1

INTERACTIVE TITLE AND

REGISTRATION MANUAL

FOR DEALER’S / TITLE SERVICES/ VEHICLE PROGRAMS

The Motor Vehicle Administration is pleased to provide online

guidance to dealers and title services. This manual is intended to

assist you with the proper completion of your transactions,

increase accuracy and reduce rejections of work. The information

provided will increase the efficiency of processing work, which

leads to greater customer service and satisfaction. The information

contained in this manual is based on law, regulation, policy,

process, and procedures of this Administration.

2

The MDOT MVA Mission

MDOT mission: The Maryland Department of Transportation is a customer-driven leader that delivers safe,

sustainable, intelligent, and exceptional transportation solutions in order to connect our customers to life's

opportunities.

MDOT MVA vision: The MDOT MVA shall provide exemplary driver and vehicle services that promote

Maryland's mobility and safety while enhancing process and product security.

MDOT MVA is focused on the following key areas which reflect our premier customer service culture with

respect to our products and services offered to the residents of Maryland.

SAFETY

•

Promote the safety and security of Maryland residents with the products and services MDOT MVA

provides.

•

Reduce fatalities and severe injuries on Maryland roads.

•

Ensure that MDOT MVA offices are safe and inviting to customers and staff.

SECURITY

•

Ensure all products, processes, and services provided by MDOT MVA meet the highest level of

security standards and are updated on a regular basis.

•

Safeguard all data and the integrity of personal and confidential information provided by MDOT MVA

customers.

INNOVATION

•

Deploy technology and processes that enable customers to interact with MDOT MVA how, when, and

where they want.

•

Use innovative technology that is current, right for the job, adaptive, and free of obstacles.

•

Provide clear, concise, consistent, and responsive communication.

PARTNERSHIP

•

Offer customer access to a variety of secure and convenient government products and services

through MDOT MVA branch offices, web, and kiosk.

•

Foster and maintain connections/partnerships with other organizations that add value and provide

convenience and opportunities for MDOT MVA customers.

•

Establish strong and effective partnerships to help achieve zero fatalities on our roadways.

3

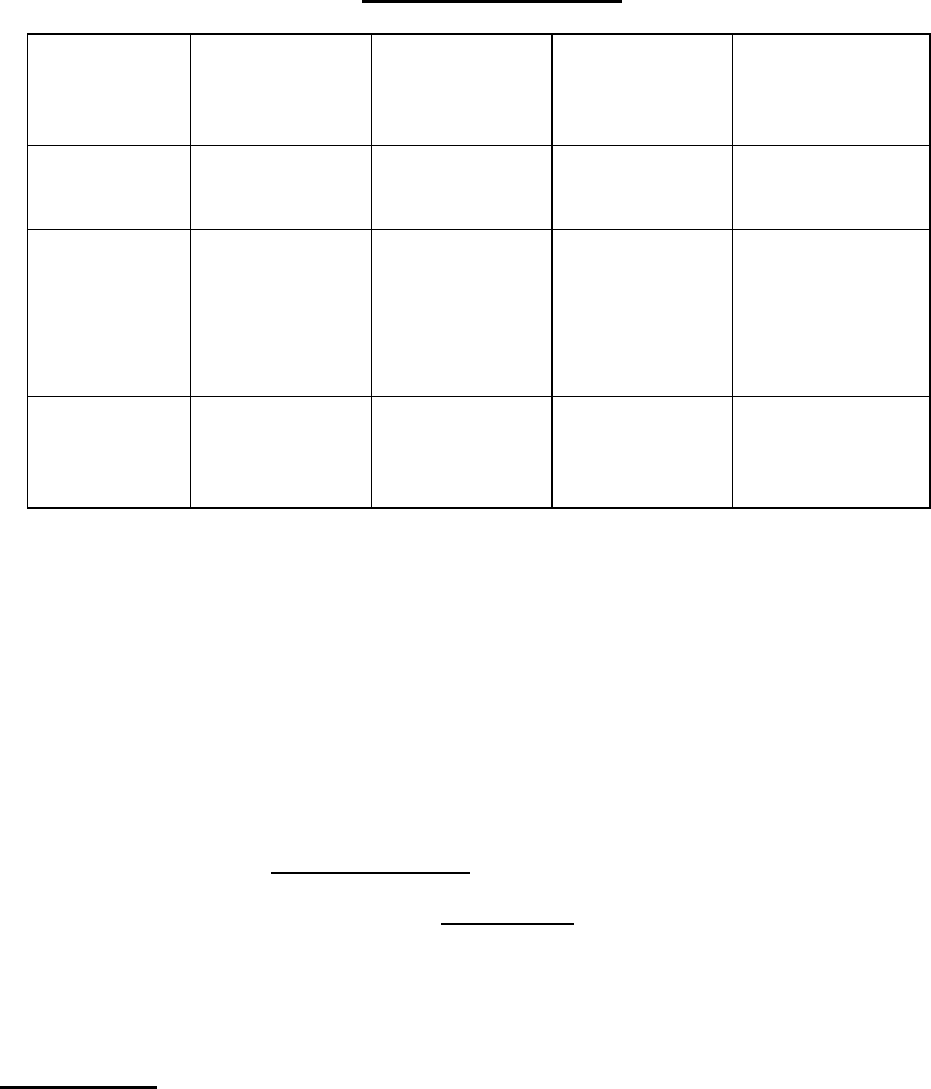

TABLE OF CONTENTS

MVA’s Mission 2

Table of Contents 3-4

MVA Contacts 5

MVA’s Website 6

Documents Required for Basic Titling Transactions 7

New Vehicle Purchased from a Dealer 8

Used Vehicle Purchased from a Dealer 9

Used Vehicle from Someone “Other than” a Dealer 10

Gifted Vehicle Between Immediate Family Members 11

Moving to Maryland—Used Vehicle Already Owned 12

Homemade Trailer 13

Properly Assembly of Title Records 14

Submitting Title Work to the MVA 15

Transmittal Sheet 16

Special Note for ERT Dealer Work 17

What Transactions Can ERT Dealers Process Electronically 18

What Transactions CANNOT be Processed by ERT Dealers Electronically 19

What Transactions Can ERT Title Services Process Electronically 20

Ordering Forms 21

eService Portal and Drawdown Account 22-23

How Do I Purchase a Maryland Vehicle Law Book 24

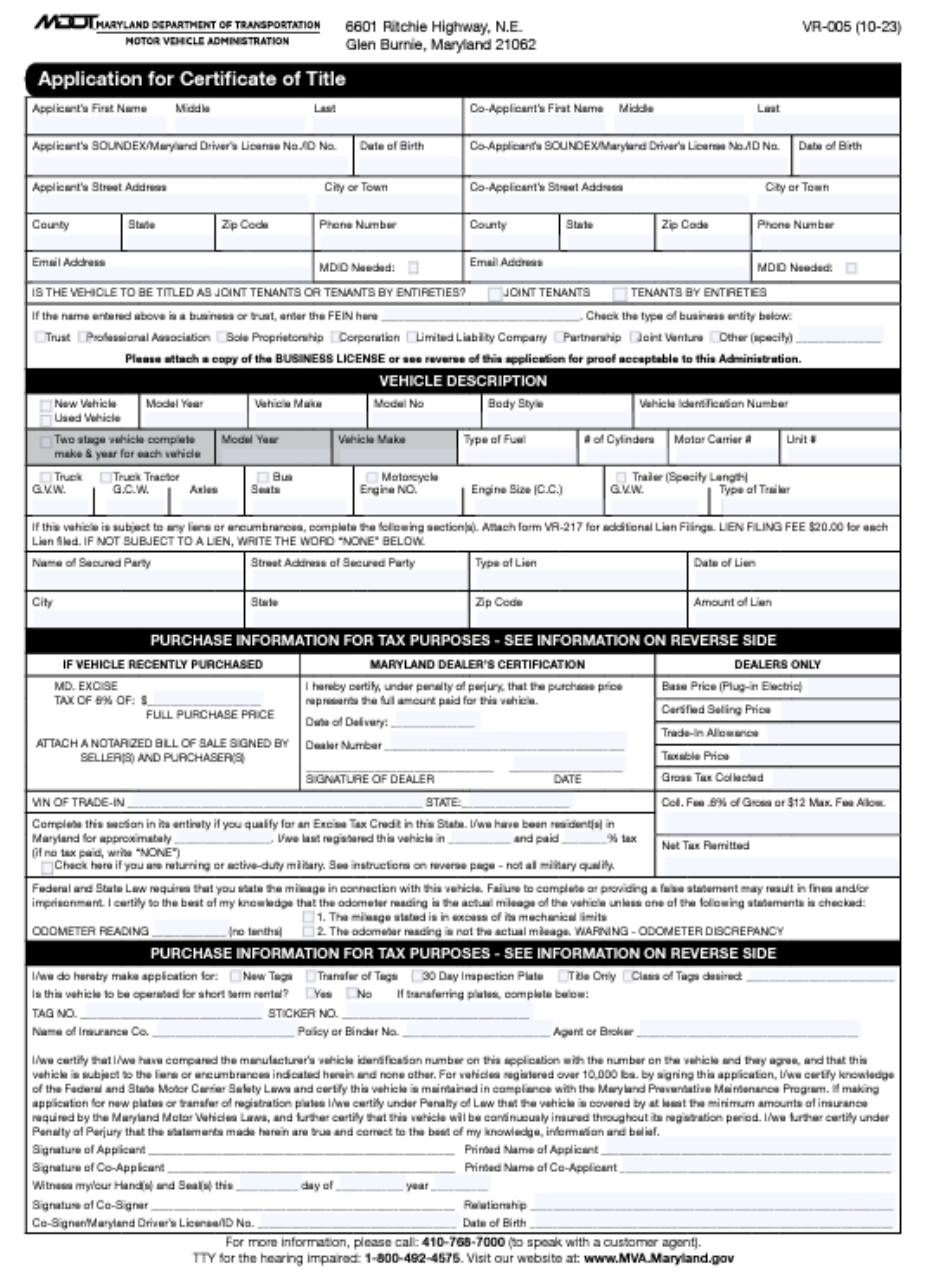

The Application for Certificate of Title – VR-005 25

Application for Certificate of Title—VR-005 Front 26

Application for Certificate of Title—VR-005 Back 27

Proper Completion of the Application for Certificate 28-59

Maryland Clean Cars Act 2007 60-61

Truth in Mileage Act of 1986 62

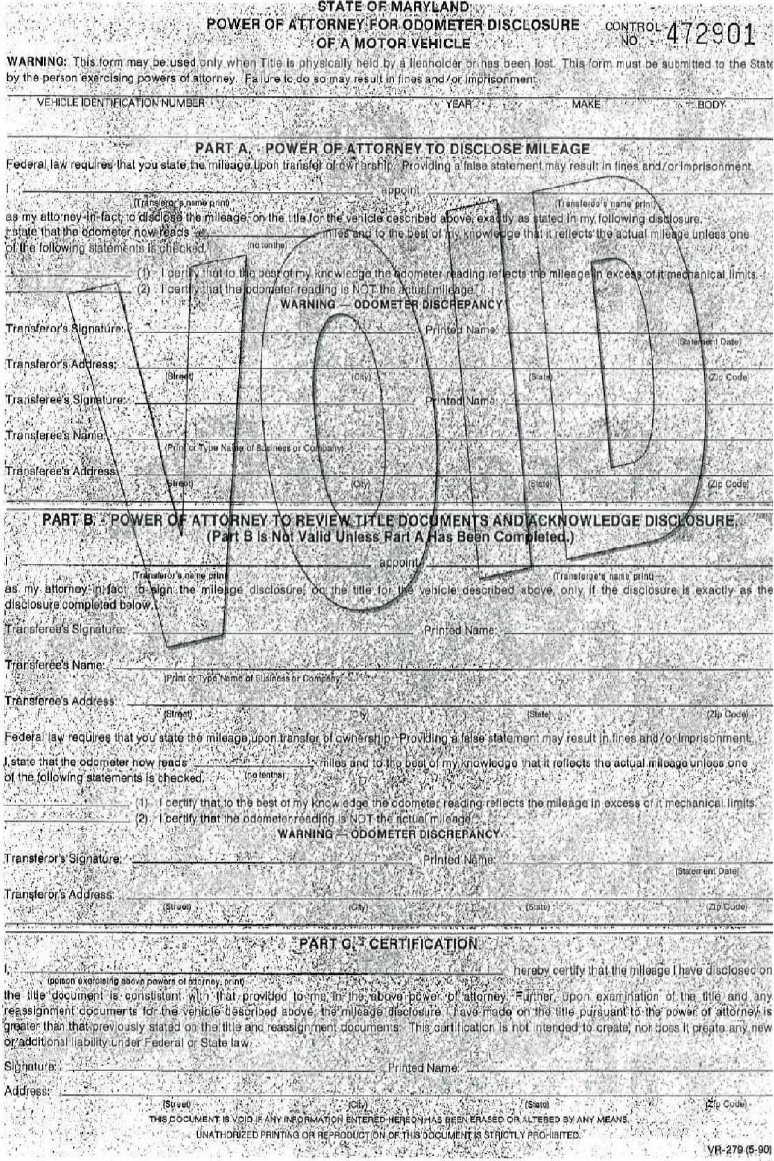

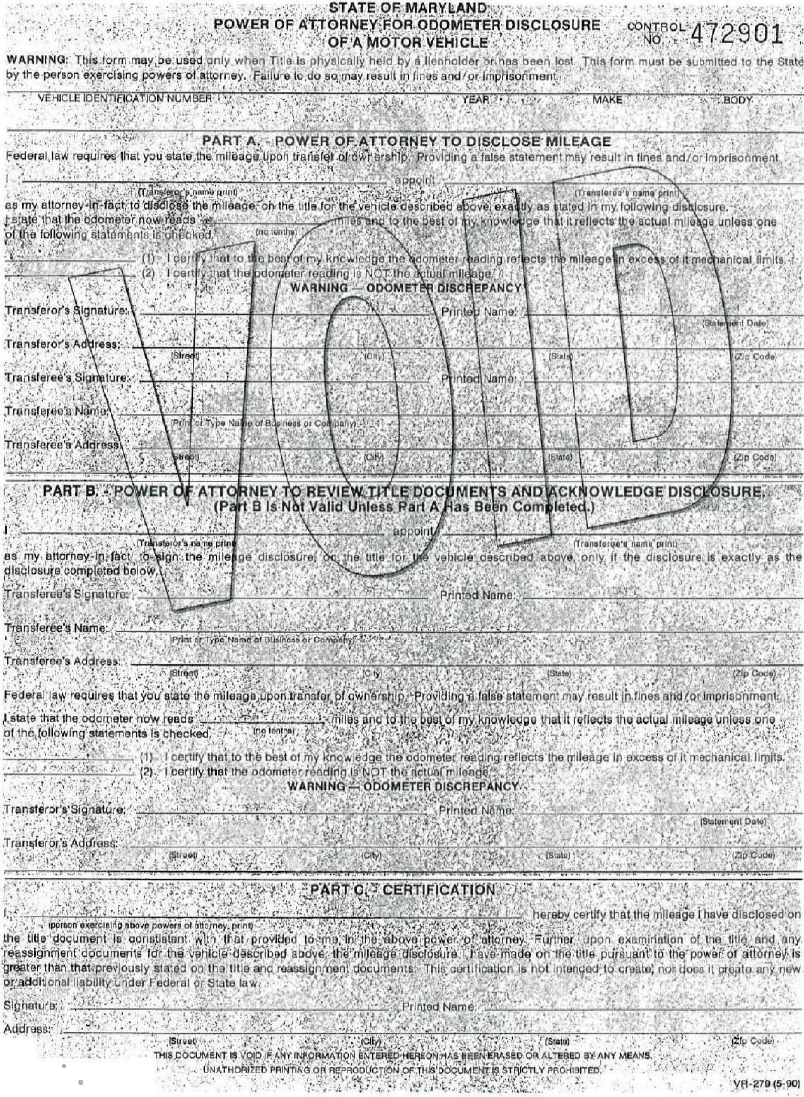

Power of Attorney 63

Power of Attorney for Odometer Disclosure Form 64

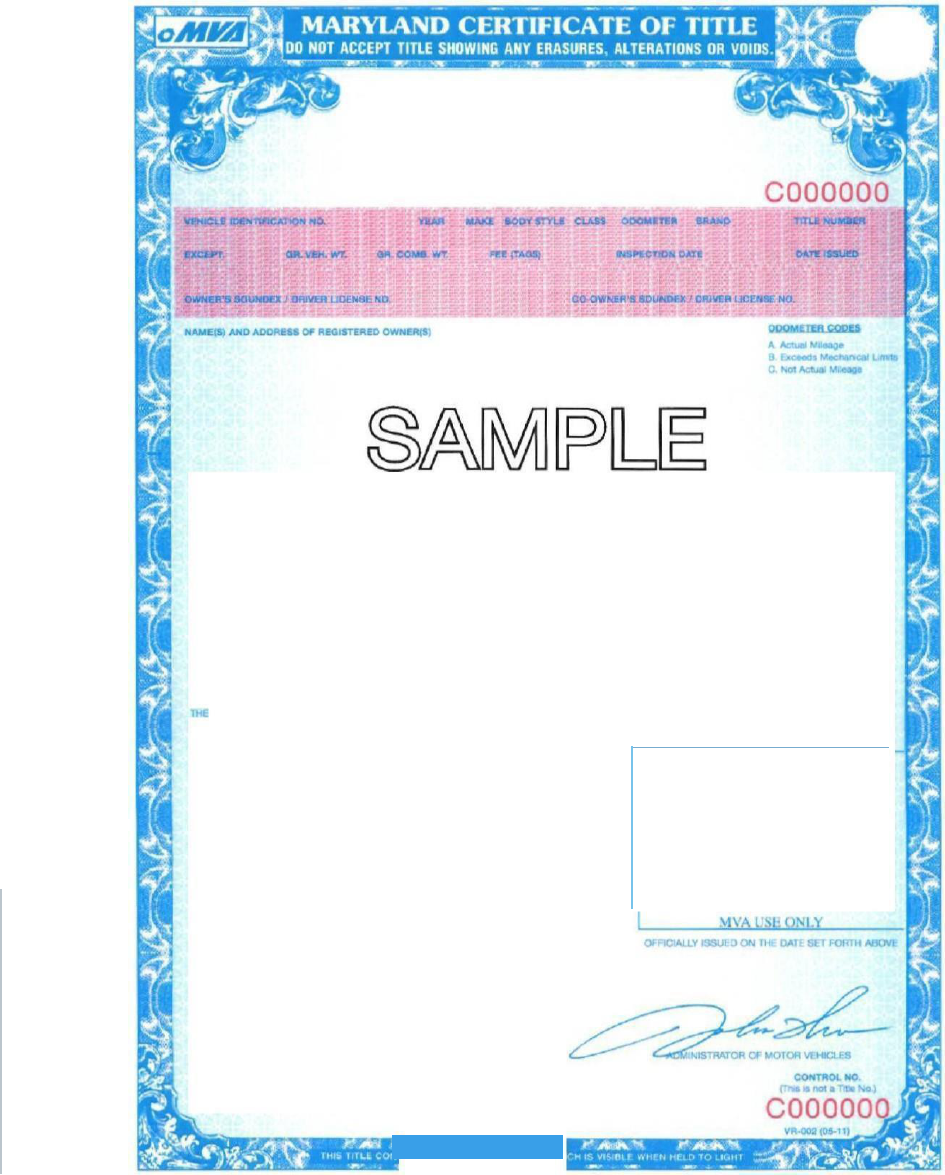

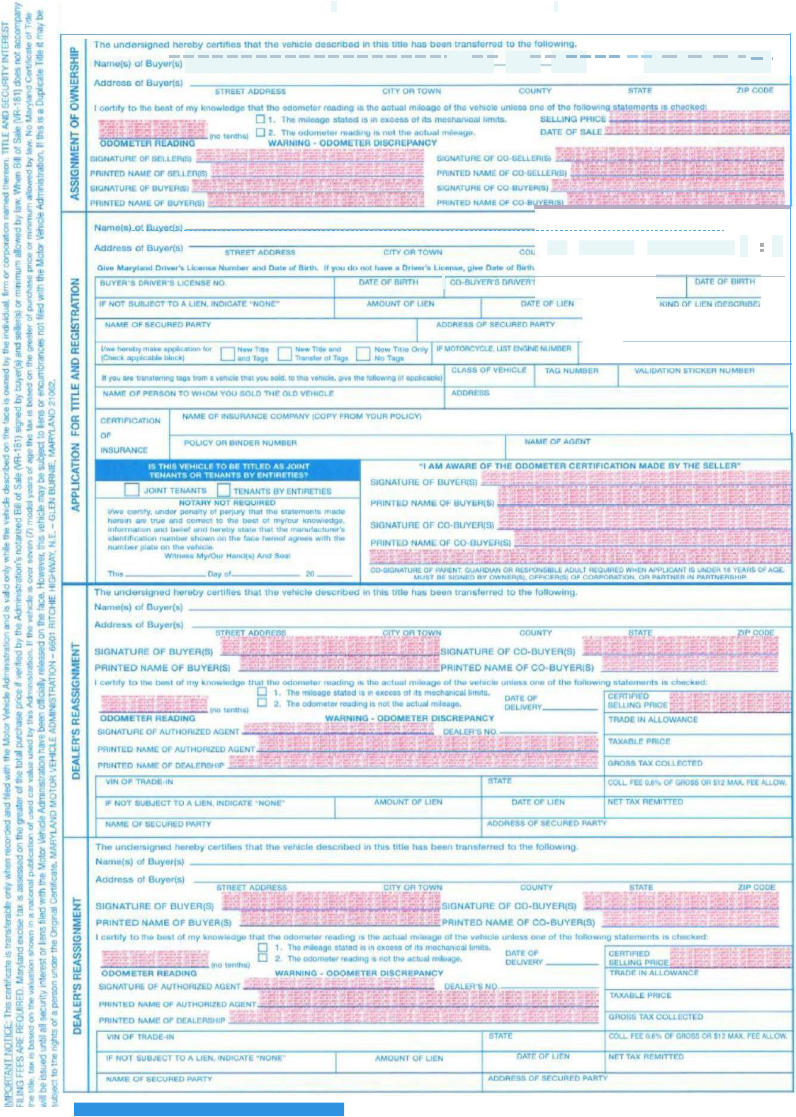

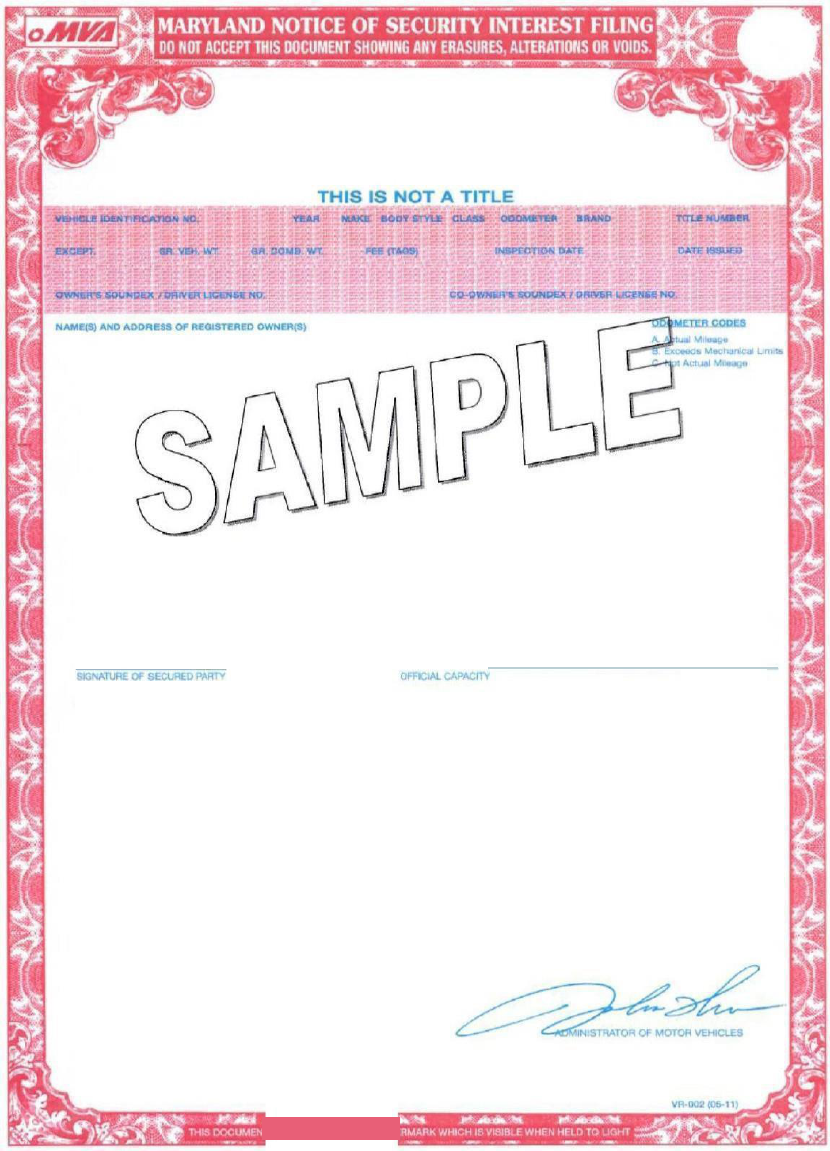

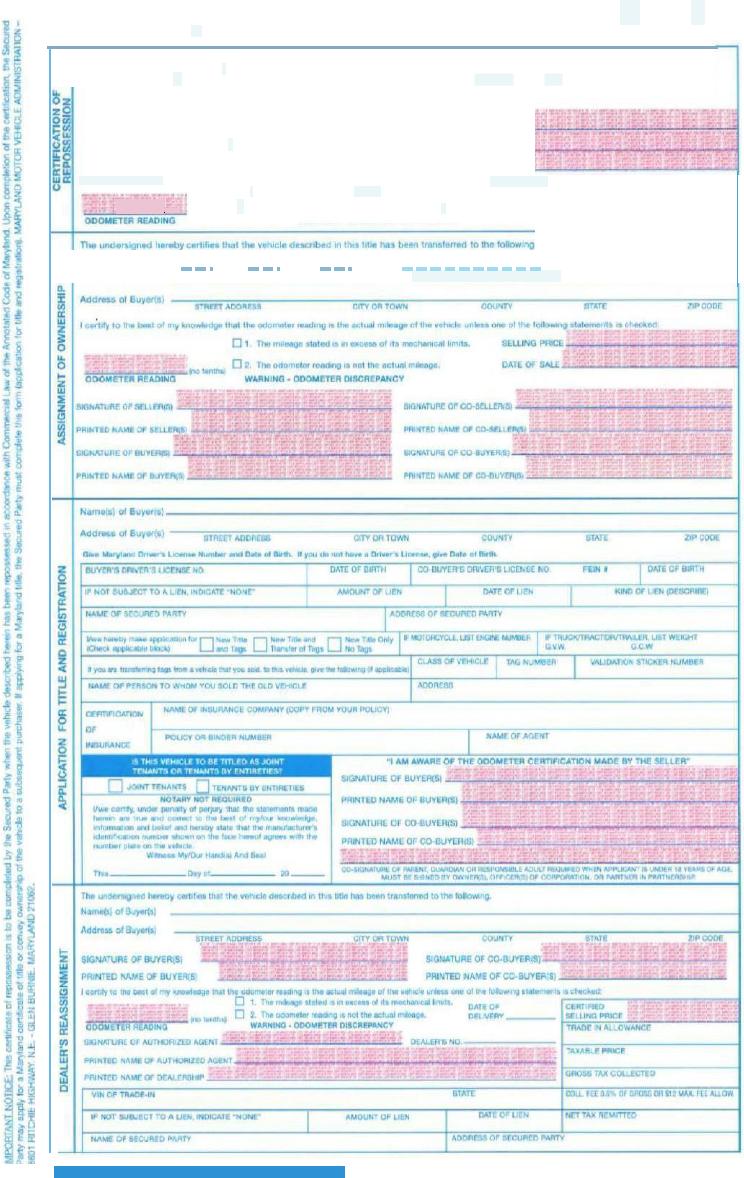

Secure Documents/Maryland Title and Security Interest Filing 65-69

Non-Conforming Documents/Reassignment Disclosure Language 70

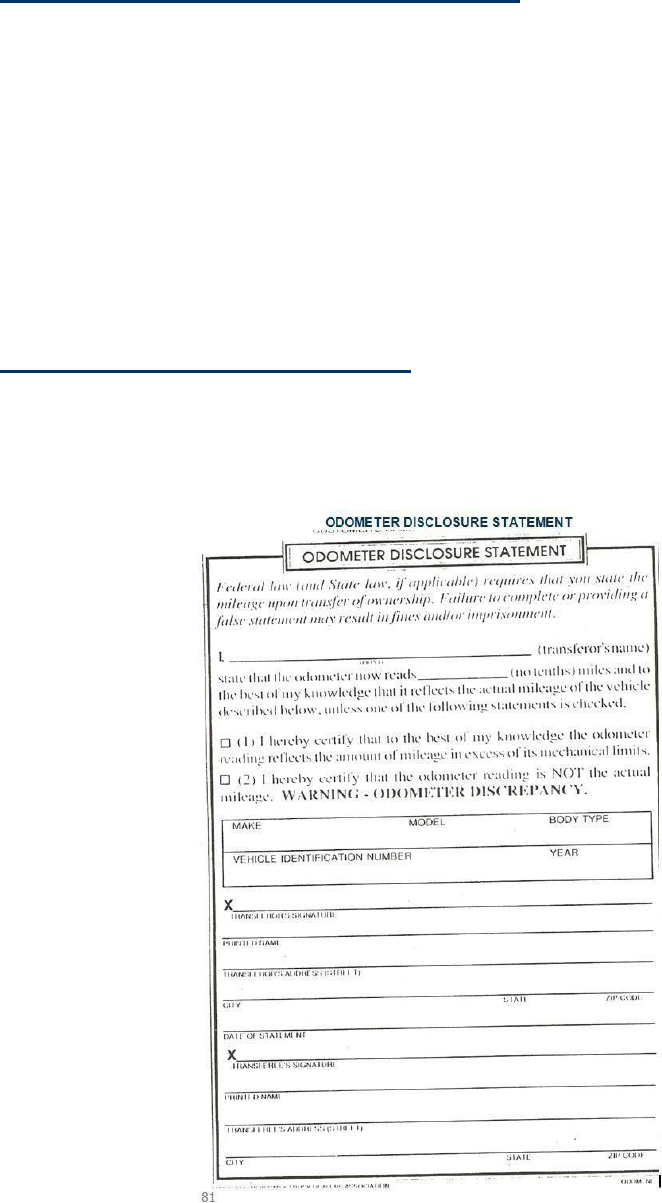

Exceptions to Odometer Disclosure Requirements/Odometer Disclosure 71-72

Involuntary Divestiture (Non-Owner Involvement)/Odometer/Mileage Reading 73

Brands/Exemptions

Record Retention Odometer Disclosure Statement/Leased Vehicles 74-75

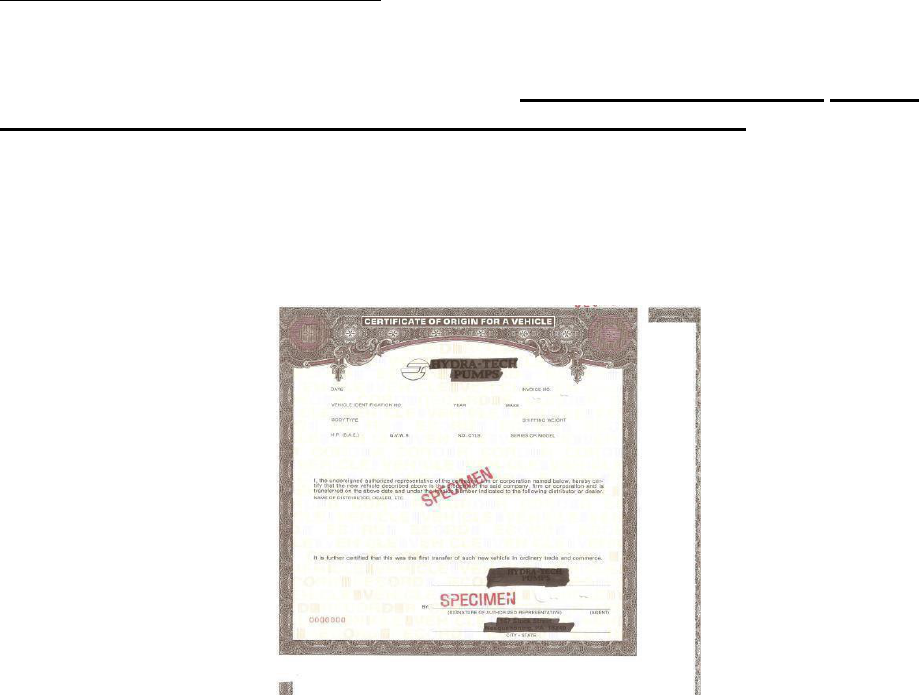

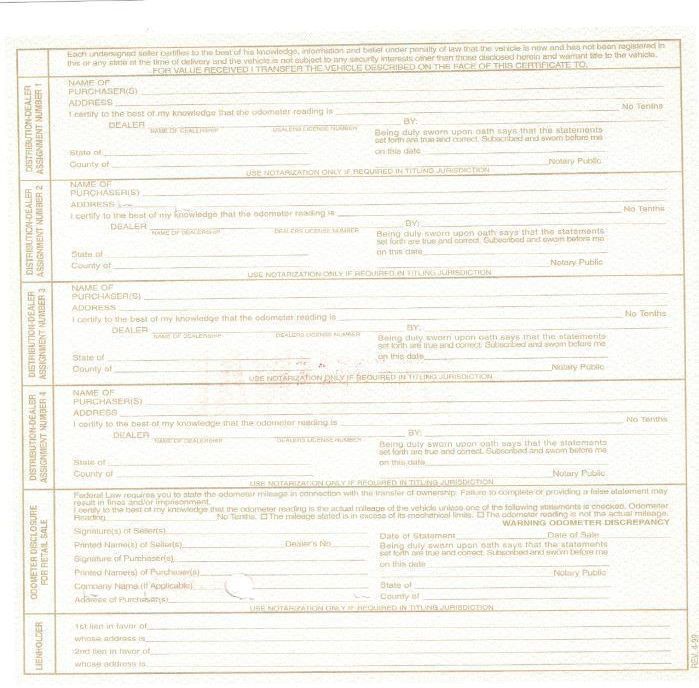

Certificate of Origin 76-79

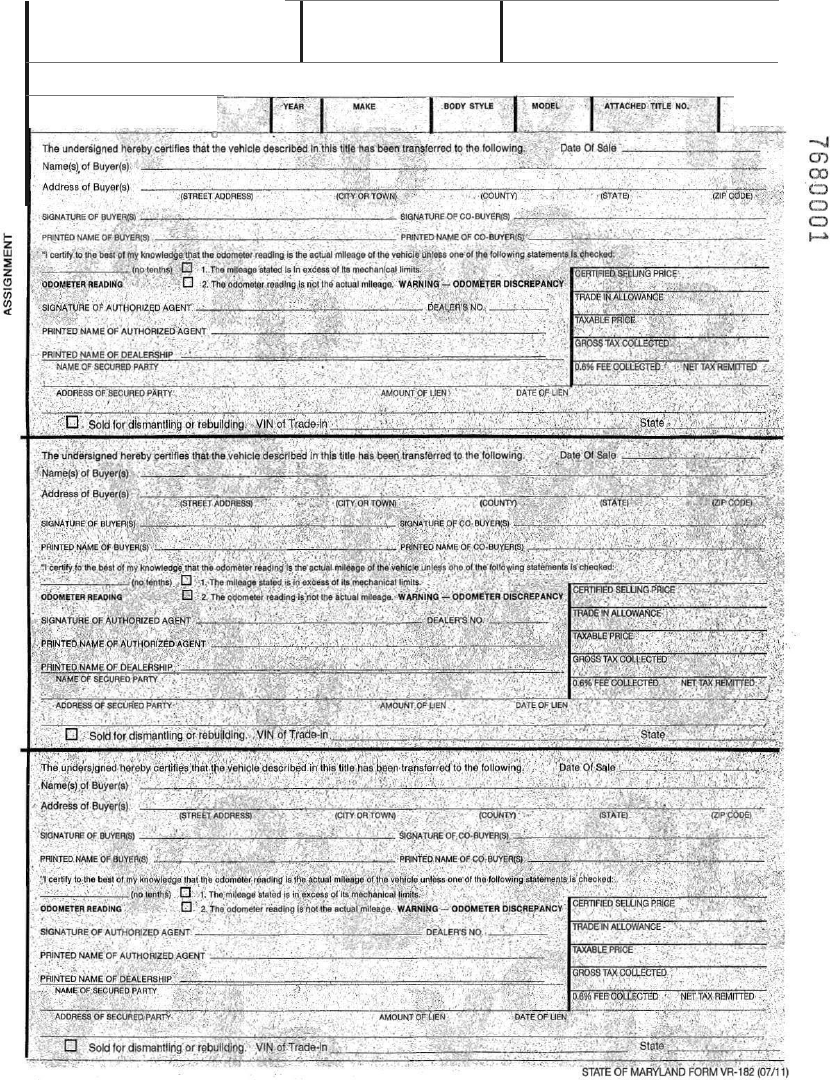

Maryland Certificate of Title Info 80-81

Maryland Notice of Security Interest Filing (SIF) 82-83

Maryland Dealer Reassignment 84-85

Out of State Titles 85

Lien Release 86

Electronic Lien Recording 87-88

Safety Inspection Requirements 89-90

Vehicles Acquired By Dealers Under Unusual Circumstances 91

4

Supporting Documents for Titling Transactions 92-100

Title 11-Subtitle 15 – Chapter 14 Certificates of Title

Dealer Resale Titles 102

Affidavit in Lieu of Title 103

Reasons Title Work May Be Rejected Dealer Duplicate Titles 104-105

Excise Tax Credit for Lemon or 60 Day Buy Back Vehicles 106

Salvage Certificates/Salvage Chart 107-109

Fraud Alert 110

Grey Market Vehicles/Helpful U.S. and National Phone Numbers 111

Vehicle Programs Legislation Effective June, July and October 2021 112-114

5

MOTOR VEHICLE ADMINISTRATION (MVA) CONTACTS

Business Licensing & Driver Instructional Services Phone

•

Manager 410-768-7035

•

Assistant Manager 410-424-3045

•

Section Manager ERT UNIT 410-762-5047

•

Supervisor BLS 410-787-7951

•

Compliance Manager 410-424-3750

Insurance Compliance Division

•

Manager 410-768-7663

•

Section Manager 410-768-7699

•

Supervisor – Phone Panel/Helpdesk 410-762-5170

•

Supervisor – Mail Review 410-787-7963

•

Supervisor – Media Processing/UMC + Judgement Cases 410-768-7310

•

Insurance Compliance Flags 410-424-3656

Motor Carrier & Electronic Services

•

To contact someone in this unit you may dial or 410-787-2951 or

Vehicle Services

•

Manager 410-787-2970

•

Assistant Manager 410-424-3644

•

Assistant Manager 410-768-7512

•

Section Manager ELS/Online Response Unit 410-787-7828

•

Section Manager 410-768-7223

•

Supervisor NMVTIS/Refunds 410-787-7871

•

Supervisor Certified Copies/Tag Return 410-787-2972

•

Supervisor Corrections/Mail-in Title/Repo/Reg Renewals/Plates 410-762-5190

•

Supervisor Flagging Unit/Salvage Unit/Duplicate Titles/Liens 410-424-3679

•

Supervisor Dealer Services 410-768-7374

6

MVA’s WEBSITE

You will find helpful information at our website.

www.mva.maryland.gov

Learn how to:

Sign up to receive Dealer Bulletins

Search for information not found in this manual,

Obtain information regarding fines for late submission of dealer work,

And much more!

This Photo by Unknown Author is licensed under CC BY-NC

7

Documents Required for Basic

Titling Transactions

•

NEW VEHICLE PURCHASES FROM A DEALER

•

USED VEHICLE PURCHASED FROM A DEALER

•

USED VEHICLE PURCHASED FROM SOMEONE “OTHER THAN A DEALER”

•

GIFTED VEHICLE BETWEEN IMMEDIATE FAMILY MEMBERS (WITHIN

MARYLAND)

•

MOVING TO MARYLAND – USED VEHICLE ALREADY OWNED

•

HOMEMADE TRAILER

This Photo by Unknown Author is licensed under CC BY-SA-NC

8

NEW VEHICLE PURCHASED FROM A DEALER

Complete and submit the following documents:

Application for Certificate of Title, Form VR-005

Certificate of Origin - properly assigned

Dealers Reassignments - (if needed) - Be sure there is a complete sequence of

ownership from the owner to the first dealer, to any subsequent dealers, and finally to the retail

buyer.

Original Dealers Bill of Sale - (photocopies are only accepted if notarized)

Note: Maryland Dealers may complete the certification section on the Application for Certificate

of Title, (Form VR-005) or the certification on the dealer’s reassignment.

Odometer Disclosure Statement - on the reverse of the Certificate of Origin and/or

any accompanying dealer reassignments. The odometer disclosure may also be on a

separate odometer disclosure statement. All odometer disclosures must meet federal

requirements.

Insurance coverage - with a company licensed to insure vehicles in Maryland. Provide the full

name of the company, policy or binder number and the agent’s name.

Trailers do not require insurance unless rented or leased.

New Tags - If purchasing tags, submit the two-year registration fee (including surcharge) for

the class of tags desired. Only trucks (1-ton and larger) and tractors pay a one-year registration

fee. See fees for registration plates under the Vehicle Services heading at

https://mva.maryland.gov/about-mva/Pages/fees.aspx. All classes of vehicles have staggered

registration and the month of titling will be the month of registration renewal.

Registration Card - Submit the registration card if transferring tags. Tags may be transferred

to a vehicle in the same owner’s name, between parents and children, and between husband and

wife. Tags may only be transferred to vehicles of vehicle classes A, M and E.

Tag transfer fee is $10.00 - If the tags being transferred are valid for less than a year, there

will also be an additional year’s registration fee and surcharge collected.

Taxes - Excise tax is 6% of the price certified by the dealer, less trade-in allowance, with no

allowance for down payment or manufacturer’s rebate. Maryland dealers may charge a processing

fee up to $500.00. This processing fee must be added to the purchase price and is taxable. NOTE: The

processing fees charged by out of state dealers are sometimes higher. The “full amount” charged for a

processing fee by an out of state dealer is taxable. Non-taxable items include dealer discount or dealer

rebates, extended warranties, mechanical repair contracts, electronic registration fees, federal excise tax,

and equipment installed to accommodate a disabled individual. See complete procedures for calculating

total purchase and taxable price in Code of Maryland Regulation (COMAR) 11.15.33.00.

Title Fee $100.00, except for rental vehicles $50.00, and motor scooters and mopeds

$20.00. Lien Filing Fee $20.00 for each lien recorded.

USED VEHICLE PURCHASED FROM A DEALER

Complete and submit the following documents:

Application for Certificate of Title, Form VR-005 or complete the application for title on the

reverse of the Maryland title,

Certificate of Title properly assigned.

Be sure there is a complete sequence of ownership from the

owner to the first dealer, to any subsequent dealers, and finally to the retail buyer.

When titling a vehicle, be sure you have the most recent title.

Dealer Reassignments (

if applicable

) – Be sure to attach any separate dealer reassignments required to

complete the sequence of ownership as stated above.

Original Dealers Bill of Sale (photocopies are only accepted if notarized)

Note: Maryland Dealers may complete the certification section on the Application for Certificate of Title

(Form VR-005) or the certification on the dealer’s reassignment.

Maryland Safety Inspection Certificate – For vehicles held in dealer inventory only, inspections are

valid for up to 6 months; or until 1000 miles has been added to the vehicle’s odometer. Note: Trucks (1

ton and larger), tractors and freight trailers may be sold un-inspected by Maryland dealers and the MVA

may sell a 30-day temporary registration to be used by the owner to complete the inspection process.

Lien Release (

if applicable

) - An acceptable lien release is a Maryland Notice of Security Interest Filing

form properly signed on the front by the lien holders authorized representative; or a lien properly

released on an out of state title; or a letter on the lien holders original letter head releasing the lien (See

additional information on requirements for lien release letters in this manual). Unless the lien release

letter is being provided to you directly from the lien holder, it is wise to verify the lien release and get

positive identification from any customer presenting a lien release letter.

Odometer Disclosure Statement

- Odometer statements are contained on all titles in compliance with the

federal truth in mileage act. Separate odometer disclosure statements are acceptable if properly signed and

completed by the seller and buyer. (See complete information on proper odometer disclosure in this manual)

Insurance coverage with a company licensed to insure vehicles in Maryland. Provide the full name of

the company, policy or binder number and the agent’s name.

Trailers do not require insurance unless rented or leased.

New Tags - If purchasing tags, submit the two-year registration fee (including surcharge) for the class

of tags desired. Only trucks (1-ton and larger) and tractors pay a one-year registration fee. See fees for

registration plates under the Vehicle Services heading at www.mva.maryland.gov. All classes of vehicles

have staggered registration and the month of titling will be the month of registration renewal.

Registration Card – Submit the registration card if transferring tags. Tags may be transferred to a vehicle

in the same owner’s name, between parents and children, and between husband and wife. Tags may only be

transferred to vehicles of the same class.

Tag transfer fee is $10.00. If the tags being transferred are valid for less than a year, there will also

be an additional year’s registration fee and surcharge collected.

Taxes - Excise tax is 6% of the price certified by the dealer, less trade-in allowance, with no allowance

for down payment or manufacturer’s rebate. Maryland dealers may charge a processing fee up to

$500.00. This processing fee must be added to the purchase price and is taxable. NOTE: The processing

fees charged by out of state dealers are sometimes higher. The “full amount” charged for a

processing fee by an out of state dealer is taxable. Non-taxable items include dealer discount or dealer

rebates, extended warranties, mechanical repair contracts, electronic registration fees, federal excise tax,

and equipment installed to accommodate a disabled individual. See complete procedures for

calculating total purchase and taxable price in Code of Maryland Regulation (COMAR) 11.15.33.00.

Title Fee $100.00, except for rental vehicles $50.00, and motor scooters and mopeds $20.00.

Lien Filing Fee $20.00 for each lien recorded.

9

10

USED VEHICLE PURCHASED FROM SOMEONE “OTHER THAN” A DEALER

Complete and submit the following documents:

Application for Certificate of Title, Form VR-005 or complete the application for title on the

reverse of the Maryland title,

Certificate of Title properly assigned. Be sure you have the most recent title.

Notarized Bill of Sale Form VR-181 with the signatures of all sellers and buyers should be

provided for vehicles 7 or less years old.

Maryland Safety Inspection is valid for 90 days from the date of inspection. Once recorded with the

MVA, the inspection certificate is only valid for 30 days from the date of inspection for a resale. If an

inspection certificate is not provided, the customer may complete a Temporary Inspection Waiver Form

VR-129 to obtain a 30-day temporary registration.

Insurance coverage with a company licensed to insure vehicles in Maryland. Provide the full name of

the company, policy or binder number and the agent’s name.

Trailers do not require insurance unless rented or leased.

Lien Release (if applicable) - An acceptable lien release is a Maryland Notice of Security Interest Filing

form properly signed on the front by the lien holders authorized representative; or a lien properly

released on an out of state title; or a letter on the lien holders original letter head releasing the lien (See

additional information on requirements for lien release letters in this manual). Unless the lien letter is

being provided to you directly from the lien holder, it is wise to verify the lien release and get positive

identification from any customer presenting a lien release letter.

New Tags - If purchasing tags, submit the two-year registration fee (including surcharge) for the class

of tags desired. Only trucks (1-ton and larger) and tractors pay a one-year registration fee. See fees for

registration plates under the Vehicle Services heading at www.mva.maryland.gov. All classes of vehicles

have staggered registration and the month of titling will be the month of registration renewal.

Registration Card - Submit the registration card if transferring tags. Tags may be transferred to a vehicle

in the same owner’s name, between parents and children, and between husband and wife. Tags may only

be transferred to vehicles with A, M or E class.

Tag transfer fee is $10.00. If the tags being transferred are valid for less than a year, there will also

be an additional year’s registration fee and surcharge collected.

Taxes

- Vehicles less than 7 years old – When a notarized bill of sale accompanies the title, the

excise tax is 6% of “the greater of” the purchase price on the bill of sale or $640.00 ($320.00 for

trailers).

If the bill of sale does not accompany the title, the excise tax is 6% of the greater of the

purchase price on the title, or the NADA clean retail book value of the vehicle. Minimum excise tax is

$38.40 ($19.20 for trailers, motor scooters and mopeds).

Taxes – Vehicles 7 years old and older – Excise tax is 6% of the greater of the purchase price on the

title or $640.00 ($320.00 for trailers, motor scooters and mopeds). Minimum excise tax is $38.40

($19.20 for trailers).

Title Fee $100.00, except for rental vehicles $50.00, and motor scooters and mopeds $20.00.

Lien Filing Fee $20.00 for each lien recorded.

11

Gifted Vehicle Between Immediate Family Members (within Maryland)

Maryland Title-properly assigned by the person(s) giving the vehicle

Application for Certificate of Title on the reverse of the Maryland title, or the

Application for Certificate of Title Form VR-005-completed by the person(s) receiving

the vehicle. When titling a vehicle, be sure you have the most recent title.

Insurance coverage with a company licensed to insure vehicles in Maryland. Provide the full name of the

company, policy or binder number and the agent’s name. Trailers do not require insurance unless rented or leased.

Gift Certification Form VR-103–completed and signed by all givers and receivers of the vehicle

Proof of Relationship–submit if last names are different, i.e., birth certificate, marriage certificate, etc.

Note: For Aunt/Uncle over 65 years old to Niece/Nephew transfers only, the Gift Title Transfers – Certified Statement

Form VR-299 may be used in place of proof of relationship

Lien Release (if subject to a lien)–Maryland’s lien release is a Notice of Security Interest Filing, properly

released on the front by the lien holder’s representative; or a Letter on Lien Holder’s Letterhead releasing the

lien. If the lien is not released, a letter from the lien holder on letterhead to authorize the change in ownership and

state whether or not the lien contract has changed or remains the same, is required. The letter must include the

year, make and vehicle identification number and specifically indicate to whom the vehicle is to be transferred.

Note: Gifts between husband and wife with an open lien are excise tax exempt, but still require a letter of

permission from the lien holder.

Note: Gifts between parents and children with an open lien need a letter signed by both, stating who made the

down payment, paid the taxes, made all payments, and will continue to make the payments. If the receiver of the

vehicle did not make all of the above payments, the transaction is taxable at 6% of the vehicle book value for

vehicles less than 7 years old; or for vehicles 7 years old and older, the minimum tax of $38.40 ($19.20 for trailers).

Letter of permission from the lien holder as stated above is, also required.

Note: Gifts with open liens between relationships “other than” husband wife, and special conditions as

stated above for parents and children, must pay excise tax.

Maryland Safety Inspection is not needed for transfers between husband/wife, parents/children, or transfers

where the title is being transferred from joint ownership to one of the owner’s individual names. ALL OTHER

RELATIONSHIPS REQUIRE MARYLAND SAFETY INSPECTION. Note: If an inspection certificate is required but not

provided, the customer may complete a Temporary Inspection Waiver Form VR-129 to obtain a 30-day temporary

registration. The cost of a temporary registration is $20.00 and is in addition to all other required fees. If temporary

registration is issued, the regular registration fee for the vehicle will be charged when the safety inspection certificate

is submitted. Once the vehicle passes, the inspection certificate will be sent electronically to the MVA.

Taxes–Excise tax is “exempt” for vehicles currently titled in Maryland and being transferred to: a spouse, son,

daughter, grandchild, parent, sister, brother, grandparent, father-in-law, mother-in-law, son-in-law, or daughter-in- law

of the vehicle owner and no money or other valuable consideration is involved in the transfer. Surviving spouse is exempt

from excise tax when transferring the title from decedent with proof of relationship. Transfers from Aunt/Uncle over 65 years

of age to Niece/Nephew are excise tax exempt.

Registration Card–Submit the registration card if transferring tags. Tags may be transferred to a vehicle in the same

owner’s name, between parents and children, and between husband and wife. Tags may only be transferred to vehicles

of the same class.

New Tags-If purchasing tags, submit the two-year registration fee (including surcharge) for the class of tags

desired. Only trucks (1-ton and larger) and tractors pay a one-year registration fee. See fees for registration plates

under the Vehicle Services heading at www.mva.maryland.gov. All classes of vehicles have staggered registration

and the month of titling will be the month of registration renewal.

Tag transfer fee is $10.00. If the tags being transferred are valid for less than a year, there will also be an

additional year’s registration fee and surcharge collected.

Title Fee $100.00, mopeds, and motor scooters $20.00. Surviving spouse is exempt from title fee when transferring

the title from decedent with proof of relationship.

Lien Filing Fee $20.00 for each lien recorded (if applicable)–Lien filing fee is not required for existing liens to

be recorded if the letter of permission from the lien holder states that the lien contract remains the same.

Note: Gifts of vehicles “not previously titled in Maryland” between family members are subject to

excise tax and a Maryland Safety Inspection.

12

MOVING TO MARYLAND – USED VEHICLE ALREADY OWNED

Complete and submit the following documents:

Application for Certificate of Title Form VR-005 Out of State Title (or ownership document

required in that state) –

Customer will need to go to a MVA office with an appointment.

The

customer will need to have their current vehicle registration card and the e m a i l o r fax number of

their lien holder. MVA will e m a il o r fax a completed VR-056 to the lien holder and sc a n t h e

c om p l e t e d f o r m i n w it h t h e t i t le d o c um e n t s. The transaction will be processed as a HOLD

TITLE. No title or SIF will be printed until the title is received.

Lien Release, if applicable.

Maryland Safety Inspection Certificate A M a r y l a n d Safety Inspection i s r eq u i re d. Once

the vehicle pa ss es, t h e Inspection station will e l e c t r o n i c a l l y se n d t he inspection

certificate to the MV A. If the applicant desires registration but does not provide a Maryland Safety

Inspection Certificate, they may apply for a 30-day temporary registration by

completing the Temporary Inspection Waiver Form VR-129. If temporary registration is applied for, the

permanent registration will not be issued until the Maryland Safety Inspection Certificate is submitted.

No t e: A Maryland Safety Inspection is not required, if the vehicle was previously titled in Maryland

In your name, or in your spouse, parent or child’s name.

Temporary Registration Fee is $20.00. Note: The fee for the regular plates will be paid when

the safety inspection certificate is submitted or can be pre-paid at the time of titling at an MVA office.

Insurance coverage with a company licensed to insure vehicles in Maryland. Provide the full name of

the company, policy or binder number and the agent’s name.

Trailers do not require insurance unless rented or leased.

Excise Tax and Excise Tax Credit – If the vehicle is titled or registered in the name of the applicant in

another state at the time of making this application, Maryland Excise Tax is 6% of the “clean retail value”

of the vehicle as shown in the JD Power Used Car Guide. Vehicles “7 years old and older” currently owned

by the applicant in another state will be charged the minimum excise tax of $38.40 ($19.20 for trailers,

motor scooters and mopeds). On passenger cars, multi-purpose vehicles, 1/2 and 3/4-ton trucks, the

value is computed by the addition or subtraction for high or low mileage. An excise tax credit is applied if

the applicant has not been a Maryland resident for more than 60 days and has paid a state sales or

excise tax in another state (excluding county or local tax). The excise tax shall apply, but at a rate

measured by the difference in Maryland’s tax rate and the other state’s tax rate. The minimum excise tax

imposed shall be $100. New residents leasing vehicles need to provide a copy of the lease contract or a

letter from the leasing company indicating taxes paid (if any) to the previous state to ensure that an

excise tax credit may be applied.

Please Note: Active-duty military living in Maryland and stationed in Maryland, an adjoining state, or DC;

and returning Maryland residents in the military, are entitled to receive an excise tax credit for up to 1

year. Please note that out of state military who are stationed in Maryland have the option of titling and

registering their vehicles in Maryland or in the state that is their home of record. More information for

Active-Duty Service Members can be found at www.mva.maryland.gov

New Tags - If purchasing tags, submit the two-year registration fee (including surcharge) for the class

of tags desired. Only trucks (1-ton and larger) and tractors pay a one-year registration fee. See fees for

registration plates under the Vehicle Services heading at www.mva.maryland.gov. All classes of vehicles

have staggered registration and the month of titling will be the month of registration renewal.

Title Fee $100.00, except for rental vehicles $50.00, and motor scooters and mopeds $20.00.

Lien Filing Fee $20.00 for each lien recorded, if applicable.

13

Homemade Trailer

Complete and submit the following documents:

Application for Certificate of Title Form VR-005

Two Pictures of the trailer are required. One picture of the entire rear view showing the lights; and

one entire side view showing the hitch

Certified Statement – Must itemize all parts used to build the trailer (provide receipts for all parts used). If

all or any of the parts were used, they must be listed and an estimated value of the used parts entered. The

certified statement also needs to contain what the owner considers to be the total value of the trailer.

Application for Assigned Vehicle Identification Number Form VR-198 – Trailers with a

gross vehicle weight of 5,000 lbs. or less may apply for assigned vehicle identification number at any

branch of the MVA. Trailers with a gross vehicle weight of 5001 lbs. or more, are required to be

taken to the garage located at the Glen Burnie branch of the MVA, on Tuesdays between

8:30am and 1:00pm, to have the vehicle identification number assigned and affixed by the Maryland

State Police Auto Theft Unit.

Temporary Inspection Waiver, Form VR-129 – Once the VIN has been issued and affixed to the

trailer, it will need to be Maryland Safety Inspected before registration plates may be issued. The

applicant may apply for a 30-day temporary registration to take the vehicle to an authorized

Maryland Safety Inspection Station. If temporary registration is requested, the permanent registration

will not be issued until the Maryland Safety Inspection Certificate is submitted. When the safety

inspection is submitted, the regular tags may be purchased. Temporary Registration Fee is

$20.00 (This fee is in addition to the cost of registration plates).

New Tags - If purchasing tags, submit the two-year registration fee (including surcharge) for the

class of tags desired. Only trucks (1-ton and larger) and tractors pay a one-year registration fee. See

fees for registration plates under the Vehicle Services heading at www.mva.maryland.gov. All classes

of vehicles have staggered registration, and the month of titling will be the month of registration

renewal.

Excise Tax – Excise tax will be 6% of the total value of the trailer. Minimum excise tax for trailers is

$19.20.

Title Fee $100.00, except for rental vehicles $50.00, and motor scooters and mopeds

$20.00. Lien Filing Fee $20.00 for each lien recorded, if applicable.

14

PROPER ASSEMBLY OF TITLE RECORD

DOCUMENTS

As of 1/1/24, MVA required electronic submission of all title work. All

title documents must be scanned into the ERT system. Bundle reports

are no longer to be sent to the MVA. All title records should be scanned in

this order:

Each title record should be as follows:

FROM TOP TO BOTTOM

Maryland MVA Title/Registration Receipt

Registration card (If Transferring Tags)

Application for Certificate of Title Form VR-005

Certificate of Origin, Title, or other acceptable ownership

document

Lien Release – Notice of Security Interest Filing

Dealer Reassignment(s)

Dealer’s Bill of Sale

Miscellaneous MVA Forms

Odometer Mileage Statements

Vehicle Emission Report (if submitted)

Copy of owner(s) driver license(s), state issued identification card

Copy of title service ID

Power of Attorney (if submitted by TSA)

EACH TITLE RECORD SHOULD BE SCANNED AS

ONE DOCUMENT. Please do not index documents

by document type.

15

Submitting Title Work to the MVA

The dealer must u p l o a d required documents, and submit taxes and

fees within 30 days of date of delivery for class A passenger cars,

class D motorcycles, class M multipurpose vehicles, and class G travel and

camping trailers. Dealerships will be charged late fines for work not

submitted within 30 days of the date of delivery. NOTE: For other

classes of vehicles, the dealer has the option of collecting the tax

and submitting it with all required documents

within 30 days of the date of

delivery; or allowing the customer to present the necessary titling

documents, pay the excise tax and all required fees to the MVA.

Dealers are required to upload all the documents and submit taxes and fees

for other classes of vehicles. If there is a lien to record, you may want to

exercise the option to upload the documents and submit taxes and fees to

ensure that the lien is properly recorded before the 30 day required time.

Maryland Vehicle Law Reference 13-113(e)

Title service agencies have 5 days to upload documents to the ERT system and submit

taxes and fees.

If you are selling a vehicle to a customer in another state the law allows

the dealer to provide the titling documents to the transferee within 30

days. However, if there is a lien to record, the selling dealer may wish to

contact the other state and mail the titling documents, taxes and fees to

that state. This will ensure that the lien is properly recorded. Phone numbers

for other state’s motor vehicle departments may be found in several national

publications. Contact your dealer’s association for the names of these

manuals.

This Photo by Unknown Author is licensed under CC BY-SA-NC

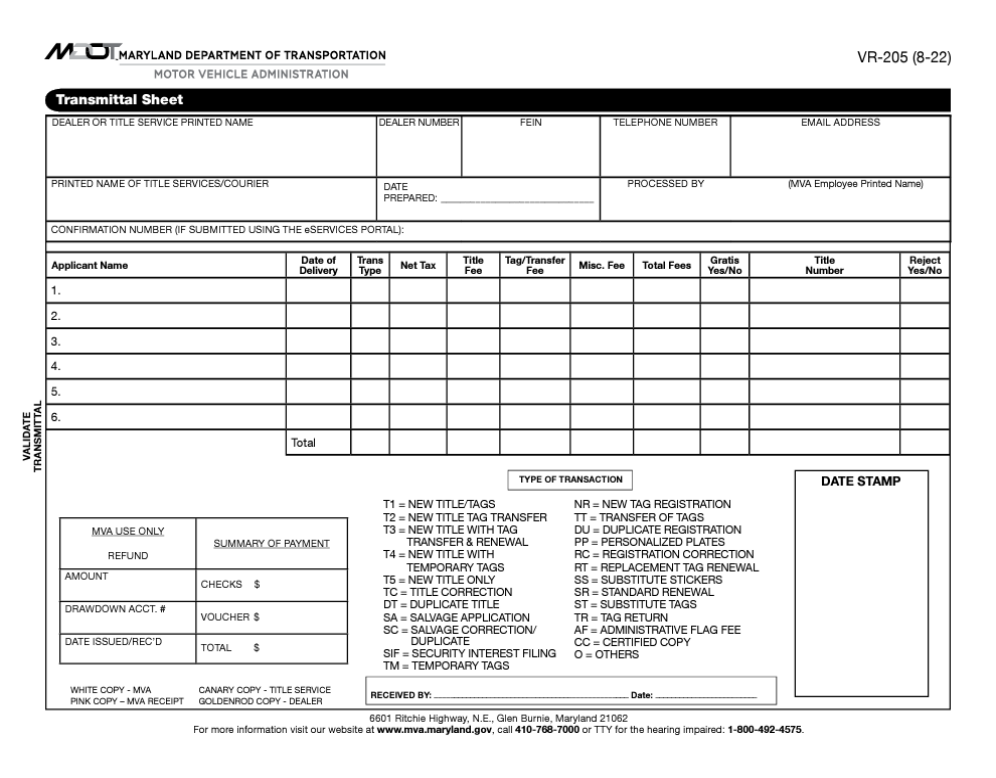

TRANSMITTAL SHEET

All title work submitted to the MVA for processing must be recorded on a

Transmittal Sheet Form VR-205. The transmittal sheet is utilized as a receipt

for drop off title work as well as a tracking sheet for title work processed.

The transmittal sheet must be completed in its entirety for processing.

Note: The confirmation number for transactions submitted on the e-services

portal must be completed on the form as well as the drawdown account

associated to the dealer or title service agency.

16

17

SPECIAL NOTE FOR ERT DEALER WORK

SUBMISSION –

• Dealers- Any transactions processed via the ERT network must be finalized within 30

days of the Date of Delivery. All paperwork must be uploaded via the ERT system within

the 30-day timeframe as well.

• Title Services- Any Transactions processed via the ERT network must be finalized within

3 days of the “Paperwork received date” when payment type is cash/credit. The

transaction must be finalized within 10 days of the “Paperwork received date” when the

payment type is a check. All paperwork must be uploaded via the ERT system within 3

days of the date of finalization.

Effective October 1, 2010, the transmission date is used for

proof of submission to MV A.

18

What transactions “CAN” ERT dealers process electronically?

•

New title and tags (T1)

•

New title and transfer of tags (T2)

•

New title and transfer with renewal of tags (T3)

•

New title only (T5)

•

Title for ATV’s - Need to use class D, enter NR in the inspection field and enter AT for

the body style

•

New tag registration (NR)

•

Standard renewal (SR)

•

Replacement tag renewal (RT)

•

Substitute tags (ST)

•

Substitute stickers (SS)

•

Duplicate registration (DU)

•

Duplicate title, Form VR-018 (DT) (Transmit only)

•

Duplicate title, Form VR-003 (Transmit only)

•

Administrative flag fee (AF)

•

Can utilize mailing address, mail address shows on title, not on database.

•

Soundex issuance with proper documents – ERT Dealers must fax driver’s license ID

card, or military ID from this country to MVA ERT Unit at 410-424-3629 or 410-768- 7070.

Otherwise the transaction needs to be submitted to MVA.

•

Tag return.

•

Change of Address

•

Branding of titles

-

Salvage processors (CO-PART, IAA AND AIC ONLY) can brand for insurance companies

-

Titles branded out of state and eligible for use on roads if the brand has been

recorded in NMVTIS.

•

State and Local Government plates, if applicable

•

MDID issuance with proper documents: To request a MDID., please email

[email protected]ryland.gov . Please be sure to send a copy of the completed

Application for Maryland Title (form VR-005) signed by the customer with a copy of the

customer’s out-of-state driver’s license or military ID

19

What transactions “CANNOT” be processed by ERT dealers?

•

No branding of titles (can only brand for CAL LEV and odometer A, B or C). A title requiring ANY

OTHER BRAND “MUST” be taken to the mva for processing, except as noted

above in the “Can Do” section

•

No VIN plate assignment

•

No new issuance of disability plates, only transfer of disability plates

•

No new issuance of personalized or organizational tags, only transfer of personalized or

organizational tags

•

No taxi (class B) no limousine (class Q) no ambulance / funeral (class C)

•

No State and Local government (not new or transferred)

•

No law enforcement

•

No excise tax-exempt for business (mergers, consolidations, newly formed, dissolving

etc.)

•

No excise tax-exempt individual transferring to inter vivos trust

•

No excise tax credit for new residents

•

No out of country gray market vehicles

•

No registration corrections (RC)

20

What transactions “CAN” ERT Title Services process electronically?

•

New title and tags (T1)

•

New title and transfer of tags (T2)

•

New title and transfer with renewal (T3)

•

New title and temporary tags (T4)

•

New title only (T5)

•

Title for ATV’S (NR in inspection field, use class D, and R in the exception field, AT for body style)

•

Temporary tag (TM)

•

New tag registration (NR)

•

Standard renewal (SR)

•

Replacement tag renewal (RT)

•

Substitute tags (ST)

•

Substitute stickers (SS)

•

Duplicate registration(DU)

•

Duplicate title (DT) transmit only

•

Administrative flag fee (AF)

•

Transfer Tags (TT)

•

Transfer Tags with Renewal (TR)

•

Can utilize mailing address (mailing address shows on title, not on database)

•

MDID issuance with proper documents - must email Driver License, ID card, or Military ID

from this country to MVA ERT UNIT (otherwise transaction needs to be submitted to e-services

portal)

•

Can do work on behalf of dealer (but cannot get .6% unless both dealer # and title service #

are entered)

•

Tag return

•

Change of Address

•

Can “only” process salvage transactions on behalf of an insurance company (Must have contract

with the insurance company and submit to MVA Business Licensing for approval).

•

Branding of titles

-

Salvage processors can brand for insurance companies.

-

Titles branded out of state and eligible for use on roads if the brand has been

recorded in NMVTIS.

•

State and Local Government plates, if applicable

•

Soundex issuance with proper documents: To request a Soundex., please email

[email protected]ryland.gov . Please be sure to send a copy of the completed Application for Maryland

Title (form VR-005) signed by the customer with a copy of the customer’s out-of-state driver’s license or

military ID

What transactions

“

C A N N O T

” be processed by ERT Title Services?

•

No duplicate title VR-003 processing

•

No branding of titles (can only brand for CAL LEV and odometer A, B or C). A TITLE

REQUIRING ANY OTHER BRAND “MUST” BE TAKEN TO THE MVA FOR PROCESSING, except

as

noted above under Branding of Titles.

•

No VIN plate assignment

•

No new issuance of disability plates, only transfer of disability plates

•

No new issuance of personalized or organizational tags, only transfer of personalized

or organizational tags

•

No taxi (class B), no limousine (class Q), no ambulance/funeral (class C)

•

No law enforcement

•

No tax exempt for business (mergers, reorganizations, newly formed, dissolutions)

•

No tax exempt - individual transferring to inter vivos trust

•

No excise tax credit for new residents

•

No out of country – (gray market vehicles)

•

No registration corrections (RC)

21

Ordering Forms

Forms can be ordered by fax from the MVA Warehouse using the fax

numbers below:

Fax: 410-582-5033

Fax requests need to be on the letterhead of the dealership or title service and must

include the complete mailing address. “DO NOT” USE P.O. BOXES. THE DELIVERY

SERVICE “WILL NOT” DELIVER TO P.O. BOXES. Be sure to include the first name,

last name and phone number of the point of contact at the dealership or title service.

Email requests may be sent to mvawarehouse@mdot.maryland.gov

Please note that “Maryland Dealer Reassignments” and the “Secure

Power of Attorney for Odometer Disclosure” may only be purchased

from the:

Maryland Automobile Dealer’s Association

(MADA) 410-269-1710 https://mdauto.org

or,

Maryland/MidAtlantic Independent Automobile Dealer’s Association

(MidAtlanticIADA) 717-238-9002

https://www.midatlanticautodealersunited.org/

22

e-Service Portal (electronic submission of paperwork) and

Drawdown Account Report

The Maryland Department of Transportation Motor Vehicle Administration (MDOT

MVA) went live with the e-Services Portal (electronic submission of paperwork) and

drawdown account report on Monday December 14, 2020. The e-Services portal

allows for the electronic submission of those transactions that cannot be processed

via the ERT systems, when you receive an error in the ERT system or the transaction

requires a speedy turnaround. These are transactions that are currently being walked

into a MDOT MVA branch office. You will be notified electronically once your

transaction is ready for pick up or of any rejections.

The Drawdown Transaction Report will allow you to view all the transactions that

were deducted from your drawdown account. Please note: this report is only for

transactions that were processed from the drawdown account. This is not a complete

account of all processed transactions.

Key things to remember:

-

All dealer and title services who need an appointment at the Glen Burnie Branch

can only schedule an appointment by calling 410-424-3625. All other

appointment at the other field offices can be scheduled online at

mva.maryland.gov.

-

All paperwork must be picked up from the selected MDOT MVA branch office.

-

All runners will need the appropriate identification when picking up paperwork.

-

Only transactions that cannot be processed via ERT are eligible for submission

or walk-in.

-

For all electronic submission, titling documents must be retained for a minimum

of one year and available for review by MDOT MVA investigators and auditors.

-

In order to submit transactions via the e-Services portal, you must have

available funds on your business drawdown account.

If you have questions or concerns, please contact MVA Vehicle Services Dealer Services

unit at 410-424-3625 or email [email protected]aryland.gov.

The following transactions are still eligible for over-the-counter processing with an

appointment.

• Duplicate Titles and Lien Maintenance

• Registration transactions not able to be processed via kiosk or ERT

• Repossessions

• Disabled Placards

• Trusts and other tax-exempt transactions

• MD salvage/ branded titles

• New to state title transactions with excise tax calculations

23

eService Portal (electronic submission of paperwork) and Drawdown Account Report

• The e-services portal account is a real time and streamline way customers can communicate & interact with MVA. It is

a new user-friendly way to manage accounts and perform a variety of tasks such as title and registration transaction

requests, make payments to the drawdown account, file documents, and so much more.

• The portal screen has 4 tabs housing Favorites, Summary, Action Center and More…

• Favorites: Allows you to make favorites

• Summary: Allows a 360 view of all locations under your business Federal Identification Number (FEIN)

• Action Center: Allows for adding and updating of customer actions, manage fleets, registration of non-

licensed business entities, track previous title and registration submissions, view and manage messages sent

from MVA, view letters mailed from MVA, management of employee’s names and addresses and management

of access for employees.

• Each account is divided into 3 tabs.

• Drawdown Account: Under this tab, you can add funds and monitor drawdown activity using the drawdown

transaction report.

• This account is a pool of money that is used for only title and registration transactions.

• Once an e-services portal account is established, an email request for a drawdown account must be

sent to mddtts@mdot.maryland.gov.

• This account cannot be used to pay late titling fees or miscellaneous customer fees.

• A refund request for part or all of these funds must be submitted via email to

[email protected]d.gov and will be mailed in 4-6 weeks.

• Dealer Account: Under this tab, you can manage your employees, make payments for late titling fees and

more activities

• Titling Account: Under this tab, you can uploading title and registration transactions

• The portal has 3 access levels:

o Employee Access: At this access level, a dealer/TSA employee can add funds to a drawdown account and

upload and submit transactions.

o Full Access: At this access type, an individual can add or cease access of any employee, submit requests, and

add funds to the account.

o Administrator Access: At this access level, an individual can add or cease accounts, review drawdown

transaction reports, and make payments to the account.

25

Guidance in the Completion of the

The Application for Certificate of Title

Form VR-005

The Application for Certificate of Title is the form you will use to

assist your customer in titling and registering their vehicle(s). It

summarizes the contents of supporting documents in a vehicle’s

title record. The pages that follow provide you with step-by-step

guidance needed to properly complete the form. Maryland

Vehicle Law requires the use of this form. When titling a vehicle,

be sure you have the most recent title.

26

27

28

Proper Completion of the Application for Certificate of

Title

Form VR-005 or Title Application Located on the Reverse of the Maryland Title

OWNER INFORMATION -

For the protection of your customers and your business, be sure to obtain positive

identification from all persons buying vehicles. In most cases, this will be a Maryland

Driver License or Maryland Identification Card. A copy of the identification provided must

be maintained with your records and submitted with the title record to the MVA.

NAMES - Full names of all owners need to be used (First, Middle, and Last). If the

customer’s name contains a middle initial only, this must be verified by the Maryland Driver’s

License, or a Maryland ID Card showing the middle initial.

For new residents to the State who have not yet obtained a Maryland Driver’s License or

a Maryland ID Card, the first, middle and last name must be furnished along with the date

of birth. Since many other states do not use full names on their Driver’s Licenses, you need

to inform the customer that in this State, they need to use their full name.

The name(s) on the application must agree with the assigned Certificate of Origin (CO) or

Title.

Change of Name – Customers having a change of name need to have their Maryland Driver

License corrected before MVA may issue a title showing the new name.

ET AL - Vehicles having more than 2 owners must have the names, soundex numbers, and

signatures of all owners on the title application, (Form VR-005). Only the first owner’s name

and soundex number is shown on the title. Previous to the system upgrade to Customer

Connect, The co-owners’ names are shown as ET AL and the co-owners’ soundex will be Z-

977-777-777-777. The vehicles listed with ET AL have been flagged and all vehicle owners

will be displayed on the vehicle record.

NOTE: When the vehicle is sold, the signatures of all owners will be required to transfer

ownership. The title record needs to be viewed to verify the names of all owners. Contact

MVA to verify the names of all owners on a vehicle showing ET AL.

BUSINESS NAMES - A business entity titling a vehicle must show proof of the legal

existence of the business at the time of titling. At the time of titling, the Federal Identification

number is required. The use of the “Z soundex number” will no longer be issued. The

following documents are acceptable as proof:

• Business License,

• Articles of Incorporation,

• Articles of Organization,

• Partnership Agreement,

• Certificate of Limited Liability Partnership,

• Registration and/or Trade Name Application from SDAT,

• Application for Sole Proprietorship and/or General Partnership filed with Business

Personal Property Unit,

29

• Articles of Merger,

• Articles of Reorganization, or

• the portion of a trust agreement that names the trust and identifies the trustees.

Information provided will be run against the Comptroller of Maryland file. If the business has not

been registered with the MVA, have them complete a Business Entity Submission of Proof for

Vehicle Titling Form VR-475. The following are examples of how names may be shown for

business owned vehicles:

USE OF CARE OF (c/o)-This was normally used for leased vehicles or when the

owner of a vehicle is located out of state, but the vehicle is being used in the State of

Maryland. The MVA will no longer use c/o on MD titles. The title will print “without” the

care of (c/o) and be mailed to the lessor; but the care of (c/o) name and address will print on

the registration card. The care of (c/o) information will also be stored electronically in MVA’s

Customer Connect System for any needed access or verification. It is important to properly

enter the insurance information as well.

Important Note for MVA agents ONLY: If the vehicle is being leased, you must select the

ownership type as “Leased” when entering this into Customer Connect, the Primary Owner

field will change to Primary Lessee Type where you will enter the lessee’s soundex

information; next, on the Vehicle Detail Screen the vehicle details are entered; then the

Leasing Agency screen will appear requesting the Lessor Type, name and address of the

lessor, and the Z- soundex number or FEIN.

Important Note: The MDID/soundex of the person or business as the lessee and the

leasing company/lessor name and address need to be entered. The leasing company

address may be an out of state address, but the lessee address must be the Maryland

address. This change ensures any flag notices relating to the vehicle will be sent to both the

owner and the person or business shown on the c/o. Even though the lessee (or driver) name

is entered in the space for co-owner/lessee, THEY ARE NOT THE CO-OWNER. They are

considered to be part of the address. The owner needs to sign all applications and

documents. The person listed as lessee may not sign the title application unless they are

granted Power of Attorney.

30

Lease Buy-Out – To determine when a lessee is excise tax exempt, when buying out a lease,

see the following information as a guide:

The Maryland Vehicle Law 13-810(C)(11:)

On transfer of a vehicle titled in this State, and issuance of a subsequent title, the vehicle is

exempt from the excise tax imposed by this part, if it is: A vehicle transferred to a lessee who

exercises an option under a vehicle leasing agreement for an initial term of more than 180

consecutive days to purchase the leased vehicle at the end of the lease.

Therefore, the vehicle must be:

•

A leased vehicle titled in Maryland;

•

The Maryland title must be assigned to a lessee(s) who is titling the vehicle in

Maryland; (please note, the title may be assigned directly from the leasing company

to the lessee(s); or in many cases the title is assigned by the leasing company to a

dealer, who in turn assigns it to the lessee(s) who is buying out the lease.

•

The lease contract accompanying the title, must be a (1) long-term lease in excess

of 180 days, and (2) the lessee must be exercising an option contained in the lease

agreement, to buy the vehicle at the end of the lease.

•

If these conditions are met, the transaction is excise tax exempt. IMPORTANT

NOTE: There is “no mention” of whether the lessee is the first lessee, second

lessee, third lessee etc. because that ”is not” what determines the excise tax

exemption.

In addition, this transaction is also exempt from a Maryland Safety Inspection under 23-106(a)(9).

Use of Trading As (T/A) and Doing Business As (DBA)-An individual whose company

is not incorporated (or an LLC) may use Trading As (T/A) and Doing Business As (DBA). As

long as the company is not incorporated (or an LLC), the owner and his/her company are

legally the same entity. Ownership is shown as follows on the application:

Owner Co-Owner

John Brown T/A Browns Little Company

MDID number/Soundex FEIN number

111 Browns Parkway

Glen Burnie AA Maryland 21009

Always obtain the FEIN number when using Trading As (T/A) or Doing Business As (DBA).

Tags may be transferred from a vehicle owned by the individual (John Brown) to a vehicle

owned by the individual T/A his company, or vice versa. An individual cannot Trade As (T/A) a

corporation, LLP, or LLC because they are separate entities. Any application received

requesting that an individual T/A an corporation or LLC must be returned for clarification as to

whether the individual or the corporation/LLC is the owner of the vehicle.

31

A Corporation may Trade As its registered trade name, for example:

America’s Best Company, Inc. T/A ABC, Inc.

In this instance, the corporation is legally the same entity as its registered trade name. You

may contact the Department of Assessments and Taxation for verification at 410-

767-1340 or www.dat.state.md.us. Please be advised, a corporation or LLC may not trade as a

separate corporation or LLC. If one corporation or LLC is using a vehicle belonging to another

corporation or LLC, c/o should be used, not T/A.

Can a corporation or LLC be a co-owner with an individual?” The answer is YES.

Even though this is an unusual request, it can be shown once it is determined that this is truly

what the customer wants. In this case, the corporation or LLC is listed as owner and the

individual as co-owner. The MVA customer agent enters the corporation’s name as owner in

CUSTOMER CONNECT and the individual’s name (do not use c/o in this case) as co- owner.

The title application must contain the FEIN and the co-owner’s MDID number. The application

must be signed by a corporate officer or “member” of the LLC as the owner (must have

capacity stated after signature), and the individual as co-owner.

SOUNDEX NUMBERS – The MVA will no longer issue soundex numbers. A

Maryland Drivers Identification (MDID) number will be created in place of the

soundex number. Enter complete and accurate soundex numbers. DO NOT USE

OUT OF STATE DRIVERS LICENSE NUMBERS. If the applicant does not have a

MDID number, be sure to give their FULL NAME AND DATE OF BIRTH.

In this case the customer agent who processes the work will assign a MDID number.

Please note: For Maryland residents who have not yet obtained their Maryland driver’s license

or ID Card, dealers and titles services using one of the “electronic registration and titling

networks” may contact the ERT Unit at ertsoundex@mdot.maryland.gov or 410-787-7823 or

410-787-2952 to receive assistance. The ERT unit can only issue a MDID if the applicant can

furnish a driver license from another state in the United States. Otherwise, the transaction

must be processed at a full service MVA branch office. Be sure to email a complete

Application for Certificate of Title Form VR-005, on the form check the box “MDID request”,

make sure the customer or business has a Maryland address, a copy of the out of state

driver’s license and the ID card of the title agent for title services is required .

Soundex Numbers for Business Owned Vehicles - The MVA will no longer issue

soundex numbers. When titling vehicles owned by companies, corporations, limited liability

companies, limited liability partnerships, partnerships, etc., be sure to use the FEIN or an

existing Z soundex number if it is available. Please note: Due to the large number of Z

numbers issued in the past, it is best to ask the business to supply a list of Z soundex

numbers that exist and have them merged to one FEIN. Please send merge requests to

32

If a new business has not titled any vehicles with the MVA, a operating office of the business

must complete a Business Entity Submission of Proof for Vehicle Titling Form VR-475.

Important Notice: Improper Issuance/Use of Z soundex numbers is

subject to investigation and penalty of law.

TRUST: For vehicles purchased from a dealer to be titled directly into a Trust, or an Inter Vivos

Trust, the dealer will need to issue a MDID number. The trustee must sign the title application

and all other required documents. A copy of the portion of the Trust Agreement that names the

trust, and the trustee(s) needs to be submitted. This is a “taxable” transaction. Tags may be

transferred from an individual (who is the primary beneficiary) to vehicle titled into an inter vivos

trust.

Please note: Excise tax exemption may only be applied in private (non-dealer) transactions

where a vehicle is already owned in Maryland, and the ownership is being transferred into an

inter vivos trust, and the owner of the vehicle is the primary beneficiary of the inter vivos trust.

Most other trust transactions are taxable. However, any other non-dealer transfers between

trusts and beneficiaries claiming excise tax exemptions, need to be processed at the MVA.

DATE OF BIRTH - Date of birth is required.

ADDRESS - Give a complete Maryland residence address (street address,

apartment/suite/unit number, city, county, state and zip code). P. O. Box may be shown along

with the street address if it is in the same zip code area as the street address. Customer Connect

can now accept a separate mailing address, along with the residence/business address.

However, the title will be mailed to the residence address. For leased vehicle transactions, be

sure to include the FEIN number and address for the lessor and MDID number for the lessee

and select the ownership type as “Leased”. Leasing company may show an out of state

address. Maryland residents in the military, stationed out of State may show an out of state

address if an Address Certification, U.S. Government Employee's", Form VR-102, is completed and

signed by the employer and the employee, or the “Temporary Inspection Waiver”, Form VR-129 is

completed and signed by Maryland members of the U.S. Armed Forces assigned out of state,

and their commanding officer.

JOINT TENANTS AND TENANTS BY ENTIRETIES are forms of ownership with rights of

survivorship. Any two (or more) people may use JOINT TENANTS. Only husband and wife

may use TENANTS BY ENTIRETIES. If Joint Tenants or Tenants by Entireties are selected, it

will have to be selected in Customer Connect under the “Relationship Field” when

processing the transaction. Upon the death of an owner, the survivor needs only to submit a

death certificate and the assigned title to transfer ownership. If there is an open lien, a letter of

authorization from the lien holder will be required. The vehicle will not become part of an estate

and are transferred excise tax exempt, title fee is waived and inspection exempt to the

surviving spouse but title fee will not be waived it the joint tenant is not the spouse or tenant by

entirety survivor.

If neither of the above is selected, joint ownership will be considered TENANTS IN

COMMON. Upon the death of an owner, the surviving owner may transfer ownership with a

death certificate, the assigned title and a lien release/letter of authorization (if applicable).

NOTE: For more information on transfer’s involving deceased owners, see booklet "Instructions

for Transferring Ownership of a Decedents Vehicle", Form VR-151. All Death Certificates

submitted must contain the seal of the Bureau of Vital Statistics.

33

Adding a beneficiary: Legislation effective October 1, 2017, allows a “sole” owner of a vehicle

titled in Maryland to indicate a beneficiary on their title. Attach the form VR-471 below if a

beneficiary is being named at the time of titling. When the title is printed, the name of the owner

will show with the letters TOD (which stands for Transfer on Death) after their name. The owner

of the vehicle has full control over the vehicle during their lifetime, may apply for liens on the

vehicle, and they can even sell the vehicle if they choose to do so. A sole owner of a vehicle that

is already titled in their name may also designate a beneficiary by completing the Beneficiary

Designation For Vehicle Title, Form VR-471, may be completed along with a duplicate title

application. The vehicle may have a lien when a beneficiary is designated. In both cases, only

TOD will show on the title after the owner’s name. The link to add a beneficiary to a vehicle is as

follows: https://mymva.maryland.gov/go/web/VehicleBeneficiary

After the death of the vehicle owner, the person named as beneficiary may bring the title into the

MVA to have the title transferred into their name. The title does not have to be signed by the

owner, but the vehicle record needs to be reviewed to confirm the name of the beneficiary on

file.The beneficiary will need a certified copy of the death certificate, or if MVA’s record for the

vehicle shows an owner deceased flag from the Bureau of Vital Statistics, we can accept that as

proof of death, as well. If the beneficiary does not have the actual title, they may apply for a

duplicate title, completing the reverse of the title entering their name as the buyer, insert TOD for

the purchase price, write the owner’s name in the space for signature of seller with the word

deceased written after it, then sign as the purchaser. The beneficiary will also need to complete

the application for title on the reverse of the title. The relationship to the deceased will determine

whether the vehicle will need to be safety inspected, and whether the registration plates can be

transferred. Transfer to a beneficiary is excise tax exempt. If the beneficiary is a spouse, parent

or child of the deceased owner, there is no safety inspection required. Otherwise, safety

inspection would be needed.

VEHICLE INFORMATION

Check the appropriate box to indicate NEW or USED vehicle.

Enter a full description of the vehicle (Year, Make, Model and Vehicle Identification

Number). Be sure to compare VIN on the application to VIN on Certificate of Origin or Title.

Enter body style, type of fuel and number of cylinders.

TWO STAGE VEHICLES – If the chassis Certificate of Origin is assigned to a second stage

manufacturer who sells the completed vehicle to a retail consumer, two certificates of origin

are required. For transactions requiring two Certificates of Origin, enter complete vehicle

information for both stages and submit Certificates of Origin for both stages. The VIN of the

first stage and the year and make of the second stage will be shown on the title. However, if

the conversion is only cosmetic, the year, make and VIN of the first stage will be shown. If

the chassis Certificate of Origin is assigned to the retail consumer, the application for title can

be accepted with one Certificate of Origin and a bill of sale for the body. This bill of sale will

be to the retail consumer.

34

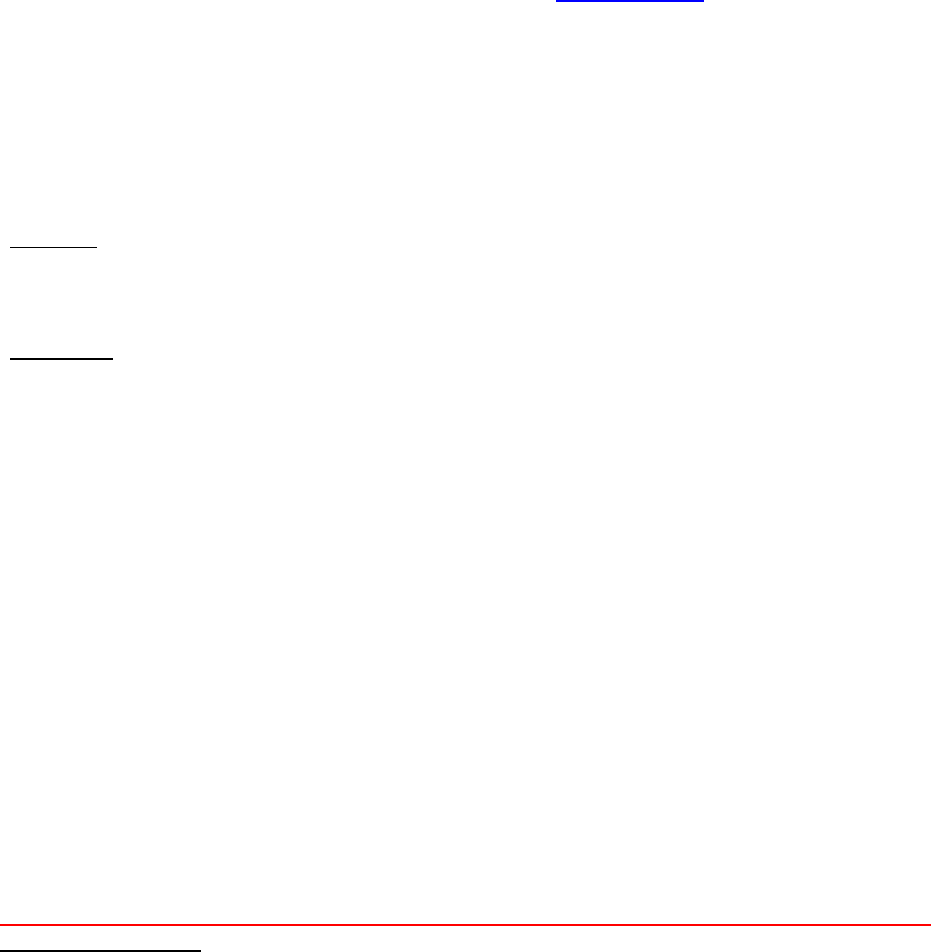

Second Stage Vehicles

Type of

Vehicle

Required

Statement of

Origin

Vehicle

Identification

# Shown on

Title

Model, Year

Shown on

Title *(1)

Model,

Name Shown

on Title

1. Type A:

Motorhome

1

st

and 2

nd

stage

manufacturer’s

1

st

stage

manufacturer’s

2

nd

stage

manufacturer’s

2

nd

stage

manufacturer’s

2. Type B:

Van

Conversions

meeting the

definition of

Motorhome

1

st

and/or 2

nd

stage

manufacturer’s

1

st

stage

manufacturer’s

1

st

or 2

nd

stage

manufacturer’s

*(3)

1

st

or 2

nd

stage

manufacturer’s

*3

3. Type C:

Chopped

Vans (Mini-

Motorhomes)

1

st

and 2

nd

stage

manufacturer’s

1

st

stage

manufacturer’s

2

nd

stage

manufacturer’s

2

nd

stage

EXCEPTIONS

1-A – Motor Vehicle Administration will accept the model year as certified by the 2

nd

stage

manufacturer provided the model year of the incomplete vehicle appears on the Federally

required label affixed to the vehicle. This label must be prominently displayed on the vehicle to

give notice to a purchaser.

2-B – Definition of Motor Home: The vehicle is equipped with permanently installed living

facilities such as toilet, sink, stove, furnishings, etc. The living portion of the vehicle is a

permanent integral living part of the entire vehicle as originally constructed by the

manufacturer or reconstructed upon the chassis of a motor vehicle.

3-C – If the conversion is more than cosmetic and the 2nd stage manufacturer is

licensed, both Certificates of Origin are required, in which case use the 2nd stage model

year and model name. If the conversion is only cosmetic, use 1

st

stage Certificate of

Origin’s vehicle identification number, year and model name.

Titling Trucks

TRUCKS - Enter GROSS VEHICLE WEIGHT (GVW), which is the weight of the vehicle plus

the load. Only enter GROSS COMBINATION WEIGHT (GCW) for a truck if it will be pulling a

"Freight Trailer" in excess of 20,000 lbs.; or a tractor pulling a trailer in excess of 10,000lbs.

GROSS COMBINATION WEIGHT (GCW) is the weight of the pulling vehicle (Truck or Tractor)

and its load plus the weight of the trailer and its load.

35

NOTE: If your customer needs assistance in selecting gross vehicle weight or gross

combination weight call "Commercial Vehicle Enforcement Division" at 410-579-5959.

1/2 AND 3/4 Ton Trucks – Usually select 7,000 lbs. GVW . However, if the GVW R is above

7,000 lbs., a GVW of 10,000 lbs. may be selected. A 1/2 or 3/4 ton truck cannot be raised

above 10,000 lbs. The Customer Connect system will print SP on the registration card, only

if a ½ or ¾ ton truck shows 10,000lbs and a two year registration. Since a certificate of

origin is not available to verify the GVWR for used truck transactions, the vehicle owner may

use the ½ and ¾ Ton Truck Owner’s Weight Certification Form VR-142A to choose the

maximum weight of 10,000 lbs., desired.

A One-ton truck’s minimum GVW is 10,000 lbs. A one-ton truck may only register for a I

year registration. One-ton trucks owners may select a higher weight in 1,000lb increments as

requested by the owner. If a truck owner is not sure how much weight to select, they can look

at the GVWR (Gross Vehicle Weight Rating) by the manufacturer, or contact "Commercial

Vehicle Enforcement Division" at 410-579-5959.

For larger trucks, see Truck Schedule of Fees Form VR-042A

Indicate on the application Truck or Truck Tractor (if applicable)

DUMP TRUCKS - A dump truck may use EPO, EPD or ED4 tags. If EPD or ED4

Dump Service tags are selected, the truck will not be subject to axle weight limitations at

weigh stations. However, if EPO tags are selected, the truck is subject to axle weight

limitations according to the bridge formula just as any other truck would be.

If dump service tags are desired, complete the Dump Truck Certification

http://mvgbintranet1/forms/VR/VR-098.pdf

Indicate the number of axles on the title application and submit a side view photograph of the

vehicle.

2-axle dump - may only show a GVW of 40,000 lbs. Enter 2X in the exception field in

CUSTOMER CONNECT or ERT program. (A higher weight may be selected for

GCW.)

3or more axles - select between 40,000 - 55,000 lbs. Enter 3X in the exception

field in CUSTOMER CONNECT or ERT program. (A higher weight may be

selected for GCW .)

4or more axles - operating in Garrett and Alleghany counties only, may select up

to 70,000 lbs. Enter 4X or higher number of axles in the exception field in

CUSTOMER CONNECT or ERT program. (A higher weight may be selected for

GCW ).

Class ED4 (4 or more axles) with lift axle certification by the manufacturer

may select between 56,000 - 70,000 lbs. Enter 4X or higher number of axles

in the exception field in CUSTOMER CONNECT or ERT program. Class

ED4 vehicles may operate statewide. The “lift axle certification” must be

carried in the vehicle and a copy needs to be submitted to the MVA to

request class ED4 registration. (A higher weight may be selected for GCW ).

Note: You must count the first axle when determining the number of axles.

36

NOTE: 3-axle dump trucks registered at 65,000 pounds prior to January 1, 1995 may

operate at that weight until December 31, 1999. However, after December 31, 1999,

65,000 lb. dump trucks may operate at that weight for a maximum of twenty years

based on the model year. Once reaching 20 model years old, they must either reduce

weight to 55,000 lbs. or have a lift axle installed.

DUMP TRUCKS IN COMBINATION WITH FREIGHT TRAILERS IN EXCESS OF

20,000 LBS: A dump truck pulling a trailer in excess of 20,000 lbs. must show both

GVW and GCW on the registration card. Registration fees for dump trucks

operating in combination are calculated as follows:

(1)

Find the fee for the “GVW ” using the Dump Truck Schedule of Fees on Form

VR-042A;

(2)

Use the Truck Schedule of fees on form VR-042A to find the “dollar

per thousand” amount for the GCW selected;

(3)

Find the difference between the GCW and the GVW ;

(4)

Multiply the “difference” times the “dollar per thousand” figure; and add the result

to the cost for the GVW in item (1). This will give you the total registration fee for

the dump truck in combination.

NOTE: When a dump truck using either EPD or ED4 tags is pulling a trailer

(freight or non-freight), the axle weight limit exemptions that normally apply to

“dump trucks” are not applicable. This means that a dump truck pulling a trailer will

have its axles weighed at the Weigh Station.

NOTE: Even though GCW is not needed unless a truck is pulling a freight trailer

in excess of 20,000lbs, the weight selected for GCW “may be” equal to or only

slightly higher” than the GVW because the truck may be operated empty while

pulling the heavy trailer.

OUT OF STATE TITLED DUMP TRUCKS REQUESTING “DUAL REGISTRATION”

IN MARYLAND

For a dump truck titled and registered in another state, usually a surrounding state,

requesting dump truck registration in Maryland, a process “Registration Only for

Dump Trucks” is now in place. This allows the registration to be issued without

sending the title information to NMVTIS since Maryland is not the state of title. The

regular title and registration must remain in place Out of State. A copy of the Out of

State Title and Out of State Registration are required along with the Dump Truck

Certification, for VR-098. This procedure may be done in Full Services Branch

Offices, and the Vehicle Services Division, at Glen Burnie MVA. There is no title fee

or tax charged, just the registration fee for the Dump Truck Weight selected. This

transaction does not require Safety Inspection. Complete the form VR-098

Certification for the Issuance of Dump Service License Plates. Dump truck

registration fees are shown on the form Dump truck Schedule of Fees, Form

VR-042A;

APPORTIONED REGISTRATION (International Registration Plan): For assistance

37

with apportioned registration, call Motor Carrier and Electronic Services at 410-787-

2971.

BRIDGE FORMULA- Information regarding bridge formulas may be obtained from

the State Highway Administration (SHA). Their number within Maryland is 1-800-

543-4564 outside Maryland 410-582-5734. You may also contact the SHA for a

Motor Carrier Handbook.

TOW TRUCKS - Complete Tow Truck Certification Form VR-294 entering Gross

Vehicle Weight Rating (GVW R) and required insurance certification information. Tow

trucks must have a minimum manufacturer’s GVW R of 10,000 lbs. or more and be

equipped as a tow truck or rollback. Vehicles showing a GVW R of 26,000 lbs. or

under will show U26 in the exception field on the registration. The registration fee will

be $185.00 plus a $17.00 surcharge. Vehicles showing a GVW R over 26,000 lbs. will

show O26 in the exception field on the registration. The registration fee will be $550.00

plus a surcharge of $17.00. Indicate tow truck or rollback on the form.

Class T will be selected for tow trucks used exclusively for towing. N/A will be shown

for GVW and GCW. Fee for U26 is $185.00. Fee for O26 is $550.00. A $17.00

surcharge will also be assessed.

Class TE will be selected for rollbacks and tow trucks used for towing and other hauling.

GVW must be entered and GCW may be entered if applicable. If weight selected is

18,000 lbs. or less fee is $185.00 and the $17.00 surcharge. Over 18,000 lbs., but less

than 26,000 use fee from regular truck chart see Truck Schedule of Fees (Form VR-

042A). If the weight selected is above 26,000 lbs. up to 40,000 lbs., the fee is $550.00.

Over 40,000 lbs. use fee from regular truck chart by clicking on the link above.

Bulletin October 2020: Tow Truck/Rollback Registration Card Changes in

Customer Connect

The Maryland Department of Transportation, Motor Vehicle Administration (MDOT MVA) has

begun its system modernization for Vehicle Services, Business Licensing, and Insurance

Compliance. The new modernized system is called Customer Connect. You will see changes on

the Tow Truck/Rollback registration cards produced by the new system and this bulletin will

explain those changes. One of the changes in the system requires that a “Use” for the vehicle be

indicated. Even though the current registration cards do not show a use, we do plan to include

that feature with a redesign of the registration card in the future. Below is an explanation of the

difference you see currently on the registration cards issued prior to July 6, 2020, and the

registration cards issued beginning July 6, 2020, when our system modernization began. We

appreciate the opportunity to bring this matter to your attention.

(Old)Registration cards, issued “prior to July 6, 2020”, for tow trucks and rollbacks show the

following information:

• Tow Truck (Exclusively for towing): Class T; Exception field U26 or O26; GWV N/A

and GCW N/A;

• Rollback (For towing or “other” hauling) Class TE, Exception field shows U26 or

O26; GVW shows weight at the thousand-pound increment selected by the owner and for

38

GCW shows N/A, or if pulling freight trailers, shows thousand-pound increment selected

by the owner.

Note: The U26 of O26 in the exception field indicates, as provided by law, that the vehicles

GVWR is either up to and including 26,000lbs, or is over 26,000lbs