PLAN SUMMARY

PEBB Life Insurance through December 31, 2021

Life insurance is a cost-effective way to protect your family and your

finances. It helps ensure your short- and long-term financial obligations

could be met if something unforeseen happens to you.

A

DF# LI-ALL-SUPP

Explore the coverage that makes it easy to give yourself and your loved ones more security today and in the future.

Basic Term Life and Accidental Death and Dismemberment (AD&D) Insurance

Your employer provides you with $35,000 in Basic Term Life insurance coverage and $5,000 in Basic AD&D insurance coverage at no

cost to you.

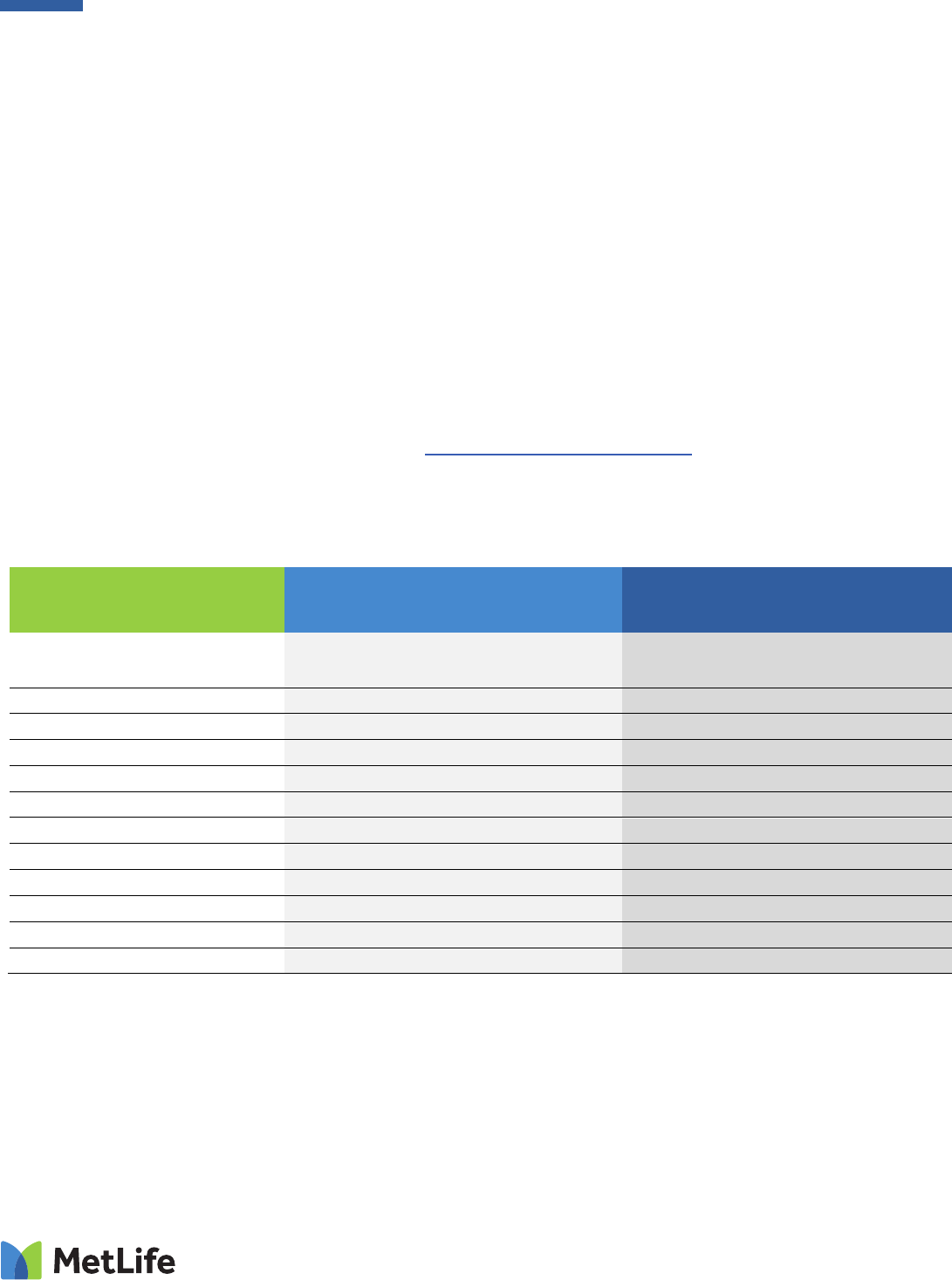

Supplemental Term Life Insurance Coverage Options

*Child(ren)’s Eligibility: Dependent children ages from 14 days to 26 years old are eligible for coverage. In TX, regardless of student status, child(ren) are covered until age 25.

Accidental Death & Dismemberment (AD&D) coverage complements your Basic and Supplemental Life insurance coverage

and helps protect you 24 hours a day, 365 days a year.

Accidental Death & Dismemberment Coverage Options

This valuable coverage benefits beyond your disability or life insurance for losses due to covered accidents — including while

commuting, traveling by public or private transportation and during business trips. MetLife’s AD&D insurance pays you benefits if you

suffer a covered accident that results in paralysis or the loss of a limb, speech, hearing or sight; brain damage; or coma. If you suffer a

covered fatal accident, benefits will be paid to your beneficiary.

Supplemental AD&D Coverage Amounts for You

• You can buy Supplemental AD&D in $10,000 increments up to a maximum of $250,000

Supplemental AD&D Coverage Amounts for Spouse/State-Registered Domestic Partner and Child(ren)

• You can choose to cover your spouse/state-registered domestic partner and child(ren) with AD&D coverage. Your spouse/state-

registered domestic partner will be eligible for coverage in $10,000 increments up to $250,000. Your child(ren) will be eligible for

coverage amounts in $5,000 increments up to $25,000.

*Child(ren)’s Eligibility: Dependent children ages from 14 days to 26 years are eligible for coverage. In TX, regardless of student status, child(ren) are covered until age 25.

Covered Losses

This AD&D insurance pays benefits for covered losses that are the result of an accidental injury or loss of life. The full amount of

AD&D coverage you select is called the “Full Amount” and is equal to the benefit payable for the loss of life. Benefits for other losses

are payable as a predetermined percentage of the Full Amount, and will be listed in your coverage in a table of Covered Losses. Such

losses include loss of limbs, sight, speech and hearing, various forms of paralysis, brain damage and coma. The maximum amount

payable for all Covered Losses sustained in any one accident is capped at 100% of the Full Amount.

For You

For Your Spouse/State-Registered

Domestic Partner

For Your Dependent Children*

$10,000 up to $1,000,000, in $10,000

increments

$5,000 up to $500,000, in $5,000

increments, not to exceed 50% of

Employee Supplemental Life

coverage amount

$5,000 up to $20,000, in $5,000

increments

Life Insurance

Standard Additional Benefits Include

Some of the standard additional benefits included in your coverage that may increase the amounts payable to you and/or defray

additional expenses that result from accidental injury or loss of life are:

• Air Bag

• Seat Belt

• Common Carrier

• Child Care Center

• Child Education

• Spouse Education

• Hospitalization

• Presumption of Death

• Exposure

What Is Not Covered by AD&D?

AD&D insurance does not include payment for any loss which is caused by or contributed to by: physical or mental illness, diagnosis of

or treatment of the illness; an infection, unless caused by an external wound accidentally sustained; suicide or attempted suicide;

injuring oneself on purpose; the voluntary intake or use by any means of any drug, medication or sedative, unless taken as prescribed

by a doctor or an over-the-counter drug taken as directed; voluntary intake of alcohol in combination with any drug, medication or

sedative; war, whether declared or undeclared, or act of war, insurrection, rebellion or active participation in a riot; committing or trying

to commit a felony; any poison, fumes or gas, voluntarily taken, administered or absorbed; service in the armed forces of any country

or international authority, except the United States National Guard; operating, learning to operate, or serving as a member of a crew of

an aircraft; while in any aircraft for the purpose of descent from such aircraft while in flight (except for self-preservation); or operating a

vehicle or device while intoxicated as defined by the laws of the jurisdiction in which the accident occurs.

Additional Coverage Information

How to Apply

*

• You may apply for life and AD&D insurance coverage quickly and securely online using the MyBenefits website. It’s easy to use.

Just go to https://mybenefits.metlife.com/wapebb.

*All applications are subject to review and approval by Metropolitan Life Insurance Company. Based on the plan design and the amount of coverage requested, Evidence of

Insurability may need to be submitted to complete your application.

For Employee Coverage

Enrollment in this Supplemental Term Life insurance plan is available without providing medical information as long as:

For New Hires

• The enrollment takes place within 31 days from the date you become eligible for benefits, and

• You are enrolling for coverage up to $500,000

If you do not meet all of the conditions stated above, you will need to provide additional medical information by completing a Statement

of Health form provided by MetLife.

For Dependent Coverage

†

You must be covered in order to obtain coverage for your spouse/state-registered domestic partner and child(ren).

Your spouse/state-registered domestic partner and dependent children do not need to provide medical information as long as:

For New Hires

• The enrollment takes place within 31 days from the date you become eligible for benefits, and

• You are enrolling for spouse/state-registered domestic partner coverage less than $100,000.

If you do not meet all of the conditions stated above, you will need to provide additional medical information by completing a Statement

of Health form provided by MetLife.

Metropolitan Life Insurance Company | 200 Park Avenue | New York, NY 10166

L0721015148[exp0723][AL,AK,AZ,AR,CA,CAN,CO,CT,DE,FL,GA,HI,ID,IL,IN,IA,KS,KY,LA,ME,MD,MA,MI,MN,MS,MO,MT,NE,NV,NH,NJ,N

M,NY,NC,ND,OH,OK,OR,PA,RI,SC,SD,TN,TX,UT,VT,VA,WA,WV,WI,WY,DC,GU,MP,PR,VI] © 2020 MetLife Services and Solutions, LLC

Life Insurance

About Your Coverage Effective Date

You must be Actively at Work on the date your coverage becomes effective. Your coverage must be in effect in order for your

spouse/state-registered domestic partner’s and eligible children’s coverage to take effect. In addition, your spouse/state-registered

domestic partner and eligible child(ren) must not be home or hospital confined or receiving or applying to receive disability benefits

from any source when their coverage becomes effective.

If Actively at Work requirements are met, coverage will become effective on the first of the month following the receipt of your

completed application for all requests that do not require additional medical information. A request for your amount that requires

additional medical information and is not approved by the date listed above will not be effective until the first of the month following the

date MetLife approved the coverage or increase if you meet Actively at Work requirements on that date, or the date that Actively at

Work requirements are met after MetLife has approved the coverage or increase. The coverage for your spouse/state-registered

domestic partner and eligible child(ren) will take effect on the date they are no longer confined, receiving or applying for disability

benefits from any source or hospitalized.

Who Can Be A Designated Beneficiary?

You can select any beneficiary other than your employer for your Basic and Supplemental coverages, and you may change your

beneficiary at any time. You can also designate more than one beneficiary. You are the beneficiary for your Dependent coverage. You

can name beneficiaries online using the MyBenefits website (https://mybenefits.metlife.com/wapebb) or by calling 866-548-7139.

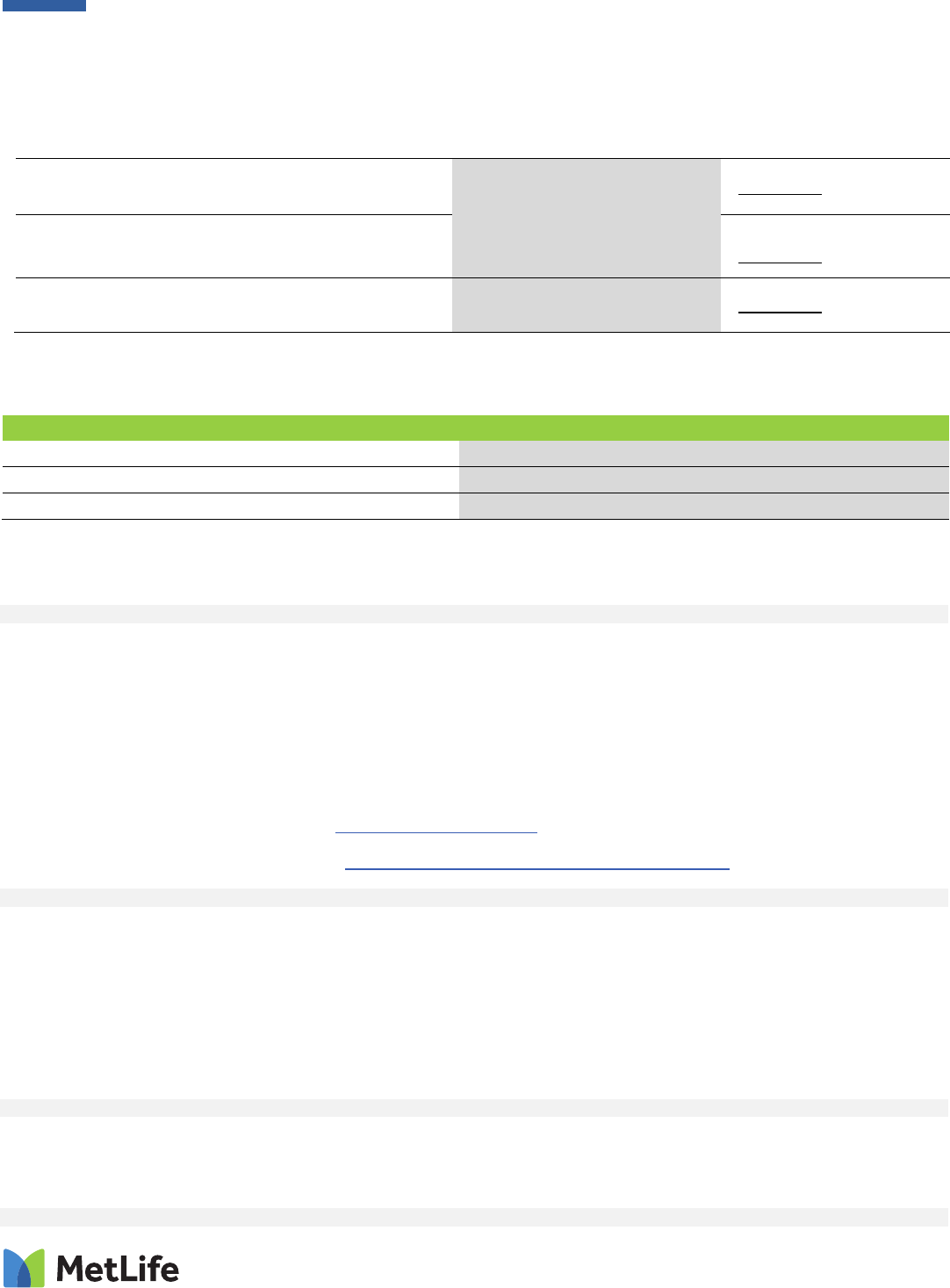

Monthly Costs* for Supplemental Term Life and Accidental Death and Dismemberment Insurance

You have the option to purchase Supplemental Term Life Insurance. Listed below are your monthly rates (based on your age as of

12/31 of the prior year) as well as those for your spouse/state-registered domestic partner (based on your age as of 12/31 of the prior

year). Rates to cover your children are also shown.

† Covers all eligible children

*Note: rates are subject to the policy’s right to change premium rates, and the employer’s right to change employee contributions.

Age

Monthly Cost Per $1,000 of Employee

Coverage

Monthly Cost Per $1,000 of Spouse/State-

Registered Domestic Partner Coverage

Tobacco User Non-Tobacco User Tobacco User Non-Tobacco User

Under 25

$0.037 $0.028 $0.037 $0.028

25 – 29 $0.043 $0.031 $0.043 $0.031

30 – 34 $0.057 $0.034 $0.057 $0.034

35 – 39 $0.066 $0.043 $0.066 $0.043

40 – 44 $0.073 $0.064 $0.073 $0.064

45 – 49 $0.111 $0.092 $0.111 $0.092

50 – 54 $0.170 $0.143 $0.170 $0.143

55 – 59 $0.317 $0.268 $0.317 $0.268

60 – 64 $0.482 $0.411 $0.482 $0.411

65 – 69 $0.929 $0.758 $0.929 $0.758

70 + $1.510 $1.131 $1.510 $1.131

Cost for your Child(ren)

†

$0.124

Metropolitan Life Insurance Company | 200 Park Avenue | New York, NY 10166

L0721015148[exp0723][AL,AK,AZ,AR,CA,CAN,CO,CT,DE,FL,GA,HI,ID,IL,IN,IA,KS,KY,LA,ME,MD,MA,MI,MN,MS,MO,MT,NE,NV,NH,NJ,N

M,NY,NC,ND,OH,OK,OR,PA,RI,SC,SD,TN,TX,UT,VT,VA,WA,WV,WI,WY,DC,GU,MP,PR,VI] © 2020 MetLife Services and Solutions, LLC

Life Insurance

Use the table below to calculate your premium based on the amount of life insurance you will need.

Example: $100,000 Supplemental Life Coverage

Repeat the three easy steps above to determine the cost for each coverage selected.

Monthly Cost for Accidental Death & Dismemberment (AD&D) Insurance

Once Enrolled, You have Access to MetLife Advantages

SM

—

Services to Help Navigate What Life May Bring

Grief Counseling

1

To help you, your dependents, and your beneficiaries cope with loss

Your employer-paid life insurance plan offers you, your dependents, and your beneficiaries’ access to grief counseling sessions and

funeral related concierge services to help cope with a loss — at no extra cost. Grief counseling services provide confidential and

professional support during a difficult time to help address personal and funeral planning needs. At your time of need, you and your

dependents have 24/7 access to a work/life counselor. You simply call a dedicated 24/7 toll-free number to speak with a licensed

professional experienced in helping individuals who have suffered a loss. Sessions can either take place in-person or by phone. You

can have up to five face-to-face grief counseling sessions per event to discuss any situation you perceive as a major loss, including but

not limited to death, bankruptcy, divorce, terminal illness, or losing a pet.

1

In addition, you have access to funeral assistance for

locating funeral homes and cemetery options, obtaining funeral cost estimates and comparisons, and more. You can access these

services by calling 1-888-319-7819 or log on to www.metlifegc.lifeworks.com (Username: metlifeassist; Password: support).

Download this helpful Funeral Planning Guide at https://www.metlife.com/funeralplanning/funeral-guide/.

Funeral Discounts and Planning Services

2

Ensuring your final wishes are honored

As a MetLife group life policyholder, you and your family may have access to funeral discounts, planning and support to help honor a

loved one’s life — at no additional cost to you. Dignity Memorial provides you and your loved ones access to discounts of up to 10% off

of funeral, cremation and cemetery services through the largest network of funeral homes and cemeteries in the United States.

When using a Dignity Memorial Network you have access to convenient planning services — either online at

www.finalwishesplanning.com, by phone (1-866-853-0954), or by paper — to help make final wishes easier to manage. You also have

access to assistance from compassionate funeral planning experts to help guide you.

Beneficiary Claim Assistance

3

(Delivering the Promise)For support when beneficiaries need it most

This program is designed to help beneficiaries sort through the details and serious questions about claims and financial needs during a

difficult time. MetLife has arranged for third party financial professionals to be available to help with filing life insurance claims,

government benefits and help with financial questions.

Life Settlement Account

4

(Total Control Account)

1. Enter the rate from the table

(example age 36)

$XX.XX

$ 0.043

2. Enter the amount of insurance in thousands of

dollars (Example: for $100,000 of coverage enter $100)

$100

$ 100

3. Monthly premium (1) x (2) $XX.XX $ 4.300

Supplemental Coverage Monthly Cost Per $1,000 of Coverage

Employee $0.019

Dependent Spouse/State-Registered Domestic Partner

$0.019

Dependent Child $0.016

Metropolitan Life Insurance Company | 200 Park Avenue | New York, NY 10166

L0721015148[exp0723][AL,AK,AZ,AR,CA,CAN,CO,CT,DE,FL,GA,HI,ID,IL,IN,IA,KS,KY,LA,ME,MD,MA,MI,MN,MS,MO,MT,NE,NV,NH,NJ,N

M,NY,NC,ND,OH,OK,OR,PA,RI,SC,SD,TN,TX,UT,VT,VA,WA,WV,WI,WY,DC,GU,MP,PR,VI] © 2020 MetLife Services and Solutions, LLC

Life Insurance

For immediate access to death proceeds

The Total Control Account

®

(TCA) settlement option provides your loved ones with a safe and convenient way to manage the proceeds

of a life or accidental death and dismemberment claim payments of $5,000 or more, backed by the financial strength and claims

paying ability of Metropolitan Life Insurance Company. TCA death claim payments relieve beneficiaries of the need to make immediate

decisions about what to do with a lump-sum check and enable them to have the flexibility to access funds as needed while earning a

guaranteed minimum interest rate on the proceeds as they assess their financial situations. Call 1-800-638-7283 for more information

about options available to you.

Travel Assistance

5

A travel assistance benefit is available when you enroll in MetLife’s AD&D coverage

Travel assistance services, offered on your basic AD&D coverage, offers you and your family access to emergency services while you

travel, plus the advantage of concierge assistance for personal and work-related travel and entertainment requests. This service

provides you and your dependents with medical, legal, transportation and financial assistance 24 hours a day, 365 days a year when

you are more than 100 miles away from home. You also have access to Mobile Assist Service to provide you information to help avoid

expensive mobile telephone charges and help effectively use overseas options. Mobile Assist Service also offers a detailed guide that

includes essential applications and resources and connects employees to their concierge services. Identity Theft Solutions is also

available to help educate you on identity theft prevention and provide assistance in the event you are a victim of identity theft. Please

visit the AXA website for more information at www.metlife.com/travelassist.

Will Preparation

6

To help ensure your decisions are carried out

When you enroll in supplemental term life coverage, you will automatically receive access to Will Preparation Services at no extra cost

to you. Both you and your spouse/state-registered domestic partner will have unlimited in-person or telephone access to one of

MetLife Legal Plans, Inc nationwide network of 17,500+ participating attorneys for preparation of or updating a will, living will or power

of attorney.* When you use a participating plan attorney, there will be no charge for the services.* Like life insurance, a carefully

prepared will (simple or complex), living will and power of attorney are important.

• A will lets you define your most important decisions, such as who will care for your children

or inherit your property.

• A living will ensures your wishes are carried out and protects your loved ones from having to make very difficult and personal

medical decisions by themselves. Also called an “advanced directive,” it is a document authorized by statutes in all states that

allows you to provide written instructions regarding use of extraordinary life-support measures and to appoint someone as your

proxy or representative to make decisions on maintaining extraordinary life-support if you should become incapacitated and unable

to communicate your wishes.

• Powers of attorney allow you to plan ahead by designating someone you know and trust to act on your behalf in the event of

unexpected occurrences or if you become incapacitated

Call 1-800-821-6400 and a Client Service Representative will assist you.

* You also have the flexibility of using an attorney who is not participating in the MetLife Legal Plans, Inc. network and being

reimbursed for covered services according to a set fee schedule. In that case you will be responsible for any attorney’s fees that

exceed the reimbursed amount.

Estate Resolution Services

SM 6

(ERS)

Personal service and compassion assistance to help probate your and your spouse’s/state-registered domestic partner’s

estates.

When you enroll in supplemental term life coverage, MetLife Estate Resolution Services

SM

provides probate services in person or over

the phone to the representative (executor or administrator) of the deceased employee's estate and the estate of the employee's

spouse/state-registered domestic partner. Estate Resolution Services include preparation of documents and representation at court

proceedings needed to transfer the probate assets from the estate to the heirs and completion of correspondence necessary to

transfer non-probate assets. ERS covers participating plan attorneys’ fees for telephone and face-to-face consultations or for the

administrator or executor to discuss general questions about the probate process.

Metropolitan Life Insurance Company | 200 Park Avenue | New York, NY 10166

L0721015148[exp0723][AL,AK,AZ,AR,CA,CAN,CO,CT,DE,FL,GA,HI,ID,IL,IN,IA,KS,KY,LA,ME,MD,MA,MI,MN,MS,MO,MT,NE,NV,NH,NJ,N

M,NY,NC,ND,OH,OK,OR,PA,RI,SC,SD,TN,TX,UT,VT,VA,WA,WV,WI,WY,DC,GU,MP,PR,VI] © 2020 MetLife Services and Solutions, LLC

Life Insurance

WillsCenter.com

7

Self-service online legal document preparation

Employees and spouses/state-registered domestic partners have access to WillsCenter.com, an online document service to prepare

and update a will, living will, power of attorney, funeral directive, memorandum of wishes or HIPAA authorization form in a secure 24/7

environment at no additional cost. This service is available with all life coverages. Log on to www.willscenter.com to register as a new

user.

Portability

So you can keep your coverage even if you leave your current employer

Should you leave PEBB coverage for any reason, and your Basic, Supplemental, and Dependent Term Life insurance under this plan

terminates, you will have an opportunity to continue group term coverage (“portability”) under a different policy, subject to plan design

and state availability. Rates will be based on the experience of the ported group and MetLife will bill you directly. Rates may be higher

than your current rates. To take advantage of this feature, you must have coverage of at least $10,000 up to a maximum of

$2,000,000.

Portability is also available on coverage you’ve selected for your spouse/state-registered domestic partner and dependent child(ren).

The maximum amount of coverage for spouse/domestic partners is $250,000; the maximum amount of dependent child coverage is

$25,000. Increases, decreases and maximums are subject to state availability.

Generally, there is no minimum time for you to be covered by the plan before you can take advantage of the portability feature. Please

see your plan certificate for specific details.

Please note that if you experience an event that makes you eligible for portable coverage, please call a MetLife representative at 1-

866-548-7139 for more information.

Transition Solutions

3

Assistance identifying solutions for your financial situations

Transition Solutions provides assistance for important, time-sensitive benefit and financial decisions due to change in benefits

including:

• Group Life Insurance Continuation Options

• Lump-sum distributions

• Reduction in benefits for active or retired employees

• Benefits coordination due to layoffs, merger, acquisition or bankruptcy

• Define Contribution Plan termination

• Retiree Group Life elimination

Additional Features

This insurance offering from your employer and MetLife comes with additional features that can provide assistance to you and your

family

Accelerate Benefits Option

8

For access to funds during a difficult time

If you become terminally ill and are diagnosed with 24 months or less to live, you have the option to receive up to 80% of your life

insurance proceeds. This can go a long way towards helping your family meet medical and other expenses at a difficult time. Amounts

not accelerated will continue under your employer’s plan for as long as you remain eligible per the certificate requirements and the

group policy remains in effect.

The accelerated life insurance benefits offered under your certificate are intended to qualify for favorable tax treatment under Section

101(g) of the Internal Revenue Code (26 U.S.C.Sec 101(g)).

10

Accelerated Benefits Option is not the same as long term care insurance (LTC). LTC provides nursing home care, home-health care,

personal or adult day care for individuals above age 65 or with chronic or disabling conditions that require constant supervision.

The Accelerated Benefits Option is also available to spouses/state-registered domestic partners insured under Dependent Life

insurance plans. This option is not available for dependent child coverage.

Conversion

Metropolitan Life Insurance Company | 200 Park Avenue | New York, NY 10166

L0721015148[exp0723][AL,AK,AZ,AR,CA,CAN,CO,CT,DE,FL,GA,HI,ID,IL,IN,IA,KS,KY,LA,ME,MD,MA,MI,MN,MS,MO,MT,NE,NV,NH,NJ,N

M,NY,NC,ND,OH,OK,OR,PA,RI,SC,SD,TN,TX,UT,VT,VA,WA,WV,WI,WY,DC,GU,MP,PR,VI] © 2020 MetLife Services and Solutions, LLC

Life Insurance

For protection after your coverage terminates

You can generally convert your group term life insurance benefits to an individual whole life insurance policy if your coverage

terminates in whole or in part due to your retirement, termination of employment, or change in employee class. Conversion is available

on all group life insurance coverages. Please note that conversion is not available on AD&D coverage. If you experience an event that

makes you eligible to convert your coverage, please call 1-877-275-6387 to begin the conversion process. Please contact MetLife for

more information.

Waiver of Premiums for Total Disability (Continued Protection)

Offering continued coverage when you need it most

If you become Totally Disabled, you may qualify to continue certain insurance. You may also be eligible for waiver of your basic,

supplemental, and dependent term life insurance premium until die, or recover from your disability, whichever is sooner.

Total Disability or Totally Disabled means you are unable to do your job and any other job for which you are fit by education, training or

experience due to injury or sickness. The Total Disability must begin before age 60, and your waiver will begin after you have satisfied

a 6-month waiting period of continuous disability. The waiver of premium will end when you die or recover.

Continuation for Surviving Dependents

Continued coverage for your dependents

This feature allows coverage for your surviving dependents, who were insured at the time of your death, to continue with premium

payment. Surviving children must continue to meet the plan’s child definition in order to be eligible and coverage will end upon your

spouse’s remarriage. Premium payments may be made directly to MetLife for up to 5 months.

If you have questions, call 1-866-548-7139.

Visit www.metlife.com/wshca to find plan information, documents, a life insurance calculator, and more!

Metropolitan Life Insurance Company | 200 Park Avenue | New York, NY 10166

L0721015148[exp0723][AL,AK,AZ,AR,CA,CAN,CO,CT,DE,FL,GA,HI,ID,IL,IN,IA,KS,KY,LA,ME,MD,MA,MI,MN,MS,MO,MT,NE,NV,NH,NJ,N

M,NY,NC,ND,OH,OK,OR,PA,RI,SC,SD,TN,TX,UT,VT,VA,WA,WV,WI,WY,DC,GU,MP,PR,VI] © 2020 MetLife Services and Solutions, LLC

Life Insurance

1- Grief Counseling services are provided through an agreement with LifeWorks US Inc. LifeWorks is not an affiliate of MetLife, and the services LifeWorks provides are

separate and apart from the insurance provided by MetLife. LifeWorks has a nationwide network of over 30,000 counselors. Counselors have master’s or doctoral degrees and

are licensed professionals. The Grief Counseling program does not provide support for issues such as: domestic issues, parenting issues, or marital/relationship issues (other

than a finalized divorce). For such issues, members should inquire with their human resources department about available company resources. This program is available to

insureds, their dependents and beneficiaries who have received a serious medical diagnosis or suffered a loss. Events that may result in a loss are not covered under this

program unless and until such loss has occurred. Services are not available in all jurisdictions and are subject to regulatory approval. Not available on all policy forms.

2- Services and discounts are provided through a member of the Dignity Memorial® Network, a brand name used to identify a network of licensed funeral, cremation and

cemetery providers that are affiliates of Service Corporation International (together with its affiliates, “SCI”), 1929 Allen Parkway, Houston, Texas. The online planning site is

provided by SCI Shared Resources, LLC. SCI is not affiliated with MetLife, and the services provided by Dignity Memorial members are separate and apart from the insurance

provided by MetLife. SCI offers planning services, expert assistance, and bereavement travel services to anyone regardless of affiliation with MetLife. Discounts through

Dignity Memorial’s network of funeral providers have been pre-negotiated. Not available where prohibited by law. If the group policy is issued in an approved state, the

discount is available for services held in any state except KY and NY, or where there is no Dignity Memorial presence (AK, MT, ND, SD, and WY). For MI and TN, the discount is

available for “At Need” services only. Not approved in AK, FL, KY, MT, ND, and NY.

3- MetLife administers the programs, but has arranged for specially-trained financial professionals offer financial education and, upon request, provide personal guidance to

employees and former employees of companies providing these programs through MetLife.

4- Subject to state law, and/or group policyholder requests, the Total Control Account is provided for all Life and AD&D benefits of $5,000 or more.The TCA is not insured by

the Federal Deposit Insurance Corporation or any government agency. The assets backing TCAs are maintained in MetLife’s general account and are subject to claims of

MetLife’s creditors. MetLife bears the investment risk of the assets backing TCAs, and expects to receive a profit. Regardless of the investment experience of such assets, the

interest credited to TCAs will never fall below the guaranteed minimum rate. Guarantees are subject to the financial strength and claims paying ability of MetLife.

5- Travel Assistance and Identity Theft Solutions services are administered by AXA Assistance USA, Inc. Certain benefits provided under the Travel Assistance program are

underwritten by Certain Underwriters at Lloyd’s London (not incorporated) through Lloyd’s Illinois, Inc. Neither AXA Assistance USA Inc. nor the Lloyd’s entities are affiliated

with MetLife, and the services and benefits they provide are separate and apart from the insurance provided by MetLife.

6- Will Preparation and MetLife Estate Resolution Services are offered by MetLife Legal Plans, Inc. Cleveland, Ohio. In certain states, legal services benefits are provided

through insurance coverage underwritten by Metropolitan Property and Casualty Insurance Company and affiliates, Warwick, Rhode Island. For New York sitused cases, the

Will Preparation service is an expanded offering that includes office consultations and telephone advice for certain other legal matters beyond Will Preparation. Tax Planning

and preparation of Living Trusts are not covered by the Will Preparation Service. Certain services are not covered by Estate Resolution Services, including matters in which

there is a conflict of interest between the executor and any beneficiary or heir and the estate; any disputes with the group policyholder, MetLife and/or any of its affiliates; any

disputes involving statutory benefits; will contests or litigation outside probate court; appeals; court costs, filing fees, recording fees, transcripts, witness fees, expenses to a

third party, judgments or fines; and frivolous or unethical matters.

7- WillsCenter.com is a document service provided by SmartLegalForms, Inc., an affiliate of Epoq Group, Ltd. SmartLegalForms, Inc. is not affiliated with MetLife and the

WillsCenter.com service is separate and apart from any insurance or service provided by MetLife. The WillsCenter.com service does not provide access to an attorney, does not

provide legal advice, and may not be suitable for your specific needs. Please consult with your financial, legal, and tax advisors for advice with respect to such matters.

WillsCenter.com is available to anyone with internet access regardless of affiliation with MetLife.

8- The Accelerated Benefits Option is subject to state regulation and is intended to qualify for favorable federal income tax treatment, in which case the benefits will not be

subject to federal income taxation. This information was written as a supplement to the marketing of life insurance products. Tax laws relating to accelerated benefits are

complex and limitations may apply. You are advised to consult with and rely on an independent tax advisor about your own particular circumstances. Receipt of accelerated

benefits may affect your eligibility, or that of your spouse or your family, for public assistance programs such as medical assistance (Medicaid), Temporary Assistance to Needy

Families (TANF), Supplementary Social Security Income (SSI) and drug assistance programs. You are advised to consult with social service agencies concerning the effect that

receipt of accelerated benefits will have on public assistance eligibility for you, your spouse or your family.

This summary provides an overview of your plan’s benefits. These benefits are subject to the terms and conditions of the contract between MetLife and WA State Health Care Authority

PEBB and are subject to each state’s laws and availability. Specific details regarding these provisions can be found in the booklet certificate. If you have additional questions regarding the

life Insurance program underwritten by MetLife, please contact your benefits administrator or MetLife. Nothing in these materials is intended to be advice for a particular situation or individual.

Like most group life insurance policies, MetLife group policies contain exclusions, limitations, terms and conditions for keeping them in force. Please see your certificate for complete details.

Metropolitan Life Insurance Company | 200 Park Avenue | New York, NY 10166

L0721015148[exp0723][AL,AK,AZ,AR,CA,CAN,CO,CT,DE,FL,GA,HI,ID,IL,IN,IA,KS,KY,LA,ME,MD,MA,MI,MN,MS,MO,MT,NE,NV,NH,NJ,N

M,NY,NC,ND,OH,OK,OR,PA,RI,SC,SD,TN,TX,UT,VT,VA,WA,WV,WI,WY,DC,GU,MP,PR,VI] © 2020 MetLife Services and Solutions, LLC

Life Insurance

Life and AD&D coverages are provided under a group insurance policy (Policy Form GPNP16-WSHCA) issued to your employer by MetLife. Life and AD&D coverages under your employer’s

plan terminates, when your employment ceases, when your Life and AD&D contributions cease, or upon termination of the group contract. Should your life insurance coverage terminate for

reasons other than non-payment of premium, you may convert it to a MetLife individual permanent policy without providing medical evidence of insurability.