HB-1-3550

4.1

OVERVIEW

Ensuring that all applicants served are eligible and receive the correct amount of

assistance is a significant responsibility of Loan Originators and Loan Approval Officials. A

borrower must be income-eligible, demonstrate a credit history that indicates ability and

willingness to repay a loan, and meet a variety of other program requirements. This chapter

provides guidance for each of these areas.

• Section 1: Evaluating Borrower Income provides instructions for calculating and

verifying annual, adjusted, and repayment income.

• Section 2: Evaluating Borrower Assets discusses Agency requirements for cash

contributions to the purchase and methods for computing income from assets.

• Section 3: Credit History identifies indicators of acceptable and unacceptable credit

and provides instructions for reviewing an applicant’s credit history.

• Section 4: Other Eligibility Requirements addresses a variety of other

requirements applicants must meet to be eligible for the program.

• Section 5: Processing the Certificate of Eligibility provides policies and

procedures for processing Form FD 1944-59, Certificate of Eligibility.

SECTION 1: EVALUATING BORROWER INCOME

4.2 OVERVIEW [7 CFR 3550.53(a) and (g), 7 CFR 3550.54]

Loan Originators use income information to: (1) help determine whether an applicant is

eligible for a loan; (2) calculate the applicant’s ability to repay a loan; and (3) determine the

amount of the loan and the amount of payment subsidy the household can obtain. When

reviewing an applicant’s repayment income, the Loan Originator must determine whether the

income is stable and dependable. This will typically be accomplished by reviewing information

provided in the application, paystubs, tax returns, and oral verifications. The Loan Originator

will generally need to look at two years p0of history to determine the dependability of the

income. In addition, the Loan Originator must determine that there is a reasonable expectation

that the income will continue. This section provides guidance for verifying and calculating

income for each of these purposes.

4-1

(01-23-03) SPECIAL PN

Revised (12-12-19) PN 532

CHAPTER 4: BORROWER ELIGIBILITY

HB-1-3550

Paragraph 4.2 Overview [7 CFR 3550.53(a) and (g), 7 CFR 3550.54]

A.

Key Concepts for Income Determinations

1.

Income Definitions

Three income definitions are used. Whenever income determinations are made, it is

essential that the Loan Originator use the correct income definition and consider income

from the appropriate household members. To determine whether the applicant will be

able to repay a loan, the Loan Originator must use repayment income. To determine

whether an applicant is income-eligible to receive a program loan or payment subsidies,

the Loan Originator must use adjusted income. Adjusted income is calculated in 2 steps.

First, the annual income of all household members is calculated. Then, certain

household deductions for which the family may qualify are subtracted from annual

income to compute adjusted income.

• Annual Income is the amount of income that is used to determine an

applicant’s eligibility for assistance. Annual income is defined as all amounts,

monetary or not that are not specifically excluded by regulations, that go to, or

are received on behalf of, the applicant/borrower, co-applicant/co-borrower,

or any other household member (even if the household member is temporarily

absent).

• Adjusted Income is used to determine whether a household is income eligible

for payment assistance. It is based on annual income and provides for

deductions to account for varying household circumstances and expenses.

• Repayment Income is used to determine whether an applicant has the ability

to make monthly loan payments. It is based only on the income attributable to

parties to the note and includes some income sources excluded for the purpose

of adjusted income. Repayment Income is used during servicing only to

determine if a borrower is eligible for a Moratorium or Reamortization as

described in Paragraph 5.5 of HB-2-3550.

2.

Whose Income To Count

For repayment income, the Loan Originator must consider only the income of

household members who will be parties to the note. For adjusted income, the income of

all household members must be considered. For both types, live-in aides, foster

children, and foster adults living in the household are not considered household

members.

____________________________________________________________________________________________

4-2

HB-1-3550

Paragraph 4.2 Overview [7 CFR 3550.53(a) and (g), 7 CFR 3550.54]

4-3

(01-23-03) SPECIAL PN

Revised (12-12-19) PN 532

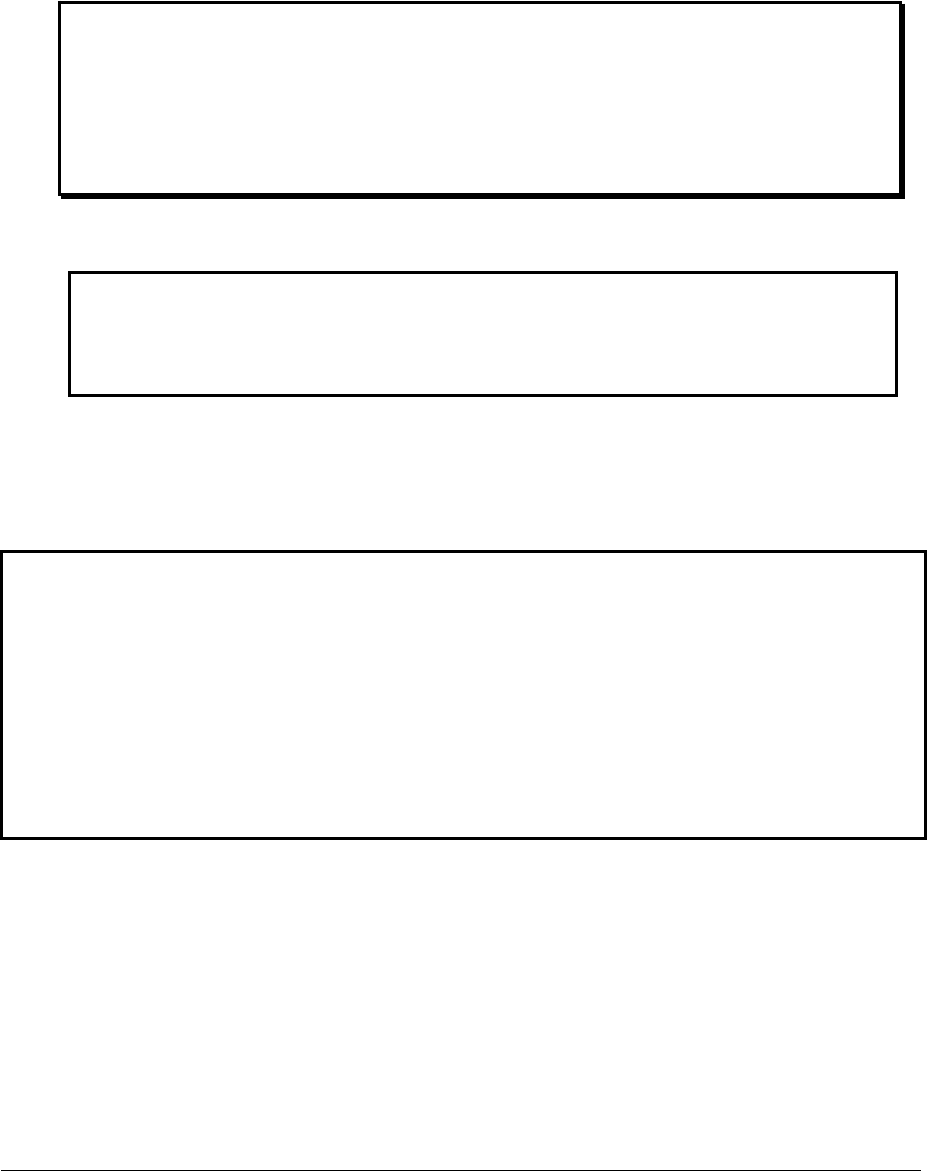

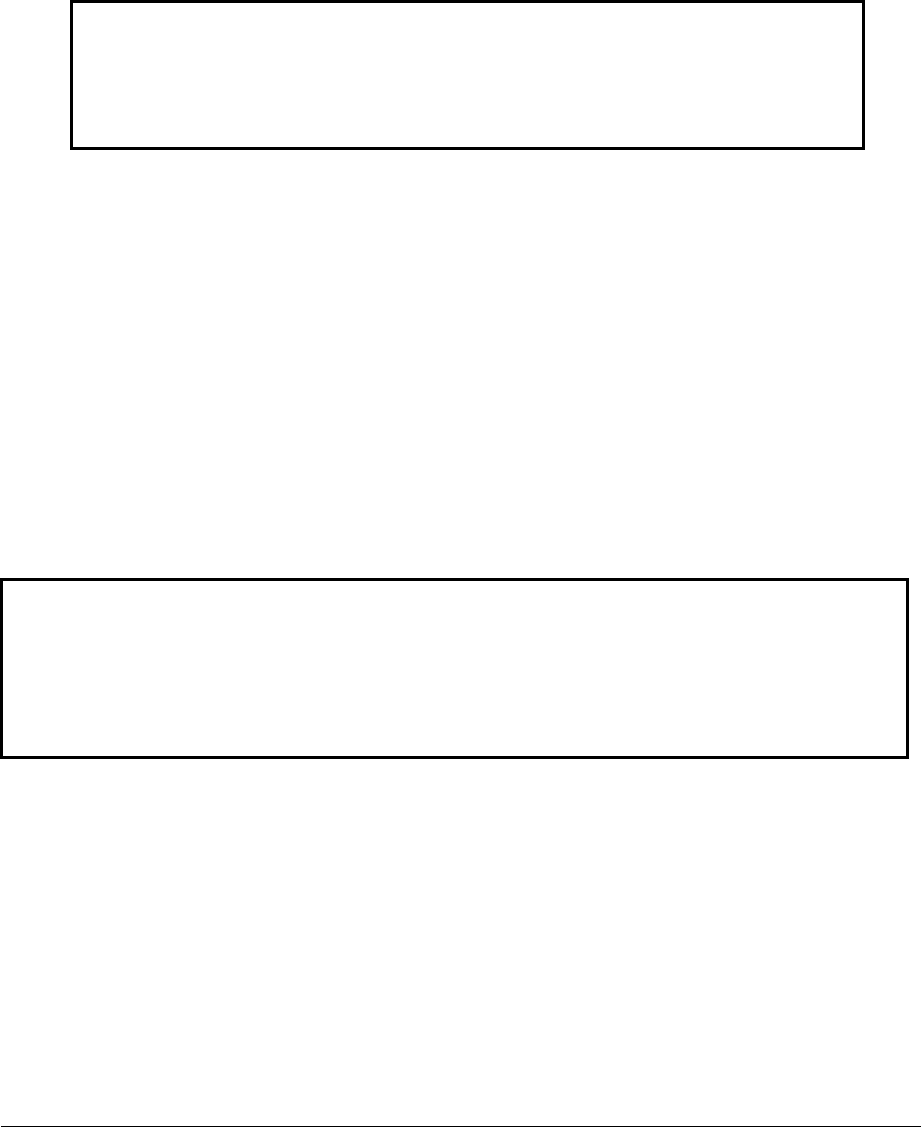

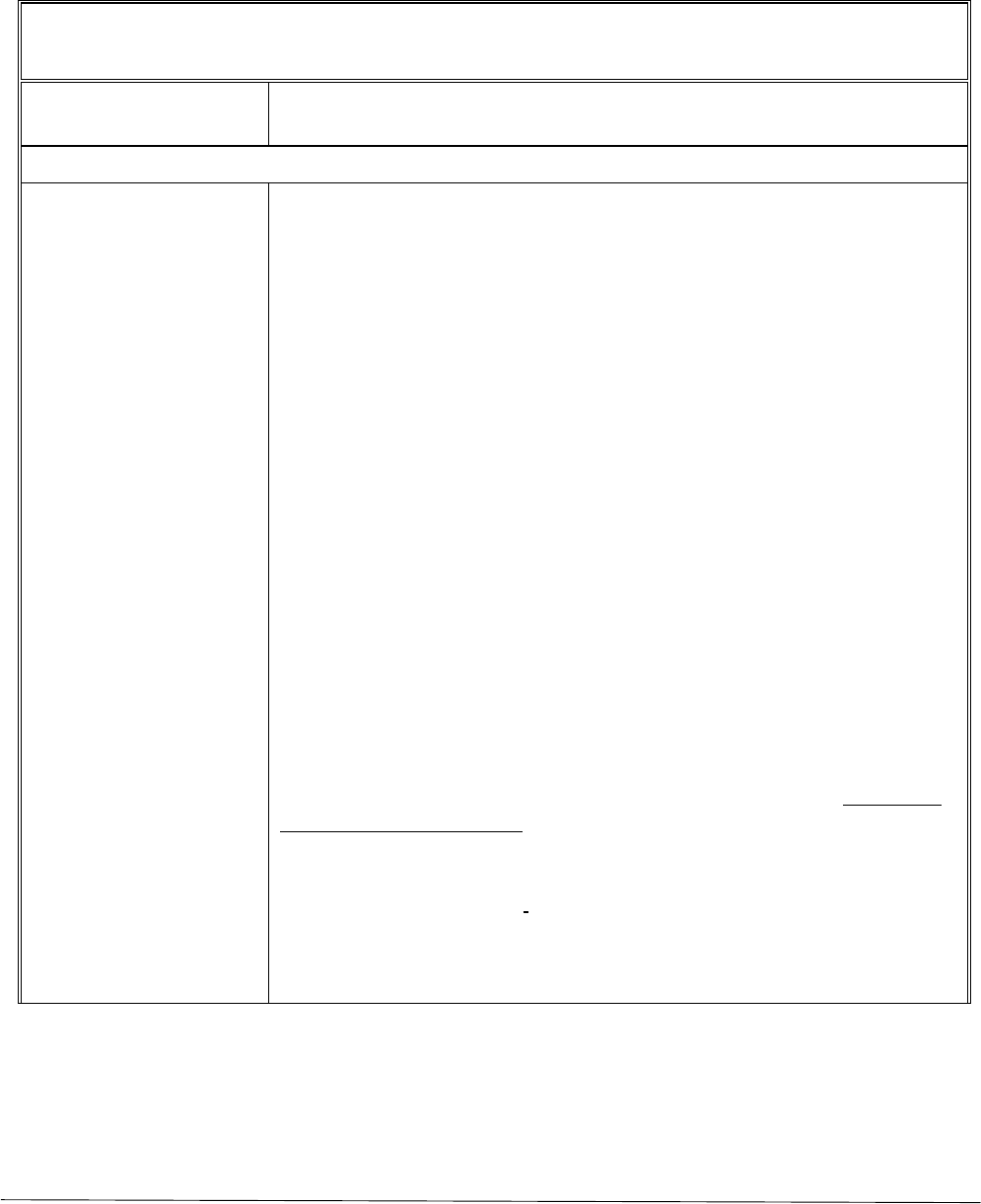

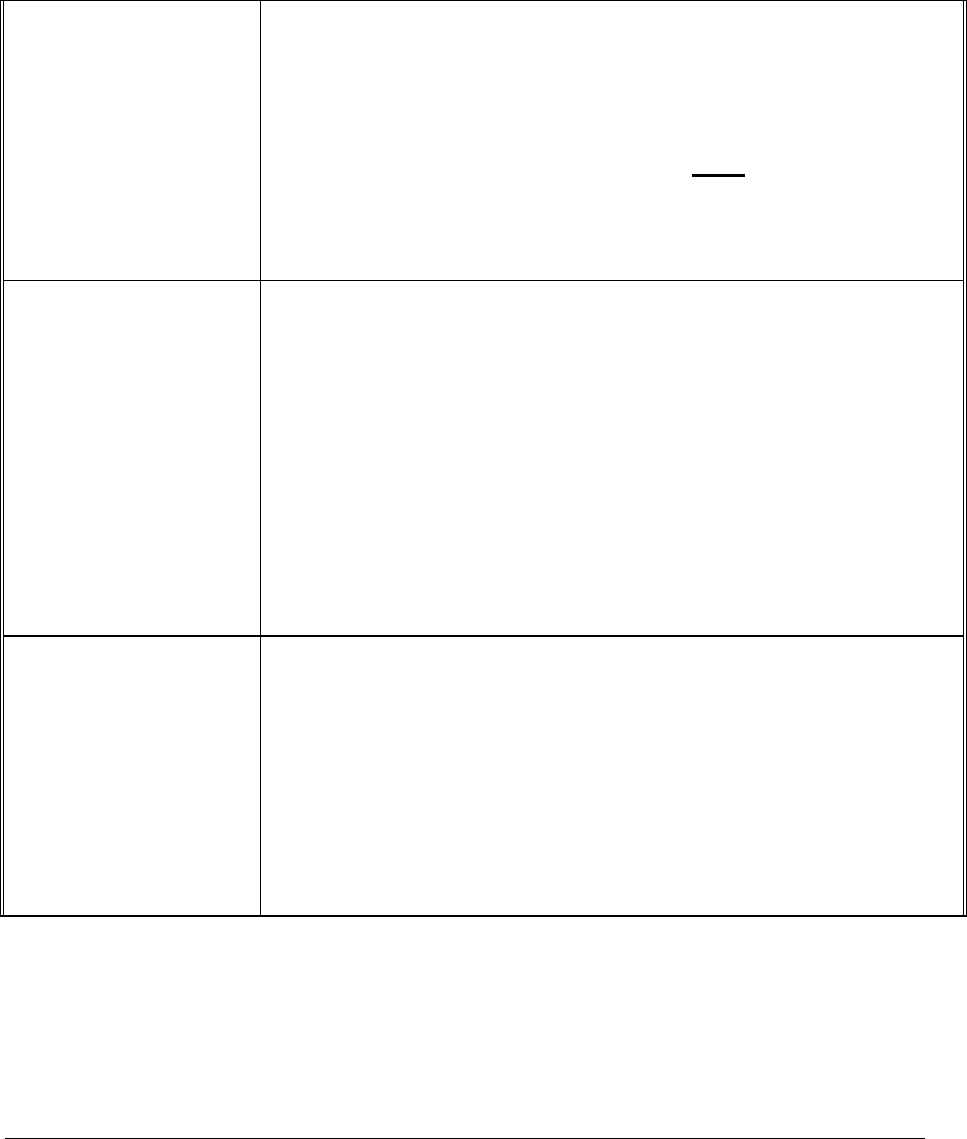

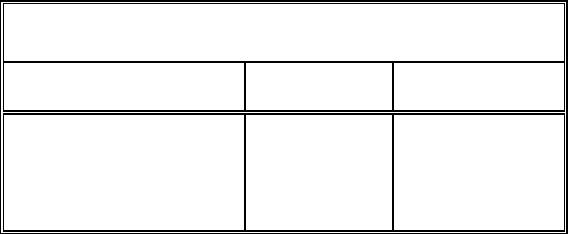

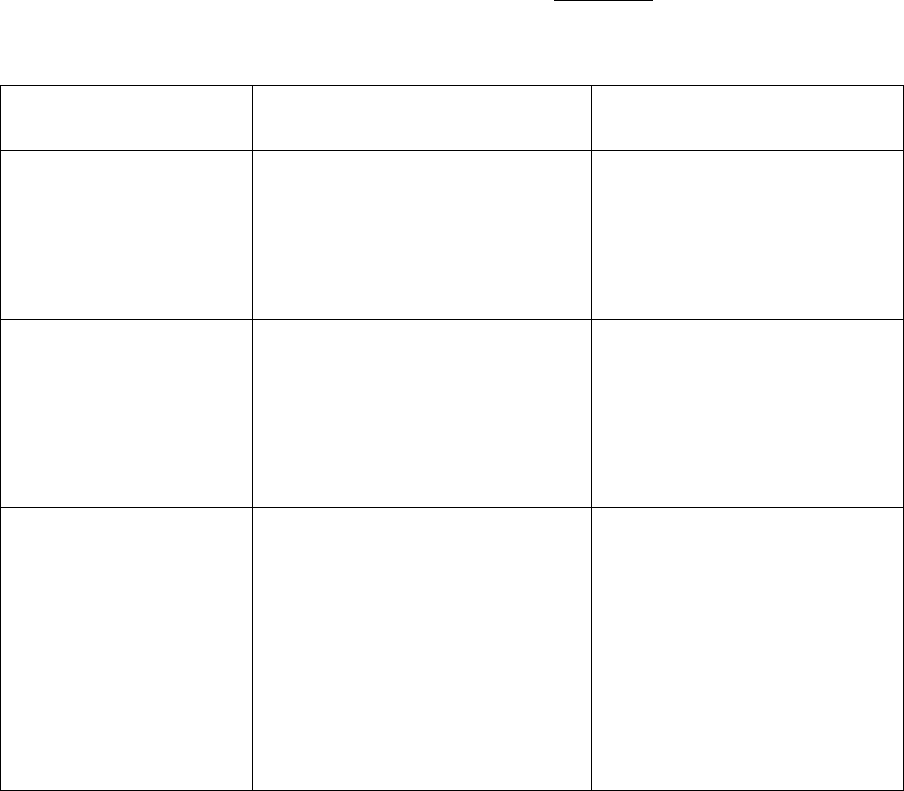

Exhibit 4-1

INCOME TO BE COUNTED

NOTE

:

The income of a full-time student 18 years old or older who is not the Applicant, Co-

Applicant/Borrower, or Spouse is excluded after it exceeds $480.

*

Reminder: The family chooses to include or exclude the permanently

confined individual’s income.

An individual permanently confined to a nursing home or hospital may not be the

applicant or co-applicant but may continue as a family member at the family’s discretion.

The family has a choice with regard to how the permanently confined individual’s

income will be counted. The family may elect either of the following:

• Include the individual’s income and receive allowable deductions related to

the medical care of the permanently confined individual; or

• Exclude the individual’s income and not receive allowable deductions

based on the medical care of the permanently confined individual.

Exhibit 4-1 is a table which lists whose income is to be counted.

Members

Employment

Income

Other Income

(including income from assets)

Applicant, Co-Applicant/Borrower

Yes

Yes

Spouse

Yes

Yes

Other Adult

Yes

Yes

Permanently Confined Family Member

Optional*

Optional*

Dependents (children under 18)

No

Yes

Full-time Student over 18

See Note

Yes

Non-Members

Foster Child

No

No

Foster Adult

No

No

Live-in Aide

No

No

HB-1-3550

Paragraph 4.2 Overview [7 CFR 3550.53(a) and (g), 7 CFR 3550.54]

3.

Income Limits

Some program rules differ according to the income of the applicant. Three different

income limits are used for the Section 502 and 504 programs. The National Office

provides the income limits and updates the limits whenever they are revised. The income

limits can be found online at: https://www.rd.usda.gov/files/RD-DirectLimitMap.pdf.

Adjusted income should be compared to the income limit to determine the category

in which each household falls. Income limits are as follows:

• The very low-income limit is an adjusted income limit developed in

consultation with HUD;

• The low-income limit is an adjusted income limit developed in consultation

with HUD; and

• The moderate-income limit is an adjusted income that does not exceed the

moderate-income limit for the guaranteed single family housing loan program.

4.

Applicant Certification and Verification Requirements

Each applicant must provide the income, expense, and household information needed

to enable the Agency to make income determinations. Most of this information is

provided on the application, but some additional follow-up with the applicant may be

required, as described in Paragraph 3.8. The applicant should be requested to provide

two years of history for a reasonable determination of income. The documentation

required will vary with the source of income. In most cases, the Loan Originator will

compare information provided on the application with the tax returns, W-2s, and other

preferred verification sources to evaluate the two-year history of income. For example,

the need to use Form RD 1910-5, Request for Verification of Employment, to document

previous employment (Part III of the form) should be rare and should be limited to cases

where the preferred verification sources are insufficient to document the applicant’s

employment history. In some instances, less than two years of history may be acceptable

when the applicant provides, and the Loan Originator documents sound justification. For

example, an applicant whose compensation changed from hourly to salary income with

the same employer in a similar job/position may be considered to have dependable and

stable income. While not typical, more than two years of history (i.e. obtaining an

additional year’s tax return) may be needed. For example, when an applicant’s income

varies significantly from year to year, the Loan Originator may need to review a longer

work/self-employment history to establish an average income. This can typically be

accomplished by obtaining an additional year’s tax return with accompanying

attachments.

4-4

HB-1-3550

Paragraph 4.2 Overview [7 CFR 3550.53(a) and (g), 7 CFR 3550.54]

4-5

(01-23-03) SPECIAL PN

Revised (07-22-19) SPECIAL PN

In the limited situations when verification from a third party is requested, a copy of

Form RD 3550-1, Authorization to Release Information, must accompany the request.

Authorization from each adult household member on the Form RD 3550-1 permits the

Loan Originator to ask for, and verification sources to release, the needed information.

Application processing should not be delayed if a third party does not respond to a

request for information. In these instances, the Loan Originator must seek to obtain the

most relevant information which can be obtained from the applicant to verify the

information. This may include, but is not limited to, evidence of deposits/withdrawals,

copies of cancelled checks, etc.

The verification and certification formats that are provided in Appendix 2 are not

official Agency forms. They are samples that may be adapted as needed for particular

circumstances. In some instances the same format can be used whether a third party is

providing the verification or the applicant is making a certification.

5.

Stable and Dependable Income

The Agency has no minimum history requirement for employment in a particular

position. The key concept is whether the applicant has a history of receiving stable

income and a reasonable expectation that the income will continue. The Loan Originator

must carefully assess the applicant’s income to establish whether it can reasonably be

expected to continue for the next two years (e.g. child support and contract income). The

applicant must provide an explanation letter for employment gaps in excess of 30 days

unless their income history is clearly seasonal in nature. The Loan Originator must

review the employment gap explanation to make a determination on the applicant’s

ability to receive stable and dependable income. If the Loan Originator determines that

an applicant’s income source is unstable and undependable, the income must be excluded

from repayment but included in annual income.

• Wage and Salary Income. Income from employment may include a base

hourly wage or salary, overtime pay, commissions, fees, tips, bonuses,

housing allowances, and other compensation for personal services of all adult

members of the household. When the applicant demonstrates a two-year

history of stable or rising income, current income from each of these sources

may be used unless there is evidence to the contrary (such as the current

employer’s oral confirmation that such income is NOT likely to continue).

HB-1-3550

Paragraph 4.2 Overview [7 CFR 3550.53(a) and (g), 7 CFR 3550.54]

4-6

• Self-employment Income. Income based on a two-year history of self-

employment, in the same line of work, is an acceptable indicator of stable and

dependable income.

• Other Sources of Income. Income from public assistance, child support,

alimony, or retirement that is consistently received is considered stable when

such payments are based on a law, written agreement or court decree, the

amount and regularity of the payments, the eligibility criteria for the

payments, such as the age of the child (when applicable), and the availability

of means to compel payments.

Example – Stable Income

Steven Green has been working for the last 6 months for LMN Contractors as a Construction Foreman.

Before that, he worked for PDQ Building Supply for 8 months as a Shift Supervisor. There is a 6-week

gap in his employment history that he explains as being the result of a lay-off after a large construction

project (where he was employed for 15 months as a construction worker) was completed. Mr. Green’s

income is considered stable because the reasons for his job changes were related to changes in job

opportunities. Even though his job changed several times, his line of work was similar.

Example – Dependable Income

Mary Brown receives SSI income for her dependent child who is 17 years of age. The SSI income

should not be counted as repayment income because it clearly cannot be expected to continue. It

would be counted as annual income since it is current verified income.

Example – Self-Employment, Commission and Other Irregular Income

Julie McAhren sells beauty products door-to-door on commission. She makes most of her money in the

months prior to Christmas but has some income throughout the year. She has no formal records of her income

other than a copy of the IRS Form 1040 she files each year. With no other information available, use the

income reflected on Julie’s copy of her Form 1040 as her annual income and make the income adjustments

according to Attachment 4-C.

Betty House sells real estate on commission. She makes most of her money during the summer months. She

has no formal records of her income other than a copy of a 1099 and the Tax Return (Form 1040) she files each

year. The gross earning on the 1099 should not be used as her annual income. Use the income and other

information on the tax return in conjunction with Attachment 4-C to calculate the self-employment income.

HB-1-3550

Paragraph 4.2 Overview [7 CFR 3550.53(a) and (g), 7 CFR 3550.54]

• Irregular Income. Irregular income from employment are earnings that may vary on

a weekly, monthly, or seasonal basis depending on the type of income. This income

is not guaranteed, nor received on a regular basis. Irregular income includes over-

time, bonus, second job, part-time, and seasonal income. Irregular income may be

considered stable when the applicant has worked in the same line of work (not

necessarily the same employer) for at least two years. Loan Originators may accept

less than a two-year history (but no less than 12-months) of irregular income if there

is a strong likelihood that the applicant will continue to receive that income. Loan

Originators must establish the income trend and calculate a monthly average for the

irregular income. When the applicant receives seasonal unemployment

compensation, it must be clearly associated with seasonal layoffs expected to recur

and be reported on the applicant’s federal income tax returns. Commission-based pay

is also considered irregular income. Additional guidance on calculating commission

income is provided in Attachment 4-C.

4-7

(01-23-03) SPECIAL PN

Revised (02-02-18) PN 508

Examples – Other Sources of Income

Janis Phillips is not always well enough to work full-time. When she is well, she works as a typist with a

temporary agency. Last year was a good year and she worked a total of nearly six months. This year,

however, she has more medical problems and does not know when or how much she will be able to work.

Because she is not working at the time, it will be best to exclude her employment income and remind her

that she must report the date when she resumes work.

Sam Shah receives social security disability. He reports that he works as a handyman periodically. He

cannot remember when or how often he worked last year; he says it was a couple of times. Sam’s earnings

appear to fit into the category of nonrecurring, sporadic income that is not included in annual income. Tell

Sam his earnings are not being included in his annual income this year, but he must report any regular work

or steady jobs he takes. Jane Smith receives child support payments for her sixteen and a half-year old son.

She has a copy of the court appointed child support agreement, which states that the child support will end

when son turns 18, and a computer print-out of a 12-month child support payment history. The child support

income should be counted in the annual income but excluded from the repayment income calculation

because it is not expected to continue for the next two years.

Example – Irregular Income

Ross Bosser is a roofer who works from April through September. He does not work in rain or windstorms. His

employer orally confirmed the total number of regular and overtime hours Ross worked during the past two years.

To calculate Ross’s anticipated income, use the average number of regular hours over the past two years times his

current regular pay rate, and the average overtime hours times his current overtime rate.

HB-1-3550

Paragraph 4.2 Overview [7 CFR 3550.53(a) and (g), 7 CFR 3550.54]

4-8

• Less Than Two Years of History. In some cases, a history of less than two years is

acceptable. The determination requires a careful analysis by the Loan Originator. This may

include an applicant who is either new to the work force, is on a probationary period, or has

returned to the work force after an extended absence. The Loan Originator may consider

reasonable allowances for less than a two-year history under the following circumstances:

• The applicant has recently changed jobs but remains in the same line of work.

• The applicant frequently changes jobs but demonstrates income continuity.

• The applicant is a recent graduate, as evidenced by college transcripts, or a recent

member of the military, as evidenced by discharge papers, entering the civilian

workforce.

• The applicant has recently re-entered the workforce after an absence due to an extended

medical illness, to care for a family member or minor child, or other similar

circumstances.

B.

Using UniFi and the Income Worksheet to Compute Income

All 3 types of income are calculated in UniFi using data entered by the Loan Originator.

Attachment 4-A, a Worksheet for Computing Income calculator that helps Loan Originators

organize applicant information for data entry and provides instructions to calculate each type of

income, will be completed and placed in the applicant’s file.

4.3

SOURCES OF INCOME

Loan Originators will consider sources of income to determine annual and repayment

income. This section provides guidance on income that will and/or will not be counted.

A.

Income Considered for Annual and Repayment Income

For annual income, consider income from the following sources that are attributable to

any household member. For repayment income, consider income from the following sources

that are: attributable to parties to the note and represent a source of dependable income.

Example – Less Than Two Years History

For the last few years, Ellen Dixon has been a homemaker with no outside employment. Now that her children

are old enough, she has taken a job as a teacher for which she has the necessary education and certifications. She

is currently half way through her 6-month probation period and her employer orally confirmed that she is a

permanent employee. Ms. Dixon’s income can be considered stable and dependable

4-9

(01-23-03) SPECIAL PN

Revised (12-12-19) PN 532

HB-1-3550

Paragraph 4.3 Sources Of Income

1. The gross amount, before any payroll deductions, of base wages and salaries,

overtime pay, commissions, fees, tips, bonuses, housing allowances, and other

compensation for personal services of all adult members of the household. If a cost

of living allowance or a proposed increase in income has been estimated to take

place on or before loan approval, loan closing, or the effective date of the payment

assistance agreement, it will be included as income. For annual income, count only

the first $480 of earned income from adult full-time students who are not the

borrower, co-borrower, or spouse.

2. The net income from the operation of a farm, business, or profession. The

following provisions apply:

• Expenditures for business or farm expansion, capital improvements, or payments

of principal on capital indebtedness shall not be used as deductions in

determining income. A deduction is allowed in the manner prescribed by Internal

Revenue Service (IRS) regulations only for interest paid in amortizing capital

indebtedness.

• Farm and non-farm business losses are considered "0" in determining

annual income. A negative amount must not be used to offset other family

income.

Employer paid and provided fringe benefits are not included in annual income regardless of whether

the benefits are reported on the employee wage statement. Fringe benefits may include, but are not

limited to:

• Child care/pet-sitting,

• Medical/life insurance,

• Car/mileage allowance,

• Stock options,

• Discounts for merchandise,

• Sport/concert/movie tickets or entertainment,

• Charity donations in employee name,

• Any reimbursement of actual work expenses.

Housing allowances may include, but are not limited to:

• Cash or non-cash contributions paid on behalf of the applicant/borrower

by persons not living in the house,

• Allowances for members of the Armed Forces,

• Allowances for members of the Clergy,

• Allowances paid by employer.

4-10

HB-1-3550

Paragraph 4.3 Sources of Income

• A deduction, based on straight line depreciation, is allowed in the manner

prescribed by IRS regulations for the exhaustion, wear and tear, and obsolescence

of depreciable property used in the operation of a farm, business, or profession by

a member of the household. The deduction must be based on an itemized

schedule showing the amount of straight-line depreciation.

• Any withdrawal of cash or assets from the operation of a farm, business, or

profession, or salaries or other amounts distributed to family members from the

farm, business, or profession, will be included in income, except to the extent the

withdrawal is for reimbursement of cash or assets invested in the operation by a

member of the household.

• A deduction is allowed for verified business expenses, such as lodging, meals,

and fuel, for business trips made by salaried employees, such as long-distance

truck drivers, who must meet these expenses without reimbursement.

• For home-based operations such as child care, product sales, and the production

of crafts, housing related expenses for the property being financed such as

mortgage interest, real estate taxes, and insurance, which may be claimed as

business expense deductions for income tax purposes, will not be deducted from

annual income.

3. Interest, dividends, and other net income of any kind from real or personal property,

including:

• The share received by adult members of the household from income distributed

from a trust fund.

• Any withdrawal of cash or assets from an investment except to the extent the

withdrawal is reimbursement of cash or assets invested by a member of the

household.

4. The full amount of periodic payments received from Social Security (including

Social Security received by adults on behalf of minors or by minors intended for

their own support, or by an applicant who is a representative payee for an adult

household member who will reside in the property), annuities, insurance policies,

retirement funds, pensions, disability or death benefits, and other similar types of

periodic receipts. However, deferred periodic amounts from supplemental income

and social security benefits that are received in a lump sum amount or in prospective

monthly amounts are not counted.

4-11

(01-23-03) SPECIAL PN

Revised (12-12-19) PN 532

HB-1-3550

Paragraph 4.3 Sources of Income

5. Payments in lieu of earnings, such as unemployment and disability compensation,

worker’s compensation, and severance pay. Unemployment income requires a

two year documentation of receipt and reasonable assurance of its

continuance. This may be appropriate for individuals employed on a

seasonal basis (e.g., farm laborers, construction workers, etc.).

6. Public assistance except as indicated in Paragraphs 4.3 C. and D.

7. Periodic allowances, such as:

• Alimony and child support received by the household; or

• Recurring monetary gifts or contributions from an organization or person who is

not a member of the household.

8. All regular pay, special pay (except for persons exposed to hostile fire), and

allowances of a member of the armed forces who is the applicant or spouse, whether

or not that family member lives in the home.

Example – Adjustment for Prior Overpayment of Benefits

Dan Steven’s social security payment of $250 per month is being reduced by $25 per month

for a period of six months to make up for a prior overpayment. Count Dan’s social security

income as $225 per month for the next six months and as $250 per month for the remaining

six months.

Examples – Regular Cash Contributions

The father of a young single parent pays her monthly utility bills. On average, he provides $100 each month.

The $100 per month must be included in the family’s annual income.

The daughter of an elderly applicant gives her mother $175 each month to assist with her living expenses.

The daughter plans to continue subsidizing her mother’s expenses. The $175 per month must be included in

the annual income.

HB-1-3550

Paragraph 4.3 Sources of Income

4-12

B.

Additional Income Considerations for Repayment Income

Consider these additional sources of income that are attributable to parties to the note and

represent a source of dependable income for repayment income only.

1. Housing assistance payment (HAP). (HUD’s Housing Choice Voucher–

Homeownership Program sometimes referred to as Section 8 for Homeownership.)

See Chapter 8.9 on how HAP payments should be handled. For additional

information on the Housing Choice Voucher – Homeownership Program, visit

http://portal.hud.gov/hudportal/HUD?src=/program_offices/public_indian_housing/pr

ograms/hcv/homeownership

2. Adoption assistance payments in excess of $480 per adopted child.

3. Reparation payments paid by a foreign government arising out of the Holocaust. If

any applicant for an Agency loan was deemed ineligible because the applicant's

income exceeded the low income limit because of the applicant's Nazi persecution

benefits, the Agency Loan Approval Official should notify the applicant to reapply

for a loan.

4. Certain income tax credits regularly received via the applicant’s employer.

5. The full amount of student financial assistance received by household members or

paid directly to the educational institution who are parties to the note. Financial

assistance includes grants, educational entitlements, work study programs, and

financial aid packages. It does not include tuition, fees, student loans, books,

equipment, materials and transportation. Any amount provided for living expenses

may be counted as repayment income.

6. Amounts received by the family in the form of refunds or rebates under State or local

law for property taxes paid on the dwelling unit.

7. Any other revenue which a Federal statute exempts will be considered repayment

income. This includes:

•

The imminent danger duty pay to a service person applicant or spouse away from

home and exposed to hostile fire.

• Payments to volunteers under the Domestic Volunteer Service Act of 1973,

including, but not limited to:

____________________________________________________________________________________________

HB-1-3550

Paragraph 4.3 Sources of Income

◊

National Volunteer Antipoverty Programs which include Volunteers In

Service To America (VISTA), Peace Corps, Service Learning Programs, and

Special Volunteer Programs.

◊

National Older American Volunteer Programs for persons age 60 and over

which include Retired Senior Volunteer Programs, Foster Grandparent

Program, Older American Community Services Program, and National

Volunteer Programs to Assist Small Business and Promote Volunteer Service

to Persons with Business Experience, Service Corps of Retired Executives

(SCORE), and Active Corps of Executives (ACE).

• Payments received after January 1, 1989, from the Agent Orange Settlement Fund

or any other fund established pursuant to the settlement in the "In Re Agent

Orange" product liability litigations, M.D.L. No. 381 (E.D.N.Y.).

• Payments received under the "Alaska Native Claims Settlement Act" or the

"Maine Indian Claims Settlement Act."

• Income derived from certain sub-marginal land of the United States that is held in

trust for certain American Indian tribes.

• Payments or allowances made under the Department of Health and Human

Services Low-Income Home Energy Assistance Program.

• Payments received from the Job Training Partnership Act.

• Income derived from the disposition of funds of the Grand River Band of Ottawa

Indians.

• The first $2,000 of per capita shares received from judgment funds awarded by

the Indian Claims Commission or the Court of Claims, or from funds held in trust

for an American Indian tribe by the Secretary of Interior.

• Payments received from programs funded under Title V of the Older Americans

Act of 1965.

• Any other income which is exempted under Federal statute.

8. Amounts paid by a State Agency to a family with a developmentally disabled family

member living at home to offset the cost of services and equipment needed to keep

the developmentally disabled family member in the home.

4-13

(01-23-03) SPECIAL PN

Revised (01-06-17) PN 492

HB-1-3550

Paragraph 4.3 Sources of Income

4-14

9. The special pay to a family member serving in the Armed Forces who is exposed to

hostile fire.

10. Income received from the Supplemental Nutrition Assistance Program (SNAP) may

be considered to calculate repayment income in an amount not to exceed 20 percent

of the total repayment income (“not to exceed” amount). The following provisions

apply:

• Only the SNAP benefits attributable to the note signers can be considered for

repayment income.

• Only the lesser of the “not to exceed” amount or the actual SNAP benefits can be

included in the applicant’s repayment income.

_________________________________________________________________________________________

Example – Income from SNAP Benefits

Eloise Thompson’s monthly income from employment is $800. She also receives $200 per month in

child support payments for her

6-year-old daughter and $200 per month in SNAP benefits. To consider

the SNAP benefits in the repayment income calculation, the “not to exceed” amount must be calculated.

Monthly repayment income excluding SNAP benefits ($800 + $200): $1,000

To calculate Income from SNAP benefits:

1. Equalize the repayment income ($1,000 / .80): $1,250

2. Calculate the “not to exceed” amount ($1,250 - $1,000): $ 250

3. Compare to actual SNAP benefits received:

$ 200

The lesser of the “not to exceed” amount or the actual SNAP benefits: $ 200

Monthly repayment income after SNAP consideration:

$1,200

HB-1-3550

Paragraph 4.3 Sources of Income

C.

Income Never Considered for Annual and Repayment Income

The following sources are never considered when calculating annual income or

repayment income:

1. Income from the employment of persons under 18 years of age, except parties to the

note and their spouses.

2. Special-Purpose Payments. These are payments made to the applicant's household

that would be discontinued if not spent for a specific purpose. Payments which are

intended to defray specific expenses of an unusual nature and which are expended

solely for those expenses should not be considered as income. Examples include, but

are not necessarily limited to, the following:

a. Medical Expenses. Funds provided by a charitable organization to defray

medical expenses, to the extent to which they are actually spent to meet those

expenses.

b. Foster Children/Adults. Payments for the care of foster children or adults.

NOTE: Foster children are not considered members of the family. Therefore, no

adjustments to income are to be made because of their presence.

3. Temporary, nonrecurring, or sporadic income (including gifts).

4. Lump-sum additions to family assets such as inheritances, capital gains, insurance

payments included under health, accident, hazard, or worker's compensation policies,

and settlements for personal or property losses.

5. Amounts that are granted specifically for, or in reimbursement of, the cost of medical

expenses for any family member.

6. Payments received on reverse amortization mortgages (these payments are

considered draw-down on the applicant’s assets).

4-15

(01-23-03) SPECIAL PN

Revised (07-22-19) SPECIAL PN

HB-1-3550

Paragraph 4.3 Sources of Income

4-16

7. Income received by foster children or foster adults who live in the household, or

live-in aides, regardless of whether the live-in aide is paid by the family or a social

services program (family members cannot be considered live-in aides unless they are

being paid by a health agency and have an address, other than a post office box,

elsewhere).

8. Amounts received by any family member participating in programs under the

Workforce Investment Act of 1998 (29 U.S.C. 2931).

• Amounts received by a person with a disability that are disregarded for a

limited time for purposes of Supplemental Security Income eligibility and

benefits because they are set aside for use under a Plan to Attain Self-

Sufficiency (PASS).

• Amounts received by a participant in other publicly assisted programs which

are specifically for or in reimbursement of out-of-pocket expenses incurred

(special equipment, clothing, transportation, child care, etc.) and which are

made solely to allow participation in a specific program.

9. Earned income tax credits.

10. Incremental earnings and benefits resulting to any family members from

participation in qualifying State or local employment training programs (including

training programs not affiliated with a local government) and training of a family

member as resident management staff. Amounts excluded by this provision must

be received under employment training programs with clearly defined goals and

objectives, and are excluded only for the period during which the family

participates in the employment training program.

11. Allowances, earnings and payments to AmeriCorps participants under the National

and Community Service Act of 1990 (42 E.S.C. 12637{d}).

HB-1-3550

Paragraph 4.3 Sources of Income

D.

Additional Income Never Considered for Annual Income

In addition, the following sources are never considered when calculating annual income:

1. Payments received for the care of foster children, or foster adults (usually individuals

with disabilities who are unable to live alone).

2. Deferred periodic payments of supplemental security income and Social Security

benefits that are received in a lump sum amount or in prospective monthly amounts.

3. Any amount of crime victim compensation received through crime victim assistance

(or payment or reimbursement of the cost of such assistance) because of the

commission of a crime against the applicant under the Victims of Crime Act (42

U.S.C. 10602).

4. Any allowance paid under 38 U.S.C. 1805 to a child suffering from spina bifida who

is the child of a Vietnam veteran.

5. Payments by the Indian Claims Commission to the Confederated Tribes and Bands of

Yakima Indian Nation or the Apache Tribe of Mescalero Reservation

(Pub.L. 95-433).

6. Housing assistance payment (HAP) (HUD’S Housing Choice Voucher

Homeownership Program, sometimes referred to as Section 8 for Homeownership).

The HAP is not included in the household’s annual income for the purpose of

determining the income category in which the household falls or determining

payment assistance.

7. Adoption assistance payments in excess of $480 per adopted child.

____________________________________________________________________________________________

4-17

(01-23-03) SPECIAL PN

Revised (12-12-19) PN 532

HB-1-3550

Paragraph 4.3 Sources of Income

4-18

E.

Verifying Sources and Amounts

The Loan Originator must verify income information provided by the applicant.

Paragraph 3.15 describes the different types of verifications. Federal Income Tax Returns

with supporting documentation are the preferred verification source for prior

income/previous employment. These documents along with paystubs (supported by oral

verification) and/or award letters are preferred when reviewing current income sources and

projecting both annual and repayment income. Written verifications provided by third-party

sources or documents prepared by third-party sources are required when the applicant is

unable to provide sufficient recent, reliable and consistent documentation.

____________________________________________________________________________________________

Examples – Income Exclusions

• The Value of Food Provided through the Meals on Wheels Program or Other

Programs Providing Food for the Needy. Shane Michaels received a hot lunch each

day during the week in the community room and an evening meal in his apartment. One

meal is provided through the Meals on Wheels program. A local church provided the

other. The value of the meals he receives is not counted as income.

• Groceries provided by persons not living in the household. Melissa Bostic’s mother

purchases and delivers groceries each week for Melissa and her two year old. The value

of these groceries is not counted as income despite the fact that these are a regular

contribution or gift.

• Amounts Received Under WIC or the School Lunch Act. Cody Britt’s two children

receive a free breakfast and reduced priced lunches at school every day through the

Special Supplemental Food Program for Women, Infants and Children (WIC). The

value of this food is not counted as income.

• Deferred periodic payments of social security benefits. Andrew Ray received

$32,000 in deferred social security benefits following a lengthy eligibility dispute. This

delayed payment of social security benefits is treated as an asset, not as income.

• Income from training programs. Jamey Hawkins is participating in a qualified state-

supported employment training program every afternoon to learn improved computer

skills. Each morning, she continues her regular job as a typist. The $250 a week she

receives as a part-time typist is included in annual income. The $150 a week she

receives for participation in the training program is excluded in annual income.

• Student financial assistance. Dylan Nessel won a scholarship from the local civic

association. The association sends him a $1,000 check each semester to help with tuition

costs. These funds are excluded from annual income.

HB-1-3550

Paragraph 4.3 Sources of Income

Each applicant must sign Form RD 3550-1, Authorization to Release Information, at

the time of application. Copies of this form must accompany any request for verification

from third-party sources. Form SSA-3288, Consent for Release of Information, may also be

used for Social Security verifications when the applicant is unable to provide a copy of an

award letter. A complete copy of the last two filed and signed IRS Form 1040, U.S.

Individual Income Tax Returns must be provided by the applicant. IRS Form W-2, Wage

and Tax Statement, and/or IRS Form 1099-MISC, Miscellaneous Income, must be attached

to the applicant’s federal income tax return in order for it to be considered a complete return.

For electronically filed tax returns, it is not necessary to require the applicant(s) to manually

sign the return for application purposes if there is sufficient documentation the applicant has

signed and filed the return electronically (e.g. use of Self-Select PIN for Free File Fillable

Forms, Electronic Filing PIN, authorized E-File Provider, etc.).

The Agency will ask the applicant to directly request, obtain, and provide a copy of their

tax return transcript for the previous two tax years (using IRS Form 4506-T, Request for

Transcript of Tax Return) if additional income validation is needed. If there are

inconsistencies between the income verifications (e.g. pay stubs, tax returns, etc.), or if the

applicant was unable to furnish complete copies of their last two filed returns (e.g. a W-2

was missing), then the transcript should be requested. The transcript should also be

requested if the income verifications appear suspicious (e.g. there is evidence of alteration).

Appendix 2 provides sample certification and verification formats for a number of

purposes.

The following chart provides guidance on acceptable alternative sources of

verifications of different types of income:

4-19

(01-23-03) SPECIAL PN

Revised (12-12-19) PN 532

HB-1-3550

Paragraph 4.3 Sources of Income

4-20

INCOME

(If Preferred Source of Verification cannot be obtained without cost,

Acceptable Alternative may be used.)

Type of Income or

Verification Source

Verification Requirements and Procedures

WAGES or SALARY

Paycheck Stubs or

The applicant must list all household members on the application and provide

Payroll Earnings

their employment status. They must be consecutive and “most recent” as of

Statements for not less

the date the loan application is made; must clearly identify the applicant (or

than four (4) consecutive

adult household member) as the employee by name and/or social security

weeks

number; must show the gross earnings for that pay period and year-to-date;

Preferred Source

and must be computer-generated or typed. Oral verifications should only be

used if the applicant has worked for the employer for less than a year or the

other types of verifications are inconsistent or suspicious, documented as

follows:

AND

Document in the running record the date of contact and list: The employer’s

name/address/phone number/contact person and title; the employee’s name,

Oral Verification as

date of employment, present position and probability of continued

permitted in Paragraph

employment; the source of the phone number (applicant, realtor, yellow

3.15 A.3.

pages, website); and the name and title of the Rural Development employee

Preferred Source

that contacted the employer. Note: The oral verification is conducted with a

current employer to confirm the applicant’s present employment and to verify

the probability of continued employment only. Income information should

not be discussed during an oral verification of employment.

Electronic Verification

It must clearly identify the applicant (or adult household member) as the

Acceptable Alternative

employee by name and/or social security number, cover the most recent pay

(in lieu of paycheck

period as of the date the initial loan application is made, and show the gross

stubs only)

earnings for the most recent 30-day pay period and year-to-date. Obtain oral

verification of employment only if the applicant has worked for the

employer for less than a year or the other types of verifications are

inconsistent or suspicious.

Written Verification of

Employment

Acceptable Alternative

If paycheck stubs or earnings statements are inconsistent or not available, the

Loan Originator must send Form RD 1910-5, Request for Verification of

Employment, to each employer for verification.

HB-1-3550

Paragraph 4.3 Sources of Income

Type of Income or

Verification Source

Verification Requirements and Procedures

For SELF-EMPLOYED

PERSONS

Income & Expense

Statement

Preferred Source

Self-employed applicants (or adult household members) must provide

current documentation of income and expenses, which cannot be older than

the previous fiscal year. The Loan Originator must compare the income and

expense information provided by the applicant with the last two complete

Federal Income Tax Returns (IRS Form 1040) along with Schedules C & F

and/or other applicable schedules, and clarify any discrepancies. IRS Form

W-2 must be attached to the applicant’s Federal Income Tax return in order

for it to be considered a complete return when the applicant has wage

income.

(NOTE: Other sources of commercial software such as Turbo Tax are not

acceptable alternatives.) Appendix 2 provides a sample format for

recording business expenses.

SUPPLEMENTAL

VERIFICATION

Seasonal Employment

Preferred Source

A household member who is a seasonal worker must provide the most recent

Federal income Tax return, the prior year’s W-2s and/or prior year’s 1099-

MISC statements.

Unemployment and

All applicants (or adult household members) must complete Form RD

Unemployment Benefits,

3550-4, Employment and Asset Certification, which provides his/her current

Disability & Worker’s

employment status and requires them to agree to inform the Agency

Compensation, Severance

immediately, in writing, if the employment status changes. If an applicant

Pay (except lump-sum

has recently become unemployed, the Loan Originator should contact the

additions)

former employer to confirm that the applicant is no longer employed and that

re-employment is not expected.

Preferred Source

Applicants (or adult household members) receiving unemployment benefits

must provide the most recent award or benefit letter prepared and signed by

the authorizing agency to verify the non-employment income. Appendix 2

provides a sample format for requesting information about unemployment

benefits.

It must clearly identify the adult household member as the employee by

name and/or social security number and cover the most recent earnings as of

the date the verification is submitted.

____________________________________________________________________________________________

4-21

(01-23-03) SPECIAL PN

Revised (01-06-17) PN 492

HB-1-3550

Paragraph 4.3 Sources of Income

4-22

Electronic Verification

Acceptable Alternative

Electronic verification for that period, copy of checks, or bank statements, all

showing gross earnings. All authorized deductions must be added back to

checks or bank statements to reflect gross amount.

Mortgage Credit

An applicant receiving a MCC must file IRS Form W-4, Employee’s

Certificates (MCC)

Withholding Allowance Certificate. This IRS form enables the applicant’s

employer to include a portion of the applicant’s income tax credit in their

regular paycheck. Income tax credits not advanced through the applicant’s

employer on at least a monthly basis cannot be included in repayment

income but may warrant consideration as a compensating factor.

Preferred Source for

MCC

The documents must be the “most recent” and identify the applicant by name

and/or social security number.

Applicable IRS Form or

Signed copies of the applicable IRS Form or a letter from the employer

Letter from Employer

stating the applicant has executed and the employer has accepted the

document.

Regular, Unearned

The applicant (or adult household member) must provide a copy of the most

Income (e.g., Social

recent award or benefit letter prepared and signed by the authorizing agency.

Security, SSI, Retirement

If the date of the letter is not within the last 12 months, require the applicant

Funds, Pensions,

to submit information updating the award, for example, a cost-of-living

Annuities, Disability or

(COLA) payment notice, Social Security Benefits Statement, or a notice of

Death Benefits) (except

change in benefits. Appendix 2 provides sample formats for requesting this

deferred periodic

information.

payments)

Preferred Source

Acceptable Alternative

The two most recent bank statements showing the amount of monthly

benefits received and IRS Form 1099 for the previous year. Loan

Originators must verify that the benefit shown on the bank statement reflects

the gross amount of the benefit prior to deductions for items such as taxes,

health benefits, insurance premiums, etc.

HB-1-3550

Paragraph 4.3 Sources of Income

4-23

(01-23-03) SPECIAL PN

Revised (07-22-19) SPECIAL PN

Alimony or Child Support

Payments

Preferred Source

Electronic Verification

Acceptable Alternative

The applicant (or adult household member) must obtain a payment history

for the last 12 months from the court appointed entity responsible for

handling payments. The average amount received will be used in the income

calculations.

The two most recent bank statements showing electronic deposit of the

monthly alimony and/or child support received AND a copy of the court

appointed divorce decree or separation agreement (if the divorce is not final)

that provides for the payment of alimony or child support and states the

amount and the period of time over which it will be received.

Divorce Decree

If (and only if) a source of income was awarded in the decree, and there is

Acceptable Alternative

not a court appointed entity responsible for handling payments, the applicant

(or adult household member) may provide a copy of the divorce decree,

separation agreement, or other document indicating the amount of the

required support payments. If the applicant reports that the amount required

by the agreement is not being received, the applicant must provide adequate

documentation of the amount being received (i.e. copies of the checks or

money orders from the payer, etc.) and certify the payments are being

received or not received.

Cancelled Checks

Acceptable Alternative

If (and only if) there is not a court appointed entity responsible for handling

payments and formal documents were never issued, support payments can be

certified as being received or not received.

Verification of Assets and

Form RD 3550-4, Employment and Asset Certification, will be used to

Income from Assets and

confirm the level of the household’s combined net assets. Obtain the two

Investments

most recent complete bank or brokerage statements showing the transaction

Preferred Source

history and the current balance. If account information is reported on a

quarterly basis, obtain the most recent quarterly statement. To further

document interest and dividend income the applicant must provide copy of

Federal tax forms and schedules clearly identifying income from interest,

dividends, and capital gains. For some assets such as mutual funds or 401(k)

accounts, copies of year-end statements can provide information about

annual income.

HB-1-3550

Paragraph 4.3 Sources of Income

4-24

If the Loan Originator has reasons to question the accuracy of the applicant’s

self-certification or bank statements, the Loan Originator sends Form RD

1944-62, Request for Verification of Deposit, to financial institutions to

verify account balances.

Verification of Gifts

Preferred Source

If funds needed for the purchase will be provided by an organization or

another person not living in the household, the Loan Originator must send

the donor Form RD 3550-2, Request for Verification of Gift/Gift Letter, to

verify whether the gift must be repaid and whether the funds have already

been transferred. Form RD 3550-2 is used to verify gifts that are non-

recurring and intended for down payment or closing costs purposes only.

Verification of Recurring

Gifts

Preferred Source

For recurring gifts, if there is no history of the gift being received prior to

application and the gift amount is needed to establish the applicant has

repayment ability, the Loan Originator must determine and document that

the gift is stable and dependable.

DEDUCTIONS

Type of Expense or

Verification Source

Verification Requirements and Procedures

Disability Assistance

Expenses

Preferred Source

To qualify for disability deductions, the applicant must describe the nature of

the expense, provide documentation of the costs, and demonstrate that the

expense enables a family member to work. If the household member

receives a form of income because of a verified disability (such as social

security disability or disability compensation), that may be used as a method

to verify the disability. Otherwise, Form RD 1944-4, Certification of

Disability or Handicap, should be used to have a physician or other medical

professional verify the household member’s disability.

Medical Expenses

Preferred Source

For elderly households only, allowable medical expenses may be deducted

from annual income. Therefore, documentation of medical expenses is not

generally required for non-elderly households. In such cases, these medical

expenses must be verified as well. Appendix 2 provides a sample format for

documenting medical expenses.

Childcare Expenses

Reasonable childcare expenses may be deducted from annual income. To

qualify for the deduction, the applicant must:

•

Identify the children receiving child care and the family member who

can work or go to school as a result of the care;

•

Demonstrate there is no adult household member available to care for

the children;

•

Identify the child care provider, hours of care provided, and costs (e.g.,

letter on the child care provider’s letterhead or a copy of a signed child care

contract); and

•

Identify the educational institution and provide documentation of

enrollment (if appropriate).

Appendix 2 provides a sample format for requesting childcare information.

HB-1-3550

Paragraph 4.3 Sources of Income

4-25

(01-23-03) SPECIAL PN

Revised (07-22-19) SPECIAL PN

1. Timing

Documentation used to verify employment, income, assets, and deductions must be

no more than 120 days old, or 180 days old for new construction by closing date. If any

of the verification documents are older than allowed, the Loan Originator must update

them before settlement. The age of certain documents, such as divorce decree and tax

returns, do not necessarily affect the validity of the underwriting decision. These types of

documents are exempt from the document age restriction unless there is evidence that the

applicant’s circumstances have changed thus warranting updated verifications.

2. Projecting Expected Income for the Next 12 Months

Once an income source is verified, the Loan Originator must project the expected

income from this source for the next 12 months. This projection should be based on a

comparison and analysis of the figures derived from using all applicable calculation

methods. To establish earning trends and avoid miscalculating income (especially from

seasonal income), the more methods used the better. However, some income sources will

only lend themselves to one method. In some cases, there may be multiple types of

income generated from one source (overtime, bonus, hourly); therefore the income

calculation method used will depend on the type of income received, rather than the

source of income. The four calculation methods are:

• Straight-based where the benefit or wage amount is converted to the annual

equivalent.

• Average where the income as reported on the benefit statements or pay stubs for

the last 30 days is averaged and then converted to the annual equivalent.

• Year-to-date (YTD) where the YTD gross earnings are divided by the YTD

interval, which is the number of calendar days elapsed between January 1 of the

current year and the last date covered by the most recent income verification, and

then multiplied by 365. The earning activity during the YTD interval should be

closely examined to determine the appropriateness of this method. Do not use

this method if the earning activity during the YTD interval is insufficient to make

an annual projection or is not reflective of the likely earning activity for the period

outside the YTD interval (the time between the last date covered by the most

recent income verification and December 31 of the current year).

• Historical where the income as reported on the previous year’s tax return is used.

Any declining income trend, especially for repayment income, must be carefully

document in the underwriting analysis.

_______________________________________________________________________________________

HB-1-3550

Paragraph 4.3 Sources of Income

4-26

After the Loan Originator determines the suitable methods and performs the

calculations, he/she must determine which figure is most representative of income likely

to be received during the next 12 months. If the figures are disparate and one figure is

not clearly the most representative, an average of the resulting figures may be used.

Selecting the lowest figure without analysis is not acceptable. The selection must be

carefully deliberated and may require additional verification.

Example - Projecting Expected Income for the Next 12 Months

Ken Anderson has worked for B & N Auto for the last two years. According to the application, Mr.

Anderson reported that he earns $10/hour, works 40 hours per week. His employer orally verified that he is expected

to work 25 hours of overtime in the next 12 months. Since Mr. Anderson is paid weekly, he submitted his last four

pay stubs through the pay period ending May 1st that show gross pay (including overtime) of $460, $415, $475, and

$445. It also shows gross YTD earnings of $5,885. Mr. Anderson’s tax return for last year showed gross wages of

$16,640.

Straight-based: Base pay: $10/hour x 40 hours/week x 52 weeks/year = $20,800

Overtime: $15/hour x 25 hours/year = $375

Total wages: $21,175

Average: ($460 + $415 + $475 + $445) / 4) x 52 weeks/year

= $23,335

YTD: ($5,885 / 121 days) x 365 = $17,754

Historical: $16,640

Looking at the four results, there is no clear earning pattern. The Loan Originator should investigate

further to determine why significant discrepancies exist between the calculation methods and what figure should be

used. Is B & N experiencing an unusual and temporary large workload? Was Mr. Anderson absent from work for

an extended period of time? Did Mr. Anderson receive a pay increase from last year? These are just a few

examples of the questions that should be answered.

NOTE: These calculations should be documented in writing and included in the case file.

HB-1-3550

Paragraph 4.3 Sources of Income

4-27

(01-23-03) SPECIAL PN

Revised (01-06-17) PN 492

3. Income of Temporarily Absent Family Members

Household members may be temporarily absent from the household for a variety of

reasons, such as temporary employment or students who live away from home during the

school year. The income of these household members is considered when computing

annual income and, if the person is a party to the note, for repayment income.

If the absent person is not considered a member of the household and is not a party to

the note, the Loan Originator must not count their income, must not consider them when

determining deductions for adjusted income, and must not consider them as a family

member for determining which income limit to use.

Examples - Temporarily Absent Family Member

James Brown and his wife have applied for a loan. At the moment, James is working on a

construction job on the other side of the State and comes home every other weekend. He earns

$600/week and uses approximately one-third of that amount for temporary living expenses. The full

amount of the income earned would be counted for both repayment and annual income.

Adam Watson works as an accountant. However, he suffers from a disability that

periodically requires lengthy stays at a rehabilitation center. When he is confined to the

rehabilitation center, he receives disability payments equaling 80% of his usual income. During the

time he is not in the unit, he will continue to be considered a family member. Even though he is not

currently in the unit, his total disability income will be counted as part of the family’s annual

income.

Desirae Bitz accepts temporary employment in another location and needs a portion of her

income to cover living expenses in the new location. The full amount of the income must be

included in annual income.

Terri Glass is on active military duty. Her permanent residence is her parents’ home where

her husband and children live. Terri is not currently exposed to hostile fire. Therefore, because her

spouse and children are in the parents’ home, her military pay must be included in annual income.

(If her spouse or dependents were not in the parent’s home, she would not be considered a family

member and her income would not be included in annual income.)

HB-1-3550

4-28

4.4

CALCULATING ANNUAL AND ADJUSTED INCOME

Adjusted income is used to determine eligibility for the Section 502 and 504 programs, as

well as eligibility for and the amount of payment subsidies under Section 502.

A.

Calculating Annual Income

Annual income is used as the base for computing adjusted income. Income of all

household members, not just parties to the note, should be considered when computing annual

income.

B.

Calculating Deductions from Annual Income

Adjusted income is calculated by subtracting from annual income any of 5 deductions

that apply to the household. Not all households are eligible for all deductions. Exhibit 4-2

summarizes these deductions. The remainder of this paragraph provides guidance on

determining whether a family is eligible for each deduction and verifying and calculating these

amounts.

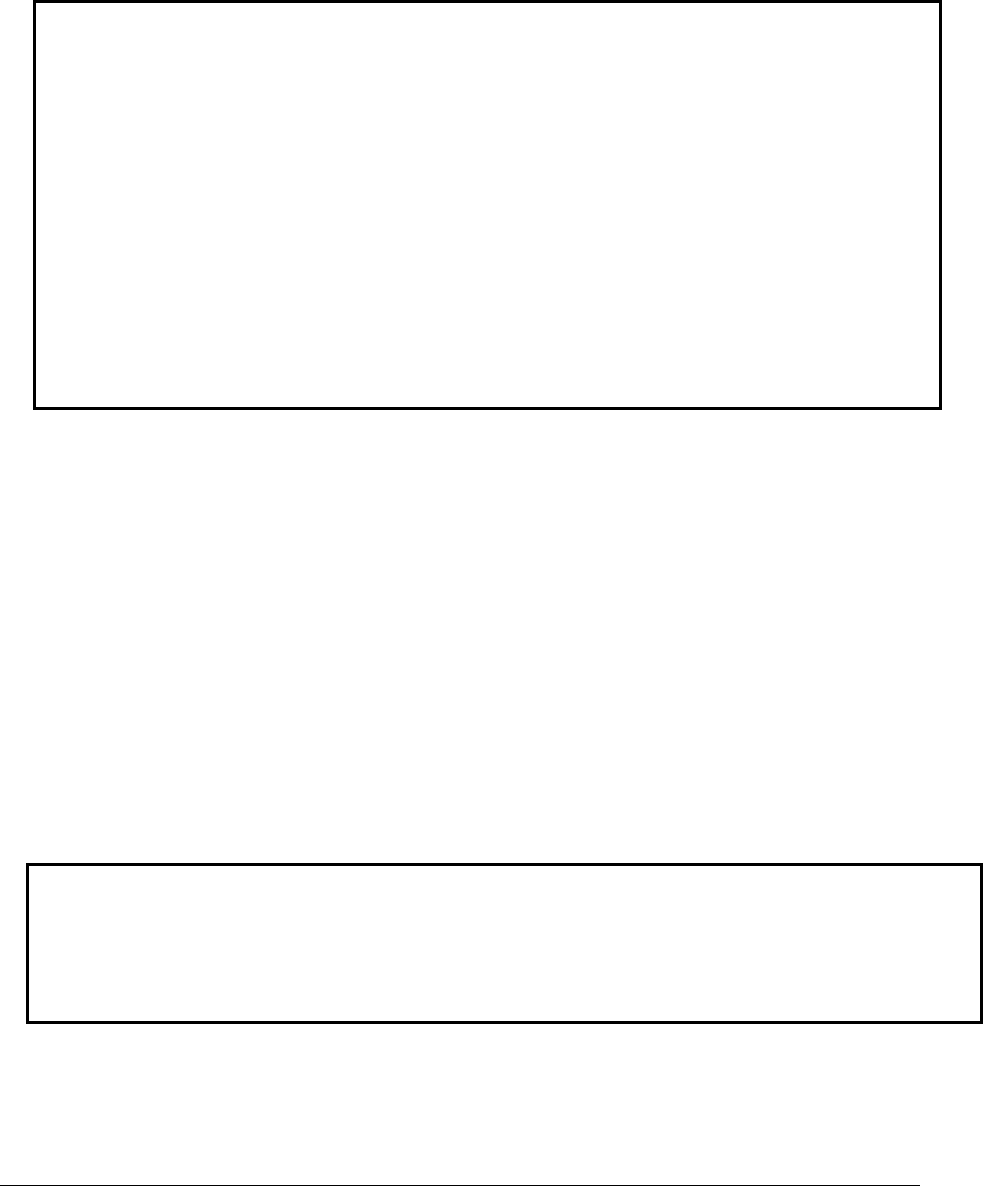

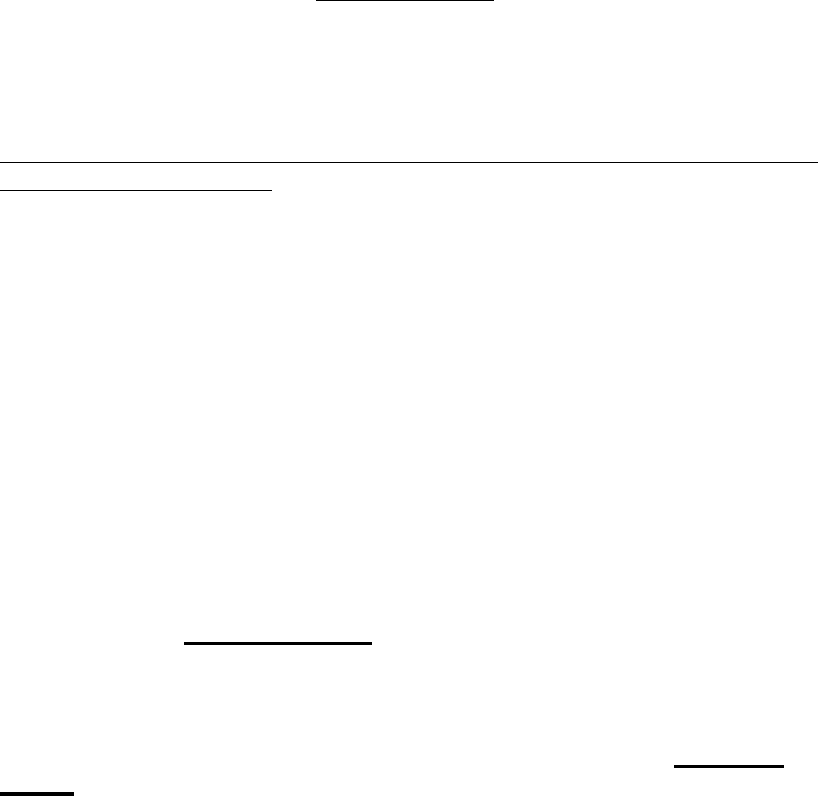

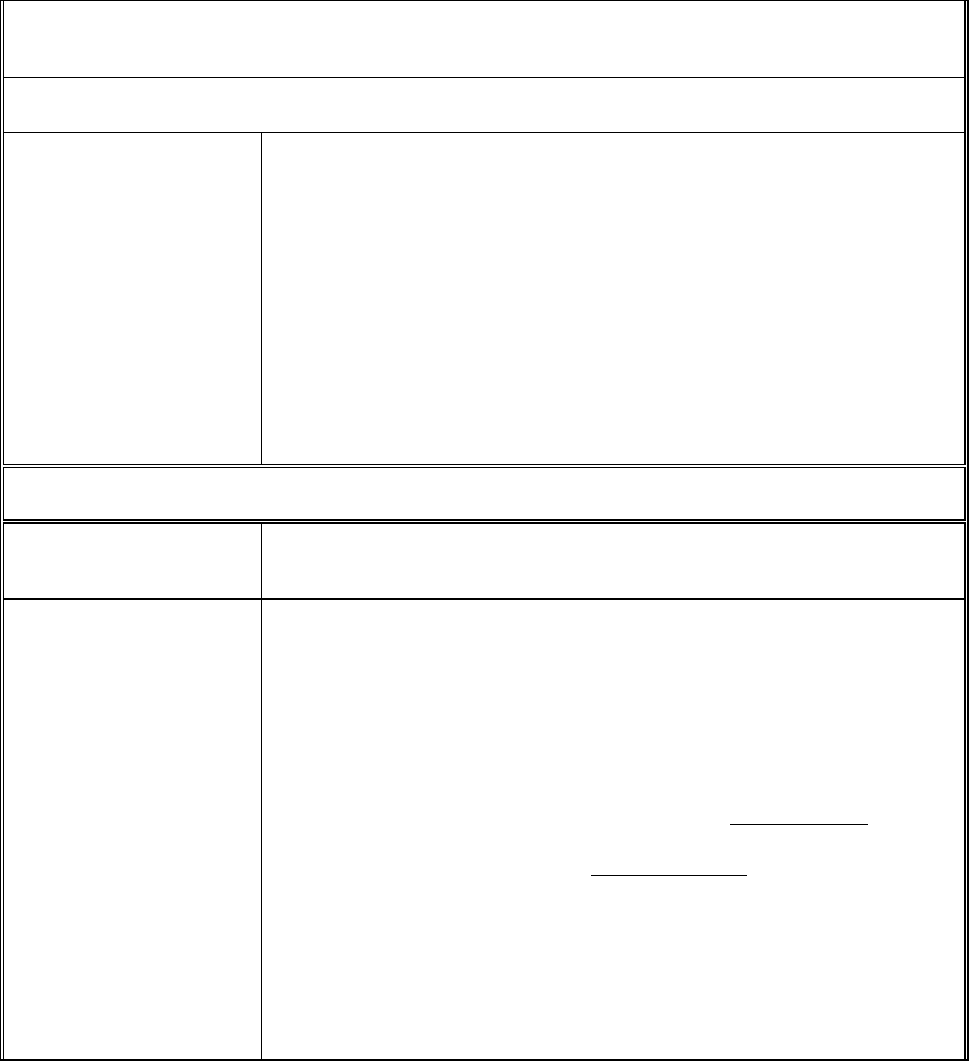

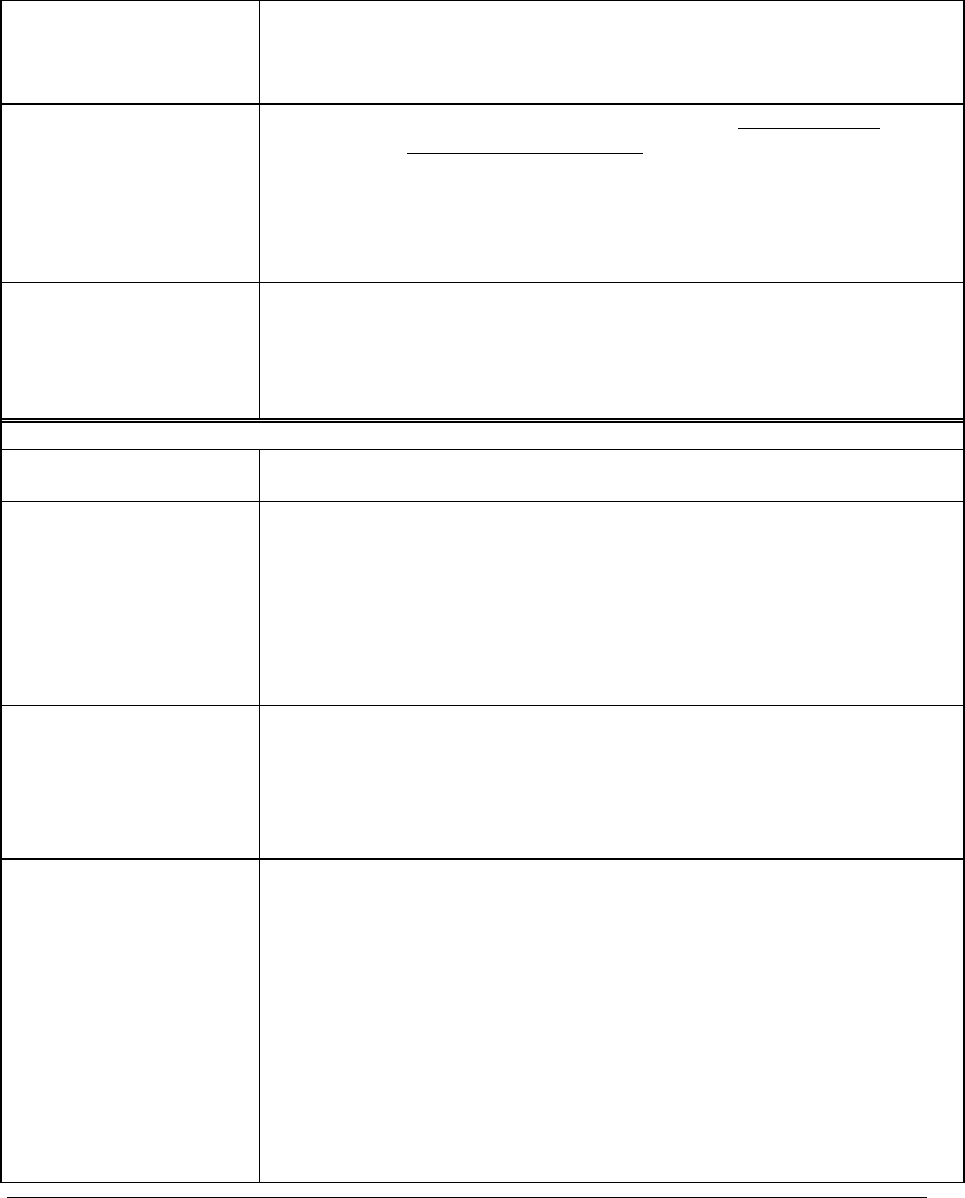

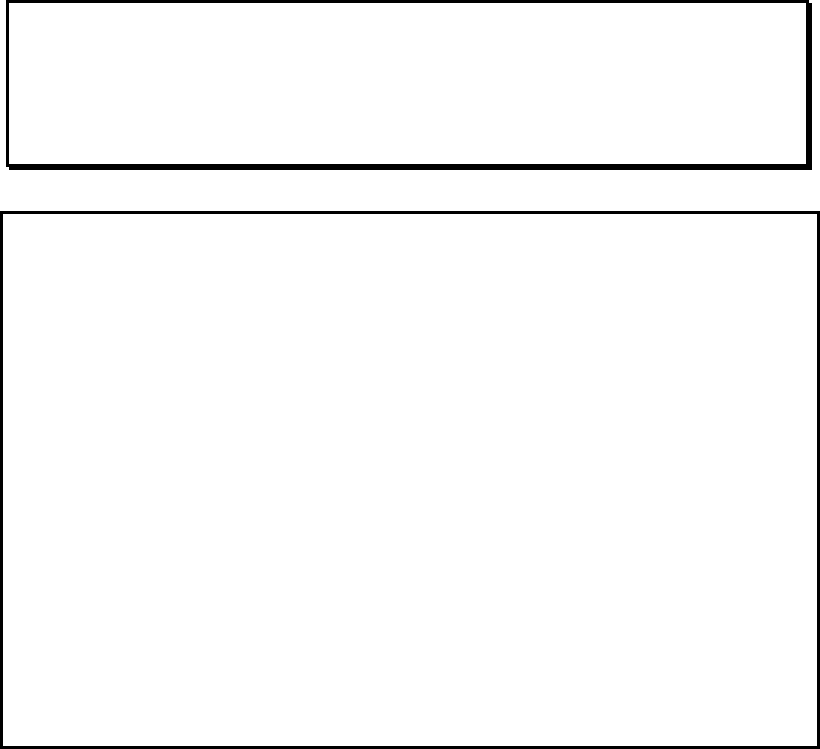

Exhibit 4-2

Allowable Deductions from Annual Income

Deduction

Elderly

Households

Nonelderly

Households

Dependent Deduction

Yes

Yes

Child Care Expenses

Yes

Yes

Elderly Household

Yes

No

Medical Expenses

Yes

No

Disability Assistance

Yes

Yes

C.

Dependent Deduction

A deduction from annual income of $480 is made for each household member who

qualifies as a dependent. Dependents are members of the household who are not the borrower,

co-borrower, or spouse, are age 17 or younger, are an individual with a disability, or are a full-

time student. The applicant/borrower, co-applicant/co-borrower, or spouse of applicant/borrower

(even if the household member is temporarily absent) may never qualify as a dependent. A

foster child, an unborn child, a child who has not yet joined the family, or a live-in aide may

never be counted as a dependent.

____________________________________________________________________________________________

HB-1-3550

Paragraph 4.4 Calculating Annual and Adjusted Income

4-29

(01-23-03) SPECIAL PN

Revised (12-12-19) PN 532

D.

Child Care Expenses

Reasonable unreimbursed child care expenses for the care of children age 12 and under

are deducted from annual income if:

(1)

the care enables a household member to work, actively seek employment, or go to

school;

(2)

no other adult household member is available to care for the children; and

(3)

in the case of child care that enables a household member to work, the expenses

deducted do not exceed the income earned by that household member. This limitation

does not apply if the child care allows a household member to go to school.

If the child care provider is a household member, the cost of the children’s care cannot be

deducted.

Child care attributable to the work of a full-time student (except for applicant/borrower,

co-applicant/co-borrower, or spouse of applicant/borrower) is limited to not more than $480,

since the employment income of full-time students in excess of $480 is not counted in the annual

income calculation. Child care payments on behalf of a minor who is not living in the household

cannot be deducted.

To qualify for the deduction, the applicant must:

• Identify the children who are receiving child care and the family member who can

work, seek employment or go to school (academic or vocational) as a result of the

care;

• Demonstrate there is no adult household member available to care for the children

during the hours care is needed;

• Identify the child care provider, hours of child care provided, and costs;

• Verify the expense is not reimbursed by an agency or individual outside the family;

and

• If the expenses enable a family member to go to school, identify the educational

institution. The family member need not be a full-time student.

____________________________________________________________________________________________

4-30

HB-1-3550

Paragraph 4.4 Calculating Annual and Adjusted Income

____________________________________________________________________________________________

Verification of Child Care Expenses

Child care hours must parallel the hours the family member works or goes to school. Appendix 2

provides a sample format applicants can use to document child care. Other acceptable formats

include a letter on the child care provider’s letterhead or a copy of a signed child care contract.

Example – Child Care Deduction

Separate Expenses for Time at Work and Time at School

Lou and Bryce have two children. Both parents work, but Lou works only part-time and goes to

school half-time. She pays $4 an hour for eight hours of child care a day. For four of those

hours, she is at work; for four of them she attends school. She receives no reimbursement for her

child care expense.

Her annual expense for child care during the hours she works is $4,000 and at school is $4,000.

She earns $6,000 a year. Bryce earns $18,000.

Lou’s child care expense while she is working cannot exceed the amount she is earning while at

work. In this case, that is not a problem. Lou earns $6,000 during the time she is paying $4,000.

Therefore, her deduction for the hours while she is working is $4,000.

Lou’s expense while she is at school is not compared to her earnings. Her expense during those

hours is $4,000 and her deduction for those hours will also be $4,000.

Lou’s total child care deduction is $8,000 ($4,000 + $4,000). The total deduction exceeds the

amount of Lou’s total earnings, but the amount she pays during the hours she works does not

exceed her earnings. If Lou’s child care costs for the hours she worked were greater than her

earnings, she would not be able to deduct all of her child care costs.

4-31

(01-23-03) SPECIAL PN

Revised (12-12-19) PN 532

HB-1-3550

Typical Disability Expenses

• Care attendant to assist an individual with disabilities

with activities of daily living directly related to

permitting the individual or another family member to

work.

• Special apparatus, such as wheelchairs, ramps, adaptations

to vehicles or work place equipment, if directly related to

permitting the individual with disabilities or another family

member to work.

Paragraph 4.4 Calculating Annual and Adjusted Income

E.

Elderly Household Deduction

A single $400 deduction is subtracted from annual income for any elderly household. To

be considered an elderly household, a party

to the note must be 62 years of age or older

or an individual with a disability. Because

this is a “family deduction” each household

receives only one deduction, even if more

than one member is elderly or disabled.

In the case of a family where the

deceased applicant/borrower or spouse was at

least 62 years old or an individual with

disabilities, the surviving family member shall continue to be classified as an “elderly

household” for the purposes of determining adjusted income if:

• At the time of death of the deceased family member, the dwelling was financed by the

Agency;

• The surviving family member occupied the dwelling with the deceased family

member at the time of death; and

• The surviving spouse (if any) has not remarried.

F.

Deduction for Disability Assistance Expense

Families are entitled to a deduction for un-reimbursed, anticipated costs for attendant care and

“auxiliary apparatus” for each family member who is a person with disabilities, to the extent these

expenses are reasonable and necessary to enable any family member 18 years of age or older who may

or may not be the member who is a person with disabilities (including the member who is a person with

disabilities) to be employed. The applicant must describe the nature of the expense, provide

documentation of the costs, and demonstrate that the expense enables a family member to work.

Reasonable documented expenses for care of the individual with disabilities in excess of 3 percent of

annual income may be deducted from annual income if the expenses:

• Enable the individual with disabilities or another family member to work;

• Are not reimbursable from insurance or any other source; and

______________________________________________________________________________________________________

4-32

HB-1-3550

Paragraph 4.4 Calculating Annual and Adjusted Income

• Do not exceed the amount of earned income included in annual income by the person

who is able to work as a result of the expenses. If the disability assistance enables more than

one person to be employed, the combined incomes of all persons must be included.

To qualify for this deduction, applicants must identify the individual with a disability on

the application. Form RD 1944-4, Certification of Disability or Handicap should be used to

request verification of the individual’s disability from a physician or other medical professional.

Example – Eligible Disability Assistance Expenses

The payments made on a motorized wheelchair for the 42-year-old son of the applicant/borrower enable the

son to leave the house and go to work each day on his own. Prior to purchase of the motorized wheelchair, the

son was unable to make the commute to work. These payments are an eligible disability assistance expense.

NOTE: Auxiliary apparatus includes, but is not limited to, items such as wheelchairs, ramps,

adaptations to vehicles, or special equipment to enable a sight-impaired person to read or type, but only

if these items are directly related to permitting the disabled person or other family member to work. If

the apparatus is not used exclusively by the person with a disability, the total cost must be prorated to

allow a specific amount for disability assistance.

• Include payments on a specially-equipped van to the extent they exceed the payments that

would be required on a car purchased for transportation of a person who does not have a disability.

• The cost of maintenance and upkeep of an auxiliary apparatus is considered a disability

assistance expense (e.g., veterinarian and food costs of a service animal; cost of maintaining

equipment that is added to a car, but not the cost of maintaining the car).

Payments to a care attendant to stay with a disabled 16-year-old child allow the child’s mother to go to work

every day. These payments are an eligible disability assistance expense. When the same provider takes care of

children and a disabled person over age 12, prorate the total cost and allocate a specific cost to attendant care.

The sum of both child care and disability assistance expenses cannot exceed the employment income of the

family member enabled to work.

NOTE: Attendant care includes, but is not limited to, expenses for home medical care, nursing services,

housekeeping and errand services, interpreters for hearing-impaired, and readers for persons with

visual disabilities.

HB-1-3550

4-33

(01-23-03) SPECIAL PN

Revised (07-22-19) SPECIAL PN

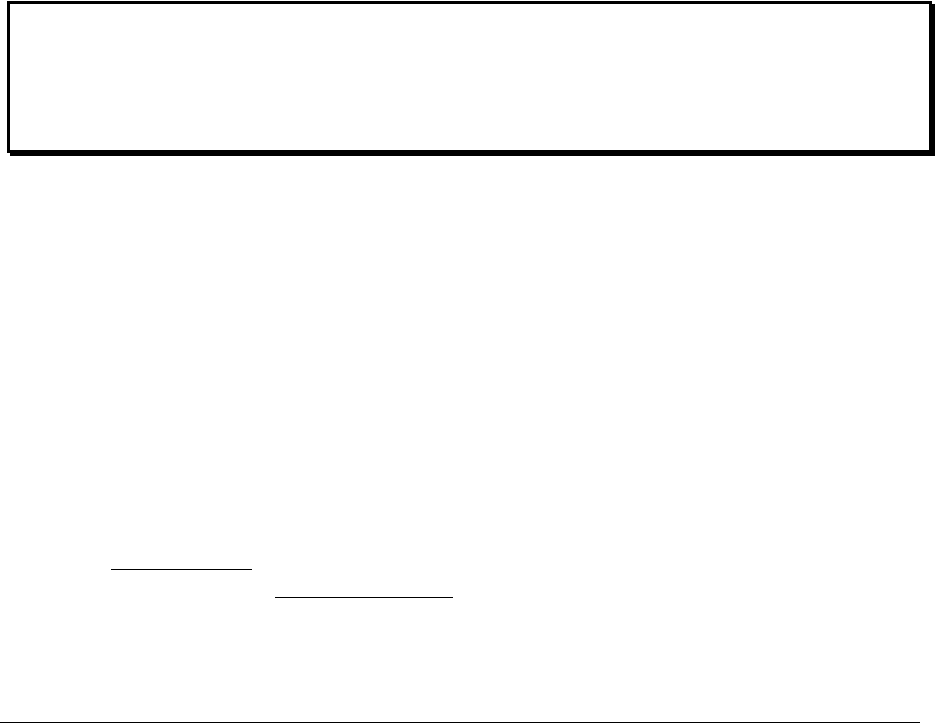

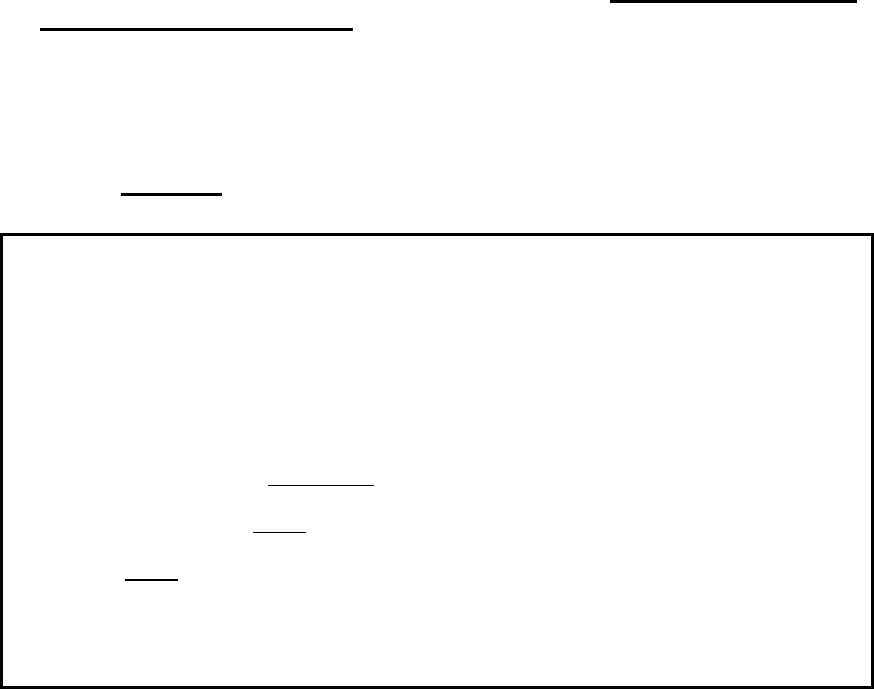

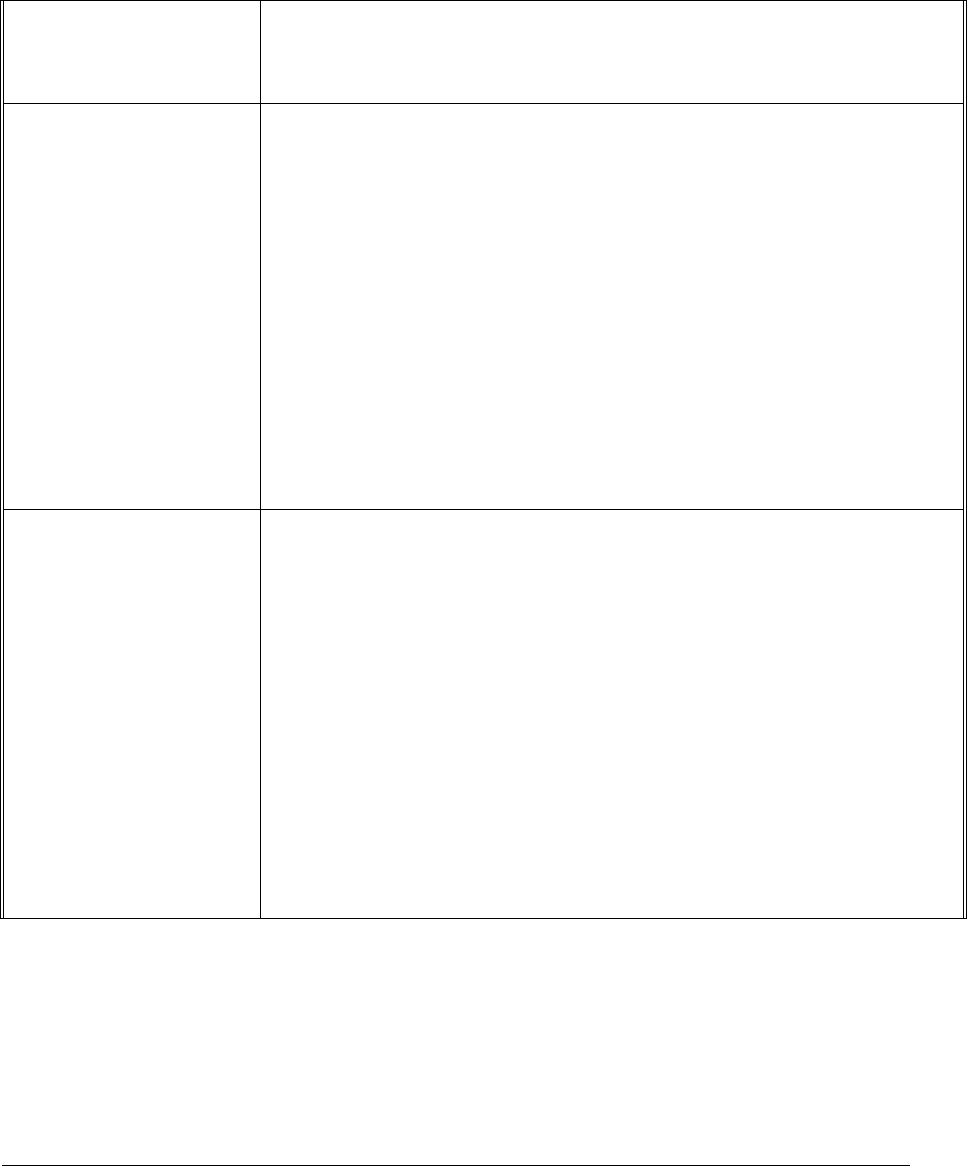

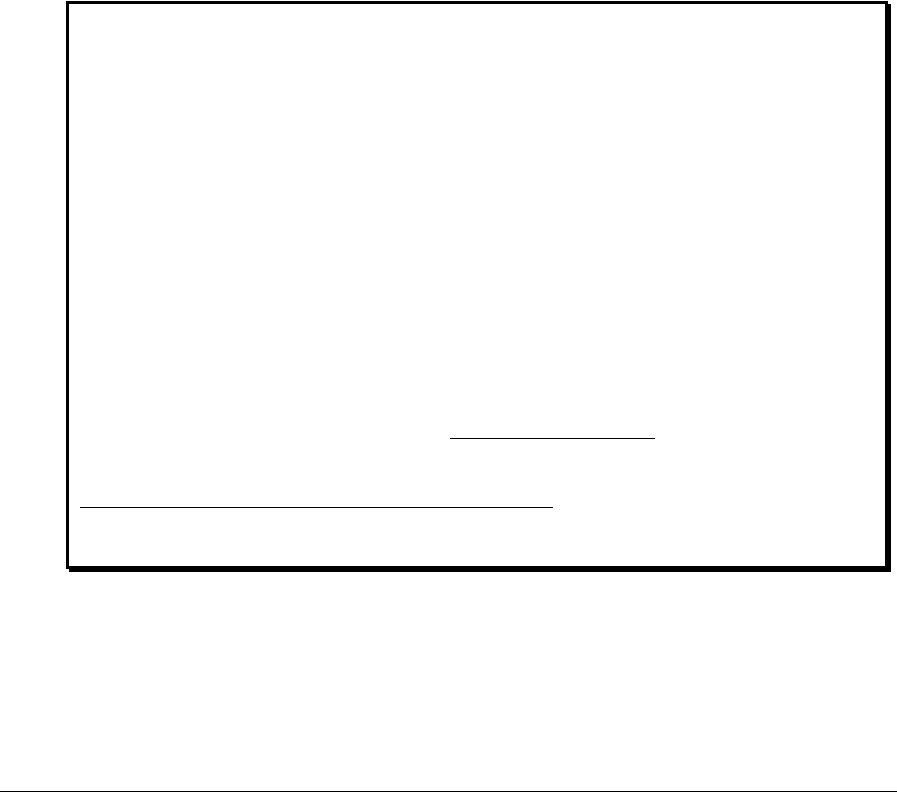

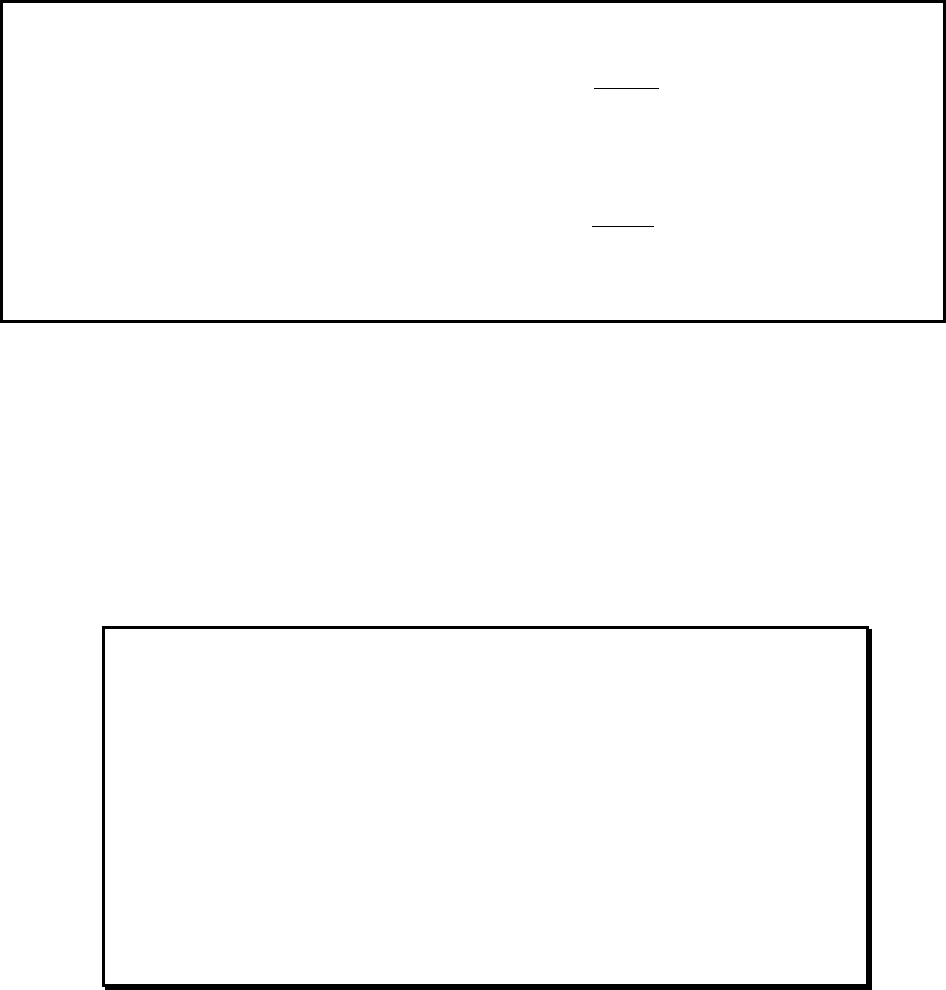

Example – Calculating a Deduction for Disability Assistance Expenses

(NOTE: $3,034 is not greater than amount earned by co-applicant/co-borrower, who is enabled to work.)

Paragraph 4.4 Calculating Annual and Adjusted Income

Applicant/Borrower earned income

$14,500

Co-Applicant/Co-Borrower earned income

+$12,700

Total Income

$27,200

Care expenses for disabled 15-year-old $ 3,850

Calculation:

$ 3,850

(3% of annual income)

-$ 816

Allowable disability assistance expenses

$ 3,034

G.

Deduction for Medical Expenses (for Elderly Households Only)

Medical expenses may be deducted from annual income for elderly households if the

expenses: (1) will not be reimbursed by insurance or another source; and (2) when combined

with any disability assistance expenses are in excess of 3 percent of annual income.

If the household qualifies for the medical expenses deduction, expenses of the entire

family are considered. For example, if a household included the head (grandmother, age 64), her

son (age 37), and her granddaughter (age 6), the medical expenses of all 3 family members

would be considered.

____________________________________________________________________________________________

Examples - Typical Medical Expenses

• Services of physicians, nurses, dentists, opticians, chiropractors, and other health care

providers

• Services of hospitals, laboratories, clinics, and other health care facilities

• Medical, Medicaid and long-term care premiums, and expenses to HMO

• Prescription and nonprescription medicine prescribed by a physician

• Dental expenses, x-rays, fillings, braces, extractions, and dentures

• Eyeglasses, contact lenses, and eye examinations

• Medical or health products or apparatus (hearing aids, batteries, wheel chairs, etc.)