1

GETTING STARTED

Creating a cash ow budget

A cash ow budget is all about tracking the timing of your

income and expenses to make sure you have enough from

week to week.

Before you can build a cash ow budget, you will need to track your income,

resources, and expenses for at least one month. Use the "Income and benets tracker”

in Module 3 and the "Spending tracker” in Module 4 to help you get started. You’ll

need the information from both of these tools to create your cash ow budget.

What to do

•

Enter your beginning balance for the week.

•

Add all of the income and benets you receive that week. Subtract all of your

expenses for that week. Include the money you spend on everyday expenses,

bills, and savings. Also include benets you use to pay for things that would

otherwise be paid for with cash, such as SNAP and TANF. Remember that some

benets may only be used for specic expenses. For example, like SNAP benets

can be used for food, but not household items, like paper towels. If you receive a

housing subsidy, include the full value of the subsidy under income and resources

and the full market rate of your rent under expenses.

•

What's left is your ending balance. If it’s positive, you have enough income and

benets to make it through the week. If it’s negative, you’re falling short.

•

Copy your ending balance for the week to the beginning balance of the next

week. Repeat these steps for the rest of the weeks that month.

A step further

If it looks like there are weeks where your expenses are more than your income and

benets, you can use the "Improving cash ow” tool to brainstorm some strategies for

getting back on track.

Consider expense and income timing

by Creating a cash ow budget

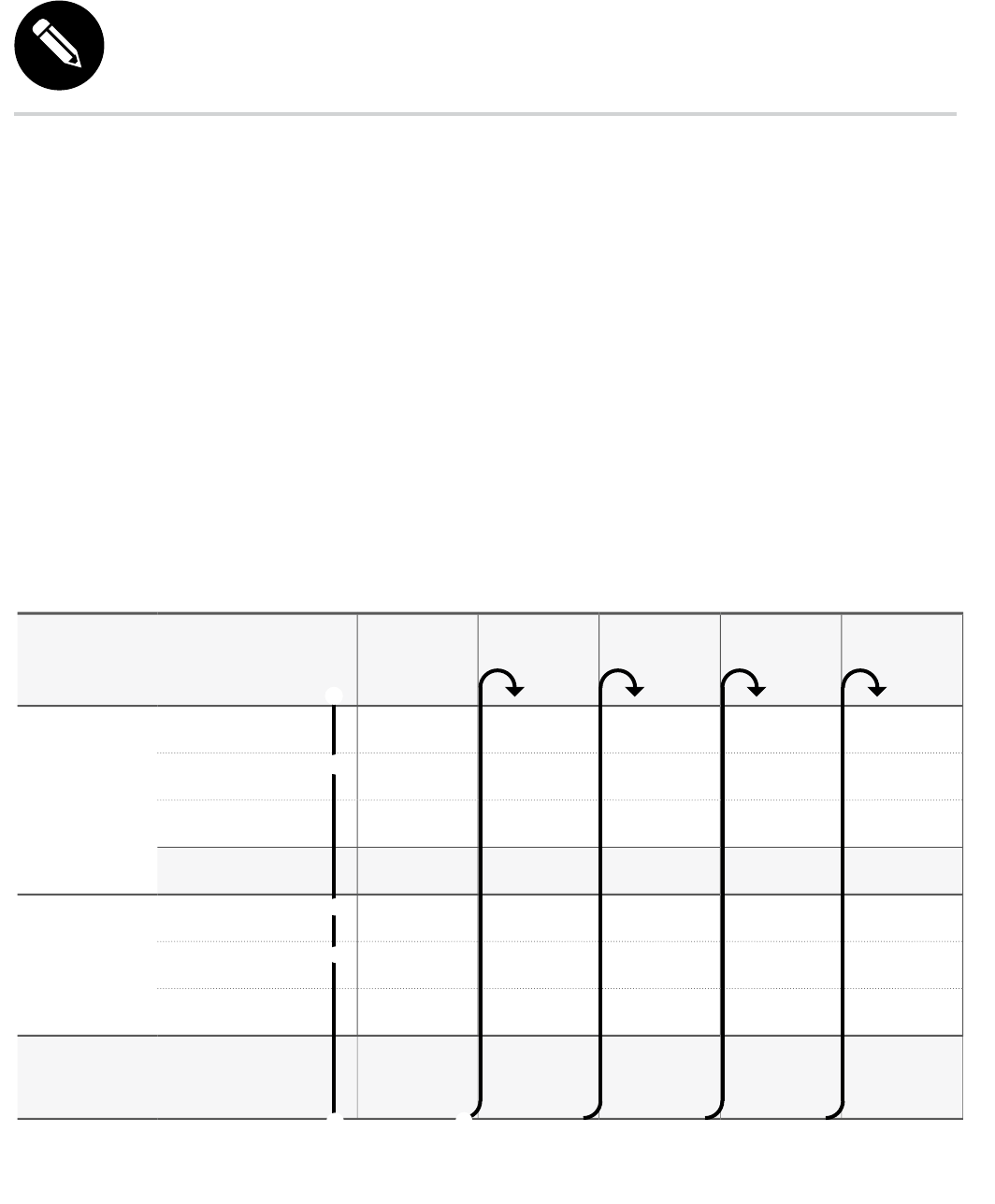

1. Enter your starting balance for the month under Week 1. This is the total amount of money

available to you from cash on-hand, prepaid cards, and checking and saving accounts.

2. Write down the amounts you receive during Week 1 from the categories listed. If you have

income from other categories, add them together and write them under "Other."

3. Add up all your income for Week 1 and enter under "Total income."

4. Write down the amounts you spend during Week 1. If you have expenses from other categories,

add them together and write them under "Other."

5. Subtract all the expenses for Week 1 from the "Total income" for Week 1. Write this amount in

"Ending weekly balance."

6. Copy the amount from "Ending weekly balance" from Week 1 into the "Starting balance" for

Week 2. Repeat steps 2 through 5 for the remaining weeks in the month.

WEEK 1 WEEK 2 WEEK 3 WEEK 4 WEEK 5

BEGINNING

WEEKLY

BALANCE

Starting

balance

$250 $400 $ $ $

ADD MONEY

YOU RECEIVE

EACH WEEK

+ 300

+ 100

+

Total income

= 650 = = = =

SUBTR AC T

YOUR WEEKLY

EXPENSES

— 200

— 35

— 15

ENDING

WEEKLY

BALANCE

= 400 = = = =

2

3

4

5 6

1

2

3

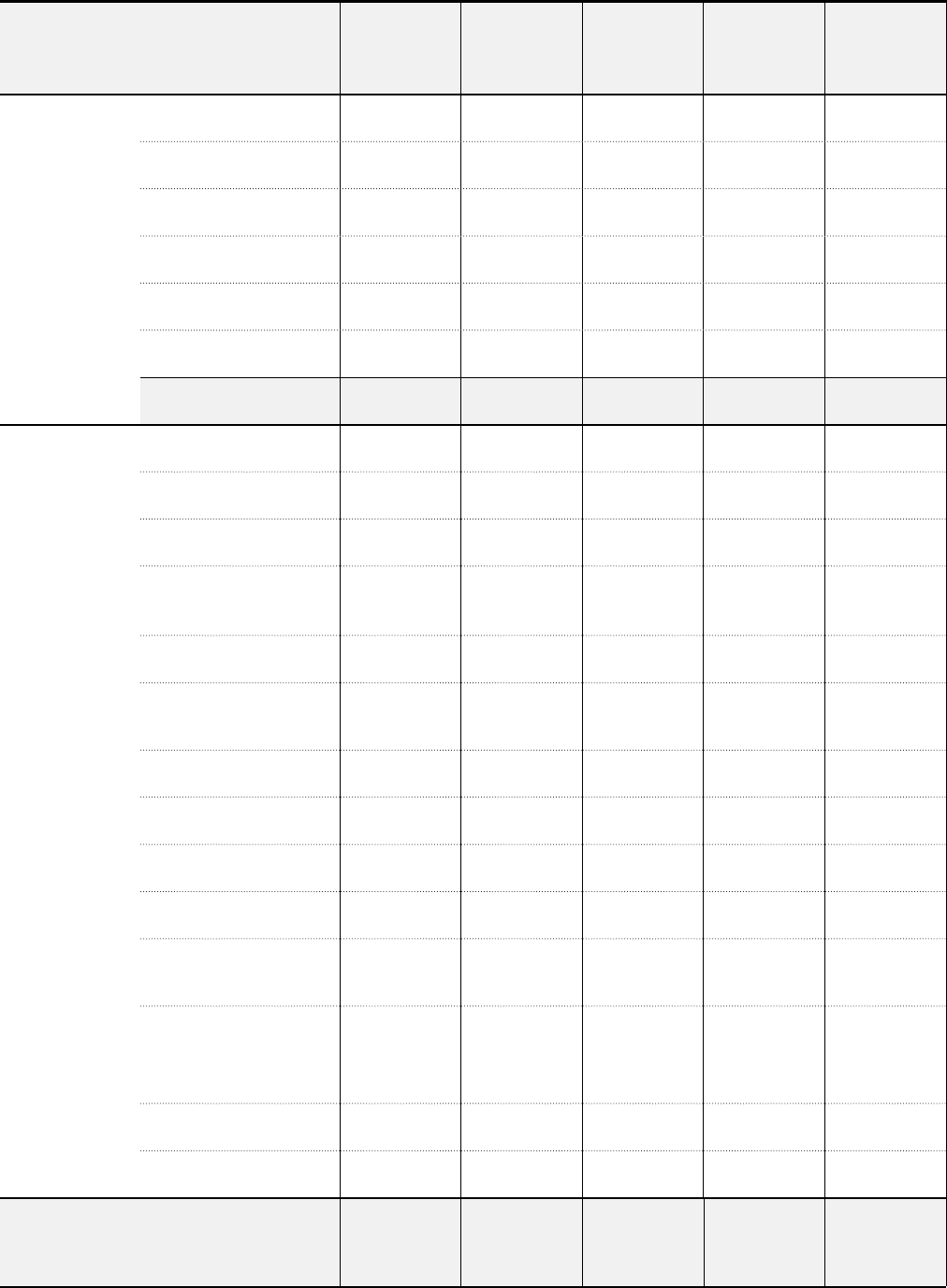

WEEK 1 WEEK 2 WEEK 3 WEEK 4 WEEK 5

BEGINNING

WEEKLY

BALANCE

Your starting balance

is a total of your cash,

prepaid card, and

account balances.

Starting

balance

$

Wk. 1 ending

balance

$

Wk. 2 ending

balance

$

Wk. 3 ending

balance

$

Wk. 4 ending

balance

$

ADD

MONEY

YOU

RECEIVE

EACH WEEK

Job 1

+

Job 2

+

Housing subsidy

+

SNAP

+

TANF

+

Other

+

Tot al in come

= = = = =

SUBTRAC T

YOUR

WEEKLY

EXPENSES

Cell phone

—

Debt payment

—

Eating out

—

Education and

childcare

—

Entertainment

—

Groceries and

other supplies

—

Health expenses

—

Helping others

—

Housing and utilities

—

Pets

—

Savings for

emergency fund

—

Savings for goals

like education or

retirement

—

Transpor t

—

Other

—

ENDING

WEEKLY

BALANCE

= = = = =

0

0

0

0

0

0

0

0

0

0

0

0

0

0

4

This tool is included in the Bureau of Consumer Financial Protection’s Your Money, Your Goals: A

nancial empowerment toolkit. The Bureau has prepared this material as a resource for the public.

This material is provided for educational and information purposes only. It is not a replacement

for the guidance or advice of an accountant, certied nancial advisor, or otherwise qualied

professional. The Bureau is not responsible for the advice or actions of the individuals or entities

from which you received the Bureau educational materials. The Bureau’s educational efforts are

limited to the materials that the Bureau has prepared.

This tool may ask you to provide sensitive information. The Bureau does not collect this information

and is not responsible for how your information may be used if you provide it to others. The Bureau

recommends that you do not include names, account numbers, or other sensitive information and

that users follow their organization’s policies regarding personal information.