WA-APCD Rules Background Paper #3 September 2015

OFM Forecasting and Research Division 1

DEFINITIONS FOR BILLED, ALLOWED AND PAID AMOUNTS

AND OTHER PAYMENT TERMS

A. INTRODUCTION

Under RCW 43.371.010(3), the mandated Washington All Payer Claims Database (APCD) data

suppliers include the state Medicaid program, Public Employees Benefits Board (PEBB) programs,

all health carriers operating in this state, all third-party administrators paying claims on behalf of

health plans in this state and the state Labor and Industries program. The data suppliers must submit

claims data, including billed amounts, allowed amounts and paid amounts, and such additional

information as defined by the Office of Financial Management (OFM) director in rule. Paper 3

provides background information for the three required definitions — billed, allowed and paid

amounts. As for ‘“such additional information,” OFM identifies and provides background

information on other health care claim payment terms that may be defined in the rule. OFM

acknowledges there may be additional claim data that should be defined in rule, and that these terms

will be identified in the rule-making process.

For this paper, OFM reviewed health care claim payment definitions from federal and state rules and

the definitions provided by Washington state health insurers. OFM also reviewed the descriptions of

payment data elements found in the other state APCD data submission guides. The information

sources for this paper are:

The Uniform Glossary

The rules for the Patient Protection and Affordable Care Act

1

(ACA)

require health insurers

and group health plans to provide a summary of benefits and coverage (SBC) and a Uniform

Glossary to their enrollees and beneficiaries. The SBC is intended to provide an easy-to-

understand summary of the benefits and coverage available under their plans. The Uniform

Glossary provides definitions of common insurance-related and medical terms to help

consumers understand the terms of coverage. The Uniform Glossary definitions do not pre-

empt definitions in state law or definitions in a health plan or health insurance policy. Health

insurers are required to make the Uniform Glossary available, upon request, to their

subscribers. In Washington, the health care insurers, the Office of the Insurance

Commissioner, Health Care Authority, Health Benefits Exchange and Department of Health

post the Uniform Glossary on their websites.

Title 182 WAC

Title 182 WAC contains the definitions and rules for the Washington state Medicaid program, a

mandated data supplier to the Washington APCD

2

. See Appendix A: Title 182 WAC

definitions.

Commercial health insurers in Washington

OFM asked Premera Blue Cross, Regence BlueShield and Group Health Cooperative to

provide the definitions they use for billed, allowed and paid amounts and other payment terms.

1

For the Uniform Glossary, see https://www.cms.gov/CCIIO/Resources/Files/Downloads/uniform-glossary-

final.pdf. The U.S. departments of Health and Human Services, Treasury and Labor worked with the National

Association of Insurance Commissioners to draft the rules for the SBC and Uniform Glossary.

2

See definitions Chapter 182-500 WAC and Chapter 182-550 WAC http://apps.leg.wa.gov/wac/default.aspx?cite=182.

WA-APCD Rules Background Paper #3 September 2015

OFM Forecasting and Research Division 2

OFM chose these health insurers because they are the three largest data suppliers to the WA-

APCD. OFM also reviewed their online samples of explanation of benefits

3

(EOB).

Medicare Glossary

To receive Medicare data, RCW 43.371.020(2)(b) requires the APCD lead organization to apply

to become a Centers for Medicare and Medicaid Services (CMS) qualified entity. CMS has a

Medicare glossary that includes analogous definitions for billed and paid amounts and other

payment terms

4

. See Appendix B: CMS Medicare glossary terms related to claim payments.

Other state APCD rules

Maine, New Hampshire, Oregon and Vermont define payment terms in their APCD rules. A

review of these rules shows that:

› None of these states define billed amount.

› Oregon and Vermont define charge which is an analogous definition to billed amount.

› Oregon is the only state that defines allowed amount and paid amount.

› These states also define other payment terms in their rules, including capitated services, co-

payment, coinsurance, deductible and prepaid amount.

APCD data submission guides

The other states describe payment data elements in their data submission guides (DSGs). The

data element descriptions provide insight into the claim payment data that are actually collected.

APCD Council core data elements

National health insurers express concern with the complexity and cost of submitting health care

claims data to multiple state APCDs that have differing rules and data element specifications.

To address this concern, the APCD Council, the U.S. Department of Health and Human

Services Agency for Healthcare Research and Quality (AHRQ) and other stakeholders

developed a list of APCD core data elements for medical claims file submission, medical

eligibility file submission and pharmacy claims file submission. Each data element is named and

assigned a data element ID. States provide the definitions for the data elements. To review the

APCD Council core set of data elements, see https://ushik.ahrq.gov/mdr/portals/apcd.

The following paper presents OFM’s findings for the definitions for billed, allowed and paid

amounts and other health care claim payment terms. The paper also lists the questions and issues for

consideration in developing payment definitions for the WA-APCD.

3

Health care insurers send EOBs to covered individuals to explain the medical treatments and/or services paid on their

behalf. For sample EOBs, see the links below.

Premera Blue Cross https://www.premera.com/wa/member/manage-my-account/explanation-of-benefits

Regence Uniform Medical Plan

https://www.regence.com/documents/10192/286192/UMP+Explanation+of+Benefits/2fca7dd3-576c-4fb3-

9ccd-a169e9cf25fe

Group Health https://provider.ghc.org/open/workingWithGroupHealth/forms/payment.pdf

4

For the full Medicare glossary of terms, see https://www.medicare.gov/glossary/e.html.

WA-APCD Rules Background Paper #3 September 2015

OFM Forecasting and Research Division 3

Paper 3 is divided into the following sections:

A. Introduction

B. Billed amount

C. Allowed amount

D. Paid amount

E. Other payment terms

F. Considerations for developing definitions

Appendices and References

Appendix A: Title 182 WAC Definitions

Appendix B: CMS Medicare glossary terms related to claim payments

References

B. BILLED AMOUNT

After reviewing the definitions in rules or provided by the health insurers, OFM found that:

Billed amount is not defined in rule by any of the states with an APCD.

Billed amount can be either the total amount billed (Premera, Group Health) or the dollar

amount charged on the service line for a service (Regence).

The Medicaid definition is not definite on whether the billed charge is the total dollar amount

or a line item charge.

Billed amount is generated by the provider billing the health plan for services.

Billed/submitted amount can also be generated by Group Health members when submitting

charges for reimbursement.

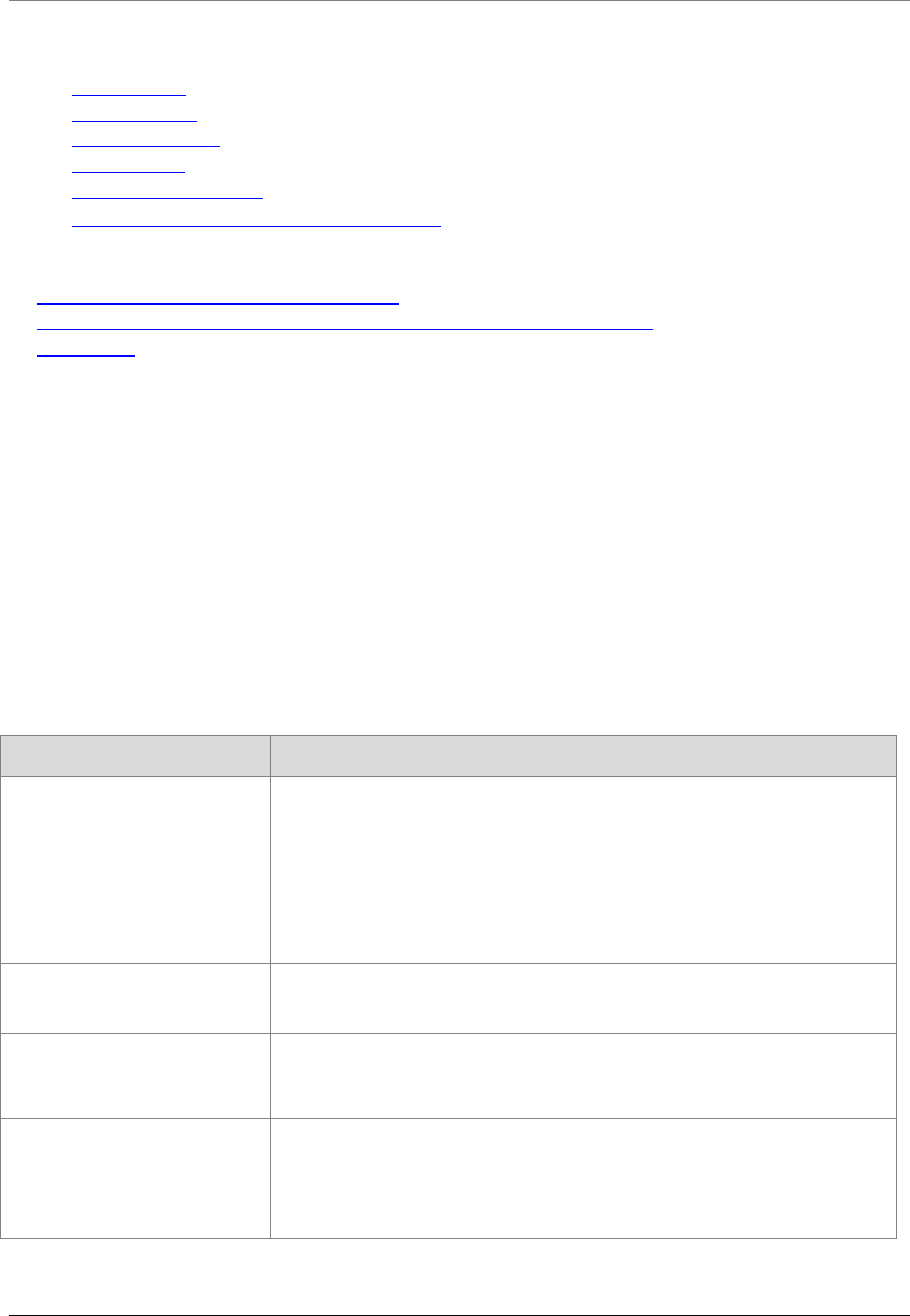

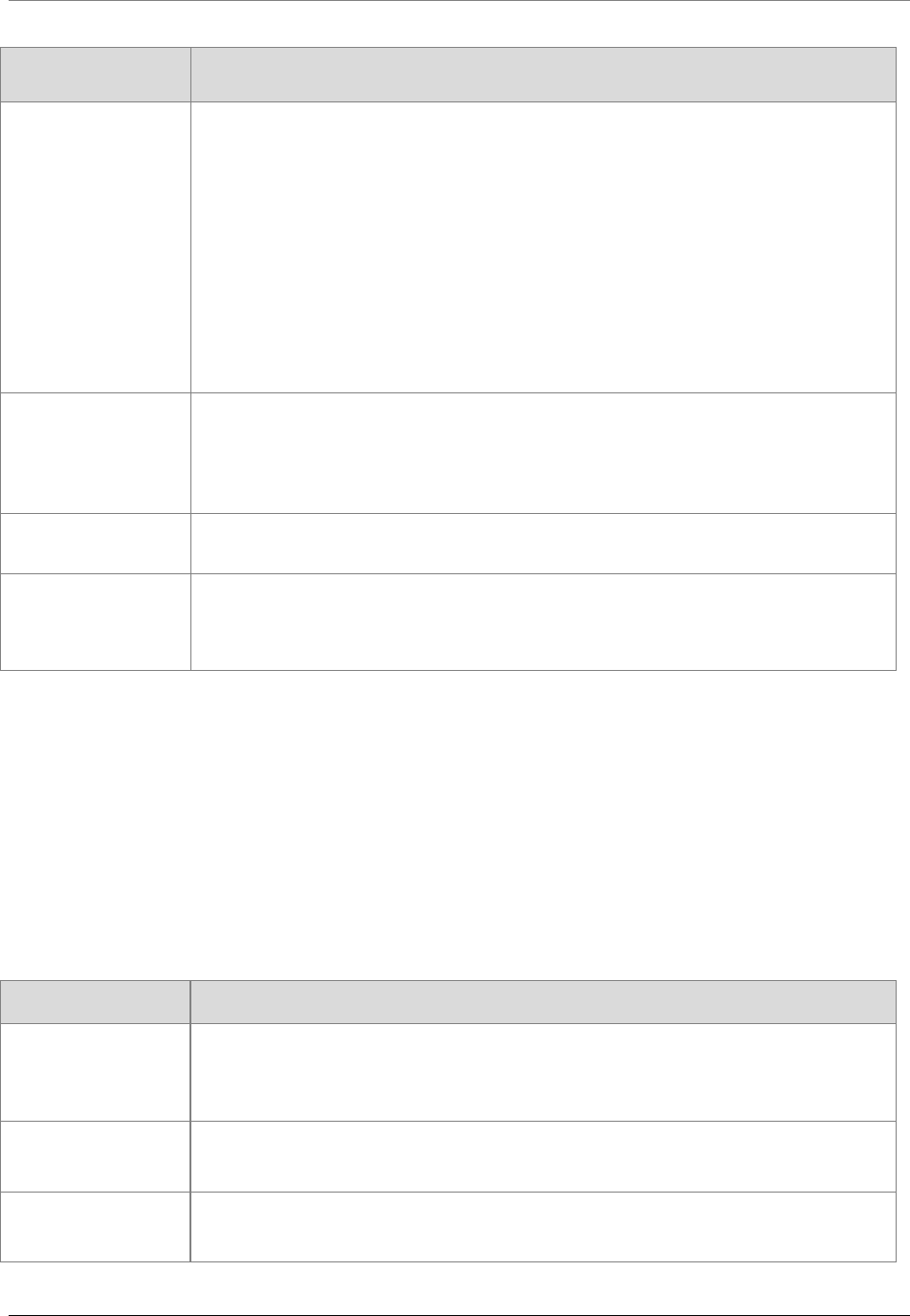

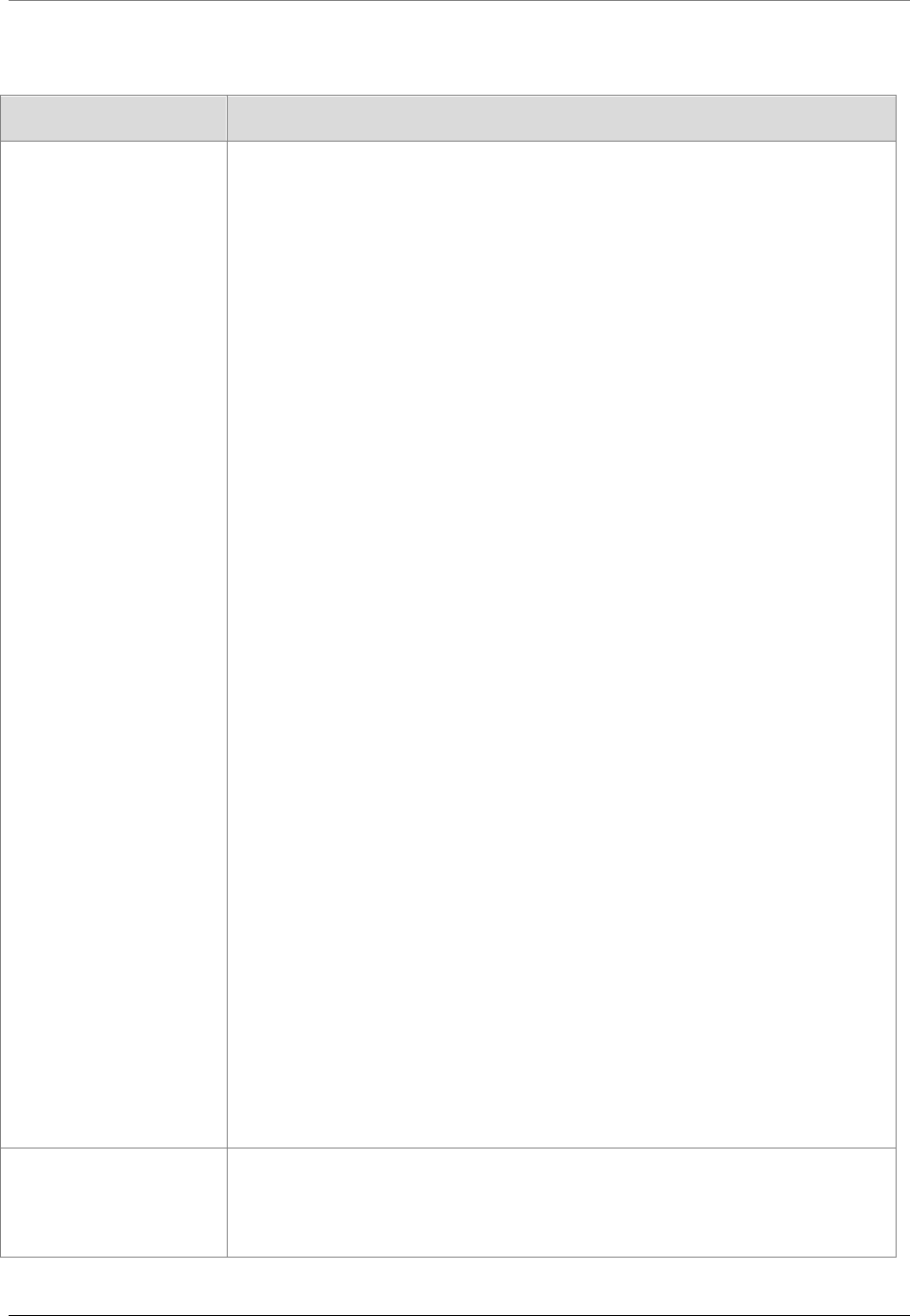

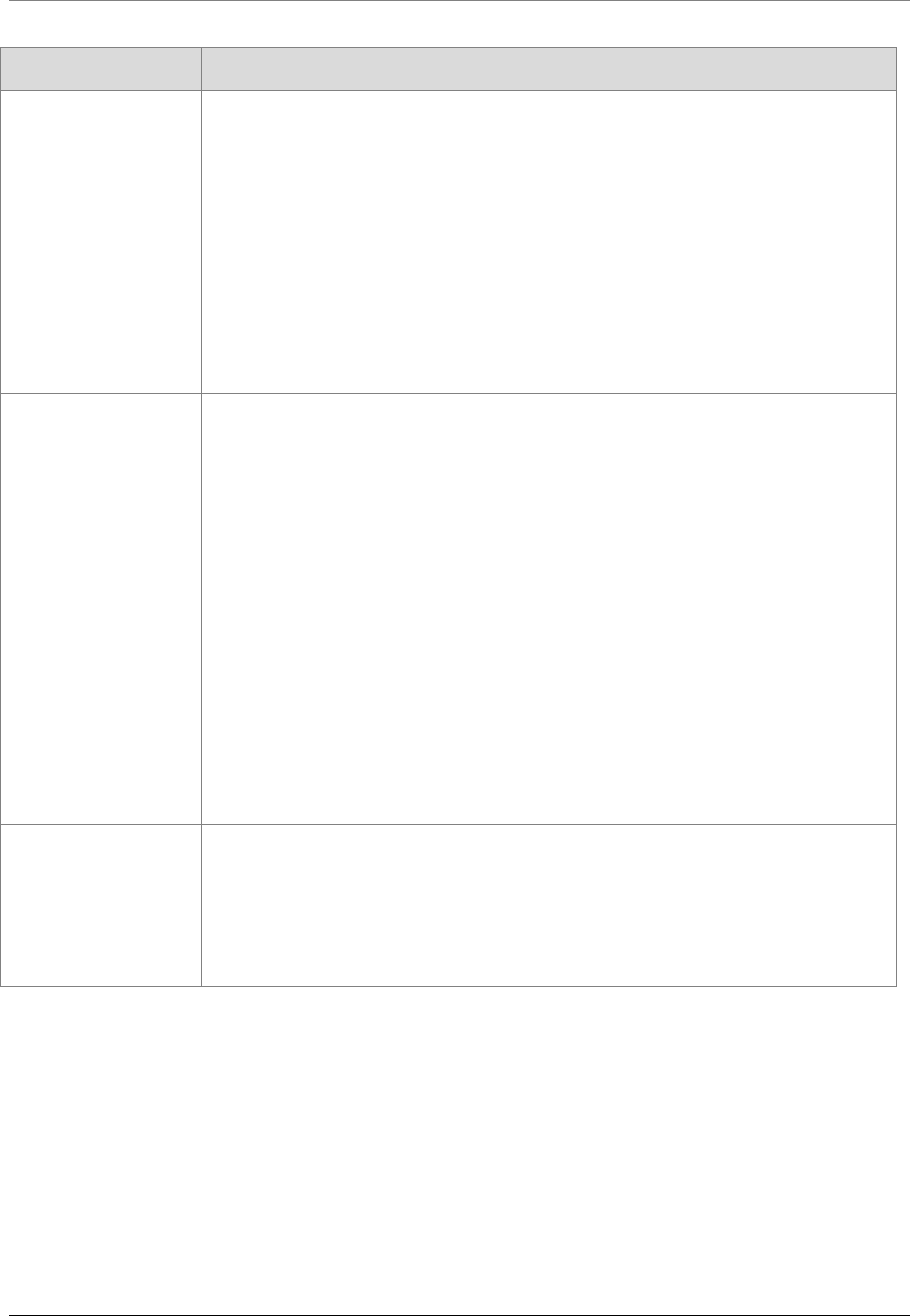

Table 1: Definitions for billed amount in rules and from health insurers

SOURCE TERM AND DEFINITION

WAC 182-550-1050 Hospital

Services Definitions

Billed charge – The charge submitted to the agency by the provider.

Allowed charges – The total billed charges for allowable services.

Allowed covered charges – The total billed charges for services minus the

billed charges for noncovered and/or denied services.

Premera Blue Cross Amount billed – The full amount billed by your provider to your health plan.

Regence BlueShield Billed – The dollar amount the provider charged on the service line for the

service rendered.

Group Health Cooperative Billed/submitted charges – The charges submitted by the provider or

member for reimbursement.

Total charges – The total amount billed to Group Health by a provider.

WA-APCD Rules Background Paper #3 September 2015

OFM Forecasting and Research Division 4

SOURCE TERM AND DEFINITION

Oregon APCD Rule Charge – The actual dollar amount charged on the claim.

Vermont APCD Rule Charge – The actual dollar amount charged on the claim.

After reviewing the descriptions of payment data elements in the other state APCD data submission

guides (DSGs), OFM found:

Minnesota and Maryland require submittal of total charges for the service billed.

Maryland has a separate data element for billed charge for pharmacy that requires the submittal

of the retail amount of the drug, including dispensing fees and administrative cost.

Connecticut and Massachusetts require submittal of the amount of the provider charges for the

claim line.

Table 2 lists the data elements and descriptions for billed amount in other state DSGs.

Table 2: Data elements and descriptions for billed amount in other state APCDs

SOURCE APCD DATA ELEMENT AND DESCRIPTION

APCD Council

core data element

Charge amount – States add their own descriptions.

Connecticut DSG Charge amount – Amount of provider charges for the claim line.

Maryland DSG Billed charge – Practitioner billed charges.

Billed charge – Retail amount for drug, including dispensing fees and administrative

cost.

Massachusetts DSG Charge amount – Amount of provider charges for the claim line.

Minnesota DSG Charge amount – Total charges for the service as reported by the provider.

C. ALLOWED AMOUNT

After reviewing the definitions in rules or provided by the health insurers, OFM found that:

Allowed amount is the maximum amount that a payer will pay a provider for a service.

Allowed amount applies to services that are included or allowed in the health care plan or the

government program.

Allowed amount applies to services provided by providers who are contracted with the health

care plan (in-network).

Allowed amount varies for providers who are not contracted with the subscriber’s health care

plan (out-of-network).

WA-APCD Rules Background Paper #3 September 2015

OFM Forecasting and Research Division 5

Allowed amount may not cover all the provider’s charges. In some cases, subscribers may have

to pay the difference.

Allowed amount may be determined by a fee schedule such as Medicare’s.

Usual customary and reasonable (UCR) amount is sometimes used to determine the allowed

amount.

Oregon is the only state that defines allowed amount (see Table 3).

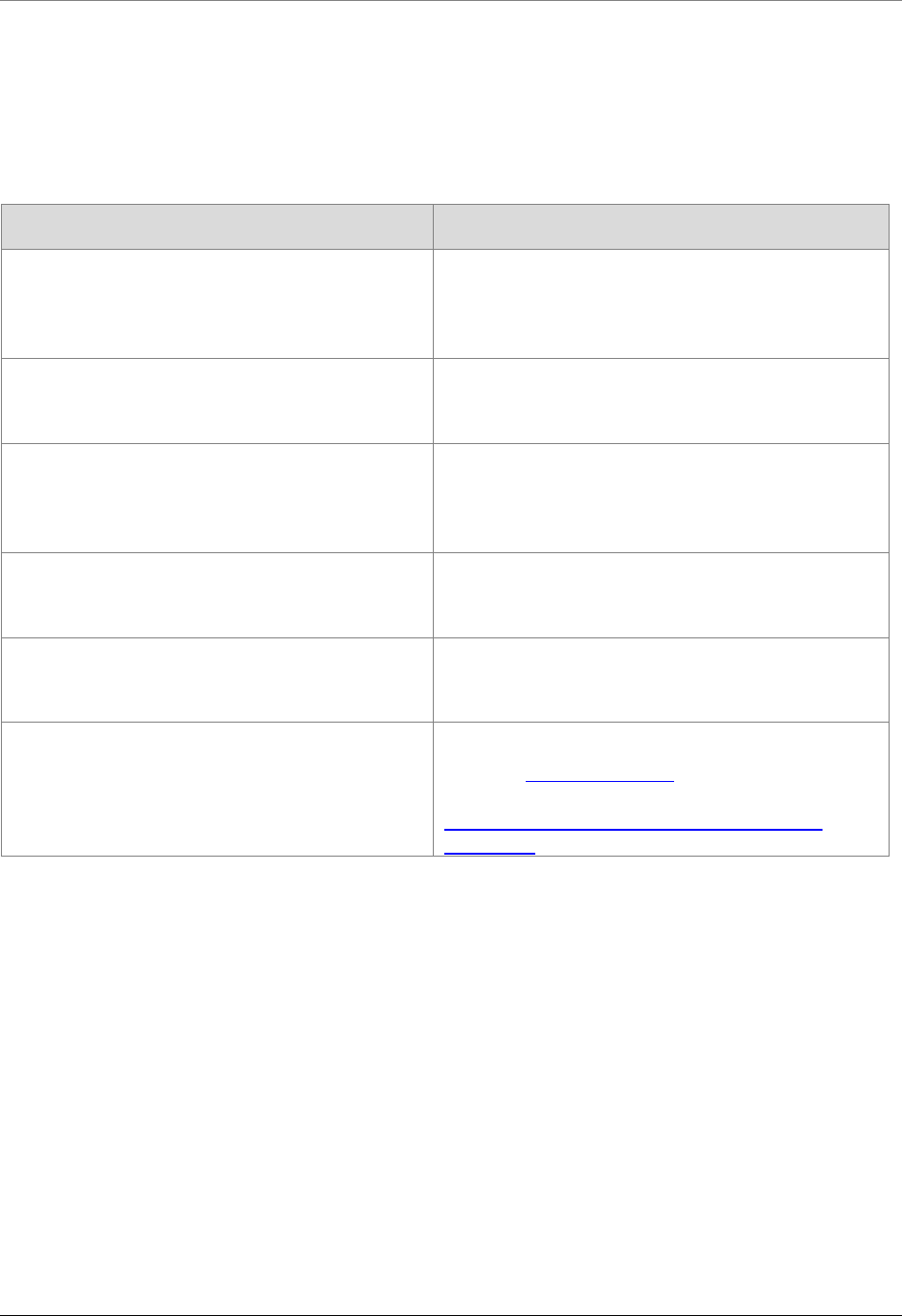

Table 3 lists the sources and definitions in rules and from health insurers for allowed amount.

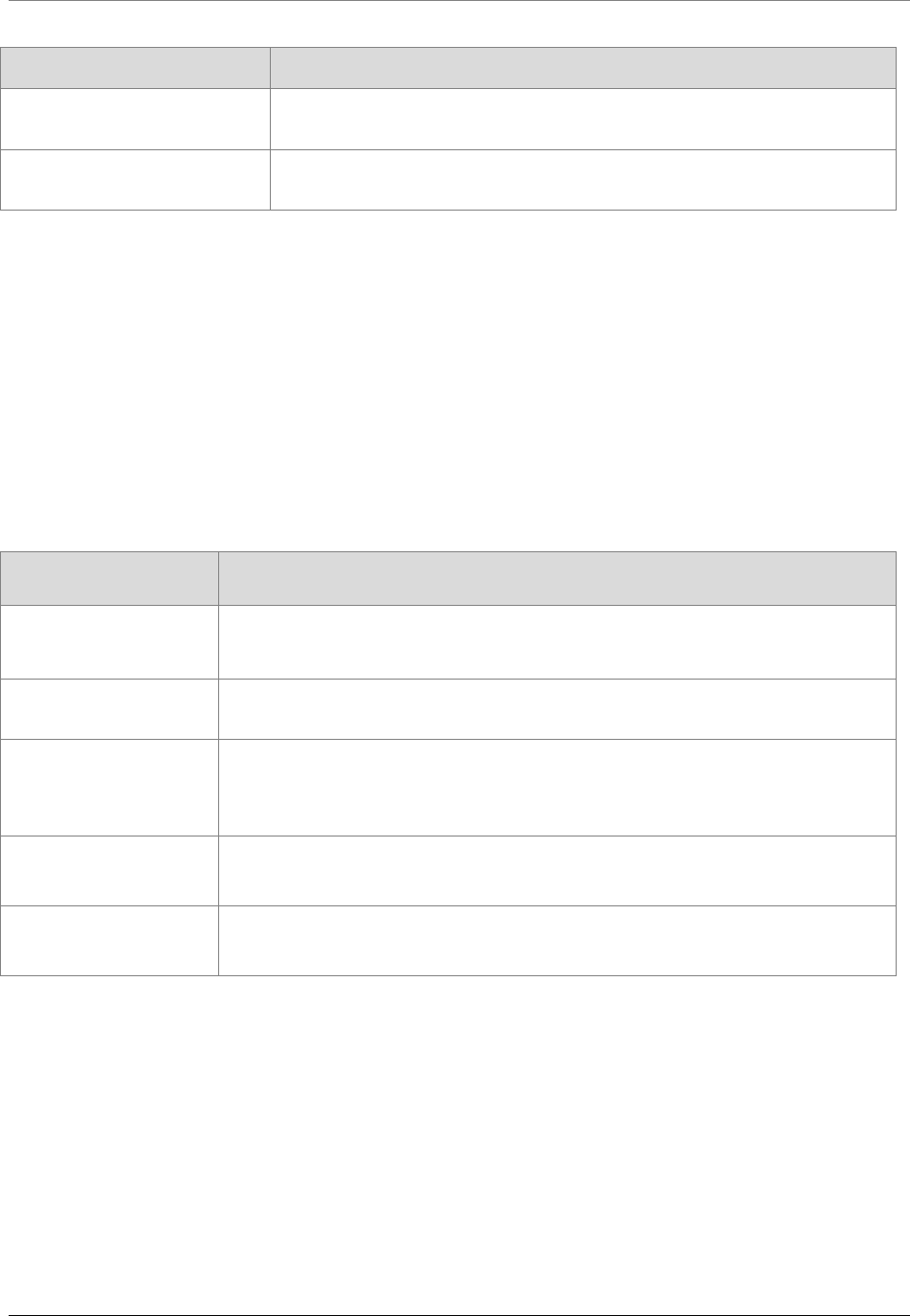

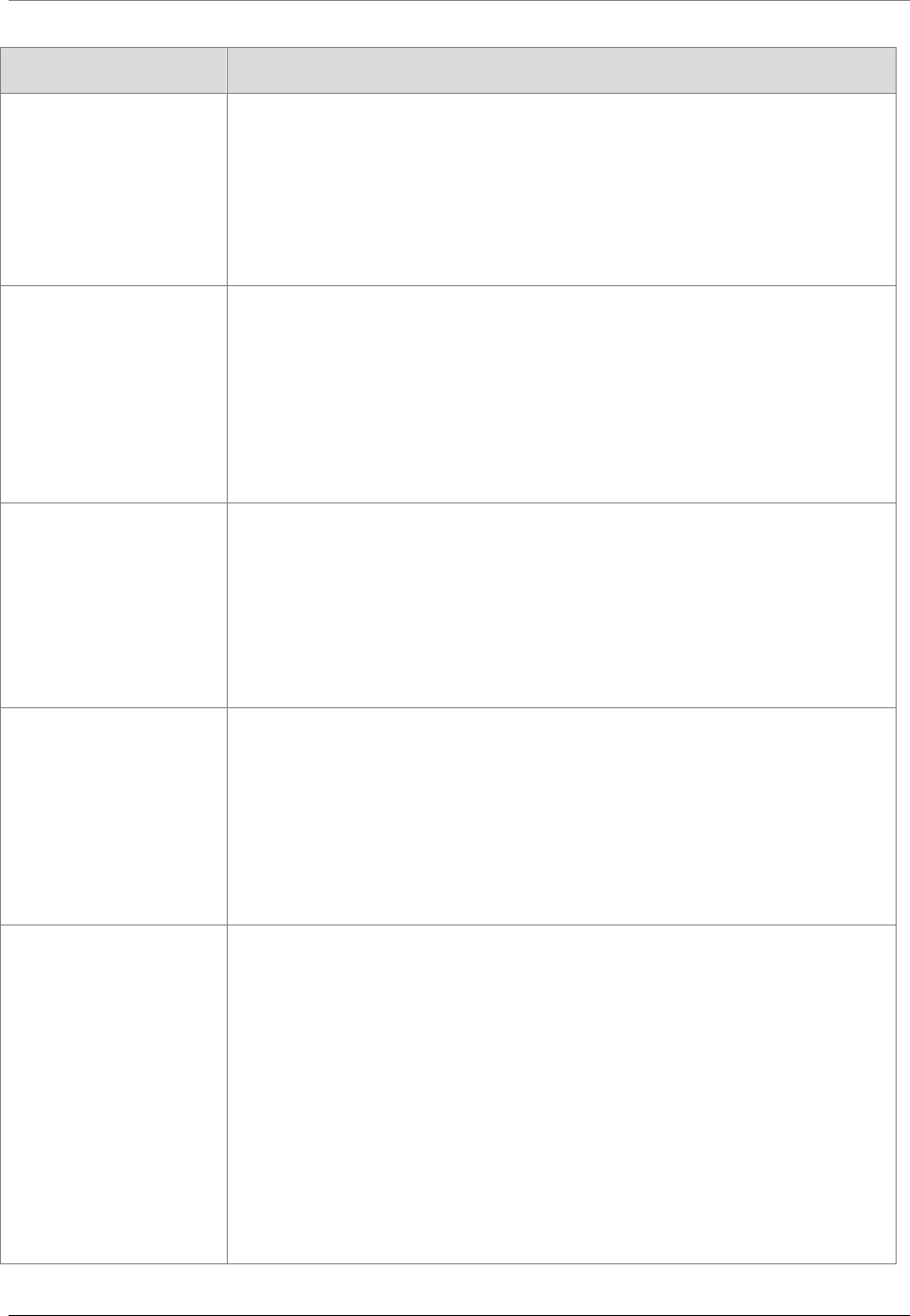

Table 3: Definitions for allowed amount in rule and from health insurers

SOURCE TERM AND DEFINITION

Uniform Glossary Allowed amount – Maximum amount on which payment is based for covered health care

services. This may be called eligible expense, payment allowance or negotiated rate. If

your provider charges more than the allowed amount, you may have to pay the

difference.

UCR (usual, customary and reasonable) – The amount paid for a medical service in a

geographic area based on what providers in the area usually charge for the same or

similar medical service. The UCR amount sometimes is used to determine the allowed

amount.

Medicare Glossary

of Terms

Medicare approved amount – In Original Medicare, this is the amount a doctor or

supplier who accepts assignment can be paid. It may be less than the actual amount a

doctor or supplier charges. Medicare pays part of this amount and you’re responsible for

the difference.

WAC 182-550-1050

Hospital services

definitions

Allowed amount – The initial calculated amount for any procedure or service, after

exclusion of any nonallowed service or charge, that the agency allows as the basis for

payment computation before final adjustments, deductions and add-ons.

Premera Blue Cross

Allowable charge – This plan provides benefits based on the allowable charge for

covered services. We reserve the right to determine the amount allowed for any given

service or supply. The allowable charge is described below.

Providers in Washington and Alaska who agreements with us – For any given

service or supply, the amount these providers have agreed to accept as payment in full

pursuant to the applicable agreement between us and the provider. These providers

agree to seek payment from us when they furnish covered services to you. You'll be

responsible only for any applicable calendar year deductibles, co-pays, coinsurance,

charges in excess of the stated benefit maximums and charges for services and supplies

not covered under this plan. Your liability for any applicable calendar year deductibles,

coinsurance, co-pays and amounts applied toward benefit maximums will be calculated

on the basis of the allowable charge.

Providers outside Washington and Alaska who have agreements with other Blue

Cross Blue Shield licensees – For covered services and supplies received outside

Washington and Alaska, or in Clark County, Washington, allowable charges are

determined as stated in the What Do I Do If I'm Outside Washington And Alaska? Section

(BlueCard® Program And Other Inter-Plan Arrangements) in this booklet.

WA-APCD Rules Background Paper #3 September 2015

OFM Forecasting and Research Division 6

SOURCE TERM AND DEFINITION

Providers who don't have agreements with us or another Blue Cross Blue Shield

licensee – The allowable charge for Washington or Alaska providers that don't have a

contract with us is the least of the three amounts shown below. The allowable charge for

providers outside Washington or Alaska who don't have a contract with us or the local

Blue Cross and/or Blue Shield Licensee is also the least of the three amounts shown

below.

An amount that is no less than the lowest amount we pay for the same or similar

service from a comparable provider who has a contracting agreement with us.

125 percent of the fee schedule determined by the Centers for Medicare and

Medicaid Services (Medicare), if available.

The provider’s billed charges, if applicable law requires a different allowable charge

than the least of the three amounts above; this plan will comply with that law.

Regence BlueShield

Allowed – The dollar amount that is allowed for services rendered by providers based on

their contractual agreements with Regence. For those providers who serve Regence

members, but don't have a contract with Regence (participating or nonparticipating), this

field represents the amount upon which the members' benefits are based.

Group Health

Cooperative

The maximum amount that Group Health will pay for a specific type of service.

Oregon rule Allowed amount – The actual amount of charges for health care services, equipment or

supplies that are covered expenses under the terms of an insurance policy or health

benefits plan.

After reviewing descriptions of payment data elements in other state DSGs, OFM found that:

In Connecticut and Massachusetts, allowed amount is the maximum amount that is

contractually allowed and that a carrier will pay to a provider for a particular procedure or

service.

In Maryland, allowed amount includes total patient and payer liability. It is the retail amount for

the specified procedure code.

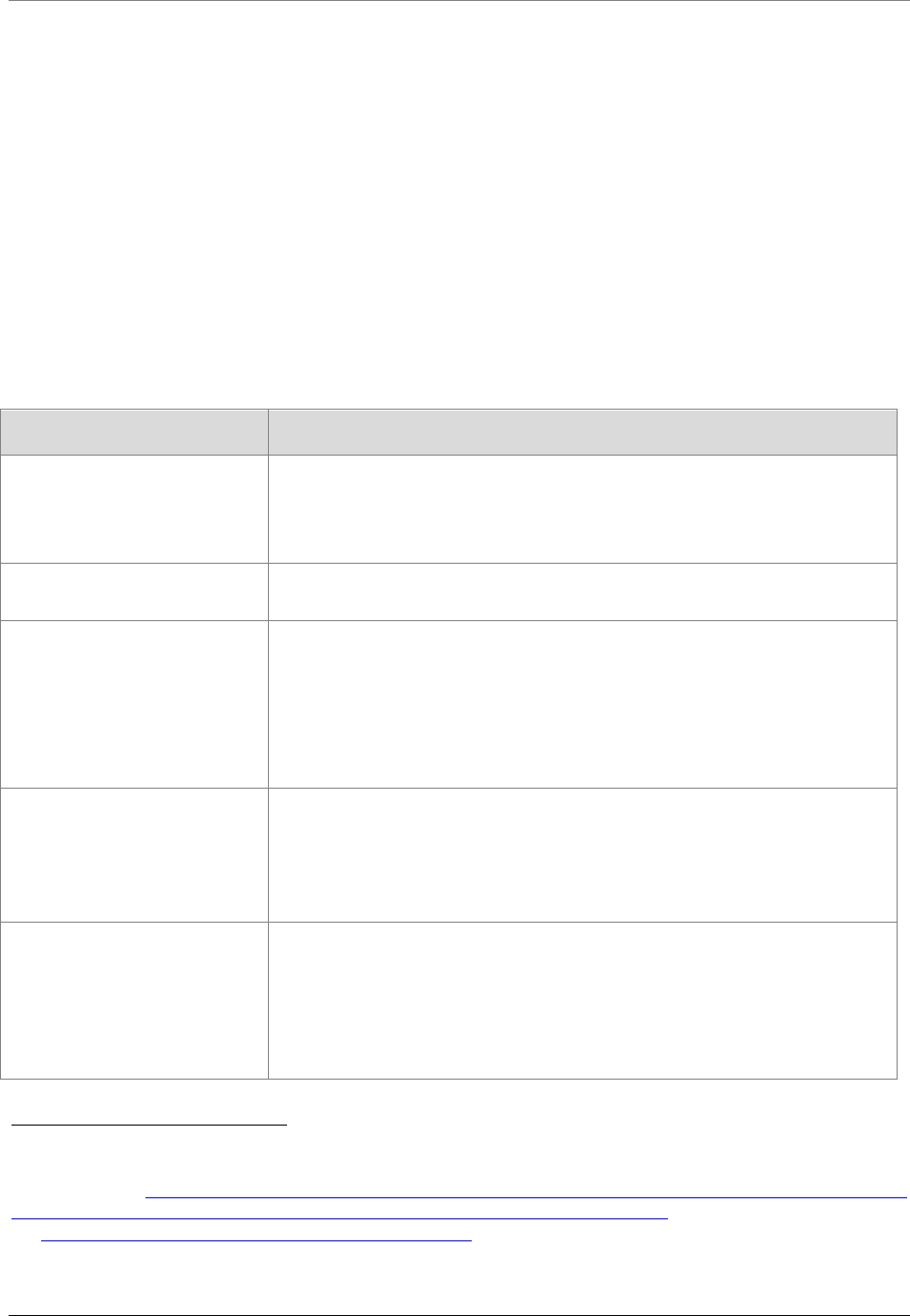

Table 4 lists the APCD data elements and descriptions for allowed amount in other state DSGs.

Table 4: Data elements for allowed amount in other state APCDs

SOURCE APCD DATA ELEMENT AND DESCRIPTION

Connecticut DSG

Allowed amount – The maximum amount contractually allowed and that a carrier will

pay to a provider for a particular procedure or service.

Maryland DSG

Allowed amount – Total patient and payer liability. Retail amount for the specified

procedure code.

Massachusetts DSG

Allowed amount – The maximum amount contractually allowed and that a carrier will

pay to a provider for a particular procedure or service.

WA-APCD Rules Background Paper #3 September 2015

OFM Forecasting and Research Division 7

D. PAID AMOUNT

After reviewing the definitions in rules or provided by the health insurers, OFM found that paid

amount:

Can have several meanings:

› Actual dollar amount paid for whole claim by health care insurer.

› Actual dollar amount paid for a claim line by health care insurer.

› Portion of the charges the health insurer is liable for.

› Amount paid for a medical service in a geographic area based on what providers in the area

usually charge for the same or similar medical service, also known as UCR.

Can be paid by the health plan and by other source.

Does not include co-pay, deductibles, coinsurance or network discount.

On pharmacy claims, paid amount may mean amount billable to the customer/group; the client

total amount due.

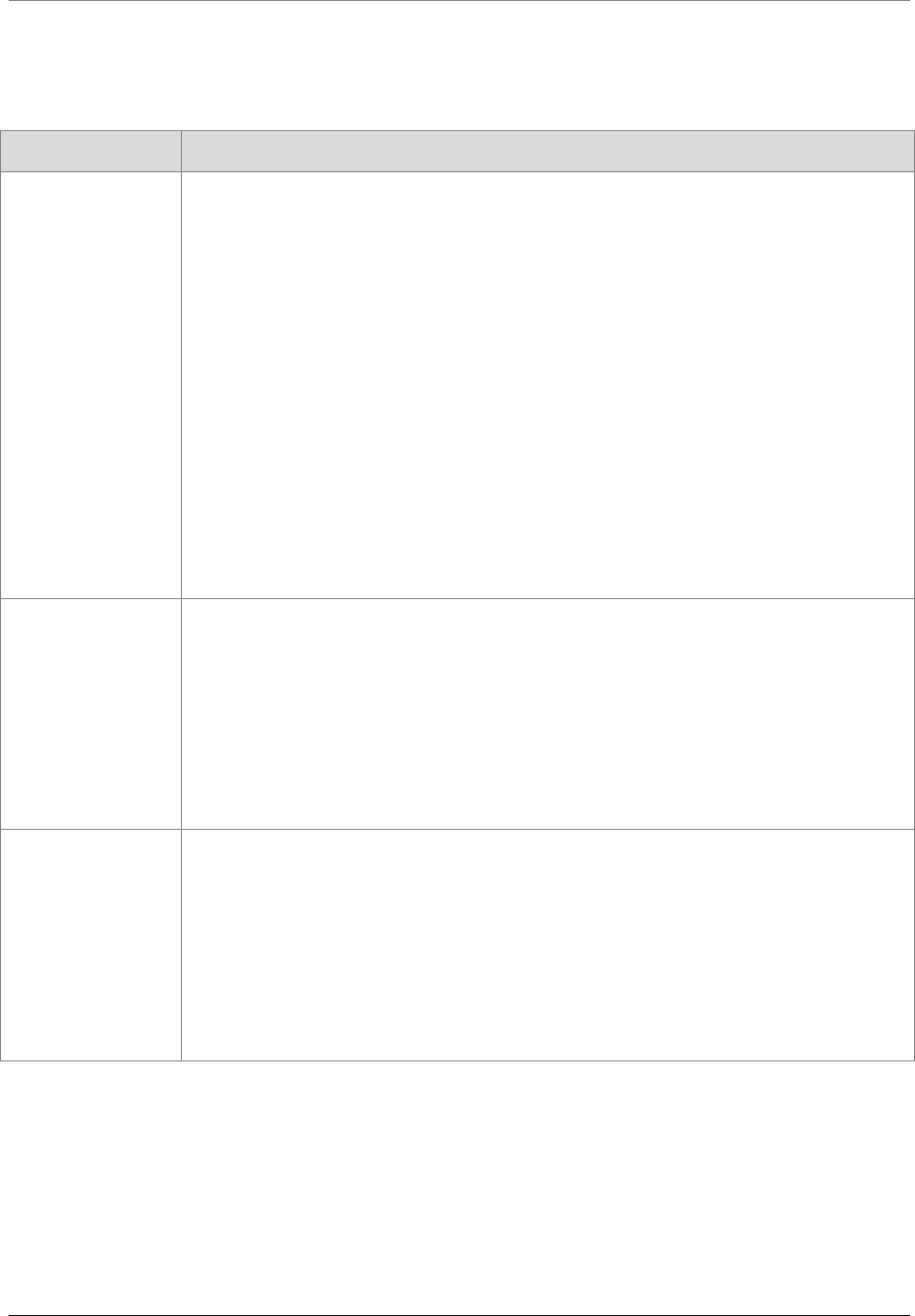

Table 5 lists the source and definition in rules and from health insurers for paid amount.

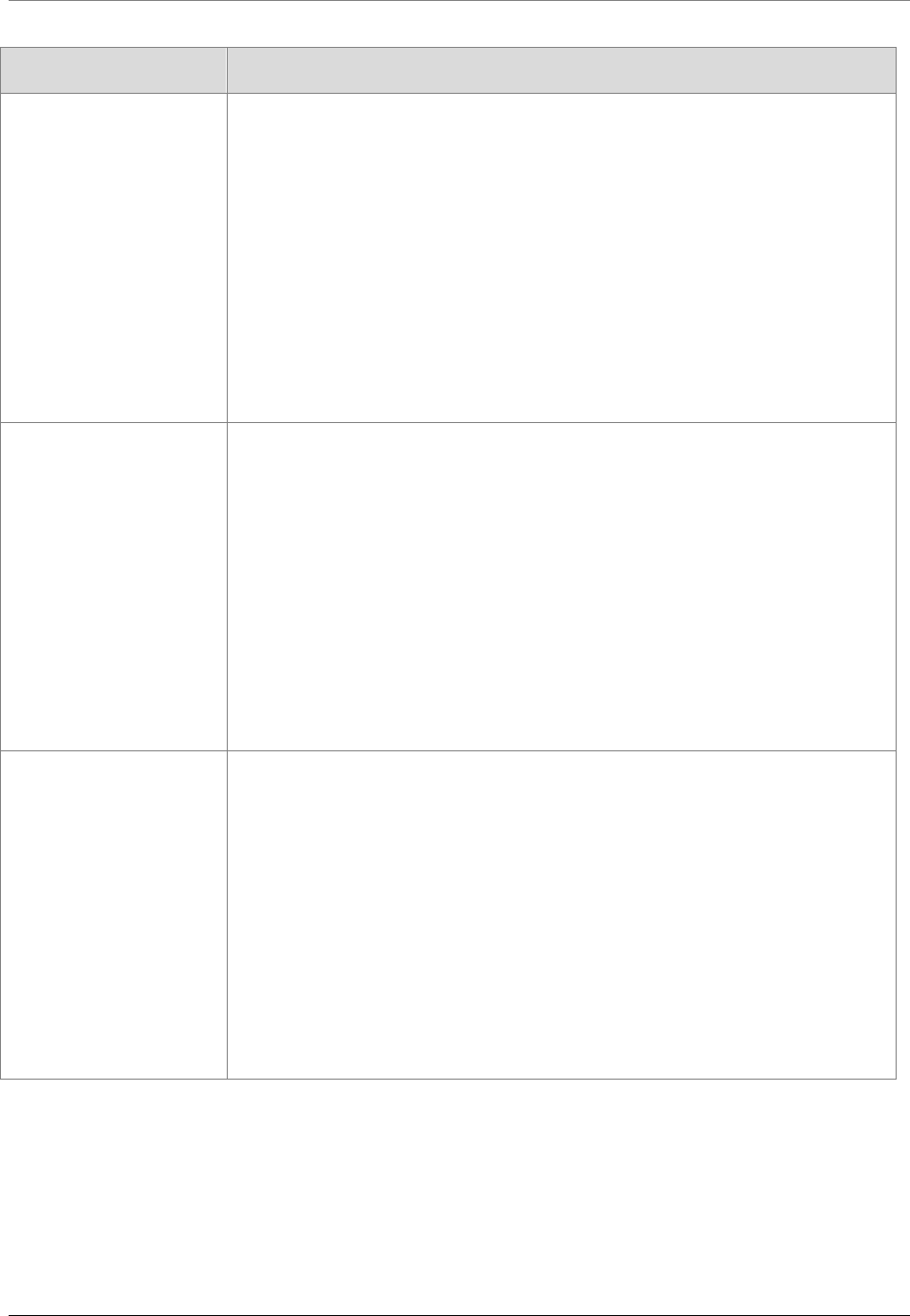

Table 5: Definitions for paid amount from rules and health insurers

SOURCE TERM AND DEFINITION

Uniform Glossary UCR (usual, customary and reasonable) – The amount paid for a medical

service in a geographic area based on what providers in the area usually

charge for the same or similar medical service. The UCR amount sometimes is

used to determine the allowed amount.

Premera Blue Cross Amount paid by your health plan – The portion of the charges eligible for

benefits minus your co-pay, deductible, coinsurance, network discount and

amount paid by another source, up to the billed amount.

Amount paid by another source – Examples of other sources: a health

funding account, other health insurance, automobile insurance, homeowners’

insurance, disability insurance, etc.

Regence BlueShield Paid – The dollar amount of the insurer, corporation or health plan's liability for

the services. On pharmacy claims, amount billable to customer/group; the client

total amount due.

Group Health Cooperative Allowance – The maximum amount payable by the health plan for certain

covered services under the coverage agreement.

Oregon Rule Paid amount – The actual dollar amount paid for claims.

Vermont Rule Payment – The actual dollar amount paid for a claim by a health insurer.

WA-APCD Rules Background Paper #3 September 2015

OFM Forecasting and Research Division 8

After reviewing descriptions of payment data elements in other state DSGs, OFM found that:

Paid amount means the total amount paid to the provider.

Some states include withhold amounts in the paid amount

5

.

Exclusions from paid amount include withhold amounts, sales tax and members’ payments.

Some state APCDs have data elements for the difference sources of the payment such as:

› Other insurance paid amount – Amount already paid by primary carrier.

› Medicare paid amount – Any amount Medicare paid toward the claim line.

› Member self-pay amount – Amount member/patient paid out of pocket on the claims line

for pharmacy.

Table 6 lists the APCD data elements and descriptions for paid amount in other state DSGs.

Table 6: Data elements for paid amount in other state APCDs

SOURCE APCD DATA ELEMENT AND DESCRIPTION

APCD Council core data

elements

Paid amount – State determines description.

Other amount paid – State determines description.

Other payer amount recognized – State determines description.

Colorado DSG Paid amount – Includes any withhold amounts.

Connecticut DSG Paid amount – Amount paid by the carrier for the claim line.

Other insurance paid amount – Amount already paid by primary carrier.

Medicare paid amount – Any amount Medicare paid toward the claim line.

Member self-pay amount – Amount member/patient paid out of pocket on the

claims line (for pharmacy claims data).

Maine DSG For medical claim file specifications, paid amount includes any withhold

amounts.

For pharmacy claims file specifications, paid amount includes all health plan

payments and excludes all member payments.

Maryland DSG Amount paid to the pharmacy by payer. Do not include patient co-payment or

sales tax.

Reimbursement amount – Amount paid to a practitioner, other health

professional, office facility or institution.

5

Withhold – Means a percentage of payment or set dollar amounts that are deducted from the payment to the physician

group/physician that may or may not be returned, depending on specific predetermined factors. For more information

on withholds, see

http://www.ama-assn.org/ama/pub/advocacy/state-advocacy-arc/state-advocacy-campaigns/private-

payer-reform/state-based-payment-reform/evaluating-payment-options/withholds.page.

See http://www.geom.uiuc.edu/usenate/payreport/how.html for more information on how health care plans pay

physicians.

WA-APCD Rules Background Paper #3 September 2015

OFM Forecasting and Research Division 9

SOURCE APCD DATA ELEMENT AND DESCRIPTION

Massachusetts DSG Paid amount – Amount paid by the carrier for the claim line.

Medicare paid amount – Amount Medicare paid on claim.

Other insurance paid amount – Amount paid by a primary carrier.

Minnesota DSG Total amount paid – This field includes all health plan payments and excludes

all member payments.

Paid amount – This field includes all health plan payments and excludes all

member payments and withholds from providers.

New Hampshire DSG Paid amount – Includes any withholds.

Utah DSG Paid Amount – Includes all health plan payments and excludes all member

payments.

E. OTHER PAYMENT TERMS

After reviewing other health care claim payment terms, OFM found five terms that are used by two

or more of the sources for this paper: coinsurance, coordination of benefits/third party liability, co-

payment, deductible and prepaid. These terms have very similar meanings regardless of the source.

OFM found that:

Coinsurance – Means the subscriber’s share of the costs.

› Usually calculated as a percentage of the cost of the medical service.

› Coinsurance for an out-of-network provider is usually a higher percentage than coinsurance

for an in-network provider.

› Medicare has per-day coinsurance for Part A and percentage coinsurance for Part B.

› Coinsurance is a payment in addition to any deductibles the subscriber pays.

Coordination of benefits/third party liability (TPL) amount – Means the amount due from a

secondary carrier, when known.

Co-payment – Means a payment by the subscriber to the health care provider.

› Is a fixed dollar amount.

› Usually paid at the time of service.

› Applies to covered services.

› May be higher for covered services from an out-of-network provider.

› May also be the full cost of the service if the full cost is less than the fixed dollar amount.

Deductible – Means the amount a subscriber pays for health care services before the health

plan begins to pay.

› There is a timeframe for deductibles, usually a year.

› Applies only to services covered in the health plan.

› May not apply to all services.

Prepaid – Has two meanings.

› In the state APCD rules, prepaid means the fee for the service equivalent that would have

been paid for a specific service if the service had not been capitated.

WA-APCD Rules Background Paper #3 September 2015

OFM Forecasting and Research Division 10

› In several of the DSGs, prepaid means the amount the carrier has prepaid toward the claim

line.

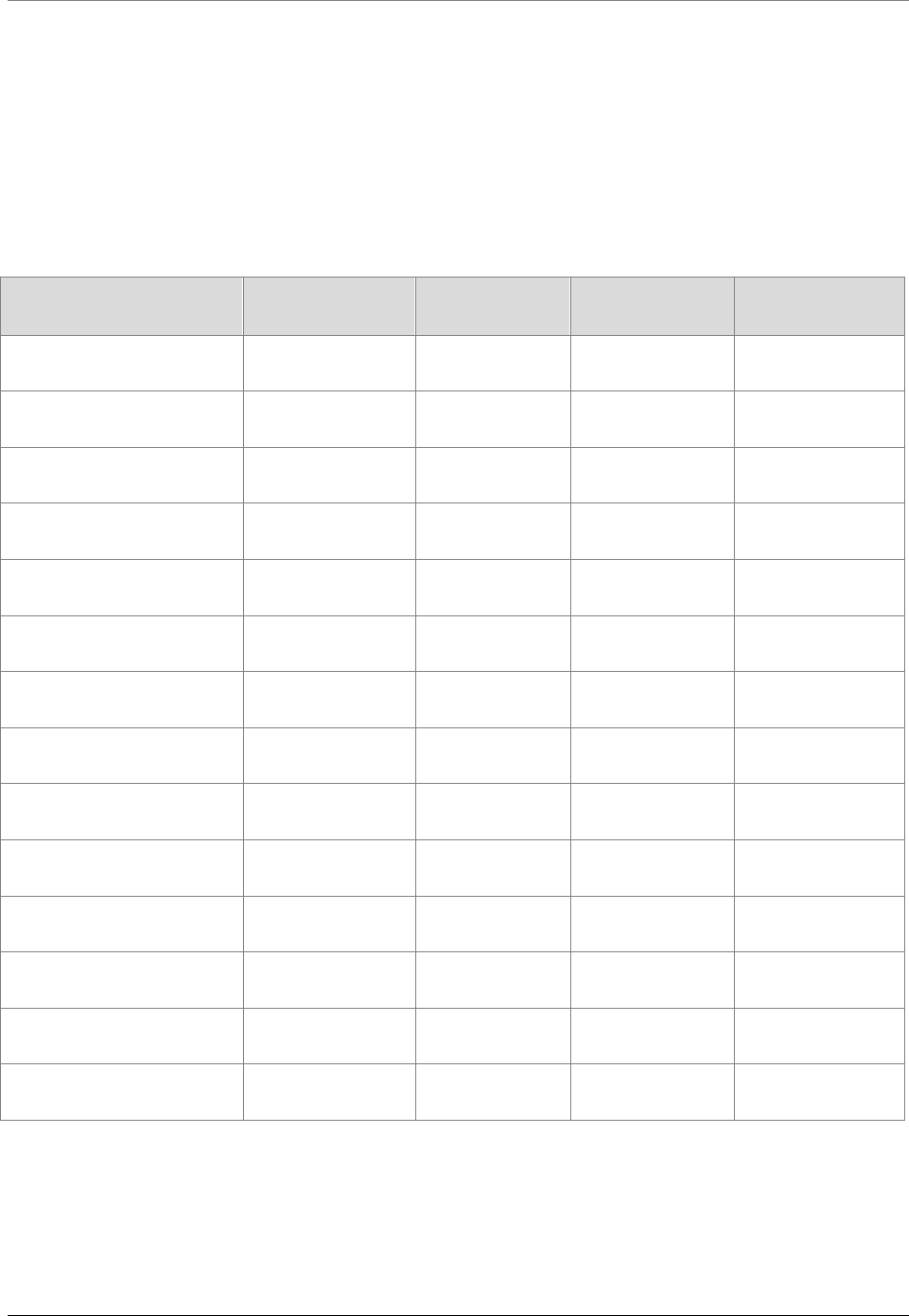

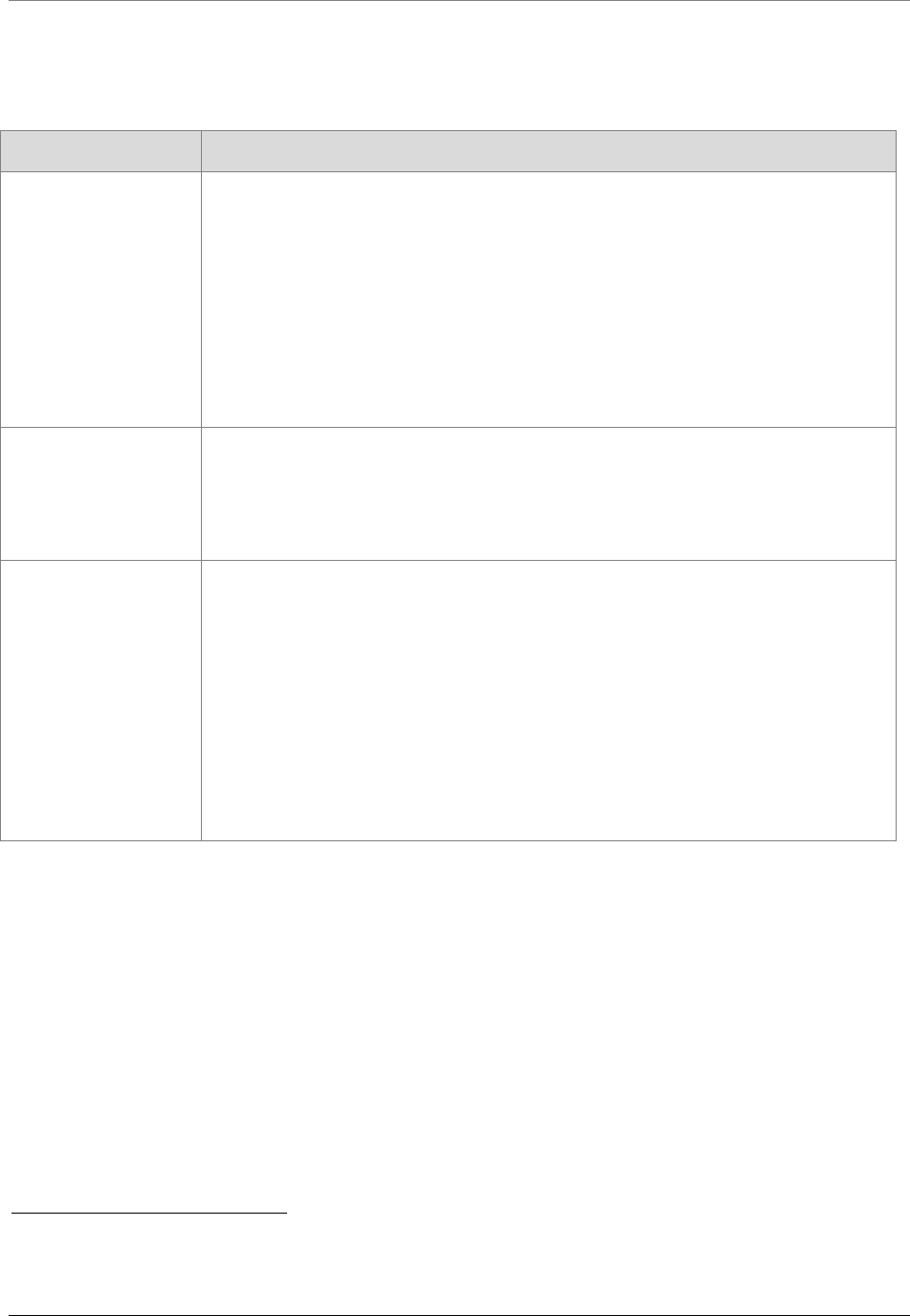

Table 7 lists the other payment terms by source. Table 8 lists the definitions for other payment

terms in rules and provided by the health insurers. Table 9 lists the descriptions for the other

payment data elements in other state APCDs.

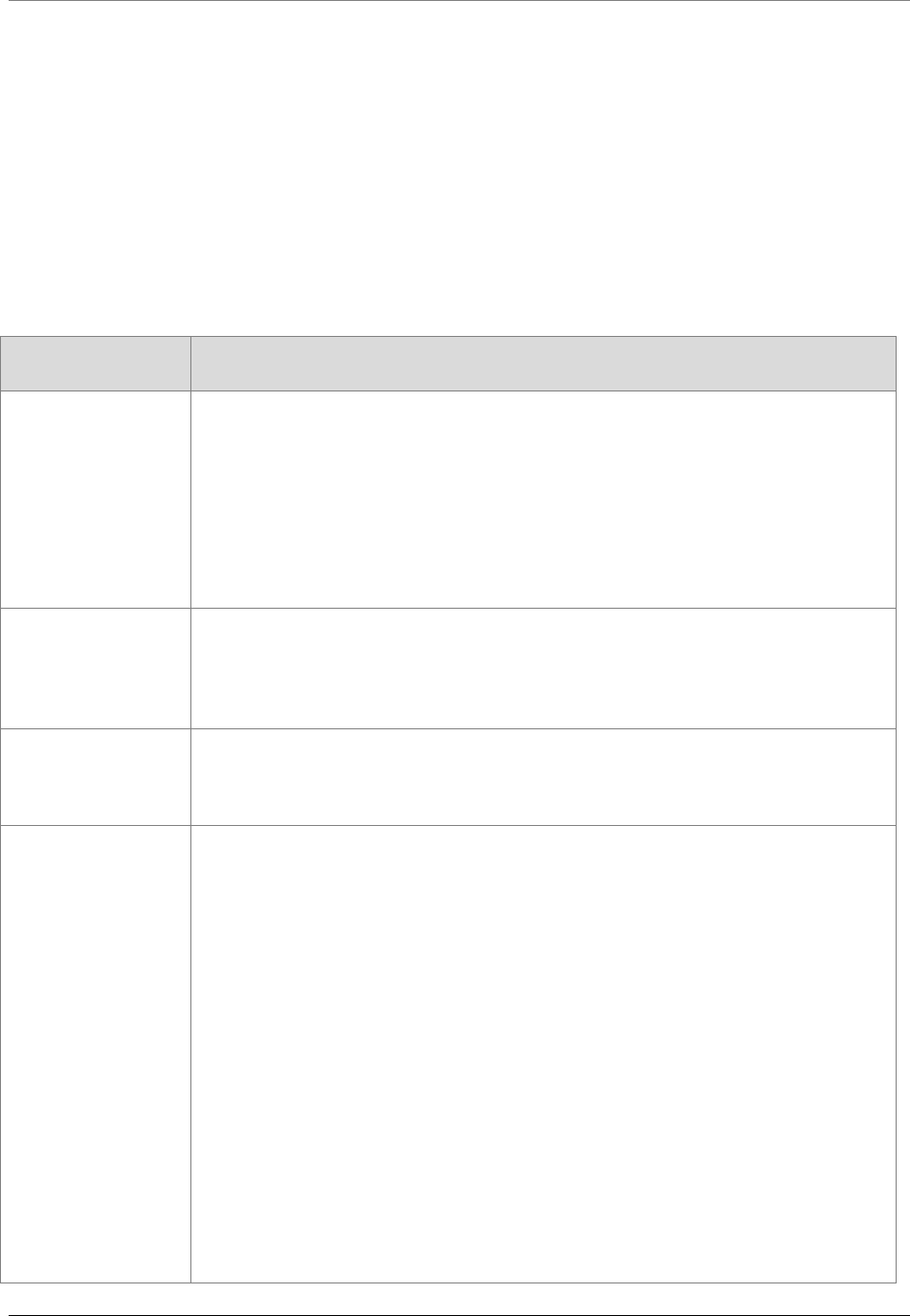

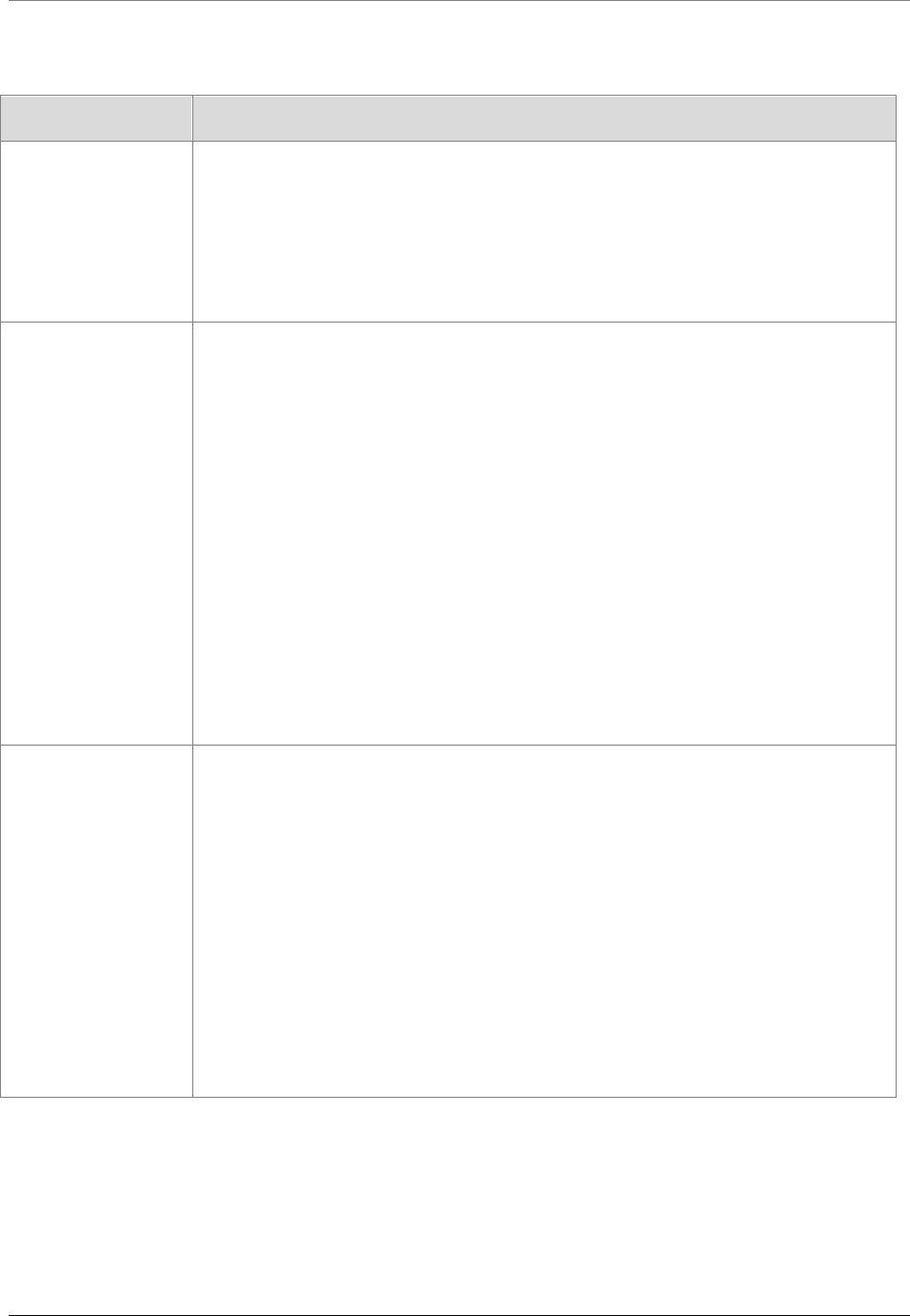

Table 7: Other payment terms by source

OTHER PAYMENT TERMS

RULES &

GLOSSARIES

HEALTH

INSURERS

OTHER STATE

APCD DSGs

APCD CORE DATA

ELEMENTS

Balance billing

Balance due

Capitated services

Coinsurance

Coordination of benefits/

TPL amount

Co-payment

Deductible

In-network coinsurance

In-network co-payment

Other patient obligations

Out-of-network coinsurance

Out-of-network co-payment

Noncovered amount

Prepaid amount

WA-APCD Rules Background Paper #3 September 2015

OFM Forecasting and Research Division 11

Table 8: Other payment terms in rule or used by health plans

SOURCE OTHER PAYMENT TERMS AND DEFINITIONS

Uniform Glossary Balance billing – When a provider bills you for the difference between the provider’s

charge and the allowed amount. For example, if the provider’s charge is $100 and

the allowed amount is $70, the provider may bill you for the remaining $30. A

preferred provider may not balance bill you for covered services.

Coinsurance – Your share of the costs of a covered health care service, calculated

as a percentage (for example, 20 percent) of the allowed amount for the service.

You pay coinsurance plus any deductibles you owe. For example, if the health

insurance or plan’s allowed amount for an office visit is $100 and you’ve met your

deductible, your coinsurance payment of 20 percent would be $20. The health

insurance or plan pays the rest of the allowed amount.

Co-payment – A fixed amount (for example, $15) you pay for a covered health care

service, usually when you get the service. The amount can vary by the type of

covered health care service.

Deductible – The amount you owe for covered health care services before your

health insurance or plan begins to pay. For example, if your deductible is $1,000,

your plan won’t pay anything until you’ve met your $1,000 deductible for covered

health care services subject to the deductible. The deductible may not apply to all

services.

In-network coinsurance – The percentage (for example, 20 percent) you pay of the

allowed amount for covered health care services to providers who contract with your

health insurance or plan. In-network coinsurance usually costs you less than out-of-

network coinsurance

In-network co-payment – A fixed amount (for example, $15) you pay for covered

health care services to providers who contract with your health insurance or plan. In-

network co-payments usually are less than out-of-network co-payments.

Out-of-network coinsurance – The percentage (for example, 40 percent) you pay

of the allowed amount for covered health care services to providers who do not

contract with your health insurance or plan. Out-of-network coinsurance usually

costs you more than in-network coinsurance.

Out-of-network co-payment – A fixed amount (for example, $30) you pay for

covered health care services from providers who do not contract with your health

insurance or plan. Out-of-network co-payments usually are more than in-network co-

payments.

Medicare Glossary of

Terms

Coinsurance – An amount you may be required to pay as your share of the cost for

services after you pay any deductibles. Coinsurance is usually a percentage (for

example, 20 percent).

WA-APCD Rules Background Paper #3 September 2015

OFM Forecasting and Research Division 12

SOURCE OTHER PAYMENT TERMS AND DEFINITIONS

Co-payment – An amount you may be required to pay as your share of the cost for

a medical service or supply, like a doctor’s visit, hospital outpatient visit or

prescription. A co-payment is usually a set amount rather than a percentage. For

example, you might pay $10 or $20 for a doctor’s visit or prescription.

Deductible – The amount you must pay for health care or prescriptions before

Original Medicare, your prescription drug plan or your other insurance begins to pay.

WAC 182-500 and

WAC 182-550

Cost-sharing – Any expenditure required by or on behalf of an enrollee with respect

to essential health benefits; such term includes deductibles, coinsurance, co-

payments or similar charges, but excludes premiums, balance billing amounts for

nonnetwork providers and spending for noncovered services. (WAC 182-500-0020).

Deductible – The dollar amount a client is responsible for before an insurer, such as

Medicare, starts paying, or the initial specific dollar amount for which the client is

responsible. (WAC 182-550-1050 Hospital services definitions).

Premera Blue Cross Co-pay – A set amount you pay for certain covered services such as office visits or

prescriptions. Co-pays are usually paid at the time of service.

Deductible – Your deductible is the amount you need to pay each year for covered

services before your plan starts paying benefits.

Coinsurance – A percentage of covered expenses that you pay after you meet your

deductible.

Group Health

Cooperative

Coinsurance – The percentage amount that a member (or possibly a member's

secondary health plan) is required to pay for covered services. For example, the

health plan may pay 80 percent of the cost of care or services and the member may

pay 20 percent.

Co-payment/co-pay – The dollar amount a member is required to pay at the time of

service for certain covered services. For example, an office visit may have a set co-

pay of $10 or $20 per visit.

Maine

Coinsurance – The dollar amount a member pays as a predetermined percentage

of the cost of a covered service after the deductible has been paid.

Co-payment – The fixed dollar amount a member pays to a health care provider at

the time a covered service is provided or the full cost of a service when that is less

than the fixed dollar amount.

Deductible – The total dollar amount a member pays toward the cost of covered

services over an established period of time before any payments are made by the

contracted third-party payer.

Prepaid amount – The fee for service equivalent that would have been paid by the

health care claims processor for a specific service if the service had not been

capitated.

WA-APCD Rules Background Paper #3 September 2015

OFM Forecasting and Research Division 13

SOURCE OTHER PAYMENT TERMS AND DEFINITIONS

Oregon Coinsurance – The percentage an enrolled member pays toward the cost of a

covered service.

Co-payment – The fixed dollar amount an enrolled member pays to a health care

provider at the time a covered service is provided or the full cost of a service when

that is less than the fixed dollar amount.

Deductible – The total dollar amount an enrolled member pays toward the cost of

covered services over an established period of time before the carrier or third-party

administrator makes any payments under an insurance policy or health benefit plan.

Prepaid amount – The fee for the service equivalent that would have been paid for

a specific service if the service had not been capitated.

New Hampshire

Capitated services – Services rendered by a provider through a contract in which

payments are based upon a fixed dollar amount for each member on a monthly

basis.

Coinsurance – The percentage a member pays toward the cost of a covered

service.

Co-payment – The fixed dollar amount a member pays to a health care provider at

the time a covered service is provided or the full cost of a service when that is less.

Prepaid amount – The fee for the service equivalent what would have been paid by

the health care claims processor for a specific service if the service has not been

capitated.

Vermont Coinsurance – The percentage a member pays toward the cost of a covered

service.

Co-payment – The fixed dollar amount a member pays to a health care provider at

the time a covered service is provided or the full cost of a service when that is less

than the fixed dollar amount.

Deductible – The total dollar amount a member pays toward the cost of covered

services over an established period of time before the contracted third-party payer

makes any payments.

Prepaid amount – The fee for the service equivalent that would have been paid for

a specific service if the service had not been capitated.

WA-APCD Rules Background Paper #3 September 2015

OFM Forecasting and Research Division 14

Table 9: Data elements for other payment terms in state APCDs

SOURCE APCD TERMS AND DESCRIPTIONS

Colorado

DSG

Co-pay amount – The pre-set fixed dollar amount for which the individual is responsible.

Coinsurance amount – The dollar figure for which the individual is responsible; not a

percentage amount.

Deductible amount – Collect this data but no description of data element.

Prepaid amount – For capitated services, the fee for service equivalent amount.

Connecticut

DSG

Deductible amount – Amount of deductible member/patient is responsible to pay on the

claim line.

Member deductible – Annual maximum out-of-pocket member deductible across all

benefit types.

Dental deductible – Maximum out-of-pocket amount of member's deductible applied to

dental benefits.

Vision deductible – Maximum out-of-pocket amount of member's deductible applied to

vision benefits.

Co-pay amount – Amount co-pay member/patient is responsible to pay.

Coinsurance amount – Amount of coinsurance member/patient is responsible to pay.

Noncovered amount – Amount of claim line charge not covered due to eligibility

limitations or unmet provider requirements.

Prepaid amount – Amount carrier has prepaid toward the claim line.

Maryland

DSG

Patient deductible – Fixed amount that the patient must pay for covered services before

benefits are payable.

Patient coinsurance/co-payment – The specified amount or percentage the patient is

required to contribute toward covered medical services after any applicable deductible.

Co-pay amount – Amount of co-pay member/patient is responsible to pay.

Coinsurance amount – Amount of coinsurance member/patient is responsible to pay.

Deductible amount – Amount of deductible member/patient is responsible to pay on the

claim line.

Other patient obligations – Any patient liability other than deductible or coinsurance/co-

payment. Includes obligations for out-of-network care (balance billing), non-covered

services or penalties.

WA-APCD Rules Background Paper #3 September 2015

OFM Forecasting and Research Division 15

SOURCE APCD TERMS AND DESCRIPTIONS

Massachusetts

DSG

Co-pay amount – Amount of co-pay member/patient is responsible to pay.

Coinsurance amount – Amount of coinsurance member/patient is responsible to pay.

Deductible amount – Amount of deductible member/patient is responsible to pay on

the claim line.

Coordination of benefits/TPL amount – Amount due from a secondary carrier when

known.

Noncovered amount – Report the amount that was charged on a claim that is not

reimbursable due to eligibility limitations or provider requirements.

Prepaid amount – Amount carrier has prepaid toward the claim line.

Minnesota DSG

Co-pay amount – Amount of co-pay member/patient is responsible to pay.

Coinsurance amount – Amount of coinsurance member/patient is responsible to pay.

Deductible amount – Amount of deductible member/patient is responsible to pay on

the claim line.

Coordination of benefits/TPL amount – Amount due from a secondary carrier when

known.

Noncovered amount – Report the amount that was charged on a claim that is not

reimbursable due to eligibility limitations or provider requirements.

Prepaid amount – Amount carrier has prepaid toward the claim line.

New Hampshire DSG Co-pay amount – The preset fixed dollar amount for which the individual is responsible.

Coinsurance amount – The dollar amount an individual is responsible for.

Prepaid amount – For capitated services, the fee for service equivalent amount.

Utah DSG Co-pay amount – The pre-set fixed dollar amount for which the individual is

responsible.

Coinsurance amount – The dollar amount an individual is responsible for, not the

percentage.

Prepaid amount – For capitated services, the fee for service equivalent amount.

WA-APCD Rules Background Paper #3 September 2015

OFM Forecasting and Research Division 16

F. CONSIDERATIONS FOR DEVELOPING CLAIM DATA DEFINITIONS

Table 10 identifies the other considerations and related questions and issues that will be discussed in

the rule-making process. This list is not exhaustive; OFM welcomes input from stakeholders.

Table 10: Considerations for developing claim data definitions

CONSIDERATIONS QUESTIONS / ISSUES

1. Are there other payment terms that should be

defined in rule besides billed, allowed and paid

amounts?

There are some common health care claims processing

terms: co-payment, coinsurance, deductible, prepaid,

coordination of benefits.

2. Do we need to consider definitions to capture

alternative payments?

There are other payment methods besides fee for

service.

3. WA-APCD data suppliers may have IT,

accounting and possibly other organizational

systems tied to their definitions.

What are the impacts that the WA-APCD definitions

have, if any, on current programs and organizational

systems?

4. Are there other claims data terms that should be

defined in rule rather than the WA-APCD data

submission guide?

It takes longer to change a term in a rule than it does in

a data submission guide.

5. Over time the definitions in the Universal Glossary

will shape the public’s understanding of these

terms.

Does this need to be taken into consideration when

developing definitions?

6. Other considerations? Please add your questions, issues, comments and send

to OFM at [email protected]ov

.

Please reference WA-APCD Rules Paper 3 in the

subject line.

WA-APCD Rules Background Paper #3 September 2015

OFM Forecasting and Research Division 17

APPENDIX A

Title 182 WAC definitions

TERMS DEFINITIONS

Billed amount Allowed charges – The total billed charges for allowable services. (WAC 182-550-1050

Hospital services definitions)

Allowed covered charges – The total billed charges for services minus the billed charges

for non-covered and/or denied services. (WAC 182-550-1050 Hospital services definitions)

Billed charge – The charge submitted to the agency by the provider (WAC 182-550-1050

Hospital services definitions)

Noncovered charges – Billed charges a provider submits to the agency on a claim and

indicates them on the claim as noncovered. (WAC 182-550-1050 Hospital services

definitions)

Usual and Customary Charge – The amount a provider typically charges to 50 percent or

more of patients who are not medical assistance clients. (WAC 182-500-0110 Medical

assistance definitions)

Allowed amount Allowed – The initial calculated amount for any procedure or service, after exclusion of any

nonallowed service or charge that the agency allows as the basis for payment computation

before final adjustments, deductions and add-ons. (WAC 182-550-1050 Hospital services

definitions)

Allowable – The calculated amount for payment, after exclusion of any nonallowed service

or charge, based on the applicable payment method before final adjustments, deductions

and add-ons. (WAC 182-550-1050 Hospital services definitions)

Other such terms Cost-sharing – Any expenditure required by or on behalf of an enrollee with respect to

essential health benefits; such term includes deductibles, coinsurance, co-payments or

similar charges, but excludes premiums, balance billing amounts for nonnetwork providers

and spending for noncovered services. (WAC-182-500-0020 Washington apple health

definitions)

Deductible – The dollar amount a client is responsible for before an insurer, such as

Medicare, starts paying or the initial specific dollar amount for which the client is responsible.

(WAC 182-550-1050 Hospital services definitions)

WA-APCD Rules Background Paper #3 September 2015

OFM Forecasting and Research Division 18

APPENDIX B

CMS Medicare glossary terms related to claim payments

TERMS DEFINITIONS

Billed amount

Limiting charge – In Original Medicare

6

, the highest amount of money you can be

charged for a covered service by doctors and other health care suppliers who don’t

accept assignment. The limiting charge is 15 percent over Medicare’s approved amount.

The limiting charge applies only to certain services and doesn’t apply to supplies or

equipment.

Excess charge – If you have Original Medicare, and the amount a doctor or other

health care provider is legally permitted to charge is higher than the Medicare-approved

amount, the difference is called the excess charge.

Allowed amount Medicare approved amount – In Original Medicare, this is the amount a doctor or

supplier that accepts assignment can be paid. It may be less than the actual amount a

doctor or supplier charges. Medicare pays part of this amount and you’re responsible for

the difference.

Other such terms Coinsurance – An amount you may be required to pay as your share of the cost for

services after you pay any deductibles. Coinsurance is usually a percentage (for

example, 20 percent).

Co-payment – An amount you may be required to pay as your share of the cost for a

medical service or supply, like a doctor’s visit, hospital outpatient visit or prescription. A

co-payment is usually a set amount, rather than a percentage. For example, you might

pay $10 or $20 for a doctor’s visit or prescription.

Deductible – The amount you must pay for health care or prescriptions before Original

Medicare, your prescription drug plan or your other insurance begins to pay.

6

Original Medicare is fee-for-service coverage under which the government pays your health care providers directly for

your Part A and/or Part B benefits.

WA-APCD Rules Background Paper #3 September 2015

OFM Forecasting and Research Division 19

REFERENCES

1. Colorado:

Statute:

http://www.leg.state.co.us/CLICS/CLICS2010A/csl.nsf/fsbillcont3/7772EFE1E998E6278725

76B700617FA4?Open&file=1330_enr.pdf

Rules: http://www.civhc.org/getmedia/2a315773-cbcd-4f75-805a-759d3cf96888/Rules-

Governing-Data-Submissions-to-APCD-2011-08-24.pdf.aspx/

2. Connecticut

Statute: http://www.cga.ct.gov/2012/ACT/Pa/pdf/2012PA-00166-R00HB-05038-PA.pdf

3. Maine

Statute: http://www.mainelegislature.org/legis/statutes/22/title22sec8703.html

Rules: https://mhdo.maine.gov/claims.htm

4. Maryland

Statute: http://www.dsd.state.md.us/comar/SubtitleSearch.aspx?search=10.25.06

Rules: http://www.dsd.state.md.us/comar/SubtitleSearch.aspx?search=10.25.06

5. Massachusetts

Statute: http://chiamass.gov/relevant-regulations-5

Rules: http://chiamass.gov/assets/docs/g/chia-regs/957-8.pdf

6. Minnesota

Statute: https://www.revisor.mn.gov/rules/?id=4653

Rules: https://www.revisor.mn.gov/rules/?id=4653.0300

7. New Hampshire

Statute: http://www.gencourt.state.nh.us/rsa/html/XXXVII/420-G/420-G-11-a.htm

Rules: http://www.gencourt.state.nh.us/rules/state_agencies/ins4000.html

8. Oregon

Statute: http://www.oregon.gov/oha/ohpr/Pages/Statutes-

Health%20Care%20Data%20Reporting.aspx

Rules: http://www.oregon.gov/oha/OHPR/rulemaking/notices/409-

025_PermComplete_2.1.13.pdf

9. Tennessee

Statute: http://state.tn.us/sos/acts/106/pub/pc0611.pdf

Rules: http://www.state.tn.us/sos/rules/0780/0780-01/0780-01-79.20100908.pdf

10. Utah

Statute: http://le.utah.gov/~2007/bills/hbillenr/hb0009.pdf

Rules: http://www.rules.utah.gov/publicat/code/r428/r428-015.htm

11. Vermont

Statute:

http://www.leg.state.vt.us/statutes/fullsection.cfm?Title=18&Chapter=221&Section=09410

Rules: http://gmcboard.vermont.gov/sites/gmcboard/files/REG_H-2008-01.pdf