PUBLIC

How to fill in the Common

Reporting Standard (CRS) Entity

self-certification form

April 2016

PUBLIC 1

Contents

Introduction ................................................................................................................................... 2

1. An overview of the form ........................................................................................................ 3

2. Your guide to filling in Part 2 of the form: Entity Type ........................................................... 4

3. Is your Entity a Financial Institution (FI)? .............................................................................. 5

4. Is your Entity another type of Financial Institution or another type of Investment Entity? ..... 8

5. Does your Entity fit any of the Non-Financial Entity (NFE) definitions? ................................ 9

6. Reporting ............................................................................................................................ 11

Glossary ..................................................................................................................................... 12

We’ve produced this guide to help you fill in the CRS Entity self-certification form. We’ve based it on the information

that’s currently available.

It’s a guide, not a substitute for taking a detailed look at the Common Reporting Standard (CRS) and it doesn’t

constitute tax advice. If there’s anything you’re not sure about, please get in touch with a tax professional.

PUBLIC 2

Introduction

What is the Common Reporting Standard?

The Organisation for Economic Co-operation and Development (OECD) has developed the Common Reporting

Standard (CRS) to stop individuals and Entities evading tax by hiding assets and income in foreign financial

accounts.

More than 90 countries have committed to rolling out the CRS. These countries, known as “Participating

Jurisdictions”, require resident financial institutions like us to collect information from our account holders to identify

the financial accounts held by foreign tax residents and report them to the tax authorities.

The tax authorities of the Participating Jurisdictions then exchange this information to determine whether these

account holders are declaring their income and paying the right amount of tax in their country of tax residence.

You can see a list of Participating Jurisdictions here: http://www.oecd.org/tax/transparency/AEOI-commitments.pdf.

What does it mean for you?

Under the CRS, we have to establish where an Entity is resident for tax purposes. As a result, we need you to fill in

the ‘Entity tax residency self-certification form’. In some cases (we’ve indicated where in this guide), we’ll also

need the Controlling Persons of your Entity to fill in a ‘Controlling Person tax residency self-certification form’.

Please note that for the purpose of this guide, partnerships, trusts and foundations are all Entities.

By filling in this form, you’ll be certifying where your Entity is resident for tax purposes and how you would classify it

under the CRS. That means, if we need to, we can report the necessary information to the tax authorities.

In some cases, we might need you to give us other supporting documents so we can confirm the information on

your self-certification form. We’ll be in touch if that’s the case.

What’s the purpose of this guide?

The rules for determining how to classify your Entity under the CRS can be complicated. The aim of this guide is to

help you determine which classification applies to your Entity. We've set out information on the different Entity types

in Sections 2-5. Section 6 gives you some information about which Entity types qualify as “Reportable Persons”

under the CRS.

The CRS requires us to get this ‘self-certification’ from you. We can help you by providing details of the various

definitions and classifications but it’s important to remember we can’t give you tax advice.

For definitions of the terms we’ve used throughout this guide, please see the Glossary on page 13.

What if you’re still not sure how you should be filling in the form or what your Entity’s

classification is?

If, after reading this guide, you’re still unclear about how to classify your Entity under the CRS, and/or where it’s

resident for tax purposes, you should get relevant tax advice. Your Relationship Manager is here to help if you have

any questions but won’t be able to provide technical or tax advice.

Are the Entity classifications under the CRS the same as the ones under FATCA?

You might already have classified your Entity under the Foreign Account Tax Compliance Act (FATCA). However,

your Entity’s classification for CRS purposes may not be the same as the one for FATCA.

The FATCA and CRS Entity classifications are similar, but there are important differences. While some

classifications – such as Financial Institution, Active NFFE/NFE and Passive NFFE/NFE exist under both regimes,

others don’t. For example, an Owner Documented Foreign Financial Institution is a classification for FATCA but not

for the CRS.

Where a classification exists under both regimes, there might be differences in the way it’s defined. For example, an

Investment Entity is a type of Financial Institution under both FATCA and the CRS, but the definition isn’t the same.

So please make sure you read the Entity definitions in this guide. And don’t assume that because your Entity is a

certain classification under FATCA, it will be the same under the CRS.

PUBLIC 3

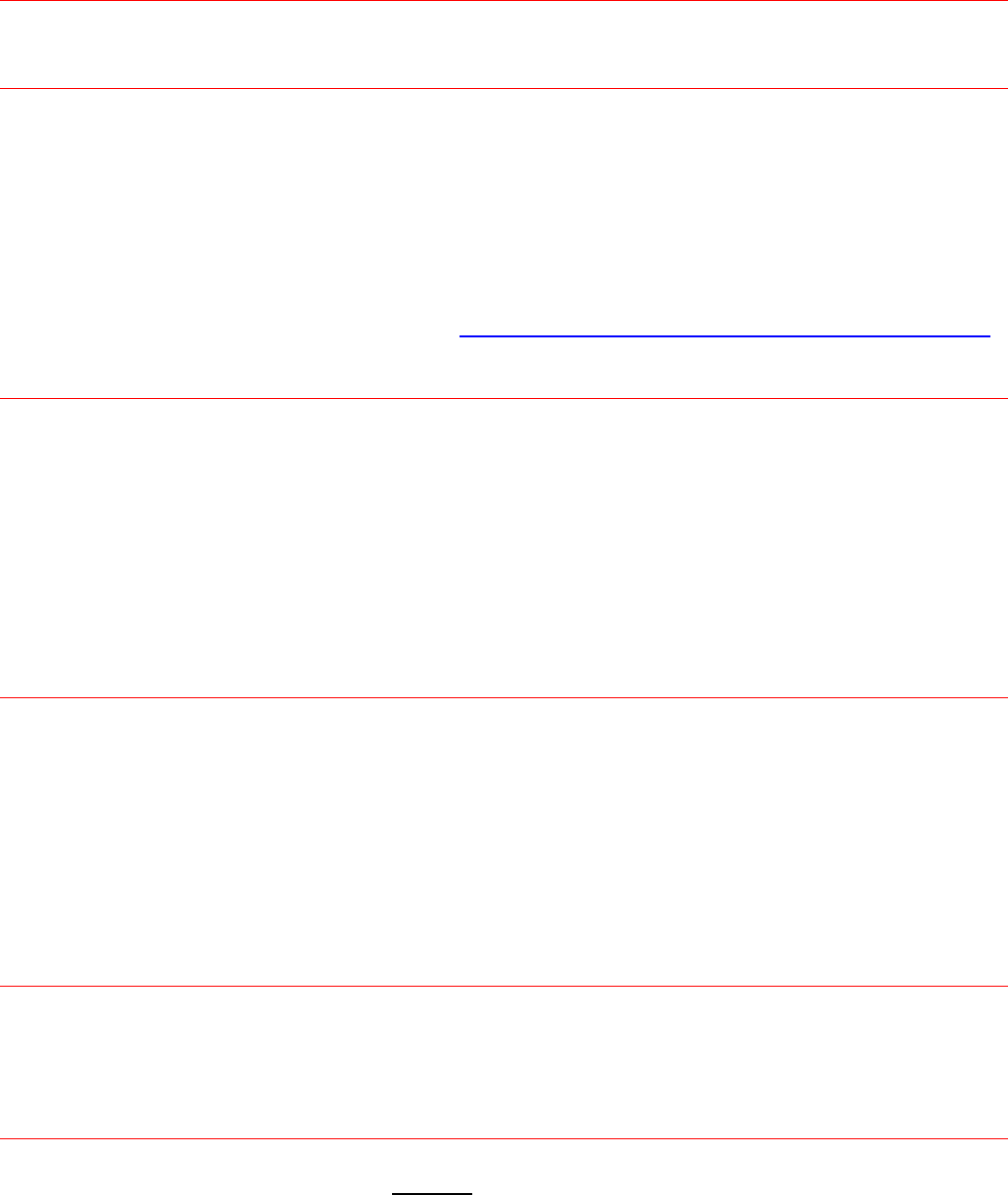

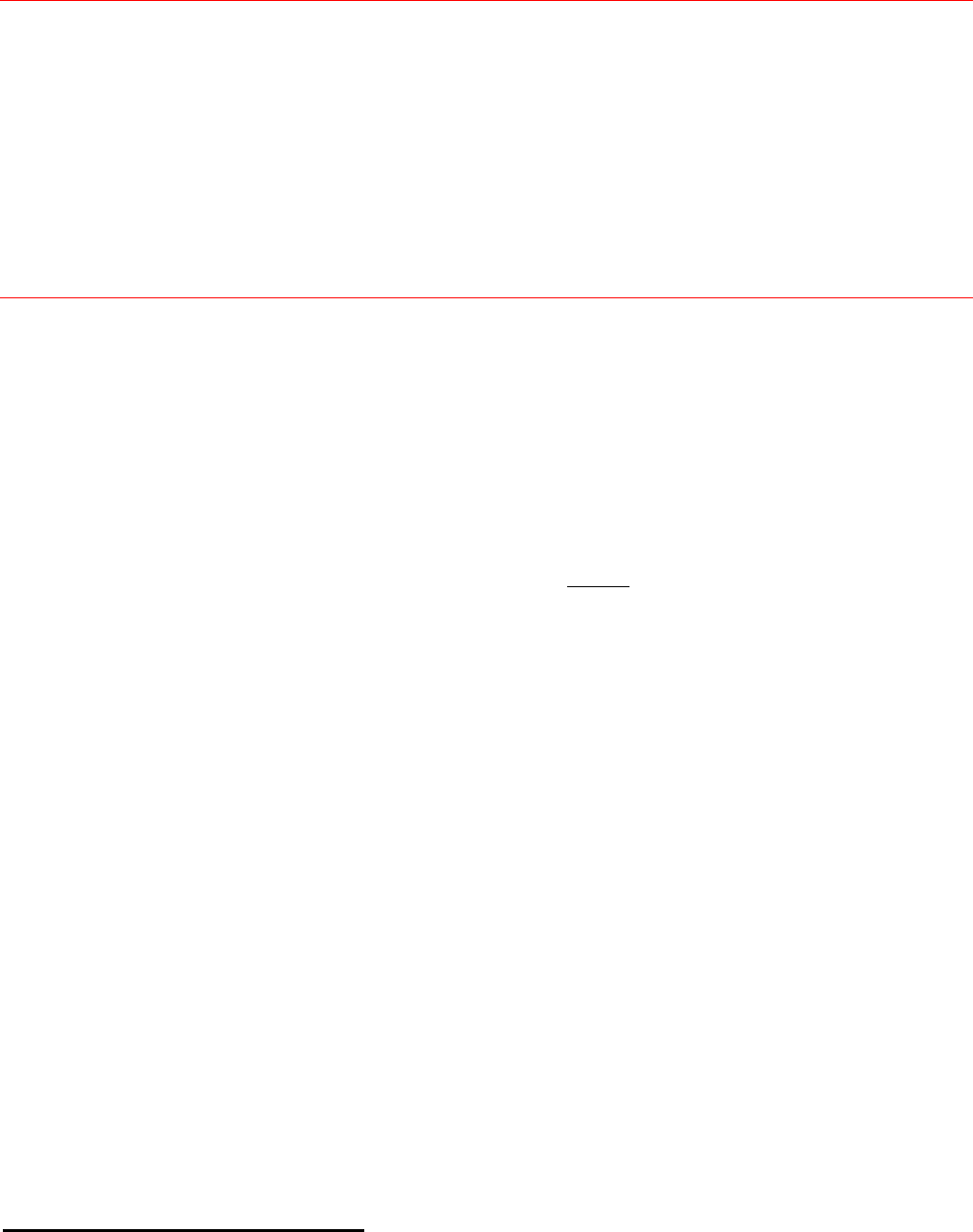

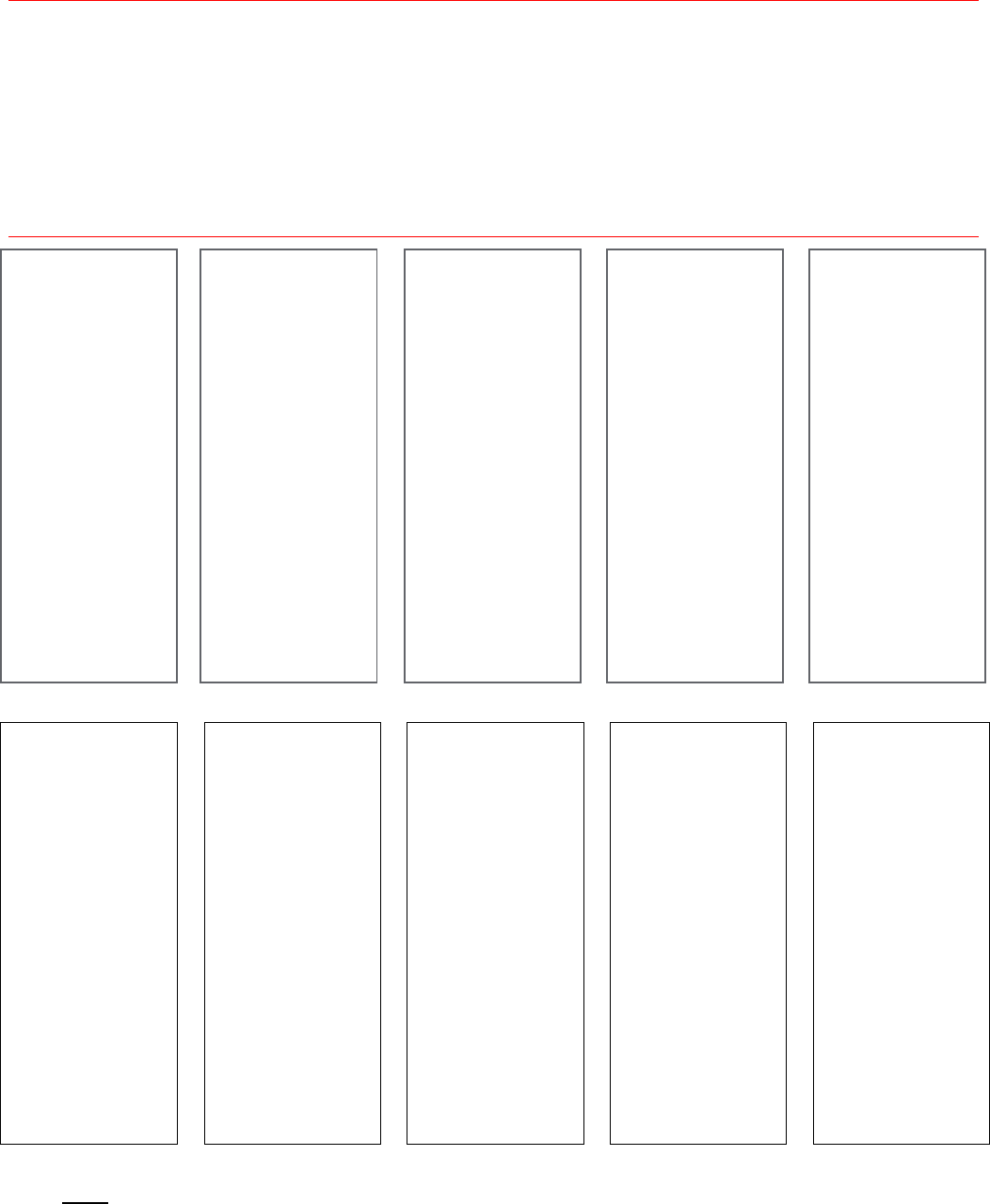

1. An overview of the form

You might find this chart helpful in understanding the form.

Part 1:

Identifying the Account Holder

You’ll need to give us the following information:

Part 1 (A): Please tell us the legal name of your Entity/Branch

Part 1 (B): Please tell us your Entity’s/Branch’s country of incorporation or organisation

Part 1 (C): Please tell us your Entity’s/Branch’s current residence address

Part 1 (D): Please tell us your Entity’s mailing address (if it’s different to the address you give us in Part 1 (C))

If “Yes” continue to the flow chart below

Make sure you read the declaration carefully before signing, dating and printing your name. Please also tell us the

capacity in which you’re signing this form on behalf of your Entity.

Please tell us in Part 3 where your Entity is resident for tax purposes, as well as its Taxpayer Identification Number (for

each country of tax residence). You can find more information on TINs below. If you can’t provide a TIN you will need to

tell us why (using Reason A, B or C). If you indicate Reason B, you will also need to tell us why.

Taxpayer Identification Number (“TIN”)

The term “TIN” means Taxpayer Identification Number (or, where there’s no TIN, its functional equivalent). A TIN is

a unique combination of letters or numbers that a jurisdiction assigns to an individual or Entity to identify them for

tax purposes. Some jurisdictions don’t issue a TIN, but they often use another number instead (a “functional

equivalent”).

Examples of TIN (for an Entity) include “Company Unique Taxpayer Reference (UTR)” in the UK, the “UID-number”

in Switzerland and the “Employer Identification Number” (EIN) in the United States.

Examples of TIN (for an individual) include a social security/insurance number, citizen/personal

identification/service code number and resident registration number.

You can find out more about TINs by visiting the OECD website: http://www.oecd.org/tax/automatic-exchange/crs-

implementation-and-assistance/tax-identification-numbers/#d.en.347759

The laws of the relevant jurisdiction determine an Entity’s ‘Country of tax residence’. Where that is might depend on the

country of incorporation, organisation, management and control or other factors. If you’re not sure which country your

Entity is resident in for tax purposes, please speak to your tax advisor. You can find general guidance on the OECD

website: http://www.oecd.org/tax/automatic-exchange/crs-implementation-and-assistance/tax-residency/#d.en.347760

In Part 2 you’ll need to tell us your Entity’s classification under the CRS (see Sections 2-5 for more guidance). Please note

that for some classifications, the Controlling Person(s) for your Entity will also need to provide us with a self-certification of

where they’re resident for tax purposes.

Part 3:

Country of Residence for Tax Purposes and related Taxpayer Identification Number (“TIN”)

or functional equivalent

Part 2:

Entity type

Part 4:

Declaration and signature

PUBLIC 4

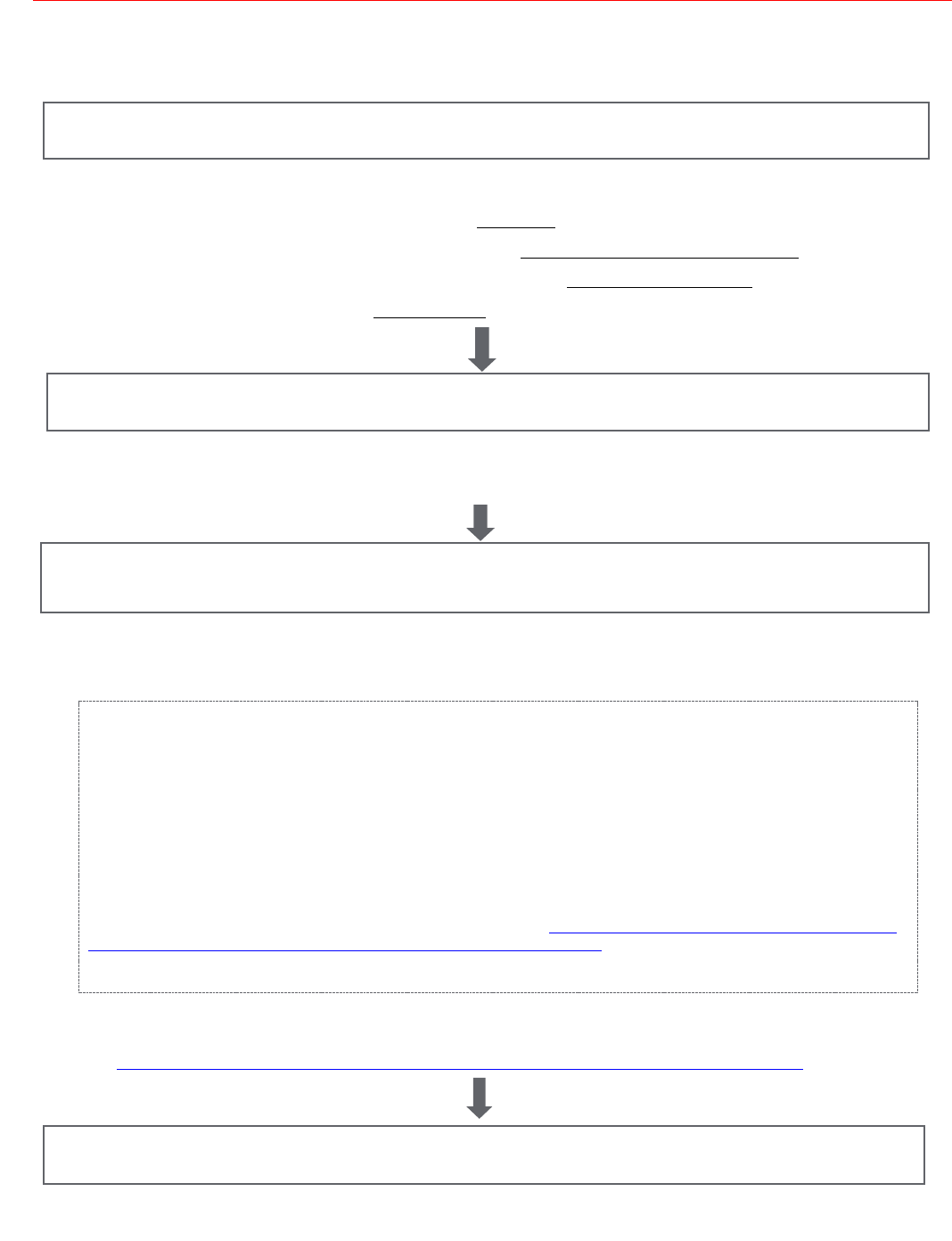

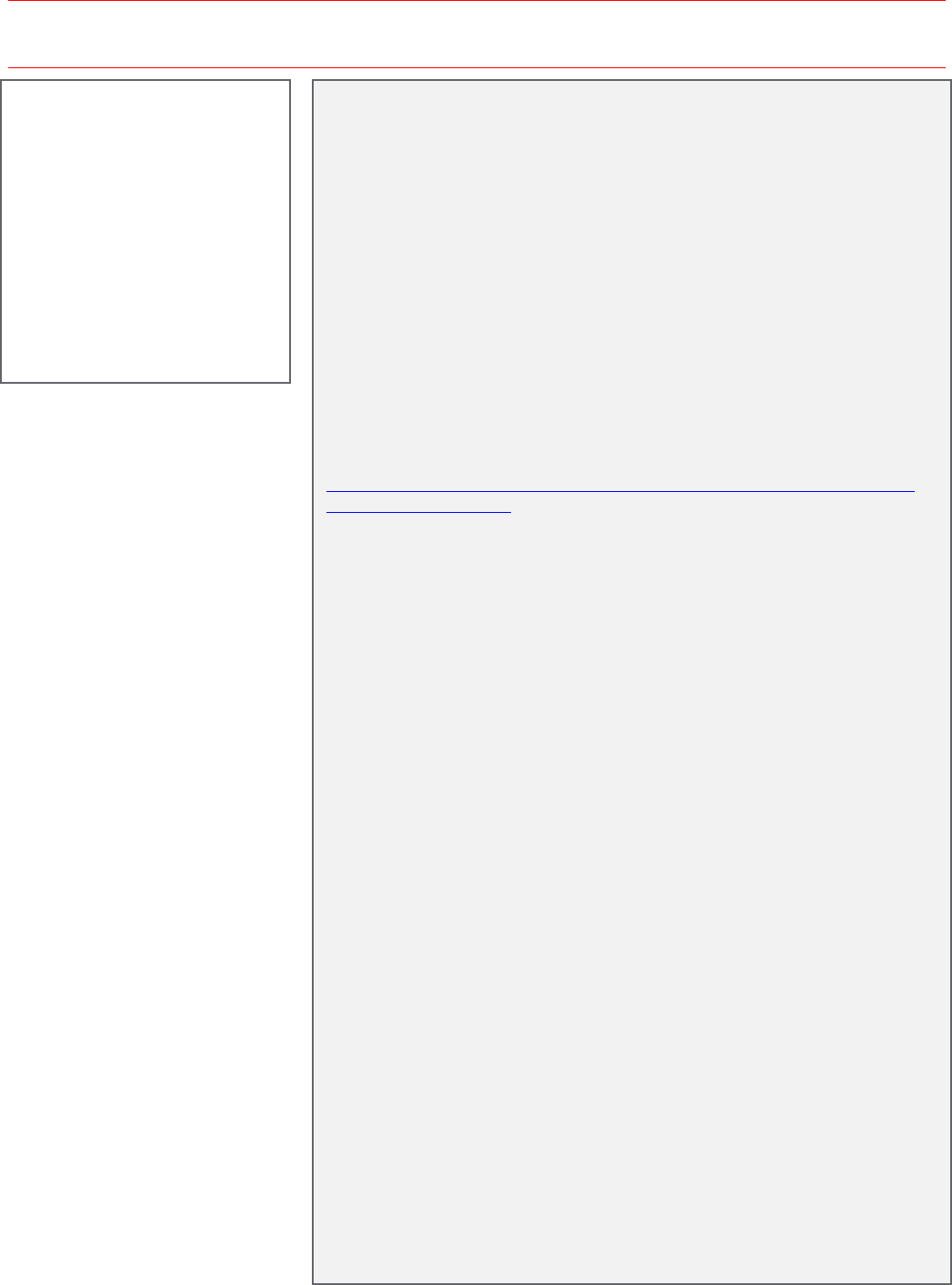

2. Your guide to filling in Part 2 of the form: Entity type

In this section of the form, you need to tell us your Entity’s classification

1

for CRS purposes and its country(ies) of

tax residency(ies). The Entity classifications in the form and this guide apply to all types of Entity including trusts,

partnerships and foundations.

Where your local tax authority has issued local guidance, you should refer to that. However, you can find more

information on our website: http://www.hsbcprivatebank.com/en/about-us/financial-regulation and the OECD’s

website: http://www.oecd.org/tax/automatic-exchange/about-automatic-exchange/

Part 2 (1)(a-b): Financial Institutions:

This applies to Entities that are Financial

Institutions. If you hold a Global Intermediary

Identification Number (“GIIN”), you’ll need to

provide it here.

Section 3 of this document provides more

guidance on which Entities may be FIs.

Some FIs will have reporting obligations of their

own under the CRS.

Part 2 (1)(c-g): Non-Financial Institutions:

This is relevant for Entities that aren’t Financial

Institutions.

Part 2 (1)(c-f): Relevant for Active NFEs.

Part 2 (1)(g): Relevant for Passive NFEs.

If your Entity isn’t a Financial Institution, it will either be an

Active Non-Financial Entity (Active NFE) or a Passive Non-

Financial Entity (Passive NFE).

Section 5 of this document gives you more guidance on

which Entities are Active NFEs and which are Passive

NFEs:

Section 5.1 – Active NFEs.

Section 5.2 – Passive NFEs. (If your Entity is an

NFE but not an Active NFE, it will automatically

be a Passive NFE. If your Entity is a Managed

Investment Entity that’s resident in a non-

Participating Jurisdiction, it will also count as a

Passive NFE.)

Part 2 (2) (a-b): Only relevant for Passive NFEs,

including Managed Investment Entities that are

resident in a non-Participating Jurisdiction.

You will need to tell us who the Entity’s Controlling

Person(s) are. And each of those Controlling

Person(s) will need to provide us with a

‘Controlling Person tax residency self-

certification form’* confirming where they are

resident for tax purposes.

* The Controlling Person form may vary from country

to country. If you require a form(s) please contact

your Relationship Manager.

Section 5.2 of this document provides more guidance on

which Entities are Passive NFEs and Controlling Persons.

The definition of ‘Managed Investment Entities resident in a

Non-Participating Jurisdiction’ may vary across jurisdictions.

Please see the Glossary and local legislation for the

definition that’s relevant for you.

1

The exact definition of each classification is a matter of local law, so may vary from country to country.

Please fill in Part 2 (1), choosing (a)-(g) as appropriate:

If you’ve told us in Part 2 (1)(a)(i) that your Entity is ‘An Investment Entity located in a Non-Participating Jurisdiction

and managed by another Financial Institution’ – or that it’s a Passive NFE in Part 2 (1)(g) – you will need to fill in Part

2 (2):

PUBLIC 5

3. Is your Entity a Financial Institution (FI)?

There are four types of FI, which we’ve set out in Sections 3.1, 3.2, 3.3 and 3.4. (See the Glossary for full

definitions.) Some FIs will have reporting obligations of their own.

Please read ALL the descriptions and examples below. If your Entity falls into ANY of these categories, please tick

the relevant type of “Financial Institution” in Part 2 (1) (a) or (b).

If your Entity doesn’t fall under any of these types of FI, that means it’s a Non-Financial Entity (NFE).

The information we’ve provided below is only meant as a guide. We recommend you refer to the local laws and

regulations in your relevant jurisdiction, and/or get expert advice, to confirm that your Entity is an FI.

3.1. How do you know if your Entity is an Investment Entity?

An Entity will be an Investment Entity if it meets either of the definitions we’ve set out below. You’ll need to

consider them both to work out whether yours is an Investment Entity (see ‘1’, below) or a Managed

Investment Entity (see ‘2’, below).

1. Investment Entity:

As a business, does your Entity carry out any of these

activities for or on behalf of a customer?

Trading in money market instruments;

Managing portfolios (individual and collective);

or

Otherwise investing, administering or managing

financial assets or money on behalf of other persons.

Does this make up a significant portion of the Entity’s

business (more than 50%)?

If you answered YES to 1, your Entity is likely to be

an Investment Entity. But you still need to consider

if it’s a Managed Investment Entity.

2. A Managed Investment Entity:

Does more than 50% of your Entity’s income mainly

come from investing, reinvesting or trading in financial

assets?

Is the Entity ‘managed by’ (see page 7) another Entity

that’s a Depository Institution, a Custodial Institution, a

Specified Insurance Company, or the first type of

Investment Entity (as we defined in 1 of this Section)?

Examples of Investment Entities

Generally, these could include:

Collective investment vehicles;

Mutual or exchange traded funds;

Private equity or hedge funds;

Venture capital or leveraged buy-out funds.

They wouldn’t include:

Entities that give non-binding investment advice to a

customer

Most Real Estate Investment Trusts (“REITs”)

An Entity that’s an Active NFE because it’s an NFE

treasury centre, NFE holding company, NFE start-up

or NFE in liquidation. See Section 5 for more on these

types of Active NFE.

If you answered YES to 2, your Entity is likely to be a Managed Investment Entity.

Under the CRS, Managed Investment Entities that are resident in a non-Participating Jurisdiction count as

Passive NFEs. If this applies to your Entity, you will need to tick Part 2 (1) (a) (i) on the self-certification

form. And each of your Entity’s Controlling Persons (see Section 5.2) will need to provide a ‘Controlling

Person tax residency self-certification form’.

Any other Investment Entities should tick Part 2 (1) (a) (ii) ‘Other Investment Entity’.

What’s a non-Participating Jurisdiction?

A Participating Jurisdiction is a jurisdiction that’s agreed to automatically exchange the information set out in the

CRS. Countries that haven’t agreed to do so are called non-Participating Jurisdictions.

PUBLIC 6

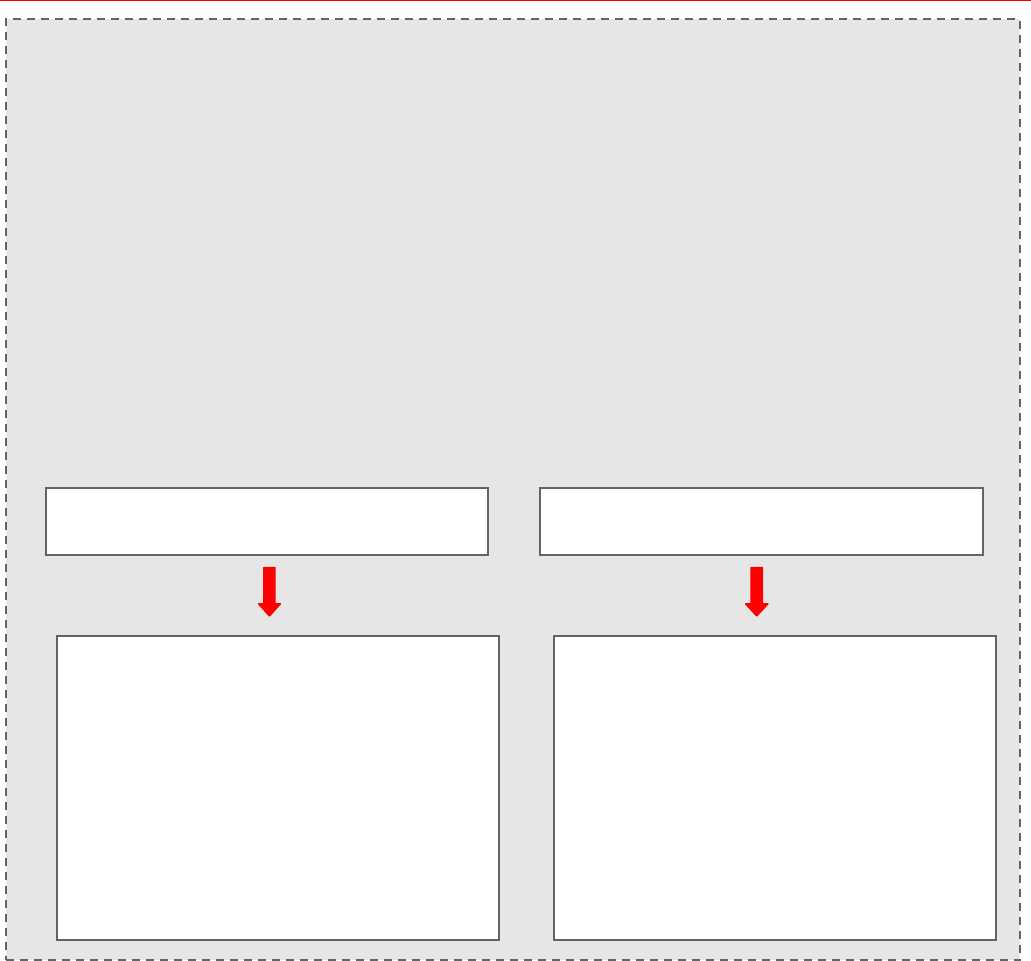

When would a Financial Institution ‘manage’ an Entity?

If an Entity that’s a Financial Institution has discretionary authority to manage all or some of the assets of

another Entity, then that Entity is ‘managed’ by a Financial Institution. A mix of Entities and individuals may

manage an Entity; if any one of them is a Financial Institution, then the Entity will be ’managed’.

When would a Financial Institution ‘manage’ a trust?

Typically, a trust is regarded as being ‘managed by’ a Financial Institution (so counts as a Managed

Investment Entity) if:

one or more of the trustees is a Financial Institution, or

the trustees have appointed a Financial Institution to manage the financial assets of the trust (‘A’

below) and/or manage the trust (‘B’ below).

A Financial Institution will manage the trust if the

trustees have appointed it to carry out the day-

to-day functions of the trust, beyond investing its

assets.

A. Manage the financial assets

of the trust?

B. Manage the trust?

A Financial Institution manages the financial

assets of a trust if it can use its discretion to

manage the trust’s investments, or its strategy

for how it invests its assets.

This will usually be the case if the trust has

appointed a discretionary fund manager to

manage its portfolio (or part of it).

It won’t be the case if the trustees of a trust

invest in retail investments.

PUBLIC 7

3.2 How do you know if your Entity is a Custodial Institution?

Things to consider

Does your Entity hold financial assets on behalf of

others? Financial assets include securities (such as

corporation stocks, notes, bonds, and debentures),

partnership interests, commodities, swaps and

insurance or annuity contracts.

Does this make up a substantial part of its business? In

other words, over the last three accounting periods, (or

since your Entity came into existence, if that’s shorter),

has 20% or more of its gross income come from holding

assets like these, and from related financial services?

If you answer YES to both of the above, your Entity is

likely to be a Custodial Institution.

Examples

Custodian banks;

Brokers;

Central securities depositories;

Trust companies;

Clearing organisations and nominees;

Employment benefit trusts holding shares for an

employee after they have been granted.

3.3. How do you know if your Entity is a Depository Institution?

Things to consider

Does your Entity accept deposits or other similar

investments in the ordinary course of a banking or

similar business?

If you answer YES to the above, your Entity is likely to

be a Depository Institution.

Examples

Savings or commercial banks;

Credit unions;

Savings and loan associations;

Industrial and provident societies;

Building societies.

3.4. How do you know if your Entity is a Specified Insurance Company?

Things to consider

Is your Entity an insurance company (see below) or a

holding company of an insurance company?

In this instance, an insurance company is an Entity that

meets any of these criteria:

o It’s regulated as an insurance business in the

country where it does business;

o In the last calendar year, the gross income it

earned from insurance, reinsurance, and

annuity contracts made up more than 50% of

its total gross income for that year; or

o At any time during the last calendar year,

the combined value of the Entity’s assets

associated with insurance, reinsurance and

annuity contracts made up more than 50% of

its total assets for that year.

Does the Entity issue, or have to make payments, with

respect to cash value insurance or annuity contracts?

If you answer YES to all of the above, your Entity is

likely to be a Specified Insurance Company.

Examples

Most life insurance companies.

An insurance company that only provides these products and

services generally wouldn’t be a FI:

General insurance;

Term life insurance;

Reinsurance companies that only provide indemnity

reinsurance contracts;

Insurance brokers.

PUBLIC 8

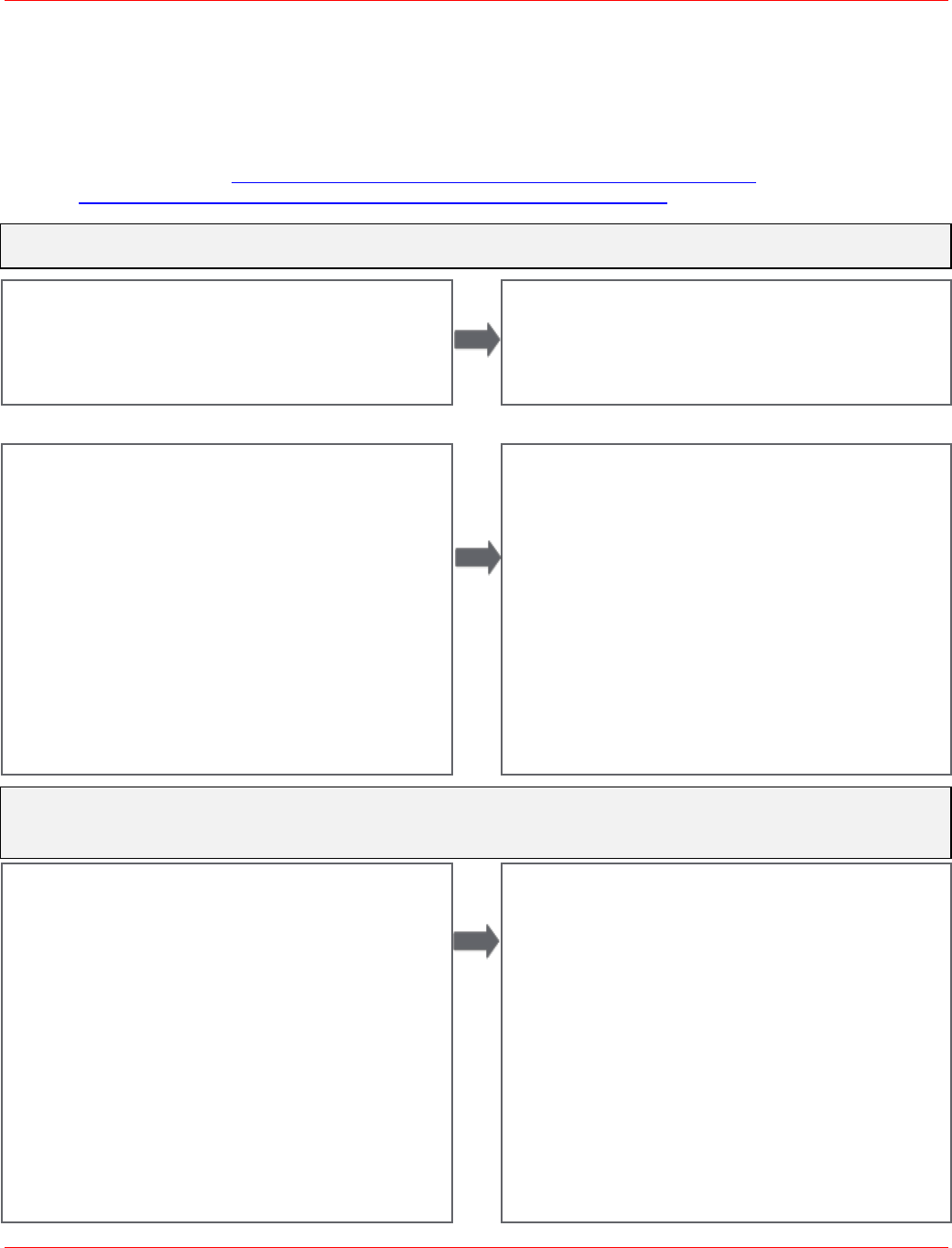

4. Is your Entity another type of Financial Institution or another type of

Investment Entity?

If your Entity falls under one of the FI classifications below (because of the kind of activities it undertakes), you

should fill in the form on that basis. Along with the guidance we’ve given you here, you should also look at the

Agreements and/or any local guidance that’s available in the jurisdiction where your Entity is opening (or holds) an

account.

1. Governmental Entity

A government or political

subdivision, or any wholly

owned agency/instrumentality

of it.

2. International

Organisation

International/supranational

organisations or any wholly

owned agency/instrumentality

of them.

3. Central Bank

An institution that, by law or

government sanction, is the

main authority (other than the

government of that jurisdiction)

for issuing currency.

4. Pension Fund of a

Governmental Entity,

International

Organisation or

Central Bank

A fund that a Governmental

Entity, International

Organisation or Central Bank

has set up to provide

retirement, disability or death

benefits to beneficiaries.

5. Qualified Credit Card

Issuer

The Entity issues credit cards. It

only accepts deposits when a

customer makes a payment

(limited to $50,000 or if not

limited, refunded to the

customer in 60 days) of more

than the balance they owe.

6. Trustee-Documented

Trust

A trust, to the extent that the

trustee is a Reporting Financial

Institution and reports

everything that needs reporting

about the reportable accounts

of the trust.

7. Exempt Collective

Investment Vehicle

An Investment Entity that’s

regulated as a collective

investment vehicle and all

interests in the collective

investment vehicle are held by

or through one or more non

Reportable Person(s).

8. Broad/Narrow

Participation

Retirement Fund

A fund providing retirement,

disability or death benefits to

current or former employees.

It’s either regulated or has

fewer than 50 participants.

9. Low-risk Entity

An Entity that’s unlikely to be

used to evade tax and domestic

law defines it as a Non-

Reporting FI.

If you don’t think your Entity is an FI, then it’s likely to be a Non-Financial Entity (NFE). In that case, you will need

to decide whether it’s an ‘Active NFE’ or a ‘Passive NFE’. Please see Section 5 for guidance.

Other types of Financial Institution

PUBLIC 9

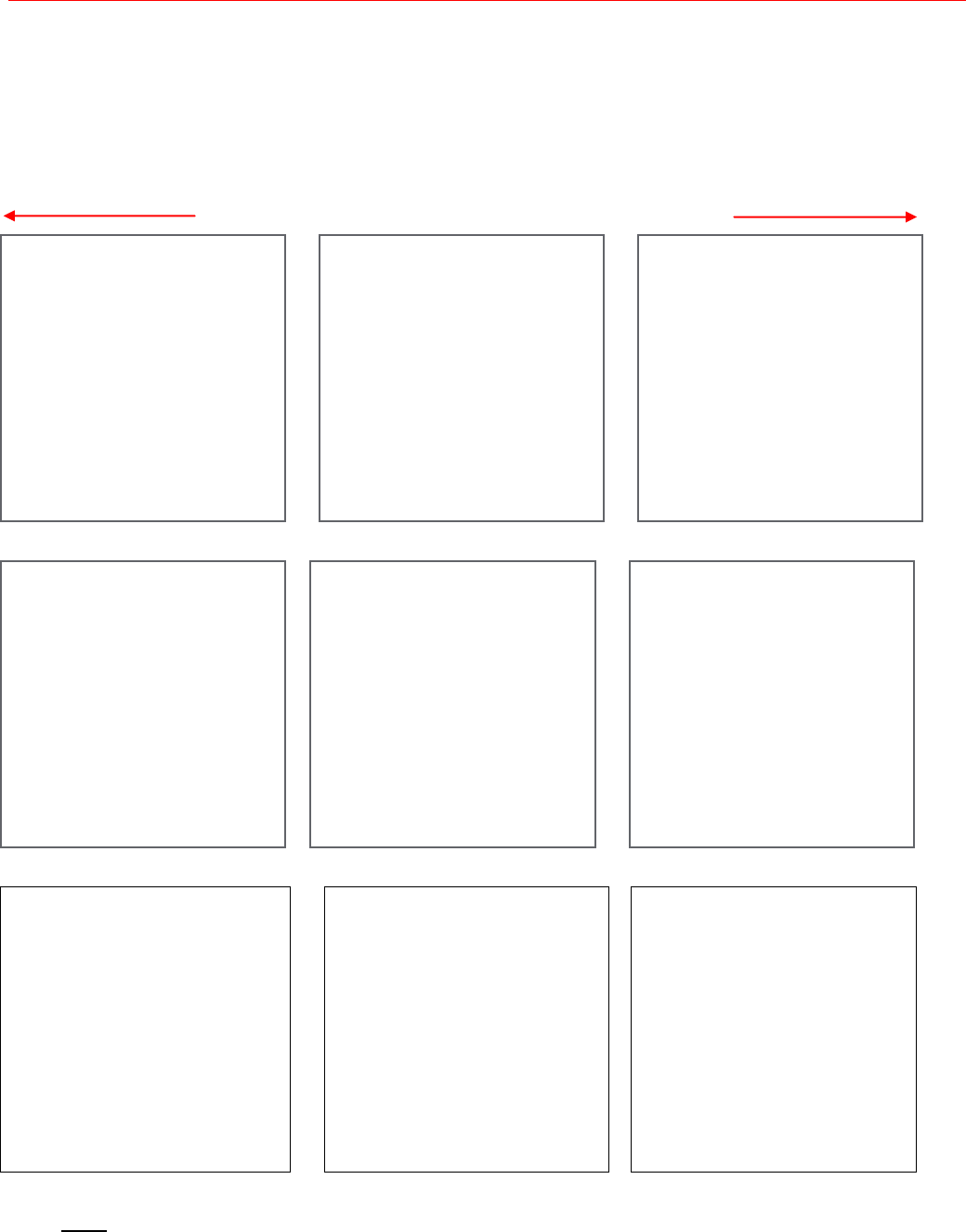

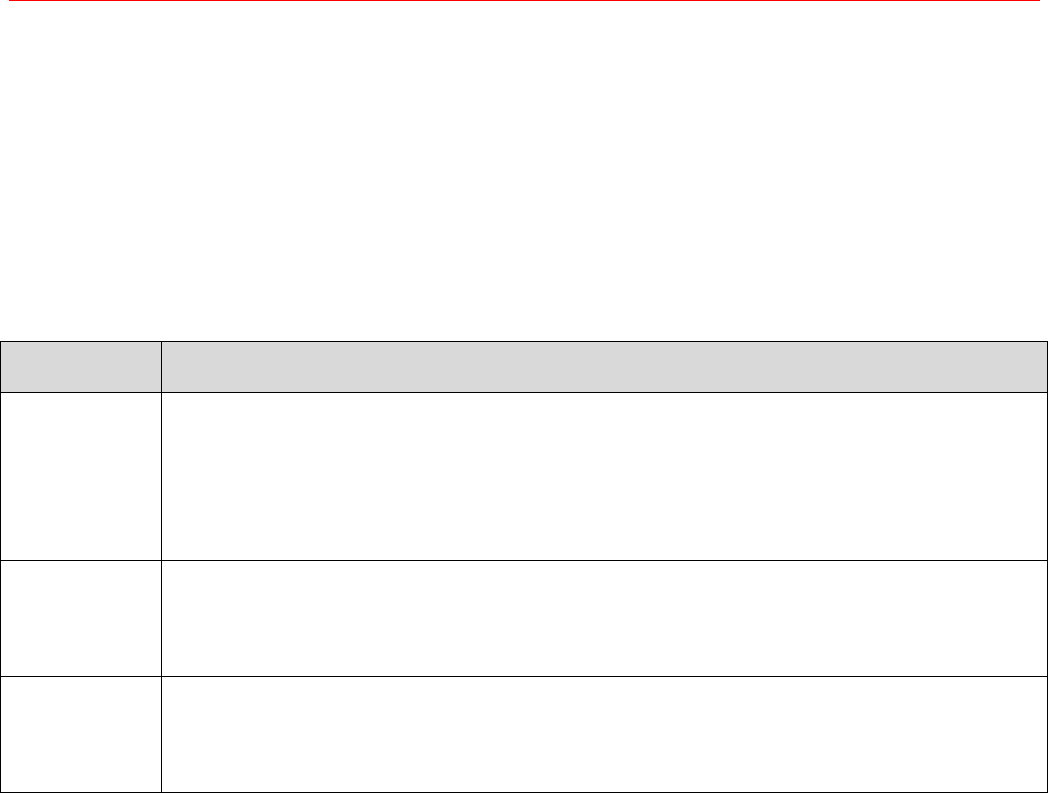

5. Does your Entity fit any of the Non-Financial Entity (NFE) definitions?

Entities that don’t fit any of the FI definitions are Non-Financial Entities (NFEs). If your Entity isn’t a FI, but you

aren’t sure whether it’s an ‘Active NFE’ or a ‘Passive NFE’, the information here may help you to work it out.

If your NFE doesn’t fit any of the Active NFE definitions, it will be a Passive NFE. That means you will need to fill in

extra forms about your Entity’s Controlling Persons (see Section 5.2).

To help you, the red reference numbers in the boxes below relate to the relevant part of the form.

5.1. How do you know if your Entity is an Active NFE?

NFE

Regularly traded

or Related Entity

of such

The stock of the

NFE is regularly

traded on an

established

securities market

or the NFE is a

Related Entity of

an Entity

the stock of which

is regularly traded

on an established

securities market.

NFE

in liquidation

The Entity wasn’t

a Financial

Institution in the

last 5 years and is

in liquidation. Or

it’s reorganising to

restart a business

other than that of

an FI.

NFE

Government

Entities

The Entity is a

government, a

political

subdivision of a

government or a

wholly owned

Entity of either.

NFE

Treasury Centre

The Entity mainly

carries out

financing/hedging

transactions

with/for non-FI

Related Entities.

NFE

Non-Profit

The Entity exists

for charitable

purposes and is

exempt from

income tax.

Part 2 (1)(c)

Part 2 (1)(f)

Part 2 (1)(d)

Part 2 (1)(f)

Part 2 (1)(f)

NFE

Start-up

The Entity isn’t yet

operating a

business and has

no operating

history. But it

plans to run a

non-FI business

(up to 24 months

after its initial

set-up).

NFE

Holding

Company

Nearly all the

Entity’s activities

consist of holding

the stock of, or

providing

financing and

services to, a

subsidiary that

engages in a

trade or business

other than that of

an FI.

NFE

Central Bank

The Entity is a

bank that, by law

or government

sanction, is the

main authority

(other than the

government in

that jurisdiction)

for issuing

currency or its

wholly owned

Entity.

NFE by reason of

Income or

Assets

Less than 50% of

the NFE’s gross

income for the last

calendar year (or

other relevant

reporting period)

was Passive

Income. And less

than 50% of the

assets it held for

the same period

were in order to

produce passive

income.

NFE

International

Organisation

The Entity is an

international

organisation, or

an Entity that’s

wholly owned by

an international

organisation.

Part 2 (1)(f)

Part 2 (1)(f)

Part 2 (1)(d)

Part 2 (1)(f)

Part 2 (1)(e)

If you don’t believe your Entity meets any of the above criteria (and it isn’t a FI), then it’s likely to be a Passive NFE.

Please see Section 5.2 for what that means.

PUBLIC 10

5.2 How do you know if your Entity is a Passive NFE?

What is a Passive NFE?

The Entity is a NFE but not an

Active NFE.

Note: Under the CRS, a

Managed Investment Entity that’s

located in a non-Participating

Jurisdiction also counts as a

Passive NFE.

Part 2 (1)(a)(i)

Part 2 (1)(g)

Part 2 (2)

If your Entity is a Passive NFE, each of its ‘Controlling Persons’ will need to

provide their details (including tax residence and TIN) on the ‘Controlling

Person tax residency self-certification form’.

We’ve explained ‘Controlling Persons’ here; for more details, see the

Glossary.

Who are the Controlling Persons?

The Controlling Persons of an Entity are the natural persons (that means

people, rather than organisations) who have control over your Entity. An

Entity may have several Controlling Persons.

To comply with our obligations under the CRS, we also need to determine

whether or not the Controlling Persons of a Passive NFE are Reportable

Persons. We need to interpret the term “Controlling Persons” in a way that

reflects the Financial Action Task Force Recommendations. You can find

these at:

http://www.fatf-gafi.org/publications/fatfrecommendations/documents/fatf-

recommendations.html

Generally, the person who has control over an Entity is the one who has a

controlling ownership interest. Typically, this means that they own a certain

percentage, for example, 25% of the Entity.

Where no person has control of the Entity through ownership interests, the

Controlling Person(s) of the Entity will be the person (or people) who has

control of the Entity “through other means”.

Where no person has control of the Entity through ownership interests, the

Reportable Person will be the person who holds the position of senior

managing official.

Note: If a Passive NFE controls another Passive NFE, we will need details

of the Controlling Person(s) at the end of the Passive NFE ownership

chain.

Who are the Controlling Persons for a trust?

In the case of a trust, the Controlling Person means the settlor(s), the

trustee(s), the protector(s) (if any), the beneficiary(ies) or class(es) of

beneficiaries, or any other natural person(s) exercising ultimate effective

control over the trust (including through a chain of control or ownership).

Under the CRS, the settlor(s), trustee(s), protector(s) (if any) and the

beneficiary(ies) or class(es) of beneficiaries, must always be treated

as Controlling Person(s) of a trust, regardless of whether or not any of

them exercises control over the activities of the trust.

However, different jurisdictions might treat discretionary beneficiaries in

different ways. Some have issued guidance stating that for CRS purposes,

a beneficiary who may receive a discretionary distribution from the trust is

only a beneficiary of the trust if they actually receive one. If you think this

may apply to your Entity, or you’re still unclear on who your Controlling

Person may be, take a look at your local guidance and/or get professional

tax advice.

PUBLIC 11

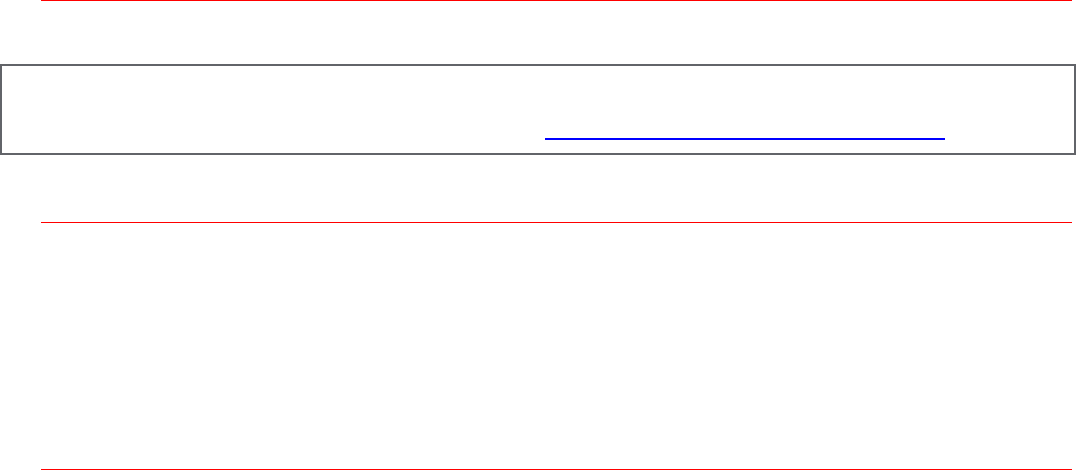

6. Reporting

6.1 Who is a Reportable Person?

Depending on your Entity’s classification, and where it’s resident for tax purposes, it may be a Reportable Person.

That means details of the account will be reportable to the tax authority in the jurisdiction where you hold the

account. That authority will then send your details to the tax authority where your Entity or Controlling Person(s)

is/are tax resident.

This table sets out the types of Entity that are Reportable Accounts. It applies when the account you hold with us is

a ‘Financial Account’ and your Entity is tax resident in a Participating Jurisdiction, other than the one where you hold

the account.

Entity

classification

Is the Entity Reportable?

Active NFE

An Active NFE that is tax resident in a Participating Jurisdiction will be reportable unless it is one

of the following:

NFE Government Entity;

NFE Regularly traded or Related Entity of such;

NFE Central Bank;

NFE International Organisation.

Passive NFE

A Passive NFE that’s tax resident in a Participating Jurisdiction will be reportable.

Controlling Person(s) of a Passive NFE will also be reportable if they are tax resident in a

Participating Jurisdiction.

FI

Financial Institutions aren’t reportable irrespective of where they’re resident for tax purposes.

Managed Investment Entities sometimes count as Passive NFEs. This means that the Controlling

Person(s) along with the details of the Entity they control may be reportable if they’re tax resident

in a Participating Jurisdiction.

6.2 What information needs reporting?

If we need to report your Entity’s account, we’ll exchange the following information (subject to local law):

For Passive NFEs (or Managed Investment Entities treated as Passive NFEs) with one or more Controlling Persons

that are Reportable Persons:

the name, address, and TIN(s) of your Entity and;

the name, address, TIN(s), date of birth and, in some instances, place of birth of each reportable Controlling

Person.

For other reportable Entity Account Holders:

The name, address and TIN(s);

For all:

The balance or value of your account as of the end of the calendar year;

Some transactional data for the calendar year, such as:

o The total gross amount of interest, dividends and other income paid or credited to your account

o The total gross proceeds from the sale or redemption of financial assets paid or credited to the

account

PUBLIC 12

Glossary

Note: We’ve provided these selected definitions to help you fill in the form. You can find further details in the OECD

“Common Reporting Standard for Automatic Exchange of Financial Account Information” (the “CRS”), the associated

“Commentary” to the CRS and domestic guidance. It’s all at: http://www.oecd.org/tax/automatic-exchange/

“Account Holder”

The “Account Holder” is the person that the Financial Institution maintaining the account has listed or identified as

the holder. This is regardless of whether that person is a flow-through Entity.

For example, if a Financial Institution has listed a trust or an estate as the holder or owner of a Financial Account,

the trust or estate is the Account Holder, rather than the trustee or the trust’s owners or beneficiaries. The same

applies if a Financial Institution has listed a partnership as the holder or owner of a Financial Account: the

partnership is the Account Holder, rather than the people in the partnership. If someone (other than a Financial

Institution) holds a Financial Account on behalf of another person, the Financial Institution treats the other person as

holding the account rather than the agent, custodian, nominee, signatory, investment advisor or intermediary.

“Active NFE”

An NFE is an Active NFE if it meets any of the criteria we’ve listed here. To sum up, those criteria refer to:

Active NFEs by reason of income and assets;

Publicly traded NFEs;

Governmental Entities, International Organisations, Central Banks, or their wholly owned Entities;

Holding NFEs that are members of a nonfinancial group;

Start-up NFEs;

NFEs that are liquidating or emerging from bankruptcy;

Treasury centres that are members of a nonfinancial group; or

Non-profit NFEs.

An Entity will be an Active NFE if it meets any of these criteria:

a. Less than 50% of the NFE’s gross income for the preceding calendar year (or other appropriate reporting period)

is passive income. And less than 50% of the assets it held during the preceding calendar year (or other

appropriate reporting period) are assets that produce passive income, or ones it holds in order to produce

passive income;

b. The stock of the NFE is regularly traded on an established securities market, or is a Related Entity of an Entity

the stock of which is regularly traded on an established securities market;

c. The NFE is (or is wholly owned by) a Governmental Entity, an International Organisation or a Central Bank;

d. Most of the NFE’s activities consist of holding (in whole or in part) the outstanding stock of, or providing financing

and services to, one or more subsidiaries that engage in trades or businesses other than that of a Financial

Institution. An Entity doesn’t qualify for this status if it functions (or holds itself out) as an investment fund, such

as a private equity fund, venture capital fund, leveraged buyout fund, or any investment vehicle whose purpose

is to buy or fund companies, and then hold interests in those companies as capital assets for investment

purposes;

e. The NFE isn’t yet operating a business and hasn’t done so before (a “start-up NFE”). But it’s investing capital in

assets with a view to running a business other than that of a Financial Institution. An NFE won’t qualify for this

status more than 24 months from its start-up date;

f. The NFE hasn’t been a Financial Institution in the last five years, and is in the process of liquidating its assets.

Or it’s reorganising with a view to carrying on or restarting operations in a business other than that of a Financial

Institution;

g. The NFE mainly carries out financing and hedging transactions with, or for, Related Entities that aren’t Financial

Institutions and doesn’t provide financing or hedging services to any Entity that isn’t a Related Entity, provided

that the group of any such Related Entities is primarily engaged in a business other than that of a Financial

Institution; or

PUBLIC 13

h. The NFE meets all of these requirements (a “non-profit NFE”):

i. It exists and operates in its jurisdiction of residence exclusively for religious, charitable, scientific, artistic,

cultural, athletic or educational purposes; or it exists and operates in that jurisdiction as a professional

organisation, business league, chamber of commerce, labour organisation, agricultural or horticultural

organisation, civic league or an organisation whose only purpose is to promote social welfare;

ii. It’s exempt from income tax in its jurisdiction of residence;

iii. It has no shareholders or members who have a proprietary or beneficial interest in its income or assets;

iv. The applicable laws of the NFE’s jurisdiction of residence or the NFE’s formation documents don’t allow the

NFE to distribute any income or assets to, or be applied for the benefit of, a private person or non-charitable

Entity. The exceptions are when it relates to carrying out the NFE’s charitable activities, or when the NFE

needs to pay reasonable compensation for services, or the fair market value of a property it’s bought; and

v. The applicable laws of the NFE’s jurisdiction of residence or the NFE’s formation documents require that, if

the NFE liquidates or dissolves, all of its assets go to a Governmental Entity or other non-profit organisation,

or escheat to the government of the NFE’s jurisdiction of residence or any political subdivision.

Note: Some entities (such as U.S. Territory NFFEs) may qualify for Active NFFE status under FATCA but not Active

NFE status under the CRS.

“Cash Value Insurance Contracts”

The term “Cash Value Insurance Contract” means an Insurance Contract (other than an indemnity reinsurance

contract between two insurance companies) that has a Cash Value.

“Control”

Generally, the “natural” person (as opposed to organisation) who ultimately has a controlling ownership interest in

the Entity has “control” over it. Typically, that means they own a certain percentage in the Entity, for example, 25%.

Where no natural person (or people) has control of the Entity through ownership interests, the Controlling Person(s)

will be the one(s) who exercise control through other means. Under the CRS, the Reportable Person in these cases

is the senior managing official.

“Controlling Person(s)”

“Controlling Persons” are the person(s) who exercise control over an entity. Where that Entity is a Passive Non-

Financial Entity (“Passive NFE”) then a Financial Institution needs to determine whether or not these Controlling

Persons are Reportable Persons. This definition corresponds to the term “beneficial owner” which the Financial

Action Task Force described in Recommendation 10 of its Recommendations (adopted in February 2012).

In the case of a trust, the Controlling Person(s) are the settlor(s), the trustee(s), the protector(s) (if any), the

beneficiary(ies) or class(es) of beneficiaries, or any other person(s) who has ultimate effective control over the trust,

including through a chain of control or ownership. Under the CRS, the settlor(s), the trustee(s), the protector(s) (if

any), and the beneficiary(ies) or class(es) of beneficiaries are always the Controlling Persons of a trust, regardless

of whether any of them has control over its activities.

Where the settlor(s) of a trust is an Entity then the CRS requires Financial Institutions to also identify the Controlling

Persons of the settlor(s) and when required report them as Controlling Persons of the trust.

In the case of a legal arrangement other than a trust, “Controlling Person(s)” means persons in equivalent or similar

positions.

“Custodial Institution”

The term “Custodial Institution” means any Entity that holds, as a substantial portion of its business, Financial

Assets on behalf of others. It applies when 20% or more of an Entity’s gross income is attributable to the holding of

Financial Assets and related financial services over a certain period. That period is (i) the three years ending 31

December (or the final day of a non-calendar year accounting period) before the year in which the Entity is

determining its status; or (ii) the length of time for which the Entity has existed whichever is shorter.

“Depository Institution”

The term “Depository Institution” means any Entity that accepts deposits in the ordinary course of a banking or

similar business.

“FATCA”

FATCA stands for the Foreign Account Tax Compliance Act provisions. These were enacted into U.S. law on March

18, 2010, as part of the Hiring Incentives to Restore Employment (HIRE) Act. FATCA creates a new information

PUBLIC 14

reporting and withholding regime for payments made to certain non-U.S. financial institutions and other non-U.S.

entities.

“Entity”

The term “Entity” means a legal person or a legal arrangement, such as a corporation, organisation, partnership,

trust or foundation. This term covers any person other than an individual (i.e. a natural person).

“Financial Institution”

The term “Financial Institution” means a “Custodial Institution”, a “Depository Institution”, an “Investment Entity” or a

“Specified Insurance Company”. Please see the relevant domestic guidance and the CRS for further classification

definitions that apply to Financial Institutions.

“Investment Entity”

The term “Investment Entity” includes two types of Entities:

i. An Entity that mainly carries out, as a business, one or more of these activities or operations for (or

on behalf of) a customer:

Trading in money market instruments (cheques, bills, certificates of deposit, derivatives, etc.); foreign

exchange; exchange, interest rate and index instruments; transferable securities; or commodity futures

trading;

Managing portfolios (both individual and collective); or

Otherwise investing, administering or managing Financial Assets or money on behalf of other persons.

These activities or operations don’t include giving non-binding investment advice to a customer.

ii. “The second type of “Investment Entity” (“Investment Entity managed by another Financial

Institution”) is any Entity whose gross income is primarily attributable to investing, reinvesting, or

trading in Financial Assets where the Entity is managed by another Entity that is a Depository

Institution, a Custodial Institution, a Specified Insurance Company, or the first type of Investment

Entity.

“Investment Entity located in a Non-Participating Jurisdiction and managed by another

Financial Institution”

The term “Investment Entity located in a Non-Participating Jurisdiction and managed by another Financial

Institution” means any Entity whose gross income mainly comes from investing, reinvesting or trading in Financial

Assets. It applies if (i) a Financial Institution manages the Entity and (ii) the Entity isn’t a Participating Jurisdiction

Financial Institution.

“Investment Entity managed by another Financial Institution”

An Entity is “managed by” another Entity if the managing Entity performs, either directly or through another service

provider on behalf of the managed Entity, any of the activities or operations described in clause (i) above in the

definition of ‘Investment Entity’.

An Entity only manages another Entity if it has discretionary authority to manage the other Entity’s assets (either in

whole or part). Where an Entity is managed by a mix of Financial Institutions, NFEs or individuals, the Entity is

considered to be managed by another Entity that is a Depository Institution, a Custodial Institution, a Specified

Insurance Company, or the first type of Investment Entity, if any of the managing Entities is such another Entity.

“NFE”

An “NFE” is any Entity that isn’t a Financial Institution.

“Non-Reporting Financial Institution”

A “Non-Reporting Financial Institution” means any Financial Institution that’s:

A Governmental Entity, International Organisation or Central Bank, other than with respect to a payment

that is derived from an obligation held in connection with a commercial financial activity of a type engaged

in by a Specified Insurance Company, Custodial Institution, or Depository Institution;

A Broad Participation Retirement Fund; a Narrow Participation Retirement Fund; a Pension Fund of a

Governmental Entity, International Organisation or Central Bank; or a Qualified Credit Card Issuer;

PUBLIC 15

An Exempt Collective Investment Vehicle; or

A Trustee-Documented Trust: a trust whose trustee is a Reporting Financial Institution and reports all the

necessary information about the trust’s Reportable Accounts;

Any other Entity that a country defines as a Non-Reporting Financial Institution in its domestic law.

“Participating Jurisdiction”

A “Participating Jurisdiction” means a jurisdiction that has an agreement in place for how it will provide the

information set out in the CRS.

“Participating Jurisdiction Financial Institution”

The term “Participating Jurisdiction Financial Institution means (i) any Financial Institution that is tax resident in a

Participating Jurisdiction, but excludes any branch of that Financial Institution that is located outside of that

jurisdiction, and (ii) any branch of a Financial Institution that is not tax resident in a Participating Jurisdiction, if that

branch is located in such Participating Jurisdiction.

“Passive Income”

To determine what the CRS means by “passive income”, you’ll need to refer to your jurisdiction’s particular rules.

Generally, passive income would include the portion of gross income that consists of:

a) dividends;

b) interest;

c) income equivalent to interest;

d) rents and royalties, other than rents and royalties derived in the course of carrying out active business, at

least in part by employees of the NFE;

e) annuities;

f) the excess of gains over losses from the sale or exchange of Financial Assets that gives rise to the passive

income we described earlier;

g) the excess of gains over losses from transactions (including futures, forwards, options, and similar

transactions) in any Financial Assets;

h) the excess of foreign currency gains over foreign currency losses;

i) net income from swaps; or

j) amounts received under cash value insurance contracts.

However, in the case of a NFE that regularly acts as a dealer in Financial Assets, passive income will not include

any income from any transaction a dealer might enter into in the ordinary course of their business.

“Passive NFE”

Under the CRS, a “Passive NFE” means any: (i) NFE that isn’t an Active NFE; and (ii) Investment Entity located in a

Non-Participating Jurisdiction and managed by another Financial Institution.

“Related Entity”

An Entity is a “Related Entity” of another Entity if either Entity controls the other or if the two Entities are under

common control. For this purpose, control includes owning (directly or indirectly) more than 50% of the vote and

value in an Entity.

“Reportable Account”

The term “Reportable Account” means an account held by one or more Reportable Persons, or by a Passive NFE

with one or more Controlling Persons that is a Reportable Person.

“Reportable Jurisdiction”

A Reportable Jurisdiction is a jurisdiction that has an obligation in place to provide financial account information.

“Reportable Jurisdiction Person”

A Reportable Jurisdiction Person is an Entity that is tax resident in a Reportable Jurisdiction(s) under the tax laws of

such jurisdiction(s) by reference to local laws in the country where the Entity is established, incorporated or

managed. An Entity such as a partnership, limited liability partnership or similar legal arrangement that has no

PUBLIC 16

residence for tax purposes shall be treated as resident in the jurisdiction in which its place of effective management

is situated. As such if an Entity certifies that it has no residence for tax purposes it should complete the form stating

the address of its principal office.

Dual resident Entities may rely on the tiebreaker rules contained in tax conventions (if applicable) to determine their

residence for tax purposes.

“Reportable Person”

A “Reportable Person” is defined as a “Reportable Jurisdiction Person”, other than:

A corporation whose stock is regularly traded on one or more established securities markets;

Any corporation that’s a Related Entity of a corporation described in clause (i);

A Governmental Entity;

An International Organisation;

A Central Bank; or

A Financial Institution (except for an Investment Entity described in Sub Paragraph A (6) b) of the CRS that

isn’t a Participating Jurisdiction Financial Institution. The CRS considers these Investment Entities to be

Passive NFEs.)

“Resident for tax purposes”

Generally, an Entity will be resident for tax purposes in a jurisdiction if, under the laws of that jurisdiction (including

tax conventions), it pays or should be paying tax therein by reason of domicile, residence, place of management or

incorporation, or any other criterion of a similar nature, and not only from sources in that jurisdiction. Dual resident

Entities may rely on the tiebreaker rules contained in tax conventions (if applicable) to solve cases of double

residence for determining their residence for tax purposes. An Entity such as a partnership, limited liability

partnership or similar legal arrangement that has no residence for tax purposes shall be treated as resident in the

jurisdiction in which its place of effective management is situated. A trust is treated as resident where one or more

of its trustees is resident. For additional information on tax residence, please talk to your tax adviser or see the

following link: [http://www.oecd.org/tax/exchange-of-tax-information/implementation-handbook-standard-for-

automatic-exchange-of-financial-account-information-in-tax-matters.htm

“Specified Insurance Company”

The term “Specified Insurance Company” means any Entity that’s an insurance company (or the holding company

of an insurance company) that issues or has to make payments with respect to, a cash value insurance contract or

an annuity contract.

“TIN” (including “functional equivalent”)

The term “TIN” means Taxpayer Identification Number (or, where there’s no TIN, a functional equivalent). A TIN is a

unique combination of letters or numbers that a jurisdiction assigns to an individual or an Entity to identify them for

the purpose of administering the jurisdiction’s tax laws. You can find further details of acceptable TINs here:

https://search.oecd.org/tax/automatic-exchange/tinsandtaxresidency/taxidentificationnumberstins/

Some jurisdictions don’t issue a TIN. However, these jurisdictions often use another high integrity number with an

equivalent level of identification (a “functional equivalent”). Examples of that type of number include, for Entities, a

Business or company registration code/number.