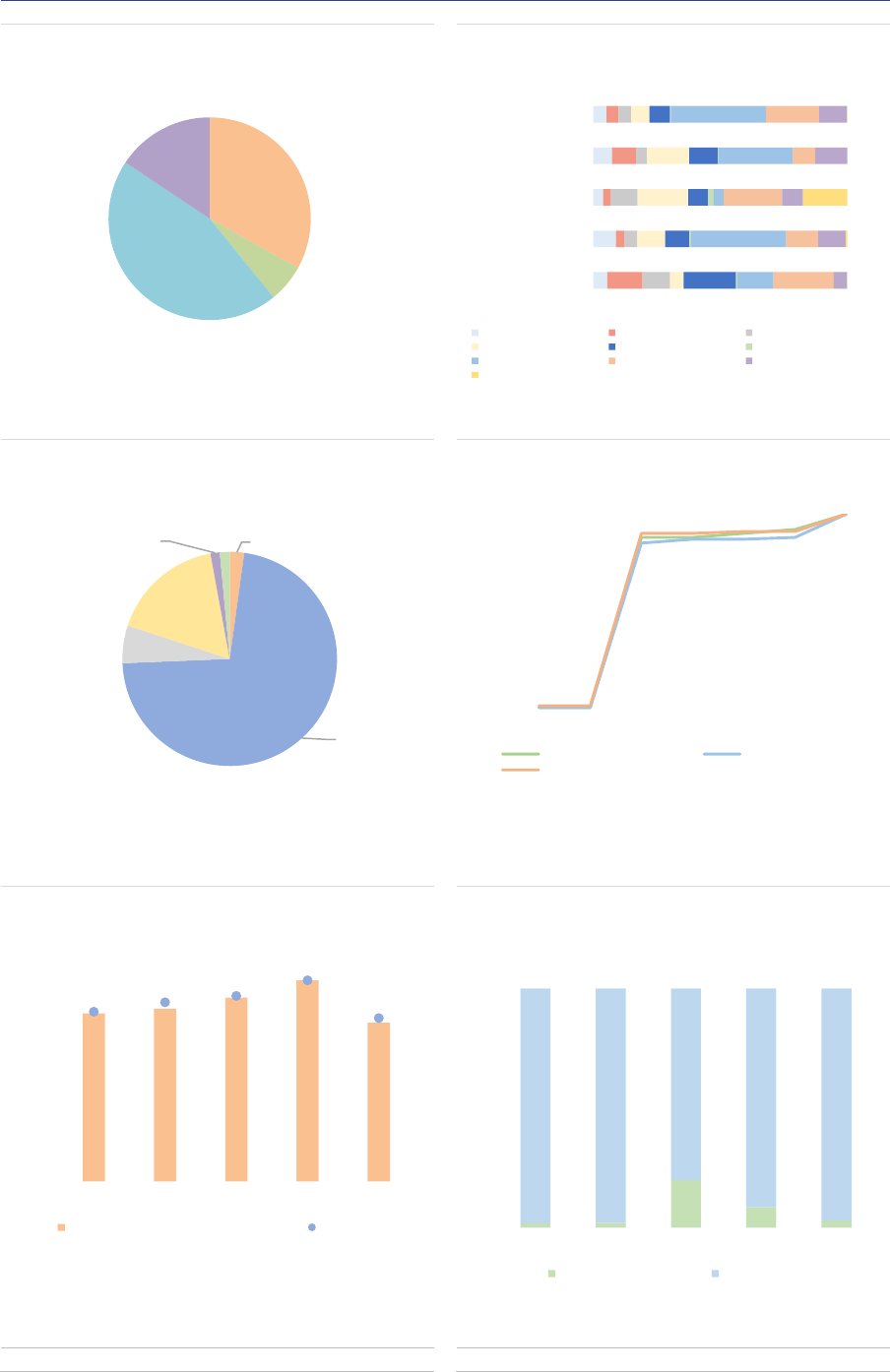

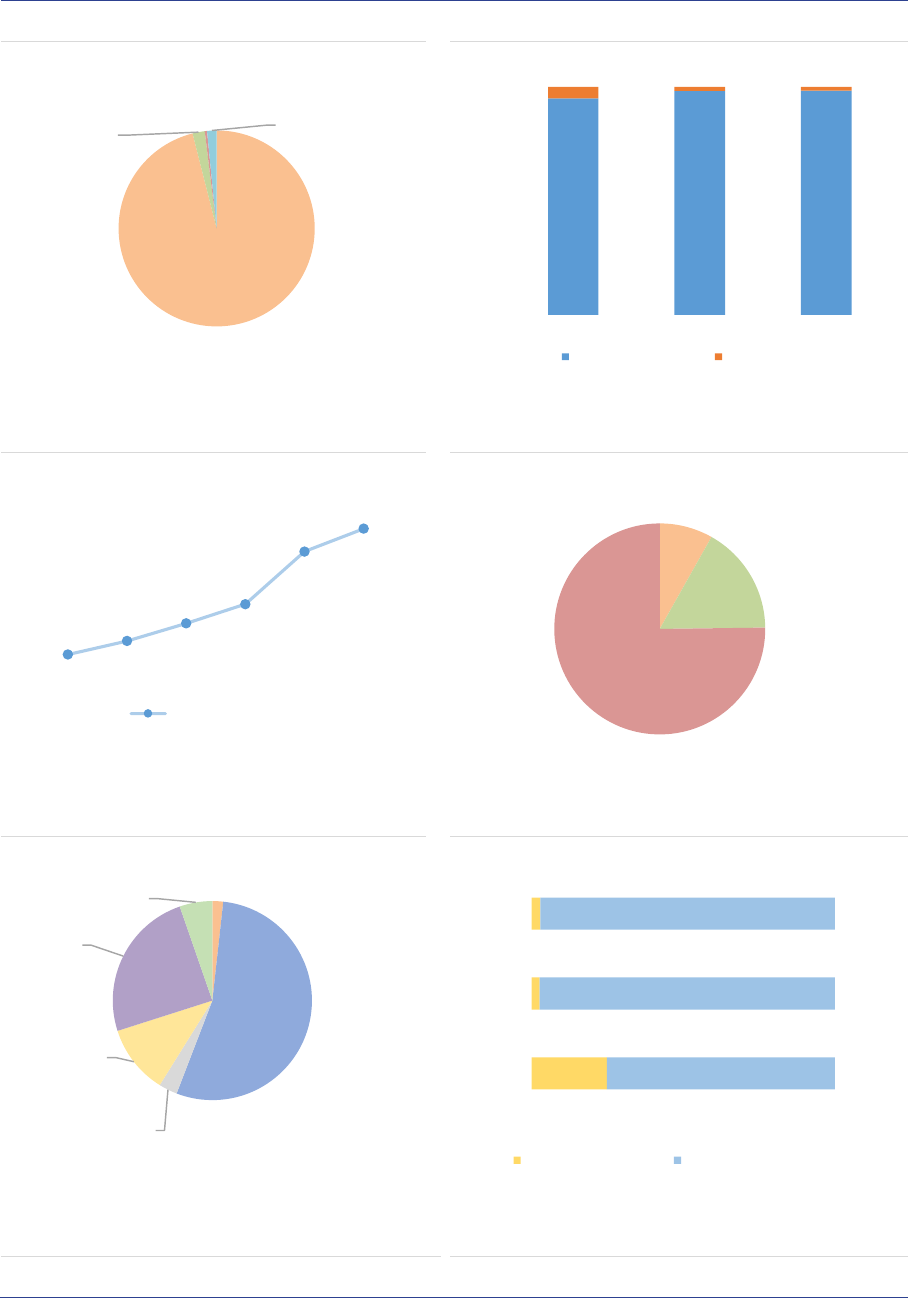

ASR-AIF.16

ASR-AIF.17

Size of the AIF industry

AIF industry by type

Growing market

‘Other AIFs’ largest type

ASR-AIF.18

ASR-AIF.19

Size of AIF by type and country

EU passport

Concentration in a few countries

Most AIFs can be passported

ASR-AIF.20

ASR-AIF.21

Leverage

Liquidity

Decline in leverage

Most AIFs open-ended

873

89

363

766

3,652

155

0

500

1,000

1,500

2,000

2,500

3,000

3,500

4,000

FoF HF PE RE Other None

2017 2018 2019 2020

Note: NAV by type of AIF managed and/or marketed by authorized AIFMs and

sub-threshold managers registered only in national jurisdictions, in EUR bn

and percent. Data for the EEA30.

Sources: AIFMD database, National Competent Authorities, ESMA.

FoF

15%

Hedge fund

1%

Private equity

6%

Real estate

13%

Other

62%

None

3%

Note: NAV by type of AIFs managed and/or marketed by authorised AIFMs and

sub-threshold managers registered only in national jurisdictions, end of 2020, in

%. FoF=Fund of funds, None=No predominant type. Data for the EEA30.

Sources: AIFMD database, National Competent Authorities, ESMA.

2,158

969

900

764

556

551

0

500

1,000

1,500

2,000

2,500

DE LU NL FR IE Other

FoF HF PE RE Other None

Note: NAV by type of AIF managed and/or marketed by authorized AIFMs and

sub-threshold managers registered only in national jurisdictions, in EUR bn.

Data for the EEA30.

Sources: AIFMD database, National Competent Authorities, ESMA.

EU

passport

78%

EU w/o passport

10%

Non-EU w/o passport

12%

Non-EU not marketed

in EU

<1%

Note: NAV of AIFs by manager's access to AIFMD passport, end of 2020, in

%.

Authorised EEA30 AIFMs with access to AIFMD passport or marketing non-

EEA30 AIFs w/o passport, sub-threshold managers registered only in national

juridisdictions w/o passporting rights. Data for the EEA30.

Sources: AIFMD database, National Competent Authorities, ESMA.

0%

25%

50%

75%

100%

125%

150%

175%

Adjusted leverage AuM/NAV

2018 2019 2020

Note: Leverage in% of NAV.AIFs managed and/or marketed by full scope

AIFMs and sub-threshold managers registered only in national jurisdictions.

Data for the EEA30.

Sources: AIFMD database, National Competent Authorities, ESMA.

0%

10%

20%

30%

40%

50%

60%

70%

80%

All AIFs RE PE

2017 2018 2019 2020

Note: Share of open-ended AIFs by type in % of NAV. AIFs managed and/or

marketed by full scope AIFMs and sub-threshold managers registered only in

national jurisdictions. Data for the EEA30.

Sources: AIFMD database, National Competent Authorities, ESMA.

ESMA Annual Statistical Report on EU Alternative Investment Funds 2022 16

Brexit implications for AIF

statistics

Summary

The UK asset management industry was an important part of the EU single financial market, and with

that also of the EU AIF market. Statistics presented in this report fall after the withdrawal of the United

Kingdom from the EU on 31 January 2020. This section compares the size and structure of UK and

EEA30 AIF sector to discuss the implications of Brexit for AIF statistics.

Comparative size of UK and

EEA30 AIFs

As a consequence of the withdrawal of the UK,

the composition and size of the EU AIF industry

has changed. While the UK withdrew from the EU

on 31 January 2020, EU law continued to apply

in the UK until the end of the transition period on

31 December 2020. However, this Annual

Statistical Report uses end-2020 data, which

were transmitted to ESMA in the course of 2021,

i.e. after the transition period, making ESMA

unable to collect data for the UK covering the year

2020.

Given these data constraints, this section uses

2019 data to illustrate the impact of Brexit on the

EEA30 AIF sector.

Size: In 2019, UK AIFs had a NAV of EUR

1,338bn compared with EUR 5,468bn for the

EEA30 (ASR-AIF.22). Therefore, the UK

accounted for 20% of the NAV of the EU sector

end-2019 (composed of EEA30 and the UK).

There were around 4,700 UK AIFs compared with

more than 28,000 for the EEA30.

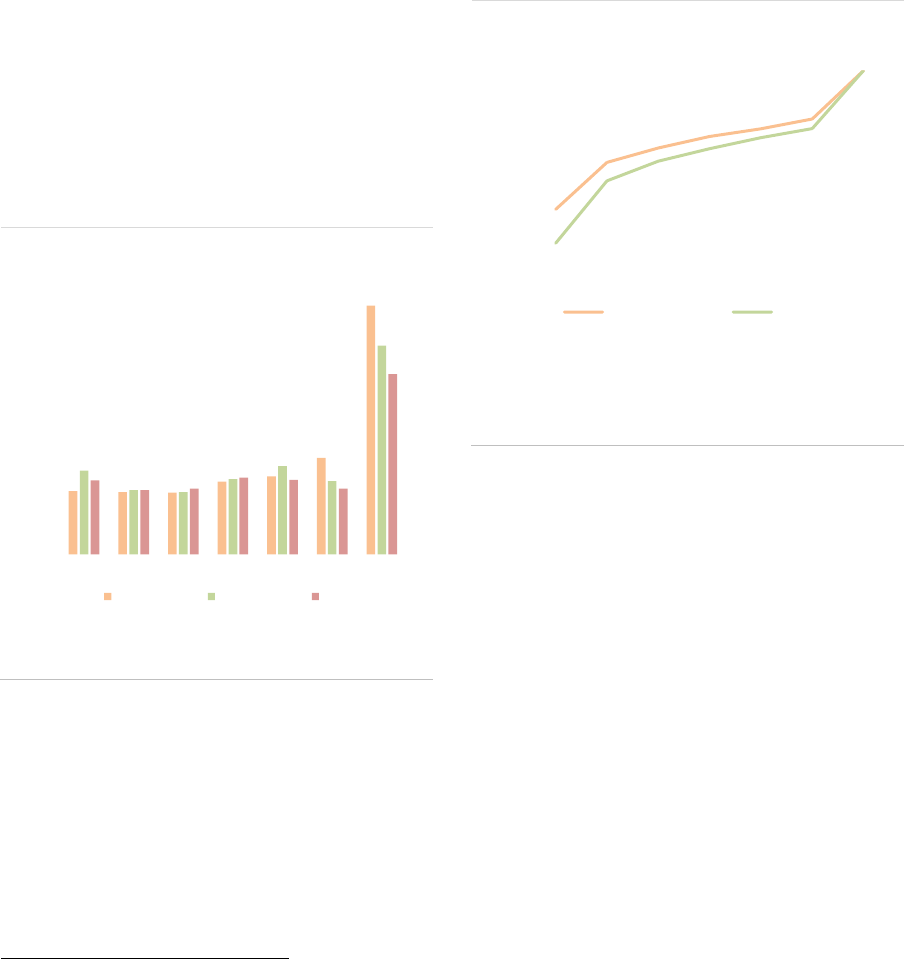

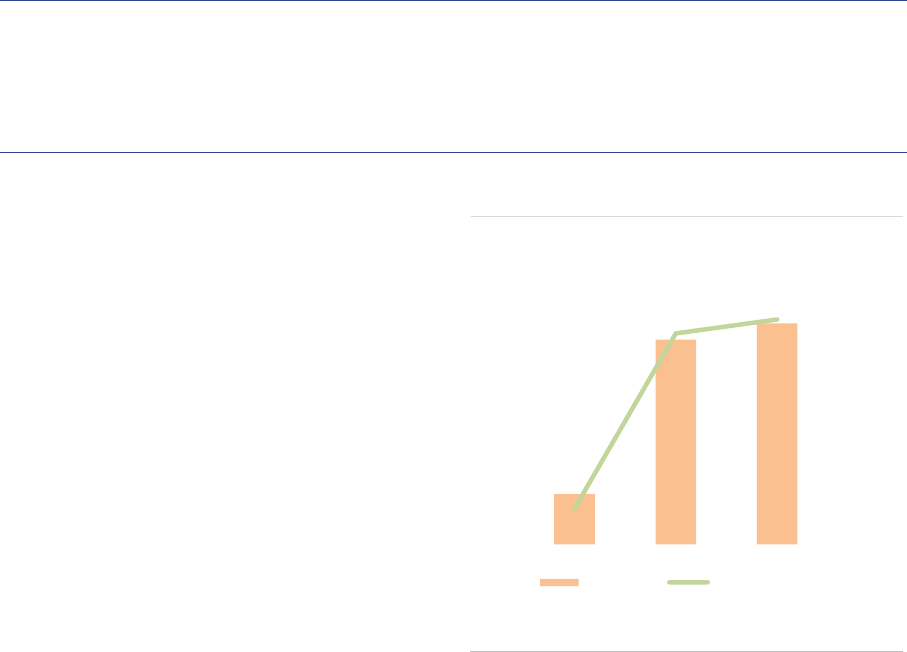

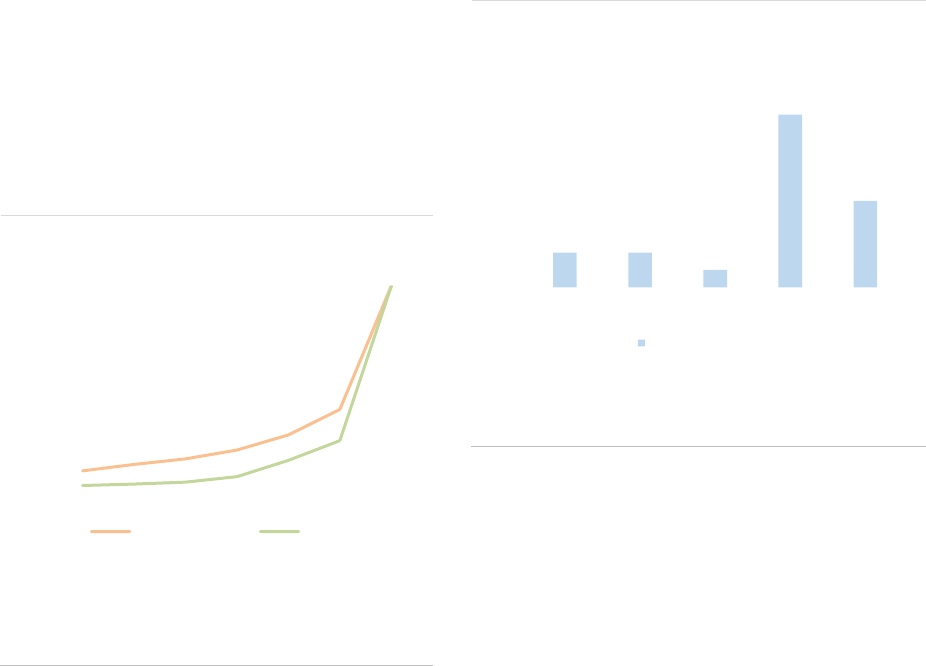

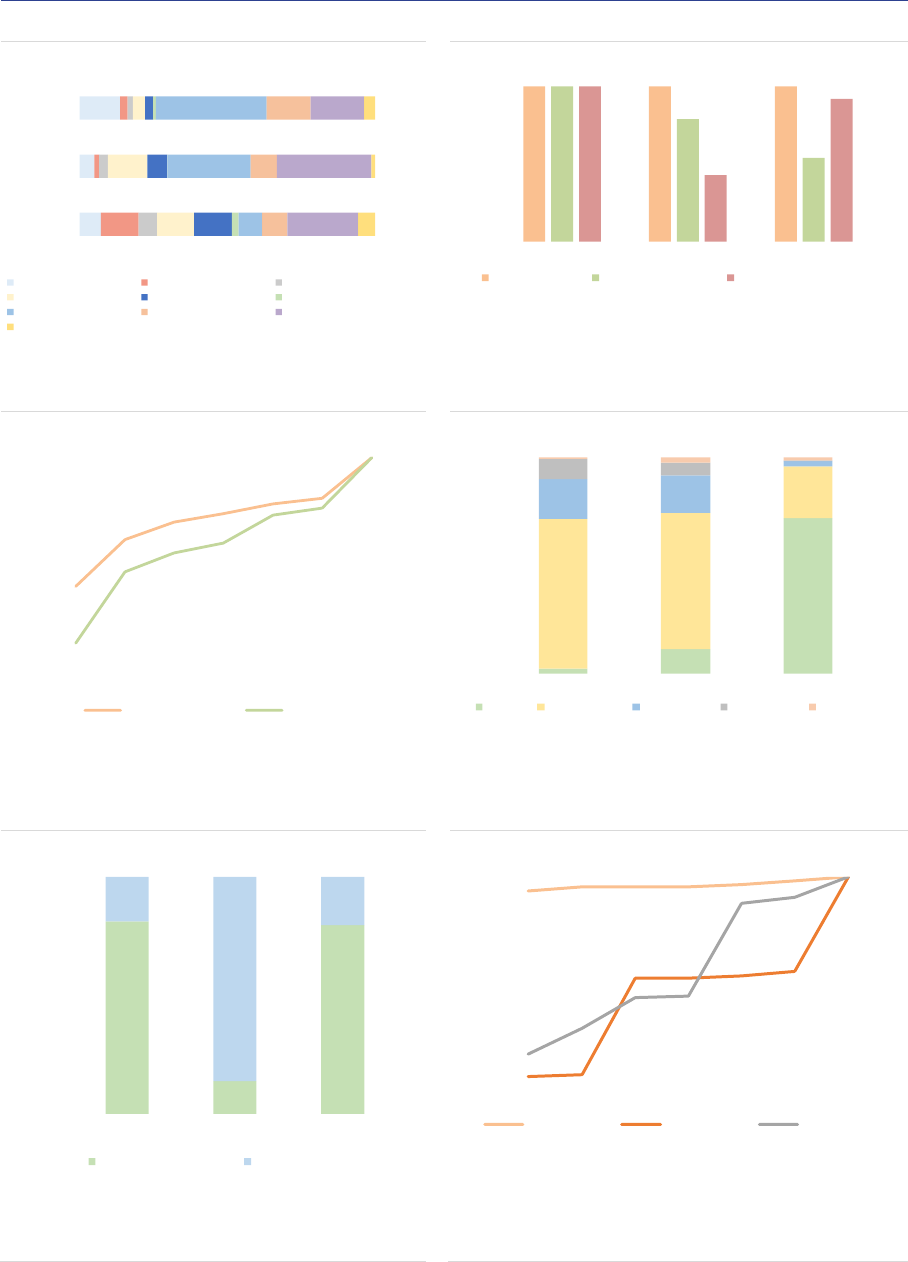

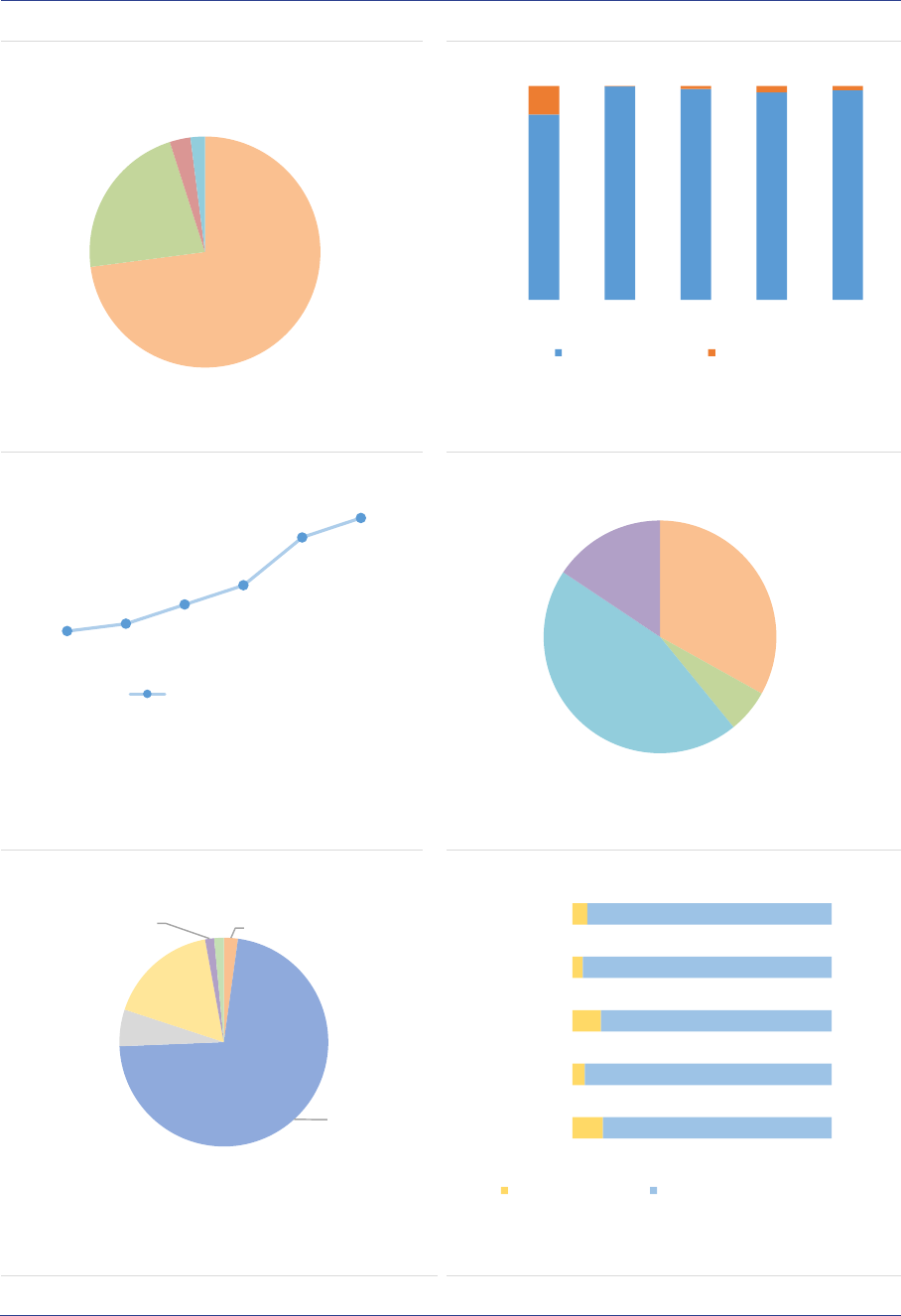

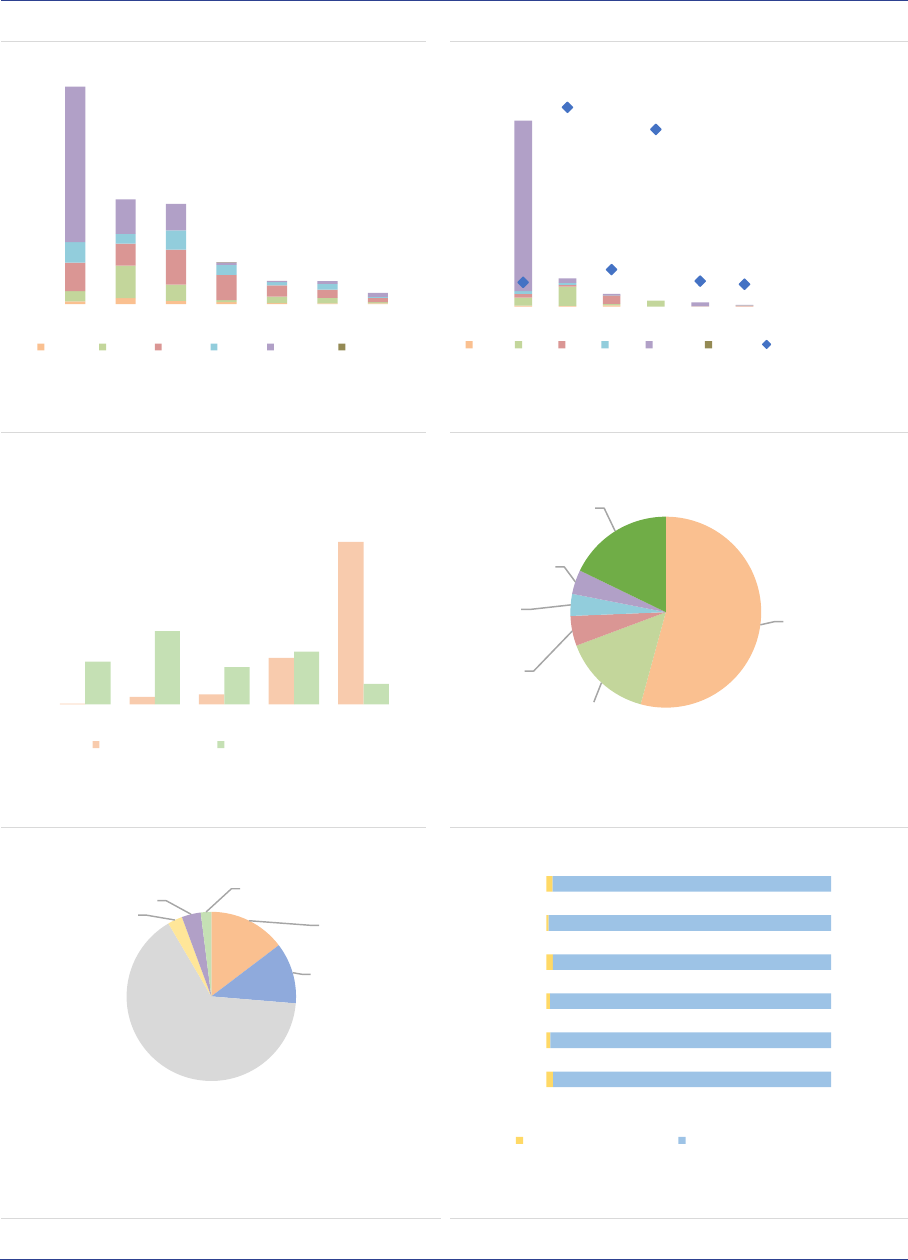

ASR-AIF.22

AIFs managed by UK and EEA30 AIFMs

Sizeable share of UK AIFs

In terms of regulatory Asset under

Management (AuM), UK AIFs accounted for

70% of the combined AuM of the UK and the

EEA30 in 2019 (ASR-AIF.23). UK AIFs reported

around EUR 22trn in 2019 compared with EUR

8.5trn for the EEA30 in 2019 (and EUR 9trn in

2020). Hedge funds managed by UK AIFMs

account for the large share of AuM (mainly due to

the use of interest rate derivatives which are

reported in notional terms). Excluding HFs, UK

AIFs AuM amounted to EUR 1.3trn.

0

5,000

10,000

15,000

20,000

25,000

30,000

35,000

0

1,000

2,000

3,000

4,000

5,000

6,000

7,000

UK 2019 EEA30 2019 EEA30 2020

NAV Number of AIFs (rhs)

Note: NAV and number of AIFs managed by AIFMs domiciled in the UK and in

the EEA30, in EUR bn.

Sources: AIFMD database, National Competent Authorities, ESMA.

ESMA Annual Statistical Report on EU Alternative Investment Funds 2022 17

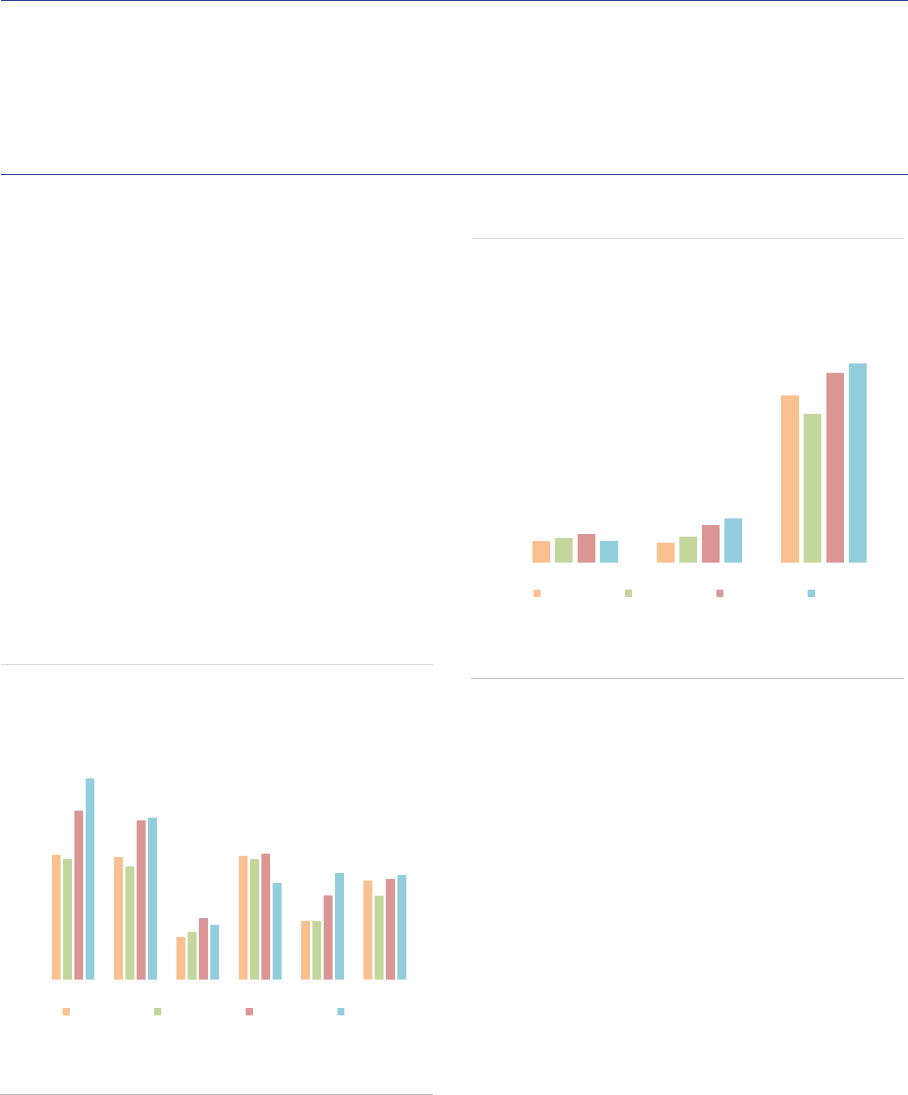

ASR-AIF.23

Regulatory AuM

Larger size for the UK due to HFs

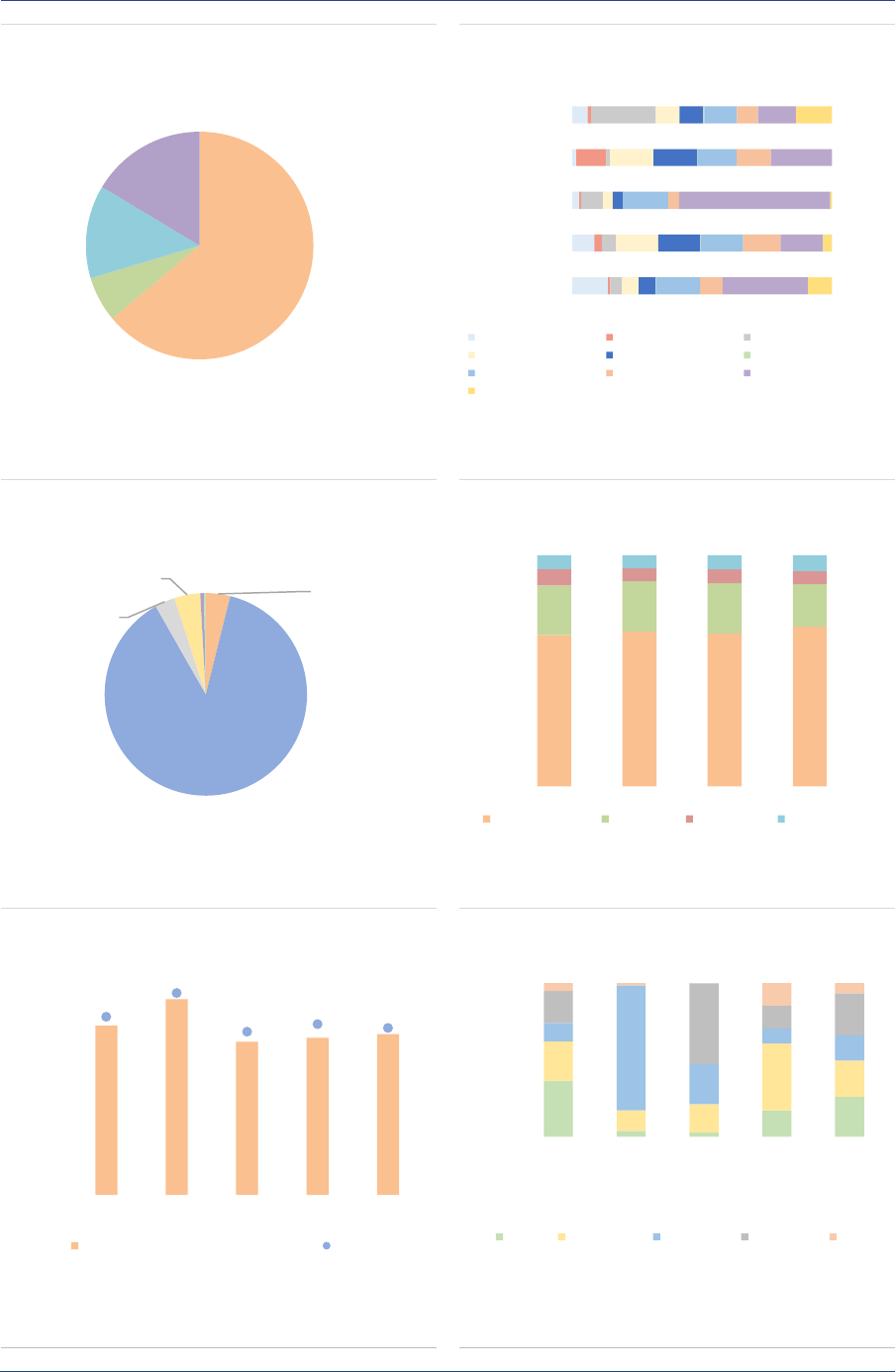

AIF type: The UK AIF sector has a different

composition compared with the EEA30, with a

larger role played by HFs and PE funds (ASR-

AIF.24). Other AIFs account for 44% of the NAV

in the UK (against 62% for the EEA30), followed

by HFs with 20% (2% for EEA30), FoFs with 14%

(15% in the EEA30), PE with 14% (5% for

EEA30), and RE with 8% (13% for the EEA30).

ASR-AIF.24

Structure of AIF sector

HFs and PE more important in the UK

Exposures: UK AIFs reported gross exposures

of EUR 21.4trn in 2019, mainly due to IRDs and

FX derivatives which account for 84% of

exposures (ASR-AIF.25). EEA30 reported gross

exposures of EUR 8.9trn, with IRDs and FX

derivatives accounting for only 15% of

exposures.

ASR-AIF.25

Gross exposures

Large exposures related to IRDs for UK AIFs

Leverage: UK AIFs report higher leverage than

EEA30 AIFs irrespective of the measure used.

The high leverage for UK AIFs is entirely driven

by the HF sector, while for other AIF types,

leverage measures are similar for UK and EEA30

AIFs. At the aggregate level, UK AIFs had a gross

leverage of 1,875% compared with 170% for

EEA30 AIFs (ASR-AIF.26).

ASR-AIF.26

Gross leverage

High leverage for UK AIFs due to HFs

Adjusted leverage indicators, when IRDs and FX

derivatives are excluded, show similar patterns

(ASR-AIF.27), with large values for UK HFs.

0

5,000

10,000

15,000

20,000

25,000

UK 2019 EEA30 2019 EEA30 2020

FoF HF PE RE Other None

Note: AuM of AIFs managed by AIFMs domiciled in the UK and in the EEA30,

in EUR bn.

Sources: AIFMD database, National Competent Authorities, ESMA.

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

UK 2019 EEA30 2019 EEA30 2020

HF FoF PE RE Other None

Note: NAV by AIF type for AIFs managed by AIFMs domiciled in the UK and in

the EEA30, in %.

Sources: AIFMD database, National Competent Authorities, ESMA.

0

4,000

8,000

12,000

16,000

20,000

UK 2019 EEA30 2019 EEA 2020

IRDs FX

Note: Gross exposure to IRDs and FX derivatives, in EUR bn.

Sources: AIFMD database, National Comptent Authorities, ESMA.

0%

300%

600%

900%

1200%

FoF HF PE RE Other Total

UK 2019 EEA30 2019 EEA 2020

Note: Gross leverage, in % of NAV.

Sources: AIFMD database, National Comptent Authorities, ESMA.

UK HFs: 8402%

UK AIFs: 1875%

ESMA Annual Statistical Report on EU Alternative Investment Funds 2022 18

ASR-AIF.27

Adjusted leverage

Higher for UK HFs compared to EEA30

Implications for AIF statistics

In terms of size and composition of the AIF

sector, Brexit had its largest impact on hedge

funds. HFs managed by UK AIFMs accounted

for more than 75% of the NAV of UK and EEA30

HFs and more than 97% of AuM. Since UK HFs

tend to be larger and use more leverage than

EEA30 AIFs, leverage measures have declined

when comparing EEA30 data for 2020 with the

2019 data published in the previous report (which

included the UK in the EU).

Private equity funds are also impacted, since

UK PEs accounted for 40% of the NAV of the

sector in 2019.

For other type of AIFs, the impact of Brexit on the

size of the sector is also significant, with

differences across types. UK AIFs accounted for

16% of FoFs in 2019 and around 12% for RE and

‘Other AIFs’.

0%

300%

600%

900%

1200%

FoF HF PE RE Other Total

UK 2019 EEA30 2019 EEA 2020

Note: Adjusted gross leverage, in % of NAV.

Sources: AIFMD database, National Comptent Authorities, ESMA.

ESMA Annual Statistical Report on EU Alternative Investment Funds 2022 19

Funds of Funds

Summary

FoFs account for 15% of the NAV of EEA30 AIFs, at around EUR 0.9tn (+4% compared with 2019).

Among AIF types, FoFs have the second largest retail investor participation at 20% of NAV. Open-ended

FoFs remain exposed to significant liquidity mismatch across all time horizons, including FoFs investing

mainly in UCITS. The potential liquidity shortage for FoFs with a liquidity deficit is 16% of their NAV short

term (within 1 week).

Market size and structure

Size: As of the end of 2020, the NAV of FoFs sold

in the EEA30 by AIFMs domiciled in the EEA30

amounted to EUR 873bn, a 4% increase

(EUR 30bn) compared with 2019. FoFs account

for 15% of the NAV of all AIFs. The evolution of

FoFs has been very different among countries. A

few countries recorded high increase in NAV:

19% in Germany and 27% in Ireland (ASR-

AIF.28). In contrast, France and the Netherlands

experienced a sharp decline in NAV, with a 23%

and a 10% drop respectively. Luxembourg FoFs

remained stable (+1%). The top 5 EU jurisdictions

account for almost 90% of total EEA30 FoFs’

NAV.

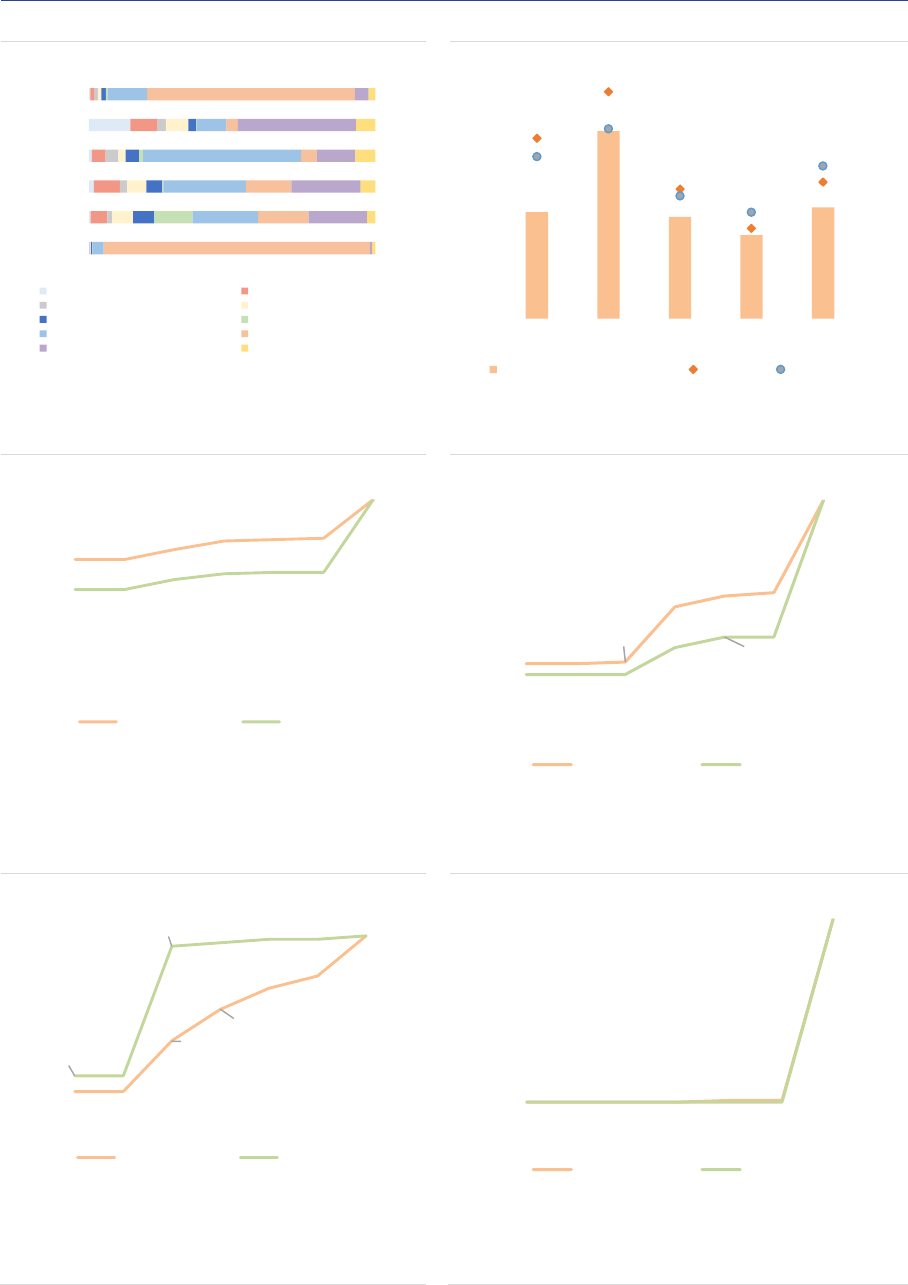

ASR-AIF.28

Funds in FoFs’ portfolios

Spread across countries

Funds of funds strategies: Funds of funds

invest in underlying collective investment

undertakings and serve the purpose of

diversifying fund-specific risk, relieving burdens

for investors to perform due diligence on

individual fund managers. FoFs pursuing

strategies beyond PE funds or HFs have

registered a sustained growth since 2018 (+34pp)

and account for 75% of NAV (ASR-AIF.29).

ASR-AIF.29

FoF strategies

Mainly outside of PE funds and HFs

Information on the most traded instruments

provided by AIFMs on behalf of the managed

funds allows to classify the CIUs in which FoFs

invest and gain insights into their activity. For

FoFs investing in PE funds and HFs the top five

traded instruments account for around 60% for of

the portfolio, while the remaining FoFs have a

slightly more diversified portfolio (ASR-

AIF.30ASR-AIF.30).

0

50

100

150

200

250

300

DE LU NL FR IE Other

2017 2018 2019 2020

Note: NAV of FoFs managed and/or marketed by authorized AIFMs and sub-

threshold managers registered only in national jurisdictions, in EUR bn. data

for the EEA30.

Sources: AIFMD database, National Competent Authorities, ESMA.

0

100

200

300

400

500

600

700

800

Fund of HF Fund of PE Other FoF

2017 2018 2019 2020

Note: NAV of FoFs by strategy, in EUR bn.AIFs managed and/or marketed by

full scope AIFMs and sub-threshold managers registered only in national

jurisdictions. Data for the EEA30.

Sources: AIFMD database, National Competent Authorities, ESMA.

ESMA Annual Statistical Report on EU Alternative Investment Funds 2021 20

ASR-AIF.30

Main instruments

Concentrated portfolios

Distribution: Most FoFs have access to the EU

passport to a large extent, with 96% licensed to

be sold throughout the EU (ASR-AIF.39ASR-

AIF.39).

Funds of Fund investors: Among AIF types,

FoFs have the second largest proportion of retail

investors (20%), although they are sold mainly to

professional investors (80%) (ASR-AIF.31ASR-

AIF.31). FoFs are diversified and usually require

less initial investment than other types of

sophisticated vehicles, so are easier to access,

especially for retail investors. Nevertheless, retail

participation varies significantly between FoF

strategies — 3% for funds of PE funds and funds

of HFs, and around to 20 % for ‘other FoFs’.

Among professional investors, pension funds and

insurance companies are the main investors,

accounting for 25% (+6pp compared to 2019) and

9% of the NAV respectively. Around 10% of FoFs’

NAV is instead held by other CIUs, (ASR-AIF.40).

In particular pension funds and other CIUs have

a large participation in FoFs investing in PE and

HFs (~60%).

ASR-AIF.31

AIF investors

Relevant retail participation

Geographical investment focus: FoFs invest

primarily in the EEA (54%), followed by

supranational issuers (25%) and North America

(11%) (ASR-AIF.41ASR-AIF.41). Since the

supranational issuers category also covers

‘multiple regions’, FoFs may invest in

geographically diversified funds, rather than in

supranational issuers specifically.

Leverage and liquidity risks

Gross exposures: FoFs have a large proportion

of their fund holdings invested in funds from the

same manager (around 40% of the NAV including

Money Market Funds and ETFs by the same

AIFMs, ASR-AIF.32ASR-AIF.32).

ASR-AIF.32

Proportion of fund holdings for FoFs

Significant cross investment

This results also from the analysis of the main

traded instruments of FoFs investing in funds

different from PE funds and HFs. For this large

residual category of FoFs, 20% of total portfolio

exposure resulting from the top five instruments

60

58

46

0%

20%

40%

60%

Fund of HF Fund of PEQ Other FoF

Hundreds

Rank 1 Rank 2 Rank 3 Rank 4 Rank5

Note: Porfolio concentration of funds of funds, end of 2020, in % of AuM.

Portfolio concentration computed as the value of top 5 instruments traded with

respect to AuM. Data for EEA30.

Sources: AIFMD database, National Competent Authorities, ESMA.

0% 20% 40% 60% 80% 100%

Other FoF

Fund of HF

Fund of

PE

Retail investors Professional investors

Note: Clients of funds of funds managed and/or marketed by authorised

AIFMs and sub-threshold managers registered only in national jurisdictionsat,

end of 2020, in % of NAV. FoF=Fund of funds, PE= Private equity fund,

HF=Hedge fund. Data for the EEA30.

Sources: AIFMD database, National Competent Authorities, ESMA.

CIUs by

the AIFM

38%

CIUs by

others

54%

ETF by the

AIFM

1%

ETF by

others

5%

MMFs by

the AIFM

1%

MMFs by

others

1%

Note: Share of collective investment undertakings held by funds of funds in

4Q20. AIFs managed and/or marketed by authorised EU AIFMs.

CIUs=Collective Investment Undertakings. Data for the EEA30.

Sources: AIFMD database, National Competent Authorities, ESMA

ESMA Annual Statistical Report on EU Alternative Investment Funds 2021 21

relates to cross investment. For funds of PE funds

and HFs the shares of CIUs managed by other

management companies is, respectively, above

40% and around 28%. Looking at the use of

derivatives, funds of HFs rely largely on FX

derivatives (ASR-AIF.33). The use of these

derivatives may serve to hedge the exposures

arising from foreign currency share classes held

in portfolio.

ASR-AIF.33

Main traded instruments

Instruments (%)

Funds of

HFs

Funds of

PE

Other

FoFs

Cash

3.0

1.8

2.0

Equities

0.9

3.4

1.5

Corporate bonds

0.0

0.0

0.1

Sovereign bonds

0.1

0.1

0.2

Convertible bonds

0.0

0.0

0.0

Loans

1.3

0.0

0.1

Structured products

0.0

0.0

0.1

CDS & equity derivatives

0.0

1.9

IRDs and FX

15.2

1.1

4.4

Other derivatives

0.0

0.0

0.5

Real assets

0.0

0.1

MMFs by other AIFMs

0.1

0.2

0.7

MMFs by the same AIFM

0.1

0.0

0.4

ETFs by other AIFMs

2.2

1.0

1.6

ETFs by the same AIFM

0.0

0.0

0.2

CIUs by other AIFMs

27.8

42.5

12.1

CIUs by the same AIFM

8.3

3.8

19.7

Other assets

0.4

3.6

0.8

Total

3.0

1.8

2.0

Note: Main traded instruments, end of 2020, % of total exposures.

Data for the EEA30.

Sources: AIFMD database, National Competent Authorities,

ESMA.

Leverage: FoFs display limited use of leverage:

regulatory AuM to NAV is 145% on aggregate,

with some variation by type (ASR-AIF.34ASR-

AIF.43). Relatively low leverage levels come from

limited exposures to derivatives and little use of

financial leverage (less than 1% of NAV).

Adjusted leverage appears stable over time and

even more limited in funds investing in PE funds

and in the large FoF residual category.

ASR-AIF.34

Adjusted leverage over time

Stable over time

Liquidity risk: Most FoFs are open-ended funds

(70% by NAV), with the exception of funds of PE

funds (ASR-AIF.42). Among open-ended FoFs,

most of funds investing in strategies beyond HFs

and PE funds offer daily liquidity to investors

(ASR-AIF.44). At the aggregate level, the

liquidity profile of FoFs points to a significant

and persisting liquidity mismatch over the

different time horizons. Within one day investors

can redeem up to 40% of the NAV, whereas 14%

of the assets can be liquidated within this time

frame. The liquidity gap reduced between three

and six months (ASR-AIF.35).

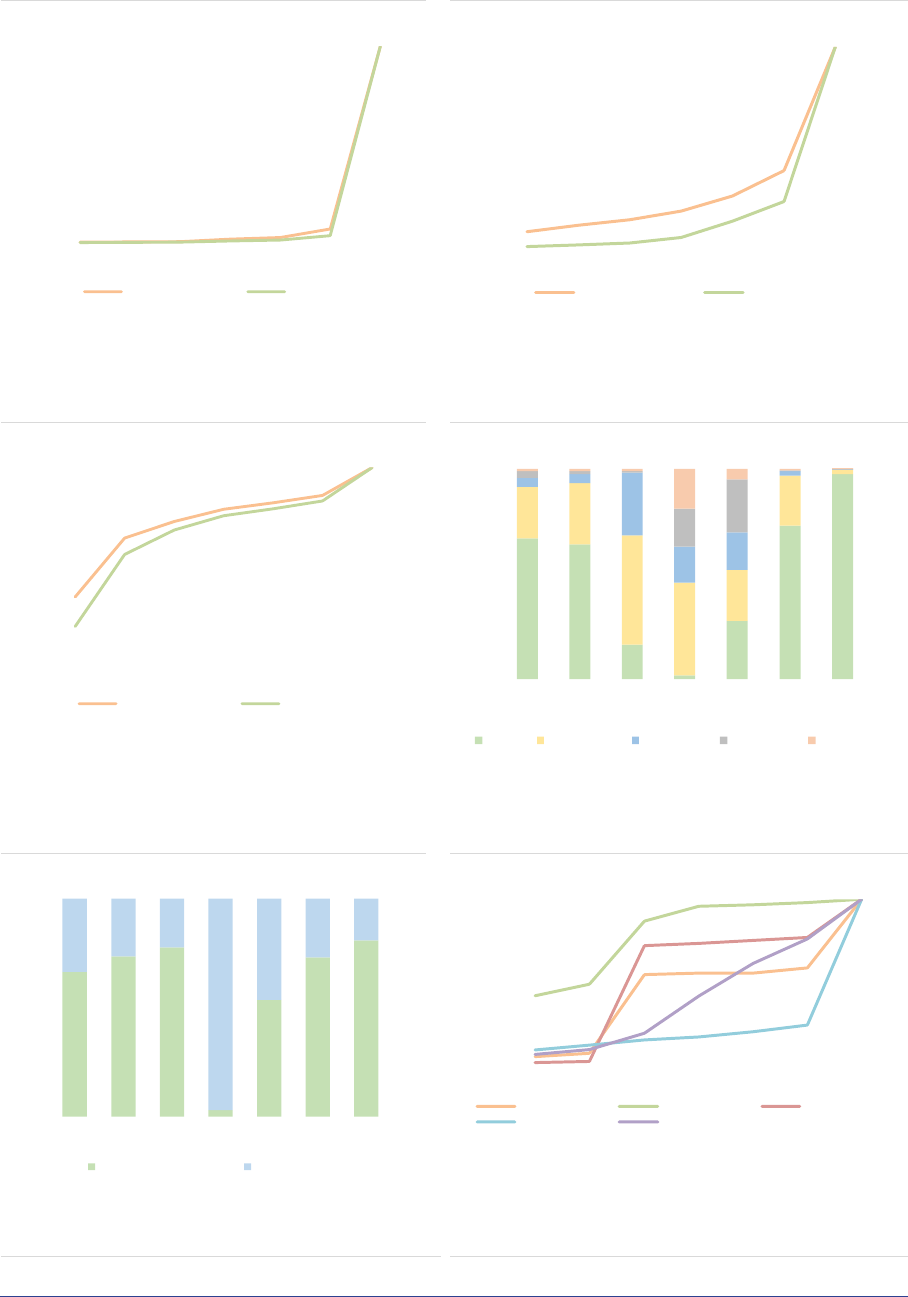

ASR-AIF.35

Liquidity profile

Significant liquidity mismatch

Most FoFs investing beyond HF and PE

strategies usually hold shares of UCITS, which

offer daily liquidity to investors. The observed

one-day liquidity gap implies that AIFMs might

consider their UCITS’ exposures subject to

liquidity risk over one day. One factor could be

that the AIFM might take into account the

0%

20%

40%

60%

80%

100%

120%

140%

Fund of HF Fund of PE Other FoF

2018 2019 2020

Note: Adjusted leverage of FoFs in % of NAV. AIFs managed and/or marketed by

full scope AIFMs and sub-threshold managers registered only in national

jurisdictions. Data for the EEA30.

Sources: AIFMD database, National Competent Authorities, ESMA.

40%

62%

70%

74%

78%

81%

100%

14%

56%

60%

73%

76%

0%

25%

50%

75%

100%

1 day or

less

2-7 d 8-30 d 31-90 d 91-180 d 181-365

d

> 365 d

Investor Portfolio

Note: Portfolio and investor liquidity profiles of funds of funds managed and/or

marketed by authorised AIFMs, end of 2020. Portfolio liquidity defined as the

percentage of the funds’ assets capable of being liquidated within each specified

period, investor liquidity defined as the shortest period for which investors can

redeem. EEA30 and non-EEA30 AIFs by authorised AIFMs marketed,

respectively, w/ and w/o passport. d=Days. Data for the EEA30.

Sources: AIFMD database, National Competent Authorities, ESMA.

ESMA Annual Statistical Report on EU Alternative Investment Funds 2021 22

settlement period required by the underlying

funds (usually T+2). Alternatively, the manager

might report a liquidity mismatch based on its

internal liquidity risk assessment. FoFs might

hold a large portion of the shares of some UCITS.

Therefore, the manager would need more time to

sell its shares, to reduce the price impact of his

sales. When considering only FoFs with a

liquidity deficit, the potential liquidity shortage in

the very short term (within 1 day) is above 30% of

their NAV and it reduces significantly within the

six-months horizon (ASR-AIF.36).

ASR-AIF.36

Liquidity profile

Some liquidity mismatch

FoFs offering daily redemptions and not requiring

any notice period to investors for redeeming their

share represent one-third of the NAV. A notice

period ranging from 1 to 7 days for FoFs allowing

to redeem on a daily basis is instead more

commonly requested (40% of NAV). Overall,

more than 40% of FoFs by NAV do not require

any redemption notice to investors (Error!

Reference source not found.).

4

Unencumbered cash is an optional field for AIFMs to

report.

ASR-AIF.37

Redemption frequency and notice period

Majority of daily funds without any notice period

Redemption

Frequency

Notice Period

None

1D

1W

1M

>1M

Total

Daily

33.5

19.1

11.3

0.6

64.0

Weekly to

Monthly

8.6

7.3

4.4

13.9

3.1

29.1

Quarterly

0.6

0.1

0.1

0.3

0.1

4.3

Longer than

quarterly

0.3

0.1

0.8

1.4

Other

0.2

0.8

0.2

0.1

1.2

Total

43.3

26.5

16.7

15

4.0

100

Note: Funds of funds by redemption frequency and notice period

given to investors, in % of NAV, end of 2020. 1D= 1 day, 1W = 2 to

7 days, 1M = 8 to 30 days, >1M = more than 30 days’ notice period.

Data for the EEA30.

Source: AIFMD database, National Competent Authorities, ESMA.

Unencumbered cash, i.e. a fund’s position in

cash or cash-like securities not subject to legal

claims by another party (e.g. from collateral

pledges or securities lending activities), is an

important indicator of a fund’s ability to mobilise

funds fast to meet redemption claims

4

. FoFs have

relatively low levels of unencumbered cash,

between 2% and 3% of the NAV across types

(ASR-AIF.38).

ASR-AIF.38

Unencumbered cash

Low cash buffers

-32

-24

-16

-8

0

1 day or

less

2-7

d

8-30

d

31-90

d

91-180

d

181-365

d

Liquidity shortage

Note: Liquidity shortage of funds of funds, % of NAV. Liquidity shortage is

defined as the sum of liquidity deficits at the level of the funds, as non

compensated by liquidity surplus. Data for the EEA30.

Sources: AIFMD database, National Competent Authorities, ESMA.

0%

1%

2%

3%

Fund of HF Fund of PE Other FoF

Unencumbered cash

Note: Unencumbered cash held by funds of funds, end of 2020, in % of NAV.

EEA30 and non-EEA30 AIFs by authorised AIFMs marketed, respectively, w/

and w/o passport. FoF=Funds of funds, HF=Hedge fund, PE=Private equity

fund. Data for the EEA30.

Sources: AIFMD database, National Competent Authorities, ESMA.

ESMA Annual Statistical Report on EU Alternative Investment Funds 2022 23

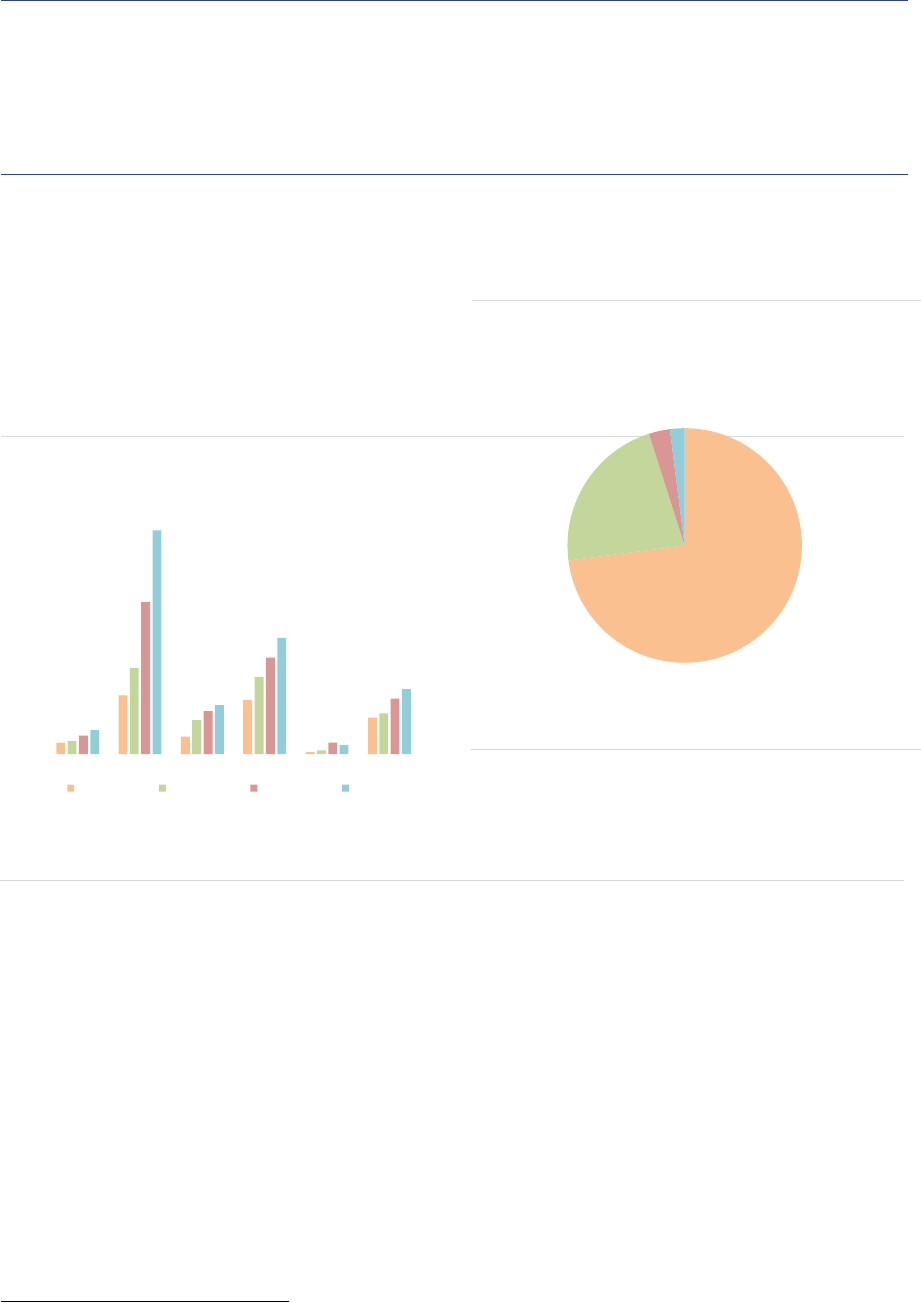

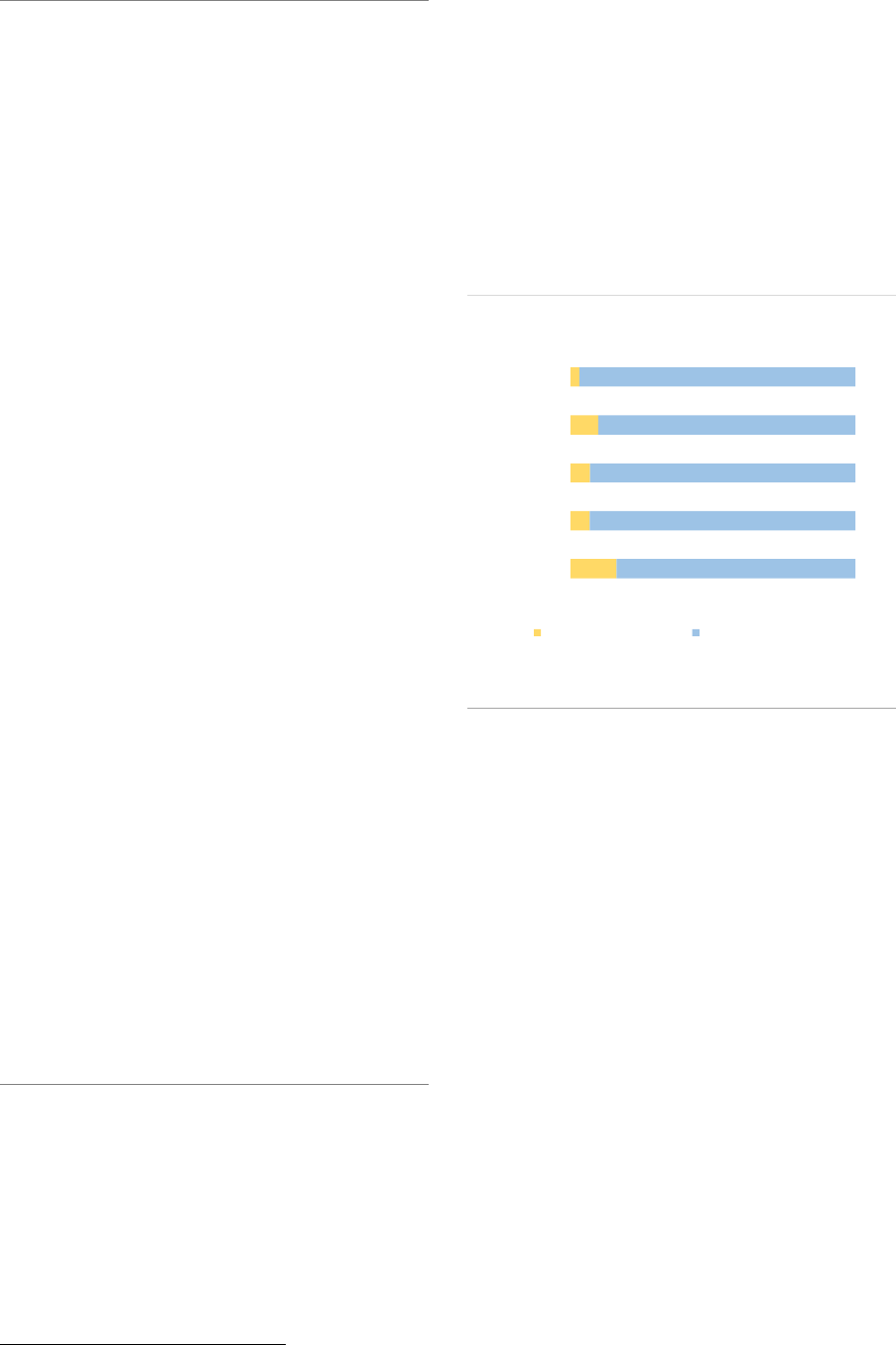

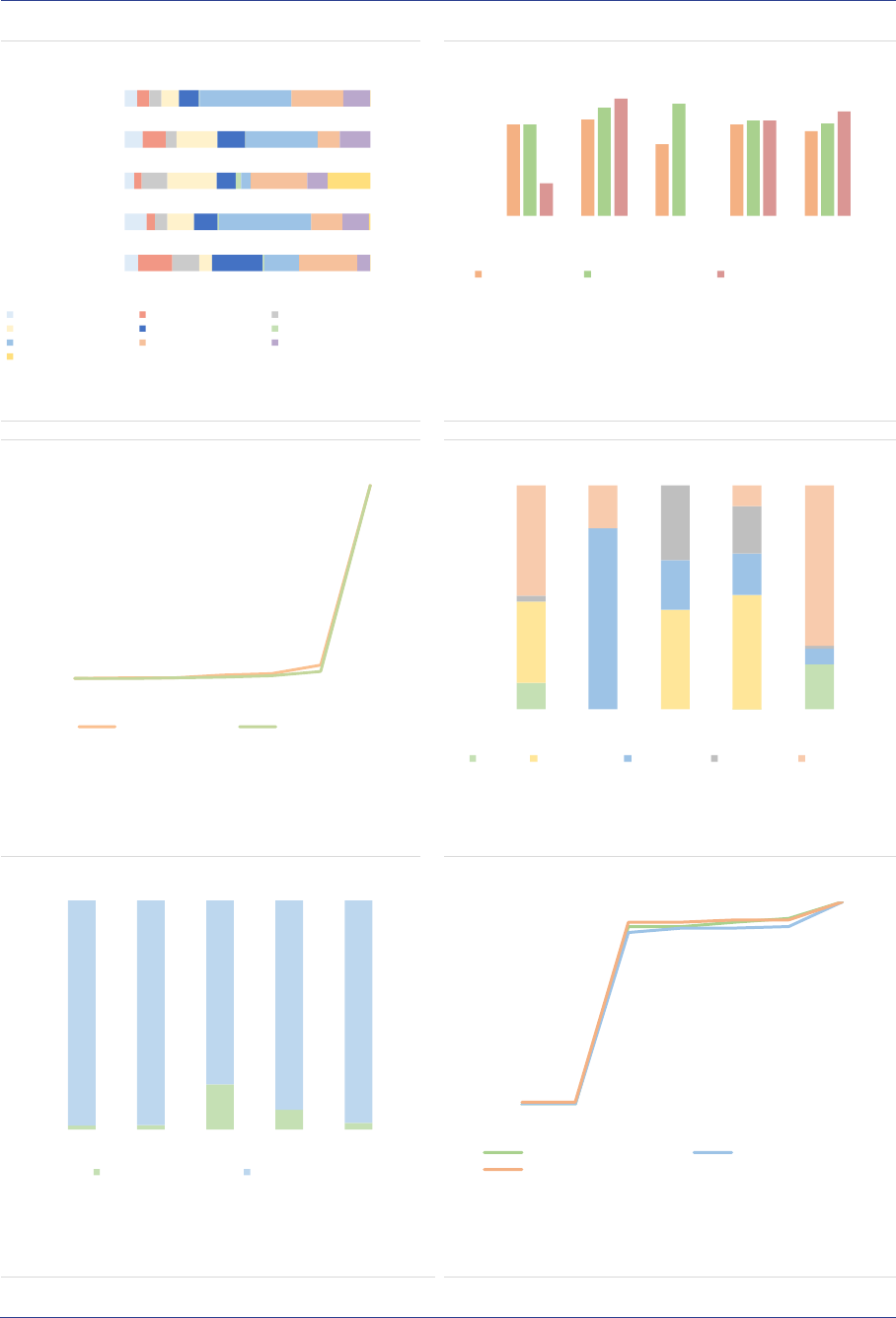

ASR-AIF.39

ASR-AIF.40

EU passport

FoF investors

Most FoFs can be passported

Mainly institutional investors

ASR-AIF.41

ASR-AIF.42

Regional investment focus

Investor rights

Mainly EEA

Funds of PE mostly closed

ASR-AIF.43

ASR-AIF.44

Leverage

Redemption frequencies

Limited leverage

Mostly daily and weekly

EU

passport

96%

EU w/o

passport

2%

Non-EU w/o passport

<1%

Non-EU not

marketed in

EU

2%

Note: NAV of funds of funds by manager's access to AIFMD passport, end of

2020, in %. Authorised EEA30 AIFMs with access to AIFMD passport or

marketing non-EEA30 AIFs w/o passport, sub-threshold managers are

registered only in national juridisdictions w/o passporting rights. Data for the

EEA30.

Sources: AIFMD database, National Competent Authorities, ESMA.

0% 20% 40% 60% 80% 100%

Other FoF

Fund of PE

Fund of HF

Banks General government Household

Insurances Non-profit None

Other CIUs Oth. fin. institutions Pension funds

Unknown

Note: Ownership of units in funds of funds managed and/or marketed by authorised

AIFMs, end of 2020, in % of NAV. FoF=Fund of funds; PE=Private equity fund,

HF=Hedge fund. Data for the EEA30.

Sources: AIFMD database, National Competent Authorities, ESMA.

Asia

2%

EEA

54%

Other Europe

3%

North

America

11%

Supra

National

25%

Rest

5%

Note: Regional investment focus of funds of funds managed and/or marketed

by authorised AIFMs and sub-threshold managers registered only in national

jurisdictions, end of 2020, in % of NAV. Geo-focus determined according to the

domicile of investments and the supranational category including investments

without a predominant geo-focus. Data for the EEA30.

Sources: AIFMD database, National Competent Authorities, ESMA.

0%

25%

50%

75%

100%

Fund of HF Fund of PE Other FoF

Open-end Closed-end

Note: Redemption rights provided in the ordinary course to investors in funds

of funds managed and/or marketed by authorised AIFMs, end of 2020, in % of

NAV. HF=Hedge fund; PE=Private equity; FoF=Fund of funds, PE=Private

equity fund. Data for the EEA30.

Sources: AIFMD database, National Competent Authorities, ESMA.

0%

40%

80%

120%

160%

Fund of HF Fund of PEQF Other FoF

Adjusted gross leverage AuM/NAV

Note: Adjusted gross leverage of funds of funds managed and/or marketed by

authorised AIFMs, end of 2020, in % of NAV. Adjusted gross leverage

computed as total exposure less IRDs with respect to NAV. FoF= Funds of

funds, PE=Private equity fund, HF=Hedge fund. Data for the EEA30.

Sources: AIFMD database, National competent authorities, ESMA.

0%

25%

50%

75%

100%

Fund of HF Fund of PE Other FoF

Daily Weekly

to monthly

Quarterly Quarterly

to yearly

Other

Note: Investor redemption frequencies allowed by open-end funds of funds

managed and/or marketed by authorised AIFMs, end of 2020, in % of NAV.

EEA30 and non-EEA30 AIFs by authorised AIFMs marketed, respectively, w/

and w/o passport. FoF=Fund of funds, PE=Private equity fund, HF=Hedge

Fund. Data for the EEA30.

Sources: AIFMD database, National Competent Authorities, ESMA.

ESMA Annual Statistical Report on EU Alternative Investment Funds 2021 24

Real Estate Funds

Summary

RE funds account for 13% of the NAV of EEA30 AIFs, at EUR 766bn. RE funds continued to grow in

2020, albeit at a more moderate pace (+9% compared with 2019). The proportion of retail investors

has continued to grow to reach 24%, the highest among AIF types. While leverage remains limited,

liquidity risk in RE funds is a concern: around 54% are open-ended, and 40% of Commercial Real

Estate (CRE) funds by NAV offer daily liquidity to investors. At the aggregate level, RE funds face

liquidity mismatch across all time periods, an indication of a structural vulnerability as the maturities of

assets and liabilities are not aligned.

Market size and structure

Size: RE funds are the third-largest AIF type by

size, with a NAV of EUR 766bn, or 13% of all

EEA30 AIFs. The size of the RE fund industry

increased by 9% in 2020, a more moderate pace

compared to 2019 (15% increase), as the result

of positive developments in housing markets. The

RE fund industry remains concentrated in a few

countries (ASR-AIF.45), with the top five

accounting for 92% of the NAV. The NAV

increased in most countries with the largest RE

fund industry.

ASR-AIF.45

Size of RE funds

Concentration in a few countries

Real Estate fund types: RE investment

strategies continue to be dominated by CRE with

64% of the NAV (-2pp compared with 2018);

while exposure to residential markets remained

stable at 16% of NAV (+1pp, ASR-AIF.52ASR-

AIF.52).

Distribution: Among AIFs, RE funds have an

extensive access to the EU passport, with 94%

able to be sold throughout the EU, a 3pp increase

from 2019 (ASR-AIF.46).

ASR-AIF.46

EU passport

High access to passport

Real Estate fund investors: RE funds are sold

mainly to professional investors (76%), with the

proportion of retail investors increasing by 3pp to

24% in 2020. The retail investor share is even

higher for CRE funds, at 33% of the NAV (+1pp)

while the share fell by 2pp to 17% for the

residential category (ASR-AIF.47ASR-AIF.47).

Among professional investors, pension funds and

insurance companies are the main investors,

accounting for 23% and 17% of the NAV

respectively (ASR-AIF.53). Households own 15%

of the NAV of RE, followed by other funds with

13% of the NAV. Banks have limited exposures

to RE funds, except for residential RE funds for

which banks hold 13% of NAV.

0

50

100

150

200

250

300

DE LU NL FR IT Other

2017 2018 2019 2020

Note: NAV of REs managed and/or marketed by authorized AIFMs and sub-

threshold managers registered only in national jurisdictions, in EUR bn. data

for the EEA30.

Sources: AIFMD database, National Competent Authorities, ESMA.

EU

passport

94%

EU w/o

passport

5%

Non-EU w/o passport

1%

Note: NAV of real estate AIFs by manager's access to AIFMD passport,

end of 2020, in %. Authorised EEA30 AIFMs with access to AIFMD

passport or marketing non-EEA30 AIFs w/o passport, sub-threshold

managers are registered only in national juridisdictions w/o passporting

rights. Data for the EEA30.

Sources: AIFMD database, National Competent Authorities, ESMA.

ESMA Annual Statistical Report on EU Alternative Investment Funds 2021 25

ASR-AIF.47

AIF investors

Large share of retail investors

Geographical investment focus: RE funds

invest overwhelmingly in the EEA (88%, +5pp

compared with 2019, ASR-AIF.54ASR-AIF.54).

RE funds have by far the largest exposures to

EEA countries compared with other AIF types.

Leverage and liquidity risks

Gross exposures: RE gross exposures are

concentrated in physical assets (around 70% of

exposures, across most RE types), in line with the

strategy used (ASR-AIF.55).

Leverage: Specific limits to balance sheet

leverage in RE funds are established in most EU

jurisdictions to mitigate the risks related to

leverage and liquidity

5

. However, those

measures are not harmonized and can vary from

one country to another (ESRB, 2021). Regulatory

AuM to NAV is 138% on aggregate, as they have

limited exposures to derivatives, with low

dispersion across RE fund types (ASR-AIF.56).

However, RE funds do use financial leverage,

with outright borrowing amounting to 11% of the

NAV (+3pp compared with 2019, the second

largest by AIF type, after HFs (ASR-AIF.48ASR-

AIF.48). In 2020, the share of unsecured

borrowing jumped from 2% to 5% of NAV.

5

In 2021, the Central Bank of Ireland published a

Consultation Paper to introduce macroprudential limits on

leverage and liquidity mismatch (CBoI, 2021).

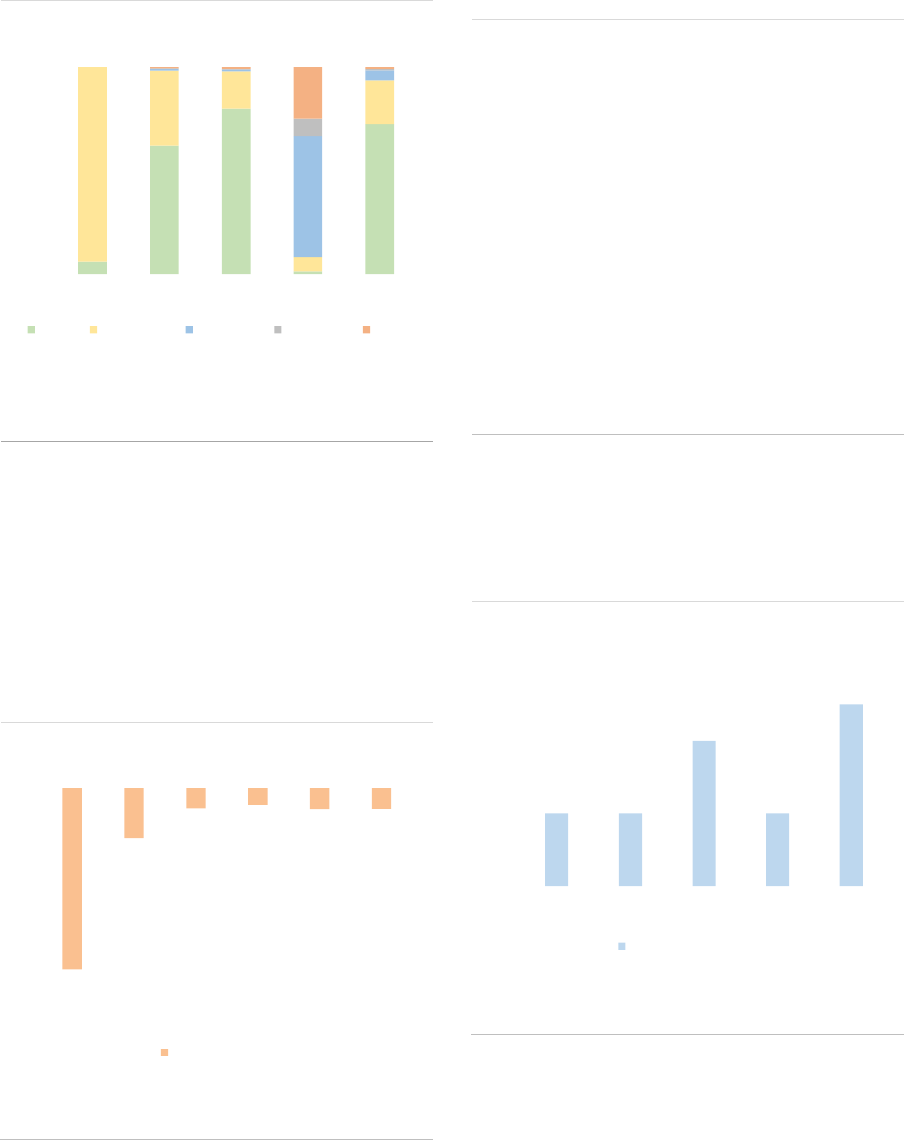

ASR-AIF.48

Financial leverage

Increase in unsecured borrowing

Financing liquidity risk for most RE funds appears

limited as most of the borrowing lines remain

available for relatively long periods. For ‘other’

RE funds, the reliance on overnight borrowing

increased by 6 pp since 2019 to amount to 17%

of financing liquidity (ASR-AIF.49).

ASR-AIF.49

Financing liquidity risk

Low short-term borrowings for most RE funds

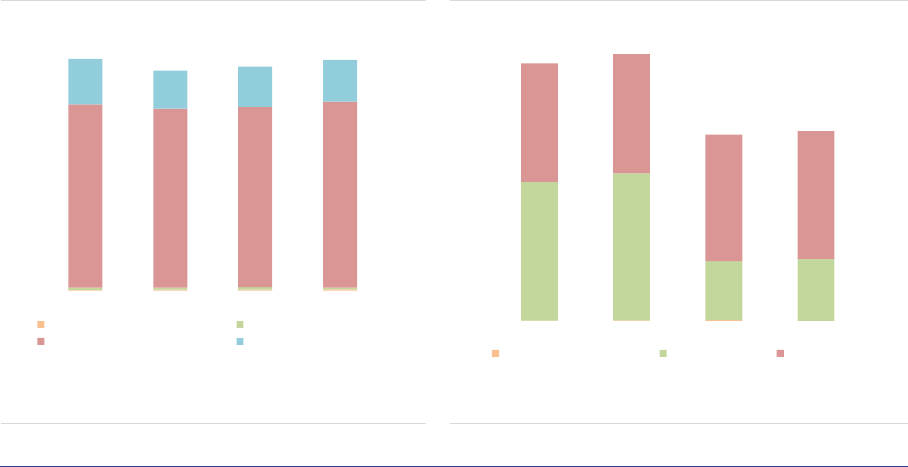

Liquidity risk: In terms of NAV, 56% of RE funds

are open-ended funds (+2pp compared with

2019) and there is considerable heterogeneity

regarding redemption frequencies for open-

ended RE funds (ASR-AIF.57). The share of RE

funds offering daily to monthly liquidity remained

stable in 2020, accounting for 55% of the NAV.

However, 40%% of CRE funds still offer daily

liquidity to investors (-2pp). At the aggregate

level, the liquidity profile of RE fund points to

significant liquidity mismatch: within a month,

investors can redeem up to 14% of the NAV,

whereas only 2% of the assets can be liquidated

0% 50% 100%

Residential

Other

Multi-strategy

Industrial

Commercial

Retail investors Professional investors

Note: Clients of real estate funds managed and/or marketed by authorised

AIFMs and sub-threshold managers registered only in national jurisdictions,

end of 2020, in % of NAV. RE = Real estate. Data for the EEA30.

Sources: AIFMD database, National Competent Authorities, ESMA.

0%

2%

4%

6%

8%

10%

12%

2019 2020

Short position borrowing sec. Secured via other

Reverse repo Secured via PB

Unsecured borrowing

Note: Share of cash and securities borrowed by RE funds, end of 2020, in % of

NAV. EEA30 and non-EEA30 AIFs by authorised AIFMs marketed, respectively,

w/ and w/o passport. Data for the EEA30.

Sources: AIFMD database, National Competent Authorities, ESMA.

26%

17%

1%

47%

100%

0%

25%

50%

75%

100%

1 day 2-7 d 8-30 d 31-90 d 91-180 d 181-365

d

> 365 d

Commercial Industrial

Other RE Residential

Note: Liquidity financing of real estate funds managed and/or marketed by

authorised AIFMs, end of 2020. Aggregate amount of borrowing and cash

financing divided depending on longest period for which creditors are

contractually committed to provide such financing, Borrowing and cash financing

include drawn and undrawn, committed and uncommitted lines of credit as well as

any term financing. RE=Real estate. Data for the EEA30.

Sources: AIFMD database, National Competent Authorities, ESMA.

ESMA Annual Statistical Report on EU Alternative Investment Funds 2021 26

within this time frame. The liquidity mismatch

occurs across all time buckets within one year

and is most prevalent for the two main strategies

(CRE and residential) which account for 80% of

NAV (ASR-AIF.50). The aggregate level of

liquidity masks important differences across

Member States, as in some countries RE funds

can only be closed-ended.

ASR-AIF.50

Liquidity profile

Persisting significant liquidity mismatch

The liquidity mismatch at the short-end can be

mitigated by cash, albeit to a lesser extent:

unencumbered cash for RE funds remains

below 6% for commercial and residential RE

funds, the two largest strategies (ASR-

AIF.51ASR-AIF.51). Furthermore, cash buffers

are significantly lower than the potential liquidity

mismatch that could arise if investors were to

redeem over longer time horizons. In that context,

funds might have to rely on liquidity management

tools, provided that they were available at the

fund level. Around 70% of open-ended RE funds

require a notice period, which in most cases is at

least three months, and 21% have lock-up

periods.

ASR-AIF.51

Unencumbered cash

Cash buffers lower than liquidity gap

8%

11%

14%

18%

26%

38%

100%

1%

5%

13%

23%

0%

25%

50%

75%

100%

1 day or

less

2-7 d 8-30 d 31-90 d 91-180 d 181-365

d