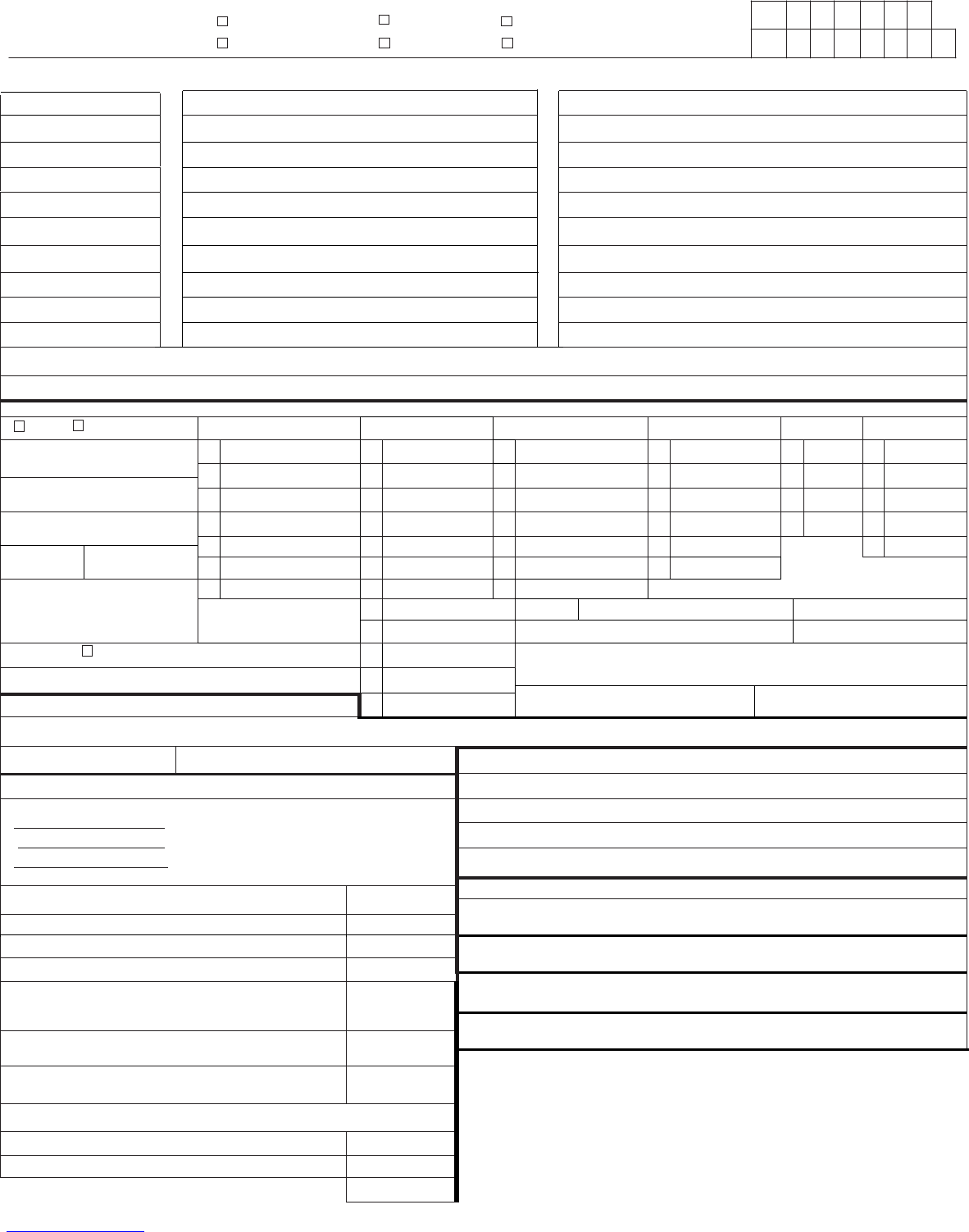

STATE OF MARYLAND — DEPARTMENT OF NATURAL RESOURCES

SECTION 1 — OWNERSHIP

Attach sheet for additional owner

DNRID / FIRST NAME / MIDDLE NAME / LAST NAME

DNRID / FIRST NAME / MIDDLE NAME / LAST NAME

DATE OF BIRTH

OWNER 2

MAILING ADDRESS

OWNER 1

CITY, STATE, ZIP

COUNTY

DRIVER'S LICENSE # &

ISSUING STATE

LAST 4 SSN OR FIN

GENDER

□

MALE

□

FEMALE

□

MALE □ FEMALE

EMAIL ADDRESS

DAYTIME TELEPHONE

EMERGENCY CONTACT

NAME

Tenants in Common Joint Tenants with Rights of Survivorship

SECTION 2 — VESSEL INFORMATION

NEW

USED

VESSEL USE

VESSEL TYPE

HULL MATERIAL

PROPULSION

FUEL

ENGINE DRIVE

HULL IDENTIFICATION #

Pleasure

Open Motorboat

Fiberglass

Propeller

Gasoline

Outboard

Commercial Fishing

Cabin Motorboat

Aluminum

Water-Jet

Diesel

Inboard

MANUFACTURER

Comm Charter Fishing

PWC

Rubber Vinyl Canvas

Sail

Electric

Sterndrive

MODEL

Comm Passenger Carry

Inflatable

Plastic

Manual

Other

Pod-Drive

Commercial Other

Pontoon Boat

Wood

Air Thrust

Other

YEAR

LENGTH

FT. IN.

Demonstration

Auxiliary Sail

Steel

Other

VESSEL NAME

(Documented Vessels Only)

Rent or Lease

Sail Only

Other

Rowboat

ENGINE

TOTAL HORSEPOWER

SERIAL NO.

Houseboat

MANUFACTURER(S)

YEAR

IF TRAILERED

Paddlecraft

USED VESSELS

Current Registration #

If not registered, explain:

LOCATION OF BOAT: RIVER/CREEK

Air Boat

DATE OF PURCHASE: DATE TAXABLE IN MD:

SECTION 3 — SECURITY INTEREST INFORMATION

Other

NAME AND ADDRESS OF SECURED PARTY/LIEN HOLDER

DATE OF LIEN

AMOUNT OF LIEN

SECTION 5 — DEALERS ONLY

DEALER SIGNATURE REQUIRED BELOW IF REQUESTING EXTENSION

SECTION 4 — TAXES & FEES

DEALER LICENSE #

$

($

$

TOTAL PURCHASE PRICE OR FAIR MARKET

VALUE ) TRADE-IN VALUE (DEALER SALES ONLY)

NET PURCHASE PRICE

TEMPORARY DECAL #

□ Brokerage Sale

TRADE-IN HULL ID #

REQUEST/REASON FOR DEALER EXTENSION

SECTION 6 — CERTIFICATION

5% Excise Tax on Net Purchase Price

Minimum - $5.00 Maximum - Tax Cap Applies

I certify under penalty of perjury that I own the vessel described above, that I have verified the hull identification

number, and that the statements made on this application are true and correct to the best of my knowledge and belief.

REQUEST FOR EXTENSION ONLY — I EXPECT TO FORWARD THE COMPLETED APPLICATION WITHIN 15 DAYS.

Reciprocal Credit for Tax Paid to Another State STATE:

Net Excise Tax Due

ALL OWNERS MUST SIGN AND DATE BELOW

Title Fee (MD registered vessels only) $2.00

Signature Date

Registration Fee – 2 year

over 16 ft. or over 7.5 hp $24.00

16 ft. or under with 7.5 hp or under NO FEE

Signature

Date

2-year Documented Use Decal

(documented vessels only) $10.00

DEPARTMENT USE

Security Interest Filing Fee

— remit only if lien is to be recorded $15.00

Penalty and interest are due when excise tax has not been

paid within 30 days of Maryland tax liability. (See reverse)

Penalty — 10% of excise tax

Interest — 1.5% per month

MAKE CHECK PAYABLE TO “DNR”

TOTAL DUE

DNR B-240 (7/24)

www.dnr.maryland.gov

MD

USCG

APPLICATION FOR: (CHECK ONE)

MARYLAND REGISTERED VESSEL

DOCUMENTED VESSEL

TITLE & REGISTRATION

DECAL & TAX PAYMENT

TITLE ONLY

DECAL ONLY

REGISTRATION ONLY

TAX PAYMENT ONLY

DATE DECAL ISSUED:

Vessel to be titled for which ownership type - Select One:

Sole Owner

PLEASE TYPE OR PRINT IN BLACK OR BLUE INK ONLY

X

X

DNRID/FULL LEGAL NAME

EMERGENCY CONTACT

PHONE #

EMERGENCY CONTACT

EMAIL ADDRESS

DEFINITIONS

Bill of Sale – A document executed by the seller that shows seller’s name and address, purchaser’s name and address, date of sale, complete vessel description,

and the gross purchase price of the vessel

Certificate of Origin – The manufacturer’s or importer’s document of “title” which establishes ownership of a vessel and provides for the transfer of that ownership

progressively from the manufacturer or importer to the dealer and purchaser

Excise tax -- §8-710.3(a) imposes a 5% vessel excise tax on all vessels operated principally in Maryland

Fair market value

§8-716(a)(3)(i) –Purchased from a licensed dealer – total purchase price as certified by the dealer on a form acceptable to the Department

§8-716(a)(3)(iii) -- All other transactions – either (a) the total purchase price verified by a Bill of Sale approved by the Department, or (b) the valuation

shown in a national publication of used vessel values adopted by the Department

Hull identification number – 12 character alpha-numeric number required by the U.S. Coast Guard to be permanently affixed, engraved or embossed on the

vessel by the manufacturer (the Department will assign a HIN to home built boats)

Interest -- §8-716.1(d)(1) – 1.5% per month or fraction of a month from the time the tax was due until paid

Length – overall length of the deck (feet and inches) from bow to stern measured in a straight line

Manufacturer – name of the builder – if home built, write in “custom”

Penalty -- §8-716.1(d) (1) – 10% of vessel excise tax – assessed when tax is not paid within 30 days of incurring liability

Purchase price -- §8-716(a)(5) – the total price of a vessel at the time of sale, including motor, accessories, freight-in, duty (if any), and excluding the price of

a trailer. Preparation charges are not taxable.

Reciprocal credit -- §8-716(f)(1) – credit for tax previously paid in another state – vessel must have been titled or registered in another jurisdiction or federally

documented and principally operated in another jurisdiction -- requires proof of tax payment to the other jurisdiction.

Registration number

Documented vessels – 6 or 7-character identifier assigned by the U.S. Coast Guard

All other vessels – 8-character identifier assigned by the state of registration in the format XX 1234 XX, with the 1

st

two letters identifying the state of

registration

State of principal operation – The jurisdiction in whose waters a vessel is or will be operated most during a calendar year

Tax liability

If your vessel was purchased in Maryland and will operate in Maryland waters a majority of the calendar year, you ARE liable for vessel excise tax and

must register the vessel within 30 days of purchase to avoid assessment of penalty and interest.

If your vessel was purchased elsewhere or previously registered in another jurisdiction, is now in Maryland waters, and will operate in Maryland waters a

majority of the calendar year, you ARE liable for vessel excise tax and must register the vessel within 30 days of entering Maryland waters.

If your vessel is duly registered in another jurisdiction but remains in Maryland waters more than 90 days in a calendar year, you MAY be liable for vessel

excise tax unless you can prove principal operation (as defined above) in another jurisdiction.

Trade-in – applicable only to sales by licensed dealers – a completed ‘Trade-In Verification Statement’ must be submitted with application

Vessel type – style that most accurately describes the vessel

Year – model year

– if custom, use the year vessel was built

Engine drive – describes engine type Sterndrive = Inboard/Outboard Pod-Drive = an engine mounted in front of the transom of a vessel and attached through

the bottom of the hull to a steerable propulsion unit

Tenants in Common – Ownership share becomes an asset of the estate of the deceased

Joint Tenants with Rights of Survivorship – Surviving parties receive equal ownership

INSTRUCTIONS

The following documents must accompany applications for title and/or registration for

v

essels to be REGISTERED in Maryland:

New

v

esse

l

--

original

M

anufac

turer’s

Certificate of Origin assigned to purchaser(s)

and original Bill of Sale (if Certificate of Origin does not contain the purchase price)

Used vessel

The following documents must accompany applications for a use

decal and/or tax

payment for DOCUMENTED vessels:

USCG stamped Bill of Sale

Photocopy of current Certificate of Documentation

Proof of prior tax paid (if seeking reciprocity credit)

REQUEST FOR EXTENSION:

Automatic 15-day extension granted, with additional

extensions at the Department’s discretion

Request for Extension must be submitted and taxes and

fees paid within 30 days of purchase

Attach copy of Bill of Sale

Original Bill of Sale and/or original title (see definition above)

o Seller must provide explanation if vessel was not

previously numbered or documented

Original Lien release (if applicable)

If

previously federally documented:

o Photocopy of seller’s most current Certificate of

Documentation

o USCG Abstract of title

o Release of ship’s mortgage (if applicable)

If previously registered in a nontitle state:

o Photocopy of most current out-of-state registration

certificate

BUSINESS HOURS ARE 8:30 TO 4:30 MONDAY THROUGH FRIDAY BY APPOINTMENT ONLY (EXCEPT STATE HOLIDAYS)

PLEASE MAKE CHECKS PAYABLE TO DNR

Annapolis Service Center

160 Harry S. Truman Pkwy

P. O. Box 1869

Annapolis MD 21404

410-260-3220

410-260-3281 (Fax)

Frederick Service Center

1601-A Bowman's Farm Rd.

Frederick, MD 21701

240-236-9950

240-236-9953 (Fax)

DNR B-240 (7/24)

dnr.maryland.gov

Bel Air Service Center

501 W. MacPhail Rd. #2

Bel Air, MD 21014

410-836-4550

410-836-4562 (Fax)

Solomons Service Center

14175 Solomons Island Rd. S

P. O. Box 1309

Solomons, MD 20688

410-535-3382

410-535-4737 (Fax)

Centreville Service Center

120 Broadway Ave. #5

Centreville, MD 21617

410-819-4100

410-819-4110 (Fax)

Salisbury Service Center

251 Tilghman Rd. #2

Salisbury, MD 21804

410-713-3840

410-713-3849 (Fax)

Essex Service Center

1338 Eastern Blvd. A

Essex, MD 21221

667-401-0760

667-401-0765 (Fax)

(No Mail. Open Mon/Wed

/Fri)

Cumberland Service Center

13300 Winchester Road, SW

Cumberland, MD 21502

301-777-2134

301-777-5865 (Fax)

(No Mail. Open Tues/Thurs)

Credit card only at this location

1-866-344-8889

EMERGENCY CONTACT INFORMATION:

Recent legislation, SB674, which is effective July 1, 2024,

states that the Department may collect alternate

emergency contact information for the vessel owner to

have on record should the vessel become abandoned.