Macroeconomic

bulletin

Winter

2023-2024

J anuary

2024

2

Bulgaria

Sovereign credit rating

Baa1 stable

BBB positive

BBB positive

❖ Almost two years have passed since the beginning of the Russian-Ukrainian war that was

expected to be over within a few months. Two years later, the fighting continues, support for

Ukraine brings with it political contradictions and division of the population. 2023 – the year of

uncertainly, increasing hostilities around the world, inflationary pressure and weak global

economic growth. Unfortunately, most of the factors from 2023 continue into 2024. Wars

continue (even with expectations to spread further), threats to international trade, inflation is

still far from central banks targets, and high interest rates slowing economic activity and global

economic growth. Oil prices remain steady despite OPEC+ attempts to influence the price

upwards but the increased US shale gas production counterbalancing this effect.

❖ The Bulgarian economy also slowed its growth in 2023 in line with the slowdown of the

European economy. Generally, the labour market continues to perform well with unemployment

rate remaining at low level, while wage growth continues to report significant increases as a

result of which private consumption will be supported by rising household disposable income.

Inflation has seriously reduced its pressure over the past year, reporting annual inflation of 5%,

expected to further decline to 2% at the end of 2024 (HICP, annual inflation).

❖ The Maastricht inflation criterion for the euro adoption seems unlikely to be met by Bulgaria by

the end of April 2024, which calls into question the Euro area entry date – January 1, 2025.

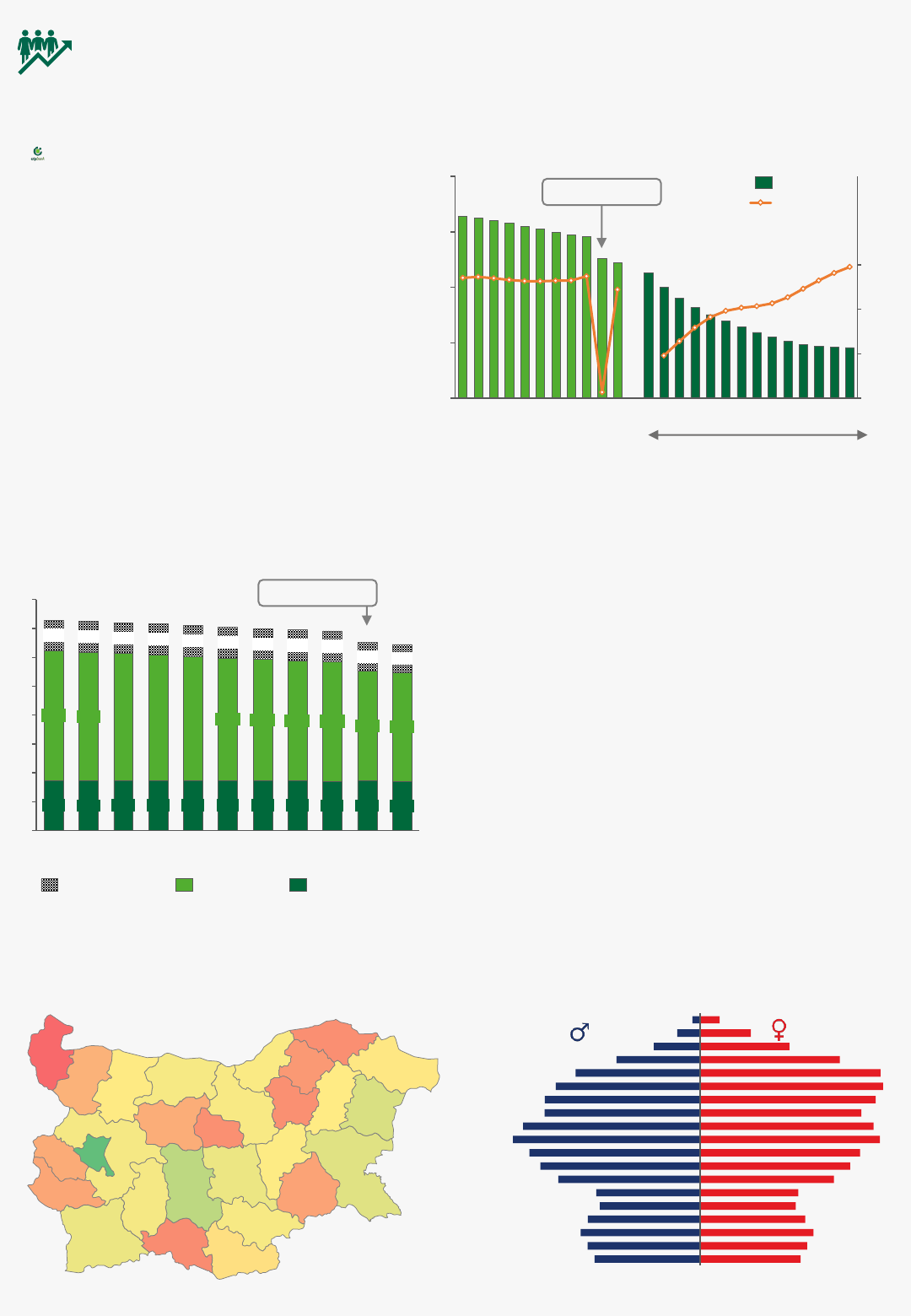

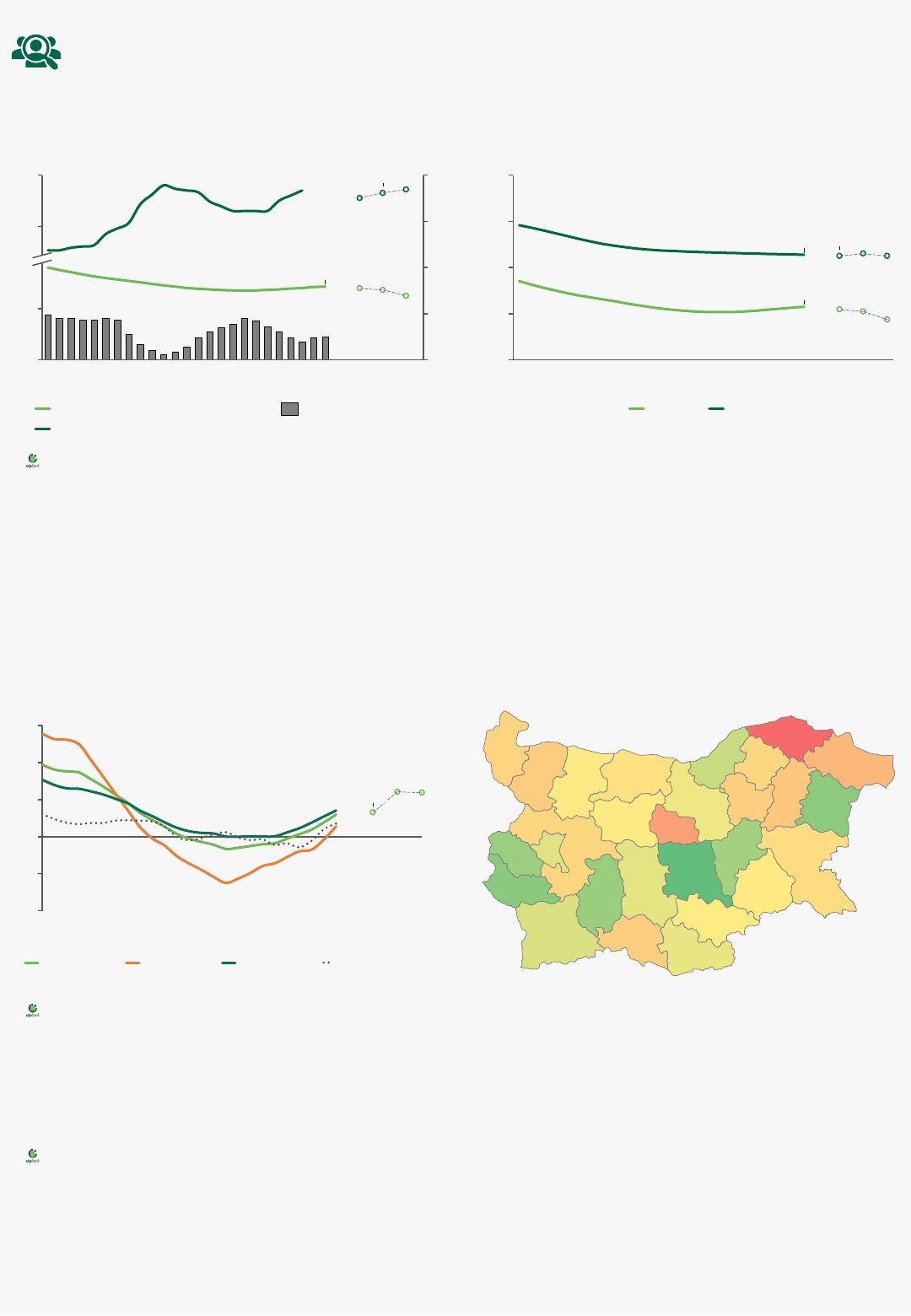

Population by working age status

Population by administrative regions

as of 31.12.2022

Demographics

3

5

6

7

8

4 -6%

-4%

-2%

0%

(mn)

2012

2013

2014

2015

2016

2017

2019

2020

2021

2022

2025

2030

2035

2040

2045

2050

2055

2060

2065

2070

2075

2080

2085

2090

2018

Population

Annual growth

0

1

2

3

4

5

6

7

8

(mn)

14%

62%

24%

2012

15%

62%

24%

2013

15%

61%

24%

2014

15%

61%

24%

2015

15%

61%

24%

2016

15%

60%

25%

2017

15%

60%

25%

2018

15%

60%

25%

2019

15%

60%

25%

2020

15%

59%

26%

2021

15%

59%

26%

2022

Under working age At working age Over working age

The published data on the Bulgarian

population as of the End-2022 confirms

the negative demographic trend, and

this would not change without taking

urgent long-term demographic and

social measures against it. The trend of

urbanization and concentration in Sofia

continues, as every fourth person lives in

Sofia-city (incl. the satellite settlements

around the capital). The forecast of Bulg..

Population of Bulgaria

population until 2080 after Census 2021 was also

revised, and the big picture looks even more

dramatic. The labour market will be thinning

more and more, it would be respectively more

difficult for companies to hire new employees, and

the only possibility to deal with that in the mid-

term is the development of digital government

management and the possible allocation of

human resources from state to private sector.

However, this requires a purposeful state policy

on digitization/automatization of the state

services offered by the administration.

The big picture looks even more dramatic after the revised forecast

90 +

85 - 89

80 - 84

75 - 79

70 - 74

65 - 69

60 - 64

55 - 59

50 - 54

45 - 49

40 - 44

35 - 39

30 - 34

25 - 29

20 - 24

15 - 19

10 - 14

5 - 9

0 - 4

Population pyramid:

The process of ageing continues

NSI Forecast

as of 31.12.2022

Census 2021

Census 2021

6%

2%

3%

1%

2%

4%

2%

2%

4%

1%

3%

2%

2%

3%

3%

2%

1%

7%

10%

5%

3%

2%

2%

1%

1%

4%

2%

20%

aria’s

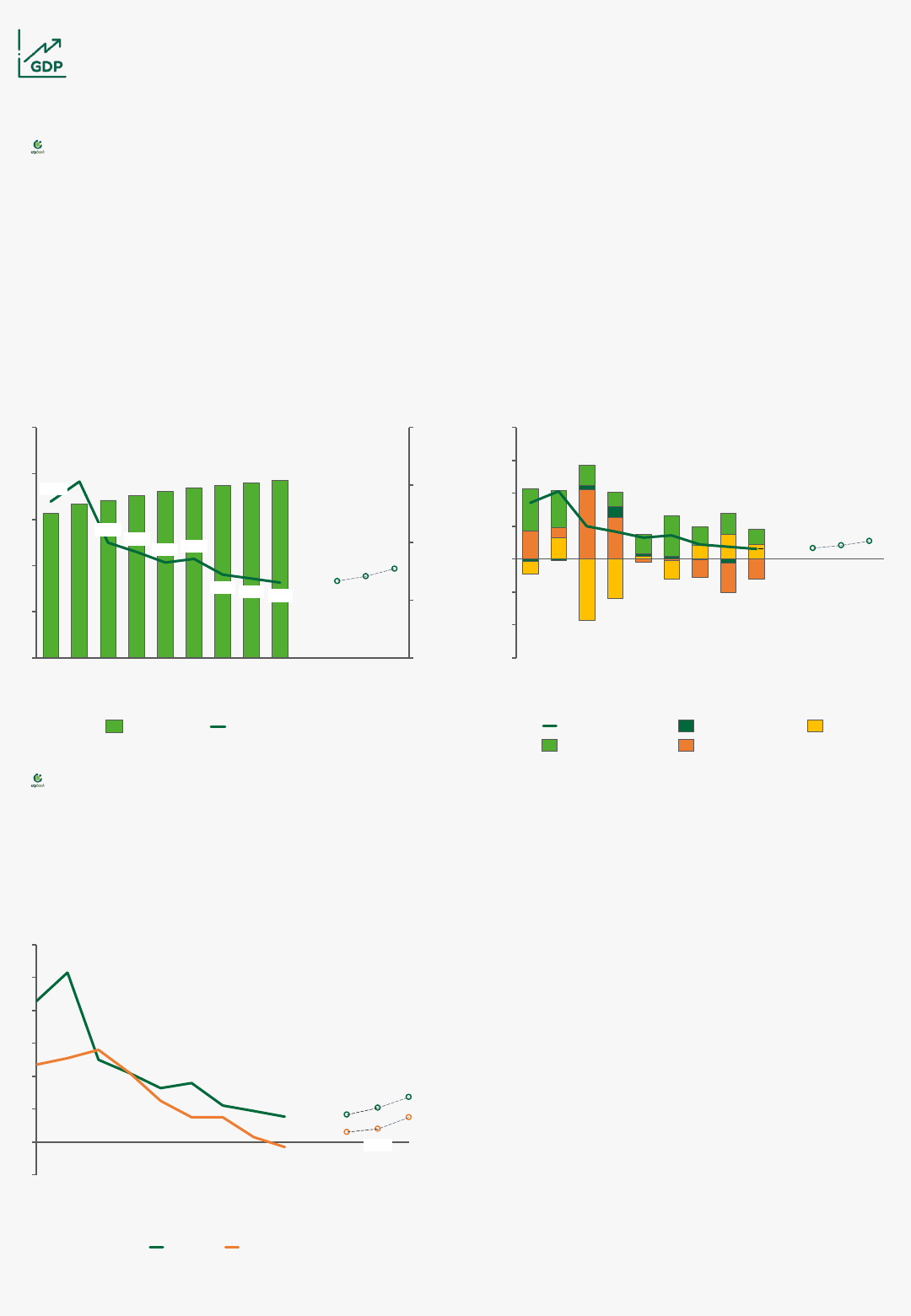

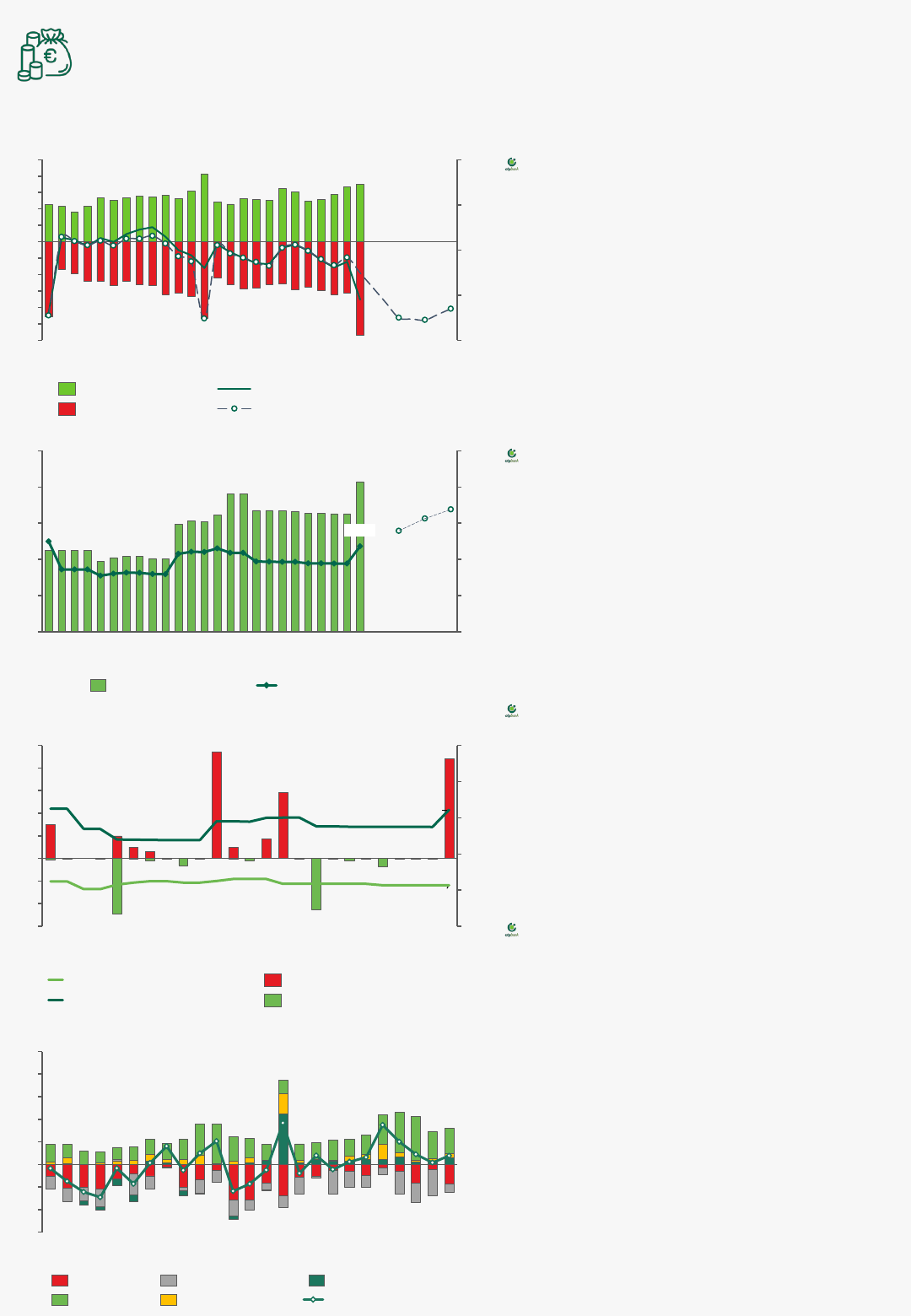

The revised GDP data affected investments mostly, altering their long-term potential. As a

result, we have also revised the forecast growth of investments in the mid-term, expecting a

strengthening of investments in both the public and private sectors, additionally supported by

Gross Domestic Product

4

1.5%

1.7%

2.1%

2.7%

-15%

-10%

-5%

0%

5%

10%

15%

20%

3Q 2021

4Q 2021

1Q 2022

2Q 2022

3Q 2022

4Q 2022

1Q 2023

2Q 2023

3Q 2023

2023

2024

2025

Annual growth (YoY)

Private comsumption

Public consumption

Investments

Net exports

The Bulgarian economy is successfully passing through the shallow recession in which the

European economy finds itself. Despite the mid-term slowdown in economic activity, we expect

the recovery to begin in early 2024. The recovery will be supported mostly by private

consumption and net exports, while investment and government spending are not yet to show

a sustained positive trend. Private consumption will continue to be the main driver of GDP

growth largely supported by low lending rates, low unemployment, increasing disposable

income and expansionary fiscal policy.

Bulgaria: GDP GDP by components

Waiting for the start of the recovery period in Europe and Bulgaria

GDP, Bulgaria vs. Euro area

-5%

0%

5%

10%

15%

20

22

24

26

28

30

BGN bn

8.6%

3Q 2021

10.3%

4Q 2021

5.0%

1Q 2022

4.2%

2Q 2022

3.3%

3Q 2022

3.6%

4Q 2022

2.2%

1Q 2023

1.9%

2Q 2023

1.5%

3Q 2023

1.7%

2023

2.1%

2024

2.7%

2025

1.5%

-0.3%

0.6%

1.5%

1.7%

2.1%

2.7%

-2%

0%

2%

4%

6%

8%

10%

12%

3Q 2021

4Q 2021

1Q 2022

2Q 2022

3Q 2022

4Q 2022

1Q 2023

2Q 2023

3Q 2023

2023

0.8%

2024

2025

Bulgaria Euro area

Annual growth (YoY), at average 2015 price

the Recovery and Resilience Facility. Net exports

have also seen a revision to the data as we expect

strong contribution to GDP growth in 2023 due to

a larger decline in import than export. 2023 is

characterized by a weak performance of net

exports, largely influenced by lower external

demand, unexpected negative events in the

Bulgarian industry and lower economic activity.

With the recovery of the European and Bulgarian

economy, expectations are for significantly more

favorable conditions for trade.

Annual growth (YoY),

at average 2015 price

Annual growth (YoY),

at average 2015 price

*Seasonally and calendar adjusted data

GDP*, volume Annual growth (YoY)

Annual average growth

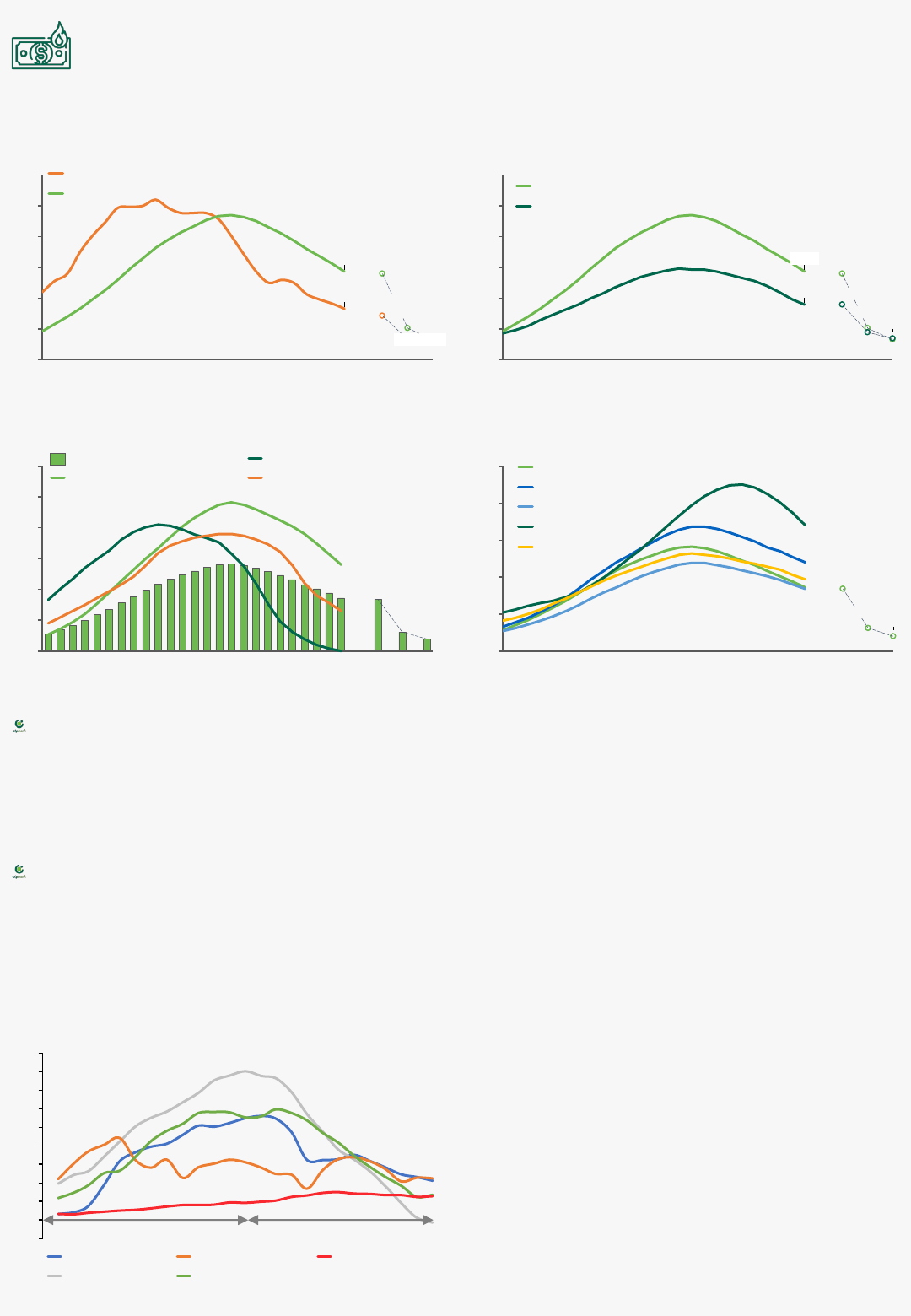

Inflation

5

0%

5%

10%

15%

20%

25%

30%

12/21

02/22

04/22

06/22

08/22

10/22

12/22

02/23

04/23

06/23

08/23

10/23

12/23

2023

2024

2025

HICP

Food and non-alcoholic beverages

Transport

Housing, water, electricity, gas

Inflation uncertainty is fading day by day, as only geopolitical tensions in various problematic

regions of the world fuel fears returning to a full-blown inflationary crisis. International prices of

energy resources are showing composure in the face of military actions, with expectations for

healthy levels in the mid-term as well.

All countries (incl. Bulgaria) close to the Russian-Ukrainian war have a large negative effect on

prices. In Bulgaria, the pressure is higher compared to the Euro Area average level but compared

to the countries of Central and Eastern Europe, the inflation in Bulgaria performs relatively well.

Harmonized Indices of Consumer Prices

(HICP)

HICP by commodity group*

Surrounded by many uncertainties, inflation is gradually reducing its pressure

HICP, Bulgaria vs. CEE countries

5.0%

8.6%

8.4%

3.1%

2.0%

4.3%

0%

3%

6%

9%

12%

15%

18%

12/21

02/22

04/22

06/22

08/22

10/22

12/22

02/23

04/23

06/23

08/23

10/23

12/23

2023

2.0%

2024

2.0%

2025

Annual inflation YoY

Annual average inflation

-5%

5%

15%

25%

35%

45%

Basic basket inflation

Annual average growth

*Three consumer groups with the largest weights in the HICP general basket are presented

2022 2023

Annual inflation YoY

HICP, Bulgaria vs. Euro area

5.4%

8.4%

3.1%

2.0%

5.4%

2.7%

2.1%

0%

3%

6%

9%

12%

15%

18%

12/21

02/22

04/22

06/22

08/22

10/22

12/22

02/23

04/23

06/23

08/23

10/23

12/23

2023

2024

2025

8.6%

Bulgaria

Euro area

The disinflationary trend continues, confirmed by

the latest data as of December 2023. Inflation

(HICP) recorded an annual increase in all goods

and services of 5%, falling sharply from 14% (Dec

2022). Despite the serious dropping trend, the

biggest contributors to the inflationary course in

2023 were services, food, alcohol and tobacco, and

restaurants. Our forecast for inflation is to ease its

pressure, showing 2% by the End-2024.

Annual average growth

Bulgaria

Czechia

Croatia

Hungary

Romania

8.4%

3.1%

2.0%

0%

5%

10%

15%

20%

25%

12/21

02/22

04/22

06/22

08/22

10/22

12/22

02/23

04/23

06/23

08/23

10/23

12/23

2023

2024

2025

Meat

Milk, Cheese & Eggs

Fruits & Vegetables

Sugar & Confectionery

Alcohol & Tobacco

The current macro-environment determines a continued strong performance of the labour

market. Among the most important drivers of rising disposable income are double-digit

nominal wage growth, declining inflation, low unemployment, low lending rates. All this will

have a positive contribution to the economic activity (private consumption is ca. 70% of GDP).

Our 2024 forecast for unemployment is 4.1% or a slight decrease by 0.1 pp. Moreover, the high

employment and staff shortages in several sectors of the economy will additionally support the

wages and as a result, the average nominal wage in 2024 will increase by 10% (in real terms by

6%). We also expect employment (20-64 years of age) to hover ca. 77% over the mid-term period.

Labour market

6

3.3%

6.1%

5.9%

-10%

-5%

0%

5%

10%

15%

09/21

11/21

01/22

03/22

05/22

07/22

09/22

11/22

01/23

03/23

05/23

07/23

09/23

2023

2024

2025

National level Public sector Private sector Financial & insurance sector

Unemployment & Employment* Unemployment

Bulgaria vs. Euro area

The increase in terms of real wages is still gaining momentum

Real wage by sectors

4.3%

4.2%

4.1%

3.7%

100

150

200

250

300

0%

3%

75%

78%

09/22

11/22

01/23

ths.

05/23

07/23

77.1%

09/23

11/21

11/23

76.7%

2023

2024

77.2%

2025

01/22

03/22

05/22

77.0%

07/22

03/23

Unemployment, annual average rate, in %

Employment rate*, in %

Unemployment (persons)

Nominal wage by location

With inflation easing, the labour market seems to be taking over as the main topic that will be

under scrutiny. The trend of the labour market in Bulgaria and the Euro Area is confirmed by

comparing it with the latest macroeconomic bulletin Autumn 2023. The mid-term forecast for

unemployment rate is to remain low, and in the context of a declining inflation and rising

wages, households’ purchasing power will be supported. Economic activity is in its bottoming-

out, however employees have kept their jobs. Business continues facing recruitment challenges.

*Unemployment rate is for the age range of 20 – 64 years of age.

4.3%

6.6%

4.2%

4.1%

3.7%

6.5%

6.6%

6.5%

2%

4%

6%

8%

10%

11/21

01/22

03/22

05/22

07/22

09/22

11/22

01/23

03/23

05/23

07/23

09/23

11/23

2024

2025

2023

Bulgaria Euro area

Annual average growth as of September 2023

Annual average growth

14%

15%

15%

13%

17%

14%

13%

18%

16%

8%

16%

12%

15%

14%

15%

15%

13%

17%

15%

18%

17%

13%

14%

13%

11%

17%

15%

15%

Annual average rate

External & Domestic government debt

Already in the past, the local elections in

Bulgaria in the autumn of 2023 did not

lead to serious upheavals in the ruling

coalition. The upcoming European

Parliament election in June 2024 are

generally not characterized by a high

political activity, so we do not expect

them to lead to extraordinary changes.

An important moment in Bulgarian

political life is the publication of the

convergence report of the European

Central Bank and European Commission,

which will assess Bulgaria’s progress to

adopt the euro. Expected publication:

June 2024

The reference date to adopt the euro

remains January 1, 2025. We expect

Bulgaria to fulfill the Maastricht criteria,

except for the inflation criterion. Inflation

in the Euro area is decreasing as well as

in Bulgaria, leaving a significant gap.

According to preliminary data, the state

budget for 2023 performs better than

expected (2.2% vs. 3.0%), which further

confirms Bulgaria’s goal to fulfill all

other Maastricht criteria. Government

debt in the mid-term is expected to

increase smoothly and gradually, fueled

mainly by chronic deficits. In general, for

the sustainable financing of the state

budget, support will be sought from the

international markets.

State budget

7

23.9%

25.6%

26.9%

10%

15%

20%

25%

30%

35%

20

25

30

35

40

45

BGN bn

11/21

01/22

03/22

05/22

07/22

09/22

11/22

01/23

03/23

05/23

07/23

09/23

11/23

2023

2024

2025

21.8%

Nominal amount, in BGN bn Governmen debt/GDP (%)

Consolidated Fiscal Program (monthly)

Government debt

Government finances – good performance and at planned levels in 2023

-3.0%

-3.1%

-2.6%

-4%

-2%

0%

2%

4%

-10

0

10

-12

-8

-6

-4

-2

2

4

6

8

BGN bn

12/21

02/22

04/22

06/22

08/22

10/22

12/22

02/23

04/23

06/23

08/23

10/23

12/23

2023

2024

2025

Revenue & Grants

Expenditure & Transfers

Budget balance, YtD (% of GDP)

Maastricht criteria, YtD (% of GDP)

Current & Capital account (monthly)

-3

-2

-1

0

1

2

3

4

5

BGN bn

10/21

12/21

02/22

04/22

06/22

08/22

10/22

12/22

02/23

04/23

06/23

08/23

10/23

Trade balance

Services, net

Primary income, net

Secondary income, net

Capital account

Current & Capital account

5.7%

16.1%

0%

5%

10%

15%

20%

25%

-3

-2

-1

0

1

2

3

4

5

BGN bn

11/21

01/22

03/22

05/22

07/22

09/22

11/22

01/23

03/23

05/23

07/23

09/23

11/23

Domestic government debt/GDP (%)

External government debt/GDP (%)

Newly issued debt (monthly)

Repayments (monthly)

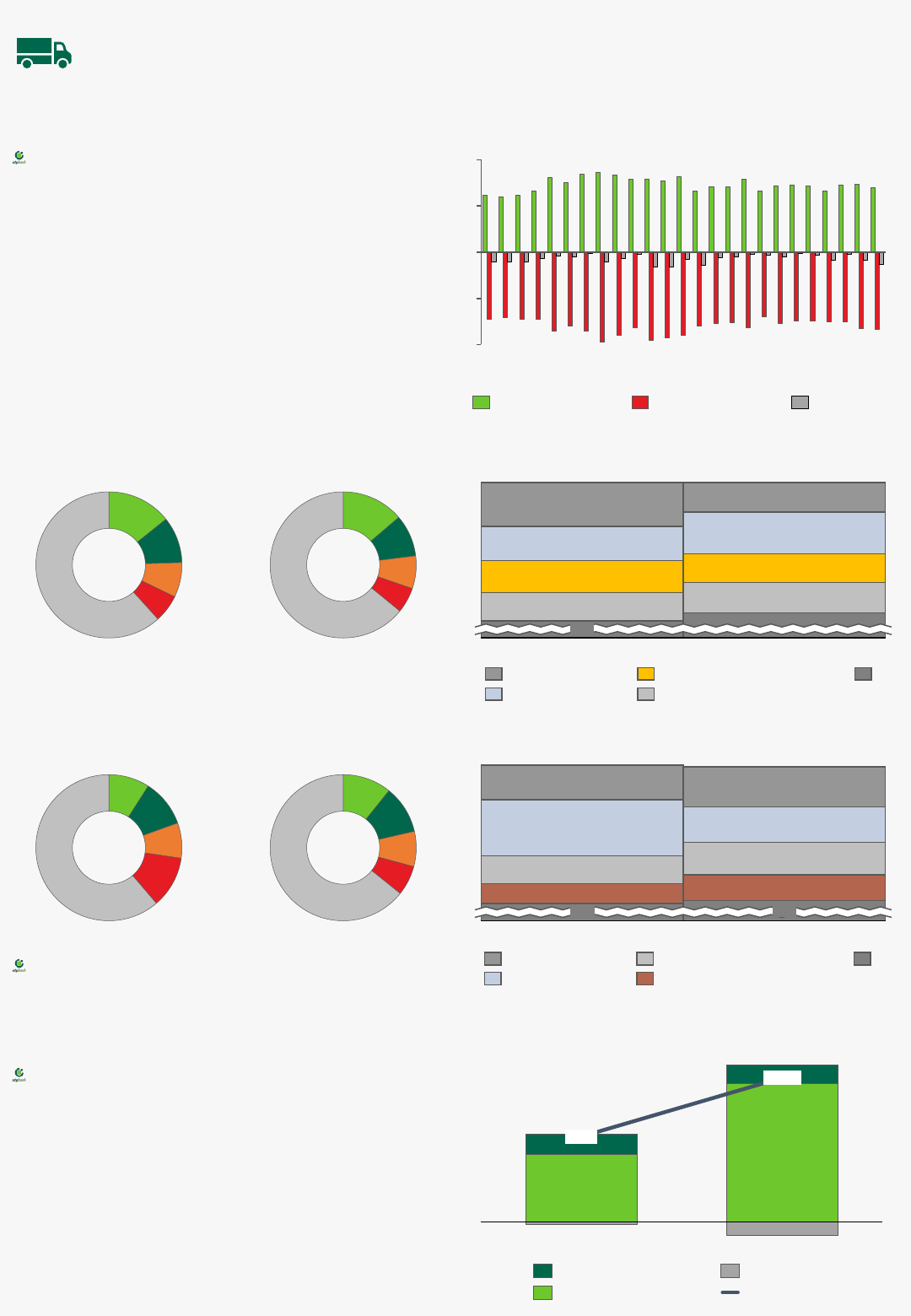

Trade & Investment

8

Export & Import (monthly)

Export, main trade partners

Contracting trade in 2023, with some tentative signs of a bottoming-out

-10

-5

0

5

10

BGN bn

11/21

01/22

03/22

05/22

07/22

09/22

11/22

01/23

03/23

05/23

07/23

09/23

11/23

Export, nominal, BGN bn Import, nominal, BGN bn Trade balance

Direct Foreign Investments (DFI)

Import, main trade partners

14%

10%

8%

6%

62%

Germany

Romania

Italy

Turkey

Other

2022

Jan - Oct

14%

9%

7%

6%

64%

Germany

Romania

Italy

Turkey

Other

2023

Jan - Oct

9%

10%

8%

11%

61%

Germany

China

Turkey

Russia

Other

2022

Jan – Oct

11%

11%

8%

7%

64%

Germany

China

Turkey

Russia

Other

2023

Jan - Oct

3.577

Nov’21 - Nov’22

6.030

Nov’22 - Nov’23

Equity

Reinvestment of earnings

Debt instruments

Total

Export by category

Import by category

12%

9%

9%

7%

63%

Jan - Oct 2022

8%

11%

8%

8%

65%

Jan - Oct 2023

Mineral fuels & Oils

Electrical & Electronics

Copper

Machinery, nuclear reactors, Boilers

Other

10%

17%

9%

6%

58%

Jan - Oct 2022

12%

11%

10%

8%

59%

Jan - Oct 2023

Electrical & Electronics

Mineral fuels & Oils

Machinery, nuclear reactors, Boilers

Vehicles

Other

Bulgaria’s net export of goods and services

for the period January – October 2023 is

expected to decrease compared to a year

ago, which is largely impacted by several

significant events in the energy sector,

cooling inflation and weakened foreign

demand.

Bulgarian trade with Russia has sharply

decreased compared to a year ago

(especially in terms of import).

The main group of exported goods that

report significant annual growth are

medicines, cosmetics, investment goods

(vehicles, machines, spare parts), while raw

materials such as fertilizers, non-ferrous

metals and wood products report the

highest decrease.

BGN bn

2.6% of GDP

3.6% of GDP

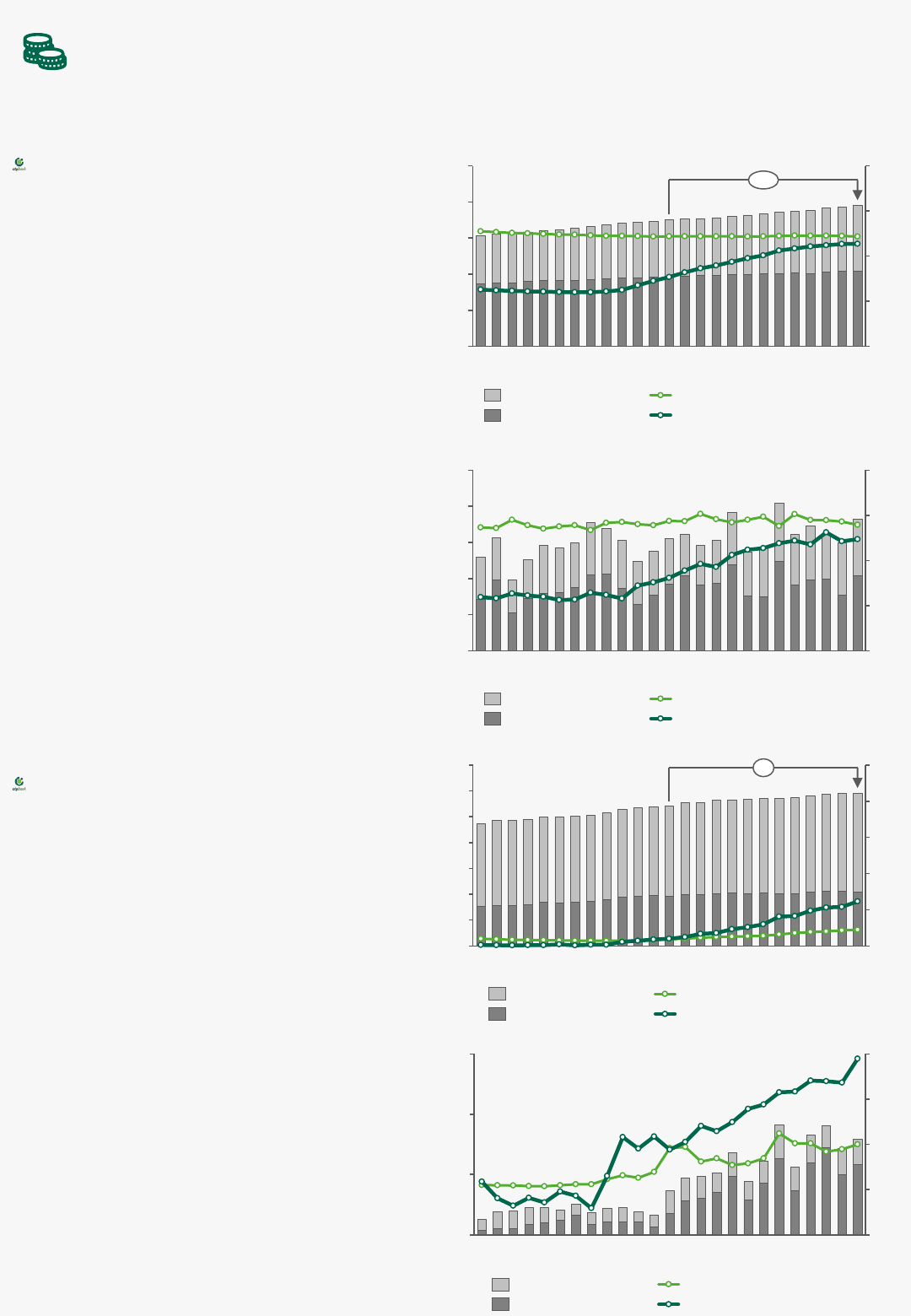

In 2023, the banks in Bulgaria improved

significantly their profitability and

efficiency, with the profit of the sector

increasing by 75% on an annual basis - in

the amount of BGN 3.3 bn as of

November 2023. The improvement is

mainly due to the increased benchmark

interest rates in 2023. In the beginning of

2024, the vibe in central banks is to hold

the current high levels for some time to

consume the desired effect, after which

the reverse process of cutting interest

rates will begin. Until mid-2024, we do

not expect central banks to start an

initiation for expansionary monetary

policy needed for recovery of economic

and lending activity in Europe.

The retail segment in Bulgaria continues

to demonstrate the resistance to the

increase in interest rates on newly

granted loans despite the taken

restrictive measures by the Bulgarian

National Bank in mid-2023. Interest rates

on mortgage loans remains at a record-

low level at the end of November 2023

and 24 consecutive months has not

budged from 2.6%. As a result of that and

together with increasing household

disposable income, the average annual

growth of new production in the

mortgage segment is 16% vs. 8% in the

consumer segment.

Banking system

9

After the strong 2023 in the banking sector, the regulators look for additional brake

Newly credits, volumes & interest rates

Performing loans, volumes & interest rates

0%

2%

4%

6%

8%

0

20

40

60

80

100

BGN bn

11/21

01/22

03/22

05/22

07/22

09/22

11/22

01/23

03/23

05/23

07/23

09/23

11/23

+11%

Households

Non-financial enterprises

Interest rate, Households

Interest rate, Non-financial enterprises

0%

2%

4%

6%

8%

0

1

2

3

4

5

BGN bn

11/21

01/22

03/22

05/22

07/22

09/22

11/22

01/23

03/23

05/23

07/23

09/23

11/23

Households

Non-financial enterprises

Interest rate, Households

Interest rate, Non-financial enterprises

Newly deposits, volumes & interest rates

Deposits, volumes & interest rates

0.0%

0.2%

0.4%

0.6%

0.8%

1.0%

0

20

40

60

80

100

120

140

BGN bn

11/21

01/22

03/22

05/22

07/22

09/22

11/22

01/23

03/23

05/23

07/23

09/23

11/23

9%

Households

Non-financial enterprises

Interest rate, Households

Interest rate, Non-financial enterprises

-1%

0%

1%

2%

3%

0

1

2

3

BGN bn

11/21

01/22

03/22

05/22

07/22

09/22

11/22

01/23

03/23

05/23

07/23

09/23

11/23

Households

Non-financial enterprises

Interest rate, Households

Interest rate, Non-financial enterprises

10

Sources

BULGARIAN NATIONAL BANK

MINISTRY OF FINANCE, BULGARIA

NATIONAL STATISTICAL INSTITUTE

STATISTICAL OFFICE OF THE EU

MINISTRY OF AGRICULTURE, BULGARIA

Disclaimer

❑ This document was issued by the Research team of DSK Bank and whether and in what time

frame an update of this analysis will be published has not been determined in advance.

❑ The macroeconomic bulletin is for information purposes only and the information

contained therein (in whole or in part) may not be disclosed, distributed, reproduced or

published for any purpose without the prior and express consent of DSK Bank.

❑ The Macroeconomic Bulletin is based on publicly available information, the sources of which

are indicated above. Neither DSK Bank nor the staff of DSK Bank assume any responsibility or

liability regarding the accuracy or completeness of this document and are not responsible

for errors in the transmission of factual or analytical data. DSK Bank reserves the right to

change this estimate without notice.

❑ This document should not be construed as an offer to sell or buy any credit/financial

product. The information in this document is general and should not be construed as

personal advice as it has not been prepared for any particular investor. Accordingly,

investors should, before taking any action thereon, seek professional investment advice.

❑ Statements in the macroeconomic bulletin may be considered forward-looking statements

that are based on current expectations and projections of future events. This forecast is not a

guarantee of future results and includes risks and uncertainties. Actual results may differ

materially from those projected as a result of various force majeure circumstances.

Contacts

www.dskbank.bg

Petar.Atanasov@dskbank.bg

0700 10 375

*2375

Actual data Forecasts

NATIONAL STATISTICAL INSTITUTE

(DEMOGRAPHIC FORECAST ONLY)

DSK BANK, RESEARCH TEAM

EUROPEAN CENTRAL BANK

(EURO AREA FORECAST ONLY)