To:

Jody Olsen, Director

Gregory Huger, Regional Director, IAP Region

Anne Hughes, Chief Compliance Officer

Dennis McMahon, Country Director, Peace Corps/Fiji

From:

Kathy A. Buller, Inspector General

Date:

September 30, 2019

Subject:

Final Report on the Audit of Peace Corps/Fiji (IG-19-04-A)

Transmitted for your information is our final report on the Audit of Peace Corps/Fiji.

Management concurred with all 12 recommendations. In its response, management described

actions it is taking or intends to take to address the issues that prompted each of our

recommendations. We closed five recommendations (numbers 2, 3, 5, 8, and 12) based on

review of corrective actions and supporting documentation. We will review and consider closing

the remaining seven recommendations when documentation reflected in the agency’s response to

the preliminary report is received. Our comments, which are in the report as Appendix E, address

these matters.

We wish to note that in closing recommendations, we are not certifying that the agency has taken

these actions or that we have reviewed their effect. Certifying compliance and verifying

effectiveness are management’s responsibilities.

You may address questions regarding follow-up or documentation to Assistant Inspector General

for Audit Judy Leonhardt at 202.692.2914 or to Senior Auditor Shane Potter at 202.692.2905.

Please accept our thanks for your cooperation and assistance in our review.

cc:

Michelle Brooks, Chief of Staff

Matt McKinney, Deputy Chief of Staff/White House Liaison

Robert Shanks, General Counsel

Patrick Young, Associate Director, Office of Global Operations

Richard Swarttz, Chief Financial Officer

Gonzalo Molina Zegarra, Chief Administrative Officer, IAP Region

Shawn Bardwell, Associate Director, Office of Safety and Security

Clark Presnell, Acting Associate Director, Office of Management

Kristin Rowe, Director of Management and Operations, Peace Corps/Fiji

Angela Kissel, Compliance Officer

Fiji Country Desk

Office of Inspector General

Office

Hotline

202.692.2900

202.692.2915 ׀ 800.233.5874

Website

OIG

Reports

Online Contact Form

OIG@peacecorpsoig.gov

Final Audit Report

Peace Corps/Fiji

IG-19-04-A

September 2019

Sunrise on Leleuvia Cay, Fiji

Peace Corps

Oce of

INSPECTOR

GENERAL

PEACE CORPS OFFICE OF INSPECTOR GENERAL

Final Audit Report: Peace Corps/Fiji (IG-19-04-A) i

EXECUTIVE SUMMARY

BACKGROUND

The Office of Inspector General (OIG) conducted an audit

of Peace Corps/Fiji (hereafter referred to as “the post”) from

April 29 to May 10, 2019.

Staff:

U.S. direct hires: 3

Full-time host- or third-country national personal services

contractors (PSCs): 19

Spending (approx.):

Fiscal Year (FY) 2018 post spending: Approximately

$1.6 million

Average regional overhead: $485,411

WHAT WE FOUND

The post’s financial and administrative operations required improvement to comply with agency

policies and applicable Federal laws and regulations. Specifically, the post did not:

• Initiate negotiations with the government of Fiji to renegotiate the 1968 Peace Corps

country agreement to exempt the Peace Corps from certain taxes and duties.

• Regularly liquidate interim advances in a timely manner.

• Accurately collect overpayments of Volunteer living allowances.

• Appropriately transfer accountability between the principal and alternate cashier.

• Ensure an appropriate contract with an auctioneer it engaged to sell property and

vehicles.

• Did not issue bills of collection (BOCs) in a timely manner.

• Did not ensure lease agreements contained all the necessary information.

RECOMMENDATIONS IN BRIEF

Our report contains 12 recommendations directed to the post and headquarters. We recommend

that the post reassess the country agreement. We also recommend that the post monitor and

document the accountability-of-funds transfer to the alternate cashier, as well as liquidate interim

advances and issue BOCs in a timely manner. In addition, we recommend that the post ensure

the Volunteers’ pro-rated living allowance calculations are accurate and that lease agreements

contain necessary information.

Figure 1: Map of Fiji.

PEACE CORPS OFFICE OF INSPECTOR GENERAL

Final Audit Report: Peace Corps/Fiji (IG-19-04-A) ii

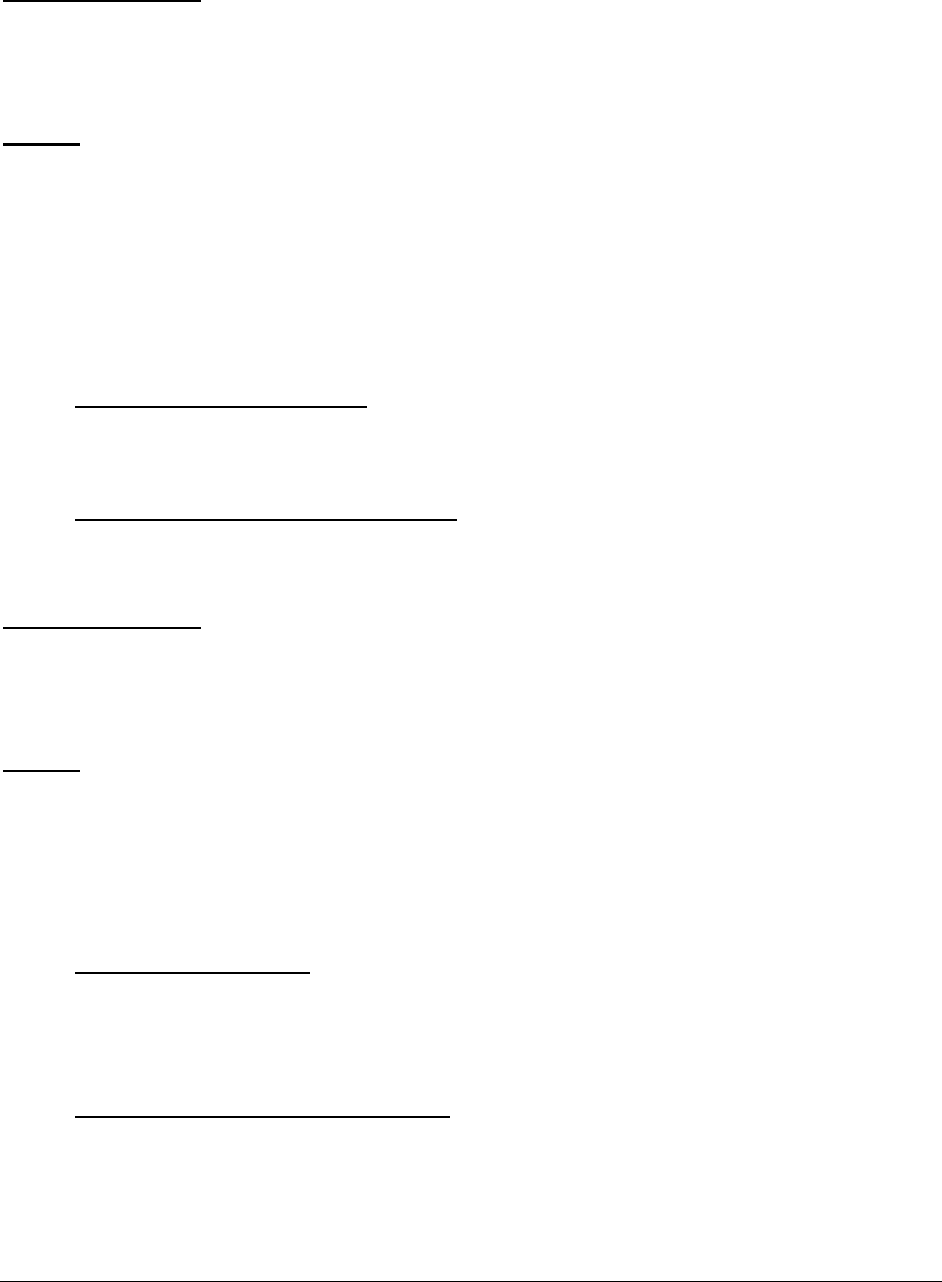

TABLE OF CONTENTS

EXECUTIVE SUMMARY................................................................................................................. i

BACKGROUND ................................................................................................................................. 1

AUDIT RESULTS .............................................................................................................................. 2

VAT ........................................................................................................................................................................ 2

IMPREST .................................................................................................................................................................. 3

VOLUNTEER ALLOWANCES ..................................................................................................................................... 4

BILLS OF COLLECTION ............................................................................................................................................ 6

PROPERTY ............................................................................................................................................................... 7

LEASES .................................................................................................................................................................... 8

QUESTIONED COSTS AND FUNDS TO BE PUT TO BETTER USE ................................. 10

LIST OF RECOMMENDATIONS................................................................................................ 11

APPENDIX A: OBJECTIVE, SCOPE, AND METHODOLOGY ........................................... 13

APPENDIX B: LIST OF ACRONYMS ........................................................................................ 16

APPENDIX C: CRITERIA USED TO SUPPORT ISSUES IN THE REPORT .................... 17

APPENDIX D: AGENCY RESPONSE TO THE PRELIMINARY REPORT ...................... 18

APPENDIX E: OIG COMMENTS ................................................................................................ 25

APPENDIX F: AUDIT COMPLETION AND OIG CONTACT.............................................. 26

PEACE CORPS OFFICE OF INSPECTOR GENERAL

Final Audit Report: Peace Corps/Fiji (IG-19-04-A) 1

BACKGROUND

OIG conducted the audit of Peace Corps/Fiji from April 29 through May 10, 2019 We previously

performed an audit of the post and issued our report (IG-08-04-A) in 2008.

The Peace Corps first established a program in Fiji in 1968. The post closed in 1998 due to a

succession of coups and reopened in 2003. Approximately 2,529 Volunteers have served in Fiji

since the post was first established. At the time of our audit, 48 Volunteers were working in the

community youth empowerment project. The post had 3 U.S. direct hires and 19 full-time PSCs.

In FY 2018, the post’s budget was approximately $1.6 million.

1

Our overall objective in auditing overseas posts is to determine whether the financial and

administrative operations are functioning effectively and in compliance with Peace Corps

policies and Federal regulations during the period under audit. Appendix A provides a full

description of our audit objective, scope, and methodology.

1

The agency does not determine a total cost per post beyond directly attributable post expenses, as certain costs are

centrally budgeted and managed by headquarters offices including the salaries and benefits of U.S. direct hires. The

Peace Corps Office of Budget and Analysis provided the total cost of approximately $23 million incurred by the

Inter-America and the Pacific region in direct support of its 20 overseas posts in FY 2018, which is an average of

$485,411 per post.

PEACE CORPS OFFICE OF INSPECTOR GENERAL

Final Audit Report: Peace Corps/Fiji (IG-19-04-A) 2

AUDIT RESULTS

VAT

The Peace Corps and the government of Fiji did not reassess the country agreement or

negotiate terms regarding tax exemptions in the agreement.

Peace Corps/Fiji was established in 1968, and Volunteers served in Fiji uninterrupted for 30

years until the suspension of operations in early 1998. The Fijian government requested the

Peace Corps’ return in 2002, and the program reopened in late 2003.

According to the Peace Corps’ “New Country Entry Guide,” the Region and the Office of

General Counsel (OGC) will determine if an existing country agreement requires revision

consistent with the model from OGC. Upon reopening, the original 1968 country agreement was

not formally reassessed and remained in effect. In a 2003 email from OGC to the Inter-America

and Pacific (IAP) Region during re-entry discussions, it was noted that there are several areas of

substantive and potentially detrimental differences between the 1968 agreement and the model

country agreement. It also noted that re-negotiation or amendment to the agreement was

authorized by the State Department.

During our review, we noted that Peace Corps/Fiji does not receive exempt status from Value

Added Tax (VAT) in the 1968 country agreement as per our current agency model. The country

agreement states that they are exempt under terms negotiated from “time to time” between the

Government of Fiji and the Government of the United States and, while this shows tax

exemption intent, it is unknown if these negotiations ever took place. As a result, the post

potentially overpaid in taxes, not having a system for reimbursement of value added tax (VAT)

in place. This same issue was raised in OIG’s 2011

Final Program Evaluation Report: Peace

Corps/Fiji (IG-12-01-E), stating:

A July 2002 Office of General Counsel (OGC) status memo recommended that, while the 1968 Country

Agreement remains in effect, the Inter-America and Pacific region should consider whether the agreement

remains adequate to the Peace Corps' needs, as the current agency model agreement is more favorable to

the Peace Corps than the original country 1968 agreement regarding taxes on goods imported into or

purchased in Fiji for the official use of the Peace Corps as well as an exemption from currency controls.

The 2011 evaluation report recommended the country agreement be reassessed to achieve cost

savings. The agency concurred with the recommendation and provided documentation to close

the recommendation. The documentation stated the Deputy Chief of Mission at the U.S.

Embassy in Fiji felt it would be inappropriate to renegotiate the country agreement with the

interim regime and would likely weaken the current agreement.

PEACE CORPS OFFICE OF INSPECTOR GENERAL

Final Audit Report: Peace Corps/Fiji (IG-19-04-A) 3

The OIG recommendation was closed with the stipulation that, after democratic elections took

place in 2014, the country agreement negotiation would move forward. Although the

recommendation was closed, the issue remained. There is no evidence that, following Fiji’s 2014

elections, the issue was ever reconsidered. According to the current CD, the staff at the post were

unaware of the issue.

Without a specific exemption from taxes and duties, the post would not be able to claim refunds

of duties and VAT paid; an amended country agreement could realize a significant cost savings

to the agency. Based on an assessment of in-country purchases by post from October 2013 to

February 2019, we estimate that the Peace Corps did not receive a potential refund of

approximately $439,500 (or $88,000 annually).

We recommend:

1. That the country director work with the Office of General

Counsel to initiate negotiations as called for in the country

agreement, with the goal of achieving tax exempt status on

certain purchases.

IMPREST

The principal cashier did not transfer accountability to the alternate cashier during extended

leave periods.

According to the Department of State’s Cashier User Guide [Section 3.3.5.2.2], “During a

planned absence of a principal cashier of more than 4 days, an unofficial transfer of

accountability must take place.” Furthermore, Peace Corps Manual Section (MS) 760,

concerning the transfer of accountability, includes the requirement for an imprest fund

reconciliation.

We found that the alternate cashier performed the principal cashier’s partial duties during

absences but was not given accountability as required by the Cashier User Guide and MS 760.

Although the post was aware of the requirements for the alternate cashier to perform cashier

duties, the post was unaware that the alternate cashier should be given accountability.

Furthermore, the principal cashier expressed reluctance about transferring accountability because

of concerns that the imprest fund was his responsibility and would not reconcile once

accountability was returned.

The Cashier User Guide also states that the alternate cashier must take accountability and act as

the cashier two to three times per quarter. At the time of the audit the post had begun work to

create a schedule for the alternate cashier, which included more training to comply with this

requirement.

PEACE CORPS OFFICE OF INSPECTOR GENERAL

Final Audit Report: Peace Corps/Fiji (IG-19-04-A) 4

When the post does not comply with established criteria, it becomes vulnerable to asset

misappropriation.

We recommend:

2. That the country director monitor and document the

transfer of accountability of funds to the alternate cashier

prior to the principal cashier going on leave for more than

4 days, in accordance with policy.

The post did not regularly collect interim cash advances in a timely manner.

OFMH Section 13.18.2 states: “The interim cash advance must be supported by a copy of the

authorized purchase document, and liquidated (accounted for) within three (3) working days…”

Out of 404 interim cash advances made from May 2018 through April 2019, 180 instances were

not collected within 3 days. Most interim advances that were not cleared in a timely manner were

for utility payments, training supplies, and miscellaneous post and Volunteer expenses. The

administrative staff, who received most of the interim advances, became complacent about

liquidating advances because management never emphasized the importance of closing out

advances.

Failure to liquidate interim cash advances within 3 days impairs the cashier’s ability to document

the status of the imprest fund and accountability to safeguard interim advances. Clearing interim

advances in a timely manner ensures the prompt return of unused funds and helps minimize

imprest fund cash required to be on hand.

We recommend:

3. That the director of management and operations review

post practices in managing interim cash advances and

enhance them to ensure clearance within 3 days. Staff

should be regularly reminded of the 3-day clearance

requirement.

VOLUNTEER ALLOWANCES

The post did not accurately calculate and consistently collect overpayments of living

allowances for early terminated Volunteers.

Volunteers receive monthly allowances while in their country of assignment including living,

leave, and other miscellaneous allowances such as travel allowance. According to MS 221.5.8,

living allowances only cover the days a Volunteer serves, and living allowance paid for a month

PEACE CORPS OFFICE OF INSPECTOR GENERAL

Final Audit Report: Peace Corps/Fiji (IG-19-04-A) 5

during which a Volunteer terminates service should be prorated and the balance collected. Leave

allowance is not prorated, and an early terminating Volunteer retains the entire payment for any

portion of a month served. Posts determine their own policies for collecting miscellaneous

allowances like travel allowance.

According to post staff, when a Volunteer early terminates, the cashier determines if any debts

are owed to the Peace Corps and vice versa. Then, the financial assistant (FA) calculates the

living allowance that should be collected from the Volunteer based on the last day of service and

initiates a request to deduct the amount from the Volunteer's readjustment allowance which is

also checked by the DMO.

We reviewed a sample of 30 payments to Volunteers who terminated their service early. Of that

sample, 13 payments contained errors resulting in the underpayment or overpayment of the

Volunteers. Three overpayments resulted from miscalculations and three pertained to cases

where the overpaid allowance was not collected via BOC or readjustment allowance. Also, in

four instances, post calculations omitted some allowance that should have been collected like

travel or leave allowance for months Volunteers were not in country. Furthermore, the post

underpaid allowances for three Volunteers in the sample by deducting an allowance payment that

had been cancelled from the Volunteer's readjustment allowance or by miscalculating the amount

to collect. The total amount of overpayment determined in this sample was $1,496 and the total

under payment was $360.

In some cases where the allowance was not fully collected, the FA based deductions on

knowledge of the amount of living allowance Volunteers typically receive instead of the actual

amount disbursed, resulting in some allowances being left out. Per MS 221.5.9, the DMO is

ultimately responsible for requesting collection from the Volunteer's readjustment allowance and

should provide sufficient oversight to ensure the accuracy of allowance deductions. Because of

insufficient controls, errors led to inaccurate collections.

We Recommend:

4. That the director of management and operations apply due diligence in

issuing bills of collection for approximately $1,496 USDE and collecting

the remaining overpaid living allowances.

5. That the director of management and operations develop and implement

a procedure to ensure the Volunteers’ pro-rated living allowance

calculations are accurate.

6. That the director of management and operations work with the Office of

the Chief Financial Officer/Global Accounts Payable to account for the

underpaid Volunteers.

PEACE CORPS OFFICE OF INSPECTOR GENERAL

Final Audit Report: Peace Corps/Fiji (IG-19-04-A) 6

BILLS OF COLLECTION

The post did not issue bills of collection in a timely manner.

OFMH 7.2.1 specifies that a bill of collection (BOC) should be entered as soon as the debt is

known. We found that the post delayed creating 6 out of 22 BOCs sampled for various grant

funds; travel advances; and volunteer living allowance refunds. Post staff waited until Volunteers

came into the office to issue and collect on BOCs. Also, the cashier notified the billing officer

when to create BOCs and was unaware of the policy to ensure BOCs are created at the time the

debt is known.

Creating BOCs in a timely manner is essential because it is an internal control procedure that

safeguards assets, maintains accurate records, and establishes a system of checks and balances.

Without a BOC, money that the post receives could be easily diverted because there is no record

of the debt.

We recommend:

7. That the director of management and operations ensure

compliance with policy to issue bills of collection as soon as

the amount is known to the Peace Corps.

8. That the director of management and operations provide

training to all administrative and financial staff on the

importance of bills of collections and who to notify when a

debt is known.

The post had long outstanding BOCs, which exceeded 30 days.

Peace Corps policy specifies that the DMO and billing officer must conduct a monthly BOC

review of outstanding BOCs older than 30 days. OFMH Section 7.2.2 states that the Billing

Officer must

:

• After 30 days — Prepare a letter to be signed by DMO, stating that the bill is now overdue….

• After 60 days — Notify the debtor’s supervisor (only for staff). Prepare a stronger letter to be signed

by CD….

• After 90 days — The Billing Officer and DMO should review. If Post determines that they should keep

the debt longer, they should contact their [Global Accounts Payable Financial Management Officer],

providing details and estimated time needed to collect.

The post did not consistently follow-up on and close BOCs outstanding for more than 30 days.

Of the sample of 123 long outstanding BOCs between FYs 2014 and 2019, we found issues with

PEACE CORPS OFFICE OF INSPECTOR GENERAL

Final Audit Report: Peace Corps/Fiji (IG-19-04-A) 7

117 of them. Eighty-five of these BOCs were issued for staff personal phone usage and the other

32 were predominantly related to staff travel. Time outstanding ranged between 31 and 396 days.

According to post staff, outstanding BOCs were reviewed during administrative team meetings,

and the cashier sent notification to debtors approximately once within a 30-day period. However,

no further official notifications were issued if the debtor did not pay.

The cashier stated that system issues near the end of the fiscal year 2016 and tracking down

temporary staff to close BOCs posed challenges for the post. Administrative staff members

explained that some difficulties persisted in closing travel advances and that staff members must

take responsibility to ensure timely reconciliation of their own advances. The number of long

outstanding BOCs decreased after 2016 when headquarters staff reached out to the post

questioning why there were so many long outstanding BOCs. Also, in 2017, staff started

receiving a monthly allowance for phone usage which reduced the number of phone bill-related

BOCs.

Conducting monthly reviews and following-up on outstanding BOCs strengthens the internal

controls, allowing the post to better manage debt and detect any misuse of government funds.

We recommend:

9. That the director of management and operations monitor

the outstanding bills of collection log every month and

initiate a collection process as required by agency policy.

PROPERTY

The post did not have a contract with an auctioneer it engaged to sell property and vehicles.

We noted the post did not have a contract with the auctioneer engaged to sell the property and

vehicles identified to be disposed of via auction. Per the DMO, the post did not see the need for a

contract as the post used the auctioneer engaged by the U.S. Embassy, and it was the only

auction house on the island. However, before the auctions, the post delivered the property and

vehicles to the auctioneer, not the Embassy.

The post’s process for selling property and vehicles had several steps. First, the general services

manager (GSM) would get Peace Corps authorization for the auctions and then prepare the

vehicles for release through Fiji Revenue and Customs Authority and the Foreign Affairs

Department. The GSM would prepare the property by removing all markings, tags, and PII for

auction. The GSM would negotiate services with the auction company and they would provide a

date for the auction. Then a representative of the post would witness the auction. The auctioneer

would provide an invoice with the sale price, commission, and net amount due to the post. The

post would then create a BOC for the net amount due in the name of the auctioneer, and the

PEACE CORPS OFFICE OF INSPECTOR GENERAL

Final Audit Report: Peace Corps/Fiji (IG-19-04-A) 8

cashier would receive the funds for deposit. By negotiating terms of the agreement, the GSM

effectively exercised implied authority, which is authorization to negotiate and procure services.

According to Peace Corps policy, no employees have the implied authority to procure services.

2

A contract with the auctioneer is important for ensuring the auctioneer conducts the auction via

agreed-upon means and is acting in a fiduciary capacity. The contract would ensure that the

auctioneer holds the property and vehicle as an agent of the post (not the buyer) and would

confirm that the title to the property belongs to the post until the sale concludes.

We found a similar issue during the follow-up audit of Peace Corps/Zambia in 2017. Per

discussion with the chief financial officer at that time, Peace Corps management was going to

issue a policy requiring posts to enter into a contract with the auctioneer whenever the post

delivers property in advance of the auction and the auctioneer holds the property or vehicles on

its premises until conclusion of the sale.

3

Peace Corps management has yet to issue such policy.

We recommend:

10. That the Office of the Chief Financial Officer/Acquisition

and Contract Management issue a policy requiring post

management to enter in to a contract with the auctioneer as

warranted by the nature of the auction arrangement.

11. That the director of management and operations sign a

contract with the auction house.

LEASES

Lease agreements did not contain the necessary information.

MS 733 “Lease Procedures” states that the estimate of square footage (and/or acreage) should be

included in the lease agreement as a Federal requirement.

We reviewed five lease agreements to determine if they were written in accordance with Peace

Corps’ policy. Four of the five lease agreements reviewed did not contain the square footage of

the rental space. The CD and DMO attributed the deficiencies to square footage not being the

central foundation of negotiation of the 4 aforementioned leases. As square footage was not

cited, it was not included in the contract. The DMO stated that an amendment would be made to

the current contract since the contract had not been closed out.

2

MS 732 6.1.4 Implied Authority

3

Follow-up Audit PC/Zambia IG-17-05-A

PEACE CORPS OFFICE OF INSPECTOR GENERAL

Final Audit Report: Peace Corps/Fiji (IG-19-04-A) 9

Square footage is an important concept in leasing because the agreed-upon amount of square

footage in a leased property will dictate the terms of the lease. Hence, the post should ensure

square footage is included in all lease agreements.

We recommend:

12. That the country director and the director of management

and operations issue a modification for the current leases to

include square footage in the description and take steps to

ensure future lease agreements meet applicable

requirements.

PEACE CORPS OFFICE OF INSPECTOR GENERAL

Final Audit Report: Peace Corps/Fiji (IG-19-04-A) 10

QUESTIONED COSTS AND

FUNDS TO BE PUT TO BETTER USE

We identified questioned costs.

Recommendation number Description Amount

1 Potential VAT cost savings $439,500

6 Volunteer Allowances Overpayment $1,496

Consistent with the Inspector General Act of 1978,

4

as amended, questioned costs and funds to

be put to better use are defined as follows:

• Questioned costs are costs that are questioned because of an alleged violation of

a provision of a law, regulation, contract, grant, cooperative agreement or

document governing expenditure of funds; a finding that, at the time of the audit,

such cost is not supported by adequate documentation; or a finding that the

expenditure of funds for the intended purpose is unnecessary or unreasonable.

• Funds to be put to better use are funds that could be used more efficiently if

management took actions to implement and complete the recommendation.

4

Inspector General Act of 1978, § 5(f) (1)-(4),5,U.S.C App.3

PEACE CORPS OFFICE OF INSPECTOR GENERAL

Final Audit Report: Peace Corps/Fiji (IG-19-04-A) 11

LIST OF RECOMMENDATIONS

We recommend:

1. That the country director work with the Office of General Counsel to initiate

negotiations as called for in the country agreement, with the goal of achieving

tax exempt status on certain purchases.

2. That the country director monitor and document the transfer of accountability

of funds to the alternate cashier prior to the principal cashier going on leave

for more than 4 days, in accordance with policy.

3. That the director of management and operations review post practices in

managing interim cash advances and enhance them to ensure clearance within

3 days. Staff should be regularly reminded of the 3-day clearance requirement.

4. That the director of management and operations apply due diligence in issuing

bills of collection for approximately $1,496 USDE and collecting the

remaining overpaid living allowances.

5. That the director of management and operations develop and implement a

procedure to ensure the Volunteers’ pro-rated living allowance calculations

are accurate.

6. That the director of management and operations work with the Office of the

Chief Financial Officer/Global Accounts Payable to account for the underpaid

Volunteers.

7. That the director of management and operations ensure compliance with

policy to issue bills of collection as soon as the amount is known to the Peace

Corps.

8. That the director of management and operations provide training to all

administrative and financial staff on the importance of bills of collections and

who to notify when a debt is known

9. That the director of management and operations monitor the outstanding bills

of collection log every month and initiate a collection process as required by

agency policy.

10. That the Office of the Chief Financial Officer/Acquisition and Contract

Management issue a policy requiring post management to enter in to a

PEACE CORPS OFFICE OF INSPECTOR GENERAL

Final Audit Report: Peace Corps/Fiji (IG-19-04-A) 12

contract with the auctioneer as warranted by the nature of the auction

arrangement.

11. That the director of management and operations sign a contract with the

auction house.

12. That the country director and the director of management and operations issue

a modification for the current leases to include square footage in the

description and take steps to ensure future lease agreements meet applicable

requirements.

PEACE CORPS OFFICE OF INSPECTOR GENERAL

Final Audit Report: Peace Corps/Fiji (IG-19-04-A) 13

APPENDIX A: OBJECTIVE, SCOPE, AND METHODOLOGY

OBJECTIVES

We conducted this audit to determine whether the financial and administrative operations at

Peace Corps/Fiji are functioning effectively and complying with Peace Corps policies and

Federal regulations.

SCOPE

This audit was conducted between April and July 2019 at the Peace Corps headquarters in

Washington, D.C. and at the overseas post location in Suva, Fiji. The scope period under review

was October 1, 2013 through May 10, 2019.

We conducted this performance audit in accordance with Generally Accepted Government

Auditing Standards. Those standards require that we plan and perform the audit to obtain

sufficient, appropriate evidence to provide a reasonable basis for our findings and conclusions

based on our audit objectives. We believe that the evidence obtained provides a reasonable basis

for our findings and conclusions based on our audit objectives.

Throughout the audit, auditors were aware of the possibility or existence of fraud, waste, or

misuse significant to the audit objectives and conducted procedures designed to obtain

reasonable assurance of detecting any such fraud as deemed appropriate.

METHODOLOGY

To obtain background information, we reviewed Federal laws and regulations as well as policies

relating to Peace Corps financial and administrative operations, such as the Federal Acquisition

Regulations, Peace Corps Manual, Overseas Financial Management Handbook, and Department

of State’s Cashier User Guide. Further, we provided questionnaires to Peace Corps headquarters

and post managers to learn about post specific processes and risk areas.

We obtained Peace Corps/Fiji’s financial information from the disbursement and BOC reports

for October 1, 2013 through May 10, 2019. While our report addresses the stated objectives, the

auditors did not review Grants, Budget, and IT of our standard audit program. This decision was

based on the results of our planning phase. Therefore, our report does not reflect any positive or

negative results in these areas.

We sorted the disbursement reports universe of 35,138 transactions and judgmentally selected

samples by the following payment types:

PEACE CORPS OFFICE OF INSPECTOR GENERAL

Final Audit Report: Peace Corps/Fiji (IG-19-04-A) 14

• Imprest Fund. We reviewed 6 months of cash counts from October 2018 to March 2019. We also

performed unannounced physical cash counts with the cashier, interviewed the cashier, and reviewed

supporting documentation related to the cash count. We reviewed 404 interim advances from April 2018 to

April 2019.

• Fuel. We reviewed five vehicle logs. We conducted a completeness test by tracing 10 fuel entries/receipts

from the vehicle logs to the Vehicle Maintenance system. In addition, we reviewed the sampled fuel

receipts with the fuel vendor’s credit card statements.

• International Cooperative Administrative Support Services (ICASS). We compared the ICASS invoice

to the ICASS agreement to ensure that the agreement was in compliance with Peace Corps policy for

allowable cost centers.

• Personal Service Contractor and Lease Payments. We sampled 5 of 5 lease types and reviewed

documentation related to the contract files. We also reviewed PSC security certifications for 10 PSCs. The

PSC contracts were chosen based on the position of the employee, variations in the contract payments, and

whether the employee contract allowed for overtime. The lease sample was selected based on the contract

prices, purpose of the lease contract, and whether the contract was active.

• Medical Inventory and Transactions. We performed medical inventory for 3 of the controlled and 9 of

the specially designated substances and sampled 2 disposal records. In addition, we conducted additions

testing by tracing three medical transactions (purchases for controlled or specially designated substances) to

verify that these purchases were recorded on the disbursement report, receiving report, and the medical

inventory records. We conducted additional sampling for the medical transactions in our review of non-

cash payments and cash/credit card transactions.

• Volunteer Payments. We selected a small judgmental sample of 10 of 13,322 transactions to determine if

the living allowances paid to Volunteers were consistent with the authorized amount. We also reconciled

the collections for overpayments made to Volunteers when they terminated their service early. We

reviewed living allowance payments for 30 of 142 Volunteers who early terminated between October 2014

and February 2019. We compared the Volunteer payments from the disbursement and calculated the

collection amount based on the Volunteer’s termination date. We reviewed the BOCs and readjustment

allowance reports to determine if the collections were complete and accurate.

• Grants. We conducted a post audit risk assessment and scoped out several areas that were not considered

high risk during our planning phase. Our risk analysis results, historical information, and auditor judgement

indicate that our resources could be better focused on the medium/high-risk areas identified. We concluded

that grants were a low risk area and no further review would be conducted.

• Personal Property and Vehicles. We performed a physical existence test for 17 out of 102 personal

property items inventoried in the Sunflower inventory tracking system in addition to the 6 vehicles listed in

the VMIS system. We also interviewed the general service manager regarding separation of duties for

inventorying personal property.

• Credit Card and Other Transactions. We sampled 8 credit card transactions and 22 transactions that

were not paid by credit cards. The 30 payments included transactions from security upgrades, medical,

travel, trainings, conferences, generators, and general expenses. The transactions were selected because

they were unusual, exceeded $3,000 USDE, or had extensive use of vendors.

In addition, we reviewed the BOCs report that had a universe of 546 collections (540

transactions). Our BOCs review consisted of the following:

PEACE CORPS OFFICE OF INSPECTOR GENERAL

Final Audit Report: Peace Corps/Fiji (IG-19-04-A) 15

• Long Outstanding. Based on the BOCs report, we calculated 123 outstanding collections over 30 days. At

the post, we interviewed staff about collection steps they had taken.

• Voids. We reviewed all 51 voided BOCs and the supporting documentation to determine that the voids

were correctly voided and rebilled if necessary.

• General Testing. We tested a sample of 22 transactions. Our sample was based on large USDE amounts,

unusual transactions, grants, Volunteer billings, and rebates claimed from the Government of Fiji. We

reviewed the supporting documentation to determine if the BOCs were accurately recorded, created timely,

properly obligated, and adequately collected.

USE OF COMPUTER-PROCESSED DATA

The Government Accountability Office’s “Assessing the Reliability of Computer-Processed

Data” defines reliability to mean that the data is “reasonably complete and accurate, meet[s] [its]

intended purposes, and [is] not subject to inappropriate alteration.”

5

During our audit, we relied on data extracted from the Peace Corps’ financial system. We

conducted limited accuracy testing of this data. During our sample testing, outlined in the

methodology section above, we compared the financial system data to underlying source

documentation to ensure consistency. We did not identify any discrepancies between the

financial system data and the source documents reviewed. We did not test to ensure that the

universe of data provided to us was complete.

However, our office uses independent auditors to annually audit the agency’s financial

statements. These auditors have determined that the financial statements were free from material

misstatements and our auditors did not identify any material weaknesses in internal controls

surrounding the financial statements. Therefore, in our professional judgement, we determined

that the data was sufficiently reliable for the purposes of this report.

REVIEW OF INTERNAL CONTROLS

Internal controls relate to management’s plans, methods, and procedures used to meet their

mission, goals, and objectives. We took steps to assess internal controls related to the Peace

Corps’ overseas financial and administrative operations. For example, we reviewed the Peace

Corps’ “Overseas Financial Management Handbook” and interviewed key individuals on roles

and processes related to disbursements and collections. Further, we met with Peace Corps

management overseas and at headquarters who were responsible for oversight of post operations.

We noted any issues we identified during our fieldwork in the “Audit Results” section of this

report. Our recommendations, if implemented, should improve the agency’s overseas financial

and administrative operations.

5

GAO “Assessing the Reliability of Computer-Processed Data” at 8 (July 2009).

PEACE CORPS OFFICE OF INSPECTOR GENERAL

Final Audit Report: Peace Corps/Fiji (IG-19-04-A) 16

APPENDIX B: LIST OF ACRONYMS

BOC

Bill of Collection

CD

Country Director

CO

Contracting Officer

COS

Close of Service

DMO

Director of Management and Operations

FA

Financial Assistant

GSM

General Services Manager

MS

Peace Corps Manual Section

OFMH

Overseas Financial Management Handbook

GAP

Global Accounts Payable

OIG

Office of Inspector General

OHS

Office of Health Services

PCMO

Peace Corps Medical Officer

PSC

Personal Services Contractor

FSN

Foreign Service National

USDE

United States Dollar Equivalent

FY

Fiscal Year

USDH

United States Direct Hire

CUG

Cashier User Guide

TG

Technical Guidance

OCFO

Office of the Chief Financial Officer

ACM

Acquisitions and Contract Management

FAR

Federal Acquisition Regulation

VMIS

Vehicle Management Information System

GAO

Government Accountability Office

OMB

Office of Management and Budget

ICASS

International Cooperative Administrative Support Services

Final Audit Report: Peace Corps/Fiji (IG-19-04-A) 17

APPENDIX C: CRITERIA USED TO SUPPORT ISSUES IN THE

REPORT

PEACE CORPS REQUIREMENTS

OVERSEAS FINANCIAL MANAGEMENT HANDBOOK (OFMH)

OFMH 7.2.1 Billing Steps

The Billing Officer performs the following tasks as soon as the debt is known, even if the exact amount

isn’t known.

OFMH Section 7.2.2 – Bill of Collection Review

2. Review and follow-up on outstanding BOCs. Run the FOR Post “Outstanding Collections” report.

Follow the steps below for BOCs outstanding 30, 60, or 90 days

OFMH Section 13.18.2 – Interim Advances

The interim cash advance must be supported by a copy of the authorized purchase document, and liquidated

(accounted for) within three (3) working days.

PEACE CORPS MANUAL SECTION (MS)

MS 221 5.8 – Partial Payment for Close of Service Volunteers

Payments for close-of-service Volunteers must be adjusted before the final payment is authorized to ensure

that the living allowance payments cover only the number of days the Volunteer served. In those cases

where the termination date of an early termination is known in advance, calculation of the final living

allowance payment must also be adjusted to cover through the last day of service. Where information is

not known in advance, the overpayment must be collected from the Volunteer or deducted from the

Volunteer’s Readjustment Allowance.

MS 221 5.9 – Overpayments at End of Service

If direct collection is not possible, the Administrative Officer must request collection from the Volunteer's

Readjustment Allowance.

MS 760 Overseas Imprest Management 8.0

In such cases, a formal transfer of funds, including imprest fund reconciliation, must be accomplished and

the combination of the safe must be changed.

CASHIER USER GUIDE

Section 3.3.5.5.2

During a planned absence of a principal cashier of more than 4 days, an unofficial transfer of accountability must

take place.

Final Audit Report: Peace Corps/Fiji (IG-19-04-A) 18

APPENDIX D: AGENCY RESPONSE TO THE PRELIMINARY

REPORT

M

EMORANDUM

To:

Kathy Buller, Inspector General

Through:

Anne Hughes, Chief Compliance Officer

From:

Greg Huger, IAP Regional Director

Dennis McMahon, Country Director, Fiji

Date:

September 26, 2019

CC:

Jody K. Olsen, Director

Michelle K. Brooks, Chief of Staff

Matt McKinney, Deputy Chief of Staff/White House Liaison

Patrick Young, Associate Director, Global Operations

Maura Fulton, Senior Advisor to the Director

Carl Sosebee, Senior Advisor to the Director

Robert Shanks, General Counsel

Sonia Delman, Associate General Counsel

Richard Swarttz, Chief Financial Officer

Joaquin Ferrao, Deputy Inspector General

Judy Leonhardt, AIG/Audits

Gonzalo Molina Zegarra, Chief Administrative Officer, IAP Operations

Kristin Rowe, Director of Management and Operations, Fiji

Subject:

Agency Response to the Preliminary Audit Report: Peace Corps/Fiji

(Proj.19-AUD-04)

Enclosed please find the agency's response to the recommendations made by the Inspector

General for Peace Corps/Fiji as outlined in the Preliminary Report on the Audit of Peace

Corps/Fiji (Proj.19-AUD-04) given to the agency on August 12, 2019.

The Region and the Post have addressed and provided supporting documentation for eight of the

12 recommendations provided By the OIG in its Preliminary Audit of Peace Corps/ Fiji and will

work to close the remaining recommendations by the set target dates.

Final Audit Report: Peace Corps/Fiji (IG-19-04-A) 19

Recommendation 1

That the country director work with the Office of General Counsel to initiate negotiations

as called for in the country agreement, with the goal of achieving tax exempt status on

certain purchases.

Concur

Response: On advice from the office of the General Counsel, post has contacted the US

Embassy in Fiji to ascertain their position and recommendation for proceeding to initiate

negotiations for achieving tax exempt status as outlined in the Country Agreement. The Post was

advised not to pursue VAT tax exemption and reimbursement strategies with the host Fijian

government. Therefore, given the guidance post received, it is the recommendation of post that

the agency refrain from requesting VAT exemption at this time, and consider re-evaluating the

prospect in the event of a change in government.

Documents to be Submitted:

• Email correspondence with OGC on this matter

• Narrative on the history of this matter.

Status and Timeline for Completion: Completed, September 2019

Recommendation 2

That the country director monitor and document the transfer of accountability of funds to

the alternate cashier prior to the principal cashier going on leave for more than 4 days, in

accordance with policy.

Concur

Response: Post has developed a training schedule for the alternate cashier and has administered

that training. Post has transferred the full accountability to the Administrative Assistant before

the Cashier has gone on leave for more than four days and will continue this practice moving

forward. During the first month, the Cashier and Director of Management and Operations DMO)

will carefully supervise and support the alternate.

Documents Submitted:

• Email to Finance Staff supporting the handover in September 2019

• Training curriculum and schedule for Alternative Cashier

• Full accountability report from FOR Post - September 2019

Status and Timeline for Completion: Completed, September 2019

Final Audit Report: Peace Corps/Fiji (IG-19-04-A) 20

Recommendation 3

That the director of management and operations (DMO) review post practices in managing

interim cash advances and enhance them to ensure clearance within 3 days. Staff should be

regularly reminded of the 3-day clearance requirement.

Concur

Response: The DMO sent an email to all staff to remind them of cashier policies and specifically

their responsibility to clear interim advances within three days. The DMO will review

outstanding advances at the weekly staff meeting. Post will identify any recurring interim

advance vulnerability and develop a plan to resolve. Post will develop guidelines for dealing

with repeat offenders and identify and enforce corrective measures for noncompliance.

Supervisors and Country Director will be informed of late clearances of cash advances.

Documents to be Submitted:

• Policy reminder email to post staff

• Post Guidance on Clearing Advances - Staff Handbook Page 31

• Report of Cleared Advances

• Copy agenda of a weekly meeting

Status and Timeline for Completion: Completed, September 2019

Recommendation 4

That the director of management and operations apply due diligence in issuing bills of

collection for approximately $1,496 USDE and collecting the remaining overpaid living

allowances.

Concur

Response: Post will work with Office of Global Accounts Payable to contact and issue BOCs for

any overpaid living allowances. OGAP will contact the Returned Peace Corps Volunteers

(RPCVs) directly for collection with support from post to provide contact information.

Documents Submitted:

• Email communication with OGAP

• Email with OGAP on process for outreach to RPCVs

Status and Timeline for Completion: October 2019

Final Audit Report: Peace Corps/Fiji (IG-19-04-A) 21

Recommendation 5

That the director of management and operations develop and implement a procedure to

ensure the Volunteers' pro-rated living allowance calculations are accurate.

Concur

Response: The DMO has implemented a system to show a breakdown of collections for each

volunteer. In addition, the Financial Assistant is required to print calculations template with

copies of Volunteers' Odyweb financial data for verification. This detailed calculation

spreadsheet will document living allowance payments, reimbursements and any deductions

required. This spreadsheet will be review by the DMO for final approval and processing.

Documents to be Submitted:

• Living allowance calculations sheet

• Example print out of Odyweb Financial Data

Status and Timeline for Completion: Completed, August 2019

Recommendation 6

That the director of management and operations work with the Office of the Chief

Financial Officer/Global Accounts Payable to account for the underpaid Volunteers.

Concur

Response: The DMO will work with OGAP to contact the RPCVs and reconcile the

underpayments.

Documents to be Submitted:

• Email communication with OGAP

• Email with OGAP on process for outreach to RPCV s

Status and Timeline for Completion: October 2019

Final Audit Report: Peace Corps/Fiji (IG-19-04-A) 22

Recommendation 7

That the director of management and operations ensure compliance with policy to issue

bills of collection as soon as the amount is known to the Peace Corps.

Concur

Response: Post has corrected this practice and will strive to create BOCs on the same day the

amount is known. If a correction to the amount due is required, the amount initially documented

would be corrected, collection would be created and verified, and the initial BOC is voided by

cashier. The new collection number is referenced in the ForPost Void approval comment box.

Documents to be Submitted:

• Memo to Finance/ Admin staff with process for BOCs

• Three examples of timely BOCs

Status and Timeline for Completion: Completed, September 2019

Recommendation 8

That the director of management and operations provide training to all administrative and

financial staff on the importance of bills of collections and who to notify when a debt is

known.

Concur

Response: Post has completed a review of the policy as well as a training with the supervisory

Finanaical Management Officer. The billing officer will provide weekly reminders for each

pending collection and will request the involvement of supervisor prior to the 30 day deadline.

Documents to be Submitted:

• Email correspondence with CFO/GAP

• Agenda from the recent training on BOCs

• Documentation of attendees and instructors of the training

Status and Timeline for Completion: Completed, September 2019

Final Audit Report: Peace Corps/Fiji (IG-19-04-A) 23

Recommendation 9

That the director of management and operations monitor the outstanding bills of collection

log every month and initiate a collection process as required by agency policy.

Concur

Response: The DMO works with the billing officer to monitor outstanding BOCs. The billing

officer provides weekly reminders for pending collections and supervisors are engaged prior to

the 30 day deadline.

Documents to be Submitted:

• Email correspondence to Staff

• BOC Log

Status and Timeline for Completion: Completed, September 2019

Recommendation 10

That the Office of the Chief Financial Officer/Acquisition and Contract Management issue

a policy requiring post management to enter into a contract with the auctioneer as

warranted by the nature of the auction arrangement.

Concur

Response: The Office of the Chief Financial Officer/Acquisition and Contract Management

recognize a need for specific guidance on this issue. The CFO will work with Acquisition and

Contract Management to add guidance on entering into a contract with an auctioneer in the

Overseas Contracting Handbook (OCH) and distribute it to all Peace Corps posts.

Documents to be Submitted:

• New OCH language regarding contracts with auctioneers

Status and Timeline for Completion: October 2019

Final Audit Report: Peace Corps/Fiji (IG-19-04-A) 24

Recommendation 11

That the director of management and operations sign a contract with the auction house.

Concur

Response: Currently, there is only one auctioneer active in Fiji. Post has used this auctioneer

when needed albeit very infrequently and typically for the resale of PC vehicles. Post is in

communication with the Acquisition and Contracts Manager regarding the selection of the most

appropriate type of contract to execute for this service. Post will adhere to the policy requiring a

contract with auctioneer.

Documents to be Submitted:

• Email correspondence with ACM

Status and Timeline for Completion: November 2019

Recommendation 12

That the country director and the director of management and operations issue a

modification for the current leases to include square footage in the description and take

steps to ensure future lease agreements meet applicable requirements.

Concur

Response: Post has amended three leases to include the square footage in the description and

will do the same for all leases moving forward. Staff will be reminded to use the most recent

standard template when developing a lease agreement.

Documents to be Submitted:

• Copies of all current post property lease agreements attached, including three

modifications and three standard leases.

Status and Timeline for Completion: Completed, August 2019

Final Audit Report: Peace Corps/Fiji (IG-19-04-A) 25

APPENDIX E: OIG COMMENTS

Management concurred with all 12 recommendations. In their response, management described

actions it is taking or intends to take to address the issues that prompted each of our

recommendations. We closed 5 recommendations (numbers 2, 3, 5, 8, and 12) based on evidence

of corrective actions that address the recommendations. The remaining 7 recommendations

remain open pending review of documentation listed in the agency’s response.

We wish to note that in closing recommendations, we are not certifying that the region or post

has taken these actions, nor that we have reviewed their effect. Certifying compliance and

verifying effectiveness are management’s responsibilities. However, when we feel it is

warranted, we may conduct a follow-up review to confirm that action has been taken and to

evaluate the impact.

Final Audit Report: Peace Corps/Fiji (IG-19-04-A) 26

APPENDIX F: AUDIT COMPLETION AND OIG CONTACT

A

UDIT COMPLETION

This audit was conducted under the direction of Assistant

Inspector General for Audit Judy Leonhardt by Auditor

Shane Potter and Program Analyst A’Daris McNeese.

OIG

C

ONTACT

If you wish to comment on the quality or usefulness of this

report to help us strengthen our product, please contact

Assistant Inspector General for Audit Judy Leonhardt at

jleonhardt@peacecorpsoig.gov or 202.692.2914.

Help Promote the Integrity, Efficiency, and

Effectiveness of the Peace Corps

Anyone knowing of wasteful practices, abuse, mismanagement,

fraud, or unlawful activity involving Peace Corps programs or

personnel should call or write the Office of Inspector General.

Reports or complaints can also be made anonymously.

Contact OIG

Reporting Hotline:

U.S./International: 202.692.2915

Toll-Free (U.S. only): 800.233.5874

Email: OIG@peacecorpsoig.gov

Online Reporting Tool: peacecorps.gov/oig/contactoig

Mail: Peace Corps Office of Inspector General

P.O. Box 57129

Washington, D.C. 20037-7129

For General Information:

Main Office: 202.692.2900

Website: peacecorps.gov/oig

Twitter: twitter.com/PCOIG