1

Pheasant Run Golf Club Business Plan

Period: 2008 - 2012

A division of Canton Leisure Services

46500 Summit Parkway

Canton, MI, 48188

Phone: 734-397-6460

Fax: 734-397-6801

Web Site: leisure.canton-mi.org

2

Table of Contents

________________________________________________________

Executive Summary 3

History 3

Organization Overview 3

Division Action Plan 6

Division Guiding Principles 6

Division Objectives 6

Vision of the Future 7

Operations 8

Summit on the Park Identity 8

Organization Structure 9

SWOT Analysis 10

Competition 11

Marketing 12

Product Mix 12

Advertising and Promotions 13

Target Market Summary 14

Market Assessment 15

Demographics 15

Market Identification 17

Market Objectives 17

Market Trends 18

Financial plan 22

3

Executive summary

History of Pheasant Run

• Arthur Hills and Associates designed course, built in 1995

• 18 hole, 7,000 yard championship course (4 sets of tees)

• In 2000 the Parks and Golf Division was separated into two unique

components with 3 full time and 40 part time and seasonal employees.

• Additional 9 holes built in 2002 allowing for greater flexibility, league play,

ability to host outings up to 216 players from 144 players previously.

• Continued growth in revenue and number of rounds

• Contract developed with outside agency (Natural Golf) to provide lessons (golf

school) at the golf range.

• In-house contracted instructors

• Current Golf Pro under contract

• Course affiliations: National Golf Foundation – USGA – GAM – PGA - GCSAA

Ecological and Community Benefits of the Golf Course.

• Recreation places for golf and non-golf activities such as jogging, walking,

cross country skiing and bird watching during non-play periods

• A place for social interaction and community events

• Community improvements that add value to land

• A business that provides skilled and semi-skilled jobs

• Provide “green space” in urban setting

• Wetland preservation areas

• Sanctuary habitats for wildlife and birds

• Turf grasses that create oxygen, air cooling and filters for ground water

• Housing bordering the course valued at $800,000

Organizational Overview

Pheasant Run Golf Club is a 27-hole championship municipal facility owned and

operated by the Charter Township of Canton. The golf course is operated under the

Leisure Services department of Canton Township. The department director oversees

the management team which consists of (1) Golf Professional and (1) Golf Course

Superintendent.

The facility vision is to provide a quality golf experience at affordable rates to the

Canton community and surrounding areas. Pheasant Run provides its customers

with an excellent services and amenities while remaining fiscally responsible and

meeting financial goals. Staff members work as a well trained team to accomplish

goals in-line with department vision.

4

Pheasant Run not only seeks to offer a well maintained course at affordable rates, but

also programs and events that foster growth in the game. The following key statistics

provide insight into a typical year at Pheasant Run.

2007 Events & Statistics

Pheasant Run hosted:

13 Charity Outings

78 Golf Outings

10 Competitive Tournaments

7 Women’s Golf Clinics

1 Junior Golf Camp

1 Junior Golf Academy

1 Family Day

10 Leagues

2 Demo Days

6 Free Instructional Clinics

Key Statistics:

37,688 Rounds Played

55,223 Point of Sale

Purchases

142 Annual Pass Holders

9,177 Range Buckets Sold

231 Days Played

3,234 Hours in Operation

The course, along with offering unique programs and events, operates at very

efficient levels. National averages for utilization rates vary from 46%-55% while

Pheasant Run operates over 50% for the season and over 65% during the peak

season. The team at Pheasant Run looks to continue growth through enhancing

facilities, programs and opportunities for new customers.

5

Revenue Enhancement

Maintain league program above 5500 rounds – 2008 estimate = $150,000

Maintenance and additions of Annual Memberships – 2008 estimate = $205,000

Advertisements in local and regional media (Michigan Golf Show, Michigan Golf Publications,

On-air radio promotions)

Promotion of Junior tournaments, Junior Summer Golf Camp, Junior Golf Academy, Women’s

Golf Clinics, Women’s League, and Senior fees during non-peak hours

Grow customer base and wallet share through promotion of In house programs such as

Player Reward Card – Loyalty program and Customer Appreciation Days

Player Development - Continue At Your Leisure tapings for golf instruction

Continue partnering with PLAYGOLFAMERICA supporting programs such as Free Lesson

Month, Women’s Golf Month, and Golf Michigan Month.

Special Events

1.

Mother’s Day – Mom’s play Free

2.

Father’s Day special

3.

LibertyFest

4.

Member Tournaments

5.

Customer Appreciation Days & Promotions

6.

Monthly email specials

7.

Tailfeather’s mailing

8.

Member Appreciation Days

9.

Demo Days

10.

Player Reward Card

11.

Oktoberfest

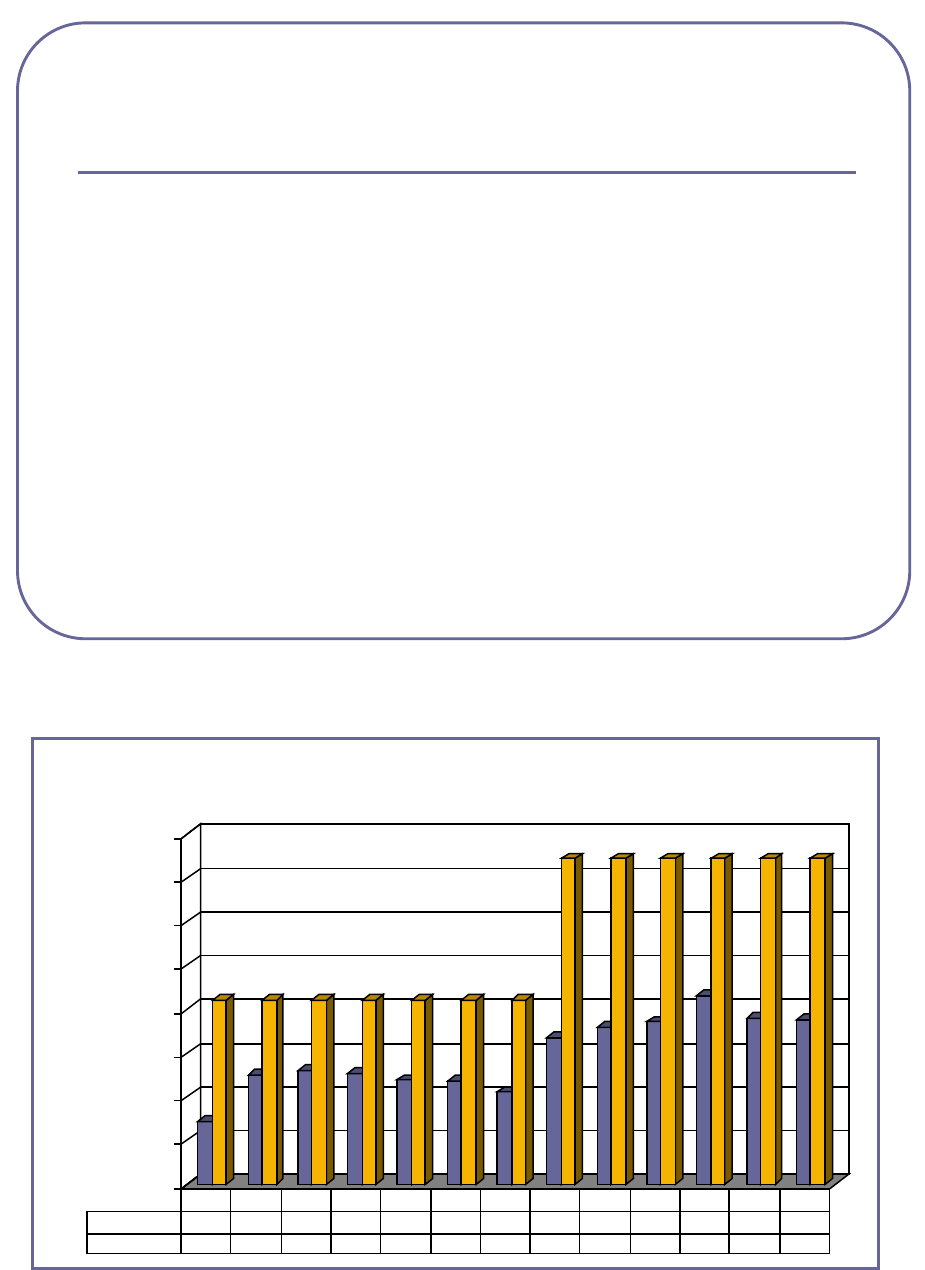

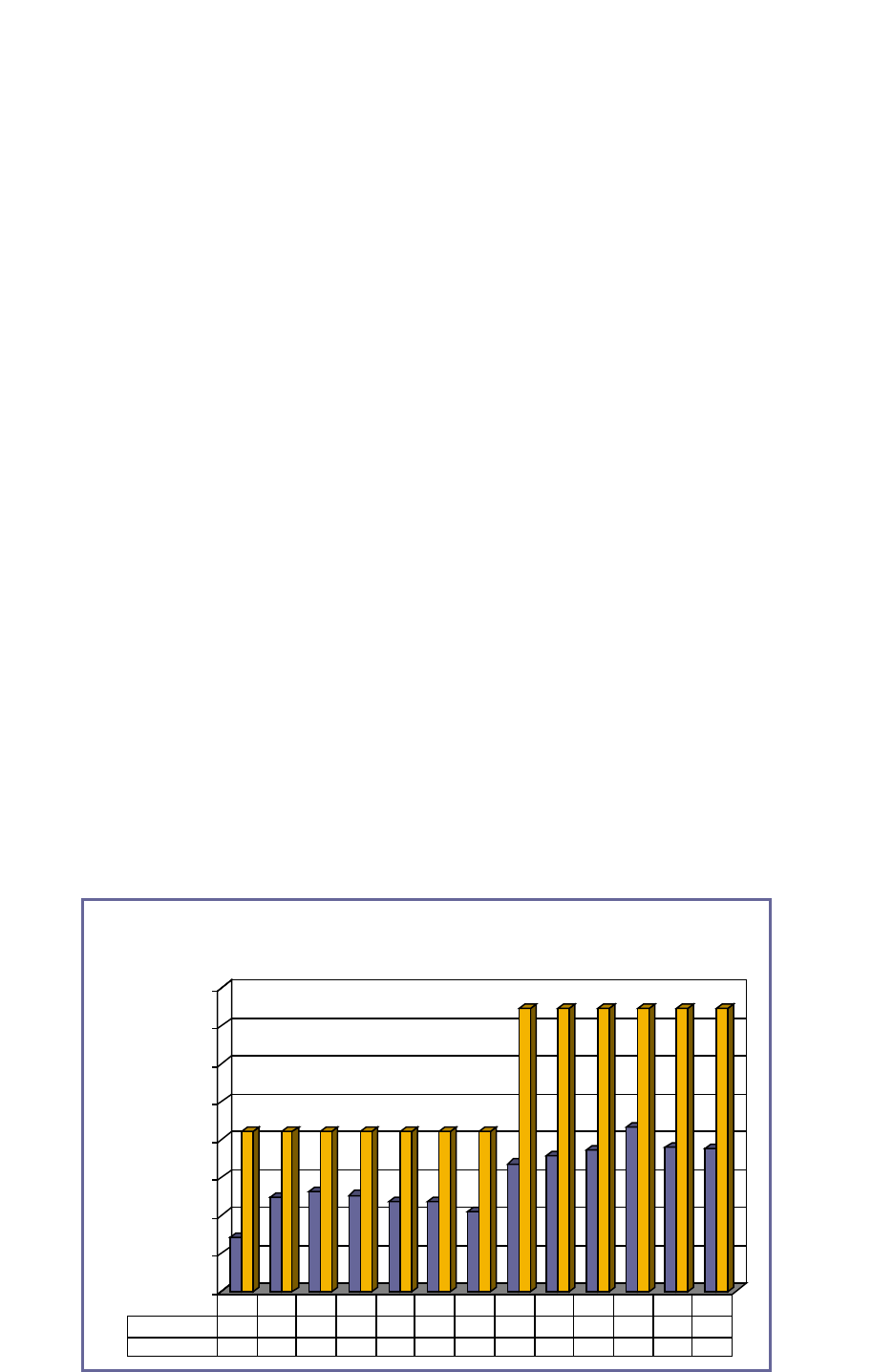

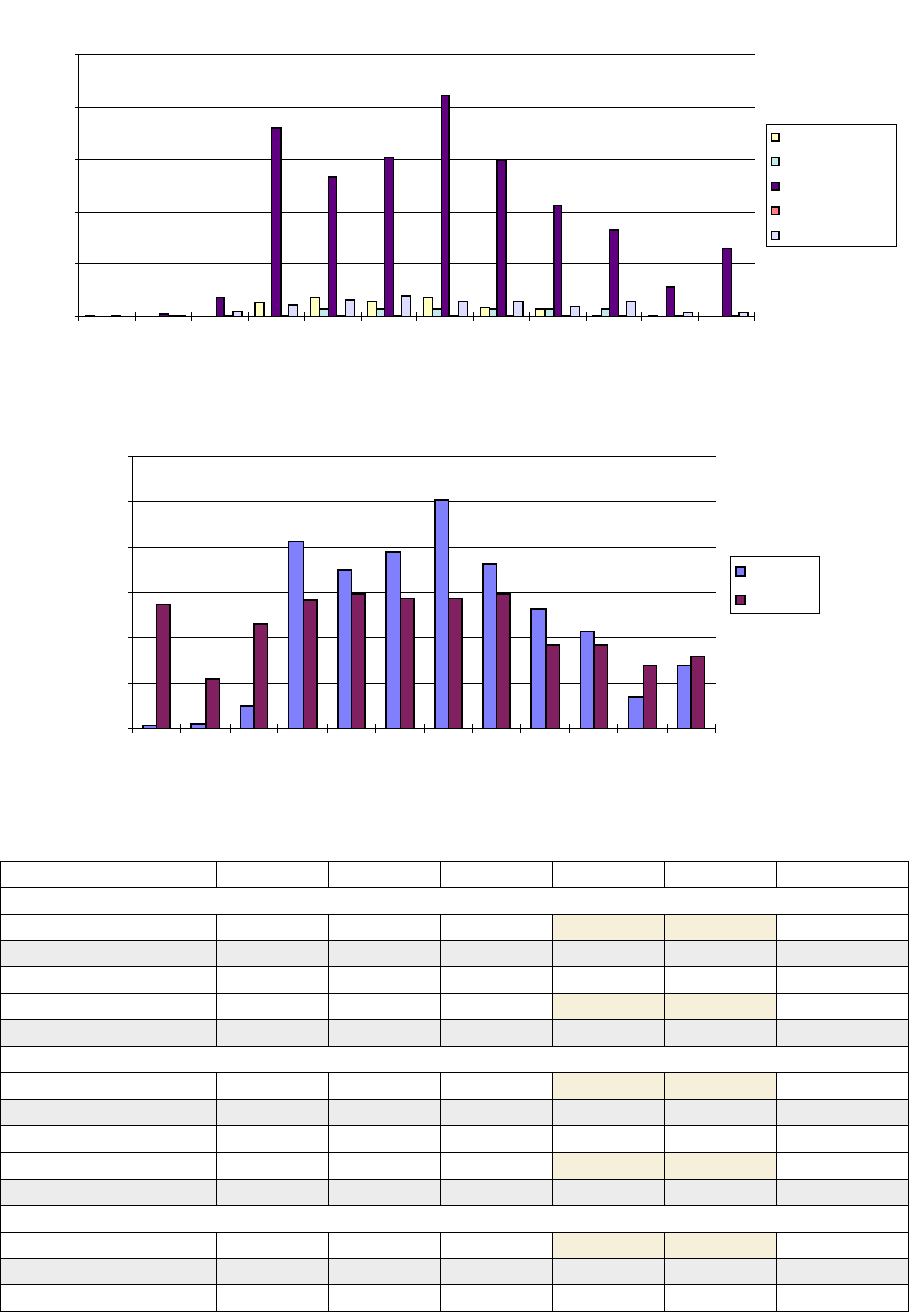

Annual Rounds Played

0

10,000

20,000

30,000

40,000

50,000

60,000

70,000

80,000

Rounds

14,326

24,856

26,087

25,299

23,750

23,672

21,058

33,594

35,799

37,091

43,082

37,849

37,688

Potential Rounds

42,000

42,000

42,000

42,000

42,000

42,000

42,000

74,376

74,376

74,376

74,376

74,376

74,376

1995

1996

1997

1998

1999

2000

2001

2002

2003

2004

2005

2006

2007

6

Division Action Plan

Division guiding principles and division objectives are accomplished through division

actions plans developed for each division of Leisure Services. These plans outline

specific initiatives that will be implemented throughout the year to work toward

division and department goals.

Division Guiding Principles

Basic Description of Core Services: Maintain and elevate an upscale, twenty seven

hole, municipal golf course with a sense of professionalism, proven golfer satisfaction,

and a commitment to enhancing the environment while using Best Management

Practices.

• Maintain and enhance “Total Golf Experience”

• Create Country Club feel for public golfing customers

• Create opportunities through growth of the game initiative

• Customer service is #1 priority to every guest entering our facility

• Maintain affordable rates for golfing public

Action areas identified by staff during the development of the DAP are as

follows:

• Targeted programming

• Environmental programming

• “It’s the experience”

• Multiculturalism activities with partnership and coordination

• Arts and heritage in cooperation with the cultural commission

• Heritage Hub with historical society and Bartlett-Travis House

• Employee development

• Strategic use of resources

• Leisure Services Advisory Committee and other commissions

• Sponsorships

• Capital improvements

• Asset management

• Integrations of forms and plans

• Opportunities inventory

Division Objectives

The Balanced Scorecard concept is used as a measurement tool for the Leisure

Services Department. The balanced scorecard transforms our strategic plan from a

passive document into and active measurement toll for the organization. It provides a

7

framework that not only provides performance measurements, but helps planners

identify what should be done and measured.

Typically governments have performed financial measurement of the organization

through the budgeting process. The financial measures, however, are inadequate for

fully guiding and evaluating the journey through the information age that agencies

must make. Therefore, the balanced scorecard is based on collecting measurable

results from the following four perspectives: Customer, Financial, Operational, and

Employee.

Vision of the Future

Pheasant Run Golf Club offers an affordable golf experience to the golfing public.

The facility which is owned and operated by Canton Township prides itself on well

maintained golf course conditions from tee to green. The staff members at Pheasant

Run look to offer exceptional customer service before, during and after the round.

The goal for the increased revenue streams comes from increasing programs outside

of regular play. Annual passes, league play and outing revenues are sources that

continue to be targeted. With expenses expected to rise slightly over the coming

years with regards to salaries & wages, utilities, and course maintenance

applications, it is imperative to target other means of revenue other than regular play.

Competitive pricing coupled with the conservation of resources will help us toward our

goal of covering operating and capital expenses. Debt services may require

additional funds to be subsidized by Township’s general fund.

8

Operations

Pheasant Run Golf Club Identity

The identity of Pheasant Run is made clear by its logo, signage, advertising and

facility appearance. Pheasant Run is located at 46500 Summit Parkway, Canton MI,

48188.

Location Description

Immediate area

Type of area

Suburban community

Adjacent uses

Residential

Benefits

Central location in the community

Proximity

Customer type

Residents & Non-Residents of all demographics

Potential customers

24,750

Competitors

Northville Hills, Lakes of Taylor, Golden Fox,

Stonebridge

Accessibility

Close to major streets Near the intersection of Canton Center and Palmer

Easy entrance / exit

Three entries, three accessible

Visibility

From road

Easy to see, high copula visible

Appeal of exterior

Peaked copula with Pheasant on top, split faced

brick, numerous windows

Landscaping

Numerous flower beds with perennials & annuals

Operating hours

The Golf Course is open April – November with peak season times

Monday – Sunday 6:15 am – 11:00 pm

9

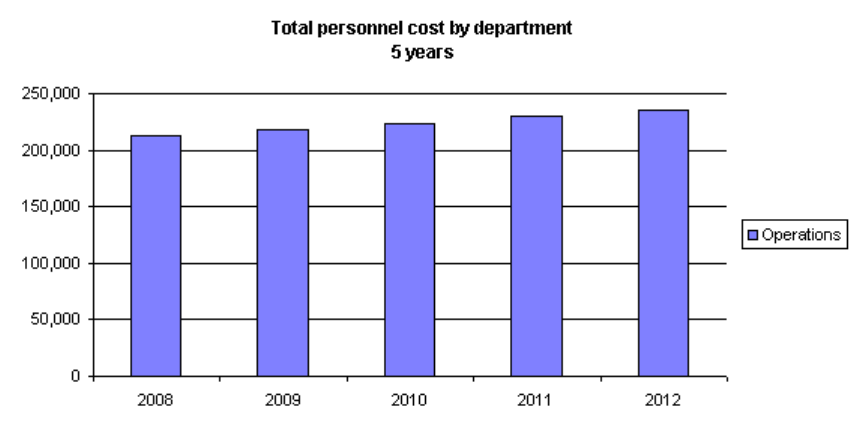

The organizational structure

Personnel

The Golf Pro is a contract position paid a portion of through part time pages, and a

portion through bonuses based on the performance of the pheasant run budget.

The 5-year projection for full time personnel is expected to show the following:

2008

2009

2010

2011

2012

Total

Operations

Headcount

2.5

2.5

2.5

2.5

2.5

2.5

Payroll

151,851

155,796

159,859

164,044

168,355

799,905

Bonuses

Payroll burden

60,740

62,318

63,944

65,618

67,342

319,962

Total cost

212,592

218,114

223,803

229,662

235,697

1,119,867

Overall total

Headcount

3

3

3

3

3

3

Payroll

151,851

155,796

159,859

164,044

168,355

799,905

Bonuses

Payroll burden

60,740

62,318

63,944

65,618

67,342

319,962

Total personnel

cost

212,592 218,114 223,803 229,662 235,697 1,119,867

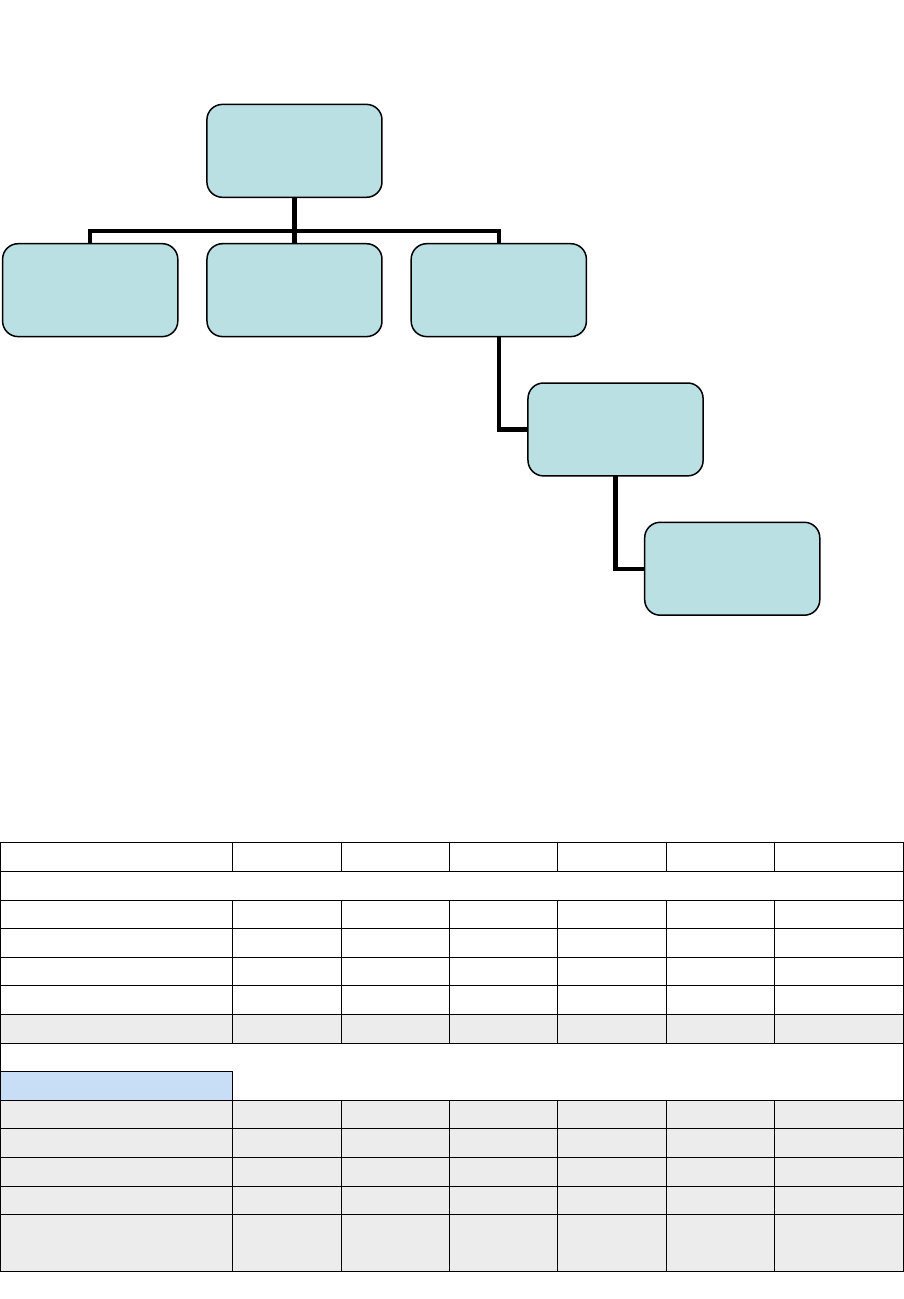

Department Director

Park and Facility

Maintenance

Supervisor

Clerk II

Superintendent

Irrigation Tech

Golf Pro

10

SWOT Analysis

Strengths:

• World renown architect

• Practice facility

• Bent grass fairways

• Course maintenance and overall quality

• Guaranteed tee time/pace of play

• Many services for a public golf course

• Exceptional customer service

• New, easier fee structure

• Free/ample parking

• Competitive rates

• Knowledgeable staff

• Enhanced image

• New Golf Cart fleet

Weaknesses:

• Narrow course with houses on both sides (Although most fairways with houses

are wide. Hole #6 may be the exception.)

• “Municipal” golf course perception

• Small, narrow clubhouse (unaccommodating)

• Funding

Opportunities:

• Expansion of clubhouse

• Regional course closings; therefore obtain golf member or guest list from

closing clubs

• Offer unique programs through growth of the game initiative otherwise not

offered at competing facilities

11

Threats:

• Unstable financials

• Unstable economy

• Competition

• Discounting as a means of increasing rounds

• Downturn of golf industry

Competition

1. Golden Fox – upscale public, privately owned

2. Northville Hills - upscale public, privately owned

3. Stonebridge – public, daily fee, privately owned

4. Links of Novi – public, daily fee, privately owned

5. Tanglewood – public, daily fee, privately owned

12

Marketing

Pheasant Run Golf Club product mix

Facilities:

• 320 acre, 27 hole golf course intermingled between single-family homes, native

areas and wetlands.

• Pen cross bent grass tees, greens and fairways connected by 10.5 miles of

paved cart paths

• Practice facility with bent grass teeing area, target greens, and 10,000 square

foot practice green

• 3,500 square foot clubhouse

• Restaurant/grill with sandwiches, beverages, snacks and banquet services and

seating for 60 (bar and pro shop)

Programs:

• Outings

• Leagues

• Corporate and Individual

1. Annual Pass Program

2. Single

3. Family

4. Corporate

Services

• Custom club fittings

• Lessons

• Ladies and Junior Clinics

• 10 minute tee times

• PGA professional staff

• Rental Clubs

• Community events

• Starters/Rangers

• Limited bag service

• Beverage cart on course

Products

• Fully stocked pro shop

• “Pro Line” golf apparel

13

Advertising and promotion

Public Relations

• Press release on increase of female golfers and what PRGC is doing to reach

this market.

• Monthly column in Canton Observer relating to golf, Canton employees etc.

• Write press releases on large events at PRGC i.e. St. Joseph Pro Am,

Chamber outing

• Sports radio advertisement (trade and promotion with them)

• Cross market with all CLS departments.

• Continue with informational emails to golfer database with course updates

• Create a promotional CD/Vide to use as a marketing tool

• Member newsletters

Community Relations

• Utilize of an on-site comment log (CIT)

Promotional

• Provide custom divot tool to all guests

• Provide neighboring communities with senior programs that lack a golf course

with coupons for their seniors to golf at Pheasant Run.

• Provide golfers with loyalty punch card – limited life span

Advertising

• Advertise in golf magazines (e.g. Michigan Links, Michigan Publixer)

• Golf insert in Detroit News and Ann Arbor News

• Partner with Michigan Tourism – place information in the Travel Stops on local

highways.

• Use NGF golfer database to implement at course, acquires spending power of

individual golfers

Direct Sales

• Host a display booth at companies

• Conduct cold calls to corporations that may have outings (e.g. Yazaki, UAW,

Chamber members, etc.) and take collateral to share.

• Conduct presentations to corporate sponsored sports groups, Toastmaster,

Business Network etc.

14

Quality Service/ Stewardship

• Send key staff to sales training

• Develop a survey tool/evaluation for event planners to complete after the

outing

• Develop quantitative measures on guest satisfaction card that is placed on the

golf cart.

• Send birthday cards to Annual Pass holders

Distribute each ‘clinic’ participant a coupon

• Train staff to be accepting of all demographics

• Train staff to teach appropriate golf etiquette

• Create Pheasant Run Ambassador Program

Existing Marketing Materials and Image

Website

Direct mail or e-mail to pass holders

Annual Pass Holder kick off party/season ending party

Michigan golf guides

Golf score cards

Yellow pages (one ad in W/NW)

Signage

Discover Guide book

Collateral folder for walk-in enquiries

Discover Leisure Newsletter

Michigan golf show

Newsletter to annual pass holders

Vertical Response Monthly (Biweekly) to database

Outing package

Collateral folder for walk-in inquiries

Community Resource Guide

Players pass – discount program

Yardage books on carts cost $3,000 in 2006

Michigan Publixer magazine

Michigan Links magazine Course Directory

GAM Discount Program (National Golf Foundation)

Membership Dues (PGA,GAM,GCSSA, Chamber etc.)

Customer Appreciation Days

OnLine Booking System

Target Market Summary

Current Market Segments (segmentation based on age, gender, experience versus

benefits sought)

• Swingin’ Seniors: older females, frequent golfers, frequent private course play.

• Junior Leaguers: younger females, third highest household income, not highly

competitive.

• Tank Tops n’ Tennis Shoes: young males, infrequent play, extremely price

sensitive, not disposed to take lessons.

15

• Public Pundits: young males, frequent public golf course play, price sensitive.

• Preoccupied Players: young males, infrequent play, second-highest household

income, not avid golfers.

• Country Club Traditionalist: older males, highest average household income,

biggest spenders on golf, frequent private course play, most likely to take

lessons.

• Pull Carts: oldest males, mostly retired, very frequent public course play, spend

slightly above average on golf.

• Dilettante Duffers: average frequency of play, interest in best equipment,

opinion leader, tries new equipment first.

Market Assessment

• Michigan ranks #1 in daily fee/municipal golf courses with 704 followed by

Florida (623) and California (621)

• Wayne County has 34 daily fee/municipal courses. The border counties of

Livingston (17), Washtenaw (21), and Oakland (55) combine to total 127 daily

fee/municipal courses within the 4 county areas. This represents 18% of the

total public/municipal golf courses in the state.

• In 2006, 2 new public courses opened in the state – down from 3 in 2005, 4 in

2004, 9 in 2003, 10 in 2002, and 17 in 2001.

• There are nearly 435,000 golfers in the Detroit Metropolitan area. 195,000 of

the 435,000 are core golfers.

• The total number of adult golfers rose from 27.3 million to 28 million. Core

golfers, which account for 91% of total rounds dropped from 12.8 million to

12.5 million. Core golfers are adults, 18 and over, who play at least 8 rounds

per year.

• Average golf fee revenue per round is approximately $25 nationwide.

Pheasant Run’s $30.

• Utilization rates nationwide average between 46% - 55% and are figured as the

amount of rounds played vs. rounds available. Pheasant Run operates over

50% for the year and over 65% during the peak season of May through

September.

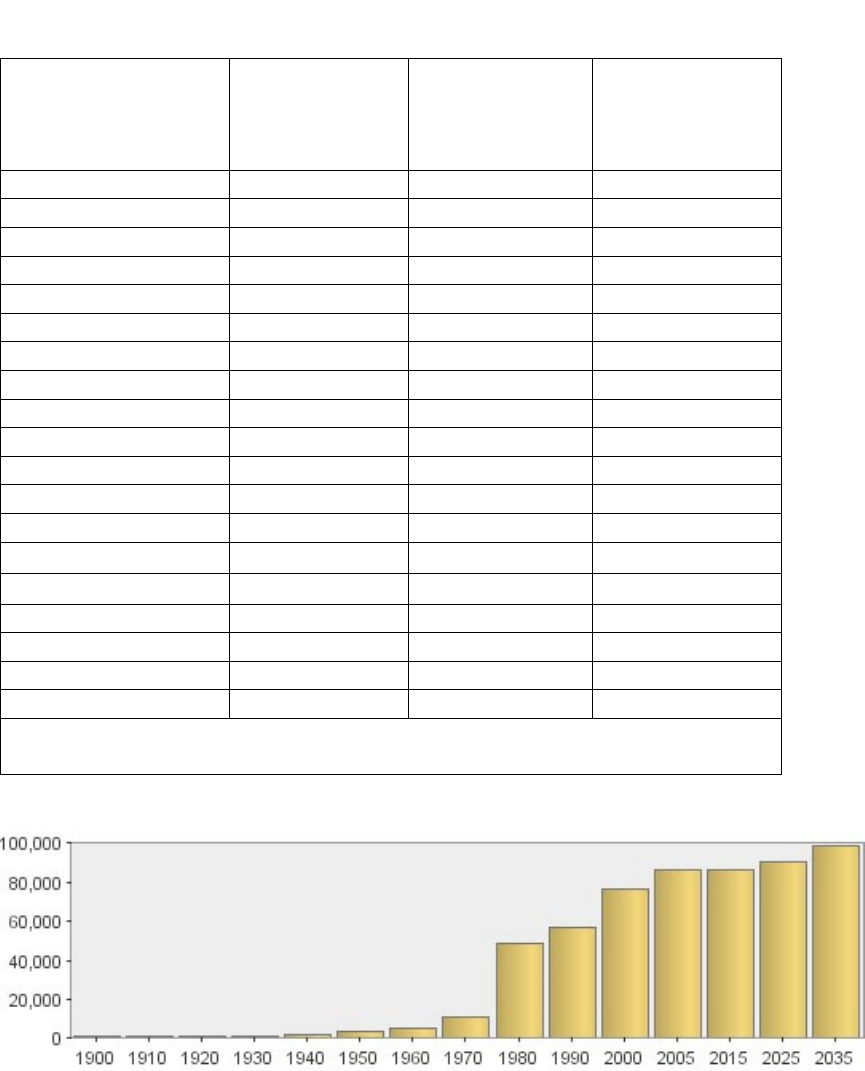

Demographics

Prior to 1960, Canton Township was primarily an agricultural community and had a

population of only 5,313. With a population growth of more than 420 percent since

1970, Canton is now home to over 86,000 people. According to SEMCOG estimates,

Canton’s population is projected to exceed 98,793 by the year 2035.

Understanding the make up of the community is vital to success in the delivery of

services. Leisure Services staff are required to regularly review demographic

information to ensure that the facilities, programs and services provided are of interest

to, and meet the needs of, our residents.

16

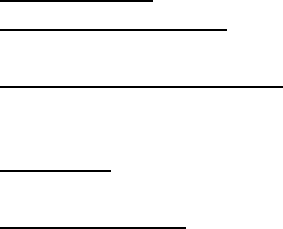

Canton Community Population

Total population

2000

(SEMCOG)

2005 American

FactFinder %

Estimates

2008 SEMCOG

Population

based on %

Estimates

Under 5 years

6,715

9.40%

8,004

5 to 9 years

6,606

9.60%

8,173

10 to 14 years

5,670

9.10%

7,747

15 to 19 years

4,982

4.60%

3,916

20 to 24 years

4,286

4.40%

3,746

25 to 29 years

5,346

4.60%

3,916

30 to 34 years

6,938

7.80%

6,640

35 to 39 years

7,619

10.40%

8,854

40 to 44 years

6,786

9.90%

8,428

45 to 49 years

5,945

8.00%

6,811

50 to 54 years

5,484

7.00%

5,959

55 to 59 years

3,520

5.70%

4,853

60 to 64 years

1,938

2.60%

2,213

65 to 69 years

1,385

1.80%

1,532

70 to 74 years

1,193

1.50%

1,277

75 to 79 years

958

1.50%

1,277

80 to 84 years

620

1.40%

1,192

85 years and over

375

0.70%

596

Total

76,366

100.00%

85,134

Source: SEMCOG (total popluation) & American FactFinder (age %

estimates)

17

Canton - Percentage of Population by Race

Race

1990

Census

2000

Census

2008 Estimated

White

52,374

(91.8%)

62,846

(82.3%)

64,106

(75.3%)

Black

1,155

(2.0%)

3,434

(4.5%)

6,470

(7.6%)

Asian or Pacific

Islander

2,532

(4.4%)

6,648

(8.7%)

12,259

(14.4%)

Hispanic, American

Indian & Other

1, 134

(1.43%)

3,438

(4.5%)

2,299

(2.7%)

Total Population

57,040

76,366

85,134

Source: SEMCOG (total population and 1990 & 2000 %) & 2005

American FactFinder (race % estimates)

Target Market ID

(Market segments based on age, gender and experience)

1. Outings

2. Corporate Transient

3. Non-Resident Males

4. Area Seniors

5. Resident Females

6. Resident Makes

Target Market Objectives

(Specific initiatives to achieve membership goals)

• Provide senior rates weekdays only and before 12:00 pm

• Conduct junior camps, promote early morning walking, and partner with junior

golf associations to provide competitions

• Provide lessons and etiquette programs and clinics

• Promote “twilight” rates and frequent player card

• Promote off-peak rates to relate with all customers

• Offer introductory rates or programs to draw new customers

• Continue to enhance annual golf pass and amenities included

• Promote golf course conditions (premier facility) that separate us from

competitors

• Offer new hard good inventory and demo programs with Demo Days

• Use PLAYGOLFAMERICA as a resource for program descriptions.

• Maintain current league program while adding league spots to designated tee

tiems

18

Market Trends

Canton Leisure Services takes a multi-faceted approach to identify trends that affect

the community. Tools used include: review of community demographics, focus group

input from our Leisure Services Advisory Committee and staff members, attendance

at educational conferences and seminars that address the topic, review of usage

patterns and popularity of program offerings and community input via surveys. Canton

Leisure Services must proactively respond to trends and issues in order to remain a

vital force in shaping Canton’s economic, social and environmental future. There are

several clear trends that may influence future operations and must be analyzed to

determine potential impact.

Trend 1 – Environmental Stewardship

Individuals are becoming aware of environmental issues and are placing a priority on

the preservation and protection of natural areas. Environmental stewardship is

defined as the maintenance and improvement of our environment for the benefit of

present and future generations. Stewardship requires sound and sensitive

management practices accomplished through the

preservation of wetlands

,

environmental education

,

environmentally friendly products

and conservation

of utilities

.

Trend 2 - Passive Recreation

Canton residents have ranked walking/hiking/nature trails as the number one park

facility need for the community. This was evident in visioning workshops conducted

for the development of the master plan for Patriot Park and from the 2005 Canton

Leisure Services Community Survey. Over 77% of survey respondents ranked trails

as their 1

st

or 2

nd

choice for new facilities in the community. A 2

nd

splash park, dog

park and community gardens also received high rankings as respondent choices. In

order to meet the meet the desired needs of the community, special focus should be

placed on the development of greenways, community gardens, provision of nature

education and a dog park.

Trend 3 - Health/Wellness

Health and wellness issues are at the fore front because of the increasing number of

unfit residents in Michigan and the economic impact of rising health care costs.

According to a study conducted by David Chenowith, PhD, one in four Michigan

residents is considered obese and at risk for chronic diseases like cancer, diabetes

and cardiovascular disease. Additionally, chronic diseases account for seven of

every ten U.S. deaths and for more than 60% of medical care expenditures. Lack of

physical activity and lack of leisure time are identified obstacles to improving health.

19

Leisure Services recognizes that the main focus is on prevention, and changing

lifestyles before an individual becomes a statistic.

Prevention, outreach and

support

are three critical factors believed to positively impact the overall health of the

community. Strategies will include: offering health screenings and a wide variety of

activity classes and health presentations to reach individuals at all fitness levels,

abilities, ages and days and times; inclusion of a health/wellness curriculum or event

in day camps, programs and special events; educate the community to make them

aware of resources that lend support and create opportunities to change health

behavior.

Trend 4 - Demographic, Social, Cultural

Canton has been one of the fastest growing communities in Southeast Michigan as

evidenced by the increase in population from the 2000 census. The Southeast

Michigan Council of Governments (SEMCOG) project that Canton’s population will

exceed 98,000 by 2030. CLS recognizes that it is imperative to understand Canton’s

demographics in order to provide services that are desired and meet the needs of the

community.

Boomers

Baby boomers have reshaped what it means to grow older. Compared with their

parents, boomers are healthier, better educated and living well into their 80’s and

beyond. The increasing lifespan has given boomers the chance to reinvent

themselves and pursue new passions at any age. As a whole, Boomers are more

affluent, tend to be more active than preceding generations and think of themselves

as younger than their parents at the same age. As they age, Boomers are shifting

from activities such as tennis and aerobics to less strenuous ones such as walking,

cycling, tai chi and yoga. Boomers are likely to live much longer and more than likely

boomer retirement will be a mix involving work, leisure and family. Canton Leisure

Services will need to provide a

diverse range of health/wellness

activities and other

programs at

varied times

to accommodate schedules and activity levels.

Millennials

A millennial is anyone born between 1981 and 2000 and there are over 75 million

today. Just as the baby boomers changed society, the sheer numbers of millennials

can do the same. Millennials are technically literate – technology has always been a

part of their lives. They expect instantaneous feedback and gratification. The 2006

Cone Millennial Cause Study cites that tragic world events such as 9/11, coupled with

recent natural disasters have motivated the Millennial Generation to develop a strong

social conscience. Technology has given them a loud and powerful voice.

Millennials have been referred to as the most civic-minded generation since World

20

War II. The Cone Study suggests that Millennials are the most socially-conscious

consumers to date. Sixty-one percent of survey respondents are currently worried

about the state of the world today and feel personally responsible to make a

difference. Millennials want to live in communities and work for businesses that care

about how it impacts or contributes to society. As millennials become adults, they will

be the next generation of Canton homeowners. Programs and services will need to

be offered that are appealing.

Easy

access to amenities

,

location to parks,

etc.,

varied communications methods

and

opportunities to give back to society

are

key.

Culture/Heritage

Nationally the population is becoming more ethnically and racially diverse. This is

reflective in Canton where the Asian and African American population has more than

doubled since the 2000 census. Increasing ethnicity provides opportunity to expand

cultural awareness, but also presents a challenge to overcome language and social

barriers. The

arts

can be utilized to bridge cultural gaps, provide connectivity and

promote cultural awareness and tolerance.

Historic preservation

will promote the

inclusion of heritage education.

Limited Discretionary Time

Society as a whole is experiencing less discretionary time and in smaller segments.

Programs and services should be offered in more

compressed time frames,

at “non-

traditional” times and with

drop-in options.

Outreach

Providing services throughout the community is important to reach the entire

community. A focus should be made to

partner with agencies to provide

recreation opportunities in identified at-risk areas

, and

provide services that

address identified parenting issues

such as child abuse, building character, etc.

Trend 5 - Technology

As technology continues to evolve and become integrated into our everyday lives,

Canton Leisure Services needs to stay current in order to provide more efficient and

convenient service. Technology should be used for

on-line purchases, virtual

tours, on-line support for health/wellness, marketing, enhanced

communication, facility security, and collection and management of data and

assets.

21

Trend 6 - The Changing Economy

According to University of Michigan economists hundreds of thousands of jobs,

mostly in manufacturing, have been lost since 2000. State-shared revenue has also

been reduced and a depressed housing market has adversely impacted taxable

values of property. These forces are requiring local municipalities to struggle with

budgets and often require them to find alternative funding sources. The Department

strives to properly maintain aging facilities, absorb rising fixed costs and enhance

services without increasing tax support. Canton Leisure Services needs to continue

to utilize the

cost recovery system

. Further development of

partnerships and

sponsorships

and expanded use of

volunteers

whenever possible will offset

expenses. The strategic use of resources and

analytical assessment of proposed

services and capital expenditures

will result in increased efficiency. By

building

an identity

and a reputation through

enhanced public awareness

and

credibility of

services

, the Department will ultimately be positioned as a necessity within the

Community.

Trend 7 - Higher Expectations of Service

Many adults today grew up with programmed recreation and continue to expect

services for themselves and their children. According to industry experts, hectic

schedules, family obligations and travel costs have resulted in an increased demand

for more flexible and convenient recreation opportunities. Dissatisfaction with the

economy, their perception of government and the inability to directly reach high

ranking (above local government) elected officials have created frustration. Residents

recognize that Canton officials and departments are accessible. By the nature of our

operation, Leisure Services staff is accessible and often deal with frustrated residents

who often have unreasonable expectations for customer service and unreasonable

demands on our facilities.

To combat this challenge,

effective customer service

is critical. Staff should

receive regular training on service standards and information and responses should

be provided to customers in a timely manner,

facility schedules

should be adjusted

in order to balance the need to generate revenue with rentals and community space

and member/drop-in time.

22

Financial plan

The goal for Pheasant Run to increase revenues annually by 3% will come from

increased participation in both Annual Golf Pass sales and the finding of new league

programs. Regular play may be increased by continuing customer loyalty programs

and through the offering of regular play incentives. Email and mailing list databases

must remain current with the offering of monthly incentives. Golf course maintenance

and turf conditions must stay at a premium as competition increases. Placing a high

priority on turf conditions and appearance will ensure to retain high levels of play

through the season.

Generated income (sales)

Revenue for the Pheasant Run can be broken down into three major categories: Golf

Green Fees, Range Fees, and Pro Shop Merchandise Fees.

Golf Green Fees include daily usage, league play and outings, Annual Pass Fees for

golf and range, Range Fees for daily usage, and Pro Shop Merchandise Fees through

hard and soft goods.

2005 2006 2007

Golf Green Fees $1,189,827 $1,078,212 $1,032,953

Range Fees $ 81,134 $ 67,030 $ 70,774

Pro Shop Merchandise $ 125,330 $ 106,748 $ 107,433

Operating Expenses $2,315,267 $2,131,084 $1,947,975

The target area for growth is with Annual Pass sales, leagues and off peak playing

times. Pheasant Run operates at 85-90% capacity on weekend morning with only 30-

40% capacity in the afternoons. This presents opportunities through incentive play

and reward programs.

Annual Rounds

0

10,000

20,000

30,000

40,000

50,000

60,000

70,000

80,000

Rounds

14,326

24,856

26,087

25,299

23,750

23,672

21,058

33,594

35,799

37,091

43,082

37,849

37,688

Potential Rounds

42,000

42,000

42,000

42,000

42,000

42,000

42,000

74,376

74,376

74,376

74,376

74,376

74,376

1995

1996

1997

1998

1999

2000

2001

2002

2003

2004

2005

2006

2007

23

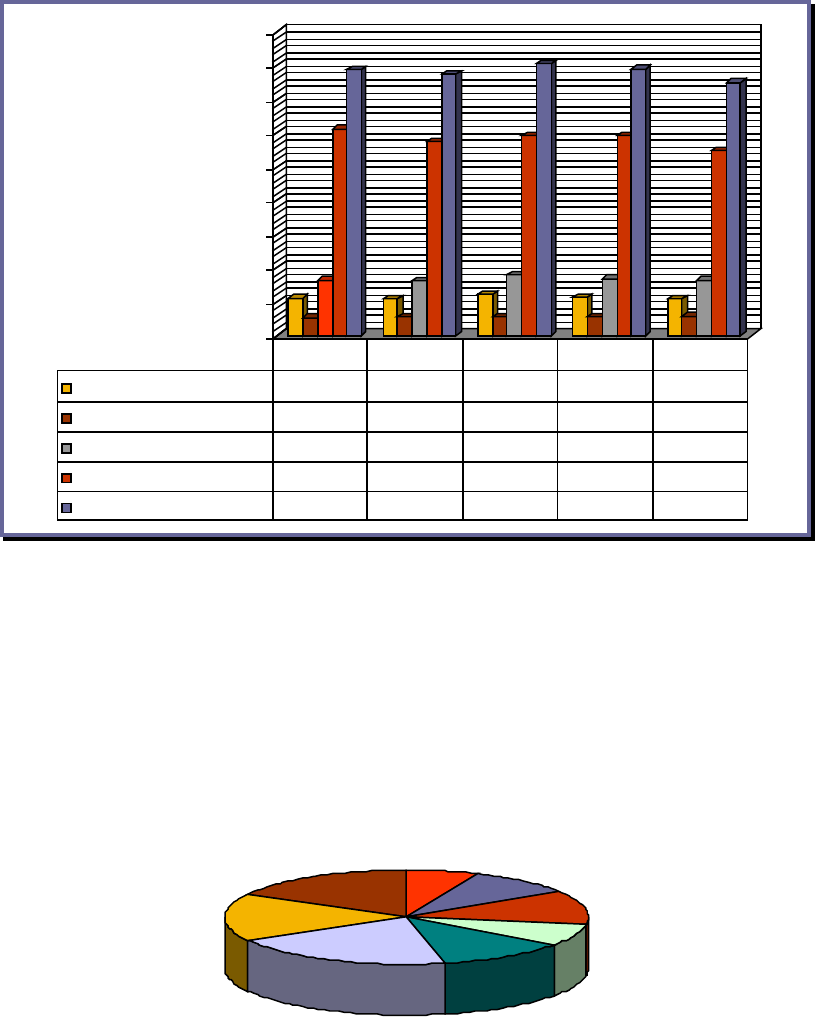

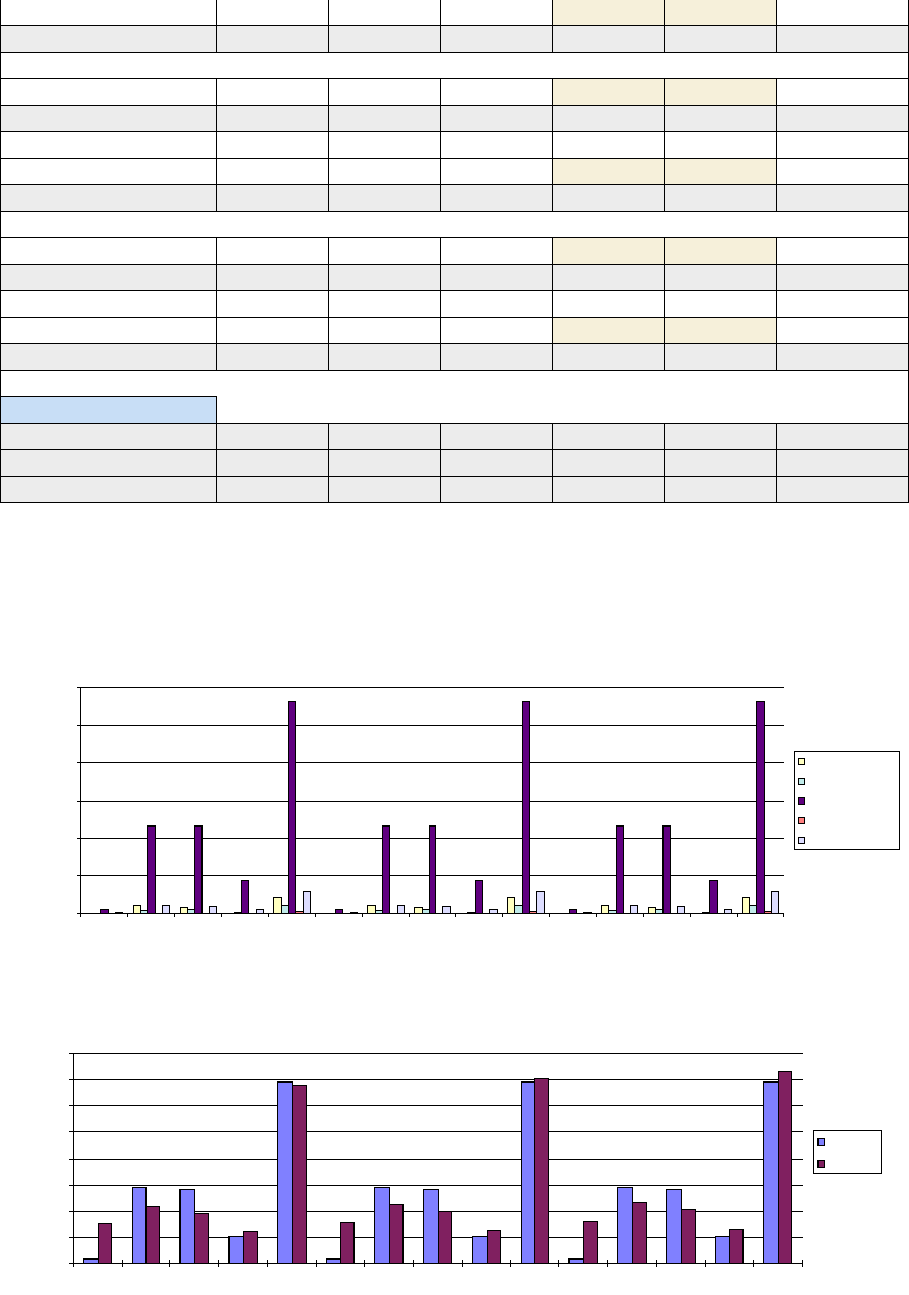

Revenues Per Round

Player Profile for Rounds Played

$0.00

$5.00

$10.00

$15.00

$20.00

$25.00

$30.00

$35.00

$40.00

$45.00

Food & Beverage

$5.51 $5.39 $6.07 $5.65 $5.36

Pro Shop

$2.65 $2.73 $2.79 $2.72 $2.85

Additional Rev. per round

$8.16 $8.12 $8.96 $8.37 $8.21

Revenue per round

$30.61 $28.69 $29.60 $29.63 $27.40

Total Rev. per round

$39.37 $38.70 $40.24 $39.43 $37.49

2004 2005 2006 3yr Ave 2007

Outings

6%

Spring/Fall

9%

Staff

12%

Senior/Junior

7%

League

12%

Member

21%

Guest

16%

Resident

17%

24

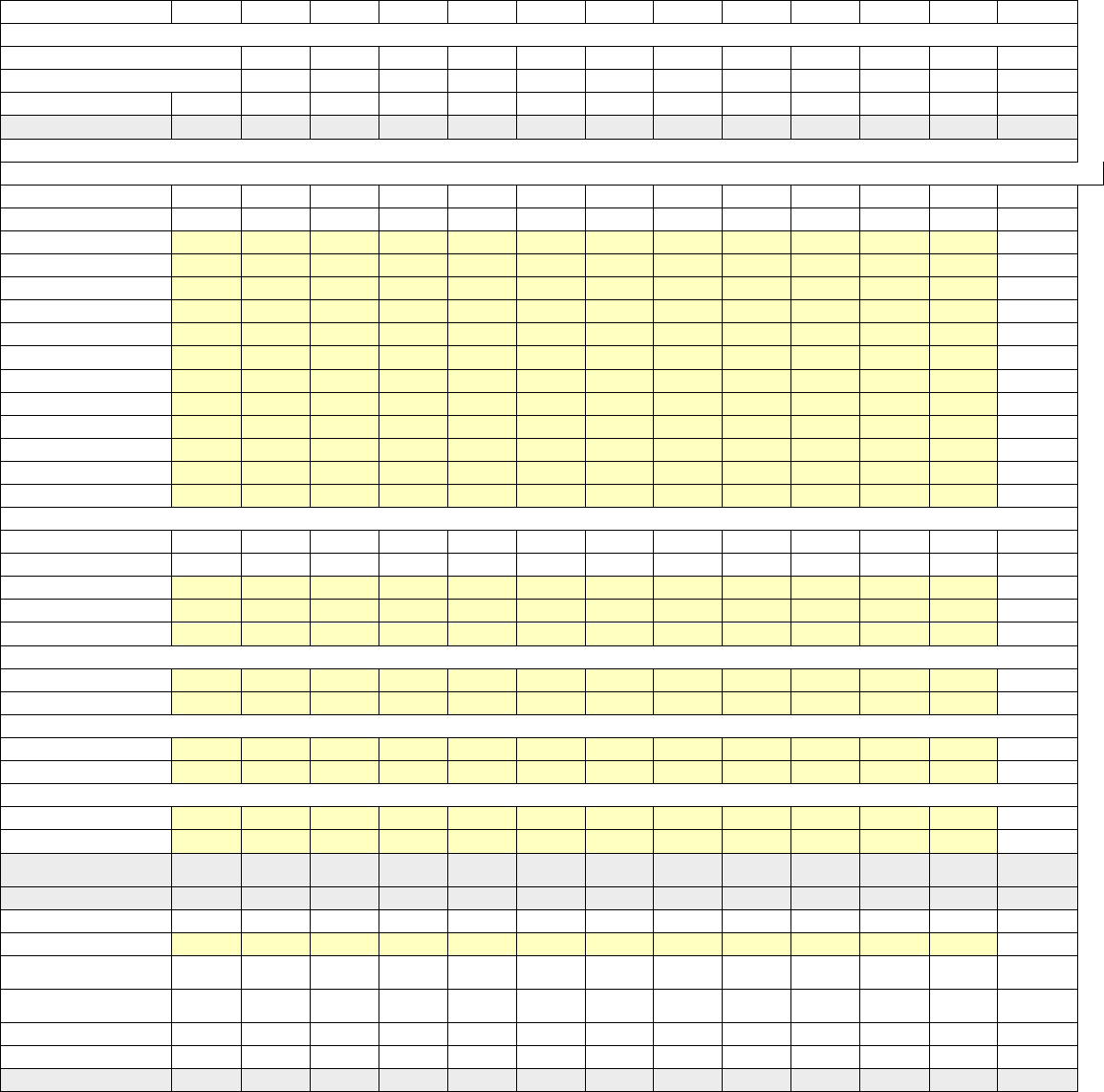

2008 Estimates

Month

Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec

Total

Revenue

Total sales

2,515 4,431 25,535 205,244 175,123 194,983 251,911 180,495 131,931 106,830 34,130 69,774 1,382,902

Cost of goods sold

Gross profit

2,515 4,431 25,535 205,244 175,123 194,983 251,911 180,495 131,931 106,830 34,130 69,774 1,382,902

Operating expenses

General & Administrative

Bad debts

Losses & thefts

Credit Card Fees

989 2,478 2,128 2,238 4,968 5,281 1,003 3,101 22,186

Operating Supplies

225 1,096 5,941 4,258 2,482 5,151 2,793 2,117 1,677 126 134 26,000

Dues and licenses

125 125 125 125 125 125 125 125 125 125 125 125 1,500

Utilities

2,667 2,667 2,667 2,667 2,667 2,667 2,667 2,667 2,667 2,667 2,667 2,667 32,000

Mag/subscriptions

46 46 46 46 46 46 46 46 46 46 46 46 550

Maintenance/repairs

5,951 7,078 29,672 25,458 57,636 32,500 46,707 36,961 20,740 22,605 11,471 5,251 302,030

Office expenses

167 167 167 167 167 167 167 167 167 167 167 167 2,000

Contracted Services

2,645 2,645 2,645 2,645 2,645 2,645 2,645 2,645 2,645 2,645 2,645 2,645 31,740

Supplies for Resale

241 28,762 42,207 3,776 12,439 3,967 917 204 58 4,429 97,000

Other

3,104 3,104 3,104 3,104 3,104 3,104 3,104 3,104 3,104 3,104 3,104 3,104 37,250

Telephone/fax/mail

167 167 167 167 167 167 167 167 167 167 167 167 2,000

Equipment Lease

2,083 2,083 2,083 2,083 2,083 2,083 2,083 2,083 2,083 2,083 2,083 2,083 25,000

Personnel

Salaries and benefits

12,654 12,654 12,654 12,654 12,654 12,654 12,654 12,654 12,654 12,654 12,654 12,654 151,851

Payroll burden

5,062 5,062 5,062 5,062 5,062 5,062 5,062 5,062 5,062 5,062 5,062 5,062 60,740

PT Wages

5,916 11,426 19,504 22,830 35,380 43,167 41,910 58,201 29,260 26,185 21,335 30,118 345,232

Overtime

3,813 3,813 3,813 3,813 3,813 3,813 22,880

PT Fringes

592 1,143 1,950 2,283 3,538 4,317 4,191 5,820 2,926 2,619 2,134 3,012 34,523

Sales promotion

Advertising/promotion

1,417 1,417 1,417 1,417 1,417 1,417 1,417 1,417 1,417 1,417 1,417 1,417 17,000

Printing & Publishing

1,417 1,417 1,417 1,417 1,417 1,417 1,417 1,417 1,417 1,417 1,417 1,417 17,000

Insurance

Liability insurance

1,667 1,667 1,667 1,667 1,667 1,667 1,667 1,667 1,667 1,667 1,667 1,667 20,000

Other insurance

Transportation

Travel

Transportation

442 2,852 4,160 9,411 4,097 1,131 22,093

Total operating

expenses

45,678 54,321 114,646 141,082 147,909 143,586 143,056 147,824 92,280 91,644 69,288 79,264 1,270,575

EBITDA

-43,163 -49,890 -89,111 64,162 27,214 51,397 108,855 32,671 39,651 15,186 -35,158 -9,490 112,327

Depreciation

7,617 7,617 7,617 7,617 7,617 7,617 7,617 7,617 7,617 7,617 7,617 7,617 91,400

Amortization

Interest on short

term loans

Interest on long term

loans

Deferred loan interest

Flexible loan interest

Net business result

-50,780 -57,507 -96,727 56,546 19,598 43,780 101,239 25,055 32,035 7,570 -42,774 -17,107 20,927

25

Sales/month per productline

year 1

0

50,000

100,000

150,000

200,000

250,000

Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec

Driving Range

Food & Beverage

Greens Fees

Other Revenue

Pro Shop

Cash in / Cash out per month

year 1

0

50,000

100,000

150,000

200,000

250,000

300,000

Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec

Cash in

Cash out

Sales Estimates

2008

2009

2010

2011

2012

Total

Driving Range

Range Fees 85,100 87,653 90,283 92,991 95,781 451,807

Net sales

85,100

87,653

90,283

92,991

95,781

451,807

Cost of goods

Cost of goods %

Gross profit 85,100 87,653 90,283 92,991 95,781 451,807

Food & Beverage

Commission 45,000 46,350 47,741 49,173 50,648 238,911

Net sales 45,000 46,350 47,741 49,173 50,648 238,911

Cost of goods

Cost of goods %

Gross profit

45,000

46,350

47,741

49,173

50,648

238,911

Greens Fees

Greens Fees 1,128,402 1,162,254 1,197,122 1,233,035 1,270,026 5,990,839

Net sales

1,128,402

1,162,254

1,197,122

1,233,035

1,270,026

5,990,839

Cost of goods

26

Cost of goods %

Gross profit 1,128,402 1,162,254 1,197,122 1,233,035 1,270,026 5,990,839

Other Revenue

Misc Revenue

9,000

9,270

9,548

9,835

10,130

47,782

Net sales 9,000 9,270 9,548 9,835 10,130 47,782

Cost of goods

Cost of goods %

Gross profit

9,000

9,270

9,548

9,835

10,130

47,782

Pro Shop

Product Sales 115,400 118,862 122,428 126,101 129,884 612,674

Net sales 115,400 118,862 122,428 126,101 129,884 612,674

Cost of goods

Cost of goods %

Gross profit 115,400 118,862 122,428 126,101 129,884 612,674

Overall total sales

Total net sales 1,382,902 1,424,389 1,467,121 1,511,134 1,556,468 7,342,015

Total cost of goods

Total gross profit 1,382,902 1,424,389 1,467,121 1,511,134 1,556,468 7,342,015

Sales/quarter per productline

3 years

0

200,000

400,000

600,000

800,000

1,000,000

1,200,000

1st qtr. 2nd qtr. 3rd qtr. 4th qtr. 2008 1st qtr. 2nd qtr. 3rd qtr. 4th qtr. 2009 1st qtr. 2nd qtr. 3rd qtr. 4th qtr. 2010

Driving Range

Food & Beverage

Greens Fees

Other Revenue

Pro Shop

Cash in / Cash out quarterly

3 years

0

200,000

400,000

600,000

800,000

1,000,000

1,200,000

1,400,000

1,600,000

1st qtr. 2nd qtr. 3rd qtr. 4th qtr. 2008 1st qtr. 2nd qtr. 3rd qtr. 4th qtr. 2009 1st qtr. 2nd qtr. 3rd qtr. 4th qtr. 2010

Cash in

Cash out