ЕNVIRONMENTAL

AND SOCIAL

RESPONSIBILITY

REPORT 2021

One of the key objectives of DSK Bank is to

become a market leader in regard to all banking

segments by establishing and maintaining high

client service standards, advanced and suitable

products and services, best corporate and ethic

practices in its relations with all interested

parties. We create key value for all our clients,

employees and shareholders by providing

appropriate solutions for their needs while

following the relevant legislation and ensuring

sustainable development.

In 2021, a strategic program for digitalization

has turned out to be a highly impactful

endeavor and undoubtedly has achieved its

ambitious purpose to even further improve

DSK Bank services and operations. During 2021,

there were sharp market trends to be observed

in digital activity in Bulgaria and DSK Bank was

among leaders in this aspect by introducing

important features. The main objective of DSK

Bank’s digital strategy is to provide modern and

high-quality online and mobile banking services

and offer wide range of online services, starting

from full E2E online onboarding of new-to-bank

clients.

The share of DSK Bank’s online and mobile

banking penetration is one of the highest in

the Bulgarian market, with faster growth of

the mobile banking usage. Recent data for

DSK Bank’s online banking - DSK Direct, show

that more than 1.3 million customers have

credentials to use it.

In 2021, the mobile app development was

focused on further improving the usability and

payments possibilities - improvement of utility

payments development of P2P payments to

mobile number, integration with Apple pay and

Google pay.

From 2022 onwards, DSK Bank will embark

on a new era of customer experience and

efficiency leadership. The Bank’s vision is to

build excellence through combining large-

scale digitization of customer journeys with a

revamped operating model.

In the beginning of 2022, we built a Digital

Factory to institutionalize the Bank’s operating

model at scale, resting on - customer-centric

service design, journey driven digitization,

agile way of working, developing talent and

capabilities of employees and technology

modernization.

Our engagements in the field of environmental

and social responsibility are manifested through

various initiatives and projects over time. By

doing so, we strive to incorporate environmental,

social and governance (ESG) considerations in

as many activities and processes as possible.

The concept of ESG is a way to achieve a future

that benefits all of us in the long-term. It is not

a single and stand-alone action, it is a long path

to go but the only possible and necessary one

to ensure economic development, greener and

more equitable place for generations to live.

INTRODUCTION

2

• by realizing the market opportunities with

a strong governance;

• by creating products and services to

support the transition plans of our customers

to low-carbon economy;

• by building strategies, policies and

systems to assess and manage the relevant

risks;

• by setting ambitious goals to our

institution aligned with the OTP Group ESG

Strategy;

• by monitoring results and regular

reporting on the progress achieved.

We strongly believe that every member of our

society can make an effort and contribute for

attaining a more sustainable world. The Bank

decided to publish this report apart from the

regulatory required disclosures as a fair and

transparent communication to all interested

stakeholders in order to emphasize the

importance of ESG topic and in particular – of

climate and environmental matters in terms of

their urgency. We use also the opportunity to

share our initiatives that took place meanwhile,

after the publication of 2021 Annual report.

For the first time we sought to associate

our actual activities with the Sustainability

Development Goals (SDGs), adopted by all UN

member states, by selecting those which we

think we have met at least to certain extent. This

selection can be further refined and harmonized

with our future plans after establishing the ESG

Strategy of DSK Bank Group with the relevant

targets.

How do we imagine the practical

application of this concept in DSK?

3

ESG stands for Environmental, Social, and Governance

but despite its frequent use in conversations, it is a

term that has no standard definition. Clearly, ESG

stands for applying non-financial factors in the

financial decision making process.

ESG can and should be defined as the corporate

contribution to the realisation of the United Nations

Sustainable Development Goals. There are 16+1 goals

in this framework with the ultimate goal that every

person on the Earth should live prosperous and fulfilling life in

peace and in harmony with nature, protecting the resources of

the planet for future generations.

There are three levers that make it imperative for businesses to

consider ESG factors carefully. The first is self-interest. In the words

of one of the worlds most powerful businessman „to prosper over

time, every company must not only deliver financial performance,

but also show how it makes a positive contribution to society”.

We want to prosper over time, however we can only do, what we

can do. What we can do, are financial services. With our products

we provide and more importantly, help our customers (Goal 17) to

provide good jobs and economic growth (Goal 8), we finance not

only affordable and clean energy (Goal 7), but industry, innovation

and infrastructure (Goal 9 and Goal 6). We guarantee access for

every Bulgarian citizen to high quality financial services, including

savings and pension products, which in turn is essential to fight

poverty (Goal 1) and enables sustainable communities (Goal 11).

The Urban Development Fund of DSK Bank invests into local

communities’ sports facilities, hospitals, museeums, educational

establishments (Goals 3 and 4).

The second lever is regulatory and market pressure. Commercial

banks, supervised by the European Central Bank are expected

to consider climate-related and environmental risks when

developing the institution’s overall business strategy, business

objectives and risk management framework, and to exercise

effective oversight of climate-related and environmental risks. In

practice we need to develop a system that not only to quantifies

but widely discloses our environmental credentials. In other

words, how our activities contribute to Goal 13, Climate Action. The

regulatory intention is to facilitate moral and market pressure.

This seems to work in Europe, where according to recent surveys,

attitudes towards the circular economy are extremely positive,

but Bulgarians are much less informed about it and apply it in

their daily lives.

The third lever is Corporate Social Responsibility. Our CSR program

is an effort to be socially accountable to ourself and the general

public, to help the communities we work in. “DSK Bank Helps”, is

focused on Children (Goals 1 and 4), on Nature (Goal 13), on Cities

(Goal 11) and volunteering (Goal 17).

Charlie Munger, another great investor said that he does not know

what the future of banking is. What he knows is „that a properly

run bank is a great contributor to civilization”.

To paraphrase him, properly governed banking system is a great

contributor towards the ultimate goal that every person on the

Earth should live prosperous and fulfilling life in peace and in

harmony with nature, protecting the resources of the planet for

future generations.

Tamas Hak-Kovacs, CEO of DSK Bank

Letter from the CEO

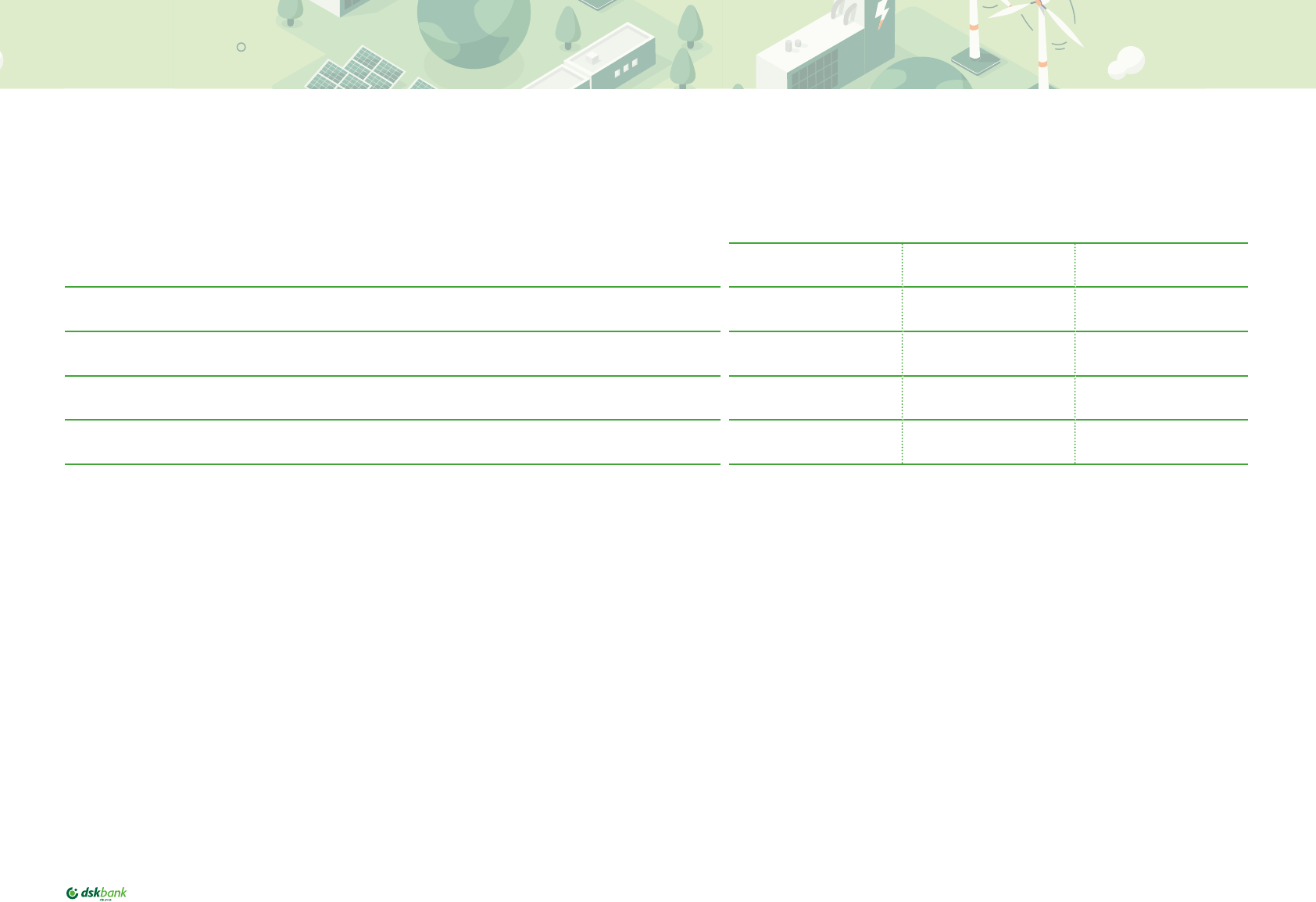

SUMMARY OF ESG ACHIEVEMENTS

2020 2021

Electricity consumption (GJ), DSK Group 88481 -6% 83092

Fuel consumption (liters), DSK Bank stand-alone 120510 -19% 97700

Total energy consumption per capita (GJ) 23,19 -13% 20,07

Scope 1 and Scope 2 CO2e emission (t) per capita 2,33 -17% 1,94

Volume of investment projects in RES powerplants financed (tsd EUR) 64781 +48% 96082

Currently, we finance ~20% of the total installed

wind and solar capacities (MW) in Bulgaria.

We prepared the first large-scale assessment

of carbon footprint of more than 200 corporate

customers in connection with our participation

in the first of its kind Climate Stress Test,

conducted by the ECB.

Project was launched in 2021 for installation

of photovoltaic plants on the roof of three

DSK Bank’s buildings that will reduce the CO

2

emissions by more than 125 tons.

Our new product Mastercard Wildlife Impact

Card, produced by 85,5% recycled and

recyclable material, won the Greenest Product

Award in the national competition “The

Greenest Companies in Bulgaria 2022”. For the

first three months since launching the sales,

more than 24 000 cards were issued.

Nearly BGN 1343000 were invested in

supporting cultural, urban development and

other social projects.

Over BGN 600000 were donated to SOS

Children Village through the DSK Bank’s ATM

system.

DSK Bank started its big and meaningful digital

transformation which includes new processes

and products, implementation of new systems

and working models that will greatly benefit

the customers. We were awarded by the Bank

of the Year Association for the best bank

digital project in 2021 – innovative solution

for contactless payment in the Sofia public

transport. The project combines innovation,

safety and carbon footprint reduction.

5

TABLE OF CONTENTS

INTRODUCTION AND STATEMENTS .................................. 2

SUMMARY OF ESG ACHIEVEMENTS ............................... 5

ESG GOVERNANCE ................................................................7

ENVIRONMENTAL CARE .................................................... 11

RESPONSIBLE FINANCING .................................................. 15

CORPORATE SOCIAL RESPONSIBILITY

THE CUSTOMER AT THE CENTER .................................... 19

RESPONSIBLE APPROACH TO EMPLOYEES .................. 23

RULES OF CONDUCT ............................................................ 25

SPONSORSHIP AND CHARITY ..........................................26

AWARDS .................................................................................28

Organizational background

Given the increased regulatory

requirements and following the OTP

Group initiatives, in 2021 DSK Bank

has put focus on the climate and

environmental aspects of sustainable

development and has defined the

contribution to green transition by

applying ESG standards as one of

its major goals for the business year

2022.

ESG

GOVERNANCE

Steering Committee

Program Sponsor

UNITS INVOLVED IN THE WG UNITS INVOLVED IN THE WG

Stream 1: Regulatory expectation

Risk Management

Corporate banking

Retail banking

ALM

OPT Leasing

HR

Logisties

Finance

PR and Comunication

Stream 2: Own operation

Stream 3: Business opportunities

Subject Owners

Program Director

Svetoslav Salev

WORKING GROUP (WG)

Steering Committee: Key Governing body of the Program

Members:

Tamàs Hàk-Kovàcs (CEO)

Arnaud Leclair (CRO and Program Sponsor)

Boyan Stefov (Corporate Banking Head)

Gergely Pókos (OTP)

Tünde Barabàs (OTP)

Subject Owners: Responsible for the execution of the tasks and for

assuring respective resources.

Svetoslav Salev – Program Director and covering Business

environment, Business strategy, Management body and

organizational structure, Risk management framework,

Credit risk management;

Lyuba Doykova – covering Risk appetite, Reporting

operational risk management, Market risk management,

Liquidity risk management, Stress – testing;

Nevyana Filipova – covering Disclosures and DSK own

operations (Pillar 2).

Project Members:

Manage daily execution of the tasks. To be continuously updated until

project scope and exact tasks are finalized

7

We started with an establishment of specially

dedicated to this topic project named ECO

in order to set the foundations of a systemic

management of climate and environmental

risks within DSK Bank’s Group and a proper

alignment with the objectives of OTP Group

to be the regional leader in financing a fair

and gradual transition to a low-carbon

economy and building a sustainable future

through responsible solutions. The main

goals of the project are to ensure the Bank’s

business sustainability in the time of climate

and environmental changes, and to develop

and implement ESG Strategy and practices

within the DSK Bank Group.

The project is structured in a way to

guarantee on one hand that the ESG topic

receives appropriate management focus and

attention from the highest decision-making

bodies while at the same time being broadly

integrated into all Bank’s operations.

Steering Committee is the key governing

body and the most important platform

for steering the Program. The Committee

regularly receives status reports to monitor

and evaluate the progress of the projected

tasks and to make decisions related to the

raised topics.

Project sponsor is the Bank’s Chief Risk Officer,

who is provided by the DSK Bank’s Management

Board with a mandate to lead the integration of

climate-risk management in DSK Bank Group,

in coordination with the OTP Green Program

Directorate and OTP Credit Approval and Risk

Management Division. Considering the potential

strategic impact of transition and/or physical

risks in the long term (as concluded from the

materiality assessment made in 2021), the Chief

Risk Officer is also mandated by the Management

Board to develop a proposal for the ESG Strategy

of DSK Bank Group by the end of the second

quarter of 2022.

Subject Owners form the core ESG team of the

Program. The members of the team are personally

assigned with responsibility for executing the

tasks in respective areas. The team performs

weekly meetings with the Sponsor and is in

contact with all relevant departments to ensure

the necessary resources and to support the

proper implementation of the relevant decisions.

The units involved in the project constitute

the Working Group. They are represented by

experts in different fields who manage the daily

execution of the tasks. These project members

can be continuously updated until project scope

and exact tasks are finalized.

In the context of its key role in implementation

of the overall business strategy and the risk

strategy of DSK Bank Group, Management

Board of the Bank oversees the climate-

related and environmental risks and bears the

primary responsibility for their managing. The

Board approves key policies, procedures and

methodologies relevant to climate-related and

environmental risks and decides on the major

actions to be taken with regard to them.

Qualitative performance criteria are determined

in 2022 targets of those Management Board’s

members who are assigned with direct

responsibilities for ensuring compliance with

the envisaged approach to climate-related and

environmental risks management.

In addition to the personal commitment

of the senior management, DSK Bank has

further enhanced the role and has engaged

the collective responsibility of different

committees within the Bank by embedding

the climate-related and environmental risks

and considerations into their agenda, incl.

committees to the Supervisory Board (Risk

Committee, Audit Committee, Remuneration

Committee).

8

Practical aspects

The ECO project started in the last quarter of

2021. Following the preliminary assessment

of the regulatory requirements and market

conditions and after getting acquainted with

OTP Group ESG Strategy, the ECO project team

elaborated a Roadmap to address the ECB

guidelines. It represents detail project plan

structured around the thirteen supervisory

expectations - tasks to be executed within the

main areas defined, deadlines and responsible

persons/units. The proposed Roadmap was

approved by the Management Board of DSK

Bank Group which also requested to receive

quarterly updates on the progress.

The main focus of ECO project in 2021 was put on

the establishment of methodology to assess the

impact of climate related and environmental

risks on the Bank Group’s risk profile. Knowing

how exactly and to what extent the climate

changes can affect our revenue and sustainable

performance is a prerequisite for defining

concrete targets and appropriate mitigation

and adaptation measures. For the purpose

of this assessment climate-risk materiality is

defined as the sensitivity of traditional risk types

(credit risk, liquidity risk, operational risk.) and

related key risk indicators (KRIs) to the impact

of climate and environmental changes. KRIs are

derived from the Risk Appetite Framework of the

DSK Bank Group and are considered based on

their input components. Sensitivity is therefore

assessed at component level. To assess the

components’ sensitivity, the transmission

channels were considered for each of the

traditional risk types, split by climate transition

risk channels, climate physical risk channels

and environmental risk channels. Considering

the limitations of available data, the method

is based on expert assessment supported by

portfolio analytics (e.g. exposure by segments,

sectors, geographical distribution of collaterals,

etc.). With such quantification support experts

and senior managers assessed the sensitivity

of KRI components on a short-, mid-, and long

term, using Low to High scale, and documented

the articulated assessment rationale. Based

on these inputs, the method derives KRI level

and risk category level materiality assessment

on a 5-step scale from Low to High materiality.

Materiality level of Medium to High shows that

the impact of climate related and environmental

risks on the Bank Group’s risk profile is material

over the respective time horizon. This way

the outcome of the assessment leads to the

conclusion that DSK Bank’s Group is materially

exposed to climate related and environmental

risks in the long-term perspective (i.e. more

than 5 years). DSK Bank’s Management Board

reviewed and approved the elaborated

materiality assessment methodology.

Another important action initiated in 2021

was consultation with an external advisor

on a methodology to be used for measuring

and estimating Scope 3 financed emissions.

It is vital to determine the finance-triggered

emissions of the Bank not only because of the

forthcoming regulatory obligation to start

disclosing them but also because we assume

as our responsibility to support the customers

in reducing their Co2 emissions through the

financial solutions provided by the Bank. After

identifying the data gaps, methodology gaps,

etc. we will set up granular plan for measuring

carbon intensity by portfolios so that be able

to start disclosing our indirect impact through

Scope 3 financed emissions in alignment with

the regulatory requirements and the OTP Group

timelines.

9

We respect the environmental regulatory and

supervisory requirements and disclose the

relevant information on the Non-financial

Declaration, part of our annual financial

statements. In particular, in view of the regulatory

requirements under Art.8 of Regulation (EU)

2020/852 on the establishment of a framework

to facilitate sustainable investment (Taxonomy

Regulation) that obliges all institutions which

publish non-financial information according

to Directive 2013/34/EU (NFRD) to report on

how and to what extent their activities are

associated with economic activities that qualify

as environmentally sustainable, for 2021 we

provided information related to the Taxonomy-

eligibility of activities of our customers and

other applicable indicators, together with

explanations on the methodology applied for

this assessment.

In accordance with the Regulation of the

European Parliament and of the Council on

sustainability-related disclosures in the financial

services sector (SFDR), in 2021 we disclosed

specific information about our approach to

the integration of sustainability risks and the

consideration of the principal adverse impacts

on sustainability in the investment decision-

making and investment advice processes. It

concerns the financial services provided by DSK

Group and can be found on the websites of DSK

Bank and its subsidiary DSK Asset Management

AD.

In 2022, DSK Bank took participation in the

first of a kind Climate Stress Test, carried out

by the European Central Bank. The exercise is

considered as a joint learning exercise with

pioneering characteristics. One of its main

objectives is to enhance the capacity of both

banks and supervisors to assess climate risk,

supervisory understanding of what climate-

relevant data banks have available and the

limitations when assessing climate-related

risks. The stress test covers three modules

focused on:

• overview of the institution’s internally

available stress testing capability and

capacity including its climate risk stress

testing framework, management and

modelling practices;

• two climate risk metrics, designed to shed

light on banks’ analytical and data capabilities

regarding climate risk. More specifically, the

metrics provide insights into the sensitivity

of banks’ income to transition risk, their

exposure to carbon-intensive industries and,

in that sense, the sustainability of the banks’

business model.

• bottom-up stress test projections,

targeting transition risk and physical risk.

Based on the developed methodology, DSK

calculated and declared the estimated Scope

1, Scope 2 and Scope 3 emissions of 236

counterparties.

We are currently preparing the ESG Strategy of

DSK Bank Group, expected to be implemented

in the second half of 2022. It will outline the

opportunities in financing climate change

mitigation and adaptation projects and will set

up relevant targets and commitments on our

road to achieve the goals defined by OTP Group

for reducing the carbon emissions.

10

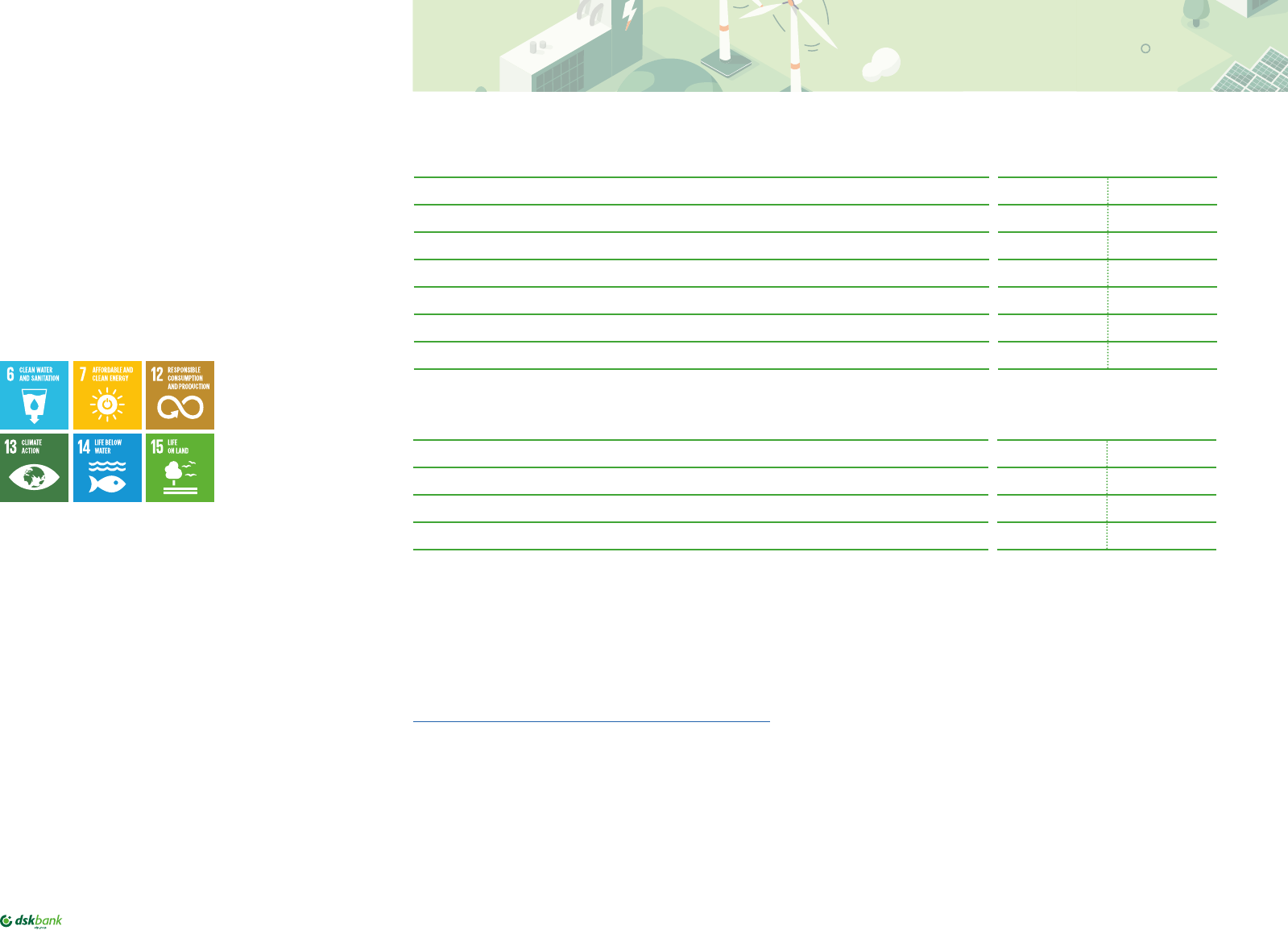

Energy consumption and GHG own emissions

OTP Group sets ambitious goals in terms of its

own operations, including the reduction of its

own emissions. The energy consumption data is

collected from all subsidiaries, incl. DSK Bank,

and available since 2016. Scope 1 and Scope

2 own emissions related to systems that are

within reasonable control of an entity, such as

onsite and purchased energy, are mandatory

part of OTP Group reporting process. The Group

uses GRI Standard and indicators for writing its

Sustainability report. The emission calculation

methodology is based on the GHG Protocol,

which is the best method currently used.

DSK Bank decided to start disclosing separately

its own GHG emissions from 2021, at DSK

Bank Group level. We published detailed

consumption and emission data on the Non-

Financial Declaration to our 2021 Annual report:

https://dskbank.bg/en/about-us/documents

The overall energy consumption has increased

by 7.6% compared to the previous year.

It is because we collected comprehensive

data from all subsidiaries of DSK Bank Group

and added it in the calculations for the first

time in 2021 (data for 2020 are on a stand-alone

basis). Energy consumption per capita has

decreased by more than 13%.

The most significant increase is observed in the

vehicles fuel consumption, resp. – fuel emissions

(Scope 1), which is due to one of our subsidiaries

with cash collection activity that requires the use

of a large fleet and frequent car trips. Actually,

the stand-alone fuel consumption of DSK Bank

has decreased from 120 510 liters for 2020 to

97700 liters for 2021.

ENVIRONMENTAL

CARE

Volume of energy consumption within the organisation (GJ) 2020 2021

Natural gas

3890 5441

Motor vehicles mineral

4861,87 19508,67

Motor vehicles biogen*

0,00 1158,41

Electricity

88480,80 83091,60

District heating

6830,00 2795,00

Total energy consumption

104062,67 111994,27

Total energy consumption per capita

23,19 20,07

* Motor vehicles biogen consumption collected separately since 2021

Scope 1 and Scope 2 CO2e emission (t) 2020 2021

Direct (Scope 1) 985,02 2088,22

Indirect (Scope 2), market-based 9470,46 8721,69

Total (Scope 1 + 2), market-based 10455,48 10809,91

Per capita, market-based 2,33 1,94

11

When buying new cars, the choice always

includes environmentally-friendly vehicles.

Currently, DSK Bank uses five electric cars for

company needs and has planned to purchase

another twelve hybrid cars by the end of 2022.

Electricity energy represents the largest part

of our consumption and the main focus of our

efforts for decreasing the own carbon footprint.

It has decreased by 6% in 2021 compared to 2020.

Along with the reduction of the number of bank

offices and work from home of employees due to

Covid-19 pandemic, this effect is due also to some

improvements made in our HQ buildings and

branch network offices, such as implementation

of simple Building Management Systems,

optimization of the Heating Ventilation and Air-

conditioning systems to work in a night mode

with low capacity, switching off the secondary

lighting, replacement of diesel heating systems

with energy-efficient air-conditioning systems,

partial replacement of depreciated air-

conditioning systems.

All renovated bank branch offices are

constructed in compliance with the vision

of the Banking group, using power-saving

facades, and the whole branch network uses

power-saving bulbs. The reconstruction of all

offices includes the use of energy-efficient and

contemporary heating, cooling, ventilation

and isolation systems and solutions, as well as

ecological materials and elements.

As a part of ongoing efforts to reduce our carbon

footprint, in November 2021 DSK Bank launched

a project for installation of photovoltaic plants

on the roof of three DSK Bank’s buildings in Sofia

and Stara Zagora. The project is expected to be

completed by the end of 2022, and the result

will be 125.1 tons less CO

2

emissions.

Technical specification was developed for

launching procedure for energy efficiency

audit. Initially, the audit is meant to cover part

of the largest buildings – three in Sofia, one in

Stara Zagora and one in Burgas. After the audit,

additional actions will be defined based on the

conclusions – repairs, replacement of windows,

lights. The final output will be improved energy

efficiency.

To draw the attention of employees and to

provoke their commitment to the issue, in May

2022 internal campaign “Green week” took

place as a step for reducing our carbon footprint

on the environment and to limit the global

warming. It was dedicated to the responsible

energy consumption and passed by sharing

information about the Bank‘s commitment to

sustainable development and the Green Deal,

interesting facts about energy and carbon

emissions and good practices for prudent

energy use or ideas on how to reduce energy

consumption in the Bank. An internal challenge

was set to reduce the electricity used in the Bank

‚s premises by 5% compared to 2021. Electricity

consumption data by buildings and branches

will be shared on a quarterly basis during the

whole 2022 and in early 2023 the unit with the

highest contribution and the winners of the

challenge will be announced.

Electricity 80%

Fuel of company cars 13%

Air-conditioning 3%

NAtural gas 3%

District Heating 1%

12

We also collect and monitor data on the

business trips of the employees (that affect

Scope 3 indirect emissions related to our own

operations), incl. number of airplane trips,

company use of own cars (km), taxi use (km).

Although the data for 2021 include those of

DSK Bank’s subsidiaries (which was not the case

for 2020), we observe significant decrease of

kilometers travelled – by 25% of the company

use of own cars and by 52% of the taxi use. It

is partly due to the measures related to the

pandemic and partly due to business reasons

- use of online meetings, which has become

common practice in our Group due to hybrid

work.

In order to stimulate commuting of our

employees by more environmentally friendly

transport, in 2021 we created new bicycle

storage spaces at two Bank’s locations in Sofia.

Other environmental initiatives

We have a tradition of raising awareness and

taking joint action to protect environmental and

natural resources. In 2021, we supported several

environmental initiatives and encouraged the

environmentally conscious behaviour of our

employees.

The purpose of DSK Bank is to mitigate its

negative impact on the environment. For years

now, the Bank fulfils the policy for no-waste

banking administration, which main goal is

protection of the environment. In practice, this

includes collection of all used toners and inkjet

cartridges of the printing devices in all Bank

branches and their recycling. The Bank applies

also a policy of responsible paper consumption

by optimizing the printing activities through

migration of transactions to the electronic

channels, double-sided printing, reducing the

number of pages of the contract General Terms

and Conditions for the products.

DSK Bank operates selective waste collection

at its sites in Sofia and Varna and has expanded

the selective collection of paper waste during

the year – 52 t paper and 30 kg PET bottles waste

collected separately in 2021.

For several years the Bank has created

organization for voluntary collection by the

employees of plastic caps and their disposal for

recycling. On 17

th

April 2022 we donated 500 kg

of plastic caps collected by the teams in our HQ

buildings in Sofia. This activity unites the care

for the nature and the support for noble causes

– the plastic caps are delivered for recycling at

the designated points and the amount collected

is spent for different charity initiatives.

Knowing that more than 360 million tons

of plastic products are produced worldwide

and that 90% of the waste in the oceans is

plastic, in the beginning of 2022 we launched

a new initiative to introduce eco-practices in

our offices by minimizing the use of plastic

products in the workplace. As a first step, we

urged our employees to replace the plastic cups

with a bottle or reusable cup. Several quick

changes were also made - all disposable cups

were removed from the water machines in the

Bank’s HQ buildings, glass cups were provided

for the needs of external visitors during business

meetings, etc.

“In DSK Bank 80 % of C0

2

emissions are created from the

usage of electricity and 13% from

motor vehicles. Reduce your carbon

mark and don’t waste energy.

Our future is in your hands.”

13

In 2021, together with Mastercard, the Bank

supported the OneTree project. The initiative

includes series of events in various parts of

Sofia, that marked the beginning of the creation

of a digital map of Sofia’s trees. Marking the

city trees on the streets and park alleys in Sofia

was easy through all kinds of mobile devices at

ednodarvo.io. With this project, OneTree drew the

attention of all citizens to take care of the trees

in the city by participating in their mapping - an

important step for smarter city management,

which aims to increase general knowledge

about the green system and contribute for its

better planning and management. The events

for the project were 5 in total, starting on May

15

th

from Borisova Garden and ending on June

12

th

in Lagera Park. Within one month, more

than 380 volunteers took part in mapping over

12,226 trees.

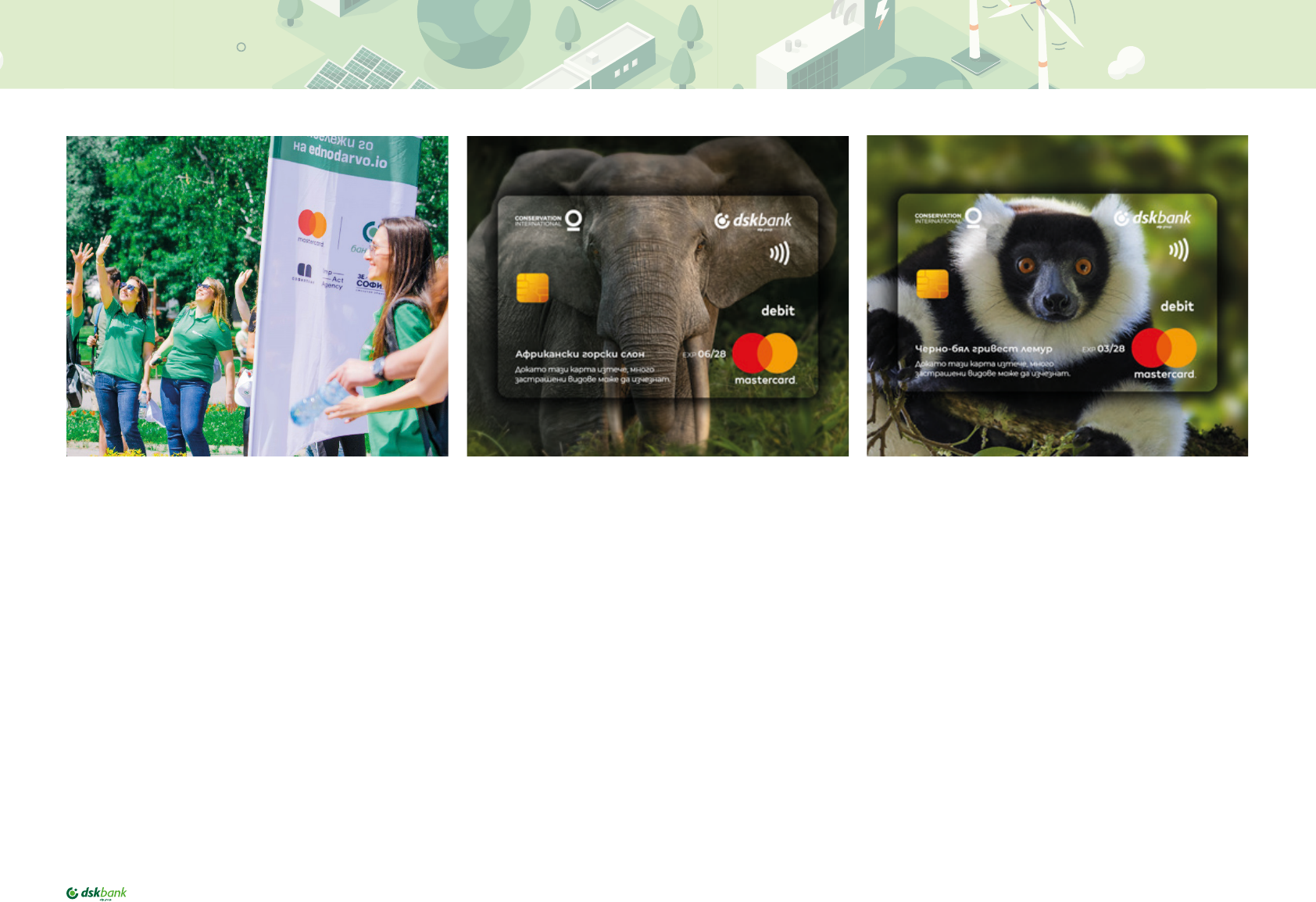

At the end of 2021, DSK Bank joined the global

Mastercard Wildlife Impact Card program for

preservation of the planet’s biodiversity. Thanks

to the efforts of the Bank and Mastercard,

Bulgaria became the first European market

to join the Program. It will allow debit card

holders to become involved in the conservation

of critically endangered species, including the

African elephant, the black-and-white maned

lemur, the yellow-tailed woolly monkey and

the pangolin. The vision of the debit card

draws attention to the message: “Until this

card expires, many endangered species may

become extinct.” The debit card can be easily

integrated into mobile wallets, and the physical

card is made from recycled materials. For

each Mastercard Wildlife Impact card issued,

DSK Bank and Mastercard will donate $ 1 to

Conservation International to help conserve and

restore wildlife habitats. By 2030, this project

will cover priority areas of 40 million hectares of

land and 4.5 million square kilometers of water

worldwide.

Customers have the opportunity to join the

program by ordering their new card since the

beginning of April 2022.

14

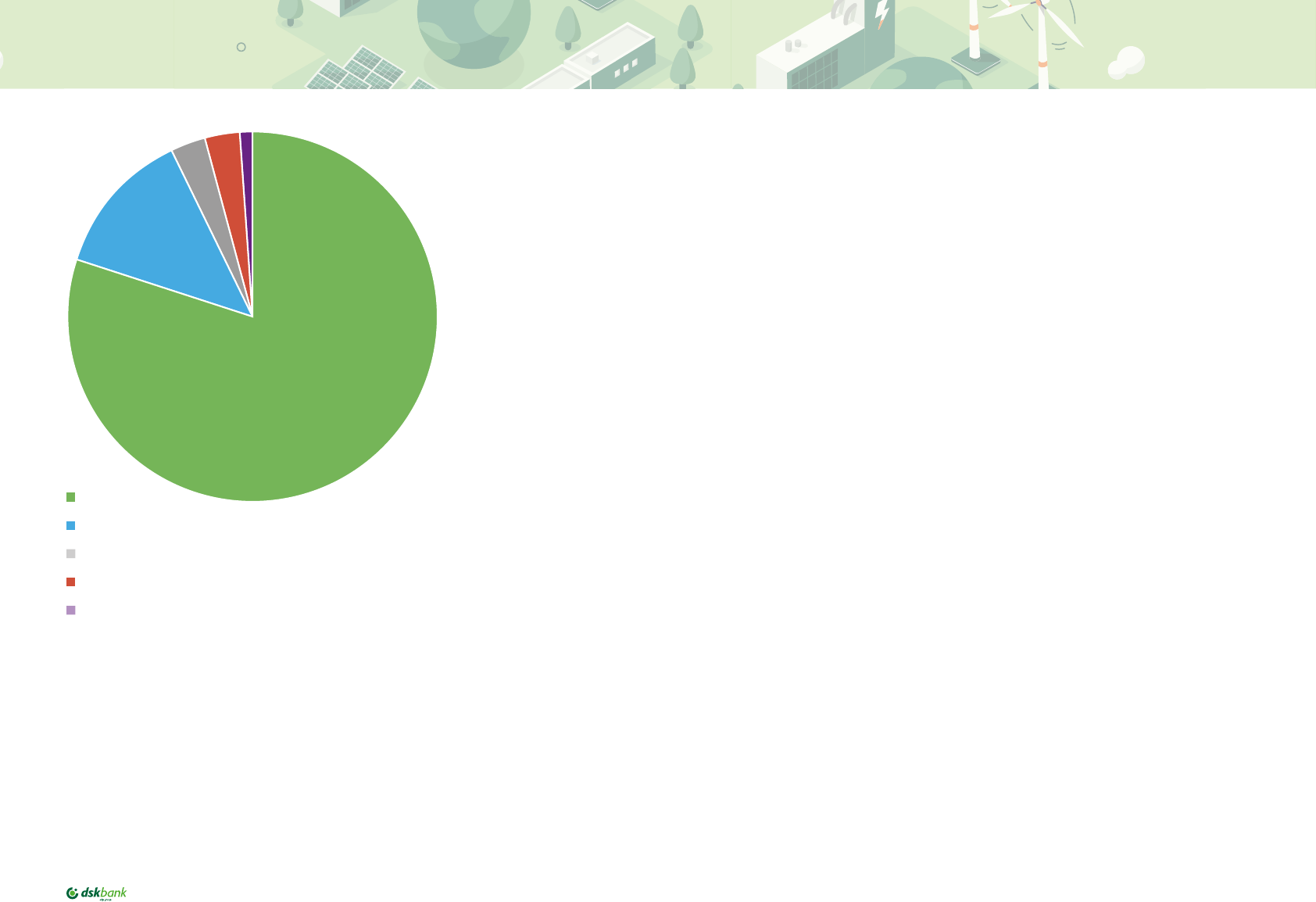

Financial solutions with positive environmental

impact

Understanding banks’ role in the changing

climate and business environment, we in DSK

Bank are aspired to provide fair and sustainable

services to our clients.

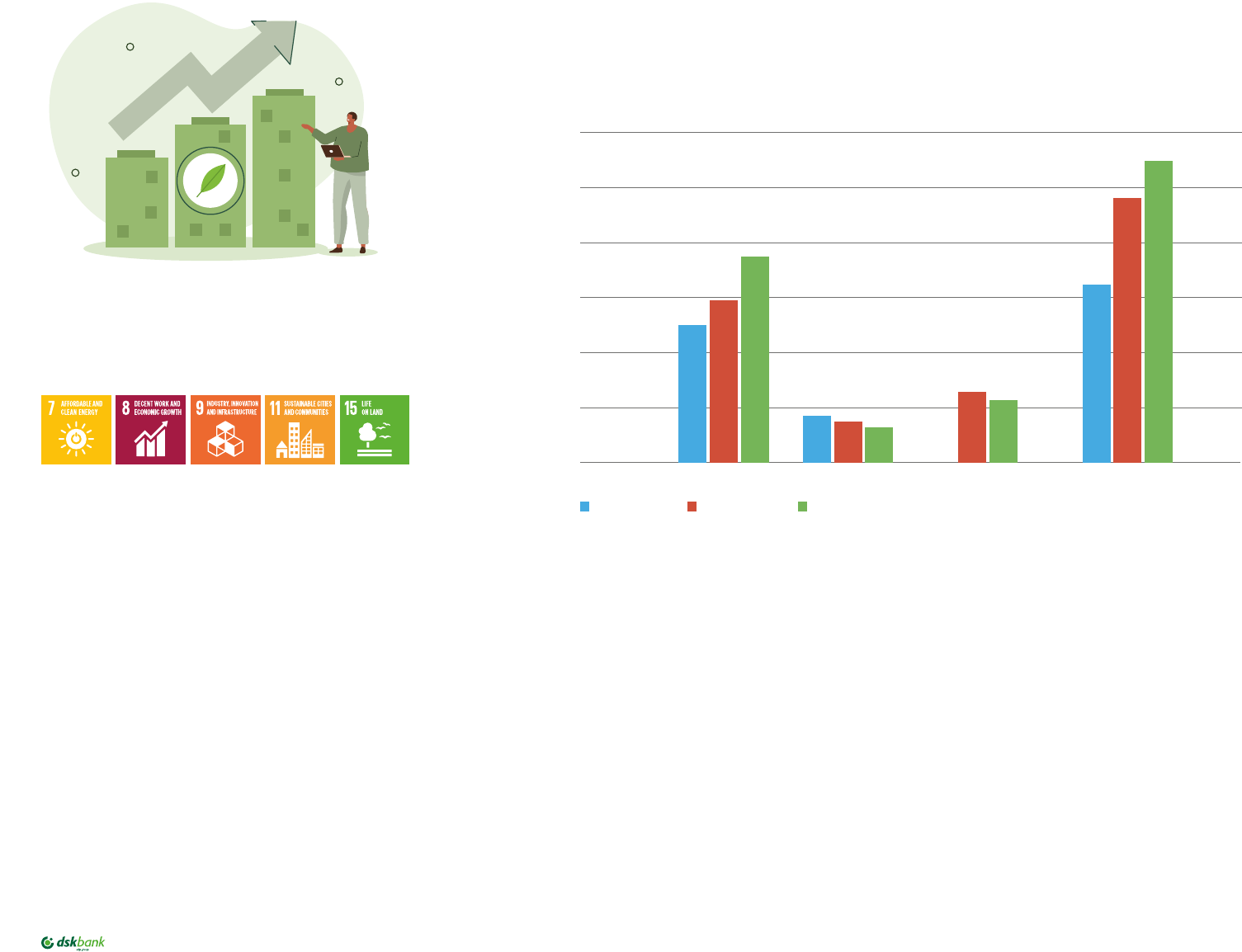

Following the road to a low-carbon economy, we

continue our financial support of investments

in renewable energy sources powerplants. Our

portfolio volume follows increasing trend, which

is additionally accelerated by the increased

demand for green energy as presented below.

On 29 June 2021, DSK Bank and OTP Bank closed

a deal with the fifth largest existing wind farm

in Bulgaria, thus increasing our exposure in

renewables It consists of two sites – Shabla and

Kamen bryag. In total, there are 14 Vesta wind

turbines with V90 power and every one of them

has a capacity of 3 MW. The produced green

energy in the windfarm will mainly be used

locally in Kavarna region. This efficient source of

energy accumulated by the power of the wind

is only of the alternatives to fossil fuels and

it contributes to the reducing of greenhouse

gas emissions, diversifying energy supplies

and reducing of dependence on unreliable and

volatile fossil fuel markets, especially oil and

gas.

We finance not only large powerplants, but

also small projects of our clients in the Small

business segment – either for commercial

purposes or for meeting their own electricity

needs. By financing significant share of solar

and wind investments in Bulgaria, we are well

positioned on the market.

RESPONSIBLE

FINANCING

*Project finance and corporate clients only

0

20000

40000

60000

80000

100000

120000

Exposure in RES powerplants in thousand EUR

Solar Water Wind Total

31.12.2020 31.12.2021 31.03.2022

15

Relatively small share in hydro

powerplants is due to the huge capacity

installed back in time (30+ years) by

the state authorities. In addition, the

utilization of these hydro PPs’ capacity

nowadays is 25-40%.

Bulgaria is still at the beginning of

its transition period, especially in the

transportation industry. Lack of charging

infrastructure and higher price compared

to fossil fuel engines are the main reasons

for the lower pace of changing vehicle

park. Only 5% (or 28,73 million EUR) of

total OTP Leasing’s portfolio of 574,68

million EUR represent electric and CNG/

LNG assets. However, we are focused on

development of a green leasing product

which should lead to increasing number

of requests for single purchase or fleet

financing of electric vehicles.

We are collaborating with major EU

financing institutions such as EBRD and

European Investment Fund, and Bulgarian

authorities. Under EIF’s and Bulgarian

government schemes we support the

most vulnerable entities on the market –

micro and SMEs credit.

As COSME scheme was introduced in the

midst of the corona-virus pandemic, its

resource was almost depleted by the end

of 2020. In 2021, we continued mainly

with JEREMIE guarantee, followed by

implementation of EGF scheme in late

2021. Bulgarian government, through state

owned Bulgarian Development Bank and

Fund Manager of Financial Instruments in

Bulgaria, provided additional guarantee

schemes for support SMEs liquidity and

recovery.

500 1000 1500 2000 2500

234673

1192166

702198

EIF JEREMIE EIF EGF EIF COSME

EIF JEREMIE EIF EGF EIF COSME

*As of 31.12.2021

*As of 31.12.2021

Renewable Installed Capacity, MW

Leasing Portfolio

Contracts signed in 2021 Contracted amount, thousand EUR

Total MW Dsk MW

Wind

Solar

Hydro*

Total Portfolio 1

Electric and

CNG assets – 0,05021394

CNG trucks and busses – 0,035054332

Electric locomotives – 0,13986501

Electric vehicles – 0,00117056

0

100

200

300

400

500

0

10000

20000

30000

40000

50000

60000

70000

BDB –

Recovery

BDB –

Recovery

FMFIB –

COVID19

FMFIB –

COVID19

63000

469

20500

126

10850

160

15520

183

3600

37

16

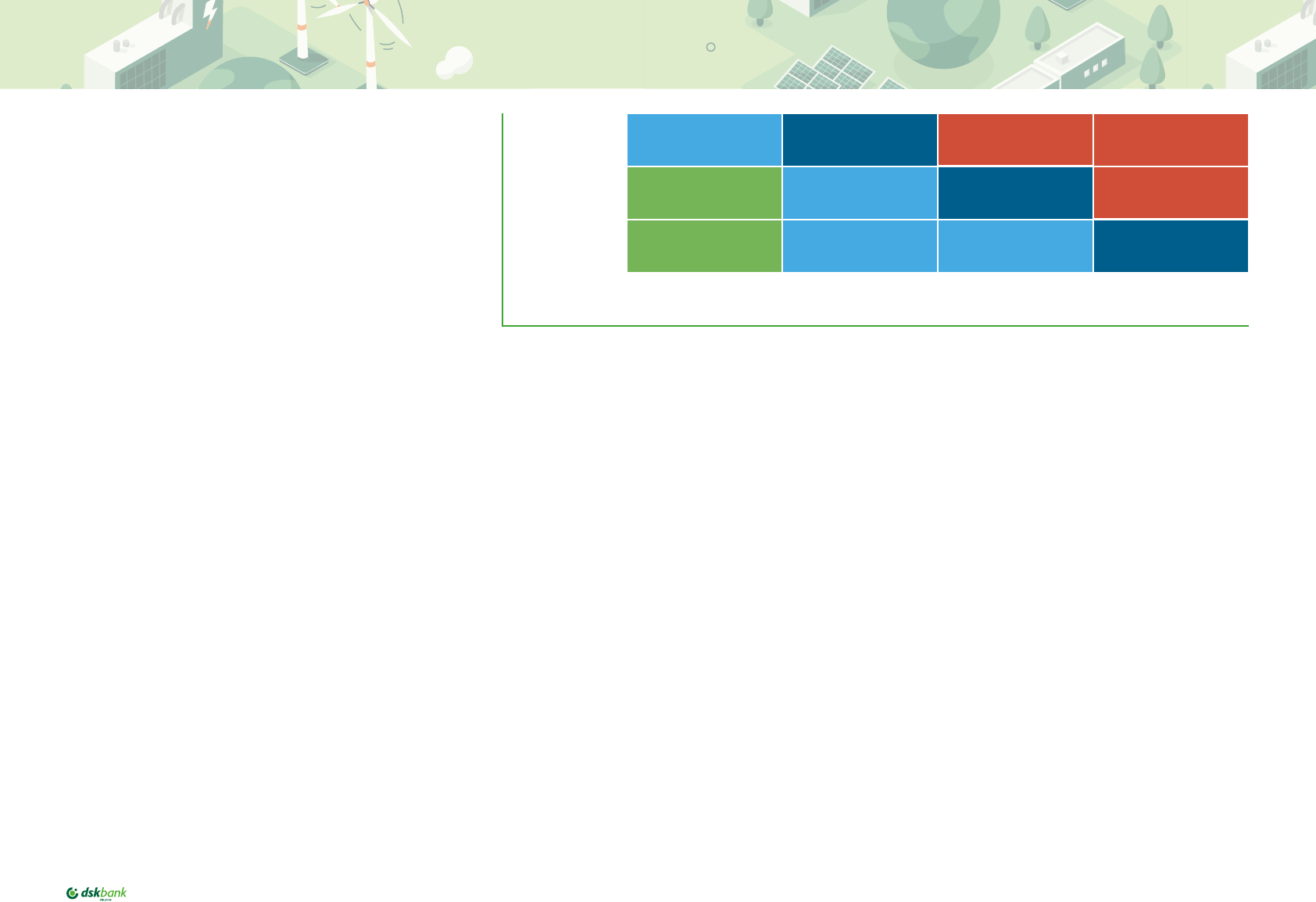

ESG risk management in the lending

Apart of renewable energy sources powerplants

financing, we assess our entire business

portfolio in line with ESG, as we understand

that managing ESG-related risks is key factor

in the credit process. Implemented in 2021,

the ESG Risk Management Framework in Loan

Origination and Monitoring of DSK Bank Group

(hereinafter: The Framework) describes roles

and responsibilities in the credit process for DSK

Bank and its leasing subsidiary OTP Leasing.

Under the Framework we apply an ESG Exclusion

List that lists activities and behaviors whose

controversial nature and impact make them

incompatible with OTP and DSK Bank Group’s

values for safeguarding human rights and

promoting sustainable development.

Based on established methodology, applied in

European banks and authorities, which considers

environmental and social factors, as well as

sector specific physical and transition risks, we

defined our own industry based ESG Risk Heat

Map. It categorizes industries in four ESG Risk

Categories, representing different risk levels:

Low, Medium, Medium-high and High ESG risk.

ESG risk category of the clients is determined

by using the Sectoral ESG Risk Heat Map,

where the business sector of the client’s main

business activity is the driver of the ESG risk

categorization.

ESG risk category of the transaction is

determined by considering two factors – the ESG

category of the client as mentioned above, and

the length of the transaction (residual in case of

existing exposure). The length of the transaction

is determined as

• Short-term: residual maturity is equal

to or less than 1 year (including the expired

transactions or transactions with no fixed

maturity, i.e. “until further notice”);

• Medium-term: residual maturity is more

than 1 year, but equal to or less than 5 years;

• Long-term: residual maturity is more than

5 years.

By applying the matrix above the final ESG risk

category of the transaction is set:

For large tickets falling in medium-high or high

category we apply ESG questionnaire for overall

assessment of the client based on its readiness

and activity in ESG. If the score is positive, ESG

risk category of the deal could be improved by

1 notch.

FMFIB –

COVID19

Length of transaction

Long Medium Medium - High High High

Medium Low Medium Medium - High High

Short Low Medium Medium Medium - High

Low Medium Medium - High High

Sectoral/client ESG risk category

17

Support of cultural and urban

development projects

Last year the Bank also contributed to the

development of local projects for cultural and

urban development. The strategic goal of these

projects is to preserve the traditions and culture,

as well as to attract more visitors and also to

use the potential and advantages of city more

hospitably and effectively.

Together with the Regional Urban Development

Fund, DSK Bank co-financed a project for

modernization of community center “Bratya

Grancharovi-2002” in Gorna Oryahovitsa. The

building of National Community Center “Bratya

Grancharovi-2002”, as well as the largest open

stage in the region - the Summer Theater with a

capacity of over 2,000 people, will be renovated

at the initiative of the Municipality of Gorna

Oryahovitsa cultural center with an area of 3,975

sq.m.

The Tutrakan Epic Memorial Complex will also be

built thanks to funding from DSK Bank and the

Regional Urban Development Fund. The complex

will be built on the land of the village of Shumentsi

in Tutrakan Municipality. The emblematic

location is recognized as a historical cultural

value with a category of “national significance”

in 2018. The project envisages the construction

of an energy efficient (energy independent)

exhibition building with futuristic design and

modern interactive equipment and furniture. The

building will be located on an area of about 800

square meters and will include a main exhibition

hall, diorama, space for commercial activities

and technical premises. The project will improve

the area around the memorial and the building,

as well as create a green recreation area.

In 2021, started the renovations of the multimedia

visitor center “Tsarevgrad Tarnov” and the

museum “Revival and Constituent Assembly” in

Veliko Tarnovo. Within the project “Expansion of

Multimedia Visitor Center” Tsarevgrad Tarnov “

will be expanded the existing center, also known

as the” Museum of Silicone Figures “, using 2

more floors of the same building located on

street” Nikola Piccolo “№ 6, Veliko Tarnovo. The

implementation of the project will enrich the

collection of figures recreating commemorative

events from the period of the Second Bulgarian

Kingdom, thus increasing the impact of the

proposed tourist attraction - unique in nature.

Among the new scenes that will be recreated in the

form of dioramas are “The Battle of Klokotnitsa”

from 1230, “The Four Gospels of Ivan Alexander”,

the so-called “Medieval Market”, as well as a

number of other interesting reconstructions. It is

expected that the renovation activities will start

in early 2022 and end in early 2023.

DSK Bank together with the Regional Urban

Development Fund grants under OP “Regions

in Growth” 2014 – 2020” and the Municipality

of Vratsa co-financed the renovations of the

Regional Library “Hristo Botev” in Vratsa.

Established in 1954, the Regional Library is an

icon image of Vratsa – it shows the soul of the

city and it stands for the city’s prosperity and

development. The building is located in the

center of the city, on one of the most attractive

shopping streets – Petropavlovska Str. The

renovations will improve the energy efficiency

and contribute to the interior environment

making it more comfortable for the readers. As a

result, the building will acquire a renovated and

welcoming look.

Last year started the renovation of the organ hall

in Dobrich with investment of over 2 million leva.

The funding is provided by the Regional Urban

Development Fund, DSK Bank and grants under

OP “Regions in Growth” 2014 – 2020”. The project

is a part of the Integrated plan for reconstruction

and development of the Municipality of Dobrich.

It will provide the renovation of “Dobrich” hall – a

visual hall with 534 seats and the corresponding

lobbies, dressing rooms, rehearsal, work

and service premises in order to encourage

participation in the cultural life of the citizens.

The hall is an important cultural and historical

hub for the community. In the implementation

of the project the construction and repair work

will be carried out in order to adopt efficiency

measures and to improve the access to the hall

for people with disabilities.

18

CORPORATE SOCIAL RESPONSIBILITY

Our social approach includes various initiatives and projects directed to, in particular, the most

numerous groups of stakeholders of the Bank, i.e. clients and employees. Our social activities and

support to other groups of the society are described in the following chapter.

THE CLIENT AT THE CENTER

Digitalization and innovation

By digitalizing the existing core products and

services in a customer-centric way, following a

journey-by-journey approach with the objective

of creating market leading and loveable digital

solutions, we strive to save clients’ time and

money, and also to protect the environmental

resources.

Following its strategy for digitalization, in 2022

DSK Bank has opened its Digital Factory. The

new unit will be a technology company within

the company, which will focus its activities on

creating digital products and personal solutions

for the clients of the largest bank in the country.

The Digital factory is the place where will be

created products and new customer experiences.

There the products will be developed not only by

employees from the Bank, but also by partners,

even by the customers themselves. With this

factory the Bank will completely change the way

the products are created so that in time DSK

Bank become as good as fintech companies.

One innovative solution is the opportunity

to apply for consumer loan with individual

conditions entirely online. The process can be

completed in less than 5 minutes without need

to visit a bank office.

Another innovative solution is an online virtual

POS application form. Online payments are made

24/7 on the e-shop through the virtual POS. DSK

Bank allows traders to apply and receive prior

approval, even if they are not customers of the

Bank. By integrating with public registers, the

form takes 2 minutes to complete.

In addition to the existing products, two new,

all-digital processes will be presented to

customers in the middle of 2022.

The first is onboarding for business clients -

a completely online process for registering

business clients, without an analogue on the

market, which saves time. The advantages

are that no visit to a bank office and paper

documents are required, and the signing is

done through an electronic signature for all

documentation. The Bank’s experts expect the

whole process to take no more than 20 minutes.

The second innovation is BizCredit - an online

application for business credit overdraft. With

this service, the Bank’s business customers

can receive financing in a few easy steps, again

entirely online. The advantages are that there

is no fee for examining a loan application, no

additional documents are required and clients

can perform the process from the comfort of

their own office.

19

Signature pads

From the beginning of 2022 DSK Bank

implemented new signature pads in its entire

branch network. The functionality covers

the writing of 33 types of basic documents

- contracts and additional agreements to

current or savings account agreements, time

deposit annexes, general terms and conditions,

declarations, package contracts, internet

banking and two cash transactions - installment

and withdrawal. This new way of working is liked

by both employees and customers because it is

considered more modern, convenient, without

printing paper and saves the effort of scanning

paper. Customers like it too - they are committed

to signing a one-page consent document and

putting 10 signatures on the device itself.

Mortgage loan client journey and value

proposition

In line with its efforts to be innovative and to

increase the quality of customer journey of clients

who are searching for a real estate property,

in 2021 DSK Bank launched a new platform

www.dskhome.bg, which is the backbone of a

new housing ecosystem. The platform www.

dskhome.bg enables customers to find offers

for real estate properties according to their

personal preferences with wider information for

the area and the profitability of the property in

case it will be rented out.

Game changing service for Sofia public transport

One of the Bank’s objective is to develop and

implement smart solutions and innovative

projects aimed at improving the urban

environment and increasing the penetration of

cashless payments.

Jointly with its subsidiary DSK Mobile, in 2021

DSK Bank introduced an innovative solution

that completely transformed the service for

purchasing transport documents in the public

transport in Sofia. Passengers who use buses,

trolleybuses, trams and Sofia metro no longer

need to carry small amounts of cash or buy

a ticket before using the transport. They can

directly use their debit or credit cards, or mobile

NFC wallets. It is enough just to tap them on

validators only when boarding the vehicle.

Financial education

During 2021, DSK Bank kept its educational

campaign “Calm on the Internet”, dedicated

to raising consumer awareness of safe banking

and safe use of the Internet. The campaign again

was aimed not only at the bank’s customers, but

also at all those who use online financial and

other services. The purpose of the initiative is

to present in a simple and understandable way

the main highlights of safe online banking and

Internet browsing. As a socially responsible and

engaged institution, DSK Bank has a mission to

provide knowledge to consumers so that they

are at ease while using electronic channels

for banking or other services in an online

environment.

20

Client services in COVID-19 pandemic

The focus on the client is of key importance

for DSK Bank’s activity. That is why, in the last

two years, during the corona-virus pandemic,

the Bank continued its efforts to ensure more

flexible services and products according to the

clients’ individual needs, so that they can make

the right financial decisions in an extraordinary

situation. We reacted in fast and adequate

manner, in order to ensure the safety of our

clients. Special section was developed and

offered on the corporate website of the Bank,

as well as visual materials used by the clients

as to receive current information about the

procedures for safe servicing in the branches,

the possibilities for using remote services and

other useful information. During the periods

of active virus spread in the country, DSK Bank

provided safe access of customers to its offices,

recommended the use of a wide network of

machine channels - ATM, electronic banking

DSK Direct and mobile banking DSK Smart, as

well as cashless payments to merchants (incl.

Online). In order to avoid the concentration of a

large number of clients, DSK Bank continued to

promote the service among the clients for pre-

booking an appointment for a visit to the larger

offices.

In support of clients affected by the pandemic

mitigation measures in place, various options

were offered for deferral and settlement of

debts in order to ensure stability, calm and

security. In 2021, the clients of DSK Bank

continued to use options for deferral of loans

under the Procedure for deferral and settlement

of due liabilities to banks, in connection with

the state of emergency imposed on March 13,

2020. Also, DSK Bank extended the term and

proposed new additional deferral schemes,

which actually enabled its clients to use a

longer grace period, initially agreed under the

moratorium. Additionally, we have retained the

opportunity for our customers to use interest-

free loans under the Program for guaranteeing

interest-free loan for protecting people who

cannot exercise their occupational activities

due to the situation caused by COVID-19, on the

basis of agreement concluded with Bulgarian

Development Bank (BDB). DSK Bank has

supported also its business clients, small and

medium enterprises, by providing an option for

BDB guaranteed loans with an agreement for

portfolio guarantees in supporting the liquidity.

21

Following the trends of the recent years and

mainly the reorientation of a numerous part of

transactions to machine and electronic channels,

as well as based on the growing demands

of consumers to receive pre-contractual

information and advice on the financial products

and services that are most appropriate to them,

DSK Bank has started implementing New

Service Model in a whole branch network for

mass customers. The Model ensures specialized

customer service - those who visit the office only

for a payment transaction can rely on faster

service with significant decrease of waiting

time, while the customers who are interested in

banking product/service can rely on professional

and individual consultation and financial

advice from individual banking consultant. The

purpose of the New Service Model is to offer an

even better customer experience with the Bank,

improve the management of customer flow in the

branches and support employees in the process

of improving their confidence, upgrading their

skills and competence.

And last, but not least, for improving the client

services, DSK Bank performs regular research of

the financial services market, in order to discover

new opportunities and niches for improving the

services offered and to monitor the development

of the standard already adopted by the market

in regard to the client services.

Complaints handling

For every received complaint a comprehensive

check and analysis of the collected information

is performed. We use the complaints as an

opportunity for improving our services. When a

mistake on the part of the Bank is established,

measures are immediately undertaken by the

responsible units. The Management is regularly

informed about the established weaknesses

and problems. To improve the competence of

the employees, trainings and consultations

from the management teams in the regional

centers are organized. Each complaint reply

contains a contact phone number and e-mail

for connection with the complaints unit if

additional information is needed regarding the

answer provided.

Client satisfaction

Generally, DSK Bank has well established

traditions for measuring the satisfaction of

its banking clients. In 2020, DSK Bank has

implemented new metrics for measuring

customer experience that allows the client to

rate the services immediately after a visit to

the Bank office. This approach guarantees the

transparency and provides an opportunity for

immediate actions for improving the services

in every bank office. The Bank uses as a metric

the world leading indicator on customer

experience measurement – transactional Net

Promoter Score (NPS). Transactional NPS for

2021 has increased compared to 2020 and

remained stable throughout the year. This

result of transactional NPS which reached 72 in

December 2021, shows high service quality level

and positive experience that customers receive

in DSK Bank.

We continue to work for improving the client

services. In 2021, the Bank actively developed

its strategic initiative (New Service Vision),

aimed to ensure outstanding client services.

In 2022, a second phase of the initiative will

be implemented, focusing on improving DSK

Bank’s employees’ knowledge on the modern

project management methodologies (agile,

service design methodology, etc.) which aims

for DSK Bank to be one step further on its way

to digitalization.

22

DSK Bank in its capacity of an employer

In DSK Bank we have a clear vision on our

employer brand: Everyone looks for employees,

we look for people! This means that our

employees are above all people of whom we

take care in the best possible way and help

them develop and reach their goals. In order to

support DSK Bank’s employer brand, a complete

Employee Value Proposition (EVP) was prepared

and communicated internally and externally.

It shows all of the non-financial aspects that

the Bank is offering to its employees. The EVP

is structured in 5 main areas: Flexible way of

working, Digital technologies, Health and well-

being, Learning and development and Culture.

They are available on the Bank’s corporate

website as well as in the internal learning

platform Moodle.

The Bank regularly participates in different

career forums, which is another connection

of the institution with young talents and

proven professionals. In addition, this regular

participation in such events keeps DSK

Bank’s relation with the universities and local

authorities at very good level. As a result, they

exchange know-how and cooperate in finding

the best students as a source for the Bank’s

internship program and recruitment in general.

In 2021, the first large-scale employee

engagement and satisfaction survey was held

for the entire OTP Group, with a high response

ratio of 92% at Group level and 92% as well

for DSK Bank. Based on the results, the rate of

employee engagement in DSK Bank was 67 %.

In response to the feedback, action plans were

prepared for all areas that need improvement.

On Bank level these are Communication and

collaboration, Recognition and Feedback

Culture, Better access to the right tools. The

respective action plans are either completed or

ongoing as planned.

RESPONSIBLE APPROACH TO EMPLOYEES

Healthy and safety at work

Contract with Occupational Health Service is in

place which provides full support of the needed

activities, assessment of the microclimat

conditions in the work space. Periodic

instruction on occupational health and safety is

performed to all employees at an annual basis

and compulsory for newly hired employees.

In 2021, the second year of the COVID-19

pandemic, we continued to protect the health

of our employees as much as possible. For

employees from all HQ units we continued to

apply the opportunity to work at home office,

incl. by schedule. Over and above the statutory

rules, we initiated an internal vaccination

campaign and provided vaccination to the

interested employees at the workplace as well

as individual consultations with specialists in

COVID-19 pandemic.

DSK Bank also ensures health support to its

employees through the Wellness Program

provided, sports card at preferential rate as well

as prophylactic examinations that were resumed

after an interruption due to the pandemic.

23

Diversity and inclusion

The DSK Bank’s mission as an employer is

to create a work environment in which its

employees have the opportunity to work in

a diverse, mutually supportive team and in

an inclusive work culture that allows them to

use their potential to the fullest. Diversity and

inclusion are essential for the implementation

of the corporate strategy. In March 2022, we

prepared and published on our website the

Diversity and Inclusion Policy of DSK Bank. The

Policy promotes diversity in management bodies

in order to attract a wide range of qualities

and competencies when recruiting members

of management bodies, to achieve diversity

of views and experiences, and to facilitate

independent opinions and reasonable decision-

making within the collective body aiming at

adequate gender representation and ensuring

that the principle of equal opportunities is

respected in the election of members of the

governing body.

The Bank commits itself to adhere to the

following principles:

Principle 1:

Diversity

In particular, the Bank is

committed to increase the

share of the under-represented

gender in the governance,

while fulfilling the legal

requirement that the members

of the management body have

adequate knowledge, skills

and experience. We set the

goal for 2023 at least two of the

members of the Management

Board and of the Supervisory

Board to be women.

Principle 2:

Equality

The Bank commits to ensure

that all employees are

provided equal opportunities

and conditions throughout

the life cycle of employees,

general working conditions,

or career development. Under

the Remuneration Policy of

DSK Bank, we consistently

apply the principle of “equal

pay for equal work”, including

by providing equal pay to

men and women for the same

position and performance.

Principle 3:

Inclusion

The Bank has zero tolerance

to all forms of harassment,

abuse and discrimination,

and is committed to create an

inclusive culture free of such

behavior.

Our employees’ interests are represented by their trade union - National Banking Syndicate, with the

Collective Agreement signed by DSK Bank, setting out the rights and obligations of every employee. As

of the end of 2021, the rate of the trade union members is 53%.

DSK Bank individual

basis employees (31 Dec)

2020 2021

Total Men Women Total Men Women

Employees, total 5302 1136 4166 5358 1159 4199

Distribution by gender 100% 21,43% 78,57% 100% 21,63% 78,37%

Turnover rate 16,18% 3,54% 12,64% 18,33% 3,58% 14,75%

24

Ethics Code and Anti-Corruption Policy

DSK Bank as part of OTP Group is committed

to the fight against corruption and states zero

tolerance to any kinds of bribery. The Bank has

adopted a Policy for corruption prevention,

where the principles of anti-corruption activity

are defined, as well as the main fields with risk

of corruption. The Policy applies for the entire

DSK Bank Group, incl. the subsidiaries. In the

course of and in connection with the DSK’s

activities, all staff members and any other

contractual partners of DSK Bank Group are

strictly prohibited from performing any act

of corruption and from participating or being

involved in corruption. The Bank consistently

and resolutely stands up against corruption.

In case of violation of the Policy by any person,

the Bank shall take all steps necessary to avert

potential negative consequences and to avoid

similar events in the future. DSK Bank ensures

the full enforcement of all Bulgarian, European

Union and international anti-corruption

regulations, and requires all of its staff members

and contractual partners to comply with such

regulations.

In addition, the Ethics Code of the Bank defines

clear principles and requirements for the

employees and the partners of the Bank, as

well as its affiliated companies, in relation

to the adherence to the ethical norms at

work. The main emphasis of the Ethics Code

includes the right of employees to participate

in the political or public life, ensuring safe and

healthy occupational environment, promotion

of mutual respect, prohibition of discrimination

and abuse, integrity in business relations,

zero tolerance to corruption and attempts to

influence, restrictions on offering and accepting

gifts above the specified value.

The Ethics Code of DSK Bank and the Anti-

Corruption Policy are publicly accessible on DSK

Bank official website.

Whistleblowing

A whistleblowing system operates within the

Bank to facilitate adequate identification and

handling of cases on potential misconduct and

unethical behavior, including discrimination.

In case of doubt or possible violation of the

norms of Ethics Code and Anti-Corruption

Policy, the employees are provided an option to

report it, including anonymously, to Regulatory

Compliance Department, which will undertake

the measures necessary as per the internal

rules.

Any request affecting human rights is treated by

the Bank as a priority.

RULES OF CONDUCT

Our employees’ professional and ethical conduct is one of the basic prerequisites for the company’s

successful development. We follow strong principles of behaviour that respect the human rights,

and do not support or tolerate any form of violation of the Bank’s rules of conduct.

25

Early childhood development

Last year DSK Bank continued its successful

partnership with SOS Children’s Villages

Bulgaria - an organization for social

development that guarantees the right of

every child to have a family and grow up in an

environment full of love, respect and security.

The partnership dates back to 2011, when the

bank committed to constantly taking care of

two SOS families.

In 2021, we celebrated 10 years of partnership

under the title “10 years together”. We celebrated

the anniversary with several additional joint

initiatives. One of the children from the foster

family we look after was an intern at the bank

for 6 months. We also sent gifts to the children

for the beginning of the school year and June

1

st

. In October, we launched online lessons

on financial literacy and personal finance

management which were led by volunteers

from the Bank on Fridays, in the afternoons. The

training targets teenagers from the SOS Youth

Centers.

Our Chief Executive Officer, Mr. Tamas Hak-

Kovac, was awarded the special prize “10 years

together” by SOS Children’s Village, and the

bank was once again the largest corporate

donor and partner of the association.

In 2021, over BGN 600 000 were accumulated

as donations through the different banking

channels. Overall, BGN 4 506 000 were provided

to SOS Children’s Villages for the last 10 years,

thanks to the successful partnership.

SPONSORSHIP

AND CHARITY

26

Charity events with the participation of

employees

In 2021, our employees participated in various

events which combined running and charity. On

19

th

September, the annual edition of the mini-

marathon with cause “Run2Gether” took place.

The initiative unites the efforts of people with

different abilities. By participating, the team of

DSK Bank gave its support to the disadvantaged

people.

In August 2021, 13 teams from the Bank took part

in the Business Run event. The event with cause

was held for the 8th time in a row. Each team

consists of 4 competitors and runs the distance

of 4 km. Traditionally, 30% of the event fees are

donated to charity.

In 2021, DSK Bank has also launched its own

Corporate Social Responsibility project for

improving the urban environment – the

campaign “City as its people”. The initiative

aims to help make Sofia a better place for living,

as well as draw attention to the problem of

vandalism and ugly inscriptions. The idea of the

campaign was to transform the scratched walls

of a location in the central part of the city, and

with the help of established Bulgarian graffiti

artists to turn them into a work of street art, the

so-called mural. The project was implemented

in three stages. During the first stage DSK Bank

challenged the residents and guests of Sofia to

send their proposal for a location or a building

that will undergo artistic transformation. At the

end of this stage, a place was chosen - one of

the walls in the subway on Bulgaria Blvd. and

Acad. Ivan Geshov”, which was transformed

with the help of graffiti artists from “140 Ideas”.

During the second stage of the campaign, the

artists, together with the help of the campaign

ambassadors transformed the chosen location.

The mural recreates in a beautiful and colorful

way the theme of continuity and tolerance

among the people in the city. This way, DSK Bank,

the artists and the ambassadors stood behind

the idea that there is a more beautiful way to

change the look of our capital than to have hate

speech on its walls. In the third stage the mural

was presented to all the residents and guests of

Sofia.

Other social projects supported

DSK Bank continues its partnership with the

BCause foundation, whose main goal is the

further development of the donation culture, it

implements policies in the field of sponsorship

and social investments, etc. In 2021, the Bank

provided a financial support for the foundation’s

campaign for collecting funds in favor of the

Fund supporting women – victims of domestic

abuse. The financial resources are directed to

the crisis centers providing services for women

and children, victims of domestic abuse.

27

In February 2021, DSK Bank was awarded

first prize in the category of „Services” in the

prestigious advertising festival, distinguishing

the efficiency of marketing communications in

Bulgaria – Effie Bulgaria.

During the same month, our campaign “Everyone

is looking for employees, we’re looking for

people” won the prize of the best Employer

Branding Campaign awarded by B2B Media.

In May 2021, our financial literacy initiative

“Financial Olympics” won the prestigious 3rd

place in the Corporate Social Responsibility

Campaign category.

June 2021 was definitely the month of the

most awards in the Bank. At the awards of the

Bulgarian Association of Public Relations for

public relations, DSK Bank was the winner of 6

awards: for crisis communication, for employer

branding campaign, for digital campaign, as

well as two special awards.

During the same month, DSK Bank was

presented with its fifth award for Most Generous

and Significant Corporate Partner from SOS

Children’s Villages Bulgaria.

In July 2021, DSK Bank was awarded Best Bank of

the Year by the Bank Association in Bulgaria and

was distinguished in “Dynamics in development”

category.

During the same month, DSK Bank was

pronounced The Best Bank in Bulgaria for

2021, according to the specialized magazine

Euromoney.

In November 2021, Global Finance recognized

DSK Bank as the Best service supplier of foreign

exchange operations in Bulgaria.

In December the Executive Director of DSK Bank

and Chairman of the Management Board of the

Association of Banks in Bulgaria Mrs. Diana

Miteva, was awarded Banker of the Year for 2021.

At the beginning of 2022 DSK Bank CEO Mr.

Tamas Hak-Kovacs was awarded Team Lead of

the Year.

Our HR manager Radoslava Krosneva was

awarded HR Manager of the Year for 2021.

DSK Bank received the prestigious award

Business Honoris Causa for its long-term

support for SOS Children Village.

In April 2022 our campaign “City as its people”

was awarded in category PR Digital on IAB Mixx

Awards.

In May 2022 our new product in collaboration

with Mastercard – Mastercard Wildlife Impact

Card, won the Greenest Product Award in the

national competition The Greenest Companies

in Bulgaria 2022.

AWARDS

28