1

State Energy Program Notice 22-05

Effective Date: November 15, 2022

SUBJECT: INFRASTRUCTURE INVESTMENT AND JOBS ACT OF 2021, ENERGY EFFICIENCY

REVOLVING LOAN FUND CAPITALIZATION GRANT PROGRAM GRANT APPLICATION

INSTRUCTIONS

Table of Contents

1.0 PURPOSE 3

2.0 SCOPE 3

2.1 ELIGIBLE APPLICANTS 3

2.2 ELIGIBLE RECIPIENTS OF LOANS, GRANTS, AND TECHNICAL ASSISTANCE 3

3.0 LEGAL AUTHORITY 4

4.0 PROGRAM OVERVIEW & GOALS 4

4.1 PROGRAM ACTIVITIES & OUTCOMES 5

4.2 DIVERSITY, EQUITY, INCLUSION, AND ACCESSIBILITY 7

4.3 JUSTICE40 INITIATIVE 8

4.4 JOB GROWTH AND QUALITY 9

4.5 LESSONS LEARNED FROM SUCCESSFUL FINANCING PROGRAMS 10

4.6 TECHNICAL ASSISTANCE 10

5.0 FUNDING 11

5.1 IIJA FORMULA ALLOCATIONS 11

5.2 COST MATCH 12

5.3 PROGRAM INCOME 12

6.0 APPLICATION INSTRUCTIONS FOR THE ENERGY EFFICIENCY REVOLVING LOAN FUND

CAPITALIZATION GRANT PROGRAM 12

6.1 OVERVIEW 12

6.2 IIJA AWARDS 13

6.3 STATE APPLICATION 13

6.3 A. STANDARD FORM 424 (APPLICATION) 13

6.3 B. STANDARD FORM 424A (BUDGET) 13

6.3 B.1. STANDARD FORM 424A 14

2

6.3 B.2 BUDGET JUSTIFICATION 14

6.3 C. MASTER FILE 16

6.3 D. ANNUAL FILE 17

6.3 E. MANDATORY REQUIREMENTS 20

6.3 F. EXPENDITURE PROHIBITIONS, LIMITATIONS, AND ALLOWANCES 24

6.3 G. OTHER FORMS 25

6.3 H. NATIONAL ENVIRONMENTAL POLICY ACT INFORMATION 25

6.4 APPLICATION FORMAT AND CHANGES 28

6.4 A. CONTENT AND FORM OF APPLICATION 28

6.4 B. OTHER SUBMISSION AND REGISTRATION REQUIREMENTS 28

6.4 C. QUESTIONS/AGENCY CONTACTS 28

6.5 REPORTING REQUIREMENTS 30

6.6 FEDERAL CHARACTER OF FUNDS 30

6.7 REJECTION OF FUNDS 30

7.0 CONCLUSION 31

REFERENCE MATERIAL 31

EE RLF IIJA Administrative and Legal Requirements Document 31

EE RLF IIJA Formula Allocations 31

EE RLF IIJA Formula Award Application Checklist 31

EE RLF IIJA Two-Year Report Template 31

EE RLF IIJA Template for Declining Funds 31

3

1.0 PURPOSE

To establish Formula Grant Application Instructions and management information for the

Energy Efficiency Revolving Loan Fund Capitalization Grant Program (EE RLF Program),

established under the Infrastructure Investment and Jobs Act (IIJA) of 2021,

1

also known as the

Bipartisan Infrastructure Law (BIL), including (1) IIJA Application Instructions, (2) Administrative

and Legal Requirements Document (ALRD), (3) IIJA Allocations, (4) the IIJA Application Checklist.

The EE RLF Program enables states, U.S. Territories, and the District of Columbia (hereinafter

referred to as “states”)

to capitalize revolving loan funds (RLFs) to provide grants and loans to

conduct commercial and residential energy audits and energy efficiency upgrades and retrofits

of building infrastructure. Of the $250 million allocated by IIJA for the program, 40% will be

provided to states according to the State Energy Program (SEP) formula described in 10 CFR

Part 420.11. The remaining 60% of funding will be allocated to a set of Priority States, as

defined in IIJA Section 40501. Allocation details can be found in the Reference Material of this

document.

2.0 SCOPE

The provisions of this Program Notice apply to states applying for capitalization grants under

the EE RLF Program.

SEP is authorized under the Energy Policy and Conservation Act, as amended (42 U.S.C. 6321 et

seq.). All grant awards made under this program shall comply with applicable laws including,

but not limited to, 2 CFR Part 200, as amended by 2 CFR Part 910, and IIJA Section 40501 and

40502.

2.1 ELIGIBLE APPLICANTS

In accordance with IIJA Section 40501 and IIJA Section 40502, funding for this program is only

available to states that are eligible for funding under SEP. Per the Energy Policy and

Conservation Act, this SEP funding is only available to states, the District of Columbia, Puerto

Rico, the Trust Territory of the Pacific Islands, or any territory or possession of the United

States, (42 U.S.C. 6202(4)). No other entity types may be considered for this funding.

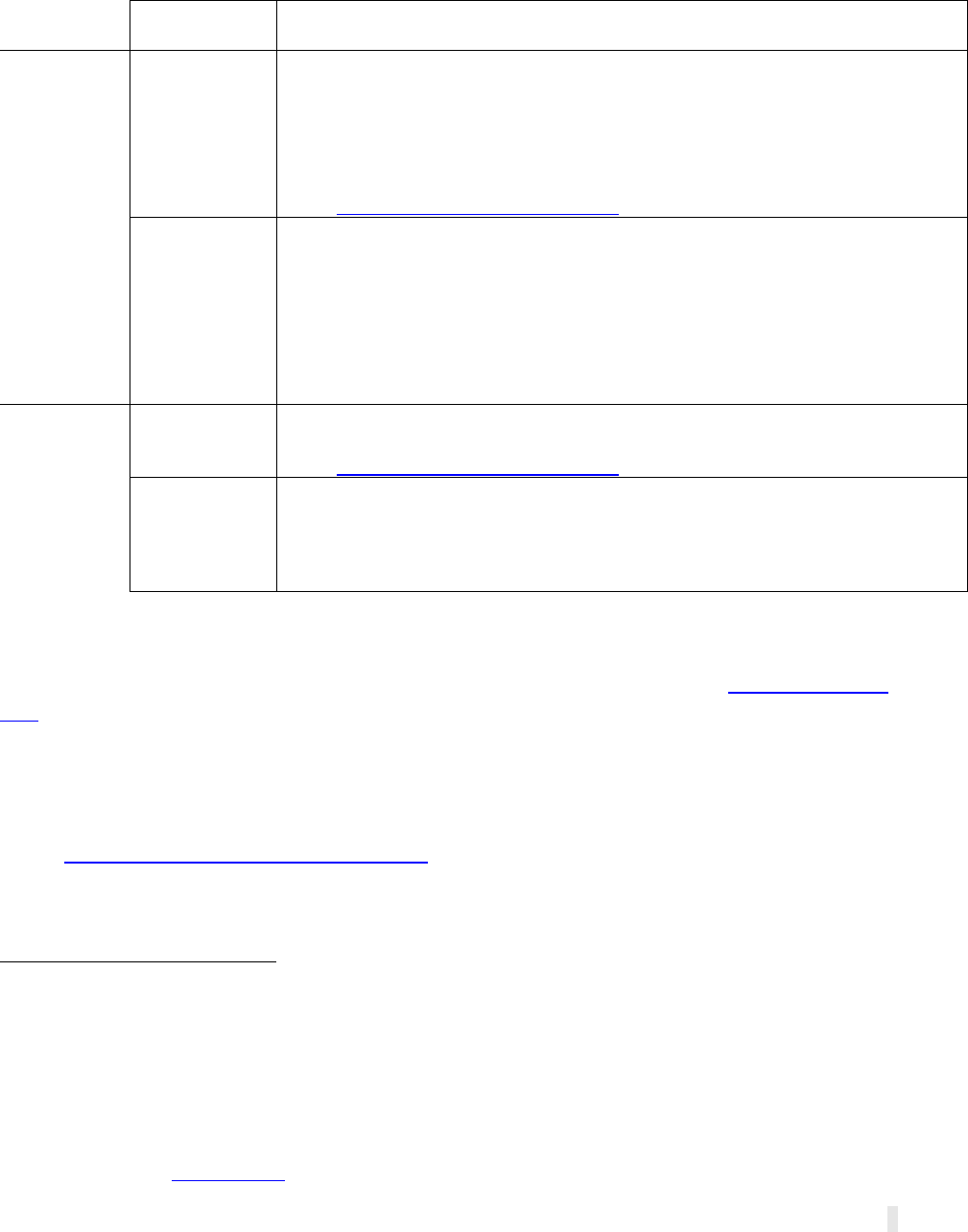

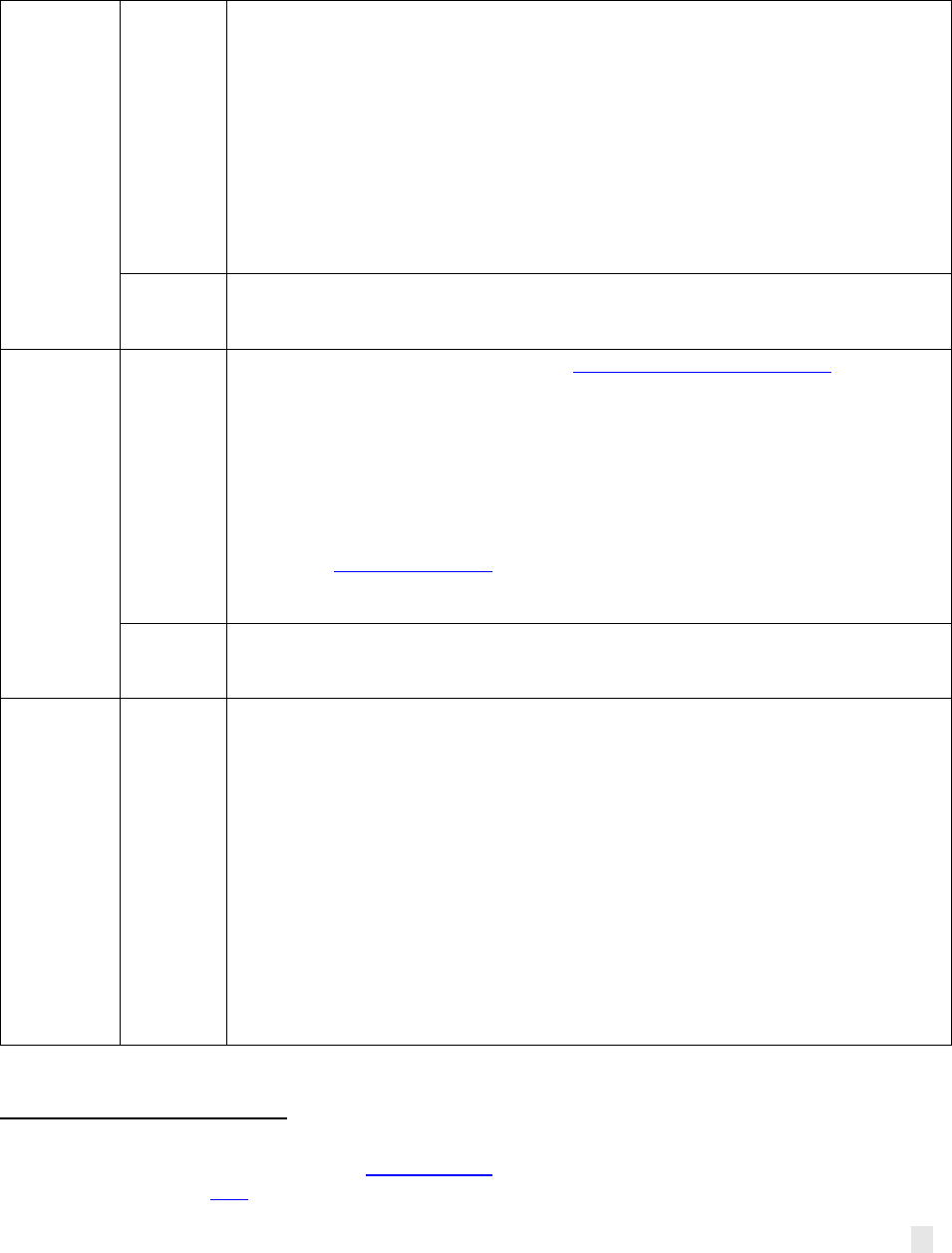

2.2 ELIGIBLE RECIPIENTS OF LOANS, GRANTS, AND TECHNICAL ASSISTANCE

See below for an overview of eligible recipients of loans, grants, and technical assistance as

defined in part (e) of IIJA Section 40502.

1

Established in Section 40502 of the Infrastructure Investment and Jobs Act, Public Law 117-58 (November 15,

2021). https://www.congress.gov/bill/117th-congress/house-bill/3684

4

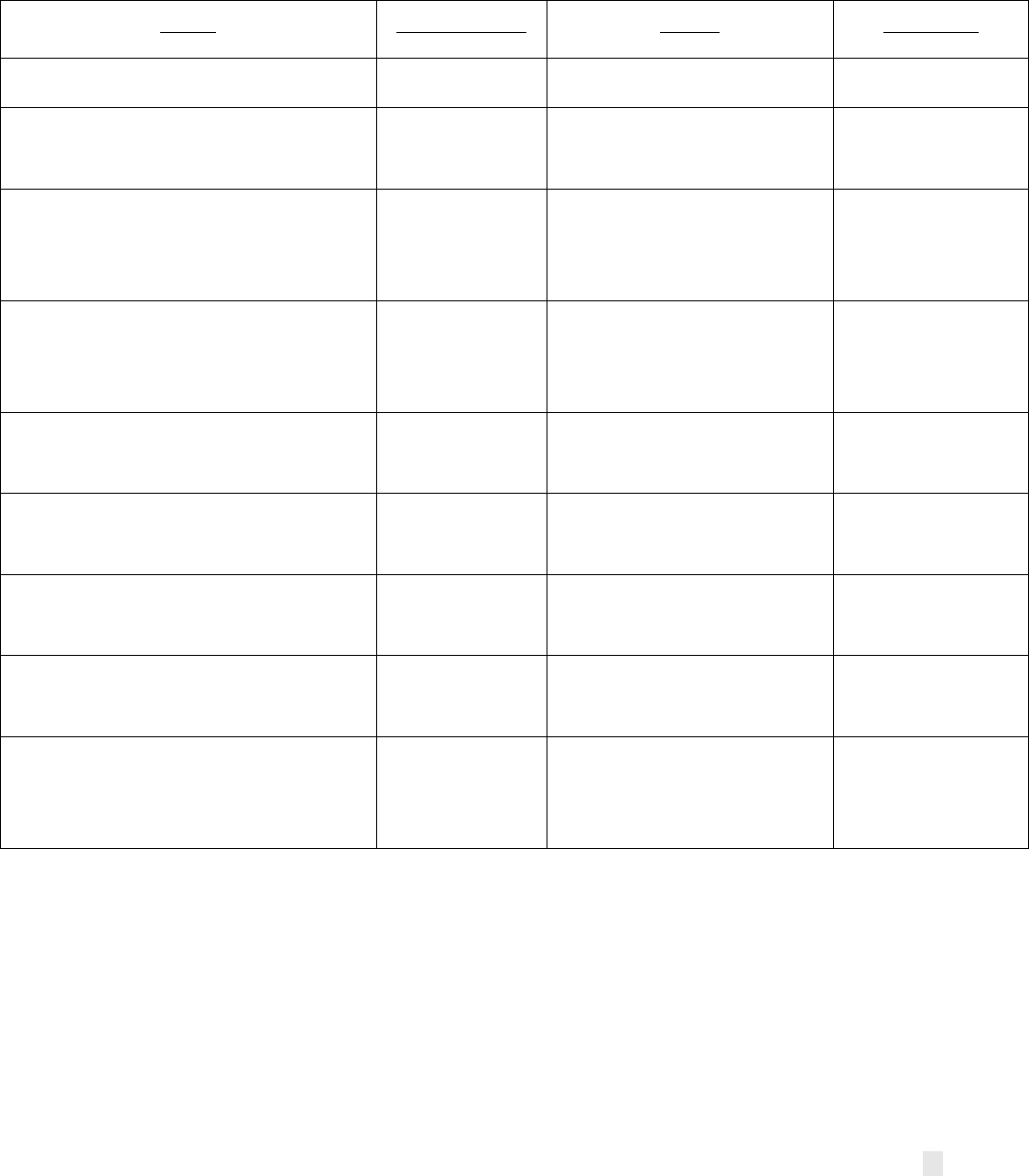

Type of

Assistance

Building Sub-

Sector

Eligible Recipient(s)

Loans

Commercial

2

(includes

publicly and

privately owned

buildings)

• A business, nonprofit organization or a public building that satisfies both of the

following:

o Conducts a majority of its business in the state that provides the loans.

o Owns or operates 1 or more commercial buildings or commercial space within a

building that serves multiple functions, such as a building for commercial and

residential operations.

• See 6.3 E. MANDATORY REQUIREMENTS

Residential

3

• An individual who owns one of the following:

o A single family home.

o A condominium or duplex.

o A manufactured housing unit.

• A business that owns or operates a multifamily housing facility.

Grants and

Technical

Assistance

Commercial

4

• A business that meets both criteria to receive loans (see above) and has fewer than

500 employees.

• See 6.3 E. MANDATORY REQUIREMENTS

Residential

5

• A low-income individual that owns a residential building.

6

3.0 LEGAL AUTHORITY

SEP is authorized under the Energy Policy and Conservation Act, as amended (42 U.S.C. 6321 et

seq.). All grant awards made under this program shall comply with applicable laws including,

but not limited to, 2 CFR Part 200, as amended by 2 CFR Part 910, and IIJA Section 40502.

4.0 PROGRAM OVERVIEW & GOALS

Projects awarded under this ALRD will be funded, in whole or in part, with funds appropriated

by the Infrastructure Investment and Jobs Act (Public Law 117-58), also known as the Bipartisan

Infrastructure Law. The IIJA is a once-in-a-generation investment in infrastructure, which will

grow a more sustainable, resilient, and equitable economy through enhancing U.S.

2

Eligible recipients of loans for commercial building audits, upgrades, and retrofits are defined in IIJA Section

40502(e)(2)(A)(iv).

3

Eligible recipients of loans for residential building audits, upgrades, and retrofits are defined in IIJA Section

40502(e)(2)(B)(iv).

4

Eligible recipients of grants and technical assistance for commercial building audits, upgrades, and retrofits are

defined in IIJA Section 40502(e)(3)(B)(i).

5

Eligible recipients of grants and technical assistance for residential building audits, upgrades, and retrofits are

defined in IIJA Section 40502(e)(3)(B)(ii).

6

See paragraph 36 of 29 U.S.C. 3102 for a definition of a low-income individual eligible for grants and technical

assistance under this program.

5

competitiveness in the world, creating good jobs, and ensuring stronger access to economic

and other benefits for disadvantaged communities. The IIJA appropriates more than $62 billion

to DOE to deliver a more equitable clean energy future for the American people.

As part of this effort, Section 40502 of IIJA authorizes the EE RLF Program and FY22

appropriations of $250,000,000, available until funding is expended and to be distributed to

states beginning in FY23.

It is critical that the projects not only contribute to building improvement goals, but also (1)

support the IIJA objectives to invest in America’s workforce by including specific elements to

accelerate job growth and job quality; and (2) advance the Administration’s equity,

environmental, and energy justice priorities, including the Justice40 Initiative.

7

The Justice40

Initiative establishes a goal that 40% of the overall benefits of certain federal investments flow

to disadvantaged communities. Also, projects supported by these investments will have

minimal negative impacts on communities with environmental justice concerns.

The EE RLF Program is a critical piece of DOE’s strategy to achieve these goals and marks a

significant investment in ensuring that homes and businesses – a key part of our nation’s

infrastructure – are efficient, clean, affordable, and resilient. States will use program funding to

establish sustainable RLFs and provide grants for energy audits, upgrades, and retrofits that will

create good-paying jobs, cut greenhouse gas emissions, and reduce energy costs, particularly

for small businesses and energy-burdened homeowners.

4.1 PROGRAM ACTIVITIES & OUTCOMES

The EE RLF Program provides an important statutory framework to build on states’ efforts to

expand energy efficiency investments, particularly in areas with greater needs and higher

barriers to accessing low-cost capital necessary to deploy clean energy technologies.

There are three primary program objectives for this program: maximizing loan volume and

leveraging private capital; accelerating and maximizing energy savings; and creating good

paying jobs and supporting the Justice40 Initiative.

(1) Maximize loan volume & leverage private capital

A state receiving a capitalization grant under this program shall, to the maximum extent

practicable, use the grant to leverage private capital. DOE encourages states to use program

funding to develop RLFs that feature credit enhancements based in public-private partnerships

such as loan loss reserves (e.g., Michigan Saves, Connecticut Green Bank) or co-lending (e.g.,

the Nebraska Dollar and Energy Savings Loan Program). Additionally, states are encouraged to

complement existing programs such as established RLF programs, Commercial Property

Assessed Clean Energy (C-PACE) programs (e.g., Minnesota’s Trillion BTU Program and

Minnesota PACE), on-bill programs, utility rebate programs (e.g., Golden State Finance

7

The Justice40 Initiative, established by Executive Order 14008, Tackling the Climate Crisis at Home and Abroad,

establishes a goal that 40% of the overall benefits of certain federal investments flow to disadvantaged

communities. https://www.whitehouse.gov/wp-content/uploads/2021/07/M-21-28.pdf

6

Authority Advanced Rebate Payment (ARP) Program), and similar established programs that can

be enhanced with additional funding. States receiving capitalization grants under this program

are encouraged to utilize and build on existing program and infrastructure within the state.

Additionally, DOE encourages states to use non-EE RLF funding (e.g., other BIL funding or

unspent American Recovery and Reinvestment Act dollars) to strategically complement EE RLF

funding and to prioritize the use of private-capital-leveraging credit enhancements (e.g., loan

loss reserves) in all programs. For example, a state may use EE RLF Program funds to serve one

high-need market segment (e.g., small and medium businesses), while non-EE RLF funds can be

used to serve a separate high-need market segment (e.g., households with high energy

burden), or vice versa.

(2) Accelerate & maximize energy savings

U.S. homes and buildings are responsible for about 40% of the nation’s energy use, including

75% of U.S. electricity use, resulting in over $400 billion spent on energy bills each year.

Transitioning to a clean energy economy will help reduce America’s energy bills and reduce air

pollution that impacts people’s health and the global climate crisis. With greater access to low-

cost financing, including through the EE RLF, there is ample opportunity for residential,

commercial, and industrial buildings to benefit from greater energy efficiency, resulting in

energy savings and supporting large-scale decarbonization. Projects financed through the EE

RLF will result in energy savings, and many will also carry benefits such as improved indoor air

quality, greater comfort in conditioned spaces, and lower operations and maintenance costs.

DOE encourages states to pursue projects that will maximize cost-saving and pollution-reducing

benefits to building owners and residents. Additionally, inclusion of aggregable data as part of

the EE RLF assessment processes – including Home Energy Score and Building Sync compliant

data - will help states and DOE better account for the energy, cost, and carbon impacts of this

program.

(3) Create good-paying jobs & support Justice40 Initiative

DOE recognizes the opportunity for federal grant funds to support economic development both

through access to energy cost savings as well as through creation of high quality, locally-based

jobs. Additionally, grant funds will only be useful if there is a ready and willing workforce that

can implement building energy audits and energy efficiency retrofits. To these ends, the

program will encourage states to use the grants to support a strong and skilled workforce

where workers are fairly compensated and supported to receive industry-recognized

credentials. DOE also encourages states to use project labor agreements and other legally

enforceable agreements that support upskilling and employment of disadvantaged

communities in the EE RLF-financed projects.

DOE encourages states to design RLFs that can serve disadvantaged populations including

households with higher-than-average energy burden as well as small businesses. There is an

opportunity for RLFs to expand access to low-cost capital for these disadvantaged populations,

which otherwise may struggle to find financing for building energy efficiency retrofits. For

7

example, RLFs can take comparatively more risks in lending to poor credit consumers, or

otherwise difficult-to-finance homes and businesses, relative to private lenders.

There is an opportunity for RLF funding to be leveraged by a state’s Weatherization Assistance

Program (WAP). However, there are two critical considerations: (1) RLF funds should

“supplement, not supplant” WAP funding per 10 CFR Part 420.18(e)(4) (i.e., states should avoid

giving grants or loans to homes that are otherwise eligible for WAP until they have exhausted

WAP as a resource); and (2) to mitigate consumer protection risks related to loans to the most

vulnerable households, states are encouraged to avoid lending to WAP-eligible homes. As part

of the loan application process, states are encouraged to include a question about household

income to screen for WAP, LIHEAP, and other similar program eligibility.

One way leveraging can be done is through the 25% of RLF funding that may go towards low-

income homes as grants. For example, an RLF grant may be used to complete a deeper retrofit

on a home than is possible with WAP funds alone, or there may be structural or repair issues in

a home that WAP cannot address, but which an RLF grant could be used to resolve.

As states consider using RLF grants and WAP

8

funding to serve low-income households, be

aware that the RLF program defines a low-income individual based on section 3 of the

Workforce and Innovation and Opportunity Act.

4.2 DIVERSITY, EQUITY, INCLUSION, AND ACCESSIBILITY

It is the policy of the Administration that:

“[T]he Federal Government should pursue a comprehensive approach to

advancing equity

9

for all, including people of color and others who have been

historically underserved, marginalized, and adversely affected by persistent

poverty and inequality. Affirmatively advancing equity, civil rights, racial justice,

and equal opportunity is the responsibility of the whole of our government.

Because advancing equity requires a systematic approach to embedding fairness

in decision-making processes, executive departments and agencies must

recognize and work to redress inequities in their policies and programs that

serve as barriers to equal opportunity. By advancing equity across the Federal

Government, we can create opportunities for the improvement of communities

that have been historically underserved, which benefits everyone.”

10

8

Households at or below 200% of the Federal Poverty Income Guidelines may be eligible for WAP.

9

The term “equity” means the consistent and systematic fair, just, and impartial treatment of all individuals,

including individuals who belong to underserved communities that have been denied such treatment, such as

Black, Latino, and Indigenous and Native American persons, Asian Americans and Pacific Islanders and other

persons of color; members of religious minorities; lesbian, gay, bisexual, transgender, and queer (LGBTQ+)

persons; persons with disabilities; persons who live in rural areas; and persons otherwise adversely affected by

persistent poverty or inequality. Executive Order 13985.

10

Executive Order 13985, “Advancing Racial Equity and Support for Underserved Communities Through the

Federal Government” (Jan. 20, 2021).

8

As part of this whole of government approach, this funding action seeks to encourage states to

include the participation of underserved communities

11

and underrepresented groups in the

activities states undertake with these funds. States are highly encouraged to include

contractors and sub-contractors from groups historically underrepresented

12,13

in their EE RLF

Program scoping and ensure associated STEM education programs are inclusive of traditionally

underrepresented populations and geographies.

14

Further, Minority Serving Institutions,

15

Minority Business Enterprises, Minority Owned Businesses, Woman Owned Businesses, Veteran

Owned Businesses, or entities located in an underserved community that meet the eligibility

requirements for receiving loans and grants are encouraged to be considered as recipients

under state RLF programs. Workforce programs should seek to reduce systemic barriers to

accessibility of quality jobs to promote diversity in the energy workforce.

4.3 JUSTICE40 INITIATIVE

The EE RLF Program is a Justice40-covered program

16

and as such contributes to the President’s

goal that 40% of the overall benefits of certain federal investments in clean energy and climate

solutions flow to disadvantaged communities that for too long have faced disinvestment and

underinvestment.

11

The Office of Management and Budget Interim Implementation Guidance for Justice40 defines a disadvantaged

community as either: (1) a group of individuals living in geographic proximity (such as census tract), or (2) a

geographically dispersed set of individuals (such as migrant workers or Native Americans), where either type of

group experiences common conditions.

12

Find workforce development resources from DOE online at: Workforce Development | Better Buildings Initiative

(energy.gov).According to the National Science Foundation’s 2019 report titled, “Women, Minorities and Persons

with Disabilities in Science and Engineering”, women, persons with disabilities, and underrepresented minority

groups—blacks or African Americans, Hispanics or Latinos, and American Indians or Alaska Natives—are vastly

underrepresented in the STEM (science, technology, engineering and math) fields that drive the energy sector. For

example, in the U.S., Hispanics, African Americans and American Indians or Alaska Natives make up 24 percent of

the overall workforce, yet only account for 9 percent of the country’s science and engineering workforce. DOE

seeks to inspire underrepresented Americans to pursue careers in energy and support their advancement into

leadership positions.

https://www.energy.gov/articles/introducing-minorities-energy-in

itiative.

13

Note that Congress recognized in section 305 of the American Innovation and Competitiveness Act of 2017,

Public Law 114-329: “[I]t is critical to our Nation’s economic leadership and global competitiveness that the United

States educate, train, and retain more scientists, engineers, and computer scientists; (2) there is currently a

disconnect between the availability of and growing demand for STEM-skilled workers; (3) historically,

underrepresented populations are the largest untapped STEM talent pools in the United States; and (4) given the

shifting demographic landscape, the United States should encourage full participation of individuals from

underrepresented populations in STEM fields.”

14

Note that Congress recognized in Section 10301 of the CHIPS and Science Act of 2022, Public Law 116-167:

“[T]he Federal Government must utilize the full talent and potential of the entire Nation by avoiding undue

geographic concentration of research and STEM education funding, encouraging broader participation of

populations underrepresented in STEM, and collaborating with nongovernment partners to ensure the leadership

of the United States in technological innovation.”

15

Minority Serving Institutions (MSIs), including Historically Black Colleges and Universities/Other Minority

Institutions as educational entities recognized by the Office of Civil Rights (OCR), U.S. Department of Education,

and identified on the OCR's Department of Education U.S. accredited postsecondary minorities’ institution list.

16

Justice40 Initiative | Department of Energy

9

Benefits include (but are not limited to) measurable direct or indirect investments or positive

project outcomes that achieve or contribute to the following in disadvantaged communities: (1)

a decrease in energy burden; (2) a decrease in environmental exposure and burdens; (3) an

increase in access to low-cost capital; (4) an increase in job creation, the clean energy job

pipeline, and job training for individuals; (5) increases in clean energy enterprise creation and

contracting (e.g., minority-owned or disadvantaged business enterprises); (6) increases in

energy democracy, including community ownership; (7) increased parity in clean energy

technology access and adoption; and (8) an increase in energy resilience.

DOE strongly encourages states to maximize these benefits and describe how applicable project

benefits will flow to disadvantaged communities to the greatest extent practicable. DOE has

released General Guidance on Justice40 Implementation designed to help states and other

interested parties incorporate Justice40 Initiative goals into DOE-funded projects. DOE will work

with interested states to develop methods for identifying and tracking these benefits.

As a best practice, DOE’s Office of Economic Impact and Diversity recommends that recipients

develop and sustain procedures and systems that can easily track what benefits are flowing to

specific communities or locations (e.g., connecting benefits accrued with zip codes, and/or

census tracts). Tracking benefits will allow funding recipients to measure progress and ensure

programs are meeting intended goals. Further analysis of this data can also be used to

empower program designers and lawmakers with information that is often needed to update or

create new programs that better assist communities most in need.

As part of its effort to ensure equity in the EE RLF Program, DOE released DE-FOA-0002716

Request for Information: Designing Equitable, Sustainable, and Effective Revolving Loan Fund

Programs. Respondents provided critical feedback on elements of revolving loan fund programs

that will ensure equitable outcomes and expand access to energy efficiency financing to

underserved communities. Recommendations from this Request for Information regarding

equity informed this document and will continue to inform technical assistance provided to

states as they design and implement revolving loan fund programs.

4.4 JOB GROWTH AND QUALITY

As an agency whose mission is to help strengthen our country’s energy prosperity, DOE strongly

supports efforts to invest in the American workforce. This includes investments that expand

quality jobs by adopting labor standards; ensure workers have a free and fair chance to join a

union; engage responsible employers; foster safe, healthy, and inclusive workplaces and

communities; and develop a diverse workforce well-qualified to build and maintain the

country’s energy infrastructure and to grow domestic manufacturing.

DOE intends to support states in efforts to support good-paying jobs with the free and fair

choice to join a union and support labor-management training partnerships, such as registered

apprenticeships. In their project planning, states are highly encouraged to engage with labor

unions and organizations that represent workers in these projects to ensure worker voice in the

10

design and execution of these projects and training opportunities. The Community Benefits

Plan FAQ provide guidance on job quality.

17

4.5 LESSONS LEARNED FROM SUCCESSFUL FINANCING PROGRAMS

DOE encourages states to consider lessons learned from established energy efficiency financing

programs and from stakeholder input received as a part of the Request for Information (RFI)

from DOE on this provision entitled, DE-FOA-0002716 Request for Information: Designing

Equitable, Sustainable, and Effective Revolving Loan Fund Programs. DOE encourages the

following as appropriate to state needs and resources, and as subject to all Federal

requirements:

• Attract Private Capital – De-risk private sector investment with credit enhancements,

engage with secondary markets after loans are originated, and share loan portfolio

performance data to send a market signal and attract additional private capital.

• Find and Target Market Gaps – Prioritize expanding access to financing for market

segments with limited financing options. For the residential market, middle-income

households with higher-than-average energy burden and poor credit often struggle to

find low-cost financing.

18

For the commercial market, small businesses including

community-serving non-profits (e.g., food banks, youth centers) often struggle to find

low-cost financing.

• Use Available Support Infrastructure – Take advantage of existing expertise and

resources from ongoing finance program administration, and/or consider partnering

with third-party service providers with experience in marketing, loan origination, and

servicing. Coordinate with existing programs including utility rebate programs and

financing programs (e.g., on-bill financing, commercial property assessed clean energy).

• Build Partnerships – Set aside time and resources to build lasting partnerships and

marketing pathways that drive loan origination and expand the speed and scale of

lending. This includes partnerships with contractors, utilities, credit unions, community

development financial institutions, green banks, and other financial institutions.

4.6 TECHNICAL ASSISTANCE

DOE will work with states and other key stakeholders to design and provide technical assistance

offerings as well as identify and disseminate best practices for RLF programs. Technical

assistance will be as flexible as possible to address state-identified needs over time and will

emphasize shared or readily accessible information (e.g., fact sheets, webinars). DOE technical

assistance will include:

• Targeted, recurring training for states and their program partners;

• Access to tools and subject matter experts to support data-driven decision making;

17

Community Benefits Plan Frequently Asked Questions (FAQs) | Department of Energy.

18

States must not supplant Weatherization Assistance Program (WAP) funding and are encouraged to refer all

households that may be eligible for WAP to the WAP program.

11

• Access to subject matter experts and convenors to facilitate state-led stakeholder

engagement and partnership building;

• Work products to inform program design (e.g., case studies, model transaction

documents);

• Opportunities to convene with peers and subject matter experts to find solutions to

persistent barriers and troubleshoot common challenges; and

• Assistance with navigating Federal requirements related to Build America, Buy America

(BABA), Davis-Bacon Act, and the National Environmental Policy Act (NEPA), among

other requirements.

5.0 FUNDING

Funding for all awards and future budget periods is contingent upon the availability of funds

appropriated by Congress for the purpose of this program and the availability of future-year

budget authority.

5.1 IIJA FORMULA ALLOCATIONS

Funding for this program will be allocated to states according to two separate allocation

formulas. Per Section 40502(b) of the IIJA, 40% of the total funding is to be allocated to all

states eligible for SEP funding according to the allocation formula established under 10 CFR Part

420.11. The remaining 60% of the total funding is to be allocated to Priority States according to

a formula established by the Secretary of the Department of Energy. Per Section 40501, a

Priority State is defined as a state that is:

• Eligible for funding under the State Energy Program, and

• Among the 15 states with the highest annual per-capita combined residential and

commercial sector energy consumption, as most recently reported by the Energy

Information Administration; or

• Among the 15 states with the highest annual per-capita energy-related carbon dioxide

emissions by state, as most recently reported by the Energy Information

Administration.

19

19

The definition of Priority States for this program can be found in paragraph 1 of IIJA Section 40501. DOE used

two data sets identified in this definition to establish the list of Priority States: (1) State Energy Data System (SEDS),

Table C14, Total Energy Consumption Estimates per Capita by End-Use Sector, Ranked by State, 2019 and (2)

Energy-Related CO2 Emission Data, Table 4, Per capita energy-related carbon dioxide emissions by state, 2019. The

energy consumption data (Table C14) was adjusted to exclude energy consumption from the transportation and

industrial sectors to align with the Priority State definition in IIJA Section 40501. A state that was in the top 15 of

either adjusted data set was determined to be a Priority State.

12

DOE has determined a list of the following 23 Priority States listed in alphabetical order:

Alabama

Kentucky

Oklahoma

Alaska

Louisiana

South Dakota

Arkansas

Michigan

Tennessee

District of Columbia

Missouri

Texas

Illinois

Montana

Virginia

Indiana

Nebraska

West Virginia

Iowa

New Mexico

Wyoming

Kansas

North Dakota

5.2 COST MATCH

Cost match is not required for the EE RLF Program funding provided by IIJA.

5.3 PROGRAM INCOME

Program income is defined in federal regulations as gross income earned by the recipient that is

directly generated by a supported activity or earned as a result of the Award. Program income

includes but is not limited to:

• Income from fees for services performed.

• The use or rental of real or personal property acquired with grant funds.

• The sale of commodities or items fabricated under a grant agreement.

• License fees and royalties on patents and copyrights.

• Payments of principal and interest on loans made with grant funds.

If the Recipient earns program income during the project period as a result of this Award, the

Recipient must add the program income to the funds committed to the Award and used to

further eligible project objectives.

(See 2 CFR Part 200.80 and 2 CFR Part 200.307 for further information.)

6.0 APPLICATION INSTRUCTIONS FOR THE ENERGY EFFICIENCY REVOLVING

LOAN FUND CAPITALIZATION GRANT PROGRAM

6.1 OVERVIEW

The application package for SEP grants consists of the State Plan and a number of required

forms. The State Plan is the heart of the application package. It is divided into three sections—

the Budget, the Master File, and the Annual File (see Section 6.3 below).

Applications must be submitted in accordance with the IIJA Energy Efficiency Revolving Loan

Fund Capitalization Grant Program Administrative and Legal Requirements Document (ALRD).

The application due date is April 21, 2023.

13

As a reminder, application documents, forms, and data submitted may be made available to the

public at DOE’s discretion following all applicable laws and regulations that protect confidential

or proprietary information.

6.2 IIJA AWARDS

IIJA awards will consist of 5-year Project Period starting in FY23.

6.3 STATE APPLICATION

The State Application consists of:

• Standard Form 424 (Application form)

• Standard Form 424A (Budget summary)

• Budget Justification

• Annual File

• Master File – Application Questions

• Various certifications

• An indirect rate agreement (if applicable)

• An environmental questionnaire (if applicable).

Program regulations govern all funds budgeted in the State Application, whatever their source.

6.3 A. STANDARD FORM 424 (APPLICATION)

A completed and signed Standard Form 424 (SF424) containing current information must be

submitted. Please ensure all sections have been updated to reflect any changes, including

changes to the person to be contacted on matters involving the application and the authorized

representative. States should select “New” in section 2.

The list of certifications and assurances referenced in Field 21 may be found here. Please verify

compliance with Intergovernmental Review (SPOC List) (whitehouse.gov).

Once the SF424 is completed, add an attachment to the document with the name, title, phone

number, and email address for both the Principal Investigator and the Business Officer.

6.3 B. STANDARD FORM 424A (BUDGET)

The budget includes Standard Form 424A Summary which includes a Budget Justification. Each

of these forms should be completed following the guidelines set out below. Please note that a

state receiving a capitalization grant under this program may use not more than 10 percent of

the grant for administrative purposes.

IIJA and SEP regulations do not define the Administrative cost categories. Any expenditure,

allowed by the Office of Management and Budget (OMB) cost principles, or by a Grantee or

Subgrantee may be charged as Administrative cost. However, certain costs in this Program that

are excluded from other categories can only be administrative. Grantee Administration and

Subgrantee Administration are considered to be unique to each organization. The organization

14

must define its administrative costs consistent with the generally-accepted accounting practices

and procedures within the organization.

o Indirect costs can be included in Grantee Administration and will be considered an

allowable cost provided there is a federally approved indirect rate(s) or cost allocation

plan. The indirect cost rate used may be approved by a federal department or agency

other than DOE. See 2 CFR 200.414 Indirect (F&A) costs for more information. The

rate/amount allowable does not invalidate the program budget category limits.

States may utilize a portion of their 10% administration funds to purchase software that

facilitates the management and tracking of loans.

6.3 B.1. STANDARD FORM 424A: Applications must include a budget for all funds including DOE,

or any other funds, if applicable. It should be completed as follows:

• Section A: Budget Summary Lines 1-4, Columns (a) through (g). On line 1, enter new

DOE funds.

• Section B: Budget Categories. Separate column headings (with the same name as the

rows in Section A) should be utilized for each funding source. The total in column g,

Section A, must equal the total of all columns in Section B.

6.3 B.2 BUDGET JUSTIFICATION: The Budget Justification consists of a detailed explanation of

the object class categories listed in line 6, Section B, of Standard Form 424A. In preparing the

Budget Justification, states should address the following as requested for each budget category.

• Personnel: Identify all positions to be supported by title and the amounts of time (e.g.,

% of time) to be expended on the EE RLF Program, the base pay rate, and the total

direct personnel compensation. Personnel must be direct costs to the project and not

duplicative of personnel costs included in the indirect pool that is the basis of any

indirect rate applied for this project.

• Fringe Benefits: If fringe cost rates are approved by a federal agency, identify the agency

and date of latest rate agreement and include a copy of the rate agreement with the

application. If fringe cost rates are not approved by a federal agency, explain how total

fringe benefit costs were calculated. Your calculations should identify all rates used

along with the base they were applied to (and how the base was derived), and a total

for each (along with the grand total). If there is an established computation

methodology approved for state-wide use, provide a copy with the SF424 Application.

• Travel: Provide the purpose of travel, such as professional conference(s), DOE

sponsored meeting(s), project monitoring, etc. Identify the number of trips, and the

destination/location if known. Provide the basis for the travel estimate such as past

trips, current quotations, federal or state travel regulations, etc. All listed travel must be

necessary or beneficial to the performance of the Energy Efficiency Revolving Loan Fund

15

Capitalization Grant Program. All foreign travel must be identified and requires pre-

approval.

• Equipment: Equipment is defined as an item with an acquisition cost greater than

$5,000 and a useful life expectancy of more than one year. List all proposed equipment

and briefly justify its need as it applies to the objectives of this award. Provide a basis of

cost such as vendor quotes, catalog prices, prior invoices, etc. If the equipment is being

proposed as cost match and was previously acquired, provide the value of its

contribution to the project and a rationale for the estimated value shown. If it is new

equipment that will retain a useful life upon completion of the project, provide a

rationale for the estimated value shown. Also, indicate whether the equipment is being

used for other projects or is 100% dedicated to this project.

• Supplies: Supplies are defined as items with an acquisition cost of $5,000 or less or a

useful life expectancy of less than one year. Supplies are generally consumed during the

project performance. List all proposed supplies and the estimated cost and briefly justify

the need for the supplies as they apply to the objectives of this award. Supply items

must be direct costs to the project and not duplicative of supply costs included in the

indirect pool that is the basis of any indirect rate applied for this project. Provide a basis

of cost for each item listed. Examples include vendor quotes, prior purchases of similar

or like items, published price list, etc.

• Contractual: All sub-recipients, vendors, contractors and consultants and their

estimated costs should be identified. Use TBD if the entity is unknown. Provide a brief

description of the work to be performed or the service to be provided. Include the basis

of cost for each item listed (competitive, historical, quote, catalog, etc.).

• Other Direct Costs: Other direct costs are direct cost items required for the project that

do not fit clearly into other categories. These direct costs must not be included in the

indirect costs (if indirect costs are proposed for this project). Examples are conference

fees, meetings within the scope of work, subscription costs, printing costs, etc., that can

be directly charged to the project and are not duplicated in indirect (overhead) costs.

Provide a general description, cost, and justification of need for each direct cost item.

Provide a basis of cost for each item. Examples include vendor quotes, prior purchases

of similar or like items, published price list, etc.

• Indirect Costs: If the indirect cost rate has been approved by a federal agency, identify

the agency and the date of the latest rate agreement and submit a copy of the

agreement with the application. If the indirect cost rate has not been approved by a

federal agency, provide the basis for computation of rates including the types of

benefits to be provided, the rate(s) used and the cost basis for each rate.

16

6.3 C. MASTER FILE

The Master File must address each mandatory application question. The questions are:

1. How will the grant funds be used? Please include a detailed explanation describing

whether the plan is to establish a new revolving loan fund or use an existing revolving

loan fund. Additionally, please describe other federal or non-federal funds that the state

is considering strategically deploying in coordination with these funds.

2. What is the need of eligible recipients for loans and grants in the state to conduct

energy audits and retrofits? Please describe the basis for needing assistance and how

the state is contemplating the use of loans vs. grants in meeting the needs of different

types of eligible recipients in the building sub-sectors described in section 2.2 of this

document.

3. In the case of a Priority State seeking a supplemental capitalization grant under

subsection (b)(2): Please justify the need for supplemental funding.

4. What are the expected benefits that building infrastructure and energy system upgrades

and retrofits will have on communities in the state?

5. How will mandatory metrics in section 6.3D of the application instructions (e.g.,

auditor’s projection of energy savings, loan performance metrics) be collected?

6. What are the existing or potential partnerships the state will use to facilitate loan

origination and servicing activities? Please describe the state’s identified and preferred

pathways to leverage capital (e.g., credit enhancements, utility rebates, and/or creative

financing structures such as on-bill or C-PACE), estimated target leveraging ratio, as well

as existing or potential partnerships to drive loan uptake, marketing, and stakeholder

engagement. Partners may include but not be limited to utilities, financial institutions

(including Community Development Financial Institutions), contractors, and other public

or private organizations.

7. How will loans and grants be prioritized for disadvantaged communities as defined by

DOE? Please include a description of existing or potential partnerships with financial

institutions (e.g., Community Development Financial Institutions) as well as

environmental justice and community groups, and the extent to which the program will

promote consumer protections and meaningfully engage, and benefit, underserved

communities.

8. How will loans and grants be used to maximize energy savings and greenhouse gas

emissions reductions through deep retrofits, beneficial electrification, and other high-

impact measures?

9. How will workforce resources and partnerships be leveraged for program

implementation? Please describe existing or potential partnerships with audit training

and certification organizations, youth corps, labor unions, Historically Black Colleges and

Universities, minority serving institutions, non-profit organizations, colleges, and trade

schools.

10. What technical assistance support from DOE will help address anticipated barriers the

state may face? Please describe the barriers and desired outcomes from the technical

assistance.

17

6.3 D. ANNUAL FILE

The Annual File section describes the program Activity for which the state requests financial

assistance under the EE RLF Program, including budget information and milestones for each

Activity, and the intended scope and goals to be attained either qualitatively or quantitatively.

The Annual File must account for all funds budgeted including funds for administrative

Activities. The Annual File must include at least one metric for each Activity. Activities that are

administrative only are exempt from this requirement.

When preparing the Annual File states should follow these steps:

1. Select Funding and/or Financing under 1. Activity.

a. States can name their program under SEO Title.

2. If a state wants to have a separate activity for administrative activities (separate from

the Funding and/or Financing Activity) a state should select Program Management

under 1. Activity.

3. Under 3. Sector a state should select commercial or residential so that DOE can track the

correct sector.

a. If a state has chosen to set up a commercial and a residential RLF, a state should

create two separate activities to maintain the separation between the

commercial and residential sectors.

4. A state should select any applicable Technology and Topic Areas under 4. Technology

and/or Topic Areas.

As program-wide performance indicators that are valuable to all SEP stakeholders, metrics are

an important element of the EE RLF Program grant reporting. The best use of metrics is

described in detail in Attachment 1 of SEP Program Notice 10-006E, “DOE Reporting

Requirements for the State Energy Program.” “Unpaired” metrics should be avoided. For

example, if a state reports the number of buildings retrofitted, the square footage retrofitted

must be included as well. DOE is working to identify metrics for future reporting on how states’

investments of DOE financial assistance impact such topics as energy equity and environmental

justice and how they relate to disadvantaged communities.

For the EE RLF Program, a state must select the following mandatory metric areas (listed below)

in each activity to ensure the state and DOE are capturing the necessary data of this program.

A state may need to select other metric areas if applicable to a state’s particular program

design. If a state chooses to utilize a portion of their funds for technical assistance, then the

state should also choose metric area 10 along with metric area 3 and 4.

Metric Area 3: Energy Audits (mandatory)

• 3a. Energy audits, by sector

o Number of investment grade audits (IGAs) performed

o Number of non-investment grade audits (IGAs) performed

18

o Square footage of buildings/facilities audited

o Auditor’s projection of energy savings (kWh, therms, MMBTU, gallons of fuel,

gallons of water)

o Average Daily Flow (MGD) of WWTF audited

o Number of projects started based on audits

Metric Area 4: Retrofits (mandatory)

• 4a. Buildings retrofitted, by sector

o Number of buildings retrofitted

o Square footage of buildings retrofitted

o Estimated project savings (KWh, therms, gallons of fuel, gallons of water, dollars)

• 4b. Building automation systems (BAS) installed, by sector

o Number of energy management systems installed

o Square footage of buildings with systems installed

• 4c. Street lights retrofitted

o Number of energy efficient streetlights installed

o Estimated project savings (kWh)

• 4d. Water conservation retrofits made, by sector

o Number of water conservation retrofits completed

o Number of water management systems installed

• 4e. Wastewater treatment facilities retrofitted

o Reduction in energy intensity (MMBTU/MG, MMBTU/kg BOD removed)

• 4f. Manufacturing re-tooling, process improvements

o Number of facilities with manufacturing space repurposed for clean energy

products

o Square footage of manufacturing space repurposed for clean energy products

o Number of manufacturing lines retrofitted

• 4g. Energy, water saved, by sector

o Reduction in electricity consumption (MWh/year)

o Reduction in water consumption (gallons/day)

o Reduction in fuel oil consumption (gallons/year)

o Reduction in natural gas consumption (MMcf/year)

o Dollars saved

Metric Area 7: Financial Instruments (if applicable)

20

• 7a. Financial incentives provided, by sector and incentive type

o Monetary value of financial incentives provided

o Total value of investments incentivized

• 7b. Existing or new financial programs utilized/created, by sector and program type

o Number of customers newly utilizing program

20

Metric Area 7: Financial Instruments. Metric 7c Loans and Grants by sector should NOT be included in an Activity

as a metric as this metric is pre-populated into the Quarterly Performance Report (QPR) for all EE RLF awards.

19

o Private dollars leveraged

o Total dollars invested as a result of financial mechanism

o Projected energy, cost savings

o Number of financial programs developed or updated

• 7d. Energy Savings Performance Contracts, by sector

o Number of contracts signed

o Dollar value of contracts signed

o Projected savings (kWh/year)

• 7e. Energy Investment Partnerships/Green Banks

o Number of projects funded

o Total monetary value of projects funded

Metric Area 8: Renewable Energy Market Development (if applicable)

• 8c. Ground source geothermal systems installed

o Number of ground source geothermal systems installed

o Total capacity of ground source geothermal systems installed (tons)

• 8e. Solar photovoltaic (PV) electric systems installed

o Number of solar PV electric systems installed

o Total capacity of solar PV electric systems installed (kW)

• 8g. Renewable thermal systems installed

o Number of solar thermal systems installed

o Total capacity of solar thermal systems installed (square feet)

o Number of other renewable thermal systems installed

o Total capacity of other renewable thermal systems installed (Btu/hr)

• 8h. Other renewable electric systems installed

o Number of other renewable systems installed

o Total capacity of other renewable systems installed (kW)

Metric Area 10: Training and Education/Technical Assistance (if applicable)

• 10a. Education and outreach conducted

o Number of contacts reached via webinars, site visits, fact sheets, or other

o Number of workshops, training, and education sessions held

o Number of people attending workshops, training, and education sessions

• 10b. Technical assistance provided

o Number of participants

• 10c. Workforce development

o Number of people trained

o Number of professional certifications achieved

o Jobs retained (Full Time Equivalent)

o Jobs created (Full Time Equivalent)

20

Metric Area 11: Other (administrative or energy storage systems, if applicable)

• 11d. Energy storage systems

o Number of battery storage systems installed

o Total capacity of battery systems installed (kW)

o Number of thermal storage systems installed

o Total capacity of thermal storage systems installed (KBtu/hr)

• 11e. Combined heat and power (CHP)

o Number of CHP screenings completed

o Number of feasibility studies completed

o Number of CHP Systems installed (technology and/or fuel type)

o Capacity of CHP systems installed (MW)

o Thermal output of CHP systems installed

For each Activity, states should identify all funding sources and the dollar amounts allocated.

The sum of the budgets of each Activity must equal the totals in Section A of the SF424A.

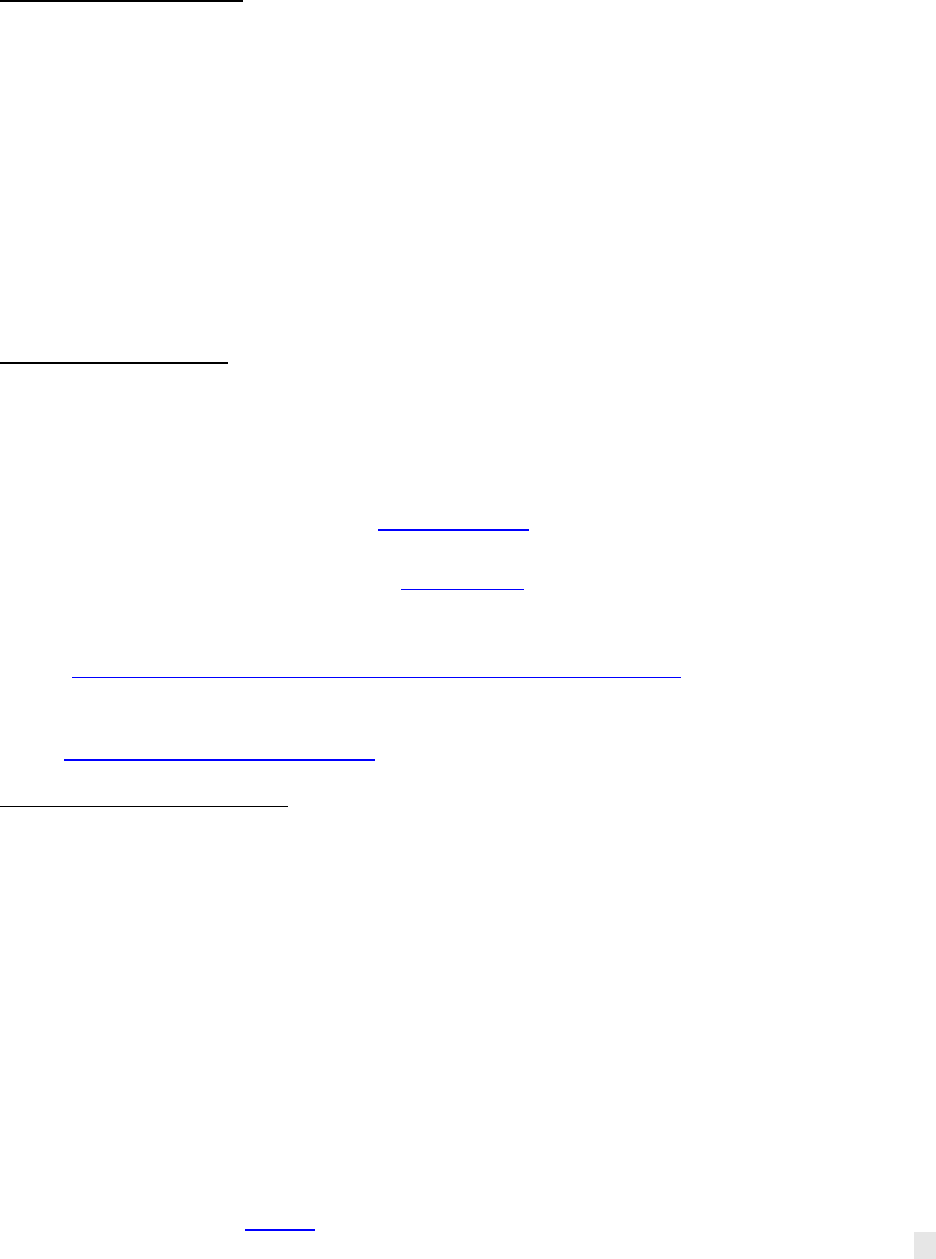

6.3 E. MANDATORY REQUIREMENTS

Timeframe for Use of Capitalization Grants

Per IIJA Section 40502(d)(2), a state must begin using a capitalization grant not more than 180

days after the date on which the grant is received. While a state does not have to make a loan

within 180 days, it must have loans available (i.e., be prepared to start accepting and processing

applications) or issue a grant within the first 180 days of award.

If your state has special circumstances that preclude it from meeting the 180-day deadline

described above, please contact your Project Officer to discuss options for moving forward with

your award.

Energy Audit, Retrofit, and Upgrade Requirements

For loans and grants provided through this program, mandatory and optional requirements for

eligible activities are laid out in IIJA Section 40502 (e) and described in the table below.

21

Required and Optional Elements of Qualifying Energy Efficiency Audits and Upgrades

Commercial

Energy

Audits

REQUIRED

• Determine the overall consumption of energy of the facility of the eligible recipient.

• Identify and recommend lifecycle cost-effective opportunities to reduce the energy

consumption of the facility of the eligible recipient.

• Identify the period and level of peak energy demand for each building within the

facility of the eligible recipient and the sources of energy consumption that are

contributing the most to that period of peak energy demand.

• Recommend controls and management systems to reduce or redistribute peak

energy consumption.

• Estimate the total energy and cost savings potential for the facility of the eligible

recipient if all recommended upgrades and retrofits are implemented, using

software approved by DOE.

21

OPTIONAL

• Recommend strategies to increase energy efficiency of the facility of the eligible

recipient through use of electric systems or other high-efficiency systems utilizing

fuels, including natural gas and hydrogen.

Residential

Energy

Audits

REQUIRED

• Use the same evaluation criteria as the Home Performance Assessment used in the

Energy Star program.

22

• Identify and recommend lifecycle cost-effective opportunities to reduce the energy

consumption of the facility of the eligible recipient.

• Recommend controls and management systems to reduce or redistribute peak

energy consumption.

• Compare the energy consumption of the residential building of the eligible recipient

to comparable residential buildings in the same geographic area.

• Provide a Home Energy Score

, or equivalent score (as determined by the

Secretary),

23

for the residential building of the eligible recipient by using DOE’s

Home Energy Score Tool or an equivalent scoring tool.

OPTIONAL

• Recommend strategies to increase energy efficiency of the facility of the eligible

recipient through use of electric systems or other high-efficiency systems utilizing

fuels, including natural gas and hydrogen.

Commercial

and

Residential

Upgrades

and

Retrofits

REQUIRED

• Recommended in the qualifying commercial energy audit or residential energy

audit, as applicable, completed for the building or facility of the eligible recipient.

• Satisfy at least 1 of the criteria in the Home Performance Assessment used in the

Energy Star program (residential only).

• Are life-cycle cost-effective.

• Improve, with respect to the building or facility of the eligible recipient, at least one

of the following:

o The physical comfort of the building or facility occupants.

o The energy efficiency of the building or facility.

o The quality of the air in the building or facility.

• Lead to at least one of the following outcomes:

o Reduce the energy intensity of the building or facility of the eligible recipient.

o Improve the control and management of energy usage of the building or facility

to reduce demand during peak times.

21

See “Software Requirements” below.

22

The Energy Star Program as established by 42 U.S.C. 6294a. Additional information on the Home Performance

Assessment can be found here.

23

See “Software Requirements” below.

22

If a loan or grant recipient chooses to do a combination of upgrade or retrofit projects, the

projects must collectively satisfy the mandatory criteria set forth above and not

individually. However, any upgrade or retrofit project must be recommended in the

audit. Below are two examples of combination upgrade or retrofit projects that potentially are

eligible if satisfying all of the criteria set forth above:

1. If an audit recommends the following and recipient chooses to implement all, and if

collectively they will satisfy the required criteria for commercial and residential

upgrades and retrofits then the following packages are allowable:

a. Solar PV + battery storage

b. Heat pumps + Smart Thermostat

c. Air Sealing + Insulation + Building Ventilation

2. If an audit recommends pre-requisite measures (e.g. outdated wiring or electric panels)

this is allowable as part of the combination of measures, not as an individual measure.

DOE encourages states to prioritize heat pumps and heat pump water heaters (HPWHs) in their

program design. For example, states can encourage adoption of heat pumps and HPWHs by

training and incentivizing auditors to consider the technology in audits, and potentially, by

incentivizing the technology through improved loan terms (e.g., lower interest rates, higher

borrowing limits). Heat pumps and HPWHs are high-efficiency and low-carbon solutions for the

two largest energy end-uses: space heating and cooling and water heating. Heat pumps provide

the best-available technology to reduce greenhouse gas emissions from on-site fuel combustion

and other heating and cooling technologies. When coupled with demand response programs or

time-varying rates that appropriately value the load shaping that heat pumps and HPWHs can

provide (through smart, grid-connected functionality and automation), these technologies can

provide substantial cost savings to the customer.

Regarding the life-cycle cost-effectiveness requirement, states are encouraged to calculate in a

manner that best suits their program, market being served, and available data sources. For the

cost-effectiveness calculation, states are strongly encouraged to include at least life-cycle

energy savings as well as the cost of energy efficiency measures. Further, states may opt to

calculate cost-effectiveness with additional quantifiable factors such as interest payments over

the life of the loan, the social cost of carbon, and health benefits.

States may also use up to 25% of funding provided by DOE for grants and technical assistance to

pursue the same set of activities laid out in the table above. However, only businesses with

fewer than 500 employees and low-income individuals who own a residential building may

receive such grants. See 2.2 ELIGIBLE RECIPIENTS for more information on eligibility for loans,

grants, and technical assistance. To maximize leveraging of private capital with available funds,

states are encouraged to use grants judiciously and to prioritize loans. DOE encourages states

to utilize the 25% allowable grants and technical assistance portion of their capitalization grants

to incentivize low-income residential owners to install heat pumps and heat pump water

heaters in conjunction with weatherization measures where appropriate.

23

Loan Term Requirements

Per IIJA Section 40502(e)(2)(C)(iii), loans provided under the EE RLF Program must be fully

amortized by the earlier of the following:

• The year in which the upgrades or retrofits carried out using the loan exceed their

expected useful life.

24

• 15 years after the upgrades or retrofits are installed.

States may set shorter amortization periods than described above for loans provided under the

EE RLF Program, but loan amortization periods must not exceed the statutory maximum of 15

years described above.

Software Requirements

Commercial energy audits financed through the EE RLF Program must estimate the total energy

and cost savings potential for the facility of the eligible recipient if all recommended upgrades

and retrofits are implemented, using software approved by DOE.

25

• DOE recommendation: Use the Audit Template software for audits of commercial and

multifamily buildings to accomplish ASHRAE Level II Audits.

26

• Require use of software that uses BuildingSync (e.g., a standard format for conveying

data), which is used by multiple energy audit software tools.

27

For information on

industry collaborators and current adopters of BuildingSync, please refer to

https://buildingdata.energy.gov/#/building-sync/collaborators.

Residential energy audits financed through the EE RLF Program must use the evaluation criteria

as the Home Performance Assessment used in the Energy Star program and provide a Home

24

In the case of a loan being used to fund multiple upgrades or retrofits, the longest-lived upgrade or retrofit shall

be used to calculate the year in which the upgrades or retrofits carried out using the loan exceed their expected

useful life.

25

IIJA Section 40502(e)(2)(A)(ii), subclauses (III) and (VI), state that commercial energy audits financed with loans

and grants under the program shall, among other things:

“(III) estimate the energy and cost savings potential of the opportunities identified in subclause (II) using

software approved by the Secretary;

…

(VI) estimate the total energy and cost savings potential for the facility of the eligible recipient if all

recommended upgrades and retrofits are implemented, using software approved by the Secretary.”

26

While multifamily buildings are classified as residential buildings under IIJA Section 40502, the Home Energy

Score audit methodology for residential buildings is not applicable for multifamily buildings. As such, and pursuant

to DOE’s authority under Section 40502(e)(2)(B)(ii)(V) to identify an “equivalent scoring tool” to the Home Energy

Score, DOE recommends that audits of multifamily buildings follow the requirements laid out for commercial

energy audit software.

27

Commercial energy audit software tools using BuildingSync: ASHRAE, Audette, BrightPower, Buildee, AECOM,

PSD, Maalka, Brand New Box, & others.

24

Energy Score, or equivalent score, for the residential building of the eligible recipient by using

DOE’s Home Energy Score Tool, or an equivalent scoring tool.

28

• DOE recommendation: Use the Home Energy Score Tool for audits of residential

buildings, not including multifamily buildings.

29

• Residential energy auditors may enter data into the Home Energy Scoring Tool directly to

comply with this requirement or may use a software tool that is connected to the Home

Energy Scoring Tool through an Application Programming Interface (API). For more

information on API-compliant software providers, please refer to Partner Resources |

Better Buildings Initiative (energy.gov).

6.3 F. EXPENDITURE PROHIBITIONS, LIMITATIONS, AND ALLOWANCES

Prohibitions:

• States may not pool loan funds across multiple states. States are expected to use their

capitalization grants within their states.

30

Limitations:

• States may use no more than 25 percent of the funding provided by DOE under this

program to provide grants or technical assistance to eligible entities for activities

described in the MANDATORY REQUIREMENTS section of this document.

• States may use no more than 10 percent of the funding provided by DOE under this

program for administrative expenses.

• Funds may be used to supplement, and no funds may be used to supplant,

weatherization activities under the Weatherization Assistance Program for Low-Income

Persons.

• Commercial and residential audits, upgrades, and retrofits financed through this

program must satisfy the criteria set forth in IIJA and described in the MANDATORY

REQUIREMENTS section of this document in order to be eligible.

• States must document their NEPA and National Historic Preservation Act (NHPA) Section

106 determinations for DOE review.

• During the award period, repayments (both interest and capital) are program income

which must be put back into the award for re-use. See 2 CFR 200.307(e).

28

IIJA Section 40502(e)(2)(B)(ii), subclause (V), states that residential energy audits financed with loans and grants

under the program shall, among other things, “provide a Home Energy Score, or equivalent score (as determined

by the Secretary), for the residential building of the eligible recipient by using the Home Energy Score Tool of the

Department or an equivalent scoring tool.”

29

Ibid.

30

States may enter into a multi-state agreement to share a service provider(s). Each state’s funds must be tracked

at the state level and must not comingle.

25

Allowances:

• States may co-lend with financial institutions, endowments, and philanthropic

organizations. For loans with multiple parties (e.g., state RLF and private capital), private

capital is not subject to Federal requirements. Non-Federal funds should be maintained

and accounted for separately from Federal funds.

• States may sell loans or a loan portfolio to the secondary market. States retain

responsibility of Federal reporting and compliance.

• States may prohibit pre-payment penalties on loans.

• Loan loss reserves and other credit enhancements are allowable.

• Public buildings are eligible under the commercial definition.

6.3 G. OTHER FORMS

The following files should be submitted as attachments with your application if applicable:

• Indirect Rate Agreement or Rate Proposal.

• Certifications regarding Lobbying (SF-LLL Disclosure Form to report lobbying).

• A document providing the name, phone number, and email address of the Principal

Investigator and Business Officer.

6.3 H. NATIONAL ENVIRONMENTAL POLICY ACT INFORMATION

DOE must comply with NEPA prior to authorizing the use of Federal funds. DOE must also

consider the effects on historic properties, pursuant to Section 106 of NHPA. Additionally, DOE

must consider the impacts to floodplains and wetlands, pursuant to 10 CFR Part 1022—

Compliance with Floodplain and Wetland Environmental Review Requirements. To streamline

these required reviews, DOE carries out each of these reviews under the umbrella of its NEPA

review. States should review and follow the NEPA determination in their award documents for

restrictions, and the list of activities that have been categorically excluded from further NEPA

review.

DOE has developed a NEPA training website with PowerPoint presentations, sample template

documents, (including a NEPA log, project scope of work, and a project layout), word document

of an Environmental Questionnaire-1 (EQ1) and an EQ1 submission guide. States are

responsible for reviewing the online NEPA training and sample documents NEPA Training, prior

to initiating projects and contacting NEPA with any questions at GONE[email protected]ov.

Subgrantees and 3rd party loan administrators are also encouraged to review the training

website.

All states but Guam have a DOE executed Historic Preservation Programmatic Agreement (PA)

for historic preservation compliance. Guam does NOT have a Historic Preservation PA and must

follow the added restrictions in the NEPA determination to ensure historic preservation

compliance. All the state’s Historic Preservation PAs and amendments can be found here.

There are two paths to complete a NEPA review for EE RLF projects: 1) states determine and

document that a project falls within a Bounded Category (see your NEPA determination for the

26

complete list of Bounded Categories and restrictions), or 2) states determine a project does not

fit within a Bounded Category and submit an EQ1 in the Project management Center for DOE to

complete a NEPA review. States will receive approval from a DOE Contracting Officer with a

NEPA determination for their records. Both paths require a documented NEPA review. DOE has

developed a NEPA log as a tool to assist states in documenting that their projects fit within the

Bounded Categories. A sample NEPA log can be found at www.energy.gov/node/4816816.

Most Bounded Categories are more restrictive than the Categorical Exclusion. The restrictions

must be followed for the Bounded Category to be applicable.

The following list of Bounded Categories of activities is applicable to states with a DOE

executed Historic Preservation PA. All the Historic Preservation PAs and amendments can be

found here. The activities in the Bounded Categories may be slightly different than the

activities in the NEPA determination. The NEPA determination included with each state’s

award documents must be followed. All project activities funded under the Energy Efficiency

Revolving Loan Fund Capitalization program (EE RLF) must be listed within the NEPA

determination or states must submit an EQ1 in the Project Management Center

(https://www.eere-pmc.energy.gov/NEPA.aspx).

Bounded Categories:

1. Administrative activities associated with management of the designated State Energy

Office and management of EE RLF to encourage energy efficiency and renewable

energy.

2. Development and implementation of outreach strategies for EE RLF effort to encourage

energy efficiency and renewable energy including facility energy audits.

3. Development and implementation of programs and strategies to encourage energy

efficiency and renewable energy such as policy development and stakeholder

engagement.

4. Residential and commercial energy analysis and monitoring, including energy use

assessments involving building monitoring equipment and smart thermostats.

5. Installation of commercially available retrofit/upgrade measures to improve air quality,

energy, and/or water efficiency in existing buildings or facilities of the eligible recipient,

based on energy audit recommendations, provided that projects adhere to the

requirements of the respective state’s DOE executed Historic Preservation PA, are

appropriately sized, and are limited to:

a. Insulation applied to building structures, ducts, hot water heater tanks, and

heating pipes.

b. Air sealing applied to building structures and/or ducts.

c. Programmable and smart thermostats.

d. Installation of energy efficient lighting.

e. Upgrading, retrofitting, tuning, repairing, and/or replacing of existing heating,

ventilation, and air conditioning (HVAC) equipment.

f. Repairing and/or replacing water heating system equipment.

27

g. Energy or water monitoring and control systems.

h. Retrofitting, repairing, and/or replacing of windows and doors, including

installation of energy efficient storm windows and energy-saving window

attachments.

i. Retrofitting or replacing of energy efficient pumps and motors for uses such as

wastewater treatment plants, where it would not alter the capacity, use,

mission, or operation of an existing facility.

j. Installation of Combined Heat and Power System—systems sized appropriately

for the buildings in which they are located, not to exceed peak electrical

production at 300kW).

6. Development, implementation, and installation of onsite renewable energy/energy

efficiency technology from renewable resources, provided that activities adhere to the

requirements of the respective state’s DOE executed Historic Preservation PA, are

installed in or on an existing structure or within the boundaries of a facility (defined as

an already disturbed area due to regular ground maintenance), do not require structural

reinforcement, no trees are removed, are appropriately sized, and are limited to:

a. Solar Electricity/Photovoltaic—not to exceed 60 kW.

b. Installing and/or repairing solar thermal systems, including solar thermal hot

water systems that are 200,000 BTU/hour or smaller in size.

7. Installing, repairing, or optimizing use of energy storage systems, including

electrochemical and thermal storage systems, provided that projects adhere to the

requirements of the respective state’s DOE executed Historic Preservation PA are

installed in or on an existing structure or within the boundaries of a facility (defined as

an already disturbed area due to regular ground maintenance), do not require structural

reinforcement, no trees are removed, and are appropriately sized not to exceed

400kWh.

States shall adhere to the restrictions of their DOE executed Historic Preservation.

As outlined above, Guam does not have a DOE executed Historic Preservation PA. The Bounded

Categories in Guam’s NEPA determination would be more restrictive than the NEPA

determination for a state with a Historic Preservation PA. Guam must follow the restrictions in

their NEPA determination or submit an EQ1 in the Project Management Center

(https://www.eere-pmc.energy.gov/NEPA.aspx) for DOE review of projects that do not comply

with the restrictions of their NEPA determination.

State are responsible for identifying and promptly notifying DOE of extraordinary

circumstances, cumulative impacts, or connected actions that may lead to significant impacts

on the environment, or any inconsistency with the “integral elements” (as contained in 10

C.F.R. Part 1021, Appendix B) as they relate to a particular Project; compliance with Section 106

of NHPA, and 10 CFR Part 1022.4—Compliance with Floodplain and Wetland Environmental

Review Requirements, as applicable.

28

States must document all activities (e.g., a NEPA log) to ensure compliance with the restrictions

of the Bounded Categories in the NEPA determination. The documentation must be available

for DOE review upon request and be submitted quarterly to [email protected].

States must adhere to the requirements included in the “Historic Preservation” term included

in the Special Terms and Conditions of the financial assistance agreement.

DOE is required to consider floodplain management and wetland protection as part of its

environmental review process (Subpart B of 10 CFR 1022). As part of this required review, DOE

determined requirements set forth in Subpart B of 10 CFR 1022 are not applicable to the

activities described in Bounded Categories 1–5j above that would occur in a floodplain or

wetland because the activities would not have short-term or long-term adverse impacts to the

floodplain or wetland. These activities are administrative or minor modifications of existing

facilities to improve environmental conditions. All other integral elements and environmental

review requirements are still applicable. All projects (except those under Bounded Categories

1–5j) must document that project activities do not occur in a floodplain or wetland. If the

project activities do occur in a floodplain or wetland (except those under Bounded Categories

1–5j), those project activities are subject to additional NEPA review and approval by DOE.

For activities/projects requiring additional NEPA review, sta

tes must complete an EQ1 at

https://www.eere-pmc.energy.gov/NEPA.aspx for review by DOE.

6.4 APPLICATION FORMAT AND CHANGES

6.4 A. CONTENT AND FORM OF APPLICATION

The State Plan application must be submitted via the PAGE online system here.

From the Home PAGE, select ‘Create New Application.’ Once the plan has been completed, be

sure to validate and submit the plan.